Adient Supplemental Investor Materials April 2019

Important information Adient has made statements in this document that are forward-looking and, therefore, are subject to risks and uncertainties. All statements in this document other than statements of historical fact are statements that are, or could be, deemed “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. In this document, statements regarding Adient’s future financial position, sales, costs, earnings, cash flows, other measures of results of operations, capital expenditures or debt levels and plans, objectives, outlook, targets, guidance or goals are forward-looking statements. Words such as “may,” “will,” “expect,” “intend,” “estimate,” “anticipate,” “believe,” “should,” “forecast,” “project” or “plan” or terms of similar meaning are also generally intended to identify forward-looking statements. Adient cautions that these statements are subject to numerous important risks, uncertainties, assumptions and other factors, some of which are beyond Adient’s control, that could cause Adient’s actual results to differ materially from those expressed or implied by such forward-looking statements, including, among others, risks related to: the impact of tax reform legislation through the Tax Cuts and Jobs Act, uncertainties in U.S. administrative policy regarding trade agreements, tariffs and other international trade relations, the ability of Adient to execute its SS&M turnaround plan, the ability of Adient to identify, recruit and retain key leadership, the ability of Adient to meet debt service requirements, the ability and terms of financing, general economic and business conditions, the strength of the U.S. or other economies, automotive vehicle production levels, mix and schedules, energy and commodity prices, the availability of raw materials and component products, currency exchange rates, the ability of Adient to effectively integrate the Futuris business, and cancellation of or changes to commercial arrangements. A detailed discussion of risks related to Adient’s business is included in the section entitled “Risk Factors” in Adient’s Annual Report on Form 10-K for the fiscal year ended September 30, 2018 filed with the SEC on November 29, 2018 and quarterly reports on Form 10-Q filed with the SEC, available at www.sec.gov. Potential investors and others should consider these factors in evaluating the forward-looking statements and should not place undue reliance on such statements. The forward-looking statements included in this document are made only as of the date of this document, unless otherwise specified, and, except as required by law, Adient assumes no obligation, and disclaims any obligation, to update such statements to reflect events or circumstances occurring after the date of this document. In addition, this document includes certain projections provided by Adient with respect to the anticipated future performance of Adient’s businesses. Such projections reflect various assumptions of Adient’s management concerning the future performance of Adient’s businesses, which may or may not prove to be correct. The actual results may vary from the anticipated results and such variations may be material. Adient does not undertake any obligation to update the projections to reflect events or circumstances or changes in expectations after the date of this document or to reflect the occurrence of subsequent events. No representations or warranties are made as to the accuracy or reasonableness of such assumptions or the projections based thereon. This document also contains non-GAAP financial information because Adient’s management believes it may assist investors in evaluating Adient’s on-going operations. Adient believes these non-GAAP disclosures provide important supplemental information to management and investors regarding financial and business trends relating to Adient’s financial condition and results of operations. Investors should not consider these non-GAAP measures as alternatives to the related GAAP measures. A reconciliation of non-GAAP measures to their closest GAAP equivalent are included in the appendix. Reconciliations of non-GAAP measures related to FY2019 guidance have not been provided due to the unreasonable efforts it would take to provide such reconciliations. Effective October 1, 2018, Adient adopted ASU No. 2014-09, “Revenue from Contracts with Customers” (Topic 606) and ASU No. 2017-07, “Improving the Presentation of Net Periodic Pension Cost and Net Periodic Benefit Cost” (“ASU No. 2017-7”). The financial information presented in this document is presented on the basis of these adjustments.

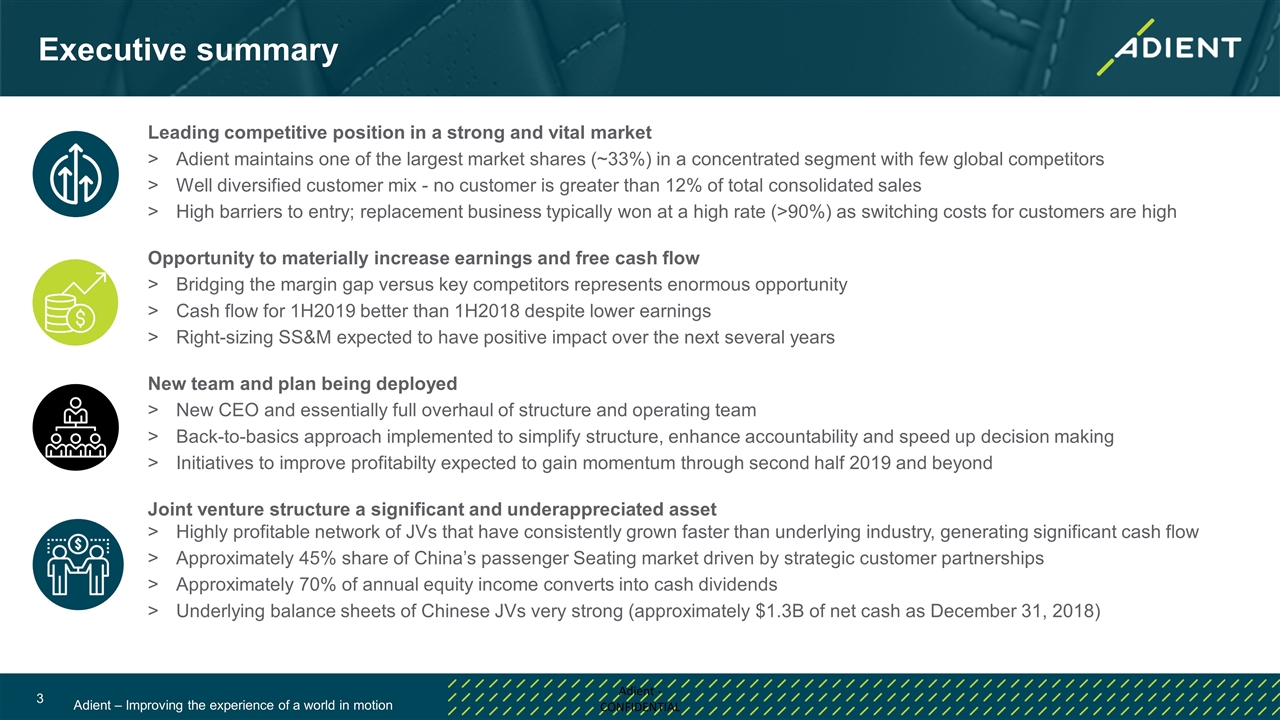

Executive summary Leading competitive position in a strong and vital market Adient maintains one of the largest market shares (~33%) in a concentrated segment with few global competitors Well diversified customer mix - no customer is greater than 12% of total consolidated sales High barriers to entry; replacement business typically won at a high rate (>90%) as switching costs for customers are high Opportunity to materially increase earnings and free cash flow Bridging the margin gap versus key competitors represents enormous opportunity Cash flow for 1H2019 better than 1H2018 despite lower earnings Right-sizing SS&M expected to have positive impact over the next several years New team and plan being deployed New CEO and essentially full overhaul of structure and operating team Back-to-basics approach implemented to simplify structure, enhance accountability and speed up decision making Initiatives to improve profitabilty expected to gain momentum through second half 2019 and beyond Joint venture structure a significant and underappreciated asset Highly profitable network of JVs that have consistently grown faster than underlying industry, generating significant cash flow Approximately 45% share of China’s passenger Seating market driven by strategic customer partnerships Approximately 70% of annual equity income converts into cash dividends Underlying balance sheets of Chinese JVs very strong (approximately $1.3B of net cash as December 31, 2018)

Adient Business Overview and Update

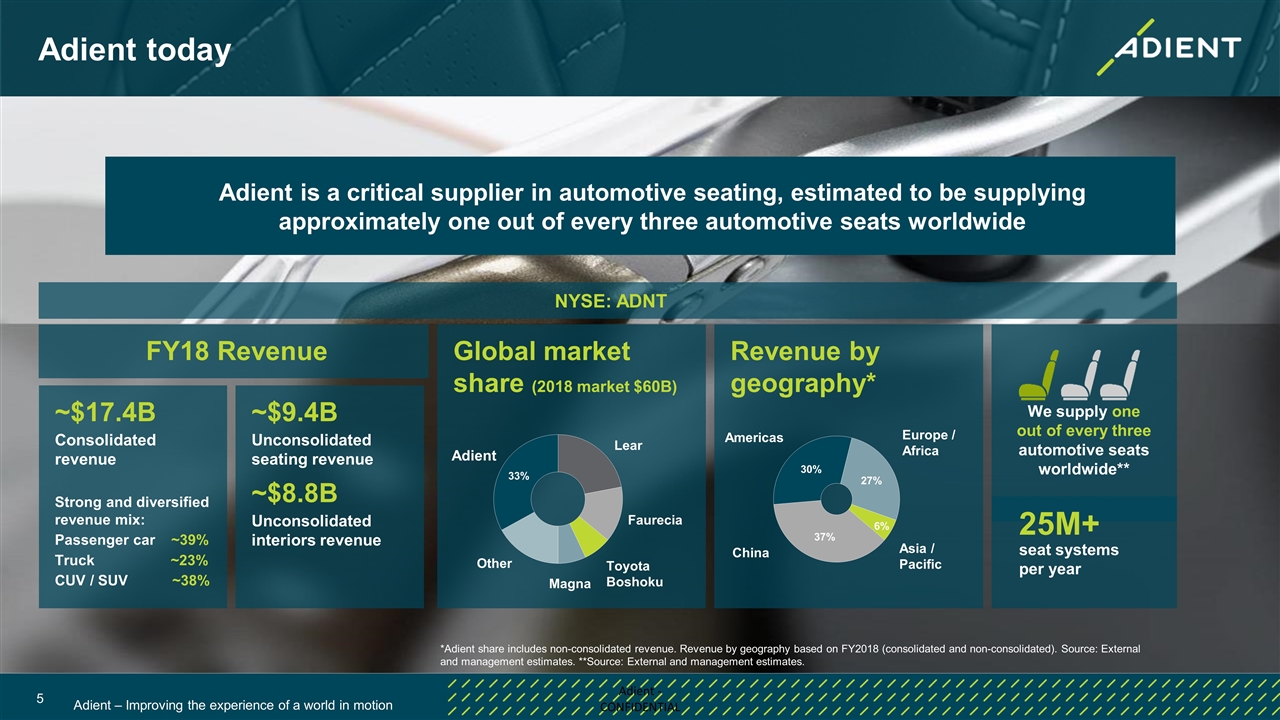

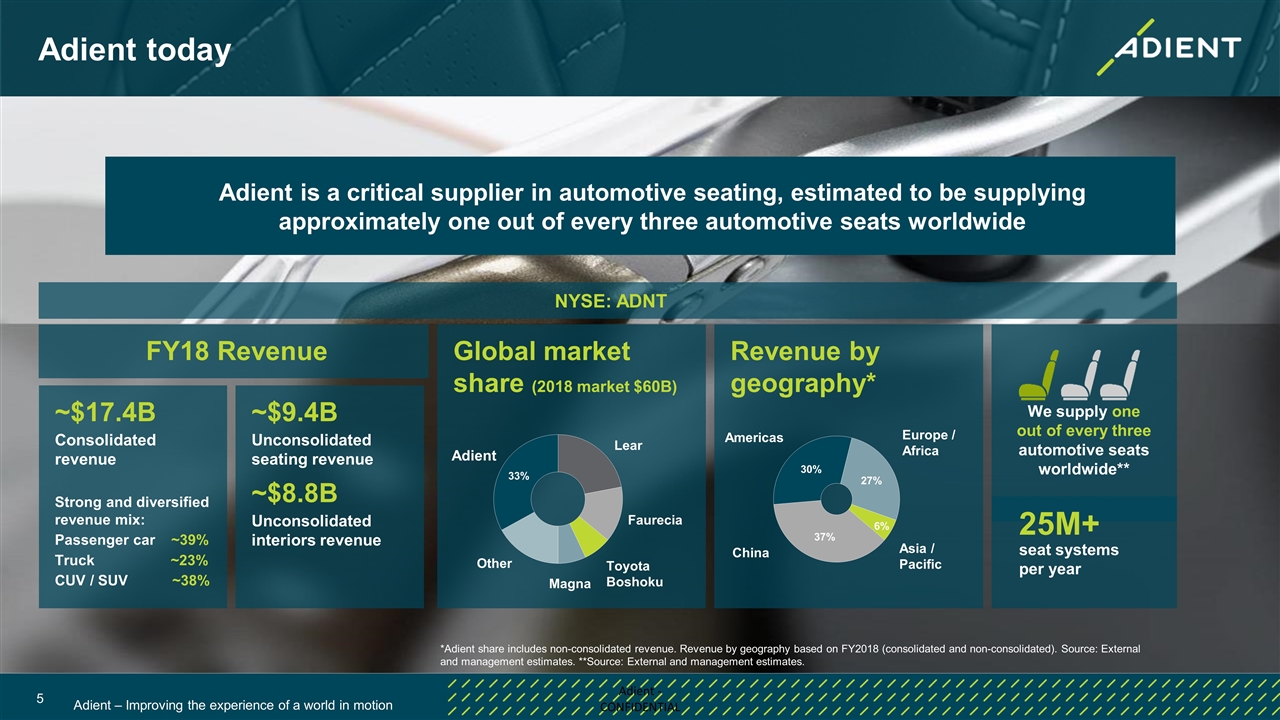

Adient today FY18 Revenue Revenue by geography* Europe / Africa China Americas Asia / Pacific NYSE: ADNT We supply one out of every three automotive seats worldwide** Global market share (2018 market $60B) Adient Other Lear Faurecia Toyota Boshoku Magna *Adient share includes non-consolidated revenue. Revenue by geography based on FY2018 (consolidated and non-consolidated). Source: External and management estimates. **Source: External and management estimates. 25M+ seat systems per year Adient is a critical supplier in automotive seating, estimated to be supplying approximately one out of every three automotive seats worldwide ~$17.4B Consolidated revenue Strong and diversified revenue mix: Passenger car ~39% Truck ~23% CUV / SUV ~38% ~$9.4B Unconsolidated seating revenue ~$8.8B Unconsolidated interiors revenue

We are located right where our customers need us most manufacturing facilities Global locations 214 32 countries Global employees 84,000 North America 56 South America 12 Asia* 50 Africa 5 Europe 91 * Does not include China joint ventures

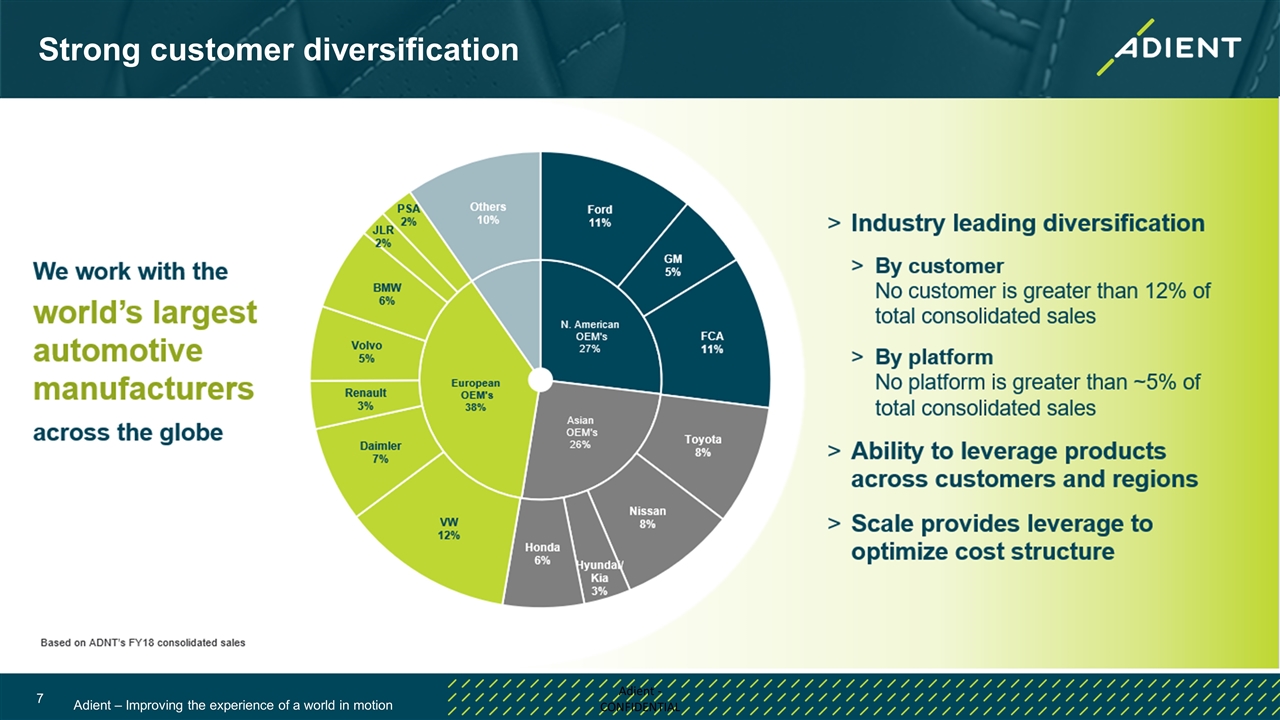

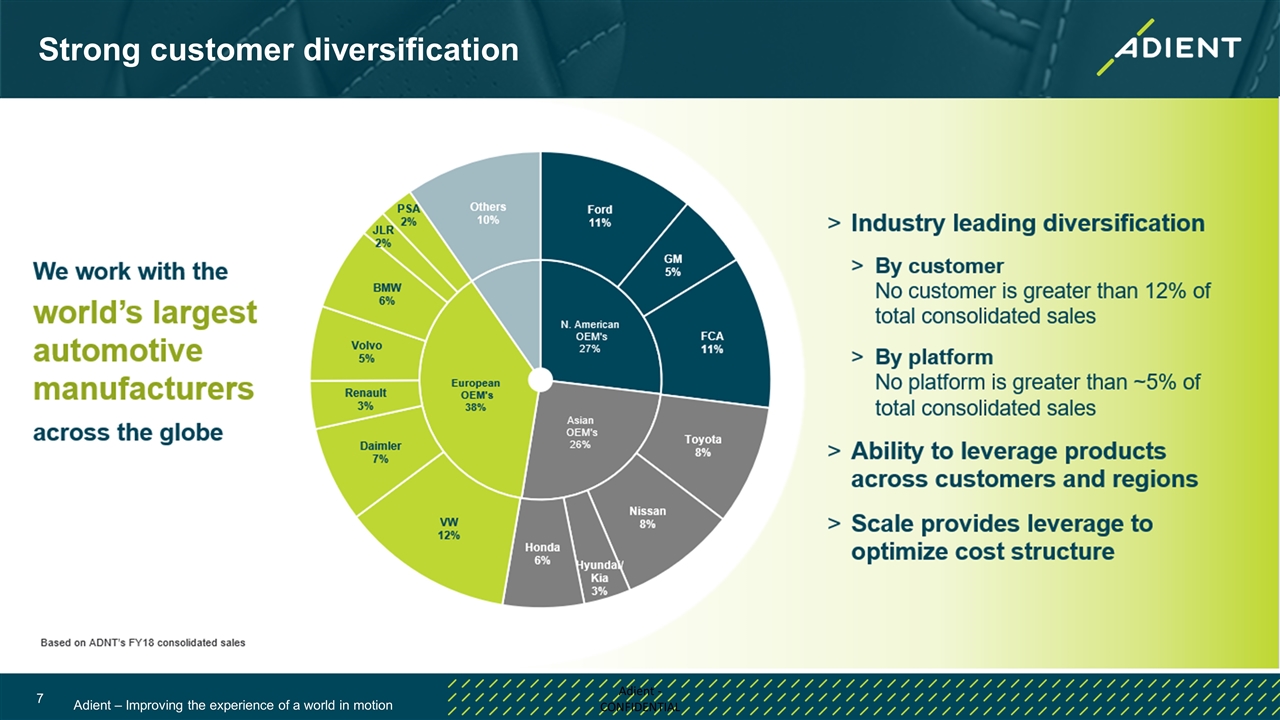

Strong customer diversification

Third-party recognition Customer Awards Nissan Best Competitiveness Award – Sunderland, UK PSA Opel Group Gold Status – Zaragoza, Spain PSA Opel Group Platinum Status – Bierun, Poland Hyundai Performance Excellence Award – Ediasa 1, Mexico Hyundai Outstanding Supplier Award – China SAIC GM Best Supplier Awards – YFAS (1 group award and 3 plant awards) Toyota Quality Performance Award - Brazil China: 30 customer awards from 10 automakers Quality / Diversity Awards Health and Safety awards from MESS union – Gebze, Turkey Excellent Partner China Certification – Burscheid, Germany WBENC’s Top Corporation for Women Businesses Toyota Supplier Diversity Award IndustryWeek Best Manufacturing Facility – West Point, GA GM Mercosur Turbo Project Award – S. America Evidence of Adient’s strong and enviable market position J.D. Power seat quality awards: Americas: 4 awards across 4 segments EMEA: 1 award China: 21 awards across 14 segments

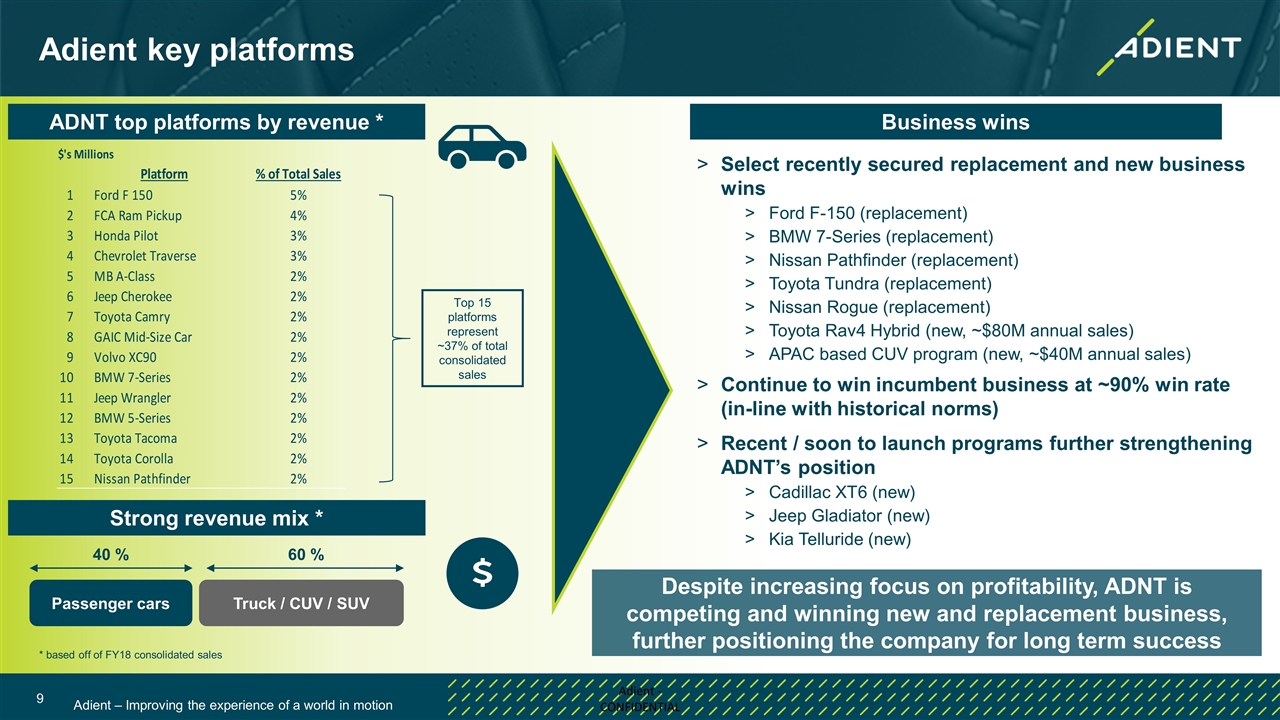

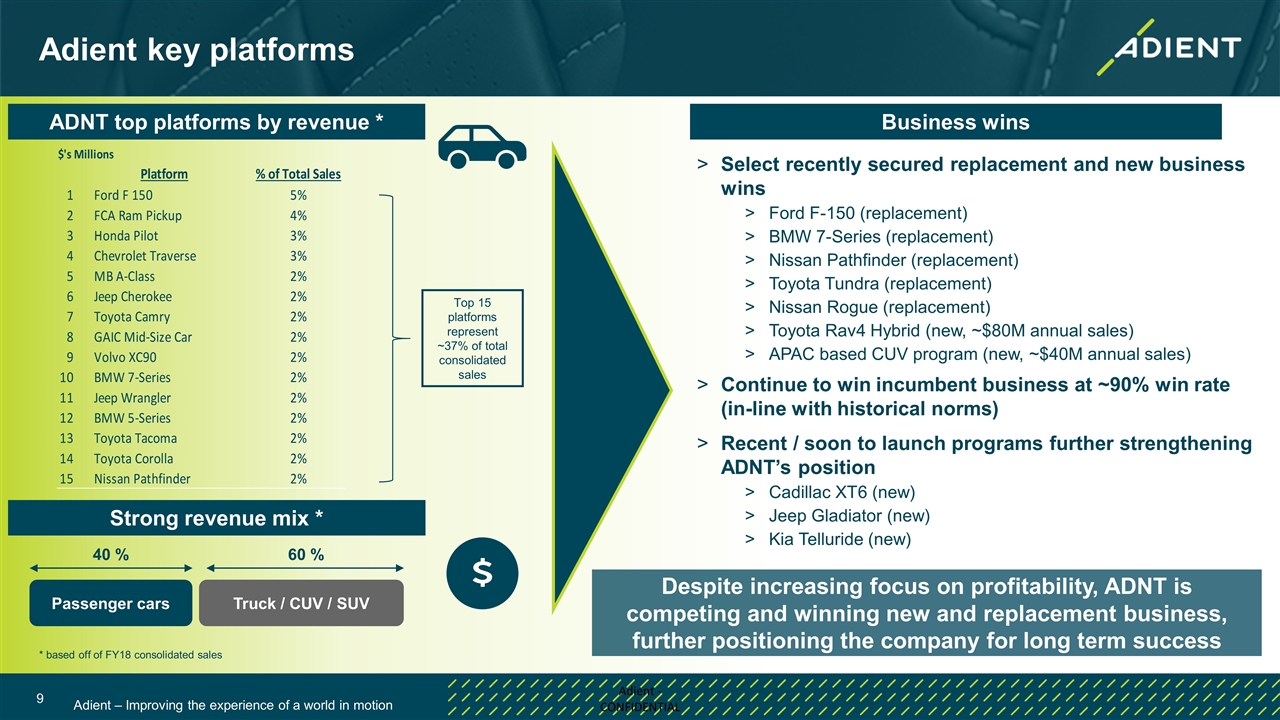

Adient key platforms ADNT top platforms by revenue * Strong revenue mix * Passenger cars Truck / CUV / SUV 40 % 60 % Business wins Select recently secured replacement and new business wins Ford F-150 (replacement) BMW 7-Series (replacement) Nissan Pathfinder (replacement) Toyota Tundra (replacement) Nissan Rogue (replacement) Toyota Rav4 Hybrid (new, ~$80M annual sales) APAC based CUV program (new, ~$40M annual sales) Continue to win incumbent business at ~90% win rate (in-line with historical norms) Recent / soon to launch programs further strengthening ADNT’s position Cadillac XT6 (new) Jeep Gladiator (new) Kia Telluride (new) * based off of FY18 consolidated sales Despite increasing focus on profitability, ADNT is competing and winning new and replacement business, further positioning the company for long term success Top 15 platforms represent ~37% of total consolidated sales

We generated $9.2B sales revenue in FY2018 We have 21 seating joint ventures* with 45% combined share of the passenger vehicle market Note: Sales revenue and all other data on slide exclude YFAI * Includes five consolidated JVs We have ~80 manufacturing locations 4 global tech centers in cities 30 Our Seating Joint Venture partnerships in China enable us to enjoy a clear leadership position in China We employ 33,000 highly engaged employees including >1,400 engineers Adient – Improving the experience of a world in motion 10

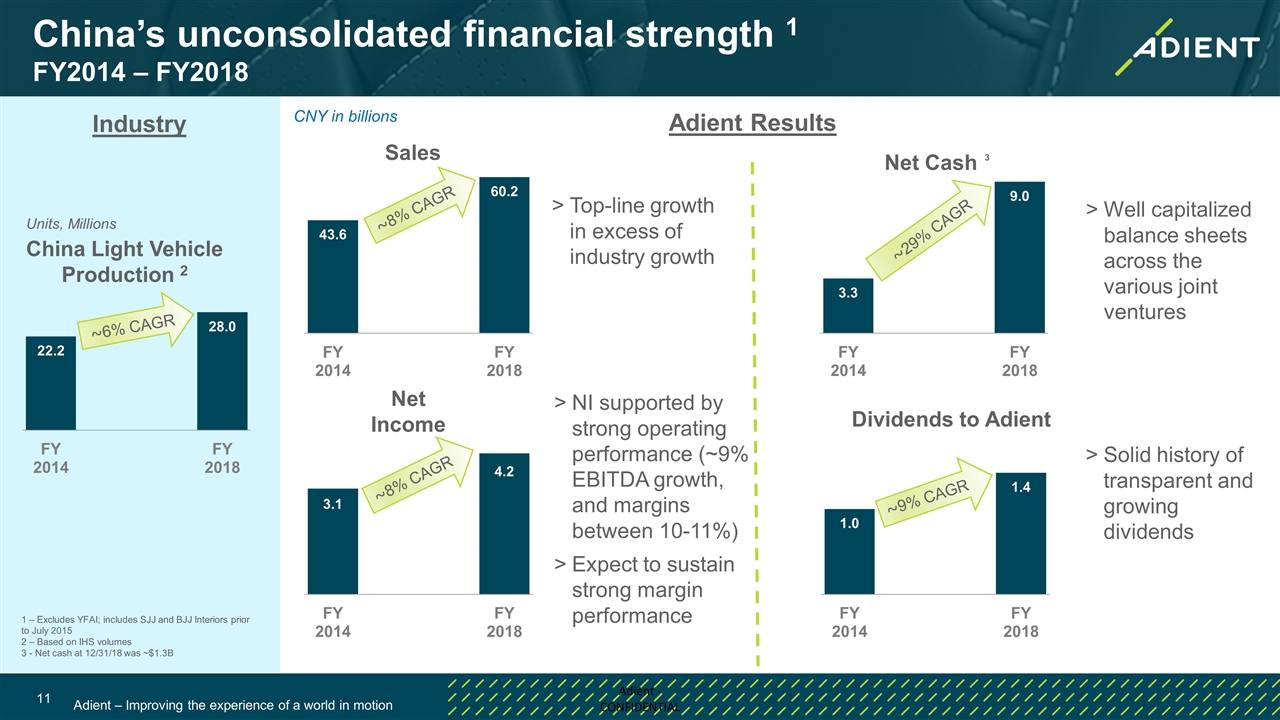

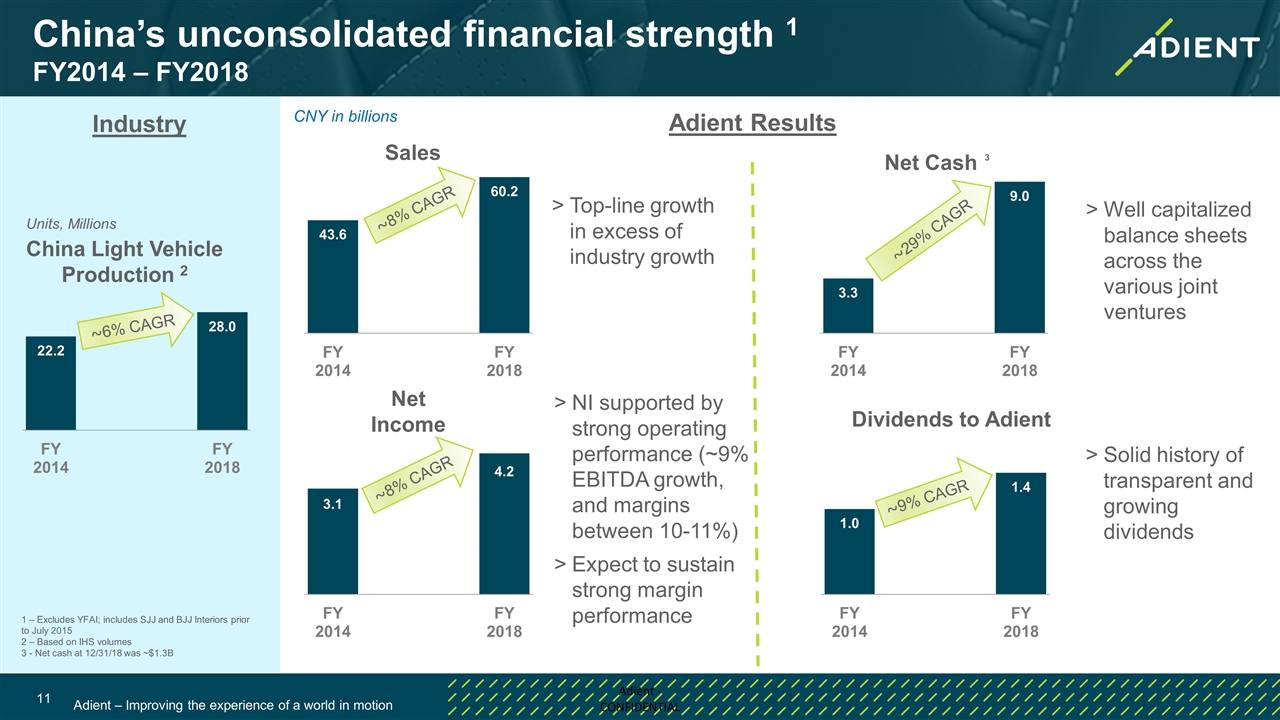

China’s unconsolidated financial strength 1 FY2014 – FY2018 Sales CNY in billions ~8% CAGR Top-line growth in excess of industry growth Net Income Net Cash Dividends to Adient NI supported by strong operating performance (~9% EBITDA growth, and margins between 10-11%) Expect to sustain strong margin performance ~29% CAGR Well capitalized balance sheets across the various joint ventures Solid history of transparent and growing dividends ~9% CAGR China Light Vehicle Production 2 Units, Millions ~6% CAGR Adient Results Industry 3 1 – Excludes YFAI; includes SJJ and BJJ Interiors prior to July 2015 2 – Based on IHS volumes 3 - Net cash at 12/31/18 was ~$1.3B ~8% CAGR

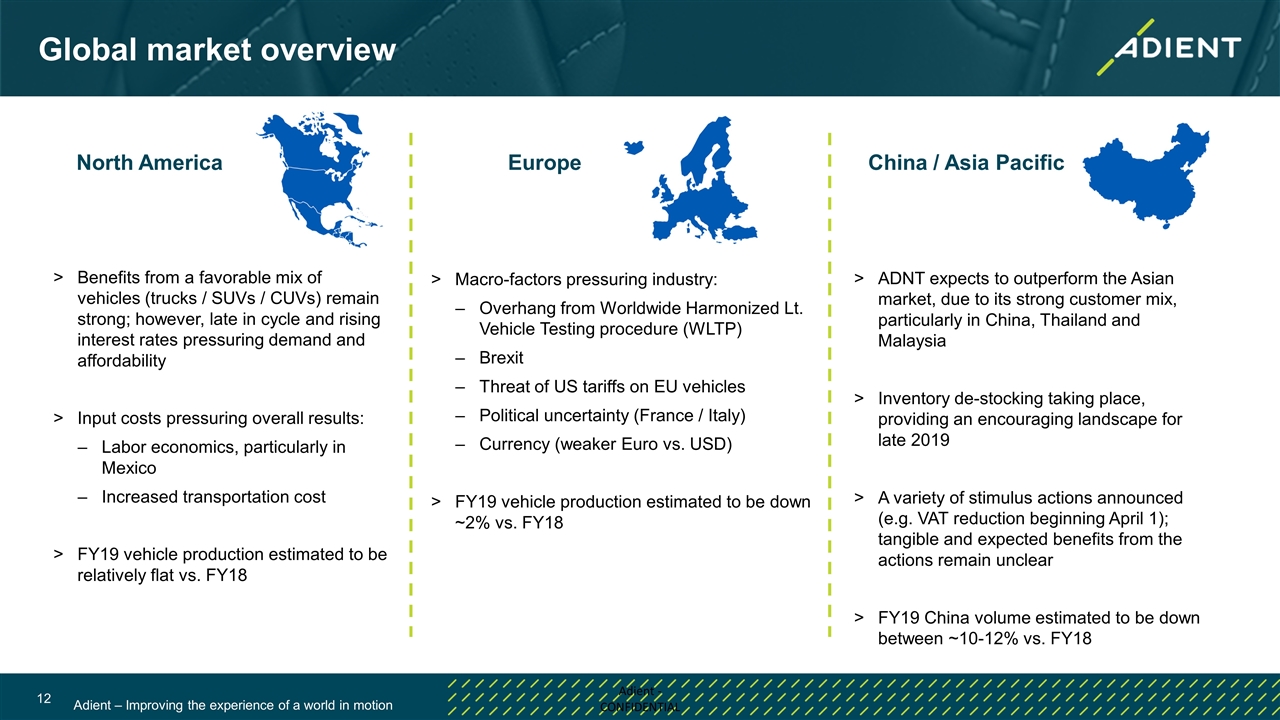

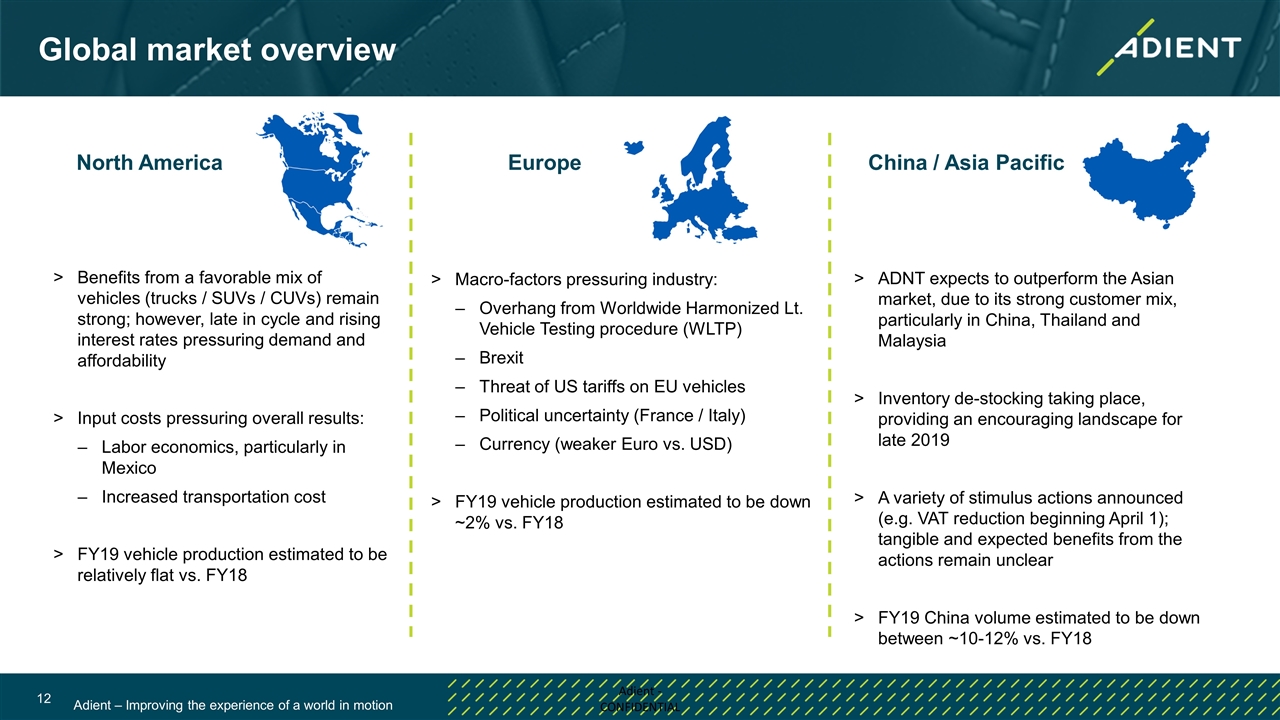

Benefits from a favorable mix of vehicles (trucks / SUVs / CUVs) remain strong; however, late in cycle and rising interest rates pressuring demand and affordability Input costs pressuring overall results: Labor economics, particularly in Mexico Increased transportation cost FY19 vehicle production estimated to be relatively flat vs. FY18 Macro-factors pressuring industry: Overhang from Worldwide Harmonized Lt. Vehicle Testing procedure (WLTP) Brexit Threat of US tariffs on EU vehicles Political uncertainty (France / Italy) Currency (weaker Euro vs. USD) FY19 vehicle production estimated to be down ~2% vs. FY18 ADNT expects to outperform the Asian market, due to its strong customer mix, particularly in China, Thailand and Malaysia Inventory de-stocking taking place, providing an encouraging landscape for late 2019 A variety of stimulus actions announced (e.g. VAT reduction beginning April 1); tangible and expected benefits from the actions remain unclear FY19 China volume estimated to be down between ~10-12% vs. FY18 North America Europe China / Asia Pacific Global market overview

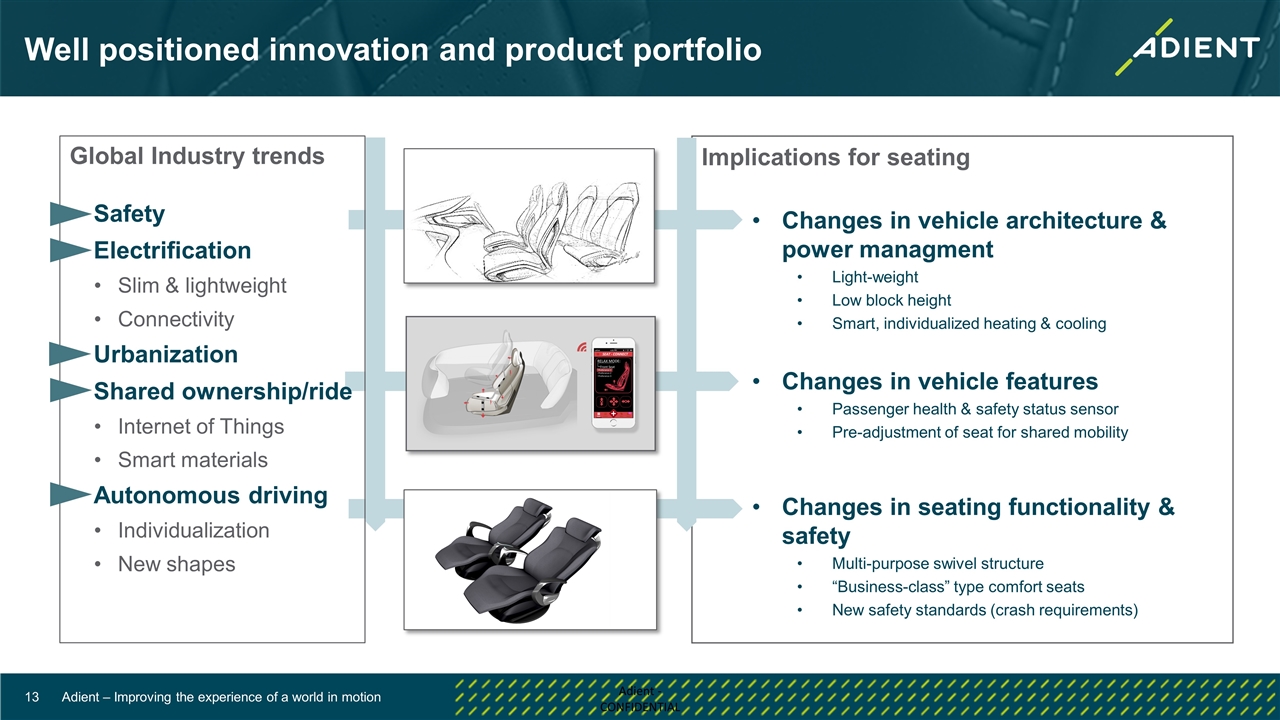

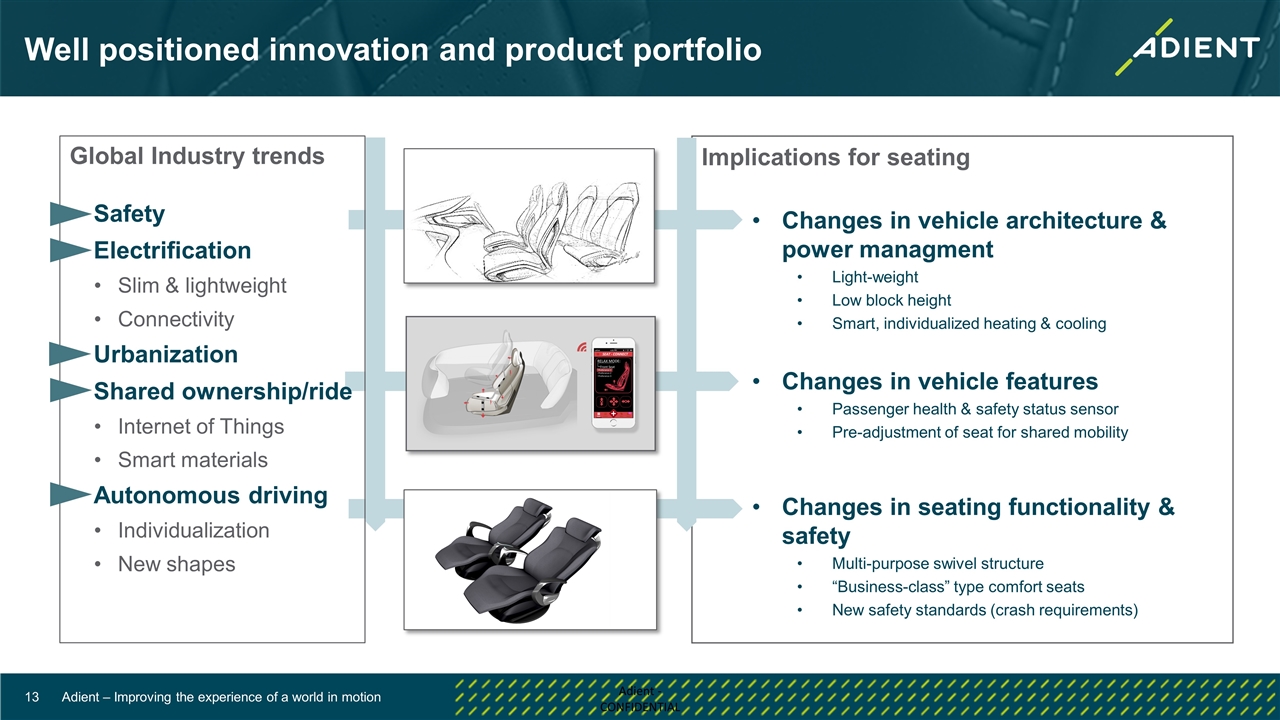

Well positioned innovation and product portfolio Changes in vehicle architecture & power managment Light-weight Low block height Smart, individualized heating & cooling Changes in vehicle features Passenger health & safety status sensor Pre-adjustment of seat for shared mobility Changes in seating functionality & safety Multi-purpose swivel structure “Business-class” type comfort seats New safety standards (crash requirements) Global Industry trends Safety Electrification Slim & lightweight Connectivity Urbanization Shared ownership/ride Internet of Things Smart materials Autonomous driving Individualization New shapes Implications for seating

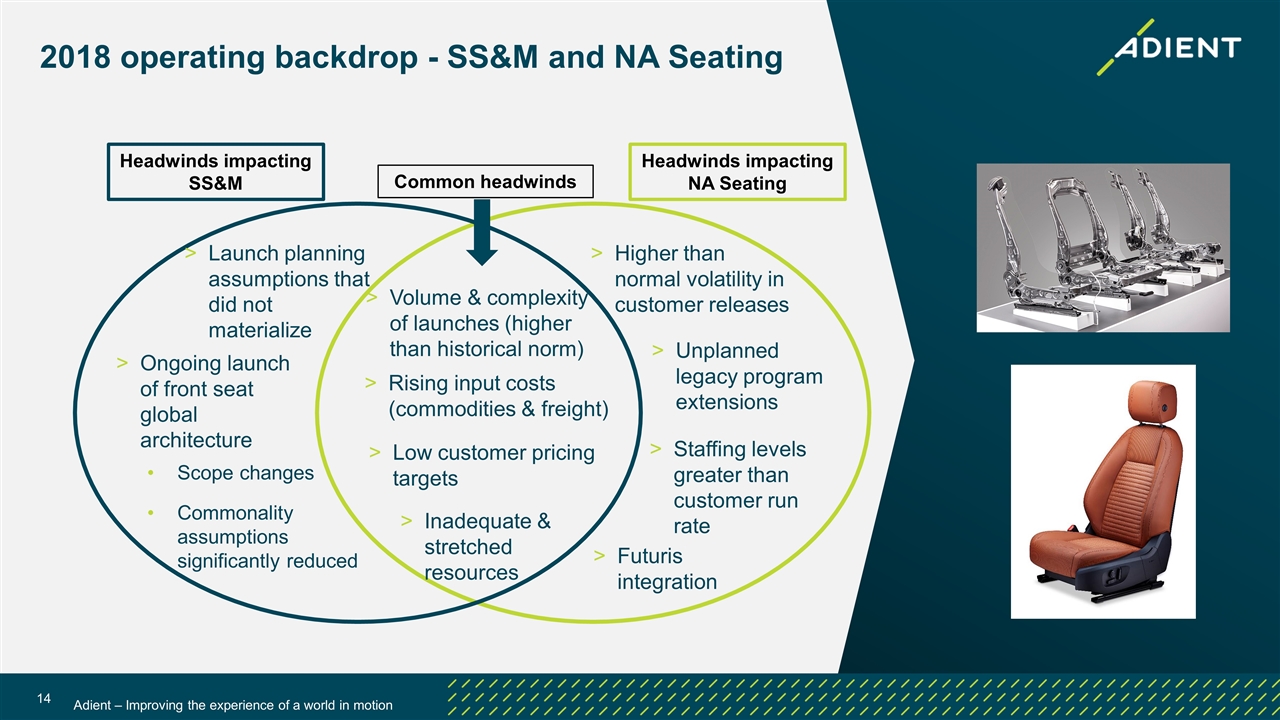

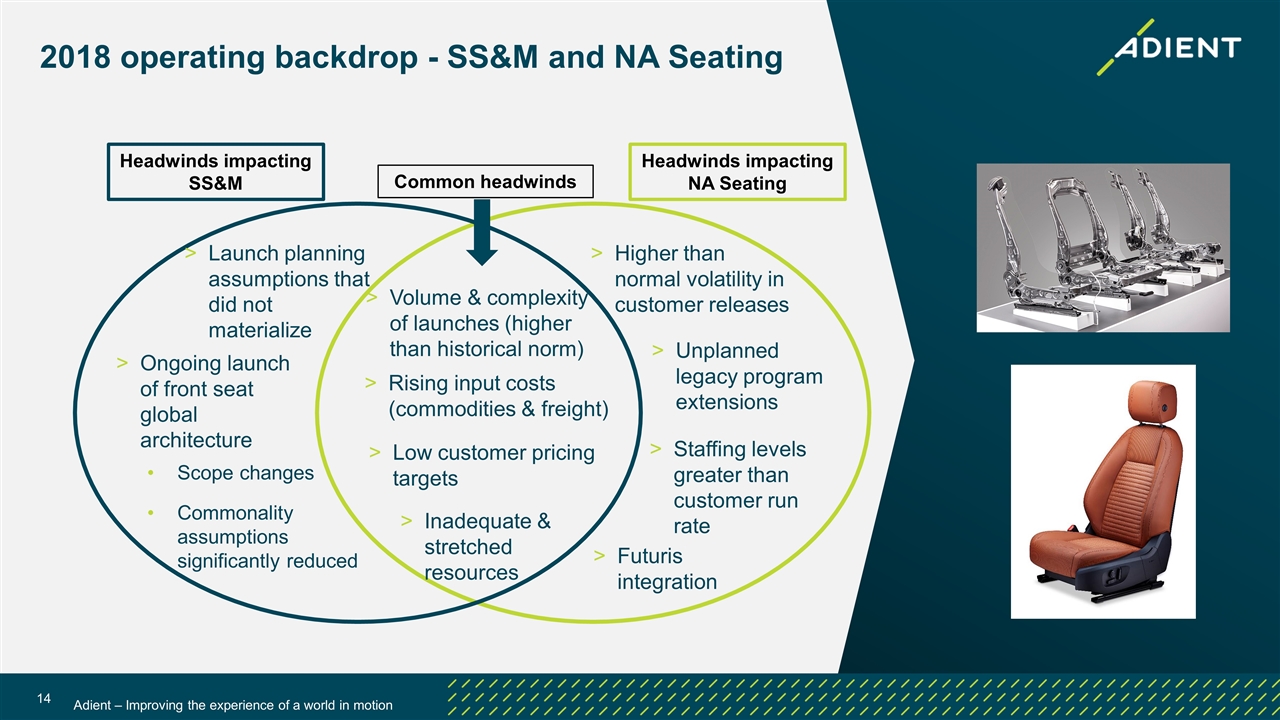

2018 operating backdrop - SS&M and NA Seating Headwinds impacting SS&M Volume & complexity of launches (higher than historical norm) Rising input costs (commodities & freight) Headwinds impacting NA Seating Higher than normal volatility in customer releases Unplanned legacy program extensions Low customer pricing targets Futuris integration Inadequate & stretched resources Staffing levels greater than customer run rate Ongoing launch of front seat global architecture Scope changes Commonality assumptions significantly reduced Launch planning assumptions that did not materialize Common headwinds

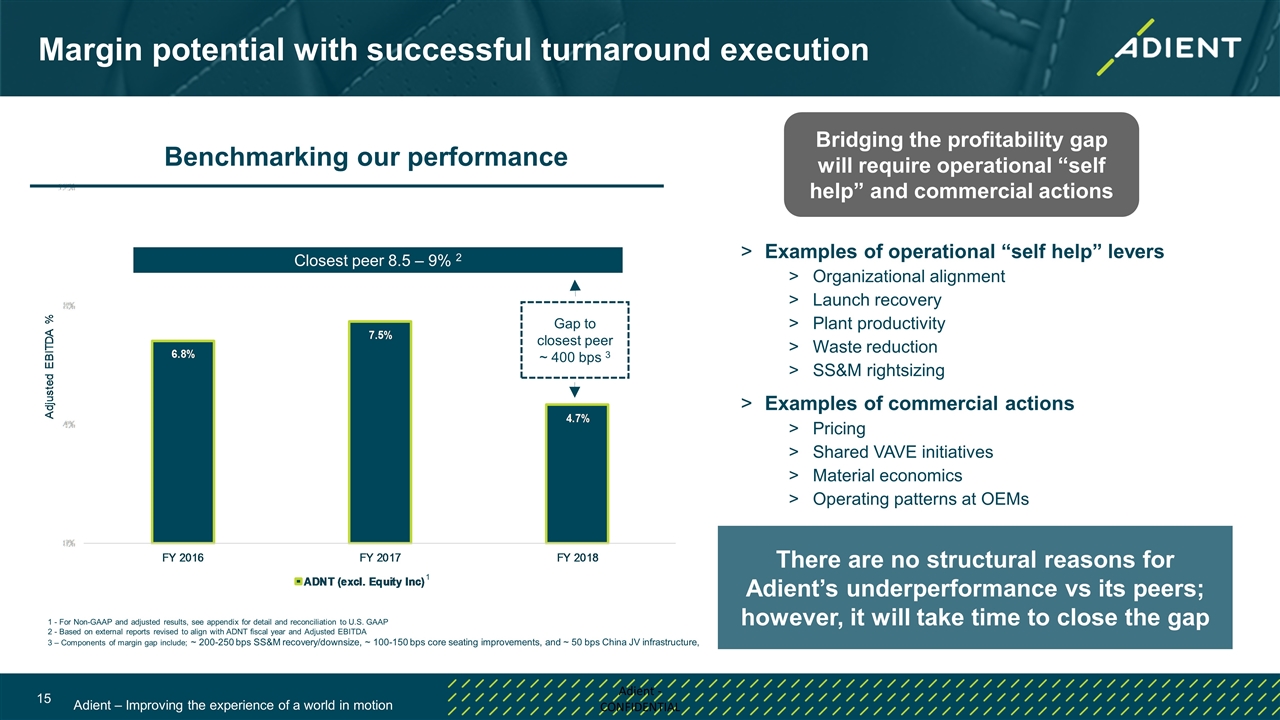

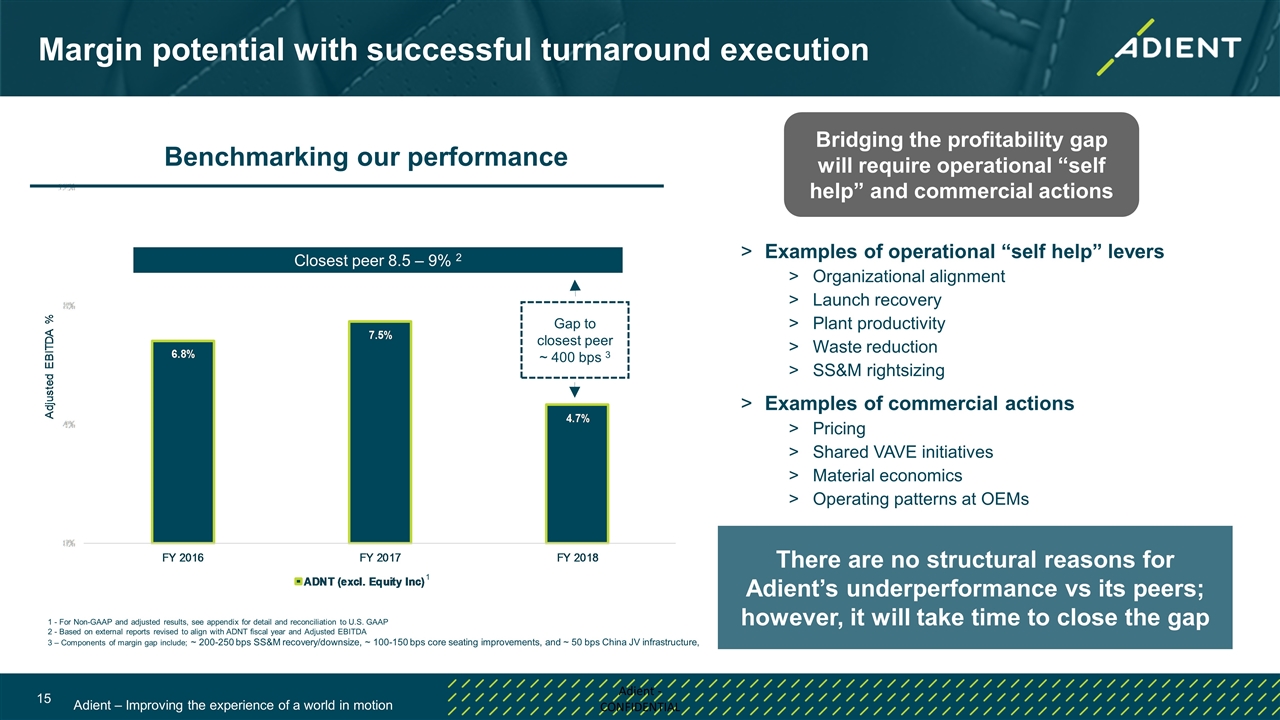

Margin potential with successful turnaround execution Benchmarking our performance 1 - For Non-GAAP and adjusted results, see appendix for detail and reconciliation to U.S. GAAP 2 - Based on external reports revised to align with ADNT fiscal year and Adjusted EBITDA 3 – Components of margin gap include; ~ 200-250 bps SS&M recovery/downsize, ~ 100-150 bps core seating improvements, and ~ 50 bps China JV infrastructure, 1 Closest peer 8.5 – 9% 2 Gap to closest peer ~ 400 bps 3 Bridging the profitability gap will require operational “self help” and commercial actions Examples of operational “self help” levers Organizational alignment Launch recovery Plant productivity Waste reduction SS&M rightsizing Examples of commercial actions Pricing Shared VAVE initiatives Material economics Operating patterns at OEMs There are no structural reasons for Adient’s underperformance vs its peers; however, it will take time to close the gap

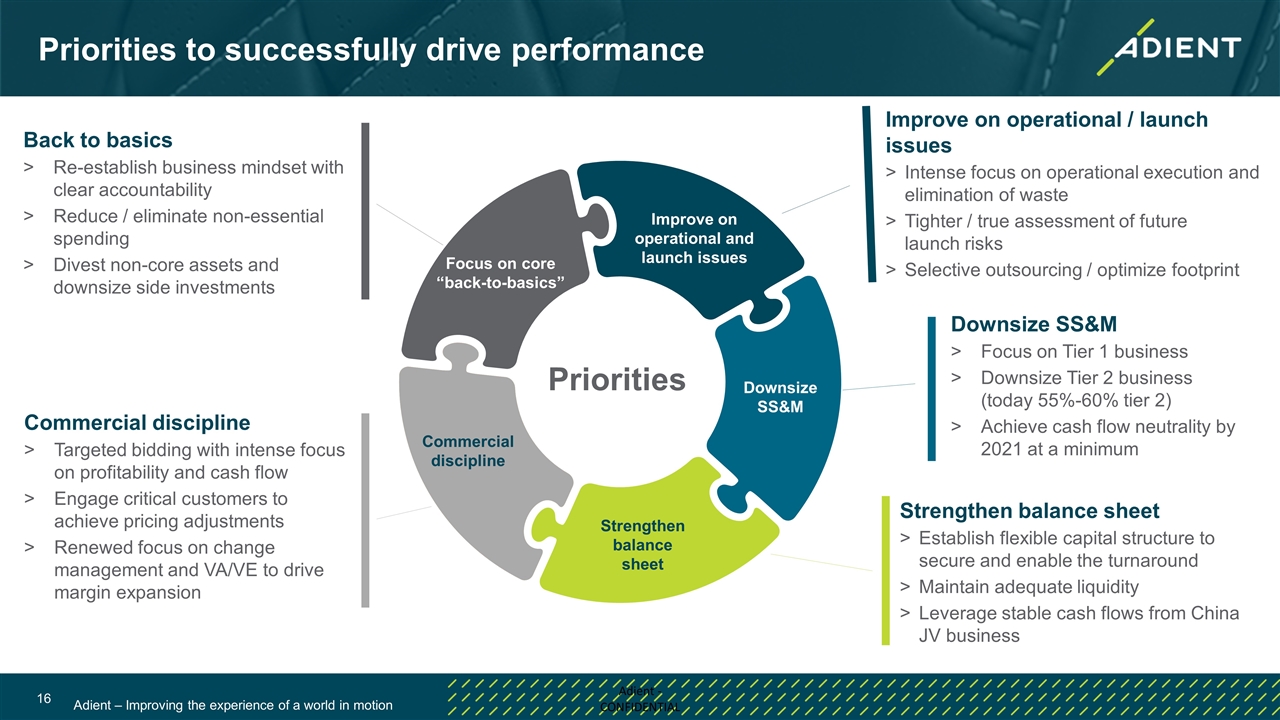

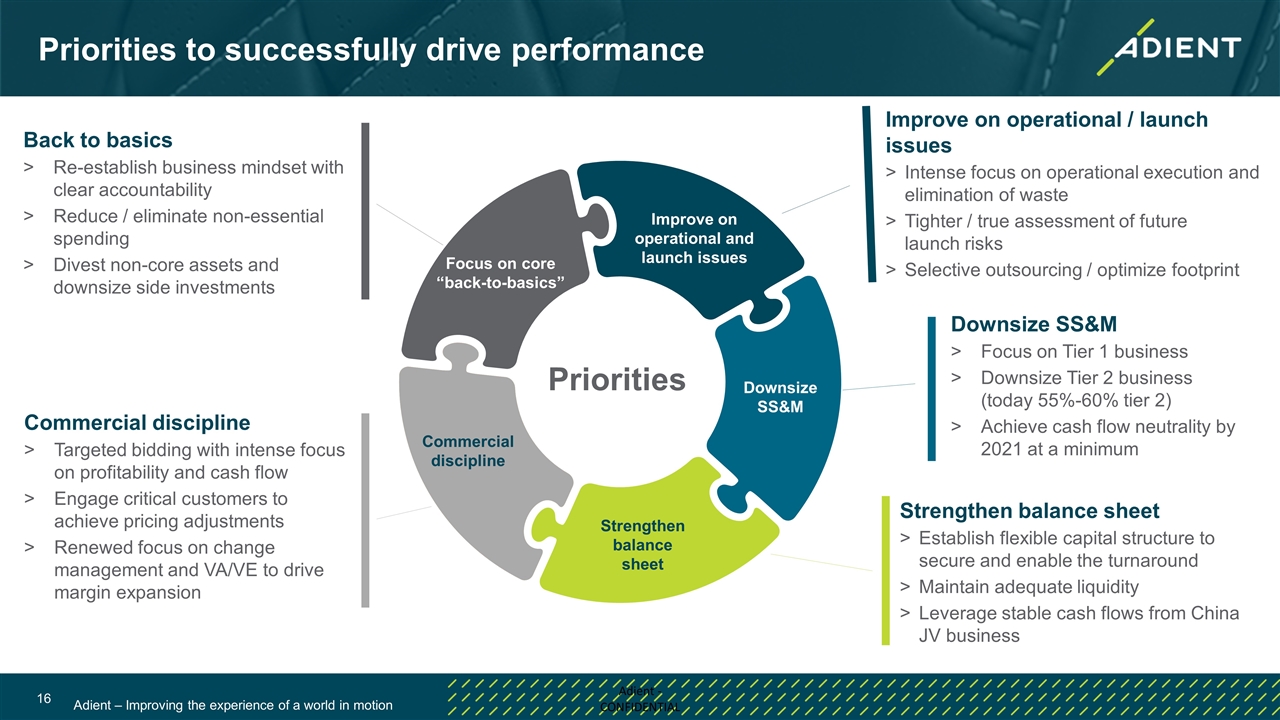

Priorities to successfully drive performance Back to basics Re-establish business mindset with clear accountability Reduce / eliminate non-essential spending Divest non-core assets and downsize side investments Focus on core “back-to-basics” Commercial discipline Strengthen balance sheet Improve on operational and launch issues Downsize SS&M Commercial discipline Targeted bidding with intense focus on profitability and cash flow Engage critical customers to achieve pricing adjustments Renewed focus on change management and VA/VE to drive margin expansion Strengthen balance sheet Establish flexible capital structure to secure and enable the turnaround Maintain adequate liquidity Leverage stable cash flows from China JV business Improve on operational / launch issues Intense focus on operational execution and elimination of waste Tighter / true assessment of future launch risks Selective outsourcing / optimize footprint Downsize SS&M Focus on Tier 1 business Downsize Tier 2 business (today 55%-60% tier 2) Achieve cash flow neutrality by 2021 at a minimum Priorities

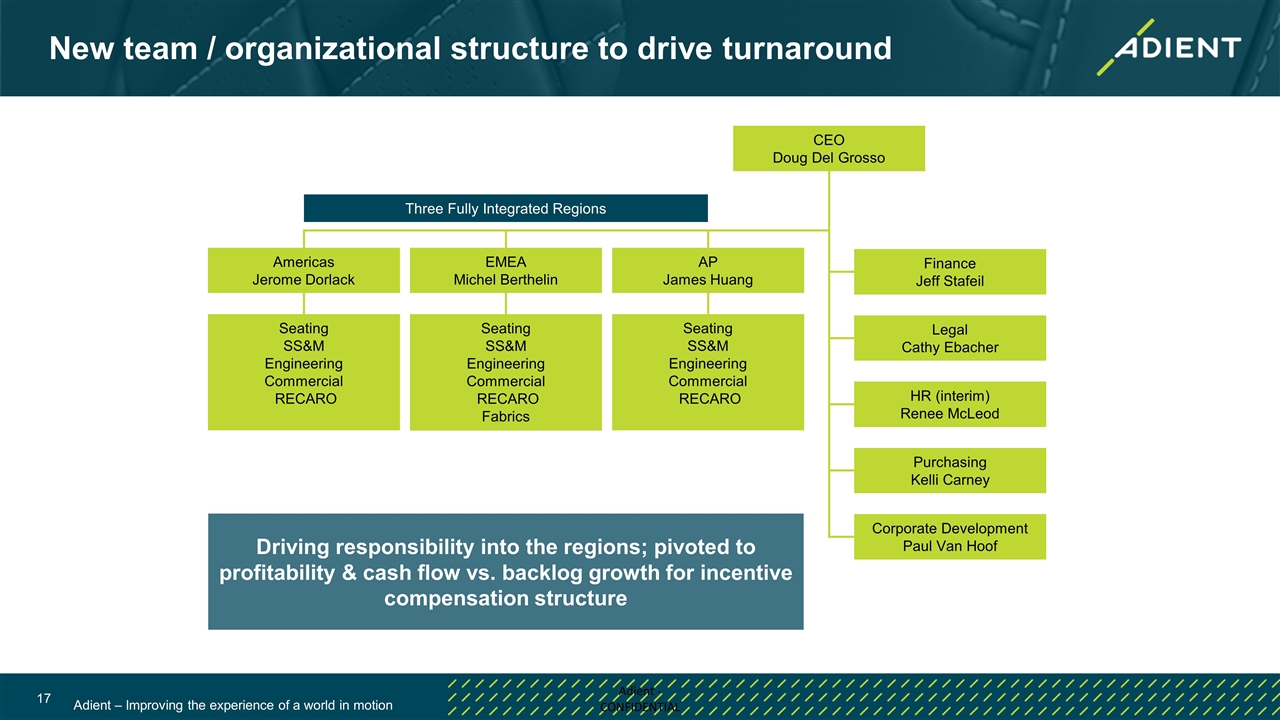

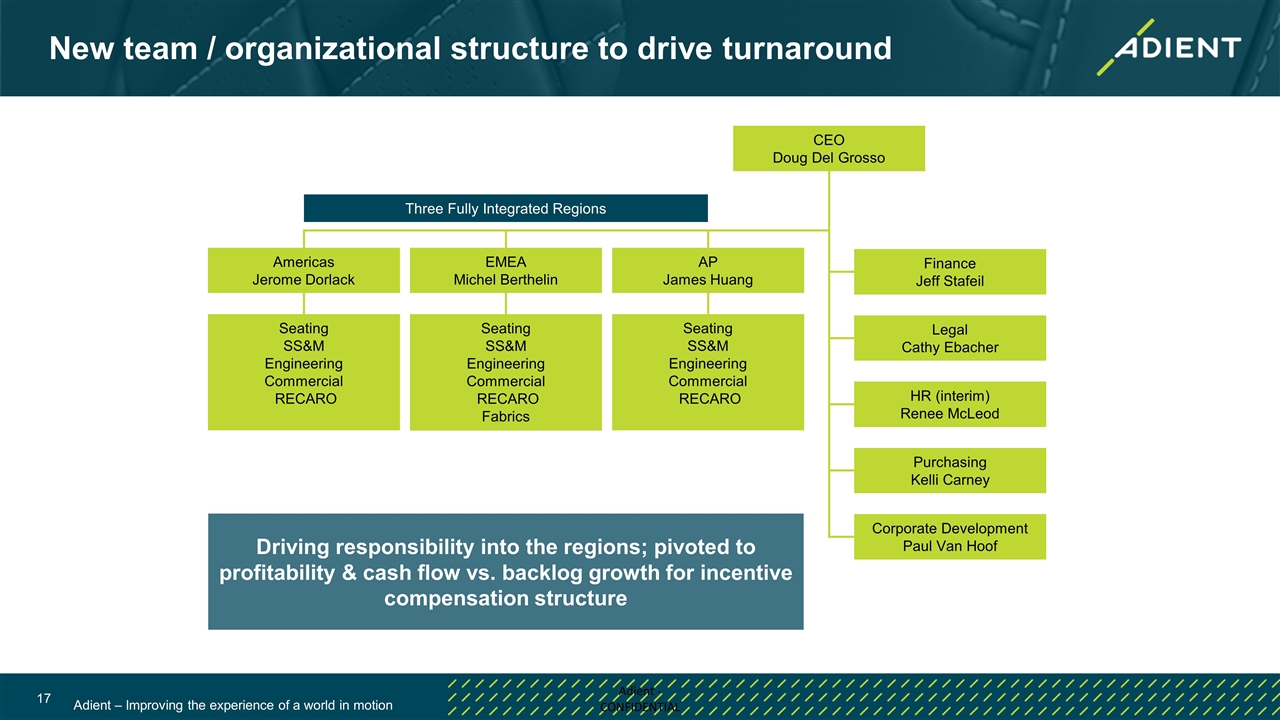

New team / organizational structure to drive turnaround CEO Doug Del Grosso Finance Jeff Stafeil EMEA Michel Berthelin Americas Jerome Dorlack HR (interim) Renee McLeod AP James Huang Legal Cathy Ebacher Purchasing Kelli Carney Seating SS&M Engineering Commercial RECARO Three Fully Integrated Regions Seating SS&M Engineering Commercial RECARO Fabrics Seating SS&M Engineering Commercial RECARO Corporate Development Paul Van Hoof Driving responsibility into the regions; pivoted to profitability & cash flow vs. backlog growth for incentive compensation structure

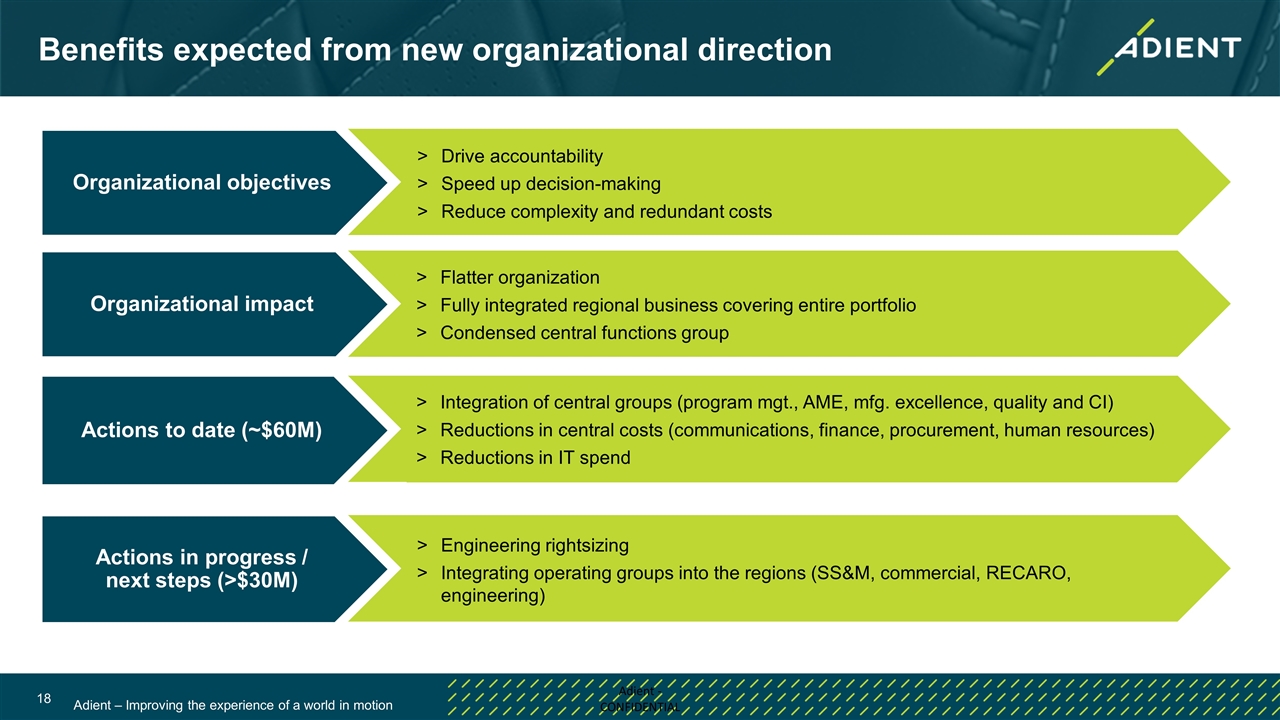

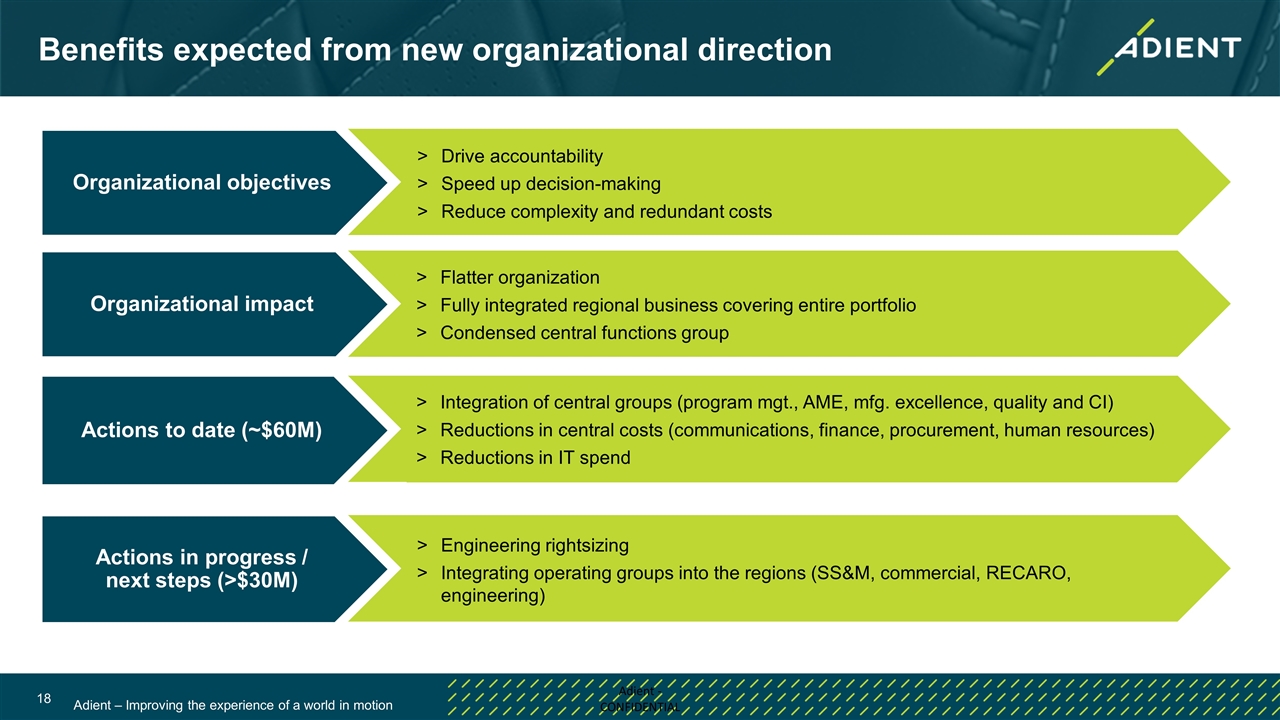

Organizational objectives Drive accountability Speed up decision-making Reduce complexity and redundant costs Organizational impact Flatter organization Fully integrated regional business covering entire portfolio Condensed central functions group Actions to date (~$60M) Integration of central groups (program mgt., AME, mfg. excellence, quality and CI) Reductions in central costs (communications, finance, procurement, human resources) Reductions in IT spend Actions in progress / next steps (>$30M) Engineering rightsizing Integrating operating groups into the regions (SS&M, commercial, RECARO, engineering) Benefits expected from new organizational direction

Focused on commercial excellence CEO-level direct customer interactions to align product economics with the high quality of seating solutions being delivered Resolved / renegotiated pricing agreements with three critical customers in last 3 months – expected to generate significant run-rate EBITDA savings Continue to see strength in new and replacement business conversion (~60% new business and ~90% replacement conversion rates for FY19 through Q2) Seating Americas and Seating Europe have recently road-mapped material Value Add / Value Engineering (VA/VE) initiatives, realizable in the next two years Increased commercial focus through product lifecycle Disciplined bidding approach – Focus on EBITDA, ROI and cash flow Change management – ensure adequate pricing for customer changes Re-establish VA/VE activities to drive material costs down and expand margins Early Successes Initiate face-to-face dialogue with customers in critically strained relationships Turn around underperforming plants; consolidate production facilities to improve competitiveness

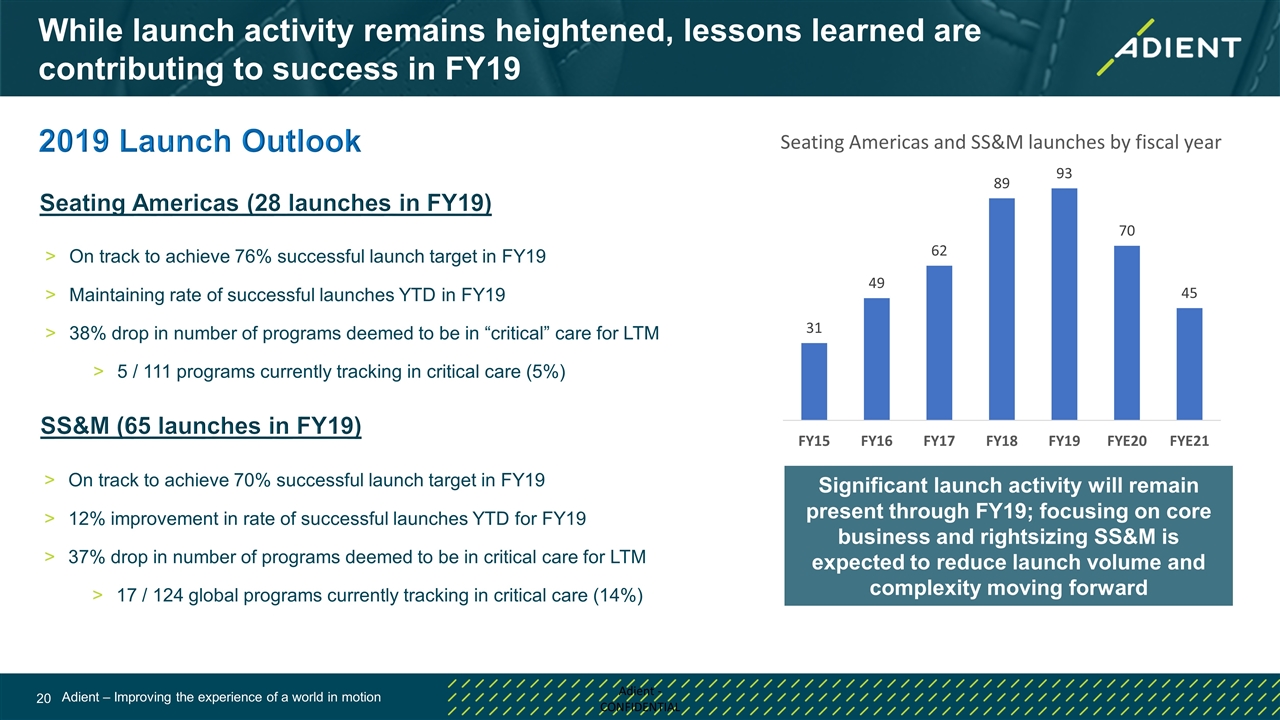

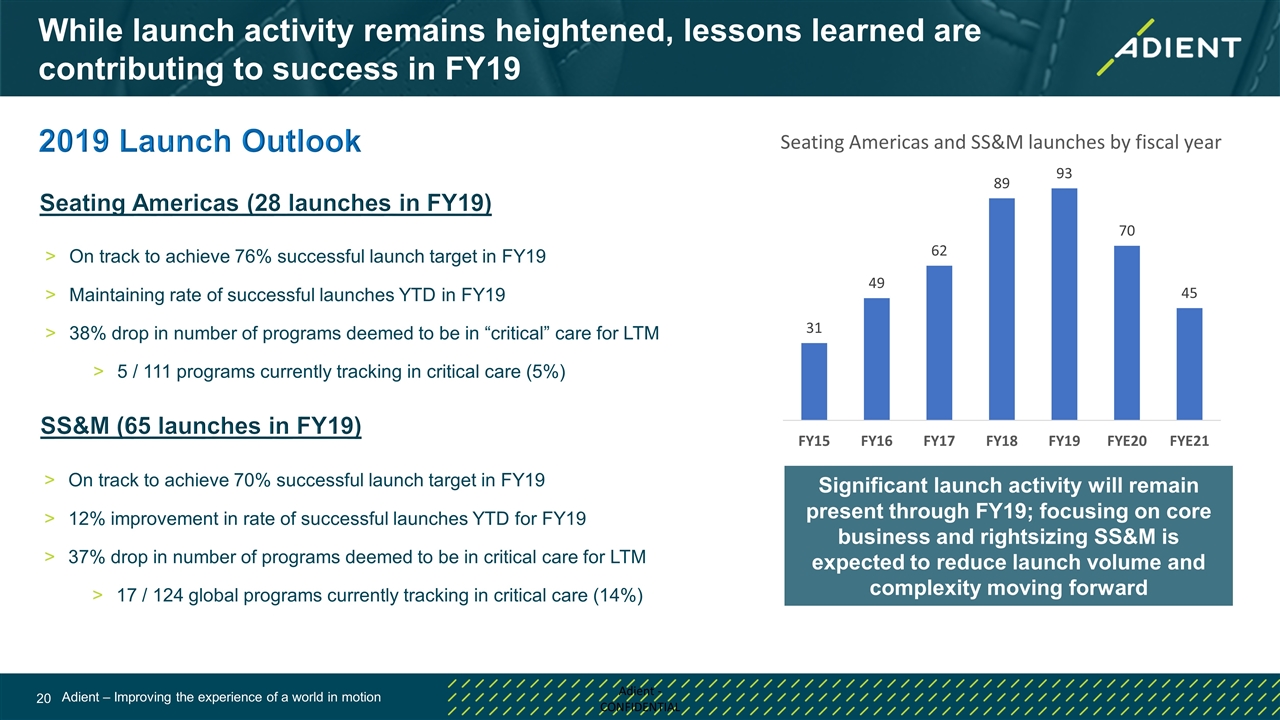

While launch activity remains heightened, lessons learned are contributing to success in FY19 Significant launch activity will remain present through FY19; focusing on core business and rightsizing SS&M is expected to reduce launch volume and complexity moving forward On track to achieve 70% successful launch target in FY19 12% improvement in rate of successful launches YTD for FY19 37% drop in number of programs deemed to be in critical care for LTM 17 / 124 global programs currently tracking in critical care (14%) 2019 Launch Outlook On track to achieve 76% successful launch target in FY19 Maintaining rate of successful launches YTD in FY19 38% drop in number of programs deemed to be in “critical” care for LTM 5 / 111 programs currently tracking in critical care (5%) Seating Americas (28 launches in FY19) SS&M (65 launches in FY19)

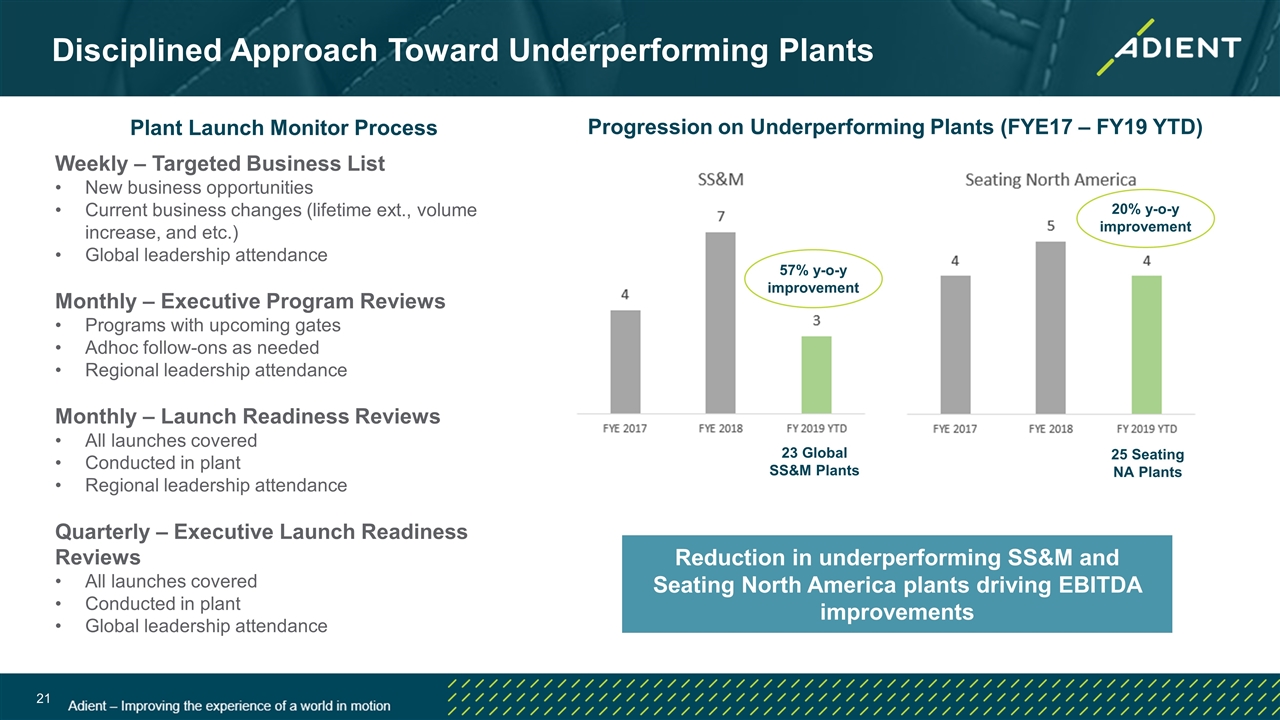

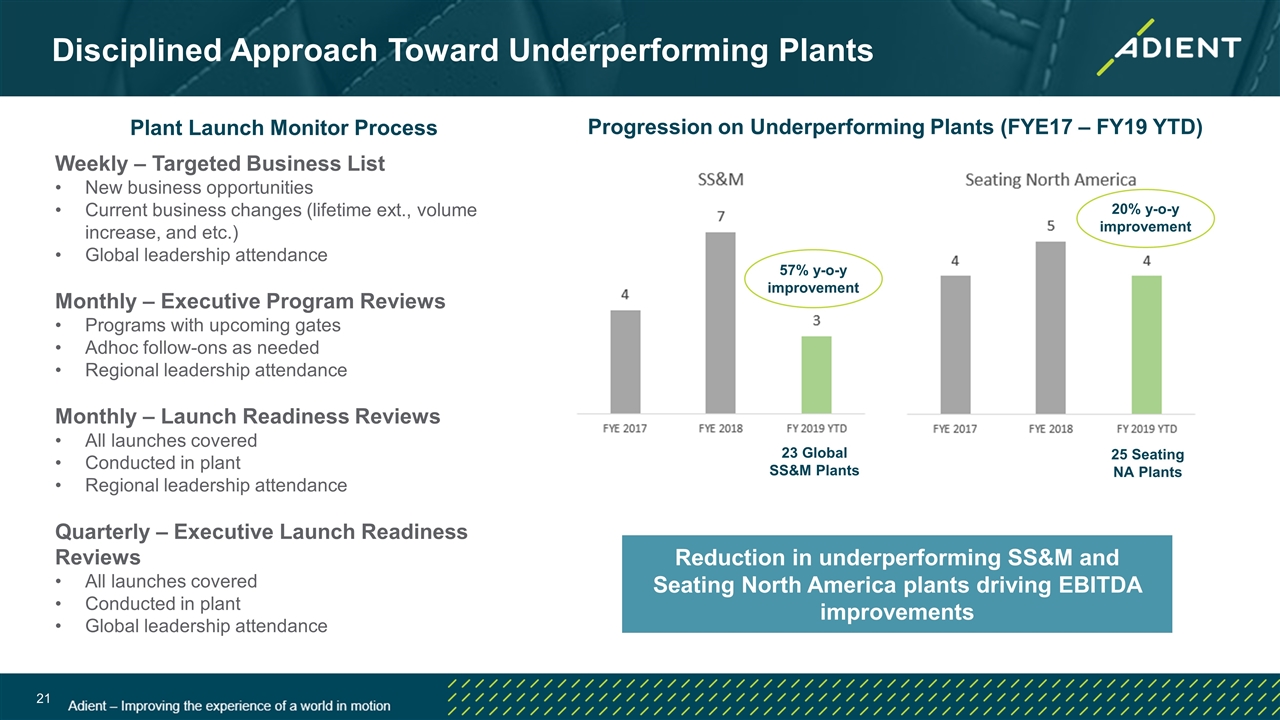

Disciplined Approach Toward Underperforming Plants Weekly – Targeted Business List New business opportunities Current business changes (lifetime ext., volume increase, and etc.) Global leadership attendance Monthly – Executive Program Reviews Programs with upcoming gates Adhoc follow-ons as needed Regional leadership attendance Monthly – Launch Readiness Reviews All launches covered Conducted in plant Regional leadership attendance Quarterly – Executive Launch Readiness Reviews All launches covered Conducted in plant Global leadership attendance Reduction in underperforming SS&M and Seating North America plants driving EBITDA improvements Plant Launch Monitor Process Progression on Underperforming Plants (FYE17 – FY19 YTD) 57% y-o-y improvement 20% y-o-y improvement 23 Global SS&M Plants 25 Seating NA Plants

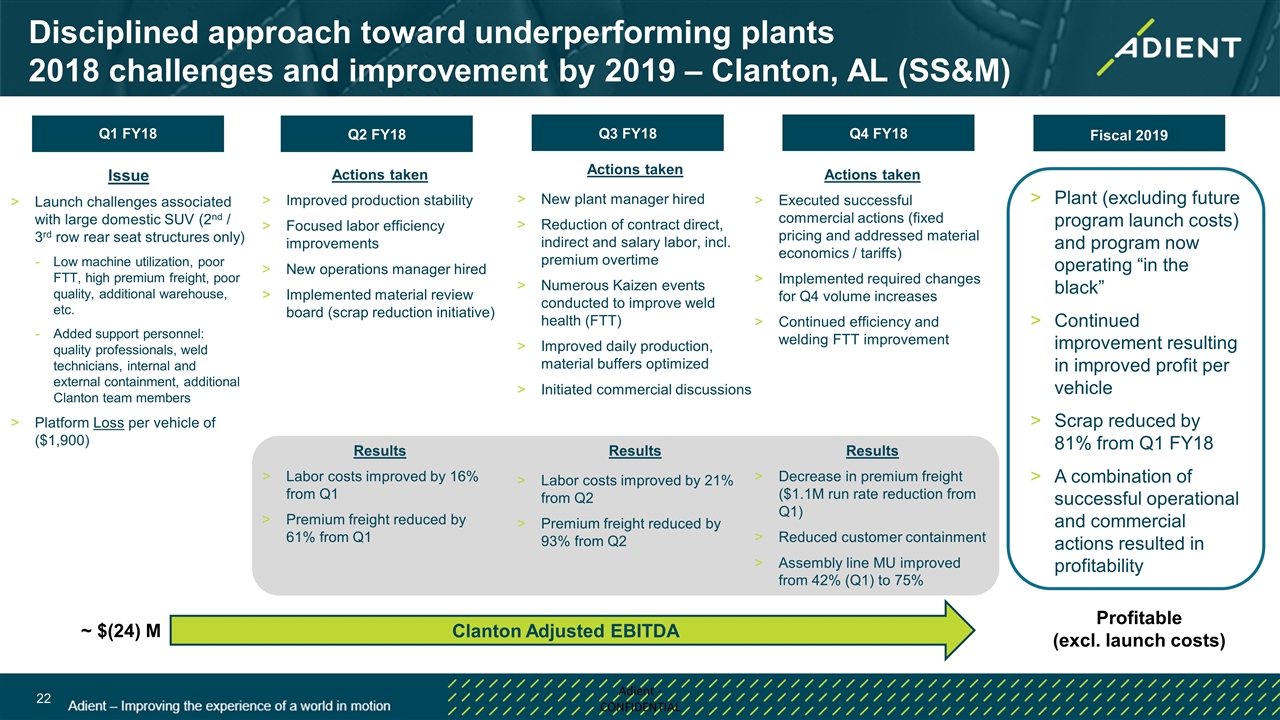

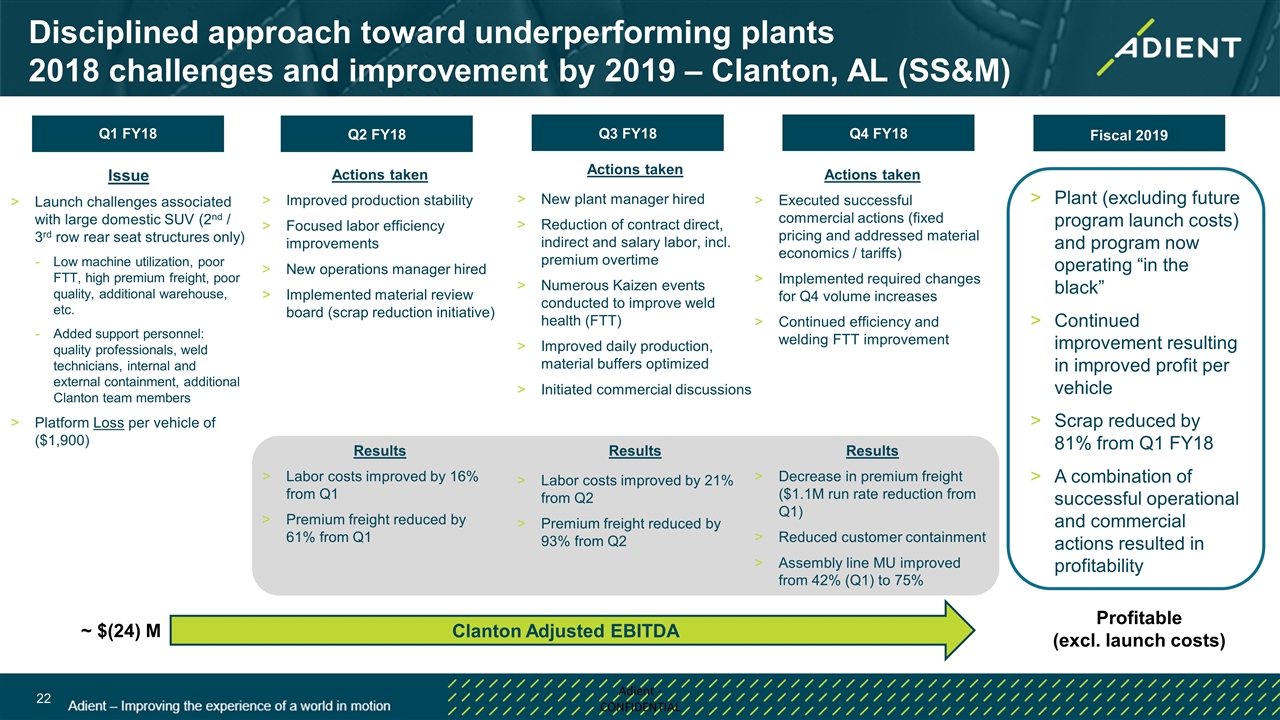

Q1 FY18 Q2 FY18 Q3 FY18 Q4 FY18 Disciplined approach toward underperforming plants 2018 challenges and improvement by 2019 – Clanton, AL (SS&M) Issue Launch challenges associated with large domestic SUV (2nd / 3rd row rear seat structures only) Low machine utilization, poor FTT, high premium freight, poor quality, additional warehouse, etc. Added support personnel: quality professionals, weld technicians, internal and external containment, additional Clanton team members Platform Loss per vehicle of ($1,900) Actions taken New plant manager hired Reduction of contract direct, indirect and salary labor, incl. premium overtime Numerous Kaizen events conducted to improve weld health (FTT) Improved daily production, material buffers optimized Initiated commercial discussions Actions taken Improved production stability Focused labor efficiency improvements New operations manager hired Implemented material review board (scrap reduction initiative) Actions taken Executed successful commercial actions (fixed pricing and addressed material economics / tariffs) Implemented required changes for Q4 volume increases Continued efficiency and welding FTT improvement ~ $(24) M Clanton Adjusted EBITDA Plant (excluding future program launch costs) and program now operating “in the black” Continued improvement resulting in improved profit per vehicle Scrap reduced by 81% from Q1 FY18 A combination of successful operational and commercial actions resulted in profitability Profitable (excl. launch costs) Fiscal 2019 Results Labor costs improved by 16% from Q1 Premium freight reduced by 61% from Q1 Results Labor costs improved by 21% from Q2 Premium freight reduced by 93% from Q2 Results Decrease in premium freight ($1.1M run rate reduction from Q1) Reduced customer containment Assembly line MU improved from 42% (Q1) to 75%

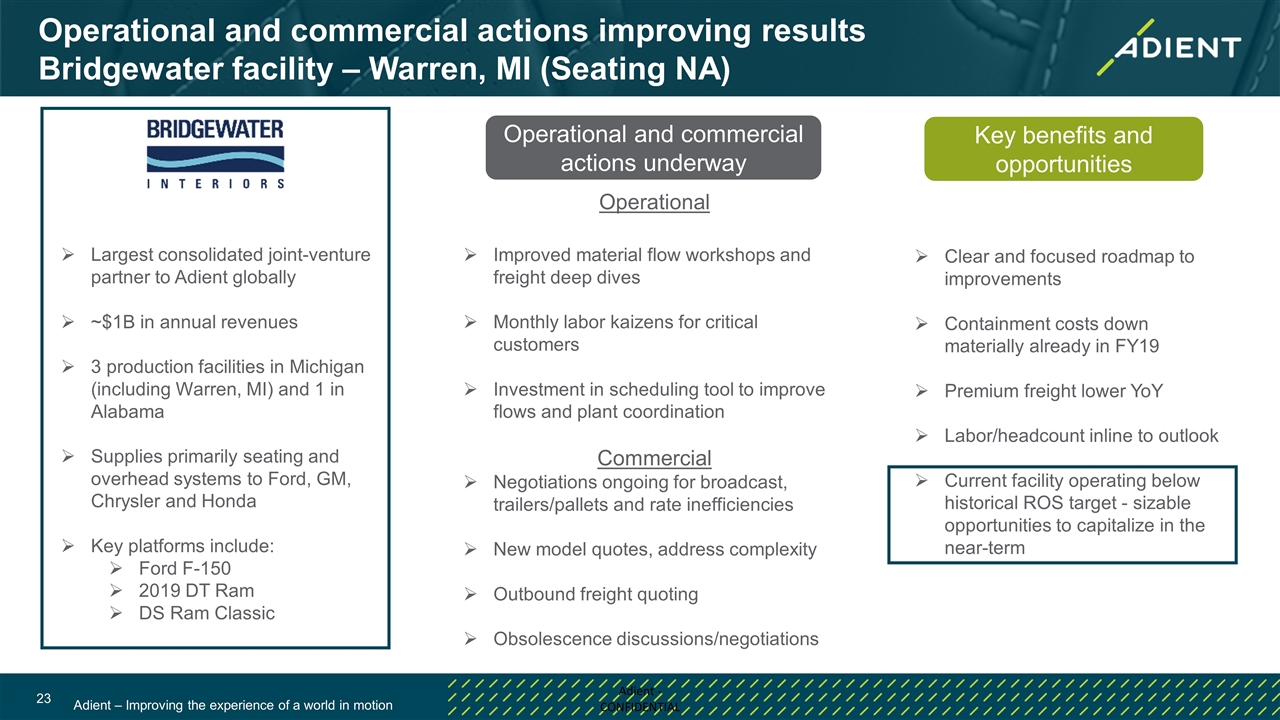

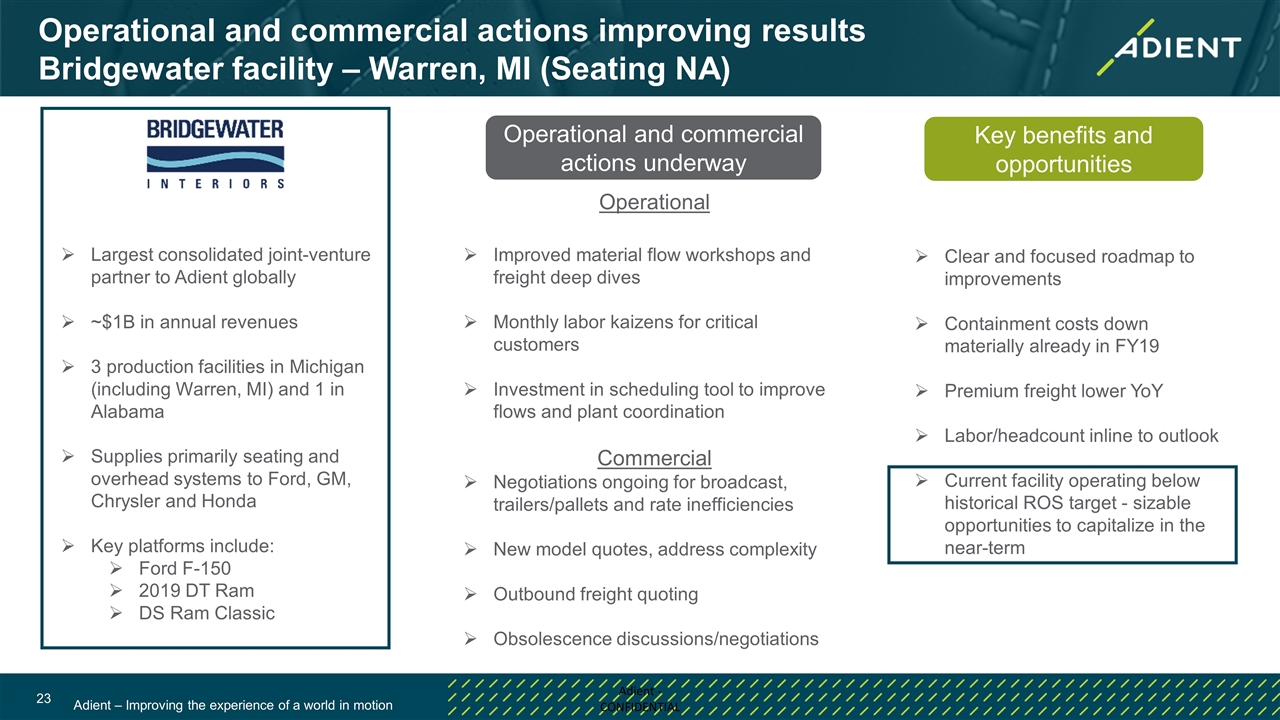

Operational and commercial actions improving results Bridgewater facility – Warren, MI (Seating NA) Operational Improved material flow workshops and freight deep dives Monthly labor kaizens for critical customers Investment in scheduling tool to improve flows and plant coordination Commercial Negotiations ongoing for broadcast, trailers/pallets and rate inefficiencies New model quotes, address complexity Outbound freight quoting Obsolescence discussions/negotiations Key benefits and opportunities Operational and commercial actions underway Clear and focused roadmap to improvements Containment costs down materially already in FY19 Premium freight lower YoY Labor/headcount inline to outlook Current facility operating below historical ROS target - sizable opportunities to capitalize in the near-term Largest consolidated joint-venture partner to Adient globally ~$1B in annual revenues 3 production facilities in Michigan (including Warren, MI) and 1 in Alabama Supplies primarily seating and overhead systems to Ford, GM, Chrysler and Honda Key platforms include: Ford F-150 2019 DT Ram DS Ram Classic

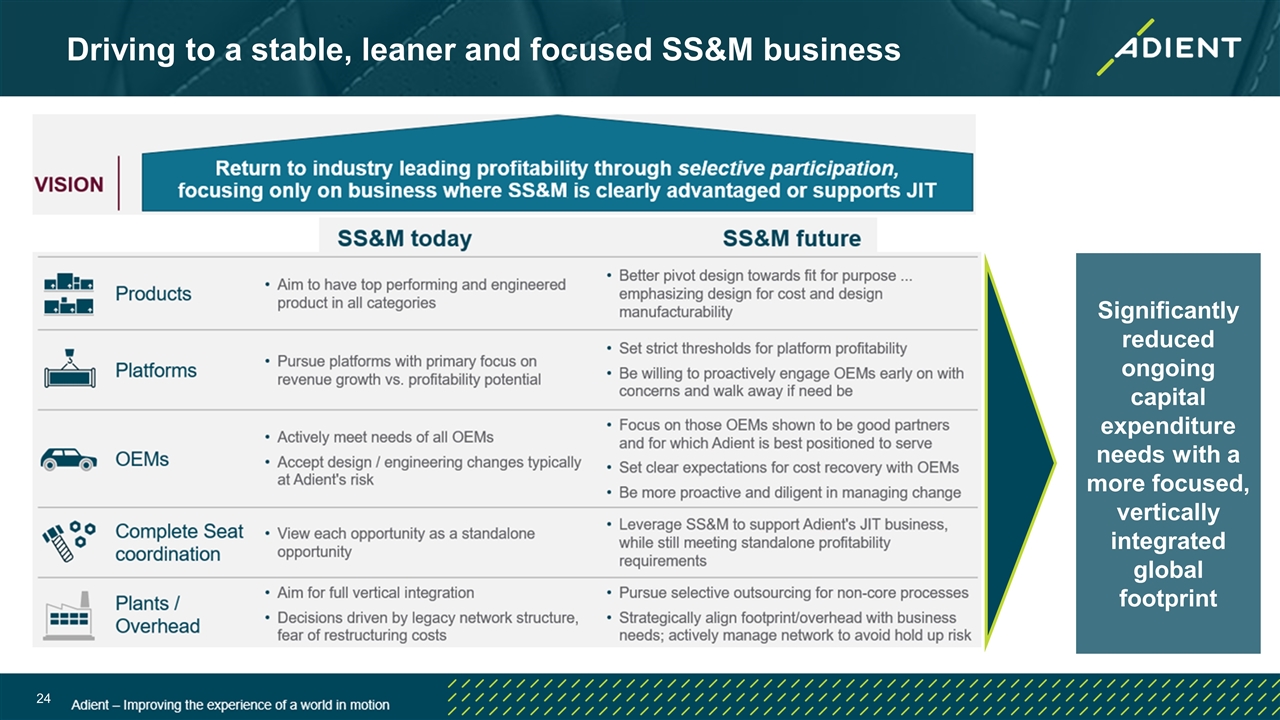

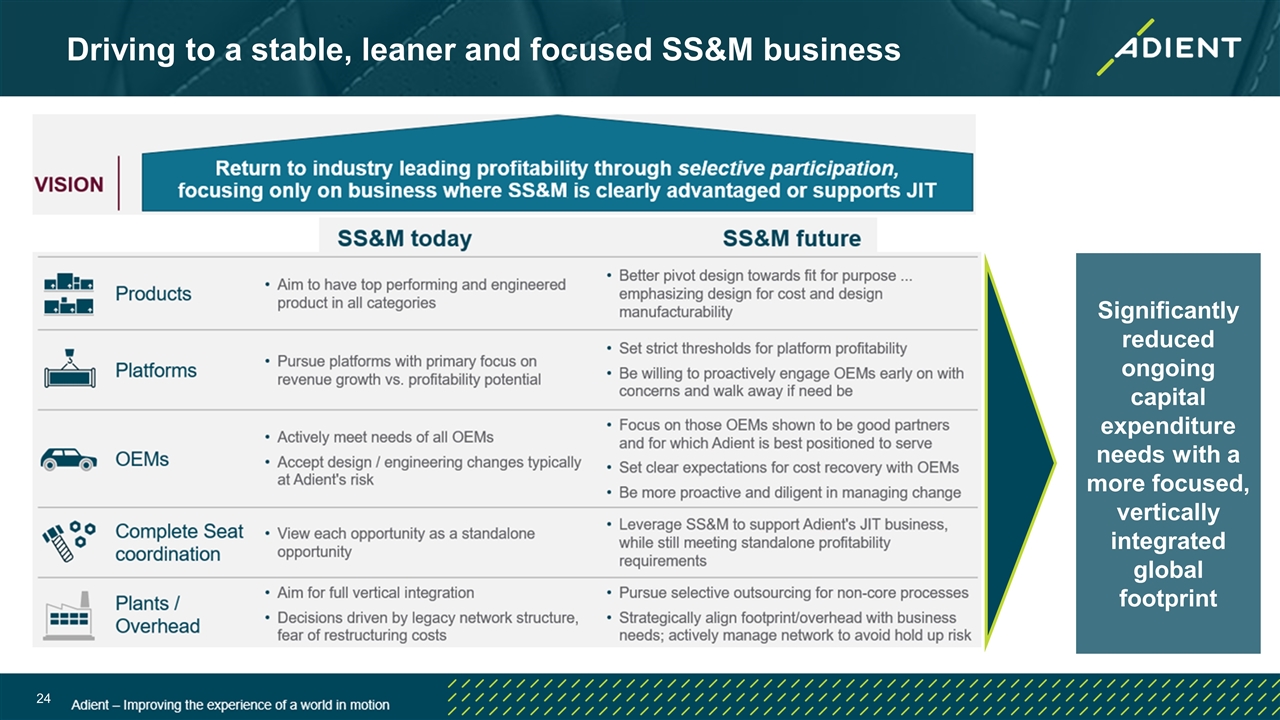

Driving to a stable, leaner and focused SS&M business Significantly reduced ongoing capital expenditure needs with a more focused, vertically integrated global footprint

Financial

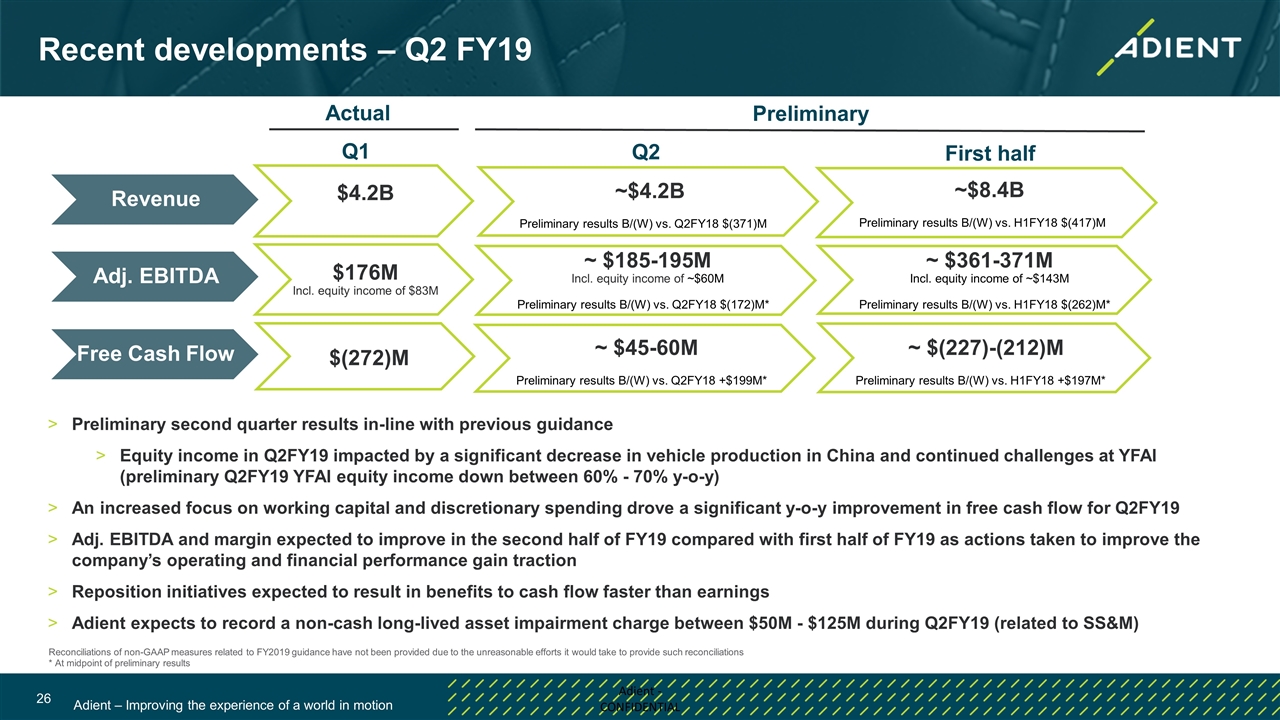

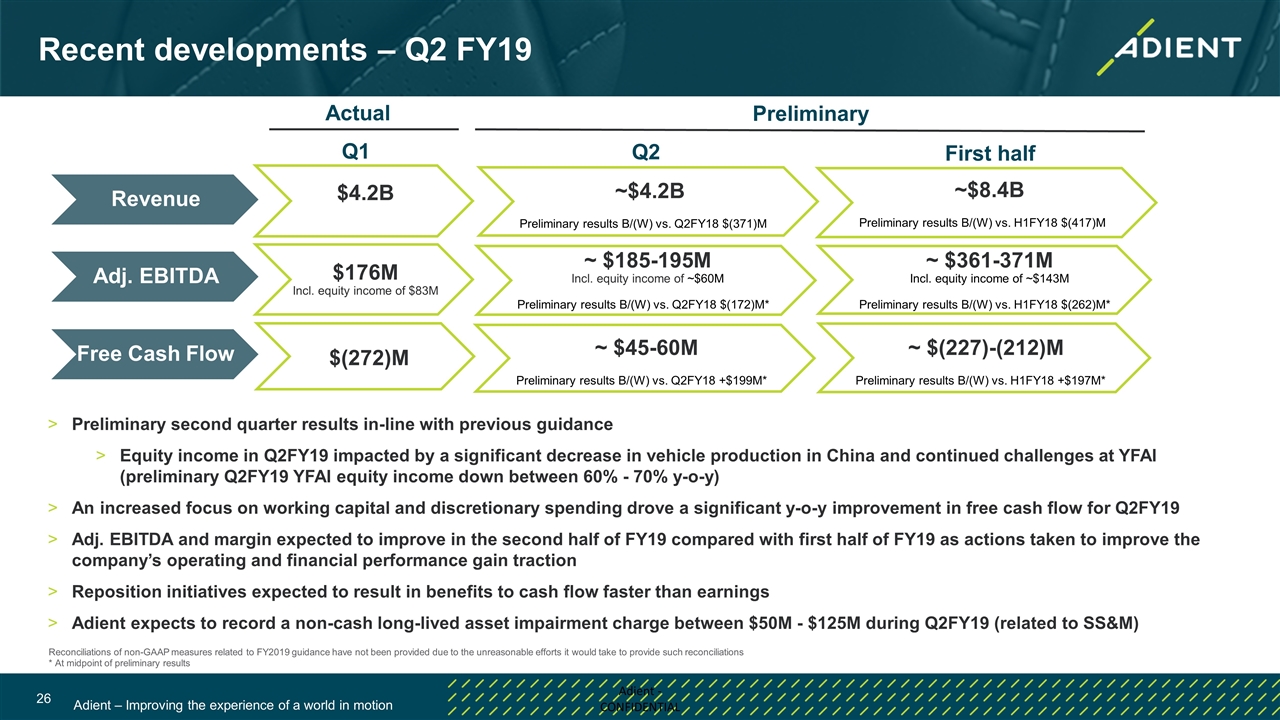

Recent developments – Q2 FY19 Revenue Adj. EBITDA Free Cash Flow $4.2B $176M Incl. equity income of $83M $(272)M Q1 Reconciliations of non-GAAP measures related to FY2019 guidance have not been provided due to the unreasonable efforts it would take to provide such reconciliations * At midpoint of preliminary results ~$4.2B Preliminary results B/(W) vs. Q2FY18 $(371)M ~ $185-195M Incl. equity income of ~$60M Preliminary results B/(W) vs. Q2FY18 $(172)M* Q2 First half Actual Preliminary Preliminary second quarter results in-line with previous guidance Equity income in Q2FY19 impacted by a significant decrease in vehicle production in China and continued challenges at YFAI (preliminary Q2FY19 YFAI equity income down between 60% - 70% y-o-y) An increased focus on working capital and discretionary spending drove a significant y-o-y improvement in free cash flow for Q2FY19 Adj. EBITDA and margin expected to improve in the second half of FY19 compared with first half of FY19 as actions taken to improve the company’s operating and financial performance gain traction Reposition initiatives expected to result in benefits to cash flow faster than earnings Adient expects to record a non-cash long-lived asset impairment charge between $50M - $125M during Q2FY19 (related to SS&M) ~ $45-60M Preliminary results B/(W) vs. Q2FY18 +$199M* ~ $(227)-(212)M Preliminary results B/(W) vs. H1FY18 +$197M* ~ $361-371M Incl. equity income of ~$143M Preliminary results B/(W) vs. H1FY18 $(262)M* ~$8.4B Preliminary results B/(W) vs. H1FY18 $(417)M

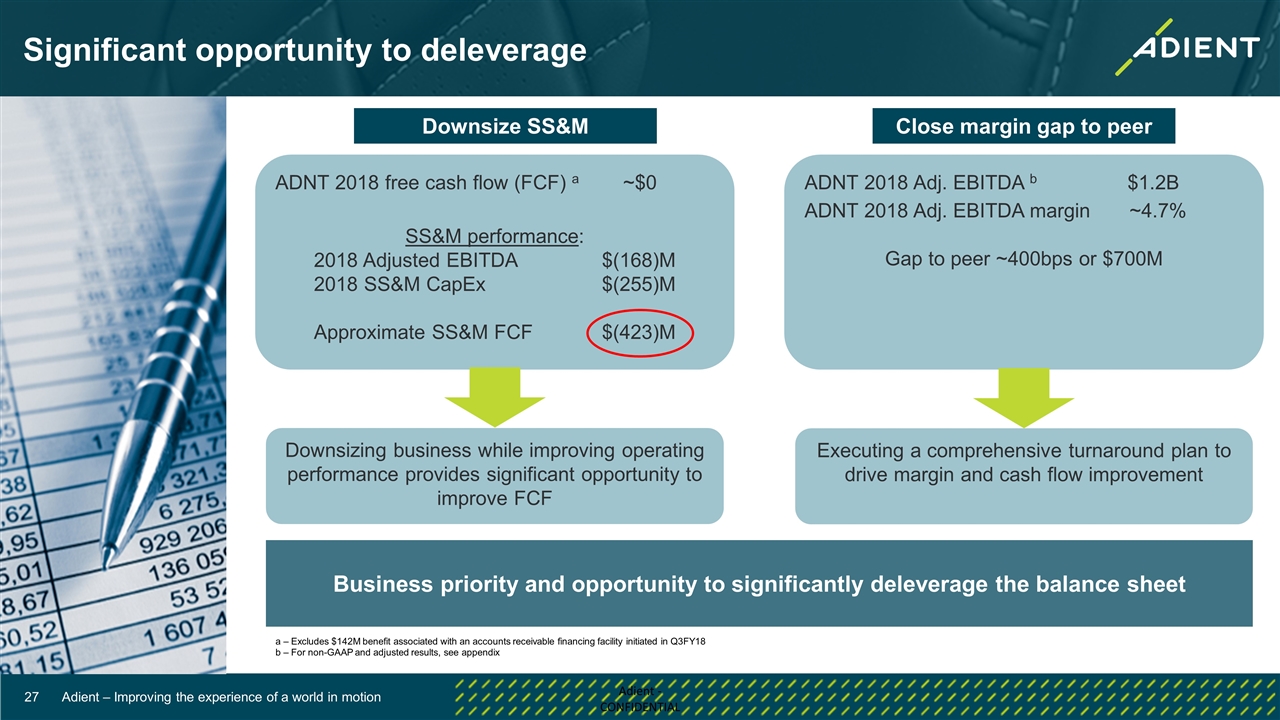

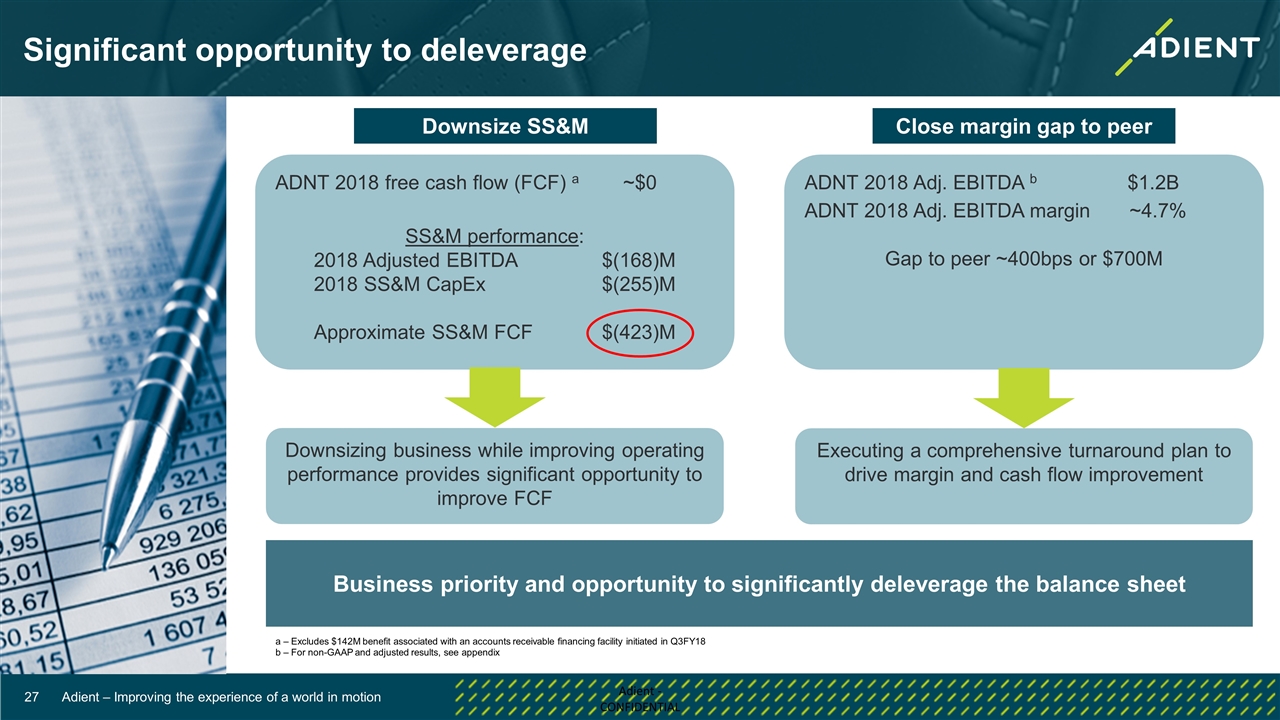

Significant opportunity to deleverage Business priority and opportunity to significantly deleverage the balance sheet Downsize SS&M ADNT 2018 free cash flow (FCF) a ~$0 SS&M performance: 2018 Adjusted EBITDA$(168)M 2018 SS&M CapEx$(255)M Approximate SS&M FCF$(423)M Downsizing business while improving operating performance provides significant opportunity to improve FCF Close margin gap to peer ADNT 2018 Adj. EBITDA b $1.2B ADNT 2018 Adj. EBITDA margin ~4.7% Gap to peer ~400bps or $700M Executing a comprehensive turnaround plan to drive margin and cash flow improvement a – Excludes $142M benefit associated with an accounts receivable financing facility initiated in Q3FY18 b – For non-GAAP and adjusted results, see appendix

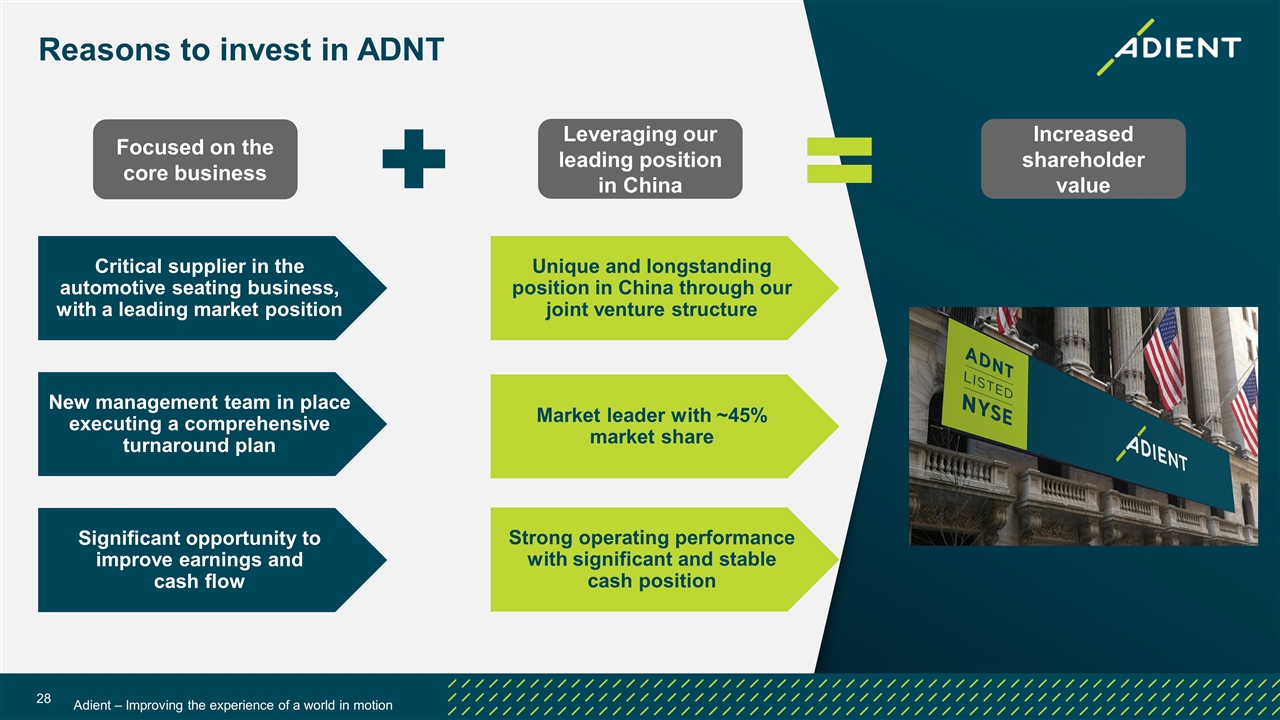

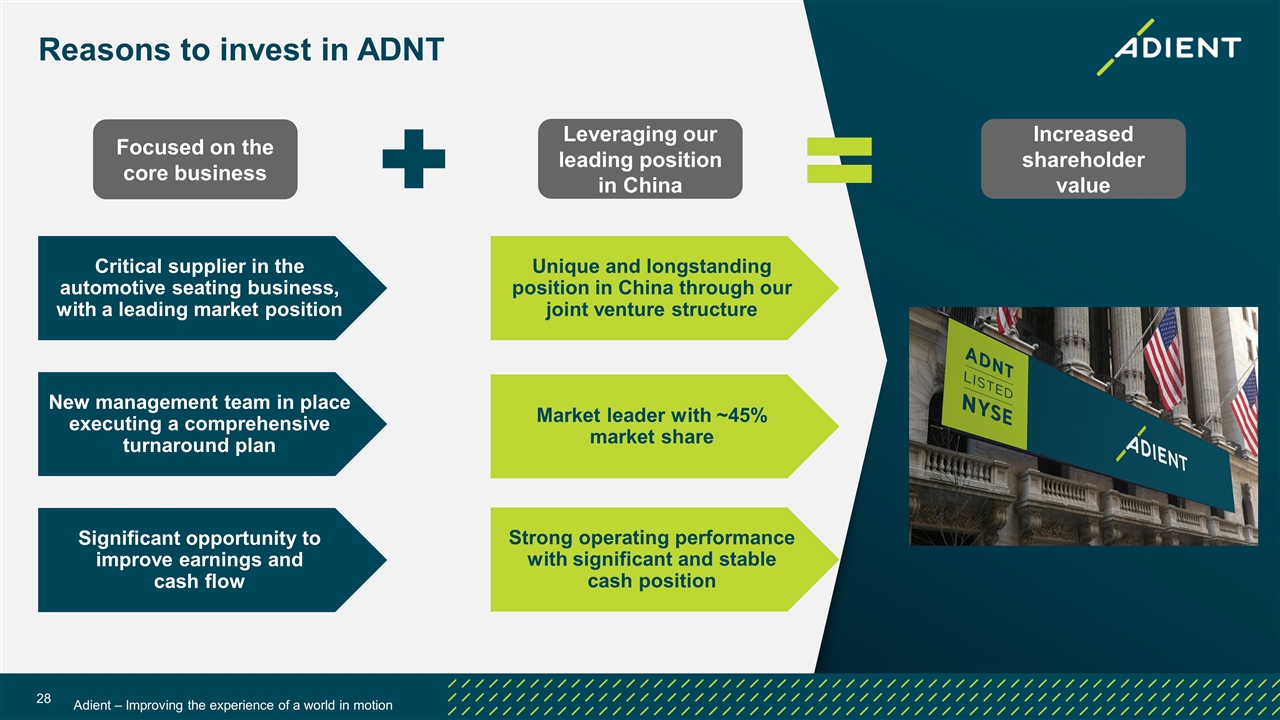

Reasons to invest in ADNT Critical supplier in the automotive seating business, with a leading market position New management team in place executing a comprehensive turnaround plan Significant opportunity to improve earnings and cash flow Unique and longstanding position in China through our joint venture structure Strong operating performance with significant and stable cash position Market leader with ~45% market share Focused on the core business Leveraging our leading position in China Increased shareholder value

Appendix

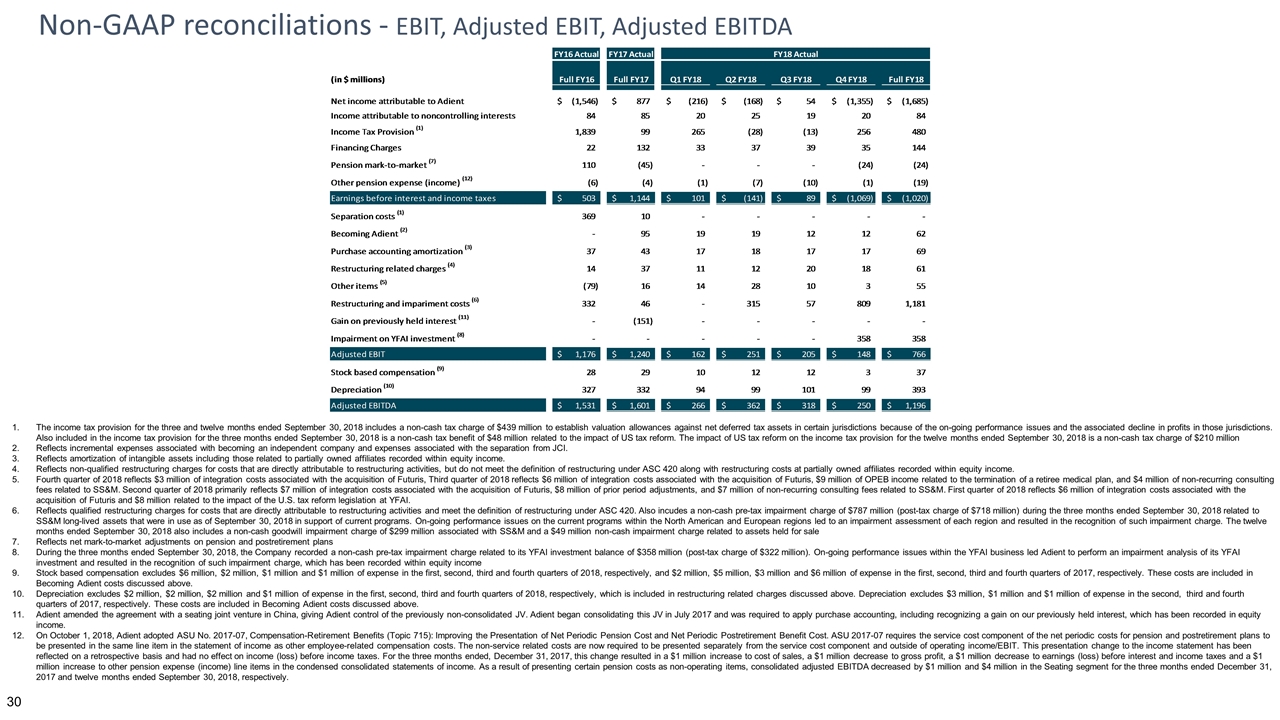

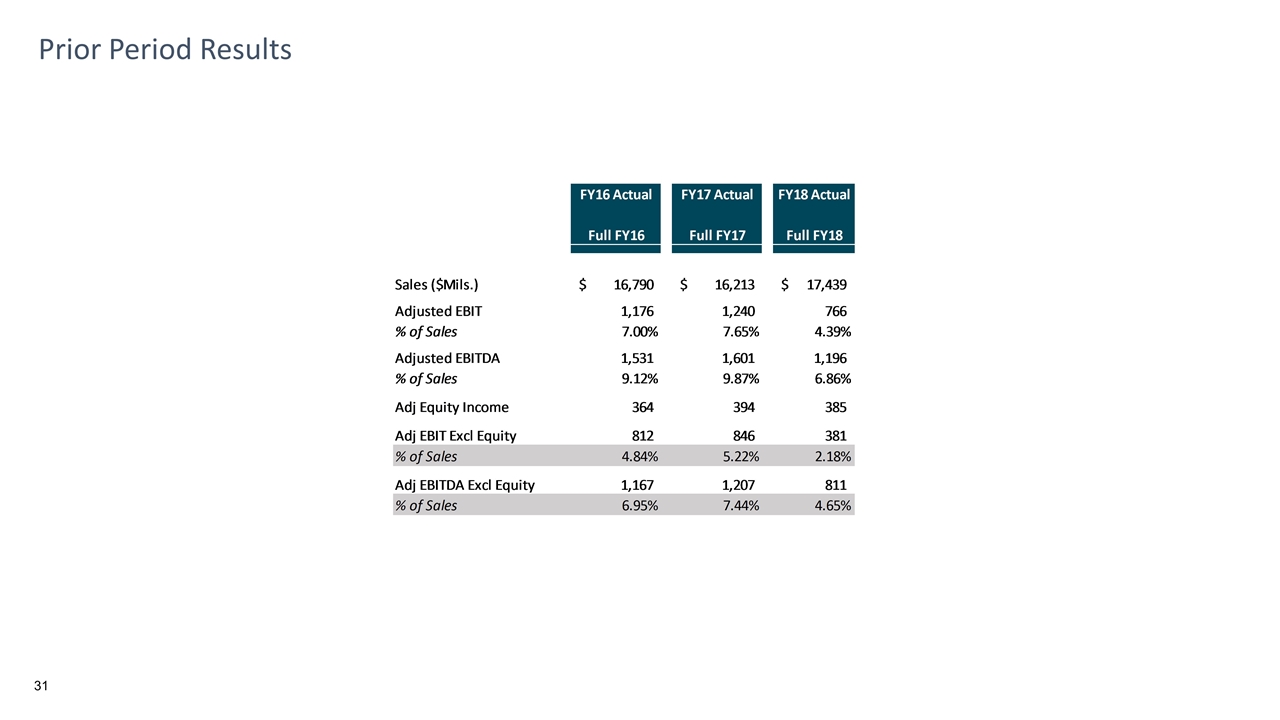

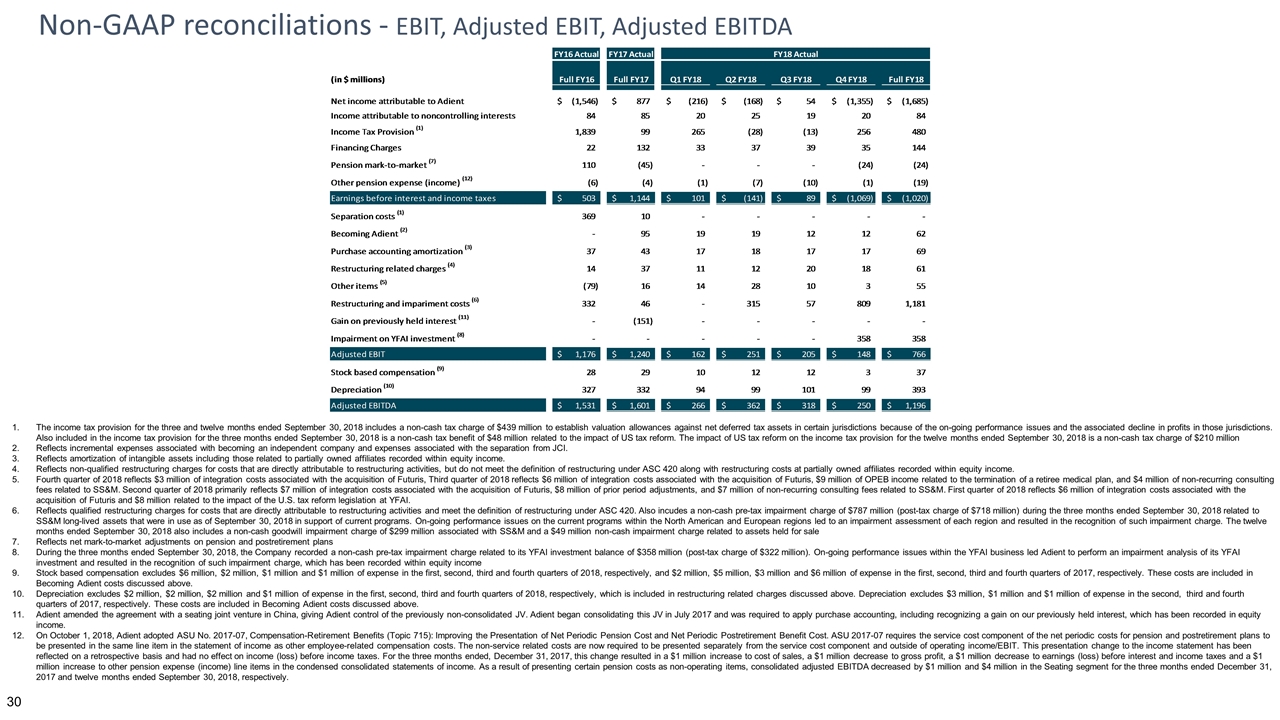

Non-GAAP reconciliations - EBIT, Adjusted EBIT, Adjusted EBITDA The income tax provision for the three and twelve months ended September 30, 2018 includes a non-cash tax charge of $439 million to establish valuation allowances against net deferred tax assets in certain jurisdictions because of the on-going performance issues and the associated decline in profits in those jurisdictions. Also included in the income tax provision for the three months ended September 30, 2018 is a non-cash tax benefit of $48 million related to the impact of US tax reform. The impact of US tax reform on the income tax provision for the twelve months ended September 30, 2018 is a non-cash tax charge of $210 million Reflects incremental expenses associated with becoming an independent company and expenses associated with the separation from JCI. Reflects amortization of intangible assets including those related to partially owned affiliates recorded within equity income. Reflects non-qualified restructuring charges for costs that are directly attributable to restructuring activities, but do not meet the definition of restructuring under ASC 420 along with restructuring costs at partially owned affiliates recorded within equity income. Fourth quarter of 2018 reflects $3 million of integration costs associated with the acquisition of Futuris, Third quarter of 2018 reflects $6 million of integration costs associated with the acquisition of Futuris, $9 million of OPEB income related to the termination of a retiree medical plan, and $4 million of non-recurring consulting fees related to SS&M. Second quarter of 2018 primarily reflects $7 million of integration costs associated with the acquisition of Futuris, $8 million of prior period adjustments, and $7 million of non-recurring consulting fees related to SS&M. First quarter of 2018 reflects $6 million of integration costs associated with the acquisition of Futuris and $8 million related to the impact of the U.S. tax reform legislation at YFAI. Reflects qualified restructuring charges for costs that are directly attributable to restructuring activities and meet the definition of restructuring under ASC 420. Also incudes a non-cash pre-tax impairment charge of $787 million (post-tax charge of $718 million) during the three months ended September 30, 2018 related to SS&M long-lived assets that were in use as of September 30, 2018 in support of current programs. On-going performance issues on the current programs within the North American and European regions led to an impairment assessment of each region and resulted in the recognition of such impairment charge. The twelve months ended September 30, 2018 also includes a non-cash goodwill impairment charge of $299 million associated with SS&M and a $49 million non-cash impairment charge related to assets held for sale Reflects net mark-to-market adjustments on pension and postretirement plans During the three months ended September 30, 2018, the Company recorded a non-cash pre-tax impairment charge related to its YFAI investment balance of $358 million (post-tax charge of $322 million). On-going performance issues within the YFAI business led Adient to perform an impairment analysis of its YFAI investment and resulted in the recognition of such impairment charge, which has been recorded within equity income Stock based compensation excludes $6 million, $2 million, $1 million and $1 million of expense in the first, second, third and fourth quarters of 2018, respectively, and $2 million, $5 million, $3 million and $6 million of expense in the first, second, third and fourth quarters of 2017, respectively. These costs are included in Becoming Adient costs discussed above. Depreciation excludes $2 million, $2 million, $2 million and $1 million of expense in the first, second, third and fourth quarters of 2018, respectively, which is included in restructuring related charges discussed above. Depreciation excludes $3 million, $1 million and $1 million of expense in the second, third and fourth quarters of 2017, respectively. These costs are included in Becoming Adient costs discussed above. Adient amended the agreement with a seating joint venture in China, giving Adient control of the previously non-consolidated JV. Adient began consolidating this JV in July 2017 and was required to apply purchase accounting, including recognizing a gain on our previously held interest, which has been recorded in equity income. On October 1, 2018, Adient adopted ASU No. 2017-07, Compensation-Retirement Benefits (Topic 715): Improving the Presentation of Net Periodic Pension Cost and Net Periodic Postretirement Benefit Cost. ASU 2017-07 requires the service cost component of the net periodic costs for pension and postretirement plans to be presented in the same line item in the statement of income as other employee-related compensation costs. The non-service related costs are now required to be presented separately from the service cost component and outside of operating income/EBIT. This presentation change to the income statement has been reflected on a retrospective basis and had no effect on income (loss) before income taxes. For the three months ended, December 31, 2017, this change resulted in a $1 million increase to cost of sales, a $1 million decrease to gross profit, a $1 million decrease to earnings (loss) before interest and income taxes and a $1 million increase to other pension expense (income) line items in the condensed consolidated statements of income. As a result of presenting certain pension costs as non-operating items, consolidated adjusted EBITDA decreased by $1 million and $4 million in the Seating segment for the three months ended December 31, 2017 and twelve months ended September 30, 2018, respectively.

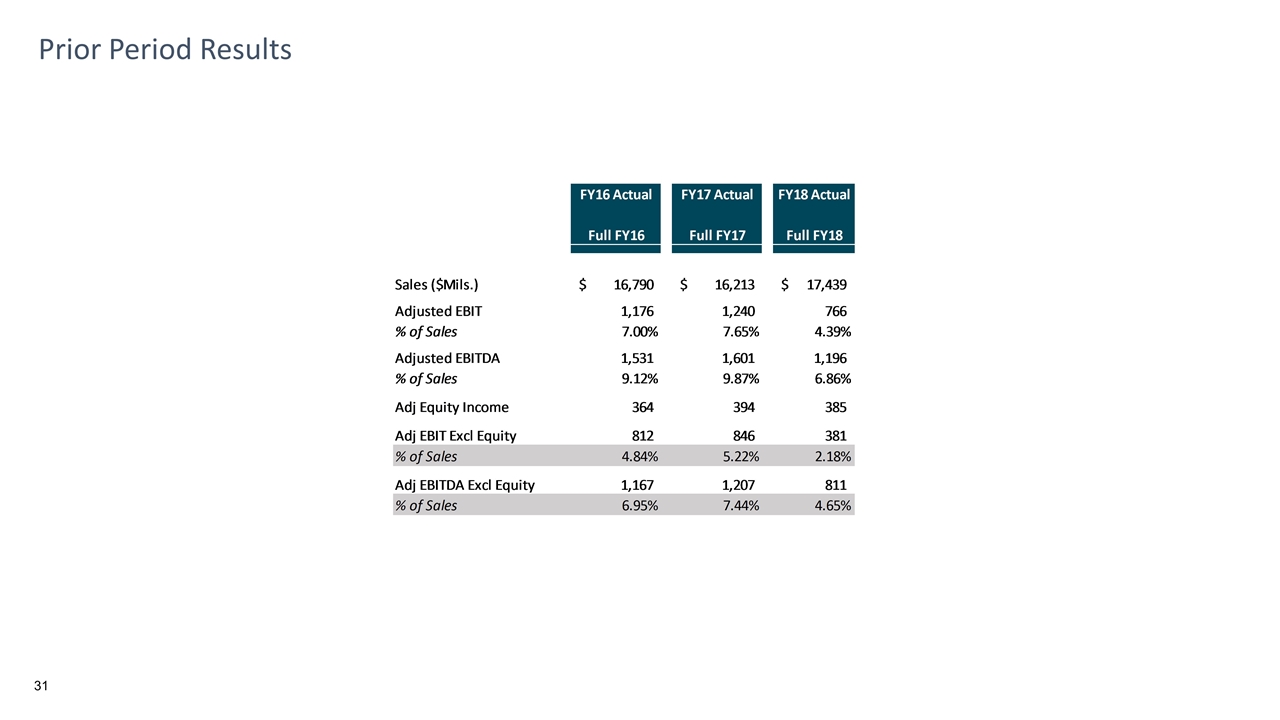

Prior Period Results Q1-2016