Separation Update: Announced Sale of Global Products August 1, 2022 Exhibit 99.2

Forward-Looking Statements Certain statements in this presentation, other than statements of historical fact, are forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Such forward-looking statements may include, without limitation, statements about the proposed transaction, the expected timetable for completing the proposed transaction, the benefits and synergies of the proposed transaction, future opportunities for the standalone Retail Services company and any other statements regarding Valvoline’s and Aramco’s future operations, financial or operating results, capital allocation, debt ratio, anticipated business levels, future earnings, dividend policy, anticipated growth, market opportunities, strategies, competitions, and other expectations and targets for future periods. Valvoline has identified some of these forward-looking statements with words such as "anticipates," "believes," "expects," "estimates," "is likely," "predicts," "projects," "forecasts," "may," "will," "should" and "intends" and the negative of these words or other comparable terminology. These forward-looking statements are based on Valvoline's current expectations, estimates, projections and assumptions as of the date such statements are made and are subject to risks and uncertainties that may cause results to differ materially from those expressed or implied in the forward-looking statements. Important factors that could cause Valvoline’s actual results to differ materially from those in the forward-looking statements include: uncertainties as to the timing of the sale of Global Products and the risk that the transaction may not be completed in a timely manner or at all, the possibility that any or all of the conditions to the consummation of the sale of Global Products may not be satisfied or waived, the effect of the announcement or pendency of the transaction on Valvoline’s ability to retain and hire key personnel and to maintain relationships with customers, supplier and other business partners, risks related to diverting management’s attention from Valvoline’s ongoing business operations, uncertainties as to Valvoline’s ability and the amount of time necessary to realize the expected benefits of the transaction, changes in the economic and financial conditions of Valvoline’s business and uncertainties and matters beyond the control of management and other factors described in the Company's filings with the Securities and Exchange Commission (the "SEC"), including in the "Risk Factors," "Management's Discussion and Analysis of Financial Condition and Results of Operations" and "Quantitative and Qualitative Disclosures about Market Risk" sections of Valvoline's most recently filed periodic reports on Forms 10-K and 10-Q, which are available on Valvoline's website at http://investors.valvoline.com/sec-filings or on the SEC's website at http://sec.gov. Valvoline assumes no obligation to update or revise these forward-looking statements for any reason, even if new information becomes available in the future, unless required by law. Regulation G: Adjusted Results Information regarding Valvoline’s definitions, calculations and reconciliation of non-GAAP measures can be found in the Appendix. Safe Harbor

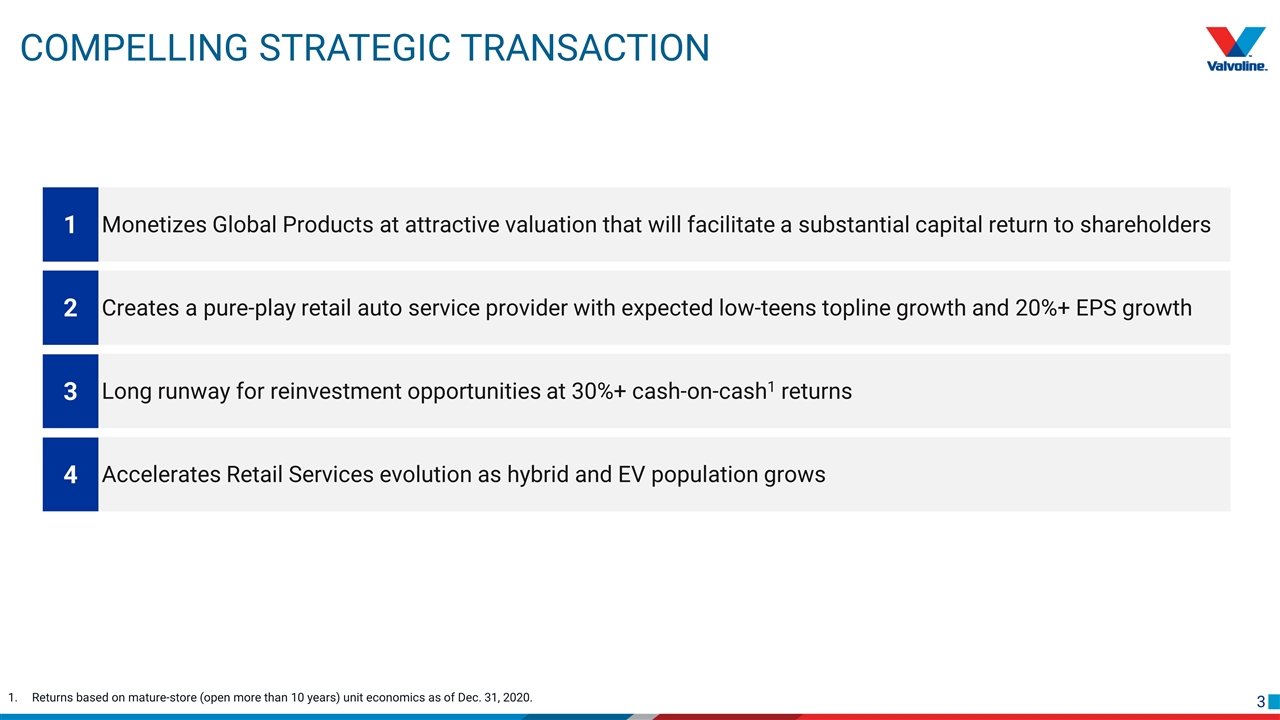

Monetizes Global Products at attractive valuation that will facilitate a substantial capital return to shareholders Creates a pure-play retail auto service provider with expected low-teens topline growth and 20%+ EPS growth Long runway for reinvestment opportunities at 30%+ cash-on-cash1 returns Accelerates Retail Services evolution as hybrid and EV population grows 1 2 3 4 Compelling Strategic Transaction Returns based on mature-store (open more than 10 years) unit economics as of Dec. 31, 2020.

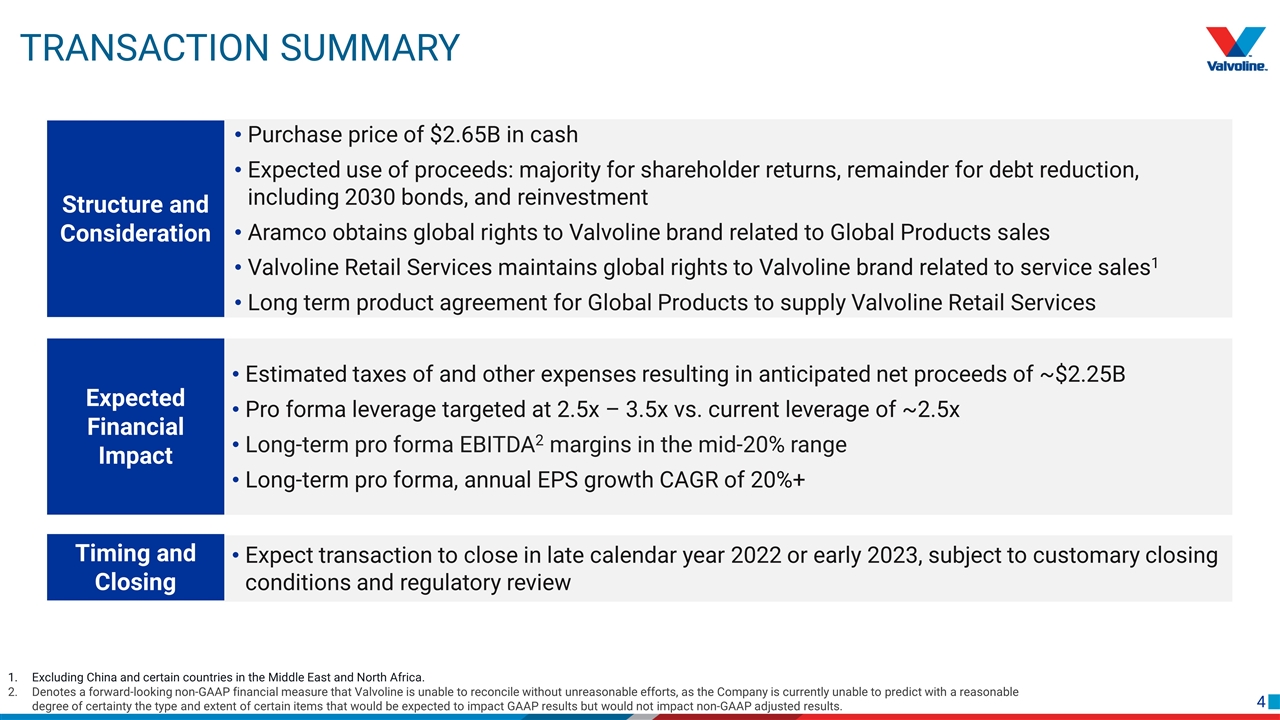

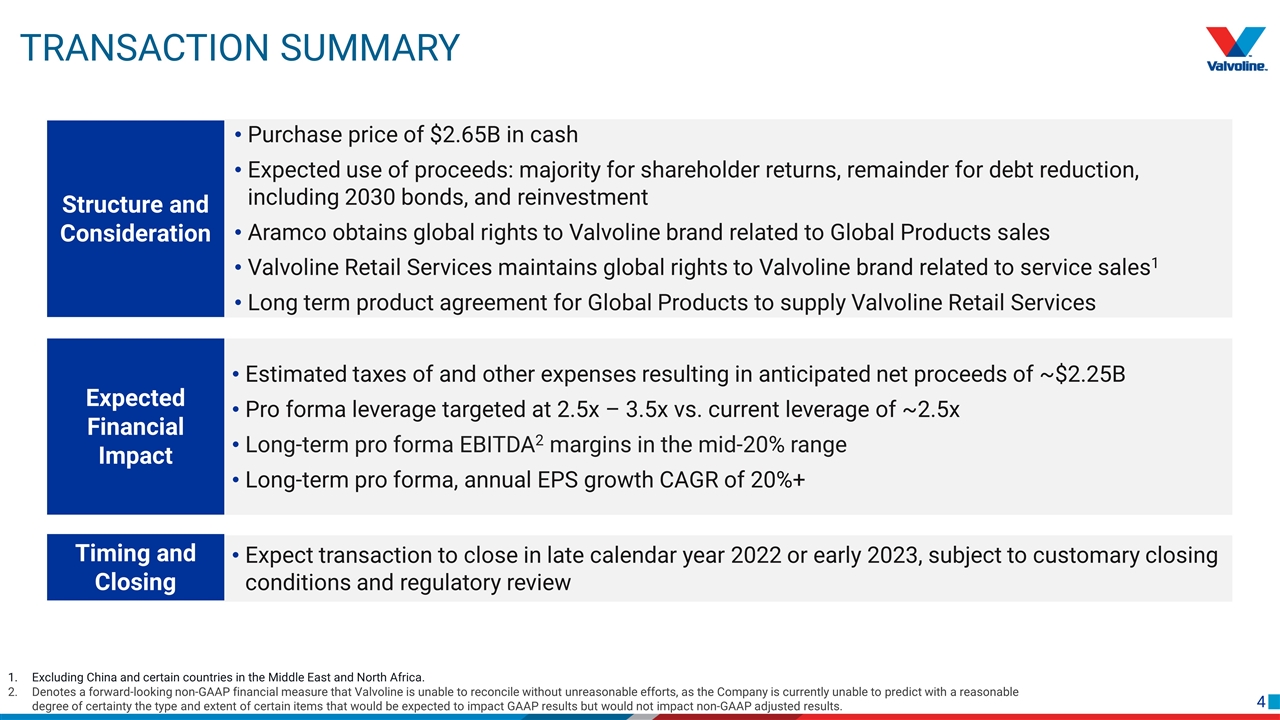

Purchase price of $2.65B in cash Expected use of proceeds: majority for shareholder returns, remainder for debt reduction, including 2030 bonds, and reinvestment Aramco obtains global rights to Valvoline brand related to Global Products sales Valvoline Retail Services maintains global rights to Valvoline brand related to service sales1 Long term product agreement for Global Products to supply Valvoline Retail Services Structure and Consideration Timing and Closing Expect transaction to close in late calendar year 2022 or early 2023, subject to customary closing conditions and regulatory review Expected Financial Impact Estimated taxes of and other expenses resulting in anticipated net proceeds of ~$2.25B Pro forma leverage targeted at 2.5x – 3.5x vs. current leverage of ~2.5x Long-term pro forma EBITDA2 margins in the mid-20% range Long-term pro forma, annual EPS growth CAGR of 20%+ Transaction Summary Excluding China and certain countries in the Middle East and North Africa. Denotes a forward-looking non-GAAP financial measure that Valvoline is unable to reconcile without unreasonable efforts, as the Company is currently unable to predict with a reasonable degree of certainty the type and extent of certain items that would be expected to impact GAAP results but would not impact non-GAAP adjusted results.

Sale of Global products TO ARAMCO A Global Leader in Lubricants Long-term owner with plans and resources to develop Valvoline’s trusted brand into a global leader Values the Global Products team, track record of innovation and supply-chain capabilities Opportunity to leverage base oil synergies and expand on the combined customer and OEM relationships Commitment to partner with Retail Services for mutual growth A Powerful Combination Why Aramco is the right home for Global Products

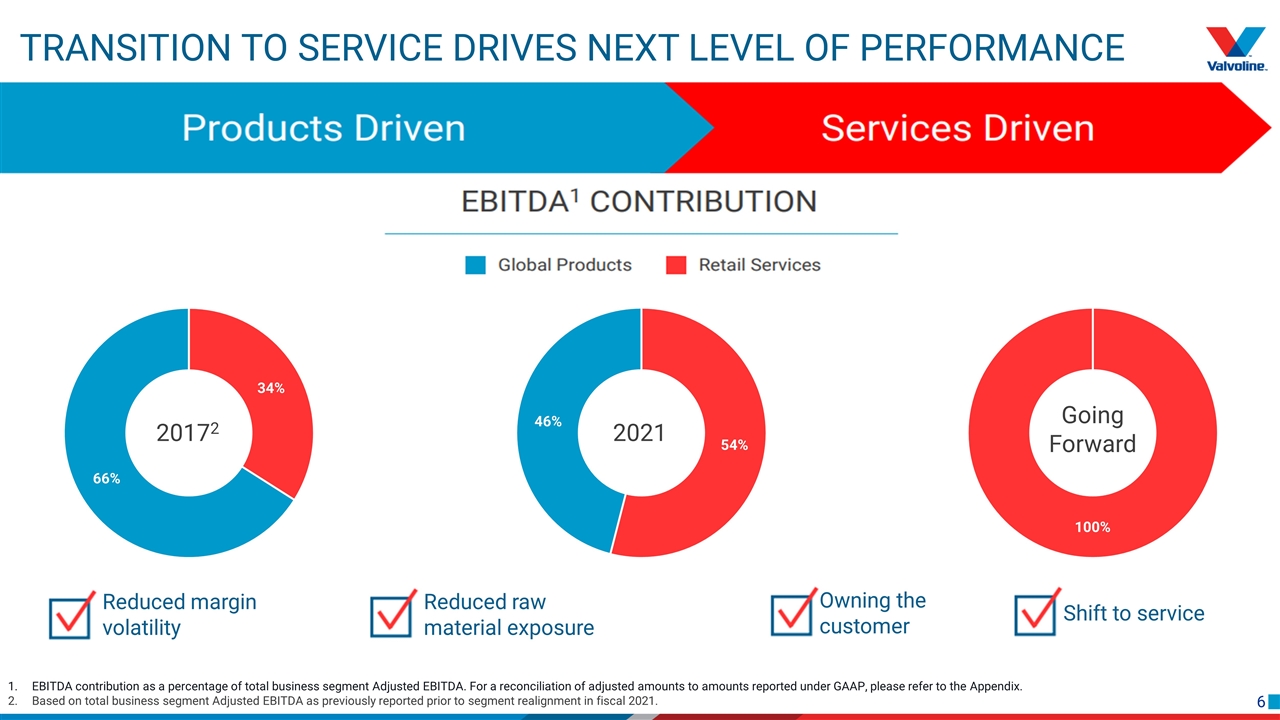

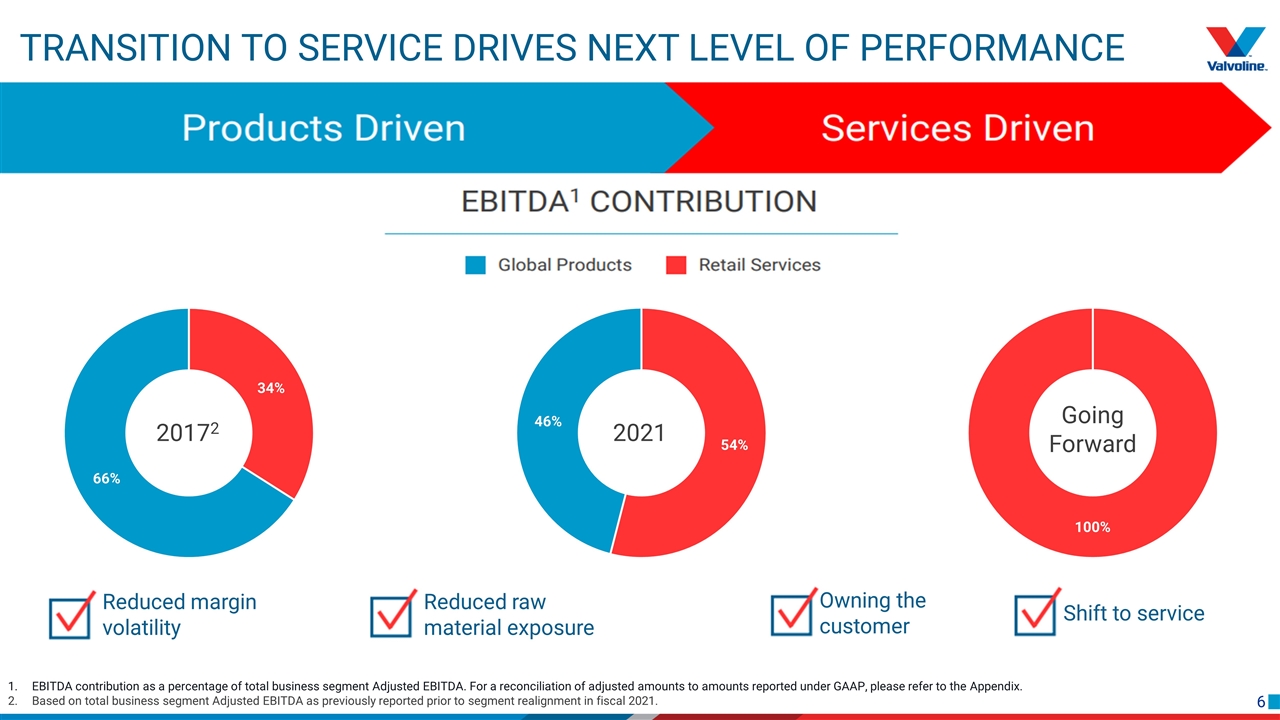

20172 2021 Going Forward Reduced margin volatility Reduced raw material exposure Owning the customer Shift to service transition to service drives next level of performance EBITDA contribution as a percentage of total business segment Adjusted EBITDA. For a reconciliation of adjusted amounts to amounts reported under GAAP, please refer to the Appendix. Based on total business segment Adjusted EBITDA as previously reported prior to segment realignment in fiscal 2021.

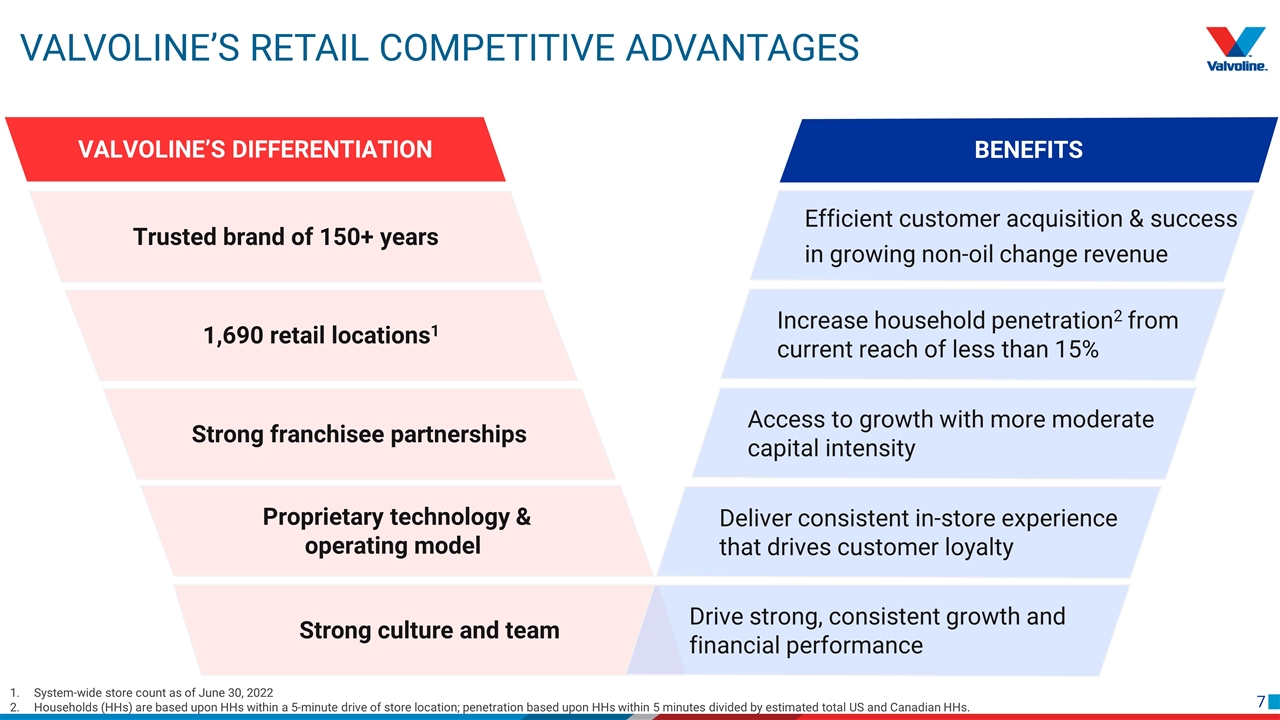

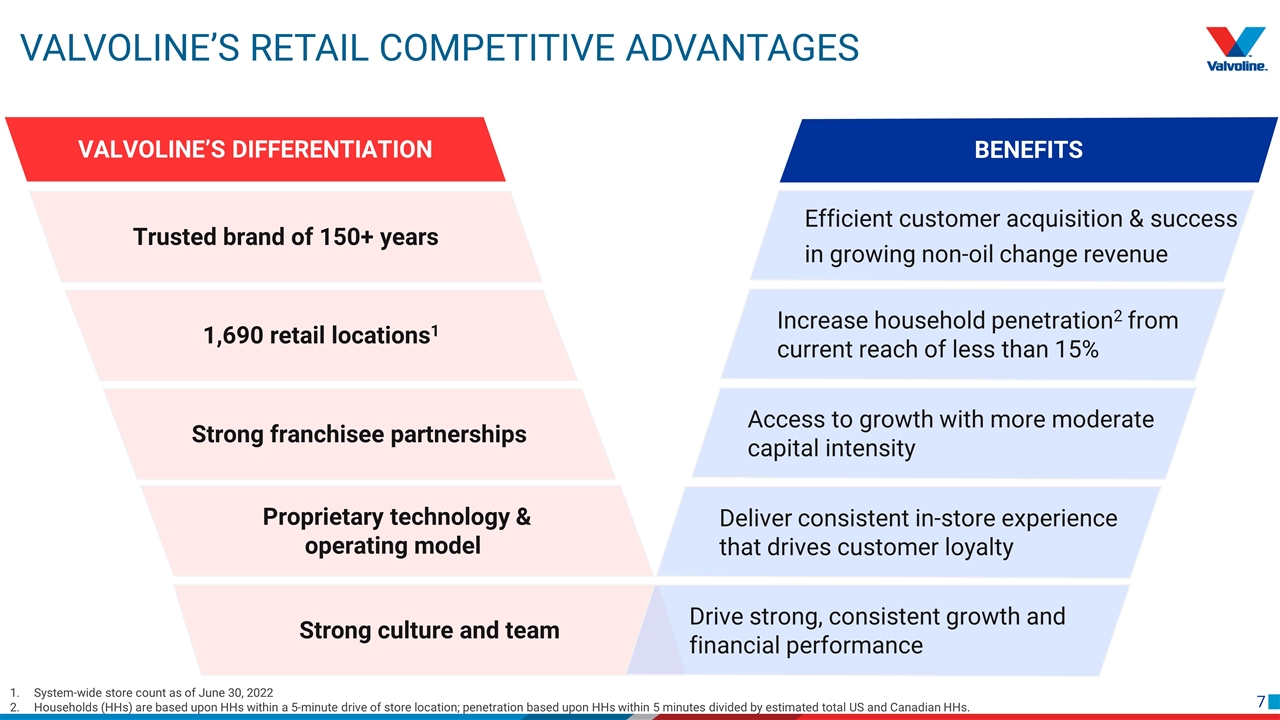

VALVOLINE’S DIFFERENTIATION Trusted brand of 150+ years 1,690 retail locations1 Strong franchisee partnerships Proprietary technology & operating model Valvoline’s Retail Competitive Advantages Strong culture and team BENEFITS Efficient customer acquisition & success in growing non-oil change revenue Increase household penetration2 from current reach of less than 15% Access to growth with more moderate capital intensity Deliver consistent in-store experience that drives customer loyalty Drive strong, consistent growth and financial performance System-wide store count as of June 30, 2022 Households (HHs) are based upon HHs within a 5-minute drive of store location; penetration based upon HHs within 5 minutes divided by estimated total US and Canadian HHs.

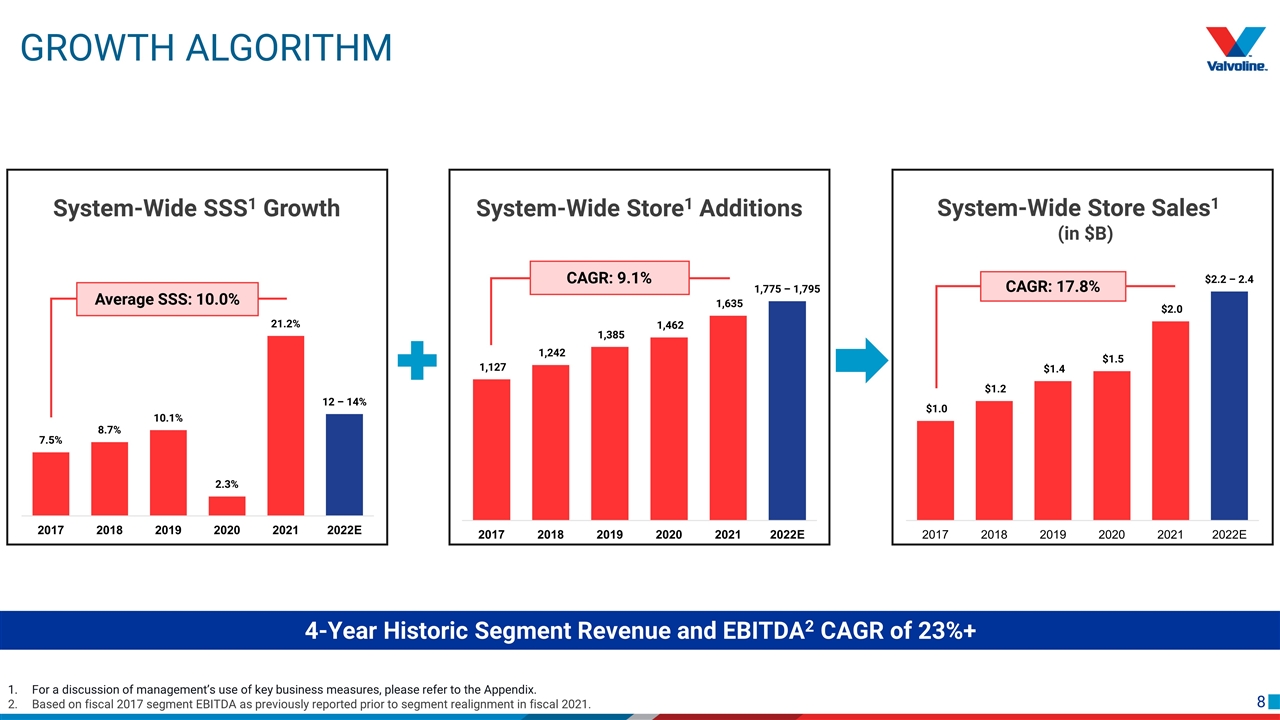

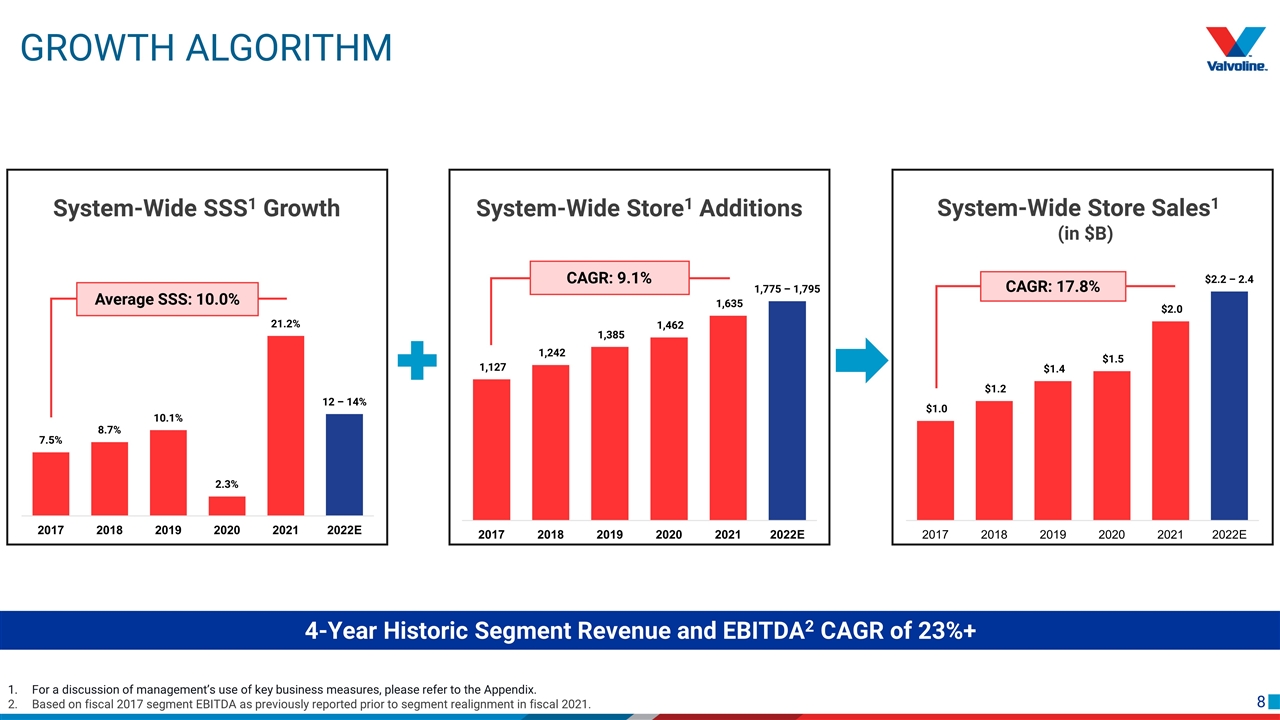

Average SSS: 10.0% CAGR: 9.1% CAGR: 17.8% Growth Algorithm System-Wide SSS1 Growth System-Wide Store Sales1 (in $B) System-Wide Store1 Additions For a discussion of management’s use of key business measures, please refer to the Appendix. Based on fiscal 2017 segment EBITDA as previously reported prior to segment realignment in fiscal 2021. 4-Year Historic Segment Revenue and EBITDA2 CAGR of 23%+

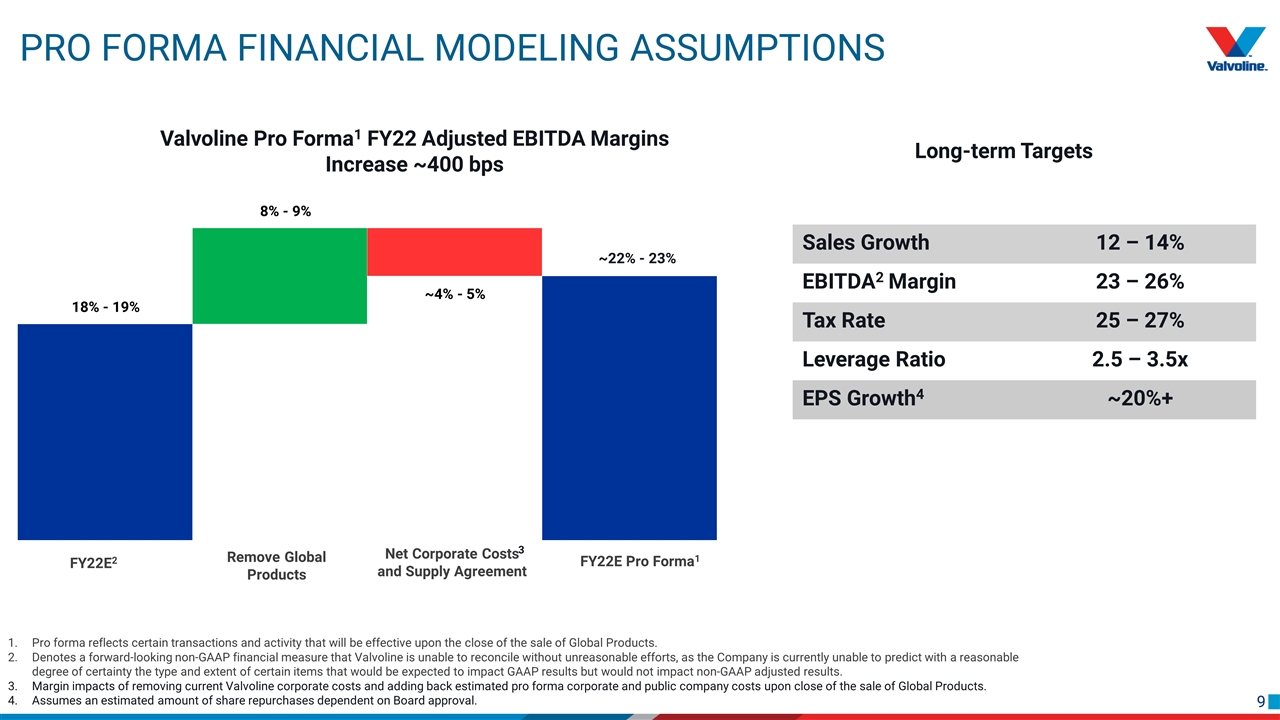

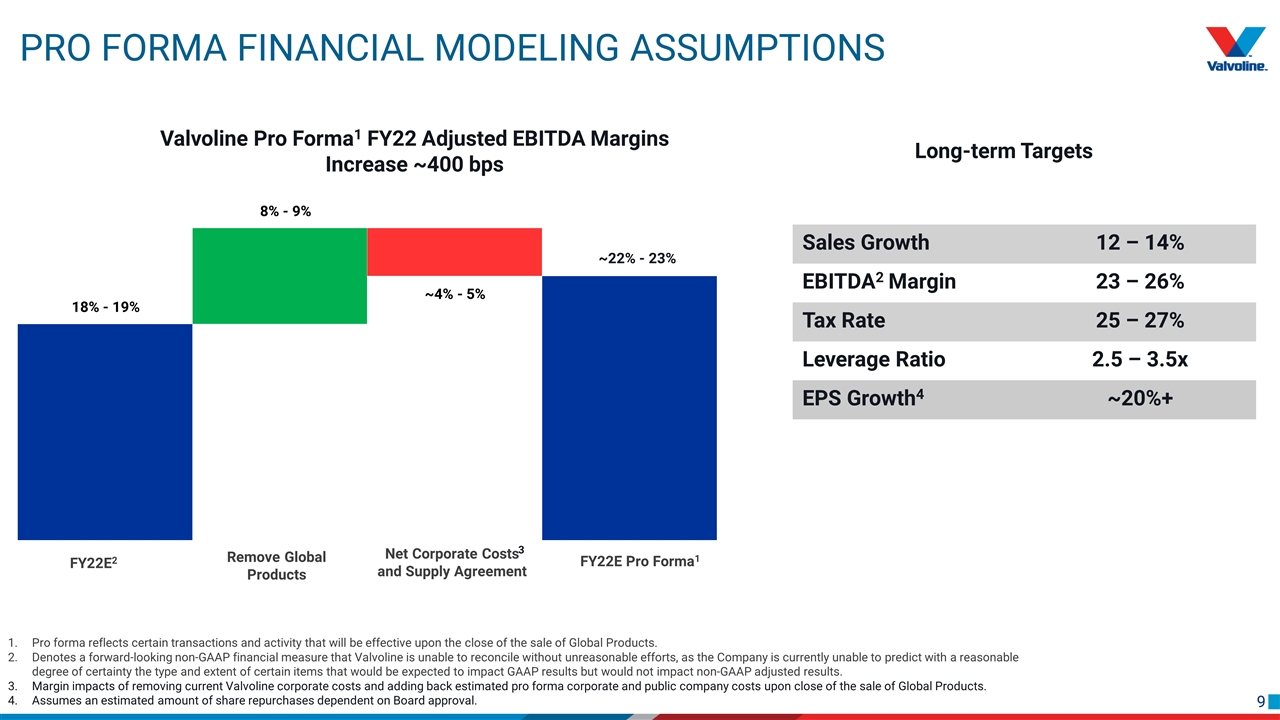

Net Corporate Costs and Supply Agreement Pro Forma Financial Modeling Assumptions 18% - 19% 8% - 9% ~4% - 5% ~22% - 23% 3 Long-term Targets FY22E2 Remove Global Products FY22E Pro Forma1 Sales Growth 12 – 14% EBITDA2 Margin 23 – 26% Tax Rate 25 – 27% Leverage Ratio 2.5 – 3.5x EPS Growth4 ~20%+ Valvoline Pro Forma1 FY22 Adjusted EBITDA Margins Increase ~400 bps Pro forma reflects certain transactions and activity that will be effective upon the close of the sale of Global Products. Denotes a forward-looking non-GAAP financial measure that Valvoline is unable to reconcile without unreasonable efforts, as the Company is currently unable to predict with a reasonable degree of certainty the type and extent of certain items that would be expected to impact GAAP results but would not impact non-GAAP adjusted results. Margin impacts of removing current Valvoline corporate costs and adding back estimated pro forma corporate and public company costs upon close of the sale of Global Products. Assumes an estimated amount of share repurchases dependent on Board approval.

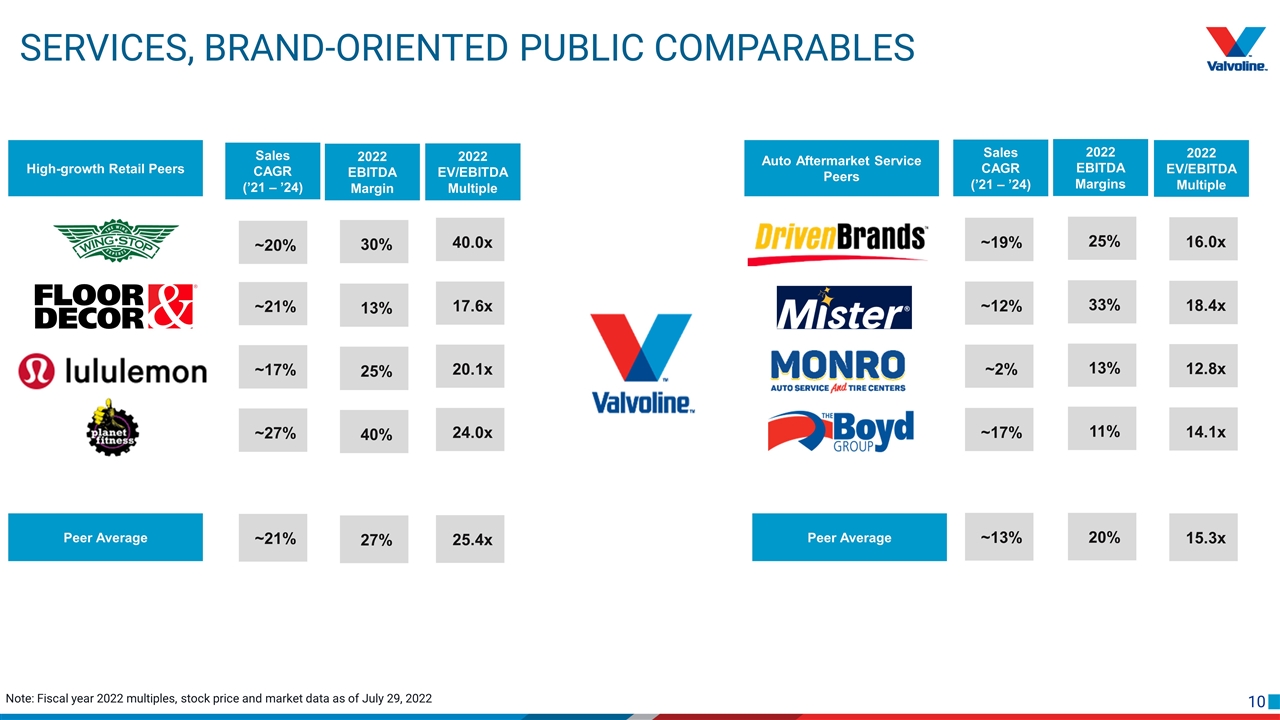

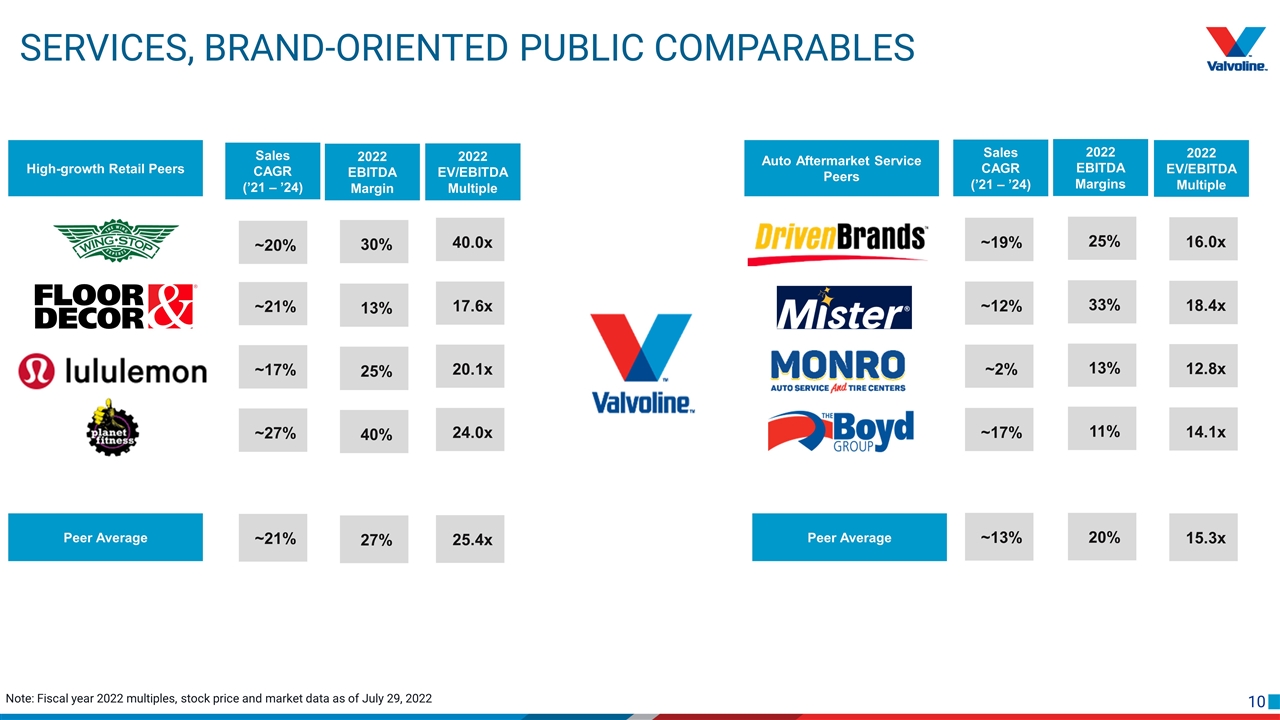

Note: Fiscal year 2022 multiples, stock price and market data as of July 29, 2022 Services, brand-oriented public Comparables Auto Aftermarket Service Peers 18.4x 12.8x 14.1x 16.0x 2022 EV/EBITDA Multiple Peer Average 15.3x High-growth Retail Peers 17.6x 20.1x 24.0x 40.0x 2022 EV/EBITDA Multiple Peer Average 25.4x ~12% ~2% ~17% ~19% Sales CAGR (’21 – ’24) ~13% ~21% ~17% ~27% ~20% Sales CAGR (’21 – ’24) ~21% 2022 EBITDA Margin 2022 EBITDA Margins 13% 25% 40% 30% 27% 33% 13% 11% 25% 20%

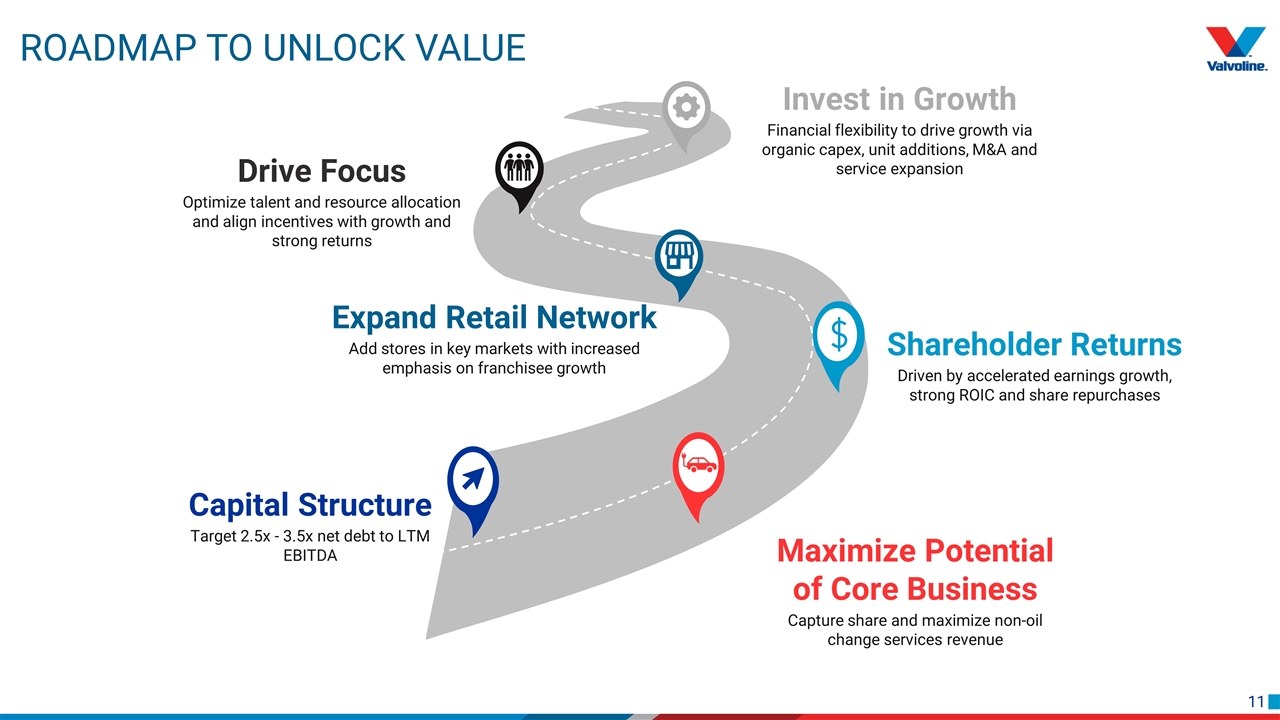

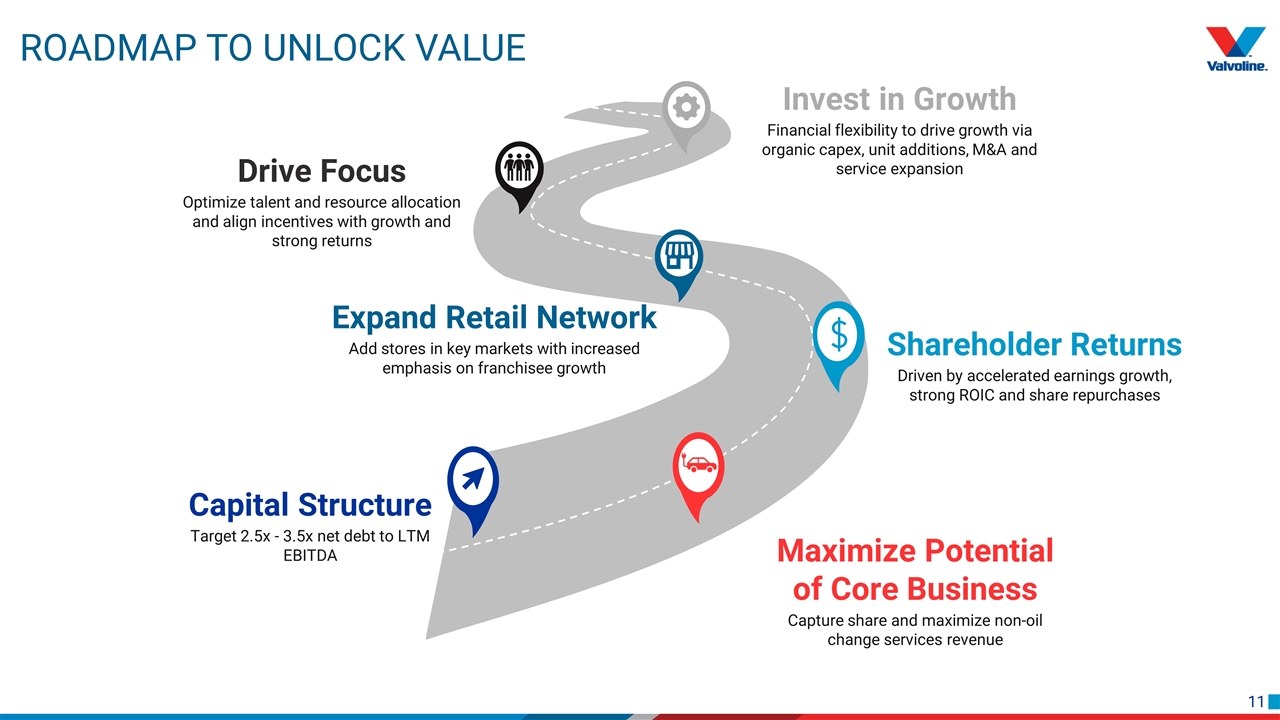

Shareholder Returns Driven by accelerated earnings growth, strong ROIC and share repurchases Maximize Potential of Core Business Capture share and maximize non-oil change services revenue Capital Structure Target 2.5x - 3.5x net debt to LTM EBITDA Drive Focus Optimize talent and resource allocation and align incentives with growth and strong returns Invest in Growth Financial flexibility to drive growth via organic capex, unit additions, M&A and service expansion Roadmap to unlock Value Expand Retail Network Add stores in key markets with increased emphasis on franchisee growth

Appendix

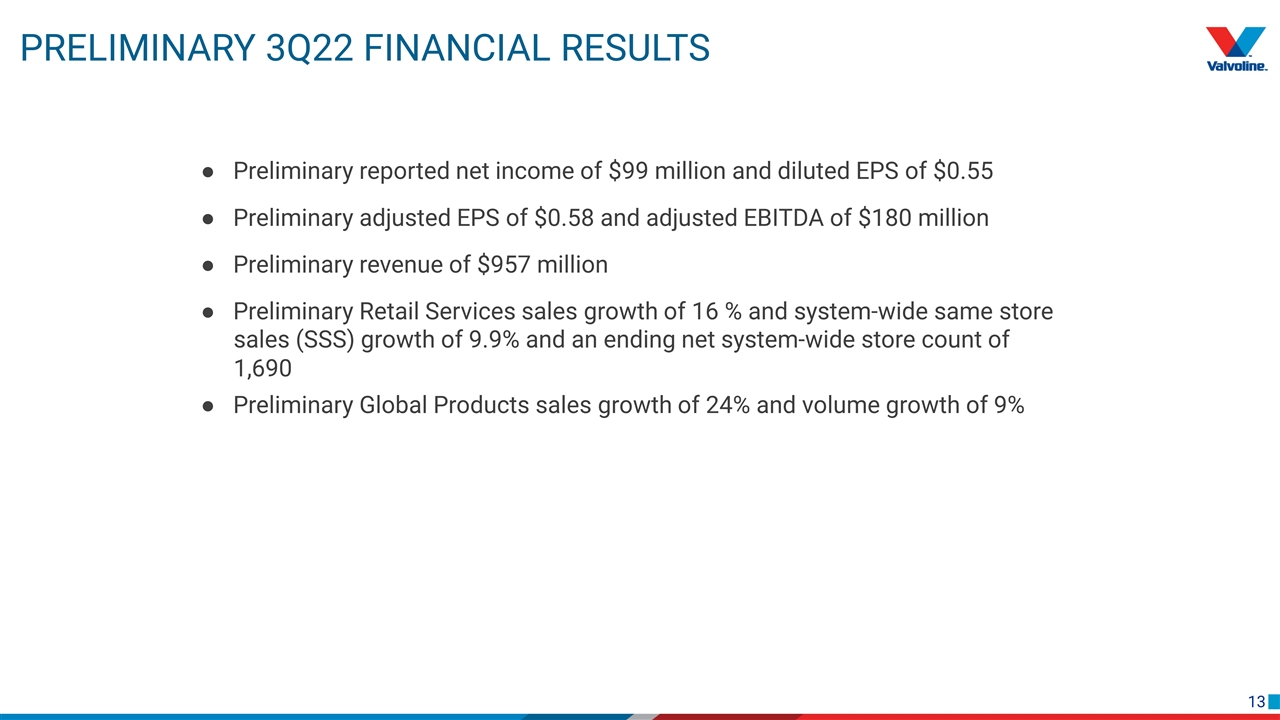

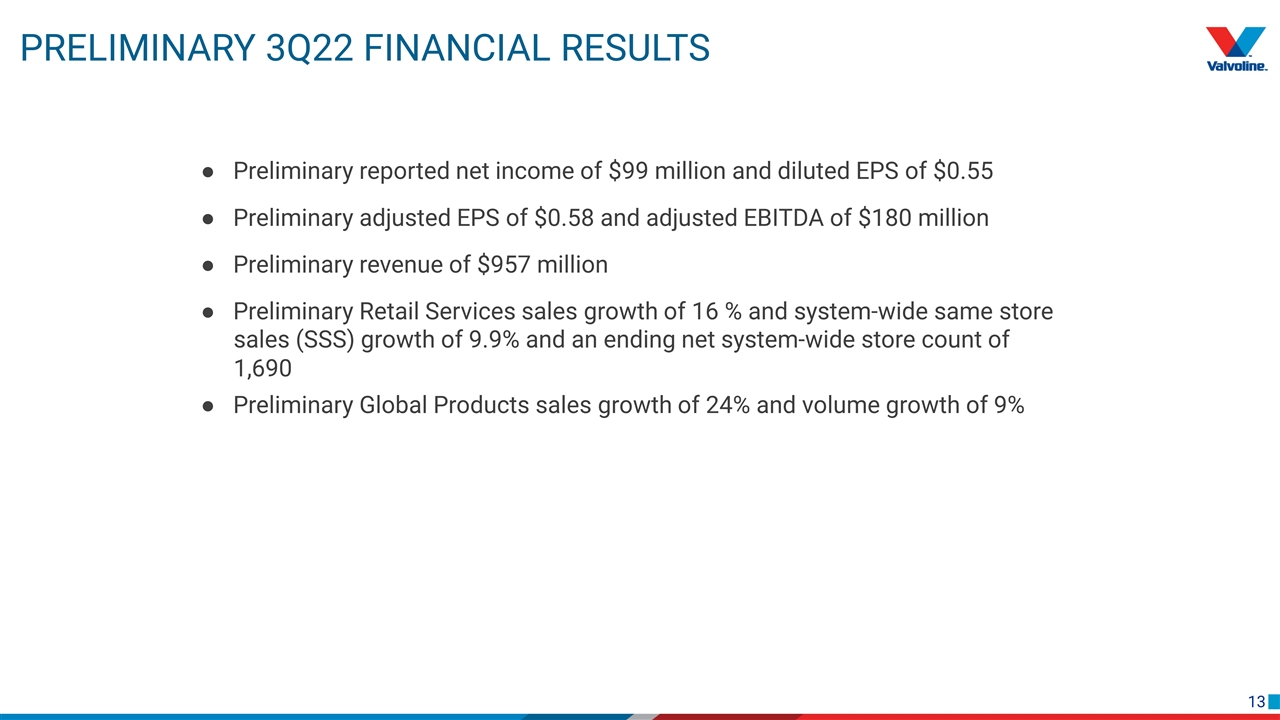

Preliminary 3Q22 financial Results ● Preliminary reported net income of $99 million and diluted EPS of $0.55 ● Preliminary adjusted EPS of $0.58 and adjusted EBITDA of $180 million ● Preliminary revenue of $957 million ● Preliminary Retail Services sales growth of 16 % and system-wide same store ● Preliminary Global Products sales growth of 24% and volume growth of 9% sales (SSS) growth of 9.9% and an ending net system-wide store count of 1,690

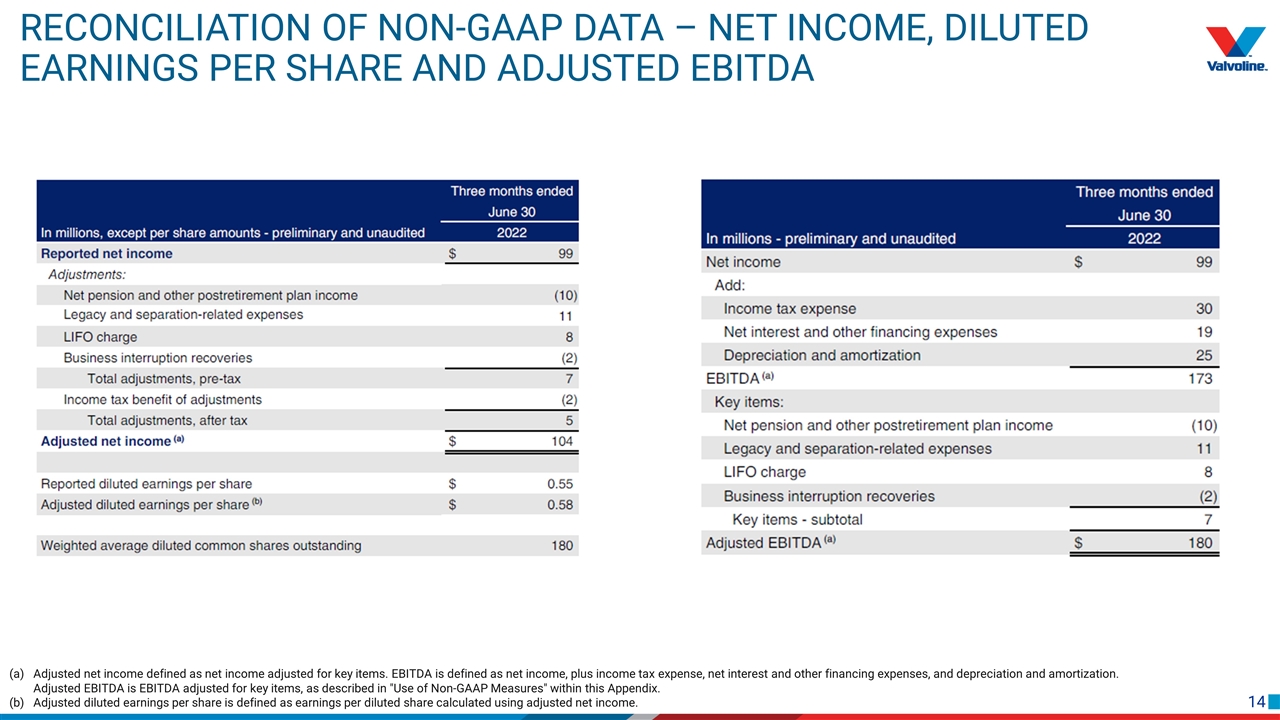

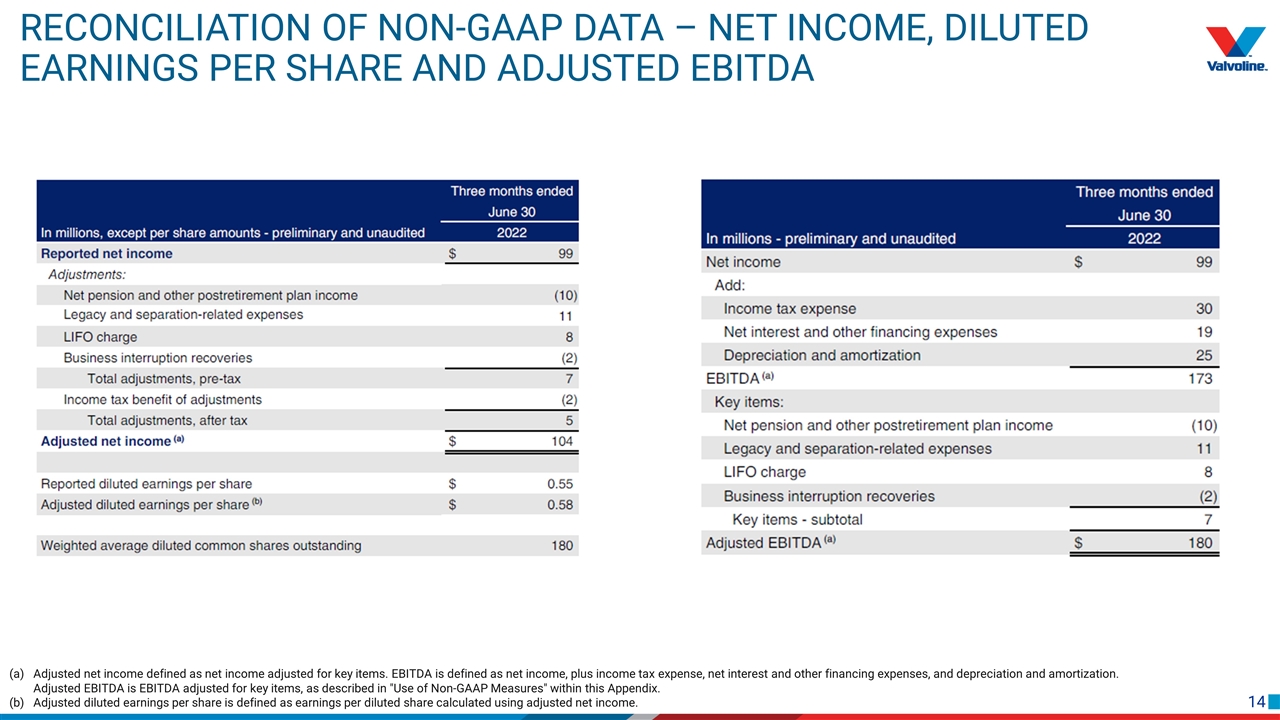

Reconciliation of non-gaap data – net income, diluted earnings per share and Adjusted ebitda Adjusted net income defined as net income adjusted for key items. EBITDA is defined as net income, plus income tax expense, net interest and other financing expenses, and depreciation and amortization. Adjusted EBITDA is EBITDA adjusted for key items, as described in "Use of Non-GAAP Measures" within this Appendix. Adjusted diluted earnings per share is defined as earnings per diluted share calculated using adjusted net income.

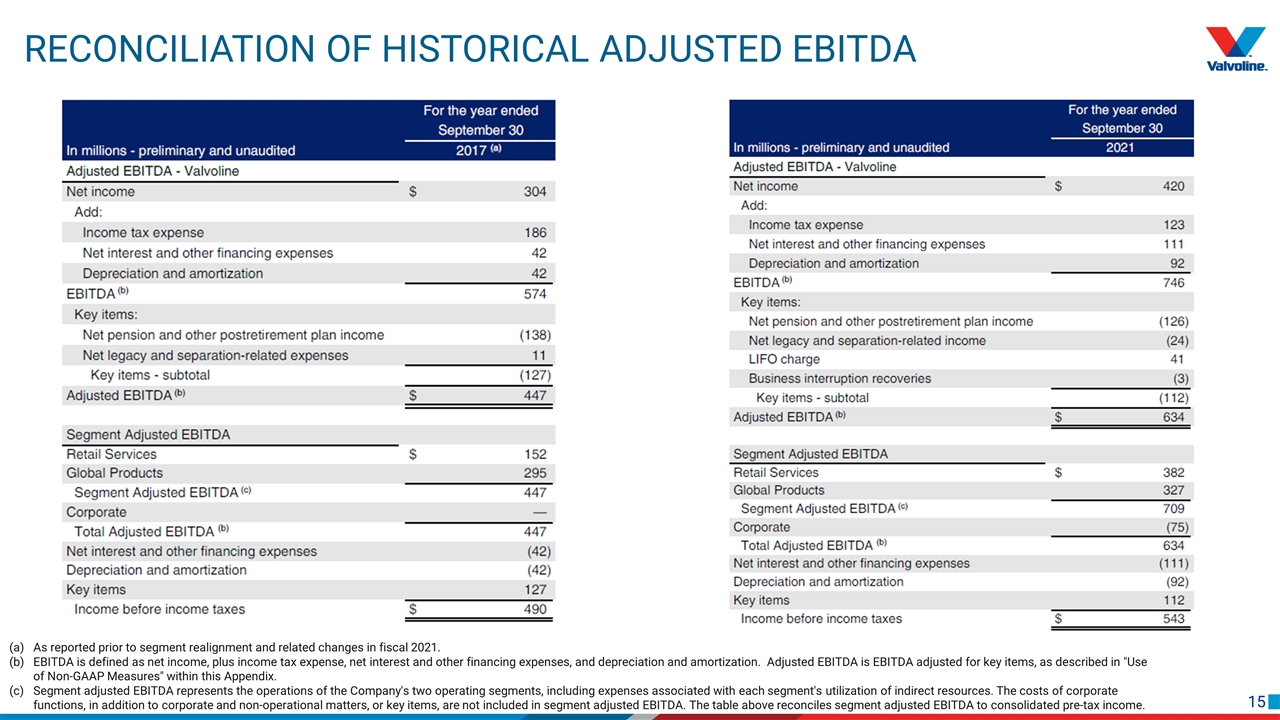

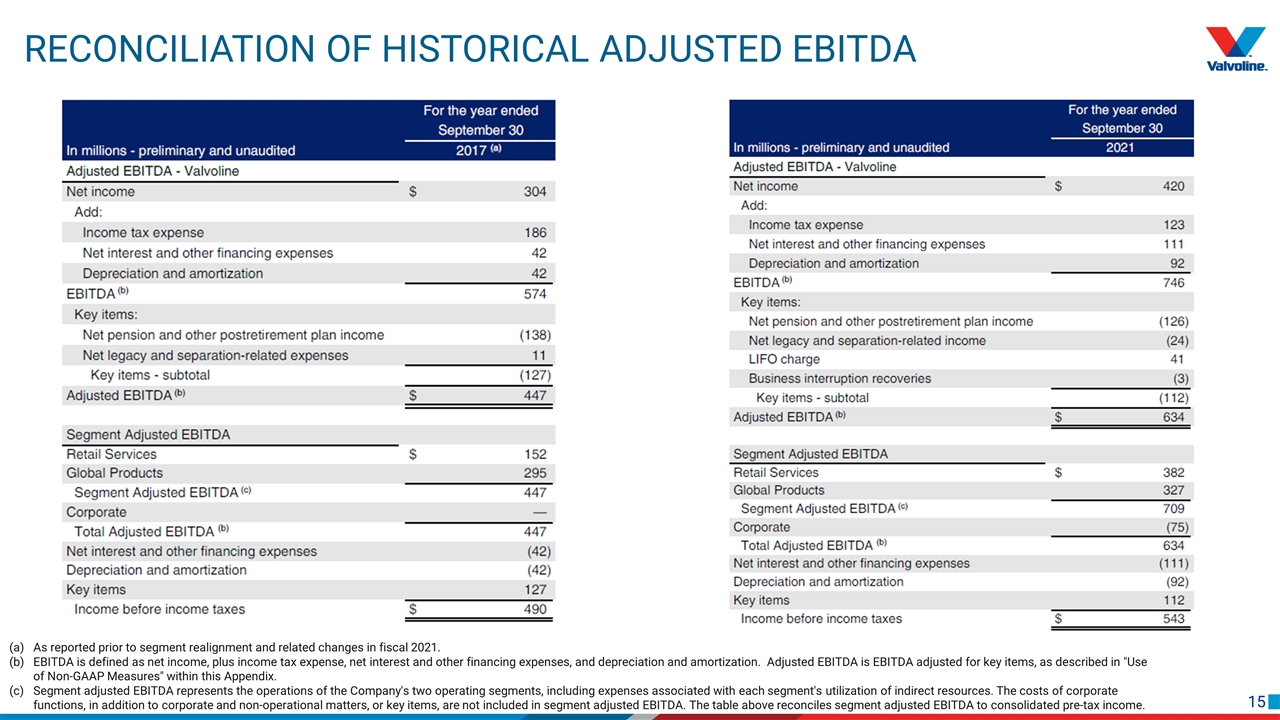

Reconciliation of historical Adjusted EBITDA As reported prior to segment realignment and related changes in fiscal 2021. EBITDA is defined as net income, plus income tax expense, net interest and other financing expenses, and depreciation and amortization. Adjusted EBITDA is EBITDA adjusted for key items, as described in "Use of Non-GAAP Measures" within this Appendix. Segment adjusted EBITDA represents the operations of the Company's two operating segments, including expenses associated with each segment's utilization of indirect resources. The costs of corporate functions, in addition to corporate and non-operational matters, or key items, are not included in segment adjusted EBITDA. The table above reconciles segment adjusted EBITDA to consolidated pre-tax income.

To supplement the financial measures prepared in accordance with U.S. GAAP, certain items within this presentation are presented on an adjusted basis. These non-GAAP measures have limitations as analytical tools and should not be considered in isolation from, or as an alternative to, or more meaningful than, the financial results presented in accordance with U.S. GAAP. The financial results presented in accordance with U.S. GAAP and the reconciliations of non-GAAP measures should be carefully evaluated. The non-GAAP information used by management may not be comparable to similar measures disclosed by other companies, because of differing methods used in calculating such measures. This presentation includes the following non-GAAP measures: adjusted EBITDA, segment adjusted EBITDA, adjusted net income and earnings per share. Refer to this Appendix for management's definition of each non-GAAP measure and reconciliation to the most comparable U.S. GAAP measure. Management believes the use of non-GAAP measures on a consolidated and operating segment basis provides a useful supplemental presentation of Valvoline's operating performance and allows for transparency with respect to key metrics used by management in operating the business and measuring performance. Management believes EBITDA measures provide a meaningful supplemental presentation of Valvoline’s operating performance between periods on a comparable basis due to the depreciable assets associated with the nature of the Company’s operations, and income tax and interest costs related to Valvoline’s tax and capital structures, respectively. Adjusted profitability measures enable comparison of financial trends and results between periods where certain items may vary independent of business performance. These adjusted measures exclude the impact of certain unusual, infrequent or non-operational activity not directly attributable to the underlying business, which management believes impacts the comparability of operational results between periods ("key items"). Key items are often related to legacy matters or market-driven events considered by management to not be reflective of the ongoing operating performance. Key items may consist of adjustments related to: legacy businesses, including the separation from Valvoline's former parent company and associated impacts of related indemnities; the separation of Valvoline’s businesses; significant acquisitions or divestitures; restructuring-related matters; tax reform legislation; debt extinguishment and modification costs; and other matters that are non-operational or unusual in nature, including the following: Net pension and other postretirement plan expense/income - includes several elements impacted by changes in plan assets and obligations that are primarily driven by changes in the debt and equity markets, as well as those that are predominantly legacy in nature and related to prior service to the Company from employees (e.g., retirees, former employees and current employees with frozen benefits). These elements include (i) interest cost, (ii) expected return on plan assets, (iii) actuarial gains/losses, and (iv) amortization of prior service cost/credit. Significant factors that can contribute to changes in these elements include changes in discount rates used to remeasure pension and other postretirement obligations on an annual basis or upon a qualifying remeasurement, differences between actual and expected returns on plan assets, and other changes in actuarial assumptions, such as the life expectancy of plan participants. Accordingly, management considers that these elements may be more reflective of changes in current conditions in global financial markets (in particular, interest rates), outside the operational performance of the business, and are also primarily legacy amounts that are not directly related to the underlying business and do not have an immediate, corresponding impact on the compensation and benefits provided to eligible employees for current service. Adjusted profitability measures include the costs of benefits provided to employees for current service, including pension and other postretirement service costs. Changes in the last-in, first out (LIFO) inventory reserve - charges or credits recognized in Cost of sales to value certain lubricant inventories at the lower of cost or market using the LIFO method. During inflationary or deflationary pricing environments, the application of LIFO can result in variability of the cost of sales recognized each period as the most recent costs are matched against current sales, while preceding costs are retained in inventories. LIFO adjustments are determined based on published prices, which are difficult to predict and largely dependent on future events. The application of LIFO can impact comparability and enhance the lag period effects between changes in inventory costs and related pricing adjustments. Use of non-gaap measures

Valvoline tracks its operating performance and manages its business using certain key measures, including system-wide store counts and same-store sales (SSS); system-wide store sales; and lubricant volumes sold. Management believes these measures are useful to evaluating and understanding Valvoline’s operating performance and should be considered as supplements to, not substitutes for, Valvoline's sales and operating income, as determined in accordance with U.S. GAAP. Sales in the Retail Services reportable segment are influenced by the number of service center stores and the business performance of those stores. Stores are considered open upon acquisition or opening for business. Temporary store closings remain in the respective store counts with only permanent store closures reflected in the activity and end of period store counts. SSS is defined as sales by U.S. Retail Services stores (company-operated, franchised and the combination of these for system-wide SSS), with new stores, including franchised conversions, excluded from the metric until the completion of their first full fiscal year in operation as this period is generally required for new store sales levels to begin to normalize. Retail Services sales are limited to sales at company-operated stores, sales of lubricants and other products to independent franchisees and Express Care operators and royalties and other fees from franchised stores. Although Valvoline does not recognize store-level sales from franchised stores as sales in its Statements of Consolidated Income, management believes system-wide and franchised SSS comparisons, store counts, and total system-wide store sales are useful to assess market position relative to competitors and overall store and segment operating performance. Management believes lubricant volumes sold in gallons by its consolidated subsidiaries is a useful measure in evaluating and understanding the operating performance of the Global Products segment. Volumes sold in other units of measure, including liters, are converted to gallons utilizing standard conversions. Key business measures