UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the Securities

Exchange Act of 1934

Filed by the Registrant ⊠

Filed by a Party other than the Registrant ☐

Check the appropriate box:

|

| | | |

| ☐ | Preliminary Proxy Statement | ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ☐ | Definitive Proxy Statement | | |

| ⊠ | Definitive Additional Materials | | |

| ☐ | Soliciting Material Pursuant to Section 240.14a-12 | | |

Cardtronics plc

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

⊠ No fee required.

☐ Fee computed on table below per Exchange Act Rules 14a-6(i) (1) and 0-11.

| |

| (1) | Title of each class of securities to which transaction applies: |

| |

| (2) | Aggregate number of securities to which transaction applies: |

| |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| |

| (4) | Proposed maximum aggregate value of transaction: |

| |

| ☐ | Fee paid previously with preliminary materials. |

| |

| ☐ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| |

| (1) | Amount Previously Paid: |

| |

| (2) | Form, Schedule or Registration Statement No. |

Shareholder Engagement, Executive Compensation, Buybacks and Governance Update May 2019

Forward Looking Statements and Non-GAAP Measures During the course of this presentation, there will be forward-looking statements within the meaning of the “safe harbor” provisions of the Private Securities Litigation Reform Act of 1995. Forward-looking statements often address our expected future business and financial performance, and often contain words such as “expects,” “anticipates,” “intends,” “plans,” “believes,” “seeks,” or “will.” The information in this presentation is based upon our current expectations as of the date hereof unless otherwise noted. Our actual future business and financial performance may differ materially and adversely from our expectations expressed in any forward-looking statements. We undertake no obligation to revise or publicly update our forward-looking statements or this presentation for any reason. Although our expectations and beliefs are based on reasonable assumptions, actual results may differ materially. The factors that may affect our results are listed in certain of our press releases and disclosed in the Company’s most recent Form 10-K and 10-Q along with other public filings with the SEC. 2

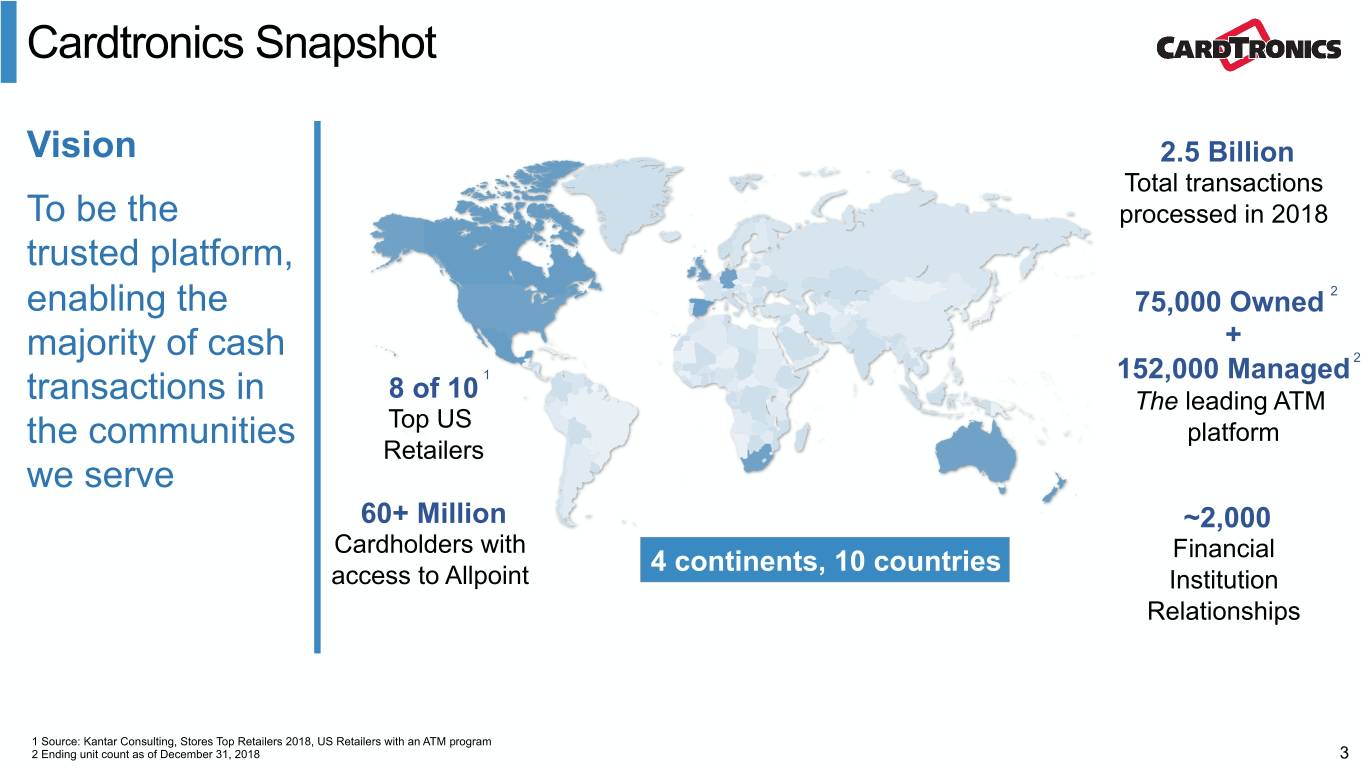

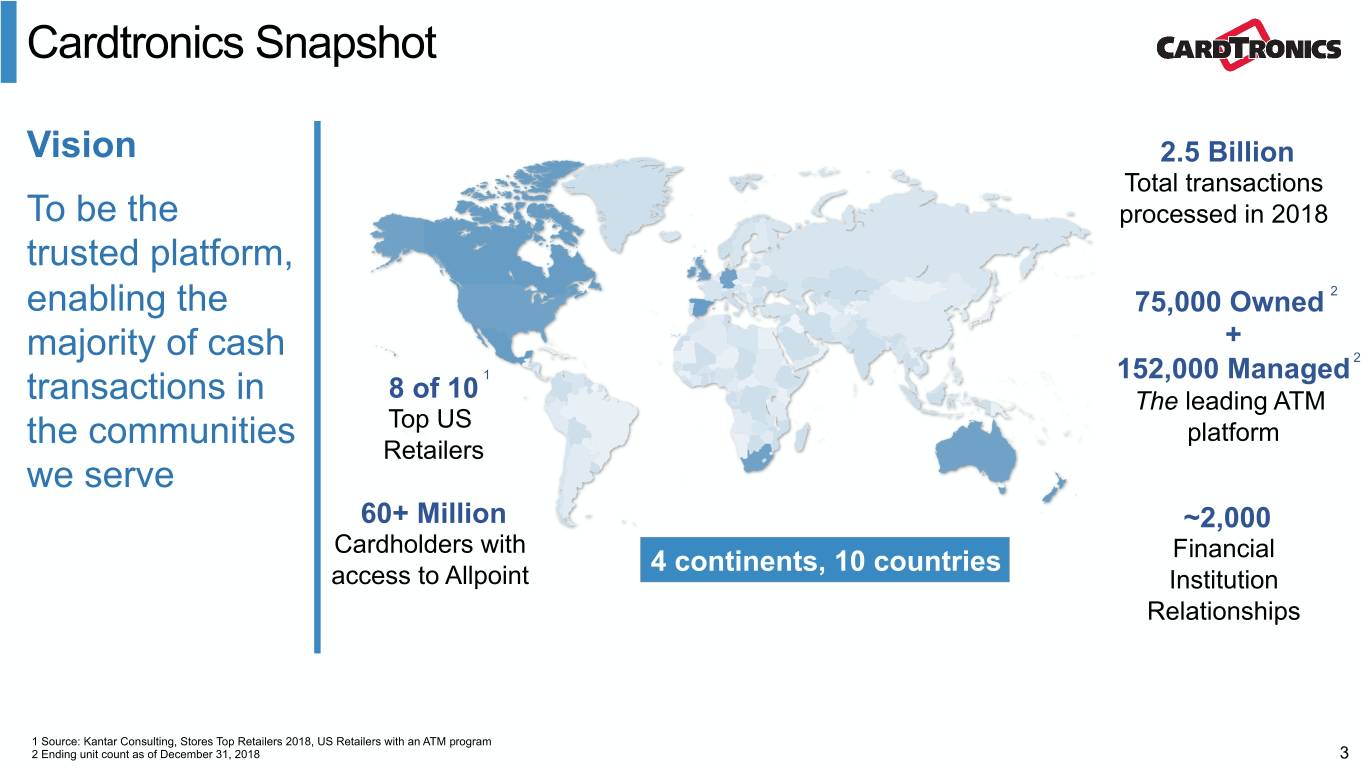

Cardtronics Snapshot Vision 2.5 Billion Total transactions To be the processed in 2018 trusted platform, enabling the 75,000 Owned 2 + majority of cash 2 1 152,000 Managed transactions in 8 of 10 The leading ATM Top US the communities platform Retailers we serve 60+ Million ~2,000 Cardholders with 4 continents, 10 countries Financial access to Allpoint Institution Relationships 1 Source: Kantar Consulting, Stores Top Retailers 2018, US Retailers with an ATM program 2 Ending unit count as of December 31, 2018 3

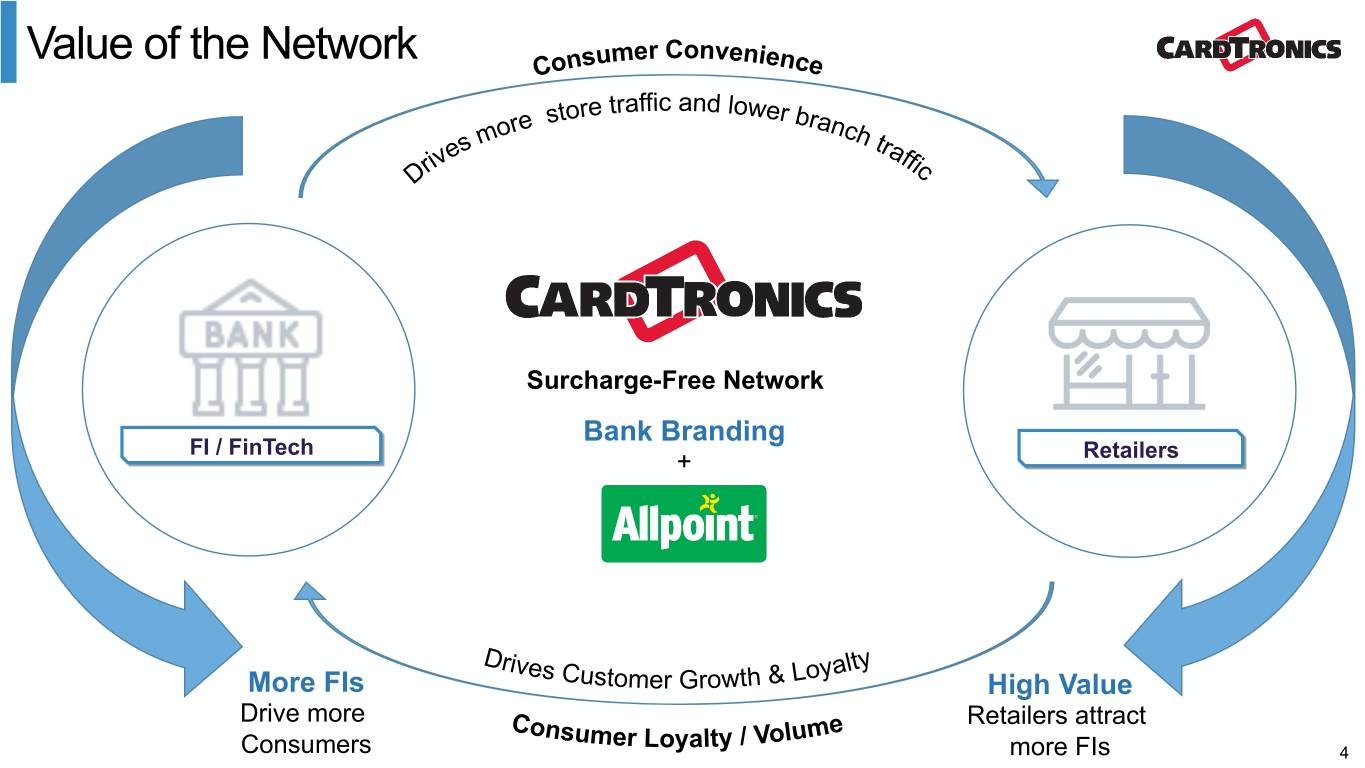

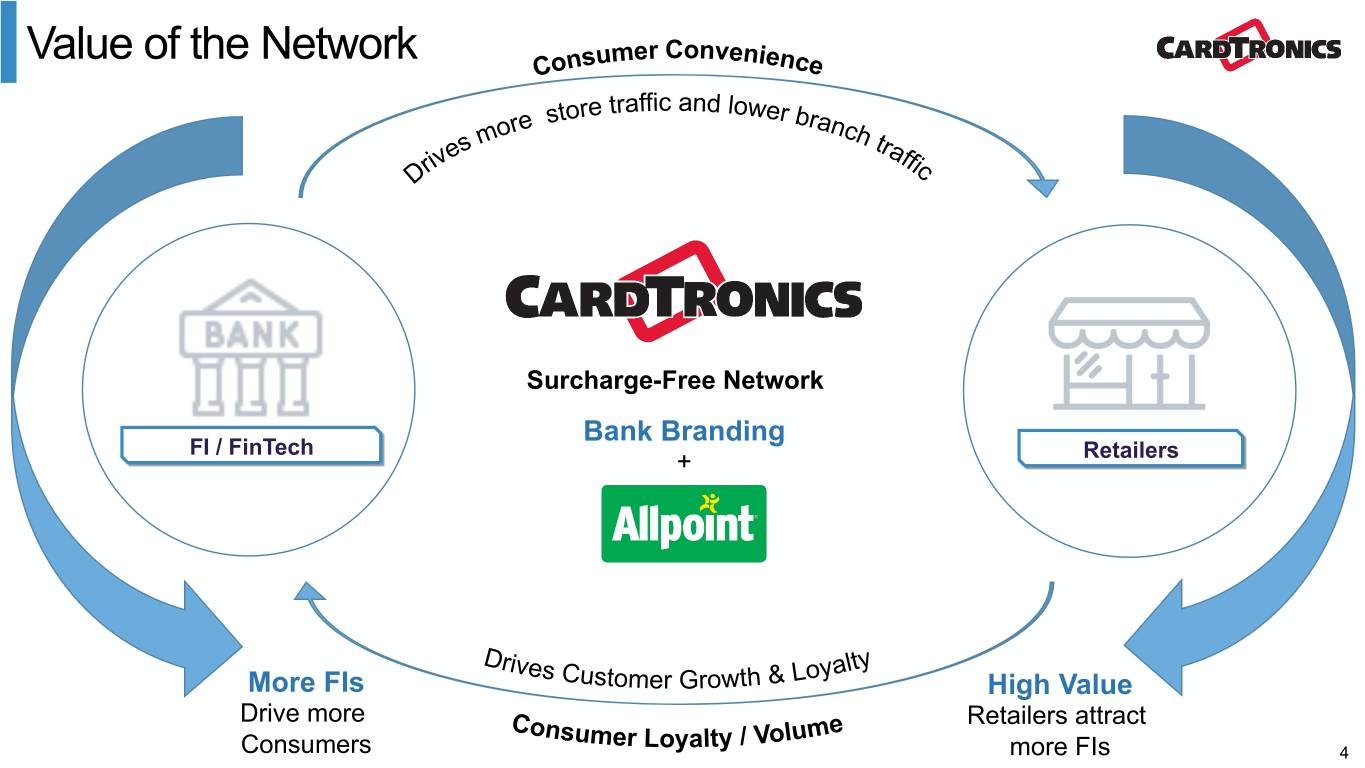

Value of the Network Surcharge-Free Network Bank Branding FI / FinTech + Retailers More FIs High Value Drive more Retailers attract Consumers more FIs 4

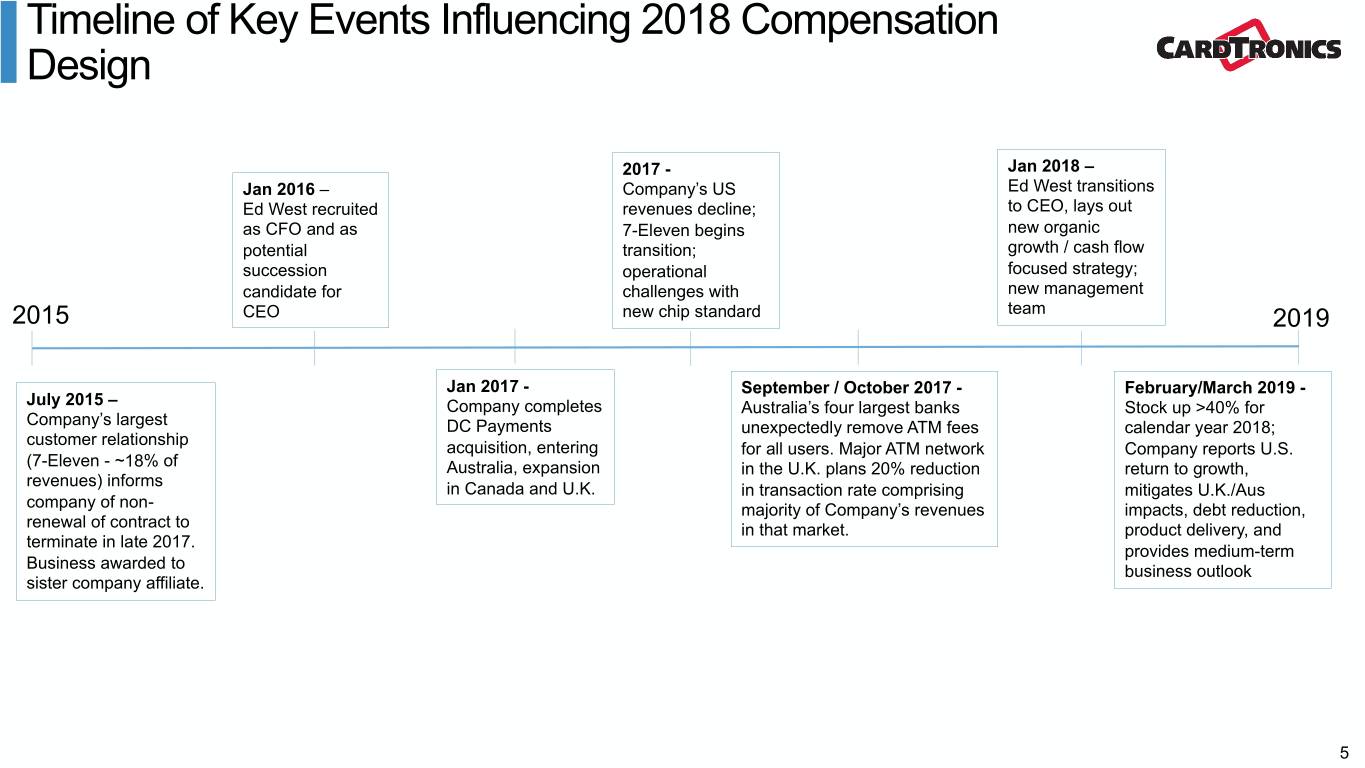

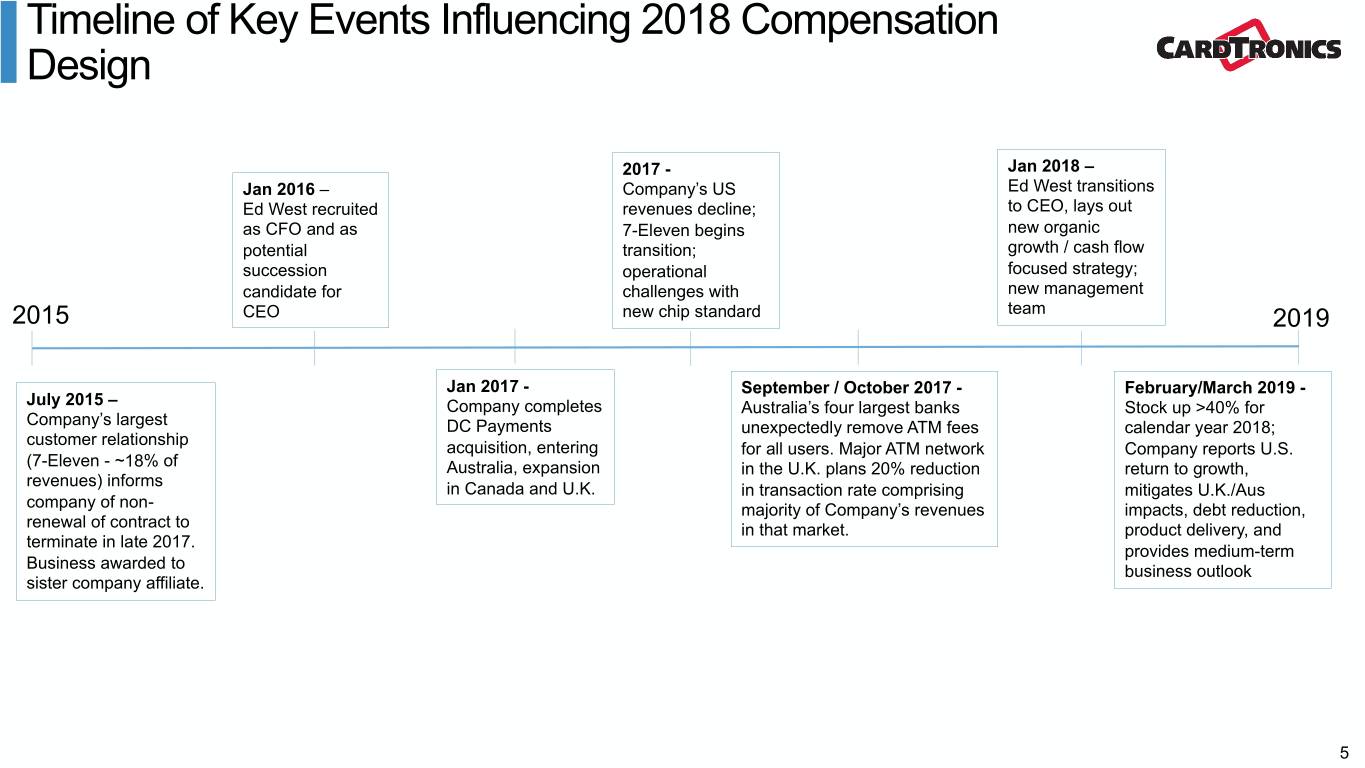

Timeline of Key Events Influencing 2018 Compensation Design 2017 - Jan 2018 – Jan 2016 – Company’s US Ed West transitions Ed West recruited revenues decline; to CEO, lays out as CFO and as 7-Eleven begins new organic potential transition; growth / cash flow succession operational focused strategy; candidate for challenges with new management 2015 CEO new chip standard team 2019 Jan 2017 - September / October 2017 - February/March 2019 - July 2015 – Company completes Australia’s four largest banks Stock up >40% for Company’s largest DC Payments unexpectedly remove ATM fees calendar year 2018; customer relationship acquisition, entering for all users. Major ATM network Company reports U.S. (7-Eleven - ~18% of Australia, expansion in the U.K. plans 20% reduction return to growth, revenues) informs in Canada and U.K. in transaction rate comprising mitigates U.K./Aus company of non- majority of Company’s revenues impacts, debt reduction, renewal of contract to in that market. product delivery, and terminate in late 2017. provides medium-term Business awarded to business outlook sister company affiliate. 5

2018 Plan Target Considerations 2018 required • 7-Eleven customer loss (12.5% of revenues in 2017) – notified of significant non-renewal in 2015 execution, • Major UK and Australia unexpected market disruptions (in late which 2017), created significant uncertainty in setting 2018 targets management • Change in strategy to organic growth focus delivered and • Business process and systems changes required was reflected • New management team in the share price +40% • Multi-year performance components 6

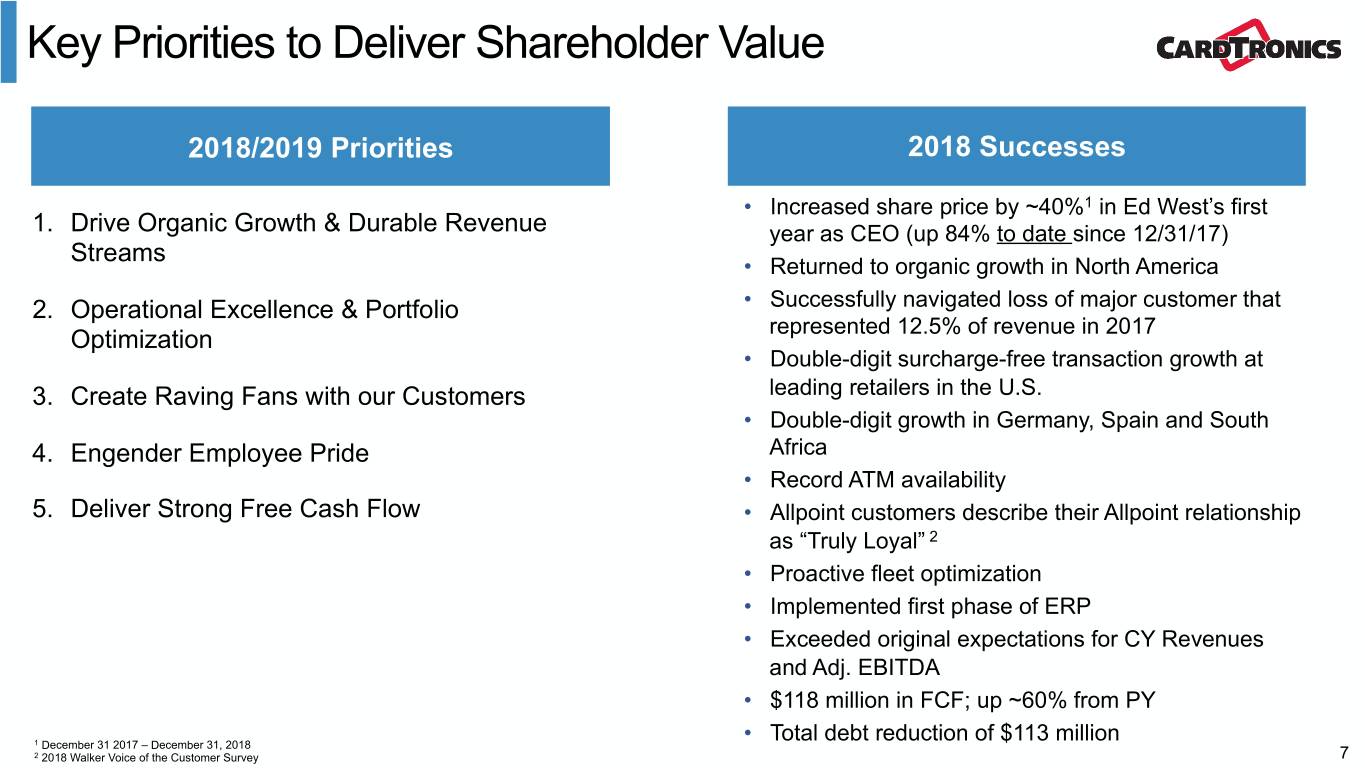

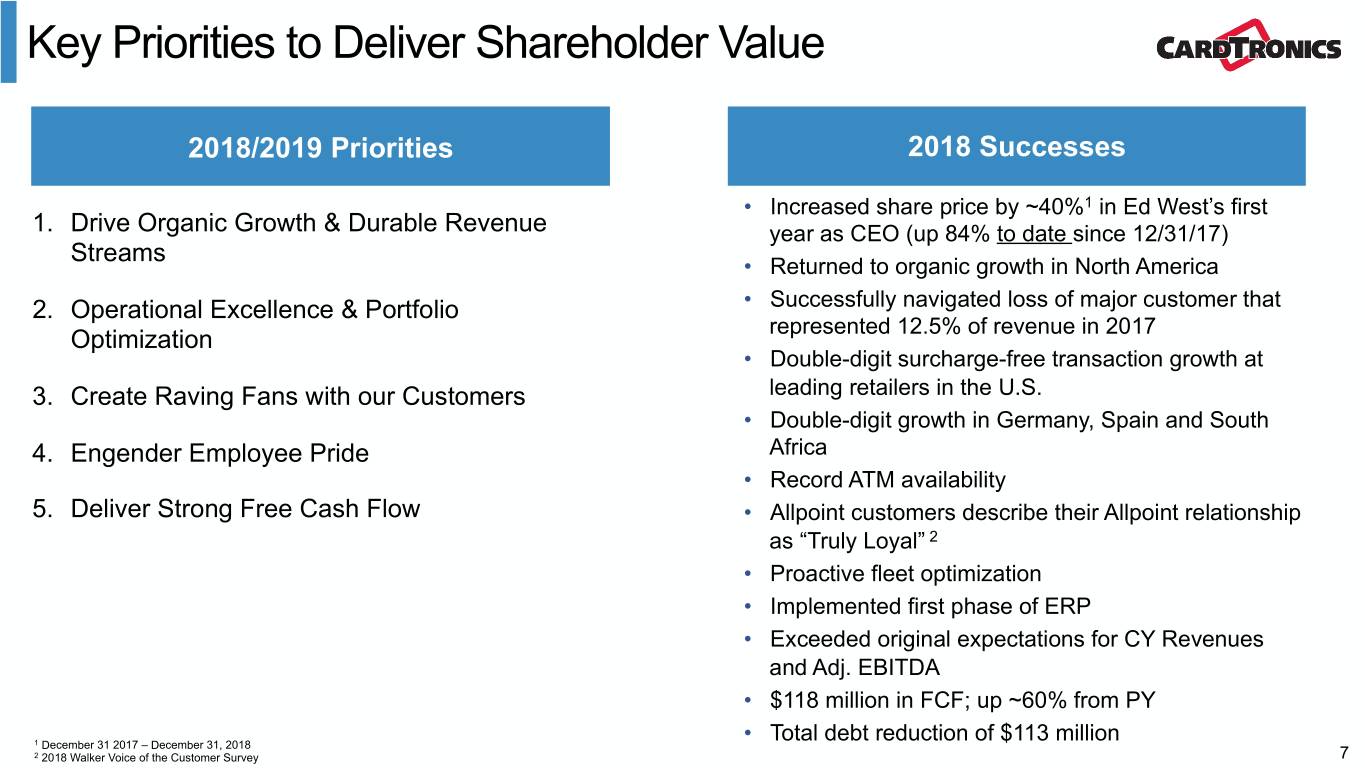

Key Priorities to Deliver Shareholder Value 2018/2019 Priorities 2018 Successes • Increased share price by ~40%1 in Ed West’s first 1. Drive Organic Growth & Durable Revenue year as CEO (up 84% to date since 12/31/17) Streams • Returned to organic growth in North America 2. Operational Excellence & Portfolio • Successfully navigated loss of major customer that represented 12.5% of revenue in 2017 Optimization • Double-digit surcharge-free transaction growth at 3. Create Raving Fans with our Customers leading retailers in the U.S. • Double-digit growth in Germany, Spain and South 4. Engender Employee Pride Africa • Record ATM availability 5. Deliver Strong Free Cash Flow • Allpoint customers describe their Allpoint relationship as “Truly Loyal” 2 • Proactive fleet optimization • Implemented first phase of ERP • Exceeded original expectations for CY Revenues and Adj. EBITDA • $118 million in FCF; up ~60% from PY • Total debt reduction of $113 million 1 December 31 2017 – December 31, 2018 2 2018 Walker Voice of the Customer Survey 7

2019 Long-Term Incentive Plan Summary Shareholders Plan Feature Notes and Multi-period Three year performance measurement period Metrics Relative TSR Equally-weighted Management Adjusted EBITDA aligned with Adjusted EBITDA cumulative three year growth required for long-term payout at target; relative TSR requires performance at above the median of peer group for target payout. value creation Other Capped at 200% of target requirements Clawback provisions adopted in 2019 Plan Subject to share ownership requirements 8

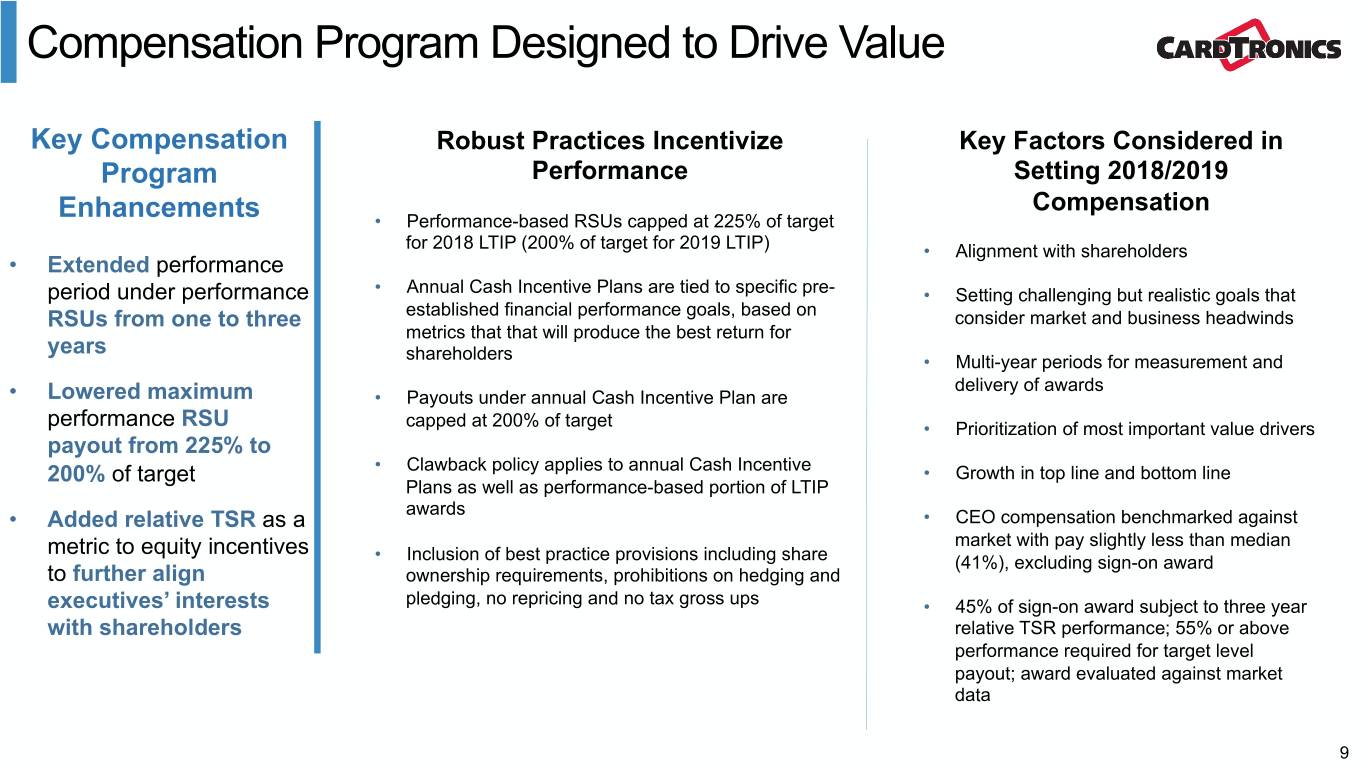

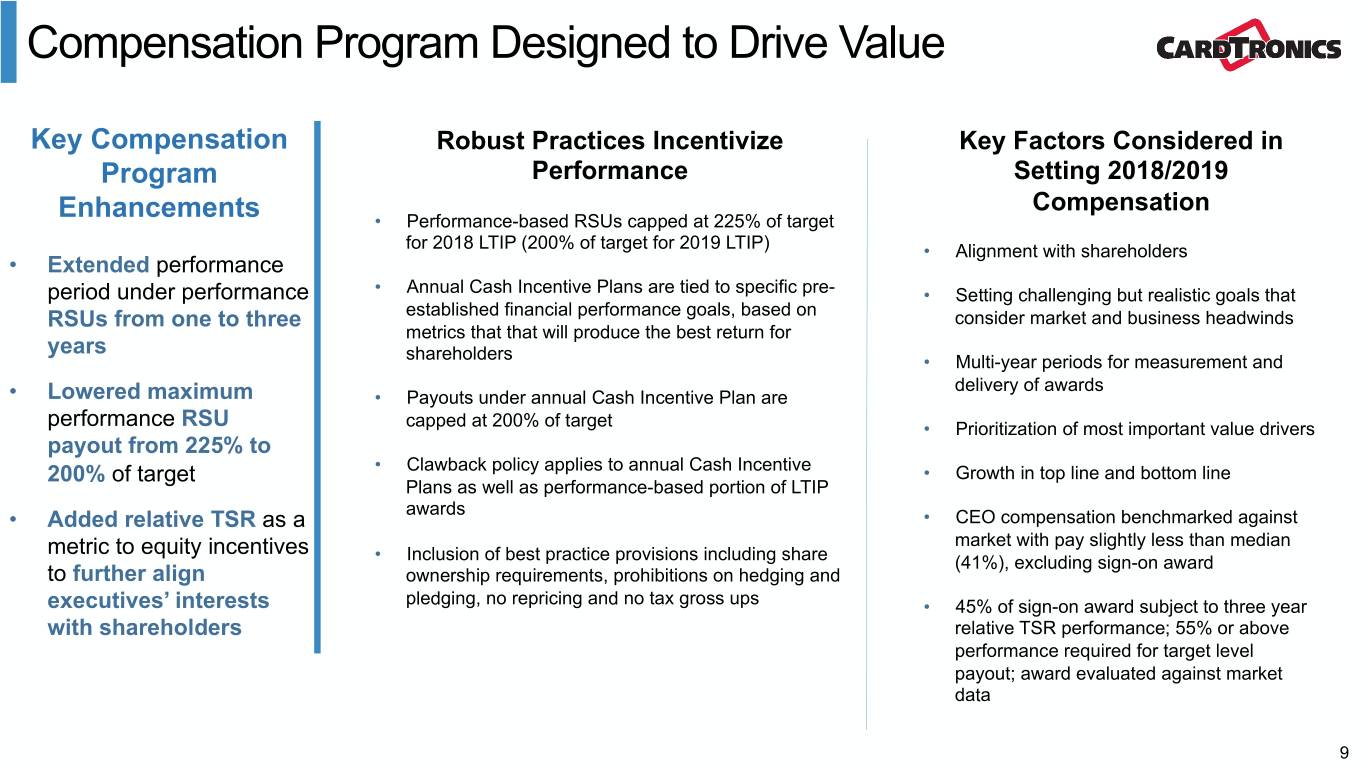

Compensation Program Designed to Drive Value Key Compensation Robust Practices Incentivize Key Factors Considered in Program Performance Setting 2018/2019 Compensation Enhancements • Performance-based RSUs capped at 225% of target for 2018 LTIP (200% of target for 2019 LTIP) • Alignment with shareholders • Extended performance period under performance • Annual Cash Incentive Plans are tied to specific pre- • Setting challenging but realistic goals that RSUs from one to three established financial performance goals, based on consider market and business headwinds metrics that that will produce the best return for years shareholders • Multi-year periods for measurement and delivery of awards • Lowered maximum • Payouts under annual Cash Incentive Plan are performance RSU capped at 200% of target • Prioritization of most important value drivers payout from 225% to 200% of target • Clawback policy applies to annual Cash Incentive • Growth in top line and bottom line Plans as well as performance-based portion of LTIP awards • Added relative TSR as a • CEO compensation benchmarked against metric to equity incentives market with pay slightly less than median • Inclusion of best practice provisions including share (41%), excluding sign-on award to further align ownership requirements, prohibitions on hedging and executives’ interests pledging, no repricing and no tax gross ups • 45% of sign-on award subject to three year with shareholders relative TSR performance; 55% or above performance required for target level payout; award evaluated against market data 9

Share Repurchase Resolution Intended to Better Align Cardtronics with U.S. Issuers • Under the U.K. Companies Act 2006, Cardtronics, like other U.K. companies, are prohibited from purchasing outstanding ordinary shares unless such purchase has been approved by a resolution of shareholders • This voting matter relates solely to the U.K. Companies Act requirement for shareholder approval up to a maximum of 5 years • Cardtronics already has shareholder approval for share repurchases through June 30, 2021 and is seeking to effectively extend the term to May 2024 and enable additional counterparties with whom the Company can execute share repurchases • Most of the company’s shareholders are U.S.-based and accustomed to share repurchases being a tool available to the Board, this proposal would bring Cardtronics closer in-line with a majority of U.S.-listed issuers • Any future share repurchases would still require Board approval and would be considered within the context of growth opportunities, market conditions, capital structure, and other factors. • On March 26, 2019, Cardtronics announced a share repurchase authorization from the Board to repurchase up to $50 million in aggregate value 10

Key Elements of Cardtronics Governance Profile • Non-executive, independent Board Chair • An independent and qualified board • All directors are independent, other than the CEO • Two financial experts on Audit Committee • Committed to ongoing board refreshment and diversity • Board of Directors and committees conduct annual performance reviews o Added two directors in 2018 • No overboarded directors and directors must 22% of Board is female o notify Nominating & Governance Committee o Average board tenure of six years prior to joining another public company Board • Strong shareholder representation on the Board • Robust investor outreach targeting more than 75% of shareholders for input on governance, • Shareholder right to call special meetings with 5% social responsibility and compensation ownership matters • No dual class capital structure • Deliberate and thoughtful committee rotations • Majority voting for directors in uncontested elections • No poison pill 11