UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

______________________

FORM 10-Q

(Mark one)

| | | | | |

| ☑ | QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the quarterly period ended December 31, 2022

OR

| | | | | |

| ☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from _________ to ___________

Commission file number 001-37884

VALVOLINE INC.

(Exact name of registrant as specified in its charter)

| | | | | |

| Kentucky | 30-0939371 |

| (State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) |

100 Valvoline Way

Lexington, Kentucky 40509

(Address of principal executive offices) (Zip Code)

Telephone Number (859) 357-7777

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

| Common stock, par value $0.01 per share | | VVV | | New York Stock Exchange |

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the Registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes þ No o

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes þ No o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| | | | | | | | | | | |

| Large accelerated filer | ☑ | Accelerated filer | ☐ |

| Non-accelerated filer | ☐ | Smaller reporting company | ☐ |

| | Emerging growth company | ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ☐ No þ

At January 31, 2023, there were 171,935,576 shares of the registrant’s common stock outstanding.

TABLE OF CONTENTS | | | | | |

| Page |

| PART I – FINANCIAL INFORMATION |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| PART II – OTHER INFORMATION |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

PART I - FINANCIAL INFORMATION

ITEM 1. FINANCIAL STATEMENTS

Valvoline Inc. and Consolidated Subsidiaries

Condensed Consolidated Statements of Comprehensive Income

| | | | | | | | | | | | | | | | | | |

| | Three months ended

December 31 | | |

| (In millions, except per share amounts - unaudited) | | 2022 | | 2021 | | | | |

| Net revenues | | $ | 332.8 | | | $ | 287.3 | | | | | |

| Cost of sales | | 214.0 | | | 175.1 | | | | | |

| Gross profit | 118.8 | | | 112.2 | | | | | |

| | | | | | | | |

| Selling, general and administrative expenses | | 66.0 | | | 60.2 | | | | | |

| Net legacy and separation-related expenses | | 25.4 | | | 2.8 | | | | | |

| Other income, net | | (1.9) | | | (2.8) | | | | | |

| Operating income | 29.3 | | | 52.0 | | | | | |

| Net pension and other postretirement plan expense (income) | | 3.7 | | | (9.3) | | | | | |

| Net interest and other financing expenses | | 18.7 | | | 17.0 | | | | | |

| Income before income taxes | 6.9 | | | 44.3 | | | | | |

| Income tax (benefit) expense | | (20.1) | | | 10.1 | | | | | |

| Income from continuing operations | | 27.0 | | | 34.2 | | | | | |

| Income from discontinued operations | | 54.9 | | | 52.8 | | | | | |

| Net income | $ | 81.9 | | | $ | 87.0 | | | | | |

| | | | | | | | |

| NET EARNINGS PER SHARE | | | | |

| Basic earnings per share | | | | | | | |

| Continuing operations | 0.16 | | | 0.19 | | | | | |

| Discontinued operations | 0.31 | | | 0.29 | | | | | |

| Basic earnings per share | $ | 0.47 | | | $ | 0.48 | | | | | |

| | | | | | | | |

| Diluted earnings per share | | | | | | | |

| Continuing operations | 0.15 | | | 0.19 | | | | | |

| Discontinued operations | 0.31 | | | 0.29 | | | | | |

| Diluted earnings per share | $ | 0.46 | | | $ | 0.48 | | | | | |

| | | | | | | | |

| WEIGHTED AVERAGE COMMON SHARES OUTSTANDING | | | | |

| Basic | | 175.2 | | | 180.5 | | | | | |

| Diluted | | 176.3 | | | 182.0 | | | | | |

| | | | | | | | |

| COMPREHENSIVE INCOME | | | | |

| Net income | | $ | 81.9 | | | $ | 87.0 | | | | | |

| Other comprehensive income (loss), net of tax | | | | | | | | |

| Currency translation adjustments | | 15.2 | | | 0.3 | | | | | |

| Amortization of pension and other postretirement plan prior service credits | | (0.4) | | | (0.4) | | | | | |

| Unrealized (loss) gain on cash flow hedges | | (1.3) | | | 2.2 | | | | | |

| Other comprehensive income | | 13.5 | | | 2.1 | | | | | |

| Comprehensive income | | $ | 95.4 | | | $ | 89.1 | | | | | |

| | | | | | | | |

See Notes to Condensed Consolidated Financial Statements.

Valvoline Inc. and Consolidated Subsidiaries

Condensed Consolidated Balance Sheets | | | | | | | | | | | | | | |

| (In millions, except per share amounts - unaudited) | | December 31

2022 | | September 30

2022 |

| Assets |

| Current assets | | | | |

| Cash and cash equivalents | | $ | 21.0 | | | $ | 23.4 | |

| Receivables, net | | 56.9 | | | 66.1 | |

| Inventories, net | | 31.2 | | | 29.4 | |

| Prepaid expenses and other current assets | | 38.7 | | | 38.0 | |

| Current assets held for sale | | 1,553.6 | | | 1,464.2 | |

| Total current assets | | 1,701.4 | | | 1,621.1 | |

| Noncurrent assets | | | | |

| Property, plant and equipment, net | | 693.3 | | | 668.6 | |

| Operating lease assets | | 253.5 | | | 248.1 | |

| Goodwill and intangibles, net | | 668.2 | | | 663.1 | |

| Deferred tax assets | | 82.2 | | | 61.6 | |

| Other noncurrent assets | | 152.9 | | | 154.3 | |

| | | | |

| Total noncurrent assets | | 1,850.1 | | | 1,795.7 | |

| Total assets | | $ | 3,551.5 | | | $ | 3,416.8 | |

| | | | |

| Liabilities and Stockholders’ Equity | | | | |

| Current liabilities | | | | |

| | | | |

| Current portion of long-term debt | | $ | 224.5 | | | $ | 162.5 | |

| Trade and other payables | | 46.6 | | | 45.0 | |

| Accrued expenses and other liabilities | | 175.2 | | | 172.6 | |

| Current liabilities held for sale | | 478.1 | | | 539.3 | |

| Total current liabilities | | 924.4 | | | 919.4 | |

| Noncurrent liabilities | | | | |

| Long-term debt | | 1,656.1 | | | 1,525.1 | |

| Employee benefit obligations | | 200.5 | | | 199.4 | |

| Operating lease liabilities | | 234.5 | | | 229.2 | |

| | | | |

| Other noncurrent liabilities | | 246.7 | | | 237.1 | |

| | | | |

| Total noncurrent liabilities | | 2,337.8 | | | 2,190.8 | |

| Commitments and contingencies | | | | |

| Stockholders' equity | | | | |

| Preferred stock, no par value, 40.0 shares authorized; no shares issued and outstanding | | — | | | — | |

| Common stock, par value $0.01 per share, 400.0 shares authorized; 173.5 and 176.1 shares issued and outstanding at December 31, 2022 and September 30, 2022, respectively | | 1.7 | | | 1.8 | |

| Paid-in capital | | 40.8 | | | 44.1 | |

| Retained earnings | | 254.6 | | | 282.0 | |

| | | | |

| | | | |

| Accumulated other comprehensive loss | | (7.8) | | | (21.3) | |

| Stockholders' equity | | 289.3 | | | 306.6 | |

| Total liabilities and stockholders’ equity | | $ | 3,551.5 | | | $ | 3,416.8 | |

| | | | |

See Notes to Condensed Consolidated Financial Statements.

Valvoline Inc. and Consolidated Subsidiaries

Condensed Consolidated Statements of Cash Flows | | | | | | | | | | | | | | |

| | Three months ended

December 31 |

| (In millions - unaudited) | | 2022 | | 2021 |

| Cash flows from operating activities | | | | |

| Net income | | $ | 81.9 | | | $ | 87.0 | |

| Adjustments to reconcile to cash flows from operations | | | | |

| Income from discontinued operations | | (54.9) | | | (52.8) | |

| | | | |

| Depreciation and amortization | | 18.5 | | | 16.9 | |

| | | | |

| Deferred income taxes | | (26.5) | | | 7.5 | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| Stock-based compensation expense | | 2.9 | | | 3.2 | |

| Other, net | | 0.6 | | | 0.6 | |

| Change in assets and liabilities | | | | |

| Receivables | | 13.4 | | | (4.7) | |

| Inventories | | (1.0) | | | 3.1 | |

| Payables and accrued liabilities | | (17.2) | | | (22.3) | |

| Other assets and liabilities | | 30.8 | | | (0.8) | |

| Operating cash flows from continuing operations | | 48.5 | | | 37.7 | |

| Operating cash flows from discontinued operations | | (57.2) | | | (5.9) | |

| Total cash (used in) provided by operating activities | | (8.7) | | | 31.8 | |

| Cash flows from investing activities | | | | |

| Additions to property, plant and equipment | | (39.9) | | | (32.0) | |

| Notes receivable, net of repayments | | (0.5) | | | 3.0 | |

| Acquisitions of businesses, net of cash acquired | | (9.6) | | | (13.6) | |

| | | | |

| | | | |

| Other investing activities, net | | 1.6 | | | (0.1) | |

| Investing cash flows from continuing operations | | (48.4) | | | (42.7) | |

| Investing cash flows from discontinued operations | | (8.4) | | | (3.1) | |

| Total cash used in investing activities | | (56.8) | | | (45.8) | |

| Cash flows from financing activities | | | | |

| Proceeds from borrowings, net of issuance costs | | 250.0 | | | — | |

| | | | |

| Repayments on borrowings | | (119.4) | | | — | |

| | | | |

| Repurchases of common stock | | (87.4) | | | (31.5) | |

| | | | |

| Cash dividends paid | | (21.8) | | | (22.5) | |

| Other financing activities | | (8.9) | | | (8.9) | |

| Financing cash flows from continuing operations | | 12.5 | | | (62.9) | |

| Financing cash flows from discontinued operations | | 60.0 | | | (0.9) | |

| Total cash provided by (used in) financing activities | | 72.5 | | | (63.8) | |

| Effect of currency exchange rate changes on cash, cash equivalents and restricted cash | | 2.1 | | | 0.1 | |

| Increase (decrease) in cash, cash equivalents and restricted cash | | 9.1 | | | (77.7) | |

| Cash, cash equivalents and restricted cash - beginning of period | | 83.9 | | | 231.4 | |

| Cash, cash equivalents and restricted cash - end of period | | $ | 93.0 | | | $ | 153.7 | |

| | | | |

See Notes to Condensed Consolidated Financial Statements.

Valvoline Inc. and Consolidated Subsidiaries

Condensed Consolidated Statements of Stockholders’ Equity

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three months ended December 31, 2022 |

| (In millions, except per share amounts - unaudited) | | Common stock | | Paid-in capital | | Retained earnings | | Accumulated other comprehensive Income (loss) | | Totals |

| Shares | | Amount |

| Balance at September 30, 2022 | | 176.1 | | | $ | 1.8 | | | $ | 44.1 | | | $ | 282.0 | | | $ | (21.3) | | | $ | 306.6 | |

| Net income | | — | | | — | | | — | | | 81.9 | | | — | | | 81.9 | |

| Dividends paid, $0.125 per common share | | — | | | — | | | 0.1 | | | (21.9) | | | — | | | (21.8) | |

| Stock-based compensation, net of issuances | | 0.3 | | | — | | | (3.4) | | | — | | | — | | | (3.4) | |

| Repurchases of common stock | | (2.9) | | | (0.1) | | | — | | | (87.4) | | | — | | | (87.5) | |

| Other comprehensive income, net of tax | | — | | | — | | | — | | | — | | | 13.5 | | | 13.5 | |

| Balance at December 31, 2022 | | 173.5 | | | $ | 1.7 | | | $ | 40.8 | | | $ | 254.6 | | | $ | (7.8) | | | $ | 289.3 | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | Three months ended December 31, 2021 |

| (In millions, except per share amounts - unaudited) | | Common stock | | Paid-in capital | | Retained deficit | | Accumulated other comprehensive income | | Totals |

| Shares | | Amount |

| Balance at September 30, 2021 | | 180.3 | | | $ | 1.8 | | | $ | 35.2 | | | $ | 90.0 | | | $ | 7.5 | | | $ | 134.5 | |

| Net income | | — | | | — | | | — | | | 87.0 | | | — | | | 87.0 | |

| Dividends paid, $0.125 per common share | | — | | | — | | | 0.1 | | | (22.6) | | | — | | | (22.5) | |

| Stock-based compensation, net of issuances | | 0.2 | | | — | | | (2.4) | | | — | | | — | | | (2.4) | |

| Repurchases of common stock | | (0.9) | | | — | | | — | | | (31.4) | | | — | | | (31.4) | |

| | | | | | | | | | | | |

| Other comprehensive income, net of tax | | — | | | — | | | — | | | — | | | 2.1 | | | 2.1 | |

| Balance at December 31, 2021 | | 179.6 | | | $ | 1.8 | | | $ | 32.9 | | | $ | 123.0 | | | $ | 9.6 | | | $ | 167.3 | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

See Notes to Condensed Consolidated Financial Statements.

| | | | | |

| Index to Notes to Condensed Consolidated Financial Statements | Page |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

Valvoline Inc. and Consolidated Subsidiaries

Notes to Condensed Consolidated Financial Statements (Unaudited)

NOTE 1 – BASIS OF PRESENTATION AND SIGNIFICANT ACCOUNTING POLICIES

The accompanying unaudited condensed consolidated financial statements have been prepared by Valvoline Inc. (“Valvoline” or the “Company”) in accordance with accounting principles generally accepted in the United States of America (“U.S. GAAP”) and Securities and Exchange Commission regulations for interim financial reporting, which do not include all information and footnote disclosures normally included in annual financial statements. Therefore, these condensed consolidated financial statements should be read in conjunction with Valvoline’s Annual Report on Form 10-K for the fiscal year ended September 30, 2022. Certain prior period amounts disclosed herein have been reclassified to conform to the current presentation.

Use of estimates, risks and uncertainties

The preparation of the condensed consolidated financial statements in conformity with U.S. GAAP requires management to make estimates and judgments that affect the reported amounts of assets, liabilities, revenues and expenses, and the disclosures of contingent matters. Although management bases its estimates on historical experience and various other assumptions that are believed to be reasonable under the circumstances, actual results could differ significantly from the estimates under different assumptions or conditions.

Valvoline has substantially maintained its operations throughout the novel coronavirus ("COVID-19") pandemic to-date and has continued precautionary measures to protect the Company's employees and customers and manage through the currently known impacts on its business. Given the unprecedented nature of the pandemic, the extent of future impacts cannot be reasonably estimated at this time due to numerous uncertainties, including the ultimate duration and severity of the pandemic.

Strategic separation

In fiscal 2022, Valvoline entered into a definitive agreement to sell its former Global Products reportable segment (“Global Products”) to Aramco Overseas Company B.V. (“Aramco”). In all periods presented within these condensed consolidated financial statements, the assets and liabilities associated with the Global Products disposal group have been classified as held for sale within the Condensed Consolidated Balance Sheets and its operations have been classified as discontinued operations within the Condensed Consolidated Statements of Comprehensive Income and Cash Flows. Refer to Note 2 for additional information regarding the Global Products business, including the assets and liabilities held for sale and income from discontinued operations. Unless otherwise noted, disclosures within the remaining notes to these condensed consolidated financial statements relate solely to the Company's continuing operations.

Inflation Reduction Act of 2022

The Inflation Reduction Act (the “IRA”) was enacted in the United States in August 2022, which includes, among other provisions, a 15% alternative minimum tax on corporate adjusted income in excess of certain thresholds for taxable years beginning after December 31, 2022. The Company is evaluating the impact this provision will have on its condensed consolidated financial statements.

The IRA also imposes an excise tax of one percent share repurchases that occur after December 31, 2022. Corporations are permitted to credit certain new stock issuances against their stock repurchases during the same taxable period. Based on current share repurchase expectations, Valvoline anticipates this excise tax will have a significant impact on its Retained earnings and cash flows related to the timing of payments.

Recent accounting pronouncements

The following accounting guidance relevant to Valvoline was either issued or adopted in the current year, or is expected to have a meaningful impact on Valvoline in future periods upon adoption.

Issued but not yet adopted

In March 2020, the Financial Accounting Standards Board (“FASB”) issued guidance related to reference rate reform that simplifies the accounting for contract modifications and hedging arrangements as the market transitions from the London Interbank Offered Rate ("LIBOR") and other interbank reference rates to alternative reference rates. The Company has interest rate swap hedging arrangements and variable rate long-term debt for which existing payments are based on LIBOR tenors expected to cease in June 2023. In December 2022, FASB issued guidance to extend the temporary transition period which now can be applied on a prospective basis through the end of December 2024 for qualifying modified arrangements.

As of December 31, 2022, 31% of Valvoline’s outstanding total long-term debt and interest rate swap agreements with a total notional amount of $275 million are under existing arrangements that mature following LIBOR cessation and do not contain fallback provisions to alternative reference rates. On December 12, 2022, Valvoline entered into an agreement to amend its existing Credit Agreement, which will be effective upon the sale of Global Products and includes the transition from LIBOR to Secured Overnight Financing Rate (“SOFR”) or an alternate base rate. This amendment is described further in Note 5 and will leave the $275 million of interest rate swap agreements remaining which mature following LIBOR cessation without fallback provisions to alternative rates. Valvoline expects to modify its interest rate swap agreements for the reference rates only commensurate with the closing of the sale of Global Products and apply the simplification guidance to this modification.

NOTE 2 - DISCONTINUED OPERATIONS

On July 31, 2022, the Company entered into a definitive agreement to sell Global Products to Aramco for a cash purchase price of $2.65 billion, subject to customary adjustments with respect to working capital and net indebtedness (the “Transaction”). The Transaction is subject to standard closing conditions, including regulatory approvals and is expected to close in early calendar year 2023.

The following table summarizes Income from discontinued operations within the Condensed Consolidated Statements of Comprehensive Income:

| | | | | | | | | | | | | | | | | | |

| | Three months ended

December 31 | | |

| (In millions) | | 2022 | | 2021 | | | | |

| Net revenues | | $ | 705.8 | | | $ | 619.0 | | | | | |

| Cost of sales | | 556.6 | | | 488.1 | | | | | |

| Gross profit | 149.2 | | | 130.9 | | | | | |

| | | | | | | | |

| Selling, general and administrative expenses | | 72.3 | | | 74.1 | | | | | |

| Net legacy and separation-related expense | | 6.2 | | | — | | | | | |

| Equity and other income, net | | (9.2) | | | (12.2) | | | | | |

| Operating income from discontinued operations | 79.9 | | | 69.0 | | | | | |

| Net pension and other postretirement plan expense | | 0.1 | | | — | | | | | |

| Net interest and other financing expenses | | 2.3 | | | 0.7 | | | | | |

| Income from discontinued operations before income taxes | 77.5 | | | 68.3 | | | | | |

| Income tax expense | | 22.6 | | | 15.5 | | | | | |

| Income from discontinued operations | $ | 54.9 | | | $ | 52.8 | | | | | |

The products used in Valvoline’s service delivery are sourced from Global Products. Valvoline will continue this arrangement following the sale of Global Products through a long-term supply agreement whereby Valvoline will purchase substantially all lubricant and certain ancillary products for its stores from Global Products. Net revenues within the results of Global Products above include product sales to the Company's continuing operations which are considered to be effectively settled at the time of the transaction and have not been eliminated. The following table summarizes these transactions:

| | | | | | | | | | | | | | | | | | |

| | | | Three months ended |

| | | | December 31 |

| (In millions) | | | | | | 2022 | | 2021 |

| Net revenues | | | | | | $ | 55.1 | | | $ | 48.4 | |

A summary of the held for sale assets and liabilities included in the Condensed Consolidated Balance Sheets follows:

| | | | | | | | | | | | | | |

| (In millions) | | December 31

2022 | | September 30

2022 |

| Current assets | | | | |

| Cash and cash equivalents | | $ | 70.5 | | | $ | 59.0 | |

| Receivables, net | | 576.1 | | | 524.3 | |

| Inventories, net | | 296.5 | | | 290.1 | |

| Prepaid expenses and other current assets | | 40.9 | | | 35.0 | |

| | | | |

| | | | |

| Property, plant and equipment, net | | 264.2 | | | 257.4 | |

| | | | |

| Goodwill and intangibles, net | | 139.8 | | | 139.8 | |

| | | | |

| | | | |

| Other noncurrent assets | | 165.6 | | | 158.6 | |

| | | | |

| Current assets held for sale | | $ | 1,553.6 | | | $ | 1,464.2 | |

| Current liabilities | | | | |

| Current portion of long-term debt | | $ | 5.2 | | | $ | — | |

| Trade and other payables | | 216.4 | | | 264.9 | |

| Accrued expenses and other liabilities | | 154.0 | | | 166.9 | |

| Long-term debt | | 28.0 | | | 30.7 | |

| Other current liabilities | | 74.5 | | | 76.8 | |

| Current liabilities held for sale | | $ | 478.1 | | | $ | 539.3 | |

| | | | |

NOTE 3 - FAIR VALUE MEASUREMENTS

The following tables set forth the Company’s financial assets and liabilities that were accounted for at fair value on a recurring basis by level within the fair value hierarchy:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | As of December 31, 2022 |

| (In millions) | | Total | | Level 1 | | Level 2 | | Level 3 | | NAV (a) |

| Cash and cash equivalents | | | | | | | | | | |

| Money market funds | | $ | 0.4 | | | $ | 0.4 | | | $ | — | | | $ | — | | | $ | — | |

| Time deposits | | 8.6 | | | — | | | 8.6 | | | — | | | — | |

| Prepaid expenses and other current assets | | | | | | | | | | |

Currency derivatives (b) | | 2.6 | | | — | | | 2.6 | | | — | | | — | |

| Interest rate swap agreements | | 4.0 | | | — | | | 4.0 | | | — | | | — | |

| Other noncurrent assets | | | | | | | | | | |

| Non-qualified trust funds | | 5.7 | | | — | | | — | | | — | | | 5.7 | |

| Interest rate swap agreements | | 12.0 | | | — | | | 12.0 | | | — | | | — | |

| Total assets at fair value | | $ | 33.3 | | | $ | 0.4 | | | $ | 27.2 | | | $ | — | | | $ | 5.7 | |

| | | | | | | | | | |

| Accrued expenses and other liabilities | | | | | | | | | | |

Currency derivatives (b) | | $ | 2.7 | | | $ | — | | | $ | 2.7 | | | $ | — | | | $ | — | |

| | | | | | | | | | |

| Other noncurrent liabilities | | | | | | | | | | |

| Deferred compensation obligations | | 20.5 | | | — | | | — | | | — | | | 20.5 | |

| Total liabilities at fair value | | $ | 23.2 | | | $ | — | | | $ | 2.7 | | | $ | — | | | $ | 20.5 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | As of September 30, 2022 |

| (In millions) | | Total | | Level 1 | | Level 2 | | Level 3 | | NAV (a) |

| Cash and cash equivalents | | | | | | | | | | |

| Money market funds | | $ | 0.4 | | | $ | 0.4 | | | $ | — | | | $ | — | | | $ | — | |

| Time deposits | | 13.3 | | | — | | | 13.3 | | | — | | | — | |

| Prepaid expenses and other current assets | | | | | | | | | | |

Currency derivatives (b) | | 6.0 | | | — | | | 6.0 | | | — | | | — | |

| Interest rate swap agreements | | 5.2 | | — | | | 5.2 | | — | | | — | |

| Other noncurrent assets | | | | | | | | | | |

| Non-qualified trust funds | | 6.4 | | | — | | | — | | | — | | | 6.4 | |

| Interest rate swap agreements | | 12.6 | | | — | | | 12.6 | | | — | | | — | |

| Total assets at fair value | | $ | 43.9 | | | $ | 0.4 | | | $ | 37.1 | | | $ | — | | | $ | 6.4 | |

| | | | | | | | | | |

| Accrued expenses and other liabilities | | | | | | | | | | |

Currency derivatives (b) | | $ | 5.2 | | | $ | — | | | $ | 5.2 | | | $ | — | | | $ | — | |

| | | | | | | | | | |

| Other noncurrent liabilities | | | | | | | | | | |

| Deferred compensation obligations | | 19.6 | | | — | | | — | | | — | | | 19.6 | |

| Total liabilities at fair value | | $ | 24.8 | | | $ | — | | | $ | 5.2 | | | $ | — | | | $ | 19.6 | |

| | | | | | | | | | |

(a)Funds measured at fair value using the net asset value ("NAV") per share practical expedient have not been classified in the fair value hierarchy.

(b)The Company had outstanding contracts with notional values of $154.5 million and $150.5 million as of December 31, 2022 and September 30, 2022, respectively.

There were no material gains or losses recognized in earnings during the three months ended December 31, 2022 or 2021 related to these assets and liabilities.

Long-term debt

Long-term debt is reported in the Condensed Consolidated Balance Sheets at carrying value, rather than fair value, and is therefore excluded from the disclosure above of financial assets and liabilities measured at fair value within

the condensed consolidated financial statements on a recurring basis. The fair values of the Company's outstanding fixed rate senior notes shown below are based on recent trading values, which are considered Level 2 inputs within the fair value hierarchy.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | December 31, 2022 | | September 30, 2022 |

| (In millions) | | Fair value | | Carrying value (a) | | Unamortized

discounts and

issuance costs | | Fair value | | Carrying value (a) | | Unamortized

discounts and

issuance costs |

| 2030 Notes | | $ | 586.1 | | | $ | 593.9 | | | $ | (6.1) | | | $ | 568.5 | | | $ | 593.7 | | | $ | (6.3) | |

| 2031 Notes | | 433.1 | | | 529.4 | | | (5.6) | | | 400.5 | | | 529.2 | | | (5.8) | |

| Total | | $ | 1,019.2 | | | $ | 1,123.3 | | | $ | (11.7) | | | $ | 969.0 | | | $ | 1,122.9 | | | $ | (12.1) | |

| | | | | | | | | | | | |

(a)Carrying values shown are net of unamortized discounts and debt issuance costs.

Refer to Note 5 for details of these senior notes as well as Valvoline's other debt instruments that have variable interest rates with carrying amounts that approximate fair value.

NOTE 4 - BUSINESS COMBINATIONS

The Company acquired 7 service center stores in single and multi-store transactions for an aggregate purchase price of $9.6 million during the three months ended December 31, 2022. These acquisitions contribute to Valvoline's retail presence in key North American markets and its increased footprint to 1,746 system-wide service center stores.

During the three months ended December 31, 2021, the Company acquired 12 service center stores in single and multi-store transactions for an aggregate purchase price of $13.6 million.

The Company’s acquisitions are accounted for as business combinations. A summary follows of the aggregate cash consideration paid and the total assets acquired and liabilities assumed for the three months ended December 31:

| | | | | | | | | | | | | | |

| (In millions) | | 2022 | | 2021 |

| | | | |

| | | | |

| Inventories | | $ | 0.3 | | | $ | — | |

| | | | |

Property, plant and equipment (a) | | 2.0 | | | 2.3 | |

| Operating lease assets | | 2.1 | | | 4.3 | |

| | | | |

Goodwill (b) | | 6.1 | | | 11.2 | |

Intangible assets (c) | | | | |

Reacquired franchise rights (d) | | 2.3 | | | — | |

| | | | |

| | | | |

| Other | | 0.1 | | | 0.1 | |

| | | | |

| | | | |

| Other current liabilities | | (0.2) | | | (0.2) | |

| Operating lease liabilities | | (2.0) | | | (4.1) | |

| Other noncurrent liabilities | | (1.1) | | | — | |

| Total net assets acquired | | $ | 9.6 | | | $ | 13.6 | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

(a)Includes $1.1 million of finance lease assets in property, plant and equipment and finance lease liabilities of $1.1 million in noncurrent liabilities for leases acquired during the three months ended December 31, 2022. No finance lease assets or liabilities were acquired during the three months ended December 31, 2021.

(b)Goodwill is generally expected to be deductible for income tax purposes and is primarily attributed to the operational synergies and potential growth expected to result in economic benefits in the respective markets of the acquisitions.

(c)Intangible assets acquired during the three months ended December 31, 2022 and 2021 have weighted average amortization periods of 9 and 5 years, respectively.

(d)Prior to the acquisition of former franchise service center stores, the Company licensed the right to operate franchised service centers, including the use of Valvoline's trademarks and trade name. In connection with these acquisitions, Valvoline reacquired those rights and recognized separate definite-lived reacquired franchise rights intangible assets, which are being amortized on a straight-line basis over the weighted average remaining term of approximately 10 years for the rights reacquired in fiscal 2023. The effective settlement of these arrangements resulted in no settlement gain or loss as the contractual terms were at market.

The fair values above are preliminary for up to one year from the date of acquisition as they may be subject to measurement period adjustments if new information is obtained about facts and circumstances that existed as of the acquisition date. The Company does not currently expect any material changes to the preliminary purchase price allocations for acquisitions completed during the last twelve months.

NOTE 5 - DEBT

The following table summarizes Valvoline’s total debt as of:

| | | | | | | | | | | | | | |

| (In millions) | | December 31

2022 | | September 30

2022 |

| 2031 Notes | | $ | 535.0 | | | $ | 535.0 | |

| 2030 Notes | | 600.0 | | | 600.0 | |

| Term Loan | | 445.6 | | | 460.0 | |

Revolver (a) | | 145.0 | | | — | |

Trade Receivables Facility (b) | | 167.0 | | | 105.0 | |

| | | | |

| | | | |

| Debt issuance costs and discounts | | (12.0) | | | (12.4) | |

| Total debt | | 1,880.6 | | | 1,687.6 | |

| | | | |

| Current portion of long-term debt | | 224.5 | | | 162.5 | |

| Long-term debt | | $ | 1,656.1 | | | $ | 1,525.1 | |

| | | | | |

(a)As of December 31, 2022, the total borrowing capacity remaining under the $475.0 million revolving credit facility was $324.6 million due to a reduction of $145.0 million for borrowings and $5.4 million for letters of credit outstanding.

(b)These outstanding accounts receivable substantially relate to the Global Products business and were reported in Current assets held for sale, with a smaller portion reported within Receivables, net in the Company’s Condensed Consolidated Balance Sheets. The Trade Receivables Facility had $8.0 million of borrowing capacity remaining and the wholly-owned financing subsidiary owned $357.6 million of outstanding accounts receivable as of December 31, 2022.

As of December 31, 2022, Valvoline was in compliance with all existing covenants under its long-term borrowings.

Senior Credit Agreement

Key terms and conditions

In December 2022, Valvoline amended the Senior Credit Agreement (the “2022 Credit Agreement”), which will be effective upon the sale of the Global Products business. The 2022 Credit Agreement will provide an aggregate principal amount of $950.0 million in senior secured credit facilities comprised of (i) a five-year $475.0 million term loan facility (the “Term Loan”) and (ii) a five-year $475.0 million revolving credit facility (the “Revolver”), including a $100.0 million letter of credit sublimit.

The principal amount of the Term Loan under the 2022 Credit Agreement will be required to be repaid in quarterly installments of approximately $5.9 million beginning with the first fiscal quarter after the sale of Global Products, with the remainder due at maturity and prepayment required in the amount of the net cash proceeds from certain events. Amounts outstanding under the 2022 Credit Agreement may be prepaid at any time, and from time to time, in whole or part, without premium or penalty. At Valvoline’s option, amounts outstanding under the 2022 Credit Agreement will bear interest at either SOFR or an alternative base rate, in each case plus the applicable interest rate margin. The interest rate will fluctuate between SOFR plus 1.375% per year and SOFR plus 2.250% per year (or between the alternative base rate plus 0.375% per year and the alternative base rate plus 1.250% per year), based upon Valvoline’s consolidated total net leverage ratio.

Effective upon completion of the sale of the Global Products business, proceeds from the borrowings under the 2022 Credit Agreement are expected to be used to pay in full the principal amounts of the current Term Loan and Revolver borrowings under the existing Credit Agreement, in addition to accrued and unpaid interest and fees, as well as expenses related to the amendment. The remaining proceeds from the 2022 Credit Agreement, including the capacity under its Revolver, are expected to fund general corporate purposes and working capital needs.

Covenants and guarantees

The 2022 Credit Agreement contains covenants and provisions that will be effective upon the sale of Global Products. These terms and conditions are consistent with the existing Credit Agreement, including the maintenance of financial covenants as of the end of each fiscal quarter and guarantees from certain of Valvoline’s existing and future subsidiaries.

NOTE 6 – INCOME TAXES

Income tax provisions for interim quarterly periods are based on an estimated annual effective income tax rate calculated separately from the effect of significant, infrequent or unusual discrete items related specifically to interim periods. The following summarizes income tax expense and the effective tax rate in each interim period:

| | | | | | | | | | | | | | | | | | |

| | Three months ended | | |

| | December 31 | | |

| (In millions) | | 2022 | | 2021 | | | | |

| Income tax (benefit) expense | | $ | (20.1) | | | $ | 10.1 | | | | | |

| Effective tax rate percentage | | (291.3) | % | | 22.8 | % | | | | |

The favorable changes in the income tax provision and effective tax rate in the three months ended December 31, 2022 were primarily attributed to release of valuation allowances due to the change in expectations regarding the utilization of certain legacy tax attributes as described further below.

Legacy tax attributes

In connection with amending the Tax Matters Agreement, management expects the Company is currently more likely than not to realize certain legacy tax attributes that were transferred from its former parent prior to Valvoline's initial public offering in late fiscal 2016. As a result, the Company recognized an income tax benefit of $26.5 million during the three months ended December 31, 2022 in connection with releasing its valuation allowance. Additionally, Valvoline recognized $24.4 million of expense within Net legacy and separation-related expenses in the Condensed Consolidated Statement of Comprehensive Income during the three months ended December 31, 2022 to reflect its increased estimated indemnity obligation due to its former parent company as a result of the terms of the amended Tax Matters Agreement.

NOTE 7 – EMPLOYEE BENEFIT PLANS

The following table summarizes the components of pension and other postretirement benefit costs (income):

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Pension benefits | | Other postretirement benefits |

| | |

| (In millions) | | 2022 | | 2021 | | 2022 | | 2021 |

| Three months ended December 31 | | | | | | | | |

| | | | | | | | |

| Interest cost | | $ | 20.6 | | | $ | 10.8 | | | $ | 0.4 | | | $ | 0.2 | |

| Expected return on plan assets | | (16.8) | | | (19.7) | | | — | | | — | |

| Amortization of prior service credits | | — | | | — | | | (0.5) | | | (0.6) | |

| | | | | | | | |

| Net periodic benefit costs (income) | | $ | 3.8 | | | $ | (8.9) | | | $ | (0.1) | | | $ | (0.4) | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

NOTE 8 – LITIGATION, CLAIMS AND CONTINGENCIES

From time to time, Valvoline is party to lawsuits, claims and other legal proceedings that arise in the ordinary course of business. The Company establishes liabilities for the outcome of such matters where losses are determined to be probable and reasonably estimable. Where appropriate, the Company has recorded liabilities with respect to these matters, which were not material for the periods presented as reflected in the condensed consolidated financial statements herein. There are certain claims and legal proceedings pending where loss is not determined to be

probable or reasonably estimable, and therefore, accruals have not been made. In addition, Valvoline discloses matters when management believes a material loss is at least reasonably possible.

In all instances, management has assessed each matter based on current information available and made a judgment concerning its potential outcome, giving due consideration to the amount and nature of the claim and the probability of success. The Company believes it has established adequate accruals for liabilities that are probable and reasonably estimable.

Although the ultimate resolution of these matters cannot be predicted with certainty and there can be no assurances that the actual amounts required to satisfy liabilities from these matters will not exceed the amounts reflected in the condensed consolidated financial statements, based on information available at this time, it is the opinion of management that such pending claims or proceedings will not have a material adverse effect on its condensed consolidated financial statements.

NOTE 9 - EARNINGS PER SHARE

The following table summarizes basic and diluted earnings per share:

| | | | | | | | | | | | | | |

| | Three months ended |

| | December 31 |

| (In millions, except per share amounts) | | 2022 | | 2021 |

| Numerator | | | | |

| Income from continuing operations | | $ | 27.0 | | | $ | 34.2 | |

| Income from discontinued operations | | 54.9 | | | 52.8 | |

| Net income | | $ | 81.9 | | | $ | 87.0 | |

| | | | |

| Denominator | | | | |

| Weighted average common shares outstanding | | 175.2 | | | 180.5 | |

Effect of potentially dilutive securities (a) | | 1.1 | | | 1.5 | |

| Weighted average diluted shares outstanding | | 176.3 | | | 182.0 | |

| | | | | |

| Basic earnings per share | | | | |

| Continuing operations | | $ | 0.16 | | | $ | 0.19 | |

| Discontinued operations | | 0.31 | | | 0.29 | |

| Basic earnings per share | | $ | 0.47 | | | $ | 0.48 | |

| | | | |

| Diluted earnings per share | | | | |

| Continuing operations | | $ | 0.15 | | | $ | 0.19 | |

| Discontinued operations | | 0.31 | | | 0.29 | |

| Diluted earnings per share | | $ | 0.46 | | | $ | 0.48 | |

|

(a)There were 0.2 million and 0.1 million outstanding stock appreciation rights not included in the computation of diluted earnings per share in the three months ended December 31, 2022 and 2021, respectively, because the effect would have been antidilutive.

NOTE 10 - SUPPLEMENTAL FINANCIAL INFORMATION

Cash, cash equivalents and restricted cash

The following provides a reconciliation of cash, cash equivalents and restricted cash reported within the Condensed Consolidated Statements of Cash Flows to the Condensed Consolidated Balance Sheets:

| | | | | | | | | | | | | | | | | | | | |

| (In millions) | | December 31

2022 | | September 30

2022 | | December 31

2021 |

| Cash and cash equivalents - continuing operations | | $ | 21.0 | | | $ | 23.4 | | | $ | 42.8 | |

Cash and cash equivalents - discontinued operations (a) | | 70.5 | | | 59.0 | | | 108.9 | |

| | | | | | |

Restricted cash - discontinued operations (a) | | 1.5 | | | 1.5 | | | 2.0 | |

| Total cash, cash equivalents and restricted cash | | $ | 93.0 | | | $ | 83.9 | | | $ | 153.7 | |

| | | | | | |

(a)Included in Current assets held for sale with the Condensed Consolidated Balance Sheets.

Accounts and other receivables

The following summarizes Valvoline’s accounts and other receivables in the Condensed Consolidated Balance Sheets as of:

| | | | | | | | | | | | | | |

| (In millions) | | December 31

2022 | | September 30

2022 |

| | | | |

| Trade | | $ | 56.4 | | | $ | 56.2 | |

| Other | | 4.1 | | | 14.5 | |

| | | | |

| Receivables, gross | | 60.5 | | | 70.7 | |

| Allowance for credit losses | | (3.6) | | | (4.6) | |

| Receivables, net | | $ | 56.9 | | | $ | 66.1 | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

Revenue recognition

The following disaggregates the Company’s net revenues by timing of revenue recognized:

| | | | | | | | | | | | | | | | | | |

| | Three months ended | | |

| | December 31 | | |

| (In millions) | | 2022 | | 2021 | | | | |

| Net revenues transferred at a point in time | | $ | 317.2 | | | $ | 273.7 | | | | | |

| Franchised revenues transferred over time | | 15.6 | | | 13.6 | | | | | |

| Net revenues | | $ | 332.8 | | | $ | 287.3 | | | | | |

The following table summarizes net revenues by category:

| | | | | | | | | | | | | | | | | | |

| | Three months ended | | |

| | December 31 | | |

| (In millions) | | 2022 | | 2021 | | | | |

| | | | | | | | |

| Oil changes and related fees | | $ | 247.2 | | | $ | 211.5 | | | | | |

| Non-oil changes and related fees | | 69.8 | | | 58.3 | | | | | |

Franchise fees and other (a) | | 15.8 | | | 17.5 | | | | | |

| Total | | $ | 332.8 | | | $ | 287.3 | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

(a)Includes $0.2 million and $3.7 million of net revenues associated with suspended operations.

NOTE 11 – SUBSEQUENT EVENTS

Share repurchases

The Company repurchased 1.6 million shares for an aggregate amount of $54.9 million from January 1, 2023 through January 31, 2023, utilizing the remaining $43.0 million in aggregate share repurchase authority under the May 17, 2021 Board authorization to repurchase up to $300.0 million of common stock (the “2021 Share Repurchase Authorization”) and leaving the Company with $1,588.1 million in aggregate share repurchase authority remaining under the November 15, 2022 Board authorization to repurchase up to $1.6 billion of common stock (the “2022 Share Repurchase Authorization”) as of February 1, 2023.

FORWARD-LOOKING STATEMENTS

Certain statements in this Quarterly Report on Form 10-Q, other than statements of historical fact, including estimates, projections, and statements related to the Company’s business plans and operating results, are forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Valvoline has identified some of these forward-looking statements with words such as “anticipates,” “believes,” “expects,” “estimates,” “is likely,” “predicts,” “projects,” “forecasts,” “may,” “will,” “should,” and “intends” and the negative of these words or other comparable terminology. These forward-looking statements are based on Valvoline’s current expectations, estimates, projections, and assumptions as of the date such statements are made and are subject to risks and uncertainties that may cause results to differ materially from those expressed or implied in the forward-looking statements. Factors that might cause such differences include, but are not limited to, those discussed under the headings “Risk Factors,” “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” and “Quantitative and Qualitative Disclosures about Market Risk” in this Quarterly Report on Form 10-Q and Valvoline’s most recently filed Annual Report on Form 10-K. Valvoline assumes no obligation to update or revise these forward-looking statements for any reason, even if new information becomes available in the future, unless required by law.

| | | | | |

| Index to Management’s Discussion and Analysis of Financial Condition and Results of Operations | Page |

| |

| |

| |

| |

| |

| |

| |

ITEM 2. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

The following discussion and analysis should be read in conjunction with the Annual Report on Form 10-K for the fiscal year ended September 30, 2022, as well as the condensed consolidated financial statements and the accompanying Notes to Condensed Consolidated Financial Statements included in Item 1 of Part I in this Quarterly Report on Form 10-Q.

BUSINESS OVERVIEW AND PURPOSE

The quick, easy, and trusted name in preventive vehicle maintenance, Valvoline leads the industry with vehicle service innovations that simplify customer’s lives and take the worry out of car care. With average customer ratings that indicate high levels of service satisfaction, Valvoline has built a new model for transparency in vehicle maintenance. From the signature 15-minute stay-in-your-car oil change to cabin air filters to battery replacements to tire rotations, the Company’s model offers maintenance solutions for all types of vehicles. The Company operates and franchises more than 1,700 service center locations and is the second and third largest chain in the United States (“U.S.”) and Canada, respectively, by number of stores through its Valvoline Instant Oil ChangeSM and Great Canadian Oil Change retail locations.

Valvoline is focused on expanding its footprint and driving a best-in-class customer experience, while evolving its service offerings to capture growing opportunities in the market by growing non-oil change services, services for the future of mobility, and pursuing fleet service solutions to address medium and heavy-duty vehicles that require comprehensive maintenance needs.

BUSINESS STRATEGY

Continuing Valvoline’s shift to services as a trusted leader in preventive automotive maintenance, the Company will continue growing through ongoing improvements in service to drive same-store sales and investments in network expansion, while continuing to develop capabilities for an evolving car parc. Valvoline’s strategic initiatives include:

•Continuing to capture increased market share and drive non-oil change revenue growth in existing stores by building on Valvoline’s strong foundation in technology and data, which enables the Company to be an industry leader in automobile aftermarket services and makes vehicle care easy for customers;

•Aggressively growing the retail footprint with company-operated store growth and an increased emphasis on franchisee unit growth;

•Developing capabilities to capture new customers through services expansion focused on fleet manager needs and needs of the evolving car parc; and

•Executing the sale of Global Products to create value for the Company's shareholders and best position the continuing operations for long-term success.

RECENT DEVELOPMENTS

Strategic separation

In fiscal 2022, the Company entered into a definitive agreement to sell its Global Products business to Aramco for a cash purchase price of $2.65 billion. Valvoline is focused on finalizing the regulatory and administrative steps necessary to complete the pre-closing conditions and complete the Transaction, which management continues to expect to occur in early calendar year 2023. Refer to Note 2 of the Notes to Condensed Consolidated Financial Statements included in Item 1 of Part I in this Quarterly Report on Form 10-Q for further details regarding the Global Products business.

COVID-19 update

Valvoline has substantially maintained its operations, demonstrating growth and strong results, while managing through the effects of the COVID-19 global pandemic. Valvoline’s offices and locations have established protocols based on continuous monitoring of the circumstances and trend data surrounding the pandemic.

Management is unable to reasonably quantify the impact of COVID-19 on its current year results. The continually evolving COVID-19 pandemic remains uncertain and while the Company cannot predict the duration or scale of the pandemic, it will continue to monitor the ongoing impacts and its effects on business, results of operations, and liquidity. The Company will continue to implement and adjust its procedures and processes as needed. For more information, refer to Risk Factors included in Item 1A of Part I in Valvoline’s Annual Report on Form 10-K for the fiscal year ended September 30, 2022.

FIRST FISCAL QUARTER 2023 OVERVIEW

The following were the significant events for the first fiscal quarter of 2023, each of which is discussed more fully in this Quarterly Report on Form 10-Q:

•Valvoline’s net revenues grew 16% over the prior year period driven by system-wide same-store sales ("SSS") growth of 11.9% and the addition of 111 net new stores to the system from the prior year.

•Net income from continuing operations declined 21% to $27.0 million and diluted earnings per share decreased 21% to $0.15 in the three months ended December 31, 2022 compared to the prior year, primarily related to increased pension and other postretirement non-service expense.

•Adjusted EBITDA increased 1% over the prior year period due to strong top-line growth offset by an inflationary cost environment as well as investments in selling, general and administrative expenses.

•The Company returned $109.2 million to its shareholders during the quarter through payment of a $0.125 per share cash dividend totaling $21.8 million and repurchases of 2.9 million shares of Valvoline common stock for $87.4 million.

Use of Non-GAAP Measures

To aid in the understanding of Valvoline’s ongoing business performance, certain items within this document are presented on an adjusted, non-GAAP basis. These non-GAAP measures have limitations as analytical tools and should not be considered in isolation from, or as an alternative to, or more meaningful than, the financial statements presented in accordance with U.S. GAAP. The financial results presented in accordance with U.S. GAAP and reconciliations of non-GAAP measures included within this Quarterly Report on Form 10-Q should be carefully evaluated.

The following are the non-GAAP measures management has included and how management defines them:

•EBITDA - net income/loss, plus income tax expense/benefit, net interest and other financing expenses, and depreciation and amortization;

•Adjusted EBITDA - EBITDA adjusted for certain unusual, infrequent or non-operational activity not directly attributable to the underlying business, which management believes impacts the comparability of operational results between periods ("key items," as further described below);

•Adjusted EBITDA margin - adjusted EBITDA divided by net revenues;

•Free cash flow - cash flows from operating activities less capital expenditures and certain other adjustments as applicable; and

•Discretionary free cash flow - cash flows from operating activities less maintenance capital expenditures and certain other adjustments as applicable.

These measures are not prepared in accordance with U.S. GAAP and management believes the use of non-GAAP measures provides a useful supplemental presentation of Valvoline's operating performance, enables comparison of financial trends and results between periods where certain items may vary independent of business performance, and allows for transparency with respect to key metrics used by management in operating the business and measuring performance. The non-GAAP information used by management may not be comparable to similar measures disclosed by other companies, because of differing methods used in calculating such measures. For a reconciliation of the most comparable U.S. GAAP measures to the non-GAAP measures, refer to the “Results of Operations” and “Financial Position, Liquidity and Capital Resources” sections below.

Management believes EBITDA measures provide a meaningful supplemental presentation of Valvoline’s operating performance due to the depreciable assets associated with the nature of the Company’s operations and income tax and interest costs related to Valvoline’s tax and capital structures, respectively. Adjusted EBITDA measures exclude the impact of key items, which consist of income or expenses associated with certain unusual, infrequent or nonoperational activity not directly attributable to the underlying business that management believes impacts the comparability of operational results between periods. Adjusted EBITDA measures enable comparison of financial trends and results between periods where key items may vary independent of business performance. Key items are often related to legacy matters or market-driven events considered by management to be outside the comparable operational performance of the business.

Key items may consist of adjustments related to: legacy businesses, including Valvoline’s separation from its former parent company and the impacts of related indemnities; the separation of Valvoline’s current businesses; significant acquisitions or divestitures; restructuring-related matters; and other matters that are non-operational or unusual in nature.

Key items also include net pension and other postretirement plan expense/income: Includes several elements impacted by changes in plan assets and obligations that are primarily driven by changes in the debt and equity markets, as well as those that are predominantly legacy in nature and related to prior service to the Company from employees (e.g., retirees, former employees, and current employees with frozen benefits). These elements include (i) interest cost, (ii) expected return on plan assets, (iii) actuarial gains/losses, and (iv) amortization of prior service

cost/credit. Significant factors that can contribute to changes in these elements include changes in discount rates used to remeasure pension and other postretirement obligations on an annual basis or upon a qualifying remeasurement, differences between actual and expected returns on plan assets, and other changes in actuarial assumptions, such as the life expectancy of plan participants. Accordingly, management considers that these elements are more reflective of changes in current conditions in global markets (in particular, interest rates), outside the operational performance of the business, and are also primarily legacy amounts that are not directly related to the underlying business and do not have an immediate, corresponding impact on the compensation and benefits provided to eligible employees for current service. Adjusted EBITDA includes the costs of benefits provided to employees for current service, including pension and other postretirement service costs.

Details with respect to the composition of key items recognized during the respective periods presented herein are set forth below in the “EBITDA and Adjusted EBITDA” section of “Results of Operations” that follows.

Management uses free cash flow and discretionary free cash flow as additional non-GAAP metrics of cash flow generation. By including capital expenditures and certain other adjustments, as applicable, management is able to provide an indication of the ongoing cash being generated that is ultimately available for both debt and equity holders as well as other investment opportunities. Free cash flow includes the impact of capital expenditures, providing a supplemental view of cash generation. Discretionary free cash flow includes the impact of maintenance capital expenditures, which are routine uses of cash that are necessary to maintain the Company's operations and provides a supplemental view of cash flow generation to maintain operations before discretionary investments in growth. Free cash flow and discretionary free cash flow have certain limitations, including that they do not reflect adjustments for certain non-discretionary cash flows, such as mandatory debt repayments.

Key Business Measures

Valvoline tracks its operating performance and manages its business using certain key measures, including system-wide, company-operated and franchised store counts and SSS and system-wide store sales. Management believes these measures are useful to evaluating and understanding Valvoline’s operating performance and should be considered as supplements to, not substitutes for, Valvoline's net revenues and operating income, as determined in

accordance with U.S. GAAP.

Net revenues are influenced by the number of service center stores and the business performance of those stores. Stores are considered open upon acquisition or opening for business. Temporary store closings remain in the respective store counts with only permanent store closures reflected in the activity and end of period store counts. SSS is defined as net revenues by U.S. stores (company-operated, franchised and the combination of these for system-wide SSS), with new stores, including franchised conversions, excluded from the metric until the completion of their first full fiscal year in operation as this period is generally required for new store sales levels to begin to normalize.

Net revenues are limited to sales at company-operated stores, in addition to royalties and other fees from independent franchised and Express Care stores. Although Valvoline does not recognize store-level sales from franchised stores as net revenues in its Condensed Consolidated Statements of Comprehensive Income, management believes system-wide and franchised SSS comparisons, store counts, and total system-wide store sales are useful to assess market position relative to competitors and overall operating performance.

RESULTS OF OPERATIONS

The following summarizes the results of the Company’s continuing operations for the period ended December 31:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three months ended December 31 | | | | | | |

| | 2022 | | 2021 | | | | | | | | | | | | |

| (In millions) | | Amount | | % of Net revenues | | Amount | | % of Net revenues | | | | | | |

| Net revenues | | $ | 332.8 | | | 100.0% | | $ | 287.3 | | | 100.0% | | | | | | | | | | | | |

| Gross profit | | $ | 118.8 | | | 35.7% | | $ | 112.2 | | | 39.1% | | | | | | | | | | | | |

| Net operating expenses | | $ | 89.5 | | | 26.9% | | $ | 60.2 | | | 21.0% | | | | | | | | | | | | |

| Operating income | | $ | 29.3 | | | 8.8% | | $ | 52.0 | | | 18.1% | | | | | | | | | | | | |

| Income from continuing operations | | $ | 27.0 | | | 8.1% | | $ | 34.2 | | | 11.9% | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | |

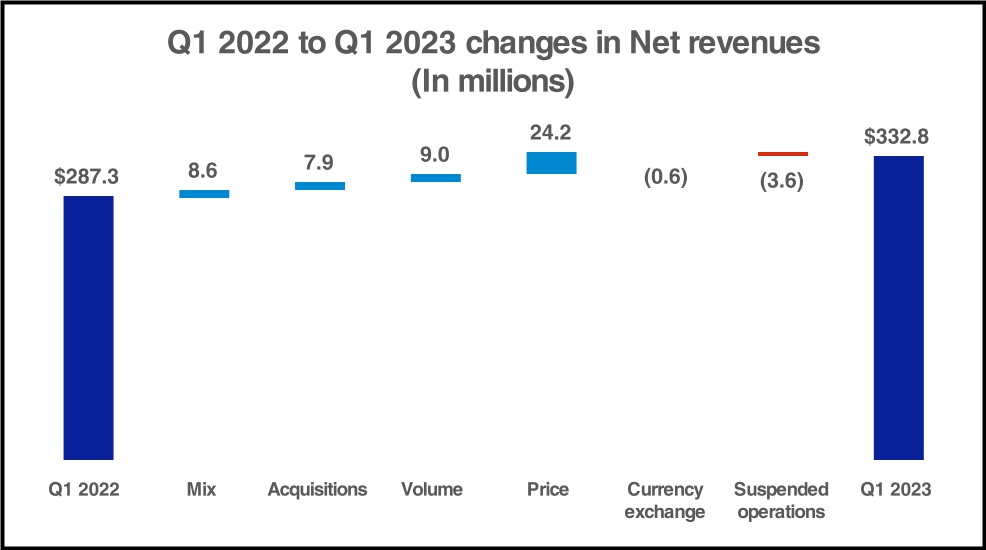

Net revenues

Net revenues increased $45.5 million, or 16%, over the prior year period due to system-wide SSS growth and acquisitions. System-wide SSS grew 11.9% compared to the prior year largely from increased ticket as a result of pricing actions taken during the prior fiscal year and increased premiumization and non-oil change services supported by investments in process execution. Additionally, net revenue growth was aided by continued gains in vehicles served and the addition of 111 net new stores over the prior year. The following reconciles the year-over-year change in net revenues:

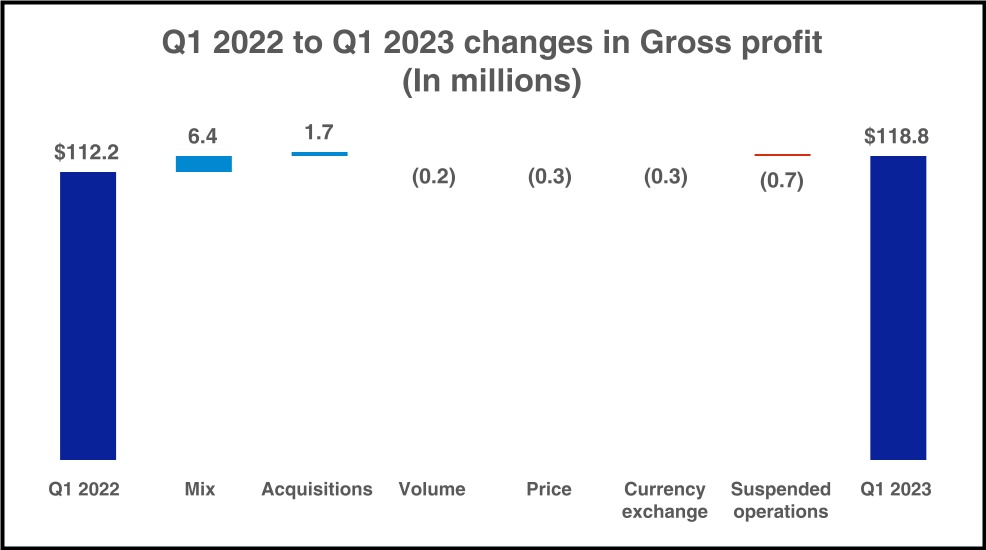

Gross profit

Gross profit increased $6.6 million, or 6%, for the three months ended December 31, 2022 compared to the prior year driven by increased non-oil change services and premiumization, in addition to unit growth through acquisitions. These benefits more than offset inflationary product and labor costs and expenses due to company store growth over the prior year that combined to pressure the top-line expansion from pricing and volumes. The following reconciles the year-over-year change in gross profit:

The decline in gross profit margin compared to the prior year period was primarily the result of the dilutive impact from passing through cost increases in company store operations, in addition to increased labor and product expenses, which included higher additive costs and delivery fees. To a lesser extent, a higher relative weighting of company operations also unfavorably impacted gross profit margins year-over-year.

Net operating expenses

Details of the components of net operating expenses are summarized below for the periods ended December 31:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three months ended December 31 | | |

| | 2022 | | 2021 | | | | | | | | |

| (In millions) | | Amount | | % of Net revenues | | Amount | | % of Net revenues | | | | |

| Selling, general and administrative expenses | | $ | 66.0 | | | 19.8 | % | | $ | 60.2 | | | 21.0 | % | | | | | | | | |

| Net legacy and separation-related expenses | | 25.4 | | | 7.6 | % | | 2.8 | | | 1.0 | % | | | | | | | | |

| Other income, net | | (1.9) | | | (0.5) | % | | (2.8) | | | (1.0) | % | | | | | | | | |

| Net operating expenses | | $ | 89.5 | | | 26.9 | % | | $ | 60.2 | | | 21.0 | % | | | | | | | | |

Selling, general and administrative expenses increased $5.8 million in the three months ended December 31, 2022 compared to the prior year period. This increase was driven by investments in advertising and labor to support future growth, including the expanded store footprint and attraction and retention of customers.

Net legacy and separation-related expenses increased $22.6 million compared to the prior year primarily due to the increased indemnity obligation of $24.4 million in the three months ended December 31, 2022 as a result of the amendment of the Tax Matters Agreement in January 2023 and the Company’s expected utilization of certain legacy tax attributes, which are payable to Valvoline’s former parent company.

Other income, net decreased $0.9 million due to an economic incentive realized in the prior year that did not recur in the current year period.

Net pension and other postretirement plan expense (income)

Net pension and other postretirement plans had increased expense of $13.0 million in the three months ended December 31, 2022 compared to the prior year period. The increase was primarily due to higher interest costs of the rate environment as a result of the most recent annual remeasurement of the plans. The higher interest costs more than offset recurring expected returns on plan assets, which declined based on prior year asset returns and a lower risk asset mix.

Net interest and other financing expenses

Net interest and other financing expenses increased $1.7 million during the three months ended December 31, 2022 due to higher outstanding borrowings compared to the prior year.

Income tax (benefit) expense

The following table summarizes income tax (benefit) expense and the effective tax rate:

| | | | | | | | | | | | | | | | | | |

| | Three months ended December 31 | | |

| (In millions) | | 2022 | | 2021 | | | | |

| Income tax (benefit) expense | | $ | (20.1) | | | $ | 10.1 | | | | | |

| Effective tax rate percentage | | (291.3) | % | | 22.8 | % | | | | |

The favorable changes in the income tax provision and effective tax rate in the three months ended December 31, 2022 were primarily attributed to release of valuation allowances due to the change in expectations regarding the utilization of certain legacy tax attributes as described further below. The Company expects an estimated effective tax rate of approximately 25.5% to 26.5% in fiscal 2023, exclusive of discrete activity.

Legacy tax attributes

In connection with amending the Tax Matters Agreement, management expects the Company is currently more likely than not to realize certain legacy tax attributes that were transferred from its former parent prior to Valvoline's initial public offering in late fiscal 2016. As a result, the Company recognized an income tax benefit of $26.5 million during the three months ended December 31, 2022 in connection with releasing its valuation allowance. Additionally, Valvoline recognized $24.4 million of expense within Net legacy and separation-related expenses in the Condensed Consolidated Statement of Comprehensive Income during the three months ended December 31, 2022 to reflect its increased estimated indemnity obligation due to its former parent company as a result of the terms of the amended Tax Matters Agreement. Payments of the indemnity obligation are currently expected to begin in future periods of fiscal 2023 as management amends its related income tax returns and begins reflecting utilization of these legacy tax attributes.

Income from discontinued operations

Income from discontinued operations for the three months ended December 31, are as follows:

| | | | | | | | | | | | | | |

| (In millions) | | 2022 | | 2021 |

| Income from discontinued operations | | $ | 54.9 | | | $ | 52.8 | |

Income from discontinued operations increased $2.1 million in the three months ended December 31, 2022 compared to the prior year period primarily driven by strong top-line growth. Growth in revenues were more than offset by increased costs, including those driven by the inflationary environment, as well as those related to the divestiture of the Global Products business; specifically, expenses incurred to consummate the separation of $6.2 million and income tax expense of $4.9 million related to the current estimated book-tax basis differences in the non-U.S. entities that will be sold with the Global Products business.

The sale of the Global Products business remains on track with closing expected in early calendar year 2023. Refer to Note 2 for further information.

Continuing operations EBITDA and Adjusted EBITDA

The following table reconciles Income from continuing operations to EBITDA and Adjusted EBITDA:

| | | | | | | | | | | | | | | | | | |

| | Three months ended

December 31 | | |

| (In millions) | | 2022 | | 2021 | | | | |

| Income from continuing operations | | $ | 27.0 | | | $ | 34.2 | | | | | |

| Income tax (benefit) expense | | (20.1) | | | 10.1 | | | | | |

| Net interest and other financing expenses | | 18.7 | | | 17.0 | | | | | |

| Depreciation and amortization | | 18.5 | | | 16.9 | | | | | |

| EBITDA | | 44.1 | | | 78.2 | | | | | |

Net pension and other postretirement plan expense (income) (a) | | 3.7 | | | (9.3) | | | | | |

| Net legacy and separation-related expenses | | 25.4 | | | 2.8 | | | | | |

| Information technology transition costs | | 0.3 | | | 1.0 | | | | | |

| Suspended operations | | (0.2) | | | (0.3) | | | | | |

| Adjusted EBITDA from continuing operations | | $ | 73.3 | | | $ | 72.4 | | | | | |

| | | | | | | | | |

(a)Net pension and other postretirement plan expense (income) includes remeasurement gains and losses, when applicable, and recurring non-service pension and other postretirement net periodic income, which consists of interest cost, expected return on plan assets and amortization of prior service credits. Refer to Note 7 in the Notes to Condensed Consolidated Financial Statements in Item 1 of Part I in this Quarterly Report on Form 10-Q for further details.

Adjusted EBITDA from continuing operations increased for the three months ended December 31, 2022 compared to the prior year period driven by robust SSS growth across the system primarily due to ticket and aided by continued gains in vehicles served. These improvements led to a $0.9 million increase in adjusted EBITDA year-over-year, which was pressured by an inflationary cost environment and investments in the business.

FINANCIAL POSITION, LIQUIDITY AND CAPITAL RESOURCES

Overview

The Company closely manages its liquidity and capital resources. Valvoline’s liquidity requirements depend on key variables, including the level of investment needed to support business strategies, the performance of the business, capital expenditures, borrowing arrangements, and working capital management. Capital expenditures, acquisitions, share repurchases, and dividend payments are components of the Company’s cash flow and capital management strategy, which to a large extent, can be adjusted in response to economic and other changes in the business environment. The Company has a disciplined approach to capital allocation, which focuses on investing in key priorities that support Valvoline’s business and growth strategies and returning capital to shareholders, while funding ongoing operations.

Continuing operations cash flows

Valvoline’s continuing operations cash flows as reflected in the Consolidated Statements of Cash Flows are summarized as follows for the three months ended December 31:

| | | | | | | | | | | | | | |

| (In millions) | | 2022 | | 2021 |

| | | | |

| | | | |

| Cash provided by (used in): | | | | |

| Operating activities | | $ | 48.5 | | | $ | 37.7 | |

| Investing activities | | $ | (48.4) | | | $ | (42.7) | |

| Financing activities | | $ | 12.5 | | | $ | (62.9) | |

| | | | |

| | | | |

| | | | |

| | | | |

Operating activities

The increase in cash flows from continuing operations provided by operating activities of $10.8 million from the prior year was due to favorable changes in net working capital, primarily receivables and payables, which were partially offset by increased interest and tax payments during the current year.

Investing activities

The increase in cash flows used in investing activities of $5.7 million from the prior year was primarily due to increased capital expenditures of $7.9 million, driven by growth investments, namely new store construction, and lower net repayments of franchisee loans receivable of $3.5 million. The combination of these changes increased cash flows used in investing activities and were partially offset by lower current year acquisition activity of $4.0 million.

Financing activities

The decrease in cash flows used in financing activities of $75.4 million from the prior year was primarily due to increased net proceeds from current year net borrowings of $130.6 million that were used for general corporate purposes and funding working capital needs. This increased source of cash from the prior year was partially offset by returning $55.9 million more in cash to shareholders through increased share repurchases.

Continuing operations free cash flow

The following sets forth free cash flow and discretionary free cash flow and reconciles cash flows from operating activities to both measures. These free cash flow measures have certain limitations, including that they do not reflect adjustments for certain non-discretionary cash flows, such as mandatory debt repayments. Refer to the “Use of Non-GAAP Measures” section included above in this Item 2 for additional information regarding these non-GAAP measures.

| | | | | | | | | | | | | | |

| | Three months ended

December 31 |

| (In millions) | | 2022 | | 2021 |

| Cash flows provided by operating activities | | $ | 48.5 | | | $ | 37.7 | |

| Less: Maintenance capital expenditures | | (4.3) | | | (4.2) | |

| Discretionary free cash flow | | 44.2 | | | 33.5 | |

| Less: Growth capital expenditures | | (35.6) | | | (27.8) | |

| Free cash flow | | $ | 8.6 | | | $ | 5.7 | |

The increase in free cash flow from continuing operations over the prior year was driven by higher cash flow provided by operating activities, partially offset by increased capital expenditures. Higher capital expenditures were primarily due to growth investments related to new store construction.

Discontinued operations cash flows

Valvoline has historically satisfied its short-term working capital and operational needs, in addition to indebtedness and other obligations, through the earnings, assets and cash flows generated by its consolidated operations. Following the Transaction, Valvoline will not be able to rely on the earnings, assets or cash flows that are attributable to the Global Products business. The cash flows of the discontinued operation are reflected in the Condensed Consolidated Statements of Cash Flows and are summarized below for the three months ended December 31:

| | | | | | | | | | | | | | |

| (In millions) | | 2022 | | 2021 |

| | | | |

| | | | |

| Cash provided by (used in): | | | | |

| Operating activities | | $ | (57.2) | | | $ | (5.9) | |

| Investing activities | | $ | (8.4) | | | $ | (3.1) | |

| Financing activities | | $ | 60.0 | | | $ | (0.9) | |

The decrease in operating cash flows provided by discontinued operations was largely due to unfavorable changes in net working capital driven by growth in accounts receivables from increased sales compared to the prior period, in addition to declines in trade and other payables. Cash flows used by investing activities of the discontinued operations were higher in the current period due to increased capital expenditures, primarily related to maintenance capital expenditures. Financing activities provided cash in the current year period due to net proceeds from borrowings under the Accounts Receivable Securitization Facility, while the prior year period activity consisted of repayments under the China Construction Facility.

Debt

Inclusive of the interest rate swap agreements, approximately 78% of Valvoline's outstanding borrowings at December 31, 2022 had fixed interest rates, with the remainder bearing variable rates. As of December 31, 2022, Valvoline was in compliance with all covenants of its debt obligations and had borrowing capacity remaining of $324.6 million for its current facilities in effect expected to remain in place after closing the Transaction.