UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the Securities Exchange Act of 1934

Filed by the Registrant ☒

Filed by a Party other than the Registrant ☐

Check the appropriate box:

☐ Preliminary Proxy Statement

☐ Confidential, for use of the Commission Only (as permitted by Rule 14a-6(e)(2))

☐ Definitive Proxy Statement

☒ Definitive Additional Materials

☐ Soliciting Materials Pursuant to sec. 240.14a-11(c) or sec. 240.14a-12

Campbell Soup Company

______________________________

(Exact Name of Registrant as Specified in its Charter)

Payment of Filing Fee (Check the appropriate box)

☒ No fee required.

☐ Fee computed on table below per Exchange Act Rules 14a-6(i)(l) and 0-11.1

(1) Title of each class of securities to which transaction applies:

________________________________________________________________________________

(2) Aggregate number of securities to which transaction applies:

________________________________________________________________________________

(3) Per unit or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

________________________________________________________________________________

(4) Proposed maximum aggregate value of transaction:

________________________________________________________________________________

(5) Total fee paid:

________________________________________________________________________________

☐ Fee paid previously with preliminary materials.

☐ Check box if any part of the fee is offset as provided by Exchange Act Tule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing.

(1) Amount Previously Paid

________________________________________________________________________________

(2) Form, Schedule or Registration Statement No.:

________________________________________________________________________________

(3) Filing Party:

________________________________________________________________________________

(4) Date Filed:

________________________________________________________________________________

FOR IMMEDIATE RELEASE

INVESTOR CONTACT: | MEDIA CONTACT: |

| Ken Gosnell | Thomas Hushen |

| (856) 342-6081 | (856) 342-5227 |

| ken_gosnell@campbellsoup.com | thomas_hushen@campbellsoup.com |

CAMPBELL FILES INVESTOR PRESENTATION

Highlights Strengths of Go-Forward Strategy and Highly Qualified Board of Directors

Outlines Unacceptable Risk Associated with Third Point's Lack of a Cogent Plan

and Underqualified Directors

Urges Shareholders to Vote the GOLD Proxy Card

CAMDEN, N.J., Oct. 12, 2018—Campbell Soup Company (NYSE: CPB) announced today it has filed an investor presentation with the U.S. Securities and Exchange Commission in connection with its 2018 Annual Meeting of Shareholders, scheduled for Nov. 29, 2018.

In the presentation, Campbell provides additional perspective around its performance over the last 18 months; highlights the strength of its recently announced plan to revitalize the company and maximize value; outlines why Third Point's actions and nominees are not aligned with shareholders' interest; and reiterates the Campbell Board's complete alignment and commitment to deliver value for all shareholders.

A copy of the presentation can be found on www.sec.gov, as well as on Campbell's shareholder resources website, www.CampbellsStrategy.com, and Campbell's investor relations website ,www.investor.campbellsoupcompany.com.

Campbell strongly recommends that shareholders vote to support the current Campbell Board of Directors with a vote on the GOLD proxy card.

If you have questions or need assistance, please contact: INNISFREE M&A Incorporated Shareholders Call Toll-Free: (877) 687-1866 Banks & Brokers Call Collect: (212) 750-5833 |

About Campbell Soup Company

Campbell (NYSE:CPB) is driven and inspired by our Purpose, "Real food that matters for life's moments." For generations, people have trusted Campbell to provide authentic, flavorful and affordable snacks, soups and simple meals, and beverages. Founded in 1869, Campbell has a heritage of giving back and acting as a good steward of the planet's natural resources. The company is a member of the Standard and Poor's 500 and the Dow Jones Sustainability Indexes. For more information, visit www.campbellsoupcompany.com or follow company news on Twitter via @CampbellSoupCo. To learn more about how we make our food and the choices behind the ingredients we use, visit www.whatsinmyfood.com.

Forward-Looking Statements

This release contains "forward-looking statements" that reflect the company's current expectations about the impact of its future plans and performance on the company's business or financial results. These forward-looking statements rely on a number of assumptions and estimates that could be inaccurate and which are subject to risks and uncertainties. The factors that could cause the company's actual results to vary materially from those anticipated or expressed in any forward-looking statement include: (1) the company's ability to execute on and realize the expected benefits from the actions it intends to take as a result of its recent strategy and portfolio review, (2) the ability to differentiate its products and protect its category leading positions, especially in soup; (3) the ability to complete and to realize the projected benefits of planned divestitures and other business portfolio changes; (4) the ability to realize the projected benefits, including cost synergies, from the recent acquisitions of Snyder's-Lance and Pacific Foods; (5) the ability to realize projected cost savings and benefits from its efficiency and/or restructuring initiatives; (6) the company's indebtedness and ability to pay such indebtedness; (7) disruptions to the company's supply chain, including fluctuations in the supply of and inflation in energy and raw and packaging materials cost; (8) the company's ability to manage changes

to its organizational structure and/or business processes, including selling, distribution, manufacturing and information management systems or processes; (9) the impact of strong competitive responses to the company's efforts to leverage its brand power with product innovation, promotional programs and new advertising; (10) the risks associated with trade and consumer acceptance of product improvements, shelving initiatives, new products and pricing and promotional strategies; (11) changes in consumer demand for the company's products and favorable perception of the company's brands; (12) changing inventory management practices by certain of the company's key customers; (13) a changing customer landscape, with value and e-commerce retailers expanding their market presence, while certain of the company's key customers maintain significance to the company's business; (14) product quality and safety issues, including recalls and product liabilities; (15) the costs, disruption and diversion of management's attention associated with campaigns commenced by activist investors; (16) the uncertainties of litigation and regulatory actions against the company; (17) the possible disruption to the independent contractor distribution models used by certain of the company's businesses, including as a result of litigation or regulatory actions affecting their independent contractor classification; (18) the impact of non-U.S. operations, including trade restrictions, public corruption and compliance with foreign laws and regulations; (19) impairment to goodwill or other intangible assets; (20) the company's ability to protect its intellectual property rights; (21) increased liabilities and costs related to the company's defined benefit pension plans; (22) a material failure in or breach of the company's information technology systems; (23) the company's ability to attract and retain key talent; (24) changes in currency exchange rates, tax rates, interest rates, debt and equity markets, inflation rates, economic conditions, law, regulation and other external factors; (25) unforeseen business disruptions in one or more of the company's markets due to political instability, civil disobedience, terrorism, armed hostilities, extreme weather conditions, natural disasters or other calamities; and (26) other factors described in the company's most recent Form 10-K and subsequent Securities and Exchange Commission filings. The company disclaims any obligation or intent to update the forward-looking statements in order to reflect events or circumstances after the date of this release.

Important Additional Information and Where to Find It

Campbell has filed a definitive proxy statement on Schedule 14A and form of associated GOLD Proxy Card with the Securities and Exchange Commission ("SEC") in connection with the solicitation of proxies for its 2018 Annual Meeting of Shareholders (the "Definitive Proxy Statement"). Campbell, its directors and certain of its executive officers will be participants in the

solicitation of proxies from shareholders in respect of the 2018 Annual Meeting. Information regarding the names of Campbell's directors and executive officers and their respective interests in the company by security holdings or otherwise is set forth in the Definitive Proxy Statement. Details concerning the nominees of Campbell's Board of Directors for election at the 2018 Annual Meeting are included in the Definitive Proxy Statement. BEFORE MAKING ANY VOTING DECISION, INVESTORS AND SHAREHOLDERS OF THE COMPANY ARE URGED TO READ ALL RELEVANT DOCUMENTS FILED WITH OR FURNISHED TO THE SEC, INCLUDING THE COMPANY'S DEFINITIVE PROXY STATEMENT AND ANY SUPPLEMENTS THERETO AND ACCOMPANYING GOLD PROXY CARD, BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION. Shareholders may obtain a free copy of the Definitive Proxy Statement and other relevant documents that Campbell files with the SEC from the SEC's website at www.sec.gov or Campbell's website at www.investor.campbellsoupcompany.com as soon as reasonably practicable after such materials are electronically filed with, or furnished to, the SEC.

Preliminary Working Draft October 12, 2018

Forward-Looking Statements This presentation contains “forward-looking statements” that reflect our current expectations about the impact of future plans and performance on our business or financial results. These forward-looking statements rely on a number of assumptions and estimates that could be inaccurate and which are subject to risks and uncertainties. The factors that could cause actual results to vary materially from those anticipated or expressed in any forward-looking statement include: our ability to execute on and realize the expected benefits from the actions we intend to take as a result of our recent strategy and portfolio review; our ability to differentiate our products and protect our category leading positions, especially in soup; our ability to complete and to realize the projected benefits of planned divestitures and other business portfolio changes; our ability to realize the projected benefits, including cost synergies, from the recent acquisitions of Snyder's-Lance and Pacific Foods; our ability to realize projected cost savings and benefits from efficiency and/or restructuring initiatives; our indebtedness and ability to pay such indebtedness; disruptions to our supply chain, including fluctuations in the supply of and inflation in energy and raw and packaging materials cost; our ability to manage changes to our organizational structure and/or business processes, including selling, distribution, manufacturing and information management systems or processes; the impact of strong competitive responses to our efforts to leverage brand power with product innovation, promotional programs and new advertising; the risks associated with trade and consumer acceptance of product improvements, shelving initiatives, new products and pricing and promotional strategies; changes in consumer demand for our products and favorable perception of our brands; changing inventory management practices by certain of our key customers; a changing customer landscape, with value and e-commerce retailers expanding their market presence, while certain of our key customers maintain significance to our business; product quality and safety issues, including recalls and product liabilities; the costs, disruption and diversion of management’s attention associated with campaigns commenced by activist investors; the uncertainties of litigation and regulatory actions against us; the possible disruption to the independent contractor distribution models used by certain of our businesses, including as a result of litigation or regulatory actions affecting their independent contractor classification; the impact of non-U.S. operations, including trade restrictions, public corruption and compliance with foreign laws and regulations; impairment to goodwill or other intangible assets; our ability to protect our intellectual property rights; increased liabilities and costs related to our defined benefit pension plans; a material failure in or a breach of our information technology systems; our ability to attract and retain key talent; changes in currency exchange rates, tax rates, interest rates, debt and equity markets, inflation rates, economic conditions, law, regulation and other external factors; unforeseen business disruptions in one or more of our markets due to political instability, civil disobedience, terrorism, armed hostilities, extreme weather conditions, natural disasters or other calamities; and other factors described in our most recent Form 10-K and subsequent Securities and Exchange Commission filings. We disclaim any obligation or intent to update these statements to reflect new information or future events. 2

Important Additional Information and Where to Find It Campbell has filed a definitive proxy statement on Schedule 14A and form of associated GOLD Proxy Card with the Securities and Exchange Commission (“SEC”) in connection with the solicitation of proxies for its 2018 Annual Meeting of Shareholders (the “Definitive Proxy Statement”). Campbell, its directors and certain of its executive officers will be participants in the solicitation of proxies from shareholders in respect of the 2018 Annual Meeting. Information regarding the names of Campbell’s directors and executive officers and their respective interests in the company by security holdings or otherwise is set forth in the Definitive Proxy Statement. Details concerning the nominees of Campbell’s Board of Directors for election at the 2018 Annual Meeting are included in the Definitive Proxy Statement. BEFORE MAKING ANY VOTING DECISION, INVESTORS AND SHAREHOLDERS OF THE COMPANY ARE URGED TO READ ALL RELEVANT DOCUMENTS FILED WITH OR FURNISHED TO THE SEC, INCLUDING THE COMPANY’S DEFINITIVE PROXY STATEMENT AND ANY SUPPLEMENTS THERETO AND ACCOMPANYING GOLD PROXY CARD, BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION. Shareholders may obtain a free copy of the Definitive Proxy Statement and other relevant documents that Campbell files with the SEC from the SEC’s website at www.sec.gov or the Company’s website at investor.campbellsoupcompany.com as soon as reasonably practicable after such materials are electronically filed with, or furnished to, the SEC. 3

4 Overview Campbell: Where We Areand How We Got Here The Campbell Board’s Plan to Revitalize a Great Company Third Point’s Empty Agenda The Situation OurSolution TheRisk The Campbell Board Strongly Believes Its Strategic Plan to Improve the Focus and Financial Performance of the Company Represents the Best Path Forward to Maximize Shareholder Value

5 The Situation:Campbell: Where We Are and How We Got Here

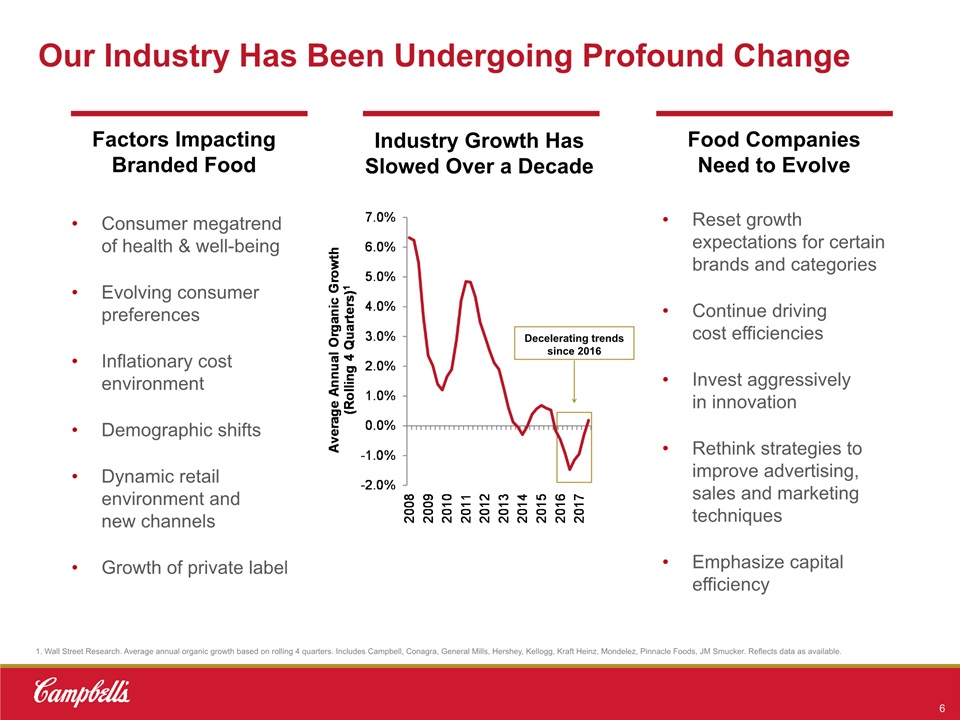

Consumer megatrend of health & well-beingEvolving consumer preferences Inflationary cost environment Demographic shiftsDynamic retail environment and new channelsGrowth of private label Reset growth expectations for certain brands and categoriesContinue driving cost efficienciesInvest aggressively in innovationRethink strategies to improve advertising, sales and marketing techniquesEmphasize capital efficiency 6 1. Wall Street Research. Average annual organic growth based on rolling 4 quarters. Includes Campbell, Conagra, General Mills, Hershey, Kellogg, Kraft Heinz, Mondelez, Pinnacle Foods, JM Smucker. Reflects data as available. Factors Impacting Branded Food Industry Growth Has Slowed Over a Decade Food Companies Need to Evolve Our Industry Has Been Undergoing Profound Change Decelerating trends since 2016

7 Sources: Wall Street Research. Universal Acknowledgment That All Food Companies Must Adapt Their Strategies and Financial Targets “The US Packaged Food industry is undergoing disruptive change: decelerating sales growth, changing food preferences… driving a new era of industry challenges.” UBS (August 30, 2018) “In a slow sales environment, global food giants need a new growth formula. Danone and Unilever are both buying higher-growth companies and using fashionable cost-cutting philosophies to improve profitability. Bigger rival Nestlé, which reported its half-year earnings on Thursday, is trying too, but less convincingly.” Reuters Breakingviews (July 27, 2017) “Consumers have had an increased inclination to have a healthier diet, and the plant-based food market is the next target for these consumers. While the industry is still very small, we expect the influx of start-up businesses entering the market to expand rapidly and gain market share at the expense of traditional branded foods companies…” Credit Suisse (September 28, 2018) “Instead of promoting canned soup, cereal and cookies from companies like Kraft Heinz, Kellogg and Mondelez International grocery stores are choosing to give better play to fresh food, prepared hot meals, and items from local upstarts more in favor with increasingly health-conscious consumers... The shift in shopper preferences started several years ago, but its impact on big food makers is intensifying now because of added pressure from retailers.” The Wall Street Journal (April 30, 2017) Representative Industry Points of View

8 Sources: Wall Street Research. We and the Rest of the Food Industry Have All Faced Significant Industry Challenges That Require Action “From an industry standpoint, we continue to see pretty challenging conditions, including a dynamic retail and consumer landscape, a very competitive environment and ongoing commodity inflation.” (July 10, 2018) Recent Food Industry Commentary “Malaise around the industry narrative has been undeniable…from absence of growth prospects to challenges around pricing power.” (September 4, 2018) “The surge in transportation costs has been well documented, and we've also seen an increase in inflation for many other cost inputs.”(August 2, 2018) “At the same time, we've been challenged by sharp increases in supply chain cost that have negatively impacted our bottom line outlook.” (March 21, 2018)

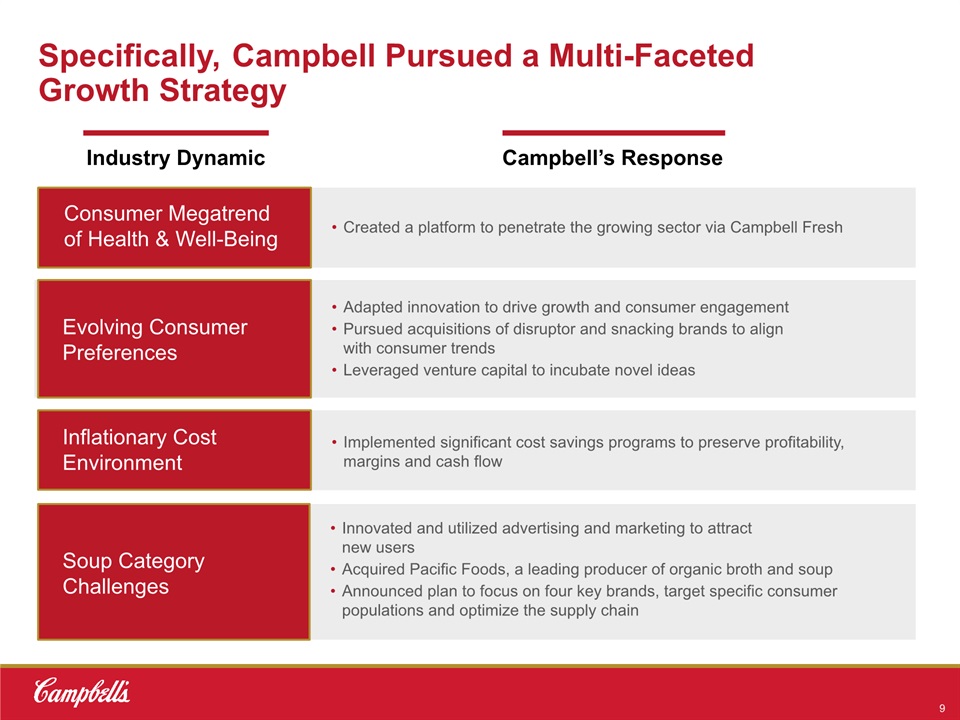

Specifically, Campbell Pursued a Multi-Faceted Growth Strategy Created a platform to penetrate the growing sector via Campbell Fresh Adapted innovation to drive growth and consumer engagementPursued acquisitions of disruptor and snacking brands to align with consumer trendsLeveraged venture capital to incubate novel ideas Inflationary Cost Environment Implemented significant cost savings programs to preserve profitability, margins and cash flow Soup Category Challenges Innovated and utilized advertising and marketing to attract new usersAcquired Pacific Foods, a leading producer of organic broth and soupAnnounced plan to focus on four key brands, target specific consumer populations and optimize the supply chain Industry Dynamic Campbell’s Response 9 Consumer Megatrend of Health & Well-Being Evolving Consumer Preferences

Historically, Our Returns Were in Line with Peers Through Fiscal 2016 10 Source: FactSet as of August 31, 2016.Note: Peers considered include selected food companies with portfolios with center-of-store exposure; Kraft Heinz excluded because of lack of historical data. FY2016 end reflects August 31, 2016 (day prior to FY2016 Full-Year Earnings Release). 30-Year TSR at FY2016 End 25-Year TSR at FY2016 End 10-Year TSR at FY2016 End 5-Year TSR at FY2016 End 3-Year TSR at FY2016 End 1-Year TSR at FY2016 End

11 30-Year Stock Price Performance - Campbell vs S&P 500 Our Performance Since FY2016 Has Been Unacceptable,but Is a Break from Our 30 Year History… Source: Bloomberg as of October 5, 2018.

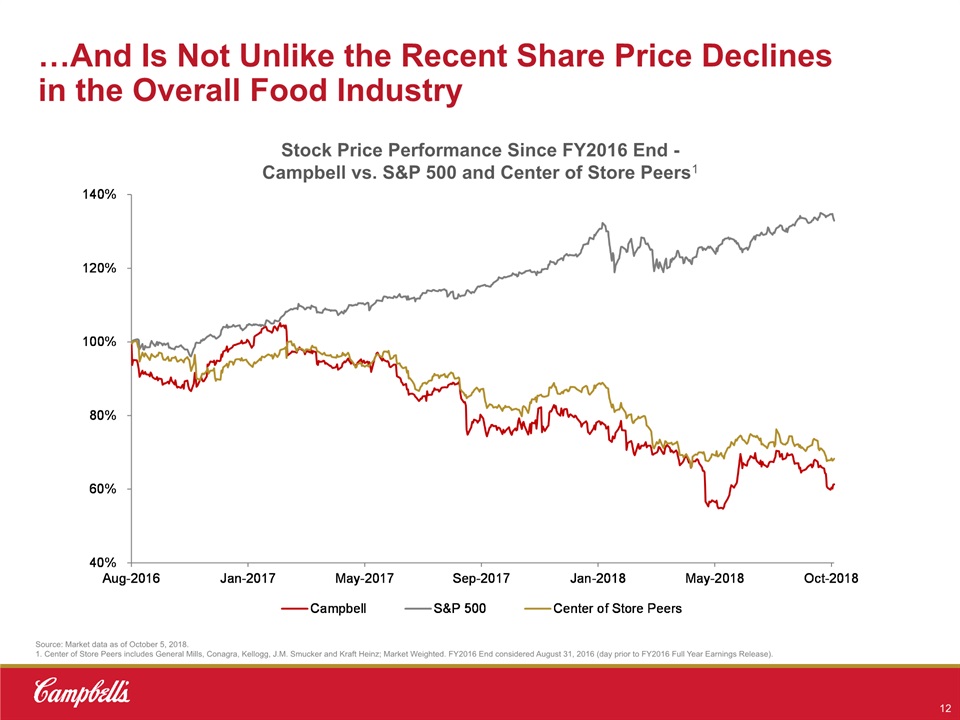

…And Is Not Unlike the Recent Share Price Declines in the Overall Food Industry 12 Source: Market data as of October 5, 2018.1. Center of Store Peers includes General Mills, Conagra, Kellogg, J.M. Smucker and Kraft Heinz; Market Weighted. FY2016 End considered August 31, 2016 (day prior to FY2016 Full Year Earnings Release). Stock Price Performance Since FY2016 End - Campbell vs. S&P 500 and Center of Store Peers1

The Board Appropriately Took Action During This Period of Underperformance Numerous actions and changes in strategy taken under prior CEO had mixed successCost cutting was highly successful and pivot to snacking was well-groundedHowever, Fresh and core businesses were more challengedThe Board recognized the lack of execution and associated underperformance and took action:President of Americas Simple Meals and Beverages removed in March 2018COO named in April 2018President of Campbell Fresh replaced in April 2018President of Americas Simple Meals and Beverages replaced in May 2018Head of HR replaced in July 2018Head of R&D replaced in September 2018CEO change: In May 2018, following a review of the Company’s results, the Board initiated a dialogue with then-CEO Denise Morrison, expressing its dissatisfaction. After further discussion, Ms. Morrison agreed with the Board that she would retire, and the Board replaced her immediately with interim CEO Keith McLoughlin, and launched a permanent CEO search process. Campbell expects to select the Company’s next CEO upon finding the best candidate, which we expect to do by the end of calendar year.Simultaneously, the Board launched a thorough and objective strategic review of the Company with best-in-class independent advisors to develop a path forward that maximizes shareholder value.After considerable analysis that encompassed a thorough review of a full slate of options, the Board concluded that the best path forward to maximize shareholder value at this time is to: Focus Campbell on two distinct businesses Pursue divestitures of non-core businesses to significantly pay down debtIncrease cost savings targetsImprove cash flow through working capital efficiencies and more disciplined capital expenditures 13

We Have Publicly Assessed Our Own Performance with Candor “A person who never made a mistake never tried anything new.” - Albert Einstein 14 Challenges Strengths “We lost focus strategically. We had too many initiatives that made the Company unnecessarily complex.”“We aggressively pursued the important consumer mega-trend of health & well-being, without having clarity on our source of uniqueness or whether we brought a competitive advantage to the space.”“We lost focus within our products and brands. We did not manage our portfolio in a differentiated manner.” “We lost focus in process and execution. Our management processes lacked the necessary operating discipline.”“And finally, we didn’t have a culture of accountability, which led to poor execution.” “We have scale and market competencies within our core CPG categories – the majority of which are in growing segments.”“We have strong supply chain and manufacturing capabilities – where we have a heritage of making great tasting real food that is both affordable and convenient.”“We know how to reduce costs and have consistently delivered our cost savings programs ahead of schedule.” “We have solid margins and cash flow generation.”“Campbell has a deep keel. As a 150-year old company, we have talent capability and commitment that is both broad and deep.”Snyder’s-Lance and Pacific Foods both “bring valuable and growing brands that align with, and complement our core capabilities.” Our Assessment

15 Our Solution:The Campbell Board’s Plan to Revitalize a Great Company

What Campbell Is Doing Right Now to Improve Performance The Campbell Board is active and engaged, having identified the need for change, and is implementing a plan to make Campbell strongerSimplify, focus & optimize portfolio to focus on core North American marketDivest non-core businesses, using the proceeds to pay down debtImprove execution, speed and efficiency, through additional cost savings programContinued commitment to our dividendCampbell strongly believes it has the right plan, to be executed by a new management team, and an active Board with the skills and experience to oversee it The Campbell Board will continue to seriously consider other strategic options if they can demonstrably enhance shareholder value beyond what we confidently believe can be achieved from executing our August 30th plan 16

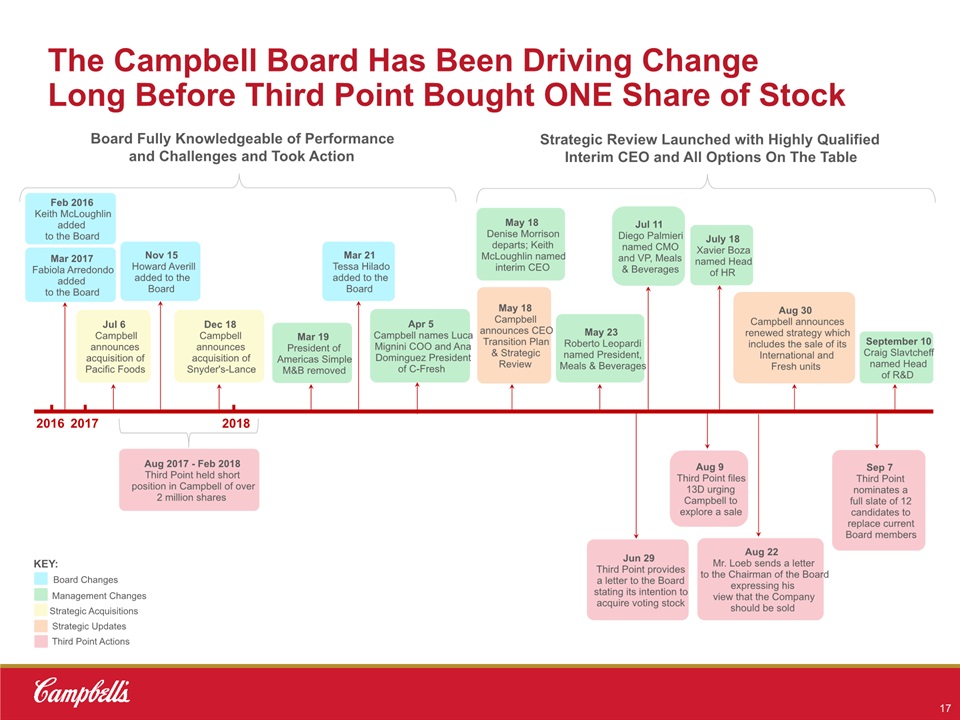

2016 2018 2017 May 23Roberto Leopardi named President, Meals & Beverages Dec 18Campbell announces acquisition of Snyder's-Lance Mar 21 Tessa Hilado added to the Board Apr 5Campbell names Luca Mignini COO and Ana Dominguez President of C-Fresh Jul 11Diego Palmieri named CMO and VP, Meals & Beverages Sep 7Third Point nominates a full slate of 12 candidates to replace current Board members Aug 22Mr. Loeb sends a letter to the Chairman of the Board expressing his view that the Company should be sold Aug 30Campbell announces renewed strategy which includes the sale of its International and Fresh units Nov 15 Howard Averill added to the Board Jun 29Third Point provides a letter to the Board stating its intention to acquire voting stock Aug 9Third Point files 13D urging Campbell to explore a sale May 18Denise Morrison departs; Keith McLoughlin named interim CEO Jul 6 Campbell announces acquisition of Pacific Foods Mar 2017Fabiola Arredondo added to the Board May 18Campbell announces CEO Transition Plan & Strategic Review The Campbell Board Has Been Driving Change Long Before Third Point Bought ONE Share of Stock 17 Board Fully Knowledgeable of Performance and Challenges and Took Action Strategic Review Launched with Highly Qualified Interim CEO and All Options On The Table KEY: Board Changes Management ChangesStrategic Acquisitions Strategic Updates Third Point Actions Aug 2017 - Feb 2018Third Point held short position in Campbell of over 2 million shares Mar 19President of Americas Simple M&B removed July 18Xavier Boza named Head of HR September 10Craig Slavtcheff named Head of R&D Feb 2016 Keith McLoughlin added to the Board

Highly engaged Board and Leadership teamBest-in-class outside advisors engagedObjective review of alternativesConsidered full range of strategic options to maximize shareholder valueDivest assets and businessesEnhance strategy and marginsSplit the companySale of companyConsidered all factors that led to operational challengesPoor execution in Fresh and SoupPortfolio complexityInadequate capital and resource allocationIndustry headwinds Building on key strengthsIconic brands with strong market positionsScale and strong competencies within core CPG categoriesStrong supply chain and manufacturing capabilitiesSuccessful multi-year cost savings programsSolid margins and cash flow generationFactoring all relevant elements for all stakeholdersShareholder value creationAll industry and business-related risksUrgency of change Strategy and Portfolio Review Highlights STRONG PROCESS: Comprehensive, Board-led Strategy and Portfolio Review 18

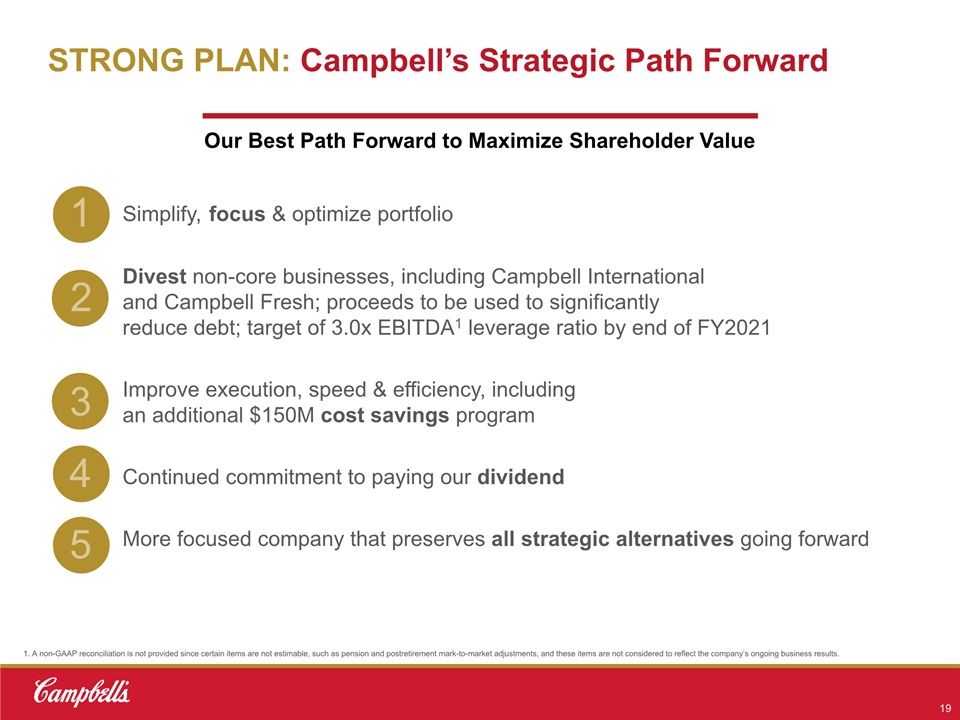

Simplify, focus & optimize portfolio Divest non-core businesses, including Campbell International and Campbell Fresh; proceeds to be used to significantly reduce debt; target of 3.0x EBITDA1 leverage ratio by end of FY2021 Improve execution, speed & efficiency, including an additional $150M cost savings program Continued commitment to paying our dividend More focused company that preserves all strategic alternatives going forward STRONG PLAN: Campbell’s Strategic Path Forward 19 1 Our Best Path Forward to Maximize Shareholder Value 2 3 4 5 1. A non-GAAP reconciliation is not provided since certain items are not estimable, such as pension and postretirement mark-to-market adjustments, and these items are not considered to reflect the company’s ongoing business results.

20 Sources: Public Filings.1. IRI MULO L52W through 6/24/18; IRI MULO L52W through 7/29/18; Market Position determined by Manufacturer rank.2. IRI All-Outlet for 52 Weeks Ending 7/29/18.3. Campbell's consumer perception survey conducted July 2018. Leading market share in 6 categories (#1 or #2) including Soup, Italian Sauce, Mexican Sauce, Crackers, Pretzels and Kettle Chips1More than 95% of all U.S. households have a Campbell product in their home2Ranked higher than competitors in taste across of 7 of 8 categories in which it competes3 Campbell Snacks Campbell Meals & Beverages Campbell’s New Structure Focuses on Fast Growing Snacks and High Margin Meals and Beverages STRONG PLAN: Our Focus Will Build a Stronger Company 1

Most recommended pretzel brand and highest customer satisfactionInvesting in innovations and marketing Investing to capture incremental revenue& marginStrong real food credentials, healthier ingredients Investing in innovation, marketing and e-commerceLeveraging organic credentials to grow share Leveraging consumer preference for taste & qualityIncreasing capacity to respond to higher demand Increasing capacity and investments in innovation, marketing and e-commercePositioning as healthier alternative to other snacks 21 Targeting higher-income, older millennialsIncreasing scale distribution into mass & grocery & reducing manufacturing cost Leveraging brand position in natural channel to introduce new innovations Targeting Gen-X consumers and cooking segmentFocusing marketing messaging on easy, affordable, delicious meal solutions Marketing portfolio strategy to increase share of shelfBuilding differentiation through cooking expertiseOptimizing marketing and trade efficiencies Sustaining Chunky franchise and clarifying roles of sub-brands Focusing on convenience Milano & Farmhouse Growing Our Campbell Snacks Franchise Stabilizing U.S. Soup 1 STRONG PLAN: Our Focus Will Build a Stronger Company (cont.)

Proposed divestitures represented ~$2.1 billion in annual net sales (FY2018)Financial advisors engaged / work commencedProceeds to be used to pay down debt and strengthen balance sheet; target of 3.0x EBITDA1 leverage ratio by the end of 2021Additional actions to further focus and refine portfolio against go-forward strategyThe Board and Management team are committed to deleveraging the company and retaining an investment grade credit rating Portfolio consists of refrigerated salsa, hummus, and dips Portfolio consists of organic beverages, dressings, and carrots #1 biscuit brand in Australia A leading supplier of Danish butter cookies in China and Hong Kong IndonesiaMalaysiaHong KongJapan Operations in 22 Campbell International Campbell Fresh STRONG PLAN: Pursuing Non-Core Business Divestitures 1. A non-GAAP reconciliation is not provided since certain items are not estimable, such as pension and postretirement mark-to-market adjustments, and these items are not considered to reflect the company’s ongoing business results. 2

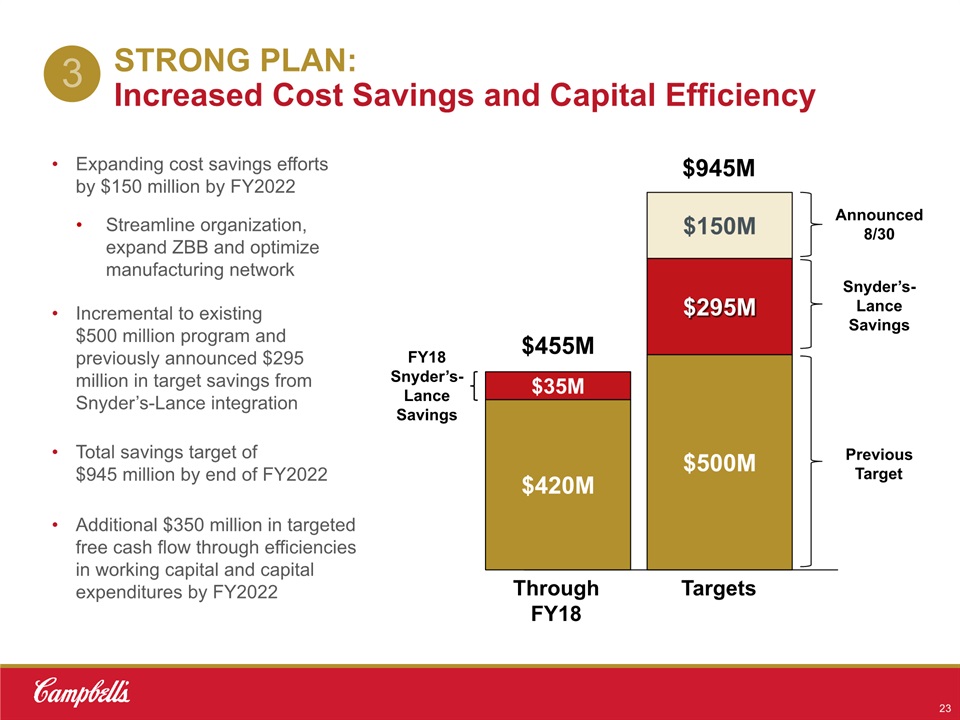

23 Expanding cost savings efforts by $150 million by FY2022Streamline organization, expand ZBB and optimize manufacturing networkIncremental to existing $500 million program and previously announced $295 million in target savings from Snyder’s-Lance integrationTotal savings target of $945 million by end of FY2022Additional $350 million in targeted free cash flow through efficiencies in working capital and capital expenditures by FY2022 $420M $500M $295M $150M Previous Target Snyder’s-Lance Savings Announced 8/30 $945M $35M FY18 Snyder’s-Lance Savings Targets Through FY18 $455M STRONG PLAN: Increased Cost Savings and Capital Efficiency 3

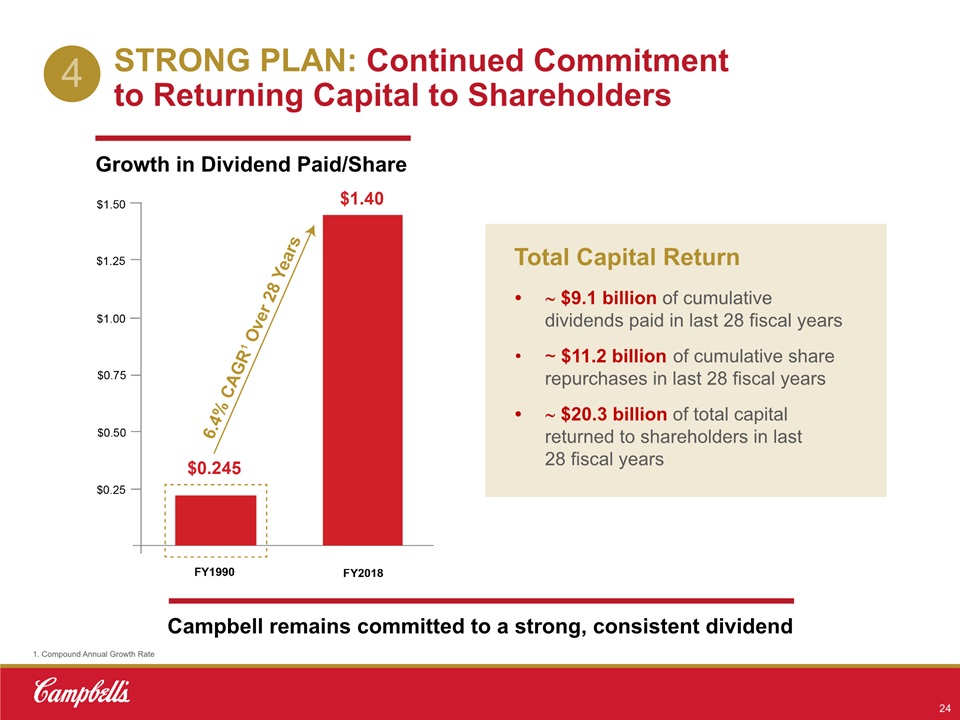

$9.1 billion of cumulative dividends paid in last 28 fiscal years~ $11.2 billion of cumulative share repurchases in last 28 fiscal years $20.3 billion of total capital returned to shareholders in last 28 fiscal years Total Capital Return 24 Growth in Dividend Paid/Share Campbell remains committed to a strong, consistent dividend 1. Compound Annual Growth Rate STRONG PLAN: Continued Commitment to Returning Capital to Shareholders 4

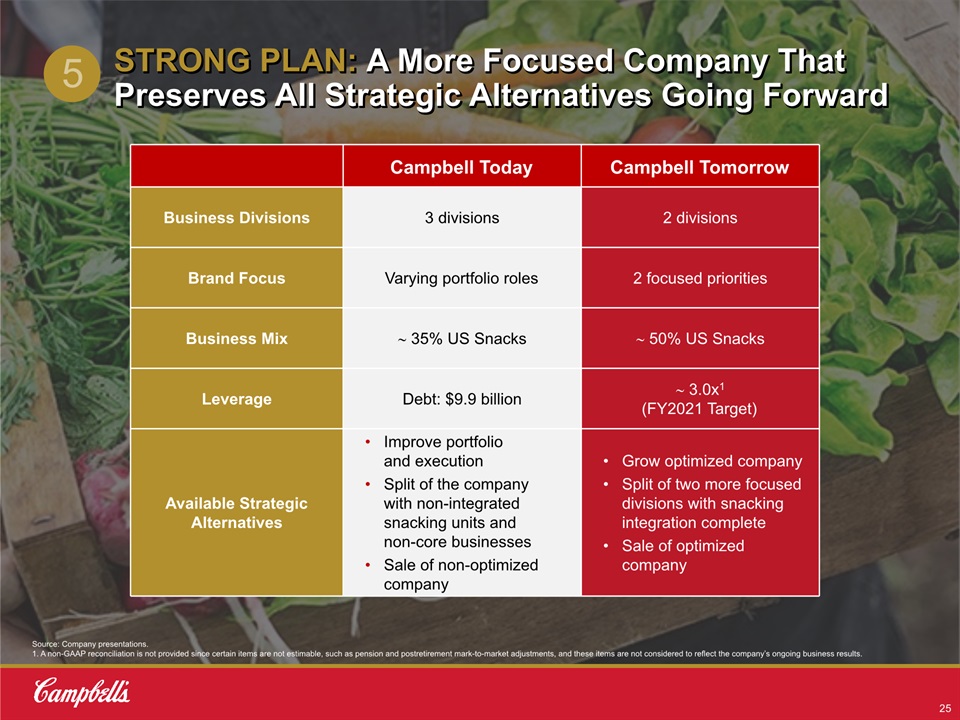

Source: Company presentations.1. A non-GAAP reconciliation is not provided since certain items are not estimable, such as pension and postretirement mark-to-market adjustments, and these items are not considered to reflect the company’s ongoing business results. STRONG PLAN: A More Focused Company That Preserves All Strategic Alternatives Going Forward 25 4 5 Campbell Today Campbell Tomorrow Business Divisions 3 divisions 2 divisions Brand Focus Varying portfolio roles 2 focused priorities Business Mix 35% US Snacks 50% US Snacks Leverage Debt: $9.9 billion 3.0x1(FY2021 Target) Available Strategic Alternatives Improve portfolio and executionSplit of the company with non-integrated snacking units and non-core businessesSale of non-optimized company Grow optimized companySplit of two more focused divisions with snacking integration completeSale of optimized company

Name Experience Keith McLoughlinInterim President and Chief Executive Officer Anthony DiSilvestroSVP & Chief Financial Officer Luca MigniniSVP & Chief Operating Officer Roberto LeopardiPresident, Campbell Meals & Beverages Carlos Abrams-RiveraPresident, Campbell Snacks Name Experience Adam CiongoliSVP & General Counsel Emily WaldorfSVP, Corporate Strategy Craig SlavtcheffVP & Head of R&D Bob FurbeeSVP, Global Supply Chain Xavier BozaSVP & Chief Human Resources Officer Executives added since 2015 26 STRONG TEAM: Transformed Management Team with Deep Bench of Talent Campbell’s Management Team Is Composed of Proven and Experienced Leaders

The Board took decisive action to install a highly qualified interim CEO to lead the Company until the search process is completeThe Board, with the support of leading candidate assessment and executive search firms, has been examining qualified candidates for months who possess a track record of proven results and achievementA number of highly qualified candidates have expressed interest in the opportunityCampbell expects to select the Company’s next CEO upon finding the best candidate, which we expect to do by the end of the calendar year Ongoing Chief Executive Officer Search STRONG TEAM: Our CEO Search Is Well Underway 27 The Board is focused on maintaining its thoughtful approach to ensure that the next choice for CEO is the best long-term fit for the Company and its plan

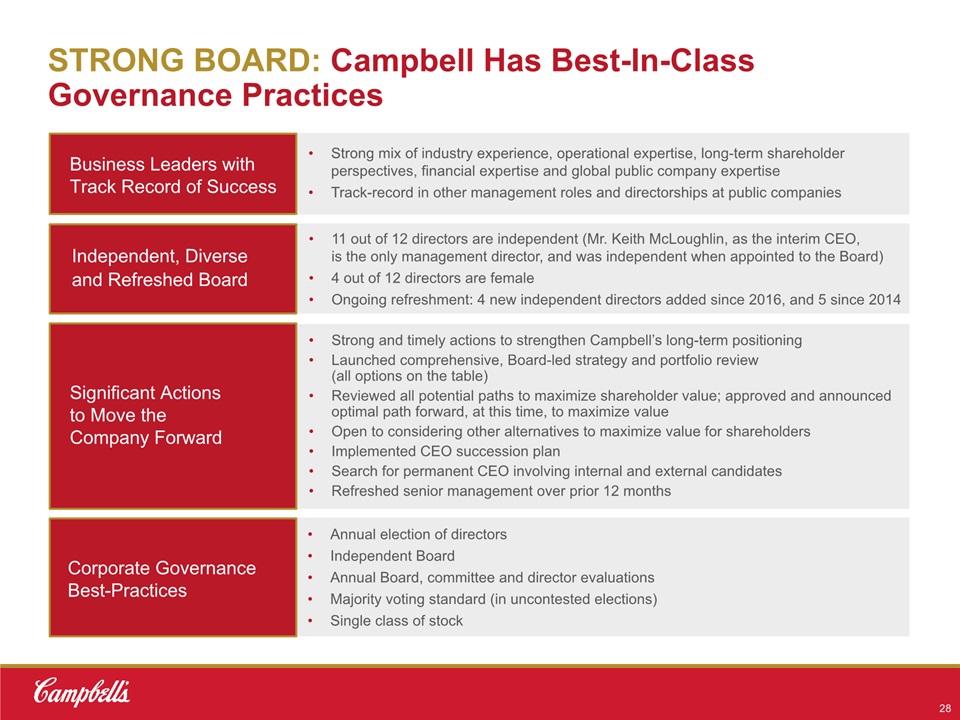

11 out of 12 directors are independent (Mr. Keith McLoughlin, as the interim CEO, is the only management director, and was independent when appointed to the Board)4 out of 12 directors are femaleOngoing refreshment: 4 new independent directors added since 2016, and 5 since 2014 Strong and timely actions to strengthen Campbell’s long-term positioningLaunched comprehensive, Board-led strategy and portfolio review (all options on the table)Reviewed all potential paths to maximize shareholder value; approved and announced optimal path forward, at this time, to maximize valueOpen to considering other alternatives to maximize value for shareholdersImplemented CEO succession planSearch for permanent CEO involving internal and external candidatesRefreshed senior management over prior 12 months Annual election of directorsIndependent BoardAnnual Board, committee and director evaluationsMajority voting standard (in uncontested elections)Single class of stock STRONG BOARD: Campbell Has Best-In-Class Governance Practices 28 Strong mix of industry experience, operational expertise, long-term shareholder perspectives, financial expertise and global public company expertiseTrack-record in other management roles and directorships at public companies Business Leaders with Track Record of Success Independent, Diverse and Refreshed Board Significant Actions to Move the Company Forward Corporate Governance Best-Practices

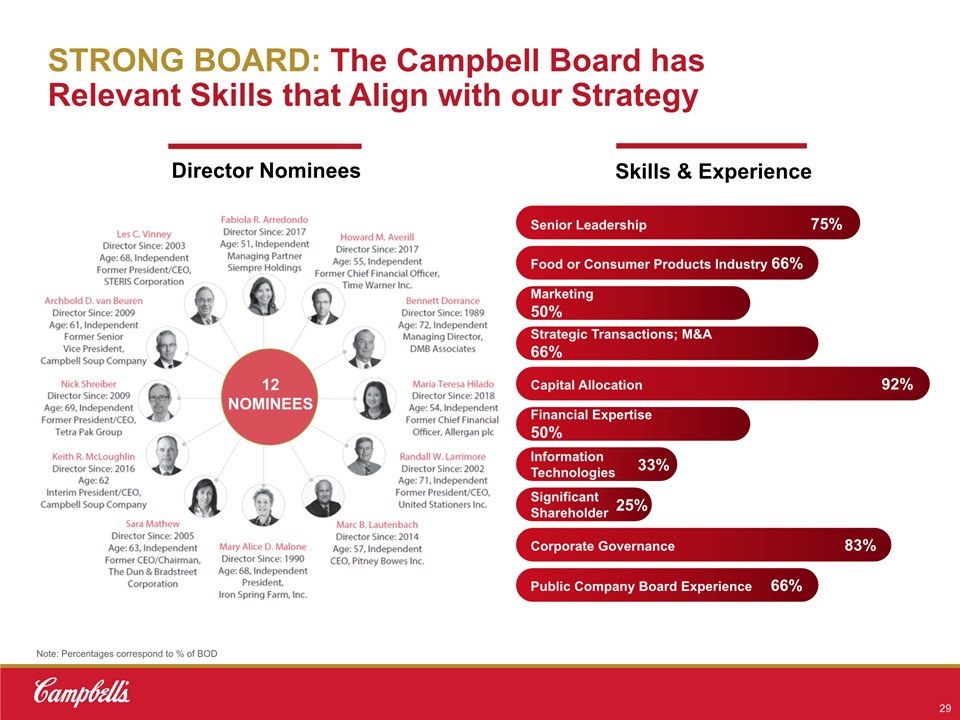

STRONG BOARD: The Campbell Board has Relevant Skills that Align with our Strategy 29 Director Nominees Senior Leadership 75% Food or Consumer Products Industry 66% Marketing 50% Strategic Transactions; M&A 66% Capital Allocation 92% Financial Expertise 50% Information Technologies Significant Shareholder 25% Corporate Governance 83% Public Company Board Experience 66% Skills & Experience 33% Note: Percentages correspond to % of BOD 12NOMINEES

30 The Risk:Third Point’s Empty Agenda

All Approaches Presented by Third Point Appear to be Aimed Exclusively at a Sale of the Company “Campbell is an iconic asset that could command an attractive price from multiple parties.”Third Point, Presentation, Oct. 1, 2018 “Only a reconstituted Board… will be able to objectively explore all strategic alternatives, including a sale of the Issuer or other business combination” George Strawbridge, Jr., 13D Filing, Aug. 9, 2018 “The only justifiable outcome of the strategic review is for the Issuer to be sold to a strategic buyer.” Third Point, 13D Filing, Aug. 9, 2018 Campbell evaluated a sale and will continue to do so if it can be shown to increase value relative to the plans outlined in our strategy and portfolio review 31 Source: Public Filings.

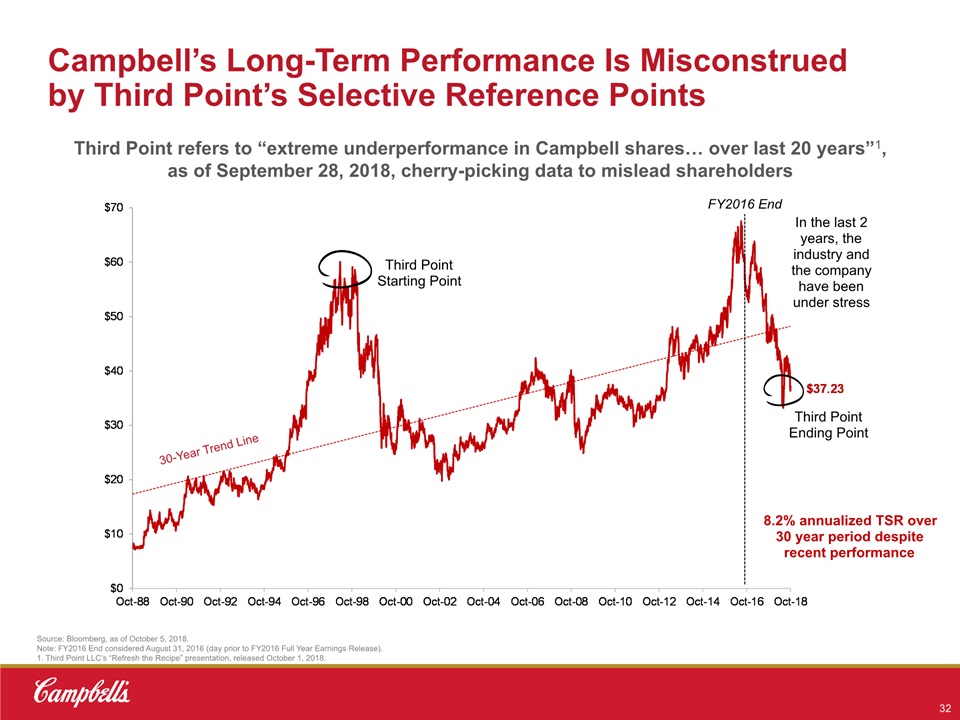

8.2% annualized TSR over 30 year period despite recent performance Source: Bloomberg, as of October 5, 2018.Note: FY2016 End considered August 31, 2016 (day prior to FY2016 Full Year Earnings Release).1. Third Point LLC’s “Refresh the Recipe” presentation, released October 1, 2018. Third Point refers to “extreme underperformance in Campbell shares… over last 20 years”1, as of September 28, 2018, cherry-picking data to mislead shareholders Third Point Starting Point Third Point Ending Point FY2016 End In the last 2 years, the industry and the company have been under stress 30-Year Trend Line Campbell’s Long-Term Performance Is Misconstrued by Third Point’s Selective Reference Points 32

Third Point’s Slate Is Not in the Best Interest of All Shareholders Director nominees are not qualified to oversee the CompanyNo incremental ideas proposed for how to run the businessDespite claiming openness, has publicly called for a sale as the only option with a recommended range of acquisition valuationsThird Point has bet against Campbell and its shareholders, holding cumulative short positions of over 2 million shares of the Company’s stock between August 2017and February 2018 33

Third Point’s Empty Plan Is Full of Simple Generalizations and Vague Recommendations Third Point’s “Plan” Underscores Their SuperficialUnderstanding of the Company Generalizations Third Point Action Plan? “Focus on growing soup business” O None “Stem margin declines in fresh food through more disciplined cost management” O None “Make product offerings more relevant to modern consumers” O None “Repair damaged relationships with key retail partners” O None “Outperform broader snacking category through smart innovation in core brands” O None “Simplify highly complex routes to market (over time)” O None 34

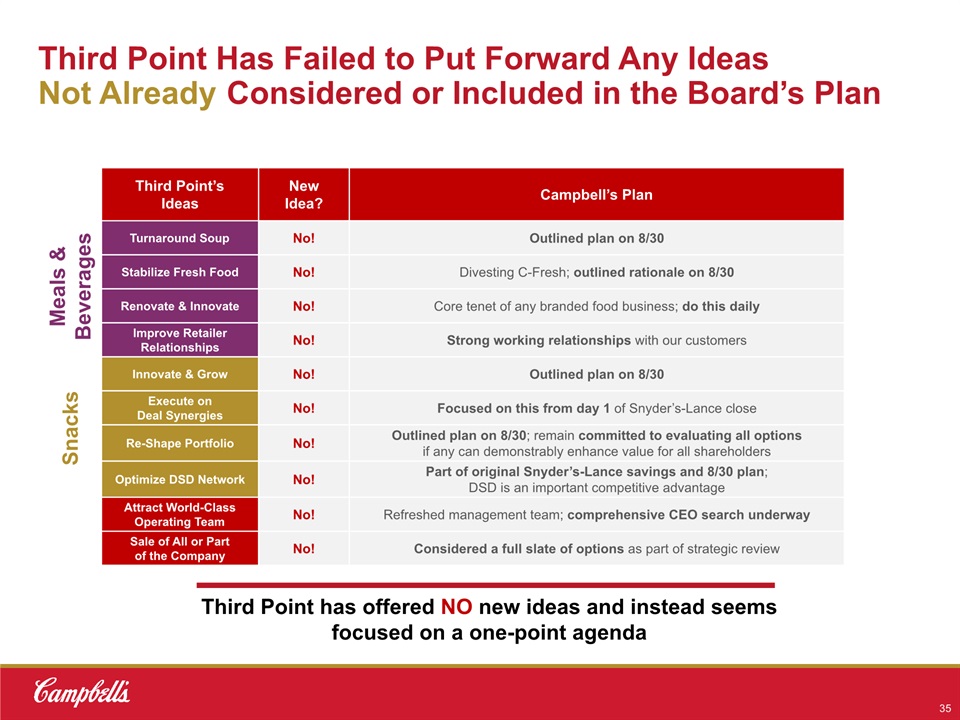

Third Point Has Failed to Put Forward Any Ideas Not Already Considered or Included in the Board’s Plan Third Point’s Ideas New Idea? Campbell’s Plan Turnaround Soup No! Outlined plan on 8/30 Stabilize Fresh Food No! Divesting C-Fresh; outlined rationale on 8/30 Renovate & Innovate No! Core tenet of any branded food business; do this daily Improve Retailer Relationships No! Strong working relationships with our customers Innovate & Grow No! Outlined plan on 8/30 Execute on Deal Synergies No! Focused on this from day 1 of Snyder’s-Lance close Re-Shape Portfolio No! Outlined plan on 8/30; remain committed to evaluating all options if any can demonstrably enhance value for all shareholders Optimize DSD Network No! Part of original Snyder’s-Lance savings and 8/30 plan; DSD is an important competitive advantage Attract World-Class Operating Team No! Refreshed management team; comprehensive CEO search underway Sale of All or Part of the Company No! Considered a full slate of options as part of strategic review Meals & Beverages Snacks Third Point has offered NO new ideas and instead seems focused on a one-point agenda 35

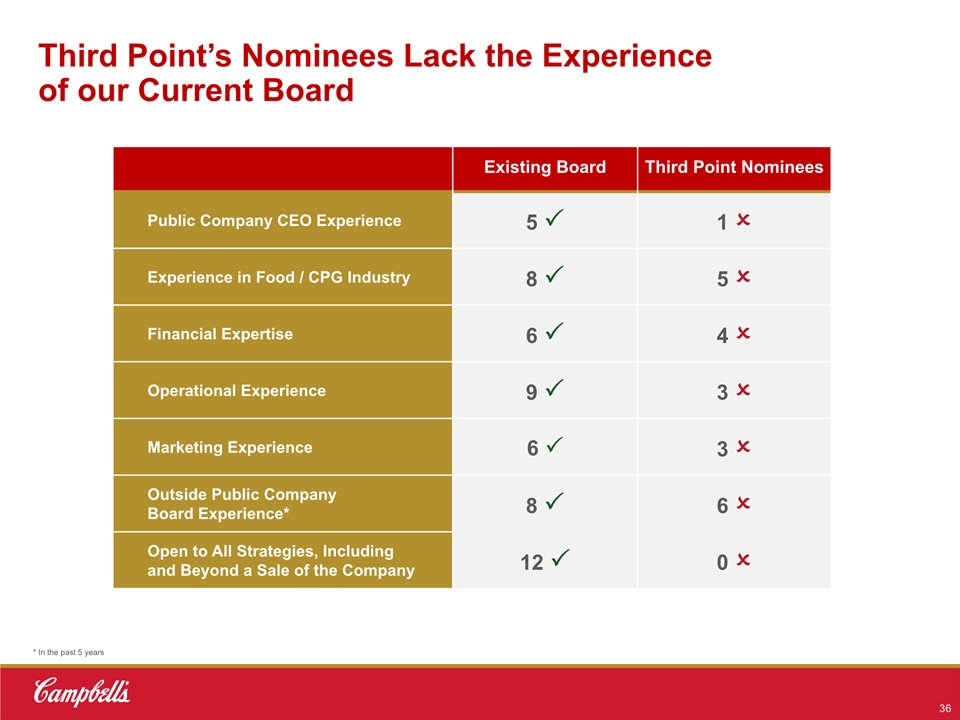

Third Point’s Nominees Lack the Experience of our Current Board * In the past 5 years 36 Existing Board Third Point Nominees Public Company CEO Experience 5 P 1 O Experience in Food / CPG Industry 8 P 5 O Financial Expertise 6 P 4 O Operational Experience 9 P 3 O Marketing Experience 6 P 3 O Outside Public Company Board Experience* 8 P 6 O Open to All Strategies, Including and Beyond a Sale of the Company 12 P 0 O * In the past 5 years

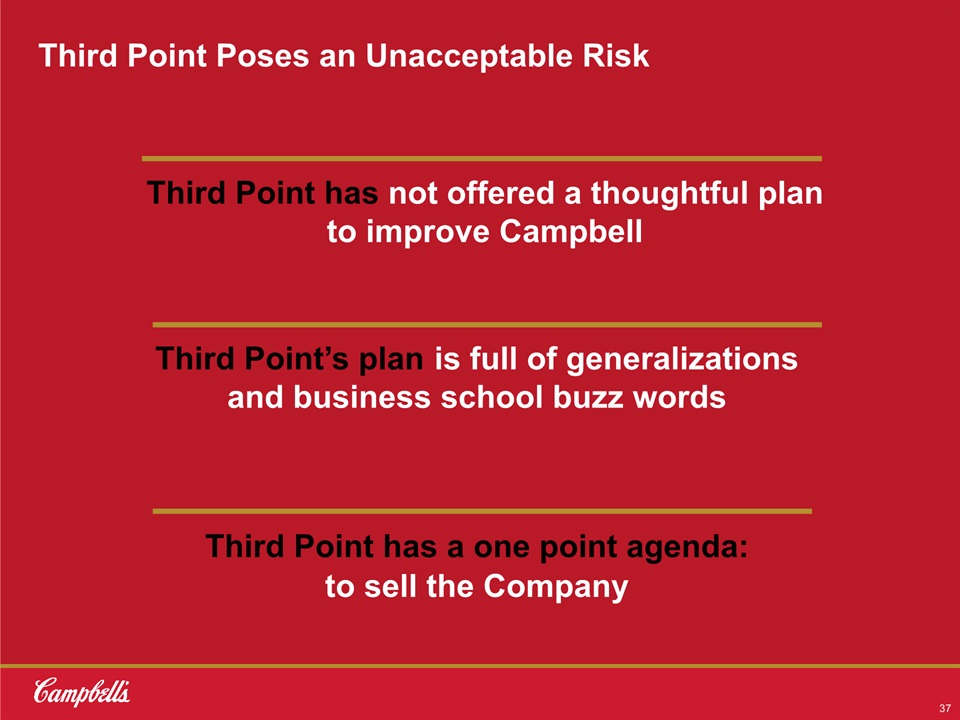

Third Point Poses an Unacceptable Risk 37 Third Point has not offered a thoughtful plan to improve Campbell Third Point’s plan is full of generalizations and business school buzz words Third Point has a one point agenda: to sell the Company

Our Commitment:The Campbell Board’s Full Commitment to Maximizing Shareholder Value 38

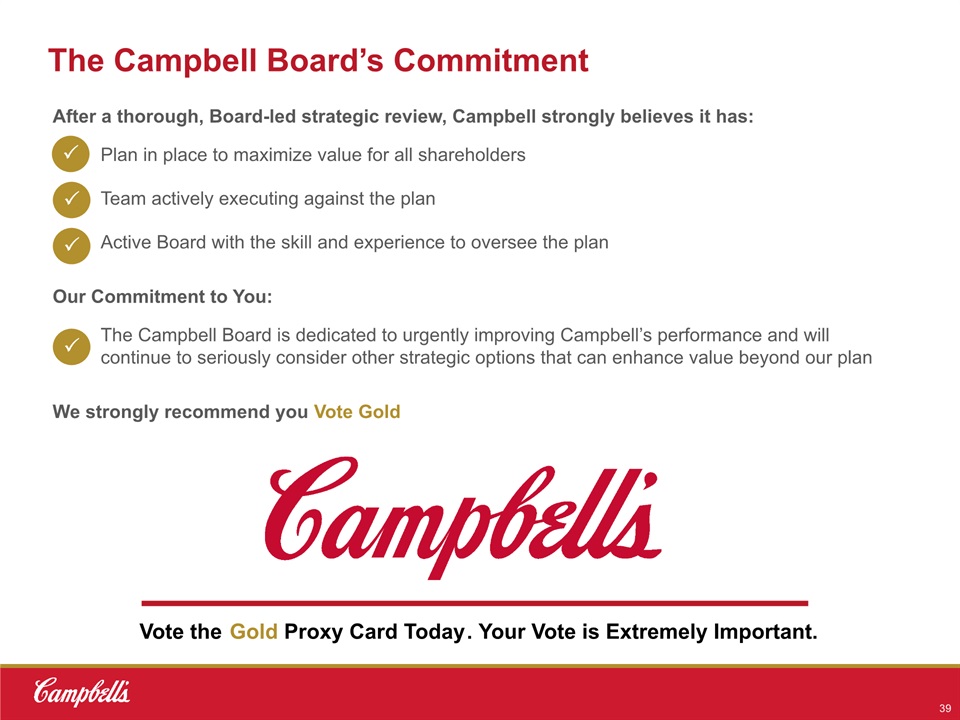

39 The Campbell Board’s Commitment After a thorough, Board-led strategic review, Campbell strongly believes it has:Plan in place to maximize value for all shareholdersTeam actively executing against the planActive Board with the skill and experience to oversee the planOur Commitment to You:The Campbell Board is dedicated to urgently improving Campbell’s performance and will continue to seriously consider other strategic options that can enhance value beyond our planWe strongly recommend you Vote Gold Vote the Gold Proxy Card Today. Your Vote is Extremely Important. P P P P

Preliminary Working Draft October 12, 2018