| DAVIS FUNDAMENTAL ETF TRUST | Table of Contents |

| Management's Discussion of Fund Performance: | |

| 2 |

| 4 |

| 6 |

| | |

| Fund Overview: | |

| 8 |

| 9 |

| 10 |

| | |

| 11 |

| | |

| Schedule of Investments: | |

| 12 |

| 14 |

| 16 |

| | |

| 18 |

| | |

| 19 |

| | |

| 20 |

| | |

| 21 |

| | |

| Financial Highlights: | |

| 26 |

| 27 |

| 28 |

| | |

| 29 |

| | |

| 31 |

This Semi-Annual Report is authorized for use by existing shareholders. Prospective shareholders must receive a current Davis Fundamental ETF Trust prospectus, which contains more information about investment strategies, risks, charges, and expenses. Please read the prospectus carefully before investing or sending money.

The views in this report were as of April 30, 2017 and may not necessarily reflect the same views on the date this report is first published or any time thereafter. These views are intended to help shareholders in understanding the Funds' investment methodology and do not constitute investment advice.

Shares of the Davis Fundamental ETF Trust are not deposits or obligations of any bank, are not guaranteed by any bank, are not insured by the FDIC or any other agency, and involve investment risks, including possible loss of the principal amount invested.

Portfolio Proxy Voting Policies and Procedures

The Funds have adopted Portfolio Proxy Voting Policies and Procedures under which the Funds vote proxies relating to securities held by the Funds. A description of the Funds' Portfolio Proxy Voting Policies and Procedures is available (i) without charge, upon request, by calling the Funds toll-free at 1-800-279-0279, (ii) on the Funds' website at www.davisetfs.com, and (iii) on the SEC's website at www.sec.gov.

In addition, the Funds are required to file Form N-PX, with their complete proxy voting record for the 12 months ended June 30th, no later than August 31st of each year. The Funds' Form N-PX filing will be available (i) without charge, upon request, by calling the Funds toll-free at 1-800-279-0279, (ii) on the Funds' website at www.davisetfs.com, and (iii) on the SEC's website at www.sec.gov.

Form N-Q

The Funds file their complete schedule of portfolio holdings with the SEC for the first and third quarters of each fiscal year on Form N-Q. The Funds' Form N-Q is available without charge, upon request, by calling 1-800-279-0279, on the Funds' website at www.davisetfs.com, and on the SEC's website at www.sec.gov. The Funds' Form N-Q may be reviewed and copied at the SEC's Public Reference Room in Washington, D.C., and information on the operation of the Public Reference Room may be obtained by calling 1-800-SEC-0330.

| DAVIS FUNDAMENTAL ETF TRUST | Management's Discussion of Fund Performance |

| DAVIS SELECT U.S. EQUITY ETF | |

Performance Overview

Davis Select U.S. Equity ETF's net asset value and market price returns (1.82% and 2.02%, respectively) underperformed the 5.37% return for the Standard & Poor's 500® Index (the "Index") for the period from January 11, 2017 (the inception date) through April 30, 2017 (the "period"). The sectors1 within the Index that reported the strongest performance were Information Technology (up 12%), Consumer Discretionary (up 8%), and Consumer Staples (up 8%). Only two sectors within the Index reported negative performance for the period, Energy (down 9%) and Telecommunication Services (down 6%). The other sector that reported weak, yet still positive, performance was Financials (up less than 1%).

Detractors from Performance

The Fund's holdings in the Energy sector were the most significant detractor2 from performance, both on an absolute basis and when compared to the Index. The Fund's Energy holdings were down about 18%, compared to down 9% for the Index sector. The Fund's three Energy holdings were the overall top three detractors for the period, Apache3 (down 23%), Encana (down 18%), and Occidental Petroleum (down 10%), respectively. The Fund also suffered from a significant overweight position in Energy holdings, versus the Index (13%, versus 7%).

When compared to the Index, the Fund's weighting in the Information Technology sector was a key detractor from performance. While the Fund's holdings performed in line with the Index sector (both up 12%), the Fund suffered from a significant underweight position (7%, versus 21%).

The Fund's largest sector weighting was in Financials. These holdings also hindered performance when compared to the Index. Although the Fund's Financials were up about 2%, compared to up less than 1% for the Index sector, the Fund suffered from a significant overweight position (38%, versus 15%). The Fund's Financial holdings were diversified across three subsets, Banks (13%), Diversified Financials (21%), and Insurance (5%). Bank of New York Mellon (down 1%), Wells Fargo (down 1%), and U.S. Bancorp (down less than 1%) were weak performers. The Fund no longer owns U.S. Bancorp.

Additional detractors included CarMax (down 13%) from the Consumer Discretionary sector and Johnson Controls (down 5%) from the Industrials sector.

The Fund had approximately 11% of its net assets invested in foreign securities. As a whole, the Fund's foreign holdings underperformed its domestic holdings.

Contributors to Performance

The Fund's holdings in the Consumer Discretionary sector were an important contributor to performance, both on an absolute basis and when compared to the Index. The Fund's Consumer Discretionary holdings were up about 9%, compared to up 8% for the Index sector. Amazon (up 16%) was the Fund's overall top contributor for the period and its second-largest holding. Adient (up 20%) was also a strong performer.

Returns from holdings in the Materials sector helped performance. The Fund's Material holdings were up about 9%, compared to up 4% for the Index sector. Monsanto (up 8%) and LafargeHolcim (up 9%) were key contributors.

Other contributors to performance came from the Fund's Industrial holdings, which were up about 6%, compared to up 5% for the Index sector. Safran (up 17%) and United Technologies (up 8%) were strong performers.

Additional contributors included Alphabet (up 12%), the Fund's third-largest holding, from the Information Technology sector; Markel (up 8%) and American Express (up 3%) from the Financials sector; and UnitedHealth Group (up 8%) from the Health Care sector.

Davis Select U.S. Equity ETF's investment objective is long-term capital growth and capital preservation. There can be no assurance that the Fund will achieve its objective. Davis Select U.S. Equity ETF's principal risks are: authorized participant concentration risk, common stock risk, cybersecurity risk, depositary receipts risk, exchange-traded fund risk, fees and expenses risk, financial services risk, focused portfolio risk, foreign country risk, foreign currency risk, headline risk, intraday indicative value risk, large-capitalization companies risk, manager risk, market trading risk, mid- and small-capitalization companies risk, and stock market risk. See the prospectus for a full description of each risk.

Davis Select U.S. Equity ETF focuses its investments in fewer companies, and it may be subject to greater risks than a more diversified fund that is not allowed to focus its investments in a few companies. The Fund's investment performance, both good and bad, is expected to reflect the economic performance of its more focused portfolio.

Past performance does not guarantee future results, Fund prices fluctuate, and the value of an investment may be worth more or less than the purchase price. Data provided in this performance overview is from January 11, 2017 (the inception date) through April 30, 2017, unless otherwise noted. Return figures for underlying Fund positions reflect the return of the security from the beginning of the period or the date of first purchase if subsequent thereto through the end of the period or the date the position is completely liquidated. The actual contribution to the Fund will vary based on a number of factors (e.g., trading activity, weighting). Portfolio holding information is as of the end of the period, from January 11, 2017 (the inception date) through April 30, 2017, unless otherwise noted.

1 | The companies included in the Standard & Poor's 500® Index are divided into eleven sectors. One or more industry groups make up a sector. For purposes of measuring concentration the Fund generally classifies companies at the industry group or industry level. See the SAI for additional information regarding the Fund's concentration policy. |

2 | A company's or sector's contribution to or detraction from the Fund's performance is a product both of its appreciation or depreciation and its weighting within the Fund. For example, a 5% holding that rises 20% has twice as much impact as a 1% holding that rises 50%. |

3 | This Management Discussion of Fund Performance discusses a number of individual companies. The information provided in this report does not provide information reasonably sufficient upon which to base an investment decision and should not be considered a recommendation to purchase, sell, or hold any particular security. The Schedule of Investments lists the Fund's holdings of each company discussed. |

| DAVIS FUNDAMENTAL ETF TRUST | Management's Discussion of Fund Performance |

| DAVIS SELECT U.S. EQUITY ETF - (CONTINUED) | |

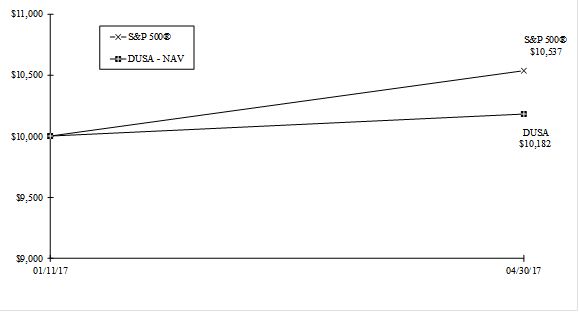

Comparison of a $10,000 investment in Davis Select U.S. Equity ETF (DUSA) versus the

Standard & Poor's 500® Index for an investment made at nav on January 11, 2017

Total Return for period ended April 30, 2017

| Fund & Benchmark Index | Since Fund's Inception (01/11/17) | Gross Expense Ratio | Net Expense Ratio |

| DUSA - Net Asset Value (NAV) | 1.82% | 1.10% | 0.60% |

| DUSA - Market Price | 2.02% | 1.10% | 0.60% |

S&P 500® Index | 5.37% | | |

The Standard & Poor's 500® Index is an unmanaged index of 500 selected common stocks, most of which are listed on the New York Stock Exchange. The Index is adjusted for dividends, weighted towards stocks with large market capitalizations, and represents approximately two-thirds of the total market value of all domestic common stocks. Investments cannot be made directly in the Index.

The performance data for Davis Select U.S. Equity ETF contained in this report represents past performance and should not be considered as an indication of future performance from an investment in the Fund today. The investment return and principal value will fluctuate so that shares may be worth more or less than their original cost when redeemed. The NAV return is based on the NAV of the Fund and the market price return represents changes to the midpoint price, which is the average of the bid-ask prices at 4:00 P.M. EST when the NAV is determined. NAV and market price returns assume that all distributions were reinvested at NAV. Market price returns do not include brokerage commissions that may be payable on secondary market transactions. If brokerage commissions were included, market price returns would be lower. Fund performance changes over time and current performance may be higher or lower than stated. The operating expense ratios may vary in future years. For more current performance information please call Investor Services at 1-800-279-0279.

Frequency Distribution of Discounts and Premiums

Bid/Ask Midpoint versus NAV through April 30, 2017

The following Frequency Distribution of Discounts and Premiums tables are provided to show the frequency at which the bid/ask midpoint price for the Fund was at a discount or premium to the daily NAV. The following tables are for comparative purposes only and represent the period January 12, 2017 (commencement of trading) through April 30, 2017. Shareholders may pay more than NAV when they buy Fund shares and receive less than NAV when they sell those shares because shares are bought and sold at current market price. Data presented represents past performance and cannot be used to predict future results.

| Number of Days Bid/Ask Midpoint At/Above NAV |

| For the Period | 0.00%-0.49% | 0.50%-0.99% | 1.00%-1.99% | >=2.00% |

| 01/12/17 – 04/30/17 | 74 | 0 | 0 | 0 |

| Number of Days Bid/Ask Midpoint Below NAV |

| For the Period | 0.00%-0.49% | 0.50%-0.99% | 1.00%-1.99% | >=2.00% |

| 01/12/17 – 04/30/17 | 0 | 0 | 0 | 0 |

| DAVIS FUNDAMENTAL ETF TRUST | Management's Discussion of Fund Performance |

| DAVIS SELECT FINANCIAL ETF | |

Performance Overview

Davis Select Financial ETF's net asset value and market price returns (3.46% and 3.61%, respectively) outperformed the 0.33% return of the S&P 500® Financials Index (the "Index") for the period from January 11, 2017 (the inception date) through April 30, 2017 (the "period"). The industries1 within the Index that reported the strongest performance were Insurance (up 3%), Diversified Financial Services (up 2%), and Capital Markets (up 1%). The industries within the Index that reported the weakest performance were Consumer Finance (down 8%) and Banks (down 1%).

Contributors to Performance

Insurance companies represented the largest industry weighting in the Fund and made the most significant contribution2 to performance, both on an absolute basis and when compared to the Index. The Fund's Insurance holdings were up about 6%, compared to up 3% for the Index. Everest Re Group3 (up 15%) was the Fund's overall top contributor for the period. Markel (up 8%), the Fund's largest holding, along with Marsh & McLennan (up 11%) and Chubb (up 6%) were also strong performers.

Returns from the Fund's Capital Markets holdings were up about 4%, compared to up 1% for the Index. These holdings were a contributor on both an absolute basis and when compared to the Index. Moody's (up 25%), S&P Global (up 20%), Julius Baer Group (up 16%), and Brookfield Asset Management (up 12%) were key contributors.

Additional contributors included Visa (up 12%) from the Diversified Financial Services industry and Alphabet (up 12%) from the Software & Services industry group.

The Fund had approximately 7% of its net assets invested in foreign securities. Although the Fund's foreign and domestic holdings both produced positive performance returns, as a whole, the Fund's foreign holdings outperformed its domestic holdings (up 13%, compared to up 3%).

Detractors from Performance

Consumer Finance companies were the most significant detractor from performance on an absolute basis. The Fund's Consumer Finance companies were down about 3%, compared to down 8% for the Index. Capital One Financial (down 9%) was the Fund's overall top detractor for the period.

Although the Fund's Bank holdings, as a whole, produced positive returns, certain holdings detracted from performance. Wells Fargo (down 1%), U.S. Bancorp (down less than 1%), and PNC Financial (down less than 1%) were weak performers.

While Capital Markets holdings, in total, contributed to performance, there were a number of Capital Markets holdings that were key detractors from Fund performance, Goldman Sachs (down 9%), Charles Schwab (down 6%), and Bank of New York Mellon (down 1%).

An additional detractor included American International Group (down 9%) from the Insurance industry.

Davis Select Financial ETF's investment objective is long-term growth of capital. There can be no assurance that the Fund will achieve its objective. Davis Select Financial ETF's principal risks are: authorized participant concentration risk, common stock risk, credit risk, cybersecurity risk, depositary receipts risk, exchange-traded fund risk, fees and expenses risk, financial services risk, focused portfolio risk, foreign country risk, foreign currency risk, headline risk, intraday indicative value risk, interest rate sensitivity risk, large-capitalization companies risk, manager risk, market trading risk, mid- and small-capitalization companies risk, and stock market risk. See the prospectus for a full description of each risk.

Davis Select Financial ETF focuses its investments in fewer companies, and it may be subject to greater risks than a more diversified fund that is not allowed to focus its investments in a few companies. The Fund's investment performance, both good and bad, is expected to reflect the economic performance of its more focused portfolio.

Davis Select Financial ETF concentrates its investments in the financial sector, and it may be subject to greater risks than a fund that does not concentrate its investments in a particular sector. The Fund's investment performance, both good and bad, is expected to reflect the economic performance of the financial sector more than a fund that does not concentrate its portfolio.

Past performance does not guarantee future results, Fund prices fluctuate, and the value of an investment may be worth more or less than the purchase price. Data provided in this performance overview is from January 11, 2017 (the inception date) through April 30, 2017, unless otherwise noted. Return figures for underlying Fund positions reflect the return of the security from the beginning of the period or the date of first purchase if subsequent thereto through the end of the period or the date the position is completely liquidated. The actual contribution to the Fund will vary based on a number of factors (e.g., trading activity, weighting). Portfolio holding information is as of the end of the period, from January 11, 2017 (the inception date) through April 30, 2017, unless otherwise noted.

1 | The companies included in the S&P 500® Financials Index are divided into five industries. One or more sub-industries make up an industry. |

2 | A company's or industries' contribution to or detraction from the Fund's performance is a product both of its appreciation or depreciation and its weighting within the Fund. For example, a 5% holding that rises 20% has twice as much impact as a 1% holding that rises 50%. |

3 | This Management Discussion of Fund Performance discusses a number of individual companies. The information provided in this report does not provide information reasonably sufficient upon which to base an investment decision and should not be considered a recommendation to purchase, sell, or hold any particular security. The Schedule of Investments lists the Fund's holdings of each company discussed. |

| DAVIS FUNDAMENTAL ETF TRUST | Management's Discussion of Fund Performance |

| DAVIS SELECT FINANCIAL ETF - (CONTINUED) | |

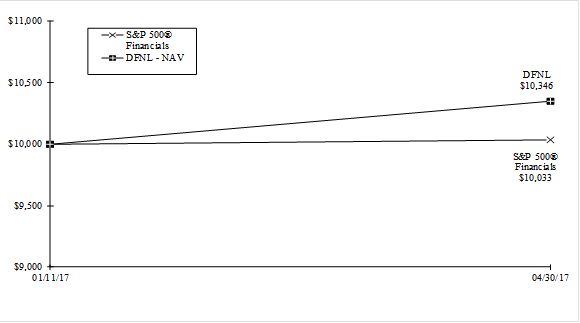

Comparison of a $10,000 investment in Davis Select Financial ETF (DFNL) versus the

Standard & Poor's 500® Financials Index for an investment made at nav on January 11, 2017

Total Return for period ended April 30, 2017

| Fund & Benchmark Index | Since Fund's Inception (01/11/17) | Gross Expense Ratio | Net Expense Ratio |

| DFNL - Net Asset Value (NAV) | 3.46% | 1.08% | 0.65% |

| DFNL - Market Price | 3.61% | 1.08% | 0.65% |

S&P 500® Financials Index | 0.33% | | |

The Standard & Poor's 500® Index is an unmanaged index of 500 selected common stocks, most of which are listed on the New York Stock Exchange. The Index is adjusted for dividends, weighted towards stocks with large market capitalizations, and represents approximately two-thirds of the total market value of all domestic common stocks. The S&P 500® Financials Index comprises those companies included in the Standard & Poor's 500® Index that are classified as members of the GICS® Financials sector. Investments cannot be made directly in the Index.

The performance data for Davis Select Financial ETF contained in this report represents past performance and should not be considered as an indication of future performance from an investment in the Fund today. The investment return and principal value will fluctuate so that shares may be worth more or less than their original cost when redeemed. The NAV return is based on the NAV of the Fund and the market price return represents changes to the midpoint price, which is the average of the bid-ask prices at 4:00 P.M. EST when the NAV is determined. NAV and market price returns assume that all distributions were reinvested at NAV. Market price returns do not include brokerage commissions that may be payable on secondary market transactions. If brokerage commissions were included, market price returns would be lower. Fund performance changes over time and current performance may be higher or lower than stated. The operating expense ratios may vary in future years. For more current performance information please call Investor Services at 1-800-279-0279.

Frequency Distribution of Discounts and Premiums

Bid/Ask Midpoint versus NAV through April 30, 2017

The following Frequency Distribution of Discounts and Premiums tables are provided to show the frequency at which the bid/ask midpoint price for the Fund was at a discount or premium to the daily NAV. The following tables are for comparative purposes only and represent the period January 12, 2017 (commencement of trading) through April 30, 2017. Shareholders may pay more than NAV when they buy Fund shares and receive less than NAV when they sell those shares because shares are bought and sold at current market price. Data presented represents past performance and cannot be used to predict future results.

| Number of Days Bid/Ask Midpoint At/Above NAV |

| For the Period | 0.00%-0.49% | 0.50%-0.99% | 1.00%-1.99% | >=2.00% |

| 01/12/17 – 04/30/17 | 74 | 0 | 0 | 0 |

| Number of Days Bid/Ask Midpoint Below NAV |

| For the Period | 0.00%-0.49% | 0.50%-0.99% | 1.00%-1.99% | >=2.00% |

| 01/12/17 – 04/30/17 | 0 | 0 | 0 | 0 |

| DAVIS FUNDAMENTAL ETF TRUST | Management's Discussion of Fund Performance |

| DAVIS SELECT WORLDWIDE ETF | |

Performance Overview

Davis Select Worldwide ETF's net asset value and market price returns (6.58% and 6.78%, respectively) performed in line with the 6.75% return for the Morgan Stanley Capital International All Country World Index (the "Index") for the period from January 11, 2017 (the inception date) through April 30, 2017 (the "period"). The sectors1 within the Index that reported the strongest performance were Information Technology (up 12%), Consumer Staples (up 10%), and Industrials (up 9%). Only one sector within the Index reported negative performance for the period, Energy (down 5%). The other sectors that reported weak, yet still positive, performance were Telecommunication Services (up less than 1%) and Financials (up 5%).

Contributors to Performance

The Fund's holdings in the Consumer Discretionary sector made the most significant contribution2 to performance, both on an absolute basis and when compared to the Index. The Fund's Consumer Discretionary holdings were up about 21%, compared to up 8% for the Index sector. Seven of the Fund's top ten contributors during the period were from the Consumer Discretionary sector, including the overall top four contributors, JD.com3 (up 31%), Adient (up 20%), Naspers (up 19%), and TAL Education Group (up 58%). The remaining contributors included the Fund's second-largest holding, Amazon (up 16%), along with New Oriental Education & Technology Group (up 34%) and Vipshop Holdings (up 24%).

Returns from specific holdings in the Information Technology sector helped performance on an absolute basis. Alphabet (up 12%), the Fund's largest holding, and Alibaba (up 19%) were key contributors.

Another contributor to performance was Safran (up 17%) from the Industrials sector.

The Fund's largest foreign exposure geographically was in Chinese companies. Chinese holdings were the most significant contributor to performance during the period.

Detractors from Performance

The Fund's holdings in the Energy sector were the most significant detractor from performance, both on an absolute basis and when compared to the Index. The Fund's Energy holdings were down about 14%, compared to down 5% for the Index sector. The Fund suffered due to stock selection and from a significant overweight position (13%, versus 7%) in the only sector with a negative return during the period. Apache (down 23%) and Encana (down 18%) were the Fund's overall top two detractors for the period, respectively. EQT (down 8%) was also a weak performer; the Fund no longer owns EQT.

Although the Fund's absolute performance benefited from Information Technology holdings, the Fund still trailed the Index. The Fund's Information Technology holdings were up about 8%, compared to up 12% for the Index sector. Angie's List (down 28%), Fang Holdings (down 12%), and Hollysys Automation (down 8%) were key detractors.

The Fund's Health Care holdings also benefited from positive absolute performance; however, Valeant Pharmaceuticals (down 37%) was a drag on the Fund's relative performance. The Fund no longer owns Valeant Pharmaceuticals.

Additional detractors included CarMax (down 13%) from the Consumer Discretionary sector, CAR (down 4%) from the Industrials sector, and Wells Fargo (down 1%) from the Financials sector.

The Fund's U.S. holdings underperformed its foreign holdings (up 5%, compared to up 10%).

Davis Select Worldwide ETF's investment objective is long-term growth of capital. There can be no assurance that the Fund will achieve its objective. Davis Select Worldwide ETF's principal risks are: authorized participant concentration risk, common stock risk, cybersecurity risk, depositary receipts risk, emerging market risk, exchange-traded fund risk, fees and expenses risk, foreign country risk, foreign currency risk, headline risk, intraday indicative value risk, large-capitalization companies risk, manager risk, market trading risk, mid- and small-capitalization companies risk, and stock market risk. See the prospectus for a full description of each risk.

Past performance does not guarantee future results, Fund prices fluctuate, and the value of an investment may be worth more or less than the purchase price. Data provided in this performance overview is from January 11, 2017 (the inception date) through April 30, 2017, unless otherwise noted. Return figures for underlying Fund positions reflect the return of the security from the beginning of the period or the date of first purchase if subsequent thereto through the end of the period or the date the position is completely liquidated. The actual contribution to the Fund will vary based on a number of factors (e.g., trading activity, weighting). Portfolio holding information is as of the end of period, from January 11, 2017 (the inception date) through April 30, 2017, unless otherwise noted.

1 | The companies included in the Morgan Stanley Capital International All Country World Index are divided into eleven sectors. One or more industry groups make up a sector. For purposes of measuring concentration the Fund generally classifies companies at the industry group or industry level. See the SAI for additional information regarding the Fund's concentration policy. |

2 | A company's or sector's contribution to or detraction from the Fund's performance is a product both of its appreciation or depreciation and its weighting within the Fund. For example, a 5% holding that rises 20% has twice as much impact as a 1% holding that rises 50%. |

3 | This Management Discussion of Fund Performance discusses a number of individual companies. The information provided in this report does not provide information reasonably sufficient upon which to base an investment decision and should not be considered a recommendation to purchase, sell, or hold any particular security. The Schedule of Investments lists the Fund's holdings of each company discussed. |

| DAVIS FUNDAMENTAL ETF TRUST | Management's Discussion of Fund Performance |

| DAVIS SELECT WORLDWIDE ETF - (CONTINUED) | |

Comparison of a $10,000 investment in Davis Select Worldwide ETF (DWLD) versus the

Morgan Stanley Capital International All Country World Index (MSCI ACWI®)

for an investment at nav on January 11, 2017

Total Return for period ended April 30, 2017

| Fund & Benchmark Index | Since Fund's Inception (01/11/17) | Gross Expense Ratio | Net Expense Ratio |

| DWLD - Net Asset Value (NAV) | 6.58% | 1.23% | 0.65% |

| DWLD - Market Price | 6.78% | 1.23% | 0.65% |

MSCI ACWI® | 6.75% | | |

The MSCI ACWI® is a free float-adjusted market capitalization weighted index that is designed to measure the equity market performance of developed and emerging markets. The Index includes reinvestment of dividends, net of foreign withholding taxes. Investments cannot be made directly in the Index.

The performance data for Davis Select Worldwide ETF contained in this report represents past performance and should not be considered as an indication of future performance from an investment in the Fund today. The investment return and principal value will fluctuate so that shares may be worth more or less than their original cost when redeemed. The NAV return is based on the NAV of the Fund and the market price return represents changes to the midpoint price, which is the average of the bid-ask prices at 4:00 P.M. EST when the NAV is determined. NAV and market price returns assume that all distributions were reinvested at NAV. Market price returns do not include brokerage commissions that may be payable on secondary market transactions. If brokerage commissions were included, market price returns would be lower. Fund performance changes over time and current performance may be higher or lower than stated. The operating expense ratios may vary in future years. For more current performance information please call Investor Services at 1-800-279-0279.

Frequency Distribution of Discounts and Premiums

Bid/Ask Midpoint versus NAV through April 30, 2017

The following Frequency Distribution of Discounts and Premiums tables are provided to show the frequency at which the bid/ask midpoint price for the Fund was at a discount or premium to the daily NAV. The following tables are for comparative purposes only and represent the period January 12, 2017 (commencement of trading) through April 30, 2017. Shareholders may pay more than NAV when they buy Fund shares and receive less than NAV when they sell those shares because shares are bought and sold at current market price. Data presented represents past performance and cannot be used to predict future results.

| Number of Days Bid/Ask Midpoint At/Above NAV |

| For the Period | 0.00%-0.49% | 0.50%-0.99% | 1.00%-1.99% | >=2.00% |

| 01/12/17 – 04/30/17 | 67 | 6 | 0 | 1 |

| Number of Days Bid/Ask Midpoint Below NAV |

| For the Period | 0.00%-0.49% | 0.50%-0.99% | 1.00%-1.99% | >=2.00% |

| 01/12/17 – 04/30/17 | 0 | 0 | 0 | 0 |

| DAVIS FUNDAMENTAL ETF TRUST | |

| DAVIS SELECT U.S. EQUITY ETF | April 30, 2017 (Unaudited) |

| Portfolio Composition | | Industry Weightings |

| (% of Fund's 04/30/17 Net Assets) | | (% of 04/30/17 Stock Holdings) |

| | | | | | | |

| | | | | Fund | | S&P 500® |

| Common Stock (U.S.) | 86.72% | | Diversified Financials | 24.23% | | 5.11% |

| Common Stock (Foreign) | 11.07% | | Capital Goods | 16.06% | | 7.39% |

| Other Assets & Liabilities | 2.21% | | Energy | 11.52% | | 6.32% |

| | 100.00% | | Retailing | 10.36% | | 5.66% |

| | | | Banks | 8.56% | | 6.31% |

| | | | Information Technology | 8.14% | | 22.50% |

| | | | Materials | 8.10% | | 2.85% |

| | | | Insurance | 4.77% | | 2.67% |

| | | | Health Care | 4.48% | | 13.96% |

| | | | Media | 2.22% | | 3.24% |

| | | | Automobiles & Components | 1.56% | | 0.69% |

| | | | Other | – | | 23.30% |

| | | | | 100.00% | | 100.00% |

| Top 10 Long-Term Holdings |

| (% of Fund's 04/30/17 Net Assets) |

| |

| Berkshire Hathaway Inc., Class B | Diversified Financial Services | 9.48% |

| Amazon.com, Inc. | Retailing | 8.22% |

| Alphabet Inc., Class C | Software & Services | 7.96% |

| United Technologies Corp. | Capital Goods | 7.30% |

| American Express Co. | Consumer Finance | 6.46% |

| Apache Corp. | Energy | 5.44% |

| Markel Corp. | Property & Casualty Insurance | 4.66% |

| UnitedHealth Group Inc. | Health Care Equipment & Services | 4.39% |

| Bank of New York Mellon Corp. | Capital Markets | 4.33% |

| Johnson Controls International PLC | Capital Goods | 4.31% |

| DAVIS FUNDAMENTAL ETF TRUST | |

| DAVIS SELECT FINANCIAL ETF | April 30, 2017 (Unaudited) |

| Portfolio Composition | | Industry Weightings |

| (% of Fund's 04/30/17 Net Assets) | | (% of 04/30/17 Stock Holdings) |

| | | | | | |

| | | | | Fund | | S&P 500® Financials |

| Common Stock (U.S.) | 91.61% | | Insurance | 28.45% | | 18.93% |

| Common Stock (Foreign) | 7.38% | | Capital Markets | 26.73% | | 19.98% |

| Other Assets & Liabilities | 1.01% | | Banks | 19.20% | | 44.78% |

| | 100.00% | | Consumer Finance | 11.30% | | 5.15% |

| | | | Diversified Financial Services | 11.06% | | 11.16% |

| | | | Software & Services | 3.26% | | – |

| | | | | 100.00% | | 100.00% |

| Top 10 Long-Term Holdings |

| (% of Fund's 04/30/17 Net Assets) |

| |

| Markel Corp. | Property & Casualty Insurance | 6.81% |

| American Express Co. | Consumer Finance | 5.97% |

| Loews Corp. | Multi-line Insurance | 5.76% |

| Berkshire Hathaway Inc., Class B | Diversified Financial Services | 5.57% |

| Visa Inc., Class A | Diversified Financial Services | 5.38% |

| Chubb Ltd. | Property & Casualty Insurance | 5.35% |

| Capital One Financial Corp. | Consumer Finance | 5.22% |

| U.S. Bancorp | Banks | 5.17% |

| Everest Re Group, Ltd. | Reinsurance | 4.53% |

| JPMorgan Chase & Co. | Banks | 4.37% |

| DAVIS FUNDAMENTAL ETF TRUST | |

| DAVIS SELECT WORLDWIDE ETF | April 30, 2017 (Unaudited) |

| Portfolio Composition | | Industry Weightings |

| (% of Fund's 04/30/17 Net Assets) | | (% of 04/30/17 Stock Holdings) |

| | | | | | | |

| | | | | | | MSCI |

| | | | | Fund | | ACWI® |

| Common Stock (U.S.) | 53.02% | | Information Technology | 17.46% | | 16.66% |

| Common Stock (Foreign) | 46.03% | | Retailing | 13.91% | | 3.68% |

| Other Assets & Liabilities | 0.95% | | Energy | 11.63% | | 6.43% |

| | 100.00% | | Banks | 8.21% | | 10.30% |

| | | | Materials | 7.46% | | 5.28% |

| | | | Media | 6.94% | | 2.51% |

| | | | Capital Goods | 6.08% | | 7.69% |

| | | | Automobiles & Components | 6.01% | | 2.52% |

| | | | Diversified Financials | 5.83% | | 3.99% |

| | | | Consumer Services | 4.94% | | 1.68% |

| | | | Transportation | 4.84% | | 2.15% |

| | | | Health Care | 3.52% | | 11.17% |

| | | | Insurance | 3.17% | | 4.00% |

| | | | Other | – | | 21.94% |

| | | | | 100.00% | | 100.00% |

| Country Diversification | | Top 10 Long-Term Holdings |

| (% of 04/30/17 Stock Holdings) | | (% of Fund's 04/30/17 Net Assets) |

| | | | | |

| United States | 53.53% | | Alphabet Inc., Class C | 6.83% |

| China | 24.64% | | Amazon.com, Inc. | 5.25% |

| Canada | 5.65% | | Naspers Ltd. - N | 4.95% |

| South Africa | 5.00% | | Adient PLC | 4.78% |

| Brazil | 3.17% | | Wells Fargo & Co. | 4.45% |

| France | 2.96% | | Apache Corp. | 4.26% |

| Switzerland | 2.25% | | Berkshire Hathaway Inc., Class B | 4.20% |

| Mexico | 1.94% | | Encana Corp. | 4.16% |

| Netherlands | 0.86% | | JD.com Inc., Class A, ADR | 3.76% |

| | 100.00% | | JPMorgan Chase & Co. | 3.68% |

| DAVIS FUNDAMENTAL ETF TRUST | Expense Example (Unaudited) |

As a shareholder of each Fund, you incur two types of costs: (1) transaction costs for purchasing and selling shares; and (2) ongoing costs, including advisory and administrative fees and other Fund expenses. The Expense Example is intended to help you understand your ongoing costs (in dollars) of investing in each Fund and to compare these costs with the ongoing costs of investing in other funds. The Expense Example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period indicated, which for each Fund is January 11, 2017* to April 30, 2017.

Actual Expenses

The information represented in the row entitled "Actual" provides information about actual account values and actual expenses. You may use the information in this row, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number under the heading "Expenses Paid During Period" to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The information represented in the row entitled "Hypothetical" provides information about hypothetical account values and hypothetical expenses based on each Fund's actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund's actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as brokerage commissions paid on purchases and sales of Fund shares. Therefore, the information in the row entitled "Hypothetical" is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would be higher.

| | Beginning Account Value | | Ending Account Value | | Expenses Paid During Period** |

| | (01/11/17)* | | (04/30/17) | | (01/11/17*-04/30/17) |

Davis Select U.S. Equity ETF | | | | | |

| (annualized expense ratio 0.60%***) | | | | | |

| Actual | $1,000.00 | | $1,018.24 | | $1.81 |

| Hypothetical | $1,000.00 | | $1,013.14 | | $1.80 |

Davis Select Financial ETF | | | | | |

| (annualized expense ratio 0.65%***) | | | | | |

| Actual | $1,000.00 | | $1,034.61 | | $1.97 |

| Hypothetical | $1,000.00 | | $1,012.99 | | $1.95 |

Davis Select Worldwide ETF | | | | | |

| (annualized expense ratio 0.65%***) | | | | | |

| Actual | $1,000.00 | | $1,065.78 | | $2.00 |

| Hypothetical | $1,000.00 | | $1,012.99 | | $1.95 |

| Hypothetical assumes 5% annual return before expenses. |

| |

| *Inception date is consistent with the commencement of investment operations and is the date the initial creation units were established. |

| |

| **Expenses are equal to each Fund's annualized operating expense ratio, multiplied by the average account value over the period, multiplied by 109/365 (to reflect the period since commencement of investment operations). |

| |

| ***The expense ratios reflect the impact, if any, of certain reimbursements and/or waivers from the Adviser. |

| DAVIS FUNDAMENTAL ETF TRUST | |

| DAVIS SELECT U.S. EQUITY ETF | April 30, 2017 (Unaudited) |

| | Shares | | Value

(Note 1) |

| COMMON STOCK – (97.79%) |

| | CONSUMER DISCRETIONARY – (13.83%) |

| | | Automobiles & Components – (1.53%) |

| | | Adient PLC | | | 7,250 | | $ | 533,310 |

| | Media – (2.17%) |

| | Liberty Global PLC, Series C * | | | 21,850 | | | 756,229 |

| | Retailing – (10.13%) |

| | Amazon.com, Inc. * | | | 3,098 | | | 2,865,619 |

| | CarMax, Inc. * | | | 11,402 | | | 667,017 |

| | | | 3,532,636 |

| | | | Total Consumer Discretionary | | | 4,822,175 |

| | ENERGY – (11.27%) |

| | Apache Corp. | | | 39,006 | | | 1,897,252 |

| | Encana Corp. (Canada) | | | 107,786 | | | 1,153,310 |

| | Occidental Petroleum Corp. | | | 14,303 | | | 880,207 |

| | Total Energy | | | 3,930,769 |

| | FINANCIALS – (36.72%) |

| | Banks – (8.37%) |

| | JPMorgan Chase & Co. | | | 17,022 | | | 1,480,914 |

| | Wells Fargo & Co. | | | 26,713 | | | 1,438,228 |

| | | | 2,919,142 |

| | Diversified Financials – (23.69%) |

| | | Capital Markets – (4.33%) |

| | Bank of New York Mellon Corp. | | | 32,094 | | | 1,510,344 |

| | Consumer Finance – (9.88%) |

| | American Express Co. | | | 28,418 | | | 2,252,126 |

| | Capital One Financial Corp. | | | 14,850 | | | 1,193,643 |

| | | 3,445,769 |

| | Diversified Financial Services – (9.48%) |

| | Berkshire Hathaway Inc., Class B * | | | 20,012 | | | 3,306,182 |

| | | | 8,262,295 |

| | Insurance – (4.66%) |

| | Property & Casualty Insurance – (4.66%) |

| | Markel Corp. * | | | 1,678 | | | 1,626,989 |

| | Total Financials | | | 12,808,426 |

| | HEALTH CARE – (4.39%) |

| | Health Care Equipment & Services – (4.39%) |

| | UnitedHealth Group Inc. | | | 8,746 | | | 1,529,500 |

| | Total Health Care | | | 1,529,500 |

| | INDUSTRIALS – (15.70%) |

| | Capital Goods – (15.70%) |

| | Johnson Controls International PLC | | | 36,145 | | | 1,502,548 |

| | Safran S.A. (France) | | | 17,222 | | | 1,426,129 |

| | United Technologies Corp. | | | 21,408 | | | 2,547,338 |

| | Total Industrials | | | 5,476,015 |

| | INFORMATION TECHNOLOGY – (7.96%) |

| | Software & Services – (7.96%) |

| | Alphabet Inc., Class C * | | | 3,064 | | | 2,775,861 |

| | Total Information Technology | | | 2,775,861 |

| DAVIS FUNDAMENTAL ETF TRUST | Schedule of Investments |

| DAVIS SELECT U.S. EQUITY ETF - (CONTINUED) | April 30, 2017 (Unaudited) |

| | Shares | | Value

(Note 1) |

| COMMON STOCK – (CONTINUED) |

| | MATERIALS – (7.92%) |

| | | LafargeHolcim Ltd. (Switzerland) | | | 22,530 | | $ | 1,279,125 |

| | Monsanto Co. | | | 12,728 | | | 1,484,212 |

| | | | | Total Materials | | | 2,763,337 |

| | TOTAL COMMON STOCK – (Identified cost $33,512,233) | | | 34,106,083 |

| | Total Investments – (97.79%) – (Identified cost $33,512,233) – (a) | | | 34,106,083 |

| | Other Assets Less Liabilities – (2.21%) | | | 770,571 |

| | Net Assets – (100.00%) | | $ | 34,876,654 |

| |

| | * | Non-income producing security. |

| |

| | (a) | Aggregate cost for federal income tax purposes is $33,512,233. At April 30, 2017, unrealized appreciation (depreciation) of securities for federal income tax purposes is as follows: |

| |

| | Unrealized appreciation | | $ | 1,279,405 |

| | Unrealized depreciation | | | (685,555) |

| | Net unrealized appreciation | | $ | 593,850 |

| |

| See Notes to Financial Statements |

| DAVIS FUNDAMENTAL ETF TRUST | |

| DAVIS SELECT FINANCIAL ETF | April 30, 2017 (Unaudited) |

| | Shares/Units | | Value

(Note 1) |

| COMMON STOCK – (98.99%) |

| | FINANCIALS – (95.76%) |

| | | Banks – (19.00%) |

| | | DBS Group Holdings Ltd. (Singapore) | | | 70,200 | | $ | 972,244 |

| | JPMorgan Chase & Co. | | | 22,994 | | | 2,000,478 |

| | PNC Financial Services Group, Inc. | | | 11,759 | | | 1,408,140 |

| | U.S. Bancorp | | | 46,191 | | | 2,368,674 |

| | Wells Fargo & Co. | | | 36,284 | | | 1,953,531 |

| | | | 8,703,067 |

| | Diversified Financials – (48.60%) |

| | | Capital Markets – (26.46%) |

| | Bank of New York Mellon Corp. | | | 41,524 | | | 1,954,120 |

| | Brookfield Asset Management Inc., Class A (Canada) | | | 30,558 | | | 1,129,118 |

| | Charles Schwab Corp. | | | 36,594 | | | 1,421,677 |

| | Goldman Sachs Group, Inc. | | | 8,190 | | | 1,832,922 |

| | Julius Baer Group Ltd. (Switzerland) | | | 24,568 | | | 1,280,252 |

| | KKR & Co. L.P. | | | 41,741 | | | 792,244 |

| | Moody's Corp. | | | 8,632 | | | 1,021,338 |

| | S&P Global Inc. | | | 8,143 | | | 1,092,709 |

| | State Street Corp. | | | 18,978 | | | 1,592,254 |

| | | 12,116,634 |

| | Consumer Finance – (11.19%) |

| | American Express Co. | | | 34,478 | | | 2,732,382 |

| | Capital One Financial Corp. | | | 29,724 | | | 2,389,215 |

| | | 5,121,597 |

| | Diversified Financial Services – (10.95%) |

| | Berkshire Hathaway Inc., Class B * | | | 15,454 | | | 2,553,155 |

| | Visa Inc., Class A | | | 26,993 | | | 2,462,302 |

| | | 5,015,457 |

| | | | 22,253,688 |

| | Insurance – (28.16%) |

| | Insurance Brokers – (3.76%) |

| | Marsh & McLennan Cos, Inc. | | | 23,250 | | | 1,723,522 |

| | Multi-line Insurance – (7.71%) |

| | American International Group, Inc. | | | 14,708 | | | 895,864 |

| | Loews Corp. | | | 56,542 | | | 2,635,988 |

| | | 3,531,852 |

| | Property & Casualty Insurance – (12.16%) |

| | Chubb Ltd. | | | 17,833 | | | 2,447,579 |

| | Markel Corp. * | | | 3,216 | | | 3,118,234 |

| | | 5,565,813 |

| | Reinsurance – (4.53%) |

| | Everest Re Group, Ltd. | | | 8,246 | | | 2,075,601 |

| | | | 12,896,788 |

| | | | Total Financials | | | 43,853,543 |

| DAVIS FUNDAMENTAL ETF TRUST | Schedule of Investments |

| DAVIS SELECT FINANCIAL ETF - (CONTINUED) | April 30, 2017 (Unaudited) |

| | Shares | | Value

(Note 1) |

| COMMON STOCK – (CONTINUED) |

| | INFORMATION TECHNOLOGY – (3.23%) |

| | | Software & Services – (3.23%) |

| | | Alphabet Inc., Class C * | | | 1,632 | | $ | 1,478,527 |

| | | | | | Total Information Technology | | | 1,478,527 |

| | TOTAL COMMON STOCK – (Identified cost $44,982,526) | | | 45,332,070 |

| | Total Investments – (98.99%) – (Identified cost $44,982,526) – (a) | | | 45,332,070 |

| | Other Assets Less Liabilities – (1.01%) | | | 462,061 |

| | Net Assets – (100.00%) | | $ | 45,794,131 |

| |

| | * | Non-income producing security. |

| |

| | (a) | Aggregate cost for federal income tax purposes is $44,982,526. At April 30, 2017, unrealized appreciation (depreciation) of securities for federal income tax purposes is as follows: |

| |

| | Unrealized appreciation | | $ | 1,066,720 |

| | Unrealized depreciation | | | (717,176) |

| | Net unrealized appreciation | | $ | 349,544 |

| |

| See Notes to Financial Statements |

| DAVIS FUNDAMENTAL ETF TRUST | |

| DAVIS SELECT WORLDWIDE ETF | April 30, 2017 (Unaudited) |

| | Shares/Units | | Value

(Note 1) |

| COMMON STOCK – (99.05%) |

| | CONSUMER DISCRETIONARY – (31.50%) |

| | | Automobiles & Components – (5.95%) |

| | | Adient PLC | | | 23,765 | | $ | 1,748,154 |

| | Delphi Automotive PLC | | | 5,310 | | | 426,924 |

| | | | 2,175,078 |

| | Consumer Services – (4.90%) |

| | New Oriental Education & Technology Group, Inc., ADR (China)* | | | 15,053 | | | 971,521 |

| | TAL Education Group, Class A, ADR (China) | | | 6,867 | | | 817,928 |

| | | | 1,789,449 |

| | Media – (6.88%) |

| | Grupo Televisa S.A.B., ADR (Mexico) | | | 28,928 | | | 702,950 |

| | Naspers Ltd. - N (South Africa) | | | 9,530 | | | 1,810,299 |

| | | | 2,513,249 |

| | Retailing – (13.77%) |

| | Amazon.com, Inc. * | | | 2,076 | | | 1,920,279 |

| | CarMax, Inc. * | | | 12,966 | | | 758,511 |

| | JD.com Inc., Class A, ADR (China)* | | | 39,208 | | | 1,375,025 |

| | Vipshop Holdings Ltd., Class A, ADR (China)* | | | 70,620 | | | 979,499 |

| | | | 5,033,314 |

| | | | Total Consumer Discretionary | | | 11,511,090 |

| | ENERGY – (11.52%) |

| | Apache Corp. | | | 32,034 | | | 1,558,134 |

| | Cabot Oil & Gas Corp. | | | 26,104 | | | 606,657 |

| | Encana Corp. (Canada) | | | 142,025 | | | 1,519,667 |

| | Paramount Resources Ltd., Class A (Canada)* | | | 41,114 | | | 524,674 |

| | Total Energy | | | 4,209,132 |

| | FINANCIALS – (17.05%) |

| | Banks – (8.13%) |

| | JPMorgan Chase & Co. | | | 15,486 | | | 1,347,282 |

| | Wells Fargo & Co. | | | 30,189 | | | 1,625,376 |

| | | | 2,972,658 |

| | Diversified Financials – (5.78%) |

| | | Capital Markets – (1.58%) |

| | Noah Holdings Ltd., ADS (China)* | | | 22,821 | | | 575,546 |

| | Diversified Financial Services – (4.20%) |

| | Berkshire Hathaway Inc., Class B * | | | 9,301 | | | 1,536,618 |

| | | | 2,112,164 |

| | Insurance – (3.14%) |

| | Multi-line Insurance – (3.14%) |

| | Sul America S.A. (Brazil) | | | 216,837 | | | 1,147,020 |

| | Total Financials | | | 6,231,842 |

| | HEALTH CARE – (3.49%) |

| | Health Care Equipment & Services – (3.49%) |

| | Aetna Inc. | | | 6,670 | | | 900,917 |

| | Diplomat Pharmacy, Inc. * | | | 23,985 | | | 374,166 |

| | Total Health Care | | | 1,275,083 |

| | INDUSTRIALS – (10.81%) |

| | Capital Goods – (6.02%) |

| | Safran S.A. (France) | | | 12,932 | | | 1,070,881 |

| DAVIS FUNDAMENTAL ETF TRUST | Schedule of Investments |

| DAVIS SELECT WORLDWIDE ETF - (CONTINUED) | April 30, 2017 (Unaudited) |

| | Shares | | Value

(Note 1) |

| COMMON STOCK – (CONTINUED) |

| | INDUSTRIALS – (CONTINUED) |

| | | Capital Goods – (Continued) |

| | | | United Technologies Corp. | | | 9,496 | | $ | 1,129,929 |

| | | | 2,200,810 |

| | Transportation – (4.79%) |

| | CAR Inc. (China)* | | | 408,000 | | | 385,007 |

| | FedEx Corp. | | | 2,753 | | | 522,244 |

| | ZTO Express (Cayman) Inc., Class A, ADR (China)* | | | 60,556 | | | 843,545 |

| | | | 1,750,796 |

| | | | | | Total Industrials | | | 3,951,606 |

| | INFORMATION TECHNOLOGY – (17.29%) |

| | Software & Services – (15.35%) |

| | Alibaba Group Holding Ltd., ADR (China)* | | | 10,924 | | | 1,261,722 |

| | Alphabet Inc., Class C * | | | 2,756 | | | 2,496,826 |

| | Angie's List Inc. * | | | 32,740 | | | 192,511 |

| | Baidu, Inc., Class A, ADR (China)* | | | 1,906 | | | 343,518 |

| | Facebook Inc., Class A * | | | 4,390 | | | 659,598 |

| | Fang Holdings Ltd., Class A, ADR (China)* | | | 195,806 | | | 655,950 |

| | | | 5,610,125 |

| | Technology Hardware & Equipment – (1.94%) |

| | Hollysys Automation Technologies Ltd. (China) | | | 44,179 | | | 708,631 |

| | Total Information Technology | | | 6,318,756 |

| | MATERIALS – (7.39%) |

| | Akzo Nobel N.V. (Netherlands) | | | 3,575 | | | 312,630 |

| | Axalta Coating Systems Ltd. * | | | 33,694 | | | 1,056,981 |

| | LafargeHolcim Ltd. (Switzerland) | | | 14,322 | | | 813,121 |

| | Monsanto Co. | | | 4,424 | | | 515,883 |

| | Total Materials | | | 2,698,615 |

| | TOTAL COMMON STOCK – (Identified cost $34,490,758) | | | 36,196,124 |

| | Total Investments – (99.05%) – (Identified cost $34,490,758) – (a) | | | 36,196,124 |

| | Other Assets Less Liabilities – (0.95%) | | | 347,262 |

| | Net Assets – (100.00%) | | $ | 36,543,386 |

| |

| | ADR: American Depositary Receipt |

| |

| | ADS: American Depositary Share |

| |

| | * | Non-income producing security. |

| |

| | (a) | Aggregate cost for federal income tax purposes is $34,490,758. At April 30, 2017, unrealized appreciation (depreciation) of securities for federal income tax purposes is as follows: |

| |

| | Unrealized appreciation | | $ | 2,318,587 |

| | Unrealized depreciation | | | (613,221) |

| | Net unrealized appreciation | | $ | 1,705,366 |

| |

| See Notes to Financial Statements |

| DAVIS FUNDAMENTAL ETF TRUST | Statements of Assets and Liabilities |

| | At April 30, 2017 (Unaudited) |

| | | | Davis Select U.S. Equity ETF | | | Davis Select Financial ETF | | | Davis Select Worldwide ETF |

| ASSETS: | | | | | | | | | | | |

| Investments in securities at value* (see accompanying Schedules of Investments) | | $ | 34,106,083 | | $ | 45,332,070 | | $ | 36,196,124 |

| Cash | | | 537,959 | | | 278,163 | | | 405,559 |

| Receivables: | | | | | | | | | |

| | Capital stock sold | | | – | | | 3,119,928 | | | 2,147,501 |

| | Dividends | | | 31,330 | | | 38,683 | | | 17,433 |

| | Investment securities sold | | | 1,419,202 | | | – | | | – |

| Prepaid expenses | | | 3,063 | | | 2,775 | | | 2,828 |

| Due from Adviser | | | 11,600 | | | 9,300 | | | 16,300 |

| | | Total assets | | | 36,109,237 | | | 48,780,919 | | | 38,785,745 |

LIABILITIES: | | | | | | | | | |

| Payables: | | | | | | | | | |

| | Investment securities purchased | | | 1,199,007 | | | 2,947,170 | | | 2,201,905 |

| Accrued investment advisory fee | | | 14,812 | | | 18,126 | | | 14,255 |

| Other accrued expenses | | | 18,764 | | | 21,492 | | | 26,199 |

| | Total liabilities | | | 1,232,583 | | | 2,986,788 | | | 2,242,359 |

NET ASSETS | | $ | 34,876,654 | | $ | 45,794,131 | | $ | 36,543,386 |

SHARES OUTSTANDING | | | 1,701,700 | | | 2,201,700 | | | 1,701,700 |

NET ASSET VALUE, per share (Net assets ÷ Shares outstanding) | | $ | 20.50 | | $ | 20.80 | | $ | 21.47 |

NET ASSETS CONSIST OF: | | | | | | | | | |

| Paid-in capital | | | 34,304,406 | | | 45,367,431 | | | 34,896,072 |

| Undistributed net investment income | | | 43,699 | | | 77,835 | | | 8,300 |

Accumulated net realized losses from investments and foreign currency transactions | | | (65,301) | | | (679) | | | (66,361) |

Net unrealized appreciation on investments and foreign currency transactions | | | 593,850 | | | 349,544 | | | 1,705,375 |

| | Net Assets | | $ | 34,876,654 | | $ | 45,794,131 | | $ | 36,543,386 |

| | | | | | | | | | | |

| *Including: | | | | | | | | | |

| | Cost of investments | | $ | 33,512,233 | | $ | 44,982,526 | | $ | 34,490,758 |

| See Notes to Financial Statements |

| DAVIS FUNDAMENTAL ETF TRUST | |

| | For the period January 11, 2017* to April 30, 2017 (Unaudited) |

| | | | Davis Select U.S. Equity ETF | | | Davis Select Financial ETF | | | Davis Select Worldwide ETF |

| INVESTMENT INCOME: | | | | | | | | | | |

| Income: | | | | | | | | | | |

| Dividends** | | $ | 83,865 | | $ | 124,989 | | $ | 49,534 |

| | Total income | | | 83,865 | | | 124,989 | | | 49,534 |

Expenses: | | | | | | | | | | |

| Investment advisory fees (Note 3) | | | 36,817 | | | 39,890 | | | 34,891 |

| Accounting, Custodian, and Transfer Agent fees | | | 10,557 | | | 11,333 | | | 17,300 |

| Audit fees | | | 5,288 | | | 5,288 | | | 5,288 |

| Legal fees | | | 5,000 | | | 5,000 | | | 5,000 |

| Reports to shareholders | | | 500 | | | 500 | | | 500 |

| Trustees' fees and expenses | | | 6,598 | | | 6,909 | | | 6,342 |

| Registration and filing fees | | | 2,750 | | | 3,250 | | | 2,750 |

| Miscellaneous | | | 6,261 | | | 6,047 | | | 6,100 |

| Total expenses | | | 73,771 | | | 78,217 | | | 78,171 |

Reimbursement/waiver of expenses by Adviser (Note 3) | | | (33,605) | | | (31,063) | | | (36,937) |

| | Net expenses | | | 40,166 | | | 47,154 | | | 41,234 |

| Net investment income | | | 43,699 | | | 77,835 | | | 8,300 |

REALIZED & UNREALIZED GAIN (LOSS) ON INVESTMENTS AND FOREIGN CURRENCY TRANSACTIONS: | | | | | | | | | | |

| Net realized gain (loss) from: | | | | | | | | | | |

| | Investment transactions | | | (65,283) | | | (825) | | | (64,061) |

| | Foreign currency transactions | | | (18) | | | 146 | | | (2,300) |

| Net realized loss | | | (65,301) | | | (679) | | | (66,361) |

| Net increase in unrealized appreciation | | | 593,850 | | | 349,544 | | | 1,705,375 |

| | Net realized and unrealized gain on investments and foreign currency transactions | | | 528,549 | | | 348,865 | | | 1,639,014 |

Net increase in net assets resulting from operations | | $ | 572,248 | | $ | 426,700 | | $ | 1,647,314 |

| *Inception date is consistent with the commencement of investment operations and is the date the initial creation units were established. |

| **Net of foreign taxes withheld as follows | | $ | 186 | | $ | 277 | | $ | 928 |

| See Notes to Financial Statements |

| DAVIS FUNDAMENTAL ETF TRUST | Statements of Changes in Net Assets |

| | For the period January 11, 2017* to April 30, 2017 (Unaudited) |

| | | | Davis Select U.S. Equity ETF | | | Davis Select Financial ETF | | | Davis Select Worldwide ETF |

OPERATIONS: | | | | | | | | | |

| Net investment income | | $ | 43,699 | | $ | 77,835 | | $ | 8,300 |

Net realized loss from investments and foreign currency transactions | | | (65,301) | | | (679) | | | (66,361) |

Net increase in unrealized appreciation on investments and foreign currency transactions | | | 593,850 | | | 349,544 | | | 1,705,375 |

| | Net increase in net assets resulting from operations | | | 572,248 | | | 426,700 | | | 1,647,314 |

CAPITAL SHARE TRANSACTIONS: | | | | | | | | | |

| Proceeds from shares sold | | | 34,304,406 | | | 45,367,431 | | | 34,896,072 |

| Cost of shares redeemed | | | – | | | – | | | – |

Net increase in net assets resulting from capital share transactions | | | 34,304,406 | | | 45,367,431 | | | 34,896,072 |

| | Total increase in net assets | | | 34,876,654 | | | 45,794,131 | | | 36,543,386 |

NET ASSETS: | | | | | | | | | |

| Beginning of period | | | – | | | – | | | – |

End of period** | | $ | 34,876,654 | | $ | 45,794,131 | | $ | 36,543,386 |

CHANGES IN SHARES OUTSTANDING: | | | | | | | | | |

| Shares outstanding, beginning of period | | | – | | | – | | | – |

| Shares sold*** | | | 1,701,700 | | | 2,201,700 | | | 1,701,700 |

| | Shares outstanding, end of period | | | 1,701,700 | | | 2,201,700 | | | 1,701,700 |

| *Inception date is consistent with the commencement of investment operations and is the date the initial creation units were established. |

| **Including undistributed net investment income of | | $ | 43,699 | | $ | 77,835 | | $ | 8,300 |

| ***Including issuance of 1,700 shares of each Fund representing the Trust seed investment. |

| See Notes to Financial Statements |

| DAVIS FUNDAMENTAL ETF TRUST | Notes to Financial Statements |

| | April 30, 2017 (Unaudited) |

NOTE 1 - SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

Davis Fundamental ETF Trust (the "Trust") was organized on March 18, 2016 as a Delaware business trust and is registered under the Investment Company Act of 1940 ("1940 Act") as amended, as an open-end management investment company. The Trust follows the reporting guidance of the Financial Accounting Standards Board ("FASB") Accounting Standards Codification Topic 946, Financial Services – Investment Companies. The Trust consists of three series of funds, Davis Select U.S. Equity ETF, Davis Select Financial ETF, and Davis Select Worldwide ETF (individually referred to as a "Fund" or collectively as the "Funds"). Each series of the Trust represents shares of beneficial interest in a separate portfolio of securities and other assets, with its own objective and policies. Davis Select U.S. Equity ETF and Davis Select Financial ETF are non-diversified and Davis Select Worldwide ETF is diversified, each an investment management company under the 1940 Act. Each Fund is an actively managed exchange-traded fund ("ETF"). Davis Selected Advisers, L.P. ("Davis Advisors" or the "Adviser"), the Funds' investment adviser, uses the Davis Investment Discipline to invest each Fund's portfolio.

Davis Select U.S. Equity ETF seeks to achieve long-term capital growth and capital preservation. It invests primarily in common stocks of large companies (generally, companies with market capitalizations of $10 billion or more at the time of initial purchase).

Davis Select Financial ETF seeks to achieve long-term growth of capital. It invests at least 80% of the Fund's net assets in securities issued by companies principally engaged in the financial services sector.

Davis Select Worldwide ETF seeks to achieve long-term growth of capital. It invests principally in common stocks issued by both United States and foreign companies, including countries with developed or emerging markets.

Because of the risk inherent in any investment program, the Funds cannot ensure that the investment objective of any of its series will be achieved. The Funds account separately for the assets, liabilities, and operations of each Fund. The assets of each Fund are segregated, and a shareholder's interest is limited to the Fund in which shares are held. The following is a summary of significant accounting policies followed by the Funds in the preparation of their financial statements.

Security Valuation - The Funds calculate the net asset value of their shares as of the close of the New York Stock Exchange ("Exchange"), normally 4:00 P.M. Eastern time, on each day the Exchange is open for business. Securities listed on the Exchange (and other national exchanges including NASDAQ) are valued at the last reported sales price on the day of valuation. Listed securities for which no sale was reported on that date are valued at the closing bid price. Securities traded on foreign exchanges are valued based upon the last sales price on the principal exchange on which the security is traded prior to the time when the Funds' assets are valued. Securities (including restricted securities) for which market quotations are not readily available or securities whose values have been materially affected by what the Adviser identifies as a significant event occurring before the Funds' assets are valued, but after the close of their respective exchanges will be fair valued using a fair valuation methodology applicable to the security type or the significant event as previously approved by the Funds' Pricing Committee and Board of Trustees. The Pricing Committee considers all facts it deems relevant that are reasonably available, through either public information or information available to the Adviser's portfolio management team, when determining the fair value of a security. To assess the appropriateness of security valuations, the Adviser may consider (i) comparing prior day prices and/or prices of comparable securities; (ii) comparing sale prices to the prior or current day prices and challenge those prices exceeding certain tolerance levels with the third-party pricing service or broker source; (iii) new rounds of financing; (iv) the performance of the market or the issuer's industry; (v) the liquidity of the security; (vi) the size of the holding in a fund; and/or (vii) any other appropriate information. The determination of a security's fair value price often involves the consideration of a number of subjective factors and is therefore subject to the unavoidable risk that the value assigned to a security may be higher or lower than the security's value would be if a reliable market quotation of the security was readily available. Fair value determinations are subject to review, approval, and ratification by the Funds' Board of Trustees at its next regularly scheduled meeting covering the period in which the fair valuation was determined.

Short-term securities purchased within 60 days to maturity are valued at amortized cost, which approximates market value.

The Funds' valuation procedures are reviewed and subject to approval by the Board of Trustees. There have been no significant changes to the fair valuation procedures during the period.

| DAVIS FUNDAMENTAL ETF TRUST | Notes to Financial Statements – (Continued) |

| | April 30, 2017 (Unaudited) |

NOTE 1 - SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES – (CONTINUED)

Fair Value Measurements - Fair value is defined as the price that the Funds would receive upon selling an investment in an orderly transaction to an independent buyer in the principal market for the investment. Various inputs are used to determine the fair value of the Funds' investments. These inputs are summarized in the three broad levels listed below.

| Level 1 – | quoted prices in active markets for identical securities |

| Level 2 – | other significant observable inputs (including quoted prices for similar investments, interest rates, prepayment speeds, credit risk, etc.) |

| Level 3 – | significant unobservable inputs (including the Fund's own assumptions in determining the fair value of investments) |

The inputs or methodologies used for valuing securities are not necessarily an indication of the risks associated with investing in those securities nor can it be assured that the Funds can obtain the fair value assigned to a security if they were to sell the security.

The following is a summary of the inputs used as of April 30, 2017 in valuing each Fund's investments carried at value:

| | Investments in Securities at Value |

| | | | | | |

| | Davis Select | | Davis Select | | Davis Select |

| | U.S. Equity ETF | | Financial ETF | | Worldwide ETF |

Valuation inputs | | | | | | | | |

| Level 1 – Quoted Prices: | | | | | | | | |

Equity securities: | | | | | | | | |

| Consumer Discretionary | $ | 4,822,175 | | $ | – | | $ | 11,511,090 |

| Energy | | 3,930,769 | | | – | | | 4,209,132 |

| Financials | | 12,808,426 | | | 43,853,543 | | | 6,231,842 |

| Health Care | | 1,529,500 | | | – | | | 1,275,083 |

| Industrials | | 5,476,015 | | | – | | | 3,951,606 |

| Information Technology | | 2,775,861 | | | 1,478,527 | | | 6,318,756 |

| Materials | | 2,763,337 | | | – | | | 2,698,615 |

| Total Level 1 | | 34,106,083 | | | 45,332,070 | | | 36,196,124 |

| | | | | | | | | |

| Level 2 – Other Significant Observable Inputs: | | | | | | | | |

| Total Level 2 | | – | | | – | | | – |

| | | | | | | | | |

| Level 3 – Significant Unobservable Inputs: | | | | | | | | |

| Total Level 3 | | – | | | – | | | – |

| Total Investments | $ | 34,106,083 | | $ | 45,332,070 | | $ | 36,196,124 |

There were no transfers of investments between levels of the fair value hierarchy during the period ended April 30, 2017.

Currency Translation - The market values of all assets and liabilities denominated in foreign currencies are recorded in the financial statements after translation to the U.S. Dollar based upon the mean between the bid and offered quotations of the currencies against U.S. Dollars on the date of valuation. The cost basis of such assets and liabilities is determined based upon historical exchange rates. Income and expenses are translated at average exchange rates in effect as accrued or incurred.

| DAVIS FUNDAMENTAL ETF TRUST | Notes to Financial Statements – (Continued) |

| | April 30, 2017 (Unaudited) |

NOTE 1 - SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES – (CONTINUED)

Foreign Currency - The Funds may enter into forward purchases or sales of foreign currencies to hedge certain foreign currency denominated assets and liabilities against declines in market value relative to the U.S. Dollar. Forward currency contracts are marked-to-market daily and the change in market value is recorded by the Funds as an unrealized gain or loss. When the forward currency contract is closed, the Funds record a realized gain or loss equal to the difference between the value of the forward currency contract at the time it was opened and value at the time it was closed. Investments in forward currency contracts may expose the Funds to risks resulting from unanticipated movements in foreign currency exchange rates or failure of the counter-party to the agreement to perform in accordance with the terms of the contract.

Reported net realized foreign exchange gains or losses arise from the sales of foreign currencies, currency gains or losses realized between the trade and settlement dates on security transactions, the difference between the amounts of dividends, interest, and foreign withholding taxes recorded on the Funds' books, and the U.S. Dollar equivalent of the amounts actually received or paid. Net unrealized foreign exchange gains or losses arise from changes in the value of assets and liabilities other than investments in securities at fiscal year end, resulting from changes in the exchange rate. The Funds include foreign currency gains and losses realized on the sales of investments together with market gains and losses on such investments in the Statements of Operations.

Federal Income Taxes - It is each Fund's policy to comply with the requirements of the Internal Revenue Code applicable to regulated investment companies, and to distribute substantially all of its taxable income, including any net realized gains on investments not offset by loss carryovers, to shareholders. Therefore, no provision for federal income or excise tax is required.

Securities Transactions and Related Investment Income - Securities transactions are accounted for on the trade date (date the order to buy or sell is executed) with realized gain or loss on the sale of securities being determined based upon identified cost. Dividend income is recorded on the ex-dividend date.

Dividends and Distributions to Shareholders - Dividends and distributions to shareholders are recorded on the ex-dividend date. Net investment income (loss), net realized gains (losses), and net unrealized appreciation (depreciation) on investments may differ for financial statement and tax purposes primarily due to differing treatments of wash sales, foreign currency transactions, in-kind transactions, and partnership income. The character of dividends and distributions made during the fiscal year from net investment income and net realized securities gains may differ from their ultimate characterization for federal income tax purposes. Also, due to the timing of dividends and distributions, the fiscal year in which amounts are distributed may differ from the fiscal year in which income or realized gain was recorded by the Funds. The Funds adjust certain components of capital to reflect permanent differences between financial statement amounts and net income and realized gains/losses determined in accordance with income tax rules.

Indemnification - Under the Funds' organizational documents, their officers and trustees are indemnified against certain liabilities arising out of the performance of their duties to the Funds. In addition, some of the Funds' contracts with their service providers contain general indemnification clauses. The Funds' maximum exposure under these arrangements is unknown since the amount of any future claims that may be made against the Funds cannot be determined and the Funds have no historical basis for predicting the likelihood of any such claims.

Use of Estimates in Financial Statements - In preparing financial statements in conformity with accounting principles generally accepted in the United States of America, management makes estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements, as well as the reported amounts of income and expenses during the reporting period. Actual results may differ from these estimates.

| DAVIS FUNDAMENTAL ETF TRUST | Notes to Financial Statements – (Continued) |

| | April 30, 2017 (Unaudited) |

NOTE 2 - PURCHASES AND SALES OF SECURITIES

The cost of purchases and proceeds from sales of investment securities (excluding in-kind purchases and redemptions and short-term securities) during the period ended April 30, 2017 were as follows:

| | Davis Select | | Davis Select | | Davis Select |

| | U.S. Equity ETF | | Financial ETF | | Worldwide ETF |

| Cost of purchases | $ | 1,656,913 | | $ | 769,700 | | $ | 3,937,297 |

| Proceeds from sales | | 1,622,949 | | | 81,015 | | | 2,073,965 |

The cost of in-kind purchases and proceeds from in-kind redemptions during the period ended April 30, 2017 were as follows:

| | Davis Select | | Davis Select | | Davis Select |

| | U.S. Equity ETF | | Financial ETF | | Worldwide ETF |

| Cost of in-kind purchases | $ | 33,543,553 | | $ | 44,294,665 | | $ | 32,691,487 |

| Proceeds from in-kind redemptions | | – | | | – | | | – |

Gains and losses on in-kind redemptions are not recognized at the Fund level for tax purposes.

NOTE 3 - INVESTMENT ADVISORY AND OTHER AGREEMENTS WITH SERVICE PROVIDERS (INCLUDING AFFILIATES)

Davis Selected Advisers-NY, Inc. ("DSA-NY"), a wholly-owned subsidiary of the Adviser, acts as sub-adviser to the Funds. DSA-NY performs research and portfolio management services for the Funds under a Sub-Advisory Agreement with the Adviser. The Funds pay no fees directly to DSA-NY.

All officers of the Funds (including the Interested Trustee/Chairman) hold positions as executive officers with the Adviser or its affiliates.

As of April 30, 2017, a related shareholder's investment in Davis Select U.S. Equity ETF, Davis Select Financial ETF, and Davis Select Worldwide ETF represents 64%, 54%, and 61% of outstanding shares, respectively. Investment activities of this shareholder could have a material impact on the Funds.

Investment Advisory Fees and Reimbursement of Expenses - Advisory fees are paid monthly to the Adviser. The annual rate for each Fund is 0.55% of the average net assets. The Adviser has contractually agreed to waive fees and/or reimburse the Funds' expenses to the extent necessary to cap total annual fund operating expenses (Davis Select U.S. Equity ETF, 0.60%; Davis Select Financial ETF, 0.65%; Davis Select Worldwide ETF, 0.65%), until one year from the date of the prospectus. After that date, there is no assurance that the Adviser will continue to cap expenses. The expense cap cannot be terminated prior to that date without the consent of the Board of Trustees. During the period ended April 30, 2017, such reimbursements for Davis Select U.S. Equity ETF, Davis Select Financial ETF, and Davis Select Worldwide ETF amounted to $33,605, $31,063, and $36,937, respectively, and are not subject to future recoupment.

Accounting, Custodian, and Transfer Agent Fees - State Street Bank and Trust Company serves as the Funds' primary accounting provider, custodian, and transfer agent.

Distributor - Foreside Fund Services, LLC ("Foreside") serves as the Funds' distributor. The Funds pay no fees directly to Foreside.

| DAVIS FUNDAMENTAL ETF TRUST | Notes to Financial Statements – (Continued) |

| | April 30, 2017 (Unaudited) |

NOTE 4 - CAPITAL STOCK

As of April 30, 2017, there were an unlimited number of shares of beneficial interest without par value authorized by the Trust. Individual shares of a Fund are listed on a national securities exchange through a broker-dealer. Such transactions may be subject to customary commission rates imposed by the broker-dealer. The price of Fund shares is based on the market price, and because ETF shares trade at a market price rather than at NAV, shares may trade at a price greater than NAV (a premium) or less than NAV (a discount).

The Funds will only issue or redeem shares that have been aggregated into blocks of 50,000 shares or multiples thereof ("Creation Units") to broker-dealers that have entered into a participation agreement with Foreside ("Authorized Participants"). The Funds generally will issue or redeem Creations Units in return for a designated portfolio of securities (and an amount of cash) the Fund specifies each day ("Creation Basket"). Authorized Participants purchasing and redeeming Creation Units may be charged a transaction fee to offset transfer and other transaction costs associated with the issuance and redemption of Creation Units.

NOTE 5 - NEW PRONOUNCEMENTS

In October 2016, the SEC voted to approve rules to modernize and enhance reporting of information provided by registered investment companies ("Reporting Modernization Rules"). The new rules also make certain amendments to Regulation S-X to require standardized, more detailed disclosure in registered investment company financial statements. The compliance date for the amendments to Regulation S-X is August 1, 2017. The Adviser is currently evaluating the amendments and their impacts, if any, on the Funds' financial statements.

| DAVIS FUNDAMENTAL ETF TRUST | |

| DAVIS SELECT U.S. EQUITY ETF | |

| The following financial information represents selected data for each share of capital stock outstanding throughout the period: |

| | Period from January 11, 2017a to April 30, 2017 |

| | (Unaudited) |

| Net Asset Value, Beginning of Period | | $ | 20.13 |

Income from Investment Operations: | | | | | | |

Net Investment Incomeb | | 0.04 |

| Net Realized and Unrealized Gains | | 0.33 |

| | Total from Investment Operations | | 0.37 |

Net Asset Value, End of Period | | $ | 20.50 |

Total Return Net Asset Valuec | | 1.82 | % |

Total Return Market Pricec | | 2.02 | % |

Ratios/Supplemental Data: | | | | | | |

| Net Assets, End of Period (in thousands) | | $ | 34,877 |

| Ratio of Expenses to Average Net Assets: | | | | |

| | Gross | | 1.10 | %d |

| | Nete | | 0.60 | %d |

| Ratio of Net Investment Income to Average Net Assets | | 0.65 | %d |

Portfolio Turnover Ratef | | 7 | % |

| a | Inception date is consistent with the commencement of investment operations and is the date the initial creation units were established. |

| | |

| b | Per share calculations were based on average shares outstanding for the period. |

| | |