First Quarter 2020 Earnings Call April 28, 2020 Exhibit 99.1

Disclosures FORWARD-LOOKING STATEMENTS This investor presentation contains forward-looking statements, as defined by federal securities laws, including statements about CapStar Financial Holdings, Inc. (“CapStar”) and its financial outlook and business environment. These statements are based on current expectations and are provided to assist in the understanding of our operations and future financial performance. Our operations and such performance involves risks and uncertainties, including but in no way limited to the effect of the COVID-19 pandemic, that may cause actual results to differ materially from those expressed or implied in any such statements. For a discussion of some of the risks and other factors that may cause such forward-looking statements to differ materially from actual results, please refer to CapStar’s filings with the Securities and Exchange Commission, including its 2019 Annual Report on Form 10-K under the sections entitled “Forward-Looking Statements” and “Item 1A. Risk Factors”. Forward-looking statements speak only as of the date they are made, and we undertake no obligation to update or revise forward-looking statements. NON-GAAP MEASURES This investor presentation includes financial information determined by methods other than in accordance with generally accepted accounting principles (“GAAP”). This financial information includes certain operating performance measures, which exclude merger-related and other charges that are not considered part of recurring operations. Such measures include: “Efficiency ratio – operating,” “Expenses – operating,” “Earnings per share – operating,” “Diluted earnings per share – operating,” “Tangible book value per share,” “Return on common equity – operating,” “Return on tangible common equity – operating,” “Return on assets – operating,” and “Tangible common equity to tangible assets.” Management has included these non-GAAP measures because it believes these measures may provide useful supplemental information for evaluating CapStar’s underlying performance trends. Further, management uses these measures in managing and evaluating CapStar’s business and intends to refer to them in discussions about our operations and performance. Operating performance measures should be viewed in addition to, and not as an alternative to or substitute for, measures determined in accordance with GAAP, and are not necessarily comparable to non-GAAP measures that may be presented by other companies. To the extent applicable, reconciliations of these non-GAAP measures to the most directly comparable GAAP measures can be found in the ‘Non-GAAP Reconciliation Tables’ included in the exhibits to this presentation.

1Q20 Earnings Call Agenda Agenda Financial Highlights and Results COVID-19 Response Risk Management FCB Update Looking Forward

Financial Highlights and Results

Financial Highlights Financial Highlights and Results Solid and improving PTPP and PTPP/A Positive operating leverage year over year and linked quarter Record noninterest and total deposit balances 1Q records: 3/9 total $1.8B, 3/31 DDA $443.0MM Records extended 4/24: total $2.0B, DDA $489.2MM 7.6% annualized EOP loan growth Knoxville $91MM pipeline; closed $3.3MM Stable Net Interest Margin Lowered deposit rates on over $400MM Emphasizing in-market, traditional fixed rate loans Increased credit spreads to 250 to 400 bps over FHLB (vs. previous 200 to 300 bps) Implemented floors on all variable rate loans and Tri-Net fixed rate loans Continued momentum of mortgage and Tri-Net businesses Sales and pipelines remain in line with 2019 Strong expense management Creating a culture of accountability – revenue and support productivity per person Implementing expense disciplines – owner-operator mindset Reviewing incentive plans for alignment with shareholder value creation

Financial Highlights Financial Highlights and Results Outstanding credit metrics Continued low net charge-offs of $43M for the quarter Low and stable criticized and classified asset levels Provided meaningful allowance for the wide range of potential outcomes of the COVID-19 pandemic $7.5MM increase in Allowance for Loan Loss Operating net income was $1.6MM or $0.08 per share Dividend of $0.05 per share Entering crisis from a position of strength Significant on and off balance sheet liquidity Solid and improving pre-tax pre-provision Income Strengthened ALLL for range of potential losses due to current uncertainty Strong and growing capital ratios Partnering with two of Tennessee’s highest performing banks

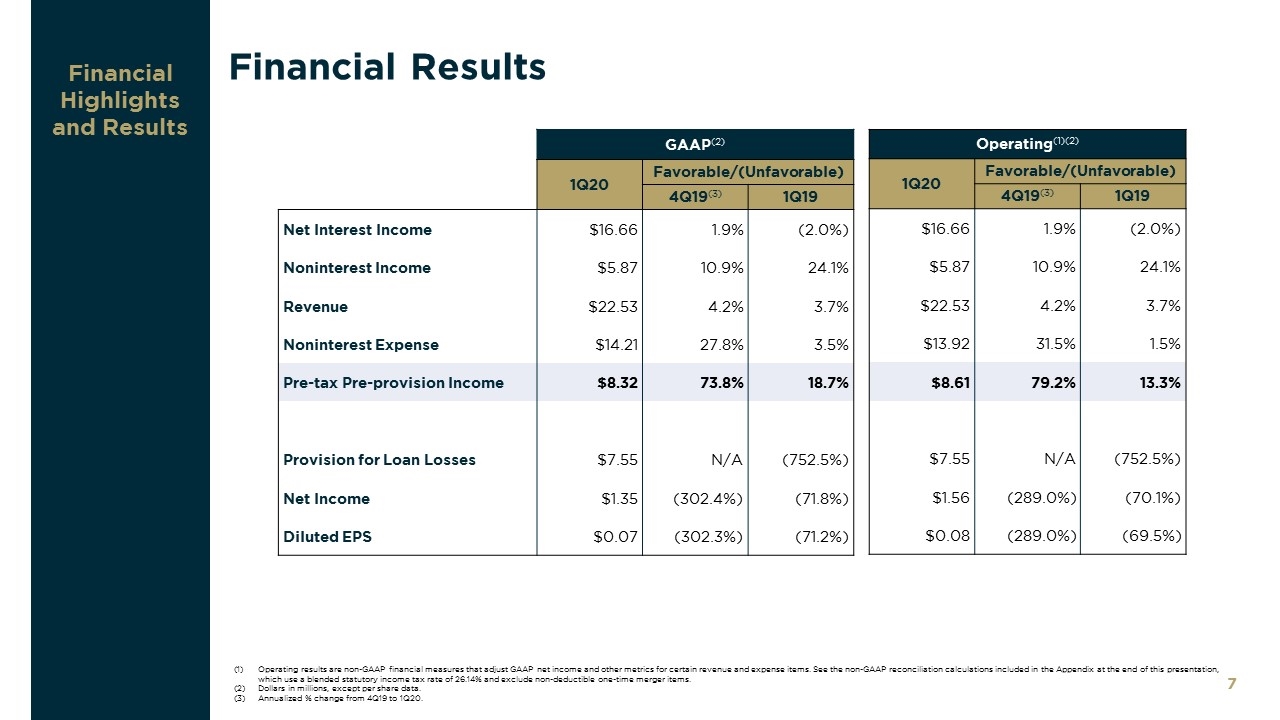

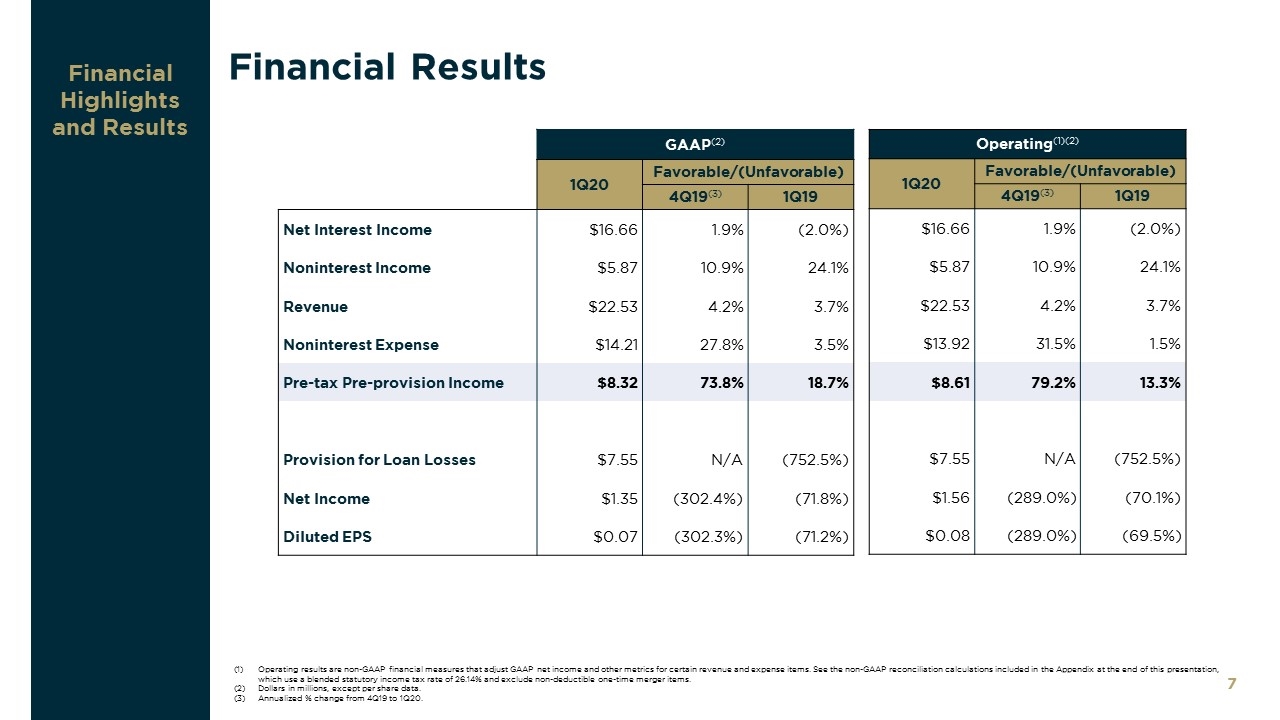

Financial Results Financial Highlights and Results GAAP(2) 1Q20 Favorable/(Unfavorable) 4Q19(3) 1Q19 Net Interest Income $16.66 1.9% (2.0%) Noninterest Income $5.87 10.9% 24.1% Revenue $22.53 4.2% 3.7% Noninterest Expense $14.21 27.8% 3.5% Pre-tax Pre-provision Income $8.32 73.8% 18.7% Provision for Loan Losses $7.55 N/A (752.5%) Net Income $1.35 (302.4%) (71.8%) Diluted EPS $0.07 (302.3%) (71.2%) Operating(1)(2) 1Q20 Favorable/(Unfavorable) 4Q19(3) 1Q19 $16.66 1.9% (2.0%) $5.87 10.9% 24.1% $22.53 4.2% 3.7% $13.92 31.5% 1.5% $8.61 79.2% 13.3% $7.55 N/A (752.5%) $1.56 (289.0%) (70.1%) $0.08 (289.0%) (69.5%) Operating results are non-GAAP financial measures that adjust GAAP net income and other metrics for certain revenue and expense items. See the non-GAAP reconciliation calculations included in the Appendix at the end of this presentation, which use a blended statutory income tax rate of 26.14% and exclude non-deductible one-time merger items. Dollars in millions, except per share data. Annualized % change from 4Q19 to 1Q20.

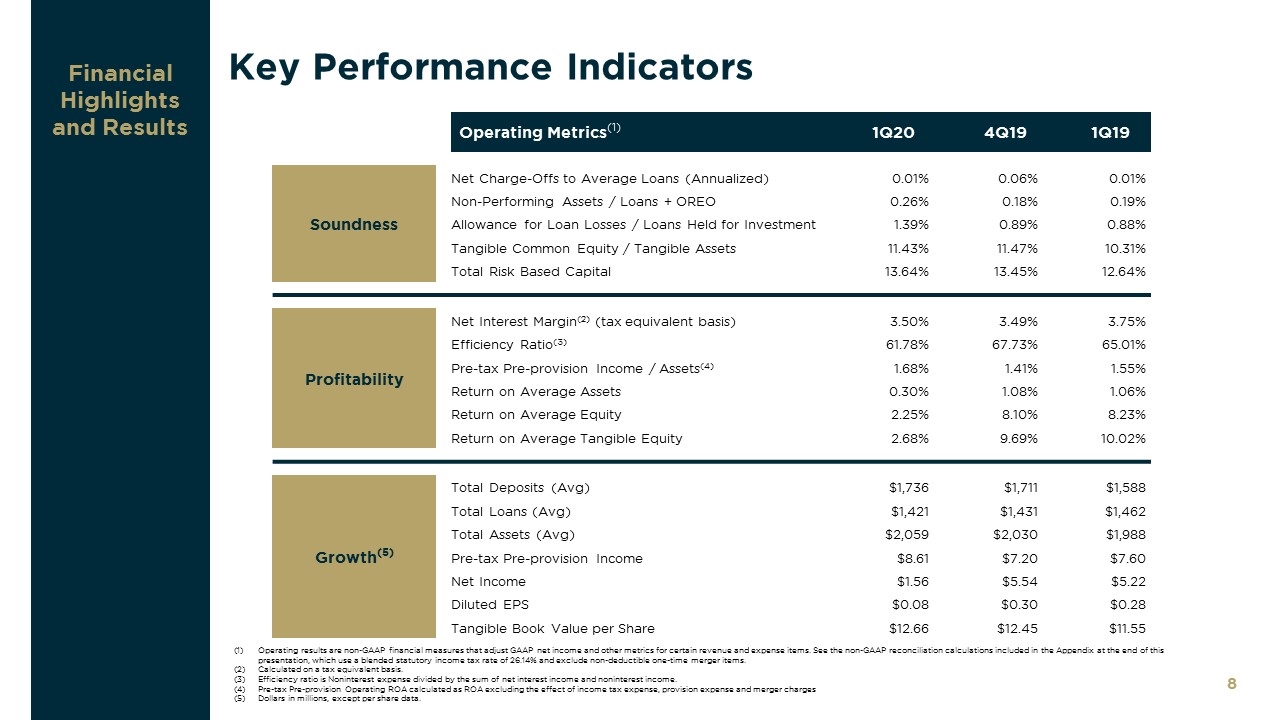

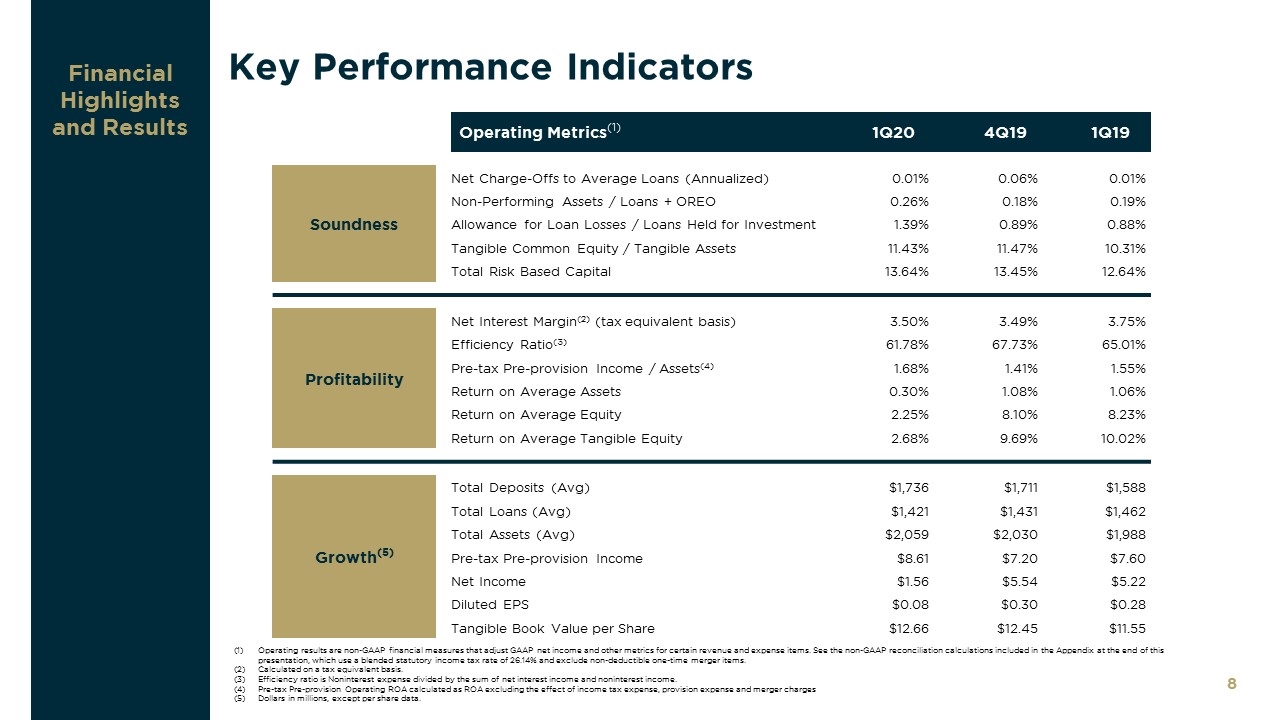

Key Performance Indicators Financial Highlights and Results Operating Metrics(1) 1Q20 4Q19 1Q19 Soundness Net Charge-Offs to Average Loans (Annualized) 0.01% 0.06% 0.01% Non-Performing Assets / Loans + OREO 0.26% 0.18% 0.19% Allowance for Loan Losses / Loans Held for Investment 1.39% 0.89% 0.88% Tangible Common Equity / Tangible Assets 11.43% 11.47% 10.31% Total Risk Based Capital 13.64% 13.45% 12.64% Profitability Net Interest Margin(2) (tax equivalent basis) 3.50% 3.49% 3.75% Efficiency Ratio(3) 61.78% 67.73% 65.01% Pre-tax Pre-provision Income / Assets(4) 1.68% 1.41% 1.55% Return on Average Assets 0.30% 1.08% 1.06% Return on Average Equity 2.25% 8.10% 8.23% Return on Average Tangible Equity 2.68% 9.69% 10.02% Growth(5) Total Deposits (Avg) $1,736 $1,711 $1,588 Total Loans (Avg) $1,421 $1,431 $1,462 Total Assets (Avg) $2,059 $2,030 $1,988 Pre-tax Pre-provision Income $8.61 $7.20 $7.60 Net Income $1.56 $5.54 $5.22 Diluted EPS $0.08 $0.30 $0.28 Tangible Book Value per Share $12.66 $12.45 $11.55 Operating results are non-GAAP financial measures that adjust GAAP net income and other metrics for certain revenue and expense items. See the non-GAAP reconciliation calculations included in the Appendix at the end of this presentation, which use a blended statutory income tax rate of 26.14% and exclude non-deductible one-time merger items. Calculated on a tax equivalent basis. Efficiency ratio is Noninterest expense divided by the sum of net interest income and noninterest income. Pre-tax Pre-provision Operating ROA calculated as ROA excluding the effect of income tax expense, provision expense and merger charges Dollars in millions, except per share data.

COVID-19 Response

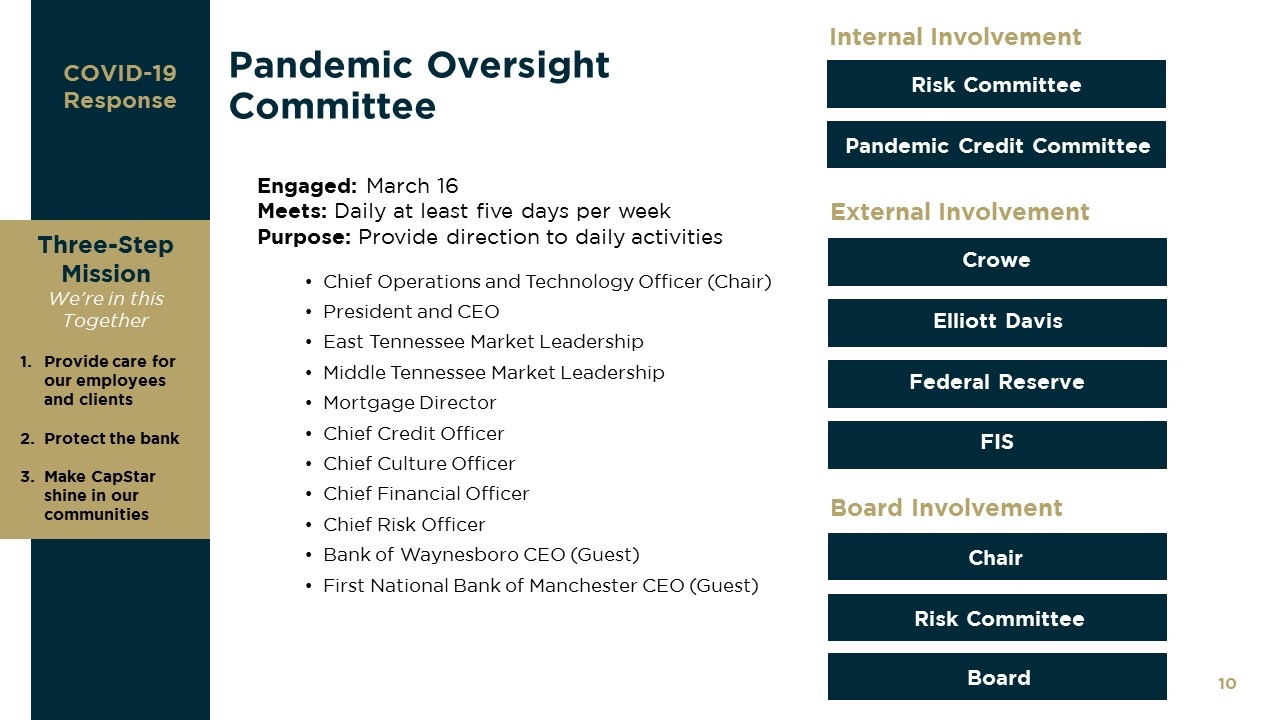

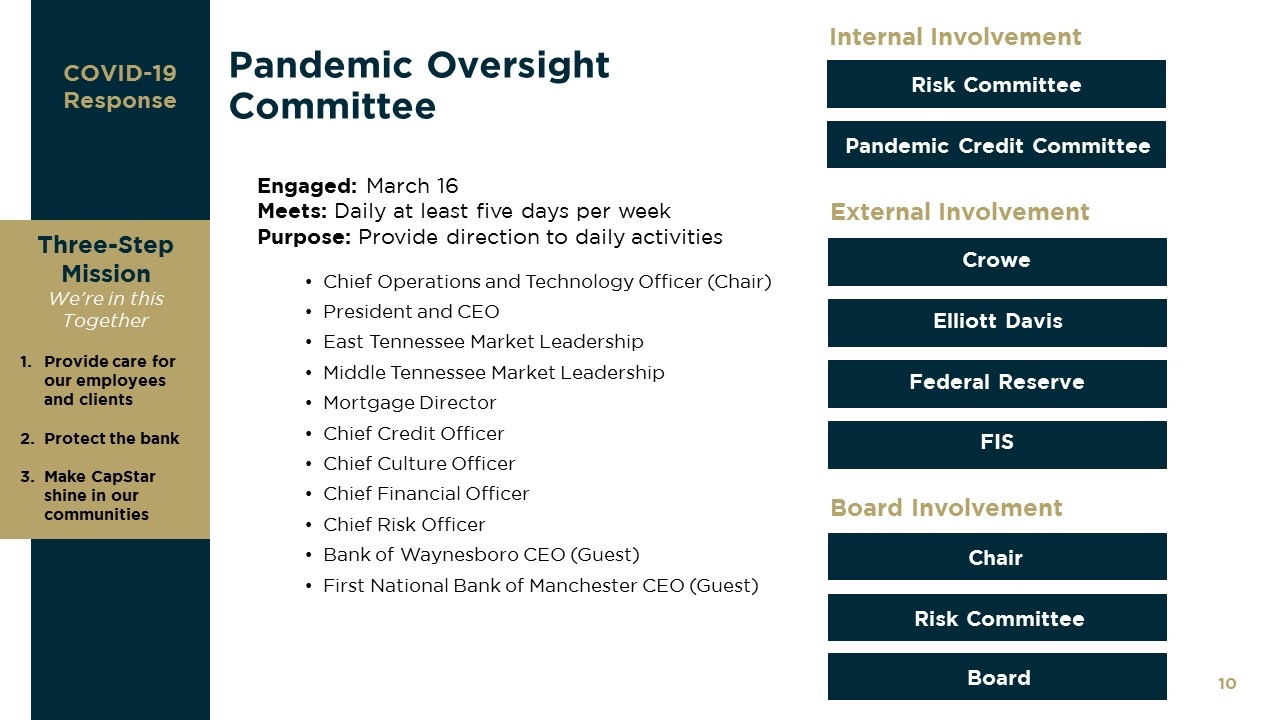

1Q20 Financial Results April 2020 Internal Involvement External Involvement Board Involvement Risk Committee Pandemic Credit Committee Crowe Elliott Davis Federal Reserve FIS Chair Risk Committee COVID-19 Response Three-Step Mission We’re in this Together Provide care for our employees and clients Protect the bank Make CapStar shine in our communities Engaged: March 16 Meets: Daily at least five days per week Purpose: Provide direction to daily activities Chief Operations and Technology Officer (Chair) President and CEO East Tennessee Market Leadership Middle Tennessee Market Leadership Mortgage Director Chief Credit Officer Chief Culture Officer Chief Financial Officer Chief Risk Officer Bank of Waynesboro CEO (Guest) First National Bank of Manchester CEO (Guest) Board Pandemic Oversight Committee

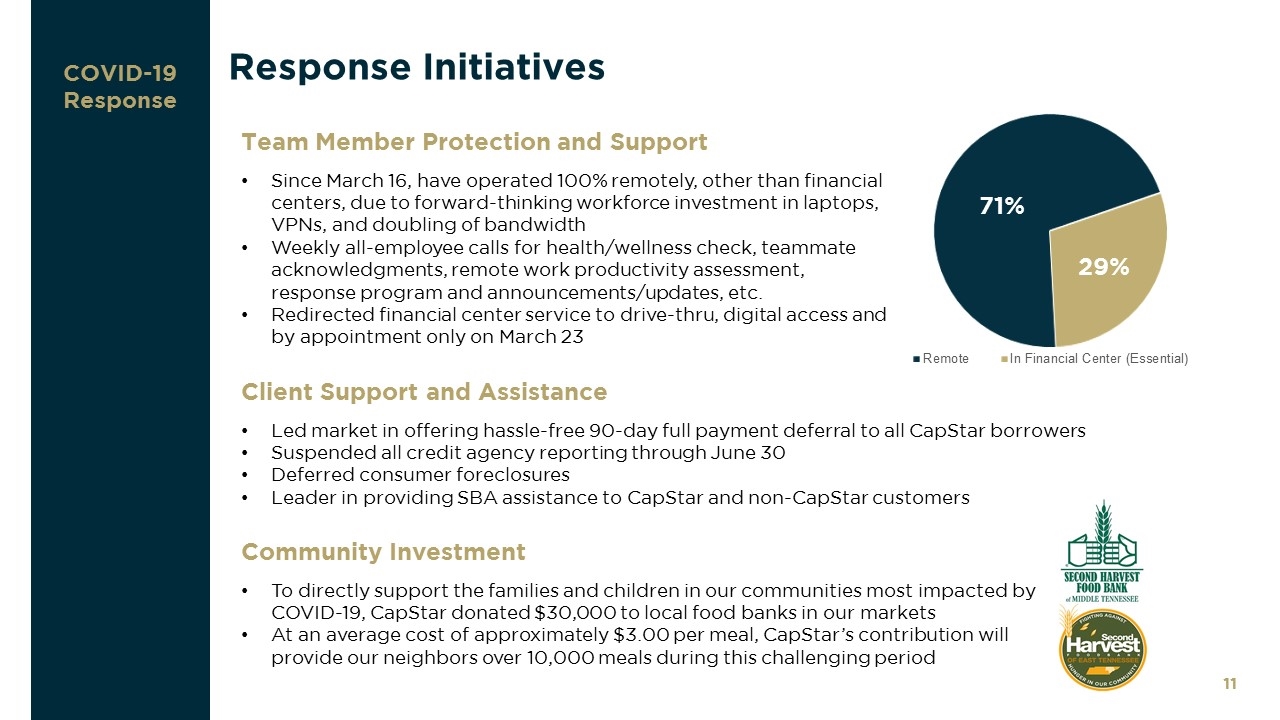

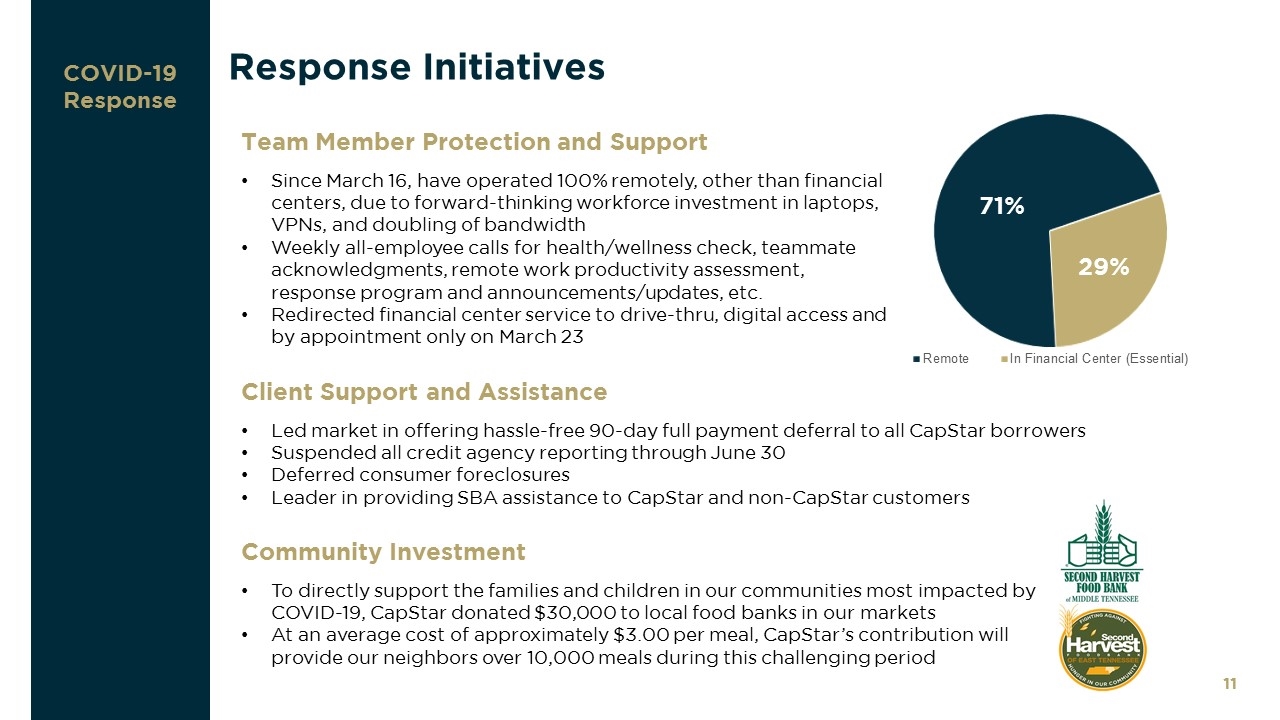

Response Initiatives COVID-19 Response Team Member Protection and Support Since March 16, have operated 100% remotely, other than financial centers, due to forward-thinking workforce investment in laptops, VPNs, and doubling of bandwidth Weekly all-employee calls for health/wellness check, teammate acknowledgments, remote work productivity assessment, response program and announcements/updates, etc. Redirected financial center service to drive-thru, digital access and by appointment only on March 23 71% 29% Client Support and Assistance Led market in offering hassle-free 90-day full payment deferral to all CapStar borrowers Suspended all credit agency reporting through June 30 Deferred consumer foreclosures Leader in providing SBA assistance to CapStar and non-CapStar customers Community Investment To directly support the families and children in our communities most impacted by COVID-19, CapStar donated $30,000 to local food banks in our markets At an average cost of approximately $3.00 per meal, CapStar’s contribution will provide our neighbors over 10,000 meals during this challenging period

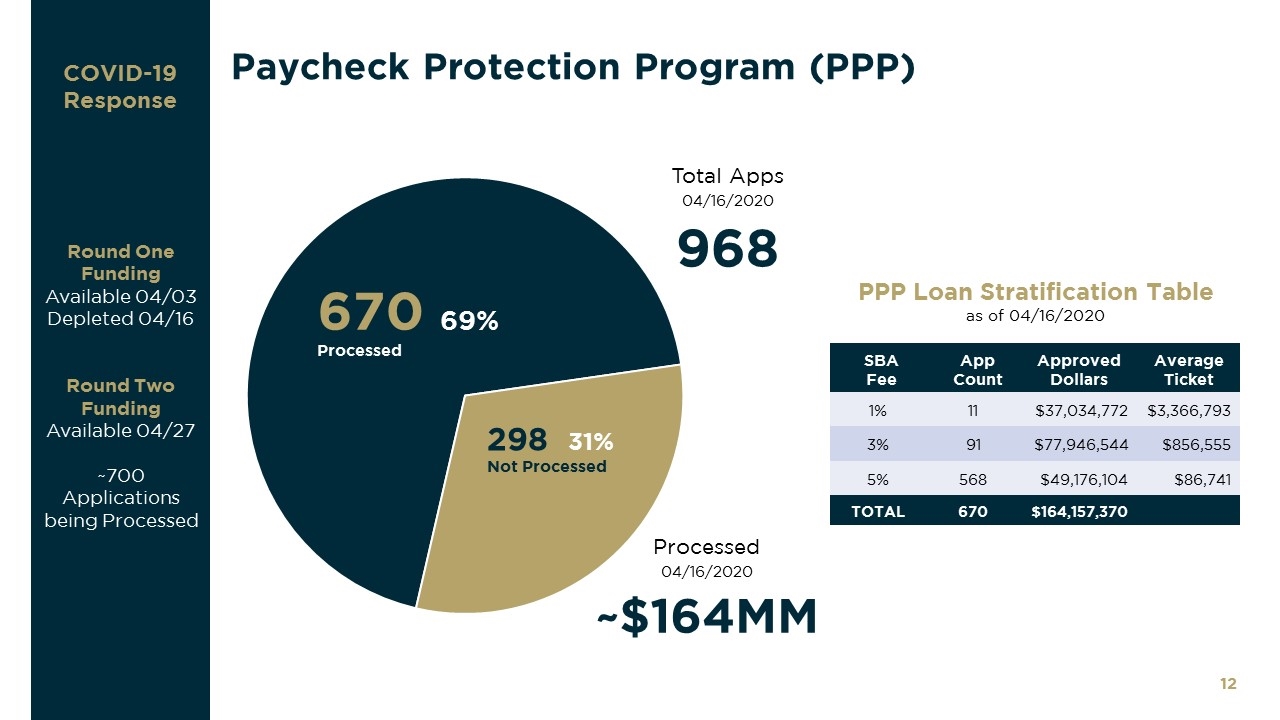

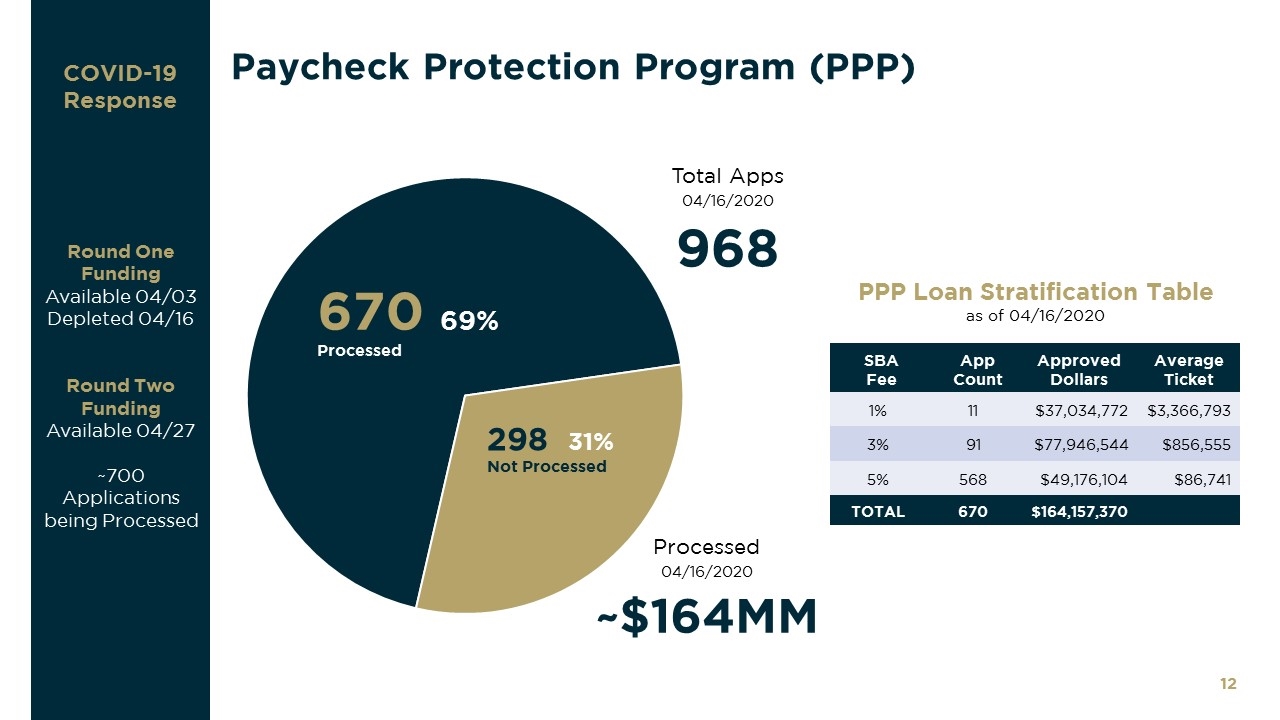

1Q20 Financial Results April 2020 670 69% Processed 298 31% Not Processed Total Apps 04/16/2020 968 Processed 04/16/2020 ~$164MM COVID-19 Response PPP Loan Stratification Table as of 04/16/2020 SBA Fee App Count Approved Dollars Average Ticket 1% 11 $37,034,772 $3,366,793 3% 91 $77,946,544 $856,555 5% 568 $49,176,104 $86,741 TOTAL 670 $164,157,370 Paycheck Protection Program (PPP) Round One Funding Available 04/03 Depleted 04/16 Round Two Funding Available 04/27 ~700 Applications being Processed

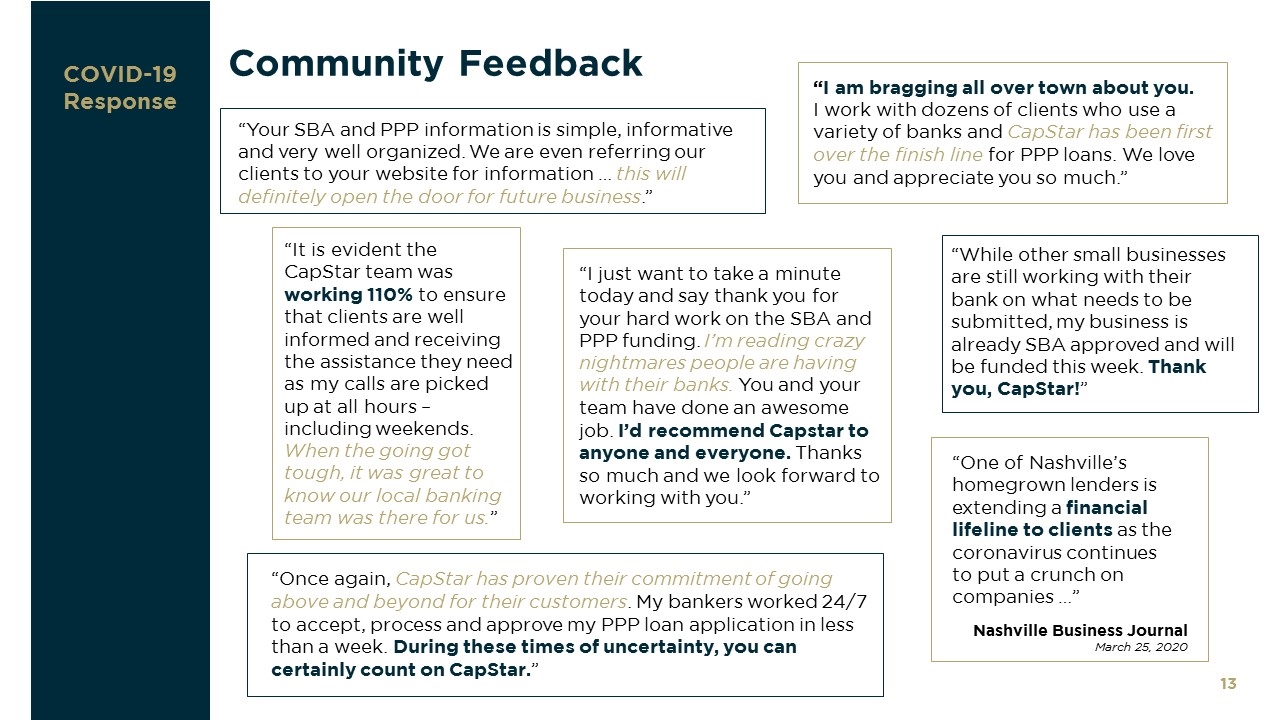

1Q20 Financial Results April 2020 COVID-19 Response “Your SBA and PPP information is simple, informative and very well organized. We are even referring our clients to your website for information … this will definitely open the door for future business.” Community Feedback “I am bragging all over town about you. I work with dozens of clients who use a variety of banks and CapStar has been first over the finish line for PPP loans. We love you and appreciate you so much.” “While other small businesses are still working with their bank on what needs to be submitted, my business is already SBA approved and will be funded this week. Thank you, CapStar!” “Once again, CapStar has proven their commitment of going above and beyond for their customers. My bankers worked 24/7 to accept, process and approve my PPP loan application in less than a week. During these times of uncertainty, you can certainly count on CapStar.” “It is evident the CapStar team was working 110% to ensure that clients are well informed and receiving the assistance they need as my calls are picked up at all hours – including weekends. When the going got tough, it was great to know our local banking team was there for us.” “One of Nashville’s homegrown lenders is extending a financial lifeline to clients as the coronavirus continues to put a crunch on companies …” Nashville Business Journal March 25, 2020 “I just want to take a minute today and say thank you for your hard work on the SBA and PPP funding. I’m reading crazy nightmares people are having with their banks. You and your team have done an awesome job. I’d recommend Capstar to anyone and everyone. Thanks so much and we look forward to working with you.”

Risk Management

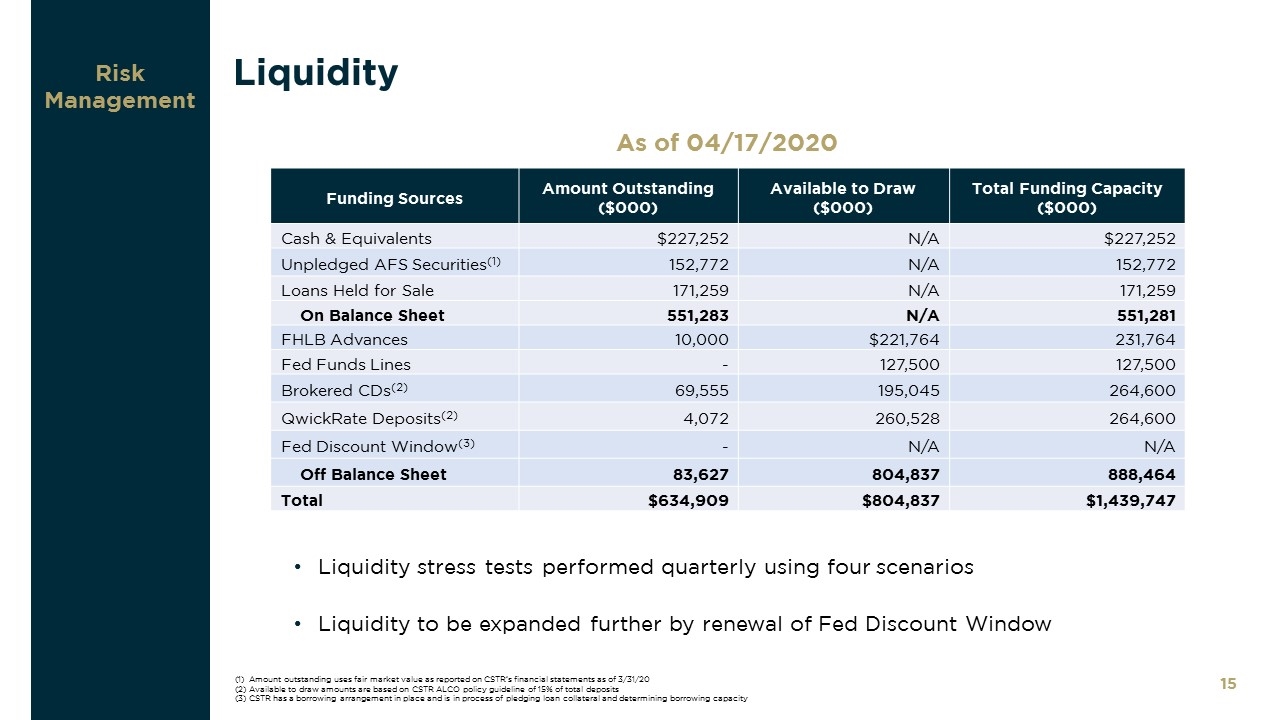

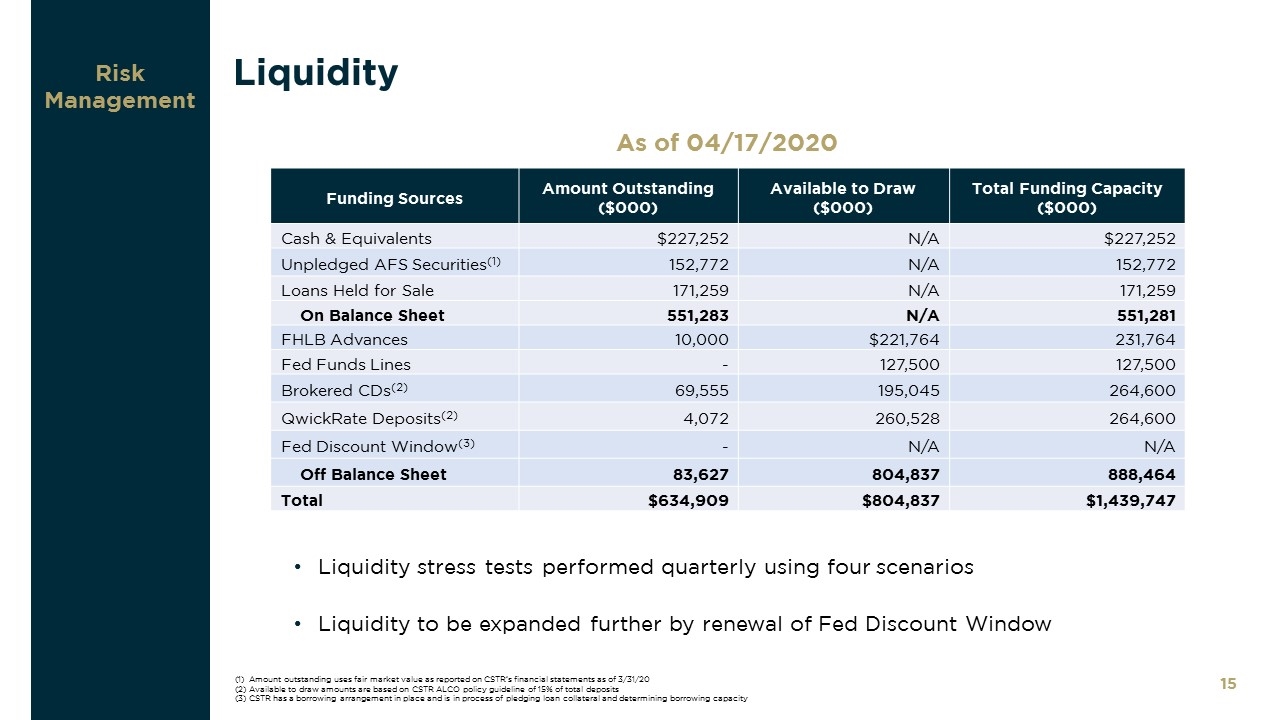

Risk Management Liquidity Funding Sources Amount Outstanding ($000) Available to Draw ($000) Total Funding Capacity ($000) Cash & Equivalents $227,252 N/A $227,252 Unpledged AFS Securities(1) 152,772 N/A 152,772 Loans Held for Sale 171,259 N/A 171,259 On Balance Sheet 551,283 N/A 551,281 FHLB Advances 10,000 $221,764 231,764 Fed Funds Lines - 127,500 127,500 Brokered CDs(2) 69,555 195,045 264,600 QwickRate Deposits(2) 4,072 260,528 264,600 Fed Discount Window(3) - N/A N/A Off Balance Sheet 83,627 804,837 888,464 Total $634,909 $804,837 $1,439,747 (1) Amount outstanding uses fair market value as reported on CSTR’s financial statements as of 3/31/20 (2) Available to draw amounts are based on CSTR ALCO policy guideline of 15% of total deposits (3) CSTR has a borrowing arrangement in place and is in process of pledging loan collateral and determining borrowing capacity Liquidity stress tests performed quarterly using four scenarios Liquidity to be expanded further by renewal of Fed Discount Window As of 04/17/2020

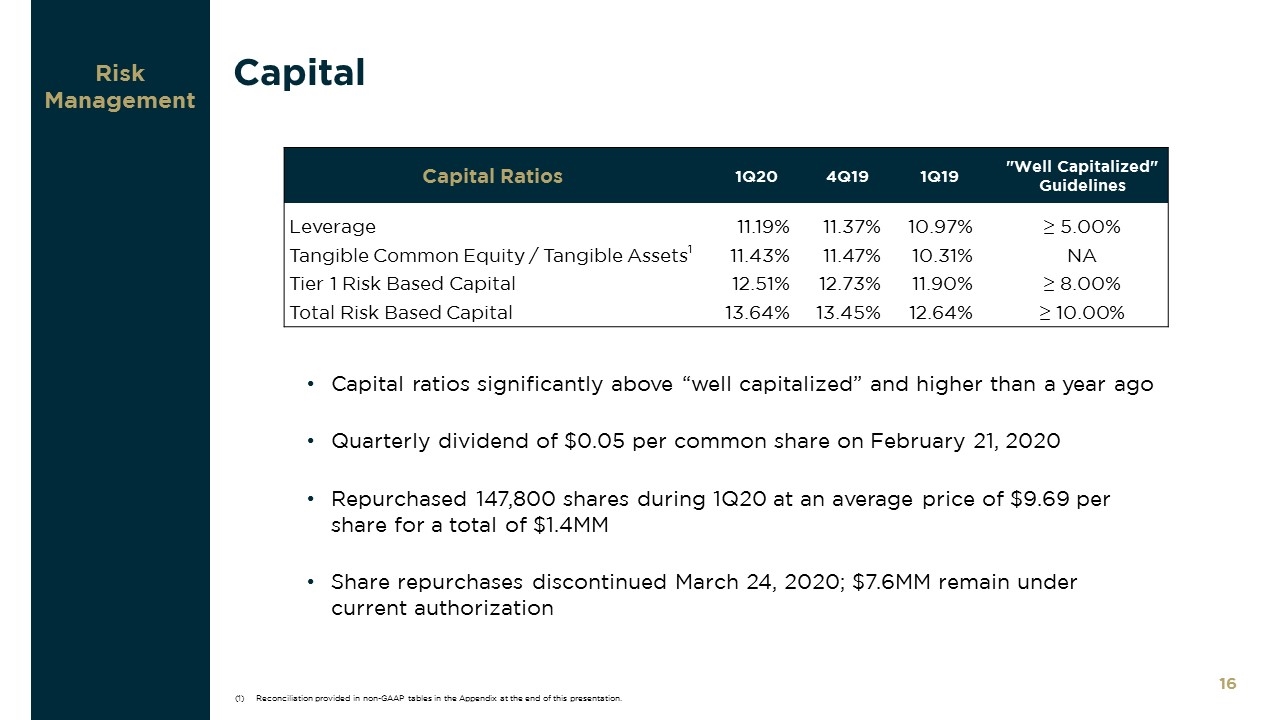

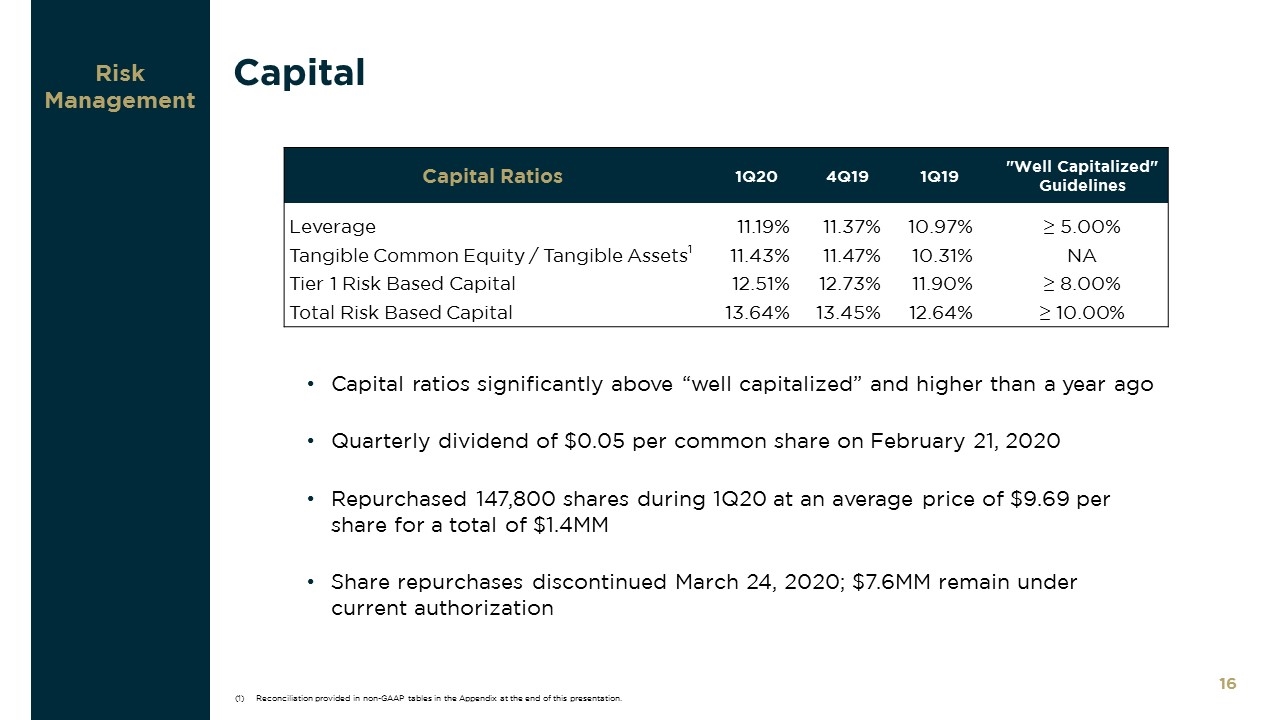

Capital ratios significantly above “well capitalized” and higher than a year ago Quarterly dividend of $0.05 per common share on February 21, 2020 Repurchased 147,800 shares during 1Q20 at an average price of $9.69 per share for a total of $1.4MM Share repurchases discontinued March 24, 2020; $7.6MM remain under current authorization Capital Ratios 1Q20 4Q19 1Q19 "Well Capitalized" Guidelines Leverage 11.19% 11.37% 10.97% ≥ 5.00% Tangible Common Equity / Tangible Assets1 11.43% 11.47% 10.31% NA Tier 1 Risk Based Capital 12.51% 12.73% 11.90% ≥ 8.00% Total Risk Based Capital 13.64% 13.45% 12.64% ≥ 10.00% (1) Reconciliation provided in non-GAAP tables in the Appendix at the end of this presentation. Risk Management Capital

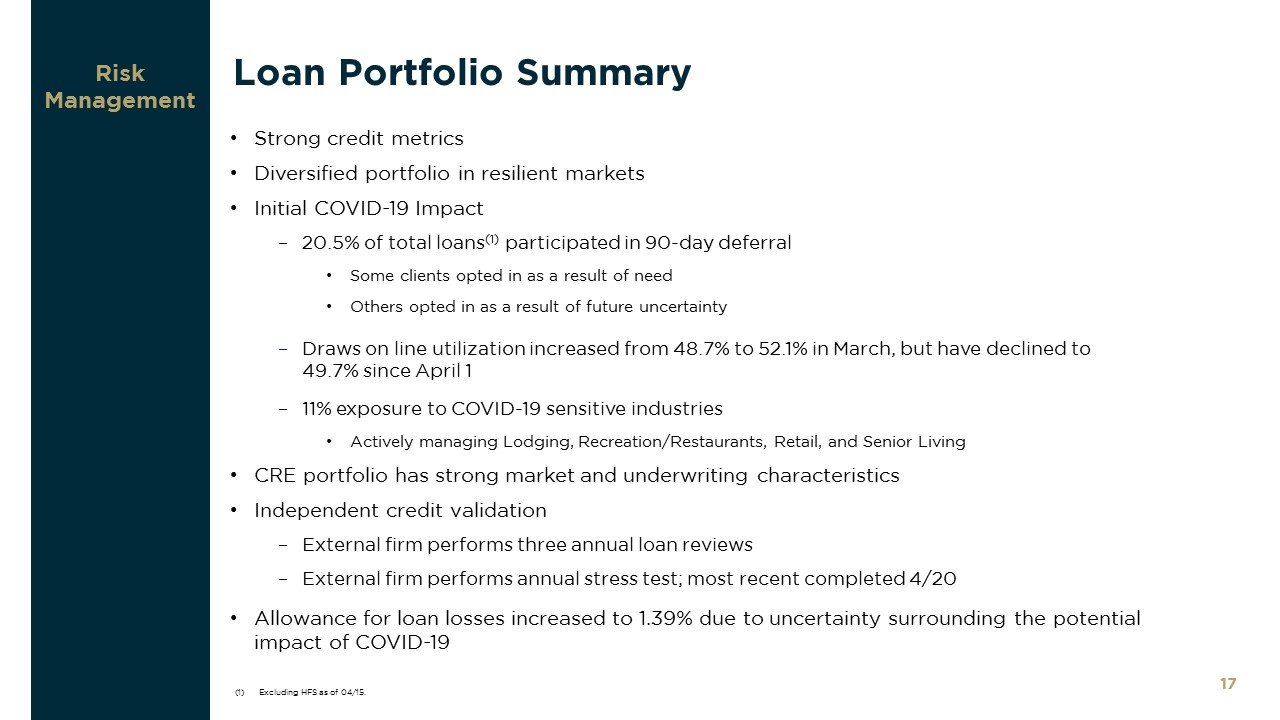

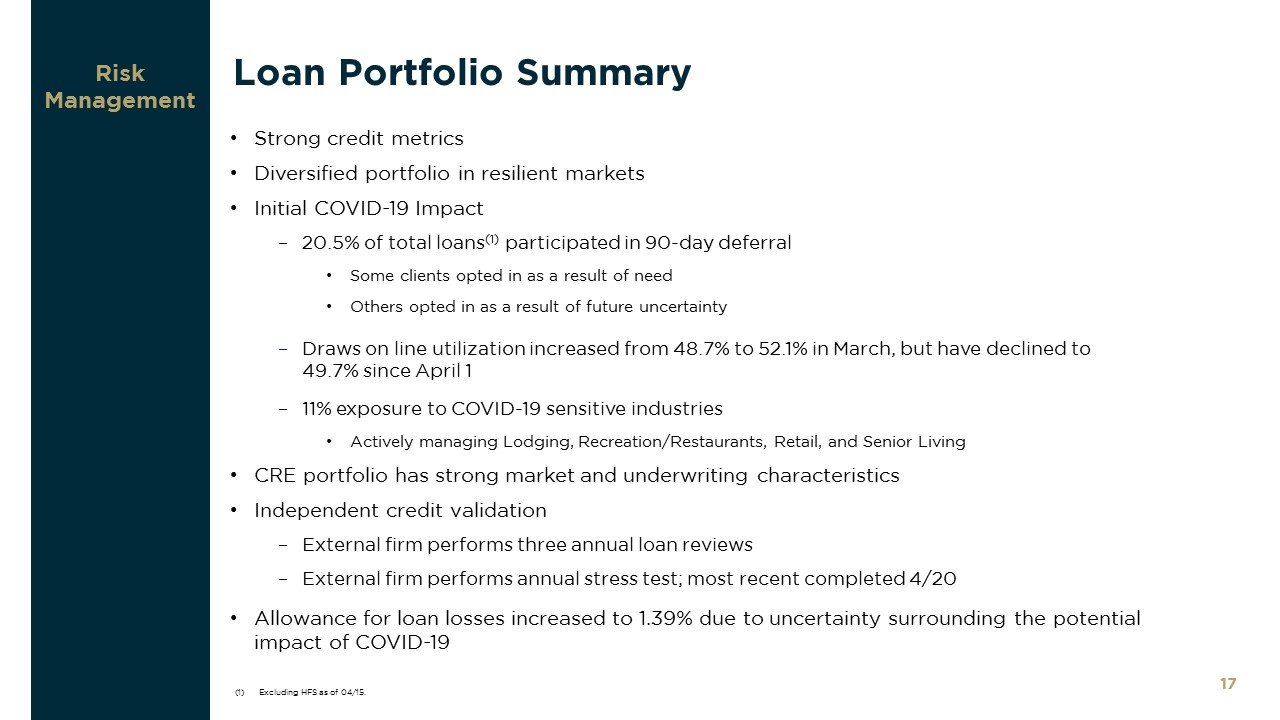

Risk Management Strong credit metrics Diversified portfolio in resilient markets Initial COVID-19 Impact 20.5% of total loans(1) participated in 90-day deferral Some clients opted in as a result of need Others opted in as a result of future uncertainty Draws on line utilization increased from 48.7% to 52.1% in March, but have declined to 49.7% since April 1 11% exposure to COVID-19 sensitive industries Actively managing Lodging, Recreation/Restaurants, Retail, and Senior Living CRE portfolio has strong market and underwriting characteristics Independent credit validation External firm performs three annual loan reviews External firm performs annual stress test; most recent completed 4/20 Allowance for loan losses increased to 1.39% due to uncertainty surrounding the potential impact of COVID-19 Loan Portfolio Summary Excluding HFS as of 04/15.

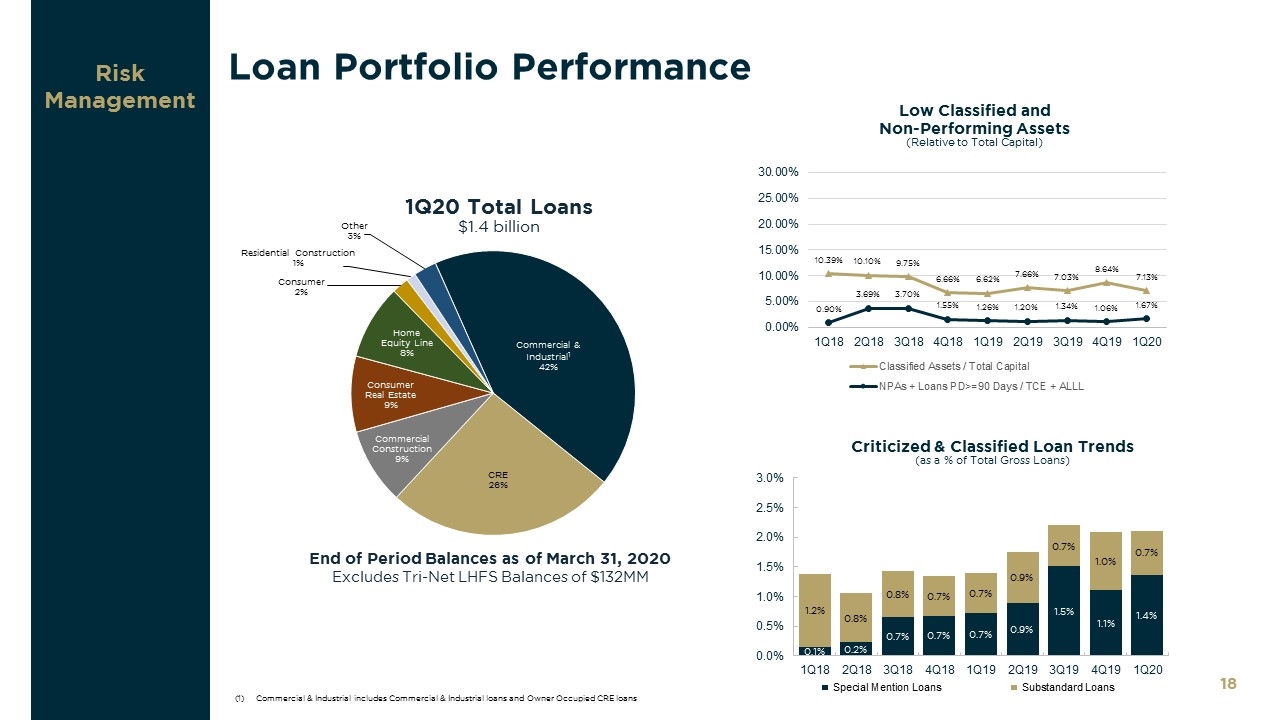

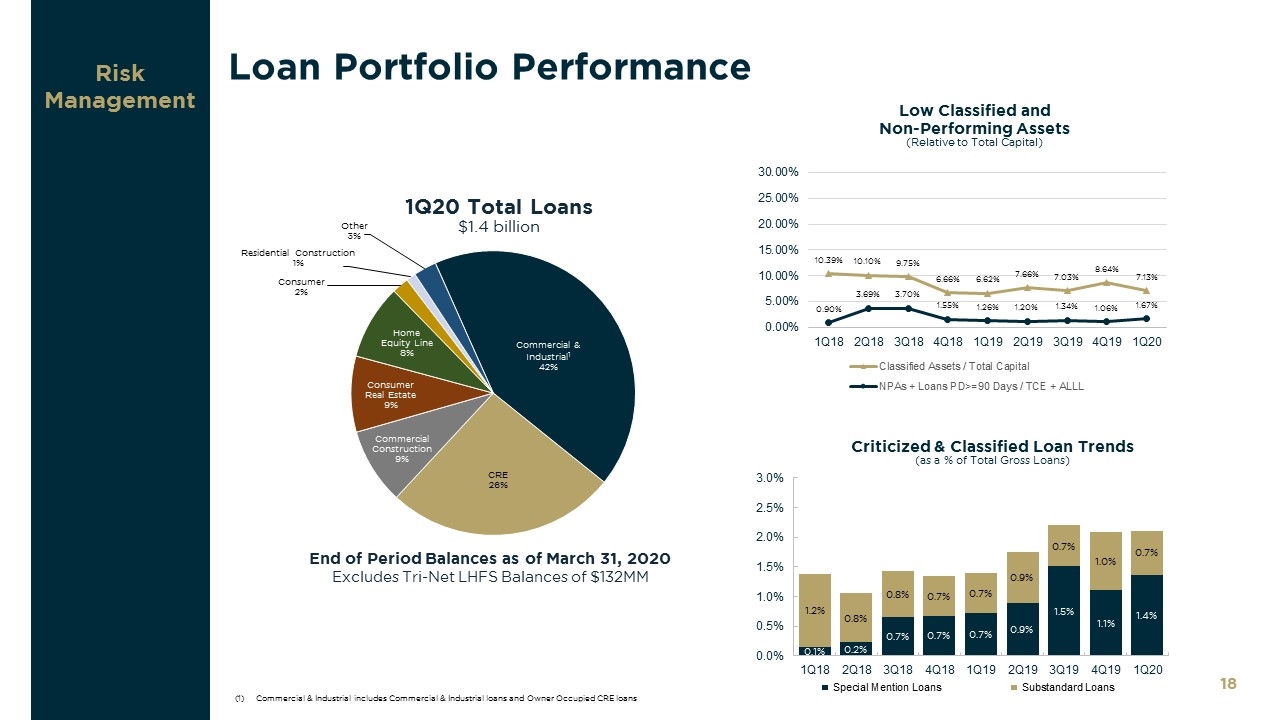

Risk Management Loan Portfolio Performance (1) Commercial & Industrial includes Commercial & Industrial loans and Owner Occupied CRE loans

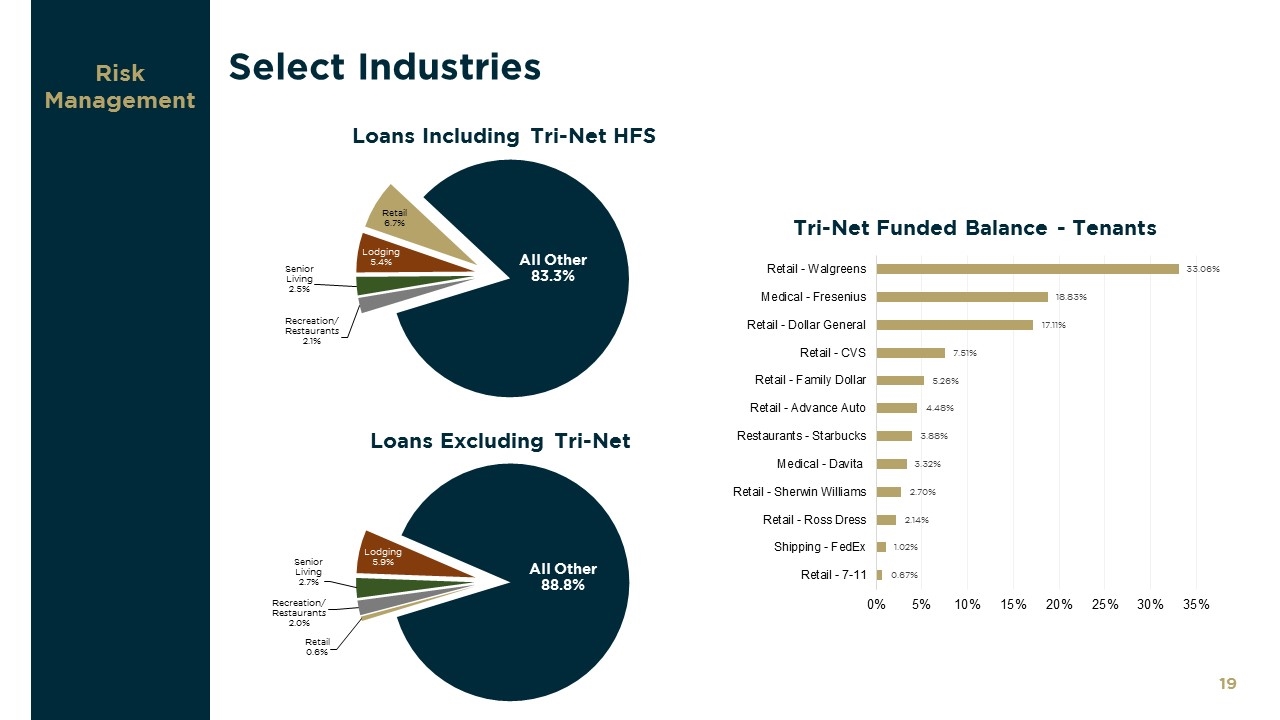

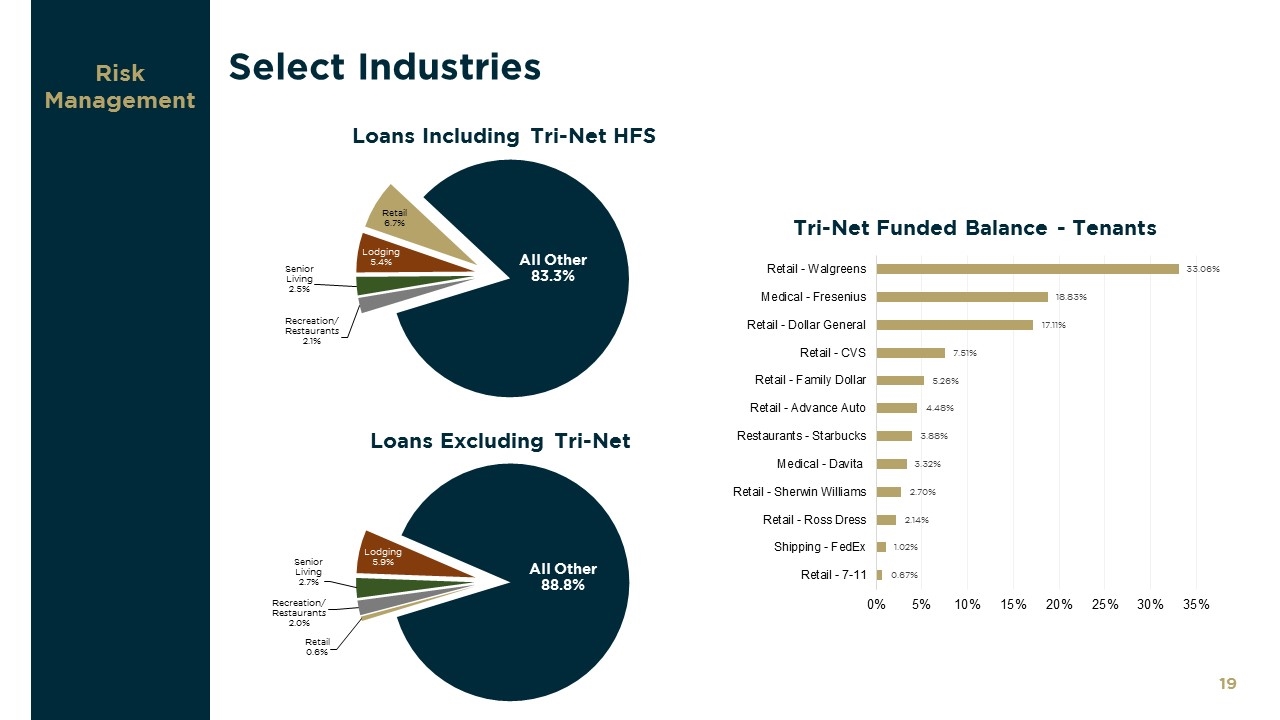

Risk Management Select Industries

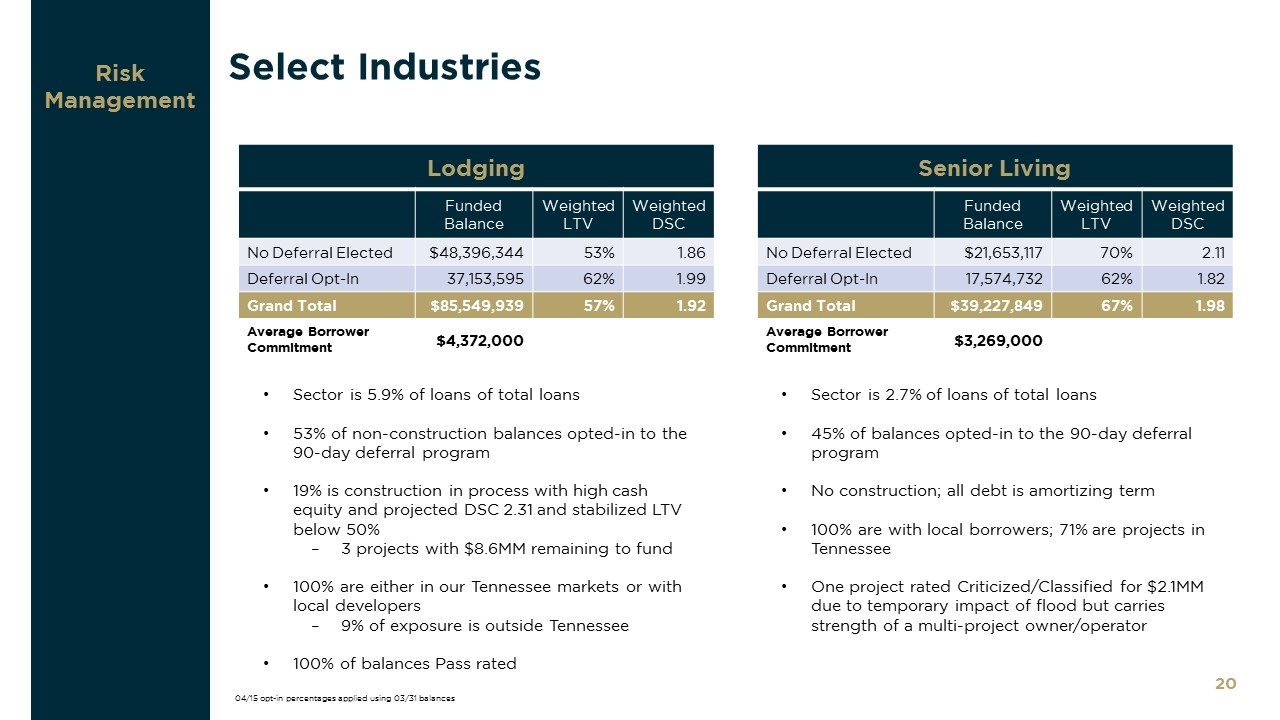

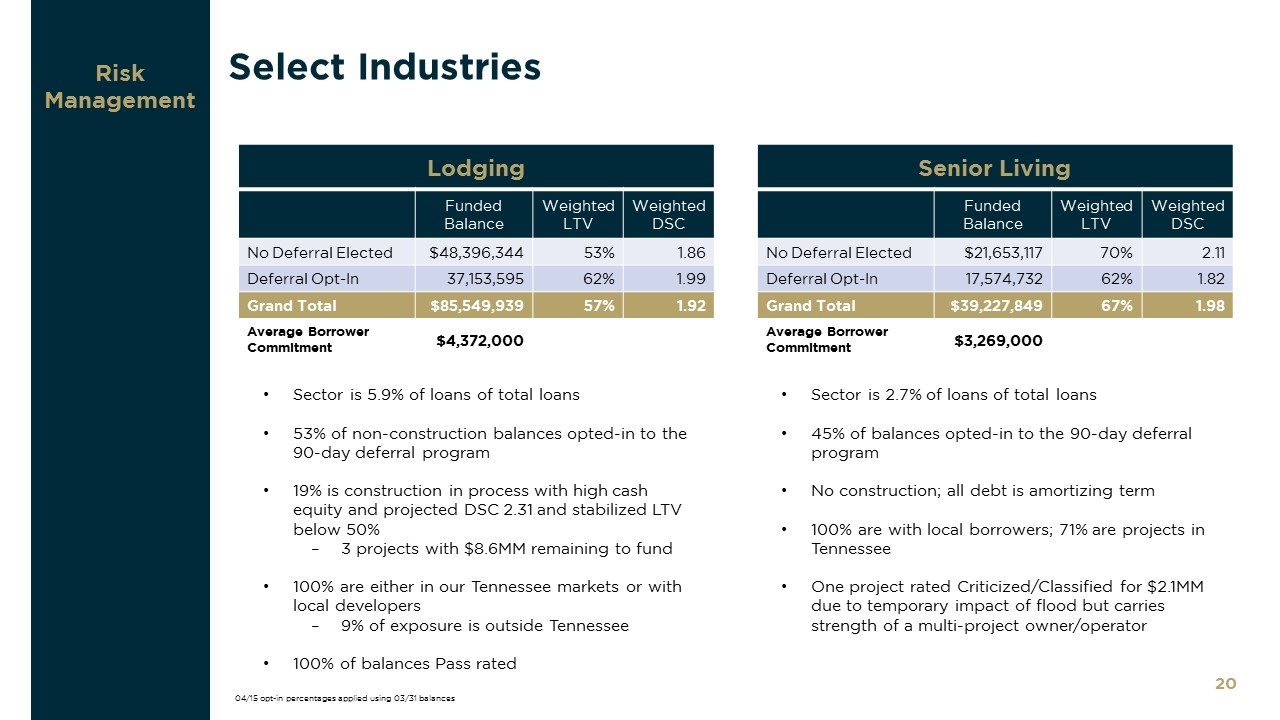

Risk Management Select Industries Lodging Funded Balance Weighted LTV Weighted DSC No Deferral Elected $48,396,344 53% 1.86 Deferral Opt-In 37,153,595 62% 1.99 Grand Total $85,549,939 57% 1.92 Average Borrower Commitment $4,372,000 Senior Living Funded Balance Weighted LTV Weighted DSC No Deferral Elected $21,653,117 70% 2.11 Deferral Opt-In 17,574,732 62% 1.82 Grand Total $39,227,849 67% 1.98 Average Borrower Commitment $3,269,000 Sector is 5.9% of loans of total loans 53% of non-construction balances opted-in to the 90-day deferral program 19% is construction in process with high cash equity and projected DSC 2.31 and stabilized LTV below 50% 3 projects with $8.6MM remaining to fund 100% are either in our Tennessee markets or with local developers 9% of exposure is outside Tennessee 100% of balances Pass rated Sector is 2.7% of loans of total loans 45% of balances opted-in to the 90-day deferral program No construction; all debt is amortizing term 100% are with local borrowers; 71% are projects in Tennessee One project rated Criticized/Classified for $2.1MM due to temporary impact of flood but carries strength of a multi-project owner/operator 04/15 opt-in percentages applied using 03/31 balances

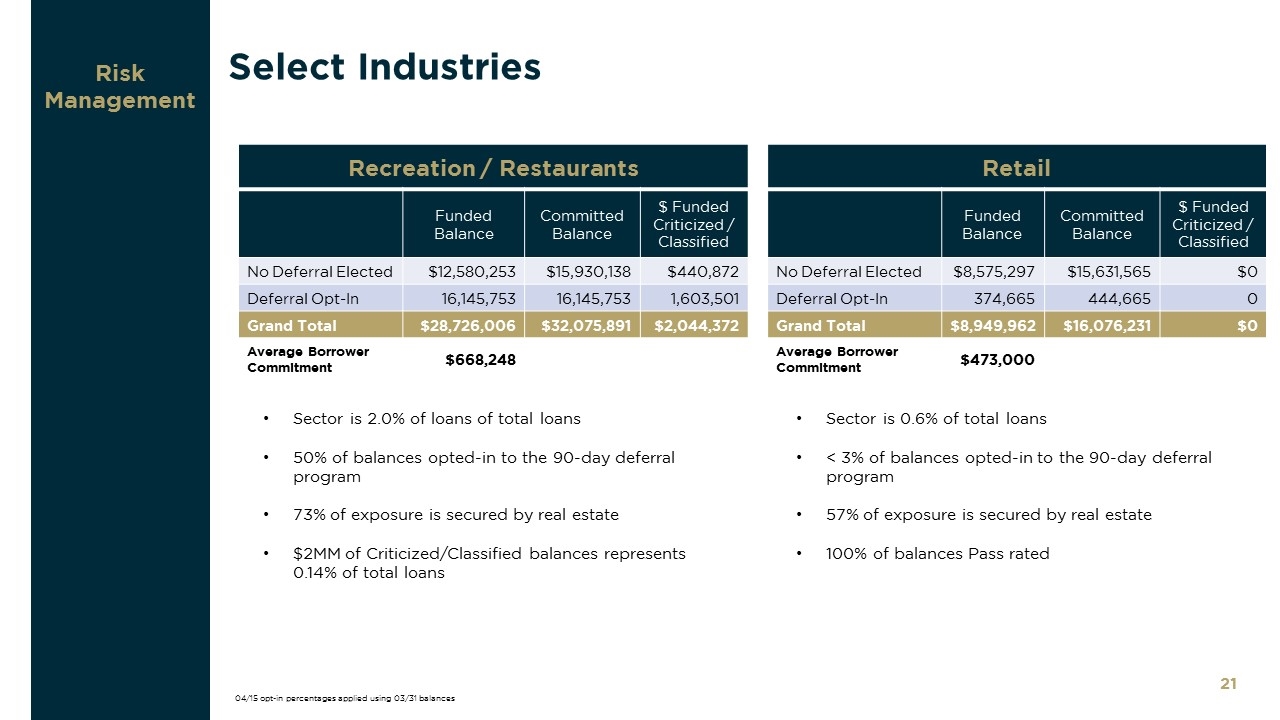

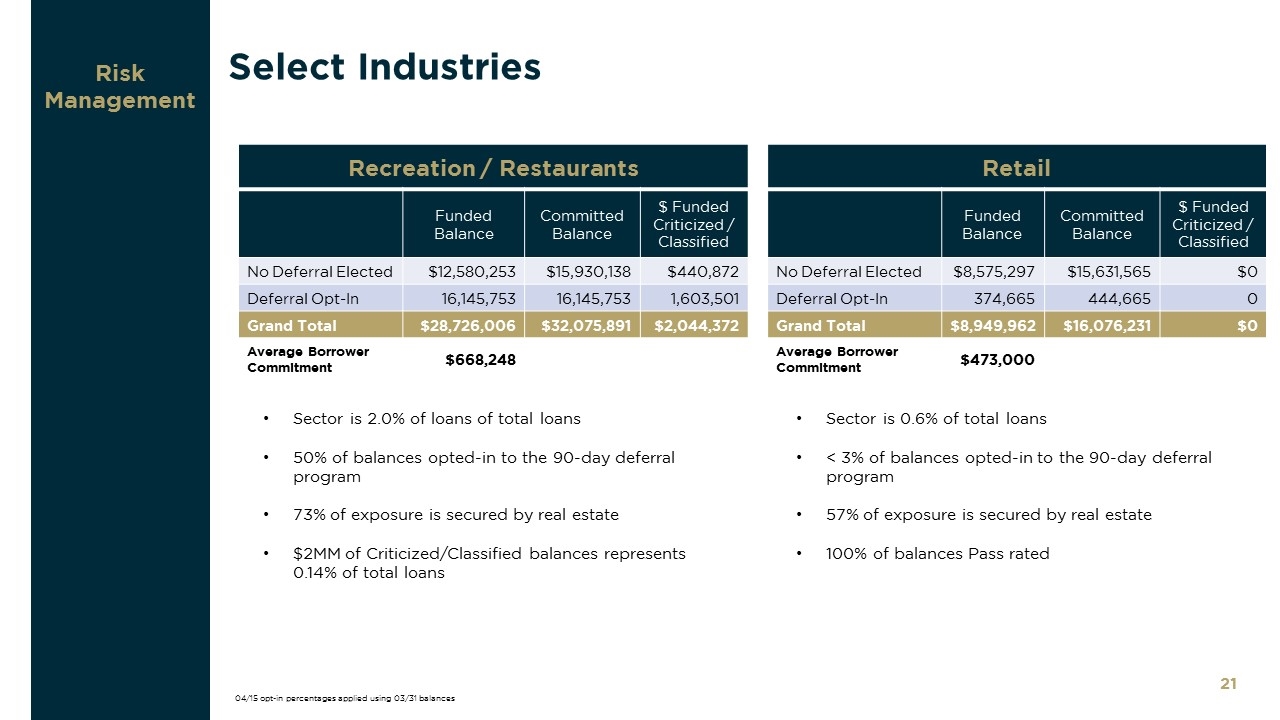

Risk Management Select Industries Recreation / Restaurants Funded Balance Committed Balance $ Funded Criticized / Classified No Deferral Elected $12,580,253 $15,930,138 $440,872 Deferral Opt-In 16,145,753 16,145,753 1,603,501 Grand Total $28,726,006 $32,075,891 $2,044,372 Average Borrower Commitment $668,248 Retail Funded Balance Committed Balance $ Funded Criticized / Classified No Deferral Elected $8,575,297 $15,631,565 $0 Deferral Opt-In 374,665 444,665 0 Grand Total $8,949,962 $16,076,231 $0 Average Borrower Commitment $473,000 Sector is 2.0% of loans of total loans 50% of balances opted-in to the 90-day deferral program 73% of exposure is secured by real estate $2MM of Criticized/Classified balances represents 0.14% of total loans Sector is 0.6% of total loans < 3% of balances opted-in to the 90-day deferral program 57% of exposure is secured by real estate 100% of balances Pass rated 04/15 opt-in percentages applied using 03/31 balances

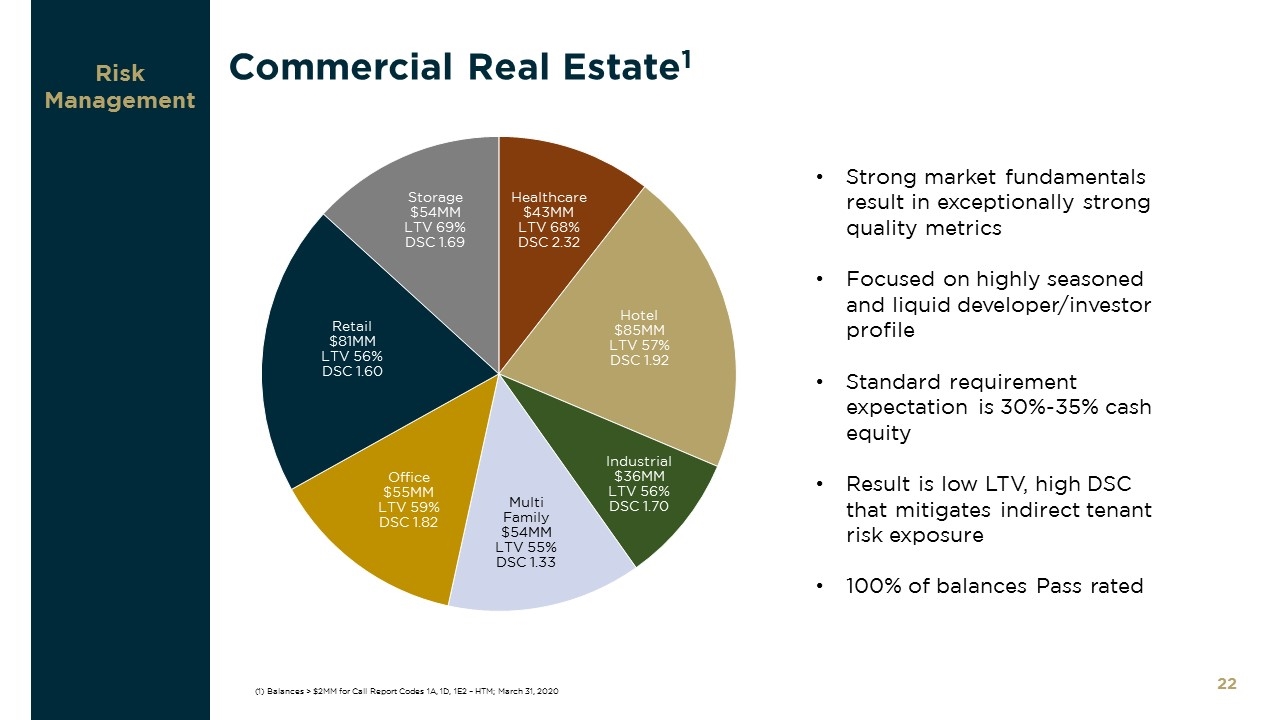

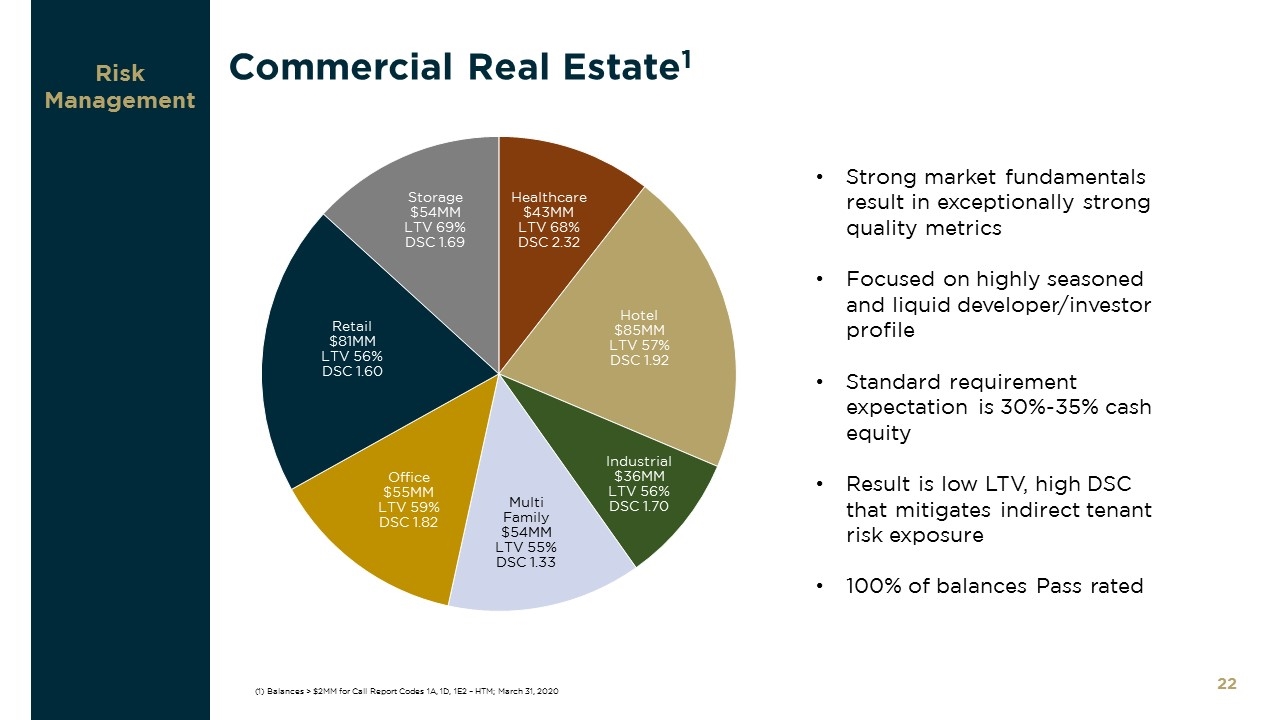

Risk Management Commercial Real Estate1 (1) Balances > $2MM for Call Report Codes 1A, 1D, 1E2 – HTM; March 31, 2020 Strong market fundamentals result in exceptionally strong quality metrics Focused on highly seasoned and liquid developer/investor profile Standard requirement expectation is 30%-35% cash equity Result is low LTV, high DSC that mitigates indirect tenant risk exposure 100% of balances Pass rated

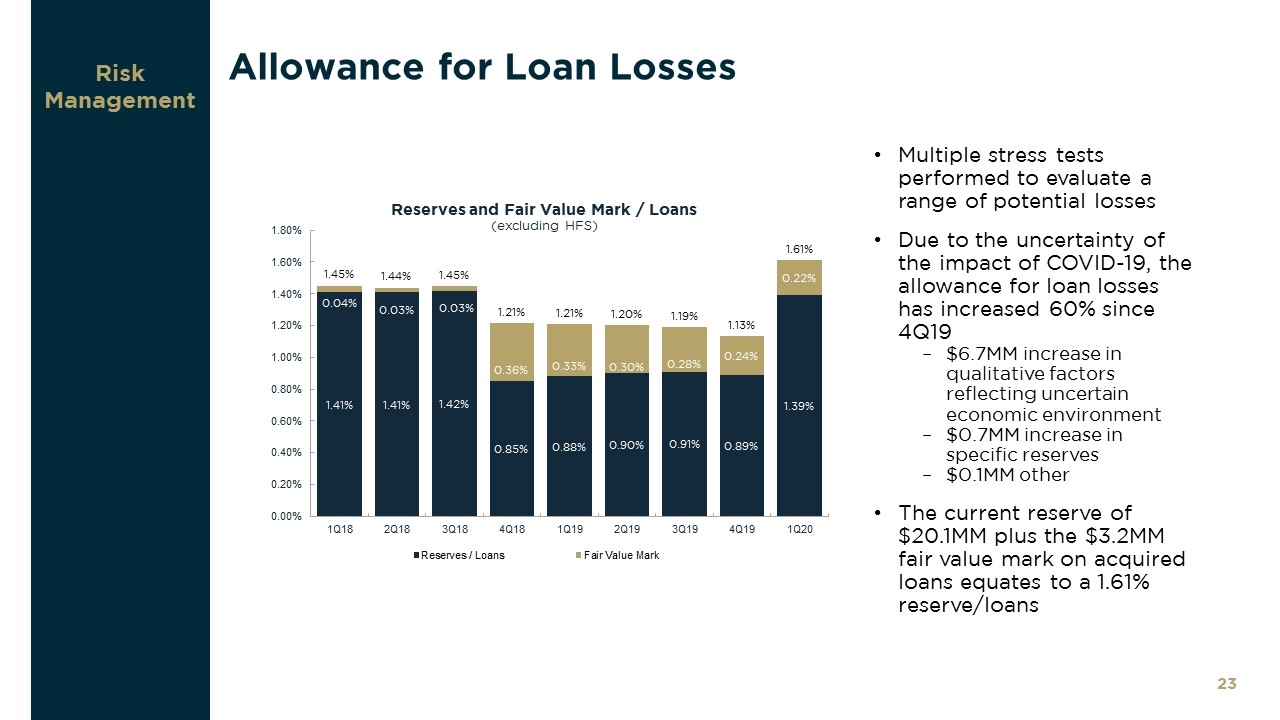

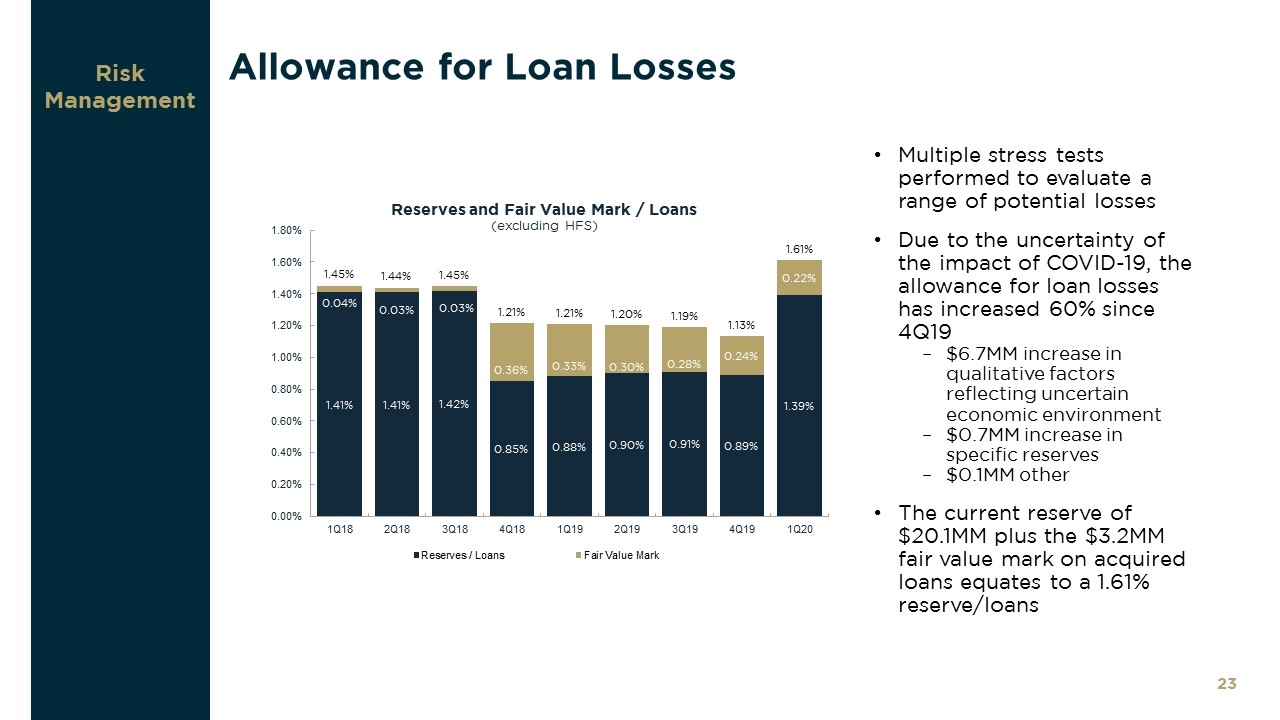

Allowance for Loan Losses Risk Management Multiple stress tests performed to evaluate a range of potential losses Due to the uncertainty of the impact of COVID-19, the allowance for loan losses has increased 60% since 4Q19 $6.7MM increase in qualitative factors reflecting uncertain economic environment $0.7MM increase in specific reserves $0.1MM other The current reserve of $20.1MM plus the $3.2MM fair value mark on acquired loans equates to a 1.61% reserve/loans

Merger Update

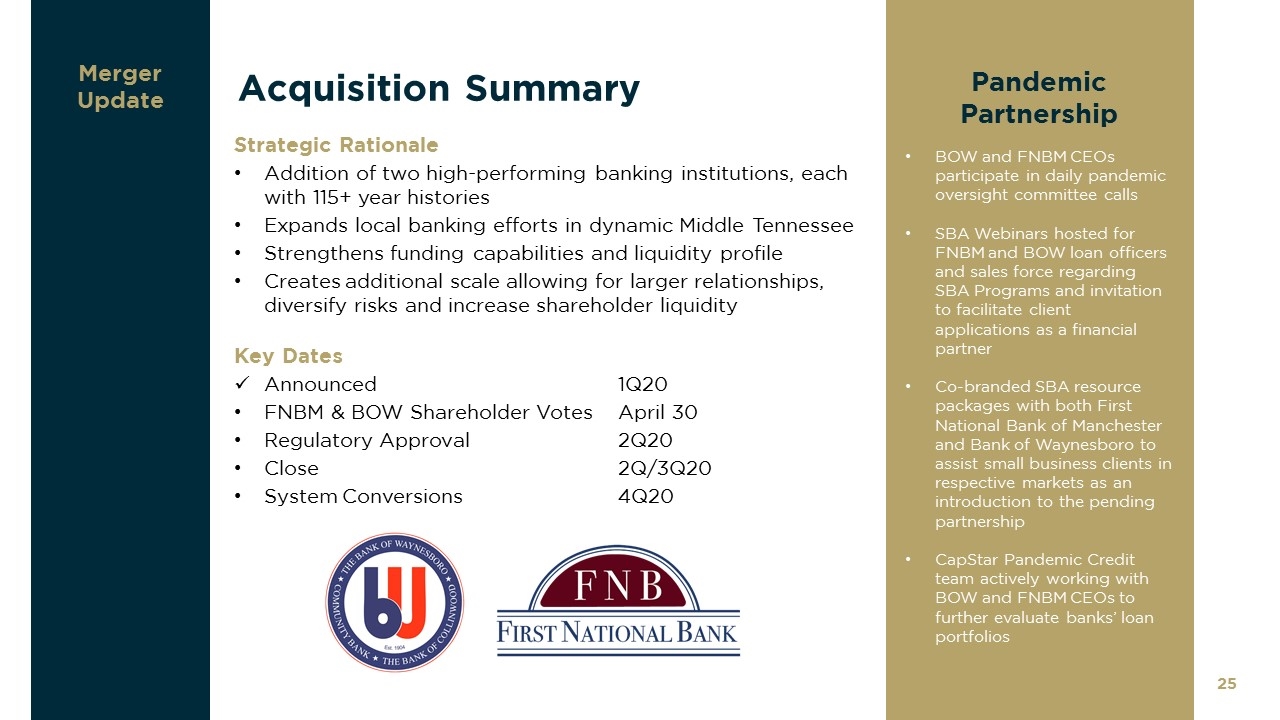

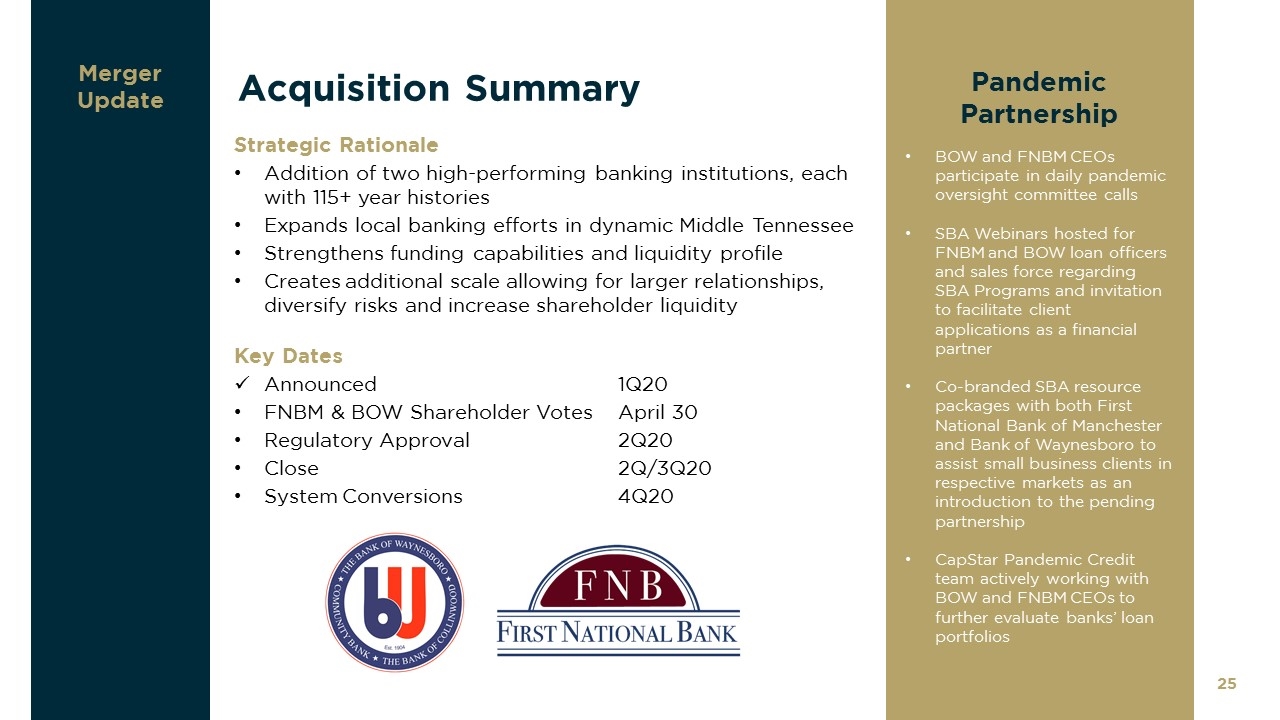

Merger Update Acquisition Summary Strategic Rationale Addition of two high-performing banking institutions, each with 115+ year histories Expands local banking efforts in dynamic Middle Tennessee Strengthens funding capabilities and liquidity profile Creates additional scale allowing for larger relationships, diversify risks and increase shareholder liquidity Key Dates Announced1Q20 FNBM & BOW Shareholder Votes April 30 Regulatory Approval2Q20 Close2Q/3Q20 System Conversions4Q20 Pandemic Partnership BOW and FNBM CEOs participate in daily pandemic oversight committee calls SBA Webinars hosted for FNBM and BOW loan officers and sales force regarding SBA Programs and invitation to facilitate client applications as a financial partner Co-branded SBA resource packages with both First National Bank of Manchester and Bank of Waynesboro to assist small business clients in respective markets as an introduction to the pending partnership CapStar Pandemic Credit team actively working with BOW and FNBM CEOs to further evaluate banks’ loan portfolios

Looking Forward

Looking Forward As we move forward, CapStar has tremendous opportunities to continue to improve our performance. Our priorities include: Delivering strong risk management practices Build liquidity, reserves, and capital Escalate portfolio monitoring and proactively manage credit portfolio Generate strong PTPP with the intention of maintaining our dividend Enhancing the level and consistency of our profitability Improving our net interest margin and its stability Implementing expense disciplines – proficient and frugal execution Eliminating prior credit “spikes” Expanding and accelerating our growth opportunities Aggressively seeking to expand customer relationships in our existing markets Strategically hiring additional talented bankers in or around our service areas Actively pursuing acquisitions of well-managed, appropriately-priced banks Improving the relative performance of our common stock Creating an accountable, owner-operator culture Reviewing company-wide incentive plans to align to shareholder performance

Appendix: Other Financial Results and Non-GAAP Reconciliations

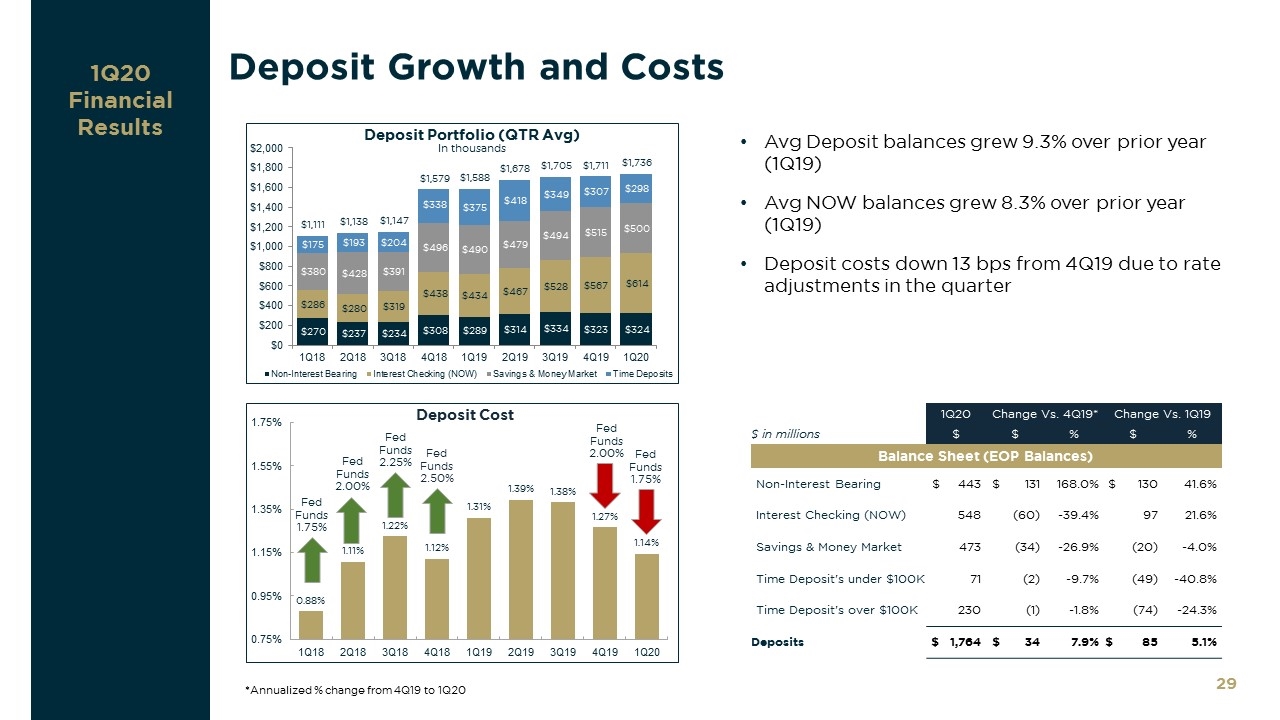

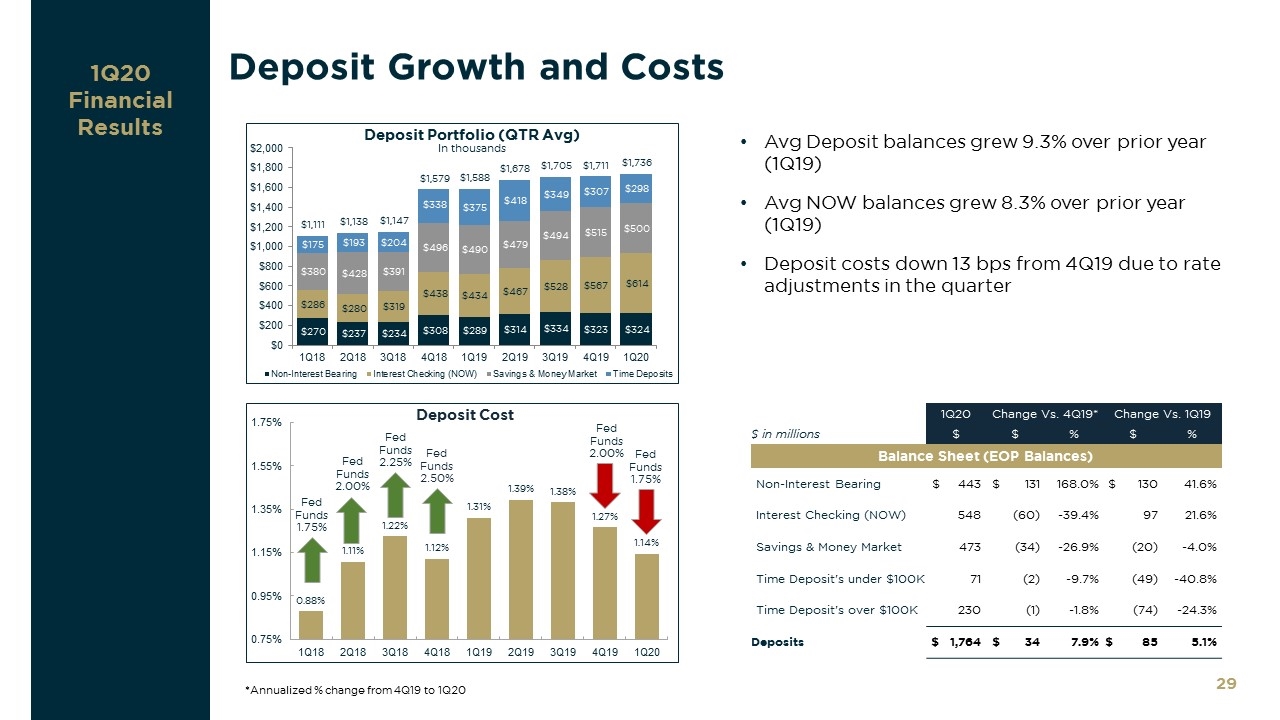

Deposit Growth and Costs 1Q20 Financial Results Avg Deposit balances grew 9.3% over prior year (1Q19) Avg NOW balances grew 8.3% over prior year (1Q19) Deposit costs down 13 bps from 4Q19 due to rate adjustments in the quarter 1Q20 Change Vs. 4Q19* Change Vs. 1Q19 $ in millions $ $ % $ % Balance Sheet (EOP Balances) Non-Interest Bearing $ 443 $ 131 168.0% $ 130 41.6% Interest Checking (NOW) 548 (60) -39.4% 97 21.6% Savings & Money Market 473 (34) -26.9% (20) -4.0% Time Deposit's under $100K 71 (2) -9.7% (49) -40.8% Time Deposit's over $100K 230 (1) -1.8% (74) -24.3% Deposits $ 1,764 $ 34 7.9% $ 85 5.1% *Annualized % change from 4Q19 to 1Q20 Fed Funds 1.75% Fed Funds 2.00% Fed Funds 2.25% Fed Funds 2.50% Fed Funds 2.00% Fed Funds 1.75%

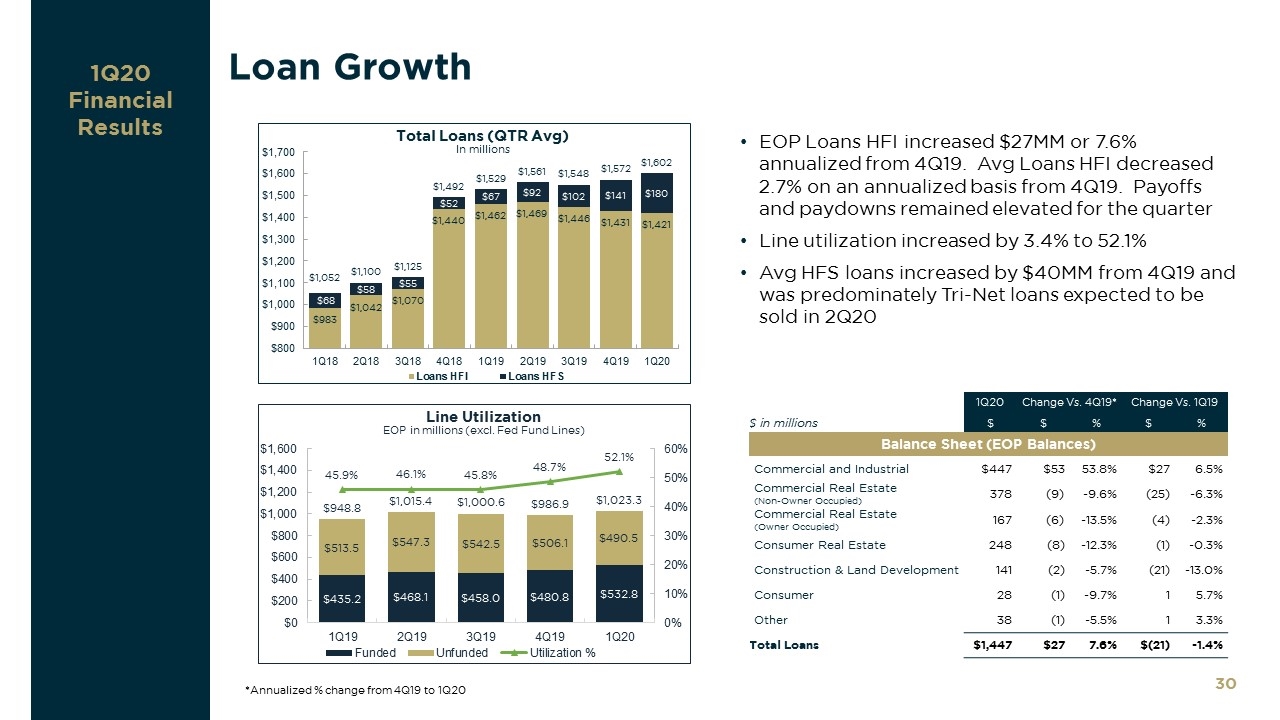

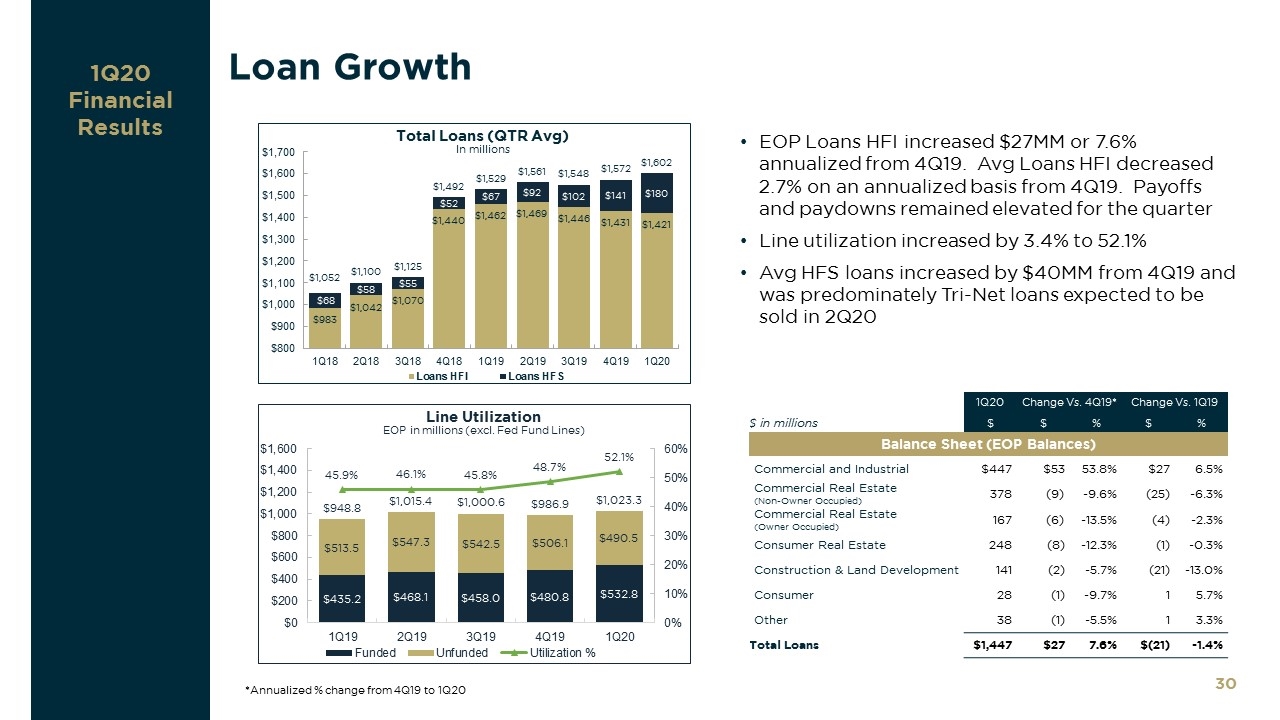

Loan Growth EOP Loans HFI increased $27MM or 7.6% annualized from 4Q19. Avg Loans HFI decreased 2.7% on an annualized basis from 4Q19. Payoffs and paydowns remained elevated for the quarter Line utilization increased by 3.4% to 52.1% Avg HFS loans increased by $40MM from 4Q19 and was predominately Tri-Net loans expected to be sold in 2Q20 *Annualized % change from 4Q19 to 1Q20 1Q20 Change Vs. 4Q19* Change Vs. 1Q19 $ in millions $ $ % $ % Balance Sheet (EOP Balances) Commercial and Industrial $447 $53 53.8% $27 6.5% Commercial Real Estate (Non-Owner Occupied) 378 (9) -9.6% (25) -6.3% Commercial Real Estate (Owner Occupied) 167 (6) -13.5% (4) -2.3% Consumer Real Estate 248 (8) -12.3% (1) -0.3% Construction & Land Development 141 (2) -5.7% (21) -13.0% Consumer 28 (1) -9.7% 1 5.7% Other 38 (1) -5.5% 1 3.3% Total Loans $1,447 $27 7.6% $(21) -1.4% 1Q20 Financial Results

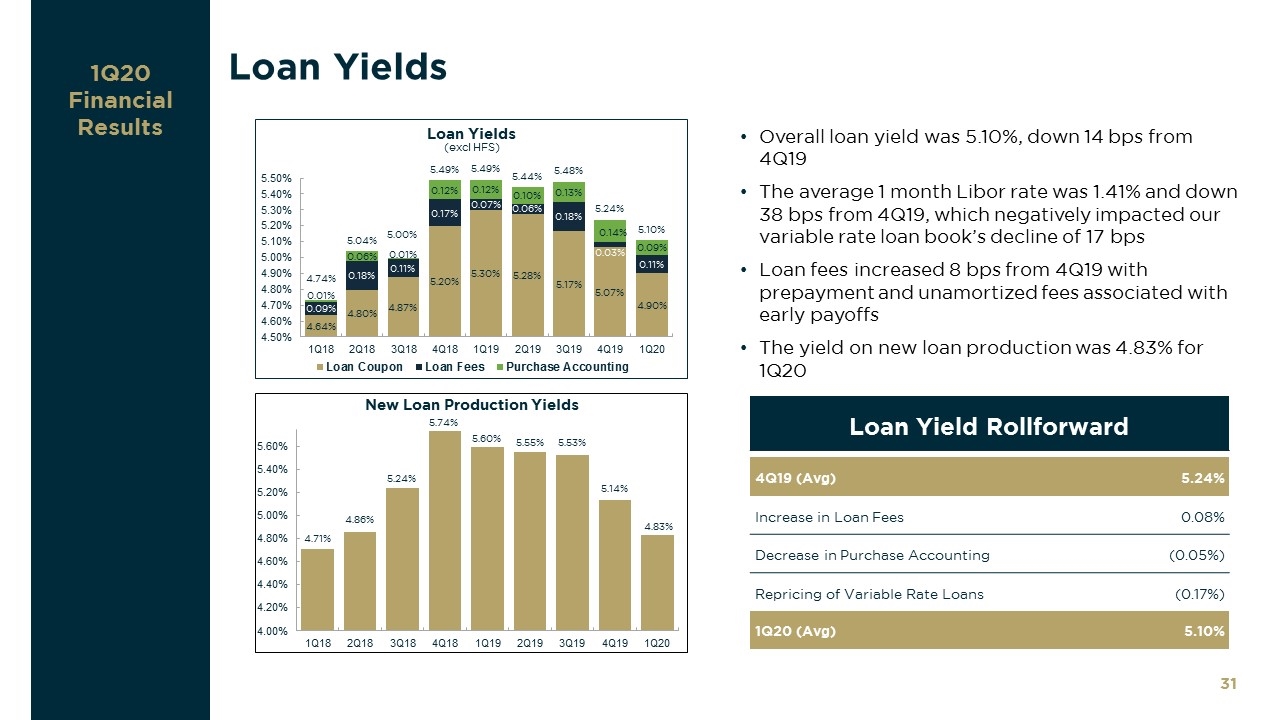

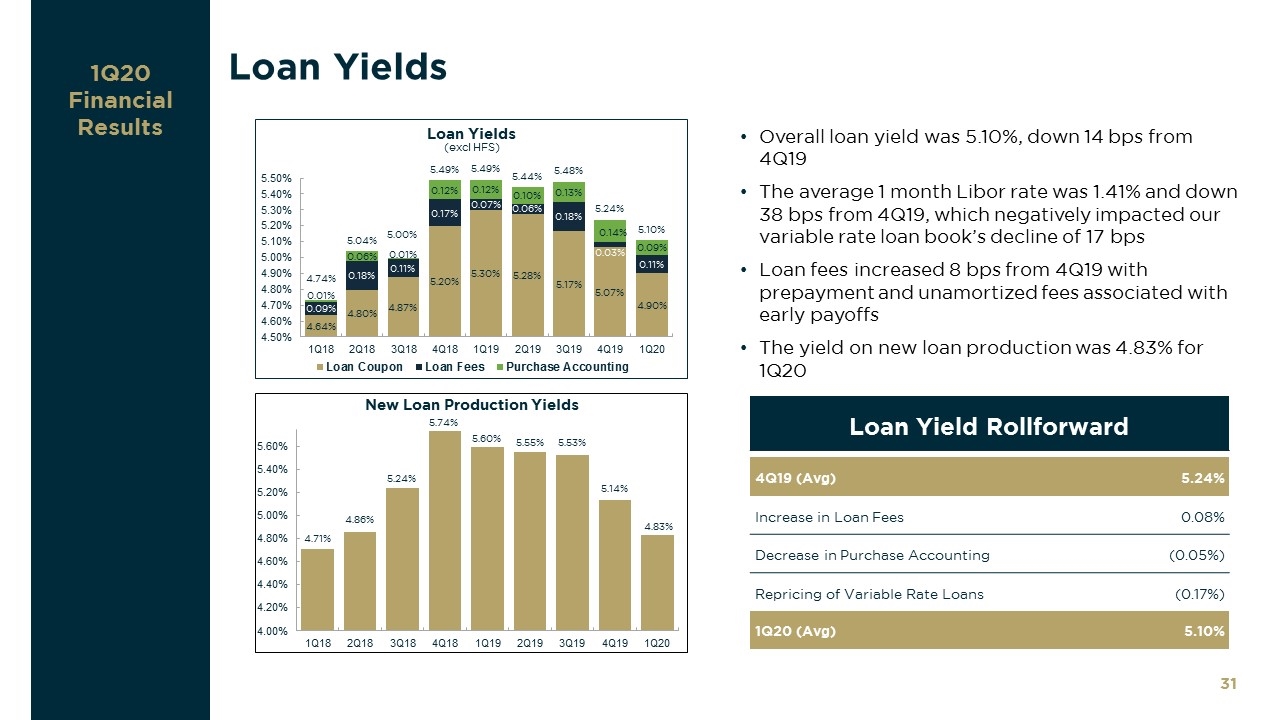

Loan Yields 1Q20 Financial Results Overall loan yield was 5.10%, down 14 bps from 4Q19 The average 1 month Libor rate was 1.41% and down 38 bps from 4Q19, which negatively impacted our variable rate loan book’s decline of 17 bps Loan fees increased 8 bps from 4Q19 with prepayment and unamortized fees associated with early payoffs The yield on new loan production was 4.83% for 1Q20 Loan Yield Rollforward 4Q19 (Avg) 5.24% Increase in Loan Fees 0.08% Decrease in Purchase Accounting (0.05%) Repricing of Variable Rate Loans (0.17%) 1Q20 (Avg) 5.10%

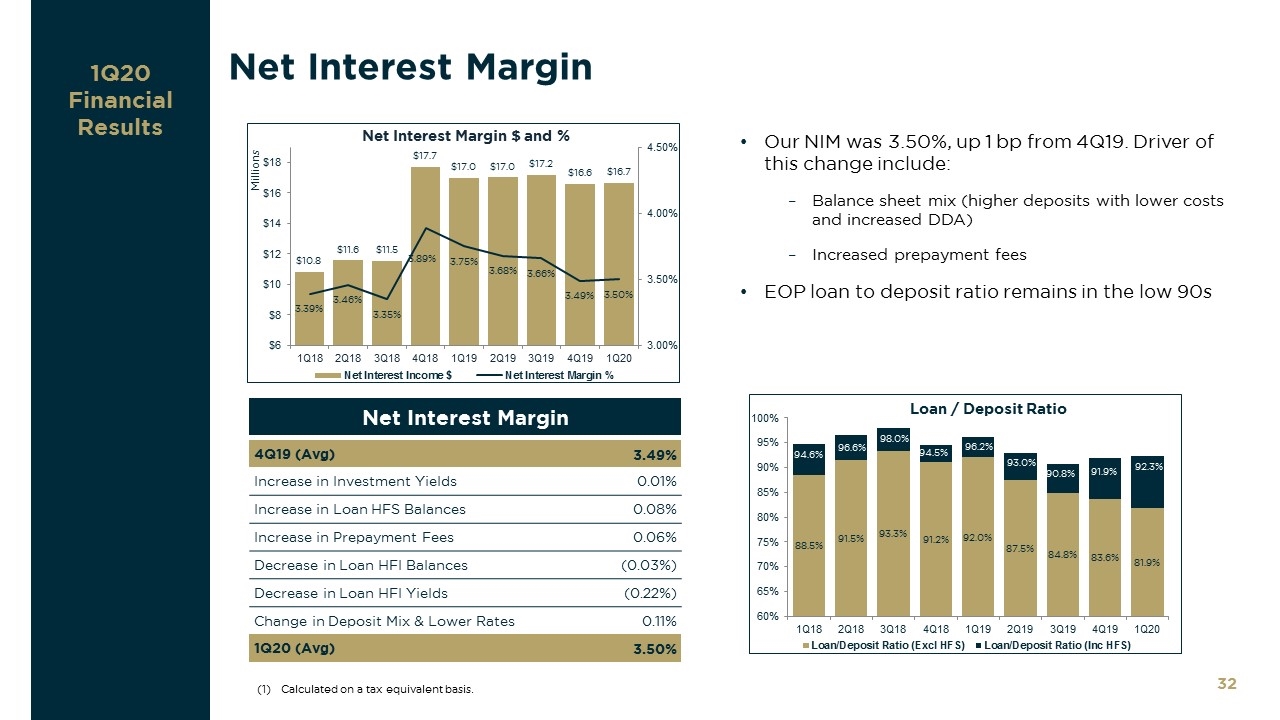

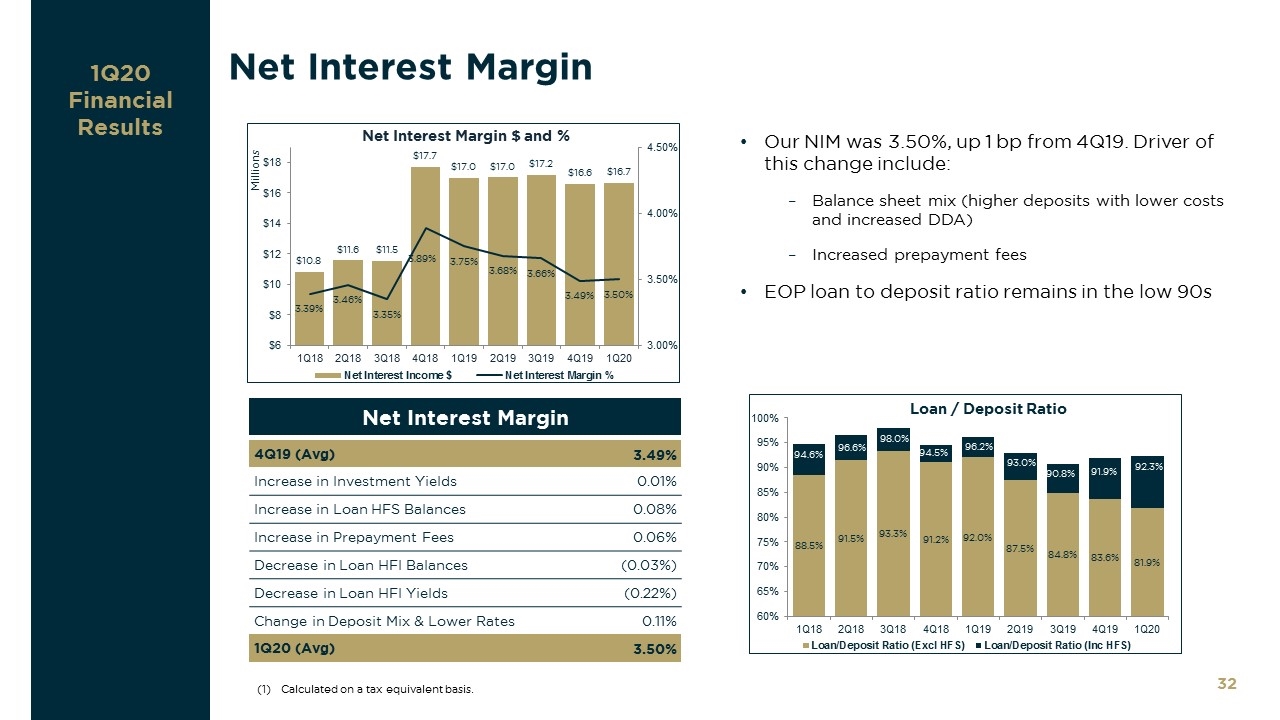

Net Interest Margin 1Q20 Financial Results Calculated on a tax equivalent basis. Net Interest Margin 4Q19 (Avg) 3.49% Increase in Investment Yields 0.01% Increase in Loan HFS Balances 0.08% Increase in Prepayment Fees 0.06% Decrease in Loan HFI Balances (0.03%) Decrease in Loan HFI Yields (0.22%) Change in Deposit Mix & Lower Rates 0.11% 1Q20 (Avg) 3.50% Our NIM was 3.50%, up 1 bp from 4Q19. Driver of this change include: Balance sheet mix (higher deposits with lower costs and increased DDA) Increased prepayment fees EOP loan to deposit ratio remains in the low 90s

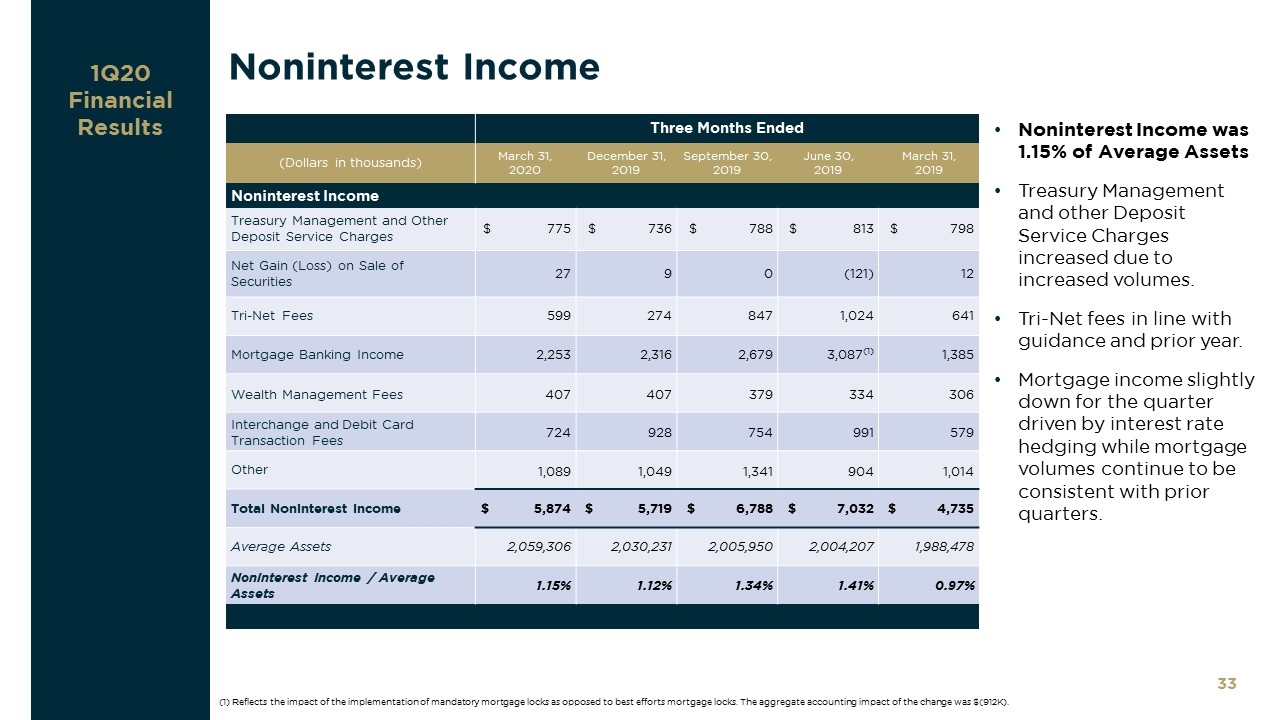

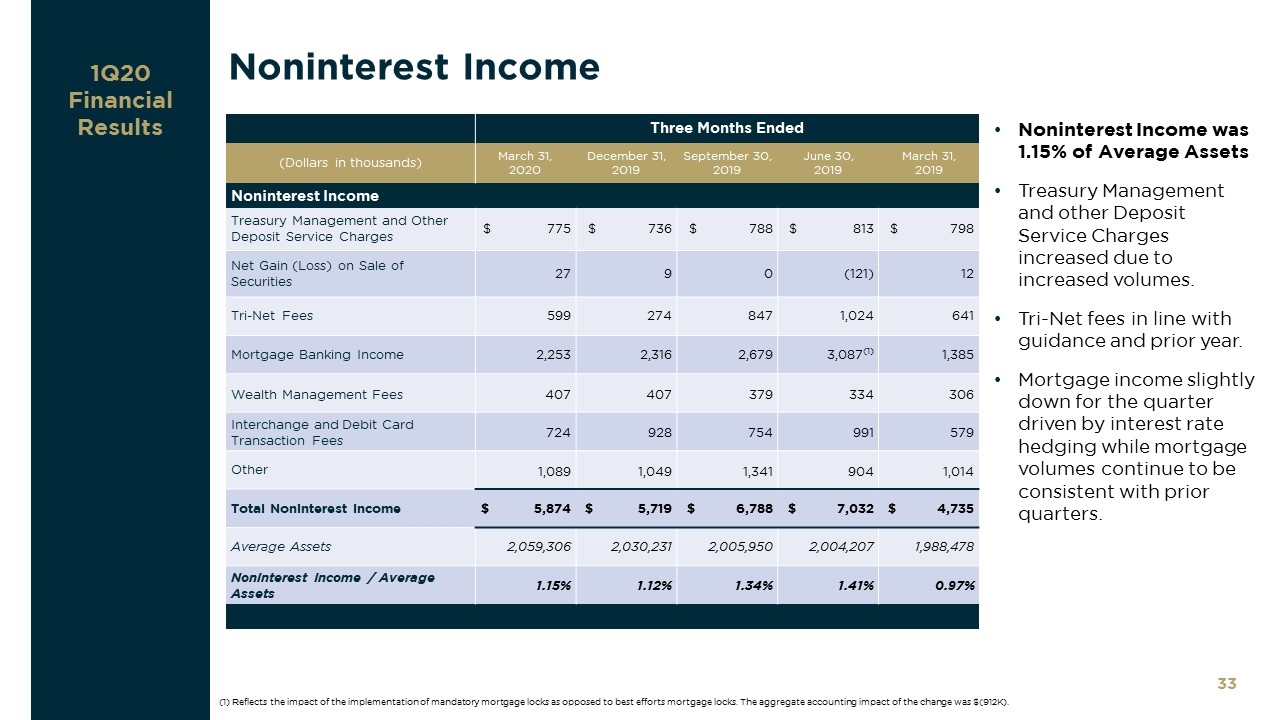

Noninterest Income 1Q20 Financial Results Noninterest Income was 1.15% of Average Assets Treasury Management and other Deposit Service Charges increased due to increased volumes. Tri-Net fees in line with guidance and prior year. Mortgage income slightly down for the quarter driven by interest rate hedging while mortgage volumes continue to be consistent with prior quarters. Three Months Ended (Dollars in thousands) March 31, December 31, September 30, June 30, March 31, 2020 2019 2019 2019 2019 Noninterest Income Treasury Management and Other Deposit Service Charges $ 775 $ 736 $ 788 $ 813 $ 798 Net Gain (Loss) on Sale of Securities 27 9 0 (121) 12 Tri-Net Fees 599 274 847 1,024 641 Mortgage Banking Income 2,253 2,316 2,679 3,087(1) 1,385 Wealth Management Fees 407 407 379 334 306 Interchange and Debit Card Transaction Fees 724 928 754 991 579 Other 1,089 1,049 1,341 904 1,014 Total Noninterest Income $ 5,874 $ 5,719 $ 6,788 $ 7,032 $ 4,735 Average Assets 2,059,306 2,030,231 2,005,950 2,004,207 1,988,478 Noninterest Income / Average Assets 1.15% 1.12% 1.34% 1.41% 0.97% (1) Reflects the impact of the implementation of mandatory mortgage locks as opposed to best efforts mortgage locks. The aggregate accounting impact of the change was $(912K).

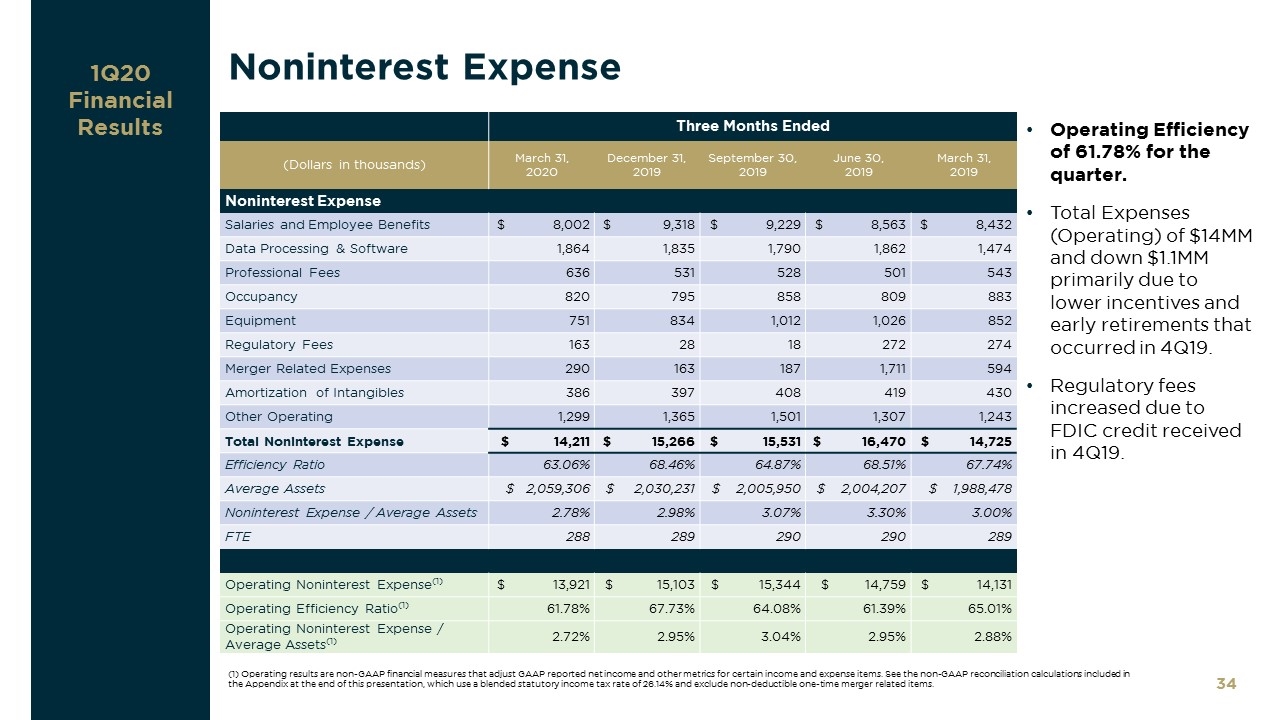

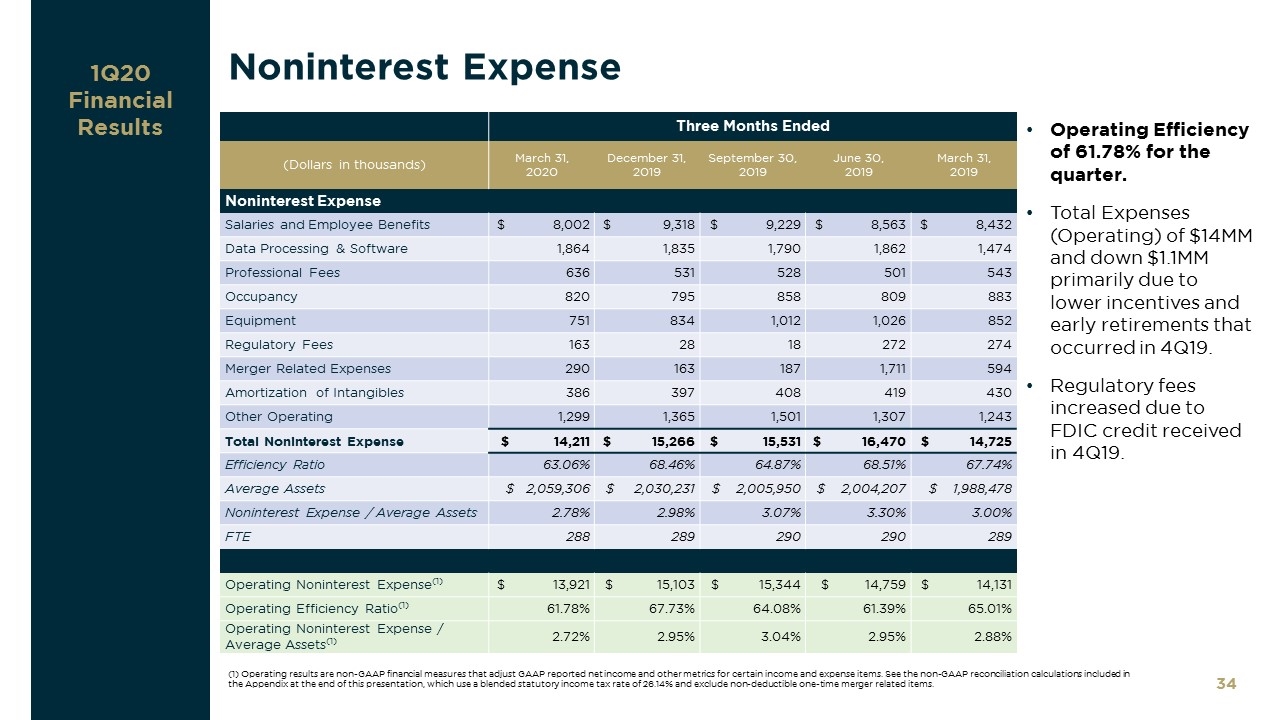

Noninterest Expense Operating Efficiency of 61.78% for the quarter. Total Expenses (Operating) of $14MM and down $1.1MM primarily due to lower incentives and early retirements that occurred in 4Q19. Regulatory fees increased due to FDIC credit received in 4Q19. Three Months Ended (Dollars in thousands) March 31, December 31, September 30, June 30, March 31, 2020 2019 2019 2019 2019 Noninterest Expense Salaries and Employee Benefits $ 8,002 $ 9,318 $ 9,229 $ 8,563 $ 8,432 Data Processing & Software 1,864 1,835 1,790 1,862 1,474 Professional Fees 636 531 528 501 543 Occupancy 820 795 858 809 883 Equipment 751 834 1,012 1,026 852 Regulatory Fees 163 28 18 272 274 Merger Related Expenses 290 163 187 1,711 594 Amortization of Intangibles 386 397 408 419 430 Other Operating 1,299 1,365 1,501 1,307 1,243 Total Noninterest Expense $ 14,211 $ 15,266 $ 15,531 $ 16,470 $ 14,725 Efficiency Ratio 63.06% 68.46% 64.87% 68.51% 67.74% Average Assets $ 2,059,306 $ 2,030,231 $ 2,005,950 $ 2,004,207 $ 1,988,478 Noninterest Expense / Average Assets 2.78% 2.98% 3.07% 3.30% 3.00% FTE 288 289 290 290 289 Operating Noninterest Expense(1) $ 13,921 $ 15,103 $ 15,344 $ 14,759 $ 14,131 Operating Efficiency Ratio(1) 61.78% 67.73% 64.08% 61.39% 65.01% Operating Noninterest Expense / Average Assets(1) 2.72% 2.95% 3.04% 2.95% 2.88% (1) Operating results are non-GAAP financial measures that adjust GAAP reported net income and other metrics for certain income and expense items. See the non-GAAP reconciliation calculations included in the Appendix at the end of this presentation, which use a blended statutory income tax rate of 26.14% and exclude non-deductible one-time merger related items. 1Q20 Financial Results

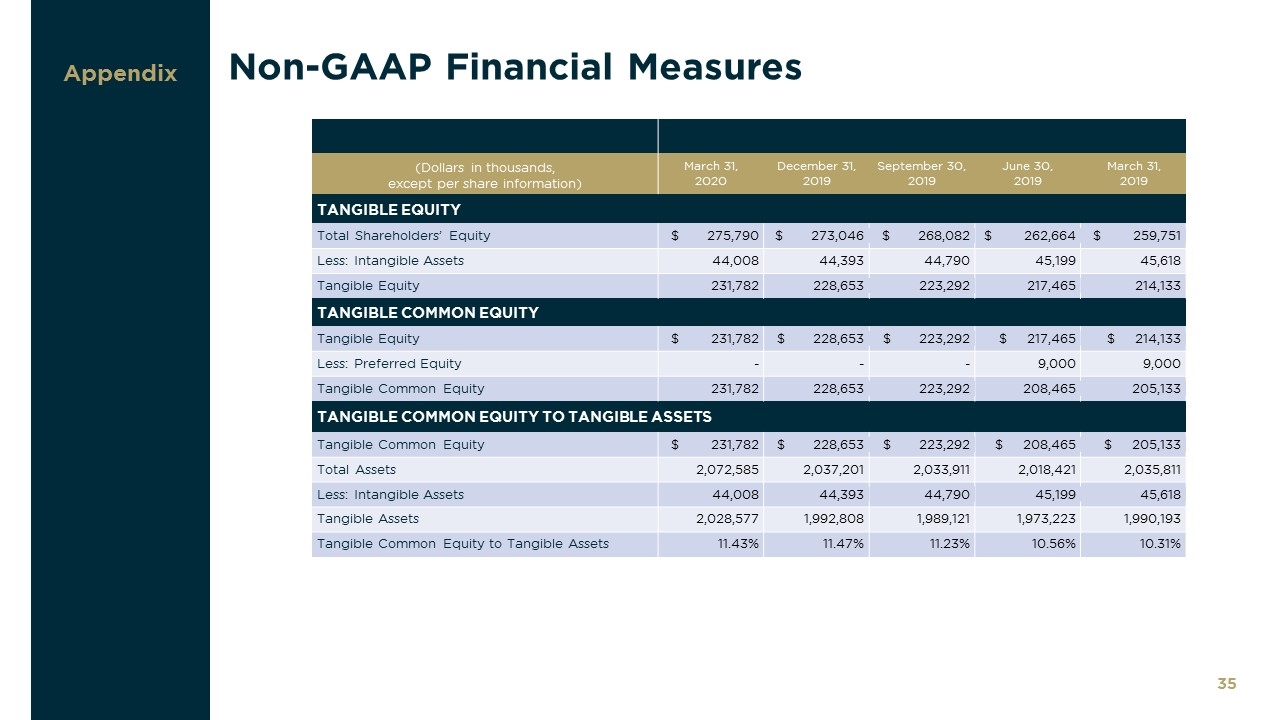

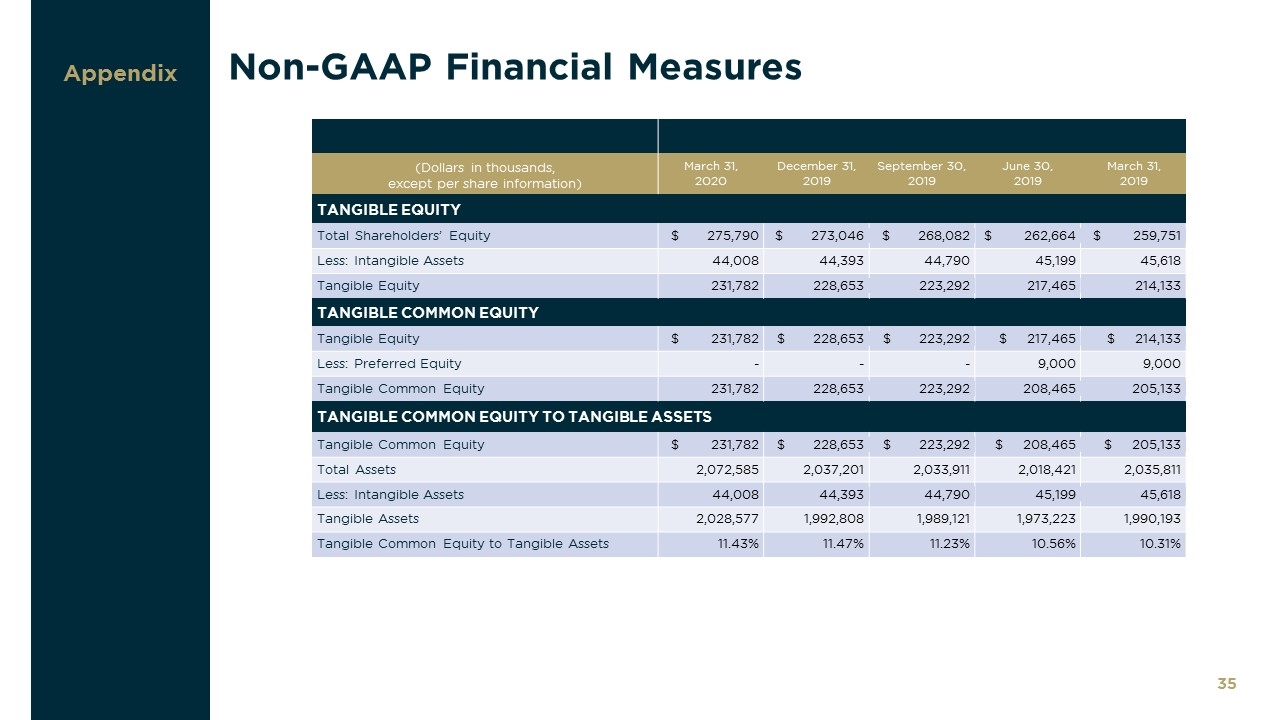

Non-GAAP Financial Measures Appendix (Dollars in thousands, except per share information) March 31, 2020 December 31, 2019 September 30, 2019 June 30, 2019 March 31, 2019 TANGIBLE EQUITY Total Shareholders’ Equity $ 275,790 $ 273,046 $ 268,082 $ 262,664 $ 259,751 Less: Intangible Assets 44,008 44,393 44,790 45,199 45,618 Tangible Equity 231,782 228,653 223,292 217,465 214,133 TANGIBLE COMMON EQUITY Tangible Equity $ 231,782 $ 228,653 $ 223,292 $ 217,465 $ 214,133 Less: Preferred Equity - - - 9,000 9,000 Tangible Common Equity 231,782 228,653 223,292 208,465 205,133 TANGIBLE COMMON EQUITY TO TANGIBLE ASSETS Tangible Common Equity $ 231,782 $ 228,653 $ 223,292 $ 208,465 $ 205,133 Total Assets 2,072,585 2,037,201 2,033,911 2,018,421 2,035,811 Less: Intangible Assets 44,008 44,393 44,790 45,199 45,618 Tangible Assets 2,028,577 1,992,808 1,989,121 1,973,223 1,990,193 Tangible Common Equity to Tangible Assets 11.43% 11.47% 11.23% 10.56% 10.31%

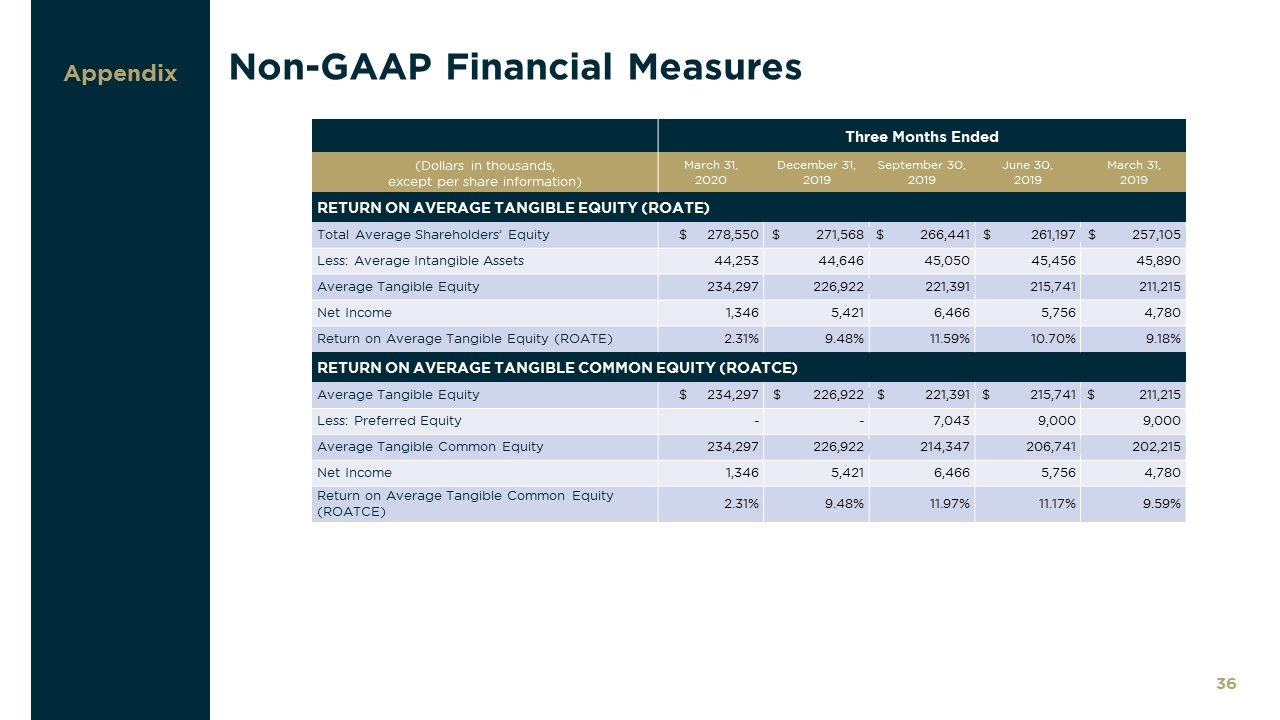

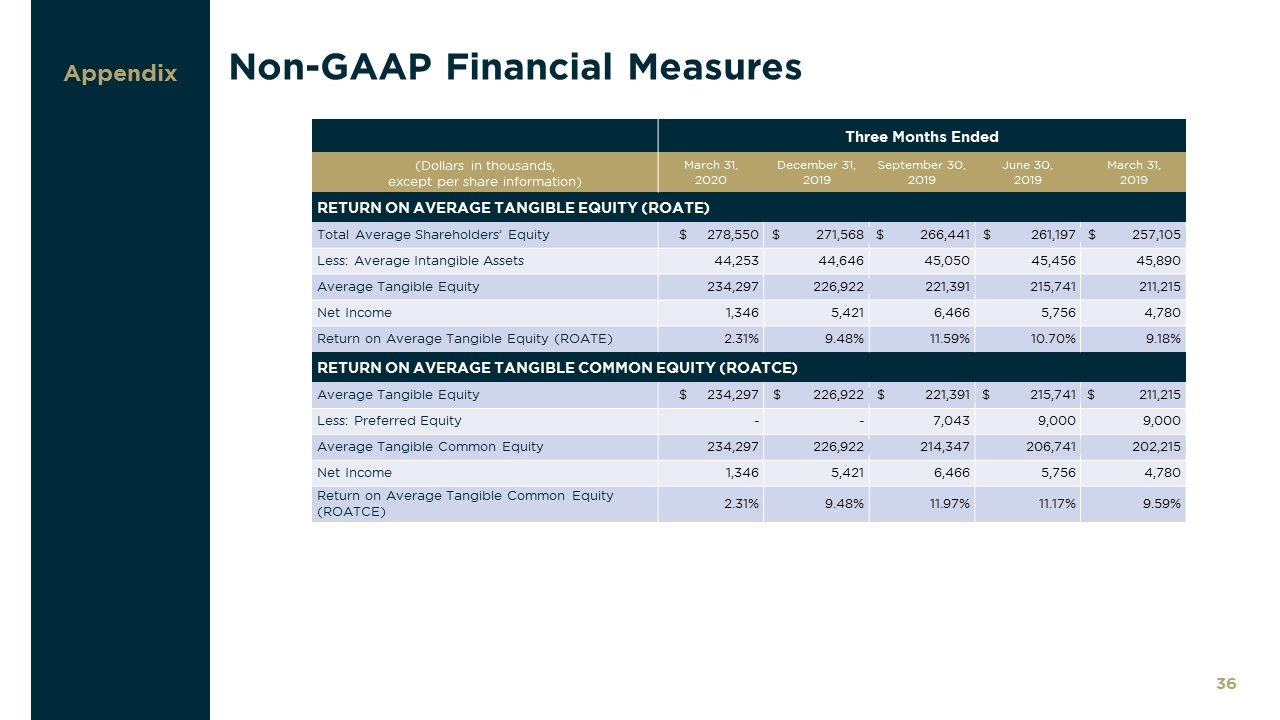

Non-GAAP Financial Measures Appendix Three Months Ended (Dollars in thousands, except per share information) March 31, 2020 December 31, 2019 September 30, 2019 June 30, 2019 March 31, 2019 RETURN ON AVERAGE TANGIBLE EQUITY (ROATE) Total Average Shareholders’ Equity $ 278,550 $ 271,568 $ 266,441 $ 261,197 $ 257,105 Less: Average Intangible Assets 44,253 44,646 45,050 45,456 45,890 Average Tangible Equity 234,297 226,922 221,391 215,741 211,215 Net Income 1,346 5,421 6,466 5,756 4,780 Return on Average Tangible Equity (ROATE) 2.31% 9.48% 11.59% 10.70% 9.18% RETURN ON AVERAGE TANGIBLE COMMON EQUITY (ROATCE) Average Tangible Equity $ 234,297 $ 226,922 $ 221,391 $ 215,741 $ 211,215 Less: Preferred Equity - - 7,043 9,000 9,000 Average Tangible Common Equity 234,297 226,922 214,347 206,741 202,215 Net Income 1,346 5,421 6,466 5,756 4,780 Return on Average Tangible Common Equity (ROATCE) 2.31% 9.48% 11.97% 11.17% 9.59%

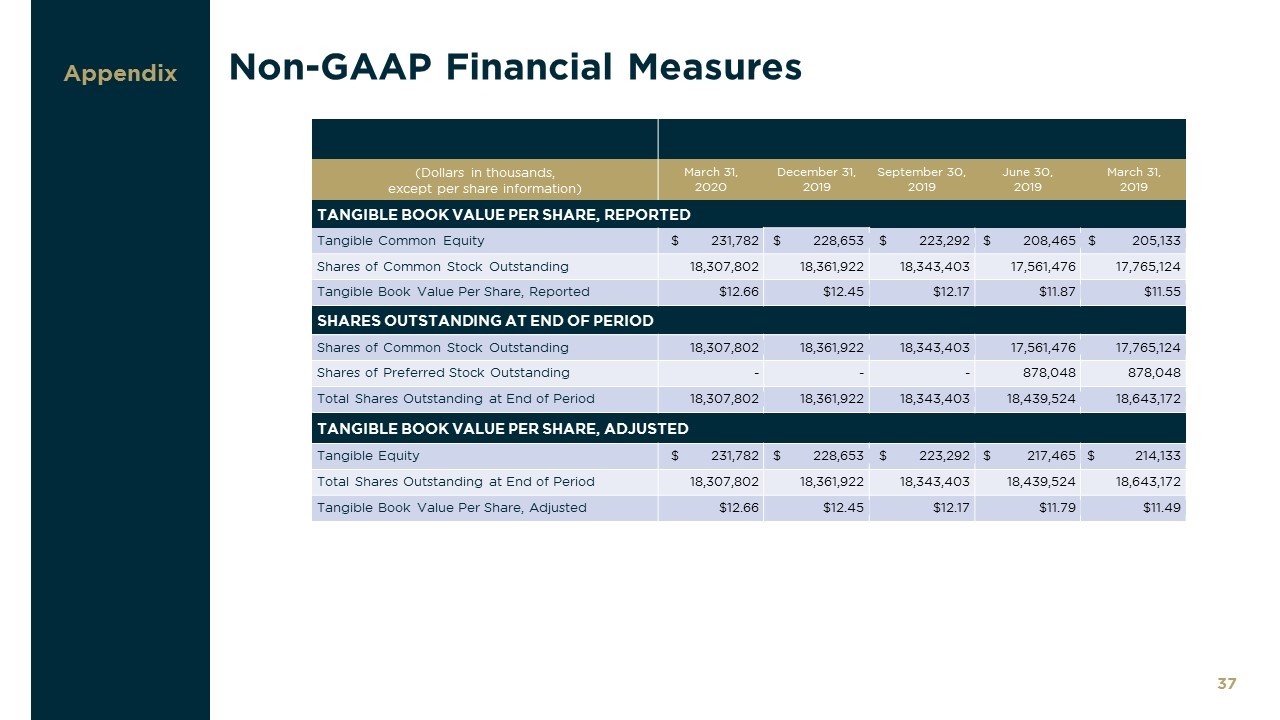

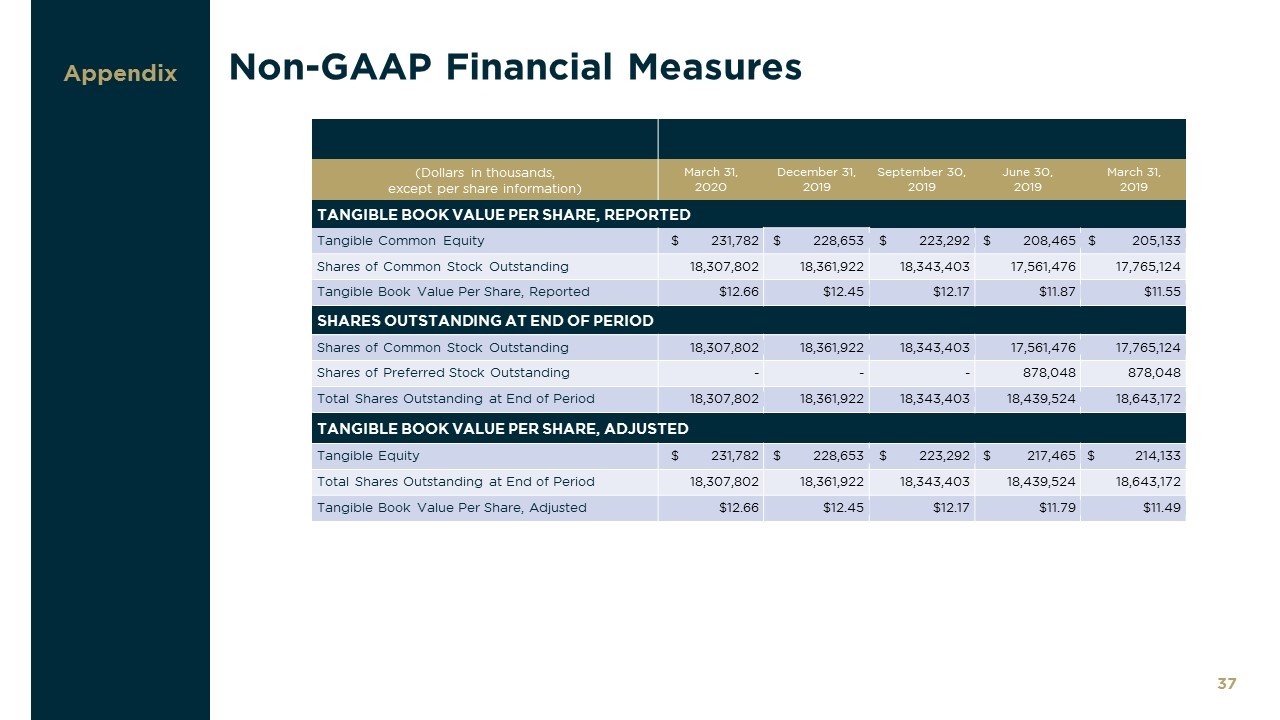

Non-GAAP Financial Measures Appendix (Dollars in thousands, except per share information) March 31, 2020 December 31, 2019 September 30, 2019 June 30, 2019 March 31, 2019 TANGIBLE BOOK VALUE PER SHARE, REPORTED Tangible Common Equity $ 231,782 $ 228,653 $ 223,292 $ 208,465 $ 205,133 Shares of Common Stock Outstanding 18,307,802 18,361,922 18,343,403 17,561,476 17,765,124 Tangible Book Value Per Share, Reported $12.66 $12.45 $12.17 $11.87 $11.55 SHARES OUTSTANDING AT END OF PERIOD Shares of Common Stock Outstanding 18,307,802 18,361,922 18,343,403 17,561,476 17,765,124 Shares of Preferred Stock Outstanding - - - 878,048 878,048 Total Shares Outstanding at End of Period 18,307,802 18,361,922 18,343,403 18,439,524 18,643,172 TANGIBLE BOOK VALUE PER SHARE, ADJUSTED Tangible Equity $ 231,782 $ 228,653 $ 223,292 $ 217,465 $ 214,133 Total Shares Outstanding at End of Period 18,307,802 18,361,922 18,343,403 18,439,524 18,643,172 Tangible Book Value Per Share, Adjusted $12.66 $12.45 $12.17 $11.79 $11.49

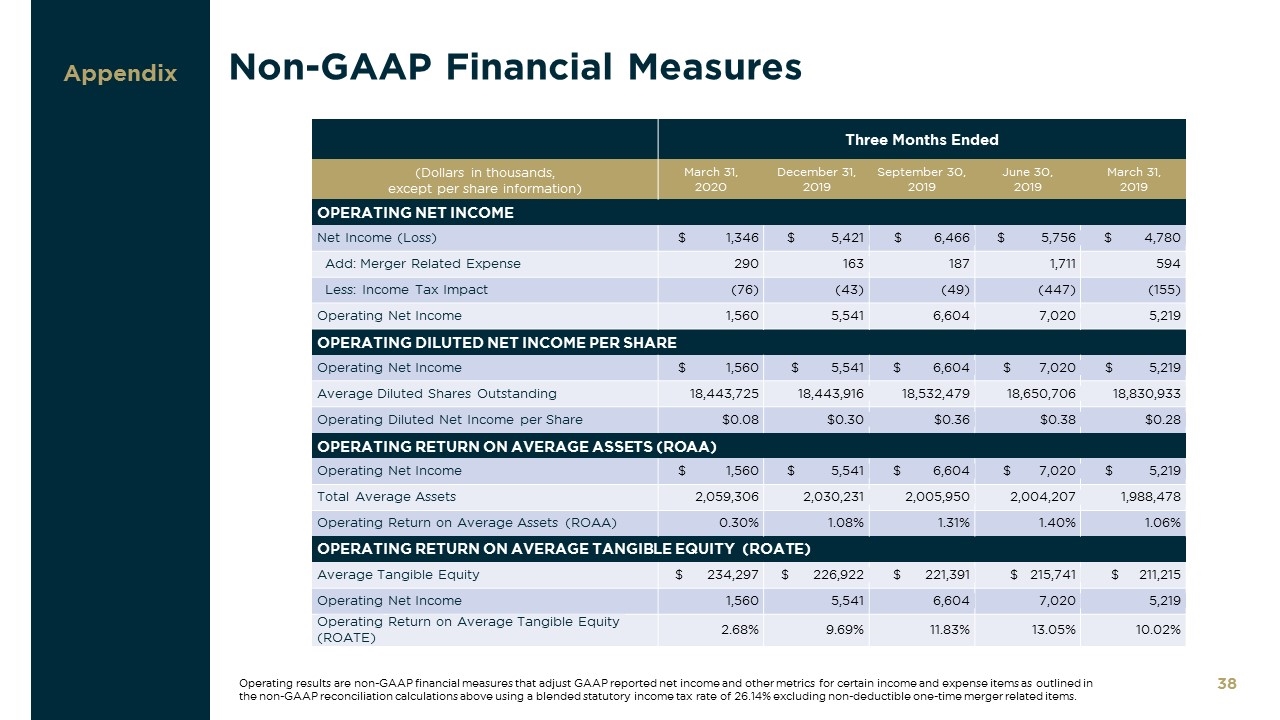

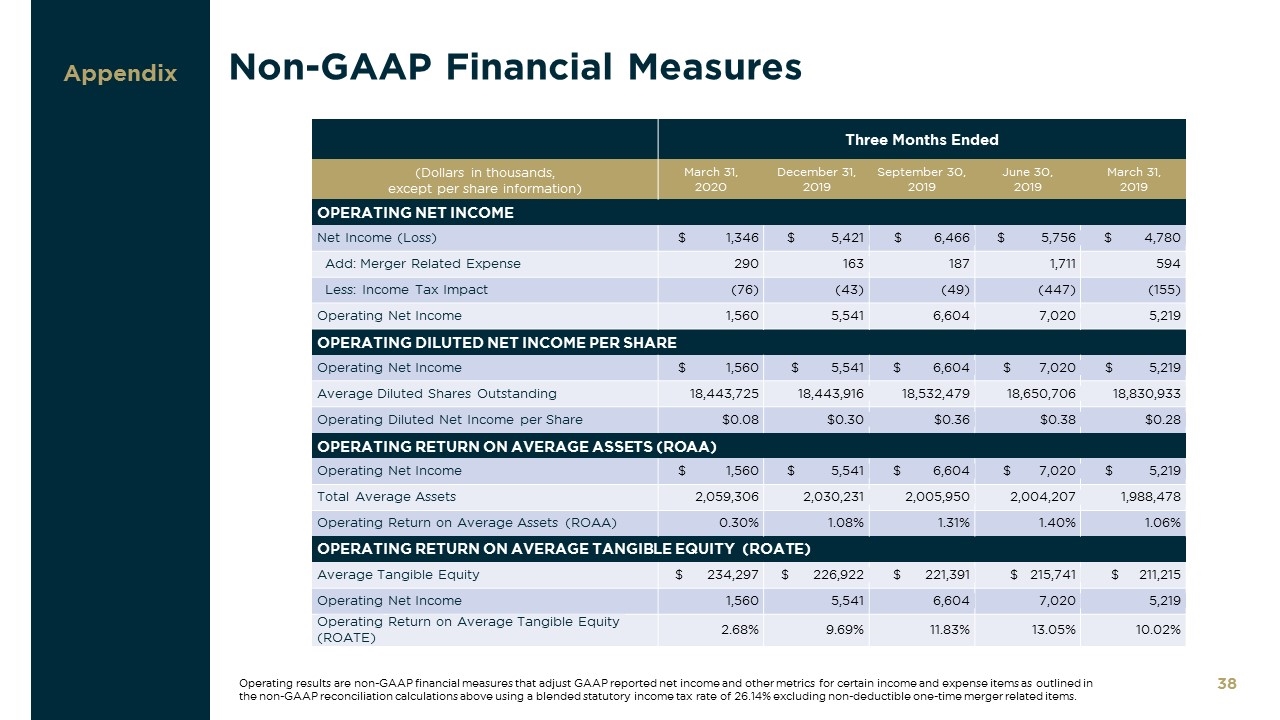

Non-GAAP Financial Measures Appendix Three Months Ended (Dollars in thousands, except per share information) March 31, 2020 December 31, 2019 September 30, 2019 June 30, 2019 March 31, 2019 OPERATING NET INCOME Net Income (Loss) $ 1,346 $ 5,421 $ 6,466 $ 5,756 $ 4,780 Add: Merger Related Expense 290 163 187 1,711 594 Less: Income Tax Impact (76) (43) (49) (447) (155) Operating Net Income 1,560 5,541 6,604 7,020 5,219 OPERATING DILUTED NET INCOME PER SHARE Operating Net Income $ 1,560 $ 5,541 $ 6,604 $ 7,020 $ 5,219 Average Diluted Shares Outstanding 18,443,725 18,443,916 18,532,479 18,650,706 18,830,933 Operating Diluted Net Income per Share $0.08 $0.30 $0.36 $0.38 $0.28 OPERATING RETURN ON AVERAGE ASSETS (ROAA) Operating Net Income $ 1,560 $ 5,541 $ 6,604 $ 7,020 $ 5,219 Total Average Assets 2,059,306 2,030,231 2,005,950 2,004,207 1,988,478 Operating Return on Average Assets (ROAA) 0.30% 1.08% 1.31% 1.40% 1.06% OPERATING RETURN ON AVERAGE TANGIBLE EQUITY (ROATE) Average Tangible Equity $ 234,297 $ 226,922 $ 221,391 $ 215,741 $ 211,215 Operating Net Income 1,560 5,541 6,604 7,020 5,219 Operating Return on Average Tangible Equity (ROATE) 2.68% 9.69% 11.83% 13.05% 10.02% Operating results are non-GAAP financial measures that adjust GAAP reported net income and other metrics for certain income and expense items as outlined in the non-GAAP reconciliation calculations above using a blended statutory income tax rate of 26.14% excluding non-deductible one-time merger related items.

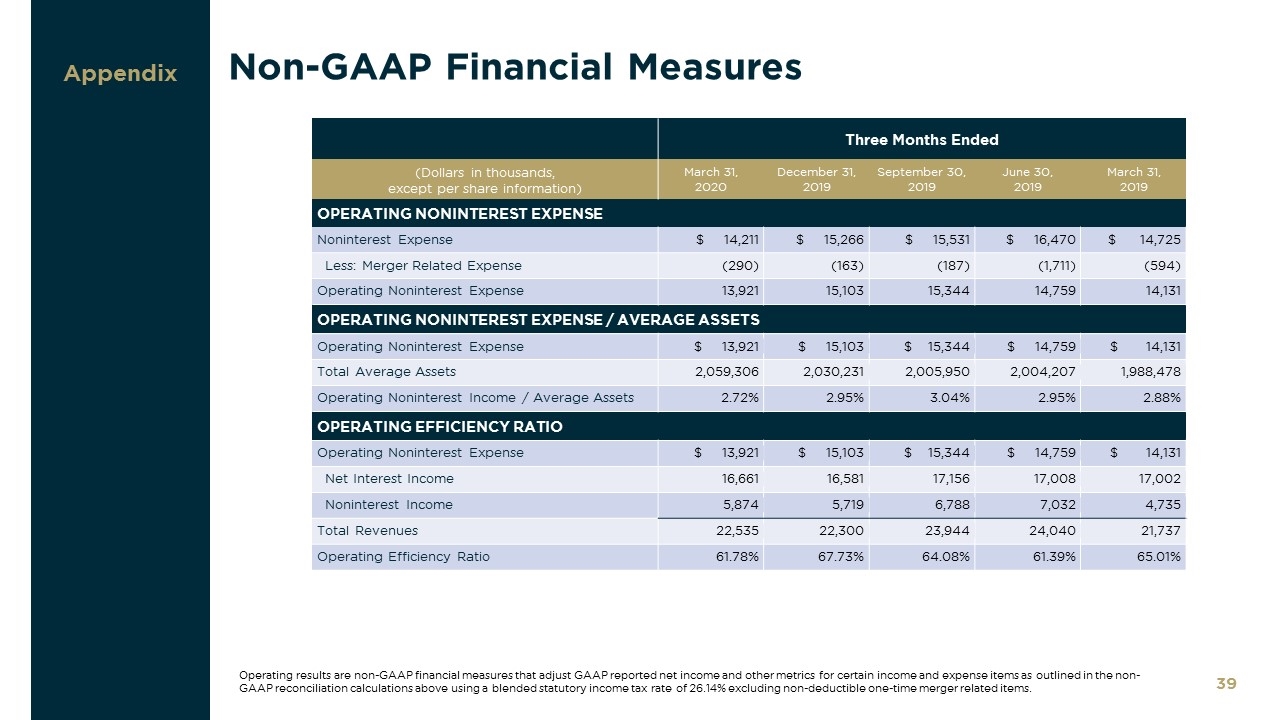

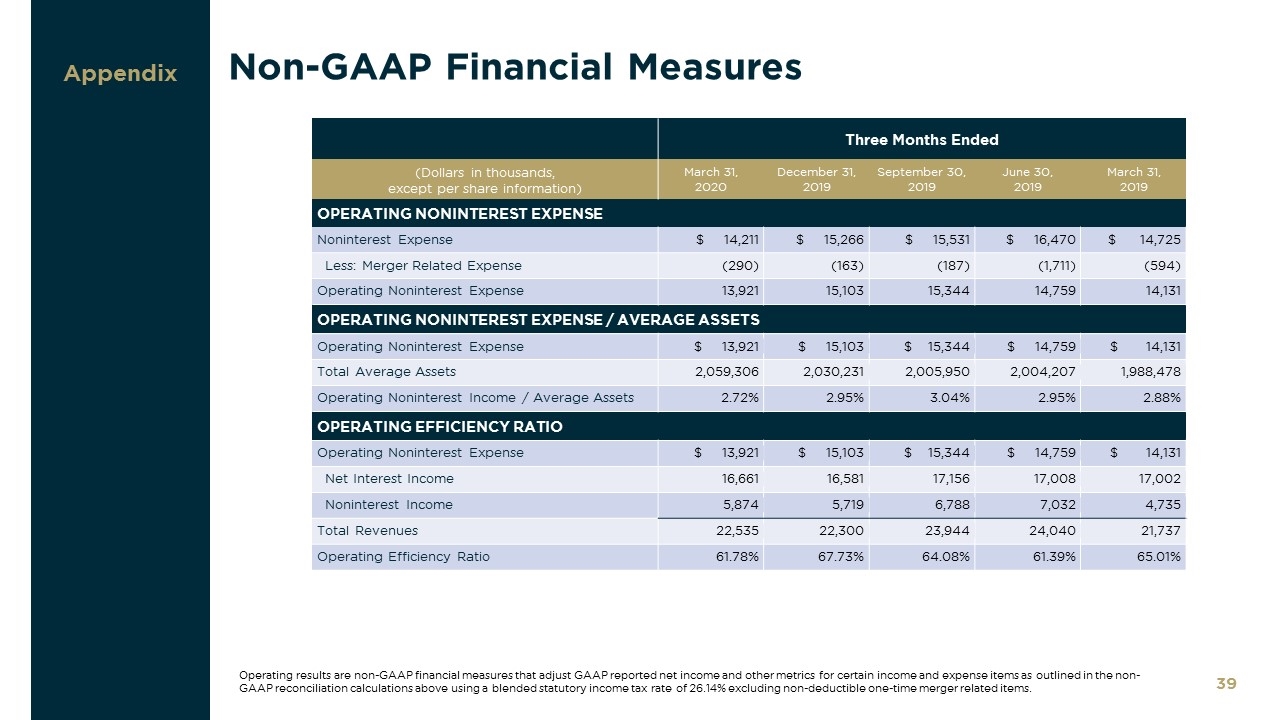

Non-GAAP Financial Measures Appendix Three Months Ended (Dollars in thousands, except per share information) March 31, 2020 December 31, 2019 September 30, 2019 June 30, 2019 March 31, 2019 OPERATING NONINTEREST EXPENSE Noninterest Expense $ 14,211 $ 15,266 $ 15,531 $ 16,470 $ 14,725 Less: Merger Related Expense (290) (163) (187) (1,711) (594) Operating Noninterest Expense 13,921 15,103 15,344 14,759 14,131 OPERATING NONINTEREST EXPENSE / AVERAGE ASSETS Operating Noninterest Expense $ 13,921 $ 15,103 $ 15,344 $ 14,759 $ 14,131 Total Average Assets 2,059,306 2,030,231 2,005,950 2,004,207 1,988,478 Operating Noninterest Income / Average Assets 2.72% 2.95% 3.04% 2.95% 2.88% OPERATING EFFICIENCY RATIO Operating Noninterest Expense $ 13,921 $ 15,103 $ 15,344 $ 14,759 $ 14,131 Net Interest Income 16,661 16,581 17,156 17,008 17,002 Noninterest Income 5,874 5,719 6,788 7,032 4,735 Total Revenues 22,535 22,300 23,944 24,040 21,737 Operating Efficiency Ratio 61.78% 67.73% 64.08% 61.39% 65.01% Operating results are non-GAAP financial measures that adjust GAAP reported net income and other metrics for certain income and expense items as outlined in the non-GAAP reconciliation calculations above using a blended statutory income tax rate of 26.14% excluding non-deductible one-time merger related items.

Contact Information Rob Anderson Chief Financial and Administrative Officer CapStar Financial Holdings, Inc. (615) 732-6470 Email: randerson@capstarbank.com CapStar Financial Holdings, Inc. 1201 Demonbreun Street, Suite 700 Nashville, TN 37203 Mail: P.O. Box 305065 Nashville, TN 37230-5065 (615) 732-6400 Telephone www.capstarbank.com (615) 732-6455 Email: ir@capstarbank.com Corporate Headquarters Executive Leadership Investor Relations