Micky Pant | CEO, Yum China

Cautionary Language Regarding Forward-Looking Statements Forward-Looking Statements. Our presentation may contain “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. We intend all forward-looking statements to be covered by the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. Forward-looking statements generally can be identified by the fact that they do not relate strictly to historical or current facts and by the use of forward-looking words such as “expect,” “expectation,” “believe,” “anticipate,” “may,” “could,” “intend,” “belief,” “plan,” “estimate,” “target,” “predict,” “likely,” “will,” “should,” “forecast,” “outlook” or similar terminology. These statements are based on current estimates and assumptions made by us in light of our experience and perception of historical trends, current conditions and expected future developments, as well as other factors that we believe are appropriate and reasonable under the circumstances, but there can be no assurance that such estimates and assumptions will prove to be correct. Forward-looking statements include, without limitation, statements regarding the future business plans, earnings and performance of Yum China including all targets, statements regarding future dividends, anticipated effects of population and macroeconomic trends and the capital structure of Yum China, statement regarding the anticipated effects of our digital and delivery capabilities on growth, and beliefs regarding the long-term drivers of Yum China’s business. Forward-looking statements are not guarantees of performance and are inherently subject to known and unknown risks and uncertainties that are difficult to predict and could cause our actual results to differ materially from those indicated by those statements. We cannot assure you that any of our expectations, estimates or assumptions will be achieved. The forward-looking statements included on our presentation are only made as of the date indicated on the relevant materials, and we disclaim any obligation to publicly update any forward-looking statement to reflect subsequent events or circumstances. Numerous factors could cause our actual results to differ materially from those expressed or implied by forward-looking statements, including, without limitation: whether we are able to achieve development goals at the times and in the amounts currently anticipated, if at all, the success of our marketing campaigns and product innovation, our ability to maintain food safety and quality control systems, our ability to control costs and expenses, including tax costs, as well as changes in political, economic and regulatory conditions in China. In addition, other risks and uncertainties not presently known to us or that we currently believe to be immaterial could affect the accuracy of any such forward-looking statements. All forward-looking statements should be evaluated with the understanding of their inherent uncertainty. You should consult our filings with the Securities and Exchange Commission (including the information set forth under the captions “Risk Factors” and “Forward-Looking Statements” in our Annual Report on Form 10-K) for additional detail about factors that could affect our financial and other results. Market and Industry Data. Unless we indicate otherwise, we base the information concerning our industry contained on this presentation on our general knowledge of and expectations concerning the industry. Our market position and market share is based on our estimates using data from various industry sources and assumptions that we believe to be reasonable based on our knowledge of the industry. We have not independently verified the data obtained from these sources and cannot assure you of the data’s accuracy or completeness. Trademarks, logos, service marks, materials, designs and other intellectual property used in this presentation are owned by Yum China Holdings, Inc. and its affiliates, or their use has been officially authorized by their respective owners. This presentation also may refer to brand names, trademarks, service marks and trade names of other companies and organizations, and these brand names, trademarks, service marks and trade names are the property of their respective owners. Non-GAAP Measures. Our presentation includes certain non-GAAP financial measures. Reconciliation of these non-GAAP financial measures to the most directly comparable GAAP measures are included on our presentation where indicated. Investors are urged to consider carefully the comparable GAAP measures and reconciliations.

Yum China by the numbers – a powerful business $16.5Bn market cap* #399 Fortune 500 2017** #1 Western QSR & CDR brands in China 7,747 stores in 1,100+ cities ~120mn members between KFC and Pizza Hut 420,000+ employees Strong management #1 restaurant operator In digital & delivery * As of the close of October 12, 2017 ** In terms of sales

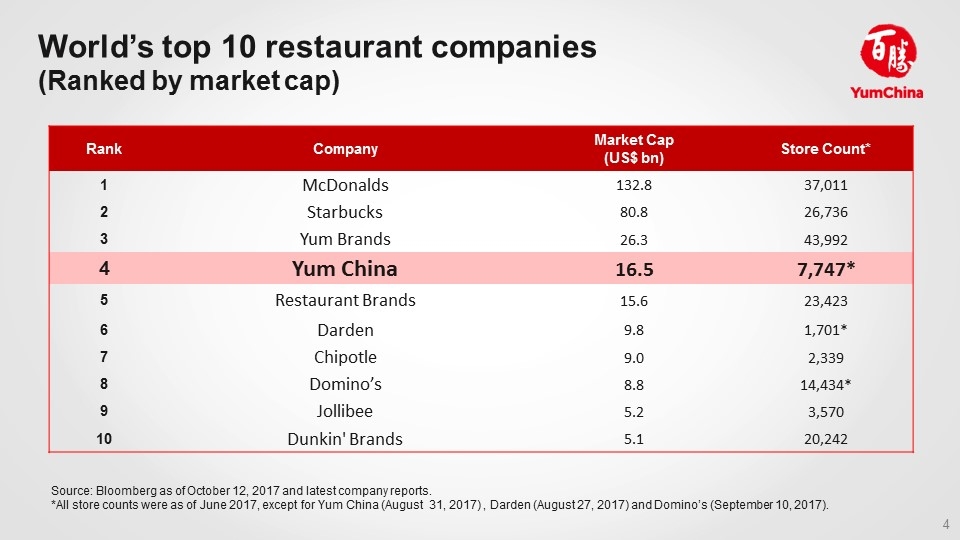

World’s top 10 restaurant companies (Ranked by market cap) Rank Company Market Cap (US$ bn) Store Count* 1 McDonalds 132.8 37,011 2 Starbucks 80.8 26,736 3 Yum Brands 26.3 43,992 4 Yum China 16.5 7,747* 5 Restaurant Brands 15.6 23,423 6 Darden 9.8 1,701* 7 Chipotle 9.0 2,339 8 Domino’s 8.8 14,434* 9 Jollibee 5.2 3,570 10 Dunkin' Brands 5.1 20,242 Source: Bloomberg as of October 12, 2017 and latest company reports. *All store counts were as of June 2017, except for Yum China (August 31, 2017) , Darden (August 27, 2017) and Domino’s (September 10, 2017).

One year since listing… Strong financial performance Daojia acquisition Share repurchase authorization Dividend initiation A B C D

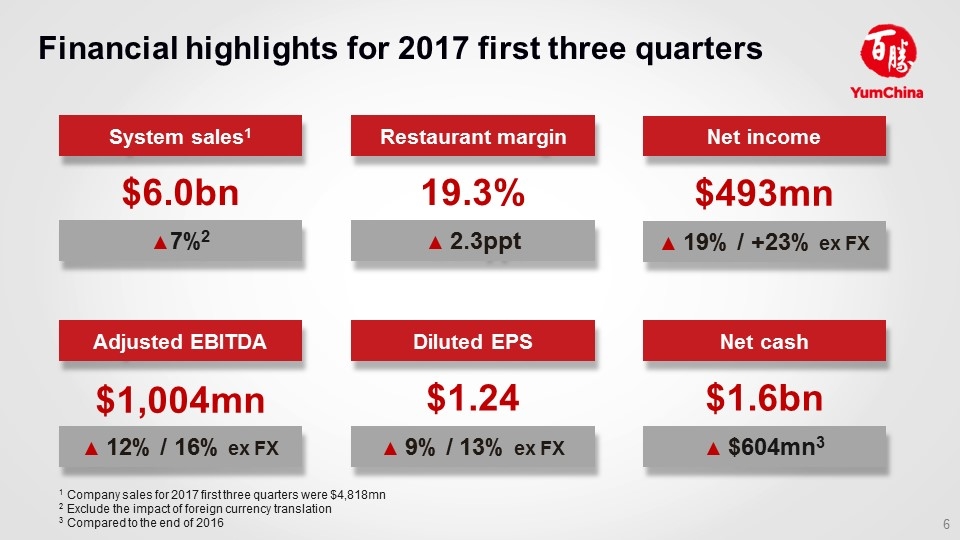

Financial highlights for 2017 first three quarters Net income ▲ 19% / +23% ex FX 1 Company sales for 2017 first three quarters were $4,818mn 2 Exclude the impact of foreign currency translation 3 Compared to the end of 2016 System sales1 Restaurant margin $493mn ▲7%2 $6.0bn ▲ 2.3ppt 19.3% Adjusted EBITDA ▲ 12% / 16% ex FX Diluted EPS Net cash ▲ 9% / 13% ex FX $1.24 ▲ $604mn3 $1.6bn $1,004mn

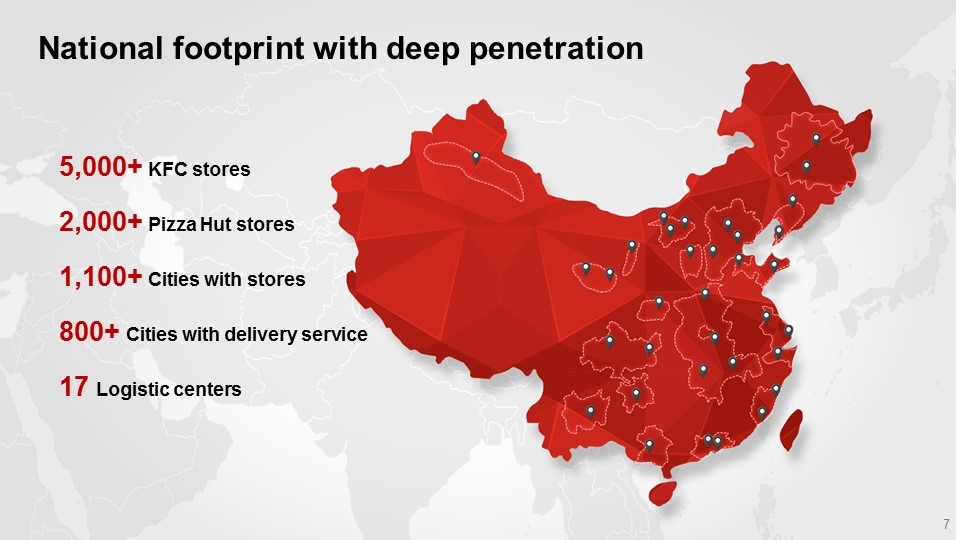

National footprint with deep penetration 5,000+ KFC stores 2,000+ Pizza Hut stores 1,100+ Cities with stores 17 Logistic centers 800+ Cities with delivery service

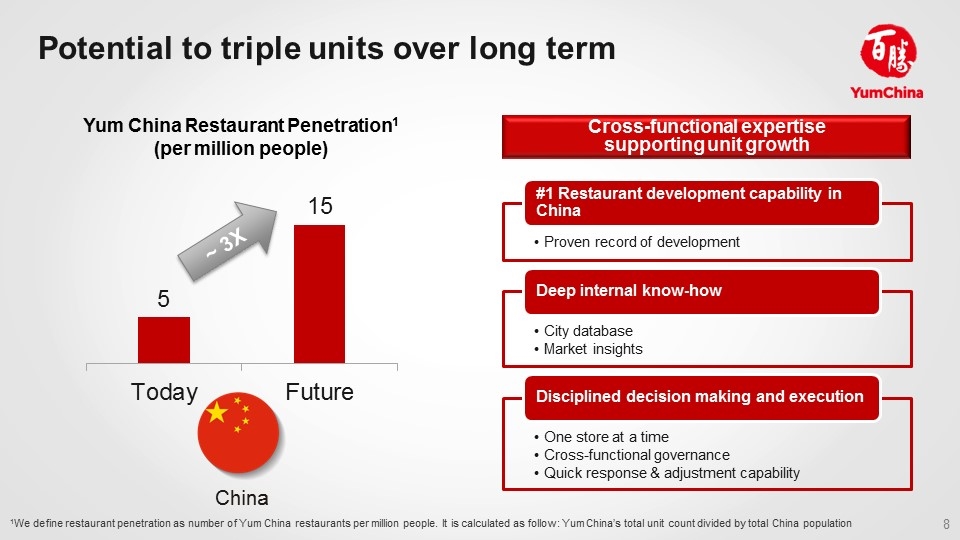

Potential to triple units over long term Yum China Restaurant Penetration1 (per million people) China Cross-functional expertise supporting unit growth ~ 3X 1We define restaurant penetration as number of Yum China restaurants per million people. It is calculated as follow: Yum China’s total unit count divided by total China population #1 Restaurant development capability in China Deep internal know-how Disciplined decision making and execution Proven record of development City database Market insights One store at a time Cross-functional governance Quick response & adjustment capability

Potential headwinds to our success Macro Geopolitical uncertainties Inflation Food Labor Currency RMB vs USD Tax Effective tax rate US tax reform

Diversified formats to support expansion - KFC

Diversified formats to support expansion – Pizza Hut

National supply chain Unrivalled development capabilities Industry leading marketing scale & coverage Best in class operations Robust IT infrastructure Unparalleled infrastructure

RMB 170mn donated for children in poverty since 2008 Yum China is a responsible partner in communities across China 10-year of One Yuan Donation Leverage digital & membership for charity 3.2 tons of potatoes sold through KFC App to help farmers in need

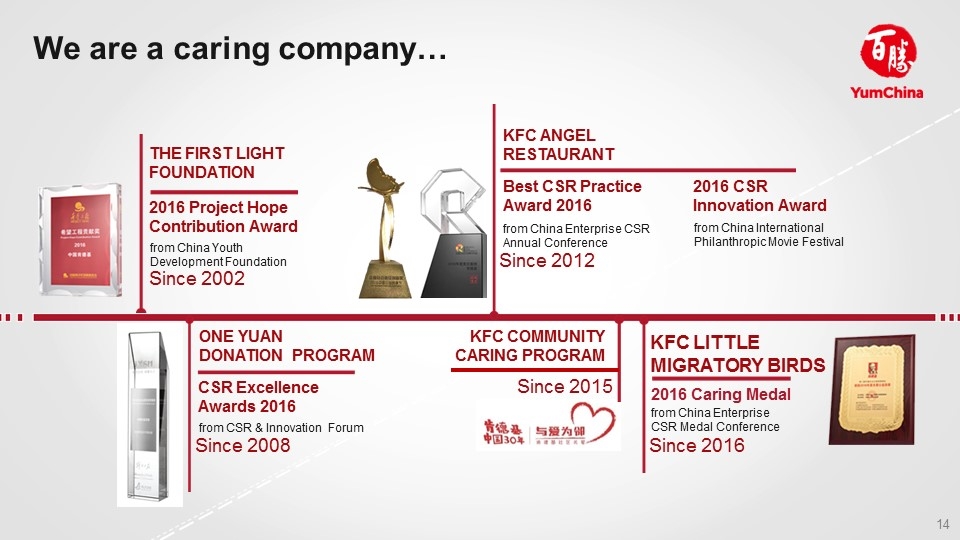

KFC LITTLE MIGRATORY BIRDS We are a caring company… THE FIRST LIGHT FOUNDATION 2016 Project Hope Contribution Award from China Youth Development Foundation Since 2002 KFC ANGEL RESTAURANT Best CSR Practice Award 2016 2016 CSR Innovation Award from China Enterprise CSR Annual Conference Since 2012 from China International Philanthropic Movie Festival ONE YUAN DONATION PROGRAM CSR Excellence Awards 2016 from CSR & Innovation Forum Since 2008 Since 2015 KFC COMMUNITY CARING PROGRAM 2016 Caring Medal from China Enterprise CSR Medal Conference Since 2016

Four key strategic priorities II. Strengthen Core Business Improve stores, innovate menu, improve quality and value I. Focus on China Invest locally for growth III. Digital and Delivery Invest and maintain lead IV. Innovation Product categories, formats and day parts

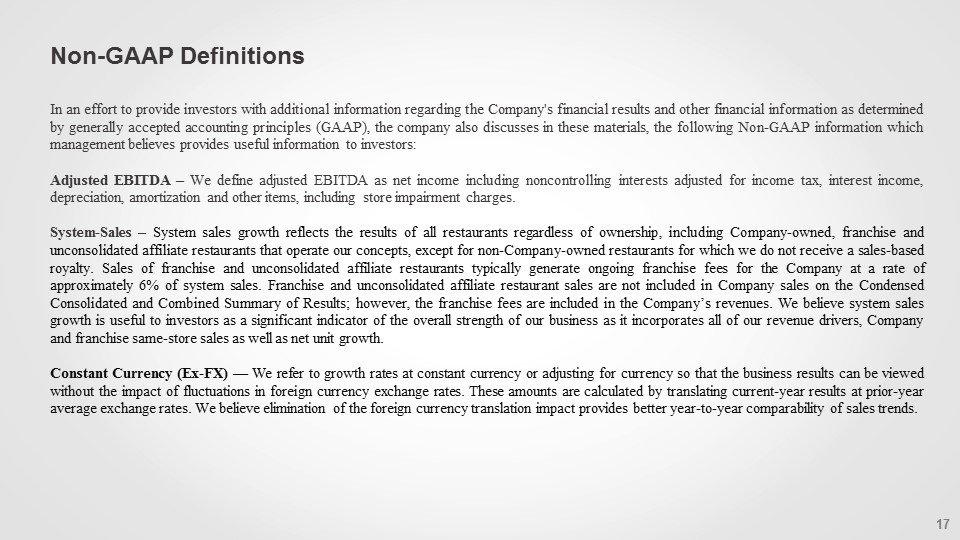

Non-GAAP Definitions In an effort to provide investors with additional information regarding the Company's financial results and other financial information as determined by generally accepted accounting principles (GAAP), the company also discusses in these materials, the following Non-GAAP information which management believes provides useful information to investors: Adjusted EBITDA – We define adjusted EBITDA as net income including noncontrolling interests adjusted for income tax, interest income, depreciation, amortization and other items, including store impairment charges. System-Sales – System sales growth reflects the results of all restaurants regardless of ownership, including Company-owned, franchise and unconsolidated affiliate restaurants that operate our concepts, except for non-Company-owned restaurants for which we do not receive a sales-based royalty. Sales of franchise and unconsolidated affiliate restaurants typically generate ongoing franchise fees for the Company at a rate of approximately 6% of system sales. Franchise and unconsolidated affiliate restaurant sales are not included in Company sales on the Condensed Consolidated and Combined Summary of Results; however, the franchise fees are included in the Company’s revenues. We believe system sales growth is useful to investors as a significant indicator of the overall strength of our business as it incorporates all of our revenue drivers, Company and franchise same-store sales as well as net unit growth. Constant Currency (Ex-FX) — We refer to growth rates at constant currency or adjusting for currency so that the business results can be viewed without the impact of fluctuations in foreign currency exchange rates. These amounts are calculated by translating current-year results at prior-year average exchange rates. We believe elimination of the foreign currency translation impact provides better year-to-year comparability of sales trends.

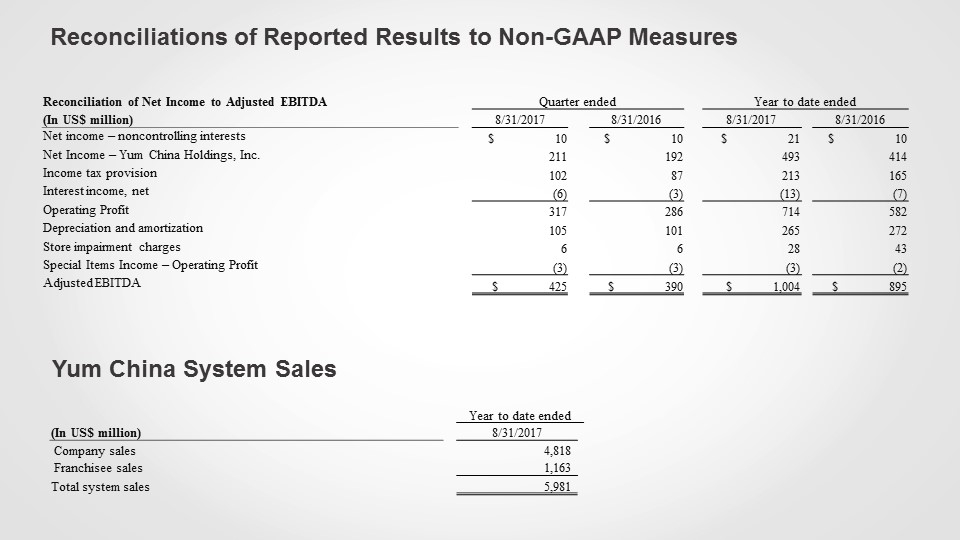

Reconciliations of Reported Results to Non-GAAP Measures Reconciliation of Net Income to Adjusted EBITDA Quarter ended Year to date ended (In US$ million) 8/31/2017 8/31/2016 8/31/2017 8/31/2016 Net income – noncontrolling interests $ 10 $ 10 $ 21 $ 10 Net Income – Yum China Holdings, Inc. 211 192 493 414 Income tax provision 102 87 213 165 Interest income, net (6) (3) (13) (7) Operating Profit 317 286 714 582 Depreciation and amortization 105 101 265 272 Store impairment charges 6 6 28 43 Special Items Income – Operating Profit (3) (3) (3) (2) Adjusted EBITDA $ 425 $ 390 $ 1,004 $ 895 Yum China System Sales Year to date ended (In US$ million) 8/31/2017 Company sales 4,818 Franchisee sales 1,163 Total system sales 5,981