- LW Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

DEF 14A Filing

Lamb Weston (LW) DEF 14ADefinitive proxy

Filed: 7 Aug 18, 8:51am

Use these links to rapidly review the document

TABLE OF CONTENTS

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

| Filed by the Registrant ý | ||

| Filed by a Party other than the Registrant o | ||

| Check the appropriate box: | ||

o | Preliminary Proxy Statement | |

o | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |

ý | Definitive Proxy Statement | |

o | Definitive Additional Materials | |

o | Soliciting Material Pursuant to §240.14a-12 | |

| Lamb Weston Holdings, Inc. | ||||

(Name of Registrant as Specified In Its Charter) | ||||

(Name of Person(s) Filing Proxy Statement, if other than the Registrant) | ||||

Payment of Filing Fee (Check the appropriate box): | ||||

ý | No fee required. | |||

o | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. | |||

| (1) | Title of each class of securities to which transaction applies: | |||

| | | | | |

| (2) | Aggregate number of securities to which transaction applies: | |||

| | | | | |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): | |||

| | | | | |

| (4) | Proposed maximum aggregate value of transaction: | |||

| | | | | |

| (5) | Total fee paid: | |||

| | | | | |

o | Fee paid previously with preliminary materials. | |||

o | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |||

(1) | Amount Previously Paid: | |||

| | | | | |

| (2) | Form, Schedule or Registration Statement No.: | |||

| | | | | |

| (3) | Filing Party: | |||

| | | | | |

| (4) | Date Filed: | |||

| | | | | |

| Lamb Weston Holdings, Inc. 599 S. Rivershore Lane Eagle, Idaho 83616 |

August 7, 2018

Dear Fellow Stockholder:

We are pleased to invite you to our Annual Meeting of Stockholders to be held on Thursday, September 27, 2018 at 8:00 a.m. Mountain Daylight Time at The Hilton Garden Inn, 145 E. Riverside Drive, Eagle, Idaho.

The accompanying Notice of Annual Meeting of Stockholders and Proxy Statement provide details about the Annual Meeting.

Your vote is important. Whether or not you plan to attend the Annual Meeting, we encourage you to vote by telephone, by Internet or by signing, dating and returning your proxy card by mail. You may also vote in person at the Annual Meeting.

Thank you for your support and interest in Lamb Weston.

Sincerely,

|  | |

W.G. Jurgensen Chairman of the Board of Directors | Thomas P. Werner Director, President and Chief Executive Officer |

LAMB WESTON HOLDINGS, INC.

599 S. Rivershore Lane

Eagle, Idaho 83616

NOTICE OF 2018 ANNUAL MEETING OF STOCKHOLDERS

Date and Time

Thursday, September 27, 2018

8:00 a.m. Mountain Daylight Time

Place

The Hilton Garden Inn

145 E. Riverside Drive

Eagle, Idaho 83616

If you attend the Annual Meeting, you will be asked to present a valid form of government-issued photo identification and an admission ticket or bank/brokerage statement to confirm stock ownership as of the record date.

Whether or not you plan to attend, please be sure to vote your shares by proxy. It is important that your shares be represented.

Stockholders of record as of the close of business on July 30, 2018 are entitled to notice of and to vote at the Annual Meeting and at any postponements or adjournments thereof.

August 7, 2018

Eryk J. Spytek

Senior Vice President, General Counsel and Corporate Secretary

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY

MATERIALS FOR THE ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD ON SEPTEMBER 27, 2018

Our Notice of Annual Meeting, Proxy Statement and Annual Report on Form 10-K for the fiscal year ended May 27, 2018 are available at www.proxyvote.com. If you receive a Notice of Internet Availability of Proxy Materials by mail, you will not receive a paper copy of our Notice of Annual Meeting, Proxy Statement and Annual Report on Form 10-K unless you specifically request a copy. You may request a paper copy by following the instructions on the Notice of Internet Availability of Proxy Materials.

We began making our proxy materials first available on or about August 7, 2018.

| | Page | |

|---|---|---|

| PROXY STATEMENT SUMMARY | 1 | |

ITEM 1. ELECTION OF DIRECTORS | 3 | |

Director Nomination and Qualification | 3 | |

ITEM 2. ADVISORY VOTE TO APPROVE EXECUTIVE COMPENSATION | 14 | |

ITEM 3. RATIFICATION OF THE SELECTION OF INDEPENDENT AUDITORS | 15 | |

CORPORATE GOVERNANCE | 15 | |

Corporate Governance Principles | 15 | |

Key Corporate Governance Practices | 15 | |

Corporate Governance Materials | 17 | |

Board Leadership Structure | 17 | |

Director Independence | 18 | |

Oversight of Risk Management | 19 | |

Meeting Attendance | 19 | |

Code of Conduct and Code of Ethics for Senior Corporate Financial Officers | 20 | |

Section 16(a) Beneficial Ownership Reporting Compliance | 20 | |

Communications with the Board | 21 | |

Related Party Transactions | 21 | |

BOARD COMMITTEES AND MEMBERSHIP | 21 | |

Committee Membership | 21 | |

Audit and Finance Committee | 22 | |

Compensation Committee | 24 | |

Nominating and Corporate Governance Committee | 27 | |

NON-EMPLOYEE DIRECTOR COMPENSATION | 28 | |

Summary of 2018 Compensation Elements | 28 | |

Director Stock Ownership Requirements | 29 | |

2018 Non-Employee Director Compensation Table | 29 | |

COMPENSATION DISCUSSION AND ANALYSIS | 30 | |

Overview | 31 | |

What We Pay and Why | 34 | |

How We Make Executive Compensation Decisions | 42 | |

Compensation Committee Report for the Year Ended May 27, 2018 | 43 | |

EXECUTIVE COMPENSATION TABLES | 44 | |

Summary Compensation Table—Fiscal 2018 | 44 | |

Grants of Plan-Based Awards—Fiscal 2018 | 45 | |

Outstanding Equity Awards at Fiscal Year-End—Fiscal 2018 | 46 | |

Option Exercises and Stock Vested—Fiscal 2018 | 47 | |

Pension Benefits—Fiscal 2018 | 47 | |

Non-Qualified Deferred Compensation—Fiscal 2018 | 48 | |

Potential Payments Upon Termination or Change of Control | 49 | |

CEO Pay Ratio | 55 |

i

ii

In this Proxy Statement, "we," "us," "our," "Company" and "Lamb Weston" refer to Lamb Weston Holdings, Inc.

This summary highlights select information contained elsewhere in this Proxy Statement. This is not a complete description, and you should read the entire Proxy Statement carefully before voting.

ANNUAL MEETING |

| Time and Date | 8:00 a.m. MDT on Thursday, September 27, 2018 | |

| Place | The Hilton Garden Inn, 145 E. Riverside Drive, Eagle, Idaho 83616 | |

| Record Date | July 30, 2018 (the "Record Date") | |

| Voting | Stockholders as of the Record Date are entitled to one vote per share of our common stock on each matter to be voted upon at the 2018 Annual Meeting of Stockholders (the "Annual Meeting"). | |

| Admission | You must register in advance in order to attend the Annual Meeting by following the registration instructions described in Question 18 under "Procedural Matters and Frequently Asked Questions" in this Proxy Statement. |

VOTING ITEMS AND BOARD RECOMMENDATION |

| Voting Item | | Board Recommendation | Page Reference | |||||||

|---|---|---|---|---|---|---|---|---|---|---|

| Item 1 | – | Election of Nine Directors | For all nominees | 3 | ||||||

| Item 2 | – | Advisory Vote to Approve Executive Compensation | For | | 14 | |||||

| Item 3 | – | Ratification of the Appointment of KPMG LLP as Independent Auditors for Fiscal Year 2019 | For | 15 | ||||||

We will also transact any other business that properly comes before the meeting.

BOARD OF DIRECTORS |

The table below provides summary information about each director nominee as of July 30, 2018.

| Name | Age | Director Since | Occupation and Experience | Independent | Audit & Finance | Comp | N&CG | |||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

Peter J. Bensen | 56 | 2017 | Former Chief Administrative Officer, McDonald's Corporation | Yes | X | |||||||||

Charles A. Blixt | 66 | 2016 | Principal, C&D Ventures | Yes | | X | Chair | |||||||

André J. Hawaux | 57 | 2017 | Former Executive Vice President and Chief Operating Officer, DICK'S Sporting Goods, Inc. | Yes | X | |||||||||

W.G. Jurgensen (Chairman) | 66 | 2016 | Former Chief Executive Officer and Director, Nationwide Financial Services, Inc. | Yes | | | | |||||||

Thomas P. Maurer | 67 | 2016 | Former Partner, Ernst & Young, LLP | Yes | Chair | |||||||||

Hala G. Moddelmog | 62 | 2017 | President and Chief Executive Officer, Metro Atlanta Chamber | Yes | | X | X | |||||||

Andrew J. Schindler | 73 | 2016 | Former Chairman, Reynolds American, Inc. | Yes | Chair | X | ||||||||

Maria Renna Sharpe | 59 | 2016 | Managing Principal, Sharpe Human Solutions, LLC | Yes | | X | X | |||||||

Thomas P. Werner | 52 | 2016 | President and Chief Executive Officer, Lamb Weston | No |

1

EXECUTIVE COMPENSATION SUMMARY

Consistent with the provisions of Section 14A of the Securities Exchange Act of 1934 (the "Exchange Act") and related U.S. Securities and Exchange Commission ("SEC") rules, we are asking our stockholders to vote to approve, on an advisory (non-binding) basis, the compensation of our named executive officers, or NEOs (as defined under "Compensation Discussion and Analysis"). This "say-on-pay" vote is not intended to address any specific item of our compensation program, but rather to address our overall approach to the compensation of our NEOs as described in this Proxy Statement.

Our executive compensation program is designed to encourage and reward behavior that promotes attainment of annual and long-term Lamb Weston goals and sustainable growth in value for our stockholders. The Compensation Committee of our Board of Directors (the "Board") believes that the program should accomplish the following objectives:

As described in further detail under "Compensation Discussion and Analysis" below, consistent with these objectives, our compensation program has been designed with a view toward linking a significant portion of the compensation of each NEO to Company performance and the growth in the value of Lamb Weston. Please read "Compensation Discussion and Analysis" and "Executive Compensation Tables" in this Proxy Statement for additional details about our executive compensation program, including information about our NEOs' fiscal year 2018 compensation.

As a matter of good governance, we are asking our stockholders to ratify the appointment of KPMG LLP as our independent auditors for the fiscal year ending May 26, 2019.

2

Director Nomination and Qualification

The Nominating and Corporate Governance Committee (the "Governance Committee") of our Board is responsible for identifying, evaluating and recommending to the Board nominees for election at the Annual Meeting. The Governance Committee considers Board candidates suggested by Board members, management and stockholders. The Governance Committee may also retain a third-party search firm to identify candidates. Based on the Governance Committee's recommendation, our Board has nominated all nine current directors for election at the Annual Meeting.

During 2017, the Governance Committee retained a third-party search firm to assist in the search and recruitment of directors, resulting in the Board's appointments of André J. Hawaux and Hala G. Moddelmog as directors on July 19, 2017 and Peter J. Bensen as a director on December 20, 2017. Charles A. Blixt, W.G. Jurgensen, Thomas P. Maurer, Andrew J. Schindler, Maria Renna Sharpe and Thomas P. Werner joined the Board in connection with our separation from Conagra Brands, Inc. (formerly ConAgra Foods, Inc., "Conagra") on November 9, 2016 when we became an independent public company (which we refer to as the "Separation"). All of the director nominees were elected by stockholders at our 2017 annual meeting of stockholders, except for Mr. Bensen, who joined our Board after the date of the meeting.

General Qualifications

The Board believes all directors should possess certain attributes, including integrity, sound business judgment and vision, to serve on our Board. We believe these characteristics are necessary to establish a competent, ethical and well-functioning Board that best represents the interests of our business, stockholders, employees, business partners and consumers. Under our Corporate Governance Principles (the "Principles"), when evaluating the suitability of individuals for nomination, the Governance Committee considers the individual's background, the Board's skill needs, diversity and business experience. The Governance Committee also considers an individual's ability to devote sufficient time and effort to fulfill his or her Lamb Weston responsibilities, taking into account the individual's other commitments. In addition, the Governance Committee considers whether an individual meets various independence requirements, including whether his or her service on boards and committees of other organizations is consistent with our conflicts of interest policy.

When determining whether to recommend a director for re-election, the Governance Committee also considers the director's attendance at Board and committee meetings and participation in, and contributions to, Board and committee activities.

Diversity

The Principles provide that the Governance Committee will review with the Board the requisite skills and characteristics for Board members, a review which includes assessing diversity. Although the Board does not have a formal written policy regarding diversity, the Governance Committee believes that diversity offers a significant benefit to the Board and Lamb Weston, as varying viewpoints contribute to a more informed and effective decision-making process. The Governance Committee seeks broad experience in relevant industries, professions and areas of expertise important to our operations, including manufacturing, marketing, finance and accounting. As shown below under "—Individual Skills and Experience," the director nominees have varied experiences, backgrounds and personal characteristics, which ensure that the Board will have diverse viewpoints, enabling it to effectively represent our business, stockholders, employees, business partners and consumers.

3

Individual Skills and Experience

When evaluating potential director nominees, the Governance Committee considers each individual's professional expertise and educational background in addition to the general qualifications described above. The Governance Committee evaluates each individual in the context of the Board as a whole. The Governance Committee works with the Board to determine the appropriate mix of backgrounds and experiences that would establish and maintain a Board that is strong in its collective knowledge, allowing the Board to fulfill its responsibilities and best perpetuate our long-term success and represent our stockholders' interests. To help the Governance Committee determine whether director nominees qualify to serve on our Board and would contribute to the Board's current and future needs, director nominees complete questionnaires regarding their backgrounds, qualifications, skills and potential conflicts of interest. Additionally, the Governance Committee conducts annual evaluations of the Board that assess the experience, skills, qualifications, diversity and contributions of each individual and of the group as a whole.

The Governance Committee communicates with the Board to identify characteristics, professional experience and areas of expertise that will help meet specific Board needs, including:

• Broad leadership experience | • Risk and compliance oversight expertise | ||

• Financial acumen | • Operations acumen | ||

• M&A or strategic experience | • Retail or consumer packaged goods experience | ||

• International expertise | • Quick service restaurant expertise | ||

• Corporate governance expertise | • Human capital experience |

The Board believes that all the director nominees are highly qualified. As the biographies below show, the director nominees have significant leadership and professional experience, knowledge and skills that qualify them for service on our Board. As a group, they represent diverse views, experiences and backgrounds. All director nominees satisfy the criteria set forth in our Principles and possess the experience, skills and qualities to fully perform his or her duties as a director and contribute to our success.

The Governance Committee recommended, and the Board nominated, each of the director nominees listed below for election at the Annual Meeting. All director nominees are standing for election as directors to hold office for a one-year term expiring at the 2019 annual meeting of stockholders or until his or her successor has been duly elected and qualified. The following presents information regarding each director nominee as of July 30, 2018, including information about the director's professional experience, public company directorships held and qualifications.

The persons named as proxies in the proxy card or electronic voting form will vote the shares represented by the proxy card or electronic voting form FOR or AGAINST the director nominees or ABSTAIN from voting, as instructed in the proxy card or electronic voting form. If a director nominee should become unavailable to serve as a director, an event that we do not anticipate occurring prior to or at the Annual Meeting, the persons designated as proxies intend to vote the shares for the person whom the Board may designate to replace that nominee. In lieu of naming a substitute, the Board may reduce the number of directors on our Board.

4

THE BOARD RECOMMENDS STOCKHOLDERS VOTE FOR EACH NOMINEE.

| Director Nominee | Experiences and Qualifications | |

|---|---|---|

| | | |

| Peter J. Bensen Age – 56 Former Chief Director Since December | Mr. Bensen served as Chief Administrative Officer of McDonald's Corporation, a global foodservice retailer, from March 2015 until his retirement in September 2016. He also served as McDonald's Corporation's Corporate Senior Executive Vice President and Chief Financial Officer from May 2014 through February 2015, and Corporate Executive Vice President and Chief Financial Officer from January 2008 through April 2014. Prior to joining McDonald's Corporation in 1996, Mr. Bensen was a senior manager for Ernst & Young LLP. Mr. Bensen currently serves on the board of directors of CarMax, Inc. since April 2018. Mr. Bensen also served on the board of directors of Catamaran Corporation from December 2011 to July 2015. Summary of experiences, qualifications and skills considered in nominating Mr. Bensen: • Broad Leadership Experience: Strong leadership capabilities and insights, including from his service as Chief Administrative Officer of McDonald's Corporation; • Financial Acumen and Risk & Compliance Oversight Expertise: Significant expertise in financial reporting and internal controls and procedures and risk management from his experience in finance executive roles, including Chief Financial Officer, at McDonald's Corporation; and • Quick Service Restaurant and International Expertise: Deep knowledge of the quick service restaurant industry from his service with a large global fast food restaurant chain. | |

| | | |

5

| Director Nominee | Experiences and Qualifications | |

|---|---|---|

| | | |

Charles A. Blixt Age – 66 Principal, C&D Ventures Director Since November | Mr. Blixt is a principal of C&D Ventures, a company that invests in entrepreneurial startups and other businesses that require capital and/or business and legal expertise. Before this, Mr. Blixt served as the interim General Counsel of Krispy Kreme Doughnuts, Inc., a retailer and wholesaler of doughnuts, complementary beverages and packaged sweets, from September 2006 until April 2007. Mr. Blixt was also Executive Vice President and General Counsel of Reynolds American, Inc., a tobacco products company, from 2004 to 2006, and Executive Vice President and General Counsel for R.J. Reynolds Tobacco Holdings, Inc., a tobacco products company, from 1995 to 2004. Mr. Blixt currently serves on the boards of directors of Atrum Coal Limited since May 2017, and Swedish Match AB since 2015, and previously from 2007 to 2011. Mr. Blixt also served on the boards of directors of Krispy Kreme Doughnuts, Inc. from 2007 until July 2016 and Targacept, Inc. from 2000 to 2015. Summary of experiences, qualifications and skills considered in nominating Mr. Blixt: • Broad Leadership Experience: Strong leadership capabilities and insights, particularly with major consumer brands, from his roles as General Counsel for Krispy Kreme Doughnuts, Inc. and Reynolds American, Inc.; • Risk & Compliance Oversight Expertise and M&A Experience: Deep expertise in risk and compliance oversight and knowledge of M&A from his extensive experience as a chief legal officer; and • Corporate Governance Expertise: Broad understanding of governance issues facing public companies from his legal background and board service to other public companies. | |

| | | |

6

| Director Nominee | Experiences and Qualifications | |

|---|---|---|

| | | |

André J. Hawaux Age – 57 Former Executive Vice Director Since July | Mr. Hawaux served as the Executive Vice President and Chief Operating Officer of DICK'S Sporting Goods, Inc., a sporting goods retailer ("DICK'S"), from August 2015 until August 2017. He also served as DICK'S interim principal financial officer from August 2016 to September 2016, Executive Vice President, Chief Operating Officer and Chief Financial Officer from February 2015 to August 2015, and Executive Vice President, Finance, Administration and Chief Financial Officer from June 2013 to January 2015. Prior to joining DICK'S in 2013, Mr. Hawaux served as the President, Consumer Foods at Conagra, a packaged food company, beginning in 2009. From 2006 to 2009, Mr. Hawaux served as Conagra's Executive Vice President and Chief Financial Officer where he was responsible for the company's Finance and Information System and Services organizations. Prior to joining Conagra, Mr. Hawaux served as general manager of a large U.S. division of PepsiAmericas, a food and beverage company, and previously served as Chief Financial Officer for Pepsi-Cola North America and Pepsi International's China business unit. Mr. Hawaux is also a Trustee of Southern New Hampshire University and a member of the board of directors of PulteGroup, Inc. since 2013. Summary of experiences, qualifications and skills considered in nominating Mr. Hawaux: • Broad Leadership Experience, Operations Acumen and Consumer Goods Experience: Strong leadership and operational capabilities and insights, particularly with major consumer-focused public companies, including as Executive Vice President and Chief Operating Officer of DICK'S and President, Consumer Foods at Conagra; • Financial Acumen: Deep expertise in financial reporting and internal controls and procedures, and knowledge of financial and capital markets, from his extensive experience in public company finance at several large public companies; and • Risk & Compliance Oversight Expertise: Valuable experience in risk management from his extensive experience in finance executive roles with large multi-national public companies. | |

| | | |

7

| Director Nominee | Experiences and Qualifications | |

|---|---|---|

| | | |

| W.G. Jurgensen Age – 66 Chairman of the Board, Director Since November | Mr. Jurgensen was appointed Chairman of the Board in September 2017. He previously served as Chief Executive Officer and a director of Nationwide Financial Services, Inc., a diversified insurance and financial services organization, and its parent, Nationwide Mutual Insurance Company, from 2000 until his retirement in 2009. He also served as Chief Executive Officer and a director of several other companies within the Nationwide enterprise, which is comprised of Nationwide Financial, Nationwide Mutual, Nationwide Mutual Fire and all of their respective subsidiaries and affiliates. Before joining Nationwide, Mr. Jurgensen served as an Executive Vice President with Bank One Corporation (now a part of JPMorgan Chase & Co.), where he was responsible for corporate banking products, including capital markets, international banking and cash management, and later served as Chief Executive Officer for First Card, First Chicago Corporation's credit card subsidiary. Mr. Jurgensen currently serves on the board of directors of American International Group, Inc. since May 2013. He previously served on the boards of directors of Conagra from August 2002 to November 2016 and The Scotts Miracle-Gro Company from May 2009 until June 2013. Summary of experiences, qualifications and skills considered in nominating Mr. Jurgensen: • Broad Leadership Experience and Operations Acumen: Strong leadership capabilities and insights, including from his service as Chief Executive Officer of several Nationwide companies; • Financial Acumen and Risk & Compliance Oversight Expertise: Significant expertise in finance, accounting and risk and compliance oversight from his service at insurance companies, including risk assessment and risk management experience; and • Corporate Governance Expertise: Broad understanding of governance issues facing public companies from his board service to other public companies. | |

| | | |

8

| Director Nominee | Experiences and Qualifications | |

|---|---|---|

| | | |

Thomas P. Maurer Age – 67 Former Partner, Ernst & Director Since November | Mr. Maurer served as a partner of Ernst & Young, LLP, a professional services firm, until his retirement in 2011. He joined Ernst & Young in 1973 and during his career served as the global coordinating partner on the audits of large multi-national and multi-location companies in the manufacturing, consumer products, and distribution industries. Mr. Maurer was a member of the Ernst & Young Global Account Partner Group, and he served two terms on the Ernst & Young Partner Advisory Council. He also served as the leader of the Retail, Consumer Products and Industrial Products Group in Ernst & Young's Chicago office. Mr. Maurer is a certified public accountant and currently serves on the board of directors of Packaging Corporation of America since May 2014. Summary of experiences, qualifications and skills considered in nominating Mr. Maurer: • Financial Acumen: Deep expertise in financial reporting, accounting and internal controls and procedures from his experience as a partner at a large, global accounting firm; • Consumer Packaged Goods Experience: Understanding of manufacturing and consumer products from his experience working with and assisting similarly situated companies as Lamb Weston; and • Corporate Governance Expertise: Broad understanding of governance issues facing public companies from his board service to other public companies. | |

| | | |

9

| Director Nominee | Experiences and Qualifications | |

|---|---|---|

| | | |

Hala G. Moddelmog Age – 62 President and Chief Director Since July | Ms. Moddelmog has served as the President and Chief Executive Officer of the Metro Atlanta Chamber since 2014. She is the first woman to lead the 159-year-old organization, which covers 29 counties and more than 15 Fortune 500 companies, as well as a multitude of small and medium-sized enterprises in the 9th largest metropolitan region in the United States. From 2010 to 2013, Ms. Moddelmog was the President of Arby's Restaurant Group, Inc., a division of Wendy's/Arby's Group, Inc., a fast food restaurant chain. Prior to her tenure at Arby's Restaurant Group, Ms. Moddelmog was President and Chief Executive Officer of Susan G. Komen for the Cure, a breast cancer organization, Chief Executive Officer of Catalytic Ventures, LLC, an entity she formed to invest and consult in multi-unit retail, and President of Church's Chicken, a subsidiary of AFC Enterprises, Inc., a fast food restaurant chain. Ms. Moddelmog currently serves on the board of directors of FleetCor Technologies, Inc. since April 2017. Ms. Moddelmog also served on the boards of directors of Amerigroup Corporation from 2009 to 2012 and AMN Healthcare Services, Inc. from 2008 to 2010. Summary of experiences, qualifications and skills considered in nominating Ms. Moddelmog: • Broad Leadership Experience: Strong leadership capabilities and insights, including from her service as President and Chief Executive Officer of the Metro Atlanta Chamber; • Quick Service Restaurant Expertise: Deep knowledge of the quick service restaurant industry from her service with multiple large fast food restaurant chains; and • Corporate Governance Expertise: Broad understanding of governance issues facing public companies from her board service to other public companies. | |

| | | |

10

| Director Nominee | Experiences and Qualifications | |

|---|---|---|

| | | |

Andrew J. Schindler Age – 73 Former Chairman, Director Since November | Mr. Schindler served as Chairman of Reynolds American, Inc., a tobacco products company, from July 2004 until his retirement in December 2005 and as Chairman and Chief Executive Officer of R. J. Reynolds Tobacco Holdings, Inc., a tobacco products company, from 1999 to 2004. Before that, Mr. Schindler served in various senior management positions with R.J. Reynolds, which he joined in 1974, including Vice President of Personnel, Executive Vice President of Operations and Chief Operating Officer of R.J. Reynolds Tobacco Company and Director of Manufacturing for Nabisco Foods. Mr. Schindler achieved the rank of captain in the U.S. Army, where he held command and staff positions in the United States and in Vietnam. Mr. Schindler also served on the boards of directors of Hanesbrands, Inc. from 2006 to April 2017, Conagra from 2007 to September 2016 and Krispy Kreme Doughnuts Inc. from 2006 until July 2016. Summary of experiences, qualifications and skills considered in nominating Mr. Schindler: • Broad Leadership Experience and Operations Acumen: Extensive leadership, management and operating experience through his service to R.J. Reynolds, including as Chief Executive Officer, Vice President of Personnel and Chief Operating Officer; • Strategic andPackaged Goods Experience: Strong people, leadership, risk-management, brand marketing, operations, strategic and personnel development experience and skills pertinent to a company with a diverse customer set, including retail customers and consumers; and • Corporate Governance Expertise: Broad understanding of governance issues facing public companies from his board service to other public companies. | |

| | | |

11

| Director Nominee | Experiences and Qualifications | |

|---|---|---|

| | | |

| Maria Renna Sharpe Age – 59 Managing Principal, Sharpe Director Since November | Ms. Sharpe has served as Managing Principal of Sharpe Human Solutions, LLC, a human resource consulting and commercial real estate investments company, since 2016. Prior to that, Ms. Sharpe served as Senior Vice President, Global Human Capital Management, Services & Operations at PepsiCo, Inc., a food and beverage company, since 2014, and was Chief Human Resources Officer, PepsiCo Europe from 2010 to 2014 and Senior Vice President, Compensation, Benefits & Human Resource Systems from 2008 to 2010. From 2004 until 2008, Ms. Sharpe was Chief Human Resources Officer & Corporate Secretary of UST Inc., a tobacco products company, responsible for the company's human resources function and corporate governance matters. Before that, Ms. Sharpe held various senior human resources and legal positions at Pepsico, Inc., including Vice President, Benefits from 2002 to 2004, Vice President, Compensation from 1999 to 2002 and Vice President, Human Resources Counsel from 1995 to 1999. Summary of experiences, qualifications and skills considered in nominating Ms. Sharpe: • Broad Leadership Experience: Strong management and leadership experience, particularly with major consumer brands, from her role as Senior Vice President, Global Human Capital Management, Services & Operations at PepsiCo, Inc.; • Consumer Packaged Goods Experience: Understanding of strategic and marketplace challenges for consumer products companies from her tenure with Pepsico, Inc.; and • Human Capital Experience: Strong human capital expertise, including significant experience in global human capital management and labor strategy, assessment and succession planning for executives, and design and administration of worldwide compensation, career management and benefit programs and management systems. | |

| | | |

12

| Director Nominee | Experiences and Qualifications | |

|---|---|---|

| | | |

Thomas P. Werner Age – 52 President and Chief Director Since November | Mr. Werner has served as our President and Chief Executive Officer and a member of our board of directors since November 2016. He previously served as President, Commercial Foods, for Conagra, a food company, since May 2015. In that role, he led the company's Lamb Weston and Foodservice businesses, as well as its previously divested Spicetec Flavors & Seasonings and J.M. Swank operations. Mr. Werner also served as interim President of Conagra's Private Brands from June 2015 through its divestiture in February 2016. Before his appointment as President, Commercial Foods, Mr. Werner served as Senior Vice President of Finance for Conagra's Private Brands and Commercial Foods operating segments from June 2013 to April 2015, and Senior Vice President of Finance for Lamb Weston from May 2011 until June 2013. Summary of experiences, qualifications and skills considered in nominating Mr. Werner: • Broad Leadership and Strategic Experience: Strong leadership and strategic capabilities and insights, particularly with major commercial customers, acquired during his tenure as President of Commercial Foods for Conagra and President and Chief Executive Officer of Lamb Weston; • Commercial Foods Experience and Operating Acumen: Deep knowledge of strategy and business development, operations, finance, marketing and commercial customer insights, supply chain management and sustainability; and • Financial Acumen: Deep expertise in finance from his extensive experience in public company finance at Conagra and Lamb Weston. | |

| | | |

13

ITEM 2. ADVISORY VOTE TO APPROVE EXECUTIVE COMPENSATION

In accordance with the Dodd-Frank Wall Street Reform and Consumer Protection Act of 2010 (the "Dodd-Frank Act") and related SEC rules, we are asking our stockholders to vote to approve, on an advisory (non-binding) basis, the compensation of our NEOs as disclosed in this Proxy Statement. Your vote is not intended to address any specific item of our compensation program, but rather to address our overall approach to the compensation of our NEOs described in this Proxy Statement. As described in detail under "Compensation Discussion and Analysis," our executive compensation program is designed to attract, retain and motivate superior executive talent, including our NEOs, who are critical to our success. At the same time, we structure our executive compensation program to focus on stockholders' interests by incenting superior sustainable performance. Under these programs, we align pay and performance by making a significant portion of our NEOs' compensation contingent on:

We also have strong compensation-related governance practices to protect our stockholders' interests. You can find more information about these practices under "Board Committees and Membership—Compensation Committee" and "Compensation Discussion and Analysis." These practices include the following:

Please read "Compensation Discussion and Analysis" and "Executive Compensation Tables" in this Proxy Statement for specific details about our executive compensation program. The Compensation Committee and the Board believe that our executive compensation program for our NEOs serves our stockholders' interests. Accordingly, we ask you to vote "FOR" the following resolution at our Annual Meeting:

"RESOLVED, that Lamb Weston's stockholders approve, on an advisory basis, the compensation paid to Lamb Weston's NEOs, as disclosed in this Proxy Statement pursuant to the Securities and Exchange Commission's compensation disclosure rules, including the Compensation Discussion and Analysis, the Executive Compensation Tables and related narrative discussion."

14

This "say-on-pay" vote is advisory. Therefore, it will not be binding on Lamb Weston, the Compensation Committee or the Board. However, the Board and Compensation Committee value our stockholders' opinions and expect to consider the outcome of the vote, along with other relevant factors, when considering NEO compensation in the future.

The Board recommends a vote "FOR" the advisory approval of our NEOs' compensation as disclosed in this Proxy Statement.

ITEM 3. RATIFICATION OF THE SELECTION OF INDEPENDENT AUDITORS

The Audit and Finance Committee is directly responsible for the selection, appointment, compensation, retention, oversight and termination of our independent auditors. The Audit and Finance Committee selected KPMG LLP, a registered public accounting firm, as our independent auditors for fiscal 2019. The Audit and Finance Committee and the Board are requesting, as a matter of policy, that stockholders ratify the selection of KPMG LLP as our independent auditors.

The Audit and Finance Committee and the Board are not required to take any action as a result of the outcome of the vote on this proposal. However, if our stockholders do not ratify the selection, the Audit and Finance Committee may investigate the reasons for our stockholders' rejection and may consider whether to retain KPMG LLP or appoint another independent auditor. Furthermore, even if the selection is ratified, the Audit and Finance Committee may appoint a different independent auditor if, in its discretion, it determines that such a change would be in Lamb Weston's and our stockholders' best interests.

KPMG LLP has served as our independent auditors since 2016 and were appointed in connection with the Separation. We expect that representatives of KPMG LLP will be present at the Annual Meeting. They will have an opportunity to make a statement if they desire to do so and to respond to appropriate questions from stockholders. Additional information about our independent auditors, including our pre-approval policies and KPMG LLP's aggregate fees for fiscal 2017 and 2018, can be found below under "Board Committees and Membership—Audit and Finance Committee."

The Board recommends a vote "FOR" the ratification of the selection of KPMG LLP as Lamb Weston's independent auditors for fiscal 2019.

We believe that having and adhering to a strong corporate governance framework is essential to our long-term success. This section describes our corporate governance framework, including our key governance principles and practices, Board leadership structure and oversight functions.

Corporate Governance Principles

The Principles articulate our governance philosophy, practices and policies in a range of areas, including: the Board's role and responsibilities; composition and structure of the Board; establishment and responsibilities of the committees of the Board; executive and director performance evaluations; and succession planning. The Governance Committee reviews the Principles annually and recommends any changes to the Board for its consideration.

Key Corporate Governance Practices

The Board is committed to performing its responsibilities in a manner consistent with sound governance practices. It routinely reviews its processes, assesses the regulatory and legislative environment and adopts governance practices as needed that support informed, competent and independent oversight on behalf of our stockholders. Our Principles provide a summary of these practices and are available on our website as

15

described below under "—Corporate Governance Materials." Highlights of our corporate governance practices include:

16

of our Fiscal 2018 Executive Compensation Program" for a summary of the stock ownership of each NEO.

Corporate Governance Materials

To learn more about our governance practices, you can access the following documents athttps://investors.lambweston.com/corporate-governance/governance-documents. We will also provide copies of any of these documents to stockholders upon written request to the Corporate Secretary.

The information on our website is not, and will not be deemed to be, a part of this Proxy Statement or incorporated into any of our other filings with the SEC.

Our current Board leadership structure consists of:

17

Separate Chairman and Chief Executive Officer

The Principles provide the Board flexibility in determining its leadership structure. Currently, W.G. Jurgensen serves as Chairman of our Board and Thomas Werner serves as our Chief Executive Officer. The Board believes that this leadership structure, which separates the Chairman and Chief Executive Officer roles, is optimal at this time. With separate Chairman and Chief Executive Officer roles, our Chairman can lead the Board in the performance of its duties by establishing agendas and ensuring appropriate meeting content, engaging with the Chief Executive Officer and senior leadership team between Board meetings on business developments and providing overall guidance to our Chief Executive Officer as to the Board's views and perspectives, particularly on the strategic direction of the Company. Meanwhile, our Chief Executive Officer can focus his time and energy on setting the strategic direction for the Company, overseeing daily operations, engaging with external constituents, developing our leaders and promoting employee engagement at all levels of the organization. As described below, we believe that our governance practices ensure that skilled and experienced independent directors provide independent leadership.

The Board periodically evaluates its leadership structure and determines the most appropriate leadership structure at that time. In considering which leadership structure will allow it to most effectively carry out its responsibilities and best represent stockholders' interests, the Board takes into account various factors. Among them are our specific business needs, our operating and financial performance, industry conditions, economic and regulatory environments, the results of Board and committee annual self-assessments, the advantages and disadvantages of alternative leadership structures based on circumstances at that time and our corporate governance practices.

The Board has determined that 8 of our 9 current directors – Mses. Moddelmog and Sharpe and Messrs. Bensen, Blixt, Hawaux, Jurgensen, Maurer and Schindler – have no material relationships with Lamb Weston and are independent within the meaning of applicable independence standards. Mr. Werner is not independent since he is a Lamb Weston employee.

The Principles require that a majority of the directors meet the NYSE independence standards. For a director to be considered independent, the Board must affirmatively determine, after reviewing all relevant information, that a director has no material relationship with Lamb Weston. In making its independence determinations, the Board has established categorical independence standards, including whether a director or a member of the director's immediate family has any current or past employment or affiliation with Lamb Weston or the independent auditors. These standards are generally consistent with the NYSE's independence standards and are included in the Principles.

In addition to satisfying our independence standards, each member of the Audit and Finance Committee of the Board must satisfy an additional SEC independence requirement that provides that the member may not accept, directly or indirectly, any consulting, advisory or other compensatory fee from us or any of our subsidiaries other than his or her director's compensation and may not be an "affiliated person" of Lamb Weston. Each member of the Audit and Finance Committee satisfies this additional independence requirement.

Similarly, the SEC and NYSE have adopted rules relating to the independence of members of the Compensation Committee of the Board. These rules require consideration of the source of the Compensation Committee member's compensation, including any consulting, advisory or other compensatory fees paid to the Compensation Committee member, and the Compensation Committee member's affiliation

18

with us, any of our subsidiaries or any affiliates of our subsidiaries. Each member of the Compensation Committee satisfies these additional independence requirements.

Our senior leadership is responsible for identifying, assessing and managing our exposure to risk. A component of this work is performed through a management-led Risk Oversight Committee, chaired by our Chief Financial Officer. The Board and its committees play an active role in overseeing management's activities and ensuring that management's plans are balanced from a risk/reward perspective. The Board and its committees perform this oversight through the following mechanisms:

Because issues related to risk oversight often overlap, certain issues may be addressed at both the committee and full Board level.

We expect directors to attend all Board meetings, the Annual Meeting and all meetings of the committees on which they serve. We understand, however, that occasionally a director may be unable to attend a meeting. Each director attended 100% of all meetings of the Board and the committees on which he or she served during fiscal 2018. In addition, all then-current directors attended our 2017 annual meeting of stockholders.

19

Code of Conduct and Code of Ethics for Senior Corporate Financial Officers

We have a written Code of Conduct that applies to members of our Board and employees. The Code of Conduct is designed to reinforce our commitment to high ethical standards and to promote:

The Code of Conduct reflects our values and contains important rules our directors and employees must follow when conducting business. The Code of Conduct is part of our global compliance and integrity program that provides support and training throughout our Company and encourages reporting of wrongdoing by offering anonymous reporting options and a non-retaliation policy.

Additionally, we have a written Code of Ethics for Senior Corporate Financial Officers (the "Code of Ethics") that applies to our Chief Executive Officer, Chief Financial Officer and Controller, who are also subject to the provisions of our Code of Conduct. Under the Code of Ethics, these senior corporate officers are required to, among other matters:

We will disclose in the Corporate Governance section of our website any amendments to our Code of Conduct or Code of Ethics and any waiver granted to an executive officer or director under these codes.

Section 16(a) Beneficial Ownership Reporting Compliance

Section 16(a) of the Exchange Act requires our executive officers, directors and persons who beneficially own more than 10% of our common stock to report to the SEC their ownership of our common stock and changes in that ownership. As a practical matter, our Corporate Secretary's office assists our directors and executive officers by monitoring their transactions and completing and filing Section 16(a) reports on their behalf.

20

We reviewed copies of reports filed pursuant to Section 16(a) of the Exchange Act and written representations from reporting persons that all reportable transactions were reported. Based solely on that review, we believe that during fiscal 2018, all required filings were timely made in accordance with Exchange Act requirements.

Interested parties may communicate with the members of the Board, our non-management directors as a group or the Chairman of the Board by writing to: Lamb Weston Holdings, Inc. Board of Directors, c/o Corporate Secretary, Lamb Weston Holdings, Inc., 599 S. Rivershore Lane, Eagle, Idaho 83616. All communications will be reviewed by the Corporate Secretary, and by internal audit as appropriate, and be reported to the Chairman of the Board. However, the Corporate Secretary routinely filters communications that are solicitations, consumer complaints, unrelated to Lamb Weston or our business or inappropriate communications.

The Board has adopted a written policy regarding the review, approval or ratification of "related party transactions." A related party transaction is one in which Lamb Weston is a participant, the amount involved exceeds $120,000 and any "related party" has or will have a direct or indirect material interest. In general, "related parties" include our directors, executive officers and 5% stockholders and their immediate family members. Under this policy, all related party transactions must be pre-approved by the Audit and Finance Committee unless circumstances make pre-approval impracticable. In the latter case, management may enter into the related party transaction, but the transaction remains subject to ratification by the Audit and Finance Committee at its next regular in-person meeting. In determining whether to approve or ratify a related party transaction, the Audit and Finance Committee will take into account, among other factors it deems appropriate, whether the transaction is fair and reasonable to Lamb Weston and the extent of the related party's interest in the transaction. No director may participate in any approval of a related party transaction in which he or she is involved. The Audit and Finance Committee, on at least an annual basis, reviews and assesses any ongoing related party transactions to determine whether the relationships remain appropriate. The Audit and Finance Committee also reports its actions with respect to any related party transaction to the full Board.

BOARD COMMITTEES AND MEMBERSHIP

The Board designates the committee members and chairs based on the Governance Committee's recommendations. The Board has three standing committees: Audit and Finance, Compensation and Governance. The Board has a written charter for each committee. The charters set forth each committee's roles and responsibilities. All committee charters are available on our website as discussed above under "Corporate Governance—Corporate Governance Materials." The following table lists the current committee membership and the number of meetings held by each committee in fiscal 2018.

| | Audit & Finance | Compensation | Governance | |||

|---|---|---|---|---|---|---|

| Peter J. Bensen | X | |||||

| Charles A. Blixt | | X | Chair | |||

| André J. Hawaux | X | |||||

| W.G. Jurgensen* | | | | |||

| Thomas P. Maurer | Chair | |||||

| Hala G. Moddelmog | | X | X | |||

| Andrew J. Schindler | Chair | X | ||||

| Maria Renna Sharpe | | X | X | |||

| | | | | | | |

| Meetings in FY 2018 | 6 | 5 | 4 |

21

The Board established the Audit and Finance Committee in accordance with Section 3(a)(58)(A) and Rule 10A-3 under the Exchange Act. The Audit and Finance Committee consists entirely of independent directors, and each director meets the independence requirements set forth in the listing standards of NYSE, Rule 10A-3 under the Exchange Act and the Audit and Finance Committee charter. The Board has determined that each Audit and Finance Committee member is "financially literate" within the meaning of NYSE rules and that Messrs. Bensen, Hawaux and Maurer are "audit committee financial experts" within the meaning of SEC regulations. No Audit and Finance Committee member received any payments in fiscal 2018 from us other than compensation for service as a director.

Under its charter, the Audit and Finance Committee is responsible for overseeing our accounting and financial reporting processes, audits of our financial statements and the appointment and retention of our independent auditors. The Audit and Finance Committee, among other duties:

The Audit and Finance Committee has established procedures for the receipt, retention and treatment, on a confidential basis, of any complaints we receive. Any person who has a complaint or concern about our accounting, internal accounting controls or auditing matters may communicate such complaints or concerns to the Audit and Finance Committee, which communications may be confidential or anonymous and may be submitted in writing to: Audit and Finance Committee, Lamb Weston Holdings, Inc., c/o Corporate Secretary, 599 S. Rivershore Lane, Eagle, Idaho 83616. All complaints and concerns will be reviewed by our head of internal audit, and by legal counsel and the Corporate Secretary as appropriate. The status of all outstanding complaints or concerns will be reported at each meeting of the Audit and Finance Committee.

22

Audit and Finance Committee Report for the Year Ended May 27, 2018

The Audit and Finance Committee assists the Board in fulfilling its oversight responsibilities by reviewing (1) the integrity of the financial statements of the Company, (2) the qualifications, independence and performance of the Company's independent auditor and internal audit department and (3) compliance by the Company with legal and regulatory requirements. The Audit and Finance Committee acts under a written charter, adopted by the Board, a copy of which is available on our website.

Management has primary responsibility for Lamb Weston's financial statements and the reporting process, including the systems of internal control over financial reporting. The independent auditor is responsible for performing an independent audit of the Company's consolidated financial statements, issuing an opinion on the conformity of those audited financial statements with generally accepted accounting principles and assessing the effectiveness of the Company's internal control over financial reporting. The Audit and Finance Committee oversees the Company's financial reporting process and internal controls on behalf of the Board.

The Audit and Finance Committee has sole authority to appoint, retain, compensate, oversee and terminate the independent auditor. The Audit and Finance Committee reviews the Company's annual audited financial statements, quarterly financial statements and other filings with the SEC. The Audit and Finance Committee reviews reports on various matters, including: (1) critical accounting policies of the Company; (2) material written communications between the independent auditor and management; (3) the independent auditor's internal quality-control procedures; (4) significant changes in the Company's selection or application of accounting principles; and (5) the effect of regulatory and accounting initiatives on the financial statements of the Company. The Audit and Finance Committee also has the authority to conduct investigations within the scope of its responsibilities and to retain legal, accounting and other advisors to assist the Audit and Finance Committee in its functions.

During the last fiscal year, the Audit and Finance Committee met and held discussions with representatives of Lamb Weston's management, its internal audit staff and KPMG LLP, Lamb Weston's independent auditor. Representatives of financial management, the internal audit staff and the independent auditor have unrestricted access to the Audit and Finance Committee and periodically meet privately with the Audit and Finance Committee. The Audit and Finance Committee reviewed and discussed with Lamb Weston's management and KPMG LLP the audited financial statements contained in the Company's Annual Report on Form 10-K for the fiscal year ended May 27, 2018.

The Audit and Finance Committee also discussed with the independent auditor the matters required to be discussed by the auditor with the Audit and Finance Committee under applicable requirements of the Public Company Accounting Oversight Board ("PCAOB") regarding the independent auditor's communications with the Audit and Finance Committee, as well as by SEC regulations. The Audit and Finance Committee also reviewed and discussed with KPMG LLP its independence and, as part of that review, received the written disclosures required by applicable professional and regulatory standards relating to KPMG LLP's independence from Lamb Weston, including those of the PCAOB. The Audit and Finance Committee also considered whether the provision of non-audit services provided by KPMG LLP to the Company during fiscal 2018 was compatible with the auditor's independence.

Based on these reviews and discussions and the report of the independent auditor, the Audit and Finance Committee recommended to the Board, and the Board approved, that the audited consolidated financial statements be included in Lamb Weston's Annual Report on Form 10-K for the fiscal year ended May 27, 2018, which was filed with the SEC on July 26, 2018.

Audit and Finance Committee:

Thomas P. Maurer, Chair

Peter J. Bensen

André J. Hawaux

23

Pre-Approval Policy

The Audit and Finance Committee's policy is to pre-approve all audit and non-audit services provided by the independent auditors. These services may include audit services, audit-related services, tax services and other permissible non-audit services. The pre-approval authority details the particular service or category of service that the independent auditors will perform, as well as pre-approved spending limits.

During fiscal 2018, the Audit and Finance Committee pre-approved all audit and non-audit services provided by the independent auditors.

Independent Auditors' Fees

Aggregate fees for professional services rendered by our independent auditors, KPMG LLP, for fiscal years 2017 and 2018 are set forth in the table below.

| | 2018 | 2017 | |||||

|---|---|---|---|---|---|---|---|

Audit Fees | $ | 2,472,489 | $ | 1,512,500 | |||

Audit-Related Fees | | — | | — | |||

Tax Fees | 37,000 | 21,000 | |||||

All Other Fees | | — | | — | |||

| | | | | | | | |

Total | $ | 2,509,489 | $ | 1,533,500 | |||

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

Compensation Committee Interlocks and Insider Participation

The Board has determined that all of the directors who served on the Compensation Committee during fiscal 2018 are independent within the meaning of the NYSE listing standards. No member of the Compensation Committee is a current, or during fiscal 2018 was a former, officer or employee of Lamb Weston or any of our subsidiaries. During fiscal 2018, no member of the Compensation Committee had a relationship that must be described under the SEC rules relating to disclosure of related party transactions (for a description of our policy on related party transactions, see "Corporate Governance—Related Party Transactions" in this Proxy Statement). During fiscal 2018, none of our executive officers served on the board of directors or compensation committee of any entity that had one or more of its executive officers serving on the Board or the Compensation Committee.

Responsibilities

The Compensation Committee's responsibilities are more fully described in our Compensation Committee charter, and include, among other duties:

24

The Compensation Committee may delegate its responsibilities to subcommittees comprised of one or more committee members or to selected members of management, subject to requirements of our bylaws and applicable laws, regulations and the terms of our stock plan.

Compensation Consultant to the Committee

The Compensation Committee retains an independent compensation consultant to assist it in evaluating executive compensation programs and advise it regarding the amount and form of executive and director compensation. It uses a consultant to provide additional assurance that our executive and director compensation programs are reasonable, competitive and consistent with our objectives.

The Compensation Committee has retained Frederic W. Cook & Co., Inc. ("F.W. Cook") as its independent compensation consultant. During fiscal 2018, F.W. Cook provided the Compensation Committee advice and services, including:

25

For the year ended May 27, 2018, F.W. Cook provided no services to Lamb Weston other than consulting services to the Compensation Committee regarding executive and non-employee director compensation.

At least annually, the Compensation Committee reviews the current engagements and the objectivity and independence of the advice that F.W. Cook provides to it on executive and non-employee director compensation. The Compensation Committee considered the specific independence factors adopted by the SEC and NYSE and determined that F.W. Cook is independent and F.W. Cook's work did not raise any conflicts of interest.

Analysis of Risk in the Compensation Architecture

In 2018, the Compensation Committee evaluated whether our compensation designs, policies and practices operate to discourage our executive officers and other employees from taking unnecessary or excessive risks. As described under "Compensation Discussion and Analysis," we design our compensation to incent executives and other employees to achieve the Company's financial and strategic goals that promote long-term stockholder returns. Our compensation design does not encourage our executives and other employees from taking excessive risks for short-term benefits that may harm the Company and our stockholders in the long-term. The Compensation Committee uses various strategies to mitigate risk, including:

F.W. Cook also reviewed the Compensation Committee's risk analysis, including the underlying procedures, and confirmed the Compensation Committee's conclusion below.

In light of these analyses, the Compensation Committee believes that our compensation programs do not create risks that are reasonably likely to have a material adverse effect on Lamb Weston.

26

Nominating and Corporate Governance Committee

The Board has determined that all of the Governance Committee members are independent within the meaning of the NYSE listing standards. The Governance Committee's charter sets out its responsibilities. Among its responsibilities are:

The Governance Committee considers Board candidates suggested by Board members, management and stockholders. The Governance Committee will consider any candidate a stockholder properly presents for election to the Board in accordance with the procedures set forth in our bylaws. The Governance Committee uses the same criteria to evaluate a candidate suggested by a stockholder as the Governance Committee uses to evaluate a candidate it identifies, which are described above under "Item 1. Election of Directors—Director Nomination and Qualification," and makes a recommendation to the Board regarding the candidate's appointment or nomination for election to the Board. After the Board's consideration of the candidate suggested by a stockholder, our Corporate Secretary will notify that stockholder whether the Board decided to appoint or nominate the candidate. For a description of how stockholders may nominate a candidate for the Governance Committee to consider for election to the Board at an annual meeting, see "2019 Annual Meeting of Stockholders" in this Proxy Statement.

If a potential candidate is identified, the Governance Committee will determine whether to conduct a full evaluation of the candidate. This determination is based on whether additional Board members are necessary or desirable. It is also based on whether, in light of the information provided or otherwise available to the Governance Committee, the prospective nominee is likely to satisfy the director qualifications and other factors described above under "Item 1. Election of Directors—Director Nomination and Qualification." If the Governance Committee determines that additional consideration is warranted, it may request a third party search firm or other third party to gather additional information about the prospective nominee. The Governance Committee may also elect to interview a candidate. After completing its evaluation process, the Governance Committee makes a recommendation to the full Board.

27

NON-EMPLOYEE DIRECTOR COMPENSATION

We use a combination of cash and equity-based incentive compensation to attract and retain highly qualified non-employee directors who will best represent our stockholders' interests. With its independent compensation consultant's assistance, the Compensation Committee benchmarks director compensation against an industry peer group and general industry data and considers the appropriateness of the form and amount of director compensation and the time commitment and skill level required to serve on the Board. The Compensation Committee recommends the non-employee director compensation program to the full Board for approval.

In addition, our 2016 Stock Plan limits the maximum fair market value of stock awards to be granted to a non-employee director, taken together with any cash fees payable to him or her, at $600,000 in any fiscal year. All stock awards made in fiscal 2018 to non-employee directors were significantly below this amount. See "—2018 Non-Employee Director Compensation Table" below for specific values.

A Lamb Weston employee who also serves as a director does not receive any additional compensation for serving as a director. Currently, Thomas Werner, our President and Chief Executive Officer, is the only director who is an employee. Compensation information for Mr. Werner is included under "Compensation Discussion and Analysis" and "Executive Compensation Tables" in this Proxy Statement.

Summary of 2018 Compensation Elements

The table below summarizes the cash and equity compensation elements in place for our non-employee directors.

| | | | | |

Annual Compensation Elements(1) | Amount ($) | |||

| | | | | |

Board Retainer | 90,000 | |||

Chairman Retainer | | 150,000 | ||

Audit and Finance Committee Chair Retainer | 20,000 | |||

Compensation Committee Chair Retainer | | 15,000 | ||

Nominating and Corporate Governance Chair Retainer | 15,000 | |||

Equity Grant Value | | 130,000 | ||

| | | | | |

We pay our non-employee directors their cash retainers quarterly. Non-employee directors can defer all or a portion of their cash retainers into an interest bearing account, Lamb Weston common stock account or other investments that track investments that are permitted by Lamb Weston's Employee Benefits Investment Committee pursuant to the Lamb Weston Directors' Deferred Compensation Plan. This program does not provide above-market earnings (as defined by SEC rules).

Non-employee directors also receive an annual stock award in the form of restricted stock units ("RSUs"). The number of RSUs granted to each director is determined by dividing the annual equity grant value ($130,000) by the closing stock price of our common stock on the NYSE on the date of grant, rounded down to the nearest share. The RSUs vest one year from the date of grant, subject to continued service during the entire term. Dividend equivalents are paid on the RSUs at the regular dividend rate in shares of our common stock. Non-employee directors may also defer receipt of their stock compensation under the Lamb Weston Directors' Deferred Compensation Plan.

28

Director Stock Ownership Requirements

To further align our non-employee directors' and our stockholders' interests, the Board has adopted stock ownership requirements for the non-employee directors. All non-employee directors are expected to hold shares of Lamb Weston common stock in an amount equal to five times the annual Board retainer ($450,000). All directors must acquire this ownership level within five years after joining the Board. Directors may not sell Lamb Weston common stock until such time as the director has achieved the retention amount (except to satisfy tax withholding requirements). If a director holds the retention amount, the director may elect to sell any shares above that amount upon vesting. If a director departs from the Board, the director may not sell the retention amount until six months after his or her date of departure from the Board. All of our current directors have served for less than five years.

2018 Non-Employee Director Compensation Table

The table below presents information regarding the compensation and stock awards that we have paid or granted to our non-employee directors.

| Name | Fees Earned or Paid in Cash(1) ($) | Stock Awards(2) ($) | All Other Compensation ($) | Total ($) | |||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

Peter J. Bensen | 39,313 | 108,321 | — | 147,634 | |||||||||

Charles A. Blixt | | 105,000 | | 173,331 | | — | | 278,331 | |||||

André J. Hawaux | 78,380 | 162,455 | — | 240,835 | |||||||||

W.G. Jurgensen | | 203,132 | | 173,331 | | — | | 376,463 | |||||

Thomas P. Maurer | 103,297 | 173,331 | — | 276,628 | |||||||||

Hala G. Moddelmog | | 78,380 | | 162,455 | | — | | 240,835 | |||||

Andrew J. Schindler | 105,000 | 173,331 | — | 278,331 | |||||||||

Maria Renna Sharpe | | 90,000 | | 173,331 | | — | | 263,331 | |||||

| Name | Outstanding RSUs(a) (#) | |||

|---|---|---|---|---|

Peter J. Bensen | 1,942 | |||

Charles A. Blixt | | 3,552 | ||

André J. Hawaux | 3,405 | |||

W.G. Jurgensen | | 3,552 | ||

Thomas P. Maurer | 3,552 | |||

Hala G. Moddelmog | | 3,405 | ||

Andrew J. Schindler | 3,552 | |||

Maria Renna Sharpe | | 3,552 | ||

29

COMPENSATION DISCUSSION AND ANALYSIS

This Compensation Discussion and Analysis (our "CD&A") provides an overview of our executive compensation program for fiscal 2018 and our executive compensation philosophies and objectives.

For fiscal 2018, our named executive officers ("NEOs") were:

Name | Title | |

|---|---|---|

| Thomas P. Werner | President and Chief Executive Officer | |

Robert M. McNutt | Senior Vice President and Chief Financial Officer | |

Eryk J. Spytek | Senior Vice President, General Counsel and Corporate Secretary | |

Sharon L. Miller | Senior Vice President and General Manager, Global Business Unit | |

Richard A. Martin | Senior Vice President and Chief Supply Chain Officer |

This CD&A is organized into the following sections:

| Overview | • Fiscal 2018 Business Highlights | |

• Fiscal 2018 Compensation Highlights | ||

• Our Executive Compensation Program, Philosophies and Objectives | ||

• Our Executive Compensation Practices | ||

• 2017 Say-on-Pay Vote | ||

What We Pay and Why | • Fiscal 2018 Executive Compensation | |

• Alignment of Executive Compensation Program with Performance | ||

• Base Salary | ||

• Annual Cash Incentive Compensation (Annual Incentive Plan) | ||

• Long-Term Incentive Compensation (Long-Term Incentive Plan) | ||

• Outstanding Performance Share Awards Granted Prior to Spinoff | ||

• Other Elements of our Fiscal 2018 Executive Compensation Program | ||

• Fiscal 2019 Executive Compensation Decisions | ||

How We Make Executive Compensation Decisions | • Role of the Board, Compensation Committee and our Executive Officers | |

• Guidance from Independent Compensation Consultant | ||

• Inputs to Setting Compensation Opportunity |

30

Lamb Weston, along with our joint venture partners, is a leading global producer, distributor, and marketer of value-added frozen potato products. We are the number one supplier of value-added frozen potato products in North America. We are also a leading supplier of value-added frozen potato products internationally, with a strong and growing presence in high-growth emerging markets, and offer a broad product portfolio to a diverse channel and customer base in over 100 countries.

Fiscal 2018 Business Highlights

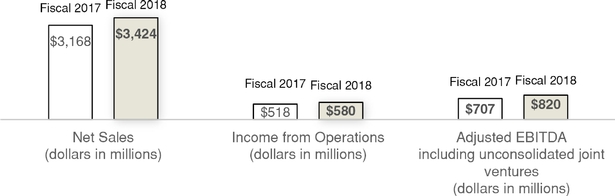

We delivered strong results in fiscal 2018, including exceeding each of our financial goals and continuing to build a strong foundation for sustainable growth as an independent company. This performance reflects our commitment to consistently deliver high service levels for our customers, and to support their long-term growth, both in North America and internationally. Specifically:

1 Adjusted EBITDA including unconsolidated joint ventures is a non-GAAP financial measure. See the discussion of non-GAAP financial measures and the reconciliation to income from operations in Appendix A to this Proxy Statement.

31

Fiscal 2018 Compensation Highlights

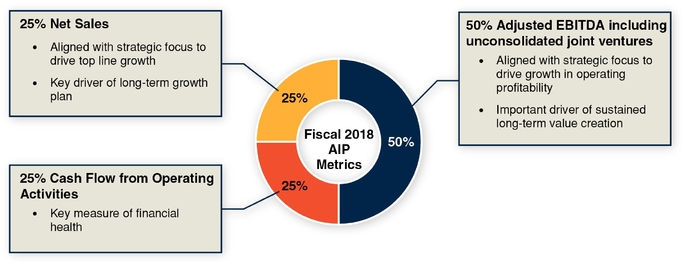

Our Compensation Committee reviews our executive compensation programs and Company performance to ensure earned awards are linked to Company performance. Consistent with our performance highlighted above, for fiscal 2018 the Compensation Committee approved the following incentive awards:

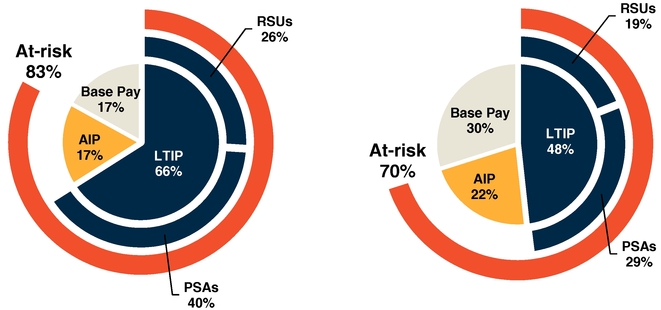

As illustrated in the charts below, the majority of our fiscal 2018 executive compensation opportunities for our NEOs was variable and realized only if the applicable financial goals were met.

| | | | | | | |||||

|---|---|---|---|---|---|---|---|---|---|---|

| | | | | | | | | | | |

| | CEO | | | NEOs (Excluding CEO) | | |||||

| Fiscal 2018 Total Compensation at Target Pay Mix | Average Fiscal 2018 Total Compensation at Target Pay Mix | |||||||||

| | | | | | | | | | | |

Our Executive Compensation Program, Philosophies and Objectives

Our Compensation Committee and management believe that compensation is an important tool to recruit, retain and motivate the executives whom we rely on for current and future success.

Our compensation program is designed to accomplish the following:

32

The Compensation Committee seeks to target total executive compensation opportunities at levels consistent with those of similarly sized companies in the consumer packaged goods industry. The current NEOs' compensation is weighted towards programs contingent upon our annual and long-term performance and incorporates multiple vesting periods to strengthen the long-term focus and stockholder linkage and promote behavior consistent with our long-term strategic plan.

Our Executive Compensation Practices

The Compensation Committee reviews our executive compensation program on an ongoing basis to evaluate whether it supports our company's executive compensation philosophies and objectives and is aligned with stockholder interests. Our executive compensation practices include the following, each of which the Compensation Committee believes reinforces our executive compensation objectives:

| ||

| | | |

ü Mix of financial goals to prevent over-emphasis on any single metric. | ||

ü Place a significant portion of pay at risk. | ||

ü Require stock ownership and share retention requirements for our executive officers and non-employee directors. | ||

ü Allow executive officers to engage in transactions in our securities only during approved trading windows and only after satisfying mandatory clearance requirements. | ||

ü Require both a change of control and termination of employment for accelerated equity vesting to occur in connection with a change of control (i.e., double-trigger), with the exception of certain legacy Conagra awards. | ||

ü Maintain a clawback policy that requires the forfeiture or recoupment of awards for our executive officers under our incentive plans in the event of detrimental conduct by the executive officer or a material restatement of our financial statements resulting from the fraudulent or dishonest actions of the executive officer. | ||

ü Use a range of strong processes and controls, including Compensation Committee and Board oversight, in our compensation practices. | ||

ü Use an independent compensation consultant who performs no other work for the Company. | ||

ü Pay incentive compensation to our NEOs only after our financial results are complete and the Compensation Committee has certified our performance results. | ||

33

| ||

| | | |

× No director or executive officer may pledge or hedge ownership of our stock. | ||

× No individual employment agreements or severance agreements with our current executive officers. | ||

× No perquisites are provided to our executive officers other than relocation benefits for new executive officers. | ||

× No backdating or re-pricing of options may occur without stockholder approval. | ||

× No change of control agreements have excise tax "gross-up" protection. | ||

× No compensation programs that encourage unreasonable risk taking will be implemented. | ||

2017 Say-on-Pay Vote

At our 2017 annual meeting of stockholders, over 95% of the votes cast on our 2017 advisory "say-on-pay" proposal were cast FOR our executive compensation program. The Compensation Committee reviewed these results and determined the Company's executive compensation philosophies and program are appropriate and aligned with stockholders' interests. As a result, we made no material changes to our executive compensation program directly in response to the 2017 stockholder advisory say-on-pay vote.

Fiscal 2018 Executive Compensation