Filed Pursuant to Rule 424(b)

File No.333-237828

Guggenheim Credit Income Fund 2021

A Business Development Company

Maximum Offering of $775,000,000 of Common Shares

Guggenheim Credit Income Fund 2021 (the “Company”) is an externally managed, non-diversified, closed-end management investment company that intends to elect to be treated as a business development company (a “BDC”) under the Investment Company Act of 1940, as amended (the “1940 Act”). We are managed by Guggenheim Partners Investment Management, LLC (“Guggenheim” or the “Advisor”), which is registered as an investment adviser with the Securities and Exchange Commission (“SEC”). We intend to elect to be treated for federal income tax purposes, beginning with our taxable year ending September 30, 2021, and intend to qualify annually thereafter, as a regulated investment company (a “RIC”) under the Internal Revenue Code of 1986, as amended (the “Code”).

Our investment objectives are to provide our shareholders with current income, capital preservation, and, to a lesser extent, long-term capital appreciation. We seek to achieve our investment objectives by investing all or substantially all of our assets in Guggenheim Credit Income Fund (the “Master Fund”), an externally managed, non-diversified, closed-end management investment company that has elected to be treated as a BDC under the 1940 Act. Thus, our investment results will be directly dependent on investment results of the Master Fund. The Master Fund has the same investment objectives as us. The Master Fund is managed by the Advisor. All portfolio company investments are made at the Master Fund level. The Master Fund invests primarily in large, privately-negotiated loans to private middle market U.S. companies, but may also invest in other debt investments, options, or other forms of equity participation. There is no minimum or maximum percentage of the Master Fund’s assets that may be invested in any of the investment categories identified above.

The Master Fund may invest in securities that are rated below investment grade (e.g., junk bonds) by rating agencies or that would be rated below investment grade if they were rated. Below investment grade securities, which are often referred to as “junk,” have predominantly speculative characteristics with respect to the issuer’s capacity to pay interest and repay principal. They may also be illiquid and difficult to value. A material amount of the Master Fund’s debt investments may contain interest rate reset provisions that may make it more difficult for the borrowers to make periodic interest payments to the Master Fund. In addition, a material amount of the Master Fund’s debt investments may not pay down principal until the end of their lifetimes, which could result in a substantial loss to the Master Fund if the portfolio companies are unable to refinance or repay their debts at maturity. There is no limit on the amount of the Master Fund's assets that may be invested in these types of securities.

We are offering on a best efforts, continuous basis up to $775,000,000 of our common shares of beneficial interest (our “Common Shares” or “Shares”) at net asset value plus any applicable sales load. Because our net asset value may fluctuate, subscriptions for this offering are for a specific dollar amount rather than a specified quantity of Shares, which may result in subscribers receiving fractional Shares. The minimum permitted purchase is $2,000 in Shares (or $2,500 for New York non-IRA investments).

There has been and is expected to be no public market for our Shares. We reserve the right to change our investment and operating policies without shareholder approval, except to the extent such approval is required by the 1940 Act. Regardless of whether or not changes in our investment and operating policies require shareholder approval, all material changes will be presented in prospectus supplements during the offering period.

Our offering period will end on or before December 31, 2022, unless otherwise extended for up to 90 days by our Board of Trustees. We will have a finite term of up to six years from the closing of this offering (contemplated to be on or before December 31, 2028) unless the Board of Trustees exercises its ability to delay pursuing a Liquidity Event for at most two additional one year periods. Guggenheim may recommend to our Board of Trustees at any time that it approve a complete Liquidity Event (as described below), and in any event will make such a recommendation no later than December 31, 2028. See “Prospectus Summary - Shareholder Liquidity Strategy.”

| |

| • | An investment in our Shares is not suitable for you if you might need access to the money you invest in the foreseeable future. |

| |

| • | We do not currently intend to list our Shares on any securities exchange and we do not expect a secondary market in the Shares to develop. |

| |

| • | Our Board of Trustees may, but is not required to, implement a share repurchase program. In addition, only a limited number of Shares will be eligible for repurchase and any such repurchases will be at a price that is estimated to be equal to our net asset value per share as of the expiration date of the tender offer, which may be more or less than the price you paid for your Shares. If a share repurchase program is implemented, we do not expect to repurchase, in any calendar year, more than 10% of the weighted average number of outstanding Shares in any 12-month period, until the year in which a Liquidity Event occurs (contemplated to be on or before December 31, 2028). Accordingly, you may not have access to the money you invest until the completion of the Company’s finite term. |

| |

| • | We have a finite term and may liquidate our assets at a time that is disadvantageous based on adverse market conditions, which may result in our incurring losses on our investments. |

| |

| • | Our distributions may be funded from offering proceeds or borrowings, which may constitute a return of capital and reduce the amount of capital available to us for investment. Any capital returned to you through distributions is |

distributed after payment of the sales load and fees and expenses of the Company, and such amounts paid is not recoverable by you.

| |

| • | Our distributions may also be funded in significant part from the reimbursement of certain expenses, which are subject to repayment to our Advisor, as well as from waivers of certain investment advisory fees, which are not subject to repayment to our Advisor. Significant portions of these distributions may not be based on our investment performance and such waivers and reimbursements by our Advisor may not continue in the future. If our Advisor does not agree to reimburse certain of our expenses, including through the waiver of their advisory fees, significant portions of these distributions may come from offering proceeds or borrowings. The repayment of any amounts owed to our Advisor reduces the future distributions to which you would otherwise be entitled. |

| |

| • | Because the Shares of the Company are not listed on a securities exchange, you are unable to sell your Shares on a securities exchange and as a result you may not be able to reduce your exposure during any market downturn. |

| |

| • | You should not expect to be able to sell your Shares regardless of how we perform. If you are able to sell your Shares, you will likely receive less than your purchase price. |

Investing in our Shares may be considered speculative and involves a high degree of risk, including the risk of a substantial loss of investment. See “Risk Factors” to read about the risks you should consider before purchasing our Shares. The use of investor return forecasts in this offering is prohibited. Any representation to the contrary and any predictions, written or oral, as to the amount or certainty of any present or future cash benefit or tax consequence that may flow from an investment in this offering is not permitted.

Our Shares are highly illiquid and appropriate only as a long-term investment. An investment in our Shares is only appropriate for investors who can bear the high degree of illiquidity and other substantial risks associated with such an investment. See “Suitability Standards” and “Risk Factors.” Depending upon the terms and pricing of any additional offerings and the value of our investments, you may experience dilution in the book value and fair value of your Shares. See “Risk Factors - Risks Related to an Investment in Our Shares - Your interest in us may be diluted if we issue additional Shares, which could reduce the overall value of an investment in us.” for more information.

This prospectus contains important information about us that a prospective investor should know before investing in our Shares. Please read this prospectus before investing and keep it for future reference. We also file with the SEC annual reports, quarterly reports, current reports, proxy statements, and other information regarding us. You may obtain a copy of any of these filings free of charge, make shareholder inquiries or request other information about us, by contacting us by mail at 330 Madison Avenue, New York, New York 10017 or by telephone at 1-888-667-4937. These documents are also available without charge at our website at www.GuggenheimCIF.com. The SEC maintains a website (www.sec.gov) that contains information regarding us.

|

| | | | | | | | |

| | | Per Share (1) | | Maximum Offering Amount (1) |

| Initial Public Offering Price | | $ | 10.53 |

| | $ | 775,000,000 |

|

Sales load (2) | | $ | 0.53 |

| | $ | 38,750,000 |

|

| Net proceeds to us (before expenses) | | $ | 10.00 |

| | $ | 736,250,000 |

|

| |

| (1) | Assumes all Shares are sold at the initial public offering price per Share, which is subject to adjustment based upon, among other things, our net asset value per Share. The price per Share and sales load per Share in this table have been rounded to the nearest penny, thus the purchase price details on your confirmation statement may differ from the price per Share and sales load per Share presented in the table above. |

| |

| (2) | The sales load on all initial and follow-on purchases of Shares includes up to 3.0% of the price per Share for selling commissions and up to 2.0% for dealer manager fees, neither of which will be paid by you for Shares issued pursuant to our Distribution Reinvestment Plan (“DRP”). In addition to the upfront selling commissions and dealer manager fees, our Advisor may pay our dealer manager an annualized fee equal to no more than 1.0% of the Company's then-current net asset value, payable quarterly. Our dealer manager will re-allow all of such amounts to participating selected dealers. Such amounts will not be paid by our shareholders. See “Plan of Distribution.” |

Because you will pay a sales load of up to 5.0% and organization and offering expenses of up to 1.5% if you invest $100 in our Shares and pay the maximum sales load, at least $93.50 but less than $95.00 of your investment will actually be available to us for investment purposes. As a result, you would have to experience a total return on your investment of between approximately 5% and 7% in order to recover these expenses. See “Use of Proceeds.”

Neither the SEC, the Attorney General of the State of New York, nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense. An investment in our Shares is NOT a bank deposit and is NOT insured by the Federal Deposit Insurance Corporation or any other government agency.

August 31, 2020

Table of Contents

ABOUT THIS PROSPECTUS

This prospectus is part of a registration statement we have filed with the SEC, in connection with a continuous offering process, to raise capital to invest in the Master Fund. This prospectus, together with any prospectus supplements, constitute the entire prospectus and we will supplement this prospectus as necessary to reflect subsequent material changes. As we or the Master Fund make material investments or have other material developments, we will periodically file prospectus supplements or may amend this prospectus to add, update, or change information contained in this prospectus. Shares are offered at net asset value plus any applicable sales load.

Our Board of Trustees will adjust the public offering price periodically to ensure that the public offering price, net of sales load, is equal to the net asset value per Share when we sell our Shares.

You should rely only on the information contained in this prospectus. Our dealer manager is Guggenheim Funds Distributors, LLC, which we refer to in this prospectus as "GFD" or our "Dealer Manager." Neither we nor our Dealer Manager has authorized any other person to provide you with different information from that contained in this prospectus. The information contained in this prospectus is complete and accurate only as of the date of this prospectus, regardless of the time of delivery of this prospectus or sale of our Shares. Any statement that we make in this prospectus may be modified or superseded by us in a subsequent prospectus supplement. The registration statement we filed with the SEC includes exhibits that provide more detailed descriptions of the matters discussed in this prospectus. You should read this prospectus, all prospectus supplements and the related registration statement exhibits, together with the additional information described under “Additional Information.”

We maintain a website at www.GuggenheimCIF.com. Information contained on our website is not incorporated by reference into this prospectus and you should not consider that information to be part of this prospectus.

MASTER/FEEDER FUND STRUCTURE

We serve as a feeder fund in a master/feeder fund structure in that we invest all or substantially all of our assets in the common shares of the Master Fund, a separate externally managed, non-diversified, closed-end management investment company that has elected to be treated as a BDC, with the same investment objectives and strategies as our investment objectives and strategies. As we raise capital, we will invest in the Master Fund at the net asset value of the Master Fund, which varies over time. We have a Board of Trustees that has overall responsibility for overseeing our management and operations. The same Trustees also serve on the Master Fund’s Board of Trustees, where they have overall responsibility for overseeing the Master Fund’s management and operations. See “Management of the Company and the Master Fund.”

While the Master Fund is expected to continuously offer its common shares and have an indefinite life, our offering period will end on or before December 31, 2022, unless otherwise extended for up to 90 days by our Board of Trustees. We will have a finite term of up to six years from the close of this offering (contemplated to be on or before December 31, 2028) unless the Board of Trustees exercises its ability to delay pursuing a Liquidity Event for at most two additional one year periods. Other feeder funds may be created over time that will invest all or substantially all of their assets in the common shares of the Master Fund. It is the Board of Trustees’ intention that one or more feeder funds will liquidate prior to the Company’s liquidation. In the event that a feeder fund liquidates, the Master Fund may sell some of its investments, borrow additional funds, or use capital raised from other feeder funds, such as ours, to meet the liquidation needs of such liquidating feeder fund.

The Master Fund makes the investments described in this prospectus with the proceeds it receives from (i) the sale of our Shares and (ii) equity capital invested by any other BDC regulated under the 1940 Act that has a principal investment strategy of investing all or substantially all of its assets in the Master Fund.

The investment advisor to the Master Fund is Guggenheim. Guggenheim oversees the management of the Master Fund’s activities and is responsible for identifying investment opportunities, making investment decisions and corporate borrowing recommendations for the Master Fund’s portfolio, and executing on its trading strategies. Guggenheim also serves as the Company’s and the Master Fund’s administrator, providing and overseeing the administrative services needed to operate the Company and the Master Fund. See “Company Profile - Our Advisor.”

SUITABILITY STANDARDS

Our Shares offered through this prospectus are suitable only as a long-term investment for persons of adequate financial means, such that they do not have a need for liquidity in this investment. We have established financial suitability standards for initial shareholders in this offering, which require that a purchaser of Shares have either:

| |

| • | a gross annual income of at least $70,000 and a net worth of at least $70,000, or |

| |

| • | a net worth of at least $250,000. |

For purposes of determining the suitability of an investor, net worth in all cases should be calculated excluding the value of an investor’s home, home furnishings, and automobiles. In the case of sales to fiduciary accounts, these minimum standards must be met by the beneficiary, the fiduciary account, or the donor or grantor who directly or indirectly supplies the funds to purchase the Shares if the donor or grantor is the fiduciary.

Those selling Shares on our behalf, and selected dealers and registered investment advisers recommending the purchase of Shares, are required to make every reasonable effort to determine that the purchase of Shares is a suitable and appropriate investment for each investor based on information provided by the investor regarding the investor’s financial situation and investment objectives. We will maintain records of the information we use to determine that an investment in the Shares is suitable and appropriate for each investor for six years. Selected dealers and registered investment advisers will be obligated to retain such records for six years or such other period of time that is required under applicable laws and regulations. In making this determination, consideration should be given to the illiquid nature of the security and the fact that we will have a finite term of up to six years from the close of this offering (contemplated to be on or before December 31, 2028) unless the Board of Trustees exercises its ability to delay pursuing a Liquidity Event for at most two additional one year periods. The selected dealer, authorized representative, or other person selling Shares will, based on a review of the information provided by the investor, consider whether the investor:

| |

| • | meets the minimum income and net worth standards established in the investor’s state; |

| |

| • | can reasonably benefit from an investment in our Shares based on the investor’s overall investment objectives and portfolio structure; |

| |

| • | is able to bear the economic risk of the investment based on the investor’s overall financial situation, including the risk that the investor may lose its entire investment; and |

| |

| • | has an apparent understanding of the following: |

•the fundamental risks of the investment;

•the lack of liquidity of the Shares;

•the restrictions on transferability of the Shares;

•the background and qualification of Guggenheim; and

•the tax consequences of the investment.

In purchasing Shares, custodians or trustees of employee pension benefit plans or individual retirement accounts (“IRAs”) may be subject to the fiduciary duties imposed by the Employee Retirement Income Security Act (“ERISA”), or other applicable laws, and to the prohibited transaction rules prescribed by ERISA and related provisions of the Code. In addition, prior to purchasing Shares, the trustee or custodian of an employee pension benefit plan or IRA should determine that such an investment would be permissible under the governing instruments of such plan or account and applicable law. In addition, we will not sell Shares to investors in the states named below unless they meet the suitability standards set forth above, as well as the additional requirements as established by those states’ securities regulators:

Alabama - Investors must have a liquid net worth of at least ten times their investment in us and our affiliated programs.

California - Investors must have either (i) a minimum net worth of at least $250,000 and a minimum annual gross income of at least $65,000 or (ii) a minimum net worth of $500,000. Each investor’s maximum investment in this offering may not be more than 10% of his or her liquid net worth. “Liquid net worth” is defined as net worth excluding the value of the investor’s home, home furnishings, and automobiles.

Idaho - Investors must have either (i) a minimum net worth of at least $85,000 and a minimum annual gross income of at least $85,000, or (ii) a minimum net worth of $300,000. In addition, an investor’s total investments in this offering shall not exceed 10% of his or her net worth.

Iowa - Investors who reside in the state of Iowa must have either (i) a minimum annual gross income of at least $100,000 and a minimum net worth of at least $100,000, or (ii) a minimum net worth of $350,000. (Net worth should be determined exclusive of home, auto and home furnishings.) In addition, each investor who is not an “accredited investor,” as defined in 17 C.F.R. § 230.501, must limit his or her aggregate investment in this offering and in the securities of other non-publicly traded business development companies to 10% of such investor's liquid net worth. (Liquid net worth should be defined as that portion of net worth that consists of cash, cash equivalents, and readily marketable securities.)

Kansas - The Kansas Securities Commissioner recommends that Kansas investors not invest, in the aggregate, more than 10% of their liquid net worth in this and other non-exchange listed BDCs. “Liquid net worth” is defined as the portion of net worth that consists of cash and cash equivalents and readily marketable securities.

Kentucky - Investors must have either (i) a minimum net worth of at least $70,000 and a minimum annual gross income of at least $70,000, or (ii) a minimum net worth of $250,000. In addition, a Kentucky resident’s investment in our Shares or the shares of our affiliated, non-publicly traded business development companies may not exceed ten percent (10%) of his or her liquid net worth. “Liquid net worth” shall be defined as that portion of a person’s net worth (total assets exclusive of home, home furnishings, and automobiles, minus total liabilities) that is comprised of cash, cash equivalents, and readily marketable securities.

Maine - The Maine Office of Securities recommends that an investor’s aggregate investment in this offering and similar direct participation investments not exceed 10% of the investor’s liquid net worth. For this purpose, “liquid net worth” is defined as that portion of net worth that consist of cash, cash equivalents, and readily marketable securities.

Massachusetts - Each investor’s aggregate investment in this offering and in other illiquid direct participation programs (including real estate investment trusts, other BDCs, oil and gas programs, equipment leasing programs, and commodity pools) may not exceed ten percent (10%) of his or her liquid net worth. “Liquid net worth” shall be defined as that portion of net worth (total assets exclusive of home, home furnishings, and automobiles, minus total liabilities) that is comprised of cash, cash equivalents, and readily marketable securities.

Missouri - Each investor's aggregate investment in our Shares may not exceed ten percent (10%) of his or her liquid net worth.

Nebraska - Each investor must have either (a) a gross annual income of at least $70,000 and a net worth of at least $70,000 or (b) a net worth of at least $250,000 (exclusive of home, home furnishing and automobiles). Each investor must also limit his or her investments in our Shares and in the securities of other non-traded business development companies to a maximum of 10% of his or her net worth.

New Jersey - Investors must have either (i) a minimum liquid net worth of at least $100,000 and a minimum annual gross income of not less than $85,000, or (ii) a minimum liquid net worth of $350,000. For these purposes, “liquid net worth” is defined as that portion of net worth (total assets exclusive of home, home furnishings, and automobiles, minus total liabilities) that consists of cash, cash equivalents, and readily marketable securities. In addition, a New Jersey investor’s investment in us, our affiliates, and other non-publicly traded direct investment programs (including real estate investment trusts, BDCs, oil and gas programs, equipment leasing programs, and commodity pools, but excluding private offerings that are exempt from registration) may not exceed ten percent (10%) of his or her liquid net worth.

New Mexico - Investors may not invest more than 10% of their liquid net worth in us, our affiliates, and other non-traded BDCs. “Liquid net worth” is defined as that portion of net worth that consists of cash, cash equivalents, and readily marketable securities.

North Dakota - Investors must represent that, in addition to the stated net income and net worth standards, they have a net worth of at least ten times their investment in us.

Ohio - Investors may not invest more than ten percent (10%) of their liquid net worth in us, our affiliates, and other non-traded BDCs. “Liquid net worth” shall be defined as that portion of net worth (total assets exclusive of home, home furnishings, and automobiles, minus total liabilities) that is comprised of cash, cash equivalents, and readily marketable securities.

Oklahoma - Investors must have either (a) a minimum net worth of at least $100,000 and a minimum annual gross income of $100,000, or (b) a minimum net worth of $250,000. In addition, an Oklahoma investor’s investment in this offering may not exceed ten percent (10%) of his or her net worth. For these purposes, “net worth” is exclusive of an investor’s home, home furnishings, and automobiles.

Oregon - Investors may not invest more than 10% of their liquid net worth in us and our affiliates. “Liquid net worth” is defined as net worth excluding the value of the investor’s home, home furnishings and automobiles.”

Puerto Rico - Investors may not invest more than 10% of their liquid net worth in us, our affiliates, and other non-traded programs. "Liquid net worth" is defined as that portion of net worth (total assets exclusive of primary residence, home furnishings, and automobiles, minus total liabilities) consisting of cash, cash equivalents, and readily marketable securities.

Tennessee - Investors who are not “accredited investors” as defined in 17 C.F.R. § 230.501 may not invest more than 10% of their liquid net worth (exclusive of home, home furnishings, and automobiles) in us.

Texas - Investors must have either (i) a minimum liquid net worth of at least $100,000 and a minimum annual gross income of at least $100,000, or (ii) a minimum liquid net worth of $250,000. For this purpose, “liquid net worth” is defined as that portion of net worth (total assets exclusive of home, home furnishings, and automobiles, minus total liabilities) that consists of cash, cash equivalents, and readily marketable securities.

Vermont - Each investor who is not an “accredited investor” as defined in 17 C.F.R. § 230.501 may not purchase an amount of Shares in this offering that exceeds 10% of the investor’s liquid net worth. For this purpose, “liquid net worth” is defined as an investor’s total assets (not including home, home furnishings, or automobiles) minus total liabilities. Vermont residents who are “accredited investors” are not subject to the limitation described in this paragraph.

In addition to investors who meet the minimum income and net worth requirements set forth above, our Shares may be sold to financial institutions that qualify as “institutional investors” under the state securities laws of the state in which they reside. “Institutional investor” is generally defined to include banks, insurance companies, investment companies as defined in the 1940 Act, pension or profit sharing trusts, and certain other financial institutions. A financial institution that desires to purchase Shares will be required to confirm that it is an “institutional investor” under applicable state securities laws.

In addition to the suitability standards established herein, a selected dealer may impose additional suitability requirements to which an investor could be subject.

PROSPECTUS SUMMARY

This summary highlights some of the information in this prospectus. It is not complete and may not contain all of the information that you may want to consider. To understand this offering fully, you should carefully read the entire prospectus, including the section entitled “Risk Factors,” before making a decision to invest in our Shares. Unless otherwise noted, the terms “we,” “us,” “our,” “GCIF 2021,” and “Company” refer to Guggenheim Credit Income Fund 2021. We refer to Guggenheim Credit Income Fund as the “Master Fund.” As we are a feeder fund in a master/feeder fund structure, all references to our portfolio/investments, our investment process or investment strategies, and our risks refer to the Master Fund’s portfolio/investments, the Master Fund’s investment process or investment strategies, and the Master Fund’s risks. Similarly, all references to Guggenheim, our management fee, and our incentive fees refer to the Master Fund, the management fee payable by the Master Fund, and the incentive fees payable by the Master Fund. We refer to Guggenheim Partners, LLC as “Guggenheim Partners.” We refer to Guggenheim Partners Investment Management, LLC as “Guggenheim” or the “Advisor.” We refer to Guggenheim Funds Distributors, LLC as our “Dealer Manager.”

Our Company

We are a non-diversified, closed-end management investment company that intends to elect to be treated as a BDC under the 1940 Act. We were formed on March 18, 2016 as a statutory trust under the laws of Delaware and have not commenced any meaningful investment operations as of the date of this prospectus. The Master Fund is focused on lending to middle market companies and is externally managed by Guggenheim, which is responsible for sourcing potential investments, conducting due diligence on prospective investments, analyzing investment opportunities, structuring investments, and monitoring our portfolio on an ongoing basis. We intend to elect to be treated for federal income tax purposes, beginning with our taxable year ending September 30, 2021 and intend to qualify annual thereafter as a RIC under the Code. The Master Fund elected to be treated for federal income tax purposes, beginning with its taxable year ending December 31, 2015 and intends to qualify annually thereafter, as a RIC under the Code.

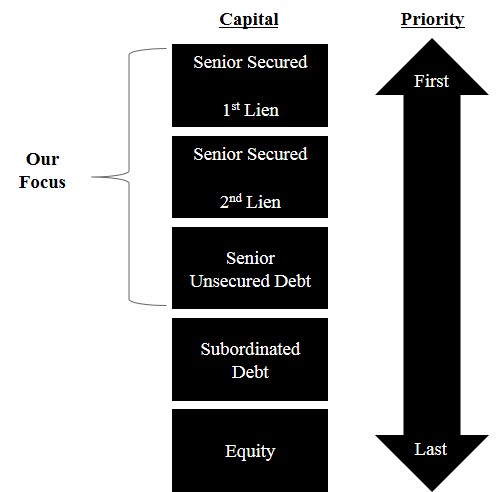

Our investment objectives are to provide our shareholders with current income, capital preservation, and, to a lesser extent, long-term capital appreciation. We seek to meet our investment objectives by investing primarily in large, privately-negotiated loans to private middle market U.S. companies. Specifically, we expect a typical borrower to have earnings before interest, taxes, depreciation, and amortization (“EBITDA”) of $25 million to $100 million and annual revenue ranging from $50 million to $1 billion. We seek to invest in businesses that have a strong reason to exist and have demonstrated competitive and strategic advantages. These companies generally possess distinguishing business characteristics, such as a leading competitive position in a well-defined market niche, unique brands, sustainable profitability and cash flow, and experienced management. We anticipate that our investments will sit senior (generally as senior secured debt) in a borrower’s capital structure and have repayment priority over other parts of a borrower’s capital structure (i.e., subordinated debt, preferred and common equity). By investing in a more senior attachment point of a borrower’s capital structure, we expect to protect our principal with less risk, which we believe provides for a distinctive risk/return profile as compared to that of a typical middle market or private equity alternative investment. In addition to privately-negotiated loans, we invest in opportunities that include more broadly syndicated assets, such as bank loans and corporate bonds. In these instances, our portfolio is more heavily weighted towards floating-rate investments, whose revenue streams may increase in a rising interest rate environment. We may also invest in fixed-rate investments, options, or other forms of equity participation, and, to a limited extent and not as a principal investment strategy, structured products such as collateralized loan obligations (“CLOs”) and collateralized debt obligations (“CDOs”). We seek to make investments which have favorable characteristics, including closing fees, prepayment premiums, lender-friendly control provisions, and lender-friendly covenants.

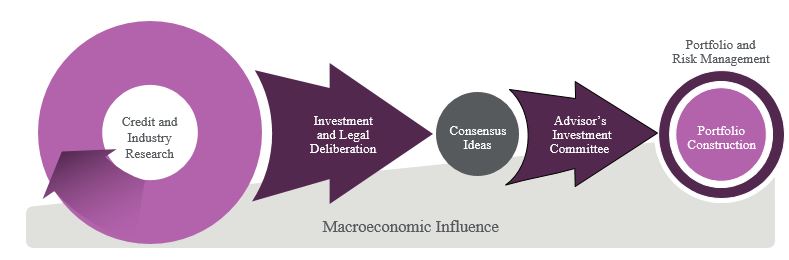

Our investment strategy leverages Guggenheim's deep research team with a relative value perspective across all corporate credit asset types. This creates a larger, proprietary opportunity set that lends itself to generating best risk-adjusted investment ideas to us. The strategy strives to create investments with a more attractive combination of risk and reward, better economics, and stronger protections than those offered in traditional transactions.

There can be no assurances that any of the investment objectives, benefits, or expectations described in the preceding paragraphs will be achieved.

Master/Feeder Fund Structure

We serve as a feeder fund in a master/feeder fund structure in that we will invest all or substantially all of our assets in the common shares of the Master Fund, a separate externally managed, non-diversified, closed-end management investment company with the same investment objectives and strategies as our investment objectives and strategies. As we raise capital, we will invest in the Master Fund at the net asset value of the Master Fund, which will vary over time. We have a Board of Trustees that has overall responsibility for overseeing our management and operations. The

same Trustees also serve on the Master Fund’s Board of Trustees. See “Management of the Company and the Master Fund.”

While the Master Fund is expected to continuously offer its common shares and have an indefinite life, our offering period will end on or before December 31, 2022, unless otherwise extended for up to 90 days by our Board of Trustees. We will have a finite term of up to six years from the close of this offering (contemplated to be on or before December 31, 2028) unless the Board of Trustees exercises its ability to delay pursuing a Liquidity Event for at most two additional one year periods. Other feeder funds may be created over time that will invest all or substantially all of their assets in the common shares of the Master Fund. It is the Board of Trustees’ intention that one or more feeder funds will liquidate prior to the Company’s liquidation. In the event that a feeder fund liquidates, the Master Fund may sell some of its investments, borrow additional funds, or use capital raised from other feeder funds, such as ours, to meet the liquidation needs of such liquidating feeder fund. If the Master Fund is required to sell a portion of its portfolio securities in order to fund the liquidation of the Company or any other feeder fund, such sales may occur at a disadvantageous time based on adverse market conditions, which may result in the Master Fund, and indirectly the Company, incurring losses or realizing a lower rate of return for its shareholders than it otherwise may realize if it did not have to sell portfolio securities to provide liquidity.

The Master Fund will make the investments described in this prospectus with the proceeds it received from (i) the direct sale of its shares, including the Seed Capital Investment (defined below), (ii) the sale of our Shares, and (iii) equity capital invested by any other BDC regulated under the 1940 Act that has a principal investment strategy of investing all or substantially all of its assets in the Master Fund.

The investment advisor to the Master Fund is Guggenheim. Guggenheim oversees the management of the Master Fund’s activities and is responsible for identifying investment opportunities, making investment decisions and corporate borrowing recommendations for the Master Fund’s portfolio, and executing on its trading strategies. Guggenheim also serves as the Company’s and the Master Fund’s administrator, providing and overseeing the administrative services needed to operate the Company and the Master Fund. See “Company Profile - Our Advisor.”

Seed Capital Investment

An affiliate of Guggenheim invested or caused to be invested $25 million in the Master Fund in exchange for Master Fund common shares (the “Seed Capital Investment”). The common shares issued by the Master Fund to the provider of its Seed Capital Investment and the common shares issued by the Master Fund to its feeder funds possess identical characteristics, rights, priorities, and preferences.

Use of Proceeds

The Master Fund began investing the proceeds of the Seed Capital Investment on April 2, 2015. We will invest the proceeds from each of our weekly subscription closings promptly in the Master Fund. Following receipt of the offering proceeds by the Master Fund, the Master Fund invests such proceeds generally within 30-90 days after each subscription date, in accordance with the Company’s and the Master Fund’s investment objectives and strategies, and consistent with market conditions and the availability of suitable investments. See “Use of Proceeds.”

Distribution Policy

Subject to our Board of Trustees' discretion and applicable legal restrictions, we intend to authorize and declare cash distributions on a weekly, semi-monthly, or monthly basis, and intend to pay such declared distributions on a monthly basis. Because we intend to qualify as a RIC, we intend to distribute at least 90% of our annual taxable income to our shareholders. A statement on Internal Revenue Service (“IRS”) Form 1099-DIV identifying the sources of the distributions will be mailed to our shareholders pursuant to IRS tax reporting requirements. See “Distributions.”

We intend to fund our cash distributions to our shareholders primarily from the income generated by our investment in the Master Fund. However, we may fund our cash distributions to shareholders from any sources of funds available to us, including expense reimbursements by our Advisor that may be subject to repayment, offering proceeds and reinvested distributions. We have not established limits on the amount of funds we may use from any available sources to make distributions. Distributions from offering proceeds and reinvested distributions could also reduce the amount of capital we ultimately invest in the Master Fund. Our distributions may not be based on our investment performance, but may be supported by our Advisor in the form of operating expense support payments pursuant to an expense support and conditional reimbursement agreement (the “Expense Support and Conditional Reimbursement Agreement”). We may be obligated to reimburse our Advisor and these reimbursement payments will reduce the future distributions that you would otherwise receive from your investment. You should understand that such distributions are not based on our investment performance. You should also understand that reimbursement payments to our Advisor in current and future periods will reduce the distributions that you would otherwise be entitled to receive. There can be no assurance that the Master Fund will achieve the performance necessary to sustain distributions

to us, or that we will be able to pay distributions at a specific rate, or at all. Guggenheim has no obligation to reduce its advisory fees or otherwise reimburse operating expenses in future periods.

Our Advisor

Guggenheim is responsible for the overall management of our investment activities, and for the day-to-day management of our investment portfolio. Under the overall supervision of our Board of Trustees, Guggenheim provides (i) investment advisory services under an investment advisory agreement with us (the “Investment Advisory Agreement”), and (ii) administrative services under an administrative services agreement with us (the “Administrative Services Agreement”). See “Advisory Agreement and Fees.” Furthermore, as required by the Omnibus Guidelines adopted by the North American Securities Administrators Association, Guggenheim and its parent company have an aggregate net worth in excess of $10.4 million. No portion of such net worth will be available to us to satisfy any of our liabilities or other obligations.

About Guggenheim

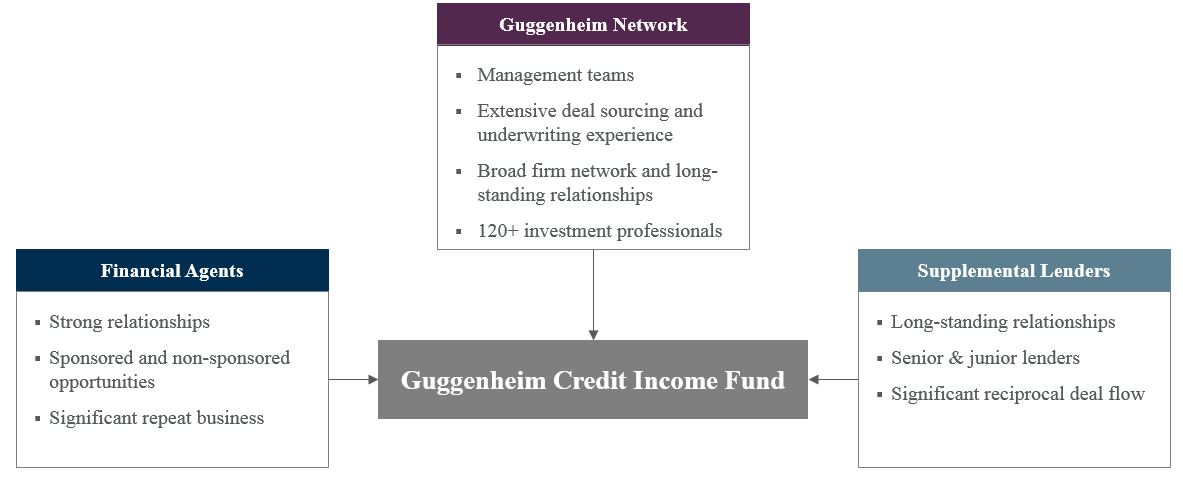

Guggenheim Investments represents the investment management businesses of Guggenheim Partners and includes Guggenheim, an SEC-registered investment adviser. Guggenheim Partners is a privately-held, global financial services firm with over 2,400 employees and more than $280 billion in assets under management as of June 30, 20201. It produces customized solutions for its clients, which include institutions, governments and agencies, corporations, insurance companies, investment advisors, family offices, and individual investors.

Guggenheim Investments manages $220 billion in assets across fixed income, equity, and alternative strategies as of June 30, 2020. Its 320+ investment professionals perform research to understand market trends and identify undervalued opportunities in areas that are often complex and underfollowed. This approach to investment management has enabled Guggenheim to deliver long-term results to its clients.

Within Guggenheim Investments is the Guggenheim Corporate Credit Team, which is responsible for all corporate credit strategies and asset management of more than $90 billion. A unified credit platform is utilized for all strategies and is organized by industry as opposed to asset class, which increases its ability to uncover relative value opportunities and to identify and source opportunities. The scale of the platform, combined with the expertise across a wide range of industries and in-house legal resources, allows Guggenheim to be a solution provider to the market and maintain an active pipeline of investment opportunities. See “Company Profile - Our Advisor.”

The following chart shows the ownership structure and relationship between the Company, Guggenheim, and the Dealer Manager:

1 Assets under management are as of 6.30.2020 and include consulting services for clients whose assets are valued at approximately $65bn.

Market Opportunity

Our investment objectives are to provide our shareholders with current income, capital preservation, and, to a lesser extent, long-term capital appreciation. We intend to meet our investment objectives by investing primarily in large, privately-negotiated loans to private middle market U.S. companies. We believe there are and will continue to be attractive investment opportunities for a variety of reasons, including the following:

| |

| • | Scarcity of Capital for Middle Market Companies. Middle market companies’ access to capital has not improved at the same pace as larger companies’ access. Because middle market borrowers have fewer options than larger borrowers, lenders to this segment achieve attractive economic terms and strong structural protections. This middle market financing gap is likely to persist as credit demand outstrips supply. Future middle market financing demand will likely increase due to impending maturities and more leveraged buyout activity, which will be met by fewer capital providers. Commercial banks are making fewer cash flow loans, in many cases focusing instead on asset based loans. Hedge funds, a primary middle market capital source in past years, have largely exited the market. Mezzanine capital remains available but is largely unsuitable as a one-stop capital solution due to high costs. |

| |

| • | Attractive Middle Market Segment. We believe the need for middle market financing combined with the lack of supply of capital to the middle market segment has created, and will continue to create, compelling investment opportunities. Compared to larger companies, middle market companies often offer more attractive economic terms and flexibility in the structuring of transactions, which we believe allows us to create more attractive debt instruments. Middle market investments are more likely to have tighter covenants and loan documentation, more attractive fees, and enhanced pricing compared to financing packages of larger companies. |

| |

| • | Significant Amounts of Middle Market Debt Coming Due. We believe that over $577 billion of debt to middle market companies will face upcoming maturities and need to be refinanced over the next five years. We believe that the large amount of maturities combined with the scarcity of capital for middle market companies will increase demand and provide attractive investment opportunities. |

| |

| • | Changes in the Regulatory Landscape Increasing the Demand for Additional Sources of Debt Financing. The post-crisis sector of commercial banking, driven by heightened oversight and regulatory pressure, is marked by dramatically increased risk management practices and requirements to increase capital and to deleverage. The Dodd Frank Act, Volcker Rule, Basel III, and Leveraged Lending Guidelines attempt to remove systematic risk in the commercial banking market. We believe this provides a need for non-traditional sources of debt financing to fill the gap where traditional sources play a reduced role. We believe the scale of our platform allows us to fulfill a differentiated role in deals that capitalize on these secular shifts in the debt capital markets, including, but not limited to, an active role in syndicated deals. |

See “Company Profile - Market Opportunity.”

Our Potential Competitive Strengths

As a BDC with a particular focus on lending activities, we may experience competition from other BDCs, commercial banks, specialty finance companies, open-end and closed-end investment companies, opportunity funds, private equity funds, and institutional investors, many of which generally have greater financial resources than we do for the purposes of lending to U.S. businesses within our stated investment focus. These competitors may also have a lower cost of capital, may be subject to less regulatory oversight, and may have lower overall operating costs. The level of competition impacts our ability to raise capital, find suitable corporate borrowers that meet our investment criteria, and acquire and originate loans to these corporate borrowers. We may also face competition from other funds in which affiliates of Guggenheim participate or advise.

We believe we have the following competitive strengths over other capital providers in our markets, which will allow us to capitalize on attractive market opportunities:

| |

| • | Corporate Credit Expertise. Guggenheim has extensive experience investing in corporate finance-focused credit. Guggenheim’s core team has been together since 2001, managing more than $90 billion in corporate credit strategies. This has allowed them to become a market leader in structuring and investing in middle market private debt, with approximately $13.6 billion in privately-negotiated debt transactions since 2002. |

| |

| • | Sourcing Capabilities and Breadth of Corporate Credit Platform. Guggenheim’s corporate credit team invests across the spectrum with investment grade, high yield, bank loans, and private debt all on one platform. This structure gives us perspective on relative value, access to better information and more detailed diligence on potential investments, and provides us with more sourcing opportunities. Guggenheim has investing experience and, as a result, maintains relationships with a number of important investment sources, such as private equity sponsors, investment banks, insurance companies, and commercial banks, as well as corporate entities and high |

net worth individuals. The depth and breadth of Guggenheim's resources and capabilities allow us to analyze complex transactions in a short time frame and give us the ability to finance entire or large portions of capital structures, providing a one stop solution for the borrower.

| |

| • | Ability to Evaluate, Structure, and Execute Solutions. Guggenheim's experience and expertise in evaluating, structuring, and executing investments allows us to implement a strategy with an attractive combination of risk and reward. Guggenheim's deep resources, including Guggenheim’s 20-person internal legal team, enable us to create investments with privately-negotiated economic terms and strong structural protections. |

| |

| • | Depth of Corporate Credit Research Capabilities. Guggenheim’s corporate credit team is comprised of more than 110 investment professionals with a database of more than 1,000 companies, investing across all levels of a company’s capital structure. Its investment process includes company and financial analysis, coupled with a legal due diligence team that has an active role in structuring transactions. This allows Guggenheim to select investments it believes to have the best risk/return profile, with adequate investor protection, and to quickly commit to term sheets in order to capitalize on those opportunities. |

| |

| • | Focus on Protecting Capital. With Guggenheim's large credit platform and deal structuring expertise, it is able to heavily negotiate economic terms and secure stronger structural protections for our investments. Stress testing companies in various environments is a critical part of Guggenheim's screening process, and Guggenheim intends to subject each company to a sensitivity analysis that considers many factors that could affect investment performance. After establishing a company’s enterprise value, Guggenheim focuses on asset coverage, cash flow, liquidation preference, and rules to determine the areas of a company’s capital structure that deliver the best packages of risk and return. For each potential investment, the legal team works closely with industry analysts to create a worst-case scenario that determines the level of control we would have, and that ensures we would be fairly compensated given our position in the capital structure. |

See “Company Profile - Our Potential Competitive Strengths.”

Our Investment Strategy

Our investment strategy leverages Guggenheim deep research team with a relative value perspective across all corporate credit asset types and industries, creating a larger, proprietary opportunity set that lends itself to generating best ideas. This strategy focuses on investing primarily in large, privately-negotiated loans to private middle market U.S. companies. We seek to invest in businesses that have a strong reason to exist and have demonstrated competitive and strategic advantages. These companies generally possess distinguishing business characteristics, such as a leading competitive position in a well-defined market niche, unique brands, sustainable profitability and cash flow, and experienced management.

While we intend to consider each investment opportunity independently, we generally focus on portfolio companies that share the following characteristics:

| |

| • | Upper Middle Market Focus. We seek to invest in private middle market U.S. companies, which typically have better credit characteristics than their smaller peers. Although there are no strict lower or upper limits on the size of a company in which we may invest, we expect to focus on companies with EBITDA of $25 million to $100 million and annual revenue ranging from $50 million to $1 billion. |

| |

| • | Favorable Position in the Capital Structure. Our portfolio generally consists of senior secured debt investments. Our investment process enables us to look at investments up and down the capital structure, allowing us to make investments at points in the capital structure where we believe we can participate in the best risk-adjusted return profile. |

| |

| • | Experienced Management Team and Strong Equity Owner Support. We seek to invest in companies with management teams and equity owners that are experienced and exhibit a strong operating track record. We favor companies in which management’s incentives are tied closely to the long-term goals of the business. Additionally, we seek to invest in businesses where we believe the owners will continue to support the company. |

| |

| • | Sustainable Profitability and Cash Flow. We intend to invest in companies that have an established track record of strong profitability and stable positive cash flow. We believe these businesses will be well positioned to maintain cash flow to cover interest and principal payments due to us, and also to take advantage of growth opportunities for their businesses. Specifically, we do not intend to invest in early stage or seed companies. As a BDC, we generally must invest at least 70% of our total assets in “qualifying assets,” which, under relevant SEC rules, includes all private U.S. companies and companies whose securities are not listed on a national securities exchange. |

| |

| • | Well-defined Market Niche and Industry Focus. We intend to invest in businesses that have a strong reason to exist and have demonstrated competitive and strategic advantages in their respective industry. We expect to invest across industries and not focus on any specific industry. |

| |

| • | Broad Target Geography with a Sizeable Concentration in the U.S. We focus on and invest at least 70% of our total assets in U.S. companies. To the extent we invest in foreign companies, we intend to do so in accordance with 1940 Act limitations and only in jurisdictions with established legal frameworks and a history of respecting creditor rights. |

While we believe that the criteria listed above are important in identifying and investing in portfolio companies, we consider each investment on a case-by-case basis. It is possible that not all of these criteria will be met by each portfolio company in which we invest. There is no limit on the maturity or duration of any investment in our portfolio. We anticipate that substantially all of the investments held in our portfolio will have either a below investment grade rating by Moody’s Investors Service and/or Standard & Poor’s, or will not be rated by any rating agency but will be of similar quality to below investment grade securities (e.g., junk bonds). Debt securities rated below investment grade (e.g., junk bonds) are generally regarded as having predominantly speculative characteristics and may carry a greater risk with respect to a borrower’s ability to pay interest and repay principal. Investment sizes will vary as our capital base changes and will ultimately be at the discretion of Guggenheim, subject to oversight by our Board of Trustees.

Other Factors Affecting Portfolio Construction

As a BDC that is regulated under the 1940 Act and intends to qualify annually as a RIC under the Code, our investment activities are subject to certain regulatory restrictions that will shape our portfolio construction. These restrictions include requirements that we invest our capital primarily in U.S. companies that are privately owned, as well as investment diversification and source of income criteria that are imposed by the Code. For a description of certain valuation risks associated with our investments in privately-owned companies, see “Risk Factors - Risks Related to Our Business - A significant portion of our investment portfolio is recorded at fair value as determined in good faith in accordance with procedures established by our Board of Trustees and, as a result, there is and will be uncertainty as to the value of our portfolio investments.”

In addition, we generally are permitted to co-invest alongside certain affiliates of Guggenheim in privately-negotiated transactions, based on an exemptive order we received from the SEC on June 28, 2016 and which was subsequently updated on January 30, 2018, including certain investments originated and directly negotiated by Guggenheim. Our ability to participate in these co-investment transactions is subject to various conditions contained in the exemptive order.

Advisor's Fees

The Company does not incur a separate advisory fee, but the Company and its shareholders are indirectly subject to the Master Fund’s advisory fee on a pro rata basis. The Master Fund pays Guggenheim a fee for its services under the Investment Advisory Agreement. The fee consists of two components: a management fee and an incentive fee. The management fee is calculated at an annual rate of 1.75% based on the simple average of the Master Fund’s gross assets (i.e., total assets) at the end of the two most recently completed calendar months and is payable monthly in arrears.

The incentive fee comprises the following two parts:

| |

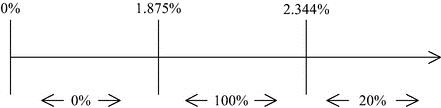

| • | An incentive fee on net investment income (the “subordinated incentive fee on income”) is calculated and payable quarterly in arrears, and is based upon pre-incentive fee net investment income for the immediately preceding quarter. No subordinated incentive fee on income is payable in any calendar quarter in which pre-incentive fee net investment income does not exceed a quarterly return to investors of 1.875% on average adjusted capital. The quarterly incentive fee on net investment income is (i) 100% of the pre-incentive fee net investment income of between 1.875% and 2.344% of average adjusted capital, plus (ii) 20% of pre-incentive fee net investment income in excess of 2.344% of average adjusted capital. For purposes of computing the subordinated incentive fee on income, the calculation methodology looks through derivatives or swaps as if the Master Fund owned the reference assets directly. Therefore, Net Interest, if any, associated with a derivative or swap (which is defined as the difference between (a) the interest income and fees received in respect of the reference assets of the derivative or swap and (b) all interest and other expenses paid by the Master Fund to the derivative or swap counterparty) is included in the calculation of quarterly pre-incentive fee net investment income for purposes of the subordinated incentive fee on income. |

| |

| • | An incentive fee on capital gains is calculated and payable in arrears as of the end of each calendar year. It is equal to 20% of realized capital gains on a cumulative basis from inception through the end of such calendar |

year, computed net of all realized capital losses and unrealized capital depreciation on a cumulative basis, less the aggregate amount of any previously paid incentive fees on capital gains as calculated in accordance with U.S. generally accepted accounting principles (“GAAP”), except as described in the next sentence. For purposes of computing the incentive fee on capital gains, the calculation methodology looks through derivatives or swaps as if the Master Fund owned the reference assets directly. Therefore, realized gains and realized losses on the disposition of any reference assets, as well as unrealized depreciation on reference assets retained in the derivative or swap, will be included on a cumulative basis in the calculation of the incentive fee on capital gains.

The incentive fee may induce Guggenheim to make investments that are more risky or more speculative than would otherwise be the case. Similarly, because the management fee is calculated based on the Master Fund’s gross assets (including any borrowings for investment purposes), Guggenheim may be encouraged to use leverage to make additional investments. See “Risk Factors - Risks Related to Guggenheim and its Respective Affiliates - Our incentive fee may induce Guggenheim to make speculative investments” and “Advisory Agreement and Fees.”

Suitability Standards

Pursuant to applicable state securities laws, Shares offered through this prospectus are suitable only as a long-term investment for persons of adequate financial means who have no need for liquidity in this investment. Initially, there is not expected to be any public market for the Shares, which means that investors will likely have limited ability to sell their Shares. As a result, we have established suitability standards that require investors to have either: (i) a net worth of at least $70,000 and an annual gross income of at least $70,000, or (ii) a net worth of at least $250,000. Under these standards, net worth does not include an investor’s home, home furnishings, or personal automobiles. In addition, our Dealer Manager requires that a potential investor (a) can reasonably benefit from an investment in us based on such investor’s overall investment objectives and portfolio structuring; (b) is able to bear the economic risk of the investment based on the prospective shareholder’s overall financial situation; and (c) has apparent understanding of (A) the fundamental risks of the investment, (B) the risk that such investor may lose his or her entire investment, (C) the lack of liquidity of the Shares, (D) the background and qualifications of Guggenheim, and (E) the tax consequences of the investment. See “Suitability Standards” for further details and additional suitability requirements that may apply to residents of specific states or clients of selected dealers.

Regulation Best Interest

The SEC adopted Regulation Best Interest ("Regulation BI") effective as of September 10, 2019. Compliance with Regulation BI was required beginning on June 30, 2020. Regulation BI establishes a new standard of conduct under the Securities Exchange Act of 1934 ("Exchange Act") for broker-dealers when making a "recommendation" of any securities transaction or investment strategy involving securities to a "retail customer," which Regulation BI defines as:

| |

| • | a natural person, or the legal representative of such natural person, who: |

| |

| • | receives a recommendation of any securities transaction or investment strategy involving securities from a broker-dealer; and |

| |

| • | uses the recommendation primarily for personal, family, or household purposes. |

When making a recommendation to a retail customer, Regulation BI requires that a broker-dealer and its associated persons act in the best interest of their retail customers at the time the recommendation is made, without placing its own financial or other interest ahead of the retail customer’s interests. This general obligation is satisfied only if a broker-dealer complies with four specific obligations:

| |

| • | Disclosure Obligation: a broker-dealer must provide certain required written disclosure before or at the time of the recommendation, about the recommendation and the relationship between the broker-dealer and its retail customer; |

| |

| • | Care Obligation: a broker-dealer must exercise reasonable diligence, care, and skill in determining that it has a reasonable basis for concluding that a recommendation satisfies the best interest standard - both with respect to the specific retail customer receiving the recommendation and at least some hypothetical retail customers; |

| |

| • | Conflict of Interest Obligation: a broker-dealer must establish, maintain, and enforce written policies and procedures reasonably designed to address conflicts of interest; and |

| |

| • | Compliance Obligation: a broker-dealer must establish, maintain, and enforce written policies and procedures reasonably designed to achieve compliance with Regulation BI. A broker-dealer must also comply with new record-making and recordkeeping requirements. |

Obligations imposed on broker-dealers under Regulation BI are in addition to and may be considered a higher standard than the obligation to apply the specific suitability standards that have been established for this offering and the obligation to make a suitability determination for each investor in this offering pursuant to other applicable laws and regulations. In adopting Regulation BI, the SEC stated that the Care Obligation "enhances" existing suitability standards. Those obligations are described above under "Suitability Standards." As of the date of this prospectus, there is limited administrative guidance and no case law regarding the interpretation and application of Regulation BI. As result, the manner in which Regulation BI will be applied to broker-dealers and their associated persons is uncertain.

In conjunction with its adoption of Regulation BI, the SEC also adopted new rules that require registered investment advisers and broker-dealers to provide a brief customer relationship summary ("CRS") to their "retail investors." Compliance with CRS and related rules was required beginning on June 30, 2020.

The CRS is designed to inform retail investors about the types of relationships and services a firm offers; the fees, costs, conflicts of interest, and required standard of conduct associated with those relationships and services; whether a firm and its financial professionals currently have reportable legal or disciplinary history; and how to obtain additional information about a firm. Firms are obligated to deliver their CRS to their current and potential retail investors, post their CRS on their website, and file their CRS with the Central Registration Depository or Investment Adviser Registration Depository. The obligation of firms to deliver their CRS to retail investors is independent of the requirement that a prospectus be delivered to you in connection with this offering. We are not responsible for any broker-dealer’s compliance with Regulation BI or any firm’s compliance with the CRS and related rules.

Plan of Distribution

We are publicly offering, through our Dealer Manager, on a best efforts basis, Shares at net asset value, calculated in accordance with Section 23(b) of the 1940 Act (as made applicable to the Company by Section 63 of the 1940 Act), plus any applicable sales load. See “Plan of Distribution.”

Our Dealer Manager is an affiliate of Guggenheim Partners and a member of the Financial Industry Regulatory Authority (“FINRA”) and the Securities Investor Protection Corporation (“SIPC”). Our Dealer Manager is not required to sell any specific number or dollar amount of Shares, but has agreed to use its best efforts to sell the Shares offered. The minimum permitted purchase is $2,000 in Shares (or $2,500 for New York non-IRA investments). This offering is available for purchase by (i) clients of financial intermediaries who charge such clients, including individuals, corporations, endowments and foundations, an ongoing fee for advisory, investment, consulting or related services, (ii) family offices and their clients, (iii) certain other institutional investors, (iv) high net worth investors, (v) investors who are clients of FINRA broker-dealer member firms receiving transaction based compensation, (vi) other non-affiliated investment companies and (vii) investors affiliated with Guggenheim and its affiliates and other individuals identified by management. Sales of this offering are subject to upfront selling commissions of up to 3.0% and Dealer Manager fees of up to 2.0% of the price per share. See "Plan of Distribution."

We will schedule weekly closings on subscriptions received and accepted by us. Subscriptions will be effective only upon our acceptance and we reserve the right to reject any subscription in whole or in part. Subscriptions will be accepted or rejected within 30 days of receipt by us and, if rejected, all funds will be returned to subscribers without deduction for any fees and expenses within ten business days from the date the subscription is rejected. We are not permitted to accept a subscription until at least five business days after the date you receive this prospectus. Additionally, we intend to update our shareholder list on a weekly basis. See “Plan of Distribution.”

Compensation Paid to the Dealer Manager and Participating Selected Dealers

Investors will pay a maximum sales load of up to 5.0% of the price per share for combined upfront selling commissions and Dealer Manager fees. The upfront selling commissions and Dealer Manager fees will not be paid in connection with purchases of shares pursuant to our DRP.

In addition to the upfront selling commissions and Dealer Manager fees, Guggenheim may pay our Dealer Manager an annualized fee (the "Additional Selling Commissions") equal to no more than 1.0% of the Company's then-current net asset value, payable quarterly. Our Dealer Manager will re-allow all of the Additional Selling Commissions to participating selected dealers. The Additional Selling Commissions will not be paid by our shareholders. Guggenheim will cease making these payments to our Dealer Manager with respect to each Share upon the earliest to occur of the following: (i) the date when the aggregate underwriting compensation would exceed that permitted under FINRA Rule 2310 over the life of the offering, which equals 10% of the gross offering proceeds from the sale of Shares in this offering (excluding Shares purchased through our DRP); (ii) the date of a Liquidity Event; (iii) the date that such Share is repurchased or is no longer outstanding; (iv) the date when the aggregate upfront selling commission, Dealer Manager fees, and Additional Selling Commissions together equal 8.0% (or such other amount, as determined by

Guggenheim) of the actual price paid for such Share; or (v) the date when Guggenheim no longer serves as our investment adviser. See "Plan of Distribution."

The maximum aggregate underwriting compensation, which includes payments of upfront selling commissions and Dealer Manager fees and all items of compensation as defined in FINRA Rule 2310 from any other sources, including, among other things, the reimbursement of training and education expenses, may not exceed 10% of the gross offering proceeds from the sale of shares in this offering (excluding shares purchased through the DRP). See "Plan of Distribution" for additional information regarding underwriting compensation.

Shareholder Liquidity Strategy

We will have a finite term of up to six years from the close of this offering (contemplated to end on or before December 31, 2028) unless the Board of Trustees exercises its ability to delay pursuing a Liquidity Event for at most two additional one year periods. At any time prior to December 31, 2028, Guggenheim may recommend to our Board of Trustees that it approve a complete Liquidity Event. A Liquidity Event could include: (i) the purchase by the Master Fund for cash of all our Master Fund shares at net asset value and the distribution of that cash to our shareholders on a pro rata basis in connection with our complete liquidation and dissolution; or (ii) subject to the approval of the shareholders of each feeder fund, a listing of the shares of the Master Fund on a national securities exchange and the liquidation and dissolution of each feeder fund, including us, at which point all shareholders of each feeder fund would become direct shareholders of the Master Fund. However, if the Board of Trustees determines that it would not be in the best interests of shareholders to pursue a Liquidity Event at that time due to adverse market conditions, the Board of Trustees could delay pursuing a Liquidity Event for at most two additional one year periods. In the sole discretion of the Board of Trustees, shareholders may be offered the ability to re-invest their liquidation proceeds into another feeder fund or exchange their shares for shares in another feeder fund.

To provide limited, interim liquidity to our shareholders, we intend to conduct quarterly tender offers in accordance with the Exchange Act. This will be the only source of liquidity for our shareholders offered by us prior to a Liquidity Event. See “Share Repurchase Program.”

Our Distribution Reinvestment Plan

We have adopted a DRP that allows our shareholders to have the full amount of their cash distributions reinvested in additional Shares. See “Distribution Reinvestment Plan.”

Share Repurchase Program

We do not currently intend to list our Shares on any securities exchange and we do not expect a secondary market in the Shares to develop. As a result, if you purchase Shares, your ability to sell your Shares will be limited. We have commenced a share repurchase program, in which we intend to repurchase, during each calendar quarter, up to 2.5% of the weighted average number of Shares outstanding in the prior four calendar quarters at a price estimated to be equal to our net asset value per share as of the expiration date of the tender offer. At the discretion of our Board of Trustees, we intend to limit the number of Shares to be repurchased during any calendar year to the number of Shares we can repurchase with cash on hand, cash available from borrowings, and cash from the sale of our investments as of the end of the applicable period to repurchase Shares. Our Board of Trustees may amend, suspend, or terminate the share repurchase program at any time. All Shares purchased by us pursuant to the share repurchase program will be retired and thereafter will be authorized and unissued shares. See “Share Repurchase Program.”

Our assets consist primarily of our investment interest in the Master Fund. Therefore, in order to finance our repurchase of Shares, we will seek to liquidate a portion of our interest in the Master Fund each quarter. Thus, each of our quarterly repurchase offers will be conducted in parallel with similar repurchase offers made by the Master Fund. Our Board of Trustees also serves as the Board of Trustees for the Master Fund and we expect that the Master Fund will conduct quarterly repurchase offers in order to permit us (and any other feeder fund) to meet our (and its) quarterly repurchase obligations. We cannot make a repurchase offer larger than that made by the Master Fund, and we expect that each quarterly repurchase offer by the Master Fund will generally apply to up to 2.5% of the Master Fund’s average number of shares outstanding in the prior four calendar quarters (or such fewer calendar quarters during the Master Fund’s first year). The Master Fund may borrow money or issue debt obligations to finance its repurchase obligations pursuant to any quarterly repurchase offer.

Reports to Shareholders

Within 45 days after the end of each fiscal quarter (other than the fourth quarter of each year), we are required to file our quarterly report on Form 10-Q. Within 90 days after the end of each fiscal year, we are required to file our annual report on Form 10-K. We intend to provide a copy of our annual report on Form 10-K to all shareholders of record as of the end of each fiscal year shortly after filing it with the SEC, or to all shareholders of record in preparation for our annual shareholders meeting. These reports, including any prospectus supplements, current reports on

Form 8-K, and any amendments to these listed reports are made available free of charge on our website at www.GuggenheimCIF.com and on the SEC’s website at www.sec.gov. See “Description of Our Capital Stock - Reports to Shareholders.”

Taxation of Our Company

We intend to elect to be treated for federal income tax purposes, beginning with our taxable year ending September 30, 2021, and intend to qualify annually thereafter, as a RIC under the Code. As a RIC, we generally will not have to pay corporate-level federal income taxes on ordinary income or capital gains we distribute to our shareholders from our tax earnings and profits. To obtain and maintain our ability to be subject to tax as a RIC, we must meet specified source-of-income and asset diversification requirements, and distribute each taxable year an amount generally at least equal to 90% of the sum of our ordinary income and realized net short-term capital gains in excess of realized net long-term capital losses, if any. We will monitor our transactions to endeavor to prevent our disqualification as a RIC. See “Tax Matters.”

Risk Factors

An investment in our Shares involves a high degree of risk and may be considered speculative. You should carefully consider the information found in “Risk Factors” before deciding to invest in our Shares. Risks involved in an investment in us include (among others) the following:

| |

| • | We are subject to all of the business risks and uncertainties associated with any business, including the risk that we will not achieve our investment objectives and that the value of our Shares could decline substantially. |

| |

| • | You should not expect to be able to sell your Shares regardless of how we perform. |

| |

| • | If you are able to sell your Shares, you will likely receive less than your purchase price and the current net asset value per share. Because you will be unable to sell your Shares, you will be unable to reduce your exposure during any market downturn. |

| |

| • | We do not intend to list our Shares on any securities exchange and we do not expect a secondary market in the Shares to develop. |

| |

| • | We have implemented a share repurchase program. Only a limited number of Shares will be eligible for repurchase and any such repurchases will be at a price estimated to be equal to our net asset value per share as of the expiration date of the tender offer. |

| |

| • | You should consider that you may not have access to the money you invest until the completion of the Company’s finite term (contemplated to be on or before December 31, 2028). |

| |

| • | An investment in our Shares is not suitable for you if you need access to the money you invest. See “Share Repurchase Program,” “Company Profile - Shareholder Liquidity Strategy,” and “Suitability Standards.” |

| |

| • | We have a finite term and we may liquidate our assets at a time that is disadvantageous based on adverse market conditions, which may result in our incurring losses on our investments. |