all of the deferred tax assets will not be realized. The Company has evaluated the positive and negative evidence bearing upon the realizability of its deferred tax assets, including its net operating losses. Based on its history of operating losses, the Company believes that it is more likely than not that the benefit of its deferred tax assets will not be realized. Accordingly, the Company has provided a full valuation allowance for deferred tax assets as of June 30, 2022, and December 31, 2021.

12. Commitments and contingencies

Contingencies

From time to time, the Company may be subject to occasional lawsuits, investigations, and claims arising out of the normal conduct of business. The Company has no significant pending or threatened litigation as of June 30, 2022.

Indemnifications

In the normal course of business, the Company enters into contracts that contain a variety of indemnifications with its employees, licensors, suppliers and service providers. Further, the Company indemnifies its directors and officers who are, or were, serving at the Company’s request in such capacities. The Company’s maximum exposure under these arrangements is unknown as of June 30, 2022. The Company does not anticipate recognizing any significant losses relating to these arrangements.

Leases

The Company enters into various non-cancelable, operating lease agreements for its facilities and equipment in order to conduct its operations. The Company expenses rent on a straight-line basis over the life of the lease and has recorded deferred rent on the Company’s balance sheets within both accrued expenses and other current liabilities and other long-term liabilities.

Total rent expense, inclusive of lease incentives, under all the operating lease agreements amounted to $0.2 million for each of the three months ended June 30, 2022 and 2021, and $0.4 million for each of the six months ended June 30, 2022 and 2021.

Item 2. Management’s Discussion and Analysis of Financial Condition and Results of Operations.

The following discussion should be read in conjunction with our condensed financial statements and accompanying footnotes appearing elsewhere in this Quarterly Report on Form 10-Q and our audited financial statements and related footnotes included in our Annual Report on Form 10-K for the year ended December 31, 2021, or Annual Report, filed with the Securities and Exchange Commission, or the SEC, on March 23, 2022.

Some of the information contained in this discussion and analysis or set forth elsewhere in this Quarterly Report on Form 10-Q, including information with respect to our plans and strategy for our business, includes forward-looking statements that involve risks and uncertainties. See “Special Note Regarding Forward-Looking Statements.” Because of many factors, including those factors set forth in the “Risk Factors” section of our Annual Report, and in section Part II, Item 1A of this Quarterly Report on Form 10-Q, our actual results could differ materially from the results described in or implied by the forward-looking statements contained in the following discussion and analysis. We do not assume any obligation to update any forward-looking statements, whether as a result of new information, future events, or otherwise, except as required by law.

Overview

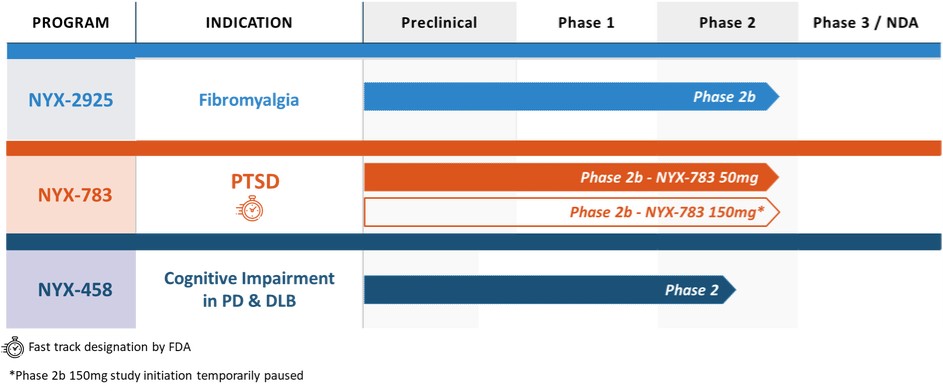

We are a clinical-stage biopharmaceutical company focused on the discovery, development, and commercialization of novel, proprietary, synthetic small molecules for the treatment of nervous system disorders. We focus our efforts on targeting and modulating N-methyl-D-aspartate receptors, or NMDArs, which are vital to normal and effective function of the brain and nervous system. We believe leveraging the therapeutic advantages of the differentiated modulatory