Bright Health Group Third Quarter 2021 – Earnings Presentation November 11, 2021

Disclaimer Statements made in this presentation that are not statements of historical fact, including statements about our beliefs and expectations, are forward-looking statements, and should be evaluated as such. Forward-looking statements include information concerning possible or assumed future results of operations, including descriptions of our business plan and strategies. These statements often include words such as “anticipate,” “expect,” “plan,” “believe,” “intend,” “project,” “forecast,” “estimates,” “projections,” and other similar expressions. These forward-looking statements include any statements regarding our plans and expectations with respect to Bright Health Group, Inc. Such forward-looking statements are subject to various risks, uncertainties and assumptions. Accordingly, there are or will be important factors that could cause actual outcomes or results to differ materially from those indicated in these statements. Factors that might materially affect such forward-looking statements include: a lack of acceptance or slow adoption of our business model; our ability to retain existing consumers and expand consumer enrollment; our ability to contract with care providers and arrange for the provision of quality care; our ability to accurately estimate our medical expenses, effectively manage our costs and claims liabilities or appropriately price our products and charge premiums; the impact of the COVID-19 pandemic on our business and results of operations; the risks associated with our reliance on third-party providers to operate our business; the impact of modifications or changes to the U.S. health insurance markets; our ability to manage the growth of our business; our ability to operate, update or implement our technology platform and other information technology systems; our ability to retain key executives; our ability to successfully pursue acquisitions and integrate acquired businesses; the occurrence of severe weather events, catastrophic health events, natural or man-made disasters, and social and political conditions or civil unrest; the impact of security incidents or breaches, loss of data and other related events on our members, patients, employees, and financial results; and the other factors set forth under the heading “Risk Factors” in Bright Health Group’s prospectus filed pursuant to Rule 424(b)(4) on June 25, 2021 and our other filings with the U.S. Securities and Exchange Commission. Except as required by law, we undertake no obligation to update publicly any forward- looking statements for any reason after the date of this release to conform these statements to actual results or to changes in our expectations. This presentation contains Adjusted EBITDA, which is a non-GAAP financial measure. This non-GAAP financial measure is an addition, and not a substitute for or superior to the most directly comparable GAAP financial measure, Net Income (Loss). Bright Health Group believes this non-GAAP measure provides useful supplemental information to investors about our operating performance and uses this measure to provide a more complete understanding of the factors and trends affecting our business than GAAP results alone. We believe that this non-GAAP measure assists management and investors in comparing operating performance across reporting periods on a consistent basis by excluding and including items that management does not believe are indicative of Bright Health Group's core operating performance. Management believes these measures are useful to investors in highlighting trends in Bright Health's operating performance, while other measures can differ significantly depending on long-term strategic decisions regarding capital structure, the tax jurisdictions in which it operates and capital investments. Management uses these measures to supplement GAAP measures of performance in the evaluation of the effectiveness of Bright Health's business strategies, to make budgeting decisions, to establish discretionary annual incentive compensation and to compare our performance against that of other peer companies using similar measures. Management supplements GAAP results with non-GAAP financial measures to provide a more complete understanding of the factors and trends affecting the business than GAAP results alone. Additionally, Adjusted EBITDA is not intended to be a measure of free cash flow available for management’s discretionary use as it does not consider certain cash requirements such as interest payments, tax payments and debt service requirements. The presentation of this measure has limitations as an analytical tool and should not be considered in isolation or as a substitute for analysis of our results as reported under GAAP. Because not all companies use identical calculations, the presentation of these measures may not be comparable to other similarly titled measures of other companies and can differ significantly from company to company. The reconciliation of this non-GAAP measure to the most directly comparable GAAP measure can be found in the appendix to this presentation. 2

3

Performance Highlights 4 Growth Surpasses Expectations 1 Q3 Results Impacted by a Confluence of Unique Factors 2 Fully Aligned Model Driving Differentiated Results 3 Solid Year-to-Date Performance and Increased Conviction in Our Model and Strategy

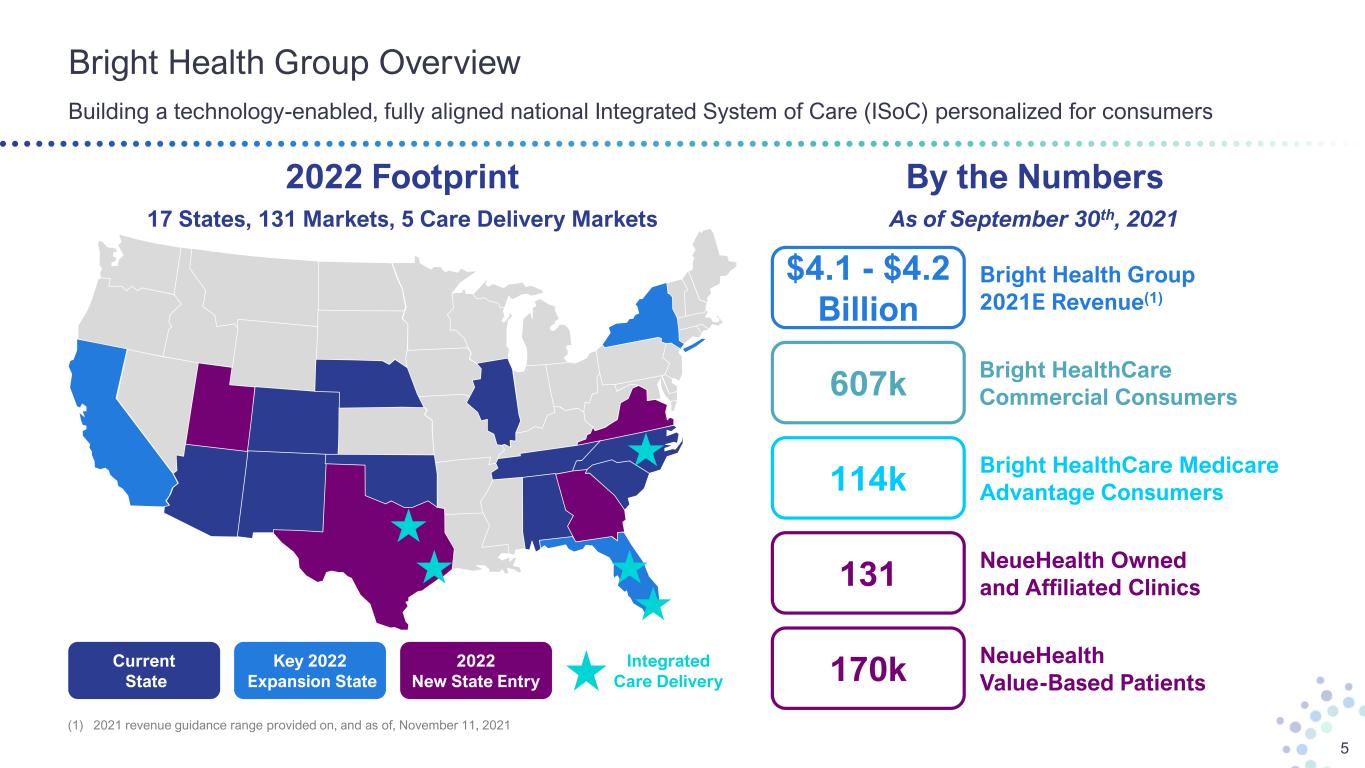

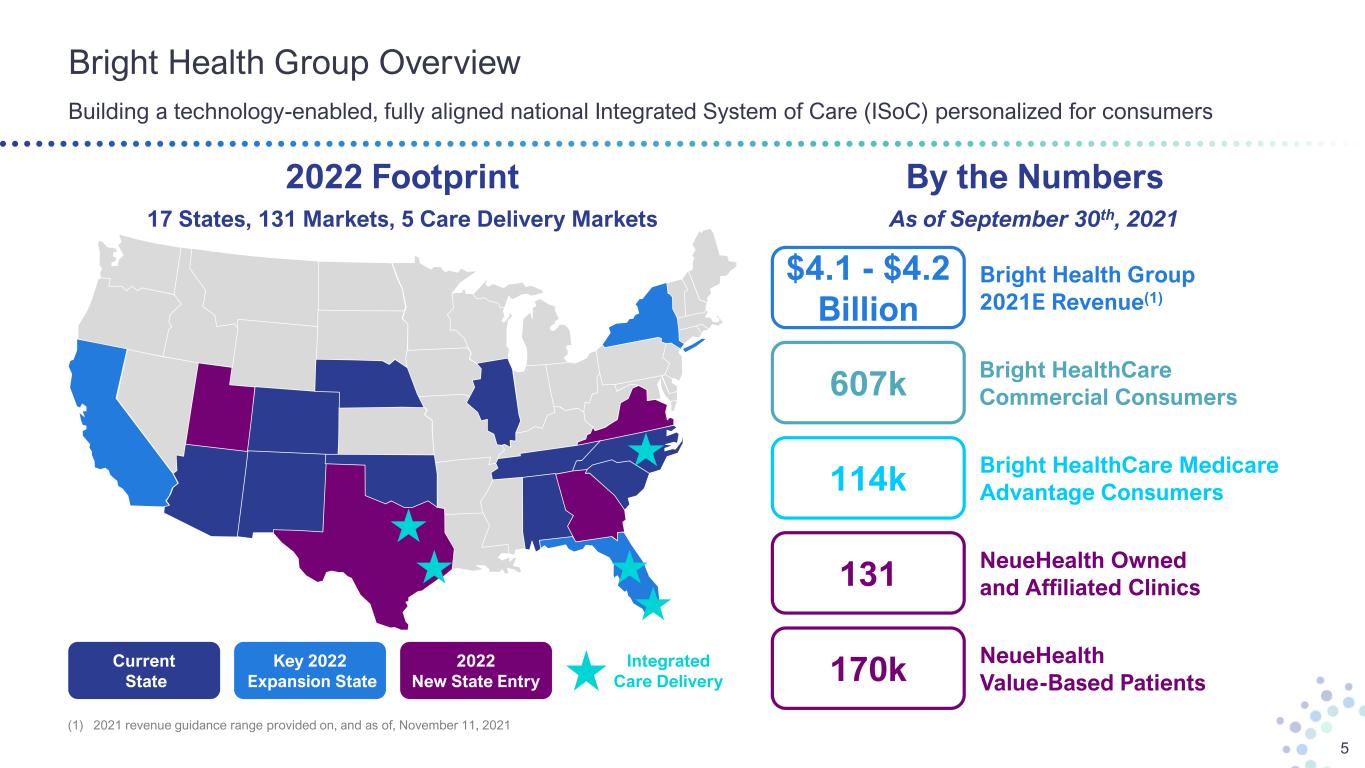

Bright Health Group Overview Building a technology-enabled, fully aligned national Integrated System of Care (ISoC) personalized for consumers 5 Current State 2022 New State Entry Key 2022 Expansion State Integrated Care Delivery 2022 Footprint 17 States, 131 Markets, 5 Care Delivery Markets By the Numbers As of September 30th, 2021 $4.1 - $4.2 Billion Bright Health Group 2021E Revenue(1) 131 NeueHealth Owned and Affiliated Clinics 607k Bright HealthCare Commercial Consumers NeueHealth Value-Based Patients170k 114k Bright HealthCare Medicare Advantage Consumers (1) 2021 revenue guidance range provided on, and as of, November 11, 2021

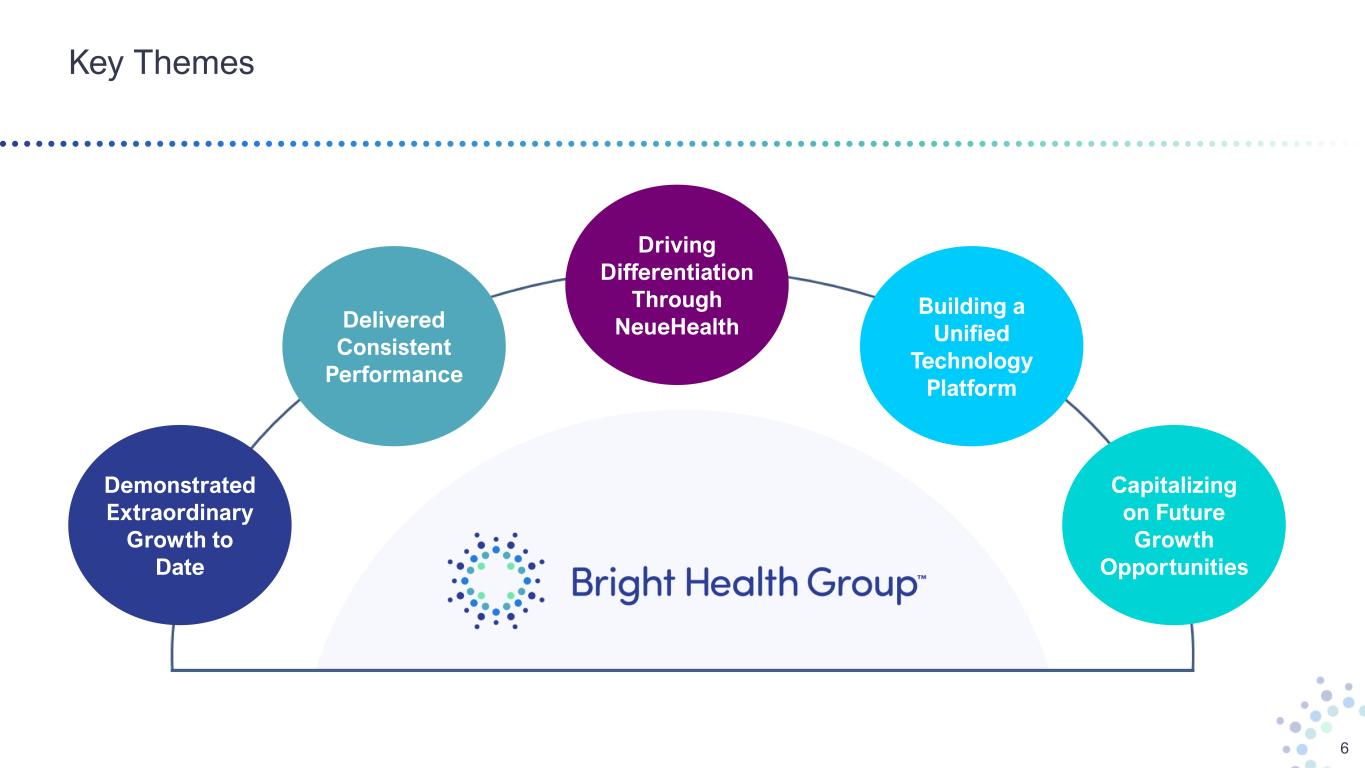

6 Key Themes Demonstrated Extraordinary Growth to Date Delivered Consistent Performance Driving Differentiation Through NeueHealth Building a Unified Technology Platform Capitalizing on Future Growth Opportunities

Business Update

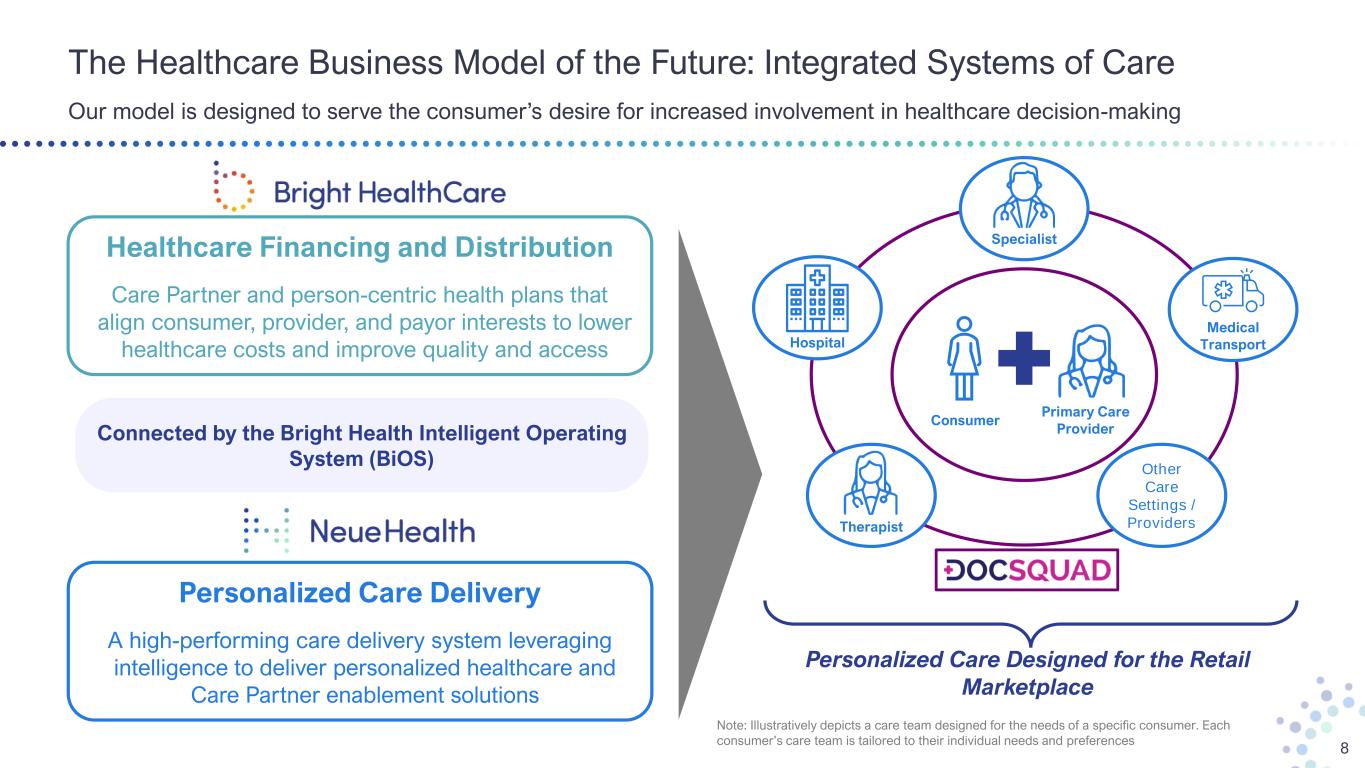

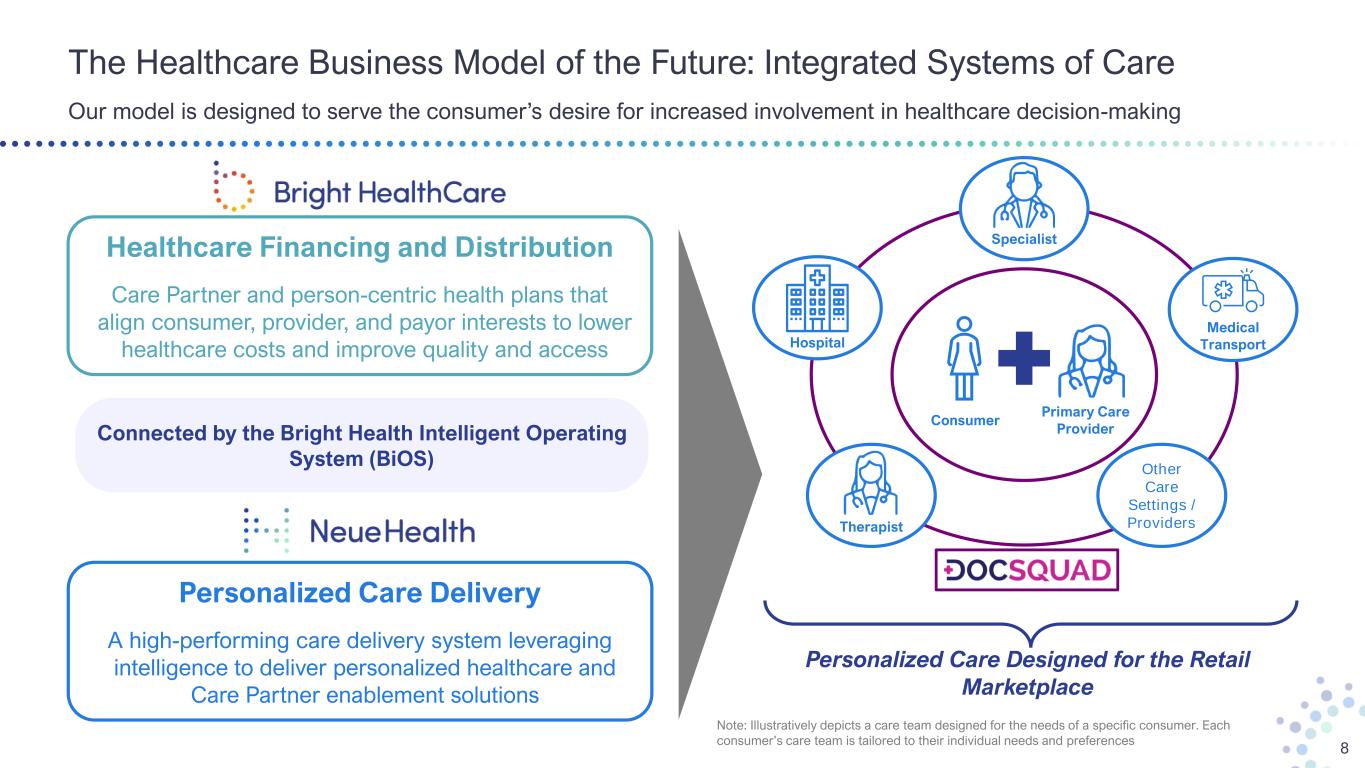

Connected by the Bright Health Intelligent Operating System (BiOS) The Healthcare Business Model of the Future: Integrated Systems of Care 8 Our model is designed to serve the consumer’s desire for increased involvement in healthcare decision-making Healthcare Financing and Distribution Care Partner and person-centric health plans that align consumer, provider, and payor interests to lower healthcare costs and improve quality and access Personalized Care Designed for the Retail Marketplace Hospital Therapist Medical Transport Personalized Care Delivery A high-performing care delivery system leveraging intelligence to deliver personalized healthcare and Care Partner enablement solutions Primary Care Provider Consumer Specialist Other Care Settings / Providers Note: Illustratively depicts a care team designed for the needs of a specific consumer. Each consumer’s care team is tailored to their individual needs and preferences

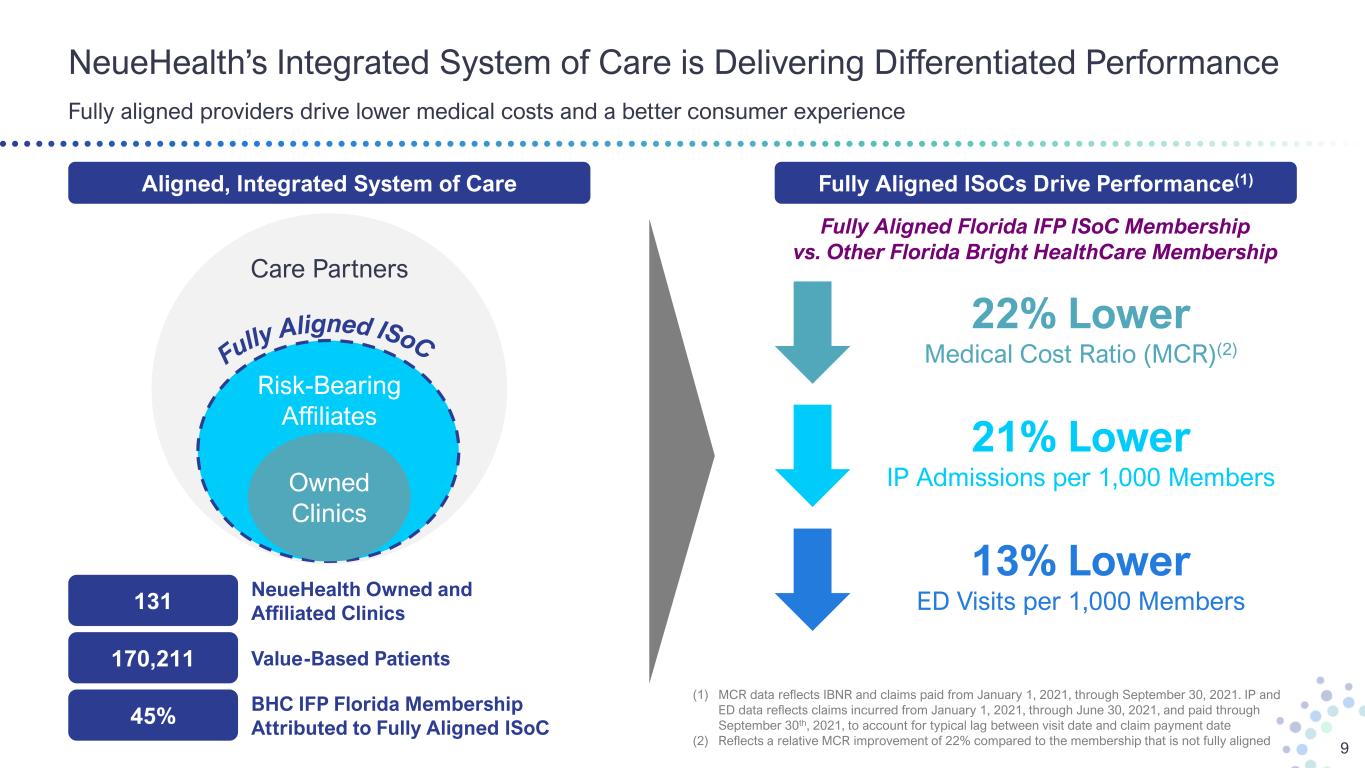

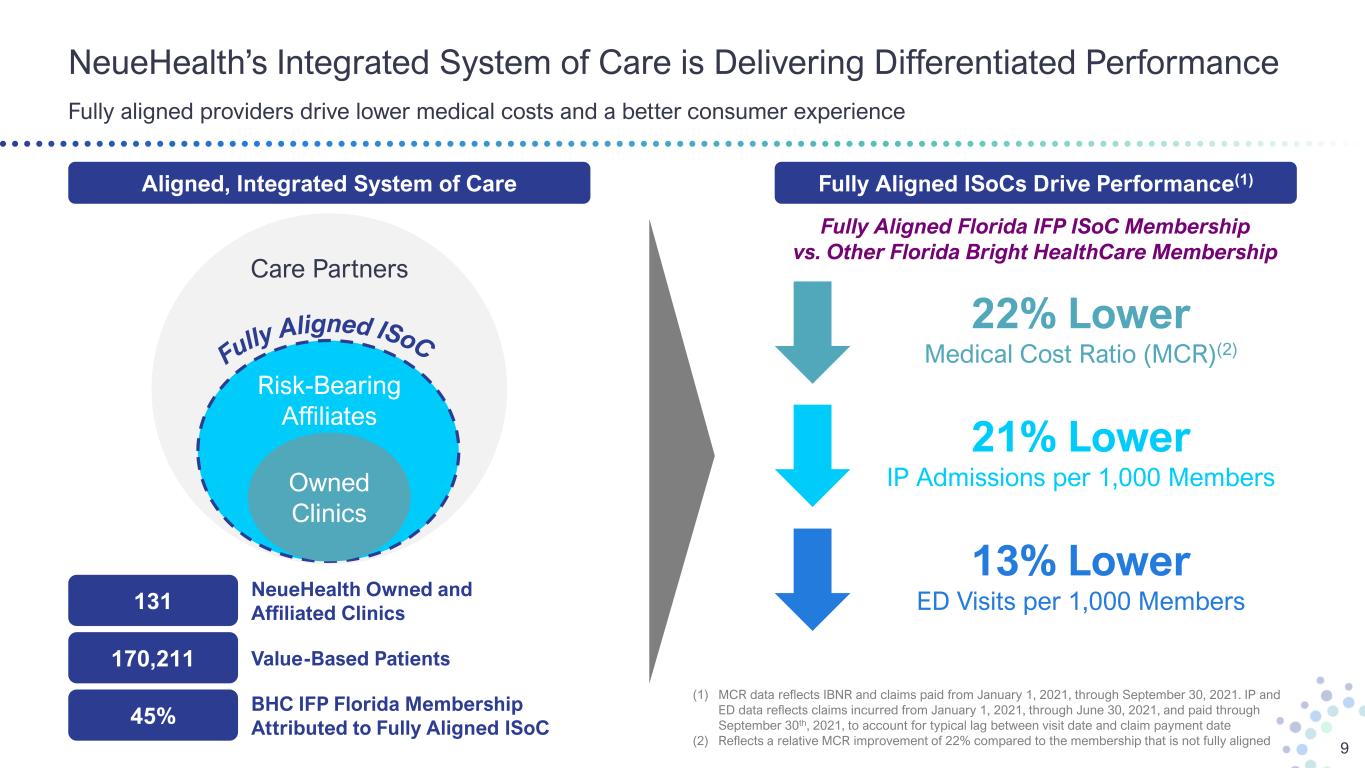

NeueHealth’s Integrated System of Care is Delivering Differentiated Performance Fully aligned providers drive lower medical costs and a better consumer experience 9 Aligned, Integrated System of Care 170,211 Value-Based Patients 131 NeueHealth Owned and Affiliated Clinics 45% BHC IFP Florida Membership Attributed to Fully Aligned ISoC (1) MCR data reflects IBNR and claims paid from January 1, 2021, through September 30, 2021. IP and ED data reflects claims incurred from January 1, 2021, through June 30, 2021, and paid through September 30th, 2021, to account for typical lag between visit date and claim payment date (2) Reflects a relative MCR improvement of 22% compared to the membership that is not fully aligned Owned Clinics Care Partners Risk-Bearing Affiliates 22% Lower Medical Cost Ratio (MCR)(2) 13% Lower ED Visits per 1,000 Members 21% Lower IP Admissions per 1,000 Members Fully Aligned ISoCs Drive Performance(1) Fully Aligned Florida IFP ISoC Membership vs. Other Florida Bright HealthCare Membership

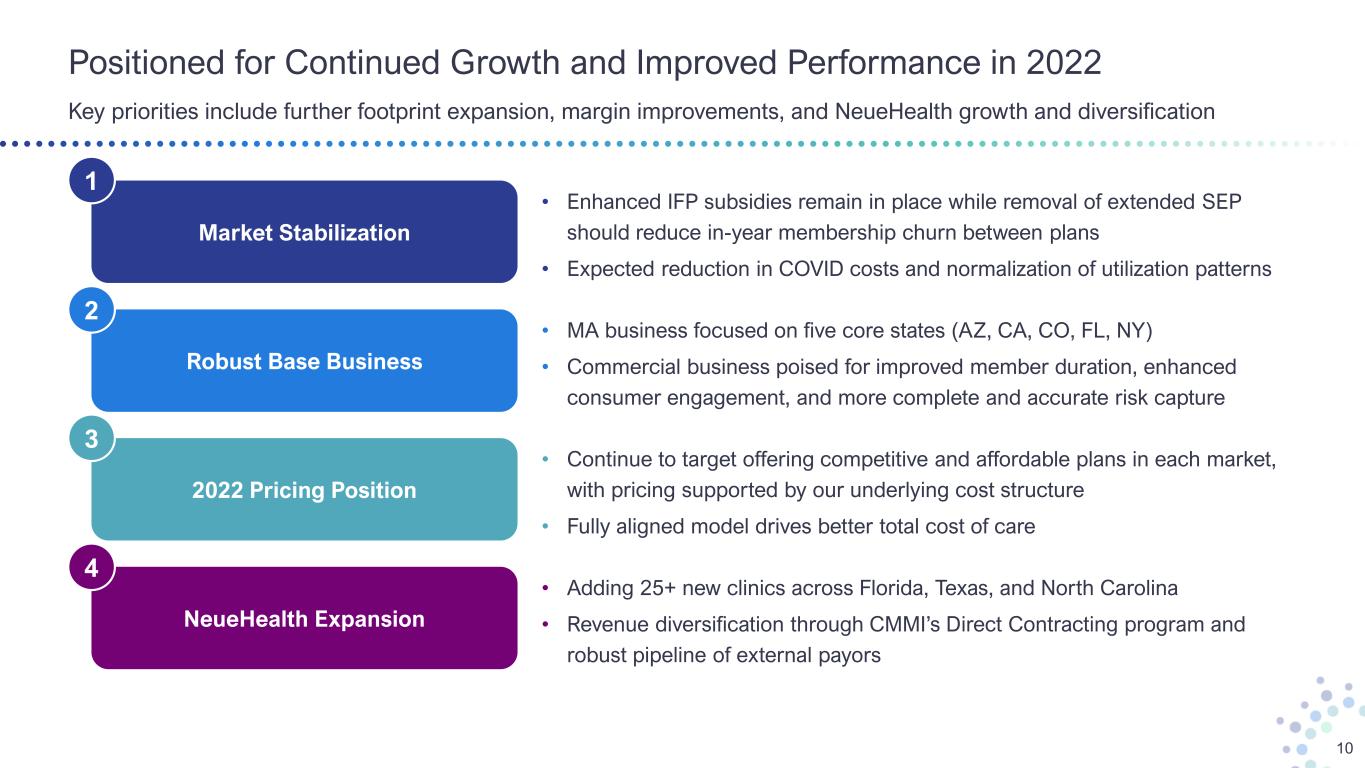

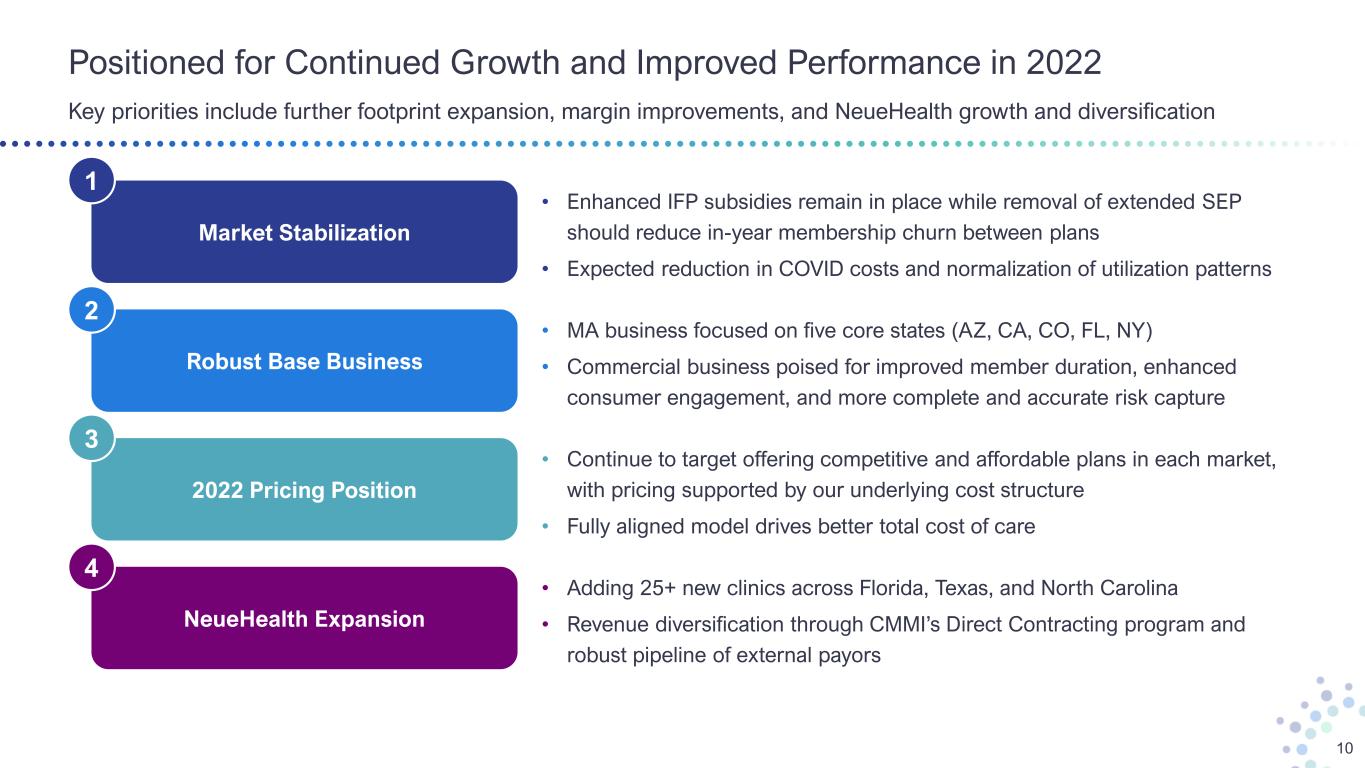

Positioned for Continued Growth and Improved Performance in 2022 Key priorities include further footprint expansion, margin improvements, and NeueHealth growth and diversification 10 Market Stabilization 1 Robust Base Business 2 2022 Pricing Position 3 NeueHealth Expansion 4 • Enhanced IFP subsidies remain in place while removal of extended SEP should reduce in-year membership churn between plans • Expected reduction in COVID costs and normalization of utilization patterns • MA business focused on five core states (AZ, CA, CO, FL, NY) • Commercial business poised for improved member duration, enhanced consumer engagement, and more complete and accurate risk capture • Continue to target offering competitive and affordable plans in each market, with pricing supported by our underlying cost structure • Fully aligned model drives better total cost of care • Adding 25+ new clinics across Florida, Texas, and North Carolina • Revenue diversification through CMMI’s Direct Contracting program and robust pipeline of external payors

Performance Update

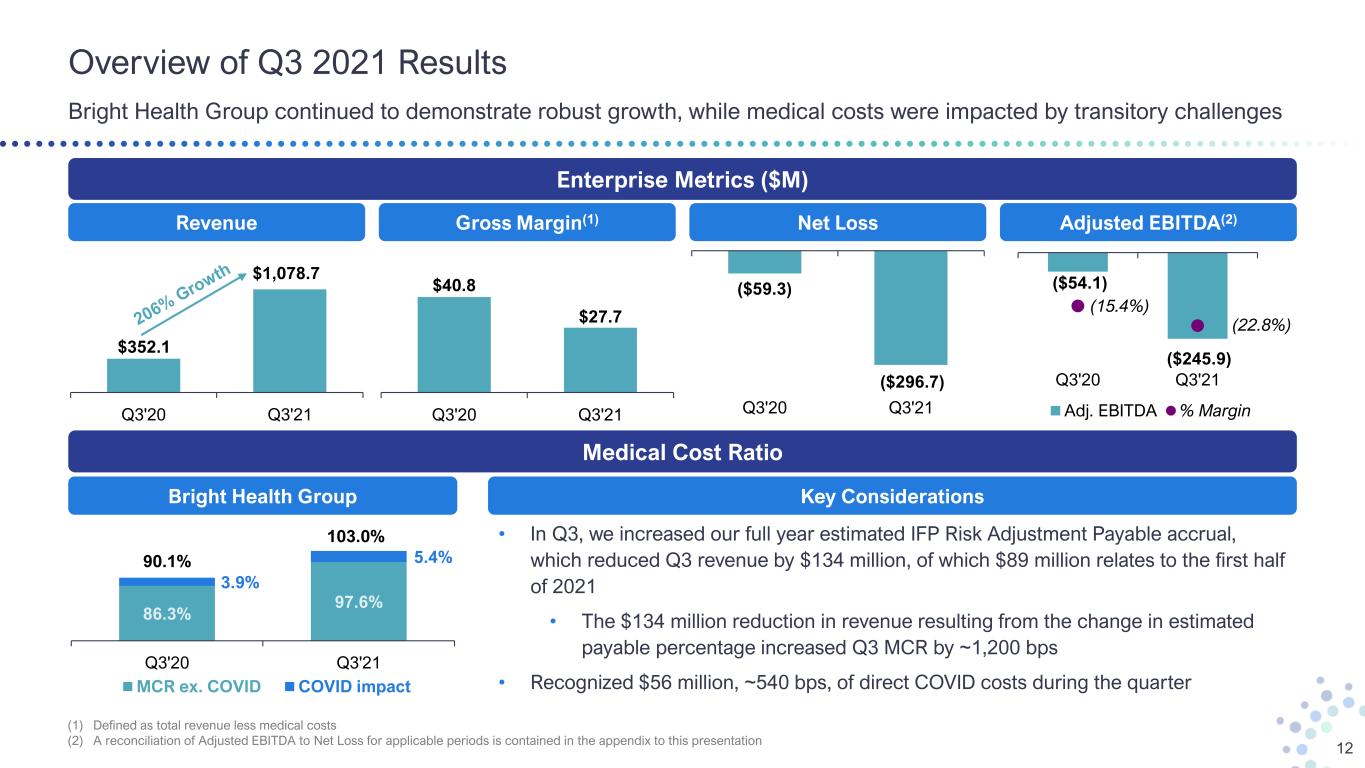

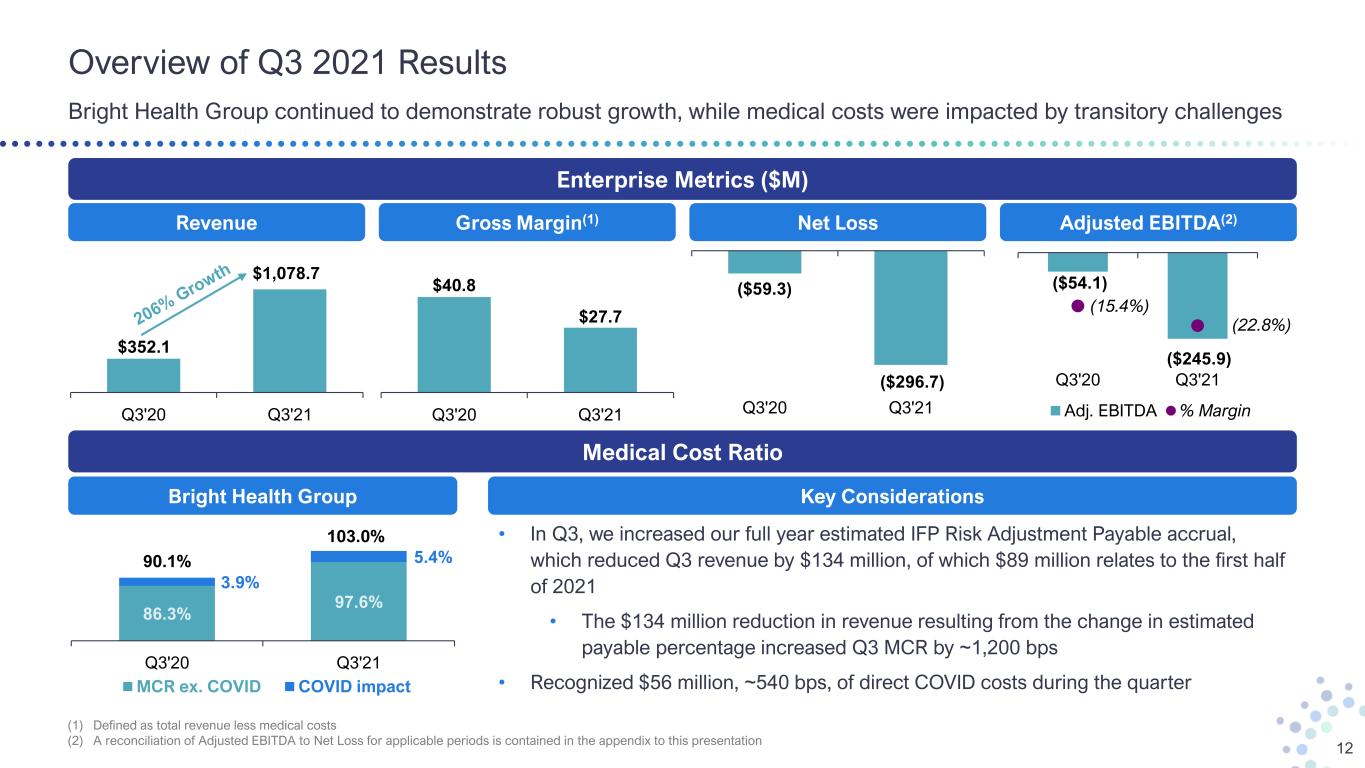

Overview of Q3 2021 Results Bright Health Group continued to demonstrate robust growth, while medical costs were impacted by transitory challenges 12 Revenue Gross Margin(1) Adjusted EBITDA(2) Enterprise Metrics ($M) Medical Cost Ratio (1) Defined as total revenue less medical costs (2) A reconciliation of Adjusted EBITDA to Net Loss for applicable periods is contained in the appendix to this presentation • In Q3, we increased our full year estimated IFP Risk Adjustment Payable accrual, which reduced Q3 revenue by $134 million, of which $89 million relates to the first half of 2021 • The $134 million reduction in revenue resulting from the change in estimated payable percentage increased Q3 MCR by ~1,200 bps • Recognized $56 million, ~540 bps, of direct COVID costs during the quarter Bright Health Group Key Considerations 86.3% 97.6% 3.9% 5.4%90.1% 103.0% Q3'20 Q3'21 MCR ex. COVID COVID impact Net Loss $352.1 $1,078.7 Q3'20 Q3'21 $40.8 $27.7 Q3'20 Q3'21 ($54.1) ($245.9) (15.4%) (22.8%) Q3'20 Q3'21 Adj. EBITDA % Margin ($59.3) ($296.7) Q3'20 Q3'21

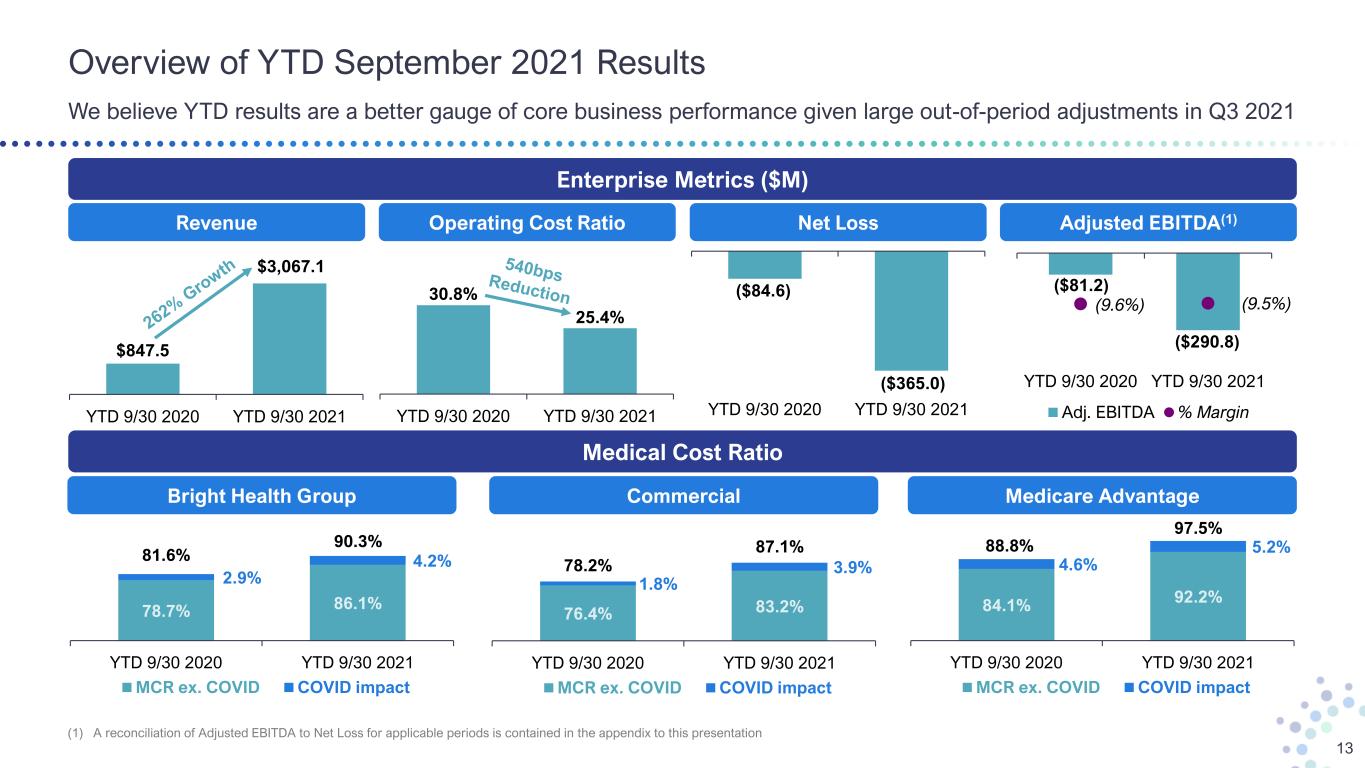

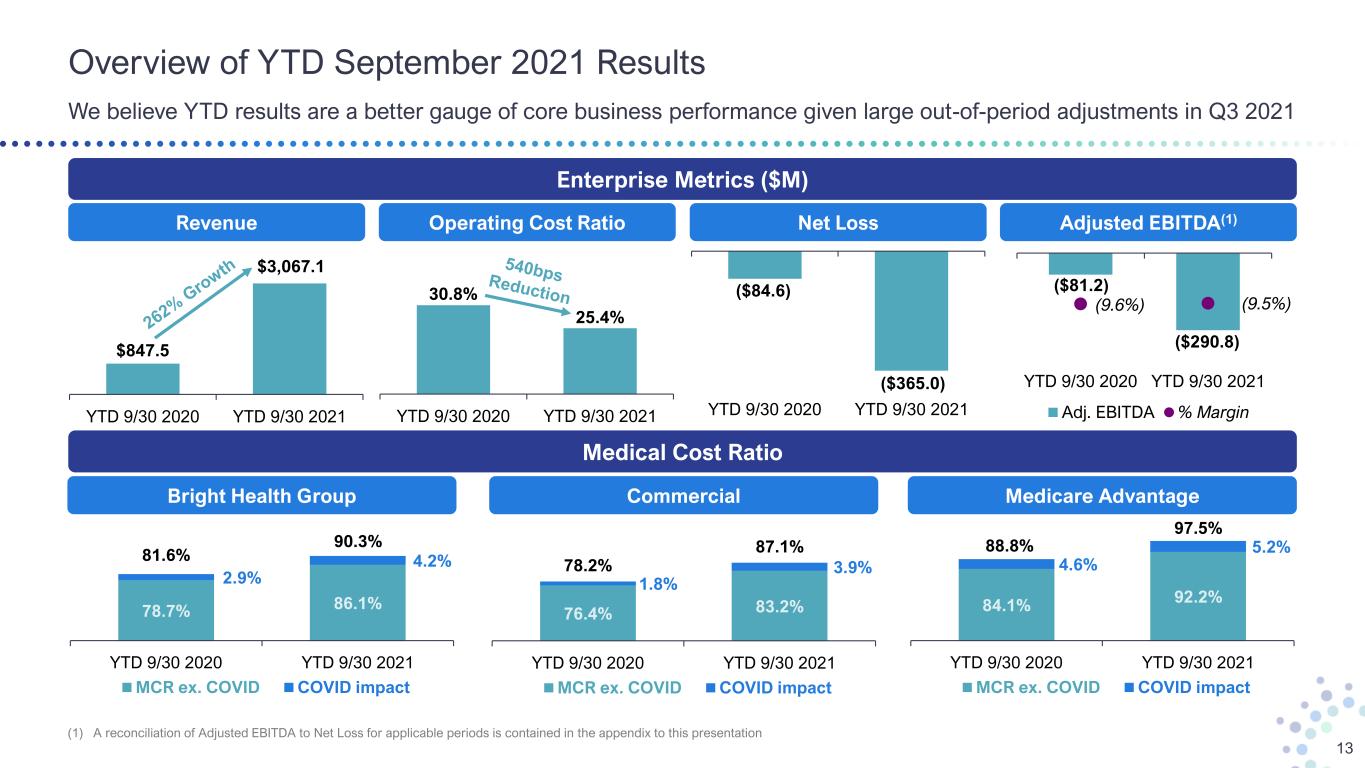

Overview of YTD September 2021 Results We believe YTD results are a better gauge of core business performance given large out-of-period adjustments in Q3 2021 13 Revenue Adjusted EBITDA(1)Operating Cost Ratio (1) A reconciliation of Adjusted EBITDA to Net Loss for applicable periods is contained in the appendix to this presentation Bright Health Group Commercial Enterprise Metrics ($M) Medical Cost Ratio Medicare Advantage 78.7% 86.1% 2.9% 4.2%81.6% 90.3% YTD 9/30 2020 YTD 9/30 2021 MCR ex. COVID COVID impact 76.4% 83.2% 1.8% 3.9% 78.2% 87.1% YTD 9/30 2020 YTD 9/30 2021 MCR ex. COVID COVID impact 84.1% 92.2% 4.6% 5.2% 88.8% 97.5% YTD 9/30 2020 YTD 9/30 2021 MCR ex. COVID COVID impact Net Loss $847.5 $3,067.1 YTD 9/30 2020 YTD 9/30 2021 30.8% 25.4% YTD 9/30 2020 YTD 9/30 2021 ($81.2) ($290.8) (9.6%) (9.5%) YTD 9/30 2020 YTD 9/30 2021 Adj. EBITDA % Margin ($84.6) ($365.0) YTD 9/30 2020 YTD 9/30 2021

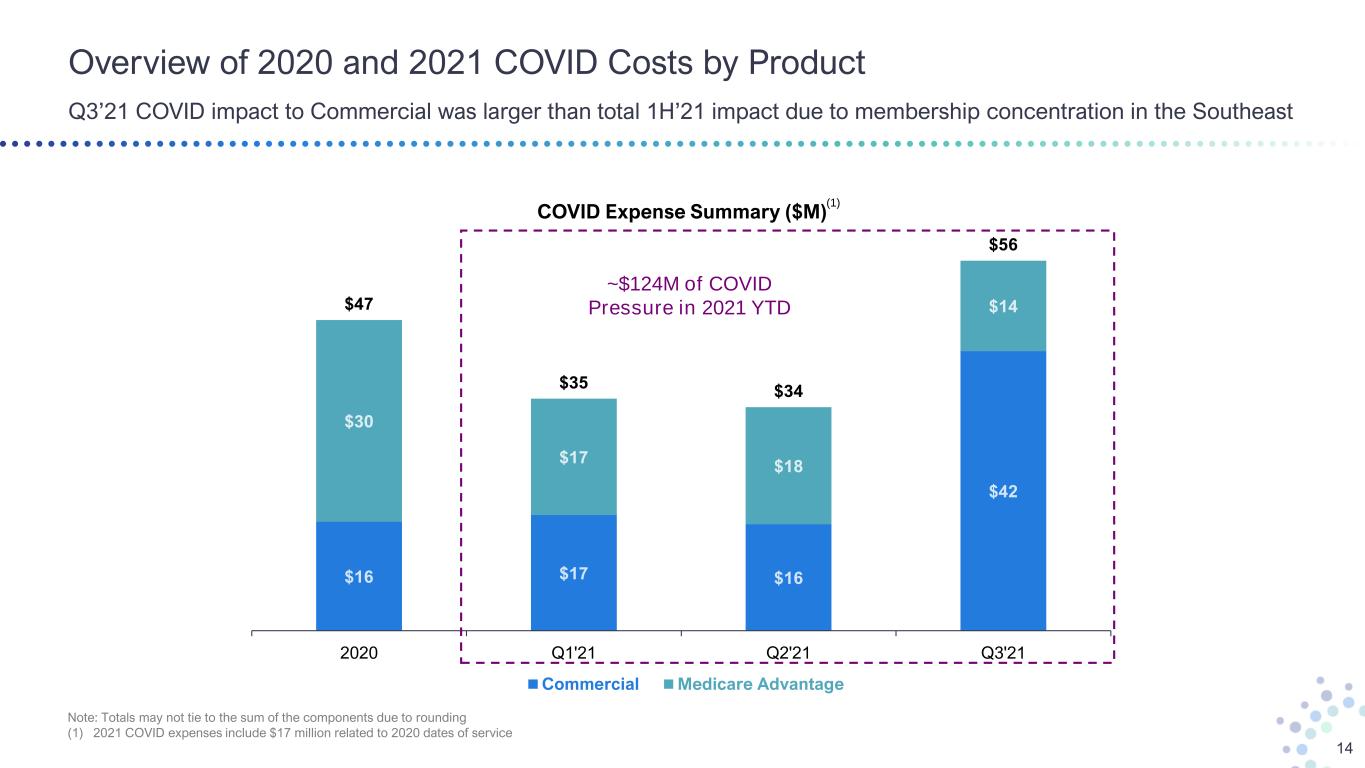

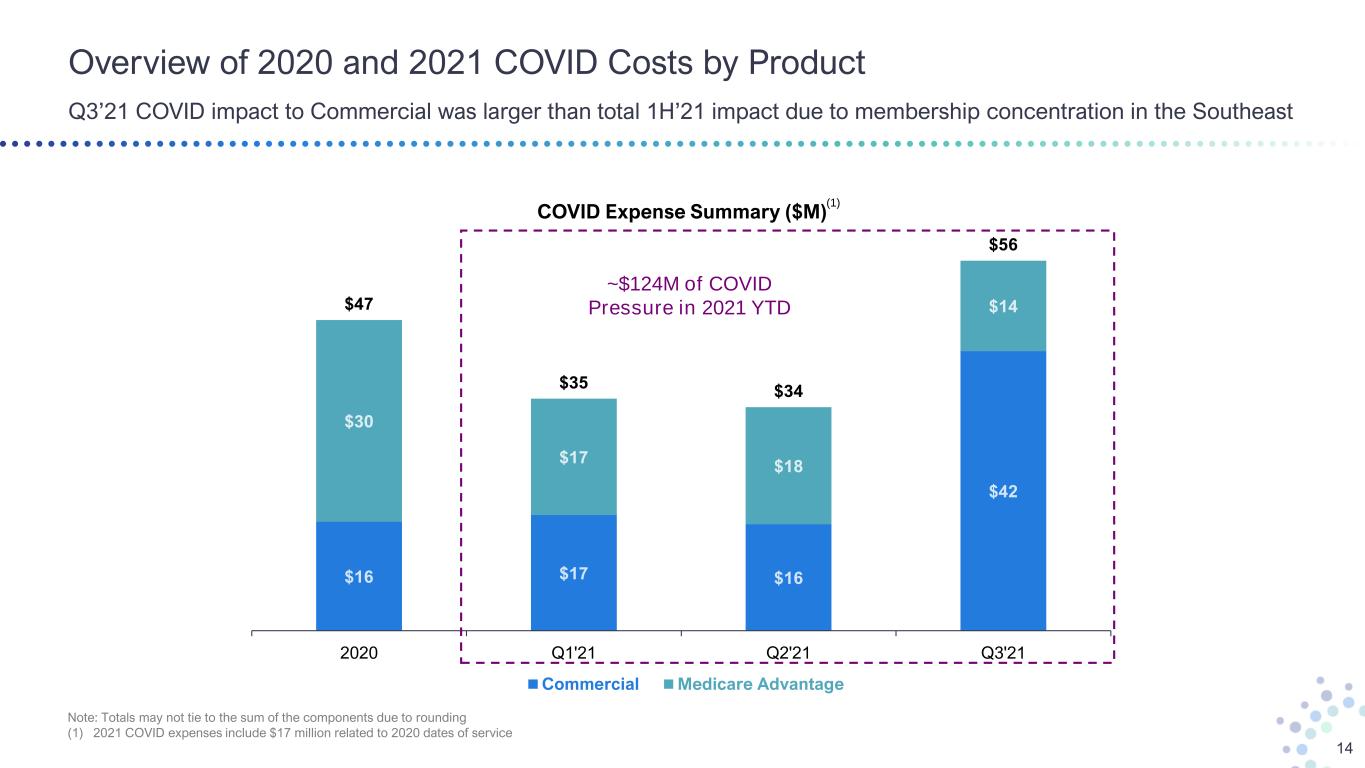

$16 $17 $16 $42 $30 $17 $18 $14 $47 $35 $34 $56 2020 Q1'21 Q2'21 Q3'21 COVID Expense Summary ($M) Commercial Medicare Advantage Overview of 2020 and 2021 COVID Costs by Product Q3’21 COVID impact to Commercial was larger than total 1H’21 impact due to membership concentration in the Southeast 14 ~$124M of COVID Pressure in 2021 YTD Note: Totals may not tie to the sum of the components due to rounding (1) 2021 COVID expenses include $17 million related to 2020 dates of service (1)

NeueHealth Continues to Expand Rapidly Accelerated movement of consumers into fully aligned Integrated Systems of Care driving growth and performance 15 ($ in millions) YTD 9/30 2020 YTD 9/30 2021 YoY Growth Value-Based Patients(1) 19,141 170,211 789% Premium Revenue $6.0 $62.7 953% Services Revenue 13.3 31.6 137% Investment Income - 109.0 NM Unaffiliated Revenue $19.3 $203.3 954% Affiliated Revenue 8.2 182.4 2,131% Total NeueHealth Revenue $27.5 $385.7 1,304% 906% YTD growth excluding investment income ~$575 million revised FY’21 segment revenue guidance, raised from ~$425 million previously 25+ planned clinic launches in 2022 2021 Highlights 2022 Expectations 7 states with Medicare FFS patients managed through Direct Contracting 2.5x+ expected increase in revenue excluding investment income, with a significant increase in revenue from external payors (1) Value-Based Patients of 19,141 and 170,211 represent end of period figures as of 9/30/2020 and 9/30/2021, respectively

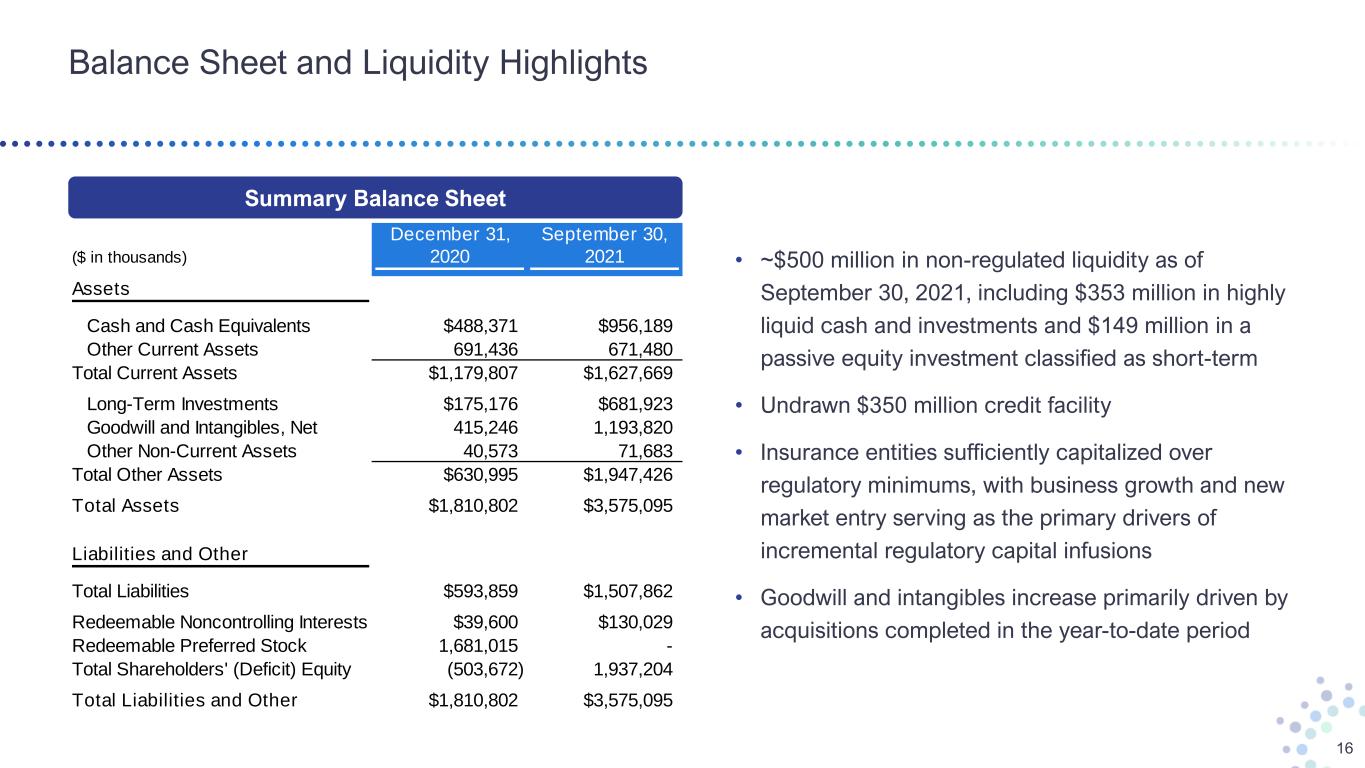

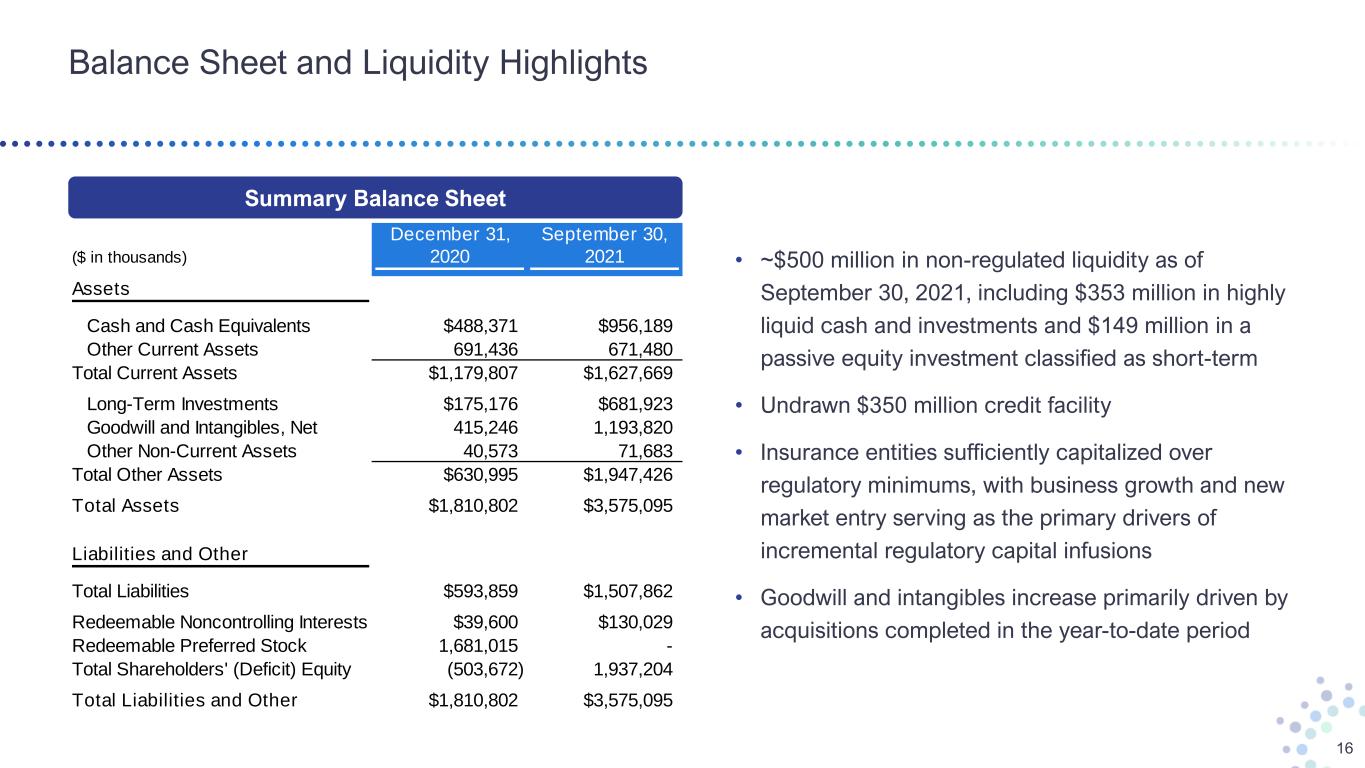

Balance Sheet and Liquidity Highlights 16 • ~$500 million in non-regulated liquidity as of September 30, 2021, including $353 million in highly liquid cash and investments and $149 million in a passive equity investment classified as short-term • Undrawn $350 million credit facility • Insurance entities sufficiently capitalized over regulatory minimums, with business growth and new market entry serving as the primary drivers of incremental regulatory capital infusions • Goodwill and intangibles increase primarily driven by acquisitions completed in the year-to-date period December 31, September 30, ($ in thousands) 2020 2021 Assets Cash and Cash Equivalents $488,371 $956,189 Other Current Assets 691,436 671,480 Total Current Assets $1,179,807 $1,627,669 Long-Term Investments $175,176 $681,923 Goodwill and Intangibles, Net 415,246 1,193,820 Other Non-Current Assets 40,573 71,683 Total Other Assets $630,995 $1,947,426 Total Assets $1,810,802 $3,575,095 Liabilities and Other Total Liabilities $593,859 $1,507,862 Redeemable Noncontrolling Interests $39,600 $130,029 Redeemable Preferred Stock 1,681,015 - Total Shareholders' (Deficit) Equity (503,672) 1,937,204 Total Liabilities and Other $1,810,802 $3,575,095 Summary Balance Sheet

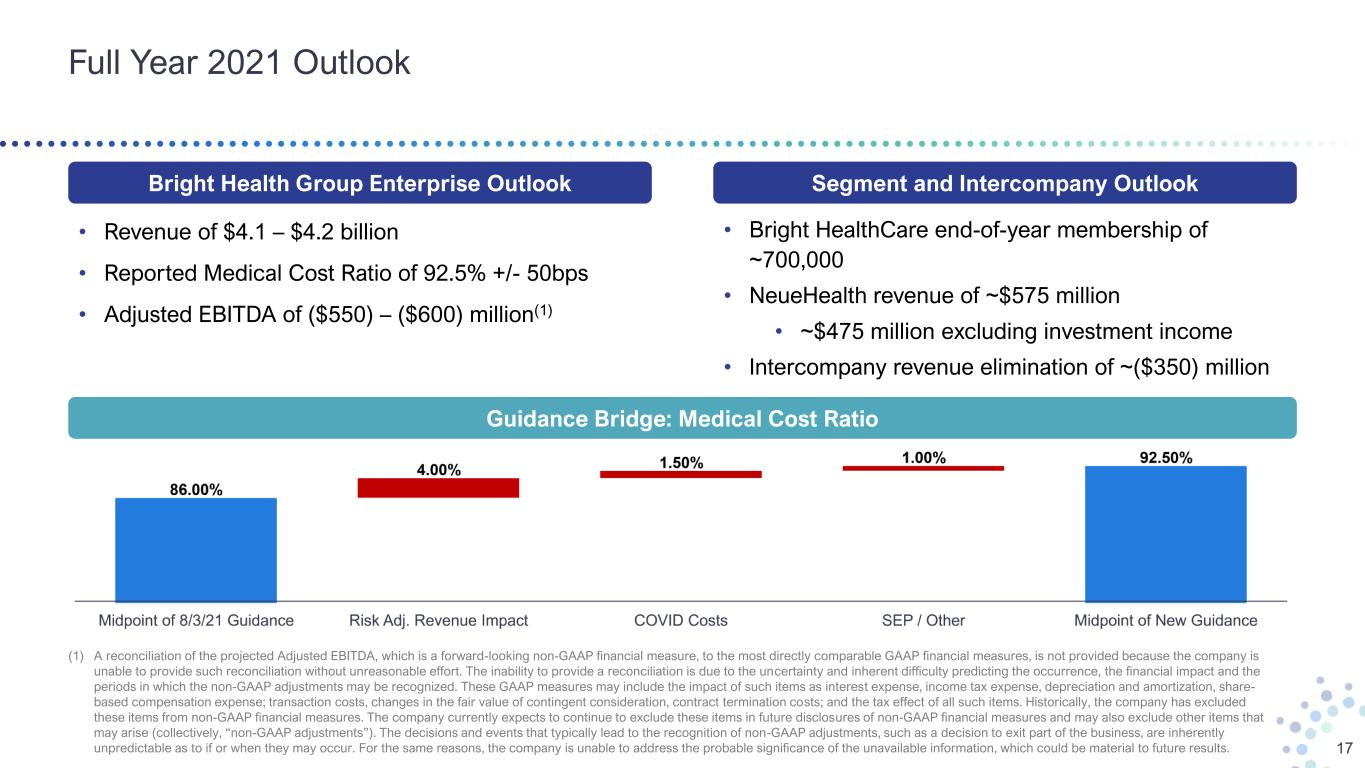

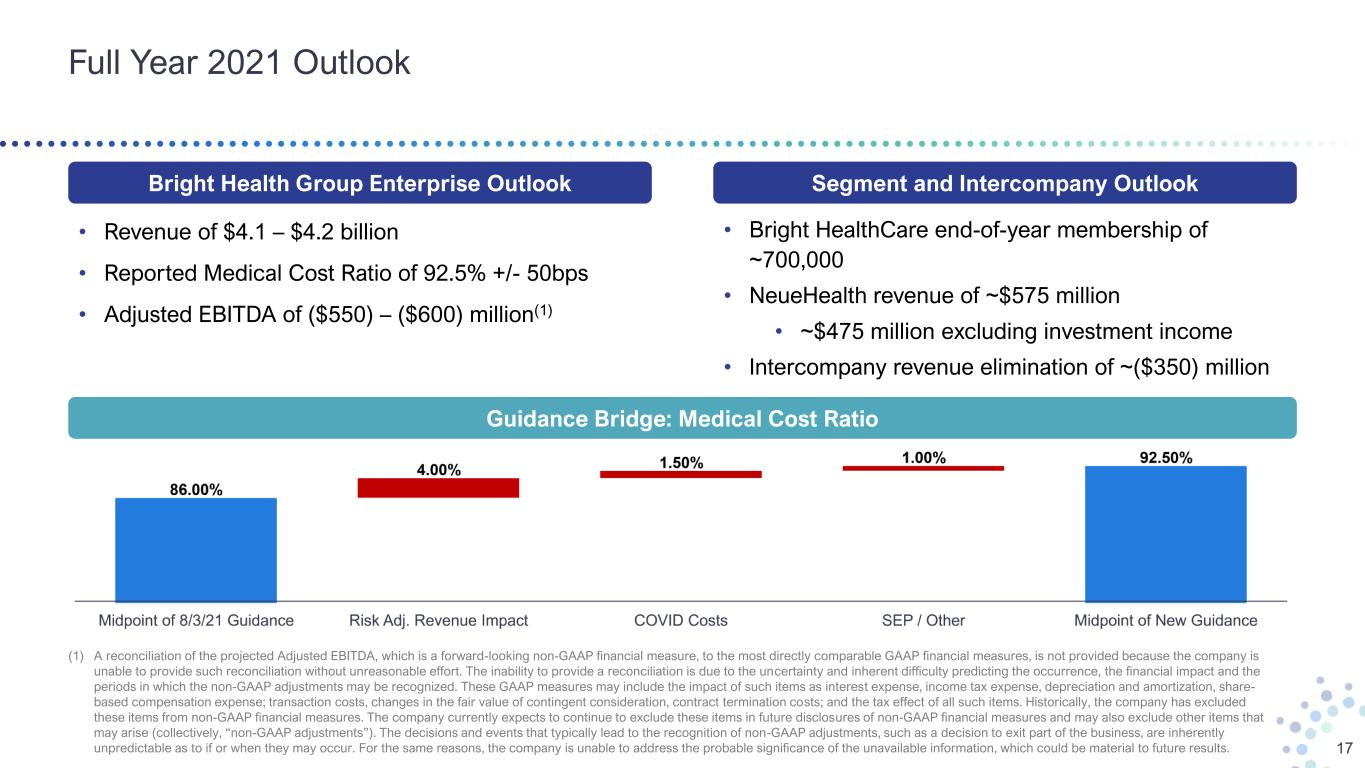

Full Year 2021 Outlook 17 • Revenue of $4.1 – $4.2 billion • Reported Medical Cost Ratio of 92.5% +/- 50bps • Adjusted EBITDA of ($550) – ($600) million(1) • Bright HealthCare end-of-year membership of ~700,000 • NeueHealth revenue of ~$575 million • ~$475 million excluding investment income • Intercompany revenue elimination of ~($350) million (1) A reconciliation of the projected Adjusted EBITDA, which is a forward-looking non-GAAP financial measure, to the most directly comparable GAAP financial measures, is not provided because the company is unable to provide such reconciliation without unreasonable effort. The inability to provide a reconciliation is due to the uncertainty and inherent difficulty predicting the occurrence, the financial impact and the periods in which the non-GAAP adjustments may be recognized. These GAAP measures may include the impact of such items as interest expense, income tax expense, depreciation and amortization, share- based compensation expense; transaction costs, changes in the fair value of contingent consideration, contract termination costs; and the tax effect of all such items. Historically, the company has excluded these items from non-GAAP financial measures. The company currently expects to continue to exclude these items in future disclosures of non-GAAP financial measures and may also exclude other items that may arise (collectively, “non-GAAP adjustments”). The decisions and events that typically lead to the recognition of non-GAAP adjustments, such as a decision to exit part of the business, are inherently unpredictable as to if or when they may occur. For the same reasons, the company is unable to address the probable significance of the unavailable information, which could be material to future results. Bright Health Group Enterprise Outlook Segment and Intercompany Outlook Guidance Bridge: Medical Cost Ratio

Appendix

Non-GAAP Reconciliation: Adjusted EBITDA 19 ($ in thousands) Three Months Ended Nine Months Ended September 30, 2020 September 30, 2021 September 30, 2020 September 30, 2021 Net Loss ($59,256) ($296,722) ($84,610) ($364,990) Interest Expense -- 1,594 -- 6,282 Income Tax Expense (Benefit) -- 73 (9,162) (18,225) Depreciation and Amortization 2,678 14,205 5,550 25,981 Transaction Costs 965 448 3,312 5,598 Share-Based Compensation Expense 1,529 24,180 3,722 43,234 Change in Fair Value of Contingent Consideration -- 304 -- 1,363 Contract Termination Costs -- 10,000 -- 10,000 Adjusted EBITDA ($54,084) ($245,918) ($81,188) ($290,757) Adjusted EBITDA