As filed with the Securities and Exchange Commission on March 5, 2020

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORMN-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number:811-23237

TRANSAMERICA ETF TRUST

(Exact Name of Registrant as Specified in Charter)

1801 California St., Suite 5200, Denver, CO 80202

(Address of Principal Executive Offices) (Zip Code)

Registrant’s Telephone Number, including Area Code:1-888-316-8077

Rhonda A. Mills, Esq., 1801 California St., Suite 5200, Denver, CO 80202

(Name and Address of Agent for Service)

Date of fiscal year end: December 31

Date of reporting period: December 31, 2019

| Item 1: | Report(s) to Shareholders. |

The Annual Report is attached.

DECEMBER 31, 2019

Beginning January 1, 2021, as permitted by regulations adopted by the Securities and Exchange Commission, the funds intend to no longer mail paper copies of the funds’ shareholder reports unless you specifically request paper copies of the reports from your financial intermediary (such as a broker-dealer or bank). Instead, the reports will be made available on a website, and you will be notified by mail each time a report is posted and provided with a website link to access the report.

If you already elected to receive shareholder reports electronically (“e-delivery”), you will not be affected by this change and you need not take any action. You may elect to receive shareholder reports and other communications from a fund electronically anytime by contacting your financial intermediary.

You may elect to receive all future reports in paper free of charge. Please contact your financial intermediary to request that you continue to receive paper copies of your shareholder reports. Your election to receive reports in paper will apply to all Transamerica funds held in your account.

Customer Service:1-888-316-8077

1801 California St., Suite 5200 Denver, CO 80202

Distributor: Foreside Fund Services, LLC

www.deltashares.com

Table of Contents

Authorized for distribution only when accompanied or preceded by a prospectus. Investors should carefully consider a fund’s investment goals, risks, charges and expenses before investing. A prospectus contains this and other information; please read it carefully before investing.

| | |

| Transamerica ETF Trust | | Annual Report 2019 |

Dear Shareholder,

On behalf of Transamerica DeltaShares®, we would like to thank you for your support and confidence in our products as we look forward to continuing to serve you and your financial professional in the future. We value the trust you have placed in us.

This annual report provides certain information about the investments and performance of your Exchange Traded Fund(s) (“ETFs”) during the fiscal year. The Securities and Exchange Commission currently requires that annual and semi-annual reports be sent to all shareholders. This report covers the12-month period ended December 31, 2019.

We believe it is important to understand market conditions over the fiscal year ended December 31, 2019, to provide a context for reading this report. As the year began, markets had reacted negatively to steadily rising interest rates and the fear that the U.S. Federal Reserve (“Fed”) was possibly on the verge of a major monetary policy error, that of raising rates into a slowing economy. The S&P 500® had declined by approximately 20% from its September 2018 high and credit spreads increased considerably as well. This negative sentiment had also extended into the international markets where both developed and emerging markets had suffered losses in excess of U.S. equities. While the ongoing U.S./China trade dispute shared some of the blame for investor angst going into 2019, most eyes were squarely on the Fed and what the path of interest rates might be for the new year. As the calendar turned to 2019, however, the Fed moderated its tone to one of patience, signaling that further rate hikes were likely off the table for the time being. U.S. equity markets reacted favorably in response and approachedall-time highs by late spring 2019.

U.S./China trade talks continued through the first few months of 2019 with little progress, and in May negotiations deteriorated as the U.S. announced a new round of tariffs. China immediately responded with tariffs of its own on U.S. exports. Equity markets initially declined on this news, however, the Fed responded to these renewed trade tensions by signaling it would “act as appropriate to sustain the expansion” which served to contain fears of an economic slowdown. The Fed then proceeded to cut the Fed Funds rate by 0.25% at three consecutive meetings from July through October, taking its policy rate down to a target range of 1.50%—1.75%. These represented the first interest rate cuts since the Fed had begun its tightening campaign in December of 2015, and global equity and credit markets responded favorably.

Markets finished the year strong as U.S./China trade relations improved and expectations of a stable growth economy combined with benign inflation and lower interest rates helped to emphasize optimism for the year ahead. While the manufacturing sector exhibited some weakness, consumer spending remained strong. Although the drama of impeachment and election uncertainties loomed over Washington, investors seem to have taken thosenon-market related developments in stride while focusing on the broader investment landscape featuring the lowest unemployment rate in fifty years, higher wages and the prospect of rising corporate earnings growth. The S&P 500®, NASDAQ and Dow Jones Industrial Average all closed the year near their highest levels ever.

For the12-month period ended December 31, 2019, the S&P 500® Index returned 31.49% while the MSCI EAFE Index, representing international developed market equities, returned 22.66%. During the same period, the Bloomberg Barclays U.S. Aggregate Bond Index returned 8.72%. Please keep in mind that it is important to maintain a diversified portfolio as investment returns have historically been difficult to predict.

In addition to your active involvement in the investment process, we firmly believe that a financial professional is a key resource to help you build a complete picture of your current and future financial needs. Financial professionals are familiar with the market’s history, including long-term returns and volatility of various asset classes. With your financial professional, you can develop an investment program that incorporates factors such as your goals, your investment timeline and your risk tolerance.

Please contact your financial professional if you have any questions about the contents of this report, and thanks again for the confidence you have placed in us.

Sincerely,

Marijn Smit

President & Chief Executive Officer

Transamerica ETF Trust

Tom Wald, CFA

Chief Investment Officer

Transamerica ETF Trust

Bloomberg Barclays U.S. Aggregate Bond Index: Measures investment grade, U.S. dollar denominated, fixed-rate taxable bonds, including Treasuries, government-related and corporate securities, as well as both mortgage- and asset-backed securities.

MSCI EAFE Index: A free float-adjusted market capitalization index that is designed to measure the equity market performance of developed markets, excluding the U.S. and Canada.

S&P 500®: A market-capitalization weighted index of 500 large U.S. companies with common stock listed on the New York Stock Exchange or NASDAQ Stock Market.

The views expressed in this report reflect those of the portfolio managers only and may not necessarily represent the views of Transamerica ETF Trust. These views are as of the date of this report and are subject to change based upon market conditions. These views should not be relied upon as investment advice and are not indicative of trading intent on behalf of Transamerica ETF Trust. Investing involves risk, including potential loss of principal. The performance data presented represents past performance and does not guarantee future results. Indexes are unmanaged and an investor cannot invest directly in an index.

Disclosure of Expenses

(unaudited)

SHAREHOLDER EXPENSES

Fund shareholders may incur two types of costs: (i) transaction costs including brokerage commissions on purchases and sales of fund shares; and (ii) ongoing costs, including management fees.

The following examples are intended to help you understand your ongoing costs (in dollars and cents) of investing in the Funds and to compare these costs with the ongoing costs of investing in other funds.

The examples are based on an investment of $1,000 invested at July 1, 2019, and held for the entiresix-month period until December 31, 2019.

ACTUAL EXPENSES

The information in the table below provides information about actual account values and actual expenses. You may use the information in these columns, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = $8.60), then multiply the result by the number in the appropriate column for your Fund titled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

HYPOTHETICAL EXAMPLE FOR COMPARISON PURPOSES

The information in the table below provides information about hypothetical account values and hypothetical expenses based on the Funds’ actual expense ratios and assumed rates of return of 5% per year before expenses, which are not the Funds’ actual returns. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in your Fund versus other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other fund(s).

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as brokerage commissions paid on purchases and sales of Fund shares. Therefore, the information under the heading “Hypothetical Expenses” is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. If any of these transaction costs were included, your costs would be higher. The expenses shown in the table do not reflect any fees that may be charged to you by brokers, financial intermediaries, or other financial institutions.

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | Actual Expenses | | | Hypothetical Expenses (A) | | | | |

| Fund | | Beginning

Account Value | | | Ending

Account Value | | | Expenses Paid

During Period (B) | | | Ending

Account Value | | | Expenses Paid

During Period (B) | | | Total

Expense Ratio (C) (D) | |

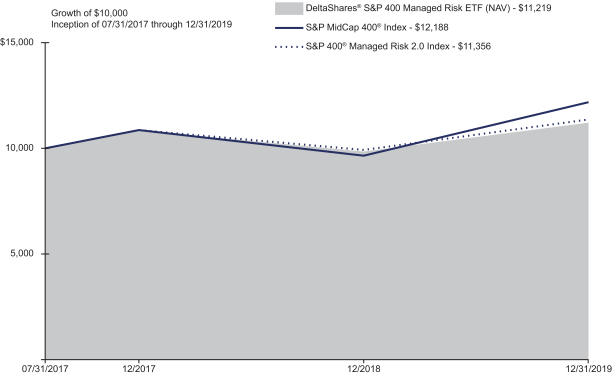

DeltaShares® S&P 400 Managed Risk ETF | | $ | 1,000.00 | | | $ | 1,042.60 | | | $ | 2.32 | | | $ | 1,022.90 | | | $ | 2.29 | | | | 0.45 | % |

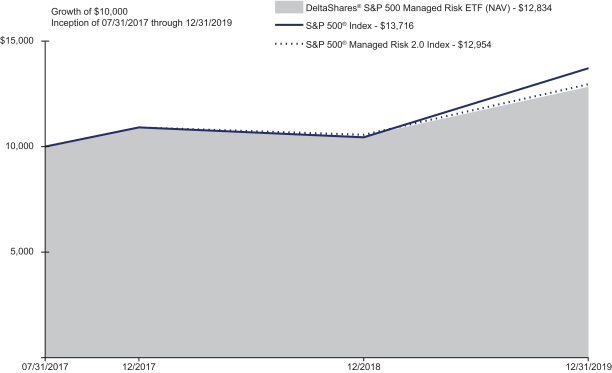

DeltaShares® S&P 500 Managed Risk ETF | | | 1,000.00 | | | | 1,091.00 | | | | 1.84 | | | | 1,023.40 | | | | 1.79 | | | | 0.35 | |

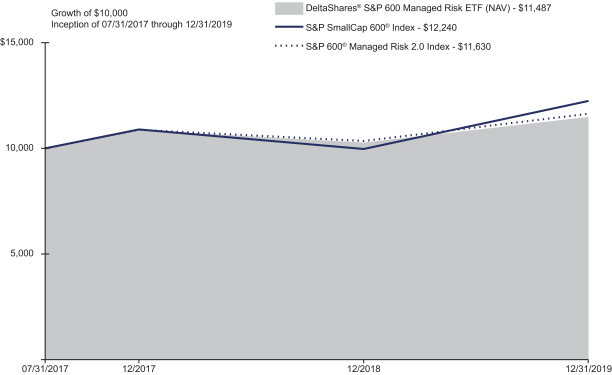

DeltaShares® S&P 600 Managed Risk ETF | | | 1,000.00 | | | | 1,049.40 | | | | 2.32 | | | | 1,022.90 | | | | 2.29 | | | | 0.45 | |

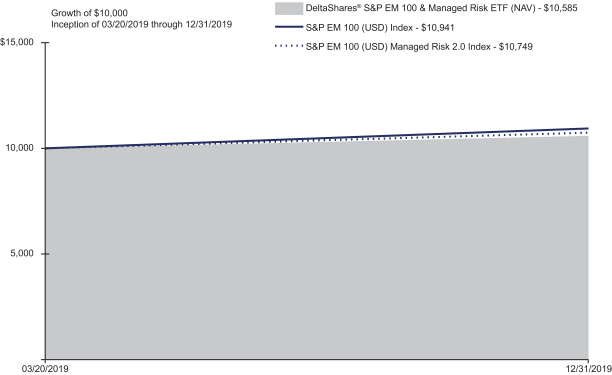

DeltaShares® S&P EM 100 & Managed Risk ETF | | | 1,000.00 | | | | 1,060.10 | | | | 3.12 | | | | 1,022.20 | | | | 3.06 | | | | 0.60 | |

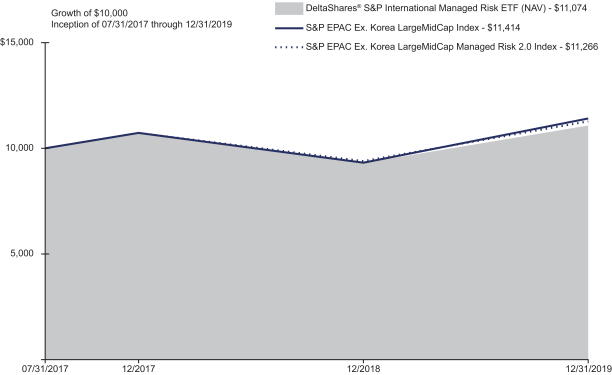

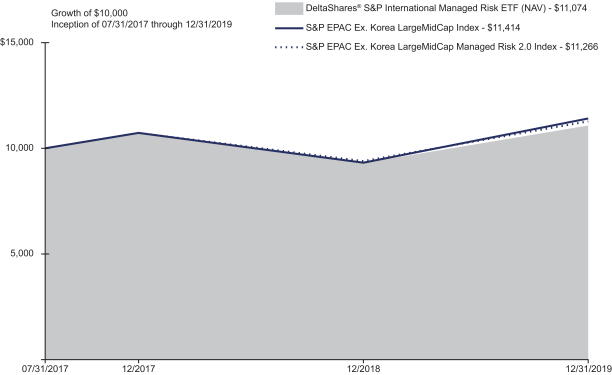

DeltaShares® S&P International Managed Risk ETF | | | 1,000.00 | | | | 1,069.80 | | | | 2.61 | | | | 1,022.70 | | | | 2.55 | | | | 0.50 | |

| | |

| |

| (A) | | 5% return per year before expenses. |

| |

| (B) | | Expenses are calculated using each Fund’s net annualized expense ratio, as disclosed in the table, multiplied by the average account value for the period, multiplied by the number of days in the period (184 days), and divided by the number of days in the year (365 days). |

| |

| (C) | | Net annualized expense ratios, as disclosed in the table, do not include the expenses of the underlying investments in which the Funds invest. The total annual fund operating expenses, as stated in the fee table of the Prospectus, may differ from the expense ratios disclosed in this report. |

| |

| (D) | | Net annualized expense ratios are reflective of any applicable fee waivers and/or reimbursements and are based on the most recent six-months and may differ from the net expense ratio displayed in the Financial Highlights which covers a twelve-month period. |

| | |

| Transamerica ETF Trust | | Annual Report 2019 |

Page 2

DeltaShares® S&P 400 Managed Risk ETF

(unaudited)

MARKET ENVIRONMENT

Stocks across the world posted positive returns in 2019. The S&P 500® also posted strong performance in 2019.

Global stock markets began the year on a positive note, with a snap recovery from the late December 2018 trough. This continued throughout January and shrugged off the longest government shutdown in U.S. history. Markets largely continued to rally through April, but gave up roughly half of theiryear-to-date gains in May. The loss was broad based, with domestic, international developed, and emerging markets all finishing the month sharply lower. However, the second quarter of 2019 finished on a higher note, with May losses closely mirrored by June gains, to complete a low volatilityV-shaped quarter.

Domestic equity returns remained in positive territory in July with the S&P 500® hitting the 3,000 price level for the first time in history. In contrast, both developed and emerging market equities fluctuated between positive and negative territory, ending the month with losses. Equity volatility picked up in August, but remained somewhat moderate. During this time, bond markets rallied around the globe. While the U.S. Federal Reserve (“Fed”) had merely paused rate hikes for the first half of the year, the Fed commenced the first of three consecutive cuts in August. Volatility then subsided, and experienced further declines, boosted by the “Phase One Trade Deal” announced in December as markets rallied through theyear-end.

PERFORMANCE OVERVIEW

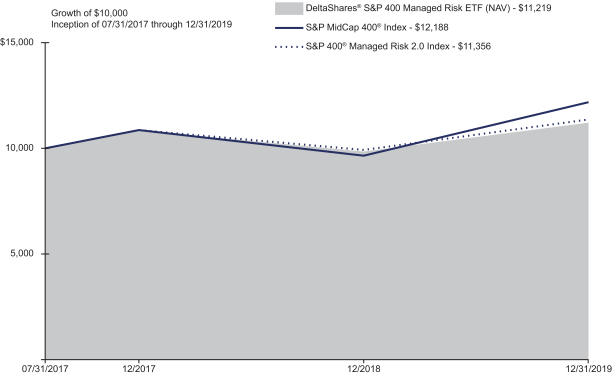

For the year ended December 31, 2019, the DeltaShares® S&P 400 Managed Risk ETF (NAV) returned 13.95%. By comparison, the S&P 400® Managed Risk 2.0 Index, (the “Underlying Index”) returned 14.50% and the S&P MidCap 400® Index returned 26.20%.

The Fund’s performance reflects annual operating expenses of the Fund, including management fees, brokerage expenses, and other fees and expenses. Index returns do not reflect fees and expenses of any kind, which would have a negative impact on returns.

STRATEGY REVIEW

The DeltaShares® S&P 400 Managed Risk ETF (the “Fund”) seeks to track the investment results, before fees and expenses, of the Underlying Index.

The Fund seeks to achieve this investment objective by holding a portfolio of securities that are included in the Underlying Index, including common stocks, U.S. Treasury bonds, and/or cash. The Underlying Index is designed to simulate, through a rules-based methodology, a dynamic portfolio with the aim of both managing the volatility of the Underlying Index and limiting losses from the Underlying Index’s equity exposure due to severe sustained market declines. The Underlying Index seeks to achieve these objectives by allocating weightings among the S&P MidCap 400® Index, the S&P U.S. Treasury Bond Current5-Year Index, and the S&P U.S. Treasury Bill0-3 Month Index. The Fund may also use derivatives in an effort to gain exposure to underlying securities and markets in a more efficient manner, to optimize the execution processes and costs for portfolio transitions or for tax management purposes. Under normal circumstances, the Fund uses a replication strategy and generally expects to invest in substantially all of the securities in the Underlying Index.

During the12-month period ended December 31, 2019, the largest contributors to the Fund’s absolute total return were equities within the information technology, industrials, and financials sectors. The largest detractors were equities within the energy sector.

During the fiscal year, the Fund used derivatives. These positions added to performance.

Blake Graves, CFA

Charles Lowery, CFA

Louis Ng

Co-Portfolio Managers

Milliman Financial Risk Management LLC

| | | | |

| Asset Allocation | | Percentage of Net

Assets | |

Common Stocks | | | 98.7 | % |

Other Investment Company | | | 9.0 | |

Short-Term Investment Company | | | 1.0 | |

Net Other Assets (Liabilities) ^ | | | (8.7 | ) |

Total | | | 100.0 | % |

| | | | |

| Current | and future portfolio holdings are subject to change and risk. |

| ^ | The Net Other Assets (Liabilities) category may include, but is not limited to, reverse repurchase agreements, forward foreign currency contracts, futures contracts, swap agreements, written options and swaptions, and cash collateral. |

| | |

| Transamerica ETF Trust | | Annual Report 2019 |

Page 3

DeltaShares® S&P 400 Managed Risk ETF

(unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Performance as of December 31, 2019 | | | | | | | | | | | | | |

| | | Average Annual Total Returns | | | | | | | | Cumulative Total Returns | | | | | | | | Inception Date | |

| | | 1 Year | | | 10 Year or

Since

Inception | | | | | | 1 Year | | | 10 Year or

Since

Inception | | | | | | | |

Fund NAV | | | 13.95 | % | | | 4.86 | % | | | | | | | 13.95 | % | | | 12.19 | % | | | | | | | 07/31/2017 | |

Fund Market | | | 13.85 | % | | | 4.78 | % | | | | | | | 13.85 | % | | | 11.98 | % | | | | | | | 07/31/2017 | |

S&P MidCap 400® Index (A) | | | 26.20 | % | | | 8.51 | % | | | | | | | 26.20 | % | | | 21.88 | % | | | | | | | | |

S&P 400® Managed Risk 2.0 Index (A)(B)(C)(D) | | | 14.50 | % | | | 5.39 | % | | | | | | | 14.50 | % | | | 13.56 | % | | | | | | | | |

(A) The S&P MidCap 400® Index is a market-capitalization weighted index of 400mid-size U.S. companies with common stock listed on the NYSE or NASDAQ.

(B) The S&P MidCap 400® Managed Risk 2.0 Index is comprised of weightings amongst the S&P MidCap 400® Index, the S&P U.S. Treasury Bond Current5-Year Index, and the S&P U.S. Treasury Bill0-3 Month Index. The S&P MidCap 400® Managed Risk 2.0 Index rebalances on a daily basis.

(C) The S&P U.S. Treasury Bond Current5-Year Index is aone-security index comprising the most recently issued5-year U.S. Treasury note or bond.

(D) The S&P U.S. Treasury Bill0-3 Month Index is designed to measure the performance of U.S. Treasury bills maturing in 0 to 3 months.

The Fund’s benchmarks are unmanaged indices used as a general measure of market performance. Calculations assume dividends and capital gains are reinvested and do not include any managerial expenses. The 10 Years or the Since Inception calculation is based on the previous 10 years or since the inception date, whichever is more recent. An index is a statistical measure of a specified financial market or sector. An index does not actually hold a portfolio of securities and therefore does not reflect deductions for fees or expenses. In comparison, a Fund’s performance is negatively impacted by these deductions. You cannot invest directly in an index.

The performance data presented represents past performance and does not guarantee future results. Performance data does not reflect the deduction of taxes that would be paid on Fund distributions or the redemption of Fund shares. The Fund’s investment return and net asset value will fluctuate. Investors’ shares when sold may be worth more or less than their original cost. Current performance may be lower or higher than performance quoted. Please see www.deltashares.com for performance data current to the most recent month end. Fund performance is net of investment fees and Fund expenses.

Performance results do not include adjustments made for financial reporting purposes in accordance with U.S. generally accepted accounting principles and may differ from amounts reported in the Financial Highlights.

Fund shares are bought and sold at Market Price, not Net Asset Value (“NAV”), and are not individually redeemed from the fund. Net Asset Value is an exchange-traded fund’s per-share value. The per-share dollar amount of the Fund is derived by dividing the total value of all the securities in the portfolio, less any liabilities, by the number of Fund shares outstanding. Market Price is the price at which a share can currently be traded in the market. The market price used to calculate the market return is determined by using the midpoint between the highest bid and the lowest offer on the exchange on which the shares of the Fund are listed for trading, as of the time that the Fund’s NAV is calculated.

Exchange-Traded Funds (ETFs) are subject to market risk, including the loss of principal. Because Fund Shares trade at market prices rather than at NAV, Fund Shares may trade at a price greater than NAV (premium) or less than NAV (discount). Shares of DeltaShares® ETFs may be bought and sold throughout the day on the exchange through any brokerage account. Buying and selling shares of ETFs will result in brokerage commissions. Diversification and asset allocation may not protect against market risk or loss of principal. Investing involves risk, including the possible loss of principal. There is no guarantee the investment objective will be achieved. Investing in medium capitalization companies involves greater risk than is customarily associated with more established companies. The prices of securities of medium capitalization companies generally are more volatile and are more likely to be adversely affected by changes in earnings results and investor expectations or poor economic or market conditions. The market prices of fixed-income securities may go up or down, sometimes rapidly and unpredictably, due to general market conditions, such as real or perceived adverse economic or political conditions, inflation, changes in interest rates, lack of liquidity in the bond markets or adverse investor sentiment. The principal risks include risks related to: Equity securities, index tracking, leveraging, derivatives such as futures, forwards, swaps, options, and investing in underlying exchange-traded funds. The use of derivatives may produce disproportionate gains or losses, may increase costs, and amplify risks.

| | |

| Transamerica ETF Trust | | Annual Report 2019 |

Page 4

DeltaShares® S&P 400 Managed Risk ETF

SCHEDULE OF INVESTMENTS

At December 31, 2019

| | | | | | | | |

| | | Shares | | | Value | |

| COMMON STOCKS - 98.7% | |

| Aerospace & Defense - 1.5% | |

Axon Enterprise, Inc.(A) (B) | | | 3,137 | | | | $ 229,879 | |

Curtiss-Wright Corp. | | | 2,256 | | | | 317,848 | |

Mercury Systems, Inc.(A) | | | 2,936 | | | | 202,907 | |

Teledyne Technologies, Inc.(A) | | | 1,928 | | | | 668,129 | |

| | | | | | | | |

| | | | | | | 1,418,763 | |

| | | | | | | | |

| Air Freight & Logistics - 0.4% | |

XPO Logistics, Inc.(A) | | | 4,879 | | | | 388,856 | |

| | | | | | | | |

| Airlines - 0.3% | |

JetBlue Airways Corp.(A) | | | 15,260 | | | | 285,667 | |

| | | | | | | | |

| Auto Components - 1.4% | |

Adient PLC(A) | | | 4,601 | | | | 97,771 | |

Dana, Inc. | | | 7,608 | | | | 138,466 | |

Delphi Technologies PLC | | | 4,550 | | | | 58,376 | |

Gentex Corp. | | | 13,372 | | | | 387,520 | |

Goodyear Tire & Rubber Co. | | | 12,293 | | | | 191,218 | |

Lear Corp. | | | 2,909 | | | | 399,115 | |

Visteon Corp.(A) | | | 1,478 | | | | 127,980 | |

| | | | | | | | |

| | | | | | | 1,400,446 | |

| | | | | | | | |

| Automobiles - 0.2% | |

Thor Industries, Inc.(B) | | | 2,918 | | | | 216,778 | |

| | | | | | | | |

| Banks - 7.2% | |

Associated Banc-Corp. | | | 8,423 | | | | 185,643 | |

BancorpSouth Bank | | | 5,072 | | | | 159,312 | |

Bank of Hawaii Corp.(B) | | | 2,129 | | | | 202,596 | |

Bank OZK | | | 6,390 | | | | 194,927 | |

Cathay General Bancorp | | | 4,003 | | | | 152,314 | |

Commerce Bancshares, Inc.(B) | | | 5,482 | | | | 372,447 | |

Cullen/Frost Bankers, Inc. | | | 3,009 | | | | 294,220 | |

East West Bancorp, Inc. | | | 7,697 | | | | 374,844 | |

First Financial Bankshares, Inc. | | | 7,181 | | | | 252,053 | |

First Horizon National Corp. | | | 16,448 | | | | 272,379 | |

FNB Corp. | | | 17,175 | | | | 218,123 | |

Fulton Financial Corp. | | | 8,675 | | | | 151,205 | |

Hancock Whitney Corp. | | | 4,610 | | | | 202,287 | |

Home BancShares, Inc. | | | 8,201 | | | | 161,232 | |

International Bancshares Corp. | | | 3,033 | | | | 130,631 | |

PacWest Bancorp | | | 6,334 | | | | 242,402 | |

Pinnacle Financial Partners, Inc. | | | 3,804 | | | | 243,456 | |

Prosperity Bancshares, Inc. | | | 4,990 | | | | 358,731 | |

Signature Bank | | | 2,854 | | | | 389,885 | |

Sterling Bancorp | | | 10,680 | | | | 225,134 | |

Synovus Financial Corp. | | | 7,746 | | | | 303,643 | |

TCF Financial Corp. | | | 8,109 | | | | 379,501 | |

Texas Capital Bancshares, Inc.(A) | | | 2,660 | | | | 151,008 | |

Trustmark Corp. | | | 3,397 | | | | 117,231 | |

UMB Financial Corp. | | | 2,284 | | | | 156,774 | |

Umpqua Holdings Corp. | | | 11,640 | | | | 206,028 | |

United Bankshares, Inc. | | | 5,367 | | | | 207,488 | |

Valley National Bancorp | | | 20,704 | | | | 237,061 | |

Webster Financial Corp. | | | 4,865 | | | | 259,596 | |

Wintrust Financial Corp. | | | 3,017 | | | | 213,905 | |

| | | | | | | | |

| | | | | | | 7,016,056 | |

| | | | | | | | |

| Beverages - 0.2% | |

Boston Beer Co., Inc., Class A(A) | | | 487 | | | | 184,013 | |

| | | | | | | | |

| Biotechnology - 0.9% | |

Arrowhead Pharmaceuticals, Inc.(A) | | | 5,291 | | | | 335,608 | |

| | | | | | | | |

| | | Shares | | | Value | |

| COMMON STOCKS (continued) | |

| Biotechnology (continued) | |

Exelixis, Inc.(A) | | | 16,061 | | | | $ 282,995 | |

Ligand Pharmaceuticals, Inc.(A) (B) | | | 928 | | | | 96,781 | |

United Therapeutics Corp.(A) | | | 2,319 | | | | 204,258 | |

| | | | | | | | |

| | | | | | | 919,642 | |

| | | | | | | | |

| Building Products - 1.2% | |

Lennox International, Inc. | | | 1,853 | | | | 452,076 | |

Owens Corning | | | 5,750 | | | | 374,440 | |

Resideo Technologies, Inc.(A) | | | 6,492 | | | | 77,450 | |

Trex Co., Inc.(A) | | | 3,084 | | | | 277,190 | |

| | | | | | | | |

| | | | | | | 1,181,156 | |

| | | | | | | | |

| Capital Markets - 2.6% | |

Affiliated Managers Group, Inc. | | | 2,604 | | | | 220,663 | |

Eaton Vance Corp. | | | 5,981 | | | | 279,253 | |

Evercore, Inc., Class A | | | 2,066 | | | | 154,454 | |

FactSet Research Systems, Inc.(B) | | | 2,006 | | | | 538,210 | |

Federated Investors, Inc., Class B | | | 5,078 | | | | 165,492 | |

Interactive Brokers Group, Inc., Class A | | | 4,057 | | | | 189,137 | |

Janus Henderson Group PLC | | | 8,225 | | | | 201,101 | |

Legg Mason, Inc. | | | 4,313 | | | | 154,880 | |

SEI Investments Co. | | | 6,672 | | | | 436,883 | |

Stifel Financial Corp. | | | 3,614 | | | | 219,189 | |

| | | | | | | | |

| | | | | | | 2,559,262 | |

| | | | | | | | |

| Chemicals - 2.5% | |

Ashland Global Holdings, Inc. | | | 3,184 | | | | 243,672 | |

Cabot Corp. | | | 3,012 | | | | 143,130 | |

Chemours Co.(B) | | | 8,642 | | | | 156,334 | |

Ingevity Corp.(A) | | | 2,211 | | | | 193,197 | |

Minerals Technologies, Inc. | | | 1,842 | | | | 106,154 | |

NewMarket Corp. | | | 390 | | | | 189,743 | |

Olin Corp. | | | 8,440 | | | | 145,590 | |

PolyOne Corp. | | | 4,066 | | | | 149,588 | |

RPM International, Inc. | | | 6,855 | | | | 526,190 | |

ScottsMiracle-Gro Co. | | | 2,094 | | | | 222,341 | |

Sensient Technologies Corp. | | | 2,237 | | | | 147,843 | |

Valvoline, Inc. | | | 9,958 | | | | 213,201 | |

| | | | | | | | |

| | | | | | | 2,436,983 | |

| | | | | | | | |

| Commercial Services & Supplies - 1.9% | |

Brink’s Co. | | | 2,644 | | | | 239,758 | |

Clean Harbors, Inc.(A) | | | 2,714 | | | | 232,725 | |

Deluxe Corp. | | | 2,225 | | | | 111,072 | |

Healthcare Services Group, Inc. | | | 3,918 | | | | 95,286 | |

Herman Miller, Inc. | | | 3,122 | | | | 130,031 | |

HNI Corp. | | | 2,264 | | | | 84,809 | |

KAR Auction Services, Inc.(B) | | | 6,807 | | | | 148,325 | |

MSA Safety, Inc. | | | 1,884 | | | | 238,062 | |

Stericycle, Inc.(A) (B) | | | 4,817 | | | | 307,373 | |

Tetra Tech, Inc. | | | 2,885 | | | | 248,572 | |

| | | | | | | | |

| | | | | | | 1,836,013 | |

| | | | | | | | |

| Communications Equipment - 1.1% | |

Ciena Corp.(A) | | | 8,177 | | | | 349,076 | |

InterDigital, Inc. | | | 1,646 | | | | 89,691 | |

Lumentum Holdings, Inc.(A) | | | 4,081 | | | | 323,623 | |

NetScout Systems, Inc.(A) | | | 3,481 | | | | 83,788 | |

ViaSat, Inc.(A) | | | 3,048 | | | | 223,098 | |

| | | | | | | | |

| | | | | | | 1,069,276 | |

| | | | | | | | |

The Notes to Financial Statements are an integral part of this report.

| | |

| Transamerica ETF Trust | | Annual Report 2019 |

Page 5

DeltaShares® S&P 400 Managed Risk ETF

SCHEDULE OF INVESTMENTS (continued)

At December 31, 2019

| | | | | | | | |

| | | Shares | | | Value | |

| COMMON STOCKS (continued) | |

| Construction & Engineering - 1.2% | |

AECOM(A) | | | 8,303 | | | | $ 358,108 | |

Dycom Industries, Inc.(A) | | | 1,666 | | | | 78,552 | |

EMCOR Group, Inc. | | | 2,968 | | | | 256,138 | |

Fluor Corp. | | | 7,409 | | | | 139,882 | |

MasTec, Inc.(A) | | | 3,187 | | | | 204,478 | |

Valmont Industries, Inc. | | | 1,138 | | | | 170,450 | |

| | | | | | | | |

| | | | | | | 1,207,608 | |

| | | | | | | | |

| Construction Materials - 0.2% | |

Eagle Materials, Inc. | | | 2,201 | | | | 199,543 | |

| | | | | | | | |

| Consumer Finance - 0.6% | |

FirstCash, Inc. | | | 2,256 | | | | 181,901 | |

Green Dot Corp., Class A(A) | | | 2,504 | | | | 58,343 | |

Navient Corp. | | | 10,282 | | | | 140,658 | |

SLM Corp. | | | 22,315 | | | | 198,827 | |

| | | | | | | | |

| | | | | | | 579,729 | |

| | | | | | | | |

| Containers & Packaging - 1.0% | |

AptarGroup, Inc. | | | 3,379 | | | | 390,680 | |

Greif, Inc., Class A | | | 1,388 | | | | 61,350 | |

O-I Glass, Inc. | | | 8,226 | | | | 98,136 | |

Silgan Holdings, Inc. | | | 4,099 | | | | 127,397 | |

Sonoco Products Co. | | | 5,291 | | | | 326,560 | |

| | | | | | | | |

| | | | | | | 1,004,123 | |

| | | | | | | | |

| Distributors - 0.5% | |

Pool Corp. | | | 2,116 | | | | 449,396 | |

| | | | | | | | |

| Diversified Consumer Services - 1.1% | |

Adtalem Global Education, Inc.(A) | | | 2,854 | | | | 99,804 | |

Graham Holdings Co., Class B | | | 230 | | | | 146,968 | |

Grand Canyon Education, Inc.(A) | | | 2,549 | | | | 244,169 | |

Service Corp. International | | | 9,662 | | | | 444,742 | |

WW International, Inc.(A) | | | 2,455 | | | | 93,805 | |

| | | | | | | | |

| | | | | | | 1,029,488 | |

| | | | | | | | |

| Diversified Financial Services - 0.3% | |

Jefferies Financial Group, Inc. | | | 13,315 | | | | 284,541 | |

| | | | | | | | |

| Electric Utilities - 1.5% | |

ALLETE, Inc. | | | 2,731 | | | | 221,675 | |

Hawaiian Electric Industries, Inc. | | | 5,760 | | | | 269,914 | |

IDACORP, Inc. | | | 2,664 | | | | 284,515 | |

OGE Energy Corp. | | | 10,581 | | | | 470,537 | |

PNM Resources, Inc. | | | 4,210 | | | | 213,489 | |

| | | | | | | | |

| | | | | | | 1,460,130 | |

| | | | | | | | |

| Electrical Equipment - 1.3% | |

Acuity Brands, Inc. | | | 2,094 | | | | 288,972 | |

EnerSys | | | 2,235 | | | | 167,245 | |

Hubbell, Inc. | | | 2,875 | | | | 424,983 | |

nVent Electric PLC | | | 8,226 | | | | 210,421 | |

Regal Beloit Corp. | | | 2,164 | | | | 185,260 | |

| | | | | | | | |

| | | | | | | 1,276,881 | |

| | | | | | | | |

| Electronic Equipment, Instruments & Components - 3.7% | |

Arrow Electronics, Inc.(A) | | | 4,305 | | | | 364,806 | |

Avnet, Inc. | | | 5,337 | | | | 226,502 | |

Belden, Inc. | | | 2,042 | | | | 112,310 | |

Cognex Corp. | | | 9,033 | | | | 506,209 | |

Coherent, Inc.(A) | | | 1,277 | | | | 212,429 | |

II-VI, Inc.(A) (B) | | | 4,610 | | | | 155,219 | |

Jabil, Inc. | | | 7,343 | | | | 303,486 | |

| | | | | | | | |

| | | Shares | | | Value | |

| COMMON STOCKS (continued) | |

| Electronic Equipment, Instruments & Components (continued) | |

Littelfuse, Inc. | | | 1,288 | | | | $ 246,394 | |

National Instruments Corp. | | | 6,235 | | | | 263,990 | |

SYNNEX Corp. | | | 2,160 | | | | 278,208 | |

Tech Data Corp.(A) | | | 1,872 | | | | 268,819 | |

Trimble, Inc.(A) | | | 13,169 | | | | 549,016 | |

Vishay Intertechnology, Inc. | | | 6,996 | | | | 148,945 | |

| | | | | | | | |

| | | | | | | 3,636,333 | |

| | | | | | | | |

| Energy Equipment & Services - 0.6% | |

Apergy Corp.(A) | | | 4,094 | | | | 138,295 | |

Core Laboratories NV(B) | | | 2,346 | | | | 88,374 | |

Patterson-UTI Energy, Inc. | | | 10,283 | | | | 107,971 | |

Transocean, Ltd.(A) (B) | | | 30,401 | | | | 209,159 | |

| | | | | | | | |

| | | | | | | 543,799 | |

| | | | | | | | |

| Entertainment - 0.4% | |

Cinemark Holdings, Inc.(B) | | | 5,635 | | | | 190,745 | |

World Wrestling Entertainment, Inc., Class A(B) | | | 2,508 | | | | 162,694 | |

| | | | | | | | |

| | | | | | | 353,439 | |

| | | | | | | | |

| Equity Real Estate Investment Trusts - 10.6% | |

Alexander & Baldwin, Inc. | | | 3,590 | | | | 75,246 | |

American Campus Communities, Inc. | | | 7,263 | | | | 341,579 | |

Brixmor Property Group, Inc. | | | 15,744 | | | | 340,228 | |

Camden Property Trust | | | 5,118 | | | | 543,020 | |

CoreCivic, Inc. | | | 6,295 | | | | 109,407 | |

CoreSite Realty Corp. | | | 1,992 | | | | 223,343 | |

Corporate Office Properties Trust | | | 5,923 | | | | 174,018 | |

Cousins Properties, Inc. | | | 7,758 | | | | 319,630 | |

CyrusOne, Inc. | | | 5,984 | | | | 391,533 | |

Diversified Healthcare Trust REIT | | | 12,575 | | | | 106,133 | |

Douglas Emmett, Inc. | | | 8,713 | | | | 382,501 | |

EastGroup Properties, Inc. | | | 2,030 | | | | 269,320 | |

EPR Properties | | | 4,147 | | | | 292,944 | |

First Industrial Realty Trust, Inc. | | | 6,710 | | | | 278,532 | |

GEO Group, Inc. | | | 6,410 | | | | 106,470 | |

Healthcare Realty Trust, Inc. | | | 7,069 | | | | 235,893 | |

Highwoods Properties, Inc. | | | 5,484 | | | | 268,222 | |

JBG SMITH Properties | | | 6,239 | | | | 248,874 | |

Kilroy Realty Corp. | | | 5,155 | | | | 432,505 | |

Lamar Advertising Co., Class A | | | 4,546 | | | | 405,776 | |

Liberty Property Trust | | | 8,340 | | | | 500,817 | |

Life Storage, Inc. | | | 2,466 | | | | 267,018 | |

Macerich Co.(B) | | | 5,824 | | | | 156,782 | |

Mack-Cali Realty Corp. | | | 4,787 | | | | 110,723 | |

Medical Properties Trust, Inc. | | | 27,351 | | | | 577,380 | |

National Retail Properties, Inc. | | | 9,072 | | | | 486,441 | |

Omega Healthcare Investors, Inc. | | | 11,550 | | | | 489,142 | |

Park Hotels & Resorts, Inc. | | | 12,654 | | | | 327,359 | |

Pebblebrook Hotel Trust(B) | | | 6,905 | | | | 185,123 | |

PotlatchDeltic Corp. | | | 3,553 | | | | 153,738 | |

PS Business Parks, Inc. | | | 1,059 | | | | 174,597 | |

Rayonier, Inc. | | | 6,835 | | | | 223,915 | |

Sabra Health Care, Inc. | | | 10,239 | | | | 218,500 | |

Service Properties Trust | | | 8,699 | | | | 211,647 | |

Spirit Realty Capital, Inc. | | | 5,272 | | | | 259,277 | |

Tanger Factory Outlet Centers, Inc.(B) | | | 4,910 | | | | 72,324 | |

Taubman Centers, Inc.(B) | | | 3,236 | | | | 100,607 | |

Urban Edge Properties | | | 6,087 | | | | 116,749 | |

The Notes to Financial Statements are an integral part of this report.

| | |

| Transamerica ETF Trust | | Annual Report 2019 |

Page 6

DeltaShares® S&P 400 Managed Risk ETF

SCHEDULE OF INVESTMENTS (continued)

At December 31, 2019

| | | | | | | | |

| | | Shares | | | Value | |

| COMMON STOCKS (continued) | |

| Equity Real Estate Investment Trusts (continued) | |

Weingarten Realty Investors | | | 6,393 | | | | $ 199,717 | |

| | | | | | | | |

| | | | | | | 10,377,030 | |

| | | | | | | | |

| Food & Staples Retailing - 0.6% | |

BJ’S Wholesale Club Holdings, Inc.(A) (B) | | | 6,458 | | | | 146,855 | |

Casey’s General Stores, Inc. | | | 1,944 | | | | 309,076 | |

Sprouts Farmers Market, Inc.(A) | | | 6,245 | | | | 120,841 | |

| | | | | | | | |

| | | | | | | 576,772 | |

| | | | | | | | |

| Food Products - 1.7% | |

Flowers Foods, Inc. | | | 10,174 | | | | 221,183 | |

Hain Celestial Group, Inc.(A) (B) | | | 4,246 | | | | 110,205 | |

Ingredion, Inc. | | | 3,529 | | | | 328,021 | |

Lancaster Colony Corp. | | | 1,046 | | | | 167,465 | |

Pilgrim’s Pride Corp.(A) | | | 2,770 | | | | 90,621 | |

Post Holdings, Inc.(A) | | | 3,513 | | | | 383,268 | |

Sanderson Farms, Inc. | | | 1,042 | | | | 183,621 | |

Tootsie Roll Industries, Inc.(B) | | | 887 | | | | 30,282 | |

TreeHouse Foods, Inc.(A) | | | 2,971 | | | | 144,093 | |

| | | | | | | | |

| | | | | | | 1,658,759 | |

| | | | | | | | |

| Gas Utilities - 1.7% | |

National Fuel Gas Co.(B) | | | 4,563 | | | | 212,362 | |

New Jersey Resources Corp. | | | 5,048 | | | | 224,989 | |

ONE Gas, Inc. | | | 2,788 | | | | 260,873 | |

Southwest Gas Holdings, Inc. | | | 2,887 | | | | 219,325 | |

Spire, Inc. | | | 2,695 | | | | 224,521 | |

UGI Corp. | | | 11,048 | | | �� | 498,928 | |

| | | | | | | | |

| | | | | | | 1,640,998 | |

| | | | | | | | |

| Health Care Equipment & Supplies - 3.3% | |

Avanos Medical, Inc.(A) | | | 2,533 | | | | 85,362 | |

Cantel Medical Corp.(B) | | | 1,980 | | | | 140,382 | |

Globus Medical, Inc., Class A(A) | | | 4,069 | | | | 239,583 | |

Haemonetics Corp.(A) | | | 2,679 | | | | 307,817 | |

Hill-Rom Holdings, Inc. | | | 3,529 | | | | 400,647 | |

ICU Medical, Inc.(A) | | | 1,016 | | | | 190,114 | |

Integra LifeSciences Holdings Corp.(A) | | | 3,767 | | | | 219,541 | |

LivaNova PLC(A) | | | 2,558 | | | | 192,950 | |

Masimo Corp.(A) | | | 2,593 | | | | 409,850 | |

NuVasive, Inc.(A) | | | 2,753 | | | | 212,917 | |

Penumbra, Inc.(A) (B) | | | 1,698 | | | | 278,930 | |

West Pharmaceutical Services, Inc. | | | 3,911 | | | | 587,941 | |

| | | | | | | | |

| | | | | | | 3,266,034 | |

| | | | | | | | |

| Health Care Providers & Services - 2.4% | |

Acadia Healthcare Co., Inc.(A) | | | 4,682 | | | | 155,536 | |

Amedisys, Inc.(A) | | | 1,705 | | | | 284,599 | |

Chemed Corp. | | | 846 | | | | 371,614 | |

Encompass Health Corp. | | | 5,212 | | | | 361,035 | |

HealthEquity, Inc.(A) | | | 3,747 | | | | 277,540 | |

MEDNAX, Inc.(A) | | | 4,456 | | | | 123,832 | |

Molina Healthcare, Inc.(A) | | | 3,314 | | | | 449,677 | |

Patterson Cos., Inc.(B) | | | 4,554 | | | | 93,266 | |

Tenet Healthcare Corp.(A) | | | 5,492 | | | | 208,861 | |

| | | | | | | | |

| | | | | | | 2,325,960 | |

| | | | | | | | |

| Health Care Technology - 0.1% | |

Allscripts Healthcare Solutions, Inc.(A) | | | 8,582 | | | | 84,232 | |

| | | | | | | | |

| Hotels, Restaurants & Leisure - 4.4% | |

Boyd Gaming Corp. | | | 4,231 | | | | 126,676 | |

Brinker International, Inc.(B) | | | 1,975 | | | | 82,950 | |

| | | | | | | | |

| | | Shares | | | Value | |

| COMMON STOCKS (continued) | |

| Hotels, Restaurants & Leisure (continued) | |

Caesars Entertainment Corp.(A) | | | 29,502 | | | | $ 401,227 | |

Cheesecake Factory, Inc.(B) | | | 2,171 | | | | 84,365 | |

Choice Hotels International, Inc.(B) | | | 1,679 | | | | 173,659 | |

Churchill Downs, Inc. | | | 1,874 | | | | 257,113 | |

Cracker Barrel Old Country Store, Inc.(B) | | | 1,272 | | | | 195,557 | |

Domino’s Pizza, Inc. | | | 2,162 | | | | 635,152 | |

Dunkin’ Brands Group, Inc. | | | 4,379 | | | | 330,790 | |

Eldorado Resorts, Inc.(A) (B) | | | 3,453 | | | | 205,937 | |

Jack in the Box, Inc. | | | 1,250 | | | | 97,538 | |

Marriott Vacations Worldwide Corp. | | | 1,978 | | | | 254,687 | |

Papa John’s International, Inc.(B) | | | 1,165 | | | | 73,570 | |

Penn National Gaming, Inc.(A) | | | 5,759 | | | | 147,200 | |

Scientific Games Corp., Class A(A) | | | 2,859 | | | | 76,564 | |

Six Flags Entertainment Corp. | | | 4,155 | | | | 187,432 | |

Texas Roadhouse, Inc. | | | 3,449 | | | | 194,248 | |

Wendy’s Co. | | | 9,728 | | | | 216,059 | |

Wyndham Destinations, Inc. | | | 4,794 | | | | 247,802 | |

Wyndham Hotels & Resorts, Inc. | | | 5,030 | | | | 315,934 | |

| | | | | | | | |

| | | | | | | 4,304,460 | |

| | | | | | | | |

| Household Durables - 1.0% | |

Helen of Troy, Ltd.(A) | | | 1,330 | | | | 239,121 | |

KB Home | | | 4,528 | | | | 155,174 | |

Tempur Sealy International, Inc.(A) | | | 2,402 | | | | 209,118 | |

Toll Brothers, Inc. | | | 6,829 | | | | 269,814 | |

TRI Pointe Group, Inc.(A) | | | 7,360 | | | | 114,669 | |

| | | | | | | | |

| | | | | | | 987,896 | |

| | | | | | | | |

| Household Products - 0.2% | |

Energizer Holdings, Inc.(B) | | | 3,401 | | | | 170,798 | |

| | | | | | | | |

| Industrial Conglomerates - 0.5% | |

Carlisle Cos., Inc. | | | 2,996 | | | | 484,873 | |

| | | | | | | | |

| Insurance - 5.1% | |

Alleghany Corp.(A) | | | 761 | | | | 608,473 | |

American Financial Group, Inc. | | | 3,956 | | | | 433,775 | |

Brighthouse Financial, Inc.(A) | | | 5,776 | | | | 226,592 | |

Brown & Brown, Inc. | | | 12,361 | | | | 488,012 | |

CNO Financial Group, Inc. | | | 7,989 | | | | 144,840 | |

First American Financial Corp. | | | 5,938 | | | | 346,304 | |

Genworth Financial, Inc., Class A(A) | | | 26,604 | | | | 117,058 | |

Hanover Insurance Group, Inc. | | | 2,082 | | | | 284,547 | |

Kemper Corp. | | | 3,311 | | | | 256,602 | |

Mercury General Corp. | | | 1,434 | | | | 69,879 | |

Old Republic International Corp. | | | 15,083 | | | | 337,407 | |

Primerica, Inc. | | | 2,186 | | | | 285,404 | |

Reinsurance Group of America, Inc. | | | 3,310 | | | | 539,729 | |

RenaissanceRe Holdings, Ltd. | | | 2,334 | | | | 457,511 | |

RLI Corp. | | | 2,109 | | | | 189,852 | |

Selective Insurance Group, Inc. | | | 3,140 | | | | 204,697 | |

| | | | | | | | |

| | | | | | | 4,990,682 | |

| | | | | | | | |

| Interactive Media & Services - 0.3% | |

TripAdvisor, Inc. | | | 5,554 | | | | 168,730 | |

Yelp, Inc.(A) | | | 3,377 | | | | 117,621 | |

| | | | | | | | |

| | | | | | | 286,351 | |

| | | | | | | | |

| Internet & Direct Marketing Retail - 0.5% | |

Etsy, Inc.(A) | | | 6,263 | | | | 277,451 | |

GrubHub, Inc.(A) (B) | | | 4,834 | | | | 235,126 | |

| | | | | | | | |

| | | | | | | 512,577 | |

| | | | | | | | |

The Notes to Financial Statements are an integral part of this report.

| | |

| Transamerica ETF Trust | | Annual Report 2019 |

Page 7

DeltaShares® S&P 400 Managed Risk ETF

SCHEDULE OF INVESTMENTS (continued)

At December 31, 2019

| | | | | | | | |

| | | Shares | | | Value | |

| COMMON STOCKS (continued) | |

| IT Services - 2.4% | |

CACI International, Inc., Class A(A) | | | 1,324 | | | | $ 330,987 | |

CoreLogic, Inc.(A) | | | 4,203 | | | | 183,713 | |

KBR, Inc. | | | 7,491 | | | | 228,476 | |

LiveRamp Holdings, Inc.(A) | | | 3,578 | | | | 171,994 | |

MAXIMUS, Inc. | | | 3,382 | | | | 251,587 | |

Perspecta, Inc. | | | 7,268 | | | | 192,166 | |

Sabre Corp. | | | 14,477 | | | | 324,864 | |

Science Applications International Corp. | | | 2,594 | | | | 225,730 | |

WEX, Inc.(A) | | | 2,288 | | | | 479,244 | |

| | | | | | | | |

| | | | | | | 2,388,761 | |

| | | | | | | | |

| Leisure Products - 0.8% | |

Brunswick Corp. | | | 4,312 | | | | 258,634 | |

Mattel, Inc.(A) (B) | | | 18,327 | | | | 248,331 | |

Polaris, Inc. | | | 3,039 | | | | 309,066 | |

| | | | | | | | |

| | | | | | | 816,031 | |

| | | | | | | | |

| Life Sciences Tools & Services - 2.1% | |

Bio-Rad Laboratories, Inc., Class A(A) | | | 1,142 | | | | 422,574 | |

Bio-Techne Corp. | | | 2,015 | | | | 442,313 | |

Charles River Laboratories International, Inc.(A) | | | 2,582 | | | | 394,426 | |

PRA Health Sciences, Inc.(A) | | | 3,343 | | | | 371,574 | |

Repligen Corp.(A) | | | 2,477 | | | | 229,123 | |

Syneos Health, Inc.(A) | | | 3,292 | | | | 195,792 | |

| | | | | | | | |

| | | | | | | 2,055,802 | |

| | | | | | | | |

| Machinery - 4.4% | |

AGCO Corp. | | | 3,313 | | | | 255,929 | |

Colfax Corp.(A) | | | 4,419 | | | | 160,763 | |

Crane Co. | | | 2,695 | | | | 232,794 | |

Donaldson Co., Inc. | | | 6,690 | | | | 385,478 | |

Graco, Inc. | | | 8,816 | | | | 458,432 | |

ITT, Inc. | | | 4,636 | | | | 342,647 | |

Kennametal, Inc. | | | 4,380 | | | | 161,578 | |

Lincoln Electric Holdings, Inc. | | | 3,232 | | | | 312,631 | |

Nordson Corp. | | | 2,705 | | | | 440,482 | |

Oshkosh Corp. | | | 3,597 | | | | 340,456 | |

Terex Corp. | | | 3,467 | | | | 103,247 | |

Timken Co. | | | 3,583 | | | | 201,759 | |

Toro Co. | | | 5,635 | | | | 448,941 | |

Trinity Industries, Inc. | | | 5,188 | | | | 114,914 | |

Woodward, Inc. | | | 2,981 | | | | 353,070 | |

| | | | | | | | |

| | | | | | | 4,313,121 | |

| | | | | | | | |

| Marine - 0.3% | |

Kirby Corp.(A) | | | 3,169 | | | | 283,721 | |

| | | | | | | | |

| Media - 1.1% | |

AMC Networks, Inc., Class A(A) | | | 2,330 | | | | 92,035 | |

Cable One, Inc. | | | 266 | | | | 395,933 | |

John Wiley & Sons, Inc., Class A | | | 2,312 | | | | 112,178 | |

Meredith Corp.(B) | | | 2,125 | | | | 68,999 | |

New York Times Co., Class A(B) | | | 7,599 | | | | 244,460 | |

TEGNA, Inc. | | | 11,465 | | | | 191,351 | |

| | | | | | | | |

| | | | | | | 1,104,956 | |

| | | | | | | | |

| Metals & Mining - 2.0% | |

Allegheny Technologies, Inc.(A) (B) | | | 6,665 | | | | 137,699 | |

Carpenter Technology Corp. | | | 2,522 | | | | 125,545 | |

Commercial Metals Co. | | | 6,272 | | | | 139,677 | |

Compass Minerals International, Inc.(B) | | | 1,791 | | | | 109,179 | |

Reliance Steel & Aluminum Co. | | | 3,523 | | | | 421,915 | |

| | | | | | | | |

| | | Shares | | | Value | |

| COMMON STOCKS (continued) | |

| Metals & Mining (continued) | |

Royal Gold, Inc. | | | 3,467 | | | | $ 423,841 | |

Steel Dynamics, Inc. | | | 11,388 | | | | 387,648 | |

U.S. Steel Corp.(B) | | | 8,988 | | | | 102,553 | |

Worthington Industries, Inc. | | | 1,951 | | | | 82,293 | |

| | | | | | | | |

| | | | | | | 1,930,350 | |

| | | | | | | | |

| Multi-Utilities - 0.8% | |

Black Hills Corp. | | | 3,248 | | | | 255,098 | |

MDU Resources Group, Inc. | | | 10,592 | | | | 314,688 | |

NorthWestern Corp. | | | 2,667 | | | | 191,144 | |

| | | | | | | | |

| | | | | | | 760,930 | |

| | | | | | | | |

| Multiline Retail - 0.2% | |

Dillard’s, Inc., Class A(B) | | | 521 | | | | 38,283 | |

Ollie’s Bargain Outlet Holdings, Inc.(A) (B) | | | 2,891 | | | | 188,811 | |

| | | | | | | | |

| | | | | | | 227,094 | |

| | | | | | | | |

| Oil, Gas & Consumable Fuels - 1.5% | |

Antero Midstream Corp.(B) | | | 15,700 | | | | 119,163 | |

Chesapeake Energy Corp.(A) (B) | | | 61,976 | | | | 51,167 | |

CNX Resources Corp.(A) | | | 9,863 | | | | 87,288 | |

EQT Corp.(B) | | | 13,513 | | | | 147,292 | |

Equitrans Midstream Corp.(B) | | | 10,772 | | | | 143,914 | |

Matador Resources Co.(A) | | | 5,796 | | | | 104,154 | |

Murphy Oil Corp.(B) | | | 7,895 | | | | 211,586 | |

PBF Energy, Inc., Class A | | | 5,385 | | | | 168,927 | |

World Fuel Services Corp. | | | 3,457 | | | | 150,103 | |

WPX Energy, Inc.(A) | | | 22,028 | | | | 302,665 | |

| | | | | | | | |

| | | | | | | 1,486,259 | |

| | | | | | | | |

| Paper & Forest Products - 0.3% | |

Domtar Corp. | | | 3,027 | | | | 115,753 | |

Louisiana-Pacific Corp. | | | 6,208 | | | | 184,191 | |

| | | | | | | | |

| | | | | | | 299,944 | |

| | | | | | | | |

| Personal Products - 0.2% | |

Edgewell Personal Care Co.(A) | | | 2,865 | | | | 88,701 | |

Nu Skin Enterprises, Inc., Class A | | | 2,936 | | | | 120,317 | |

| | | | | | | | |

| | | | | | | 209,018 | |

| | | | | | | | |

| Pharmaceuticals - 0.8% | |

Catalent, Inc.(A) | | | 7,734 | | | | 435,424 | |

Nektar Therapeutics(A) (B) | | | 9,299 | | | | 200,719 | |

Prestige Consumer Healthcare, Inc.(A) | | | 2,655 | | | | 107,528 | |

| | | | | | | | |

| | | | | | | 743,671 | |

| | | | | | | | |

| Professional Services - 0.9% | |

ASGN, Inc.(A) | | | 2,791 | | | | 198,077 | |

FTI Consulting, Inc.(A) | | | 1,989 | | | | 220,103 | |

Insperity, Inc. | | | 1,987 | | | | 170,961 | |

ManpowerGroup, Inc. | | | 3,117 | | | | 302,661 | |

| | | | | | | | |

| | | | | | | 891,802 | |

| | | | | | | | |

| Real Estate Management & Development - 0.5% | |

Jones Lang LaSalle, Inc. | | | 2,724 | | | | 474,221 | |

| | | | | | | | |

| Road & Rail - 0.8% | |

Avis Budget Group, Inc.(A) | | | 3,005 | | | | 96,881 | |

Knight-Swift Transportation Holdings, Inc.(B) | | | 6,494 | | | | 232,745 | |

Landstar System, Inc. | | | 2,086 | | | | 237,533 | |

Ryder System, Inc. | | | 2,817 | | | | 152,991 | |

Werner Enterprises, Inc. | | | 2,341 | | | | 85,189 | |

| | | | | | | | |

| | | | | | | 805,339 | |

| | | | | | | | |

The Notes to Financial Statements are an integral part of this report.

| | |

| Transamerica ETF Trust | | Annual Report 2019 |

Page 8

DeltaShares® S&P 400 Managed Risk ETF

SCHEDULE OF INVESTMENTS (continued)

At December 31, 2019

| | | | | | | | |

| | | Shares | | | Value | |

| COMMON STOCKS (continued) | |

| Semiconductors & Semiconductor Equipment - 4.1% | |

Cabot Microelectronics Corp. | | | 1,538 | | | | $ 221,964 | |

Cirrus Logic, Inc.(A) | | | 3,055 | | | | 251,763 | |

Cree, Inc.(A) | | | 5,693 | | | | 262,732 | |

Cypress Semiconductor Corp. | | | 19,521 | | | | 455,425 | |

First Solar, Inc.(A) | | | 4,012 | | | | 224,511 | |

MKS Instruments, Inc. | | | 2,881 | | | | 316,939 | |

Monolithic Power Systems, Inc. | | | 2,135 | | | | 380,073 | |

Semtech Corp.(A) | | | 3,502 | | | | 185,256 | |

Silicon Laboratories, Inc.(A) | | | 2,293 | | | | 265,942 | |

SolarEdge Technologies, Inc.(A) | | | 2,569 | | | | 244,286 | |

Synaptics, Inc.(A) | | | 1,769 | | | | 116,347 | |

Teradyne, Inc. | | | 8,858 | | | | 604,027 | |

Universal Display Corp. | | | 2,241 | | | | 461,803 | |

| | | | | | | | |

| | | | | | | 3,991,068 | |

| | | | | | | | |

| Software - 3.8% | |

ACI Worldwide, Inc.(A) | | | 6,110 | | | | 231,477 | |

Blackbaud, Inc. | | | 2,600 | | | | 206,960 | |

CDK Global, Inc. | | | 6,417 | | | | 350,882 | |

Ceridian HCM Holding, Inc.(A) (B) | | | 5,327 | | | | 361,597 | |

CommVault Systems, Inc.(A) | | | 2,223 | | | | 99,235 | |

Fair Isaac Corp.(A) | | | 1,531 | | | | 573,635 | |

j2 Global, Inc.(B) | | | 2,447 | | | | 229,308 | |

LogMeIn, Inc. | | | 2,580 | | | | 221,209 | |

Manhattan Associates, Inc.(A) | | | 3,378 | | | | 269,396 | |

PTC, Inc.(A) | | | 5,494 | | | | 411,446 | |

Teradata Corp.(A) | | | 5,947 | | | | 159,201 | |

Tyler Technologies, Inc.(A) | | | 2,061 | | | | 618,341 | |

| | | | | | | | |

| | | | | | | 3,732,687 | |

| | | | | | | | |

| Specialty Retail - 2.3% | |

Aaron’s, Inc. | | | 3,550 | | | | 202,741 | |

American Eagle Outfitters, Inc. | | | 8,395 | | | | 123,407 | |

AutoNation, Inc.(A) | | | 3,112 | | | | 151,337 | |

Bed Bath & Beyond, Inc.(B) | | | 6,690 | | | | 115,737 | |

Dick’s Sporting Goods, Inc. | | | 3,362 | | | | 166,385 | |

Five Below, Inc.(A) | | | 2,943 | | | | 376,292 | |

Foot Locker, Inc. | | | 5,658 | | | | 220,605 | |

Murphy USA, Inc.(A) | | | 1,528 | | | | 178,776 | |

RH(A) | | | 862 | | | | 184,037 | |

Sally Beauty Holdings, Inc.(A) (B) | | | 6,149 | | | | 112,219 | |

Urban Outfitters, Inc.(A) | | | 3,729 | | | | 103,554 | |

Williams-Sonoma, Inc.(B) | | | 4,102 | | | | 301,251 | |

| | | | | | | | |

| | | | | | | 2,236,341 | |

| | | | | | | | |

| Technology Hardware, Storage & Peripherals - 0.2% | |

NCR Corp.(A) | | | 6,745 | | | | 237,154 | |

| | | | | | | | |

| | | | | | | | |

| | | Shares | | | Value | |

| COMMON STOCKS (continued) | |

| Textiles, Apparel & Luxury Goods - 1.0% | |

Carter’s, Inc. | | | 2,334 | | | | $ 255,199 | |

Columbia Sportswear Co.(B) | | | 1,535 | | | | 153,792 | |

Deckers Outdoor Corp.(A) | | | 1,479 | | | | 249,744 | |

Skechers U.S.A., Inc., Class A(A) | | | 7,078 | | | | 305,699 | |

| | | | | | | | |

| | | | | | | 964,434 | |

| | | | | | | | |

| Thrifts & Mortgage Finance - 0.6% | |

LendingTree, Inc.(A) (B) | | | 405 | | | | 122,893 | |

New York Community Bancorp, Inc. | | | 24,703 | | | | 296,930 | |

Washington Federal, Inc. | | | 4,141 | | | | 151,768 | |

| | | | | | | | |

| | | | | | | 571,591 | |

| | | | | | | | |

| Trading Companies & Distributors - 0.7% | |

GATX Corp. | | | 1,855 | | | | 153,687 | |

MSC Industrial Direct Co., Inc., Class A | | | 2,381 | | | | 186,837 | |

NOW, Inc.(A) | | | 5,751 | | | | 64,641 | |

Watsco, Inc. | | | 1,726 | | | | 310,939 | |

| | | | | | | | |

| | | | | | | 716,104 | |

| | | | | | | | |

| Water Utilities - 0.6% | |

Aqua America, Inc. | | | 11,409 | | | | 535,538 | |

| | | | | | | | |

| Wireless Telecommunication Services - 0.1% | |

Telephone & Data Systems, Inc. | | | 5,170 | | | | 131,473 | |

| | | | | | | | |

Total Common Stocks

(Cost $87,494,639) | | | | 96,512,753 | |

| | | | | |

|

| SHORT-TERM INVESTMENT COMPANY - 1.0% | |

| Money Market Fund - 1.0% | |

State Street Institutional Treasury Money Market Fund, 1.44%(C) | | | 926,406 | | | | 926,406 | |

| | | | | | | | |

Total Short-Term Investment Company

(Cost $926,406) | | | | 926,406 | |

| | | | | |

|

| OTHER INVESTMENT COMPANY - 9.0% | |

| Securities Lending Collateral - 9.0% | |

State Street Navigator Securities Lending Trust - Government Money Market Portfolio, 1.56%(C) | | | 8,808,019 | | | | 8,808,019 | |

| | | | | | | | |

Total Other Investment Company

(Cost $8,808,019) | | | | 8,808,019 | |

| | | | | |

Total Investments

(Cost $97,229,064) | | | | 106,247,178 | |

Net Other Assets (Liabilities) - (8.7)% | | | | | | | (8,482,495 | ) |

| | | | | | | | |

| | |

Net Assets - 100.0% | | | | | | | $ 97,764,683 | |

| | | | | | | | |

| |

FUTURES CONTRACTS:

| | | | | | | | | | | | | | | | | | | | | | | | |

Long Futures Contracts | |

| Description | | Number of

Contracts | | | Expiration

Date | | | Notional

Amount | | | Value | | | Unrealized

Appreciation | | | Unrealized

Depreciation | |

S&P Midcap 400®E-Mini Index | | | 6 | | | | 03/20/2020 | | | $ | 1,226,608 | | | $ | 1,238,880 | | | $ | 12,272 | | | $ | — | |

The Notes to Financial Statements are an integral part of this report.

| | |

| Transamerica ETF Trust | | Annual Report 2019 |

Page 9

DeltaShares® S&P 400 Managed Risk ETF

SCHEDULE OF INVESTMENTS (continued)

At December 31, 2019

SECURITY VALUATION:

Valuation Inputs(D)

| | | | | | | | | | | | | | | | | | |

| | | Level 1 -

Unadjusted

Quoted Prices | | | Level 2 -

Other Significant

Observable Inputs | | | Level 3 -

Significant

Unobservable Inputs | | | Value | |

ASSETS | |

Investments | |

Common Stocks | | $ | 96,512,753 | | | $ | — | | | $ | — | | | $ | 96,512,753 | |

Short-Term Investment Company | | | 926,406 | | | | — | | | | — | | | | 926,406 | |

Other Investment Company | | | 8,808,019 | | | | — | | | | — | | | | 8,808,019 | |

| | | | | | | | | | | | | | | | |

Total Investments | | $ | 106,247,178 | | | $ | — | | | $ | — | | | $ | 106,247,178 | |

| | | | | | | | | | | | | | | | |

Other Financial Instruments | |

Futures Contracts(E) | | $ | 12,272 | | | $ | — | | | $ | — | | | $ | 12,272 | |

| | | | | | | | | | | | | | | | |

Total Other Financial Instruments | | $ | 12,272 | | | $ | — | | | $ | — | | | $ | 12,272 | |

| | | | | | | | | | | | | | | | |

FOOTNOTES TO SCHEDULE OF INVESTMENTS:

| | |

| (A) | | Non-income producing securities. |

| (B) | | All or a portion of the securities are on loan. The total value of all securities on loan is $8,592,139. The amount of securities on loan indicated may not correspond with the securities on loan identified because securities with pending sales are in the process of recall from the brokers. |

| (C) | | Rates disclosed reflect the yields at December 31, 2019. |

| (D) | | There were no transfers in or out of Level 3 during the year ended December 31, 2019. Please reference the Security Valuation section of the Notes to Financial Statements for more information regarding security valuation and pricing inputs. |

| (E) | | Futures contracts and/or forward foreign currency contracts are valued at unrealized appreciation (depreciation). |

The Notes to Financial Statements are an integral part of this report.

| | |

| Transamerica ETF Trust | | Annual Report 2019 |

Page 10

DeltaShares® S&P 500 Managed Risk ETF

(unaudited)

MARKET ENVIRONMENT

Stocks across the world posted positive returns in 2019. The S&P 500® also posted strong performance in 2019.

Global stock markets began the year on a positive note, with a snap recovery from the late December 2018 trough. This continued throughout January and shrugged off the longest government shutdown in U.S. history. Markets largely continued to rally through April, but gave up roughly half of theiryear-to-date gains in May. The loss was broad based, with domestic, international developed, and emerging markets all finishing the month sharply lower. However, the second quarter of 2019 finished on a higher note, with May losses closely mirrored by June gains, to complete a low volatilityV-shaped quarter.

Domestic equity returns remained in positive territory in July with the S&P 500® hitting the 3,000 price level for the first time in history. In contrast, both developed and emerging market equities fluctuated between positive and negative territory, ending the month with losses. Equity volatility picked up in August, but remained somewhat moderate. During this time, bond markets rallied around the globe. While the U.S. Federal Reserve (“Fed”) had merely paused rate hikes for the first half of the year, the Fed commenced the first of three consecutive cuts in August. Volatility then subsided, and experienced further declines, boosted by the “Phase One Trade Deal” announced in December as markets rallied through the fiscal year end.

PERFORMANCE OVERVIEW

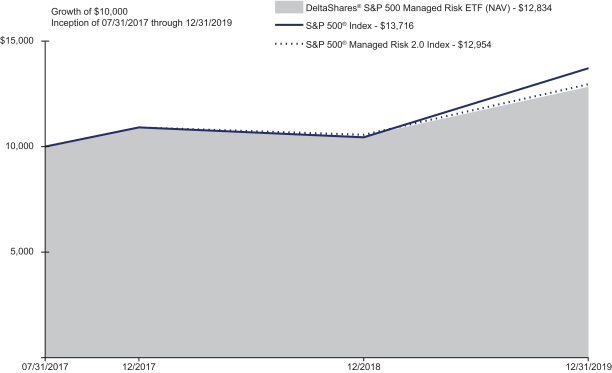

For the year ended December 31, 2019, the DeltaShares® S&P 500 Managed Risk ETF (NAV) returned 22.30%. By comparison, the S&P 500® Managed Risk 2.0 Index (the “Underlying Index”) returned 22.74% and the S&P 500® Index returned 31.49%.

The Fund’s performance reflects annual operating expenses of the Fund, including management fees, brokerage expenses, and other fees and expenses. Index returns do not reflect fees and expenses of any kind, which would have a negative impact on returns.

STRATEGY REVIEW

The DeltaShares® S&P 500 Managed Risk ETF (the “Fund”) seeks to track the investment results, before fees and expenses, of the Underlying Index.

The Fund seeks to achieve this investment objective by holding a portfolio of securities that are included in the Underlying Index, including common stocks, U.S. Treasury bonds, and/or cash. The Underlying Index is designed to simulate, through a rules-based methodology, a dynamic portfolio with the aim of both managing the volatility of the Underlying Index and limiting losses from the Underlying Index’s equity exposure due to severe sustained market declines. The Underlying Index seeks to achieve these objectives by allocating weightings among the S&P 500® Index, the S&P U.S. Treasury Bond Current5-Year Index, and the S&P U.S. Treasury Bill0-3 Month Index. The Fund may also use derivatives in an effort to gain exposure to underlying securities and markets in a more efficient manner, to optimize the execution processes and costs for portfolio transitions or for tax management purposes. Under normal circumstances, the Fund uses a replication strategy and generally expects to invest in substantially all of the securities in the Underlying Index.

During the12-month period ended December 31, 2019, the largest contributors to the Fund’s absolute total return were equities within the information technology, financials, communications services, and health care sectors. From both an asset class and equity sector perspective, there were no detractors during the period, but the least impactful contributors were U.S. Treasury bonds as well as equities within the energy and materials sectors.

During the fiscal year, the Fund used derivatives. These positions added to performance.

Blake Graves, CFA

Charles Lowery, CFA

Louis Ng

Co-Portfolio Managers

Milliman Financial Risk Management LLC

| | | | |

| Asset Allocation | | Percentage of Net

Assets | |

Common Stocks | | | 98.5 | % |

Short-Term Investment Company | | | 1.3 | |

Other Investment Company | | | 0.4 | |

Net Other Assets (Liabilities) ^ | | | (0.2 | ) |

Total | | | 100.0 | % |

| | | | |

| Current | and future portfolio holdings are subject to change and risk. |

| ^ | The Net Other Assets (Liabilities) category may include, but is not limited to, reverse repurchase agreements, forward foreign currency contracts, futures contracts, swap agreements, written options and swaptions, and cash collateral. |

| | |

| Transamerica ETF Trust | | Annual Report 2019 |

Page 11

DeltaShares® S&P 500 Managed Risk ETF

(unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Performance as of December 31, 2019 | | | | | | | | | | | | | | | | |

| | | Average Annual Total Returns | | | | | | | | Cumulative Total Returns | | | | | | | | Inception Date | |

| | | 1 Year | | | 10 Year or

Since

Inception | | | | | | 1 Year | | | 10 Year or

Since

Inception | | | | | | | |

Fund NAV | | | 22.30 | % | | | 10.85 | % | | | | | | | 22.30 | % | | | 28.34 | % | | | | | | | 07/31/2017 | |

Fund Market | | | 22.42 | % | | | 10.82 | % | | | | | | | 22.42 | % | | | 28.24 | % | | | | | | | 07/31/2017 | |

S&P 500® Index(A) | | | 31.49 | % | | | 13.94 | % | | | | | | | 31.49 | % | | | 37.16 | % | | | | | | | | |

S&P 500® Managed Risk 2.0 Index (A)(B)(C)(D) | | | 22.74 | % | | | 11.28 | % | | | | | | | 22.74 | % | | | 29.54 | % | | | | | | | | |

(A) The S&P 500® Index is a market-capitalization weighted index of 500 large U.S. companies with common stock listed on the NYSE or NASDAQ.

(B) The S&P 500® Managed Risk 2.0 Index is comprised of weightings amongst the S&P 500® Index, the S&P U.S. Treasury Bond Current5-Year Index, and the S&P U.S. Treasury Bill0-3 Month Index. The S&P 500® Managed Risk 2.0 Index rebalances on a daily basis.

(C) The S&P U.S. Treasury Bond Current5-Year Index is aone-security index comprising the most recently issued5-year U.S. Treasury note or bond.

(D) The S&P U.S. Treasury Bill0-3 Month Index is designed to measure the performance of U.S. Treasury bills maturing in 0 to 3 months.

The Fund’s benchmarks are unmanaged indices used as a general measure of market performance. Calculations assume dividends and capital gains are reinvested and do not include any managerial expenses. The 10 Years or the Since Inception calculation is based on the previous 10 years or since the inception date, whichever is more recent. An index is a statistical measure of a specified financial market or sector. An index does not actually hold a portfolio of securities and therefore does not reflect deductions for fees or expenses. In comparison, a Fund’s performance is negatively impacted by these deductions. You cannot invest directly in an index.

The performance data presented represents past performance and does not guarantee future results. Performance data does not reflect the deduction of taxes that would be paid on Fund distributions or the redemption of Fund shares. The Fund’s investment return and net asset value will fluctuate. Investors’ shares when sold may be worth more or less than their original cost. Current performance may be lower or higher than performance quoted. Please see www.deltashares.com for performance data current to the most recent month end. Fund performance is net of investment fees and Fund expenses.

Performance results do not include adjustments made for financial reporting purposes in accordance with U.S. generally accepted accounting principles and may differ from amounts reported in the Financial Highlights.

Fund shares are bought and sold at Market Price, not Net Asset Value (“NAV”), and are not individually redeemed from the fund. Net Asset Value is an exchange-traded fund’s per-share value. The per-share dollar amount of the Fund is derived by dividing the total value of all the securities in the portfolio, less any liabilities, by the number of Fund shares outstanding. Market Price is the price at which a share can currently be traded in the market. The market price used to calculate the market return is determined by using the midpoint between the highest bid and the lowest offer on the exchange on which the shares of the Fund are listed for trading, as of the time that the Fund’s NAV is calculated.

Exchange-Traded Funds (ETFs) are subject to market risk, including the loss of principal. Because Fund Shares trade at market prices rather than at NAV, Fund Shares may trade at a price greater than NAV (premium) or less than NAV (discount). Shares of DeltaShares® ETFs may be bought and sold throughout the day on the exchange through any brokerage account. Buying and selling shares of ETFs will result in brokerage commissions. Diversification and asset allocation may not protect against market risk or loss of principal. Investing involves risk, including the possible loss of principal. There is no guarantee the investment objective will be achieved. Equity securities represent an ownership interest in an issuer, rank junior in a company’s capital structure and consequently may entail greater risk of loss than debt securities. The market prices of fixed-income securities may go up or down, sometimes rapidly and unpredictably, due to general market conditions, such as real or perceived adverse economic or political conditions, inflation, changes in interest rates, lack of liquidity in the bond markets or adverse investor sentiment. The principal risks include risks related to: Equity securities, index tracking, leveraging, derivatives such as futures, forwards, swaps, options, and investing in underlying exchange-traded funds. The use of derivatives may produce disproportionate gains or losses, may increase costs, and amplify risks.

| | |

| Transamerica ETF Trust | | Annual Report 2019 |

Page 12

DeltaShares® S&P 500 Managed Risk ETF

SCHEDULE OF INVESTMENTS

At December 31, 2019

| | | | | | | | |

| | | Shares | | | Value | |

| COMMON STOCKS - 98.5% | |

| Aerospace & Defense - 2.4% | |

Arconic, Inc. | | | 6,107 | | | | $ 187,912 | |

Boeing Co. | | | 8,429 | | | | 2,745,831 | |

General Dynamics Corp. | | | 3,694 | | | | 651,437 | |

Huntington Ingalls Industries, Inc. | | | 645 | | | | 161,818 | |

L3 Harris Technologies, Inc. | | | 3,485 | | | | 689,577 | |

Lockheed Martin Corp. | | | 3,913 | | | | 1,523,644 | |

Northrop Grumman Corp. | | | 2,471 | | | | 849,950 | |

Raytheon Co. | | | 4,390 | | | | 964,659 | |

Textron, Inc. | | | 3,599 | | | | 160,515 | |

TransDigm Group, Inc. | | | 785 | | | | 439,600 | |

United Technologies Corp. | | | 12,790 | | | | 1,915,430 | |

| | | | | | | | |

| | | | | | | 10,290,373 | |

| | | | | | | | |

| Air Freight & Logistics - 0.5% | |

CH Robinson Worldwide, Inc. | | | 2,132 | | | | 166,722 | |

Expeditors International of Washington, Inc. | | | 2,685 | | | | 209,484 | |

FedEx Corp. | | | 3,784 | | | | 572,179 | |

United Parcel Service, Inc., Class B | | | 11,047 | | | | 1,293,162 | |

| | | | | | | | |

| | | | | | | 2,241,547 | |

| | | | | | | | |

| Airlines - 0.4% | |

Alaska Air Group, Inc. | | | 1,942 | | | | 131,570 | |

American Airlines Group, Inc.(A) | | | 6,146 | | | | 176,267 | |

Delta Air Lines, Inc. | | | 9,074 | | | | 530,648 | |

Southwest Airlines Co. | | | 7,467 | | | | 403,069 | |

United Airlines Holdings, Inc.(B) | | | 3,431 | | | | 302,237 | |

| | | | | | | | |

| | | | | | | 1,543,791 | |

| | | | | | | | |

| Auto Components - 0.1% | |

Aptiv PLC | | | 4,025 | | | | 382,254 | |

BorgWarner, Inc. | | | 3,255 | | | | 141,202 | |

| | | | | | | | |

| | | | | | | 523,456 | |

| | | | | | | | |

| Automobiles - 0.3% | |

Ford Motor Co. | | | 61,389 | | | | 570,918 | |

General Motors Co. | | | 19,821 | | | | 725,448 | |

Harley-Davidson, Inc. | | | 2,432 | | | | 90,446 | |

| | | | | | | | |

| | | | | | | 1,386,812 | |

| | | | | | | | |

| Banks - 5.5% | |

Bank of America Corp. | | | 127,625 | | | | 4,494,953 | |

Citigroup, Inc. | | | 34,417 | | | | 2,749,574 | |

Citizens Financial Group, Inc. | | | 6,853 | | | | 278,300 | |

Comerica, Inc. | | | 2,273 | | | | 163,088 | |

Fifth Third Bancorp | | | 11,188 | | | | 343,919 | |

First Republic Bank | | | 2,657 | | | | 312,065 | |

Huntington Bancshares, Inc. | | | 16,281 | | | | 245,517 | |

JPMorgan Chase & Co. | | | 49,446 | | | | 6,892,772 | |

KeyCorp | | | 15,528 | | | | 314,287 | |

M&T Bank Corp. | | | 2,080 | | | | 353,080 | |

People’s United Financial, Inc. | | | 7,001 | | | | 118,317 | |

PNC Financial Services Group, Inc. | | | 6,908 | | | | 1,102,724 | |

Regions Financial Corp. | | | 15,207 | | | | 260,952 | |

SVB Financial Group(B) | | | 813 | | | | 204,096 | |

Truist Financial Corp. | | | 21,142 | | | | 1,190,717 | |

US Bancorp | | | 22,406 | | | | 1,328,452 | |

Wells Fargo & Co. | | | 60,674 | | | | 3,264,261 | |

Zions Bancorp NA | | | 2,687 | | | | 139,509 | |

| | | | | | | | |

| | | | | | | 23,756,583 | |

| | | | | | | | |

| Beverages - 1.8% | |

Brown-Forman Corp., Class B | | | 2,872 | | | | 194,147 | |

| | | | | | | | |

| | | Shares | | | Value | |

| COMMON STOCKS (continued) | |

| Beverages (continued) | |

Coca-Cola Co. | | | 60,789 | | | | $ 3,364,671 | |

Constellation Brands, Inc., Class A | | | 2,641 | | | | 501,130 | |

Molson Coors Brewing Co., Class B | | | 2,962 | | | | 159,652 | |

Monster Beverage Corp.(B) | | | 6,018 | | | | 382,444 | |

PepsiCo, Inc. | | | 21,983 | | | | 3,004,416 | |

| | | | | | | | |

| | | | | | | 7,606,460 | |

| | | | | | | | |

| Biotechnology - 2.0% | |

AbbVie, Inc. | | | 23,313 | | | | 2,064,133 | |

Alexion Pharmaceuticals, Inc.(B) | | | 3,489 | | | | 377,335 | |

Amgen, Inc. | | | 9,367 | | | | 2,258,103 | |

Biogen, Inc.(B) | | | 2,845 | | | | 844,197 | |

Gilead Sciences, Inc. | | | 19,945 | | | | 1,296,026 | |

Incyte Corp.(B) | | | 2,818 | | | | 246,068 | |

Regeneron Pharmaceuticals, Inc.(B) | | | 1,259 | | | | 472,729 | |

Vertex Pharmaceuticals, Inc.(B) | | | 4,054 | | | | 887,623 | |

| | | | | | | | |

| | | | | | | 8,446,214 | |

| | | | | | | | |

| Building Products - 0.3% | |

A.O. Smith Corp. | | | 2,161 | | | | 102,950 | |

Allegion PLC | | | 1,465 | | | | 182,451 | |

Fortune Brands Home & Security, Inc. | | | 2,194 | | | | 143,356 | |

Johnson Controls International PLC | | | 12,161 | | | | 495,075 | |

Masco Corp. | | | 4,479 | | | | 214,947 | |

| | | | | | | | |

| | | | | | | 1,138,779 | |

| | | | | | | | |

| Capital Markets - 2.6% | |

Ameriprise Financial, Inc. | | | 1,997 | | | | 332,660 | |

Bank of New York Mellon Corp. | | | 13,230 | | | | 665,866 | |

BlackRock, Inc. | | | 1,859 | | | | 934,519 | |

Cboe Global Markets, Inc. | | | 1,748 | | | | 209,760 | |

Charles Schwab Corp. | | | 18,023 | | | | 857,174 | |

CME Group, Inc. | | | 5,649 | | | | 1,133,867 | |

E*TRADE Financial Corp. | | | 3,562 | | | | 161,608 | |

Franklin Resources, Inc. | | | 4,397 | | | | 114,234 | |

Goldman Sachs Group, Inc. | | | 5,024 | | | | 1,155,168 | |

Intercontinental Exchange, Inc. | | | 8,779 | | | | 812,496 | |

Invesco, Ltd. | | | 5,868 | | | | 105,507 | |

MarketAxess Holdings, Inc. | | | 598 | | | | 226,708 | |

Moody’s Corp. | | | 2,560 | | | | 607,770 | |

Morgan Stanley | | | 19,393 | | | | 991,370 | |

MSCI, Inc. | | | 1,335 | | | | 344,670 | |

Nasdaq, Inc. | | | 1,809 | | | | 193,744 | |

Northern Trust Corp. | | | 3,340 | | | | 354,842 | |

Raymond James Financial, Inc. | | | 1,946 | | | | 174,089 | |

S&P Global, Inc. | | | 3,853 | | | | 1,052,062 | |

State Street Corp. | | | 5,732 | | | | 453,401 | |

T. Rowe Price Group, Inc. | | | 3,684 | | | | 448,859 | |

| | | | | | | | |

| | | | | | | 11,330,374 | |

| | | | | | | | |

| Chemicals - 1.9% | |

Air Products & Chemicals, Inc. | | | 3,475 | | | | 816,590 | |

Albemarle Corp. | | | 1,672 | | | | 122,123 | |

Celanese Corp. | | | 1,906 | | | | 234,667 | |

CF Industries Holdings, Inc. | | | 3,428 | | | | 163,653 | |

Corteva, Inc. | | | 11,798 | | | | 348,749 | |

Dow, Inc. | | | 11,689 | | | | 639,739 | |

DuPont de Nemours, Inc. | | | 11,679 | | | | 749,792 | |

Eastman Chemical Co. | | | 2,144 | | | | 169,933 | |

Ecolab, Inc. | | | 3,953 | | | | 762,889 | |

The Notes to Financial Statements are an integral part of this report.

| | |

| Transamerica ETF Trust | | Annual Report 2019 |

Page 13

DeltaShares® S&P 500 Managed Risk ETF

SCHEDULE OF INVESTMENTS (continued)

At December 31, 2019

| | | | | | | | |

| | | Shares | | | Value | |

| COMMON STOCKS (continued) | |

| Chemicals (continued) | |

FMC Corp. | | | 2,043 | | | | $ 203,932 | |

International Flavors & Fragrances, Inc.(A) | | | 1,683 | | | | 217,141 | |

Linde PLC | | | 8,468 | | | | 1,802,837 | |

LyondellBasell Industries NV, Class A | | | 4,047 | | | | 382,360 | |

Mosaic Co. | | | 5,512 | | | | 119,280 | |

PPG Industries, Inc. | | | 3,728 | | | | 497,651 | |

Sherwin-Williams Co. | | | 1,295 | | | | 755,684 | |

| | | | | | | | |

| | | | | | | 7,987,020 | |

| | | | | | | | |

| Commercial Services & Supplies - 0.4% | |

Cintas Corp. | | | 1,322 | | | | 355,724 | |

Copart, Inc.(B) | | | 3,225 | | | | 293,282 | |

Republic Services, Inc. | | | 3,321 | | | | 297,661 | |

Rollins, Inc. | | | 2,220 | | | | 73,615 | |

Waste Management, Inc. | | | 6,153 | | | | 701,196 | |

| | | | | | | | |

| | | | | | | 1,721,478 | |

| | | | | | | | |

| Communications Equipment - 1.0% | |

Arista Networks, Inc.(B) | | | 855 | | | | 173,907 | |

Cisco Systems, Inc. | | | 66,878 | | | | 3,207,469 | |

F5 Networks, Inc.(B) | | | 958 | | | | 133,785 | |

Juniper Networks, Inc. | | | 5,277 | | | | 129,972 | |

Motorola Solutions, Inc. | | | 2,701 | | | | 435,239 | |