- 2 -

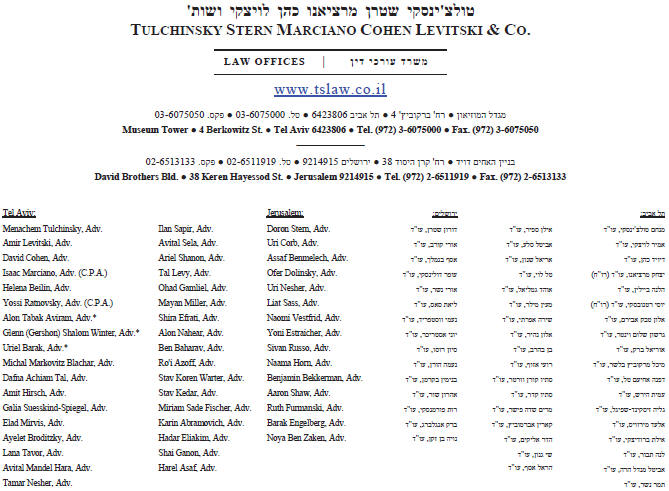

TULCHINSKY STERN MARCIANO COHEN LEVITSKI & CO.

6.000% Senior Notes due 2025 (the “Exchange Euro Notes”) for an equal principal amount of Teva Finance II’s 6.000% Senior Notes due 2025 (the “Original Euro Notes”); and (B) of up to $1,000,000,000 in aggregate principal amount of Teva Finance III 7.125% Senior Notes due 2025 (the “Exchange USD Notes”, and together with the Exchange Euro Notes, the “Exchange Notes”) for an equal principal amount of Teva Finance III’s 7.125% Senior Notes due 2025 (the “Original USD Notes”, and together with the Original Euro Notes, the “Original Notes”) to be guaranteed (the “Guarantees”) by the Guarantor, pursuant to the Registration Statement.

The Exchange Notes are to be issued in exchange for and in replacement of the Original Notes and are subject to the exchange offer pursuant to the Registration Statement. The Exchange Euro Notes are being issued pursuant to an indenture dated as of March 14, 2018, as supplemented by a second supplemental indenture (such indenture, as so supplemented, the “Euro Notes Indenture”), dated as of November 25, 2019, among Teva Finance II, Teva, The Bank of New York Mellon, as trustee (the “Trustee”), and The Bank of New York Mellon, London Branch, as paying agent. The Exchange USD Notes are being issued pursuant to an indenture dated as of March 14, 2018, as supplemented by a second supplemental indenture (such indenture, as so supplemented, the “USD Notes Indenture”, and together with the Euro Notes Indenture, the “Indentures”), dated as of November 25, 2019, among Teva Finance III, Teva and the Trustee, as trustee.

For purposes of the opinions hereinafter expressed, we have examined originals or copies, certified and otherwise identified to our satisfaction, of such documents, corporate records, certificates of public officials and other instruments as we have deemed necessary as a basis for the opinions expressed herein. Insofar as the opinions expressed herein involve factual matters, we have relied (without independent factual investigation), to the extent we deemed proper or necessary, upon certificates of, and other communications with, officers and employees of Teva and upon certificates of public officials. We have also considered such questions of Israeli law as we have deemed relevant and necessary as a basis for the opinions hereinafter expressed.

In making our examination, we have assumed the genuineness of all signatures, the legal capacity of natural persons, the authenticity of all documents submitted to us as originals, the conformity to original documents of all documents submitted to us as certified, photostatic or facsimile copies and the authenticity of the originals of such copies and the legal capacity and due authenticity of all persons executing such documents. We have assumed the same to have been properly given and to be accurate, and we have assumed the truth of all facts communicated to us by Teva, and have assumed that all consents, minutes and protocols of meetings of Teva’s board of directors and shareholders which have been provided to us are true, accurate and have been properly prepared in accordance with Teva’s incorporation documents and all applicable laws.

In connection with all of the opinions expressed below, we have assumed that, at or prior to the time of the delivery of any such Exchange Note, (i) the Exchange Notes have been specifically authorized and approved for issuance and sale by Teva by all necessary corporate action, and such authorization shall not have been modified or rescinded (ii) the Exchange Notes will be issued, sold and delivered as contemplated by the relevant underwriting agreement, if applicable, and the Registration Statement; (iii) Teva has received the consideration provided for in the necessary corporate action and, if applicable, the underwriting agreements; (iv) the Registration Statement (including any post-effective amendments) is effective under the Act, and such effectiveness shall not have been terminated or rescinded; and (v) there shall not have occurred any change in law affecting the validity or enforceability of any such Exchange Note. We have also assumed that none of the terms of any Exchange Note to be established

2