Exhibit 99.2

Innovative Industrial Properties Fourth Quarter 2024 Supplemental Financial Information

Innovative Industrial Properties 2 Overview 3 Forward - Looking Statements 4 Company Overview Financial Information 5 Quarterly Performance Summary 6 Balance Sheet 7 Net Income 8 Statements of Cash Flows 9 FFO, Normalized FFO, and AFFO Reconciliation 10 Historical Net Income 11 Historical FFO, Normalized FFO, and AFFO Reconciliation Portfolio Data 12 Capital Commitments 13 Leasing Summary 14 Top Tenants Overview 15 – 17 Property List 18 Secured Loans Capitalization 19 Capital and Debt Summary 20 – 21 Definitions 22 Analyst Coverage 23 Senior Management Team and Board of Directors Table of Contents

Innovative Industrial Properties 3 Forward - Looking Statements This Supplemental Financial Information Package includes "forward - looking statements" (within the meaning of the Private Securities Litigation Reform Act of 1995 , Section 27 A of the Securities Act of 1933 , as amended, and Section 21 E of the Securities Exchange Act of 1934 , as amended) that are subject to risks and uncertainties . In particular, statements pertaining to our capital resources, portfolio performance and results of operations contain forward - looking statements . Likewise, our statements regarding anticipated growth in our funds from operations and anticipated market and regulatory conditions, our strategic direction, our dividend rate and policy, demographics, results of operations, plans and objectives are forward - looking statements . Forward - looking statements involve numerous risks and uncertainties, and you should not rely on them as predictions of future events . Forward - looking statements depend on assumptions, data or methods which may be incorrect or imprecise, and we may not be able to realize them . We do not guarantee that the transactions and events described will happen as described (or that they will happen at all) . You can identify forward - looking statements by the use of forward - looking terminology such as "believes“, "expects“, "may“, "will“, "should“, "seeks“, "approximately“, "intends“, "plans“, "estimates" or "anticipates" or the negative of these words and phrases or similar words or phrases . You can also identify forward - looking statements by discussions of strategy, plans or intentions . The following factors, among others, could cause actual results and future events to differ materially from those set forth or contemplated in the forward - looking statements : rates of default on leases for our assets ; our ability to re - lease properties upon tenant defaults or lease terminations for the rent we currently receive, or at all ; concentration of our portfolio of assets and limited number of tenants ; the estimated growth in and evolving market dynamics of the regulated cannabis market ; the demand for regulated cannabis facilities ; inflation dynamics ; our ability to improve our internal control over financial reporting, including our inability to remediate an identified material weakness, and the costs and the time associated with such efforts ; the impact of pandemics on us, our business, our tenants, or the economy generally ; war and other hostilities, including the conflicts in Ukraine and Israel ; our business and investment strategy ; our projected operating results ; actions and initiatives of the U . S . or state governments and changes to government policies and the execution and impact of these actions, initiatives and policies, including the fact that cannabis remains illegal under federal law ; availability of suitable investment opportunities in the regulated cannabis industry ; our understanding of our competition and our potential tenants’ alternative financing sources ; the expected medical - use or adult - use cannabis legalization in certain states ; shifts in public opinion regarding regulated cannabis ; the potential impact on us from litigation matters, including rising liability and insurance costs ; the additional risks that may be associated with certain of our tenants cultivating, processing and/or dispensing adult - use cannabis in our facilities ; the state of the U . S . economy generally or in specific geographic areas ; economic trends and economic recoveries ; our ability to access equity or debt capital ; financing rates for our target assets ; our level of indebtedness, which could reduce funds available for other business purposes and reduce our operational flexibility ; covenants in our debt instruments, which may limit our flexibility and adversely affect our financial condition ; our ability to maintain our investment grade credit rating ; changes in the values of our assets ; our expected portfolio of assets ; our expected investments ; interest rate mismatches between our assets and our borrowings used to fund such investments ; changes in interest rates and the market value of our assets ; the degree to which any interest rate or other hedging strategies may or may not protect us from interest rate volatility ; the impact of and changes in governmental regulations, tax law and rates, accounting guidance and similar matters ; how and when any forward equity sales may settle ; our ability to maintain our qualification as a real estate investment trust for U . S . federal income tax purposes ; our ability to maintain our exemption from registration under the Investment Company Act of 1940 ; availability of qualified personnel ; and market trends in our industry, interest rates, real estate values, the securities markets or the general economy . The risks included here are not exhaustive, and additional factors could adversely affect our business and financial performance . In addition, we discussed a number of material risks in our most recent Annual Report on Form 10 - K and subsequent Quarterly Reports on Form 10 - Q . Those risks continue to be relevant to our performance and financial condition . Moreover, we operate in a very competitive and rapidly changing environment . New risk factors emerge from time to time and it is not possible for management to predict all such risk factors, nor can it assess the impact of all such risk factors on our business or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained in any forward - looking statements . Any forward - looking statement made by us speaks only of the date on which we make it . We undertake no obligation to publicly update or revise any forward - looking statements, whether as a result of new information, future events or otherwise, except as may be required by law . Stockholders and investors are cautioned not to unduly rely on such forward - looking statements when evaluating the information presented in our filings and reports . This supplemental financial information package includes certain non - GAAP financial measures . These non - GAAP measures are presented for supplemental information and should not be considered a substitute for financial information presented in accordance with GAAP . The definition of these non - GAAP measures is set forth under the section entitled "Definitions . " A reconciliation of these non - GAAP measures to the most directly comparable GAAP measures is set forth in section entitled "FFO, Normalized FFO and AFFO Reconciliation . Market and industry data are included in this presentation . We have obtained substantially all of this information from internal studies, public filings, other independent published industry sources and market studies prepared by third parties . We believe these internal studies, public filings, other independent published industry sources and market studies prepared by third parties are reliable . However, this information may prove to be inaccurate . No representation or warranty is made as to the accuracy of such information . All amounts shown in this report are unaudited . This Supplemental Financial Information Package is not an offer to sell or solicitation to buy securities of Innovative Industrial Properties, Inc . Any offers to sell or solicitations to buy securities of Innovative Industrial Properties, Inc . shall be made only by means of a prospectus approved for that purpose .

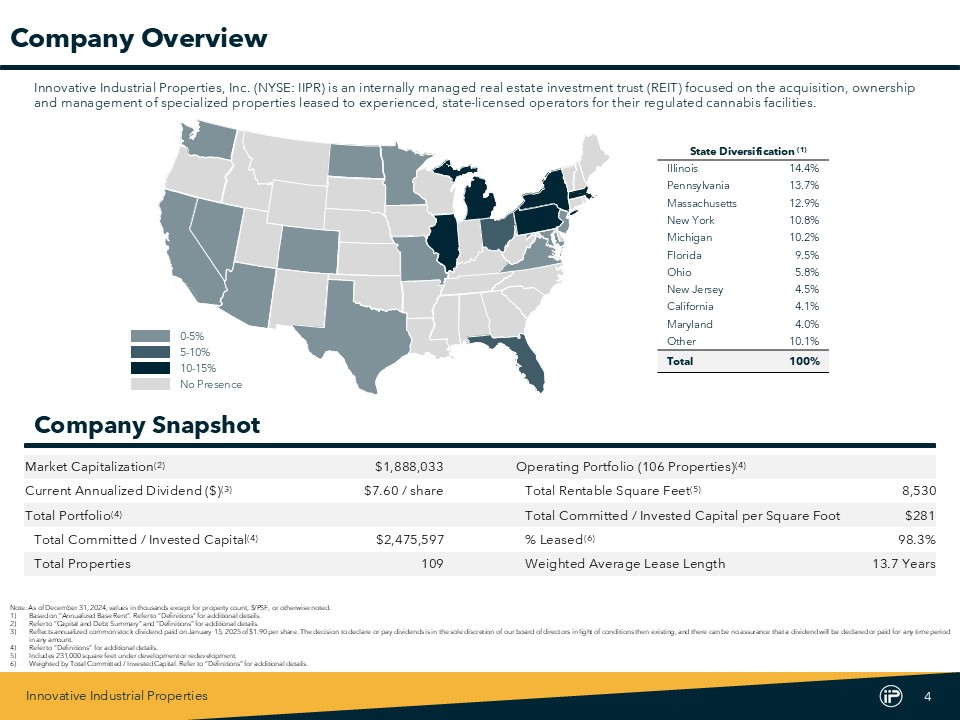

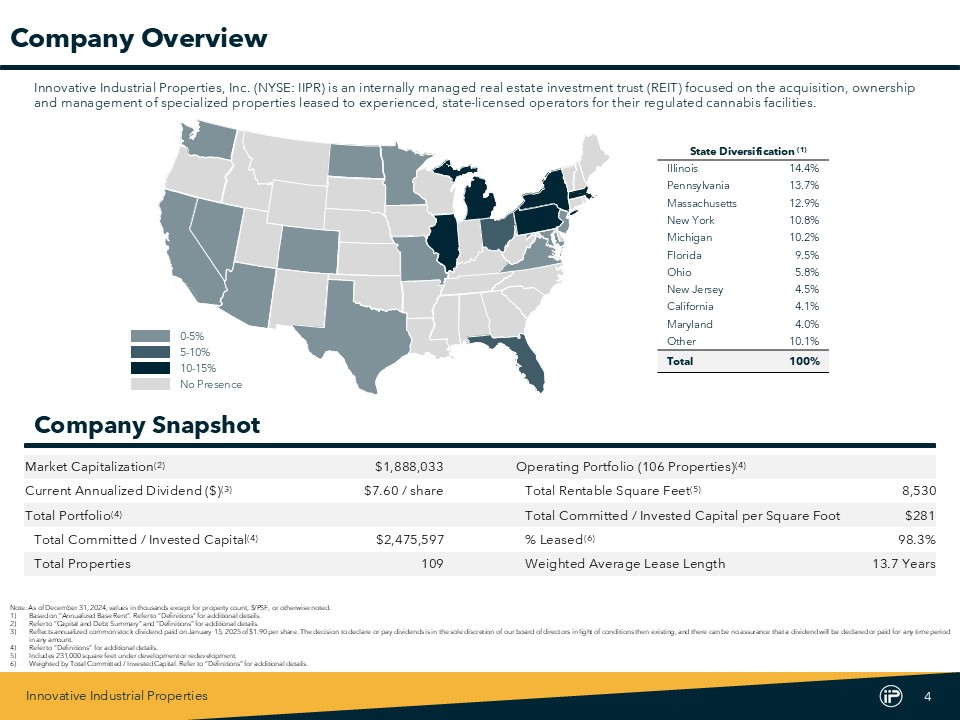

Innovative Industrial Properties 4 Company Snapshot State Diversification (1) 14.4% Illinois 13.7% Pennsylvania 12.9% Massachusetts 10.8% New York 10.2% Michigan 9.5% Florida 5.8% Ohio 4.5% New Jersey 4.1% California 4.0% Maryland 10.1% Other 100% Total Company Overview Innovative Industrial Properties, Inc. (NYSE: IIPR) is an internally managed real estate investment trust (REIT) focused on t he acquisition, ownership and management of specialized properties leased to experienced, state - licensed operators for their regulated cannabis facilities . Note : As of December 31 , 2024 , values in thousands except for property count, $ /PSF, or otherwise noted . 1) Based on “Annualized Base Rent” . Refer to “Definitions” for additional details . 2) Refer to “Capital and Debt Summary” and “Definitions” for additional details . 3) Reflects annualized common stock dividend paid on January 15 , 2025 of $ 1 . 90 per share . The decision to declare or pay dividends is in the sole discretion of our board of directors in light of conditions then existing, and there can be no assurance that a dividend will be declared or paid for any time period in any amount . 4) Refer to “Definitions” for additional details . 5) Includes 231 , 000 square feet under development or redevelopment . 6) Weighted by Total Committed / Invested Capital . Refer to “Definitions” for additional details . Operating Portfolio (106 Properties) (4) $1,888,033 Market Capitalization (2) 8,530 Total Rentable Square Feet (5) $7.60 / share Current Annualized Dividend ($) (3) $281 Total Committed / Invested Capital per Square Foot Total Portfolio (4) 98.3% % Leased (6) $2,475,597 Total Committed / Invested Capital (4) 13.7 Years Weighted Average Lease Length 109 Total Properties 10 - 15% No Presence 0 - 5% 5 - 10%

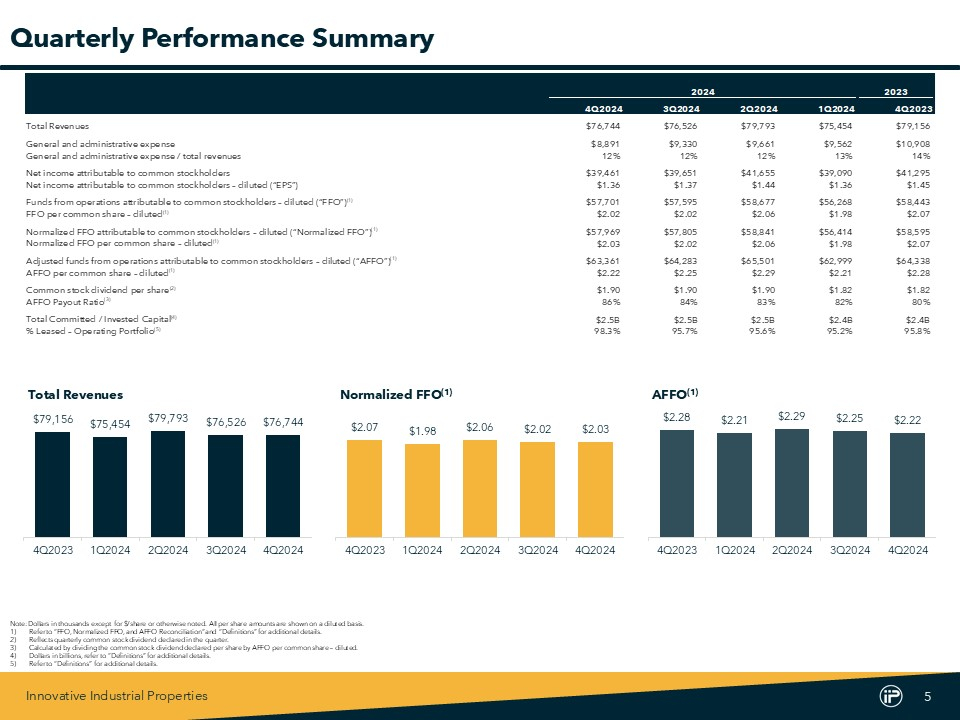

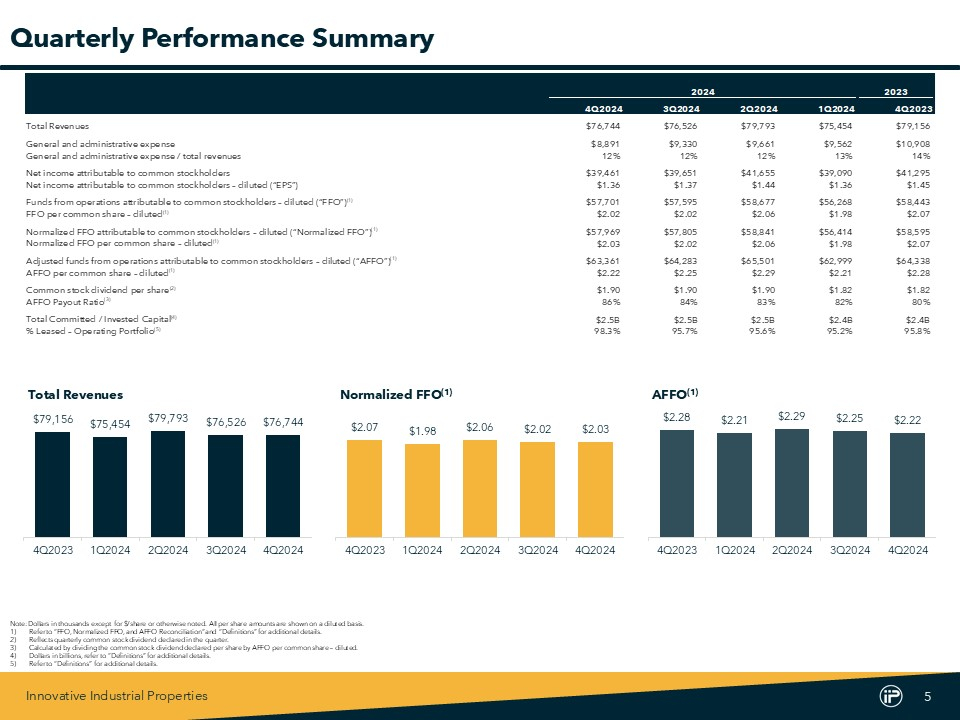

Innovative Industrial Properties 5 Delta 2024 2023 4Q2024 3Q2024 2Q2024 1Q2024 4Q2023 Total Revenues $76,744 $76,526 $79,793 $75,454 $79,156 General and administrative expense $8,891 $9,330 $9,661 $9,562 $10,908 General and administrative expense / total revenues 12% 12% 12% 13% 14% Net income attributable to common stockholders $39,461 $39,651 $41,655 $39,090 $41,295 Net income attributable to common stockholders – diluted (“EPS”) $1.36 $1.37 $1.44 $1.36 $1.45 Funds from operations attributable to common stockholders – diluted (“FFO”) (1) $57,701 $57,595 $58,677 $56,268 $58,443 FFO per common share – diluted (1) $2.02 $2.02 $2.06 $1.98 $2.07 Normalized FFO attributable to common stockholders – diluted (“Normalized FFO”) (1) $57,969 $57,805 $58,841 $56,414 $58,595 Normalized FFO per common share – diluted (1) $2.03 $2.02 $2.06 $1.98 $2.07 Adjusted funds from operations attributable to common stockholders – diluted (“AFFO”) (1) $63,361 $64,283 $65,501 $62,999 $64,338 AFFO per common share – diluted (1) $2.22 $2.25 $2.29 $2.21 $2.28 Common stock dividend per share (2) $1.90 $1.90 $1.90 $1.82 $1.82 AFFO Payout Ratio (3) 86% 84% 83% 82% 80% Total Committed / Invested Capital (4) $2.5B $2.5B $2.5B $2.4B $2.4B % Leased – Operating Portfolio (5) 98.3% 95.7% 95.6% 95.2% 95.8% Quarterly Performance Summary Note : Dollars in thousands except for $ /share or otherwise noted . All per share amounts are shown on a diluted basis . 1) Refer to “FFO, Normalized FFO, and AFFO Reconciliation” and “Definitions” for additional details . 2) Reflects quarterly common stock dividend declared in the quarter . 3) Calculated by dividing the common stock dividend declared per share by AFFO per common share – diluted . 4) Dollars in billions, refer to “Definitions” for additional details . 5) Refer to “Definitions” for additional details . $2.28 $2.21 $2.29 $2.25 $2.22 4Q2023 1Q2024 2Q2024 3Q2024 4Q2024 AFFO (1) $2.07 $1.98 $2.06 $2.02 $2.03 4Q2023 1Q2024 2Q2024 3Q2024 4Q2024 Normalized FFO (1) $79,156 $75,454 $79,793 $76,526 $76,744 4Q2023 1Q2024 2Q2024 3Q2024 4Q2024 Total Revenues

Innovative Industrial Properties 6 December 31, December 31, (In thousands, except share and per share amounts) 2024 2023 Assets Real estate, at cost: Land $146,772 $142,524 Buildings and improvements 2,230,807 2,108,218 Construction in progress 62,393 117,773 Total real estate, at cost 2,439,972 2,368,515 Less accumulated depreciation (271,190) (202,692) Net real estate held for investment 2,168,782 2,165,823 Construction loan receivable 22,800 22,000 Cash and cash equivalents 146,245 140,249 Restricted cash - 1,450 Investments 5,000 21,948 Right of use office lease asset 946 1,355 In-place lease intangible assets, net 7,385 8,245 Other assets, net 26,889 30,020 Total assets $2,378,047 $2,391,090 Liabilities and stockholders’ equity Liabilities: Exchangeable Senior Notes, net - $4,431 Notes due 2026, net 297,865 296,449 Building improvements and construction funding payable 10,230 9,591 Accounts payable and accrued expenses 10,561 11,406 Dividends payable 54,817 51,827 Rent received in advance and tenant security deposits 57,176 59,358 Other liabilities 11,338 5,056 Total liabilities 441,987 438,118 Stockholders’ equity: Preferred stock, par value $0.001 per share, 50,000,000 shares authorized: 9.00% Series A cumulative redeemable preferred stock, liquidation preference of $25.00 per share, 1,002,673 and 600,000 shares issued and outstanding at December 31, 2024 and December 31, 2023, respectively 23,632 14,009 Common stock, par value $0.001 per share, 50,000,000 shares authorized: 28,331,833 and 28,140,891 shares issued and outstanding at December 31, 2024 and December 31, 2023, respectively 28 28 Additional paid-in capital 2,124,113 2,095,789 Dividends in excess of earnings (211,713) (156,854) Total stockholders’ equity 1,936,060 1,952,972 Total liabilities and stockholders ’ equity $2,378,047 $2,391,090 Balance Sheet

Innovative Industrial Properties 7 For the Three Months Ended For the Years Ended December 31, December 31, (In thousands, except share and per share amounts) 2024 2023 2024 2023 Revenues: Rental (including tenant reimbursements) $76,717 $78,615 $306,936 $307,349 Other 27 541 1,581 2,157 Total revenues 76,744 79,156 308,517 309,506 Expenses: Property expenses 7,605 7,193 28,472 24,893 General and administrative expense 8,891 10,908 37,444 42,832 Depreciation and amortization expense 18,240 17,098 70,807 67,194 Total expenses 34,736 35,199 136,723 134,919 Gain (loss) on sale of real estate - - (3,449) - Income from operations 42,008 43,957 168,345 174,587 Interest income 2,553 1,821 10,988 8,446 Interest expense (4,536) (4,145) (17,672) (17,467) Gain (loss) on exchange of Exchangeable Senior Notes - - - 22 Net income 40,025 41,633 161,661 165,588 Preferred stock dividends (564) (338) (1,804) (1,352) Net income attributable to common stockholders $39,461 $41,295 $159,857 $164,236 Net income attributable to common stockholders per share: Basic $1.38 $1.46 $5.58 $5.82 Diluted $1.36 $1.45 $5.52 $5.77 Weighted-average shares outstanding: Basic 28,254,565 27,996,393 28,226,402 27,977,807 Diluted 28,554,335 28,279,834 28,530,650 28,255,797 Net Income

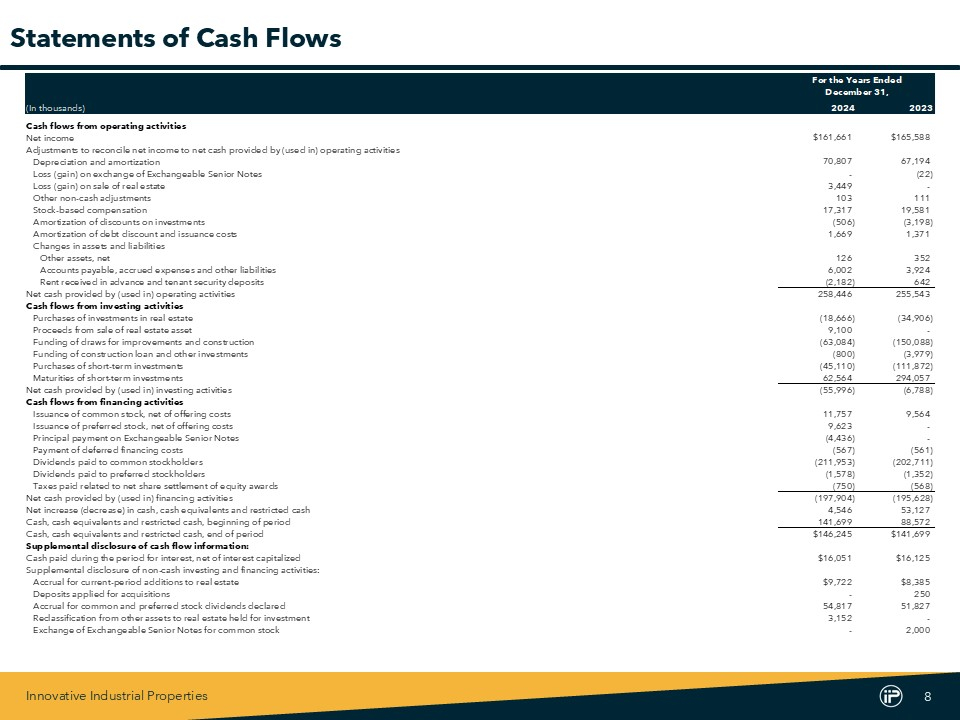

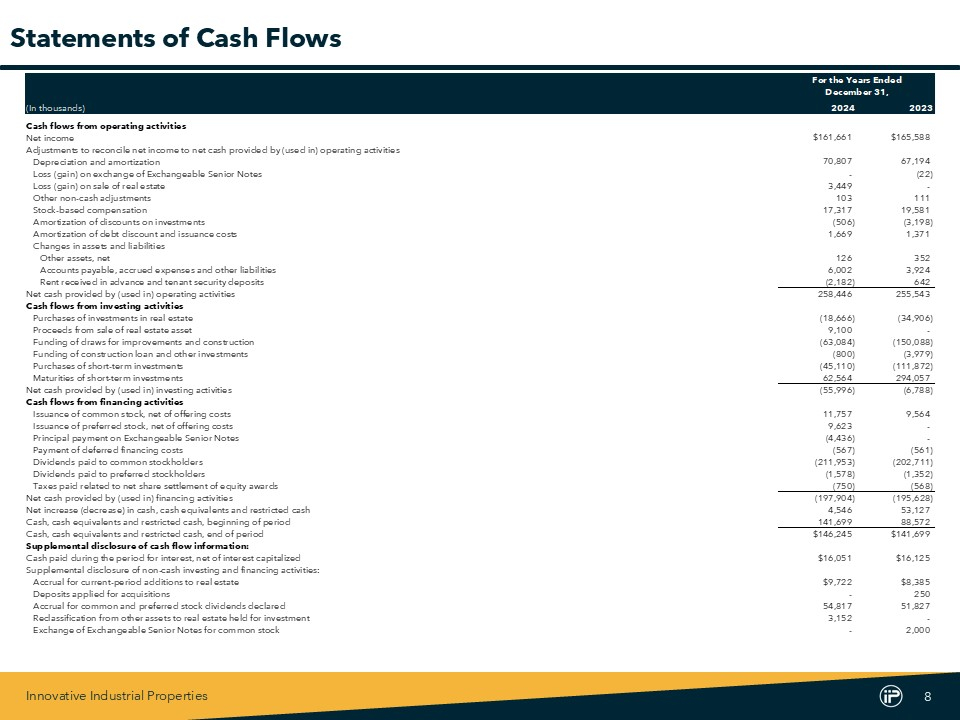

Innovative Industrial Properties 8 For the Years Ended December 31, (In thousands) 2024 2023 Cash flows from operating activities Net income $161,661 $165,588 Adjustments to reconcile net income to net cash provided by (used in) operating activities Depreciation and amortization 70,807 67,194 Loss (gain) on exchange of Exchangeable Senior Notes - (22) Loss (gain) on sale of real estate 3,449 - Other non-cash adjustments 103 111 Stock-based compensation 17,317 19,581 Amortization of discounts on investments (506) (3,198) Amortization of debt discount and issuance costs 1,669 1,371 Changes in assets and liabilities Other assets, net 126 352 Accounts payable, accrued expenses and other liabilities 6,002 3,924 Rent received in advance and tenant security deposits (2,182) 642 Net cash provided by (used in) operating activities 258,446 255,543 Cash flows from investing activities Purchases of investments in real estate (18,666) (34,906) Proceeds from sale of real estate asset 9,100 - Funding of draws for improvements and construction (63,084) (150,088) Funding of construction loan and other investments (800) (3,979) Purchases of short-term investments (45,110) (111,872) Maturities of short-term investments 62,564 294,057 Net cash provided by (used in) investing activities (55,996) (6,788) Cash flows from financing activities Issuance of common stock, net of offering costs 11,757 9,564 Issuance of preferred stock, net of offering costs 9,623 - Principal payment on Exchangeable Senior Notes (4,436) - Payment of deferred financing costs (567) (561) Dividends paid to common stockholders (211,953) (202,711) Dividends paid to preferred stockholders (1,578) (1,352) Taxes paid related to net share settlement of equity awards (750) (568) Net cash provided by (used in) financing activities (197,904) (195,628) Net increase (decrease) in cash, cash equivalents and restricted cash 4,546 53,127 Cash, cash equivalents and restricted cash, beginning of period 141,699 88,572 Cash, cash equivalents and restricted cash, end of period $146,245 $141,699 Supplemental disclosure of cash flow information: Cash paid during the period for interest, net of interest capitalized $16,051 $16,125 Supplemental disclosure of non-cash investing and financing activities: Accrual for current-period additions to real estate $9,722 $8,385 Deposits applied for acquisitions - 250 Accrual for common and preferred stock dividends declared 54,817 51,827 Reclassification from other assets to real estate held for investment 3,152 - Exchange of Exchangeable Senior Notes for common stock - 2,000 Statements of Cash Flows

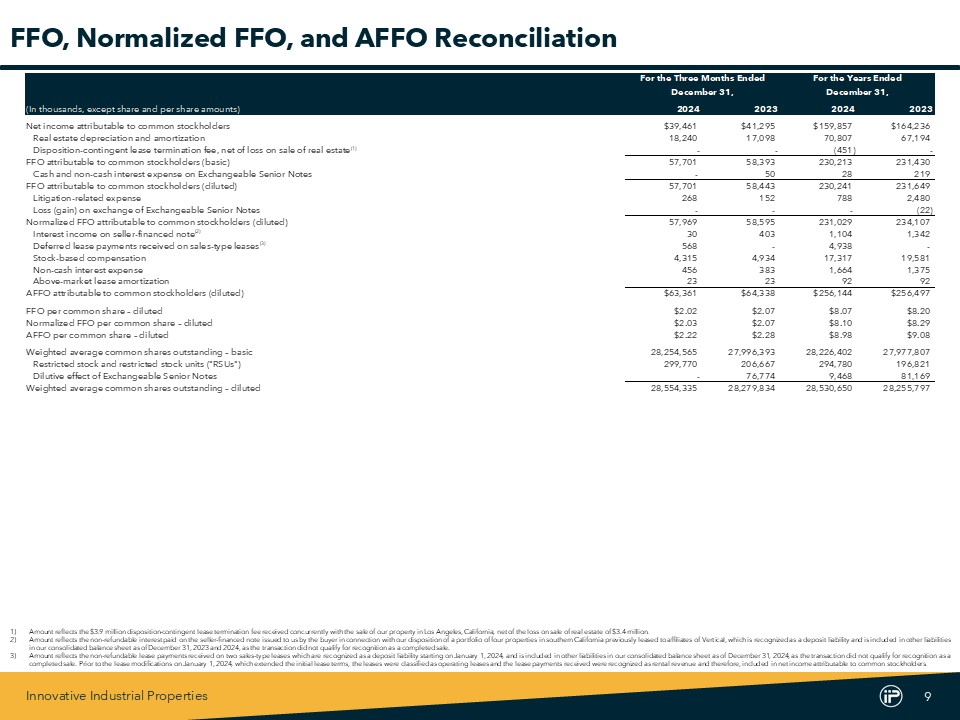

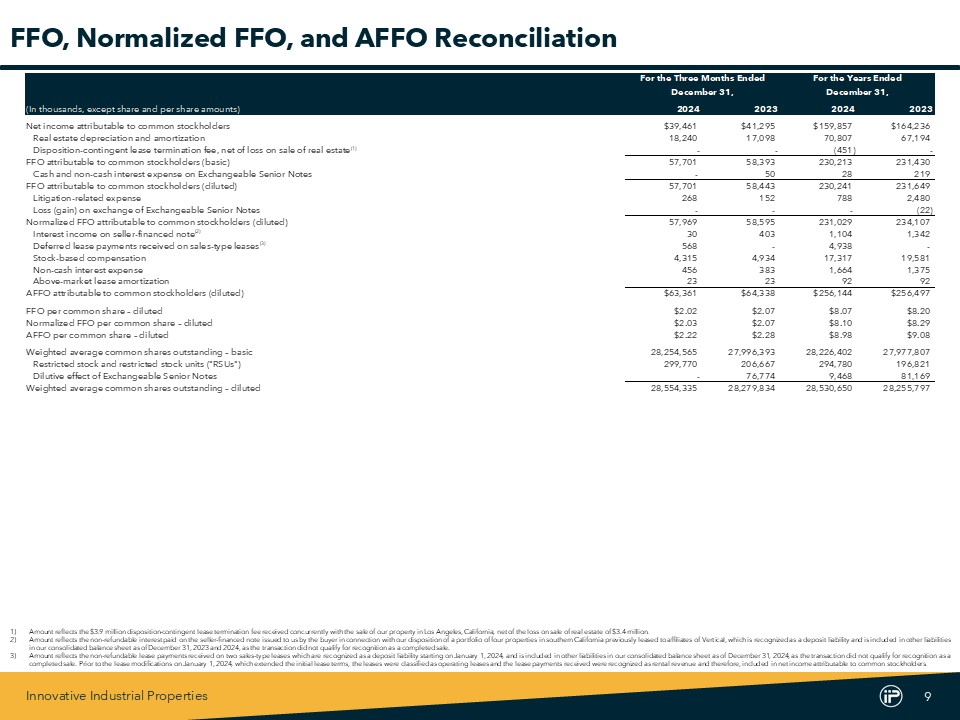

Innovative Industrial Properties 9 For the Three Months Ended For the Years Ended December 31, December 31, (In thousands, except share and per share amounts) 2024 2023 2024 2023 Net income attributable to common stockholders $39,461 $41,295 $159,857 $164,236 Real estate depreciation and amortization 18,240 17,098 70,807 67,194 Disposition-contingent lease termination fee, net of loss on sale of real estate (1) - - (451) - FFO attributable to common stockholders (basic) 57,701 58,393 230,213 231,430 Cash and non-cash interest expense on Exchangeable Senior Notes - 50 28 219 FFO attributable to common stockholders (diluted) 57,701 58,443 230,241 231,649 Litigation-related expense 268 152 788 2,480 Loss (gain) on exchange of Exchangeable Senior Notes - - - (22) Normalized FFO attributable to common stockholders (diluted) 57,969 58,595 231,029 234,107 Interest income on seller-financed note (2) 30 403 1,104 1,342 Deferred lease payments received on sales-type leases (3) 568 - 4,938 - Stock-based compensation 4,315 4,934 17,317 19,581 Non-cash interest expense 456 383 1,664 1,375 Above-market lease amortization 23 23 92 92 AFFO attributable to common stockholders (diluted) $63,361 $64,338 $256,144 $256,497 FFO per common share – diluted $2.02 $2.07 $8.07 $8.20 Normalized FFO per common share – diluted $2.03 $2.07 $8.10 $8.29 AFFO per common share – diluted $2.22 $2.28 $8.98 $9.08 Weighted average common shares outstanding – basic 28,254,565 27,996,393 28,226,402 27,977,807 Restricted stock and restricted stock units ("RSUs") 299,770 206,667 294,780 196,821 Dilutive effect of Exchangeable Senior Notes - 76,774 9,468 81,169 Weighted average common shares outstanding – diluted 28,554,335 28,279,834 28,530,650 28,255,797 FFO, Normalized FFO, and AFFO Reconciliation 1) Amount reflects the $ 3 . 9 million disposition - contingent lease termination fee received concurrently with the sale of our property in Los Angeles, California, net of the loss on sale of real estate of $ 3 . 4 million . 2) Amount reflects the non - refundable interest paid on the seller - financed note issued to us by the buyer in connection with our disposition of a portfolio of four properties in southern California previously leased to affiliates of Vertical, which is recognized as a deposit liability and is included in other liabilities in our consolidated balance sheet as of December 31 , 2023 and 2024 , as the transaction did not qualify for recognition as a completed sale . 3) Amount reflects the non - refundable lease payments received on two sales - type leases which are recognized as a deposit liability starting on January 1 , 2024 , and is included in other liabilities in our consolidated balance sheet as of December 31 , 2024 , as the transaction did not qualify for recognition as a completed sale . Prior to the lease modifications on January 1 , 2024 , which extended the initial lease terms, the leases were classified as operating leases and the lease payments received were recognized as rental revenue and therefore, included in net income attributable to common stockholders .

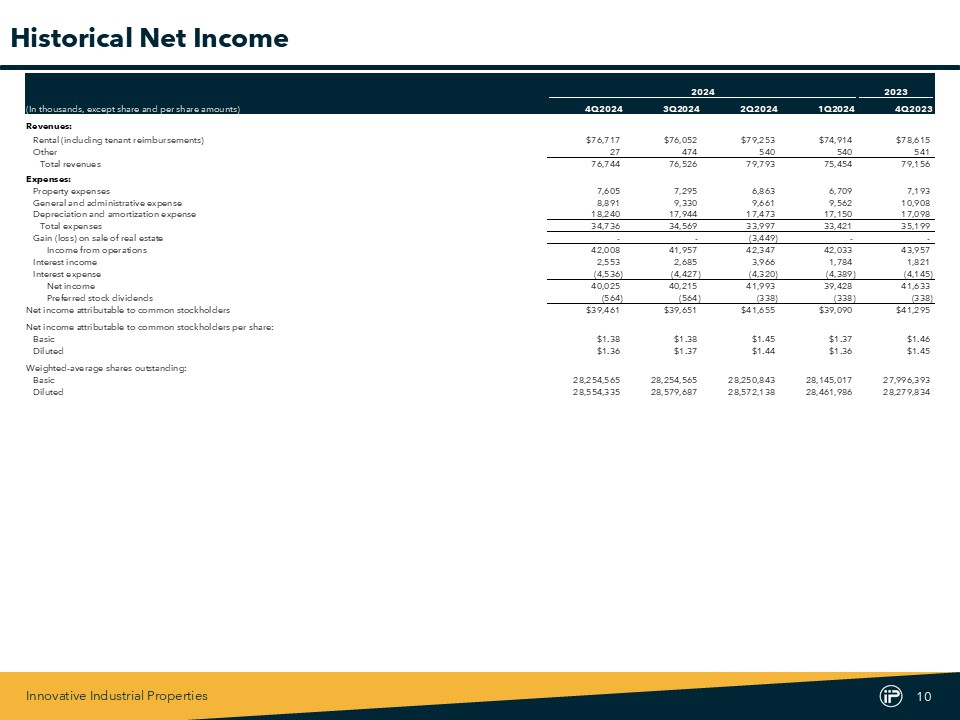

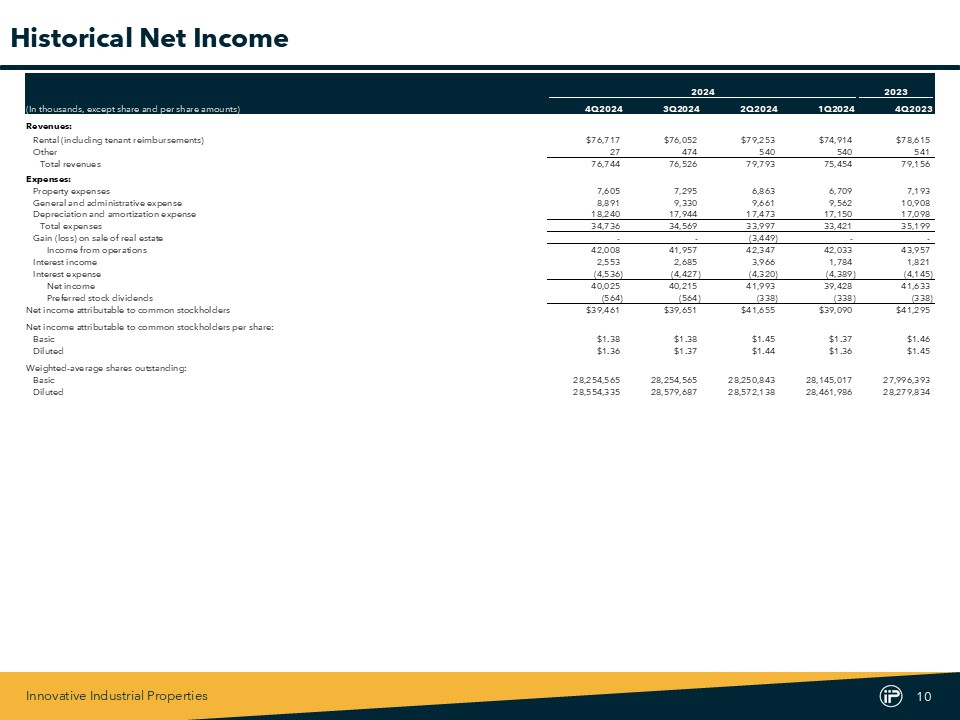

Innovative Industrial Properties 10 2024 2023 (In thousands, except share and per share amounts) 4Q2024 3Q2024 2Q2024 1Q2024 4Q2023 Revenues: Rental (including tenant reimbursements) $76,717 $76,052 $79,253 $74,914 $78,615 Other 27 474 540 540 541 Total revenues 76,744 76,526 79,793 75,454 79,156 Expenses: Property expenses 7,605 7,295 6,863 6,709 7,193 General and administrative expense 8,891 9,330 9,661 9,562 10,908 Depreciation and amortization expense 18,240 17,944 17,473 17,150 17,098 Total expenses 34,736 34,569 33,997 33,421 35,199 Gain (loss) on sale of real estate - - (3,449) - - Income from operations 42,008 41,957 42,347 42,033 43,957 Interest income 2,553 2,685 3,966 1,784 1,821 Interest expense (4,536) (4,427) (4,320) (4,389) (4,145) Net income 40,025 40,215 41,993 39,428 41,633 Preferred stock dividends (564) (564) (338) (338) (338) Net income attributable to common stockholders $39,461 $39,651 $41,655 $39,090 $41,295 Net income attributable to common stockholders per share: Basic $1.38 $1.38 $1.45 $1.37 $1.46 Diluted $1.36 $1.37 $1.44 $1.36 $1.45 Weighted-average shares outstanding: Basic 28,254,565 28,254,565 28,250,843 28,145,017 27,996,393 Diluted 28,554,335 28,579,687 28,572,138 28,461,986 28,279,834 Historical Net Income

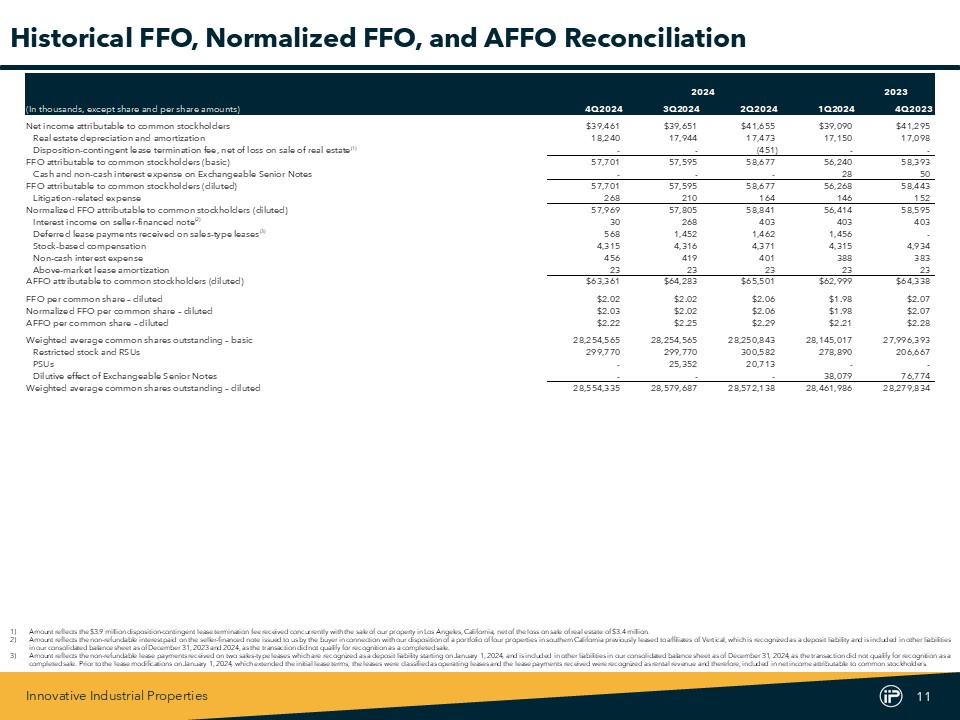

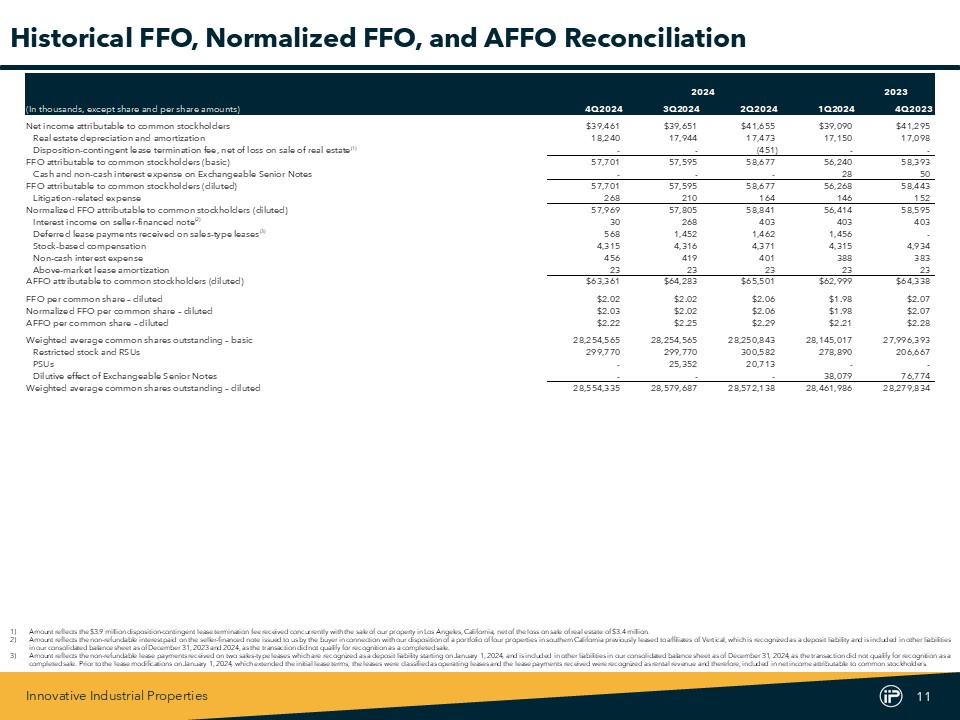

Innovative Industrial Properties 11 2024 2023 (In thousands, except share and per share amounts) 4Q2024 3Q2024 2Q2024 1Q2024 4Q2023 Net income attributable to common stockholders $39,461 $39,651 $41,655 $39,090 $41,295 Real estate depreciation and amortization 18,240 17,944 17,473 17,150 17,098 Disposition-contingent lease termination fee, net of loss on sale of real estate (1) - - (451) - - FFO attributable to common stockholders (basic) 57,701 57,595 58,677 56,240 58,393 Cash and non-cash interest expense on Exchangeable Senior Notes - - - 28 50 FFO attributable to common stockholders (diluted) 57,701 57,595 58,677 56,268 58,443 Litigation-related expense 268 210 164 146 152 Normalized FFO attributable to common stockholders (diluted) 57,969 57,805 58,841 56,414 58,595 Interest income on seller-financed note (2) 30 268 403 403 403 Deferred lease payments received on sales-type leases (3) 568 1,452 1,462 1,456 - Stock-based compensation 4,315 4,316 4,371 4,315 4,934 Non-cash interest expense 456 419 401 388 383 Above-market lease amortization 23 23 23 23 23 AFFO attributable to common stockholders (diluted) $63,361 $64,283 $65,501 $62,999 $64,338 FFO per common share – diluted $2.02 $2.02 $2.06 $1.98 $2.07 Normalized FFO per common share – diluted $2.03 $2.02 $2.06 $1.98 $2.07 AFFO per common share – diluted $2.22 $2.25 $2.29 $2.21 $2.28 Weighted average common shares outstanding – basic 28,254,565 28,254,565 28,250,843 28,145,017 27,996,393 Restricted stock and RSUs 299,770 299,770 300,582 278,890 206,667 PSUs - 25,352 20,713 - - Dilutive effect of Exchangeable Senior Notes - - - 38,079 76,774 Weighted average common shares outstanding – diluted 28,554,335 28,579,687 28,572,138 28,461,986 28,279,834 Historical FFO, Normalized FFO, and AFFO Reconciliation 1) Amount reflects the $ 3 . 9 million disposition - contingent lease termination fee received concurrently with the sale of our property in Los Angeles, California, net of the loss on sale of real estate of $ 3 . 4 million . 2) Amount reflects the non - refundable interest paid on the seller - financed note issued to us by the buyer in connection with our disposition of a portfolio of four properties in southern California previously leased to affiliates of Vertical, which is recognized as a deposit liability and is included in other liabilities in our consolidated balance sheet as of December 31 , 2023 and 2024 , as the transaction did not qualify for recognition as a completed sale . 3) Amount reflects the non - refundable lease payments received on two sales - type leases which are recognized as a deposit liability starting on January 1 , 2024 , and is included in other liabilities in our consolidated balance sheet as of December 31 , 2024 , as the transaction did not qualify for recognition as a completed sale . Prior to the lease modifications on January 1 , 2024 , which extended the initial lease terms, the leases were classified as operating leases and the lease payments received were recognized as rental revenue and therefore, included in net income attributable to common stockholders .

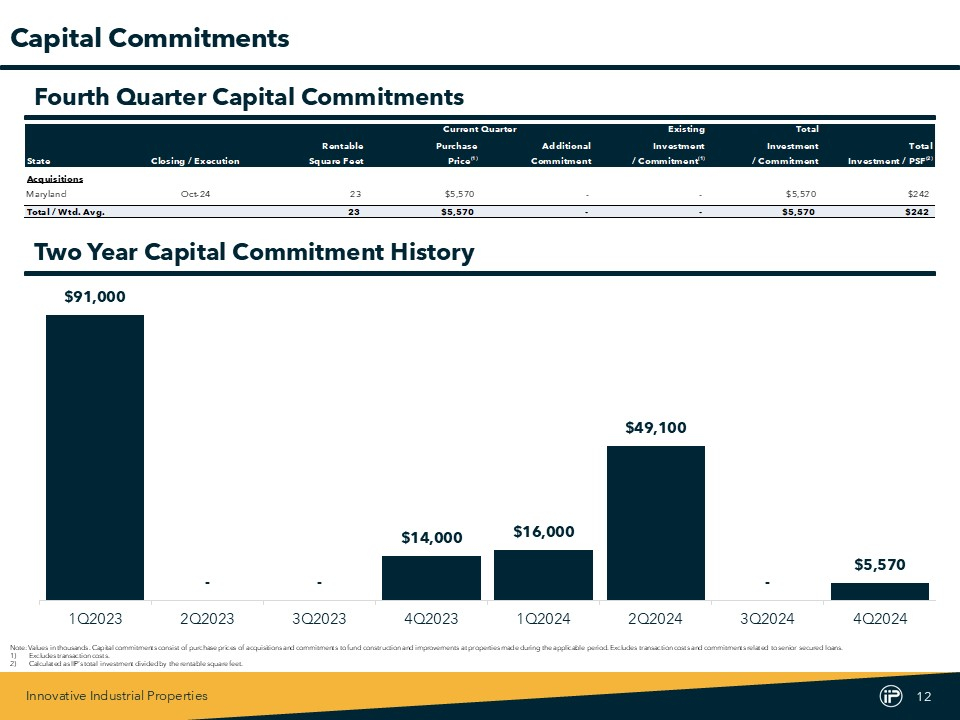

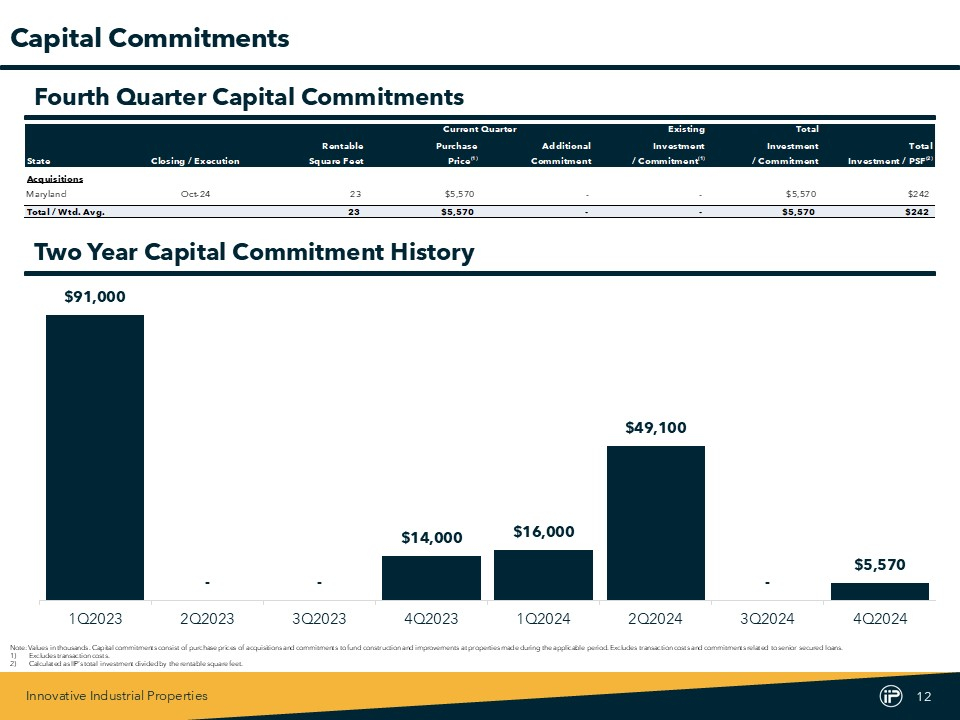

Innovative Industrial Properties 12 Current Quarter Existing Total Rentable Purchase Additional Investment Investment Total State Closing / Execution Square Feet Price (1) Commitment / Commitment (1) / Commitment Investment / PSF (2) Acquisitions Maryland Oct-24 23 $5,570 - - $5,570 $242 Total / Wtd. Avg. 23 $5,570 - - $5,570 $242 Capital Commitments Note : Values in thousands . Capital commitments consist of purchase prices of acquisitions and commitments to fund construction and improvements at properties made during the applicable period . Excludes transaction costs and commitments related to senior secured loans . 1) Excludes transaction costs . 2) Calculated as IIP’s total investment divided by the rentable square feet . Two Year Capital Commitment History $91,000 - - $14,000 $16,000 $49,100 - $5,570 1Q2023 2Q2023 3Q2023 4Q2023 1Q2024 2Q2024 3Q2024 4Q2024 Fourth Quarter Capital Commitments

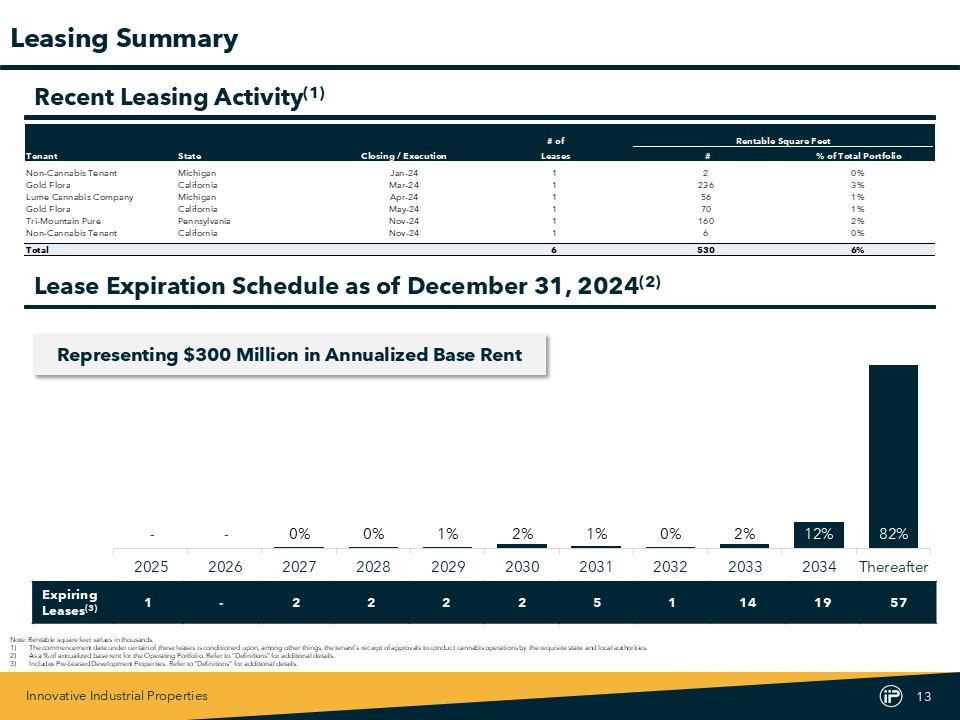

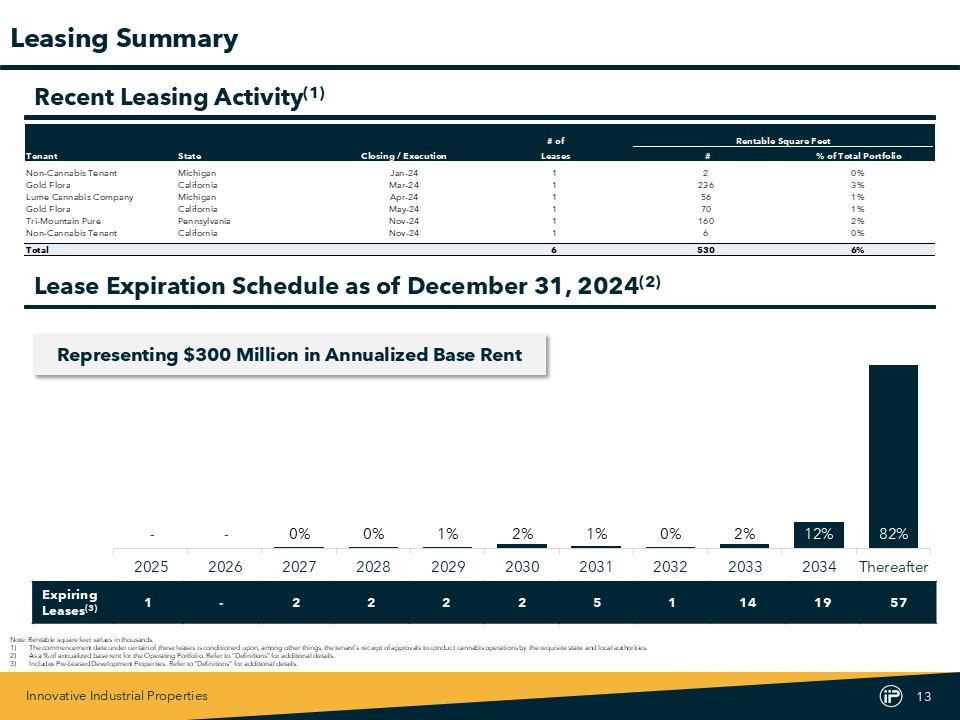

Innovative Industrial Properties 13 # of Rentable Square Feet Rentable Square Feet Tenant State Closing / Execution Leases # % of Total Portfolio Non-Cannabis Tenant Michigan Jan-24 1 2 0% Gold Flora California Mar-24 1 236 3% Lume Cannabis Company Michigan Apr-24 1 56 1% Gold Flora California May-24 1 70 1% Tri-Mountain Pure Pennsylvania Nov-24 1 160 2% Non-Cannabis Tenant California Nov-24 1 6 0% Total 6 530 6% Note : Rentable square feet values in thousands . 1) The commencement date under certain of these leases is conditioned upon, among other things, the tenant’s receipt of approvals to conduct cannabis operations by the requisite state and local authorities . 2) As a % of annualized base rent for the Operating Portfolio . Refer to “Definitions” for additional details . 3) Includes Pre - Leased Development Properties . Refer to “Definitions” for additional details . Leasing Summary Recent Leasing Activity (1) - - 0% 0% 1% 2% 1% 0% 2% 12% 82% 2025 2026 2027 2028 2029 2030 2031 2032 2033 2034 Thereafter Representing $300 Million in A nnualized Base Rent 57 19 14 1 5 2 2 2 2 - 1 Expiring Leases (3) Lease Expiration Schedule as of December 31, 2024 (2)

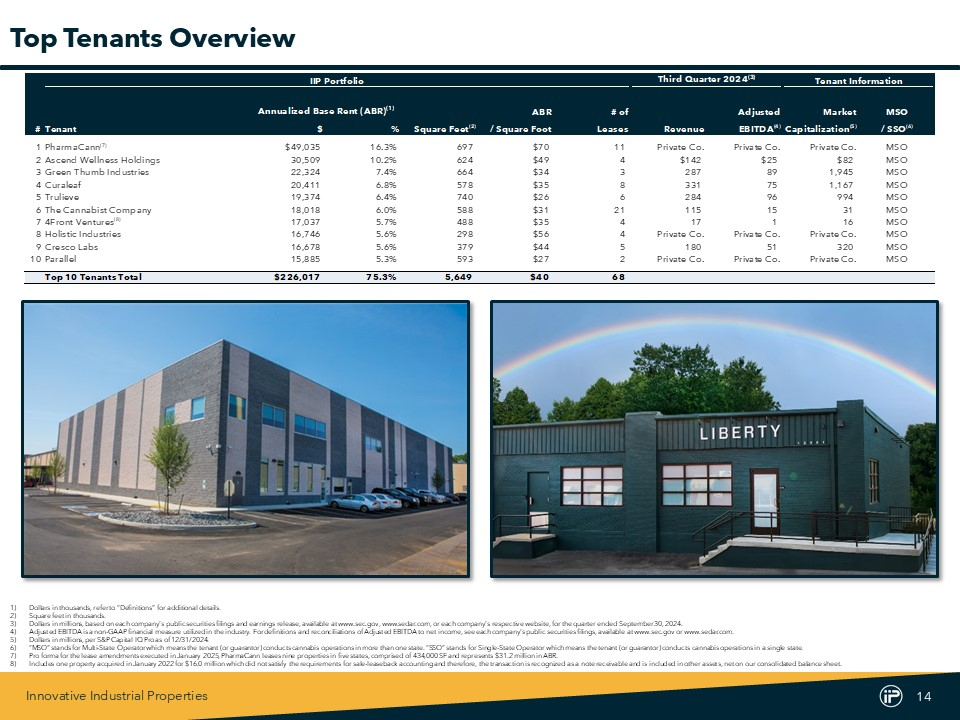

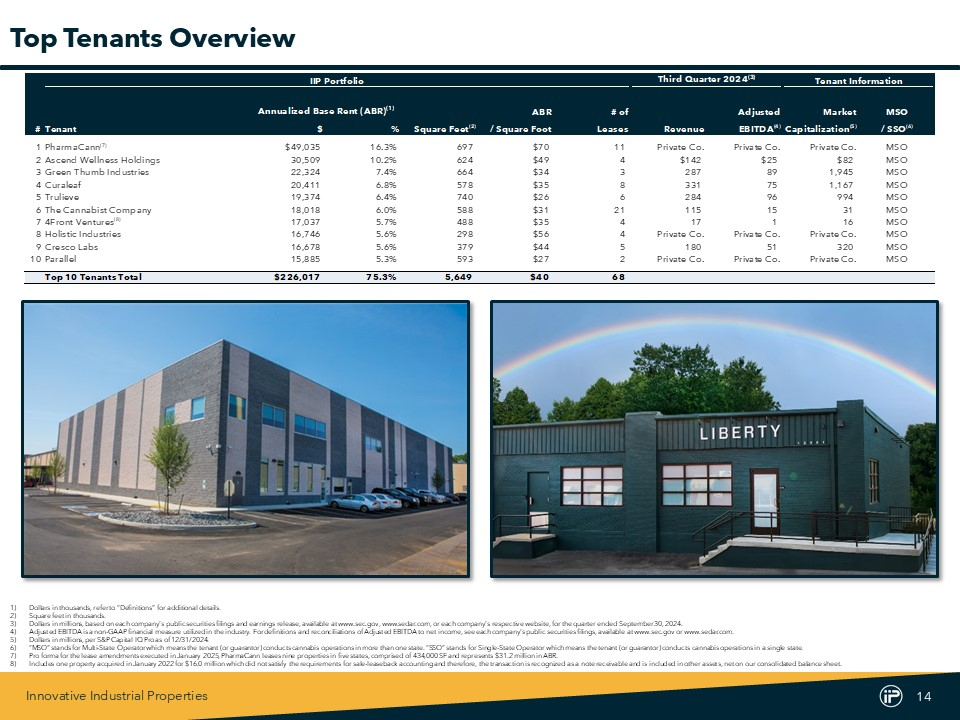

Innovative Industrial Properties 14 IIP Portfolio Third Quarter 2024 (3) Tenant Information Annualized Base Rent (ABR) (1) ABR # of Adjusted Market MSO #Tenant $ % Square Feet (2) / Square Foot Leases Revenue EBITDA (4) Capitalization (5) / SSO (6) 1 PharmaCann (7) $49,035 16.3% 697 $70 11 Private Co. Private Co. Private Co. MSO 2Ascend Wellness Holdings 30,509 10.2% 624 $49 4 $142 $25 $82 MSO 3Green Thumb Industries 22,324 7.4% 664 $34 3 287 89 1,945 MSO 4Curaleaf 20,411 6.8% 578 $35 8 331 75 1,167 MSO 5Trulieve 19,374 6.4% 740 $26 6 284 96 994 MSO 6The Cannabist Company 18,018 6.0% 588 $31 21 115 15 31 MSO 7 4Front Ventures (8) 17,037 5.7% 488 $35 4 17 1 16 MSO 8Holistic Industries 16,746 5.6% 298 $56 4 Private Co. Private Co. Private Co. MSO 9Cresco Labs 16,678 5.6% 379 $44 5 180 51 320 MSO 10Parallel 15,885 5.3% 593 $27 2 Private Co. Private Co. Private Co. MSO Top 10 Tenants Total $226,017 75.3% 5,649 $40 68 Top Tenants Overview 1) Dollars in thousands, r efer to “Definitions” for additional details . 2) Square feet in thousands . 3) Dollars in millions, based on each company’s public securities filings and earnings release, available at www . sec . gov, www . sedar . com, or each company’s respective website, for the quarter ended September 30 , 2024 . 4) Adjusted EBITDA is a non - GAAP financial measure utilized in the industry . For definitions and reconciliations of Adjusted EBITDA to net income, see each company’s public securities filings, available at www . sec . gov or www . sedar . com . 5) Dollars in millions, per S&P Capital IQ Pro as of 12 / 31 / 2024 . 6) “MSO” stands for Multi - State Operator which means the tenant (or guarantor) conducts cannabis operations in more than one state . “SSO” stands for Single - State O perator which means the tenant (or guarantor) conducts cannabis operations in a single state . 7) Pro forma for the lease amendments executed in January 2025 , PharmaCann leases nine properties in five states, comprised of 434 , 000 SF and represents $ 31 . 2 million in ABR . 8) Includes one property acquired in January 2022 for $ 16 . 0 million which did not satisfy the requirements for sale - leaseback accounting and therefore, the transaction is recognized as a note receivable and is included in other assets, net on our consolidated balance sheet .

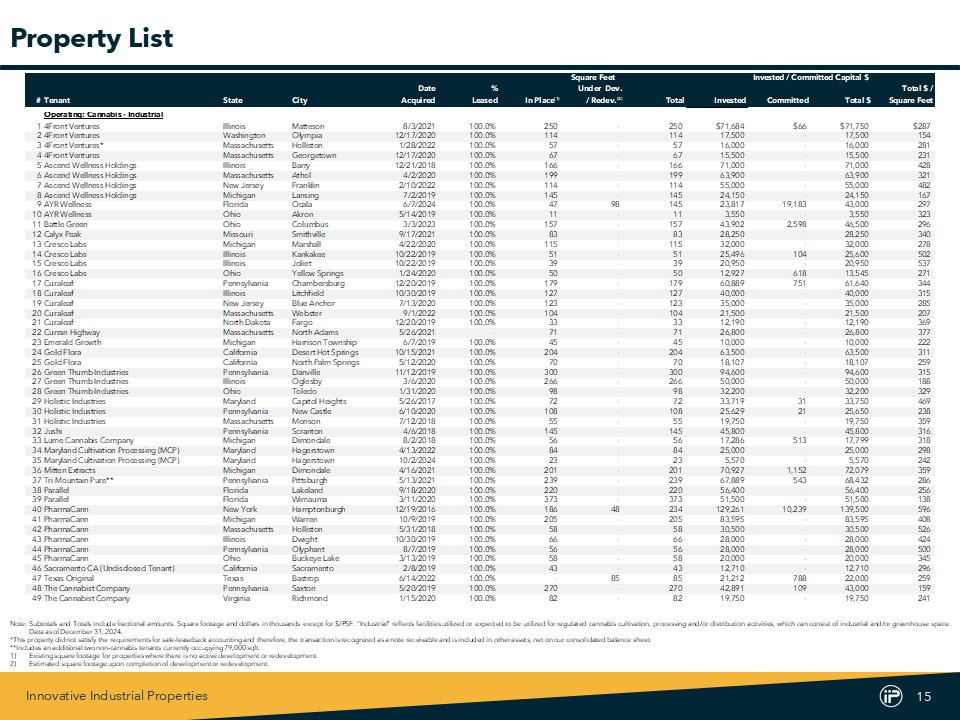

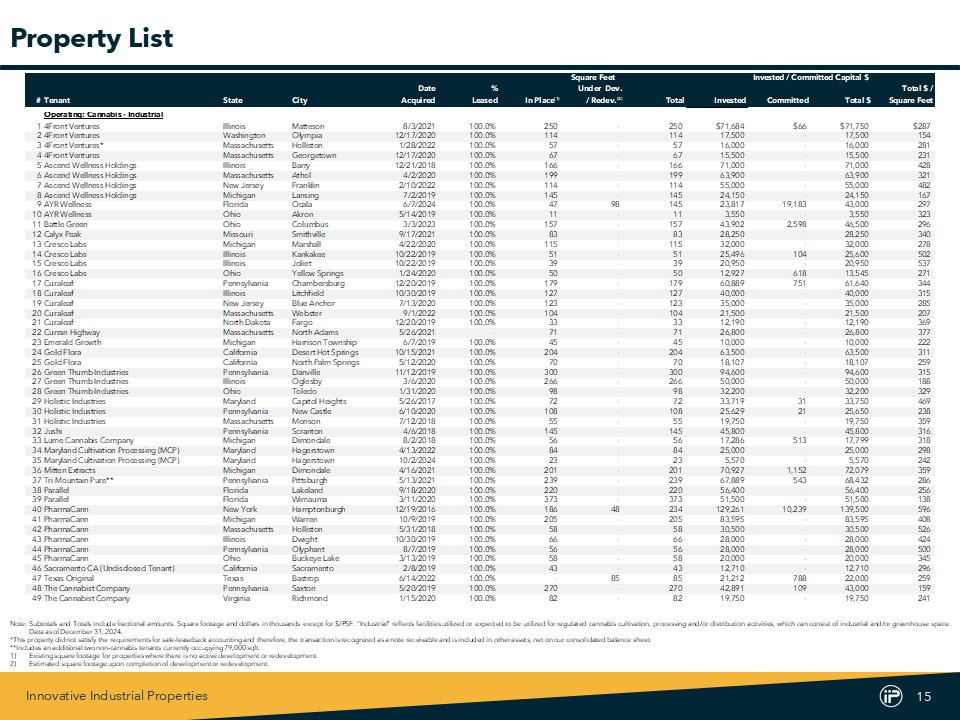

Innovative Industrial Properties 15 Square Feet Invested / Committed Capital $ Date % Under Dev. Total $ / #Tenant State City Acquired Leased In Place (1) / Redev. (2) Total Invested Committed Total $ Square Feet Operating: Cannabis - Industrial 14Front Ventures Illinois Matteson 8/3/2021 100.0% 250 - 250 $71,684 $66 $71,750 $287 24Front Ventures Washington Olympia 12/17/2020 100.0% 114 - 114 17,500 - 17,500 154 34Front Ventures* Massachusetts Holliston 1/28/2022 100.0% 57 - 57 16,000 - 16,000 281 44Front Ventures Massachusetts Georgetown 12/17/2020 100.0% 67 - 67 15,500 - 15,500 231 5Ascend Wellness Holdings Illinois Barry 12/21/2018 100.0% 166 - 166 71,000 - 71,000 428 6Ascend Wellness Holdings Massachusetts Athol 4/2/2020 100.0% 199 - 199 63,900 - 63,900 321 7Ascend Wellness Holdings New Jersey Franklin 2/10/2022 100.0% 114 - 114 55,000 - 55,000 482 8Ascend Wellness Holdings Michigan Lansing 7/2/2019 100.0% 145 - 145 24,150 - 24,150 167 9AYR Wellness Florida Ocala 6/7/2024 100.0% 47 98 145 23,817 19,183 43,000 297 10AYR Wellness Ohio Akron 5/14/2019 100.0% 11 - 11 3,550 - 3,550 323 11Battle Green Ohio Columbus 3/3/2023 100.0% 157 - 157 43,902 2,598 46,500 296 12Calyx Peak Missouri Smithville 9/17/2021 100.0% 83 - 83 28,250 - 28,250 340 13Cresco Labs Michigan Marshall 4/22/2020 100.0% 115 - 115 32,000 - 32,000 278 14Cresco Labs Illinois Kankakee 10/22/2019 100.0% 51 - 51 25,496 104 25,600 502 15Cresco Labs Illinois Joliet 10/22/2019 100.0% 39 - 39 20,950 - 20,950 537 16Cresco Labs Ohio Yellow Springs 1/24/2020 100.0% 50 - 50 12,927 618 13,545 271 17Curaleaf Pennsylvania Chambersburg 12/20/2019 100.0% 179 - 179 60,889 751 61,640 344 18Curaleaf Illinois Litchfield 10/30/2019 100.0% 127 - 127 40,000 - 40,000 315 19Curaleaf New Jersey Blue Anchor 7/13/2020 100.0% 123 - 123 35,000 - 35,000 285 20Curaleaf Massachusetts Webster 9/1/2022 100.0% 104 - 104 21,500 - 21,500 207 21Curaleaf North Dakota Fargo 12/20/2019 100.0% 33 - 33 12,190 - 12,190 369 22Curran Highway Massachusetts North Adams 5/26/2021 - 71 - 71 26,800 - 26,800 377 23Emerald Growth Michigan Harrison Township 6/7/2019 100.0% 45 - 45 10,000 - 10,000 222 24Gold Flora California Desert Hot Springs 10/15/2021 100.0% 204 - 204 63,500 - 63,500 311 25Gold Flora California North Palm Springs 5/12/2020 100.0% 70 - 70 18,107 - 18,107 259 26Green Thumb Industries Pennsylvania Danville 11/12/2019 100.0% 300 - 300 94,600 - 94,600 315 27Green Thumb Industries Illinois Oglesby 3/6/2020 100.0% 266 - 266 50,000 - 50,000 188 28Green Thumb Industries Ohio Toledo 1/31/2020 100.0% 98 - 98 32,200 - 32,200 329 29Holistic Industries Maryland Capitol Heights 5/26/2017 100.0% 72 - 72 33,719 31 33,750 469 30Holistic Industries Pennsylvania New Castle 6/10/2020 100.0% 108 - 108 25,629 21 25,650 238 31Holistic Industries Massachusetts Monson 7/12/2018 100.0% 55 - 55 19,750 - 19,750 359 32Jushi Pennsylvania Scranton 4/6/2018 100.0% 145 - 145 45,800 - 45,800 316 33Lume Cannabis Company Michigan Dimondale 8/2/2018 100.0% 56 - 56 17,286 513 17,799 318 34Maryland Cultivation Processing (MCP) Maryland Hagerstown 4/13/2022 100.0% 84 - 84 25,000 - 25,000 298 35Maryland Cultivation Processing (MCP) Maryland Hagerstown 10/2/2024 100.0% 23 - 23 5,570 - 5,570 242 36Mitten Extracts Michigan Dimondale 4/16/2021 100.0% 201 - 201 70,927 1,152 72,079 359 37Tri-Mountain Pure** Pennsylvania Pittsburgh 5/13/2021 100.0% 239 - 239 67,889 543 68,432 286 38Parallel Florida Lakeland 9/18/2020 100.0% 220 - 220 56,400 - 56,400 256 39Parallel Florida Wimauma 3/11/2020 100.0% 373 - 373 51,500 - 51,500 138 40PharmaCann New York Hamptonburgh 12/19/2016 100.0% 186 48 234 129,261 10,239 139,500 596 41PharmaCann Michigan Warren 10/9/2019 100.0% 205 - 205 83,595 - 83,595 408 42PharmaCann Massachusetts Holliston 5/31/2018 100.0% 58 - 58 30,500 - 30,500 526 43PharmaCann Illinois Dwight 10/30/2019 100.0% 66 - 66 28,000 - 28,000 424 44PharmaCann Pennsylvania Olyphant 8/7/2019 100.0% 56 - 56 28,000 - 28,000 500 45PharmaCann Ohio Buckeye Lake 3/13/2019 100.0% 58 - 58 20,000 - 20,000 345 46Sacramento CA (Undisclosed Tenant) California Sacramento 2/8/2019 100.0% 43 - 43 12,710 - 12,710 296 47Texas Original Texas Bastrop 6/14/2022 100.0% - 85 85 21,212 788 22,000 259 48The Cannabist Company Pennsylvania Saxton 5/20/2019 100.0% 270 - 270 42,891 109 43,000 159 49The Cannabist Company Virginia Richmond 1/15/2020 100.0% 82 - 82 19,750 - 19,750 241 Note : Subtotals and Totals include fractional amounts . Square footage and dollars in thousands except for $ /PSF . “Industrial” reflects facilities utilized or expected to be utilized for regulated cannabis cultivation, processing and/or distribution activities, which can consist of industrial and/or greenhouse space . Data as of December 31 , 2024 . * This property did not satisfy the requirements for sale - leaseback accounting and therefore, the transaction is recognized as a note receivable and is included in other assets, net on our consolidated balance sheet . **Includes an additional two non - cannabis tenants currently occupying 79 , 000 sqft . 1) Existing square footage for properties where there is no active development or redevelopment . 2) Estimated square footage upon completion of development or redevelopment . Property List

Innovative Industrial Properties 16 Square Feet Invested / Committed Capital $ Date % Under Dev. Total $ / #Tenant State City Acquired Leased In Place (1) / Redev. (2) Total Invested Committed Total $ Square Feet 50The Cannabist Company New Jersey Vineland 7/16/2020 100.0% 50 - 50 $11,820 - $11,820 $236 51The Cannabist Company Colorado Denver 10/30/2018 100.0% 58 - 58 11,250 - 11,250 194 52The Cannabist Company Colorado Denver 12/14/2021 100.0% 18 - 18 9,917 - 9,917 551 53The Cannabist Company Colorado Denver 12/14/2021 100.0% 12 - 12 3,276 - 3,276 273 54The Pharm Arizona Willcox 12/15/2017 100.0% 358 - 358 20,000 - 20,000 56 55TILT Holdings Pennsylvania White Haven 2/15/2023 100.0% 58 - 58 15,000 - 15,000 259 56Trulieve Massachusetts Holyoke 7/26/2019 100.0% 150 - 150 43,500 - 43,500 290 57Trulieve Florida Alachua 1/22/2021 100.0% 295 - 295 41,650 - 41,650 141 58Trulieve Maryland Hancock 8/13/2021 100.0% 115 - 115 29,515 - 29,515 257 59Trulieve Florida Quincy 10/23/2019 100.0% 120 - 120 17,000 - 17,000 142 60Trulieve*** Nevada Las Vegas 7/12/2019 100.0% 43 - 43 9,600 - 9,600 223 61Trulieve Arizona Cottonwood 4/27/2022 100.0% 17 - 17 5,238 - 5,238 308 62Verdant California Cathedral City 3/25/2022 100.0% 23 - 23 15,250 - 15,250 663 63Vireo New York Perth 10/23/2017 100.0% 389 - 389 81,358 - 81,358 209 64Vireo Minnesota Otsego 11/8/2017 100.0% 89 - 89 9,710 - 9,710 109 Operating: Cannabis - Industrial Subtotal / Wtd. Avg. 98.8% 7,680 231 7,911 $2,149,886 $36,715 $2,186,601 $276 Operating: Cannabis - Retail 65Curaleaf North Dakota Dickinson 12/14/2021 100.0% 5 - 5 $2,045 - $2,045 $409 66Curaleaf North Dakota Devils Lake 12/14/2021 100.0% 4 - 4 1,614 - 1,614 404 67Curaleaf Pennsylvania Bradford 12/14/2021 100.0% 3 - 3 1,058 - 1,058 353 68Green Peak (Skymint) Michigan East Lansing 10/25/2019 100.0% 3 - 3 3,372 28 3,400 1,133 69Green Peak (Skymint) Michigan Lansing 11/4/2019 100.0% 14 - 14 2,225 - 2,225 159 70Green Peak (Skymint) Michigan Flint 11/4/2019 100.0% 6 - 6 2,180 - 2,180 363 71PharmaCann Colorado Commerce City 2/21/2020 100.0% 5 - 5 2,300 - 2,300 460 72PharmaCann Colorado Aurora 12/14/2021 100.0% 2 - 2 1,674 - 1,674 837 73PharmaCann Colorado Berthoud 12/14/2021 100.0% 6 - 6 1,406 - 1,406 234 74PharmaCann Colorado Mancos 12/14/2021 100.0% 4 - 4 1,148 - 1,148 287 75PharmaCann Colorado Pueblo 2/19/2020 100.0% 3 - 3 1,049 - 1,049 350 76Schwazze Colorado Ordway 12/14/2021 100.0% 2 - 2 400 - 400 200 77Schwazze Colorado Rocky Ford 12/14/2021 100.0% 13 - 13 400 - 400 31 78Schwazze Colorado Las Animas 12/14/2021 100.0% 2 - 2 400 - 400 200 79South Mason Drive Michigan Newaygo 11/8/2019 - 2 - 2 995 - 995 498 80The Cannabist Company Colorado Denver 12/14/2021 100.0% 4 - 4 7,338 - 7,338 1,834 81The Cannabist Company Colorado Pueblo 12/14/2021 100.0% 6 - 6 4,878 - 4,878 813 82The Cannabist Company Colorado Aurora 12/14/2021 100.0% 5 - 5 4,229 - 4,229 846 83The Cannabist Company Colorado Glenwood Springs 12/14/2021 100.0% 4 - 4 4,187 - 4,187 1,047 84The Cannabist Company Colorado Fort Collins 12/14/2021 100.0% 5 - 5 3,977 - 3,977 795 85The Cannabist Company Colorado Aurora 12/14/2021 100.0% 4 - 4 3,601 - 3,601 900 86The Cannabist Company New Jersey Vineland 7/16/2020 100.0% 4 - 4 2,165 - 2,165 541 87The Cannabist Company Colorado Aurora 12/14/2021 100.0% 5 - 5 1,991 - 1,991 398 88The Cannabist Company Colorado Englewood 12/14/2021 100.0% 4 - 4 1,778 - 1,778 445 89The Cannabist Company Colorado Trinidad 12/14/2021 100.0% 9 - 9 1,728 - 1,728 192 90The Cannabist Company Colorado Silver Plume 12/14/2021 100.0% 4 - 4 1,444 - 1,444 361 91The Cannabist Company Colorado Black Hawk 12/14/2021 100.0% 4 - 4 1,321 - 1,321 330 92The Cannabist Company Colorado Edgewater 12/14/2021 100.0% 5 - 5 1,089 - 1,089 218 93The Cannabist Company Colorado Sheridan 12/14/2021 100.0% 2 - 2 890 - 890 445 94The Pharm Arizona Phoenix 9/19/2019 100.0% 2 - 2 2,500 - 2,500 1,250 95Verano Pennsylvania Harrisburg 3/23/2022 100.0% 3 - 3 2,750 - 2,750 917 96Wilder Road Michigan Bay City 11/4/2019 - 4 - 4 1,740 - 1,740 435 Operating: Cannabis - Retail Subtotal / Wtd. Avg. 96.1% 148 - 148 $69,870 $28 $69,898 $472 Note : Subtotals and Totals include fractional amounts . Square footage and dollars in thousands except for $ /PSF . “Industrial” reflects facilities utilized or expected to be utilized for regulated cannabis cultivation, processing and/or distribution activities, which can consist of industrial and/or greenhouse space . Data as of December 31 , 2024 . *** Harvest Health & Recreation Inc . , which is a subsidiary of Trulieve Inc . , executed a lease guaranty in favor of IIP for tenant’s obligations at the property . 1) Existing square footage for properties where there is no active development or redevelopment . 2) Estimated square footage upon completion of development or redevelopment . Property List (Continued)

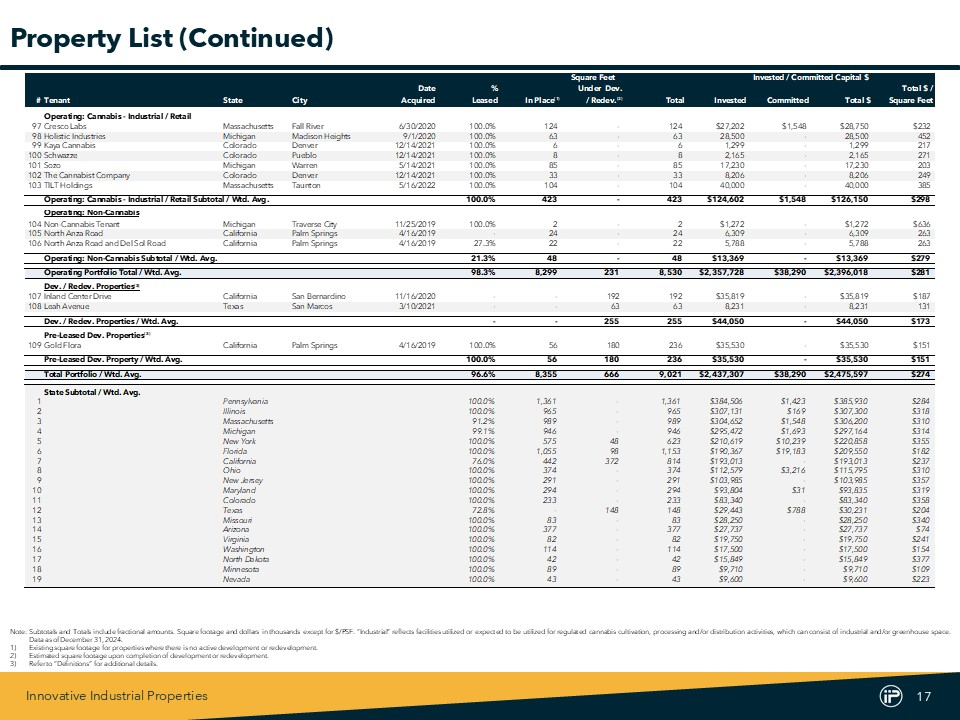

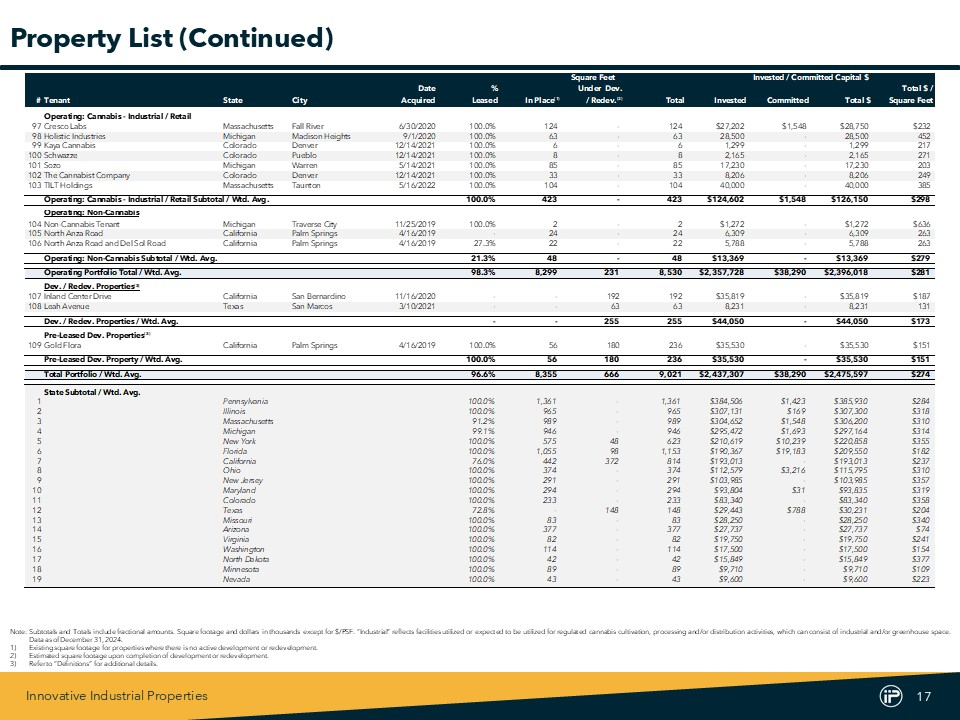

Innovative Industrial Properties 17 Square Feet Invested / Committed Capital $ Date % Under Dev. Total $ / #Tenant State City Acquired Leased In Place (1) / Redev. (2) Total Invested Committed Total $ Square Feet Operating: Cannabis - Industrial / Retail 97Cresco Labs Massachusetts Fall River 6/30/2020 100.0% 124 - 124 $27,202 $1,548 $28,750 $232 98Holistic Industries Michigan Madison Heights 9/1/2020 100.0% 63 - 63 28,500 - 28,500 452 99Kaya Cannabis Colorado Denver 12/14/2021 100.0% 6 - 6 1,299 - 1,299 217 100 Schwazze Colorado Pueblo 12/14/2021 100.0% 8 - 8 2,165 - 2,165 271 101 Sozo Michigan Warren 5/14/2021 100.0% 85 - 85 17,230 - 17,230 203 102 The Cannabist Company Colorado Denver 12/14/2021 100.0% 33 - 33 8,206 - 8,206 249 103 TILT Holdings Massachusetts Taunton 5/16/2022 100.0% 104 - 104 40,000 - 40,000 385 Operating: Cannabis - Industrial / Retail Subtotal / Wtd. Avg. 100.0% 423 - 423 $124,602 $1,548 $126,150 $298 Operating: Non-Cannabis 104 Non-Cannabis Tenant Michigan Traverse City 11/25/2019 100.0% 2 - 2 $1,272 - $1,272 $636 105 North Anza Road California Palm Springs 4/16/2019 - 24 - 24 6,309 - 6,309 263 106 North Anza Road and Del Sol Road California Palm Springs 4/16/2019 27.3% 22 - 22 5,788 - 5,788 263 Operating: Non-Cannabis Subtotal / Wtd. Avg. 21.3% 48 - 48 $13,369 - $13,369 $279 Operating Portfolio Total / Wtd. Avg. 98.3% 8,299 231 8,530 $2,357,728 $38,290 $2,396,018 $281 Dev. / Redev. Properties (3) 107 Inland Center Drive California San Bernardino 11/16/2020 - - 192 192 $35,819 - $35,819 $187 108 Leah Avenue Texas San Marcos 3/10/2021 - - 63 63 8,231 - 8,231 131 Dev. / Redev. Properties / Wtd. Avg. - - 255 255 $44,050 - $44,050 $173 Pre-Leased Dev. Properties (3) 109 Gold Flora California Palm Springs 4/16/2019 100.0% 56 180 236 $35,530 - $35,530 $151 Pre-Leased Dev. Property / Wtd. Avg. 100.0% 56 180 236 $35,530 - $35,530 $151 Total Portfolio / Wtd. Avg. 96.6% 8,355 666 9,021 $2,437,307 $38,290 $2,475,597 $274 State Subtotal / Wtd. Avg. 1 Pennsylvania 100.0% 1,361 - 1,361 $384,506 $1,423 $385,930 $284 2 Illinois 100.0% 965 - 965 $307,131 $169 $307,300 $318 3 Massachusetts 91.2% 989 - 989 $304,652 $1,548 $306,200 $310 4 Michigan 99.1% 946 - 946 $295,472 $1,693 $297,164 $314 5 New York 100.0% 575 48 623 $210,619 $10,239 $220,858 $355 6 Florida 100.0% 1,055 98 1,153 $190,367 $19,183 $209,550 $182 7 California 76.0% 442 372 814 $193,013 - $193,013 $237 8 Ohio 100.0% 374 - 374 $112,579 $3,216 $115,795 $310 9 New Jersey 100.0% 291 - 291 $103,985 - $103,985 $357 10 Maryland 100.0% 294 - 294 $93,804 $31 $93,835 $319 11 Colorado 100.0% 233 - 233 $83,340 - $83,340 $358 12 Texas 72.8% - 148 148 $29,443 $788 $30,231 $204 13 Missouri 100.0% 83 - 83 $28,250 - $28,250 $340 14 Arizona 100.0% 377 - 377 $27,737 - $27,737 $74 15 Virginia 100.0% 82 - 82 $19,750 - $19,750 $241 16 Washington 100.0% 114 - 114 $17,500 - $17,500 $154 17 North Dakota 100.0% 42 - 42 $15,849 - $15,849 $377 18 Minnesota 100.0% 89 - 89 $9,710 - $9,710 $109 19 Nevada 100.0% 43 - 43 $9,600 - $9,600 $223 Property List (Continued) Note : Subtotals and Totals include fractional amounts . Square footage and dollars in thousands except for $ /PSF . “Industrial” reflects facilities utilized or expected to be utilized for regulated cannabis cultivation, processing and/or distribution activities, which can consist of industrial and/or greenhouse space . Data as of December 31 , 2024 . 1) Existing square footage for properties where there is no active development or redevelopment . 2) Estimated square footage upon completion of development or redevelopment . 3) Refer to “Definitions” for additional details .

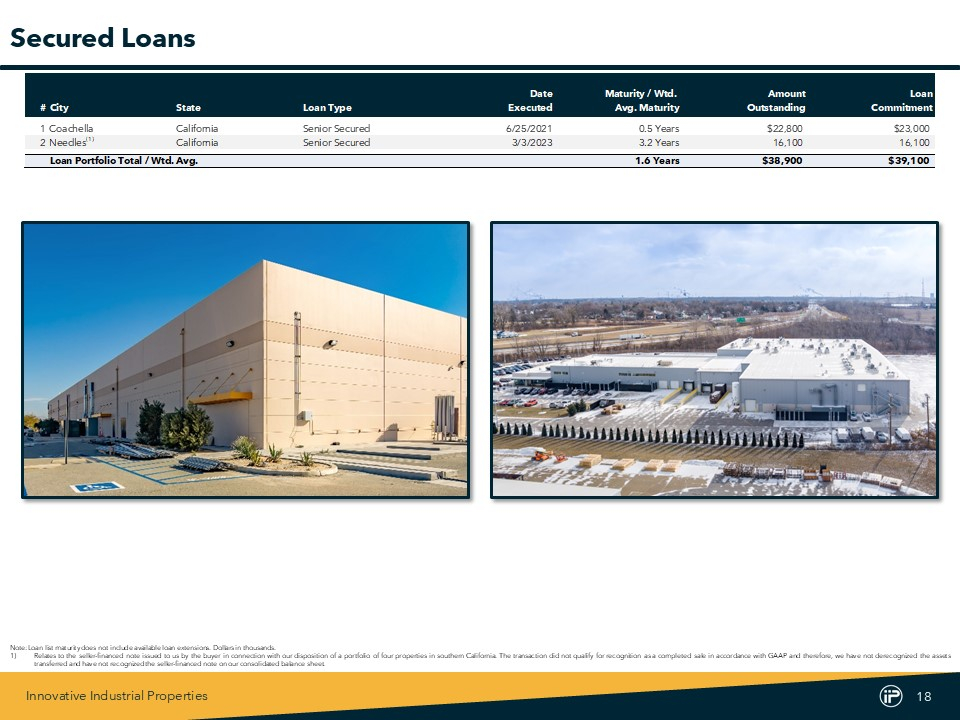

Innovative Industrial Properties 18 Date Maturity / Wtd. Amount Loan #City State Loan Type Executed Avg. Maturity Outstanding Commitment 1Coachella California Senior Secured 6/25/2021 0.5 Years $22,800 $23,000 2 Needles (1) California Senior Secured 3/3/2023 3.2 Years 16,100 16,100 Loan Portfolio Total / Wtd. Avg. 1.6 Years $38,900 $39,100 Secured Loans Note : Loan list maturity does not include available loan extensions . Dollars in thousands . 1) Relates to the seller - financed note issued to us by the buyer in connection with our disposition of a portfolio of four properties in southern California . The transaction did not qualify for recognition as a completed sale in accordance with GAAP and therefore, we have not derecognized the assets transferred and have not recognized the seller - financed note on our consolidated balance sheet .

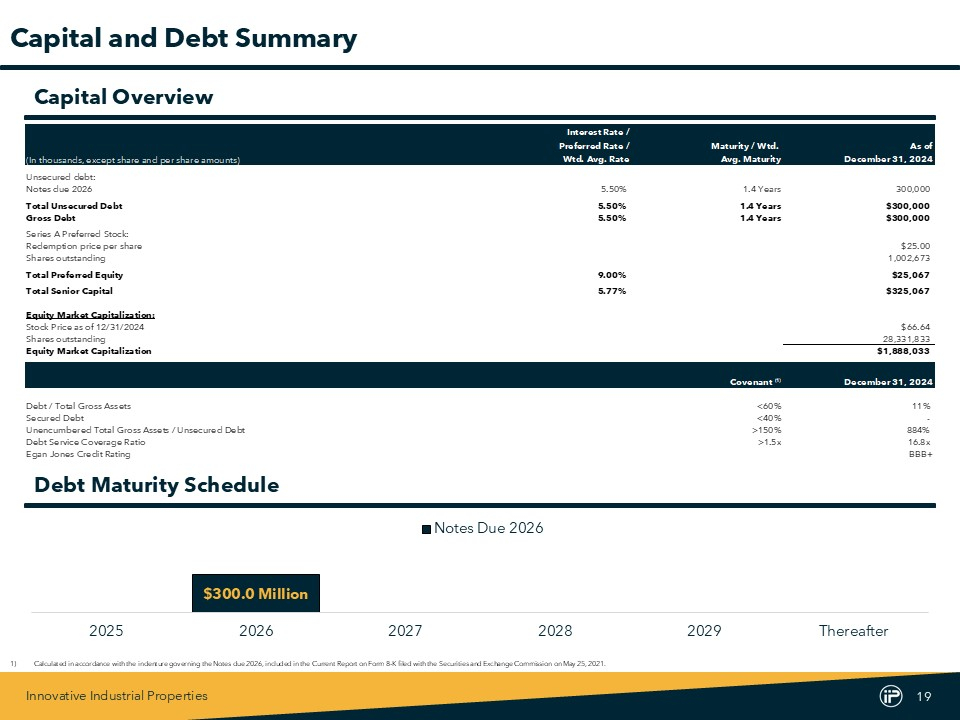

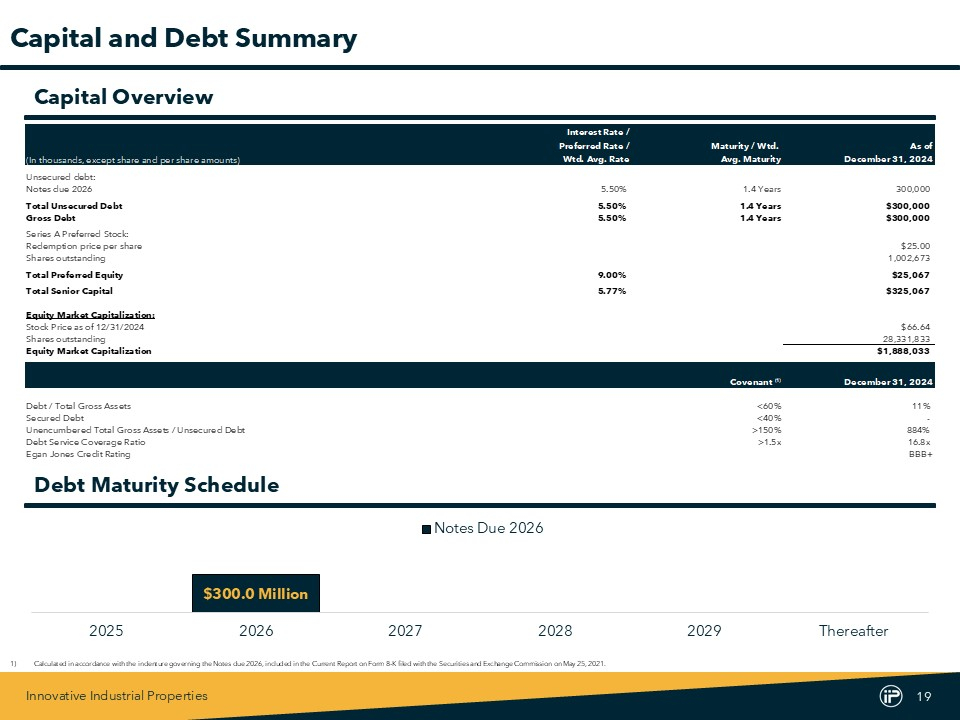

Innovative Industrial Properties 19 Interest Rate / Preferred Rate / Maturity / Wtd. As of (In thousands, except share and per share amounts) Wtd. Avg. Rate Avg. Maturity December 31, 2024 Unsecured debt: Notes due 2026 5.50% 1.4 Years 300,000 Total Unsecured Debt 5.50% 1.4 Years $300,000 Gross Debt 5.50% 1.4 Years $300,000 Series A Preferred Stock: Redemption price per share $25.00 Shares outstanding 1,002,673 Total Preferred Equity 9.00% $25,067 Total Senior Capital 5.77% $325,067 Equity Market Capitalization: Stock Price as of 12/31/2024 $66.64 Shares outstanding 28,331,833 Equity Market Capitalization $1,888,033 Covenant (1) December 31, 2024 Debt / Total Gross Assets <60% 11% Secured Debt <40% - Unencumbered Total Gross Assets / Unsecured Debt >150% 884% Debt Service Coverage Ratio >1.5x 16.8x Egan Jones Credit Rating BBB+ Debt Maturity Schedule Capital and Debt Summary $300.0 Million 2025 2026 2027 2028 2029 Thereafter Notes Due 2026 Capital Overview 1) Calculated in accordance with the indenture governing the Notes due 2026 , included in the Current Report on Form 8 - K filed with the Securities and Exchange Commission on May 25 , 2021 .

Innovative Industrial Properties 20 Definitions • Adjusted Funds From Operations (“AFFO”): Management believes that AFFO and AFFO per share are appropriate supplemental measures of a REIT’s operating performance. We calculate AFFO by adjusting Normalized FFO for certain cash and non - cash items. • Annualized Base Rent (“ABR”): ABR is calculated by multiplying the sum of contractually due base rents and property management fees for the last month in the quarter, by twelve. • Development / Redevelopment (“Dev. / Redev.”) Properties: Defined as non - operating assets under development that are not leased and not ready for their intended use. • Exchangeable Senior Notes: 3.75% E xchangeable Senior Notes paid off in full in February 2024. • Funds From Operations (“FFO”): FFO and FFO per share are operating performance measures adopted by the National Association of Real Estate Investment Trusts, Inc. (“NAREIT”). NAREIT defines FFO as the most commonly accepted and reported measure of a REIT’s ope rating performance equal to net income (computed in accordance with GAAP), excluding gains (or losses) from sales of property, depre cia tion, amortization and impairment related to real estate properties, and after adjustments for unconsolidated partnerships and join t v entures. Management also excludes from FFO any disposition - contingent lease termination fee received in connection with a property sale. Management believes that net income, as defined by GAAP, is the most appropriate earnings measurement. However, management be lie ves FFO and FFO per share to be supplemental measures of a REIT’s performance because they provide an understanding of the operat ing performance of our properties without giving effect to certain significant non - cash items, primarily depreciation expense. Histo rical cost accounting for real estate assets in accordance with GAAP assumes that the value of real estate assets diminishes predictably ov er time. However, real estate values instead have historically risen or fallen with market conditions. We believe that by excluding the effect of depreciation, FFO and FFO per share can facilitate comparisons of operating performance between periods. We report FFO and FFO per share because th ese measures are observed by management to also be the predominant measures used by the REIT industry and by industry analysts to ev aluate REITs and because FFO per share is consistently reported, discussed, and compared by research analysts in their notes and pub lic ations about REITs. For these reasons, management has deemed it appropriate to disclose and discuss FFO and FFO per share. • GAAP: Accounting principles generally accepted in the United States. • Gross Debt: Calculated as the sum of the principal amount outstanding of the Notes due 2026.

Innovative Industrial Properties 21 Definitions (Continued) • Normalized Funds From Operations (“Normalized FFO”): We compute normalized funds from operations (“Normalized FFO”) by adjusting FFO, as defined by NAREIT, to exclude certain GAAP income and expense amounts that we believe are infrequent and unusual in n atu re and/or not related to our core real estate operations. Exclusion of these items from similar FFO - type metrics is common within the equi ty REIT industry, and management believes that presentation of Normalized FFO and Normalized FFO per share provides investors with a metric to ass ist in their evaluation of our operating performance across multiple periods and in comparison to the operating performance of other compa nie s, because it removes the effect of unusual items that are not expected to impact our operating performance on an ongoing basis. Normali zed FFO is used by management in evaluating the performance of our core business operations. Items included in calculating FFO that may be ex clu ded in calculating Normalized FFO include certain transaction - related gains, losses, income or expense or other non - core amounts as the y occur. • Notes due 2026 : 5.50% Unsecured Senior Notes due 2026. • Operating Portfolio: All properties that (a) are leased or (b) are not leased but ready for their intended use. • Pre - Leased Development (“Dev.”) Properties: Defined as non - operating assets under development that are leased but not ready for their intended use. • Series A Preferred: 9.00% Series A Cumulative Redeemable Preferred Stock, $0.001 par value per share. • Total Committed / Invested Capital: Includes (1) total investments in properties (consisting of purchase price and construction funding and improvements reimbursed to tenants, if any, but excluding transaction costs) and (2) total additional commitments to reimburs e c ertain tenants and sellers for completion of construction and improvements at the properties. Excludes loans listed in “Secured Loans”. • Total Portfolio: All properties, including Development / Redevelopment Properties, Pre - Leased Redevelopment Properties, and Operating Portfolio, as of quarter end. • Total Preferred Equity: Calculated by multiplying the total Series A Preferred shares outstanding by the $25 redemption price per share. • Total Senior Capital: Calculated as the sum of Gross Debt and the redemption value of the Series A Preferred Stock. • % Leased: The weighted average leased percentage of the Operating Portfolio by Total Committed / Invested Capital. Excludes Development / Redevelopment Properties and Pre - Leased Redevelopment Properties.

Innovative Industrial Properties 22 Analyst Coverage Contact Information Research Firms Analyst Email: agrey@allianceg.com Phone: 888 - 543 - 4448 Alliance Global Partners Aaron Grey Email: tcatherwood@btig.com Phone: 212 - 738 - 6140 BTIG Tom Catherwood Email: mross@compasspointllc.com Phone: 202 - 534 - 1392 Compass Point Research and Trading Merrill Ross Email: eric.deslauriers@craig - hallum.com Phone: 617 - 275 - 5177 Craig - Hallum Capital Group LLC Eric Des Lauriers Email: ahecht@jmpsecurities.com Phone: 415 - 835 - 3963 JMP Securities Aaron Hecht Email: alexander.goldfarb@psc.com Phone: 212 - 466 - 7937 Piper Sandler Alexander Goldfarb Email: bkirk@roth.com Phone: 203 - 355 - 3473 Roth Capital Partners Bill Kirk Email: arosivach@wolferesearch.com Phone: 646 - 582 - 9250 Wolfe Research Andrew Rosivach Email: ir@iipreit.com Phone: 858 - 997 - 3332 Investor Relations

Innovative Industrial Properties 23 Senior Management Team and Board of Directors Senior Management Title Name Executive Chairman Alan Gold President, Chief Executive Officer and Director Paul Smithers Chief Financial Officer and Treasurer David Smith Chief Operating Officer Catherine Hastings Chief Investment Officer Ben Regin Senior Vice President, Asset Management Tracie Hager Senior Vice President, Real Estate Counsel Kelly Spicher Vice President, Chief Accounting Officer Andy Bui Board of Directors Title Name Executive Chairman Alan Gold President, Chief Executive Officer and Director Paul Smithers Vice Chairman (Independent) Gary Kreitzer Director (Independent) David Stecher Director (Independent) Scott Shoemaker, MD Director (Independent) Mary Allis Curran