43rd Annual J.P. Morgan Healthcare Conference January 2025 neffy – the transformative needle-free solution for severe allergic reactions NASDAQ: SPRY Exhibit 99.2

Forward-looking statements Statements in this presentation that are not purely historical in nature are “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements in this presentation include, without limitation, statements regarding: the design and potential benefits of neffy, including the likelihood allergy patients and caregivers will choose to carry and dose neffy compared to needle-bearing options; ARS Pharma’s expected competitive position; the potential market, demand and expansion opportunities for neffy; the anticipated sales of neffy and gross-to-net percentage range; the anticipated timing for approval of the supplemental regulatory application for 1 mg neffy dose for children 15 kg to 30 kg; the timeline for commercialization of neffy outside of the United States; the potential ability of neffy to treat acute flares in patients with chronic spontaneous urticaria; the timing for initiating a single pivotal study in urticaria and potential launch; ARS Pharma’s marketing and commercialization strategies; the expected composition and reach of ARS Pharma’s commercial force; the potential for the neffy Experience Program; the likelihood of neffy attaining favorable coverage and the expected timing of coverage decisions; the timing and expected percentage of commercial coverage with unrestricted access; ARS Pharma’s projected operating runway; the anticipated benefits of ARS Pharma’s ex-U.S. partnerships; the expected intellectual property protection for neffy; and any statements of assumptions underlying any of the foregoing. These forward-looking statements are subject to the safe harbor provisions under the Private Securities Litigation Reform Act of 1995. Because such statements are subject to risks and uncertainties, actual results may differ materially from those expressed or implied by such forward-looking statements. Words such as “anticipate,” “demonstrate,” “expect,” “indicate,” “plan,” “potential,” “target,” “will” and similar expressions are intended to identify forward-looking statements. These forward-looking statements are based upon ARS Pharma’s current expectations and involve assumptions that may never materialize or may prove to be incorrect. Actual results and the timing of events could differ materially from those anticipated in such forward-looking statements as a result of various risks and uncertainties, which include, without limitation: risks associated with preliminary financial results, which are subject to revision based upon the company’s year-end closing procedures and the completion and external audit of ARS Pharma’s year-end financial statements; the ability to maintain regulatory approval for neffy for its current indication and obtain and maintain regulatory approval for neffy for additional indications; results from clinical trials and non-clinical studies may not be indicative of results that may be observed in the future; potential safety and other complications from neffy; the labeling for neffy in any future indication or patient population; the scope, progress and expansion of developing and commercializing neffy; ARS Pharma’s reliance on its licensing partners; the potential for payors and governments to delay, limit or deny coverage or reimbursements for neffy; the size and growth of the market therefor and the rate and degree of market acceptance thereof vis-à-vis intramuscular injectable products; net product sales may not be indicative of profitability or profitability at expected levels; reliance on survey results with small samples sizes; ARS Pharma’s ability to protect its intellectual property position; and the impact of government laws and regulations. Additional risks and uncertainties that could cause actual outcomes and results to differ materially from those contemplated by the forward-looking statements are included under the caption “Risk Factors” in ARS Pharma’s Quarterly Report on Form 10-Q for the quarter ended September 30, 2024, filed with the Securities and Exchange Commission (“SEC”) on November 13, 2024. This and other documents ARS Pharma files with the SEC can also be accessed on ARS Pharma’s website at ir.ars-pharma.com by clicking on the link “Financials & Filings” under the “Investors & Media” tab. The forward-looking statements included in this presentation are made only as of the date hereof. ARS Pharma assumes no obligation and does not intend to update these forward-looking statements, except as required by law. ARS Pharmaceuticals, Inc. Investor Presentation – January 2025

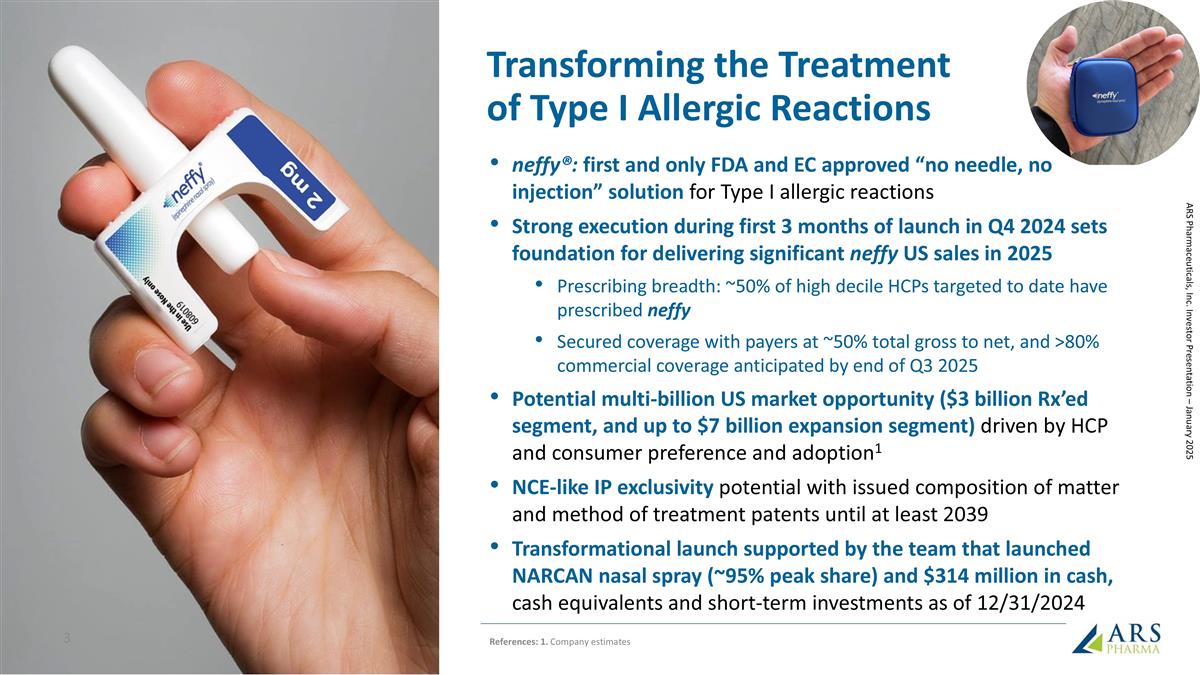

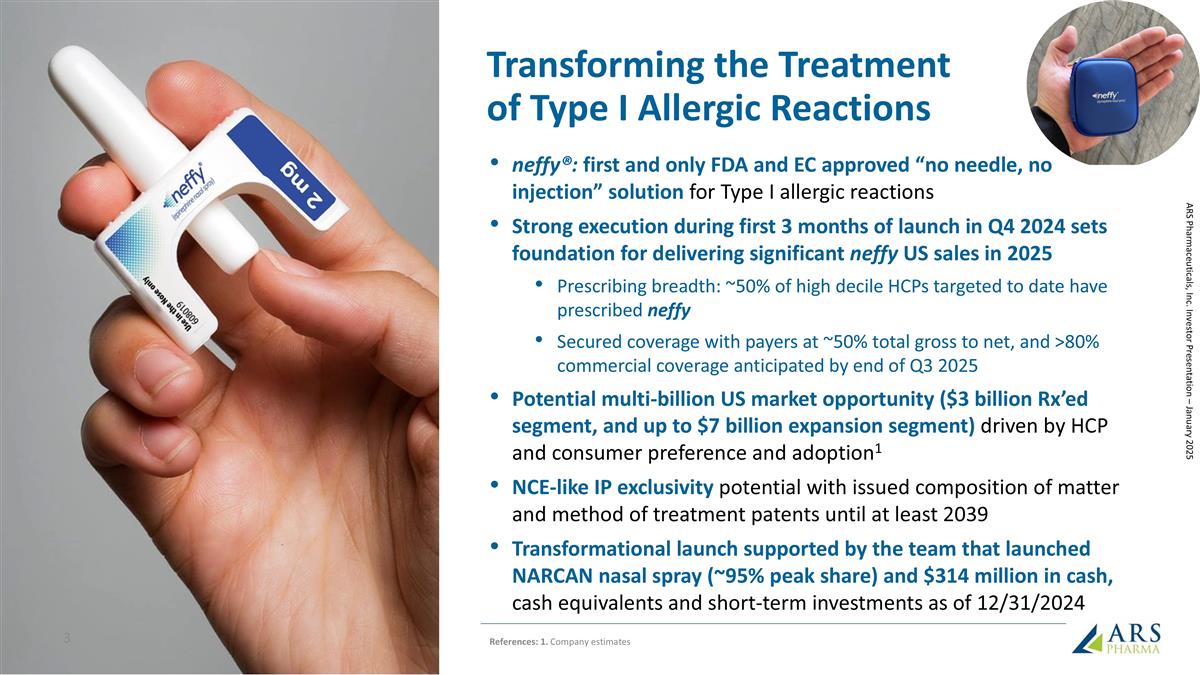

Transforming the Treatment of Type I Allergic Reactions neffy®: first and only FDA and EC approved “no needle, no injection” solution for Type I allergic reactions Strong execution during first 3 months of launch in Q4 2024 sets foundation for delivering significant neffy US sales in 2025 Prescribing breadth: ~50% of high decile HCPs targeted to date have prescribed neffy Secured coverage with payers at ~50% total gross to net, and >80% commercial coverage anticipated by end of Q3 2025 Potential multi-billion US market opportunity ($3 billion Rx’ed segment, and up to $7 billion expansion segment) driven by HCP and consumer preference and adoption1 NCE-like IP exclusivity potential with issued composition of matter and method of treatment patents until at least 2039 Transformational launch supported by the team that launched NARCAN nasal spray (~95% peak share) and $314 million in cash, cash equivalents and short-term investments as of 12/31/2024 ARS Pharmaceuticals, Inc. Investor Presentation – January 2025 References: 1. Company estimates

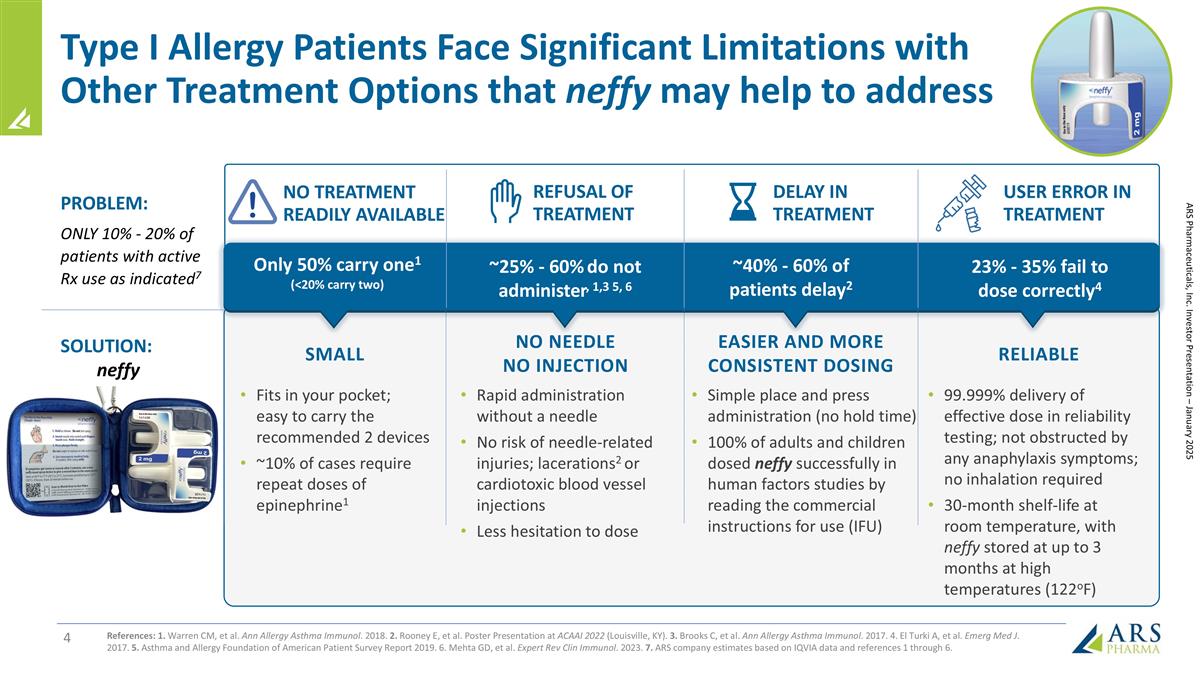

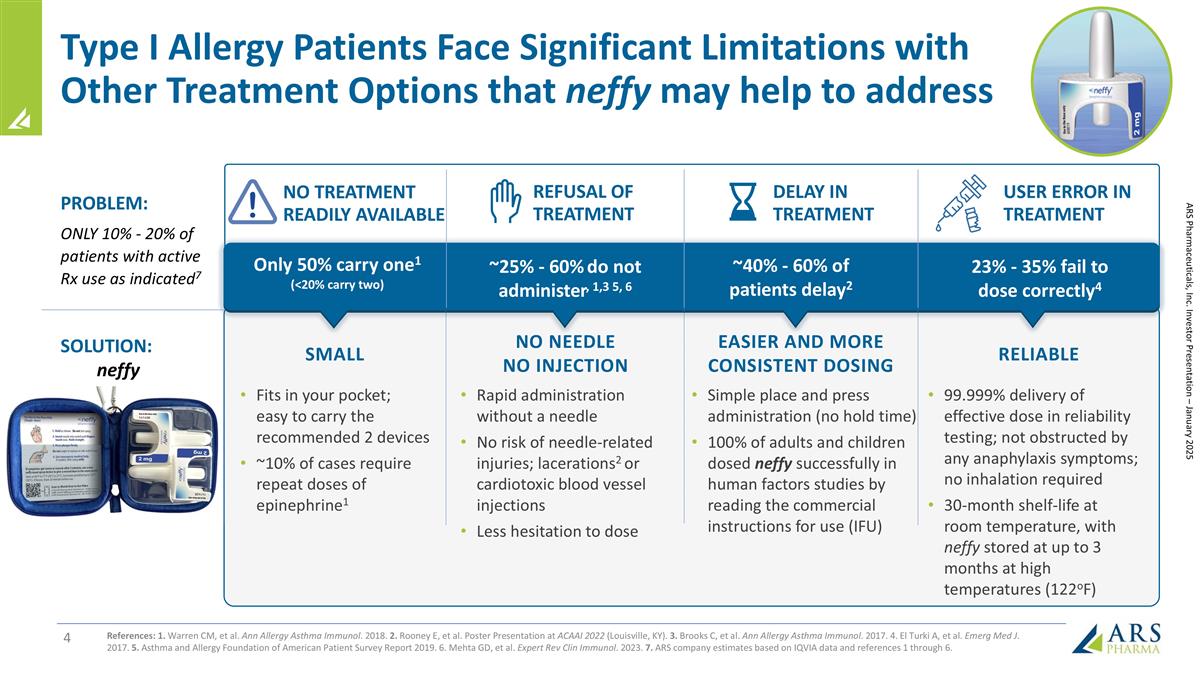

Type I Allergy Patients Face Significant Limitations with Other Treatment Options that neffy may help to address References: 1. Warren CM, et al. Ann Allergy Asthma Immunol. 2018. 2. Rooney E, et al. Poster Presentation at ACAAI 2022 (Louisville, KY). 3. Brooks C, et al. Ann Allergy Asthma Immunol. 2017. 4. El Turki A, et al. Emerg Med J. 2017. 5. Asthma and Allergy Foundation of American Patient Survey Report 2019. 6. Mehta GD, et al. Expert Rev Clin Immunol. 2023. 7. ARS company estimates based on IQVIA data and references 1 through 6. Rapid administration without a needle No risk of needle-related injuries; lacerations2 or cardiotoxic blood vessel injections Less hesitation to dose NO NEEDLE NO INJECTION Fits in your pocket; easy to carry the recommended 2 devices ~10% of cases require repeat doses of epinephrine1 EASIER AND MORE CONSISTENT DOSING Simple place and press administration (no hold time) 100% of adults and children dosed neffy successfully in human factors studies by reading the commercial instructions for use (IFU) RELIABLE 99.999% delivery of effective dose in reliability testing; not obstructed by any anaphylaxis symptoms; no inhalation required 30-month shelf-life at room temperature, with neffy stored at up to 3 months at high temperatures (122oF) Only 50% carry one1 (<20% carry two) ~25% - 60% do not administer, 1,3 5, 6 NO TREATMENT READILY AVAILABLE REFUSAL OF TREATMENT ~40% - 60% of patients delay2 DELAY IN TREATMENT 23% - 35% fail to dose correctly4 USER ERROR IN TREATMENT SOLUTION: neffy PROBLEM: ONLY 10% - 20% of patients with active Rx use as indicated7 SMALL ARS Pharmaceuticals, Inc. Investor Presentation – January 2025

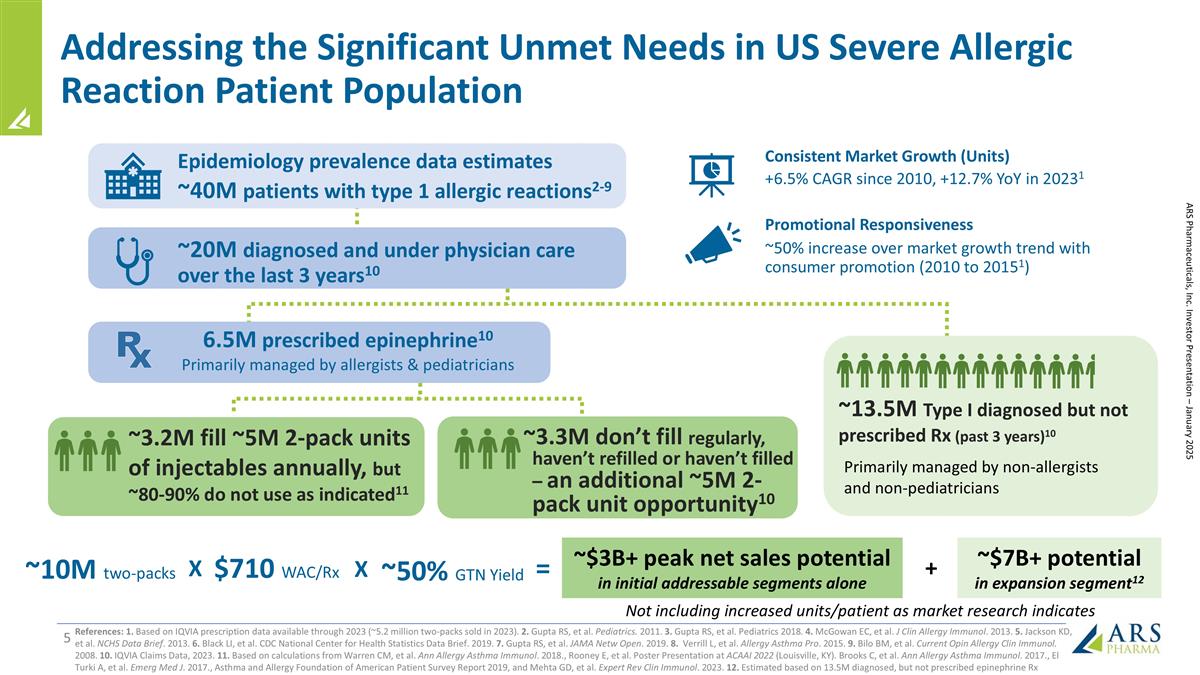

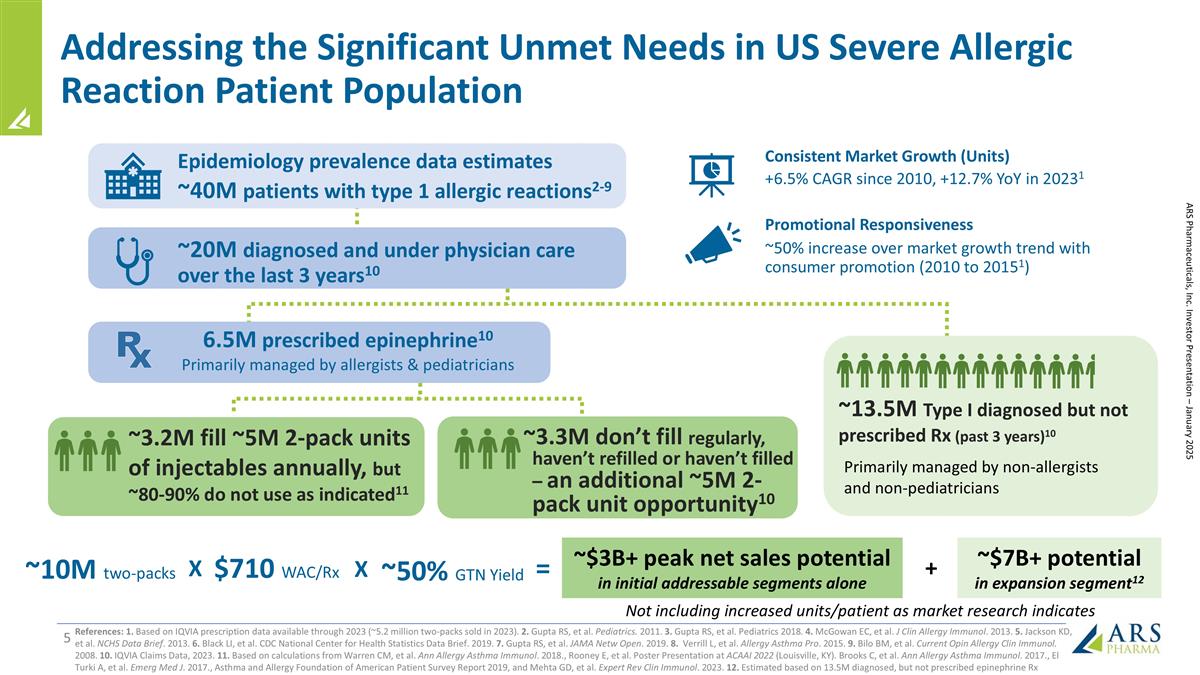

Addressing the Significant Unmet Needs in US Severe Allergic Reaction Patient Population References: 1. Based on IQVIA prescription data available through 2023 (~5.2 million two-packs sold in 2023). 2. Gupta RS, et al. Pediatrics. 2011. 3. Gupta RS, et al. Pediatrics 2018. 4. McGowan EC, et al. J Clin Allergy Immunol. 2013. 5. Jackson KD, et al. NCHS Data Brief. 2013. 6. Black LI, et al. CDC National Center for Health Statistics Data Brief. 2019. 7. Gupta RS, et al. JAMA Netw Open. 2019. 8. Verrill L, et al. Allergy Asthma Pro. 2015. 9. Bilo BM, et al. Current Opin Allergy Clin Immunol. 2008. 10. IQVIA Claims Data, 2023. 11. Based on calculations from Warren CM, et al. Ann Allergy Asthma Immunol. 2018., Rooney E, et al. Poster Presentation at ACAAI 2022 (Louisville, KY). Brooks C, et al. Ann Allergy Asthma Immunol. 2017., El Turki A, et al. Emerg Med J. 2017., Asthma and Allergy Foundation of American Patient Survey Report 2019, and Mehta GD, et al. Expert Rev Clin Immunol. 2023. 12. Estimated based on 13.5M diagnosed, but not prescribed epinephrine Rx Promotional Responsiveness ~20M diagnosed and under physician care over the last 3 years10 Epidemiology prevalence data estimates ~40M patients with type 1 allergic reactions2-9 ~50% increase over market growth trend with consumer promotion (2010 to 20151) Consistent Market Growth (Units) +6.5% CAGR since 2010, +12.7% YoY in 20231 ~3.2M fill ~5M 2-pack units of injectables annually, but ~80-90% do not use as indicated11 ~13.5M Type I diagnosed but not prescribed Rx (past 3 years)10 ~3.3M don’t fill regularly, haven’t refilled or haven’t filled – an additional ~5M 2-pack unit opportunity10 6.5M prescribed epinephrine10 Primarily managed by allergists & pediatricians Primarily managed by non-allergists and non-pediatricians $710 WAC/Rx ~50% GTN Yield ~10M two-packs ~$3B+ peak net sales potential in initial addressable segments alone = X X ~$7B+ potential in expansion segment12 + ARS Pharmaceuticals, Inc. Investor Presentation – January 2025 Not including increased units/patient as market research indicates

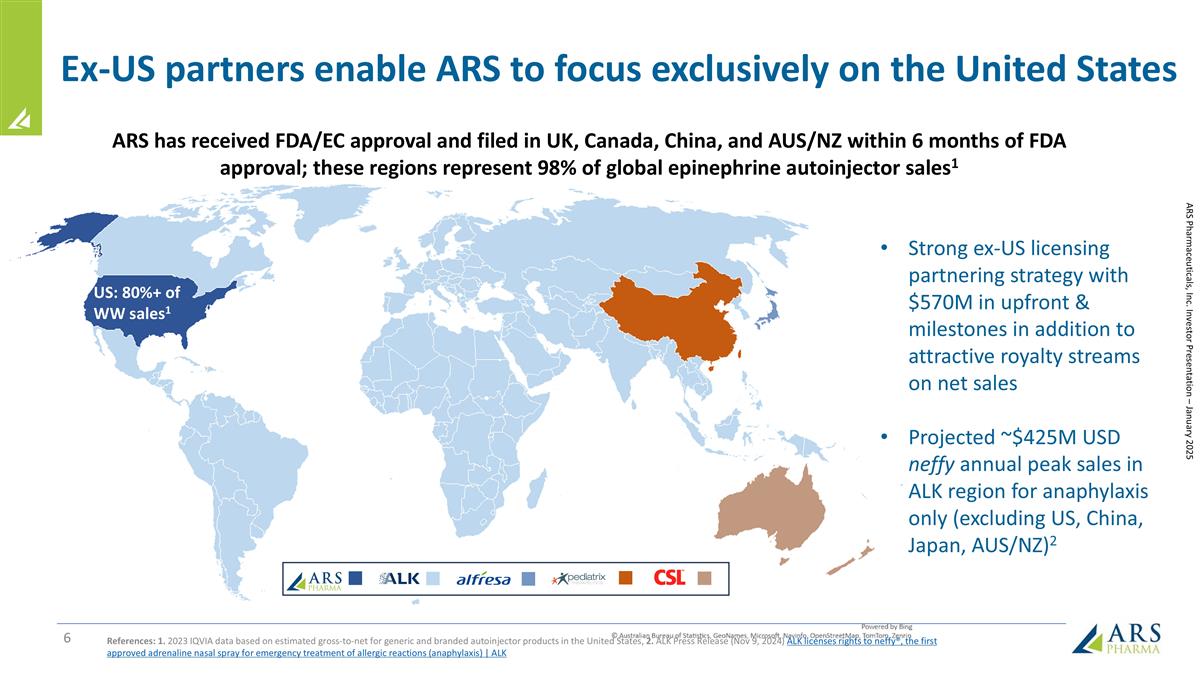

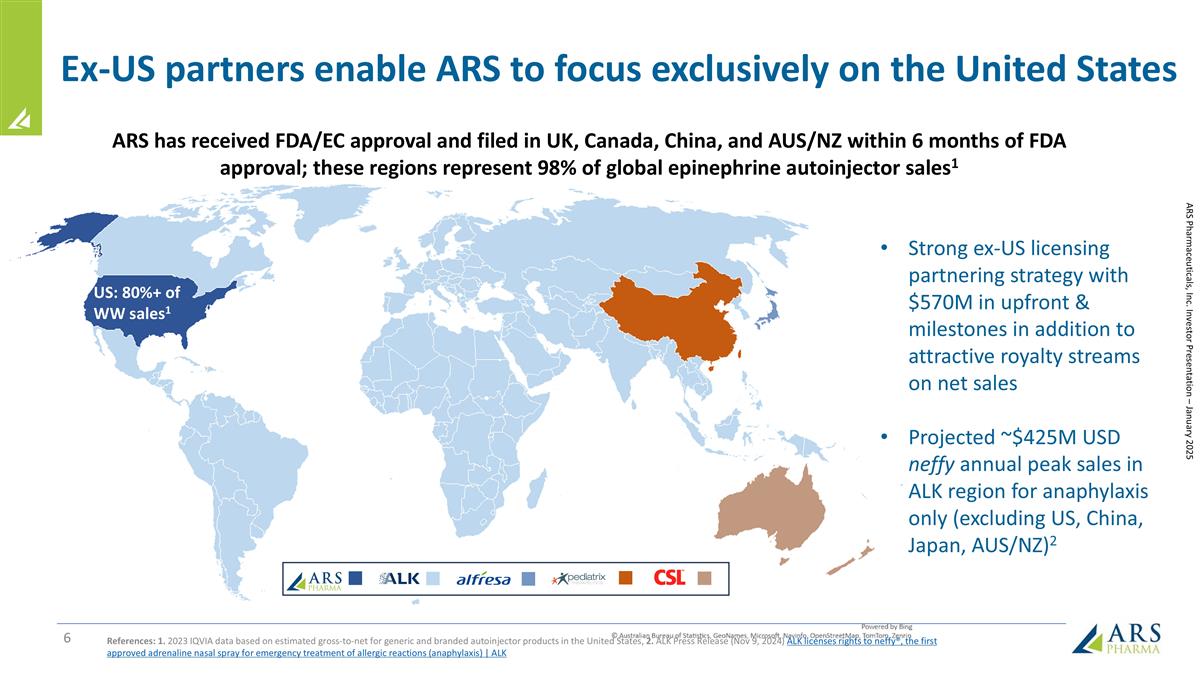

Ex-US partners enable ARS to focus exclusively on the United States References: 1. 2023 IQVIA data based on estimated gross-to-net for generic and branded autoinjector products in the United States, 2. ALK Press Release (Nov 9, 2024) ALK licenses rights to neffy®, the first approved adrenaline nasal spray for emergency treatment of allergic reactions (anaphylaxis) | ALK ARS Pharmaceuticals, Inc. Investor Presentation – January 2025 US: 80%+ of WW sales1 ARS has received FDA/EC approval and filed in UK, Canada, China, and AUS/NZ within 6 months of FDA approval; these regions represent 98% of global epinephrine autoinjector sales1 Strong ex-US licensing partnering strategy with $570M in upfront & milestones in addition to attractive royalty streams on net sales Projected ~$425M USD neffy annual peak sales in ALK region for anaphylaxis only (excluding US, China, Japan, AUS/NZ)2

Commercialization Progress ARS Pharmaceuticals, Inc. Investor Presentation – January 2025

ACTIVATE PATIENTS Accelerated DTC campaign prior to end of school year to increase awareness and motivate patients and caregivers to seek neffy REACH MORE PRESCRIBERS Option to expand CME, direct HCP marketing and sales force to drive prescriber uptake FACILITATE ACCESS Obtain 60%, growing to 80%+ commercial coverage of neffy with a total gross to net yield of ~50% EDUCATE PRESCRIBERS Drive adoption within specialty and high prescribers that have a long history of using injection neffy Strategic Objectives for Commercialization ARS Pharmaceuticals, Inc. Investor Presentation – January 2025 Launch of 2 mg neffy within 9 weeks of FDA approval Q4 2024 Early to mid 2025 Mid to late 2025 (Sept 23, 2024 launch)

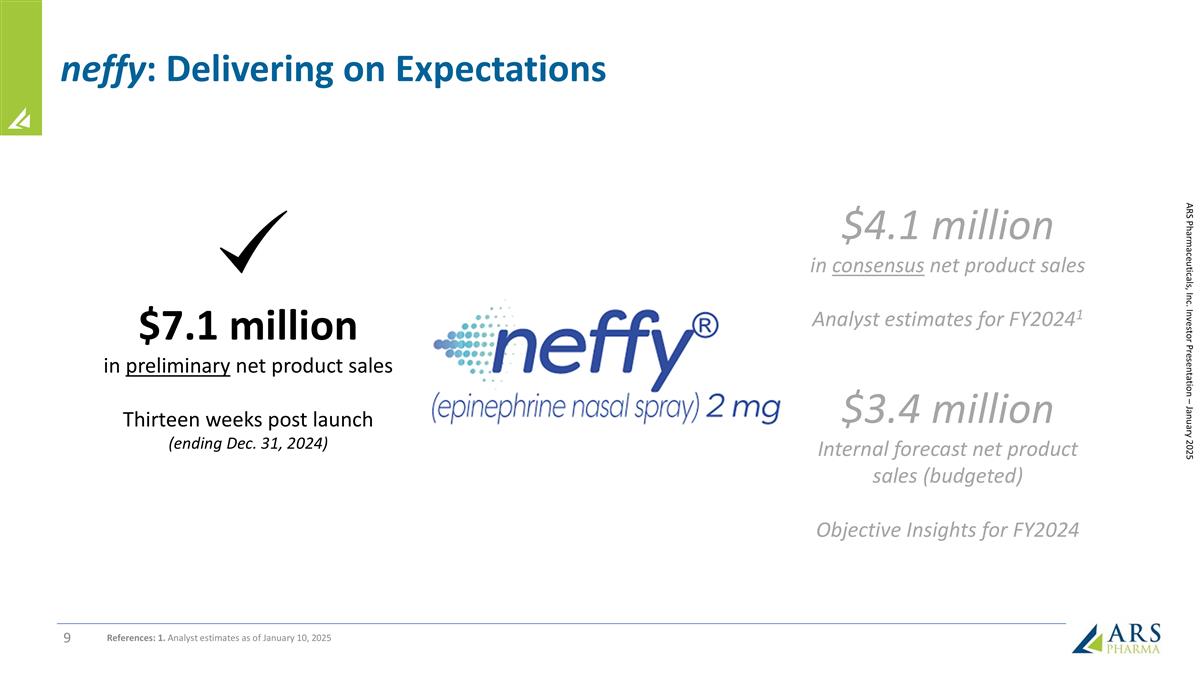

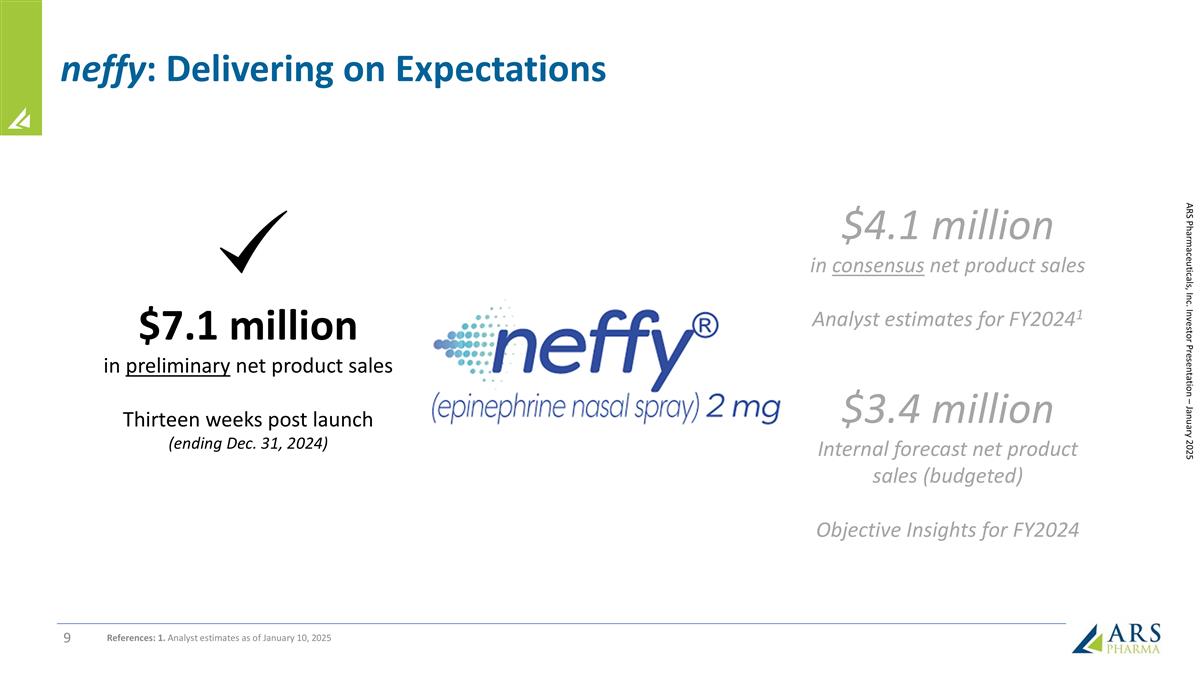

neffy: Delivering on Expectations $7.1 million in preliminary net product sales Thirteen weeks post launch (ending Dec. 31, 2024) ARS Pharmaceuticals, Inc. Investor Presentation – January 2025 $4.1 million in consensus net product sales Analyst estimates for FY20241 $3.4 million Internal forecast net product sales (budgeted) Objective Insights for FY2024 References: 1. Analyst estimates as of January 10, 2025

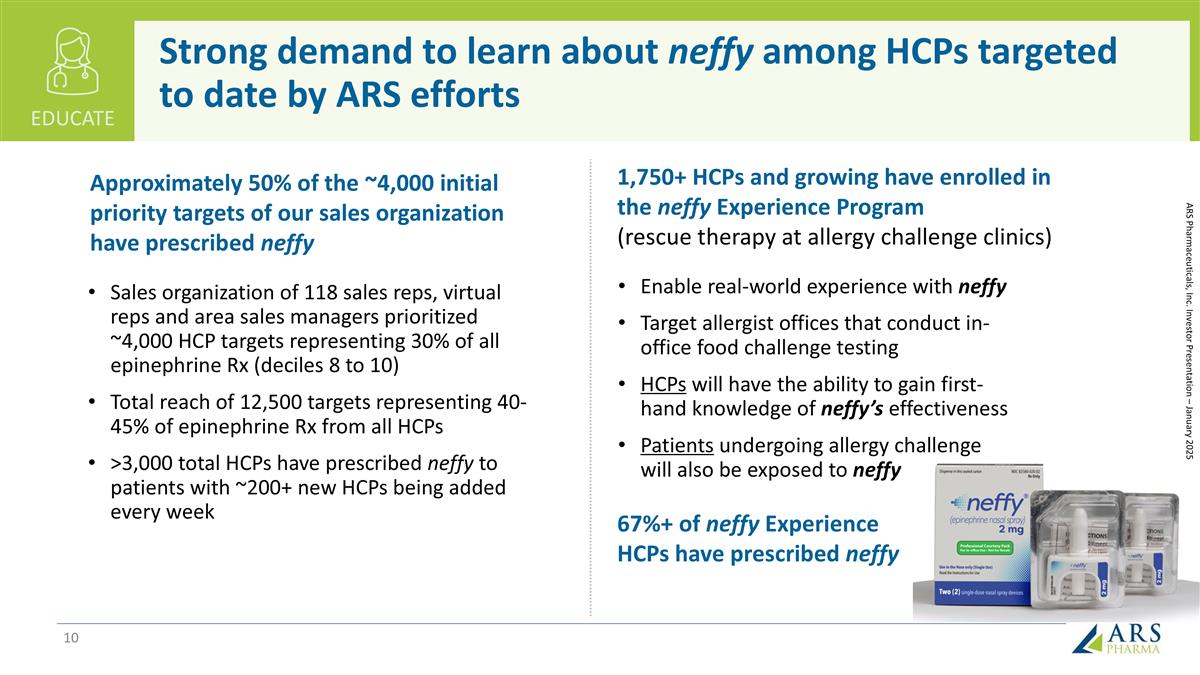

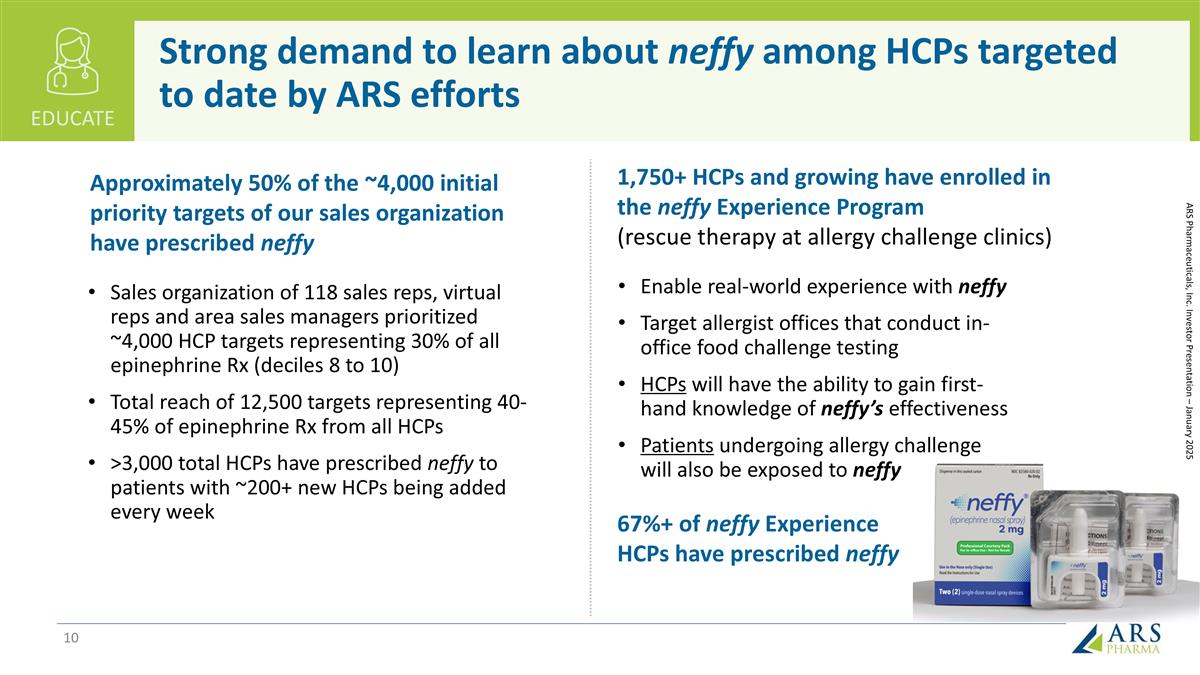

EDUCATE Enable real-world experience with neffy Target allergist offices that conduct in-office food challenge testing HCPs will have the ability to gain first-hand knowledge of neffy’s effectiveness Patients undergoing allergy challenge will also be exposed to neffy 1,750+ HCPs and growing have enrolled in the neffy Experience Program (rescue therapy at allergy challenge clinics) Strong demand to learn about neffy among HCPs targeted to date by ARS efforts ARS Pharmaceuticals, Inc. Investor Presentation – January 2025 67%+ of neffy Experience HCPs have prescribed neffy Approximately 50% of the ~4,000 initial priority targets of our sales organization have prescribed neffy Sales organization of 118 sales reps, virtual reps and area sales managers prioritized ~4,000 HCP targets representing 30% of all epinephrine Rx (deciles 8 to 10) Total reach of 12,500 targets representing 40-45% of epinephrine Rx from all HCPs >3,000 total HCPs have prescribed neffy to patients with ~200+ new HCPs being added every week

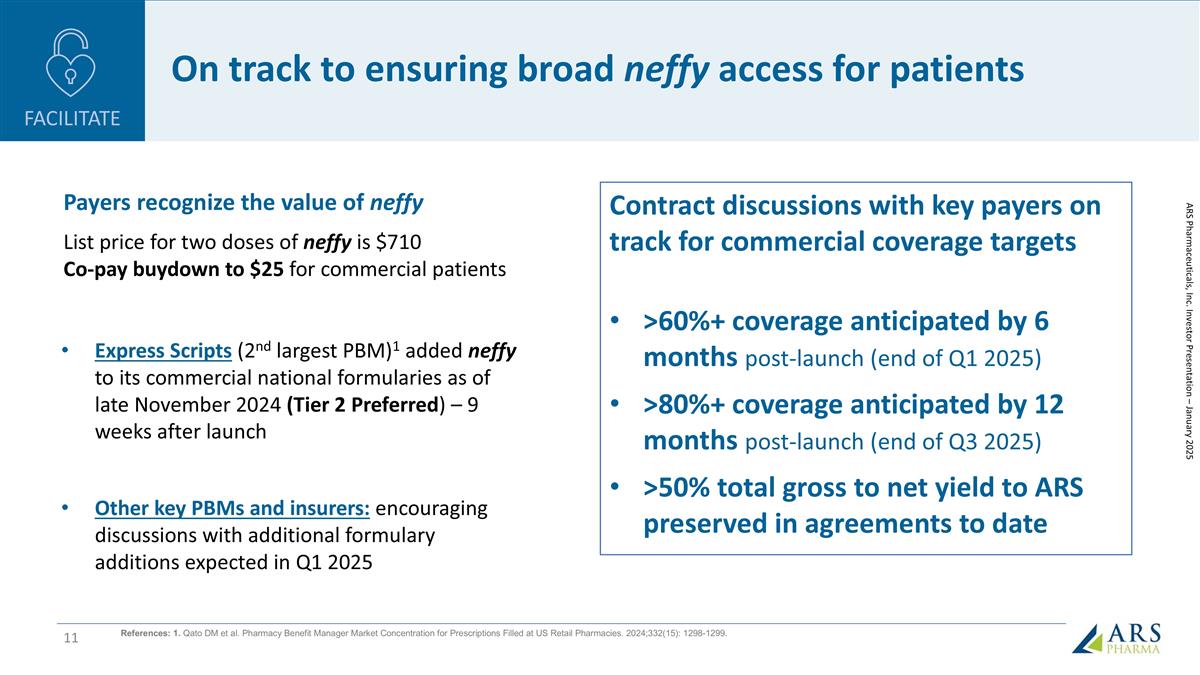

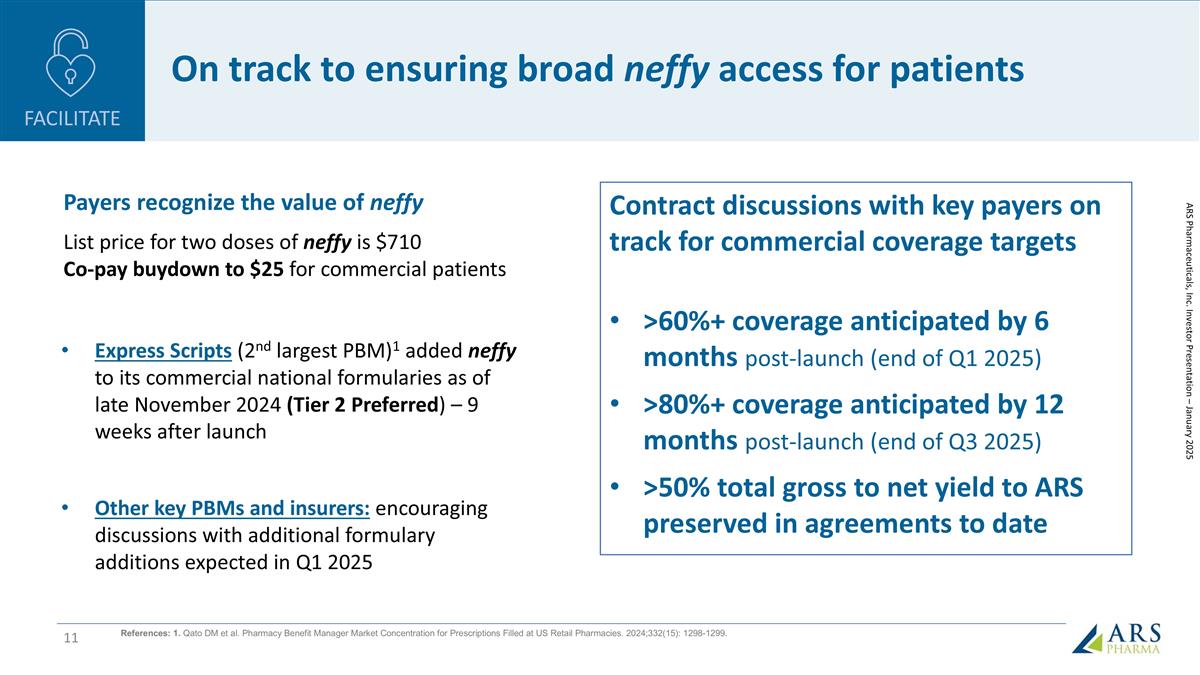

On track to ensuring broad neffy access for patients FACILITATE ARS Pharmaceuticals, Inc. Investor Presentation – January 2025 Contract discussions with key payers on track for commercial coverage targets >60%+ coverage anticipated by 6 months post-launch (end of Q1 2025) >80%+ coverage anticipated by 12 months post-launch (end of Q3 2025) >50% total gross to net yield to ARS preserved in agreements to date List price for two doses of neffy is $710 Co-pay buydown to $25 for commercial patients References: 1. Qato DM et al. Pharmacy Benefit Manager Market Concentration for Prescriptions Filled at US Retail Pharmacies. 2024;332(15): 1298-1299. Express Scripts (2nd largest PBM)1 added neffy to its commercial national formularies as of late November 2024 (Tier 2 Preferred) – 9 weeks after launch Other key PBMs and insurers: encouraging discussions with additional formulary additions expected in Q1 2025 Payers recognize the value of neffy

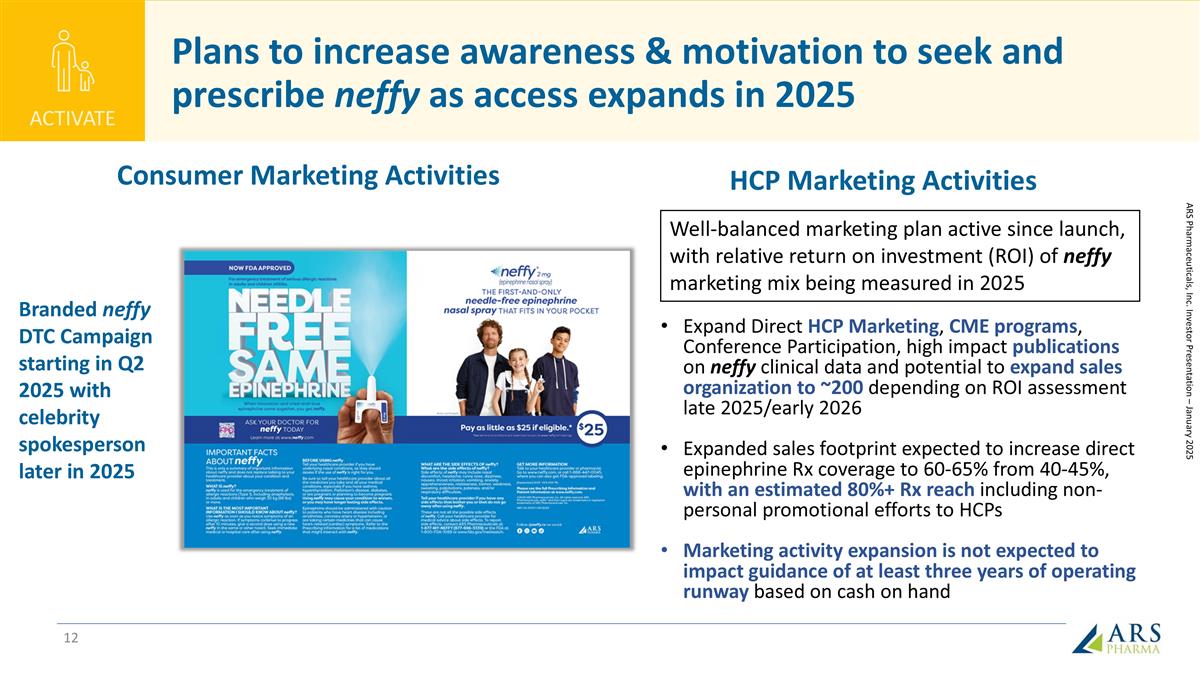

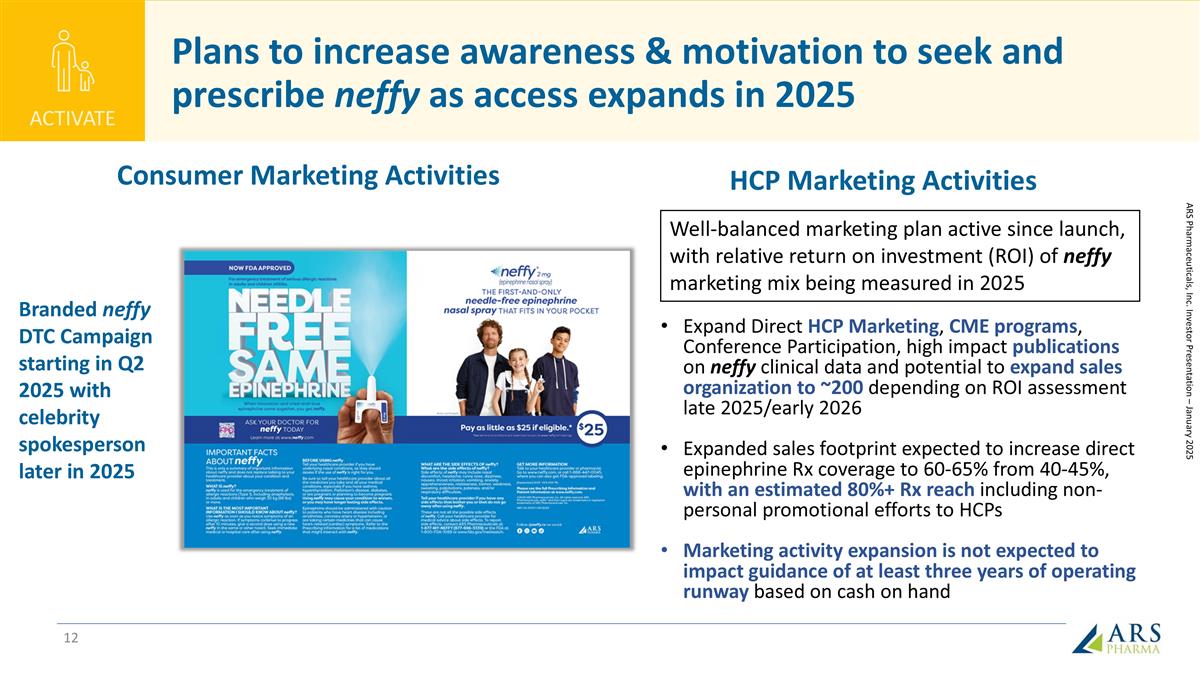

Plans to increase awareness & motivation to seek and prescribe neffy as access expands in 2025 ACTIVATE Consumer Marketing Activities ARS Pharmaceuticals, Inc. Investor Presentation – January 2025 Branded neffy DTC Campaign starting in Q2 2025 with celebrity spokesperson later in 2025 Expand Direct HCP Marketing, CME programs, Conference Participation, high impact publications on neffy clinical data and potential to expand sales organization to ~200 depending on ROI assessment late 2025/early 2026 Expanded sales footprint expected to increase direct epinephrine Rx coverage to 60-65% from 40-45%, with an estimated 80%+ Rx reach including non-personal promotional efforts to HCPs Marketing activity expansion is not expected to impact guidance of at least three years of operating runway based on cash on hand Well-balanced marketing plan active since launch, with relative return on investment (ROI) of neffy marketing mix being measured in 2025 HCP Marketing Activities

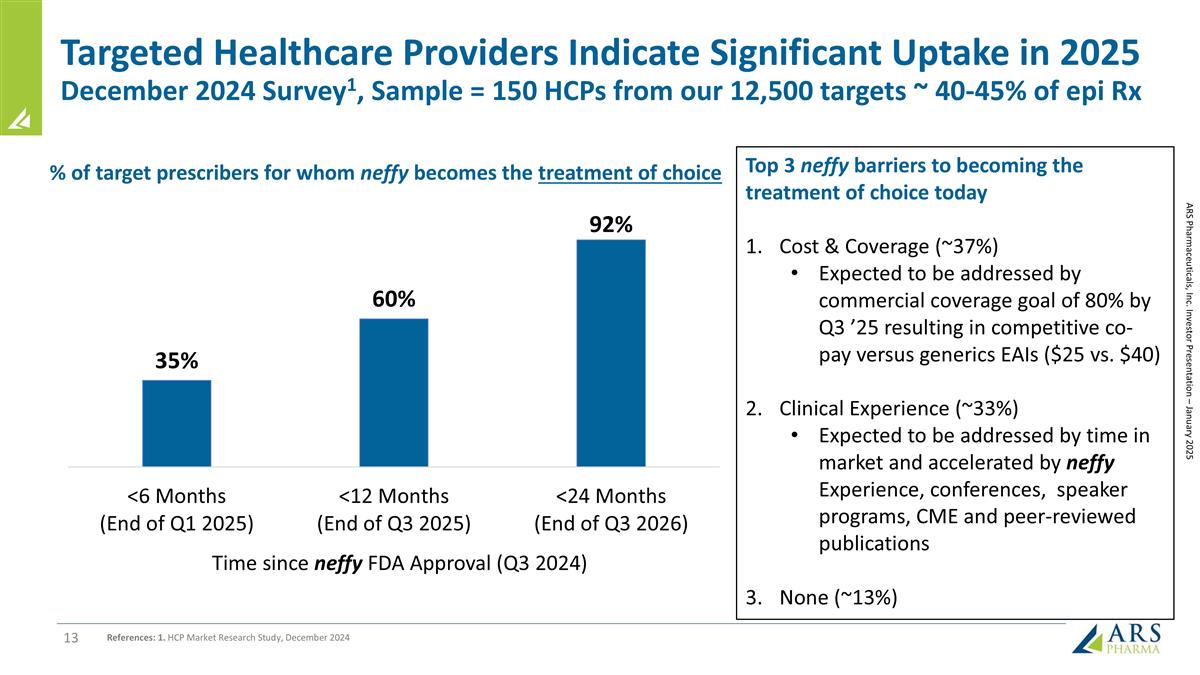

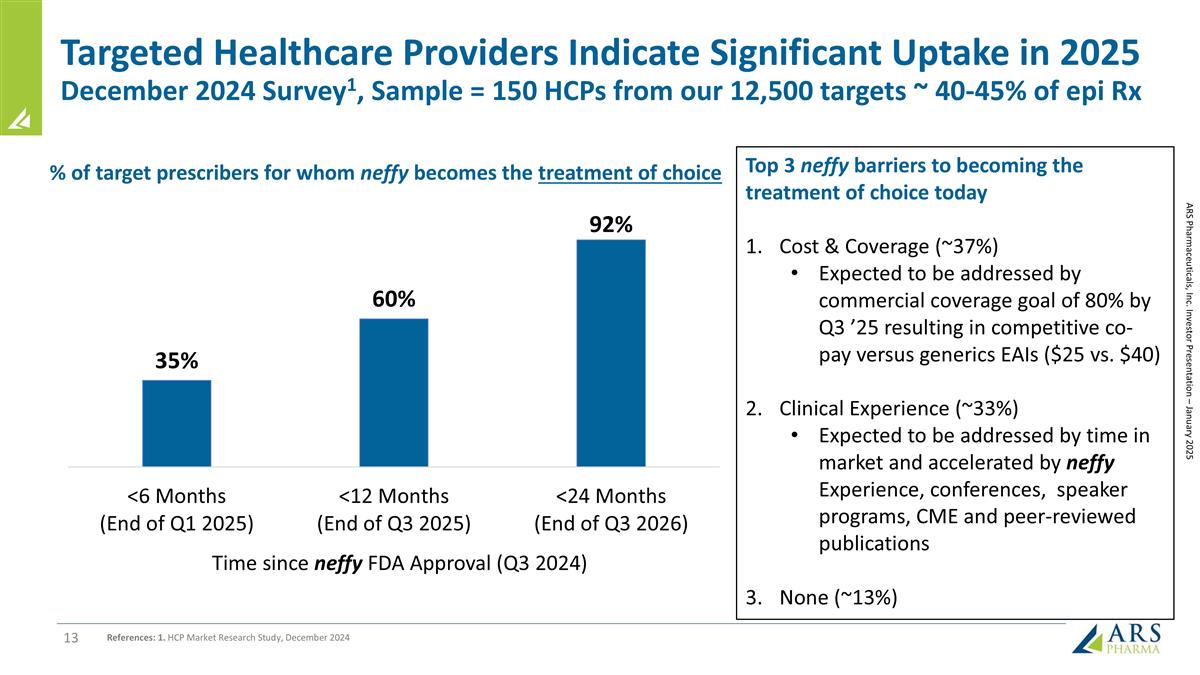

Targeted Healthcare Providers Indicate Significant Uptake in 2025 December 2024 Survey1, Sample = 150 HCPs from our 12,500 targets ~ 40-45% of epi Rx References: 1. HCP Market Research Study, December 2024 ARS Pharmaceuticals, Inc. Investor Presentation – January 2025 % of target prescribers for whom neffy becomes the treatment of choice Time since neffy FDA Approval (Q3 2024) Top 3 neffy barriers to becoming the treatment of choice today Cost & Coverage (~37%) Expected to be addressed by commercial coverage goal of 80% by Q3 ’25 resulting in competitive co-pay versus generics EAIs ($25 vs. $40) Clinical Experience (~33%) Expected to be addressed by time in market and accelerated by neffy Experience, conferences, speaker programs, CME and peer-reviewed publications None (~13%)

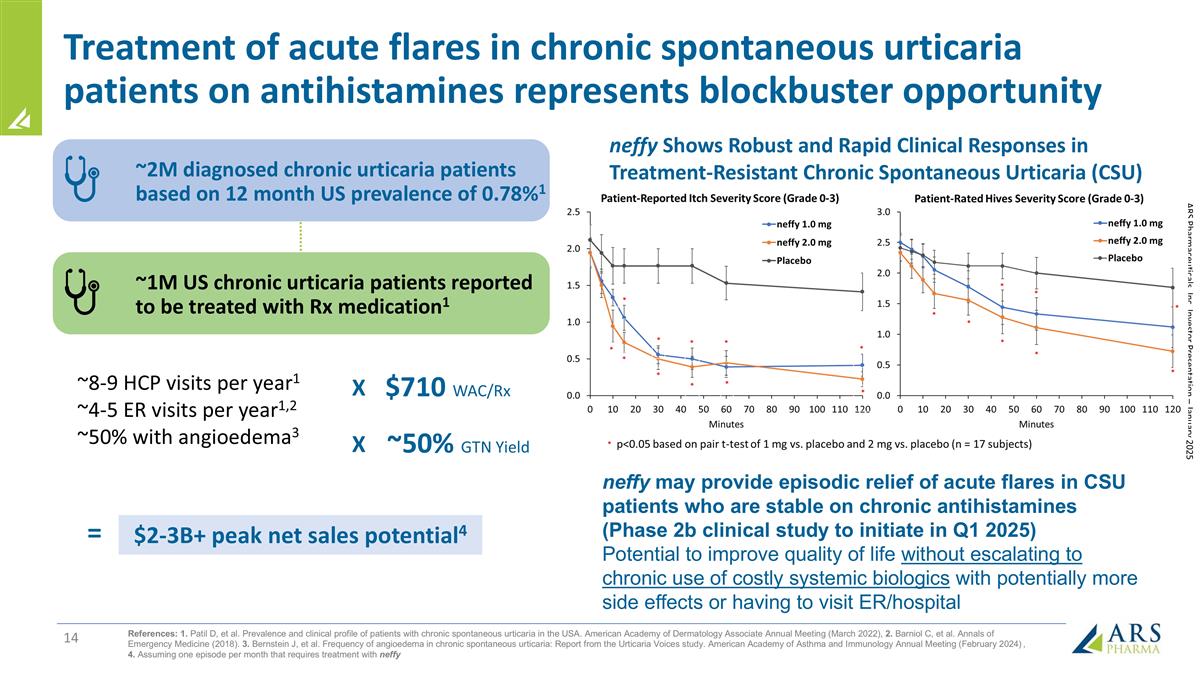

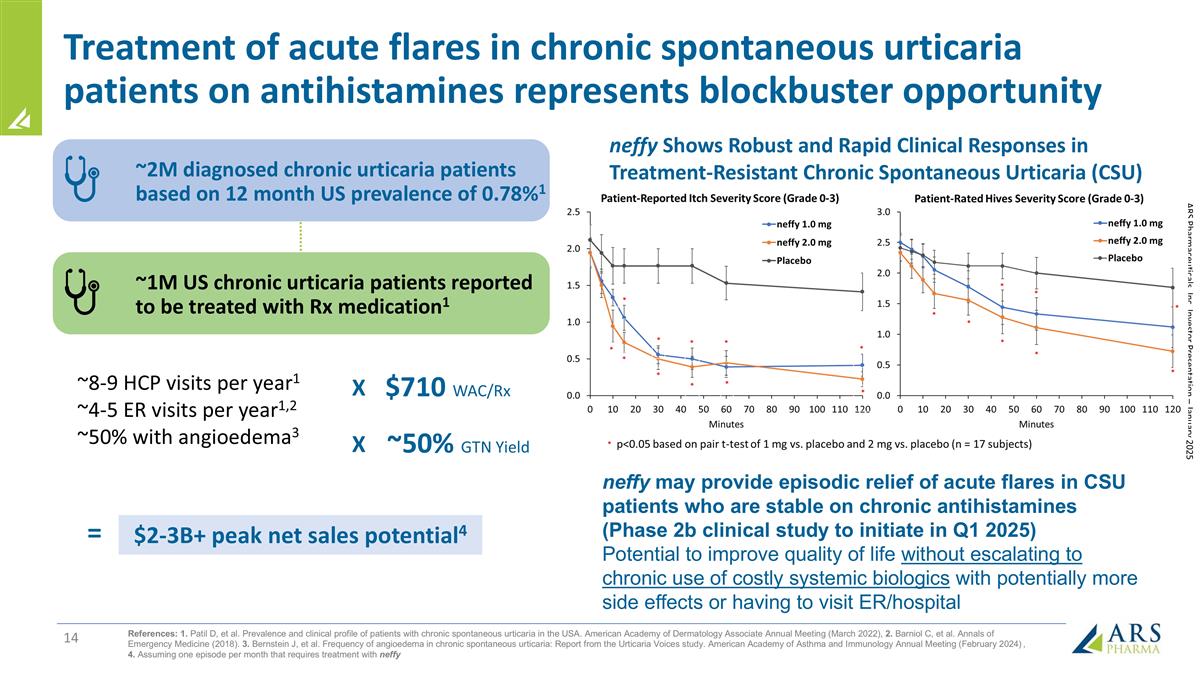

Treatment of acute flares in chronic spontaneous urticaria patients on antihistamines represents blockbuster opportunity ~2M diagnosed chronic urticaria patients based on 12 month US prevalence of 0.78%1 ~1M US chronic urticaria patients reported to be treated with Rx medication1 ~8-9 HCP visits per year1 ~4-5 ER visits per year1,2 ~50% with angioedema3 neffy may provide episodic relief of acute flares in CSU patients who are stable on chronic antihistamines (Phase 2b clinical study to initiate in Q1 2025) Potential to improve quality of life without escalating to chronic use of costly systemic biologics with potentially more side effects or having to visit ER/hospital References: 1. Patil D, et al. Prevalence and clinical profile of patients with chronic spontaneous urticaria in the USA. American Academy of Dermatology Associate Annual Meeting (March 2022), 2. Barniol C, et al. Annals of Emergency Medicine (2018). 3. Bernstein J, et al. Frequency of angioedema in chronic spontaneous urticaria: Report from the Urticaria Voices study. American Academy of Asthma and Immunology Annual Meeting (February 2024) , 4. Assuming one episode per month that requires treatment with neffy $710 WAC/Rx ~50% GTN Yield $2-3B+ peak net sales potential4 X X = ARS Pharmaceuticals, Inc. Investor Presentation – January 2025 neffy Shows Robust and Rapid Clinical Responses in Treatment-Resistant Chronic Spontaneous Urticaria (CSU)

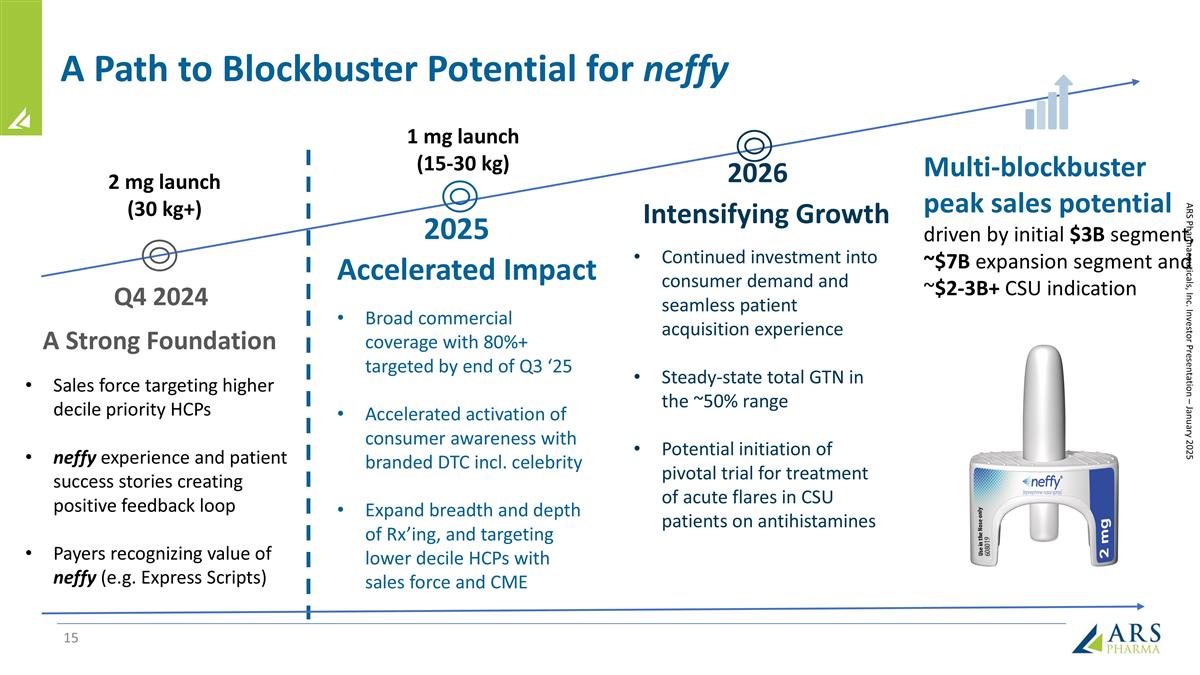

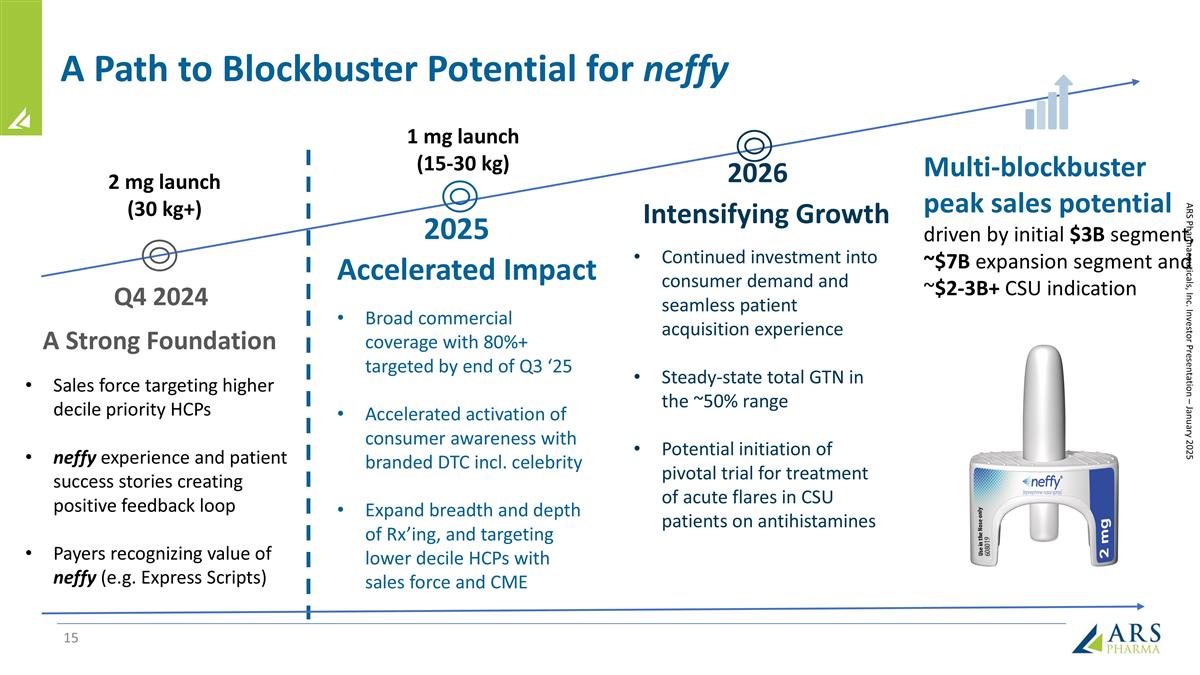

A Path to Blockbuster Potential for neffy Q4 2024 2025 2026 Multi-blockbuster peak sales potential driven by initial $3B segment, ~$7B expansion segment and ~$2-3B+ CSU indication Broad commercial coverage with 80%+ targeted by end of Q3 ‘25 Accelerated activation of consumer awareness with branded DTC incl. celebrity Expand breadth and depth of Rx’ing, and targeting lower decile HCPs with sales force and CME Continued investment into consumer demand and seamless patient acquisition experience Steady-state total GTN in the ~50% range Potential initiation of pivotal trial for treatment of acute flares in CSU patients on antihistamines Sales force targeting higher decile priority HCPs neffy experience and patient success stories creating positive feedback loop Payers recognizing value of neffy (e.g. Express Scripts) A Strong Foundation Accelerated Impact Intensifying Growth ARS Pharmaceuticals, Inc. Investor Presentation – January 2025 2 mg launch (30 kg+) 1 mg launch (15-30 kg)