may incur additional expenses to the extent necessary to seek recovery upon default or to negotiate new terms with a defaulting portfolio company. In addition, if one of our portfolio companies were to go bankrupt, depending on the facts and circumstances, including the extent to which we actually provided significant managerial assistance to that portfolio company, a bankruptcy court might re-characterize our debt holding and subordinate all or a portion of our claim to that of other creditors.

Uncertainty about the financial stability of the United States and of several countries in the European Union (“EU”) could have a significant adverse effect on our business, financial condition and results of operations.

Downgrades of the U.S. government’s credit rating, or warnings regarding downgrades, by S&P Global Ratings or other rating agencies, and the government’s credit and deficit concerns in general, could cause interest rates and borrowing costs to rise, which may negatively impact both the perception of credit risk associated with our debt portfolio and our ability to access the debt markets on favorable terms. In addition, a decreased U.S. government credit rating could create broader financial turmoil and uncertainty, which may weigh heavily on our financial performance and the value of our common stock.

Protectionism and other governmental causes of recessions and other negative economic factors may increase. Risks resulting from any future debt crisis in Europe or any similar crisis could have a detrimental impact on the global economic recovery, sovereign and non-sovereign debt in these countries and the financial condition of European financial institutions. Market and economic disruptions have affected, and may in the future affect, consumer confidence levels and spending, personal bankruptcy rates, levels of incurrence and defaults on consumer debt and home prices, among other factors. We cannot assure you that market disruptions in Europe, including the increased cost of funding for certain governments and financial institutions, will not impact the global economy. To the extent uncertainty regarding the United Kingdom or the EU negatively impacts consumer confidence, market conditions and credit factors, our business, financial condition and results of operations could be materially adversely affected.

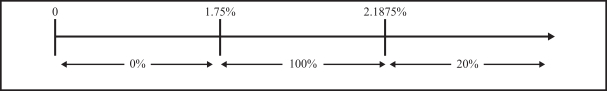

In October 2014, the Federal Reserve announced that it was concluding its bond-buying program, or quantitative easing, which was designed to stimulate the economy and expand the Federal Reserve’s holdings of long-term securities. It is unclear what effect, if any, the conclusion of the Federal Reserve’s bond-buying program has had or will have on the value of our investments. However, it is possible that, without quantitative easing by the Federal Reserve, these developments, along with the U.S. government’s credit and deficit concerns and the European sovereign debt crisis, could cause interest rates and borrowing costs to rise, which may negatively impact our ability to access the debt markets on favorable terms. In October 2019, the Federal Reserve decreased the federal funds rate to 1.75% followed by another decrease in March 2020 to 0.25%.

The U.S. Congress has passed, and the President signed into law on December 22, 2017, a tax reform bill that, among other things, significantly changed the taxation of business entities (including by significantly lowering corporate tax rates), the deductibility of interest expense, and the timing in which certain income items are recognized. Additionally, the Trump administration has called for significant change to U.S. trade, healthcare, immigration, foreign, and government regulatory policy. In this regard, there is significant uncertainty with respect to legislation, regulation and government policy at the federal level, as well as the state and local levels. Recent events have created a climate of heightened uncertainty and introduced new and difficult-to-quantify macroeconomic and political risks with potentially far-reaching implications. There has been a corresponding meaningful increase in the uncertainty surrounding interest rates, inflation, foreign exchange rates, trade volumes and fiscal and monetary policy. To the extent the U.S. Congress or Trump administration implements changes to U.S. policy, those changes may impact, among other things, the U.S. and global economy, international trade and relations, unemployment, immigration, corporate taxes, healthcare, the U.S. regulatory environment, inflation and other

36