Exhibit LO

1 | P a g e Transnational Matters, PLLC 2121 Biscayne Boulevard, # 1878 Miami, Florida 33137 d k @TransnationalMatters.com www.TransnationalMatters.com Office: 305 417 9866 Date: January 2, 2025 Re: Legal Opinion on the 3(a)(10) Settlement Agreement To Whom It May Concern: I am pleased to submit the enclosed legal opinion prepared by Transnational Matters PLLC on behalf of our client, the Jake P . Noch Family Office, LLC, and Music Licensing, Inc . This legal opinion pertains to the issuance of unrestricted securities under the 3 (a)( 10 ) Settlement Agreement, as approved by the Twentieth Judicial Circuit Court . The opinion meticulously analyzes the application of the Section 3 (a)( 10 ) exemption, demonstrating that the securities issued under this agreement are free trading and not subject to the typical restrictions imposed on affiliates under Rule 144 of the Securities Act of 1933 . It further confirms that the investor is not deemed an underwriter under the Securities Act, reinforcing that the transaction is compliant with all relevant federal securities laws and SEC regulations . This legal opinion was prepared with careful consideration of the court’s findings during the fairness hearing, and it addresses the key legal principles and precedents governing the application of the Section 3 (a)( 10 ) exemption . Please review the enclosed legal opinion and do not hesitate to contact me should you have any questions or require further clarification. Thank you for your attention to this matter. Sincerely,

2 | P a g e Davy Karkason Esq. Founding Attorney at Law Transnational Matters, PLLC

Legal Opinion: Issuance of Unrestricted Securities under the 3(a)(10) Settlement Agreement I. Introduction This legal opinion is provided regarding the 3(a)(10) Settlement Agreement between Music Licensing, Inc. ("the Company") and Jake P. Noch, both individually and on behalf of the Jake P. Noch Family Office, LLC ("the Investor"). The primary focus of this opinion is to establish that the securities issued under this agreement are unrestricted and free trading under the Securities Act of 1933, based exclusively on the Section 3(a)(10) exemption, which applies to securities issued as part of a court - approved settlement. The opinion will address the application of the Section 3(a)(10) exemption to the issuance of these securities, explore the legal rationale behind the court's approval, and analyze why the shares are not subject to the restrictions typically imposed on affiliates under Rule 144 of the Securities Act. This opinion will further establish that the Investor is not deemed an underwriter under the Securities Act, and the structure of the transaction fully complies with federal securities laws and SEC regulations. The 3(a)(10) Settlement Agreement provides an annual allocation of $12,000,000 USD to Mr. Noch and his affiliated entities. This amount includes both the proceeds from the sale of shares and the coverage of external costs, such as commissions, custody fees, and other previously unrealized amounts. This opinion will demonstrate that the application of the Section 3(a)(10) exemption to this transaction is both legally sound and factually accurate, ensuring that the securities issued are free trading without the limitations typically imposed by Rule 144 or other regulations. II. Summary of Legal Opinion The 3(a)(10) Settlement Agreement has been meticulously structured to comply with Section 3(a)(10) of the Securities Act of 1933, which provides an exemption from the registration requirements under Section 5 of the Act. The exemption allows for the issuance of securities in exchange for bona fide claims, provided that the transaction is approved by a court following a fairness hearing. This legal opinion confirms that the securities issued under this agreement are unrestricted and free trading solely by virtue of the Section 3(a)(10) exemption. The opinion concludes that the securities issued under the agreement are not subject to Rule 144 restrictions, despite the Investor ’ s affiliate status, because the court ’ s approval under Section 3(a)(10) supersedes the restrictions typically imposed on affiliates. Furthermore, the Investor is not deemed an underwriter under the Securities Act, as the securities are issued as part of a settlement rather than for the purpose of distribution. This conclusion is supported by detailed legal analysis, including SEC rules, regulations, and case law, establishing the factual accuracy of the transaction's structure and compliance.

The $12,000,000 annual allocation to Mr. Noch is handled in a manner consistent with the legal requirements of Section 3(a)(10). The issuance of securities is directly tied to the realization of this set amount, ensuring that the transaction is legally compliant and does not create incentives related to fluctuations in the Company ’ s stock price. III. Background and Legal Framework A. Factual Background on the Structure of the 3(a)(10) Settlement Agreement The 3(a)(10) Settlement Agreement was carefully designed to resolve significant financial obligations between Music Licensing, Inc. and the Investor by issuing securities that are exempt from registration under Section 5 of the Securities Act of 1933. Section 3(a)(10) provides an exemption from the registration requirements for securities issued in exchange for bona fide claims, provided that the terms of the issuance are approved by a court after a fairness hearing (Securities Act of 1933, † 3(a)(10), 15 U.S.C. † 77c(a)(10)). The fairness hearing conducted by the Twentieth Judicial Circuit Court confirmed that the issuance of securities under this agreement was fair, transparent, and equitable. The court ’ s approval of the settlement under Section 3(a)(10) allowed the Company to issue unrestricted securities, thereby enabling the Company to fulfill its financial obligations to Mr. Noch, including the annual $12,000,000 allocation. 1. Strategic Considerations and Legal Rationale The decision to utilize the Section 3(a)(10) exemption was driven by several critical considerations: • Efficient Settlement of Claims: The Section 3(a)(10) exemption allows the Company to issue securities without the need for SEC registration, provided the issuance is approved by a court. This exemption was particularly vital for the Company, which had an obligation to allocate $12,000,000 annually to Mr. Noch. By leveraging the exemption, the Company could issue securities efficiently, without the delays and costs associated with registration under Section 5 (Securities Act of 1933, † 5, 15 U.S.C. † 77e). The exemption was essential to meeting the Company's financial obligations while adhering to legal standards for timely settlements (Multicanal S.A., 340 B.R. 154, 162 (Bankr. S.D.N.Y. 2006)). • Avoidance of Rule 144 Restrictions: Rule 144 imposes restrictions on the resale of securities by affiliates, including mandatory holding periods, volume limitations, and conditions designed to prevent market manipulation (17 C.F.R. † 230.144). However, by structuring the transaction under the Section 3(a)(10) exemption and securing court approval, the Company ensured that the shares issued to Mr. Noch were unrestricted and free trading. The SEC has consistently recognized that securities issued under a court - approved 3(a)(10) settlement are not subject to Rule 144 restrictions, provided the settlement is fair and receives court approval (ScripsAmerica, Inc. v. Ironridge Global LLC, 56 F. Supp. 3d 1121, 1165 (C.D. Cal. 2014); SEC Staff Legal Bulletin No. 3A).

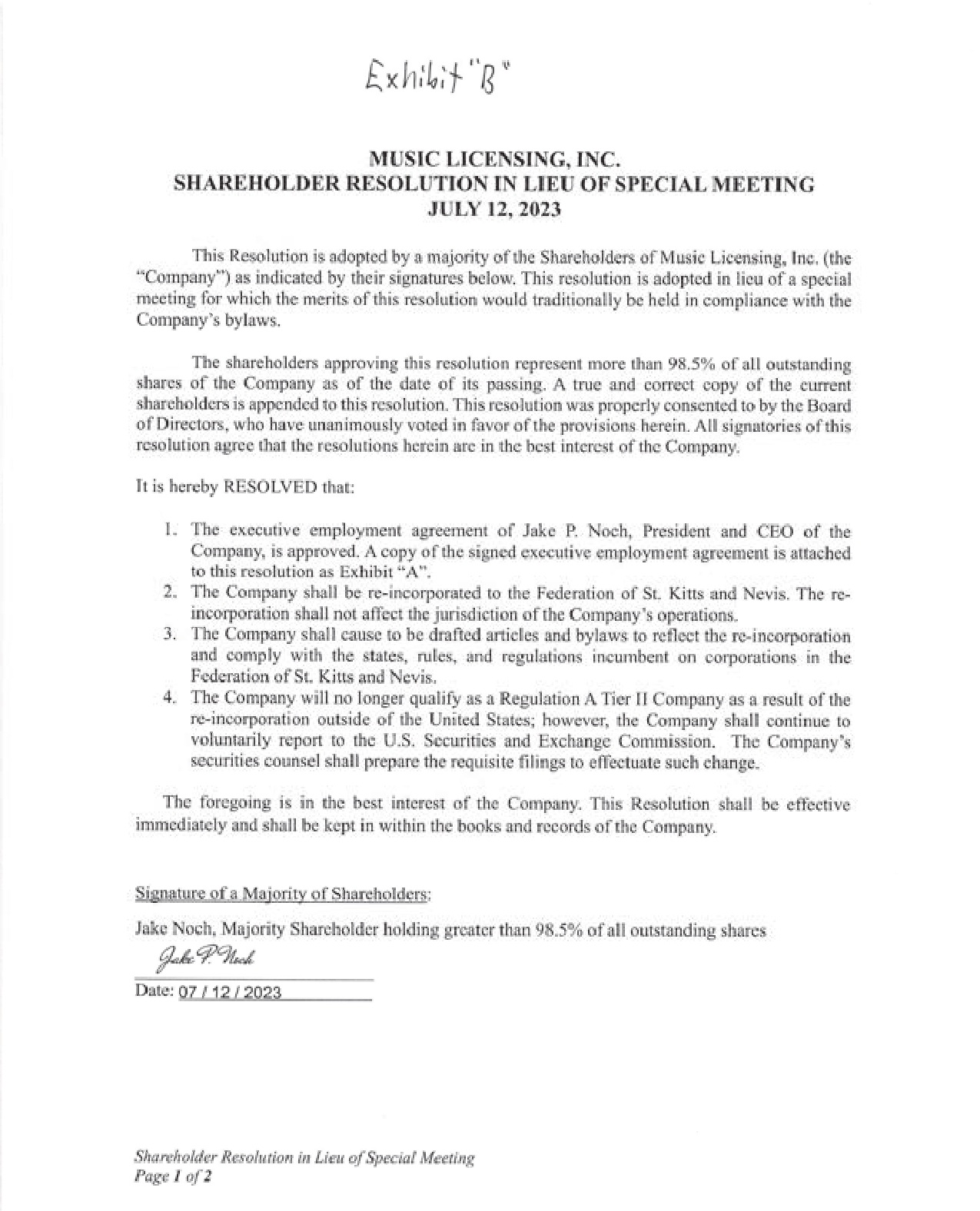

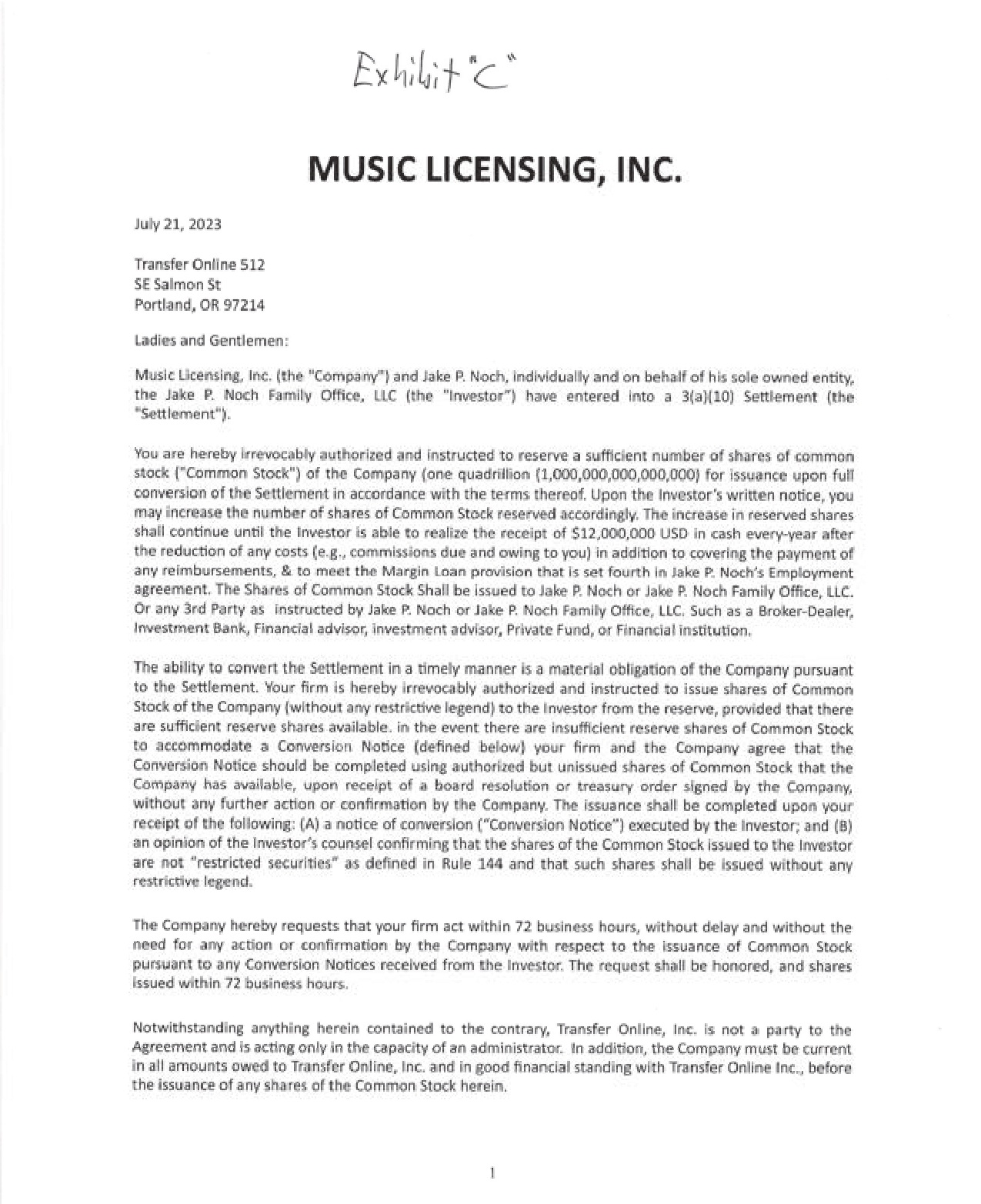

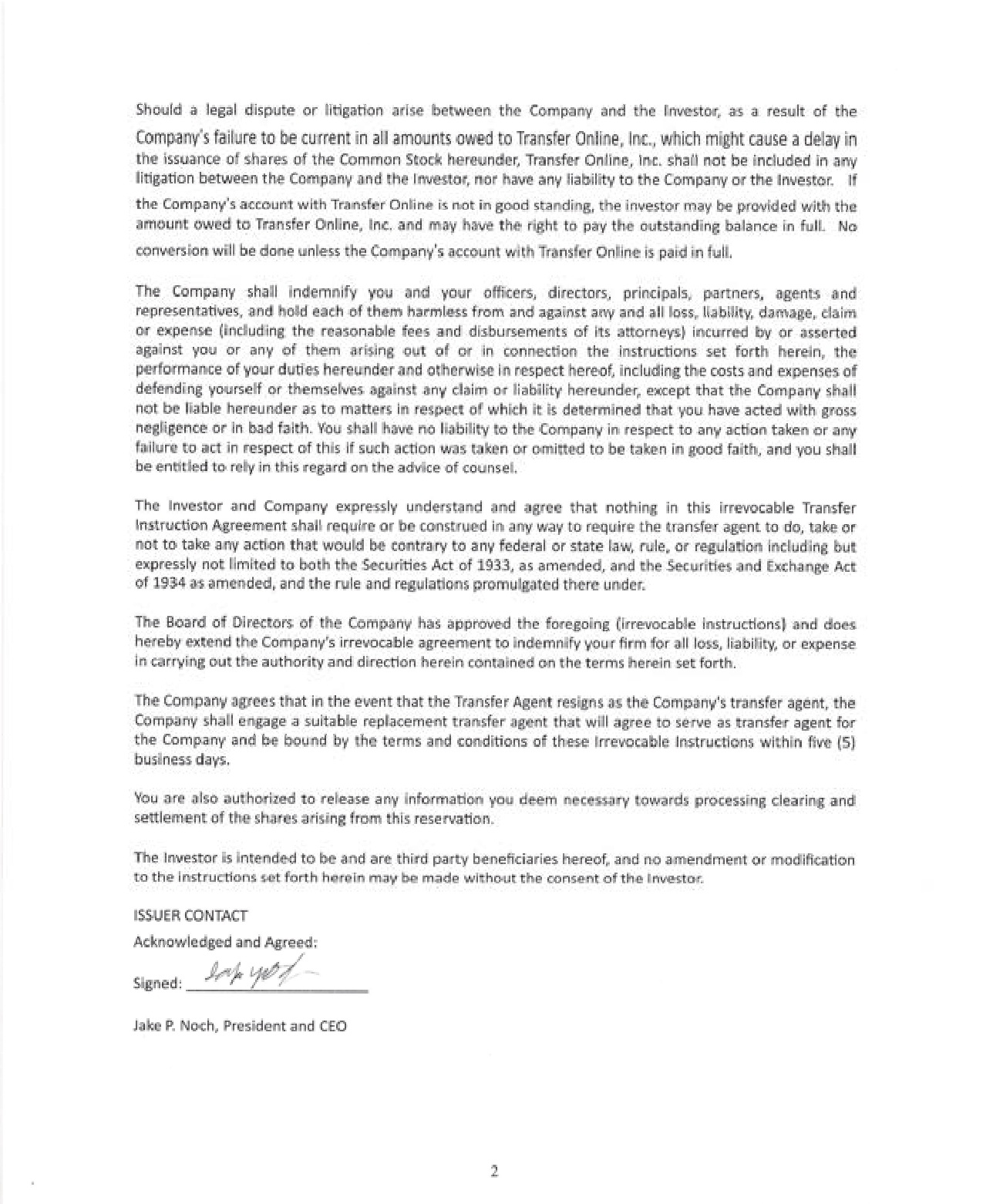

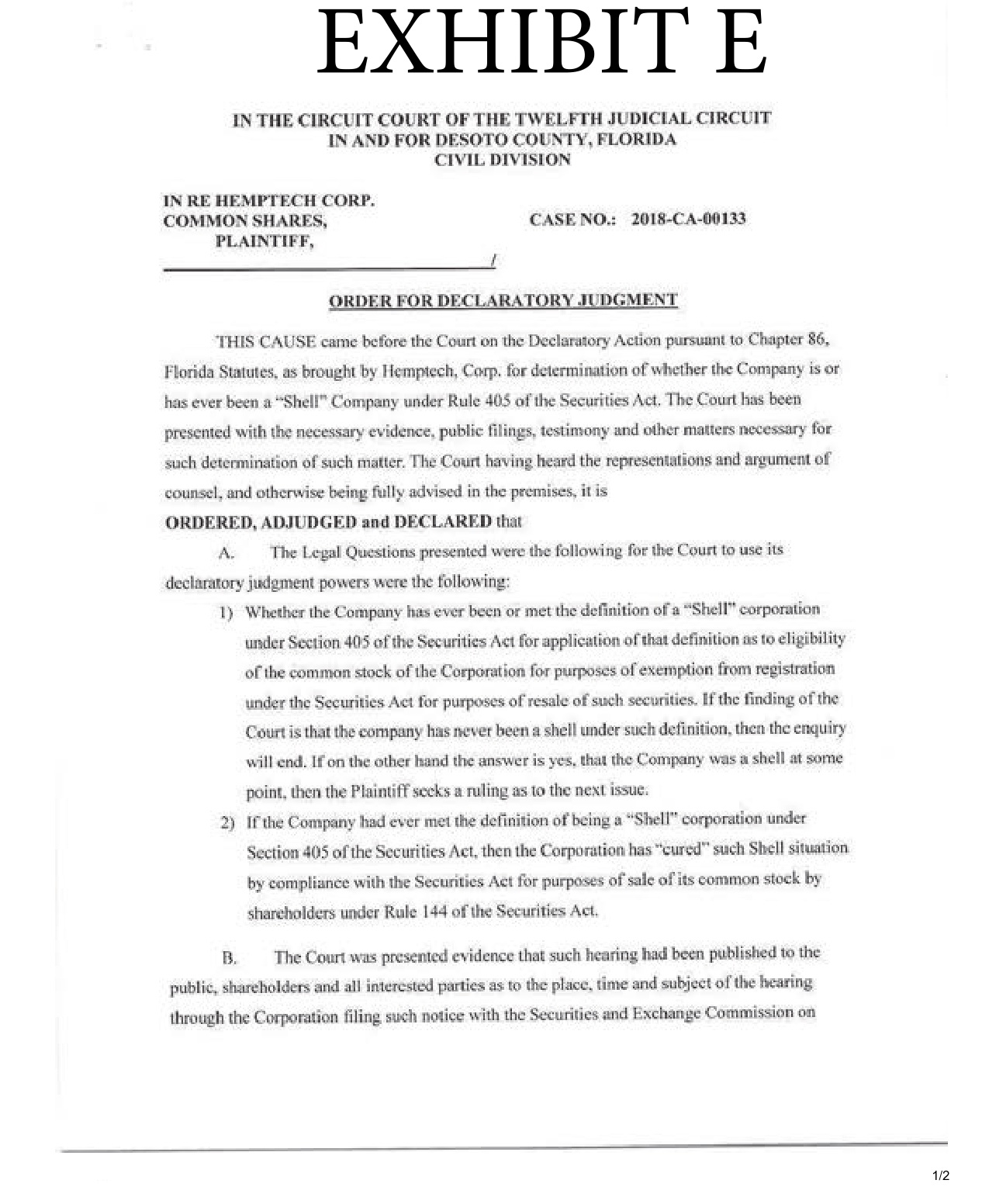

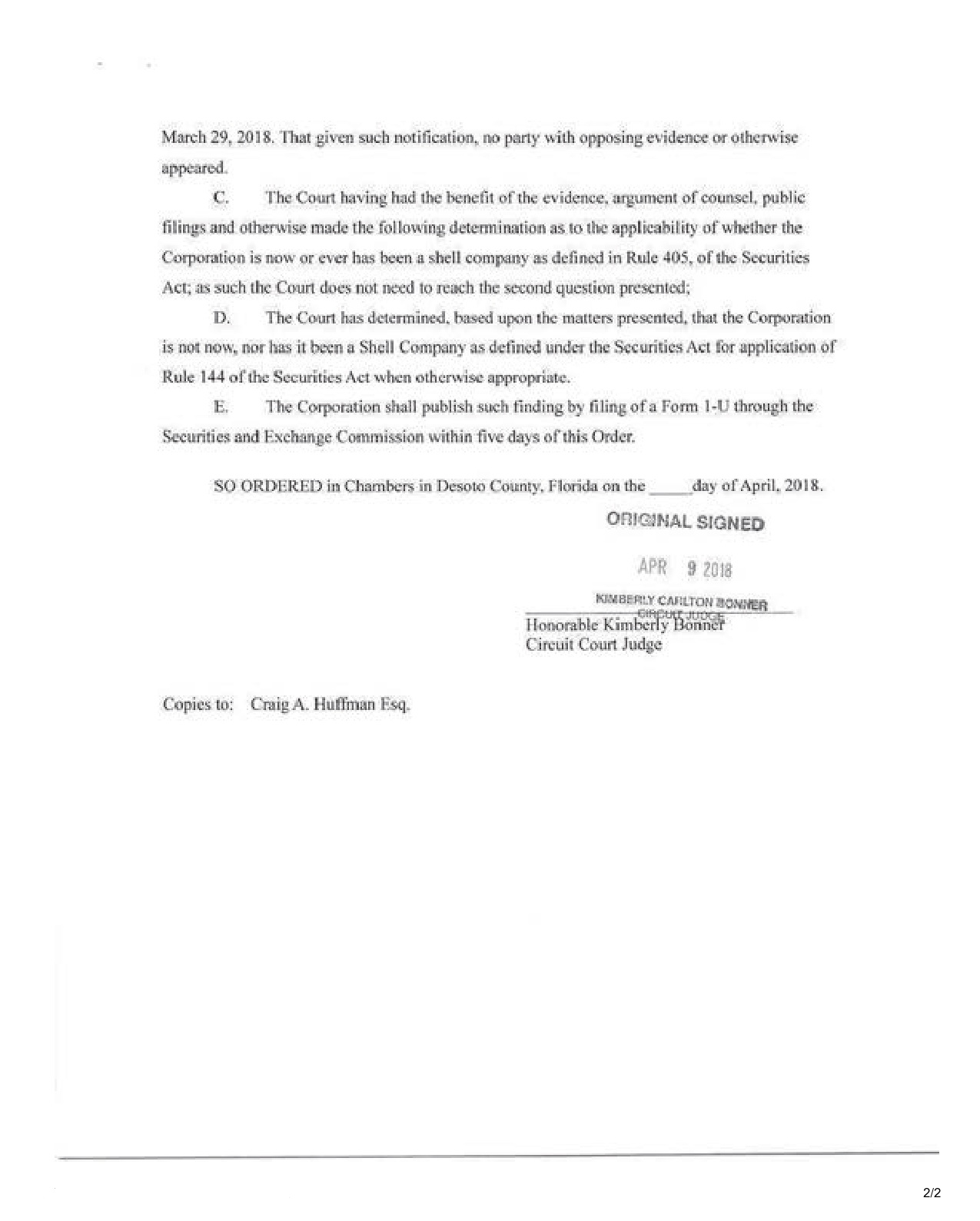

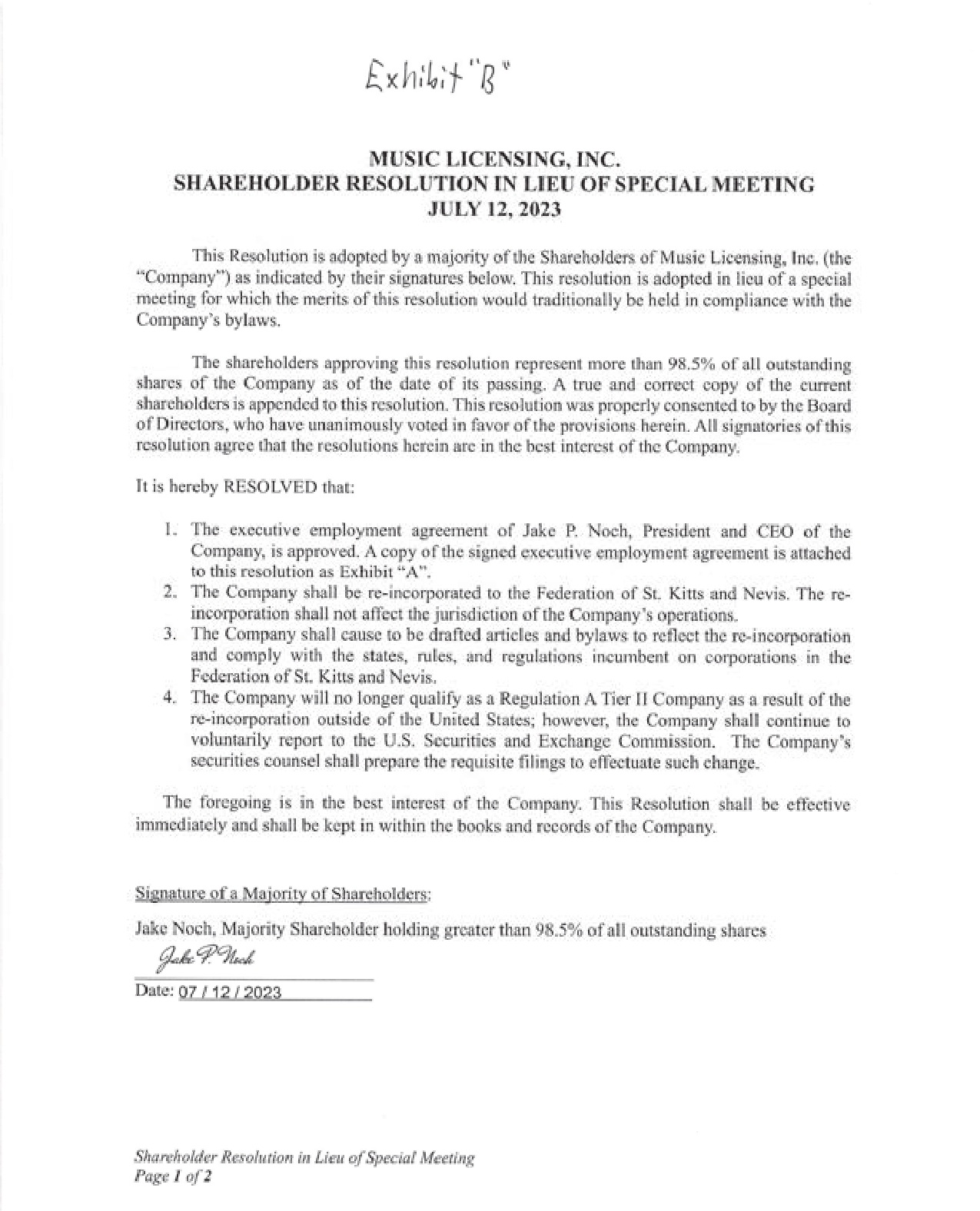

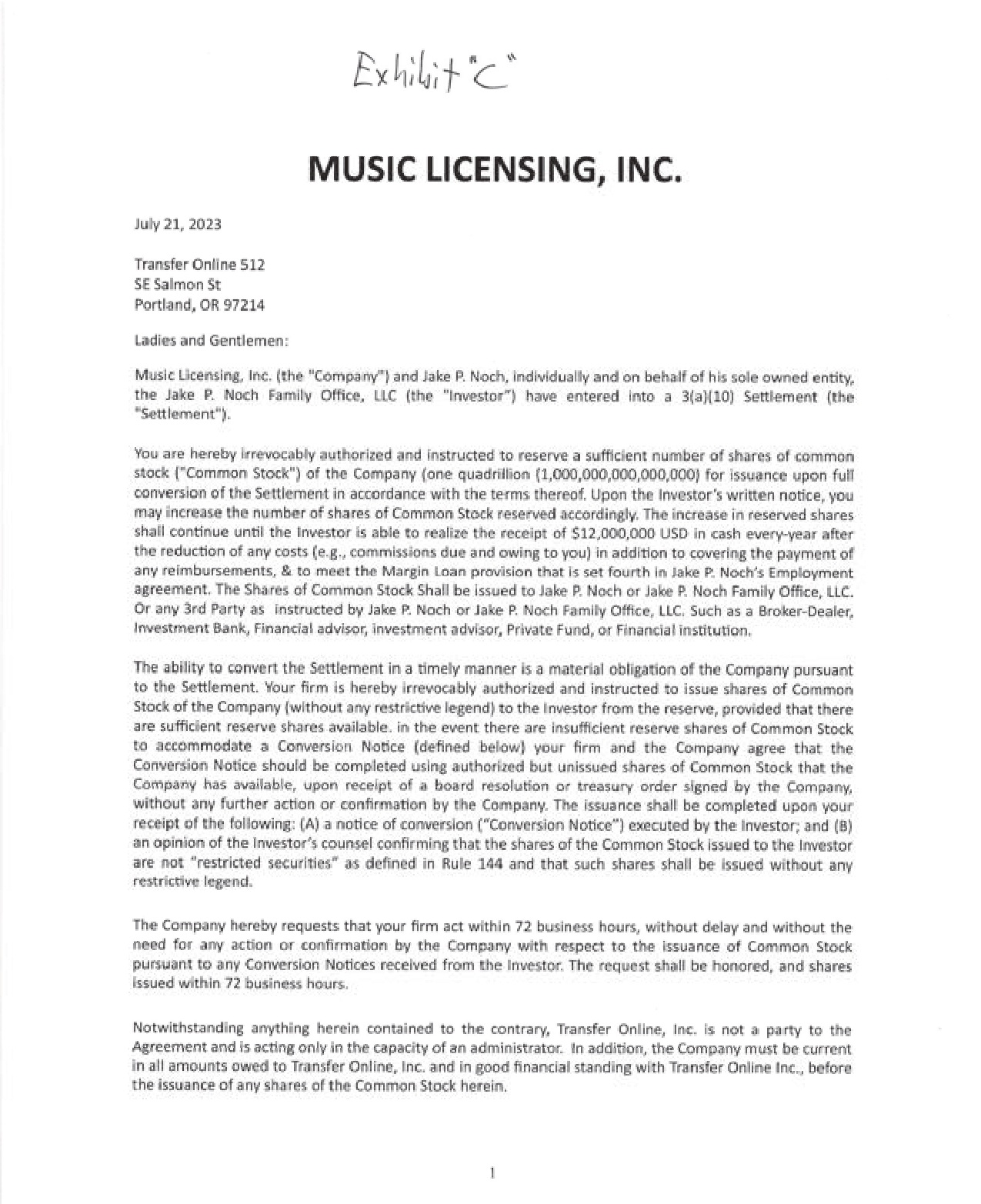

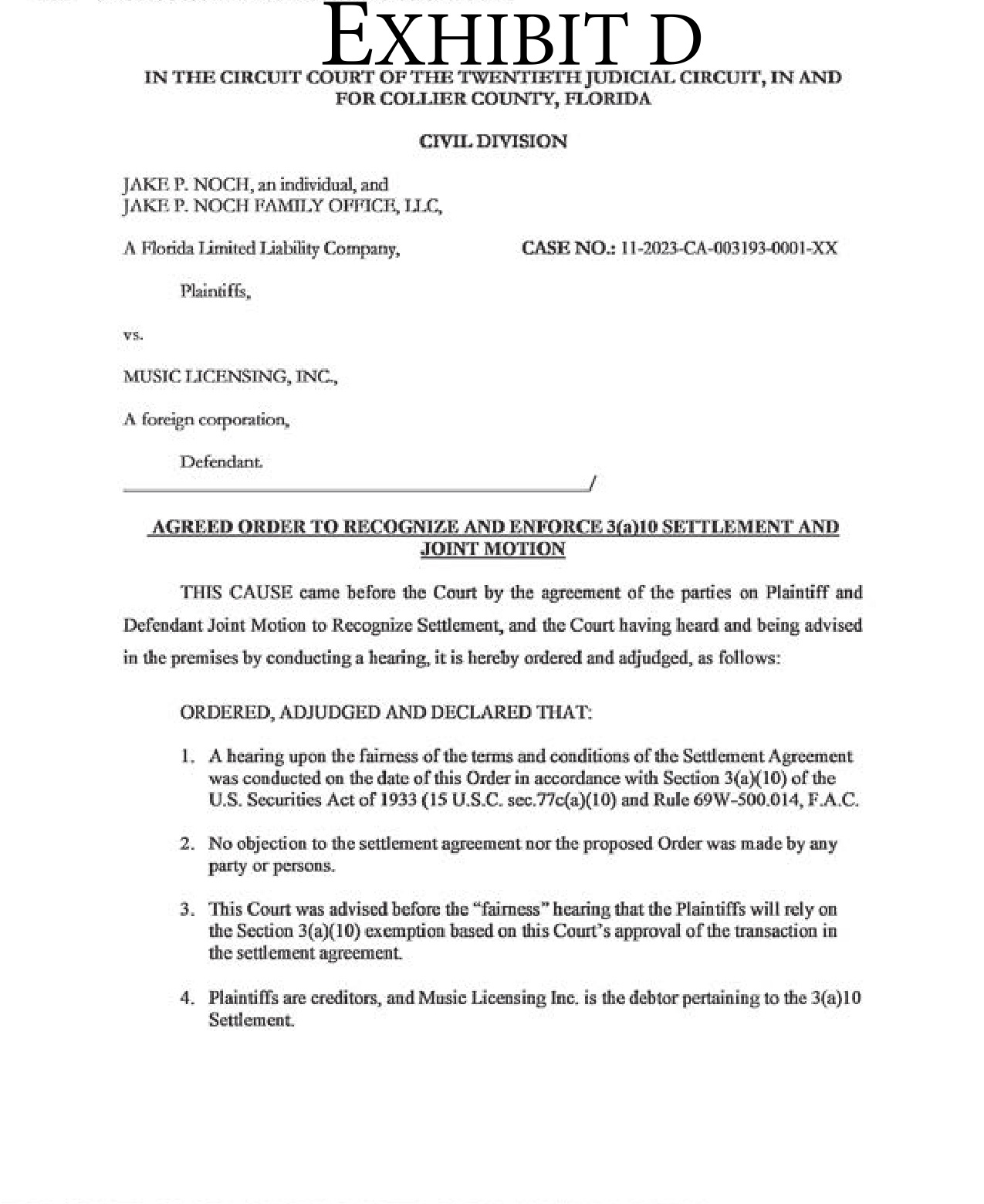

• Judicial Oversight and Transparency: The fairness hearing required under Section 3(a)(10) acts as a critical substitute for the registration process under Section 5 of the Securities Act, ensuring that the transaction is fair and compliant with federal securities laws (Securities Act of 1933, † 5, 15 U.S.C. † 77e). The court ’ s involvement is crucial for providing an independent assessment of the fairness of the settlement, thereby validating the issuance of securities without the need for registration (Brucker v. Thyssen – Bornemisza Europe N.V., 424 F.Supp. 679 (S.D.N.Y. 1976)). • Allocation of a Set Amount: The 3(a)(10) Settlement Agreement is structured to ensure that the $12,000,000 annual allocation to Mr. Noch includes both realized proceeds and external costs, such as commissions and fees. This structure adheres to SEC rules governing the issuance of securities, with a particular focus on fairness and transparency, ensuring that the issuance of securities complies with federal securities laws (Securities Act of 1933, † 3(a)(10)). 2. Development of the 3(a)(10) Settlement Agreement The 3(a)(10) Settlement Agreement evolved through a series of carefully considered steps, ensuring compliance with the Securities Act of 1933: • Initial Employment Agreement (June 25, 2023): The Employment Agreement between Music Licensing, Inc. and Jake P. Noch established the foundation for the 3(a)(10) Settlement Agreement. The agreement outlined Mr. Noch ’ s compensation structure, including a convertible note allowing him to convert a specific dollar amount into Company shares, providing flexibility in his compensation and ensuring that the transaction could be structured to meet both legal and financial objectives (Exhibit A). • Shareholder Resolution (July 12, 2023): The Shareholder Resolution ratified the Employment Agreement, ensuring that the Company had the necessary corporate approval to issue shares under the 3(a)(10) Settlement Agreement. This resolution complied with the requirements for corporate governance and was essential for securing the legal foundation for the issuance of shares under the forthcoming settlement (Exhibit B). • 3(a)(10) Settlement Agreement (July 21, 2023): The formal Settlement Agreement was executed, detailing the terms under which the Company would issue shares to Mr. Noch. The agreement was specifically structured to ensure that the shares issued were unrestricted and not subject to Rule 144 limitations, aligning with the requirements of Section 3(a)(10) of the Securities Act (Exhibit C). • Fairness Hearing and Court Approval (December 7, 2023): The Twentieth Judicial Circuit Court conducted a fairness hearing to evaluate the fairness and equity of the Settlement Agreement. The court ’ s approval confirmed that the issuance of securities under the 3(a)(10) Settlement Agreement was lawful and exempt from the registration requirements of Section 5. The fairness hearing was a critical component of this process, providing the necessary legal validation for the transaction and ensuring compliance with federal securities laws (Exhibit D).

• Agreed Order to Amend (July 19, 2024): Following the initial court approval, an Agreed Order to Amend was issued, clarifying that the shares issued under the agreement were not subject to Rule 144 restrictions. This order further reinforced the legal standing of the transaction, ensuring that the securities were unrestricted and could be freely traded without additional regulatory burdens (Exhibit F). B. The 3(a)(10) Exemption and Court Approval Section 3(a)(10) of the Securities Act of 1933 provides an exemption from the registration requirements under Section 5 for securities issued in exchange for bona fide claims, provided that the terms and conditions of the issuance are approved by a court after a fairness hearing (Securities Act of 1933, † 3(a)(10), 15 U.S.C. † 77c(a)(10)). The exemption is designed to facilitate the settlement of legitimate claims by allowing the issuance of securities without the delays and costs associated with SEC registration. In this case, the Twentieth Judicial Circuit Court conducted a fairness hearing to assess the terms of the 3(a)(10) Settlement Agreement. The court ’ s approval is a critical element of the exemption, as it provides the necessary legal validation for the issuance of unrestricted securities. The fairness hearing ensures that the settlement is conducted transparently and equitably, protecting the interests of all parties involved. The court ’ s approval exempts the securities from the registration requirements of Section 5 of the Securities Act, allowing the Company to fulfill its financial obligations to Mr. Noch without additional regulatory hurdles (Multicanal S.A., 340 B.R. 154, 162 (Bankr. S.D.N.Y. 2006)). C. The Importance of Court Approval Court approval under Section 3(a)(10) is the cornerstone of the exemption, as it substitutes the need for registration under Section 5 of the Securities Act. The fairness hearing conducted by the court serves as an independent assessment of the settlement ’ s terms, ensuring that the transaction is transparent, fair, and compliant with federal securities laws. The court ’ s approval legitimizes the issuance of unrestricted securities, making them free trading and not subject to Rule 144 restrictions, despite the affiliate status of the Investor (Brucker v. Thyssen – Bornemisza Europe N.V., 424 F.Supp. 679 (S.D.N.Y. 1976)). The SEC has consistently affirmed that securities issued under a court - approved 3(a)(10) settlement are exempt from Rule 144 restrictions, provided that the court has conducted a thorough fairness hearing and explicitly approved the transaction. This judicial oversight ensures that the issuance of securities is conducted in a manner that is both transparent and compliant with the legal framework governing the settlement of bona fide claims (SEC Staff Legal Bulletin No. 3A). D. The Impact of Loper Bright Enterprises v. Raimondo on This Legal Opinion The Supreme Court's decision in Loper Bright Enterprises v. Raimondo reinforces the importance of judicial oversight in the application of statutory exemptions under federal law. The court emphasized that clear legislative intent and judicial scrutiny are necessary to ensure that

regulatory actions are grounded in explicit statutory authority (Loper Bright Enterprises v. Raimondo, 142 S. Ct. 1687 (2022)). In the context of the 3(a)(10) Settlement Agreement, the court ’ s approval under Section 3(a)(10) aligns with these principles, providing the necessary judicial oversight to ensure that the transaction is conducted in accordance with the law. The court ’ s involvement in conducting the fairness hearing and approving the transaction ensures that the issuance of unrestricted securities is both lawful and compliant with federal securities laws, reinforcing the legitimacy of the $12,000,000 allocation to Mr. Noch (Securities Act of 1933, † 3(a)(10)). IV. Compliance with Key Securities Laws and SEC Regulations A. Securities Act of 1933 The Securities Act of 1933 is the primary federal law governing the issuance of securities in the United States. Section 5 of the Securities Act requires that all securities offered or sold in interstate commerce be registered with the SEC unless an exemption applies (Securities Act of 1933, † 5, 15 U.S.C. † 77e). The Section 3(a)(10) exemption provides a critical pathway for companies to issue securities without registration, provided that the transaction is approved by a court following a fairness hearing (Securities Act of 1933, † 3(a)(10), 15 U.S.C. † 77c(a)(10)). The 3(a)(10) Settlement Agreement complies with the Securities Act by utilizing the registration exemption provided under Section 3(a)(10). The court ’ s approval of the transaction following the fairness hearing ensures that the securities issued are unrestricted and free trading, consistent with the requirements of the Securities Act (Multicanal S.A., 340 B.R. 154, 162 (Bankr. S.D.N.Y. 2006)). B. Securities Exchange Act of 1934 The Securities Exchange Act of 1934 governs the trading of securities in the secondary market and imposes various reporting and disclosure requirements on public companies. The 3(a)(10) Settlement Agreement ensures that the Company ’ s reporting obligations are maintained throughout the execution of the agreement, including the filing of periodic reports such as Forms 10 - K and 10 - Q (Securities Exchange Act of 1934, 15 U.S.C. † 78m and 78o(d)). The Company has adhered to the requirements of Sections 13 and 15(d) of the Exchange Act, which mandate ongoing disclosure of material information to ensure that investors have access to accurate and timely information about the Company ’ s financial condition and operations. The issuance of securities under the 3(a)(10) Settlement Agreement is fully compliant with these requirements, ensuring that the transaction is transparent and consistent with the Company ’ s obligations under the Exchange Act. This compliance is essential in maintaining investor confidence and ensuring that the $12,000,000 allocation to Mr. Noch is conducted in a manner that is fair and transparent (Securities Exchange Act of 1934, 15 U.S.C. † 78m). C. SEC Rules and Regulations

The 3(a)(10) Settlement Agreement complies with specific SEC rules and regulations governing the issuance of securities, the conduct of public companies, and the disclosure requirements applicable to such transactions. Key SEC rules and regulations relevant to this transaction include: • Rule 144 (17 C.F.R. † 230.144): Rule 144 governs the sale of restricted and controlled securities, including those held by affiliates of the issuer. Under the Section 3(a)(10) exemption, the securities issued to Mr. Noch are not subject to the holding periods, volume limitations, or other conditions imposed by Rule 144, provided that the transaction has been approved by the court following a fairness hearing (SEC Staff Legal Bulletin No. 3A). • Rule 10b - 5 (17 C.F.R. † 240.10b - 5): Rule 10b - 5 prohibits fraudulent practices in connection with the purchase or sale of securities. The fairness hearing and court approval under Section 3(a)(10) ensure that the transaction is conducted transparently and without any fraudulent intent, thereby complying with the requirements of Rule 10b - 5. • Rule 12b - 20 (17 C.F.R. † 240.12b - 20): Rule 12b - 20 requires that all material information be disclosed in filings with the SEC to ensure that they are not misleading. The Company ’ s periodic reports related to the 3(a)(10) Settlement Agreement comply with this rule by providing full and accurate disclosure of the material terms and conditions of the transaction. • Rule 144A (17 C.F.R. † 230.144A): Rule 144A addresses the resale of restricted securities by qualified institutional buyers. Although not directly applicable to the 3(a)(10) Settlement Agreement, the rule ’ s principles underscore the importance of ensuring that securities issued under a court - approved settlement are not subject to unnecessary restrictions, reinforcing the unrestricted status of the shares issued to Mr. Noch. • Rule 506(c) (17 C.F.R. † 230.506(c)): While Rule 506(c) under Regulation D allows for the issuance of securities without registration under certain conditions, the 3(a)(10) Settlement Agreement does not rely on this rule. Instead, it relies exclusively on the Section 3(a)(10) exemption, which provides a broader basis for the issuance of unrestricted securities. • Rule 14a - 4 (17 C.F.R. † 240.14a - 4): Rule 14a - 4 governs the requirements for proxy statements and shareholder approvals. The Company has ensured that the corporate actions necessary to approve the 3(a)(10) Settlement Agreement, including the Shareholder Resolution, comply with this rule, providing the necessary corporate governance and shareholder protections. • Rule 10D - 1 (17 C.F.R. † 240.10D - 1): Rule 10D - 1 requires listed companies to implement policies to recoup executive compensation in cases of financial restatements. The Company ’ s compliance with this rule ensures that the $12,000,000 allocation to Mr. Noch is conducted in a manner consistent with federal securities laws and does not result in unjust enrichment.

These SEC rules and regulations provide the legal framework within which the 3(a)(10) Settlement Agreement operates. By ensuring compliance with these rules, the Company has structured the transaction in a manner that is both legally sound and factually accurate, allowing for the issuance of unrestricted securities under the Section 3(a)(10) exemption. V. Affiliate Status, Underwriter Status, and Legal Justification A. Overview of Affiliate Status under Rule 144 An “ affiliate” under securities law is generally defined as a person or entity with control over the issuer, such as an executive officer, director, or significant shareholder. Rule 144 of the Securities Act of 1933 imposes restrictions on the sale of securities by affiliates, including mandatory holding periods, volume limitations, and other conditions designed to prevent market manipulation and ensure that adequate disclosure is provided when securities are sold (17 C.F.R. † 230.144). The purpose of these restrictions is to prevent affiliates, who are often insiders with significant control over the issuer, from engaging in transactions that could adversely affect the market for the issuer ’ s securities. However, under the Section 3(a)(10) exemption, these restrictions do not apply to securities issued to affiliates, provided that the settlement is court - approved after a fairness hearing (SEC Staff Legal Bulletin No. 3A). B. Affiliate Eligibility for 3(a)(10) Exemption While affiliates are typically subject to the restrictions of Rule 144, the Section 3(a)(10) exemption allows for the issuance of unrestricted securities to affiliates, provided that the transaction is approved by a court following a fairness hearing. The fairness hearing conducted by the Twentieth Judicial Circuit Court provided the necessary legal oversight, ensuring that the transaction was fair and compliant with SEC regulations (ScripsAmerica, Inc. v. Ironridge Global LLC, 56 F. Supp. 3d 1121, 1165 (C.D. Cal. 2014)). This exemption is particularly important in the context of the $12,000,000 annual allocation to Mr. Noch, as it allows the Company to issue the necessary securities to fulfill this obligation without being subject to the holding periods and volume limitations that would typically apply under Rule 144. The court ’ s approval of the 3(a)(10) Settlement Agreement effectively removes these restrictions, allowing the securities to be freely traded. C. Court Petition and Approval Regarding Rule 144 Affiliate Restrictions During the court proceedings related to the 3(a)(10) Settlement Agreement, the parties specifically petitioned the court for approval to exempt the securities issued under the agreement from the restrictions typically imposed under Rule 144. This petition was a critical component of the settlement process, as it sought to ensure that the securities could be freely traded despite the Investor ’ s status as an affiliate of the Company.

The court carefully considered the petition during the fairness hearing, taking into account the structure of the transaction, the legal principles governing the 3(a)(10) exemption, and the need to ensure that the settlement was conducted in a manner that was fair and equitable to all parties involved. After a thorough review of the settlement terms, the court approved the petition, concluding that the issuance of unrestricted securities to the Investor was lawful and consistent with the legal framework governing court - approved settlements (Exhibit D). Legal Basis for Court Approval The court ’ s decision to exempt the securities from Rule 144 restrictions is supported by established legal precedents and SEC guidance. Courts have consistently held that securities issued under a court - approved 3(a)(10) settlement are not subject to the restrictions of Rule 144, provided that the court has conducted a thorough fairness hearing and has explicitly approved the transaction. This legal framework ensures that the issuance of unrestricted securities is lawful and in compliance with federal securities laws (ScripsAmerica, Inc. v. Ironridge Global LLC, 56 F. Supp. 3d 1121, 1165 (C.D. Cal. 2014); SEC Staff Legal Bulletin No. 3A). The court ’ s approval of the transaction under Section 3(a)(10) further legitimizes the issuance of unrestricted securities, ensuring that the $12,000,000 allocation to Mr. Noch is conducted in a manner that is both lawful and equitable. The court ’ s oversight provides a critical safeguard against potential abuses, ensuring that the transaction adheres to the legal framework governing the settlement of bona fide claims. D. Definition of an Underwriter under the Securities Act Under the Securities Act of 1933, an “ underwriter” is broadly defined as any person who has purchased from an issuer with a view to, or offers or sells for an issuer in connection with, the distribution of any security, or participates or has a direct or indirect participation in such undertaking (Securities Act of 1933, † 2(a)(11), 15 U.S.C. † 77b(a)(11)). The classification of an underwriter carries significant regulatory implications, including the requirement to register the securities being offered and to provide detailed disclosures to investors. However, the classification of an underwriter is not applicable in the context of a court - approved 3(a)(10) settlement, where the securities are issued in exchange for bona fide claims and are not intended for public distribution. E. Why the Investor Is Not Deemed an Underwriter The Investor, Jake P. Noch, in his individual capacity and on behalf of the Jake P. Noch Family Office, LLC, is not deemed an underwriter under the Securities Act for several reasons: 1. No Intent to Distribute Securities: The securities were issued to the Investor not for the purpose of public distribution but to satisfy bona fide financial obligations owed by the Company. The Investor ’ s role was not to purchase the securities with a view to distribute them in the market, but rather to receive them as part of a settlement agreement. The SEC has consistently taken the position that recipients of securities in a court - approved

settlement under Section 3(a)(10) are not underwriters, as they are not engaging in a distribution of securities (SEC Staff Legal Bulletin No. 3A). 2. Fairness Hearing and Court Approval: The court ’ s approval of the settlement after a fairness hearing further supports the conclusion that the Investor is not an underwriter. The fairness hearing serves as an independent assessment that the settlement, including the issuance of securities, is fair and does not involve a public distribution in the traditional sense. Courts have upheld that where securities are issued under a court - approved settlement, the recipient is not deemed an underwriter because the transaction does not involve the typical risks and activities associated with underwriting (Multicanal S.A., 340 B.R. at 162). 3. Absence of a Public Offering: The securities issued under the 3(a)(10) Settlement Agreement are not part of a public offering. The issuance of shares was not conducted as an offering to the general public, but rather as a private transaction intended to settle specific claims. The lack of a public offering element further distinguishes the Investor ’ s role from that of an underwriter (Securities Act of 1933, † 2(a)(11)). 4. No Direct or Indirect Participation in Distribution: The Investor did not participate, directly or indirectly, in the distribution of the securities. The receipt of the shares was solely for the purpose of settling financial obligations, without any intent or plan to distribute the securities in the public market. The absence of participation in a distribution is a key factor in determining underwriter status (Brucker v. Thyssen – Bornemisza Europe N.V., 424 F.Supp. at 685). Legal Precedents and Regulatory Guidance The determination that the Investor is not an underwriter is consistent with established legal precedents and SEC guidance. In ScripsAmerica, Inc. v. Ironridge Global LLC , the court held that the recipient of securities under a 3(a)(10) settlement was not an underwriter, as the transaction did not involve a distribution of securities (ScripsAmerica, Inc. v. Ironridge Global LLC, 56 F. Supp. 3d 1121, 1165 (C.D. Cal. 2014)). The SEC has also clarified in its Staff Legal Bulletin No. 3A that recipients of securities in a court - approved settlement are not considered underwriters, as their receipt of the securities is not for the purpose of distribution. This legal framework ensures that the Investor ’ s receipt of securities under the 3(a)(10) Settlement Agreement is conducted in a manner that is both lawful and compliant with federal securities laws. The court ’ s approval of the settlement, combined with the absence of any intent or participation in the distribution of securities, confirms that the Investor is not an underwriter and that the transaction is legally sound. VI. Structure of the Settlement Agreement A. Financial Objectives of the Settlement Agreement

The 3(a)(10) Settlement Agreement is specifically structured to ensure that the Investor realizes a set amount of $12,000,000 USD annually. This set amount is inclusive of both the realized proceeds from the sale of shares and other external costs such as commissions, custody fees, asset management fees, and previously unrealized amounts. The agreement ’ s structure is designed to ensure that these financial objectives are met in a manner that is both legally compliant and financially beneficial to all parties involved (Exhibit C). The $12,000,000 allocation is a critical component of the Settlement Agreement, as it represents the total financial obligation owed by the Company to the Investor. By structuring the issuance of shares in a manner that is directly tied to the realization of this set amount, the Company is able to fulfill its financial obligations without being subject to the restrictions typically imposed under Rule 144. This legal framework ensures that the transaction is conducted in a manner that is both fair and equitable, and that the Investor receives the full benefit of the settlement. B. Issuance of Shares Based on Realized Set Amount The shares issued under the 3(a)(10) Settlement Agreement are determined by the amount necessary to achieve the $12,000,000 set amount, rather than a fixed number of shares. This ensures that the Investor meets the financial objective regardless of fluctuations in the share price. If the share price decreases, additional shares may be issued to meet the target, while if the share price increases, fewer shares may be necessary (Exhibit F). This flexible approach to the issuance of shares is critical in ensuring that the Settlement Agreement is conducted in a manner that is both legally compliant and financially advantageous to all parties involved. By tying the issuance of shares to the realization of the set amount, the Company is able to fulfill its financial obligations while minimizing the impact of market fluctuations on the value of the shares. This structure is consistent with legal principles that emphasize the need for fairness and transparency in the settlement of bona fide claims (Securities Act of 1933, † 3(a)(10)). C. Neutral Impact of Stock Price Fluctuations on Incentives A key feature of the 3(a)(10) Settlement Agreement is its neutral impact on the Investor's incentives, irrespective of stock price fluctuations. The Investor's compensation is based solely on the realization of the $12,000,000 set amount, not on the number of shares issued. This ensures that there are no incentives to influence the stock price, as the Investor's financial outcome is tied exclusively to the realization of the set amount (Exhibit C). This structure effectively eliminates any potential conflicts of interest that could arise from the Investor ’ s status as an affiliate of the Company. By removing any financial incentives related to stock price fluctuations, the Settlement Agreement ensures that the transaction is conducted in a manner that is both fair and transparent. The neutral impact of stock price fluctuations further reinforces the legality and integrity of the transaction, ensuring that the Investor receives the full benefit of the settlement without any undue influence on the market. D. Mechanism for Return of Excess Shares to Transfer Agent

The 3(a)(10) Settlement Agreement includes a mechanism for the return of any excess shares to the transfer agent, ensuring that the Investor does not receive more shares than necessary to achieve the $12,000,000 set amount. This mechanism is designed to maintain the fairness and transparency of the transaction, ensuring that the issuance of shares is conducted in a manner that is consistent with the legal framework governing securities issuance (Exhibit F). By incorporating this mechanism into the Settlement Agreement, the Company is able to safeguard the interests of all parties involved, ensuring that the issuance of shares is conducted in a manner that is both legally compliant and financially fair. The return of excess shares further reinforces the legality and fairness of the transaction, ensuring that the Investor receives only the shares necessary to achieve the set amount, without any undue influence on the market. VII. Legal Compliance and Enforcement A. Enforcement of the Settlement Agreement The legal framework established by the 3(a)(10) Settlement Agreement and the subsequent Court orders provides a robust basis for enforcement. The Court ’ s explicit approval of the settlement terms, including the issuance of unrestricted shares to an affiliate, serves as a powerful legal endorsement, ensuring that the transaction is not only compliant with federal and state securities laws but also enforceable in the event of any disputes. The court ’ s approval of the Settlement Agreement is a critical component of its enforceability, as it provides the necessary legal authority to ensure that the transaction is conducted in a manner that is fair, transparent, and compliant with federal securities laws. This legal framework ensures that the $12,000,000 allocation to Mr. Noch is conducted in a manner that is both lawful and equitable, and that the Investor receives the full benefit of the settlement without any undue influence on the market. B. Prevention of Misuse The structure of the settlement agreement is designed to prevent any potential misuse or evasion of regulatory requirements. By requiring court approval, the 3(a)(10) exemption ensures that the transaction is conducted transparently and in good faith. The Court ’ s role in overseeing the fairness of the transaction acts as a safeguard against any attempts to use the exemption improperly. This oversight, combined with the strategic structure of the settlement, ensures that the issuance of shares is both legally compliant and ethically sound (See Exhibit D, Exhibit F). VIII. Conclusion Based on the detailed legal analysis and the Court ’ s approval, the issuance of unrestricted shares under the 3(a)(10) Settlement Agreement is fully compliant with the relevant securities laws. The court ’ s oversight, coupled with the strategic design of the settlement agreement, ensures that the transaction is fair, equitable, and enforceable. The affiliate status of the Investor does not impose

additional restrictions, thanks to the exemptions provided by Section 3(a)(10) and the Court ’ s Order. Furthermore, the Investor is not deemed an underwriter, as the transaction did not involve a public distribution of securities, and the Investor did not participate in any activities characteristic of underwriting (ScripsAmerica, Inc. v. Ironridge Global LLC, 56 F. Supp. 3d 1121, 1165 (C.D. Cal. 2014)). The agreement ’ s design, which ties the issuance of shares to the realization of a $12,000,000 set amount and neutralizes any incentives related to stock price fluctuations, further supports the legality and fairness of the transaction (Exhibit F). IX. Appendix of Exhibits • Exhibit A : Employment Agreement between Plaintiff, Jake P. Noch, and Defendant, Music Licensing, Inc. • Exhibit B : Shareholder Resolution adopted by Music Licensing, Inc. on July 12, 2023. • Exhibit C : Settlement Agreement entered into on July 21, 2023, between Defendant, Music Licensing, Inc., and Plaintiffs. • Exhibit D : Court order from the Twentieth Judicial Circuit Court in Florida, dated December 7, 2023, recognizing and enforcing the 3(a)(10) settlement. • Exhibit E : Court order from the Twelfth Judicial Circuit Court defining Music Licensing, Inc. as a non - shell company. • Exhibit F : Amended Court Order from the Twentieth Judicial Circuit Court in Florida, dated July 19, 2024, clarifying the original 3(a)(10) Court Order and the unrestricted trading of shares. X. Appendix of Legal Citations • Securities Act of 1933 † 3(a)(10), 15 U.S.C. † 77c(a)(10) (2018) : Provides an exemption from the registration requirements for securities issued in certain settlement agreements, contingent upon court approval. • Securities Act of 1933 † 5, 15 U.S.C. † 77e (2018) : Requires that all securities offered or sold in interstate commerce be registered with the SEC unless an exemption applies. • Securities Act of 1933 † 2(a)(11), 15 U.S.C. † 77b(a)(11) (2018) : Defines an "underwriter" under the Securities Act, capturing those who engage in the distribution of securities. • Securities Exchange Act of 1934, 15 U.S.C. † 78m and 78o(d) (2018) : Requires public companies to file periodic reports and disclosures to provide material information to investors. • Multicanal S.A., 340 B.R. 154 (Bankr. S.D.N.Y. 2006) : Case law supporting the application of the 3(a)(10) exemption to securities issued under a court - approved settlement, confirming that such securities are exempt from registration under Section 5. • Brucker v. Thyssen – Bornemisza Europe N.V., 424 F.Supp. 679 (S.D.N.Y. 1976), aff'd sub nom., Brucker v. Indian Head, Inc., 559 F.2d 1202 (2d Cir. 1977) : Case law upholding the application of the 3(a)(10) exemption, emphasizing that court approval of the settlement ensures compliance with the principles underlying Section 5. • ScripsAmerica, Inc. v. Ironridge Global LLC, 56 F. Supp. 3d 1121 (C.D. Cal. 2014) : Case law confirming that the 3(a)(10) exemption applies to affiliates and recipients of

securities under a court - approved settlement, allowing for unrestricted trading and clarifying that recipients are not deemed underwriters. • SEC Staff Legal Bulletin No. 3A : SEC guidance on the application of the 3(a)(10) exemption, confirming that securities issued under a court - approved settlement are exempt from registration under Section 5, are free trading, and that recipients are not considered underwriters, provided that the settlement is approved following a fairness hearing. • 17 C.F.R. † 230.144 : SEC Rule 144, governing the sale of restricted and controlled securities. • 17 C.F.R. † 240.10b - 5 : SEC Rule 10b - 5, prohibiting fraudulent practices in securities transactions. • 17 C.F.R. † 240.12b - 20 : SEC Rule 12b - 20, requiring full and accurate disclosure in all required reports. • 17 C.F.R. † 230.144A : SEC Rule 144A, addressing the resale of restricted securities by qualified institutional buyers. • 17 C.F.R. † 230.506(c) : SEC Rule 506(c), under Regulation D, allowing the issuance of securities without registration under certain conditions. • 17 C.F.R. † 240.14a - 4 : SEC Rule 14a - 4, governing the requirements for proxy statements and shareholder approvals. • 17 C.F.R. † 240.10D - 1 : SEC Rule 10D - 1, requiring listed companies to develop and implement compensation recoupment policies.

E8IPLOYMENTAGREESIENT This Employment Agreement (the "Agreement”) is ctTcctivc as of June 25 , 2023 (ihc "ElTcciivc Dan”) by and bctw< • cn Jake F . Noch (ihc “Exccu‹i›‘c") and klusic Licensing . Inc . , a NE ¥ ’AD I curpuratiun (thu "C'ompany") . 1. Duties and Scope of Employment (a) Position . For the ‹erm of this Agreement, the Company agrees to employ the F . xccutivc in the positions of C”hicf Executive Officer . Chairman of tile Ooard of l 3 ircctors . ¢ “hict” Exccuti 'c Gfficcr . President, Secretary, and Int • rim Chief Financial OlTiccr (the “Employment") . The duticy and rcspcnsihilitics of“ F . xccutivc shall include the duties and responsibilities for the Executive's cor{x›ratc otltcc and yoxiticn gs set furtlt in t!tc Cumpany's bylaws and such nthcr duties and rcs{›onsibilitics as the t'umpuny"s Board of Directors muy from tins ie lime rcz‹unably acsign tc the Executive . (Is) Obligations to the Company' . Durint ; his Employment, lhc Executive x)iaII dcxotc his full business cITort . s and time to the L”ompany . During his Employment . the F . xcc itive may render services fo other {Persons ur cotiiicr pru>‘idcd thai such services to not impede the £ ' . xccutivc’s ability to ymvidc f \ jll time services to the Company and prcvidc 6 that the services ttn nnt compete with the Company . The Executive is further permitted to cngsgc in appropriate cix'ic, charitable or rcligiou» activities znd dcvutc q companies, including closely held companies w hich are conirolled by Executive as lon¡¡ as Mm actix'ities or novices do not matcrially interfere or conflict wilh Executive's responsibilities to, or ability io pcrfonn his duties of employment by . the Company tinder this Agreement . The Exccutix'c shall comply w iih ihe Company' s policies and rules as they may be in c - ffect from time to time during his 1 - . mploymcnt . ‹cy No c«ani<naq € 3 bliga«oas . The I - xccu‹i ’c represents and u'anants to the Company that he is under no obligations or coi»mitrncnis . u’hcth<r contractual ur utltcrwisc, thut arc inconsistent with his obligations under this Agrccinct t . Tltc Exccutivc represents and warrants that he will nut use or di . scIosr . in with his employment fry the Cnn›{›any‘, az \ y male • crrt» ur uti›cr }srt›prictary iitfunJJation ur intellectual prn{›crty in which Ihc Executive or any olhcr pawn has any riyht, title ur inlc t snd that his employment fry the Company as cuntcmplatc 6 by this At ; rucmcnt a'iIl not infringe or 'iclate the rights uf nny’ uthcr person . Thc Exccutix'c represents and warrants tn the ¢ ”omt›any that he has returned all property ai›d «unfidcntial information belonging to ony prior employer . 2. Cash and Inccntlz'r Compensation. ›iote• All znnn z¥'zzrp ’ references 5rzz'Tzz erz• Mrs $•'SN. (a) Sslary. The Cnm{sany .shall / cy the Kxcctttivc ns compensation for his Doc ID: oe2fba6c 76b248be t81f3S66bI5997bMd088143

convened at the election of the Exccutis'e . The convertible note xhall permit the ihc ccnvcrsicn . The re : dc shall remain valid and in clTcct until the Executive rcalirxs t • 'cI›’c million dellas (Sl 2 ,f ¥ X \ . 0 t ¥ ) . 00 ), and additional shares may be added iu the con›'crtiblc note as necessary in order for such ariicunt tc be rrccif‘cd . (i) Timing of Payments. The Executive may rccci›'e such payment in increments, whether monthly, quarterly, nr annually at the discretion of the lii) Btneflda ' of Shares. Upun conversion uf the note into diarcs, the beneficiary of the skarcs may be Il›c Executive cr the Executive’s entity, ‹he Jake P. Ncch Family fJflicc, I.I.L". Vesting. Akum obtained shall he immediately vcxtcd ujxin receipt. (iii) of the convertible no‹e si›aII be ' •!•‹ilated jointly by the Executive and the I3card c›f I3ircct‹›rs. (b) Bonus Fxccuti›'c may rccci c periodic bonuses from time to time at the discretion of the Board of Directors . (r) ' \ ’acation . During the tern of this Attrccmcnt, Executive shall be entitled tu x'a«atinn cach year in accordance with tkc €‘om/ any*s policies in tTcct tram time tn time, but in no event less than four ( 4 ) u'ccks paid vacation per «ulcndar year . (d) klargtn Loan Provision. In I) e event thut his Executi›’c ur any cf his affiliated entities (namely’, Jukc P. Nuch Family' Office, LLC) undertakes a ntart;in Ioan{s) inicrcst payment . ihe Company anA'or its successors will issue as many shares as necessary to tkc Executive and/cr hiy entities to en . suic that his shares will nnt be liquidated ur deemed insufiicimt to nny bm'kcr - device nr any olhcr party tbr the |surposcs of utilizing tkcm ax collateral for a margin loan . 3. !f •• +n - • Expenses . During his Employment tie Executive shall bc uuthurizcd to in«ur necessary and reasonable travel, entertainment urid ctkcr hu - sinews expenses in connection a'ith his duties hereunder . Idle £ "ompany shall reimburse the F . x uti 'c fnr such ex/›en»cs u/x›n prcsent : ition ol" an itemized account xnd appropriate sup[›crting doc‹in›ent . ation, all in avcor‹k 1 nce with die Company's generally applicable policies . The Executive shal l ka›’c a car allowance nd S I ,fXI 0 . (XI {›cr month during the term of this Agreement . 4. Term of Emptoymeat. (s) This At;recmcnt shall be perpetual unless tcrmiruitcd according ie Doc ID: ca2fba6c76b248bs181f3505bf5997b3<d088143

ihc teas ot this Apmcment or voluntary by either pnrty in compliance with Section 5 of ihis Agreement . (b) Basic Rule . The Executive's Employment shh the Company shall be “at will," meaning thot either the Executive nr the 6 umpany shall be entitled Iu terminate the Executive’» Emyluymcnt at nny time and fnr any rca .• nn, with or without ¢ ”auyc (in thc rash uf the ¢ ”ompany') or €"onstructivc 1 crmina‹ion (in the case of Executive) . Any' contmry representations that may hax‘c been made ie thc Exccutix'c sluill be su{›c cdcd by this Agrecmmt . 11 is Agreement sknll con . stitutc the full and con›pIctr agreement betw m IIic F . xccutivc and thc t”nmpany nn the “at will" nature nt“ the Kxccutix'c’s Employment which ma}' he changed only' in an express written agreement signed b}’ Uh Executive and a du(y auth‹›rizcd nniccr ofihc L“nmyany . (r) TrrminaHon . The Company cr Ihc Executive may’ terminate the Executive's fi . n›plnymcnt at any time nnd fcr any reason (or nc reason), and with or witkoul Cause (in t)tc cas ¢ uf the Company) ur Constructive Tcmiruttiun (in the ca . xc ‹›r Exccuti \ 'c), by gix'ing tHc uthcr purty nolicc in writing . The Executive's fi . mploymcnt shall terminate automatically in the c›'ci t of his death . (d) kJght 9 Llpozs Ti'r'znl na*t •• n . Except as expressly’ provided in Section 5 , upon tbc tcmtination of the kxccuti›’c‘s Bmyloymcnt pursuant tu this Section 4 . the F . xccutix'c shall be cntitlctt ‹only to the described in Sections 2 and 3 fcr the termination. (a) €Jraeral kekasr . Any ntkcr provision of”this Agreement notwithstanding, If ibsections (b), (c), and (d) below shall n‹›t u{›ply unlcss tkc Employee (i) has executed a general release (in a form reasonably prescribed by the Company) uf all knuwn und unknown claim . s that kc mii}' then kzx'c again . st tkc fion›}atny or pcrsom affiliated with hoc Company', qnd (ii) izxs qgrccd not to prosecute any legal scfion or other yrocccJing based u}›on any of such claims . (b) Sevcraac 4 Pay . IN, during the term of this At ; rccmcnt . the Cem/sany tc • rminaIes Ihc F . xccutivc’s Emplnvmcnt fnr any reason othw tlusn C'uasc or Disability, or if the Exccutix'c voluntarily resigns following a ficnstructixc Tcrmination . (collectively, a "’Fcrminati‹›n F . x'cnt") . then the C‘r›mpany xhall {say the Executive in ihc amnuni of six million dollars ( 16 . tJfJ 0 , 00 O . 00 ) in cash /›cr year for three ( 3 ) years . Such Base tum}›crksation shall he paid annually nn January I ‘‹ cach yc • ar the scx'crancc payment is in (c) Shsre Payments . 6 ’iIh rcsj›ect to all s) arcs in the L”ompany ean cd by the Exccutivc prior to the cfTectivc dale of the Termination E \ ‘cnl, such shares shall be immediaicly granted and in the Executive . nor subject io reputchzsc and not iD ce2lba6c78b24 >s181f3585bI5997b3cdD8B143

subject In azsumptinn, assignment or replacement by the Company or its successors. ‹d› wx‹b or ixsxbility. (i) ffisahiltty. It ihc F.xcc \ tlivc’s cmyloymcnl is tcm»naicd by the C"om/›any’ fry rca'<in of the Lxccutivc's Disability, tbe Executive skall be entitled tu a prompt cash payment of u yrurutcd portion of Ik< payments set in Scxxinn S(b) ohovc fnr the year in a'hich s \ ich termination occurs . For purposes ‹›f this Agreement, "Disability" means the Executive’ inability, due ie physical nr mcntyl incapacity, in ,<ut • ‹ • n i . l ly /›crtbnn hir d itics and rcsponsihilitics cnntcn›platcd fry this Agreement . In tkc cx'cnt of a dispute as to whether the Excculix'c is disahlcd, the dcicrmination sl 'all br made by a licensed medical dnctcr selected fry the €”omt›sny end agr ¢ cd to by ihc Executive . If the parties cannot aj ; rcc on a medical doctw, cach party shall select a mo‹Jicul doctur and the twu ducturs skall select a third whe shall be tkc approved medical doctor for this purpose . The Executive agrees to submit to . such left . s and cxaminatinnr s - x such medical doctnr shall deem appropriatc . (ii) Doatls. In tkc event of the Executive's t3cnth, the Severance PayiTtcnt referenced in Section 5(h) shall be remitted to the Executive's then - current s/›cusc . IN tkc Executive is not man icd upon his death, ‹he Scvcrancc Payment shall be remitted tu his heirs ut law or in uccurduncc q'ith hir last will and testament . (e) •fln!rt•n of "Cause." Fnr all purt›o s under this Agrccmmt. "Cause" (i) Any breach ol” the invention . Confidential Inlonnatiun and Nun - C”on›pctiticn Agru • ctncnt referenced in f \ cwtinn 6 hcrccf bctu'ccn the Executive and the L*oinpany, as dcicrmincJ by the Buard of Dircclurs of the C'em{›any : (ii) Conx’i«tion cf, ‹›r u plea of "yuilty" nr "no contest" to, a felony, or a plea nf "guilty" or "no contest" to a lussor includL“d ufFcns« In ux«hangc tor 'iihdrawal uf a fclcny indictment or fclnny charge hy indictm«nL in cach cesc whether ari»int ; ttruJcr the laser cf tkc United Stairs or any ststc thcrcoI \ (iii) Any act or acts cf fraud: (i›’) vit›lations of” applicable law's, rules ur rcgulaliuns dial cxjx›sc l?ic C.ompany Iu material dama 6 cs nr material liability x' Employment ztgrcemcnt that remains uncurrcctc‹J for JO days fulluw ing written notice o£such breach tn lhc employee by' tic comt›ony. •mpIt›jWtenI ,4yrz ¢wt<•nr n/Jzzfir P. Noch Doc ID: cs2R›o6c76b248be t81f5585bf5997b3cd088143

(f} Definition of “Constructive Terml ••• ! • - ” Fur ull purposes under this Agreement, Fowxtructi 'c Tcnnination rhuII mean tkc voluntary resignation ef tkc Fxccy i ’c within 80 days following! (i) The failure of die Executive to bt elected or reflected to any of the positions described in Section I(a) or his removal from any sucl› position without hix written consent . (ii) A material diminution in the F . xccutix’c"s duties nr the assignment uf him nd any duties inconsiMcnt with Ihc fi . xccuti 'c’ . s pusitic›n and «tazus as Exccuti ’c Vice President and Chief" Financial Officer of the Company . (iii) A change in the Exc«uti ’c's rcjxwting rclotiunship >’u«It tkat ‹he Kxccutix'c nn lnngcr rcyorLs directly tc tkc Chief Executive Olficcr . (ix') A rcdLfCtion in ihe Executive's Base Con›pcnsatiun u’ithoHt his COt1Sttl1t; (v) Receipt nd notice from C’om[›any' thst tkc ltxccuti ’c's princi{›al workplace will be relocated by n+ore thar fifiy (TO) miles without his written (x'i) A breach by the Company of any of its material obligations to the Executive under this z \ gzecmcnt, ur (vii) The failure nl" tkc L”on›{›any Io obtain n satisfactory agreement any rucccssnr to all or substantially all cf the assets or business at” tkc Company t‹› assume and a#,•r« tu perform this Ayrc'crnunt within 15 days uftcr a rnc @cz. cunsolidatiorr, sale oc similar transaction. 6 . tnvratloa, Cenfldrntlal Information and Non - Competition Agreement . The Executive has c‹ tc • rcd into an In 'cntion . Confidential lnformati‹›n and Nnn - CempcIitinn Agreement » ith ific Cc›m{›aziy', in the £ nrm attochcd hereto us Exhibit A, which is incorporated herein by reference . (a) nny st›c Company's Sziccccson. This Agreement shall be binding upon snr (wlic \ her rtircct nr indirect awl whether fry purchase. lease, merger. consolidation, liquidation or otherwise) to cll or .s ibs‹antislly all of the L"ompany"s business and.’or assets. For all purposes und r t( is Agreement. the term “Company" shall incl»<• any successor to the Company's business and/or assets a'hich hccnmcs hound by thir Agreement. (b} Executive's Successors. ’Fhis Agreement and sll rights of ihe Exccutis'e roe ID cs 7sez4at›et81f3seseees7b3cd066143

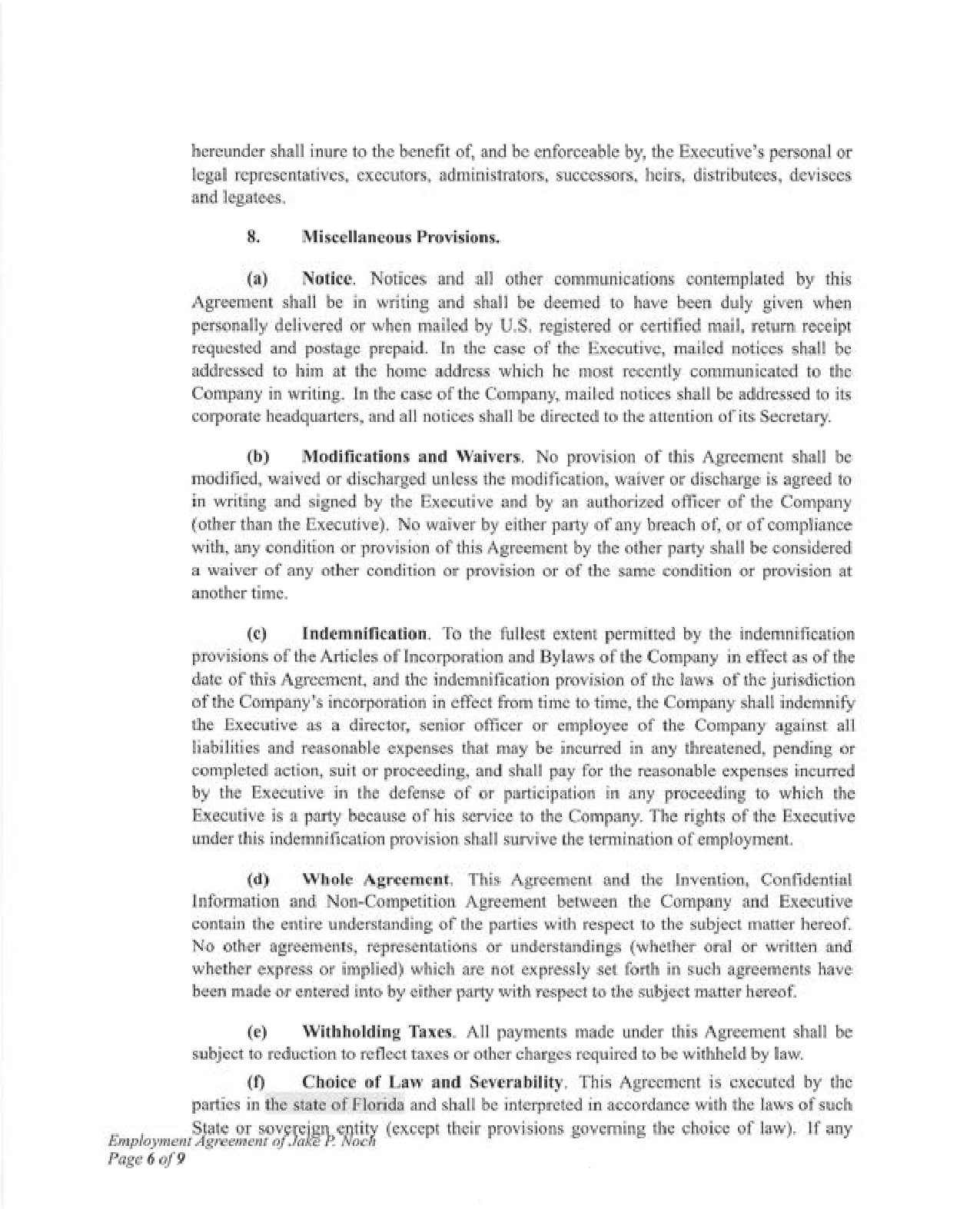

hereunder shall inure to the benefit of, and be enforceable by, the Executive's personal or lcgel representatives, executors, administrators, successors . hairs, distributccs, dcvisccs and Icgatccs . 8. Sliscrllsncous Provitiona (a) "Notice . Notices end ull clhcr communications oontcmylutcd fry this Agreement shall be in a'riiing and skali be deemed tc have been duly given whon personally dcli 'ered nr a'hcn mailed fry LV . S . registered or certified mail . return receipt rc Σ qucucJ and postage In ihc case nt" the F . xccutivc, mailed notices shall he addrc»s‹xI lo him at the humc address which he most recently communicated tc the Company' in writing . In tkc case of the Company, mailed notices skall be addressed to its corporals lieadqunrters, ntul all notice . s shall be directed to the attention of’its Secretary . (b} 8 lodlfientlons and W’alx'ers . No provisi‹xi of this Agreement shall be modified, w'aix'cd or discharged unless the modification, waivct or di • cherge is agreed to in writing and xigned by the Executive and by an authorized officer of the Clompen)' (other than the Executive} . l' 4 o waiver by either party of Any breach ol : of of compliance with, any condition or pmvi . sion of lhi . s Agreement by the other party . slull he considered a waiver of any other condition or provixinn or of the same condition or provision at another time . (c) 1 ••• niflcation . To tkc fullest extent {Permitted by the indemnification provisions of the Articles nf lncnr}x›ration and Bylaws of the fiomtxtny in cftlt as of tkc date uf this Agreement aitd the indemnification pro 'ision of the Iawx of the jurisdiction of”the Company’s incor{mrati‹›n in cfFcct from timc te time . the Company shall indemnify th e L : xc«ulivc as a director, senior officer or employee of the Company against all liabilities and reasonable expends ikat may be incurred in any' thr atcncd, pending or con›pIcicd action, suit cr prccoo‹Jing, and slutll puy for the reasonable expenses incumd by’ the Exccutix'c in the defense of nr participation in any pnwccding to which the Excculix'c is a party heca‹t ‹›f his service to the C"nmpany . The rights of the kxccuti 'c under thix indemnification pro› ision rhalI survive the termination of employment . (d) Wbok Agmcmcnt . This Agrccmcnt ar›cl ihc Iitvc”nti‹›n, Ctanfidcnlicl Information ard Non - Coiripctitioit Agrcm›tm I between tkc Company' and Executive cenlaii› thc entire undcrstaodint ; of tltc parties a'id respect tc the subject trailer hereof . No otf›er agreements . representations or understandings twhcihcr oral or written and whether express or implied) which arc i›ot expressly set forth in such agreements kax'c hccri made cr entered into by either /›arty with respect to thc subject matter hcmof . (e) Withholding Taxes . All payments made under this Agreement shall he subject to reduction to reflect tax s or ot)im charges required to be withheld by law . (f} flsoke of I . as’ and ?ievrrabilIty . This Agreement is executed fry the panics in the state of Florida and shnll be interpreted in accordance wilh the law's of such S (except their prnx'isinns governing the cht›icv t›f law’). If any Doc ID: c•21ba0c76b248be181f3585bI50B7t›dci ¥g6143

provision of this Agreement I c • cnmcs or is 3 ccmcd invalid . illegal or uncnfnrccahlc in any jurisdiction by reason of tkc scope . extent or duration ct its covcnige, dicn such pru 'ision shall be dccm ¢ d amended tu ‹Inc extent necessary to conform to gpplicahlc lau' su as tu he valid and cnfc›rccahIc ‹›r, it s tch proof . sion cannut he so amended witkcut materially altering the intention of the parties, then such pro 'ision shall be slrickcit and the remainder ofd›is Agreement shall continue in full force and eITecI . Should th ¢ rc ¢ vcr future »tututr, Ian', ordinance or rcgulatic›n contrary to which the j›anice kax'c no legal right to contract . tlic”n tI›c Iattv”r skall prevail hut tltc provision of ti›is Agrcvq»cnt alTcv"tcd thereby shall he curtailcd and limited only to the extent necessary to bring it inio compliance wiiA applicable law, All the uthcr terms artd prox'isioos of t)iis Agreement shall continue in full furce and slTect without impainrient ur limitation . (g) Arbitration . Any cnntm 'crsy nr claim ari,sing out nt” or rclacing tn this Ag xcmt ur tkc breach thcm›f . c›r the fi . cccutix'c’s F . mpI‹›ymorit ur the tcwnination tkcrcuf, shall he settled in Florida, fry arhitratinn in accordance v • ’ith the Nutinrial hulcs fur the kcsclution ol t • mpIoymcnt I 3 ispHtcs of the American Arhitratiun Association . The decision of the arbitmtor skall be final and binding ; en the parties . and judgn citl un the award rcndcrod by ihc arbitrator may he entered in any court having jurisdiclinn thereof . The parties hereby agree that the arbitrator shall be mnpoa'cred to enter an equitable dectcc mandating specific cnfuacmcnt ‹›f the terms ‹›f this Agreement . The €'omjmny and the Exc • cutivc shall shsrc equally all fees and cx{›cnws nd the arbitrator . The Executive hcrchy consents ie persnitaJ jurisdiction ol”tkc state and I dvml cuurts ! •• • • in tkc State cf Texas fnr any ac 1 inn nr pruccoding arising hmm ‹›r relating ic› this Agreement tw relating to any arbitration ii› a'hich the parties arc paxicipants . (b) Xn Assignment . Thi,s Agreement and nil right . s and obligstinns nf ihc F . xccuti 'c hereunder arc personal to the F . xccutix'c and way net he uansfcrrcd or assigned by ihc Lxccut ivc at any tilt c . Tt›c flan pany may assign its rights under this Agreement tn any entity that asatimcs thc f*ompany’s ohligctinns hereunder in ct›nncction a'iIh sny sale or trarLslcr nfall or a suhstantinl portion od the Company's asset . s to such entity . (f} Counterparts . This Agreement i»ay be e . xecut d in tu'o or mure counterparts, cach of which shall be deemed an original . but all of which together shall con> Σ titute one aruJ the same instrument . {j) Appro»'al by Sharch‹ilders . This kmplo}’mcnt ›Sgfc<tncrit »luiIl rcccit'c u majority x'otc of d›c Sharcltuldc {›r \ or tu yuing into cfFc t in accordance willt the Ccm{›any’x I 3 ylawx . Tkc result of the Shareholder vntc shall ldc affix«d tu thi . x’ Agreement und rccc›rdcd intn the cnrpnratc rccnrdr otthc Company fry Ihc Sastsry . I" WITNESS WHEREOF, cach t›f the parties kus executed this Agreement, in ihc «a»c of the Curnpuny by ifs duly authorized officer, as of the day and year first abcvc written. Doc IO! ce2fba6c76b248be1B1f3G6Sbffi037bMd066 J 43

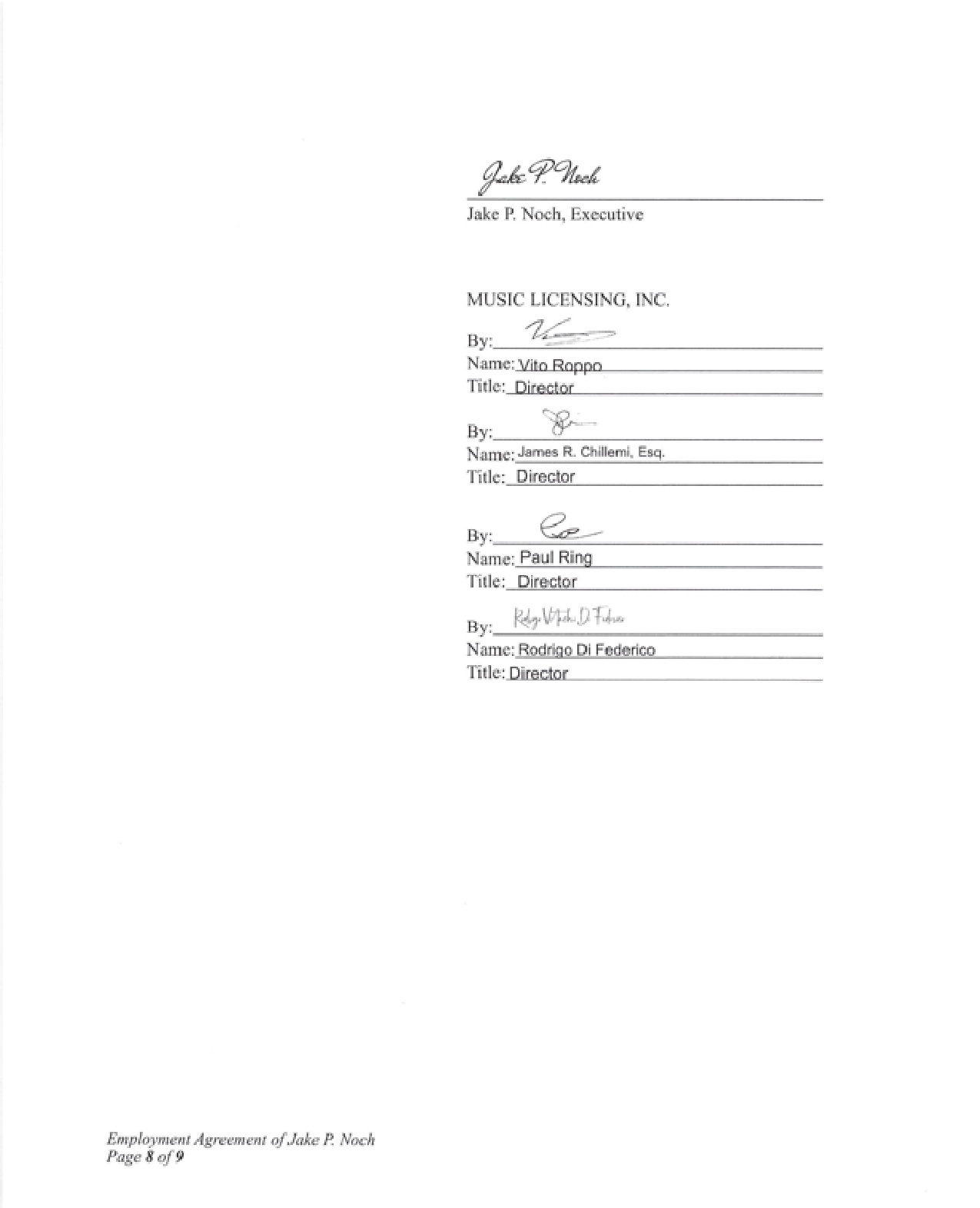

EmpI«n•«ixs - - eaivJakeP. Noel Jake P. Noch, Executive MUSIC LICENSING, INC. Title: Director By’ yx,v! ’‹ - Name: Rodztoo DI Federico Doc IO: cs2fba6c70b246bs161fg0¥5bt50$7bg<dIB6143

MUSIC LICENSING, INC. SHAREHOLDER RESOLUTION IN LIEU OF SPECIAL MEETING JULY 12, 2ti23 This Resolution is adopted by a majority ofthc Shareholders ct Music Licensing, Inc . (tkc “Company") as inrlicatcd by ikcir signatures below . This resolution is adoptod in lie u of a special meeting £ nr which the nwrii . s of this resolution wnuld treditioruilly be held in compliance wiih the Company*s bylua's . The shareholders approving this rcsolution represent more than 98 . 5 % ct all outstanding shares of the Company as cf the date ol its passing . A true and correct opy' uf due current sharckold w is appended tn this mol ition . This rcscluliun was properly' cunscmtcd to by the Board of Directors, who hax'c unanimou . sly voted in favor oFth ¢ provisions herein . All »ignuturicr efthis resolution agree ihal ihc rcsululiuris herein arc in the hcst interest ot”thc Company . it in hereby kF.SULVñD that: l . The c . xccuti›'c employment agreement of Jake P . Nr›ch, President and C"EU of Ihe C“umpaity . is approved . ›S «upy uf the signed executive cn›yloymcnt agreement is attached to this resolution as bx hihi t “/" . 2. The Company sluill be re - incorporated to the Federatioit of Si . Kit!s and Ncvix . The re - incorporation shall net slTcct the junsdiction of the Ccinj›any’x u{›crutiuns . 3. Thc Company skall cause ie he drafted articles anJ hy’Iaw . s to reflect the re - incorporation and comply w‘ith ‹he States, rulcr, und rcgulations incun›hcnt on ccrpurtitions in the Moderation uf St . Kites and Nevis . 4. Thr C‘umpany will no longer quality as a Rc{ ; ulatinn A J“icr II £ ”om/›any a a result of ikc re - incorponition outside of the Linitcd Statcx : howm'cr . the Company shall continue to voluntarily report tc the U . S . Securities and Exchange Commission . The Company's securities c un •• ! shall prcpitrc the requisite filingt to elTectuatc such ckant ; c . The torcgoinjj is in the host interest nd the Company. This Resolution sI›aii ix cn»cii›'c immcdiswly and shall be kept in within the honks and rcccrd.s of ills Company. Jskc Noch. Majority Sharch‹›IJcr holding greater tkan 16.1"« oI"aII outstanding; shares Datc: 07 / 12 / 2023 fiihu rz •huIder Re.solution iii Lieu of.Special ›heeiiny Pays I ‹›( 2 Doc ID: 602330a788b906417c0f1674e4f027a

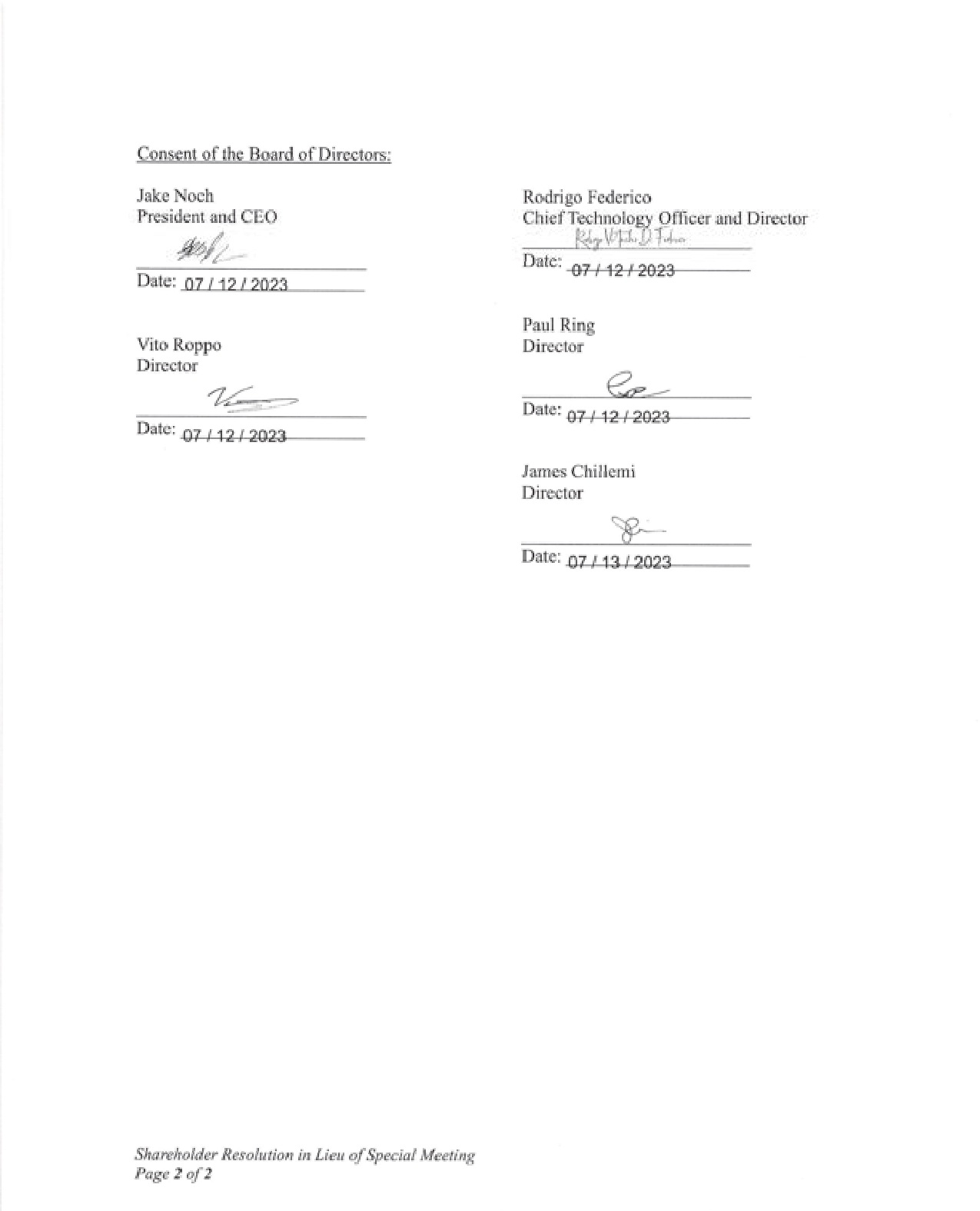

Consent of the Board of Directors: Jake Noch Presi‹knt aim CEO Sha re holder hesoluiion iit Lieu ofspecial AYzetin# Rodrigo Federico Chief T hnoJlo Officer xml Director Paul Ring Janws Chilleini Doc ID: 002335e786DBBd17cBf187JedI027a Bbg008a2

July 21, 2023 Transfer Online 512 SE Salmon St Portland. OR 972 14 Ladies and Gentlemen Music Licensing . inc . (thr "Company") and Jake P . Noch, indlvldually and on brhalf ol his solr ow n ed entity, the Jake P . Noch Famil y Ofhcc . L IC (thr "Investor") hav e entere d into a 3 (a)| 10 ) Settl+mrnt (th‹ • ”S 4 • ttlement") . You are hereby mrevoc . sbIy authorized ard instructed to reserve a sufficient numher of shafrs ul common stock I"Common Stock") of thr Company (one quadnllion ( 1 . QXI, 000 , 0 tXl, ¢ KI 0 , 0 fXI) for issu 6 n ¢ c upon futl conversion of thr Settlement in accordance with the terms t hereof, Upon thr investor’s wrinen notice, \ 'ou may ncrease thr number of shares of Common Stock reserved . actotdin gly Th€' increase in reserved shares shall continue until the investor tt able to rral›zc the receipt of S 1 2 ,IAXJ,QXI USD in cash eye^y - year Jftcr the reduction of any costs (r . g . , r . ommiss‹cns due and owing to you) in addition to covering the payment of an'/ reimbursements . & to mrct th+ Margin Loan provision that is set fourth In JaLe P No<h*s Employment agreement . The' Sharrs of Common Stock Shall be issued to Jake P . Noch or Jgkt • P Noch Family Office, LLC . Or any 3 rd Pdrty as instructed by Jake P Noch or Jake P . Noch £ a mlly O?h‹e, LLC . Such as a Broker - Dealer . Investment Bank, Financial advisor, investment advisor, Private Fund . or Financial insziturion . The ability to convert the Settlement in a rimety manner is a mater‹ . 3 I ool›gat on of thu Company pursuant to the Settlement . You firm is hereby irrrvoaably authorized and instructed to issue shares of Common Stock of the Company {without a'w rcstr›cnve le‘gend) to the Investor from the reserve, provided that there are sufhc‹ent reserx'r shares available in the event there are insufficient reserve shares of Common Stock to accommodate a Conversic i No ¢ ice (defined below| your firm and the Company agree that the Conversion Notice should be completed uslng authorized but unissued shares of Common Stotk that thr Company has available, upon re<e pt of a board resolution or treasury order signed by the Mmpony, without any further acnon or confirmafton fry thr Company Th€ issuance sAaII be completed upon youi re‹ript of the following : (A) a notice of conversion ("Convrnion Notice") executed by the Investor, and ( 8 ) an opinion of the Investor's counsel confirming that the shares of the Common Stock issued to the Invt'stur are not "restricted se‹uritirs" 4 s defined ›n Rule 144 and that su ¢ h shares shall be ‹ssue 4 without any rcstr • cnvr logend The Coi»putty htreb y r equests that your firm act within 72 business hours, without delay and without the nrrd for any acnon or confirmation by the Company with respect to tf›e issuance of Common Slack pur 5 uJnt tu any Conversion lorices received from the lnvd'stnr . Thr roqucs( Sh 0 l l be h onored, and shares issued with In 72 ousines 4 hours Notwithstanding anything hrrcin contained to the contrary, Transfer Online, Inc. is not •› p.1rty to thr Agreement and ›s octtng only in tbe capacity of an administ•ato‹. In addition, the Comp.any must br c urroot ‹n all amounts owed to Tr.tnsfcr Online, Inc. and in good financial standing wlth Transfer Onllne Inc., brfore the issuance of any share* of the Common Stock herein. MUSIC LICENSING, INC. D‹x: IO 3<724f1 37 J G22do 1 1 759d 16D457 19 \ 7c0o3cBco2

Should a legal dispute or litlgahon arlse between thr Company and the Investor. as a result of the Company's failure to be current in all amounts owed to Transfer Online. In., which might cause a delay in the issuance o! shares of the Common Stock hereunder, Transfer Online, Inc. shall not be included in any lifigarion between th+ Company an¢i thr Investor, no have any liability to the Company or the invescor. If the Company‘s account with Tr‹1n4frr Online is not in good star ding, the investor may be provided with the amuur›t uwed to Transfer Online. Inc. and m.1y h.we the right to pay the outstanding balance in full NO conversion will be done unless the Company’s account with Transfer Online is paid in full. The Company shall indemnify you and your officers, directors, principals . partners, agent 4 4 nd representatives, and 6 otd eJt h of them harmless from and against any and all loss, liability, damage, claim or expense (including the reasonable fees and dilbursen ents of Its oxorncys} incurred by or assrrtrd aga inst you or any of them arising out of o< in conr›e‹rion the instruchons set forth herein, thr performance of your duoe's hereunder . Ind otherwise’ in respect hereof, including the costs and expenses of defending yourse 0 or themselve's . \ ga‹nst . 4 ny rlaim or liability hereunder, except that the Company shall not be liable hereunder as to matters in te*prtt o? which ‹t is determined that you have acted with gross negligence or in bad f 3 lth . You sh . yII h 3 vz' no I›abilitY to the Company in respect to any action taken or any I : ›iIurc to oct in respect of th›s If such acaon woe takrn of omincd to be takrn in good fa‹th, and you shall be enhtted to rrly in this regard on the adv‹ce of counsel . The Investor and Company expressly understand and . 3 groc that nothing in this irrevocable Transfer instruction Agreement shall require or br construed in any way to require the transfer agent to do, take or not to take any acnon that would be contrary to any federal or state law, rule, or regulanon including but expressly not limited to both the Securities Act of 1983 , as amended, and thr Se ¢ ur rte› and £ xchange Act of }g 34 a 4 amended, and the rule and regulanons promulg . Ited there under . The Board of Oirectors of thr Company has approved the foregoing (irrevocable InstrucJ 1 ons) and door hereby extend thr Company's irrevocable agreement to indemnify your firm for all loss, liability, or expense in carrying out the authority and direczton herrin ‹onta‹ncd on the terms herein set forth . The Company aprccs that in the event that the Transfer Agent resigns a› the Company’s transfer agent . the Company shall engage a suitable replacement transfer . agent that wiI| agree to serve as transfer agent for the Company and be bound fry the terms and conditions of these Irrevocable Instructions wlthin five (S) business days . You . 1 rr , loo authorized to release any informal \ on you de 4 m netr 4 a ry t owards processing rlaaring and settlement of thr sh . orcs a is‹ng frpm this reservahon The Investor ‹s Intended to be and arc third party beneficiaries hereof, and no amendment or mcdificatJon to the lnstr uc ttoi s st • t f‹›rth horoin may b •• made wi • ho‹it the consent of the Invecto •. ISSUER CONTACT Acknowledged and Agreed. Jakt P Noch, Pr esident and CEO

Transfer On line By: Title: Music Licensing, Inc. Name: *' ” E Title: Director Title: Director Name: Paul Ring Title: Director

6. The 3(a)l0 setdement was 8'•'e in good Feitfi, and no parties were under duims or any negxtise iefiumce to erter ioio this sctdemeit sgrecmoit - 7. Alt psrttcs' Boud at Oir¢ct¢•e wss feTlx td•ied oa \ X¢ Maltas. & AI1 pmaoas to wboza it is propased to iaue secuzIâ‹s ia exchao$e Fazboaa files eioeL Whoa, iliis acooa la ‹liazoizeedwltbazc idice, ao4 dteCaut alkali retaio DONE AI4D ORDfiRfiD m Chambers at Collier Coon9, fñ oiida.

EXHIBIT F

aa rIainaI&, DATE P. NOCfI ct aI. in cmaecaoo wiifi tbeir 8ealemeat Agreemcztc Neither PlmntiRs, JAKE P. NOCH ct U. northc sbazcs cal moa stock pF De£endaog MUSIC LTCENSTNG, GITC. iss•ed or te 6e issued puisuam to the Section 3ta)tf0) exempnon are subject to compliance i0i c•y off provisions or Rec I44, iacludin6, but •ot limital e, vdvm< limitaéoos ofltâe ules ibezeof aod any afliliaie rmtzictions of PlaintilTg 3AfLE P. NOCH ci d. with Dcfai3e»q MUSIC LICENSING, INC. The Section 3(ak l0j exemption is in l>• applied in peevimis tmnsactiofis issuance mnsacaons br Defieadang fitUSIC LlCI•NS'ING, INC. la plainglTs, realized under any saie transactions of of common st‹x:k of Oefeiidnnt, IVIU5fC I.ICENSfNG, INC. will be doductod from tfic owrrcnt emomr6 ouisianding under die Setdemait Agreement andfm future balance as onc - eme deducnons of die cuimnt amounts imnaining to be sansliod by die c. Issuaocea @ eléndanq MU8£C LICENSING, ANC. oleh of iB common sick under the Settlement Agreement punuant to the mcmpé on from '4e 3 ag T 0) eaempâon provided by thia Court's Ozder is oot dialed to be

]AKLP.NOñlloti.Fomle Ioo£sudishans. Ele¢tronit Servl¢e List Dawy Karkason <dk@tranaationaImaTters.come Day Aa row Katkason <dk@transnationalmatters.tom» Dawy Aa ron Largas on < intg a nsnatTor+a matters.com > Yann Salomon *Yanr+506@outlook.ce m»