| Thomas G. Voekler Direct Dial: 804.823.4001 Direct Fax: 804.823.4099 tvoekler@kv-legal.com |

May 1, 2018

VIA EDGAR AND FEDEX OVERNIGHT

Mr. John Reynolds, Assistant Director,

Office of Beverages, Apparel, and Mining

Division of Corporation Finance

United States Securities and Exchange Commission

Mail Stop 3561

100 F Street, N.E.

Washington, D.C. 20549

| Re: | Smart Rx Systems, Inc. |

Draft Offering Statement on Form 1-A

Submitted January 12, 2018

CIK No. 0001672227

Dear Mr. Reynolds:

This letter is submitted on behalf of Smart Rx Systems, Inc., a Florida corporation (the “Company”), in response to comments received from the staff of the Division of Corporation Finance (the “Staff”) of the U.S. Securities and Exchange Commission (the “Commission”) in a letter (the “Comment Letter”) dated February 7, 2018 and oral comments received on February 8, 2018 with respect to the Issuer’s Draft Offering Statement on Form 1-A (CIK No. 0001672227) filed with the Commission on January 12, 2018 (the “Draft Offering Statement. The Company intend to follow this letter with the filing of the First Amendment to the Draft Offering Statement (the “DOS/A”) containing changes made in response to the Staff’s comments and for the purpose of updating and revising certain information in the Draft Offering Statement as soon as possible and available. All the available exhibits to the DOS/A will be filed concurrently with the DOS/A in proper format. Certain capitalized terms set forth in this letter are used as defined in the Offering Statement.

For ease of reference, each Staff comment is printed below in bold, and is followed by the corresponding response of the Issuer.

For the Staff’s ease of review, we have also provided two clean copies of the DOS filed with the Commission on January 12, 2018. All page references within the Issuer’s responses are to pages of the clean copy of the DOS.

| 1. | We note the statement on page 39 that you may “re-sell the exchanged Preferred Shares as secondary shares offered as part of the REG A.” Please advise us of your proposed timing and the mechanics of such exchanges and secondary offers. |

Company’s Response: This disclosure was left over in error from a previous draft, and the Company apologizes for the inconvenience to the Staff. There are no resales planned during the Offering. Language in the Offering Circular has been modified accordingly.

1401 E. Cary St. | Richmond, VA 23219 | Phone: 804-823-4000

Mailing Address | P.O. Box 2470 | Richmond, VA 23218-2470

www.kv-legal.com

Mr. John Reynolds

U.S. Securities and Exchange Commission

May 1, 2018

Page 2 of 16

| 2. | We note you are conducting a $1 million minimum offering. Please disclose the specified date by which the offering will terminate if you do not reach the minimum. Please refer to Rule 10b-9 of the Exchange Act. |

Company’s Response: The Company has determined that such a minimum has deminimis value as there is sufficient interest in the Company, and therefore no minimum will be implemented. The Company is conducting a $50 million Offering, which will last the maximum time, if necessary and applicable, under REG A rules, which is up to 12 months from the date of initiation of Offering after Qualification. Language in the Offering Circular has been modified accordingly.

| 3. | We note that your REG A Preferred Stock and REG A Common Stock will be offered in two tranches. Additionally, we note that the second phase will not start until approximately four months after the conclusion of the first phase. Please revise or provide an analysis of how you determined the second phase to be consistent with the continuous offering requirements of Rule 251(d)(3). |

Company’s Response: After the Company receives Qualification of this Offering, it may be still selling Shares of the Offering by June 30, 2018, the cut-off time when our first semi-annual filing under REG A rules is required to be filed and disclosed. The Company would be filing, by that date in August 2018, an amendment including the required Form, and disclosures related to it, as well as updated disclosures on the Company’s progress through the date of such filing. These disclosures could be considered material disclosures, aside from the required Form related unaudited financial statements for the first half fiscal year, such as new installations, acquired pharmacies, licenses that became effective, and material new contracts for multiple locations, which the Company believes could occur during the first half fiscal year, and such materiality could require requalification.

The Company also believes that it may receive some comments on the amendment that will be filed. Therefore, during the period between July 1, 2018, and the date of qualification of such amendment by the Staff, which could be at least two to four months, the Company would expect that sales would be suspended awaiting requalification and then resume shortly after requalification. The Company would continue marketing efforts through the Broker Dealers and any portals, but not accept sales until either requalification or the receipt of no further comments from the Staff on that amendment and Form.

The Company does not believe that this is inconsistent with the intent of Rule 251(d)(3), to coordinate the unique Qualification standards and their timing under REG A Rules, with the nature of a continuous offering. The Company also believe that if it simply does not take sales for the remaining portion of the Offering through the Broker Dealers during this period, but are allowed to conduct active marketing, there is no effective inconsistency with the actual continued offering relative to the initiation of the Offering after Qualification, and the termination of the Offering, whether because all $50 million has been placed, the Company terminates the Offering prior to the $50 million is placed at some lesser number, which is indeterminate at this time, or because the Company reaches the maximum 12 month offering deadline.

Mr. John Reynolds

U.S. Securities and Exchange Commission

May 1, 2018

Page 3 of 16

| 4. | We note the statement on page 1 that the Kiosk is in full compliance FDA and other federal and state regulations, “and it performs all functions more efficiently than a traditional retail pharmacy.” Please identify the specific provisions of federal and state regulations for which you have obtained approvals, licenses or other necessary certifications to conduct your kiosk and other operations. Please also disclose the basis for the statement that your Kiosk is more efficient than traditional retail pharmacies. |

Company’s Response: The Company must be licensed as a pharmacy in each location of our Kiosk, and in each of our locations, currently Florida and Texas, we are licensed as a pharmacy. We have provided federal, Florida and Texas references and documentations about the specific codes, laws, procedures, etc., regarding obtaining pharmacy licenses, permits, or ID numbers. If we receive licenses in other states prior to the Qualification of this Offering, we shall provide an update.

In the future, we plan to have pharmacies that are licensed as remote pharmacies, although we cannot guarantee we will be able to do that and we do not have any as of the date of this response letter.

ScriptPro has U.S. Food and Drug Administration (the “FDA”) approval for its use, as a manufacturer of the robotic devices known as kiosks. The Company is not separately required to obtain FDA approval for the use of ScriptPro kiosks, as modified by the Company’s proprietary technology, which features the Company believes are described sufficiently in its revised disclosure. Two of the main reasons for such treatment by the FDA are the nature of pharmacy regulations related to the filling of individual prescriptions, and the licensing process by the Drug Enforcement Administration (the “DEA”), which is a part of the FDA enforcement of its rules. Licensed Pharmacies, not any devices, are responsible for such features as accuracy, counting, non-contamination or interaction with other medications, labeling, etc. Our Smart PharmAssist™ Kiosks are used by licensed pharmacies, whether they are owned and operated by the Company, or leased and contracted for the Company’s services. As a result, when they are used by the Company or third-party pharmacies, the pharmacy, and not its Kiosk, is responsible.

The DEA, National Council for Prescription Drug Programs (“NCPDP”) and National Provider Identifier (“NPI”), as well as state pharmacy licenses we obtained to operate each pharmacy, and in the future, any remote pharmacy, as applicable, are obtained from U.S. agencies and the pharmacy board in each state: the DEA license from the FDA, the NCPDP and NPI numbers from Centers for Medicare and Medicaid Services, Florida pharmacy license from Florida Board of Pharmacy, and Texas pharmacy license from Texas State Board of Pharmacy.

The approvals, licenses and other necessary certifications we have obtained and related specific provisions are listed below:

Federal:

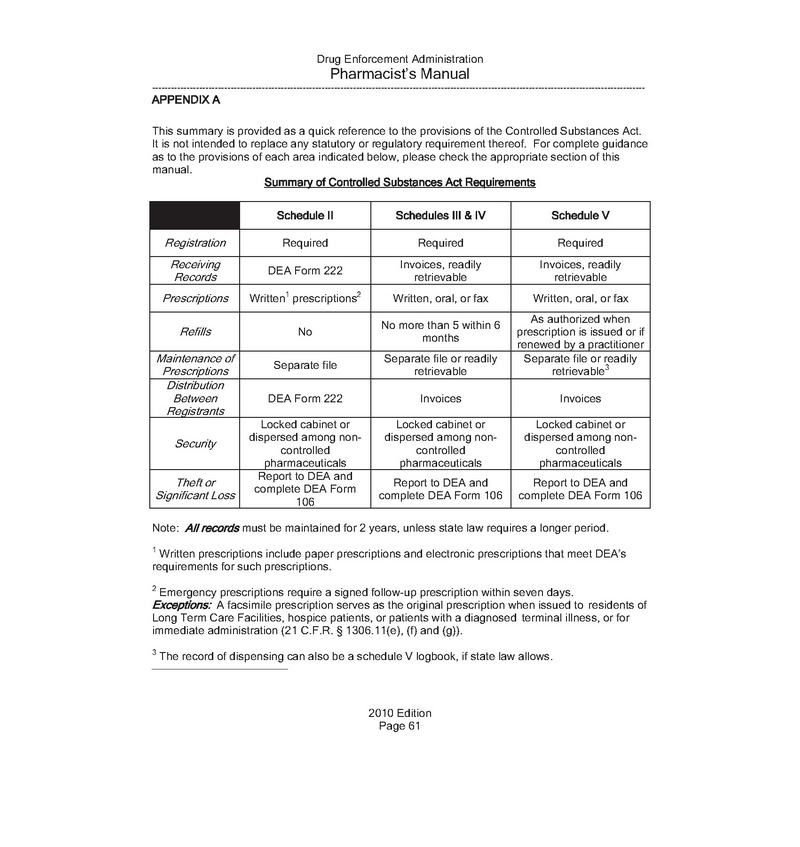

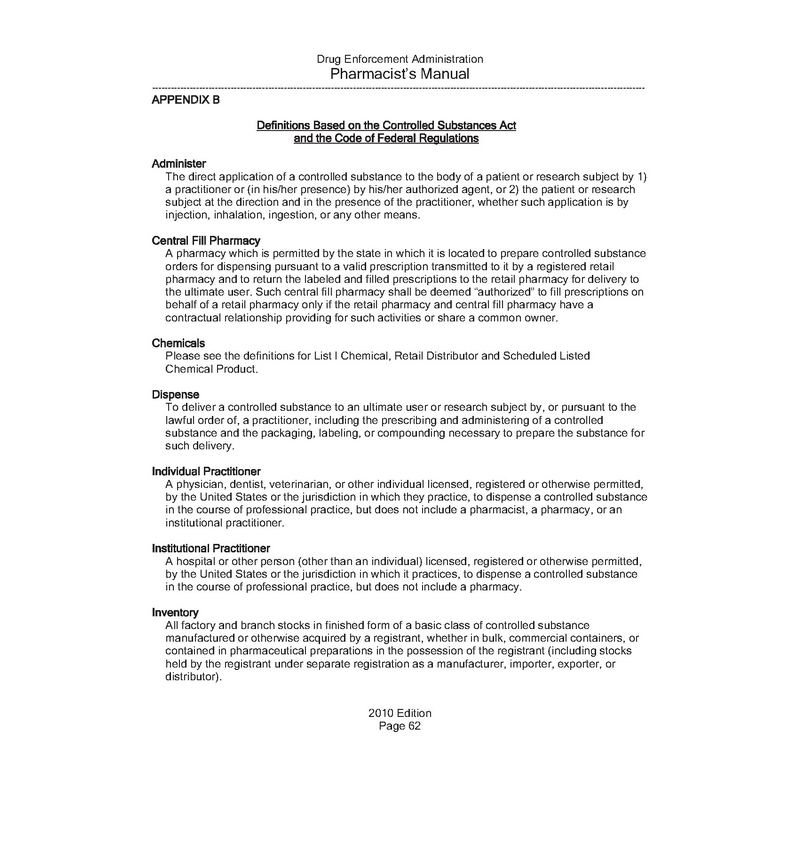

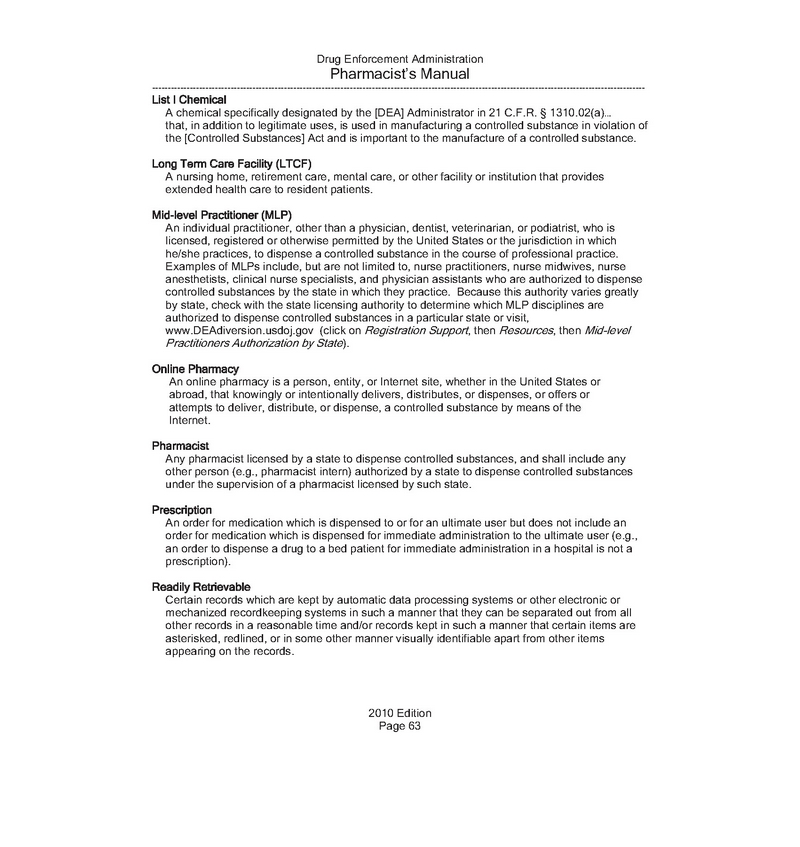

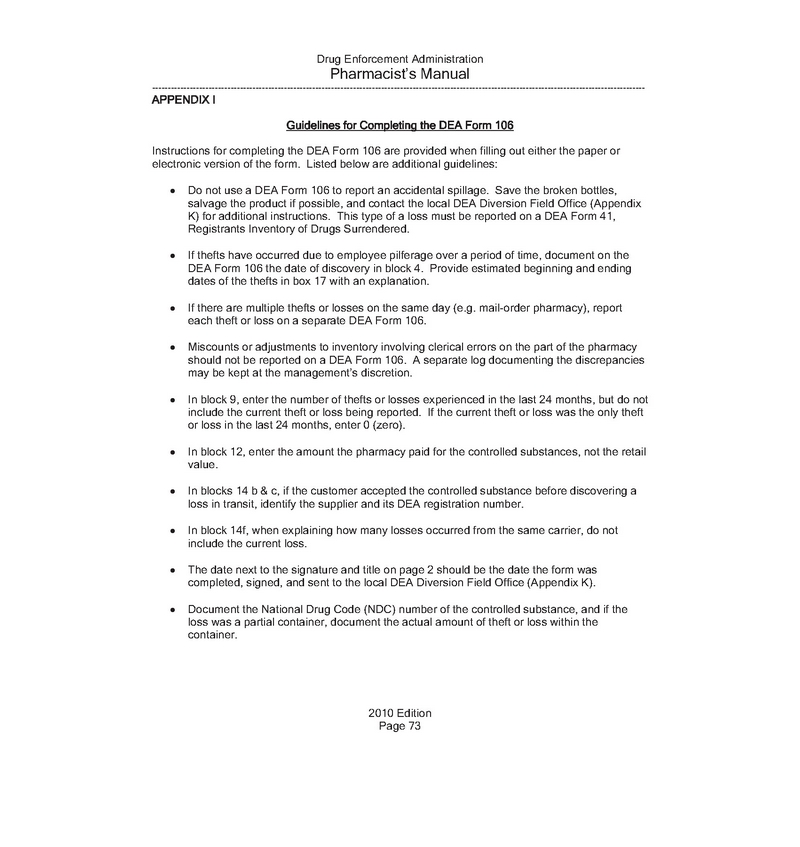

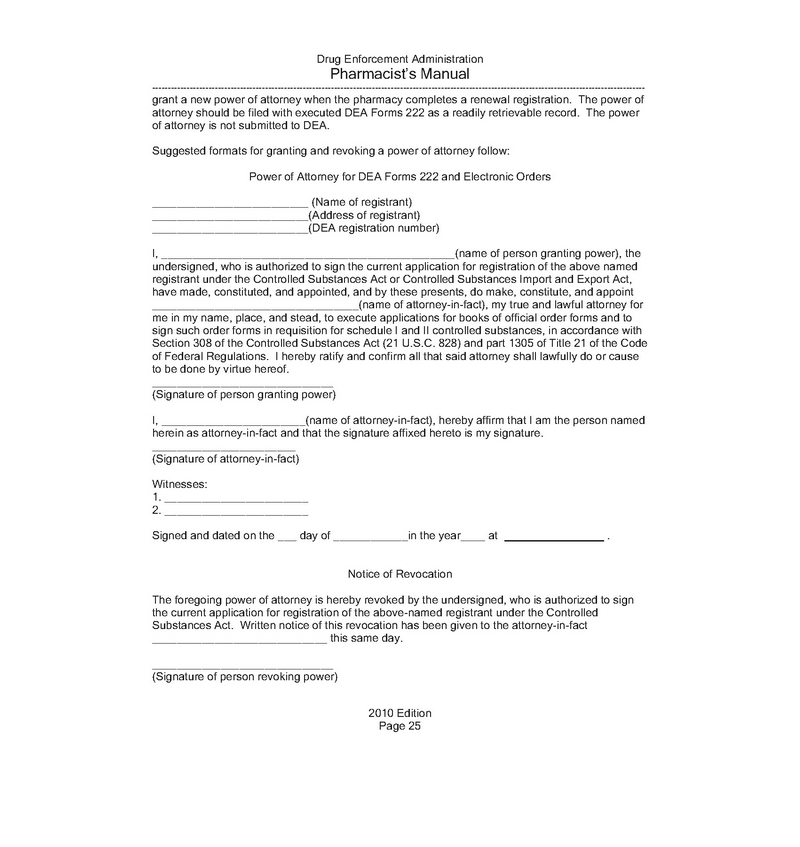

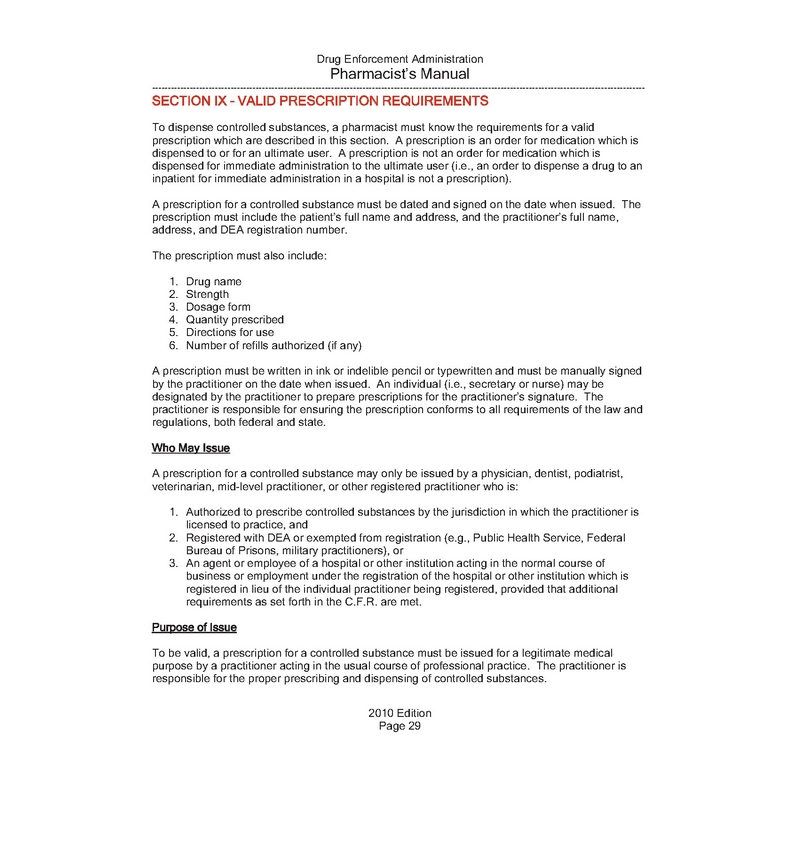

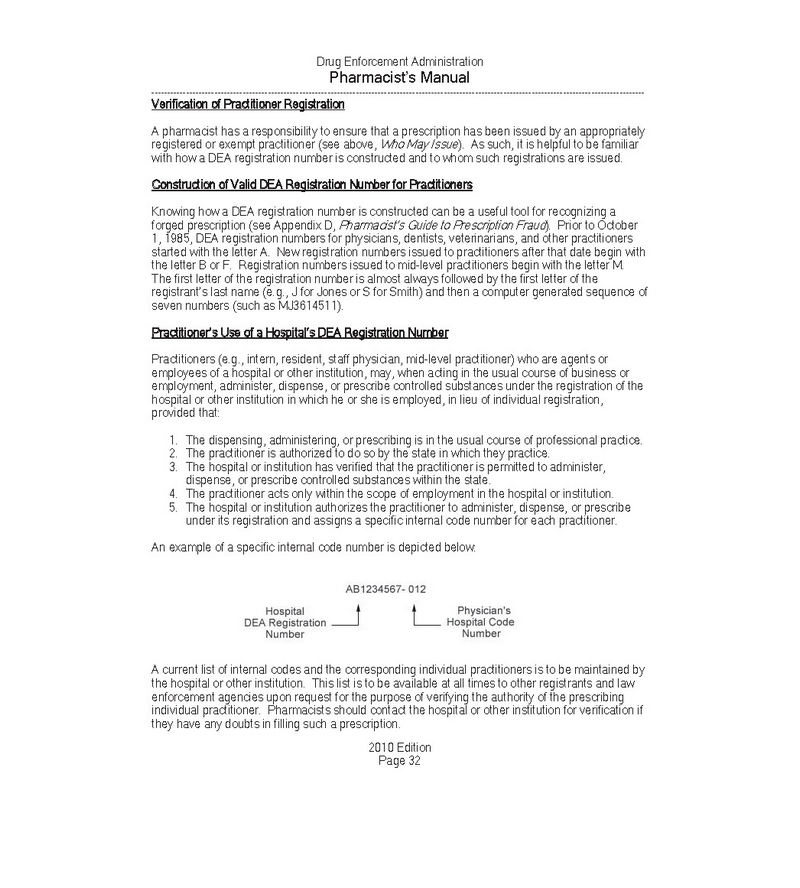

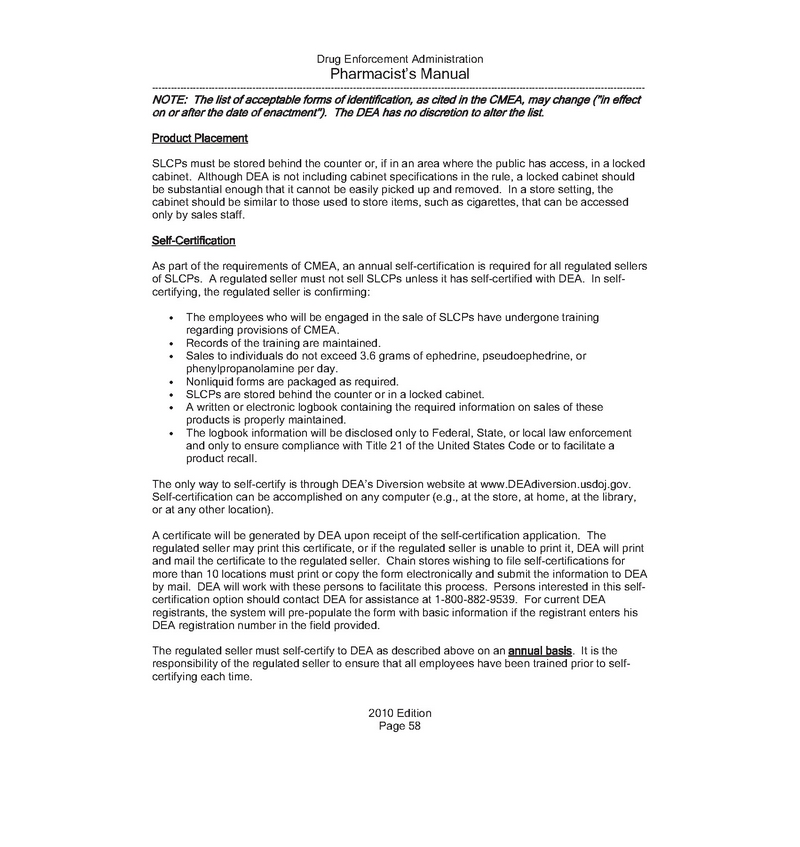

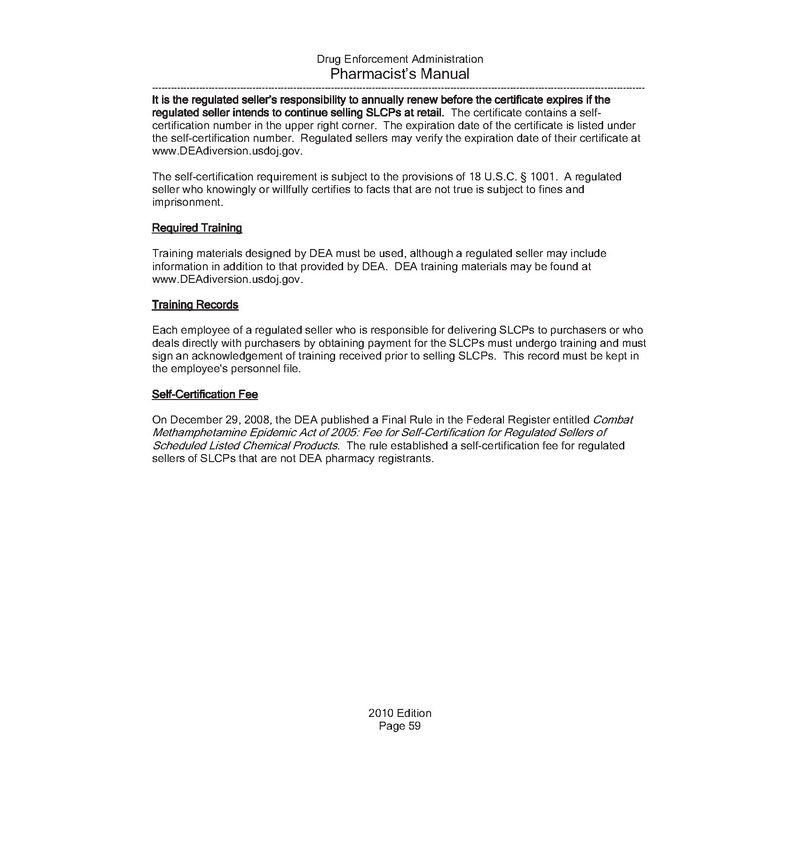

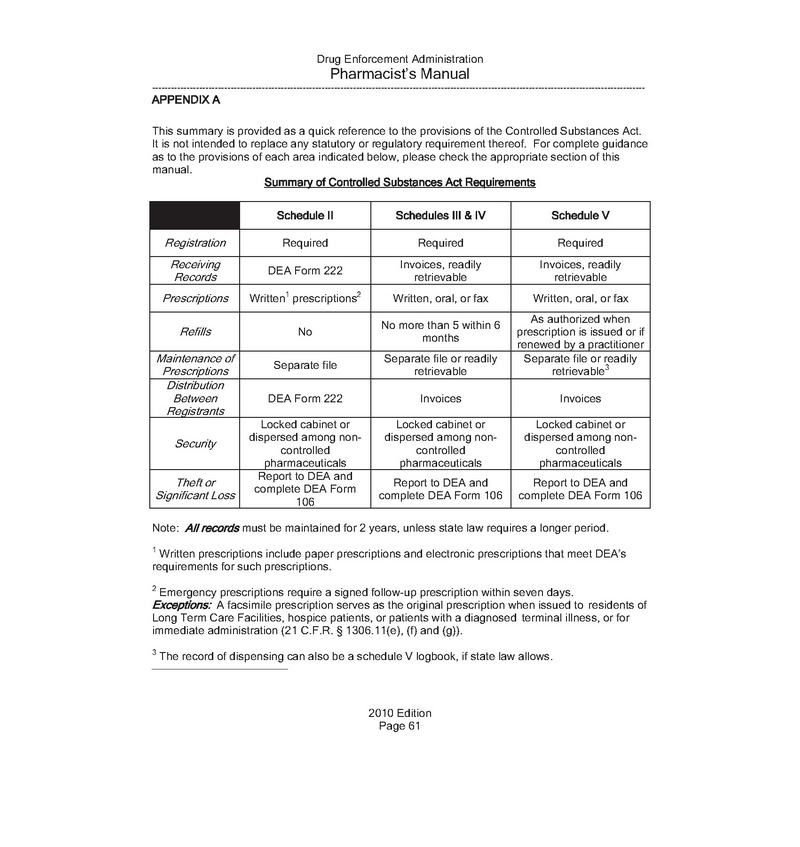

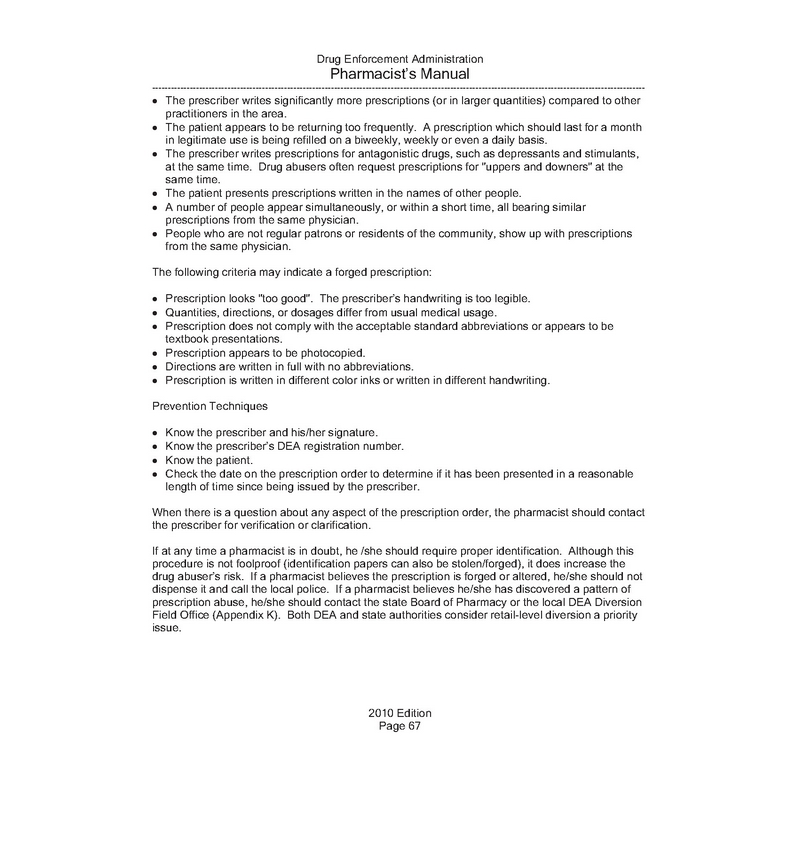

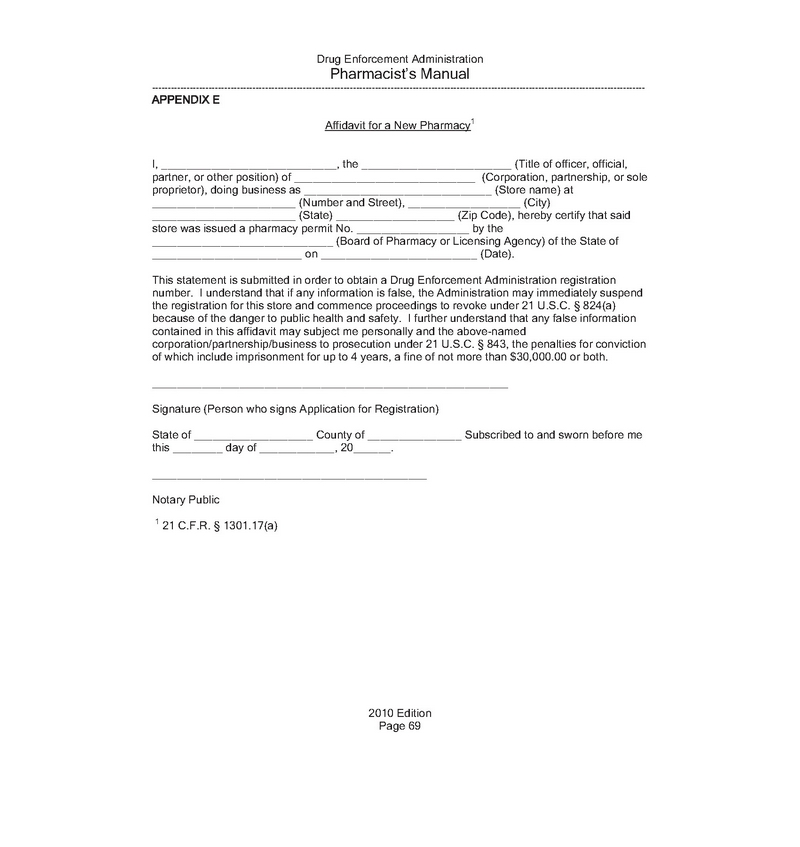

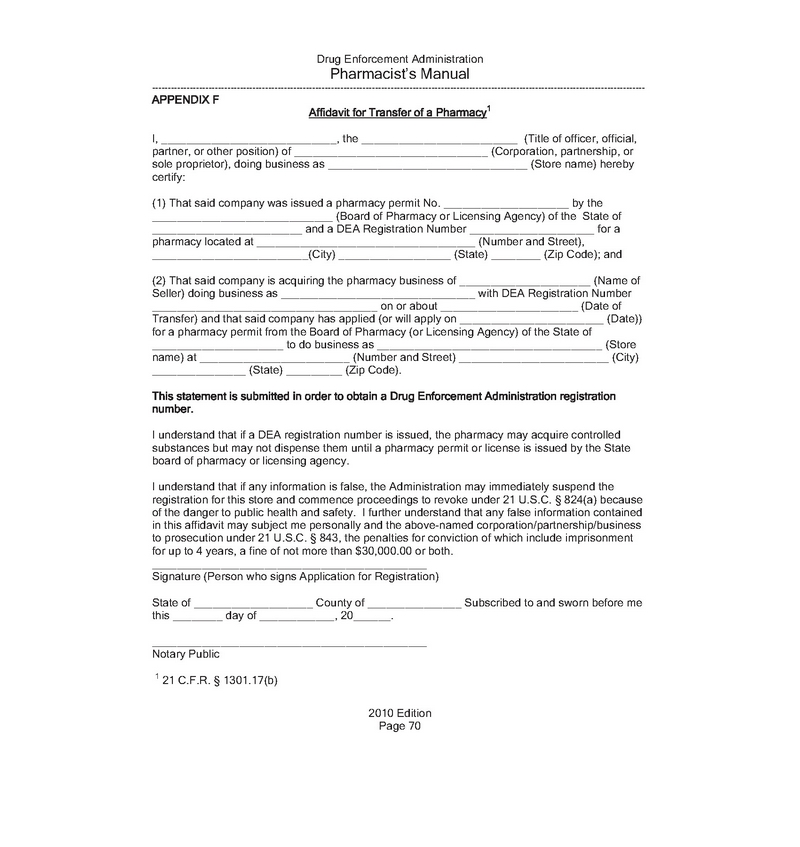

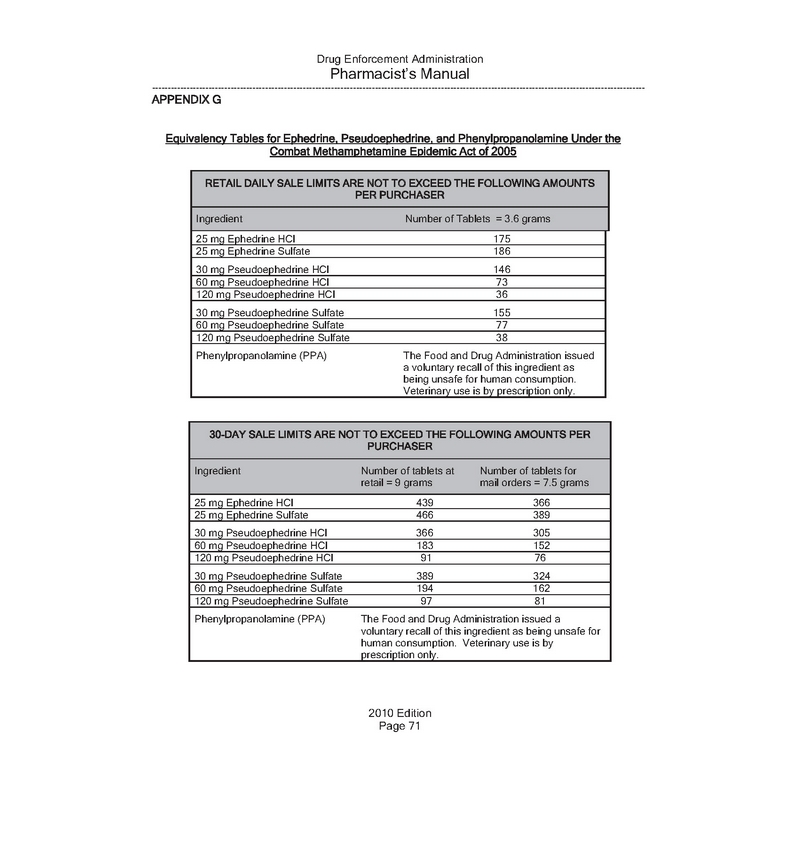

1) DEA:

We have attached the DEA requirements to obtain a pharmacy license, which are Sections I through VIII of the Pharmacy Manual, related to activities over which the DEA has jurisdiction as attachment No.1 to this letter. These are pursuant to the Controlled Substances Act (“CSA”), Title 21 United States Code (“21 U.S.C.”) 801-971 and the DEA regulations, Title 21, Code of Federal Regulations (“21 C.F.R.”), Parts 1300 to End. We have also attached the Pharmacist’s Manual from the Drug Enforcement Administration Office of Diversion Control of U.S. Department of Justice as attachment No.2 to this letter.

Mr. John Reynolds

U.S. Securities and Exchange Commission

May 1, 2018

Page 4 of 16

2) NCPDP:

NCPDP was founded in 1977 as the extension of a Drug Ad Hoc Committee that made recommendations for the US National Drug Code (“NDC”). NCPDP is a not-for-profit, ANSI-accredited, standards development organization with over 1575 members representing most sectors of the pharmacy services industry. The membership provides healthcare business solutions through education and standards. NCPDP has been named in US federal legislation, including Health Insurance Portability and Accountability Act and the Medicare Prescription Drug, Improvement, and Modernization Act. NCPDP members have created standards such as the Telecommunication Standard and Batch Standard, the SCRIPT Standard for Electronic Prescribing, the Manufacturers Rebate Standard and more to improve communication within the pharmacy industry.

NCPDP participants include most segments involved in the pharmacy services sector of healthcare. The membership is in three categories:

| § | Producer/Provider includes all types of retail pharmacies (including chains, independents, online pharmacy), pharmaceutical manufacturers, and long-term care providers. |

| § | Payer/Processor includes Pharmacy Benefit management companies, health insurers, state and federal agencies, and health maintenance organizations. |

| § | Vendor/General Interest includes healthcare consultants, systems vendors, database management organizations, Physician Service Organizations, professional/trade associations, and wholesale drug distributors. |

| § | 62% of NCPDP members fall within the Senior Manager to CEO professional levels. |

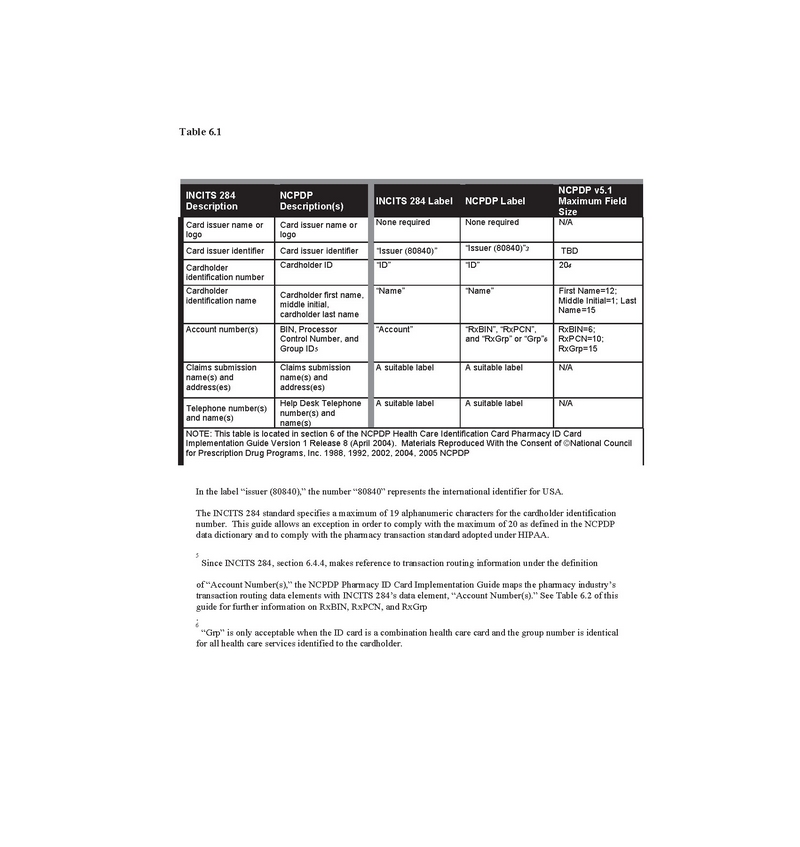

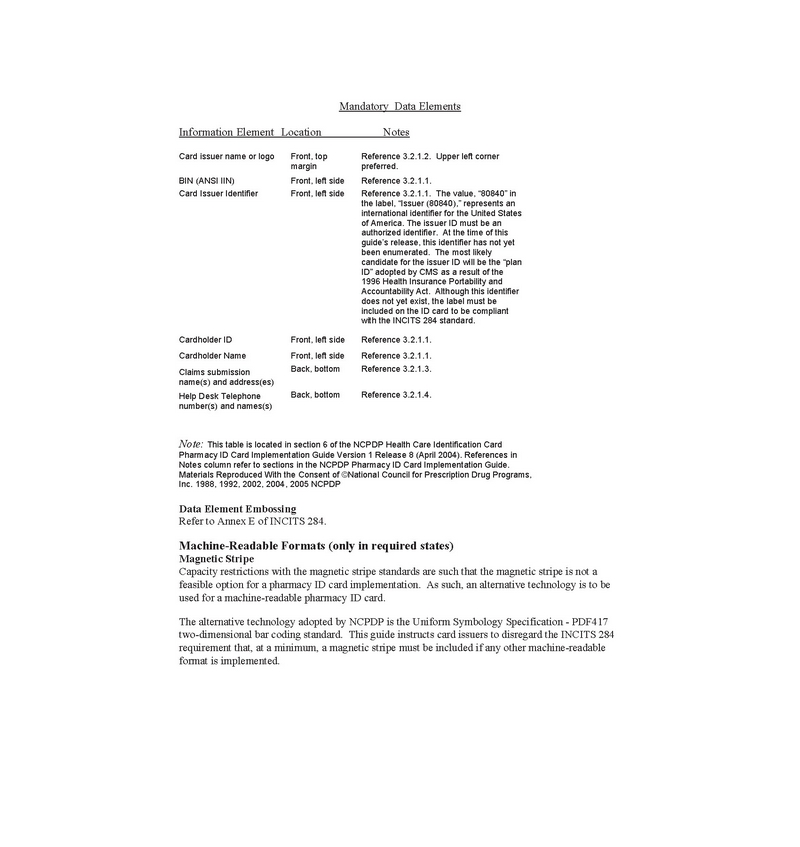

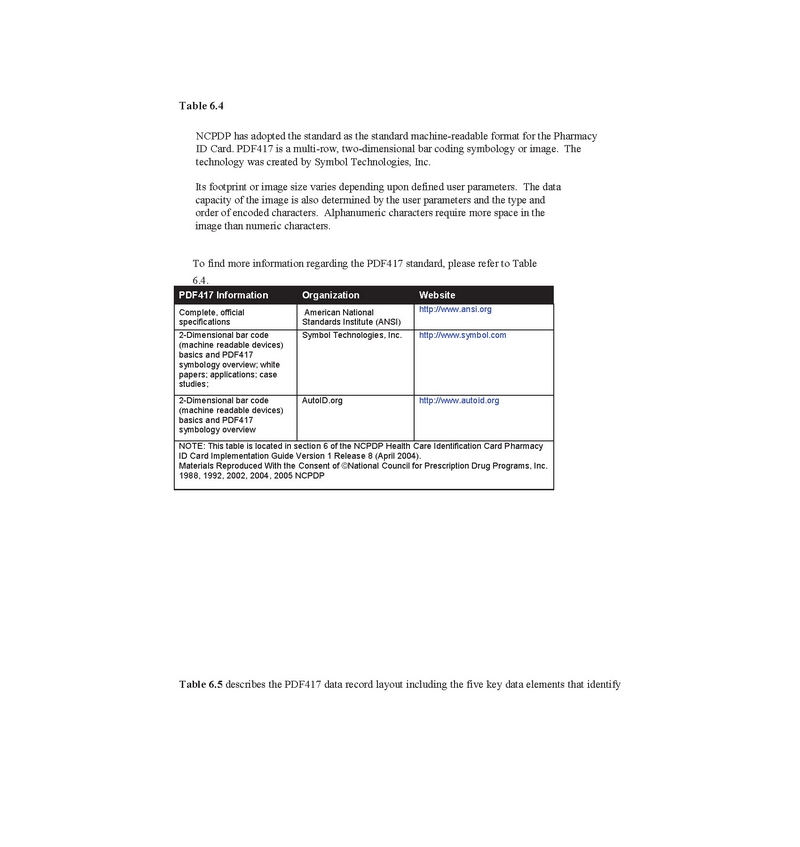

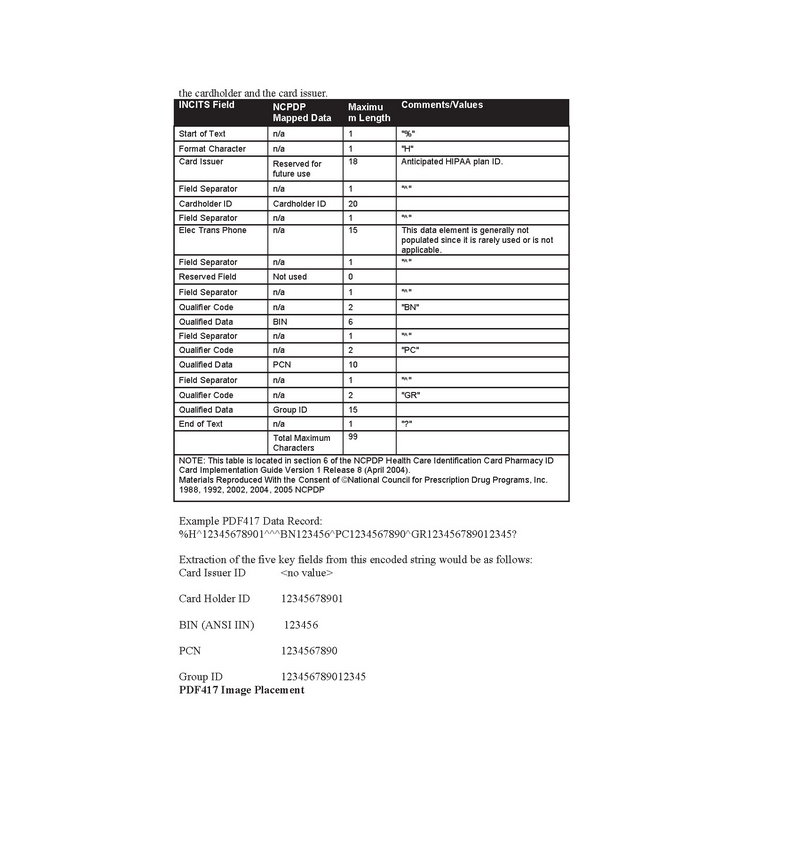

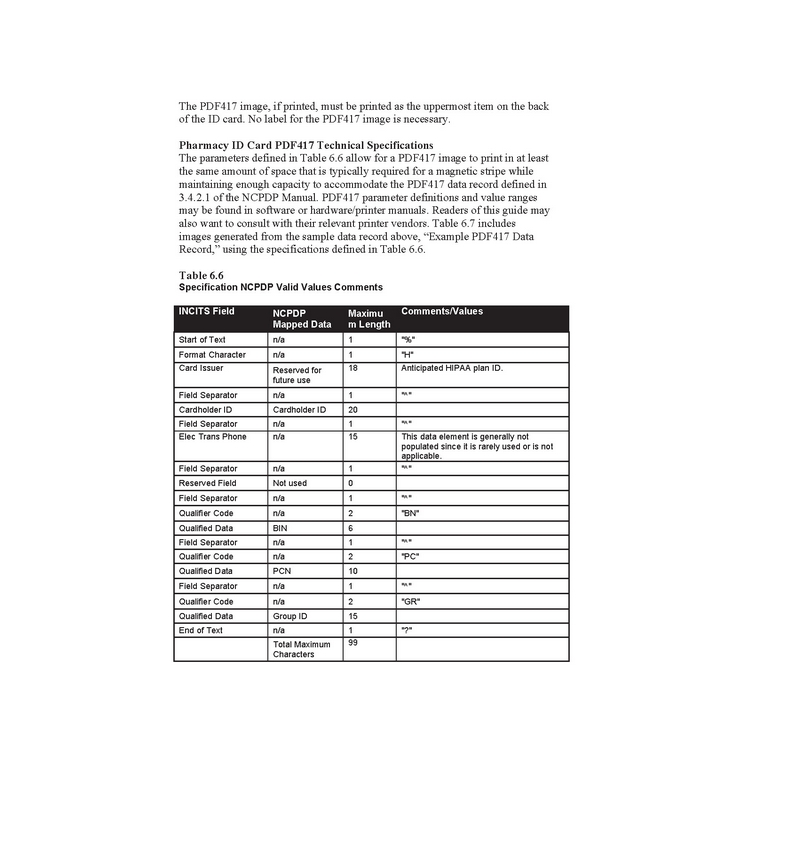

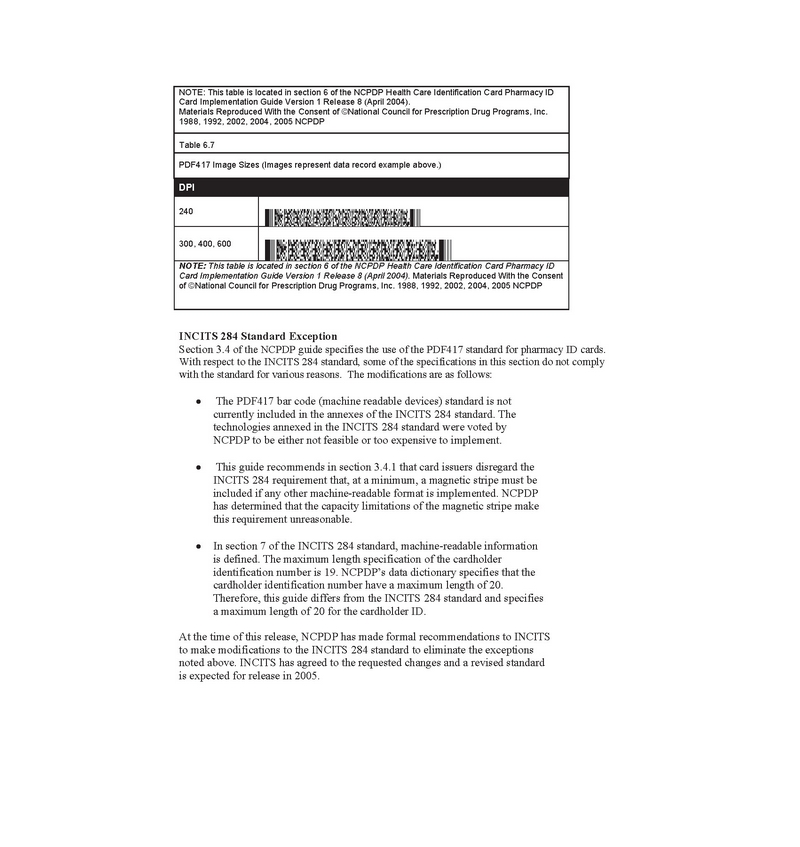

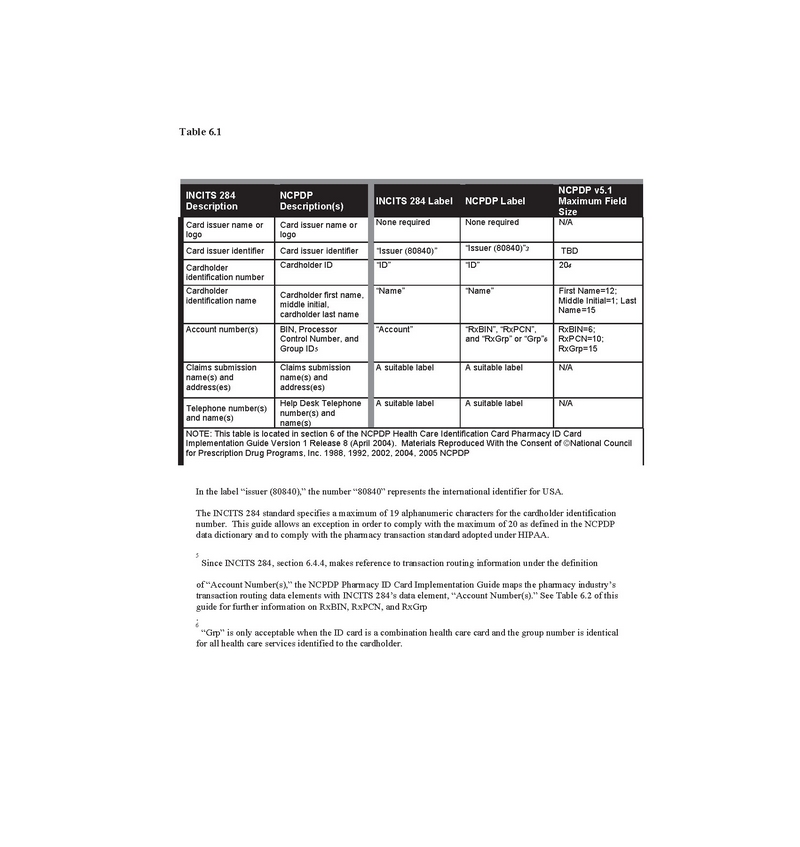

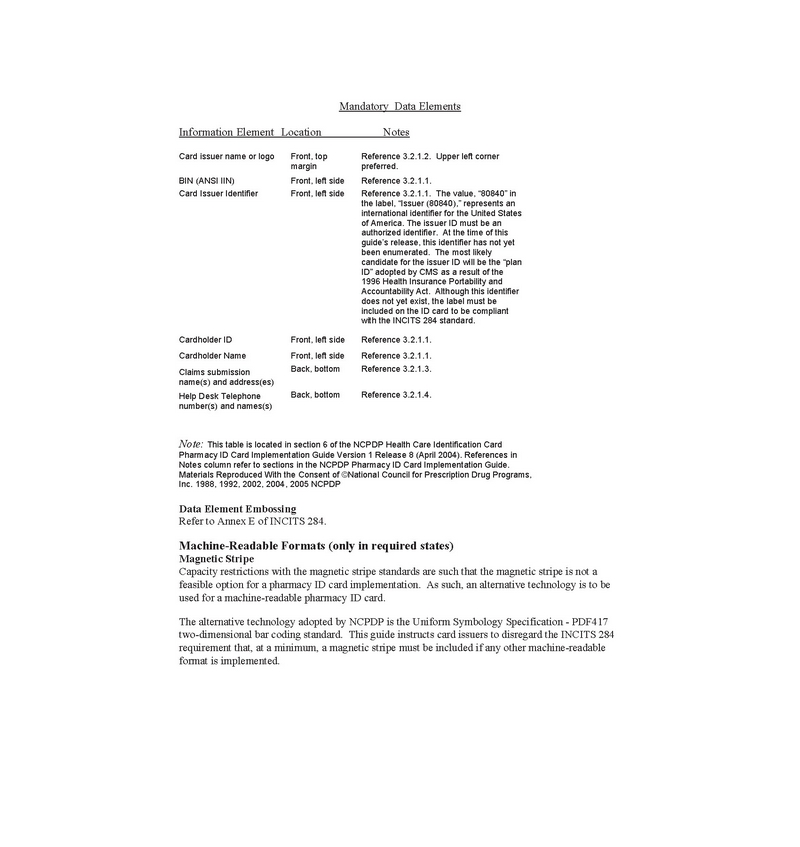

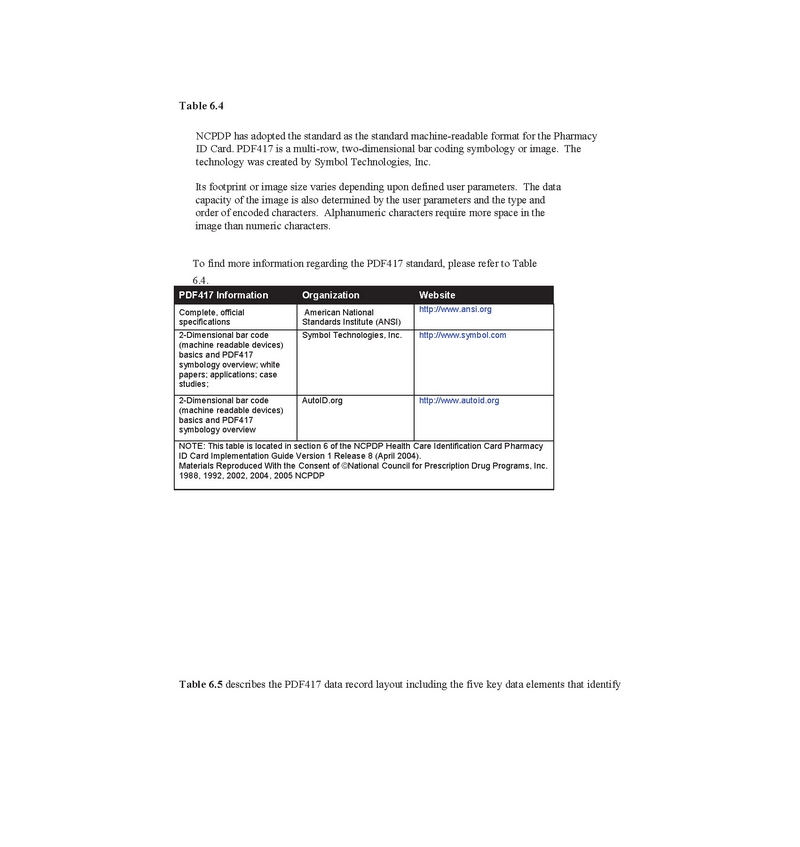

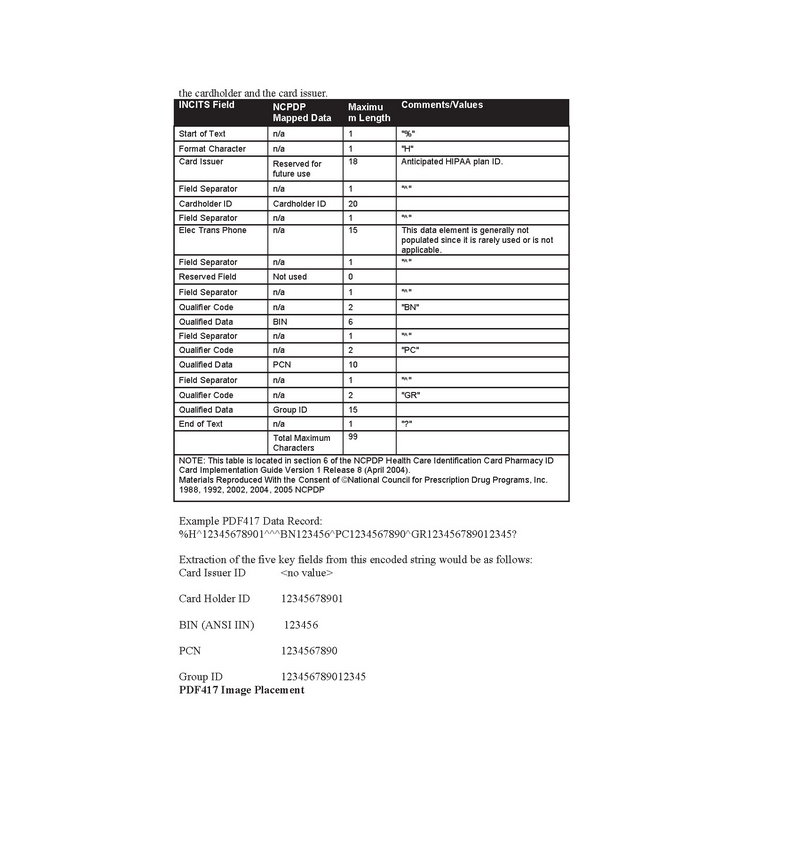

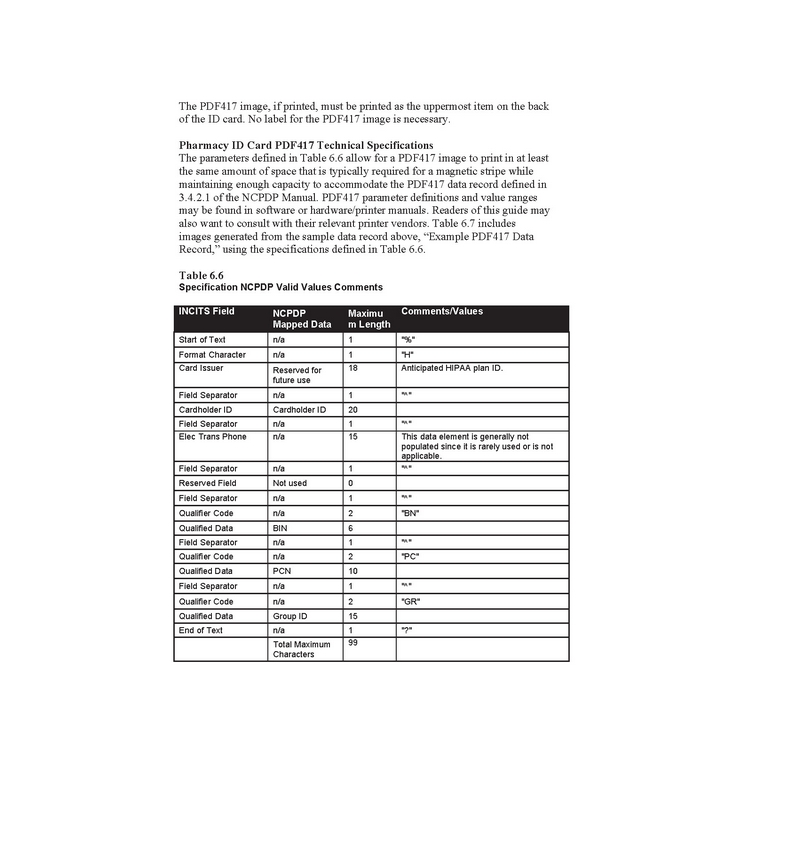

We have attached Appendix 13: NCPDP Pharmacy Identification Specification Information as attachment No.3 to this letter.

3) NPI:

NPI is a unique 10-digit identification number issued to health care providers in the United States by the Centers for Medicare and Medicaid Services (“CMS”). The NPI has replaced the unique physician identification number (“UPIN”) as the required identifier for Medicare services, and is used by other payers, including commercial healthcare insurers. The transition to the NPI was mandated as part of the Administrative Simplifications portion of the Health Insurance Portability and Accountability Act of 1996 (“HIPAA”), and CMS began issuing NPIs in October 2006.

All individual HIPAA covered healthcare providers (physicians, pharmacists, physician assistants, dentists, denturists, chiropractors, clinical social workers, professional counselors, physical therapists, occupational therapists, pharmacy technicians, athletic trainers etc.) or organizations (hospitals, home health care agencies, nursing homes, residential treatment centers, group practices, laboratories, pharmacies, medical equipment companies, etc.) must obtain an NPI for use in all HIPAA standard transactions, even if a billing agency prepares the transaction. Once assigned, a provider's NPI is permanent and remains with the provider regardless of job or location changes.

Mr. John Reynolds

U.S. Securities and Exchange Commission

May 1, 2018

Page 5 of 16

Individuals employed as pharmacists and pharmacy technicians must be HIPPA certified prior to their employment and maintaining such certification according to HIPPA rules.

States:

1) Florida:

Title XXXII Regulation of Professions and Occupations Chapter 465 Pharmacy of The 2017 Florida Statutes covers requirements and procedures related to activities over which Florida has jurisdiction.

2) Texas:

Title 22 Examining Boards Part 15 Texas State Board of Pharmacy Chapter 291 Pharmacies of Texas Administrative Code covers requirements and procedures related to activities over which Texas has jurisdiction, including remote pharmacy related requirements.

Our locations now have DEA licenses, permits or ID numbers assigned by NCPDP and NPI, and state license from each state.

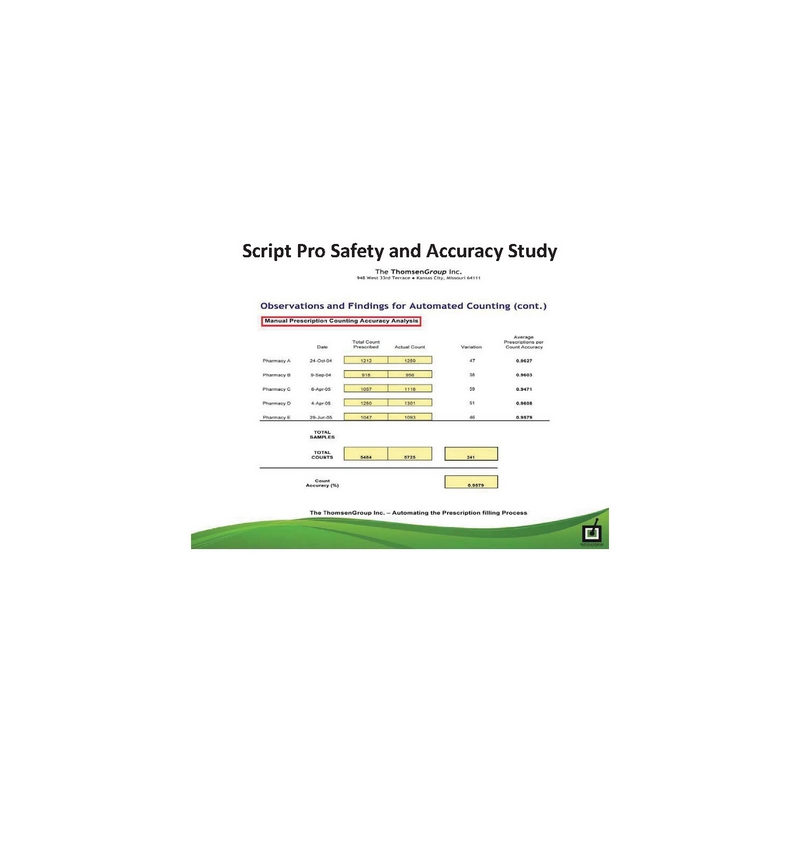

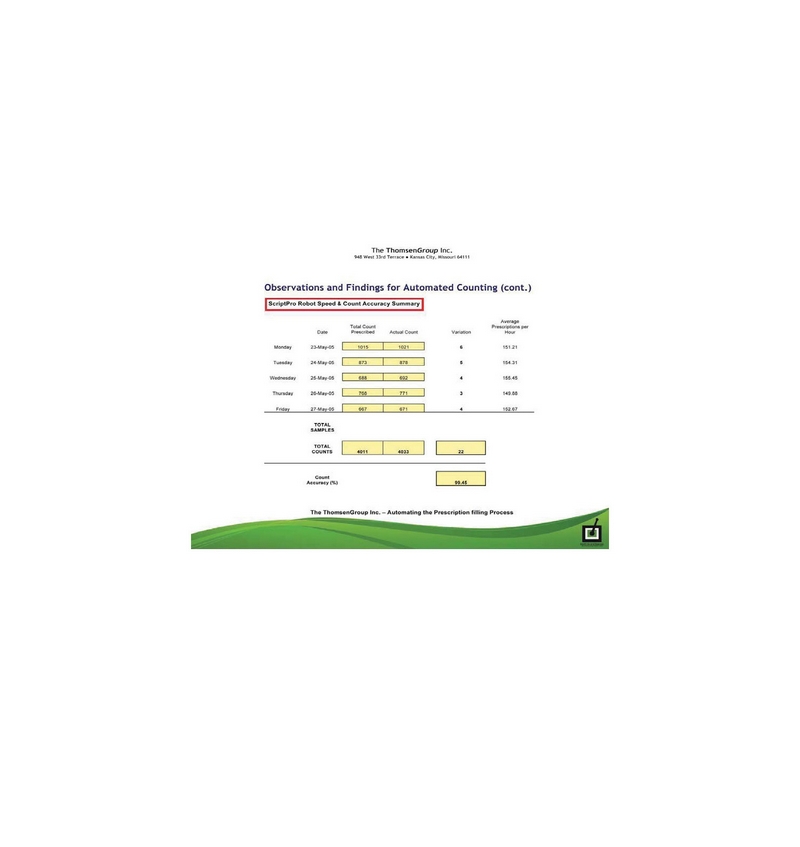

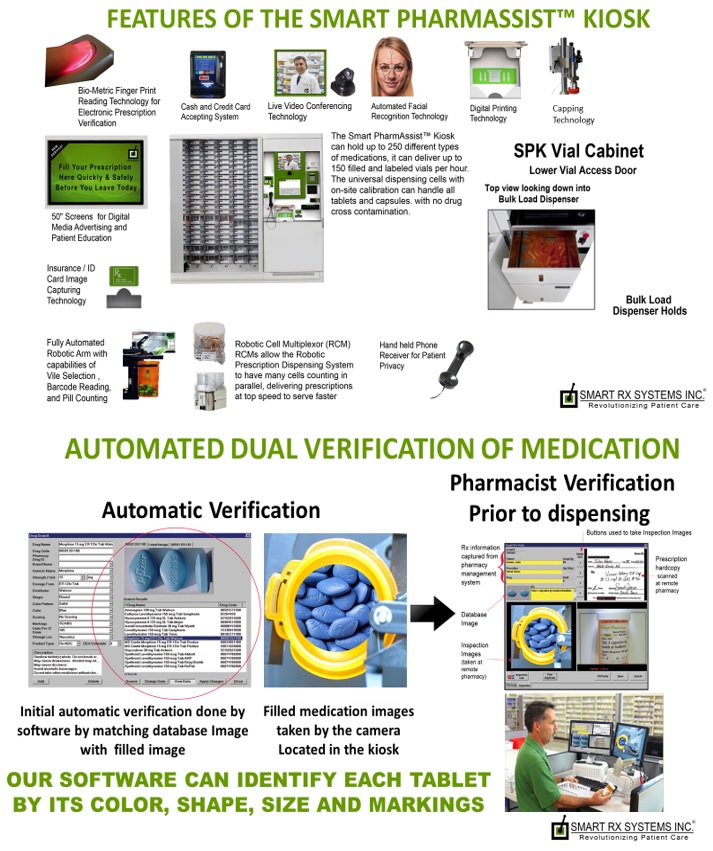

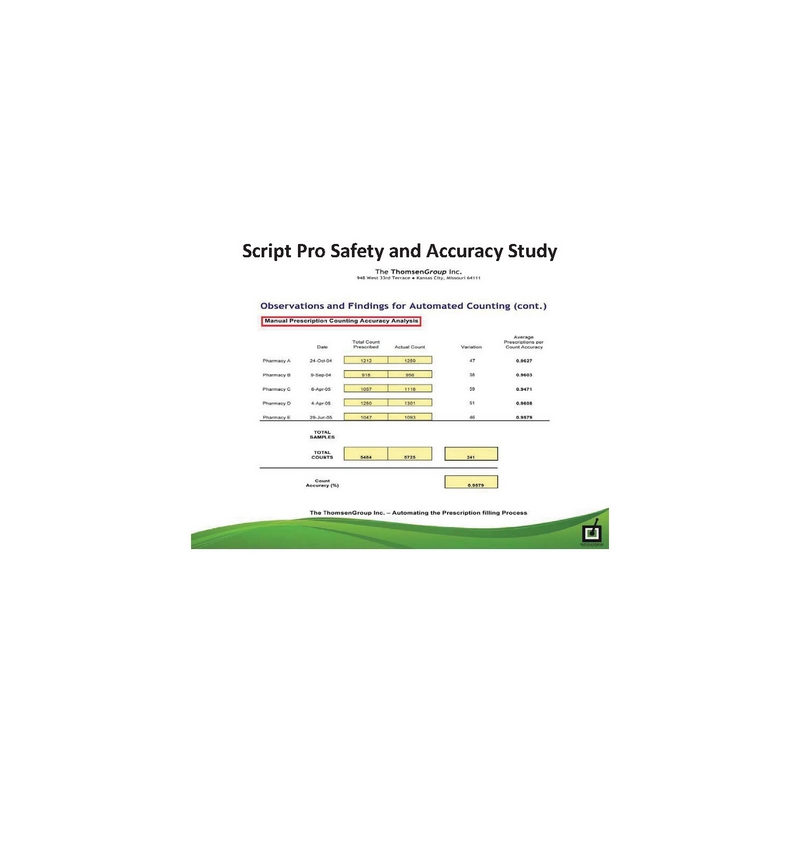

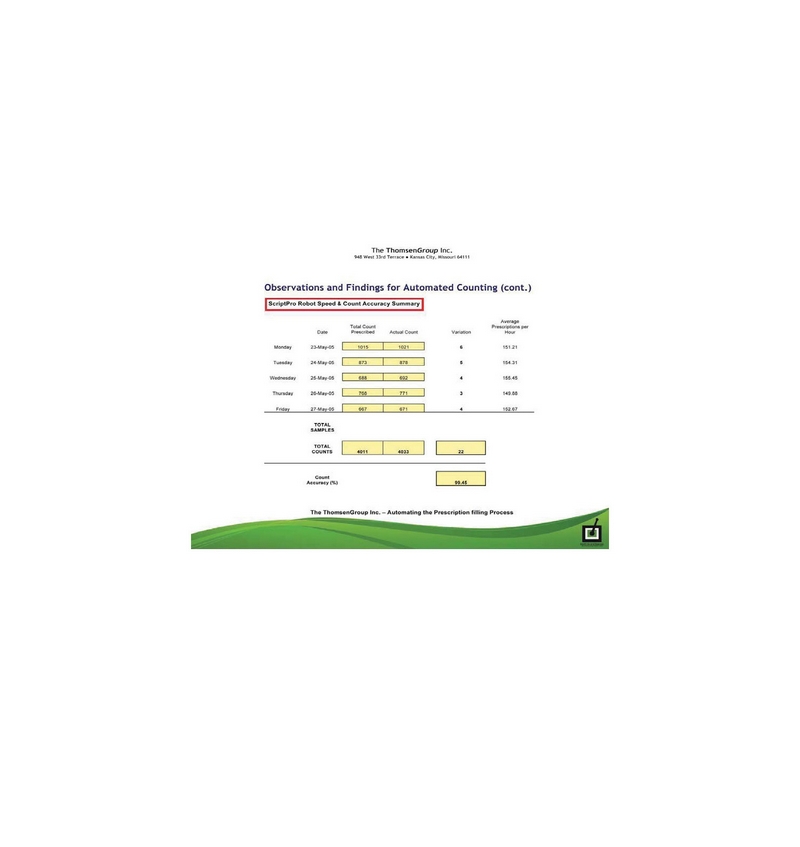

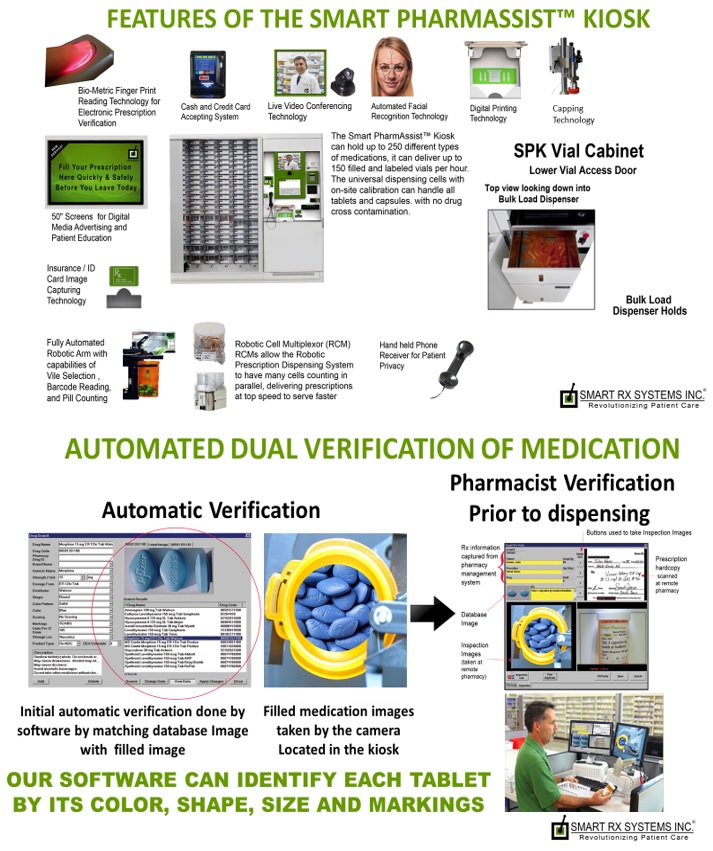

In response to the comment regarding efficiency of Kiosks, the Company has provided ScriptPro Robot Performance Statistics and ScriptPro Safety and Accuracy Study as attachment No. 4 to this letter. Please see the Company’s suggestion disclosures below for its Offering Circular regarding the Kiosks’ efficiency compared with the traditional retail pharmacies, most of which are prima facie aspects of the function of prescription fulfillment steps, patient interaction or active responses to situational behavior of patients in any prescription fulfilment or delivery scenario, either in a traditional pharmacy or at one of our Kiosks, and part of which are simply implicit capability differences between software and robotic aspects or features and human responses and capabilities:

| · | The time to robotically fill a prescription counting from the time of receipt by the Kiosk, until it is available to be picked up by a patient, is around 2 minutes. It could be longer, up to 5 minutes in cases of the patient’s first visit as the patient’s identification and insurance information must be entered for the first time. |

| · | The wait time to fill a prescription under similar terms in a traditional pharmacy is an average of 30- 45 minutes. The circumstances in traditional pharmacies preclude “immediate” fulfillment, since the majority of retail pharmacies utilize manual processes rather than automation. These manual functions may include a lack of electronic receipt of prescriptions, counting the pills, filling vials, labeling vials and drug verification. Human activities cannot match the robotic activities driven by the immediate nature of the software. |

| · | The time that a prescription is received by our Kiosk and the time it initiates fulfillment activities within the Kiosk, is in minutes (assuming the patient is in the database. If the patient is new and is not in the database, when the patient arrives at the Kiosk or our pharmacy and provides all the same information they would provide a traditional pharmacy, the prescription is then filled within approximately 2 minutes). A traditional pharmacy would not be able to initiate the fulfillment as quickly as a software driven robotic procedure, not to mention matching software and imaging technology to accurately count, fill vials, label, and perform drug verification. |

Mr. John Reynolds

U.S. Securities and Exchange Commission

May 1, 2018

Page 6 of 16

| · | The level of accuracy of fulfillment in traditional pharmacies varies between small or formulating pharmacies, and large “chain” pharmacies, but it is in the range of 92- 94%, compared with our Kiosks at a documented 99.7% for counting, and 99.9% for all other robotic functions. Humans take breaks, get sick, weak, and tired, but, the Kiosks work 24/7/365, except during brief periods of servicing hours, within a documented 99.46% uptime rate. |

| · | Considering how many actual prescriptions this involves, in the 100’s of millions per annum, such percentage differentials are startling, and one would expect that robotic mechanical and software functions would be more efficient and accurate than human implementation over a long period of time, especially for repetitive functions and activities. Getting robotic mechanical functions to operate within a few milliseconds of the software commands is standard in robotics in general, and not at all like human implementation of similar activities. |

| · | In our Kiosk locations at medical office buildings, or in physicians’ offices, the proximity to the prescribing physicians’ physical presence can be a significant time efficiency if there is a pharmacist issue or question relating to the prescription, compared with the pharmacists’ process of trying to reach the prescribing physician by phone or email or text to answer the concern or question, or the patient or technician appearing physically at the physicians’ staff desk to immediately clarify in person. This is a huge time differential and patient efficiency. |

| · | Our Kiosks at medical buildings where multiple physicians’ practices are located, representing 40 to over a hundred physicians of various types of practices, or within the office space of specific physicians’ offices, only stock in inventory primarily the types of medications specific to those physicians’ typical prescription experience. This reduces the need and cost of carrying hundreds of medications carried by traditional pharmacies that these physicians never prescribe, reduces significantly medications that are prescribed very rarely, reduces the cost of carrying unneeded medications for long periods of time, which also affects expiration and loss of value on expired medications, reduces the inventory cost and accounting frequency and refilling time and costs, and saves pharmacists’ and technicians’ time, and therefore their labor cost, in stocking shipments into shelves and containers. Our Kiosks are refreshed and refilled by our pharmacists or the pharmacists at each location, inclusive of drug verification at time of refilling, or at time of fulfillment of prescriptions. All counseling of patients on site or remote is performed by pharmacists, and while counseling is the same at traditional pharmacies, the wait and time constraints on a pharmacists’ time may be very much longer at a traditional pharmacy than at one of our Kiosks. |

| · | Our Kiosks at medical buildings where multiple physicians’ practices are located, representing 40 to over a hundred physicians of various types of practices, or within the office space of specific physicians’ offices, which is all our current Kiosks and Kiosks expected to be installed in 2018, save our patients the time of driving or walking or taking public transit to a retail pharmacy in another location, placing the order with that pharmacy, waiting for it, then driving home or to their workplace, or their child’s school. This is a significant time efficiency of our Kiosk’s on-site point-of-care fulfillment advantage compared with remote retail pharmacies. |

Mr. John Reynolds

U.S. Securities and Exchange Commission

May 1, 2018

Page 7 of 16

| · | Most of our Kiosks also carry in inventory commonly prescribed OTC medications, so patients don’t have to go to a remote retail pharmacy for a portion of their prescriptions. |

| · | Our Kiosks hold up to 225 medications per Kiosk, whose dimensions are more compact than an equal spatial arrangement in traditional pharmacies, saving space and the cost of that space, and making movement and access within the space allocated to the “behind the counter” part of the pharmacy easier and more efficient for the pharmacist and technicians. |

| · | Our Kiosks are secure, stable, managed and 24/7 supported by the manufacturer as well as our procedures, and as it does not need breaks or “get tired” like humans. Our security is considerably more effective, as our whole system of housing the medications is enclosed and locked, whereas traditional pharmacies allow virtually anyone who violates the “behind the counter” space to access the predominant inventory on open shelving. The third-party manufacturers’ technicians are also providing another set of “eyes” on the inventory and procedures, whereas at traditional pharmacies there is no such automatic safety procedure. |

| · | Many patients believe that fulfillment at point-of-care increases adherence to obtaining the prescription, compared with just skipping getting it filled at all, and to following the directions for use, since they are more private and not at a remote retail pharmacy in an open area with lots of other shoppers around. Physicians’ cannot control post-prescribing patient adherence, so anything that can improve patient adherence is positive and more efficient. |

| · | Time and cost savings of our Kiosks allow pharmacists and technicians to concentrate on Medication Therapy and advice to patients instead of counting pills and inventory, as observed and experienced at each of our current locations |

| · | We offer Mail Order Medication Service for Prescription Refills, whereas most retail pharmacies do not want to offer that service, since they want customers to come in again and again to sell other non-medical products. This feature is popular with our customers. |

| · | Our customer patients and their prescribing physicians tell us they are satisfied with the efficiencies, procedures and convenience of our Kiosks. They “vote with their feet.” As our utilizations rates increase, the satisfaction is rising. |

| · | In the future, we can use these Kiosks for: |

| § | Remote Pharmacies managed by the central location of Pharmacists |

| § | Picking up the prescriptions at the location of choice |

| § | Talking to a remote Pharmacist for counseling |

| § | Refills by telephone calls to a central location |

Mr. John Reynolds

U.S. Securities and Exchange Commission

May 1, 2018

Page 8 of 16

| · | Slides below graphically demonstrate features of efficiency. |

Mr. John Reynolds

U.S. Securities and Exchange Commission

May 1, 2018

Page 9 of 16

| 5. | We note the reference on page 8 to “a sale resulting in the REG A Stockholders’ receiving less than their investment or its Stated Value.” Please revise to identify the “REG A Stockholders” and disclose where the term is defined. For example, it is unclear if REG A Stockholders is defined as anyone who purchases in this offering. Similarly, please revise to clarify the terms “pre-offering Preferred Stock” and “Original, Series A and Series A+ Preferred Stockholders.” |

Company’s Response: The Company will revise the Offering Circular to update and clarify the issues addressed in this comment in its next filing as requested by Staff. While it states later that only through this Offering can Series REG A or Class REG A shares be purchased, the Company believes it has clarified all sections in which it could be misunderstood.

| 6. | We note the statement on page 39 that “[o]ne of the risks of this Offering is that we may not raise sufficient minimum proceeds to both continue our operations as planned and make a timely redemption of both the principal and yield represented by the Stated Value of the Preferred Stocks.” Please revise here, Use of Proceeds on page 19 and the third paragraph on page 28 to address the impact on your current and planned operations assuming you receive significantly less than 50% of the maximum offering amount. Please also quantify approximately what minimum proceeds would allow you to continue operations and make timely redemptions. |

Company’s Response: The Company will modify the disclosure in the Offering Circular in its next filing as requested by Staff. Disclosure now includes the following language:

While this is our first Offering, we can continue our operations without any proceeds from this Offering. However, we believe we would experience much faster growth from internal progress otherwise. About $5 million would provide sufficient capital to enhance our software and open or acquire 30 to 50 Kiosks locations or pharmacy licenses, while $10 million from the proceeds of this Offering would be advantageous to our accelerated growth and achievement of positive EBITDA and earnings. Such amounts of proceeds from this Offering would represent more than has been previously available to us at any time. Our total cash and contributed capital to the date of this response letter is under $10 million (not inclusive of tangible or intangible operating or intellectual assets), over a 5-year period.

At the under $10 million level of proceeds from this Offering, we would be able to enhance our current operations and pursue a more modest expansion of our planned operations, by example: acquire national mail order licenses and operate in most, if not all states, but not as quickly in most or all states; acquire or newly license a lesser number of formulating pharmacies in multiple states; we would be able to secure multiple Kiosk contracts, but would need to either contract with the new contract entities the initial ownership of inventory, or arrange inventory finance lines of credit in different states, to stock the initial inventory; continue penetration of single Kiosk contracts in the offices or buildings of multi-physician practices; expand the number of distributors in more states to market our services; build out and finish development of our MedSpas® service and product lines, but would be more limited on how many we could implement without further capital contributions (each one is a separate potential profit center); and still have adequate corporate cash available to provide for ad hoc more modest developments and acquisitions. This may still be significant progress for us, even though far short of the $50 million level.

Mr. John Reynolds

U.S. Securities and Exchange Commission

May 1, 2018

Page 10 of 16

We strengthen our cash flow and current operations as each of our current and contracted Kiosks and MedSpas® increase their sales, so any additions as a result of this Offering further develop our current operations and EBITDA.

We provide a summary table of what and how we would expect to spend $5 million and $10 million, respectively. We would make some partial redemptions of Series A chronologically, Series A+, and Original Preferred, but in proportion to the lesser proceeds.

The table immediately below represents our estimated organizational and offering costs and expenses from gross proceeds (“O&O”), to result in our net proceeds available for use in our business. The actual O&O costs may be different from that which is disclosed below, and we reserve the ability to alter the O&O, in our sole discretion, if market conditions dictate as such, which would change the available proceeds to us.

| | AT $50 M AMOUNT | % | AT $25M AMOUNT | % | AT $10M | % | AT $5M | % |

| Gross Proceeds | $50,000,000 | 100% | $25,000,000 | 50% | $10,000,000 | 20% | $5,000,000 | 10% |

| Estimated O &O Expenses 1 | $1,000,000 | 2% | $450,000 | 1.8% | $400,000 | 4% | $350,000 | 7% |

| Selling Commissions, Fees & Expense Reimbursements 2 | $5,000,000 | 10% | $2,500,000 | 10% | $1,000,000 | 10% | $500,000 | 10% |

| Net Proceeds Available to our Company | $44,000,000 | 88% | $22,050,000 | 88.2% | $8,600,000 | 86% | $4,150,000 | 83% |

1. Estimated O&O expenses include legal; accounting; printing; advertising; travel; experts’ reports; appraisals and/or valuations; documentation archiving; word processing; independent investigative reports; marketing; transfer and disbursement agent; payment and escrow agents; Portal and administration; blue sky compliance and state filings; FINRA filing; and other expenses of this Offering. At the time of this filing, the SEC does not require filing fees to file a Form 1-A.

2. Our Co-Managers will receive selling commissions of [⚫ ]% of the gross offering proceeds, which it may reallow and pay to selected dealers, a Co-managing fee of [⚫ ]%, which it may reallow and pay, in part, to participating broker dealers, and a nonaccountable expense allowance of [⚫ ]% of the gross offering proceeds, which it may reallow and pay to participating broker dealers. We will reimburse accountable expenses up to [⚫ ]% of the gross proceeds from this offering to our Co-Managers for fees or expenses paid to Portal or RIA’s. If we raise the maximum offering amount, we will also reimburse our Co-Managers or RIA’s for accountable expenses of up to $[⚫ ] for filing, due diligence, and legal fees incurred by it.

We also believe that since the Series REG A Preferred offered only through this Offering, it is anticipated to be redeemed from proceeds of the planned IPO, or if we list at the end of this Offering, a Registered Primary Offering (the “RPO”) on that Exchange, we plan to take every opportunity for full or partial redemption of our past Series’ Shareholders to demonstrate to our new Series REG A shareholders the good faith intentions of fulfilling our representations as soon as practical. There is timing risk in any investment of this nature and no one can predict market conditions at the time we anticipate conducting such offering. See Risk Factors, sub-section [⚫ ].

This Offering is for the purposes of further expansion of our Kiosk systems, more geographic penetration, more acquisitions, more new services’ initiations, and increased new products and services development.

As described in our Section entitled “Description of Securities”, our redemption timing for 100% of our Non-Voting Preferred Series A, and partial redemption of Series A+, owned by our non-management and non-Director Founders, and the deminimis percentage of Original Preferred, owned by our management, Directors and advisors, that is scheduled to be redeemed, at the earlier of sufficient proceeds from this Offering and in parts in the planned IPO about a year after this Offering. If we do not redeem the scheduled amounts in full or at all, in this Offering, we still plan to conduct a traditional IPO, although there is no guarantee that we will be able to do that, at which time we would expect to redeem any remaining Series A, A+ and a scheduled portion of Original Preferred.

Mr. John Reynolds

U.S. Securities and Exchange Commission

May 1, 2018

Page 11 of 16

If we do not, for any reason, redeem all the scheduled Series A, A+ and Original Preferred in these offerings, we will initiate partial redemptions in intervals defined by cash flow availability until either our internal growth is sufficient to warrant another offering, or we may sell the Company to a larger entity or fund.

If we are forced to redeem these Series of Preferred’s in partial amounts in either this Offering, or the subsequent planned Listing, we then shall begin by redeeming the earliest issued Series A Preferred shares first, those dating to 2014, 2015 and 2016, and then the Series A issued in 2017, and then the Series A+ issued in 2017,pari passu with Original Preferred, in amounts to be determined by the Board as determined by circumstances at the time.

If we sell the Company, all redemptions occur essentially simultaneously, and the terms of each Series dictate the priority of redemption from sales proceeds, as detailed in each Shareholder’s Stock Purchase Agreement.

| 7. | “If investors successfully seek rescission, we would face severe financial demands”…, page 14. Please revise to clarify the background and circumstances giving rise to the risk. |

Company’s Response: The Company is not aware of any issues or complaints, or any threatened proceedings, and the Company believes that its existing shareholders appear to be pleased with its progress. However, the Company believes this to be a common risk in all public offerings for newly reporting companies with no history of public reporting or managing large numbers of public investors, and could be a material issue if it arises.

| 8. | It appears that you paid ScriptPro USA, Inc. to install kiosks in Texas, New York, Louisiana and Florida during 2017. Please revise here and page 27 where you discuss your increasing revenues to disclose the number of kiosks you operate. Additionally, please revise to clarify whether you install and operate the kiosks. For example, we note the statement on page 20 that ScriptPro USA, Inc. leases, installs and maintains the kiosk and on page 23 you state that you install the kiosks. Refer to Item 7 of Form 1-A. |

Company’s Response: Both the Company and ScriptPro install their respective parts of the equipment. The Company installs the predominant majority of the software since the ScriptPro software is essentially only inventory related. ScriptPro’s equipment system is proprietary to them, just as the Company’s equipment system and software are proprietary to it. The Company pays ScriptPro to install and provide ongoing maintenance of their kiosk equipment, which is the same price for installation and maintenance services, whether the Company is directly leasing the unit for its own operated pharmacies, or the lease of the unit is being paid for by one of its customers. The Company pays for its equipment and software required to make the unit to become a SmartAssist Kiosk®, as well as its installation and maintenance. The current models of the SmartAssist Kiosk® could not exist without the equipment provided by both the Company and ScriptPro.

Mr. John Reynolds

U.S. Securities and Exchange Commission

May 1, 2018

Page 12 of 16

The Company operates five Kiosks within physicians’ offices or in their medical office buildings, usually on the first or ground floor, as of April 30, 2018. The Company believes it will receive its insurance carriers’ licenses, or state and DEA licenses to open five more for which it has been waiting to open, by May 31, 2018, bringing its total to 10. The Company expects to be fully licensed to install five more Kiosks in similar locations by July 31, 2018, bringing its total in such locations to 15. Without financing proceeds from this Offering, the Company could install 15 to 20 more by the end of 2018.

The Company also operates three “brick and mortar” pharmacies incorporating its Kiosks and plans to purchase at least 20 more by the end of 2018. If the Company is successful in purchasing 20 or more “brick and mortar” pharmacies, it could be able to install 20 or more Kiosks by the end of 2018 in those pharmacies in order to gain efficiencies and security.

Additionally, the Company started its first commercially operating Smart MedSpas® in April 2018. Depending on success, it may be developing three to five more Smart MedSpas® by the end of 2018.

Should the Company successfully obtain financing from this Offering, it would have the capital to increase the number of physicians’ offices’ locations, medical office building locations, acquired pharmacies and licenses of “brick and mortar” locations, and Smart MedSpas® dramatically.

Kiosks usually take four to six weeks to be manufactured, tested, delivered, and installed. The Company can at any given time have 40 Kiosks operational in four to six weeks. However, each location’s pharmacy and DEA licenses, and other insurance carriers’ licenses, usually take from 90 days to 120 days from the date of application, whether it’s a transfer or a new license.

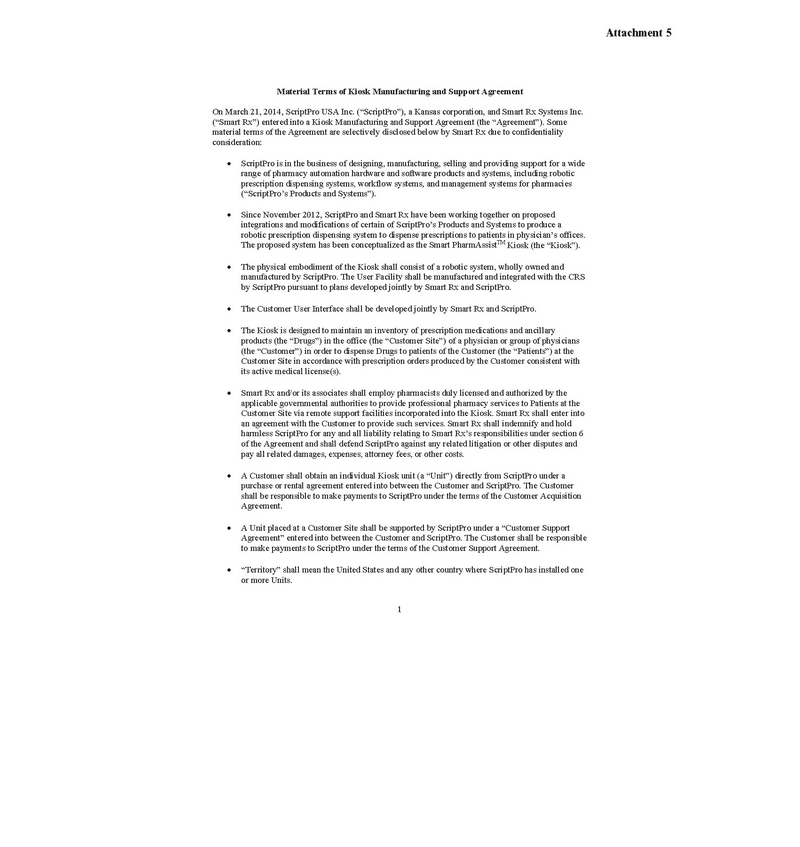

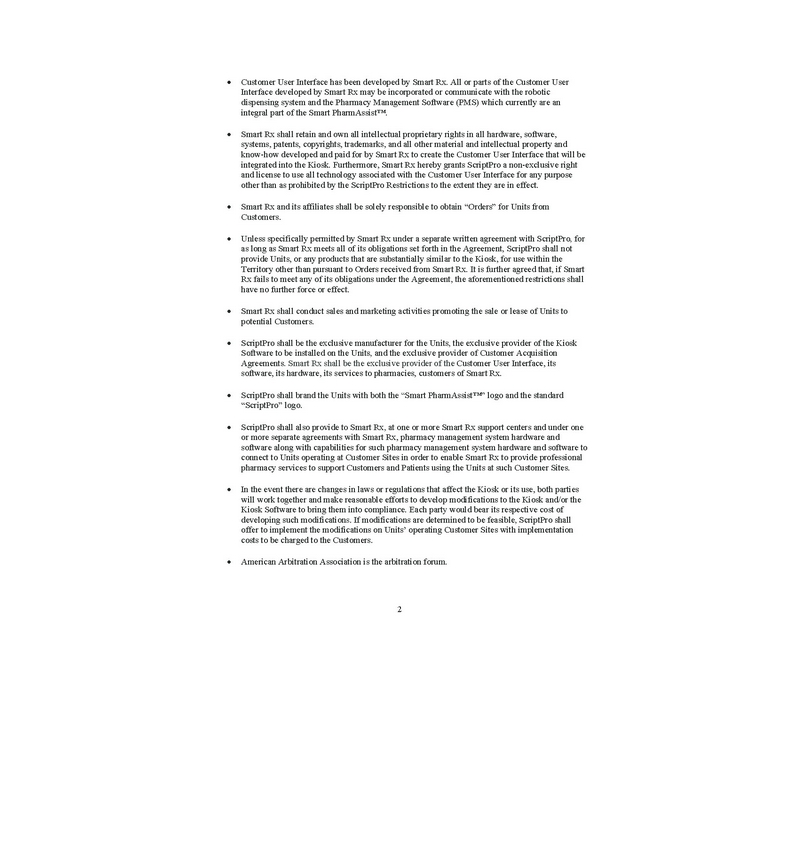

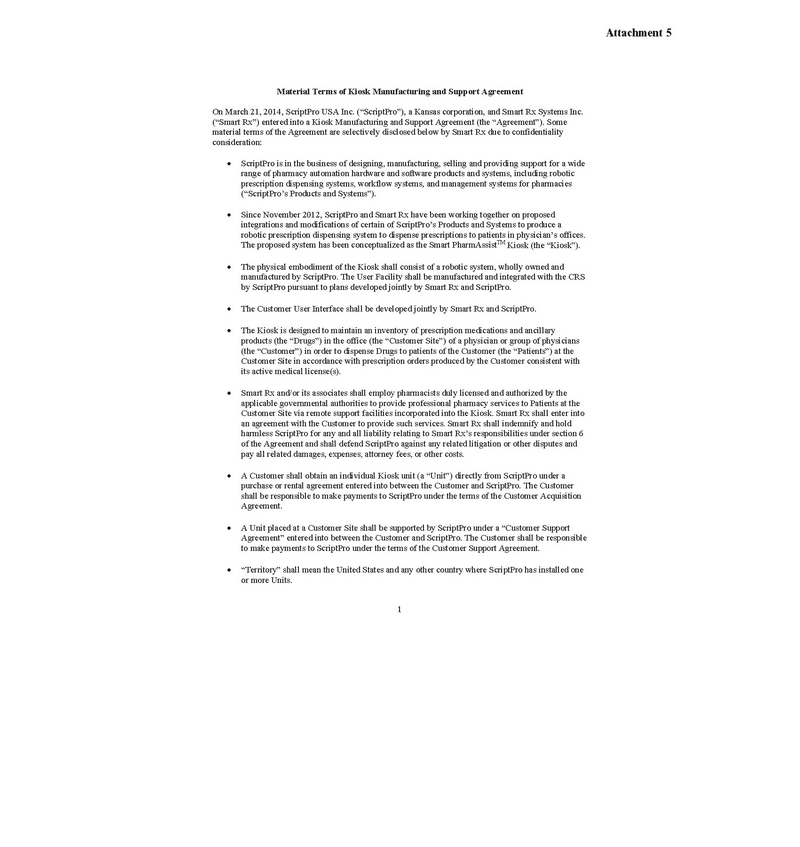

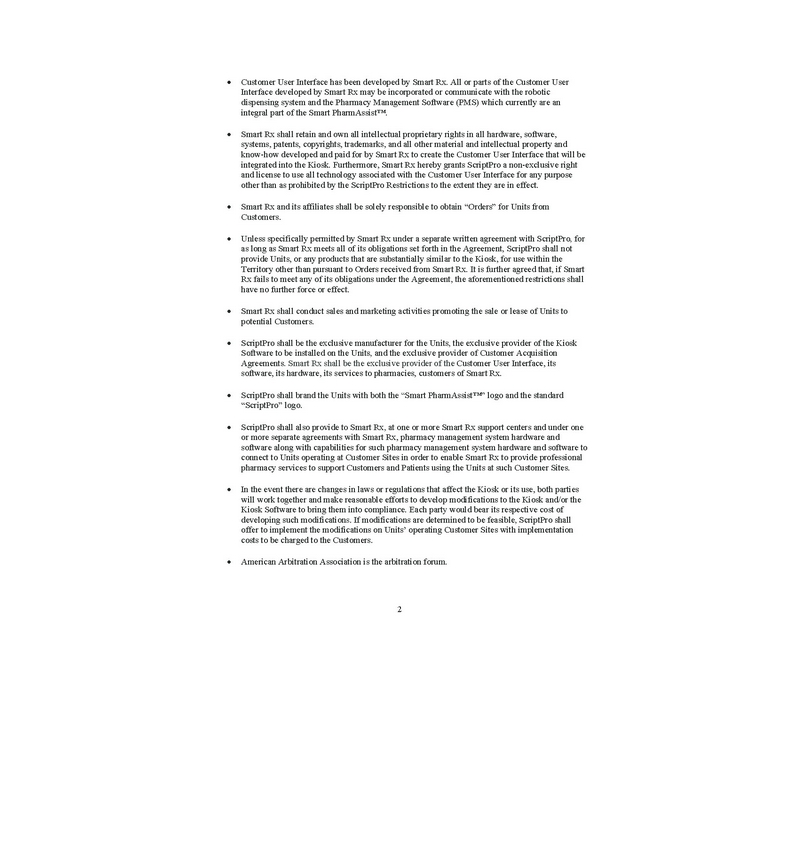

| 9. | Please disclose the material terms of the exclusive agreement with ScriptPro USA, Inc. and file it as an exhibit. Refer to Item 17.6(b) of Form 1-A. |

Company’s Response: The Company has provided the material terms of the Kiosk Manufacturing and Support Agreement by and between ScriptPro and the Company dated March 21, 2014, along with the material term of the Amendment of the aforementioned Agreement dated May 22, 2015, as attachment No.5 to this letter. We also incorporated a summary of the material terms in the narrative of the Offering Circular in the Section entitled “Supplier and Quality Assurance.” The Company and ScriptPro consider this agreement to be highly confidential and unique, so they believe the disclosure of the material terms should be adequate for disclosure purposes.

| 10. | Please revise Liquidity and Capital Resources to address any material proceeds from the 2017 crowdfunding offering. |

Company’s Response: We cancelled the crowdfunding offering as a result of other institutional investment from Founding Shareholders in amounts greater than the maximum allowed under REG CF, which is disclosed in the Section entitled “Securities Issued through April 30, 2018”, on page 34. It was never marketed other than residing on a portal.

Mr. John Reynolds

U.S. Securities and Exchange Commission

May 1, 2018

Page 13 of 16

| 11. | We note the statement on page 34 that you expect to “incorporate an affiliate corporation coincident with the availability of proceeds from conducting this Offering, to act as the operating company responsible for implementing part of our plans.” Please revise to disclose the place of incorporation, ownership structure and planned articles of incorporation of the affiliated corporation. Please revise Interest of Management and Others in Certain Transactions to disclose the material terms of the planned arrangement with the affiliate. We may have further comment. |

Company’s Response: The entity will be a wholly owned subsidiary of the Company, and the Company believes there is no conflict of interest with management or any third parties. When the corporation is incorporated in Florida, the articles of incorporation shall be identical in terms and structure as the Company’s articles of incorporation, except that this operating subsidiary will not require as many Classes or Series of shares as the Company, and it shall be filed as an exhibit to the Offering Circular. We intend to eventually have all operations performed by our subsidiaries so that at some point in the near future, the Company can function solely as a holding company of the various operating subsidiaries.

| 12. | You have $36 million in intangible assets as of December 31, 2016. Most of these assets appear to have resulted from transactions with related parties, such as your owners. Please tell us the GAAP literature you relied upon for capitalizing, versus expensing, these costs and explain how you complied with the applicable literature for each material intangible asset recorded. Also, tell us how you determined the values of the amounts recorded and explain why that method is appropriate under GAAP. In doing so, also tell us how the related-party nature of these transactions with your owners was considered in arriving at the amounts recorded under GAAP. Refer to ASCs 350, 730 and 985, as well as ASC 845-10-S99-1. |

Company’s Response: ASC 350-30-25-1 Intangibles – Goodwill and Other - General Intangibles Other than Goodwill -Recognition states that an intangible asset that is acquired either individually or with a group of assets shall be recognized.

ASC 805-50-35-1 states that after the acquisition, the acquiring entity accounts for the asset or liability in accordance with the appropriate generally accepted accounting principles (GAAP).

SSVS No. 1 allows AICPA members to express either a conclusion of value or a calculated value.

One of the methods recommended by the SSVS No. 1 is the Income Approach. Two frequently used valuation methods under the income approach include the capitalization of benefits method (for example, earnings or cash flows) and the discounted future benefits method (for example, earnings or cash flows). One of the methods used to capitalize each material intangible asset was the discounted cash flow method.

Another method that was used was the market approach. SSVS No. 1 recommends three frequently used valuation methods under the market approach for valuing a business, business ownership interest, or security are as follows:

| · | Guideline public company method |

| · | Guideline company transactions method |

Mr. John Reynolds

U.S. Securities and Exchange Commission

May 1, 2018

Page 14 of 16

| · | Guideline sales of interests in the subject entity, such as business ownership interests or securities |

Each of the acquired assets were initially valued by one or more of these standards. In addition, each asset has been revalued each year in accordance with GAAP standards. The few instances in 2016 or 2017 where increases or decreases were recognized were effected as a result of positive or negative developments in cash flow expectations or publicly filed disclosures’ comparables.

The Related Party Disclosures Topic provides disclosures requirements for related party transactions and certain common control relationships.

The transactions between the Company and its principal owners, management, or members have been properly disclosed on the Company’s financial statements and the Offering Circular. In addition, the Company’s recognized values were discounted deeply below both comparables in public filings and the 2014 valuation by 3rd party, and therefore below arm’s length transactions had there been non-affiliated parties.

| 13. | Please include the disclosures required by ASCs 350-30-50, 730-10-50 and 985-20-50, as applicable. |

Company’s Response:The Company will incorporate the disclosures required under these ASC codes in its Draft Offering Statement to be filed as DOS/A. Also, responses to Comment 12 above has engendered the principles of these related codes.

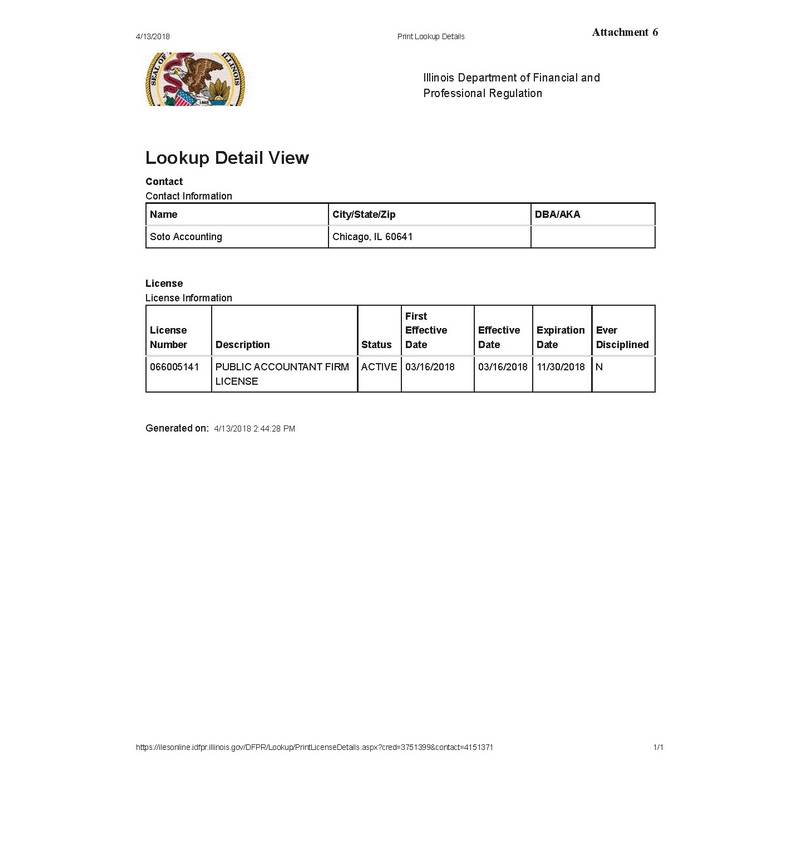

| 14. | Please tell us how you determined that the accounting firm signing the audit report and consent is properly registered in Illinois. If only a person is registered, please remove the references to the accounting firm from the filing, replace them with the person’s name and make arrangements for the person to provide an audit report and consent, if they performed an audit. Refer to paragraph (c)(1)(iii) of Part F/S in Form 1-A and Rule 2-01 of Regulation S-X. |

Company’s Response: The firm did not register itself in the past, but recently registered in Illinois at nominal cost and time. It has received its registration from the State of Illinois, which should now be visible through an online search of the Illinois records. For the Staff’s convenience, we have attached a copy of the license details of the accounting firm from the website of Illinois Department of Financial and Professional Regulation as attachment No.6 to this letter.

| 15. | Please include interim statements of cash flows for the current interim period and comparative period of the preceding year. Also, include an income statement for the comparative period of the preceding year and appropriate footnotes to the interim financial statements. Refer to paragraph (b)(4) of Part F/S in Form 1-A. |

Company’s Response: The Company will file the 2017 audited financial statements along with the 2016 and 2015 audited financial statements in the next filing. The 2017 audited financial statements is not complete at the time of this confidential response letter.

Mr. John Reynolds

U.S. Securities and Exchange Commission

May 1, 2018

Page 15 of 16

| 16. | Please file the agreements for the acquisitions disclosed on page 20 as exhibits to the extent material. Refer to Item 17.7 of Form 1-A. |

Company’s Response: We have provided a Business Purchase Agreement by and between the Company and Jino J. Moran regarding stock sale dated June 16, 2017, and a Purchase of Vista Specialty Pharmacy LLC Agreement by and between the Company and Vista Specialty Pharmacy LLC dated June 28, 2017 as attachments No.7 and No.8 to this letter. We will also file the aforementioned agreements as exhibits in the Company’s next filing.

| 17. | Please file your contract with the “well respected distribution company who will have exclusive distribution rights for the company’s products and services in the state of Texas,” as referenced on page F-20. |

Company’s Response: The Company does not believe that one contract regarding distribution in one state to be material.

| 18. | Oral comment: In the current draft of Form 1-A, the Company indicates its intention to have seven directors following the completion of the 2nd phase of the offering and also to establish an Audit Committee and a Compensation Committee by then. Please clarify how and when does the Company plan to inform the investors and potential investors regarding the related information? Please refer to Rule 255 of the Exchange Act. |

Company’s Response: The Company has publicly filed in its previous Form C disclosures its plans and eligible directors for each future planned offering, so the Company believes that all of its current investors are aware of the seven director plan and the plan to establish both an Audit and Compensation Committee, as preparation for a national exchange Listing. The Company has also disclosed in this Offering Circular similar disclosure on page 31. The Company believes all existing and future shareholders should be aware of the Company’s plans.

| 19. | Oral comment: Please file the Broker-Dealer Agreement as an exhibit, or advise on when the Company plans to file it. |

Company’s Response: We contemplate signing Broker Dealer Agreements with Co-Managers, or subsequent members of the syndicate selling group of brokers, after our first or second Amendment, as applicable, and the Company will file such agreement as an exhibit to the Offering Circular at such time.

| 20. | Oral comment: On the cover page of the Form 1-A, the Company indicates to use Folio Investments, Inc. to act as its online intermediary technology platform to post the offering materials on its website. Please advise on the compliance with Rule 255 online intermediary regulations of the Exchange Act regarding testing-the-water materials. |

Company’s Response: The references to Folio were an error in the draft. The Company is not using Folio to post anything at this time and may never use them in the future. The Company will not deploy any test-the-waters methods at this time. The Company is currently speaking only to investment banks and due diligence officers of registered Broker Dealers who may act as Co-Managers or syndicate members of this Offering, as further referenced in the response to Comment 19 above, to determine their interest in conducting due diligence on our Company at an appropriate time. The Company has not spoken or written to any registered person at any Broker-Dealer or RIA whom is not a control principal and licensed as an investment banker of that Dealer, or a due diligence officer officially representing that Dealer or RIA firm.

Mr. John Reynolds

U.S. Securities and Exchange Commission

May 1, 2018

Page 16 of 16

| 21. | Oral comment: The SEC noticed that there is currently information on the Company’s website about crowdfunding, but the company has filed a Form CW previously to withdraw the crowdfunding. Please advise. |

Company’s Response: The Company apologizes for this timing oversight on its part and thanks the Staff for bringing it to its attention. The pages and online references were supposed to be completely removed, and the Company believed all but one was removed earlier, thus the Investor Relations page still had a window. The Company has now had its web contractor removed that remaining reference.

The Company respectfully believes that the responses above reflecting the revisions to the Draft Offering Statement to be contained in the DOS/A, and the supplemental information contained herein, are responsive to the Staff’s comments. Please feel free to contact me at the above number for any questions related to this filing. We appreciate the Staff’s timely response.

| | Very truly yours, | |

| | | |

| | /s/ Thomas G. Voekler | |

| | Thomas G. Voekler | |

cc: Mr. Sandeep Mathow (via electronic mail)

Mr. Michael Scillia (via electronic mail)

Ms. Jingwen (Katherine) Luo (via electronic mail)

Enclosures