- INSW Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

DEF 14A Filing

International Seaways (INSW) DEF 14ADefinitive proxy

Filed: 26 Apr 24, 4:17pm

| Check the appropriate box: | |||

| | | ||

| ☐ | | | Preliminary Proxy Statement |

| ☐ | | | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ☒ | | | Definitive Proxy Statement |

| ☐ | | | Definitive Additional Materials |

| ☐ | | | Soliciting Material Pursuant to Sec.240.14a-12 |

| INTERNATIONAL SEAWAYS, INC. |

| (Name of Registrant as Specified In Its Charter) |

| Not Applicable |

| (Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

| ☒ | | | No fee required. |

| ☐ | | | Fee paid previously with preliminary materials. |

| ☐ | | | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11 |

| (1) | Electing the ten (10) director nominees named in the accompanying Proxy Statement, each to serve until the annual meeting of the Company to be held in 2025; |

| (2) | Ratifying the appointment of Ernst & Young LLP as the Company’s independent registered public accounting firm for 2024; and |

| (3) | Approving, by advisory vote, the compensation of the Named Executive Officers for 2023 as described in the accompanying proxy statement: |

| | | By order of the Board of Directors, | |

| | | JAMES D. SMALL III | |

| | | ||

| | | Chief Administrative Officer, Senior Vice President, | |

| | | General Counsel and Secretary | |

| New York, New York | | | |

| April 26, 2024 | | |

| • | the Notice of Annual Meeting of Stockholders of the Company to be held on June 12, 2024; |

| • | the Company’s Proxy Statement for the Annual Meeting; |

| • | the Company’s Annual Report on Form 10-K for the year ended December 31, 2023; and |

| • | the form of proxy card. |

| • | Further built upon on our track record as a disciplined capital allocator |

| • | In a cyclical business such as ours, we believe that disciplined capital allocation requires levers to be pulled at the right times in the cycle. We have a track record of buying vessel assets as low points, voluntarily decreasing our leverage and returning a substantial amount of cash to shareholders. |

| • | We paid out $322 million in returns to our stockholders during 2023 primarily in the form of dividends with $14 million in share repurchases. |

| • | Our three dual-fuel LNG VLCCs were delivered during the first half of 2023 and commenced employment on seven-year time charters with the oil major Shell. |

| • | Completed the $42 million purchase of two 2009-built Aframaxes that were previously bareboat chartered-in at a significant discount to the then current market value of such vessels. |

| • | Continued to maintain our fleet optimization program: |

| • | We sold three 2008-built MRs resulting in net proceeds of approximately $39 million after debt repayment. |

| • | We entered into construction contracts for six dual-fuel ready LR1 product carriers (including two carriers contracted for in April 2024), which are expected to deliver between the second half of 2025 and the third quarter of 2026. The total construction cost for the vessels will be approximately $347 million, which will be paid for through a combination of long-term financing and available liquidity. |

| • | We opportunistically locked in $173 million of minimum revenues (before reduction for brokerage commissions) on non-cancelable time charters with durations of two to three years for one Suezmax, one Aframax and six MRs with charter party expiry dates ranging from February 2025 to June 2026. These charters have increased the contracted future minimum revenues remaining under our time charter agreements (excluding any applicable profit share) to approximately $354 million from January 1, 2024 through charter expiry. |

| • | Executed a number of liquidity enhancing, deleveraging and financing diversification initiatives, including: |

| • | We prepaid $324 million of outstanding debt under our $750 Million Facility Term Loan and COSCO Lease Financing during 2023. This ultimately resulted in the release of 30 vessels from the collateral packages of the respective credit facilities. |

| • | As a result of the principal prepayments made under the $750 Million Facility Term Loan during 2023, the scheduled quarterly principal amortization under the $750 Million Facility Term Loan decreased from $30 million at the beginning of the year to $19 million at the end of the year. |

| • | We entered into a secured $160 million revolving credit facility, which matures on March 27, 2029 and reduces on a 20-year-age-adjusted profile. |

| • | We ended 2023 with undrawn revolving credit facilities of approximately $414 million. |

| • | Environment. Due to the nature of our business, environmental and climate change-related risks are key considerations for us. Greenhouse gas (“GHG”) emissions, which are largely caused by burning fossil fuels, contribute to the warming of the global climate system. Our industry, which is heavily dependent on the burning of fossil fuels, faces the dual challenge of reducing its carbon footprint by transitioning to the use of low-carbon fuels while extending the economic and social benefits of delivering energy to consumers across the globe. We welcome and support efforts to increase transparency and to promote investors’ understanding of how we and our industry peers are addressing the climate change-related risks and opportunities particular to our industry. |

| • | Achieved year-on-year reduction on gross emissions; |

| • | Reported on Scope 2 emissions, which cover purchased energy, heat, cooling, and/or steam at our business locations, for the first time, demonstrating transparency and accountability; |

| • | Took delivery in 2023 of our three dual-fuel LNG VLCC tankers, prioritizing the safety and efficiency training of our seafarers to operate these ships. These tankers exceed today’s standards as well as exceed 2025 targets significantly; |

| • | Implemented operational improvements dedicated to reducing emissions contributing to more sustainable operations; |

| • | In 2022, as we refinanced our senior secured debt, we further enhanced our sustainability-linked features to include seafarer safety metrics, in lost time incident frequency rates, and a measure of our commitment to sustainable principles as demonstrated by “green” capital expenditure, such as investments in energy savings initiatives that in addition reduce emissions; |

| • | Participation on the Board of Directors of the International Tanker Owners Pollution Federation, the leading not-for-profit marine ship pollution response advisors; |

| • | Proactively monitored the regulatory landscape to adapt to evolving environmental and requirements; and |

| • | Specifically considering overall fuel consumption when selecting vessel purchase candidates and ships in our fleet to consider for disposition, in order to reduce our fleet’s contribution to GHG emissions. |

| • | Social. We operate a well-maintained fleet staffed by experienced officers and crews, and we believe that our seafarers are as crucial to our success as the team ashore that supports them. Through our technical and commercial management partners and our own in-house expertise, we have developed a global network to support our seafarers while delivering shipping services safely and effectively to our customers. Our philosophy is one of continual improvement throughout ship and shoreside operations, and we are committed to providing our mariners a safe, high quality place to work in an environment where they can thrive professionally. We maintain a robust safety and compliance culture that reflects the leadership and commitment displayed every day by our senior officers and shoreside staff. Furthermore, we believe in fair and transparent business practices, and we do not tolerate unethical business dealings or facilitation payments. |

| • | Governance. ESG matters are of significant relevance to us, and the Board regularly engages in discussions relating to both ESG risks and opportunities. All of our current directors (other than the Chief Executive Officer and the former Chief Executive Officer of Diamond S) are independent for service on the Board, which includes experts in both shipping and compliance. Our management team, led by the Chief Executive Officer, executes the action plans as approved by the Board and works to manage ESG-related risks and opportunities. We participate in the Marine Anti-Corruption Network, a global business network of over 100 members whose vision is a maritime industry free of corruption that enables fair trade to the benefit of society at large. |

| • | Any stockholder can attend the Annual Meeting live via the Internet at www.virtualshareholdermeeting.com/INSW2024 |

| • | Webcast starts at 2:00 p.m., Eastern Time |

| • | Online check-in is expected to begin at 1:45 p.m., Eastern time, and you should allow up to 15 minutes for the online check-in procedures. |

| • | Stockholders will be able to vote and submit questions while attending the Annual Meeting |

| • | Please have your 16-digit control number to enter the Annual Meeting |

| • | Information on how to attend and participate via the Internet will be posted at www.virtualshareholdermeeting.com/INSW2024 |

Doug Wheat Independent Chairman of the Board Age: 73 Chairman since November 2016 Committee Membership • None | | | Professional Experience | ||||||

| | • | | | Mr. Wheat is currently the Managing Partner of Wheat Investments, LLC, a private investment firm | |||||

| | • | | | From 2007 to 2016, he was the founding and Managing Partner of the private equity company Southlake Equity Group | |||||

| | • | | | From 1992 to 2006, Mr. Wheat was the President of Haas Wheat & Partners (“Haas Wheat”) | |||||

| | • | | | Prior to the formation of Haas Wheat, Mr. Wheat was a founding member of the merchant banking group at Donaldson, Lufkin & Jenrette, where he specialized in leveraged buyout financing | |||||

| | • | | | From 1974 to 1984, Mr. Wheat practiced corporate and securities law in Dallas, Texas | |||||

| | Skills and Expertise | ||||||||

| | • | | | Mr. Wheat’s finance and legal expertise and experience serving on numerous boards of directors make him a valuable asset to the Board | |||||

| | Other Board Experience | ||||||||

| | • | | | Current Public Boards | |||||

| | | | ○ | | | Overseas Shipholding Group, Inc. (“OSG”) (NYSE: OSG) (Chairman) | |||

| | | | ○ | | | AMN Healthcare Services, Inc. (NYSE: AMN) (Chairman since 2007; director since 1999) | |||

| | • | | | Previous Boards & Organizations: Dex Media, Inc. (Vice Chairman); SuperMedia (Chairman prior to merger with Dex One); Playtex Products (Chairman); Dr. Pepper/Seven-Up Companies, Inc.; Dr. Pepper Bottling of the Southwest, Inc.; Walls Industries, Inc.; Alliance Imaging, Inc.; Thermadyne Industries, Inc.; Sybron International Corporation; Nebraska Book Corporation; ALC Communications Corporation; Mother’s Cookies, Inc.; and Stella Cheese Company | |||||

| | Education and Certification | ||||||||

| | • | | | Mr. Wheat received both his Juris Doctor and Bachelor of Science degrees from the University of Kansas | |||||

Darron M. Anderson Independent Director Nominee Age: 55 Committee Membership • None | | | Professional Experience | ||||||

| | • | | | Mr. Anderson currently serves of President and Chief Executive Officer of Stallion Infrastructure Services Ltd., a market leading temporary infrastructure services company supporting many different end-markets including the U.S. oil and gas industry (“Stallion”). | |||||

| | • | | | From March 2017 until 2021 when he became President and Chief Executive Officer of Stallion, Mr. Anderson was President and Chief Executive Officer of Ranger Energy Services, Inc. (“RES”) (NYSE: RNGR), a diversified completion and production services company operating across all major U.S. Shale Basins. Mr. Anderson was responsible for successfully implementing and executing an initial public offering on the NYSE of RES in August 2017. | |||||

| | • | | | Mr. Anderson began his career in the oil and natural gas industry as a drilling engineer for Chevron Corporation in 1998, holding positions of increasing responsibility across U.S. Land, Offshore and Canada. Mr. Anderson resigned from Chevron in 1998 to pursue an entrepreneurial career in oil field services where he spent the last 26 years building successful service organizations focused on land and offshore drilling, completion and production operations. | |||||

| | Skills and Expertise | ||||||||

| | • | | | Mr. Anderson’s extensive leadership experience in the energy industry, particularly in offshore and on land drilling, with an entrepreneurial spirit and mindset, and demonstrated significant visionary, transactional and operational improvement skills, will make him a valuable asset to the Board. | |||||

| | | | |||||||

| | Other Board Experience | ||||||||

| | • | | | Current Public Boards | |||||

| | | | ○ | | | Tidewater, Inc. (NYSE: TDW) | |||

| | • | | | Previous Boards & Organizations: Ranger Energy Services, Inc. (NYSE: RNGR); Sidewinder Drilling, LLC; and Express Energy Services, LLC. | |||||

| | Education and Certification | ||||||||

| | • | | | Mr. Anderson holds a Bachelor of Science in Petroleum Engineering from the University of Texas, Austin. | |||||

Timothy J. Bernlohr Independent Director Age: 65 Director since November 2016 Committee Membership • Compensation (Chair) • Governance | | | Professional Experience | ||||||

| | • | | | Mr. Bernlohr is the Founder and Managing Member of TJB Management Consulting, LLC (“TJB”), which specializes in providing project-specific consulting services to businesses in transformation, including restructurings, interim executive management and strategic planning services | |||||

| | • | | | Prior to founding TJB in 2005, he was the President and Chief Executive Officer of RBX Industries, Inc. (“RBX”), a nationally recognized leader in the design, manufacture and marketing of rubber and plastic materials to the automotive, construction and industrial markets | |||||

| | • | | | Before joining RBX in 1997, Mr. Bernlohr spent 16 years in the International and Industry Products division of Armstrong World Industries and held various management positions | |||||

| | • | | | Mr. Bernlohr has significant experience in both the energy and maritime sectors having served as chairman or director of Petro Rig; Hercules Offshore, Inc.; Aventime Renewable Resources; Trident Resources; San Antonio Oil and Gas S.A.; Windstar Cruise Lines; Senvion S.A.; Edison Mission Energy; and US Power Generating Company. | |||||

| | Skills and Expertise | ||||||||

| | • | | | Mr. Bernlohr’s experience serving as a chief executive of an international manufacturing company and his varied directorship positions make him a valuable asset to the Board | |||||

| | Other Board Experience | ||||||||

| | • | | | Current Public Boards | |||||

| | | | ○ | | | WestRock Company (NYSE: WRK) (Chairman of the Compensation Committee) | |||

| | • | | | Previous Boards & Organizations: Atlas Air Worldwide Holdings, Inc; Chemtura Corporation; Rock-Tenn Company (a predecessor of WestRock Company); Cash Store Financial Services, Inc; Skyline Champion Corporation; OSG; and F45 Training Holdings Inc. | |||||

| | Education and Certification | ||||||||

| | • | | | Mr. Bernlohr is a graduate of Pennsylvania State University | |||||

Ian T. Blackley Independent Director Age: 69 Director since July 2013 Committees Membership • Audit • Governance | | | Professional Experience | ||||||

| | • | | | Mr. Blackley was the President and Chief Executive Officer of OSG (the former parent corporation of the Company) from January 2015 until his retirement in December 2016 | |||||

| | • | | | From September 2014 to November 2016, Mr. Blackley was the Senior Vice President and Chief Financial Officer of the Company | |||||

| | • | | | After joining OSG in 1991, Mr. Blackley held numerous operating and financial positions before he was appointed President and Chief Executive Officer, including Executive Vice President and Chief Operating Officer (from December 2014 to January 2015), Senior Vice President (from May 2009 to December 2014), Chief Financial Officer (from April 2013 to December 2014) and Head of International Shipping (from January 2009 to April 2013) | |||||

| | • | | | Mr. Blackley began his seagoing career in 1971, serving as a captain from 1987 to 1991 | |||||

| | Skills and Expertise | ||||||||

| | • | | | Mr. Blackley’s extensive experience both with the shipping industry generally, and the Company in particular, makes him a valuable asset to the Board | |||||

| | Other Board Experience | ||||||||

| | • | | | Mr. Blackley does not currently serve on other public company boards | |||||

| | • | | | Previous Boards & Organizations: Gard P.& I. (Bermuda) Ltd.; OSG (including the Company as a wholly-owned subsidiary) | |||||

| | Education and Certification | ||||||||

| | • | | | Mr. Blackley holds a diploma in Nautical Science from Glasgow College of Nautical Studies and a Master Mariner Class I license | |||||

A. Kate Blankenship Independent Director Age: 59 Director since July 2021 Committees Membership • Audit • Compensation | | | Professional Experience | ||||||

| | • | | | Mrs. Blankenship served as Chief Accounting Officer and Company Secretary of Frontline Ltd. from 1994 to 2005 | |||||

| | Skills and Expertise | ||||||||

| | • | | | Mrs. Blankenship’s substantial experience in international shipping as an accountant and a director makes her a valuable asset to the Board | |||||

| | Other Board Experience | ||||||||

| | • | | | Current Public Boards | |||||

| | | | ○ | | | Borr Drilling Limited (NYSE: BORR) (Chair of the Audit Committee and Compensation Committee) | |||

| | | | ○ | | | 2020 Bulkers Ltd. (OSE: 2020) | |||

| | • | | | Previous Boards & Organizations: Diamond S Shipping Inc. (“Diamond S”) (until merger with the Company); Eagle Bulk Shipping Inc.; North Atlantic Drilling Ltd.; Archer Limited; Golden Ocean Group Limited; Frontline Ltd.; Avance Gas Holding Limited; Ship Finance International Limited; Golar LNG Limited; Golar LNG Partners LP; Seadrill Limited; and Seadrill Partners LLC | |||||

| | Education and Certification | ||||||||

| | • | | | Mrs. Blankenship has a Bachelor of Commerce degree from the University of Birmingham | |||||

| | • | | | Mrs. Blankenship is also a Member of the Institute of Chartered Accountants of England and Wales | |||||

Randee E. Day Independent Director Age: 76 Director since November 2016 Committees Membership • Audit (Chair) • Compensation | | | Professional Experience | ||||||

| | • | | | Ms. Day is President and Chief Executive Officer of Day & Partners, LLC, a maritime consulting and advisory company | |||||

| | • | | | From 2020 until June 2022, she was also a senior advisor to Teneo, a global capital advisory and restructuring firm | |||||

| | • | | | Prior to founding Day & Partners, LLC in 2011, Ms. Day served as interim Chief Executive Officer of DHT Holdings Inc. (NYSE: DHT) | |||||

| | • | | | Ms. Day was previously a Managing Director at the Seabury Group, a transportation advisory firm, the Division Head of JP Morgan’s shipping group in New York, and has additional banking experience at Continental Illinois National Bank, Bank of America and the Export-Import Bank of the United States | |||||

| | Skills and Expertise | ||||||||

| | • | | | Ms. Day’s extensive experience in the shipping and banking industries makes her a valuable asset to the Board | |||||

| | Other Board Experience | ||||||||

| | • | | | Ms. Day does not currently serve on other public company boards. | |||||

| | • | | | Previous Boards & Organizations: DHT Holdings, Inc.; TBS International, Inc.; Tidewater, Inc.; Ocean Rig ASA; Excel Maritime Carriers Inc.; and Eagle Bulk Shipping Inc. | |||||

| | Education and Certification | ||||||||

| | • | | | Ms. Day is a graduate of the School of International Relations at the University of Southern California and did graduate studies at George Washington University | |||||

| | • | | | Ms. Day is also a graduate of the Senior Executives in National and International Security Program at the Kennedy School at Harvard University | |||||

David I. Greenberg Independent Director Age: 70 Director since June 2017 Committee Membership • Audit • Governance (Chair) | | | Professional Experience | |||

| | • | | | Mr. Greenberg is a Managing Director of Cortina Partners LLC, a private equity firm that invests in and manages companies in the textile, health care, communications, and medical transportation and bedding industries | ||

| | • | | | From 2017 to March 2022, Mr. Greenberg was Special Advisor (and from 2008 through 2016 was a member of the Executive Committee) for LRN Corporation, serving as Chief Executive Officer during 2020. LRN advises global companies on governance, ethics, compliance, culture and strategy issues | ||

| | • | | | For 20 years prior to 2008, Mr. Greenberg served in various senior positions at Altria Group, Inc. (then the parent company of Phillip Morris USA), Phillip Morris International, Kraft Foods and Miller Brewing — culminating in his role as Senior Vice President, Chief Compliance Officer and a member of the Corporate Management Committee | ||

| | • | | | Earlier in his career, Mr. Greenberg was a partner in the Washington, D.C. law firm of Arnold & Porter | ||

| | Skills and Expertise | |||||

| | • | | | Mr. Greenberg’s investment and legal experience, particularly with respect to governance-related matters, makes him a valuable asset to the Board | ||

| | Other Board Experience | |||||

| | • | | | Mr. Greenberg does not currently serve on other public company boards | ||

| | • | | | Other Boards & Organizations: Adventure Genie, Inc. (Chairman); Acqua Recovery (Chairman) | ||

| | Education and Certification | |||||

| | • | | | Mr. Greenberg attended Williams College and has Juris Doctor and Master of Business Administration degrees from the University of Chicago | ||

Kristian K. Johansen Independent Director Nominee Age: 52 Director Nominee Committee Membership • None | | | Professional Experience | ||||||

| | • | | | Mr. Johansen currently serves as the Chief Executive Officer of TGS ASA (“TGS”) (Oslo Stock Exchange (“OSE”): TGS), a leading energy data and intelligence company. Prior to being appointed to his current position in TGS in March 2016, Mr. Johansen held several senior executive positions at TGS, including Chief Operating Officer from 2015 to 2016 and Chief Financial Officer from 2010 to 2015. | |||||

| | • | | | Prior to joining TGS, Mr. Johansen served as an Associate Director of Danske Markets Inc., a Norwegian investment firm from 2000 to 2005, Executive Vice President and Chief Financial Officer of AF Gruppen ASA, a public Norwegian engineering and construction company from 2005 to 2007 and as Executive Vice President and Chief Financial Officer of EDB Business Partner ASA (formerly OSE: TIETO), a Norwegian information technology company, from 2007 to 2010. | |||||

| | Skills and Experience | ||||||||

| | • | | | Mr. Johansen’s wide experience of executive and board positions in the global energy industry, combined with international finance and capital markets knowledge, will make him a valuable asset to the Board. | |||||

| | Other Board Experience | ||||||||

| | • | | | Current Public Boards | |||||

| | | | ○ | | | Valaris Limited (NYSE: VAL), an offshore drilling contractor | |||

| | • | | | Other Boards & Organizations: | |||||

| | | | Previous Boards & Organizations: Prosafe SE; Agrinos ASA; and Seven Drilling ASA. | ||||||

| | Education and Certification | ||||||||

| | • | | | Mr. Johansen has a Bachelor and Masters degree in Business Administration from the University of New Mexico. | |||||

Craig H. Stevenson, Jr. Director Age: 70 Director since July 2021 Committee Membership • None | | | Professional Experience | |||

| | • | | | Mr. Stevenson served as a consultant to the Company from the merger with Diamond S until January 2022 | ||

| | • | | | From March 2019 until the merger, he served as Chief Executive Officer, President and director of Diamond S | ||

| | • | | | Mr. Stevenson founded DSS Holdings L.P. (“DSS LP”), the predecessor of Diamond S, in 2007 and served as its Chief Executive Officer, President and a member of its board of directors since its establishment | ||

| | • | | | Mr. Stevenson was previously the Chairman of the Board and Chief Executive Officer of OMI Corporation and oversaw its sale in 2007, having first joined in 1993 as Senior Vice President – Commercial | ||

| | Skills and Expertise | |||||

| | • | | | Mr. Stevenson’s substantial experience and expertise in the shipping industry and knowledge of Diamond S’ affairs as its former Chief Executive Officer and President make him a valuable asset to the Board | ||

| | Other Board Experience | |||||

| | • | | | Mr. Stevenson does not currently serve on other public company boards | ||

| | • | | | Other Boards & Organizations: American Bureau of Shipping; Previous Boards & Organizations: Diamond S (until merger with the Company); SFL Corporation Limited (formerly named Ship Finance International Limited) (Non-Executive Chairman and subsequently director); Intermarine (Non-Executive Chairman) | ||

| | Education and Certification | |||||

| | • | | | Mr. Stevenson attended Lamar University, where he graduated with a degree in business administration | ||

Lois K. Zabrocky Director, President & Chief Executive Officer Age: 54 Director since May 2018 Committee Membership • None | | | Professional Experience | ||||||

| | • | | | Ms. Zabrocky has been the President and Chief Executive Officer of the Company since the spin-off from OSG on November 30, 2016 (the “Spin-Off”). Under her leadership, the Company’s operating and newbuilding fleet has grown from 55 vessels (including six vessels held by joint ventures) to more than 80 vessels and the Company’s revenues have increased from under $300 million to more than $1 billion. | |||||

| | • | | | Prior to the Spin-Off, Ms. Zabrocky served as Co-President and Head of the International Flag Strategic Business Unit of OSG, where she was responsible for the strategic plan and profit and loss performance of OSG’s international tanker fleet. | |||||

| | • | | | Ms. Zabrocky previously served in various roles during her more than 25 years at OSG, including Senior Vice President, Chief Commercial Officer of the International Flag Strategic Business Unit, and Head of the International Product Carrier and Gas Strategic Business Unit | |||||

| | Skills and Expertise | ||||||||

| | • | | | Ms. Zabrocky’s long experience with the Company and the shipping industry makes her a valuable asset to the Board | |||||

| | Other Board Experience | ||||||||

| | • | | | Current Public Boards | |||||

| | | | ○ | | | Tidewater, Inc. (NYSE: TDW) | |||

| | • | | | Other Boards & Organizations: Gard P. & I. (Bermuda) Ltd.; ITOPF Limited, a not-for-profit ship pollution advisor providing advice worldwide on responses to spills of oil, chemicals and other substances at sea; the Company (as a wholly-owned subsidiary of OSG) | |||||

| | Education and Certification | ||||||||

| | • | | | Ms. Zabrocky holds a Bachelor of Science degree from the United States Merchant Marine Academy and holds a Third Mate’s License | |||||

| | • | | | She has also completed the Harvard Business School Strategic Negotiations and Finance for Senior Executives courses | |||||

| | | Fees earned or Paid in Cash ($)(1) | | | Stock Awards ($)(2) | | | Change in Pension Value and Nonqualified Deferred Compensation Earnings ($) | | | All Other Compensation ($) | | | Total ($) | |

| Timothy J. Bernlohr | | | 108,250 | | | 100,000 | | | — | | | — | | | 208,250 |

| Ian T. Blackley | | | 98,250 | | | 100,000 | | | — | | | — | | | 198,250 |

| A. Kate Blankenship | | | 90,000 | | | 100,000 | | | — | | | — | | | 190,000 |

| Randee E. Day | | | 112,500 | | | 100,000 | | | — | | | — | | | 212,500 |

| David I. Greenberg | | | 110,000 | | | 100,000 | | | — | | | — | | | 210,000 |

| Joseph I. Kronsberg | | | 80,000 | | | 100,000 | | | — | | | — | | | 180,000 |

Nadim Z. Qureshi(3) | | | 90,000 | | | 100,000 | | | — | | | — | | | 190,000 |

| Craig H. Stevenson, Jr. | | | 80,000 | | | 100,000 | | | — | | | — | | | 180,000 |

| Douglas D. Wheat | | | 172,000 | | | 220,000 | | | — | | | — | | | 392,000 |

| (1) | Consists of annual Board fees, annual Board Chairman and annual Chairman of the Audit, Compensation and Governance Committees fees, and annual committee member fees. |

| (2) | Stock awards are calculated at grant date fair value in accordance with FASB Topic 718. As of December 31, 2023, the Chairman of the Board held 5,798 shares or unvested restricted shares of Common Stock and, as of such date, each non-employee director held 2,635 shares of unvested restricted shares of Common Stock, for an aggregate of 26,878 shares of unvested restricted shares of Common Stock at 2023 year end. |

| (3) | Mr. Qureshi resigned as a director on February 19, 2024. In connection with his resignation, the Company and Mr. Qureshi entered into an agreement under which, among other matters, the Company accelerated the vesting of Mr. Qureshi’s 2023 stock award of 2,635 shares of Common Stock (having a fair market value at the time of the award of $100,000), the Company will not seek any reimbursement of the cash director fees paid to Mr. Qureshi in advance for the first quarter of 2024 and Mr. Qureshi agreed not to (i) compete with the Company’s crude and product tanker operations for a one year period commencing on the date of his resignation and (ii) solicit any employee of the Company or retain the services of any such employee for a two year period commencing on the date of his resignation. |

| • | A Code of Business Conduct and Ethics, which is an integral part of the Company’s business conduct compliance program and embodies the commitment of the Company and its subsidiaries to conduct operations in accordance with the highest legal and ethical standards. The Code of Business Conduct and Ethics applies to all of the Company’s officers, directors and employees. Each is responsible for understanding and complying with the Code of Business Conduct and Ethics. |

| • | An Insider Trading Policy which prohibits the Company’s directors and employees from purchasing or selling securities of the Company while in possession of material nonpublic information or otherwise using such information for their personal benefit. The Insider Trading Policy also prohibits the Company’s directors and employees from hedging or pledging their ownership of securities of the Company. |

| • | An Anti-Bribery and Corruption Policy which memorializes the Company’s commitment to adhere faithfully to both the letter and spirit of all applicable anti-bribery legislation in the conduct of the Company’s business activities worldwide. |

| • | An Incentive Compensation Recoupment Policy under which, depending on the circumstances, (i) executive officers of the Company are required to repay or return erroneously awarded compensation to the Company in accordance with clawback rules under the 1934 Act and New York Stock Exchange listing standards and (ii) officers of the Company, in the good faith discretion of the Board of Directors or the Compensation Committee, are required to repay all or a portion of incentive compensation paid to them by the Company. |

| • | judgment, character, age, integrity, expertise, tenure on the Board, skills and knowledge useful to the oversight of the Company’s business; |

| • | status as “independent” or an “audit committee financial expert” or “financially literate” as defined by the NYSE or the SEC; |

| • | high level managerial, business or other relevant experience, including, but not limited to, experience in the industries in which the Company operates, and, if the candidate is an existing member of the Board, any change in the member’s principal occupation or business associations; |

| • | absence of conflicts of interest with the Company; and |

| • | ability and willingness of the candidate to spend a sufficient amount of time and energy in furtherance of Board matters. |

| | | International Seaways, Inc. Audit Committee: | |

| | | ||

| | | Randee E. Day, Chair | |

| | | A. Kate Blankenship | |

| | | Ian T. Blackley | |

| | | David I. Greenberg | |

| | | April 26, 2024 |

| • | Audit Fees. Audit fees incurred by the Company to EY were $1,251,200 in 2023 and $1,233,000 in 2022. Audit fees incurred by the Company to EY for 2023 and 2022 include fees for professional services rendered for the audit of the Company’s annual financial statements for the years ended December 31, 2023 and 2022; the review of the financial statements included in the Company’s Forms 10-Q for the respective quarters in the years ended December 31, 2023 and 2022; financial audits and reviews for certain of the Company’s subsidiaries and expenses incurred related to the performance of the services noted above. |

| • | Audit-Related Fees. Audit-related fees incurred by the Company to EY in 2023 were $100,000 and in 2022 were $120,000, all for services associated with the Company’s registration statement filings. |

| • | Tax Fees. Tax fees incurred by the Company to EY were $15,000 in 2023 and $23,600 in 2022. Tax fees relate to the preparation of certain foreign tax returns. |

| • | All Other Fees. There were no other fees incurred by the Company to EY in 2023 and 2022. |

| • | Attract, motivate, retain and reward highly-talented executives and managers, whose leadership and expertise are critical to the Company’s overall growth and success; |

| • | Compensate each executive based upon the scope and impact of his or her position as it relates to achieving the Company’s corporate goals and objectives, as well as on the potential of each executive to assume increasing responsibility within the Company; |

| • | Align the interests of the Company’s executives with those of its stockholders by linking incentive compensation rewards to the achievement of performance goals that maximize stockholder value; and |

| • | Reward the achievement of both the short-term and long-term strategic objectives necessary for sustained optimal business performance. |

| Incumbent | | | NEOs Position |

| Lois K. Zabrocky | | | President and Chief Executive Officer (“CEO”) |

| Jeffrey D. Pribor | | | Chief Financial Officer (“CFO”), Senior Vice President and Treasurer |

| James D. Small III | | | Chief Administrative Officer, Senior Vice President, General Counsel & Secretary |

| Derek G. Solon | | | Senior Vice President (Chief Commercial Officer) |

| William F. Nugent | | | Senior Vice President (Chief Technical and Sustainability Officer) |

| COMPENSATION PROGRAM OBJECTIVES | |||||||||

| Overall Objectives | | | • | | | Attract, motivate, retain and reward highly talented executives and managers, whose leadership and expertise are critical to our overall growth and success. | |||

| | | | | | |||||

| | | • | | | Align the interests of our executives with those of our stockholders. | ||||

| | | | | | |||||

| | | • | | | Support the long-term retention of the Company’s executives to maximize opportunities for teamwork, continuity of management and overall effectiveness. | ||||

| | | | | | |||||

| | | • | | | Compensate each executive competitively (1) within the marketplace for talent in which we operate; (2) based upon the scope and impact of his or her position as it relates to achieving our corporate goals and objectives; and (3) based on the potential of each executive to assume increasing responsibility within the Company. | ||||

| | | | | | |||||

| | | • | | | Discourage excessive and imprudent risk-taking. | ||||

| | | | | | |||||

| | | • | | | Structure the total compensation program to reward the achievement of both the short-term and long-term strategic objectives necessary for sustained optimal business performance. | ||||

| | | | | | | ||||

| Pay Mix Objectives | | | • | | | Provide a mix of both fixed and variable (“at-risk”) compensation, each of which has a different time horizon and payout form (cash and equity), to reward the achievement of annual and sustained, long-term performance. For the 2023 fiscal year, the pay mix at target for the Chief Executive Officer and the average for the other NEOs is displayed below. | |||

| | | | | | | ||||

| Pay-For-Performance Objectives | | | • | | | Use our incentive compensation program and plans to align the interests of our executives with those of our stockholders by linking incentive compensation rewards to the achievement of performance goals that maximize stockholder value by: | |||

| | | | | | | ||||

| | | | | – | | | Ensuring our compensation programs are consistent with, and supportive of, our short-term and long-term strategic, operating and financial objectives. | ||

| | | | | | | ||||

| | | | | – | | | Placing a significant portion of our executives’ compensation at risk, with payouts dependent on the achievement of both corporate and individual performance goals, which are set annually by the Compensation Committee. | ||

| | | | | | | ||||

| | | | | – | | | Encouraging balanced performance by employing a variety of performance measures to avoid over-emphasis on the short-term or any one metric. | ||

| | | | | | | ||||

| | | | | – | | | Applying judgment and reasonable discretion in making compensation decisions to avoid relying solely on formulaic program design, taking into account both what has been accomplished and how it has been accomplished in light of the existing commercial environment. | ||

| WHAT WE DO | | | |

| | | ||

| Pay For Performance | | | We align the interests of our executives and stockholders using performance-based annual cash incentive compensation and service and performance-based long-term cash and equity incentive compensation. |

| | | ||

| Compensation Benchmarking | | | We compare our executives’ total compensation to a consistent peer group for comparable market data. We evaluate that peer group annually to ensure that it remains appropriate, and we add or remove peers only when our Compensation Committee determines, with the advice of its independent compensation consultant, it is clearly warranted. |

| | | ||

| Stock Ownership Guidelines | | | We maintain and track progress against, stock ownership guidelines for our executives and non-employee directors. |

| | | ||

| Anti-Hedging and Anti-Pledging Policies | | | We maintain policies and procedures for transactions in the Company’s securities that are designed to ensure compliance with all insider trading rules and that prohibit all hedging, pledging and short selling of our stock by all directors, officers and employees. |

| | | ||

| Compensation Recoupment Policy | | | Our Incentive Compensation Recoupment Policy, all of our incentive compensation plans and the terms of our equity agreements describe the circumstances pursuant to which (i) Executive Officers are required to repay or return erroneously awarded compensation to the Company in accordance with clawback rules under the 1934 Act and New York Stock Exchange listing standards or (ii) the Board of Directors or the Compensation Committee may, in its good faith discretion, require officers to repay to the Company all or a portion of incentive compensation they receive. |

| | | ||

| Annual Risk Assessment | | | We conduct an annual comprehensive risk analysis of our executive compensation program with our independent compensation consultant to ensure that our program does not encourage inappropriate risk-taking. |

| | | ||

| Independent Compensation Consultant | | | Our Compensation Committee engages an independent compensation consultant to review and provide recommendations regarding our executive compensation program. |

| WHAT WE DO NOT DO | | | |

| | | ||

| Automatic Salary Increases & Bonus Payments | | | We do not provide for automatic salary or bonus increases. |

| | | ||

| Excise Tax Gross-Ups | | | We do not provide for any tax gross-ups. |

| | | ||

| Executive Benefits / Perquisites | | | We do not maintain any defined benefit or active supplemental retirement plan; nor do we provide other personal benefits or perquisites to our named executive officers that are not available to all employees other than excess liability insurance coverage. |

| | | ||

| Supplemental Executive Retirement Plans (“SERPs”) | | | We do not provide any SERPs. |

| | | ||

| Dividends | | | We do not pay dividends on unvested equity awards (other than restricted stock) until, and only to the extent, those awards vest. |

| | | ||

| Long-Term Incentive Plan | | | Our long-term equity incentive plan prohibits liberal share recycling and repricing or buyouts of underwater options or stock appreciation rights without stockholder approval. |

| Algoma Central Corporation | | | Genesis Energy, L.P. |

| DHT Holdings, Inc. | | | Kirby Corporation |

| Dorian LPG Ltd. | | | Matson, Inc. |

| Eagle Bulk Shipping Inc. | | | Pangaea Logistics Solutions, Ltd. |

| Euronav NV | | | Tidewater Inc. |

| Genco Shipping & Trading Limited | | | TORM plc |

| Algoma Central Corporation | | | Genesis Energy, L.P. |

| Dorian LPG Ltd. | | | Kirby Corporation |

| Eagle Bulk Shipping Inc. | | | Matson, Inc. |

| Euronav NV | | | Tidewater Inc. |

| Genco Shipping & Trading Limited | | | TORM plc |

| • | Base salary |

| • | Annual (performance-based cash) incentive compensation |

| • | Long-term (equity) incentive compensation |

| • | Severance arrangements |

| • | Retirement benefits generally available to all employees |

| • | Welfare and similar benefits (e.g., medical, dental, disability and life insurance) available to all employees |

| Name | | | Position | | | 2023 Salary |

| Lois K. Zabrocky | | | President and Chief Executive Officer | | | $750,000 |

| Jeffrey D. Pribor | | | Chief Financial Officer, Senior Vice President and Treasurer | | | $580,000 |

| James D. Small III | | | Chief Administrative Officer, Senior Vice President, General Counsel & Secretary | | | $530,000 |

| Derek G. Solon | | | Senior Vice President (Chief Commercial Officer) | | | $410,000 |

| William F. Nugent | | | Senior Vice President (Chief Technical and Sustainability Officer) | | | $410,000 |

| (Dollars in thousands) | | | |

| Income from vessel operations | | | $615,431 |

| Depreciation and amortization | | | 129,038 |

| Gain on sale of vessels, net | | | (35,934) |

| Third-party debt modification fees | | | 568 |

| Legal and consulting expenses for shareholder activism-related matters | | | 1,392 |

| Non-cash stock compensation expense | | | 8,518 |

| Non-cash amortization of a prepaid Directors and officers run off policy related to the Merger | | | 600 |

| Non-cash rent expense | | | 811 |

| | | 720,423 | |

| Drydock expenditures | | | (35,117) |

| Vessel expenditures (excluding $192.4 million of newbuild and vessel purchase costs) | | | (14,875) |

| Earnings from Shipping Operations (ESO) | | | $670,431 |

| Individual | | | Company ESO | | | Business/ Operational Metrics | | | Individual Performance Goals |

| Ms. Zabrocky | | | 60% | | | 15% | | | 25% |

| Messrs. Pribor and Small | | | 60% | | | 10% | | | 30% |

| Messrs. Solon and Nugent | | | 33.3% | | | 33.3% | | | 33.4% |

| • | For ESO achievement, the performance factor (i.e., payout) can range from 0% to a maximum of 150% (corresponding to a 130% ESO achievement level, as detailed below). |

| • | For the business/operational metrics and individual performance goals, the payout can range from 0% to a maximum of 130% (corresponding with actual achievement level). |

| • | If the achievement level for ESO is below 70%, the payout on the commercial and operational metrics cannot exceed its target (100%) and the payout on the individual performance goals component (MBO) cannot exceed 50% of the individual performance goals (MBO) target. |

| • | If the achievement level for the business/operational metrics is below 70%, the performance factor (payout) for this measure is zero, resulting in no bonus being payable in respect of this measure. |

| • | If the individual performance achievement level for any NEO is below 70%, it would result in no bonus being payable on this metric. |

| ($ Thousands) | | | | | ESO Threshold | |

Performance Factor (Payout As a % of Target) | | | % Achievement | | | 2023 |

| 50.00% | | | 70% | | | 109,700 |

| 58.40% | | | 75% | | | 136,141 |

| 66.70% | | | 80% | | | 162,582 |

| 75.00% | | | 85% | | | 189,023 |

| 83.30% | | | 90% | | | 215,464 |

| 91.70% | | | 95% | | | 241,905 |

| 100.0% | | | 100% | | | 268,346 |

| 108.4% | | | 105% | | | 294,787 |

| 116.7% | | | 110% | | | 321,228 |

| 125.0% | | | 115% | | | 347,669 |

| 133.3% | | | 120% | | | 374,110 |

| 141.7% | | | 125% | | | 400,551 |

| 150.0% | | | 130% | | | 426,992 |

| • | Identifying, developing and executing business strategy; |

| • | Achieving revenue, operating expenses and general and administrative expense targets; |

| • | Enhancing lines of communication with key customers and investors; |

| • | Evaluating and executing strategic alternatives; merging and integrating where needed; |

| • | Evaluating financial initiatives, capital allocation choices and balance sheet recapitalization; |

| • | Further establishing and executing ESG initiatives, including the Company’s “get to green” initiative; |

| • | Reviewing and identifying operational risks and performing risk assessments; and |

| • | Assessing and engaging in special projects, including additional fleet renewal assessments, business development, scrubber technology implementation and maintenance, capital management, leadership development, ensuring ethics throughout the organization, insurance projects, risk management, disaster planning, contingency planning, succession planning, cyber security protection and projects, compensation planning and financial strategy and reporting. |

| Incumbent | | | Total Grant Date Value | | | Stock Options | | | Time-Based RSUs | | | Performance- Based RSUs |

| Lois K. Zabrocky | | | $1,875,000 | | | $— | | | $937,500 | | | $937,500 |

| Jeffrey D. Pribor | | | $1,015,000 | | | $— | | | $507,500 | | | $507,500 |

| James D. Small III | | | $662,500 | | | $— | | | $331,250 | | | $331,250 |

| Derek G. Solon | | | $512,500 | | | $— | | | $256,250 | | | $256,250 |

| William F. Nugent | | | $512,500 | | | $— | | | $256,250 | | | $256,250 |

| • | The cumulative target ROIC for the three-year period is 8.57% (with a minimum threshold performance achievement of 5.57% resulting in 50% of the applicable PRSUs vesting, and a maximum performance achievement of 11.57% resulting in 150% of the applicable PRSUs vesting). |

| • | TSR performance is described in the following table. If the absolute value of three-year TSR is negative, then the payout for the TSR component of the PRSUs is capped at 100%. |

| TSR | | | Threshold | | | Target | | | Maximum |

| Performance Achievement | | | 25th Percentile | | | 50th Percentile | | | 90th Percentile |

| Payout | | | 50% | | | 100% | | | 150% |

| • | any earned, unpaid base salary through the date of termination; |

| • | any earned, unpaid annual bonus applicable to the performance year prior to the termination; |

| • | reimbursement of any business expenses not reimbursed as of the date of termination. |

Name and Current Position | | | Date of Original Agreement | | | Base Salary at 12/31/2023 | | | Bonus Target at 12/31/2023 | | | Additional Terms / Amendments to Employment Agreements in 2023 and 2024 | ||||||

Lois K. Zabrocky President and CEO | | | 9/29/14 (originally entered into with OSG; assumed in Spin-Off) | | | $750,000 (increasing to $800,000 for 2024) | | | 125% | | | • | | | Severance benefits in the event of termination without cause or resignation with good reason include: | |||

| | | | ○ | | | salary continuation for 24 months | ||||||||||||

| | | | ○ | | | a lump sum payment of $1,049,999 | ||||||||||||

| | | | ○ | | | accelerated vesting of all outstanding and unvested options, RSUs and other equity-based grants or cash in lieu of grants that in all cases are not performance-based upon a termination without cause, for good reason, by death or disability; performance-based awards will be treated as set out below in the “Potential Payments Upon Termination and Change in Control” section | ||||||||||||

| | • | | | Equity grant target set at 250% of base salary for 2023 and 2024. | ||||||||||||||

| | • | | | Amended as of March 8, 2023 to increase base salary for 2023 to $750,000 | ||||||||||||||

| | • | | | Amended as of March 14, 2024 to increase base salary for 2024 to $800,000. | ||||||||||||||

| | | | | | | | | | | | | |||||||

Jeffrey D. Pribor Senior Vice President, CFO and Treasurer | | | 11/9/16 | | | $580,000 (increasing to $610,000 for 2024) | | | 100% | | | • | | | Severance benefits in the event of termination without cause or resignation with good reason include: | |||

| | | | ○ | | | 12 months’ continuation of annual base salary plus Target Bonus (18 months’ in the event of a change in control) | ||||||||||||

| | | | ○ | | | a lump sum payment of a pro rata portion of his annual bonus based on actual achievement | ||||||||||||

| | | | ○ | | | accelerated vesting of the outstanding time-based awards that would have vested on the next regularly scheduled vesting date following the termination date | ||||||||||||

| | | | ○ | | | pro-rated vesting of all performance-based RSUs and other equity-based grants, to the extent the applicable performance goals are achieved | ||||||||||||

| | • | | | Amended as of March 8, 2023 to increase base salary for 2023 to $580,000. | ||||||||||||||

| | • | | | Amended as of March 8, 2023 to increase equity grant target to 175% of base salary. | ||||||||||||||

| | • | | | Amended as of March 14, 2024 to increase base salary for 2024 to $610,000. | ||||||||||||||

Name and Current Position | | | Date of Original Agreement | | | Base Salary at 12/31/2023 | | | Bonus Target at 12/31/2023 | | | Additional Terms / Amendments to Employment Agreements in 2023 and 2024 | ||||||

James D. Small III Senior Vice President, Chief Administrative Officer, Secretary & General Counsel | | | 2/13/15 (originally entered into with OSG; assumed in Spin-Off) | | | $530,000 (increasing to $555,000 for 2024) | | | 100% | | | • | | | Severance benefits in the event of termination without cause or resignation with good reason include: | |||

| | | | ○ | | | salary continuation for 24 months | ||||||||||||

| | | | | | | | | | ○ | | | a lump sum payment of $950,000 | ||||||

| | | | | | | | | | ○ | | | accelerated vesting of all outstanding and unvested time-based options, RSUs and other equity-based grants upon a termination without cause, for good reason, by death or disability; performance-based awards will be treated as set out below in the “Potential Payments Upon Termination and Change in Control” section | ||||||

| | | | | | | | • | | | Amended as of March 8, 2023 to increase base salary for 2023 to $530,000 | ||||||||

| | | | | | | | • | | | Amended as of March 14, 2024 to increase base salary for 2024 to $555,000. | ||||||||

| • | President and CEO — 5 × base salary |

| • | Senior Vice Presidents — 2 x base salary |

| • | Vice Presidents — 1 x base salary |

| • | Independent Non-Employee Directors — 3 x annual board service cash retainer |

| | | Compensation Committee: | |

| | | ||

| | | Timothy J. Bernlohr, Chair | |

| | | Randee E. Day | |

| | | A. Kate Blankenship | |

| | | ||

| | | April 26, 2024 |

Name and Principal Position | | | Year | | | Salary(1) | | | Bonus | | | Stock Awards(2)(3) | | | Option Awards | | | Non-Equity Incentive Plan Compensation(4) | | | Change in Pension Value and Nonqualified Deferred Compensation Earnings | | | All Other Compensation(5) | | | Total |

| Lois Zabrocky President and Chief Executive Officer | | | 2023 | | | $748,973 | | | $— | | | $2,028,776 | | | $— | | | $1,231,242 | | | $— | | | $266,375 | | | $4,275,366 |

| | | 2022 | | | $696,185 | | | $— | | | $3,497,628 | | | $— | | | $1,165,490 | | | $— | | | $49,844 | | | $5,409,147 | |

| | | 2021 | | | $675,000 | | | $— | | | $1,136,956 | | | $562,494 | | | $633,302 | | | $— | | | $44,798 | | | $3,052,550 | |

| | | | | | | | | | | | | | | | | | | | |||||||||

| Jeffrey D. Pribor Senior Vice President, Chief Financial Officer and Treasurer | | | 2023 | | | $579,365 | | | $— | | | $1,098,219 | | | $— | | | $765,559 | | | $— | | | $37,826 | | | $2,480,969 |

| | | 2022 | | | $546,673 | | | $— | | | $1,526,674 | | | $— | | | $734,982 | | | $— | | | $38,398 | | | $2,846,727 | |

| | | 2021 | | | $529,692 | | | $— | | | $535,610 | | | $264,993 | | | $398,942 | | | $— | | | $34,411 | | | $1,763,648 | |

| | | | | | | | | | | | | | | | | | | | |||||||||

| James D. Small III Senior Vice President, Chief Administrative Officer, Secretary and General Counsel | | | 2023 | | | $529,433 | | | $— | | | $716,772 | | | $— | | | $696,335 | | | $— | | | $32,693 | | | $1,975,233 |

| | | 2022 | | | $500,202 | | | $— | | | $1,256,490 | | | $— | | | $671,000 | | | $— | | | $31,208 | | | $2,458,900 | |

| | | 2021 | | | $485,000 | | | $— | | | $408,458 | | | $202,080 | | | $362,159 | | | $— | | | $28,826 | | | $1,486,523 | |

| | | | | | | | | | | | | | | | | | | | |||||||||

| Derek G. Solon Senior Vice President and Chief Commercial Officer | | | 2023 | | | $409,327 | | | $— | | | $554,511 | | | $— | | | $489,005 | | | $— | | | $24,207 | | | $1,477,050 |

| | | 2022 | | | $374,192 | | | $— | | | $941,408 | | | $— | | | $395,912 | | | $— | | | $49,844 | | | $1,761,356 | |

| | | 2021 | | | $332,800 | | | $— | | | $280,433 | | | $138,741 | | | $262,089 | | | $— | | | $44,798 | | | $1,058,861 | |

| | | | | | | | | | | | | | | | | | | | |||||||||

| William F. Nugent Senior Vice President and Chief Technical and Sustainability Officer | | | 2023 | | | $409,327 | | | $— | | | $554,511 | | | $— | | | $480,309 | | | $— | | | $48,593 | | | $1,492,740 |

| | | 2022 | | | $374,192 | | | $— | | | $941,408 | | | $— | | | $395,912 | | | $— | | | $49,844 | | | $1,761,356 | |

| | | 2021 | | | $332,800 | | | $— | | | $280,433 | | | $138,741 | | | $263,035 | | | $— | | | $44,798 | | | $1,059,807 |

| (1) | The salary amounts reflect the actual gross salary received during the year. |

| (2) | On March 8, 2023, Ms. Zabrocky and Messrs. Pribor, Small, Solon and Nugent received time-based equity awards. One-third of these awards vests on each of the first, second and third anniversaries of the grant date of the award. The 2023 amounts in this column represent in the aggregate grant date fair value of the RSU awards calculated in accordance with accounting guidance as follows: For the grant, Ms. Zabrocky - $1,003,256, Mr. Pribor - $543,084, Mr. Small - $354,453, Mr. Solon - $274,213 and Mr. Nugent - $274,213. In prior years, this column reflected the Compensation Committee’s grant date values and not the grant date fair value in accordance with accounting guidance. The Compensation Committee grant date values for the RSUs are $937,500 for Ms. Zabrocky, $507,500 for Mr. Pribor, $331,250 for Mr. Small and $256,250 for each of Messrs. Solon and Nugent. |

| (3) | Ms. Zabrocky and Messrs. Pribor, Small, Solon and Nugent received PRSU grants on March 8, 2023. The performance awards vest in full on December 31, 2025, subject to the Compensation Committee’s certification of achievement of the performance measures and targets. Settlement of the PRSUs may be either in shares of common stock or cash, as determined by the Compensation Committee in its discretion, and shall occur as soon as practicable following the Compensation Committee’s certification of the achievement of the applicable performance measures and targets for 2025 and in any event no later than March 15, 2026. The number of PRSUs shall be subject to an increase or decrease depending on performance against the applicable performance measures and targets with the maximum number of PRSUs vesting equivalent to 150% of the PRSUs awarded. The 2023 amounts in this column represent the aggregate grant date fair value of the PRSU award at target, calculated in accordance with accounting guidance, as follows: Ms. Zabrocky — $1,025,520, Mr. Pribor — $555,136, Mr. Small — $362,319, Mr. Solon — $280,298 and Mr. Nugent — $280,298. The aggregate grant date fair value of the PRSUs at maximum level of payout is as follows: Ms. Zabrocky - $1,538,280, Mr. Pribor - $832,704, Mr. Small - $543,479, Mr. Solon - $420,448 and Mr. Nugent - $420,448. For information with respect to grant date fair values, see Note 13. “Capital Stock and Stock Compensation” to INSWs consolidated financial statements included in INSW’s 2022 Annual Report. |

| (4) | The amounts in this column for 2023, 2022 and 2021 reflect the amounts paid in 2024, 2023 and 2022 under the Company’s Cash Incentive Compensation Plan for performance in 2023, 2022, and 2021, respectively. |

| (5) | See the “All Other Compensation Table” below for additional information. |

| Name | | | Savings Plan Matching Contribution(1) | | | Life Insurance Premiums(2) | | | Other(3) | | | Total |

| Lois K. Zabrocky | | | $19,800 | | | $1,158 | | | $245,417 | | | $266,375 |

| Jeffrey D. Pribor | | | $19,800 | | | $753 | | | $17,273 | | | $37,826 |

| James D. Small III | | | $19,800 | | | $1,158 | | | $11,735 | | | $32,693 |

| Derek G. Solon | | | $19,800 | | | $1,158 | | | $3,249 | | | $24,207 |

| William F. Nugent | | | $19,800 | | | $1,158 | | | $27,635 | | | $48,593 |

| (1) | Constitutes INSW’s matching contributions under the Savings Plan. |

| (2) | Life insurance premiums represent the cost of term life insurance paid on behalf of the NEO. |

| (3) | Includes the following amounts for each NEO under plans and arrangements generally maintained by us for all employees (other than “umbrella” liability insurance coverage): (a) medical and dental coverage premiums of $24,386 for Ms. Zabrocky, $14,024 for Mr. Pribor, $8,486 for Mr. Small, $0 for Mr. Solon and $24,386 for Mr. Nugent, (b) long-term and short-term disability plan premiums for each NEO of $735; (c) a premium for excess liability insurance coverage for each NEO of $2,514; and (d) Ms. Zabrocky received $217,782 when INSW paid out the SERP. |

| | | | | Estimated Future Payouts Under Non-Equity Incentive Plan Awards(1) | | | Estimated Future Payouts Under Equity Incentive Plan Awards(2) | | | All Other Stock Awards: Number of Shares of Stock or Stock Units(3) | | | All Other Option Awards: Number of Securities Underlying Options (#) | | | Exercise or Base Price of Option Awards ($/Sh) | | | Grant Date Fair Value of Stock and Option Awards(4) | ||||||||||||||

| Name | | | Grant Date | | | Threshold | | | Target | | | Maximum | | | Threshold (#) | | | Target (#) | | | Maximum (#) | | | | | | | | | ||||

| Lois K. Zabrocky | | | 3/8/2023 | | | $468,750 | | | $937,500 | | | $1,406,250 | | | 9,765 | | | 19,530 | | | 29,295 | | | 19,530 | | | | | $ | | | $2,028,776 | |

| Jeffrey D. Pribor | | | 3/8/2023 | | | $290,000 | | | $580,000 | | | $870,000 | | | 5,286 | | | 10,572 | | | 15,858 | | | 10,572 | | | | | $ | | | $1,098,219 | |

| James D. Small III | | | 3/8/2023 | | | $265,000 | | | $530,000 | | | $795,000 | | | 3,450 | | | 6,900 | | | 10,350 | | | 6,900 | | | | | $ | | | $716,772 | |

| Derek G. Solon | | | 3/8/2023 | | | $205,000 | | | $410,000 | | | $615,000 | | | 2,669 | | | 5,338 | | | 8,007 | | | 5,338 | | | | | $ | | | $554,511 | |

| William F. Nugent | | | 3/8/2023 | | | $205,000 | | | $410,000 | | | $615,000 | | | 2,669 | | | 5,338 | | | 8,007 | | | 5,338 | | | | | $ | | | $554,511 | |

| (1) | Amounts actually paid under these awards for 2023 are set forth above under “ – Elements of the 2023 Executive Officer Compensation Program – 2023 Actual Annual Incentive Paid.” |

| (2) | In 2023, Ms. Zabrocky and Messrs. Pribor, Small, Solon and Nugent received PRSU grants on March 8, 2023. These performance awards vest in full on December 31, 2025, subject to the Compensation Committee’s certification of achievement of the performance measures. Settlement of the PRSUs may be either in shares of common stock or cash, as determined by the Compensation Committee in its discretion, and shall occur as soon as practicable following the Compensation Committee’s certification of the achievement of the applicable performance measures and targets for 2025 and in any event no later than March 15, 2026. The number of PRSUs shall be subject to an increase or decrease depending on performance against the applicable performance measures and targets with the maximum number of PRSUs vesting equivalent to 150% of the PRSUs awarded. |

| (3) | These grants comprise time-based RSUs. The grants made on March 8, 2023 vest in equal installments on the first, second and third anniversaries of the date of grant. |

| (4) | For information with respect to grant date fair values, see Note 13, “Capital Stock and Stock Compensation” to INSW’s consolidated financial statements included in INSW’s 2023 Annual Report. |

| Name | | | Year | | | Option Awards | | | Stock/RSU Awards | |||||||||||||||||||||

| | | Grant Year | | | Number of Securities Underlying Unexercised Options (#) Exercisable | | | Number of Securities Underlying Unexercised Options (#) Unexercisable | | | Equity Incentive Plan Awards: Number of Securities Underlying Unexercised Unearned Options (#) Unexercisable | | | Options Exercise Price | | | Option Expiration Date | | | Number of Shares or Units of Stock That Have Not Vested (#) | | | Market Value of Shares or Units of Stock That Have Not Vested (#)(1) | | | Equity Incentive Plan Awards: Number of Unearned Shares, Units or Other Rights That Have Not Vested (#) | | | Equity Incentive Plan Awards: Market or Payout Value of Unearned Shares, Units or Other Rights That Have Not Vested(1) | |

| Lois K. Zabrocky | | | 2020 | | | 19,370 | | | | | — | | | $21.93 | | | 4/2/2030 | | | | | | | | | |||||

| | | 2021 | | | 18,901 | | | 18,901(2) | | | — | | | $21.58 | | | 3/17/2031 | | | 8,689(3) | | | $395,176 | | | —(4) | | | $— | |

| | | 2022 | | | — | | | — | | | — | | | — | | | — | | | 32,760(5) | | | $1,489,924 | | | 49,139(6) | | | $2,234,842 | |

| | | 2022 | | | — | | | — | | | — | | | — | | | — | | | 52,416(5) | | | $2,383,880 | | | — | | | $— | |

| | | 2023 | | | — | | | — | | | — | | | — | | | — | | | 19,530(7) | | | $888,224 | | | 19,530(8) | | | $888,224 | |

| | | | | | | | | | | | | | | | | | | | | |||||||||||

| Jeffrey D. Pribor | | | 2017 | | | 17,442 | | | — | | | — | | | $19.13 | | | 3/29/2027 | | | | | | | | | ||||

| | | 2018 | | | 28,995 | | | — | | | — | | | $17.46 | | | 4/4/2028 | | | | | | | | | |||||

| | | 2019 | | | 31,289 | | | — | | | — | | | $17.21 | | | 4/5/2029 | | | | | | | | | |||||

| | | 2020 | | | 26,342 | | | — | | | — | | | $21.93 | | | 4/2/2030 | | | | | | | | | |||||

| | | 2021 | | | 17,808 | | | 8,905(2) | | | — | | | $21.58 | | | 3/17/2031 | | | 4,093(3) | | | $186,150 | | | —(4) | | | $— | |

| | | 2022 | | | — | | | — | | | — | | | — | | | — | | | 15,434(5) | | | $701,938 | | | 23,151(6) | | | $1,052,907 | |

| | | 2022 | | | — | | | — | | | — | | | — | | | — | | | 20,580(5) | | | $935,978 | | | — | | | $— | |

| | | 2023 | | | — | | | — | | | — | | | — | | | — | | | 10,572(7) | | | $480,815 | | | 10,572(8) | | | $480,815 | |

| | | | | | | | | | | | | | | | | | | | | |||||||||||

| James D. Small III | | | | | | | | | | | | | | | | | | | | | ||||||||||

| | | | | | | | | | | | | | | | | | | | | |||||||||||

| | | 2020 | | | 10,438 | | | — | | | — | | | $21.93 | | | 4/2/2030 | | | | | | | | | |||||

| | | 2021 | | | 13,580 | | | 6,791(2) | | | — | | | $21.58 | | | 3/17/2031 | | | 3,122(3) | | | $141,989 | | | —(4) | | | $— | |

| | | 2022 | | | — | | | — | | | — | | | — | | | — | | | 11,769(5) | | | $535,254 | | | 17,653(6) | | | $802,858 | |

| | | 2022 | | | — | | | — | | | — | | | — | | | — | | | 18,830(5) | | | $856,388 | | | — | | | $— | |

| | | 2023 | | | — | | | — | | | — | | | — | | | — | | | 6,900(7) | | | $313,812 | | | 6,900(8) | | | $313,812 | |

| | | | | | | | | | | | | | | | | | | | | |||||||||||

| Derek G. Solon | | | 2020 | | | 3,673 | | | | | — | | | $21.93 | | | 4/2/2030 | | | | | | | | | |||||

| | | 2021 | | | 4,662 | | | 4,662(2) | | | — | | | $21.58 | | | 3/17/2031 | | | 2,143(3) | | | $97,464 | | | —(4) | | | $— | |

| | | 2022 | | | — | | | — | | | — | | | — | | | — | | | 8,818(5) | | | $401,043 | | | 13,226(6) | | | $601,518 | |

| | | 2022 | | | — | | | — | | | — | | | — | | | — | | | 14,108(5) | | | $641,632 | | | — | | | $— | |

| | | 2023 | | | — | | | — | | | — | | | — | | | — | | | 5,338(7) | | | $242,772 | | | 5,338(8) | | | $242,772 | |

| | | | | | | | | | | | | | | | | | | | | |||||||||||

| William F. Nugent | | | | | | | | | | | | | | | | | | | | | ||||||||||

| | | 2021 | | | — | | | 4,662(2) | | | — | | | $21.58 | | | 3/17/2031 | | | 2,143(3) | | | $97,464 | | | —(4) | | | — | |

| | | 2022 | | | — | | | — | | | — | | | — | | | — | | | 8,818(5) | | | $401,043 | | | 13,226(6) | | | $601,518 | |

| | | 2022 | | | — | | | — | | | — | | | — | | | — | | | 14,108(5) | | | $641,632 | | | — | | | $— | |

| | | 2023 | | | — | | | — | | | — | | | — | | | — | | | 5,338(7) | | | $242,772 | | | 5,338(8) | | | $242,772 | |

| | | | | | | | | | | | | | | | | | | | | |||||||||||

| (1) | Based on the closing price of INSW common stock of $45.48 on December 29, 2023. |

| (2) | These unvested options vested and became exercisable on March 17, 2024. |

| (3) | These unvested RSUs vested on March 17, 2024. |

| (4) | These PRSUs vested on December 31, 2023, subject to achievement of the performance measures with a maximum payout of 150% for half of the grant and with a payout of 88.8% for the second half of the grant. |

| (5) | One-half of these RSUs vested on April 7, 2024. The remaining half will vest on April 7, 2025, subject to accelerated vesting in the event of certain terminations of employment. |

| (6) | These PRSUs will vest on December 31, 2024, subject to performance achievement. The PRSUs have a maximum payout of 150% of target. |

| (7) | One-third of these RSUs vested on March 8, 2024. The remaining two-thirds will vest ratably on each of the second and third anniversaries of March 8, 2023, subject to accelerated vesting in the event of certain terminations of employment. |

| (8) | These PRSUs will vest on December 31, 2025, subject to performance achievement. These PRSUs have a maximum payout of 150% of target. |

| | | Option Awards | | | RSU/Stock Awards | |||||||

| Name | | | Number of Shares Acquired on Exercise (#)(1) | | | Value Realized on Exercise(2) | | | Number of Shares Acquired on Vesting (#)(3) | | | Value Realized on Vesting(4) |

| Lois K. Zabrocky | | | 0 | | | $0 | | | 90,945 | | | $4,136,179 |

| Jeffrey D. Pribor | | | 0 | | | $0 | | | 40,635 | | | $1,848,080 |

| James D. Small III | | | 9,205 | | | $418,643 | | | 32,671 | | | $1,485,877 |

| Derek G. Solon | | | 4,662 | | | $212,028 | | | 22,901 | | | $1,041,537 |

| William F. Nugent | | | 8,335 | | | $379,076 | | | 22,901 | | | $1,041,537 |

| (1) | Mr. Small exercised stock options on March 2, 2023 in the amount of 9,205. Mr. Solon exercised stock options on August 28, 2023 in the amount of 4,662. Mr. Nugent exercised stock options on August 17, 2023 in the amounts of 3,673 and 4,662. |

| (2) | The value realized on exercise is the difference between the market value of the shares on the exercise date and the exercise price of the option, multiplied by the number of options shown in the table. |

| (3) | Ms. Zabrocky and Messrs. Pribor, Small, Solon and Nugent had RSUs vest on March 17, 2023, April 2, 2023 and April 7, 2023 in the amounts of (a) 8,688, 8,550 and 42,586, respectively, for Ms. Zabrocky; (b) 4,093, 3,876 and 18,006, respectively, for Mr. Pribor; (c) 3,121, 3,072 and 15,298, respectively, for Mr. Small; (d) 2,143, 1,621 and 11,462, respectively, for Mr. Solon and (e) 2,143, 1,621 and 11,462, respectively, for Mr. Nugent. Ms. Zabrocky and Messrs. Pribor, Small, Solon and Nugent all had PRSUs vest on December 31, 2023 in the amounts of 31,121, 14,660, 11,180, 7,675 and 7,675, respectively. |

| (4) | The value realized on vesting is calculated by multiplying the number of shares shown in the table by the closing market price of the Company’s common stock as of December 31, 2023, which was $45.48 per share. |

| Name | | | Executive Contributions in 2023 | | | Company Contributions on 2023 | | | Aggregate Earnings/ Losses in 2023(1) | | | Aggregate Withdrawals/ Spin-Offs in 2023 | | | Aggregate Balance at December 31, 2023 |

| Lois K. Zabrocky | | | $— | | | $— | | | $2,083 | | | $217,782 | | | $— |

| Jeffrey D. Pribor | | | $— | | | $— | | | $— | | | $— | | | $— |

| James D. Small III | | | $— | | | $— | | | $— | | | $— | | | $— |

| Derek G. Solon | | | $— | | | $— | | | $— | | | $— | | | $— |

| William F. Nugent | | | $— | | | $— | | | $— | | | $— | | | $— |

| (1) | The aggregate earnings constitute interest accrued between January 1, 2023 and the plan payout date. There were no executive or INSW contributions in 2023. |

Event(1) | | | Lois K. Zabrocky | | | Jeffrey D. Pribor | | | James D. Small III | | | Derek G. Solon | | | William F. Nugent |

| Involuntary Termination Without Cause or Voluntary Resignation for Good Reason, Including in Connection with a Change in Control | | | | | | | | | | | |||||

Cash Severance Payment(2) | | | $1,500,000 | | | $870,000 | | | $1,060,000 | | | $410,000 | | | $410,000 |

Pro Rata Bonus Payment(3) | | | $937,500 | | | $580,000 | | | $530,000 | | | $0 | | | $0 |

Bonus Payment(4) | | | $0 | | | $0 | | | $0 | | | $410,000 | | | $410,000 |

Equity Awards(5) | | | $5,608,939 | | | $2,729,450 | | | $2,010,203 | | | $0 | | | $0 |

| Lump Sum Payment | | | $1,049,999 | | | $0 | | | $950,000 | | | $0 | | | $0 |

| Total | | | $9,096,438 | | | $4,179,450 | | | $4,550,203 | | | $820,000 | | | $820,000 |

| | | | | | | | | ||||||||

| Death/Disability | | | | | | | | | | | |||||

| Pro Rata Bonus Payment | | | $0 | | | $580,000(6) | | | $0 | | | $0 | | | $0 |

| Equity Awards | | | $0 | | | $0 | | | $0 | | | $0 | | | $0 |

| Total | | | $0 | | | $580,000 | | | $0 | | | $0 | | | $0 |

| (1) | The values in this table reflect estimated payments associated with various termination scenarios. |

| (2) | This reflects a cash severance payment equal to 24 months of base salary for Ms. Zabrocky and Mr. Small per the terms of their respective employment agreements. Mr. Pribor is entitled to 18 months of base salary plus target bonus if the separation is without cause or for good reason and due to a change in control as shown in this table and 12 months of base salary plus target bonus if he is terminated without cause or resigns with good reason without a change in control per the terms of his employment agreement. Messrs. Solon and Nugent are entitled to 12 months of base salary plus target bonus. |

| (3) | For Ms. Zabrocky and Messrs. Pribor and Small a pro-rata target bonus is provided for in their respective employment agreements. The amounts listed assume a termination of employment occurs on the last business day of the year. For Mr. Pribor the pro-rata target is to be based on actual Company performance (other than for individual goal metrics, which are calculated at target) if no bonus payment is made to other executive officers of the Company in respect of the year in which the separation from service occurs due to business unit and company performance objectives not being met, then no amount shall be payable to Mr. Pribor. |

| (4) | Messrs. Solon and Nugent are entitled to receive a 12-month bonus calculated at target for the year if terminated. |

| (5) | For Ms. Zabrocky and Mr. Small all option shares and time based RSUs (and any other equity-based grant or cash in lieu of grants that is not performance-based) granted to Ms. Zabrocky and Mr. Small, to the extent not otherwise vested, shall vest as of the separation date, as applicable. The unvested PRSUs will be forfeited in the event of termination. As of December 31, 2023, Ms. Zabrocky had 113,395 unvested RSUs and 18,901 unvested stock options with a strike price of $21.58. Mr. Pribor had 50,678 unvested RSUs and 8,905 unvested stock options with a strike price of $21.58. Mr. Small had 40,631 unvested RSUs and 6,791 unvested stock options with a strike price of $21.58 . For Mr. Pribor, those unvested RSUs and stock options that otherwise would have vested on the next regularly scheduled vesting date following the separation will vest upon the separation date. For RSUs, this will amount to 4,093, 7,717, 10,290 and 3,524 units vesting at $45.48 for 3/17/21, 4/7/22 and 3/8/2023 respectively, for actual value of $1,165,364. For unvested stock options this will amount to 8,904 vesting at the difference of their respective strike price and the share price upon vesting of $45.48 for 3/17/21 for an actual value realized of $212,837. For PRSUs, Mr. Pribor will receive a number of unvested units prorated for the number of weeks actually worked. The number of unvested units reflected herein for Mr. Pribor includes: 12,279 at a rate of $45.48 multiplied by 145 the number of weeks worked for a total value of 558,449 at a rate of $45.48 multiplied by 90 the number of weeks worked for a total value of $653,529 for the 4/7/2022 grant; and 10,572 at a rate of $45.48 multiplied by 42 the number of weeks worked for a total value of $139,270 for the 3/8/23 grant. Messrs. Solon and Nugent would be entitled to vesting of their unvested time-based RSUs and unvested stock options if the separation is for “good reason” and within 12 months of a “change in control”; otherwise, the unvested RSUs and unvested stock options shall immediately be forfeited (as reflected above). For Messrs. Solon and Nugent all PRSUs shall immediately be forfeited on the separation date. |

| (6) | Regarding Mr. Pribor being of eligible retirement age, over age 65, he will receive his contractual amounts shown above. He will not receive any other retirement benefits from the company. Upon Mr. Pribor’s disability, Mr. Pribor, or in the case of his death, his estate, is entitled to receive the pro-rata portion of his annual bonus at target for the year of termination. The amount listed in the table reflects his disability or death occurring on December 31, 2023, the last business day of the year. |

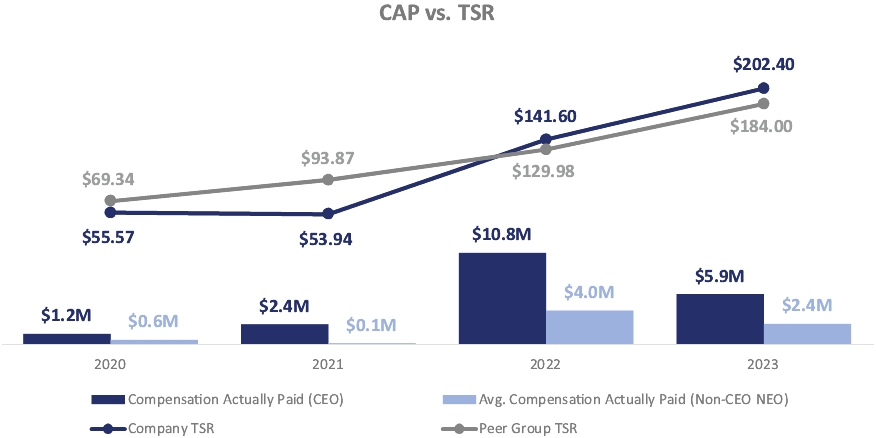

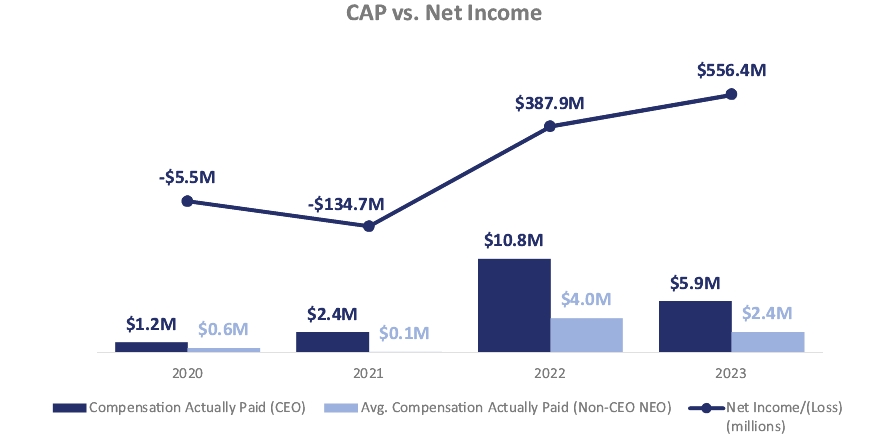

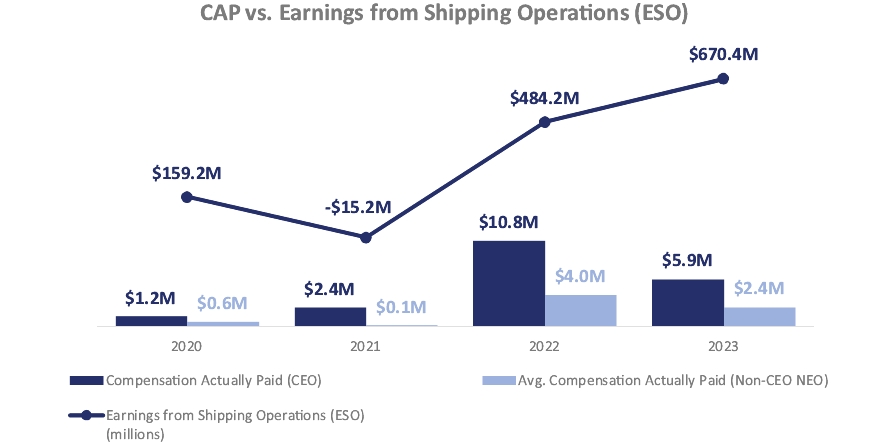

| Year | | | Summary Compensation Table Total for PEO(1) | | | Compensation Actually Paid to PEO(2) | | | Average Summary Compensation Table Total for Non-PEO NEOs(3) | | | Average Compensation Actually Paid to Non-PEO NEOs(4) | | | Value of Initial Fixed $100 Investment Based On: | | | Net Income/(Loss) (millions) | | | Earnings from Shipping Operations (ESO) (millions)(6) | |||

| | Total Shareholder Return | | | Peer Group Total Shareholder Return(5) | | |||||||||||||||||||

| (a) | | | (b) | | | (c) | | | (d) | | | (e) | | | (f) | | | (g) | | | (h) | | | (i) |

| 2023 | | | $4,275,366 | | | $5,922,656 | | | $1,856,498 | | | $2,412,331 | | | $202.40 | | | $184.47 | | | $556.45 | | | $670.43 |

| 2022 | | | $5,409,147 | | | $10,805,863 | | | $2,207,085 | | | $3,985,834 | | | $141.60 | | | $130.01 | | | $387.90 | | | $484.22 |

| 2021 | | | $3,052,550 | | | $2,366,989 | | | $1,342,210 | | | $1,121,434 | | | $53.94 | | | $93.90 | | | $(134.67) | | | $(15.23) |

| 2020 | | | $3,374,108 | | | $1,229,503 | | | $1,386,334 | | | $561,587 | | | $55.57 | | | $69.36 | | | $(5.53) | | | $159.22 |

| (1) | The dollar amounts reported in column (b) are the amounts of total compensation reported for Ms. Lois Zabrocky (who was our President and Chief Executive Officer for all years presented) in the “Total” column of the Summary Compensation Table (“SCT”). |

| (2) | The dollar amounts reported in column (c) represent the amount of compensation actually paid to Ms. Zabrocky, as computed in accordance with Item 402(v) of Regulation S-K (“CAP”). |

| (3) | The dollar amounts reported in column (d) represent the average of the amounts reported for our non-CEO NEOs as a group in the “Total” column of the SCT for each applicable year. The non-CEO NEOs included for purposes of calculating the average amounts in each applicable year are as follows: Messrs. Jeffrey D. Pribor, James D. Small III, Derek G. Solon and William F. Nugent. |