BVH OVERVIEW

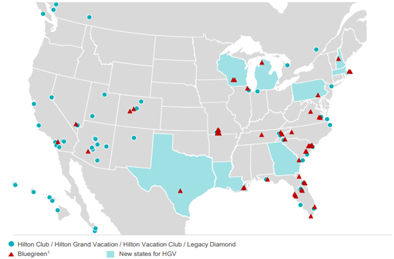

BVH is a leading vacation ownership company that markets and sells VOIs and manages resorts in popular leisure and urban destinations. As of September 30, 2023, BVH’s resort network operates 49 Club Resorts (resorts in which owners in the Bluegreen Vacation Club (the “Vacation Club”) have the right to control and use most of the units in connection with their VOI ownership) and an additional 23 Club Associate Resorts (resorts in which owners in the Vacation Club have the right to use only a limited number of units in connection with their VOI ownership). These Club Resorts and Club Associate Resorts are primarily located in high-volume, “drive-to” vacation locations, including Orlando, Panama City Beach, Las Vegas, the Smoky Mountains, Myrtle Beach, Charleston, the Branson, Missouri area, Nashville and New Orleans, among others. Through BVH’s points-based system, the approximately 216,000 Vacation Club owners have the flexibility to stay at units available at any of BVH’s resorts and have access to over 11,600 other hotels and resorts through partnerships and exchange networks.

BVH’s sales and marketing platform is currently supported by marketing relationships with nationally recognized consumer brands, such as Bass Pro and Choice Hotels. We believe these marketing relationships have helped generate sales within BVH’s core demographic, as described below.

The Vacation Club has grown from approximately 170,000 owners as of December 31, 2012 to approximately 216,000 owners as of September 30, 2023. The average Vacation Club owner is 48 years old and has an average annual household income of approximately $84,000. According to U.S. census data, households with an annual income of $50,000 to $100,000 represent approximately 28% of the total population. We believe BVH’s ability to effectively scale the transaction size to suit its customer, as well as its high quality, conveniently located, “drive-to” resorts are key factors in attracting its core target demographic.

BVH reports its results through two reportable segments: (i) Sales of VOIs and Financing; and (ii) Resort Operations and Club Management. For more information regarding BVH’s segments, see “Management’s Discussion and Analysis of Financial Condition and Results of Operations—BVH,” and Note 17: Segment reporting in BVH’s audited consolidated financial statements and Note 14: Segment reporting in BVH’s unaudited condensed consolidated financial statements, each included in this offering memorandum.

The Sales of VOIs and Financing segment includes BVH’s marketing and sales activities related to the VOIs that are owned by BVH, VOIs BVH acquires under just-in-time and secondary market inventory arrangements, and sales of VOIs through fee-for-service arrangements with third-party developers, as well as consumer financing activities in connection with sales of VOIs owned by BVH, and title services operations.

The Resort Operations and Club Management segment includes management services activities for the Vacation Club and for a majority of the HOAs of the resorts within the Vacation Club. BVH also provides reservation services, services to owners and billing and collections services to the Vacation Club and certain HOAs, which are included in the resort operations and club management segment. Additionally, this segment includes revenue from the Traveler Plus program, food and beverage and other retail operations, rental services activities, and management of construction activities for certain fee-based developer clients.

BVH’s tour flow consisted of approximately 246,839 tours for the twelve months ended September 30, 2023, compared to 243,448 tours for the year ended December 31, 2022, 213,599 tours for the year ended December 31, 2021 and 120,801 tours for the year ended December 31, 2020. As of September 30, 2023, Bluegreen’s Vacation Club had approximately 216,000 members, compared to approximately 218,000 members as of December 31, 2022, 217,000 members as of December 31, 2021 and 218,000 members as of December 31, 2020. For the twelve months ended September 30, 2023 and the years ended December 31, 2022, 2021 and 2020, BVH’s VPG was approximately $3,152, $3,073, $2,907 and $3,046, respectively. For the twelve months ended September 30, 2023 and the years ended December 31, 2022, 2021 and 2020, BVH had default rates of 10.5%, 8.5%, 8.4% and 9.8%, respectively.