Other programs

In addition to exploring Plinabulin’s therapeutic potential in combination with immuno-oncology agents, we have a pipeline of preclinical immuno-oncology product candidates and have utilized our research collaborators to advance these programs.

BPI-002 and BPI-003 programs

Our BPI-002 program is based on an oral small molecule agent, similar to a CTLA-4 antibody, which induces T-cell activation and preclinical studies have shown that it is synergistic to checkpoint inhibitors in immune competent colon cancer animal model. BPI-002 is currently in preclinical studies and we plan to initiate a clinical study in 2020. Our IKK program, BPI-003, is based on a novel small molecule inhibitor of IKK, a protein kinase. IKK is involved in survival of some tumor cells as well as in the production of a number of cytokines and growth factors that serve as survival factors for various tumors. Our IKK inhibitor has shown promising activity in multiple animal models of pancreatic cancer.

BPI-004 program

Our BPI-004 program is focused on a small molecule that induces the production of neo-antigens by tumor cells, allowing tumors containing no immune cells to be infiltrated by the immune system. A large proportion of human cancers do not produce antigens that are recognized by the immune system. As a result, these tumors do not respond to treatments that work through interaction with the patient’s immune response. For example, these tumors will not respond to treatment with PD-1 inhibitors. A treatment that induces the tumor cells to produce antigens has the potential to make these cancers responsive to PD-1 inhibitors.

Ubiquitination drug development platform

We are also investigating an alternative approach to cancer treatment in which disease-causing proteins are marked for early degradation. This approach uses a protein called a ubiquitin E3 ligase to target and promote the destruction of disease-causing proteins, such as oncogenes. To trigger degradation, the target protein is labeled with poly-ubiquitin by a specific ubiquitin ligase enzyme. Poly-ubiquitin acts as an indicating tag to cellular proteasome machinery that the target protein should be destroyed. One approach to tagging the target protein is using a “molecular glue” to bind the ubiquitin ligase to the target protein.

We are collaborating with Dr. Ning Zheng, a Howard Hughes Medical Institute Investigator, and his group at the University of Washington on a unique “molecular glue” used to selectively tag certain oncogene proteins with E3 ligase, one of the ubiquitin ligase enzymes. Dr. Huang, co-founder of BeyondSpring, and Dr. Zheng were the first to discover the crystal structure of the only two classes of E3 ligases. This work forms the structural basis for the selection of the small molecules to be studied as a potential “molecular glue.” The first target protein is expected to be oncogene KRAS. KRAS is frequently mutated in pancreas, colon, lung and uterus cancers. This novel platform technology has the potential to significantly reduce the amount of oncogene protein in the cell and such disease-causing protein is not targeted by current therapeutic approaches.

Plinabulin in other indications

Tumors with RAS mutations

We have identified that tumors that have mutations in an oncogene called RAS are particularly sensitive to Plinabulin. An oncogene is a gene that is a changed or mutated form of a gene involved in normal cell growth, which has the potential to cause cancer. A particular type of oncogene is the mutation of the RAS gene (HRAS, KRAS and NRAS), which is frequently found in human tumors. We believe that based on data from preclinical studies, Plinabulin will work together with standard-of-care agents in tumors with RAS mutations, including NSCLC and colorectal cancer. Mutations in KRAS are found in a large proportion of tumors including 16% of NSCLC, 36% of colon adenocarcinomas, and 69% of pancreatic ductal adenocarcinomas.

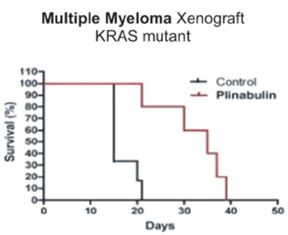

In a preclinical study, Plinabulin led to increased survival in a mouse multiple myeloma model containing a mutant KRAS gene. The figure below shows the survival of mice containing a mutant KRAS gene when treated with Plinabulin compared to those who were not treated with Plinabulin. Mice receiving Plinabulin at a dose level of 7.5 mg/kg twice weekly for three weeks had median survival of 35 days compared to 15 days in the control group (p=0.0041).

While specific KRAS mutations are not believed to be a major cause of glioblastoma, systems analyses have estimated that signaling through the KRAS pathway is altered in 88% of glioblastoma tumors. Plinabulin is able to cross the blood-brain barrier and led to a significant survival advantage in a KRAS-driven mouse model of glioblastoma.

While we continue to be primarily focused on the use of Plinabulin in advanced NSCLC, in CIN and in combination with immuno-oncology agents, if the necessary resources and financing are available, we may decide to further investigate the effect of Plinabulin in RAS mutant tumors.

Principal Investigators and Scientific Advisors

Our clinical trials are led by world renowned leaders in the clinical community, which we believe demonstrates their confidence in of our clinical trials.

NSCLC

Dr. David Ettinger, Chairman of the NCCN guidelines for NSCLC in the U.S. has guided the study design and is assisting with Study 103. Dr. Ettinger is Alex Grass Professor of Oncology, Sidney Kimmel Comprehensive Cancer Center at Johns Hopkins University.

Dr. Yan Sun, our lead clinical investigator for NSCLC in China is Chairman of the NCCN guidelines for NSCLC in China and the Director of National GCP Center for Anticancer Agents Cancer Hospital in Beijing, a hospital that treats 320,000 patients a year. In 1997, Dr. Sun also co-founded the Steering Committee of the Chinese Society of Clinical Oncology and served as its Chairman and President from 1997 to 2013. Dr. Sun was the lead clinical investigator for the Phase 3 trials of other lung cancer drugs that received approval from the NMPA, including icotinib.

CIN

Dr. Douglas Blayney of Stanford University, a board member of the NCCN and contributor to the NCCN guidelines for neutropenia management, is our principal investigator for both Study 105 and Study 106. Dr. Blayney is the former president of ASCO and a former member of the FDA’s Oncologic Drugs Advisory Committee.

Dr. Jeffrey Crawford is DSMB Chairman for Study 105 and Study 106. He is Chairman of NCCN Guidelines for Neutropenia Management in U.S. and the lead investigator of the U.S. multicenter, randomized trial of Filgrastim (G-CSF, Neupogen), leading to FDA approval. Dr. Crawford is Professor of Medicine at Duke University.

Dr. Yuankai Shi, Chairman of the NCCN guidelines for neutropenia management in China, is our principal investigator for the Chinese portion of both studies. Dr. Shi is Director of Oncology Department at Cancer Hospital Chinese Academy of Medical Sciences.

Ubiquitination platform

Dr. Avram Hershko is our SAB member of ubiquitination platform. He brought in nearly 50 years of research leadership in ubiquitination pathway and is the winner of 2004 Nobel Prize in Chemistry for discovery of ubiquitin-mediated protein degradation. Dr. Hershko is Distinguished Professor at Rappaport Faculty of Medicine at Technion in Haifa.

Intellectual Property

The proprietary nature of, and protection for, our product candidates and their methods of use are an important part of our strategy to develop and commercialize novel medicines, as described in more detail below. We have obtained U.S. patents and filed patent applications in the U.S. and other countries relating to certain of our product candidates, and are pursuing additional patent protection for them and for other of our product candidates and technologies.

Our success will depend significantly on our ability to obtain and maintain patent and other proprietary protection for our product candidates and other commercially important products, technologies, inventions and know-how, as well as on our ability to defend and enforce our patents including any patent that we have or may issue from our patent applications, preserve the confidentiality of our trade secrets and operate without infringing the valid and enforceable patents and proprietary rights of other parties.

As of March 31, 2019, we owned or co-owned 76 patents, in 36 jurisdictions, including 20 issued U.S. patents. We also owned seven pending U.S. non-provisional patent applications as well as corresponding patent applications pending in other jurisdictions and seven pending U.S. provisional patent applications. In addition, we owned five pending international patent applications related to Plinabulin and Plinabulin analogs filed under the PCT, which we plan to file nationally in the U.S. and in other jurisdictions directed to reduction of CIN, the therapeutic use of tubulin binding compounds, dosage regimens, the treatment of thrombocytopenia, and use in combination with G-CSF therapy.

Our patent portfolio as of March 29, 2019 included sixteen issued U.S. patents directed to Plinabulin and Plinabulin analogs, their synthesis and their use in the treatment of various disorders. In particular, we owned nine issued U.S. patents directed to the Plinabulin composition of matter, methods of synthesizing Plinabulin, polymorphic forms of Plinabulin, and methods of treating various disorders with Plinabulin including various cancers such as lung cancer, NSCLC, breast cancer, skin cancer, prostate cancer, myeloma, RAS mutant tumors, and brain tumors, and fungal infections, and methods of using Plinabulin for inhibiting cell proliferation, promotion of microtubule depolymerization, and inducement of vascular collapse in a tumor. These U.S. patents were scheduled to expire between 2021 and 2036, excluding any potential patent term restorations. The patent portfolio also contained counterpart patents granted in 35 foreign jurisdictions including Japan, South Korea, China, Europe and other countries.

The term of individual patents may vary based on the countries in which they are obtained. In most countries in which we file including the U.S., the term of an issued patent is generally 20 years from the earliest claimed filing date of a non-provisional patent application in the applicable country. In the U.S., the term of a patent may be lengthened in some cases by a patent term adjustment, which extends the term of a patent to account for administrative delays by the USPTO, in excess of a patent applicant’s own delays during the prosecution process, or may be shortened if a patent is terminally disclaimed over a commonly owned patent having an earlier expiration date. In addition, in certain instances, the term of one patent for a given drug product can be restored (extended) to recapture a portion of the term effectively lost as a result of the FDA regulatory review period. However, the restoration period cannot be longer than five years and the total patent term including the restoration period must not exceed 14 years following FDA approval. We plan to seek such an extension of one of our U.S. patents directed to Plinabulin or its use when appropriate.

In certain foreign jurisdictions similar extensions as compensation for regulatory delays are also available. The actual protection afforded by a patent varies on a claim by claim and country by country basis and depends upon many factors, including the type of patent, the scope of its coverage, the availability of any patent term extensions or adjustments, the availability of legal remedies in a particular country and the validity and enforceability of the patent. In particular, up to a five-year extension may be available in the EU and Japan. We plan to seek such extensions as appropriate.

Furthermore, the patent positions of biotechnology and pharmaceutical products and processes like those we intend to develop and commercialize are generally uncertain and involve complex legal and factual questions. No consistent policy regarding the breadth of claims allowed in such patents has emerged to date in the U.S. The scope of patent protection outside the U.S. is even more uncertain. Changes in the patent laws or in interpretations of patent laws in the U.S. and other countries have diminished, and may further diminish, our ability to protect our inventions and enforce our intellectual property rights and, more generally, could affect the value of intellectual property.

Additionally, while we have already secured a number of issued patents directed to our product candidates, we cannot predict the breadth of claims that may issue from our pending patent applications or may have or may be issued from patents and patent applications owned by others. Substantial scientific and commercial research has been conducted for many years in the areas in which we have focused our development efforts, which has resulted in other parties having a number of issued patents and pending patent applications relating to such areas. Patent applications in the U.S. and elsewhere are generally published only after 18 months from the priority date, and the publication of discoveries in the scientific or patent literature frequently occurs substantially later than the date on which the underlying discoveries were made. Therefore, patents and patent applications relating to drugs similar to our current product candidates and any future drugs, discoveries or technologies we might develop may have already been issued or filed, which could prohibit us from commercializing our product candidates.

The biotechnology and pharmaceutical industries are characterized by extensive litigation regarding patents and other intellectual property rights. Our ability to maintain and solidify our proprietary position for our product candidates and technology will depend on our success in obtaining effective claims and enforcing those claims once granted. We do not know whether any of the pending patent applications that we currently own, may file or license from others will result in the issuance of any patents. The issued patents that we own or may receive in the future, may be challenged, invalidated or circumvented, and the rights granted under any issued patents may not provide us with proprietary protection or competitive advantages against competitors with similar technology. Furthermore, our competitors may be able to independently develop and commercialize similar drugs or duplicate our technology, business model or strategy without infringing our patents. Because of the extensive time required for clinical development and regulatory review of a drug we may develop, it is possible that, before any of our product candidates can be commercialized, any related patent may expire or remain in force for only a short period following commercialization, thereby reducing any advantage of any such patent.

We may rely, in some limited circumstances, on trade secrets and unpatented know-how to protect aspects of our technology. However, trade secrets can be difficult to protect. We seek to protect our proprietary technology and processes, in part, by entering into confidentiality agreements with consultants, scientific advisors and contractors and invention assignment agreements with our employees. We also seek to preserve the integrity and confidentiality of our data and trade secrets by maintaining physical security of our premises and physical and electronic security of our information technology systems. While we have confidence in these individuals, organizations and systems, agreements or security measures may be breached, and we may not have adequate remedies for any breach. In addition, our trade secrets may otherwise become known or be independently discovered by competitors. To the extent that our consultants, contractors or collaborators use intellectual property owned by others in their work for us, disputes may arise as to the rights in related or resulting know-how and inventions.

Our commercial success will also depend in part on not infringing the proprietary rights of other parties. The existence of any patent by others with claims covering or related to aspects of our product candidates would require us to alter our development of commercial strategies, redesign our product candidates or processes, obtain licenses or cease certain activities. Such licenses may not be available on reasonable commercial terms or at all, which could require us to cease development or commercialization of our product candidates. In addition, our breach of any license agreements or failure to obtain a license to proprietary rights that we may require to develop or commercialize our product candidates would have a material adverse impact on us. If others have prepared and filed patent applications in the U.S. that also claim technology to which we have filed patent applications or otherwise wish to challenge our patents, we may have to participate in interferences, post-grant reviews, inter partes reviews, derivation or other proceedings in the USPTO and other patent offices to determine issues such as priority of claimed invention or validity of such patent applications as well as our own patent applications and issued patents.

For more information on these and other risks related to intellectual property, see “Item 3. Key Information—D. Risk Factors—Risks Related to Our Intellectual Property.”

Competition

Our industry is highly competitive and subject to rapid and significant change. While we believe that our development and commercialization experience, scientific knowledge and industry relationships provide us with competitive advantages, we face competition from pharmaceutical and biotechnology companies, including specialty pharmaceutical companies, and generic drug companies, academic institutions, government agencies and research institutions.

There are a number of large pharmaceutical and biotechnology companies that currently market and sell drugs or are pursuing the development of drugs for the treatment of cancer for which we are developing our product candidates. For example, both Genetech Inc. and Eli Lilly and Company currently market and sell drugs, Tarceva and Cyramza. Cyramza is approved to treat NSCLC once the disease has progressed after platinum-containing chemotherapy. Moreover, a number of additional drugs are currently in ongoing Phase 3 clinical trials as second and third line treatments of NSCLC, and may become competitors if and when they receive regulatory approval.

Neutropenia can be prevented or treated by G-CSF, a protein that promotes the survival, proliferation and differentiation of neutrophils. Recombinant G-CSF therapies, such as filgrastim (Neupogen), a short-acting drug, and pegfilgrastim (Neulasta), a long-acting drug, are commonly used to prevent and treat CIN. The major manufacturer of these competing therapies is Amgen.

While we are investigating an alternative approach to cancer treatment by using molecular glue technology to tag oncogene proteins with ubiquitin ligase and destroy such proteins, there are a number of companies who are also working on using such technology to target and destroy oncogene proteins. See “—Plinabulin, Our Lead Drug Candidate—Other programs.”

Many of our competitors have longer operating histories, better name recognition, stronger management capabilities, better supplier relationships, a larger technical staff and sales force and greater financial, technical or marketing resources than we do. Mergers and acquisitions in the pharmaceutical and biotechnology industries may result in even more resources being concentrated among a smaller number of our competitors. Our commercial opportunity could be reduced or eliminated if our competitors develop or market products or other novel therapies that are more effective, safer or less costly than our current product candidates, or any future product candidates we may develop, or obtain regulatory approval for their products more rapidly than we may obtain approval for our current product candidates or any such future product candidates. Our success will be based in part on our ability to identify, develop and manage a portfolio of product candidates that are safer and more effective than competing products.

Government Regulation

Government authorities in the U.S. at the federal, state and local level and in other countries extensively regulate, among other things, the research and clinical development, testing, manufacture, quality control, approval, labeling, packaging, storage, record-keeping, promotion, advertising, distribution, post-approval monitoring and reporting, marketing, pricing, export and import of drug products, such as those we are developing. Generally, before a new drug can be marketed, considerable data demonstrating its quality, safety and efficacy must be obtained, organized to address the requirements of and in the format specific to each regulatory authority, submitted for review and approved by the regulatory authority. This process is very lengthy and expensive, and success is uncertain.

Drugs are also subject to other federal, state and local statutes and regulations. The process of obtaining regulatory approvals and the subsequent compliance with appropriate federal, state, local and foreign statutes and regulations require the expenditure of substantial time and financial resources. Failure to comply with the applicable regulatory requirements at any time during the product development process, approval process or after approval, may subject an applicant to administrative or judicial sanctions. These sanctions could include, among other actions, the regulatory authority’s refusal to approve pending applications, withdrawal of an approval, clinical holds, untitled or warning letters, voluntary product recalls or withdrawals from the market, product seizures, total or partial suspension of production or distribution, injunctions, disbarment, fines, refusals of government contracts, restitution, disgorgement, or civil or criminal penalties. Any such administrative or judicial enforcement action could have a material adverse effect on us.

U.S. Regulation

U.S. Government Regulation and Product Approval

Government authorities in the U.S. at the federal, state and local level extensively regulate, among other things, the research, development, testing, manufacture, quality control, approval, labeling, packaging, storage, record-keeping, promotion, advertising, distribution, post-approval monitoring and reporting, marketing, export and import of drug products such as those we are developing. In the U.S., the FDA regulates drugs under the FDCA and its implementing regulations and biologics under the FDCA and the Public Health Service Act and its implementing regulations.

From time to time, legislation is drafted, introduced and passed in Congress that could significantly change the statutory provisions governing the approval, manufacturing and marketing of products regulated by the FDA. In addition to new legislation, FDA regulations and policies are often revised or reinterpreted by the agency in ways that may significantly affect our business and our product candidates or any future product candidates we may develop. It is impossible to predict whether further legislative or FDA regulation or policy changes will be enacted or implemented and what the impact of such changes, if any, may be.

U.S. Drug Development Process

The process of obtaining regulatory approvals and maintaining compliance with appropriate federal, state and local statutes and regulations requires the expenditure of substantial time and financial resources. Failure to comply with the applicable U.S. requirements at any time during the product development process, approval process, or after approval, may subject an applicant to administrative or judicial sanctions or lead to voluntary product recalls. Administrative or judicial sanctions could include the FDA’s refusal to approve pending applications, withdrawal of an approval, a clinical hold, untitled or warning letters, product seizures, total or partial suspension of production or distribution, injunctions, fines, refusals of government contracts, restitution, disgorgement or civil or criminal penalties. The process required by the FDA before a drug may be marketed in the U.S. generally involves the following:

| • | completion of nonclinical laboratory tests, preclinical studies and formulation studies according to Good Laboratory Practices, or GLP, regulations; |

| • | submission to the FDA of an IND, which must become effective before human clinical trials may begin; |

| • | approval by an independent IRB, at each clinical site before each trial may be initiated; |

| • | performance of adequate and well-controlled human clinical trials according to GCP, to establish the safety and efficacy of the proposed product for its intended use; |

| • | preparation and submission to the FDA of an NDA, for a drug; |

| • | satisfactory completion of an FDA advisory committee review, if applicable; |

| • | satisfactory completion of an FDA inspection of the manufacturing facility or facilities at which the product, or components thereof, are produced to assess compliance with cGMP; and |

| • | payment of user fees and FDA review and approval of the NDA. |

The testing and approval process requires substantial time, effort and financial resources and we cannot be certain that any approvals for our product candidates, or any future product candidates we may develop, will be granted on a timely basis, if at all.

Once a drug product candidate is identified for development, it enters the nonclinical testing stage. Nonclinical tests include laboratory evaluations of product chemistry, toxicity, formulation and stability, as well as preclinical studies. An Investigational New Drug, or IND, sponsor must submit the results of the nonclinical tests, together with manufacturing information, analytical data and any available clinical data or literature, to the FDA as part of the IND prior to commencing any testing in humans. An IND sponsor must also include a protocol detailing, among other things, the objectives of the clinical trial, dosing procedures, subject selection and exclusion criteria, the parameters to be used in monitoring safety, and the effectiveness criteria to be evaluated if the initial clinical trial lends itself to an efficacy evaluation. Some nonclinical testing may continue even after the IND is submitted. The IND automatically becomes effective 30 days after receipt by the FDA, unless the FDA raises concerns or questions related to a proposed clinical trial and places the trial on a clinical hold within that 30-day time period. In such a case, the IND sponsor and the FDA must resolve any outstanding concerns before the clinical trial can begin. Clinical holds also may be imposed by the FDA at any time before or during clinical trials due to safety concerns or noncompliance, and may be imposed on all products within a certain class of products. The FDA also can impose partial clinical holds, for example, prohibiting the initiation of clinical trials of a certain duration or for a certain dose.

We are conducting our current clinical trials under two INDs. Our investigators in connection with investigator-led clinical trials are being conducted under separate INDs.

All clinical trials must be conducted under the supervision of one or more qualified investigators in accordance with GCP regulations. These regulations include the requirement that all research subjects provide informed consent in writing before their participation in any clinical trial. Further, an IRB representing each institution participating in a clinical trial must review and approve the plan for any clinical trial before it commences at that institution, and the IRB must conduct continuing review and reapprove the study at least annually. An IRB is responsible for protecting the rights of clinical trial subjects and considers, among other things, whether the risks to individuals participating in the clinical trial are minimized and are reasonable in relation to anticipated benefits. The IRB also approves the information regarding the clinical trial and the consent form that must be provided to each clinical trial subject or his or her legal representative and must monitor the clinical trial until completed. Each new clinical protocol and any amendments to the protocol must be submitted for FDA review, and to the IRBs for approval.

Human clinical trials are typically conducted in three sequential phases that may overlap or be combined:

| • | Phase 1. The product is initially introduced into a small number of healthy human subjects or patients and tested for safety, dosage tolerance, absorption, metabolism, distribution and excretion and, if possible, to gain early evidence on effectiveness. In the case of some products for severe or life-threatening diseases, especially when the product is suspected or known to be unavoidably toxic, the initial human testing may be conducted in patients. |

| • | Phase 2. The drug is administered to a limited patient population to identify possible adverse effects and safety risks, to preliminarily evaluate the efficacy of the product for specific targeted diseases and to determine dosage tolerance and optimal dosage and schedule. |

| • | Phase 3. The drug is administered to an expanded patient population, generally at geographically dispersed clinical trial sites, in well-controlled clinical trials to generate data to evaluate the efficacy and safety of the product for approval, to establish the overall risk-benefit profile of the product, and to provide adequate information for the labeling of the product. |

Progress reports detailing the results of the clinical trials must be submitted at least annually to the FDA and safety reports must be submitted to the FDA and clinical investigators within 15 calendar days for serious and unexpected suspected adverse events, any clinically important increase in the rate of a serious suspected adverse reaction over that listed in the protocol or investigator’s brochure, or any findings from other studies or animal or in vitro testing that suggest a significant risk in humans exposed to the drug candidate. Additionally, a sponsor must notify FDA of any unexpected fatal or life-threatening suspected adverse reaction no later than 7 calendar days after the sponsor’s receipt of the information. Phase 1, Phase 2 and Phase 3 testing may not be completed successfully within any specified period, if at all. The FDA or the sponsor may suspend or terminate a clinical trial at any time on various grounds, including a finding that the research subjects or patients are being exposed to an unacceptable health risk. Similarly, an IRB can suspend or terminate approval of a clinical trial at its institution if the clinical trial is not being conducted in accordance with the IRB’s requirements or if the product has been associated with unexpected serious harm to subjects.

Concurrent with clinical trials, companies usually complete additional preclinical studies and must also develop additional information about the chemistry and physical characteristics of the product and finalize a process for manufacturing the product in commercial quantities in accordance with cGMP requirements. The manufacturing process must be capable of consistently producing quality batches of the product drug and, among other things, the manufacturer must develop methods for testing the identity, strength, quality and purity of the final product. Additionally, appropriate packaging must be selected and tested and stability studies must be conducted to demonstrate that the product drug does not undergo unacceptable deterioration over its shelf life.

U.S. Review and Approval Processes

The results of product development, nonclinical studies and clinical trials, together with other detailed information regarding the manufacturing process, analytical tests conducted on the product, proposed labeling and other relevant information, are submitted to the FDA as part of an NDA requesting approval to market the new drug. Under the Prescription Drug User Fee Act, as amended, applicants are required to pay fees to the FDA for reviewing an NDA. These user fees, as well as the annual fees required for commercial manufacturing establishments and for approved products, can be substantial. The NDA review fee alone can currently exceed $2.4 million, and is likely to increase over time. The user fee requirement is subject to certain limited deferrals, waivers and reductions.

The FDA reviews all NDAs submitted within 60 days of submission to ensure that they are sufficiently complete for substantive review before it accepts them for filing. The FDA may request additional information rather than accept an NDA for filing. In this event, the NDA must be re-submitted with the additional information. The re-submitted application also is subject to review before the FDA accepts it for filing.

Once the submission is accepted for filing, the FDA begins an in-depth substantive review. The FDA’s established goal is to review 90% of NDA applications given “Priority” status – where there is evidence that the proposed product would be a significant improvement in the safety or effectiveness in the treatment, diagnosis, or prevention of a serious condition – within 6 months, and 90% of applications given “Standard” status within 10 months, whereupon a review decision is to be made. The FDA, however, may not approve a drug within these established goals, and its review goals are subject to change from time to time. The FDA reviews an NDA to determine, among other things, whether a product is safe and effective for its intended use. The FDA also evaluates whether the product’s manufacturing is cGMP-compliant to assure the product’s identity, strength, quality and purity. Before approving an NDA, the FDA typically will inspect the facility or facilities where the product is or will be manufactured. The FDA will not approve an application unless it determines that the manufacturing processes and facilities are in compliance with cGMP requirements and adequate to assure consistent production of the product within required specifications. The FDA also may refer the NDA to an advisory committee for review, evaluation and recommendation as to whether the application should be approved and under what conditions. An advisory committee is a panel of experts, including clinicians and other scientific experts, who provide advice and recommendations when requested by the FDA. The FDA is not bound by the recommendation of an advisory committee, but it considers such recommendations when making decisions.

The approval process is lengthy and difficult and the FDA may refuse to approve an NDA if the applicable regulatory criteria are not satisfied or may require additional clinical data or other data and information. Even if such data and information are submitted, the FDA may ultimately decide that the NDA does not satisfy the criteria for approval. Data obtained from clinical trials are not always conclusive, and the FDA may interpret data differently than we interpret the same data. The FDA will issue a complete response letter if the agency decides not to approve the NDA in its present form. The complete response letter usually describes all of the specific deficiencies that the FDA identified in the NDA that must be satisfactorily addressed before it can be approved. The deficiencies identified may be minor, for example, requiring labeling changes, or major, for example, requiring additional clinical trials. Additionally, the complete response letter may include recommended actions that the applicant might take to place the application in a condition for approval. If a complete response letter is issued, the applicant may either resubmit the NDA, addressing all of the deficiencies identified in the letter, or withdraw the application or request an opportunity for a hearing.

If a product receives regulatory approval, the approval may be significantly limited to specific diseases and dosages or the indications for use may otherwise be limited, which could restrict the commercial value of the product. Further, the FDA may require that certain contraindications, warnings or precautions be included in the product labeling. In addition, the FDA may require post-approval studies, including Phase 4 clinical trials, to further assess a product’s safety and effectiveness after NDA approval and may require testing and surveillance programs to monitor the safety of approved products that have been commercialized. The FDA also may conclude that an NDA may only be approved with a REMS designed to mitigate risks through, for example, a medication guide, physician communication plan, or other elements to assure safe use, such as restricted distribution methods, patient registries and other risk minimization tools.

Post-Approval Requirements

Any products for which we receive FDA approval would be subject to continuing regulation by the FDA, including, among other things, record-keeping requirements, reporting of adverse experiences with the product, providing the FDA with updated safety and efficacy information, product sampling and distribution requirements, complying with certain electronic records and signature requirements and complying with FDA promotion and advertising requirements. The FDA strictly regulates labeling, advertising, promotion and other types of information on products that are placed on the market. Products may be promoted only for the approved indications and in accordance with the provisions of the approved label. Further, manufacturers must continue to comply with cGMP requirements, which are extensive and require considerable time, resources and ongoing investment to ensure compliance. In addition, changes to the manufacturing process generally require prior FDA approval before being implemented and other types of changes to the approved product, such as adding new indications and additional labeling claims, are also subject to further FDA review and approval.

Manufacturers and other entities involved in the manufacturing and distribution of approved products are required to register their establishments with the FDA and certain state agencies, and are subject to periodic unannounced inspections by the FDA and certain state agencies for compliance with cGMP and other laws. The cGMP requirements apply to all stages of the manufacturing process, including the production, processing, sterilization, packaging, labeling, storage and shipment of the product. Manufacturers must establish validated systems to ensure that products meet specifications and regulatory requirements, and test each product batch or lot prior to its release. We rely, and expect to continue to rely, on third parties for the production of clinical quantities of our product candidates and any future product candidates we may develop. Future FDA and state inspections may identify compliance issues at the facilities of our contract manufacturers that may disrupt production or distribution or may require substantial resources to correct.

The FDA may withdraw a product approval if compliance with regulatory requirements is not maintained or if problems occur after the product reaches the market. Later discovery of previously unknown problems with a product may result in restrictions on the product’s marketing or even complete withdrawal of the product from the market. Further, the failure to maintain compliance with regulatory requirements may result in administrative or judicial actions, such as fines, untitled or warning letters, holds on clinical trials, product seizures, product detention or refusal to permit the import or export of products, refusal to approve pending applications or supplements, restrictions on marketing or manufacturing, injunctions or consent decrees, or civil or criminal penalties, or may lead to voluntary product recalls.

Patent Term Restoration and Marketing Exclusivity

Depending upon the timing, duration and specifics of FDA approval of the use of our product candidates, or any future product candidates we may develop, some of our U.S. patents may be eligible for limited patent term extension under the Drug Price Competition and Patent Term Restoration Act of 1984, commonly referred to as the Hatch-Waxman Act. The Hatch-Waxman Act permits a patent restoration term of up to five years as compensation for patent term lost during product development and the FDA regulatory review process. However, patent term restoration cannot extend the remaining term of a patent beyond a total of 14 years from the product’s approval date. The patent term restoration period is generally one-half the time between the effective date of an IND and the submission date of an NDA plus the time between the submission date of an NDA and the approval of that application, except that this review period is reduced by any time during which the applicant failed to exercise due diligence. Only one patent applicable to an approved product is eligible for the extension and the application for the extension must be submitted prior to the expiration of the patent. The USPTO, in consultation with the FDA, reviews and approves the application for any patent term extension or restoration. In the future, if available, we intend to apply for restorations of patent term for some of our currently owned patents beyond their current expiration dates, depending on the expected length of the clinical trials and other factors involved in the filing of the relevant NDA; however, any such extension may not be granted to us.

Market exclusivity provisions under the FDCA can also delay the submission or the approval of certain applications. The FDCA provides a five-year period of non-patent marketing exclusivity within the U.S. to the first applicant to gain approval of an NDA for a new chemical entity. A drug is a new chemical entity if the FDA has not previously approved any other new drug containing the same active moiety, which is the molecule or ion responsible for the action of the drug substance. During the exclusivity period, the FDA may not accept for review an abbreviated new drug application, or ANDA, or a 505(b)(2) NDA submitted by another company for another version of such drug where the applicant does not own or have a legal right of reference to all the data required for approval. However, an application may be submitted after four years if it contains a certification of patent invalidity or non-infringement. The FDCA also provides three years of marketing exclusivity for an NDA, 505(b)(2) NDA or supplement to an existing NDA if new clinical investigations, other than bioavailability studies, that were conducted or sponsored by the applicant are deemed by the FDA to be essential to the approval of the application, for example, new indications, dosages or strengths of an existing drug. This three-year exclusivity covers only the conditions of use associated with the new clinical investigations and does not prohibit the FDA from approving ANDAs for drugs containing the original active agent. Five-year and three-year exclusivity will not delay the submission or approval of a full NDA. However, an applicant submitting a full NDA would be required to conduct or obtain a right of reference to all of the nonclinical studies and adequate and well-controlled clinical trials necessary to demonstrate safety and effectiveness.

Disclosure of Clinical Trial Information

Sponsors of clinical trials of FDA-regulated products, including drugs are required to register and disclose certain clinical trial information, which is publicly available at www.clinicaltrials.gov. Information related to the product, patient population, phase of investigation, study sites and investigators, and other aspects of the clinical trial is then made public as part of the registration. Sponsors are also obligated to disclose the results of their clinical trials after completion. Disclosure of the results of these trials can be delayed until the new product or new indication being studied has been approved. Competitors may use this publicly available information to gain knowledge regarding the progress of development programs.

Pharmaceutical Coverage, Pricing and Reimbursement

Significant uncertainty exists as to the coverage and reimbursement status of any products for which we may obtain regulatory approval. In the U.S., sales of any products for which we may receive regulatory approval for commercial sale will depend in part on the availability of coverage and reimbursement from third-party payors. Third-party payors include government authorities, managed care providers, private health insurers and other organizations. The process for determining whether a payor will provide coverage for a product may be separate from the process for setting the reimbursement rate that the payor will pay for the product. Third-party payors may limit coverage to specific products on an approved list, or formulary, which might not include all of the FDA-approved products for a particular indication. Moreover, a payor’s decision to provide coverage for a product does not imply that an adequate reimbursement rate will be approved. Adequate third-party reimbursement may not be available to enable us to maintain price levels sufficient to realize an appropriate return on our investment in product development.

Third-party payors are increasingly challenging the price and examining the medical necessity and cost- effectiveness of medical products and services, in addition to their safety and efficacy. In order to obtain coverage and reimbursement for any product that might be approved for sale, we may need to conduct expensive pharmacoeconomic studies in order to demonstrate the medical necessity and cost-effectiveness of any products, in addition to the costs required to obtain regulatory approvals. Our product candidates, or any future product candidates we may develop, may not be considered medically necessary or cost-effective. If third-party payors do not consider a product to be cost-effective compared to other available therapies, they may not cover the product after approval as a benefit under their plans or, if they do, the level of payment may not be sufficient to allow a company to sell its products at a profit.

The U.S. government, including the Trump administration, and state legislatures have shown significant interest in implementing cost containment programs to limit the growth of government-paid health care costs, including price controls, restrictions on reimbursement, requirements for substitution of generic products for branded prescription drugs, and increased transparency around drug pricing practices. For example, the Affordable Care Act contains provisions that may reduce the profitability of drug products, including, for example, increased rebates for drugs reimbursed by Medicaid programs, extension of Medicaid rebates to Medicaid managed care plans, mandatory discounts for certain Medicare Part D beneficiaries and annual fees based on pharmaceutical companies’ share of sales to federal health care programs. There also has been increased public and governmental scrutiny of the cost of drugs and drug pricing strategies, including by the U.S. Senate and federal and state prosecutors. In May 2018, President Trump released the Blueprint which, along with related drug pricing measures proposed since the Blueprint, could cause significant operational and reimbursement changes for the pharmaceutical industry. Adoption of government controls and measures, and tightening of restrictive policies in jurisdictions with existing controls and measures, could limit payments for pharmaceuticals including our product candidates, if any achieve approval.

The marketability of any products for which we receive regulatory approval for commercial sale may suffer if the government and third-party payors fail to provide adequate coverage and reimbursement. In addition, the emphasis on cost containment measures in the U.S. has increased and we expect will continue to increase the pressure on pharmaceutical pricing. Coverage policies and third-party reimbursement rates also may change at any time. Even if favorable coverage and reimbursement status is attained for one or more products for which we receive regulatory approval, less favorable coverage policies and reimbursement rates may be implemented in the future.

Other Healthcare Laws and Compliance Requirements

If we obtain regulatory approval of our products, we may be subject to various federal and state laws targeting fraud and abuse in the healthcare industry. These laws may impact, among other things, our proposed sales, marketing and education programs. In addition, we may be subject to patient privacy regulation by both the federal government and the states in which we conduct our business. The laws that may affect our ability to operate include:

| • | the federal Anti-Kickback Statute, which prohibits, among other things, persons from knowingly and willfully soliciting, receiving, offering or paying remuneration, directly or indirectly, in cash or in kind, to induce or reward, or in return for, either the referral of an individual for, or the purchase, order, or recommendation of, an item or service reimbursable under a federal healthcare program, such as the Medicare and Medicaid programs; |

| • | federal civil and criminal false claims laws, false statement laws, and civil monetary penalty laws, which prohibit, among other things, individuals or entities from knowingly presenting, or causing to be presented, claims for payment from Medicare, Medicaid, or other third-party payors that are false or fraudulent, or making a false statement or record material to payment of a false claim or avoiding, decreasing, or concealing an obligation to pay money to the federal government; |

| • | HIPAA, which imposes federal criminal and civil liability for executing a scheme to defraud any healthcare benefit program and making false statements relating to healthcare matters; |

| • | the federal transparency laws, including the federal Physician Payments Sunshine Act, which is part of the Affordable Care Act, that requires applicable manufacturers of covered drugs to disclose payments and other transfers of value provided to physicians and teaching hospitals and physician ownership and investment interests; |

| • | HIPAA, as amended by the Health Information Technology for Economic and Clinical Health Act and its implementing regulations, also imposes certain requirements relating to the privacy, security and transmission of individually identifiable health information; and |

| • | state law equivalents of each of the above federal laws, such as anti-kickback and false claims laws which may apply to items or services reimbursed by any third-party payor, including commercial insurers, state laws that require pharmaceutical companies to comply with the pharmaceutical industry’s voluntary compliance guidelines, and state laws governing the privacy and security of health information in certain circumstances, many of which differ from each other in significant ways and are not preempted by HIPAA, thus complicating compliance efforts. |

The Affordable Care Act broadened the reach of the fraud and abuse laws by, among other things, amending the intent requirement of the federal Anti-Kickback Statute and the applicable criminal healthcare fraud statutes contained within 42 U.S.C. § 1320a-7b. Pursuant to the statutory amendment, a person or entity no longer needs to have actual knowledge of this statute or specific intent to violate it in order to have committed a violation. In addition, the Affordable Care Act provides that a claim including items or services resulting from a violation of the federal Anti-Kickback Statute constitutes a false or fraudulent claim for purposes of the False Claims Act or the civil monetary penalties statute. Many states have adopted laws similar to the federal Anti-Kickback Statute, some of which apply to the referral of patients for healthcare items or services reimbursed by any source, not only the Medicare and Medicaid programs.

Although we would not submit claims directly to payors, manufacturers can be held liable under the federal False Claims Act and other healthcare laws if they are deemed to “cause” the submission of false or fraudulent claims by, for example, providing inaccurate billing or coding information to customers or promoting a product off-label. In addition, our future activities relating to the reporting of wholesaler or estimated retail prices for our products, the reporting of prices used to calculate Medicaid rebate information and other information affecting federal, state, and third-party reimbursement for our products, and the sale and marketing of our products, will be subject to scrutiny under the False Claims Act. Penalties for a False Claims Act violation include three times the actual damages sustained by the government, plus mandatory civil penalties, and the potential for exclusion from participation in federal healthcare programs. The applicable civil penalties are subject to an annual increase based on inflation; effective January 29, 2018, the penalties are between $11,181 and $22,363 for each separate false claim. In addition, although the federal False Claims Act is a civil statute, conduct that results in a False Claims Act violation may also implicate various federal criminal statutes. Further, private individuals have the ability to bring actions under the federal False Claims Act and certain states have enacted laws modeled after the federal False Claims Act.

Patient Protection and the Affordable Care Act

The Affordable Care Act, enacted in March 2010, includes measures that have or will significantly change the way health care is financed in the U.S. by both governmental and private insurers. Among the provisions of the Affordable Care Act of greatest importance to the pharmaceutical industry are the following:

| • | The Medicaid Drug Rebate Program requires pharmaceutical manufacturers to enter into and have in effect a national rebate agreement with the Secretary of the Department of Health and Human Services as a condition for states to receive federal matching funds for the manufacturer’s outpatient drugs furnished to Medicaid patients. The Affordable Care Act increased pharmaceutical manufacturers’ rebate liability on most branded prescription drugs from 15.1% of the average manufacturer price to 23.1% of the average manufacturer price, added a new rebate calculation for line extensions of solid oral dosage forms of branded products, and modified the statutory definition of average manufacturer price. The Affordable Care Act also expanded the universe of Medicaid utilization subject to drug rebates by requiring pharmaceutical manufacturers to pay rebates on Medicaid managed care utilization and expanding the population potentially eligible for Medicaid drug benefits. |

| • | In order for a pharmaceutical product to receive federal reimbursement under the Medicare Part B and Medicaid programs or to be sold directly to U.S. government agencies, the manufacturer must extend discounts to entities eligible to participate in the 340B drug pricing program. The Affordable Care Act expanded the types of entities eligible to receive discounted 340B pricing. |

| • | The Affordable Care Act imposed a requirement on manufacturers of branded drugs to provide a 50% discount off the negotiated price of branded drugs dispensed to Medicare Part D patients in the coverage gap (i.e., the “donut hole”). |

| • | The Affordable Care Act imposed an annual, nondeductible fee on any entity that manufactures or imports certain branded prescription drugs, apportioned among these entities according to their market share in certain government healthcare programs, although this fee does not apply to sales of certain products approved exclusively for orphan indications. |

In addition to these provisions, the Affordable Care Act established a number of bodies whose work may have a future impact on the market for certain pharmaceutical products. These include the Patient-Centered Outcomes Research Institute, established to oversee, identify priorities in, and conduct comparative clinical effectiveness research and the Center for Medicare and Medicaid Innovation within the Centers for Medicare and Medicaid Services, to test innovative payment and service delivery models to lower Medicare and Medicaid spending.

The Affordable Care Act has been subject to challenges and numerous ongoing efforts to repeal or amend the Act in whole or in part. Since the November 2016 U.S. election, President Trump and the U.S. Congress have made numerous efforts to repeal or amend the Affordable Care Act in whole or in part. For example, the Tax Cuts and Jobs Act, which President Trump signed into law in December 2017, repealed the Affordable Care Act’s individual health insurance mandate, which is considered a key component of the Affordable Care Act. Thus, the full impact of the Affordable Care Act, or any law replacing elements of it, on our business remains unclear. These and other laws may result in additional reductions in healthcare funding, which could have a material adverse effect on customers for our product candidates, if we gain approval for any of them. Although we cannot predict the full effect on our business of the implementation of existing legislation or the enactment of additional legislation pursuant to healthcare and other legislative reform, we believe that legislation or regulations that would reduce reimbursement for, or restrict coverage of, our products could adversely affect how much or under what circumstances healthcare providers will prescribe or administer our product candidates if we gain approval for any of them.

Chinese Regulation

In China, we operate in an increasingly complex legal and regulatory environment. We are subject to a variety of Chinese laws, rules and regulations affecting many aspects of our business. This section summarizes the principal Chinese laws, rules and regulations relevant to our business and operations.

General Regulations on China Food and Drug Administration

In China, the NMPA monitors and supervises the administration of pharmaceutical products, as well as medical devices and equipment. The NMPA’s primary responsibility includes evaluating, registering and approving new drugs, generic drugs, imported drugs and traditional Chinese medicines; approving and issuing permits for the manufacture, export and import of pharmaceutical products and medical appliances; approving the establishment of enterprises for pharmaceutical manufacture and distribution; formulating administrative rules and policies concerning the supervision and administration of food, cosmetics and pharmaceuticals; and handling significant accidents involving these products. The local provincial drug administrative authorities are responsible for supervision and administration of drugs within their respective administrative regions.

The Drug Administration Law of the People’s Republic of China, or the PRC Drug Administration Law, promulgated by the Standing Committee of the National People’s Congress in 1984, as amended in 2001, 2013 and 2015, respectively, and the Implementing Measures of the PRC Drug Administration Law promulgated by the State Council in 2002, as amended in 2016, set forth the legal framework for the administration of pharmaceutical products, including the research, development and manufacturing of drugs.

The PRC Drug Administration Law was revised in December 2001, December 2013 and again in April 2015. The purpose of the revisions was to strengthen the supervision and administration of pharmaceutical products and to ensure the quality and safety of those products for human use. The revised PRC Drug Administration Law applies to entities and individuals engaged in the development, production, trade, application, supervision and administration of pharmaceutical products. It regulates and prescribes a framework for the administration of pharmaceutical preparations of medical institutions and for the development, research, manufacturing, distribution, packaging, pricing and advertisement of pharmaceutical products. A draft amendment on the PRC Drug Administration Law was published by the National People’s Congress on November 1, 2018, which has yet to take effect. The draft amendment incorporates the Drug Marketing Authorization Holder System and change the responsible drug administrative authorities from provincial level to county level. Revised Implementing Measures of the PRC Drug Administration Law promulgated by the State Council took effect in September 2002, as amended in 2016, providing detailed implementing regulations for the revised PRC Drug Administration Law.

Under these regulations, we need to follow related regulations for nonclinical research, clinical trials and production of new drugs.

Good Laboratories Practice Certification for Nonclinical Research

To improve the quality of animal research, the CFDA promulgated the Administrative Measures for Good Laboratories Practice of Preclinical Laboratory in 2003, which was amended in July, 2017, and began to conduct the certification program of the GLP. In April 2007, the CFDA issued the Circular on Measures for Certification of Good Laboratory Practice, or CFDA Circular 214, providing that the NMPA is responsible for certification of nonclinical research institutions. Under CFDA Circular 214, the NMPA decides whether an institution is qualified for undertaking pharmaceutical nonclinical research upon the evaluation of the institution’s organizational administration, its research personnel, its equipment and facilities and its operation and management of nonclinical pharmaceutical projects. If all requirements are met, a GLP Certification will be issued by the NMPA and the result will be published on the NMPA’s website.

Currently for all our ongoing projects, we cooperated with NMPA certified GLP laboratories operated by Joinn Laboratories to conduct the studies following GLP based on NMPA requirements.

Approval for Clinical Trials and Production of New Drugs

According to the Provisions for Drug Registration promulgated by the CFDA in 2007, Drug Administration Law promulgated and amended by the Standing Committee of the National People’s Congress in 2015, Circular on Regulations for Special Approval on New Drug Registration issued by the CFDA in 2009, and Circular on Information Publish Platform for Pharmaceutical Clinical Trials issued by the CFDA in 2013, we must comply with the following procedures and obtain several approvals for clinical trials and production of new drugs.

Clinical Trial Application

Upon completion of its nonclinical research, a research institution must apply for approval of a Clinical Trial Application before conducting clinical trials.

Special Examination and Approval for Domestic Category 1 Pharmaceutical Products

Domestic Category 1 New Drugs Are Eligible for Special Examination and Approval

According to Provisions for Drug Registration promulgated by the CFDA in 2007, drug registration applications are divided into three different types, namely Domestic New Drug Application, Domestic Generic Drug Application, and Imported Drug Application. Drugs fall into one of three categories, namely chemical medicine, biological product or traditional Chinese or natural medicine. A Category 1 drug is a new drug that has never been marketed in any country and will be manufactured in China. Our product candidates qualify as a domestic Category 1 new drug.

According to Provisions on the Administration of Special Examination and Approval of Registration of New Drugs, or the Special Examination and Approval Provisions promulgated by the CFDA in January 2009, the NMPA conducts special examination and approval for new drugs registration application when:

| 1. | the effective constituent of drug extracted from plants, animals, minerals, etc. as well as the preparations thereof have never been marketed in China, and the material medicines and the preparations thereof are newly discovered; |

| 2. | the chemical raw material medicines as well as the preparations thereof and the biological product have not been approved for marketing home and abroad; |

| 3. | the new drugs are for treating AIDS, malignant tumors and rare diseases, etc., and have obvious advantages in clinic treatment; or |

| 4. | the new drugs are for treating diseases with no effective methods of treatment. |

The Special Examination and Approval Provisions provide that the applicant may file for special examination and approval at the stage of Clinical Trial Application if the drug candidate falls within item (1) or (2). The provisions provide that for product candidates that fall within items (3) or (4), the application for special examination and approval must be made when filing for production.

We believe that our current product candidates fall within items (2) and (3) above. Therefore, we may file an application for special examination and approval at the Clinical Trial Application stage, which may enable us to pursue a more expedited path to approval in China and bring therapies to patients more quickly.

The Advantages of Category 1 New Drugs over Category 5 Drugs

Prior to the enactment of Reform Plan for Registration Category of Chemical Medicine, Category 3 drugs are drugs which have already been marketed abroad by multinational companies, but are not yet approved in China, and Category 3 drugs are reclassified as Category 5 according to the Reform Plan for Registration Category of Chemical Medicine issued by CFDA in March 2016. Compared with the application for Category 5 drugs, the application for Category 1 domestic new drugs has a more straight-forward registration pathway. According to Provisions for Drug Registration, where a special examination and approval treatment is granted, the application for clinical trial and manufacturing will be handled with priority and with enhanced communication with the Center for Drug Evaluation of the NMPA, or the CDE, which will establish a working mechanism for communicating with the applicants. If it becomes necessary to revise the clinical trial scheme or make other major alterations during the clinical trial, the applicant may file an application for communication. When an application for communication is approved, the CDE will arrange the communication with the applicant within one month.

In comparison, according to Provisions for Drug Registration, the registration pathway for Category 5 drugs is complicated and evolving. Category 5 drug applications may only be submitted after a company obtains an NDA approval and receives the CPP granted by a major regulatory authority, such as the FDA or the EMA. Multinational companies may need to apply for conducting multi-regional clinical trials, which means that companies do not have the flexibility to design the clinical trials to fit the Chinese patients and standard-of-care. Category 5 product candidates may not qualify to benefit from fast track review with priority at the Clinical Trial Application stage. Moreover, a requirement to further conduct local clinical trials can potentially delay market access by several years from its international NDA approval. Further, according to Opinions on Reforming the Review and Approval Process for Pharmaceutical Products and Medical Devices issued by the State Council in August 2015, which is a guideline for future legislation and NMPA examination, the drugs which have already been marketed abroad may no longer be categorized as new drugs under Chinese law in the future, and therefore may not be able to enjoy any preferential treatment for new drugs. In order to implement this guideline, in March 2016, the CFDA issued the Reform Plan for Registration Category of Chemical Medicine, which changed the registration category of chemical medicine stipulated in Provisions for Drug Registration. According to the Interpretation of Reform Plan for Registration Category of Chemical Medicine issued by CFDA, a new drug refers to a drug that has never been marketed in China or abroad.

Our product candidates are all new therapeutic agents and we expect that all of our current product candidates fall under the Category 1 application process. Although the regulatory framework normally requires approval of separate Clinical Trial Applications prior to initiating each phase of clinical development, in December 2015, the CFDA approved our Clinical Trial Application including all phases of clinical trials for Plinabulin as a direct anticancer agent in NSCLC when combined with docetaxel and for the treatment of CIN.

Changes to the Review and Approval Process

In August 2015, the State Council issued Opinions on Reforming the Review and Approval Process for Pharmaceutical Products and Medical Devices, providing several potential policy changes that could benefit the pharmaceutical industry:

| • | A plan to accelerate innovative drug approval with a special review and approval process, with a focus on areas of high unmet medical needs, including drugs for HIV, cancer, serious infectious diseases, orphan diseases and drugs on national priority lists; |

| • | A plan to adopt a policy which would allow companies to act as the marketing authorization holder and to hire contract manufacturing organizations to produce drug products; |

| • | A plan to improve the review and approval of clinical trials, and to allow companies to conduct clinical trials in China at the same time as they are doing so in other countries and encourage local clinical trial organizations to participate in international multi-center clinical trials. |

In November 2015, the Standing Committee of the National People’s Congress issued the Decision on Authorizing the State Council to Conduct the Pilot Program of the System of the Holders of Drug Marketing Licenses in Certain Areas and the Relevant Issues, which authorized the State Council to conduct the pilot program of the system of the holders of drug marketing licenses in Beijing, Tianjin, Hebei, Shanghai, Jiangsu, Zhejiang, Fujian, Shandong, Guangdong and Sichuan, and authorized the State Council to conduct reforms of registration category for drugs.

In November 2015, the CFDA released the Circular Concerning Several Policies on Drug Registration Review and Approval, which further clarified the following policies potentially simplifying and accelerating the approval process of clinical trials:

| • | A one-time umbrella approval procedure allowing approval of all phases of a new drug’s clinical trials at once, rather than the current phase-by-phase approval procedure, will be adopted for new drugs’ clinical trial applications; |

| • | A fast track drug registration or clinical trial approval pathway will be available for the following applications: (1) registration of innovative new drugs treating HIV, cancer, serious infectious diseases and orphan diseases; (2) registration of pediatric drugs; (3) registration of geriatric drugs that treat China-prevalent diseases; (4) registration of drugs sponsored by national science and technology grants; (5) registration of innovative drugs using advanced technology, using innovative treatment methods, or having distinctive clinical benefits; (6) registration of foreign innovative drugs to be manufactured locally in China; (7) concurrent applications for new drug clinical trials which are already approved in the U.S. or European Union, or concurrent drug registration applications for drugs which have applied for marketing authorization and passed onsite inspections in the U.S. or European Union and are manufactured using the same production line in China; and (8) clinical trial applications for drugs with urgent clinical need and patent expiry within three years, and marketing authorization applications for drugs with urgent clinical need and patent expiry within one year. |

In December 2017, the CFDA released the Opinions on Encouraging the Prioritized Evaluation and Approval for Drug Innovations, which further stipulated the scope of priority review and approval. The following drugs will be entitled to priority review and approval:

| • | Applications for drugs with obvious clinical benefits if any of the following circumstances applies: (1) registration applications for innovative drugs that are not marketed in China and abroad; (2) registration applications for innovative drugs to be manufactured locally in China; (3) registration applications for drugs using advanced formulation technology, using innovative treatment methods, or having distinctive clinical benefits; (4) clinical trial applications for patented drugs with patent to be expired in three years and manufacturing applications for drugs with patent to be expired in one year; (5) concurrent applications for new drug clinical trials which are already approved in the U.S. or European Union, or concurrent drug registration applications for drugs which have applied for marketing authorization and passed onsite inspections in the U.S. or European Union and are manufactured using the same production line in China; (6) registration applications for traditional Chinese drugs (including ethnic drugs) with clear clinical directions in the prevention and treatment of severe diseases; (7) registration applications for new drugs sponsored by national science and technology grants and of which clinical trials were conducted by a national clinical medical research center and approved by the administration department of such center. |

| • | Applications for drugs with obvious clinical benefits in the prevention and treatment of following diseases: (1) HIV; (2) pulmonary tuberculosis; (3) viral hepatitis; (4) orphan diseases; (5) malignant tumor; (6) pediatric drugs; (7) senile diseases. |

In May 2016, the General Office of the State Council issued Circular 41, which signals that the Drug Marketing Authorization Holder System is finally put into implementation. Circular 41 allows institutions of drugs research and development and research specialist staffs in Beijing, Tianjin, Hebei, Shanghai, Jiangsu, Zhejiang, Fujian, Shandong, Guangdong and Sichuan, to act as the applicant of drugs registration and to submit applications for drug clinical trials and drugs marketing. For the drugs newly registered after the effective date of Circular 41, applicants are allowed to submit applications for becoming a drugs marketing authorization holder at the same time as they submit applications for drug clinical trials or drugs marketing. In August 2016, the CFDA issued Circular on Conducting Works Regarding the Pilot Program for the Drug Marketing Authorization Holder System, which further detail the application procedures stipulated in Circular 41. In August 2017, the CFDA issued the Circular on the Matters Relating to Promotion of the Pilot Program for the Drug Marketing Authorization Holder System. This notice is issued, among other things, to advance implementation of a system pilot program for holders of drug marketing authorization, to delineate the rights and obligations of such holders, to enhance the quality of drug manufacturing process and to improve the responsibility system over drug manufacturing and marketing supply chains. In October 2018, the NMPA issued the Decisions on Extending the Period of the Pilot Program for the Drug Marketing Authorization Holder System in Several Regions (Draft), which extends the expiration date of the pilot program from November 4, 2018 to the implementation date of the revised Drug Administration Law.

Non-Inferiority Standard

In China, a drug may receive regulatory approval without showing superiority in its primary endpoint. Rather, a drug may be approved for use if it shows non-inferiority in its primary endpoint and superiority in one of its secondary endpoints.

Accelerated or Conditional Approval

In October 2017, the Central Committee of the Communist Party of China and General Office of the State Council issued the Opinions on Deepening the Reform of the Evaluation and Approval System and Inspiring Innovation of Drugs and Medical Devices. This opinion provides that, among other things:

| • | the review and approval process should be accelerated for drugs or medical devices that are urgently in need for clinical practice; |

| • | for drugs or medical devices that are (i) for treatment of severe and life threatening diseases that cannot be cured in an effective manner, or (ii) urgently in need to improve public health, if early and mid-term indicators in clinical trials for the aforementioned drugs or medical devices show efficacy and potential clinical value, the marketing of these drugs and medical devices may be approved conditionally, and companies who desire to market such drugs or medical devices shall develop risk control plans for conducting researches according to applicable requirements; |

| • | extension of the patent term for certain new drugs may be granted, given that clinical trials and the review and approval process may cause delay in bringing new drugs to the market; and |

| • | clinical trial data obtained from foreign countries may be used to register drugs and medical devices in China if such data meet applicable requirements for the registration of drugs and medical devices in China. |

Four Phases of Clinical Trials

A clinical trial consists of Phases 1, 2, 3 and 4. Phase 1 refers to the initial clinical pharmacology and safety evaluation studies in humans. Phase 2 refers to the preliminary evaluation of a drug candidate’s therapeutic effectiveness and safety for particular indication(s) in patients, which provides evidence and support for the design of Phase 3 clinical trial and settles the administrative dose regimen. Phase 3 refers to clinical trials undertaken to confirm the therapeutic effectiveness of a drug. Phase 3 is used to further verify the drug’s therapeutic effectiveness and safety on patients with target indication(s), to evaluate overall benefit-risk relationships of the drug, and ultimately to provide sufficient evidence for the review of drug registration application. Phase 4 refers to a new drug’s post-marketing study to assess therapeutic effectiveness and adverse reactions when the drug is widely used, to evaluate overall benefit-risk relationships of the drug when used among general population or specific groups, and to adjust the administration dose, etc.

Drug Clinical Practice Certification