UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

(Rule 14a-101)

INFORMATION REQUIRED IN

PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the Registrant ¨ Filed by a Party other than the Registrant x

Check the appropriate box:

| | |

| ¨ | | Preliminary Proxy Statement |

| ¨ | | Confidential, For Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| x | | Definitive Proxy Statement |

| ¨ | | Definitive Additional Materials |

| ¨ | | Soliciting Material Pursuant to § 240.14a-12 |

GAS NATURAL INC.

(Name of Registrant as Specified in Its Charter)

Richard M. Osborne,

Darryl L. Knight,

Terence S. Profughi,

Joseph M. Gorman,

Martin W. Hathy, and

Lauren Tristano

The Committee to Re-Energize Gas Natural

(Name of Person(s) Filing Proxy Statement, if Other Than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| | | | |

| |

| x | | No fee required. |

| |

| ¨ | | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | (1) | | Title of each class of securities to which transaction applies: |

| | (2) | | Aggregate number of securities to which transaction applies: |

| | (3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | (4) | | Proposed maximum aggregate value of transaction: |

| | (5) | | Total fee paid: |

| |

| ¨ | | Fee paid previously with proxy materials. |

| |

| ¨ | | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | (1) | | Amount previously paid: |

| | (2) | | Form, Schedule or Registration Statement No.: |

| | (3) | | Filing Party: |

| | (4) | | Date Filed: |

2016 ANNUAL MEETING OF SHAREHOLDERS

OF

GAS NATURAL INC.

PROXY STATEMENT

OF

THE COMMITTEE TO RE-ENERGIZE GAS NATURAL

PLEASE SIGN, DATE AND MAIL THE ENCLOSED WHITE PROXY CARD TODAY

The Committee to Re-Energize Gas Natural is providing you with this proxy statement in connection with our solicitation of proxies to be used at the 2016 annual meeting of shareholders of Gas Natural Inc. (“Gas Natural” or the “Company”) and any postponements, adjournments or continuations thereof (the “Annual Meeting”).

At the Annual Meeting, we are seeking your support to:

| | • | | Vote on the election of the Participants’ six director nominees to the Company’s Board of Directors, to serve for a one year term until the next annual meeting or until their successors are duly elected and qualified, and |

| | • | | Repeal any provision of the Company’s Amended and Restated Code of Regulations, dated as of December 2, 2015 (the “Code”), in effect as of the date of the Annual Meeting which was not included in the Code as in effect on May 24, 2016 (the “Code Preservation Proposal”). |

In addition, you will be asked to:

| | • | | Vote on the ratification of the appointment of MaloneBailey, LLP as the Company’s independent auditor for the year ending December 31, 2016, |

| | • | | Vote, on an advisory basis, on the compensation of the Company’s named executive officers, and |

| | • | | Vote on such other business that may properly come before the Annual Meeting. |

The “Participants” making this solicitation, and the members of the Committee, are its six nominees (each a “Nominee”) to Gas Natural’s Board of Directors (the “Board”): Richard M. Osborne, Darryl L. Knight, Terence S. Profughi, Joseph M. Gorman, Martin W. Hathy, and Lauren Tristano. At the Annual Meeting, the Participants will seek the election to the Board of each Nominee. Each Nominee has consented, if elected, to serve as a director.

This Proxy Statement and the WHITE proxy card are first being furnished to shareholders on or about June 16, 2016.

We strongly urge you to carefully consider the information set forth in this Proxy Statement and then support our efforts to elect our Nominees by signing, dating and returning the enclosed WHITE proxy card in the postage paid envelope provided. If you have already voted a proxy card furnished by the Company’s management, you have every right to change your votes by signing, dating and returning a later dated proxy card or by voting in person at the Annual Meeting.

Even if you plan to attend the Annual Meeting, you are requested to complete, sign, date and return the WHITE proxy card in the enclosed postage paid envelope provided so that it is received at least one business day prior to the Annual Meeting, or, in the event that the Annual Meeting is adjourned or postponed, at least one business day prior to the date fixed for the adjourned or postponed meeting. If you have any questions or require any assistance with your vote, please contact Georgeson, which is assisting us, at their address and toll-free numbers listed below.

1

Important Notice Regarding the Availability of Proxy Materials for the 2016 Annual Meeting of Shareholders:

This Proxy Statement, as well as other proxy materials to be distributed by the Participants, are available free of charge online at https://www.proxy-direct.com/rgn-27926 (registered shareholders) and

http://www.ReEnergizeEgas.com

IMPORTANT

Your vote is important, no matter how many Shares you own. We urge you to sign, date, and return the enclosed WHITE proxy card today to vote FOR the election of our Nominees.

| | • | | If your Shares are registered in your own name, please sign and date the enclosed WHITE proxy card and return it in the enclosed envelope today. |

| | • | | If your Shares are held in a brokerage account or bank, you are considered the beneficial owner of the Shares, and these proxy materials, together with a WHITE voting form, are being forwarded to you by your broker or bank. As a beneficial owner, you must instruct your broker, trustee or other representative how to vote. Your broker cannot vote your Shares on your behalf without your instructions. |

| | • | | Depending upon your broker or custodian, you may be able to vote either by toll-free telephone or by the Internet. Please refer to the enclosed voting form for instructions on how to vote electronically. You may also vote by signing, dating and returning the enclosed voting form. |

Since only your latest dated proxy card will count, we urge you not to return any proxy card you receive from the Company. Even if you return the management proxy card marked “withhold” as a protest against the incumbent directors, it will revoke any proxy card you may have previously sent to us. Remember, you can vote for our six Nominees only on our WHITE proxy card. So please make certain that the latest dated proxy card you return is the WHITE proxy card.

If you have any questions, require assistance in voting your WHITE proxy card,

or need additional copies of the Participants’ proxy materials,

please contact Georgeson at the phone number or email listed below.

Georgeson LLC

1290 Avenue of the Americas, 9th Floor

New York, NY 10104

Call Toll-Free: (888) 219-8320

Or email ReEnergizeEgas@Georgeson.com

2

WHY WE ARE SOLICITING YOUR PROXY

In 2003, Mr. Osborne co-founded The Committee to Re-Energize Energy West (the predecessor corporation to Gas Natural) to elect four directors to the Energy West board. That committee successfully placed multiple directors on the Energy West board pursuant to a negotiated settlement. Mr. Osborne subsequently became the Gas Natural Chairman in 2005 and its Chief Executive Officer is 2007.

Notwithstanding the success of the Company since Mr. Osborne took the reins in 2003, in 2014 the Board replaced Mr. Osborne as CEO with his son, Gregory, and then removed Mr. Osborne from the Board by not nominating him for re-election at the 2014 annual meeting of shareholders.

In the two short years since his ouster, many of the same issues that prompted Mr. Osborne to form The Committee to Re-Energize Energy West have re-emerged, along with many other new issues. Before the situation gets worse, Mr. Osborne re-formed The Committee to Re-Energize Gas Natural to replace the entire Board with nominees who again will be more responsible in their direction of the management of Gas Natural than the current Board. The Committee is urgently soliciting your proxy to enable it to implement a new business strategy for Gas Natural.

The Committee believes the following recent events illustrate the Company’s declining financial condition, the Board’s questionable corporate governance practices, and otherwise highlight our concerns:

| | • | | Gas Natural’s performance has suffered since Mr. Osborne was ousted; |

| | • | | Gas Natural’s common stock price fell from an all-time high (dividend and split adjusted) of about $12.00 per share in the summer of 2014 to a closing price of $6.90 per share on May 24, 2016, the last trading day before our nomination became public; |

| | • | | Gas Natural has cut its dividend payment by almost 45%; |

| | • | | Gas Natural is selling off the Company’s strategic assets; |

| | • | | Gas Natural is borrowing money from its largest shareholder at above market rates; |

| | • | | Gas Natural has entered into employment agreements with each of its executive officers, and executive compensation has soared since 2014; and |

| | • | | The Board adopted an amendment to the Company’s Code of Regulations to make it harder for shareholders to act. |

These events and failures have led us to believe that your investment in Gas Natural is not being maximized by the current Board. We believe in Gas Natural’s future, but not without some changes. In the following sections, we describe in further detail why we believe the shareholders of Gas Natural deserve a prompt and comprehensive change in the way Gas Natural is doing business.

3

Gas Natural’s Performance Has Suffered

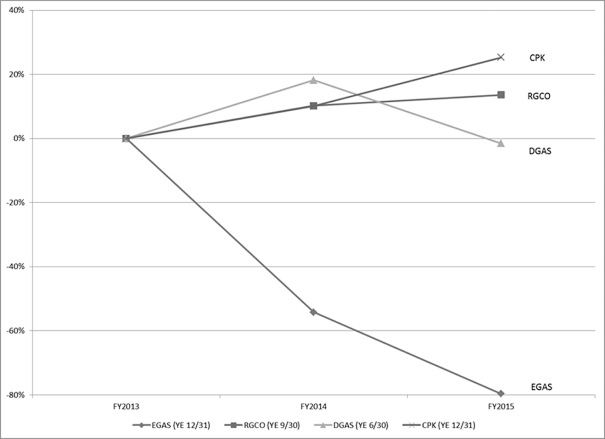

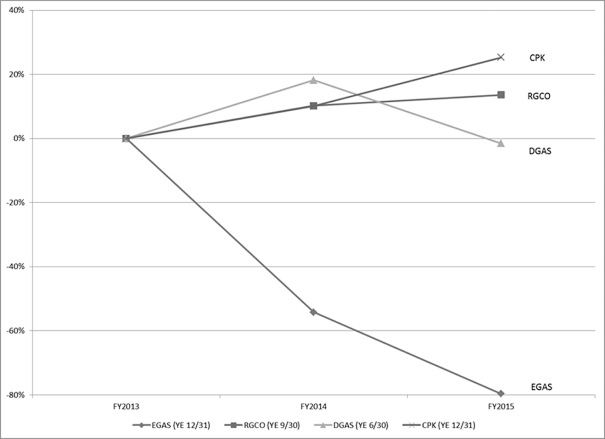

Gas Natural’s financial performance has suffered since Mr. Osborne last supervised the Company’s operations as Chairman and CEO. The following chart and graph illustrate the dramatic decline in the Company’s annual operating income since fiscal year 2013, Mr. Osborne’s last full fiscal year as the Company’s Chairman and CEO, as compared to some of its peers (dollars in millions).

| | | | | | | | | | | | | | | | |

| | | Fiscal Year

2013 | | | Fiscal Year

2014 | | | Fiscal Year

2015 | | | % Change

(2013-2015) | |

Gas Natural (YE 12/31) | | $ | 5.9 | | | $ | 2.7 | | | $ | 1.2 | | | | (80 | %) |

RGC Resources (YE 9/30) | | $ | 8.8 | | | $ | 9.7 | | | $ | 10.0 | | | | 14 | % |

Delta Natural Gas Company (YE 6/30) | | $ | 13.2 | | | $ | 15.6 | | | $ | 13.0 | | | | (2 | %) |

Chesapeake Utilities (YE 12/31) | | $ | 32.8 | | | $ | 36.1 | | | $ | 41.1 | | | | 25 | % |

The Committee believes that Delta Natural Gas Company (NASDAQ: DGAS), RGC Resources, Inc. (NASDAQ:RGCO), and Chesapeake Utilities Corporation (NYSE:CPK) are comparable to Gas Natural as each distributes and sells natural gas to residential, commercial and industrial customers within its service territories (although Chesapeake also distributes electricity and propane) and is subject to the same market conditions as the Company. Notwithstanding the fact that the same market conditions affected these companies, their performance improved, or at least remained stable, compared to Gas Natural over the same period. We note that while Gas Natural was blaming unseasonably warm weather for its poor performance for the quarter ended March 31, 2016, RGC Resources attributed its growth during the same quarter to improved margins and customer growth. Similarly, while noting that warmer weather contributed to its decline in operating income, Chesapeake Utilities stated that decline was significantly offset by increased gross margins on certain businesses.

4

Gas Natural’s Share Price Has Significantly Dropped in Value Since 2014

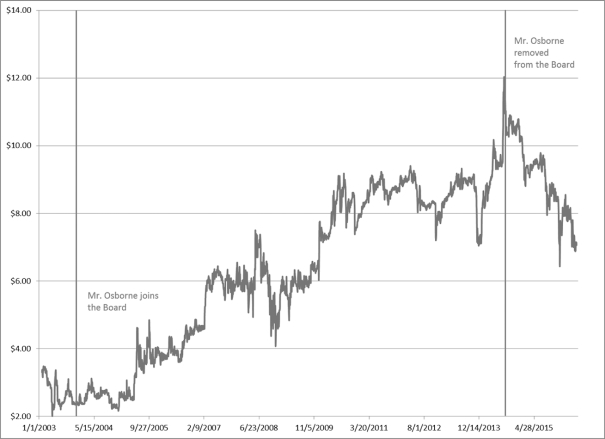

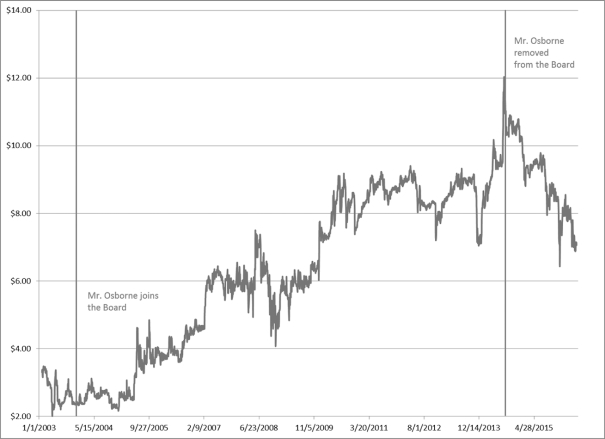

Under Mr. Osborne’s stewardship, Gas Natural’s stock price increased from a low of about $2.40 in December 2003, to an all-time high in the summer of 2014 of about $12.00, adjusted for dividends and stock splits.

Source: Yahoo! Finance

Since reaching that all-time high, Gas Natural’s shares have declined in value to a closing price of $6.90 on May 24, 2016, the day before our nomination became public, a near steady decline in value of almost 43% since Mr. Osborne’s ouster in 2014. By comparison, over the same time period, the stock price for both Delta Natural Gas Company and Chesapeake Utilities increased almost 40%, and the stock price for RGC Resources, Inc. increased almost 26%.

5

Source: Yahoo! Finance

Gas Natural has Reduced Your Dividend

In March of 2003, the Board of Energy West failed to pay a dividend for the first time since 1944. After Mr. Osborne became Chairman in 2005, the Board reinstated the dividend, and it gradually increased to $0.54 a share annually. On April 21, 2016, the Company announced that it cut the dividend to $0.30 annually.

Gas Natural is Selling Assets and Contracting

With almost no explanation to the shareholders regarding the underlying business reason or strategy (other than a non-descript reference to monetizing non-core assets), Gas Natural is selling assets. In July 2015, the Company sold its subsidiary, Energy West Wyoming, Inc., as well as its Wyoming pipeline assets and related real estate, equipment and contracts for approximately $15.4 million. In November 2015, the Company sold nearly all of the assets and liabilities of its Pennsylvania utilities, Clarion and Walker, for $848,000, and on December 11, 2015, the Company sold nearly all of the assets and liabilities of its Kentucky subsidiary PGC for proceeds of $1.9 million. The Committee believes the Company is selling strategic assets with no apparent strategic plan to grow the Company While the Company’s claims that it is selling non-core assets to redirect its energies to assets with higher-growth potential, the Company has yet to reinvest the cash, but has increased executive compensation and cut your dividend.

Gas Natural has Struggled with its Debt and Borrowed From its Largest Shareholder at Above Market Rates

Gas Natural had to obtain three separate bridge loans over the course of a year from NIL Funding Corporation, which is an affiliate of The InterTech Group, Inc. The InterTech Group is controlled by Anita

6

Zucker, the Company’s largest shareholder, who owns 9.9% of the Company’s outstanding stock. In addition, two of the Company’s directors, Michael Bender and Robert Johnston, are affiliated with The InterTech Group.

On April 10, 2015, the Company obtained a $5 million bridge loan from NIL Funding Corporation that had a 180-day term with interest at 7.5% per annum and a $100,000 origination fee. On October 26, 2015, the Company obtained a new $3 million bridge loan from NIL Funding Corporation. This loan had a six-month term with interest at 6.95% per annum and a $60,000 origination fee. On April 15, 2016, the Company obtained a $4 million bridge loan from NIL Funding Corporation that has a six-month term with interest at 7.5% and an $80,000 origination fee. In addition, this most current bridge loan provides that NIL Funding Corporation may convert any part of the amounts due and unpaid into common shares of Gas Natural at a conversion price of 95% of the previous day’s closing price for the Company’s shares. By contrast, based on publicly available information, the Committee believes that Gas Natural’s peers borrow at rates ranging from LIBOR plus 1.00% (RGC) to LIBOR plus 1.075% (DGAS),which in each case is less than 3%, to 4.26% (RGC and DGAS unsecured debt), all with longer terms and lower percentage origination or availability fees.

The Committee believes that these bridge loans, especially together with the related origination fees, provide for above market interest rates, which is particularly disturbing considering the loans were made by an entity related to the Company’s largest shareholder. In addition, this shareholder recently filed a Schedule 13D that says the purpose of her ownership in the Company includes exploring “other alternatives with respect to her investment in the shares, including but not limited to one or more extraordinary corporate transactions involving [Gas Natural], changes in the present board of directors or management of [Gas Natural], or changes in the [Gas Natural’s] business or corporate structure.”

The Committee believes these successive short-term bridge loans from a related party at rates higher than the Company’s peers, as opposed to borrowing from unrelated commercial lenders as its peers do, indicate that the Company is struggling to manage its debt.

Executive Compensation Has Soared Since 2014

During his tenure as Chairman and CEO of Gas Natural, Mr. Osborne did not have an employment agreement. Immediately upon Mr. Osborne’s ouster in 2014, the Company entered into an employment agreement with Gregory Osborne that increased his base salary by 10% to $275,000, entitled him to annual equity grants, provided for certain other perquisites and provided for severance benefits upon his termination of employment in certain circumstances. The Company subsequently entered into employment agreements, also containing severance payments in certain circumstances, with Kevin J. Degenstein, Chief Operating Officer and Chief Compliance Officer, and Jed Henthorne, Corporate Controller. Of particular note, the severance provisions in these employment agreements guarantee minimum severance payments to these executives if the executive is terminated without cause, and the definition of cause in their agreements does not include poor performance. Furthermore, Gregory Osborne’s agreement provides for severance if the Company simply decides not to renew the agreement.

In addition, executive compensation has soared since 2014. For example, Gregory Osborne’s base salary increased by $132,000, or almost 53%, from 2014 to 2015. Messrs. Degenstein, Henthorne and Sprague also saw increases from 2014 to 2015 in base salary and total compensation.

The Board Has Practiced Questionable Corporate Governance

On August 4, 2014, the Board adopted an amendment to the Company’s Code of Regulations to increase the stock ownership percentage required to call a special meeting of the Company’s shareholders from 10% to 25%. By its own admission, the Board adopted this amendment in response to a shareholder’s attempt to call a special meeting to remove the then current Board. Ironically, that shareholder held less than 5% of the Company’s outstanding stock and was unable to get any other shareholder to act with it to call the special meeting even under

7

the then existing regulations. Nonetheless, the Board acted to entrench itself and increase the stock ownership required to call a special meeting by 150%. Then, on July 23, 2015, Gas Natural announced that it had entered into indemnification agreements with each of its directors, which will serve to insulate them from liability for their actions.

The Company rationalized this change to the Code in part by citing to the fact that 25% is the statutory default under Ohio corporate law to call a special meeting. What they failed to mention is that the statute also allows the Board to lower the threshold, which the Board determined to do under Mr. Osborne’s stewardship. The Committee believes a lower threshold is more shareholder friendly than a higher threshold. In fact, independent corporate governance advocates like Institutional Shareholder Services recommend a threshold of 10%, the Company’s prior standard. Furthermore, the ISS voting guidelines provide that ISS will generally recommend a vote against or withhold from directors individually, committee members, or the entire board (except new nominees, who should be considered case-by-case) if the board amends the company’s bylaws or charter without shareholder approval in a manner that materially diminishes shareholders’ rights or that could adversely impact shareholders. The Committee believes the unilateral action of the Board, without seeking shareholder approval, to reduce the threshold, rather than the threshold itself, is the most problematic aspect of this Board action.

To summarize, Gas Natural has suffered declining performance since Mr. Osborne was ousted. Shareholders have felt the effect of the Company’s financial condition by not receiving the quarterly dividends they have become accustomed to receiving and by suffering a significant decline in the Company’s share price. Management has had its opportunity to address these issues — it is now time for a change to re-energize Gas Natural.

The Committee’s Solutions to the Problems

Gas Natural’s results since Mr. Osborne was forced out speak for themselves. As was the case in 2003, this Committee holds the incumbent Board of Directors responsible for Gas Natural’s dismal performance and does not believe that the Board that led the Company into its current condition should remain at the helm without change. We believe that Gas Natural’s Board and management have failed to formulate and implement a business plan and strategy to keep the Company financially sound. Therefore, we are nominating Richard M. Osborne, Darryl L. Knight, Terence S. Profughi, Joseph M. Gorman, Martin W. Hathy and Lauren Tristano for election to the Board of Directors.

Once elected to the Board, our director nominees will use the detailed financial and operational information available to them as directors to reach our goals of increasing profitability and enhancing shareholder value. We believe that our director nominees’ election will provide management with the perspective necessary to increase profitability and maximize shareholder value.

Some of the initiatives that our nominees would seek to implement include:

| | • | | Reinstating the Company’s dividend to $0.54 annually and considering further increases to the amount of the dividend in accordance with the Board’s fiduciary duties. There can be no assurances as to how soon the Committee will be able to restore the dividend as we may first need to improve the Company’s financial performance, which has suffered under current management. The Committee believes, however, that given Mr. Osborne’s ten year history of delivering comparable dividends during his tenure with the Company, we will eventually be able to do so. It took the Board nearly two years to reinstate the dividend when Mr. Osborne first joined the Board in 2003. |

| | • | | Amending the Company’s Code of Regulations to restore all shareholder rights eliminated by the current Board. Currently, the Committee believes that it only needs to restore the threshold to call a special meeting. However, the current Board has also come out against our Code Preservation Proposal and has reserved the right to continue to make unilateral amendments to the Code without shareholder approval, so there may be other amendments to unwind. |

8

| | • | | Terminating all employment agreements with the executive officers of the Company. Of course, the Committee will attempt to terminate these agreements in a way to minimize any financial impact on the Company, including by failing to renew them as opposed to terminating them (other than in the case of Gregory Osborne) or determining whether there is an ability to terminate any executive for cause. Depending on the circumstances, however, we may not be able to terminate an employment agreement or an executive without having to pay severance, which is exactly why the Committee is against these types of employment agreements. We are not able at this time to quantify the financial impact. |

| | • | | Increasing customer growth, in part by hiring additional field representatives to service customers. |

| | • | | Improving gross margins by cutting expenses, including executive compensation. The Committee believes that if the Company’s peers like RGC Resources and Chesapeake Utilities can improve their margins under the current market conditions, so too can the Company with the right leadership. We need access to the operational information of the Company to determine the best way to do so. |

| | • | | Rationalizing the Company’s capital structure to avoid borrowing from shareholders at above market interest rates. Given the Company’s current financial performance, there can be no assurances as to how soon we can transition the Company to more traditional financing sources or as to the terms of such borrowing. |

| | • | | Providing management with strategic, operational and financial oversight necessary to establish a strategic vision for the Company’s business. Given our Nominees’ extensive collective experience in the utility industry as well as in owning and operating industrial and manufacturing companies, as compared to the current members of the Board, we believe we are better positioned to provide this strategic vision. |

9

[THIS PAGE INTENTIONALLY LEFT BLANK]

10

PROPOSAL ONE

ELECTION OF THE DIRECTORS

The Participants propose that the shareholders elect Richard M. Osborne, Darryl L. Knight, Terence S. Profughi, Joseph M. Gorman, Martin W. Hathy, and Lauren Tristano, as directors of Gas Natural at the Annual Meeting. Each Nominee, if elected, would hold office until the next annual meeting of shareholders and until a successor has been duly elected and qualified, or as otherwise provided by the Code or by Ohio law.

We strongly urge you to elect our Nominees by signing, dating and returning the enclosed WHITE proxy card in the postage paid envelope provided to you with this Proxy Statement. If you have signed the enclosed WHITE proxy card, you have given us authority to vote FOR the Nominees unless authority to vote for any of them is withheld.

The Nominees

Richard M. Osborne, 70, joined the Company’s board as a director in 2003 and served as chairman of the board of the Company from 2005 to May 2014 and chief executive officer of the Company from November 2007 to May 2014. He is currently the president and chief executive officer of OsAir, Inc., a company he founded in 1963, which operates as a property developer and manufacturer of industrial gases for pipeline delivery, and the vice president of Ohio Rural Natural Gas Co-Op, a natural gas distribution cooperative, a position he has held since September 2014. Since 1998, Mr. Osborne has been chairman of the board, chief executive officer and a director of John D. Oil and Gas Company (“JDOG”), an oil and gas exploration company in Mentor, Ohio. From 2010 to 2014, Mr. Osborne was chairman of each of Northeast Ohio Natural Gas Corporation and Orwell Natural Gas Company, natural gas distribution companies acquired by the Company in January 2010. From 2006 to February 2009 he was a director of Corning Natural Gas Corporation, a publicly-held public utility company in Corning, New York, and from September 2008 to January 2009 he was a director of PVF Capital Corp., a publicly-held holding company for Park View Federal Savings Bank in Solon, Ohio. He is the father of Gregory J. Osborne, the Company’s current chief executive officer. Mr. Osborne’s business address is 7001 Center St., Mentor, Ohio 44060.

In November 2011, the United States District Court issued an order appointing a receiver to marshal and maintain the value of the assets of JDOG, Great Plains Exploration, LLC, and Oz Gas, Ltd., companies owned by the Richard M. Osborne Trust (Osborne Trust), of which Mr. Osborne is trustee, in connection with an action brought by one of the companies’ creditors. In January and February 2012, Great Plains Exploration, Oz Gas and JDOG filed voluntary petitions for relief under the Bankruptcy Code in the United States Bankruptcy Court. The bankruptcy proceedings are ongoing. Mr. Osborne is involved in various transactions and legal proceedings with the Company and its affiliates as discussed in Gas Natural’s proxy materials. Please see “Additional Information — Gas Natural’s Proxy Statement” on pages 17-18.

Richard Osborne’s background as chairman and chief executive officer of various public companies, including the Company, and many years of experience owning and managing companies in energy and utility related industries would provide the Company’s board with invaluable management and operational direction as well as a unique insight in considering growth opportunities for the Company.

Darryl L. Knight, 52, is the President of Ohio Rural Natural Gas Co-Op, a natural gas distribution cooperative located in Mentor, Ohio, a position that he has held since September 2014. Previous to that, Mr. Knight was the President & General Manager of Frontier Natural Gas, a natural gas distribution company serving over 3,000 customers located in Elkin, NC from October 2012 through September 2014. In addition, Mr. Knight served as President of Independence Oil from December 2012 until November 2013 when it was sold to Blue Ridge Energies. Mr. Knight served as Corporate Director of Purchasing for Gas Natural Inc. from

11

February 2009 through October 2012. Mr. Knight served as Vice President of Energy West Resources, a non-regulated division of Energy West Inc. located in Great Falls MT from May 2008 through February 2009. Mr. Knight’s business address is 7001 Center St., Mentor, Ohio 44060.

Mr. Knight’s industry experience and background managing companies in energy and utility related industries would provide the Company’s board with a wide range of industry specific knowledge.

Terence S. Profughi, 70, is currently the Chairman of Chagrin Venture Ltd. Inc., a holding company for investments in real estate and manufacturing companies ranging from the heat treating to commercial food equipment, a position he has had since 1979. From 1983 through 2016, he was the Chairman and CEO of Hi TecMetal Group, Inc., a specialist in the fields of brazing, heat treating and welding. During his tenure with Hi TecMetal Group, Inc., Mr. Profughi lead the formation or acquisition of over 50 related businesses. He was a director of the Council of Smaller Enterprises (COSE) from 1985 to 1994. From 1997 to 2002, he was a Director of First County Bank. Mr. Profughi’s business address is 11339 Butternut Rd., Chardon, Ohio 44024.

Mr. Profughi’s background as chairman and chief executive officer of an industrial company and many years of experience owning, acquiring and managing industrial companies would provide the Company’s board with invaluable management and operational direction as well as a unique insight in considering growth opportunities for the company.

Joseph Michael Gorman (Mike), 64, is the President of Gorbec Pharmaceuticals, Inc., a contract developer and manufacturer of prescription pharmaceutical products, a position he has held since 2006. In addition to automotive and consumer businesses, Mr. Gorman has owned domestic and international companies in the highly regulated field of pharmaceutical manufacturing. Mr. Gorman’s business address is 3232 Kitty Hawk Rd., Wilmington, NC 28405.

Mr. Gorman’s diverse industry experience and background with business development for companies in highly regulated industries would provide the Company’s board with invaluable management and operational direction as well as a unique insight in considering growth opportunities for the company.

Martin W. Hathy, 65, is currently retired. Prior to his retirement in 2010, he was the co-owner and President of Lake Erie Iron and Metal Company and its subsidiaries Welder’s Supply, Great Lakes Propane and Great Lakes Oxygen, which provided supplies and industrial gases to the welding industry, prior their acquisition by AirGas, Inc. in 2009. Mr. Hathy continued to provide his services to AirGas until his subsequent retirement in 2010. Mr. Hathy’s business address is 8185 Lakeshore Blvd., Mentor, Ohio 44060.

Mr. Hathy’s diverse industry background and many years of experience owning and managing industrial companies would provide the Company’s board with invaluable management and operational direction as well as wide range of industry specific knowledge.

Lauren Tristano, 32, is the Executive Liaison for Mr. Osborne and the various companies he owns and manages, which position she has held since February, 2016. For the six years prior to coming to work for Mr. Osborne, Ms. Tristano worked as a registered nurse in emergency rooms and neonatal intensive care units throughout Chicago and has managed a funeral home and livery service. Ms. Tristano is a member of the Junior League of Chicago, Chicago Cares, and a board member for Holy Name Cathedral. Previously, Ms. Tristano served on the board for the Metropolitan Club of Chicago and Key Bank Club in Cleveland. Ms. Tristano’s business address is 7001 Center St., Mentor, Ohio 44060.

Ms. Tristano’s background and public service experience, in addition to her diversity of viewpoint, would provide the Company’s board with valuable insight and direction.

If elected as directors of the Company, each of the Nominees, other than Mr. Osborne, would be considered an “independent director” within the meaning of the New York Stock Exchange listing standards applicable to

12

board composition. Mr. Osborne would not be considered independent because he was employed by the Company within the past three years and his son is currently CEO of the Company.

Voting for the Election of Directors

Pursuant to Article 5 of Gas Natural’s Articles of Incorporation, the vote for the election of directors is not cumulative. Directors are elected by a plurality of the votes cast at the meeting. “Plurality” means that the director nominees who receive the greatest number of votes cast are elected, up to the maximum number of directors to be elected at the meeting. The Code of Gas Natural provides that its Board is to be comprised of a minimum of five and a maximum of nine directors, as determined from time to time by resolution of the Board. As disclosed in the Company’s Definitive Proxy Statement for the 2015 annual meeting of shareholders, the Board has resolved that the entire Board consist of six directors.

The Participants have nominated a full slate of directors for election to the Board. If for some reason, only a portion of the Nominees are elected to the Board, each Nominee elected will serve with any of the nominees of Gas Natural’s current Board that are elected. In such scenario, however, there is no assurance that all of the nominees of Gas Natural’s current Board, if any, that are elected will serve with each Nominee that is elected. Instead, all or some of such nominees of Gas Natural’s current Board may resign, in which case such nominees of Gas Natural’s current Board who are elected and choose not to resign, together with each Nominee that is elected, will constitute all of the members of the Board. Pursuant to the Code, if there is a vacancy created by any such resignation, a majority of the remaining directors, even if that majority may be less than a quorum, may appoint a qualified person to fill the vacancy for the remainder of the term, or such position may be filled by a plurality of the votes cast at a meeting of the shareholders.

We are seeking your proxy for the election to the Board of Richard M. Osborne, Darryl L. Knight, Terence S. Profughi, Joseph M. Gorman, Martin W. Hathy, and Lauren Tristano. We will use the authority granted to us by our WHITE proxy card to vote for the Nominees. The Participants in this solicitation intend to vote all of their Shares in favor of the Nominees. As of the date of this proxy statement, Mr. Osborne is the record and beneficial owner of 4,977 Shares (in his name personally, as trustee of the Osborne Trust, and via power of attorney granted by Alta Gas Services LLC (f/k/a John D. Oil and Gas Marketing LLC)), Mr. Hathy is the beneficial owner of 2,000 Shares and no other Nominee owns any Shares. The date of each purchase and sale of Shares by the Participants within the past two years, and the number of Shares in each such purchase and sale is contained in Appendix I. Except as disclosed herein, none of the Participants is, or was within the past year, a party to any contract, arrangements or understandings with any person with respect to any securities of Gas Natural. None of the Participants, or any of their associates, have any arrangement or understanding with any person with respect to any future employment by Gas Natural or its affiliates; or except as otherwise disclosed herein, with respect to any future transactions to which Gas Natural or any of its affiliates will or may be a party.

In order for your views to be represented at the Annual Meeting, please mark, sign, date and return the WHITE proxy card in the enclosed postage prepaid envelope. We strongly urge you to vote FOR the Nominees by signing, dating and returning the enclosed WHITE proxy card in the postage paid envelope provided to you with this Proxy Statement. Shares represented by properly executed WHITE proxy cards will be voted at the Annual Meeting as marked and, in the absence of specific instructions, will be voted FOR the election of the Nominees to the Board.

13

PROPOSAL TWO

APPROVAL OF THE CODE PRESERVATION PROPOSAL

The Participants propose to repeal any provision of the Code in effect at the time this proposal becomes effective which was not included in the Code as in effect on May 24, 2016, the day the Mr. Osborne submitted his letter to the Company nominating the Nominees:

RESOLVED, that the Amended and Restated Code of Regulations of the Company be amended to repeal any provision in effect at the time this proposal becomes effective, which were not included in the Code as in effect on May 24, 2016, as filed with the Securities and Exchange Commission on December 3, 2015.

The Code Preservation Proposal is intended to preserve the Code as in effect prior to the submission of Mr. Osborne’s letter to the Company nominating the Nominees. This proposal will protect and maintain the status quo of the Company’s corporate governance processes by unwinding any amendments to the Code made after the date hereof and prior to the Annual Meeting that may operate to disenfranchise shareholders in the corporate governance process.

Voting for the Code Preservation Proposal

Under the Code, adoption of the Code Preservation Proposal requires the affirmative vote of holders of a majority of the Company’s Shares outstanding and entitled to vote at the annual meeting. Abstentions and shares not in attendance and not voted at the annual meeting will have the same effect as a vote AGAINST the proposal to adopt the Code Preservation Proposal.

In order for your views to be represented at the Annual Meeting, please mark, sign, date and return the WHITE proxy card in the enclosed postage prepaid envelope. We strongly urge you to vote FOR the Code Preservation Proposal by signing, dating and returning the enclosed WHITE proxy card in the postage paid envelope provided to you with this Proxy Statement. Shares represented by properly executed WHITE proxy cards will be voted at the Annual Meeting as marked and, in the absence of specific instructions, will be voted FOR the Code Preservation Proposal.

14

PROPOSAL THREE

RATIFICATION OF THE APPOINTMENT OF MALONEBAILEY LLC AS THE COMPANY’S INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM FOR 2016

As discussed in further detail in the Company’s 2016 Proxy Statement, MaloneBailey LLP served as independent registered public accounting firm to the Company in 2015 and is expected to be retained to serve in such capacity in 2016. The Board has directed that management submit the selection of the independent registered accounting firm for ratification by the shareholders at the Annual Meeting. This proposal will pass if more shares are voted in favor of the action than shares voted against the action.

We make no recommendation with respect to this proposal and intend to vote our shares FOR this proposal. Shares represented by properly executed WHITE proxy cards will be voted at the Annual Meeting as marked and, in the absence of specific instructions, will be voted FOR the ratification of MaloneBailey LLP as the Company’s independent registered public accounting firm for 2016.

PROPOSAL FOUR

ADVISORY VOTE ON EXECUTIVE COMPENSATION

As discussed in further detail in the Company’s 2016 Proxy Statement, the Company is conducting an annual, non-binding advisory vote on the compensation of the named executive officers of the Company as disclosed in the Company’s 2016 Proxy Statement. This proposal, commonly known as a “say on pay” vote, will be presented at the Annual Meeting as an advisory vote which is not binding upon the Company. The Board could, if it concluded it was in the Company’s best interests to do so, choose not to follow or address the outcome of the advisory resolution. This non-binding proposal will pass if more shares are voted in favor of the action than shares voted against the action.

We make no recommendation with respect to this proposal and intend to vote our shares AGAINST this proposal. Shares represented by properly executed WHITE proxy cards will be voted at the Annual Meeting as marked and, in the absence of specific instructions, will be voted AGAINST this proposal.

OTHER PROPOSALS

At the date of this Proxy Statement, the Participants know of no other proposals to be brought before the Annual Meeting. If any other matters should properly come before the Annual Meeting, the persons named on the enclosed WHITE proxy card will vote that WHITE proxy on such other matters in accordance with their judgment.

15

VOTING AND PROCEDURES

Record Date; Votes

Only shareholders of record as of the close of business on the record date set by the Company for the Annual Meeting (the “Record Date”) will be entitled to notice of and to vote at the Annual Meeting. The Company has not yet announced the Record Date but is required to announce it in its definitive proxy materials. We will supplementally provide you notice of the Annual Meeting date, time, and location, and the Record Date once it becomes available. The Company has reported to us that as of May 27, 2016, there were 10,480,773 shares of common stock, par value $0.15, of the Company outstanding (the “Shares”), each of which is entitled to one vote on each matter properly brought before the meeting.

Quorum

No votes may be taken at the Annual Meeting, other than to adjourn, unless a quorum has been constituted consisting of the representation of at least a majority of the outstanding Shares as of the Record Date. Accordingly, for example, based on 10,480,773 Shares outstanding as of May 27, 2016, the presence, in person or by proxy, of the holders of at least 5,240,387 Shares entitled to vote constitutes a quorum for transacting business at the Annual Meeting. If you do not return a signed proxy card, your Shares will not count toward the presence of a quorum. If you submit a properly executed proxy card, even if you don’t indicate how to vote or you abstain from any proposal, your Shares will count toward the presence of a quorum.

Discretionary Voting; Abstentions

Because brokers or banks holding Shares in “street name” may vote your Shares on the proposals to be considered at the Annual Meeting only if you provide instructions on how to vote, your failure to provide instructions will result in your shares not being present at the meeting, not counting toward the presence of a quorum, and not being voted on these proposals. Consequently, there cannot be any broker non-votes occurring in connection with any of the proposals at the Annual Meeting.

Abstentions will be counted to determine whether or not a quorum is present. Abstentions will have the effect as a vote AGAINST the Code Preservation Proposal. Abstentions will not count as votes cast in the election of directors, in the vote on ratifying the appointment of the Company’s independent registered public accounting firm, or on the advisory vote relating to the Company’s executive compensation program.

It is very important that all of the shareholders vote their Shares. Whether or not you are able to attend the Annual Meeting, we urge you to complete the enclosed WHITE proxy and return it in the enclosed self-addressed, prepaid envelope.

Revocation of Proxies

Any shareholder who has mailed a proxy card may revoke it, at any time prior to voting, by: (i) delivering to Georgeson LLC at the address below a written notice, bearing a LATER date than the date of the proxy, stating that the proxy is revoked; (ii) delivering a duly executed WHITE proxy bearing a LATER date than the proxy delivered previously; or (iii) attending the Annual Meeting, withdrawing the proxy, and voting in person.

Although a revocation is effective if delivered to Gas Natural, the Participants request that either the original or a copy of any revocation be mailed to Georgeson LLC, so that the Participants will be aware of all revocations.

Questions

If you have any questions about giving your proxy or require assistance, please call:

Georgeson LLC

1290 Avenue of the Americas, 9th Floor

New York, NY 10104

Call Toll-Free: (888) 219-8320

Or email ReEnergizeEgas@Georgeson.com

16

COST AND METHOD OF SOLICITATION

The Participants have retained Georgeson LLC (“Georgeson”) to conduct the solicitation, for which Georgeson is to receive a fee of $100,000 and reimbursement for its reasonable out-of-pocket expenses. The Participants have agreed to indemnify Georgeson against certain liabilities and expenses. Insofar as indemnification for liabilities arising under the federal securities laws may be permitted to Georgeson pursuant to the foregoing provisions, we have been informed that in the opinion of the SEC, such indemnification is against public policy and is therefore unenforceable. As part of the solicitation, the Participants may communicate with shareholders by mail, courier services, Internet, advertising, telephone or telecopier or in person. It is anticipated that Georgeson will employ approximately four persons to solicit proxies from shareholders for the Annual Meeting. The total expenditures in furtherance of, or in connection with, the solicitation of proxies is approximately $190,000 to date, and is estimated to be up to $500,000 in total.

The Participants will pay all costs related to the solicitation of proxies and intend to seek reimbursement from the Company for all of the costs and expenses associated with the proxy solicitation without a shareholder vote in the event that the Participants are elected to the Board.

ADDITIONAL INFORMATION

Company Contact Information

The mailing address of the principal executive office of Gas Natural is:

Gas Natural Inc.

1375 East 9th Street, Suite 3100

Cleveland, Ohio 44114

(800) 570-5688

Shareholder Proposals

Pursuant to Rule 14a-8, proposals of shareholders intended for inclusion in next year’s management proxy circular to be furnished to all shareholders entitled to vote at the next annual meeting of shareholders must be received at Gas Natural’s principal executive offices not less than 120 calendar days before the date of Gas Natural’s management proxy circular released to shareholders in connection with the previous year’s annual meeting. However, if Gas Natural does not hold an annual meeting the previous year, or if the date of the current year’s annual meeting is changed by more than 30 days from the date of the previous year’s meeting, then the deadline is a reasonable time before Gas Natural begins to print and send its proxy materials.

Shareholder proposals not intended for inclusion in next year’s management proxy circular, but which are instead sought to be presented directly at next year’s annual meeting, will be considered untimely if notice of the matter is not received by Gas Natural no earlier than 120 days prior to the date of the previous year’s annual meeting, and no later than 60 days prior to the date of the previous year’s annual meeting. However, if Gas Natural did not hold an annual meeting the previous year, or if the date of the current year’s annual meeting is changed by more than 30 days from the date of the previous year’s meeting, then the shareholder’s notice shall be timely if given no later than 10 calendar days following the first date upon which public disclosure of the date of such annual meeting is made.

17

Gas Natural’s Proxy Statement

We have omitted from our Proxy Statement certain disclosure required by applicable law that is expected to be included in the Company’s proxy statement relating to the Annual Meeting based on reliance on Rule 14a-5(c). This disclosure includes, among other things, information on the Record Date, date, time, and location of the Annual Meeting, information on Mr. Osborne’s related party transactions and adverse proceedings with the Company, information concerning stock ownership of management and other major shareholders, and other important information. The Participants take no responsibility for the accuracy or completeness of any information contained in Gas Natural’s public filings as described in the Proxy Statement.

| | |

| June 16, 2016 | | The Committee to Re-Energize Gas Natural |

18

APPENDIX I

The following table indicates the date of each purchase and sale of Shares by Richard M. Osborne within the past two years, and the number of Shares in each such purchase and sale:

| | | | | | | | | | | | |

Class of Security | | Securities Purchased

/ (Sold) | | | Price Per

Security ($) | | | Date of Purchase

or Sale | |

| Richard M. Osborne | |

| | | |

Common | | | 100 | | | $ | 7.82990 | | | | 4/13/2016 | |

| Richard M. Osborne, Trustee | |

| | | |

Common | | | (47,000 | ) | | $ | 7.53240 | | | | 4/15/2016 | |

Common | | | (12,000 | ) | | $ | 7.45180 | | | | 4/14/2016 | |

Common | | | 100 | | | $ | 7.82990 | | | | 4/13/2016 | |

Common | | | (5,000 | ) | | $ | 11.31010 | | | | 8/19/2014 | |

Common | | | (122 | ) | | $ | 11.33000 | | | | 8/19/2014 | |

Common | | | (3,000 | ) | | $ | 11.25000 | | | | 8/19/2014 | |

Common | | | (4,878 | ) | | $ | 11.25010 | | | | 8/19/2014 | |

Common | | | (2,100 | ) | | $ | 11.35000 | | | | 8/19/2014 | |

Common | | | (2,900 | ) | | $ | 11.26010 | | | | 8/19/2014 | |

Common | | | (5,000 | ) | | $ | 11.25000 | | | | 8/19/2014 | |

Common | | | (4,500 | ) | | $ | 11.25010 | | | | 8/19/2014 | |

Common | | | (600 | ) | | $ | 11.26000 | | | | 8/19/2014 | |

Common | | | (4,400 | ) | | $ | 11.25010 | | | | 8/19/2014 | |

Common | | | (5,000 | ) | | $ | 11.25000 | | | | 8/19/2014 | |

Common | | | (5,000 | ) | | $ | 11.25000 | | | | 8/19/2014 | |

Common | | | (5,000 | ) | | $ | 11.25000 | | | | 8/19/2014 | |

Common | | | (7,000 | ) | | $ | 11.25000 | | | | 8/19/2014 | |

Common | | | (5,000 | ) | | $ | 11.27010 | | | | 8/19/2014 | |

Common | | | (500 | ) | | $ | 11.26000 | | | | 8/19/2014 | |

Common | | | (2,500 | ) | | $ | 11.26000 | | | | 8/19/2014 | |

Common | | | (2,000 | ) | | $ | 11.25000 | | | | 8/19/2014 | |

Common | | | (900 | ) | | $ | 11.17010 | | | | 8/19/2014 | |

Common | | | (5,000 | ) | | $ | 11.22000 | | | | 8/19/2014 | |

Common | | | (5,000 | ) | | $ | 11.30860 | | | | 8/19/2014 | |

Common | | | (500 | ) | | $ | 11.30800 | | | | 8/19/2014 | |

Common | | | (5,000 | ) | | $ | 11.25080 | | | | 8/19/2014 | |

Common | | | (5,000 | ) | | $ | 11.25240 | | | | 8/19/2014 | |

Common | | | (5,000 | ) | | $ | 11.27004 | | | | 8/19/2014 | |

Common | | | (1,900 | ) | | $ | 11.30105 | | | | 8/19/2014 | |

Common | | | (5,000 | ) | | $ | 11.25180 | | | | 8/19/2014 | |

Common | | | (600 | ) | | $ | 11.28003 | | | | 8/19/2014 | |

Common | | | (1,600 | ) | | $ | 11.25005 | | | | 8/19/2014 | |

| Martin W. Hathy | |

| | | |

Common | | | 2,000 | | | $ | 7.20 | | | | 5/15/2016 | |

19

IMPORTANT

Tell your Board what you think! Your vote is important. No matter how many Shares you own, please give us your proxy FOR the election of our Nominees, FOR the Code Preservation Proposal, FOR the ratification of the appointment of MaloneBailey, LLP, and AGAINST the non-binding advisory vote on executive compensation, by taking three steps:

| | • | | SIGNING the enclosed WHITE proxy card, |

| | • | | DATING the enclosed WHITE proxy card, and |

| | • | | MAILING the enclosed WHITE proxy card TODAY in the envelope provided (no postage is required if mailed in the United States). |

If any of your Shares are held in the name of a brokerage firm, bank, bank nominee or other institution, only it can vote such Shares and only upon receipt of your specific instructions. Your broker cannot vote your Shares on your behalf without your instructions. Depending upon your broker or custodian, you may be able to vote either by toll-free telephone or by the Internet. Please refer to the enclosed voting form for instructions on how to vote electronically. You may also vote by signing, dating and returning the enclosed WHITE voting form.

Since only your latest dated proxy card will count, we urge you not to return any proxy card you receive from the Company. Even if you return the management proxy card marked “withhold” as a protest against the incumbent directors, it will revoke any proxy card you may have previously sent to us. Remember, you can vote for our six Nominees only on our WHITE proxy card. So please make certain that the latest dated proxy card you return is the WHITE proxy card.

If you have any questions or require any additional information concerning this Proxy Statement, please contact Georgeson at the address set forth below.

Georgeson LLC

1290 Avenue of the Americas, 9th Floor

New York, NY 10104

Call Toll-Free: (888) 219-8320

Or email ReEnergizeEgas@Georgeson.com

20

EVERY SHAREHOLDER’S VOTE IS IMPORTANT

| | | | |

| | EASY VOTING OPTIONS: |

| | |

| |  | | VOTE ON THE INTERNET Log on to: www.proxy-direct.com or scan the QR code Follow the on-screen instructions available 24 hours |

| | |

| |  | | VOTE BY PHONE Call 1-800-337-3503 Follow the recorded instructions available 24 hours |

| | |

| |  | | VOTE BY MAIL Vote, sign and date this Proxy Card and return in the postage-paid envelope |

Please detach at perforation before mailing.

| | | | |

| WHITE PROXY CARD | | GAS NATURAL INC. | | WHITE PROXY CARD |

| | 2016 ANNUAL MEETING OF SHAREHOLDERS | | |

THIS PROXY IS SOLICITED BY AND ON BEHALF OF THE COMMITTEE TO RE-ENERGIZE GAS NATURAL, MADE UP OF RICHARD M. OSBORNE, DARRYL L. KNIGHT, TERENCE S. PROFUGHI, JOSEPH M. GORMAN, MARTIN W. HATHY, AND LAUREN TRISTANO (THE “NOMINEES”).

The undersigned shareholder of Gas Natural Inc. (“Gas Natural”) hereby appoints Richard M. Osborne, Darryl L. Knight, Terence S. Profughi, Joseph M. Gorman, Martin W. Hathy, and Lauren Tristano (the “Nominees”) as my/our proxyholder with full power of substitution at the 2016 Annual Meeting of Shareholders and at any adjournment, postponement, or continuation thereof (the “Annual Meeting”), and to vote in accordance with the following direction (or if no directions have been given, as described below).

If no direction is indicated, by signing, dating and returning this WHITE proxy you have given us discretionary authority and we will vote FOR the election of our Nominees, FOR the Code Preservation Proposal, FOR the ratification of the appointment of MaloneBailey, LLP, and AGAINST the non-binding advisory vote on executive compensation.

This WHITE proxy confers discretionary authority in respect of amendments to matters identified in the Notice of Meeting or other matters that may properly come before the meeting, in each case of which we did not know, a reasonable time before this solicitation, are to be presented at the meeting.

Proxies submitted must be received by the last business day prior to the Annual Meeting, or, in the event that the Annual Meeting is adjourned or postponed, by the last business day prior to the date fixed for the adjourned or postponed meeting.

| | | | |

VOTE VIA THE INTERNET: www.proxy-direct.com VOTE VIA THE TELEPHONE: 1-800-337-3503 |

�� | | | | |

|

To change the address on your account, please check the box at right and indicate your new address in the address space below. Please note that changes to the registered name(s) on the account may not be submitted via this method. ¨ |

|

|

|

GSC_27926_061316 |

EVERY SHAREHOLDER’S VOTE IS IMPORTANT

Important Notice Regarding the Availability of Proxy Materials for the

2016 Annual Shareholders Meeting.

The Committee to Re-Energize Gas Natural Proxy Statement

and this WHITE Proxy Card are available at:

https://www.proxy-direct.com/rgn-27926

IF YOU VOTE ON THE INTERNET OR BY TELEPHONE,

YOU NEED NOT RETURN THIS PROXY CARD

Please detach at perforation before mailing.

TO VOTE, MARK BLOCKS BELOW IN BLUE OR BLACK INK. Example: ¢

THE COMMITTEE TO RE-ENERGIZE GAS NATURAL RECOMMENDS A VOTE FOR ALL NOMINEES LISTED IN PROPOSAL 1 AND FOR PROPOSAL 2. THE COMMITTEE MAKES NO RECOMMENDATION WITH RESPECT TO PROPOSALS 3 AND 4.

| | | | | | | | | | | | | | | | | | | | |

| 1. | | To elect the Participants’ six director nominees to the Company’s Board of Directors, to serve for a one year term until the next annual meeting or until their successors are duly elected and qualified. | | FOR | | WITHHOLD | | FOR ALL |

| | | | | | | | | | | | | | | | ALL | | ALL | | EXCEPT |

| | | | 01. | | Richard M. Osborne | | 02. | | Darryl L. Knight | | 03. | | Terence S. Profughi | | ¨ | | ¨ | | ¨ |

| | | | 04. | | Joseph M. Gorman | | 05. | | Martin W. Hathy | | 06. | | Lauren Tristano | | | | | | |

| | | | | | | | | | |

| | INSTRUCTIONS: To withhold authority to vote for any individual nominee(s), mark the box “FOR ALL EXCEPT” and write the nominee name(s) on the line provided below. | | | | | | | | |

| | | | | | FOR | | AGAINST | | ABSTAIN |

| 2. | | The Committee’s proposal to repeal any provision of the Company’s Amended and Restated Code of Regulations, dated as of December 2, 2015 (the “Code”) in effect as of the date of the Annual Meeting which was not included in the Code as in effect on May 24, 2016. | | | | ¨ | | ¨ | | ¨ |

| | | | | | FOR | | AGAINST | | ABSTAIN |

| 3. | | The Company’s proposal to ratify the appointment of MaloneBailey, LLP as the Company’s independent auditor for the year ending December 31, 2016. | | | | ¨ | | ¨ | | ¨ |

| | | | | | FOR | | AGAINST | | ABSTAIN |

| 4. | | The Company’s proposal to approve, on an advisory basis, the compensation of the Company’s named executive officers for 2015. | | | | ¨ | | ¨ | | ¨ |

I/We authorize you to act in accordance with my/our instructions set out above. I/We hereby revoke any proxy previously given with respect to the Annual Meeting.

Please sign exactly as your name(s) appear(s) hereon. When signing as attorney, executor, administrator, or other fiduciary, please give full title as such.

Joint owners should each sign personally. All holders must sign. If a corporation or partnership, please sign in full corporate or partnership name by authorized officer.

| | | | | | | | | | | | |

Signature — Please sign within the box | | Date (mm/dd/yyyy) | | | | Signature — (Joint Owners) | | Date (mm/dd/yyyy) | | |

| | | | | | | | | | | | |

GSC_27926_061316