Founded in 2011 | Located in Los Angeles, CA | NASDAQ:FLGT 1 Exhibit 99.2

Disclaimer Forward-Looking Statements and Market Data This presentation contains forward-looking statements, which are statements other than those of historical facts and which represent the estimates and expectations of Fulgent Genetics, Inc. (the “Company”) about future events based on current views and assumptions. Examples of forward-looking statements made in this presentation include, among others, those related its anticipated growth and positioning, the Company’s mission and strategies, the success of its business model and strategy, anticipated future revenue and guidance, evaluations and judgments regarding the Company’s business, products, technologies, competitive landscape, scalability, plans regarding development and launch of potential future products, and any businesses the Company may seek to acquire or has acquired, including statements regarding CSI Laboratories and Helio Health. The Company’s views and assumptions on which these forward-looking statements are based may prove to be incorrect. As a result, matters discussed in any forward-looking statements are subject to risks, uncertainties and changes in circumstances that may cause actual results to differ materially from those discussed or implied by any forward-looking statements. Important factors that could cause actual results to differ materially from those implied by forward-looking statements are disclosed under “Risk Factors” and “Management's Discussion and Analysis of Financial Condition and Results of Operations” in the Company’s reports filed with the Securities and Exchange Commission ("SEC"), including its annual report on Form 10-K filed on March 8, 2021, and other reports it files from time to time. Because of these factors, you should not rely upon forward-looking statements as predictions of future events. The forward-looking statements in this presentation are made only as of the date hereof, and, except as required by law, the Company assumes no obligation to update any forward-looking statements in the future. The company’s reports filed with the SEC, including its annual report on Form 10-K for the year ended December 31, 2020 filed with the SEC on March 8, 2021 and the other reports it files from time to time, including subsequently filed quarterly and current reports, are made available on the company’s website upon their filing with the SEC. These reports contain more information about the company, its business and the risks affecting its business, as well as its results of operations for the periods covered by the financial results included in this press release. This presentation also includes market data and forecasts with respect to the industry in which the Company operates. In some cases the Company relies upon and refers to market data and certain industry forecasts that have been obtained from third-party surveys, market research, consultant surveys, publicly available information and industry publications that the Company believes to be reliable. These data and estimates involve a number of assumptions and limitations, and you are cautioned not to give undue weight to such estimates. Non-GAAP Financial Measures This presentation contains certain supplemental financial measures that are not calculated pursuant to U.S. generally accepted accounting principles (“GAAP”). These non-GAAP measures are in addition to, not a substitute for or superior to, measures of financial performance prepared in accordance with GAAP. A reconciliation of non-GAAP measures to GAAP measures is contained in this presentation.

Mission, Core Values, and Strategy Mission Develop flexible and affordable genomic testing that improves the everyday lives of those around us Core Values Innovation Customer service and commitment Quality Efficiency Strategy Leverage our proprietary NGS platform for broad application Operational excellence Disciplined M&A We are a premier global, technology-based genetic testing company focused on transforming patient care in oncology, infectious and rare diseases, and reproductive health

Leadership Team Esteemed background in molecular science and pathology Most recently Chief Medical Officer at NeoGenomics; prior senior role at Clarient. Chairman Emeritus of Pathology at City of Hope National Medical Center Brandon Perthuis Chief Commercial Officer Dr. Lawrence Weiss Chief Medical Officer Ming Hsieh Chief Executive Officer Dr. Harry Gao Lab Director and Chief Scientific Officer James Xie Chief Operating Officer Paul Kim Chief Financial Officer Extensive experience leading genetic testing commercialization programs since 2003 Previously VP of Sales and Marketing of the Medical Genetics Laboratory at Baylor College of Medicine Prior to Baylor, held senior roles at PerkinElmer and Spectral Genomics B.S. in Biomedical Science Responsible for managing all global operations, product vision and product engineering Served as an SVP of Cogent B.A. in Engineering, M.S. in Industrial Engineering and an M.S. in Computer Science Experienced financial leader and Certified Public Accountant Previously CFO of Cogent Systems; sold to 3M for $943M in 2010 B.A. in Economics from University of California at Berkeley Previously Lab Director at City of Hope Clinical molecular genetics training fellowship and post-doctoral fellowship at Harvard Medical School M.S. in Immunology, and M.D. and Ph.D. in Microbiology, Immunology, and Medical Genetics Experienced operational leader, entrepreneur and philanthropist Previously CEO, President, and Chairman of Cogent Systems Member of the National Academy of Engineering; Fellow of the National Academy of Inventors; Trustee of USC

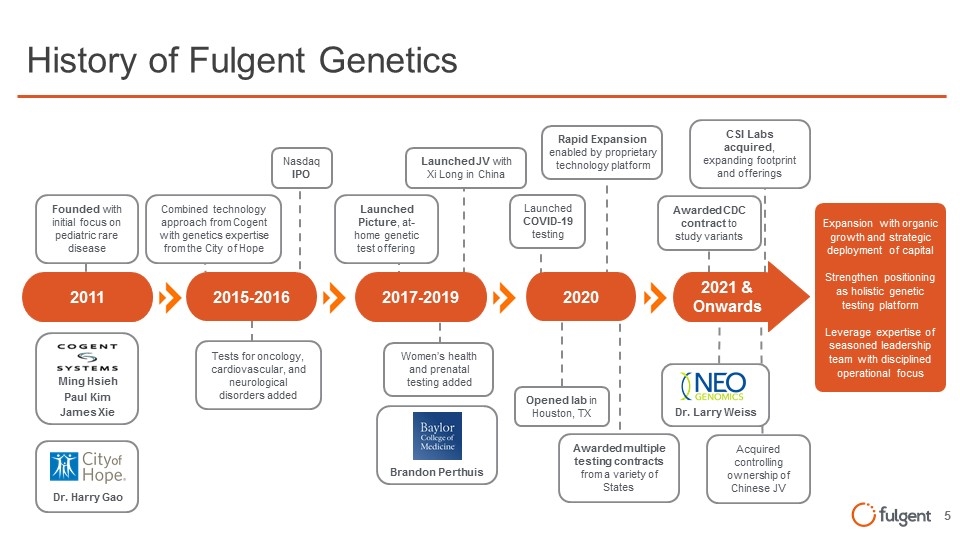

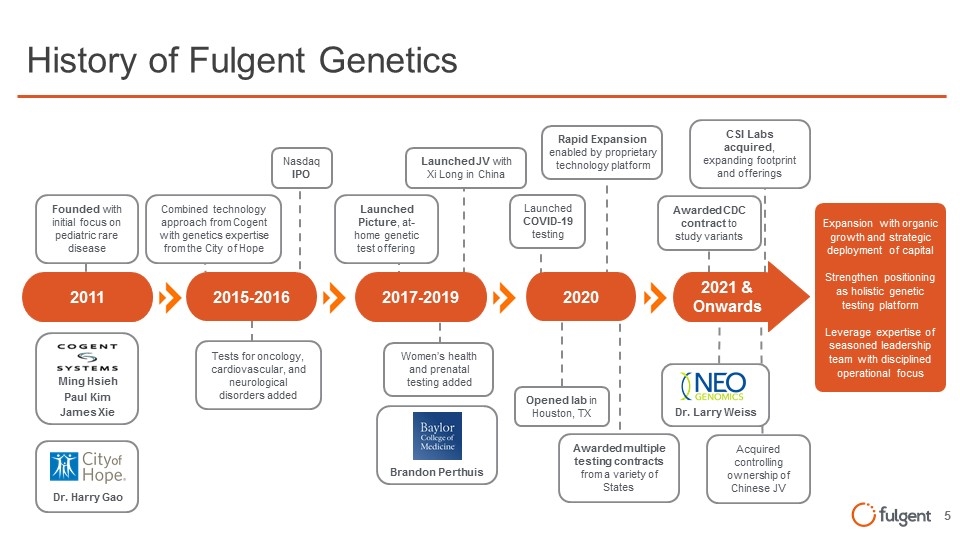

Dr. Larry Weiss Ming Hsieh Paul Kim James Xie Dr. Harry Gao History of Fulgent Genetics Expansion with organic growth and strategic deployment of capital Strengthen positioning as holistic genetic testing platform Leverage expertise of seasoned leadership team with disciplined operational focus 2011 2017-2019 2020 2021 & Onwards 2015-2016 Founded with initial focus on pediatric rare disease Women’s health and prenatal testing added Launched Picture, at-home genetic test offering Launched JV with Xi Long in China Nasdaq IPO Tests for oncology, cardiovascular, and neurological disorders added Combined technology approach from Cogent with genetics expertise from the City of Hope Launched COVID-19 testing Opened lab in Houston, TX CSI Labs acquired, expanding footprint and offerings Rapid Expansion enabled by proprietary technology platform Awarded CDC contract to study variants Awarded multiple testing contracts from a variety of States Brandon Perthuis Acquired controlling ownership of Chinese JV

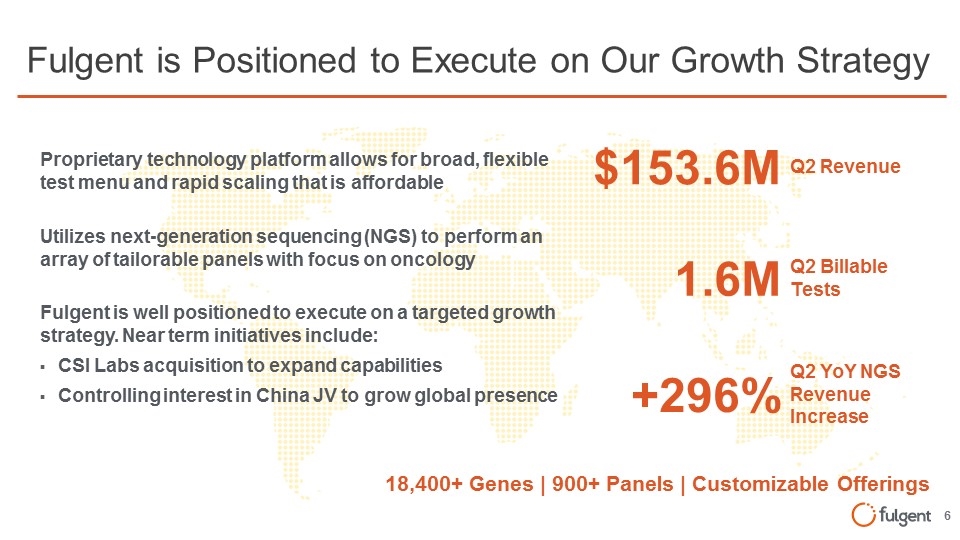

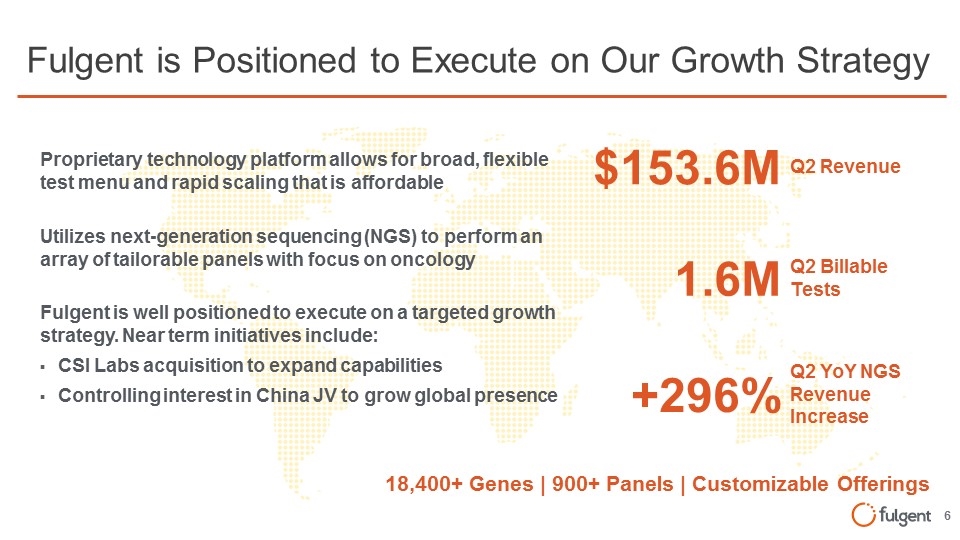

Fulgent is well positioned to execute on a targeted growth strategy. Near term initiatives include: CSI Labs acquisition to expand capabilities Controlling interest in China JV to grow global presence Fulgent is Positioned to Execute on Our Growth Strategy Proprietary technology platform allows for broad, flexible test menu and rapid scaling that is affordable 18,400+ Genes | 900+ Panels | Customizable Offerings $153.6M Q2 Revenue 1.6M Q2 Billable Tests +296% Q2 YoY NGS Revenue Increase Utilizes next-generation sequencing (NGS) to perform an array of tailorable panels with focus on oncology

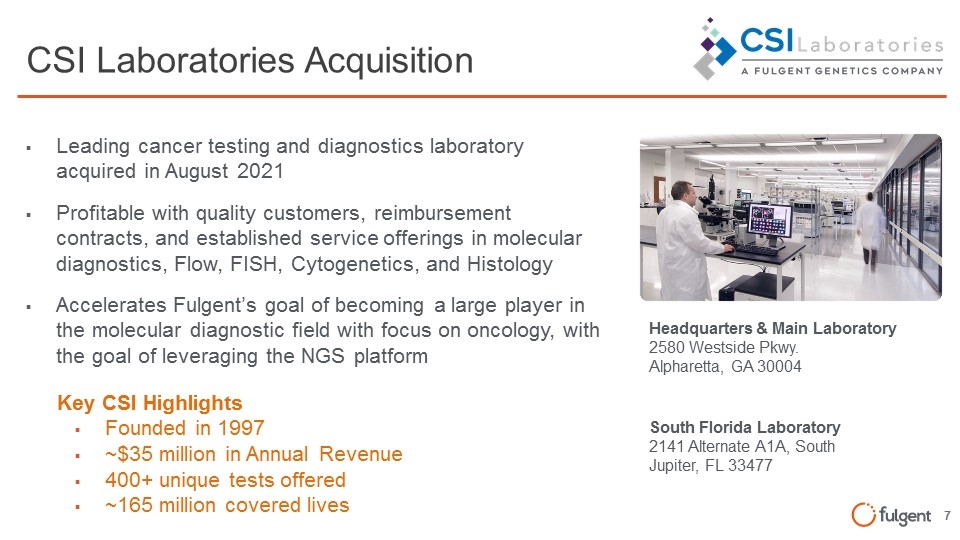

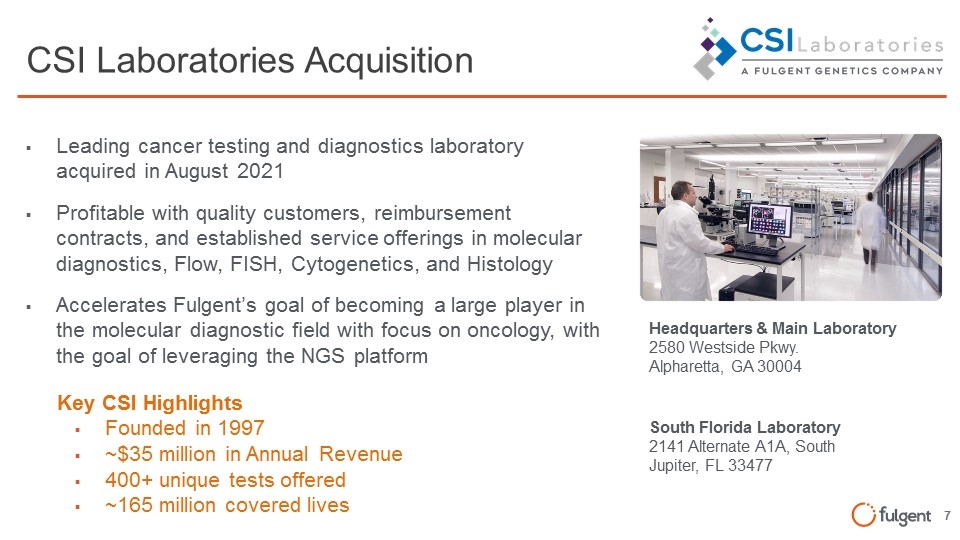

CSI Laboratories Acquisition Leading cancer testing and diagnostics laboratory acquired in August 2021 Headquarters & Main Laboratory 2580 Westside Pkwy. Alpharetta, GA 30004 South Florida Laboratory 2141 Alternate A1A, South Jupiter, FL 33477 Accelerates Fulgent’s goal of becoming a large player in the molecular diagnostic field with focus on oncology, with the goal of leveraging the NGS platform Profitable with quality customers, reimbursement contracts, and established service offerings in molecular diagnostics, Flow, FISH, Cytogenetics, and Histology Key CSI Highlights Founded in 1997 ~$35 million in Annual Revenue 400+ unique tests offered ~165 million covered lives

Fulgent Equity Investment: $20 Million Helio Health Investment & Strategic Partnership Emerging liquid biopsy company for early detection of cancer with proven management team USA Office 9950 Research Drive Irvine, CA 92618 China Office No. 1908, Building 10, Jianguo Rd Chaoyang District, Beijing, 100022 +86 10 58208807 Fulgent enters the early detection liquid biopsy space, and Helio benefits from the operational capabilities and establishment of Fulgent Exclusive commercial agreement LDT US & Canada Poised to access both the US and China markets

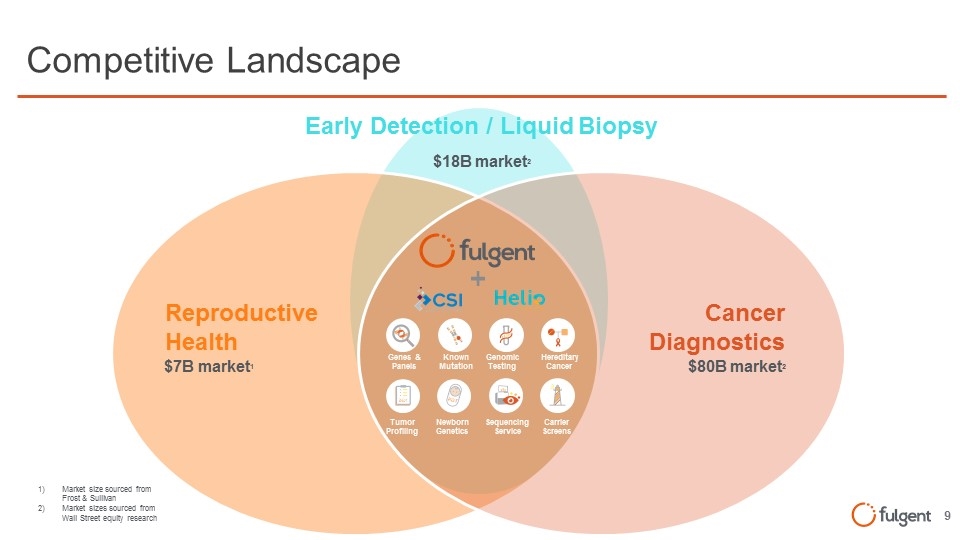

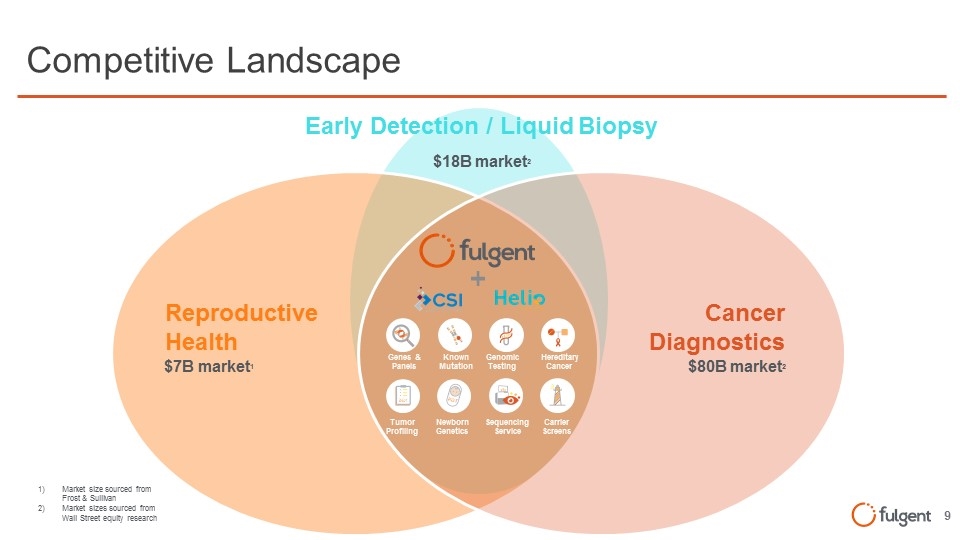

Competitive Landscape Cancer Diagnostics Reproductive Health Genes & Panels Known Mutation Genomic Testing Hereditary Cancer Tumor Profiling Newborn Genetics Carrier Screens Sequencing Service $18B market2 $80B market2 $7B market1 Market size sourced from Frost & Sullivan Market sizes sourced from Wall Street equity research Early Detection / Liquid Biopsy

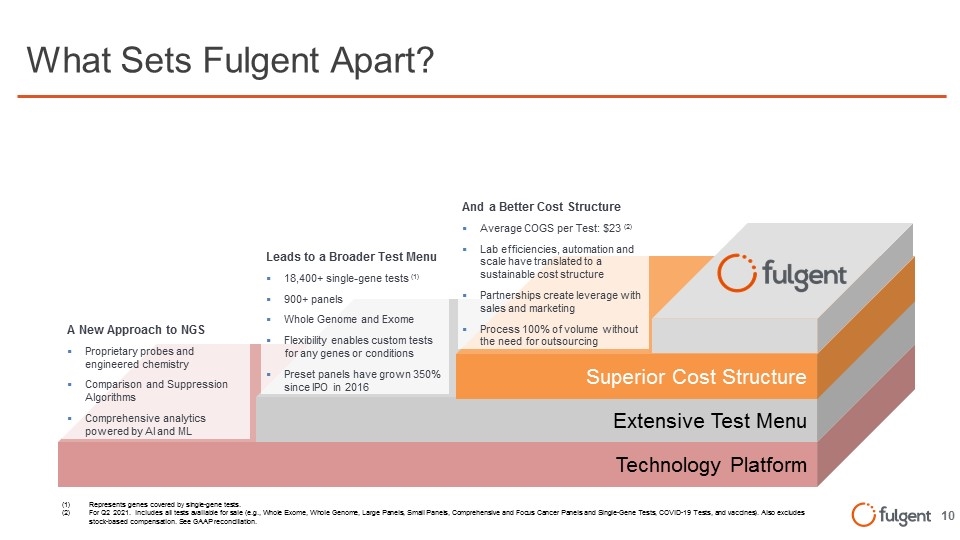

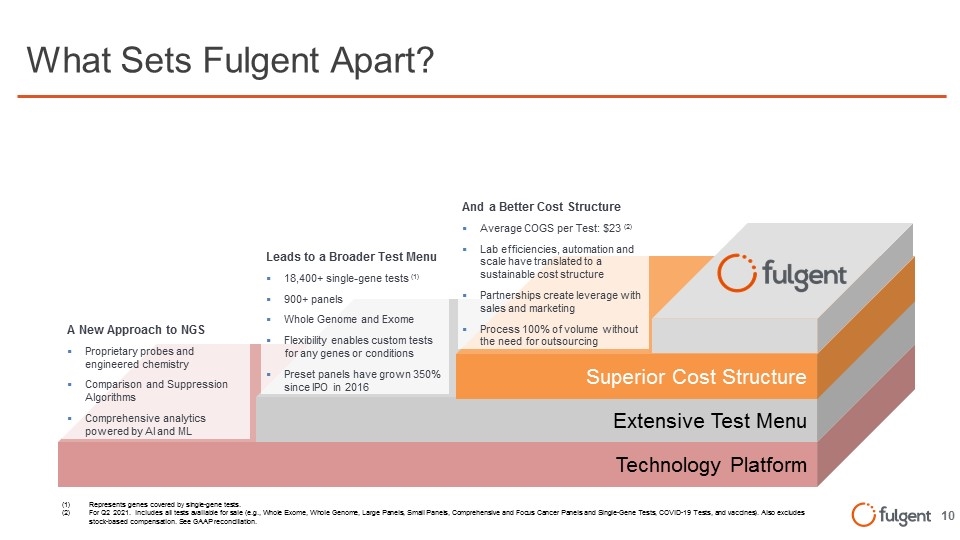

What Sets Fulgent Apart? (1)Represents genes covered by single-gene tests. (2)For Q2 2021. Includes all tests available for sale (e.g., Whole Exome, Whole Genome, Large Panels, Small Panels, Comprehensive and Focus Cancer Panels and Single-Gene Tests, COVID-19 Tests, and vaccines). Also excludes stock-based compensation. See GAAP reconciliation. Technology Platform A New Approach to NGS Proprietary probes and engineered chemistry Comparison and Suppression Algorithms Comprehensive analytics powered by AI and ML Extensive Test Menu Superior Cost Structure And a Better Cost Structure Average COGS per Test: $23 (2) Lab efficiencies, automation and scale have translated to a sustainable cost structure Partnerships create leverage with sales and marketing Process 100% of volume without the need for outsourcing Leads to a Broader Test Menu 18,400+ single-gene tests (1) 900+ panels Whole Genome and Exome Flexibility enables custom tests for any genes or conditions Preset panels have grown 350% since IPO in 2016

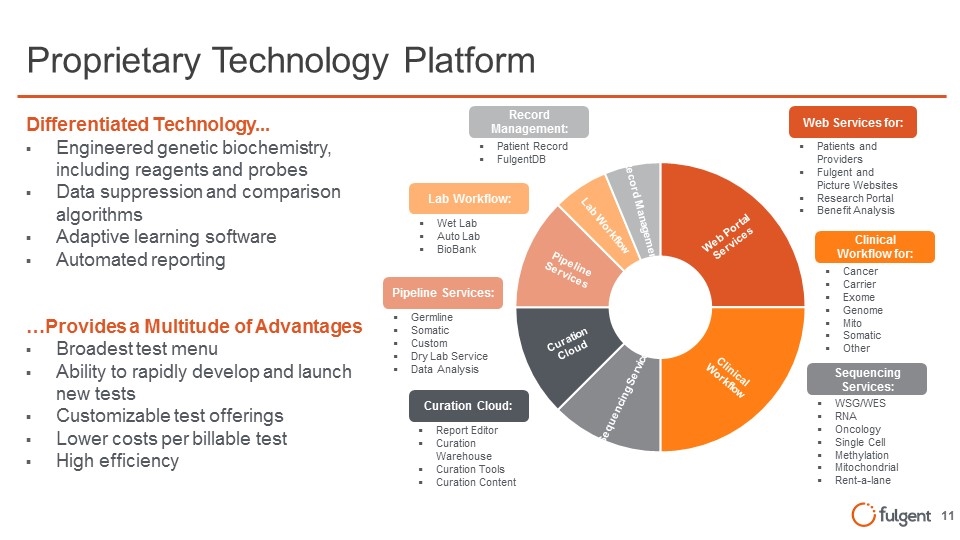

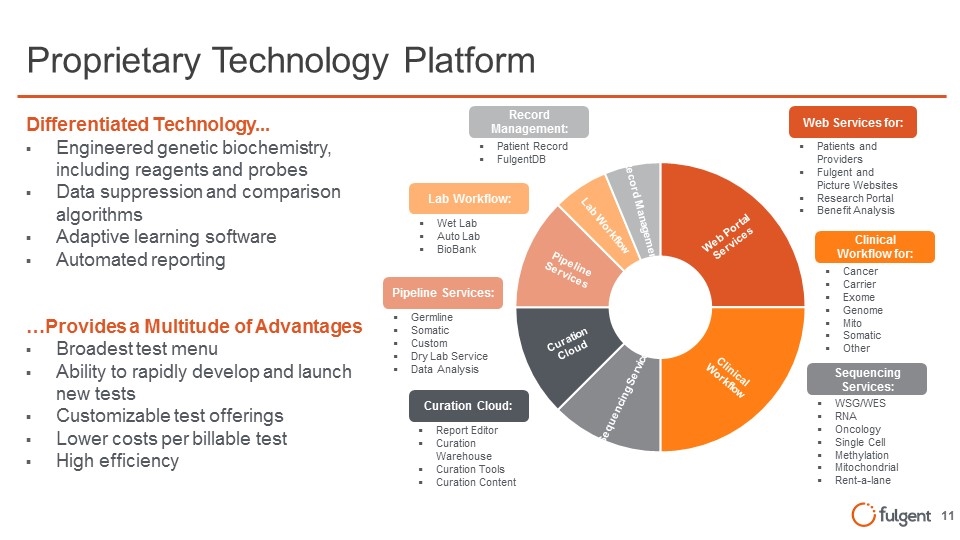

Proprietary Technology Platform Differentiated Technology... Engineered genetic biochemistry, including reagents and probes Data suppression and comparison algorithms Adaptive learning software Automated reporting …Provides a Multitude of Advantages Broadest test menu Ability to rapidly develop and launch new tests Customizable test offerings Lower costs per billable test High efficiency Clinical Workflow for: Cancer Carrier Exome Genome Mito Somatic Other Web Services for: Patients and Providers Fulgent and Picture Websites Research Portal Benefit Analysis Sequencing Services: WSG/WES RNA Oncology Single Cell Methylation Mitochondrial Rent-a-lane Lab Workflow: Wet Lab Auto Lab BioBank Record Management: Patient Record FulgentDB Pipeline Services: Germline Somatic Custom Dry Lab Service Data Analysis Curation Cloud: Report Editor Curation Warehouse Curation Tools Curation Content

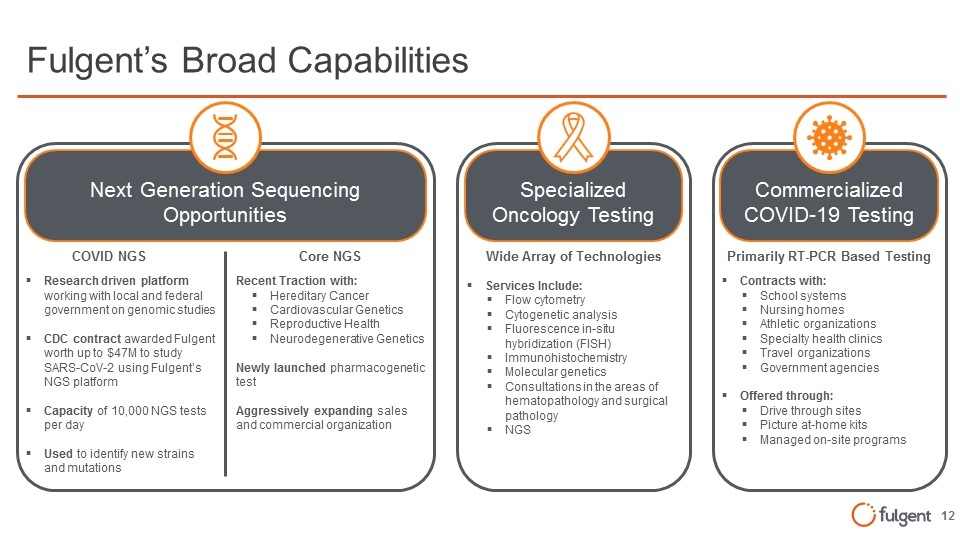

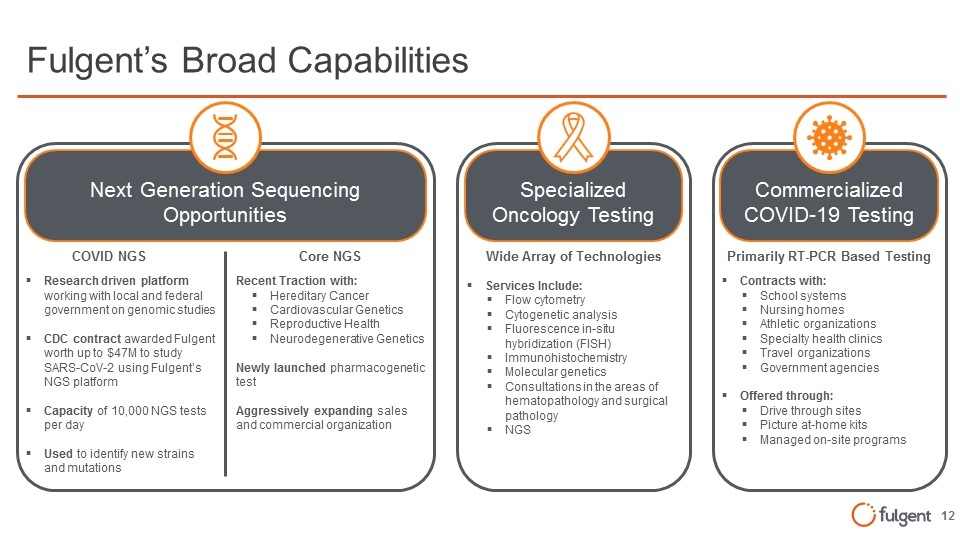

Commercialized COVID-19 Testing Commercialized COVID-19 Testing Specialized Oncology Testing Next Generation Sequencing Opportunities Specialized Oncology Testing Core NGS Recent Traction with: Hereditary Cancer Cardiovascular Genetics Reproductive Health Neurodegenerative Genetics Newly launched pharmacogenetic test Aggressively expanding sales and commercial organization Wide Array of Technologies Services Include: Flow cytometry Cytogenetic analysis Fluorescence in-situ hybridization (FISH) Immunohistochemistry Molecular genetics Consultations in the areas of hematopathology and surgical pathology NGS Fulgent’s Broad Capabilities COVID NGS Research driven platform working with local and federal government on genomic studies CDC contract awarded Fulgent worth up to $47M to study SARS-CoV-2 using Fulgent’s NGS platform Capacity of 10,000 NGS tests per day Used to identify new strains and mutations Primarily RT-PCR Based Testing Contracts with: School systems Nursing homes Athletic organizations Specialty health clinics Travel organizations Government agencies Offered through: Drive through sites Picture at-home kits Managed on-site programs Next Generation Sequencing Opportunities

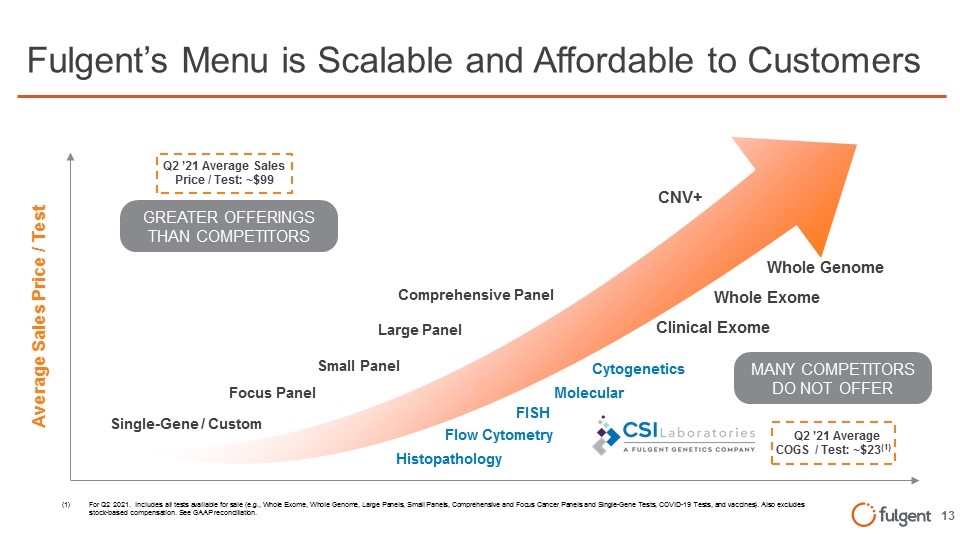

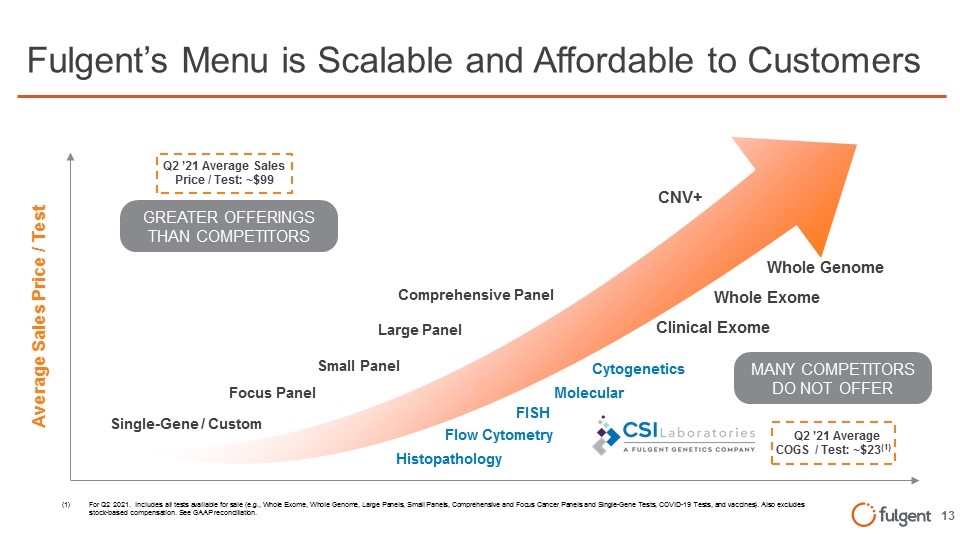

Fulgent’s Menu is Scalable and Affordable to Customers Large Panel Small Panel Focus Panel Single-Gene / Custom Comprehensive Panel Average Sales Price / Test Whole Genome Whole Exome Q2 ’21 Average Sales Price / Test: ~$99 Q2 ’21 Average COGS / Test: ~$23(1) Clinical Exome GREATER OFFERINGS THAN COMPETITORS CNV+ MANY COMPETITORS DO NOT OFFER Flow Cytometry FISH Histopathology Cytogenetics Molecular (1)For Q2 2021. Includes all tests available for sale (e.g., Whole Exome, Whole Genome, Large Panels, Small Panels, Comprehensive and Focus Cancer Panels and Single-Gene Tests, COVID-19 Tests, and vaccines). Also excludes stock-based compensation. See GAAP reconciliation.

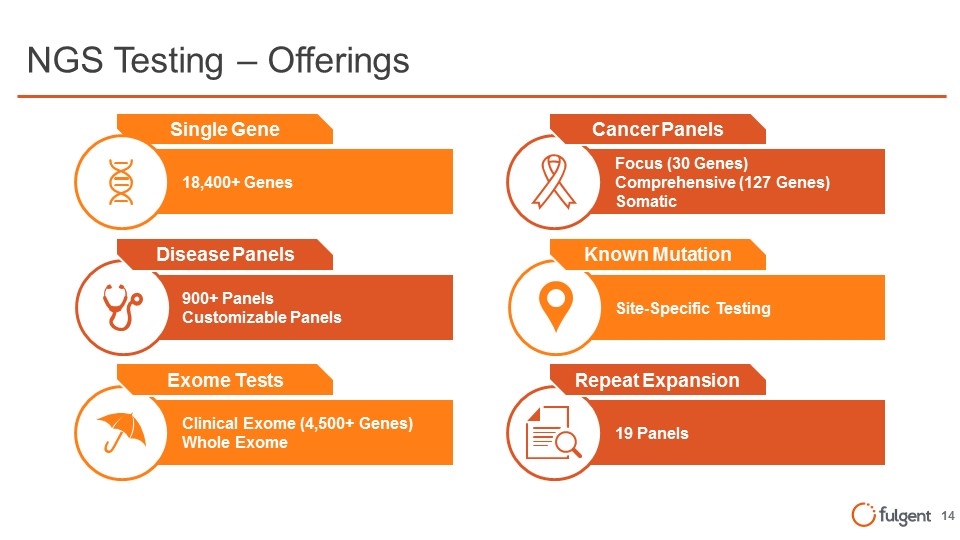

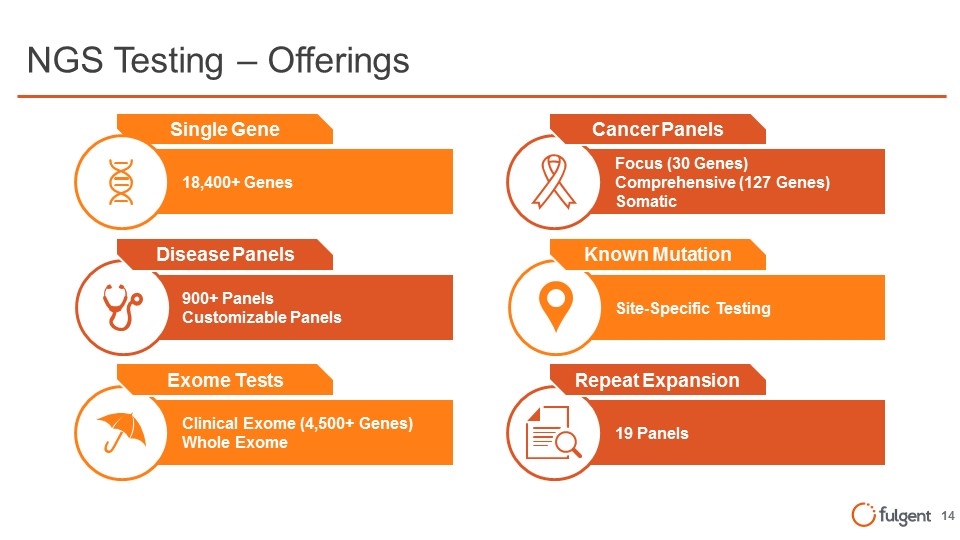

NGS Testing – Offerings Site-Specific Testing Known Mutation Focus (30 Genes) Comprehensive (127 Genes) Somatic Cancer Panels 19 Panels Repeat Expansion 18,400+ Genes Single Gene 900+ Panels Customizable Panels Disease Panels Clinical Exome (4,500+ Genes) Whole Exome Exome Tests

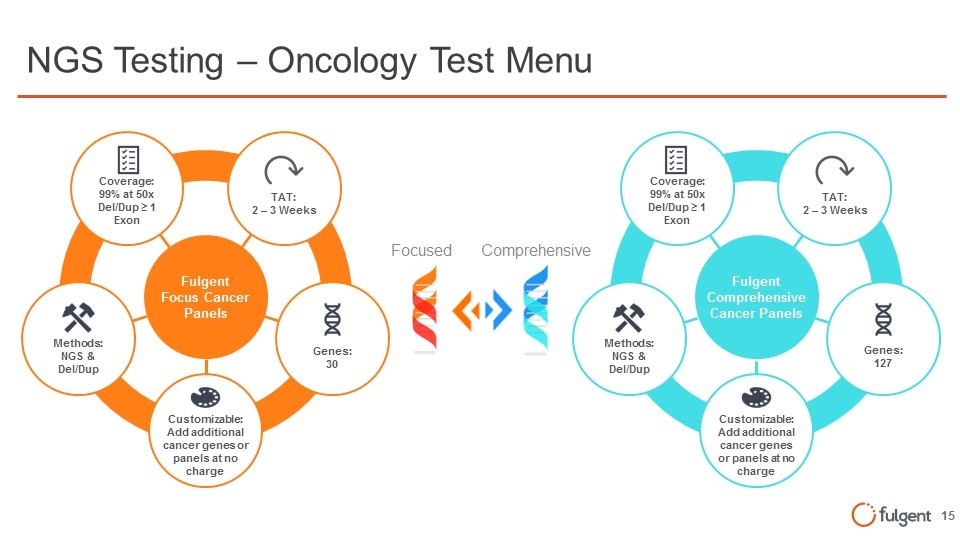

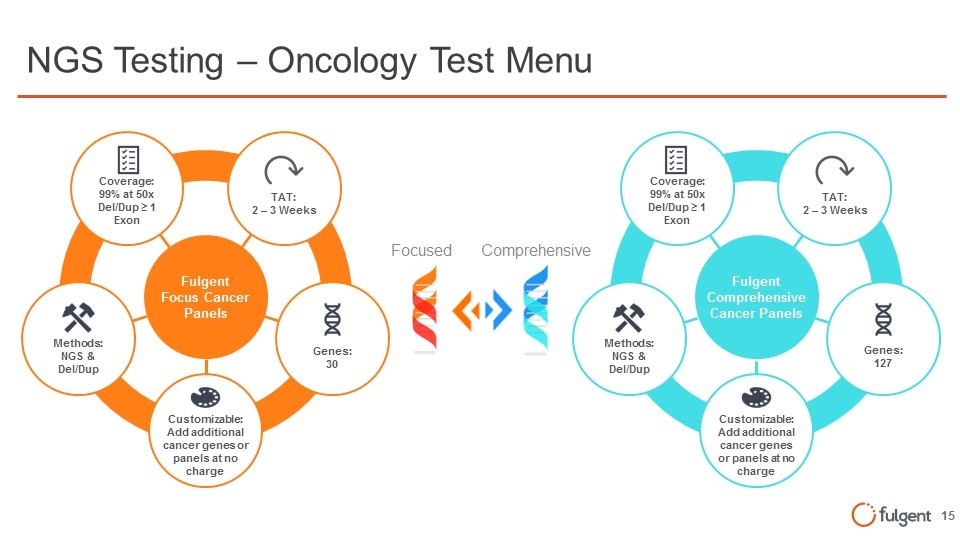

NGS Testing – Oncology Test Menu Fulgent Focus Cancer Panels Fulgent Comprehensive Cancer Panels Customizable: Add additional cancer genes or panels at no charge Genes: 30 Methods: NGS & Del/Dup Coverage: 99% at 50x Del/Dup ≥ 1 Exon TAT: 2 – 3 Weeks Customizable: Add additional cancer genes or panels at no charge Methods: NGS & Del/Dup Genes: 127 Coverage: 99% at 50x Del/Dup ≥ 1 Exon TAT: 2 – 3 Weeks Focused Comprehensive

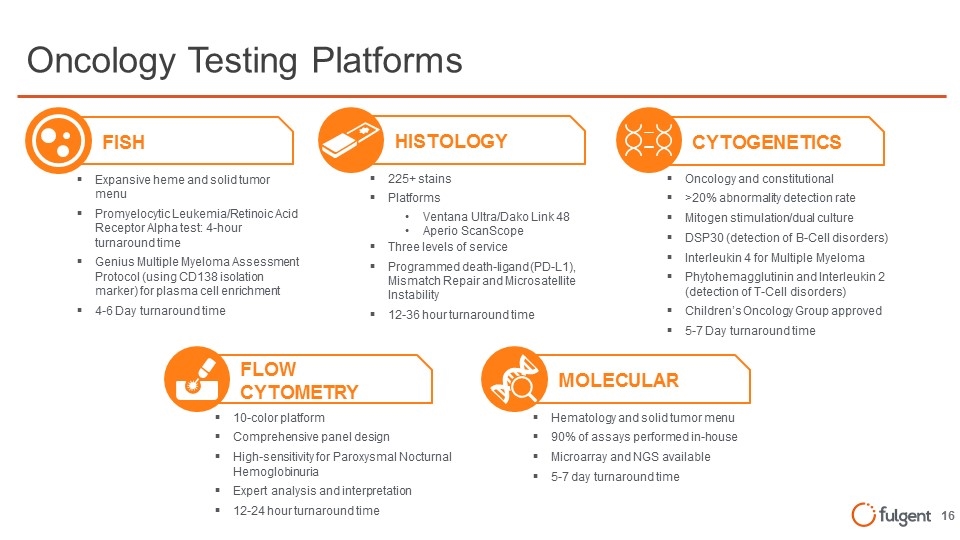

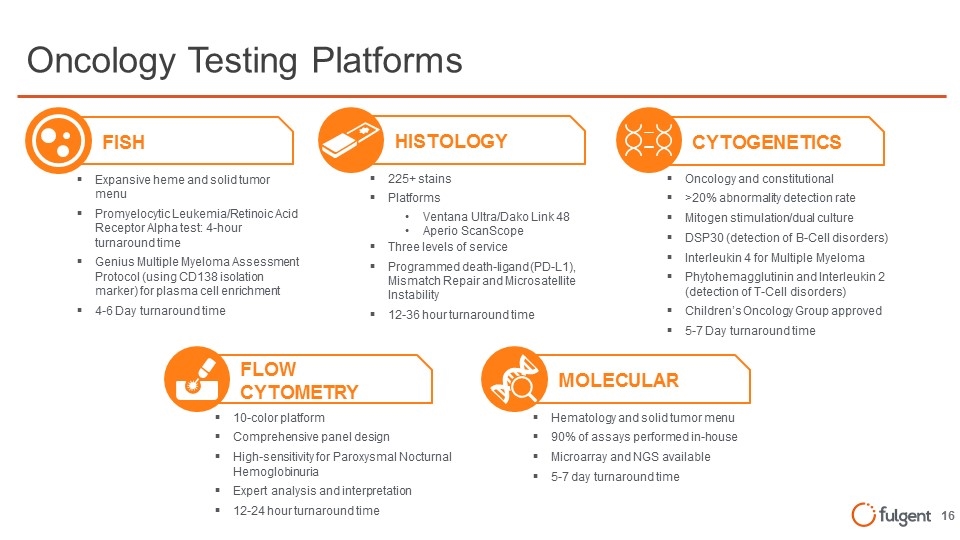

FISH Oncology Testing Platforms Expansive heme and solid tumor menu Promyelocytic Leukemia/Retinoic Acid Receptor Alpha test: 4-hour turnaround time Genius Multiple Myeloma Assessment Protocol (using CD138 isolation marker) for plasma cell enrichment 4-6 Day turnaround time 225+ stains Platforms Ventana Ultra/Dako Link 48 Aperio ScanScope Three levels of service Programmed death-ligand (PD-L1), Mismatch Repair and Microsatellite Instability 12-36 hour turnaround time HISTOLOGY Hematology and solid tumor menu 90% of assays performed in-house Microarray and NGS available 5-7 day turnaround time MOLECULAR 10-color platform Comprehensive panel design High-sensitivity for Paroxysmal Nocturnal Hemoglobinuria Expert analysis and interpretation 12-24 hour turnaround time FLOW CYTOMETRY Oncology and constitutional >20% abnormality detection rate Mitogen stimulation/dual culture DSP30 (detection of B-Cell disorders) Interleukin 4 for Multiple Myeloma Phytohemagglutinin and Interleukin 2 (detection of T-Cell disorders) Children’s Oncology Group approved 5-7 Day turnaround time CYTOGENETICS

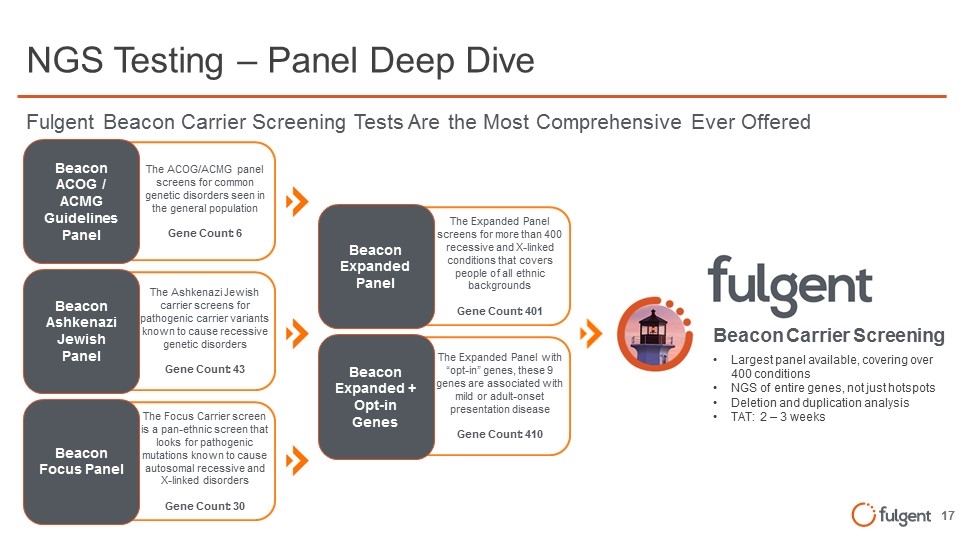

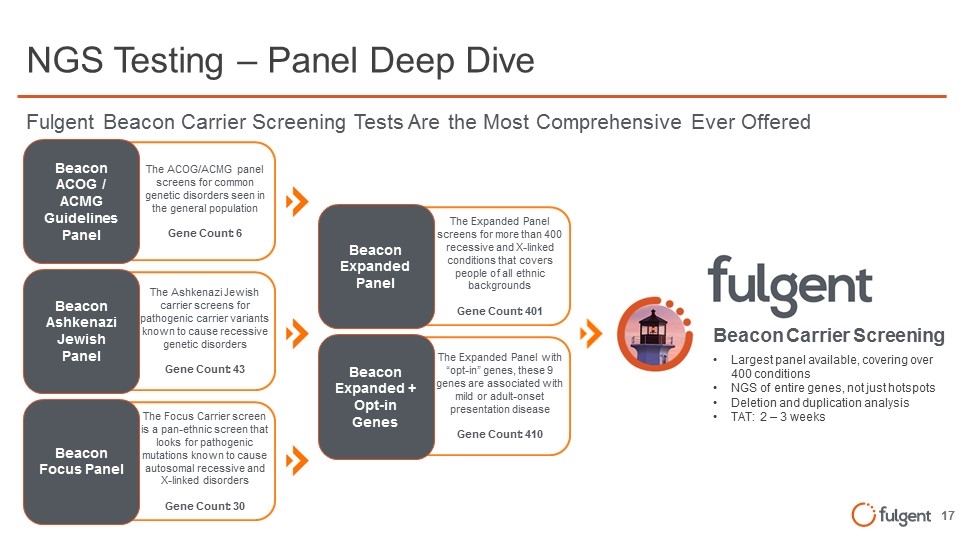

The Focus Carrier screen is a pan-ethnic screen that looks for pathogenic mutations known to cause autosomal recessive and X-linked disorders Gene Count: 30 The Ashkenazi Jewish carrier screens for pathogenic carrier variants known to cause recessive genetic disorders Gene Count: 43 The ACOG/ACMG panel screens for common genetic disorders seen in the general population Gene Count: 6 The Expanded Panel with “opt-in” genes, these 9 genes are associated with mild or adult-onset presentation disease Gene Count: 410 The Expanded Panel screens for more than 400 recessive and X-linked conditions that covers people of all ethnic backgrounds Gene Count: 401 NGS Testing – Panel Deep Dive Largest panel available, covering over 400 conditions NGS of entire genes, not just hotspots Deletion and duplication analysis TAT: 2 – 3 weeks Beacon Carrier Screening Beacon ACOG / ACMG Guidelines Panel Beacon Ashkenazi Jewish Panel Beacon Focus Panel Beacon Expanded Panel Beacon Expanded + Opt-in Genes Fulgent Beacon Carrier Screening Tests Are the Most Comprehensive Ever Offered

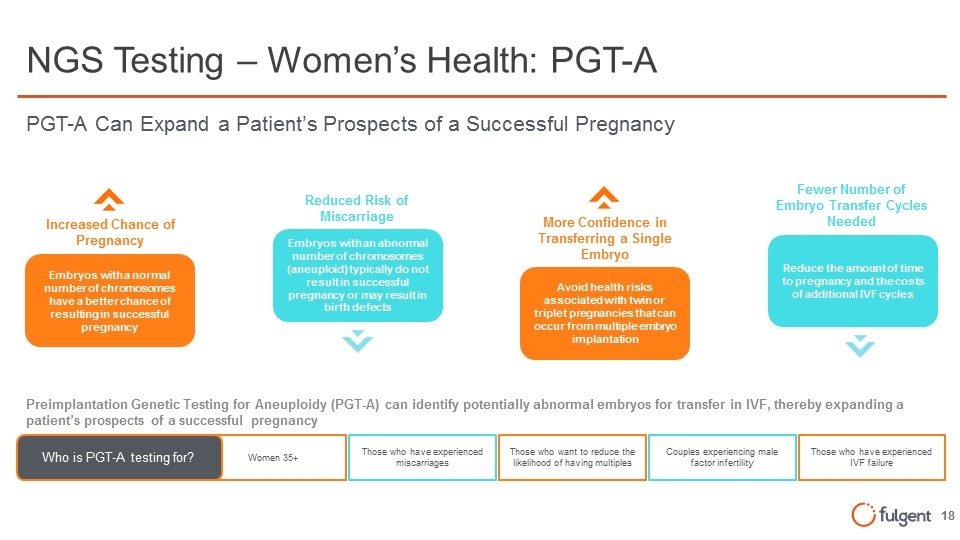

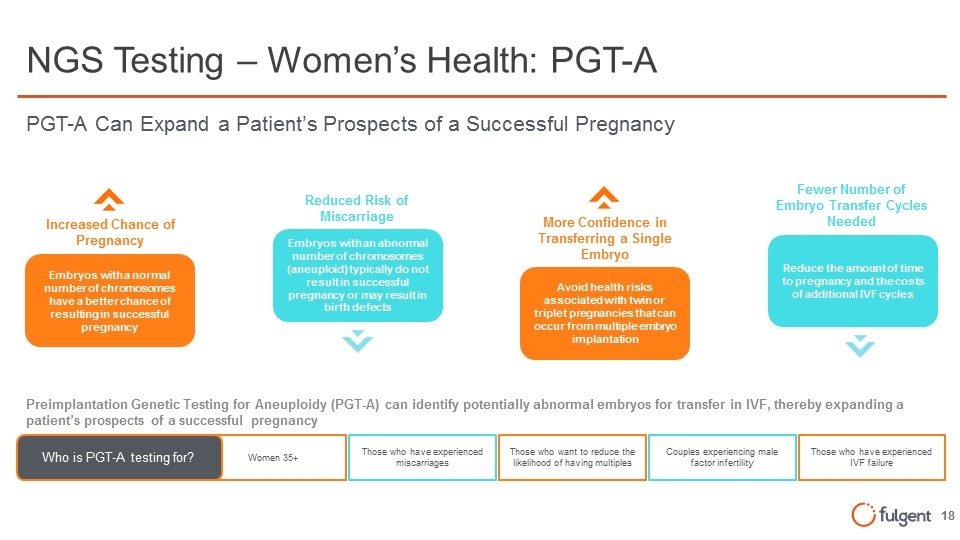

NGS Testing – Women’s Health: PGT-A Increased Chance of Pregnancy Embryos with a normal number of chromosomes have a better chance of resulting in successful pregnancy More Confidence in Transferring a Single Embryo Avoid health risks associated with twin or triplet pregnancies that can occur from multiple embryo implantation Reduced Risk of Miscarriage Embryos with an abnormal number of chromosomes (aneuploid) typically do not result in successful pregnancy or may result in birth defects Fewer Number of Embryo Transfer Cycles Needed Reduce the amount of time to pregnancy and the costs of additional IVF cycles PGT-A Can Expand a Patient’s Prospects of a Successful Pregnancy Preimplantation Genetic Testing for Aneuploidy (PGT-A) can identify potentially abnormal embryos for transfer in IVF, thereby expanding a patient’s prospects of a successful pregnancy Women 35+ Who is PGT-A testing for? Those who have experienced miscarriages Those who want to reduce the likelihood of having multiples Couples experiencing male factor infertility Those who have experienced IVF failure

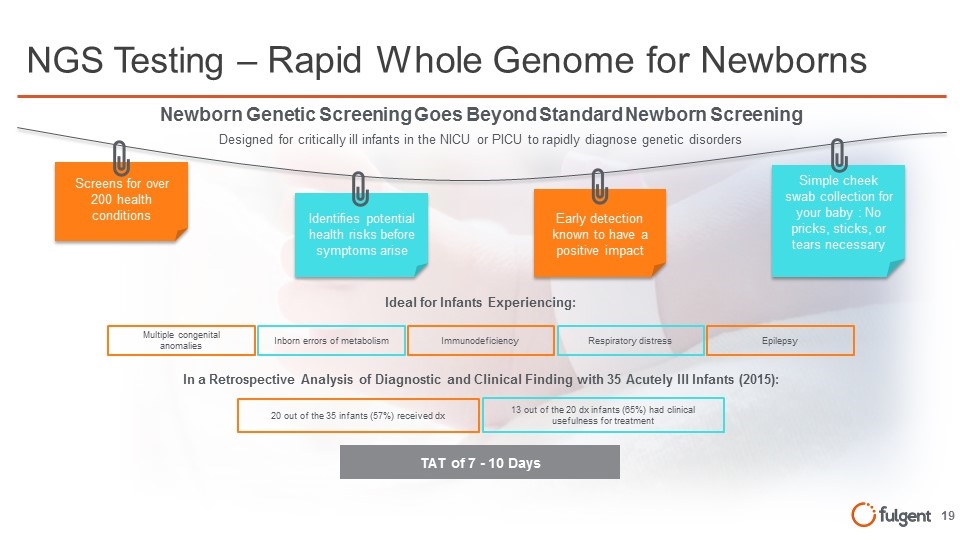

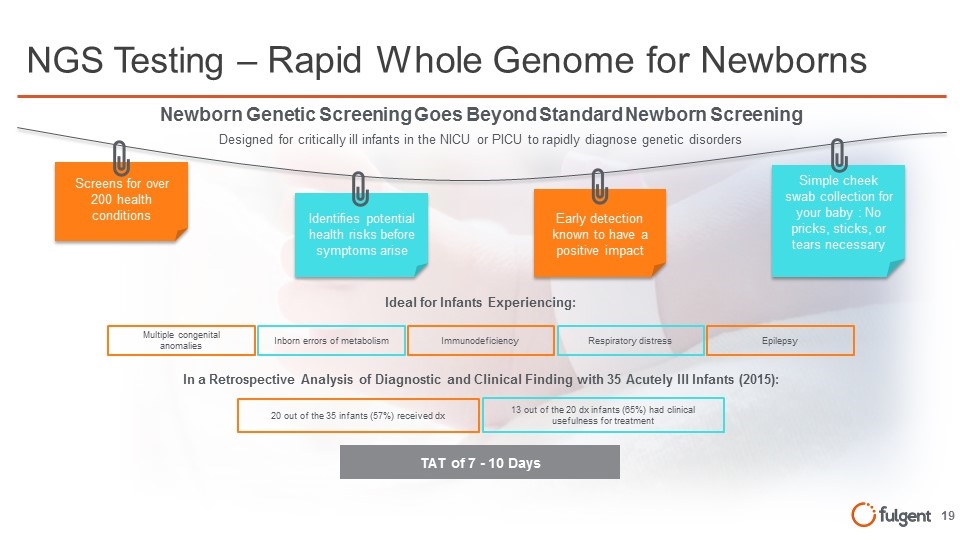

NGS Testing – Rapid Whole Genome for Newborns Screens for over 200 health conditions Identifies potential health risks before symptoms arise Early detection known to have a positive impact Simple cheek swab collection for your baby : No pricks, sticks, or tears necessary Newborn Genetic Screening Goes Beyond Standard Newborn Screening Multiple congenital anomalies Inborn errors of metabolism Immunodeficiency Respiratory distress Epilepsy Ideal for Infants Experiencing: 20 out of the 35 infants (57%) received dx 13 out of the 20 dx infants (65%) had clinical usefulness for treatment In a Retrospective Analysis of Diagnostic and Clinical Finding with 35 Acutely Ill Infants (2015): TAT of 7 - 10 Days Designed for critically ill infants in the NICU or PICU to rapidly diagnose genetic disorders

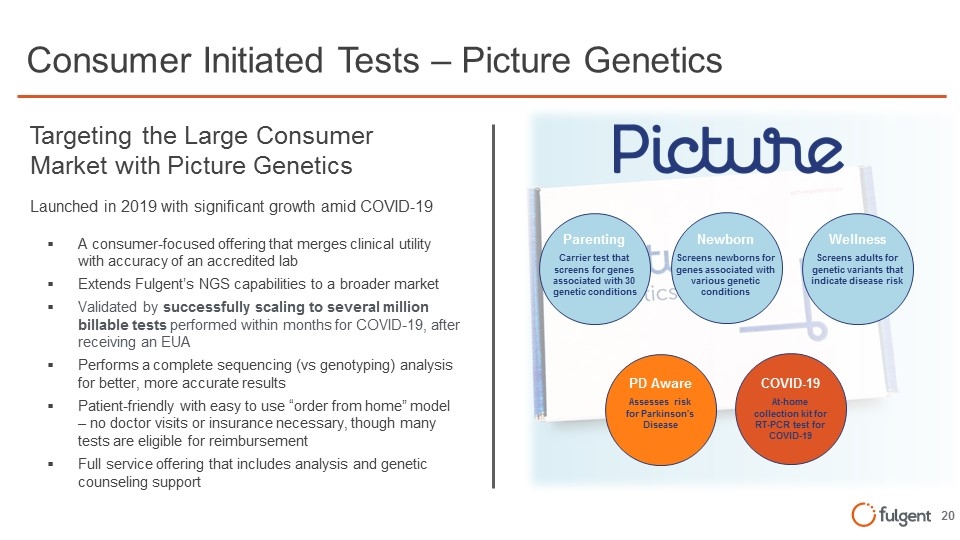

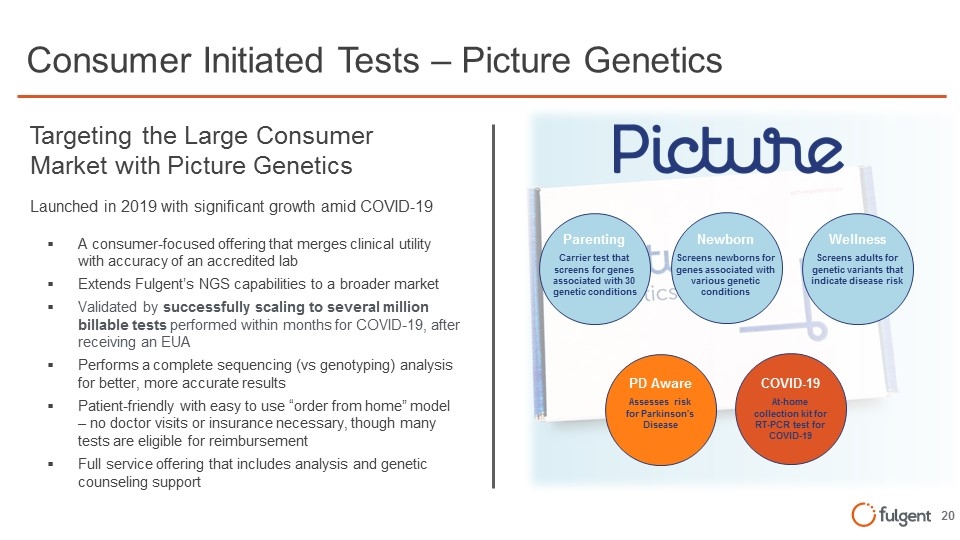

Parenting Carrier test that screens for genes associated with 30 genetic conditions Newborn Screens newborns for genes associated with various genetic conditions Wellness Screens adults for genetic variants that indicate disease risk PD Aware Assesses risk for Parkinson's Disease COVID-19 At-home collection kit for RT-PCR test for COVID-19 Consumer Initiated Tests – Picture Genetics Targeting the Large Consumer Market with Picture Genetics Launched in 2019 with significant growth amid COVID-19 A consumer-focused offering that merges clinical utility with accuracy of an accredited lab Extends Fulgent’s NGS capabilities to a broader market Validated by successfully scaling to several million billable tests performed within months for COVID-19, after receiving an EUA Performs a complete sequencing (vs genotyping) analysis for better, more accurate results Patient-friendly with easy to use “order from home” model – no doctor visits or insurance necessary, though many tests are eligible for reimbursement Full service offering that includes analysis and genetic counseling support

China Strategy FF Gene Biotech Joint Venture Joint venture between Fulgent, Xi Long Scientific, and Fuzhou Jinqiang Investment Partnership (FJIP) Fulgent owns controlling interest Brings Fulgent’s NGS capabilities to the Chinese genetic testing market Fulgent will increase testing capacity and expand the sales organization in China Currently ~100 employees on the ground Test menu mirrors Fulgent’s existing capabilities in the US Primary focus today is on China, the largest genetic testing market in the world – projected to grow at 30% CAGR to $4.5B in 20301 Ongoing evaluation of additional international opportunities Physical presence in China is a significant competitive advantage vs. US testing companies 1 Source: China Insight Consultancy (CIC)

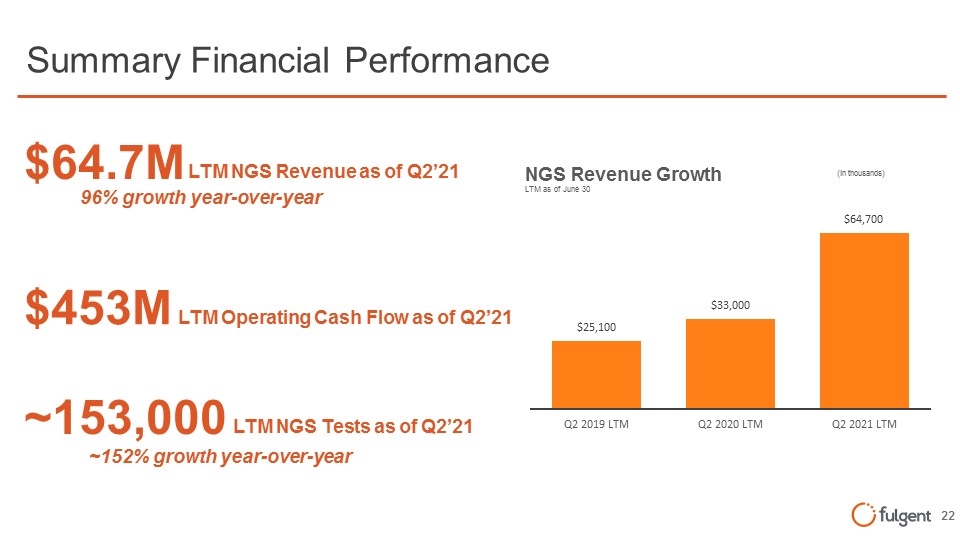

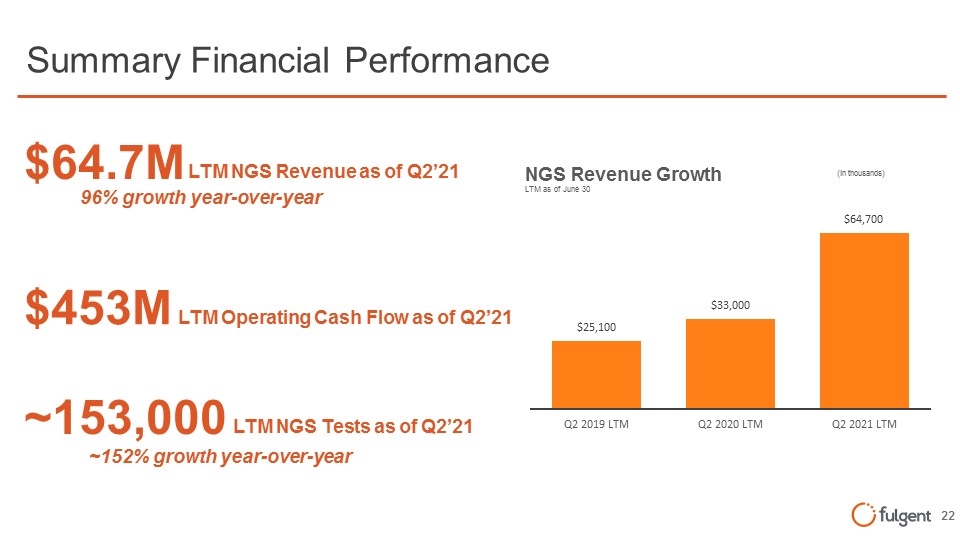

Summary Financial Performance $64.7M LTM NGS Revenue as of Q2’21 $453M LTM Operating Cash Flow as of Q2’21 ~153,000 LTM NGS Tests as of Q2’21 96% growth year-over-year ~152% growth year-over-year (in thousands) NGS Revenue Growth LTM as of June 30 (in thousands) $25,100 Q2 2019 LTM $33,000 Q2 2020 LTM $64,700 Q2 2021 LTM

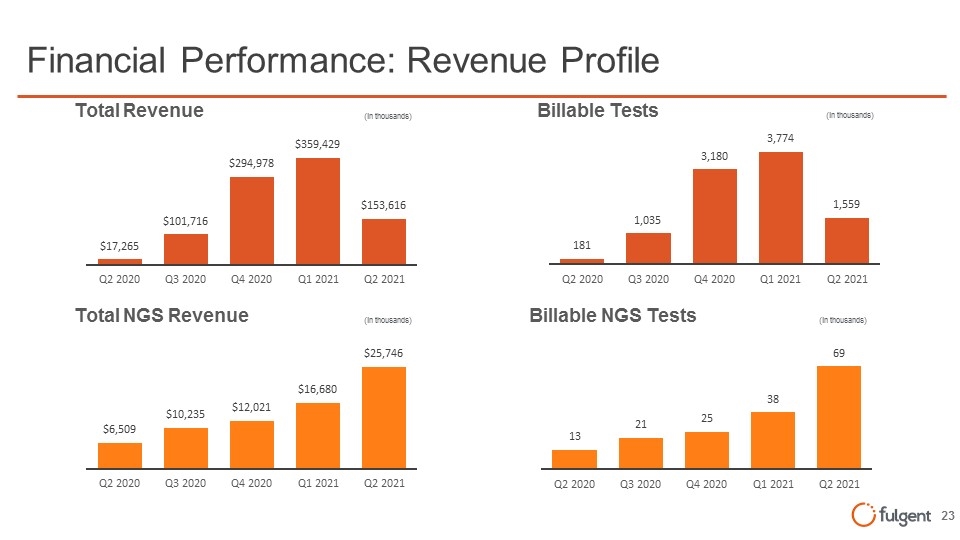

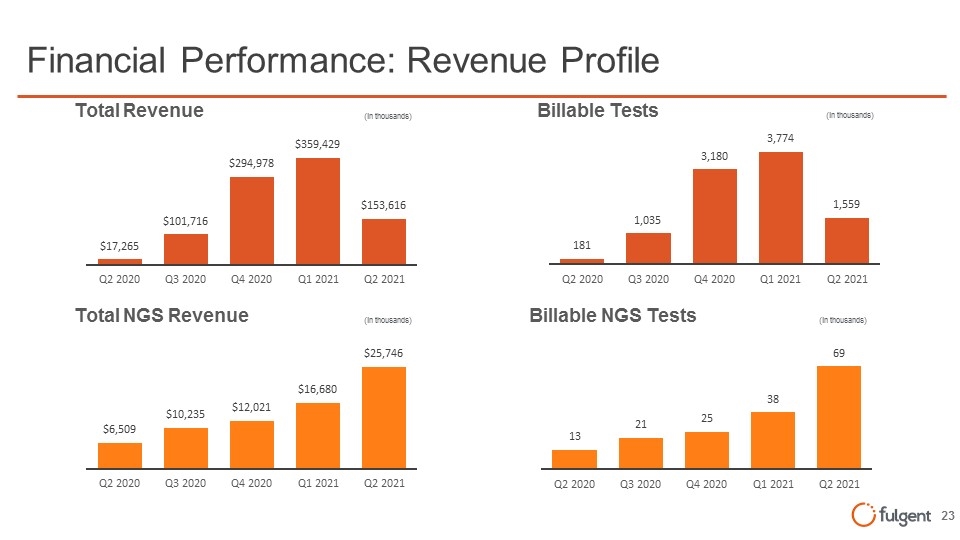

Financial Performance: Revenue Profile Total Revenue (in thousands) $17,265 Q2 2020 $101,716 Q3 2020 $294,978 Q4 2020 $359,429 Q1 2021 $153,616 Q2 2021 Total NGS Revenue (in thousands) $6,509 Q2 2020 $10,235 Q3 2020 $12,021 Q4 2020 $16,680 Q1 2021 $25,746 Q2 2021 Billable Tests (in thousands) 181 Q2 2020 1,035 Q3 2020 3,180 Q4 2020 3,774 Q1 2021 1,559 Q2 2021 Billable NGS Tests (in thousands) 13 Q2 2020 21 Q3 2020 25 Q4 2020 38 A1 2021 69 Q2 2021 fulgent

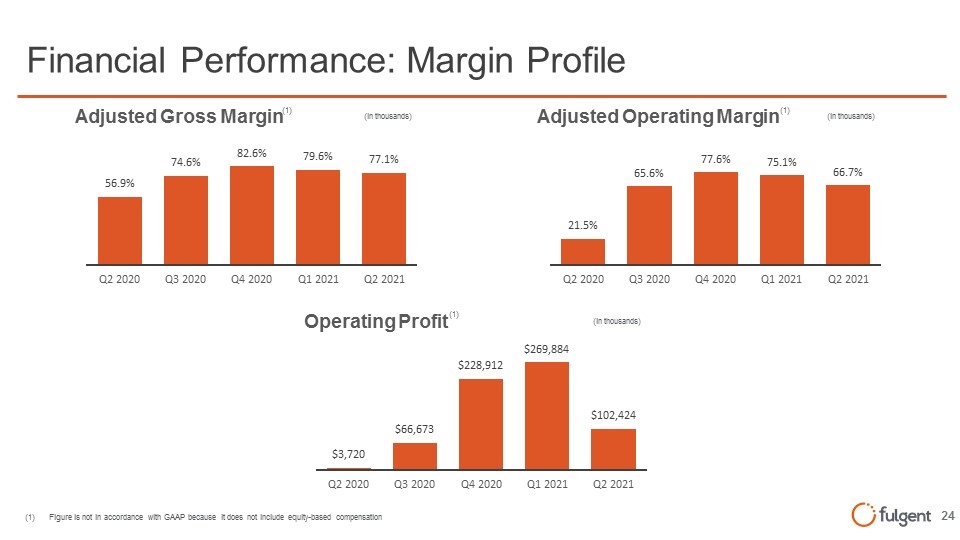

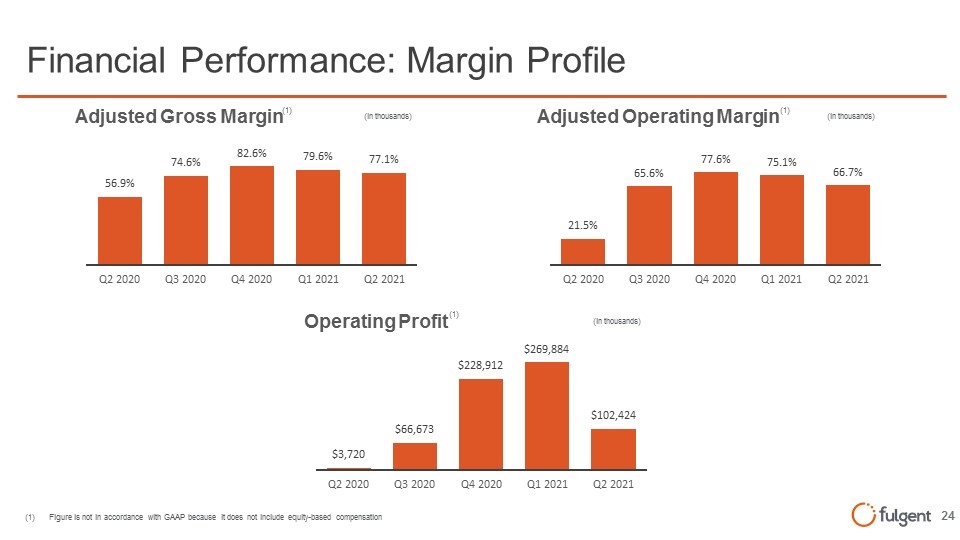

(1) Figure is not in accordance with GAAP because it does not include equity-based compensation Financial Performance: Margin Profile (1) (1) Adjusted Gross Margin (in thousands) 56.9% Q2 2020 74.6% Q3 2020 82.6% Q4 2020 79.6% Q1 2021 77.1% Q2 2021 Adjusted Operating Margin (in thousands) 21.5% Q2 2020 65.6% Q3 2020 77.6% Q4 2020 75.1% Q4 2020 75.1% Q1 2021 66.7% Q2 2021 Operating Profit (in thousands) (1) $3,720 Q2 2020 $66,673 Q3 2020 $228,912 Q4 2020 269,884 Q1 2021 $102,424 Q2 2021 fulgent

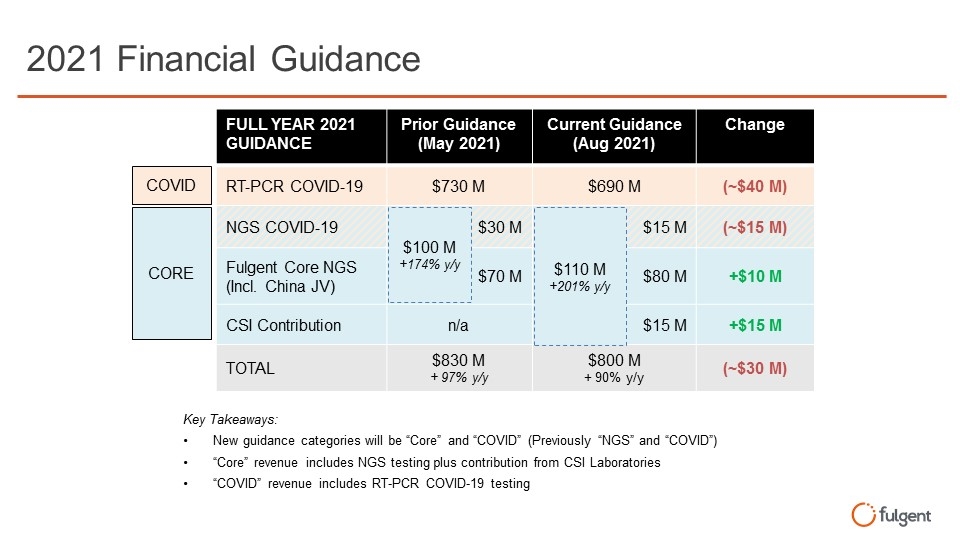

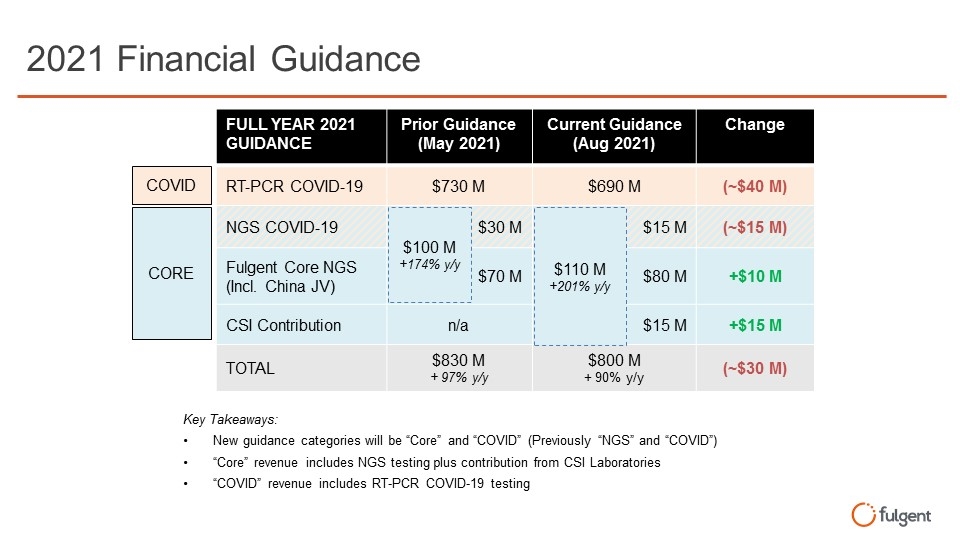

2021 Financial Guidance FULL YEAR 2021 GUIDANCE Prior Guidance (May 2021) Current Guidance (Aug 2021) Change RT-PCR COVID-19 $730 M $690 M (~$40 M) NGS COVID-19 $30 M $15 M (~$15 M) Fulgent Core NGS (Incl. China JV) $70 M $80 M +$10 M CSI Contribution n/a $15 M +$15 M TOTAL $830 M + 97% y/y $800 M + 90% y/y (~$30 M) $100 M +174% y/y COVID CORE Key Takeaways: New guidance categories will be “Core” and “COVID” (Previously “NGS” and “COVID”) “Core” revenue includes NGS testing plus contribution from CSI Laboratories “COVID” revenue includes RT-PCR COVID-19 testing $110 M +201% y/y FULL YEAR 2021 GUIDANCE Prior Guidance (May 2021) Current Guidance (Aug 2021) Change RT-PCR COVID-19 $730 M $690 M (~$40 M) NGS COVID-19 $30 M $15 M (~$15 M) Fulgent Core NGS (Incl. China JV) $70 M $80 M +$10 M CSI Contribution n/a $15 M +$15 M TOTAL $830 M + 97% y/y $800 M + 90% y/y (~$30 M) fulgent

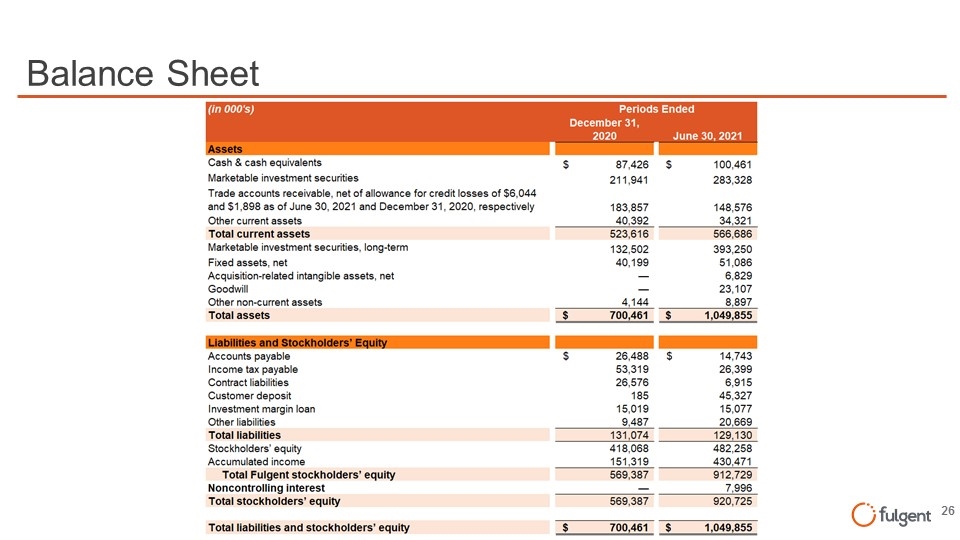

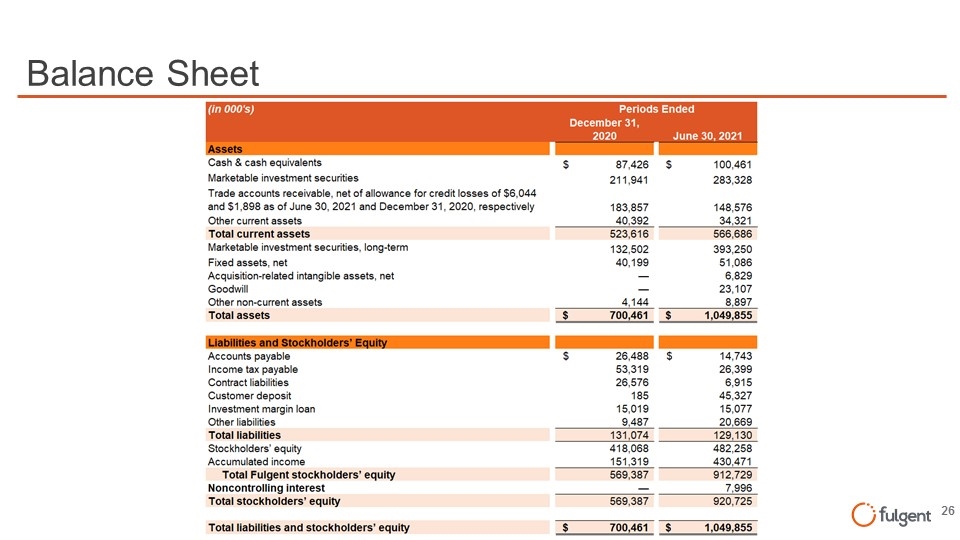

Balance Sheet (tn OOO's) Periods Ended December 31, 2020 June 30, 2021 Cash & cash equivalents $ 87,426 $ 100,461 Marketable investment securities Trade accounts recaivable, net of allowanca for cradit losses of $6,044 211,941 283,328 and $1,898 as of June 30, 2021 and December 31, 2020,respectively 183,857 148,576 other current assets 40,392 34,321 Totalcurrent assets 523,616 566,686 Marketable investment securities, long-term 132,502 393,250 Fixed essets, net 40,199 51,086 Acquisition-related intangible assets, net 6,829 Goodwill 23,107 other non-current assets 4 144 8 897 Totalassets $ 700, 46 1 $ 1 , 049, 855 LlablllUes and Stockholders'! Accounts payable $ 26,488 $ 14,743 Income tax payable 53,319 26,399 Contract liabilities 26,576 6,915 Customer deposit 185 45,327 Investment marginloan 15,019 15,077 other liabilities 9 487 20 669 Totalliabilities 131 ,074 129,130 Stockholders' equity 418,068 482,258 Accumulated income 151,319 430,471 TotalFulgent stockholders' equity 569,387 912,729 NoncontrolllngInterest 7 996 Totalstockholders' equity 569,387 920,725 Totalliabilities and stockholders' equity $ 700, 46 1 $ 1 , 049, 855 fulgent

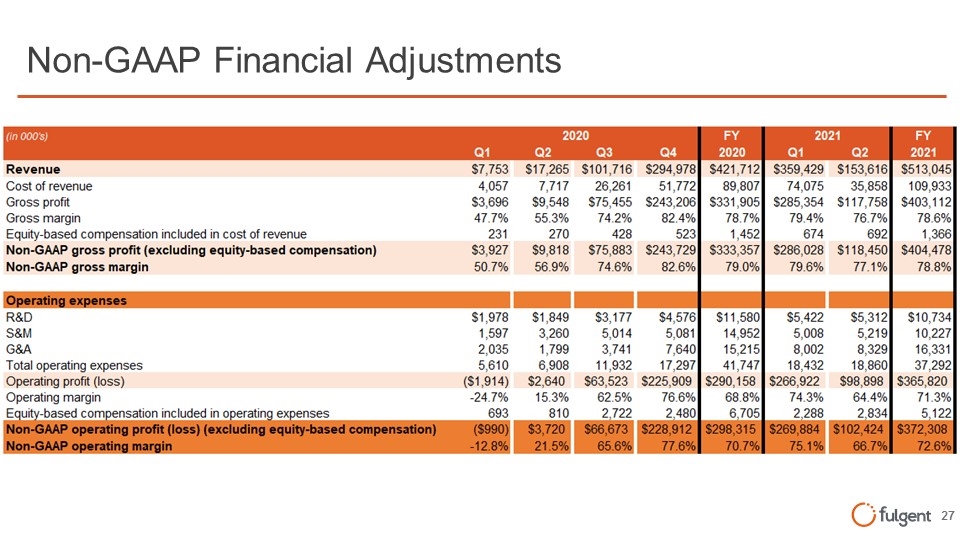

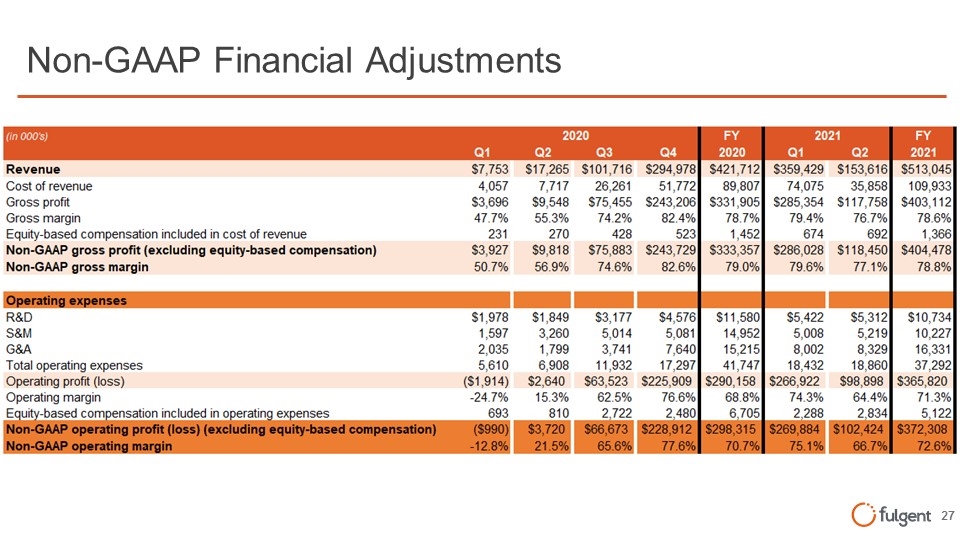

Non-GAAP Financial Adjustments (rn OOO's) FY FY 2020 2021 Revenue $7,753 $17,265 $101,716 $294,978 $421,712 $359,429 $153,616 $513,045 Cost of revenue 4,057 7,717 26,261 51,772 89,807 74,075 35,858 109,933 Gross profit $3,696 $9,548 $75,455 $243,206 $331,905 $285,354 $117,758 $403,112 Gross margin 47.7% 55.3% 74.2% 82.4% 78.7% 79.4% 76.7% 78.6% Equity-based compensation included in cost of revenue 231 270 428 523 1,452 674 692 1,366 Non-GAAP gross profit (excluding equity-based compensation) $3,927 $9,818 $75,883 $243,729 $333,357 $286,028 $118,450 $404,478 Q1 Q2 Q3 04 2020 01 02 2021 R&D $1,849 $3,177 $4,576 $11,580 $5,422 $5,312 $10,734 S&M 3,260 5,014 5,081 14,952 5,008 5,219 10,227 G&A 1,799 3,741 7,640 15,215 8,002 8,329 16,331 Totaloperating expenses 6,908 11,932 17,297 41,747 18,432 18,860 37,292 Operating profit (loss) $2,640 $63,523 $225,909 $290,158 $266,922 $98,898 $365,820 Operating margin 15.3% 62.5% 76.6% 68.8% 74.3% 64.4% 71.3% E ui -based com ensationincluded in o erating ex enses 810 2 722 2 480 6 705 2 288 2 834 5,122 Non-GAAP gross margin 5 0.7% 56.9% 74.6% 82.6% 79.0% 79.6% $1,978 1,597 2,035 5,610 ($1,914) -24.7% 693 ($990) -12.8% Operating Expenses I II 77.1% 78.8% Non-GMP operating profit (loss) (excluding e-q-u-ity---b-a-se-d-c-o-m-p-en-s-a-ti-on-)-------- $3,720 $66,673 1 $228,912 $298,315 $269,884»!1 $102,424 $372,308 Non-GMP rd in 21. 5 65.6 77.6% 70.7% 75.1 66.7% 72.6% fulgent

Founded in 2011 | Located in Los Angeles, CA | NASDAQ:FLGT