Adient Investor Meetings February / March 2020 Exhibit 99.1

Important information Adient has made statements in this document that are forward-looking and, therefore, are subject to risks and uncertainties. All statements in this document other than statements of historical fact are statements that are, or could be, deemed “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. In this document, statements regarding Adient’s future financial position, sales, costs, earnings, cash flows, other measures of results of operations, capital expenditures or debt levels and plans, objectives, outlook, targets, guidance or goals are forward-looking statements. Words such as “may,” “will,” “expect,” “intend,” “estimate,” “anticipate,” “believe,” “should,” “forecast,” “project” or “plan” or terms of similar meaning are also generally intended to identify forward-looking statements. Adient cautions that these statements are subject to numerous important risks, uncertainties, assumptions and other factors, some of which are beyond Adient’s control, that could cause Adient’s actual results to differ materially from those expressed or implied by such forward-looking statements, including, among others, risks related to: the ability of Adient to close the transactions subject to the Yanfeng agreement, the ability of Adient to effectively launch new business at forecasted and profitable levels, the ability of Adient to execute its turnaround plan, uncertainties in U.S. administrative policy regarding trade agreements, tariffs and other international trade relations, the impact of tax reform legislation through the Tax Cuts and Jobs Act, the ability of Adient to meet debt service requirements, terms of financing, general economic and business conditions, the strength of the U.S. or other economies, automotive vehicle production levels, mix and schedules, energy and commodity prices, the availability of raw materials and component products, currency exchange rates, the cancellation of or changes to commercial arrangements, and the ability of Adient to identify, recruit and retain key leadership. A detailed discussion of risks related to Adient’s business is included in the section entitled “Risk Factors” in Adient’s Annual Report on Form 10-K for the fiscal year ended September 30, 2019 filed with the SEC on November 22, 2019 and subsequent quarterly reports on Form 10-Q filed with the SEC, available at www.sec.gov. Potential investors and others should consider these factors in evaluating the forward-looking statements and should not place undue reliance on such statements. The forward-looking statements included in this document are made only as of the date of this document, unless otherwise specified, and, except as required by law, Adient assumes no obligation, and disclaims any obligation, to update such statements to reflect events or circumstances occurring after the date of this document. In addition, this document includes certain projections provided by Adient with respect to the anticipated future performance of Adient’s businesses. Such projections reflect various assumptions of Adient’s management concerning the future performance of Adient’s businesses, which may or may not prove to be correct. The actual results may vary from the anticipated results and such variations may be material. Adient does not undertake any obligation to update the projections to reflect events or circumstances or changes in expectations after the date of this document or to reflect the occurrence of subsequent events. No representations or warranties are made as to the accuracy or reasonableness of such assumptions or the projections based thereon. This document also contains non-GAAP financial information because Adient’s management believes it may assist investors in evaluating Adient’s on-going operations. Adient believes these non-GAAP disclosures provide important supplemental information to management and investors regarding financial and business trends relating to Adient’s financial condition and results of operations. Investors should not consider these non-GAAP measures as alternatives to the related GAAP measures. A reconciliation of non-GAAP measures to their closest GAAP equivalent are included in the appendix. Reconciliations of non-GAAP measures related to FY2020 guidance have not been provided due to the unreasonable efforts it would take to provide such reconciliations.

Today’s agenda Executive summary Operations update Turnaround plan solidly on track Strategic actions further positioning Adient for long-term success Innovation: balancing the “now” with the “future” Financial update Successfully transitioned from “stabilization” to “improvement” phase of turnaround De-risking the balance sheet Driving shareholder value

Executive summary Leading competitive position in a strong and vital market Adient maintains one of the largest market shares (~33%) in a concentrated segment with few global competitors Well diversified customer mix - no customer is greater than 12% of total consolidated sales High barriers to entry; replacement business typically won at a high rate (>90%) as switching costs for customers is high Profitable new business wins (including alternative propulsion programs) strengthening Adient’s market position Significant opportunity to materially increase earnings and free cash flow Bridging the margin gap versus key competitors represents enormous opportunity The company has successfully transitioned to the “improvement phase” of its turnaround plan Right-sizing structures and mechanisms expected to have positive impact over the next several years Earnings and cash flow improvement expected from “self-help” initiatives (not dependent on improving industry conditions) With operations stabilized and steadily improving, executing strategic transactions to further enhance shareholder value Agreement with joint venture partner Yanfeng to restructure existing joint venture relationships expands strategic partnership (enabler to right-sizing structures and mechanisms) Recent portfolio adjustments demonstrate management‘s commitment to the core business and focus on capital allocation Joint venture structure a significant and underappreciated asset Highly profitable network of JVs generating significant cash flow Estimated 40% - 45% share of China’s passenger Seating market driven by strategic customer partnerships On average, approximately 70% of annual equity income converts into cash dividends Underlying balance sheets of Chinese JVs very strong (approximately $1.5B of net cash as of Dec. 31, 2019)

Impact of COVID-19 on Adient’s FY20 outlook The coronavirus has caused a great deal of uncertainty for the auto industry both inside and outside of China China’s auto industry has experienced a staggered restart to operations after the Lunar New Year Holiday ended on Feb. 9, 2020 (certain customer plants are not expected to restart until March or later) Many cities remain on lockdown, with travel restrictions preventing employees from returning to work; truck driver shortages are causing significant logistical issues Based on the industry’s staggered restart to operations, production volumes are expected to be down significantly in Adient’s fiscal second quarter Feb. and March production estimated to be down ~70% and 40%, respectively, vs. prior estimates; gradual improvement expected thereafter with full capabilities achieved after June Impact of virus outside of China is minimal as customers and suppliers are working together with Adient to address potential production disruptions Adient’s unconsolidated seating JVs maintain healthy cash positions to help “weather the storm” (net cash position totaled ~$1.5B at Dec. 31, 2019) Operational improvements in Americas and EMEA continue to accelerate, partially offsetting the approximate $70M headwinds in China (consolidated and unconsolidated impact assuming above production declines materialize) Adient’s FY20 outlook for Adj. EBITDA is tracking towards the low end of the guidance range (~$870M - $910M) Equity income for FY20 revised down to between ~$175M and $185M (previously between ~$235M and $245M); fiscal Q2 equity income of approximately $0 To ensure the health and safety of Adient employees, Adient has implemented a variety of safety measures, including: Restricting business travel Implementing an office sanitization program and enforcing strict hygiene protocols Convening a Global Response Team to assess risks to our business and ensure we have coordinated contingency plans in place We are in daily contact with our customers and suppliers to monitor their situations The China team is focused on business improvement actions to help offset the negative impact of lower volumes (e.g. reduce SG&A costs, focus on discretionary spending, opportunities for launch cost and CapEx reductions, etc.) Adient specifics Note: The guidance set forth above speaks as of February 25, 2020. The company does not intend to provide further updates on its guidance until it releases its second quarter results in May.

Adient – Improving the experience of a world in motion Operations update

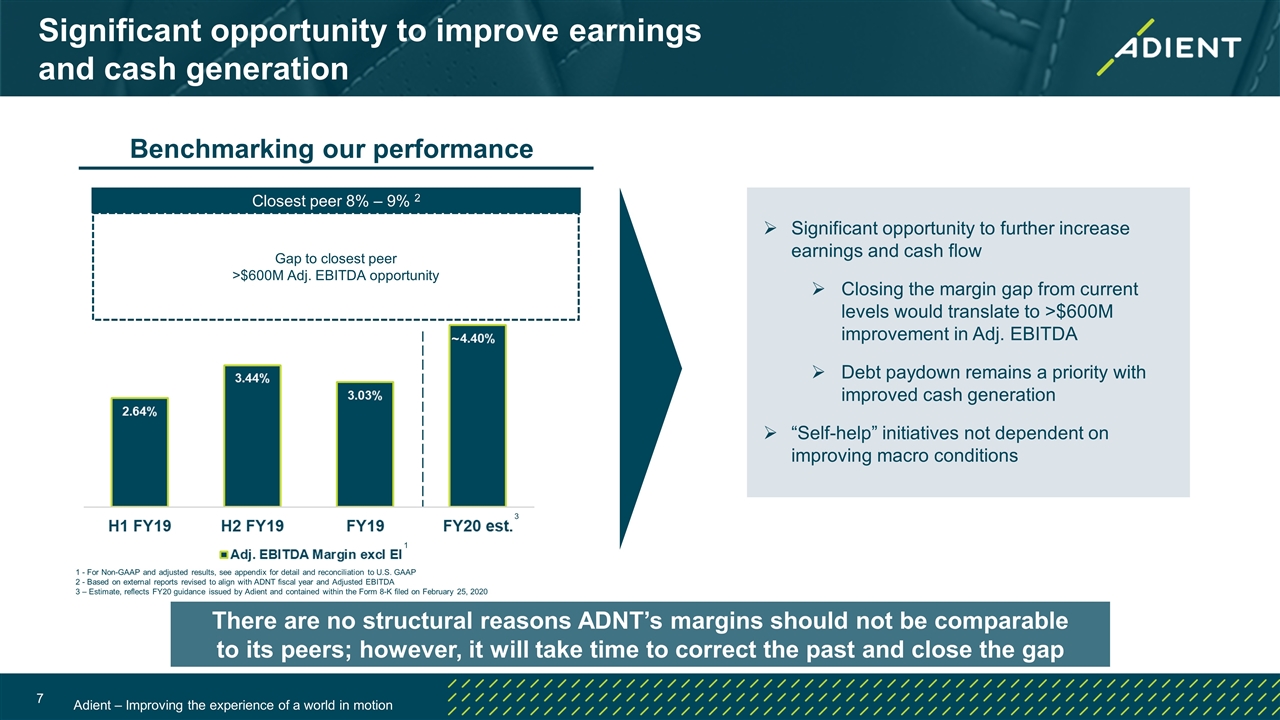

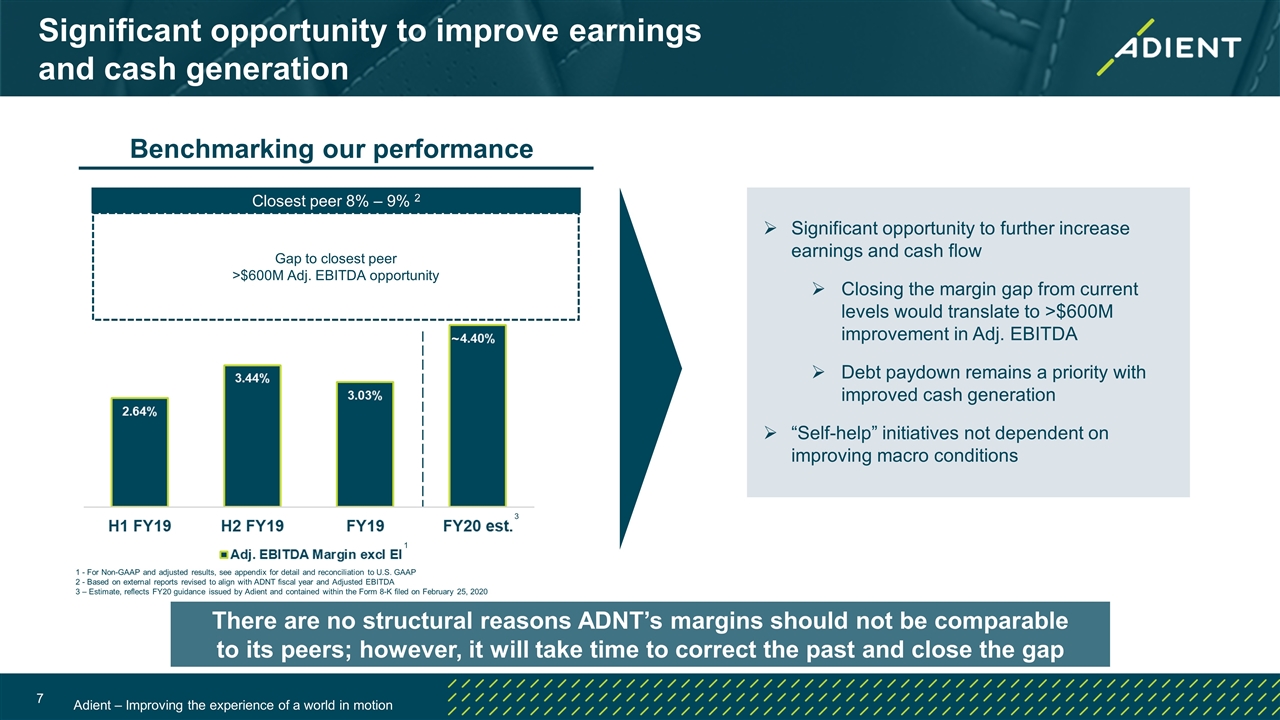

Significant opportunity to improve earnings and cash generation There are no structural reasons ADNT’s margins should not be comparable to its peers; however, it will take time to correct the past and close the gap Benchmarking our performance 1 - For Non-GAAP and adjusted results, see appendix for detail and reconciliation to U.S. GAAP 2 - Based on external reports revised to align with ADNT fiscal year and Adjusted EBITDA 3 – Estimate, reflects FY20 guidance issued by Adient and contained within the Form 8-K filed on February 25, 2020 1 Closest peer 8% – 9% 2 Gap to closest peer >$600M Adj. EBITDA opportunity 3 Significant opportunity to further increase earnings and cash flow Closing the margin gap from current levels would translate to >$600M improvement in Adj. EBITDA Debt paydown remains a priority with improved cash generation “Self-help” initiatives not dependent on improving macro conditions ~

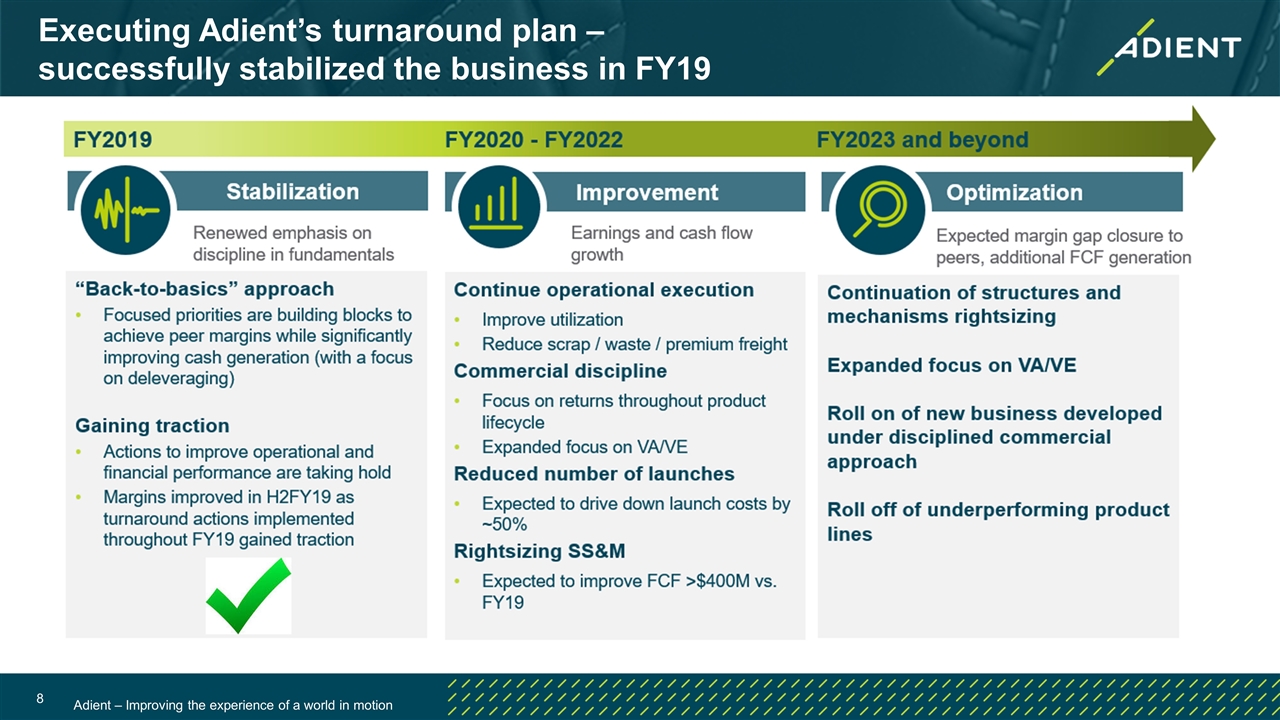

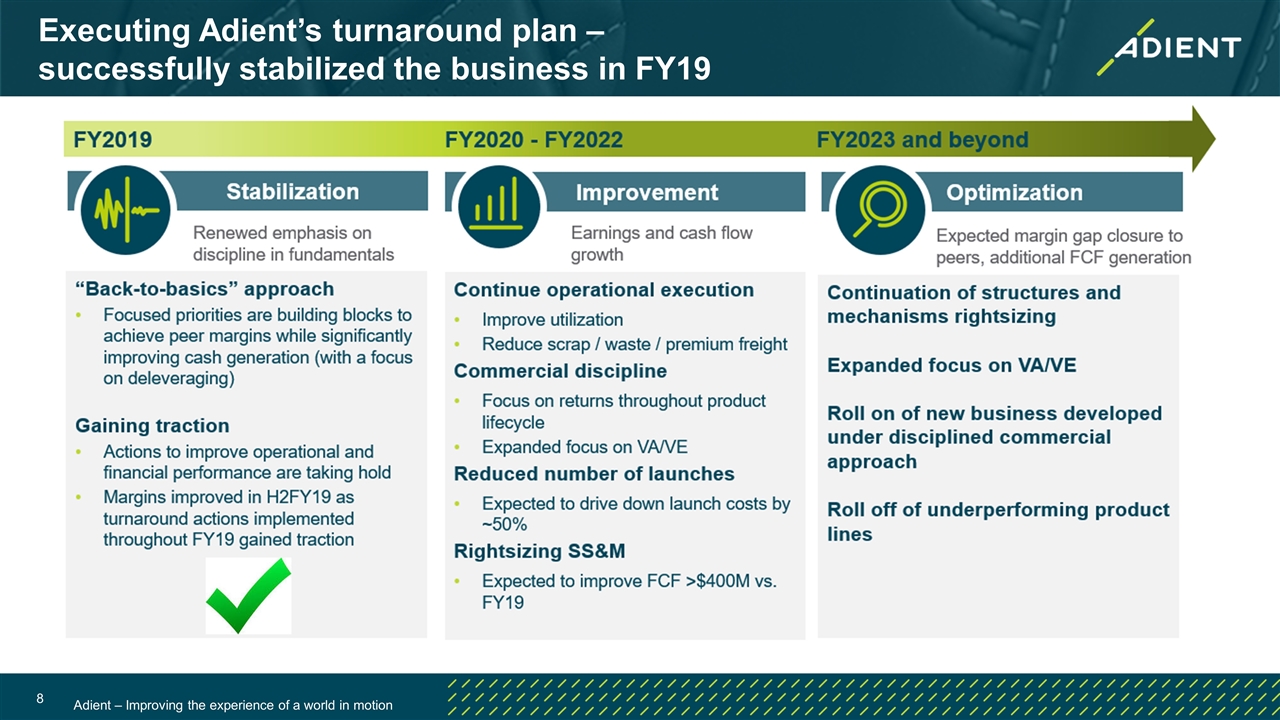

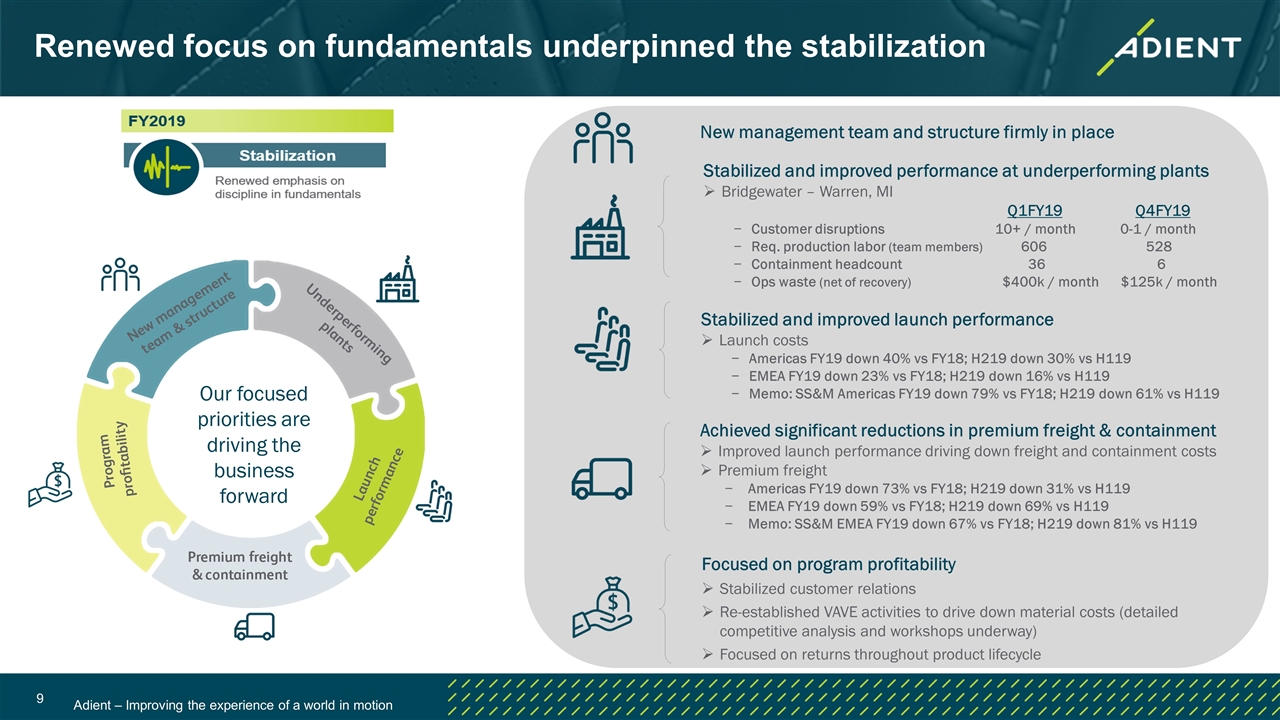

Executing Adient’s turnaround plan – successfully stabilized the business in FY19

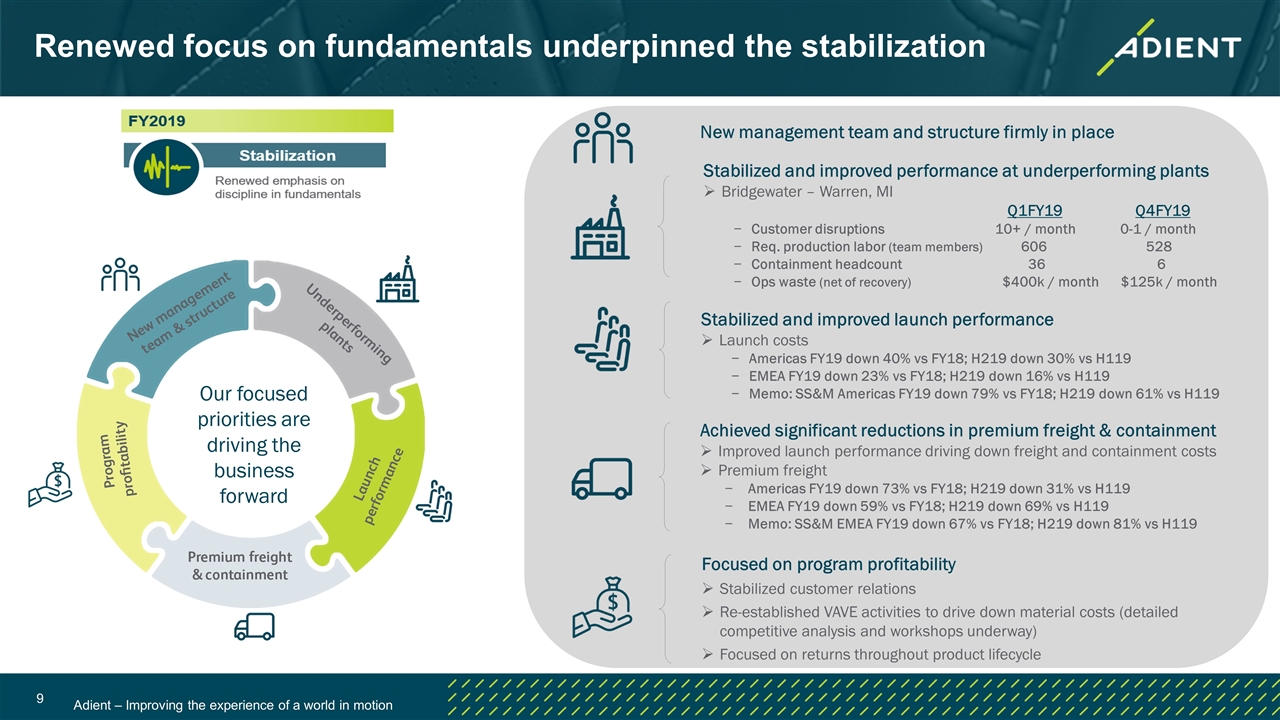

New management team and structure firmly in place Achieved significant reductions in premium freight & containment Improved launch performance driving down freight and containment costs Premium freight Americas FY19 down 73% vs FY18; H219 down 31% vs H119 EMEA FY19 down 59% vs FY18; H219 down 69% vs H119 Memo: SS&M EMEA FY19 down 67% vs FY18; H219 down 81% vs H119 Focused on program profitability Stabilized customer relations Re-established VAVE activities to drive down material costs (detailed competitive analysis and workshops underway) Focused on returns throughout product lifecycle Stabilized and improved launch performance Launch costs Americas FY19 down 40% vs FY18; H219 down 30% vs H119 EMEA FY19 down 23% vs FY18; H219 down 16% vs H119 Memo: SS&M Americas FY19 down 79% vs FY18; H219 down 61% vs H119 Stabilized and improved performance at underperforming plants Bridgewater – Warren, MI Q1FY19 Q4FY19 Customer disruptions 10+ / month 0-1 / month Req. production labor (team members) 606 528 Containment headcount 36 6 Ops waste (net of recovery) $400k / month $125k / month Renewed focus on fundamentals underpinned the stabilization Our focused priorities are driving the business forward

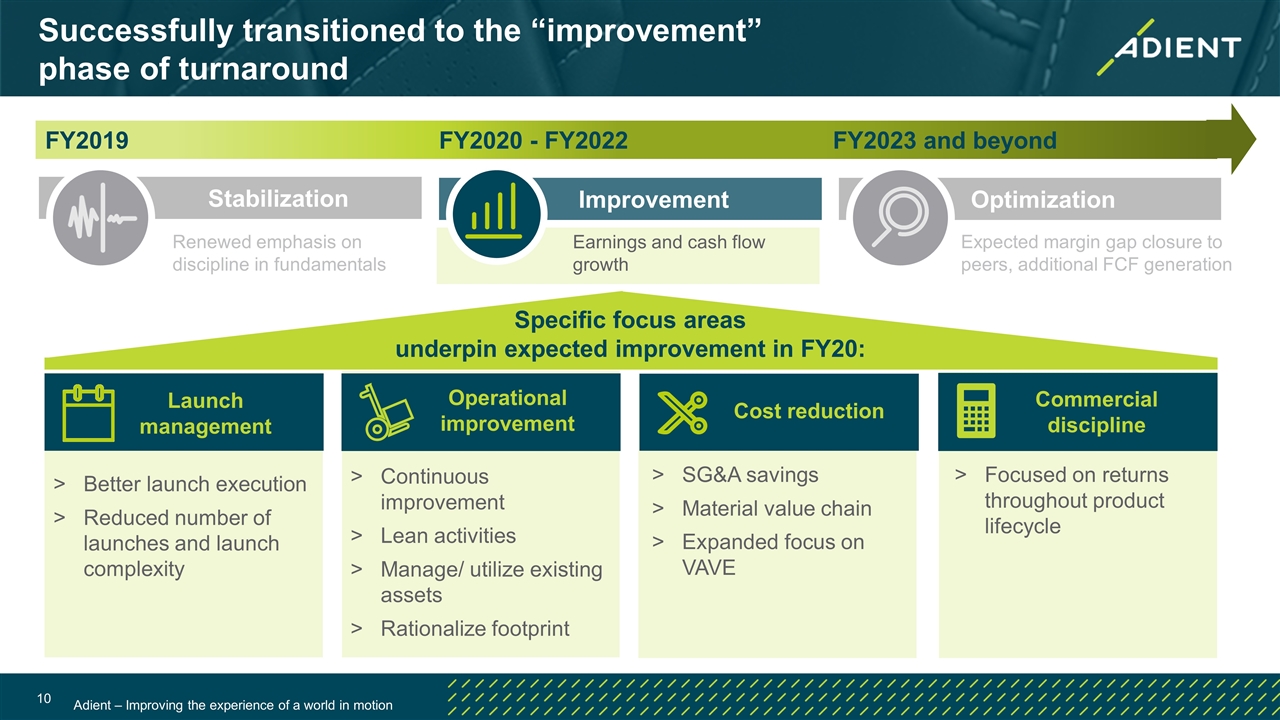

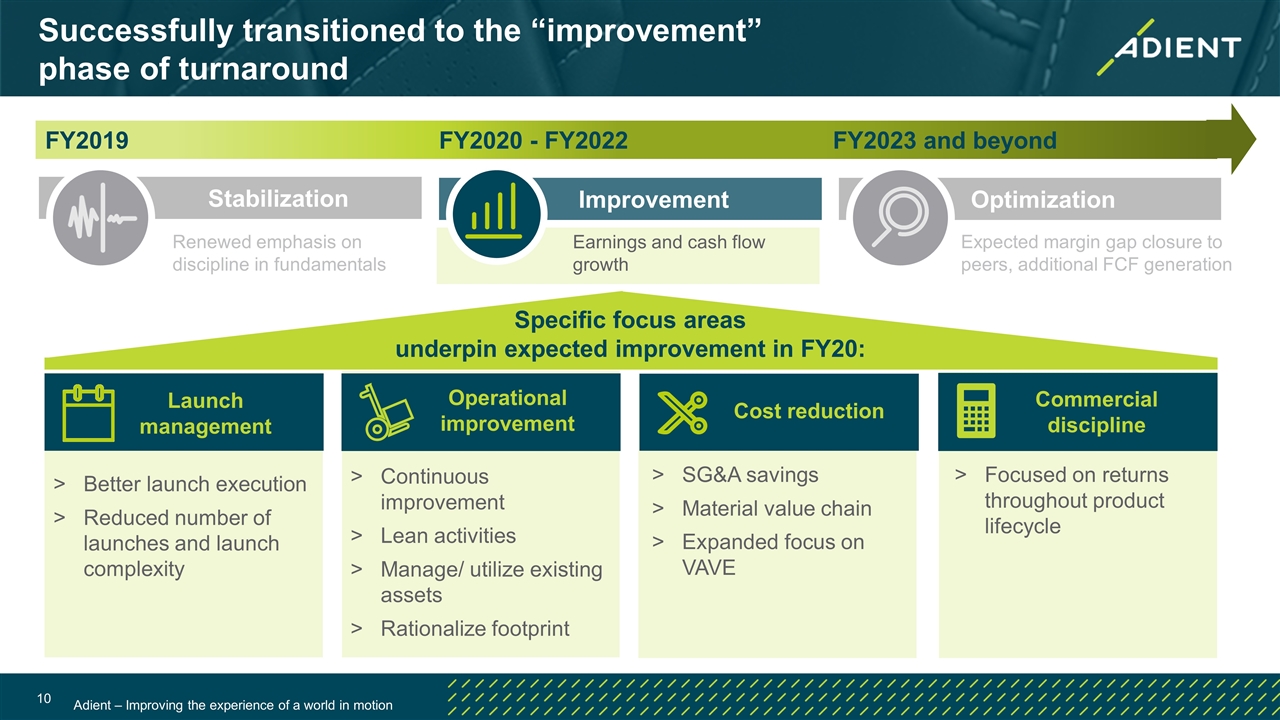

Successfully transitioned to the “improvement” phase of turnaround Stabilization Optimization Expected margin gap closure to peers, additional FCF generation Renewed emphasis on discipline in fundamentals Improvement Better launch execution Reduced number of launches and launch complexity SG&A savings Material value chain Expanded focus on VAVE Continuous improvement Lean activities Manage/ utilize existing assets Rationalize footprint Focused on returns throughout product lifecycle Launch management Operational improvement Cost reduction Commercial discipline Specific focus areas underpin expected improvement in FY20: FY2019 FY2020 - FY2022 FY2023 and beyond Earnings and cash flow growth

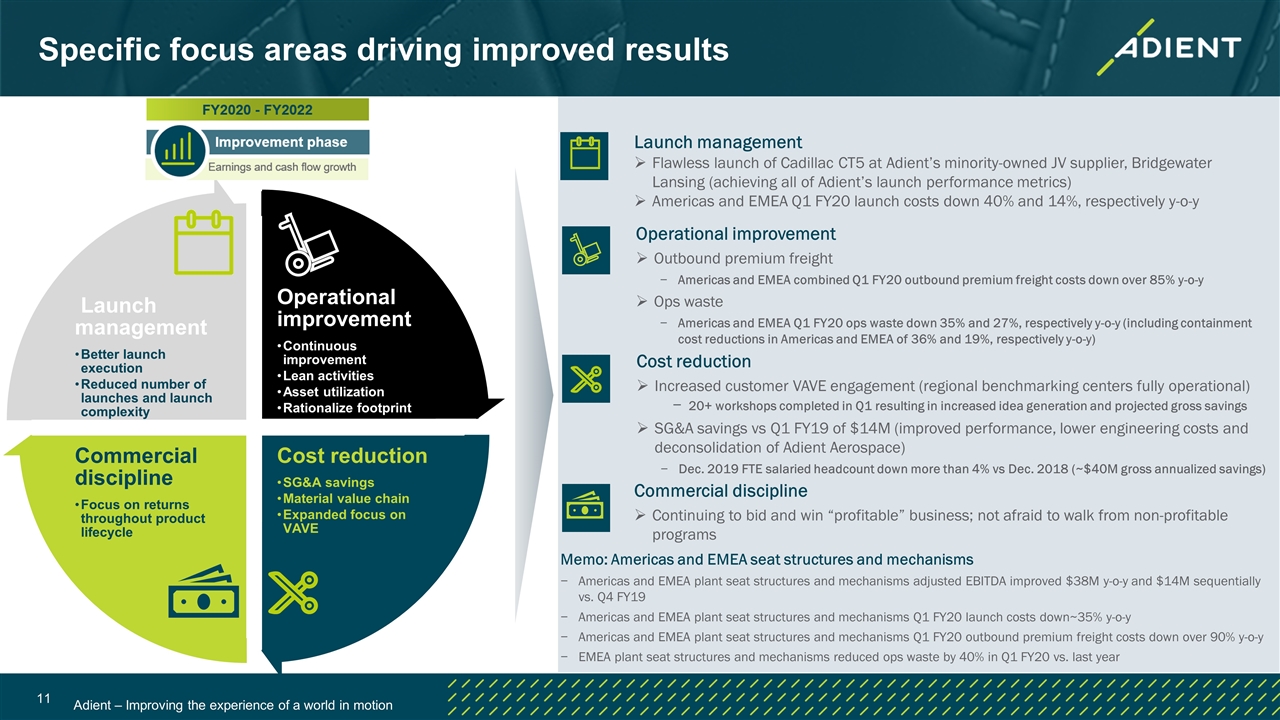

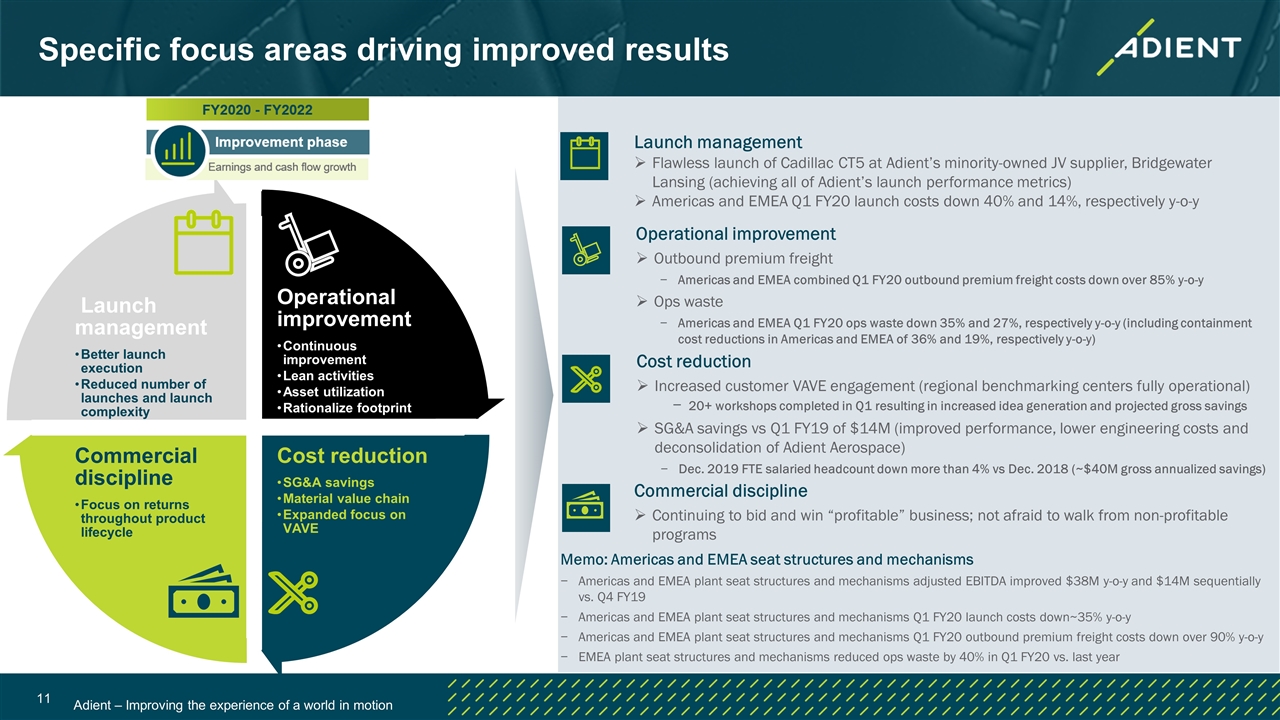

Specific focus areas driving improved results Launch management Flawless launch of Cadillac CT5 at Adient’s minority-owned JV supplier, Bridgewater Lansing (achieving all of Adient’s launch performance metrics) Americas and EMEA Q1 FY20 launch costs down 40% and 14%, respectively y-o-y Cost reduction Increased customer VAVE engagement (regional benchmarking centers fully operational) 20+ workshops completed in Q1 resulting in increased idea generation and projected gross savings SG&A savings vs Q1 FY19 of $14M (improved performance, lower engineering costs and deconsolidation of Adient Aerospace) Dec. 2019 FTE salaried headcount down more than 4% vs Dec. 2018 (~$40M gross annualized savings) Operational improvement Outbound premium freight Americas and EMEA combined Q1 FY20 outbound premium freight costs down over 85% y-o-y Ops waste Americas and EMEA Q1 FY20 ops waste down 35% and 27%, respectively y-o-y (including containment cost reductions in Americas and EMEA of 36% and 19%, respectively y-o-y) Commercial discipline Continuing to bid and win “profitable” business; not afraid to walk from non-profitable programs Memo: Americas and EMEA seat structures and mechanisms Americas and EMEA plant seat structures and mechanisms adjusted EBITDA improved $38M y-o-y and $14M sequentially vs. Q4 FY19 Americas and EMEA plant seat structures and mechanisms Q1 FY20 launch costs down~35% y-o-y Americas and EMEA plant seat structures and mechanisms Q1 FY20 outbound premium freight costs down over 90% y-o-y EMEA plant seat structures and mechanisms reduced ops waste by 40% in Q1 FY20 vs. last year Operational improvement Cost reduction Commercial discipline Launch management Better launch execution Continuous improvement SG&A savings Material value chain Expanded focus on VAVE Focus on returns throughout product lifecycle Reduced number of launches and launch complexity Lean activities Asset utilization Rationalize footprint

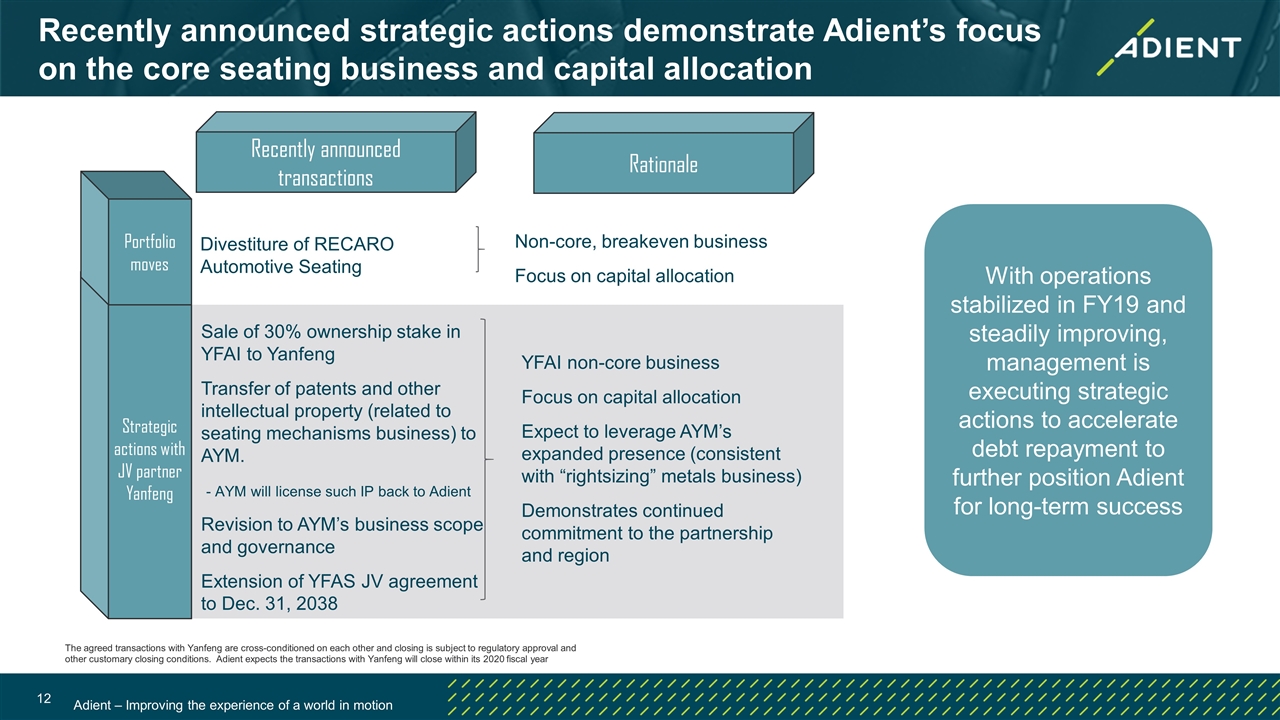

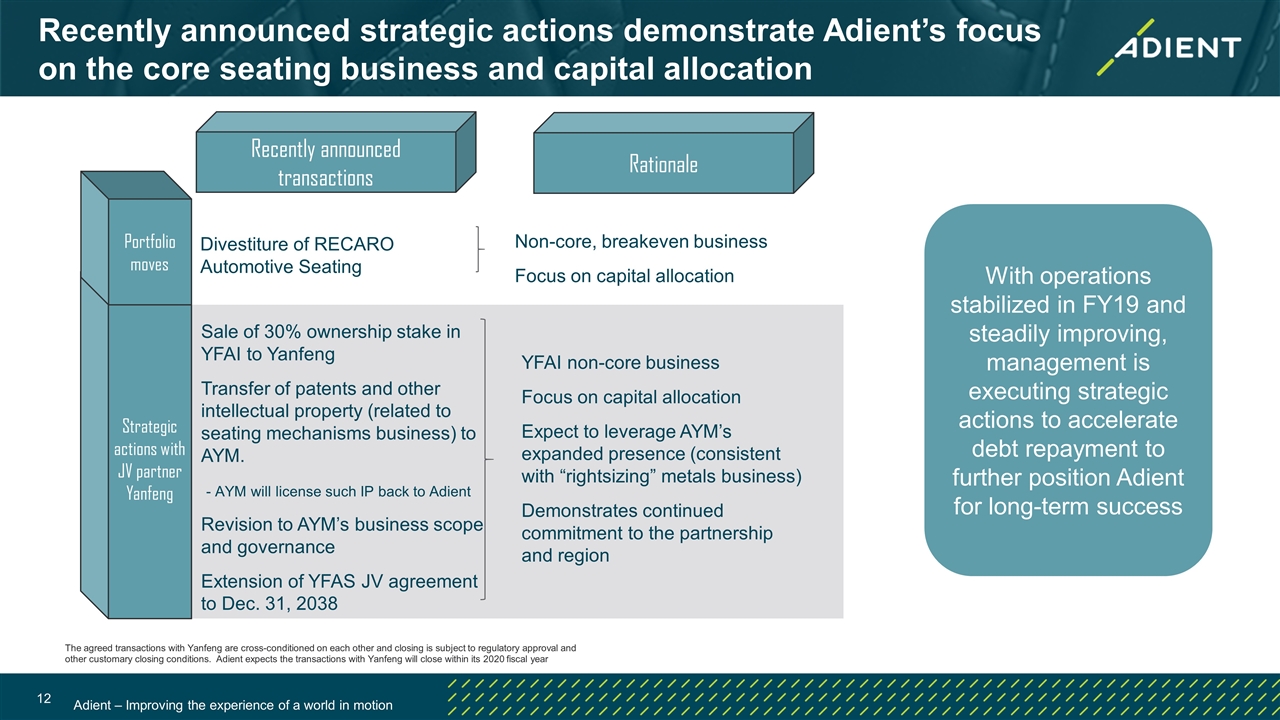

Recently announced strategic actions demonstrate Adient’s focus on the core seating business and capital allocation Recently announced transactions Rationale Divestiture of RECARO Automotive Seating Non-core, breakeven business Focus on capital allocation Sale of 30% ownership stake in YFAI to Yanfeng Transfer of patents and other intellectual property (related to seating mechanisms business) to AYM. - AYM will license such IP back to Adient Revision to AYM’s business scope and governance Extension of YFAS JV agreement to Dec. 31, 2038 YFAI non-core business Focus on capital allocation Expect to leverage AYM’s expanded presence (consistent with “rightsizing” metals business) Demonstrates continued commitment to the partnership and region Strategic actions with JV partner Yanfeng Portfolio moves The agreed transactions with Yanfeng are cross-conditioned on each other and closing is subject to regulatory approval and other customary closing conditions. Adient expects the transactions with Yanfeng will close within its 2020 fiscal year With operations stabilized in FY19 and steadily improving, management is executing strategic actions to accelerate debt repayment to further position Adient for long-term success

Adient – Improving the experience of a world in motion Innovation: Balancing the “now” with the “future”

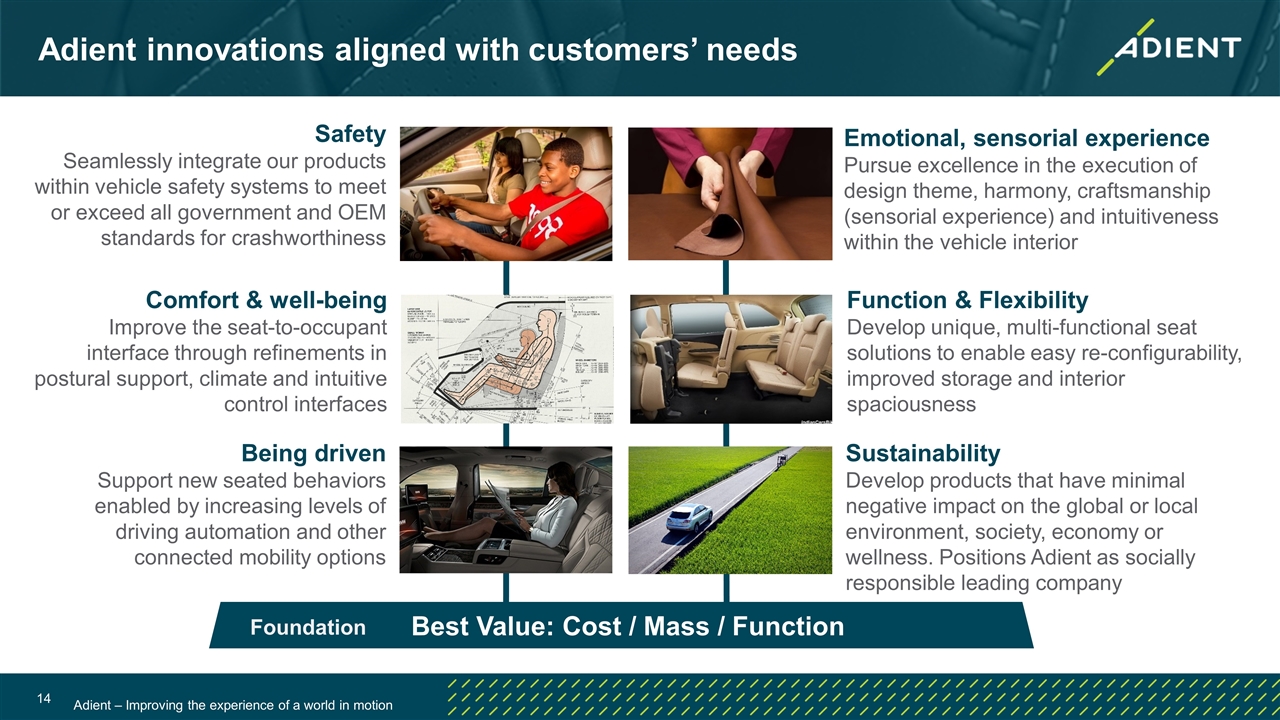

Adient innovations aligned with customers’ needs Safety Seamlessly integrate our products within vehicle safety systems to meet or exceed all government and OEM standards for crashworthiness Sustainability Develop products that have minimal negative impact on the global or local environment, society, economy or wellness. Positions Adient as socially responsible leading company Being driven Support new seated behaviors enabled by increasing levels of driving automation and other connected mobility options Emotional, sensorial experience Pursue excellence in the execution of design theme, harmony, craftsmanship (sensorial experience) and intuitiveness within the vehicle interior Function & Flexibility Develop unique, multi-functional seat solutions to enable easy re-configurability, improved storage and interior spaciousness Comfort & well-being Improve the seat-to-occupant interface through refinements in postural support, climate and intuitive control interfaces Best Value: Cost / Mass / Function Foundation

Collaborative workshops create value for Adient, our customers and end-users Current environment Auto manufacturers are facing extreme pressure to maintain (expand) margins while increasing investment for “Auto 2.0” (autonomous operation, alternative propulsion, etc.). This places pressure on auto part suppliers to increase efficiencies for their customers — and creates a difficult environment for auto part suppliers to maintain and expand their margins. Our Solution: Collaborative Workshops Collaborative workshops are designed to be more than a VAVE idea incubator. Adient’s “focused innovation management” solicits input from numerous sources, including: • Focus groups • Leading industry observers • Emerging trends • Customers and suppliers Enables value-add solutions to enhance the end-user experience, reduction of costs associated with non-customer facing components. Adient’s scale across regions and customers — combined with our customers’ incentives to create value — has resulted in numerous win-win solutions. Implemented ideas are being used to supplement pricing / efficiency requirements.

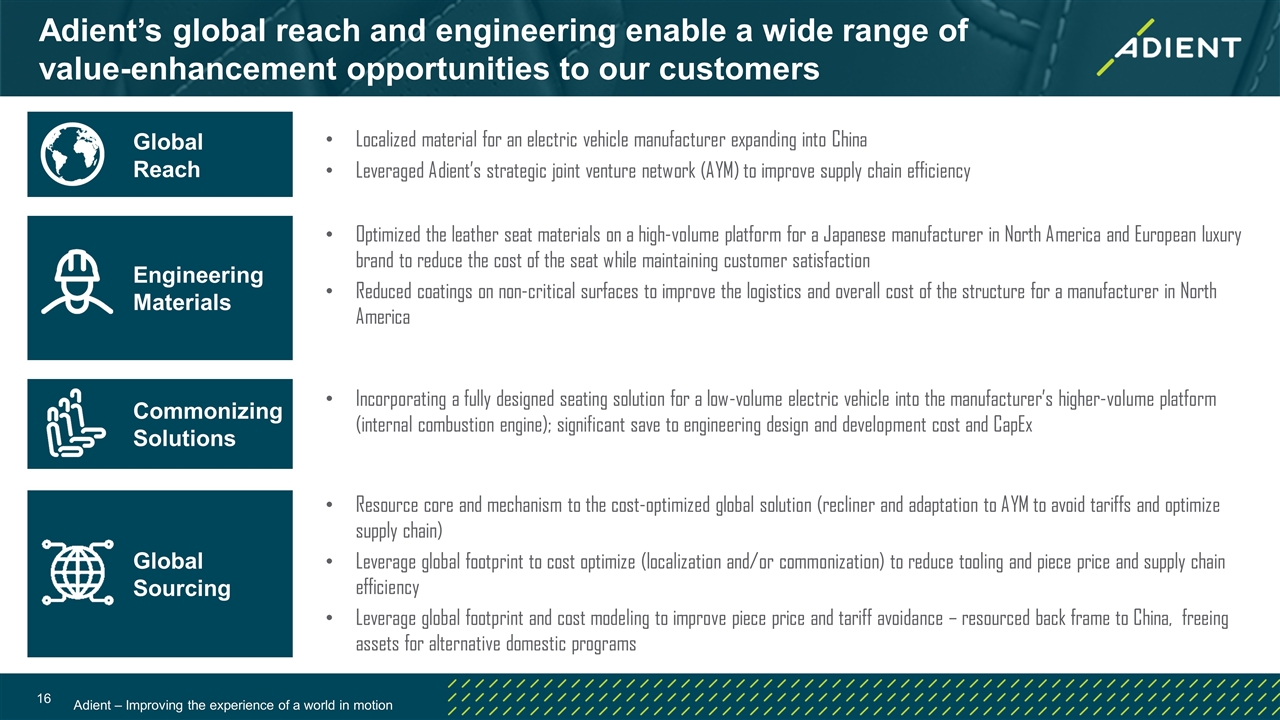

Adient’s global reach and engineering enable a wide range of value-enhancement opportunities to our customers Optimized the leather seat materials on a high-volume platform for a Japanese manufacturer in North America and European luxury brand to reduce the cost of the seat while maintaining customer satisfaction Reduced coatings on non-critical surfaces to improve the logistics and overall cost of the structure for a manufacturer in North America Resource core and mechanism to the cost-optimized global solution (recliner and adaptation to AYM to avoid tariffs and optimize supply chain) Leverage global footprint to cost optimize (localization and/or commonization) to reduce tooling and piece price and supply chain efficiency Leverage global footprint and cost modeling to improve piece price and tariff avoidance – resourced back frame to China, freeing assets for alternative domestic programs Global Reach Engineering Materials Global Sourcing CommonizingSolutions Incorporating a fully designed seating solution for a low-volume electric vehicle into the manufacturer’s higher-volume platform (internal combustion engine); significant save to engineering design and development cost and CapEx Localized material for an electric vehicle manufacturer expanding into China Leveraged Adient’s strategic joint venture network (AYM) to improve supply chain efficiency

Satisfying our customers’ needs with award-winning solutions: 2020 North American Car, Utility and Truck of the Year Adient's industry-leading seats and components were included in two of the three North American Car, Utility and Truck of the Year (NACTOY) winners Jeep Gladiator Kia Telluride In the Jeep Gladiator seats, Adient supplies the foam from our Greenfield, OH, plant as well as the JIT complete seat assembly from our Northwood, OH, facility For the Kia Telluride, Adient is the JIT supplier from our West Point, GA, plant We also congratulate the other Adient teams that worked on vehicles nominated for NACTOY awards – Ram Heavy Duty, Hyundai Sonata and Lincoln Aviator

Adient – Improving the experience of a world in motion Financial performance

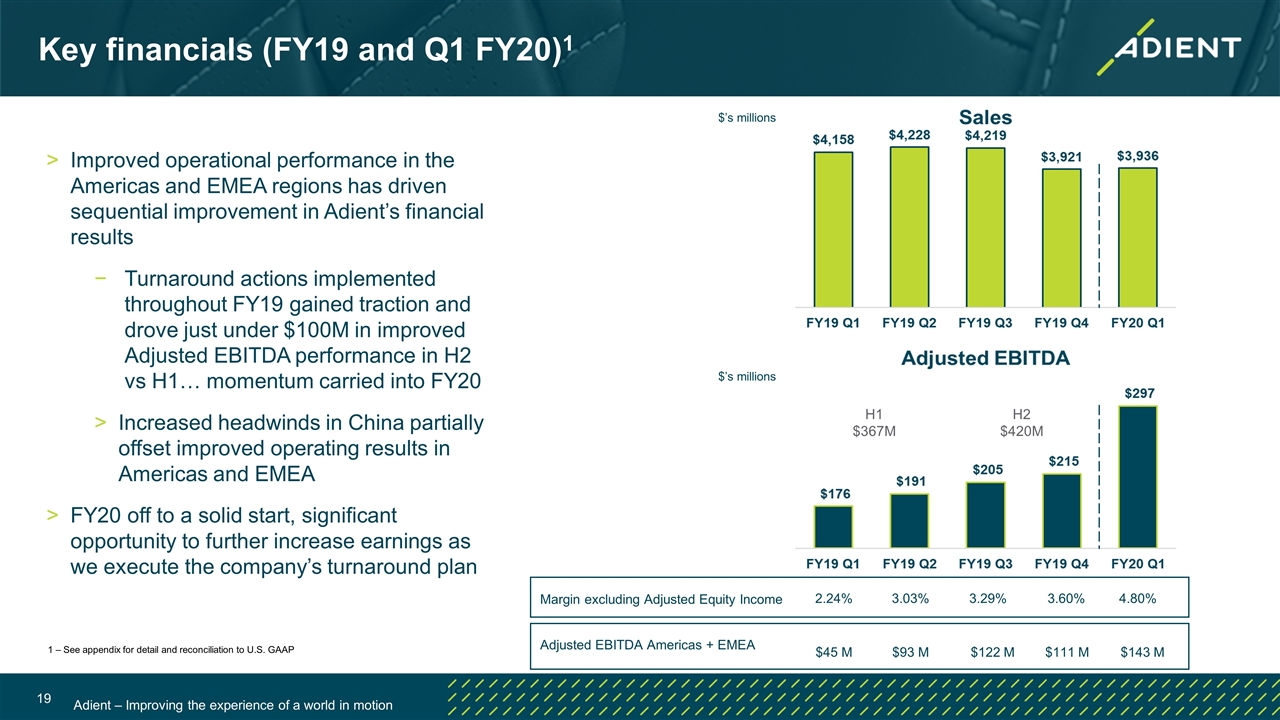

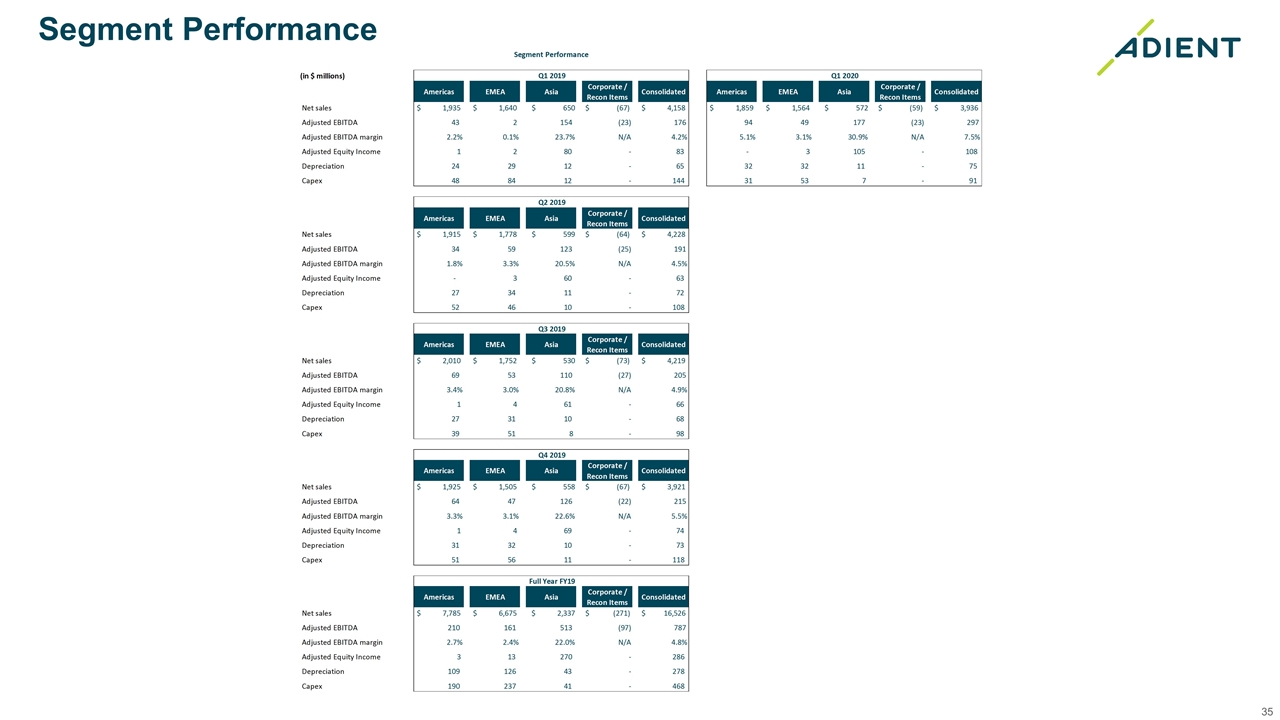

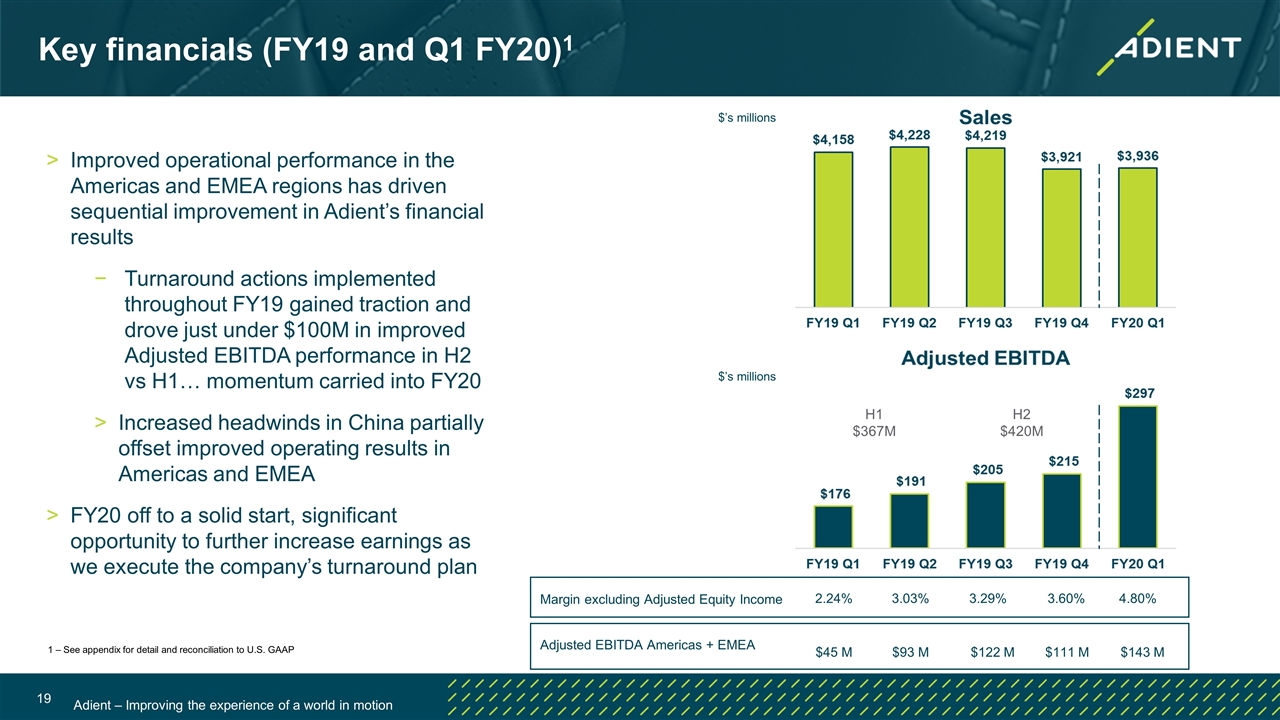

Key financials (FY19 and Q1 FY20)1 1 – See appendix for detail and reconciliation to U.S. GAAP Improved operational performance in the Americas and EMEA regions has driven sequential improvement in Adient’s financial results Turnaround actions implemented throughout FY19 gained traction and drove just under $100M in improved Adjusted EBITDA performance in H2 vs H1… momentum carried into FY20 Increased headwinds in China partially offset improved operating results in Americas and EMEA FY20 off to a solid start, significant opportunity to further increase earnings as we execute the company’s turnaround plan Margin excluding Adjusted Equity Income Adjusted EBITDA Americas + EMEA 2.24% 3.03% 3.29% 3.60% 4.80% $45 M $93 M $122 M $111 M $143 M $’s millions $’s millions H1 $367M H2 $420M

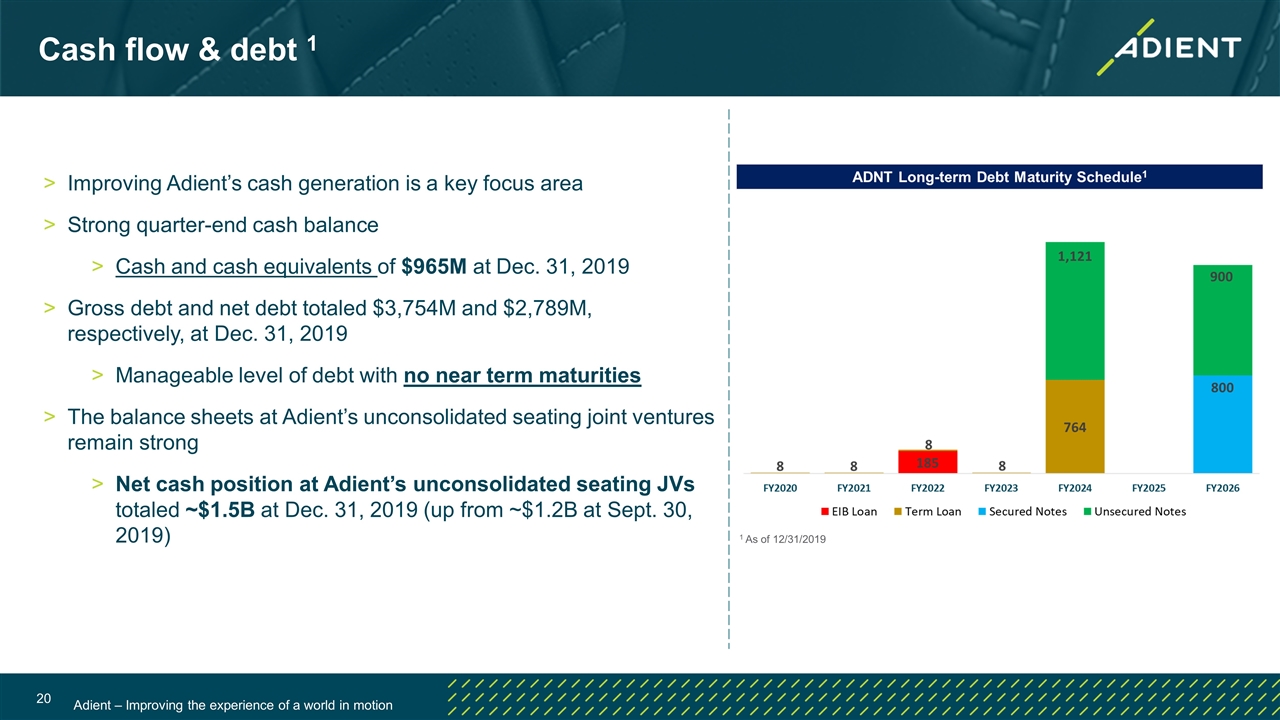

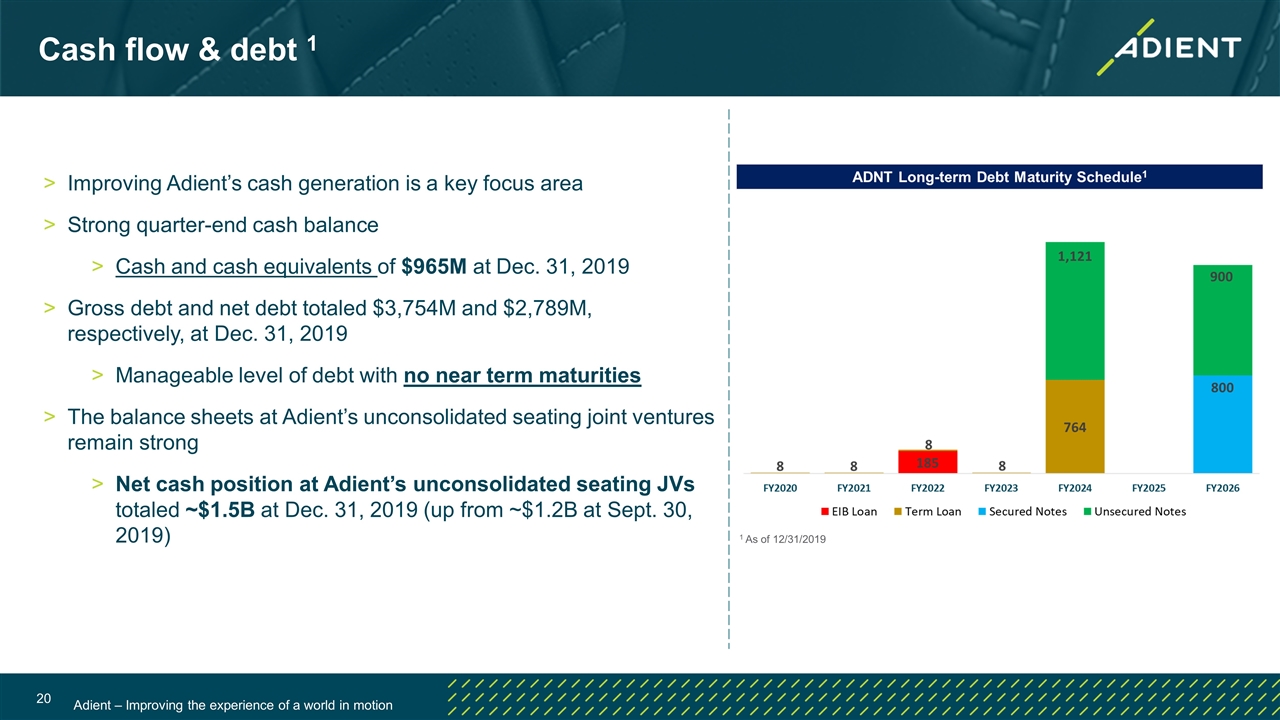

Cash flow & debt 1 Improving Adient’s cash generation is a key focus area Strong quarter-end cash balance Cash and cash equivalents of $965M at Dec. 31, 2019 Gross debt and net debt totaled $3,754M and $2,789M, respectively, at Dec. 31, 2019 Manageable level of debt with no near term maturities The balance sheets at Adient’s unconsolidated seating joint ventures remain strong Net cash position at Adient’s unconsolidated seating JVs totaled ~$1.5B at Dec. 31, 2019 (up from ~$1.2B at Sept. 30, 2019) 1 As of 12/31/2019

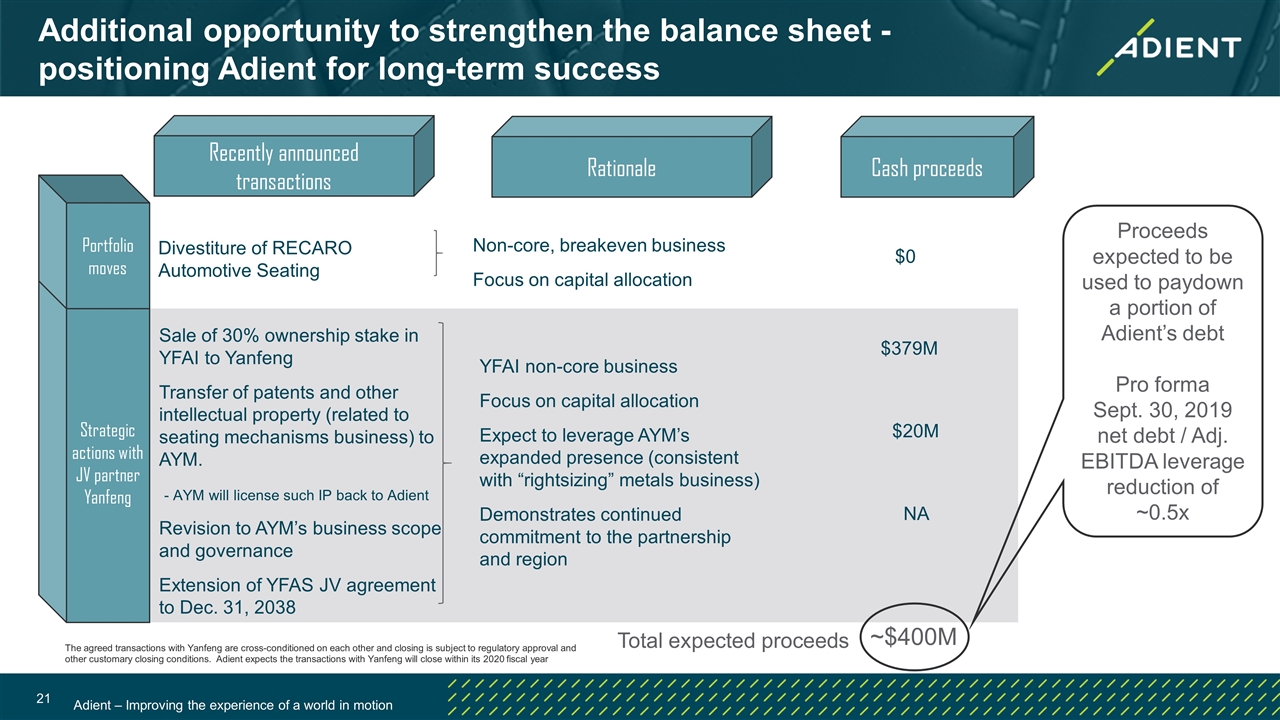

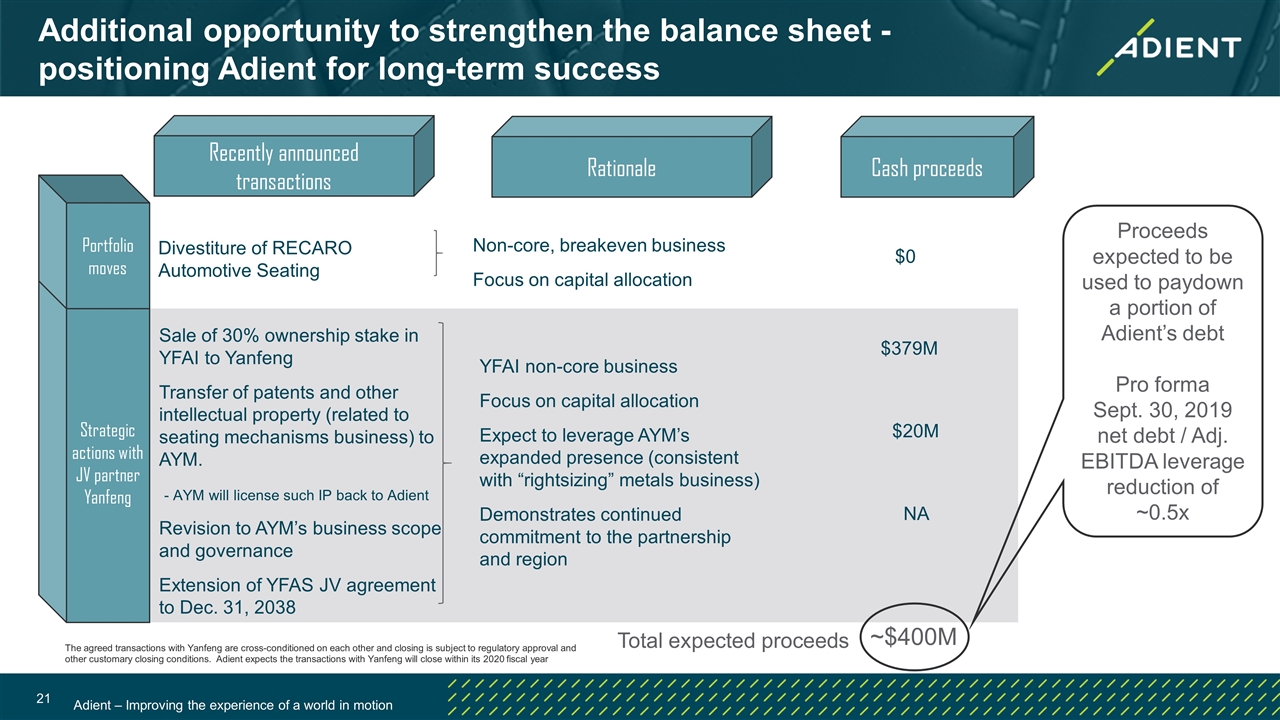

Additional opportunity to strengthen the balance sheet - positioning Adient for long-term success Recently announced transactions Rationale Cash proceeds Divestiture of RECARO Automotive Seating Non-core, breakeven business Focus on capital allocation Sale of 30% ownership stake in YFAI to Yanfeng Transfer of patents and other intellectual property (related to seating mechanisms business) to AYM. - AYM will license such IP back to Adient Revision to AYM’s business scope and governance Extension of YFAS JV agreement to Dec. 31, 2038 $0 YFAI non-core business Focus on capital allocation Expect to leverage AYM’s expanded presence (consistent with “rightsizing” metals business) Demonstrates continued commitment to the partnership and region $379M $20M NA Total expected proceeds ~$400M Strategic actions with JV partner Yanfeng Portfolio moves Proceeds expected to be used to paydown a portion of Adient’s debt Pro forma Sept. 30, 2019 net debt / Adj. EBITDA leverage reduction of ~0.5x The agreed transactions with Yanfeng are cross-conditioned on each other and closing is subject to regulatory approval and other customary closing conditions. Adient expects the transactions with Yanfeng will close within its 2020 fiscal year

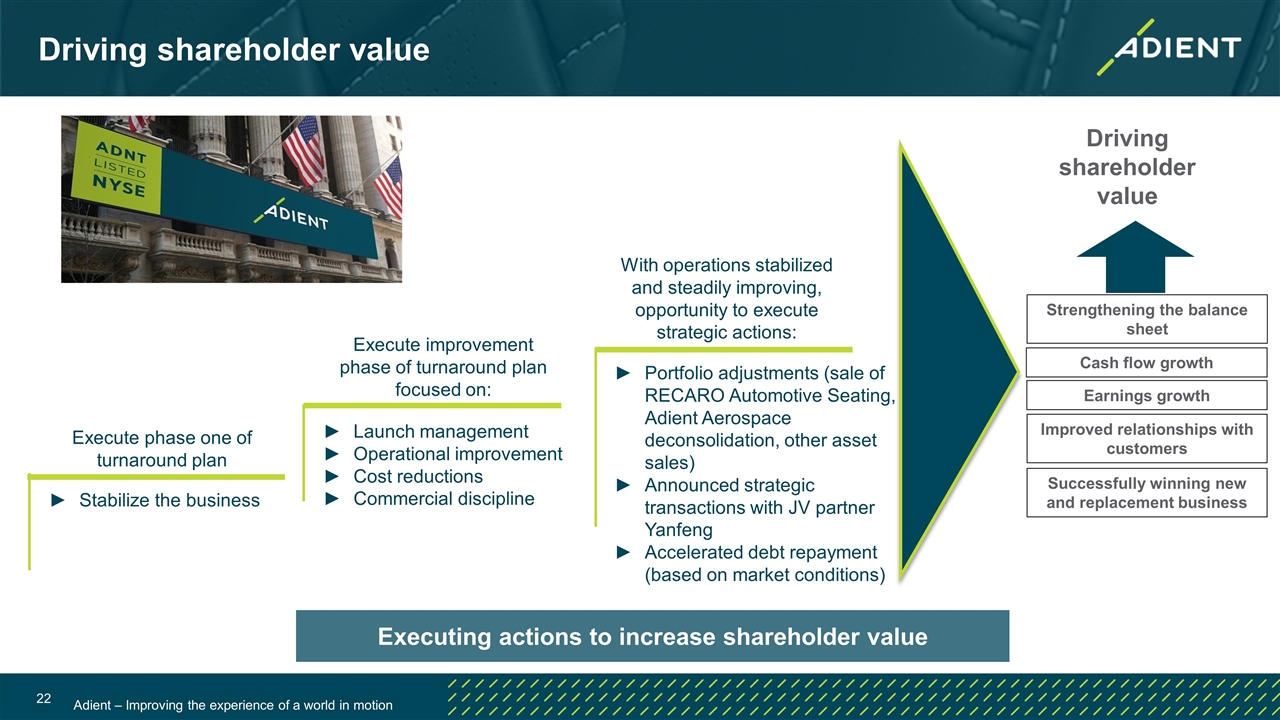

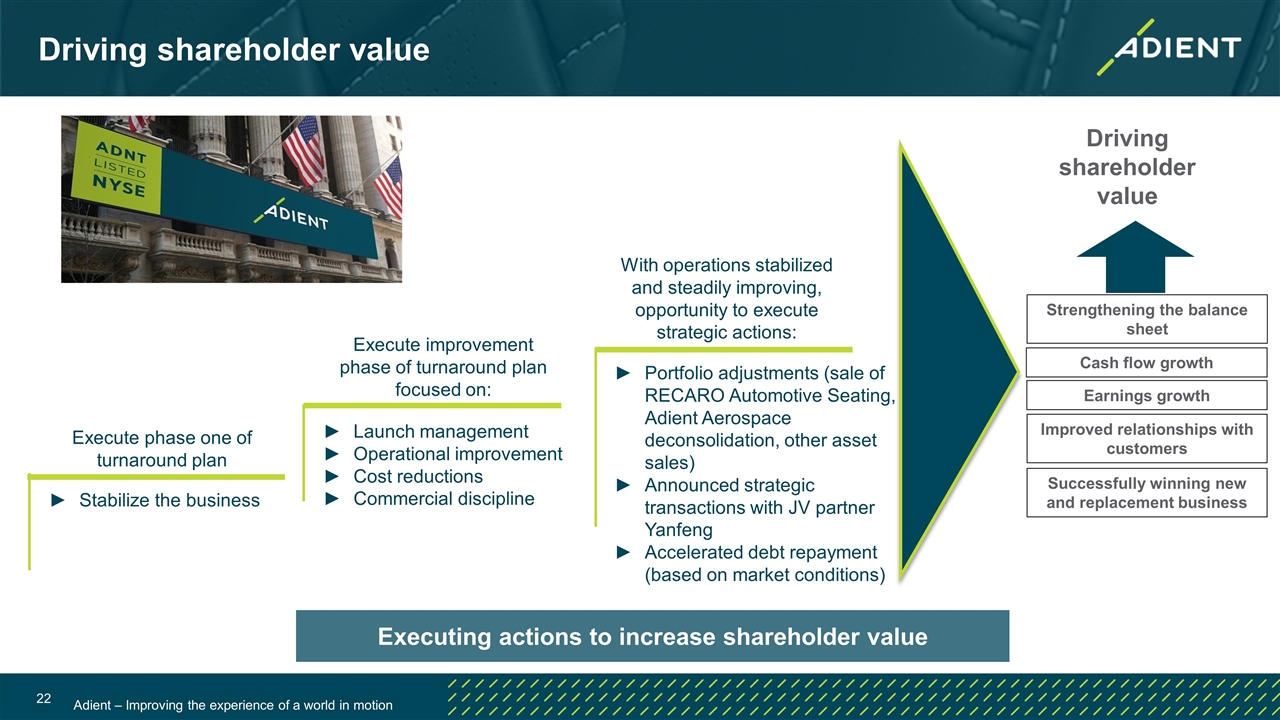

Driving shareholder value Stabilize the business Launch management Operational improvement Cost reductions Commercial discipline Driving shareholder value Portfolio adjustments (sale of RECARO Automotive Seating, Adient Aerospace deconsolidation, other asset sales) Announced strategic transactions with JV partner Yanfeng Accelerated debt repayment (based on market conditions) Execute phase one of turnaround plan Execute improvement phase of turnaround plan focused on: With operations stabilized and steadily improving, opportunity to execute strategic actions: Executing actions to increase shareholder value Earnings growth Cash flow growth Strengthening the balance sheet Successfully winning new and replacement business Improved relationships with customers

Adient – Improving the experience of a world in motion Appendix: about Adient & financial reconciliations

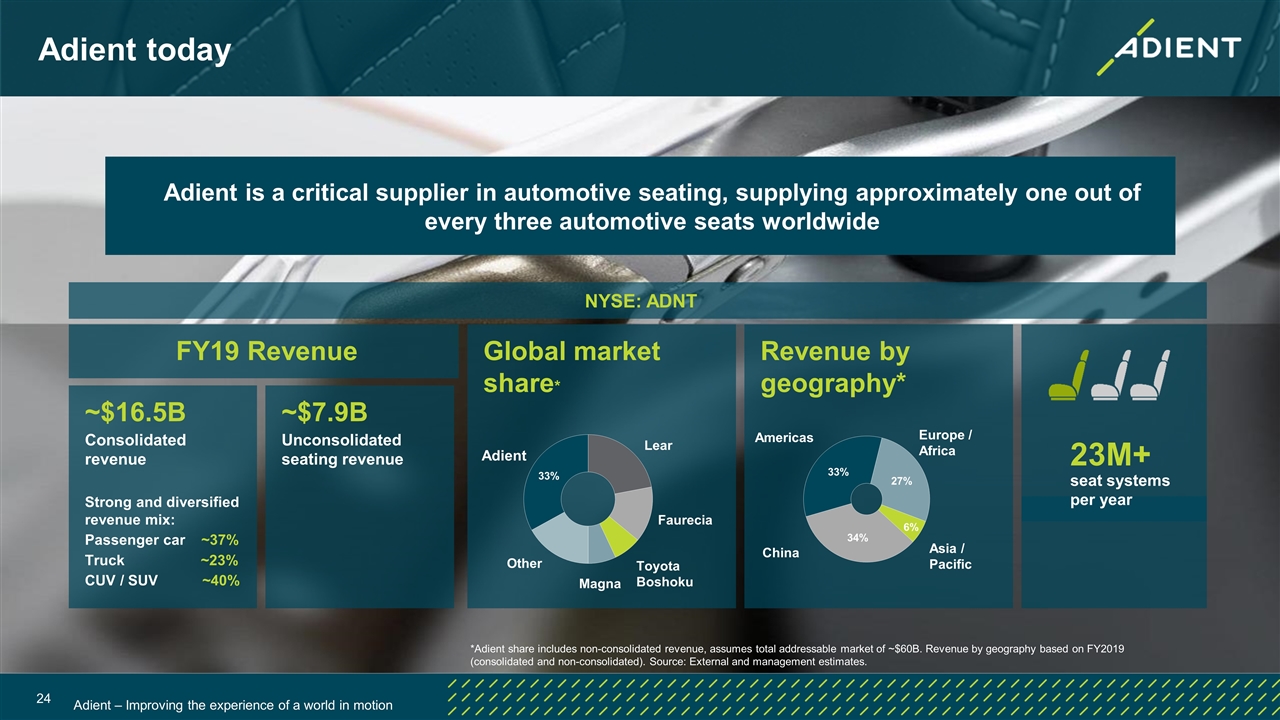

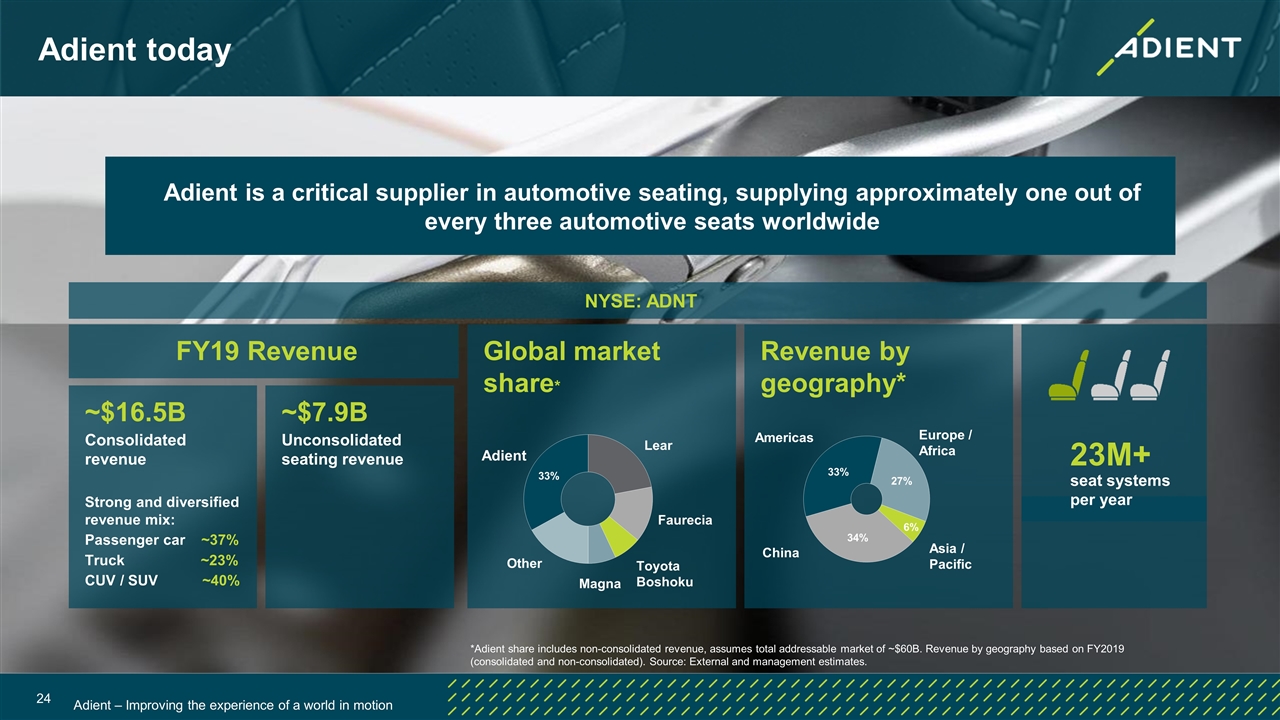

Adient today FY19 Revenue Revenue by geography* Europe / Africa China Americas Asia / Pacific NYSE: ADNT Global market share* Adient Other Lear Faurecia Toyota Boshoku Magna *Adient share includes non-consolidated revenue, assumes total addressable market of ~$60B. Revenue by geography based on FY2019 (consolidated and non-consolidated). Source: External and management estimates. 23M+ seat systems per year Adient is a critical supplier in automotive seating, supplying approximately one out of every three automotive seats worldwide ~$16.5B Consolidated revenue Strong and diversified revenue mix: Passenger car ~37% Truck ~23% CUV / SUV ~40% ~$7.9B Unconsolidated seating revenue

Edit Master text styles Second level Third level Fourth level Fifth level We are located where our customers need us most manufacturing facilities Global locations 220 35 countries Global employees 83,000 North America South America Asia Africa Adient – Improving the experience of a world in motion Europe

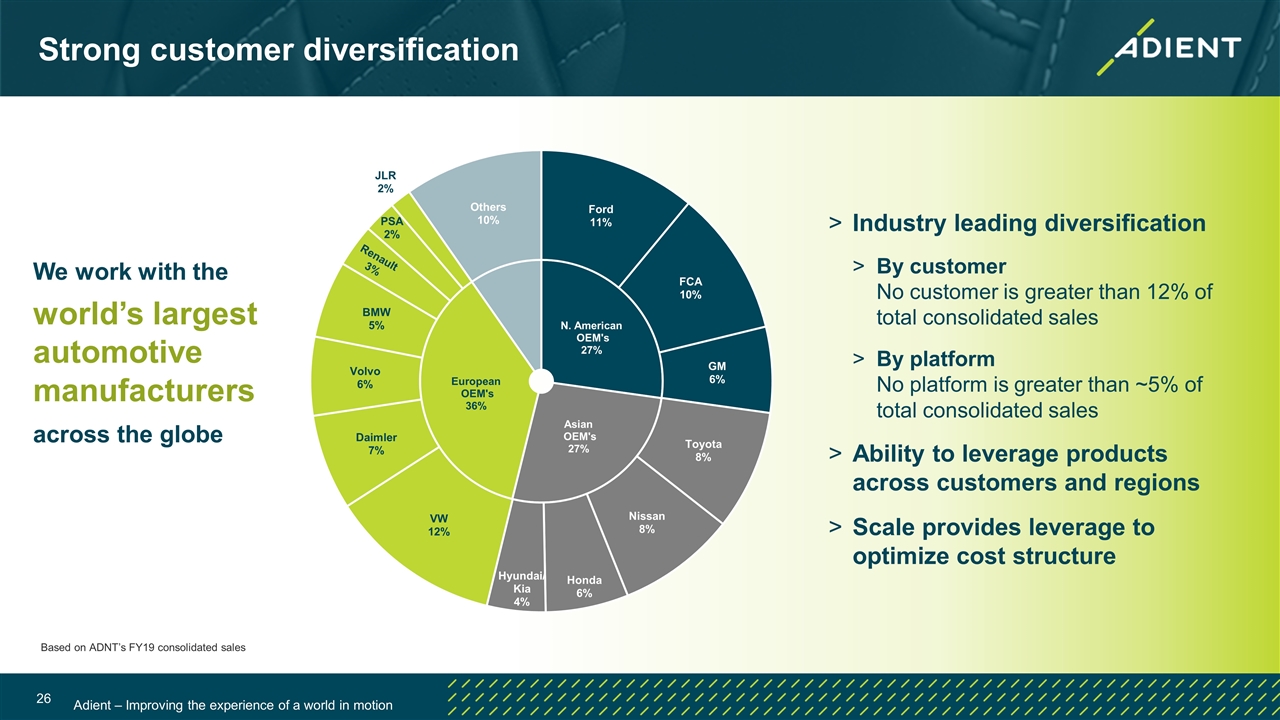

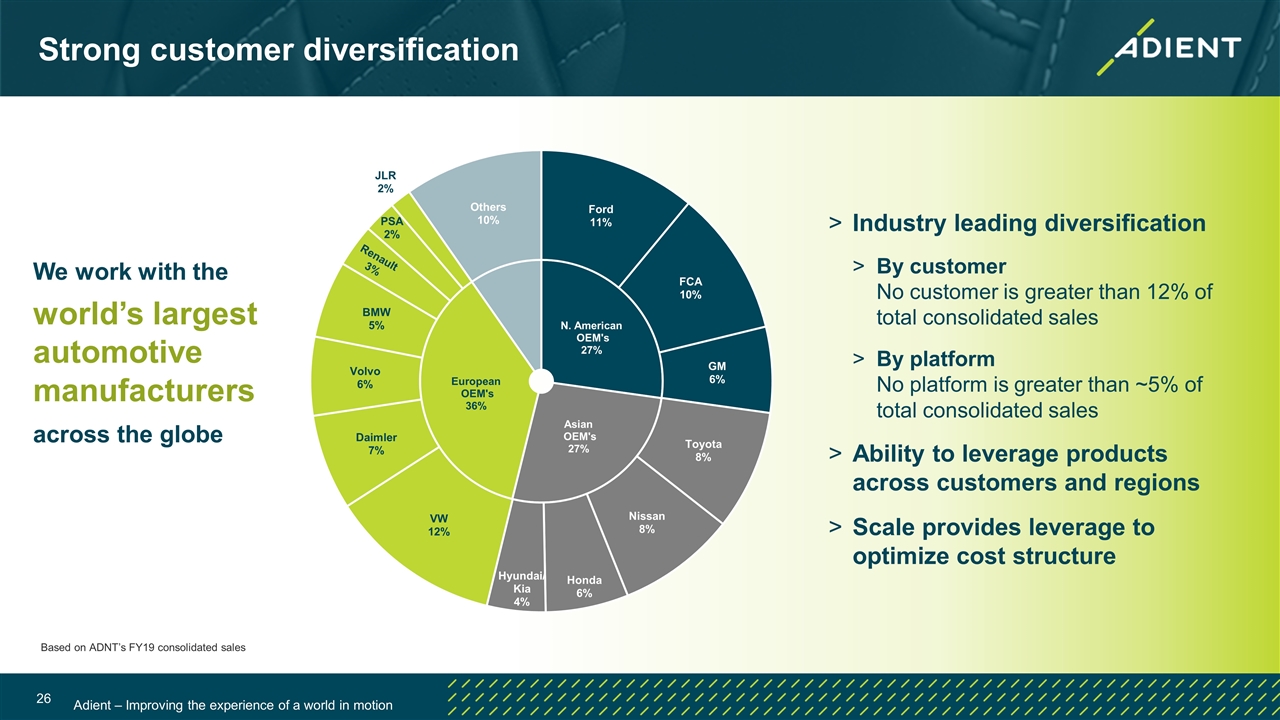

Strong customer diversification Industry leading diversification By customer No customer is greater than 12% of total consolidated sales By platform No platform is greater than ~5% of total consolidated sales Ability to leverage products across customers and regions Scale provides leverage to optimize cost structure Based on ADNT’s FY19 consolidated sales We work with the world’s largest automotive manufacturers across the globe

We generated $7.4B sales revenue in FY2019 We have 19 seating joint ventures* with ~ 40% - 45% combined share of the passenger vehicle market ** * Includes six consolidated JVs ** Based on FY19 mgmt. estimates We have ~79 manufacturing locations 4 global tech centers in cities 30 Our Seating Joint Venture partnerships in China enable us to enjoy a clear leadership position in China We employ 31,000 highly engaged employees including >1,400 engineers Adient – Improving the experience of a world in motion

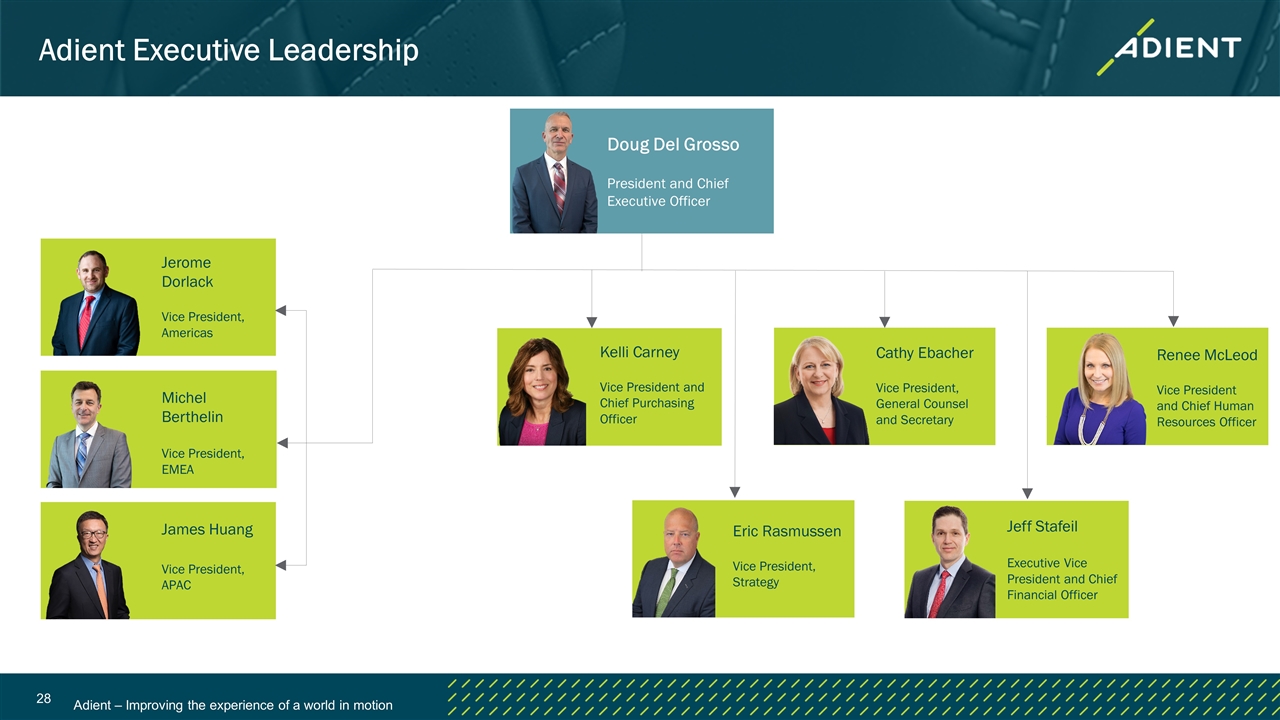

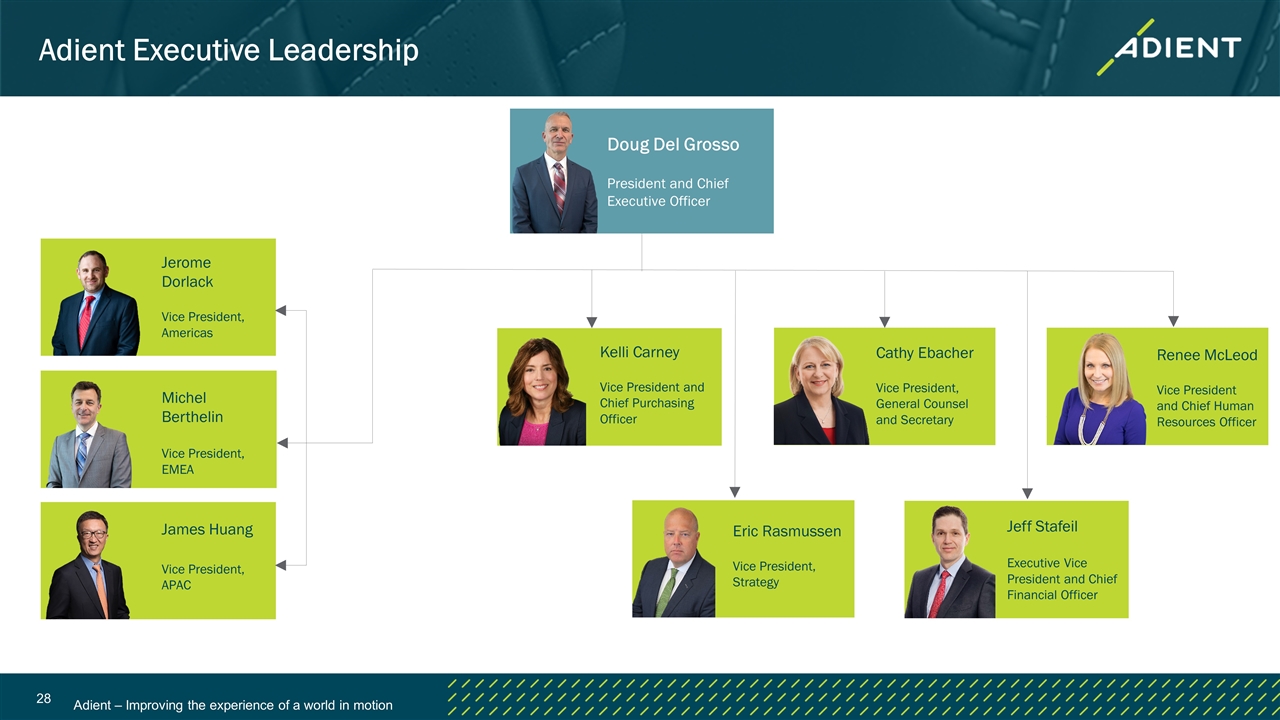

Adient Executive Leadership Doug Del Grosso President and Chief Executive Officer Renee McLeod Vice President and Chief Human Resources Officer Jerome Dorlack Vice President, Americas Cathy Ebacher Vice President, General Counsel and Secretary Jeff Stafeil Executive Vice President and Chief Financial Officer Michel Berthelin Vice President, EMEA Kelli Carney Vice President and Chief Purchasing Officer James Huang Vice President, APAC Eric Rasmussen Vice President, Strategy

The right products Providing world-class seat systems and components that offer safety, functionality and comfort with proven quality

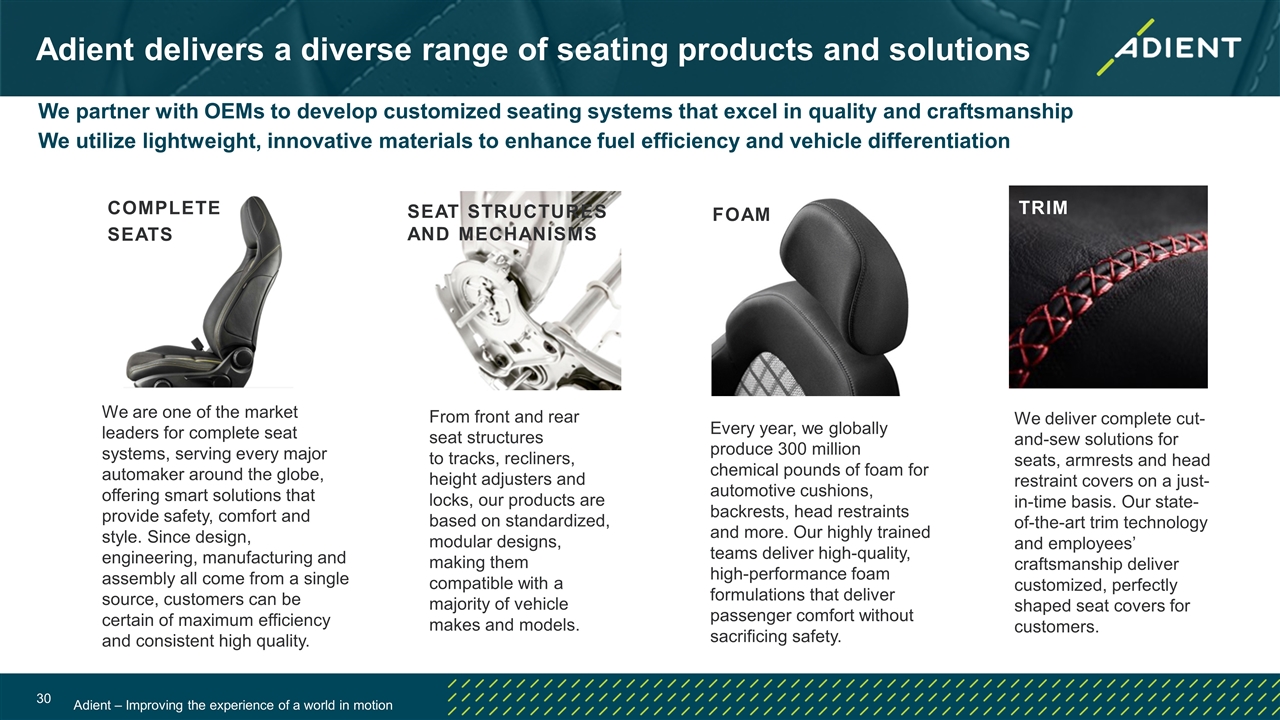

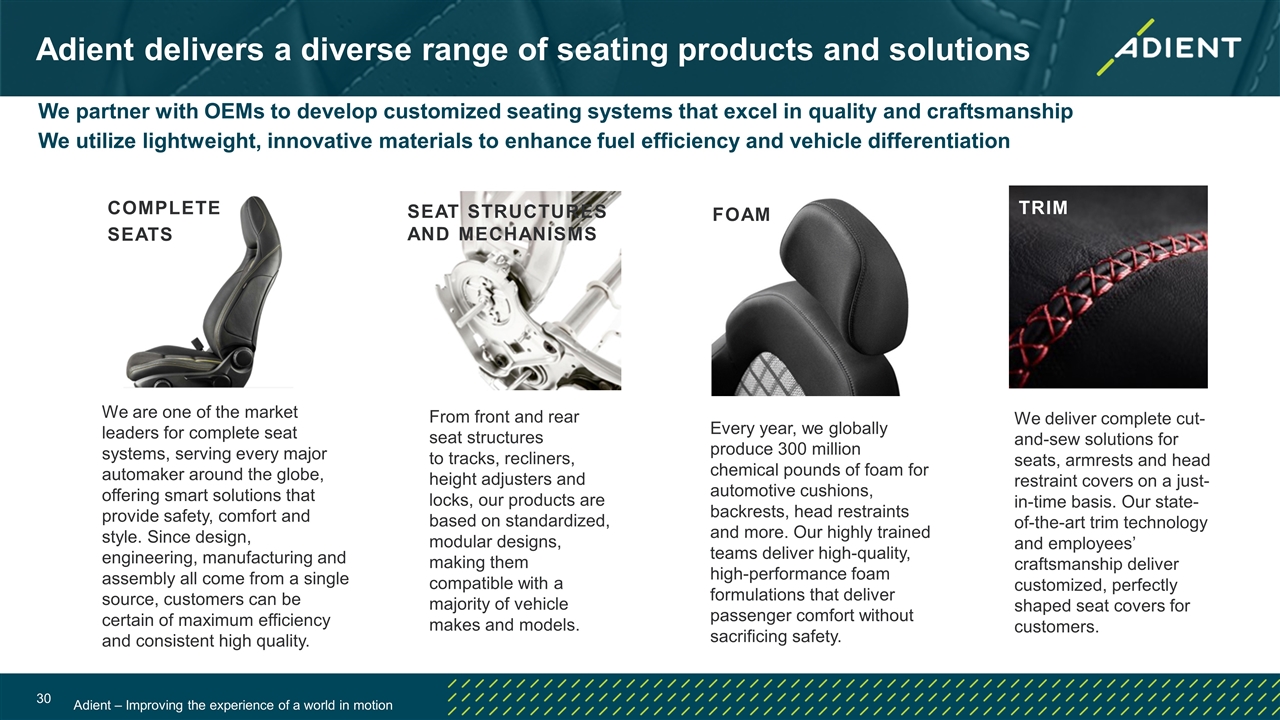

Adient delivers a diverse range of seating products and solutions From front and rear seat structures to tracks, recliners, height adjusters and locks, our products are based on standardized, modular designs, making them compatible with a majority of vehicle makes and models. SEAT STRUCTURES AND MECHANISMS FOAM Every year, we globally produce 300 million chemical pounds of foam for automotive cushions, backrests, head restraints and more. Our highly trained teams deliver high-quality, high-performance foam formulations that deliver passenger comfort without sacrificing safety. TRIM We deliver complete cut-and-sew solutions for seats, armrests and head restraint covers on a just-in-time basis. Our state-of-the-art trim technology and employees’ craftsmanship deliver customized, perfectly shaped seat covers for customers. We partner with OEMs to develop customized seating systems that excel in quality and craftsmanship We utilize lightweight, innovative materials to enhance fuel efficiency and vehicle differentiation COMPLETE SEATS We are one of the market leaders for complete seat systems, serving every major automaker around the globe, offering smart solutions that provide safety, comfort and style. Since design, engineering, manufacturing and assembly all come from a single source, customers can be certain of maximum efficiency and consistent high quality.

Adient – Improving the experience of a world in motion Appendix: financial reconciliations

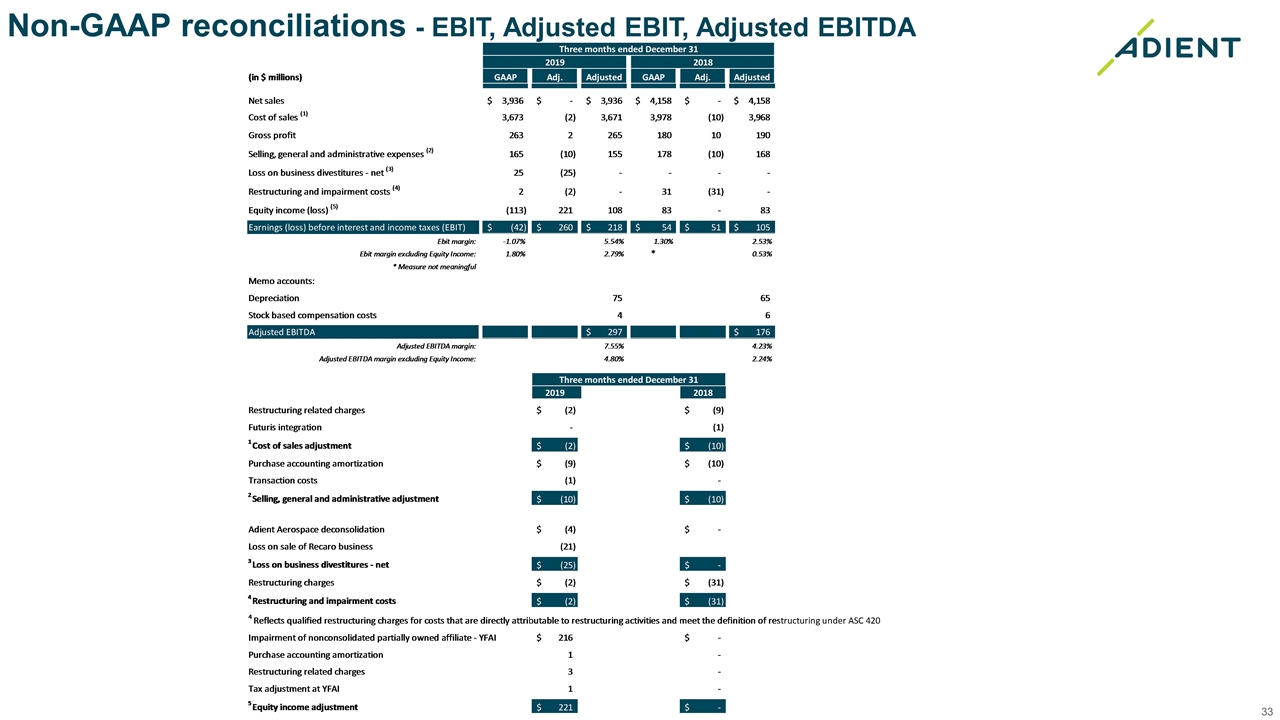

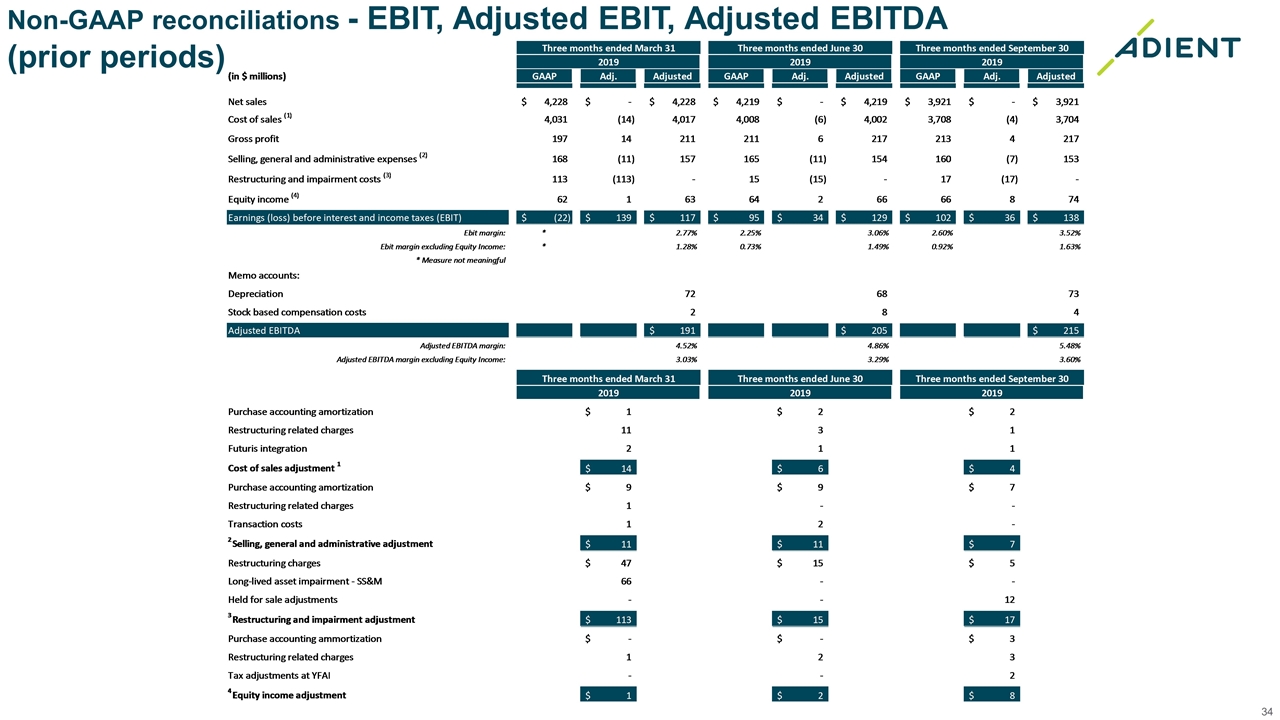

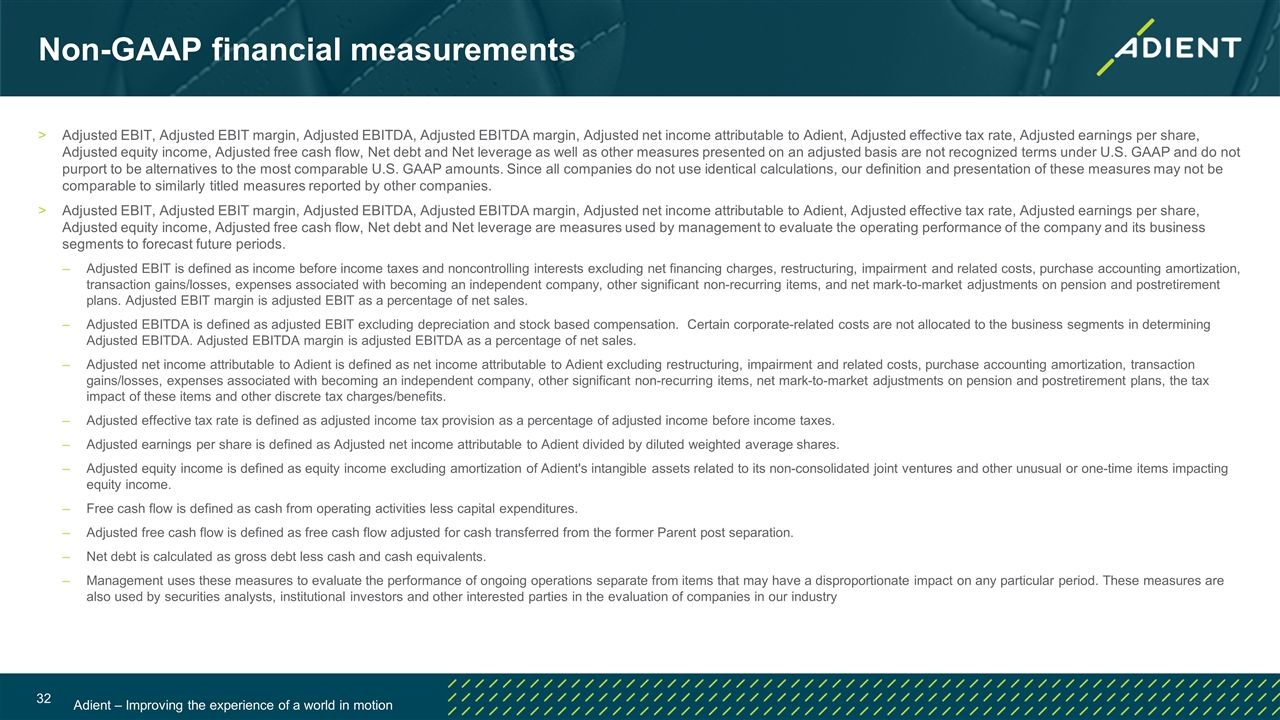

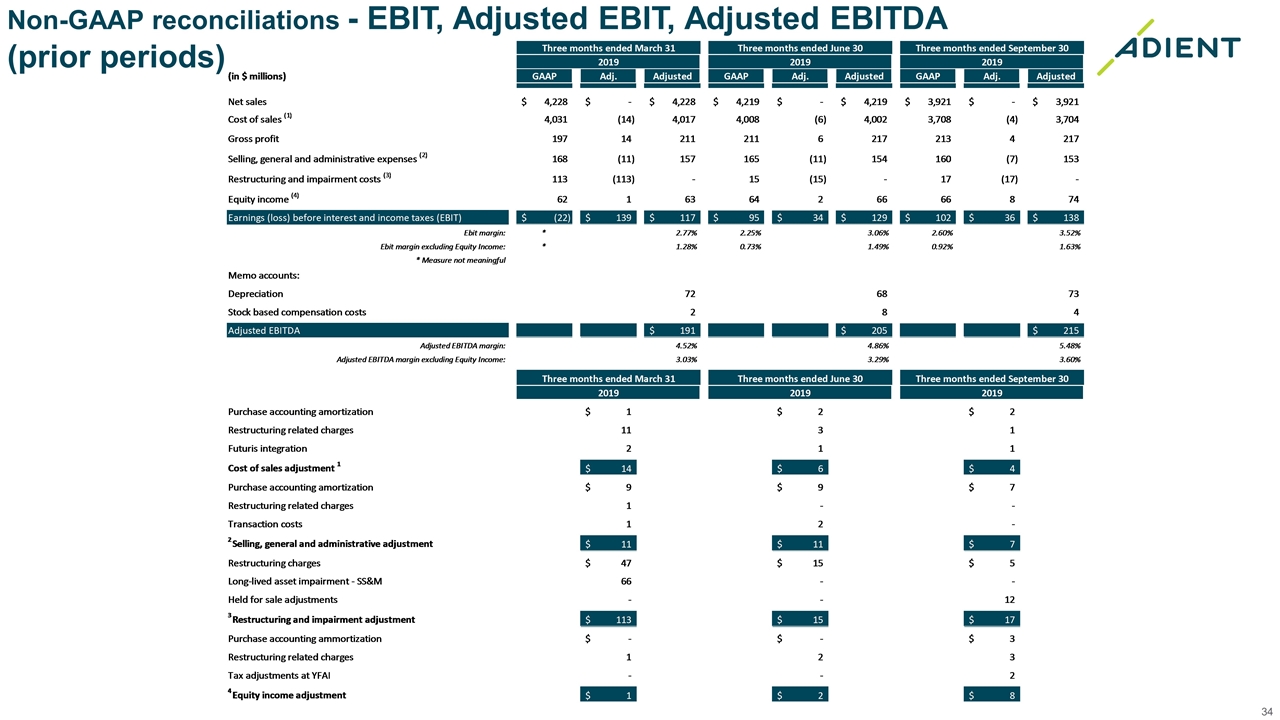

Non-GAAP financial measurements Adjusted EBIT, Adjusted EBIT margin, Adjusted EBITDA, Adjusted EBITDA margin, Adjusted net income attributable to Adient, Adjusted effective tax rate, Adjusted earnings per share, Adjusted equity income, Adjusted free cash flow, Net debt and Net leverage as well as other measures presented on an adjusted basis are not recognized terms under U.S. GAAP and do not purport to be alternatives to the most comparable U.S. GAAP amounts. Since all companies do not use identical calculations, our definition and presentation of these measures may not be comparable to similarly titled measures reported by other companies. Adjusted EBIT, Adjusted EBIT margin, Adjusted EBITDA, Adjusted EBITDA margin, Adjusted net income attributable to Adient, Adjusted effective tax rate, Adjusted earnings per share, Adjusted equity income, Adjusted free cash flow, Net debt and Net leverage are measures used by management to evaluate the operating performance of the company and its business segments to forecast future periods. Adjusted EBIT is defined as income before income taxes and noncontrolling interests excluding net financing charges, restructuring, impairment and related costs, purchase accounting amortization, transaction gains/losses, expenses associated with becoming an independent company, other significant non-recurring items, and net mark-to-market adjustments on pension and postretirement plans. Adjusted EBIT margin is adjusted EBIT as a percentage of net sales. Adjusted EBITDA is defined as adjusted EBIT excluding depreciation and stock based compensation. Certain corporate-related costs are not allocated to the business segments in determining Adjusted EBITDA. Adjusted EBITDA margin is adjusted EBITDA as a percentage of net sales. Adjusted net income attributable to Adient is defined as net income attributable to Adient excluding restructuring, impairment and related costs, purchase accounting amortization, transaction gains/losses, expenses associated with becoming an independent company, other significant non-recurring items, net mark-to-market adjustments on pension and postretirement plans, the tax impact of these items and other discrete tax charges/benefits. Adjusted effective tax rate is defined as adjusted income tax provision as a percentage of adjusted income before income taxes. Adjusted earnings per share is defined as Adjusted net income attributable to Adient divided by diluted weighted average shares. Adjusted equity income is defined as equity income excluding amortization of Adient's intangible assets related to its non-consolidated joint ventures and other unusual or one-time items impacting equity income. Free cash flow is defined as cash from operating activities less capital expenditures. Adjusted free cash flow is defined as free cash flow adjusted for cash transferred from the former Parent post separation. Net debt is calculated as gross debt less cash and cash equivalents. Management uses these measures to evaluate the performance of ongoing operations separate from items that may have a disproportionate impact on any particular period. These measures are also used by securities analysts, institutional investors and other interested parties in the evaluation of companies in our industry

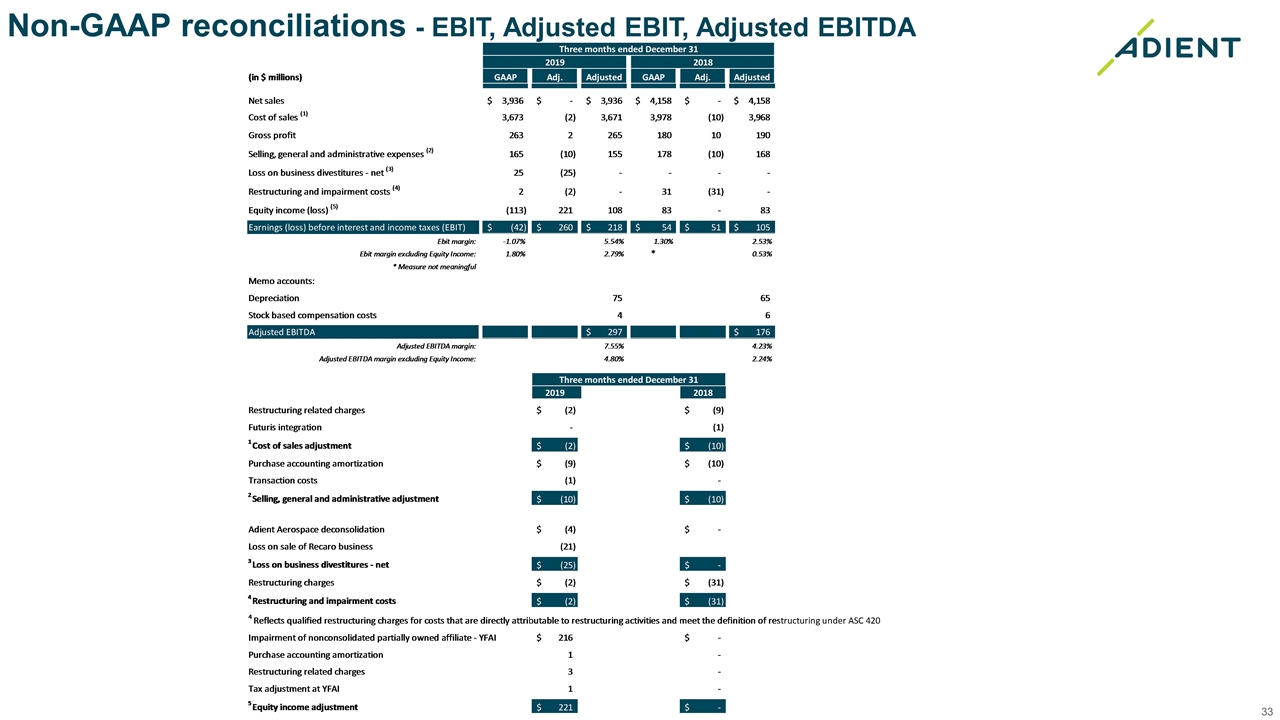

Non-GAAP reconciliations - EBIT, Adjusted EBIT, Adjusted EBITDA 33

Non-GAAP reconciliations - EBIT, Adjusted EBIT, Adjusted EBITDA (prior periods) 34

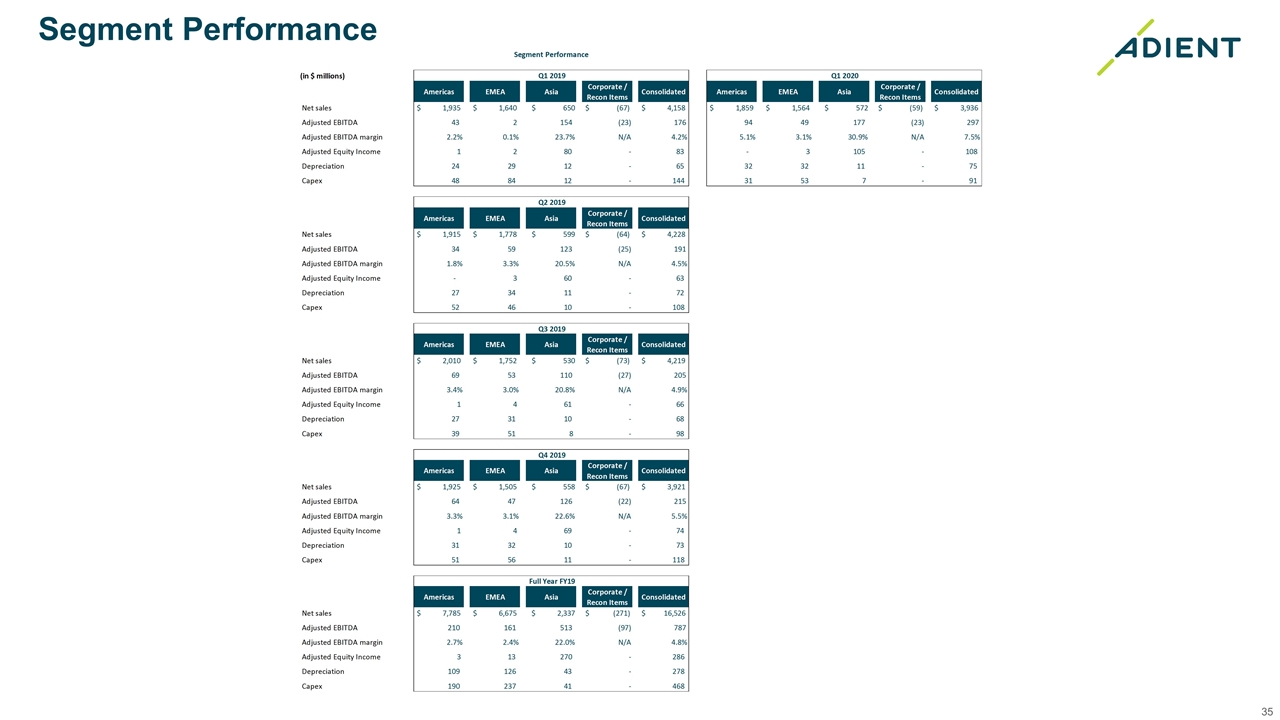

Segment Performance 35