- JELD Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

DEF 14A Filing

JELD-WEN Holding (JELD) DEF 14ADefinitive proxy

Filed: 25 Mar 19, 5:28pm

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

Filed by the Registrant ☒

Filed by a Party other than the Registrant o

Check the appropriate box:

| o | Preliminary Proxy Statement |

| o | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ☒ | Definitive Proxy Statement |

| o | Definitive Additional Materials |

| o | Soliciting Material under §240.14a-12 |

JELD-WEN HOLDING, INC. |

(Name of Registrant as Specified in its Charter) |

(Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

Payment of Filing Fee (Check the appropriate box):

☒ | No fee required. | |

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. | ||

(1) | Title of each class of securities to which transaction applies: | |

(2) | Aggregate number of securities to which transaction applies: | |

(3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): | |

(4) | Proposed maximum aggregate value of transaction: | |

(5) | Total fee paid: | |

o | Fee paid previously with preliminary materials. | |

o | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |

(1) | Amount Previously Paid: | |

(2) | Form, Schedule or Registration Statement No.: | |

(3) | Filing Party: | |

(4) | Date Filed: | |

March 25, 2019

Dear Fellow Shareholders:

On behalf of the Board of Directors, I invite you to attend the 2019 Annual Meeting of Shareholders (the “Annual Meeting”) of JELD-WEN Holding, Inc., on Thursday, May 9, 2019, at 8:00 a.m. (Eastern Time) at our headquarters located at 2645 Silver Crescent Drive, Charlotte, North Carolina 28273.

At the Annual Meeting, you will be asked to: (i) elect four Class II directors to our Board of Directors, (ii) approve, on a nonbinding, advisory basis, the compensation of our named executive officers, (iii) ratify the selection of PricewaterhouseCoopers LLP as our independent auditor for 2019 and (iv) transact any other business that may properly come before the Annual Meeting or any adjournment or postponement of the meeting. In addition, management will report on the progress of our business and respond to comments and questions of general interest to our shareholders.

It is important that your shares be represented and voted, regardless of whether you plan to attend the Annual Meeting in person. You may vote on the Internet, by telephone or by completing and mailing a proxy or voting card. Voting by Internet, telephone or mail will ensure your shares are represented at the Annual Meeting. If you attend the meeting in person, you may choose to revoke your proxy and vote in person.

Securities and Exchange Commission rules allow companies to furnish proxy materials to their shareholders on the Internet. We are pleased to take advantage of these rules and believe that they enable us to provide you with the information you need, while making delivery more efficient and more environmentally friendly. In accordance with these rules, on March 25, 2019, we mailed a Notice of Internet Availability of Proxy Materials to each of our shareholders providing instructions on how to access our proxy materials and the 2018 Annual Report over the Internet. While the Notice of Internet Availability of Proxy Materials cannot itself be used to vote your shares, it provides instructions on how to vote online or by telephone and includes instructions on how to request a printed set of the proxy materials, including the 2018 Annual Report.

On behalf of management and our Board of Directors, we thank you for your continued support and interest in JELD-WEN Holding, Inc.

Sincerely, | |

| |

Kirk A. Hachigian Chairman of the Board of Directors |

JELD-WEN Holding, Inc. Notice of 2019 Annual Meeting of Shareholders | ||||

Date: Thursday, May 9, 2019 | • • • • • • • • • • • • • • | Time: 8:00 a.m. Eastern Time | • • • • • • • • • • • • • • | Location: JELD-WEN Holding, Inc. Headquarters 2645 Silver Crescent Drive Charlotte, North Carolina 28273 |

Record Date | March 11, 2019. Only shareholders of record of the Company’s common stock at the close of business on the record date are entitled to receive notice of, and to vote at, the Annual Meeting and any adjournments or postponements of the meeting. | |

Items of Business | • | To elect four nominees as Class II directors to our Board of Directors; |

• | To approve, on a nonbinding, advisory basis, the compensation of our named executive officers; | |

• | To ratify the selection of PricewaterhouseCoopers LLP as our independent auditor for 2019; and | |

• | To transact any other business as may properly come before the Annual Meeting or any adjournments or postponements of the meeting. | |

Proxy Materials | Attached to this meeting notice you will find a proxy statement that contains further information about the items upon which you will be asked to vote and the meeting itself. Your vote is very important — you may vote on the Internet, by telephone or by completing and mailing a proxy or voting card as explained in the attached Proxy Statement. | |

Admission to the Meeting | To attend the Annual Meeting, shareholders will be asked to present a valid photo identification and proof of share ownership as described in the “Information about the Annual Meeting and Voting” section of the attached Proxy Statement. | |

Proxy Voting | Important. Even if you plan to attend the Annual Meeting, we encourage you to submit your proxy by Internet, telephone or mail prior to the meeting. If you later choose to revoke your proxy or change your vote, you may do so by following the procedures described in the “Information about the Annual Meeting and Voting” section in the attached Proxy Statement. | |

Access to Proxy Materials | A Notice of Internet Availability of Proxy Materials (the “Notice”) containing instructions on how to access proxy materials (including the 2019 Proxy Statement and 2018 Annual Report) were first mailed on or about March 25, 2019 to all shareholders entitled to vote at the Annual Meeting, and the proxy materials were posted under the Financials section on the Company’s website, investors.jeld-wen.com, and on the website referenced in the Notice on the same day. | |

On behalf of the Board of Directors,

Rebekah J. Toton

Corporate Secretary

Charlotte, North Carolina

March 25, 2019

IMPORTANT INFORMATION REGARDING THE AVAILABILITY OF PROXY MATERIALS

This Notice of Meeting, Proxy Statement, Proxy Card and 2018 Annual Report, which includes our

annual report on Form 10-K for the year ended December 31, 2018, are available at www.proxyvote.com.

2019 PROXY STATEMENT SUMMARY

This summary highlights information about JELD-WEN Holding, Inc. and the upcoming 2019 Annual Meeting of Shareholders (the “Annual Meeting”). This summary does not contain all the information you should consider, and you should read the entire Proxy Statement carefully before voting. Unless the context otherwise requires, all references in this Proxy Statement to “JELD-WEN,” “Company,” “we,” “us” and “our” refer to JELD-WEN Holding, Inc. and its subsidiaries.

Our mailing address and principal executive office is 2645 Silver Crescent Drive, Charlotte, North Carolina 28273. Our website is located at investors.jeld-wen.com. The information contained on, or that can be accessed through, our website is not a part of this Proxy Statement.

How to Vote Your Shares |

If you were a shareholder of record as of March 11, 2019, you may cast your vote in one of the following ways:

Internet Visit www.proxyvote.com and follow the instructions on your proxy card. |  Phone Call 1-800-690-6903 or the number on your proxy card or voting instruction form. You will need the 16-digit control number provided on your proxy card or voting instruction form. |  Complete, sign and date the proxy card or voting instruction form and mail it in the accompanying pre-addressed envelope. |  In Person See “Questions and Answers About the Annual Meeting - How can I attend the Annual Meeting?” on page 48 for details on what to bring to the Annual Meeting. | |||||

If you hold your shares in “street name,” you should follow the instructions provided by your bank or broker.

CORPORATE GOVERNANCE HIGHLIGHTS |

Our Board of Directors (the “Board”) is committed to maintaining the highest standards of integrity and ethics and to the continuous improvement of our corporate governance principles and practices. The following are some highlights of our governance framework:

| • | Separation of the roles of CEO and Chairman of the Board |

| • | Majority of directors are independent |

| • | Fully independent board committees |

| • | Adoption of clawback, anti-hedging and anti-pledging policies |

| • | Director resignation policy for directors elected by less than a majority vote |

| • | Mandatory retirement age for directors |

| • | Minimum stockholding requirements for directors and executives |

| • | Limitation on the number of public boards on which a director may serve |

| • | Annual self-evaluation of the Board and its committees |

| • | Annual organization and talent reviews conducted by the Board |

i

Voting Matters and Board RecommendationS |

Proposal 1: Elect Four Class II Directors to Our Board of Directors |

We are asking our shareholders to elect the following Class II Director nominees:

|  |  |  |

William F. Banholzer, Ph.D. | Martha (Stormy) Byorum | Greg G. Maxwell | Matthew Ross |

Director Since: 2017 | Director Since: 2014 | Director Since: 2017 | Director Since: 2011 |

Occupation: Research Professor at the University of Wisconsin in Chemical and Biological Engineering and Chemistry Departments | Occupation: Founder and CEO of Cori Investment Advisors, LLC | Occupation: Former Executive Vice President, Finance, and CFO of Phillips 66 | Occupation: Managing Director of Onex Partners |

Independent: Yes | Independent: Yes | Independent: Yes | Independent: No |

Committees: Compensation Committee; Governance and Nominating Committee | Committees: Audit Committee; Governance and Nominating Committee (Chair) | Committees: Audit Committee (Chair) | Committees: None |

If elected, each director would serve for a three-year term concluding at the annual meeting of shareholders to be held in 2022, or until his or her successor is duly elected and qualified, subject to his or her earlier death, resignation or removal. The Board recommends that you vote FOR each director nominee.

ii

Proposal 2: Advisory Vote to Approve the Compensation of Our Named Executive Officers |

We are asking our shareholders to approve, on a nonbinding, advisory basis, the compensation of our named executive officers (“NEOs”) as described in the “Compensation of Executive Officers” section of this Proxy Statement beginning on page 17.

Executive Compensation Practices

During 2018, our Compensation Committee reviewed our compensation programs and practices to ensure alignment with our compensation philosophy.

Our compensation practices include: | Our compensation practices do not include: | ||

✔ | Base Salary and an Annual Management Incentive Plan | × | Hedging or Pledging Stock |

✔ | Long-Term Equity Incentives | × | Options Repricing |

✔ | Clawback Policy | × | Excessive Perquisites for Executives |

✔ | Stock Ownership Requirements | × | Tax Gross-Ups Including Excise Taxes in Connection with a Change in Control |

✔ | Double-Trigger Vesting Upon a Change in Control | ||

✔ | Tally Sheets and Risk Analysis | ||

2018 Executive Compensation Highlights

Our compensation program is premised on a pay-for-performance philosophy and places a significant percentage of NEO compensation at risk. In 2018, we compensated our NEOs that are current employees as follows:

Base Salary | A fixed, competitive component of compensation based on duties and responsibilities. | Page 20 |

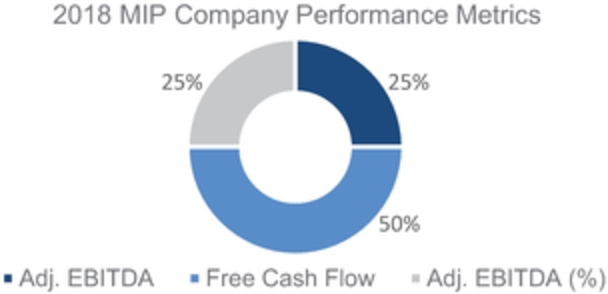

Annual Management Incentive Plan | Designed to motivate achievement of short-term performance goals by linking a portion of NEO compensation to the achievement of our operating plan. | Page 20 |

Long-Term Incentive Plan | Designed to encourage performance that creates a strong pay-for-performance alignment of the Company’s compensation program and long-term shareholder value creation. | Page 24 |

Proposal 3: Ratification of the Selection of Independent Auditor |

We are asking our shareholders to ratify the appointment of PricewaterhouseCoopers LLP (“PwC”) as our independent auditor for 2019. Information on professional services performed and fees billed by PwC are presented beginning on page 39 of this Proxy Statement.

iii

JELD-WEN HOLDING, INC. 2019 PROXY STATEMENT

TABLE OF CONTENTS

1 | Corporate Governance at JELD-WEN | ||||||||

2 | Board of Directors | ||||||||

3 | Compensation of Executive Officers | Compensation Discussion and Analysis | |||||||

Section 4 – 2018 Compensation Tables | |||||||||

4 | Audit Committee Matters | ||||||||

5 | Proposals to be Voted on at the Annual Meeting | ||||||||

6 | Information About the Annual Meeting and Voting | ||||||||

PROXY STATEMENT

FOR THE ANNUAL MEETING OF SHAREHOLDERS

TO BE HELD ON MAY 9, 2019

1. CORPORATE GOVERNANCE AT JELD-WEN

We believe that good corporate governance helps to ensure that the Company is managed for the long-term benefit of our shareholders. We regularly review and consider our corporate governance policies and practices, taking into account the Securities and Exchange Commission’s (the “SEC”) corporate governance rules and regulations, the corporate governance standards of the New York Stock Exchange (the “NYSE”), and shareholder feedback.

We have adopted the JELD-WEN Holding, Inc. Board Guidelines on Corporate Governance Matters (the “Corporate Governance Guidelines”), which provide a framework for the governance of the Company as a whole and describe the principles and practices that the Board follows in carrying out its responsibilities. Our Corporate Governance Guidelines address, among other things:

| • | The composition, structure and policies of the Board and its committees; |

| • | Director qualification standards; |

| • | Expectations and responsibilities of directors; |

| • | Management succession planning; |

| • | The evaluation of Board performance; |

| • | Principles of Board compensation; and |

| • | Communications with shareholders and non-management directors. |

Our Corporate Governance Guidelines further require that the Board, acting through the Governance and Nominating Committee (as described below), conduct a self-evaluation at least annually to determine whether it and its committees are functioning effectively. In addition, our Corporate Governance Guidelines require that each committee conduct an annual self-evaluation to assess its compliance with the requirements of its charter and the Corporate Governance Guidelines, as well as ways in which committee processes and effectiveness may be enhanced.

Our Corporate Governance Guidelines are posted in the Governance section of our website at investors.jeld-wen.com. Our Governance and Nominating Committee reviews the Corporate Governance Guidelines at least annually to ensure that they effectively promote the best interests of both the Company and our shareholders and that they comply with all applicable laws, regulations and the corporate governance standards of the NYSE. In 2018, the Board amended the Corporate Governance Guidelines to reflect changes as a result of the Company no longer being a “controlled company,” as well as other enhancements to reflect best practices in corporate governance.

Code of Business Conduct and Ethics

We have adopted a code of ethics applicable to all of our directors, officers (including our principal executive officer, principal financial officer and principal accounting officer) and employees, known as the Code of Business Conduct and Ethics (“Code of Business Conduct”). The Code of Business Conduct is available in the Governance section of our website at investors.jeld-wen.com. In the event that we amend or waive certain provisions of the Code of Business Conduct applicable to our principal executive officer, principal financial officer or principal accounting officer that requires disclosure under applicable SEC rules, we intend to disclose the same on our website.

2019 Proxy Statement | 1

In accordance with the terms of our Restated Certificate of Incorporation and our Amended and Restated Bylaws (our “Bylaws”), our Board is divided into three classes – Class I, Class II and Class III – with members of each class serving staggered three-year terms. The members of the classes are divided as follows:

| • | The Class I directors are Kirk Hachigian, Gary S. Michel, Anthony Munk and Steven Wynne, whose terms are set to expire at the annual meeting of shareholders to be held in 2021. Mr. Hachigian has indicated his intention to retire at the conclusion of the Annual Meeting; |

| • | The Class II directors are William F. Banholzer, Martha (Stormy) Byorum, Greg G. Maxwell and Matthew Ross, whose terms are expiring at the Annual Meeting. If re-elected, each of these directors’ terms will next expire at the annual meeting of shareholders to be held in 2022; and |

| • | The Class III directors are Suzanne Stefany, Bruce Taten and Roderick Wendt, whose terms are set to expire at the annual meeting of shareholders to be held in 2020. |

Board Leadership Structure

Our Corporate Governance Guidelines provide our Board with flexibility in determining the appropriate leadership structure for the Company. Our Board has elected to separate the roles of Chief Executive Officer and Chairman. These positions are currently held by Gary Michel, our President and Chief Executive Officer, and Kirk Hachigian, our Chairman. The Board believes that a leadership structure that separates these roles is appropriate for the Company due to the differences between the two roles. The Chief Executive Officer is responsible for setting our strategic direction, providing day-to-day leadership and managing our business, while the Chairman provides guidance to the Chief Executive Officer, chairs board meetings, presides over executive sessions of non-management directors and provides information to the members of our Board in advance of such meetings. Following Mr. Hachigian’s anticipated retirement at the conclusion of the Annual Meeting, Matthew Ross will assume the role of Chairman.

Risk Oversight

Our Board oversees management’s enterprise-wide risk management function, both as a collective Board and through its committees. At least annually, the Board reviews strategic risks and opportunities facing the Company. Other important categories of risk are assigned to designated Board committees that report back to the full Board. In general, the committees oversee the following:

Committee | Primary Areas of Risk Oversight |

Audit Committee | Risks related to major financial risk exposures, significant legal, regulatory and compliance issues, internal controls and the overall risk assessment and risk management function |

Compensation Committee | Risks associated with compensation policies and practices, including incentive compensation, and executive succession planning |

Governance and Nominating Committee | Risks related to corporate governance, effectiveness of Board and committee oversight and review of director candidates, conflicts of interest and director independence, as well as shareholder concerns |

The Audit Committee meets at least quarterly with our Chief Financial Officer, head of Internal Audit, General Counsel and our independent auditor to receive regular updates regarding management’s assessment of risk exposures, including liquidity, credit and operational risks such as data privacy and cybersecurity, and the processes in place to monitor such risks and review results of operations, financial reporting and assessments of internal controls over financial reporting.

2 |

The Compensation Committee meets at least quarterly to consider management’s assessment of employee and compensation risks, monitor incentive and equity-based compensation plans and, at least annually, review the Company’s compensation programs to ensure they are appropriately aligned with the Company’s strategic direction and avoid incentivizing unnecessary or excessive risk taking.

The Governance and Nominating Committee meets quarterly to oversee risks related to overall corporate governance, including board and committee composition, director candidates and independence matters, and actively engages in overseeing risks associated with succession planning for the Board and senior management.

Our Board believes that the division of risk management responsibilities described above is an effective approach for addressing the risks facing the Company and that our Board leadership structure supports this approach.

Meetings of the Board and Its Committees

During the fiscal year ended December 31, 2018, the Board held six meetings. All of the directors who served during the fiscal year ended December 31, 2018 attended at least 75% of the total meetings of the Board and each of the Board committees on which such director served during their respective tenures. Directors are expected to make best efforts to attend all Board meetings, all meetings of the committee or committees of the Board of which they are a member and the annual meeting of shareholders. Attendance by telephone or videoconference is deemed attendance at a meeting. All of our directors attended the annual meeting of shareholders held in 2018.

Pursuant to our Corporate Governance Guidelines, our Board plans to hold at least four meetings each year, with additional meetings to occur (or action to be taken by unanimous consent, either in writing or by electronic transmission) at the discretion of the Board.

Executive Sessions of Non-Management Directors

Pursuant to our Corporate Governance Guidelines, in order to ensure free and open discussion and communication among the non-management directors of the Board, the non-management directors meet in executive session at most Board meetings with no members of senior management present. Our Chairman presides at these executive sessions.

A shareholder or any interested party may submit a written communication to the Board or to the chairperson of any of the Audit, Compensation, or Governance and Nominating Committees, or to the Chairman of the Board or the non-management or independent directors as a group, by addressing such communications to: Corporate Secretary, JELD-WEN Holding, Inc., 2645 Silver Crescent Drive, Charlotte, North Carolina 28273. The Corporate Secretary will, as appropriate, forward such communication to our Board or to any individual director, select directors or committee of our Board to whom the communication is directed. Such communications may be made confidentially or anonymously.

The Board has an Audit Committee, a Compensation Committee and a Governance and Nominating Committee, as described below. Each of these committees currently consists entirely of independent directors. Each of the Audit Committee, Compensation Committee and Governance and Nominating Committee operates under a written charter approved by the Board, copies of which are available in the Governance section of our website at investors.jeld-wen.com.

2019 Proxy Statement | 3

The following table shows the membership of each committee of our Board as of December 31, 2018, and the number of meetings held by each committee during the fiscal year ended December 31, 2018. The Board intends to review committee assignments shortly after the Annual Meeting.

Director | Audit Committee | Compensation Committee | Governance and Nominating Committee |

Kirk Hachigian (1) | |||

William F. Banholzer, Ph.D. (2) | ✔ | ✔ | |

Martha (Stormy) Byorum (1) | ✔ | Chair | |

Greg G. Maxwell | Chair | ||

Gary S. Michel | |||

Anthony Munk | |||

Matthew Ross (1) | |||

Suzanne Stefany | ✔ | ✔ | |

Bruce Taten (1) | Chair | ✔ | |

Roderick Wendt | |||

Steven Wynne | ✔ | ||

Number of Meetings in 2018 | 6 | 8 | 4 |

| (1) | On April 26, 2018, in order to comply with the NYSE transition rules regarding independence following our ceasing to be a “controlled company” within the meaning of the NYSE listing requirements, the Board removed Mr. Hachigian from the Governance and Nominating Committee and Mr. Ross from the Compensation Committee and appointed Ms. Byorum and Mr. Taten, respectively, in their stead. |

| (2) | On April 26, 2018, the Board appointed Mr. Banholzer to the Governance and Nominating Committee. |

Audit Committee

Currently, the members of the Audit Committee are Greg Maxwell, as Chair, Martha (Stormy) Byorum, Suzanne Stefany and Steven Wynne. The Board has determined that Mr. Maxwell qualifies as our “audit committee financial expert” within the meaning of regulations adopted by the SEC. The Audit Committee recommends the annual appointment and reviews the independence of auditors and reviews the scope of audit and non-audit assignments and related fees, the results of the annual audit, accounting principles used in financial reporting, internal auditing procedures, the adequacy of our internal control procedures and investigations into matters related to audit functions. The Audit Committee is also responsible for risk oversight on behalf of our Board. See “Risk Oversight.” The Board has determined that all members of the Audit Committee are financially literate and independent within the meaning of the NYSE listing standards and Rule 10A-3(b)(1) under the Securities Exchange Act of 1934, as amended (the “Exchange Act”).

The charter of the Audit Committee permits the committee to delegate, in its discretion, its duties and responsibilities to one or more subcommittees as it deems appropriate.

Compensation Committee

Currently, the members of the Compensation Committee are Bruce Taten, as Chair, William F. Banholzer and Suzanne Stefany. The principal responsibilities of the Compensation Committee are to review and approve matters involving executive and director compensation, recommend changes in employee benefit programs, authorize equity and other incentive arrangements and authorize the Company to enter into employment and other employee-related agreements.

The charter of the Compensation Committee permits the committee to delegate, in its discretion, its duties and responsibilities to a subcommittee of the Compensation Committee as it deems appropriate and to the extent permitted by applicable law. All members of the Compensation Committee are independent within the meaning of the NYSE listing standards.

4 |

Governance and Nominating Committee

Currently, the members of the Governance and Nominating Committee are Martha (Stormy) Byorum, as Chair, William F. Banholzer and Bruce Taten. The Governance and Nominating Committee assists our Board in identifying individuals qualified to be board members, makes recommendations for nominees for committees, reviews related-party transactions, and develops, recommends to the Board and reviews our Corporate Governance Guidelines.

The charter of the Governance and Nominating Committee permits the committee to, in its sole discretion, delegate its duties and responsibilities to one or more subcommittees as it deems appropriate. All members of the Governance and Nominating Committee are independent within the meaning of the NYSE listing standards.

Compensation Committee Interlocks and Insider Participation

None of our executive officers serves, or in the past year has served, as a member of the board of directors or compensation committee (or other committee performing equivalent functions) of any entity that has one or more executive officers serving on our Board or Compensation Committee. No interlocking relationship exists between any member of our Compensation Committee and any executive, member of the board of directors or member of the compensation committee (or other committee performing equivalent functions) of any other company.

No Hedging and No Pledging Policy

The Company’s Securities Trading and Disclosure Policy prohibits all directors and executive officers of the Company from engaging in short-term or speculative transactions involving Company securities, including the purchase or sale of financial instruments (including options, puts, calls, straddles, equity swaps or other derivative securities that are directly linked to Company stock) or other transactions (such as short sales) that are designed to, or that have the effect of, hedging or offsetting any decrease in the market value of Company stock.

Likewise, the policy prohibits pledging of Company stock as collateral by directors and executive officers. The policy also allows the Board to waive the policy under exceptional circumstances. No director or executive officer has pledged Company stock or sought a waiver of the policy since the adoption of the policy in connection with the Company’s initial public offering (“IPO”) in 2017. At the time of the IPO, one director (Mr. Wendt) had an outstanding pledge of 220,000 shares (approximately 6% of his beneficial holdings at the time) securing a loan that had been in effect for several years. Because the pledge was entered prior to the adoption of the policy and to avoid any hardship on Mr. Wendt that would have resulted from requiring him to eliminate the pledge, the Board granted a waiver for the existing pledge at the time of the IPO, and that pledge remains outstanding. Mr. Wendt has advised the Board that he is endeavoring to reduce the size of and ultimately eliminate the pledge of Company stock.

Director and Executive Officer Share Ownership Guidelines

Our directors, executive officers and certain other senior executives are required to maintain a minimum equity stake in the Company. This policy reflects the Board’s belief that our directors and most senior executives should maintain a significant personal financial stake in JELD-WEN to promote long-term shareholder value. In addition, the policy helps align executive and shareholder interests, which reduces the incentive for excessive short-term risk taking. Each of our NEOs and certain other executive officers are required to acquire and maintain ownership of shares of our common stock equal to a specified multiple of his or her base salary, which ranges from one to five times base salary, as shown in the table below. In addition, our directors must obtain common stock or restricted stock units (“RSUs”) with a value equivalent to four times the annual cash retainer within five years of the later of the IPO or joining the Board. Each director and executive officer subject to a share ownership requirement must retain 50% of all net shares (post-tax) that vest until achieving his or her minimum share ownership requirement.

Chief Executive Officer | 5x annual base salary |

Chief Financial Officer | 3x annual base salary |

Other Executive Officers | 2x annual base salary |

Other officers designated by the Board | 1x annual base salary |

2019 Proxy Statement | 5

2. Board of Directors

Role of the Board of Directors

The Board oversees the management of the Company’s business and affairs. Shareholders elect the members of the Board to act on their behalf and to oversee their interests. Unless reserved to the shareholders under applicable law or our Bylaws, all corporate authority resides in the Board as the representative of the shareholders.

The Board selects and appoints executive officers to manage the day-to-day operations of the Company, while retaining ultimate oversight responsibilities. Together, the Board and management share an ongoing commitment to the highest standards of corporate governance and ethics. The Board reviews all aspects of our governance policies and practices, including our Corporate Governance Guidelines and the Company’s Code of Business Conduct, at least annually and makes changes as necessary. The Corporate Governance Guidelines and the Code of Business Conduct, along with all committee charters, are available in the Governance section of the Company’s website at investors.jeld-wen.com.

Director Selection Process and Qualifications

The Governance and Nominating Committee is responsible for identifying and reviewing the qualifications of potential director nominees and recommending to the Board those candidates to be nominated for election to the Board. The Governance and Nominating Committee does not apply any specific minimum qualifications when considering director nominees. Instead, the Governance and Nominating Committee considers all factors it deems appropriate, which may include, among others:

| • | ensuring that the Board, as a whole, is appropriately diverse and the extent to which a candidate would fill a present need on the Board; |

| • | the Board’s size and composition; |

| • | our corporate governance policies and any applicable laws; |

| • | individual director performance, expertise, relevant business and financial experience, integrity and willingness to serve actively; |

| • | the number of other public and private company boards on which a director candidate serves; and |

| • | consideration of director nominees properly proposed by third parties with the legal right to nominate directors or by shareholders in accordance with our Bylaws. |

The Governance and Nominating Committee monitors the mix of specific experience, qualifications and skills of the directors in order to assure that the Board, as a whole, has the necessary tools to perform its oversight function effectively in light of the Company’s business and structure. Although the Company does not have a formal policy with respect to diversity, as a matter of practice, the Governance and Nominating Committee considers diversity in the context of the Board as a whole and takes into account considerations relating to ethnicity, gender, cultural diversity and the range of perspectives that the directors bring to their work. Shareholders may also nominate directors for election at the Company’s annual shareholders meeting by following the provisions set forth in our Bylaws, whose qualifications the Governance and Nominating Committee will consider and evaluate on a basis substantially similar to the basis on which it considers other nominees.

6 |

Members of the Board of Directors

The following table sets forth, as of March 11, 2019, the name and age of each director of the Company:

Name | Age | Position |

Kirk Hachigian | 58 | Chairman of the Board |

William F. Banholzer, Ph.D. | 62 | Director |

Martha (Stormy) Byorum | 70 | Director |

Greg G. Maxwell | 62 | Director |

Gary S. Michel | 56 | Director and Chief Executive Officer |

Anthony Munk | 58 | Director |

Matthew Ross | 42 | Director |

Suzanne Stefany | 55 | Director |

Bruce Taten | 63 | Director |

Roderick Wendt | 64 | Vice Chairman and Director |

Steven Wynne | 66 | Director |

Set forth below is a brief account of the business experience and qualifications of each of our directors, except for Mr. Hachigian, who has indicated his intention to retire from the Board at the conclusion of the Annual Meeting.

William F. Banholzer, Class II Director. Dr. Banholzer has served on our Board since August 2017. Since October 2013, he has served as a Research Professor at the University of Wisconsin, with appointments in the Chemical & Biological Engineering Department, Chemistry Department and the Wisconsin Energy Institute. After a 30-year career in industrial research, Dr. Banholzer retired from Dow Chemical Company (“Dow Chemical”) in January 2014 having served, most recently, as Executive Vice President since 2010 and as Chief Technology Officer since July 2005. In addition to his CTO role, he also led Dow Chemical’s Venture Capital, Licensing and New Business Development activities. He also served as a member of the board of directors for Dow Corning Corporation, Dow Kokam and for the philanthropic organization, The Dow Chemical Company Foundation. Prior to his time at Dow Chemical, Dr. Banholzer had a 22-year career with General Electric Company (“GE”), where he held positions of increasing authority including his role of Vice President, Global Technology, GE Advanced Materials. Dr. Banholzer was elected to the National Academy of Engineering in 2002 and was elected to serve a three-year term on the NAE Council in 2006. He has received a number of awards including the NAE Buche Award, Industrial Research Institute’s Holland Award for R&D management, the American Chemical Society’s Earl B. Barnes Award, the Council of Chemical Research’s Pruitt Award and the Founders and AGILE Awards of the American Institute of Chemical Engineers. He has served as a board member for Wilsonart International and as a board member for the Madison Symphony Orchestra since 2014. Dr. Banholzer holds a bachelor’s degree in chemistry from Marquette University as well as a master’s degree and doctorate in chemical engineering from the University of Illinois. He is a certified Six Sigma, reliability engineering Master Blackbelt. Dr. Banholzer brings to the Board expertise in technology and innovation and governance, and extensive management experience with leading industrial companies.

William F. Banholzer, Class II Director. Dr. Banholzer has served on our Board since August 2017. Since October 2013, he has served as a Research Professor at the University of Wisconsin, with appointments in the Chemical & Biological Engineering Department, Chemistry Department and the Wisconsin Energy Institute. After a 30-year career in industrial research, Dr. Banholzer retired from Dow Chemical Company (“Dow Chemical”) in January 2014 having served, most recently, as Executive Vice President since 2010 and as Chief Technology Officer since July 2005. In addition to his CTO role, he also led Dow Chemical’s Venture Capital, Licensing and New Business Development activities. He also served as a member of the board of directors for Dow Corning Corporation, Dow Kokam and for the philanthropic organization, The Dow Chemical Company Foundation. Prior to his time at Dow Chemical, Dr. Banholzer had a 22-year career with General Electric Company (“GE”), where he held positions of increasing authority including his role of Vice President, Global Technology, GE Advanced Materials. Dr. Banholzer was elected to the National Academy of Engineering in 2002 and was elected to serve a three-year term on the NAE Council in 2006. He has received a number of awards including the NAE Buche Award, Industrial Research Institute’s Holland Award for R&D management, the American Chemical Society’s Earl B. Barnes Award, the Council of Chemical Research’s Pruitt Award and the Founders and AGILE Awards of the American Institute of Chemical Engineers. He has served as a board member for Wilsonart International and as a board member for the Madison Symphony Orchestra since 2014. Dr. Banholzer holds a bachelor’s degree in chemistry from Marquette University as well as a master’s degree and doctorate in chemical engineering from the University of Illinois. He is a certified Six Sigma, reliability engineering Master Blackbelt. Dr. Banholzer brings to the Board expertise in technology and innovation and governance, and extensive management experience with leading industrial companies.

Martha (Stormy) Byorum, Class II Director. Ms. Byorum has served on our Board since July 2014. She is the Founder and CEO of Cori Investment Advisors, LLC, a provider of alternative finance solutions for Latin American and U.S. Hispanic investors, which was spun off in 2003 from Violy, Byorum & Partners Holdings, LLC, a leading independent strategic advisory and investment banking firm specializing in Latin America. Previously Ms. Byorum was an Executive Vice President of Stephens, Inc., a private investment banking firm, from 2005 through 2013, and Senior Managing Director of Stephens Cori Capital Advisors, a division of Stephens, Inc., from 2005 to 2012. In 1996, prior to co-founding Violy, Byorum & Partners Holdings, LLC, Ms. Byorum ended a 24-year career at Citibank, where, among other roles, she served as Chief of Staff and Chief Financial Officer for Citibank’s Latin America Banking Group from 1986 to 1990, overseeing $15 billion in loans and coordinating activities in 22 countries. Ms. Byorum was later appointed head of Citibank’s U.S. Corporate Banking Business and a member of the bank’s Operating Committee and a Customer Group Head with global

Martha (Stormy) Byorum, Class II Director. Ms. Byorum has served on our Board since July 2014. She is the Founder and CEO of Cori Investment Advisors, LLC, a provider of alternative finance solutions for Latin American and U.S. Hispanic investors, which was spun off in 2003 from Violy, Byorum & Partners Holdings, LLC, a leading independent strategic advisory and investment banking firm specializing in Latin America. Previously Ms. Byorum was an Executive Vice President of Stephens, Inc., a private investment banking firm, from 2005 through 2013, and Senior Managing Director of Stephens Cori Capital Advisors, a division of Stephens, Inc., from 2005 to 2012. In 1996, prior to co-founding Violy, Byorum & Partners Holdings, LLC, Ms. Byorum ended a 24-year career at Citibank, where, among other roles, she served as Chief of Staff and Chief Financial Officer for Citibank’s Latin America Banking Group from 1986 to 1990, overseeing $15 billion in loans and coordinating activities in 22 countries. Ms. Byorum was later appointed head of Citibank’s U.S. Corporate Banking Business and a member of the bank’s Operating Committee and a Customer Group Head with global

2019 Proxy Statement | 7

Greg G. Maxwell, Class II Director. Mr. Maxwell has served on our Board since February 2017. He previously served as Executive Vice President, Finance, and Chief Financial Officer for Phillips 66, a diversified energy manufacturing and logistics company, from April 2012 until his retirement in December 2015. From 2003 until 2012, Mr. Maxwell served as Senior Vice President, Chief Financial Officer and Controller for Chevron Phillips Chemical Company, a petrochemical company jointly owned by Chevron Corporation and Phillips 66. He also served as Vice President, Chief Financial Officer and a member of the board of directors of Phillips 66 Partners LP and on the board of directors of DCP Midstream LLC and Chevron Phillips Chemical Company until his retirement in 2015. Mr. Maxwell has served as a director, chairman of the audit committee and member of the compensation committee of Range Resources Corporation since September 2015 and was elected to serve as the non-executive chairman of the board and member of Range Resources Corporation’s audit committee effective July 2018. He has over 37 years of experience in various financial roles within the petrochemical and oil and gas industries and, in addition, is a certified public accountant and a certified internal auditor. Mr. Maxwell earned a Bachelor of Accountancy degree from New Mexico State University in 1978. Mr. Maxwell brings to our Board expertise in accounting, finance, internal audit, information technology and corporate and strategic planning.

Greg G. Maxwell, Class II Director. Mr. Maxwell has served on our Board since February 2017. He previously served as Executive Vice President, Finance, and Chief Financial Officer for Phillips 66, a diversified energy manufacturing and logistics company, from April 2012 until his retirement in December 2015. From 2003 until 2012, Mr. Maxwell served as Senior Vice President, Chief Financial Officer and Controller for Chevron Phillips Chemical Company, a petrochemical company jointly owned by Chevron Corporation and Phillips 66. He also served as Vice President, Chief Financial Officer and a member of the board of directors of Phillips 66 Partners LP and on the board of directors of DCP Midstream LLC and Chevron Phillips Chemical Company until his retirement in 2015. Mr. Maxwell has served as a director, chairman of the audit committee and member of the compensation committee of Range Resources Corporation since September 2015 and was elected to serve as the non-executive chairman of the board and member of Range Resources Corporation’s audit committee effective July 2018. He has over 37 years of experience in various financial roles within the petrochemical and oil and gas industries and, in addition, is a certified public accountant and a certified internal auditor. Mr. Maxwell earned a Bachelor of Accountancy degree from New Mexico State University in 1978. Mr. Maxwell brings to our Board expertise in accounting, finance, internal audit, information technology and corporate and strategic planning.

Gary S. Michel, President and Chief Executive Officer, Class I Director. Mr. Michel joined the Company as President and Chief Executive Officer and became a member of our Board on June 18, 2018. Mr. Michel joined the Company from Honeywell International, Inc., where he served as the President and Chief Executive Officer of the Home and Building Technologies strategic business group since October 2017. Prior to that, he spent 32 years at Ingersoll Rand, most recently as Senior Vice President and president of its residential heating, ventilation and air conditioning business and as a member of Ingersoll Rand’s enterprise leadership team from 2011 to 2017. He began his career there in 1985 as an application engineer and held various product, sales and business management roles before moving into a series of leadership positions across various geographic and market segments. Mr. Michel holds a B.S. in mechanical engineering from Virginia Tech and an M.B.A. from the University of Phoenix. He has served as a member of the board of directors of Cooper Tire & Rubber Company since 2015. Mr. Michel was selected to serve on JELD-WEN’s Board in light of his board experience, his extensive background in management, engineering and global sales, and his position as our CEO.

Gary S. Michel, President and Chief Executive Officer, Class I Director. Mr. Michel joined the Company as President and Chief Executive Officer and became a member of our Board on June 18, 2018. Mr. Michel joined the Company from Honeywell International, Inc., where he served as the President and Chief Executive Officer of the Home and Building Technologies strategic business group since October 2017. Prior to that, he spent 32 years at Ingersoll Rand, most recently as Senior Vice President and president of its residential heating, ventilation and air conditioning business and as a member of Ingersoll Rand’s enterprise leadership team from 2011 to 2017. He began his career there in 1985 as an application engineer and held various product, sales and business management roles before moving into a series of leadership positions across various geographic and market segments. Mr. Michel holds a B.S. in mechanical engineering from Virginia Tech and an M.B.A. from the University of Phoenix. He has served as a member of the board of directors of Cooper Tire & Rubber Company since 2015. Mr. Michel was selected to serve on JELD-WEN’s Board in light of his board experience, his extensive background in management, engineering and global sales, and his position as our CEO.

Anthony Munk, Class I Director. Mr. Munk is a Senior Managing Director at Onex Corporation (“Onex”) and has been a member of our Board since October 2011. Since joining Onex in 1988, Mr. Munk has worked on numerous private equity transactions. These transactions include the acquisitions and realizations of Husky Injection Molding Systems Ltd., RSI Home Products, Tomkins plc, Vencap Equities Alberta Ltd., Imperial Parking Ltd., ProSource Inc. and Loews Cineplex; and the initial public offering of the Cineplex Galaxy Income Fund, which acquired the Canadian operations of Loews Cineplex, Cineplex Odeon and the operations of Onex’ subsidiary, Galaxy Entertainment. More recently, Mr. Munk was involved in the acquisitions by Onex of Jack’s Family Restaurants and Moran Foods, LLC (“Save-A-Lot”). Mr. Munk also currently serves on the boards of directors of Barrick Gold Corporation, Save-A-Lot and Clarivate Analytics. Mr. Munk previously served on the board of directors of RSI Home Products, Husky Injection Molding Systems Ltd., Cineplex Inc. and Jack’s Family Restaurants. Prior to joining Onex, Mr. Munk was a Vice President with First Boston Corporation in London, England and an Analyst with Guardian Capital in Toronto. Mr. Munk holds a B.A. from Queen’s University. Mr. Munk’s experience in a variety of strategic and financing transactions and investments qualifies him to serve as a member of our Board. His high level of financial expertise is a valuable asset to our Board and, as an executive with Onex, he has extensive knowledge of our business. His service on other boards of directors over the years enables him to provide our Board with a valuable perspective on corporate governance issues.

Anthony Munk, Class I Director. Mr. Munk is a Senior Managing Director at Onex Corporation (“Onex”) and has been a member of our Board since October 2011. Since joining Onex in 1988, Mr. Munk has worked on numerous private equity transactions. These transactions include the acquisitions and realizations of Husky Injection Molding Systems Ltd., RSI Home Products, Tomkins plc, Vencap Equities Alberta Ltd., Imperial Parking Ltd., ProSource Inc. and Loews Cineplex; and the initial public offering of the Cineplex Galaxy Income Fund, which acquired the Canadian operations of Loews Cineplex, Cineplex Odeon and the operations of Onex’ subsidiary, Galaxy Entertainment. More recently, Mr. Munk was involved in the acquisitions by Onex of Jack’s Family Restaurants and Moran Foods, LLC (“Save-A-Lot”). Mr. Munk also currently serves on the boards of directors of Barrick Gold Corporation, Save-A-Lot and Clarivate Analytics. Mr. Munk previously served on the board of directors of RSI Home Products, Husky Injection Molding Systems Ltd., Cineplex Inc. and Jack’s Family Restaurants. Prior to joining Onex, Mr. Munk was a Vice President with First Boston Corporation in London, England and an Analyst with Guardian Capital in Toronto. Mr. Munk holds a B.A. from Queen’s University. Mr. Munk’s experience in a variety of strategic and financing transactions and investments qualifies him to serve as a member of our Board. His high level of financial expertise is a valuable asset to our Board and, as an executive with Onex, he has extensive knowledge of our business. His service on other boards of directors over the years enables him to provide our Board with a valuable perspective on corporate governance issues.8 |

Matthew Ross, Class II Director. Mr. Ross is a Managing Director of Onex Partners, an affiliate of Onex, has been a member of our Board since October 2011 and will become Chairman of the Board at the conclusion of the Annual Meeting following his re-election to the Board. Mr. Ross joined Onex in 2006 and is responsible for Onex’ efforts in the building products, retail and restaurant industries. Since joining Onex, Mr. Ross has worked on Onex’ investments in RSI Home Products Inc., Tomkins plc, Husky Injection Molding Systems, Jack’s Family Restaurants and Save-A-Lot. Mr. Ross currently serves on the board of directors of Jack’s Family Restaurants and Save-A-Lot and previously served as a director of RSI Home Products Inc. from 2012 to 2013. Prior to joining Onex, Mr. Ross spent five years with the private equity funds of Brown Brothers Harriman & Co. as well as DB Capital Partners, the former private equity division of Deutsche Bank AG. Mr. Ross holds a B.A. from Amherst College and an M.B.A. from The Wharton School at the University of Pennsylvania. Mr. Ross’s experience in a variety of strategic and financing transactions and investments qualifies him to serve as a member of our Board. As an executive with Onex who has a specific focus on investments in the building products industry, Mr. Ross has extensive knowledge of our business as well as the markets in which we operate.

Matthew Ross, Class II Director. Mr. Ross is a Managing Director of Onex Partners, an affiliate of Onex, has been a member of our Board since October 2011 and will become Chairman of the Board at the conclusion of the Annual Meeting following his re-election to the Board. Mr. Ross joined Onex in 2006 and is responsible for Onex’ efforts in the building products, retail and restaurant industries. Since joining Onex, Mr. Ross has worked on Onex’ investments in RSI Home Products Inc., Tomkins plc, Husky Injection Molding Systems, Jack’s Family Restaurants and Save-A-Lot. Mr. Ross currently serves on the board of directors of Jack’s Family Restaurants and Save-A-Lot and previously served as a director of RSI Home Products Inc. from 2012 to 2013. Prior to joining Onex, Mr. Ross spent five years with the private equity funds of Brown Brothers Harriman & Co. as well as DB Capital Partners, the former private equity division of Deutsche Bank AG. Mr. Ross holds a B.A. from Amherst College and an M.B.A. from The Wharton School at the University of Pennsylvania. Mr. Ross’s experience in a variety of strategic and financing transactions and investments qualifies him to serve as a member of our Board. As an executive with Onex who has a specific focus on investments in the building products industry, Mr. Ross has extensive knowledge of our business as well as the markets in which we operate.

Suzanne Stefany, Class III Director. Ms. Stefany has served on our Board since October 2017. Since August 2017, she has served as a partner for the Strategic Advisory Group at PJT Partners, a global advisory-focused investment bank. From 2005 until August of 2017, Ms. Stefany held the roles of Managing Director and Global Industry Analyst at Wellington Management Company where she was responsible for investing portfolios and recommending stocks for a variety of global industries. Prior to joining Wellington Management Company, Ms. Stefany built her investment advisory career, spending time at companies such as Loomis Sayles, Invesco Capital Management and Putnam Investments. Ms. Stefany currently serves as the executive board chair and chief volunteer officer for the South Shore YMCA. She holds bachelor’s degrees in economics and Spanish from Tufts University and earned a master’s degree in finance from the Sloan School of Management at Massachusetts Institute of Technology, where she was awarded the Martin Trust Fellowship through the recommendation of peers and faculty. Ms. Stefany is recognized as an expert in her field and brings to the Board over 20 years of investment advisory experience, specializing in strategy and shareholder value creation.

Suzanne Stefany, Class III Director. Ms. Stefany has served on our Board since October 2017. Since August 2017, she has served as a partner for the Strategic Advisory Group at PJT Partners, a global advisory-focused investment bank. From 2005 until August of 2017, Ms. Stefany held the roles of Managing Director and Global Industry Analyst at Wellington Management Company where she was responsible for investing portfolios and recommending stocks for a variety of global industries. Prior to joining Wellington Management Company, Ms. Stefany built her investment advisory career, spending time at companies such as Loomis Sayles, Invesco Capital Management and Putnam Investments. Ms. Stefany currently serves as the executive board chair and chief volunteer officer for the South Shore YMCA. She holds bachelor’s degrees in economics and Spanish from Tufts University and earned a master’s degree in finance from the Sloan School of Management at Massachusetts Institute of Technology, where she was awarded the Martin Trust Fellowship through the recommendation of peers and faculty. Ms. Stefany is recognized as an expert in her field and brings to the Board over 20 years of investment advisory experience, specializing in strategy and shareholder value creation.

Bruce Taten, Class III Director. Mr. Taten has served on our Board since April 2014. He previously served as Senior Vice President, General Counsel and Chief Compliance Officer for Cooper Industries, plc from 2008 until its merger with Eaton Corporation in October 2012. Previously, Mr. Taten was Vice President and General Counsel at Nabors Industries from 2003 until 2008 and earlier practiced law with Simpson Thacher & Bartlett LLP and Sutherland Asbill & Brennan LLP. Before attending law school, he practiced as a C.P.A. with Peat Marwick Mitchell & Co., which is now known as KPMG, in New York. Mr. Taten currently is a practicing attorney and private investor. He is admitted to practice law in the states of Texas and New York. He currently serves on the board of directors of Moran Foods, LLC. Mr. Taten holds a B.S. and Masters degree from Georgetown University and a J.D. from Vanderbilt University. Mr. Taten brings experience in corporate governance, mergers and acquisitions, tax, finance and securities offerings and compliance to the Board.

Bruce Taten, Class III Director. Mr. Taten has served on our Board since April 2014. He previously served as Senior Vice President, General Counsel and Chief Compliance Officer for Cooper Industries, plc from 2008 until its merger with Eaton Corporation in October 2012. Previously, Mr. Taten was Vice President and General Counsel at Nabors Industries from 2003 until 2008 and earlier practiced law with Simpson Thacher & Bartlett LLP and Sutherland Asbill & Brennan LLP. Before attending law school, he practiced as a C.P.A. with Peat Marwick Mitchell & Co., which is now known as KPMG, in New York. Mr. Taten currently is a practicing attorney and private investor. He is admitted to practice law in the states of Texas and New York. He currently serves on the board of directors of Moran Foods, LLC. Mr. Taten holds a B.S. and Masters degree from Georgetown University and a J.D. from Vanderbilt University. Mr. Taten brings experience in corporate governance, mergers and acquisitions, tax, finance and securities offerings and compliance to the Board.

Roderick Wendt, Vice Chairman and Class III Director. Mr. Wendt has served as Vice Chairman since January 2014 and as a director since June 1985. He joined the Company in 1980, working in various legal, marketing, window manufacturing and sales positions of increasing authority culminating in his service as President and Chief Executive Officer from 1992 to August 2011. Mr. Wendt served as Executive Chairman and Chief Executive Officer of the Company from 2011 to March 2013. Mr. Wendt served as a director of the Portland Branch at the Federal Reserve Bank of San Francisco from 2009 to 2014 and as its chairman from 2013 to 2014. He has been a Managing Member of Spruce Street Ventures since 2013. He also served as a member of the Economic Advisory Council at the Federal Reserve Bank of San Francisco from 2006 to 2008. Mr. Wendt serves on the board of directors of Brooks Resources Corporation, Roseburg Forest Products, Bank of the West and Sky Lakes Medical Center, on the board of trustees of Willamette University, and is president of the board of the Wendt Family Foundation. He earned a B.A. from Stanford University and a J.D. from

Roderick Wendt, Vice Chairman and Class III Director. Mr. Wendt has served as Vice Chairman since January 2014 and as a director since June 1985. He joined the Company in 1980, working in various legal, marketing, window manufacturing and sales positions of increasing authority culminating in his service as President and Chief Executive Officer from 1992 to August 2011. Mr. Wendt served as Executive Chairman and Chief Executive Officer of the Company from 2011 to March 2013. Mr. Wendt served as a director of the Portland Branch at the Federal Reserve Bank of San Francisco from 2009 to 2014 and as its chairman from 2013 to 2014. He has been a Managing Member of Spruce Street Ventures since 2013. He also served as a member of the Economic Advisory Council at the Federal Reserve Bank of San Francisco from 2006 to 2008. Mr. Wendt serves on the board of directors of Brooks Resources Corporation, Roseburg Forest Products, Bank of the West and Sky Lakes Medical Center, on the board of trustees of Willamette University, and is president of the board of the Wendt Family Foundation. He earned a B.A. from Stanford University and a J.D. from

2019 Proxy Statement | 9

Willamette University College of Law and is a member of the Oregon State Bar. Mr. Wendt is the son of our late founder, Richard L. Wendt. Mr. Wendt provides helpful insight into the Company’s operations, risks and opportunities developed through his years of experience as an executive of the Company and extensive knowledge of the markets in which we operate.

Steven Wynne, Class I Director. Mr. Wynne has served on our Board since March 2012. Since July 2012, Mr. Wynne has served as an Executive Vice President of Health Services Group, a diversified health insurance company, where he previously served as Senior Vice President from February 2010 to January 2011. From January 2011 through July 2012, he served as Executive Vice President of the Company. From March 2004 through March 2007, Mr. Wynne was President and Chief Executive Officer of SBI International, Ltd., the parent company of sports apparel and footwear company Fila. From August 2001 through March 2002, and from April 2003 through February 2004, he was a partner in the Portland, Oregon law firm of Ater Wynne LLP. From April 2002 through March 2003, Mr. Wynne served as acting Senior Vice President and General Counsel of FLIR Systems, Inc., a publicly traded technology company. He serves on the boards of directors of FLIR Systems, Inc., Pendleton Woolen Mills, Lone Rock Resources and Northwest Natural Gas Company, and he previously served as a director of Planar Systems Inc. from 1996 to 2013. Mr. Wynne received a B.A. and a J.D. from Willamette University. Mr. Wynne has developed a high degree of familiarity with the Company’s operations, risks and opportunities through his experience as an executive of the Company and his extensive management experience across a number of entities.

Steven Wynne, Class I Director. Mr. Wynne has served on our Board since March 2012. Since July 2012, Mr. Wynne has served as an Executive Vice President of Health Services Group, a diversified health insurance company, where he previously served as Senior Vice President from February 2010 to January 2011. From January 2011 through July 2012, he served as Executive Vice President of the Company. From March 2004 through March 2007, Mr. Wynne was President and Chief Executive Officer of SBI International, Ltd., the parent company of sports apparel and footwear company Fila. From August 2001 through March 2002, and from April 2003 through February 2004, he was a partner in the Portland, Oregon law firm of Ater Wynne LLP. From April 2002 through March 2003, Mr. Wynne served as acting Senior Vice President and General Counsel of FLIR Systems, Inc., a publicly traded technology company. He serves on the boards of directors of FLIR Systems, Inc., Pendleton Woolen Mills, Lone Rock Resources and Northwest Natural Gas Company, and he previously served as a director of Planar Systems Inc. from 1996 to 2013. Mr. Wynne received a B.A. and a J.D. from Willamette University. Mr. Wynne has developed a high degree of familiarity with the Company’s operations, risks and opportunities through his experience as an executive of the Company and his extensive management experience across a number of entities.

Director Independence and Independence Determinations

Following the completion of a secondary offering in May 2017 by selling shareholders that included investment funds managed by Onex, we ceased to be a “controlled company” within the meaning of the listing standards of the NYSE. However, during a one-year transition period following the secondary offering, we qualified for, and relied on, exemptions from certain corporate governance standards that would otherwise provide protection to our shareholders. The transition rules of the listing standards of the NYSE required us to have a fully independent Governance and Nominating Committee and Compensation Committee and have a majority independent Board within one year of the date we ceased to qualify as a “controlled company” and to perform an annual performance evaluation of our Governance and Nominating and Compensation Committees. On April 26, 2018, in order to comply with the NYSE transition rules regarding independence following our ceasing to be a “controlled company” within the meaning of the NYSE listing requirements, the Board removed Mr. Hachigian from the Governance and Nominating Committee and Mr. Ross from the Compensation Committee and appointed Ms. Byorum and Mr. Taten, respectively, in their stead.

Under our Corporate Governance Guidelines and the listing standards of the NYSE, a director is not independent unless our Board affirmatively determines that he or she does not have a material relationship with us or any of our subsidiaries. Our Corporate Governance Guidelines define independence in accordance with the independence definition in the current listing standards of the NYSE. Our Corporate Governance Guidelines require our Board to review the independence of all directors at least annually. In the event a director has a relationship with the Company that is relevant to his or her independence and is not addressed by the objective tests set forth in the NYSE independence definition, our Board will determine, considering all relevant facts and circumstances, whether such relationship is material.

Our Board has affirmatively determined that William F. Banholzer, Martha (Stormy) Byorum, Greg G. Maxwell, Suzanne Stefany, Bruce Taten and Steven Wynne are independent directors under the rules of the NYSE and independent directors as such term is defined in Rule 10A-3(b)(1) under the Exchange Act.

Director Resignation Policy

Our Corporate Governance Guidelines require any non-employee incumbent director nominee who does not receive the affirmative vote of the majority of shares voted in connection with his or her uncontested election to tender his or her resignation from the Board promptly following certification of the shareholder vote. The Governance and Nominating Committee will consider and recommend to the Board whether to accept the resignation. The Board will act on the recommendation and disclose publicly the results of its decision. Any director who tenders his or her offer of resignation under this policy will not participate in the deliberation or determination whether to accept the resignation.

10 |

Director Compensation Structure

The Board approved a Non-Employee Director Compensation Policy that sets the compensation of our non-employee directors. The Governance and Nominating Committee reviews this policy on an annual basis, typically in conjunction with the annual meeting of shareholders, and recommend changes to the Board as it deems appropriate.

The following table describes the components of our non-employee directors’ compensation for 2018:

Compensation Element | Compensation Amount |

Annual Cash Retainer | $90,000 paid quarterly in arrears |

Annual Equity Retainer | $110,000 in RSUs that vest one year from the date of grant (or, if earlier, on the date of the next annual meeting of shareholders) |

Board and Committee Fees | None |

Chair Fee* | $25,000 for the Audit Committee $18,000 for the Compensation Committee $15,000 for the Governance and Nominating Committee |

Board Chair Fee** | $100,000 paid quarterly in arrears |

Stock Ownership Guidelines | Ownership of common stock or RSUs equivalent to four times the annual cash retainer within five years of the later of the IPO or joining the Board*** |

| * | Chair fees paid unless such position is held by the Chairman of the Board or an employee of Onex. |

| ** | Board chair fee paid unless position is held by an employee of JELD-WEN or of Onex. |

| *** | As of December 31, 2018, each of Messrs. Hachigian, Taten, Wendt and Wynne satisfied this guideline. All other directors (other than employees of Onex) are expected to satisfy this guideline within the required period. |

Annual Cash Retainer

In 2018, non-employee directors received an annual cash retainer of $90,000, paid quarterly in arrears. Under the Non-Employee Director Compensation Policy, members of the Board who are our employees receive no additional compensation for their service on the Board. For all or part of 2018, our employee-directors were Messrs. Beck, Michel and Wendt. Amounts due to members of our Board who are employees of Onex are paid directly to Onex. In 2018, Messrs. Munk and Ross were the only directors who were also employees of Onex.

Annual Equity Retainer

In 2018, eligible non-employee directors were entitled to an annual grant of $110,000 in RSUs under the Company’s 2017 Omnibus Equity Plan (the “Omnibus Equity Plan”), which RSUs vest one year from the date of the grant (or, if earlier, on the date of the next annual meeting of shareholders), subject to continued service on the Board through the earlier of the vesting date or the end of the director’s term. Directors appointed to the Board during the year receive a prorated RSU award. The value of awards due to members of the Board who are employees of Onex are paid directly to Onex in cash on the first anniversary of the date of grant. In accordance with this policy, on April 26, 2018, (a) each of Messrs. Hachigian, Banholzer, Maxwell, Taten, Tolbert and Wynne and Ms. Byorum and Ms. Stefany received a grant of 3,789 RSUs, and (b) the Company paid $220,000 to Onex in respect of RSUs granted to the other non-employee directors on April 26, 2017.

2019 Proxy Statement | 11

The following table provides summary information for the year ended December 31, 2018, relating to compensation paid to or accrued by us on behalf of our non-employee directors who served in this capacity during 2018. Pursuant to the Non-Employee Director Compensation Policy approved by the Board, (a) Messrs. Beck, Michel and Wendt were employees and did not receive additional compensation for serving as a director, and (b) Messrs. Munk and Ross were employees of Onex, so the cash value of their compensation was paid to Onex. Messrs. Michel’s, Hachigian’s and Beck’s compensation is reported in the Summary Compensation Table and related compensation tables beginning on page 28.

Director | Fees Earned or Paid in Cash | Stock Awards(1) | Option Awards($)(2) | All Other Compensation | Total | ||||||||||

William Banholzer | $ | 90,000 | $ | 110,000 | — | — | $ | 200,000 | |||||||

Martha (Stormy) Byorum (3) | $ | 101,250 | $ | 110,000 | — | — | $ | 211,250 | |||||||

Greg G. Maxwell | $ | 115,000 | $ | 110,000 | — | — | $ | 225,000 | |||||||

Anthony Munk (4) | $ | 200,000 | — | — | — | $ | 200,000 | ||||||||

Matthew Ross (4) | $ | 200,000 | — | — | — | $ | 200,000 | ||||||||

Suzanne Stefany | $ | 90,000 | $ | 110,000 | — | — | $ | 200,000 | |||||||

Bruce Taten (3) | $ | 103,500 | $ | 110,000 | — | — | $ | 213,500 | |||||||

Patrick Tolbert (5) | $ | 45,000 | — | — | — | $ | 45,000 | ||||||||

Roderick Wendt (6) | — | — | — | $ | 208,000 | $ | 208,000 | ||||||||

Steven Wynne | $ | 90,000 | $ | 110,000 | — | — | $ | 200,000 | |||||||

| (1) | Reflects the grant date fair value of RSUs, calculated in accordance with FASB ASC Topic 718. For 2018, the calculation is described in Note 23—Stock Compensation in our audited financial statements for the year ended December 31, 2018 in our annual report on Form 10-K into which this Proxy Statement is incorporated by reference. As of December 31, 2018, each of Messrs. Banholzer, Maxwell, Taten and Wynne and Ms. Byorum and Ms. Stefany had 3,789 RSUs outstanding. |

| (2) | As of December 31, 2018, Messrs. Wendt and Wynne had 141,669 and 45,362 vested stock options, respectively, outstanding. |

| (3) | Committee chair fees paid to Ms. Byorum and Mr. Taten in 2018 were prorated to reflect their appointment to these positions in April 2018. |

| (4) | Pursuant to the Non-Employee Director Compensation Policy, the cash value of compensation payable to Onex directors is paid directly to Onex. |

| (5) | Mr. Tolbert left the Board on April 25, 2018. |

| (6) | Mr. Wendt is an employee of the Company. In 2018, he received a salary of $200,000 and 401(k) matching contributions of $8,000. |

Policy Regarding Certain Relationships and Related Party Transactions

Our Board has adopted a written policy providing that the Governance and Nominating Committee will review and approve or ratify transactions in which we participate and in which a related party has or will have a direct or indirect material interest. Under this policy, the Governance and Nominating Committee is to obtain all information it believes to be relevant to a review and approval or ratification of these transactions. After consideration of the relevant information, the Governance and Nominating Committee is to approve only those related party transactions that the Governance and Nominating Committee believes are in the best interests of the Company. In particular, our policy with respect to related party transactions requires our Governance and Nominating Committee to consider the benefits to the Company; the impact on a director’s independence in the event the related party is a director, an immediate family member of a director or an entity in which a director has a position or relationship; the overall fairness of the transaction to both the Company and the related party; and any other matters the Governance and Nominating Committee deems appropriate. A “related party” is any person who is or was one of our executive officers, directors or director nominees or is a holder of more than 5% of our common stock, or their immediate family members or any entity owned or controlled by any of the foregoing persons.

12 |

In consideration of his services as interim CEO, the Board entered into a contract with Mr. Hachigian, effective February 27, 2018, pursuant to which he was paid a biweekly consulting fee of $76,923. Under this agreement, Mr. Hachigian received an aggregate of $684,615 through June 2018 when his services as interim CEO ceased upon Mr. Michel’s assumption of the role of President and CEO. In addition, Mr. Hachigian received a grant of 314,267 RSUs on February 27, 2018 (the “RSU Grant”). Under the terms of this grant, the number of RSUs vesting on the first anniversary of the date of grant would be based upon the portion of the twelve-month period during which Mr. Hachigian served as interim CEO. On February 27, 2019, the RSU Grant partially vested and Mr. Hachigian received 105,903 shares in recognition of his services as interim CEO from February 28, 2018 through June 29, 2018. The remainder of the RSU Grant was forfeited.

We, Onex, certain of our directors and executive officers and other pre-IPO shareholders entered into a registration rights agreement dated October 3, 2011 in connection with the Onex investment that was amended and restated on January 24, 2017 in connection with our IPO, amended further on May 12, 2017 and November 12, 2017 (as amended and restated and as subsequently amended, the “Registration Rights Agreement”). Pursuant to the Registration Rights Agreement, certain shareholders who are party to the Registration Rights Agreement have the right to require us to register their shares under the Securities Act of 1933, as amended (the “Securities Act”) under specified circumstances, including the right to require us to facilitate underwritten offerings as well as to make available shelf registration statements permitting sales of shares into the market from time to time over an extended period, and will have incidental registration rights in certain circumstances. The Registration Rights Agreement was originally entered into prior to the adoption of our related-party transactions policy. No rights were exercised pursuant to the Registration Rights Agreement during the fiscal year ended December 31, 2018.

Other than described above, we did not enter into any new related party transactions during the fiscal year ended December 31, 2018 in which the amount involved exceeded or will exceed $120,000, and in which any of our executive officers, directors or holders of more than 5% of any class of our voting securities, or an affiliate or immediate family member thereof, had or will have a direct or indirect material interest. We have not made payments to non-employee directors, other than the fees they are entitled as described in “Director Compensation Structure” and reimbursement of expenses related to their services as a director. Compensation paid to employee directors is described in the “Summary Compensation Table” for Messrs. Beck and Michel and in “2018 Director Compensation” for Mr. Wendt.

2019 Proxy Statement | 13

Security Ownership of Certain Beneficial Owners and Management