| | | FREE WRITING PROSPECTUS |

| | | FILED PURSUANT TO RULE 433 |

| | | REGISTRATION FILE NO.: 333-206677-05 |

| | | |

Free Writing Prospectus

Structural and Collateral Term Sheet

$702,787,500

(Approximate Initial Pool Balance)

$575,004,000

(Approximate Aggregate Certificate Balance of Offered Certificates)

Wells Fargo Commercial Mortgage Trust 2016-C34

as Issuing Entity

Wells Fargo Commercial Mortgage Securities, Inc.

as Depositor

Wells Fargo Bank, National Association

Natixis Real Estate Capital LLC

Rialto Mortgage Finance, LLC

Silverpeak Real Estate Finance LLC

Basis Real Estate Capital II, LLC

as Sponsors and Mortgage Loan Sellers

Commercial Mortgage Pass-Through Certificates

Series 2016-C34

May 3, 2016

| WELLS FARGO SECURITIES |

| Lead Manager and Sole Bookrunner |

| |

Academy Securities Co-Manager | Deutsche Bank Securities Co-Manager | Natixis Securities Americas LLC Co-Manager |

STATEMENT REGARDING THIS FREE WRITING PROSPECTUS

The depositor has filed a registration statement (including a prospectus) with the Securities and Exchange Commission (‘‘SEC’’) (SEC File No. 333-206677) for the offering to which this communication relates. Before you invest, you should read the prospectus in the registration statement and other documents the depositor has filed with the SEC for more complete information about the depositor, the issuing entity and this offering. You may get these documents for free by visiting EDGAR on the SEC Web site at www.sec.gov. Alternatively, the depositor, any underwriter, or any dealer participating in the offering will arrange to send you the prospectus after filing if you request it by calling toll free 1-800-745-2063 (8 a.m. – 5 p.m. EST) or by emailing wfs.cmbs@wellsfargo.com.

Nothing in this document constitutes an offer of securities for sale in any jurisdiction where the offer or sale is not permitted. The information contained herein is preliminary as of the date hereof, supersedes any such information previously delivered to you and will be superseded by any such information subsequently delivered and ultimately by the final prospectus relating to the securities. These materials are subject to change, completion, supplement or amendment from time to time.

This free writing prospectus has been prepared by the underwriters for information purposes only and does not constitute, in whole or in part, a prospectus for the purposes of Directive 2003/71/EC (as amended) and/or Part VI of the Financial Services and Markets Act 2000, as amended, or other offering document.

STATEMENT REGARDING ASSUMPTIONS AS TO SECURITIES, PRICING ESTIMATES AND OTHER INFORMATION

The attached information contains certain tables and other statistical analyses (the “Computational Materials”) which have been prepared in reliance upon information furnished by the Mortgage Loan Sellers. Numerous assumptions were used in preparing the Computational Materials, which may or may not be reflected herein. As such, no assurance can be given as to the Computational Materials’ accuracy, appropriateness or completeness in any particular context; or as to whether the Computational Materials and/or the assumptions upon which they are based reflect present market conditions or future market performance. The Computational Materials should not be construed as either projections or predictions or as legal, tax, financial or accounting advice. You should consult your own counsel, accountant and other advisors as to the legal, tax, business, financial and related aspects of a purchase of these securities. Any weighted average lives, yields and principal payment periods shown in the Computational Materials are based on prepayment and/or loss assumptions, and changes in such prepayment and/or loss assumptions may dramatically affect such weighted average lives, yields and principal payment periods. In addition, it is possible that prepayments or losses on the underlying assets will occur at rates higher or lower than the rates shown in the attached Computational Materials. The specific characteristics of the securities may differ from those shown in the Computational Materials due to differences between the final underlying assets and the preliminary underlying assets used in preparing the Computational Materials. The principal amount and designation of any security described in the Computational Materials are subject to change prior to issuance. None of Wells Fargo Securities, LLC, Academy Securities, Inc., Deutsche Bank Securities Inc., Natixis Securities Americas LLC or any of their respective affiliates, make any representation or warranty as to the actual rate or timing of payments or losses on any of the underlying assets or the payments or yield on the securities. The information in this presentation is based upon management forecasts and reflects prevailing conditions and management’s views as of this date, all of which are subject to change. In preparing this presentation, we have relied upon and assumed, without independent verification, the accuracy and completeness of all information available from public sources or which was provided to us by or on behalf of the Mortgage Loan Sellers or which was otherwise reviewed by us.

This free writing prospectus contains certain forward-looking statements. If and when included in this free writing prospectus, the words “expects”, “intends”, “anticipates”, “estimates” and analogous expressions and all statements that are not historical facts, including statements about our beliefs or expectations, are intended to identify forward-looking statements. Any forward-looking statements are made subject to risks and uncertainties which could cause actual results to differ materially from those stated. Those risks and uncertainties include, among other things, declines in general economic and business conditions, increased competition, changes in demographics, changes in political and social conditions, regulatory initiatives and changes in customer preferences, many of which are beyond our control and the control of any other person or entity related to this offering. The forward-looking statements made in this free writing prospectus are made as of the date stated on the cover. We have no obligation to update or revise any forward-looking statement.

Wells Fargo Securities is the trade name for the capital markets and investment banking services of Wells Fargo & Company and its subsidiaries, including but not limited to Wells Fargo Securities, LLC, a member of NYSE, FINRA, NFA and SIPC, Wells Fargo Prime Services, LLC, a member of FINRA, NFA and SIPC, and Wells Fargo Bank, N.A. Wells Fargo Securities, LLC and Wells Fargo Prime Services, LLC are distinct entities from affiliated banks and thrifts.

IMPORTANT NOTICE REGARDING THE OFFERED CERTIFICATES

The information herein is preliminary and may be supplemented or amended prior to the time of sale. Prospective investors should understand that, when considering the purchase of the Offered Certificates, a contract of sale will come into being no sooner than the date on which the relevant class of certificates has been priced and the investor has otherwise taken all actions the investor must take to become committed to purchase the Offered Certificates, and the investor has therefore entered into a contract of sale. Any “indications of interest” expressed by any prospective investor, and any “soft circles” generated by the underwriters, prior to the time of sale, will not create binding contractual obligations for such prospective investors, on the one hand, or the underwriters, the depositor or any of their respective agents or affiliates, on the other hand.

In addition, the Offered Certificates referred to in these materials and the asset pool backing them are subject to modification or revision (including the possibility that one or more classes of certificates may be split, combined or eliminated at any time prior to issuance or availability of a final prospectus) and are offered on a “when, as and if issued” basis. As a result of the foregoing, a prospective investor may commit to purchase certificates that have characteristics that may change, and each prospective investor is advised that all or a portion of the certificates referred to in these materials may be issued without all or certain of the characteristics described in these materials. The underwriters’ obligation to sell certificates to any prospective investor is conditioned on the certificates and the transaction having the characteristics described in these materials. If the underwriters determine that a condition is not satisfied in any material respect, such prospective investor will be notified, and neither the depositor nor the underwriters will have any obligation to such prospective investor to deliver any portion of the Offered Certificates which such prospective investor has committed to purchase, and there will be no liability between the underwriters, the depositor or any of their respective agents or affiliates, on the one hand, and such prospective investor, on the other hand, as a consequence of the non-delivery.

The underwriters described in these materials may from time to time perform investment banking services for, or solicit investment banking business from, any company named in these materials. The underwriters and/or their affiliates or respective employees may from time to time have a long or short position in any security or contract discussed in these materials.

The information contained herein supersedes any previous such information delivered to any prospective investor and will be superseded by information delivered to such prospective investor prior to the time of sale.

IMPORTANT NOTICE RELATING TO AUTOMATICALLY-GENERATED EMAIL DISCLAIMERS

Any legends, disclaimers or other notices that may appear at the bottom of any email communication to which this free writing prospectus is attached relating to (1) these materials not constituting an offer (or a solicitation of an offer), (2) no representation that these materials are accurate or complete and may not be updated or (3) these materials possibly being confidential, are not applicable to these materials and should be disregarded. Such legends, disclaimers or other notices have been automatically generated as a result of these materials having been sent via Bloomberg or another system.

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

| Wells Fargo Commercial Mortgage Trust 2016-C34 | Certificate Structure |

| | | | | | | | | | | | | | | | |

| | | Class | Expected Ratings

(DBRS/Fitch/Moody’s)(1) | Approximate Initial

Certificate Balance or

Notional Amount(2) | Approx. Initial

Credit

Support(3) | Pass-Through

Rate Description | Weighted Average

Life

(Years)(4) | Expected

Principal

Window(4) | Certificate

Principal to

Value Ratio(5) | Certificate

Principal

U/W NOI

Debt Yield(6) |

| | | Offered Certificates | | | | |

| | | A-1 | AAA(sf)/AAAsf/Aaa(sf) | $33,179,000 | 30.000% | (7) | 2.81 | 06/16 – 03/21 | 46.1% | 14.5% |

| | | A-2 | AAA(sf)/AAAsf/Aaa(sf) | $100,629,000 | 30.000% | (7) | 4.93 | 03/21 – 05/21 | 46.1% | 14.5% |

| | | A-3 | AAA(sf)/AAAsf/Aaa(sf) | $115,000,000(8) | 30.000% | (7) | 9.64 | 11/25 – 02/26 | 46.1% | 14.5% |

| | | A-4 | AAA(sf)/AAAsf/Aaa(sf) | $172,158,000 | 30.000% | (7) | 9.78 | 02/26 – 04/26 | 46.1% | 14.5% |

| | | A-SB | AAA(sf)/AAAsf/Aaa(sf) | $45,985,000 | 30.000% | (7) | 7.32 | 05/21 – 11/25 | 46.1% | 14.5% |

| | | A-S | AAA(sf)/AAAsf/Aa2(sf) | $35,139,000 | 25.000% | (7) | 9.89 | 04/26 – 04/26 | 49.4% | 13.5% |

| | | X-A | AAA(sf)/AAAsf/NR | $527,090,000(9) | N/A | Variable(10) | N/A | N/A | N/A | N/A |

| | | X-B | AAA(sf)/AA-sf/NR | $36,018,000(11) | N/A | Variable(12) | N/A | N/A | N/A | N/A |

| | | B | AA(low)(sf)/AA-sf/NR | $36,018,000 | 19.875% | (7) | 9.89 | 04/26 – 04/26 | 52.8% | 12.6% |

| | | C | A(low)(sf)/A-sf/NR | $36,896,000 | 14.625% | (7) | 9.89 | 04/26 – 04/26 | 56.3% | 11.9% |

| | | | | | | | | |

| | | Non-Offered Certificates | | | | | | |

| | | X-E | AAA(sf)/BB-sf/NR | $20,205,000(13) | N/A | Variable(14) | N/A | N/A | N/A | N/A |

| | | X-FG | AAA(sf)/NR/NR | $20,205,000(15) | N/A | Variable(16) | N/A | N/A | N/A | N/A |

| | | X-H | AAA(sf)/NR/NR | $21,084,500(17) | N/A | Variable(18) | N/A | N/A | N/A | N/A |

| | | A-3FL | AAA(sf)/AAAsf/Aaa(sf)(19) | $25,000,000(20)(21) | 30.000% | LIBOR plus [ ](22) | 9.64 | 11/25 – 02/26 | 46.1% | 14.5% |

| | | A-3FX | AAA(sf)/AAAsf/Aaa(sf) | $0(20)(21) | 30.000% | (7) | 9.64 | 11/25 – 02/26 | 46.1% | 14.5% |

| | | D | BBB(low)(sf)/BBB-sf/NR | $41,289,000 | 8.750% | (7) | 9.89 | 04/26 – 04/26 | 60.1% | 11.1% |

| | | E | BB(high)(sf)/BB-sf/NR | $20,205,000 | 5.875% | (7) | 9.96 | 04/26 – 05/26 | 62.0% | 10.8% |

| | | F | BB(low)(sf)/B-sf/NR | $7,907,000 | 4.750% | (7) | 9.98 | 05/26 – 05/26 | 62.8% | 10.6% |

| | | G | B(low)(sf)/NR/NR | $12,298,000 | 3.000% | (7) | 9.98 | 05/26 – 05/26 | 63.9% | 10.4% |

| | | H | NR/NR/NR | $21,084,500 | 0.000% | (7) | 9.98 | 05/26 – 05/26 | 65.9% | 10.1% |

Notes:

| | |

| (1) | The expected ratings presented are those of DBRS, Inc. (“DBRS”), Fitch Ratings, Inc. (“Fitch”) and Moody’s Investors Service, Inc. (“Moody’s”) which the depositor hired to rate the offered certificates. One or more other nationally recognized statistical rating organizations that were not hired by the depositor may use information they receive pursuant to Rule 17g-5 under the Securities Exchange Act of 1934, as amended (the “Exchange Act”) or otherwise, to rate or provide market reports and/or published commentary related to the offered certificates. We cannot assure you as to what ratings a non-hired nationally recognized statistical rating organization would assign or that its reports will not express differing, possibly negative, views of the mortgage loans and/or the offered certificates. The ratings of each class of offered certificates address the likelihood of the timely distribution of interest and, except in the case of the Class X-A and X-B certificates, the ultimate distribution of principal due on those classes on or before the Rated Final Distribution Date. See “Risk Factors—Other Risks Relating to the Certificates—Nationally Recognized Statistical Rating Organizations May Assign Different Ratings to the Certificates; Ratings of the Certificates Reflect Only the Views of the Applicable Rating Agencies as of the Dates Such Ratings Were Issued; Ratings May Affect ERISA Eligibility; Ratings May Be Downgraded” and “Ratings” in the Preliminary Prospectus, expected to be dated May 3, 2016 (the “Preliminary Prospectus”). DBRS, Fitch and Moody’s have informed us that the “sf” designation in their ratings represents an identifier for structured finance product ratings. |

| | |

| (2) | The certificate balances and notional amounts set forth in the table are approximate. The actual initial certificate balances and notional amounts may be larger or smaller depending on the initial pool balance of the mortgage loans definitively included in the pool of mortgage loans, which aggregate cut-off date balance may be as much as 5% larger or smaller than the amount presented in the Preliminary Prospectus. |

| | |

| (3) | The approximate initial credit support with respect to the Class A-1, A-2, A-3, A-3FL, A-3FX, A-4 and A-SB Certificates represents the approximate credit enhancement for the Class A-1, A-2, A-3, A-4, A-3FL, A-3FX and A-SB Certificates in the aggregate. |

| | |

| (4) | Weighted Average Lives and Expected Principal Windows are calculated based on an assumed prepayment rate of 0% CPR and the “Structuring Assumptions” described under “Yield and Maturity Considerations—Weighted Average Life” in the Preliminary Prospectus. |

| | |

| (5) | The Certificate Principal to Value Ratio for each Class of Certificates (other than the Class A-1, A-2, A-3, A-3FL, A-3FX, A-4 and A-SB Certificates) is calculated as the product of (a) the weighted average Cut-off Date LTV Ratio for the mortgage loans and (b) a fraction, the numerator of which is the total initial Certificate Balance of such Class of Certificates and all Classes of Principal Balance Certificates senior to such Class of Certificates and the denominator of which is the total initial Certificate Balance of all of the Principal Balance Certificates. The Certificate Principal to Value Ratio for each of the Class A-1, A-2, A-3, A-3FL, A-3FX, A-4 and A-SB Certificates is calculated in the aggregate for those Classes as if they were a single Class and is calculated as the product of (a) the weighted average Cut-off Date LTV Ratio for the mortgage loans and (b) a fraction, the numerator of which is the total initial aggregate Certificate Balances of such Classes of Certificates and the denominator of which is the total initial Certificate Balance of all of the Principal Balance Certificates. In any event, however, excess mortgaged property value associated with a mortgage loan will not be available to offset losses on any other mortgage loan. |

| | |

| (6) | The Certificate Principal U/W NOI Debt Yield for each Class of Certificates (other than the Class A-1, A-2, A-3, A-3FL, A-3FX, A-4 and A-SB Certificates) is calculated as the product of (a) the weighted average U/W NOI Debt Yield for the mortgage loans and (b) a fraction, the numerator of which is the total initial Certificate Balance of all of the Classes of Principal Balance Certificates and the denominator of which is the total initial Certificate Balance for such Class of Certificates and all Classes of Principal Balance Certificates senior to such Class of Certificates. The Certificate Principal U/W NOI Debt Yield for each of the Class A-1, A-2, A-3, A-3FL, A-3FX, A-4 and A-SB Certificates is calculated in the aggregate for those Classes as if they were a single Class and is calculated as the product of (a) the weighted average U/W NOI Debt Yield for the mortgage loans and (b) a fraction, the numerator of which is the total initial Certificate Balance of all of the Classes of Principal Balance Certificates and the denominator of which is the total aggregate initial Certificate Balances for the Class A-1, A-2, A-3, A-3FL, A-3FX, A-4 and A-SB Certificates. In any event, however, cash flow from each mortgaged property supports only the related mortgage loan and will not be available to support any other mortgage loan. |

| | |

| (7) | The pass-through rates for the Class A-1, A-2, A-3, A-3FX, A-4, A-SB, A-S, B, C, D, E, F, G and H Certificates in each case will be one of the following: (i) a fixed rateper annum, (ii) a variable rate per annum equal to the weighted average of the net mortgage interest rates on the mortgage loans for the related distribution date, (iii) a variable rateper annum equal to the lesser of (a) a fixed rate and (b) the weighted average of the net mortgage interest rates on the mortgage loans for the related distribution date or (iv) a variable rateper annum equal to the weighted average of the net mortgage interest rates on the mortgage loans for the related distribution date minus a specified percentage. For purposes of the calculation of the weighted average of the net mortgage interest rates on the mortgage loans for each distribution date, the mortgage interest rates will be adjusted as necessary to a 30/360 basis. |

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

| Wells Fargo Commercial Mortgage Trust 2016-C34 | Certificate Structure |

| | |

| (8) | Represents the initial certificate balance of the Class A-3 Certificates that will be issued on the closing date. |

| | |

| (9) | The Class X-A Certificates are notional amount certificates. The Notional Amount of the Class X-A Certificates will be equal to the aggregate Certificate Balance of the Class A-1, A-2, A-3, A-4, A-SB and A-S Certificates and the Class A-3FX regular interest outstanding from time to time. The Class X-A Certificates will not be entitled to distributions of principal. |

| | |

| (10) | The pass-through rate for the Class X-A Certificates for any distribution date will be aper annum rate equal to the excess, if any, of (a) the weighted average of the net mortgage interest rates on the mortgage loans for the related distribution date, over (b) the weighted average of the pass-through rates on the Class A-1, A-2, A-3, A-4, A-SB and A-S Certificates and the Class A-3FX regular interest for the related distribution date, weighted on the basis of their respective Certificate Balances outstanding immediately prior to that distribution date. For purposes of the calculation of the weighted average of the net mortgage interest rates on the mortgage loans for each distribution date, the mortgage interest rates will be adjusted as necessary to a 30/360 basis. |

| | |

| (11) | The Class X-B Certificates are notional amount certificates. The Notional Amount of the Class X-B Certificates will be equal to the Certificate Balance of the Class B Certificates outstanding from time to time. The Class X-B Certificates will not be entitled to distributions of principal. |

| | |

| (12) | The pass-through rate for the Class X-B Certificates for any distribution date will be aper annum rate equal to the excess, if any, of (a) the weighted average of the net mortgage interest rates on the mortgage loans for the related distribution date, over (b) the pass-through rate on the Class B Certificates for the related distribution date. For purposes of the calculation of the weighted average of the net mortgage interest rates on the mortgage loans for each distribution date, the mortgage interest rates will be adjusted as necessary to a 30/360 basis. |

| | |

| (13) | The Class X-E Certificates are notional amount certificates. The Notional Amount of the Class X-E Certificates will be equal to the Certificate Balance of the Class E Certificates outstanding from time to time. The Class X-E Certificates will not be entitled to distributions of principal. |

| | |

| (14) | The pass-through rate for the Class X-E Certificates for any distribution date will be aper annumrate equal to the excess, if any, of (a) the weighted average of the net mortgage interest rates on the mortgage loans for the related distribution date, over (b) the pass-through rate on the Class E Certificates for the related distribution date. For purposes of the calculation of the weighted average of the net mortgage interest rates on the mortgage loans for each distribution date, the mortgage interest rates will be adjusted as necessary to a 30/360 basis. |

| | |

| (15) | The Class X-FG Certificates are notional amount certificates. The Notional Amount of the Class X-FG Certificates will be equal to the aggregate Certificate Balance of the Class F and G Certificates outstanding from time to time. The Class X-FG Certificates will not be entitled to distributions of principal. |

| | |

| (16) | The pass-through rate for the Class X-FG Certificates for any distribution date will be aper annumrate equal to the excess, if any, of (a) the weighted average of the net mortgage interest rates on the mortgage loans for the related distribution date, over (b) the weighted average of the pass-through rates on the Class F and G Certificates for the related distribution date, weighted on the basis of their respective Certificate Balances outstanding immediately prior to that distribution date. For purposes of the calculation of the weighted average of the net mortgage interest rates on the mortgage loans for each distribution date, the mortgage interest rates will be adjusted as necessary to a 30/360 basis. |

| | |

| (17) | The Class X-H Certificates are notional amount certificates. The Notional Amount of the Class X-H Certificates will be equal to the Certificate Balance of the Class H Certificates outstanding from time to time. The Class X-H Certificates will not be entitled to distributions of principal. |

| | |

| (18) | The pass-through rate for the Class X-H Certificates for any distribution date will be aper annum rate equal to the excess, if any, of (a) the weighted average of the net mortgage interest rates on the mortgage loans for the related distribution date, over (b) the pass-through rate on the Class H Certificates for the related distribution date. For purposes of the calculation of the weighted average of the net mortgage interest rates on the mortgage loans for each distribution date, the mortgage interest rates will be adjusted as necessary to a 30/360 basis. |

| | |

| (19) | The ratings assigned to the Class A-3FL Certificates reflect only the receipt of up to the fixed rate of interest equal to the pass-through rate for the Class A-3FX regular interest. The ratings of DBRS, Fitch and Moody’s do not address any shortfalls or delays in payment that investors in the Class A-3FL Certificates may experience as a result of the conversion of the pass-through rate on Class A-3FL Certificates from a floating interest rate to a fixed rate following a default under the swap agreement. See “Ratings” in the Private Placement Memorandum. |

| | |

| (20) | The aggregate initial certificate balance of the Class A-3, A-3FL and A-3FX Certificates will be $140,000,000. The aggregate certificate balance of the Class A-3FL and A-3FX Certificates will at all times equal the certificate balance of the Class A-3FX regular interest. The initial certificate balance of the Class A-3FL certificates is $25,000,000. The certificate balance of the Class A-3FX certificates will initially be $0. The initial certificate balance of the Class A-3FX regular interest is $25,000,000. |

| | |

| (21) | The Class A-3FL Certificates will evidence a beneficial interest in a grantor trust that includes the Class A-3FX regular interest and an interest rate swap contract. Under some circumstances, holders of the Class A-3FL Certificates may exchange all or a portion of their certificates for a like principal amount of Class A-3FX Certificates having the same pass-through rate as the Class A-3FX regular interest. The aggregate certificate balance of the Class A-3FL Certificates may be adjusted from time to time as a result of such an exchange. |

| | |

| (22) | The pass-through rate applicable to the Class A-3FL Certificates on each distribution date will be aper annum rate equal to LIBOR plus a specified percentage; provided, however, that under certain circumstances (generally involving a default or termination under the related interest rate swap contract), the pass-through rate applicable to the Class A-3FL Certificates may convert to a rate equal to the pass-through rate on the Class A-3FX regular interest; provided, further, that if such per annum rate is determined to be below zero, the per annum rate will be deemed to be zero. The initial LIBOR rate will be determined two LIBOR business days prior to the Closing Date, and subsequent LIBOR rates for the Class A-3FL Certificates will be determined two LIBOR business days before the start of the related interest accrual period. |

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

| Wells Fargo Commercial Mortgage Trust 2016-C34 | Transaction Highlights |

| II. | Transaction Highlights |

Mortgage Loan Sellers:

| | | | | | | | | | | | |

| Mortgage Loan Seller | | Number of

Mortgage Loans | | Number of

Mortgaged

Properties | | Aggregate Cut-off

Date Balance | | % of Initial Pool

Balance |

| Wells Fargo Bank, National Association | | 32 | | | 32 | | | $236,472,369 | | 33.6 | % |

| Natixis Real Estate Capital LLC(1) | | 9 | | | 28 | | | 206,001,998 | | 29.3 | |

| Rialto Mortgage Finance, LLC | | 15 | | | 19 | | | 127,599,500 | | 18.2 | |

| Silverpeak Real Estate Finance LLC | | 8 | | | 9 | | | 103,037,089 | | 14.7 | |

| Basis Real Estate Capital II, LLC | | 4 | | | 4 | | | 29,676,544 | | 4.2 | |

| Total | | 68 | | | 92 | | | $702,787,500 | | 100.0 | % |

| (1) | One of the Mortgage Loans for which Natixis Real Estate Capital LLC is the mortgage loan seller was originated by its affiliate, Natixis, New York Branch. |

Loan Pool:

| Initial Pool Balance: | $702,787,500 |

| Number of Mortgage Loans: | 68 |

| Average Cut-off Date Balance per Mortgage Loan: | $10,335,110 |

| Number of Mortgaged Properties: | 92 |

| Average Cut-off Date Balance per Mortgaged Property(1): | $7,638,995 |

| Weighted Average Mortgage Interest Rate: | 5.052% |

| Ten Largest Mortgage Loans as % of Initial Pool Balance: | 50.2% |

| Weighted Average Original Term to Maturity (months): | 111 |

| Weighted Average Remaining Term to Maturity (months): | 109 |

| Weighted Average Original Amortization Term (months)(2): | 353 |

| Weighted Average Remaining Amortization Term (months)(2): | 352 |

| Weighted Average Seasoning (months): | 2 |

| |

| (1) | Information regarding mortgage loans secured by multiple properties is based on an allocation according to relative appraised values or the allocated loan amounts or property-specific release prices set forth in the related loan documents or such other allocation as the related mortgage loan seller deemed appropriate. |

| (2) | Excludes any mortgage loan that does not amortize. |

Credit Statistics:

| Weighted Average U/W Net Cash Flow DSCR(1): | 1.48x |

| Weighted Average U/W Net Operating Income Debt Yield(1): | 10.1% |

| Weighted Average Cut-off Date Loan-to-Value Ratio(1): | 65.9% |

| Weighted Average Balloon Loan-to-Value Ratio(1): | 57.7% |

| % of Mortgage Loans with Additional Subordinate Debt(2): | 18.3% |

| % of Mortgage Loans with Single Tenants(3): | 2.7% |

| (1) | With respect to any mortgage loan that is part of a whole loan, loan-to-value ratio, debt service coverage ratio and debt yield calculations include the relatedpari passu companion loan(s) but exclude any related subordinate companion loan(s) (unless otherwise stated). The debt service coverage ratio, debt yield and loan-to-value ratio information do not take into account any subordinate debt (whether or not secured by the related mortgaged property), that currently exists or is allowed under the terms of any mortgage loan. See “Description of the Mortgage Pool—Mortgage Pool Characteristics” in the Preliminary Prospectus and Annex A-1 to the Preliminary Prospectus. |

| (2) | The percentage figure expressed as “% of Mortgage Loans with Additional Subordinate Debt” is determined as a percentage of the initial pool balance and does not take into account any future subordinate debt (whether or not secured by the mortgaged property), that may be permitted under the terms of any mortgage loan or the pooling and servicing agreement. See “Description of the Mortgage Pool—Additional Indebtedness—Other Unsecured Indebtedness”. |

| (3) | Excludes mortgage loans that are secured by multiple single tenant properties. |

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

| Wells Fargo Commercial Mortgage Trust 2016-C34 | Transaction Highlights |

Loan Structural Features:

Amortization:Based on the Initial Pool Balance, 91.1% of the mortgage pool (66 mortgage loans) has scheduled amortization, as follows:

52.1% (32 mortgage loans) provides for an interest-only period followed by an amortization period; and

39.0% (34 mortgage loans) requires amortization during the entire loan term.

Interest-Only:Based on the Initial Pool Balance, 8.9% of the mortgage pool (2 mortgage loans) provides for interest-only payments during the entire loan term. The Weighted Average Cut-off Date Loan-to-Value Ratio and Weighted Average U/W Net Cash Flow DSCR for those mortgage loans are 63.9% and 1.95x, respectively.

Hard Lockboxes: Based on the Initial Pool Balance, 37.3% of the mortgage pool (12 mortgage loans) have hard lockboxes in place.

Reserves:The mortgage loans require amounts to be escrowed monthly as follows (excluding any mortgage loans with springing provisions):

| Real Estate Taxes: | 88.1% of the pool |

| Insurance: | 78.6% of the pool |

| Capital Replacements: | 93.1% of the pool |

| TI/LC: | 93.6% of the pool(1) |

| (1)The percentage of Initial Pool Balance for mortgage loans with TI/LC reserves is based on the aggregate principal balance allocable to loans that include retail, office and industrial properties. |

Call Protection/Defeasance: Based on the Initial Pool Balance, the mortgage pool has the following call protection and defeasance features:

92.6% of the mortgage pool (62 mortgage loans) features a lockout period, then defeasance only until an open period;

5.8% of the mortgage pool (4 mortgage loans) features a lockout period, then the greater of a prepayment premium or yield maintenance until an open period;

1.6% of the mortgage pool (2 mortgage loans) features a lockout period, then the greater of a prepayment premium or yield maintenance or defeasance until an open period; and

Please refer to Annex A-1 to the Preliminary Prospectus for further information regarding individual loan call protection.

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

| Wells Fargo Commercial Mortgage Trust 2016-C34 | Issue Characteristics |

| III. | Issue Characteristics |

| Securities Offered: | $575,004,000 approximate monthly pay, multi-class, commercial mortgage REMIC pass-through certificates consisting of 10 classes (Classes A-1, A-2, A-3, A-4, A-SB, A-S, B, C, X-A and X-B), which are offered pursuant to a registration statement filed with the SEC (such classes of certificates, the “Offered Certificates”). |

| | |

| Mortgage Loan Sellers: | Wells Fargo Bank, National Association (“WFB”), Natixis Real Estate Capital LLC (“Natixis”), Rialto Mortgage Finance, LLC (“RMF”), Silverpeak Real Estate Finance LLC (“SPREF”) and Basis Real Estate Capital II, LLC (“Basis”). |

| | |

| Sole Lead Bookrunning Manager: | Wells Fargo Securities, LLC |

| | |

| Co-Managers: | Academy Securities, Inc., Deutsche Bank Securities Inc. and Natixis Securities Americas LLC |

| | |

| Rating Agencies: | DBRS, Inc., Fitch Ratings, Inc. and Moody’s Investors Service, Inc. |

| | |

| Master Servicer: | Wells Fargo Bank, National Association |

| | |

| Special Servicer: | LNR Partners, LLC |

| | |

| Certificate Administrator: | Wells Fargo Bank, National Association |

| | |

| Trustee: | Wilmington Trust, National Association |

| | |

| Operating Advisor: | Pentalpha Surveillance LLC |

| | |

| Asset Representations Reviewer: | Pentalpha Surveillance LLC |

| | |

| Initial Majority Controlling Class Certificateholder: | Prime Finance CMBS B-Piece Holdco I, L.P. |

| | |

| Cut-off Date: | The Cut-off Date with respect to each mortgage loan is the due date for the monthly debt service payment that is due in May 2016 (or, in the case of any mortgage loan that has its first due date in June 2016, the date that would have been its due date in May 2016 under the terms of that mortgage loan if a monthly debt service payment were scheduled to be due in that month). |

| | |

| Expected Closing Date: | On or about May 24, 2016. |

| | |

| Determination Dates: | The 11th day of each month (or if that day is not a business day, the next succeeding business day), commencing in June 2016. |

| | |

| Distribution Dates: | The fourth business day following the Determination Date in each month, commencing in June 2016. |

| | |

| Rated Final Distribution Date: | The Distribution Date in May 2049. |

| | |

| Interest Accrual Period: | With respect to any Distribution Date, the calendar month immediately preceding the month in which such Distribution Date occurs. |

| | |

| Day Count: | The Offered Certificates will accrue interest on a 30/360 basis. |

| | |

| Minimum Denominations: | $10,000 for each Class of Offered Certificates (other than the Class X-A and X-B Certificates) and $1,000,000 for the Class X-A and X-B Certificates. Investments may also be made in any whole dollar denomination in excess of the applicable minimum denomination. |

| | |

| Clean-up Call: | 1% |

| | |

| Delivery: | DTC, Euroclear and Clearstream Banking |

| | |

| ERISA/SMMEA Status: | Each Class of Offered Certificates is expected to be eligible for exemptive relief under ERISA. No Class of Offered Certificates will be SMMEA eligible. |

| | |

| Risk Factors: | THE CERTIFICATES INVOLVE CERTAIN RISKS AND MAY NOT BE SUITABLE FOR ALL INVESTORS. SEE THE “RISK FACTORS” SECTION OF THE PRELIMINARY PROSPECTUS. |

| | |

| Bond Analytics Information: | The Certificate Administrator will be authorized to make distribution date statements, CREFC® reports and certain supplemental reports (other than confidential information) available to certain financial modeling and data provision services, including Bloomberg, L.P., Trepp, LLC, Intex Solutions, Inc., Markit Group Limited, Interactive Data Corp., BlackRock Financial Management, Inc., CMBS.com, Inc. and Thomson Reuters Corporation. |

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

| Wells Fargo Commercial Mortgage Trust 2016-C34 | Characteristics of the Mortgage Pool |

| IV. | Characteristics of the Mortgage Pool(1) |

| A. | Ten Largest Mortgage Loans |

Mortgage Loan

Seller | Mortgage Loan Name | City | State | Number of Mortgage

Loans / Mortgaged Properties | Mortgage Loan Cut-off Date Balance ($) | % of Initial Pool Balance (%) | Property

Type | Number of SF/Rooms | Cut-off Date Balance Per SF/Room | Cut-off Date LTV Ratio (%) | Balloon LTV Ratio (%) | U/W NCF DSCR (x) | U/W NOI Debt Yield (%) |

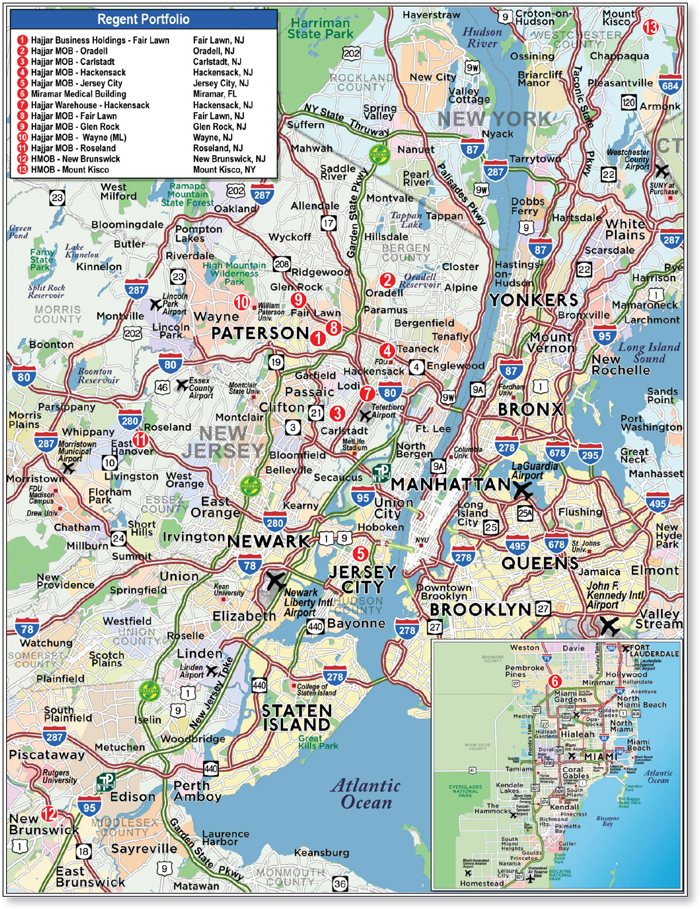

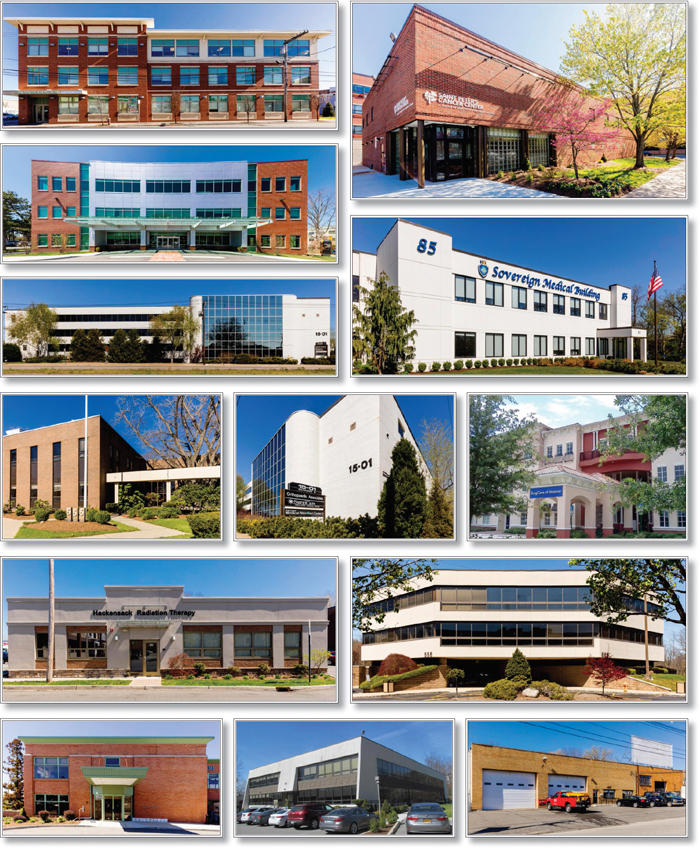

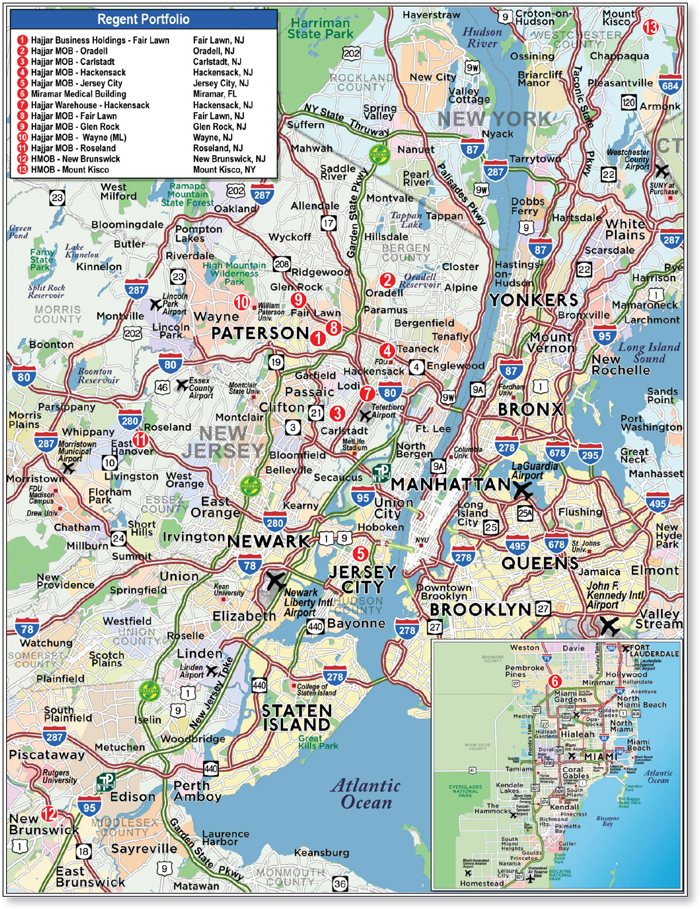

| Natixis | Regent Portfolio | Various | Various | 1 / 13 | $70,000,000 | 9.96% | Various | 352,001 | $232 | 62.2% | 59.6% | 1.45x | 10.1% |

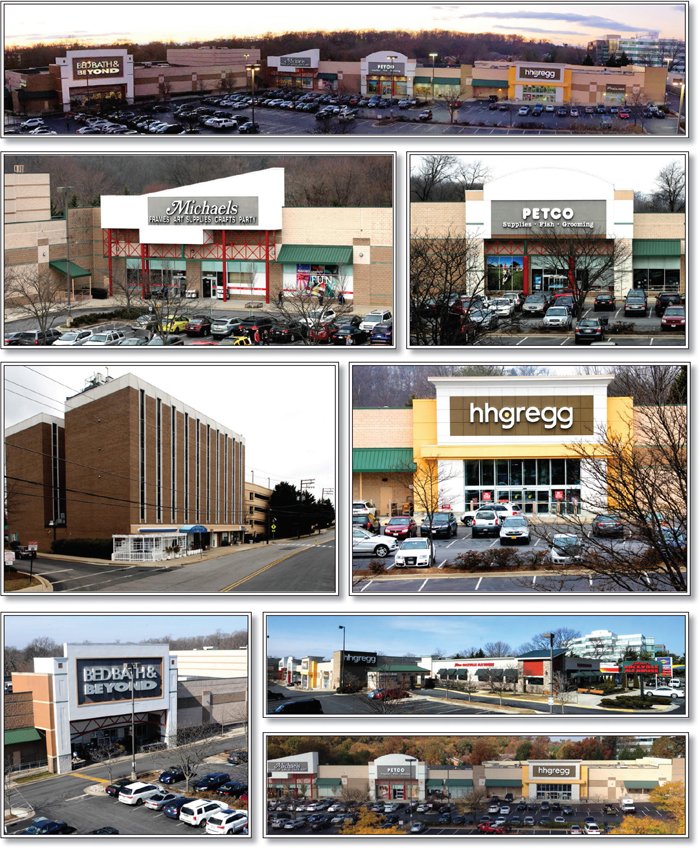

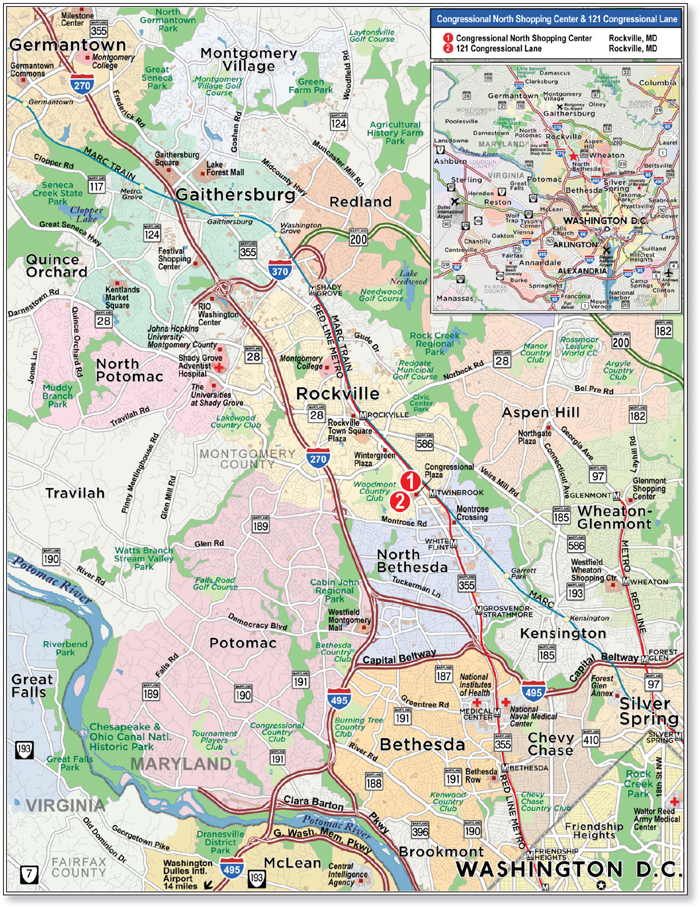

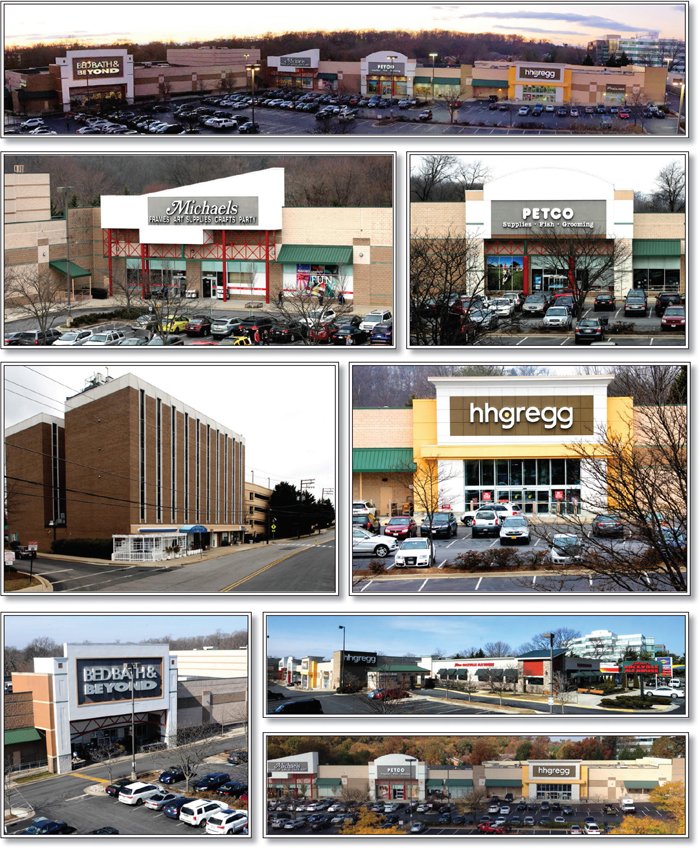

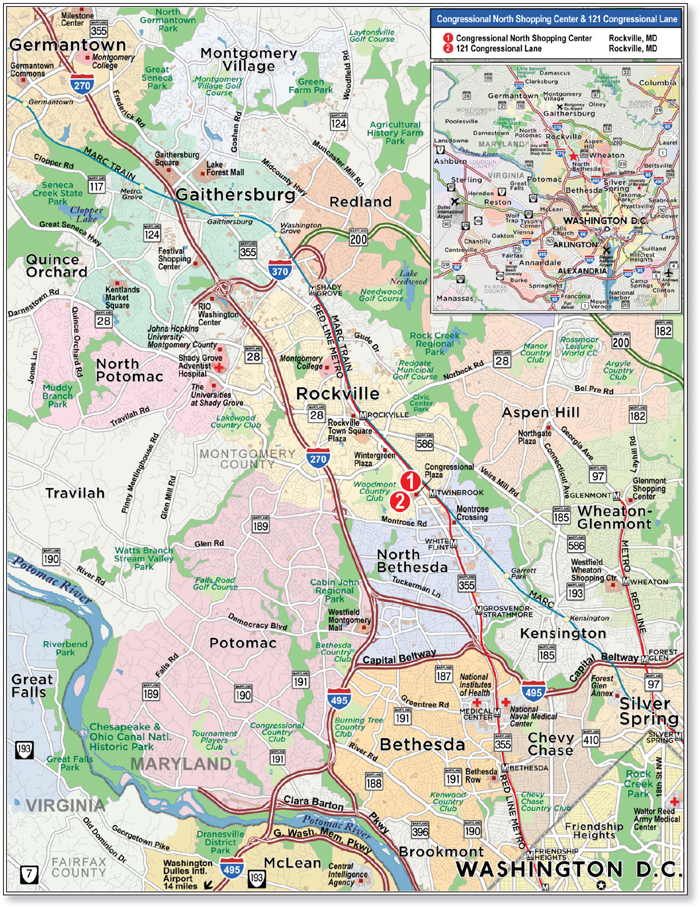

| Natixis | Congressional North Shopping Center & 121 Congressional Lane | Rockville | MD | 1 / 2 | 58,750,000 | 8.4 | Various | 232,201 | 253 | 64.5 | 64.5 | 1.95 | 8.9 |

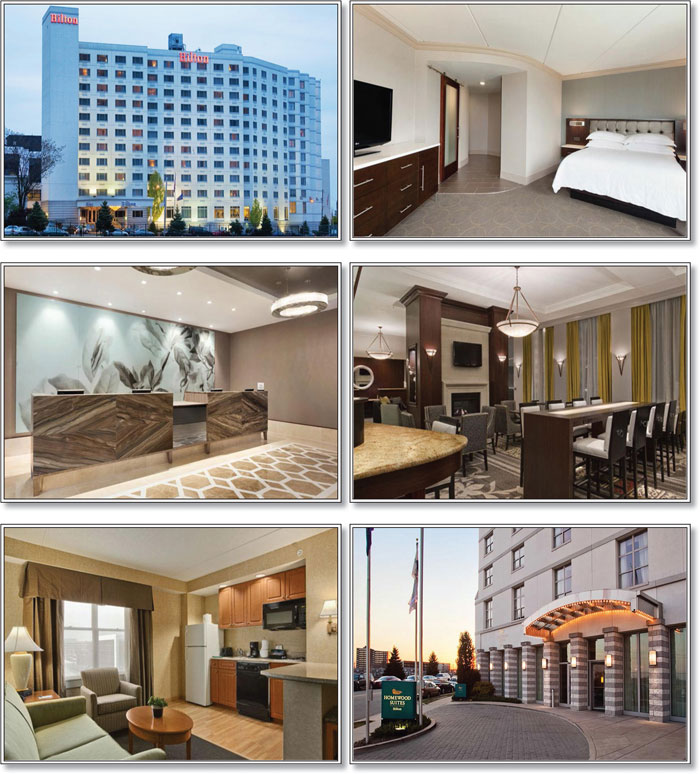

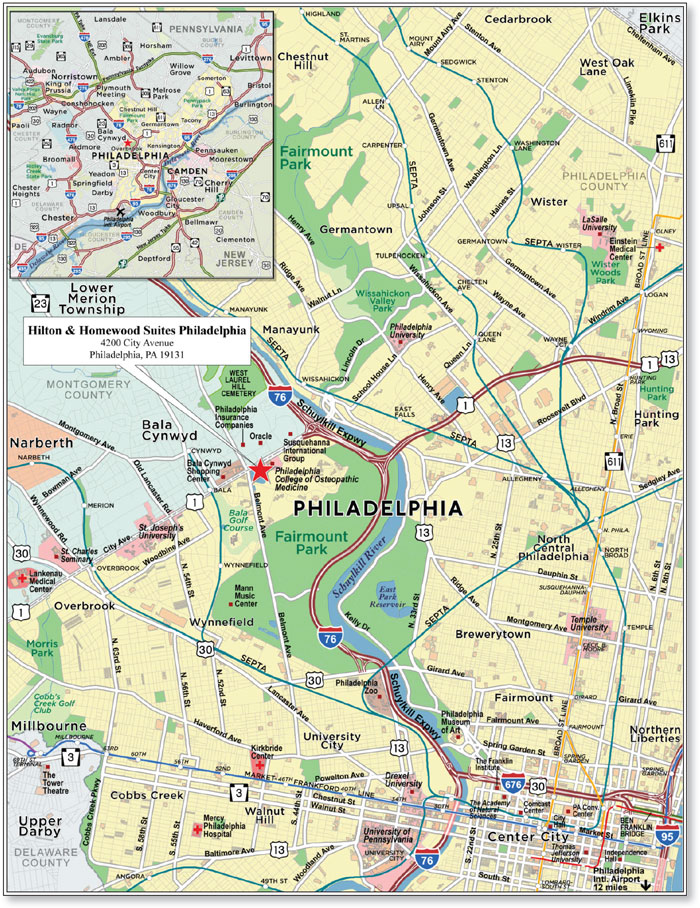

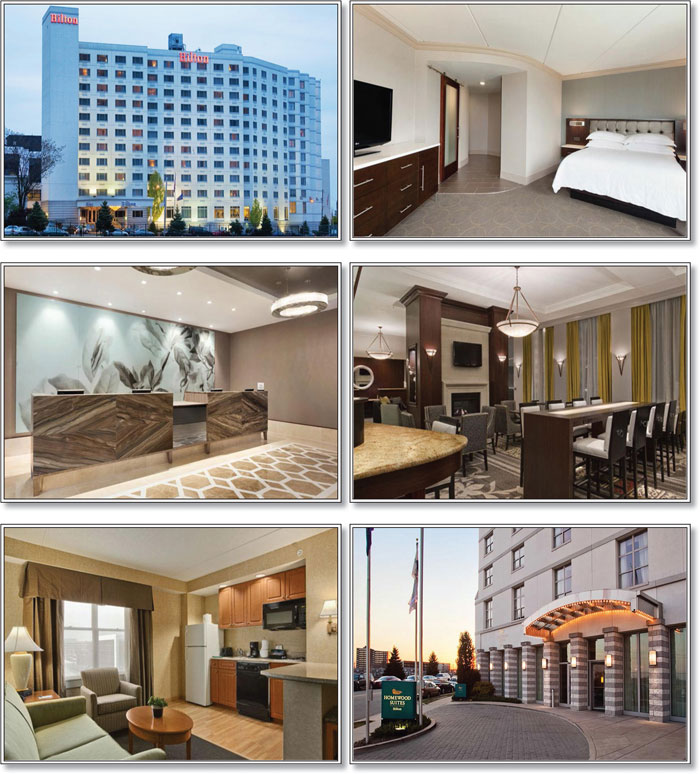

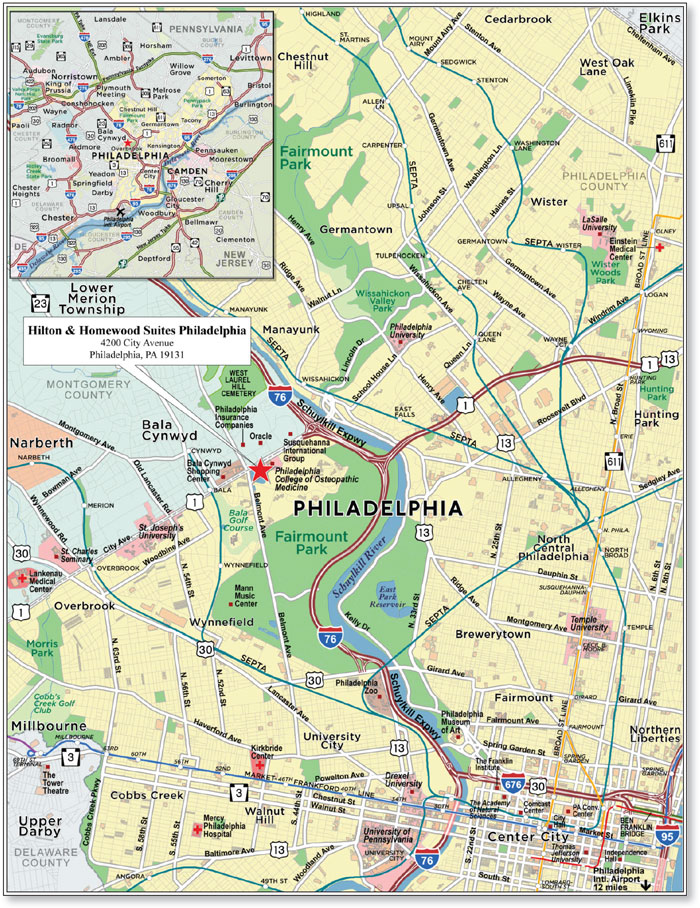

| WFB | Hilton & Homewood Suites Philadelphia | Philadelphia | PA | 1 / 1 | 44,779,868 | 6.4 | Hospitality | 331 | 135,287 | 58.5 | 48.0 | 1.68 | 12.5 |

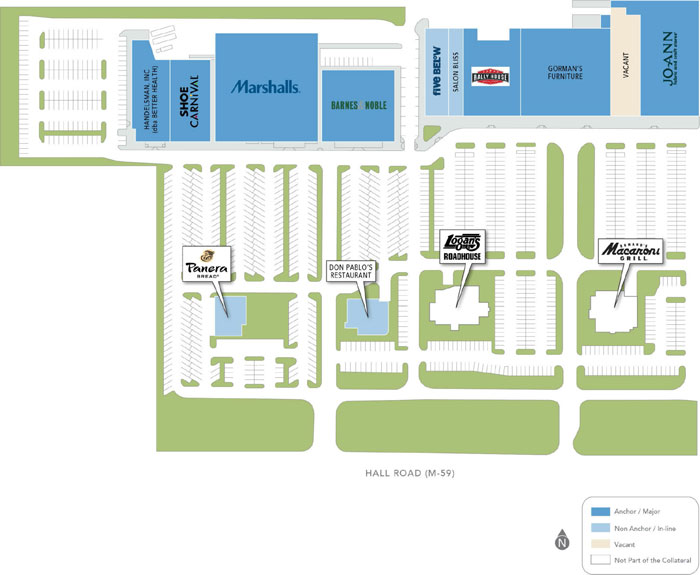

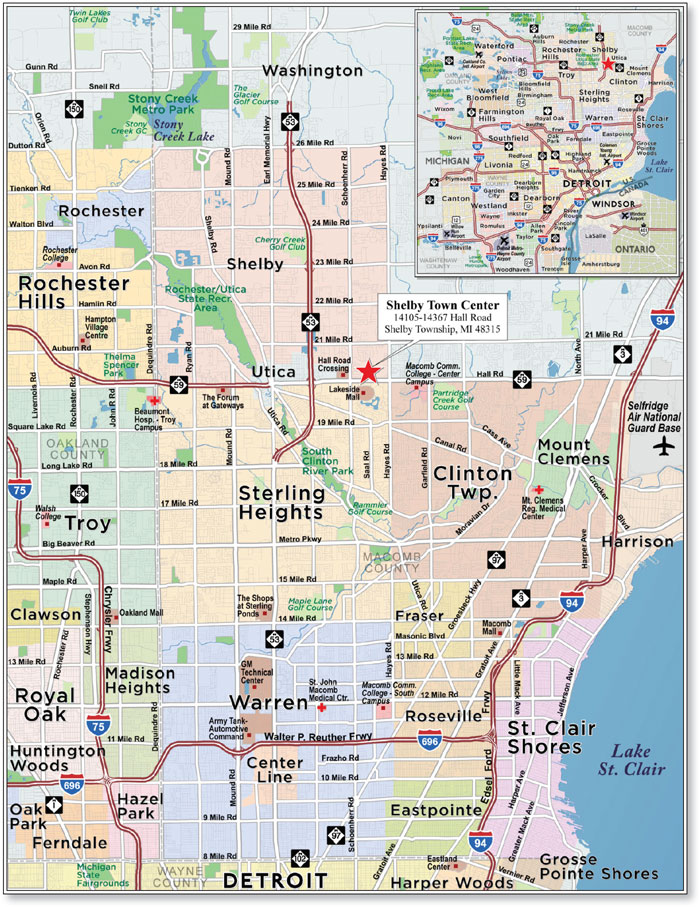

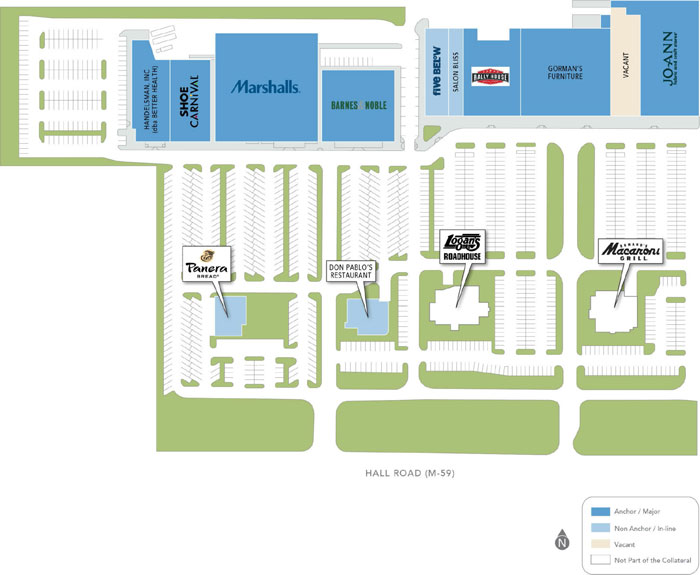

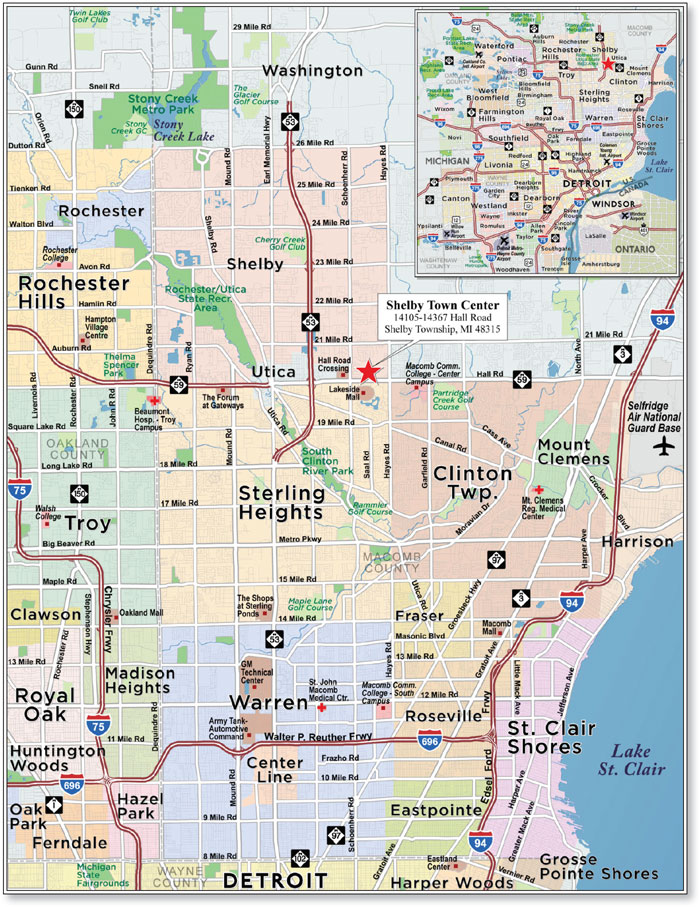

| RMF | Shelby Town Center | Shelby Township | MI | 1 / 1 | 30,000,000 | 4.3 | Retail | 238,229 | 126 | 70.7 | 62.5 | 1.40 | 9.5 |

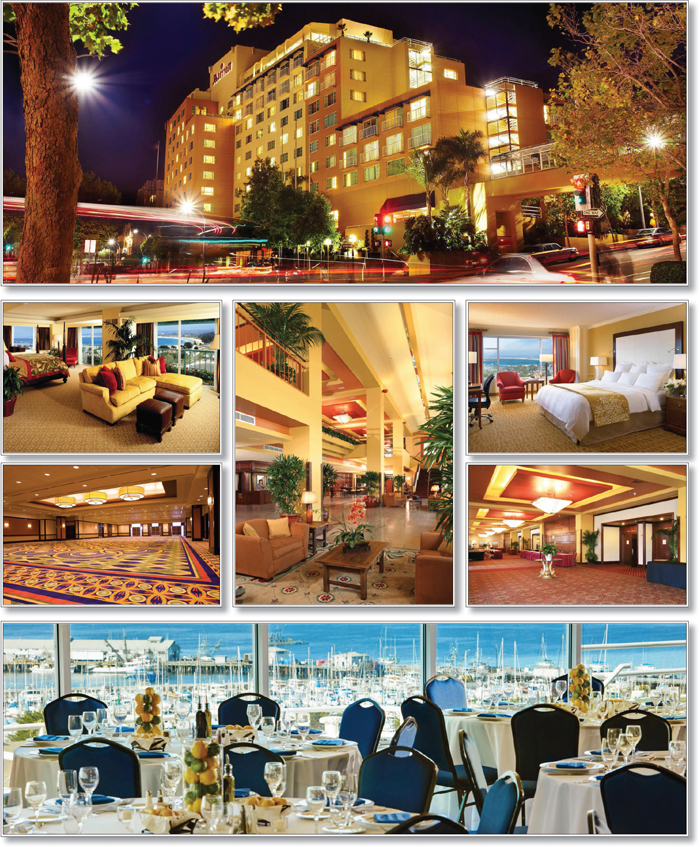

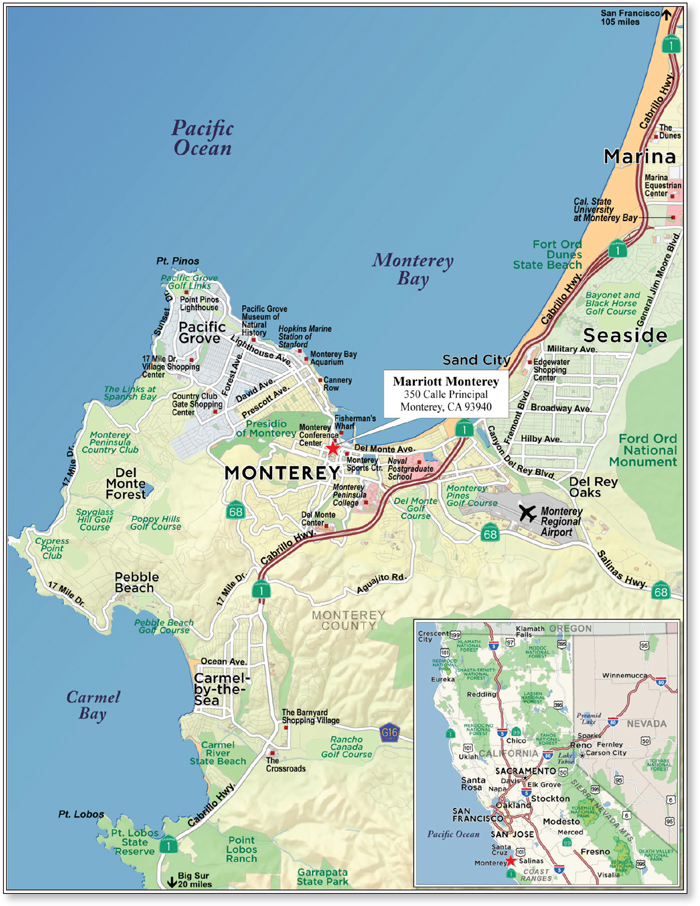

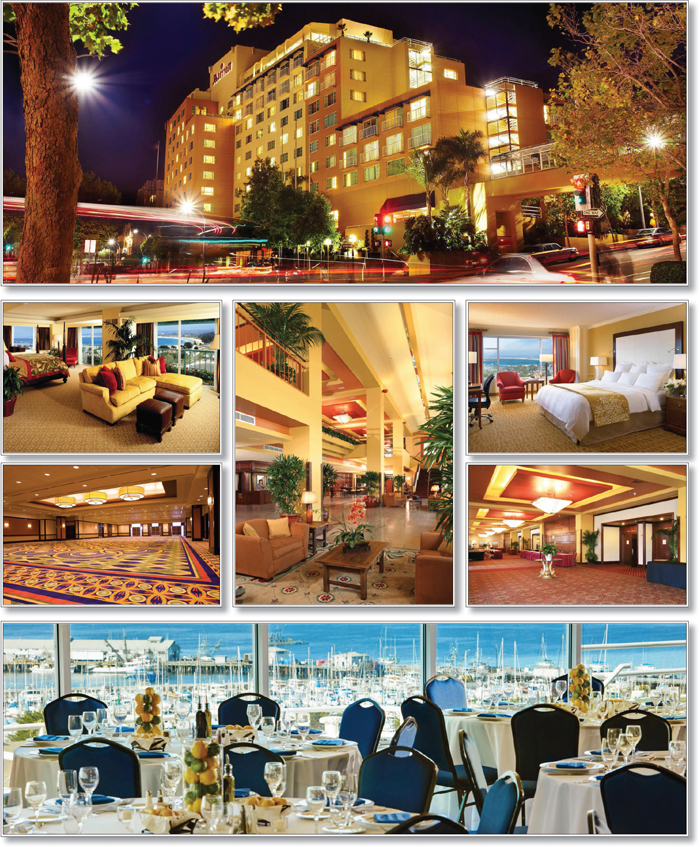

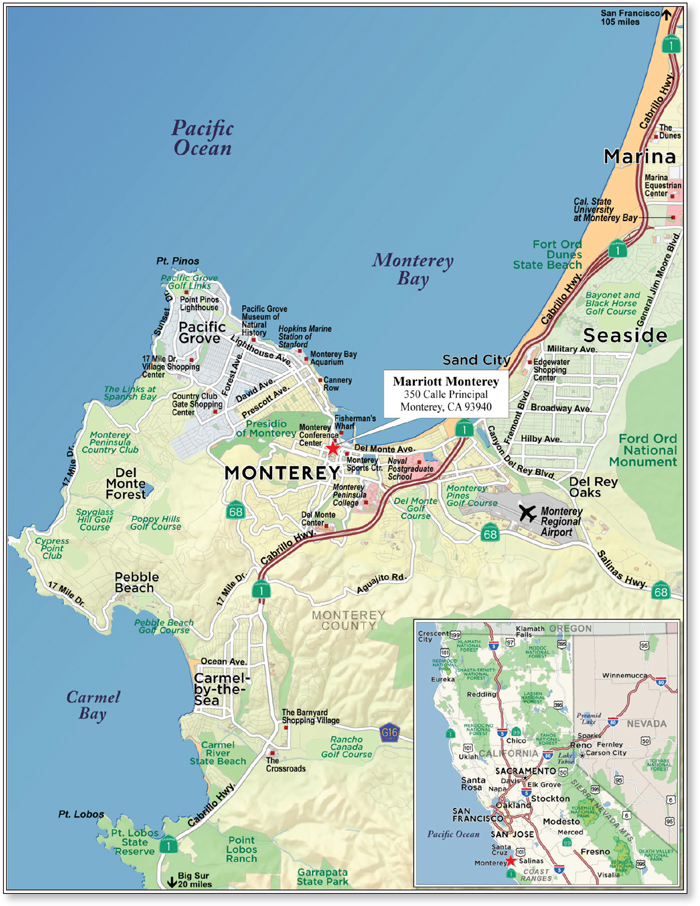

| Natixis | Marriott Monterey | Monterey | CA | 1 / 1 | 29,967,471 | 4.3 | Hospitality | 341 | 190,409 | 54.1 | 45.3 | 1.60 | 13.2 |

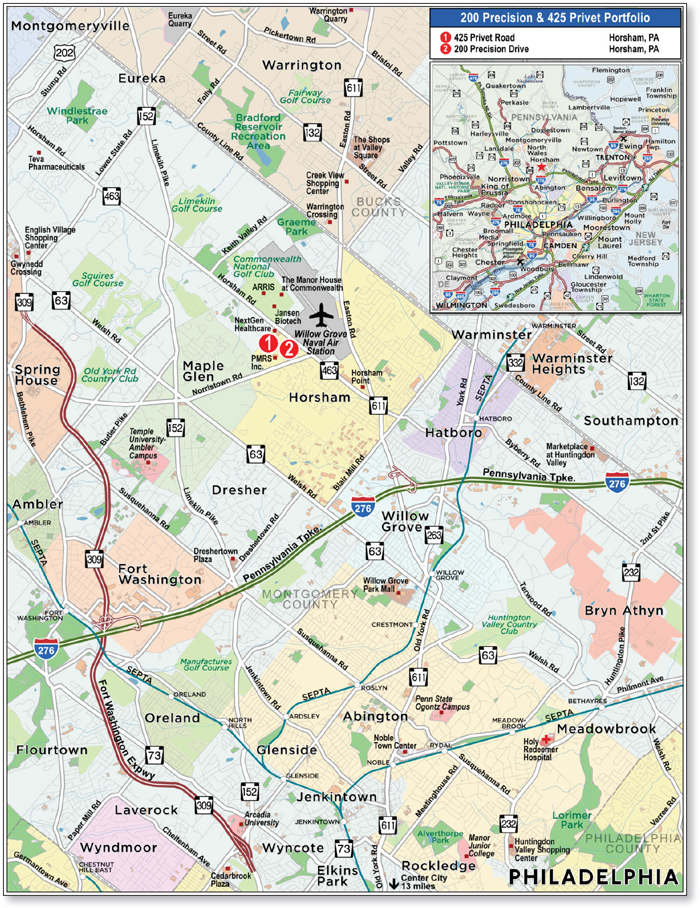

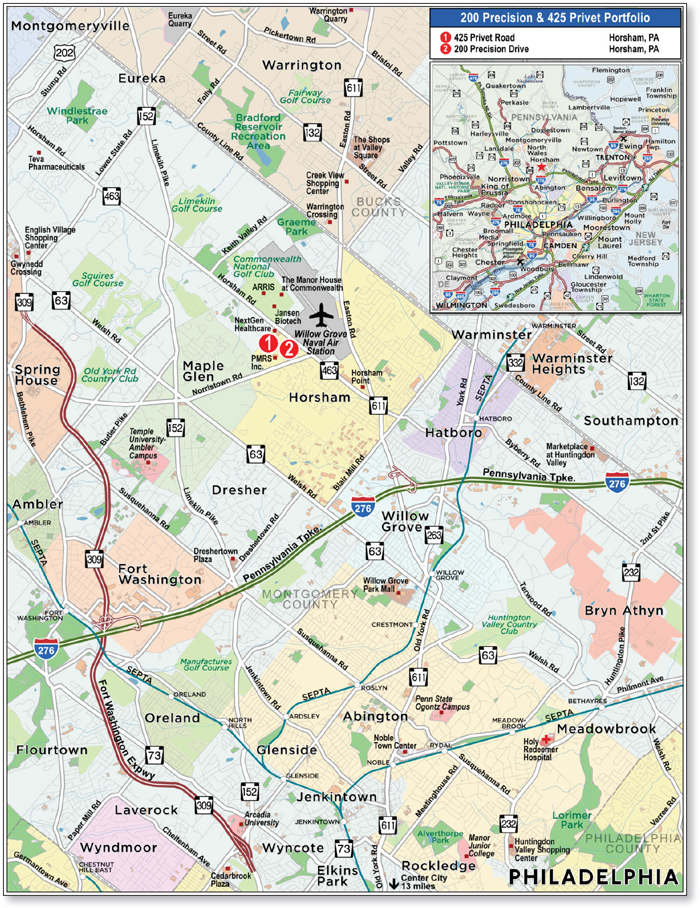

| SPREF | 200 Precision & 425 Privet Portfolio | Horsham | PA | 1 / 2 | 28,000,000 | 4.0 | Various | 246,790 | 113 | 71.6 | 64.5 | 1.53 | 10.2 |

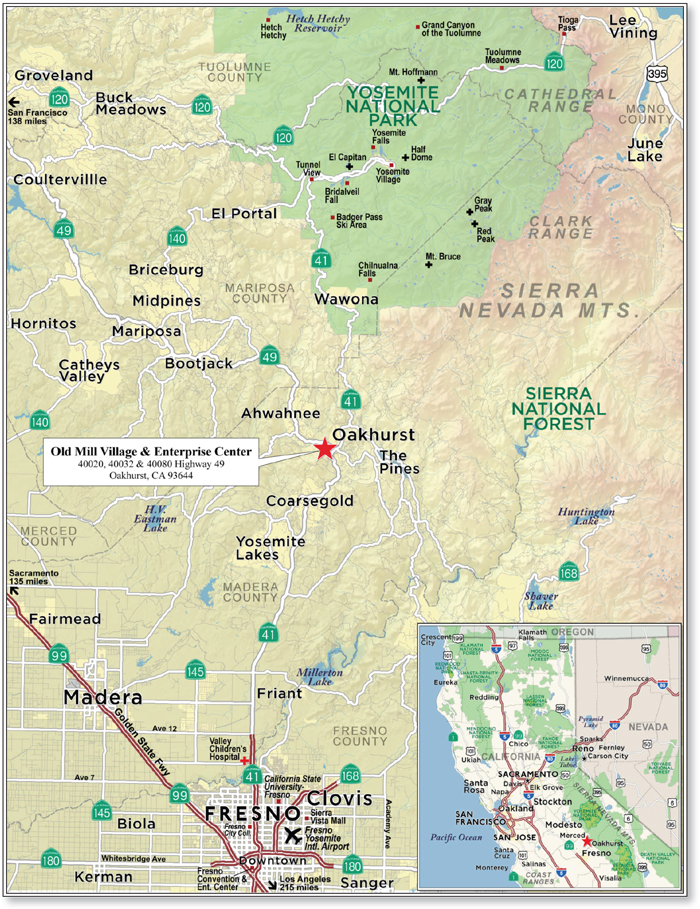

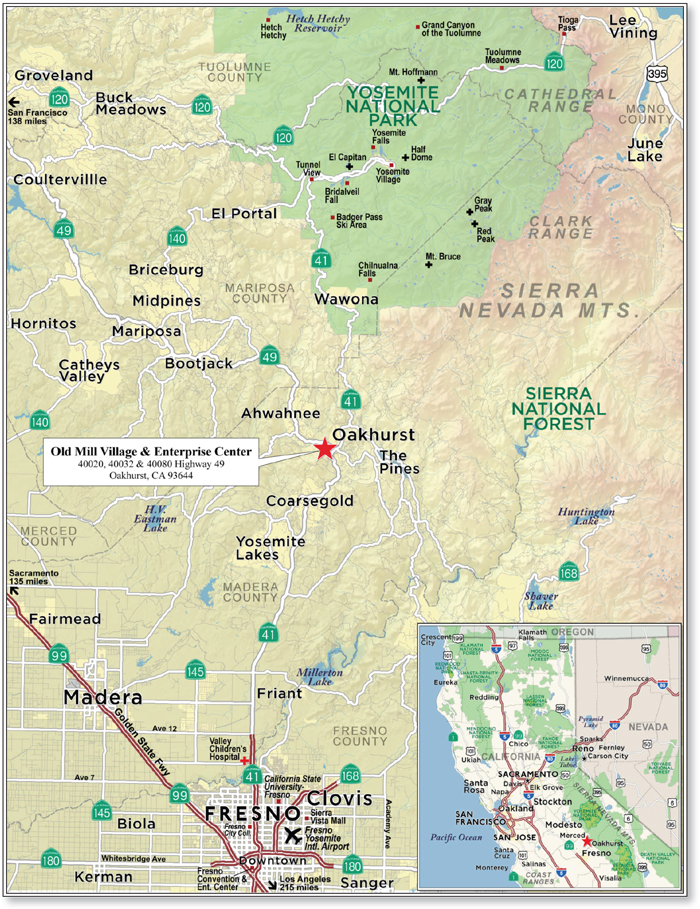

| WFB | Old Mill Village & Enterprise Center | Oakhurst | CA | 1 / 1 | 24,314,370 | 3.5 | Mixed Use | 332,759 | 73 | 70.5 | 44.2 | 1.25 | 10.5 |

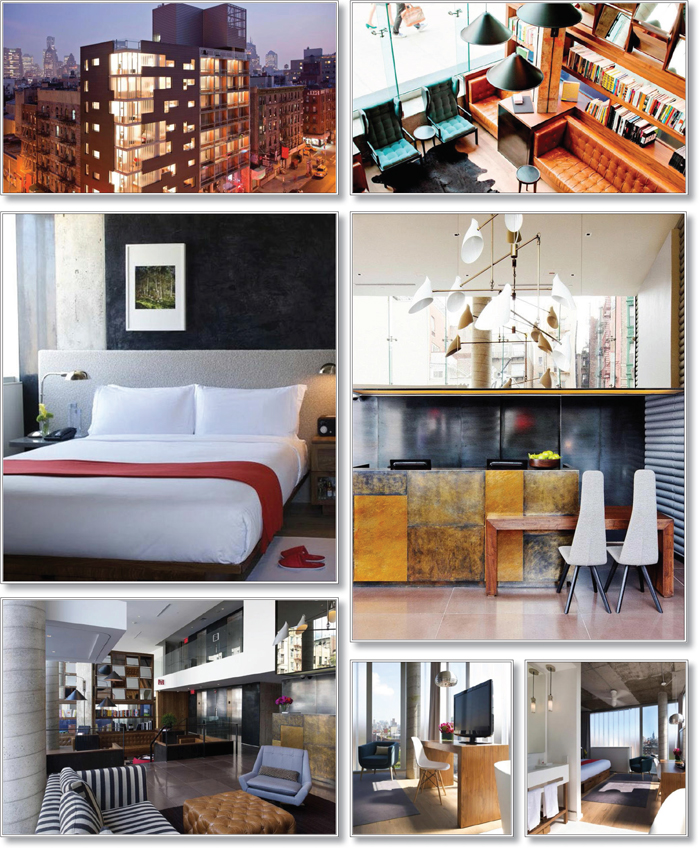

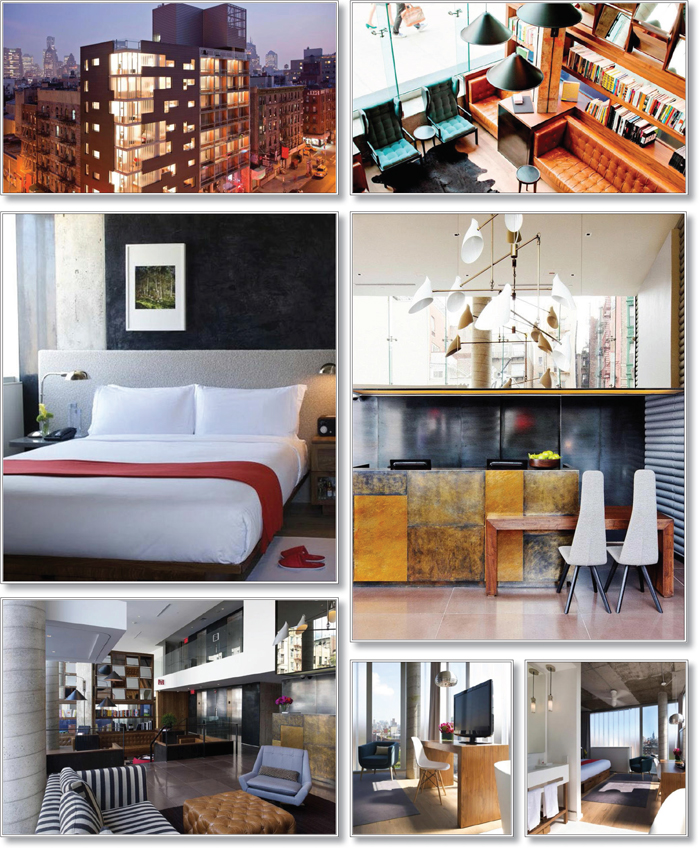

| SPREF | Nolitan Hotel | New York | NY | 1 / 1 | 24,000,000 | 3.4 | Hospitality | 57 | 421,053 | 60.8 | 50.4 | 1.40 | 10.4 |

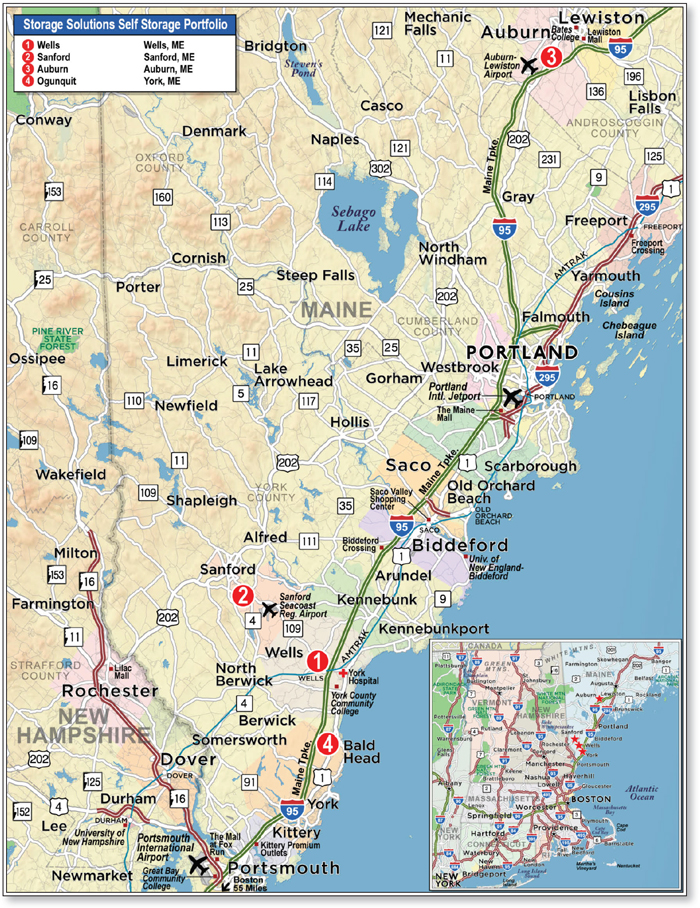

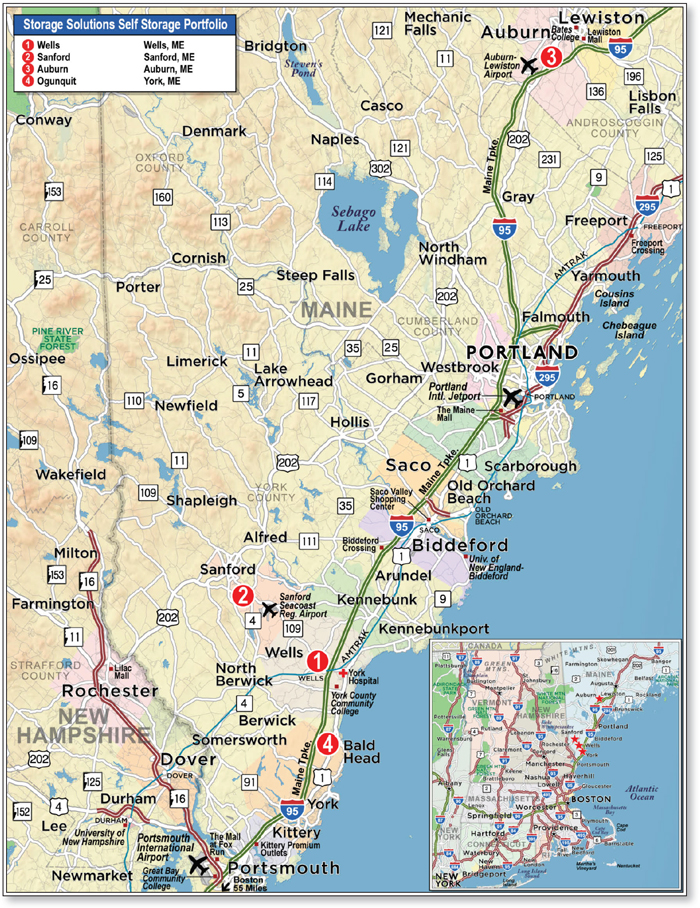

| RMF | Storage Solutions Self Storage Portfolio | Various | ME | 1 / 4 | 22,380,000 | 3.2 | Self Storage | 259,420 | 86 | 65.6 | 62.8 | 1.42 | 9.5 |

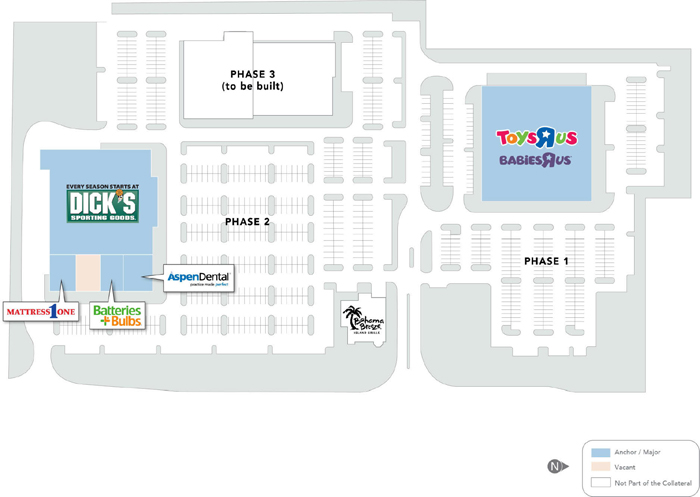

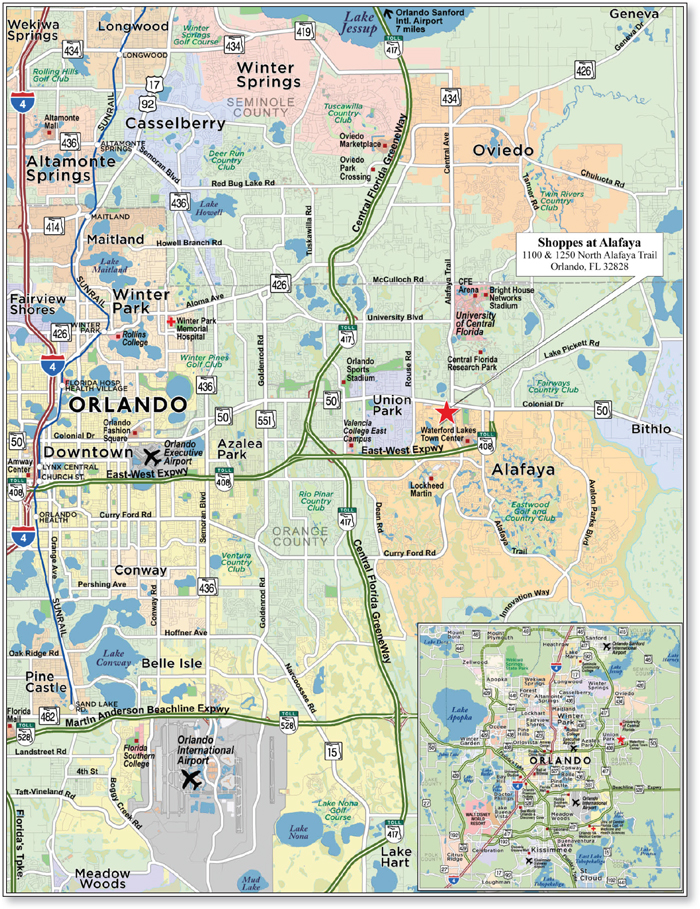

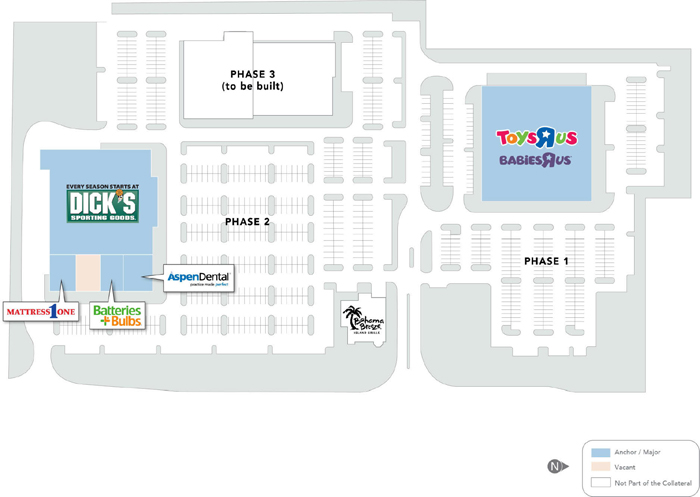

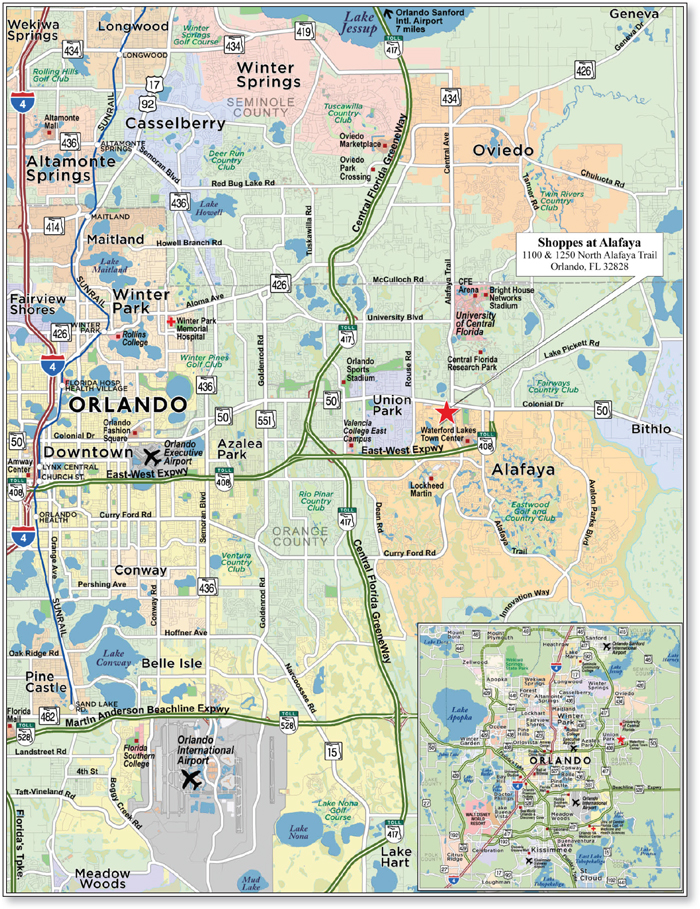

| Basis | Shoppes at Alafaya | Orlando | FL | 1 / 1 | 20,950,000 | 3.0 | Retail | 120,639 | 174 | 73.1 | 63.7 | 1.25 | 8.8 |

| Top Three Total/Weighted Average | | 3 / 16 | $173,529,868 | 24.7% | | | | 62.0% | 58.3% | 1.68x | 10.3% |

| Top Five Total/Weighted Average | | 5 / 18 | $233,497,339 | 33.2% | | | | 62.1% | 57.1% | 1.63x | 10.6% |

| Top Ten Total/Weighted Average | | 10 / 27 | $353,141,708 | 50.2% | | | | 64.2% | 57.1% | 1.55x | 10.4% |

| Non-Top Ten Total/Weighted Average | | 58 / 65 | $349,645,792 | 49.8% | | | | 67.6% | 58.3% | 1.41x | 9.9% |

| (1) | With respect to any mortgage loan that is part of a whole loan, Cut-off Date Balance Per SF/Room, loan-to-value ratio, debt service coverage ratio and debt yield calculations include the relatedpari passu companion loan(s) but exclude any related subordinate companion loan(s) (unless otherwise stated). With respect to each mortgage loan, debt service coverage ratio, debt yield and loan-to-value ratio information do not take into account of subordinate debt (whether or not secured by the related mortgaged property), if any, that currently exists or is allowed under the terms of such mortgage loan. |

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

| Wells Fargo Commercial Mortgage Trust 2016-C34 | Characteristics of the Mortgage Pool |

| B. | Summary of thePari PassuWhole Loans |

| Property Name | Mortgage Loan Seller | Note(s) | Related Notes in Loan Group (Original Balance) | Holder of Note | Lead Servicer for the Entire Whole loan | Current Master Servicer Under Related Securitization Servicing Agreement | Current Special Servicer Under Related Securitization Servicing Agreement |

| Regent Portfolio | Natixis | A-1 | $70,000,000 | WFCM 2016-C34 | Yes | Wells Fargo Bank, National Association | LNR Partners, LLC |

| Natixis | A-2 | $11,500,000 | (1) | No | TBD | TBD |

| Marriott Monterey | Natixis | A-1 | $35,000,000 | CGCMT 2016-P3 | Yes | Wells Fargo Bank, National Association | C-III Asset Management LLC |

| Natixis | A-2 | $30,000,000 | WFCM 2016-C34 | No | Wells Fargo Bank, National Association | LNR Partners, LLC |

| (1) | The relatedpari passu companion loan Note A-2 is currently held by an affiliate of Natixis and is expected to be contributed to a future securitization. No assurance can be provided that the Note A-2 will not be split further. |

| C. | Mortgage Loans with Additional Secured and Mezzanine Financing |

| Loan No. | Mortgage Loan Seller | Mortgage Loan Name | Mortgage

Loan

Cut-off Date Balance ($) | % of Initial Pool Balance (%) | Subordinate Debt

Cut-off Date Balance ($) | Mezzanine Debt Cut-off Date Balance ($) | Total Debt Interest Rate (%)(1) | Mortgage Loan U/W NCF DSCR (x)(2) | Total Debt U/W NCF DSCR (x) | Mortgage Loan Cut-off Date U/W NOI Debt Yield (%)(2) | Total Debt Cut-off Date U/W NOI Debt Yield (%) | Mortgage Loan Cut-off Date LTV Ratio (%)(2) | Total Debt Cut-off Date LTV Ratio (%) |

| 1 | Natixis | Regent Portfolio | $70,000,000 | 9.96% | NAP | $10,000,000 | 6.064% | 1.45x | 1.17x | 10.1% | 9.0% | 62.2% | 69.8% |

| 2 | Natixis | Congressional North Shopping Center & 121 Congressional Lane | 58,750,000 | 8.4 | 4,500,000 | NAP | 4.823 | 1.95 | 1.64 | 8.9 | 8.3 | 64.5 | 69.4 |

| Total/Weighted Average | $128,750,000 | 18.3% | $4,500,000 | $10,000,000 | 5.498% | 1.68x | 1.38x | 9.6% | 8.7% | 63.2% | 69.6% |

| (1) | Total Debt Interest Rate for any specified mortgage loan reflects the weighted average of the interest rates on the respective components of the total debt. |

| (2) | With respect to the Regent Portfolio mortgage loan, which is part of a whole loan, the loan-to-value ratio, debt service coverage ratio and debt yield calculations include the relatedpari passucompanion loan(s). With respect to the Congressional North Shopping Center & 121 Congressional Lane mortgage loan, which is part of a whole loan, the loan-to-value ratio, debt service coverage ratio and debt yield calculations exclude the related subordinate companion loan. |

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

| Wells Fargo Commercial Mortgage Trust 2016-C34 | Characteristics of the Mortgage Pool |

| D. | Previous Securitization History(1) |

Loan

No. | Mortgage Loan

Seller | Mortgage

Loan or Mortgaged

Property Name | City | State | Property Type | Mortgage Loan

or Mortgaged Property Cut-off Date Balance ($) | % of

Initial Pool Balance (%) | Previous

Securitization |

| 2 | Natixis | Congressional North Shopping Center & 121 Congressional Lane | Rockville | MD | Various | $58,750,000 | 8.4% | BACM 2006-4 |

| 3 | WFB | Hilton & Homewood Suites Philadelphia | Philadelphia | PA | Hospitality | 44,779,868 | 6.4 | CD 2007-CD4 |

| 4 | RMF | Shelby Town Center | Shelby Township | MI | Retail | 30,000,000 | 4.3 | MSC 2005-HQ7 |

| 5 | Natixis | Marriott Monterey | Monterey | CA | Hospitality | 29,967,471 | 4.3 | JPMCC 2006-LDP8 |

| 7 | WFB | Old Mill Village & Enterprise Center | Oakhurst | CA | Mixed Use | 24,314,370 | 3.5 | BACM 2006-2 |

| 8 | SPREF | Nolitan Hotel | New York | NY | Hospitality | 24,000,000 | 3.4 | COMM 2012-CR5 |

| 11 | RMF | Embassy Plaza | Tucson | AZ | Retail | 17,500,000 | 2.5 | WBCMT 2006-C25; MLMT 2004-MKB1 |

| 12 | WFB | Manchester Parkade | Manchester | CT | Mixed Use | 16,439,932 | 2.3 | GSMS 2006-GG6 |

| 13 | Natixis | Matrix Portfolio | Various | Various | Various | 16,370,000 | 2.3 | JPMCC 2008-C2 |

| 14 | WFB | Tempe Square | Tempe | AZ | Retail | 15,625,000 | 2.2 | CSMC 2006-C3 |

| 16 | WFB | Pacific Palisades Bowl MHC | Pacific Palisades | CA | Manufactured Housing Community | 12,900,000 | 1.8 | BACM 2006-1 |

| 17 | WFB | Sonora Plaza I | Sonora | CA | Retail | 12,700,000 | 1.8 | JPMCC 2006-CB16 |

| 21 | Natixis | Securlock Colony | The Colony | TX | Self Storage | 9,908,634 | 1.4 | COMM 2006-C7 |

| 22 | WFB | Security Public Storage - Santa Rosa | Santa Rosa | CA | Self Storage | 9,801,255 | 1.4 | BSCMS 2006-T22 |

| 23 | SPREF | Overbrook Plaza | Philadelphia | PA | Retail | 9,400,000 | 1.3 | GECMC 2006-C1 |

| 39 | WFB | Northwood Hills Apartments | Dallas | TX | Multifamily | 4,784,743 | 0.7 | CSMC 2006-C2 |

| 40 | WFB | Victorville Self Storage | Victorville | CA | Self Storage | 4,500,000 | 0.6 | LBUBS 2006-C6 |

| 41 | RMF | Corners Shopping Center | Shelby Township | MI | Retail | 4,495,302 | 0.6 | CSMC 2006-C1 |

| 47 | SPREF | PetSmart - Killeen | Killeen | TX | Retail | 3,487,089 | 0.5 | LBUBS 2007-C2 |

| 48 | Natixis | Shoppes of Waterville Commons | Waterville | ME | Retail | 3,410,820 | 0.5 | MSC 2006-HQ9 |

| 51 | WFB | Stor It 4 Less - Sun Valley, CA | Sun Valley | CA | Self Storage | 2,993,404 | 0.4 | GECMC 2006-C1 |

| 53 | WFB | Maple Place Shopping Center | Novi | MI | Retail | 2,845,320 | 0.4 | MSC 2005-T19 |

| 54 | WFB | Parkway Pavillion | Clarksville | TN | Retail | 2,700,000 | 0.4 | MSC 2006-HQ9 |

| 56 | WFB | Shoppes at First Colony | Sugar Land | TX | Retail | 2,650,000 | 0.4 | CSMC 2006-C4 |

| 58 | WFB | Windswept Plaza | Rockport | TX | Retail | 2,288,466 | 0.3 | CSMC 2006-C3 |

| 60 | RMF | CVS Akron | Akron | OH | Retail | 1,692,820 | 0.2 | MSC 2006-T23 |

| 62 | WFB | Plaza Center I & II | Parker | CO | Office | 1,600,000 | 0.2 | BSCMS 2006-PW13 |

| 66 | WFB | Security Public Storage - Riverbank | Riverbank | CA | Self Storage | 1,348,483 | 0.2 | MSC 2006-T23 |

| 68 | WFB | Sandoval Self Storage | Laredo | TX | Self Storage | 1,261,123 | 0.2 | CGCMT 2006-C5 |

| | Total | | | | | $372,514,100 | 53.0% | |

| (1) | The table above represents the most recent securitization with respect to the mortgaged property securing the related mortgage loan, based on information provided by the related borrower or obtained through searches of a third-party database. While loans secured by the above mortgaged properties may have been securitized multiple times in prior transactions, mortgage loans in this securitization are only listed in the above chart if the mortgage loan paid off a loan in another securitization. The information has not otherwise been confirmed by the mortgage loan sellers. |

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

| Wells Fargo Commercial Mortgage Trust 2016-C34 | Characteristics of the Mortgage Pool |

| E. | Mortgage Loans with Scheduled Balloon Payments and Related Classes |

| | | | | | | | | | | | | | | | | |

| Class A-2(1) |

| Loan No. | Mortgage Loan Seller | Mortgage Loan Name | State | Property Type | Mortgage Loan Cut-off Date Balance ($) | % of Initial Pool Balance (%) | Balloon Balance ($) | % of Class

A-2 Certificate Balance (%)(2) | SF/ Pads/ Units | Loan per SF/ Pad/Unit ($)(3) | U/W NCF DSCR (x)(3) | U/W NOI Debt Yield (%)(3) | Cut-off Date LTV Ratio (%)(3) | Balloon LTV Ratio (%)(3) | Rem. IO Period (mos.) | Rem.

Term to Maturity

(mos.) |

| 1 | Natixis | Regent Portfolio | Various | Various | $70,000,000 | 9.96% | $67,030,271 | 66.6% | 352,001 | $232 | 1.45x | 10.1% | 62.2% | 59.6% | 24 | 60 |

| 9 | RMF | Storage Solutions Self Storage Portfolio | ME | Self Storage | 22,380,000 | 3.2 | 21,437,400 | 21.3 | 259,420 | 86 | 1.42 | 9.5 | 65.6 | 62.8 | 22 | 58 |

| 34 | RMF | Bit O Heaven MHC | TX | Manufactured Housing Community | 5,437,500 | 0.8 | 5,187,335 | 5.2 | 759 | 7,164 | 1.29 | 10.1 | 70.5 | 67.3 | 11 | 59 |

| 39 | WFB | Northwood Hills Apartments | TX | Multifamily | 4,784,743 | 0.7 | 4,277,197 | 4.3 | 192 | 24,921 | 1.85 | 14.4 | 57.0 | 50.9 | 0 | 58 |

| Total/Weighted Average | | | $102,602,243 | 14.6% | $97,932,204 | 97.3% | | | 1.45x | 10.2% | 63.1% | 60.3% | 22 | 59 |

| (1) | The table above presents the mortgage loan(s) whose balloon payments would be applied to pay down the principal balance of the Class A-2 Certificates, assuming a 0% CPR and applying the “Structuring Assumptions” described in the Preliminary Prospectus, including the assumptions that (i) none of the mortgage loans in the pool experience prepayments prior to maturity, defaults or losses; (ii) there are no extensions of maturity dates of any mortgage loans in the pool; and (iii) each mortgage loan in the pool is paid in full on its stated maturity date. Each Class of Certificates evidences undivided ownership interests in the entire pool of mortgage loans. Debt service coverage ratio, debt yield and loan-to-value ratio information do not take into account subordinate debt (whether or not secured by the related mortgaged property), if any, that currently exists or is allowed under the terms of any mortgage loan. See Annex A-1 to the Preliminary Prospectus. |

| (2) | Reflects the percentage equal to the Balloon Balance divided by the initial Class A-2 Certificate Balance. |

| (3) | With respect to the Regent Portfolio mortgage loan, which is part of a whole loan, the Loan per SF/Pad/Unit, loan-to-value ratio, debt service coverage ratio and debt yield calculations include the relatedpari passu companion loan(s). |

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

Wells Fargo Commercial Mortgage Trust 2016-C34 | Characteristics of the Mortgage Pool |

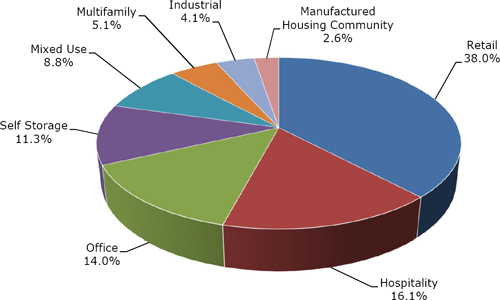

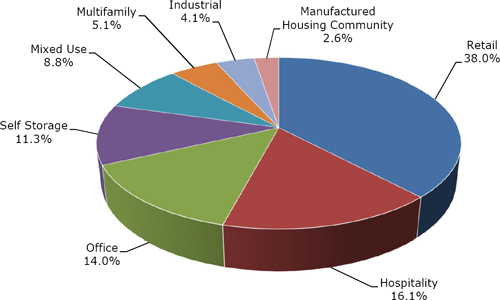

| F. | Property Type Distribution(1) |

| Property Type | Number of Mortgaged Properties | Aggregate

Cut-off Date Balance ($) | % of Initial Pool Balance (%) | Weighted Average Cut-

off Date LTV

Ratio (%) | Weighted

Average

Balloon LTV

Ratio (%) | Weighted

Average

U/W NCF

DSCR (x) | Weighted

Average

U/W NOI

Debt Yield

(%) | Weighted

Average U/W

NCF Debt

Yield (%) | Weighted

Average

Mortgage

Rate (%) |

| Retail | 33 | $267,010,815 | 38.0 | % | 68.7 | % | 61.7 | % | 1.48 | x | 9.4 | % | 8.8 | % | 4.960 | % |

| Anchored | 12 | 204,345,637 | 29.1 | | 68.7 | | 62.6 | | 1.51 | | 9.3 | | 8.7 | | 4.861 | |

| Unanchored | 8 | 26,046,525 | 3.7 | | 68.1 | | 56.8 | | 1.36 | | 10.1 | | 9.3 | | 5.305 | |

| Single Tenant | 6 | 18,885,510 | 2.7 | | 65.4 | | 58.7 | | 1.39 | | 9.0 | | 8.8 | | 5.329 | |

| Shadow Anchored | 7 | 17,733,143 | 2.5 | | 72.8 | | 61.1 | | 1.41 | | 10.3 | | 9.4 | | 5.191 | |

| Hospitality | 5 | 113,321,995 | 16.1 | | 57.3 | | 47.5 | | 1.66 | | 12.7 | | 10.9 | | 5.207 | |

| Full Service | 3 | 98,747,339 | 14.1 | | 57.7 | | 47.8 | | 1.59 | | 12.2 | | 10.4 | | 5.145 | |

| Extended Stay | 1 | 8,979,582 | 1.3 | | 46.8 | | 38.5 | | 2.54 | | 18.0 | | 16.4 | | 5.000 | |

| Limited Service | 1 | 5,595,074 | 0.8 | | 66.6 | | 57.6 | | 1.43 | | 12.4 | | 11.0 | | 6.640 | |

| Office | 15 | 98,213,128 | 14.0 | | 64.5 | | 60.2 | | 1.46 | | 10.2 | | 9.6 | | 5.144 | |

| Medical | 13 | 78,030,008 | 11.1 | | 63.0 | | 59.4 | | 1.44 | | 10.1 | | 9.5 | | 5.239 | |

| Suburban | 2 | 20,183,120 | 2.9 | | 70.1 | | 63.3 | | 1.55 | | 10.4 | | 9.7 | | 4.774 | |

| Self Storage | 21 | 79,751,777 | 11.3 | | 64.2 | | 56.0 | | 1.43 | | 9.5 | | 9.4 | | 5.069 | |

| Self Storage | 21 | 79,751,777 | 11.3 | | 64.2 | | 56.0 | | 1.43 | | 9.5 | | 9.4 | | 5.069 | |

| Mixed Use | 5 | 61,633,065 | 8.8 | | 70.1 | | 54.9 | | 1.38 | | 10.0 | | 9.2 | | 4.891 | |

| Industrial/Retail | 1 | 24,314,370 | 3.5 | | 70.5 | | 44.2 | | 1.25 | | 10.5 | | 9.7 | | 4.710 | |

| Retail/Industrial/Office | 1 | 16,439,932 | 2.3 | | 74.7 | | 61.6 | | 1.41 | | 10.4 | | 9.1 | | 4.970 | |

| Retail/Office | 1 | 10,149,400 | 1.4 | | 65.7 | | 60.9 | | 1.24 | | 8.6 | | 8.2 | | 5.260 | |

| Office/Retail | 1 | 7,029,363 | 1.0 | | 64.5 | | 64.5 | | 1.95 | | 8.9 | | 8.7 | | 4.369 | |

| Multifamily/Retail | 1 | 3,700,000 | 0.5 | | 69.8 | | 61.5 | | 1.44 | | 10.2 | | 10.0 | | 5.710 | |

| Multifamily | 6 | 35,811,286 | 5.1 | | 69.3 | | 61.1 | | 1.38 | | 9.8 | | 9.2 | | 5.175 | |

| Garden | 6 | 35,811,286 | 5.1 | | 69.3 | | 61.1 | | 1.38 | | 9.8 | | 9.2 | | 5.175 | |

| Industrial | 5 | 28,707,935 | 4.1 | | 67.4 | | 56.7 | | 1.39 | | 9.7 | | 9.2 | | 4.972 | |

| Flex | 2 | 14,737,943 | 2.1 | | 68.4 | | 58.1 | | 1.47 | | 10.2 | | 9.6 | | 4.844 | |

| Warehouse | 3 | 13,969,992 | 2.0 | | 66.5 | | 55.2 | | 1.30 | | 9.2 | | 8.8 | | 5.107 | |

| Manufactured Housing Community | 2 | 18,337,500 | 2.6 | | 69.7 | | 62.0 | | 1.33 | | 9.1 | | 8.9 | | 5.299 | |

| Manufactured Housing Community | 2 | 18,337,500 | 2.6 | | 69.7 | | 62.0 | | 1.33 | | 9.1 | | 8.9 | | 5.299 | |

| Total/Weighted Average: | 92 | $702,787,500 | 100.0 | % | 65.9 | % | 57.7 | % | 1.48 | x | 10.1 | % | 9.4 | % | 5.052 | % |

| (1) | Because this table presents information relating to the mortgaged properties and not the mortgage loans, the information for mortgage loans secured by more than one mortgaged property is based on allocated amounts (allocating the mortgage loan balance to each of those properties according to the relative appraised values of the mortgaged properties or the allocated loan amounts or property-specific release prices set forth in the related mortgage loan documents or such other allocation as the related mortgage loan seller deemed appropriate). With respect to any mortgage loan that is part of a whole loan, the loan-to-value ratio, debt service coverage ratio and debt yield calculations include the relatedpari passu companion loan(s) but exclude any related subordinate companion loan(s) (unless otherwise stated). With respect to each mortgage loan, debt service coverage ratio, debt yield and loan-to-value ratio information do not take into account of any subordinate debt (whether or not secured by the related mortgaged property) that currently exists or is allowed under the terms of such mortgage loan. See Annex A-1 to the Preliminary Prospectus. |

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

Wells Fargo Commercial Mortgage Trust 2016-C34 | Characteristics of the Mortgage Pool |

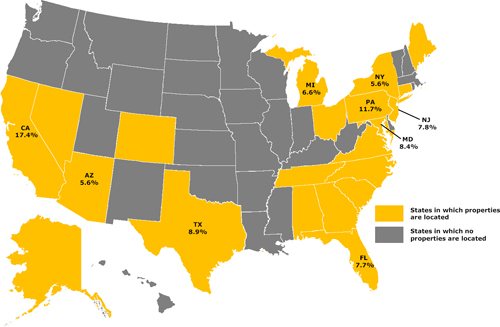

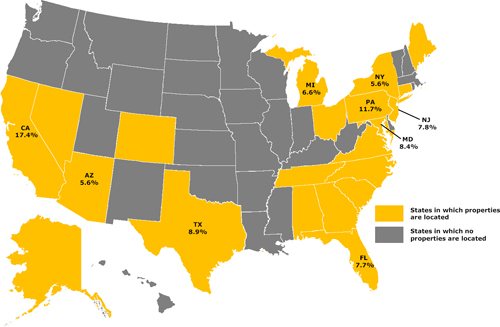

| G. | Geographic Distribution(1)(2) |

| Location | Number of

Mortgaged

Properties | Aggregate

Cut-off Date

Balance ($) | % of Initial

Pool Balance

(%) | Weighted

Average Cut-

off Date LTV

Ratio (%) | Weighted

Average

Balloon LTV

Ratio (%) | Weighted

Average

U/W NCF

DSCR (x) | Weighted

Average U/W

NOI Debt

Yield (%) | Weighted

Average U/W

NCF Debt

Yield (%) | Weighted

Average

Mortgage

Rate (%) |

| California | 12 | $122,346,046 | 17.4 | % | 64.8 | % | 51.8 | % | 1.41 | x | 10.5 | % | 9.6 | % | 5.027 | % |

| Northern | 8 | 95,052,642 | 13.5 | | 64.3 | | 50.1 | | 1.42 | | 10.9 | | 9.8 | | 5.067 | |

| Southern | 4 | 27,293,404 | 3.9 | | 66.7 | | 57.5 | | 1.40 | | 9.2 | | 8.9 | | 4.889 | |

| Pennsylvania | 4 | 82,179,868 | 11.7 | | 64.8 | | 55.7 | | 1.59 | | 11.4 | | 10.1 | | 4.830 | |

| Texas | 14 | 62,271,681 | 8.9 | | 67.7 | | 58.0 | | 1.34 | | 9.7 | | 9.2 | | 5.325 | |

| Maryland | 2 | 58,750,000 | 8.4 | | 64.5 | | 64.5 | | 1.95 | | 8.9 | | 8.7 | | 4.369 | |

| New Jersey | 11 | 54,851,167 | 7.8 | | 62.2 | | 59.6 | | 1.45 | | 10.1 | | 9.6 | | 5.213 | |

| Florida | 10 | 54,155,573 | 7.7 | | 68.9 | | 60.7 | | 1.35 | | 9.7 | | 9.0 | | 5.336 | |

| Michigan | 5 | 46,035,986 | 6.6 | | 68.5 | | 59.1 | | 1.43 | | 10.2 | | 9.5 | | 5.143 | |

| Arizona | 3 | 39,425,000 | 5.6 | | 67.6 | | 62.7 | | 1.33 | | 9.0 | | 8.3 | | 4.765 | |

| New York | 3 | 39,188,334 | 5.6 | | 62.1 | | 54.1 | | 1.42 | | 10.3 | | 9.5 | | 5.313 | |

| Other(3) | 28 | 143,583,846 | 20.4 | | 67.2 | | 58.4 | | 1.46 | | 10.2 | | 9.6 | | 5.171 | |

| Total/Weighted Average | 92 | $702,787,500 | 100.0 | % | 65.9 | % | 57.7 | % | 1.48 | x | 10.1 | % | 9.4 | % | 5.052 | % |

| (1) | The mortgaged properties are located in 21 states and the District of Columbia. |

| (2) | Because this table presents information relating to the mortgaged properties and not the mortgage loans, the information for mortgage loans secured by more than one mortgaged property is based on allocated amounts (allocating the mortgage loan balance to each of those properties according to the relative appraised values of the mortgaged properties or the allocated loan amounts or property-specific release prices set forth in the related mortgage loan documents or such other allocation as the related mortgage loan seller deemed appropriate). With respect to any mortgage loan that is part of a whole loan, the loan-to-value ratio, debt service coverage ratio and debt yield calculations include the relatedpari passu companion loan(s) but exclude any related subordinate companion loan(s) (unless otherwise stated). With respect to each mortgage loan, debt service coverage ratio, debt yield and loan-to-value ratio information do not take into account of any subordinate debt (whether or not secured by the related mortgaged property) that currently exists or is allowed under the terms of such mortgage loan. See Annex A-1 to the Preliminary Prospectus. |

| (3) | Includes 12 other states and District of Columbia. |

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

Wells Fargo Commercial Mortgage Trust 2016-C34 | Characteristics of the Mortgage Pool |

| H. | Characteristics of the Mortgage Pool(1) |

| CUT-OFF DATE BALANCE |

Range of Cut-off Date

Balances ($) | Number of

Mortgage

Loans | Aggregate Cut-

off Date Balance | % of Initial

Pool Balance |

| 1,261,123 - 2,000,000 | 9 | $13,511,409 | 1.9 | % |

| 2,000,001 - 3,000,000 | 9 | 23,562,745 | 3.4 | |

| 3,000,001 - 4,000,000 | 8 | 28,223,964 | 4.0 | |

| 4,000,001 - 5,000,000 | 6 | 27,769,634 | 4.0 | |

| 5,000,001 - 6,000,000 | 6 | 33,503,637 | 4.8 | |

| 6,000,001 - 7,000,000 | 4 | 26,450,000 | 3.8 | |

| 8,000,001 - 9,000,000 | 2 | 17,679,582 | 2.5 | |

| 9,000,001 - 10,000,000 | 4 | 38,209,889 | 5.4 | |

| 10,000,001 - 15,000,000 | 6 | 74,800,000 | 10.6 | |

| 15,000,001 - 20,000,000 | 4 | 65,934,932 | 9.4 | |

| 20,000,001 - 30,000,000 | 7 | 179,611,841 | 25.6 | |

| 30,000,001 - 50,000,000 | 1 | 44,779,868 | 6.4 | |

| 50,000,001 - 70,000,000 | 2 | 128,750,000 | 18.3 | |

| Total: | 68 | $702,787,500 | 100.0 | % |

| Average: | $10,335,110 | | |

| | | | |

| UNDERWRITTEN NOI DEBT SERVICE COVERAGE RATIO |

Range of U/W NOI

DSCRs (x) | Number of

Mortgage

Loans | Aggregate Cut-

off Date Balance | % of Initial

Pool Balance |

| 1.20 | 1 | $3,835,000 | 0.5 | % |

| 1.21 - 1.30 | 8 | 63,410,464 | 9.0 | |

| 1.31 - 1.40 | 15 | 125,893,683 | 17.9 | |

| 1.41 - 1.50 | 14 | 132,664,711 | 18.9 | |

| 1.51 - 1.60 | 8 | 128,772,439 | 18.3 | |

| 1.61 - 1.70 | 8 | 76,173,128 | 10.8 | |

| 1.71 - 1.80 | 3 | 8,296,126 | 1.2 | |

| 1.81 - 1.90 | 1 | 1,686,439 | 0.2 | |

| 1.91 - 2.00 | 4 | 84,397,339 | 12.0 | |

| 2.01 - 2.50 | 5 | 68,678,589 | 9.8 | |

| 2.51 - 2.78 | 1 | 8,979,582 | 1.3 | |

| Total: | 68 | $702,787,500 | 100.0 | % |

| Weighted Average: | 1.59x | | |

| | | | |

| UNDERWRITTEN NCF DEBT SERVICE COVERAGE RATIO |

Range of U/W NCF

DSCRs (x) | Number of

Mortgage

Loans | Aggregate Cut-

off Date Balance | % of Initial

Pool Balance |

| 1.20 | 4 | $28,430,723 | 4.0 | % |

| 1.21 - 1.30 | 16 | 125,117,302 | 17.8 | |

| 1.31 - 1.40 | 20 | 194,421,458 | 27.7 | |

| 1.41 - 1.50 | 10 | 143,441,821 | 20.4 | |

| 1.51 - 1.60 | 5 | 69,305,593 | 9.9 | |

| 1.61 - 1.70 | 4 | 52,466,306 | 7.5 | |

| 1.71 - 1.80 | 2 | 3,896,126 | 0.6 | |

| 1.81 - 1.90 | 3 | 12,980,106 | 1.8 | |

| 1.91 - 2.00 | 2 | 62,400,000 | 8.9 | |

| 2.01 - 2.50 | 1 | 1,348,483 | 0.2 | |

| 2.51 - 2.54 | 1 | 8,979,582 | 1.3 | |

| Total: | 68 | $702,787,500 | 100.0 | % |

| Weighted Average: | 1.48x | | |

| LOAN PURPOSE |

| Loan Purpose | Number of

Mortgage

Loans | Aggregate Cut-

off Date Balance | % of Initial

Pool Balance |

| Refinance | 51 | $598,330,089 | 85.1 | % |

| Acquisition | 17 | 104,457,411 | 14.9 | |

| Total: | 68 | $702,787,500 | 100.0 | % |

| | | | | |

| MORTGAGE RATE |

Range of Mortgage Rates

(%) | Number of

Mortgage

Loans | Aggregate Cut-

off Date Balance | % of Initial

Pool Balance |

| 4.369 - 4.500 | 1 | $58,750,000 | 8.4 | % |

| 4.501 - 4.750 | 7 | 89,933,445 | 12.8 | |

| 4.751 - 5.000 | 13 | 176,822,134 | 25.2 | |

| 5.001 - 5.250 | 23 | 184,795,061 | 26.3 | |

| 5.251 - 5.500 | 17 | 134,959,684 | 19.2 | |

| 5.501 - 5.750 | 4 | 43,007,514 | 6.1 | |

| 5.751 - 6.000 | 1 | 3,487,089 | 0.5 | |

| 6.251 - 6.500 | 1 | 5,437,500 | 0.8 | |

| 6.501 - 6.640 | 1 | 5,595,074 | 0.8 | |

| Total: | 68 | $702,787,500 | 100.0 | % |

| Weighted Average: | 5.052% | | |

| | | | |

| UNDERWRITTEN NOI DEBT YIELD |

Range of U/W NOI

Debt Yields (%) | Number of

Mortgage

Loans | Aggregate Cut-

off Date Balance | % of Initial

Pool Balance |

| 8.0 | 1 | $3,835,000 | 0.5 | % |

| 8.1 - 9.0 | 18 | 219,517,944 | 31.2 | |

| 9.1 - 10.0 | 14 | 123,434,108 | 17.6 | |

| 10.1 - 11.0 | 21 | 235,621,998 | 33.5 | |

| 11.1 - 12.0 | 4 | 17,145,302 | 2.4 | |

| 12.1 - 13.0 | 5 | 55,957,506 | 8.0 | |

| 13.1 - 14.0 | 2 | 32,162,835 | 4.6 | |

| 14.1 - 15.0 | 1 | 4,784,743 | 0.7 | |

| 15.1 - 16.0 | 1 | 1,348,483 | 0.2 | |

| 17.1 - 18.0 | 1 | 8,979,582 | 1.3 | |

| Total: | 68 | $702,787,500 | 100.0 | % |

| Weighted Average: | 10.1% | | |

| | | | |

| UNDERWRITTEN NCF DEBT YIELD |

Range of U/W NCF

Debt Yields (%) | Number of

Mortgage

Loans | Aggregate Cut-

off Date Balance | % of Initial

Pool Balance |

| 8.0 | 4 | $28,354,454 | 4.0 | % |

| 8.1 - 9.0 | 28 | 305,299,283 | 43.4 | |

| 9.1 - 10.0 | 19 | 239,272,562 | 34.0 | |

| 10.1 - 11.0 | 9 | 101,156,904 | 14.4 | |

| 11.1 - 12.0 | 3 | 9,100,000 | 1.3 | |

| 12.1 - 13.0 | 2 | 4,491,490 | 0.6 | |

| 13.1 - 14.0 | 1 | 4,784,743 | 0.7 | |

| 15.1 - 16.0 | 1 | 1,348,483 | 0.2 | |

| 16.1 - 16.4 | 1 | 8,979,582 | 1.3 | |

| Total: | 68 | $702,787,500 | 100.0 | % |

| Weighted Average: | 9.4% | | |

| (1) | With respect to any mortgage loan that is part of a whole loan, the loan-to-value ratio, debt service coverage ratio and debt yield calculations include the relatedpari passucompanion loan(s) but exclude any related subordinate companion loan(s) (unless otherwise stated). With respect to each mortgage loan, debt service coverage ratio, debt yield and loan-to-value ratio information do not take into account any subordinate debt (whether or not secured by the related mortgaged property), that currently exists or is allowed under the terms of such mortgage loan. See Annex A-1 to the Preliminary Prospectus. Prepayment provisions for each mortgage loan reflects the entire life of the loan (from origination to maturity). |

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

Wells Fargo Commercial Mortgage Trust 2016-C34 | Characteristics of the Mortgage Pool |

| ORIGINAL TERM TO MATURITY |

Original Terms to

Maturity (months) | Number of

Mortgage

Loans | Aggregate Cut-

off Date Balance | % of Initial

Pool Balance |

| 60 | 4 | $102,602,243 | 14.6 | % |

| 120 | 64 | 600,185,258 | 85.4 | |

| Total: | 68 | $702,787,500 | 100.0 | % |

| Weighted Average: | 111 months | | |

| |

| REMAINING TERM TO MATURITY |

Range of Remaining Terms

to Maturity (months) | Number of

Mortgage

Loans | Aggregate Cut-

off Date Balance | % of Initial

Pool Balance |

| 58 - 60 | 4 | $102,602,243 | 14.6 | % |

| 85 - 120 | 64 | 600,185,258 | 85.4 | |

| Total: | 68 | $702,787,500 | 100.0 | % |

| Weighted Average: | 109 months | | |

| |

| ORIGINAL AMORTIZATION TERM(2) |

Original

Amortization Terms

(months) | Number of

Mortgage

Loans | Aggregate Cut-

off Date Balance | % of Initial

Pool Balance |

| Non-Amortizing | 2 | $62,400,000 | 8.9 | % |

| 240 | 1 | 24,314,370 | 3.5 | |

| 300 | 9 | 29,412,647 | 4.2 | |

| 330 | 1 | 3,487,089 | 0.5 | |

| 360 | 55 | 583,173,394 | 83.0 | |

| Total: | 68 | $702,787,500 | 100.0 | % |

| Weighted Average(3): | 353 months | | |

(2) The original amortization term shown for any mortgage loan that is interest-only for part of its term does not include the number of months in its interest-only period and reflects only the number of months as of the commencement of amortization remaining from the end of such interest-only period. (3) Excludes the non-amortizing mortgage loans. |

| |

| REMAINING AMORTIZATION TERM(4) |

Range of Remaining Amortization Terms

(months) | Number of

Mortgage

Loans | Aggregate Cut-

off Date Balance | % of Initial

Pool Balance |

| Non-Amortizing | 2 | $62,400,000 | 8.9 | % |

| 237 - 240 | 1 | 24,314,370 | 3.5 | |

| 241 - 300 | 9 | 29,412,647 | 4.2 | |

| 301 - 360 | 56 | 586,660,483 | 83.5 | |

| Total: | 68 | $702,787,500 | 100.0 | % |

| Weighted Average(5): | 352 months | | |

(4) The remaining amortization term shown for any mortgage loan that is interest-only for part of its term does not include the number of months in its interest-only period and reflects only the number of months as of the commencement of amortization remaining from the end of such interest-only period. (5) Excludes the non-amortizing mortgage loans. |

| |

| LOCKBOXES |

| Type of Lockbox | Number of

Mortgage

Loans | Aggregate Cut-

off Date Balance | % of Initial

Pool Balance |

| Springing | 46 | $393,107,640 | 55.9 | % |

| Hard/Springing Cash Management | 9 | 170,812,454 | 24.3 | |

| Hard/Upfront CashManagement | 3 | 91,300,000 | 13.0 | |

| None | 9 | 31,127,474 | 4.4 | |

| Soft/Springing Cash Management | 1 | 16,439,932 | 2.3 | |

| Total: | 68 | $702,787,500 | 100.0 | % |

| |

| PREPAYMENT PROVISION SUMMARY |

| Prepayment Provision | Number of

Mortgage

Loans | Aggregate Cut-

off Date Balance | % of Initial

Pool Balance |

| Lockout / Def / Open | 62 | $650,670,291 | 92.6 | % |

| Lockout / GRTR 1% or YM / Open | 3 | 34,217,471 | 4.9 | |

| Lockout / GRTR 1% or YM or Def / Open | 2 | 11,149,738 | 1.6 | |

| Lockout / GRTR 2% or YM / Open | 1 | 6,750,000 | 1.0 | |

| Total: | 68 | $702,787,500 | 100.0 | % |

| CUT-OFF DATE LOAN-TO-VALUE RATIO |

Range of Cut-off Date LTV

Ratios (%) | Number of

Mortgage

Loans | Aggregate Cut-

off Date Balance | % of Initial

Pool Balance |

| 38.5 - 40.0 | 1 | $1,348,483 | 0.2 | % |

| 45.1 - 50.0 | 1 | 8,979,582 | 1.3 | |

| 50.1 - 55.0 | 5 | 42,717,471 | 6.1 | |

| 55.1 - 60.0 | 2 | 49,564,610 | 7.1 | |

| 60.1 - 65.0 | 16 | 225,458,197 | 32.1 | |

| 65.1 - 70.0 | 21 | 141,446,123 | 20.1 | |

| 70.1 - 74.7 | 22 | 233,273,034 | 33.2 | |

| Total: | 68 | $702,787,500 | 100.0 | % |

| Weighted Average: | 65.9% | | |

| |

| BALLOON LOAN-TO-VALUE RATIO |

| Range of Balloon LTV Ratios (%) | Number of

Mortgage

Loans | Aggregate Cut-

off Date Balance | % of Initial

Pool Balance |

| 32.1 - 35.0 | 1 | $1,348,483 | 0.2 | % |

| 35.1 - 40.0 | 1 | 8,979,582 | 1.3 | |

| 40.1 - 45.0 | 3 | 31,814,370 | 4.5 | |

| 45.1 - 50.0 | 6 | 85,297,279 | 12.1 | |

| 50.1 - 55.0 | 15 | 84,397,218 | 12.0 | |

| 55.1 - 60.0 | 18 | 173,387,343 | 24.7 | |

| 60.1 - 65.0 | 19 | 268,875,725 | 38.3 | |

| 65.1 - 67.3 | 5 | 48,687,500 | 6.9 | |

| Total: | 68 | $702,787,500 | 100.0 | % |

| Weighted Average: | 57.7% | | |

| |

| AMORTIZATION TYPE |

| Type of Amortization | Number of

Mortgage

Loans | Aggregate Cut-

off Date Balance | % of Initial

Pool Balance |

| Interest-only, Amortizing Balloon | 32 | $366,135,500 | 52.1 | % |

| Amortizing Balloon | 34 | 274,252,000 | 39.0 | |

| Interest-only, Balloon | 2 | 62,400,000 | 8.9 | |

| Total: | 68 | $702,787,500 | 100.0 | % |

| |

| ORIGINAL TERM OF INTEREST-ONLY PERIOD FOR PARTIAL IO LOANS |

| IO Terms (months) | Number of

Mortgage

Loans | Aggregate Cut-

off Date Balance | % of Initial

Pool Balance |

| 12 | 2 | $8,137,500 | 1.2 | % |

| 24 | 13 | 168,688,000 | 24.0 | |

| 36 | 11 | 99,015,000 | 14.1 | |

| 48 | 2 | 39,200,000 | 5.6 | |

| 60 | 3 | 35,470,000 | 5.0 | |

| 84 | 1 | 15,625,000 | 2.2 | |

| Total: | 32 | $366,135,500 | 52.1 | % |

| Weighted Average: | 36 months | | |

| |

| SEASONING |

| Seasoning (months) | Number of

Mortgage

Loans | Aggregate Cut-

off Date Balance | % of Initial

Pool Balance |

| 0 | 8 | $140,100,000 | 19.9 | % |

| 1 | 27 | 199,375,472 | 28.4 | |

| 2 | 16 | 107,267,994 | 15.3 | |

| 3 | 12 | 157,862,911 | 22.5 | |

| 4 | 3 | 59,081,123 | 8.4 | |

| 5 | 1 | 11,100,000 | 1.6 | |

| 6 | 1 | 28,000,000 | 4.0 | |

| Total: | 68 | $702,787,500 | 100.0 | % |

| Weighted Average: | 2 months | | |

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

| Wells Fargo Commercial Mortgage Trust 2016-C34 | Certain Terms and Conditions |

V. Certain Terms and Conditions

| Interest Entitlements: | | The interest entitlement of each Class of Offered Certificates on each Distribution Date generally will be the interest accrued during the related Interest Accrual Period on the related Certificate Balance or Notional Amount at the related pass-through rate, net of any prepayment interest shortfalls allocated to that Class for such Distribution Date as described below. If prepayment interest shortfalls arise from voluntary prepayments (without Master Servicer consent) on particular non-specially serviced loans during any collection period, the Master Servicer is required to make a compensating interest payment to offset those shortfalls, generally up to an amount equal to the portion of its master servicing fees that accrue at 0.25 basis pointsper annum. The remaining amount of prepayment interest shortfalls will be allocated to reduce the interest entitlement on all Classes of Certificates,pro rata, based on their respective amounts of accrued interest for the related Distribution Date. If a Class receives less than the entirety of its interest entitlement on any Distribution Date, then the shortfall (excluding any shortfall due to prepayment interest shortfalls), together with interest thereon, will be added to its interest entitlement for the next succeeding Distribution Date. |

| | | | |

| Principal Distribution Amount: | | The Principal Distribution Amount for each Distribution Date generally will be the aggregate amount of principal received or advanced in respect of the mortgage loans, net of any non-recoverable advances and interest thereon and workout-delayed reimbursement amounts that are reimbursed to the Master Servicer, the Special Servicer or the Trustee during the related collection period. Non-recoverable advances and interest thereon are reimbursable from principal collections and advances before reimbursement from other amounts. Workout-delayed reimbursement amounts are reimbursable from principal collections. |

| | | | |

| Distributions: | | On each Distribution Date, funds available for distribution from the mortgage loans, net of specified trust fees, expenses and reimbursements will generally be distributed in the following amounts and order of priority (in each case to the extent of remaining available funds): |

| | | | |

| | | 1. | Class A-1, A-2, A-3, A-4, A-SB, X-A, X-B, X-E, X-FG and X-H Certificates and Class A-3FX regular interest: To interest on the Class A-1, A-2, A-3, A-4, A-SB, X-A, X-B, X-E, X-FG and X-H Certificates and the Class A-3FX regular interest,pro rata, according to their respective interest entitlements. |

| | | | |