November 06, 2024 Conduent Q3 2024 Financial Results

2 Forward-Looking Statements This document, any exhibits or attachments to this document, and other public statements we make may contain “forward-looking statements” as defined in the Private Securities Litigation Reform Act of 1995. The words “anticipate,” “believe,” “estimate,” “expect,” expectations," "in front of us," "plan," “intend,” “will,” “aim,” “should,” “could,” “forecast,” “target,” “may,” "continue to," "looking to continue," "endeavor," "if,” “growing,” “projected,” “potential,” “likely,” "see", "ahead", "further," "going forward," "on the horizon," "as we progress," "going to," "path from here forward," "think," "path to deliver," "from here," and similar expressions (including the negative and plural forms of such words and phrases), as they relate to us, are intended to identify forward-looking statements, but the absence of these words does not mean that a statement is not forward looking. All statements other than statements of historical fact included in this presentation or any attachment to this presentation are forward-looking statements, including, but not limited to, statements regarding our financial results, condition and outlook; changes in our operating results; general market and economic conditions; our portfolio rationalization plans; our share repurchases; strength of our sales pipeline and balance sheet; our growth strategy; expectations regarding our trajectory toward top line growth, sequential margin improvement, less capital intensity and improved cash flow conversion; statements regarding our expected deployable capital target; and our projected financial performance for the full year 2024 and 2025, including all statements made under the sections captioned "Debt Maturity", “FY 2023 Actuals and FY 2024 Outlook”, "Divestiture Update", "Mid-Term Outlook", and "Segment Revenue Trend" within this presentation. These statements reflect our current views with respect to future events and are subject to certain risks, uncertainties and assumptions many of which are outside of our control, that could cause actual results to differ materially from those expected or implied by such forward-looking statements contained in this document, any exhibits to this document and other public statements we make. Important factors and uncertainties that could cause our actual results to differ materially from those in our forward-looking statements include, but are not limited to: risks related to recently completed dispositions including (i) the transfer of our BenefitWallet health savings account, medical savings account and flexible spending account portfolio, (ii) the sale of our Curbside Management and Public Safety Solutions businesses and (iii) the sale of our Casualty Claims Solutions business, including but not limited to our ability to realize the benefits anticipated from such transactions, unexpected costs, liabilities or delays in connection with such transactions, and the significant transaction costs associated with such transactions; government appropriations and termination rights contained in our government contracts; the competitiveness of the markets in which we operate and our ability to renew commercial and government contracts, including contracts awarded through competitive bidding processes; our ability to recover capital and other investments in connection with our contracts; our reliance on third-party providers; risk and impact of geopolitical events and increasing geopolitical tensions (such as the wars in Ukraine and the Middle East), macroeconomic conditions, natural disasters and other factors in a particular country or region on our workforce, customers and vendors; our ability to deliver on our contractual obligations properly and on time; changes in interest in outsourced business process services; claims of infringement of third-party intellectual property rights; our ability to estimate the scope of work or the costs of performance in our contracts; the loss of key senior management and our ability to attract and retain necessary technical personnel and qualified subcontractors; our failure to develop new service offerings and protect our intellectual property rights; our ability to modernize our information technology infrastructure and consolidate data centers; expectations relating to environmental, social and governance considerations; utilization of our stock repurchase program; the failure to comply with laws relating to individually identifiable information and personal health information; the failure to comply with laws relating to processing certain financial transactions, including payment card transactions and debit or credit card transactions; breaches of our information systems or security systems or any service interruptions; our ability to comply with data security standards; developments in various contingent liabilities that are not reflected on our balance sheet, including those arising as a result of being involved in a variety of claims, lawsuits, investigations and proceedings; risks related to divestitures and acquisitions; risk and impact of potential goodwill and other asset impairments; our significant indebtedness and the terms of such indebtedness; our failure to obtain or maintain a satisfactory credit rating and financial performance; our ability to obtain adequate pricing for our services and to improve our cost structure; our ability to collect our receivables, including those for unbilled services; a decline in revenues from, or a loss of, or a reduction in business from or failure of significant clients; fluctuations in our non-recurring revenue; increases in the cost of voice and data services or significant interruptions in such services; our ability to receive dividends or other payments from our subsidiaries; and other factors that are set forth in the “Risk Factors” section, the “Legal Proceedings” section, the “Management's Discussion and Analysis of Financial Condition and Results of Operations” section and other sections in our Annual Reports on Form 10-K, as well as in our Quarterly Reports on Form 10-Q and Current Reports on Form 8-K filed with or furnished to the Securities and Exchange Commission. Any forward-looking statements made by us in this presentation speak only as of the date on which they are made. We are under no obligation to, and expressly disclaim any obligation to, update or alter our forward- looking statements, whether because of new information, subsequent events or otherwise, except as required by law. Cautionary Statements

3 Non-GAAP Financial Measures We have reported our financial results in accordance with accounting principles generally accepted in the U.S. (U.S. GAAP). In addition, we have discussed our financial results using non-GAAP measures. We believe these non-GAAP measures allow investors to better understand the trends in our business and to better understand and compare our results. Accordingly, we believe it is necessary to adjust several reported amounts, determined in accordance with U.S. GAAP, to exclude the effects of certain items as well as their related tax effects. Management believes that these non-GAAP financial measures provide an additional means of analyzing the results of the current period against the corresponding prior period. However, these non-GAAP financial measures should be viewed in addition to, and not as a substitute for, our reported results prepared in accordance with U.S. GAAP. Our non-GAAP financial measures are not meant to be considered in isolation or as a substitute for comparable U.S. GAAP measures and should be read only in conjunction with our Condensed Consolidated Financial Statements prepared in accordance with U.S. GAAP. Our management regularly uses our supplemental non-GAAP financial measures internally to understand, manage and evaluate our business and make operating decisions, and providing such non-GAAP financial measures to investors allows for a further level of transparency as to how management reviews and evaluates our business results and trends. These non-GAAP measures are among the primary factors management uses in planning for and forecasting future periods. Compensation of our executives is based in part on the performance of our business based on certain of these non-GAAP measures. Refer to the "Non-GAAP Financial Measures" and "Non-GAAP Reconciliations" sections in this document for a discussion of these non-GAAP measures and their reconciliation to the reported U.S. GAAP measures. Cautionary Statements

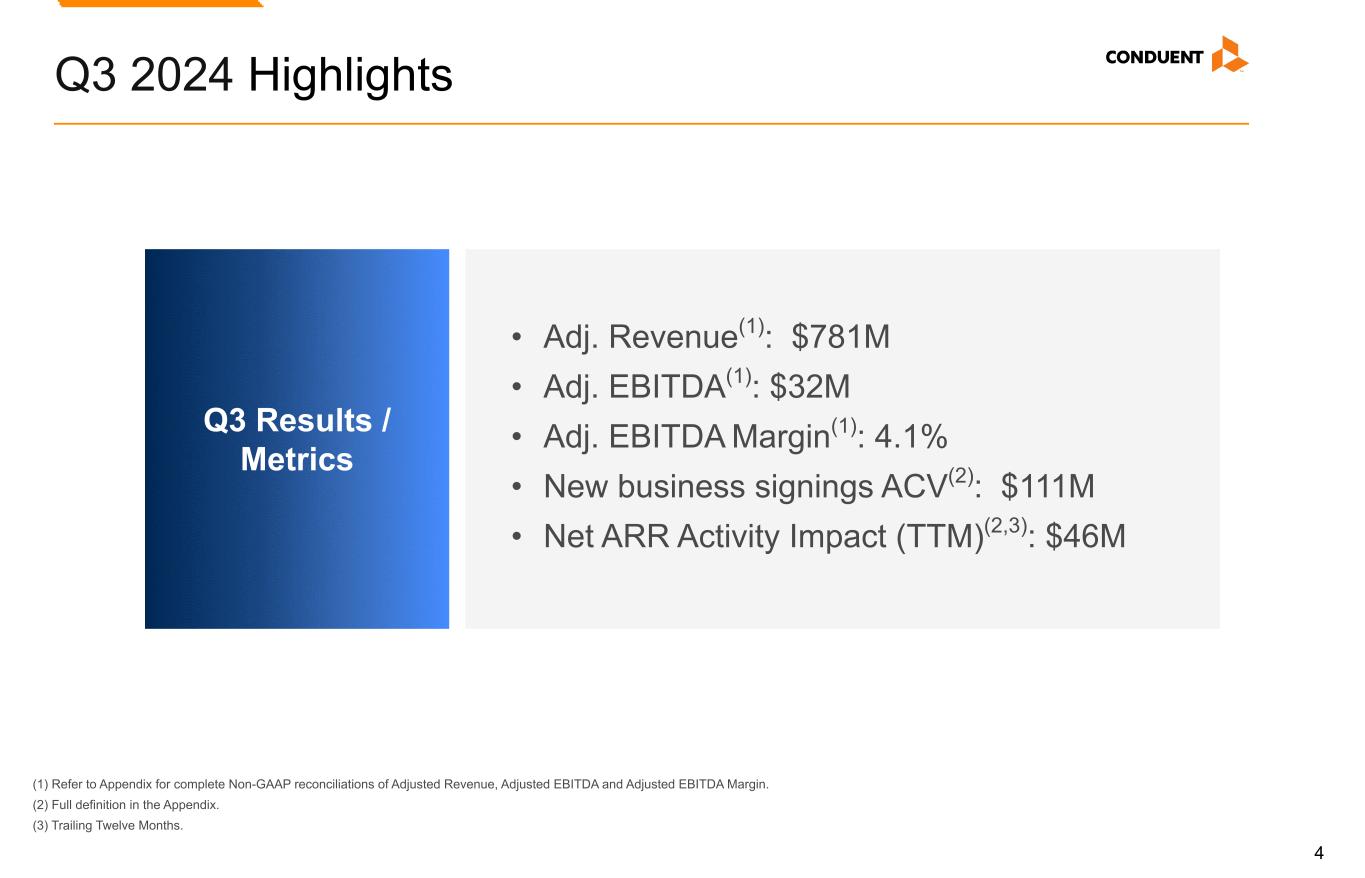

4 Q3 2024 Highlights (1) Refer to Appendix for complete Non-GAAP reconciliations of Adjusted Revenue, Adjusted EBITDA and Adjusted EBITDA Margin. (2) Full definition in the Appendix. (3) Trailing Twelve Months. Q3 Results / Metrics • Adj. Revenue(1): $781M • Adj. EBITDA(1): $32M • Adj. EBITDA Margin(1): 4.1% • New business signings ACV(2): $111M • Net ARR Activity Impact (TTM)(2,3): $46M

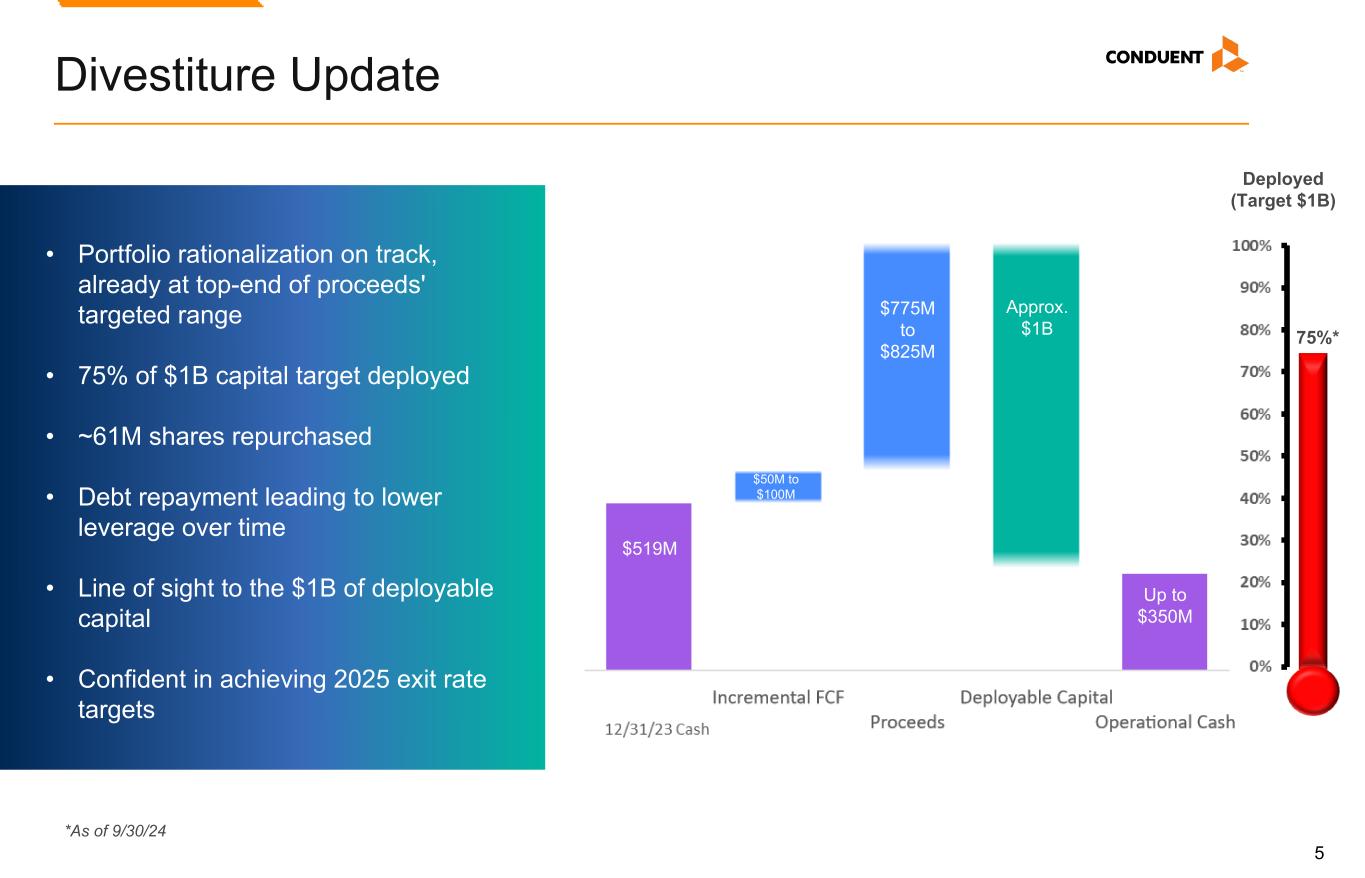

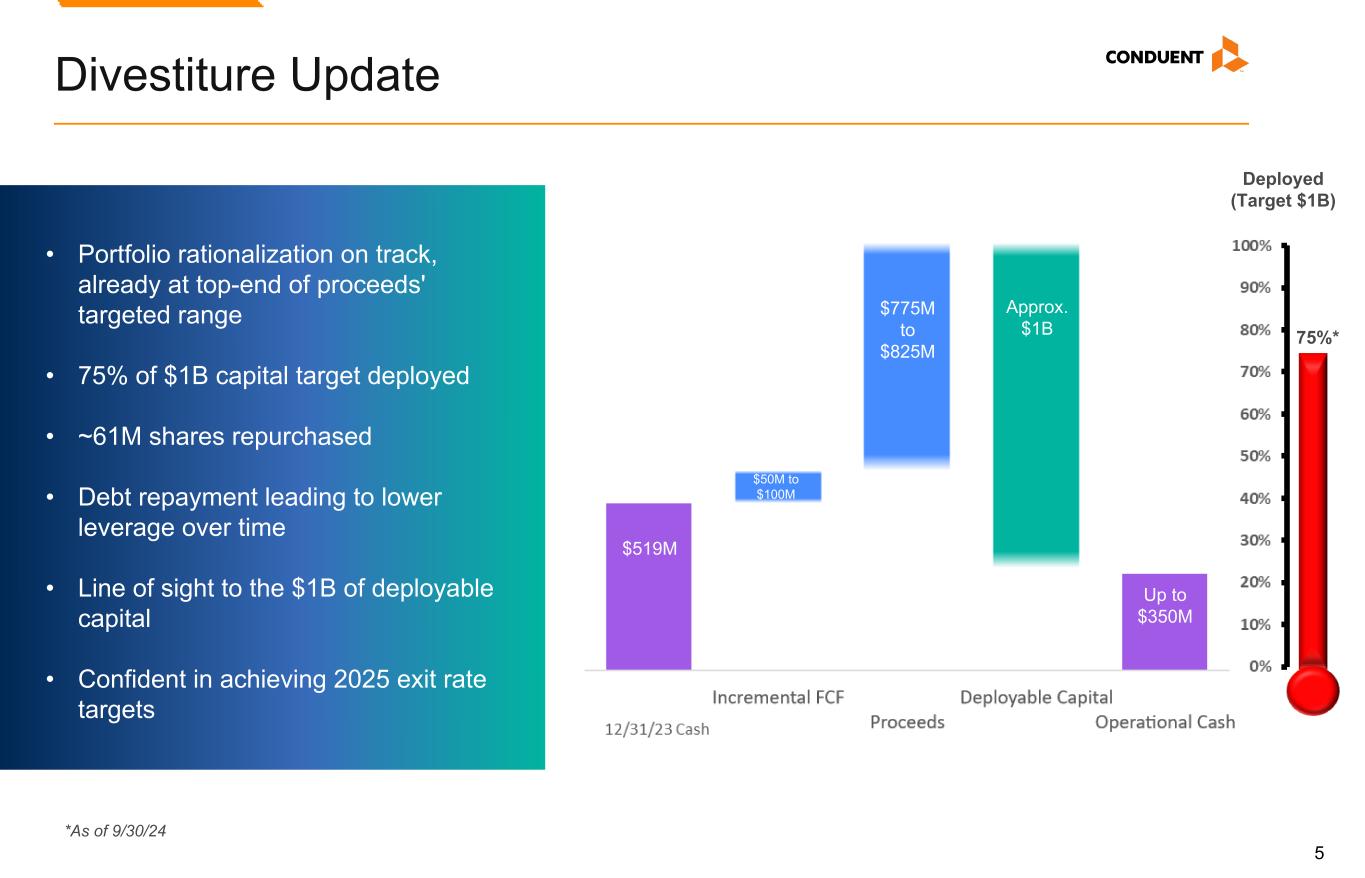

5 Divestiture Update $519M Up to $350M $50M to $100M $775M to $825M Approx. $1B 75%* Deployed (Target $1B) • Portfolio rationalization on track, already at top-end of proceeds' targeted range • 75% of $1B capital target deployed • ~61M shares repurchased • Debt repayment leading to lower leverage over time • Line of sight to the $1B of deployable capital • Confident in achieving 2025 exit rate targets *As of 9/30/24

6 Key Sales Metrics TCV Signings (incl. ARR(1) + NRR(1)) $434 $810 $395 $242 $659 $266 $257 $143 $273 $235 Renewal NB Q3' 23 Q4' 23 Q1' 24 Q2' 24 Q3' 24 $0M $500M $1,000M New Business (ARR(1) + NRR(1) Breakdown) $53 $68 $31 $61 $63 $96 $74 $71 $109 $50 NB ARR NB NRR Q3' 23 Q4' 23 Q1' 24 Q2' 24 Q3' 24 $0M $100M $200M New Business ARR Avg. Contract Length $141 $137 $96 $141 $111 Q3' 23 Q4' 23 Q1' 24 Q2' 24 Q3' 24 $0M $50M $100M $150M New Business ACV(1) Signings 3.2yrs 2.7yrs 2.3yrs 2.7yrs 2.9yrs Q3' 23 Q4' 23 Q1' 24 Q2' 24 Q3' 24 —yrs 2.0yrs 4.0yrs (1) Full definition in the Appendix.

7 Key Sales Metrics New Business ACV(1) Q3 New Business ACV(1) by Segment (1) Full definition in the Appendix. (2) Trailing Twelve Months. $266 $235 Q3'23 Q3'24 $0M $100M $200M $300M New Business TCV(1) $53 $63 Q3'23 Q3'24 $0M $25M $50M $75M $67M $16M $28M Commercial Government Transportation Net ARR Activity (TTM)(1,2) $91 $49 $6 $(47) $46 Q3' 23 Q4' 23 Q1' 24 Q2' 24 Q3' 24 $-100M $0M $100M $141 $111 Q3'23 Q3'24 $0M $50M $100M $150M New Business ARR(1)

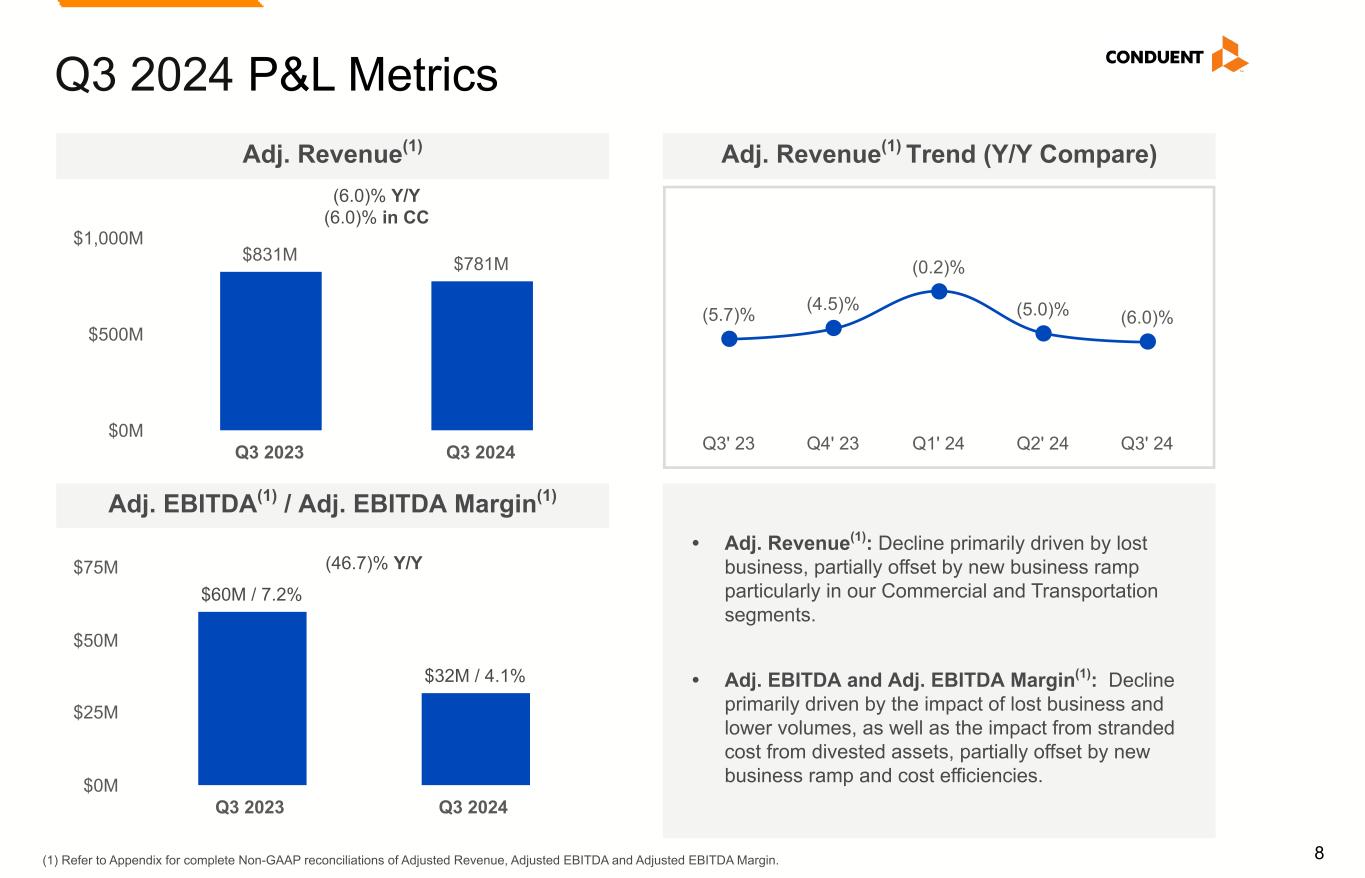

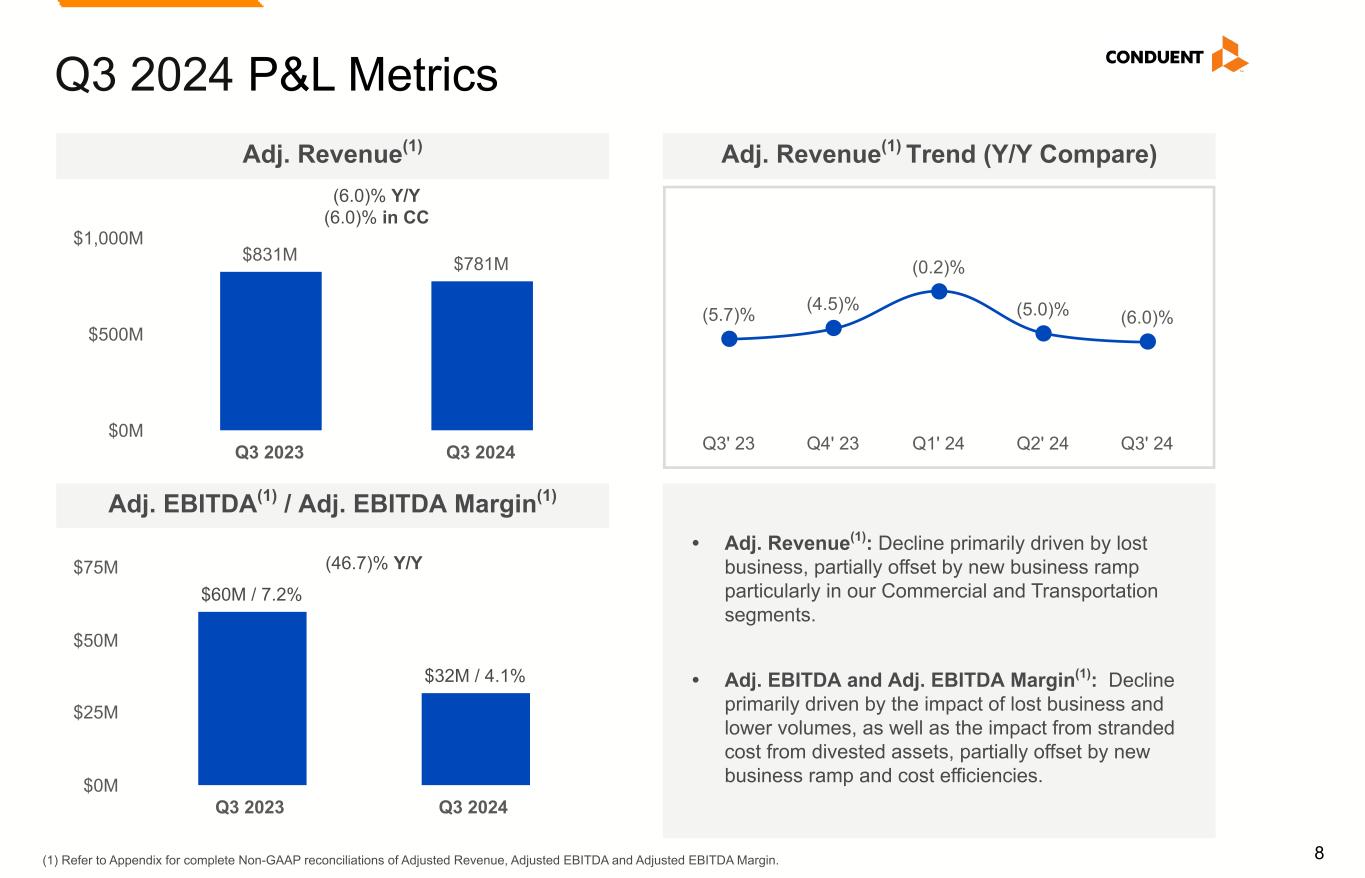

8 Q3 2024 P&L Metrics $831M $781M Q3 2023 Q3 2024 $0M $500M $1,000M (6.0)% Y/Y (6.0)% in CC Adj. Revenue(1) $60M / 7.2% $32M / 4.1% Q3 2023 Q3 2024 $0M $25M $50M $75M Adj. EBITDA(1) / Adj. EBITDA Margin(1) (46.7)% Y/Y • Adj. Revenue(1): Decline primarily driven by lost business, partially offset by new business ramp particularly in our Commercial and Transportation segments. • Adj. EBITDA and Adj. EBITDA Margin(1): Decline primarily driven by the impact of lost business and lower volumes, as well as the impact from stranded cost from divested assets, partially offset by new business ramp and cost efficiencies. (5.7)% (4.5)% (0.2)% (5.0)% (6.0)% Q3' 23 Q4' 23 Q1' 24 Q2' 24 Q3' 24 Adj. Revenue(1) Trend (Y/Y Compare) (1) Refer to Appendix for complete Non-GAAP reconciliations of Adjusted Revenue, Adjusted EBITDA and Adjusted EBITDA Margin.

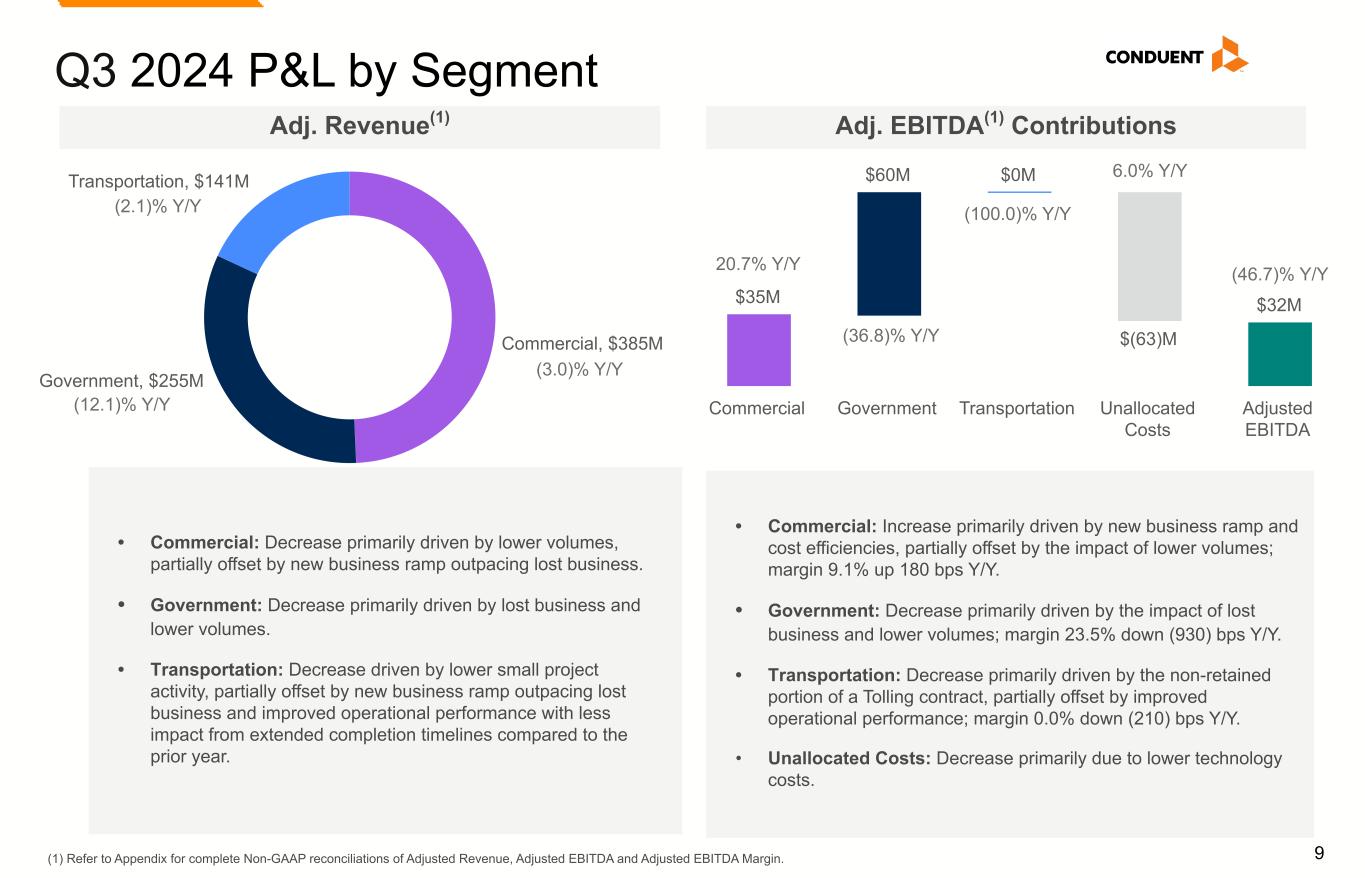

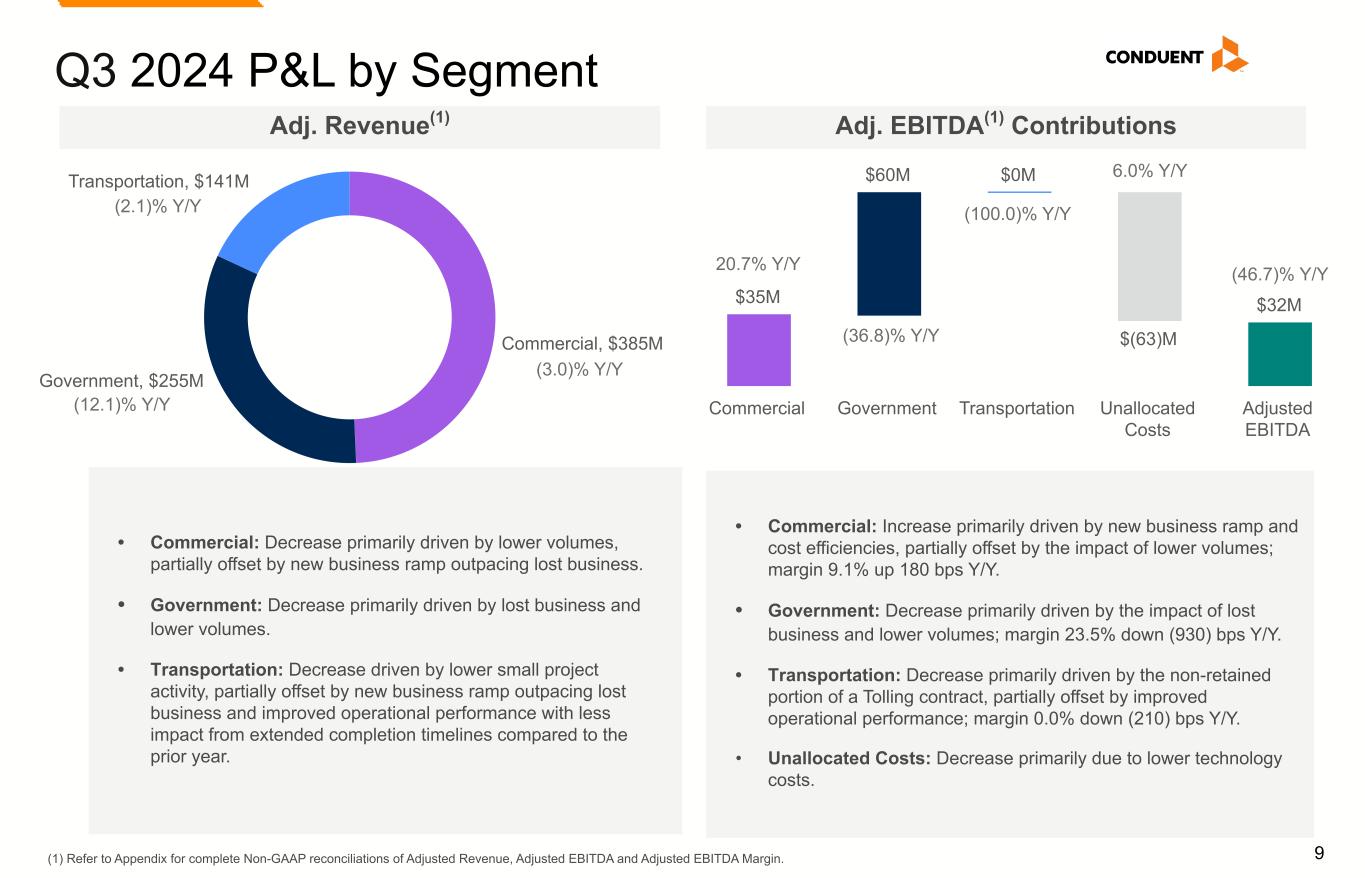

9 $35M $60M $0M $(63)M $32M Commercial Government Transportation Unallocated Costs Adjusted EBITDA Q3 2024 P&L by Segment (1) Refer to Appendix for complete Non-GAAP reconciliations of Adjusted Revenue, Adjusted EBITDA and Adjusted EBITDA Margin. Commercial, $385M Government, $255M Transportation, $141M (2.1)% Y/Y (12.1)% Y/Y (3.0)% Y/Y (100.0)% Y/Y (36.8)% Y/Y 20.7% Y/Y Adj. Revenue(1) Adj. EBITDA(1) Contributions (46.7)% Y/Y 6.0% Y/Y • Commercial: Decrease primarily driven by lower volumes, partially offset by new business ramp outpacing lost business. • Government: Decrease primarily driven by lost business and lower volumes. • Transportation: Decrease driven by lower small project activity, partially offset by new business ramp outpacing lost business and improved operational performance with less impact from extended completion timelines compared to the prior year. • Commercial: Increase primarily driven by new business ramp and cost efficiencies, partially offset by the impact of lower volumes; margin 9.1% up 180 bps Y/Y. • Government: Decrease primarily driven by the impact of lost business and lower volumes; margin 23.5% down (930) bps Y/Y. • Transportation: Decrease primarily driven by the non-retained portion of a Tolling contract, partially offset by improved operational performance; margin 0.0% down (210) bps Y/Y. • Unallocated Costs: Decrease primarily due to lower technology costs.

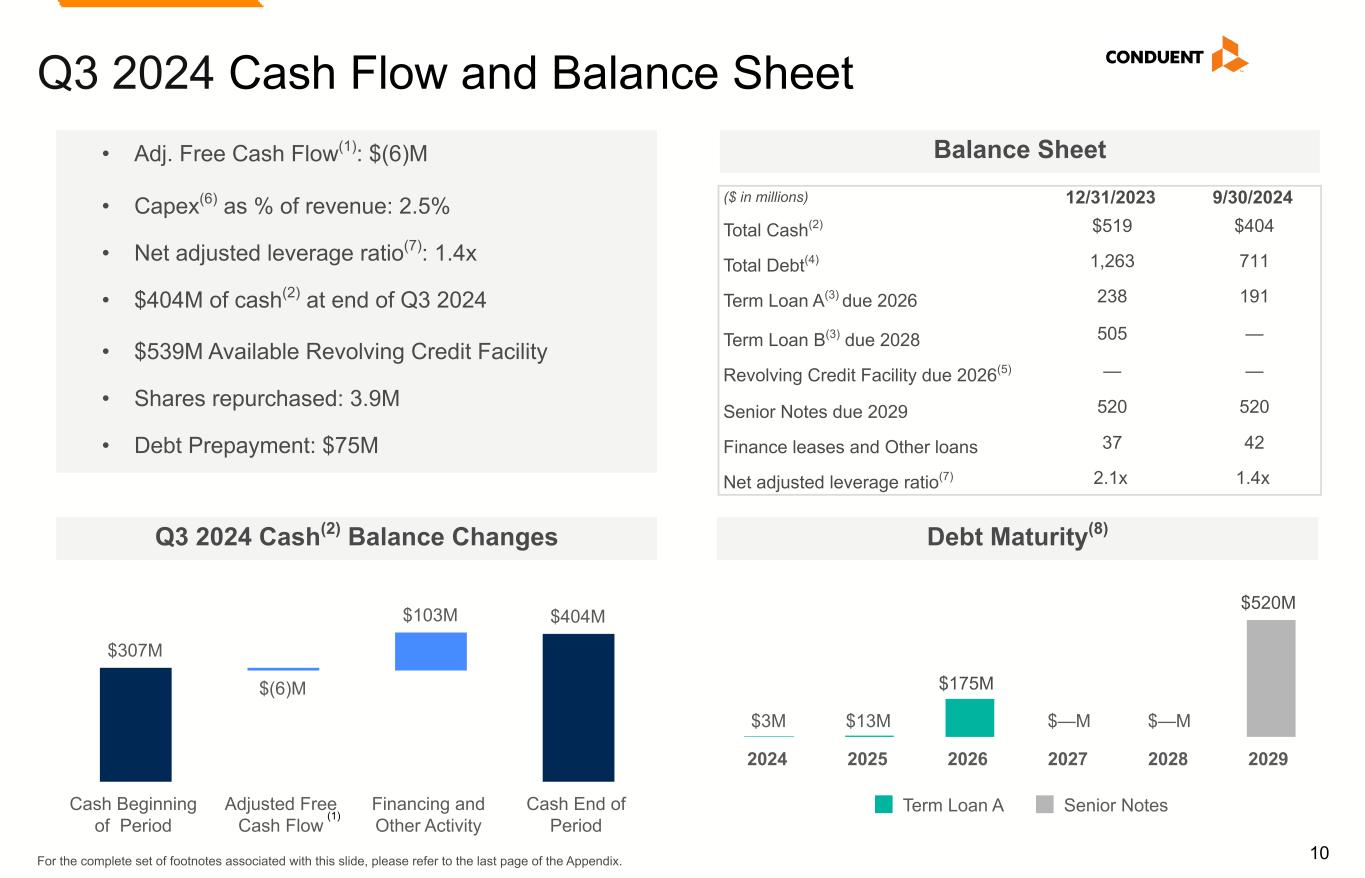

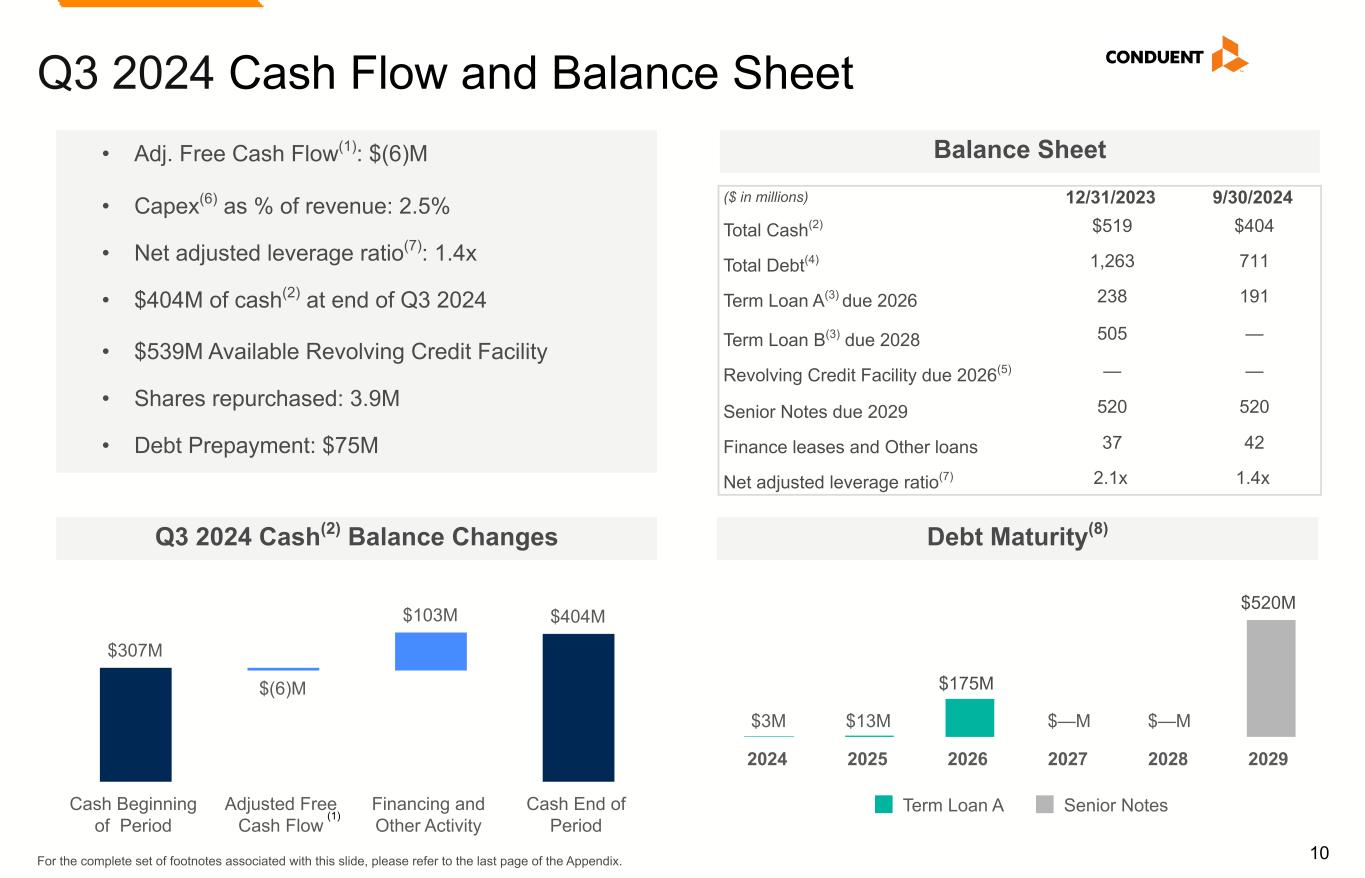

10 Q3 2024 Cash Flow and Balance Sheet Q3 2024 Cash(2) Balance Changes Balance Sheet For the complete set of footnotes associated with this slide, please refer to the last page of the Appendix. ($ in millions) 12/31/2023 9/30/2024 Total Cash(2) $519 $404 Total Debt(4) 1,263 711 Term Loan A(3) due 2026 238 191 Term Loan B(3) due 2028 505 — Revolving Credit Facility due 2026(5) — — Senior Notes due 2029 520 520 Finance leases and Other loans 37 42 Net adjusted leverage ratio(7) 2.1x 1.4x Debt Maturity(8) $307M $(6)M $103M $404M Cash Beginning of Period Adjusted Free Cash Flow Financing and Other Activity Cash End of Period • Adj. Free Cash Flow(1): $(6)M • Capex(6) as % of revenue: 2.5% • Net adjusted leverage ratio(7): 1.4x • $404M of cash(2) at end of Q3 2024 • $539M Available Revolving Credit Facility • Shares repurchased: 3.9M • Debt Prepayment: $75M $3M $13M $—M $—M Term Loan A Senior Notes 2024 2025 2026 2027 2028 2029 $520M (1) $175M

11 FY 2023 Actuals and FY 2024 Outlook(2) (1) Refer to Appendix for complete Non-GAAP reconciliations of Adjusted Revenue, Adjusted EBITDA, Adjusted EBITDA Margin and Adjusted Free Cash Flow. (2) Refer to Appendix for additional information regarding Non-GAAP Outlook. (3) FY 2023 Other Modeling Considerations are not adjusted for completed or anticipated divestiture activity or use of such proceeds. FY 2023 Actuals FY 2024 Outlook(2) $3,320MAdj. Revenue(1) Other Modeling Considerations(3) Adj. EBITDA Margin(1) $3,185M - $3,215M Interest Expense Restructuring CapEx 7.4% 3.75% - 4.0% $111M Approx. $71M $62M $116M Approx. $30M Approx. $90M Adj. Free Cash Flow(1) $(5)M Approx. ($50M)

12 Mid-Term Outlook(2,3) (1) Refer to Appendix for complete Non-GAAP reconciliations of Adjusted EBITDA, Adjusted EBITDA Margin and Adjusted Free Cash Flow (2) Refer to Appendix for additional information regarding Non-GAAP Outlook. (3) Initial FY 2024 Outlook is not adjusted for completed or anticipated divestiture activity or use of such proceeds. (4) Included in Margin. (5) Refer to the Reconciliation of Net Debt and Net Adjusted Leverage Ratio found in the Appendix. Initial FY 2024 Outlook(2,3) Revenue Other Modeling Considerations Adj. EBITDA Margin(1) Adj. Free Cash Flow(1) as % of Adj. EBITDA(1) $3,600M - $3,700M Interest Expense Restructuring CapEx as a % of Revenue 8% - 9% 5% - 10% ~$107M ~$30M ~3% Announced + Others ~$450M ~30% Other 2025 Assumptions 2% - 4% Growth 2% - 2.5% Margin Expansion 2025 Exit Rate $3,000M - $3,300M 8% - 9% 25% - 30% ~$38M ~$15M ~2.7% Divestitures Cost Efficiency (included in Margin) Debt repayment ~$664M Net Proceeds Total Debt(5) Closed ~$780M ~$50M(4) Net Adj. Leverage(5) Target 2.0 to 2.5x $1.3B FY 2023 Reported Actuals $3,722M 10.2% (1.3)% $111M $62M 3.1% 2.1x $1.3B ~$50M(4) ~1.0x $0.6B to $0.7B

CEO Update

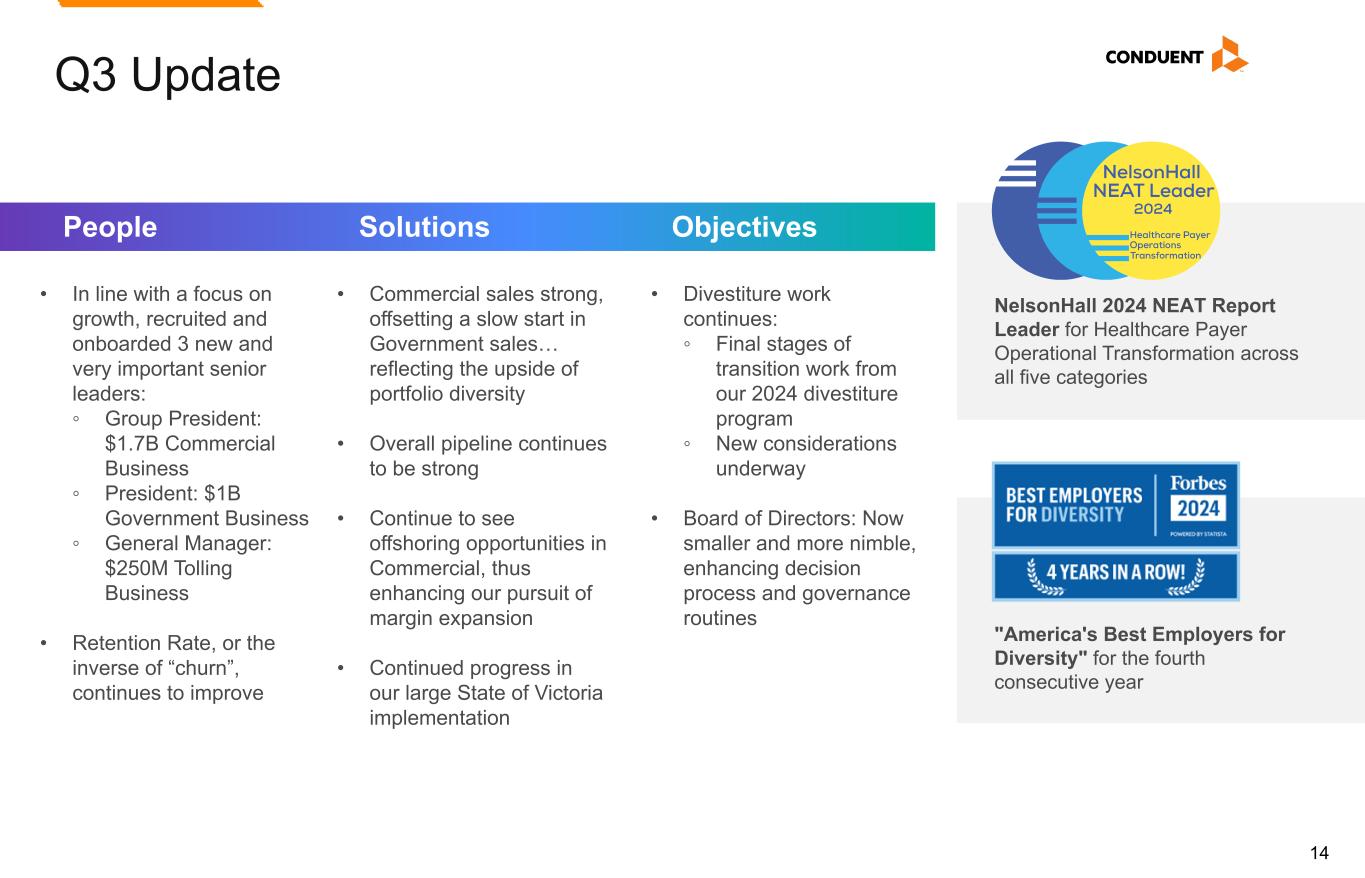

14 Q3 Update People NelsonHall 2024 NEAT Report Leader for Healthcare Payer Operational Transformation across all five categories "America's Best Employers for Diversity" for the fourth consecutive year • In line with a focus on growth, recruited and onboarded 3 new and very important senior leaders: ◦ Group President: $1.7B Commercial Business ◦ President: $1B Government Business ◦ General Manager: $250M Tolling Business • Retention Rate, or the inverse of “churn”, continues to improve Objectives • Divestiture work continues: ◦ Final stages of transition work from our 2024 divestiture program ◦ New considerations underway • Board of Directors: Now smaller and more nimble, enhancing decision process and governance routines Solutions • Commercial sales strong, offsetting a slow start in Government sales… reflecting the upside of portfolio diversity • Overall pipeline continues to be strong • Continue to see offshoring opportunities in Commercial, thus enhancing our pursuit of margin expansion • Continued progress in our large State of Victoria implementation

15 Conduent at-a-Glance ResultsScale Outcomes ~90% Recurring Revenue 8%-9% 2025 Exit Rate(1) Adj. EBITDA Margin(2) 8% CAGR New Business Sales ACV 2019 - 2025 $3.0B - $3.3B 2025 Exit Rate(1) Adj. Revenue(2) ~50% of Fortune 100 are Clients 46 of 50 States with Conduent Public Sector Solutions +30 points NPS(3) improvement since 2017 20 years Average Tenure of Top 20 Clients ~40% Improvement in client retention since 2021 (1) Consistent with the Company's publicly disclosed mid-term outlook. (2) Refer to Appendix for complete Non-GAAP reconciliations of Adjusted Revenue and Adjusted EBITDA Margin. (3) Net Promoter Score

16 Commercial Solutions Robust portfolio of technology-led solutions driving efficiencies and end-user experience across multiple industries 2 ~$1.7B Revenue(1)~$340M ACV(1,2) Industry-Specific Solutions Comprehensive industry-specific solutions combining advanced technology and expertise to drive operational excellence and regulatory compliance ~$1.4B Total Revenue(1) ~$0.3B Total Revenue(1) Cross-Industry Solutions Transforming end-to-end business processes by automating and streamlining mission critical operations with technology solutions, while delivering connected, omnichannel digital experiences Finance, Accounting and Procurement Solutions Integrated Digital Solutions Healthcare Claims Management HR Outsourcing Solutions Multichannel Communications Complex Experience Management(3) Banking Back-Office Solutions(4) Legal and Compliance Analytics Employee Benefit Solutions Pharma Patient Assistance (1) Projected 2025 Exit Rate, consistent with the Company’s publicly disclosed mid-term outlook. Refer to Mid-Term Outlook slide for more details. (2) Full definition in the Appendix. (3) Complex Experience Management represents 29 clients, 14 of which have other Conduent services and solutions, and customer needs requiring skilled associates, where continuum of service across Conduent's offerings is important. (4) Banking Back-Office Solutions exclude financial institutions products and services other than Banking Operations, Lockbox and Loan Manager.

17 Government and Transportation Solutions Helping governments and agencies deliver high quality programs to their constituents 3 Transportation SolutionsGovernment Solutions (Health, Human Services & Payments) ~$1.0B Total Revenue(1) ~$0.6B Total Revenue(1) Helping state agencies streamline enrollment, determine eligibility, adjudicate claims and meet modularity mandates for government-funded healthcare programs Helping agencies collect payments, manage operations / equipment / service, and enable digital transactions for Transit and Road Usage Charging (RUC) globally Delivering government-distributed payments and services seamlessly and securely utilizing proprietary software and expertise Government Healthcare Solutions Eligibility and Enrollment Solutions Child Support Solutions e.g. Child Care Payments Payment Card Programs e.g. Unemployment Insurance Benefit Card Programs e.g. SNAP Tolling Roadside and Backoffice Solutions (RUC) Transit Fare Collection and Equipment Solutions (1) Projected 2025 Exit Rate, consistent with the Company’s publicly disclosed mid-term outlook. Refer to Mid-Term Outlook slide for more details. (2) Full definition in the Appendix. ~$170M Government ACV(1,2) ~$130M Transportation ACV(1,2)

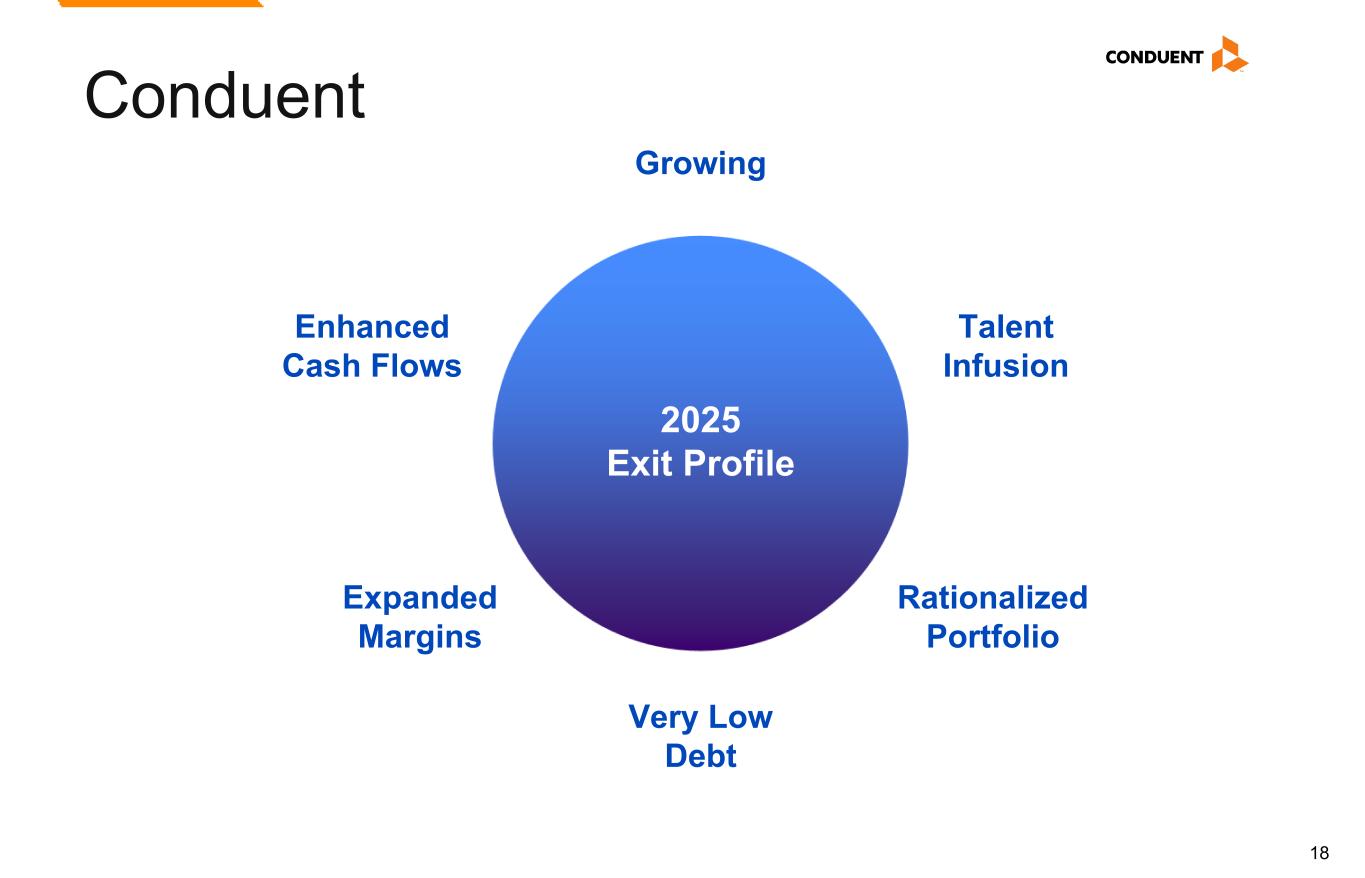

18 Conduent 2025 Exit Profile Rationalized Portfolio Talent Infusion Enhanced Cash Flows Expanded Margins Growing Very Low Debt

Appendix

20 Definitions New Business Total Contract Value (TCV): Estimated total future revenues from contracts signed during the period related to new logo, new service line or expansion with existing customers. New Business Non-Recurring Revenue (NRR): Metric measures the non-recurring revenue for any new business signing, includes: i. Signing value of any contract with term less than 12 months; ii. Signing value of project based revenue, not expected to continue long term. New Business Annual Recurring Revenue (ARR): Metric measures the revenue from recurring services provided to the client for any new business signing. ARR represents the recurring services provided to a customer with the opportunity for renewal at the end of the contract term. The calculation of ARR is (Total Contract Value less Non-Recurring Revenue) divided by the Contract Term. New Business Annual Contract Value (ACV): (New Business TCV / contract term) multiplied by 12. Renewal TCV Signings: Estimated total future revenues from contracts signed during the period related to renewals. Renewal Signings Annual Recurring Revenue (ARR): Metric measures the revenue from recurring services provided to the client for any renewal signing. ARR represents the recurring services provided to a customer with the opportunity for renewal at the end of the contract term. The calculation of ARR is: (Total Contract Value - Non-Recurring Revenue) / the Contract Term. Net ARR Activity Metric: Projected Annual Recurring Revenue for contracts signed in the prior 12 months, less the annualized impact of any client losses, contractual volume and price changes, and other known impacts for which the Company was notified in that same time period, which could positively or negatively impact results. The metric annualizes the net impact to revenue. Timing of revenue impact varies and may not be realized within the forward 12-month timeframe. The metric is for indicative purposes only. This metric excludes non-recurring revenue signings. This metric is not indicative of any specific 12 month timeframe. Total New Business Pipeline (Cumulative Pipeline): TCV pipeline of deals in all sell stages. Extends past next 12 month period to include total pipeline. Excludes the impact of divested business as required. Implied New Business Average Contract Length: (New business TCV – New business NRR) / New business ARR = Implied New Business Average Contract Length.

21 Non-GAAP Financial Measures We have reported our financial results in accordance with accounting principles generally accepted in the U.S. (U.S. GAAP). In addition, we have discussed our financial results using non-GAAP measures. We believe these non-GAAP measures allow investors to better understand the trends in our business and to better understand and compare our results. Accordingly, we believe it is necessary to adjust several reported amounts, determined in accordance with U.S. GAAP, to exclude the effects of certain items as well as their related tax effects. Management believes that these non-GAAP financial measures provide an additional means of analyzing the results of the current period against the corresponding prior period. However, these non-GAAP financial measures should be viewed in addition to, and not as a substitute for, the Company’s reported results prepared in accordance with U.S. GAAP. Our non-GAAP financial measures are not meant to be considered in isolation or as a substitute for comparable U.S. GAAP measures and should be read only in conjunction with our Condensed Consolidated Financial Statements prepared in accordance with U.S. GAAP. Our management regularly uses our non-GAAP financial measures internally to understand, manage and evaluate our business and make operating decisions. Providing such non-GAAP financial measures to investors allows for a further level of transparency as to how management reviews and evaluates our business results and trends. These non-GAAP measures are among the primary factors management uses in planning for and forecasting future periods. Compensation of our executives is based in part on the performance of our business based on certain of these non-GAAP measures. Management cautions that amounts presented in accordance with Conduent's definition of non-GAAP financial measures may not be comparable to similar measures disclosed by other companies because not all companies calculate non-GAAP measures in the same manner. Reconciliations of the following non-GAAP financial measures to the most directly comparable financial measures calculated and presented in accordance with U.S. GAAP Reconciliations are provided below. These reconciliations also include the income tax effects for our non-GAAP performance measures in total, to the extent applicable. The income tax effects are calculated under the same accounting principles as applied to our reported pre-tax performance measures under ASC 740, which employs an annual effective tax rate method. The noted income tax effect for our non-GAAP performance measures is effectively the difference in income taxes for reported and adjusted pre-tax income calculated under the annual effective tax rate method. The tax effect of the non-GAAP adjustments was calculated based upon evaluation of the statutory tax treatment and the applicable statutory tax rate in the jurisdictions in which such charges were incurred. Adjusted Revenue, Adjusted Profit Before Tax. Adjusted Net Income (Loss), Adjusted Diluted Earnings per Share, Adjusted Weighted Average Common Shares Outstanding, and Adjusted Effective Tax Rate. We make adjustments to Net Income (Loss) before Income Taxes for the following items, as applicable, to the particular financial measure, for the purpose of calculating Adjusted Revenue, Adjusted Net Income (Loss), Adjusted Profit Before Tax, Adjusted Diluted Earnings per Share, Adjusted Weighted Average Common Shares Outstanding, and Adjusted Effective Tax Rate: • Amortization of acquired intangible assets. The amortization of acquired intangible assets is driven by acquisition activity, which can vary in size, nature and timing as compared to other companies within our industry and from period to period. • Restructuring and related costs. Restructuring and related costs include restructuring and asset impairment charges as well as costs associated with our strategic transformation program. • (Gain) loss on divestitures and transaction costs, net. Represents (gain) loss on divested businesses and transaction costs. • Goodwill Impairment. This represents goodwill impairment charges related to entering the agreement to transfer the BenefitWallet portfolio. • Loss on extinguishment of debt. This represents write-off related debt issuance costs related to prepayments of debt. • Litigation settlements (recoveries), net. Litigation settlements (recoveries), net represents provisions for various matters subject to litigation. • Other charges (credits). This includes Other (income) expenses, net on the Condensed Consolidated Statements of Income (loss) and other insignificant (income) expenses and other adjustments. • Divestitures. Revenue and Adjusted EBITDA of divested businesses are excluded. The Company provides adjusted net income and adjusted EPS financial measures to assist our investors in evaluating our ongoing operating performance for the current reporting period and, where provided, over different reporting periods, by adjusting for certain items which may be recurring or non-recurring and which in our view do not necessarily reflect ongoing performance. We also internally use these measures to assess our operating performance, both absolutely and in comparison to other companies, and in evaluating or making selected compensation decisions. Management believes that the adjusted effective tax rate, provided as supplemental information, facilitates a comparison by investors of our actual effective tax rate with an adjusted effective tax rate which reflects the impact of the items which are excluded in providing adjusted net income and certain other identified items, and may provide added insight into our underlying business results and how effective tax rates impact our ongoing business. Non-GAAP Financial Measures

22 Adjusted Revenue, Adjusted Operating Income and Adjusted Operating Margin. We make adjustments to Revenue, Costs and Expenses and Operating Margin for the following items, as applicable,for the purpose of calculating Adjusted Revenue, Adjusted Operating Income and Adjusted Operating Margin: • Amortization of acquired intangible assets. • Restructuring and related costs. • Interest expense. Interest expense includes interest on long-term debt and amortization of debt issuance costs. • Goodwill impairment. • Loss on extinguishment of debt. • (Gain) loss on divestitures and transaction costs, net. • Litigation settlements (recoveries), net. • Other charges (credits). • Divestitures. We provide our investors with adjusted revenue, adjusted operating income and adjusted operating margin information, as supplemental information, because we believe it offers added insight, by itself and for comparability between periods, by adjusting for certain non-cash items as well as certain other identified items which we do not believe are indicative of our ongoing business, and may also provide added insight on trends in our ongoing business. Non-GAAP Financial Measures

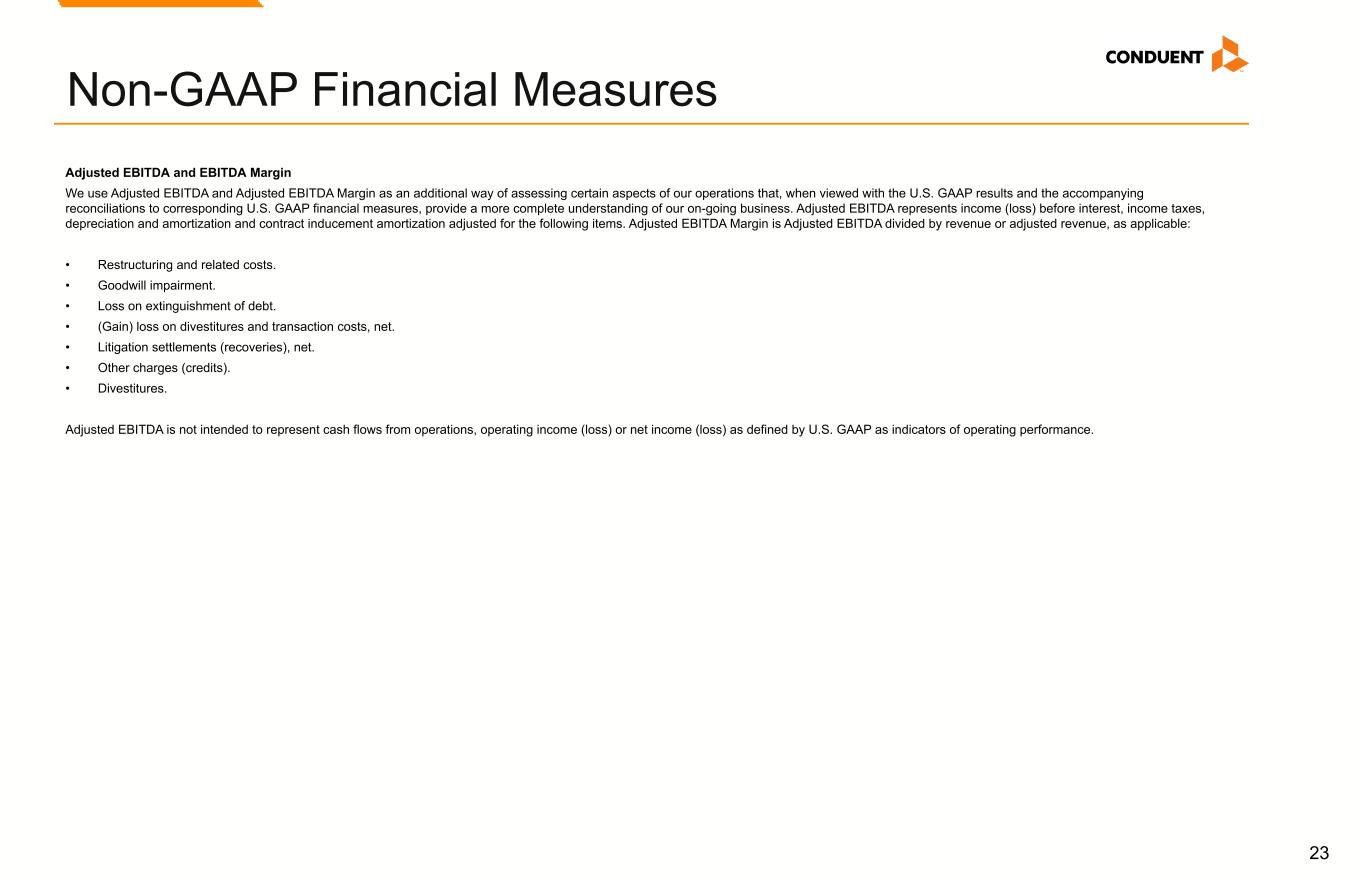

23 Adjusted EBITDA and EBITDA Margin We use Adjusted EBITDA and Adjusted EBITDA Margin as an additional way of assessing certain aspects of our operations that, when viewed with the U.S. GAAP results and the accompanying reconciliations to corresponding U.S. GAAP financial measures, provide a more complete understanding of our on-going business. Adjusted EBITDA represents income (loss) before interest, income taxes, depreciation and amortization and contract inducement amortization adjusted for the following items. Adjusted EBITDA Margin is Adjusted EBITDA divided by revenue or adjusted revenue, as applicable: • Restructuring and related costs. • Goodwill impairment. • Loss on extinguishment of debt. • (Gain) loss on divestitures and transaction costs, net. • Litigation settlements (recoveries), net. • Other charges (credits). • Divestitures. Adjusted EBITDA is not intended to represent cash flows from operations, operating income (loss) or net income (loss) as defined by U.S. GAAP as indicators of operating performance. Non-GAAP Financial Measures

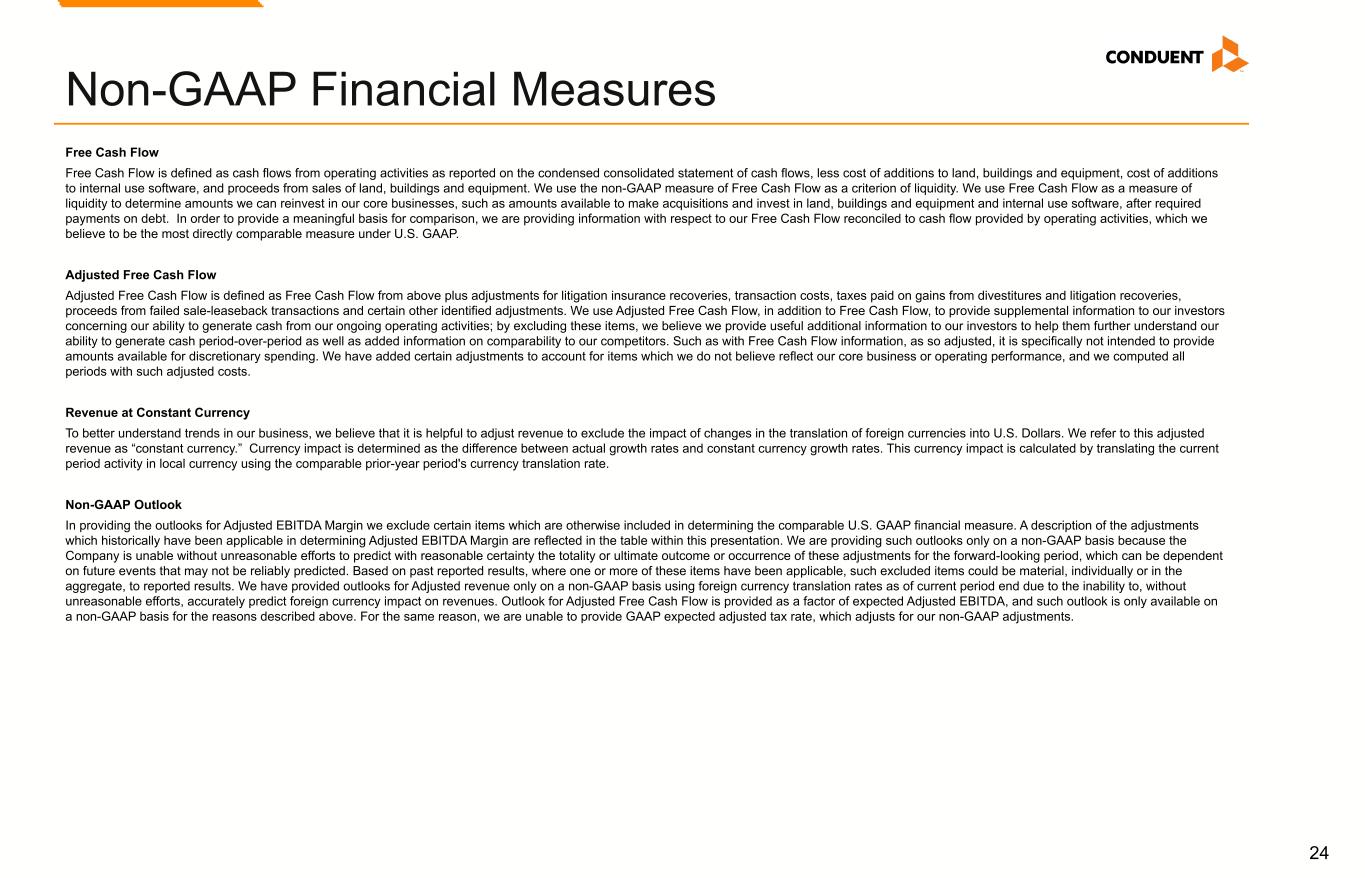

24 Free Cash Flow Free Cash Flow is defined as cash flows from operating activities as reported on the condensed consolidated statement of cash flows, less cost of additions to land, buildings and equipment, cost of additions to internal use software, and proceeds from sales of land, buildings and equipment. We use the non-GAAP measure of Free Cash Flow as a criterion of liquidity. We use Free Cash Flow as a measure of liquidity to determine amounts we can reinvest in our core businesses, such as amounts available to make acquisitions and invest in land, buildings and equipment and internal use software, after required payments on debt. In order to provide a meaningful basis for comparison, we are providing information with respect to our Free Cash Flow reconciled to cash flow provided by operating activities, which we believe to be the most directly comparable measure under U.S. GAAP. Adjusted Free Cash Flow Adjusted Free Cash Flow is defined as Free Cash Flow from above plus adjustments for litigation insurance recoveries, transaction costs, taxes paid on gains from divestitures and litigation recoveries, proceeds from failed sale-leaseback transactions and certain other identified adjustments. We use Adjusted Free Cash Flow, in addition to Free Cash Flow, to provide supplemental information to our investors concerning our ability to generate cash from our ongoing operating activities; by excluding these items, we believe we provide useful additional information to our investors to help them further understand our ability to generate cash period-over-period as well as added information on comparability to our competitors. Such as with Free Cash Flow information, as so adjusted, it is specifically not intended to provide amounts available for discretionary spending. We have added certain adjustments to account for items which we do not believe reflect our core business or operating performance, and we computed all periods with such adjusted costs. Revenue at Constant Currency To better understand trends in our business, we believe that it is helpful to adjust revenue to exclude the impact of changes in the translation of foreign currencies into U.S. Dollars. We refer to this adjusted revenue as “constant currency.” Currency impact is determined as the difference between actual growth rates and constant currency growth rates. This currency impact is calculated by translating the current period activity in local currency using the comparable prior-year period's currency translation rate. Non-GAAP Outlook In providing the outlooks for Adjusted EBITDA Margin we exclude certain items which are otherwise included in determining the comparable U.S. GAAP financial measure. A description of the adjustments which historically have been applicable in determining Adjusted EBITDA Margin are reflected in the table within this presentation. We are providing such outlooks only on a non-GAAP basis because the Company is unable without unreasonable efforts to predict with reasonable certainty the totality or ultimate outcome or occurrence of these adjustments for the forward-looking period, which can be dependent on future events that may not be reliably predicted. Based on past reported results, where one or more of these items have been applicable, such excluded items could be material, individually or in the aggregate, to reported results. We have provided outlooks for Adjusted revenue only on a non-GAAP basis using foreign currency translation rates as of current period end due to the inability to, without unreasonable efforts, accurately predict foreign currency impact on revenues. Outlook for Adjusted Free Cash Flow is provided as a factor of expected Adjusted EBITDA, and such outlook is only available on a non-GAAP basis for the reasons described above. For the same reason, we are unable to provide GAAP expected adjusted tax rate, which adjusts for our non-GAAP adjustments. Non-GAAP Financial Measures

25 Government (0.3)% (8.2)% (2.3)% (9.3)% (12.1)% Q3' 23 Q4' 23 Q1' 24 Q2' 24 Q3' 24 Transportation —% 3.9% 23.1% 1.4% (2.1)% Q3' 23 Q4' 23 Q1' 24 Q2' 24 Q3' 24 Commercial (11.0)% (4.9)% (5.2)% (4.4)% (3.0)% Q3' 23 Q4' 23 Q1' 24 Q2' 24 Q3' 24 Segment Adjusted Revenue(1) Trend Adj. Revenue(1) Growth Rates (2025 Exit Rate): As communicated in the March 2023 Investor Briefing, the expected growth rates for each business segment exiting 2025 are as follows: Commercial: 3% to 5% Government: ~3% Transportation: ~4% (1) Refer to complete Non-GAAP reconciliations of Adjusted Revenue elsewhere in this Appendix.

26 Non-GAAP Reconciliations (in millions) Q3 2024 Q2 2024 Q1 2024 FY 2023 Q4 2023 Q3 2023 Q2 2023 Q1 2023 REVENUE Revenue $ 807 $ 828 $ 921 $ 3,722 $ 953 $ 932 $ 915 $ 922 Adjustment: Divestitures(1) (26) (54) (100) (402) (102) (101) (100) (99) Adjusted Revenue 781 774 821 3,320 851 831 815 823 Foreign currency impact — 1 (2) (12) (5) (8) (2) 3 Revenue at Constant Currency $ 781 $ 775 $ 819 $ 3,308 $ 846 $ 823 $ 813 $ 826 ADJUSTED NET INCOME (LOSS) Income (Loss) From Continuing Operations $ 123 $ 216 $ 99 $ (296) $ 6 $ (289) $ (7) $ (6) Adjustments: Amortization of acquired intangible assets(2) 1 2 1 7 2 1 2 2 Restructuring and related costs 4 8 9 62 13 7 13 29 Loss on extinguishment of debt 1 3 2 — — — — — Goodwill impairment — — — 287 — 287 — — (Gain) loss on divestitures and transaction costs, net (188) (347) (161) 10 2 3 3 2 Litigation settlements (recoveries), net 1 1 4 (30) (8) — (1) (21) Other charges (credits) (2) — (2) 3 6 (2) — (1) Total Non-GAAP Adjustments (183) (333) (147) 339 15 296 17 11 Income tax adjustments(3) 39 92 32 (43) (11) (25) (4) (3) Adjusted Net Income (Loss) Before Adjustment for Divestitures (21) (25) (16) — 10 (18) 6 2 Divestitures(1) $ (3) $ (8) $ (24) $ (103) $ (27) $ (26) $ (27) $ (23) Adjusted Net Income (Loss) $ (24) $ (33) $ (40) $ (103) $ (17) $ (44) $ (21) $ (21) Adjusted Revenue, Revenue at Constant Currency, Adjusted Net Income (Loss), Adjusted Effective Tax Rate, Adjusted Operating Income (Loss) and Adjusted EBITDA (see footnotes on last page of Non-GAAP reconciliations)

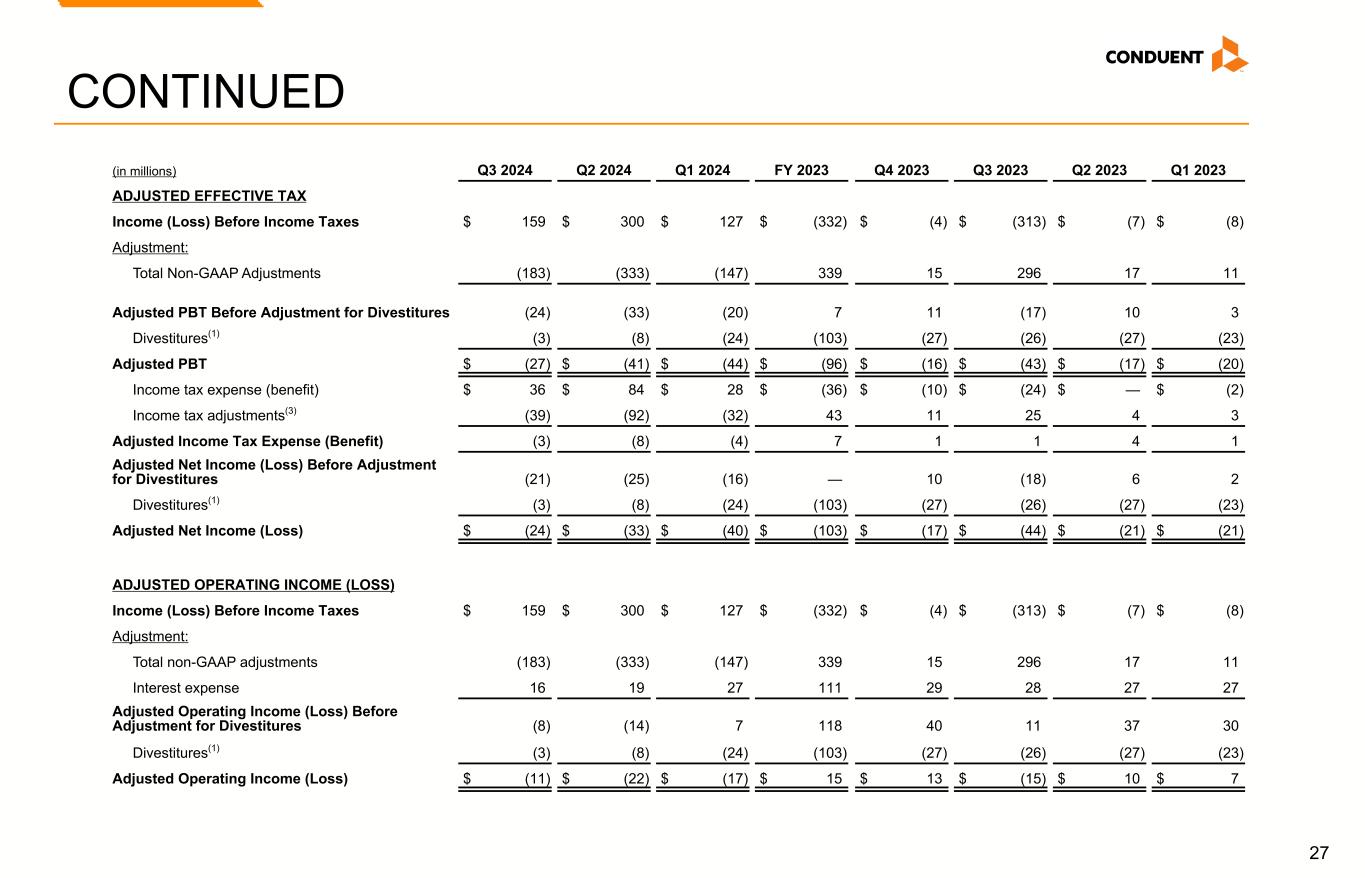

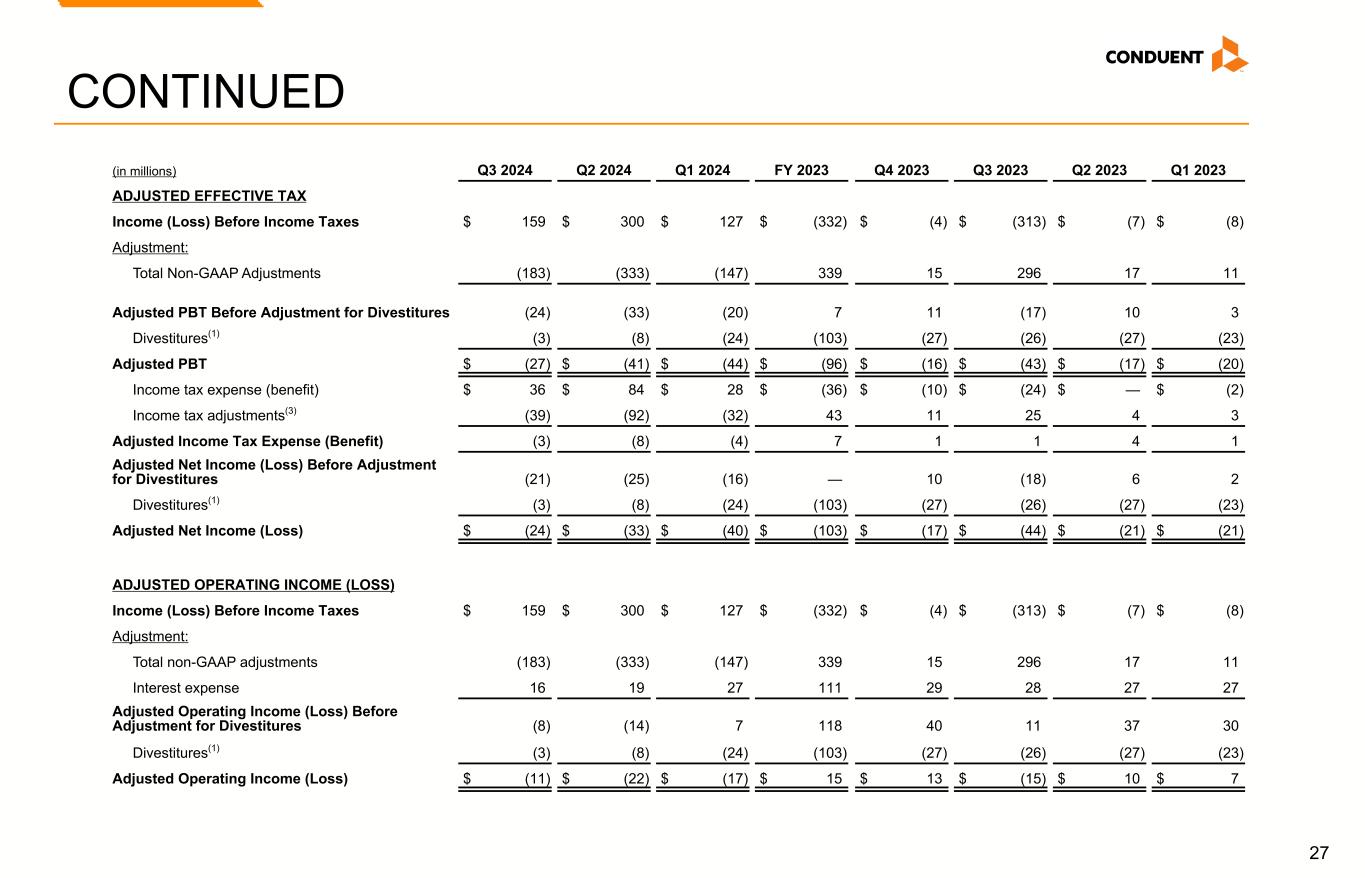

27 CONTINUED (in millions) Q3 2024 Q2 2024 Q1 2024 FY 2023 Q4 2023 Q3 2023 Q2 2023 Q1 2023 ADJUSTED EFFECTIVE TAX Income (Loss) Before Income Taxes $ 159 $ 300 $ 127 $ (332) $ (4) $ (313) $ (7) $ (8) Adjustment: Total Non-GAAP Adjustments (183) (333) (147) 339 15 296 17 11 Adjusted PBT Before Adjustment for Divestitures (24) (33) (20) 7 11 (17) 10 3 Divestitures(1) (3) (8) (24) (103) (27) (26) (27) (23) Adjusted PBT $ (27) $ (41) $ (44) $ (96) $ (16) $ (43) $ (17) $ (20) Income tax expense (benefit) $ 36 $ 84 $ 28 $ (36) $ (10) $ (24) $ — $ (2) Income tax adjustments(3) (39) (92) (32) 43 11 25 4 3 Adjusted Income Tax Expense (Benefit) (3) (8) (4) 7 1 1 4 1 Adjusted Net Income (Loss) Before Adjustment for Divestitures (21) (25) (16) — 10 (18) 6 2 Divestitures(1) (3) (8) (24) (103) (27) (26) (27) (23) Adjusted Net Income (Loss) $ (24) $ (33) $ (40) $ (103) $ (17) $ (44) $ (21) $ (21) ADJUSTED OPERATING INCOME (LOSS) Income (Loss) Before Income Taxes $ 159 $ 300 $ 127 $ (332) $ (4) $ (313) $ (7) $ (8) Adjustment: Total non-GAAP adjustments (183) (333) (147) 339 15 296 17 11 Interest expense 16 19 27 111 29 28 27 27 Adjusted Operating Income (Loss) Before Adjustment for Divestitures (8) (14) 7 118 40 11 37 30 Divestitures(1) (3) (8) (24) (103) (27) (26) (27) (23) Adjusted Operating Income (Loss) $ (11) $ (22) $ (17) $ 15 $ 13 $ (15) $ 10 $ 7

28 (in millions) Q3 2024 Q2 2024 Q1 2024 FY 2023 Q4 2023 Q3 2023 Q2 2023 Q1 2023 ADJUSTED EBITDA Net Income (Loss) $ 123 $ 216 $ 99 $ (296) $ 6 $ (289) $ (7) $ (6) Income tax expense (benefit) 36 84 28 (36) (10) (24) — (2) Depreciation and amortization 44 51 62 264 65 81 57 61 Contract inducement amortization 1 — 1 3 — 1 1 1 Interest expense 16 19 27 111 29 28 27 27 EBITDA Before Adjustment for Divestitures 220 370 217 46 90 (203) 78 81 Divestitures(1) (3) (8) (24) (103) (27) (26) (27) (23) Divestitures depreciation and amortization(1) (1) (3) (9) (28) (8) (6) (7) (7) EBITDA 216 359 184 (85) 55 (235) 44 51 Adjustments: Restructuring and related costs 4 8 9 62 13 7 13 29 Loss on extinguishment of debt 1 3 2 — — — — — Goodwill impairment — — — 287 — 287 — — (Gain) loss on divestitures and transaction costs, net (188) (347) (161) 10 2 3 3 2 Litigation settlements (recoveries), net 1 1 4 (30) (8) — (1) (21) Other charges (credits) (2) — (2) 3 6 (2) — (1) Adjusted EBITDA $ 32 $ 24 $ 36 $ 247 $ 68 $ 60 $ 59 $ 60 CONTINUED

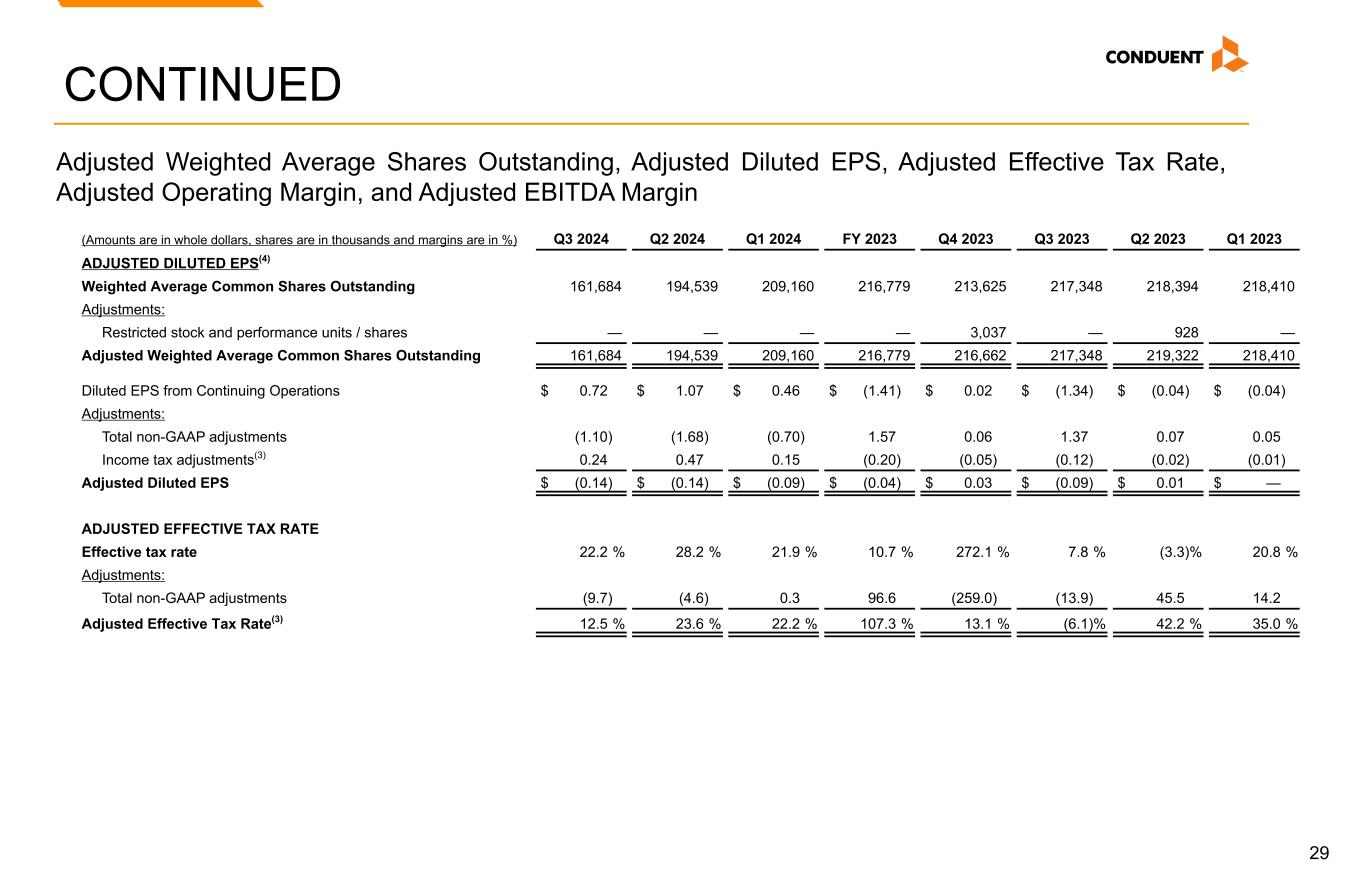

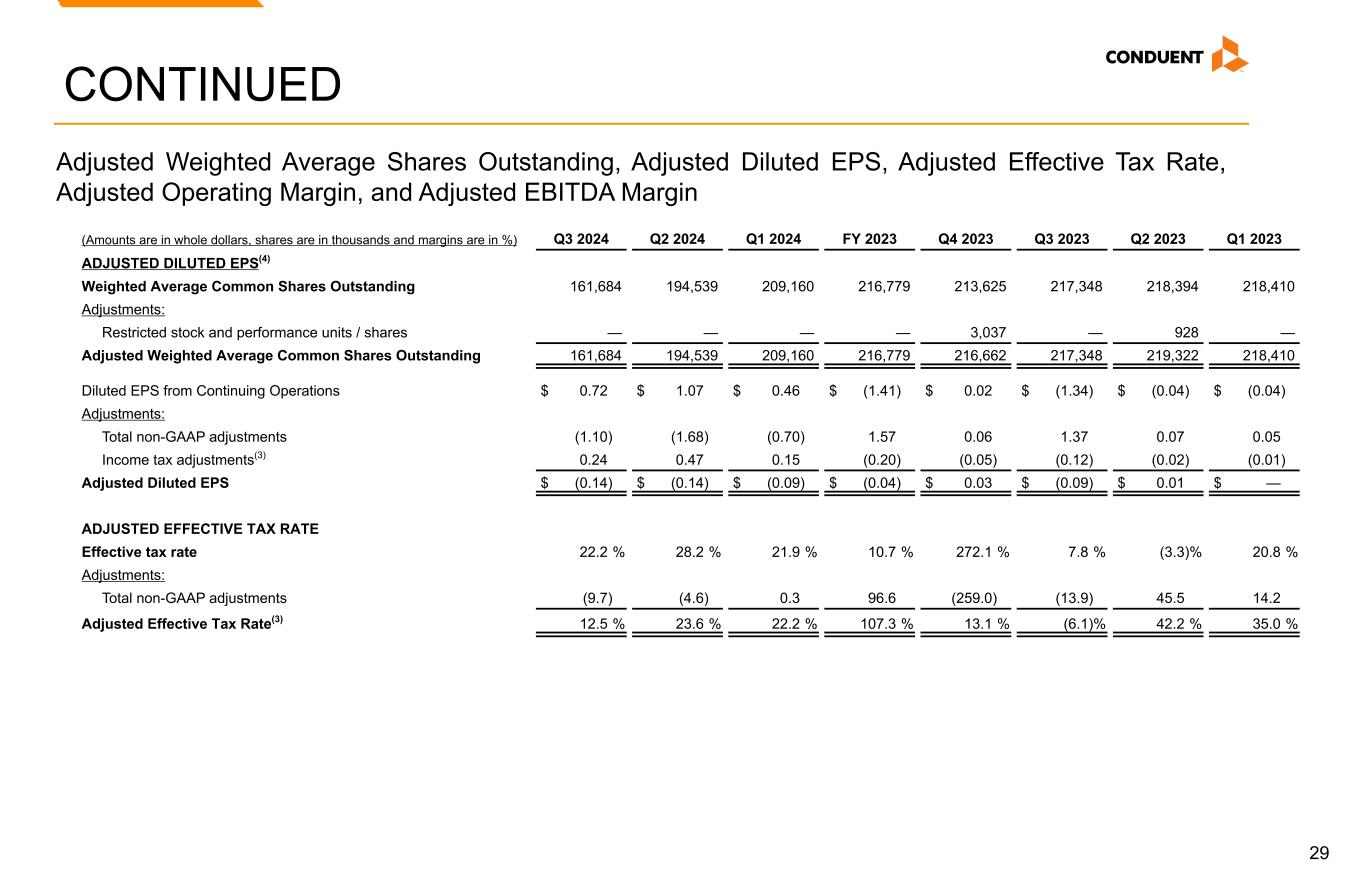

29 CONTINUED (Amounts are in whole dollars, shares are in thousands and margins are in %) Q3 2024 Q2 2024 Q1 2024 FY 2023 Q4 2023 Q3 2023 Q2 2023 Q1 2023 ADJUSTED DILUTED EPS(4) Weighted Average Common Shares Outstanding 161,684 194,539 209,160 216,779 213,625 217,348 218,394 218,410 Adjustments: Restricted stock and performance units / shares — — — — 3,037 — 928 — Adjusted Weighted Average Common Shares Outstanding 161,684 194,539 209,160 216,779 216,662 217,348 219,322 218,410 Diluted EPS from Continuing Operations $ 0.72 $ 1.07 $ 0.46 $ (1.41) $ 0.02 $ (1.34) $ (0.04) $ (0.04) Adjustments: Total non-GAAP adjustments (1.10) (1.68) (0.70) 1.57 0.06 1.37 0.07 0.05 Income tax adjustments(3) 0.24 0.47 0.15 (0.20) (0.05) (0.12) (0.02) (0.01) Adjusted Diluted EPS $ (0.14) $ (0.14) $ (0.09) $ (0.04) $ 0.03 $ (0.09) $ 0.01 $ — ADJUSTED EFFECTIVE TAX RATE Effective tax rate 22.2 % 28.2 % 21.9 % 10.7 % 272.1 % 7.8 % (3.3) % 20.8 % Adjustments: Total non-GAAP adjustments (9.7) (4.6) 0.3 96.6 (259.0) (13.9) 45.5 14.2 Adjusted Effective Tax Rate(3) 12.5 % 23.6 % 22.2 % 107.3 % 13.1 % (6.1) % 42.2 % 35.0 % Adjusted Weighted Average Shares Outstanding, Adjusted Diluted EPS, Adjusted Effective Tax Rate, Adjusted Operating Margin, and Adjusted EBITDA Margin

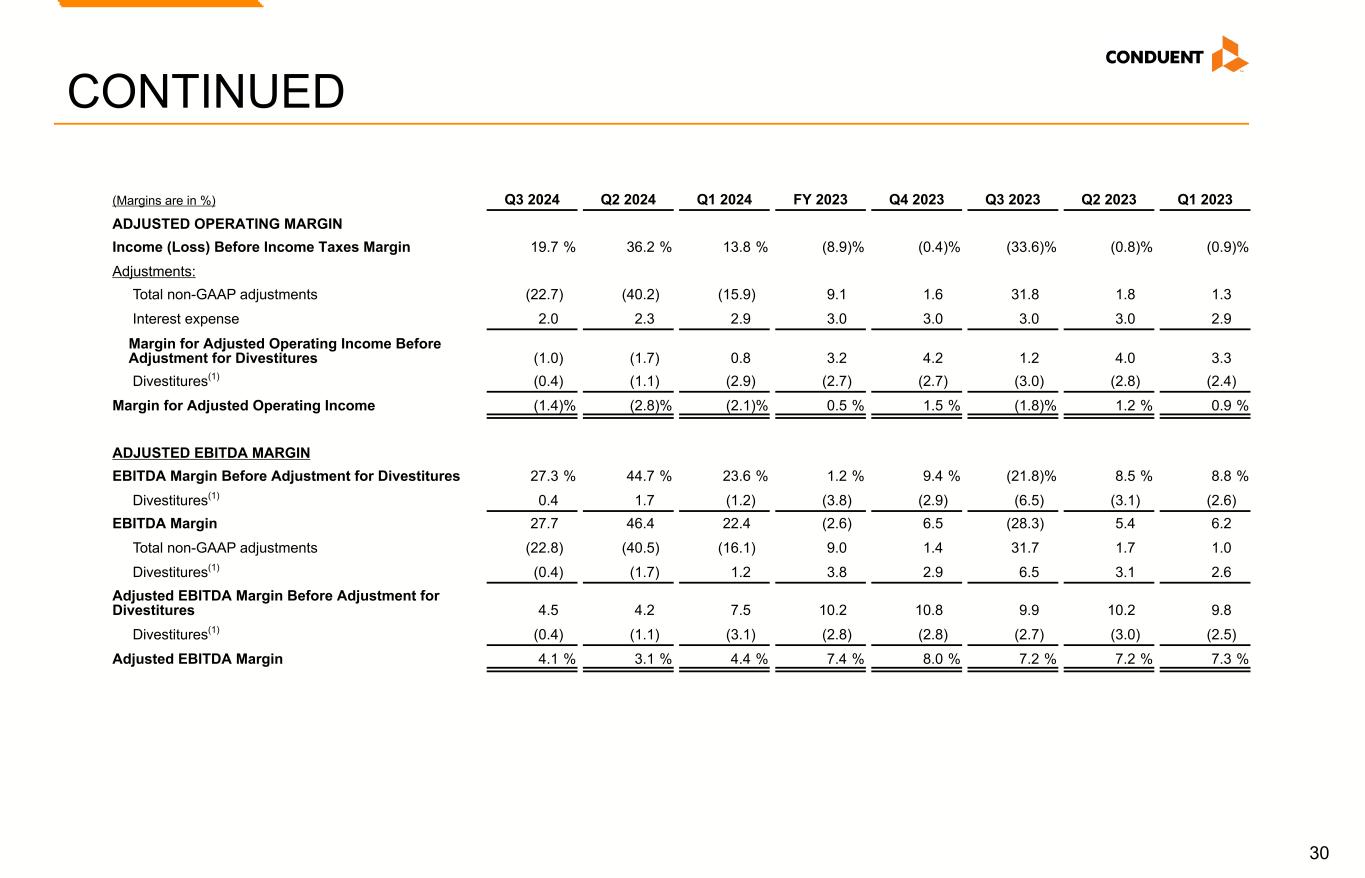

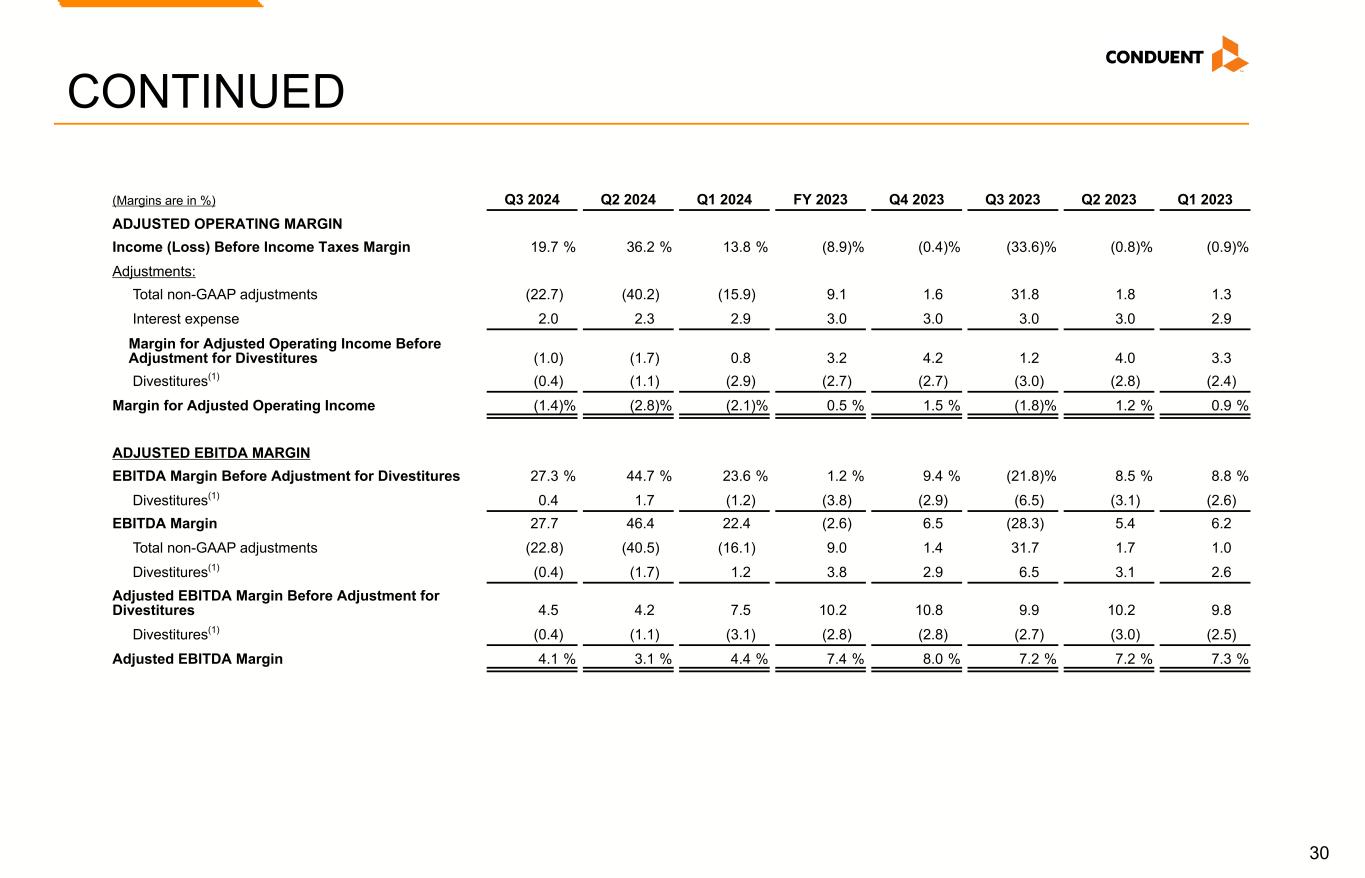

30 (Margins are in %) Q3 2024 Q2 2024 Q1 2024 FY 2023 Q4 2023 Q3 2023 Q2 2023 Q1 2023 ADJUSTED OPERATING MARGIN Income (Loss) Before Income Taxes Margin 19.7 % 36.2 % 13.8 % (8.9) % (0.4) % (33.6) % (0.8) % (0.9) % Adjustments: Total non-GAAP adjustments (22.7) (40.2) (15.9) 9.1 1.6 31.8 1.8 1.3 Interest expense 2.0 2.3 2.9 3.0 3.0 3.0 3.0 2.9 Margin for Adjusted Operating Income Before Adjustment for Divestitures (1.0) (1.7) 0.8 3.2 4.2 1.2 4.0 3.3 Divestitures(1) (0.4) (1.1) (2.9) (2.7) (2.7) (3.0) (2.8) (2.4) Margin for Adjusted Operating Income (1.4) % (2.8) % (2.1) % 0.5 % 1.5 % (1.8) % 1.2 % 0.9 % ADJUSTED EBITDA MARGIN EBITDA Margin Before Adjustment for Divestitures 27.3 % 44.7 % 23.6 % 1.2 % 9.4 % (21.8) % 8.5 % 8.8 % Divestitures(1) 0.4 1.7 (1.2) (3.8) (2.9) (6.5) (3.1) (2.6) EBITDA Margin 27.7 46.4 22.4 (2.6) 6.5 (28.3) 5.4 6.2 Total non-GAAP adjustments (22.8) (40.5) (16.1) 9.0 1.4 31.7 1.7 1.0 Divestitures(1) (0.4) (1.7) 1.2 3.8 2.9 6.5 3.1 2.6 Adjusted EBITDA Margin Before Adjustment for Divestitures 4.5 4.2 7.5 10.2 10.8 9.9 10.2 9.8 Divestitures(1) (0.4) (1.1) (3.1) (2.8) (2.8) (2.7) (3.0) (2.5) Adjusted EBITDA Margin 4.1 % 3.1 % 4.4 % 7.4 % 8.0 % 7.2 % 7.2 % 7.3 % CONTINUED

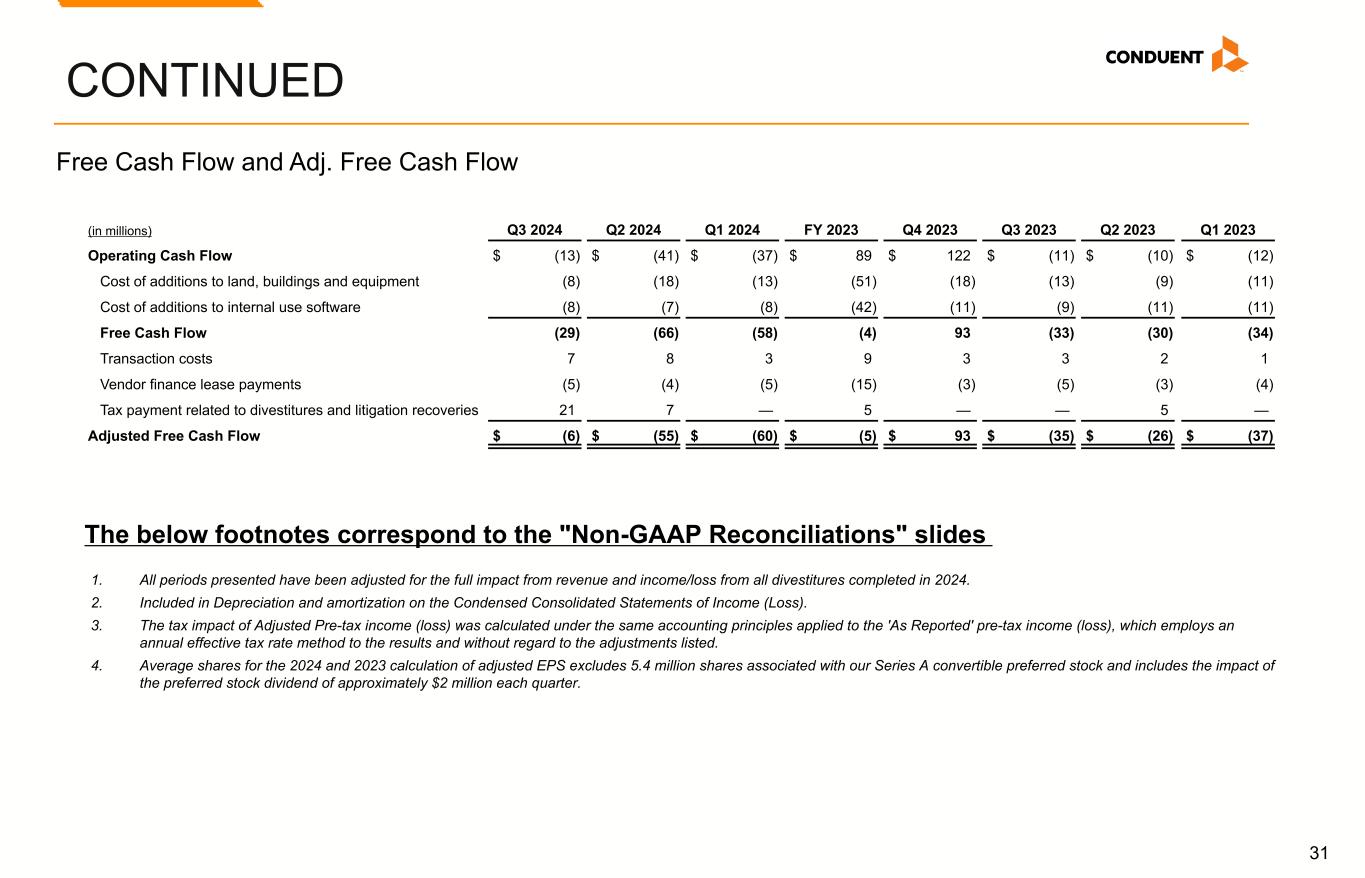

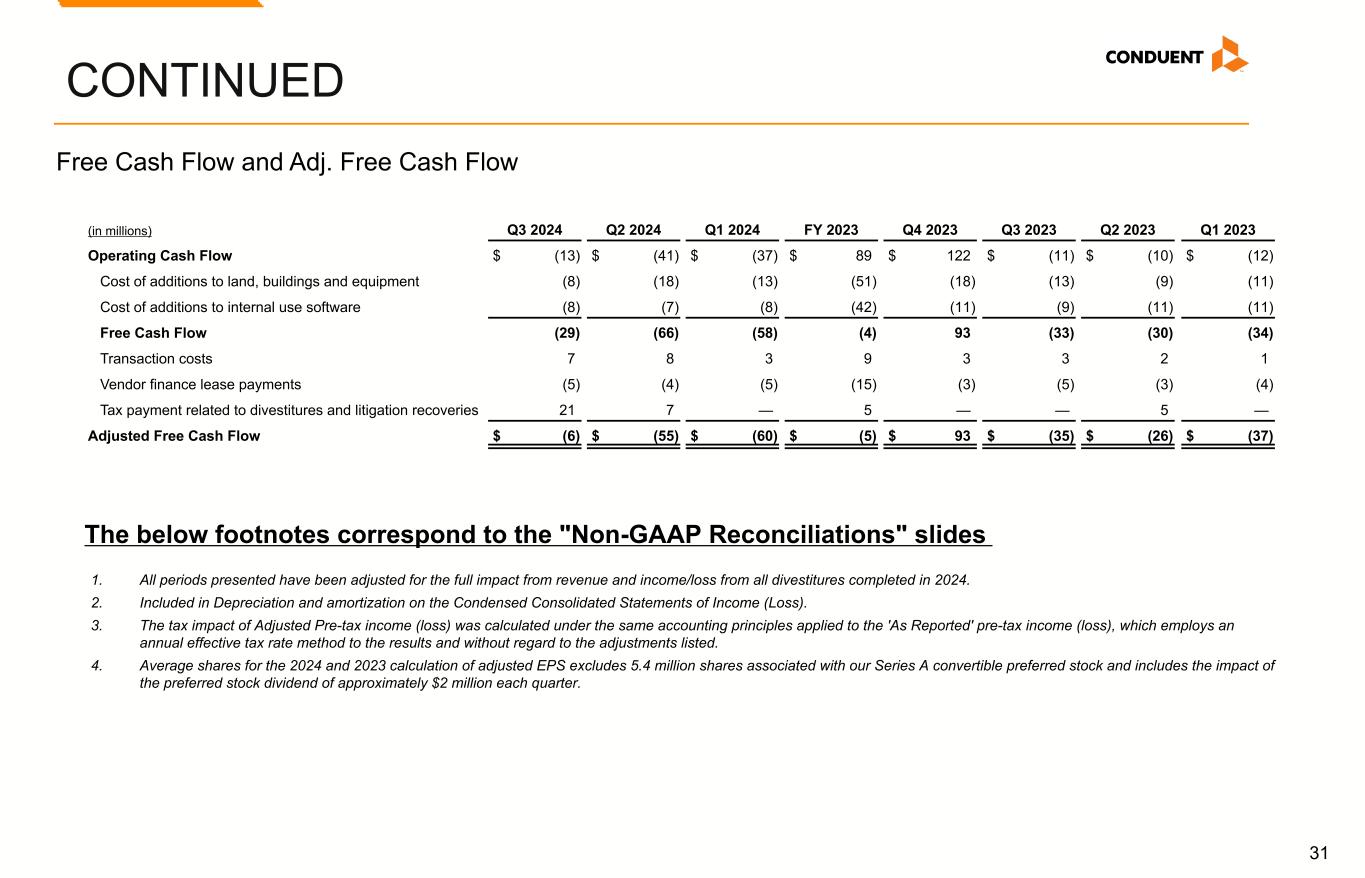

31 CONTINUED (in millions) Q3 2024 Q2 2024 Q1 2024 FY 2023 Q4 2023 Q3 2023 Q2 2023 Q1 2023 Operating Cash Flow $ (13) $ (41) $ (37) $ 89 $ 122 $ (11) $ (10) $ (12) Cost of additions to land, buildings and equipment (8) (18) (13) (51) (18) (13) (9) (11) Cost of additions to internal use software (8) (7) (8) (42) (11) (9) (11) (11) Free Cash Flow (29) (66) (58) (4) 93 (33) (30) (34) Transaction costs 7 8 3 9 3 3 2 1 Vendor finance lease payments (5) (4) (5) (15) (3) (5) (3) (4) Tax payment related to divestitures and litigation recoveries 21 7 — 5 — — 5 — Adjusted Free Cash Flow $ (6) $ (55) $ (60) $ (5) $ 93 $ (35) $ (26) $ (37) Free Cash Flow and Adj. Free Cash Flow The below footnotes correspond to the "Non-GAAP Reconciliations" slides 1. All periods presented have been adjusted for the full impact from revenue and income/loss from all divestitures completed in 2024. 2. Included in Depreciation and amortization on the Condensed Consolidated Statements of Income (Loss). 3. The tax impact of Adjusted Pre-tax income (loss) was calculated under the same accounting principles applied to the 'As Reported' pre-tax income (loss), which employs an annual effective tax rate method to the results and without regard to the adjustments listed. 4. Average shares for the 2024 and 2023 calculation of adjusted EPS excludes 5.4 million shares associated with our Series A convertible preferred stock and includes the impact of the preferred stock dividend of approximately $2 million each quarter.

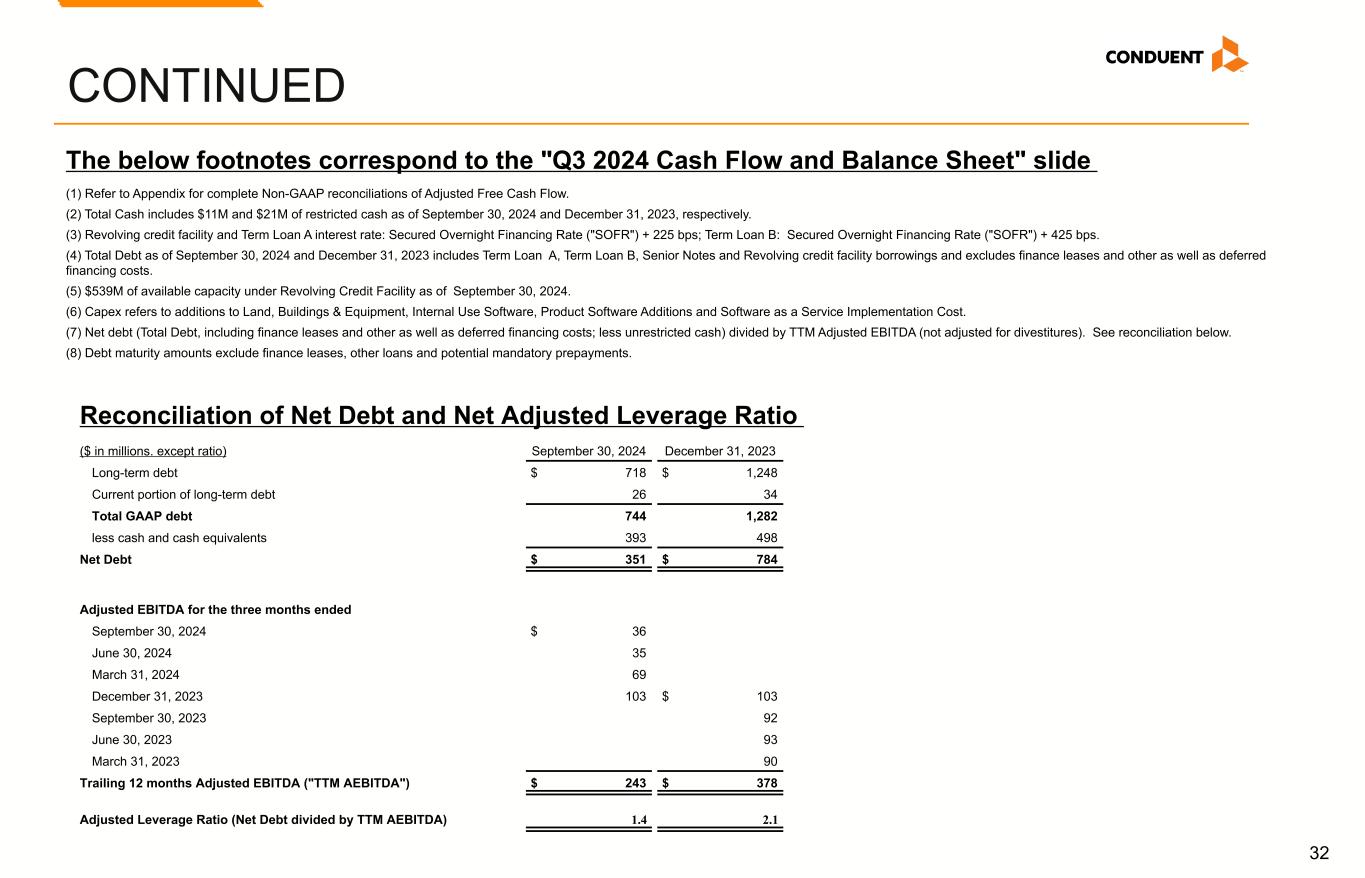

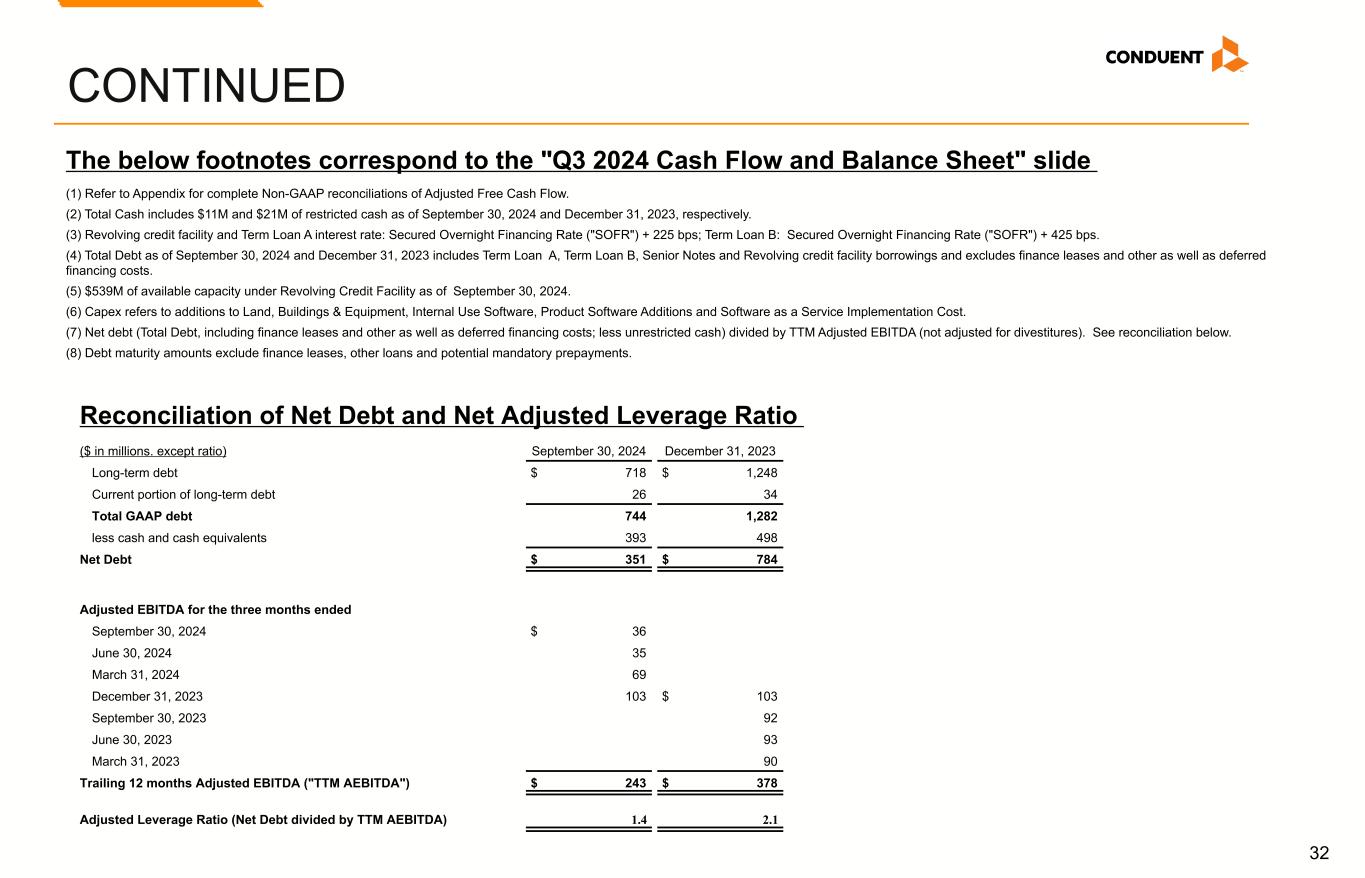

32 CONTINUED ($ in millions. except ratio) September 30, 2024 December 31, 2023 Long-term debt $ 718 $ 1,248 Current portion of long-term debt 26 34 Total GAAP debt 744 1,282 less cash and cash equivalents 393 498 Net Debt $ 351 $ 784 Adjusted EBITDA for the three months ended September 30, 2024 $ 36 June 30, 2024 35 March 31, 2024 69 December 31, 2023 103 $ 103 September 30, 2023 92 June 30, 2023 93 March 31, 2023 90 Trailing 12 months Adjusted EBITDA ("TTM AEBITDA") $ 243 $ 378 Adjusted Leverage Ratio (Net Debt divided by TTM AEBITDA) 1.4 2.1 (1) Refer to Appendix for complete Non-GAAP reconciliations of Adjusted Free Cash Flow. (2) Total Cash includes $11M and $21M of restricted cash as of September 30, 2024 and December 31, 2023, respectively. (3) Revolving credit facility and Term Loan A interest rate: Secured Overnight Financing Rate ("SOFR") + 225 bps; Term Loan B: Secured Overnight Financing Rate ("SOFR") + 425 bps. (4) Total Debt as of September 30, 2024 and December 31, 2023 includes Term Loan A, Term Loan B, Senior Notes and Revolving credit facility borrowings and excludes finance leases and other as well as deferred financing costs. (5) $539M of available capacity under Revolving Credit Facility as of September 30, 2024. (6) Capex refers to additions to Land, Buildings & Equipment, Internal Use Software, Product Software Additions and Software as a Service Implementation Cost. (7) Net debt (Total Debt, including finance leases and other as well as deferred financing costs; less unrestricted cash) divided by TTM Adjusted EBITDA (not adjusted for divestitures). See reconciliation below. (8) Debt maturity amounts exclude finance leases, other loans and potential mandatory prepayments. The below footnotes correspond to the "Q3 2024 Cash Flow and Balance Sheet" slide Reconciliation of Net Debt and Net Adjusted Leverage Ratio

© 2024 Conduent, Inc. All rights reserved. Conduent and Conduent Agile Star are trademarks of Conduent, Inc. and/or its subsidiaries in the United States and/or other countries.