Exhibit 99.1

Shareholders’ Meeting June 6, 2018

CPHC Financial Results Cautionary Statement: From time to time, in reports filed with the SEC, in press releases, and in other communications to shareholders or the investing public, we may make forward - looking statements concerning possible or anticipated future financial performance, business activities or plans which are typically preceded by the words “believes, expects, anticipates, intends” or similar expressions. For such forward - looking statements, we claim the protection of the safe harbor for forward - looking statements contained in federal securities laws . Shareholders and the investing public should understand that such forward - looking statements are subject to risks and uncertainties which could affect our actual results, and cause actual results to differ materially from those indicated in the forward - looking statements.

CPHC Financial Results Cautionary Statement (continued): These presentation materials use the terms “EBITDA” and “adjusted EBITDA.” EBITDA represents earnings before interest income, income tax expense, and depreciation and amortization. Neither EBITDA nor adjusted EBITDA are measures of performance or liquidity calculated in accordance with generally accepted accounting principles in the United States of America ("GAAP"). They should not be considered an alternative to, or more meaningful than, net income as an indicator of our operating performance or cash flows from operating activities as a measure of liquidity. In our Form 10 - K for the year ended December 31, 2017 and our Form 10 - Q for the quarter ended March 31, 2018 as filed with Securities and Exchange Commission, we included tables reconciling these non - GAAP financial measures to GAAP. Copies of these SEC filings are available on the Company’s website.

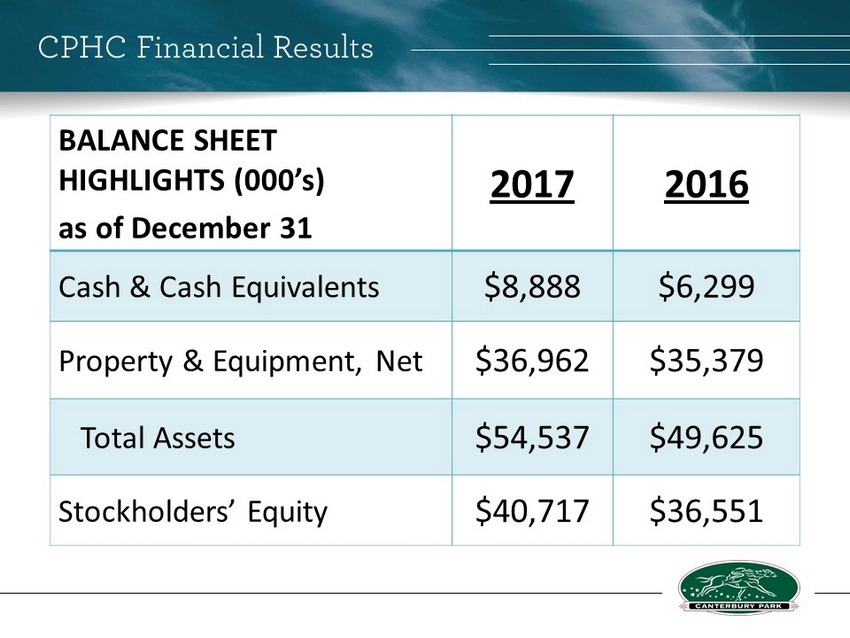

CPHC Financial Results BALANCE SHEET HIGHLIGHTS (000’s) as of December 31 2017 2016 Cash & Cash Equivalents $8,888 $6,299 Property & Equipment, Net $36,962 $35,379 Total Assets $54,537 $49,625 Stockholders’ Equity $40,717 $36,551

CPHC Financial Results OPERATING HIGHLIGHTS (000’s) Year Ended December 31 2017 2016 Net Revenues $56,953 $52,460 Operating Expenses $52,432 $45,319 Net Income $4,091 $4,196 Diluted Net Income Per Share $0.93 $0.97

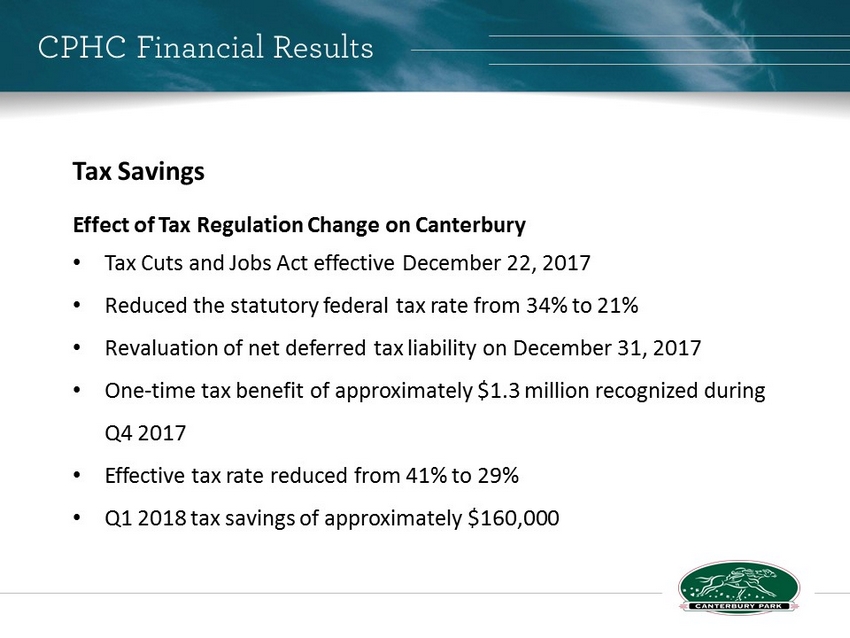

CPHC Financial Results Tax Savings Effect of Tax Regulation Change on Canterbury • Tax Cuts and Jobs Act effective December 22, 2017 • Reduced the statutory federal tax rate from 34% to 21% • Revaluation of net deferred tax liability on December 31, 2017 • One - time tax benefit of approximately $1.3 million recognized during Q4 2017 • Effective tax rate reduced from 41% to 29% • Q1 2018 tax savings of approximately $160,000

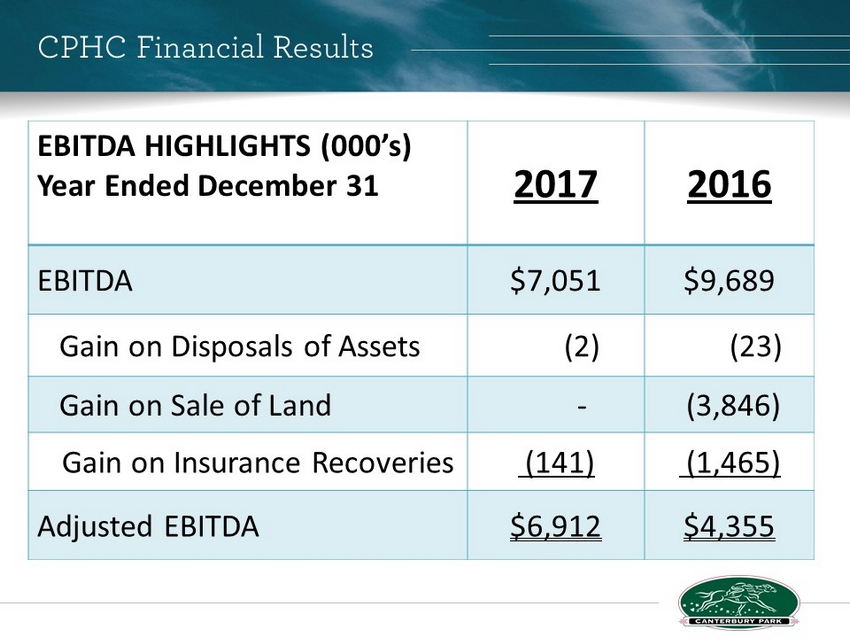

CPHC Financial Results EBITDA HIGHLIGHTS (000’s) Year Ended December 31 2017 2016 EBITDA $7,051 $9,689 Gain on Disposals of Assets (2) (23) Gain on Sale of Land - (3,846) Gain on Insurance Recoveries (141) (1,465) Adjusted EBITDA $6,912 $4,355

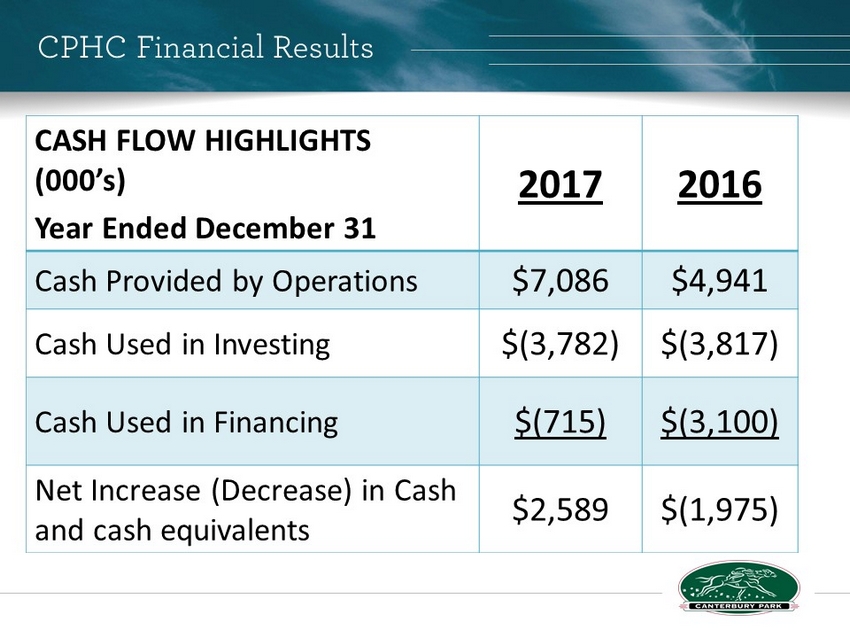

CPHC Financial Results CASH FLOW HIGHLIGHTS (000’s) Year Ended December 31 2017 2016 Cash Provided by Operations $7,086 $4,941 Cash Used in Investing $(3,782) $(3,817) Cash Used in Financing $(715) $(3,100) Net Increase (Decrease) in Cash and cash equivalents $2,589 $(1,975)

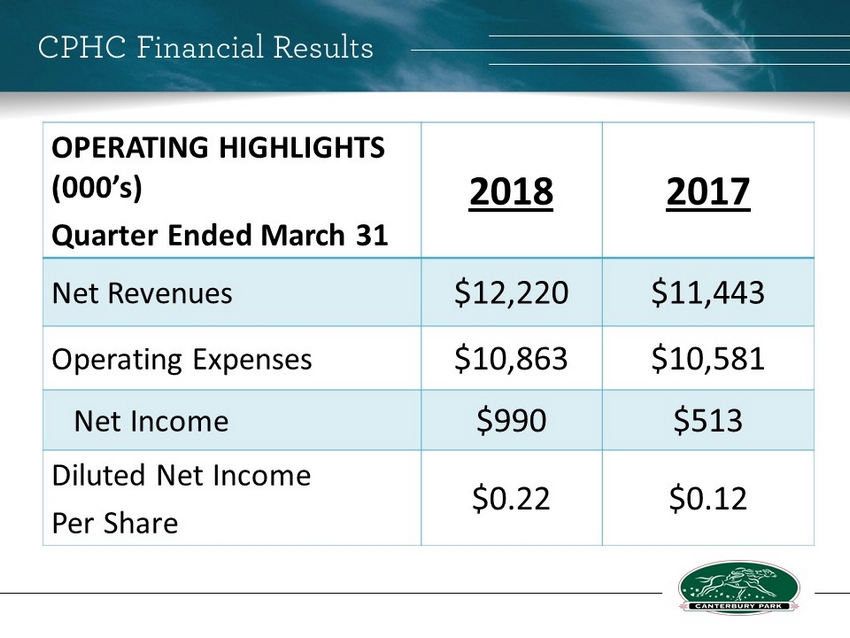

CPHC Financial Results OPERATING HIGHLIGHTS (000’s) Quarter Ended March 31 2018 2017 Net Revenues $12,220 $11,443 Operating Expenses $10,863 $10,581 Net Income $990 $513 Diluted Net Income Per Share $0.22 $0.12

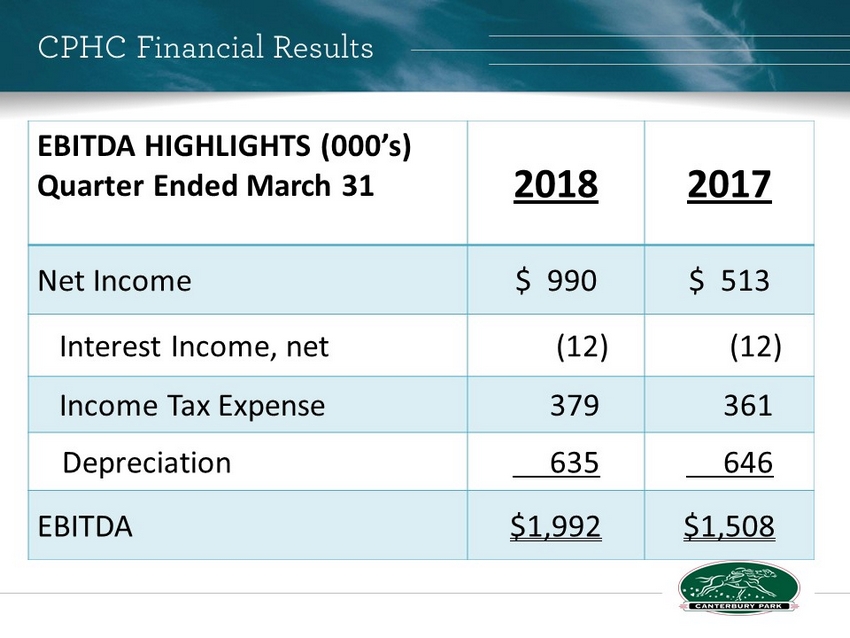

CPHC Financial Results EBITDA HIGHLIGHTS (000’s) Quarter Ended March 31 2018 2017 Net Income $ 990 $ 513 Interest Income, net (12) (12) Income Tax Expense 379 361 Depreciation 635 646 EBITDA $1,992 $1,508

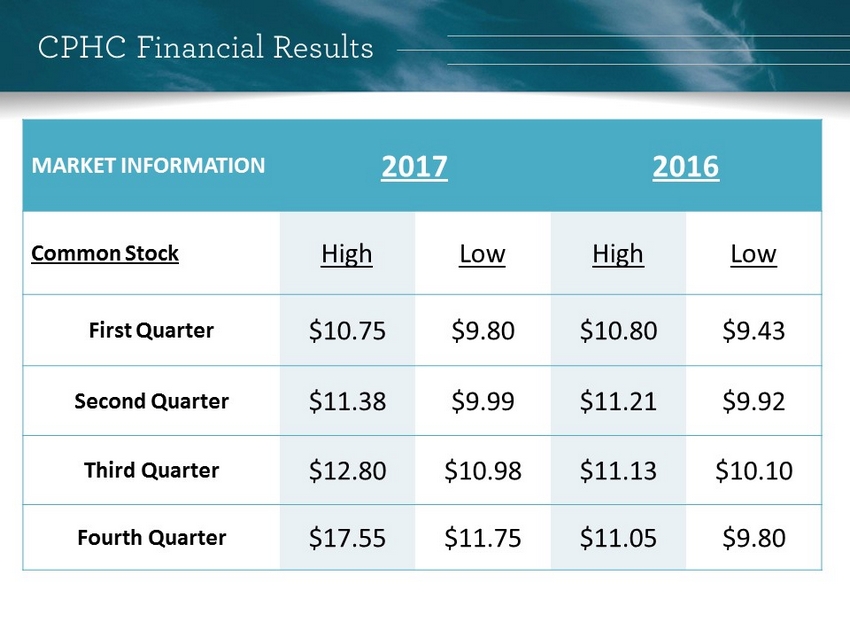

CPHC Financial Results MARKET INFORMATION 2017 2016 Common Stock High Low High Low First Quarter $10.75 $9.80 $10.80 $9.43 Second Quarter $11.38 $9.99 $11.21 $9.92 Third Quarter $12.80 $10.98 $11.13 $10.10 Fourth Quarter $17.55 $11.75 $11.05 $9.80

Financial Trends

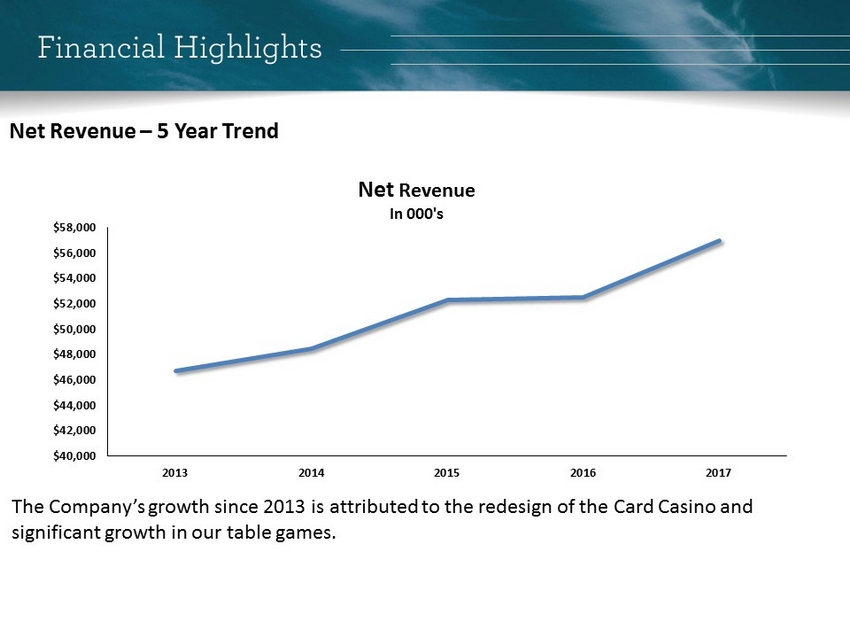

Net Revenue – 5 Year Trend The Company’s growth since 2013 is attributed to the redesign of the Card Casino and significant growth in our table games. Financial Highlights $40,000 $42,000 $44,000 $46,000 $48,000 $50,000 $52,000 $54,000 $56,000 $58,000 2013 2014 2015 2016 2017 Net Revenue In 000's

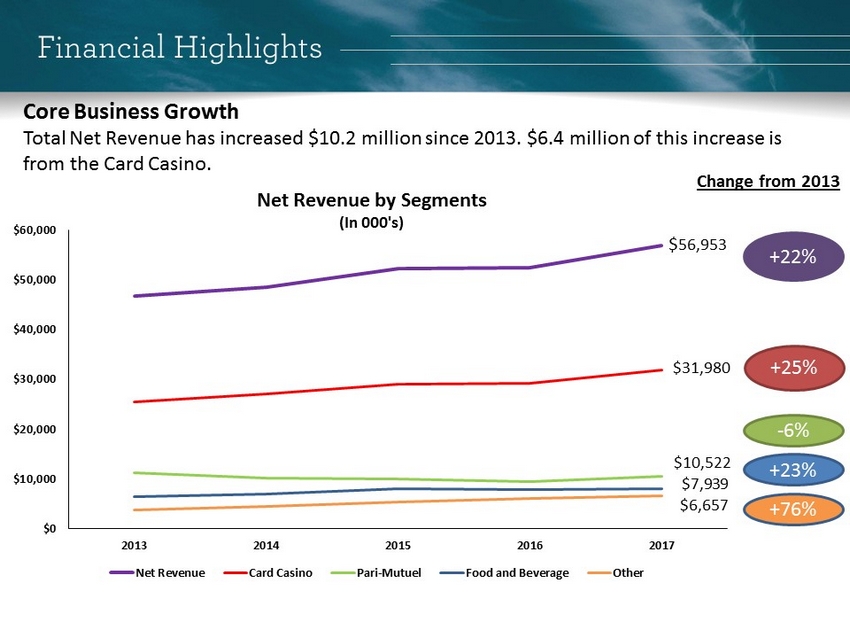

Core Business Growth Total Net Revenue has increased $10.2 million since 2013. $6.4 million of this increase is from the Card Casino. +25% +23% - 6% Change from 2013 +22% Financial Highlights $0 $10,000 $20,000 $30,000 $40,000 $50,000 $60,000 2013 2014 2015 2016 2017 Net Revenue by Segments (In 000's) Net Revenue Card Casino Pari-Mutuel Food and Beverage Other $6,657 +76% $ 56,953 $31,980 $10,522 $7,939

Financial Highlights Net Revenue by Segments Card Casino 56% Pari - Mutuel 18% Food and Beverage 14% Other 12% 2017

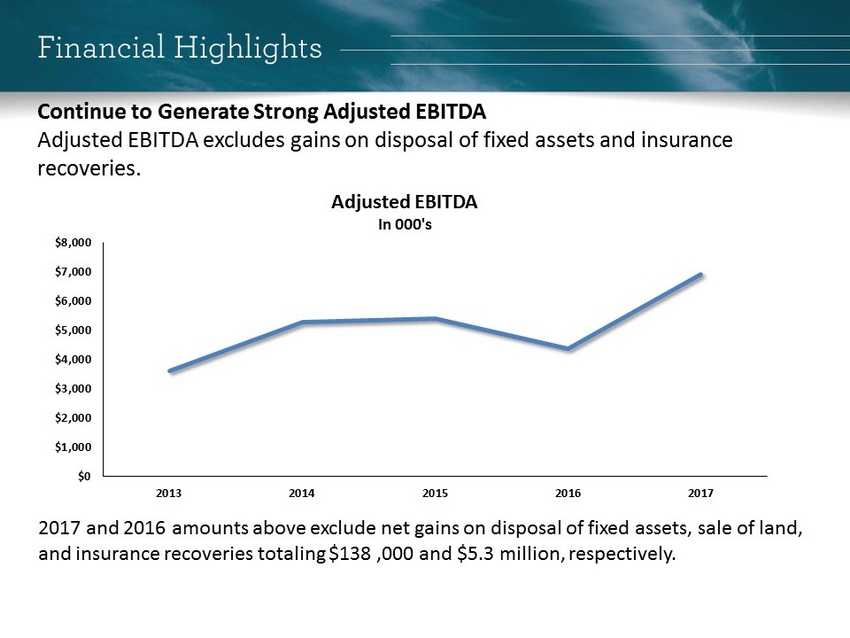

Continue to Generate Strong Adjusted EBITDA Adjusted EBITDA excludes gains on disposal of fixed assets and insurance recoveries. 2017 and 2016 amounts above exclude net gains on disposal of fixed assets, sale of land, and insurance recoveries totaling $138 ,000 and $5.3 million, respectively. Financial Highlights $0 $1,000 $2,000 $3,000 $4,000 $5,000 $6,000 $7,000 $8,000 2013 2014 2015 2016 2017 Adjusted EBITDA In 000's

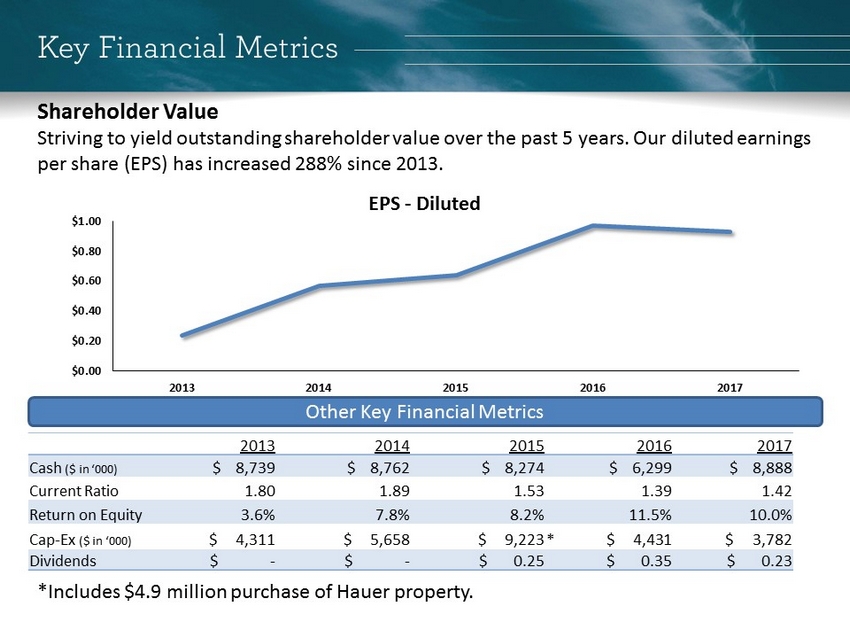

2013 2014 2015 2016 2017 Cash ($ in ‘000) $ 8,739 $ 8,762 $ 8,274 $ 6,299 $ 8,888 Current Ratio 1.80 1.89 1.53 1.39 1.42 Return on Equity 3.6% 7.8% 8.2% 11.5% 10.0% Cap - Ex ($ in ‘000) $ 4,311 $ 5,658 $ 9,223 * $ 4,431 $ 3,782 Dividends $ - $ - $ 0.25 $ 0.35 $ 0.23 Key Financial Metrics Other Key Financial Metrics Shareholder Value Striving to yield outstanding shareholder value over the past 5 years. Our diluted earnings per share (EPS) has increased 288% since 2013. *Includes $4.9 million purchase of Hauer property. $0.00 $0.20 $0.40 $0.60 $0.80 $1.00 2013 2014 2015 2016 2017 EPS - Diluted

Vision: To generate sustainable growth in our core operations while creating new opportunities to expand and broaden our business. Canterbury Park Guiding Principles Mission: To provide our guests with a premier gaming, entertainment and event experience by conducting ourselves #TheCanterburyWay.

Racing: Competitive live racing May thru September fueled by the SMSC Purse Enhancement Agreement; Draws nearly a half - million people annually; Racebook attracts avid horseplayers year - round. Cards: Diverse array of table gaming options including table games (such as Blackjack, Baccarat & more) and poker; Known for friendly dealers and loyal customers. Catering & Events: More than 85,000 square feet of flexible space for trade shows, conferences, meetings and galas; Plus, built in fun. Real Estate Development: Ownership of 383 acres, including 110 acres of land ready for development that is not currently used for operations and has been transferred to Canterbury Park Development, LLC. Canterbury Park is a Premier Entertainment, Gaming and Event Business with a Track Record of Success.

Experienced Executive Management Team - Over 150 years of experience in the industry - In 2017, added experienced executives Dan Kennedy, Sr. VP of Operations and Rob Wolf, CFO - Led Canterbury Park to profitability 21 of past 22 years Valuable Real Estate to Drive Long - Term Growth in Shareholder Value - We continue to make significant investments in our facilities - Ownership of 383 acres in fast growing county - 110 acres ready for development as Canterbury Commons - Approval of Tax Increment Financing (TIF) Redevelopment District March 2018 - Partnering with Doran Companies to construct luxury apartment complex Key Investment Highlights

Positioned for Continued Success - SMSC Purse Enhancement Agreement solidifies quality racing for years to come. - Positive trend in Table Games business - Catering & Events infrastructure investments showing returns - Potential new revenue streams and customer awareness via land development

Strong Balance Sheet and Financial Position: - $9 million in unrestricted cash and no long term debt - $3 million note receivable from United Properties - Significant appreciation in land value, which is not reflected on our balance sheet Dividend History ‒ Established dividend policy in 2016 with quarterly dividend of $0.05 per share ‒ Dividend increased to $0.06 per share in July 2017 and $0.07 per share in March 2018 Key Investment Highlights

Recent Highlights - General Improved Financial Results ‒ Nine consecutive years of revenue growth; record level of adjusted EBITDA in 2017. Formalized Customer Service Measurement Program - Implemented ongoing surveys, secret shops, focus groups and data collection initiatives to improve customer experience. Exceeded Regional and National Benchmarks for Employee Satisfaction - Created leadership task force for continued enhancement in satisfaction and engagement.

Recent Highlights - Racing Resumed Live Racing on Kentucky Derby Day in 2017 - Expanded season to 22 weeks; 70 days. - Exceeded 20,000 patrons three times in 2017 (only 20,000+ fans three total prior times in company history) Captured Minnesota ADW Revenue Based on Modified Legislation - Source market fees generated $1.6 million total for Minnesota’s racing industry; $881,000 in revenue to Canterbury Park. - Helped drive overall revenue growth in racing segment in 2017

Recent Highlights - Racing Successful Shipping Incentive Program Launch - Introduced new shipping & starter bonuses - Partnered with Horsemen in 2017; expanded marketing program in 2018 Increased Average Field Size - Increased from 7.68 in 2016 to 8.03 in 2017 - Field size is 10% above national average

Recent Highlights - Cards Significant Table Games Revenue Growth in 2017 - 17% Growth in Table Games revenue in 2017 compared to 2016 - Significantly enhanced promotional spend from Player Pool Expanded Quantity & Introduction of New Games - Added 4 th game to Bud Light Party Pit; Added two tables in Card Casino. - Positive response to conversion to Face Up Pai Gow - Reviewing additional games and expansion opportunities in 2018 Increased Table Games Hold Percentage - Allowed for increased revenue percentage capture rate in 2018

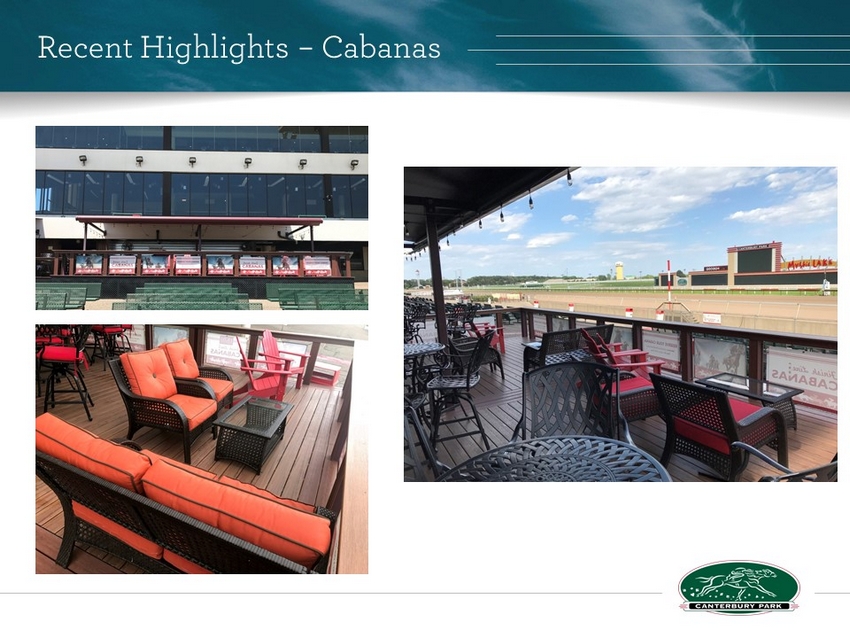

Highlights – Catering, Events & Sponsorships Significant Growth in Catering & Sponsorship Revenue - Eclipsed $1 Million Catering revenue mark in 2017 - Expanded Cabana offerings; Addition of Group Host/Tour program - Increased sponsorship revenue from $469k in 2014 to $780k in 2017 New Events & Opportunities - Hosted Hyundai courtesy car parking from November – February - Flat Track motorcycle racing returning to Canterbury Park in 2018 - Successful inaugural winter ‘Horse Skijoring’ event in February 2018

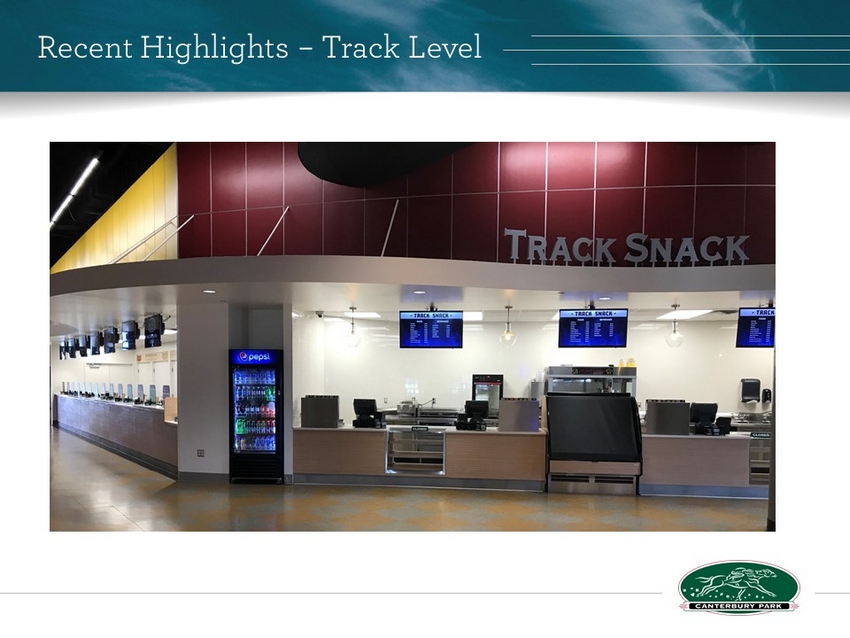

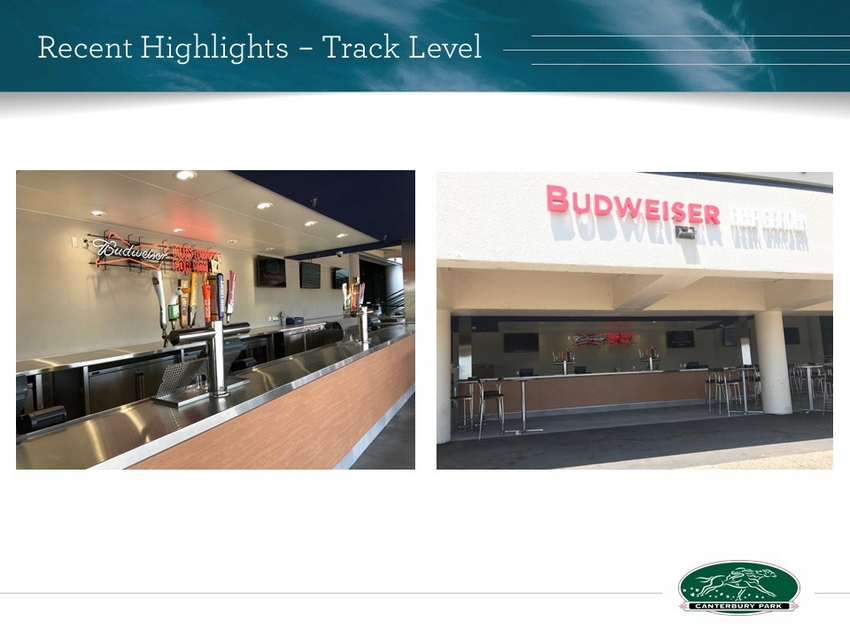

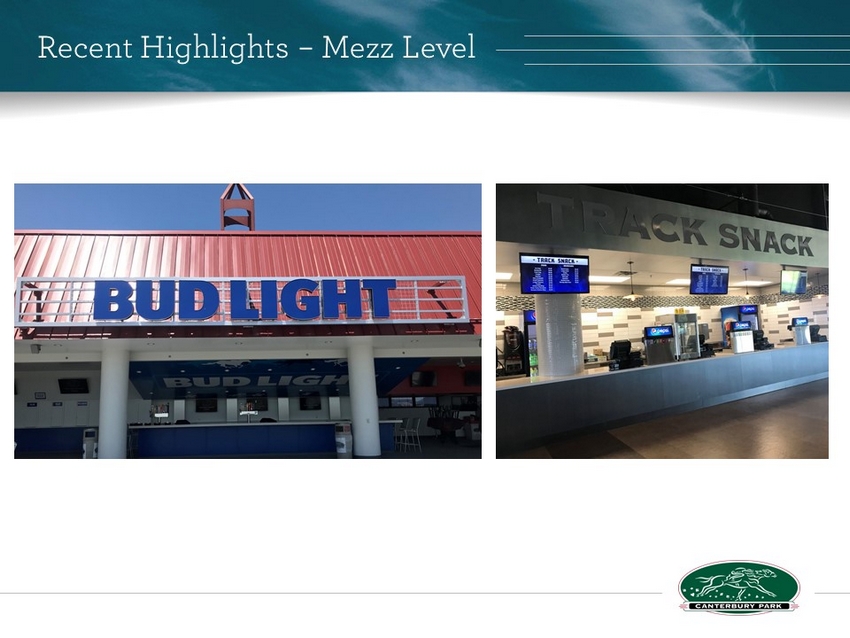

Recent Highlights – Property Made Significant Strides in Long - Term Development Vision - Received key city approvals. - Finalized apartment project contracts Renovated Track Level & More - Remodeled concessions, bar and mutuels plus added external bar to enhance efficiency (2018) - Expanded Cabanas, addition of Big Thrill Factory, modified Mezz level concessions and introduced Bud Light Bar (Spring 2017) - Working on longer - range track level plans

Recent Highlights – Track Level

Recent Highlights – Track Level

Recent Highlights – Track Level

Recent Highlights – Cabanas

Recent Highlights – Little Big Thrill Factory

Recent Highlights – Mezz Level

Sports Betting Ruling • Ruling Overview – Court ruled in favor of Phil Murphy vs. NCAA which strikes down the Professional and Amateur Sports Protection Act (PASPA) – Court indicated that Congress can regulate sports gambling directly, but if not, each state is free to act on its own. • What Happens Next – Uncertainty over next federal steps – MN will likely consider a number of scenarios – Canterbury will evaluate the implications of changes to the racing industry, our partnership with SMSC and our shareholder interests.

Property Development Update

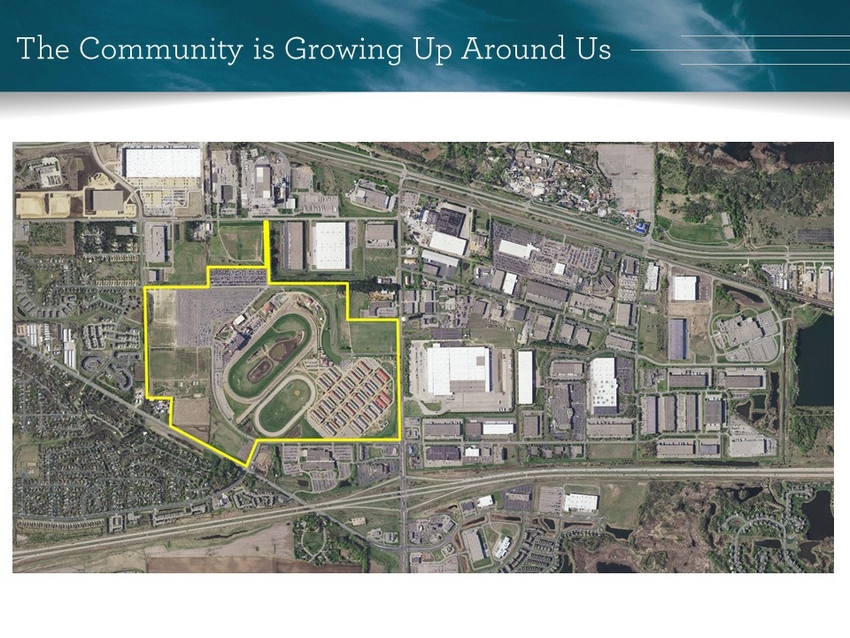

The Community is Growing Up Around Us

The Community is Growing Up Around Us

Vision A NEW PLACE TO LIVE, STAY, WORK AND PLAY . Redevelopment Concepts First In Market Entertainment & Restaurant Options Destination Retail Opportunities New Lifestyle Housing Initiatives Distinctive Hotel Experiences & More Canterbury Commons

Canterbury Commons Conceptualizing a New Place to LIVE, Stay, Work & Play Apartments by Doran Creating A New Space for Lifestyle Renters Upscale Townhomes Meeting the Demands of Our Region 55+ Housing Co - Op Keeping People in our Community

Apartments by Doran

Townhome Concepts

Canterbury Commons Conceptualizing a New Place to Live, STAY , Work & Play Extended Stay Hotel Full - Service Boutique Hotel Wisconsin Dells’ Style Hotel Waterpark

Canterbury Commons Conceptualizing a New Place to Live, STAY , Work & Play

Canterbury Commons Conceptualizing a New Place to Live, Stay, WORK & Play Office/Business Park Creating a platform to attract high - end jobs and grow Shakopee’s business base

Canterbury Commons Conceptualizing a New Place to Live, Stay, WORK & Play

Canterbury Commons Conceptualizing a New Place to Live, Stay, Work & PLAY Destination Experience Concepts • New Restaurant Choices • ‘ Eater’tainment Options • Specialty Retail • Family Entertainment Venues • Indoor Waterpark • Community Gathering Spaces

Canterbury Commons Conceptualizing a New Place to Live, Stay, Work & PLAY

Canterbury Commons Conceptualizing a New Place to Live, Stay, Work & PLAY

Development Timeline December 19, 2017 City Council approval of Comprehensive Plan Amendment • Approved by a 4 - 1 vote March 6, 2018 City Council approval of Tax Increment Financing Plan • Approved by a 4 - 1 vote April 17, 2018 City Council vote on Preliminary Plat and Comprehensive Plan for Phase I of development July 2018 City Council action on Tax Increment Finance development contract

Development Timeline July 2018 City Council action on final plat for Phase I of development August 2018 Final approval of financing of Phase I Doran apartments • Begin construction of Phase I apartments Spring 2019 Begin construction of Shenandoah road extension Fall 2019 Completion of Shenandoah road extension Fall 19 Anticipated opening of Phase I apartments

Development Plan – First Phase

Redevelopment Masterplan

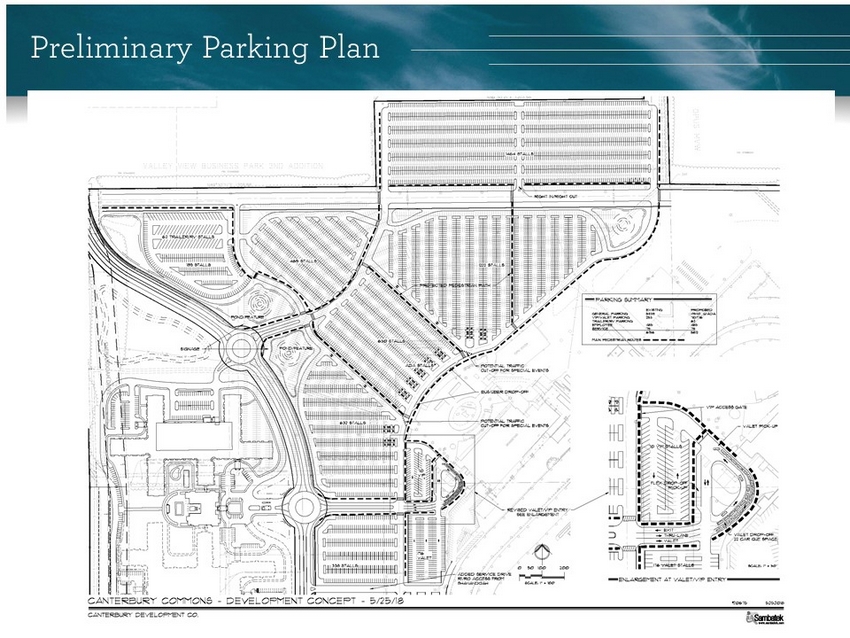

Preliminary Parking Plan

The Triple Crown Doran Companies Apartment Project • Phase I – 295 units – 13.2 acres at $224,000 per acre – Canterbury Equity Contribution $3 million for 27.4% ownership • Phase II – 300 units – 10.5 acres at $224,000 per acre – Canterbury Equity Contribution $2.4 million for 27.4% ownership • Total project cost over $100 million

Doran Companies Tony Kuechle Senior Vice President of Development

Thank you!