Exhibit 99.1

Shareholders’ Meeting June 5, 2019

CPHC Financial Results Cautionary Statement: From time to time, in reports filed with the SEC, in press releases, and in other communications to shareholders or the investing public, we may make forward - looking statements concerning possible or anticipated future financial performance, business activities or plans which are typically preceded by the words “believes, expects, anticipates, intends” or similar expressions. For such forward - looking statements, we claim the protection of the safe harbor for forward - looking statements contained in federal securities laws . Shareholders and the investing public should understand that such forward - looking statements are subject to risks and uncertainties which could affect our actual results, and cause actual results to differ materially from those indicated in the forward - looking statements.

CPHC Financial Results Cautionary Statement (continued): These presentation materials use the terms “EBITDA” and “adjusted EBITDA.” EBITDA represents earnings before interest income, income tax expense, and depreciation and amortization. Neither EBITDA nor adjusted EBITDA are measures of performance or liquidity calculated in accordance with generally accepted accounting principles in the United States of America ("GAAP"). They should not be considered an alternative to, or more meaningful than, net income as an indicator of our operating performance or cash flows from operating activities as a measure of liquidity. In our Form 10 - K for the year ended December 31, 2018 and our Form 10 - Q for the quarter ended March 31, 2019 as filed with Securities and Exchange Commission, we included tables reconciling these non - GAAP financial measures to GAAP. Copies of these SEC filings are available on the Company’s website.

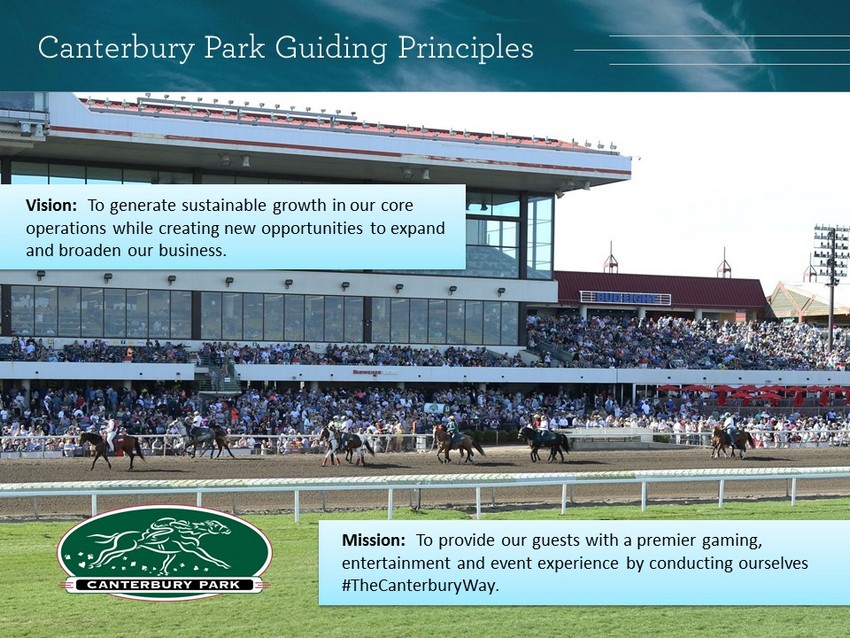

Vision: To generate sustainable growth in our core operations while creating new opportunities to expand and broaden our business. Canterbury Park Guiding Principles Mission: To provide our guests with a premier gaming, entertainment and event experience by conducting ourselves #TheCanterburyWay.

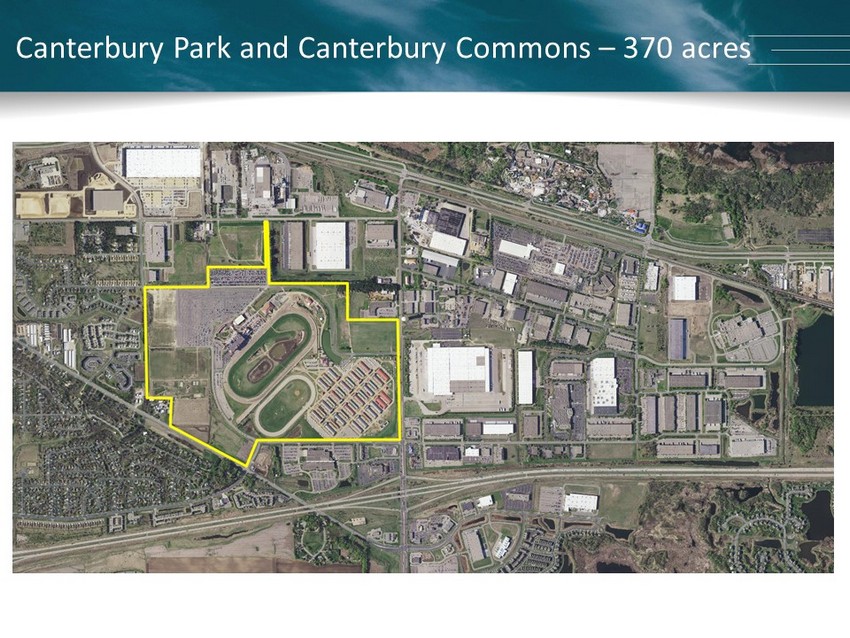

Racing: Competitive live racing May thru September fueled by the SMSC Purse Enhancement Agreement; Draws nearly a half - million guests annually with average daily attendance consistently more than 6,500; Racebook attracts avid horseplayers year - round offering racing from around the world. Cards: Diverse array of table gaming options including table games (such as Blackjack, Baccarat & more) and poker in a newly expanded room; Known for friendly dealers and loyal customers. Hospitality: With 24/7 action, food service options are always available to suit our guests’ needs in the new Trifecta Café. Little Chicago Chophouse, an upscale dining experience located just steps from the gaming floor, opened in May 2019; More than 85,000 square feet of flexible space for trade shows, conferences, meetings and galas; Plus, built in fun. Real Estate Development: Ownership of 370 acres, including approximately 127 acres available for real estate development. Canterbury Park is a Premier Entertainment, Gaming and Event Business with a Track Record of Success

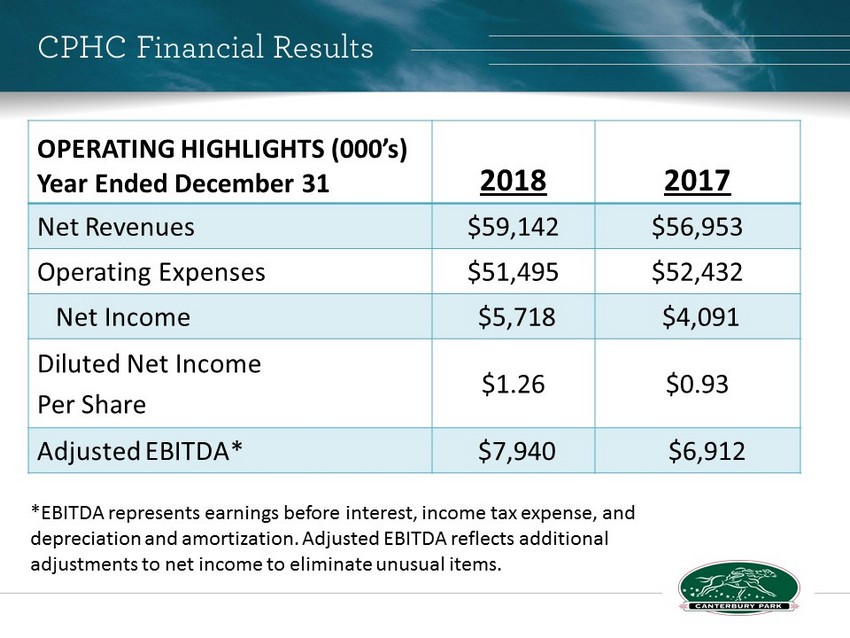

CPHC Financial Results OPERATING HIGHLIGHTS (000’s) Year Ended December 31 2018 2017 Net Revenues $59,142 $56,953 Operating Expenses $51,495 $52,432 Net Income $5,718 $4,091 Diluted Net Income Per Share $1.26 $0.93 Adjusted EBITDA* $7,940 $6,912 *EBITDA represents earnings before interest, income tax expense, and depreciation and amortization. Adjusted EBITDA reflects additional adjustments to net income to eliminate unusual items.

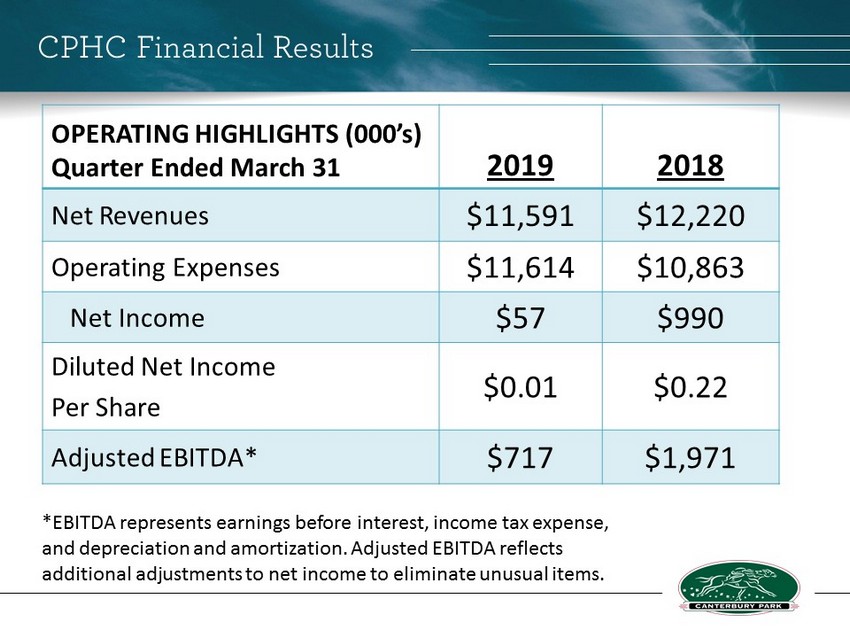

CPHC Financial Results OPERATING HIGHLIGHTS (000’s) Quarter Ended March 31 2019 2018 Net Revenues $11,591 $12,220 Operating Expenses $11,614 $10,863 Net Income $57 $990 Diluted Net Income Per Share $0.01 $0.22 Adjusted EBITDA* $717 $1,971 *EBITDA represents earnings before interest, income tax expense, and depreciation and amortization. Adjusted EBITDA reflects additional adjustments to net income to eliminate unusual items.

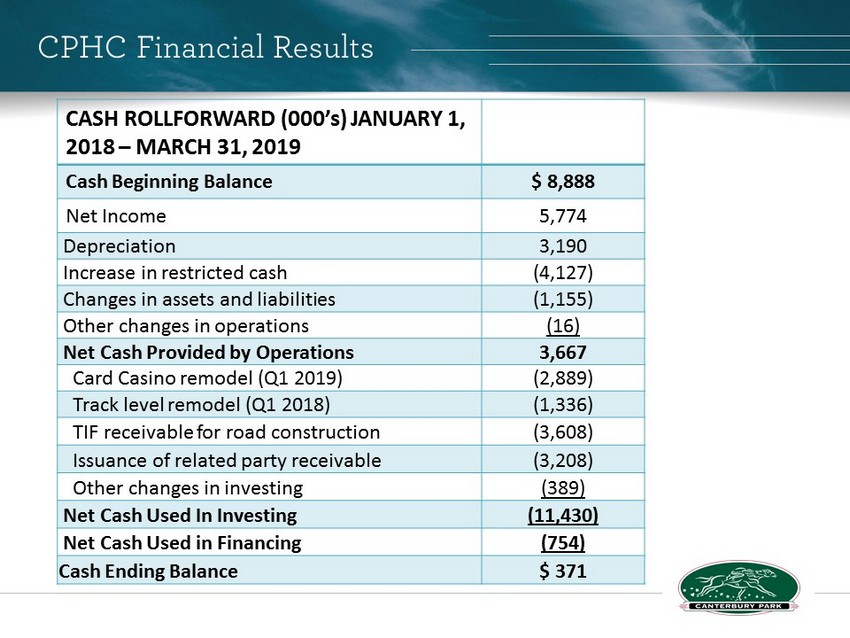

CPHC Financial Results CASH ROLLFORWARD (000’s) JANUARY 1, 2018 – MARCH 31, 2019 Cash Beginning Balance $ 8,888 Net Income 5,774 Depreciation 3,190 Increase in restricted cash (4,127) Changes in assets and liabilities (1,155) Other changes in operations (16) Net Cash Provided by Operations 3,667 Card Casino remodel (Q1 2019) (2,889) Track level remodel (Q1 2018) (1,336) TIF receivable for road construction (3,608) Issuance of related party receivable (3,208) Other changes in investing (389) Net Cash Used In Investing (11,430) Net Cash Used in Financing (754) Cash Ending Balance $ 371

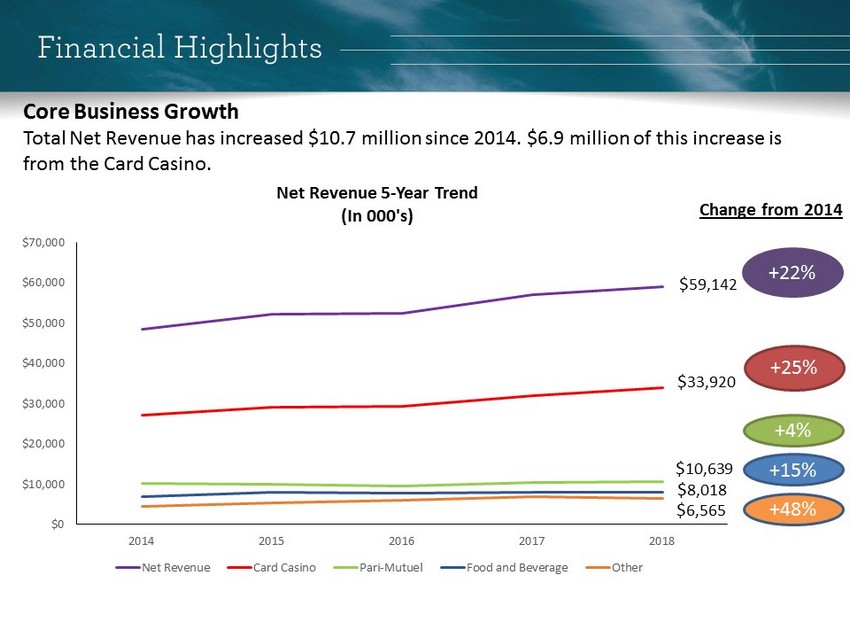

Core Business Growth Total Net Revenue has increased $10.7 million since 2014. $6.9 million of this increase is from the Card Casino. +25% +15% +4% Change from 2014 +22% Financial Highlights +48% $ 59,142 $0 $10,000 $20,000 $30,000 $40,000 $50,000 $60,000 $70,000 2014 2015 2016 2017 2018 Net Revenue 5 - Year Trend (In 000's) Net Revenue Card Casino Pari-Mutuel Food and Beverage Other $ 10,639 $ 8,018 $ 6,565 $ 33,920

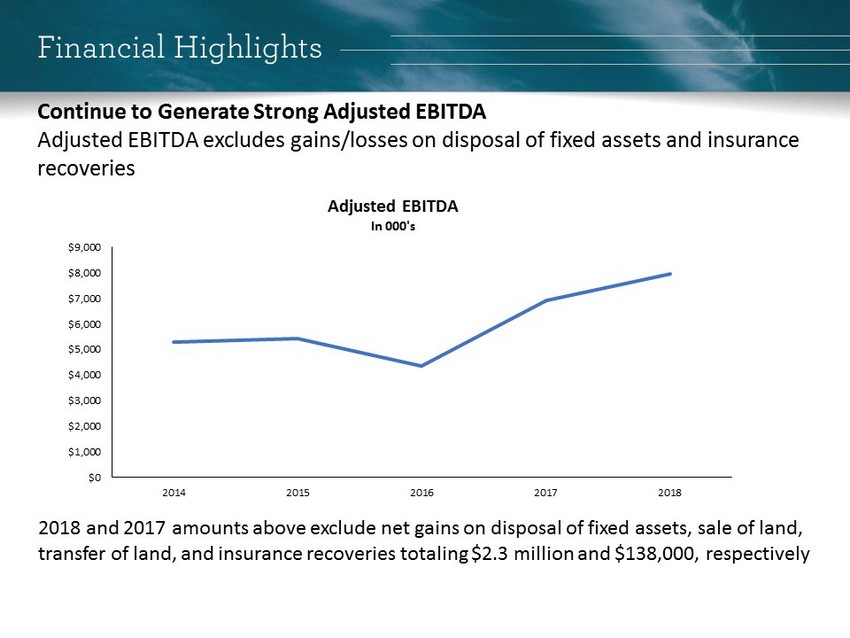

Continue to Generate Strong Adjusted EBITDA Adjusted EBITDA excludes gains/losses on disposal of fixed assets and insurance recoveries 2018 and 2017 amounts above exclude net gains on disposal of fixed assets, sale of land, transfer of land, and insurance recoveries totaling $2.3 million and $138,000, respectively Financial Highlights $0 $1,000 $2,000 $3,000 $4,000 $5,000 $6,000 $7,000 $8,000 $9,000 2014 2015 2016 2017 2018 Adjusted EBITDA In 000's

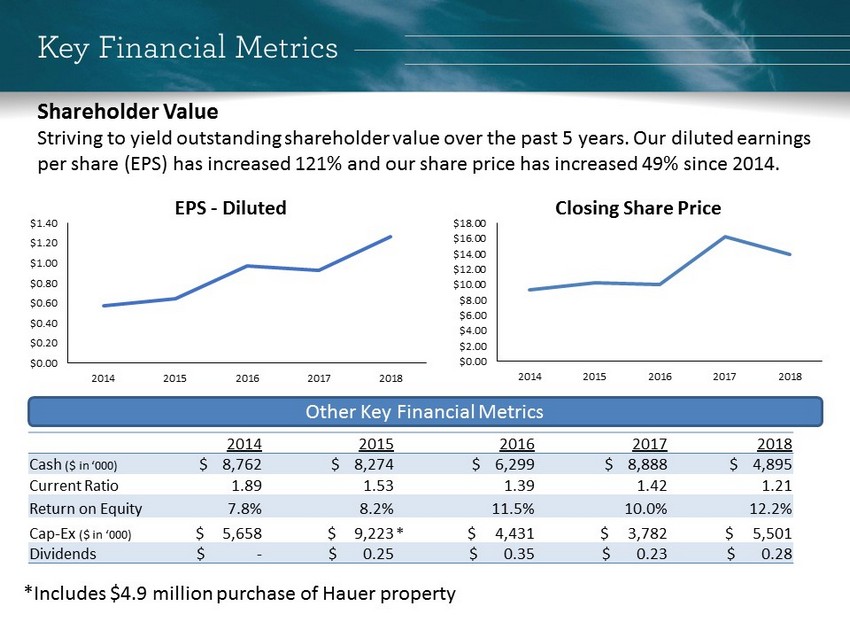

2014 2015 2016 2017 2018 Cash ($ in ‘000) $ 8,762 $ 8,274 $ 6,299 $ 8,888 $ 4,895 Current Ratio 1.89 1.53 1.39 1.42 1.21 Return on Equity 7.8% 8.2% 11.5% 10.0% 12.2% Cap - Ex ($ in ‘000) $ 5,658 $ 9,223 * $ 4,431 $ 3,782 $ 5,501 Dividends $ - $ 0.25 $ 0.35 $ 0.23 $ 0.28 Key Financial Metrics Other Key Financial Metrics Shareholder Value Striving to yield outstanding shareholder value over the past 5 years. Our diluted earnings per share (EPS) has increased 121% and our share price has increased 49% since 2014. *Includes $4.9 million purchase of Hauer property $0.00 $0.20 $0.40 $0.60 $0.80 $1.00 $1.20 $1.40 2014 2015 2016 2017 2018 EPS - Diluted $0.00 $2.00 $4.00 $6.00 $8.00 $10.00 $12.00 $14.00 $16.00 $18.00 2014 2015 2016 2017 2018 Closing Share Price

Experienced Executive Management Team - Over 150 years of experience in the industry - Dedicated, loyal workforce with high retention levels - Led Canterbury Park to profitability 22 of past 23 years - Record level of revenue and net income in 2018 Valuable Real Estate to Drive Long - Term Growth in Shareholder Value - Continued investment/enhancement of existing facilities - Ownership of 370 acres in fast growing county - 127 acres ready for development as Canterbury Commons - Approval of Tax Increment Financing (TIF) Redevelopment District March 2018 Key Investment Highlights

Solid Financial Position - Significant appreciation in land value, which is not reflected on our balance sheet - Ten consecutive years of revenue growth; record level of revenue, net income, and adjusted EBITDA in 2018 - Increased stockholders’ equity $6M to $47M, total assets $7M to $61M, and property & equipment $1.2M to $38M during 2018 Dividend History ‒ Established dividend policy in 2016 ‒ Increased annual dividend in 2018 to $0.28 per common share from $0.23 in 2017 Key Investment Highlights

Recent Highlights - Racing 2018 Live Race Meet Produced Record Handle and Purses Paid - A successful 69 - day race meet was highlighted by strong growth in Out - of - State revenue of nearly 16% Captured Minnesota ADW Revenue Based on Modified Legislation - Source market fees generated $1.7 million total for Minnesota’s racing industry; $878,000 in revenue to Canterbury Park - Helped drive overall revenue growth in racing segment in 2018

Positioned For Growth - Cards Remodeled & Expanded Card Casino - Increased capacity for rapidly growing Table Games from 32 to 43 tables - Created High Limit room for courting and maintaining high value guests - Created grand entrance from live racing and event space to introduce new audience to our Card Casino Focused Marketing Initiatives on Card Casino Growth - Hiring of experienced, casino facing marketing executive to lead player development strategies - Introduction of first - to - market games to casino mix - Significant increases in player pool marketing expenditures

Positioned For Growth - Cards Revised Poker Revenue/Promotional Model - Modified rake structure to enhance available promotional fund marketing dollars - Introduced sweeping changes to daily promo schedule - Added Tournament Director specific role where growth opportunity exists Enhanced Analytical Capabilities - Development of internal analytics team to help measure results and maximize profitability - Formalized and established labor, table utilization, and other efficiency targets

Positioned For Growth - Hospitality New Team, New Talent - New leadership team brings significant experience in restaurant and facility food and beverage operations - New ideas to make food a more featured part of Canterbury experience Enhanced Onsite Food & Beverage Opportunity - Create food experiences that can attract a different audience and command a different/higher price point - Little Chicago Chophouse: Upscale dining - Trifecta Café: Italian, Asian and American served 24/7 - Pit Boss Authentic Texas Barbeque, Morning Line Brew (proudly brewing Starbucks), Canterbury Cantina, etc. – new racing and event stand/revenue opportunities - Little Chicago Chophouse – Opened in May 2019, bringing upscale dining to

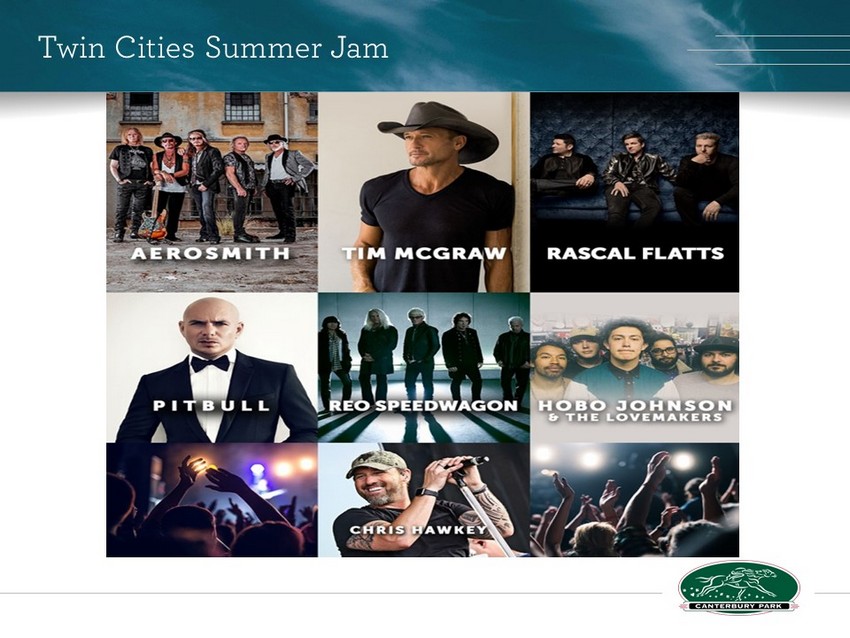

Positioned For Growth - Hospitality Catering Opportunities - Revised catering operations team and sales structure - Enhanced VIP package opportunities and upgrades - Showcased expanded vision of catering and event opportunities at open house event - Record catering revenue in 2018 Enhanced Event Experiences - Inaugural Twin Cities Summer Jam 3 - Day Music Festival - Expected to draw 50,000 guests over 3 - day event - New AFTE Flat Track Motorcycle Races in 2018 - Created winter Horse Skijoring event 2018/2019

Twin Cities Summer Jam

Positioned For Growth - Real Estate Development Project Management & Marketing - Hired Director of Development to lead planning and future phase recruitment - Planning and identification of development partners for 50 - acre Phase I nearing completion Triple Crown Apartments - Transferred 13 acres of land to Doran/Canterbury joint venture - Construction underway; Pre - leasing expected fall of 2019 - Long - term revenue stream anticipated beginning 2020 Tax Increment Financing (TIF) - Approval of TIF Redevelopment District in March 2018 - Commenced construction on Shenandoah Drive; Critical roadway to attracting development opportunities

Canterbury Park and Canterbury Commons – 370 acres

Vision A NEW PLACE TO LIVE, STAY, WORK AND PLAY . Redevelopment Concepts First In Market Entertainment & Restaurant Options Destination Retail Opportunities New Lifestyle Housing Initiatives Distinctive Hotel Experiences & More Canterbury Commons

Canterbury Commons Conceptualizing a New Place to LIVE, Stay, Work & Play Apartments by Doran Creating A New Space for Lifestyle Renters Upscale Townhomes Meeting the Demands of Our Region 55+ Housing Co - Op Keeping People in our Community

Canterbury Commons Conceptualizing a New Place to Live, STAY , Work & Play Extended Stay Hotel Full - Service Boutique Hotel Wisconsin Dells Style Hotel Waterpark

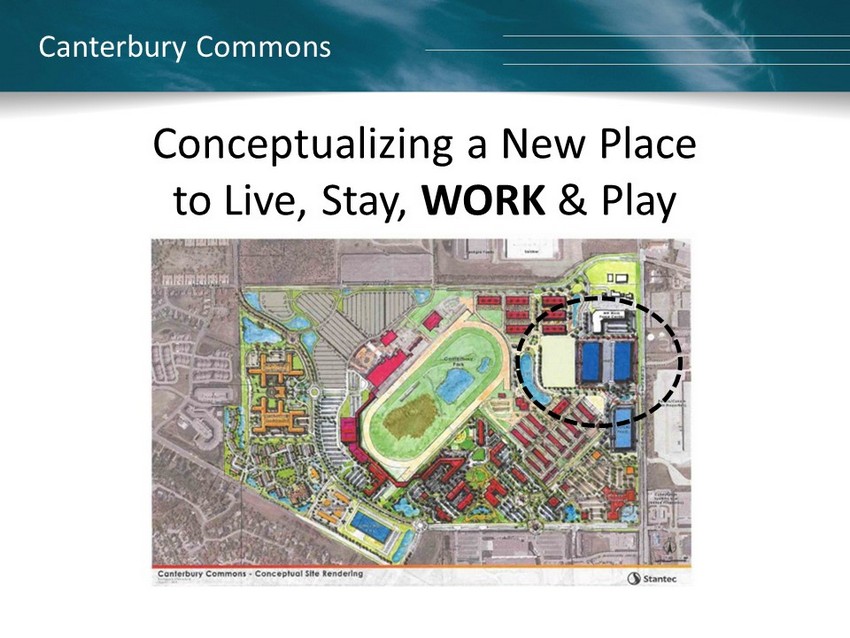

Canterbury Commons Conceptualizing a New Place to Live, Stay, WORK & Play Office/Business Park Creating a platform to attract high - end jobs and grow Shakopee’s business base

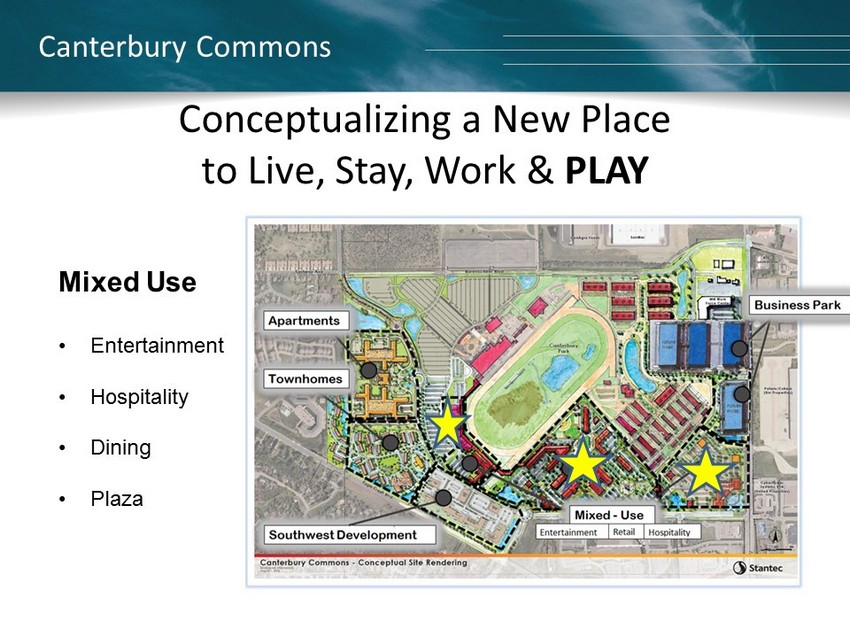

Canterbury Commons Conceptualizing a New Place to Live, Stay, Work & PLAY Destination Experience Concepts • New Restaurant Choices • ‘ Eater’tainment Options • Specialty Retail • Family Entertainment Venues • Indoor Waterpark • Community Gathering Spaces

Conceptual Master Plan

Canterbury Commons Conceptualizing a New Place to LIVE, Stay, Work & Play Apartments by Doran Lifestyle Renters: Triple Crown Apartments Upscale Townhomes Meeting the Demands of Our Region 55+ Housing Rental and Ownership Strong Interest Strong Interest

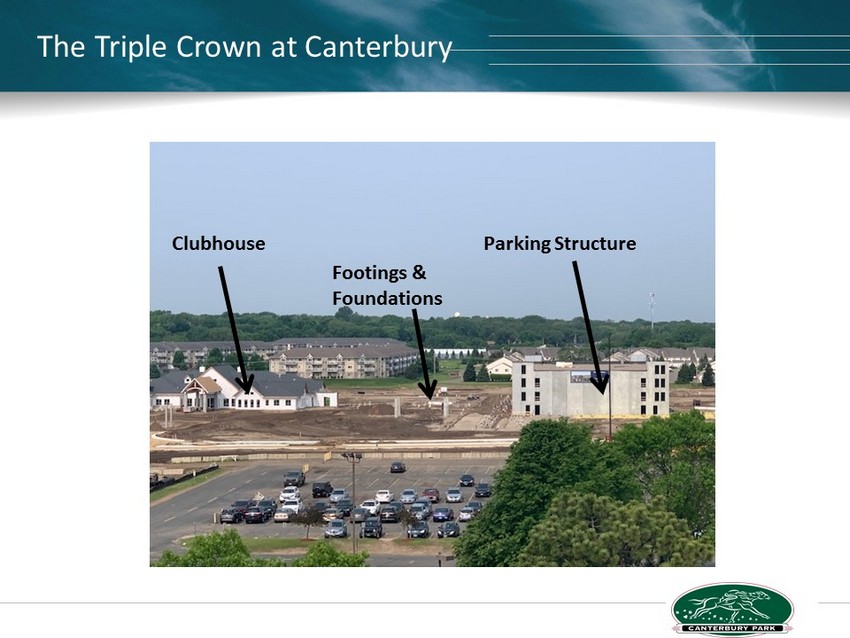

The Triple Crown at Canterbury Clubhouse Parking Structure Footings & Foundations

The Triple Crown at Canterbury

The Triple Crown at Canterbury Renderings

The Triple Crown at Canterbury

The Triple Crown at Canterbury

The Triple Crown at Canterbury

The Triple Crown at Canterbury

The Triple Crown at Canterbury

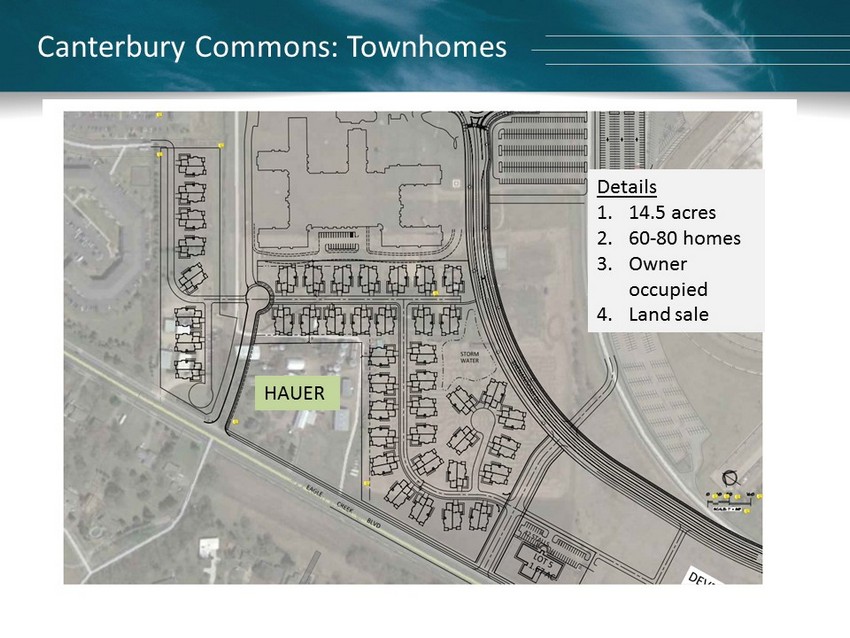

Canterbury Commons: Townhomes HAUER Details 1. 14.5 acres 2. 60 - 80 homes 3. Owner occupied 4. Land sale

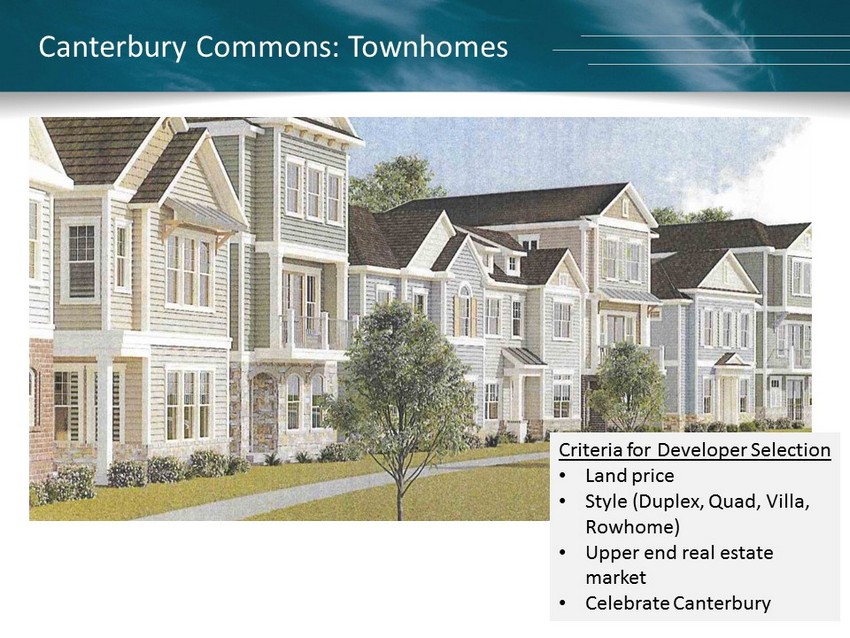

Canterbury Commons: Townhomes Criteria for Developer Selection • Land price • Style (Duplex, Quad, Villa, Rowhome) • Upper end real estate market • Celebrate Canterbury

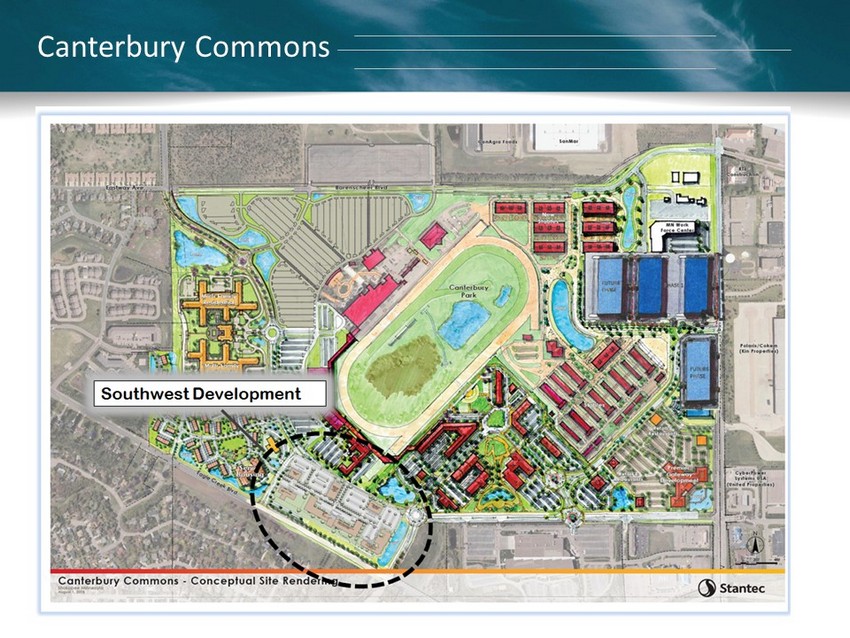

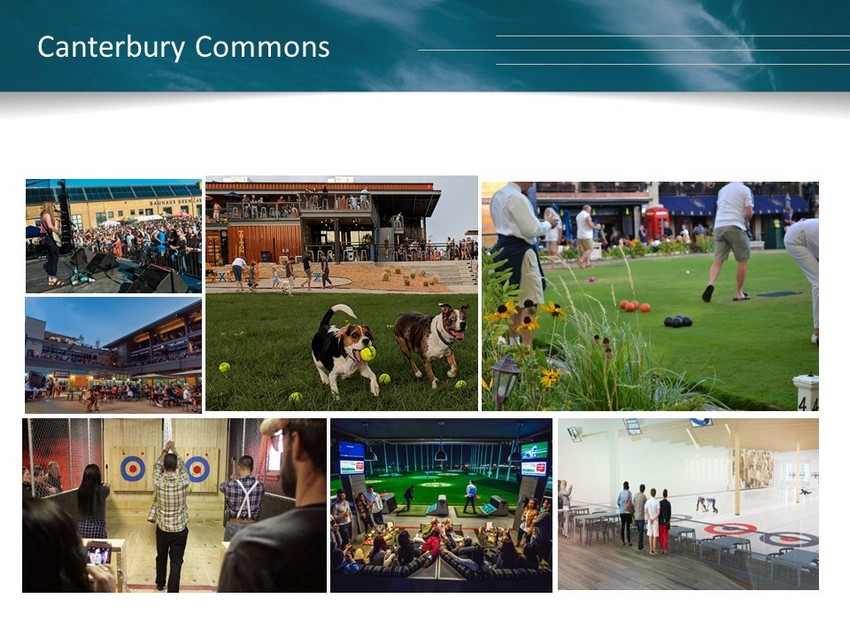

Canterbury Commons

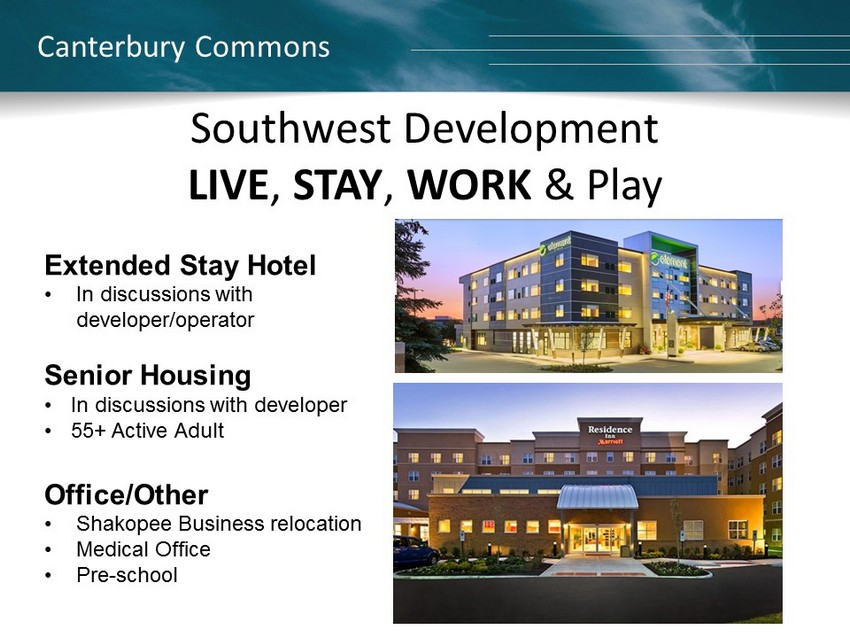

Canterbury Commons Southwest Development LIVE , STAY , WORK & Play Extended Stay Hotel • In discussions with developer/operator Senior Housing • In discussions with developer • 55+ Active Adult Office/Other • Shakopee Business relocation • Medical Office • Pre - school

Southwest Development Concept Plan Massing Plan • Views of Track • Efficient Parking • Underground Parking • Shared Parking • 1 to 4 story buildings

Canterbury Commons Conceptualizing a New Place to Live, Stay, WORK & Play

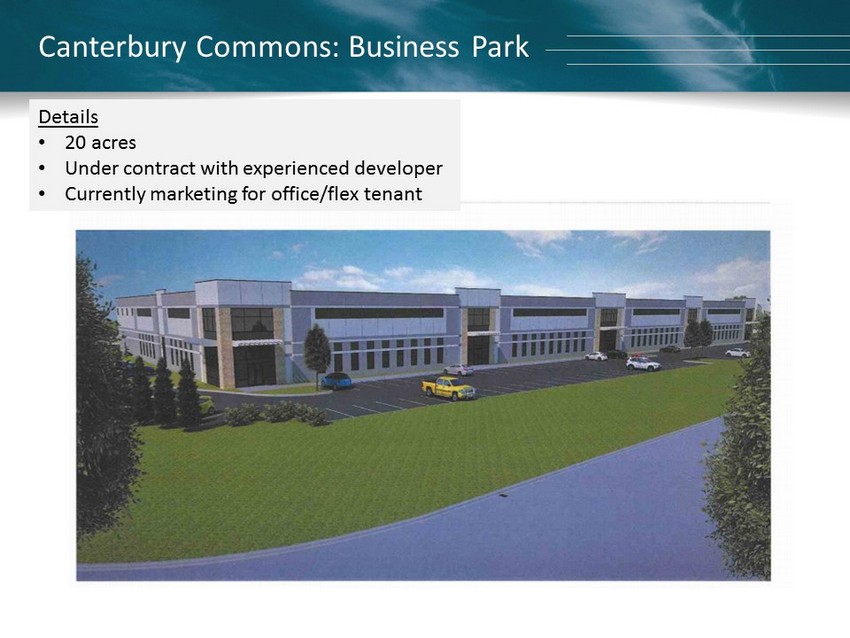

Canterbury Commons: Business Park Details • 20 acres • Under contract with experienced developer • Currently marketing for office/flex tenant

Canterbury Commons Mixed Use • Entertainment • Hospitality • Dining • Plaza Conceptualizing a New Place to Live, Stay, Work & PLAY

Canterbury Commons

Canterbury Commons: Master Planning Design Team / Master Planner / Landscape Architect 1. Landscape Design in Canterbury Parking Lot 2. Branding – Branded Development 3. Design Specs for Future Development 4. Programming of Space 5. Integrate Uses – mixed use, public plaza, barns 6. Visioning 7. Design Charrette with Stakeholders

Development Timeline Triple Crown Apartments (Doran Cos.) Broke ground Oct. 2018 Club House and Model unit: Fall Occupancy Early 2020 Townhomes Developer selection, Summer of 2019 Targeted construction, 2020 Southwest Development Replat, entitlement Summer of 2019 Contingent on selecting a partner but site work in the Fall 2019 anticipated Targeted construction, 2020

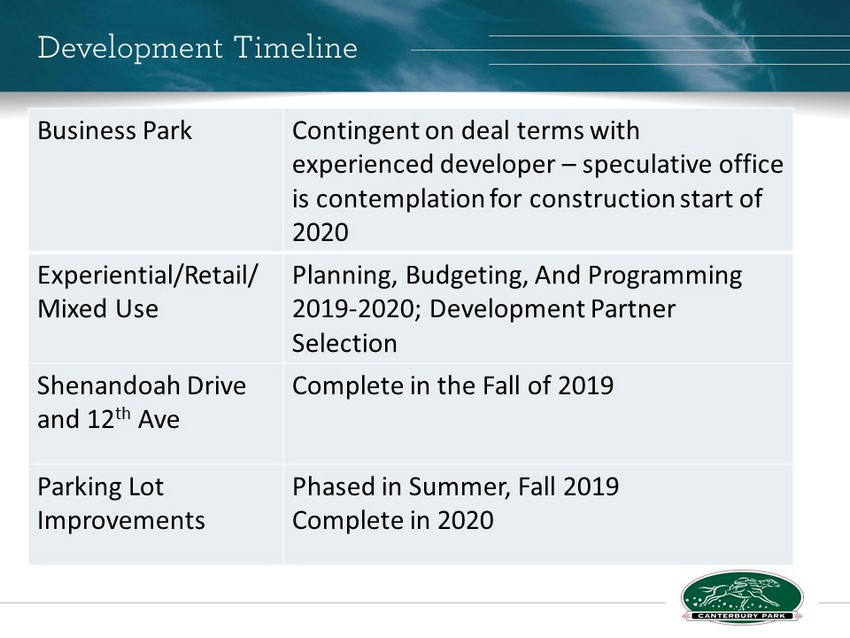

Development Timeline Business Park Contingent on deal terms with experienced developer – speculative office is contemplation for construction start of 2020 Experiential /Retail/ Mixed Use Planning , Budgeting, And Programming 2019 - 2020; Development Partner Selection Shenandoah Drive and 12 th Ave Complete in the Fall of 2019 Parking Lot Improvements Phased in Summer, Fall 2019 Complete in 2020

Development Plan – First Phase Great progress in the past year on the first phase of Canterbury Commons Shenandoah Road construction underway, opening the opportunity to develop over 50 acres Uses are programmed and we are finalizing the development partner selection process Residential and office uses as well as an extended stay hotel will be a catalyst for further development Will establish a significant tax base for creating TIF revenues that will reimburse for public infrastructure costs 50 acres

Thank you!