Ex-(a)(1)(ii)

Nuveen Preferred and Income 2022 Term Fund

MR A SAMPLE

DESIGNATION (IF ANY)

ADD 1

ADD 2

ADD 3

ADD 4

ADD 5

ADD 6

C 1234567890 J N T

Tax ID certification on file: <Certified Y/N>

TOTAL SHARES 1234567890

LETTER OF TRANSMITTAL TO TENDER SHARES OF NUVEEN PREFERRED AND INCOME 2022 TERM FUND

Pursuant to the Offer to Purchase dated January 20, 2022, Nuveen Preferred and Income 2022 Term Fund (the “Fund”) has offered to purchase up 3,955,722 of its common shares. The offer expires at 5:00 p.m., New York City time, on February 17, 2022, unless extended. See Instructions on the reverse side.

I/we, the undersigned, hereby surrender to you for tendering the share(s) identified below. I/we hereby agree to the terms and conditions of the Offer to Purchase dated January 20, 2022 (“Offer to Purchase”). I/we hereby certify and warrant that: (i) I/we have received and read the Offer to Purchase; (ii) I/we have complied with all instructions on the reverse side of this Letter of Transmittal and the requirements of the Offer to Purchase; (iii) I/we have full authority to surrender these certificate(s) and give the instructions in this Letter of Transmittal; and (iv) the shares represented by these certificates are free and clear of all liens, restrictions, adverse claims and encumbrances.

Please complete the back if you would like to transfer ownership or request special mailing.

Breakdown of your holding here at Computershare:

| | | | | | | | |

| | |

| Total Certificated Shares | | Total Book-Entry Share | | | Total Shares | |

| 1234567890 | | | 1234567890 | | | | 1234567890 | |

| 1 | | | | | | | | |

Signature: This form must be signed by all of the registered holder(s) exactly as their name(s) appears on the certificate(s) or by person(s) authorized to sign on behalf of the registered holder(s) by documents transmitted herewith. If this Letter of Transmittal or any certificates or stock powers are signed by trustees, executors, administrators, guardians, agents, attorneys-in-fact, officers of corporations or others acting in a fiduciary or representative capacity, such persons should so indicate when signing and must submit proper evidence satisfactory to the Fund of their authority to so act, or in lieu of evidence guaranteed by an Eligible Institution. Additionally, if any of the tendered Shares are held of record by two or more joint holders, all such holders must sign this Letter of Transmittal.

| | | | |

| | | | |

| Signature of Shareholder | | Date | | Daytime Telephone # |

| | | | |

| Signature of Shareholder | | Date | | Daytime Telephone # |

| | | | | | |

PLACE AN X IN ONE TENDER BOX ONLY |

2 | | | | 3 |

| ☐ Tender All | | or | | ☐ Partial Tender WHOLE SHARES FRACTIONS |

Please locate your certificate(s) and send them along with the completed Letter of Transmittal.

| ☐ | CHECK HERE IF SHARE CERTIFICATES HAVE BEEN MUTILATED, LOST, STOLEN OR DESTROYED. SEE INSTRUCTION 6. |

1 2 3 4 5 6 7 8 9 0 1 2 T E N D N B B C 0 1

01UQ0J

Document Number

| | | | |

| 4 Special Transfer Instructions | | 5 Special Mailing Instructions |

| If you want your stock certificate(s) for Fund shares and/or check for cash to be issued in another name, fill in this section with the information for the new account/payee name. | | Signature Guarantee Medallion | | Fill in ONLY if you want your stock certificate(s) for Fund shares and/or check for cash to be mailed to someone other than the registered holder or to the registered holder at an address other than that shown on the front of this Letter of Transmittal. |

| | (Title of Officer Signing this Guarantee) |

| | |

| | |

| | |

| | |

| Name (Please Print First, Middle & Last Name) | | (Name of Guarantor - Please Print) | | Name (Please Print First, Middle & Last Name) |

Address (Number and Street) (City, State & Zip Code) | | (Address of Guarantor Firm) | | Address (Number and Street) (City, State & Zip Code) |

| (Tax Identification or Social Security Number) |

INSTRUCTIONS FOR COMPLETING THE LETTER OF TRANSMITTAL

1. Sign, date and include your daytime telephone number in this Transmittal form in Box 1. After completing all other applicable sections, return this Letter of Transmittal and your stock certificates in the enclosed envelope. The method of delivery of any documents, including share certificates, is at the election and risk of the tendering shareholder. If documents are sent by mail, it is recommended that they be sent by registered mail, properly insured, with return receipt requested.

2. If you are tendering all your shares for cash, please check this box only.

3. If you are tendering some of your shares for cash, please check the box, indicate the number of shares you wish to tender and receive in cash.

4. If you want your certificate(s) for Fund shares and/or check for cash to be issued in another name, fill in Box 4. Special Transfer Instructions must be medallion guaranteed.

5. Complete Box 5 only if your certificate(s) for Fund shares and/or check for cash is to be delivered to a person other than the registered holder or to the registered holder at a different address.

6. Mutilated, Lost, Stolen or Destroyed Certificates. If any certificate representing Shares has been mutilated, lost, stolen or destroyed, the shareholder should promptly call the Depositary at 1-800-257-8787. The shareholder will then be instructed by the Depositary as to the steps that must be taken to replace the certificate. This Letter of Transmittal and related documents cannot be processed until the procedures for replacing lost or destroyed certificates have been followed.

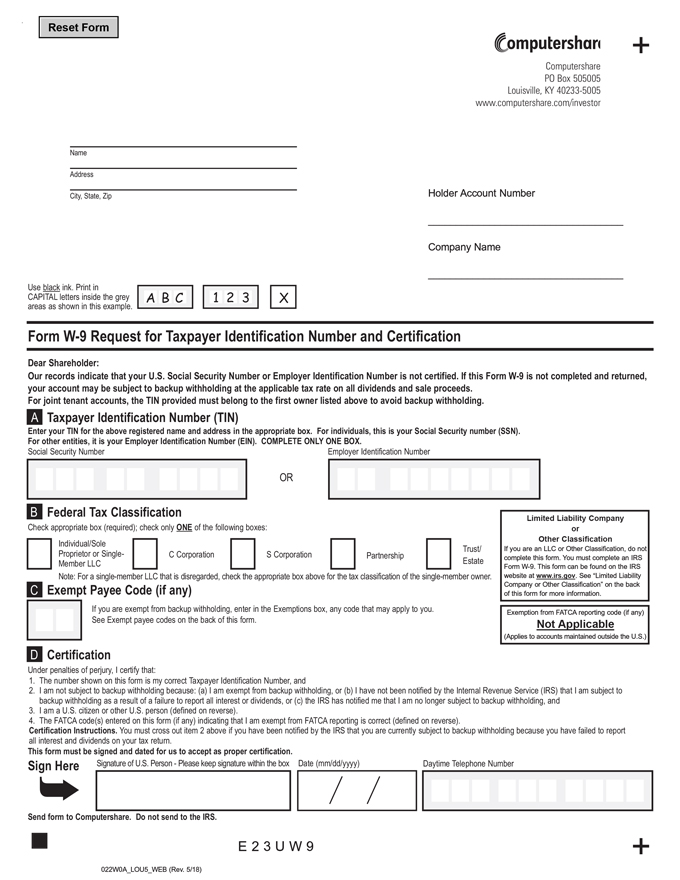

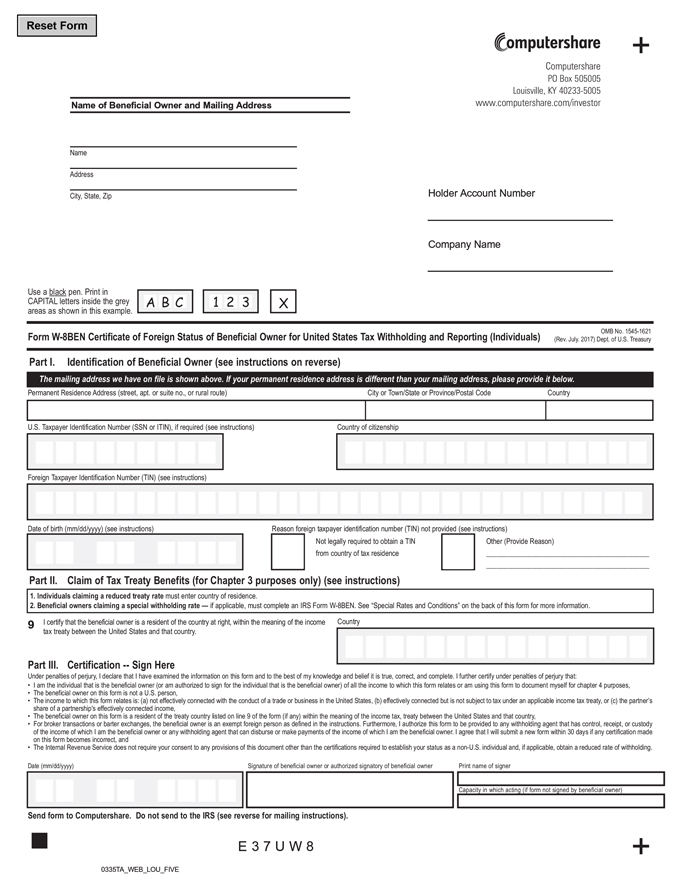

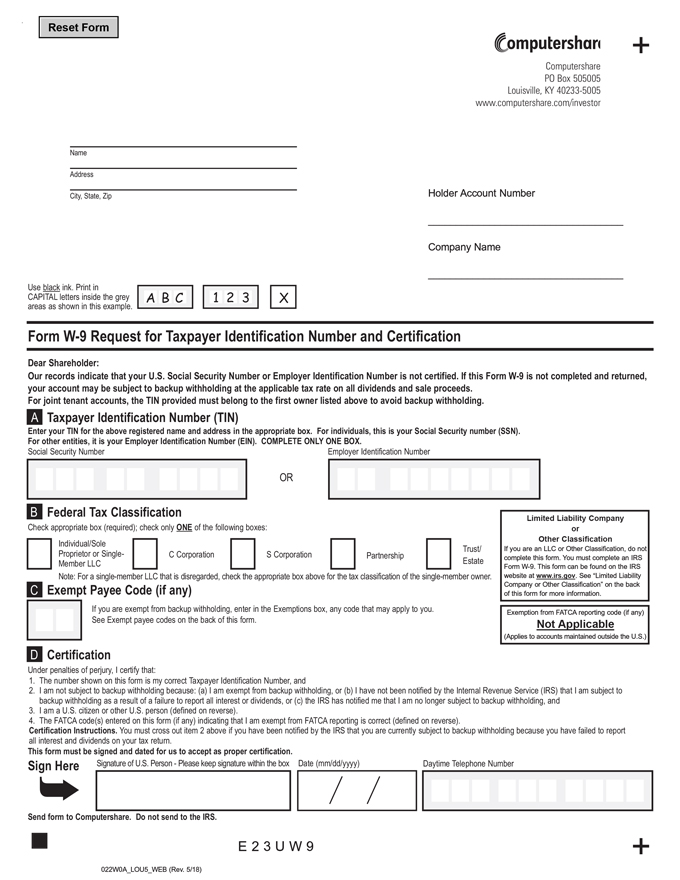

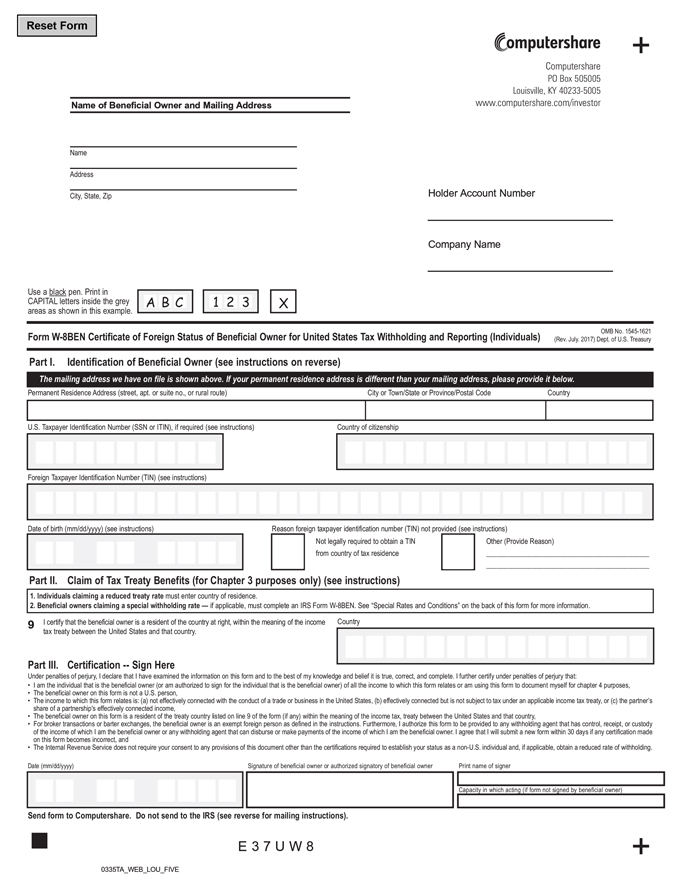

Form W-9: Under U.S. Federal Income Tax law, a stockholder is required to provide Computershare with such shareholder’s correct Taxpayer Identification Number. If your Taxpayer Identification Number is not certified on our records, we have enclosed a Form W-9 for you to complete and return. Failure to provide the information on the form may subject you to backup withholding on any reportable payment. If you are a foreign individual seeking to qualify as an exempt recipient from backup withholding, you must complete and submit the enclosed Form W-8BEN to Computershare.

| | |

The Information Agent for the Offer is: Georgeson LLC All Holders Call Toll Free: (888) 658-5755 | | The Depositary for the Offer is: Computershare By Mail: Computershare Trust Company, N.A. c/o Voluntary Corporate Actions P.O. Box 43011 Providence, RI 02940-3011 By Registered, Certified or Express Mail or Overnight Courier: Computershare Trust Company, N.A. c/o Voluntary Corporate Actions 150 Royall Street, Suite V, Canton, MA 02021 |

2

Reset Form Computershare Computershare PO Box 505005 Louisville, KY 40233-5005 www.computershare.com/investor Name Address City, State, Zip Holder Account Number Company Name Use black ink. Print in CAPITAL letters inside the grey areas as shown in this example. ABC 123 X Form W-9 Request for Taxpayer Identification Number and Certification Dear Shareholder: Our records indicate that your U.S. Social Security Number or Employer Identification Number is not certified. If this Form W-9 is not completed and returned, your account may be subject to backup withholding at the applicable tax rate on all dividends and sale proceeds. For joint tenant accounts, the TIN provided must belong to the first owner listed above to avoid backup withholding. A Taxpayer Identification Number (TIN) Enter your TIN for the above registered name and address in the appropriate box. For individuals, this is your Social Security number (SSN). For other entities, it is your Employer Identification Number (EIN). COMPLETE ONLY ONE BOX. Social Security Number Employer Identification Number OR B Federal Tax Classification Check appropriate box (required); check only ONE of the following boxes: Individual/Sole Proprietor or Single-Member LLC C Corporation S Corporation Partnership Trust/Estate Note: For a single-member LLC that is disregarded, check the appropriate box above for the tax classification of the single-member owner. C Exempt Payee Code (if any) If you are exempt from backup withholding, enter in the Exemptions box, any code that may apply to you. See Exempt payee codes on the back of this form. Limited Liability Company or Other Classification If you are an LLC or Other Classification, do not complete this form. You must complete an IRS Form W-9. This form can be found on the IRS website at www.irs.gov. See “Limited Liability Company or Other Classification” on the back of this form for more information. Exemption from FATCA reporting code (if any) Not Applicable (Applies to accounts maintained outside the U.S.) D Certification Under penalties of perjury, I certify that: 1. The number shown on this form is my correct Taxpayer Identification Number, and 2. I am not subject to backup withholding because: (a) I am exempt from backup withholding, or (b) I have not been notified by the Internal Revenue Service (IRS) that I am subject to backup withholding as a result of a failure to report all interest or dividends, or (c) the IRS has notified me that I am no longer subject to backup withholding, and 3. I am a U.S. citizen or other U.S. person (defined on reverse). 4. The FATCA code(s) entered on this form (if any) indicating that I am exempt from FATCA reporting is correct (defined on reverse). Certification Instructions. You must cross out item 2 above if you have been notified by the IRS that you are currently subject to backup withholding because you have failed to report all interest and dividends on your tax return. This form must be signed and dated for us to accept as proper certification. Sign Here Signature of U.S. Person - Please keep signature within the box Date (mm/dd/yyyy) Daytime Telephone Number Send form to Computershare. Do not send to the IRS. E 2 3 U W 9 022W0A_LOU5_WEB (Rev. 5/18)

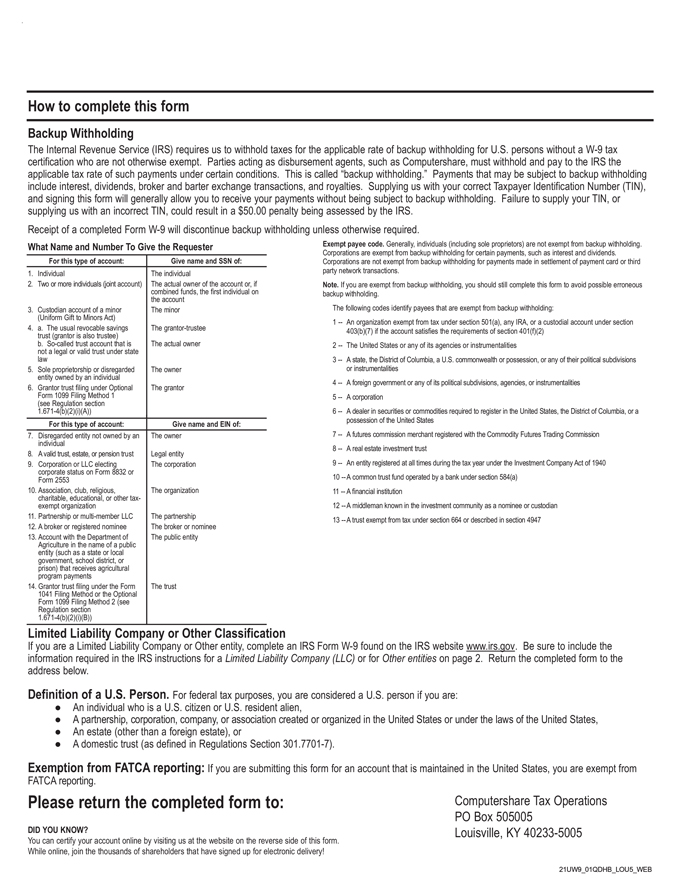

How to complete this form Backup Withholding The Internal Revenue Service (IRS) requires us to withhold taxes for the applicable rate of backup withholding for U.S. persons without a W-9 tax certification who are not otherwise exempt. Parties acting as disbursement agents, such as Computershare, must withhold and pay to the IRS the applicable tax rate of such payments under certain conditions. This is called “backup withholding.” Payments that may be subject to backup withholding include interest, dividends, broker and barter exchange transactions, and royalties. Supplying us with your correct Taxpayer Identification Number (TIN), and signing this form will generally allow you to receive your payments without being subject to backup withholding. Failure to supply your TIN, or supplying us with an incorrect TIN, could result in a $50.00 penalty being assessed by the IRS. Receipt of a completed Form W-9 will discontinue backup withholding unless otherwise required. What Name and Number To Give the Requester For this type of account: 1. Individual 2. Two or more individuals (joint account) 3. Custodian account of a minor (Uniform Gift to Minors Act) 4. a. The usual revocable savings trust (grantor is also trustee) b. So-called trust account that is not a legal or valid trust under state law 5. Sole proprietorship or disregarded entity owned by an individual 6. Grantor trust filing under Optional Form 1099 Filing Method 1 (see Regulation section 1.671-4(b)(2)(i)(A)) Give name and SSN of: The individual The actual owner of the account or, if combined funds, the first individual on the account The minor The grantor-trustee The actual owner The owner The grantor For this type of account: 7. Disregarded entity not owned by an individual 8. A valid trust, estate, or pension trust 9. Corporation or LLC electing corporate status on Form 8832 or Form 2553 10. Association, club, religious, charitable, educational, or other tax-exempt organization 11. Partnership or multi-member LLC 12. A broker or registered nominee 13. Account with the Department of Agriculture in the name of a public entity (such as a state or local government, school district, or prison) that receives agricultural program payments 14. Grantor trust filing under the Form 1041 Filing Method or the Optional Form 1099 Filing Method 2 (see Regulation section 1.671-4(b)(2)(i)(B)) Give name and EIN of: The owner Legal entity The corporation The organization The partnership The broker or nominee The public entity The trust Exempt payee code. Generally, individuals (including sole proprietors) are not exempt from backup withholding. Corporations are exempt from backup withholding for certain payments, such as interest and dividends. Corporations are not exempt from backup withholding for payments made in settlement of payment card or third party network transactions. Note. If you are exempt from backup withholding, you should still complete this form to avoid possible erroneous backup withholding. The following codes identify payees that are exempt from backup withholding: 1 — An organization exempt from tax under section 501(a), any IRA, or a custodial account under section 403(b)(7) if the account satisfies the requirements of section 401(f)(2) 2 — The United States or any of its agencies or instrumentalities 3 — A state, the District of Columbia, a U.S. commonwealth or possession, or any of their political subdivisions or instrumentalities 4 — A foreign government or any of its political subdivisions, agencies, or instrumentalities 5 — A corporation 6 — A dealer in securities or commodities required to register in the United States, the District of Columbia, or a possession of the United States 7 — A futures commission merchant registered with the Commodity Futures Trading Commission 8 — A real estate investment trust 9 — An entity registered at all times during the tax year under the Investment Company Act of 1940 10 — A common trust fund operated by a bank under section 584(a) 11 — A financial institution 12 — A middleman known in the investment community as a nominee or custodian 13 — A trust exempt from tax under section 664 or described in section 4947 Limited Liability Company or Other Classification If you are a Limited Liability Company or Other entity, complete an IRS Form W-9 found on the IRS website www.irs.gov. Be sure to include the information required in the IRS instructions for a Limited Liability Company (LLC) or for Other entities on page 2. Return the completed form to the address below. Definition of a U.S. Person. For federal tax purposes, you are considered a U.S. person if you are: An individual who is a U.S. citizen or U.S. resident alien, A partnership, corporation, company, or association created or organized in the United States or under the laws of the United States, An estate (other than a foreign estate), or A domestic trust (as defined in Regulations Section 301.7701-7). Exemption from FATCA reporting: If you are submitting this form for an account that is maintained in the United States, you are exempt from FATCA reporting. Please return the completed form to: DID YOU KNOW? You can certify your account online by visiting us at the website on the reverse side of this form. While online, join the thousands of shareholders that have signed up for electronic delivery! Computershare Tax Operations PO Box 505005 Louisville, KY 40233-5005 21UW9_01QDHB_LOU5_WEB

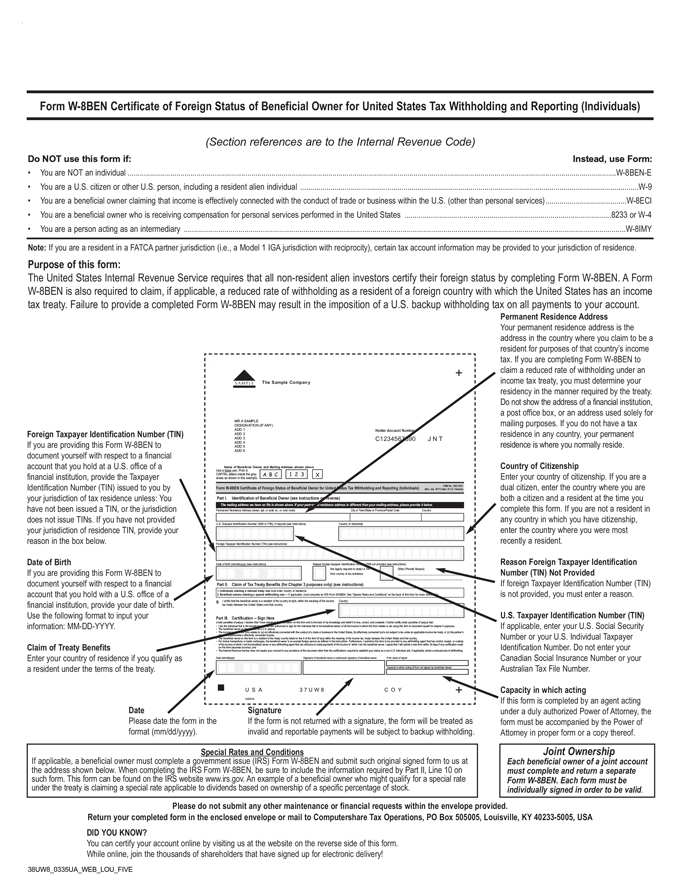

Reset Form Computershare Computershare PO Box 505005 Louisville, KY 40233-5005 www.computershare.com/investor Name of Beneficial Owner and Mailing Address Name Address City, State, Zip Holder Account Number Company Name Use a black pen. Print in CAPITAL letters inside the grey areas as shown in this example. ABC 123 X OMB No. 1545-1621 Form W-8BEN Certificate of Foreign Status of Beneficial Owner for United States Tax Withholding and Reporting (Individuals) (Rev. July. 2017) Dept. of U.S. Treasury Part I. Identification of Beneficial Owner (see instructions on reverse) The mailing address we have on file is shown above. If your permanent residence address is different than your mailing address, please provide it below. Permanent Residence Address (street, apt. or suite no., or rural route) City or Town/State or Province/Postal Code Country U.S. Taxpayer Identification Number (SSN or ITIN), if required (see instructions) Country of citizenship Foreign Taxpayer Identification Number (TIN) (see instructions) Date of birth (mm/dd/yyyy) (see instructions) Reason foreign taxpayer identification number (TIN) not provided (see instructions) Not legally required to obtain a TIN Other (Provide Reason) from country of tax residence Part II. Claim of Tax Treaty Benefits (for Chapter 3 purposes only) (see instructions) 1. Individuals claiming a reduced treaty rate must enter country of residence. 2. Beneficial owners claiming a special withholding rate — if applicable, must complete an IRS Form W-8BEN. See “Special Rates and Conditions” on the back of this form for more information. 9 I certify that the beneficial owner is a resident of the country at right, within the meaning of the income Country tax treaty between the United States and that country. Part III. Certification — Sign Here Under penalties of perjury, I declare that I have examined the information on this form and to the best of my knowledge and belief it is true, correct, and complete. I further certify under penalties of perjury that: I am the individual that is the beneficial owner (or am authorized to sign for the individual that is the beneficial owner) of all the income to which this form relates or am using this form to document myself for chapter 4 purposes, The beneficial owner on this form is not a U.S. person, The income to which this form relates is: (a) not effectively connected with the conduct of a trade or business in the United States, (b) effectively connected but is not subject to tax under an applicable income tax treaty, or (c) the partner’s share of a partnership’s effectively connected income, The beneficial owner on this form is a resident of the treaty country listed on line 9 of the form (if any) within the meaning of the income tax, treaty between the United States and that country, For broker transactions or barter exchanges, the beneficial owner is an exempt foreign person as defined in the instructions. Furthermore, I authorize this form to be provided to any withholding agent that has control, receipt, or custody of the income of which I am the beneficial owner or any withholding agent that can disburse or make payments of the income of which I am the beneficial owner. I agree that I will submit a new form within 30 days if any certification made on this form becomes incorrect, and The Internal Revenue Service does not require your consent to any provisions of this document other than the certifications required to establish your status as a non-U.S. individual and, if applicable, obtain a reduced rate of withholding. Date (mm/dd/yyyy) Signature of beneficial owner or authorized signatory of beneficial owner Print name of signer Capacity in which acting (if form not signed by beneficial owner) Send form to Computershare. Do not send to the IRS (see reverse for mailing instructions). E37UW8 0335TA_WEB_LOU_FIVE

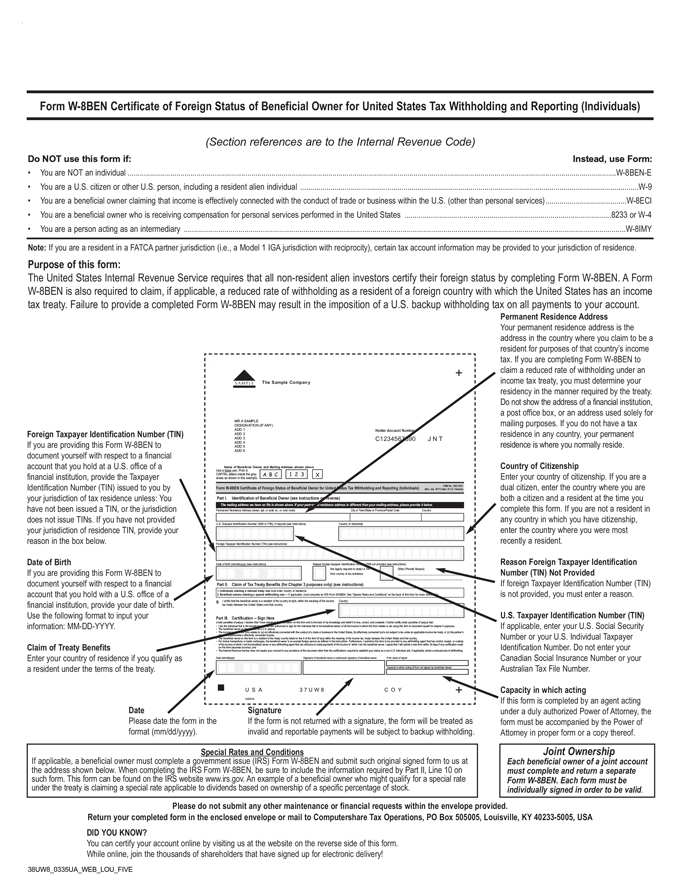

Form W-8BEN Certificate of Foreign Status of Beneficial Owner for United States Tax Withholding and Reporting (Individuals) (Section references are to the Internal Revenue Code) Do NOT use this form if: Instead, use Form: You are NOT an individual W-8BEN-E You are a U.S. citizen or other U.S. person, including a resident alien individual W-9 You are a beneficial owner claiming that income is effectively connected with the conduct of trade or business within the U.S. (other than personal services) W-8ECI You are a beneficial owner who is receiving compensation for personal services performed in the United States 8233 or W-4 You are a person acting as an intermediary W-8IMY Note: If you are a resident in a FATCA partner jurisdiction (i.e., a Model 1 IGA jurisdiction with reciprocity), certain tax account information may be provided to your jurisdiction of residence. Purpose of this form: The United States Internal Revenue Service requires that all non-resident alien investors certify their foreign status by completing Form W-8BEN. A Form W-8BEN is also required to claim, if applicable, a reduced rate of withholding as a resident of a foreign country with which the United States has an income tax treaty. Failure to provide a completed Form W-8BEN may result in the imposition of a U.S. backup withholding tax on all payments to your account. Foreign Taxpayer Identification Number (TIN) If you are providing this Form W-8BEN to document yourself with respect to a financial account that you hold at a U.S. office of a financial institution, provide the Taxpayer Identification Number (TIN) issued to you by your jurisdiction of tax residence unless: You have not been issued a TIN, or the jurisdiction does not issue TINs. If you have not provided your jurisdiction of residence TIN, provide your reason in the box below. Date of Birth If you are providing this Form W-8BEN to document yourself with respect to a financial account that you hold with a U.S. office of a financial institution, provide your date of birth. Use the following format to input your information: MM-DD-YYYY. Claim of Treaty Benefits Enter your country of residence if you qualify as a resident under the terms of the treaty. Date Please date the form in the format (mm/dd/yyyy). Signature If the form is not returned with a signature, the form will be treated as invalid and reportable payments will be subject to backup withholding. Permanent Residence Address Your permanent residence address is the address in the country where you claim to be a resident for purposes of that country’s income tax. If you are completing Form W-8BEN to claim a reduced rate of withholding under an income tax treaty, you must determine your residency in the manner required by the treaty. Do not show the address of a financial institution, a post office box, or an address used solely for mailing purposes. If you do not have a tax residence in any country, your permanent residence is where you normally reside. Country of Citizenship Enter your country of citizenship. If you are a dual citizen, enter the country where you are both a citizen and a resident at the time you complete this form. If you are not a resident in any country in which you have citizenship, enter the country where you were most recently a resident. Reason Foreign Taxpayer Identification Number (TIN) Not Provided If foreign Taxpayer Identification Number (TIN) is not provided, you must enter a reason. U.S. Taxpayer Identification Number (TIN) If applicable, enter your U.S. Social Security Number or your U.S. Individual Taxpayer Identification Number. Do not enter your Canadian Social Insurance Number or your Australian Tax File Number. Capacity in which acting If this form is completed by an agent acting under a duly authorized Power of Attorney, the form must be accompanied by the Power of Attorney in proper form or a copy thereof. Special Rates and Conditions If applicable, a beneficial owner must complete a government issue (IRS) Form W-8BEN and submit such original signed form to us at the address shown below. When completing the IRS Form W-8BEN, be sure to include the information required by Part II, Line 10 on such form. This form can be found on the IRS website www.irs.gov. An example of a beneficial owner who might qualify for a special rate under the treaty is claiming a special rate applicable to dividends based on ownership of a specific percentage of stock. Joint Ownership Each beneficial owner of a joint account must complete and return a separate Form W-8BEN. Each form must be individually signed in order to be valid. Please do not submit any other maintenance or financial requests within the envelope provided. Return your completed form in the enclosed envelope or mail to Computershare Tax Operations, PO Box 505005, Louisville, KY 40233-5005, USA DID YOU KNOW? You can certify your account online by visiting us at the website on the reverse side of this form. While online, join the thousands of shareholders that have signed up for electronic delivery! 38UW8_0335UA_WEB_LOU_FIVE