Second Quarter 2018 Earnings Call July 27, 2018 Exhibit 99.2

Terminology The terms “we,” “our,” “us,” “the Company,” “CSTR” and “CapStar” that appear in this presentation refer to CapStar Financial Holdings, Inc. and its wholly-owned subsidiary, CapStar Bank. The terms “CapStar Bank,” “the Bank” and “our Bank” that appear in this presentation refer to CapStar Bank. Contents of Presentation Except as is otherwise expressly stated in this presentation, the contents of this presentation are presented as of the date on the front cover of this presentation. Market Data Market data used in this presentation has been obtained from government and independent industry sources and publications available to the public, sometimes with a subscription fee, as well as from research reports prepared for other purposes. Industry publications and surveys and forecasts generally state that the information contained therein has been obtained from sources believed to be reliable. CSTR did not commission the preparation of any of the sources or publications referred to in this presentation. CSTR has not independently verified the data obtained from these sources, and, although CSTR believes such data to be reliable as of the dates presented, it could prove to be inaccurate. Forward-looking information obtained from these sources is subject to the same qualifications and the additional uncertainties regarding the other forward-looking statements in this presentation. Non-GAAP Disclaimer This presentation includes the following financial measures that have been prepared other than in accordance with generally accepted accounting principles in the United States (“non-GAAP financial measures”): pre-tax, pre-provision net income, pre-tax, pre-provision return on average assets, tangible equity, tangible common equity, tangible assets, return on average tangible equity, return on average tangible common equity, book value per share (as adjusted), tangible book value per share (as reported and as adjusted), tangible equity to tangible assets, tangible common equity to tangible assets and adjusted shares outstanding at end of period. CSTR non-GAAP financial measures (i) provide useful information to management and investors that is supplementary to its financial condition, results of operations and cash flows computed in accordance with GAAP, (ii) enable a more complete understanding of factors and trends affecting the Company’s business, and (iii) allow investors to evaluate the Company’s performance in a manner similar to management, the financial services industry, bank stock analysts and bank regulators; however, CSTR acknowledges that its non-GAAP financial measures have a number of limitations. As such, you should not view these disclosures as a substitute for results determined in accordance with GAAP, and they are not necessarily comparable to non-GAAP financial measures that other companies use. See the Appendix to this presentation for a reconciliation of non-GAAP financial measures to the most directly comparable GAAP financial measures. Disclaimers

Important Additional Information about the Mergers and Where to Find It In connection with the mergers described more fully in CapStar’s earnings release that is dated and was furnished to the Securities and Exchange Commission (the “SEC”) on July 26, 2018 (the “Mergers”), CapStar has filed with the SEC a registration statement on Form S-4 (File Number 333-226112) that includes a joint proxy statement of CapStar and Athens Bancshares Corporation (“Athens”) and a prospectus of CapStar, as well as other relevant documents concerning the proposed Mergers. This presentation does not constitute an offer to sell or the solicitation of an offer to buy any securities or a solicitation of any vote or approval. SHAREHOLDERS OF CAPSTAR AND ATHENS ARE URGED TO READ THE REGISTRATION STATEMENT AND THE JOINT PROXY STATEMENT/PROSPECTUS REGARDING THE MERGERS AND ANY OTHER RELEVANT DOCUMENTS FILED WITH THE SEC, AS WELL AS ANY AMENDMENTS OR SUPPLEMENTS TO THOSE DOCUMENTS, BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT THE MERGERS. When filed, this presentation and other documents relating to the Mergers filed by CapStar with the SEC can be obtained free of charge from the SEC’s website at www.sec.gov. These documents also can be obtained free of charge by accessing CapStar’s website at https://ir.capstarbank.com/ under the tab “Financials & Filings.” Alternatively, these documents can be obtained free of charge from CapStar upon written request to CapStar Financials Holding, Inc., 1201 Demonbreun Street, Suite 700, Nashville, Tennessee 37203, Attention: Investor Relations or by calling (615) 732-6455. Participants in the Solicitation CapStar, Athens and certain of their respective directors, executive officers and employees may be deemed to be participants in the solicitation of proxies in respect of the proposed Mergers. Information regarding CapStar’s directors and executive officers is available in its definitive proxy statement, which was filed with the SEC on March 19, 2018, and certain of its Current Reports on Form 8-K. Information about the directors and executive officers of Athens is set forth in the joint proxy statement/prospectus filed with the SEC. Other information regarding the participants in the proxy solicitation and a description of their direct and indirect interests, by security holdings or otherwise, are contained in the joint proxy statement/prospectus and other relevant materials filed with the SEC. Free copies of this document may be obtained as described in the preceding paragraph. Disclaimers

Certain statements in this presentation are forward-looking statements that reflect our current views with respect to, among other things, future events and our financial and operational performance. These statements are often, but not always, made through the use of words or phrases such as “may,” “should,” “could,” “predict,” “potential,” “believe,” “will likely result,” “including, without limitation, the terms, timing and closing of the proposed Mergers”, “expect,” “continue,” “will,” “anticipate,” “seek,” “aspire”, “estimate,” “intend,” “plan,” “project,” “projection,” “forecast,” “ roadmap,” “goal,” “target,” “guidance”, “would,” and “outlook,” or the negative version of those words or other comparable words of a future or forward-looking nature. These forward-looking statements are not historical facts, and are based on current expectations, estimates and projections about our industry, management’s beliefs and certain assumptions made by management, many of which, by their nature, are inherently uncertain and beyond our control. The inclusion of these forward-looking statements should not be regarded as a representation by us or any other person that such expectations, estimates and projections will be achieved. Accordingly, we caution you that any such forward-looking statements are not guarantees of future performance and are subject to risks, assumptions and uncertainties that are difficult to predict. Although we believe that the expectations reflected in these forward-looking statements are reasonable as of the date made, actual results may prove to be materially different from the results expressed or implied by the forward-looking statements. There are or will be important factors that could cause our actual results to differ materially from those indicated in these forward-looking statements, including, but not limited to, the following: The terms, timing, and closing of the proposed mergers with Athens; the acceptance by customers of Athens of the Company’s products and services if the proposed mergers close; the ability of the Company and Athens to complete the mergers; the ability of the Company and Athens to satisfy the conditions to the completion of the merger transaction, including the approval of the merger transaction by Athens’ shareholders and the receipt of all regulatory approvals required for the merger transaction on the terms expected in the merger agreement; economic conditions (including interest rate environment, government economic and monetary policies, the strength of global financial markets and inflation and deflation) that impact the financial services industry as a whole and/or our business; the concentration of our business in the Nashville metropolitan statistical area (“MSA”) and the effect of changes in the economic, political and environmental conditions on this market; increased competition in the financial services industry, locally, regionally or nationally, which may adversely affect pricing and the other terms offered to our clients; our dependence on our management team and board of directors and changes in our management and board composition; our reputation in the community; our ability to execute our strategy and to achieve our loan ROAA and efficiency ratio goals, hire seasoned bankers, loan and deposit growth through organic growth and strategic acquisitions; credit risks related to the size of our borrowers and our ability to adequately identify, assess and limit our credit risk; our concentration of large loans to a small number of borrowers; the significant portion of our loan portfolio that originated during the past two years and therefore may less reliably predict future collectability than older loans; the adequacy of reserves (including our allowance for loan and lease losses) and the appropriateness of our methodology for calculating such reserve; non-performing loans and leases; non-performing assets; charge-offs, non-accruals, troubled debt restructurings, impairments and other credit-related issues; adverse trends in the healthcare service industry, which is an integral component of our market’s economy; our management of risks inherent in our commercial real estate loan portfolio, and the risk of a prolonged downturn in the real estate market, which could impair the value of our collateral and our ability to sell collateral upon any foreclosure; governmental legislation and regulation, including changes in the nature and timing of the adoption and effectiveness of new requirements under the Dodd-Frank Act of 2010, as amended, Basel guidelines, capital requirements, accounting regulation or standards and other applicable laws and regulations; the impact of the Tax Cuts and Job Act of 2017 on the Company and its financial performance and results of operations; the loss of large depositor relationships, which could force us to fund our business through more expensive and less stable sources; operational and liquidity risks associated with our business, including liquidity risks inherent in correspondent banking; volatility in interest rates and our overall management of interest rate risk, including managing the sensitivity of our interest-earning assets and interest-bearing liabilities to interest rates, and the impact to our earnings from a change in interest rates; the potential for our bank’s regulatory lending limits and other factors related to our size to restrict our growth and prevent us from effectively implementing our business strategy; strategic acquisitions we may undertake to achieve our goals; the sufficiency of our capital, including sources of capital and the extent to which we may be required to raise additional capital to meet our goals; fluctuations in the fair value of our investment securities that are beyond our control; deterioration in the fiscal position of the U.S. government and downgrades in Treasury and federal agency securities; potential exposure to fraud, negligence, computer theft and cyber-crime; the adequacy of our risk management framework; our dependence on our information technology and telecommunications systems and the potential for any systems failures or interruptions; our dependence upon outside third parties for the processing and handling of our records and data; our ability to adapt to technological change; the financial soundness of other financial institutions; our exposure to environmental liability risk associated with our lending activities; our engagement in derivative transactions; our involvement from time to time in legal proceedings and examinations and remedial actions by regulators; the susceptibility of our market to natural disasters and acts of God; and the effectiveness of our internal controls over financial reporting and our ability to remediate any future material weakness in our internal controls over financial reporting. The foregoing factors should not be construed as exhaustive and should be read in conjunction with those factors that are detailed from time to time in the Company’s periodic and current reports filed with the Securities and Exchange Commission, including those factors included in the Company’s Annual Report on Form 10-K for the year ended December 31, 2017 under the headings “Item 1A. Risk Factors” and “Cautionary Note Regarding Forward-Looking Statements” and in the Company’s Quarterly Reports on Form 10-Q and Current Reports on Form 8-K. If one or more events related to these or other risks or uncertainties materialize, or if our underlying assumptions prove to be incorrect, actual results may differ materially from our forward-looking statements. Accordingly, you should not place undue reliance on any such forward-looking statements. Any forward-looking statement speaks only as of the date of this presentation, and we do not undertake any obligation to publicly update or review any forward-looking statement, whether as a result of new information, future developments or otherwise, except as required by law. New risks and uncertainties may emerge from time to time, and it is not possible for us to predict their occurrence or how they will affect us. Safe Harbor Statements

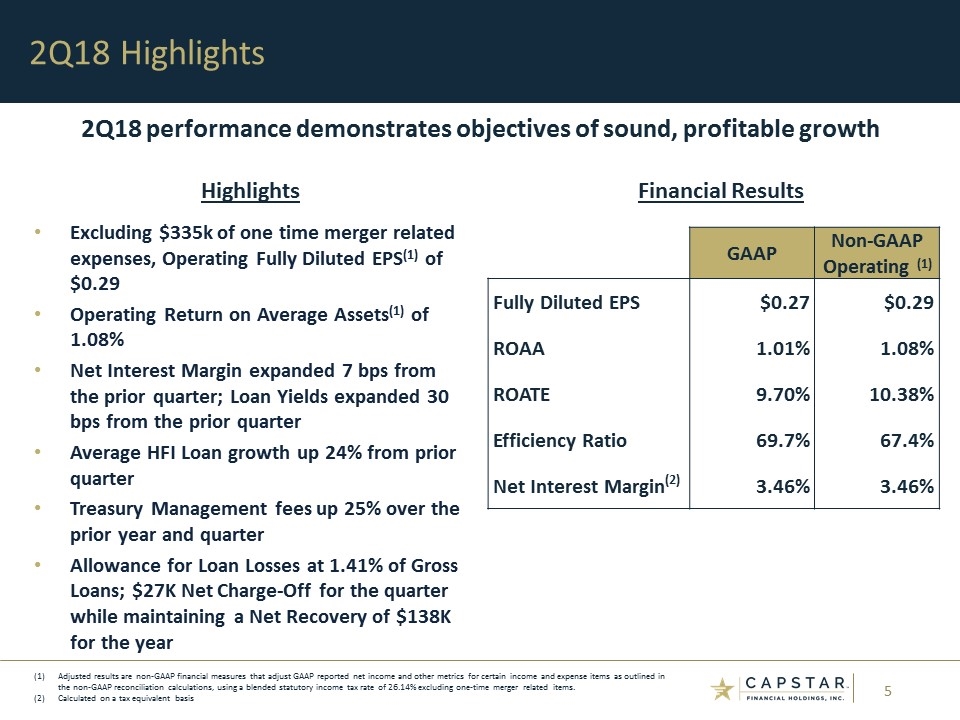

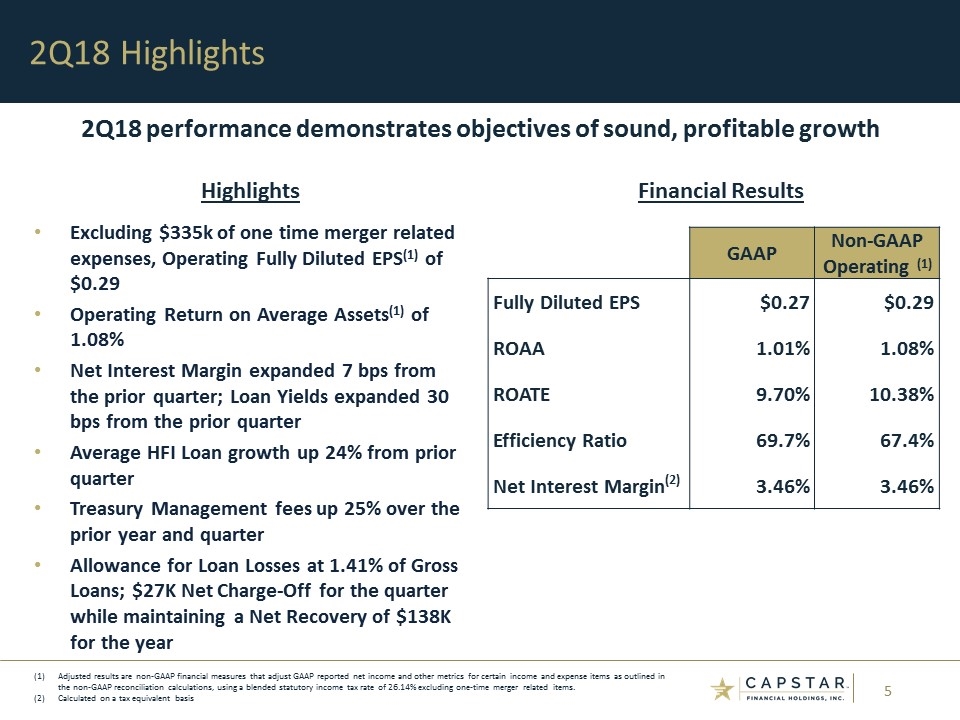

Excluding $335k of one time merger related expenses, Operating Fully Diluted EPS(1) of $0.29 Operating Return on Average Assets(1) of 1.08% Net Interest Margin expanded 7 bps from the prior quarter; Loan Yields expanded 30 bps from the prior quarter Average HFI Loan growth up 24% from prior quarter Treasury Management fees up 25% over the prior year and quarter Allowance for Loan Losses at 1.41% of Gross Loans; $27K Net Charge-Off for the quarter while maintaining a Net Recovery of $138K for the year 2Q18 Highlights Adjusted results are non-GAAP financial measures that adjust GAAP reported net income and other metrics for certain income and expense items as outlined in the non-GAAP reconciliation calculations, using a blended statutory income tax rate of 26.14% excluding one-time merger related items. Calculated on a tax equivalent basis GAAP Non-GAAP Operating (1) Fully Diluted EPS $0.27 $0.29 ROAA 1.01% 1.08% ROATE 9.70% 10.38% Efficiency Ratio 69.7% 67.4% Net Interest Margin(2) 3.46% 3.46% Highlights Financial Results 2Q18 performance demonstrates objectives of sound, profitable growth

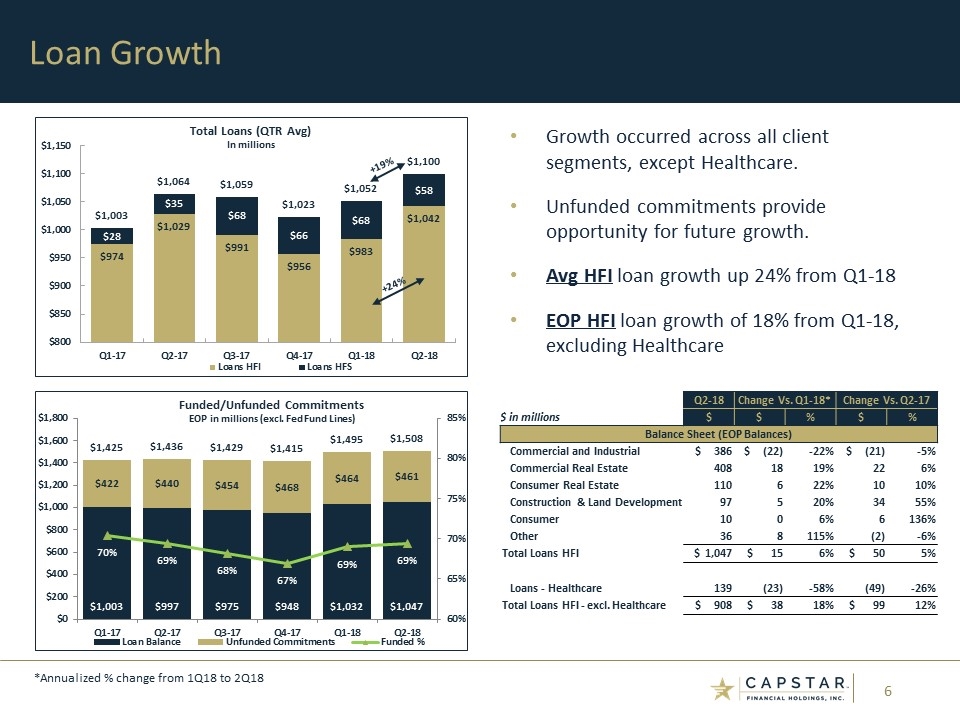

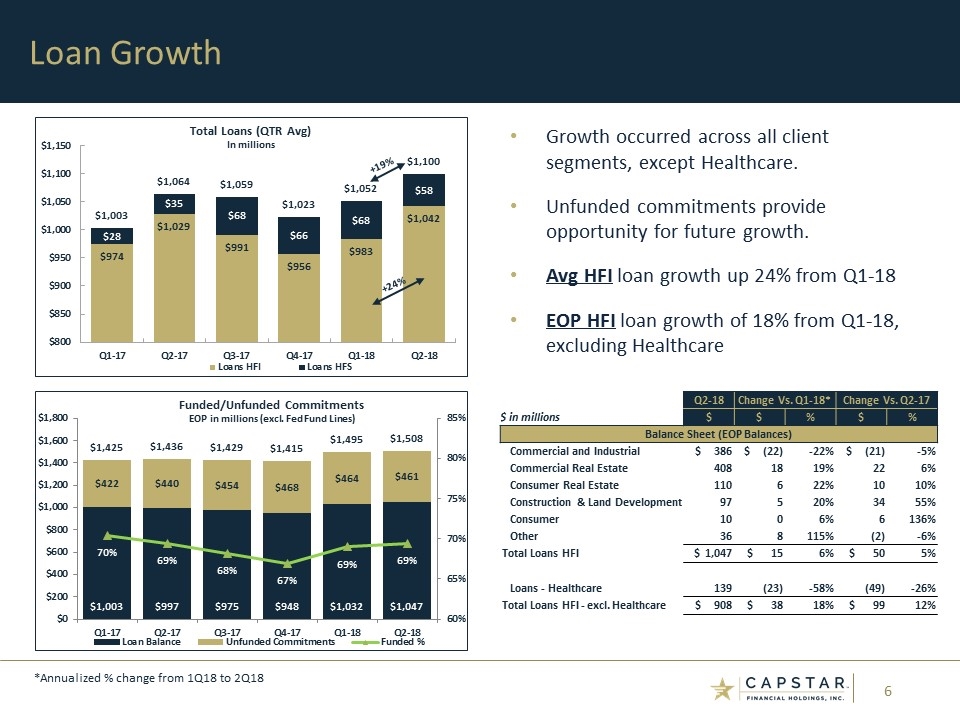

Loan Growth *Annualized % change from 1Q18 to 2Q18 Growth occurred across all client segments, except Healthcare. Unfunded commitments provide opportunity for future growth. Avg HFI loan growth up 24% from Q1-18 EOP HFI loan growth of 18% from Q1-18, excluding Healthcare Q2-18 Change Vs. Q1-18* Change Vs. Q2-17 $ in millions $ $ % $ % Balance Sheet (EOP Balances) Commercial and Industrial $ 386 $ (22) -22% $ (21) -5% Commercial Real Estate 408 18 19% 22 6% Consumer Real Estate 110 6 22% 10 10% Construction & Land Development 97 5 20% 34 55% Consumer 10 0 6% 6 136% Other 36 8 115% (2) -6% Total Loans HFI $ 1,047 $ 15 6% $ 50 5% Loans - Healthcare 139 (23) -58% (49) -26% Total Loans HFI - excl. Healthcare $ 908 $ 38 18% $ 99 12% +19% +24%

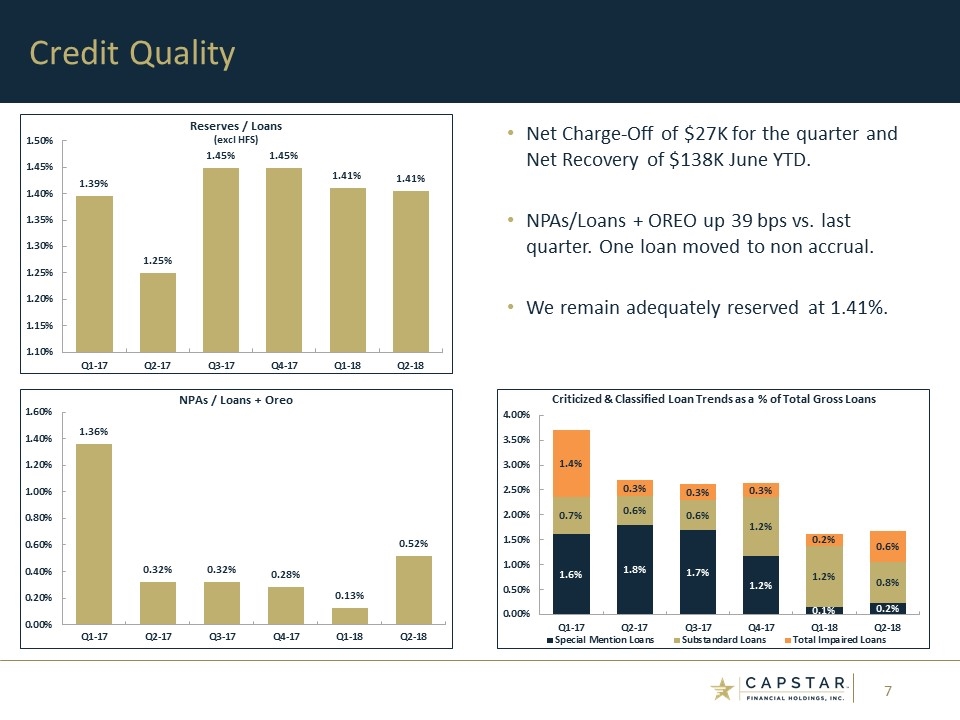

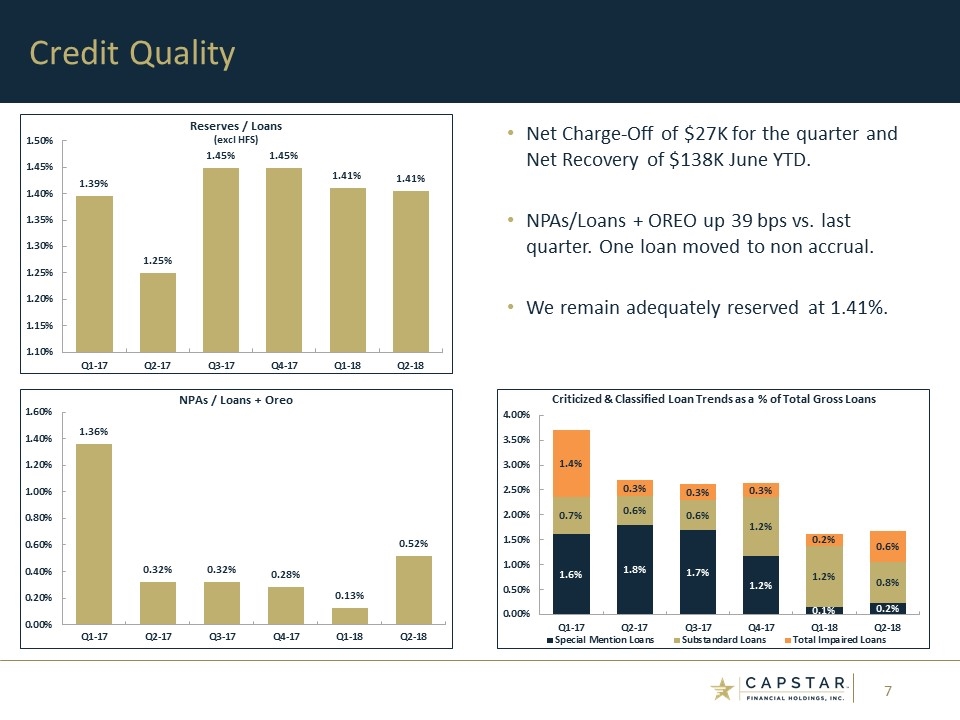

Credit Quality Net Charge-Off of $27K for the quarter and Net Recovery of $138K June YTD. NPAs/Loans + OREO up 39 bps vs. last quarter. One loan moved to non accrual. We remain adequately reserved at 1.41%.

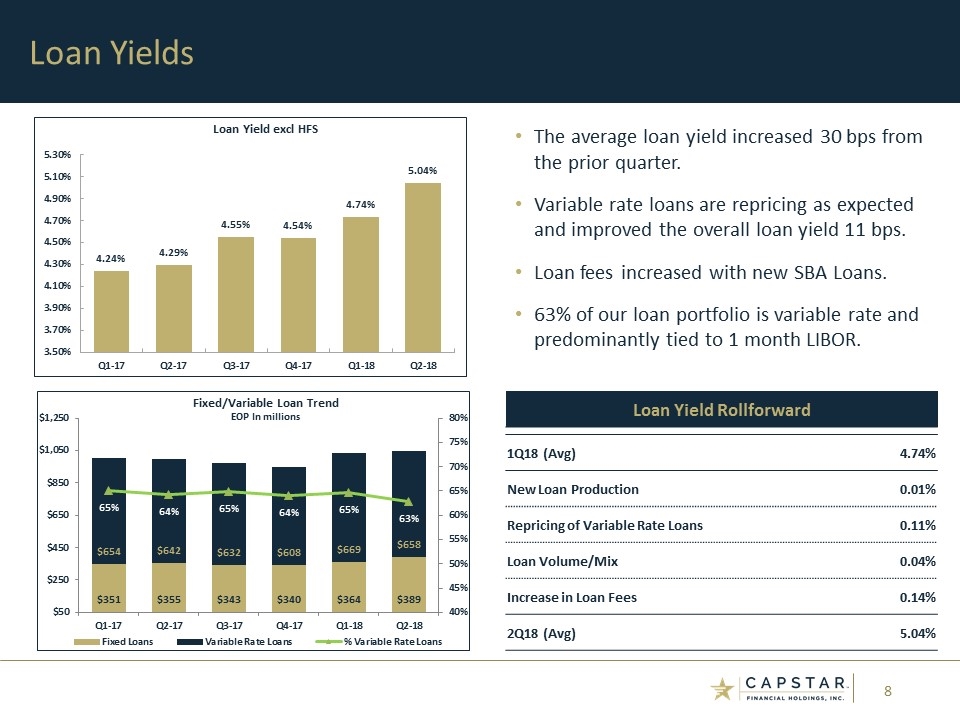

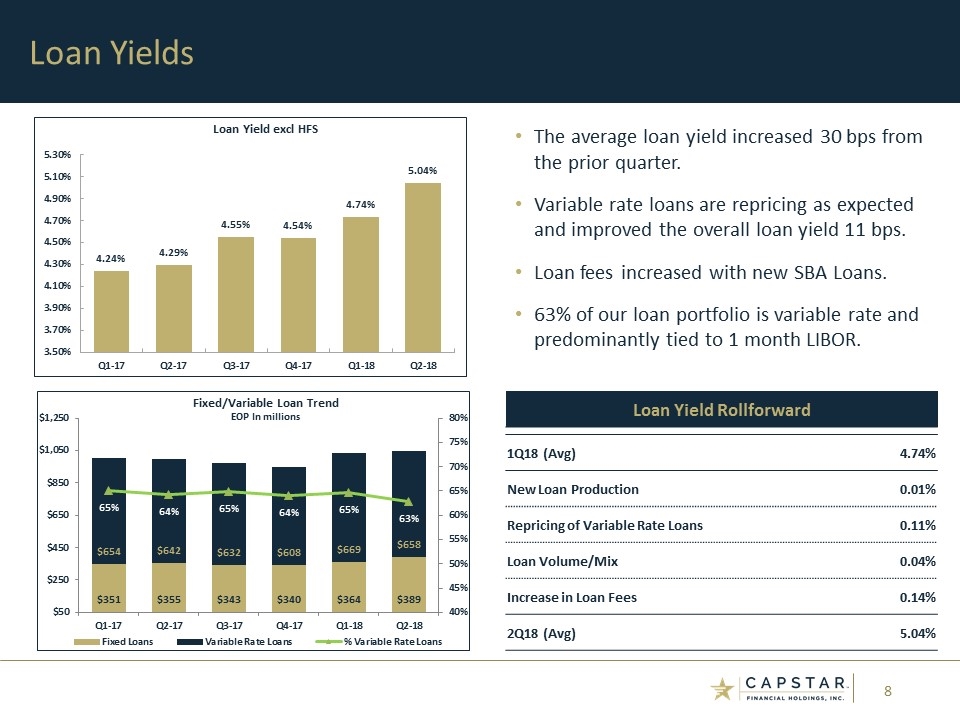

Loan Yields The average loan yield increased 30 bps from the prior quarter. Variable rate loans are repricing as expected and improved the overall loan yield 11 bps. Loan fees increased with new SBA Loans. 63% of our loan portfolio is variable rate and predominantly tied to 1 month LIBOR. Loan Yield Rollforward 1Q18 (Avg) 4.74% New Loan Production 0.01% Repricing of Variable Rate Loans 0.11% Loan Volume/Mix 0.04% Increase in Loan Fees 0.14% 2Q18 (Avg) 5.04%

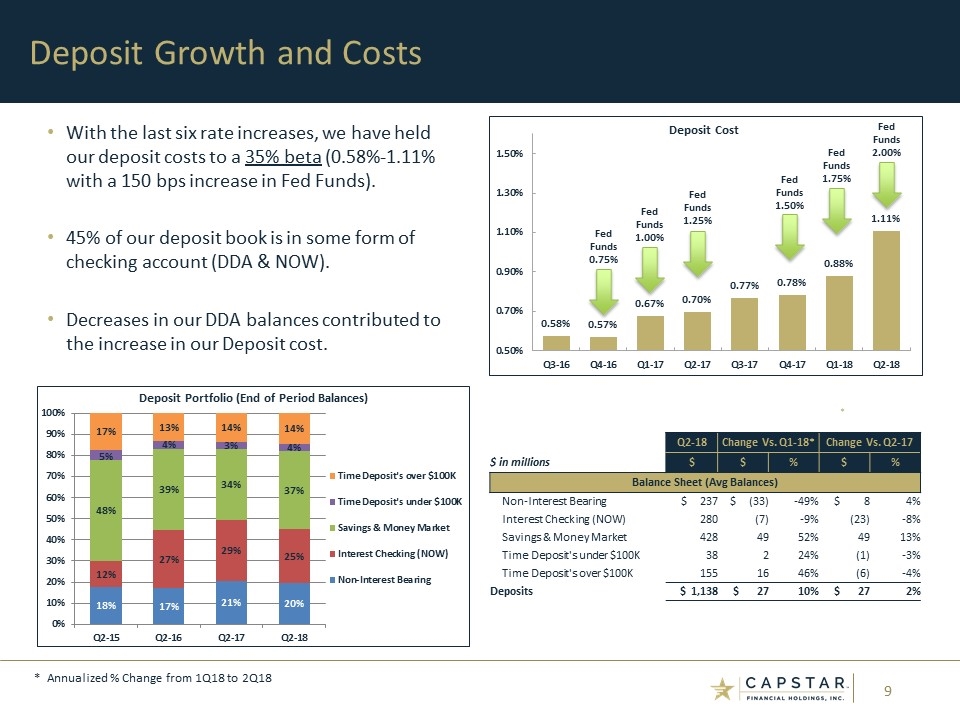

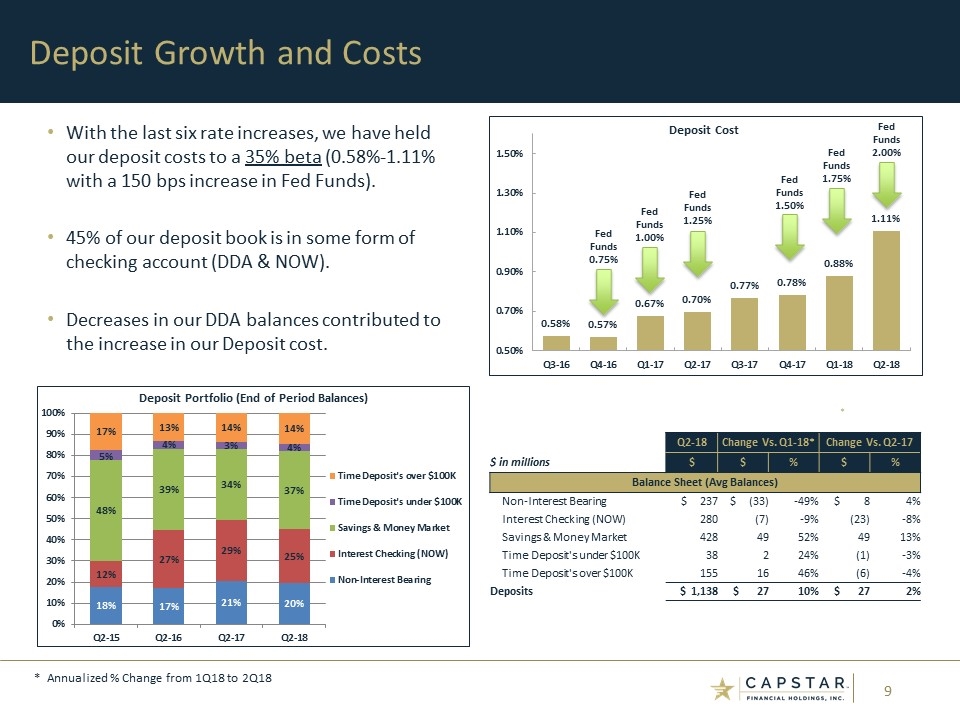

Fed Funds 0.75% Fed Funds 1.00% Fed Funds 1.25% Fed Funds 1.50% Fed Funds 1.75% Fed Funds 2.00% Deposit Growth and Costs * * Annualized % Change from 1Q18 to 2Q18 With the last six rate increases, we have held our deposit costs to a 35% beta (0.58%-1.11% with a 150 bps increase in Fed Funds). 45% of our deposit book is in some form of checking account (DDA & NOW). Decreases in our DDA balances contributed to the increase in our Deposit cost. Q2-18 Change Vs. Q1-18* Change Vs. Q2-17 $ in millions $ $ % $ % Balance Sheet (Avg Balances) Non-Interest Bearing $ 237 $ (33) -49% $ 8 4% Interest Checking (NOW) 280 (7) -9% (23) -8% Savings & Money Market 428 49 52% 49 13% Time Deposit's under $100K 38 2 24% (1) -3% Time Deposit's over $100K 155 16 46% (6) -4% Deposits $ 1,138 $ 27 10% $ 27 2%

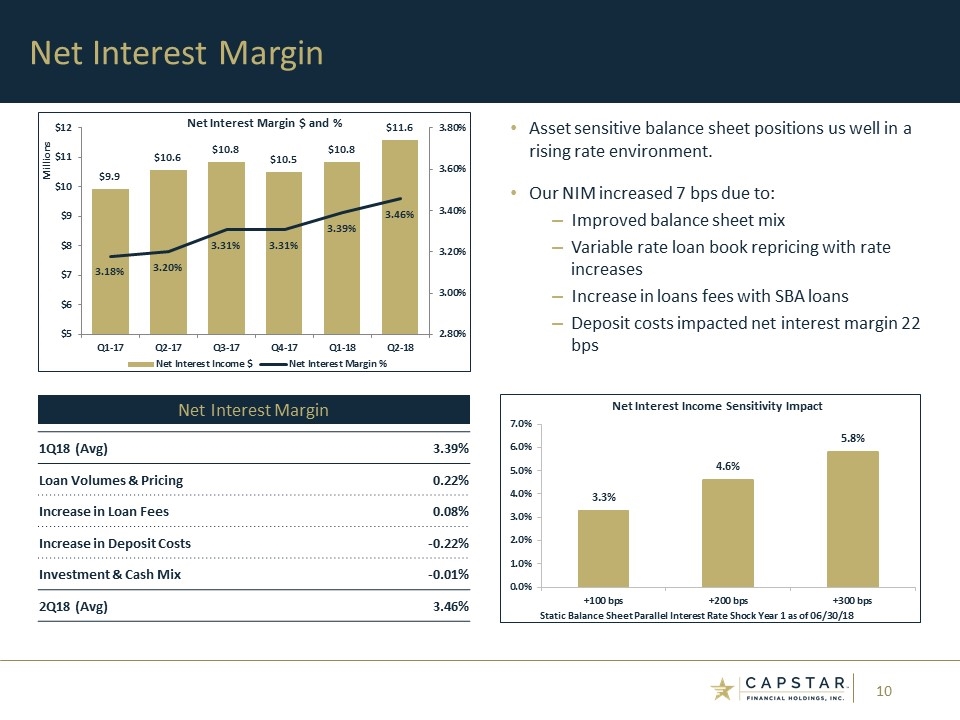

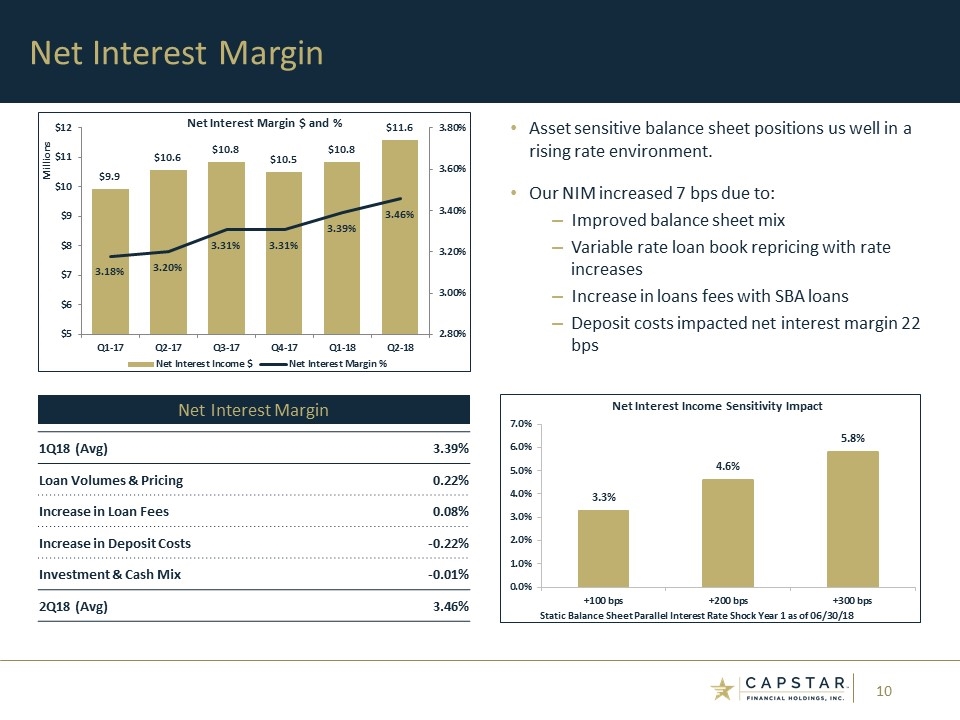

Net Interest Margin Asset sensitive balance sheet positions us well in a rising rate environment. Our NIM increased 7 bps due to: Improved balance sheet mix Variable rate loan book repricing with rate increases Increase in loans fees with SBA loans Deposit costs impacted net interest margin 22 bps Net Interest Margin 1Q18 (Avg) 3.39% Loan Volumes & Pricing 0.22% Increase in Loan Fees 0.08% Increase in Deposit Costs -0.22% Investment & Cash Mix -0.01% 2Q18 (Avg) 3.46%

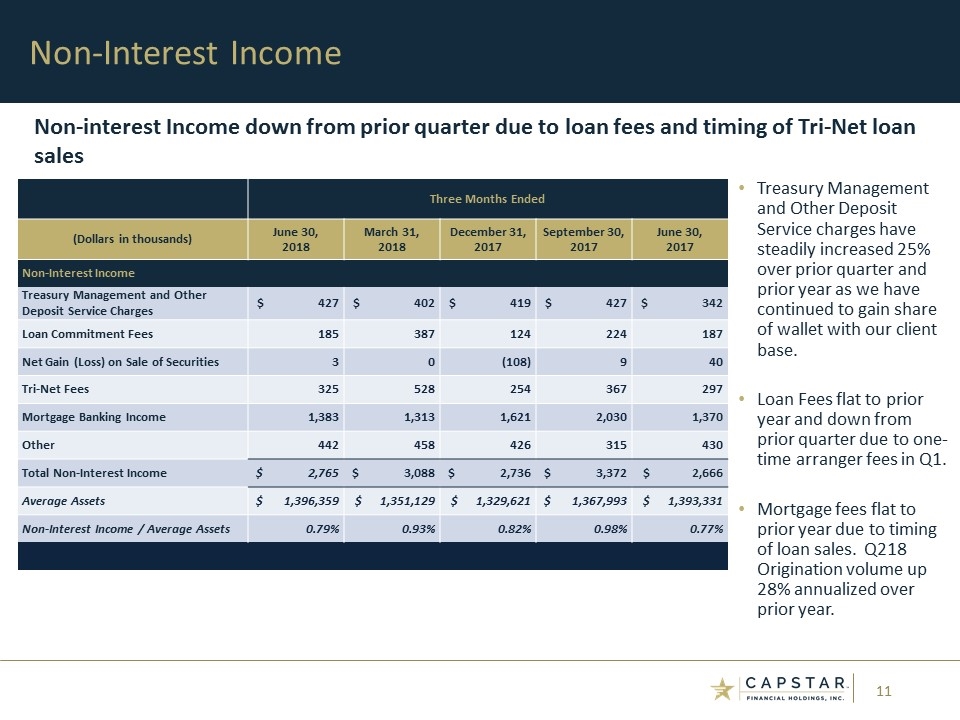

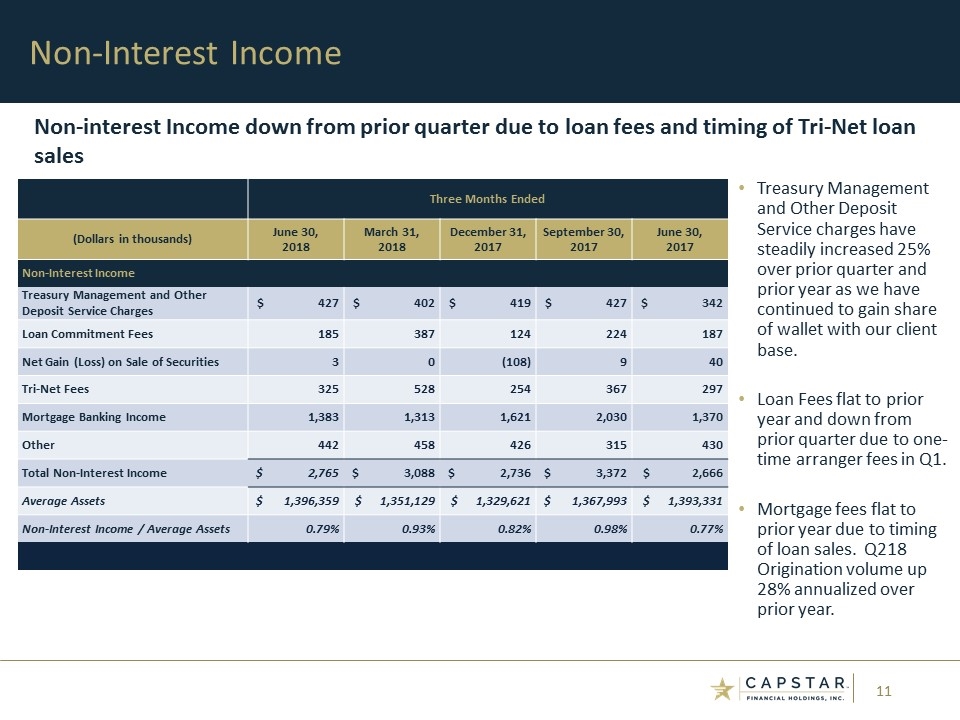

Non-Interest Income Treasury Management and Other Deposit Service charges have steadily increased 25% over prior quarter and prior year as we have continued to gain share of wallet with our client base. Loan Fees flat to prior year and down from prior quarter due to one-time arranger fees in Q1. Mortgage fees flat to prior year due to timing of loan sales. Q218 Origination volume up 28% annualized over prior year. Three Months Ended (Dollars in thousands) June 30, March 31, December 31, September 30, June 30, 2018 2018 2017 2017 2017 Non-Interest Income Treasury Management and Other Deposit Service Charges $ 427 $ 402 $ 419 $ 427 $ 342 Loan Commitment Fees 185 387 124 224 187 Net Gain (Loss) on Sale of Securities 3 0 (108) 9 40 Tri-Net Fees 325 528 254 367 297 Mortgage Banking Income 1,383 1,313 1,621 2,030 1,370 Other 442 458 426 315 430 Total Non-Interest Income $ 2,765 $ 3,088 $ 2,736 $ 3,372 $ 2,666 Average Assets $ 1,396,359 $ 1,351,129 $ 1,329,621 $ 1,367,993 $ 1,393,331 Non-Interest Income / Average Assets 0.79% 0.93% 0.82% 0.98% 0.77% Non-interest Income down from prior quarter due to loan fees and timing of Tri-Net loan sales

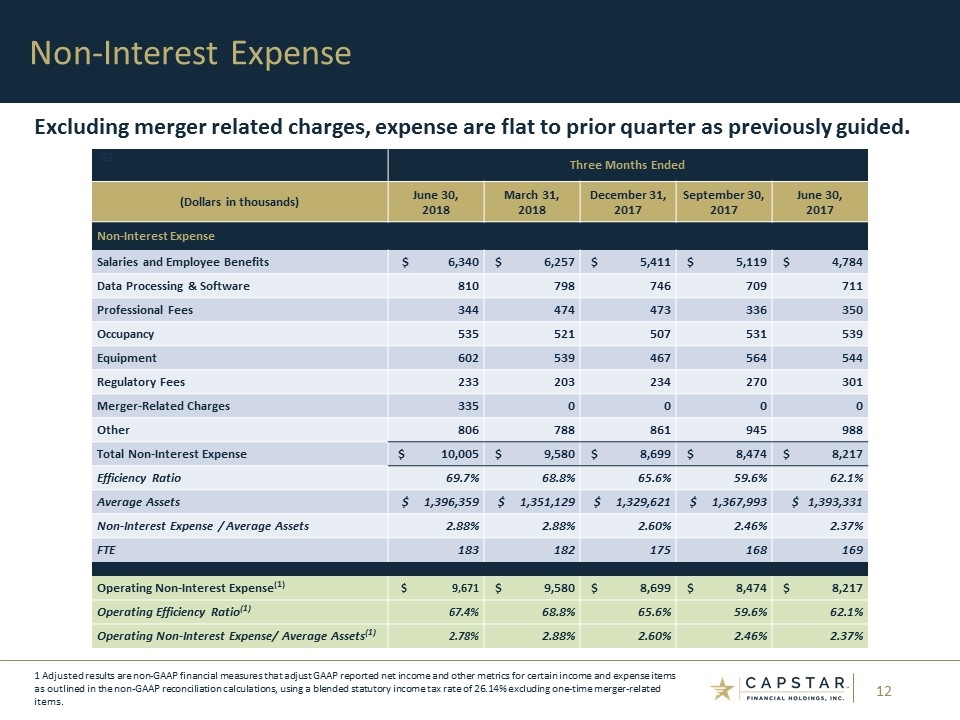

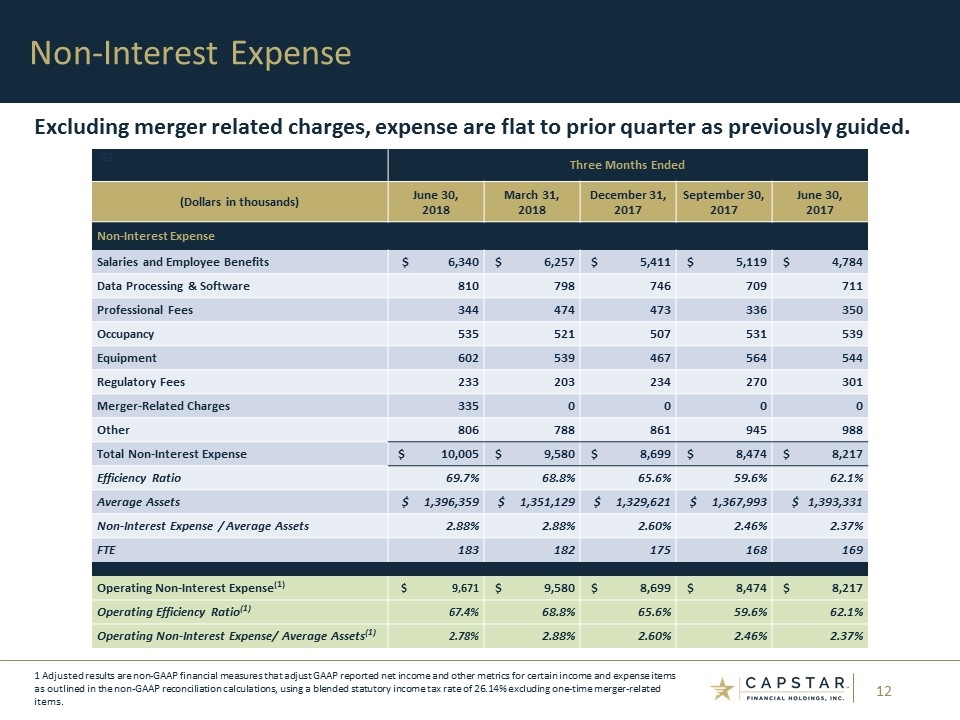

Non-Interest Expense .42 Three Months Ended (Dollars in thousands) June 30, March 31, December 31, September 30, June 30, 2018 2018 2017 2017 2017 Non-Interest Expense Salaries and Employee Benefits $ 6,340 $ 6,257 $ 5,411 $ 5,119 $ 4,784 Data Processing & Software 810 798 746 709 711 Professional Fees 344 474 473 336 350 Occupancy 535 521 507 531 539 Equipment 602 539 467 564 544 Regulatory Fees 233 203 234 270 301 Merger-Related Charges 335 0 0 0 0 Other 806 788 861 945 988 Total Non-Interest Expense $ 10,005 $ 9,580 $ 8,699 $ 8,474 $ 8,217 Efficiency Ratio 69.7% 68.8% 65.6% 59.6% 62.1% Average Assets $ 1,396,359 $ 1,351,129 $ 1,329,621 $ 1,367,993 $ 1,393,331 Non-Interest Expense / Average Assets 2.88% 2.88% 2.60% 2.46% 2.37% FTE 183 182 175 168 169 Operating Non-Interest Expense(1) $ 9,671 $ 9,580 $ 8,699 $ 8,474 $ 8,217 Operating Efficiency Ratio(1) 67.4% 68.8% 65.6% 59.6% 62.1% Operating Non-Interest Expense/ Average Assets(1) 2.78% 2.88% 2.60% 2.46% 2.37% Excluding merger related charges, expense are flat to prior quarter as previously guided. 1 Adjusted results are non-GAAP financial measures that adjust GAAP reported net income and other metrics for certain income and expense items as outlined in the non-GAAP reconciliation calculations, using a blended statutory income tax rate of 26.14% excluding one-time merger-related items.

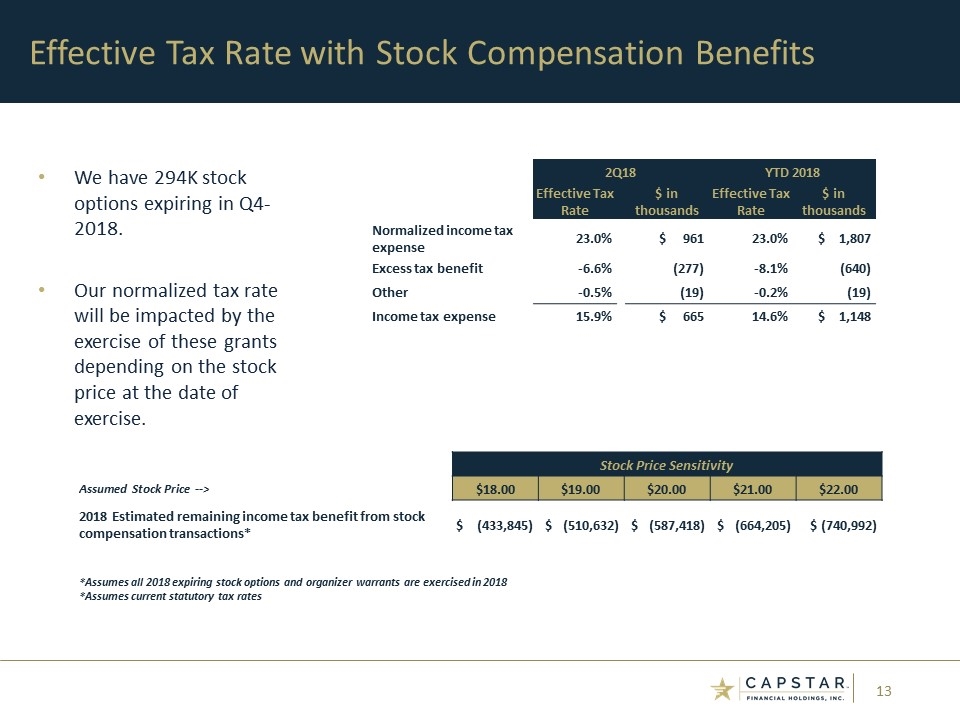

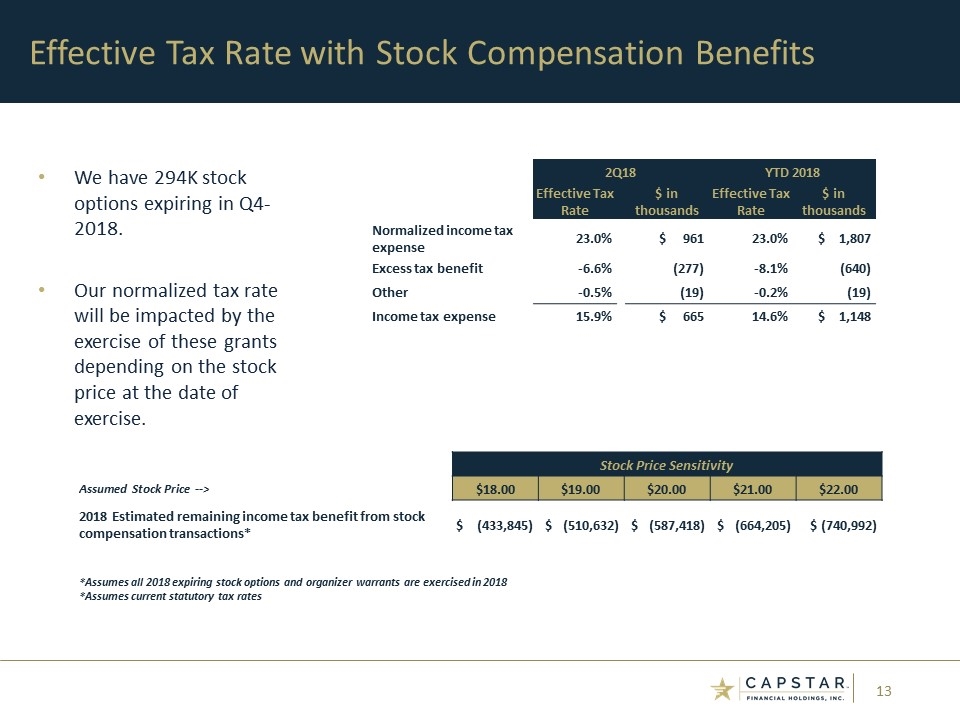

We have 294K stock options expiring in Q4-2018. Our normalized tax rate will be impacted by the exercise of these grants depending on the stock price at the date of exercise. Effective Tax Rate with Stock Compensation Benefits 2Q18 YTD 2018 Effective Tax Rate $ in thousands Effective Tax Rate $ in thousands Normalized income tax expense 23.0% $ 961 23.0% $ 1,807 Excess tax benefit -6.6% (277) -8.1% (640) Other -0.5% (19) -0.2% (19) Income tax expense 15.9% $ 665 14.6% $ 1,148 Stock Price Sensitivity Assumed Stock Price --> $18.00 $19.00 $20.00 $21.00 $22.00 2018 Estimated remaining income tax benefit from stock compensation transactions* $ (433,845) $ (510,632) $ (587,418) $ (664,205) $ (740,992) *Assumes all 2018 expiring stock options and organizer warrants are exercised in 2018 *Assumes current statutory tax rates

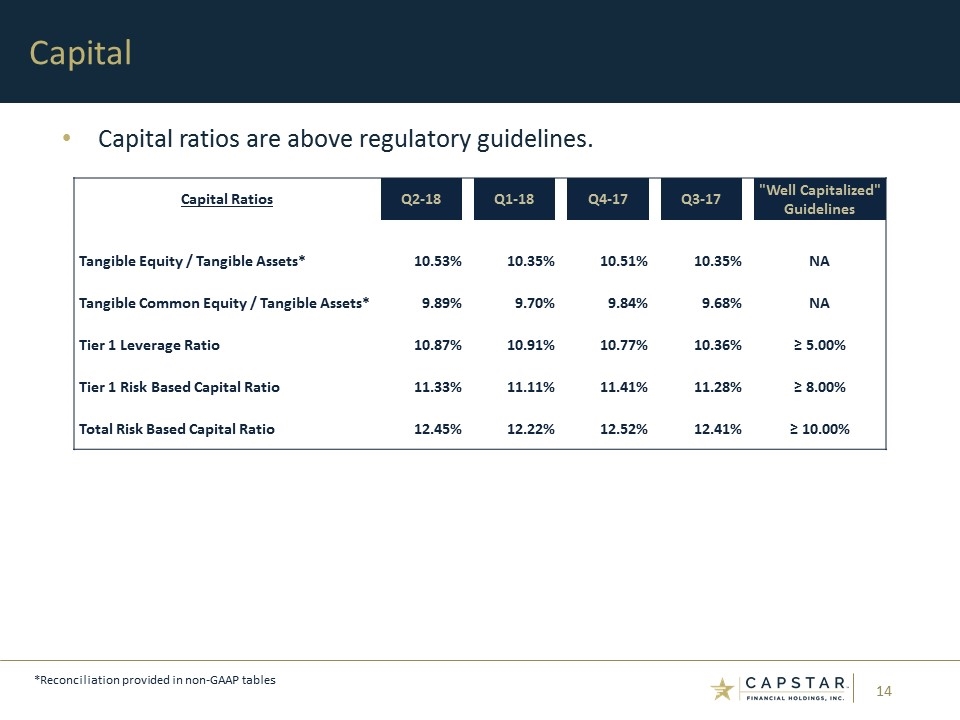

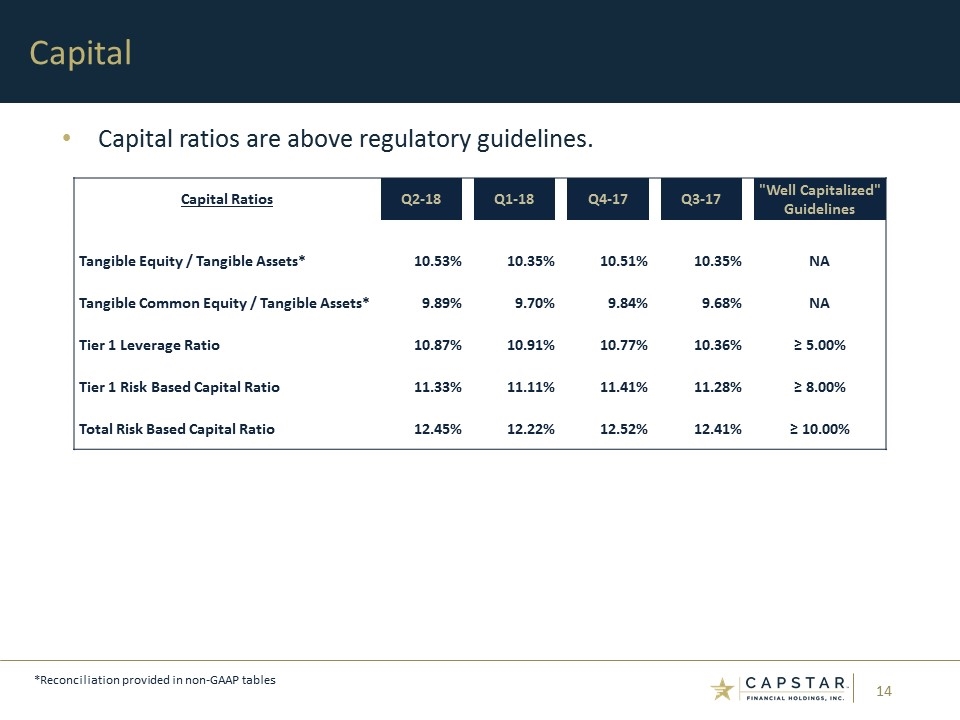

Capital ratios are above regulatory guidelines. Capital *Reconciliation provided in non-GAAP tables Capital Ratios Q2-18 Q1-18 Q4-17 Q3-17 "Well Capitalized" Guidelines Tangible Equity / Tangible Assets* 10.53% 10.35% 10.51% 10.35% NA Tangible Common Equity / Tangible Assets* 9.89% 9.70% 9.84% 9.68% NA Tier 1 Leverage Ratio 10.87% 10.91% 10.77% 10.36% ≥ 5.00% Tier 1 Risk Based Capital Ratio 11.33% 11.11% 11.41% 11.28% ≥ 8.00% Total Risk Based Capital Ratio 12.45% 12.22% 12.52% 12.41% ≥ 10.00%

Integration progressing as planned; closing anticipated in the fourth quarter 2018. CapStar and Athens share a common vision of creating a high performing financial institution across the state of Tennessee. The combination adds diversity in terms of industry, business mix and geography. Athens is an established and highly profitable community bank with dominant deposit market share in its primary market. Accretive to CapStar’s deposit base and overall funding needs. Financial compelling transaction, resulting in double digit earnings accretion, manageable tangible book value dilution, and an enhanced pro forma capital position. Confident in our ability to execute on deal economics 6% EPS accretion in 2019 and 10%+ in 2020 25% Cost savings phased in at 60% in 2019; 100% thereafter We believe the combination will create a strong financial institution with an expanded product offering, attractive funding profile and enhanced scale to drive efficiency. Athens Update *Refer to “Safe Harbor Statements” and “Disclaimers”

CapStar’s strategy remains one of sound, profitable growth. Focused on increasing primary bank status with more clients. Focused on Athens integration and capturing synergies. Organic growth opportunities through market share takeaway. Strong first half performance with no credit issues. Key Takeaways* *Refer to “Safe Harbor Statements” on page 3

Appendix: Historical Financials

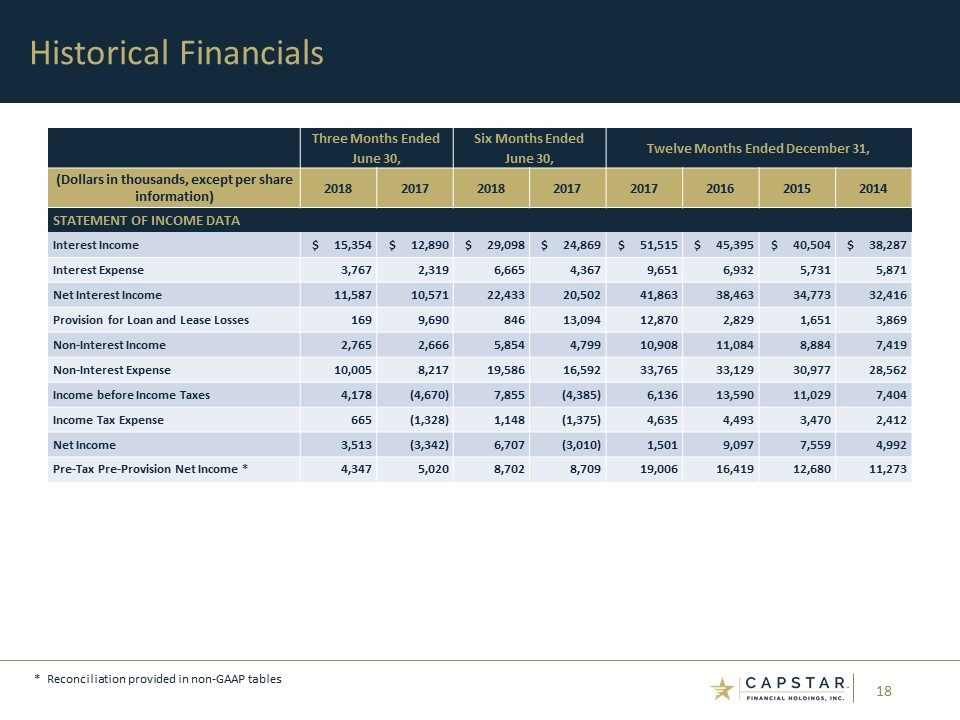

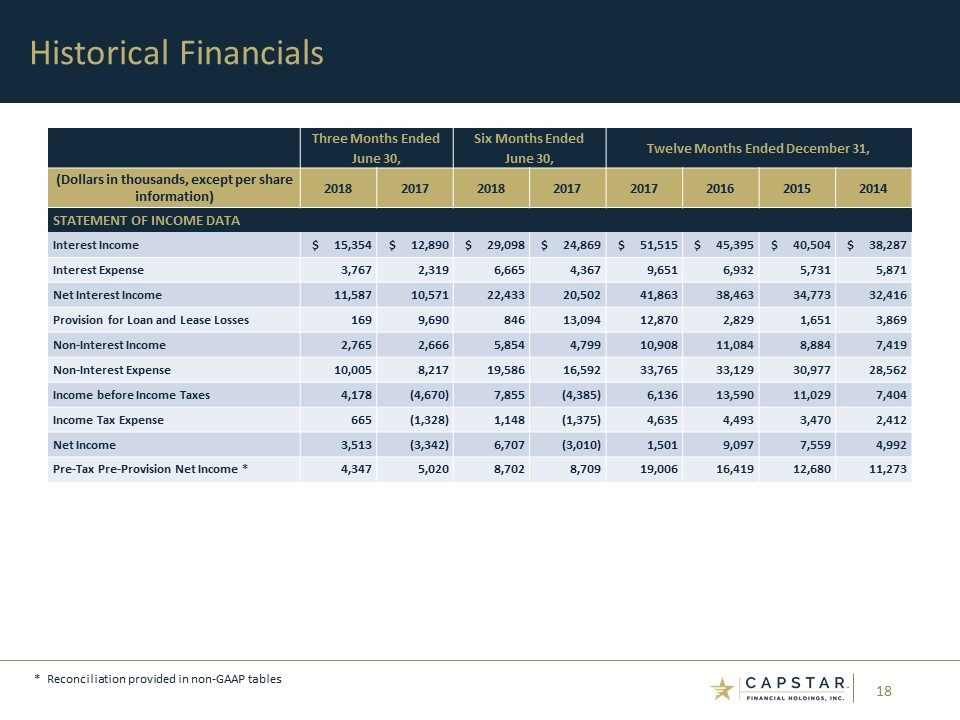

Historical Financials * Reconciliation provided in non-GAAP tables Three Months Ended Six Months Ended Twelve Months Ended December 31, June 30, June 30, (Dollars in thousands, except per share information) 2018 2017 2018 2017 2017 2016 2015 2014 STATEMENT OF INCOME DATA Interest Income $ 15,354 $ 12,890 $ 29,098 $ 24,869 $ 51,515 $ 45,395 $ 40,504 $ 38,287 Interest Expense 3,767 2,319 6,665 4,367 9,651 6,932 5,731 5,871 Net Interest Income 11,587 10,571 22,433 20,502 41,863 38,463 34,773 32,416 Provision for Loan and Lease Losses 169 9,690 846 13,094 12,870 2,829 1,651 3,869 Non-Interest Income 2,765 2,666 5,854 4,799 10,908 11,084 8,884 7,419 Non-Interest Expense 10,005 8,217 19,586 16,592 33,765 33,129 30,977 28,562 Income before Income Taxes 4,178 (4,670) 7,855 (4,385) 6,136 13,590 11,029 7,404 Income Tax Expense 665 (1,328) 1,148 (1,375) 4,635 4,493 3,470 2,412 Net Income 3,513 (3,342) 6,707 (3,010) 1,501 9,097 7,559 4,992 Pre-Tax Pre-Provision Net Income * 4,347 5,020 8,702 8,709 19,006 16,419 12,680 11,273

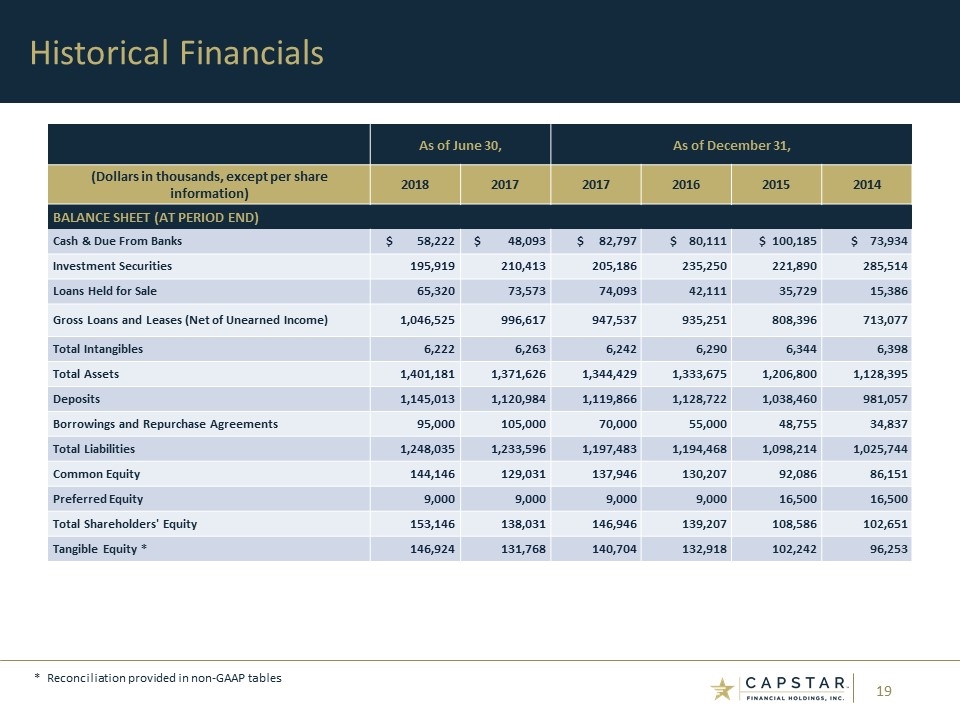

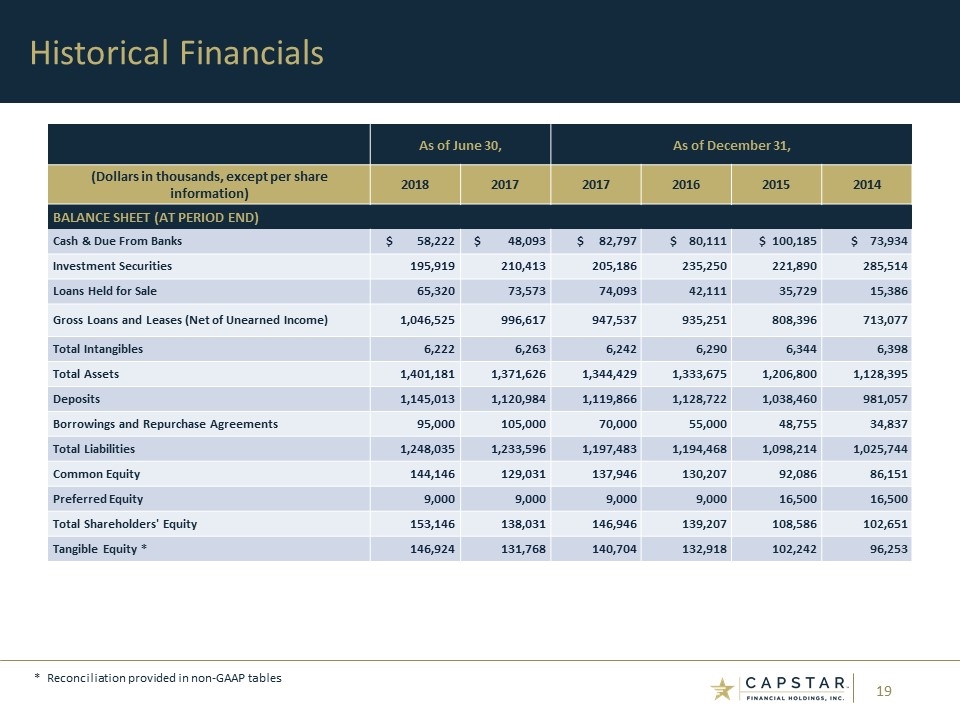

Historical Financials * Reconciliation provided in non-GAAP tables As of June 30, As of December 31, (Dollars in thousands, except per share information) 2018 2017 2017 2016 2015 2014 BALANCE SHEET (AT PERIOD END) Cash & Due From Banks $ 58,222 $ 48,093 $ 82,797 $ 80,111 $ 100,185 $ 73,934 Investment Securities 195,919 210,413 205,186 235,250 221,890 285,514 Loans Held for Sale 65,320 73,573 74,093 42,111 35,729 15,386 Gross Loans and Leases (Net of Unearned Income) 1,046,525 996,617 947,537 935,251 808,396 713,077 Total Intangibles 6,222 6,263 6,242 6,290 6,344 6,398 Total Assets 1,401,181 1,371,626 1,344,429 1,333,675 1,206,800 1,128,395 Deposits 1,145,013 1,120,984 1,119,866 1,128,722 1,038,460 981,057 Borrowings and Repurchase Agreements 95,000 105,000 70,000 55,000 48,755 34,837 Total Liabilities 1,248,035 1,233,596 1,197,483 1,194,468 1,098,214 1,025,744 Common Equity 144,146 129,031 137,946 130,207 92,086 86,151 Preferred Equity 9,000 9,000 9,000 9,000 16,500 16,500 Total Shareholders' Equity 153,146 138,031 146,946 139,207 108,586 102,651 Tangible Equity * 146,924 131,768 140,704 132,918 102,242 96,253

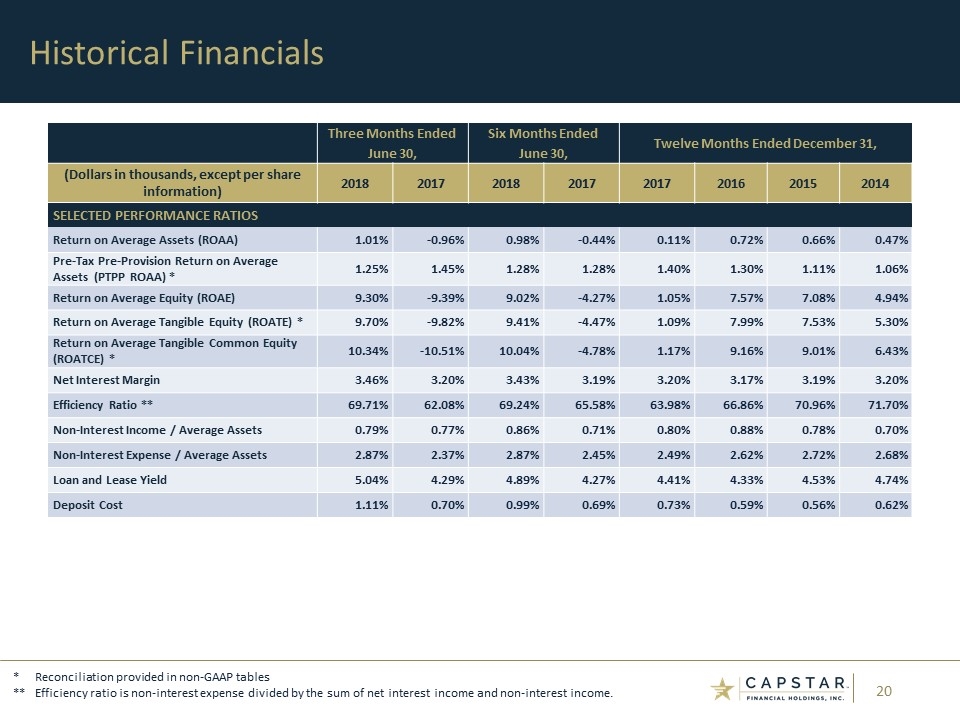

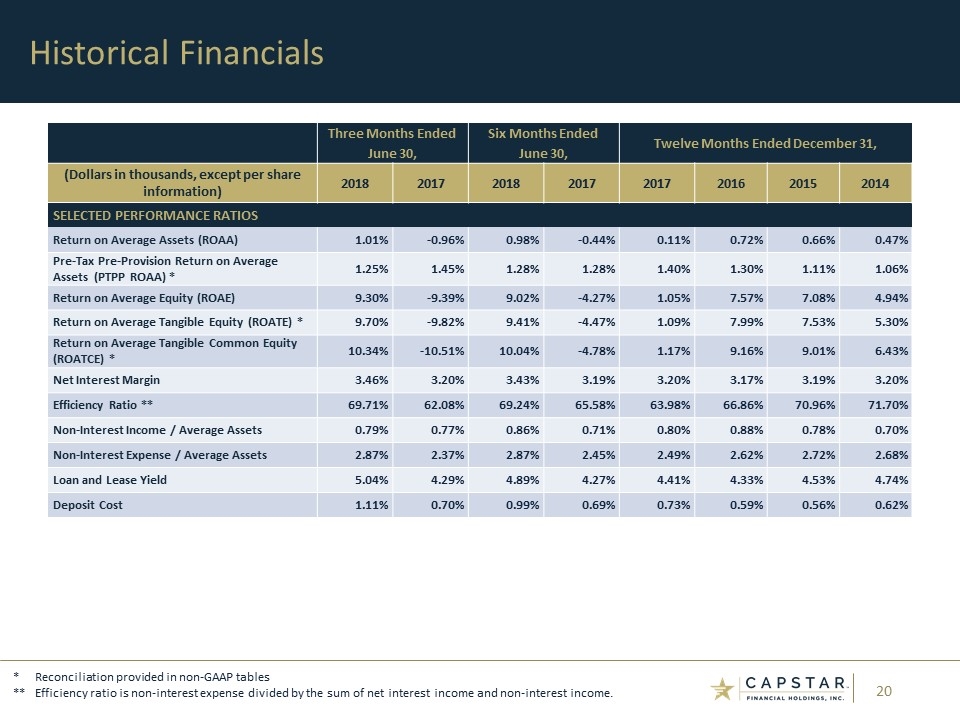

Historical Financials * Reconciliation provided in non-GAAP tables ** Efficiency ratio is non-interest expense divided by the sum of net interest income and non-interest income. Three Months Ended Six Months Ended Twelve Months Ended December 31, June 30, June 30, (Dollars in thousands, except per share information) 2018 2017 2018 2017 2017 2016 2015 2014 SELECTED PERFORMANCE RATIOS Return on Average Assets (ROAA) 1.01% -0.96% 0.98% -0.44% 0.11% 0.72% 0.66% 0.47% Pre-Tax Pre-Provision Return on Average Assets (PTPP ROAA) * 1.25% 1.45% 1.28% 1.28% 1.40% 1.30% 1.11% 1.06% Return on Average Equity (ROAE) 9.30% -9.39% 9.02% -4.27% 1.05% 7.57% 7.08% 4.94% Return on Average Tangible Equity (ROATE) * 9.70% -9.82% 9.41% -4.47% 1.09% 7.99% 7.53% 5.30% Return on Average Tangible Common Equity (ROATCE) * 10.34% -10.51% 10.04% -4.78% 1.17% 9.16% 9.01% 6.43% Net Interest Margin 3.46% 3.20% 3.43% 3.19% 3.20% 3.17% 3.19% 3.20% Efficiency Ratio ** 69.71% 62.08% 69.24% 65.58% 63.98% 66.86% 70.96% 71.70% Non-Interest Income / Average Assets 0.79% 0.77% 0.86% 0.71% 0.80% 0.88% 0.78% 0.70% Non-Interest Expense / Average Assets 2.87% 2.37% 2.87% 2.45% 2.49% 2.62% 2.72% 2.68% Loan and Lease Yield 5.04% 4.29% 4.89% 4.27% 4.41% 4.33% 4.53% 4.74% Deposit Cost 1.11% 0.70% 0.99% 0.69% 0.73% 0.59% 0.56% 0.62%

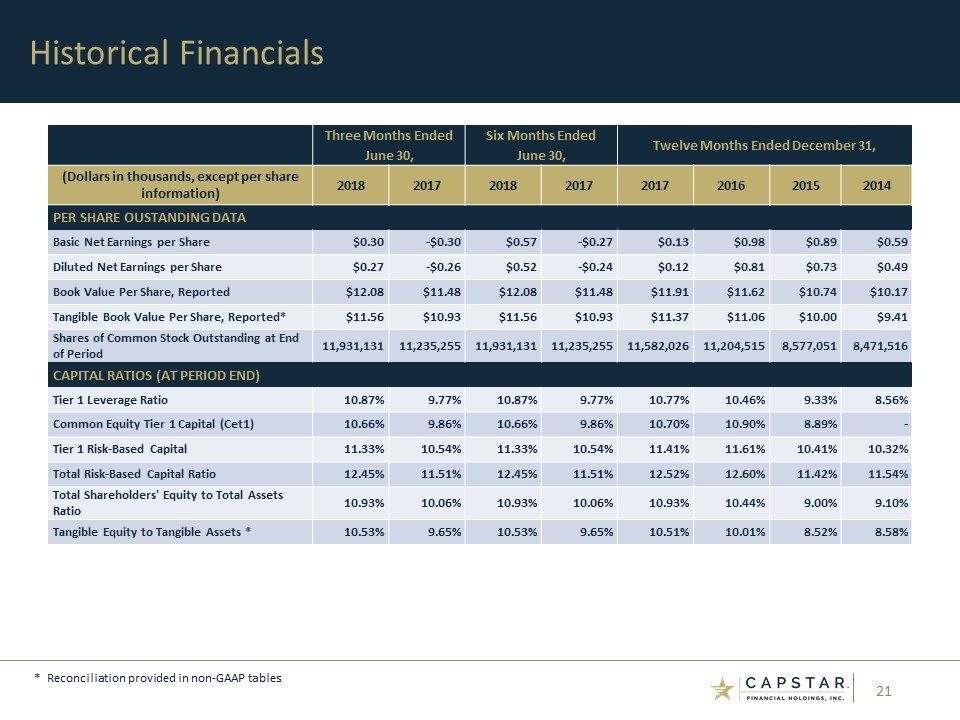

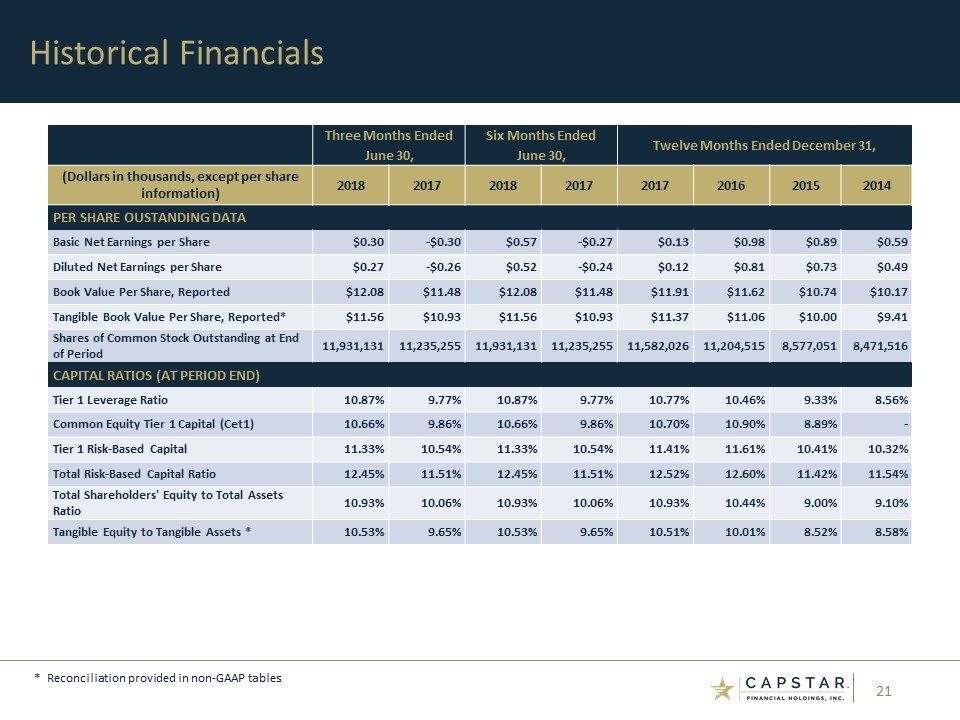

Historical Financials * Reconciliation provided in non-GAAP tables Three Months Ended Six Months Ended Twelve Months Ended December 31, June 30, June 30, (Dollars in thousands, except per share information) 2018 2017 2018 2017 2017 2016 2015 2014 PER SHARE OUSTANDING DATA Basic Net Earnings per Share $0.30 -$0.30 $0.57 -$0.27 $0.13 $0.98 $0.89 $0.59 Diluted Net Earnings per Share $0.27 -$0.26 $0.52 -$0.24 $0.12 $0.81 $0.73 $0.49 Book Value Per Share, Reported $12.08 $11.48 $12.08 $11.48 $11.91 $11.62 $10.74 $10.17 Tangible Book Value Per Share, Reported* $11.56 $10.93 $11.56 $10.93 $11.37 $11.06 $10.00 $9.41 Shares of Common Stock Outstanding at End of Period 11,931,131 11,235,255 11,931,131 11,235,255 11,582,026 11,204,515 8,577,051 8,471,516 CAPITAL RATIOS (AT PERIOD END) Tier 1 Leverage Ratio 10.87% 9.77% 10.87% 9.77% 10.77% 10.46% 9.33% 8.56% Common Equity Tier 1 Capital (Cet1) 10.66% 9.86% 10.66% 9.86% 10.70% 10.90% 8.89% - Tier 1 Risk-Based Capital 11.33% 10.54% 11.33% 10.54% 11.41% 11.61% 10.41% 10.32% Total Risk-Based Capital Ratio 12.45% 11.51% 12.45% 11.51% 12.52% 12.60% 11.42% 11.54% Total Shareholders' Equity to Total Assets Ratio 10.93% 10.06% 10.93% 10.06% 10.93% 10.44% 9.00% 9.10% Tangible Equity to Tangible Assets * 10.53% 9.65% 10.53% 9.65% 10.51% 10.01% 8.52% 8.58%

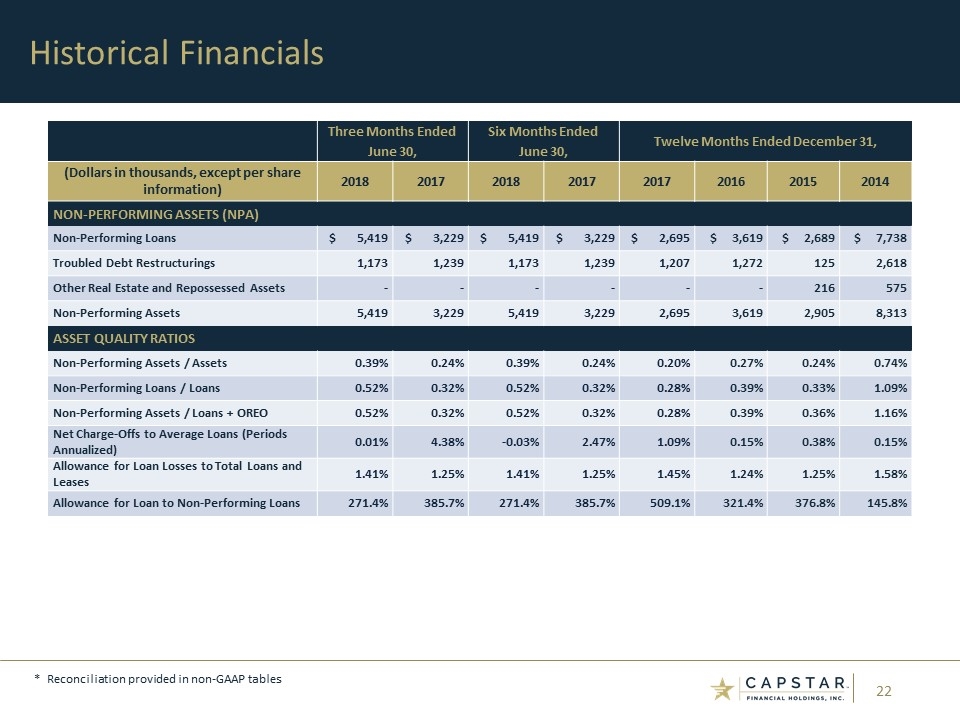

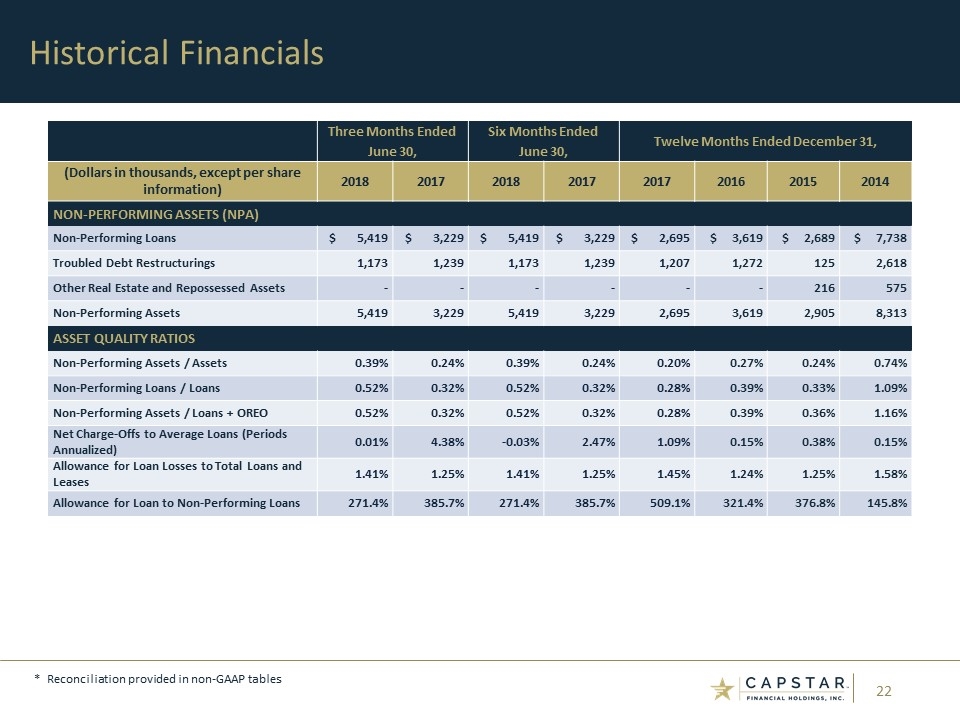

Historical Financials * Reconciliation provided in non-GAAP tables Three Months Ended Six Months Ended Twelve Months Ended December 31, June 30, June 30, (Dollars in thousands, except per share information) 2018 2017 2018 2017 2017 2016 2015 2014 NON-PERFORMING ASSETS (NPA) Non-Performing Loans $ 5,419 $ 3,229 $ 5,419 $ 3,229 $ 2,695 $ 3,619 $ 2,689 $ 7,738 Troubled Debt Restructurings 1,173 1,239 1,173 1,239 1,207 1,272 125 2,618 Other Real Estate and Repossessed Assets - - - - - - 216 575 Non-Performing Assets 5,419 3,229 5,419 3,229 2,695 3,619 2,905 8,313 ASSET QUALITY RATIOS Non-Performing Assets / Assets 0.39% 0.24% 0.39% 0.24% 0.20% 0.27% 0.24% 0.74% Non-Performing Loans / Loans 0.52% 0.32% 0.52% 0.32% 0.28% 0.39% 0.33% 1.09% Non-Performing Assets / Loans + OREO 0.52% 0.32% 0.52% 0.32% 0.28% 0.39% 0.36% 1.16% Net Charge-Offs to Average Loans (Periods Annualized) 0.01% 4.38% -0.03% 2.47% 1.09% 0.15% 0.38% 0.15% Allowance for Loan Losses to Total Loans and Leases 1.41% 1.25% 1.41% 1.25% 1.45% 1.24% 1.25% 1.58% Allowance for Loan to Non-Performing Loans 271.4% 385.7% 271.4% 385.7% 509.1% 321.4% 376.8% 145.8%

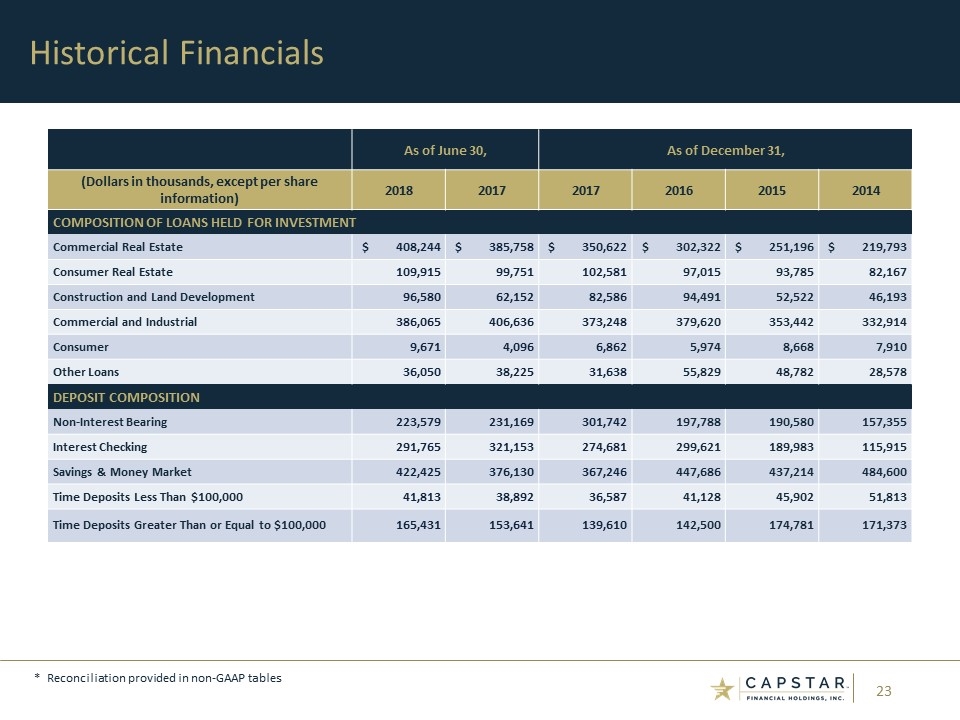

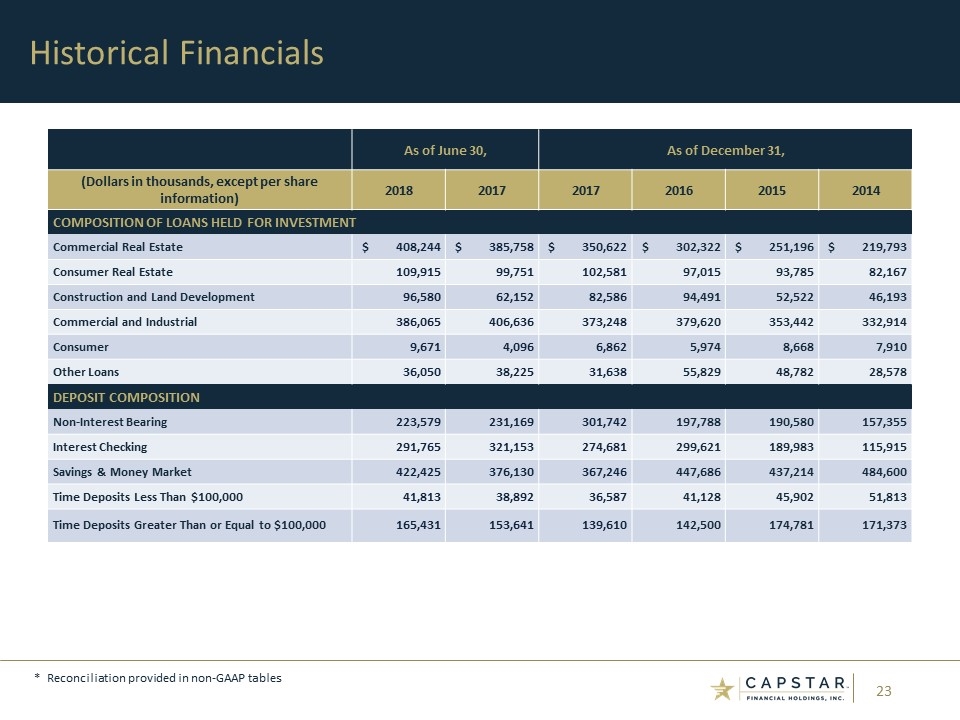

Historical Financials * Reconciliation provided in non-GAAP tables As of June 30, As of December 31, (Dollars in thousands, except per share information) 2018 2017 2017 2016 2015 2014 COMPOSITION OF LOANS HELD FOR INVESTMENT Commercial Real Estate $ 408,244 $ 385,758 $ 350,622 $ 302,322 $ 251,196 $ 219,793 Consumer Real Estate 109,915 99,751 102,581 97,015 93,785 82,167 Construction and Land Development 96,580 62,152 82,586 94,491 52,522 46,193 Commercial and Industrial 386,065 406,636 373,248 379,620 353,442 332,914 Consumer 9,671 4,096 6,862 5,974 8,668 7,910 Other Loans 36,050 38,225 31,638 55,829 48,782 28,578 DEPOSIT COMPOSITION Non-Interest Bearing 223,579 231,169 301,742 197,788 190,580 157,355 Interest Checking 291,765 321,153 274,681 299,621 189,983 115,915 Savings & Money Market 422,425 376,130 367,246 447,686 437,214 484,600 Time Deposits Less Than $100,000 41,813 38,892 36,587 41,128 45,902 51,813 Time Deposits Greater Than or Equal to $100,000 165,431 153,641 139,610 142,500 174,781 171,373

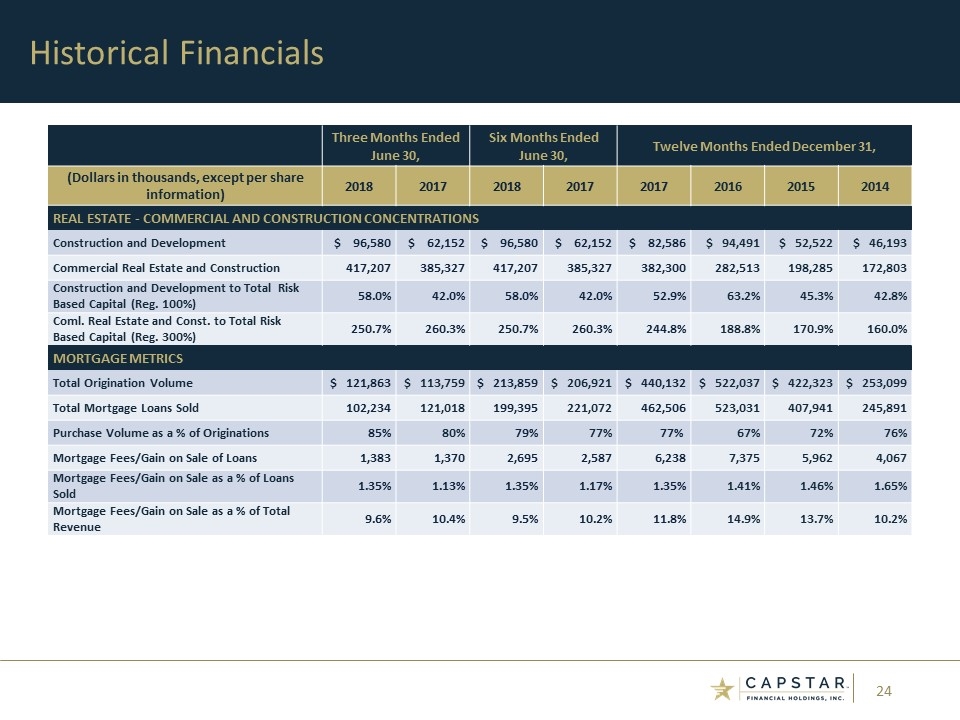

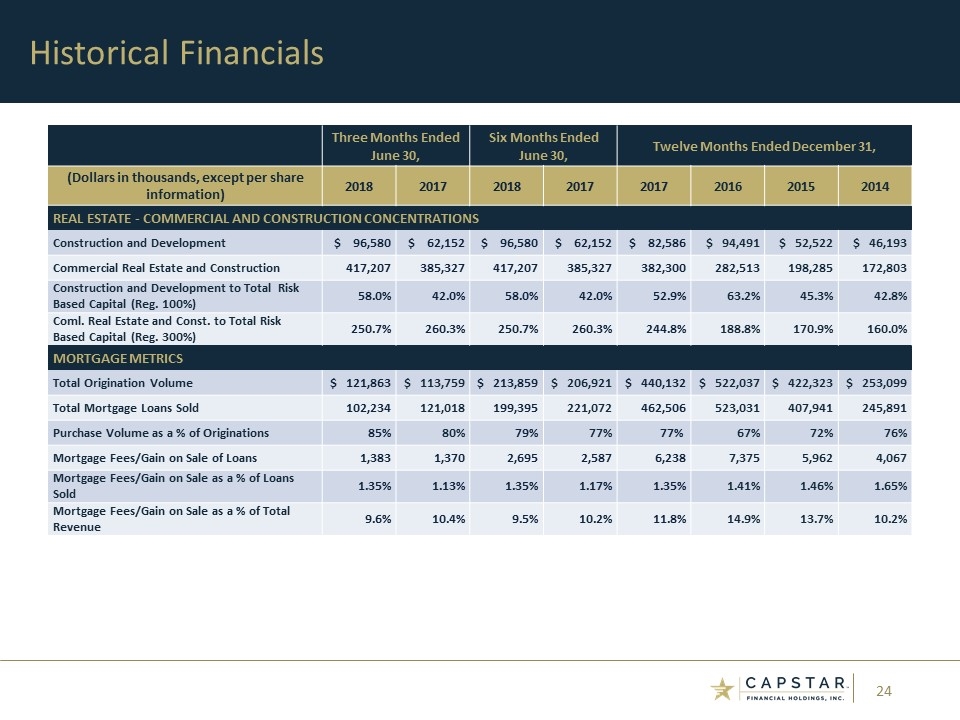

Historical Financials Three Months Ended Six Months Ended Twelve Months Ended December 31, June 30, June 30, (Dollars in thousands, except per share information) 2018 2017 2018 2017 2017 2016 2015 2014 REAL ESTATE - COMMERCIAL AND CONSTRUCTION CONCENTRATIONS Construction and Development $ 96,580 $ 62,152 $ 96,580 $ 62,152 $ 82,586 $ 94,491 $ 52,522 $ 46,193 Commercial Real Estate and Construction 417,207 385,327 417,207 385,327 382,300 282,513 198,285 172,803 Construction and Development to Total Risk Based Capital (Reg. 100%) 58.0% 42.0% 58.0% 42.0% 52.9% 63.2% 45.3% 42.8% Coml. Real Estate and Const. to Total Risk Based Capital (Reg. 300%) 250.7% 260.3% 250.7% 260.3% 244.8% 188.8% 170.9% 160.0% MORTGAGE METRICS Total Origination Volume $ 121,863 $ 113,759 $ 213,859 $ 206,921 $ 440,132 $ 522,037 $ 422,323 $ 253,099 Total Mortgage Loans Sold 102,234 121,018 199,395 221,072 462,506 523,031 407,941 245,891 Purchase Volume as a % of Originations 85% 80% 79% 77% 77% 67% 72% 76% Mortgage Fees/Gain on Sale of Loans 1,383 1,370 2,695 2,587 6,238 7,375 5,962 4,067 Mortgage Fees/Gain on Sale as a % of Loans Sold 1.35% 1.13% 1.35% 1.17% 1.35% 1.41% 1.46% 1.65% Mortgage Fees/Gain on Sale as a % of Total Revenue 9.6% 10.4% 9.5% 10.2% 11.8% 14.9% 13.7% 10.2%

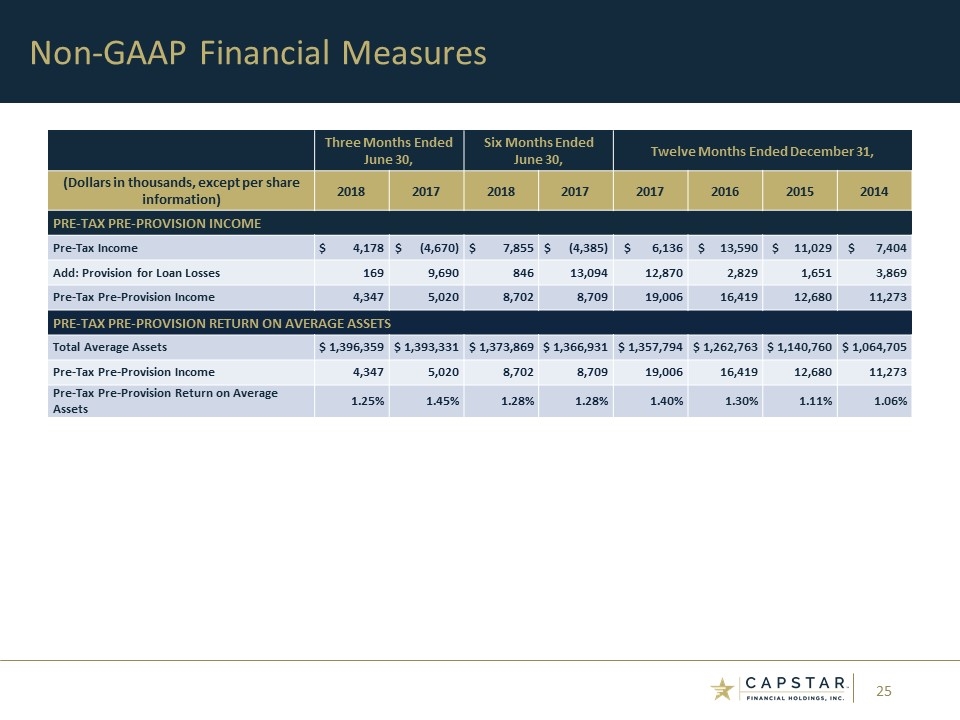

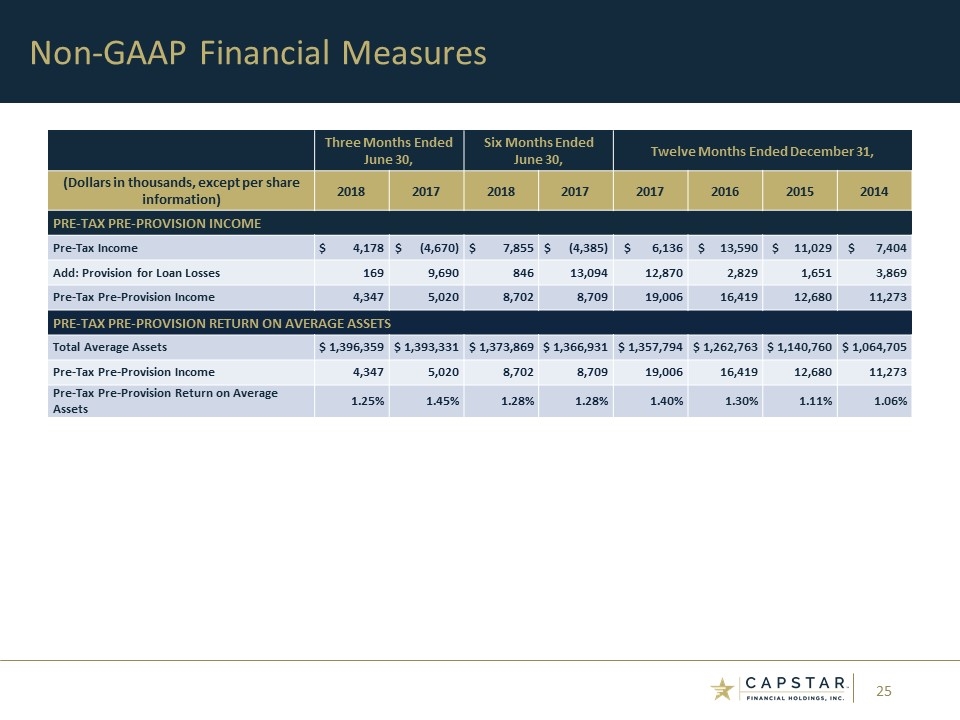

Three Months Ended June 30, Six Months Ended June 30, Twelve Months Ended December 31, (Dollars in thousands, except per share information) 2018 2017 2018 2017 2017 2016 2015 2014 PRE-TAX PRE-PROVISION INCOME Pre-Tax Income $ 4,178 $ (4,670) $ 7,855 $ (4,385) $ 6,136 $ 13,590 $ 11,029 $ 7,404 Add: Provision for Loan Losses 169 9,690 846 13,094 12,870 2,829 1,651 3,869 Pre-Tax Pre-Provision Income 4,347 5,020 8,702 8,709 19,006 16,419 12,680 11,273 PRE-TAX PRE-PROVISION RETURN ON AVERAGE ASSETS Total Average Assets $ 1,396,359 $ 1,393,331 $ 1,373,869 $ 1,366,931 $ 1,357,794 $ 1,262,763 $ 1,140,760 $ 1,064,705 Pre-Tax Pre-Provision Income 4,347 5,020 8,702 8,709 19,006 16,419 12,680 11,273 Pre-Tax Pre-Provision Return on Average Assets 1.25% 1.45% 1.28% 1.28% 1.40% 1.30% 1.11% 1.06% Non-GAAP Financial Measures

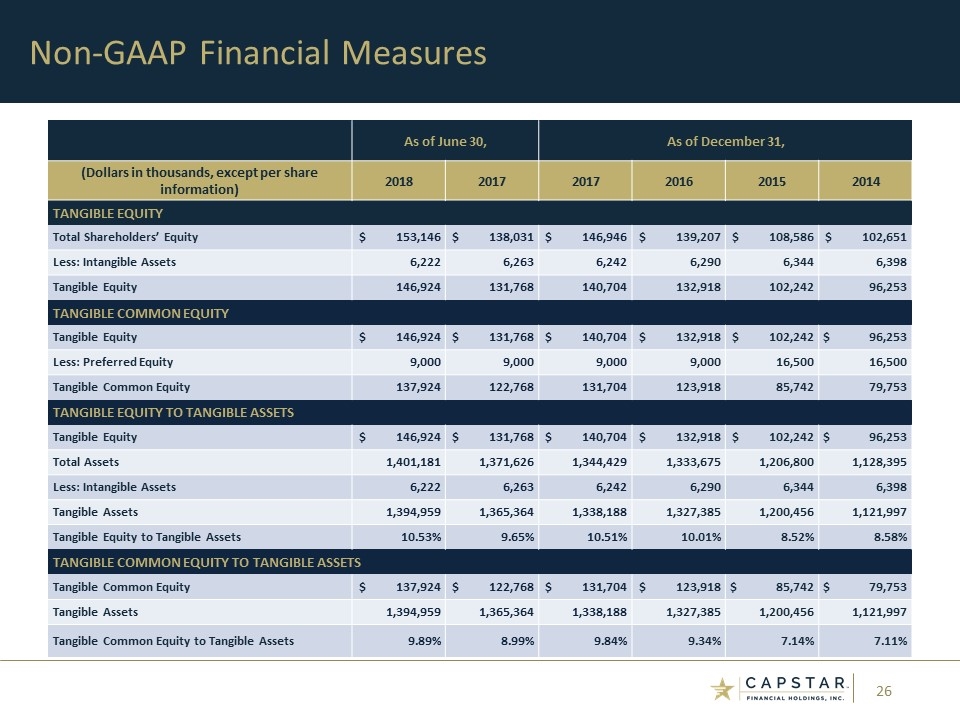

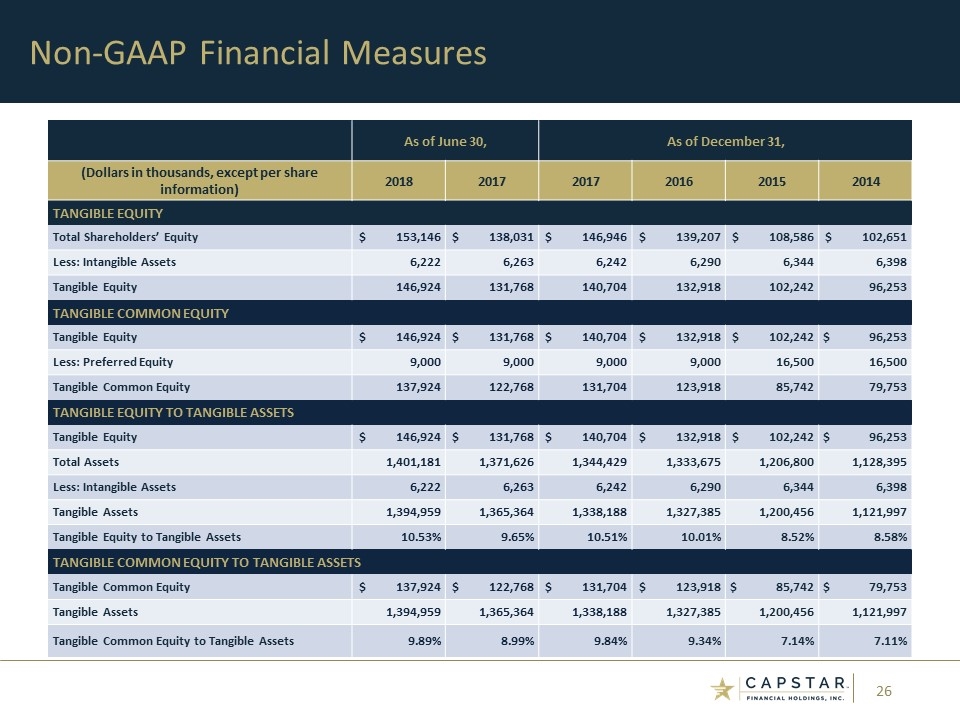

As of June 30, As of December 31, (Dollars in thousands, except per share information) 2018 2017 2017 2016 2015 2014 TANGIBLE EQUITY Total Shareholders’ Equity $ 153,146 $ 138,031 $ 146,946 $ 139,207 $ 108,586 $ 102,651 Less: Intangible Assets 6,222 6,263 6,242 6,290 6,344 6,398 Tangible Equity 146,924 131,768 140,704 132,918 102,242 96,253 TANGIBLE COMMON EQUITY Tangible Equity $ 146,924 $ 131,768 $ 140,704 $ 132,918 $ 102,242 $ 96,253 Less: Preferred Equity 9,000 9,000 9,000 9,000 16,500 16,500 Tangible Common Equity 137,924 122,768 131,704 123,918 85,742 79,753 TANGIBLE EQUITY TO TANGIBLE ASSETS Tangible Equity $ 146,924 $ 131,768 $ 140,704 $ 132,918 $ 102,242 $ 96,253 Total Assets 1,401,181 1,371,626 1,344,429 1,333,675 1,206,800 1,128,395 Less: Intangible Assets 6,222 6,263 6,242 6,290 6,344 6,398 Tangible Assets 1,394,959 1,365,364 1,338,188 1,327,385 1,200,456 1,121,997 Tangible Equity to Tangible Assets 10.53% 9.65% 10.51% 10.01% 8.52% 8.58% TANGIBLE COMMON EQUITY TO TANGIBLE ASSETS Tangible Common Equity $ 137,924 $ 122,768 $ 131,704 $ 123,918 $ 85,742 $ 79,753 Tangible Assets 1,394,959 1,365,364 1,338,188 1,327,385 1,200,456 1,121,997 Tangible Common Equity to Tangible Assets 9.89% 8.99% 9.84% 9.34% 7.14% 7.11% Non-GAAP Financial Measures

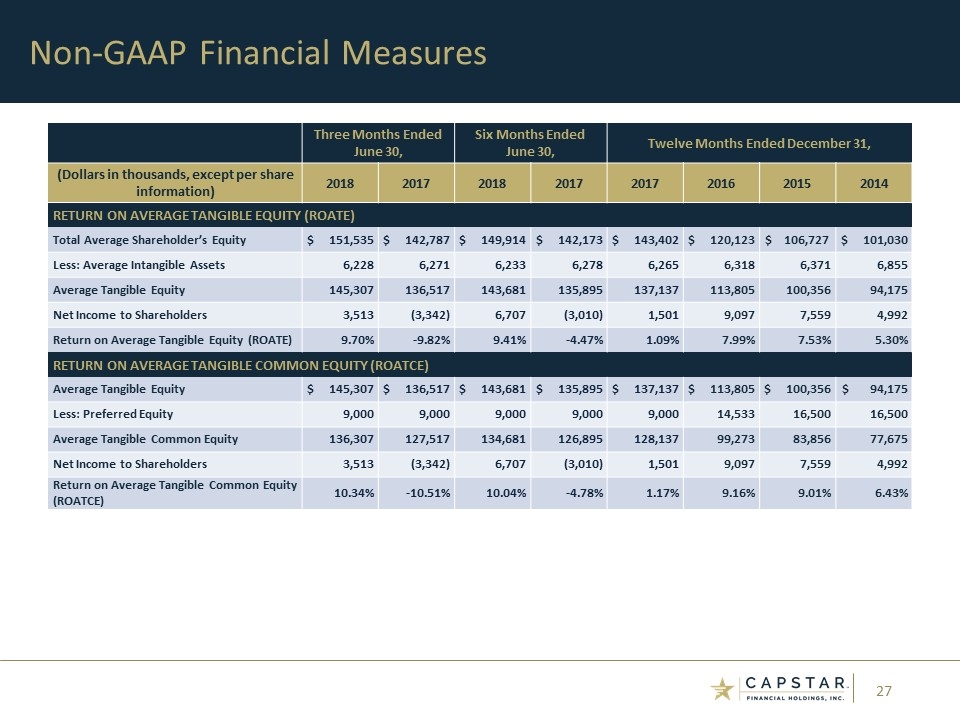

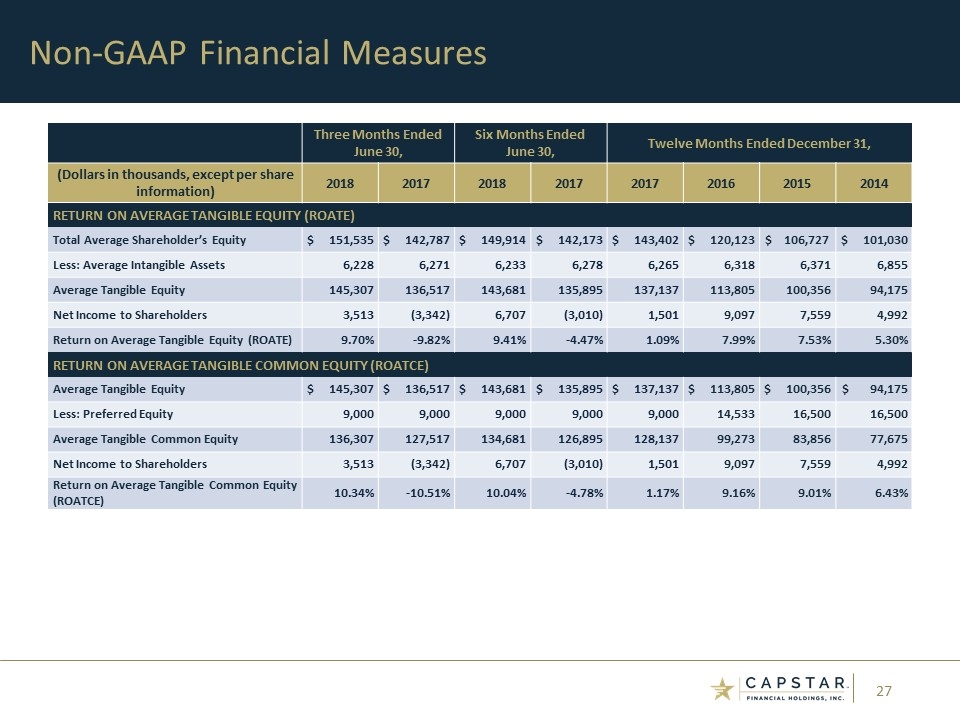

Three Months Ended June 30, Six Months Ended June 30, Twelve Months Ended December 31, (Dollars in thousands, except per share information) 2018 2017 2018 2017 2017 2016 2015 2014 RETURN ON AVERAGE TANGIBLE EQUITY (ROATE) Total Average Shareholder’s Equity $ 151,535 $ 142,787 $ 149,914 $ 142,173 $ 143,402 $ 120,123 $ 106,727 $ 101,030 Less: Average Intangible Assets 6,228 6,271 6,233 6,278 6,265 6,318 6,371 6,855 Average Tangible Equity 145,307 136,517 143,681 135,895 137,137 113,805 100,356 94,175 Net Income to Shareholders 3,513 (3,342) 6,707 (3,010) 1,501 9,097 7,559 4,992 Return on Average Tangible Equity (ROATE) 9.70% -9.82% 9.41% -4.47% 1.09% 7.99% 7.53% 5.30% RETURN ON AVERAGE TANGIBLE COMMON EQUITY (ROATCE) Average Tangible Equity $ 145,307 $ 136,517 $ 143,681 $ 135,895 $ 137,137 $ 113,805 $ 100,356 $ 94,175 Less: Preferred Equity 9,000 9,000 9,000 9,000 9,000 14,533 16,500 16,500 Average Tangible Common Equity 136,307 127,517 134,681 126,895 128,137 99,273 83,856 77,675 Net Income to Shareholders 3,513 (3,342) 6,707 (3,010) 1,501 9,097 7,559 4,992 Return on Average Tangible Common Equity (ROATCE) 10.34% -10.51% 10.04% -4.78% 1.17% 9.16% 9.01% 6.43% Non-GAAP Financial Measures

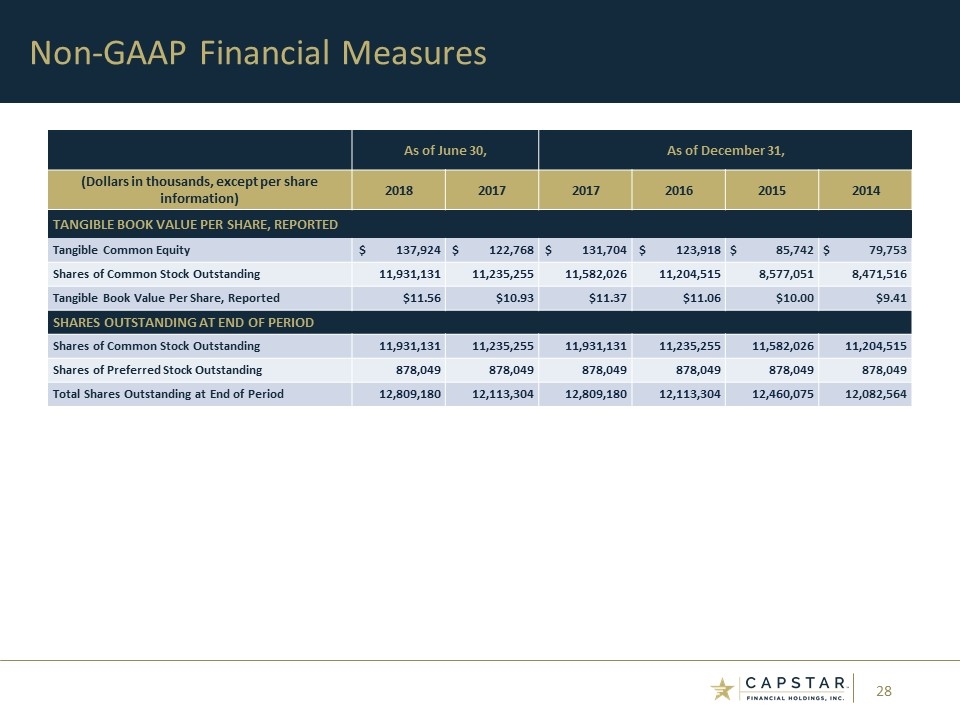

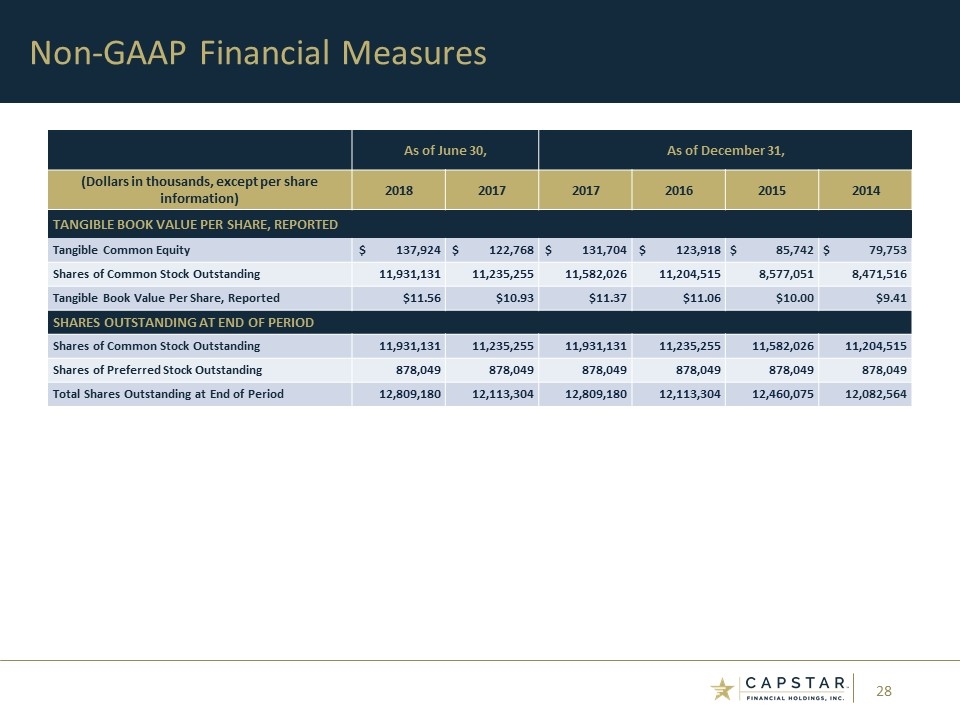

As of June 30, As of December 31, (Dollars in thousands, except per share information) 2018 2017 2017 2016 2015 2014 TANGIBLE BOOK VALUE PER SHARE, REPORTED Tangible Common Equity $ 137,924 $ 122,768 $ 131,704 $ 123,918 $ 85,742 $ 79,753 Shares of Common Stock Outstanding 11,931,131 11,235,255 11,582,026 11,204,515 8,577,051 8,471,516 Tangible Book Value Per Share, Reported $11.56 $10.93 $11.37 $11.06 $10.00 $9.41 SHARES OUTSTANDING AT END OF PERIOD Shares of Common Stock Outstanding 11,931,131 11,235,255 11,931,131 11,235,255 11,582,026 11,204,515 Shares of Preferred Stock Outstanding 878,049 878,049 878,049 878,049 878,049 878,049 Total Shares Outstanding at End of Period 12,809,180 12,113,304 12,809,180 12,113,304 12,460,075 12,082,564 Non-GAAP Financial Measures

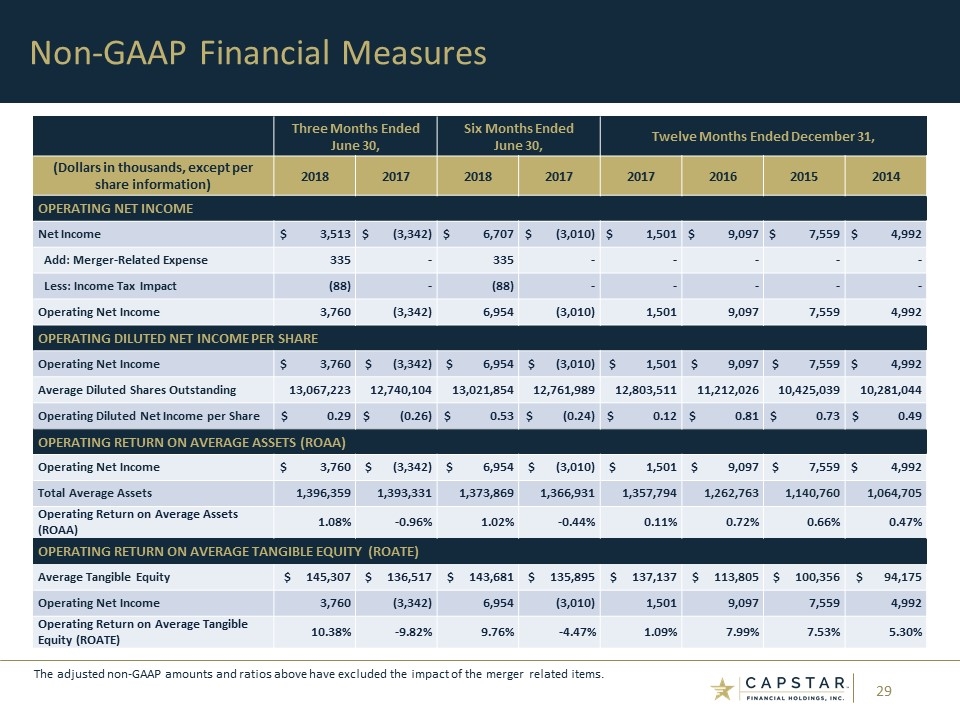

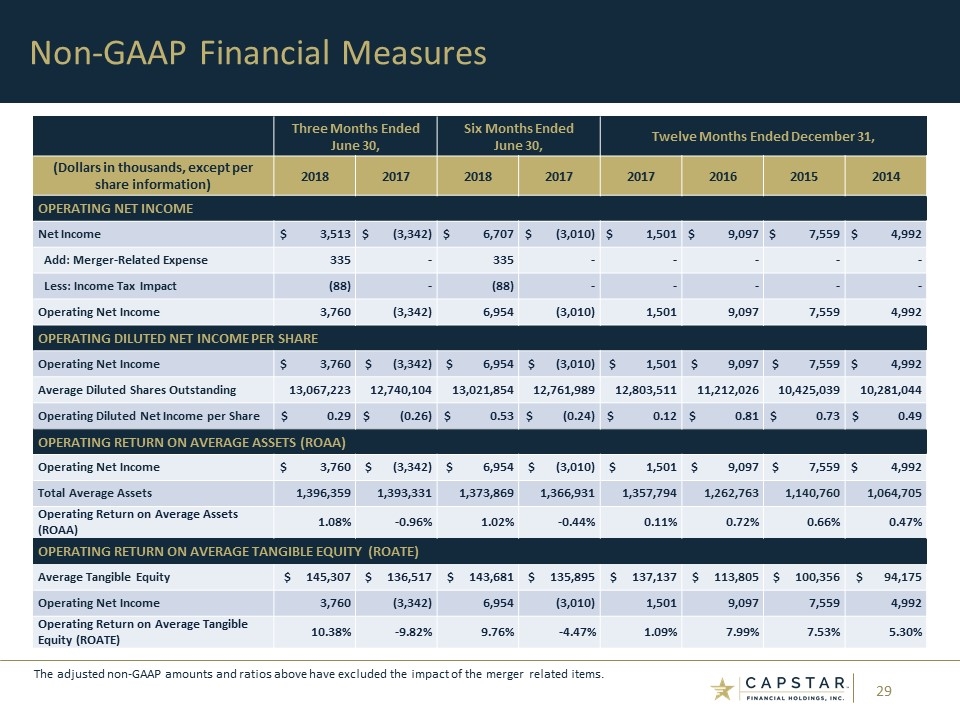

Three Months Ended June 30, Six Months Ended June 30, Twelve Months Ended December 31, (Dollars in thousands, except per share information) 2018 2017 2018 2017 2017 2016 2015 2014 OPERATING NET INCOME Net Income $ 3,513 $ (3,342) $ 6,707 $ (3,010) $ 1,501 $ 9,097 $ 7,559 $ 4,992 Add: Merger-Related Expense 335 - 335 - - - - - Less: Income Tax Impact (88) - (88) - - - - - Operating Net Income 3,760 (3,342) 6,954 (3,010) 1,501 9,097 7,559 4,992 OPERATING DILUTED NET INCOME PER SHARE Operating Net Income $ 3,760 $ (3,342) $ 6,954 $ (3,010) $ 1,501 $ 9,097 $ 7,559 $ 4,992 Average Diluted Shares Outstanding 13,067,223 12,740,104 13,021,854 12,761,989 12,803,511 11,212,026 10,425,039 10,281,044 Operating Diluted Net Income per Share $ 0.29 $ (0.26) $ 0.53 $ (0.24) $ 0.12 $ 0.81 $ 0.73 $ 0.49 OPERATING RETURN ON AVERAGE ASSETS (ROAA) Operating Net Income $ 3,760 $ (3,342) $ 6,954 $ (3,010) $ 1,501 $ 9,097 $ 7,559 $ 4,992 Total Average Assets 1,396,359 1,393,331 1,373,869 1,366,931 1,357,794 1,262,763 1,140,760 1,064,705 Operating Return on Average Assets (ROAA) 1.08% -0.96% 1.02% -0.44% 0.11% 0.72% 0.66% 0.47% OPERATING RETURN ON AVERAGE TANGIBLE EQUITY (ROATE) Average Tangible Equity $ 145,307 $ 136,517 $ 143,681 $ 135,895 $ 137,137 $ 113,805 $ 100,356 $ 94,175 Operating Net Income 3,760 (3,342) 6,954 (3,010) 1,501 9,097 7,559 4,992 Operating Return on Average Tangible Equity (ROATE) 10.38% -9.82% 9.76% -4.47% 1.09% 7.99% 7.53% 5.30% Non-GAAP Financial Measures The adjusted non-GAAP amounts and ratios above have excluded the impact of the merger related items.

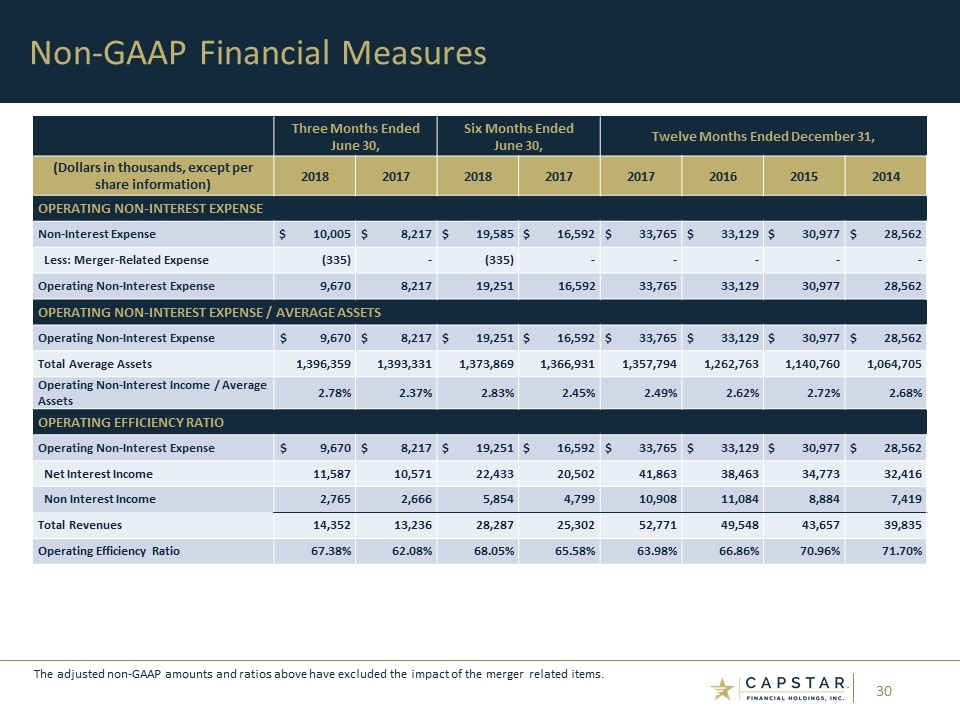

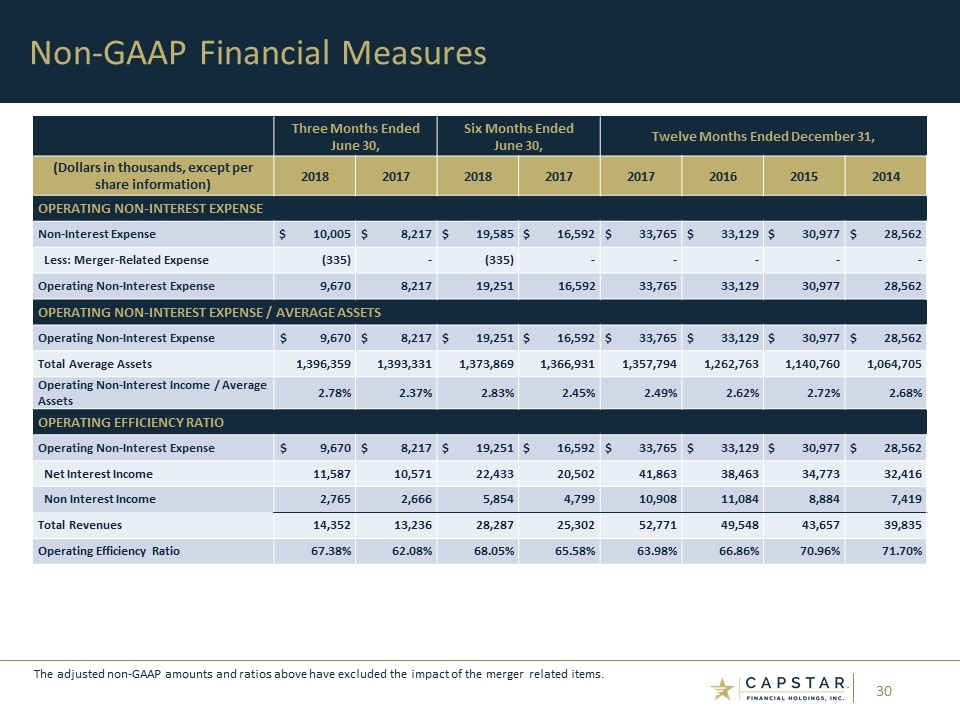

Three Months Ended June 30, Six Months Ended June 30, Twelve Months Ended December 31, (Dollars in thousands, except per share information) 2018 2017 2018 2017 2017 2016 2015 2014 OPERATING NON-INTEREST EXPENSE Non-Interest Expense $ 10,005 $ 8,217 $ 19,585 $ 16,592 $ 33,765 $ 33,129 $ 30,977 $ 28,562 Less: Merger-Related Expense (335) - (335) - - - - - Operating Non-Interest Expense 9,670 8,217 19,251 16,592 33,765 33,129 30,977 28,562 OPERATING NON-INTEREST EXPENSE / AVERAGE ASSETS Operating Non-Interest Expense $ 9,670 $ 8,217 $ 19,251 $ 16,592 $ 33,765 $ 33,129 $ 30,977 $ 28,562 Total Average Assets 1,396,359 1,393,331 1,373,869 1,366,931 1,357,794 1,262,763 1,140,760 1,064,705 Operating Non-Interest Income / Average Assets 2.78% 2.37% 2.83% 2.45% 2.49% 2.62% 2.72% 2.68% OPERATING EFFICIENCY RATIO Operating Non-Interest Expense $ 9,670 $ 8,217 $ 19,251 $ 16,592 $ 33,765 $ 33,129 $ 30,977 $ 28,562 Net Interest Income 11,587 10,571 22,433 20,502 41,863 38,463 34,773 32,416 Non Interest Income 2,765 2,666 5,854 4,799 10,908 11,084 8,884 7,419 Total Revenues 14,352 13,236 28,287 25,302 52,771 49,548 43,657 39,835 Operating Efficiency Ratio 67.38% 62.08% 68.05% 65.58% 63.98% 66.86% 70.96% 71.70% Non-GAAP Financial Measures The adjusted non-GAAP amounts and ratios above have excluded the impact of the merger related items.

CapStar Financial Holdings, Inc. 1201 Demonbreun Street, Suite 700 Nashville, TN 37203 Mail: P.O. Box 305065 Nashville, TN 37230-5065 (615) 732-6400 Telephone www.capstarbank.com (615) 732-6455 Email: ir@capstarbank.com Contact Information Investor Relations Executive Leadership Claire W. Tucker President and Chief Executive Officer CapStar Financial Holdings, Inc. (615) 732-6402 Email: ctucker@capstarbank.com Rob Anderson Chief Financial and Administrative Officer CapStar Financial Holdings, Inc. (615) 732-6470 Email: randerson@capstarbank.com Corporate Headquarters