Alcoa Corporation Investor Presentation September 2017 Exhibit 99.1

This presentation contains statements that relate to future events and expectations and as such constitute forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements include those containing such words as “anticipates,” “believes,” “could,” “estimates,” “expects,” “forecasts,” “goal,” “intends,” “may,” “outlook,” “plans,” “projects,” “seeks,” “sees,” “should,” “targets,” “will,” “would,” or other words of similar meaning. All statements by Alcoa Corporation that reflect expectations, assumptions or projections about the future, other than statements of historical fact, are forward-looking statements, including, without limitation, forecasts concerning global demand growth for bauxite, alumina, and aluminum, and supply/demand balances; statements, projections or forecasts of future or targeted financial results or operating performance; and statements about strategies, outlook, business and financial prospects. These statements reflect beliefs and assumptions that are based on Alcoa Corporation’s perception of historical trends, current conditions and expected future developments, as well as other factors that management believes are appropriate in the circumstances. Forward-looking statements are not guarantees of future performance and are subject to known and unknown risks, uncertainties, and changes in circumstances that are difficult to predict. Although Alcoa Corporation believes that the expectations reflected in any forward-looking statements are based on reasonable assumptions, it can give no assurance that these expectations will be attained and it is possible that actual results may differ materially from those indicated by these forward-looking statements due to a variety of risks and uncertainties. Such risks and uncertainties include, but are not limited to: (a) material adverse changes in aluminum industry conditions, including global supply and demand conditions and fluctuations in London Metal Exchange-based prices and premiums, as applicable, for primary aluminum, alumina, and other products, and fluctuations in indexed-based and spot prices for alumina; (b) deterioration in global economic and financial market conditions generally; (c) unfavorable changes in the markets served by Alcoa Corporation; (d) the impact of changes in foreign currency exchange rates on costs and results; (e) increases in energy costs; (f) changes in discount rates or investment returns on pension assets; (g) the inability to achieve the level of revenue growth, cash generation, cost savings, improvement in profitability and margins, fiscal discipline, or strengthening of competitiveness and operations anticipated from restructuring programs and productivity improvement, cash sustainability, technology advancements, and other initiatives; (h) the inability to realize expected benefits, in each case as planned and by targeted completion dates, from acquisitions, divestitures, facility closures, curtailments, restarts, expansions, or joint ventures; (i) political, economic, and regulatory risks in the countries in which Alcoa Corporation operates or sells products; (j) the outcome of contingencies, including legal proceedings, government or regulatory investigations, and environmental remediation; (k) the impact of cyberattacks and potential information technology or data security breaches; and (l) the other risk factors discussed in Item 1A of Alcoa Corporation’s Form 10-K for the fiscal year ended December 31, 2016 and other reports filed by Alcoa Corporation with the U.S. Securities and Exchange Commission. Alcoa Corporation disclaims any obligation to update publicly any forward-looking statements, whether in response to new information, future events or otherwise, except as required by applicable law. Market projections are subject to the risks discussed above and other risks in the market. Information contained in the following slides that has previously been presented publicly by Alcoa speaks as of the date it was originally presented as indicated. Alcoa is not updating or affirming any of such information as of today’s date. The provision of this information shall not create any implication that the information has not changed since it was originally presented. Cautionary Statement regarding Forward-Looking Statements Important information

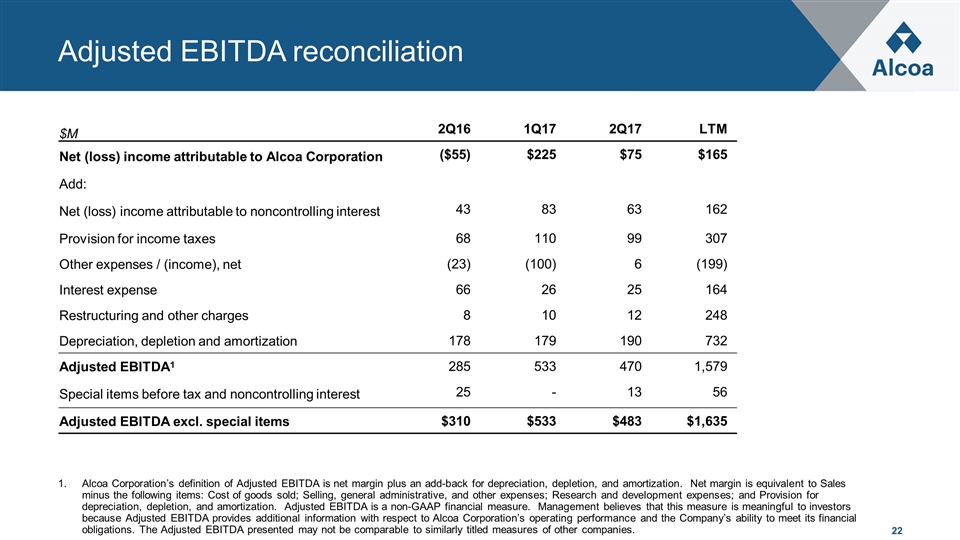

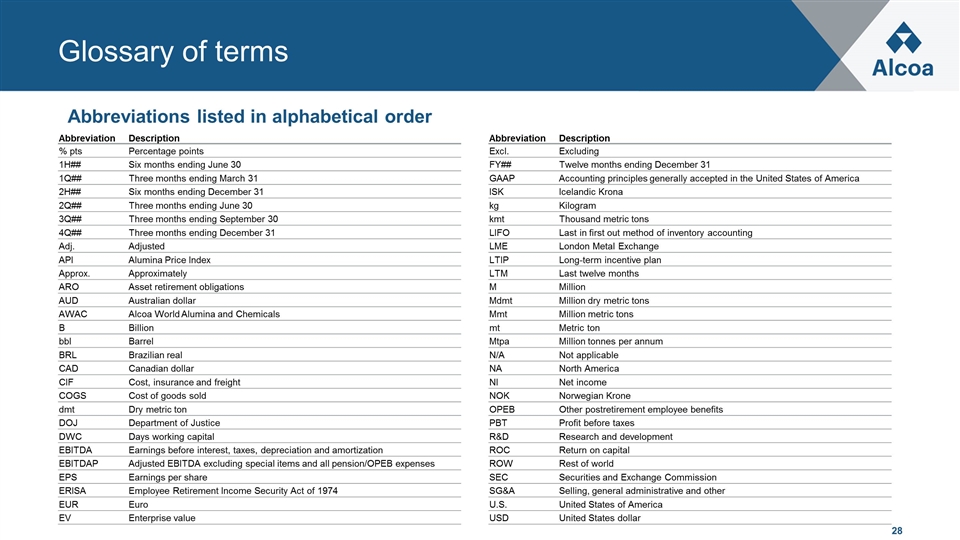

This presentation includes unaudited “non-GAAP financial measures” (GAAP means accounting principles generally accepted in the United States of America) as defined in Regulation G under the Securities Exchange Act of 1934. Alcoa Corporation believes that the presentation of non-GAAP financial measures is useful to investors because such measures provide (i) additional information about the operating performance of Alcoa Corporation and (ii) insight on the ability of Alcoa Corporation to meet its financial obligations, by adjusting the most directly comparable GAAP financial measure for the impact of, among others, “special items” as defined by the Company, non-cash items in nature, and/or nonoperating expense or income items. The presentation of non-GAAP financial measures is meant to supplement, and is not intended to be a substitute for and should not be considered in isolation from, the financial measures reported in accordance with GAAP. See the appendix for reconciliations of the non-GAAP financial measures included in this presentation to their most directly comparable GAAP financial measures. Alcoa Corporation has not provided a reconciliation of any forward-looking non-GAAP financial measures to the most directly comparable GAAP financial measures due primarily to the variability and complexity in making accurate forecasts and projections, as not all of the information for a quantitative reconciliation is available to the company without unreasonable effort. References to historical EBITDA herein mean Adjusted EBITDA. Non-GAAP financial measures Important information (continued) A glossary of abbreviations and defined terms used throughout this presentation can be found in the appendix. Glossary of terms

2Q17 Financial Information as presented on July 19, 2017 and Other Information

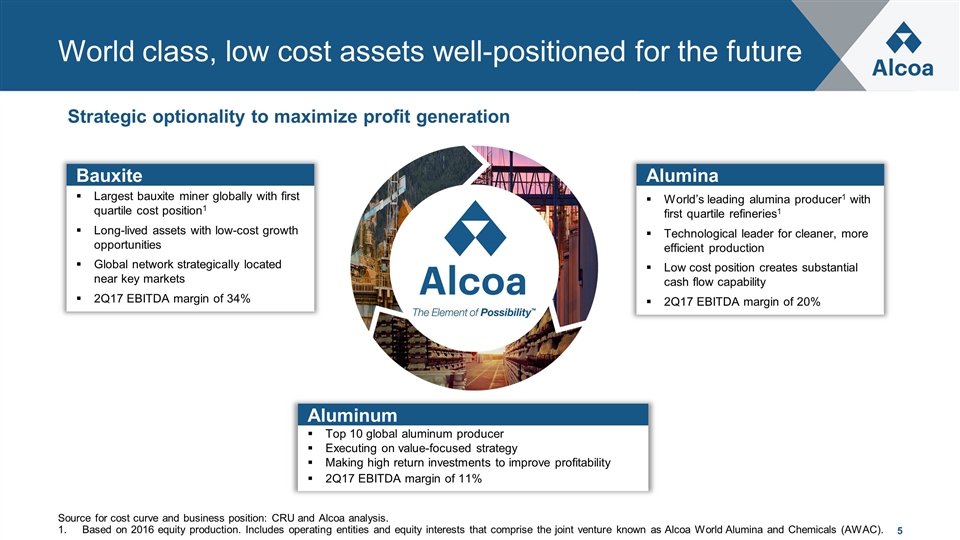

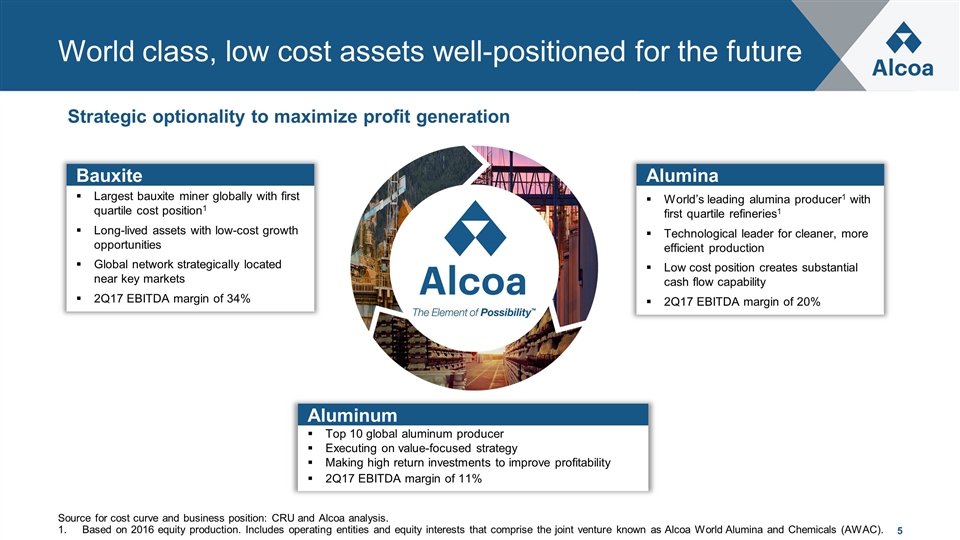

Strategic optionality to maximize profit generation World class, low cost assets well-positioned for the future Source for cost curve and business position: CRU and Alcoa analysis. Based on 2016 equity production. Includes operating entities and equity interests that comprise the joint venture known as Alcoa World Alumina and Chemicals (AWAC). Largest bauxite miner globally with first quartile cost position1 Long-lived assets with low-cost growth opportunities Global network strategically located near key markets 2Q17 EBITDA margin of 34% Bauxite World’s leading alumina producer1 with first quartile refineries1 Technological leader for cleaner, more efficient production Low cost position creates substantial cash flow capability 2Q17 EBITDA margin of 20% Alumina Aluminum Top 10 global aluminum producer Executing on value-focused strategy Making high return investments to improve profitability 2Q17 EBITDA margin of 11% Aluminum

Warrick smelter partial restart rationale and overview Key information and financial impacts Warrick smelter restart announced on July 11 Strategic benefits of an integrated facility Restarting three of five potlines (161 kmt of 269 kmt), first hot metal in January, 2018 Restart expected to be complete in 2Q18 Estimate restart expense of $30 to $35 million to be incurred in 2H171 Plan to record an after-tax benefit of ~$25 million in 3Q17 to reverse closure accruals1 Self-generating all power requirements from on site Warrick power station Increase asset utilization Efficient source of molten metal for rolling mill Meet future rolling mill volume requirements Special items excluded from Adjusted EBITDA results in 3Q17 and 4Q17.

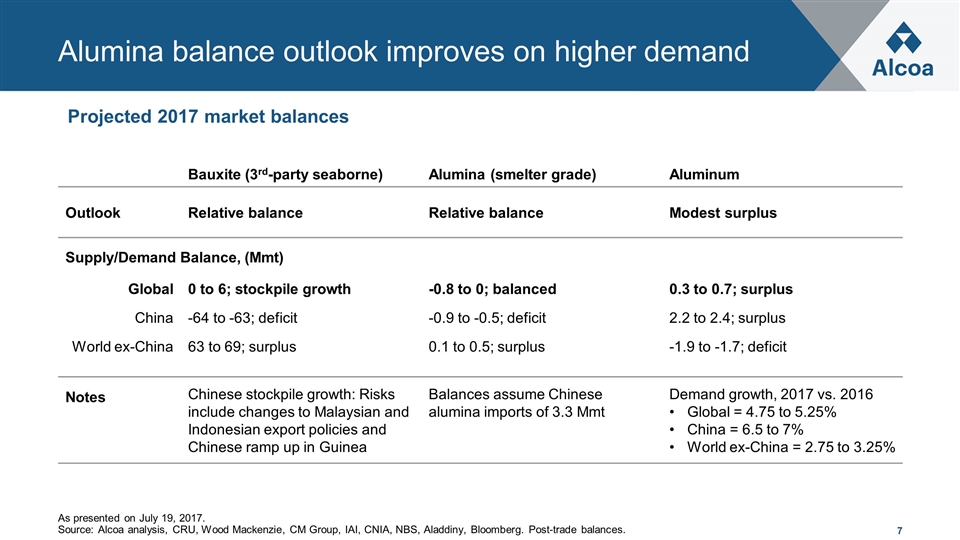

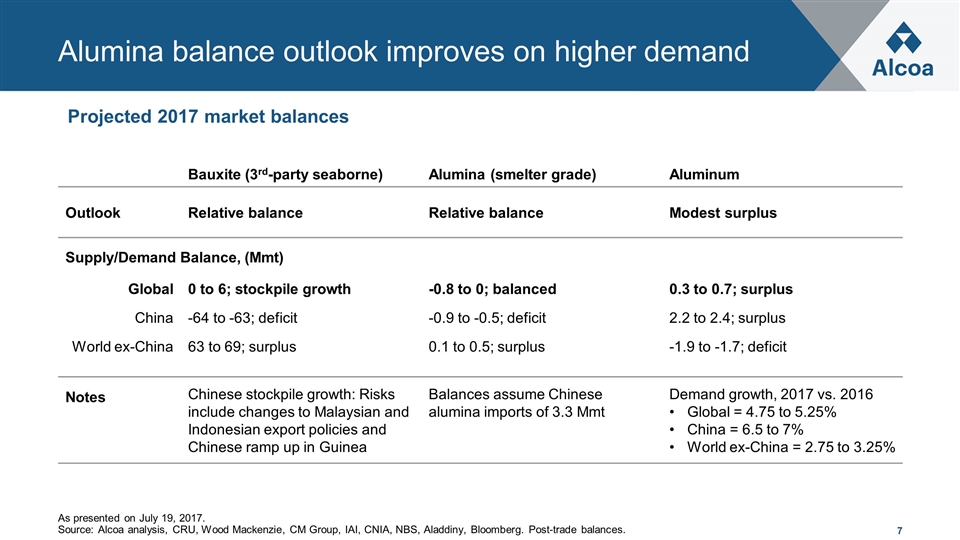

Projected 2017 market balances Alumina balance outlook improves on higher demand As presented on July 19, 2017. Source: Alcoa analysis, CRU, Wood Mackenzie, CM Group, IAI, CNIA, NBS, Aladdiny, Bloomberg. Post-trade balances. Bauxite (3rd-party seaborne) Alumina (smelter grade) Aluminum Outlook Relative balance Relative balance Modest surplus Supply/Demand Balance, (Mmt) Global 0 to 6; stockpile growth -0.8 to 0; balanced 0.3 to 0.7; surplus China -64 to -63; deficit -0.9 to -0.5; deficit 2.2 to 2.4; surplus World ex-China 63 to 69; surplus 0.1 to 0.5; surplus -1.9 to -1.7; deficit Notes Chinese stockpile growth: Risks include changes to Malaysian and Indonesian export policies and Chinese ramp up in Guinea Balances assume Chinese alumina imports of 3.3 Mmt Demand growth, 2017 vs. 2016 Global = 4.75 to 5.25% China = 6.5 to 7% World ex-China = 2.75 to 3.25%

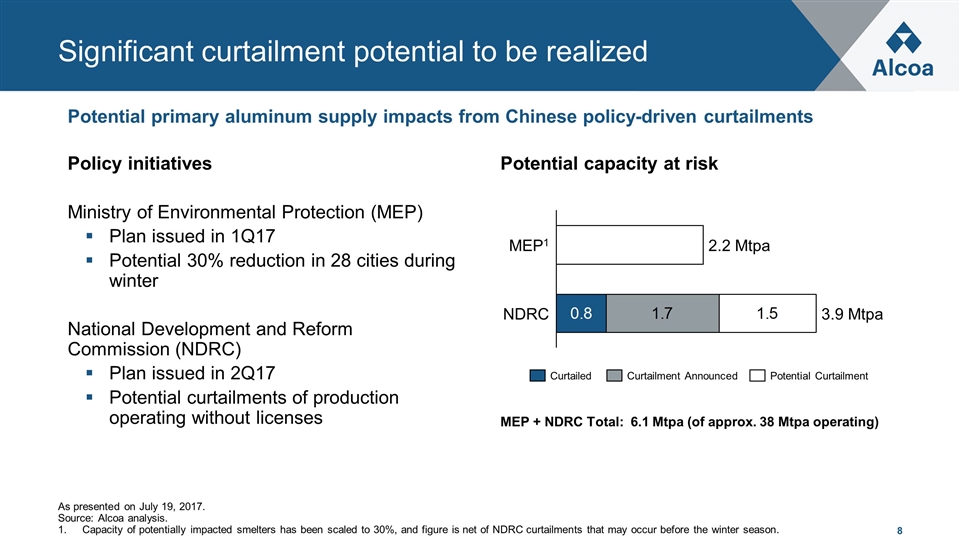

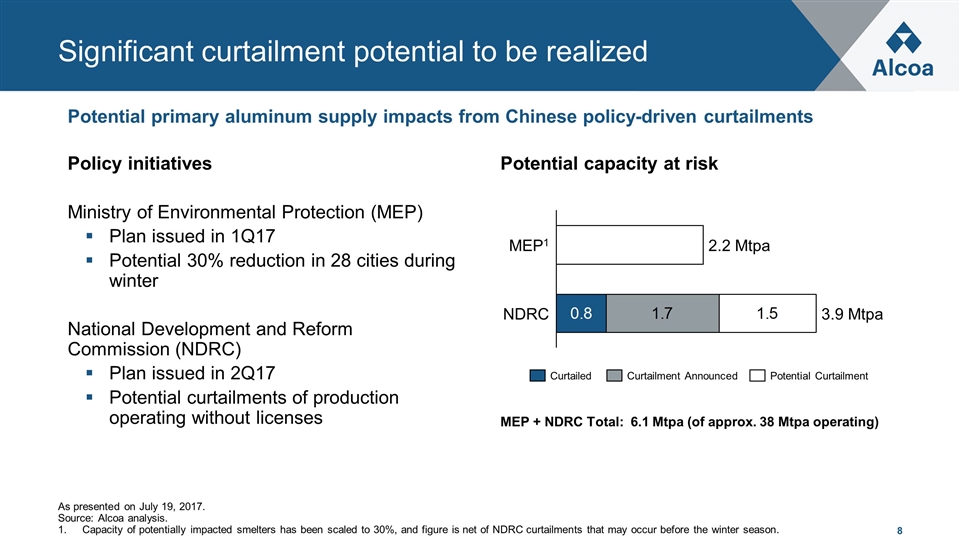

Potential primary aluminum supply impacts from Chinese policy-driven curtailments Policy initiatives Significant curtailment potential to be realized Ministry of Environmental Protection (MEP) Plan issued in 1Q17 Potential 30% reduction in 28 cities during winter National Development and Reform Commission (NDRC) Plan issued in 2Q17 Potential curtailments of production operating without licenses Potential capacity at risk As presented on July 19, 2017. Source: Alcoa analysis. Capacity of potentially impacted smelters has been scaled to 30%, and figure is net of NDRC curtailments that may occur before the winter season. Mtpa 1 Mtpa MEP + NDRC Total: 6.1 Mtpa (of approx. 38 Mtpa operating)

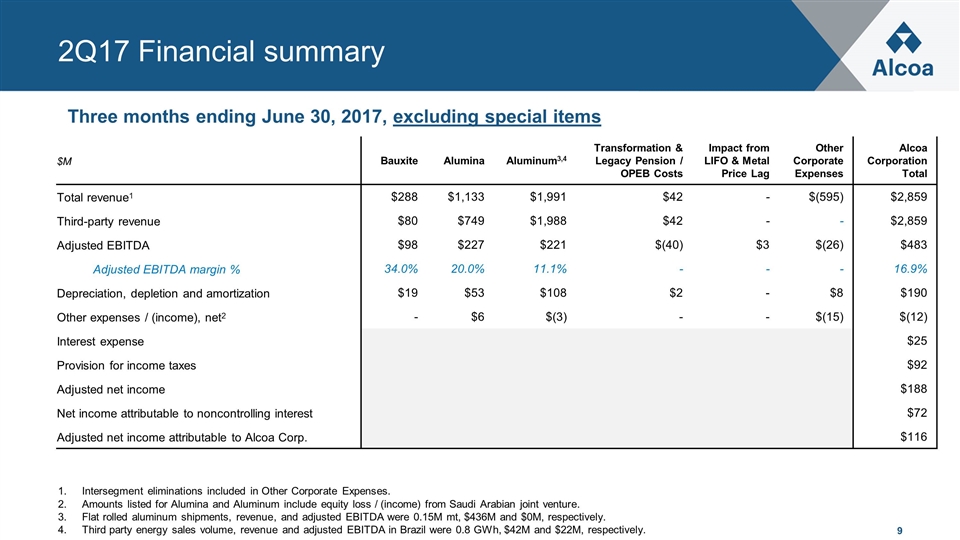

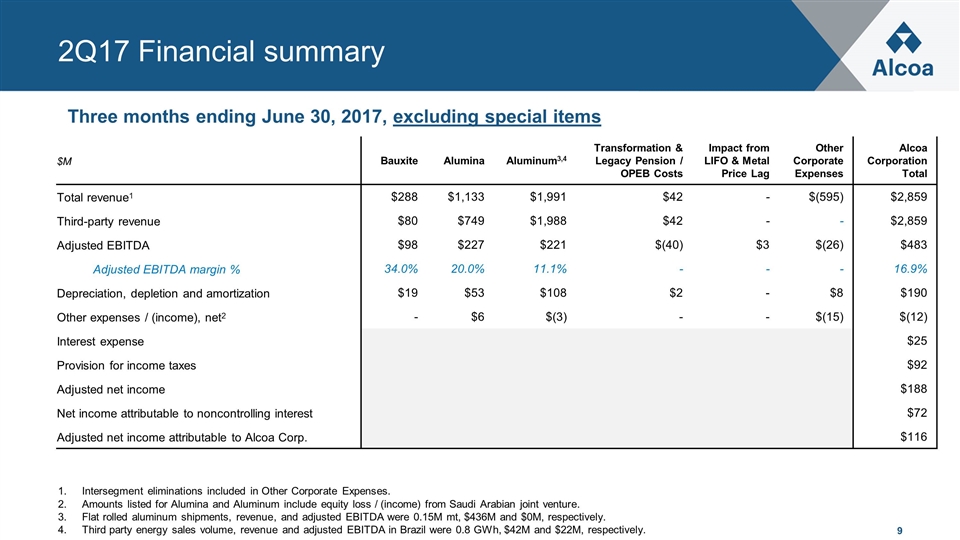

2Q17 Financial summary $M Bauxite Alumina Aluminum3,4 Transformation & Legacy Pension / OPEB Costs Impact from LIFO & Metal Price Lag Other Corporate Expenses Alcoa Corporation Total Total revenue1 $288 $1,133 $1,991 $42 - $(595) $2,859 Third-party revenue $80 $749 $1,988 $42 - - $2,859 Adjusted EBITDA $98 $227 $221 $(40) $3 $(26) $483 Adjusted EBITDA margin % 34.0% 20.0% 11.1% - - - 16.9% Depreciation, depletion and amortization $19 $53 $108 $2 - $8 $190 Other expenses / (income), net2 - $6 $(3) - - $(15) $(12) Interest expense $25 Provision for income taxes $92 Adjusted net income $188 Net income attributable to noncontrolling interest $72 Adjusted net income attributable to Alcoa Corp. $116 Intersegment eliminations included in Other Corporate Expenses. Amounts listed for Alumina and Aluminum include equity loss / (income) from Saudi Arabian joint venture. Flat rolled aluminum shipments, revenue, and adjusted EBITDA were 0.15M mt, $436M and $0M, respectively. Third party energy sales volume, revenue and adjusted EBITDA in Brazil were 0.8 GWh, $42M and $22M, respectively. Three months ending June 30, 2017, excluding special items

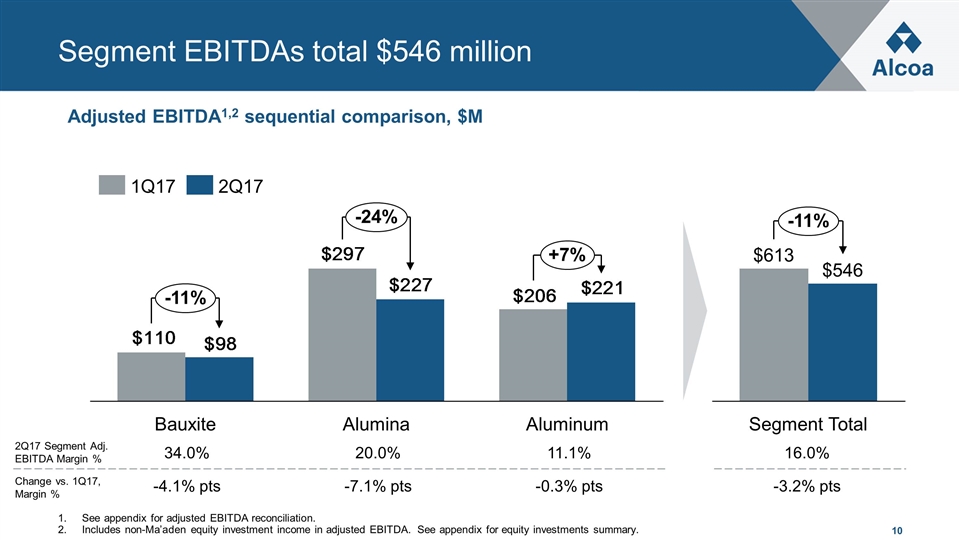

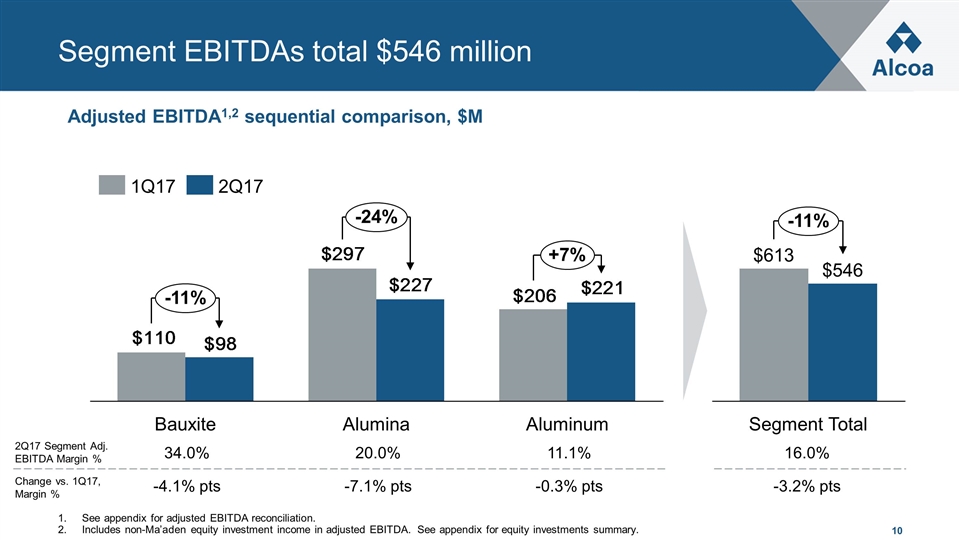

Adjusted EBITDA1,2 sequential comparison, $M Segment EBITDAs total $546 million See appendix for adjusted EBITDA reconciliation. Includes non-Ma’aden equity investment income in adjusted EBITDA. See appendix for equity investments summary. 34.0% 20.0% 11.1% -4.1% pts -7.1% pts -0.3% pts 2Q17 Segment Adj. EBITDA Margin % Change vs. 1Q17, Margin % 16.0% -3.2% pts

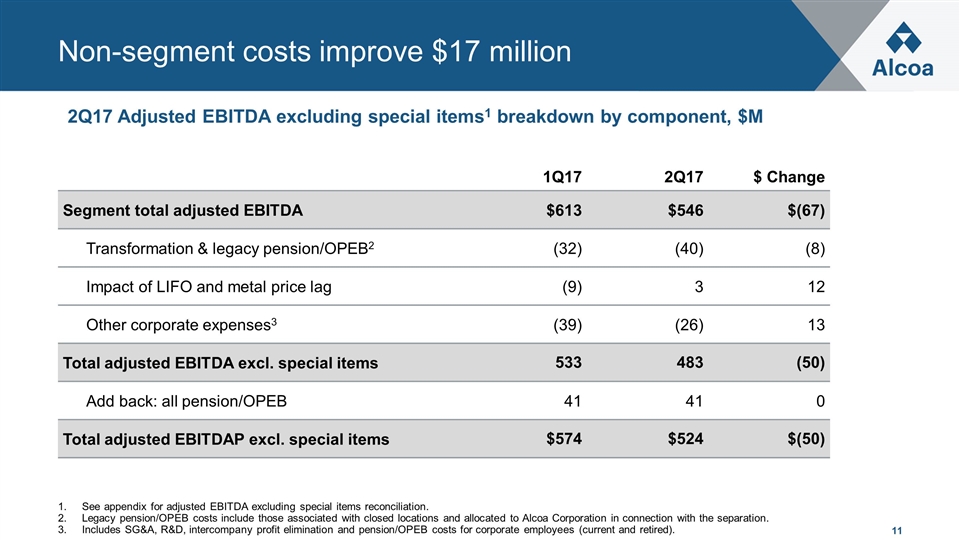

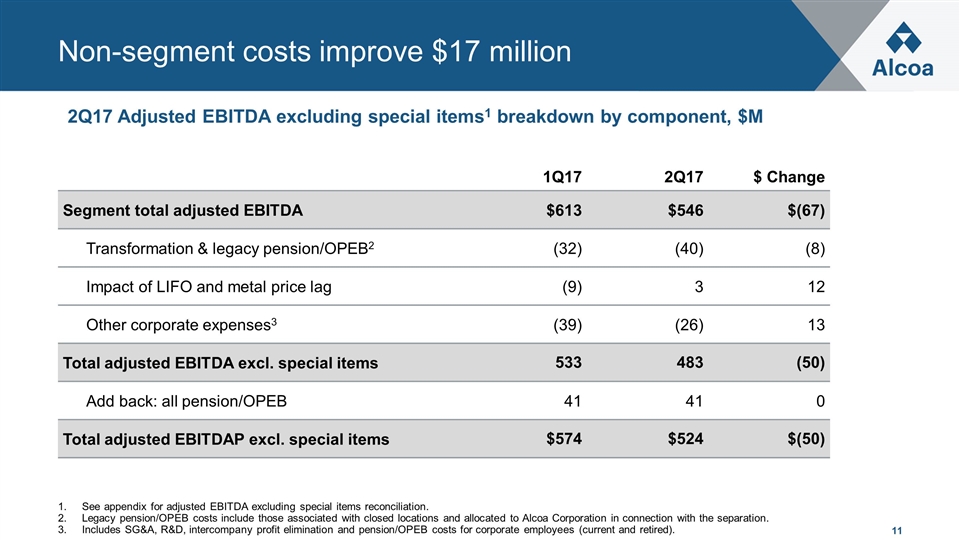

1Q17 2Q17 $ Change Segment total adjusted EBITDA $613 $546 $(67) Transformation & legacy pension/OPEB2 (32) (40) (8) Impact of LIFO and metal price lag (9) 3 12 Other corporate expenses3 (39) (26) 13 Total adjusted EBITDA excl. special items 533 483 (50) Add back: all pension/OPEB 41 41 0 Total adjusted EBITDAP excl. special items $574 $524 $(50) 2Q17 Adjusted EBITDA excluding special items1 breakdown by component, $M Non-segment costs improve $17 million See appendix for adjusted EBITDA excluding special items reconciliation. Legacy pension/OPEB costs include those associated with closed locations and allocated to Alcoa Corporation in connection with the separation. Includes SG&A, R&D, intercompany profit elimination and pension/OPEB costs for corporate employees (current and retired).

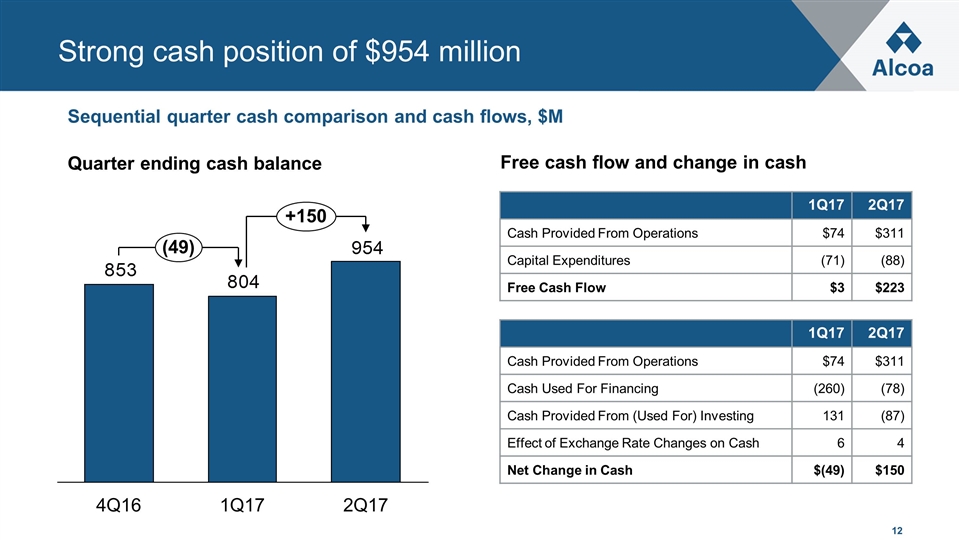

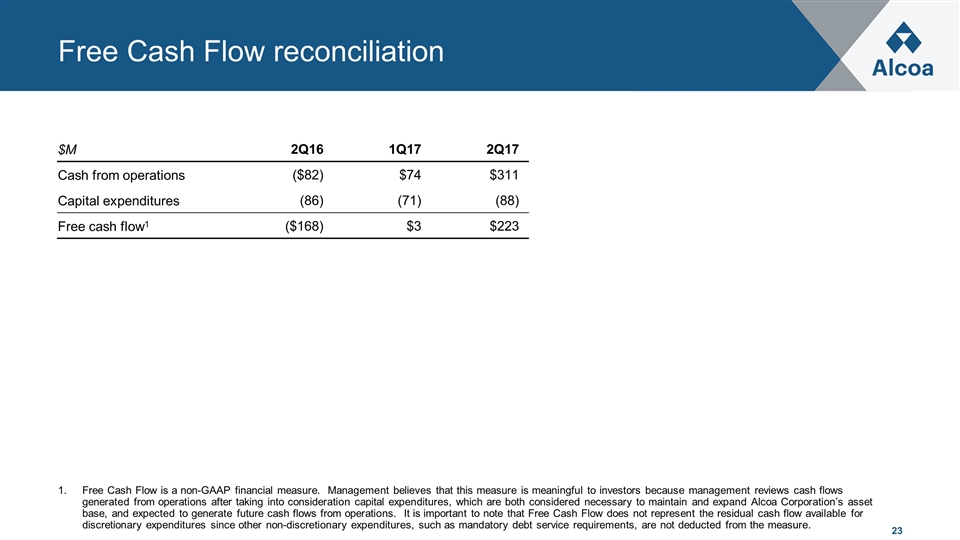

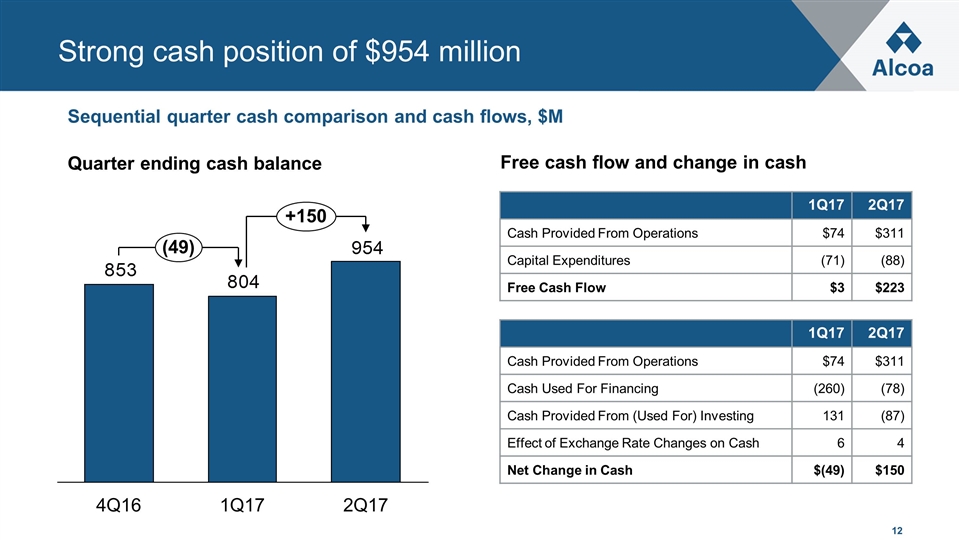

Sequential quarter cash comparison and cash flows, $M Quarter ending cash balance Strong cash position of $954 million 1Q17 2Q17 Cash Provided From Operations $74 $311 Capital Expenditures (71) (88) Free Cash Flow $3 $223 1Q17 2Q17 Cash Provided From Operations $74 $311 Cash Used For Financing (260) (78) Cash Provided From (Used For) Investing 131 (87) Effect of Exchange Rate Changes on Cash 6 4 Net Change in Cash $(49) $150 Free cash flow and change in cash

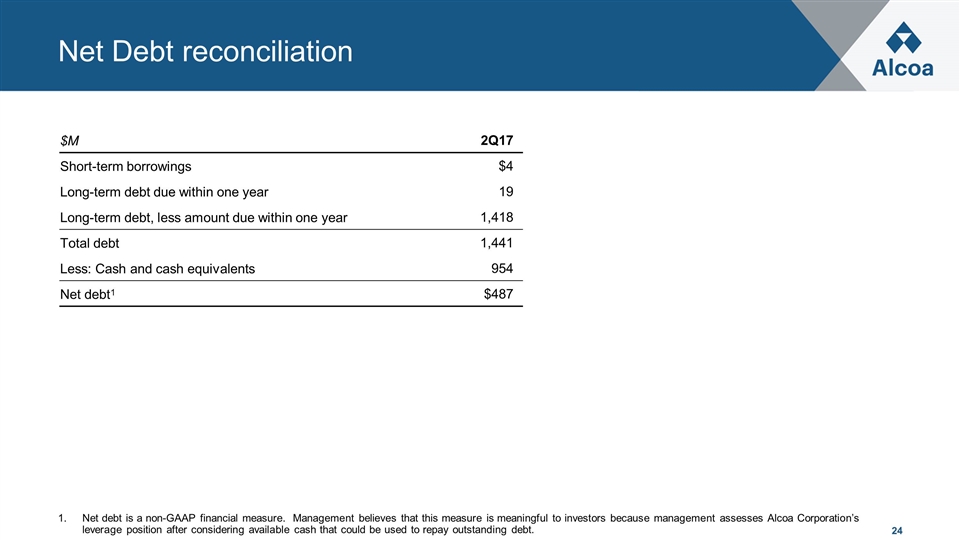

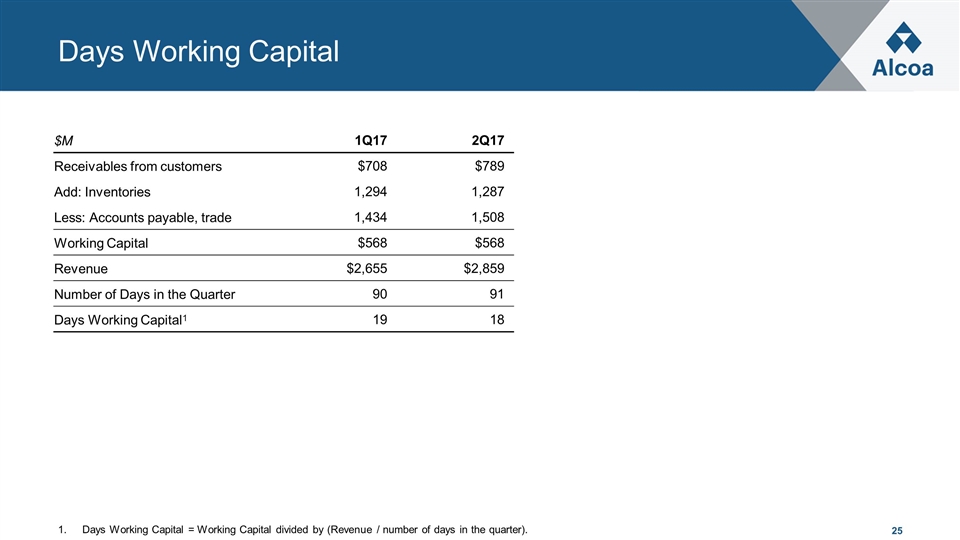

Manage cash position Optimize working capital Key financial metrics as of June 30, 2017 Balance sheet strengthens $46M in return seeking capital expenditures and $113M in sustaining capital expenditures. Annualized; see appendix for 1H17 Annualized ROC reconciliation and calculation. Debt ratings for Alcoa Corporation and Alcoa Nederland Holding BV, as of September 10, 2017. 1H17 Capital Expenditures1 $159M 1H17 Return on Capital2 6.1% Net Debt-to-LTM Adjusted EBITDA 0.3x Pension & OPEB Net Liability $2.9B Cash $954M 2Q17 Days Working Capital 18 Days Maintain assets Invest in return seeking projects Manage leverage Focus on pension and OPEB S&P BB-, Moody’s Ba2, Fitch BB+3

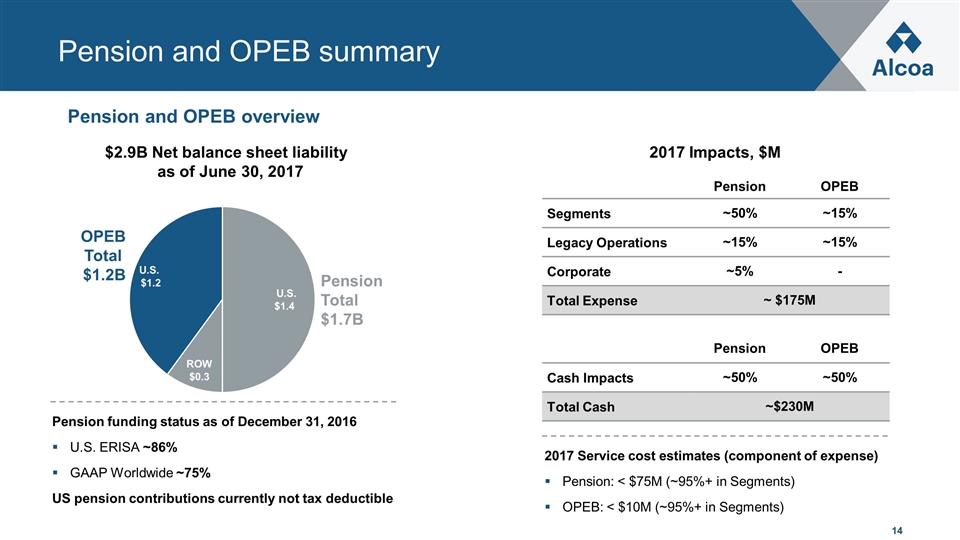

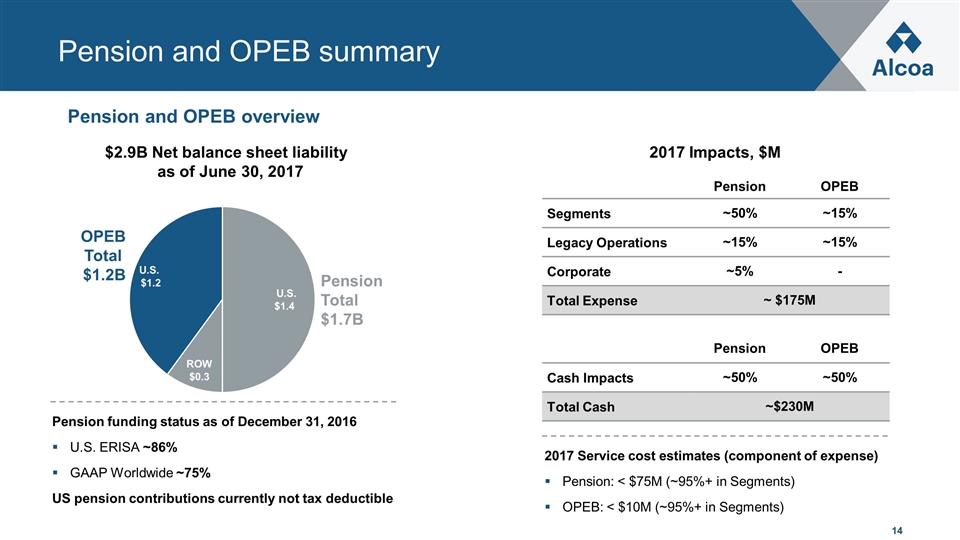

Pension and OPEB overview Pension and OPEB summary 2017 Service cost estimates (component of expense) Pension: < $75M (~95%+ in Segments) OPEB: < $10M (~95%+ in Segments) Total $1.2B U.S. $1.2 ROW Total $1.7B U.S. $1.4 $2.9B Net balance sheet liability as of June 30, 2017 2017 Impacts, $M Pension OPEB Segments ~50% ~15% Legacy Operations ~15% ~15% Corporate ~5% - Total Expense ~ $175M Pension OPEB Cash Impacts ~50% ~50% Total Cash ~$230M Pension funding status as of December 31, 2016 U.S. ERISA ~86% GAAP Worldwide ~75% US pension contributions currently not tax deductible

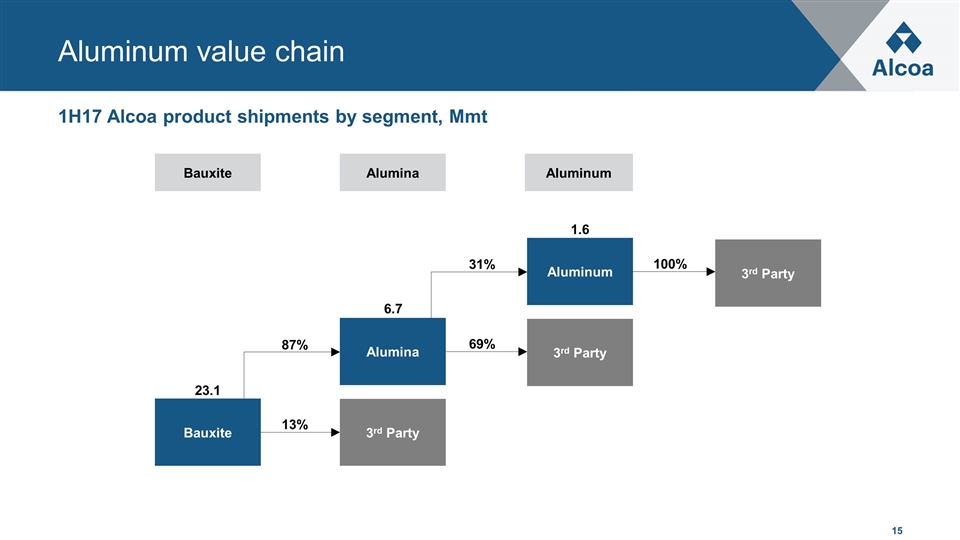

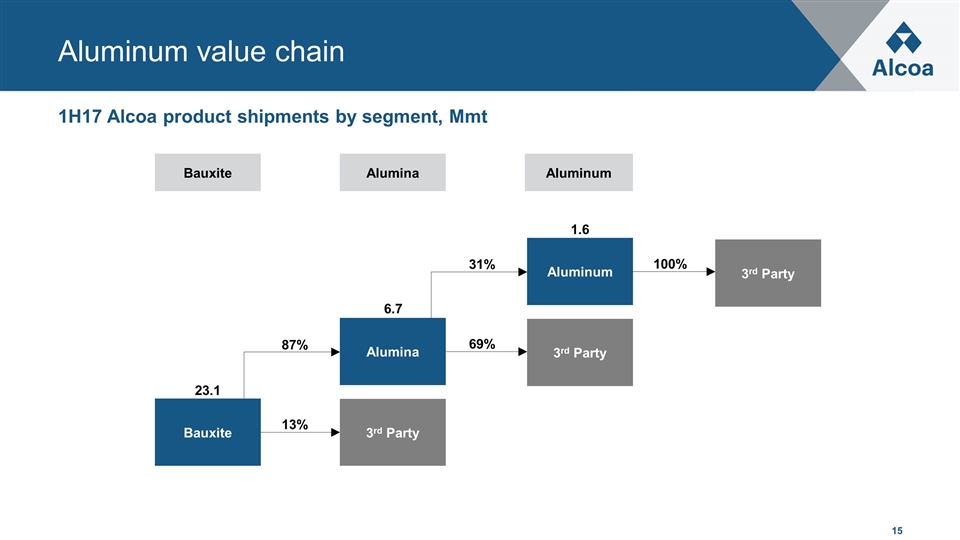

Bauxite 1H17 Alcoa product shipments by segment, Mmt Aluminum value chain Bauxite Alumina Aluminum 3rd Party 23.1 87% 13% 6.7 3rd Party 31% 69% Alumina 3rd Party 100% Aluminum 1.6

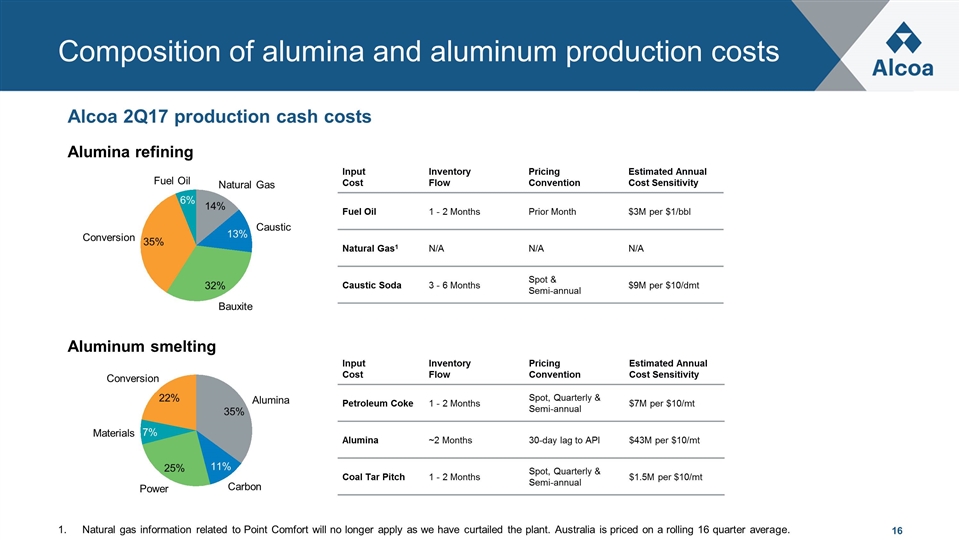

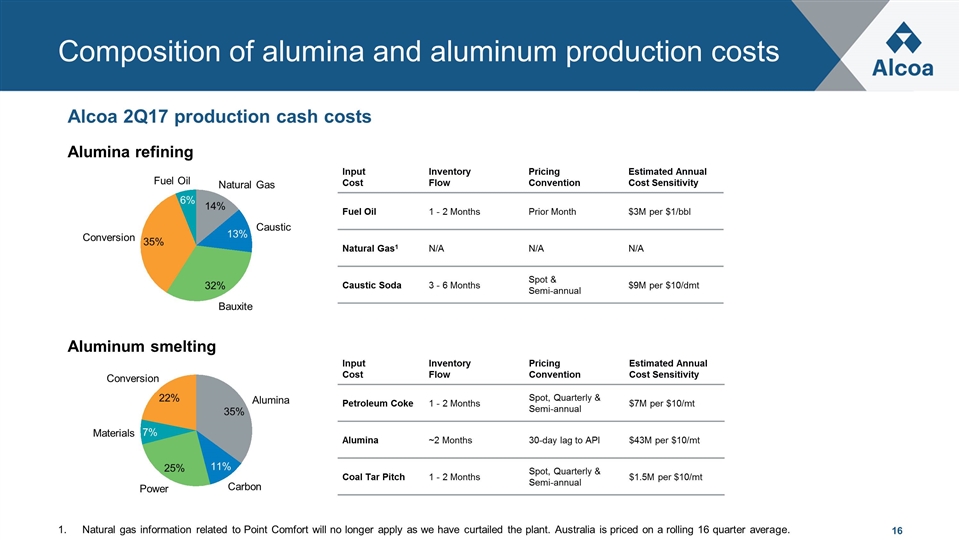

Alcoa 2Q17 production cash costs Alumina refining Composition of alumina and aluminum production costs Natural gas information related to Point Comfort will no longer apply as we have curtailed the plant. Australia is priced on a rolling 16 quarter average. Input Cost Inventory Flow Pricing Convention Estimated Annual Cost Sensitivity Fuel Oil 1 - 2 Months Prior Month $3M per $1/bbl Natural Gas1 N/A N/A N/A Caustic Soda 3 - 6 Months Spot & Semi-annual $9M per $10/dmt Aluminum smelting Input Cost Inventory Flow Pricing Convention Estimated Annual Cost Sensitivity Petroleum Coke 1 - 2 Months Spot, Quarterly & Semi-annual $7M per $10/mt Alumina ~2 Months 30-day lag to API $43M per $10/mt Coal Tar Pitch 1 - 2 Months Spot, Quarterly & Semi-annual $1.5M per $10/mt

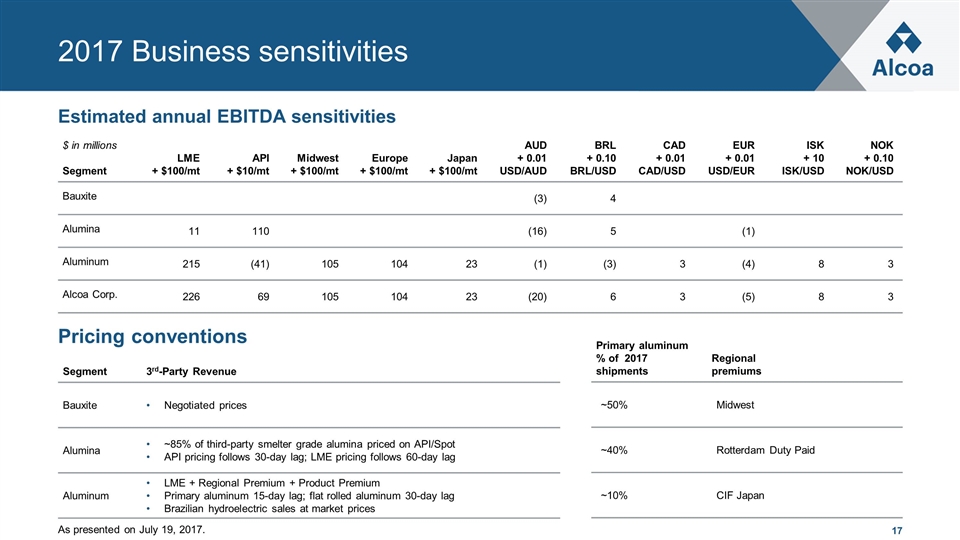

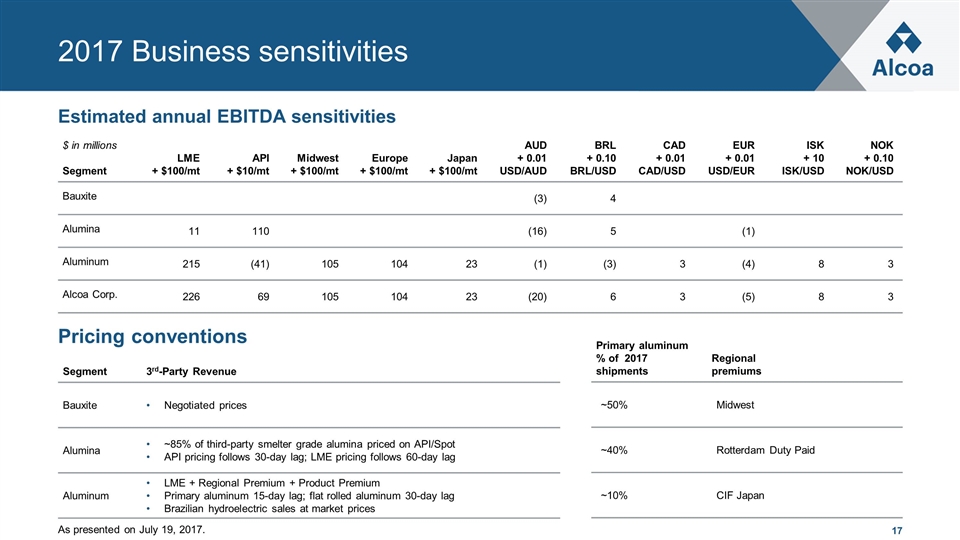

$ in millions Segment LME + $100/mt API + $10/mt Midwest + $100/mt Europe + $100/mt Japan + $100/mt AUD + 0.01 USD/AUD BRL + 0.10 BRL/USD CAD + 0.01 CAD/USD EUR + 0.01 USD/EUR ISK + 10 ISK/USD NOK + 0.10 NOK/USD Bauxite (3) 4 Alumina 11 110 (16) 5 (1) Aluminum 215 (41) 105 104 23 (1) (3) 3 (4) 8 3 Alcoa Corp. 226 69 105 104 23 (20) 6 3 (5) 8 3 Estimated annual EBITDA sensitivities 2017 Business sensitivities Pricing conventions Segment 3rd-Party Revenue Bauxite Negotiated prices Alumina ~85% of third-party smelter grade alumina priced on API/Spot API pricing follows 30-day lag; LME pricing follows 60-day lag Aluminum LME + Regional Premium + Product Premium Primary aluminum 15-day lag; flat rolled aluminum 30-day lag Brazilian hydroelectric sales at market prices Primary aluminum % of 2017 shipments Regional premiums ~50% Midwest ~40% Rotterdam Duty Paid ~10% CIF Japan As presented on July 19, 2017.

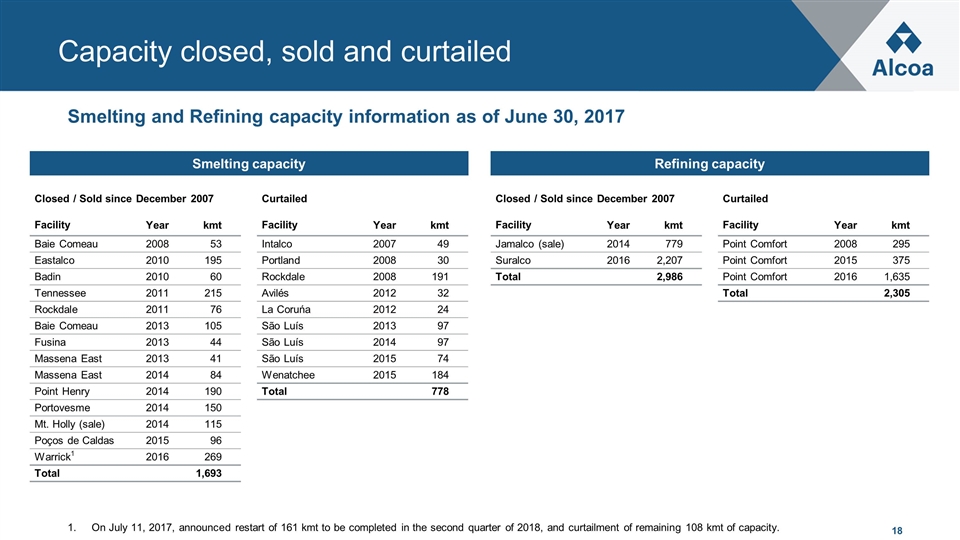

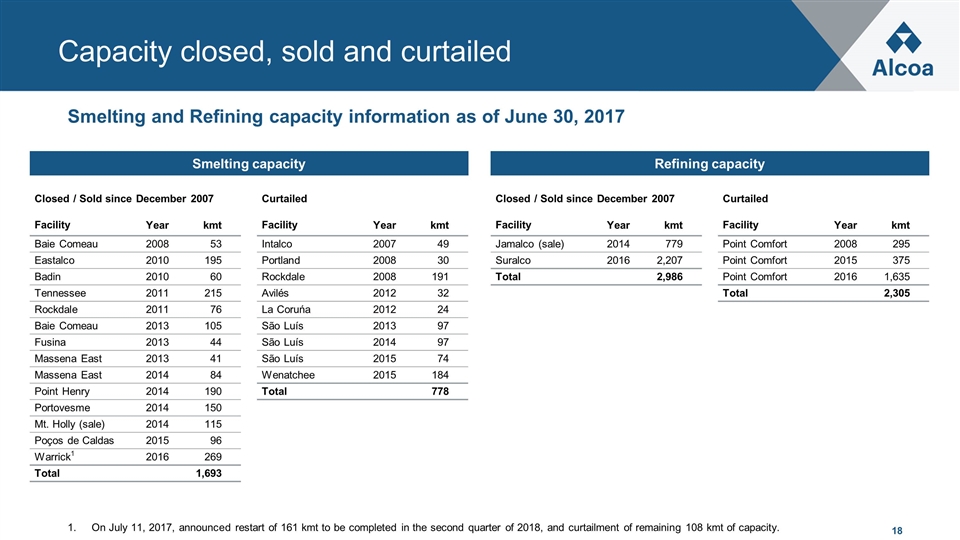

Capacity closed, sold and curtailed Smelting capacity Refining capacity Smelting and Refining capacity information as of June 30, 2017 Closed / Sold since December 2007 Facility Year kmt Baie Comeau 2008 53 Eastalco 2010 195 Badin 2010 60 Tennessee 2011 215 Rockdale 2011 76 Baie Comeau 2013 105 Fusina 2013 44 Massena East 2013 41 Massena East 2014 84 Point Henry 2014 190 Portovesme 2014 150 Mt. Holly (sale) 2014 115 Poços de Caldas 2015 96 Warrick1 2016 269 Total 1,693 Curtailed Facility Year kmt Intalco 2007 49 Portland 2008 30 Rockdale 2008 191 Avilés 2012 32 La Coruńa 2012 24 São Luís 2013 97 São Luís 2014 97 São Luís 2015 74 Wenatchee 2015 184 Total 778 Closed / Sold since December 2007 Facility Year kmt Jamalco (sale) 2014 779 Suralco 2016 2,207 Total 2,986 Curtailed Facility Year kmt Point Comfort 2008 295 Point Comfort 2015 375 Point Comfort 2016 1,635 Total 2,305 On July 11, 2017, announced restart of 161 kmt to be completed in the second quarter of 2018, and curtailment of remaining 108 kmt of capacity.

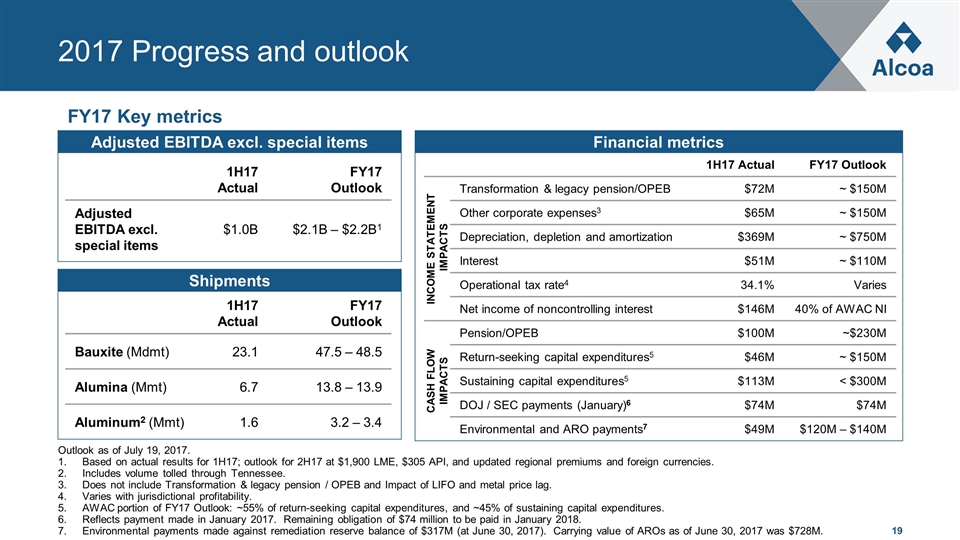

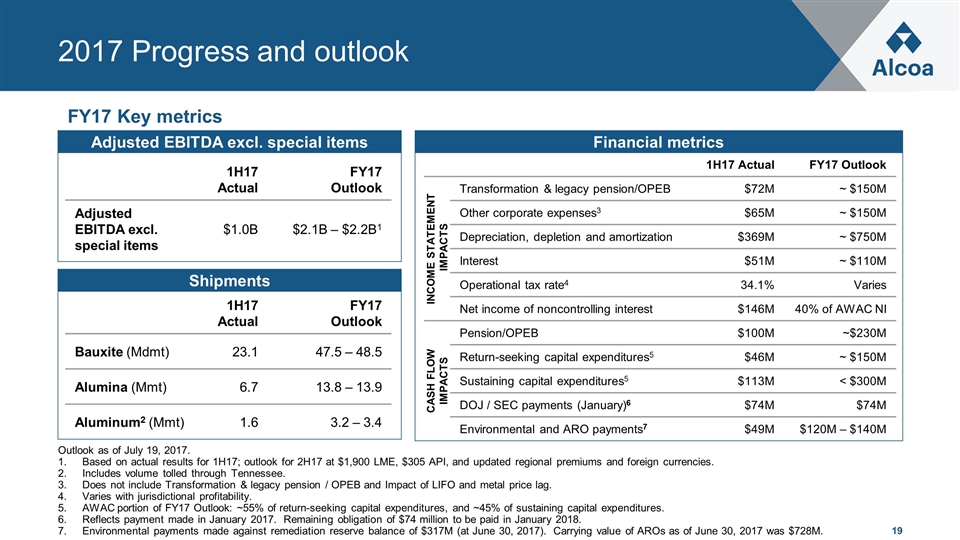

FY17 Key metrics 2017 Progress and outlook Outlook as of July 19, 2017. Based on actual results for 1H17; outlook for 2H17 at $1,900 LME, $305 API, and updated regional premiums and foreign currencies. Includes volume tolled through Tennessee. Does not include Transformation & legacy pension / OPEB and Impact of LIFO and metal price lag. Varies with jurisdictional profitability. AWAC portion of FY17 Outlook: ~55% of return-seeking capital expenditures, and ~45% of sustaining capital expenditures. Reflects payment made in January 2017. Remaining obligation of $74 million to be paid in January 2018. Environmental payments made against remediation reserve balance of $317M (at June 30, 2017). Carrying value of AROs as of June 30, 2017 was $728M. Shipments Financial metrics 1H17 Actual FY17 Outlook INCOME STATEMENT IMPACTS Transformation & legacy pension/OPEB $72M ~ $150M Other corporate expenses3 $65M ~ $150M Depreciation, depletion and amortization $369M ~ $750M Interest $51M ~ $110M Operational tax rate4 34.1% Varies Net income of noncontrolling interest $146M 40% of AWAC NI CASH FLOW IMPACTS Pension/OPEB $100M ~$230M Return-seeking capital expenditures5 $46M ~ $150M Sustaining capital expenditures5 $113M < $300M DOJ / SEC payments (January)6 $74M $74M Environmental and ARO payments7 $49M $120M – $140M 1H17 Actual FY17 Outlook Bauxite (Mdmt) 23.1 47.5 – 48.5 Alumina (Mmt) 6.7 13.8 – 13.9 Aluminum2 (Mmt) 1.6 3.2 – 3.4 Adjusted EBITDA excl. special items 1H17 Actual FY17 Outlook Adjusted EBITDA excl. special items $1.0B $2.1B – $2.2B1

Appendix & Reconciliations

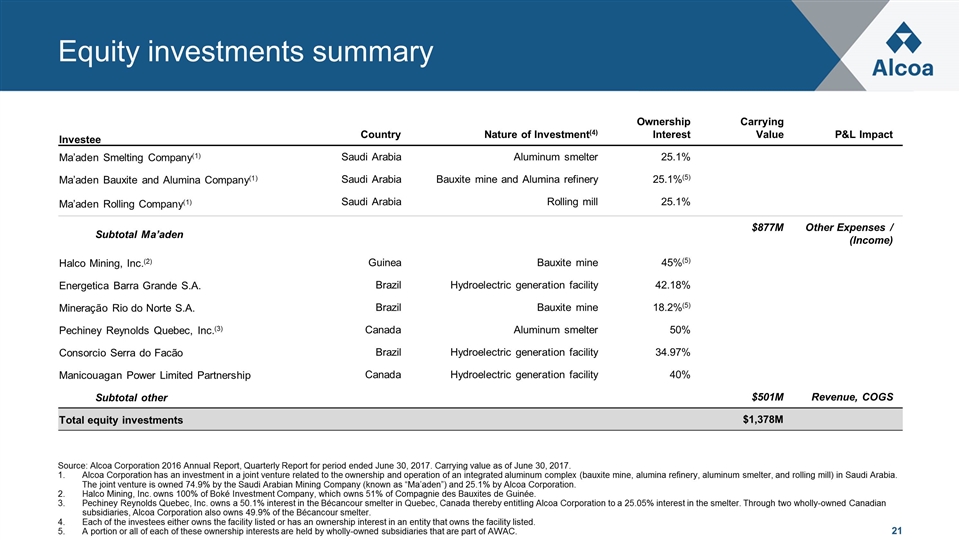

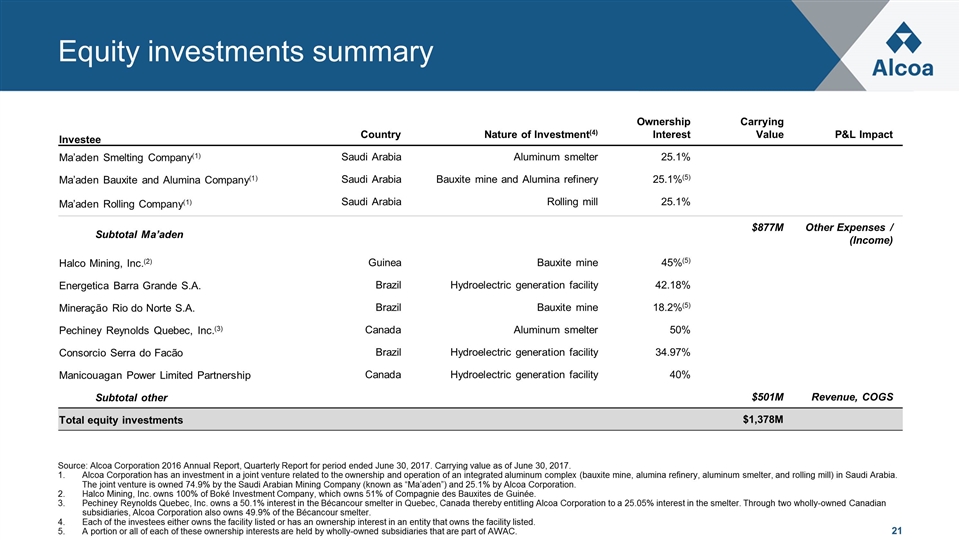

Source: Alcoa Corporation 2016 Annual Report, Quarterly Report for period ended June 30, 2017. Carrying value as of June 30, 2017. Alcoa Corporation has an investment in a joint venture related to the ownership and operation of an integrated aluminum complex (bauxite mine, alumina refinery, aluminum smelter, and rolling mill) in Saudi Arabia. The joint venture is owned 74.9% by the Saudi Arabian Mining Company (known as “Ma’aden”) and 25.1% by Alcoa Corporation. Halco Mining, Inc. owns 100% of Boké Investment Company, which owns 51% of Compagnie des Bauxites de Guinée. Pechiney Reynolds Quebec, Inc. owns a 50.1% interest in the Bécancour smelter in Quebec, Canada thereby entitling Alcoa Corporation to a 25.05% interest in the smelter. Through two wholly-owned Canadian subsidiaries, Alcoa Corporation also owns 49.9% of the Bécancour smelter. Each of the investees either owns the facility listed or has an ownership interest in an entity that owns the facility listed. A portion or all of each of these ownership interests are held by wholly-owned subsidiaries that are part of AWAC. Equity investments summary Investee Country Nature of Investment(4) Ownership Interest Carrying Value P&L Impact Ma’aden Smelting Company(1) Saudi Arabia Aluminum smelter 25.1% Ma’aden Bauxite and Alumina Company(1) Saudi Arabia Bauxite mine and Alumina refinery 25.1%(5) Ma’aden Rolling Company(1) Saudi Arabia Rolling mill 25.1% Subtotal Ma’aden $877M Other Expenses / (Income) Halco Mining, Inc.(2) Guinea Bauxite mine 45%(5) Energetica Barra Grande S.A. Brazil Hydroelectric generation facility 42.18% Mineração Rio do Norte S.A. Brazil Bauxite mine 18.2%(5) Pechiney Reynolds Quebec, Inc.(3) Canada Aluminum smelter 50% Consorcio Serra do Facão Brazil Hydroelectric generation facility 34.97% Manicouagan Power Limited Partnership Canada Hydroelectric generation facility 40% Subtotal other $501M Revenue, COGS Total equity investments $1,378M

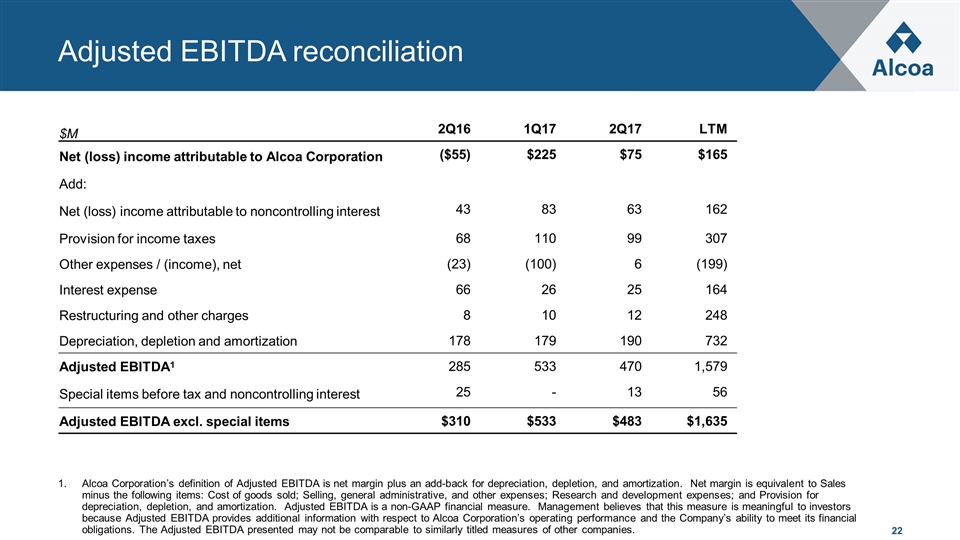

Adjusted EBITDA reconciliation $M 2Q16 1Q17 2Q17 LTM Net (loss) income attributable to Alcoa Corporation ($55) $225 $75 $165 Add: Net (loss) income attributable to noncontrolling interest 43 83 63 162 Provision for income taxes 68 110 99 307 Other expenses / (income), net (23) (100) 6 (199) Interest expense 66 26 25 164 Restructuring and other charges 8 10 12 248 Depreciation, depletion and amortization 178 179 190 732 Adjusted EBITDA1 285 533 470 1,579 Special items before tax and noncontrolling interest 25 - 13 56 Adjusted EBITDA excl. special items $310 $533 $483 $1,635 Alcoa Corporation’s definition of Adjusted EBITDA is net margin plus an add-back for depreciation, depletion, and amortization. Net margin is equivalent to Sales minus the following items: Cost of goods sold; Selling, general administrative, and other expenses; Research and development expenses; and Provision for depreciation, depletion, and amortization. Adjusted EBITDA is a non-GAAP financial measure. Management believes that this measure is meaningful to investors because Adjusted EBITDA provides additional information with respect to Alcoa Corporation’s operating performance and the Company’s ability to meet its financial obligations. The Adjusted EBITDA presented may not be comparable to similarly titled measures of other companies.

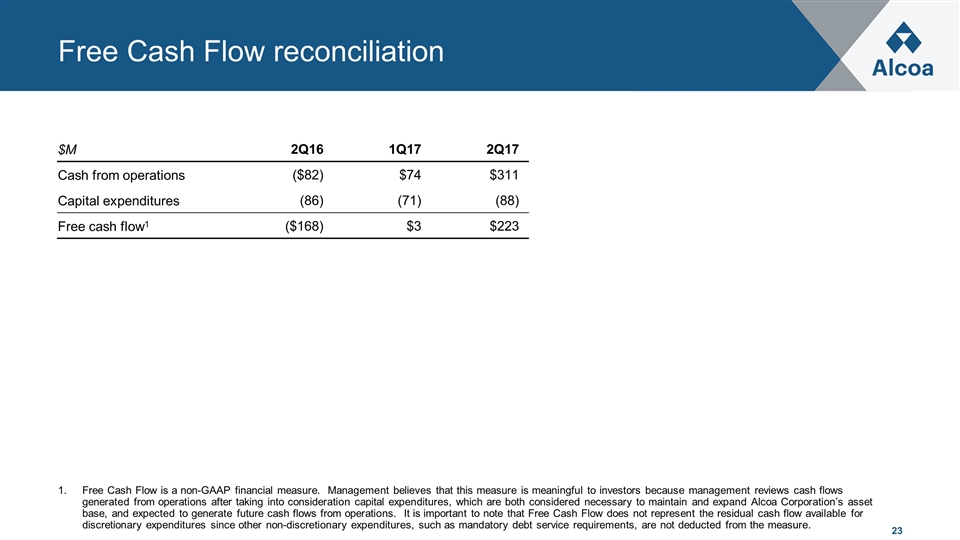

Free Cash Flow reconciliation $M 2Q16 1Q17 2Q17 Cash from operations ($82) $74 $311 Capital expenditures (86) (71) (88) Free cash flow1 ($168) $3 $223 Free Cash Flow is a non-GAAP financial measure. Management believes that this measure is meaningful to investors because management reviews cash flows generated from operations after taking into consideration capital expenditures, which are both considered necessary to maintain and expand Alcoa Corporation’s asset base, and expected to generate future cash flows from operations. It is important to note that Free Cash Flow does not represent the residual cash flow available for discretionary expenditures since other non-discretionary expenditures, such as mandatory debt service requirements, are not deducted from the measure.

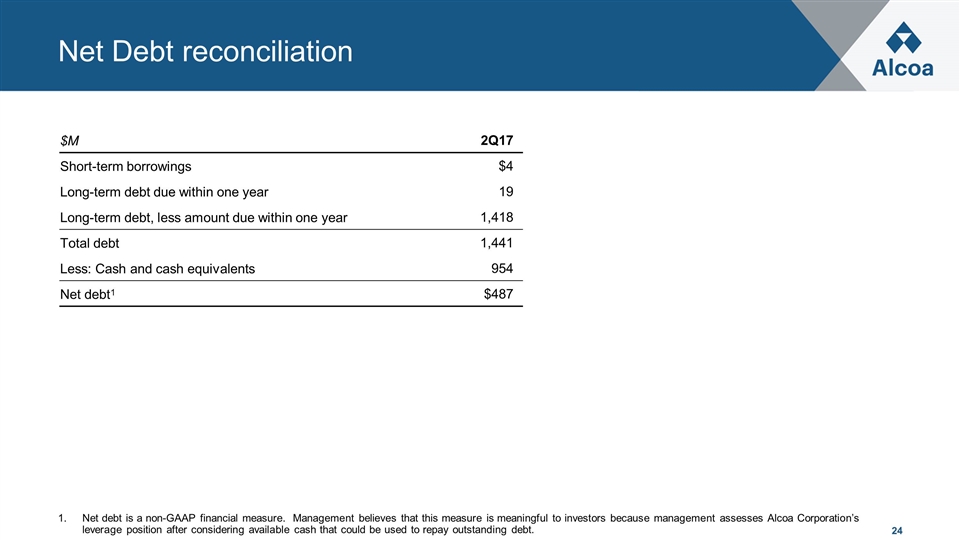

Net Debt reconciliation $M 2Q17 Short-term borrowings $4 Long-term debt due within one year 19 Long-term debt, less amount due within one year 1,418 Total debt 1,441 Less: Cash and cash equivalents 954 Net debt1 $487 Net debt is a non-GAAP financial measure. Management believes that this measure is meaningful to investors because management assesses Alcoa Corporation’s leverage position after considering available cash that could be used to repay outstanding debt.

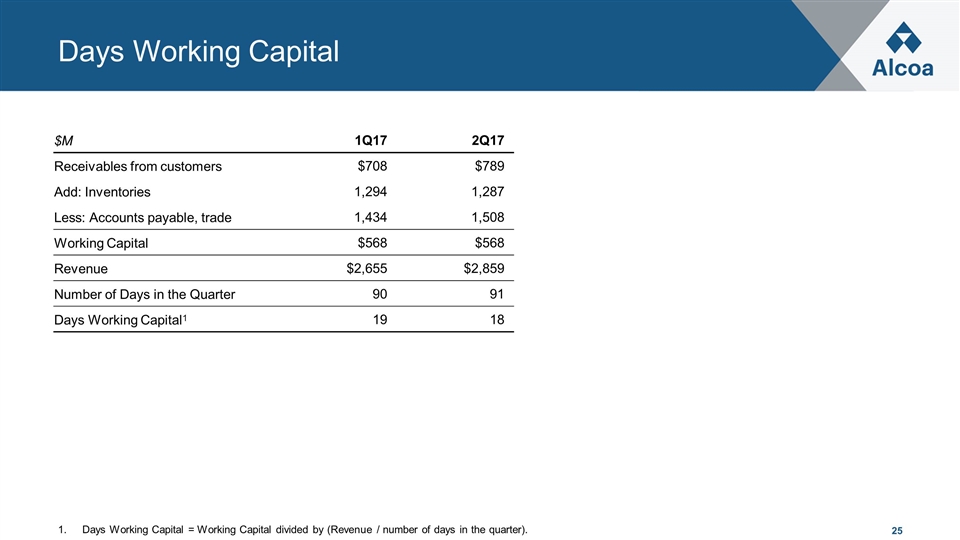

Days Working Capital $M 1Q17 2Q17 Receivables from customers $708 $789 Add: Inventories 1,294 1,287 Less: Accounts payable, trade 1,434 1,508 Working Capital $568 $568 Revenue $2,655 $2,859 Number of Days in the Quarter 90 91 Days Working Capital1 19 18 Days Working Capital = Working Capital divided by (Revenue / number of days in the quarter).

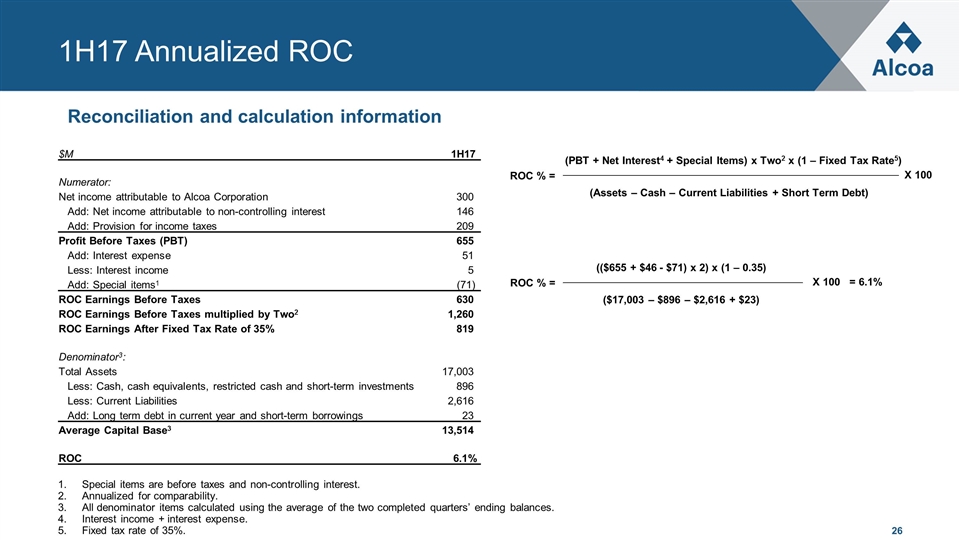

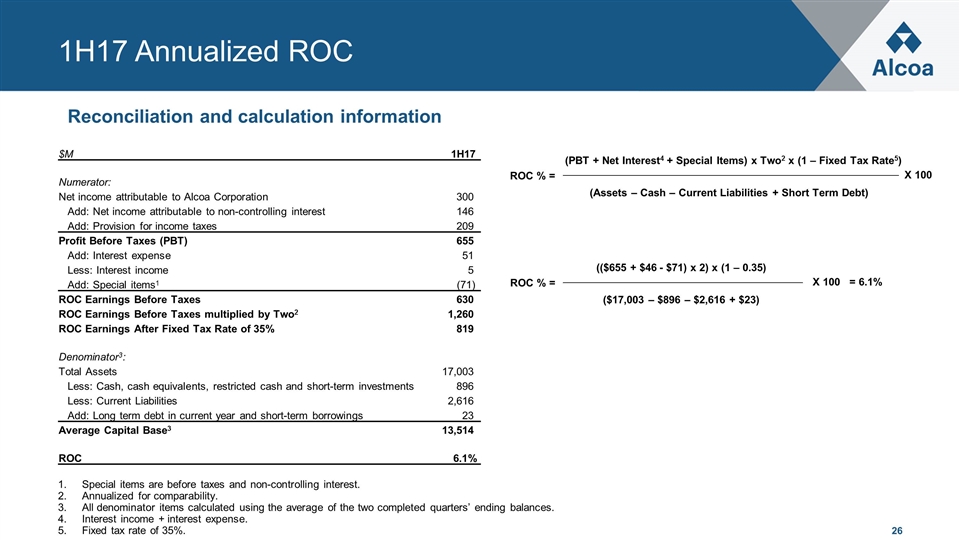

1H17 Annualized ROC $M 1H17 Numerator: Net income attributable to Alcoa Corporation 300 Add: Net income attributable to non-controlling interest 146 Add: Provision for income taxes 209 Profit Before Taxes (PBT) 655 Add: Interest expense 51 Less: Interest income 5 Add: Special items1 (71) ROC Earnings Before Taxes 630 ROC Earnings Before Taxes multiplied by Two2 1,260 ROC Earnings After Fixed Tax Rate of 35% 819 Denominator3: Total Assets 17,003 Less: Cash, cash equivalents, restricted cash and short-term investments 896 Less: Current Liabilities 2,616 Add: Long term debt in current year and short-term borrowings 23 Average Capital Base3 13,514 ROC 6.1% Special items are before taxes and non-controlling interest. Annualized for comparability. All denominator items calculated using the average of the two completed quarters’ ending balances. Interest income + interest expense. Fixed tax rate of 35%. (PBT + Net Interest4 + Special Items) x Two2 x (1 – Fixed Tax Rate5) (Assets – Cash – Current Liabilities + Short Term Debt) ROC % = X 100 (($655 + $46 - $71) x 2) x (1 – 0.35) ($17,003 – $896 – $2,616 + $23) ROC % = X 100 = 6.1% Reconciliation and calculation information

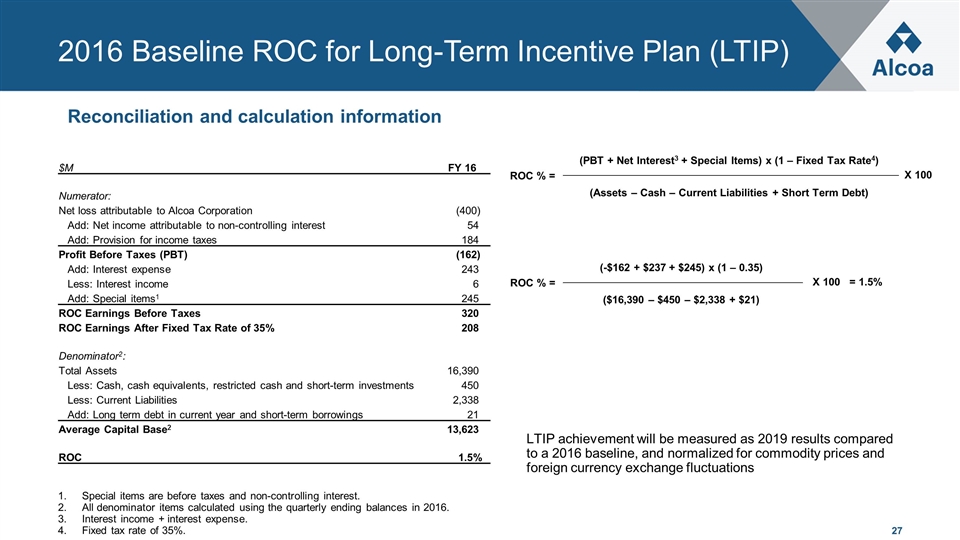

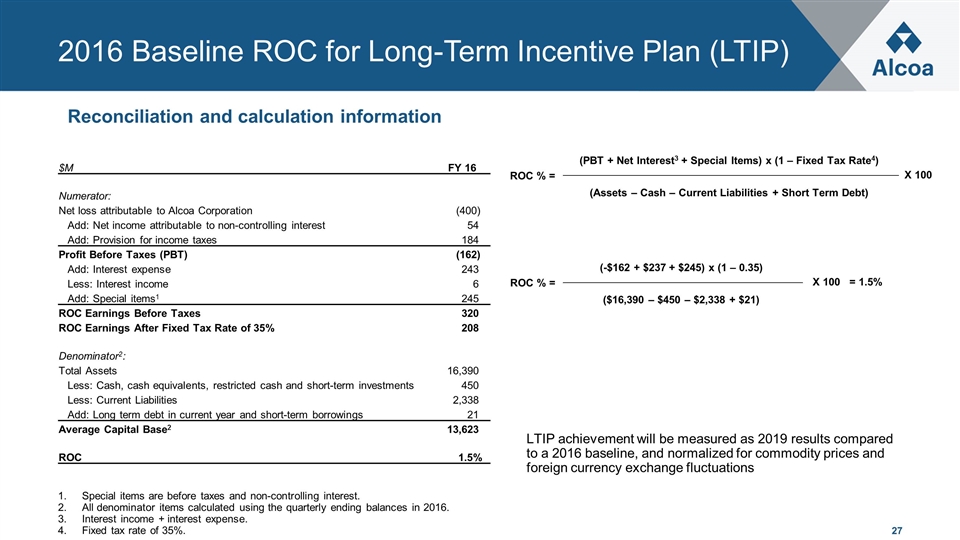

2016 Baseline ROC for Long-Term Incentive Plan (LTIP) $M FY 16 Numerator: Net loss attributable to Alcoa Corporation (400) Add: Net income attributable to non-controlling interest 54 Add: Provision for income taxes 184 Profit Before Taxes (PBT) (162) Add: Interest expense 243 Less: Interest income 6 Add: Special items1 245 ROC Earnings Before Taxes 320 ROC Earnings After Fixed Tax Rate of 35% 208 Denominator2: Total Assets 16,390 Less: Cash, cash equivalents, restricted cash and short-term investments 450 Less: Current Liabilities 2,338 Add: Long term debt in current year and short-term borrowings 21 Average Capital Base2 13,623 ROC 1.5% Special items are before taxes and non-controlling interest. All denominator items calculated using the quarterly ending balances in 2016. Interest income + interest expense. Fixed tax rate of 35%. (PBT + Net Interest3 + Special Items) x (1 – Fixed Tax Rate4) (Assets – Cash – Current Liabilities + Short Term Debt) ROC % = X 100 (-$162 + $237 + $245) x (1 – 0.35) ($16,390 – $450 – $2,338 + $21) ROC % = X 100 = 1.5% Reconciliation and calculation information LTIP achievement will be measured as 2019 results compared to a 2016 baseline, and normalized for commodity prices and foreign currency exchange fluctuations

Abbreviations listed in alphabetical order Glossary of terms Abbreviation Description % pts Percentage points 1H## Six months ending June 30 1Q## Three months ending March 31 2H## Six months ending December 31 2Q## Three months ending June 30 3Q## Three months ending September 30 4Q## Three months ending December 31 Adj. Adjusted API Alumina Price Index Approx. Approximately ARO Asset retirement obligations AUD Australian dollar AWAC Alcoa World Alumina and Chemicals B Billion bbl Barrel BRL Brazilian real CAD Canadian dollar CIF Cost, insurance and freight COGS Cost of goods sold dmt Dry metric ton DOJ Department of Justice DWC Days working capital EBITDA Earnings before interest, taxes, depreciation and amortization EBITDAP Adjusted EBITDA excluding special items and all pension/OPEB expenses EPS Earnings per share ERISA Employee Retirement Income Security Act of 1974 EUR Euro EV Enterprise value Abbreviation Description Excl. Excluding FY## Twelve months ending December 31 GAAP Accounting principles generally accepted in the United States of America ISK Icelandic Krona kg Kilogram kmt Thousand metric tons LIFO Last in first out method of inventory accounting LME London Metal Exchange LTIP Long-term incentive plan LTM Last twelve months M Million Mdmt Million dry metric tons Mmt Million metric tons mt Metric ton Mtpa Million tonnes per annum N/A Not applicable NA North America NI Net income NOK Norwegian Krone OPEB Other postretirement employee benefits PBT Profit before taxes R&D Research and development ROC Return on capital ROW Rest of world SEC Securities and Exchange Commission SG&A Selling, general administrative and other U.S. United States of America USD United States dollar