Use these links to rapidly review the document

TABLE OF CONTENTS

INDEX TO THE FINANCIAL STATEMENTS

As filed with the Securities and Exchange Commission on July 12, 2016

Registration No. 333-212003

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

AMENDMENT NO. 1

TO

FORM F-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

TGLT S.A.

(Exact name of Registrant as specified in its charter)

TGLT S.A.

(Translation of Registrant's name into English)

| Republic of Argentina (State or other jurisdiction of incorporation or organization) | 8880 (Primary Standard Industrial Classification Code Number) | Not Applicable (I.R.S. Employer Identification No.) |

TGLT S.A.

Av. Scalabrini Ortiz 3333, City of Buenos Aires

Republic of Argentina

(+ 54-11-5252-5050)

(Address, including zip code, and telephone number, including area code, of Registrant's principal executive offices)

CT Corporation System

111 8th Avenue, 13th Floor

New York, New York 10011

(212) 894-8800

(Name, address, including zip code, and telephone number, including area code, of agent for service)

| With copies to: | ||

Stephen Double, Esq. Holland & Knight LLP 31 West 52nd Street New York, NY 10019 | Nicholas A. Kronfeld, Esq. Davis Polk & Wardwell LLP 450 Lexington Avenue New York, New York 10017 | |

Approximate date of commencement of proposed sale to the public:

As soon as practicable after this registration statement becomes effective.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. o

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

CALCULATION OF REGISTRATION FEE

| Title of each class of securities to be registered | Proposed maximum aggregate offering price(3) | Amount of registration fee(4) | ||

|---|---|---|---|---|

Common shares, par value Ps.1.00 per share(1)(2) | US$50,000,000 | US$5,035 | ||

| ||||

- (1)

- Includes common shares that the international underwriters may purchase solely pursuant to their option to purchase additional shares and common shares which are to be offered outside the United States but which may be resold from time to time in the United States in transactions requiring registration under the Securities Act, including common shares which the registrant may sell to current shareholders pursuant to preemptive rights and accretion rights. Offers and sales of shares outside the United States are being made pursuant to Regulation S under the Securities Act of 1933 and are not covered by this Registration Statement.

- (2)

- A separate registration statement on Form F-6 will be filed for the registration of American depositary shares issuable upon deposit of the common shares registered hereby.

- (3)

- Estimated solely for the purpose of computing the amount of the registration fee pursuant to Rule 457(o) under the Securities Act.

- (4)

- Fee previously paid.

The Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933, or until this Registration Statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

The information in this prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the U.S. Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and we are not soliciting offers to buy these securities in any jurisdiction where the offer or sale is not permitted.

SUBJECT TO COMPLETION, DATED , 2016

PROSPECTUS

Common Shares

TGLT S.A.

which may be represented by American depositary shares

This is the initial public offering in the United States of our shares of common stock, par value Ps.1.00 per share and one vote per share. We are offering common shares in a global offering, which consists of an international offering in the United States and other countries outside Argentina and a concurrent offering in Argentina. In the aggregate, common shares, which may be represented by American depositary shares, or ADSs, are being offered by us in the global offering. Each ADS represents 15 common shares. The international offering of the ADSs in the United States and other countries outside Argentina is being underwritten by the international underwriters named in this prospectus. In the Argentine offering, common shares are being offered to investors in Argentina through the Argentine placement agent named in this prospectus. The closings of the international and Argentine offerings are conditioned upon each other.

The initial public offering price of the ADSs in the international offering is expected to be between US$ and US$ per ADS, and the offering price of the common shares in the Argentine offering is expected to be between US$ and US$ per common share. After the pricing of this offering, we expect the ADSs to trade on the New York Stock Exchange, or the NYSE, under the symbol "TGLT." Prior to this offering our common shares have traded, and subsequent to this offering will continue to trade, on the Mercado de Valores de Buenos Aires, or MERVAL, under the symbol "TGLT." The latest reported closing sale price of our common shares on the MERVAL on July 11, 2016 was Ps.19.40 per share, or US$1.32 per share (equivalent to a price of US$19.78 per ADS) based on the rate of exchange on that day.

The offering of our common shares in Argentina will be registered with the Argentine securities regulator (Comisión Nacional de Valores, or CNV). Neither the U.S. Securities and Exchange Commission, or the Commission, nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

All of our existing shareholders have a preferential right, including preemptive rights and accretion rights, to subscribe to our capital increase resulting from the global offering. The preferential subscription period will expire on or about , 2016. In order to facilitate the execution of the global offering, existing shareholders representing % of our capital stock have agreed to waive or assign to the international underwriters their preferential rights in respect of the common shares to be issued pursuant to the global offering. These shareholders may nonetheless seek to acquire shares in the global offering and, if they are willing to purchase shares at the public offering price, will be allocated shares consistent with their original preferential rights.

We are an "emerging growth company" as defined in Section 2(a)(19) of the Securities Act of 1933, as amended, and, as such, are allowed to provide in this prospectus more limited disclosures than an issuer that would not so qualify. In addition, for as long as we remain an emerging growth company, we will qualify for certain limited exceptions from the Sarbanes-Oxley Act of 2002. Please see "Risk Factors—Risks Relating to the ADSs and this Offering—We are an "emerging growth company" and we cannot be certain whether the reduced requirements applicable to emerging growth companies will make our ADSs less attractive to investors" and "Prospectus Summary—Implications of Being an Emerging Growth Company."

Investing in the common shares and ADSs involves risks. See "Risk Factors" beginning on page 31 of this prospectus.

| | Per ADS | Total | Per common share | Total | ||||

|---|---|---|---|---|---|---|---|---|

Public offering price | US$ | US$ | US$ | US$ | ||||

Underwriting discounts and commissions | US$ | US$ | US$ | US$ | ||||

Proceeds, before expenses, to us | US$ | US$ | US$ | US$ | ||||

| ||||||||

We have granted the international underwriters the right for a period of 30 days from the date of this prospectus to purchase in the aggregate up to an additional common shares represented by ADSs at the initial public offering price paid by investors minus any applicable discounts and commissions pursuant to the international underwriters option to purchase additional shares. New shareholders will not have preemptive or accretion rights with respect to the common shares offered pursuant to the international underwriters' option to purchase additional common shares.

The common shares and ADSs will be ready for delivery on or about, 2016.

Global Coordinators and Joint Bookrunners

| J.P. Morgan | Morgan Stanley |

Joint Bookrunners

| Santander | UBS |

The date of this prospectus is , 2016.

| | Page | |||

|---|---|---|---|---|

PRESENTATION OF FINANCIAL AND OTHER INFORMATION | ii | |||

PROSPECTUS SUMMARY | 1 | |||

THE OFFERING | 19 | |||

SUMMARY OF SELECTED CONSOLIDATED FINANCIAL DATA | 25 | |||

RISK FACTORS | 31 | |||

USE OF PROCEEDS | 68 | |||

FORWARD-LOOKING STATEMENTS | 69 | |||

ARGENTINE ECONOMY AND MARKET OVERVIEW | 71 | |||

EXCHANGE RATES | 95 | |||

EXCHANGE CONTROLS | 97 | |||

MARKET INFORMATION | 101 | |||

CAPITALIZATION | 105 | |||

DILUTION | 106 | |||

SELECTED CONSOLIDATED FINANCIAL AND OTHER INFORMATION | 108 | |||

MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS | 114 | |||

BUSINESS | 148 | |||

REGULATORY OVERVIEW | 200 | |||

MANAGEMENT AND CORPORATE GOVERNANCE | 214 | |||

MAJOR SHAREHOLDERS | 235 | |||

RELATED PARTY TRANSACTIONS | 237 | |||

DESCRIPTION OF BYLAWS AND CAPITAL STOCK | 240 | |||

DESCRIPTION OF AMERICAN DEPOSITARY SHARES | 246 | |||

DIVIDENDS AND DIVIDEND POLICY | 254 | |||

TAXATION | 256 | |||

UNDERWRITING | 263 | |||

GLOBAL OFFERING EXPENSES | 274 | |||

VALIDITY OF THE SECURITIES | 275 | |||

EXPERTS | 275 | |||

ENFORCEMENT OF JUDGMENTS AGAINST FOREIGN PERSONS | 275 | |||

WHERE YOU CAN FIND MORE INFORMATION | 275 | |||

INDEX TO THE FINANCIAL STATEMENTS | F-1 | |||

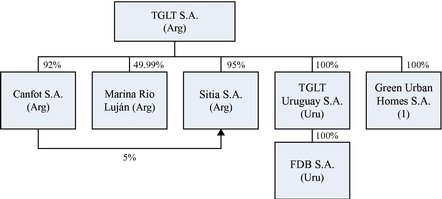

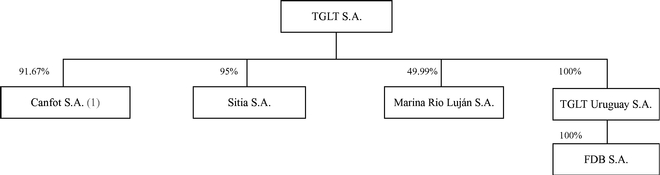

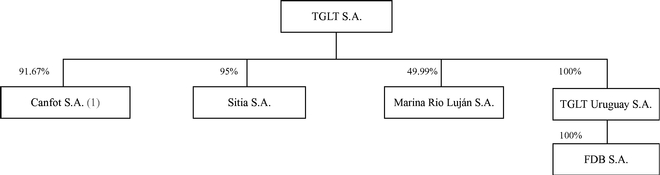

In this prospectus, we use the terms "we," "us," and "our" to refer to TGLT S.A. and its consolidated subsidiaries unless otherwise indicated. References to "Operating Companies" mean Canfot S.A., or Canfot, Marina Río Luján S.A., or MRL, Sitia S.A., or Sitia, and our subsidiaries in Uruguay, TGLT Uruguay S.A., or TGLT Uruguay, and FDB S.A., or FDB.

References to "common shares" refer to shares of our common stock, all with a par value of Ps.1.00 per share and references to "ADSs" are to American depositary shares, each representing 15 common shares, except where the context requires otherwise.

The term "Argentina" refers to the Republic of Argentina. The terms "Argentine government," and the "government," refer to the federal government of Argentina, the term "Central Bank" refers to theBanco Central de la República Argentina, or the Argentine Central Bank, and the term "CNV" refers to the ArgentineComisión Nacional de Valores, or the Argentine securities regulator. "IFRS" refers to International Financial Reporting Standards, as issued by the International Accounting Standards Board. The term "Uruguay" refers to the Oriental Republic of Uruguay.

The term "contracted sales" refers to the aggregate amount of sales resulting from all contracts for the sale of units entered into during a certain period, including new units and units in inventory. Contracted sales are recorded upon signing of a sales contract with a customer. Contracted sales are accounted for at their historical value plus any contractual exchange rate or inflation adjustments.

The term "gross leasing area," or GLA, refers to the amount of floor space available to be rented at a property, including the total floor area designated for occupancy. The term "gross sellable area," or GSA, refers to the amount of floor space available to be sold at a property, including the total floor area designated for occupancy.

We have not authorized anyone to provide any information other than that contained or incorporated by reference in this prospectus or in any free writing prospectus prepared by or on behalf of us or to which we may have referred you. We take no responsibility for, and can provide no assurance as to the reliability of, any other information that others may give you. We, the international underwriters, the Argentine placement agent or any of our or their affiliates have not authorized any other person to provide you with different or additional information. We, the international underwriters, the Argentine placement agent, or any of our or their affiliates are not making an offer to sell the ADSs or common shares in any jurisdiction where the offer or sale is not permitted. You should assume that the information appearing in this prospectus is accurate only as of the date on the front cover of this prospectus, regardless of the time of delivery of this prospectus or any sale of the ADSs or common shares. Our business, financial condition, results of operations and prospects may have changed since the date on the front cover of this prospectus.

The offering of ADSs is being made in the United States and elsewhere outside Argentina solely on the basis of the information contained in this prospectus. We are also offering common shares in Argentina using a Spanish-language prospectus that has been filed with the CNV. The Argentine prospectus is in a different format than this prospectus in accordance with CNV regulations but contains substantially the same information included in this prospectus, other than the information regarding the ADSs.

The Argentine public offering of the common shares was approved by the CNV on , 2016 by Resolution No. .

No offer or sale of ADSs may be made in Argentina except under circumstances that do not constitute a public offer under Argentine laws and regulations.

i

PRESENTATION OF FINANCIAL AND OTHER INFORMATION

Financial Statements

We maintain our financial books and records in Pesos and prepare our consolidated financial statements in Argentina in accordance with IFRS, as issued by the IASB, and all financial information included in this prospectus is presented in accordance with IFRS, except as otherwise indicated. In particular, this prospectus contains certain non-IFRS financial measures which are defined under "Summary of Selected Consolidated Financial Data." Our consolidated financial statements at December 31, 2015 and 2014 and for each of the two years ended December 31, 2015 and December 31, 2014 have been audited, as stated in the report appearing herein, and are included in this prospectus and referred to as our "audited consolidated financial statements." Financial information as of March 31, 2016 and 2015 and for the three months ended March 31, 2016 and 2015 has been derived from our unaudited interim consolidated financial statements as of and for the three months ended March 31, 2016 and 2015, included in this prospectus and referred to as our "unaudited interim consolidated financial statements".

Currencies and Rounding

The terms "U.S. dollar" and "U.S. dollars" and the symbol "US$" refer to the legal currency of the United States. The terms "Peso" and "Pesos" and the symbol "Ps." refer to the legal currency of Argentina.

We have translated certain of the Peso amounts contained in this prospectus into U.S. dollars for convenience purposes only using rates published by the Central Bank and Banco de la Nación Argentina, or the National Bank of Argentina. Unless otherwise indicated, financial information extracted or derived from our consolidated financial statements and contained in this prospectus has been translated into U.S. dollars at the bid closing rate as of December 31, 2015, which was Ps.12.94 per one U.S. dollar, as published the National Bank of Argentina for the fiscal year 2015, and at the bid closing rate as of March 31, 2016, which was Ps.14.60 per one U.S. dollar, as published the National Bank of Argentina for the three months ended March 31, 2016. For non-financial information contained in this prospectus, the rate used to translate such amounts (i) as of March 31, 2016, which was Ps.14.5817 to US$1.00, which was the Tipo de Cambio de Referencia, or reference exchange rate reported by the Central Bank for U.S. dollars, (ii) as of December 31, 2015 was Ps.13.0050 to US$1.00, which was the Tipo de Cambio de Referencia, or reference exchange rate reported by the Central Bank for U.S. dollars and (iii) as of December 31, 2014 was Ps.8.5520 to US$1.00, which was the reference exchange rate reported by the Central Bank for U.S. dollars. The Federal Reserve Bank of New York does not report a noon buying rate for Pesos. The U.S. dollar equivalent information presented in this prospectus is provided solely for the convenience of investors and should not be construed as implying that the Peso amounts represent, or could have been or could be converted into, U.S. dollars at such rates or at any other rate. See "Exchange Rates" for more detailed information regarding the translation of Pesos into U.S. dollars.

All "as adjusted" amounts contained in this prospectus have been adjusted to reflect the receipt by us of the estimated net proceeds at an assumed public offering price of US$ per common share (or US$ per ADS), the midpoint of the price range set forth on the cover page of this prospectus.

Certain figures included in this prospectus have been subject to rounding adjustments. Accordingly, figures shown as totals in certain tables may not be an arithmetic aggregation of the figures that precede them.

ii

Market Share and Other Information

We make statements in this prospectus about our competitive position and market share in, and the market size of, the Argentine and Uruguayan real estate industry. We have made these statements on the basis of statistics and other information derived from industry publications and other third-party sources that we believe are reliable. Although we have no reason to believe that any of this information or these reports are inaccurate in any material respect, neither we, the international underwriters, the Argentine placement agent nor any of our or their affiliates have independently verified the competitive position, market share and market size or market growth data provided by third parties or by industry or general publications.

Non-IFRS Information

This prospectus includes adjusted gross profit and adjusted operating profit figures. Adjusted gross profit and adjusted operating profit are presented as supplemental information and are not IFRS data. We believe that these are useful indicators of our operating performance because they provide an indication of our operating performance, independent of our financing decisions. Additionally, these metrics may allow for the comparison of our results with other companies in the industry that use similar financial measures as well as with other companies whose financing costs are not included in their gross or operating profit. However, adjusted gross profit and adjusted operating profit should not be considered in isolation, as substitutes for gross profit and operating profit determined in accordance with IFRS or as a measure of a company's profitability. In addition, our calculation of adjusted gross profit and adjusted operating profit may not be comparable to other companies' similarly titled measures.

Measurement and Other Data

In this prospectus, we present most information for real estate properties in meters (m) and square meters (m2 or sqm).

iii

This summary highlights information contained elsewhere in this prospectus. This summary does not contain all of the information you should consider before investing in the ADSs. You should read this entire prospectus carefully, especially the section in this prospectus entitled "Risk Factors" beginning on page 31 and our financial statements and the related notes thereto appearing at the end of this prospectus, before making an investment decision. As used in this prospectus, references to "TGLT," the "company," "we," "us" and "our" refer to TGLT S.A. and its consolidated subsidiaries, except where the context otherwise requires.

Overview

We are one of the fastest growing integrated real estate companies in Argentina in terms of developed area, with substantial focus in Argentina. Since our establishment in 2005, we have focused on the development of residential properties, and are currently expanding our commercial real estate operations, particularly in the office and logistics sectors.

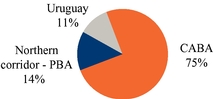

We have a proven track record of implementing our integrated business model to achieve substantial growth, in particular since our initial share offering, or IPO, on the MERVAL on November 5, 2010, through which we raised approximately Ps.220 million to fund our aggressive growth plan in the residential real estate sector. We have also developed mixed-use residential and commercial projects since 2010. By successfully deploying the capital we raised through our MERVAL IPO despite the economic challenges facing Argentina since the crisis in 2001-2002, we have achieved significant growth, with our contracted sales increasing from US$41.3 million (Ps.161.5 million) for the fiscal year ended December 31, 2010—the year of our IPO on the MERVAL—to US$113.6 million (Ps.1.052,4 million) for the fiscal year ended December 31, 2015, at the average exchange rate for the applicable year, achieving a compound growth rate in U.S. dollars of 22.4%. for this period. We are now the largest residential real estate company in Argentina in terms of total GSA, with more than 596,000 square meters (including our Forum Puerto del Buceo project in Montevideo, Uruguay) in different stages of development, across 11 large projects with 94 buildings.

In developing our residential projects, we have primarily focused on the high income purchasers who can typically afford to purchase properties in cash. However, we have also developed several projects that target the middle income segment, which we believe is poised for significant growth, as mortgage financing once again becomes available to Argentine purchasers, which we believe will occur as a result of expected political, regulatory and economic developments in Argentina.

As an integrated real estate company, we control all aspects of the real estate development process with a management team experienced in all key areas of real estate development and operations, including land identification and acquisition, government licensing and relations, project management, commercialization and sales. During the development process, while we retain the decisions and control of these functions, we entrust the actual execution of certain functions, such as architecture and construction, to specialized companies under our close supervision. We also provide specialized value-added services that seek to maintain or increase the value of real estate properties owned by us and our clients.

We believe that our integrated business model will (i) allow us to capture value throughout the business cycle, as we are able to focus on different market segments at different points in the cycle, (ii) provide flexibility to take advantage of different opportunities that arise in Argentina's rapidly evolving real estate market, (iii) give us the ability to match our cash flows and our risk exposure across different business lines with the different cash requirements and return profiles of our business lines, and (iv) generate critical mass as we combine operations, realize synergies and take advantage of cross selling opportunities through our brokerage business and with our corporate clients.

1

Through this integrated business model and our experience in developing mixed-use projects, we plan to take advantage of current market opportunities to grow more aggressively in two core areas of commercial real estate:

- •

- for-lease Class A office buildings—which are buildings with above average rents for the area in which they are located, high quality standard finishes and systems, exceptional locations and a recognized market presence; and

- •

- premium logistics centers, or PLCs—which are integrated warehouses, built with advanced features, including dock levers, high resistance floors, climate control and support offices, in the Buenos Aires metropolitan area.

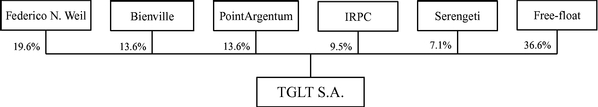

Our senior management team has extensive experience in creating and developing successful real estate companies. Federico Weil, our founder, CEO and Chairman, founded some of the most prominent real estate companies in Argentina, such as Adecoagro (NYSE: AGRO), and Alejandro Belio, our COO, was CEO of Faena Properties S.A. and Creaurban S.A., two large property developers in Argentina. We are also backed by leading institutional investors, including PointArgentum Master Fund LP, or PointArgentum, an affiliate of PointState Capital LP, and Bienville Argentina Opportunities Fund, LP, or Bienville, an affiliate of Bienville Capital Management, LLC, two major investment funds that each currently hold 13.6% of our common shares.

Our integrated business model is comprised of three business lines:

- •

- Residential: For over ten years we have successfully developed for-sale multifamily residential and mixed-use projects in Buenos Aires and Rosario, Argentina and Montevideo, Uruguay. We have targeted high-income segments of the population that can afford to buy real estate in cash, without mortgage credit assistance, given the particularities of the markets in which we operate. However, we have also developed several large projects targeted at middle-income segments of the population. We believe that ongoing economic reforms, in particular the expected expansion of available mortgage credit and the expected resulting increase in demand, will positively impact the residential real estate sector specifically, and provide us with significant opportunities for

2

growth and enhanced margins. Our residential projects are in varying stages of development, and include the following:

Project | Location | Segment | Area (sqm GSA) | Buildings | Status | |||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

Forum Puerto Madero | Puerto Madero, Buenos Aires | Homes & Retail | 34,000 | 1 | 100% sold. Delivered in 2008 | |||||||

Forum Puerto Norte | Rosario, Santa Fe | Homes & Offices | 52,639 | 11 | 100% sold. 99% delivered as of first quarter of 2016. | |||||||

Forum Alcorta | Bajo Belgrano, Buenos Aires | Homes | 39,763 | 3 | 98% sold. 93% of Tower One and 82% of Tower Two delivered. In Tower Three, delivered 21% of sellable units and expected to continue throughout 2016. | |||||||

Forum Puerto del Buceo | Montevideo, Uruguay | Homes | 48,185 | 1 | 66% sold. Deliveries expected in 2016 - 2018 | |||||||

Astor Palermo | Palermo, Buenos Aires | Homes & Parking | 14,763 | 1 | 98% sold. Delivered 77% of total sellable units as of the first quarter of 2016. | |||||||

Astor Núñez | Núñez, Buenos Aires | Homes & Retail | 20,368 | 2 | 95% sold. Deliveries expected in 2016 | |||||||

Astor Caballito | Caballito, Buenos Aires | Homes | 31,114 | 3 | Currently suspended due to injunction. See "Business—Our Business Lines—Residential Real Estate—Residential Projects Under Development—Astor—Astor Caballito." | |||||||

Metra Puerto Norte (Brisario) | Rosario, Santa Fe | Homes & Retail | 68,613 | 11 | 61% of Phase 1 (out of 5 phases) sold. First deliveries expected in 2017. | |||||||

Metra Devoto | Devoto, Buenos Aires | Homes | 19,392 | 4 | 6% sold. Commercial launch to general public expected in 2016 to 2022. | |||||||

Venice | Tigre, Buenos Aires | Mixed uses | 208,676 | 53 | 60% of Phase 1 (out of of 4 phases) sold. Deliveries expected in 2016 - 2022 | |||||||

Proa (Brisario) | Rosario, Santa Fe | Mixed uses | 65,166 | 4 | Launch expected for third quarter of 2016. | |||||||

Astor San Telmo | San Telmo, Buenos Aires | Homes & Retail | 27,542 | 1 | 13% sold. Commercial launch to general public in 2016. 68 of 404 units sold. | |||||||

| | | | | | | | | | | | | |

Total (excluding Forum Puerto Madero) | 596,221 | 94 | ||||||||||

- •

- Commercial: Our plan is to identify and invest in opportunities in the for-lease Class A office building and PLC sectors, primarily in the Buenos Aires metropolitan area. We believe that a strong and sizable portfolio of office and logistics assets will provide us with stable, long-term

3

- •

- Services: We provide specialized value-added services, including brokerage, in order to optimize our customers' experience, as well as maximize our control over the marketing process. These kinds of services allow us to increase the revenue we generate from our own projects by expanding our margins and generating additional revenue from third-party developments. We also believe that through our services we create significant synergies for our operations, including obtaining market intelligence and providing the highest standard of customer care.

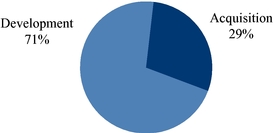

cash flows from lease payments which will help us fund new developments and counterbalance the cyclical nature of the residential sector. Between 2008 and 2011, we developed for-sale office buildings in Rosario, Argentina and in 2014, we acquired 31% of a property for the development of a for-lease 23,000 square meter GLA, office building in Buenos Aires. We are seeking permits to develop a 6,000 square meter GLA for-lease office building within our Brisario mixed-use project in Rosario. We expect that this project will be delivered in the fourth quarter of 2018, and will require a total investment of Ps.256.2 million (US$19.97 million), of which we have invested Ps.16.2 million (US$1.11 million) as of March 31, 2016. Additionally, we have commenced negotiations for the potential acquisition of properties in the Buenos Aires metropolitan area. While we have not yet acquired rights to these additional sites, we believe that these and other sites that we have identified represent a strong pipeline of strategically located properties for commercial development. Approximately 80% of the proceeds from this offering will be used to grow our portfolio of commercial properties.

Real Estate Market Opportunity in Argentina

We believe that we are well positioned to seize the market opportunity that we expect will be created by economic improvement in Argentina. The economic and financial environment going forward in Argentina is expected to be significantly influenced by the election of President Mauricio Macri, who took office on December 10, 2015. We anticipate that Argentina will benefit from the change in regulatory, fiscal and monetary policy and other reforms that have been, and continue to be, enacted by the Macri Administration, which we expect will increase the country's overall competitiveness, economic prospects and gross domestic product, or GDP, growth. We also believe that ongoing economic reforms, in particular the increased availability of mortgages, will positively impact the real estate sector specifically, and provide us with significant opportunities for growth and enhanced margins.

Our existing portfolio and investment plan provide investors with focused exposure to Argentina's residential and commercial real estate sectors. We highlight below the key market opportunities that we intend to capture.

Residential Real Estate Development Opportunity

We believe that changes in economic policies being implemented by the Macri Administration will result in significant opportunities in the residential real estate industry. In particular, we expect that increases in the availability of credit, greater stability throughout the sector and a lower real exchange rate will result in higher prices and lower costs, which will in turn lead to enhanced margins.

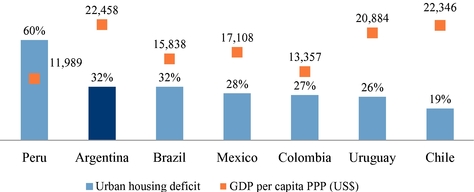

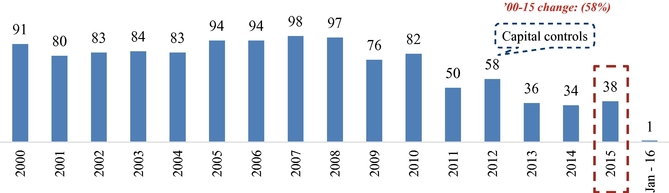

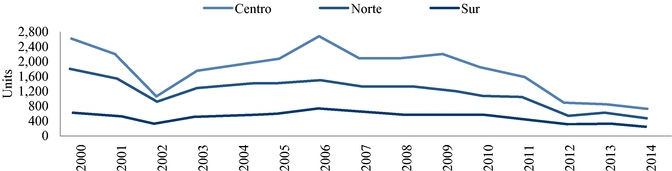

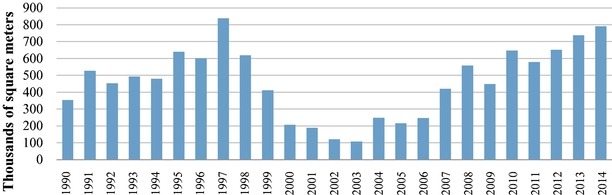

Argentina has one of the highest GDPs per capita in Latin America (as measured on a purchasing power parity, or PPP, basis), but over the last several years, a lack of both available mortgage credit and new construction in the residential real estate sector has led to a collapse of both supply and demand across Argentina, with a particularly acute impact in Buenos Aires. Additionally, since the strengthening of capital controls by the previous administration in 2011, the aggregate number of residential real estate transactions has significantly decreased, with the number of construction permits in 2015 only roughly matching pre-Argentina crisis levels reached in 2000, according to theInstituto de Estadistica y Registro de la Industria de la Construcción (the Construction Industry Statistics and

4

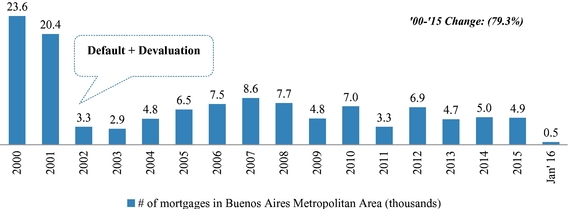

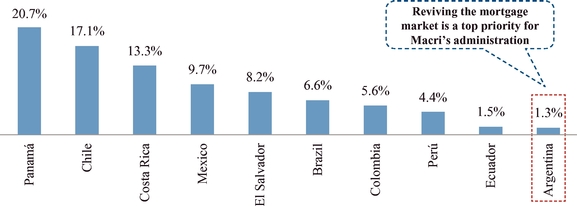

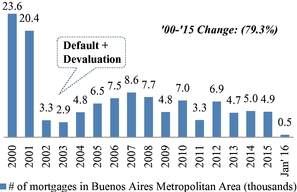

Registration Institute, or IERIC). Additionally, mortgages have become increasingly scarce since Argentina's sovereign bond default and the resulting currency devaluation in 2002, and the supply of apartments is currently at its lowest level since 2002. Due to the significant lack of available mortgage credit over the last several years, Argentine homeowners and purchasers are substantially underleveraged when compared to purchasers in other markets. As a result, we believe that the expected increase in mortgage availability will lead to significant increases in demand.

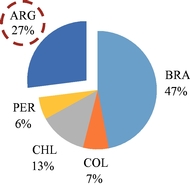

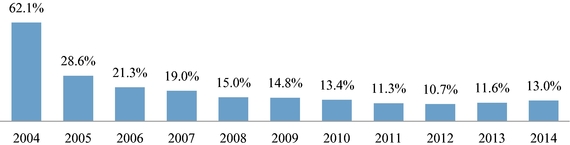

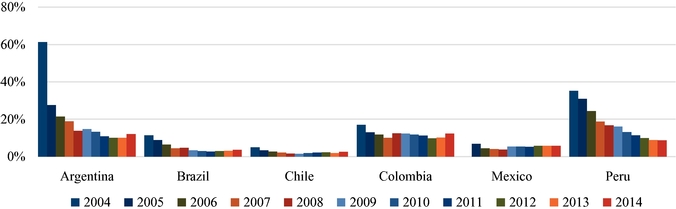

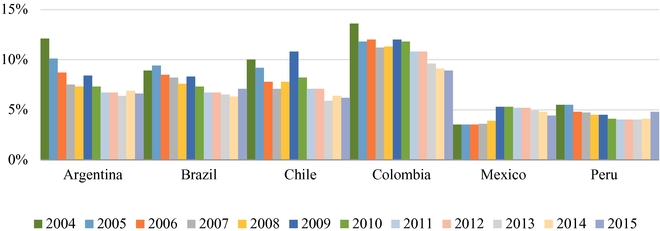

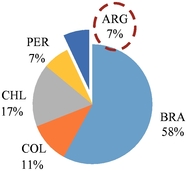

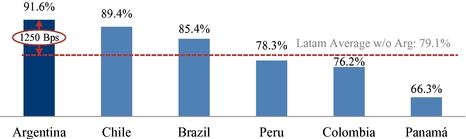

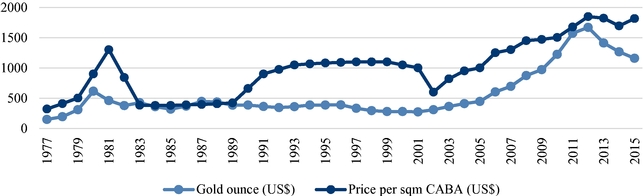

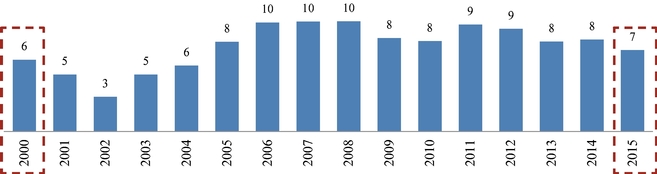

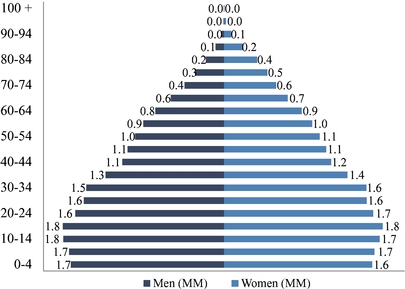

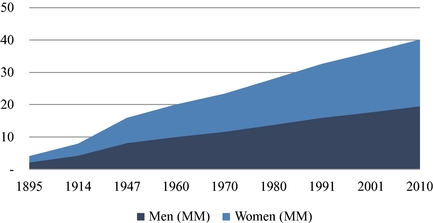

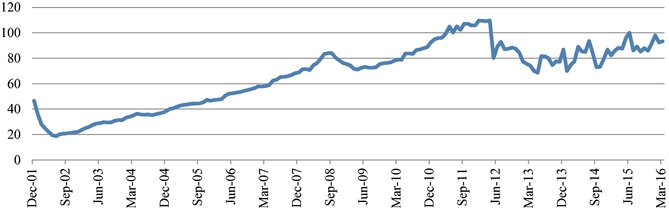

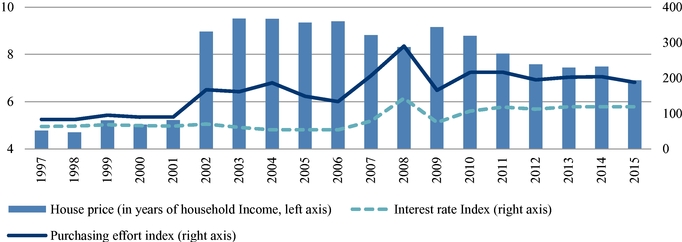

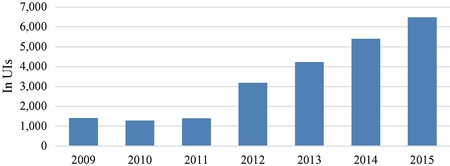

The following tables provide information about the availability of mortgages in Argentina.

Mortgages have almost disappeared since the 2002 default and devaluation

Source: Camara Inmobiliaria Argentina

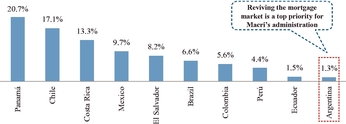

Source: Titularizadora Colombiana 2013

President Macri has stated that reviving the mortgage market is one of his administration's top priorities and, among other measures, the Central Bank has recently implemented an inflation-adjusted currency for mortgage credit called Unidad de Vivienda, or UVI (Central Bank Communication "A" 5945), following successful experiences in Chile, Mexico and Uruguay. The UVI had an initial value of Ps.14.05 (equivalent to 0.001 of the average construction cost of one square meter of a residence as of March 31, 2016) and will be adjusted daily by the inflation index reported by the Central Bank (theCoeficiente de Estabilización de Referencia, or CER). Futhermore, in April 2016, a bill aiming to give legislative force to the Central Bank's iniatitive was sent to Congress and as of the date of this prospectus, it has been approved by the committees in the upper chambers of Congress. This bill provides that the deposits denominated in UVIs will be subject to the general terms and conditions of the Central Bank rules and that the Central Bank will have the authority to apply the law. The creation

5

of the UVI is expected to help fuel the recovery of the mortgage credit market. Banks can lend long-term protecting their capital through the application of the indexing mechanism implicit in the UVI, and families can borrow at rates at which installments become more affordable than they are today in a context of very high nominal rates. The UVI also generates a competitive savings alternative that will likely allow banks to attract larger amounts of long-term deposits. Additionally, the National Bank of Argentina and the Bank of the Province of Buenos Aires, the largest and second largest state-owned credit institutions in Argentina, have made public announcements regarding their intent to prioritize mortgage lending. These factors, coupled with the fact that banks are expected to gain further access to long-term funding following the recent successful return of Argentina to the international capital markets and particularly if inflation in the country begins to subside to levels around or below 10%, which is an objective of the Macri Administration for 2017 and onwards, should help the development of the mortgage credit market, supporting the demand for the homes we produce, as the penetration of mortgage loans as a percentage of GDP reaches the levels seen in other countries in the region.

On June 29, 2016, the Argentine Congress passed a law providing a tax amnesty and tax reform, allowing Argentines to repatriate funds held abroad without adverse tax consequences. See "—Recent Regulatory Changes in Argentina—Tax reforms." We believe that one likely effect of the tax amnesty will be to enable Argentines to invest a larger portion of their savings in real estate, which could benefit our sales, although the timing and extent of any benefit to our business from this reform are uncertain. According to the Tax Justice Network, Argentines hold approximately US$500 billion (an amount roughly equivalent to one year of Argentina's GDP, according to the IMF) in undeclared savings.

We believe that the new economic situation, with increased availability of credit generally, and mortgage credit in particular, increased economic and political stability and a lower real exchange rate will result in increased opportunities in the real estate industry, higher real estate prices and lower development costs, which will boost profitability. We believe that construction costs in U.S. dollars will decrease as the Argentine government tries to reduce the real exchange rate to improve competitiveness and attract foreign direct investment back to Argentina. Additionally, with an improved mortgage credit market, more households should be able to purchase either a first home or a new, more desirable home. We believe that real estate prices will increase in line with greater demand.

Commercial Real Estate Development Opportunity

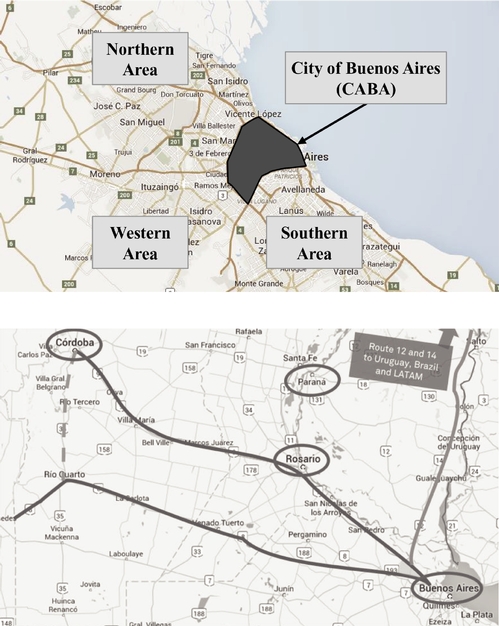

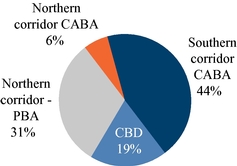

We intend to assemble a prime portfolio of for-lease Class A office buildings for corporate use and PLCs in Argentina, mainly in the Buenos Aires metropolitan area.

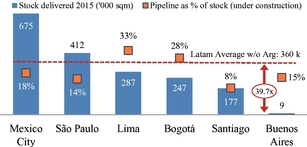

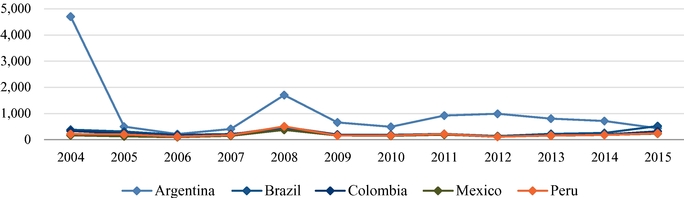

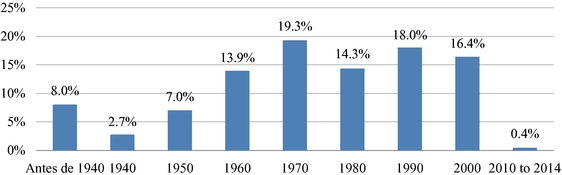

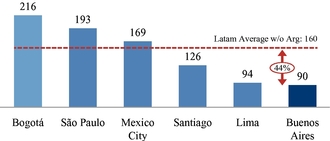

Class A Office Sector: The premium office sector in Argentina, and in particular in Buenos Aires, has experienced very limited growth during the last decade as a result of low foreign investment in Argentina. In particular, a very low level of investment has occurred in Class A offices. According to Colliers International, between 2002 and 2014, the supply of Class A offices grew at a compounded yearly rate of 1.5%, significantly below the compounded yearly growth rate of the Argentine GDP of 5.1% for the same period. Office penetration in Buenos Aires is the lowest among other large capital cities in Latin America, with 90 square meters of GLA per thousand residents, 44% below the relevant regional average, which we believe represents a significant opportunity for increases in both supply and demand.

In addition, because new office space development in Buenos Aires in recent years relative to the existing stock has been minimal, the average age of existing stock has increased and continues to age. Compared to large cities in Latin America, Buenos Aires has a smaller pipeline of new projects (15% of current stock). Further, only a very small portion of office space in Buenos Aires complies with the environmental sustainability standards that are increasingly desired by multinational corporations.

6

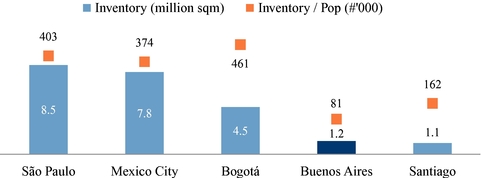

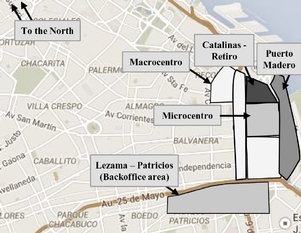

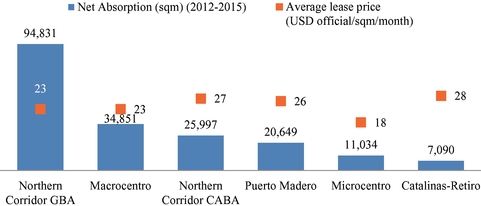

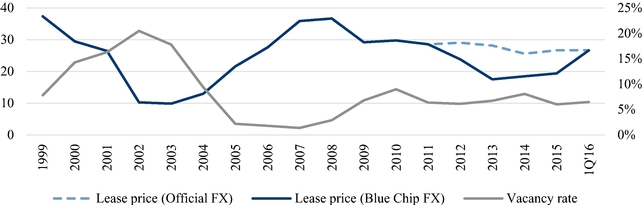

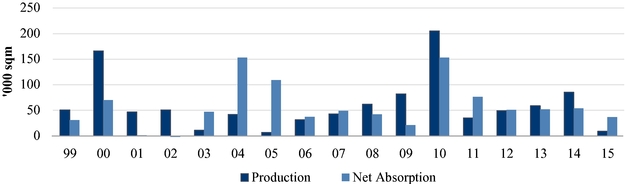

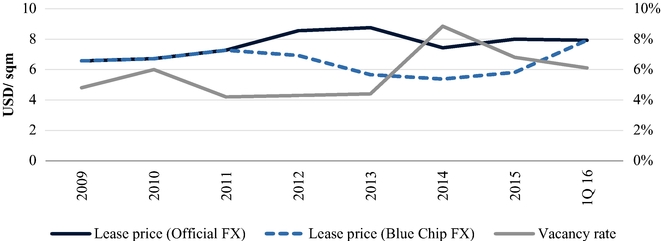

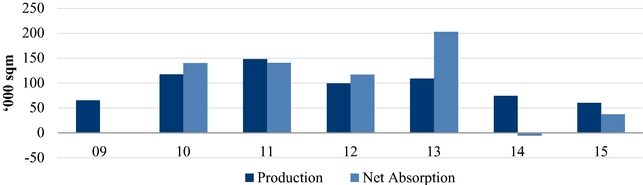

The following charts set forth information regarding the limited supply, and ageing stock, of Class A office space in Buenos Aires.

| Limited new supply spurs an increasingly ageing stock | Low regional penetration in Class A office sector | |

|  |

Source: Newmark Grubb Knight Frank (Report for third quarter of 2015), Jones Lang Lassalle, Colliers, Cushman & Wakefield

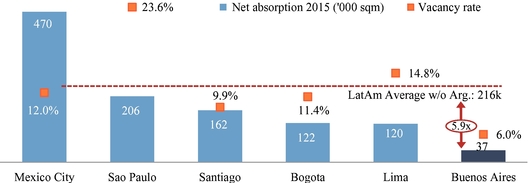

Demand for Class A offices has also lagged in recent years, but we expect demand to increase as the Argentine economy recovers. However, even with the weak demand for office space, vacancy rates in Buenos Aires are currently in the lower end in Latin America. We believe that, as a result of economic reforms introduced by the Macri Administration, corporations that already operate in Argentina will launch long-delayed investment plans and new international companies will commence or relaunch operations in Argentina, increasing headcount and helping drive the recovery in demand for commercial properties. Supply is also expected to increase, but at a slower rate than the increase in demand, given the extended period of time it takes to complete a typical Class A office development project. As a result, we anticipate that office lease rates are likely to increase as demand grows faster than supply.

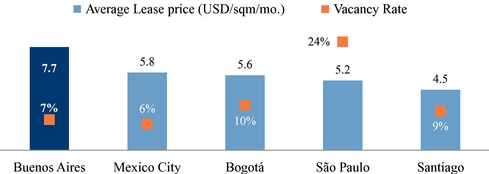

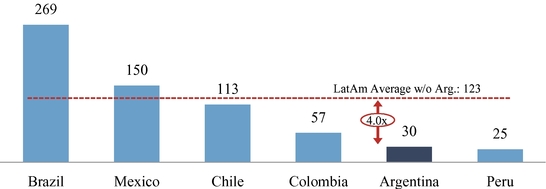

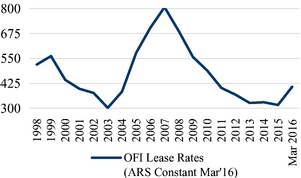

Premium Logistics Centers: We believe that the substantial under-supply, low vacancy rates and growing demand in the PLC market presents a significant opportunity for our business. Additionally, to our knowledge, no international industrial real estate developers are currently actively present in Argentina, which we believe increases the significance of our opportunity to capitalize on an early-mover advantage.

PLCs are particularly needed, as Argentina has the third largest road network in Latin America, and has a freight transportation system that is truck-centered, with 84% of grain and related products being transported by truck in 2012. According to data published by the United Nations Economic Commission for Latin America, or CEPAL, compared to other Latin American countries, Argentina has more trucks per thousand inhabitants (47) than Brazil (16), Chile (8) and Mexico (5).

7

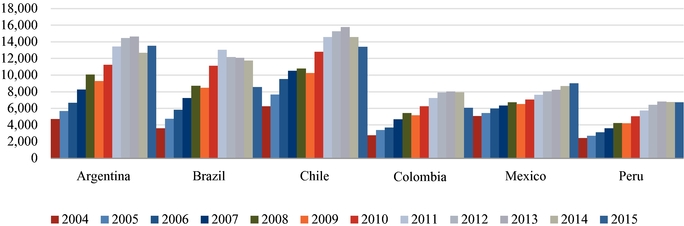

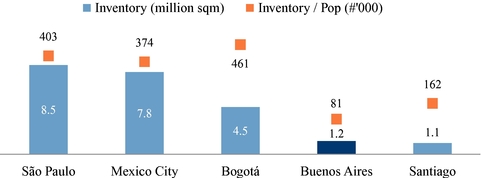

Nevertheless, logistics real estate infrastructure in Argentina is substantially underdeveloped, and is characterized by low regional penetration, as shown in the following table.

Source: Cushman & Wakefield, Newmark Grubb, United Nations Population Division

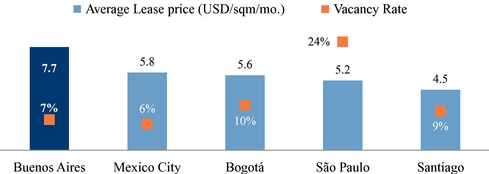

We believe that in Latin America, companies are increasingly moving their logistics operations from their own facilities to multi-tenant PLCs owned by third parties. This trend has been seen to a significantly lesser extent in Argentina. With 1.2 million square meters of GLA, Buenos Aires has the lowest inventory of PLCs and the lowest penetration among comparable cities in Latin America. As a result, Buenos Aires has one of the lowest vacancy rates and highest lease rates in Latin America, as shown in the following table.

Source: Cushman & Wakefield, Newmark Grubb

Our Competitive Strengths

- •

- We are the only integrated publicly-listed real estate company focused substantially on Argentina.

Following the implementation of our commercial real estate strategy, we will be uniquely positioned in the Argentine market as the only integrated and diversified publicly-listed real estate company focused substantially on the development of both residential and office and logistics real estate in Argentina, and the operation of the latter. We believe that the benefits we derive from our leading position in the residential market, including our deep industry knowledge, development expertise and relationships with potential real estate sellers and construction companies, provide us with an advantage in the expansion into the commercial real estate sector through the development, and strategic acquisition, of for-lease prime office buildings and PLCs in the Buenos Aires metropolitan area. Our integrated investment plan provides investors with exposure to both Argentina's residential and commercial real estate sectors.

8

- •

- We have one of the largest residential development portfolio in Argentina composed of unique and iconic properties under market leading brands.

We are one of the largest residential real estate developer in terms of total GSA in Argentina and have an unmatched portfolio of properties, in terms of size and quality of projects, in various stages of development, and have a proven track record of successfully managing the entire value chain of real estate development.

As a result of our leading position, we are able to quickly deploy capital in building our portfolio. We currently have 11 large residential projects under development, consisting of 94 buildings and over 596,000 square meters, which are located in the largest and most affluent urban areas of the country that cover 36% of Argentina's population and 56% of its GDP, as well as in Montevideo, Uruguay. We expect to deliver these projects over the course of the next twelve years at a total investment of Ps.15.1 billion (US$1.03 billion), of which Ps.4.3 billion (US$294.5 million) has been invested as of March 31, 2016. See "Business—Our Business Lines—Residential Projects Under Development" for a discussion of each project's anticipated completion date, costs incurred to date and budgeted costs. We have also identified several additional sites, that we are in the process of evaluating for development.

Additionally, we believe that our properties stand out for their quality, their unique and iconic design and their ability to define their surroundings. In 2015, TGLT was ranked by Clarín ARQ, a prestigious architectural and construction publication in Argentina, as the best developer in Argentina across all categories (quality, customer service, integrity and, financial strength, among others). In addition to their design, the premium nature and prices or our projects are enhanced by market leading brands, including Forum, Astor and Metra, which help drive demand for our properties and have allowed us to achieve strong operating profits. We believe that our ability to leverage our brand recognition in the residential space, coupled with our development expertise, industry knowledge and established relationships, will provide us with a distinct advantage as we expand in the premium office and logistics real estate markets.

- •

- Our company has a proven track record of acquiring land at attractive prices and successfully creating value throughout the development process.

Our team has over ten years of experience in identifying premium properties within each of our targeted sub-markets, successfully negotiating acquisitions and closing transactions in time to avoid significant competition. Our land acquisitions in the residential sector over the last ten years are a consistent example of our agility and market knowledge, which we believe we can successfully leverage in our expansion into developing and acquiring office and logistics projects. We have already identified a pipeline of residential properties, office buildings and PLC opportunities, combining development and acquisitions, in the most in-demand and premium locations.

In addition, we have developed an extended network of relationships with third-party brokers and land and property owners that has allowed us to build a sizeable pipeline of investment opportunities.

- •

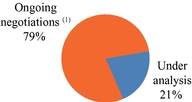

- We have a strong and actionable pipeline of properties for potential acquisition and development and a flexible platform, with an efficient cost structure, to successfully execute on these opportunities

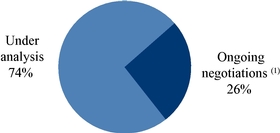

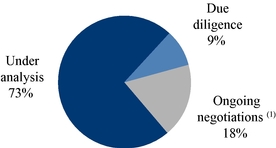

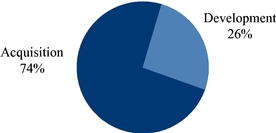

In the residential sector, we have identified five potential land acquisition opportunities and a potential GSA of 146,353 square meters.

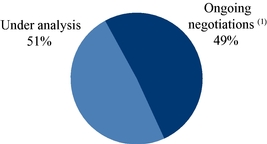

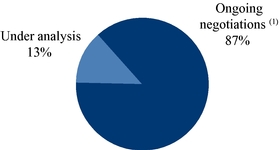

In the office business line, we have identified 21 potential land or building acquisition opportunities with a potential GLA of 656,744 square meters with a total potential investment of US$1.8 billion. In the logistics business line, we have identified 11 potential land or building acquisition opportunities with a potential GLA of 1.2 million square meters and a total potential investment of US$1.1 billion. We expect to finance the investments we pursue with up to 40% debt. We believe that we are well prepared and positioned to rapidly deploy capital into some of these pipeline projects to seize an early-mover advantage.

9

We have an established and integrated real estate operating platform which allows us to perform all fundamental real estate functions in-house and achieve important synergies. We believe that our integrated platform will facilitate execution of our pipeline. Additionally, our operating platform has been designed such that, at little incremental cost, it can successfully scale with the number of projects we undertake while allowing us to maintain the level of quality and care demonstrated in existing projects.

The price and other terms of acquisition have not been agreed to with respect to the properties included in the pipeline and none of the pipeline property acquisitions are probable. There are no rights of first refusal, options or exclusivities signed as of the date of this prospectus, only verbal negotiations and terms sheet discussions. There can be no assurance that we will complete any of the acquisitions under negotiation or analysis.

- •

- We are a publicly-listed company with a robust corporate governance structure, backed by leading institutional investors as strategic shareholders, and led by a highly experienced management team with a proven track record.

We became a publicly-listed company in Argentina in November 2010 when we listed our shares on the MERVAL and have been backed by institutional investors since 2007 (including PointArgentum and Bienville since 2015). Our market visibility is, among others, the result of our commitments under CNV rules for public companies in Argentina and our relationships with our current and previous institutional investors.

We believe that our corporate governance policies, including our audit committee, a code of ethics and an internal code of conduct, provide us with a competitive advantage in dealing with our customers, suppliers, financial institutions and other service providers in the Argentine real estate sector, and we expect that they will allow us to maximize value for our shareholders.

Additionally, we have a highly qualified team across all key areas of real estate development and operations. Our senior management team has an average of over 13 years of experience in the industry and, as of March 31, 2016, was supported by approximately 91 employees. See "Business—Human Resources." Our founder, CEO and Chairman, Federico Weil, has proven his strong leadership capabilities by successfully operating in a variety of business and economic cycles, including through major national and global financial and real estate crises. Mr. Weil also has a proven track record in building successful real estate companies, having also founded Adecoagro (NYSE: AGRO). We believe that Mr. Weil, as well as our management team, will continue to have a long-term commitment to our business.

In addition, we are backed by leading institutional investors including PointArgentum and Bienville. PointArgentum is an Argentine-focused investment fund managed by PointState Argentum LLC, an affiliate of New York-based SEC-registered investment firm PointState Capital LP. PointState Capital LP managed US$19.7 billion of assets as of June 6, 2016.

Bienville is an Argentine-dedicated investment fund managed by Bienville Capital Management LLC in association with Explorador Capital Management LLC. It is a New York-based, SEC-registered investment firm founded in 2008 that manages approximately US$797 million of assets as of June 6, 2016.

Our Business Strategy

- •

- Continue consolidating our position as the leading residential real estate developer in Argentina through continued strategic expansion.

We believe that ongoing economic reforms, in particular the expansion of available mortgage credit and the expected resulting increase in demand, will positively impact the residential real estate sector specifically, and provide us with significant opportunities for growth and increased profitability. We plan

10

to continue our existing strategy in this sector, namely by focusing on premium properties in the mid-to high-income sectors in the metropolitan areas of Buenos Aires and Rosario, Argentina, as well as Montevideo, Uruguay. We aim to focus our land banking efforts in order to take advantage of expected infrastructure improvements and changes in zoning that can create significant value appreciation of the properties we acquire.

Our residential operations rely on presale deposits for the majority of their financing. As of March 31, 2016, advances from clients amounted to Ps.2,529.9 million, representing 76.8% of our residential inventory, which we believe demonstrates our capacity to develop residential properties with relatively low levels of external capital. Additionally, as of December 31, 2015 and December 31, 2014, advances from clients amounted to Ps.2,199.8 million and Ps.1,592.6 million, respectively, which represented 70.6% and 67.0%, respectively, of our residential inventories. We expect that our significantly increased capitalization following this offering will reduce our reliance on presale deposits for financing, which we expect in turn will result in increased operating margins due to reduced discounts offered to clients.

Investments in for-lease commercial properties depend to a larger extent on long-term capital (equity or long-term debt) for financing. We also intend to obtain advance lease payments to finance a portion of the initial investment, and we will rely on cash flow from operations to finance maintenance capital expenditures.

- •

- Become a leader in the Argentine commercial real estate market by creating a portfolio of premium assets.

We plan to position ourselves as a market leader in the offices and logistics business lines, which we believe are likely to benefit from increases in lease rates and occupancy due to market and economic dynamics. We expect to benefit from an early-mover advantage as we have already identified and started negotiations for a sizable number of opportunities that we have identified in these business lines. Our strategy is to continue to identify, evaluate and invest in opportunities in the for-lease Class A office building and PLC sectors, primarily in the Buenos Aires metropolitan area. We believe that a strong and sizable portfolio of office and logistics assets will provide us with stable, long-term cash flows, which will help offset the cyclical nature of the residential sector as well as provide additional funding for new developments.

In general, we plan to target the development and opportunistic acquisition of income-producing properties, focusing on areas where supply is constrained and we have identified significant pent-up demand. We believe that we are well-positioned to capitalize on these opportunities through our well-established networks and relationships. We intend to pursue these opportunities, either as sole investors or as co-investors, in this case only as long as we preserve the control of the development process, if any, and the management of the properties. We will also seek to optimize the overall value and performance of our properties by seeking to (i) maintain high retention rates with tenants; (ii) maximize occupancy; (iii) control operating expenses; (iv) maintain our properties to high standards; and (v) prudently invest in our buildings.

- •

- Continue to develop unique and iconic properties.

We expect to leverage our experience and capabilities to identify attractive development opportunities in order to expand our portfolio of unique and iconic properties. Additionally, we expect that the projects in our pipeline will, as did our prior projects, stand out for their quality, their unique and iconic design and their ability to define their surroundings, which we believe makes them irreplaceable trophy addresses for our customers. We expect to take advantage of new, high-quality land that will come onto the market as the City of Buenos Aires makes zoning changes and expands its public transport network.

11

- •

- Strengthen and expand our real estate services business.

We intend to increase our services revenues through Sitia, our residential and commercial real estate brokerage subsidiary, and through Houseboard, our community management platform that supports the operation and administration of our projects. Our services businesses provide an additional source of recurring and independent cash flow, while remaining isolated from our project development risks. The development of brokerage and building management services represents a further step forward in terms of the integration of our real estate platform, allowing us to improve profitability as we cross-sell between our different lines of business. We also expect this additional cash flow stream to provide additional cash to fund the development of new projects and grow our business with financial stability.

- •

- Maintain a sound financial structure by favoring operational leverage.

We plan to continue our conservative approach towards the use of working capital and maintaining leverage levels in line with industry norms. We will continue to seek to secure the land for our projects by locking up as little capital as possible, using purchase options and seller financing structures, in addition to exchanges of land for finished units in the case of residential projects.

In for-lease commercial properties, we intend to partially finance the acquisition or development of the properties with prudent financial terms, which we expect to include loan-to-value financing of not more than 40% and interest rates below expected initial cap rates.

Our Corporate Structure and Shareholders

The following diagram illustrates our current shareholders and ownership structure. Percentages indicate the ownership interest currently held.

Recent Tax Issues

Law No. 26,893, which amended the Income Tax Law, was enacted on September 23, 2013. This law provides that the distribution of dividends by an Argentine corporation is subject to an income withholding tax at a rate of 10.0%, unless such dividends are distributed to Argentine corporate entities. An equalization tax of 35.0% is applied to dividends paid either to residents or non-residents when the dividends payable in cash or in kind exceed taxable profits accumulated at the end of the tax period preceding the distribution. However, on June 29, 2016, the Argentine Congress passed a law that abrogates the 10% income tax withholding on dividends and therefore eliminates the distinction between payment of dividends to Argentine or non-Argentine corporate entities or individuals. As of the date of this prospectus, this law has not yet been promulgated by the Macri Administration and therefore is not yet in effect.

In addition, law No. 26,893 establishes that the sale, exchange or other transfer of shares and other securities is subject to a 15.0% capital gains tax for Argentine resident individuals and foreign beneficiaries. In such cases, the law presumes a 90.0% net income of the Argentine resident individuals and foreign beneficiaries, to which the 15.0% rate must be applied. Thus, an effective withholding rate of 13.5% of the gross purchase price applies to such transactions. However, non-resident individuals or foreign legal entities may opt to pay 15.0% on the difference between the gross amount of the transaction less the costs incurred in the country in order to obtain and maintain the income and the

12

deductions allowed by the Income Tax Law. When shares, quotas, securities or bonds are transferred to a non-Argentine individual or foreign legal entity, the buyer is responsible for the tax. Capital gains resulting from the sale of publicly traded shares and securities remain exempt. There is an exemption for Argentine resident individuals if certain requirements are met; however, there is no such exemption for non-Argentine residents.

The income tax treatment of income derived from the sale of ADSs, dividends or exchanges of shares from the ADS facility may not be uniform under the revised Argentine income tax law. The potentially varying treatment of source income could impact both Argentine resident holders as well as non-Argentine resident holders. In addition, should a sale of ADSs be deemed to give rise to Argentine source income, as of the date of this prospectus no regulations have been issued regarding the mechanism for paying the Argentine capital gains tax when the sale exclusively involves non-Argentine parties. As of the date of this prospectus, no administrative or judicial rulings have clarified the ambiguity in the law.

As of the date of this prospectus, many aspects of these new taxes remain unclear. For more information, see "Taxation—Material Argentine Tax Considerations."

Fees that May be Paid by ADS Investors

The following table summarizes certain fees and expenses in connection with the ADSs:

Persons depositing or withdrawing shares or ADS holders must pay: | For: | |

|---|---|---|

| $5.00 (or less) per 100 ADSs (or portion of 100 ADSs) | Issuance of ADSs, including issuances resulting from a distribution of shares or rights or other property | |

| Cancellation of ADSs for the purpose of withdrawal, including if the deposit agreement terminates | ||

| $.05 (or less) per ADS | Any cash distribution to ADS holders | |

| A fee equivalent to the fee that would be payable if securities distributed to you had been shares and the shares had been deposited for issuance of ADSs | Distribution of securities distributed to holders of deposited securities that are distributed by the depositary to ADS holders | |

| $.05 (or less) per ADS per calendar year | Depositary services | |

| Registration or transfer fees | Transfer and registration of shares on our share register to or from the name of the depositary or its agent when you deposit or withdraw shares | |

| Expenses of the depositary | Cable, telex and facsimile transmissions (when expressly provided in the deposit agreement) | |

| Converting foreign currency to U.S. dollars | ||

| Taxes and other governmental charges the depositary or the custodian has to pay on any ADSs or shares underlying ADSs, such as stock transfer taxes, stamp duty or withholding taxes | As necessary | |

| Any charges incurred by the depositary or its agents for servicing the deposited securities | As necessary |

For more information, see "Description of American Depositary Shares—Fees and Expenses."

13

Impact of Devaluation of the Peso on U.S. Investors

After several years of moderate variations in the nominal exchange rate, the Peso has undergone significant devaluation over the last three years. In 2010 and 2011, the devaluation of the Peso with respect to the U.S. dollar was 5% and 8%, respectively. In 2012, the Peso lost approximately 14% of its value with respect to the U.S. dollar. This was followed in 2013 and 2014 by a devaluation of the Peso with respect to the U.S. dollar that exceeded 30%, including a loss of approximately 24% in January 2014. In 2015, the Peso lost approximately 52% of its value with respect to the U.S. dollar, mainly concentrated after December 16, 2015. During the first quarter of 2016, the exchange rate of the Peso with respect to the U.S. dollar rate went from Ps.13.3 to Ps.14.8 per U.S. dollar, an 11% devaluation for the period.

Any further devaluation could have an impact on U.S. investors by decreasing our shareholder equity expressed in U.S. dollars, for instance if net income fails to increase at a pace greater than the rate of devaluation.

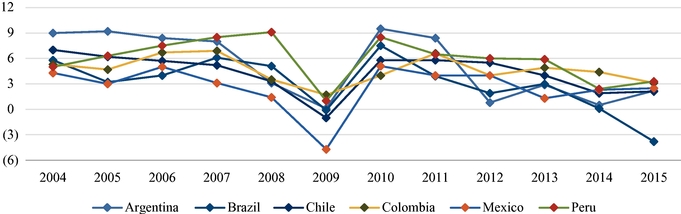

Challenges in the Argentine Market

Argentina faces a number of economic, regulatory and political challenges. After recovering from the 2001-2002 crisis, the pace of growth of Argentina's economy has diminished, inflation levels have been high and the Peso underwent devaluation in the period from 2003 to 2011. In 2012, the Argentine economy grew slightly by 0.8% according toInstituto Nacional de Estadística y Censos (National Institute of Statistics and Census, or INDEC), as domestic investment contracted, primarily as a result of a decrease in construction and capital goods imports. In 2013, the Argentine economy grew by 2.9% according to INDEC. In 2014, the Argentine economy again grew slightly by 0.5%, according to INDEC. In addition, according to INDEC, Argentina recorded inflation levels in 2012, 2013, 2014 and the nine-month period ended September 30, 2015 of 10.8%, 10.9%, 23.9% and 10.7%, respectively. However, private sector estimates in Argentina reported higher levels of inflation than those calculated by INDEC, on average reporting inflation rates in 2012, 2013, 2014 and the nine-month period ended September 30, 2015 of 25.3%, 28.0%, 38.5% and 18.6%, respectively. In December 2015, after President Macri assumed office, the Macri Administration decided to halt the publishing of macroeconomic information in order to review and organize INDEC data to be able to produce more reliable statistics. See "—Impact of Devaluation of the Peso on U.S. Investors" above for a description of the impact of the devaluation of the Peso.

The economic and financial environment going forward in Argentina is expected to be significantly influenced by the presidential elections held on November 22, 2015, which resulted in Mr. Mauricio Macri being elected President of Argentina. The Macri Administration is expected to continue to adjust long-standing fiscal and monetary policies that have resulted in recurrent public sector deficits, inflation and pervasive foreign exchange controls and limited foreign investment. Sustainable economic growth and improved employment in the short and medium term will depend upon the manner in which the above-mentioned issues are addressed and may be adversely affected if these issues are not adequately addressed.

Recent Regulatory Changes in Argentina

Since assuming office on December 10, 2015, the Macri Administration has announced several significant economic and policy reforms, including:

- •

- Foreign exchange reforms. On December 17, 2015, after President Macri assumed office, the Central Bank issued Communication "A" 5850, which lifted many foreign exchange controls. Currently, there is free access to theMercado Único y Libre de Cambios, or MULC, the foreign exchange market, to purchase foreign currency without prior authorization from the Central Bank or theAdministración Federal de Ingresos Públicos, the Argentine Tax Authority, or AFIP. The aggregate amount of foreign currency that can be purchased is US$2.0 million per month

14

- •

- Foreign trade reforms. The Argentine government eliminated export duties on wheat, corn, beef and regional products, and reduced the duty on soybeans by 5% to 30%. Further, the 5% export duty on most industrial exports was eliminated. With respect to payments for imports of goods and services, the Macri Administration announced the elimination of amount limitations for access to the MULC for any new transactions as of December 17, 2015 and for existing debts for imports of goods and services as of April 22, 2016.

- •

- Infrastructure state of emergency and reforms. The Argentine government has also declared a state of emergency with respect to the national electrical system by Decree No. 134/2015, which will be effective until December 31, 2017. This will allow the Argentine government to take actions designed to guarantee the supply of electricity. In this context, subsidy policies were reexamined and new electricity tariffs were applied as of February 1, 2016. New tariff increases varied depending on geographical location and consumption levels. In addition, through Resolution No. 31/2016 of the Ministry of Energy and Mining, the Macri administration announced the elimination of certain natural gas subsidies and adjustments to natural gas rates. On June 6, 2016, the Argentine government agreed to ease the increases in gas rates through Resolution 99/2016, which established a maximum increase of 400% on residential consumers and 500% on clubs, hotels, shops and small and medium-sized businesses, effective retroactively as of April 1, 2016. Also, through Resolution 111/2016, the amount of kilowatts/hour that beneficiaries of the social tariff of certain provincies could consume on a monthly basis without cost was doubled.

- •

- Reforms to Antitrust Policies. On February 16, 2016, the Macri Administration appointed a President of the National Antitrust Commission (Comisión Nacional de Defensa de la Competencia, or CNDC) as part of the changes to be introduced by the Macri Administration in the area of antitrust, including the term renewal of the rest of its members, improving the efficiency of their processes and a comprehensive reform of the law focused on protecting consumers and avoiding market disruptions

- •

- Holdout Bondholders. Since assuming office, the Macri Administration adopted a different negotiation strategy than the one followed by the previous administration to resolve the litigation with holdout sovereign bondholders and bring the country back to the international capital markets. Pursuant to this new strategy, negotiations with holdout bondholders were resumed in January 2016 and on February 5, 2016, an official proposal of payment was accepted by two of the six biggest creditors. Such proposal included an offer of settlement of all claims with the

for each resident. In addition, this Communication: (i) reduced the required period that the proceeds of any new financial indebtedness incurred by residents, held by foreign creditors and transferred through the MULC, must be kept in Argentina, from 365 calendar days to 120 calendar days from the date of the transfer of the relevant amount; and (ii) eliminated the minimum holding period of 72 business hours for purchases and subsequent sales of the securities. In addition, the mandatory deposit of 30% of certain funds remitted to Argentina was eliminated, among other changes to the foreign exchange regime. Moreover, on March 31, 2016, the Central Bank issued Communication "A" 5937, which established new mechanisms that facilitate the acquisition of foreign currencies for the purpose of paying imported goods and no limits are set for the amounts to be acquired. Nonetheless, all transactions must be authorized by the Central Bank. Additionally, controls for the repatriation of investments of non-resident portfolios were relaxed for investments made in Argentina during their periods of residency. Although these changes in foreign exchange policies tend to allow free access to the MULC, limitations remain. See "Risk Factors—Risks Relating to Argentina—Fluctuations in the value of the Peso could adversely affect the Argentine economy, and consequently our results of operations or financial condition" and "Exchange Controls" for further descriptions of these reforms.

15

- •

- Tax reforms. On June 29, 2016, the Argentine Congress passed a law that provides for a tax amnesty and tax reform. The new tax amnesty aims to pay pensioners and help fund a multi-billion dollar infrastructure program. The amnesty will allow people with undeclared dollars and overseas assets to bring them into the formal system without penalty or the need to explain the source of the funds. The law also provides that there will be no charge on assets worth up to US$25,000, and a discounted applicable tax of 5% on property and assets worth up to US$80,000. Above that threshold, the applicable tax will be 10% until the end of 2016 and 15% until the end of March 2017, when the amnesty window is scheduled to close. The law also includes provisions related to the following: (i) Personal Assets Tax: reduction of the tax rate from 0.5% to 0.25%, for the personal assets tax corresponding to Argentine and foreign domiciled individuals and foreign domiciled entities related to shareholding; (ii) Dividends: abrogation of the 10% income tax withholding on dividends in respect of both Argentine and non-Argentine resident shareholders; (iii) Minimum Deemed Income Tax: Abrogation of this tax as of January 1, 2019. As of the date of this prospectus, this law has not yet been promulgated by the Macri Administration and therefore is not yet in effect.

holders, subject to two conditions: (i) obtaining approval by the Argentine Congress, and (ii) the lifting of the pari passu injunctions. The settlement proposal contemplated two frameworks for settlement. The "standard offer", which was open to all holdout bondholders, provided for payment equal to 100% of the principal amount of the relevant bonds plus up to 50% of the principal due as interest. The "pari passu offer", extended to plaintiffs holding pari passu injunctions, provided for payment equal to the full amount of the monetary judgment or the accrued claim value less a specified discount. Any eligible holdout bondholder could accept the terms of the settlement proposal in accordance with the procedures set forth and published by the Ministry of Economy. On February 29, 2016, Argentina reached an agreement with the remaining four largest creditors for a US$4.65 billion cash payment. The latter amount includes US$4.4 billion for 75% of principal and interest of the New York claims, as well as US$235 million for claims outside that jurisdiction and a portion of the holdout bondholders' legal fees. On March 2, 2016, the United States District Court for the Southern District of New York, or the District Court, ruled to lift all injunctions that prevented the country from making payments to creditors of restructured debt upon (i) the repeal of all legislative obstacles to settlement with the holdout bondholders, including the Argentine Lock Law and the Sovereign Payment Law; and (ii) the settlement of all agreements signed with plaintiffs before February 29, 2016. On April 1, 2016, Argentina enacted Law No 27,249, which repealed the Lock Law and the Sovereign Payment Law, while also ratifying all of the agreements entered into with the holdout bondholders. On April 22, 2016, Argentina paid US$ 6.2 billion to settle all agreements entered into with holdout bondholders as of February 29, 2016. Finally, on the same date, the District Court lifted all the injunctions granted in all cases. See "Risk Factors—Risks Relating to Argentina—A lack of financing for Argentine companies, whether due to market forces or government regulation may negatively impact our financial condition or cash flows" for more information regarding the current situation.

Implications of Being an Emerging Growth Company

As a company with less than US$1.0 billion in revenue for our fiscal year ending December 31, 2015, we qualify as an "emerging growth company" as defined in the Jumpstart Our Business Startups Act of 2012, or the JOBS Act. As an emerging growth company, we may take advantage of specified reduced disclosure and other requirements that are otherwise applicable to public companies in the U.S. These reduced requirements include (i) not being required to comply with the auditor attestation requirements of Section 404(b) of the Sarbanes-Oxley Act of 2002, as amended, or the Sarbanes-Oxley Act, in the assessment of the emerging growth company's internal control over financial reporting; and (ii) the ability to include only two years of audited financial statements in addition to any required

16

interim financial statements and correspondingly reduced disclosure in management's discussion and analysis of financial condition and results of operations in the registration statement for this offering of which this prospectus forms a part. The JOBS Act also provides that an emerging growth company does not need to comply with any new or revised financial accounting standards until such date that a private company is otherwise required to comply with such new or revised accounting standards.

We may take advantage of these reduced disclosure obligations until the last day of our fiscal year following the fifth anniversary of the date of the first sale of the ADSs pursuant to an effective registration statement under the Securities Act of 1933, as amended, or the Securities Act, and as a result, such reduced disclosure obligations will cease in 2022. However, if certain events occur prior to the end of such five-year period, including if we become a "large accelerated filer," with at least US$700 million of equity securities held by non-affiliates, our annual gross revenue exceeds US$1.0 billion or we issue more than US$1.0 billion of non-convertible debt in any three-year period, we will cease to be an emerging growth company.

We have elected to take advantage of certain of the reduced disclosure obligations in this prospectus and may elect to take advantage of other reduced reporting requirements in future filings with the Securities and Exchange Commission, or the Commission. As a result, the information that we provide to our shareholders and holders of the ADSs may be different than the information you might receive from other publicly-listed companies in which you hold equity interests.

The JOBS Act provides that an emerging growth company can take advantage of an extended transition period for complying with new or revised accounting standards. We have irrevocably elected not to avail ourselves of this exemption and, therefore, we will be subject to the same new or revised accounting standards as other publicly-listed companies that are not emerging growth companies.

Recent Developments