Exhibit B

YOUR VOTE AND SUPPORT ARE IMPORTANT - SUBMIT ONLY YOUR BLUE PROXY OR BLUE VIF TODAY

FOR ASSISTANCE VOTING YOUR PROXY, PLEASE CONTACT

SHORECREST GROUP

Toll-free at 1-888-637-5789; brokers and banks - 647-931-7454

Email: contact@shorecrestgroup.com

Please visit www.savedtea.com for updates

saveDTEA Proxy Circular Summary

This summary highlights information contained elsewhere in this saveDTEA Proxy Circular. It does not contain all of the information that you should consider. Please read the entire saveDTEA Proxy Circular carefully before voting.

Voting Recommendations

| | |

Proposal | | Recommendation |

| |

Elect Herschel Segal | | FOR |

| |

Elect M. William Cleman | | FOR |

| |

Elect Pat De Marco, CPA, CA | | FOR |

| |

Elect Emilia Di Raddo, CPA, CA | | FOR |

| |

Elect Max Ludwig Fischer, Ph.D. | | FOR |

| |

Elect Peter Robinson | | FOR |

| |

Elect Roland Walton | | FOR |

VoteFOR the resolution setting the number of directors of DAVIDsTEA to be elected at eight.

VoteFOR the appointment of Ernst & Young LLP, Chartered Professional Accountants, as auditor of DAVIDsTEA Inc. for the ensuing year and authorizing the Board of Directors to fix its remuneration.

Record Date

You are entitled to vote at the meeting if you were a holder of common shares at the close of business on April 30, 2018.

Proxy Submission Deadline

To ensure your vote is counted, please submit yourBLUE proxy orBLUE voting instruction form (VIF) prior to 9:00 a.m. (eastern time) on Tuesday, June 12, 2018.

Please vote allBLUE VIF or proxies that you receive to ensure that all of your shares are counted. You may discard any yellow management proxies that you receive.

Attending the Annual Meeting

If you plan to attend the Annual Meeting, please follow the instructions on page viii of this saveDTEA Proxy Circular.

Meeting Information

| | Date: | Thursday June 14, 2018 |

| | Time: | 9:30 a.m. (eastern time) |

| | Place: | Fairmont Queen Elizabeth Hotel |

| | | 900 René-Lévesque Blvd. West |

How you can vote

Your vote is important. To ensure that your shares will be represented and voted at the meeting, please submit your vote as soon as possible by one of the following methods.

Beneficial Shareholders

(You hold your shares with a bank, broker or other intermediary)

By Internet:

www.proxyvote.com using the 16-digit control number located on yourBLUE Broadridge VIF.

By Telephone:

The toll-free number along with your control number is listed on yourBLUE VIF.

Registered Shareholders

(You hold a physical share certificate in your name)

By Email:

Send a copy of your executedBLUE proxy tocontact@shorecrestgroup.com.

By Fax:

Send a copy of your executedBLUE proxy to 1-416-931-7349

Delivery in person, by courier or mail:

Shorecrest Group

67 Yonge St., Suite 901

Toronto, Ontario

M5E 1J8

|

Your vote is important! The enclosed information is important and requires your immediate attention. If you have any questions, please contact Shorecrest Group, our proxy agent, by telephone at1-888-637-5789 or1-647-931-7454 or bye-mail at contact@shorecrestgroup.com |

| | |

www.saveDTEA.com | |  |

May 11, 2018

Dear Fellow Shareholder:

As a founder and the principal shareholder of DAVIDsTEA Inc. (“DAVIDsTEA”), I am asking for your vote at DAVIDsTEA’s annual meeting to be held on Thursday, June 14, 2018 at 9:30 a.m. (eastern time) at the Fairmont Queen Elizabeth Hotel, 900René-Lévesque Blvd. West, Montreal, Québec, and at any and all adjournments or postponements thereof (the “Meeting”). Through Rainy Day Investments Ltd. (“RDI”), I own approximately 46.4% of the outstanding common shares of DAVIDsTEA and have proposed a slate of new directors who will work in the best interests ofall DAVIDsTEA shareholders.

The seven nominees proposed by RDI (collectively, the “RDI Nominees”) bring impeccable credentials in retailing and finance and vast business experience to DAVIDsTEA’s governance. A clear majority of the RDI Nominees are independent of me and RDI. They share a common vision for DAVIDsTEA and a belief in its future.

With your help, we will achieve a result at the Meeting which will serve the interests of all shareholders by reconstituting the Board with the following seven highly-qualified RDI Nominees: M. William Cleman, Pat De Marco, CPA, CA, Emilia Di Raddo, CPA, CA, Max Ludwig Fischer, Ph.D., Peter Robinson, Roland Walton and myself. Each of the RDI Nominees has the requisite experience, expertise, perspective and motivation to maximize DAVIDsTEA’s true potential value.

At the Meeting on June 14, shareholders will have an opportunity to affect DAVIDsTEA’s future by voting for the seven RDI Nominees. This election is perhaps the most important in DAVIDsTEA’s history. A vote for the RDI Nominees will start the process by which DAVIDsTEA can achieve its great potential.

Your vote is important no matter how many shares you own. If you care about DAVIDsTEA and the value of your shares, please vote for the RDI Nominees TODAY.

Please vote online or return your completedBLUE proxy form orBLUEvoting instruction form by using any one of the methods set out in the proxy form or voting instruction form so that it arrives no later than 9:00 a.m. (eastern time) on Tuesday, June 12, 2018. Thank you for your support.

| | |

Yours truly, RAINY DAY INVESTMENTS LTD. |

| |

| per: | | (signed) “Herschel H. Segal” |

| | Herschel H. Segal President |

YOUR VOTE AND SUPPORT ARE IMPORTANT - SUBMIT ONLY YOUR BLUE PROXY OR BLUE VIF TODAY

FOR ASSISTANCE VOTING YOUR PROXY, PLEASE CONTACT

SHORECREST GROUP

Toll-free at 1-888-637-5789; brokers and banks - 647-931-7454

Email: contact@shorecrestgroup.com

Please visit www.savedtea.com for updates

ii

PROXY CIRCULAR

SOLICITATION OF PROXIES BY AND ON BEHALF OF RDI FOR THE ANNUAL MEETING OF SHAREHOLDERS OF DAVIDsTEA INC. TO BE HELD ON JUNE 14, 2018

RDI RECOMMENDS THAT YOU VOTE ON THEBLUE PROXY FORM ORBLUE VOTING INSTRUCTION FORM

VoteFOR the election of the seven following RDI Nominees as directors of DAVIDsTEA Inc.:

| | ● | | Emilia Di Raddo, CPA, CA |

| | ● | | Max Ludwig Fischer, Ph.D. |

VoteFOR the resolution setting the number of directors of DAVIDsTEA to be elected at the Meeting at eight.

VoteFOR the appointment of Ernst & Young LLP, Chartered Professional Accountants, as auditor of DAVIDsTEA Inc. for the ensuing year and authorizing the Board of Directors to fix its remuneration.

VOTE ONLY YOURBLUE PROXY FORM ORBLUE VIF TODAY

YOU HAVE THE POWER TO HELP TURNAROUND DAVIDsTEA

YOUR VOTE AND SUPPORT ARE IMPORTANT - SUBMIT ONLY YOUR BLUE PROXY OR BLUE VIF TODAY

FOR ASSISTANCE VOTING YOUR PROXY, PLEASE CONTACT

SHORECREST GROUP

Toll-free at 1-888-637-5789; brokers and banks - 647-931-7454

Email: contact@shorecrestgroup.com

Please visit www.savedtea.com for updates

iii

QUESTIONS AND ANSWERS

The following list of Questions and Answers is intended to address some of the key questions regarding the annual meeting of holders of common shares (“Shares”) of DAVIDsTEA Inc. (“DAVIDsTEA”) to be held on Thursday, June 14, 2018 at 9:30 a.m. (eastern time) at the Fairmont Queen Elizabeth Hotel, 900René-Lévesque Blvd. West, Montreal, Québec, Canada and at any and all adjournments or postponements thereof (the “Meeting”). This section is a summary only and is qualified in its entirety by the more detailed information contained elsewhere in this Circular. Shareholders are urged to read this Circular in its entirety.

| Q. | WHAT IS THE PURPOSE OF THE MEETING? |

| A. | This is the annual meeting of DAVIDsTEA, at which shareholders will elect the Board of Directors. At the Meeting, there will be two slates of directors for shareholders to vote on; one slate put forward by the management of DAVIDsTEA, and a second slate of seven nominees that we have put forward (the “RDI Nominees”). |

| Q. | WHO IS LEADING THE EFFORT TO RECONSTITUTE THE BOARD? |

| A. | This effort is being led by RDI, a holding company owned by Herschel Segal, a founder of DAVIDsTEA and a director until March 5, 2018. RDI owns approximately 46.4% of the outstanding Shares. |

| Q. | WHY SHOULD I SUPPORT HERSCHEL SEGAL AND RDI’S SLATE OF SEVEN NOMINEES? |

| A. | Herschel Segal, a founder and principal shareholder of DAVIDsTEA, believes that poor operating decisions and unproductive leadership by the current Board of Directors and management of DAVIDsTEA have greatly eroded shareholder value. Operating losses continue each quarter, and for the most recent fiscal year, were approximately four times greater than in the previous year. Financial results continue to be deeply disturbing. Thestatus quo is not an option. |

In order to improve operations and effect a financial turnaround, aunified Board of Directors is needed, one which shares a common vision for DAVIDsTEA’s future. The strategic review process favoured by the current Board of Directors has run its course; DAVIDsTEA and the Board of Directors need to get to workimmediately to revitalize the business. With a new, unified Board of Directors, DAVIDsTEA will be able to make substantial progress in improving operations and financial performance, for the benefit ofall shareholders. The slate of new directors, the seven RDI Nominees, will work in the best interests ofall DAVIDsTEA shareholders.

| Q. | WHY IS THERE A NEED FOR CHANGE? |

| A. | Management and the Board of Directors of DAVIDsTEA have not been able to manage the business profitably. Rather, they have sought buyers for the business, or portions thereof, while operations are suffering. |

Herschel Segal believes in the future of DAVIDsTEA. His vision for DAVIDsTEA is to build on its strengths, including a well-known brand, a loyal customer base across Canada and passionate employees, while addressing weaknesses such as U.S. operations and excessive product and organizational costs. With the right focus, DAVIDsTEA can restore growth, position itself on a sustainable path, and create value for the long-term – for shareholders, customers and employees. The economy is strong, the DAVIDsTEA brand resonates with a new generation of consumers, and the tea business offers

YOUR VOTE AND SUPPORT ARE IMPORTANT - SUBMIT ONLY YOUR BLUE PROXY OR BLUE VIF TODAY

FOR ASSISTANCE VOTING YOUR PROXY, PLEASE CONTACT

SHORECREST GROUP

Toll-free at 1-888-637-5789; brokers and banks - 647-931-7454

Email: contact@shorecrestgroup.com

Please visit www.savedtea.com for updates

iv

compelling opportunities for creating long-term shareholder value. By focusing on the right priorities, DAVIDsTEA can aspire to a great future as an iconic Canadian brand.

| Q. | WHAT IS RDI’S PLAN FOR DAVIDsTEA? |

| A. | RDI’s plan is straightforward. Herschel Segal believes that the tea industry is growing, consumers in Canada and the United States are increasingly health conscious and aware of the benefits of specialty teas, and DAVIDsTEA has a well-recognized brand name and a loyal customer base across Canada, all of which are important factors for an operational and financial turnaround. Mr. Segal further believes that the basis for a financial turnaround is a focus on DAVIDsTEA’s operations, with good products and satisfied customers. Specifically, Mr. Segal believes that DAVIDsTEA can effect an operational and financial turnaround as follows: |

| | ● | | Focus on and listen to the customer, enhance the customer experience and make sure that customers are satisfied |

| | ● | | Provide excellent productsat a compelling price by rebuilding DAVIDsTEA’s buying department and improving the creativity and efficiency of product development |

| | ● | | Create ongoing,two-way communication between DAVIDsTEA’s head office and its stores, and provide support to the stores and their personnel |

| | ● | | Focus on the Canadian market, where the DAVIDsTEA brand has been successful, and expand the number of stores in Canada |

| | ● | | Stabilize operations in the United States |

| | ● | | Reduce overhead costs, including a reduction of head office personnel |

| | ● | | Assess DAVIDsTEA’s senior management and make any necessary changes |

| | ● | | Provide clear direction from the Board of Directors to senior management and employees |

| Q. | WHY DO YOU BELIEVE THE RDI NOMINEES CAN BEST HELP DAVIDsTEA? |

| A. | The RDI Nominees were invited to serve in light of their diverse skills and experience and their commitment to an operational and financial turnaround of DAVIDsTEA. They collectively have expertise in the retail industry, financial expertise, and experience with public companies and other large organizations. We believe that a Board of Directors comprised of the RDI Nominees will be able to provide clear direction to DAVIDsTEA’s senior management and employees and are confident that the RDI Nominees will help DAVIDsTEA effect an operational and financial turnaround. |

| Q. | DAVIDsTEA BLAMES HERSCHEL SEGAL FOR ITS PROBLEMS. IS THAT VALID? |

| A. | Such a claim is completely unfounded. Herschel Segal is a successful retail-industry entrepreneur and a founder of DAVIDsTEA. Mr. Segal’s vision and financing were critical to DAVIDsTEA’s rapid early growth and success. At no time since 2012 has Herschel Segal held an executive position at DAVIDsTEA, controlled or directed the operations of DAVIDsTEA, been involved in its management or been Chairman of the Board. During the fiscal year ended February 3, 2018, for which DAVIDsTEA |

YOUR VOTE AND SUPPORT ARE IMPORTANT - SUBMIT ONLY YOUR BLUE PROXY OR BLUE VIF TODAY

FOR ASSISTANCE VOTING YOUR PROXY, PLEASE CONTACT

SHORECREST GROUP

Toll-free at 1-888-637-5789; brokers and banks - 647-931-7454

Email: contact@shorecrestgroup.com

Please visit www.savedtea.com for updates

v

| | recently announced its deeply disturbing results, Mr. Segal was one voice on aten-member Board of Directors and NOT a member of management. In short, any claim that Herschel Segal is responsible for DAVIDsTEA’s operating losses and other negative financial results is fiction. |

| Q. | ARE THE RDI NOMINEES “INDEPENDENT”? |

| A. | All of the RDI Nominees are at the date hereof “independent” within the meaning of Canadian National Instrument52-110 -Audit Committees (“NI52-110”), and “Independent Directors” as defined in Nasdaq Rule 5605(a)(2). |

In the event that the RDI Nominees are elected as the Board of Directors at the Meeting, it is expected that Herschel Segal will be appointed as Executive Chairman of the Board of Directors and that M. William Cleman will be appointed as “lead director” of the Board of Directors within the meaning of Canadian securities regulations. Mr. Cleman will be “independent” within the meaning of NI52-110 and an “Independent Director” as defined in Nasdaq Rule 5605(a)(2). If Mr. Segal is appointed as Executive Chairman, a clear majority of the RDI Nominees will be “independent” within the meaning of NI52-110 and “Independent Directors” as defined in Nasdaq Rule 5605(a)(2).

| Q. | WHO WILL BE ON THE AUDIT COMMITTEE OF DAVIDsTEA? |

| A. | In the event that the RDI Nominees are elected as the Board of Directors at the Meeting, it is expected that M. William Cleman, Pat De Marco, CPA, CA, and Roland Walton will be appointed to the Audit Committee of the Board of Directors. As noted above, each of these three RDI Nominees is at the date hereof “independent” within the meaning of NI52-110 and an “Independent Director” as defined in Nasdaq Rule 5605(a)(2). Further, each has confirmed that he: (i) is able to read and understand fundamental financial statements, including DAVIDsTEA’s balance sheet, income statement, and cash flow statement, and (ii) has past employment experience in finance or accounting, requisite professional certification in accounting, or any other comparable experience or background which results in his financial sophistication, including being or having been a chief executive officer, chief financial officer or other senior officer with financial oversight responsibilities, all as required by Nasdaq Rule 5600. Further, each of the three is “financially literate” within the meaning of Canadian securities regulations. |

| Q. | WHAT ARE YOUR PLANS FOR THE MANAGEMENT OF DAVIDsTEA? |

| A. | In the event that the RDI Nominees are elected as the Board of Directors at the Meeting, it is expected that Herschel Segal will be appointed as Executive Chairman of the Board of Directors. The RDI Nominees will assess DAVIDsTEA’s senior management and make any necessary changes. Further, the RDI Nominees will provide clear direction to senior management and employees with respect to operations and a turnaround plan for DAVIDsTEA. |

| Q. | COULD RDI HAVE AVOIDED A PROXY FIGHT? |

| A. | In March, RDI and its legal counsel initiated discussions with the Board of Directors of DAVIDsTEA and with three minority shareholders, each of whom owns more than 10% of the Shares, with the objective of reaching an agreement with them on a slate of nominees for election as the Board of Directors of DAVIDsTEA. As a compromise, RDI proposed a slate of nine nominees, consisting of: five nominees of RDI; three nominees to be proposed by the Board of Directors and/or the minority shareholders; and the Chief Executive Officer of DAVIDsTEA. Both the Board of Directors and three minority shareholders refused this compromise slate of nominees. Accordingly, RDI formally submitted the names of seven RDI Nominees in accordance with Article 11 ofBy-law2015-1 of DAVIDsTEA, the “advance notice” |

YOUR VOTE AND SUPPORT ARE IMPORTANT - SUBMIT ONLY YOUR BLUE PROXY OR BLUE VIF TODAY

FOR ASSISTANCE VOTING YOUR PROXY, PLEASE CONTACT

SHORECREST GROUP

Toll-free at 1-888-637-5789; brokers and banks - 647-931-7454

Email: contact@shorecrestgroup.com

Please visit www.savedtea.com for updates

vi

| | provision, and at the Meeting will formally nominate the seven RDI Nominees for election as the Board of Directors of DAVIDsTEA. |

| Q. | IS HERSCHEL SEGAL SEEKING CONTROL OF DAVIDSTEA WITHOUT PAYING A PREMIUM? |

| A. | DAVIDsTEA has stated that by nominating the RDI Nominees to replace the current Board of Directors, Herschel Segal is proposing to gain control of the Board “without having paid a premium to other shareholders” and that he views DAVIDsTEA as a “family business”. Let’s set the record straight – Herschel Segal, the principal shareholder of DAVIDsTEA, has confirmed hislong-term commitment to DAVIDsTEA and proposed a detailed plan for an operational and financial turnaround designed to create value – forall DAVIDsTEA shareholders. The slate of seven RDI Nominees, a clear majority of whom are independent of Mr. Segal and RDI, will work in the best interests ofall DAVIDsTEA shareholders. With a new, unified Board of Directors, DAVIDsTEA will be able to make substantial progress in improving operations and financial performance, for the benefit ofall DAVIDsTEA shareholders. RDI is committed to doing everything necessary in order to revitalize the business of DAVIDsTEA, for the good ofall DAVIDsTEA shareholders. |

| Q. | WHY ARE SHAREHOLDERS BEING ASKED TO VOTE “FOR” SETTING THE NUMBER OF DIRECTORS AT EIGHT, WHEN THERE ARE ONLY SEVEN RDI NOMINEES? |

| A. | The Articles of DAVIDsTEA provide that the number of directors shall be a minimum of three and a maximum of fifteen. RDI understands that pursuant to an employment agreement between DAVIDsTEA and the Chief Executive Officer, the latter must be a director of DAVIDsTEA for so long as he is Chief Executive Officer. Accordingly, at the Meeting, RDI will propose that shareholders adopt a resolution setting the number of directors to be elected at the Meeting at eight (seven RDI Nominees and the Chief Executive Officer). |

| Q. | WHEN AND WHERE IS THE MEETING? |

| A. | The Meeting is scheduled to be held on June 14, 2018 at 9:30 a.m. (eastern time) at the Fairmont Queen Elizabeth Hotel,900 René-Lévesque Blvd. West, Montreal, Québec, Canada. |

| Q. | WHO IS ENTITLED TO VOTE? |

| A. | Shareholders owning Shares on April 30, 2018 (the “Record Date”) are entitled to vote. Each Share is entitled to one vote on the items of business identified in the notice of meeting sent by DAVIDsTEA. |

| Q. | HOW MANY SHARES ARE ENTITLED TO VOTE? |

| A. | DAVIDsTEA has disclosed in the Management Circular that there were 25,912,061 Shares outstanding as of the Record Date. |

| Q. | HOW DO I VOTE MYBLUE PROXY FORM ORBLUE VOTING INSTRUCTION FORM? |

| A. | If you are aBeneficial Shareholder (meaning your shares are held through a broker or other intermediary), you may vote in person, by Internet, by fax, by telephone, or by mail or delivery as follows: |

YOUR VOTE AND SUPPORT ARE IMPORTANT - SUBMIT ONLY YOUR BLUE PROXY OR BLUE VIF TODAY

FOR ASSISTANCE VOTING YOUR PROXY, PLEASE CONTACT

SHORECREST GROUP

Toll-free at 1-888-637-5789; brokers and banks - 647-931-7454

Email: contact@shorecrestgroup.com

Please visit www.savedtea.com for updates

vii

| | ● | | To vote in person: Insert your name in the space provided on the enclosedBLUE voting instruction form (“VIF”) or submit any other document in writing to your nominee (e.g. broker, advisor, trust company) that requests that you should be appointed as proxy. Then, follow the instructions on theBLUE VIF and sign and return theBLUE VIF in accordance with the instructions provided (also see the question “What’s the Difference Between a Beneficial and a Registered Shareholder?” below for more information). Before the start of the Meeting on June 14, 2018, register with the representative(s) from AST Trust Company (Canada) who will be located at a scrutineers’ table just outside the meeting room. You should bring photo ID to the Meeting. |

| | ● | | To vote by Internet: Go towww.proxyvote.com and vote using the16-digit control number found on yourBLUE VIF. If you are a U.S. resident, follow the instructions provided with yourBLUE VIF or other proxy document. |

| | ● | | To vote by telephone: If you are a Canadian Beneficial Shareholder, call the toll-free number found on yourBLUE VIF or1-800-474-7493 or1-800-474-7501 (French) and vote using the16-digit control number found on theBLUE VIF. If you are a U.S. Beneficial Shareholder, follow the instructions provided with yourBLUE VIF or other proxy document. |

| | ● | | To vote by fax: Properly complete, sign and date yourBLUE proxy form and return it by fax to Broadridge at1-905-507-7793 (for Canadian Beneficial Shareholders only). |

| | ● | | To vote by mail or delivery: Properly complete, sign and date theBLUE VIF and enclose it using the postage-paid envelope. |

| A. | If you are aRegistered Shareholder (meaning your Shares are held by you directly and not by your broker or other intermediary), you may vote in person, by email, by fax, or by mail or delivery as follows: |

| | ● | | To vote in person: You do not need to complete and return the enclosedBLUE proxy form. All you need to do is to come to the Meeting with yourBLUE proxy form. Before the start of the Meeting on June 14, 2018, register with the representative(s) from AST Trust Company (Canada), who will be located at a scrutineers’ table just outside the meeting room. You should bring photo ID to the Meeting. |

| | ● | | To vote by fax or email: Properly complete, sign and date yourBLUE proxy form and return it by fax to Shorecrest Group at647-931-7349 or by email to contact@shorecrestgroup.com. |

| | ● | | To vote by mail or delivery: Properly complete, sign and date theBLUE proxy form and return it in the postage prepaid envelope provided to Shorecrest Group at 67 Yonge Street, Suite 901, Toronto, Ontario M5E 1J8. |

| Q. | WHAT’S THE DIFFERENCE BETWEEN A BENEFICIAL AND A REGISTERED SHAREHOLDER? |

| A. | You are a “Registered Shareholder” if your shares are held in your name and you are in possession of a physical share certificate or a direct registration statement that indicates the same. The vast majority of shareholders arenot Registered Shareholders but are “Beneficial Shareholders”. You are a Beneficial Shareholder if your shares are held by a broker, advisor, trust company or other similar person. |

YOUR VOTE AND SUPPORT ARE IMPORTANT - SUBMIT ONLY YOUR BLUE PROXY OR BLUE VIF TODAY

FOR ASSISTANCE VOTING YOUR PROXY, PLEASE CONTACT

SHORECREST GROUP

Toll-free at 1-888-637-5789; brokers and banks - 647-931-7454

Email: contact@shorecrestgroup.com

Please visit www.savedtea.com for updates

viii

As a Beneficial Shareholder you should have received this Circular from your nominee, together with a request for voting instructions relating to the Shares you hold. Please follow the voting instructions provided by your nominee in order to vote your Shares. If you are a Beneficial Shareholder who has voted and want to change your mind and vote in person, contact your nominee to discuss whether this is possible and what procedure to follow. Since only Registered Shareholders or their proxyholders can attend and vote at the Meeting, if you attend the Meeting as a Beneficial Shareholder you will not automatically be shown as a Registered Shareholder on DAVIDsTEA’s shareholder register and DAVIDsTEA will have no record of your shareholdings or of your entitlement to vote unless your nominee has appointed you as proxyholder. Therefore, if you are a Beneficial Shareholder and wish to vote in person at the Meeting, insert your own name in the space provided on theBLUE VIF sent to you by your nominee and sign and return theBLUE VIF in accordance with the signing and returning instructions provided. By doing so, you are instructing your nominee to appoint yourself as proxyholder. You should bring photo ID to the Meeting.

To find out what type of shareholder you are, call Shorecrest Group toll-free at1-888-637-5789; brokers and banks -647-931-7454.

| Q. | WHAT PROXY FORM OR VIF SHOULD I VOTE? |

| A. | Vote ONLY theBLUE proxy form orBLUE VIF enclosed by marking “FOR” with respect to the election of the RDI Nominees as outlined in theBLUE proxy form orBLUE VIF. You may revoke a proxy already given pursuant to management’s solicitation of proxies by completing and delivering the enclosedBLUE proxy form. A later-datedBLUE proxy form revokes any and all prior proxies given by you in connection with the Meeting. A Registered Shareholder who has given a proxy may also revoke the proxy at any time prior to use by depositing an instrument in writing revoking the proxy, executed by such Registered Shareholder or by his, her or its attorney authorized in writing or by electronic signature or, if the Registered Shareholder is a corporation, by an officer or attorney thereof properly authorized, either: (i) at the registered office of DAVIDsTEA at 5430 Ferrier Street, Mont Royal, Québec, Canada H4P 1M2 at any time up to and including the last business day preceding the day of the Meeting or any adjournment or postponement thereof; or (ii) with the chairman of the Meeting on the day of the Meeting or any adjournment or postponement thereof; or (iii) in any other manner permitted by law. |

| Q. | WHAT IF I PLAN TO ATTEND THE MEETING AND VOTE IN PERSON? |

| A. | If you are a Registered Shareholder planning to attend the Meeting on June 14, 2018 and wish to vote your Shares in person at the Meeting, although it is preferred, it is not necessary to complete or return the proxy form. Your vote will be taken and counted at the Meeting. Please register with DAVIDsTEA’s transfer agent, AST Trust Company (Canada), upon arrival at the Meeting. If you are a Beneficial Shareholder, (i.e. if your Shares are held in the name of a nominee) and you wish to attend the Meeting, please refer to the question, “How Do I Vote my Blue Proxy Form or Blue Voting Instruction Form?” above for voting instructions. |

| Q. | WHAT HAPPENS IF I SIGN THE PROXY FORM OR VIF ENCLOSED WITH THIS CIRCULAR? |

| A. | Signing the enclosedBLUE proxy form orBLUE VIF gives authority to RDI’s representatives or to any other person you have appointed to vote your Shares at the Meeting. |

YOUR VOTE AND SUPPORT ARE IMPORTANT - SUBMIT ONLY YOUR BLUE PROXY OR BLUE VIF TODAY

FOR ASSISTANCE VOTING YOUR PROXY, PLEASE CONTACT

SHORECREST GROUP

Toll-free at 1-888-637-5789; brokers and banks - 647-931-7454

Email: contact@shorecrestgroup.com

Please visit www.savedtea.com for updates

ix

| Q. | HOW WILL MY PROXY BE VOTED? |

| A. | You may indicate on theBLUE proxy form orBLUE VIF how you want your proxyholder to vote your Shares, or you can let your proxyholder decide for you. If you specify on theBLUE proxy form orBLUEVIF how you want your Shares to be voted on a particular resolution (by indicating FOR, AGAINST or WITHHOLD, as applicable), then your proxyholder must vote your Shares accordingly. If you have not specified on theBLUE proxy form orBLUE VIF how you want your Shares to be voted on a particular resolution, then your proxyholder may vote your Shares as he or she sees fit. |

Unless contrary instructions are provided, Shares represented by proxies received by RDI will be voted “FOR” the election of the RDI Nominees named in the Circular as directors of DAVIDsTEA, “FOR” the resolution setting the number of directors of DAVIDsTEA to be elected at the Meeting at eight, and “FOR” the appointment of Ernst & Young LLP, Chartered Professional Accountants, as auditor of DAVIDsTEA for the ensuing year.

| Q. | CAN I APPOINT SOMEONE OTHER THAN RDI’S REPRESENTATIVES TO VOTE MY SHARES? |

| A. | Yes, you may appoint someone other than RDI’s representatives to vote your Shares. Please write the name of this person, who need not be a shareholder, in the blank space provided in theBLUE proxy form, orBLUE VIF or by completing another proxy form. It is important to ensure that any other person so appointed is aware that he or she has been appointed to vote your Shares andMUST attend the Meeting in order to vote your Shares. That person should bring photo ID to the Meeting. |

| Q. | WHAT DO I DO WITH MY COMPLETEDBLUE PROXY ORBLUE VIF? |

| A. | Return your completedBLUE proxy form orBLUE VIF by using any one of the methods prescribed on theBLUE proxy form or VIF so that it arrives no later than 9:00 a.m. (eastern time) on Tuesday, June 12, 2018. This will ensure that your vote is recorded. For assistance in voting, please contact RDI’s proxy solicitation agent, Shorecrest Group, by email at contact@shorecrestgroup.com or by callingtoll-free at1-888-637-5789; brokers and banks -647-931-7454. |

| Q. | WHAT IF I WANT TO REVOKE MY PROXY OR VOTING INSTRUCTION FORM? |

| A. | If you are aBeneficial Shareholder, you can revoke a previously-deposited voting instruction form or proxy by notifying your broker, trust company or other advisor in writing. |

If you are aRegistered Shareholder, you can revoke a previously-deposited proxy by:

| | (i) | Completing aBLUE proxy form that is dated later than the proxy form you are revoking and mailing it to Shorecrest Group, 67 Yonge St, Suite 901, Toronto, Ontario M5E 1J8 so that it is received no later than 9:00 a.m. (eastern time) on Tuesday, June 12, 2018, or |

| | (ii) | Depositing an instrument in writing executed by you or by your attorney authorized in writing, as the case may be: |

| | (a) | At the registered office of DAVIDsTEA at any time up to and including the last business day preceding the day the Meeting or any adjournment or postponement of the Meeting is to be held; or |

YOUR VOTE AND SUPPORT ARE IMPORTANT - SUBMIT ONLY YOUR BLUE PROXY OR BLUE VIF TODAY

FOR ASSISTANCE VOTING YOUR PROXY, PLEASE CONTACT

SHORECREST GROUP

Toll-free at 1-888-637-5789; brokers and banks - 647-931-7454

Email: contact@shorecrestgroup.com

Please visit www.savedtea.com for updates

x

| | (b) | With the Chairman of the Meeting prior to its commencement on the day of the Meeting or any adjournment or postponement of the Meeting. |

| Q. | WHAT IF AMENDMENTS OR OTHER MATTERS ARE BROUGHT TO THE MEETING? |

| A. | The enclosedBLUE proxy form orBLUE VIF gives the persons named on it the authority to use their discretion in voting on amendments to or variations of matters identified in the notice of meeting sent by DAVIDsTEA and other matters which may properly come before the Meeting. At the time of printing this Circular, RDI knows of no such amendments, variations or other matters, except as described herein. If any matters, which are not now known, should properly come before the Meeting, the persons named in theBLUE proxy form orBLUE VIF will vote on such matters in accordance with their judgment. |

| Q. | WHAT DO I DO IF I ALREADY VOTED A MANAGEMENT PROXY? |

| A. | Even if you have already voted using the Management Proxy, you have every right to change your vote. Only the later-dated proxy will be counted at the Meeting. Vote only theBLUE proxy form on or before 9:00 a.m. (eastern time) on Tuesday, June 12, 2018. For more information or assistance voting yourBLUE proxy form, please contact Shorecrest Group by email at contact@shorecrestgroup.com or by calling toll-free at1-888-637-5789; brokers and banks -647-931-7454. |

A Beneficial Shareholder may revoke a voting instruction form or proxy authorization form given to an intermediary at any time by written notice to the intermediary, except that an intermediary may not act on a revocation of a voting instruction form or proxy authorization form that is not received by the intermediary in sufficient time prior to the Meeting.

QUESTIONS MAY BE DIRECTED TO THE PROXY SOLICITOR

SHORECREST GROUP

toll-free at1-888-637-5789; brokers and banks -647-931-7454

Email:contact@shorecrestgroup.com

VOTE ONLY YOURBLUE PROXY ORBLUE VIF TODAY

YOUR VOTE AND SUPPORT ARE IMPORTANT - SUBMIT ONLY YOUR BLUE PROXY OR BLUE VIF TODAY

FOR ASSISTANCE VOTING YOUR PROXY, PLEASE CONTACT

SHORECREST GROUP

Toll-free at 1-888-637-5789; brokers and banks - 647-931-7454

Email: contact@shorecrestgroup.com

Please visit www.savedtea.com for updates

TABLE OF CONTENTS

| | | | |

Proxy Circular | | | 1 | |

| |

Recommendation to Shareholders | | | 1 | |

| |

Forward-Looking Statements | | | 2 | |

| |

Notice to Shareholders in the United States | | | 2 | |

| |

Background to this Solicitation | | | 2 | |

| |

A Need for a Turnaround at DAVIDsTEA | | | 3 | |

| |

Operational and Financial Turnaround Plan | | | 3 | |

| |

Questionable Management Decisions | | | 4 | |

| |

Deeply Disturbing Financial Results | | | 4 | |

| |

Poor Stock Performance and Limited Liquidity | | | 5 | |

| |

Excessive Executive Compensation | | | 6 | |

| |

The RDI Nominees | | | 6 | |

| |

Matters to be Acted Upon at the Meeting | | | 7 | |

| |

Recommendation to Shareholders | | | 16 | |

| |

Voting Securities and Principal Shareholders | | | 16 | |

| |

Interest of Informed Persons in Material Transactions | | | 17 | |

| |

Interest of Certain Persons in Matters to be Acted Upon | | | 17 | |

| |

Executive Compensation, Indebtedness of Directors and Executive Officers, Management Contracts, and | | | | |

Securities Authorized for Issuance Under Equity Compensation Plans | | | 17 | |

| |

General Proxy Information | | | 17 | |

| |

Additional Information | | | 21 | |

| |

Approval | | | 22 | |

YOUR VOTE AND SUPPORT ARE IMPORTANT - SUBMIT ONLY YOUR BLUE PROXY OR BLUE VIF TODAY

FOR ASSISTANCE VOTING YOUR PROXY, PLEASE CONTACT

SHORECREST GROUP

Toll-free at 1-888-637-5789; brokers and banks - 647-931-7454

Email: contact@shorecrestgroup.com

Please visit www.savedtea.com for updates

1

PROXY CIRCULAR

This dissident proxy circular (this “Circular”) dated May 11, 2018 and the accompanyingBLUE proxy form orBLUE voting instruction form (“VIF”) are provided to you in connection with the solicitation of proxies by and on behalf of Rainy Day Investments Ltd. (“RDI” or “we”) to be used at the annual meeting of holders of shares (“Shares”) of DAVIDsTEA Inc. (“DAVIDsTEA”) to be held on Thursday, June 14, 2018 at 9:30 a.m. (eastern time) at the Fairmont Queen Elizabeth Hotel, 900René-Lévesque Blvd. West, Montreal, Québec, Canada at any and all adjournments or postponements thereof (the “Meeting”).

This solicitation of proxies is made by RDI. This solicitation of proxies is NOT made by or on behalf of management of DAVIDsTEA.

You were sent a management information circular dated May 10, 2018 (the “Management Circular”) and a management form of proxy (the “Management Proxy”) from management of DAVIDsTEA soliciting proxies in connection with the Meeting. According to the Management Circular, management of DAVIDsTEA is proposing six directors for election to the Board.

If you support RDI’s proposals, use only theBLUE proxy form orBLUE VIF enclosed with this Circular. If you previously returned a Management Proxy, you have the right to change your vote. To do so, simply sign, date and return theBLUE proxy form. A later-datedBLUE proxy form supersedes a previously-completed Management Proxy. A Beneficial Shareholder may revoke a VIF or proxy authorization form given to an intermediary at any time by written notice to the intermediary, except that an intermediary may not act on a revocation of a VIF or proxy authorization form that is not received by the intermediary in sufficient time prior to the Meeting.

RDI is soliciting proxies in support of the election of the following seven nominees as directors of DAVIDsTEA: Herschel Segal, M. William Cleman, Pat De Marco, CPA, CA, Emilia Di Raddo, CPA, CA, Max Ludwig Fischer, Ph.D., Peter Robinson and Roland Walton (collectively, the “RDI Nominees”).

RECOMMENDATION TO SHAREHOLDERS

RDI recommends that you vote “FOR” the election of the RDI Nominees. The individuals named in the enclosedBLUE proxy form andBLUE VIF intend to cast the votes represented by such proxy “FOR” the election of the RDI Nominees, unless you direct that the Shares represented thereby be voted otherwise.

Your vote is very important to the future of your investment in DAVIDsTEA. If, after reading this Circular, you agree that a change to the current Board is necessary and that the RDI Nominees will better serve your interests as a shareholder of DAVIDsTEA, please sign, date and deposit the enclosedBLUE proxy form orBLUE VIF. Please follow the instructions under the heading “General Proxy Information” in this Circular with respect to depositing a proxy.

Unless otherwise noted, the information concerning DAVIDsTEA contained in this Circular has been taken from, or is based upon, publicly-available documents or records on file with securities regulatory authorities in Canada and the United States and other public sources. Although RDI has no knowledge that would indicate that any statement contained therein is untrue or incomplete, RDI does not assume responsibility for the accuracy or completeness of such information or for any failure by DAVIDsTEA to disclose material information which may affect the significance or accuracy of such information.

Information concerning DAVIDsTEA is available on SEDAR at www.sedar.com and on EDGAR at www.sec.gov.

YOUR VOTE AND SUPPORT ARE IMPORTANT - SUBMIT ONLY YOUR BLUE PROXY OR BLUE VIF TODAY

FOR ASSISTANCE VOTING YOUR PROXY, PLEASE CONTACT

SHORECREST GROUP

Toll-free at 1-888-637-5789; brokers and banks - 647-931-7454

Email: contact@shorecrestgroup.com

Please visit www.savedtea.com for updates

2

Based on publicly-available information, the registered and head office of DAVIDsTEA is at 5430 Ferrier Street, Mont Royal, Québec, Canada H4P 1M2. All currency references in this Circular are to Canadian dollars, unless indicated otherwise.

FORWARD-LOOKING STATEMENTS

Certain statements contained in this Circular constitute “forward-looking information” as such term is defined in applicable Canadian securities legislation. The words “may”, “would”, “could”, “should”, “potential”, “will”, “seek”, “intend”, “plan”, “anticipate”, “believe”, “estimate”, “expect” and similar expressions as they relate to RDI, the intentions of RDI, the impact of the RDI Nominees, if elected, on the financial condition, operations, business and strategies of DAVIDsTEA, future management and other matters related to DAVIDsTEA, are intended to identify forward-looking information. All statements other than statements of historical fact may be forward-looking information. Such statements reflect RDI’s current views and intentions with respect to future events and are subject to certain risks, uncertainties and assumptions. Material factors or assumptions that were applied in providing forward-looking information include, but are not limited to, the actual financial health of DAVIDsTEA, the support expressed by shareholders to RDI and the current general economic environment. Many factors could cause the actual results, performance or achievements that may be expressed or implied by such forward-looking information to vary from those described herein should one or more of these risks or uncertainties materialize. Should any factor affect DAVIDsTEA in an unexpected manner, or should assumptions underlying the forward-looking information prove incorrect, the actual results or events may differ materially from the results or events predicted. Any such forward-looking information is expressly qualified in its entirety by this cautionary statement. Moreover, RDI does not assume responsibility for the accuracy or completeness of such forward-looking information. The forward-looking information included in this Circular is made as of the date of this Circular and RDI undertakes no obligation to publicly update or revise any forward-looking information, other than as required by applicable law.

NOTICE TO SHAREHOLDERS IN THE UNITED STATES

DAVIDsTEA is governed by the laws of Canada. This solicitation of proxies is not subject to the requirements of section 14(a) of the United StatesSecurities Exchange Act of 1934, as amended. Accordingly, this solicitation of proxies is made in the United States with respect to securities of DAVIDsTEA in accordance with Canadian corporate and securities laws and this Circular has been prepared in accordance with disclosure requirements applicable in Canada. DAVIDsTEA shareholders in the United States should be aware that these Canadian requirements are different from the requirements applicable to proxy statements under the United StatesSecurities Exchange Act of 1934, as amended.

BACKGROUND TO THIS SOLICITATION

| ● | | In early March 2018, DAVIDsTEA asked that RDI provide the Corporate Governance and Nominating Committee of the Board of Directors with the names of RDI’s proposed nominees for election to the Board of Directors at the Meeting. |

| ● | | On March 12, 2018, after the close of the markets, RDI issued a press release announcing that it intended to submit a slate of nominees to DAVIDsTEA for election as the Board of Directors. |

| ● | | In the March 12 press release, RDI reiterated its statement of February 20, 2018 that RDI has no intention of selling its shares of DAVIDsTEA at this time. |

YOUR VOTE AND SUPPORT ARE IMPORTANT - SUBMIT ONLY YOUR BLUE PROXY OR BLUE VIF TODAY

FOR ASSISTANCE VOTING YOUR PROXY, PLEASE CONTACT

SHORECREST GROUP

Toll-free at 1-888-637-5789; brokers and banks - 647-931-7454

Email: contact@shorecrestgroup.com

Please visit www.savedtea.com for updates

3

| ● | | On March 19, 2018, RDI submitted a slate of nominees to the Corporate Governance and Nominating Committee for election as the Board of Directors of DAVIDsTEA at the Meeting, and issued a press release announcing that it had done so. |

| ● | | In the March 19 press release, Herschel Segal stated “This is a slate of quality candidates with a common vision for DAVIDsTEA and with the competencies and experience necessary for a turn-around of the company, for the benefit of all DAVIDsTEA shareholders”. Mr. Segal further noted that a clear majority of the nominees are independent of RDI. |

| ● | | On April 25, 2018, RDI formally submitted to DAVIDsTEA the names of the seven RDI Nominees for election to the Board of Directors of DAVIDsTEA at the Meeting. RDI submitted the names of the RDI Nominees in accordance with Article 11 ofBy-law2015-1 of DAVIDsTEA, the “advance notice” provision. At the same time, RDI issued a detailed press release announcing that it had done so. |

A NEED FOR A TURNAROUND AT DAVIDsTEA

Herschel Segal resigned from the Board of Directors of DAVIDsTEA on March 5, 2018 due to his belief that a majority of the current Board members do not share his vision for a financial turnaround of DAVIDsTEA through a focus on improving operations; they instead consider a continuing strategic review process to be DAVIDsTEA’s priority. Mr. Segal concluded that in order to revitalize DAVIDsTEA’s operations, RDI had to propose a slate of new directors sharing his vision for, and long-term commitment to, DAVIDsTEA.

Mr. Segal believes that DAVIDsTEA must focus on an operational and financial turnaround that positions DAVIDsTEA on a sustainable path and creates long-term value – for shareholders, customers and employees. With a new, unified Board of Directors sharing this common vision, Mr. Segal believes that DAVIDsTEA can aspire to a great future as an iconic Canadian brand.

Herschel Segal’s fundamental conviction is that good products and satisfied customers are basic ingredients for a profitable business. The leadership of DAVIDsTEA needs to rebuild the corporate culture, from the boardroom to the store and online sales channels, to deliver a variety of quality products priced as a good-value proposition for the consumer, and with empathetic, enthusiastic communication with the customer. These straightforward principles will lead to a strengthening of DAVIDsTEA’s retail operations in Canada and the United States, as well as the virtual online shopping experience.

DAVIDsTEA is at a critical juncture; thestatus quo is not an option. Herschel Segal wants, and DAVIDsTEA needs, a unified Board of Directors committed to an operational and financial turnaround built upon straightforward, fundamental principles. It’s time to get to work on turning around DAVIDsTEA.

At the Meeting on June 14, shareholders will have an opportunity to affect DAVIDsTEA’s future by voting for the seven RDI Nominees. This election is perhaps the most important in DAVIDsTEA’s history. A vote for the RDI Nominees will start the process by which DAVIDsTEA can achieve its great potential.

OPERATIONAL AND FINANCIAL TURNAROUND PLAN

Herschel Segal believes that the tea industry is growing, consumers in Canada and the United States are increasingly health conscious and aware of the benefits of specialty teas, and DAVIDsTEA has a well-recognized brand name and a loyal customer base across Canada, all of which are important factors for an operational and financial turnaround. Mr. Segal further believes that the basis for a financial turnaround is a focus on DAVIDsTEA’s operations, with good products and satisfied customers. Specifically, Mr. Segal believes that DAVIDsTEA can effect an operational and financial turnaround as follows:

YOUR VOTE AND SUPPORT ARE IMPORTANT - SUBMIT ONLY YOUR BLUE PROXY OR BLUE VIF TODAY

FOR ASSISTANCE VOTING YOUR PROXY, PLEASE CONTACT

SHORECREST GROUP

Toll-free at 1-888-637-5789; brokers and banks - 647-931-7454

Email: contact@shorecrestgroup.com

Please visit www.savedtea.com for updates

4

| ● | | Focus on and listen to the customer, enhance the customer experience and make sure that customers are satisfied |

| ● | | Provide excellent products at a compelling price by rebuilding DAVIDsTEA’s buying department and improving the creativity and efficiency of product development |

| ● | | Create ongoing,two-way communicationbetween DAVIDsTEA’s head office and its stores, and provide support to the stores and their personnel |

| ● | | Focus on the Canadian market, where the DAVIDsTEA brand has been successful, and expand the number of stores in Canada |

| ● | | Stabilize operations in the United States |

| ● | | Reduce overhead costs, including a reduction of head office personnel |

| ● | | Assess DAVIDsTEA’s senior managementand make any necessary changes |

| ● | | Provide clear direction from the Board of Directors to senior management and employees |

QUESTIONABLE MANAGEMENT DECISIONS

DAVIDsTEA’s management and Board of Directors have made a number of decisions that have contributed to DAVIDsTEA’s poor financial performance. In particular, DAVIDsTEA has been slow to respond to changing trends in the way consumers shop. In short, mall traffic has decreased as more consumers shop online.E-commerce sales represented only 12.2% of DAVIDsTEA’s total sales in fiscal 2017, 10.6% in fiscal 2016 and 9.4% in fiscal 2015. DAVIDsTEA has not responded adequately to this important trend. Management has failed to devote sufficient resources toe-commerce and alternative sources of revenue.

Management has also failed to focus on thein-store experience, including the time required to serve customers. If customers perceive that there are lengthy waiting times at DAVIDsTEA stores, they will go elsewhere. This problem has not been rectified.

DAVIDsTEA initially experienced considerable success with a grassroots marketing program, including community events and engagement. As a result of this creative marketing approach, DAVIDsTEA was able to build strong brand recognition and support. In the past few years, DAVIDsTEA has deviated from this marketing approach, with mitigated results. It’s time to return to what succeeded in the past and to what gave DAVIDsTEA its unique community-focused identity.

DEEPLY DISTURBING FINANCIAL RESULTS

DAVIDsTEA’s financial results for the 2017 fiscal year are deeply disturbing. Compared to the previous fiscal year, sales increased by 3.7% while comparable sales decreased by 6.0%. Even with an increase in sales, gross profit decreased. Selling, general and administration expenses increased. Operating losses for the fiscal year were approximately four times greater than in the previous fiscal year. All of this led to a loss of $24.7 million in results from operating activities compared to a loss of $6.3 million in the previous fiscal year. Net loss grew to $28.5 million from a net loss of $3.7 million for the previous year. Fully-diluted loss was $1.11 per share compared to a loss of $0.15 per share in the previous fiscal year.

YOUR VOTE AND SUPPORT ARE IMPORTANT - SUBMIT ONLY YOUR BLUE PROXY OR BLUE VIF TODAY

FOR ASSISTANCE VOTING YOUR PROXY, PLEASE CONTACT

SHORECREST GROUP

Toll-free at 1-888-637-5789; brokers and banks - 647-931-7454

Email: contact@shorecrestgroup.com

Please visit www.savedtea.com for updates

5

These financial results cannot be sustained going forward and confirm the need for change.

POOR STOCK PERFORMANCE AND LIMITED LIQUIDITY

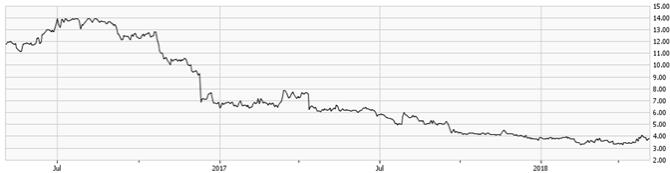

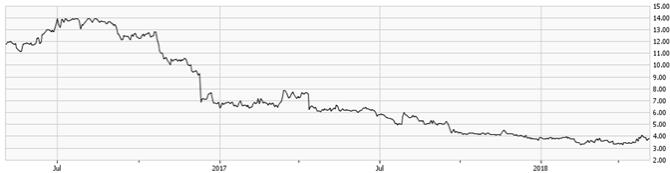

The closing price of DAVIDsTEA’s shares on Nasdaq on May 9, 2018 was US $3.65. This compares with US $6.15 on May 9, 2017 and US $11.94 on May 9, 2016. In short, the price of DAVIDsTEA stock has fallen by almost 70% in two years. All shareholders have suffered from this precipitous decline, as shown in Figure 1 below.

Figure 1: Trading Price of Shares (in US $)

*Source: TMX Money website

With the steep decline in the stock price, the market capitalization of DAVIDsTEA has decreased dramatically over the past year, as set out in Figure 2 below, from approximately US$160 million to less than US$100 million today, a drop in one year of approximately 37.5%.

Figure 2: Market Capitalization (in US $)

*Source: S&P Global Market Intelligence, a division of S&P Global Inc.

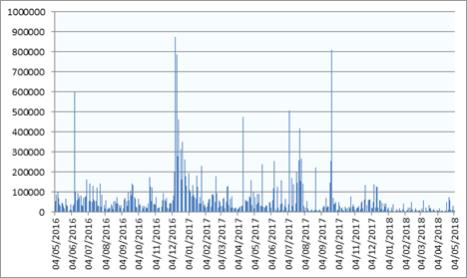

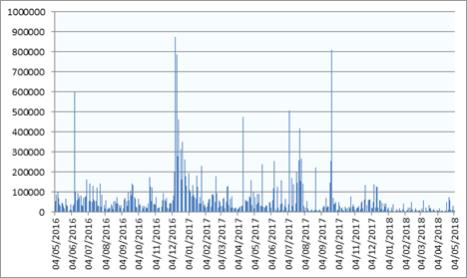

Further, there is limited trading volume in DAVIDsTEA’s shares. Figure 3 below sets out daily trading volume on Nasdaq for the past two years - in short, there is a lack of liquidity, with fewer than 100,000 shares changing

YOUR VOTE AND SUPPORT ARE IMPORTANT - SUBMIT ONLY YOUR BLUE PROXY OR BLUE VIF TODAY

FOR ASSISTANCE VOTING YOUR PROXY, PLEASE CONTACT

SHORECREST GROUP

Toll-free at 1-888-637-5789; brokers and banks - 647-931-7454

Email: contact@shorecrestgroup.com

Please visit www.savedtea.com for updates

6

hands on most trading days. On May 9, 2018, 1,963 shares traded. All of this has occurred under DAVIDsTEA’s current management and Board of Directors.

Figure 3: Trading Volume

*Source: Data sourced from TMX Money website

EXCESSIVE EXECUTIVE COMPENSATION

As noted in the media following DAVIDsTEA’s recent announcement of its results for the fiscal year ended February 3, 2018, DAVIDsTEA paid an aggregate amount of approximately US $3.68 million (CAD $4.73 million) in executive compensation (including base salary, bonuses, severance pay and other benefits) to six executives during the fiscal year, notwithstanding a net loss of $28.5 million for the year. This included a total of approximately US $800,000 for the Chief Executive Officer, almost US $1 million for the former Chief Financial Officer and almost US $850,000 for the former Chief Operating Officer and President of DAVIDsTEA’s U.S. subsidiary. RDI believes that executive compensation should be based on performance.

THE RDI NOMINEES

Herschel Segal leads the slate of RDI Nominees. If the slate is elected at the Meeting, it is expected that Mr. Segal will be appointed as Executive Chairman of the Board of Directors of DAVIDsTEA. The six other RDI Nominees are: M. William Cleman, a corporate director and consultant; Pat De Marco, CPA, CA, President of Viau Foods Inc., located in Laval, Québec; Emilia Di Raddo, CPA, CA, President of Le Château Inc., a leading Canadian fashion retailer based in Montreal, Québec; Max Ludwig Fischer, Ph.D., a retired professor with an interest in holistic nutrition and herbal medicine; Peter Robinson, until recently CEO of the David Suzuki Foundation and prior thereto CEO of Mountain EquipmentCo-op, a Canadian consumers’ cooperative; and Roland Walton, former President of Tim Hortons Canada.

The RDI Nominees were invited to serve in light of their diverse skills and experience and their commitment to an operational and financial turnaround of DAVIDsTEA. The RDI Nominees collectively have expertise in the retail industry, financial expertise, and experience with public companies and other large organizations. Herschel Segal believes that a Board of Directors comprised of the RDI Nominees will be able to provide clear direction to

YOUR VOTE AND SUPPORT ARE IMPORTANT - SUBMIT ONLY YOUR BLUE PROXY OR BLUE VIF TODAY

FOR ASSISTANCE VOTING YOUR PROXY, PLEASE CONTACT

SHORECREST GROUP

Toll-free at 1-888-637-5789; brokers and banks - 647-931-7454

Email: contact@shorecrestgroup.com

Please visit www.savedtea.com for updates

7

DAVIDsTEA’s senior management and employees and is confident that the RDI Nominees will help DAVIDsTEA effect an operational and financial turnaround.

At present, all of the RDI Nominees are “independent” within the meaning of applicable Canadian securities regulations and Nasdaq rules. If Herschel Segal is appointed as Executive Chairman of the Board after the Meeting, a clear majority of the RDI Nominees will be “independent”. In addition, at least three, if not more, of the RDI Nominees are “financially literate” and “independent” within the meaning of Canadian securities regulations and Nasdaq rules and have the skills required in order to be members of the Audit Committee of DAVIDsTEA.

MATTERS TO BE ACTED UPON AT THE MEETING

RDI asks that shareholders elect each of Herschel Segal, M. William Cleman, Pat De Marco, CPA, CA, Emilia Di Raddo, CPA, CA, Max Ludwig Fischer, Ph.D., Peter Robinson and Roland Walton as directors of DAVIDsTEA, in each case to hold office until the next annual meeting of DAVIDsTEA or until their respective successors are elected or appointed.

YOUR VOTE AND SUPPORT ARE IMPORTANT - SUBMIT ONLY YOUR BLUE PROXY OR BLUE VIF TODAY

FOR ASSISTANCE VOTING YOUR PROXY, PLEASE CONTACT

SHORECREST GROUP

Toll-free at 1-888-637-5789; brokers and banks - 647-931-7454

Email: contact@shorecrestgroup.com

Please visit www.savedtea.com for updates

8

The RDI Nominees

| | | | | | |

Herschel Segal

Westmount, Québec |

Since January 1969, Herschel Segal has served as President and Chief Executive Officer of RDI, an investment company. In 1959, Mr. Segal founded Le Château Inc., a clothing retailer listed on the TSX Venture Exchange, and served as its Chief Executive Officer until September 2006. Mr. Segal served as Executive Chairman of Le Château Inc. until February 2007 and remains a director. Mr. Segal holds a Bachelor of Arts degree from McGill University. Mr. Segal is a founder of DAVIDsTEA and was a director from 2008 until his resignation on March 5, 2018. | |

Age: 87 Status: Independent Joined Board: 2008 (resigned March 5, 2018) 2017 Votes in favour: 99.64% Shares Held: 12,012,538 (through RDI) |

Public board membership | | Board committee membership | |

Le Château Inc. | | Board | |

Principal Occupation for Past Five Years | |

Rainy Day Investments Ltd. | | President and CEO | | 1969 - Present | |

Expertise | |

• Senior Leadership • Finance/Accounting • Retail Industry • Food and Beverage Industry • Brand Marketing • Public Companies | |

YOUR VOTE AND SUPPORT ARE IMPORTANT – SUBMIT ONLY YOUR BLUE PROXY OR BLUE VIF TODAY

FOR ASSISTANCE VOTING YOUR PROXY, PLEASE CONTACT

SHORECREST GROUP

Toll-free at 1-888-637-5789; brokers and banks - 647-931-7454

Email: contact@shorecrestgroup.com

Please visit www.savedtea.com for updates

9

| | | | | | | | |

M. William Cleman Côte St. Luc, Québec |

M. William Cleman is an experienced operating and financial executive in the retail and real estate sectors and is a corporate director and consultant. Mr. Cleman has been a director of New Look Vision Group Inc., a company listed on the Toronto Stock Exchange, and its predecessor entities since 2005. From January 2015 to July 2015, Mr. Cleman was a member of the Board of Directors and head of the special committee of Hartco Inc., a company listed on the Toronto Stock Exchange which was privatized in November 2015. Since 2008, he has been Chairman of the Board of Arbell Inc., a private distribution company, and was a member of the Board of Directors of Hart Stores Inc., a company listed on the TSX Venture Exchange, from June 2008 until its privatization in February 2015. He was a director of Gemmar Systems from 2005 to 2007, and from April 2002 to November 2005 was a member of the Board of Directors of Le Château Inc., a company then listed on the Toronto Stock Exchange. Mr. Cleman retired as Chairman and Chief Executive Officer of Bouclair Inc., aMontréal-based retail chain in the home furnishings sector, in 2003. Previously, Mr. Cleman held senior positions at Bouclair Inc. from 1994. From 1989 to 1994, he was a partner in Cleman Ludmer Steinberg Inc., a merchant bank. From 1971 to 1989, Mr. Cleman had a successful career at Steinberg Inc., a major food retailer and real estate company. When Mr. Cleman left Steinberg Inc. in 1989 upon its sale to a private investor, he held the position of Chairman and CEO of Ivanhoe Inc., the real estate subsidiary of Steinberg Inc. Mr. Cleman holds a Bachelor of Commerce degree from McGill University and a Masters of Business Administration degree from the University of Western Ontario, London, Ontario. | | | |

Age: 68 Status: Independent Joined Board: To be elected Shares Held: Nil |

Public board membership | | Board committee membership | | | |

New Look Vision Group Inc. | | Human Resources and Compensation Committee Executive Committee Audit Committee | | | |

Principal Occupation for Past Five Years | | | | | |

Corporate Director and Consultant | | 2003 - Present | | | |

Expertise | | | |

• Senior Leadership • Finance/Accounting • Retail Industry • Food and Beverage Industry • Brand Marketing • Public Companies | | | |

YOUR VOTE AND SUPPORT ARE IMPORTANT – SUBMIT ONLY YOUR BLUE PROXY OR BLUE VIF TODAY

FOR ASSISTANCE VOTING YOUR PROXY, PLEASE CONTACT

SHORECREST GROUP

Toll-free at 1-888-637-5789; brokers and banks - 647-931-7454

Email: contact@shorecrestgroup.com

Please visit www.savedtea.com for updates

10

| | | | | | |

Pat De Marco, CPA, CA Dollard-des-Ormeaux, Québec |

Pat De Marco has been President and Chief Operating Officer of Viau Food Products Inc. of Laval, Québec, a large Canadian processor of beef and pork products, since 2008. Prior thereto, Mr. De Marco held senior executive positions at Moores Retail Group Inc., Canada’s leading menswear retailer, from 1995 as Chief Financial Officer and from 2002 as President. Prior to that, Mr. De Marco was a partner at Ernst & Young LLP, where for 13 years he audited and consulted for companies in the manufacturing, real estate and consumer goods sectors. Mr. De Marco is a CPA, and holds a Bachelor of Commerce degree from Concordia University, Montreal, Québec. | |

Age: 57 Status: Independent Joined Board: To be elected Shares Held: Nil |

Principal Occupation for Past Five Years | | | |

Viau Food Products Inc. | | President & COO | | 2008 to present | |

Expertise | |

• Senior Leadership • Finance/Accounting • Retail Industry • Food and Beverage Industry • Brand Marketing | |

YOUR VOTE AND SUPPORT ARE IMPORTANT – SUBMIT ONLY YOUR BLUE PROXY OR BLUE VIF TODAY

FOR ASSISTANCE VOTING YOUR PROXY, PLEASE CONTACT

SHORECREST GROUP

Toll-free at 1-888-637-5789; brokers and banks - 647-931-7454

Email: contact@shorecrestgroup.com

Please visit www.savedtea.com for updates

11

| | | | | | |

Emilia Di Raddo, CPA, CA Montreal, Québec |

Emilia Di Raddo has been the President of Le Château Inc., a company listed on the TSX Venture Exchange, since 2000, where she has also served on the Board of Directors since 2001 and served as Chief Financial Officer from 1996 to 2000. Prior to that, Mrs. Di Raddo was a partner at Ernst & Young LLP where she practiced for more than 15 years for companies operating in the retail and consumer products industries. Mrs. Di Raddo received a Bachelor of Commerce degree and a Diploma in Accountancy from Concordia University, Montreal, Québec, and is a chartered accountant and CPA. She was a director of DAVIDsTEA from August 21, 2012 to January 31, 2013 and from March 2014 until her resignation on May 10, 2018. | |

Age: 60 Status: Independent Joined Board: From August 21, 2012 to January 31, 2013 and from March 2014 to May 10, 2018. 2017 Votes in favour: 99.65% Shares Held: Nil |

Public board membership | | Board committee membership | |

Le Château Inc. | | Board | |

Principal Occupation for Past Five Years | | | |

Le Château Inc. | | President | | 2000 to present | |

Expertise | |

• Senior Leadership • Finance/Accounting • Retail Industry • Technology/ecommerce • Brand Marketing • Public Companies • Digital and Social Media | |

YOUR VOTE AND SUPPORT ARE IMPORTANT – SUBMIT ONLY YOUR BLUE PROXY OR BLUE VIF TODAY

FOR ASSISTANCE VOTING YOUR PROXY, PLEASE CONTACT

SHORECREST GROUP

Toll-free at 1-888-637-5789; brokers and banks - 647-931-7454

Email: contact@shorecrestgroup.com

Please visit www.savedtea.com for updates

12

| | | | | | |

Max Ludwig Fischer, Ph.D. Toronto, Ontario |

From 1980 to 2013, Max Ludwig Fischer was Professor of German and International Studies at Willamette University, Salem, Oregon, where he also held administrative positions, including Chair of the Department of German and Russian Studies. Since 2008, Mr. Fischer has been a consultant to the President and CEO of Rancho La Puerta in Tecate, Mexico, a consistent winner of Travel & Leisure’s “Best Spa Destination”, as well as aBi-Annual Lecturer on Nutrition and Natural Healing Modalities at Rancho La Puerta. In 2018, Mr. Fischer was an invited lecturer on “The Concept of Holistic Living” at the Omega Institute, Rhinebeck, New York. Mr. Fischer holds a Ph.D. in Philosophy and a Masters of Arts degree from the University of Colorado, Boulder, Colorado, and a Bachelor of Arts degree in English and sociology from the University of Regensburg, Regensburg, Germany. Mr. Fischer is the author of numerous publications on 20th century literature, exile literature and intercultural communications. In addition to his expertise in literature, Mr. Fischer has a deep interest in psychology, holistic living and natural nutrition. | |

Age: 67 Status: Independent Joined Board: To be elected Shares Held: Nil |

Principal Occupation for Past Five Years | | | |

Retired | | | | | |

Willamette University, Salem, Oregon | | Professor of German and International Studies | | 1980-2013 | |

Expertise | |

• Senior Leadership • Regulatory/Legal • Food and Beverage Industry • Digital and Social Media | |

YOUR VOTE AND SUPPORT ARE IMPORTANT – SUBMIT ONLY YOUR BLUE PROXY OR BLUE VIF TODAY

FOR ASSISTANCE VOTING YOUR PROXY, PLEASE CONTACT

SHORECREST GROUP

Toll-free at 1-888-637-5789; brokers and banks - 647-931-7454

Email: contact@shorecrestgroup.com

Please visit www.savedtea.com for updates

13

| | | | | | |

Peter Robinson Mayne Island, British Columbia |

Peter Robinson possesses diverse leadership experience spanning more than four decades in business, government and thenon-profit sectors. He was Chief Executive Officer of the David Suzuki Foundation from 2008 to 2017 and, from 2000 to 2008, was Chief Executive Officer of Mountain EquipmentCo-op, a Canadian consumers’ cooperative that sells outdoor recreation gear and clothing exclusively to its members. From 1983 to 2000, Mr. Robinson held a number of positions with BC Housing, a government agency, including Chief Executive Officer from 1999 to 2000. Mr. Robinson holds a Bachelor of Arts degree in geography from Simon Fraser University, Burnaby, British Columbia, and a Master of Arts degree in Conflict Analysis and Management and a Doctor of Social Sciences degree, both from Royal Roads University, Victoria, British Columbia. He has been extensively involved in community and humanitarian work, including serving as a director from 2012 to 2017 of Imagine Canada, a national charitable organization, governor of the Canadian Red Cross Society from 2010 to 2012, and Chair of the Board of Governors and Chancellor of Royal Roads University from 2007 to 2010. Mr. Robinson has received several honorary degrees and awards, including Honorary Doctor of Laws from Royal Roads University in 2014, Honorary Doctor of Technology from the British Columbia Institute of Technology in 2010, the Queen’s Diamond Jubilee Medal in 2012 and the Order of Red Cross from the Canadian Red Cross Society in 2005. | |

Age: 66 Status: Independent Joined Board: To be elected Shares Held: Nil |

Principal Occupation for Past Five Years | | | |

Private Farm | | Owner | | 2017 - present | |

David Suzuki Foundation | | CEO | | 2008 - 2017 | |

Expertise | |

• Senior Leadership • Finance/Accounting • Retail Industry • Technology/ecommerce • Brand Marketing • Digital and Social Media | |

YOUR VOTE AND SUPPORT ARE IMPORTANT – SUBMIT ONLY YOUR BLUE PROXY OR BLUE VIF TODAY

FOR ASSISTANCE VOTING YOUR PROXY, PLEASE CONTACT

SHORECREST GROUP

Toll-free at 1-888-637-5789; brokers and banks - 647-931-7454

Email: contact@shorecrestgroup.com

Please visit www.savedtea.com for updates

14

| | | | | | |

Roland Walton Oakville, Ontario |

Roland Walton has more than 35 years of experience in the food service industry. Mr. Walton spent 18 years as a member of the executive team at Tim Hortons, holding various key leadership positions including President of Tim Hortons Canada from 2012 to 2015, Chief Operating Officer from 2008 to 2012, Executive Vice-President Operations Canada and the United States from 2000 to 2008 and Executive Vice-President Operations Canada from 1997 to 2000. Prior thereto, Mr. Walton spent 13 years with Pizza Hut/Pepsico in operations and general management positions in Canada and the United States. Mr. Walton began his career with Wendy’s Restaurants. Mr. Walton was a member of the board of the Canadian Restaurant and Foodservices Association (CRFA) for more than 15 years beginning in 1997 and served as Treasurer on the Executive Committee for four years. His service with the CRFA culminated with Mr. Walton being named an Honorary Fellow in 2012. Mr. Walton currently serves as Vice Chairman of Food for Life, anot-for-profit organization based in Burlington, Ontario. Mr. Walton holds a Bachelor of Commerce degree from Guelph University. | |

Age: 62 Status: Independent Joined Board: To be elected Shares Held: Nil |

Public board membership | | Board committee membership | |

| | | |

Principal Occupation for Past Five Years | | | |

Retired | | | | | |

Tim Hortons Canada | | President | | 2012 - 2015 | |

Expertise | | |

• Senior Leadership • Finance/Accounting • Retail Industry • Food and Beverage Industry • Brand Marketing | | |

Each of the RDI Nominees has consented to being named as a nominee in this Circular. It is not contemplated that any of the RDI Nominees will be unable to stand for election to the Board or to serve as a director, if elected. If for any reason, any of the RDI Nominees do not stand for election or are unable to serve as such, proxies in favour of the RDI Nominees will be voted for another nominee in the discretion of the persons named in the enclosedBLUE proxy form orBLUE VIF unless the shareholder has specified in his/her proxy or VIF that his/her Shares are to be withheld from voting in the election of the RDI Nominees.

RDI believes that, if elected, each of the RDI Nominees will be “independent” within the meaning of Canadian National Instrument58-101 -Disclosure of Corporate Governance Practices.

YOUR VOTE AND SUPPORT ARE IMPORTANT – SUBMIT ONLY YOUR BLUE PROXY OR BLUE VIF TODAY

FOR ASSISTANCE VOTING YOUR PROXY, PLEASE CONTACT

SHORECREST GROUP

Toll-free at 1-888-637-5789; brokers and banks - 647-931-7454

Email: contact@shorecrestgroup.com

Please visit www.savedtea.com for updates

15

To the knowledge of RDI, none of the RDI Nominees is or has been indebted to DAVIDsTEA at any time since the beginning of DAVIDsTEA’s most recently-completed financial year, or has indebtedness to another entity which is the subject of a guarantee, support agreement, letter of credit or other similar arrangement or understanding provided by DAVIDsTEA.

Cease Trade Orders and Bankruptcies

Other than as set out below, none of the RDI Nominees:

| | (a) | is, or within the last ten years has been, a director, chief executive officer or chief financial officer of any company that: (i) was subject to a cease trade order, an order similar to a cease trade order, or an order that denied the relevant company access to any exemption under applicable securities legislation, and which in all cases was in effect for a period of more than 30 consecutive days (an “Order”), which Order was issued while the RDI Nominee was acting in the capacity as director, chief executive officer or chief financial officer of such company; or (ii) was subject to an Order that was issued after the RDI Nominee ceased to be a director, chief executive officer or chief financial officer and which resulted from an event that occurred while the RDI Nominee was acting in the capacity as director, chief executive officer or chief financial officer of such company; |

| | (b) | is, or within the last ten years has been, a director or executive officer of any company that, while the RDI Nominee was acting in that capacity, or within a year of the RDI Nominee ceasing to act in that capacity, became bankrupt, made a proposal under any legislation relating to bankruptcy or insolvency or was subject to or instituted any proceedings, arrangement or compromise with creditors or had a receiver, receiver manager or trustee appointed to hold its assets; or |

| | (c) | has, within the last ten years, become bankrupt, made a proposal under any legislation relating to bankruptcy or insolvency or become subject to or instituted any proceedings, arrangement or compromise with creditors or had a receiver, receiver manager or trustee appointed to hold his assets. |

M. William Cleman was a director of Hart Stores Inc. (“HSI”) when it sought protection from its creditors under theCompanies’ Creditors Arrangement Act (Canada) on August 30, 2011. On February 27, 2012, the Québec Superior Court sanctioned and approved a Plan of Compromise and Arrangement filed by HSI under theCompanies’ Creditors Arrangement Act (Canada). The Plan of Compromise and Arrangement was voted on and accepted by the creditors of HSI at a meeting held on February 15, 2012.

The shares of HSI were subject to cease-trade orders issued by the securities commissions of Québec, Ontario, British Columbia, Alberta and Manitoba, respectively, starting in August 2012, which cease-trade orders related to the audited financial statements of HIS for the fiscal year ended January 29, 2012 and its interim financial statements for the three-month period ended April 29, 2012. In connection with a going-private transaction effected in February 2015, HSI obtained partial revocation orders from the five provincial securities commissions, in order to complete the going-private transaction.

Penalties and Sanctions

To the knowledge of RDI, none of the RDI Nominees has been subject to: (a) any penalties or sanctions imposed by a court relating to securities legislation or by a securities regulatory authority or has entered into a settlement agreement with a securities regulatory authority; or (b) any other penalties or sanctions imposed by a court or

YOUR VOTE AND SUPPORT ARE IMPORTANT - SUBMIT ONLY YOUR BLUE PROXY OR BLUE VIF TODAY

FOR ASSISTANCE VOTING YOUR PROXY, PLEASE CONTACT

SHORECREST GROUP

Toll-free at 1-888-637-5789; brokers and banks - 647-931-7454

Email: contact@shorecrestgroup.com

Please visit www.savedtea.com for updates

16

regulatory body that would likely be considered important to a reasonable securityholder in deciding whether to vote for a proposed director.

RECOMMENDATION TO SHAREHOLDERS

Election of Seven RDI Nominees

RDI recommends that you voteFOR the election of the seven RDI Nominees. The individuals named in the enclosedBLUE proxy form orBLUE VIF intend to cast the votes represented by such proxyFOR the election of the seven RDI Nominees, unless you direct that the Shares represented thereby be voted otherwise.

Number of Directors

The Articles of DAVIDsTEA provide that the number of directors shall be a minimum of three and a maximum of fifteen. RDI understands that pursuant to an employment agreement between DAVIDsTEA and the Chief Executive Officer, the latter must be a director of DAVIDsTEA for so long as he is Chief Executive Officer. Accordingly, at the Meeting, RDI will propose that shareholders adopt a resolution setting the number of directors to be elected at the Meeting at eight (seven RDI Nominees and the Chief Executive Officer). The individuals named in the enclosedBLUE proxy form orBLUE VIF intend to cast the votes represented by such proxyFOR a resolution setting at eight the number of directors to be elected at the Meeting, unless you direct that the Shares represented thereby be voted otherwise.

Appointment of Auditor

Based on the Management Circular, the Board has proposed that Ernst & Young LLP bere-appointed as the auditor of DAVIDsTEA until the next annual meeting of shareholders, at a remuneration to be fixed by the Board. RDI recommends that you vote “FOR” the appointment of Ernst & Young LLP as auditor of DAVIDsTEA for the ensuing year and to authorize the directors to fix its remuneration. The individuals named in the enclosedBLUE proxy form orBLUEVIF intend to cast the votes represented by such proxyFOR the appointment of Ernst & Young LLP as auditor of DAVIDsTEA for the ensuing year and to authorize the directors to fix its remuneration, unless you direct that the Shares represented thereby be voted otherwise.

Other Business

As at the date hereof, RDI knows of no amendments, variations or other matters to be presented for action at the Meeting. If, however, any amendments, variations or other matters properly come before the Meeting, the persons named as proxyholder in theBLUEproxy form orBLUE VI will vote on such matters in accordance with their best judgment on the matter.

VOTING SECURITIES AND PRINCIPAL SHAREHOLDERS

For purposes of the Meeting, DAVIDsTEA established April 30, 2018 as the Record Date for determining shareholders entitled to notice of the Meeting and to vote at the Meeting. To the knowledge of RDI, based on publicly-available information, as at the Record Date, there were 25,912,061 Shares issued and outstanding; each Share is entitled to one vote.

To the knowledge of RDI, based on publicly-available information, a quorum of shareholders will be present at the Meeting if the holders of 331/3% of the Shares entitled to vote at the Meeting are present in person or represented by proxy, provided that a quorum shall be not less than two persons.

YOUR VOTE AND SUPPORT ARE IMPORTANT - SUBMIT ONLY YOUR BLUE PROXY OR BLUE VIF TODAY

FOR ASSISTANCE VOTING YOUR PROXY, PLEASE CONTACT

SHORECREST GROUP