- ASIX Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

CORRESP Filing

AdvanSix (ASIX) CORRESPCorrespondence with SEC

Filed: 16 Aug 16, 12:00am

August 16, 2016

AdvanSix Inc.

Form 10

File No. 001-37774

Dear Mr. Ingram:

We refer to the letter dated August 3, 2016 (the “Comment Letter”), from the U.S. Securities and Exchange Commission (the “SEC”) to AdvanSix Inc. (the “Company”) setting forth the comments of the staff of the SEC (the “Staff”) on the Company’s Registration Statement on Form 10, File No. 001-37774, filed on July 25, 2016 (the “Registration Statement”).

Concurrently with this response letter, the Company is electronically transmitting Amendment No. 2 to the Registration Statement (the “Amendment”), which includes an amended Information Statement as Exhibit 99.1 (the “Information Statement”), for filing under the Securities Exchange Act of 1934. The Amendment includes revisions made in response to the comments of the Staff in the Comment Letter. We have enclosed for your convenience four clean copies of the Amendment and four copies of the Amendment that have been marked to show changes made to the originally filed Registration Statement.

The numbered paragraphs and headings below correspond to the paragraphs and headings set forth in the Comment Letter. Each of the Staff’s comments is set forth in bold, followed by the Company’s response to each comment. The page numbers in the responses refer to pages in the marked copy of the Information Statement.

| 2 |

Amendment No. 1 to Form 10

Exhibits

General

| 1. | It appears that the schedules to Exhibits 10.1, 10.2 and 10.3 are missing. Absent an order granting confidential treatment, Item 601(b)(10) of Regulation S-K requires the filing of material contracts, including attachments, in their entirety. Attachments include, for example, annexes, appendices, exhibits and schedules. Please note that Item 601(b)(2) of Regulation S-K provides a carve-out for schedules or attachments that are not material to an investment decision, but Item 601(b)(10) does not include a similar provision. Please advise. |

Response: The Company acknowledges the Staff’s comment and has re-filed Exhibits 10.1, 10.2 and 10.3, including all attachments, with the Amendment.

Exhibit 99.1

General

| 2. | Please update your financial statements for the quarter ending June 30, 2016 pursuant to Rule 3-12 of Regulation S-X. |

Response: The Company acknowledges the Staff’s comment and has included financial statements and corresponding financial information for the quarter ending June 30, 2016 in the Amendment to comply with Rule 3-12 of Regulation S-X.

Risk Factors, page 6

Risks Relating to our Common Stock and the Securities Market, page 17

General

| 3. | Please add risk factor disclosure to address the material risks associated with the exclusive forum provision of your certificate of incorporation. |

Response: The Company has revised its disclosure on page 19 of the Information Statement to address the Staff’s comment.

Unaudited Pro Forma Combined Financial Statements, page 31

| 4. | We note that you intend to reflect the potential dilution from common shares related to equity awards granted under Honeywell’s stock-based compensation program in your determination of diluted earnings per share amounts. Please clarify whether these equity awards will be settled in shares of your common stock |

| 3 |

or Honeywell’s common stock. If they will be settled in shares of Honeywell’s common stock, please help us better understand the basis for reflecting in your pro forma weighted-average diluted number of shares outstanding pursuant to Rule 11-02(b)(6) of Regulation S-X.

Response: The Company has revised its disclosure on pages 37 and 38 of the Information Statement to address the Staff’s comment.

Certain Relationships and Related Party Transactions, page 70

| 5. | Please expand this section to include the materials terms of your agreements with Honeywell. For example, please expand your disclosure to discuss all the material terms of the Transition Services agreement, including the specific services you expect to receive from Honeywell, summary of payment terms, early termination provision, and any other material terms of this agreement. |

Response: The Company has revised its disclosure on pages 76 though 78 of the Information Statement to address the Staff’s comment.

Financial Statements

Note 1. Organization, Operations and Basis of Presentation, page F-8

| 6. | We note that Honeywell decided to include an additional product line subject to the Spin-Off transaction which resulted in a change in reporting entity. Please help us better understand how you determined what product lines should be included in your carve-out financial statements. Please also address whether the entire resins and chemicals business of Honeywell is reflected in your carve-out financial statements. If not all of this business is reflected in these carve-out financial statements, please help us understand why. |

Response: With the inclusion of the additional product line to which the Staff refers, the entire resins and chemicals business of Honeywell (“R&C”) is reflected in the carve-out financial statements.

All product lines manufactured and sold by Honeywell which contain caprolactam or Nylon 6, or which are co-products of the caprolactam manufacturing process, were considered for inclusion in the carve-out financial statements. A small number of immaterial product lines were candidates for exclusion from the carve-out financial statements either because the final finishing stage of the manufacturing process occurred off-site at a location to be retained by Honeywell or, with respect to co-products of the caprolactam manufacturing process, because the customers for the product line were not traditional customers of the Company and had been serviced by another part of Honeywell’s sales and marketing organization with better knowledge of these customers’ needs.

| 4 |

Income Taxes, page F-11

| 7. | We note your response to comment 20 of our letter dated June 8, 2016. In a similar manner to your response, please expand your disclosures to better explain the methodology used to prepare your tax provision and correspondingly your basis for using this methodology. We remind you that Question 3 of SAB Topic 1:B.1 states that the staff has required a pro forma income statement for the most recent year and interim period reflecting a tax provision calculated on the separate return basis when the historical income statements in the filing do not reflect the tax provision on the separate return basis. Please tell us what consideration you gave to this guidance in preparing your pro form financial statements. |

Response: The Company has revised its disclosure on pages F-11 and F-12 of the Information Statement to address the Staff’s comments. The Company supplementally advises the Staff that, as described in Question 3 of SAB Topic 1:B.1, to produce the pro forma income statement, the historical income statement was adjusted to reflect a tax provision calculated on a separate return basis to account for losses generated by R&C that are not expected to be utilized by the Company on a standalone basis but will be utilized by other Honeywell businesses in a combined tax filing. This adjustment is reflected in Note (j) accompanying the unaudited pro forma combined financial statements on pages 37 and 38 of the Information Statement.

* * * *

| 5 |

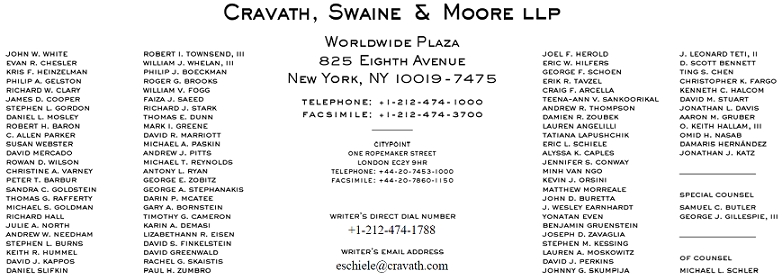

Please contact me at (212) 474-1788 with any questions you may have regarding the Registration Statement or this letter. Electronic mail transmissions may be sent to me at eschiele@cravath.com and facsimile transmissions may be sent to my attention at (212) 474-3700.

| Sincerely, | |

| /s/ Eric L. Schiele | |

| Eric L. Schiele |

Mr. Jay Ingram

U.S. Securities and Exchange Commission

Division of Corporation Finance

100 F Street N.E.

Washington, D.C. 20549-3628

Copies to:

Ms. Asia Timmons-Pierce

U.S. Securities and Exchange Commission

Division of Corporation Finance

100 F Street N.E.

Washington, D.C. 20549-3628

Encls.

VIA FEDERAL EXPRESS AND EDGAR

Copy to:

Ms. Erin N. Kane

Chief Executive Officer

AdvanSix Inc.

115 Tabor Road

Morris Plains, NJ 07950

VIA EMAIL