UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

811-23159

(Investment Company Act file number)

Apollo Diversified Credit Fund

(Exact name of registrant as specified in charter)

9 West 57th Street, New York

New York 10019

(Address of principal executive offices)

212-515-3200

(Registrant's telephone number, including area code)

ALPS Fund Services, Inc.

1290 Broadway, Suite 1000

Denver, CO 80203

(Name and address of agent for service)

Copy to:

Ryan P. Brizek

Simpson Thacher & Bartlett LLP

900 G Street, N.W.

Washington, D.C. 20001

Date of fiscal year end: December 31

Date of reporting period: January 1 - June 30, 2024

Item 1. Reports to Stockholders.

Table of Contents

| Shareholder Letter (Unaudited) | 02 |

| Portfolio Update (Unaudited) | 15 |

| Consolidated Schedule of Investments | 17 |

| Consolidated Statement of Assets and Liabilities | 28 |

| Consolidated Statement of Operations | 30 |

| Consolidated Statements of Changes in Net Assets | 31 |

| Consolidated Statement of Cash Flows | 33 |

| Consolidated Financial Highlights | 35 |

| Notes to Consolidated Financial Statements | 47 |

| Dividend Reinvestment Policy | 68 |

| Additional Information | 69 |

| Approval of Investment Advisory Contract | 70 |

| Trustees and Officers | 72 |

| Service Providers | 74 |

| Privacy Notice | 75 |

APOLLO DIVERSIFIED CREDIT FUND

Shareholder Letter (Unaudited)

Dear Valued Shareholders,

We are pleased to present an update for Apollo Diversified Credit Fund (the “Fund”) covering the first half of 2024. We will also share our perspective regarding the investment environment and potential opportunities for the Fund.

Market Overview

An apt assessment of the performance of risk assets during the second quarter is good, but not great. The Federal Reserve (the “Fed”) appeared to have regained its touch with signs that its restrictive monetary policy was finally bringing down inflation toward its long-term target. The core consumer price index—which excludes food and energy costs—rose 0.1% sequentially in June, the smallest monthly advance in three years and the headline inflation rate declined month-over-month for the first time since 2020. Additionally, US hiring and wage growth decelerated in June as the unemployment rate ticked up, leading Fed Chair Jerome Powell to describe the labor market as “no longer overheated,” at a mid-July conference.1

We expect to continue to see a bifurcation in the credit market. On one hand, we believe that strong technicals should continue to support robust repricing and refinancing activity in the syndicated markets. However, we also expect to see rising distress among more levered high yield and leveraged loan issuers, as well as an increase in liability management exercises.

Outlook

We continue to maintain a cautious approach, but we believe this environment may provide an attractive opportunity for large, scaled investors, and we expect our “credit first” philosophy to be on full display as we seek to deliver more stable returns through a tumultuous and uncertain 2024.

Fund Snapshot

| Structure | 1940 Act Closed-End Interval Fund |

| Inception Date | April 3, 2017 |

| Apollo Inception Date2 | May 2, 2022 |

| Pricing | Daily NAV |

| Subscription Frequency | Daily |

| Repurchase Frequency3 | Quarterly (5% of Fund shares outstanding) |

| Distribution Frequency | Quarterly |

| Tax Reporting | 1099-DIV |

Fund Summary Stats

| Managed Assets4 | $1.1 billion |

| Leverage5 | 12.2% |

| Portfolio Companies | 147 |

| Average Duration (Years)6 | 2.2 |

| Q2 2024 Annualized Distribution Rate (Class I Share)7 | 9.21% |

| Last Twelve Months’ Distribution Rate (Class I Share)7 | 9.54% |

| Portfolio Weighted Average Yield8 | 9.9% |

| Floating Rate Exposure9 | 85.5% |

| Senior Secured | 93.3% |

| North America/Europe/Other10 | 77% / 22% / 1% |

Past performance is not indicative of future results. Holdings and allocations are subject to change without notice. Diversification does not eliminate the risk of experiencing investment losses. Source: Apollo Analysts. The views expressed here are Apollo’s own, unless otherwise noted. Holdings and allocations, unless disclosed otherwise, are based on Managed Assets. The Fund is actively managed and its characteristics will vary. Active portfolio management could result in underperformance. For discussion purposes only. The expected allocations are subject to a variety of factors, including Apollo’s analysis of investment opportunities, and is subject to change at any time without notice. There is no guarantee these expected allocations will occur.

02

APOLLO DIVERSIFIED CREDIT FUND

Fund Performance2

For the month ended June 30, 2024, Apollo Diversified Credit Fund’s (the “Fund”) Class I Shares (NASDAQ: CRDIX) returned 0.95%, bringing quarter-to-date (“QTD”), year-to-date (“YTD”) and one-year net returns as of June 30, 2024, to 1.98%, 5.05% and 11.54%, respectively.

The Fund produced positive performance across all five of its strategy pillars in June, with the highest contribution from private credit, specifically corporate direct lending, as well as a strong month from performing credit. The Fund’s corporate direct lending strategy continued to perform well as the higher interest rate environment supports income generation from the Fund’s floating rate, senior secured loans.

The Fund announced a second quarter distribution of $0.483 per Class I Share, which equates to an annualized distribution rate of 9.21% as of June 30, 2024.7 We believe the Fund continues to provide a compelling value proposition for investors seeking current income in this higher for longer interest rate environment.

Apollo Diversified Credit Fund is a closed-end management investment company that is operated as an interval fund. Limited liquidity is provided to shareholders only through the Fund’s quarterly repurchase offers for no less than 5% of the Fund’s shares outstanding at net asset value. The Fund is only suitable for investors who can bear the risks associated with the limited liquidity of the Fund and should be viewed as a long-term investment. There is no guarantee that an investor will be able to sell all the shares that the investor desires to sell in the repurchase offer. There is no secondary market for the Fund’s shares and none is expected to develop. Please see the Fund’s current prospectus for further information on the Fund’s objective, strategy and risk factors.

Past performance is not indicative of future results. Investment return and the principal value of an investment will fluctuate. Shares may be worth more or less than original cost when redeemed. Investing involves risk, including loss of principal. Performance includes reinvestment of distributions and is net of all Fund expenses. Fund returns greater than one year are annualized. Fund returns would have been lower had expenses not been waived during the period. The Fund return does not reflect the deduction of any applicable Fund share class sales load, third-party brokerage commissions or third-party investment advisory fees paid by investors to a financial intermediary for such services. If the deduction of such fees was reflected, the performance would be lower. Returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Investing in the Fund involves risks, including the risk that you may receive little or no return on your investment or that you may lose part or all of your investment. The ability of the Fund to achieve its investment objective depends, in part, on the ability of the Adviser to allocate effectively the assets of the Fund among the various securities and investments in which the Fund invests. There can be no assurance that the actual allocations will be effective in achieving the Fund’s investment objective or delivering positive returns. Due to financial statement adjustments, performance information presented for the Fund herein differs from the Fund’s performance included in the Fund’s financial statements which are prepared in accordance with U.S. GAAP. Such differences generally are attributable to valuation adjustments to certain of the Fund’s investments which are reflected in the financial statements. Current performance may be lower or higher than the performance quoted. The most recent performance is available at www.apollo.com/adcf or by calling 888.926.2688. The Fund offers multiple different classes of shares. An investment in any share class of the Fund represents an investment in the same assets of the Fund. However, the purchase restrictions, ongoing fees, expenses, distributions, and performance for each share class are different.

For more information on the differences in share classes, refer to the applicable prospectus, which can be found at: www.apollo.com/adcf.

The views expressed here are Apollo’s own, unless otherwise noted.

03

APOLLO DIVERSIFIED CREDIT FUND

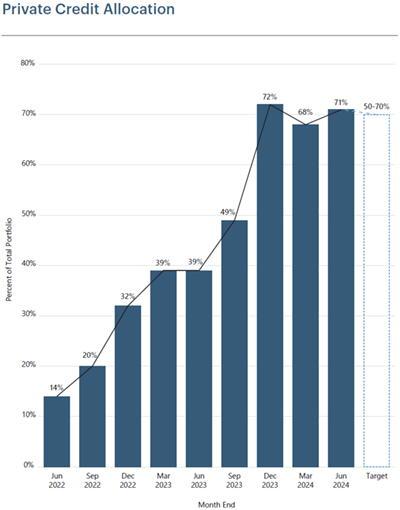

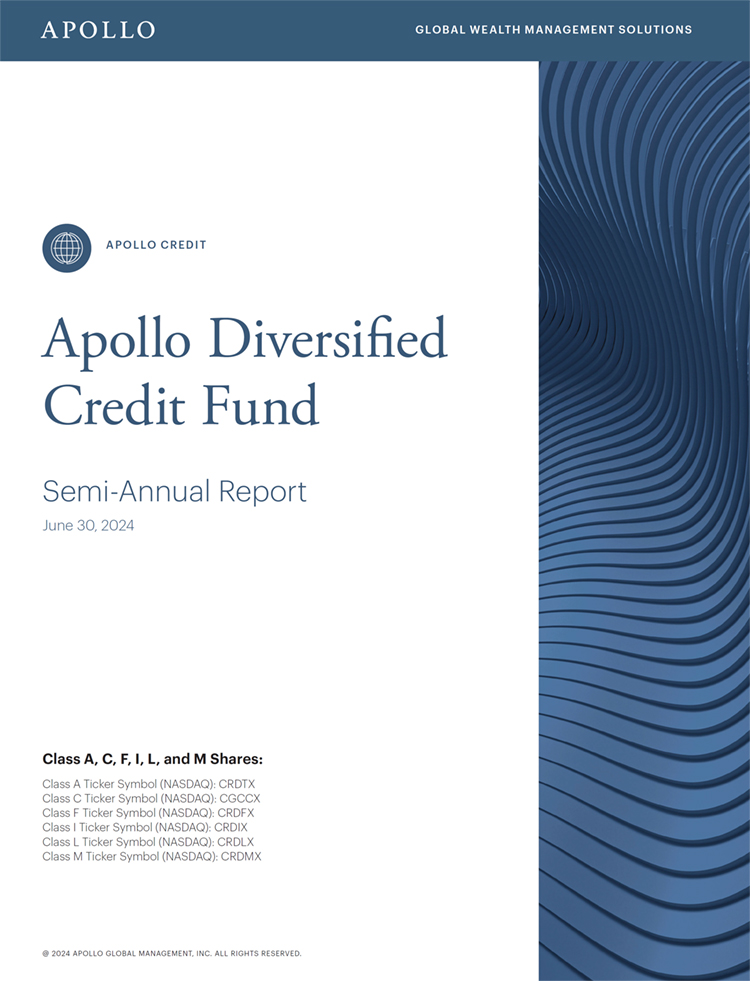

Private Credit

As of June 30, 2024

Private Credit Overview

We continued to witness a solid opportunity set for private credit throughout the first half of 2024. Despite the strong return of the syndicated credit markets this year, Leveraged Commentary & Data indicates that the volume of private credit loans taken out by the broadly syndicated loan (“BSL”) market slowed during the second quarter. Additionally, while the rebound in syndicated credit markets was driven by refinancings and repricings, most mergers and acquisitions (“M&A”) and leveraged buy out (“LBO”) deals—or de novo issuance—have been financed by the private credit market.11 Executives at major US banks said during recent earning calls that they’re seeing more dialogue on M&A and predicted that dealmaking will continue to progress. Ultimately, as discussed in previous letters, we believe that for credit markets to function effectively, both types of lending—public and private—need to co-exist and provide tailored solutions that depend on the borrower’s profile, investment lifecycle and specific needs.

In terms of fundraising, direct lending dominated capital raising activity during the first quarter, according to Preqin. Private debt strategies were a favorite destination for allocators, with direct lending funds raising nearly $25 billion in the first three months of 2024.12

Turning to the higher-for-longer interest rate environment, elevated borrowing costs have several implications for direct lenders. With short-term dated base rates above 5% and five-year SOFR swaps slightly below 4% as of mid-July, we believe direct lending continues to represent a compelling total return opportunity.13 At the same time, higher borrowing costs continue to pressure issuers, especially highly leveraged companies. A recent report from Morningstar indicated that as of June 2024, about 10% of private credit issuers were seeking covenant relief, and that more than half of this cohort carried ratings of CCC or lower.14 This is unsurprising as rates have now been elevated for two years, which has increased interest expense burdens for floating-rate borrowers. We believe this highlights the importance of the vintage of a fund’s portfolio as well as credit selection as many companies that tapped the market in 2021—when the low-rate environment in the aftermath of the pandemic fed a dealmaking frenzy—now face a steep maturity wall and higher interest rates.

Past performance is not indicative of future results. Holdings and allocations are subject to change without notice. Diversification does not eliminate the risk of experiencing investment losses. Source: Apollo Analysts. The views expressed here are Apollo’s own, unless otherwise noted. Holdings and allocations, unless disclosed otherwise, are based on Managed Assets. The Fund is actively managed and its characteristics will vary. Active portfolio management could result in underperformance. For discussion purposes only. The expected allocations are subject to a variety of factors, including Apollo’s analysis of investment opportunities, and is subject to change at any time without notice. There is no guarantee these expected allocations will occur.

04

APOLLO DIVERSIFIED CREDIT FUND

Corporate Direct Lending

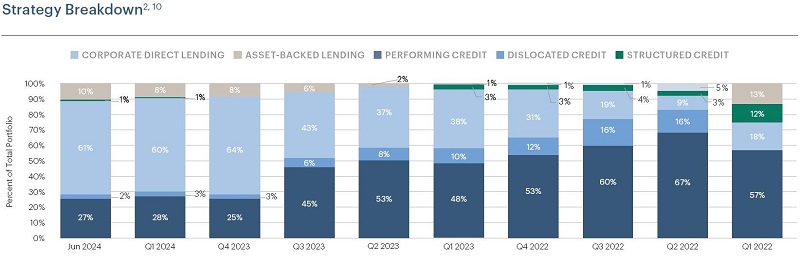

The Fund’s Corporate Direct Lending strategy targets large scale corporate originations and sponsor-backed issuers, utilizing Apollo’s proprietary sourcing channel.

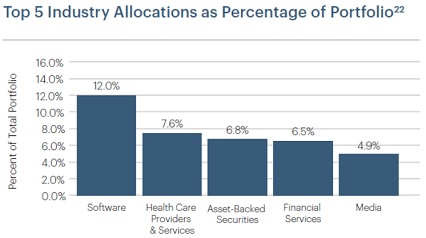

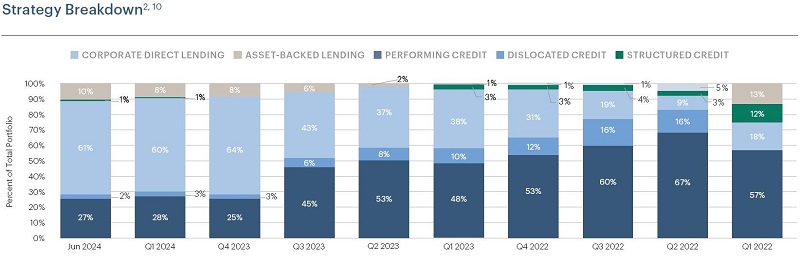

As of June 30, 2024, 61% of the Fund’s portfolio was allocated to corporate direct lending across 71 issuers of 2022-2024 vintage with a weighted average EBITDA of approximately $260 million15 and weighted average net LTV of approximately 38%,16 reflective of our “Large Cap” orientation and top-of-capital structure portfolio allocation.

In the first half of 2024, Apollo Credit closed on $10.4 billion of gross commitments for $8.5 billion of funded deployment across 41 large-cap direct lending deals, more than double the number of deals and dollars deployed over this same period last year. Apollo Diversified Credit participated in many of these transactions, highlighting the alignment across our credit platform.

Out of 311 potential deals identified by Apollo professionals, only 41 were closed, a close rate of about 13%, underscoring our selective process.

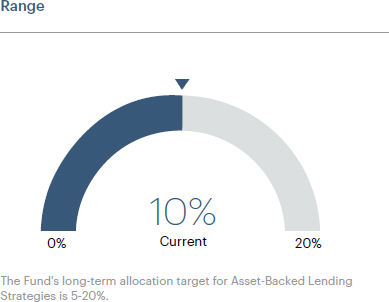

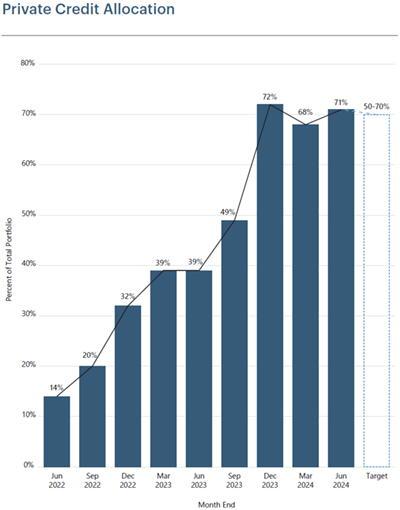

Asset-Backed Lending

The Fund’s Asset-Backed Lending strategy focuses on agile deployment of capital into origination and proprietary sourcing channels across a broad mandate of asset-backed investments, with a focus on investments collateralized by tangible investments.

As of June 30, 2024, the Fund increased its exposure to asset-backed lending to 10% of the Fund’s portfolio, adding two deals across consumer finance and financial assets segments. We believe these assets may present an attractive risk-return profile and adds diversification and downside protection17 through less correlated and in our opinion, resilient collateral pools.

Past performance is not indicative of future results. Holdings and allocations are subject to change without notice. Diversification does not eliminate the risk of experiencing investment losses. Source: Apollo Analysts. The views expressed here are Apollo’s own, unless otherwise noted. Holdings and allocations, unless disclosed otherwise, are based on Managed Assets. The Fund is actively managed and its characteristics will vary. Active portfolio management could result in underperformance. For discussion purposes only. The expected allocations are subject to a variety of factors, including Apollo’s analysis of investment opportunities, and is subject to change at any time without notice. There is no guarantee these expected allocations will occur.

05

APOLLO DIVERSIFIED CREDIT FUND

Public Credit

As of June 30, 2024

Public Credit Overview

Leveraged loans, as represented by the J.P. Morgan Leveraged Loan Index, were up 0.32% in June and leveraged loan yields decreased 13 bps and spreads rose 3 bps in June to 8.78% and 464 bps, respectively. The J.P. Morgan Leveraged Loan Index is up 4.62% YTD as of June 30, 2024, with spreads 35 bps lower from the start of the year.18

High-yield bonds, as represented by the J.P. Morgan High Yield Bond Index, were up 0.93% in June and high-yield bond yields and spreads decreased 11 bps and increased 2 bps in June to 8.03% and 351 bps, respectively. The J.P. Morgan High Yield Bond Index is up 2.87% YTD as of June 30, 2024, with spreads 26 bps lower from the start of the year.18

As of the end of June, the par weighted U.S. high-yield bond default rate decreased 23 bps month-over-month, to approximately 1.79% and the leveraged loan default rate decreased 19 bps month-over-month, to approximately 3.10%.18, 19

Primary activity in June was the second heaviest month on record for leveraged loans and the lightest of 2024 for high-yield bonds. Institutional loan issuance totaled $149.6 billion (including $11.1 billion of non-refinancing/repricing) and high-yield bond issuance volume totaled $17.9 billion (including $3.8 billion of non-refinancing) in June.18

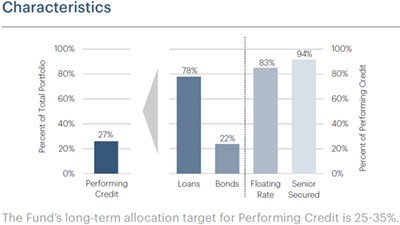

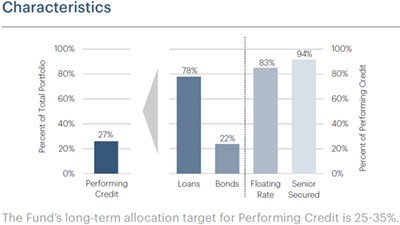

Performing Credit

The Fund’s Performing Credit strategy primarily pursues liquid, performing senior secured corporate credits to generate total return.

The Fund’s exposure within this strategy is predominately focused on senior secured positions across industries with resilient business models that we believe may continue to generate strong cash flow across various economic environments. The Fund’s portfolio allocation is currently tilted towards floating rate assets over fixed rate assets, consistent with our views of a higher for longer interest rate environment. As of June 30, 2024, the strategy had exposure to 45 issuers with a weighted average yield of 9.7%.

Past performance is not indicative of future results. Holdings and allocations are subject to change without notice. Diversification does not eliminate the risk of experiencing investment losses. Source: Apollo Analysts. The views expressed here are Apollo’s own, unless otherwise noted. Holdings and allocations, unless disclosed otherwise, are based on Managed Assets. The Fund is actively managed and its characteristics will vary. Active portfolio management could result in underperformance. For discussion purposes only. The expected allocations are subject to a variety of factors, including Apollo’s analysis of investment opportunities, and is subject to change at any time without notice. There is no guarantee these expected allocations will occur.

06

APOLLO DIVERSIFIED CREDIT FUND

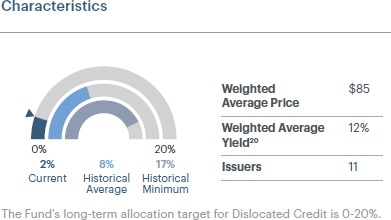

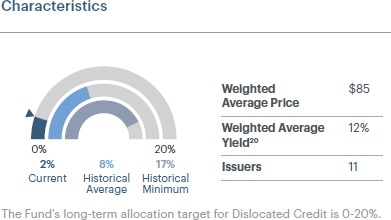

Dislocated Credit

The Fund’s Dislocated Credit strategy seeks to use contingent capital to tactically pursue “dislocated” credit opportunities (e.g., stressed, performing assets across the credit spectrum that sell-off due to technical and/or non-fundamental reasons) in between traditional, passive investment mandates and “distressed-for-control” investment mandates.

As we allocate additional capital to private credit given the relative risk-reward in this market environment, we continue to pare back our exposure in the Dislocated Credit strategy as credit spreads tighten and prices trend higher. We maintain the optionality and liquidity to engage as interest rate volatility remains high with market expectations of interest rate cuts changing with every economic data release, which in our opinion, can potentially lead to dislocations in the future.

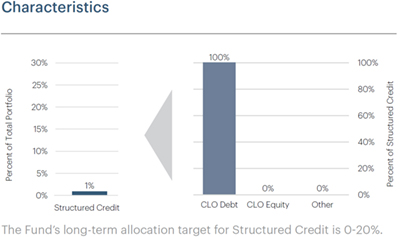

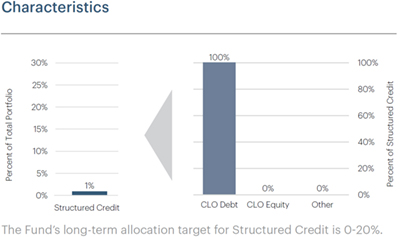

Structured Credit

The Fund’s Structured Credit strategy seeks out high-quality structured credit opportunities of various asset types, vintages, maturities, jurisdictions, and capital structure priorities, including debt and equity tranches of CLOs, commercial and residential mortgage-backed securities, consumer and commercial asset-backed securities, whole loans and regulatory capital relief transactions.

While a smaller part of the Fund’s allocation today, we believe there are likely to be increased instances of market dislocations, and we stand ready to deploy capital as opportunities present themselves.

Past performance is not indicative of future results. Holdings and allocations are subject to change without notice. Diversification does not eliminate the risk of experiencing investment losses. Source: Apollo Analysts. The views expressed here are Apollo’s own, unless otherwise noted. Holdings and allocations, unless disclosed otherwise, are based on Managed Assets. The Fund is actively managed and its characteristics will vary. Active portfolio management could result in underperformance. For discussion purposes only. The expected allocations are subject to a variety of factors, including Apollo’s analysis of investment opportunities, and is subject to change at any time without notice. There is no guarantee these expected allocations will occur.

07

APOLLO DIVERSIFIED CREDIT FUND

Portfolio Detail

As of June 30, 2024

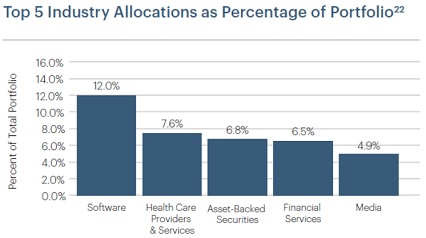

Attribution by Strategy

| | June (bps) | Last

3 Months (bps) | YTD

(bps) | 7/1/22-

6/30/24

(bps) | Apollo Inception to Date2 (bps) |

| Private Credit | 49 | 218 | 466 | 637 | 558 |

| Corporate Direct Lending | 49 | 207 | 428 | 615 | – |

| Asset-Backed Lending | 0 | 11 | 38 | 22 | – |

| Public Credit | 22 | 59 | 153 | 817 | 331 |

| Performing Credit | 20 | 47 | 119 | 645 | – |

| Dislocated Credit | 1 | 8 | 30 | 141 | – |

| Structured Credit | 1 | 4 | 4 | 31 | – |

| Currency Hedge | 23 | 14 | 53 | -4 | 6 |

| Residual21 | 16 | -47 | -74 | -149 | -141 |

| Net Fees & Expenses | -15 | -46 | -93 | -170 | -158 |

| Total (Net) | 95 | 198 | 505 | 1,131 | 596 |

Top 10 Holdings as Percentage of Portfolio10

| Issuer | Industry22 | Percent of Allocation |

| Ardagh Group S.A. | Household Products | 2.2% |

| Carvana Auto Receivables Trust 2024-N2 | Asset-Backed Securities | 2.1% |

| Commscope, Inc. | Communications Equipment | 1.8% |

| BDO USA, P.A. | Commercial Services & Supplies | 1.8% |

| K. Hovnanian Enterprises Inc. | Household Durables | 1.8% |

| Bellis Acquisition Company PLC/ASDA | Consumer Staples Distribution & Retail | 1.7% |

| Avalara, Inc. | Software | 1.7% |

| Redfin Corporation | Real Estate Management & Development | 1.6% |

| GBT Group Services B.V. | Consumer Finance | 1.5% |

| EG Global Finance PLC | Specialty Retail | 1.4% |

| Total | 17.6% |

Past performance is not indicative of future results. Holdings and allocations are based on Managed Assets and are subject to change without notice and may not be representative of current or future allocations. Diversification does not eliminate the risk of experiencing investment losses. Source: Apollo Analysts. For discussion purposes only. Attribution for periods greater than one year are annualized. The Fund pursues its investment objective through a “multi-asset” approach centered around five key strategy pillars, as described above: (1) corporate direct lending, (2) asset-backed lending, (3) performing credit, (4) dislocated credit and (5) structured credit. “Attribution by Strategy” is intended to show characters of the portfolio and provide an estimate as to which strategy pillars within the Fund contributed (positively or negatively) to the Fund’s overall performance during the period represented. Such attribution analysis should not be relied upon for investment decisions. Strategy and asset classification prior to Apollo Inception (May 2, 2022) was generated by the previous management team of the Fund’s investment adviser and as such Apollo Inception to Date attribution is only summarized for Private Credit, Public Credit, Currency Hedge, Residual, and Net Fees & Expenses. Total (Net) performance reflects the Fund’s Class I share and includes reinvestment of distributions and is net of all Fund expenses during the relevant period. Net Fees & Expenses reflects the net expenses paid by the Fund’s Class I shares during the relevant period. The figures reflect the impact of fee waivers and expense limitation and reimbursement agreements in effect during the given period, some of which have since expired. The Fund’s current expense limitation and reimbursement agreement will remain in effect at least through April 30, 2025. Total (Net) performance of the Fund’s Class I shares would have been lower had fees not been waived during the period. The Fund return does not reflect the deduction of any applicable Fund share class sales load, third-party brokerage commissions or third-party investment advisory fees paid by investors to a financial intermediary for such services. If the deduction of such fees was reflected, the performance would be lower. Returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

08

APOLLO DIVERSIFIED CREDIT FUND

Correlation Summary23

| As of 6/30/2024 | Correlation to Fund: Last 3 Months | Correlation to Fund: Since Apollo Inception (5/2/22)2 |

Bloomberg US Aggregate Bond Index | 0.78 | 0.38 |

Bloomberg Municipal Bond Index | 0.69 | 0.45 |

Bloomberg US Corporate Bond Index | 0.77 | 0.47 |

Morningstar LSTA US Leveraged Loan Index | 0.60 | 0.74 |

ICE BofA US High Yield Index | 0.78 | 0.86 |

Past performance is not indicative of future results. Holdings and allocations are subject to change without notice. Diversification does not eliminate the risk of experiencing investment losses. Source: Apollo Analysts. Holdings and allocations, unless disclosed otherwise, are based on Managed Assets. The Fund is actively managed and its characteristics will vary. Active portfolio management could result in underperformance.

Fund Management

Apollo Global Management, Inc. and its consolidated subsidiaries (“Apollo”), which includes the Fund’s investment adviser, Apollo Capital Credit Adviser, LLC, has built one of the world’s largest alternative credit platforms, managing $476 billion in institutional and private assets.24, 25 We draw on 30+ years of experience, seeking to provide excess returns across the risk spectrum through our proprietary origination, an extensive credit toolkit, and a flexible capital base that can respond to the changing needs of borrowers. We offer solutions designed to align with investors’ needs for return — at what we believe to be the appropriate level of risk and liquidity. Apollo Diversified Credit Fund builds on Apollo’s global credit platform, our differentiated sourcing engine, and our status as a preferred lending partner.

| | $476B | | 368 | |

| | in credit assets under management24, 25 | | dedicated credit investment professionals24 | |

The views expressed here are Apollo’s own, unless otherwise noted.

09

APOLLO DIVERSIFIED CREDIT FUND

Glossary

Annualized Return: Calculated by annualizing cumulative return (i.e., adjusting it for a period of one year). Annualized return includes capital appreciation and assumes a reinvestment of dividends and distributions.

Attribution: An assessment of the performance of a portfolio or its investments.

Asset-Backed Securities (ABS): Financial securities backed by income-generating assets.

Basis Point (bps): A unit of measure used to describe the percentage change. One basis point is equivalent to 0.01% (1/100th of a percent) or 0.0001 in decimal form.

Bloomberg Municipal Bond Index: Measures the performance of US investment grade general obligation and revenue bonds with maturities from one to 30 years.

Bloomberg US Aggregate Bond Index: Measures the performance of the US investment grade bond market.

Bloomberg US Corporate Bond Index: Measures the performance of the investment grade, fixed-rate, taxable corporate bond market. It includes US dollar-denominated securities issued by US and non-US industrial, utility and financial firms.

Bond: A debt instrument, also considered a loan, that an investor makes to a corporation, government, federal agency or other organization (known as an issuer) in which the issuer typically agrees to pay the owner the amount of the face value of the bond on a future date, and to pay interest at a specified rate at regular intervals.

Bond Rating: A method of evaluating the quality and safety of a bond. This rating is based on an examination of the issuer’s financial strength and the likelihood that it will be able to meet scheduled repayments. Ratings range from AAA (best) to D (worst). Bonds receiving a rating of BB or below are not considered investment grade because of the relative potential for issuer default.

Capital Relief Transactions: A transaction that seeks to provide credit protection on a portfolio of loans.

Collateralized Loan Obligation (CLO): A structured credit security backed by a pool of bank loans, structured so there are several classes of bondholders with varying maturities, called tranches. Debt and equity securities of CLOs are sold in tranches where each CLO tranche has a different priority on distributions, unique risk exposures, and yield expectations based on the tranche’s place in the capital structure. Distributions begin with the senior debt tranches (CLO debt) and flow down to the equity tranches (CLO equity).

Commercial Mortgage-Backed Securities (CMBS): Investment products that are backed by mortgages on commercial properties.

Cumulative Return: The compound return of an investment. It includes capital appreciation and assumes a reinvestment of dividends and distributions.

Earnings Before Interest, Taxes, Depreciation, and Amortization (EBITDA): A statistic used to assess operating performance and profitability.

ICE BofA US High Yield Index: Tracks the performance of US dollar denominated below investment grade corporate debt publicly issued in the US domestic market.

J.P. Morgan High Yield Bond Index: Designed to mirror the investible universe of US dollar high-yield corporate debt market, including domestic and international issues.

J.P. Morgan Leveraged Loan Index: Designed to mirror the investable universe of US Dollar-denominated institutional leveraged loans, including US and international borrowers.

Leveraged Buyout (LBO): Purchase of a controlling share in a company using outside capital.

Loan-to-Value (LTV) Ratio: An assessment of lending risk that financial institutions and other lenders examine before lending to a company.

Morningstar LSTA US Leveraged Loan Index: Designed to deliver comprehensive coverage of the US leveraged loan market using PitchBook LCD data to monitor the performance, activity, and key characteristics of the market.

Mortgage-Backed Securities: Investment products that are backed by mortgages on commercial or residential properties.

Net Asset Value (NAV): Represents a fund’s per-share price. NAV is calculated by dividing a fund’s total net assets by its number of shares outstanding.

Secured Overnight Financing Rate (SOFR): A broad measure of the cost of borrowing cash overnight collateralized by Treasury securities. The SOFR is a benchmark interest rate for dollar-denominated derivatives and loans.

Whole Loan: A single loan issued to a borrower.

10

APOLLO DIVERSIFIED CREDIT FUND

Important Disclosure Information (Unaudited)

This material is neither an offer to sell nor a solicitation to purchase any security. Investors should carefully consider the investment objectives, risks, charges and expenses of Apollo Diversified Credit Fund (the “Fund”). This information and other important details about the Fund are contained in the prospectus, which can be obtained by visiting www.apollo.com/adcf. Please read the prospectus carefully before investing.

Past performance is not indicative of future results. Investment return and the principal value of an investment will fluctuate. Shares may be worth more or less than original cost when redeemed. Investing involves risk, including loss of principal. Performance includes reinvestment of distributions and reflects management fees and other expenses. Fund returns would have been lower had expenses not been waived during the period. The Fund return does not reflect the deduction of all fees, including any applicable Fund share class sales load, third-party brokerage commissions or third-party investment advisory fees paid by investors to a financial intermediary for brokerage services. If the deduction of such fees was reflected, the performance would be lower. Returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Investing in the Fund involves risks, including the risk that you may receive little or no return on your investment or that you may lose part or all of your investment. The ability of the Fund to achieve its investment objective depends, in part, on the ability of the Adviser to allocate effectively the assets of the Fund among the various securities and investments in which the Fund invests. There can be no assurance that the actual allocations will be effective in achieving the Fund’s investment objective or delivering positive returns. Current performance may be lower or higher than the performance quoted. The most recent performance is available at www.apollo.com/adcf or by calling 888.926.2688.

The Fund is a closed-end management investment company that is operated as an interval fund. The shares have no history of public trading, nor is it intended that the shares will be listed on a public exchange at this time. No secondary market is expected to develop for the Fund’s shares. Limited liquidity is provided to shareholders only through the Fund’s quarterly repurchase offers for no less than 5% and no more than 25% of the Fund’s shares outstanding at net asset value. There is no guarantee that an investor will be able to sell all the shares that the investor desires to sell in the repurchase offer. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than the original cost. Due to these restrictions, an investor should consider an investment in the Fund to be of limited liquidity. The Fund is suitable only for investors who can bear the risks associated with the limited liquidity of the Fund and should be viewed as a long-term investment. Investing in the Fund is speculative and involves a high degree of risk, including the risks associated with leverage and the risk of a substantial loss of investment. There is no guarantee that the investment strategies will work under all market conditions.

The Fund’s distribution policy is to make quarterly distributions to shareholders. Shareholders should not assume that the source of a distribution from the Fund is net profit. Please refer to the Fund’s most recent Section 19(a) notice for an estimate of the composition of the Fund’s most recent distribution, available at www.apollo.com/adcf, and the Fund’s semi-annual or annual reports filed with the U.S. Securities and Exchange Commission (the “SEC”) and available on the Fund’s website for additional information regarding the composition of distributions. The Fund’s distributions may be affected by numerous factors, including but not limited to changes in Fund expenses including the amount of expenses waived by the Fund’s Adviser, investment performance, realized and projected market returns, fluctuations in market interest rates, and other factors. There is no assurance that the Fund’s distribution rate will be sustainable in the future nor are distributions guaranteed.

Investors in the Fund should understand that the net asset value (“NAV”) of the Fund will fluctuate, which may result in a loss of the principal amount invested. All investments contain risk and may lose value The Fund’s investments may be negatively affected by the broad investment environment and capital markets in which the Fund invests, including the debt market, real estate market, and/or the equity securities market. The value of the Fund’s investments will increase or decrease based on changes in the prices of the investments it holds. This will cause the value of the Fund’s shares to increase or decrease. The use of leverage by the Fund will magnify the Fund’s gains or losses. The Fund is “diversified” under the Investment Company Act of 1940. Diversification does not eliminate the risk of experiencing investment losses. Holdings are subject to change without notice. The Fund is not intended to be a complete investment program.

Investing in lower-rated securities involves special risks in addition to the risks associated with investments in investment grade securities, including a high degree of credit risk. Lower-rated securities may be regarded as predominately speculative with respect to the issuer’s continuing ability to meet principal and interest payments. Analysis of the creditworthiness of issuers/issues of lower-rated securities may be more complex than for issuers/issues of higher quality debt securities. Securities that are in the lowest rating category are considered to have extremely poor prospects of ever attaining any real investment standing, to have a current identifiable vulnerability to default and/or to be unlikely to have the capacity to pay interest and repay principal. There is a risk that issuers will not make payments, resulting in losses to the Fund. In addition, the credit quality of securities may be lowered if an issuer’s financial condition changes. Lower credit quality may lead to greater volatility in the price of a security and in shares of the Fund. Lower credit quality also may affect liquidity and make it difficult to sell the security. Default, or the market’s perception that an issuer is likely to default, could reduce the value and liquidity of securities, thereby reducing the value of your investment in Fund shares. The Adviser’s judgments about the attractiveness, value and potential appreciation of a particular sector and securities in which the Fund invests may prove to be incorrect and may not produce the desired results. Foreign investing involves special risks such as currency fluctuations and political uncertainty. The use of leverage by the Fund will magnify the Fund’s gains or losses. There is no guarantee that the Fund’s leverage strategy will be successful.

This sales material must be accompanied or preceded by the prospectus and must be read in conjunction with the Fund’s prospectus in order to fully understand all the implications and risks of an investment in the Fund. This sales material is neither an offer to sell nor a solicitation of an offer to buy securities. Investments mentioned herein may not be suitable for prospective investors. An offering is made only by the prospectus, which must be made available to you prior to making a purchase of shares and is available at www.apollo.com/adcf. Prior to making an investment, investors should read the prospectus, including the “Risk Factors” section therein, which contain the risks and uncertainties that we believe are material to our business, operating results.

11

APOLLO DIVERSIFIED CREDIT FUND

Alternative investments often are speculative, typically have higher fees than traditional investments, often include a high degree of risk and are suitable only for eligible, long-term investors who are willing to forgo liquidity and put capital at risk for an indefinite period of time. They may be highly illiquid and can engage in leverage and other speculative practices that may increase volatility and risk of loss.

The Fund is advised by Apollo Capital Credit Adviser, LLC (“ACCA”). ACCA is registered as an investment adviser with the SEC pursuant to the provisions of the Investment Advisers Act of 1940, as amended (the “Advisers Act”). The Fund is sub-advised by Apollo Credit Management, LLC (“Apollo”). Apollo is registered as an investment adviser with the SEC pursuant to the provisions of the Advisers Act. Apollo and ACCA are affiliates of Apollo Global Management, Inc. and its consolidated subsidiaries. ACCA was acquired by Apollo Global Management, Inc., on May 2, 2022. Performance prior to May 2, 2022 was generated under the previous management team of the Fund’s former investment adviser, which was not affiliated with Apollo. The current management team of ACCA is responsible for performance on and after May 2, 2022. Registration with the SEC does not constitute an endorsement by the SEC nor does it imply a certain level of skill or training.

This material may contain certain forward-looking statements. Such forward-looking statements can generally be identified by our use of forward-looking terminology such as “may,” “will,” “expect,” “intend,” “anticipate,” “estimate,” “believe,” “continue,” or other similar words. Because such statements include risks, uncertainties and contingencies, actual results may differ materially from the expectations, intentions, beliefs, plans or predictions of the future expressed or implied by such forward-looking statements. As a result, investors should not rely on such forward-looking statements. These risks, uncertainties and contingencies include, but are not limited to: uncertainties relating to changes in general economic and real estate conditions; uncertainties relating to the implementation of our investment strategy; uncertainties relating to capital proceeds; and other risk factors as outlined in the Fund’s prospectus, statement of additional information, annual report and semi-annual report filed with the SEC.

This material may not be distributed, transmitted or otherwise communicated to others, in whole or in part, without the express written consent of Apollo Global Management, Inc. (together with its subsidiaries, “Apollo”).

This material has been distributed for informational purposes only and should not be considered as investment advice or a recommendation of any particular security, strategy or investment product or be relied upon for any other purpose. The views expressed represent an assessment of market conditions at a specific point in time, are opinions only and should not be relied upon as investment advice regarding a particular investment or markets in general. Such information does not constitute a recommendation to buy or sell specific securities or investment vehicles. It should not be assumed that any investment will be profitable or will equal the performance of the fund(s) or any securities or any sectors mentioned herein. Information contained herein has been obtained from sources deemed to be reliable, but not guaranteed. Apollo Global Management and its affiliates do not provide tax, legal or accounting advice. This material is not intended to provide, and should not be relied on for, tax, legal or accounting advice. You should consult your own tax, legal and accounting advisors before engaging in any transaction. This material represents views as of the date of this presentation and is subject to change without notice of any kind.

Notwithstanding the forgoing, nothing herein is intended to impede an individual from communicating directly with the US Securities and Exchange Commission or other regulatory agency about a possible securities law violation.

12

APOLLO DIVERSIFIED CREDIT FUND

Endnotes

| 1. | Source: Bloomberg, June 2024. |

| 2. | Apollo Capital Credit Adviser, LLC, f/k/a Griffin Capital Credit Advisor, LLC (hereinafter “ACCA,” and together with ACCA’s affiliated registered investment advisers directly and indirectly owned by Apollo Global Management, Inc., “Apollo”) was acquired by Apollo Global Management, Inc., on May 2, 2022. Performance prior to May 2, 2022 was generated under the previous management team of the Fund’s former investment adviser, which was not affiliated with Apollo. The current management team of ACCA is responsible for performance on and after May 2, 2022. |

| 3. | Limited liquidity is provided to shareholders only through the Fund’s quarterly repurchase offers for no less than 5% of the Fund’s shares outstanding at net asset value. There is no guarantee that an investor will be able to sell all the shares that the investor desires to sell in the repurchase offer. Due to these restrictions, an investor should consider an investment in the Fund to be of limited liquidity. |

| 4. | Managed Assets are equal to the total of the Fund’s assets, including assets attributable to financial leverage, minus accrued liabilities, other than debt representing financial leverage. Holdings and allocations, unless disclosed otherwise, are based on Managed Assets. |

| 5. | Leverage is equal to consolidated Fund borrowings divided by total managed assets. The use of leverage by the Fund will magnify the Fund’s gains or losses. There is no guarantee that the Fund’s leverage strategy will be successful. |

| 6. | Duration is a measure of how sensitive the price of a debt instrument (such as a bond) is to a change in interest rates and is measured in years. |

| 7. | Past performance is not indicative of future results. Investment return and the principal value of an investment will fluctuate. Shares may be worth more or less than original cost when redeemed. Investing involves risk, including loss of principal. The Fund’s distribution policy is to make quarterly distributions to shareholders. Shareholders should not assume that the source of a distribution from the Fund is net profit. Please refer to the Fund’s most recent Section 19(a) notice for an estimate of the composition of the Fund’s most recent distribution, available at www.apollo.com/adcf, and the Fund’s semi-annual or annual reports filed with the U.S. Securities and Exchange Commission (the “SEC”) and available on the Fund’s website for additional information regarding the composition of distributions. Under GAAP, the composition of the Fund’s distribution on June 30, 2024 was estimated to include a de minimis amount of return of capital and should not be confused with yield or income. It is important to note that differences exist between the Fund’s accounting records prepared in accordance with GAAP and recordkeeping practices required under income tax regulations. Therefore, the characterization of Fund distributions for federal income tax purposes may be different from GAAP characterization estimates. The determination of what portion of each year’s distributions constitutes ordinary income, qualifying dividend income, short or long-term capital gains or return of capital is determined at year-end and reported to shareholders on Form 1099-DIV, which is mailed every year in late January. The Fund does not provide tax advice. The Fund’s distributions may be affected by numerous factors, including but not limited to changes in Fund expenses including the amount of expenses waived by the Fund’s Adviser, investment performance, realized and projected market returns, fluctuations in market interest rates, and other factors. There is no assurance that the Fund’s distribution rate will be sustainable in the future nor are distributions guaranteed. Last Twelve Months’ Distribution Rate (Class I Share) as of June 30, 2024. |

| 8. | Represents the Fund’s weighted average yield to worst at current market value of the Fund’s underlying holdings, excluding cash. Yield to worst is an estimate of the lowest yield expected from a debt investment, absent a default. |

| 9. | Based on the Fund’s total market value exposure to debt securities. |

| 10. | Based on market value of the Fund’s underlying securities. Excludes cash and other net assets. Totals may not sum due to rounding. |

| 11. | PitchBook LCD, Data through June 30, 2024. |

| 13. | Federal Reserve Bank of New York, retrieved from FRED, Federal Reserve Bank of St. Louis, July 2024. |

| 14. | Morningstar, June 2024. |

| 15. | Represents weighted average EBITDA of the Fund’s directly originated debt investments based on latest information tracked on our portfolio companies and excludes certain portfolio companies for which these metrics are not meaningful (for instance, portfolio companies with negative EBTIDA). |

| 16. | Weighted average net loan-to-value (LTV) is net debt through the respective loan tranche in which the Fund has invested divided by the estimated enterprise value of the portfolio company. Based on latest information tracked on the Fund’s underlying portfolio companies and excludes certain portfolio companies for which these metrics are not meaningful (for instance, portfolio companies with negative EBTIDA). |

| 17. | References to “downside protection” and “diversification” does not guarantee against loss of value, including the loss of the entire principal amount invested. The value of any investment could decline and/or become worthless. |

| 18. | J.P. Morgan – North America Credit Research, July 2024. |

| 19. | Includes distressed exchanges. |

| 20. | Weighted average yield is represented by yield-to-worst, which is an estimate of the lowest yield that you can expect to earn from a debt investment, absent a default. |

| 21. | Represents cash and other net assets including positions not categorized within the strategies described in the “Attribution by Strategy” table. |

| 22. | Based on the Global Industry Classification Standard (GICS). |

| 23. | Past correlations are not indicative of future correlations, which may vary. Correlation is a statistical measure of how two securities move in relation to each other. A correlation ranges from -1 to 1. A positive correlation of 1 implies that as one security moves, either up or down, the other security will move in lockstep, in the same direction. A negative correlation of -1 indicates that the securities have moved in the opposite direction. If the correlation is 0, the movements of the securities are said to have no correlation; they are completely random. Data source: Morningstar using daily data. Assets and securities contained within indices and peer funds may be different than the assets and securities contained in Apollo Diversified Credit Fund and will therefore have different risk and reward profiles. An investment cannot be made in an index, which is unmanaged and has returns that do not reflect any trading, management or other costs. Please see the glossary for descriptions of indices. |

13

APOLLO DIVERSIFIED CREDIT FUND

| 25. | Assets under management (AUM) refers to the assets of the funds, partnerships and accounts to which Apollo provides investment management, advisory, or certain other investment-related services, including, without limitation, capital that such funds, partnerships and accounts have the right to call from investors pursuant to capital commitments. Our AUM equals the sum of: 1. the NAV, plus used or available leverage and/or capital commitments, or gross assets plus capital commitments, of the yield and certain hybrid funds, partnerships and accounts for which we provide investment management or advisory services, other than certain CLOs, CDOs, and certain perpetual capital vehicles, which have a fee-generating basis other than the mark-to-market value of the underlying assets; for certain perpetual capital vehicles in yield, gross asset value plus available financing capacity; 2. the fair value of the investments of the equity and certain hybrid funds, partnerships and accounts Apollo manages or advises, plus the capital that such funds, partnerships and accounts are entitled to call from investors pursuant to capital commitments, plus portfolio level financings; 3. the gross asset value associated with the reinsurance investments of the portfolio company assets Apollo manages or advises; and 4. the fair value of any other assets that Apollo manages or advises for the funds, partnerships and accounts to which Apollo provides investment management, advisory, or certain other investment-related services, plus unused credit facilities, including capital commitments to such funds, partnerships and accounts for investments that may require pre-qualification or other conditions before investment plus any other capital commitments to such funds, partnerships and accounts available for investment that are not otherwise included in the clauses above. |

Apollo’s AUM measure includes Assets Under Management for which Apollo charges either nominal or zero fees. Apollo’s AUM measure also includes assets for which Apollo does not have investment discretion, including certain assets for which Apollo earns only investment-related service fees, rather than management or advisory fees. Apollo’s definition of AUM is not based on any definition of Assets Under Management contained in its governing documents or in any management agreements of the funds Apollo manages. Apollo considers multiple factors for determining what should be included in its definition of AUM. Such factors include but are not limited to (1) Apollo’s ability to influence the investment decisions for existing and available assets; (2) Apollo’s ability to generate income from the underlying assets in the funds it manages; and (3) the AUM measures that Apollo uses internally or believes are used by other investment managers. Given the differences in the investment strategies and structures among other alternative investment managers, Apollo’s calculation of AUM may differ from the calculations employed by other investment managers and, as a result, this measure may not be directly comparable to similar measures presented by other investment managers. Apollo’s calculation also differs from the manner in which its affiliates registered with the SEC report “Regulatory Assets Under Management” on Form ADV and Form PF in various ways.

Apollo uses AUM, Gross capital deployment and Dry powder as performance measurements of its investment activities, as well as to monitor fund size in relation to professional resource and infrastructure needs.

14

| Apollo Diversified Credit Fund | Portfolio Update |

June 30, 2024 (Unaudited)

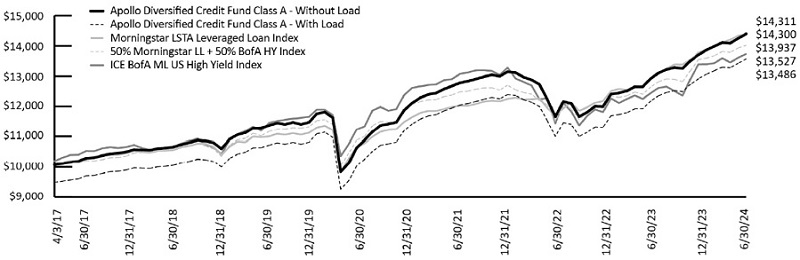

Performance (for the period ended June 30, 2024)

| | 6 Month | 1 Year | 3 Year**** | 5 Year**** | Since

Inception**** | Inception |

| Apollo Diversified Credit Fund - A - With Load* | -1.17% | 4.87% | 1.97% | 3.56% | 4.22% | 4/3/17 |

| Apollo Diversified Credit Fund - A - Without Load | 4.86% | 11.25% | 4.01% | 4.79% | 5.08% | 4/3/17 |

| Apollo Diversified Credit Fund - C - With Load** | 3.48% | 9.49% | 3.63% | 4.56% | 4.91% | 4/3/17 |

| Apollo Diversified Credit Fund - C - Without Load | 4.48% | 10.49% | 3.63% | 4.56% | 4.91% | 4/3/17 |

| Apollo Diversified Credit Fund - I - NAV | 5.00% | 11.59% | 4.14% | 4.88% | 5.13% | 4/3/17 |

| Apollo Diversified Credit Fund - M - NAV | 4.56% | 10.65% | – | – | 3.44% | 11/2/21 |

| Apollo Diversified Credit Fund - L - With Load*** | 0.26% | 6.23% | 2.38% | 3.80% | 4.29% | 9/5/17 |

| Apollo Diversified Credit Fund - L - Without Load | 4.73% | 10.96% | 3.87% | 4.71% | 4.96% | 9/5/17 |

| Apollo Diversified Credit Fund - F - NAV | 5.84% | 13.96% | 5.58% | 5.74% | 5.69% | 9/25/17 |

| ICE BofA ML US High Yield Index | 2.62% | 10.45% | 1.65% | 3.73% | 4.26% | 4/3/17 |

| Morningstar LSTA Leveraged Loan Index | 4.40% | 11.11% | 6.14% | 5.53% | 5.06% | 4/3/17 |

| 50% S&P LL + 50% BofA HY Index | 3.51% | 10.81% | 3.93% | 4.66% | 4.69% | 4/3/17 |

| * | Adjusted for initial maximum sales charge of 5.75% |

| ** | Adjusted for contingent deferred sales charge of 1.00% on shares repurchased during the first 365 days after their purchase |

| *** | Adjusted for initial maximum sales charge of 4.25% |

The Fund has chosen to benchmark against a blended benchmark of 50% Morningstar LSTA US Leveraged Loan Index and 50% ICE BofA ML US High Yield Index to align with target portfolio asset allocation. Morningstar LSTA US Leveraged Loan Index: Designed to deliver comprehensive coverage of the US leveraged loan market using PitchBook LCD data to monitor the performance, activity, and key characteristics of the market. ICE BofA Merrill Lynch U.S. High Yield Index: Tracks the performance of U.S. dollar denominated below investment grade corporate debt publicly issued in the U.S. domestic market.

Indexes are not actively managed and do not reflect deduction of fees, expenses or taxes. An investor cannot invest directly into an index.

The returns shown above do not reflect the deduction of taxes a shareholder would pay on Fund distributions or redemption of Fund shares.

The performance data quoted above represents past performance. Past performance is not indicative of future results. Investment return and value of the Fund shares will fluctuate so that an investor’s shares, when sold or redeemed, may be worth more or less than their original cost. Performance may be lower or higher than performance data quoted. The Fund's current performance is available by calling 1-888-926-2688 or by visiting www.apollo.com/adcf

Apollo Capital Credit Adviser, LLC (formerly, Griffin Capital Credit Advisor, LLC) was acquired by Apollo Global Management, Inc., an affiliate of the Fund’s sub-adviser, on May 2, 2022. Performance prior to May 2, 2022 was generated under the previous management team of the Fund’s investment adviser. The current management team of the Fund’s investment adviser is responsible for performance on and after May 2, 2022.

Class A shares are offered subject to a maximum sales charge of 5.75% of the offering price and Class L shares are offered subject to a maximum sales charge of 4.25% of the offering price. Class C, Class I and Class M shares are offered at net asset value per share. Class C shares may be subject to a 1.00% contingent deferred sales charge on shares redeemed during the first 365 days after their purchase. Class F Shares are no longer offered except for reinvestment of dividends at net asset value. The Adviser and the Fund have entered into an expense limitation and reimbursement agreement with respect to Class F shares (the “Class F Expense Limitation Agreement”) and a separate agreement with respect to all other classes of shares (the “Multi-Class Expense Limitation Agreement” and together with the Class F Expense Limitation Agreement, the “Expense Limitation Agreements”). Pursuant to the Class F Expense Limitation Agreement, the Adviser has contractually agreed to waive its fees and/or to reimburse the Fund for expenses the Fund incurs to the extent necessary to maintain the Fund’s total annual operating expenses after fee waivers and/or reimbursements (including taxes, interest, brokerage commissions, acquired fund fees and expenses, and extraordinary expenses, such as litigation or reorganization costs and organizational costs and offering costs) to the extent that they exceed, per annum, 1.50% of the Fund’s average daily net assets attributable to Class F shares. Pursuant to the Multi-Class Expense Limitation Agreement, the Adviser has contractually agreed to waive its fees and/or reimburse the Fund for expenses the Fund incurs, but only to the extent necessary to maintain the Fund’s total annual operating expenses after fee waivers and/or reimbursement (exclusive of any taxes, interest, brokerage commissions, acquired fund fees and expenses, and extraordinary expenses, such as litigation or reorganization costs, but inclusive of organizational costs and offering costs) to the extent that such expenses exceed, per annum, 2.25% of Class A average daily net assets, 3.00% of Class C average daily net assets, 2.00% of Class I average daily net assets, 2.50% of Class L average daily net assets and 2.75% of Class M average daily net assets (the “Expense Limitations”). In consideration of the Adviser’s agreement to limit the Fund’s expenses, the Fund has agreed to repay the Adviser (or any successor thereto) in the amount of any fees waived and reimbursed, subject to the limitations that: (1) the reimbursement for fees and expenses will be made only if payable not more than three years from the date on which they were incurred; and (2) the reimbursement may not be made if it would cause the lesser of the Expense Limitation applicable to such Class in place at the time of waiver or at the time of reimbursement to be exceeded. In addition, pursuant to the Multi-Class Expense Limitation Agreement, any such repayment must be approved by the Fund's Board of Trustees (the "Board" or the "Trustees"). The Expense Limitation Agreements will remain in effect at least through April 30, 2025. The Multi-Class Expense Limitation Agreement may then be renewed for consecutive twelve-month periods provided that the Adviser specifically approves such continuance at least annually. The Class F Expense Limitation Agreement shall continue in effect so long as Class F shares are outstanding. The Expense Limitation Agreements may be terminated only by the Board on written notice to the Adviser and will automatically terminate at such time as the Management Agreement between the Adviser and the Fund terminates. For the period of August 16, 2021 to March 31, 2022, the Adviser voluntarily waived or absorbed operating expenses (excluding interest, brokerage commissions, acquired fund fees and expenses and extraordinary expenses) of the Fund in excess of 1.50% of net assets. For the period April 1, 2022 to September 30, 2022, the Adviser voluntarily waived or absorbed operating expenses (excluding interest, brokerage commissions, acquired fund fees and expenses and extraordinary expenses) of the Fund in excess of 1.00% of net assets. For the period October 1, 2022 to December 31, 2022, the Adviser voluntarily waived or absorbed operating expenses (excluding interest, brokerage commissions, acquired fund fees and expenses and extraordinary expenses) of the Fund in excess of 1.25% of net assets. The voluntary waiver was separate and apart from the contractual waiver. Fund returns would have been lower in the absence of the election by the Fund's investment adviser to bear certain of the Fund's operating expenses. Please review the Fund's Prospectus for additional information regarding the Fund's fees and expenses.

| Semi-Annual Report | June 30, 2024 | 15 |

| Apollo Diversified Credit Fund | Portfolio Update |

June 30, 2024 (Unaudited)

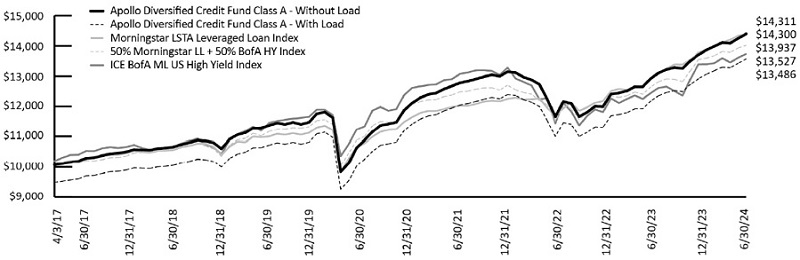

Performance of $10,000 Initial Investment (for the period ended June 30, 2024)

The graph shown above represents historical performance of a hypothetical investment of $10,000 in the Class A Shares of the Fund since inception. Past performance is not indicative of future results. All returns reflect reinvested distributions, but do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

Apollo Capital Credit Adviser, LLC (formerly, Griffin Capital Credit Advisor, LLC) was acquired by Apollo Global Management, Inc., an affiliate of the Fund’s sub-adviser, on May 2, 2022. Performance prior to May 2, 2022 was generated under the previous management team of the Fund’s investment adviser. The current management team of the Fund’s investment adviser is responsible for performance on and after May 2, 2022.

| 16 | 1.888.926.2688 | www.apollo.com |

| Apollo Diversified Credit Fund | Consolidated Schedule of Investments |

June 30, 2024 (Unaudited)

| Description | | Country | | Spread Above Index | | | Rate | | | Maturity Date | | | Principal Amount | | | Value (Note 2)(a) | |

| BANK LOANS (83.21%)(b) | | | | | | | | | | | |

| | | | | | | | | | | | |

| AEROSPACE & DEFENSE (1.11%)(c) | | | | | | | | | | | |

| Forming Machining Industries Holdings LLC, Second Lien Initial Term Loan | | United States | | 1M SOFR + 8.75% | | | 14.25 | % | | 10/09/26 | | | $ | 320,791 | | | $ | 200,494 | |

| MRO Holdings, First Lien Term Loan(d)(e) | | United States | | 3M SOFR + 5.00% | | | 10.59 | % | | 12/18/28 | | | | 10,672,131 | | | | 10,631,577 | |

| | | | | | | | | | | | | | | | | | | 10,832,071 | |

| AUTOMOTIVE (1.98%) | | | | | | | | | | | |

| Crash Chanmpions, First Lien Term Loan(c)(e) | | United States | | 1M SOFR + 4.75% | | | 10.08 | % | | 02/23/29 | | | | 3,750,000 | | | | 3,770,306 | |

| Dodge Construction Network LLC, Second Lien Term Loan(c) | | United States | | 3M SOFR + 8.25% | | | 13.74 | % | | 02/25/30 | | | | 1,513,158 | | | | 688,487 | |

| Neutron Holdings, First Lien Term Loan(d)(f) | | United States | | | | | 10.00 | % | | 09/30/26 | | | | 10,000,000 | | | | 9,925,000 | |

| Truck-Lite Co. LLC, First Lien Term Loan(c)(d)(g) | | United States | | 3M SOFR + 5.75% | | | 11.07 | % | | 02/13/31 | | | | 4,921,000 | | | | 4,845,217 | |

| Truck-Lite Revolver, First Lien Term Loan(c)(d)(h) | | United States | | 3M SOFR + 5.75% | | | 5.75 | % | | 02/13/30 | | | | 17,778 | | | | 17,502 | |

| | | | | | | | | | | | | | | | | | | 19,246,512 | |

| BANKING, FINANCE, INSURANCE & REAL ESTATE (11.09%) | | | | | | | | | | | |

| Alter Domus, First Lien Term Loan(c)(e) | | Luxembourg | | 1M SOFR + 3.50% | | | 4.00 | % | | 05/14/31 | | | | 1,396,707 | | | | 1,404,570 | |

| Evoriel, First Lien Term Loan (9.12% PIK)(c)(d)(g) | | France | | 6M EUR + 5.25% | | | 9.12 | % | | 04/02/31 | | | € | 2,854,173 | | | | 2,995,545 | |

| Evoriel Delayed Draw, First Lien Term Loan (9.12% PIK)(c)(d)(g)(h) | | France | | 6M EUR + 5.25% | | | 9.12 | % | | 04/02/31 | | | | 32,619 | | | | 34,235 | |

| Higginbotham Delayed Draw AMD4, First Lien Term Loan(c)(d)(h) | | United States | | 3M SOFR + 4.75% | | | 10.09 | % | | 11/24/28 | | | $ | 222,600 | | | | 220,374 | |

| Higginbotham Insurance Agency, Inc., Delayed Draw, First Lien Term Loan, AMD1(c)(d) | | United States | | 3M SOFR + 5.50% | | | 10.94 | % | | 11/24/28 | | | | 620,720 | | | | 620,720 | |

| Higginbotham Insurance Agency, Inc., Delayed Draw, First Lien Term Loan, AMD3(c)(d) | | United States | | 3M SOFR + 5.50% | | | 10.94 | % | | 11/24/28 | | | | 2,207,411 | | | | 2,207,411 | |

| Higginbotham Insurance Agency, Inc., First Lien Term Loan, AMD1(c)(d)(e) | | United States | | 3M SOFR + 5.50% | | | 10.94 | % | | 11/24/28 | | | | 2,128,914 | | | | 2,128,914 | |

| Hyperion Refinance SARL, First Lien Term Loan(c)(e) | | United Kingdom | | 1M SOFR + 3.50% | | | 8.84 | % | | 02/15/31 | | | | 8,977,500 | | | | 9,008,158 | |

| Insight XI, First Lien Term Loan, (4.35% PIK)(c)(d)(g) | | Cayman Islands | | 3M SOFR + 3.85% | | | 9.19 | % | | 08/28/24 | | | | 14,716,041 | | | | 14,716,041 | |

| Insight XI, First Lien Term Loan(c)(d)(g) | | Cayman Islands | | 3M SOFR + 3.85% | | | 6.75 | % | | 08/28/24 | | | | 182,841 | | | | 182,841 | |

| LendingTree Inc., First Lien Term Loan(c)(d) | | United States | | 3M SOFR + 5.75% | | | 11.09 | % | | 03/27/31 | | | | 2,467,347 | | | | 2,436,505 | |

| Paisley Bidco, First Lien Term Loan(c)(d) | | United Kingdom | | 6M EUR + 5.25% | | | 9.10 | % | | 05/07/31 | | | € | 1,825,038 | | | | 1,939,866 | |

| Paisley Bidco, First Lien Term Loan(c)(d) | | United Kingdom | | 3M SONIA + 5.25% | | | 10.45 | % | | 05/07/31 | | | £ | 5,314,494 | | | | 6,667,638 | |

| Patrimonio, First Lien Term Loan(d)(f) | | Colombia | | | | | 17.41 | % | | 06/30/28 | | | COP$ | 40,050,600,000 | | | | 9,788,855 | |

| Redfin Corp, Delayed Draw, First Lien Term Loan(c)(d) | | United States | | 3M SOFR + 5.75% | | | 11.08 | % | | 10/20/28 | | | $ | 8,478,750 | | | | 8,287,978 | |

| Redfin Corp, First Lien Term Loan(c)(d)(e) | | United States | | 3M SOFR + 5.75% | | | 11.05 | % | | 10/20/28 | | | | 8,436,250 | | | | 8,246,434 | |

| Safe-Guard Products, First Lien Term Loan(c)(d)(e) | | United States | | 3M SOFR + 5.00% | | | 10.32 | % | | 04/03/30 | | | | 10,853,727 | | | | 10,745,190 | |

| Stretto, First Lien Term Loan(c)(d)(e) | | United States | | 3M SOFR + 6.00% | | | 11.33 | % | | 10/13/28 | | | | 14,812,500 | | | | 14,738,437 | |

| VEPF VII Holdings, LP, First Lien Term Loan, (9.84% PIK)(c)(d)(g) | | United States | | 3M SOFR + 4.50% | | | 9.84 | % | | 02/28/28 | | | | 3,296,063 | | | | 3,296,063 | |

| Violin Finco, First Lien Term Loan(c)(d) | | United Kingdom | | 6M SONIA + 5.5% | | | 10.71 | % | | 06/24/31 | | | £ | 6,561,739 | | | | 8,211,713 | |

| | | | | | | | | | | | | | | | | | | 107,877,488 | |

See Notes to Consolidated Financial Statements.

| Semi-Annual Report | June 30, 2024 | 17 |

| Apollo Diversified Credit Fund | Consolidated Schedule of Investments |

June 30, 2024 (Unaudited)

| Description | | Country | | Spread Above Index | | Rate | | | Maturity Date | | | Principal Amount | | | Value (Note 2)(a) | |

| BEVERAGE, FOOD & TOBACCO (0.55%)(c) | | | | | | | | | |

| Market Bidco Ltd., First Lien Term Loan | | United Kingdom | | 6M EUR L + 4.75% | | | 8.58 | % | | 11/04/27 | | | € | 5,000,000 | | | $ | 5,350,388 | |

| | | | | | | | | | | | | | | | | | | | |

| CAPITAL EQUIPMENT (3.88%)(c) | | | | | | | | | |

| Cube Industrials, Inc., First Lien Term Loan(d)(e) | | United States | | 3M SOFR + 6.00% | | | 11.33 | % | | 10/18/30 | | | $ | 9,837,414 | | | | 9,812,820 | |

Enstall Solar Group B.V., First Lien Term Loan(d) | | Netherlands | | 3M EUR L + 6.00% | | | 9.83 | % | | 08/30/28 | | | € | 5,955,000 | | | | 6,170,241 | |

Husky Injection Molding Systems Ltd., First Lien Term Loan(e) | | Canada | | 1M SOFR + 5.00% | | | 10.33 | % | | 02/15/29 | | | $ | 9,087,286 | | | | 9,119,500 | |

| JPW Industries, Term Loan, First Lien Term Loan(d) | | United States | | 3M SOFR + 5.88% | | | 11.20 | % | | 11/22/28 | | | | 7,960,000 | | | | 7,800,800 | |

| LSF12 Donnelly Bidco, LLC, First Lien Term Loan(d)(e) | | United States | | 3M SOFR + 6.50% | | | 11.84 | % | | 10/02/29 | | | | 4,962,500 | | | | 4,864,243 | |

| | | | | | | | | | | | | | | | | | | 37,767,604 | |

| CHEMICALS, PLASTICS, & RUBBER (1.03%)(c) | | | | | | | | | |

Deccan Holdings B.V., First Lien Term Loan (1.75% PIK)(d)(g) | | India | | 3M SOFR + 1.75% | | | 7.08 | % | | 09/16/25 | | | | 3,450,495 | | | | 3,450,495 | |

| Heubach, Term Loan, First Lien Term Loan (2.00% PIK)(d)(g) | | United States | | 3M SOFR + 10.00% | | | 10.00 | % | | 04/30/24 | | | | 662,691 | | | | 155,732 | |

| LSF11 A5 HoldCo LLC, First Lien Term Loan(e) | | United States | | 3M SOFR + 3.50% | | | 8.96 | % | | 10/15/28 | | | | 6,384,871 | | | | 6,380,881 | |

| Neptune Husky US Bidco, LLC, First Lien Term Loan(d)(i)(n) | | Luxembourg | | | | | | | | 01/03/29 | | | | 3,835,145 | | | | – | |

| | | | | | | | | | | | | | | | | | | 9,987,108 | |

| CONSUMER GOODS: DURABLE (0.57%)(c) | | | | | | | | | |

| Poly-Wood, First Lien Term Loan(d) | | United States | | 3M SOFR + 5.75% | | | 11.09 | % | | 03/20/30 | | | | 3,627,273 | | | | 3,545,659 | |

| Varsity Brands Holding Co., Inc., First Lien Term Loan(e) | | United States | | 3M SOFR + 5.00% | | | 10.46 | % | | 12/15/26 | | | | 1,973,835 | | | | 1,996,535 | |

| | | | | | | | | | | | | | | | | | | 5,542,194 | |

| CONSUMER GOODS: NON-DURABLE (5.49%)(c) | | | | | | | | | |

| ABG Intermediate Holdings 2 LLC, First Lien Term Loan(e) | | United States | | 3M SOFR + 2.75% | | | 8.09 | % | | 12/21/28 | | | | 7,464,415 | | | | 7,480,501 | |

| Altern Marketing, First Lien Term Loan(d)(e) | | United States | | 3M SOFR + 6.00% | | | 11.35 | % | | 06/13/28 | | | | 6,685,714 | | | | 6,702,429 | |

| Iconix, First Lien Term Loan(d) | | United States | | 3M SOFR + 6.00% | | | 11.49 | % | | 08/22/29 | | | | 11,270,422 | | | | 11,157,718 | |

| Iconix, First Lien Term Loan(d) | | United States | | 3M SOFR + 6.00% | | | 11.49 | % | | 08/22/29 | | | | 1,921,897 | | | | 1,902,678 | |

| KDC US Holdings, Inc., First Lien Term Loan(e) | | Canada | | 3M SOFR + 4.50% | | | 9.84 | % | | 08/15/28 | | | | 6,814,220 | | | | 6,841,204 | |

| Men's Wearhouse LLC, First Lien Term Loan(e) | | United States | | 3M SOFR + 6.50% | | | 11.84 | % | | 02/26/29 | | | | 9,584,800 | | | | 9,568,841 | |

| PDC Brands, First Lien Term Loan(d) | | United States | | 3M SOFR + 5.25% | | | 5.25 | % | | 06/27/30 | | | | 8,474,453 | | | | 8,389,708 | |

| Revlon, Revolver, First Lien Term Loan(d)(h) | | United States | | 3M SOFR + 4.50% | | | 10.44 | % | | 05/02/26 | | | | 1,353,846 | | | | 1,353,846 | |

| | | | | | | | | | | | | | | | | | | 53,396,925 | |

| CONTAINERS, PACKAGING & GLASS (3.35%) | | | | | | | | | |

| Ardagh, First Lien Term Loan(d)(f) | | Luxembourg | | | | | 8.88 | % | | 06/13/29 | | | € | 22,000,000 | | | | 23,266,399 | |

| Trident TPI Holdings, Inc., First Lien Term Loan(c)(e) | | United States | | 3M SOFR + 4.00% | | | 9.33 | % | | 09/15/28 | | | $ | 9,293,078 | | | | 9,318,262 | |

| | | | | | | | | | | | | | | | | | | 32,584,661 | |

| ENERGY: OIL & GAS (0.00%)(d)(j)(n) | | | | | | | | | |

| AMH Litigation Trust, First Lien Delayed Draw Term Loan | | United States | | | | | | | | 06/08/25 | | | | 1,118 | | | | – | |

| AMH Litigation Trust, First Lien Delayed Draw Term Loan | | United States | | | | | | | | 06/06/25 | | | | 1,044 | | | | – | |

| | | | | | | | | | | | | | | | | | | – | |

See Notes to Consolidated Financial Statements.

| 18 | 1.888.926.2688 | www.apollo.com |

| Apollo Diversified Credit Fund | Consolidated Schedule of Investments |

June 30, 2024 (Unaudited)

| Description | | Country | | Spread Above Index | | Rate | | | Maturity Date | | | Principal Amount | | | Value (Note 2)(a) | |

| ENVIRONMENTAL INDUSTRIES (1.18%)(c)(d) | | | | | | | | | |

| Heritage Environmental, First Lien Term Loan(e) | | United States | | 3M SOFR + 5.50% | | | 10.83 | % | | 01/31/31 | | | $ | 4,395,604 | | | $ | 4,384,615 | |

| Ruler BidCo B1, First Lien Term Loan | | Luxembourg | | 6M EUR L + 5.50% | | | 9.22 | % | | 04/29/30 | | | € | 3,951,573 | | | | 4,168,459 | |

| Ruler BidCo B2, First Lien Term Loan | | Luxembourg | | 6M SOFR + 5.50% | | | 10.84 | % | | 04/29/30 | | | $ | 1,618,319 | | | | 1,606,182 | |

| Ruler BidCo Delayed Draw, First Lien Term Loan(h) | | Luxembourg | | 6M EUR L + 6.50% | | | 9.21 | % | | 04/29/30 | | | € | 1,243,200 | | | | 1,311,435 | |

| | | | | | | | | | | | | | | | | | | 11,470,691 | |

| HEALTHCARE & PHARMACEUTICALS (11.26%)(c) | | | | | | | | | |

| Advarra Holdings, Inc., First Lien Term Loan(d)(e) | | United States | | 3M SOFR + 5.25% | | | 10.59 | % | | 08/24/29 | | | $ | 13,550,467 | | | | 13,550,467 | |

| Allied Benefit Systems Intermediate LLC, First Lien Term Loan(d)(e) | | United States | | 3M SOFR + 5.25% | | | 10.59 | % | | 10/31/30 | | | | 8,432,474 | | | | 8,432,474 | |

| AthenaHealth Group, Inc., First Lien Term Loan(e) | | United States | | 3M SOFR + 3.25% | | | 8.59 | % | | 02/15/29 | | | | 3,979,695 | | | | 3,971,617 | |

Bausch Health Americas, Inc., First Lien Term Loan(e) | | United States | | 3M SOFR + 5.25% | | | 10.69 | % | | 02/01/27 | | | | 7,453,094 | | | | 6,820,736 | |

| Corpuls, First Lien Term Loan(d) | | Germany | | 6M EUR L + 7.00% | | | 10.72 | % | | 06/28/30 | | | € | 4,000,000 | | | | 4,240,964 | |

| Curia Global, Inc., First Lien Term Loan(e) | | United States | | 3M SOFR + 3.75% | | | 9.18 | % | | 08/30/26 | | | $ | 6,303,114 | | | | 5,953,197 | |

| Exactcare Parent, First Lien Term Loan(d)(e) | | United States | | 3M SOFR + 5.50% | | | 10.84 | % | | 11/03/29 | | | | 4,496,926 | | | | 4,474,442 | |

| Inovalon, First Lien Term Loan, (2.75% PIK)(d)(e)(g) | | United States | | 3M SOFR + 3.50% | | | 9.09 | % | | 11/24/28 | | | | 10,476,216 | | | | 10,292,882 | |

| Inovalon, Second Lien Term Loan, (16.09% PIK)(d)(g) | | United States | | 3M SOFR + 10.50% | | | 16.09 | % | | 11/25/33 | | | | 129,543 | | | | 123,065 | |

Keystone Acquisition, First Lien Term Loan(d)(e) | | United States | | 3M SOFR + 5.50% | | | 10.84 | % | | 12/17/29 | | | | 8,865,000 | | | | 8,754,188 | |

| Keystone Acquisition, Revolver, First Lien Term Loan(d)(h) | | United States | | 3M SOFR + 5.25% | | | 10.84 | % | | 12/17/29 | | | | 246,667 | | | | 243,583 | |

| Milano Acquisition Corp., First Lien B Term Loan(e) | | United States | | 3M SOFR + 4.00% | | | 9.44 | % | | 10/01/27 | | | | 7,396,355 | | | | 7,180,604 | |

| OMH-HealthEdge Holdings, LLC, First Lien Term Loan(d)(e) | | United States | | 3M SOFR + 6.00% | | | 11.23 | % | | 10/08/29 | | | | 14,400,000 | | | | 14,328,000 | |

| Project Dolphin, First Lien Term Loan(d) | | United Kingdom | | 6M SONIA + 6.25% | | | 11.49 | % | | 11/19/29 | | | £ | 5,000,000 | | | | 6,162,461 | |

| Tivity Health, Inc., First Lien Term Loan(d) | | United States | | 3M SOFR + 6.00% | | | 11.34 | % | | 06/28/29 | | | $ | 7,368,750 | | | | 7,331,906 | |

Zest Acquisition Corp., First Lien Term Loan(e) | | United States | | 3M SOFR + 5.50% | | | 10.83 | % | | 02/08/28 | | | | 3,940,000 | | | | 3,974,475 | |

| Zeus Company, First Lien Term Loan(d)(e) | | United States | | 3M SOFR + 5.50% | | | 10.84 | % | | 02/28/31 | | | | 3,771,930 | | | | 3,762,500 | |

| | | | | | | | | | | | | | | | | | | 109,597,561 | |

| HIGH TECH INDUSTRIES (11.31%)(c) | | | | | | | | | |

| Access Group, First Lien Delayed Draw Term Loan, (4.00% PIK)(d)(g) | | United Kingdom | | 3M SONIA + 5.25% | | | 10.46 | % | | 06/28/29 | | | £ | 2,057,000 | | | | 2,554,738 | |

| Access Group, First Lien Term Loan, (4.00% PIK)(d)(g) | | United Kingdom | | 3M SONIA + 5.25% | | | 10.46 | % | | 06/28/29 | | | | 3,943,000 | | | | 4,897,099 | |

| Anaplan Inc., First Lien Term Loan(d)(e) | | United States | | 3M SOFR + 5.75% | | | 11.09 | % | | 06/21/29 | | | $ | 9,417,548 | | | | 9,417,548 | |

| Auctane, Inc., First Lien Term Loan(d)(e) | | United States | | 3M SOFR + 5.75% | | | 11.18 | % | | 10/05/28 | | | | 9,824,121 | | | | 9,824,121 | |

| Avalara Inc., First Lien Term Loan(d) | | United States | | 3M SOFR + 7.25% | | | 12.59 | % | | 10/19/28 | | | | 18,181,818 | | | | 18,318,182 | |

| Azurite Intermediate Delayed Draw, First Lien Term Loan, (2.50% PIK)(d)(g)(h) | | United States | | 3M SOFR + 6.50% | | | 11.84 | % | | 03/19/31 | | | | 2,400,000 | | | | 2,364,000 | |

| Azurite Intermediate, First Lien Term Loan, (2.50% PIK)(d)(g) | | United States | | 3M SOFR + 6.50% | | | 11.84 | % | | 03/19/31 | | | | 1,650,000 | | | | 1,625,250 | |

| Barossa Unitranche, Delayed Draw, First Lien Term Loan(d)(h) | | France | | 3M EUR L + 6.50% | | | 10.22 | % | | 04/25/31 | | | € | 468,000 | | | | 487,422 | |

| Barossa Unitranche, First Lien Term Loan(d) | | France | | 3M EUR L + 6.50% | | | 10.22 | % | | 04/25/31 | | | | 4,662,000 | | | | 4,855,470 | |

| Certinia, First Lien Term Loan(d)(e) | | United States | | 3M SOFR + 7.25% | | | 12.58 | % | | 08/03/29 | | | $ | 3,529,412 | | | | 3,432,353 | |

See Notes to Consolidated Financial Statements.

| Semi-Annual Report | June 30, 2024 | 19 |

| Apollo Diversified Credit Fund | Consolidated Schedule of Investments |

June 30, 2024 (Unaudited)

| Description | | Country | | Spread Above Index | | Rate | | | Maturity Date | | | Principal Amount | | | Value (Note 2)(a) | |

| HIGH TECH INDUSTRIES (continued) | | | | | | | | | |

| Coupa Holdings LLC, First Lien Term Loan(d)(e) | | United States | | 3M SOFR + 5.50% | | | 10.83 | % | | 02/27/30 | | | $ | 6,046,728 | | | $ | 6,061,845 | |