OFFICE LEASE AGREEMENT

BETWEEN

AAT TORREY 13-14, LLC

AS LANDLORD

AND

IDEAYA BIOSCIENCES, INC.

AS TENANT

STANDARD FORM

MODIFIED GROSS OFFICE LEASE

This Standard Form Modified Gross Office Lease ("Lease") is entered into effective as of November 14, 2023, between AAT TORREY 13-14, LLC, a Delaware limited liability company ("Landlord"), and IDEAYA BIOSCIENCES, INC., a Delaware corporation ("Tenant"), who agree as follows:

1.Agreement to Let. Landlord hereby leases to Tenant, and Tenant hereby leases from Landlord, upon all of the terms, provisions, and conditions contained in this Lease, (i) those certain Premises described in the Principal Lease Provisions below, consisting of a portion of that certain Building described in the Principal Lease Provisions below, which is in turn a part of the Project (as described in the Principal Lease Provisions below), along with (ii) the non-exclusive right to use, in common with Landlord, Landlord's invitees and licensees, and the other tenants and users of space within the Project, those portions of the Project intended for use by, or benefiting, tenants of the Project in common including, without limitation, the landscaped areas, passageways, walkways, hallways, elevators, parking areas, and driveways of the Building and the Project, but excluding all interior areas of the other buildings in the Project other than the Building (collectively, the “Common Areas”). Notwithstanding anything contained herein to the contrary, this Lease confers no rights to Tenant regarding the roof, exterior walls, or utility raceways of the Building, nor rights to any other building in the Project, nor with regard to either the subsurface of the land below the ground level of the Project or with regard to the air space above the ceiling of the Premises; provided, however, that Tenant shall have the limited right to access systems and equipment exclusively serving the Premises (for which Tenant has maintenance and repair responsibilities pursuant to Paragraph 10.1, below) that may be located on the roof, in exterior or demising walls, in utility raceways, in the airspaces above the ceiling of the Premises, or in any other portion of the Building or the Common Areas for the sole purpose of maintaining, repairing, and replacing such systems and equipment, in all cases subject to the terms of this Lease.

2.Principal Lease Provisions. The following are the Principal Lease Provisions of this Lease. Other portions of this Lease explain and describe these Principal Lease Provisions in more detail and should be read in conjunction with this Paragraph. In the event of any conflict between the Principal Lease Provisions and the other portions of this Lease, the Principal Lease Provisions will control. (Terms shown in quotations are defined terms used elsewhere in this Lease)

2.1.“Project”: That certain office project, commonly referred to as Torrey Reserve, in San Diego, California, as more particularly depicted on the attached Exhibit “A”.

2.2.“Building”: That certain building within the Project as designated on the attached Exhibit “A”, sometimes referred to as Torrey Reserve 14, whose mailing address is 11710 El Camino Real, San Diego, California 92130.

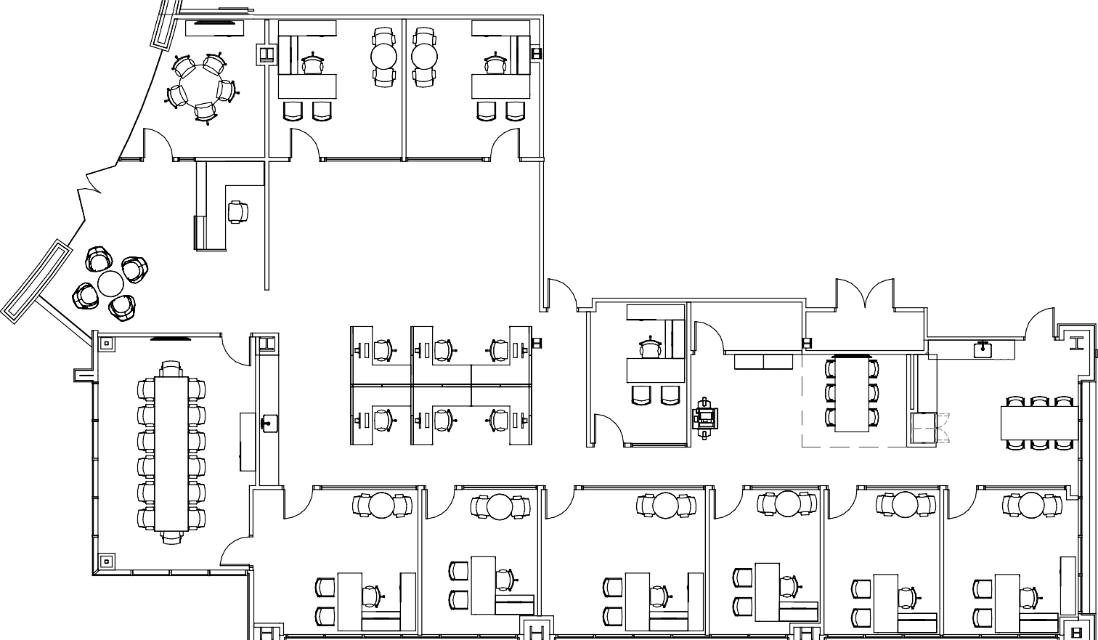

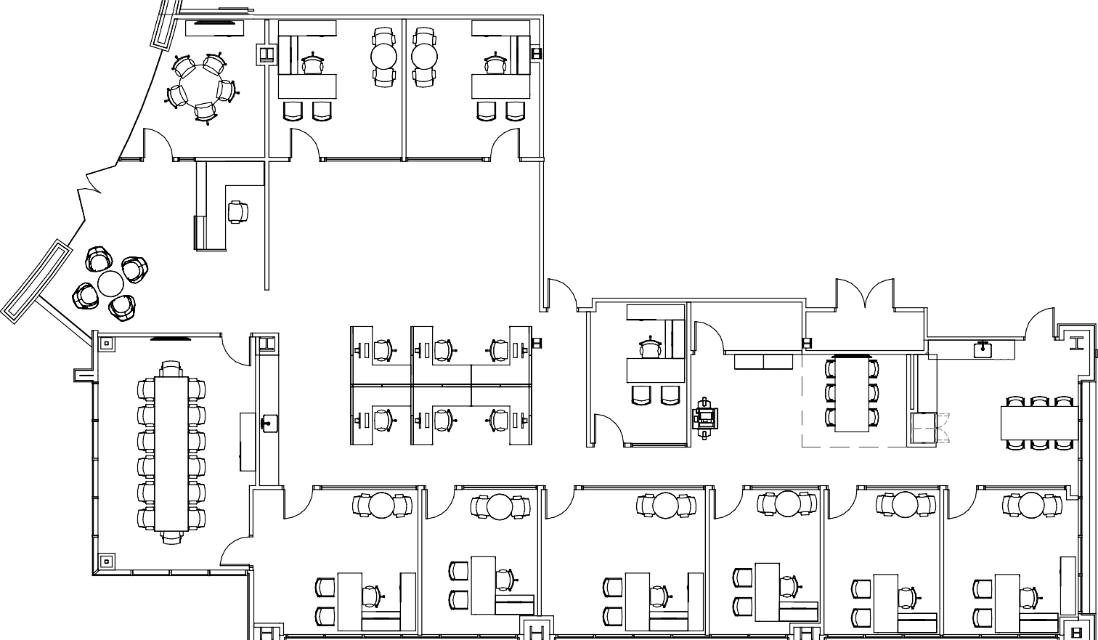

2.3.”Premises”: Suite 100; consisting of a portion of the 1st floor of the Building, as more particularly described on the attached Exhibit “B”.

2.4.Area of the Premises: Approximately 5,737 Rentable Square Feet of space. The term “Rentable Square Feet”, “Usable Square Footage”, and similar terms dealing with Rentable or Usable means of describing measurements of square footages, will have the meanings of such term adopted by the Building Owners and Managers Association International (relative to multi-tenant floors). The Premises are agreed for all purposes to contain the Rentable Square Footage stated above, regardless of minor variations.

2.5.“Initial Lease Term”: Four (4) years and three (3) months plus any additional days required for the Initial Expiration Date to occur on the last day of a month as set forth in Paragraph 2.5.2, below, beginning as of the Lease Commencement Date and ending as of the Initial Expiration Date.

2.5.1.“Lease Commencement Date”: The date which is the later to occur of (i) the date of Substantial Completion of Landlord’s Work (as defined below), pursuant to the attached Exhibit “C”, or (ii) December 1, 2023; provided, however, the Lease Commencement Date shall occur no later than January 1, 2024.

1

American Assets Trust – Lease Form 1/31/2023

2.5.2.“Initial Expiration Date”: That date which is four (4) years and three (3) months (plus, if such date is not the final day of a calendar month, however many days are left in the final calendar month of the Term) after the Lease Commencement Date.

2.5.3.Extension Rights. One (1) Option to Extend for a period of three (3) years subject to the terms and conditions set forth in Paragraph 3.2, below

2.6.“Basic Monthly Rent”: $5.45 per Rentable Square Foot, net of electricity and other utilities separately metered to the Premises, subject to adjustment pursuant to attached Addendum No. 1. Basic Monthly Rent will always be due and payable on or before the first day of the applicable month, except that the first month’s Basic Monthly Rent will be due and payable upon the date of Landlord’s execution of this Lease.

2.7.“Rent Commencement Date”: The Lease Commencement Date.

2.8.“Security Deposit”: $35,190.89, Tenant's Security Deposit—which is due and payable on the date of Tenant's execution of this Lease—does not constitute last month's rent. Last month's rent must be separately paid by Tenant on or before the first day of the last month of the Term. If Tenant exercises any Option to Extend (as defined below) contained herein, then as a condition precedent to the effectiveness of Tenant's exercise of such Option to Extend, Tenant shall pay to Landlord an amount equal to the difference between the Basic Monthly Rent for the last year of such Extension Term (as defined below) and the amount of the Security Deposit then held by Landlord; which additional amount will be added to, and constitute a part of, the Security Deposit from that point forward.

2.9.“Base Year”: Calendar year 2024.

2.10.Address for Landlord:

AAT Torrey 13-14, LLC

c/o American Assets Trust Management, LLC

3420 Carmel Mountain Road, Suite 100

San Diego, CA 92121

Attn: Property Management (Office)

2.11.Addresses for Tenant:

Legal Notices Addresses

IDEAYA Biosciences

7000 Shoreline Court, Suite 350

South San Francisco, CA 94080

Attn: General Counsel

2.12.“Permitted Use”: The Premises shall be used for general office purposes, in accordance with all applicable Laws, statutes, ordinances, and regulations and the provisions of this Lease, and for no other use.

2.13.Building Standard Operating Hours:

Monday through Friday: 7:00 a.m.-6:00 p.m.

Saturday: 9:00 a.m.-1:00 p.m.

(excluding Sundays and any local, state, and federal holidays)

2.14.Participating Brokers:

Landlord’s: CBRE, Inc.

Tenant’s: Kidder Mathews

2.15.Initial Payment Amounts: $66,457.54 (which represents the Security Deposit of $35,190.89, plus the first month’s Basic Monthly Rent of $31,266.65) is payable on the date Tenant executes this Lease.

3.1.Description of Term. The term of this Lease (“Term”) shall commence on the “Lease Commencement Date”, and shall expire on the “Initial Expiration Date”, subject to (i)

2

American Assets Trust – Lease Form 1/31/2023

any extension rights described in Paragraph 3.2, below, and (ii) earlier termination by Landlord, as provided in this Lease. The term “Expiration Date”, as used in this Lease, shall mean the Initial Expiration Date, any earlier date upon which this Lease is terminated by Landlord, as provided below, or if the Term is extended pursuant to Paragraph 3.2, below, then the expiration date of any exercised Extension Term.

3.2.Extension Rights. Tenant shall, subject to all of the provisions of this Paragraph 3.2 (including all subparagraphs hereof), have one (1) option to extend the Term (the “Option to Extend”) for an additional term of three (3) years (the "Extension Term"), provided Tenant or a Permitted Transferee is in occupancy 90% of the Premises at the time of exercise of the Option to Extend and Tenant gives Landlord written notice via overnight nationally-recognized courier (such as FedEx or UPS), with signature acknowledgement by recipient required, of its election to exercise such Option to Extend no less than 12 months and no more than 15 months prior to the then-applicable Expiration Date of the Term. Such notice will constitute Tenant’s binding irrevocable election to extend the Term pursuant to this Paragraph 3.2 and may not subsequently be revoked by Tenant except as provided below. Time is of the essence with respect to the timing of such requirement to give notice to Landlord.

3.2.1.Restrictions on Transferability of Option. The Option to Extend is personal to the Tenant originally named in this Lease or any Permitted Transferee (as defined below) and may not be exercised by anyone other than such originally named Tenant or a Permitted Transferee.

3.2.2.Conditions Terminating Tenant’s Rights to Exercise Option. Tenant shall not have the right to exercise the Option to Extend, notwithstanding anything set forth above to the contrary: (a) during any period of time commencing from the date Landlord gives to Tenant a bona fide written notice that Tenant is in default under any provision of this Lease and continuing until the default alleged in said notice is cured; or (b) during the period of time commencing on the day after a monetary obligation to Landlord is due from Tenant and unpaid (without any necessity for notice thereof to Tenant) and continuing until the obligation is paid. The period of time within which the Option to Extend may be exercised shall not be extended or lengthened by reason of Tenant’s inability to exercise the Option to Extend because of the foregoing provisions of this Paragraph 3.2.2, even if the effect thereof is to eliminate Tenant’s right to exercise the Option to Extend.

3.2.3.Conditions Terminating Tenant’s Option Rights. All rights with respect to the Option to Extend (including rights as to subsequent Extension Terms, if any) shall terminate and be of no further force or effect even after Tenant’s due and timely exercise of the Option to Extend, if, as of the date of the commencement of the Extension Term, Tenant is in default of its obligations under this Lease beyond any applicable notice and cure period.

3.2.4.Terms and Conditions of Extension of Term. If Tenant duly and timely exercises the Option to Extend for an Extension Term, then this Lease shall remain in full force and effect for such additional three (3) year period, except that the Basic Monthly Rent will adjust as of the first day of the first Extension Term such that for the first year of the first Extension Term the Basic Monthly Rent shall be equal to the then prevailing base rental rate (adjusted to account for tenant improvement and similar refurbishment or construction allowances, free rent, periods and other tenant benefits/concessions typically associated with a renewal lease) for renewal leases of comparable Class A office space of comparable size, location, quality, views and Project amenities (i.e., staffed fitness center, conference center, daycare center and multiple food and beverage offerings) in the Carmel Valley/Del Mar Heights submarket, as projected for the first day of the applicable Extension Term and determined pursuant to Paragraph 3.2.5, below (the "Then-Prevailing Rate").

3.2.5.Determination of Then-Prevailing Rate. If Tenant properly exercises the Option to Extend for an Extension Term, then Landlord shall, subject to the terms and conditions set forth in this Paragraph 3.2, within 15 business days after receipt of Tenant's Option Exercise Notice, provide Tenant with written notice of the Then-Prevailing Rate and the Then-Prevailing Increase Rate and the calculation of the new Basic Monthly Rent to be effective during the first year of the Extension Term. Tenant shall have 10 business days from the date of Landlord's notice in which to (i) accept the Landlord's determination of the Then-Prevailing Rate, or (ii) dispute Landlord's determination of the Then-Prevailing Rate. If Tenant fails to notify Landlord, in writing, of its disagreement with Landlord's determination of the Then-Prevailing Rate within such 10 business day period, then Tenant will be deemed to have accepted Landlord's determination and Landlord's determination shall be binding on both parties. If Tenant disputes such determination, then its notice to Landlord disputing such determination must set forth Tenant's determination of the Then-Prevailing Rate. Upon receipt of Tenant's notice, Landlord and Tenant shall promptly meet and, in good faith, attempt to agree upon the Then-Prevailing

3

American Assets Trust – Lease Form 1/31/2023

Rate. If Landlord and Tenant are unable to reach agreement upon the Then-Prevailing Rate within 30 days of the date of Landlord's receipt of Tenant's dispute notice, then the parties shall promptly submit such dispute to the San Diego office of the American Arbitration Association (the "AAA"), or its successor, for resolution before a single arbitrator (who must have at least ten years' experience in the Carmel Valley/Del Mar Heights commercial real estate market as a real estate broker or MAI appraiser) in accordance with Real Estate Industry Arbitration Rules of the AAA. Within 10 days of the commencement of the arbitration, Landlord and Tenant shall each provide the arbitrator with their respective written determination of the Then-Prevailing Rate—which determinations will not be disclosed by the arbitrator until both parties have submitted their respective written determinations. The arbitrator's sole authority will be to select between the Landlord's and the Tenant's respective written determinations of the Then-Prevailing Rate, as provided to the arbitrator in accordance with the preceding sentence; provided, however, if either party fails to timely submit such a written determination to the arbitrator, then the arbitrator shall use the written determination of such party as set forth in the notices described above as part of the initiation of the subject process. In no event may such arbitrator select any other amount as the Then-Prevailing Rate. The decision of the arbitrator shall be final and binding upon all parties, and not subject to appeal, and the cost of the arbitration and the arbitrator’s fee shall be shared equally between Landlord and Tenant.

4.Delivery of Possession.

4.1.Delivery Requirements. On or before the Lease Commencement Date, Landlord, at its cost, shall have Substantially Completed the work, if any, required to be completed by Landlord prior to the tender of possession of the Premises to Tenant, as described in Exhibit “C” to this Lease (“Landlord's Work”) and shall tender possession of the Premises to Tenant (subject to Landlord's reserved rights hereunder and Landlord's right to continue the completion of Landlord's Work without material interference by Tenant). Landlord's tender of possession of the Premises shall consist of Landlord's notification (which notification may be telephonic, by written notice, or by electronic transmission—such as by facsimile or email) that possession of the Premises is then available to Tenant, and instructing Tenant that Tenant may obtain the keys to the Premises from Landlord's offices. Tenant's refusal to accept such tender (or avoidance thereof) shall not affect the Lease Commencement Date or delay the Rent Commencement Date and such dates will be calculated as if no such refusal or avoidance had occurred. Pursuant to the provisions of attached Exhibit "C", following the Lease Commencement Date, Landlord shall provide Tenant with a factually accurate "Confirmation of Lease Terms" (herein so called) written memorandum in the form of attached hereto as Exhibit "H"; provided, however, that any failure by Landlord to provide the Confirmation of Lease Terms shall not affect the validity or enforceability of this Lease or any of the provisions hereof. Tenant shall execute and return to Landlord the Confirmation of Lease Terms memorandum within 10 days after its submittal by Landlord to Tenant. Failure by Tenant to execute the Confirmation of Lease Terms memorandum shall not amend or in any way affect the terms thereof, but shall be deemed as Tenant's final and conclusive acceptance of the terms of the Confirmation of Lease Terms.

4.2.Definition of Substantial Completion. For purposes of this Lease, the term “Substantially Complete” (and its grammatical variations, such as Substantial Completion) when used with reference to Landlord's Work, will mean that Landlord's Work has been completed in the Premises pursuant to Exhibit "C", with the exception of any punch list items of a minor nature that do not interfere with Tenant’s ability to complete Tenant’s Work and may be finally completed within thirty (30) days by Landlord.

4.3.Final Completion. Except for any items set forth on a written, detailed “punch-list” of excepted items delivered to Landlord upon the Lease Commencement Date, and subject to the terms of this Lease, Tenant shall, as of the Lease Commencement Date, be deemed to have (i) determined that, to Tenant's knowledge, the Premises comply with all applicable Laws and ordinances, and that the Premises are in first-class condition and repair, (ii) acknowledged that Landlord's Work has been Substantially Completed, (iii) accepted the Premises in its then as-is condition with no right to require Landlord to perform any additional work therein, except as set forth on the punch list, and (iv) waived any express or implied warranties regarding the condition of the Premises, including any implied warranties of fitness for a particular purpose or habitability, suitability, merchantability, quality or condition.

5.Use of Premises and Common Areas.

5.1.Permitted Use of Premises. Tenant may use the Premises for the Permitted Use specified in the Principal Lease Provisions and for no other use without Landlord’s consent. Any change or deviation in the Permitted Use will require Landlord's prior written consent, which consent may be granted or withheld in Landlord's sole and exclusive discretion.

4

American Assets Trust – Lease Form 1/31/2023

5.2.Compliance with Laws. Landlord covenants that the Premises will comply with the Americans With Disabilities Act of 1990, as amended (42 U.S.C. 12181 et seq.) (the “ADA”) and all other applicable federal, state and local laws, statutes, ordinances, or other governmental rules, regulations or requirements (collectively, together with the ADA, “Laws”) as of the Lease Commencement Date. After the Lease Commencement Date, Tenant shall comply with all Laws with respect to Tenant's particular use of the Premises, Tenant’s Work or any Alterations. Such obligation to comply with Laws shall include without limitation compliance with the ADA and the California Unruh Civil Rights Act. In addition to the foregoing, if Tenant's particular use of the Premises (including the construction or installation of Tenant’s Work, Alterations, as defined below) or any modifications to Tenant’s use of the Premises or Project results in the need for modifications or alterations to any other portion of the Project (including but not limited to the Common Areas of the Project) in order to comply with the ADA or other applicable Laws, then Tenant shall additionally be responsible, upon demand, for the cost of such modifications and alterations plus a supervisory fee of 10% of such cost payable to Landlord. Tenant acknowledges and agrees that it has reviewed the CASp Inspection Disclosure and Acknowledgment attached to this Lease as Exhibit “F”, and California Civil Code Section 1938, attached thereto and incorporated herein, at least 48 hours prior to the execution of this Lease. Tenant shall indemnify, defend (with counsel reasonably satisfactory to Landlord), and hold Landlord (and its partners, members, shareholders, directors, officers, employees, agents, assigns, and any successors to Landlord's interest in the Project) harmless from and against any and all losses, costs, demands, damages, expenses (including reasonable attorneys' fees and expenses), claims, causes of action, judgments, penalties, fines, or liabilities, to the extent arising from Tenant's failure to satisfy its obligations under this Paragraph including, without limitation, (i) any costs, expenses, and liabilities incurred by Landlord in connection with responding to any demand by any governmental authority that Landlord undertake any modifications or alterations which are Tenant's responsibility pursuant to this Paragraph or for which Tenant is obligated to reimburse Landlord hereunder, as well as (ii) any attorneys' fees, costs, expenses, and liabilities incurred by Landlord in responding to, defending, pursuing, or otherwise being involved with any action, suit, or proceeding arising out of any claim relating to the non-compliance of the Premises or the Project with the ADA or any similar Laws where such action, suit, or proceeding relates to, or arises from, Tenant's particular use of the Premises, Tenant’s Work or any Alterations.

5.3.Condition During Periods of Non-Use. During any period of time in which Tenant is not continuously using and occupying the Premises for the operation of its business, Tenant shall take such measures as may be necessary or desirable, in Landlord's reasonable opinion, to secure the Premises from break-ins and use by unauthorized persons, to minimize the appearance of non-use, and to otherwise maintain the interior portions of Tenant's Premises, including all windows and doors, in first class condition.

5.4.Use of Common Areas. Tenant's use of the Common Areas shall at all times comply with the provisions of all Rules (as defined below) regarding such use as Landlord may from time to time adopt which do not materially increase Tenant's obligations or materially decrease Tenant's rights under the Lease. In no event shall the rights granted to Tenant to use the Common Areas include the right to store any property in the Common Areas, whether temporarily or permanently. Any property stored in the Common Areas may be removed by Landlord and disposed of, and the cost of such removal and disposal shall be payable by Tenant to Landlord upon demand. Additionally, in no event may Tenant use any portion of the Common Areas for loading, unloading, or parking, except in those areas specifically designated by Landlord for such purposes, nor for any group social event, sidewalk sale, employment fair or similar commercial or unauthorized purpose. Without limiting the generality of the rights of Landlord under this Paragraph 5.4, Landlord also reserves the right to temporarily close any portion of the Common Areas for maintenance purposes so long as reasonable access to the Premises remains available.

5.5.General Covenants and Limitations on Use. In addition to the Rules, Tenant’s and Tenant's agents’, employees’, officers’, independent contractors’, licensees’, guests and invitees’ (collectively, “Tenant's Invitees”) use of the Premises and the Project, will be subject to the following additional general covenants and limitations on use.

5.5.1.Tenant shall not do, bring, or keep anything in or about the Premises that will cause a cancellation of any insurance covering the Premises. If the rate of any insurance carried by Landlord is increased as a result of Tenant's use of the Premises or Tenant’s failure to continuously use and occupy the Premises, Tenant shall pay the amount of such increase to Landlord, within 10 days after Landlord delivers to Tenant a notice of such increase.

5.5.2.No noxious or unreasonably offensive activity shall be carried on, in or upon the Premises by Tenant or Tenant's Invitees, nor shall anything be done or kept in the Premises which may be or become a public nuisance or which may cause unreasonable

5

American Assets Trust – Lease Form 1/31/2023

embarrassment, disturbance, or annoyance to others in the Project, or on adjacent or nearby property. To that end, Tenant additionally covenants and agrees that no light shall be emitted from the Premises which is unreasonably bright or causes unreasonable glare; no sounds shall be emitted from the Premises which are unreasonably loud or annoying; and no odor shall be emitted from the Premises which is or might be noxious or offensive to others in the Building, on the Project, or on adjacent or near-by property.

5.5.3.No unsightliness shall be permitted in the Premises which is visible from the Common Areas. Without limiting the generality of the foregoing, all equipment, objects, and materials shall be kept enclosed within the Premises and screened from view or in Common Areas trash enclosures; no refuse, scraps, debris, garbage, trash, bulk materials, or waste shall be kept, stored, or allowed to accumulate except as may be properly enclosed within appropriate containers in the Premises and promptly and properly disposed of.

5.5.4.The Premises shall not be used for sleeping or washing clothes, nor shall the Premises be used for cooking or the preparation, manufacture, or mixing of anything that might emit any offensive odor or objectionable noises or lights onto the Project or nearby properties.

5.5.5.All pipes, wires, conduit, cabling, poles, antennas, and other equipment/facilities for or relating to utilities, telecommunications, computer equipment, or the transmission or reception of audio or visual signals must be kept and maintained enclosed within the Premises (except to the extent included as part of Landlord's Work, Tenant's Work, or otherwise approved by Landlord).

5.5.6.Tenant shall not keep or permit to be kept any bicycle, motorcycle, or other vehicle, nor any animal (excluding service animals), bird, reptile, or other exotic creature in the Premises.

5.5.7.Neither Tenant nor Tenant's Invitees shall do anything that will cause damage or waste to the Project. Neither the floor nor any other portion of the Premises shall be overloaded. Tenant shall be responsible for all structural engineering required to determine structural load for items placed in the Premises by Tenant. Tenant shall fasten all files, bookcases, and like furnishings to walls in a manner to prevent tipping over in the event of earthquake, tremor, or other earth movements. Landlord shall not be responsible for any damage or liability for such events. No machinery, equipment, apparatus, or other appliance shall be used or operated in or on the Premises that will in any manner injure, vibrate, or shake all or any part of the Project or be allowed to interfere with the equipment of any other tenant within the Project (or other property owned by Landlord or its affiliates), including, without limitation, interference with transmission and reception of telephone, telecommunications, television, radio, or similar signals.

5.5.8.The Premises will be used only as a commercial facility and not as a place of public accommodation as defined by ADA. Tenant shall not offer its goods and services to the general public at the Premises.

5.6.Access Rights. Except as set forth herein, Tenant will have 24 hour-a-day, 7 day-a-week access to the Building and the Premises. Notwithstanding the foregoing, no failure of such access rights will constitute an eviction (constructive or otherwise) or a disturbance of Tenant’s use and possession of the Premises or relieve Tenant from paying Rent or performing any of its obligations under this Lease; except that Tenant shall be entitled to equitable abatement of its Rent (as defined below) obligations hereunder to the extent such lack of access is due to Landlord's negligence or intentional misconduct and continues for a period in excess of 3 business days. Landlord will not be liable, under any circumstances, for a loss of or injury to property or for injury to or interference with Tenant’s business, including loss of profits through, in connection with, or incidental to a failure to furnish access under this Paragraph. Notwithstanding the foregoing, Landlord agrees to use reasonable efforts to promptly correct any such interruption of access.

5.7.Remedies for Breach. In the event of any breach of this Paragraph 5 by Tenant or Tenant's Invitees, Landlord, at its election and in addition to its other rights and remedies under this Lease, may pay the cost of correcting such breach and Tenant shall immediately, upon demand, pay Landlord the cost thereof, plus a supervisory fee in the amount of 10% of such cost.

6.1.Security Deposit. Upon Tenant’s execution of this Lease, Tenant shall

6

American Assets Trust – Lease Form 1/31/2023

deposit with Landlord good funds in the amount of the Security Deposit (if any) set forth in the Principal Lease Provisions, to secure the performance by Tenant of its obligations under this Lease, including without limitation Tenant's obligations (i) to pay Basic Monthly Rent and Additional Rent (as defined below), (ii) to repair damages to the Premises and/or the Project caused by Tenant or Tenant’s Invitees, (iii) to surrender the Premises in the condition required by Paragraph 23.1, below, and (iv) to remedy any other defaults by Tenant in the performance of any of its obligations under this Lease. If Tenant commits any default under this Lease, Landlord may, at its election, use the Security Deposit to cure such default, and to compensate Landlord for all damages actually suffered by Landlord which are directly attributable to such default, including, without limitation, reasonable attorneys' fees and costs incurred by Landlord. Upon demand by Landlord, Tenant shall promptly pay to Landlord a sum equal to any portion of the Security Deposit so used by Landlord, in order to maintain the Security Deposit in the amount set forth in the Principal Lease Provisions above (subject to increase as set forth below). Should Landlord choose to apply the Security Deposit against damages suffered by it, such application shall not establish or signify a waiver of any other rights or remedies of Landlord hereunder, nor shall such application constitute an accord and satisfaction. If the Basic Monthly Rent shall, from time to time, increase during the Term, then, upon demand by Landlord, Tenant shall deposit with Landlord cash in an amount necessary to increase the Security Deposit such that it shall at all times bear the same proportion to the then‑current Basic Monthly Rent as the initial Security Deposit bears to the initial Basic Monthly Rent. Within 45 days following the Expiration Date or earlier termination of this Lease, Landlord shall deliver to Tenant, at Tenant's last known address, any portion of the Security Deposit not used by Landlord, as provided in this Paragraph. Landlord may commingle the Security Deposit (and any advance Rent received by Landlord) with Landlord's other funds and Landlord shall not pay interest on such Security Deposit to Tenant. Tenant waives the provisions of California Civil Code Section 1950.7 (or any successor statute), and any similar principle of Laws with respect to Landlord’s ability to apply the Security Deposit against future rent damages. Furthermore, upon lawful termination of the Lease as a result of Tenant’s default, Landlord shall be entitled to immediately apply the Security Deposit against damages computed under California Civil Code Section 1951.2, without the requirement that Tenant first be given notice and an opportunity to cure, and notwithstanding that the damages have not been finally adjudicated by a court. Tenant may not assign or encumber Tenant's residual rights in the Security Deposit without the consent by Landlord.

7.Rent and Rent Adjustments.

7.1.Initial Monthly Rent. Tenant shall pay to Landlord as minimum monthly rent, without deduction, setoff, prior notice, or demand, the Basic Monthly Rent described in the Principal Lease Provisions (subject to adjustment as provided in the attached Addendum), in advance, on or before the first day of each calendar month, beginning on the Rent Commencement Date and thereafter throughout the Term. If the Rent Commencement Date is other than the first day of a calendar month, then the Basic Monthly Rent payable by Tenant for the second month of the Term following the Rent Commencement Date (acknowledging that the first month’s rent is payable upon Lease execution) shall be prorated on the basis of the actual number of days during the Term occurring during the first partial calendar month thereof.

7.2.Rental Adjustments. The Basic Monthly Rent shall be increased periodically in accordance with the provisions of attached Addendum No. 1 to this Lease.

7.3.Additional Rent. In addition to paying the Basic Monthly Rent pursuant to this Paragraph 7, Tenant shall pay to Landlord (in accordance with Paragraph 8 below), commencing on January 1, 2025, Tenant’s Share (as defined below) of the annual Operating Expenses (as defined below) that are in excess of the amount of Operating Expenses applicable to the Base Year. The amounts payable pursuant to this Paragraph, together with all other amounts of any kind (other than Basic Monthly Rent) payable by Tenant to Landlord under the terms of this Lease, constitute additional rent for the Premises and are collectively and individually referred to in this Lease as “Additional Rent”.

7.4.General Rental Provisions. All “Rent” (which includes Basic Monthly Rent and all “Additional Rent” hereunder) shall be paid to Landlord at the same address as notices are to be delivered to Landlord pursuant to the Principal Lease Provisions, as Landlord may change such address from time to time pursuant to the terms of this Lease.

8.1.Definitions. The following definitions apply in this Paragraph 8 (and elsewhere in this Lease):

7

American Assets Trust – Lease Form 1/31/2023

8.1.1.Operating Expenses. Subject to the Excluded Costs (as defined below) relating to the Project, the term “Operating Expenses” means all expenses, costs, and amounts of every kind or nature that Landlord pays or incurs because of or in connection with the ownership, operation, management, maintenance, or repair of the Building, Common Areas and Project. Operating Expenses include, without limitation, the following amounts paid or incurred by Landlord relative to the Building, Common Areas and Project: (a) the cost of supplying utilities to all portions of the Project (other than tenant suites), including without limitation water, waste deposit, power, electricity, heating, ventilation, and air conditioning, (b) Tax Expenses and Insurance Expenses (as such terms are defined below), (c) the cost of providing janitorial services, window washing services and of operating, managing, maintaining, and repairing all building systems, including without limitation utility, mechanical, sanitary, storm drainage, and elevator systems, and the cost of supplies, tools, and equipment, as well as maintenance and service contracts in connection with those systems, (d) the cost of licenses, certificates, permits, and inspections relating to the operation of the Project, (e) the cost of landscaping, (f) the cost of repairing, cleaning, sweeping, painting, striping, replacing and repaving, curbs, parking areas, walkways, guardrails, bumpers, fences, screens, flagpoles, bicycle racks, signs, and other markers, drainage pipes, ducts, conduits, lighting facilities, and all other elements and amenities of the Common Area, (g) the cost of inspection, maintenance, repair, and acquisition costs (including depreciation) of any and all machinery and equipment used in the operation and maintenance of the Project, including personal property taxes and other charges and taxes incurred in connection with such equipment; (h) the cost of maintenance of and compliance with federal, state, or local governmental ambient air, environmental, health, and safety standards; (i) the cost of consumable materials, (j) intentionally omitted, (k) the cost of maintenance, repair, and restoration of any parking areas or structures, including, without limitation, resurfacing, repainting, restriping, and cleaning costs, (l) fees, charges, and other costs, including administrative, whether paid to Landlord, an affiliate of Landlord's, or a third party, consulting fees, legal fees, and accounting fees of all persons engaged by Landlord or otherwise reasonably incurred by Landlord in connection with the operation, management, maintenance, and repair of the Project, (m) wages, salaries, and other compensation and benefits of all persons engaged in the operation, maintenance, repair, or security of the Project plus employer’s Social Security taxes, unemployment taxes, insurance, and any other taxes imposed on Landlord that may be levied on those wages, salaries, and other compensation and benefits. If any of Landlord’s employees provide services for more than one project of Landlord's, only the prorated portion of those employees’ wages, salaries, other compensation and benefits, and taxes reflecting the percentage of their working time devoted to the Project will be included in the Operating Expenses, (n) payments under any easement, CC&R's, license, operating agreement, declaration, restrictive covenant, or other instrument relating to the sharing of costs affecting the Project, (o) amortization (including interest on the unamortized cost at a rate equal to the floating commercial loan rate announced from time to time by Bank of America as its “reference rate” (or a comparable rate selected by Landlord if such reference rate ceases to be published) plus 3 percentage points per annum) of the cost of acquiring or renting personal property used in the maintenance, repair, and operation of the Project, (p) intentionally omitted, (q) fees and expenses for consultants retained by Landlord from time to time for the purposes of energy conservation, waste treatment, and water recycling, (r) the costs of any capital improvements, structural modifications, equipment or devices made, installed and/or paid for by Landlord, (i) in order to comply with any Laws, change in Laws, or any other rules, regulations or requirements of any governmental or quasi-governmental authority having jurisdiction or of the board of fire underwriters or similar insurance body (except to the extent Tenant is otherwise obligated, pursuant to this Lease, to undertake such improvements or structural modifications at Tenant’s cost), or (ii) in order to cause or attempt to cause labor saving, energy saving, or other economies in the maintenance and operation of the Project (including, without limitation, as related to energy generation, water recycling and waste treatment), and (s) the cost of maintenance of all heating, ventilating and air condition systems, including, without limitation, heating and condenser water to facilitate the production of air conditioning (collectively, “HVAC”) relating to individual premises and/or the Common Areas, other than HVAC systems exclusively serving other tenants’ premises that are directly paid for, or reimbursed, by such other tenants. All capital expenditures shall be amortized (including interest on the unamortized cost at the rate stated in subparagraph (o) of this Paragraph) over their useful life, as reasonably determined by Landlord’s certified public accountant. Operating Expenses will not, however, include any Excluded Costs (as defined below).

8.1.2.Excluded Costs. “Excluded Costs” means the following expenses, as they relate to the Operating Expenses: (i) depreciation, principal, interest, and fees on mortgages or ground lease payments, except as otherwise expressly provided herein, (ii) legal fees incurred in negotiating and enforcing tenant leases, or disputes with other tenants, its employees or property manager, (iii) real estate brokers’ leasing commissions and advertising costs in connection with leasing space in the Project, (iv) initial improvements or alterations to tenant spaces in the Project, (v) the cost of providing any service directly to and paid directly by

8

American Assets Trust – Lease Form 1/31/2023

a single individual tenant, or costs incurred for the benefit of a single tenant, (vi) costs of any items to the extent Landlord actually receives reimbursement therefor from insurance proceeds, under warranties, or from a tenant or other third party (such costs shall be excluded or deducted – as appropriate – from Operating Expenses in the year in which the reimbursement is received), or which are paid out of reserves previously included in Operating Expenses, (vii) costs incurred due to Landlord’s breach of Laws or ordinance, (viii) repairs necessitated by the negligence or willful misconduct of Landlord or Landlord's employees, agents, or contractors, (ix) capital expenses other than those specifically included in the definition of Operating Expenses, (x) charitable or political contributions and membership fees or other payments to trade organizations, (xi) costs of Landlord’s Work which are to be borne by Landlord pursuant to attached Exhibit “C”, if any, (xii) rent and similar charges for Landlord’s on-site management office and/or leasing office or any other offices of Landlord or its affiliates, (xiii) Landlord's general overhead expenses not related to the Project, (xiv) any cost due to Landlord’s breach of this Lease, debt service (including without limitation, interest, principal and any impound payments) required to be made on any mortgage or deed of trust recorded with respect to the Project, (xv) repairs and replacements paid for by insurance proceeds, or would have been so reimbursed if Landlord had in force all insurance required to be carried by Landlord under this Lease, (xvi) intentionally deleted; (xvii) bad debt loss, rent loss, or reserves of any kind; (xviii) costs associated with the operation of the business of the entity which constitutes Landlord, as the same are distinguished from the costs of operation of the Building, (xix) overhead and profit increment paid to the Landlord or to subsidiaries or affiliates of the Landlord for services to the extent the same exceeds the costs of such services rendered by qualified, first-class unaffiliated third parties on a competitive basis; (xx) costs, including fines or penalties, incurred due to a violation of any law in force and effect as of the Lease Commencement Date; (xxi) costs incurred to comply with laws relating to the removal of Hazardous Substances which were in existence in the Project prior to the Lease Commencement Date, or after the Lease Commencement Date to the extent not caused by Tenant; (xxii) wages and benefits of any employee above property manager, or (xxiii) property management fees in excess of 3.5% of the gross revenue of the Project.

8.1.3.Expense Year. “Expense Year” means the Base Year, and each calendar year after the Base Year, in which any portion of the Term falls, through and including the calendar year in which the Term expires.

8.1.4.Tenant's Share. “Tenant’s Share” means a fraction, the numerator of which is the total aggregate Rentable Square Feet in the Premises, and the denominator of 18,788 which is the total aggregate Rentable Square Feet in the Building. As of the Lease Commencement Date, the Tenant's Share will be 30.54%. If either the Premises or the Building are expanded or reduced, Tenant’s Share shall be appropriately adjusted. Tenant’s Share for the Expense Year in which that change occurs shall be determined on the basis of the number of days during the Expense Year in which each such Tenant’s Share was in effect.

8.2.Adjustment of Operating Expenses. Operating Expenses shall be adjusted as follows:

8.2.1.Gross Up Adjustment When a Building is Less Than Fully Occupied. If the occupancy of the total Rentable Square Footage of the completed, partially occupied Building is less than 95%, Landlord shall make an appropriate adjustment to the variable components of the Operating Expenses for that Expense Year, as estimated by Landlord in its sole discretion using sound accounting and management principles, to determine the amount of Operating Expenses that would have been incurred had such building been 95% occupied. This amount shall be considered to have been the amount of Operating Expenses for that Expense Year. For purposes of this Paragraph 8.2. “variable components” include only those component expenses that are affected by variations in occupancy levels, such as nightly janitorial service to Tenants’ Premises or water usage.

8.2.2.Adjustment When Landlord Adds Additional Buildings to the Project. If Landlord adds additional buildings within the Project following the Base Year, Landlord shall make an appropriate adjustment to the Operating Expenses for the Base Year, as reasonably determined by Landlord using sound accounting and management principles, to determine the amount of Operating Expenses that would have been incurred for the Base Year if such additional building had been complete and 95% occupied during the Base Year.

8.2.3.Adjustment When Landlord Does Not Furnish a Service to All Tenants. If, during any part of any Expense Year (including the Base Year), Landlord is not furnishing a particular service or work (the cost of which, if furnished by Landlord, would be included in Operating Expenses) to a tenant (other than Tenant) that has undertaken to perform such service or work in lieu of receiving it from Landlord, Operating Expenses for that Expense Year shall be considered to be increased by an amount equal to the additional Operating

9

American Assets Trust – Lease Form 1/31/2023

Expenses that Landlord would reasonably have incurred during such period if Landlord had furnished such service or work to that tenant. Likewise, if, during any part of any Expense Year (including the Base Year), Landlord begins furnishing a particular service or work (the cost of which, if furnished by Landlord, would be included in Operating Expenses) to a tenant (other than Tenant) that was previously undertaken by Tenant in lieu of receiving it from Landlord, Operating Expenses for that Expense Year shall be considered to be decreased by an amount equal to the reduction in Operating Expenses that would reasonably have occurred during such period now that Landlord is furnishing such service or work to that tenant.

8.2.4.Additional Costs. If due to a change in the types of costs being incurred by Landlord as Operating Expenses (such as, for example, the commencement or cessation of security services—but not a mere change in how a particular cost is handled—such as going from an in-house to an outside landscaping service), the Base Year Operating Expenses need to be adjusted to eliminate the effect of such change, Landlord shall reasonably adjust the Base Year Operating Expenses and notify Tenant of such change in writing. Furthermore, Landlord shall have the right to reasonably decrease the amount of the Base Year Operating Expenses for purposes of calculating Increased Operating Expenses to eliminate the effect of abnormally high costs, or unusual costs, of a particular type or types (such as, by way of example, abnormally high energy costs associated with the “energy crisis” of 2001) occurring during the Base Year. There shall be no cap on Operating Expenses.

8.2.5.Common Areas. Landlord shall elect to partition/separate portions of the Common Areas of the Project such that the Operating Expenses (including, but not limited to Tax Expenses and Insurance Expenses) associated with such partitioned Common Areas are equitably allocated to particular buildings or parcels within the Project.

8.3.Tax Expenses. “Taxes” means and refers to all federal, state, county, or local government or municipal taxes, fees, charges, or other impositions of every kind or nature, whether general, special, ordinary, or extraordinary. Taxes include, without limitation, taxes, fees, and charges such as real property taxes, general and special assessments (including, without limitation, maintenance assessment district assessments, facilities benefit assessments and similar district fees and assessments), transit taxes and surcharges, leasehold taxes, school taxes, sewer charges and taxes based on the receipt of rent (including gross receipts or sales taxes applicable to the receipt of rent, unless required to be paid by Tenant), and personal property taxes imposed on Landlord's fixtures, machinery, equipment, apparatus, systems, appurtenances, and other personal property used in connection with the Project or the Building, as the case may be, along with reasonable legal and other professional fees, costs and disbursements incurred in connection with proceedings to contest, determine or reduce real property taxes. Notwithstanding the foregoing, the following shall be excluded from Taxes: (a) all excess profits taxes, franchise taxes, gift taxes, capital stock taxes, inheritance and succession taxes, estate taxes, federal, state, and local income taxes, and other taxes applied or measured by Landlord’s general or net income (as opposed to rents, receipts, or income attributable to operations at the Building), and (b) personal property taxes attributable to property owned or installed by or for other tenants of the Project. For all purposes of this Lease, the term “Tax Expenses” shall mean the sum of all Taxes that are paid or incurred by Landlord because of or in connection with the ownership, leasing, and/or operation of the Project from time to time.

8.4.Calculation and Payment of Operating Expenses. Tenant’s Share of the increased Operating Expenses for any Expense Year shall be calculated and paid as follows:

8.4.1.Calculation of Excess. If Operating Expenses for any Expense Year (other than the Base Year) ending or beginning within the Term exceeds the amount of Operating Expenses applicable to the Base Year, Tenant shall pay as Additional Rent to Landlord an amount equal to Tenant’s Share of that excess, in the manner stated below.

8.4.2.Statement/Payment of Operating Expenses. Tenant shall pay to Landlord, on the first day of each calendar month during the Term, commencing January 1, 2025, as Additional Rent, without notice, demand, offset, or deduction (except as provided below), an amount (“Tenant's Monthly Payment”) equal to one-twelfth of Tenant's Share of the amount by which the Operating Expenses for each Expense Year following the Base Year exceed the Base Year Operating Expenses (such excess being referred to herein as the “Increased Operating Expenses”), as estimated (and subsequently reconciled) by Landlord in the most recently delivered Estimated Statement (as defined below). Landlord intends to deliver to Tenant, prior to the commencement of each Expense Year following the Base Year during the Term, a written statement (“Estimated Statement”) setting forth Landlord's estimate of the Operating Expenses and Increased Operating Expenses allocable to the ensuing Expense Year, and Tenant's Share of such Increased Operating Expenses. Landlord may, at its option, during any Expense Year, deliver to Tenant a revised Estimated Statement, revising Landlord's estimate of the Operating

10

American Assets Trust – Lease Form 1/31/2023

Expenses and Increased Operating Expenses, in accordance with Landlord's most current estimate. Within approximately 90 days after the end of each Expense Year during the Term, Landlord intends to deliver to Tenant a written statement (“Actual Statement”) setting forth the actual Operating Expenses allocable to the preceding Expense Year. Tenant's failure to object to Landlord regarding the contents of an Actual Statement, in writing, within 90 days after delivery to Tenant of such Actual Statement, shall constitute Tenant's absolute and final acceptance and approval of the Actual Statement. If the sum of Tenant's Monthly Payments actually paid by Tenant during any Expense Year exceeds Tenant's Share of the actual Increased Operating Expenses allocable to such Expense Year, then such excess will be credited against future Tenant's Monthly Payments, unless such Expense Year was the Expense Year during which the Lease Expiration Date occurs (the “Last Calendar Year”), in which event either (i) such excess shall be credited against any monetary default of Tenant under this Lease, or (ii) if Tenant is not in default under this Lease, then Landlord shall (within the time frame for returning Tenant's Security Deposit) pay to Tenant such excess. If the sum of Tenant's Monthly Payments actually paid by Tenant during any Expense Year is less than Tenant's Share of the actual Increased Operating Expenses allocable to such Expense Year, then Tenant shall, within 30 days after delivery of the Actual Statement, pay to Landlord the amount of such deficiency. Landlord's delay in delivering any Estimated Statement or Actual Statement will not release Tenant from its obligation to pay any Tenant's Monthly Payment or any such excess upon receipt of the Estimated Statement or the Actual Statement, as the case may be. The references in this Paragraph 8.4 to the actual Increased Operating Expenses allocable to an Expense Year, shall include, if such Expense Year is the Last Calendar Year, the actual Increased Operating Expenses allocable to the portion of such year prior to the Lease Expiration Date, calculated on a pro rata basis, without regard to the date of a particular expenditure. The provisions of this Paragraph 8.4 shall survive the termination of this Lease, and even though the Term has expired and Tenant has vacated the Premises, when the final determination is made of Tenant’s Share of Operating Expenses for the year in which this Lease terminates, Tenant shall immediately pay any increase due over the estimated expenses paid by Tenant pursuant hereto and conversely any overpayment made in Tenant's estimated payments shall be immediately rebated by Landlord to Tenant.

8.5.Landlord's Books and Records. If Tenant disputes (in a writing delivered to Landlord setting forth with specificity the basis for such dispute and the portions of such Actual Statement which Tenant disputes) the amount of Additional Rent stated in an Actual Statement within 90 days after delivery thereof to Tenant, Tenant may, upon at least 5 business days’ notice to Landlord, request an opportunity to inspect and audit Landlord’s records and supporting documentation regarding such Actual Statement (but not regarding any other Actual Statement). Such inspection and audit must be conducted by an independent certified public accountant within 180 days after the date Tenant received the Actual Statement, shall be at Tenant’s sole cost and expense (except as provided below), and Landlord shall, at its election, either provide copies of such records and supporting documentation to Tenant or make such records and supporting documentation relating to the matter in dispute available to Tenant for its inspection at Landlord’s business office during normal business hours. If Tenant fails to dispute (in writing, as provided above) the amount of Additional Rent stated in an Actual Statement within 90 days after Tenant’s receipt thereof, or if Tenant's inspection and audit fails to disclose a discrepancy in such Actual Statement within 180 days after Tenant's receipt of the Actual Statement in question, then the Actual Statement will be deemed accurate and binding on Tenant and Tenant will be estopped from raising or pursuing any claim or defense to the contrary. If it is determined as a result of Tenant's timely audit of Landlord's records (and Landlord's certified public accountant's concurrence therewith) that Tenant was overcharged relative to the Operating Expenses, such overcharge shall entitle Tenant to a credit against its next payment of Operating Expenses in the amount of the overcharge plus, in the case of an overcharge exceeding 3% of the Operating Expenses, the reasonable third party costs of such audit (and if such credit occurs following the expiration of the Term, Landlord shall promptly pay the amount of such credit to Tenant). If it is determined as a result of Tenant's timely audit of Landlord's records (and Landlord's certified public accountant's concurrence therewith), or otherwise, that Tenant was undercharged relative to the Operating Expenses, Tenant shall, within 30 days after written demand, pay such undercharge to Landlord. Landlord shall be entitled to a copy of any such audit. For avoidance of doubt, Landlord shall not be required to provide or make available to Tenant any of Landlord’s records (i) that would result in the disclosure of confidential information pertaining to any other tenant in the Project or (ii) under any circumstances, except as may be required by Laws, unless Tenant exercises its inspection and audit rights pursuant to this Paragraph 8.5. Notwithstanding anything to the contrary in this Paragraph 8.5, Tenant's right to inspect and audit Landlord's records and to otherwise dispute any Actual Statement are subject to the following conditions:

8.5.1.No audit may be conducted during the months of December or April, and Tenant's auditor must make an advance appointment with Landlord's audit supervisor at a mutually acceptable time (which Landlord will use reasonable efforts to schedule within 60 days of Tenant's request).

11

American Assets Trust – Lease Form 1/31/2023

8.5.2.Before conducting an audit, Tenant must pay the full amount of Tenant's Share of Operating Expenses billed and must not be in default of any other provisions of this Lease.

8.5.3.Tenant may review only those records of Landlord specifically related to the specific Operating Expenses which Tenant has disputed. Tenant may not review any other records or any other leases or agreements, or Landlord's tax returns or financial statements.

8.5.4.In conducting an audit, Tenant must utilize an independent certified public accountant experienced in auditing commercial office property records, subject to Landlord's reasonable prior approval.

8.5.5.Upon receipt thereof, Tenant will deliver to Landlord a copy of the audit report and all accompanying data.

8.5.6.Tenant will keep confidential all agreements involving the rights provided in this Paragraph 8.5 and the results of any audits conducted hereunder. Notwithstanding the foregoing, Tenant will be permitted to furnish the foregoing information to its attorneys, accountants, and auditors to the extent necessary to perform their respective services for Tenant.

8.5.7.An audit may be conducted only once with respect to any Actual Statement, even if the audit conducted does not address every Operating Expense set forth in the Actual Statement.

8.5.8.Tenant may not use an auditor under this Paragraph 8.5 who is paid on a contingency basis, or whose pay is based, in whole or in part, on the amount of recovery or any reduction of Tenant’s Share of Additional Rent resulting from such audit.

9.Utilities and Services.

9.1.Tenant’s Utility Costs. Except as provided below, Tenant shall pay when due all bills for gas, electricity, and other utilities used at the Premises on and after the Rent Commencement Date and through and including the date of expiration of this Lease, that are separately metered and assessed for utility services servicing the Premises during the Term.

9.2.Standard Tenant Services. Subject to the terms and conditions contained herein, Landlord shall provide the following services during the Term.

9.2.1.Subject to limitations imposed by all governmental rules, regulations and guidelines applicable thereto, Landlord shall provide HVAC when necessary for normal comfort for normal office use in the Premises during Building Standard Operating Hours.

9.2.2.Landlord shall provide adequate electrical wiring and facilities sufficient to provide electrical current to the Premises for Project-standard ordinary and customary office uses and excluding electrical power required for electric data processing equipment, computer rooms, special lighting in excess of Building standard lighting, or any other item of electrical equipment which (individually) consumes more than 1.8 kilowatts at rated capacity in which requires a voltage other than 120 volts single phase. In addition to the foregoing, Landlord shall replace lamps, starters, and ballasts for Project-standard lighting fixtures within the Premises upon Tenant’s request; the expense of which will be an Operating Expense. Tenant shall replace lamps, starters, and ballasts for non-Project-standard lighting fixtures within the Premises at Tenant’s sole expense. Landlord shall also provide electrical service in connection with Common Area needs, such as lighting.

9.2.3.Landlord shall provide adequate electricity and other customary utility services to the Premises. Landlord shall also provide hot and cold city water from the regular Building outlets for drinking, lavatory and toilet purposes in the Building Common Areas and at points of supply within the Premises.

9.2.4.Landlord shall provide 5 day per week ordinary and customary, basic janitorial services in and about the Premises in a manner consistent with other comparable buildings in the vicinity of the Building. Landlord shall not be required to provide janitorial services to above-Project-standard improvements installed in the Premises including but not limited to metallic trim, wood floor covering, glass panels, interior windows, kitchen/dining areas, executive washrooms, or shower facilities. Any janitorial services required by Tenant and provided by Landlord in excess of such ordinary and customary, basic janitorial services shall be separately paid for by Tenant, as Additional Rent, within 10 days of written demand.

12

American Assets Trust – Lease Form 1/31/2023

9.2.5.Landlord shall provide nonexclusive, non-attended automatic passenger elevator service during the Building Standard Operating Hours, shall have one elevator available at all other times, including on the Holidays, and shall provide nonexclusive, non-attended automatic passenger escalator service during Building Standard Operating Hours only.

9.2.6.Landlord shall provide nonexclusive freight elevator service subject to scheduling by Landlord.

Tenant shall cooperate fully with Landlord at all times and abide by all regulations and requirements that Landlord may reasonably prescribe for the proper functioning and protection of the HVAC, electrical, mechanical, and plumbing systems.

9.3.Over-Standard Tenant Use. Tenant shall not exceed the rated capacity of the Building’s electrical and other utility systems, which systems will be consistent in capacity with other first class office buildings built at or about the same time as the Building. In the event of any damage to any of the Project’s systems caused by Tenant’s use thereof in excess of ordinary and customary usage for a professional office. Tenant shall be responsible for all costs and expenses incurred by Landlord as a result of such over-use. In addition, if Tenant requires any utilities or services described in this Paragraph 9, which are to be provided by Landlord, in excess of the standard levels being provided by Landlord, or during hours other than Building Standard Operating Hours, Landlord shall have the right to impose reasonable restrictions on such usage and/or commercially reasonable charges therefor. The initial charge to Tenant for heating and air conditioning during hours other than Building Standard Operating Hours will be $55.00 per hour (or portion thereof), subject to increase over the Term, including the Extension Term, if any. Such charges are Additional Rent relative to the provision of such services and are not an offset to any Operating Expenses.

9.4.Conduit and Wiring. Installation of all types of conduit and wiring exclusively serving the Premises (other than as part of Landlord's Work), including but not limited to Tenant's Work, is subject to the requirements of Paragraph 22, below, Exhibit “C”, and the Landlord’s reasonable approval of the location, manner of installation, and qualifications of the installing contractor. All such conduit and wiring will, at Landlord's option, become Landlord's property upon the expiration of the Term. Upon expiration of the Term, Landlord may elect to require Tenant to remove such conduit and wiring at Tenant's expense and, with respect to such conduit and wiring, return the Premises and the Common Areas to substantially their pre-existing condition. If Landlord constructs new or additional utility facilities, including without limitation wiring, plumbing, conduits, and/or mains, resulting from Tenant's changed or increased utility requirements, Tenant shall on demand promptly pay (or advance) to Landlord the cost of such items as Additional Rent.

9.5.Utilities Generally. Tenant agrees that, except as specifically provided below, Landlord will not be liable for damages, by abatement of Rent or otherwise, for failure to furnish or for delay in furnishing any utility or related service (including, without limitation, telephone and telecommunication services) or for diminution in the quality or quantity of any utility or related service. Such failure, delay, or diminution will not constitute an eviction or a disturbance of Tenant’s use and possession of the Premises or relieve Tenant from paying Rent or performing any of its obligations under this Lease, except that Tenant will be entitled to an equitable abatement of Rent for the period of such failure, delay, or diminution to the extent such the following are satisfied; (i) failure, delay, or diminution is directly attributable to Landlord’s gross negligence or intentional misconduct, (ii) such failure, delay or diminution prevents Tenant from using, and Tenant does not use, the Premises or the affected portion thereof for the conduct of Tenant's business operations therein, (iii) Tenant was using the Premises or such affected portion for the conduct of Tenant's business operations immediately prior to the failure, delay or diminution, (iv) such failure, delay, or diminution continues for more than 2 consecutive business days (or 10 business days in any 12-month period) after delivery of written notice of such failure, delay, or diminution from Tenant to Landlord, (v) the restoration of such utility or related service is reasonably within the control of Landlord, and (vi) Tenant’s losses arising from such failure, delay, or diminution are not covered by any insurance required to be maintained by Tenant under this Lease or otherwise maintained by Tenant. Landlord and Tenant acknowledge that such abatement of Basic Monthly Rent and Additional Rent constitutes reasonable liquidated damages for any and all of Tenant's monetary loss caused by the interruption of such utility and/or service, given that Tenant's actual damages are extremely difficult or impossible to calculate. Except as otherwise expressly provided in this Lease, in no event shall such failure, delay, or diminution in the quality or quantity of any utility or service relieve Tenant of any of its obligations under the Lease, or constitute constructive eviction or entitle Tenant to consequential damages. Landlord will not be liable, under any circumstances, for a loss of or injury to property or for injury to or interference with Tenant’s business, including loss of profits through, in connection with, or

13

American Assets Trust – Lease Form 1/31/2023

incidental to a failure to furnish any of the utilities or services under this Paragraph. Notwithstanding the foregoing, Landlord agrees to use reasonable efforts to promptly correct any such interruption of utilities or services (unless such interruption of service was caused by the negligence of Tenant, or anyone acting by, through or under Tenant). Tenant hereby waives the provisions of California Civil Code Section 1932(1) or any other applicable existing or future Laws permitting the termination of this Lease due to the interruption or failure of or inability to provide any services required to be provided by Landlord hereunder. If any governmental authority having jurisdiction over the Project imposes mandatory controls, or suggests voluntary guidelines applicable to the Project, relating to the use or conservation of water, gas, electricity, power, or the reduction of automobile emissions, Landlord, at its sole discretion, may comply with such mandatory controls or voluntary guidelines and, accordingly, require Tenant to so comply. Landlord shall not be liable for damages to persons or property for any such reduction, nor shall such reduction in any way be construed as a partial eviction of Tenant, cause an abatement of Rent, or operate to release Tenant from any of Tenant's obligations under this Lease, except as specifically provided in this Paragraph 9.5. By executing this Lease, Tenant hereby authorizes Landlord to obtain information regarding Tenant’s utility and energy usage at the Premises directly from the applicable utility providers or any governmental agency and Tenant shall execute, within 5 days of Landlord’s request, any additional documentation required by any applicable utility provider evidencing such authorization. Further, within 15 days of Landlord’s request, Tenant shall provide to Landlord all requested information regarding Tenant’s utility and energy usage at the Premises, which information may include copies of Tenant’s utilities bills.

10.1.Tenant's Duties. Tenant shall at its sole cost maintain, repair, replace, and repaint, all in first class condition, the interior of the Premises, all building systems exclusively serving the Premises and located within the Premises or the walls of the Premises, and any damage to the Premises or the Project resulting from the acts or omissions of Tenant or any of Tenant's Invitees. Tenant shall maintain all communications conduit, equipment, and wiring serving the Premises, whether in the Premises or not (and specifically including all of Tenant’s Work and all wiring, equipment, and conduit located on the roof of the Building), regardless of the ownership of said conduit or wiring, subject to Landlord’s reasonable approval of Tenant’s maintenance/repair contractor and manner of maintenance/repair (but excluding those portions of the Premises which are the express responsibility of Landlord pursuant to Paragraph 10.2 below). Notwithstanding anything to the contrary contained herein, Tenant shall pay any and all maintenance and recurring costs for supplemental HVAC units exclusively serving the Premises, or any portion thereof, upon presentation of invoice from Landlord. If Tenant fails to maintain, repair, replace, or repaint any portion of the Premises or the Project as provided above then following 10 days’ written notice thereof to Tenant, Landlord may, at its election, maintain, repair, replace, or repaint any such portion of the Premises or the Project and Tenant shall promptly reimburse Landlord, as Additional Rent, for Landlord's actual cost thereof, plus a supervisory fee in the amount of 10% of Landlord’s actual cost. Notwithstanding the foregoing, if following Tenant’s payment (or performance) of its obligations under this Paragraph, Landlord receives payment from an insurer for such work, Tenant will be entitled to receive such proceeds (after Landlord has first been fully reimbursed for its costs and expenses relative thereto including Landlord’s costs and expenses in obtaining such proceeds) to the extent Tenant previously paid or incurred third party costs relative thereto.

10.2.Landlord's Duties. Landlord shall, as part of the Operating Expenses (subject to Section 8.1), maintain, repair, replace, and repaint, all in good order and condition, consistent with other first-class office buildings in the vicinity of the Building, the Common Areas and all portions of the interior and exterior of the Building and any other buildings in the Project (including, without limitation, all electrical, mechanical, plumbing, fire/life safety, and other building systems), except to the extent of Tenant's obligations as set forth in Paragraph 10.1, above. Landlord's failure to perform its obligations set forth above will not release Tenant of its obligations under this Lease, including without limitation Tenant's obligation to pay Rent. Tenant waives the provisions of California Civil Code Section 1942 (or any successor statute), and any similar principle of Laws with respect to Landlord's obligations for tenantability of the Premises and Tenant's right to make repairs and deduct the expense of such repairs from rent. If Landlord fails to perform any of its repair and maintenance obligations under this Paragraph 10.2 and such failure materially and adversely impairs Tenant’s ability to use and occupy the Premises for the Permitted Use, Tenant will have the right, to perform such repairs and/or maintenance to the extent necessary to enable Tenant to resume its use and occupancy of the Premises. Notwithstanding the foregoing, prior to exercising such right, Tenant must, except as provided below in connection with an emergency, have given Landlord at least 30 days’ prior written notice of the nature of the problem and Tenant’s intention to exercise its rights under this Paragraph if such matter is not resolved within such 30-day period; provided, however, if the nature of the matter giving rise to such repair or maintenance obligation will reasonably require more than 30

14

American Assets Trust – Lease Form 1/31/2023

days to remedy and Landlord is proceeding with due diligence to remedy such matter, then such 30 day period will be extended for such additional time as may be necessary for Landlord to complete such repairs or maintenance. Notwithstanding the preceding sentence, in the case of an emergency which poses an imminent threat of death, injury, or severe damage to persons or property, the required notice from Tenant may be provided orally rather than in writing and for such shorter period of time (i.e., less than 30 days) as Tenant, in the exercise of its reasonable judgment deems appropriate under the exigent circumstances (however, at a minimum, Tenant shall at least contact Landlord telephonically prior to commencing such work so that Landlord may, at its election, make arrangements to handle such emergency itself). If Landlord fails to fulfill its repair and maintenance obligations under this Paragraph, and as a result thereof Tenant exercises the foregoing right to correct such matter, then Landlord shall reimburse Tenant for the reasonable third-party costs incurred by Tenant to complete such repairs and/or maintenance within 30 days after receipt of Tenant’s written demand therefor, together with copies of the paid invoices evidencing the costs so incurred. Any such repairs or maintenance performed by Tenant, as permitted herein, must be performed in a good and workmanlike manner by licensed contractors. Under no circumstances may Tenant offset any amount it is owed by Landlord pursuant to this Paragraph (or otherwise) against any Rent obligation under this Lease.

11.1.General Parking Rights. Subject to the remaining provisions of this Paragraph 11, Landlord grants to Tenant (for the benefit of Tenant and Tenant’s Invitees) the right to the non-exclusive use of the unreserved parking area within the boundaries of and serving the Project (the “Parking Area”). Tenant's use of the Parking Area shall be subject to such rules as Landlord may, in its reasonable and non-discriminatory discretion, adopt from time to time with respect to the Parking Area, including without limitation (i) rules providing for the payment of charges or fees by users of the Parking Area subject to the term and conditions set forth in Paragraph 11.2, below, specifically including the final sentence therein, and in such event the charges or fees shall be deemed Additional Rent, (ii) rules limiting tenants of the Project (including, without limitation, Tenant) to the use of, or excluding the use of, certain parking spaces or certain portions of the Parking Area, in order to maintain the availability of accessible parking spaces for clients, guests, and invitees of tenants of the Project, and (iii) rules limiting tenants of the Project (including without limitation Tenant), and their employees, to the use of a restricted number of parking spaces or a restricted area. If Tenant, or any of Tenant's employees, fails to comply with any such rules or requirement (such as, by way of example, parking in areas designated as visitor parking only), then Landlord will have the right to either have such vehicles towed from the Project at Tenant's expense, or to charge Tenant $100.00 per day per car for any cars which are parked in violation of such requirements. Furthermore, Landlord shall have the right to immobilize such improperly parked vehicles by use of a "boot" or other device. Tenant shall not assign or sublet such parking privileges separate and apart from the other rights of Tenant under this Lease.

11.2.Parking Ratios. As of the Rent Commencement Date (and subject to temporary interruptions in connection with Landlord’s continued development of the Project, as provided below), the parking ratio within the Project applicable to Tenant will be four (4) spaces per 1,000 Usable Square Feet (“USF”) of space within the Premises. The foregoing (4:1,000 USF) parking ratio includes all spaces within the Project, including covered, uncovered, reserved, unreserved, handicap, and visitor parking spaces. Of the total spaces described above, a maximum of four (4) of said total spaces may be reserved in the parking garage by Tenant at the rate of $100.00 per space per month, subject to future escalation by Landlord provided, however, that in no event shall such escalation be more than three percent (3%) during any consecutive 12 month period. All unreserved parking shall be provided on a free and unassigned basis during the Initial Lease Term (i.e., first come, first served).