NYIAX, Inc.

180 Maiden Lane, 11th Floor

New York, NY 10005

VIA EDGAR

June 1, 2022

U.S. Securities and Exchange Commission

Division of Corporation Finance

Office of Trade & Services

Washington, D.C. 20549

Amendment No. 1 to Draft Registration Statement on Form S-1

Submitted February 7, 2022

CIK No. 0001679379

Ladies and Gentlemen:

NYIAX, Inc. (the “Company,” “we,” “our” or “us”) hereby transmits the Company’s response to the comments of the staff of the Division of Corporation Finance (the “Staff”) of the Securities and Exchange Commission (the “Commission”) with respect to the Company’s confidential submission of its Amendment No. 1 to Draft Registration Statement on Form S-1 on February 7, 2022 as set forth in the Staff’s letter dated February 24, 2022 (the “Comment Letter”). Concurrently with filing of this letter, the Company is publicly filing a Registration Statement on Form S-1 (the “Amended Registration Statement”), which includes changes to reflect responses to the Staff’s comments.

For reference purposes, the text of the Comment Letter has been reproduced herein with responses below each numbered comment. All capitalized terms used and not otherwise defined herein shall have the meanings set forth in the Amended Registration Statement.

Amendment No. 1 to Draft Registration Statement on Form S-1

Management’s Discussion and Analysis of Financial Condition and Results of Operations, page 22

| 1. | We note your response to prior comment 3; however, we also note your disclosure on page 45 that you have “commenced commercial use of the NYIAX platform as of 2021.” Please revise to provide a clear timeline of when you began to monetize and commercialize the NYIAX platform. |

Response: Pursuant to the comment, we have revised and reconciled the disclosures at pages 25 and 54 in the Amended Registration Statement.

Results of Operations, page 25

| 2. | We note that your presentation of results of operations is combined with your non-GAAP measures and reconciliation. To avoid giving undue prominence to your non-GAAP financial measures, such as Adjusted EBITDA Loss and Operating Expenses, excluding share based compensation and amortization and depreciation, please move references to non-GAAP measures so that they follow the results of operations disclosures, which are presented on a GAAP basis. Refer to Item 10(e)(1)(i)(A) of Regulation S-K and Question 102.10 of the non-GAAP C&DIs. |

Response: Pursuant to the comment, we have divided information between GAAP and non-GAAP disclosures as appropriate, and moved references to non-GAAP measures to pages 29 and 33.

| 3. | Please revise your results of operations to present and provide a discussion of your historical GAAP basis financial statements as required by Item 303 of Regulation S-K. Any discussion of non-GAAP measures (such as Operating Expenses, excluding share based compensation and amortization and depreciation) should be in addition to, and not in lieu of, a discussion of your historical results of operations required by Item 303 of Regulation S-K. |

Response: Pursuant to the comment, we have revised our results of operations to present and provide a discussion of our historical GAAP basis financial statements on pages 27-29 and pages 31-33 and a discussion of the non-GAAP financial measures on pages 29-31 and pages 33-35.

| 4. | We note your response to prior comment 9 and additional disclosures. In the discussion of your historical GAAP financial statements, please revise to separately discuss and quantify each significant factor contributing to the change for each of the line items presented. For example, technology and development and selling and general expenses both declined from 2019 to 2020, but there is no discussion of the reason for these decreases. Please revise your disclosure to comply with Item 303(b) of Regulation S-K, which sets forth “where the financial statements reflect material changes from period-to-period in one or more line items, including where material changes within a line item offset one another, describe the underlying reasons for these material changes in quantitative and qualitative terms.” |

Response: Pursuant to the comment, we have added disclosures of each significant factor contributing to the change for each of the line items presented and described the underlying reasons for these material changes in quantitative and qualitative terms. For example, for Technology and Administration, we added: “The Company’s technology and development increased due to additional functionality developed for our platform.”; and for Selling General and Administrative, we added: “Selling general and administrative increased to $7,096,645 from $4,100,627, or $2,996,018 (73%), from 2020 to 2021 primarily resulting from a marked increase in sales and marketing staff with related expenses and administrative costs related to the Company going public, such as an annual audit. Sales and marketing staff increased from one (year end 2020) to eleven (year end 2021)”.

NYIAX Platform and Nasdaq Technology, page 33

| 5. | We note your response to prior comment 13 and your revised disclosure here. Please revise to also disclose other material terms of your IT Services Agreement or other material agreements with Nasdaq, such as termination provisions, exclusivity provisions or any other provisions that restrict NYIAX’s ability to freely use the technology covered by the co-patent. Additionally, please be advised that we may have additional comments once the agreement is filed. |

Response: Pursuant to the comment, we have revised the disclosures at pages 38-39 in the Amended Registration Statement.

Business

Our Clients, page 45

| 6. | We note your response to prior comment 14 and your revised disclosures. Please revise to also provide a summary of the material terms of your agreements with your material customers. Additionally, while we note that you disclose the number of customers you provided services for during the year ended December 31, 2021, please also disclose your number of customers as of the end of each period presented in your financial statements. |

Response: Pursuant to the comment, we have revised the disclosures to (i) add a summary of the material terms of our agreements with the material customers at page 53 in the Amended Registration Statement; and (ii) disclose the number of customers as of December 31, 2021 at page 54 in the Amended Registration Statement.

General

| 7. | In order to better evaluate your responses to prior comments 17 and 24-27 and better understand your current business operations, please provide the following: |

| ● | An illustrative example of the lifecycle of a contract; |

| ● | The material terms of a representative contract; |

| ● | A description of the services that the platform provides through the lifecycle of a contract, from pre-execution to post-execution, as well as of the services that are automated through the smart contract and/or blockchain; |

| ● | An explanation as to whether the contracts are individually negotiated or standardized, and if the former how the contracts are individually negotiated through the platform; |

| ● | An explanation as to how contracts are priced on the platform; |

| ● | Clarification as to whether the contracts are tradeable after execution. In this regard, there is disclosure in the filing indicating that the contracts can be traded or re-traded; and |

| ● | An explanation of why the company refers to the contracts as “traded” if the market is a bilateral contract market. |

Response: Please see Exhibit A attached hereto fore responses to each bullet point. We have also revised the disclosures throughout the Amended Registration Statement to remove the usage of “trade”. In addition, we have also included a summary of the lifecycle of a contract at page 48.

| 8. | Your response to prior comment 24 states that the contracts managed on your platform are not financial instruments and that you removed disclosures stating that your platform provides a marketplace where advertising or audience campaigns are listed, bought, or sold and traded as if they were a financial instrument through a forward or a future contract methodology. We note, however, that pages 22 and 38 continue to contain these disclosures. Please revise to remove these disclosures or advise. |

Response: We have further revised the disclosures previously included at pages 22, 23 and 38 of Amendment No. 1 to Draft Registration Statement on Form S-1 on February 7, 2022, as well as throughout the rest of the Amended Registration Statement, to remove the usage of “trade”.

| 9. | In response to prior comment 28, you state that you currently have no plans to extend your platform to other assets classes. However, disclosures on pages 1, 33 and 46 continue to reference the use of your platform with other complex asset classes. We also note your disclosure on page 1 that your technology creates opportunities beyond your initial market in media and advertising. If you have no plans to extend your platform to other asset classes, please revise to explicitly state this. To the extent you do have plans to extend your platform to other asset classes, we reissue prior comment 28. Additionally, to the extent you continue to reference “complex asset classes”, please revise to provide your definition of this term. |

Response: We have revised the disclosures at pages 2, 39, 49 and 55 to state that we currently have no plans to extend our platform to other asset classes. In addition, we have removed all references of “complex asset classes” previously included at pages 1, 33 and 47 in the Amendment No. 1 to Draft Registration Statement on Form S-1 on February 7, 2022.

We thank the Staff for its review of the foregoing and the Amended Registration Statement. If you have further comments, please feel free to contact to our counsel, Mitchell L. Lampert, Esq., Robinson & Cole LLP, at mlampert@rc.com or by telephone at 203-462-7559.

| | Sincerely, |

| | |

| | /s/ Christopher Hogan |

| | Christopher Hogan,

Interim Chief Executive Officer |

| cc: | Mitchell L. Lampert, Esq. Robinson & Cole LLP |

Exhibit A – Response to Comment #7

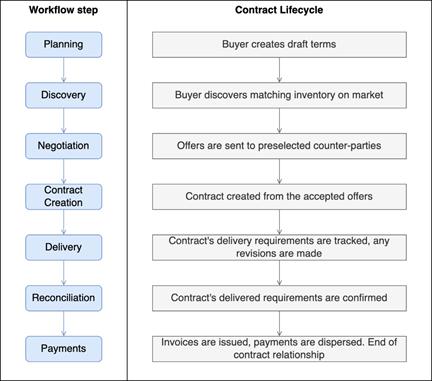

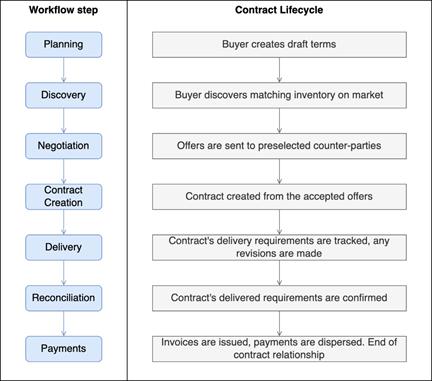

| 1) | An illustrative example of the lifecycle of a contract. |

| 2) | The material terms of a representative contract. |

NYIAX contract is represented by the following attributes:

| ● | Counterparties:buyer account/seller account; |

| ● | Contract parameters in terms of metrics for view or impressions; |

| ● | Media inventory properties (sites, channels or applications); |

| ● | Standardized media inventory attributes (advertising specific attributes like content type, ad type, language, ad sizes, content categories, etc. Full NYIAX attributes taxonomy is available for all participants); |

| ● | Standardize contract terms (count of record for delivery tracking and payment terms). |

| 3) | A description of the services that the platform provides through the lifecycle of a contract, from pre-execution to post-execution, as well as of the services that are automated through the smart contract and/or blockchain. |

As described in Diagram 1 of this document NYIAX platform provides the following services through the lifecycle of a contract:

NYIAX utilization of the blockchain and smart contract is used for tracking from Contract Formation to Payments. Pre-execution means Contract Creation prior to Delivery. Post execution is Delivery to Payments.

3.1. Planning

Planning services include Buyer’s campaign media planning and Seller’s contract management system tools.

Buyer’s campaign media tools allow the buyer to:

| ● | Create a campaign – a container object that allows tracking main advertising objectives, budgets, and counterparties involved. |

| ● | Create a counterparty budget – a control and validation object that allows tracking budgets broken down by individual counterparties as well as media and terms restrictions, guaranteeing that future purchases won’t contradict overall campaign restrictions. |

| ● | Create and share with the Seller an order request – a communication object that enables the seller to submit their available inventory to the buyer for purchase. |

| ● | Plan and track overall campaign spending broken down by counterparty, media type, timeframe, etc. |

Seller contract management tools provide capabilities for the sellers to manage their available inventory:

| ● | Ability to receive and track all the campaigns that the seller is involved with. |

| ● | Ability to review and respond to all the received order requests. |

| ● | Ability to submit and manage available inventory as sell orders either on the market or directly provided to the buyer. |

3.2. Discovery

A set of tools that allows participating buyers and sellers to search and discover the following object available in the platform:

| ● | sellers’ and buyers’ firms; |

| ● | properties (sites, channels or applications); |

| ● | individual sell orders, published on the market; |

| ● | individual order requests, published on the market. |

Discovery and search support sophisticated filtration and sorting tools supporting a variety of attributes including dates, volumes, proposed contract terms, compliance requirements, etc.

3.3. Negotiation

NYIAX negotiation process consists of the following steps:

| ● | Buyer selects available sell orders either from the market or received from individual sellers; |

| ● | Buyer submits bids with proposed price and volume for the individual sell orders preselected on the previous step; |

| ● | NYIAX validates the sell orders and bids to guarantee their compliance with the campaign and budget restriction; |

| ● | Seller, after reviewing the offer, may might accept, decline or provide a counteroffer or series of counter offers until buyer ultimately ends negotiation by entering into a contract or passes on the Seller. |

3.4. Contract Creation

When the seller accepts the bids, NYIAX’s system creates a contract between buyer’s account and seller’s account via Nasdaq matching system, which guarantees accuracy of the match between buyer’s and seller’s attributes specifying the contract requirements.

Pairing process between results in contract creation that generates a line item (line item is a term more widely used in advertising) that constitutes an individual contract between the parties.

A set of line items traded between the same counterparties within the constraints of the same campaign and budget are grouped into an insertion order that represents a contract between the buyer and the seller with the set of individual line items listed under it.

3.5. Delivery

NYIAX facilitates the communication between 2 parties of the contract to guarantee a timely contract delivery process.

3.6. Reconciliation

The NYIAX system tracks the delivery process of the contracts registered in within the platform on a daily basis, which includes but is not limited to the information coming from the count of record sources for the individual contracts: date and time of delivery, delivered volume, cost of the delivered volume, quality metrics, etc.

NYIAX facilitates the reconciliation process between parties by tracking any discrepancies between the reported sources and confirming with both parties the final volume and value of the executed contract requirements.

3.7. Payment

Based on the reconciled delivered volume of the contract, NYIAX’s system issues and tracks invoices for the buyers and payments to the sellers.

| 4) | An explanation as to whether the contracts are individually negotiated or standardized, and if the former how the contracts are individually negotiated through the platform. |

The contract structure is standardized by NYIAX attributes taxonomy, but NYIAX does allow for bespoken attributes by the buyer and sell. Additionally, the volume, price and overall value of the contract might be negotiated between parties. Point 3.3. Negotiation section of this document provides the details of this process.

| 5) | An explanation as to how contracts are priced on the platform. |

The price per volume and overall value of the contract is suggested by the buyer via bidding process and might be either accepted, declined or renegotiated by the seller. The seller might decline a bid but submit a new sell order with different conditions that might be more accessible for the buyer, thus starting a new round of the negotiation.

| 6) | Clarification as to whether the contracts are tradeable after execution. In this regard, there is disclosure in the filing indicating that the contracts can be traded or re-traded, and an explanation of why the company refers to the contracts as “traded” if the market is a bilateral contract market. |

The term was incorrect. We used the term “traded” as a work of art. NYIAX is referring to a Seller’s inventory status, which has been accepted via negotiating. There is no re-trading of the NYIAX contracts into a secondary market.

8