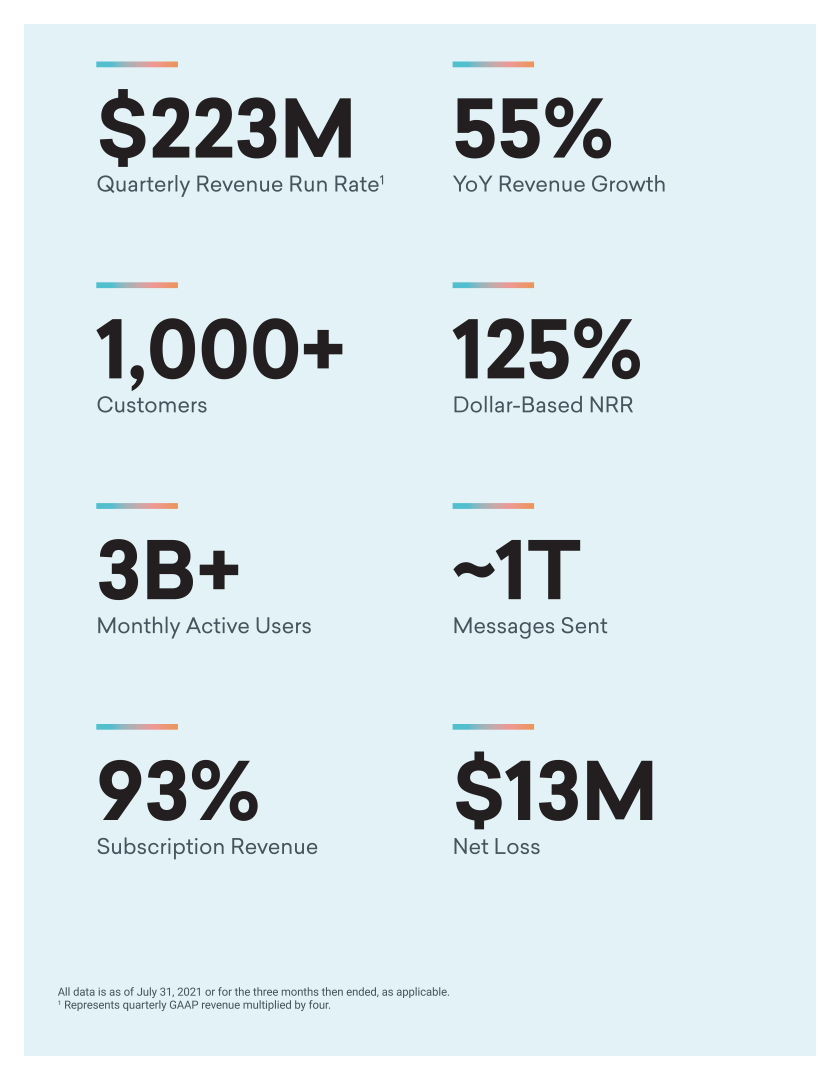

We primarily generate revenue from the sale of subscriptions to customers for the use of our platform. The terms of our subscription agreements are primarily annual with a dollar weighted-average contract length of 24 months as of July 31, 2021. Our subscription fees are principally based on an upfront commitment by our customers for a specific number of monthly active users, on a cost-per-message basis for volume of email and/or SMS messages sent, platform access and/or support and certain add-on products. Additionally, we provide professional services, which better enable customers to successfully onboard and use our platform, including certain premium professional services such as email deliverability support and dedicated technical support staff. Subscription and professional services fees comprised 93.2% and 6.8% of our revenue, respectively, for fiscal year 2020, 93.9% and 6.1%, respectively, for fiscal year 2021, 93.1% and 6.9%, respectively, for the six months ended July 31, 2021 and 93.8% and 6.2%, respectively, for the six months ended July 31, 2020.

Our customers include many established global enterprises and leading technology innovators. Our customers span a wide variety of sizes and industries, including retail, eCommerce, media, entertainment and on-demand services.

We have a highly efficient go-to-market strategy focused on acquiring new customers and expanding use of our products for existing customers. As of July 31, 2021, we had 1,119 customers, up from 890 customers as of January 31, 2021 and 728 customers as of January 31, 2020. In addition, 82, 71 and 45 of our customers had annual recurring revenue, or ARR, of $500,000 or more (inclusive of customers with ARR of $1.0 million or more, described below) as of July 31, 2021, January 31, 2021 and January 31, 2020, respectively, accounting for approximately 50%, 50% and 41% of our ARR, respectively. Further, as of July 31, 2021, we had 41 customers with ARR of $1.0 million or more, up from 31 and 18 customers as of January 31, 2021 and 2020, respectively, accounting for approximately 37%, 33% and 25% of our ARR, respectively. As of July 31, 2021, January 31, 2021 and January 31, 2020, no single customer represented more than 5% of our ARR. For more information about how we calculate ARR, see the section titled “— Factors Affecting Our Performance — Expanding Within Our Existing Customer Base.”

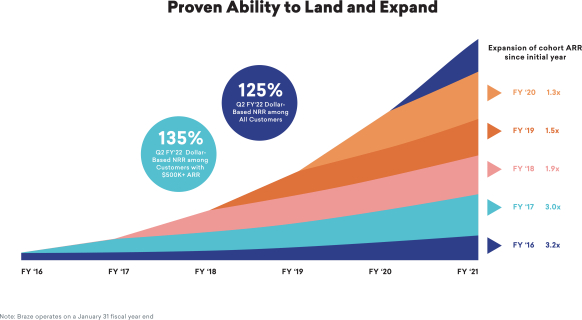

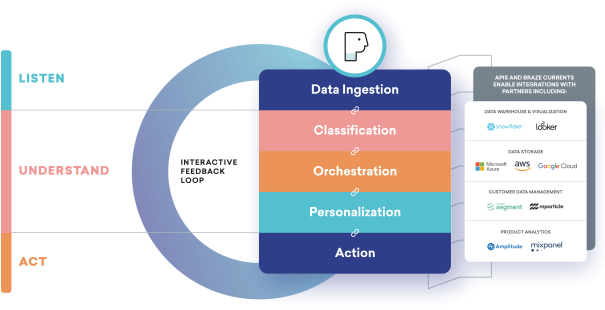

We employ a land-and-expand business model centered around offering products that are easy to adopt and have a rapid time to value. We expand our reach within existing customers when our customers add new channels, purchase additional subscription products such as Braze Currents, implement new engagement strategies, or onboard new business units and geographies. We also grow as our customers grow because our pricing is based in large part on the number of consumers that our customers reach and the volume of messages our customers send. Accordingly, as our customers increase the use of our platform and increase the number of end users reached via our platform, the value of our contracts with such customers also increases. We believe our successful land-and-expand strategy is evidenced by our dollar-based net retention rate, which for the trailing 12 months ended July 31, 2021, January 31, 2021 and January 31, 2020 was 125%, 123% and 126%, respectively, for all our customers, and 135%, 133% and 127%, respectively, for our customers with ARR of $500,000 or more. For more information about how we calculate dollar-based net retention rate, see the section titled “— Factors Affecting Our Performance — Expanding Within Our Existing Customer Base.”

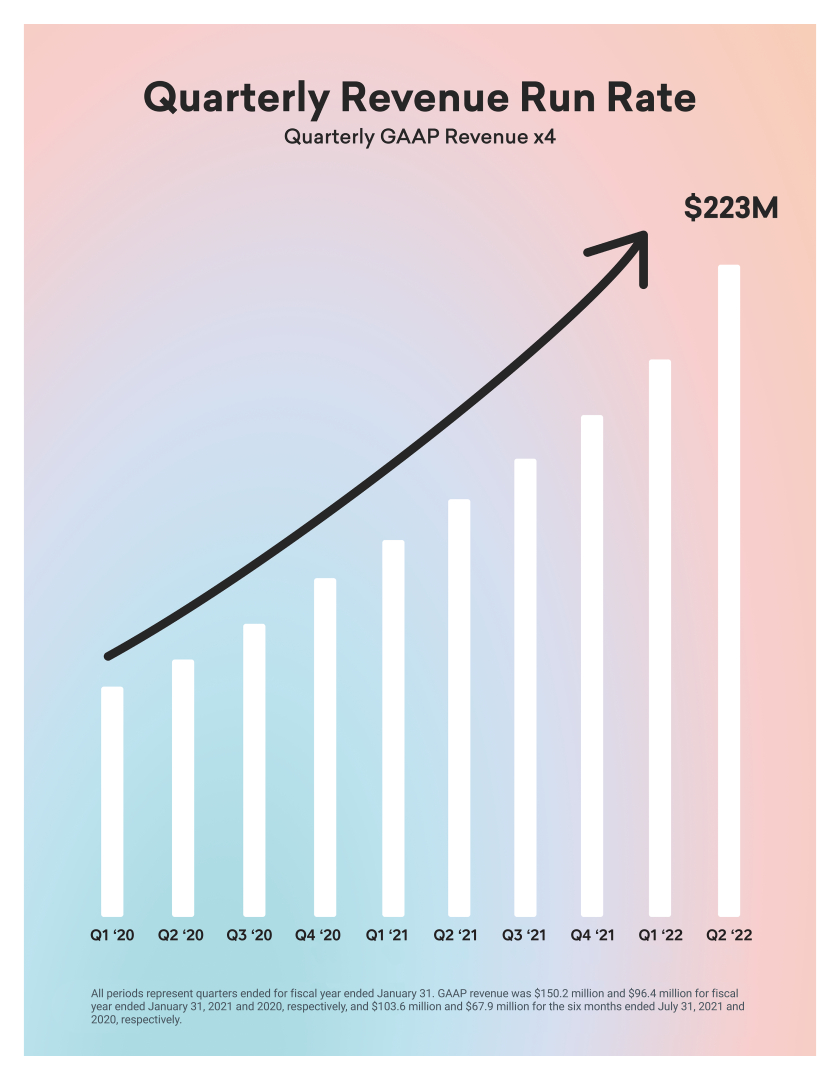

We have grown significantly in recent periods. We generated revenue of $150.2 million and $96.4 million in fiscal year 2021 and fiscal year 2020, respectively, representing year-over-year growth of 56%. We generated revenue of $103.6 million and $67.9 million in the six months ended July 31, 2021 and 2020, respectively, representing period-over-period growth of 53%. We had net losses of $32.0 million, $31.8 million, $25.8 million and $12.4 million in fiscal year 2021, fiscal year 2020 and the six months ended July 31, 2021 and 2020, respectively. We had net cash used in operating activities of $6.1 million, $7.4 million, $8.4 million and $0.2 million in fiscal year 2021, fiscal year 2020 and the six months ended July 31, 2021 and 2020, respectively. Our free cash flow was $(10.4) million, $(9.9) million, $(10.3) million and $(3.0) million in fiscal year 2021, fiscal year 2020 and the six months ended July 31, 2021 and 2020, respectively. See the section titled “— Non-GAAP Free Cash Flow” for additional information about how we calculate free cash flow, a non-GAAP financial metric, and a reconciliation to net cash used in operating activities, the most directly comparable measure calculated in accordance with accounting principles generally accepted in the United States, or GAAP.

69