Exhibit 99.2 FOURTH-QUARTER AND FULL YEAR 2018 RESULTS PRESENTATION February 19, 2019

DISCLOSURES Forward-Looking Statements This presentation contains certain "forward-looking statements" regarding business strategies, market potential, future financial performance, the potential of our categories and brands, the estimated impact of tax reform on our results, litigation outcomes, our outlook for 2019, and our expectations, beliefs, plans, objectives, prospects, assumptions, or other future events. Forward-looking statements are generally identified by our use of forward-looking terminology such as “anticipate”, “believe”, “continue”, “could”, “estimate”, “expect”, “intend”, “may”, “might”, “plan”, “potential”, “predict”, “seek”, or “should”, or the negative thereof or other variations thereon or comparable terminology. Where, in any forward-looking statement, we express an expectation or belief as to future results or events, such expectation or belief is based on the current plans, expectations, assumptions, estimates, and projections of our management. Although we believe that these statements are based on reasonable expectations, assumptions, estimates and projections, they are only predictions and involve known and unknown risks, many of which are beyond our control that could cause actual outcomes and results to be materially different from those indicated in such statements. Our actual results could differ materially from the results contemplated by these forward-looking statements due to a number of factors, including the factors discussed in our Annual Reports on Form 10-K and our Quarterly Reports on Form 10-Q, both filed with the Securities and Exchange Commission. The assumptions underlying the guidance provided for 2019 include the achievement of anticipated improvements in end markets, competitive position, and product portfolio; stable macroeconomic factors; continued inflation in materials and freight; no changes in foreign currency exchange and tax rates; successful integration of recent acquisitions; and our future business plans. The forward-looking statements included in this release are made as of the date hereof, and except as required by law, we undertake no obligation to update, amend or clarify any forward-looking statements to reflect events, new information or circumstances occurring after the date of this release.. Non-GAAP Financial Measures This presentation presents certain “non-GAAP” financial measures. The components of these non-GAAP measures are computed by using amounts that are determined in accordance with accounting principles generally accepted in the United States of America (“GAAP”). A reconciliation of non-GAAP financial measures used in this presentation to their nearest comparable GAAP financial measures is included at the end of this presentation. The company provides certain guidance solely on a non-GAAP basis because the company cannot predict certain elements that are included in certain reported GAAP results, including the variables and individual adjustments necessary for a reconciliation to GAAP. While management is not able to specifically quantify the reconciliation items for forward-looking non-GAAP measures without unreasonable effort, the company expects these items to be similar to the types of charges and costs excluded from Adjusted EBITDA in prior periods. Management bases the estimated ranges of non-GAAP measures for future periods on its reasonable estimates of such factors as assumed effective tax rate, assumed interest expense, stock-based compensation expense, litigation expense, and other assumptions about capital requirements for future periods. The variability of these items may have a significant impact on our future GAAP financial results. We use Adjusted EBITDA, Adjusted EBITDA margin, Adjusted net income, and Adjusted EPS because we believe they assist investors and analysts in comparing our operating performance across reporting periods on a consistent basis by excluding items that we do not believe are indicative of our core operating performance. Management believes Adjusted EBITDA and Adjusted EBITDA margin are helpful in highlighting trends because they exclude the results of decisions that are outside the control of management, while other measures can differ significantly depending on long-term strategic decisions regarding capital structure, the tax jurisdictions in which we operate, and capital investments. We use Adjusted EBITDA and Adjusted EBITDA margin to measure our financial performance and also to report our results to our board of directors. Further, our executive incentive compensation is based in part on Adjusted EBITDA. In addition, we use Adjusted EBITDA as calculated herein for purposes of calculating compliance with our debt covenants in certain of our debt facilities. Adjusted EBITDA should not be considered as an alternative to net income as a measure of financial performance or to cash flows from operations as a liquidity measure. We define Adjusted EBITDA as net income (loss), adjusted for the following items: loss from discontinued operations, net of tax; equity of non-consolidated entities; income tax (benefit) expense; depreciation and amortization; interest expense, net; impairment and restructuring charges; gain on previously held shares of equity investment; (gain) loss on sale of property and equipment; share-based compensation expense; non-cash foreign exchange transaction/translation (income) loss; other non-cash items; and costs related to debt restructuring and debt refinancing. Adjusted EBITDA margin is defined as Adjusted EBITDA divided by net revenues. We present free cash flow because we believe it assists investors and analysts in determining the quality of our earnings. We also use free cash flow to measure our financial performance and to report to our board of directors. In addition, our executive incentive compensation is based in part on free cash flow. We define free cash flow as cash flow from operations less capital expenditures (including purchases of intangible assets). Free cash flow should not be considered as an alternative to cash flows from operations as a liquidity measure. Adjusted net income represents net income adjusted for the after-tax impact of i) non-cash foreign currency (gains) losses, ii) impairment and restructuring charges, iii) one-time non-cash gains, iv) other non- recurring expenses associated with certain matters such as our initial public offering, secondary offering, mergers, and litigation. Adjusted EPS represents net income per diluted share adjusted to exclude the estimated per share impact of the same specifically identified items used to calculate adjusted net income as described above. Where applicable such items are tax-effected at our estimated annual effective tax rate. Other companies may compute these measures differently. No non-GAAP metric should be considered as an alternative to any other measure derived in accordance with GAAP. Due to rounding, numbers presented throughout this document may not sum precisely to the totals provided and percentages may not precisely reflect the absolute figures. 2 |

INTRODUCTION Gary Michel, President and CEO |

KEY TAKEAWAYS . Delivered fourth quarter revenue and earnings in line with guidance . Core growth headwinds continued in certain business lines . Sequential improvement in execution in the fourth quarter Favorable price/cost realization North America and Australasia delivered core margin expansion . Europe performance impacted by ongoing unfavorable mix and one-time items . Recent acquisitions continue to perform on plan . 2018 caps fifth straight year of Adjusted EBITDA growth . Outlook for 2019 assumes core margin expansion accelerating as year progresses . Reaffirm 15% Adjusted EBITDA margin target by 2022 JELD-WEN Excellence Model (JEM) deployment driving global footprint consolidation and cost productivity initiatives DELIVERED GUIDANCE; WELL-POSITIONED FOR CONTINUED IMPROVEMENT IN 2019 4 |

FOURTH QUARTER SUMMARY Financial Summary . Q4 net revenues increased 11.8% . Revenue growth driven primarily by 14% growth from acquisitions . Net income of $39.7 million, an increase of $133.4 million, driven by acquisitions and non-recurring tax charges in 2017 . Adjusted EBITDA of $109.6 million with margins of 10.0%, 60 basis points margin contraction . Core margin expansion in North America and Australasia offset by Europe . Free Cash Flow of $101.0 million for FY 2018 . Delivered on net leverage improvement, ending quarter at target range below 3.0x Capital Allocation . 2.2 million shares of common stock repurchased for $41.4 million . $125.0 million available for additional share repurchases through December 2019 CORE MARGIN EXPANSION IN NORTH AMERICA AND AUSTRALASIA; OVERALL MARGIN CONTRACTION FROM VOLUME/MIX PRIMARILY IN EUROPE 5 |

JELD-WEN EXCELLENCE MODEL UPDATE Objectives Status Update . Driving JEM Culture through continuous Doubled the number of locations where JEM improvement tools were deployed in 2018 Safety and Compliance Over 2,000 employees trained globally on Quality A3 problem solving Customer Experience 90%+ of all facilities delivered improved Productivity service levels in 2018 Sourcing Footprint rationalization acceleration enabled by JEM tools in place across all regions Healthy increase in pipeline of productivity projects identified for 2019 JEM DEPLOYMENT ON TARGET 6 |

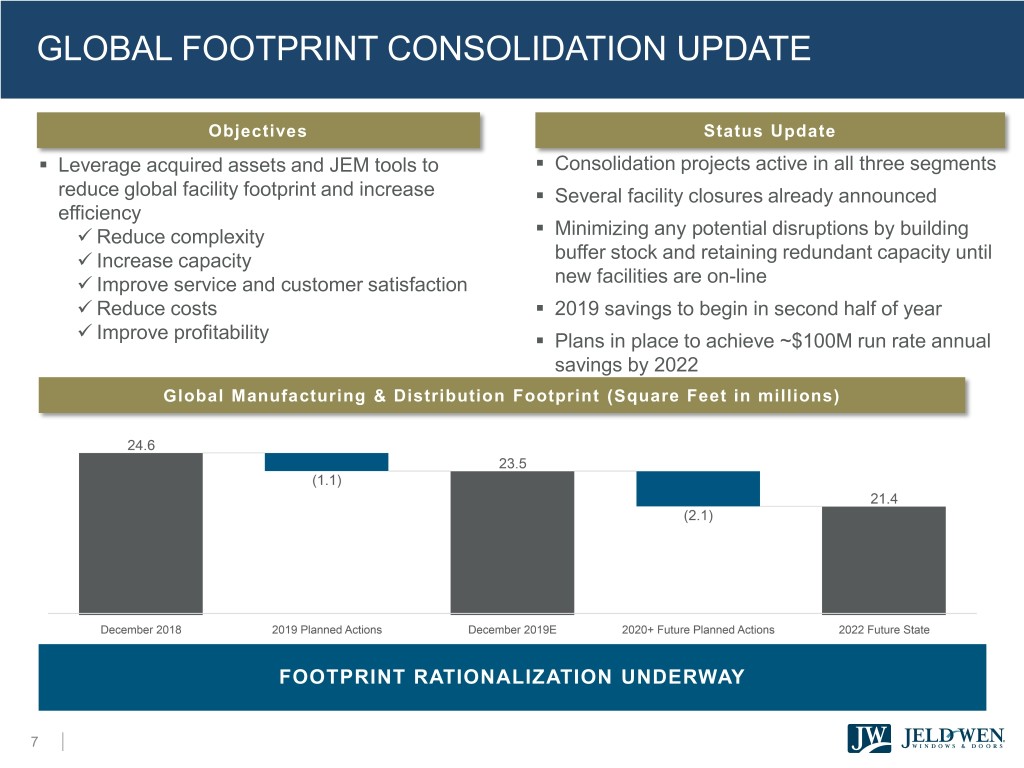

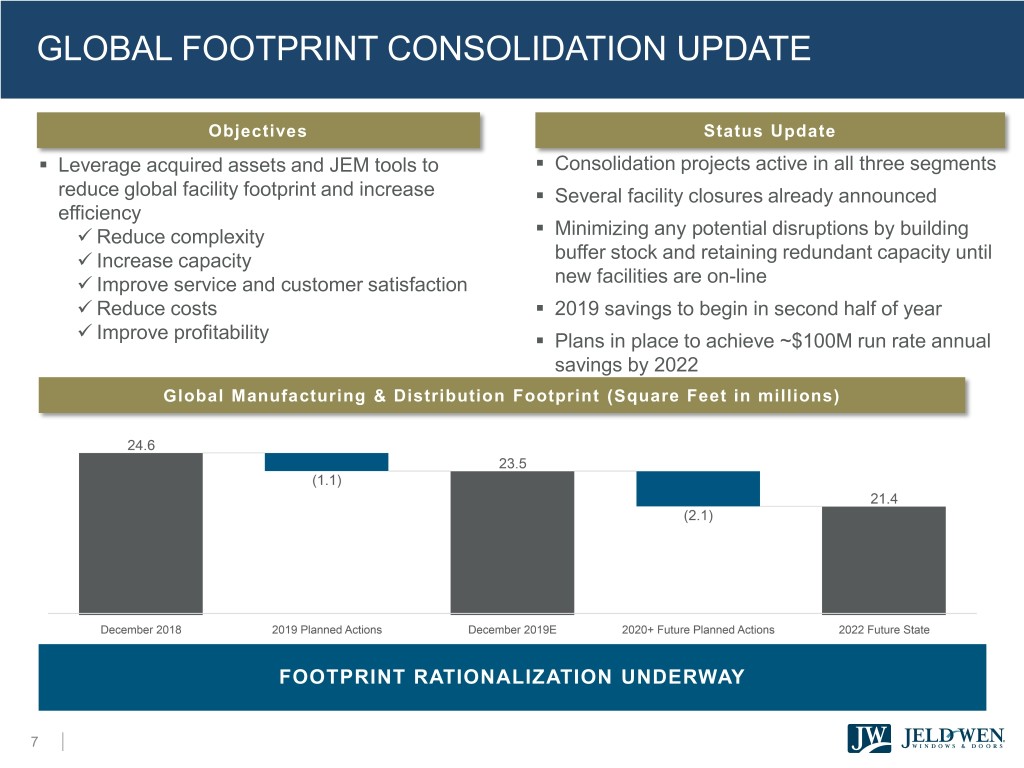

GLOBAL FOOTPRINT CONSOLIDATION UPDATE Objectives Status Update . Leverage acquired assets and JEM tools to . Consolidation projects active in all three segments reduce global facility footprint and increase . Several facility closures already announced efficiency . Reduce complexity Minimizing any potential disruptions by building Increase capacity buffer stock and retaining redundant capacity until Improve service and customer satisfaction new facilities are on-line Reduce costs . 2019 savings to begin in second half of year Improve profitability . Plans in place to achieve ~$100M run rate annual savings by 2022 Global Manufacturing & Distribution Footprint (Square Feet in millions) FOOTPRINT RATIONALIZATION UNDERWAY 7 |

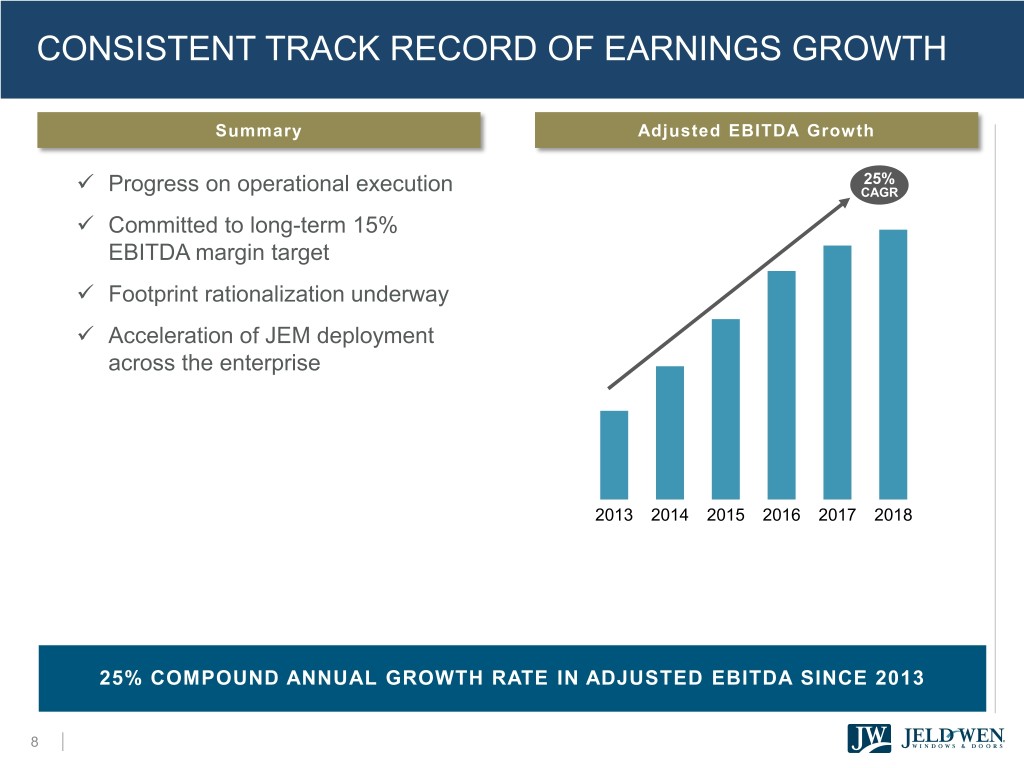

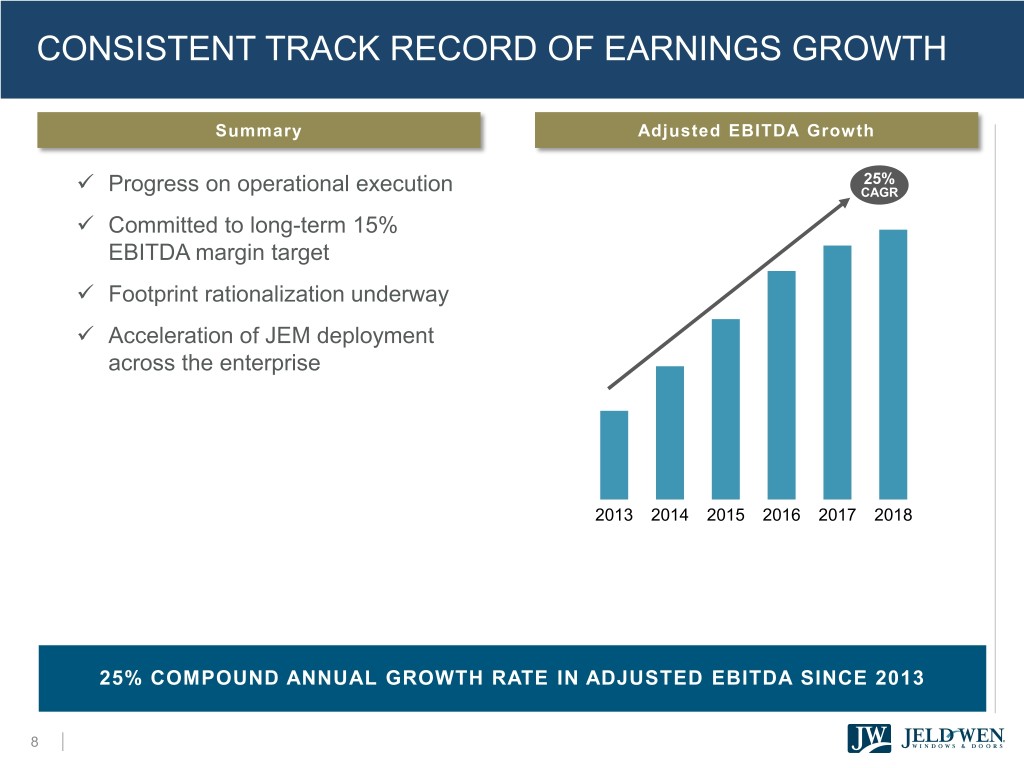

CONSISTENT TRACK RECORD OF EARNINGS GROWTH Summary Adjusted EBITDA Growth 25% Progress on operational execution CAGR Committed to long-term 15% EBITDA margin target Footprint rationalization underway Acceleration of JEM deployment across the enterprise 2013 2014 2015 2016 2017 2018 25% COMPOUND ANNUAL GROWTH RATE IN ADJUSTED EBITDA SINCE 2013 8 |

FINANCIAL REVIEW John Linker, Executive Vice President and CFO |

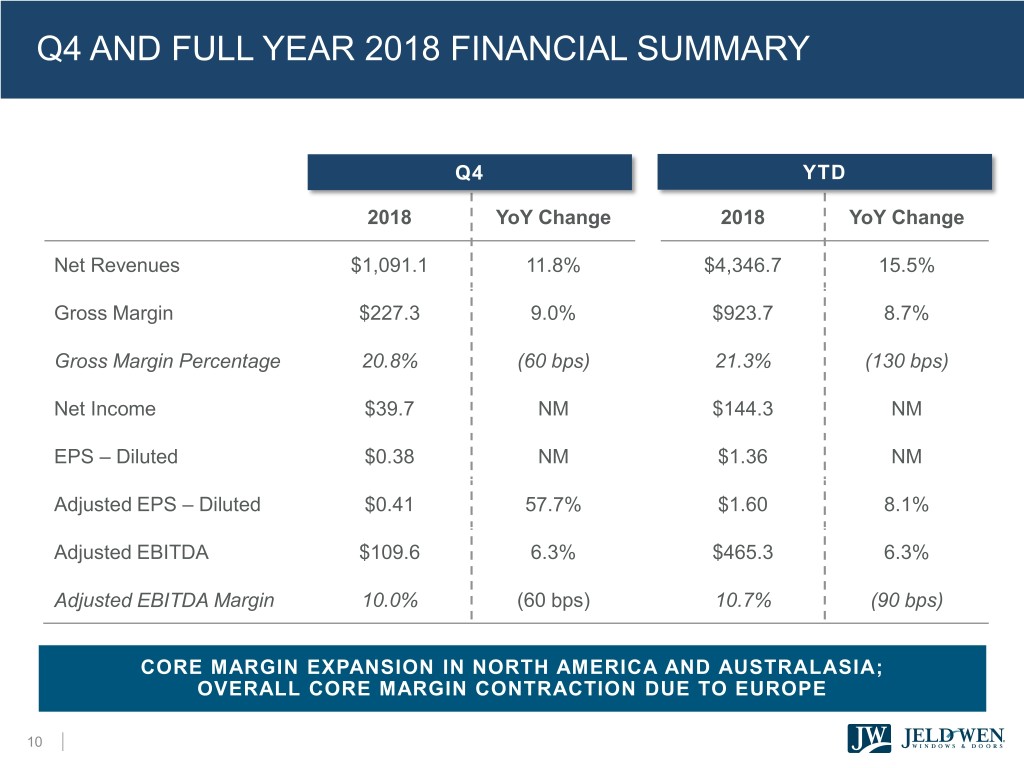

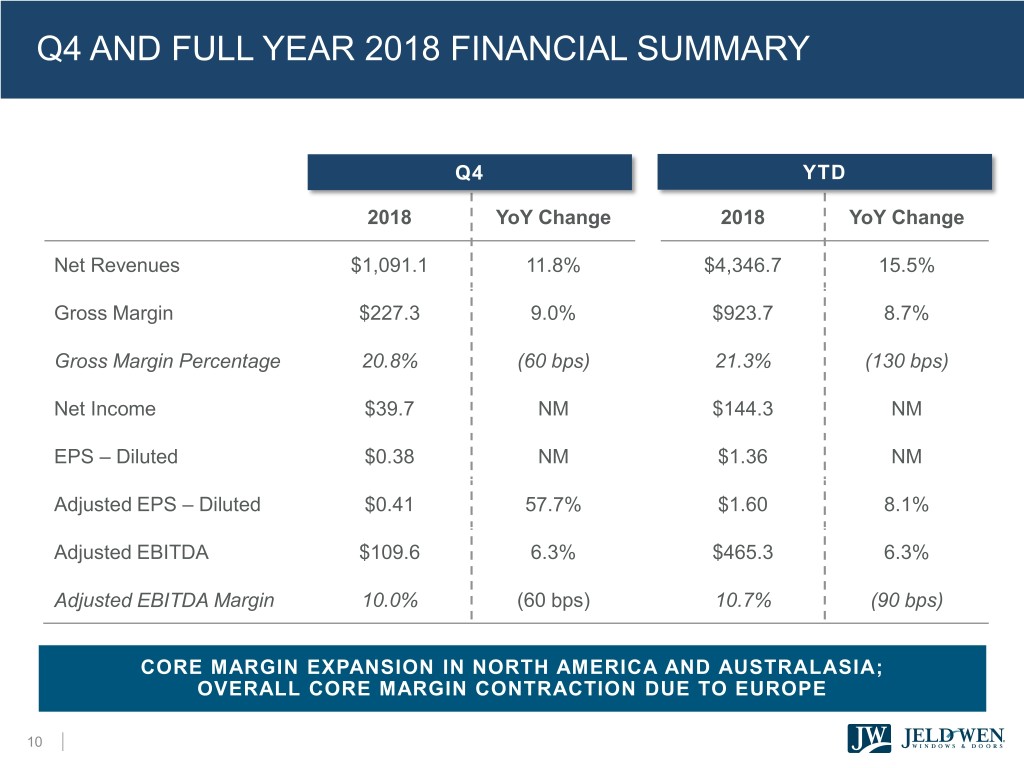

Q4 AND FULL YEAR 2018 FINANCIAL SUMMARY Q4 YTD 2018 YoY Change 2018 YoY Change Net Revenues $1,091.1 11.8% $4,346.7 15.5% Gross Margin $227.3 9.0% $923.7 8.7% Gross Margin Percentage 20.8% (60 bps) 21.3% (130 bps) Net Income $39.7 NM $144.3 NM EPS – Diluted $0.38 NM $1.36 NM Adjusted EPS – Diluted $0.41 57.7% $1.60 8.1% Adjusted EBITDA $109.6 6.3% $465.3 6.3% Adjusted EBITDA Margin 10.0% (60 bps) 10.7% (90 bps) CORE MARGIN EXPANSION IN NORTH AMERICA AND AUSTRALASIA; OVERALL CORE MARGIN CONTRACTION DUE TO EUROPE 10 |

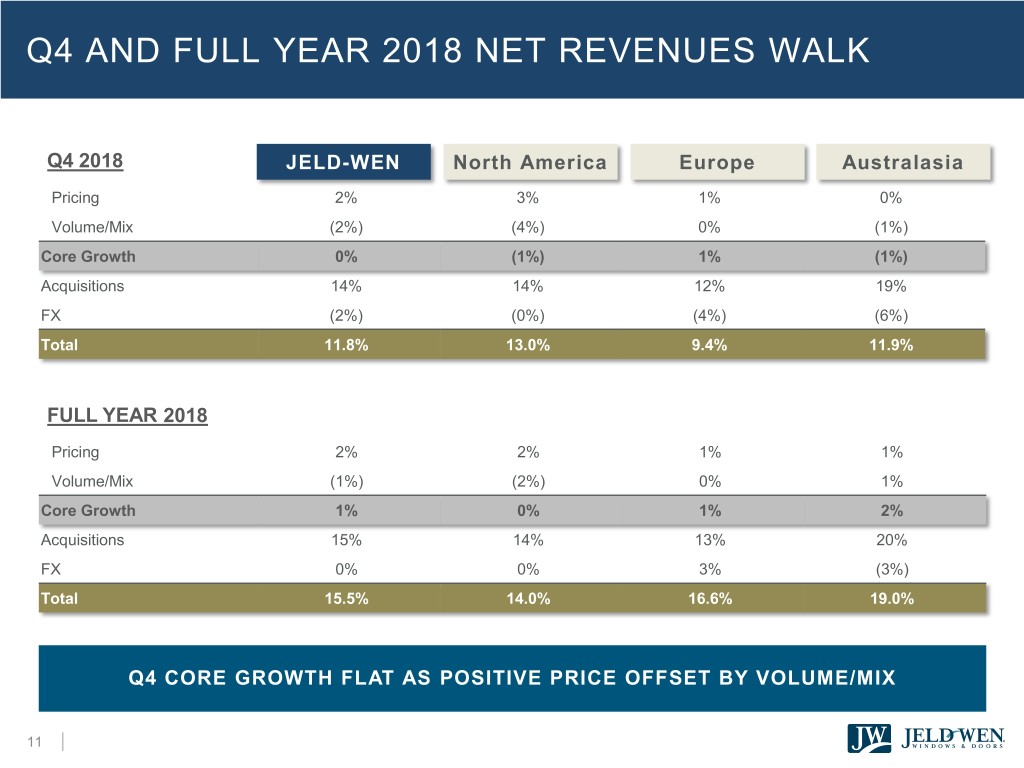

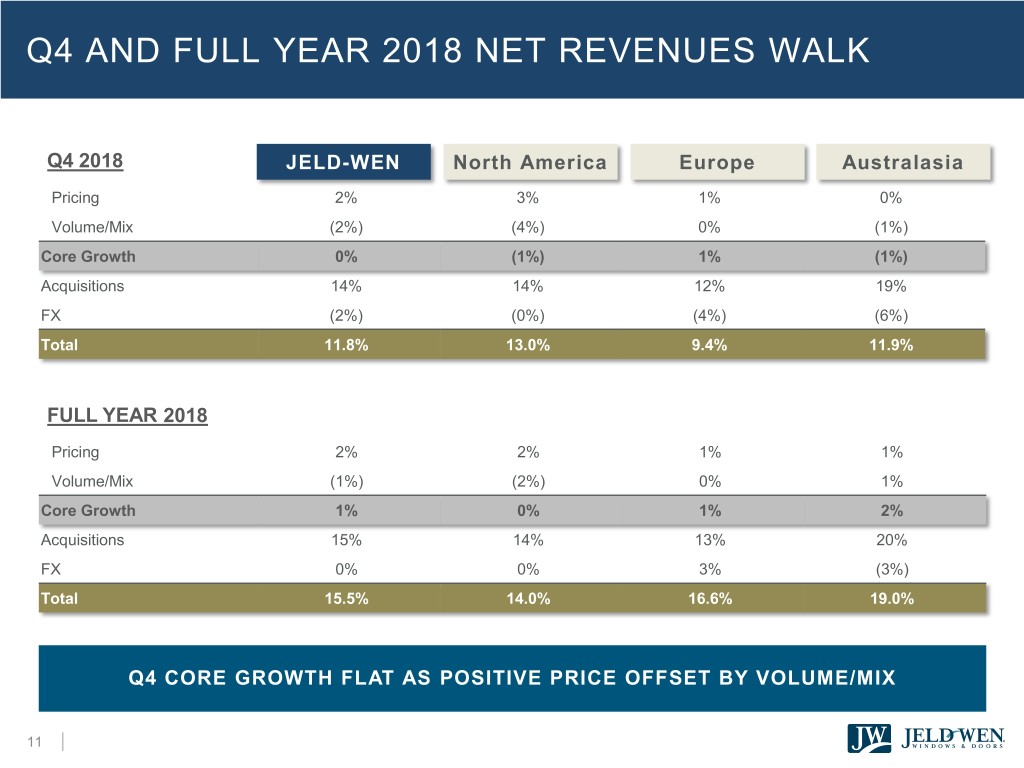

Q4 AND FULL YEAR 2018 NET REVENUES WALK Q4 2018 JELD-WEN North America Europe Australasia Pricing 2% 3% 1% 0% Volume/Mix (2%) (4%) 0% (1%) Core Growth 0% (1%) 1% (1%) Acquisitions 14% 14% 12% 19% FX (2%) (0%) (4%) (6%) Total 11.8% 13.0% 9.4% 11.9% FULL YEAR 2018 Pricing 2% 2% 1% 1% Volume/Mix (1%) (2%) 0% 1% Core Growth 1% 0% 1% 2% Acquisitions 15% 14% 13% 20% FX 0% 0% 3% (3%) Total 15.5% 14.0% 16.6% 19.0% Q4 CORE GROWTH FLAT AS POSITIVE PRICE OFFSET BY VOLUME/MIX 11 |

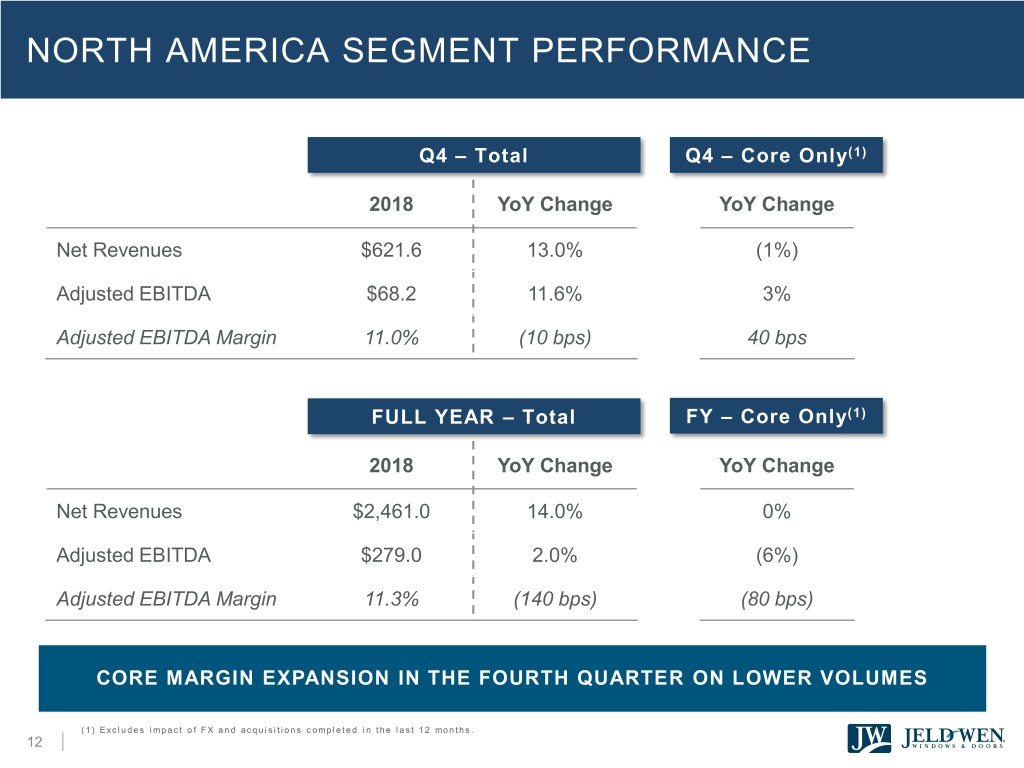

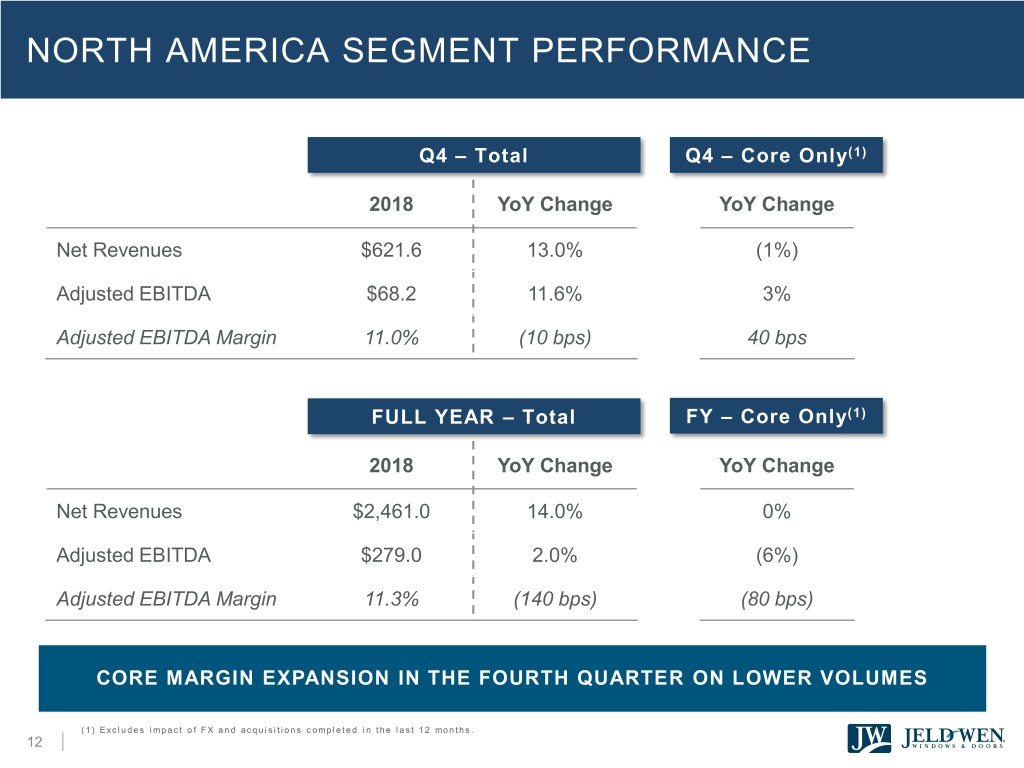

NORTH AMERICA SEGMENT PERFORMANCE Q4 – Total Q4 – Core Only(1) 2018 YoY Change YoY Change Net Revenues $621.6 13.0% (1%) Adjusted EBITDA $68.2 11.6% 3% Adjusted EBITDA Margin 11.0% (10 bps) 40 bps FULL YEAR – Total FY – Core Only(1) 2018 YoY Change YoY Change Net Revenues $2,461.0 14.0% 0% Adjusted EBITDA $279.0 2.0% (6%) Adjusted EBITDA Margin 11.3% (140 bps) (80 bps) CORE MARGIN EXPANSION IN THE FOURTH QUARTER ON LOWER VOLUMES (1) Excludes impact of FX and acquisitions completed in the last 12 months. 12 |

EUROPE SEGMENT PERFORMANCE Q4 – Total $M USD Q4 – Core Only(1) 2018 YoY Change YoY Change Net Revenues $302.5 9.4% 1% Adjusted EBITDA $29.3 (16.9%) (16%) Adjusted EBITDA Margin 9.7% (310 bps) (210 bps) FULL YEAR – Total $M USD FY – Core Only(1) 2018 YoY Change YoY Change Net Revenues $1,215.8 16.6% 1% Adjusted EBITDA $129.2 (2.8%) (9%) Adjusted EBITDA Margin 10.6% (210 bps) (120 bps) ONGOING CHALLENGES IN VOLUME AND MIX (1) Excludes impact of FX and acquisitions completed in the last 12 months. 13 |

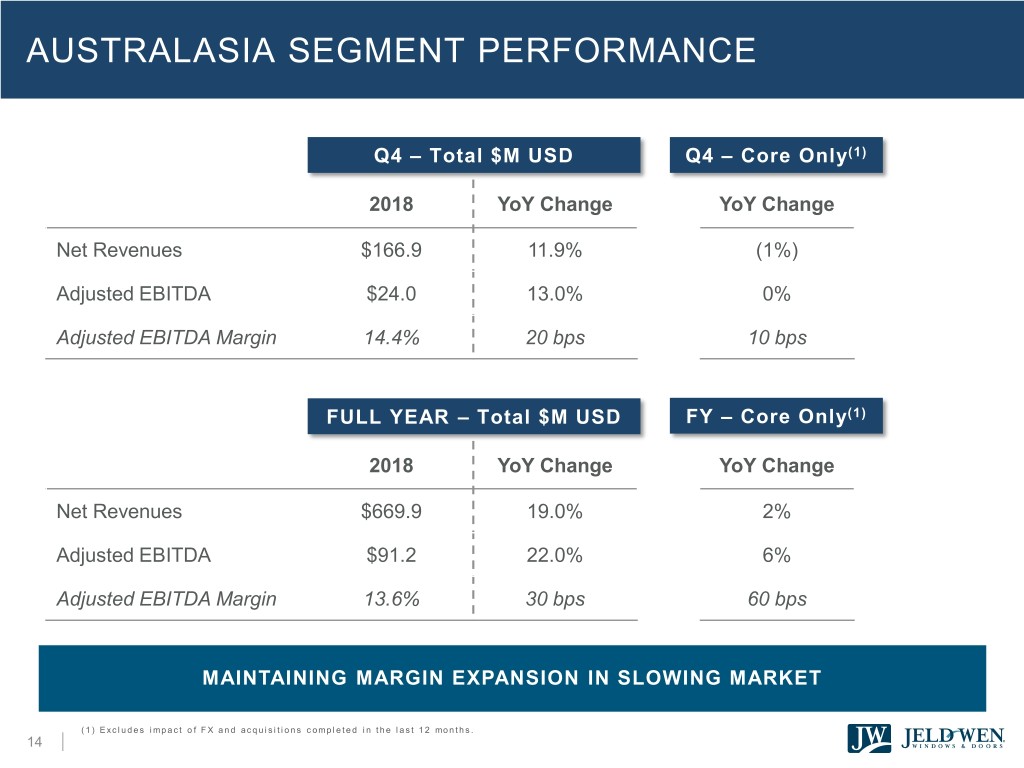

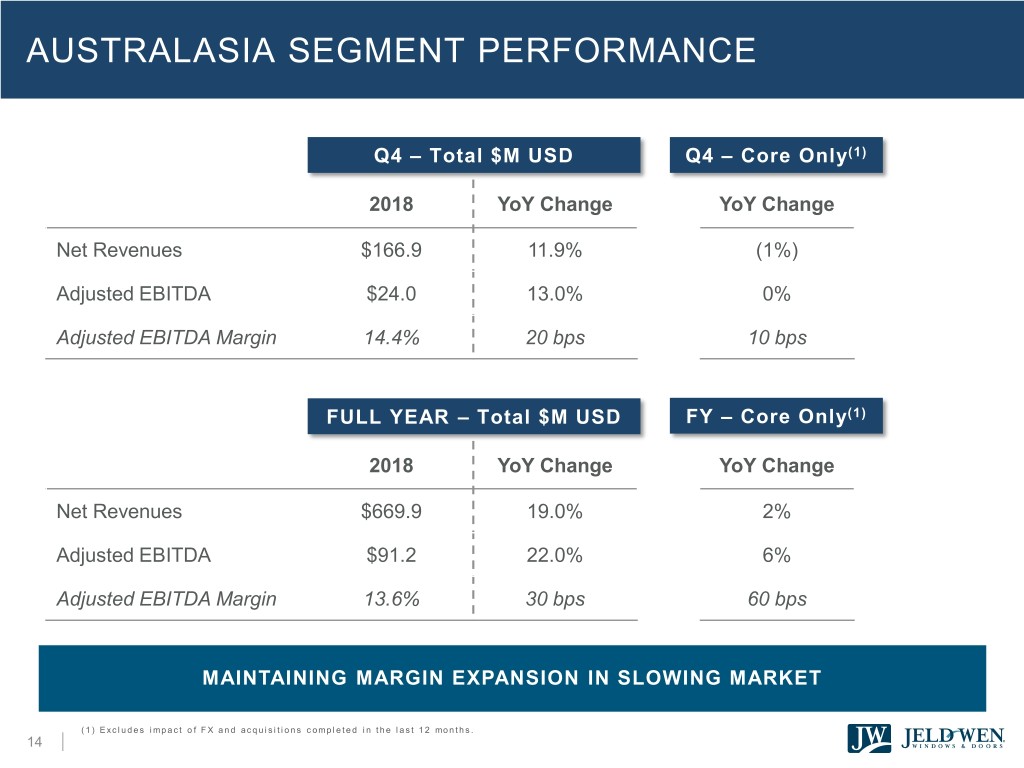

AUSTRALASIA SEGMENT PERFORMANCE Q4 – Total $M USD Q4 – Core Only(1) 2018 YoY Change YoY Change Net Revenues $166.9 11.9% (1%) Adjusted EBITDA $24.0 13.0% 0% Adjusted EBITDA Margin 14.4% 20 bps 10 bps FULL YEAR – Total $M USD FY – Core Only(1) 2018 YoY Change YoY Change Net Revenues $669.9 19.0% 2% Adjusted EBITDA $91.2 22.0% 6% Adjusted EBITDA Margin 13.6% 30 bps 60 bps MAINTAINING MARGIN EXPANSION IN SLOWING MARKET (1) Excludes impact of FX and acquisitions completed in the last 12 months. 14 |

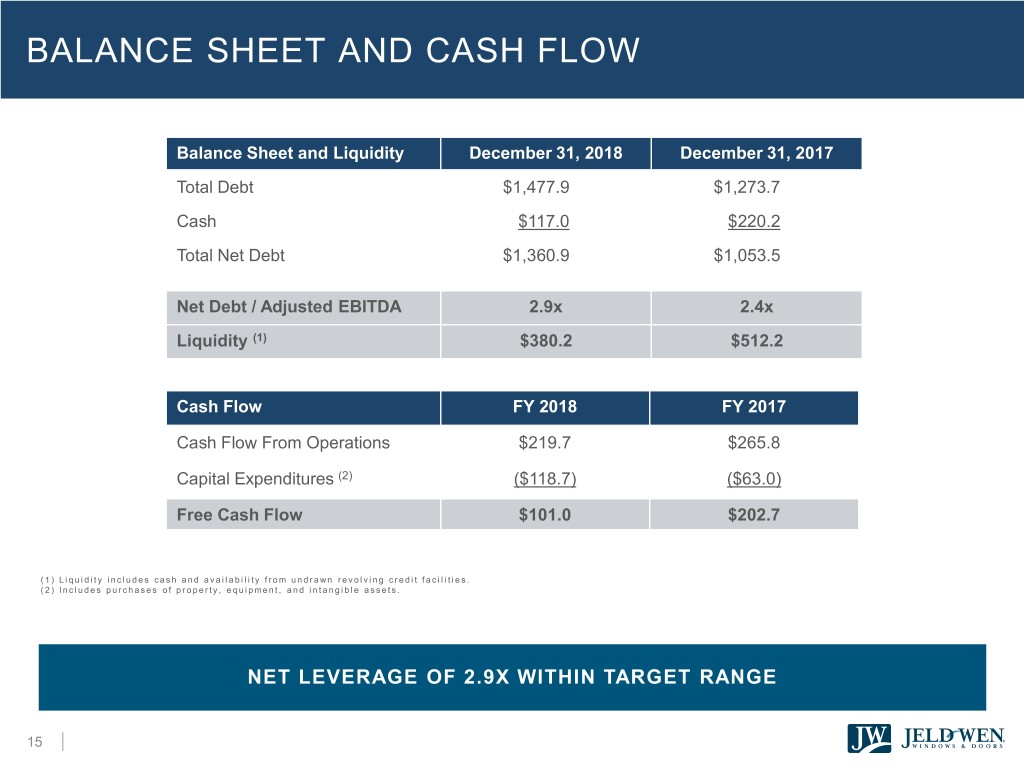

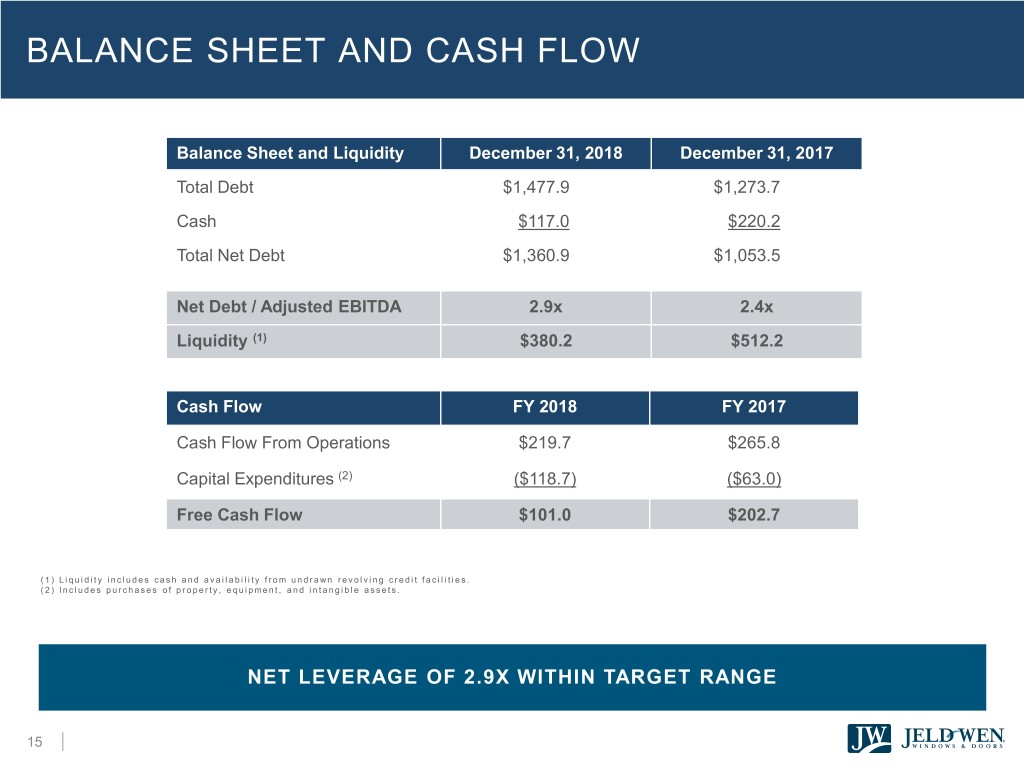

BALANCE SHEET AND CASH FLOW Balance Sheet and Liquidity December 31, 2018 December 31, 2017 Total Debt $1,477.9 $1,273.7 Cash $117.0 $220.2 Total Net Debt $1,360.9 $1,053.5 Net Debt / Adjusted EBITDA 2.9x 2.4x Liquidity (1) $380.2 $512.2 Cash Flow FY 2018 FY 2017 Cash Flow From Operations $219.7 $265.8 Capital Expenditures (2) ($118.7) ($63.0) Free Cash Flow $101.0 $202.7 (1) Liquidity includes cash and availability from undrawn revolving credit facilities. (2) Includes purchases of property, equipment, and intangible assets. NET LEVERAGE OF 2.9X WITHIN TARGET RANGE 15 |

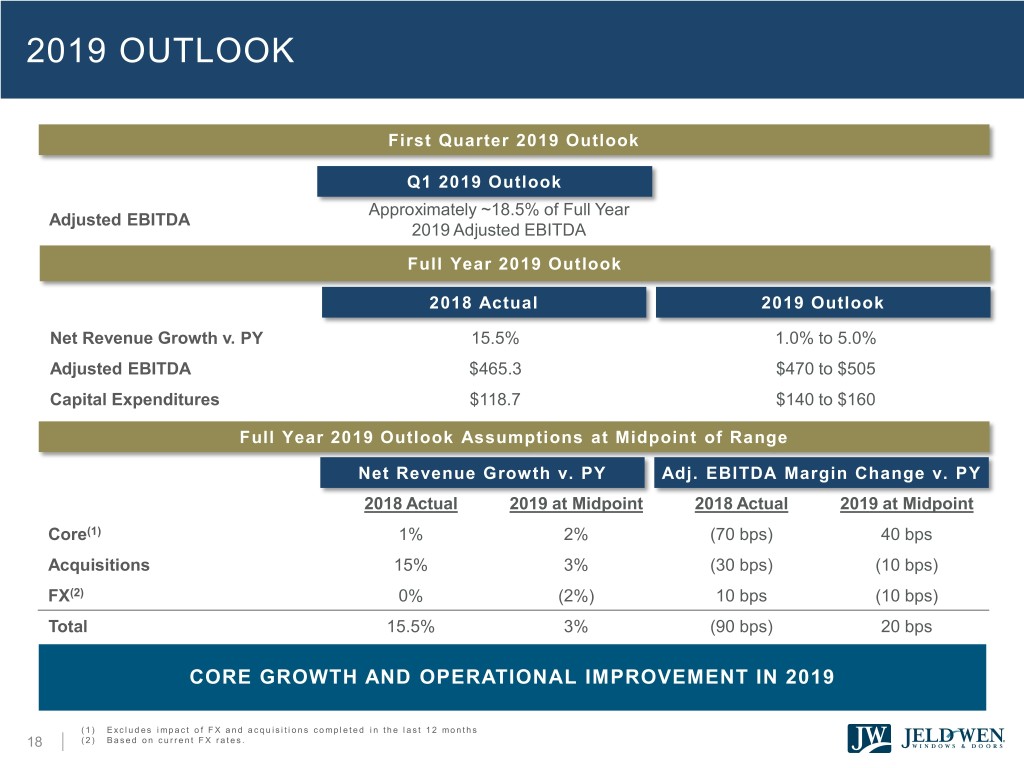

2019 OUTLOOK |

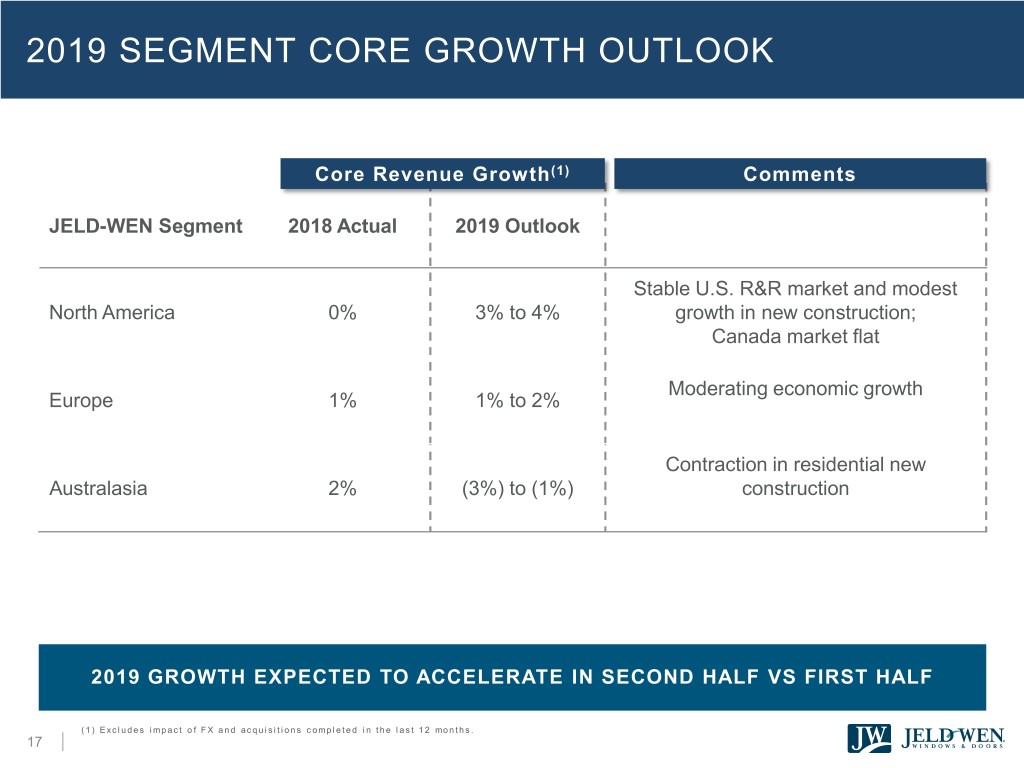

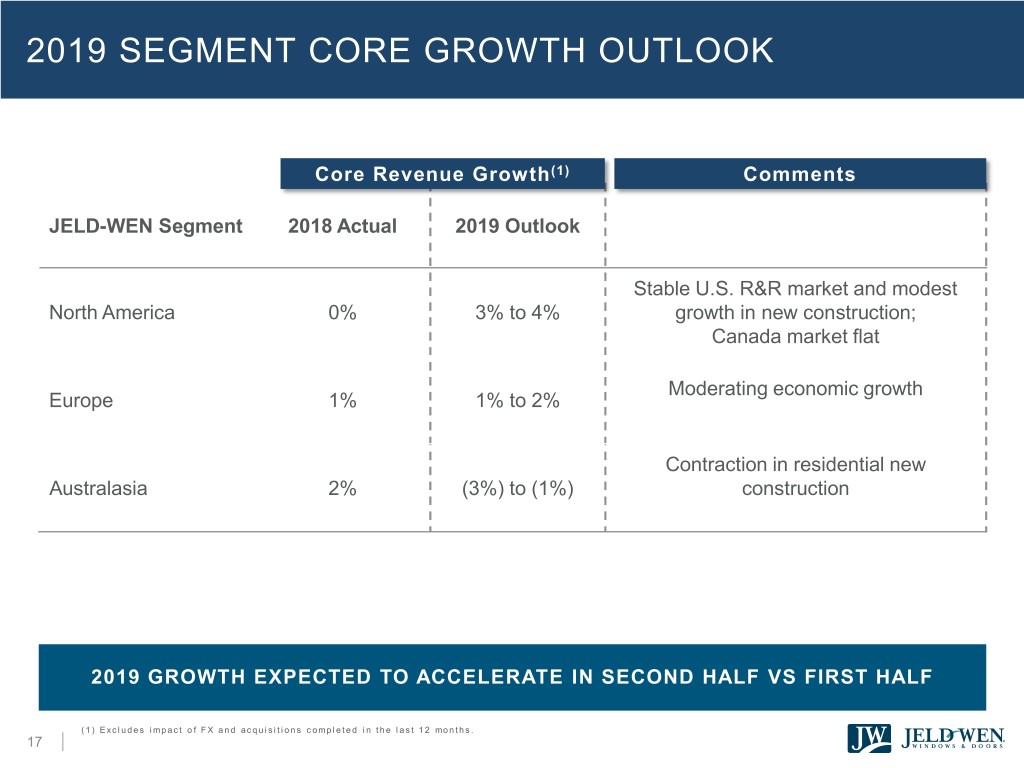

2019 SEGMENT CORE GROWTH OUTLOOK Core Revenue Growth(1) Comments JELD-WEN Segment 2018 Actual 2019 Outlook Stable U.S. R&R market and modest North America 0% 3% to 4% growth in new construction; Canada market flat Moderating economic growth Europe 1% 1% to 2% Contraction in residential new Australasia 2% (3%) to (1%) construction 2019 GROWTH EXPECTED TO ACCELERATE IN SECOND HALF VS FIRST HALF (1) Excludes impact of FX and acquisitions completed in the last 12 months. 17 |

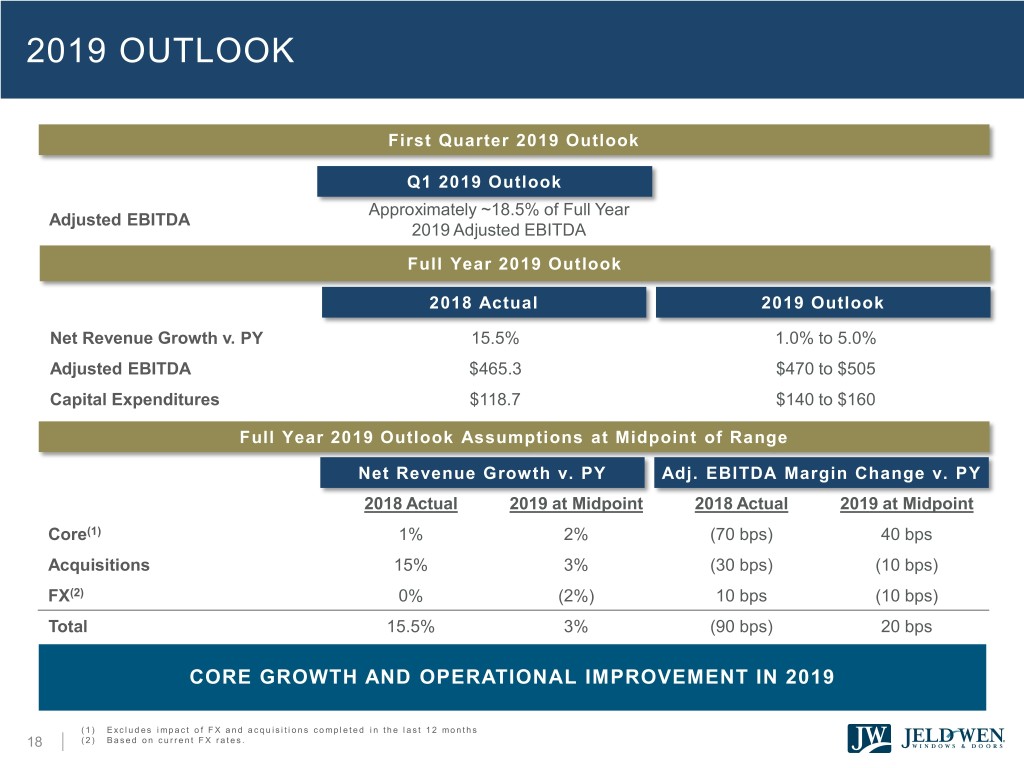

2019 OUTLOOK First Quarter 2019 Outlook Q1 2019 Outlook Approximately ~18.5% of Full Year Adjusted EBITDA 2019 Adjusted EBITDA Full Year 2019 Outlook 2018 Actual 2019 Outlook Net Revenue Growth v. PY 15.5% 1.0% to 5.0% Adjusted EBITDA $465.3 $470 to $505 Capital Expenditures $118.7 $140 to $160 Full Year 2019 Outlook Assumptions at Midpoint of Range Net Revenue Growth v. PY Adj. EBITDA Margin Change v. PY 2018 Actual 2019 at Midpoint 2018 Actual 2019 at Midpoint Core(1) 1% 2% (70 bps) 40 bps Acquisitions 15% 3% (30 bps) (10 bps) FX(2) 0% (2%) 10 bps (10 bps) Total 15.5% 3% (90 bps) 20 bps CORE GROWTH AND OPERATIONAL IMPROVEMENT IN 2019 (1) Excludes impact of FX and acquisitions completed in the last 12 months 18 | (2) Based on current FX rates.

JELD-WEN’S STRATEGIC GROWTH DRIVERS Accelerate Disciplined Capital Expand Margins 1 Top Line Growth 2 3 Allocation % ``` Invest for Growth Culture and Tools Shareholder Value JELD-WEN IS POSITIONED TO DRIVE GROWTH AND LONG TERM SHAREHOLDER VALUE 19 |

APPENDIX |

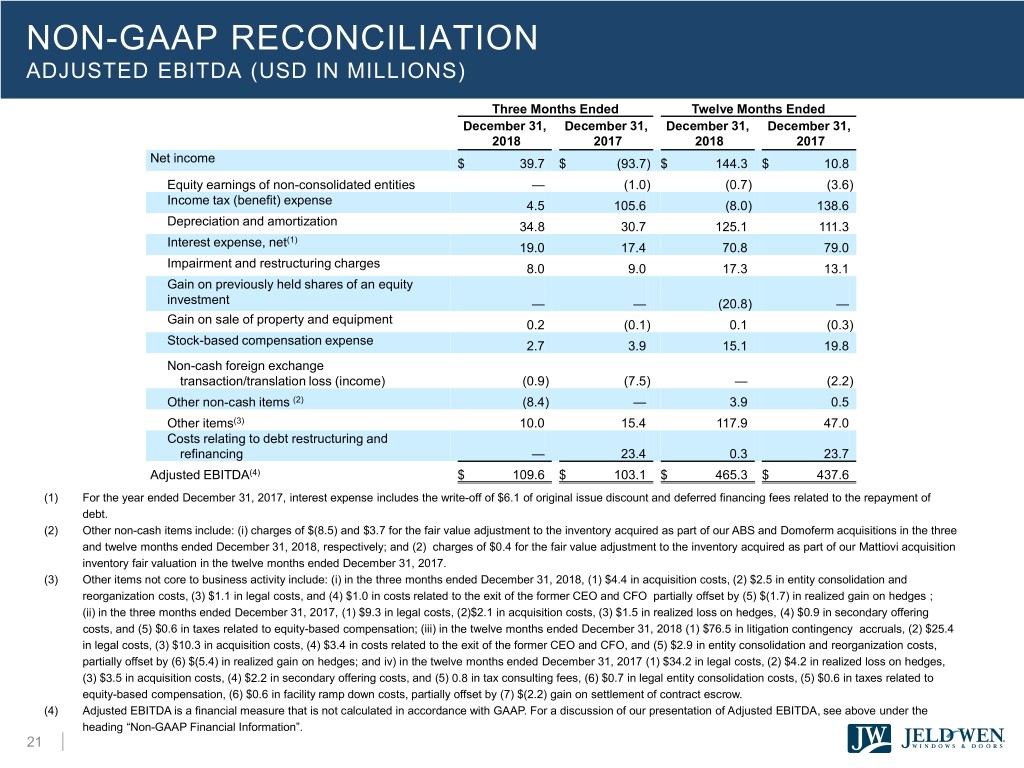

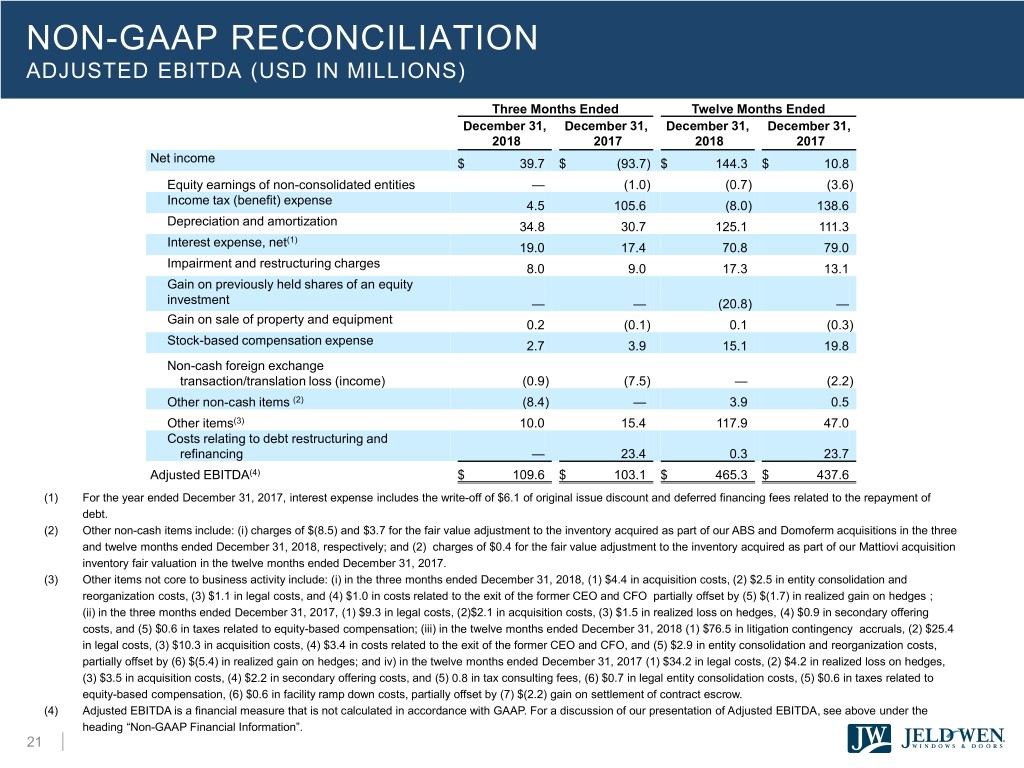

NON-GAAP RECONCILIATION ADJUSTED EBITDA (USD IN MILLIONS) Three Months Ended Twelve Months Ended December 31, December 31, December 31, December 31, 2018 2017 2018 2017 Net income $ 39.7 $ (93.7) $ 144.3 $ 10.8 Equity earnings of non-consolidated entities — (1.0) (0.7) (3.6) Income tax (benefit) expense 4.5 105.6 (8.0) 138.6 Depreciation and amortization 34.8 30.7 125.1 111.3 (1) Interest expense, net 19.0 17.4 70.8 79.0 Impairment and restructuring charges 8.0 9.0 17.3 13.1 Gain on previously held shares of an equity investment — — (20.8) — Gain on sale of property and equipment 0.2 (0.1) 0.1 (0.3) Stock-based compensation expense 2.7 3.9 15.1 19.8 Non-cash foreign exchange transaction/translation loss (income) (0.9) (7.5) — (2.2) Other non-cash items (2) (8.4) — 3.9 0.5 Other items(3) 10.0 15.4 117.9 47.0 Costs relating to debt restructuring and refinancing — 23.4 0.3 23.7 Adjusted EBITDA(4) $ 109.6 $ 103.1 $ 465.3 $ 437.6 (1) For the year ended December 31, 2017, interest expense includes the write-off of $6.1 of original issue discount and deferred financing fees related to the repayment of debt. (2) Other non-cash items include: (i) charges of $(8.5) and $3.7 for the fair value adjustment to the inventory acquired as part of our ABS and Domoferm acquisitions in the three and twelve months ended December 31, 2018, respectively; and (2) charges of $0.4 for the fair value adjustment to the inventory acquired as part of our Mattiovi acquisition inventory fair valuation in the twelve months ended December 31, 2017. (3) Other items not core to business activity include: (i) in the three months ended December 31, 2018, (1) $4.4 in acquisition costs, (2) $2.5 in entity consolidation and reorganization costs, (3) $1.1 in legal costs, and (4) $1.0 in costs related to the exit of the former CEO and CFO partially offset by (5) $(1.7) in realized gain on hedges ; (ii) in the three months ended December 31, 2017, (1) $9.3 in legal costs, (2)$2.1 in acquisition costs, (3) $1.5 in realized loss on hedges, (4) $0.9 in secondary offering costs, and (5) $0.6 in taxes related to equity-based compensation; (iii) in the twelve months ended December 31, 2018 (1) $76.5 in litigation contingency accruals, (2) $25.4 in legal costs, (3) $10.3 in acquisition costs, (4) $3.4 in costs related to the exit of the former CEO and CFO, and (5) $2.9 in entity consolidation and reorganization costs, partially offset by (6) $(5.4) in realized gain on hedges; and iv) in the twelve months ended December 31, 2017 (1) $34.2 in legal costs, (2) $4.2 in realized loss on hedges, (3) $3.5 in acquisition costs, (4) $2.2 in secondary offering costs, and (5) 0.8 in tax consulting fees, (6) $0.7 in legal entity consolidation costs, (5) $0.6 in taxes related to equity-based compensation, (6) $0.6 in facility ramp down costs, partially offset by (7) $(2.2) gain on settlement of contract escrow. (4) Adjusted EBITDA is a financial measure that is not calculated in accordance with GAAP. For a discussion of our presentation of Adjusted EBITDA, see above under the heading “Non-GAAP Financial Information”. 21 |

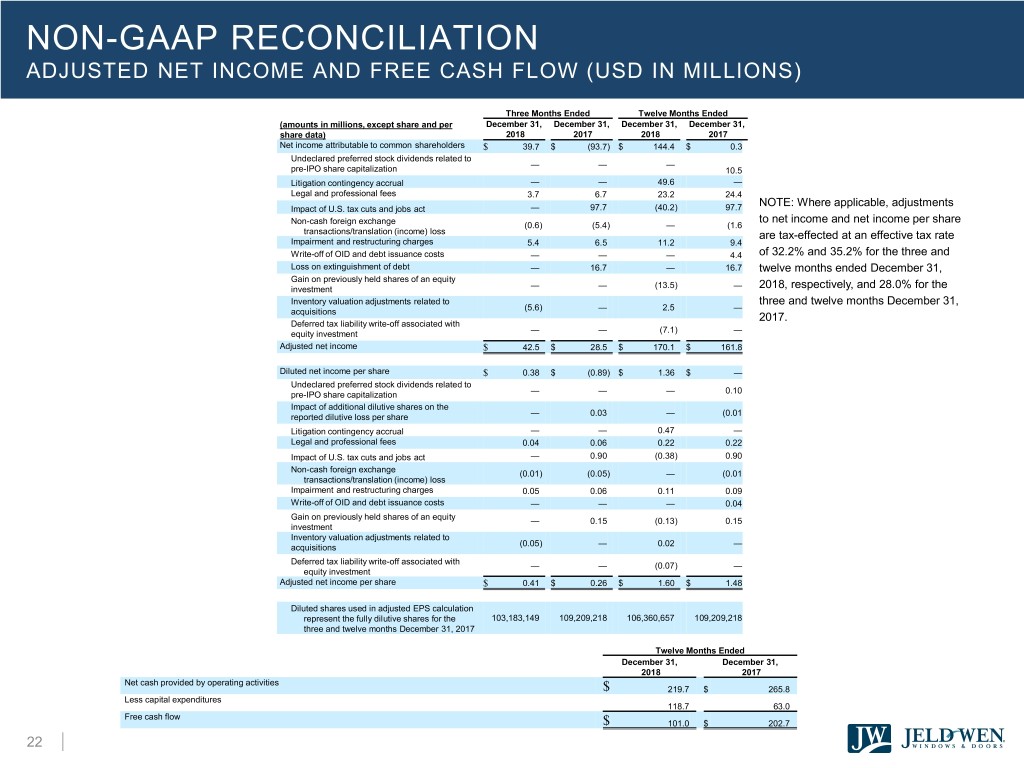

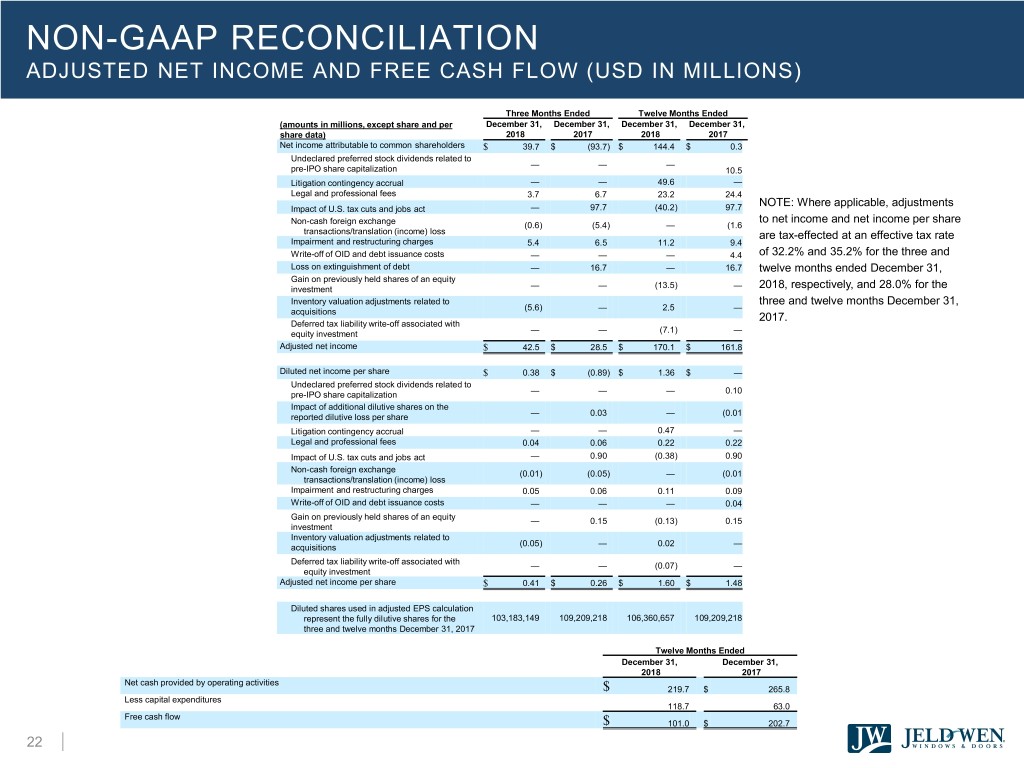

NON-GAAP RECONCILIATION ADJUSTED NET INCOME AND FREE CASH FLOW (USD IN MILLIONS) Three Months Ended Twelve Months Ended (amounts in millions, except share and per December 31, December 31, December 31, December 31, share data) 2018 2017 2018 2017 Net income attributable to common shareholders $ 39.7 $ (93.7) $ 144.4 $ 0.3 Undeclared preferred stock dividends related to — — — pre-IPO share capitalization 10.5 Litigation contingency accrual — — 49.6 — Legal and professional fees 3.7 6.7 23.2 24.4 NOTE: Where applicable, adjustments Impact of U.S. tax cuts and jobs act — 97.7 (40.2) 97.7 to net income and net income per share Non-cash foreign exchange (0.6) (5.4) — (1.6 transactions/translation (income) loss are tax-effected at an effective tax rate Impairment and restructuring charges 5.4 6.5 11.2 9.4 Write-off of OID and debt issuance costs — — — 4.4 of 32.2% and 35.2% for the three and Loss on extinguishment of debt — 16.7 — 16.7 twelve months ended December 31, Gain on previously held shares of an equity investment — — (13.5) — 2018, respectively, and 28.0% for the Inventory valuation adjustments related to three and twelve months December 31, acquisitions (5.6) — 2.5 — 2017. Deferred tax liability write-off associated with equity investment — — (7.1) — Adjusted net income $ 42.5 $ 28.5 $ 170.1 $ 161.8 Diluted net income per share $ 0.38 $ (0.89) $ 1.36 $ — Undeclared preferred stock dividends related to pre-IPO share capitalization — — — 0.10 Impact of additional dilutive shares on the reported dilutive loss per share — 0.03 — (0.01 Litigation contingency accrual — — 0.47 — Legal and professional fees 0.04 0.06 0.22 0.22 Impact of U.S. tax cuts and jobs act — 0.90 (0.38) 0.90 Non-cash foreign exchange (0.01) (0.05) — (0.01 transactions/translation (income) loss Impairment and restructuring charges 0.05 0.06 0.11 0.09 Write-off of OID and debt issuance costs — — — 0.04 Gain on previously held shares of an equity — 0.15 (0.13) 0.15 investment Inventory valuation adjustments related to acquisitions (0.05) — 0.02 — Deferred tax liability write-off associated with — — (0.07) — equity investment Adjusted net income per share $ 0.41 $ 0.26 $ 1.60 $ 1.48 Diluted shares used in adjusted EPS calculation represent the fully dilutive shares for the 103,183,149 109,209,218 106,360,657 109,209,218 three and twelve months December 31, 2017 Twelve Months Ended December 31, December 31, 2018 2017 Net cash provided by operating activities $ 219.7 $ 265.8 Less capital expenditures 118.7 63.0 Free cash flow $ 101.0 $ 202.7 22 |