Filed Pursuant to Rule 424(b)(3)

Registration No. 333-260183

PROSPECTUS

JUPITER NEUROSCIENCES, INC.

3,600,000 Shares of

Common Stock

This prospectus relates to 3,600,000 shares of common stock, par value US$0.0001 per share, of Jupiter Neurosciences, Inc. that may be sold from time to time by the selling stockholders named in this prospectus (the “Selling Stockholders”) following the closing of our initial public offering, described in greater detail in the Public Offering Prospectus (defined below).

We will not receive any of the proceeds from the sale of our common stock by the Selling Stockholders.

Since there is currently no public market established for our securities, the Selling Stockholders will sell at a fixed price of $4.00 per share, the price at which we sell shares in our public offering pursuant to the registration statement of which this prospectus is a part. Once, and if, our common stock are listed on the Nasdaq Capital Market and there is an established market for these resale shares, the Selling Stockholders may sell the resale shares from time to time, at the market price prevailing on the Nasdaq Capital Market at the time of offer and sale, or at prices related to such prevailing market prices or in negotiated transactions or a combination of such methods of sale directly or through brokers.

Our common stock has been approved for listing on Nasdaq Capital Market (“Nasdaq Capital Market”) under the symbol “JUNS”.

No resales of shares of common stock covered by this prospectus shall occur until the shares of common stock sold in our initial public offering begin trading on The Nasdaq Capital Market. The Selling Stockholders may offer and sell the shares of common stock being offered by this prospectus from time to time in public or private transactions, or both. These sales will occur at fixed prices, at market prices prevailing at the time of sale, at prices related to prevailing market prices, or at negotiated prices. The Selling Stockholders may sell shares to or through underwriters, broker-dealers or agents, who may receive compensation in the form of discounts, concessions or commissions from the selling stockholders, the purchasers of the shares, or both. Any participating broker-dealers and any Selling Stockholders who are affiliates of broker-dealers may be deemed to be “underwriters” within the meaning of the Securities Act of 1933, as amended (the “Securities Act”), and any commissions or discounts given to any such broker-dealer or affiliates of a broker-dealer may be regarded as underwriting commissions or discounts under the Securities Act. The Selling Stockholders have informed us that they do not have any agreement or understanding, directly or indirectly, with any person to distribute their shares of common stock. See “Plan of Distribution” for a more complete description of the ways in which the common stock may be sold.

On November 8, 2024, the registration statement under the Securities Act of 1933 containing this prospectus relating to the resale offering by the Selling Stockholders and a separate prospectus relating to our initial public offering (the “Public Offering Prospectus”) was declared effective by the Securities and Exchange Commission (the “SEC”). On December 4, 2024, we closed on our initial public offering of 2,750,000 shares of common stock at the public offering price of $4.00 per share of common stock under the Public Offering Prospectus through the underwriter named on the cover page of the Public Offering Prospectus. We received approximately $9,515,000 in net proceeds from our initial public offering after payment of underwriting discounts and commissions and estimated expenses of the offering.

We are an “emerging growth company” under the federal securities laws and, as such, we have elected to comply with certain reduced public company reporting requirements for this prospectus and future filings. See “Prospectus Summary— Implications of Being an Emerging Growth Company.”

Investing in our common stock involves a high degree of risk. Before buying any shares, you should carefully read the discussion of the material risks of investing in our common stock under the heading “Risk Factors” beginning on page 15 of this prospectus.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed on the adequacy or accuracy of this prospectus. Any representation to the contrary is a criminal offense.

The date of this prospectus is December 2, 2024

TABLE OF CONTENTS

No dealer, salesperson or other individual has been authorized to give any information or to make any representation other than those contained in this prospectus in connection with the offer made by this prospectus and, if given or made, such information or representations must not be relied upon as having been authorized by us. This prospectus does not constitute an offer to sell or a solicitation of an offer to buy any securities in any jurisdiction in which such an offer or solicitation is not authorized or in which the person making such offer or solicitation is not qualified to do so, or to any person to whom it is unlawful to make such offer or solicitation. Neither the delivery of this prospectus nor any sale made hereunder shall, under any circumstances, create any implication that there has been no change in our affairs or that information contained herein is correct as of any time subsequent to the date hereof.

For investors outside the United States: We have not done anything that would permit this offering or possession or distribution of this prospectus in any jurisdiction where action for that purpose is required, other than in the United States. Persons outside the United States who come into possession of this prospectus must inform themselves, and observe any restrictions relating to, the offering of the shares of our common stock and the distribution of this prospectus outside the United States.

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

This prospectus contains forward-looking statements that involve substantial risks and uncertainties. All statements other than statements of historical facts contained in this prospectus, including statements regarding our future results of operations and financial position, business strategy, development plans, planned preclinical studies and clinical trials, future results of clinical trials, expected research and development costs, regulatory strategy, timing and likelihood of success, as well as plans and objectives of management for future operations, are forward-looking statements. In some cases, you can identify forward-looking statements by terms such as “may,” “will,” “should,” “would,” “expect,” “plan,” “anticipate,” “could,” “intend,” “target,” “project,” “contemplate,” “believe,” “estimate,” “predict,” “potential” or “continue” or the negative of these terms or other similar expressions. Forward-looking statements contained in this prospectus include, but are not limited to, statements about:

| | ● | the ability of our preclinical studies and planned clinical trials to demonstrate safety and efficacy of our product candidate JOTROL, and other positive results; |

| | | |

| | ● | the timing, progress and results of preclinical studies and clinical trials for JOTROL and other product candidates we may develop, including statements regarding the timing of initiation and completion of studies or trials and related preparatory work, the period during which the results of the studies or trials will become available, and our research and development programs; |

| | | |

| | ● | the timing, scope and likelihood of regulatory filings and approvals, including timing of INDs and final FDA approval of JOTROL and any other future product candidates; |

| | | |

| | ● | the timing, scope or likelihood of foreign regulatory filings and approvals; |

| | | |

| | ● | our ability to develop and advance our current product candidate JOTROL and programs into, and successfully complete, clinical studies; |

| | | |

| | ● | our manufacturing, commercialization, and marketing capabilities and strategy; |

| | | |

| | ● | our plans relating to commercializing our product candidates, if approved, including the geographic areas of focus and sales strategy; |

| | | |

| | ● | the need to hire additional personnel and our ability to attract and retain such personnel; |

| | | |

| | ● | the size of the market opportunity for our product candidate JOTROL, including our estimates of the number of patients who suffer from the diseases we are targeting; |

| | | |

| | ● | our expectations regarding the approval and use of our product candidate JOTROL in combination with other drugs; |

| | | |

| | ● | our competitive position and the success of competing therapies that are or may become available; |

| | | |

| | ● | our estimates of the number of patients that we will enroll in our clinical trials; |

| | | |

| | ● | the beneficial characteristics, and the potential safety, efficacy and therapeutic effects of our product candidate JOTROL; |

| | | |

| | ● | our ability to obtain and maintain regulatory approval of our product candidate JOTROL; |

| | ● | our plans relating to the further development of our product candidate JOTROL, including additional indications we may pursue; |

| | | |

| | ● | existing regulations and regulatory developments in the United States, Europe and other jurisdictions; |

| | | |

| | ● | our intellectual property position, including the scope of protection we are able to establish and maintain for intellectual property rights covering JOTROL and other product candidates we may develop, including the extensions of existing patent terms where available, the validity of intellectual property rights held by third parties, and our ability not to infringe, misappropriate or otherwise violate any third-party intellectual property rights; |

| | | |

| | ● | our continued reliance on third parties to conduct additional preclinical studies and planned clinical trials of our product candidate JOTROL, and for the manufacture of our product candidate JOTROL for preclinical studies and clinical trials; |

| | | |

| | ● | our relationships with patient advocacy groups, key opinion leaders, regulators, the research community and payors; |

| | | |

| | ● | our ability to obtain, and negotiate favorable terms of, any collaboration, licensing or other arrangements that may be necessary or desirable to develop, manufacture or commercialize our product candidate JOTROL; |

| | | |

| | ● | the pricing and reimbursement of JOTROL and other product candidates we may develop, if approved; |

| | | |

| | ● | the rate and degree of market acceptance and clinical utility of JOTROL and other product candidates we may develop; |

| | | |

| | ● | our estimates regarding expenses, future revenue, capital requirements and needs for additional financing; |

| | | |

| | ● | our financial performance; |

| | | |

| | ● | the period over which we estimate our existing cash and cash equivalents will be sufficient to fund our future operating expenses and capital expenditure requirements; |

| | | |

| | ● | the impact of laws and regulations; |

| | | |

| | ● | our expectations regarding the period during which we will qualify as an emerging growth company under The Jumpstart Our Business Startups Act of 2012 and a smaller reporting company under the Securities Exchange Act of 1934, as amended; |

| | | |

| | ● | our anticipated use of our existing resources and the proceeds from our initial public offering; and |

| | | |

| | ● | the price of our common stock could be subject to rapid and substantial volatility. As a relatively small-capitalization company with relatively small public float, we may experience greater stock price volatility, extreme price run-ups, lower trading volume and less liquidity than large-capitalization companies. In addition, if the trading volumes of our common stock are low, persons buying or selling in relatively small quantities may easily influence prices of our common stock. This low volume of trades could also cause the price of our common stock to fluctuate greatly, with large percentage changes in price occurring in any trading day session. Holders of our common stock may also not be able to readily liquidate their investment or may be forced to sell at depressed prices due to low volume trading. |

We have based these forward-looking statements largely on our current expectations and projections about our business, the industry in which we operate and financial trends that we believe may affect our business, financial condition, results of operations and prospects, and these forward-looking statements are not guarantees of future performance or development. These forward-looking statements speak only as of the date of this prospectus and are subject to a number of risks, uncertainties and assumptions described in the section titled “Risk Factors” and elsewhere in this prospectus. Because forward-looking statements are inherently subject to risks and uncertainties, some of which cannot be predicted or quantified, you should not rely on these forward-looking statements as predictions of future events. The events and circumstances reflected in our forward-looking statements may not be achieved or occur and actual results could differ materially from those projected in the forward-looking statements. Except as required by applicable law, we do not plan to publicly update or revise any forward-looking statements contained herein until after we distribute this prospectus, whether as a result of any new information, future events or otherwise.

In addition, statements that “we believe” and similar statements reflect our beliefs and opinions on the relevant subject. These statements are based upon information available to us as of the date of this prospectus, and while we believe such information forms a reasonable basis for such statements, such information may be limited or incomplete, and our statements should not be read to indicate that we have conducted an exhaustive inquiry into, or review of, all potentially available relevant information. These statements are inherently uncertain and you are cautioned not to unduly rely upon these statements.

MARKET, INDUSTRY AND OTHER DATA

This prospectus contains estimates, projections and other information concerning our industry, our business and the markets for our product candidate, including data regarding the estimated size of such markets and the incidence of certain medical conditions. We obtained the industry, market and similar data set forth in this prospectus from our internal estimates and research and from academic and industry research, publications, surveys and studies conducted by third parties, including governmental agencies. In some cases, we do not expressly refer to the sources from which this data is derived. Information that is based on estimates, forecasts, projections, market research or similar methodologies is inherently subject to uncertainties and actual events or circumstances may differ materially from events and circumstances that are assumed in this information.

TRADEMARKS AND COPYRIGHTS

We own or have rights to trademarks or trade names that we use in connection with the operation of our business, including our corporate names, logos and website names. In addition, we own or have the rights to copyrights, trade secrets and other proprietary rights that protect the content of our products and the formulations for such products. This prospectus may also contain trademarks, service marks and trade names of other companies, which are the property of their respective owners. Our use or display of third parties’ trademarks, service marks, trade names or products in this prospectus is not intended to, and should not be read to, imply a relationship with or endorsement or sponsorship of us. Solely for convenience, some of the copyrights, trade names and trademarks referred to in this prospectus are listed without their ©, ® and ™ symbols, but we will assert, to the fullest extent under applicable law, our rights to our copyrights, trade names and trademarks. All other trademarks are the property of their respective owners.

PROSPECTUS SUMMARY

This summary highlights certain information about us, this offering, and selected information contained in this prospectus. This summary is not complete and does not contain all of the information that you should consider before deciding whether to invest in our common stock. For a more complete understanding of the Company and this offering, we encourage you to read and consider the more detailed information in this prospectus, including “Risk Factors” and the financial statements and related notes. Unless the context otherwise requires, “JNS,” “we,” “us,” “our,” or “the Company” refer to Jupiter Neurosciences, Inc., a Delaware corporation.

Unless otherwise noted, the share and per share information in this prospectus reflects a reverse stock split of the outstanding common stock of the Company at a one for two (1-for-2) ratio, which was effected on January 25, 2022 (“Reverse Stock Split”) and the fifteen-for-four (15-for-4) stock split (“2024 Forward Stock Split”) of our outstanding common stock, which was effected on June 14, 2024.

Business Overview

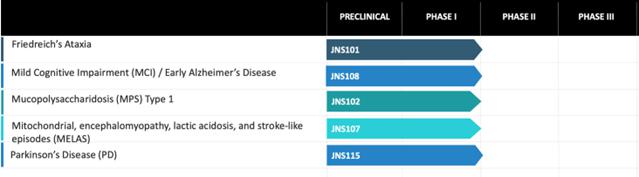

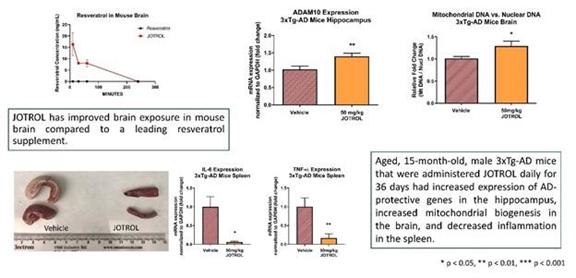

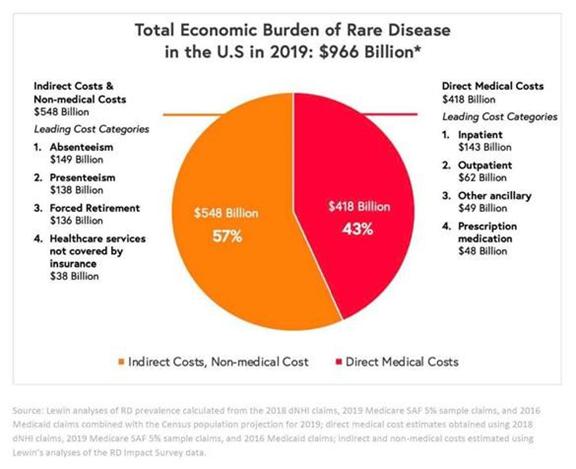

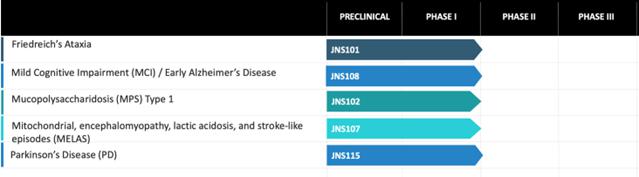

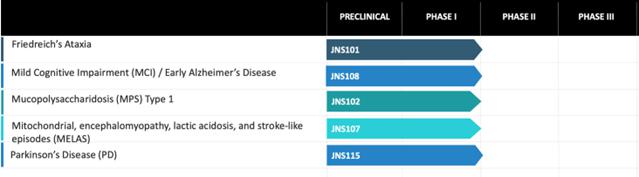

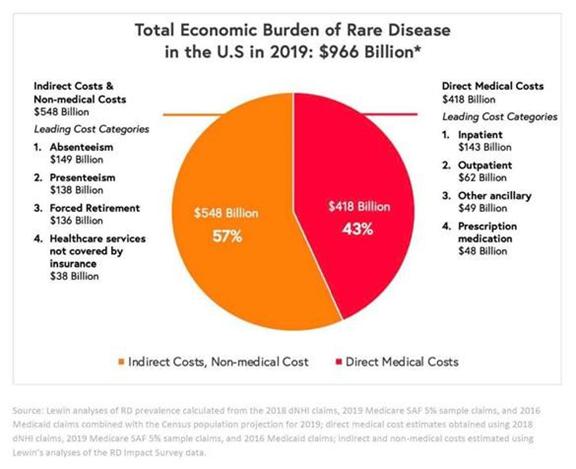

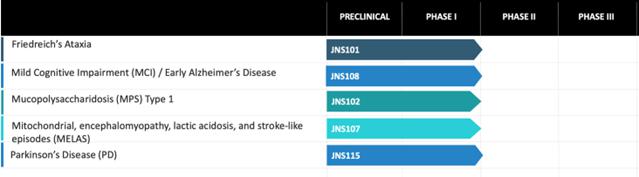

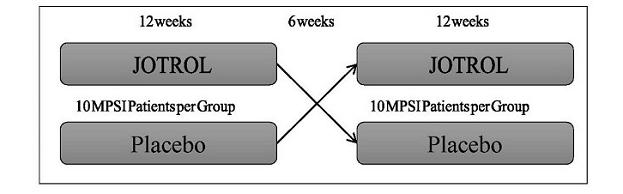

Jupiter Neurosciences, Inc. (the “Company”) is a clinical stage research and development pharmaceutical company located in Jupiter, Florida. The Company incorporated in Delaware in January 2016. The Company has developed a unique resveratrol platform product primarily targeting treatment of neuro-inflammation. The product candidate, called JOTROL, has many potential indications of use for rare diseases, of which we are primarily targeting Mucopolysaccharidoses Type 1, Friedreich’s Ataxia, and MELAS. In the larger disease areas, we are primarily targeting Parkinson’s Disease and Mild Cognitive Impairment/early Alzheimer’s disease. Recent developments are guiding us to focusing strongly on Parkinson’s Disease as well as development of our product in the South-East Asian market.

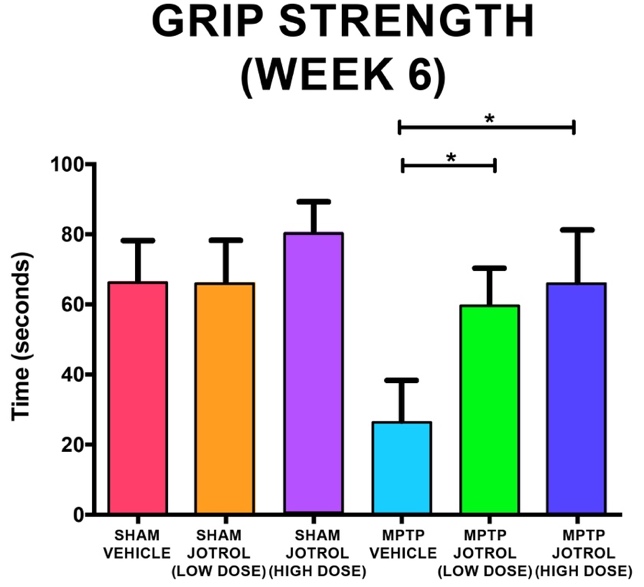

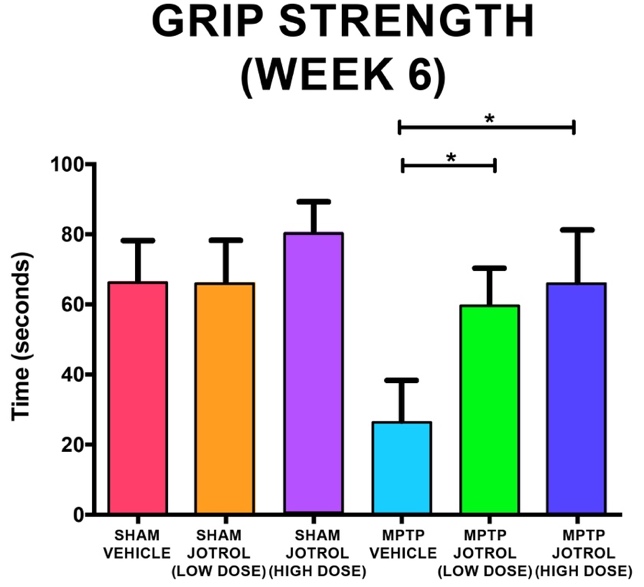

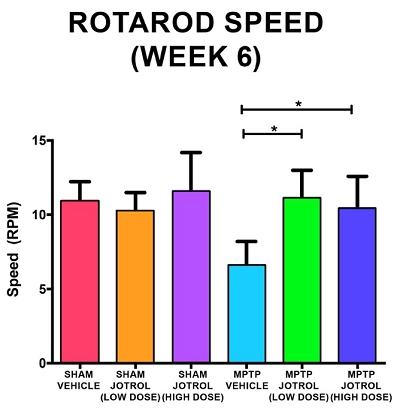

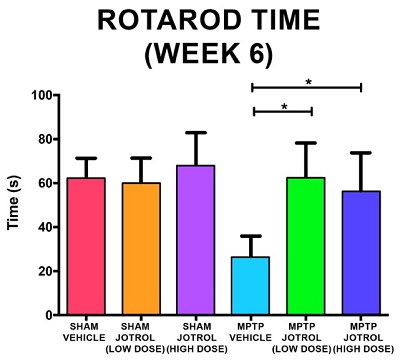

The Company has recently completed preclinical activities in a validated mouse model of Parkinson’s Disease (PD) at the University of Miami. The model of PD that was used mimics many aspects of the disease utilizing a unilateral injection of a neurotoxin precursor that elicits nigral cell loss, striatal dopamine loss and behavior deficits similar to physiological characteristics of human disease. We believe that results from this trial indicates that PD might be the best target for treatment solution among the multiple indications where JOTROL might play a role. The trial design and outcomes are further described in the section “Description of Business”. On May 23, 2024, the US Senate unanimously passed the National Plan to End Parkinson’s Act, the first-ever federal legislation dedicated to ending Parkinson’s disease. A cross-country strategy to end Parkinson’s and atypical parkinsonism has the potential to:

| | ● | Dramatically increase federal research funding; |

| | ● | Develop more effective pathways for treatments and cures; |

| | ● | Improve early diagnosis; |

| | ● | Spark new and improved models for patient care; |

| | ● | Create standards and measures to prevent Parkinson’s disease; |

| | ● | Address health disparities in diagnosis, treatment and clinical trial participation and |

| | ● | Enhance public awareness of the disease. |

The Company intends to follow the various opportunities closely with a particular focus on seeking available funding to accelerate research and development JOTROL’s Parkinson’s Disease indication. However, there is no assurance that such funding will ever become available or be awarded to the Company.

We have over the past 2 years received a strong interest in JOTROL from various Asian organizations. We believe that this interest has been triggered, in part, by (i) resveratrol becoming commonly used in Asian herbal medicines as a therapeutic strategy as described in available scientific literature published by PubMed Central: PMCID: PMC7498443 (September 2020), (ii) Hong Kong’s and China’s recent approval of the patent for JOTROL, (iii) China releasing a list of approximately 120 rare disease indications issued jointly by five national bodies, including the National Health Commission, Ministry of Science and Technology, Ministry of Industry and Information Technology, State Drug Administration, and State Administration of Traditional Chinese Medicine (May 2018), that we believe JOTROL can be applicable as a treatment for MPS-1 and MELAS in this population, (iv) recent publications regarding JOTROL in the Journal of Alzheimer’s Disease and AAPS Open (Journal of Alzheimer’s Disease 86 (2022) 173–190 February 2022; Kemper et al. AAPS Open June 2022), and (v) the projected increase of the Traditional Chinese Medicine (“TCM”) market due to several factors which of one is reformulation of existing compounds. Our Chairman & CEO, Christer Rosén, presented in person, our company’s status and pipeline at the BIOHK 2023 in Hong Kong in September of 2023. The presentation led to several follow-on meetings, and we have therefore recently agreed to service agreements in the areas of CMC (Chemistry, Manufacturing, and Controls), regulatory affairs and clinical trial management. These agreements are with companies that, we believe, have the knowledge and network in the South-East Asian market to accelerate steps that is needed to have a product that can have treatment value in the territory. In addition, we are in active negotiations with Dominant Treasure Health (“DTH”), a BVI company. DTH has demonstrated to us through several company introductions that they have business relationships, either directly or through affiliates, with many South-East Asian pharmaceutical companies as well as companies involved in distribution and sales of TCM, Traditional Chinese Medicine. We are therefore planning to engage DTH in active business development in China, Malaysia and Singapore as soon as we have financing in place for their engagement. DTH has already introduced us to three Chinese companies, Beimei Pharma, http://en.beimeiyaoye.com, that specializes in pediatric medications, Sichuan Kelun Pharmaceutical Co., Ltd., a publicly traded company that is part of the Kelun Industrial Group, https://www.kelun.com/, and Tianjin Pharmaceuticals, https://en.pharm.com.cn/, that advocates the corporate core values of “Love, Integrity and Power”. TCM products are run in a separate division within Tianjin. Discussions with all three companies are ongoing. We believe that with DTH’s assistance we can co-ordinate and oversee the work of our service providers in the territory and more expediently negotiate and finalize an out-license agreement with one or more pharmaceutical companies in South-East Asia. The agreements are further described in the section “Other Material Agreements”. The Asian market is very large and hard to penetrate for a small company and we believe that our strategy with these agreements have the possibility to accelerate an out-licensing deal in the South-East Asian territories. However, there are no assurances that this approach will be successful.

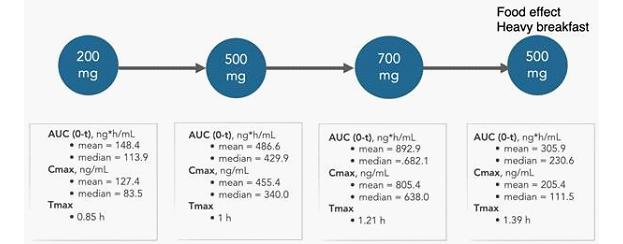

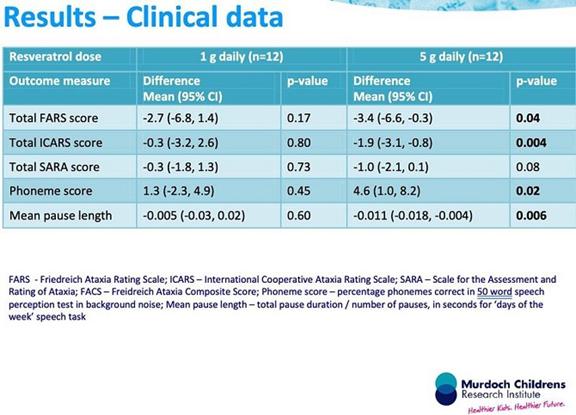

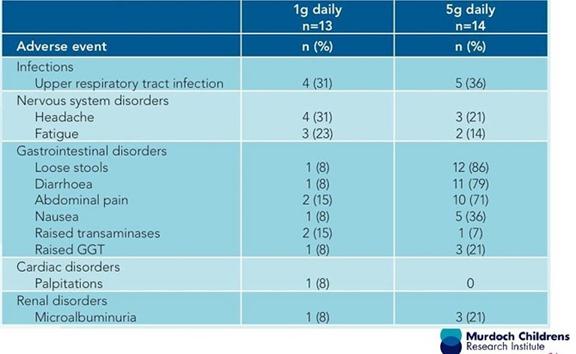

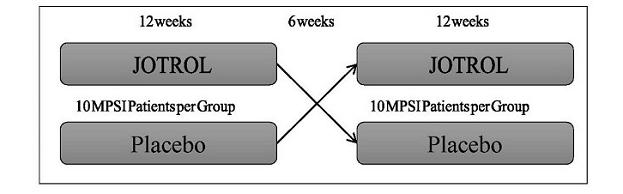

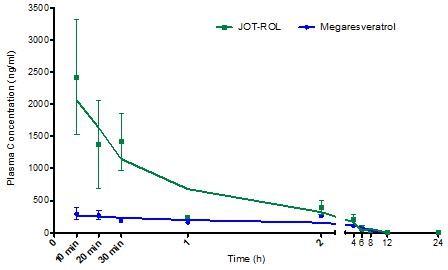

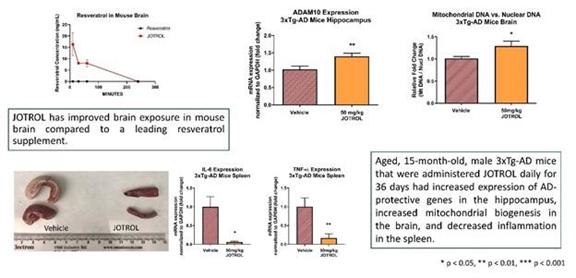

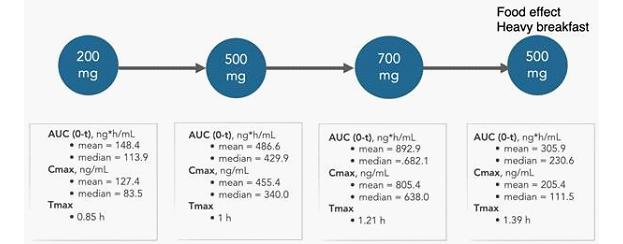

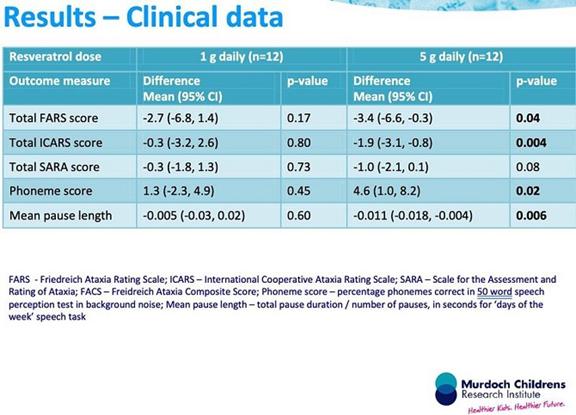

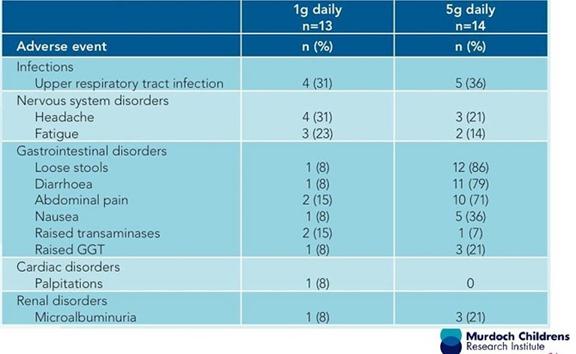

We believe that a high dose of resveratrol is needed for therapeutic effects. Currently available resveratrol products are associated with severe gastrointestinal (GI) side effects at the dose levels we believe are needed. Our belief is based on available scientific literature, preclinical trial results conducted in mice and rats, and previously conducted human trials with resveratrol. We believe that JOTROL, based on the results from our Phase I trial, see section “Description of Business”, has the potential to deliver a therapeutically effective dose of resveratrol in the blood stream without causing gastrointestinal (GI) side effects. Based on our pre-clinical and Phase I study results, we expect that JOTROL will resolve “the major obstacle of resveratrol’s poor bioavailability” as discussed in AY Berman’s summary article in the Journal of Precision Oncology (AY Berman, 2017). Based on our own preclinical studies we believe that resveratrol has the ability to cross the blood-brain barrier. Studies conducted in Friedreich’s ataxia (FA) and Alzheimer’s disease (AD) patients, resulted in positive effects on oxidative stress, inflammation, and mitochondrial function. The FA study was concluded in Australia by Murdoch Children’s Research Institute in 2015 (Yiu et al.). The AD study was conducted in 2015 by the Alzheimer’s Disease Cooperative Study with Professor Raymond Turner, MD, Ph.D., Georgetown, as principal investigator (Turner et al.). Both studies have been published in scientific journals and further described in the section “Description of Business”.

In 2020, we received approval for full funding, $1.76 million, for our Phase I study from the National Institute on Aging (“NIA”). Since there were unanticipated higher costs, mostly due to COVID-19 related additional procedures during the Phase I trial, a supplemental grant of $233,281 was submitted to the NIA in December of 2021. We were awarded the supplemental grant on April 7, 2022. In the NIA scientific review summary statement of our Phase I study application, it is stated that the NIA is looking forward to a Phase II study with an enhanced resveratrol product, based on the earlier study results from the well published Turner et al. Alzheimer’s study. In April 2021, we submitted our first grant application to the NIA for full funding of a Phase II trial in Mild Cognitive Impairment (MCI) and early Alzheimer’s disease. The Phase II trial was designed to focus on 3 areas: 1) safety and tolerability; 2) pharmacokinetics and pharmacodynamics, measuring of responses from 2 different doses vs. placebo; and 3) measuring of effect on multiple biomarkers related to the disease. The application was not accepted but we were encouraged by the NIA to refine our application and submit again. We have since submitted three grant applications, with budgets of $20 million or higher, to the NIA for full funding of such Phase II trial but none of those applications were successful. The NIA scientific review of our Alzheimer’s Phase II trial grant application, which is attached as Exhibit 10.38 to the registration statement of which this prospectus forms a part, shows a total score of 47 which is our best score so far. A score of 40 or below is necessary for being considered for funding. After discussions with the NIA, we have decided to apply, in September of 2024, for a much smaller grant, $2.5 million, for a Proof-of-Concept study focusing on JOTROL’s effect on MCI validated biomarkers. The final study design is not yet determined but a draft synopsis is described in the section “Description of Business”. There is no guarantee that this and future grant applications will be successful and therefore the rejection of our future grant application may significantly delay the Company’s plans in connection with MCI and Alzheimer’s and may have a significant impact on the Company’s financial performance.

The Company continues to apply for grants opportunistically and on August 12, 2022, submitted an application for a $10.1 million grant to the Department of Defense for a Phase II Friedreich’s Ataxia study. This study planned to assess the efficacy of JOTROL as a potential treatment for FA through a randomized, blinded, placebo-controlled clinical trial. On December 30 the Company received notification that the application was not recommended for funding. The grounds for denial were the weaknesses noted in the peer review summary statement, attached as Exhibit 10.33 to the registration statement of which this prospectus forms a part, specifically concerning clinical impact and research strategy and feasibility.

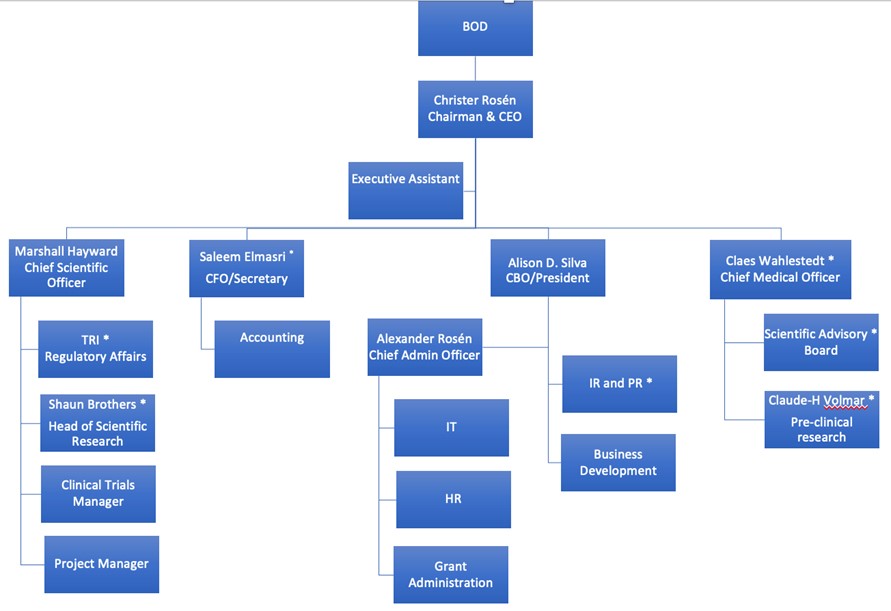

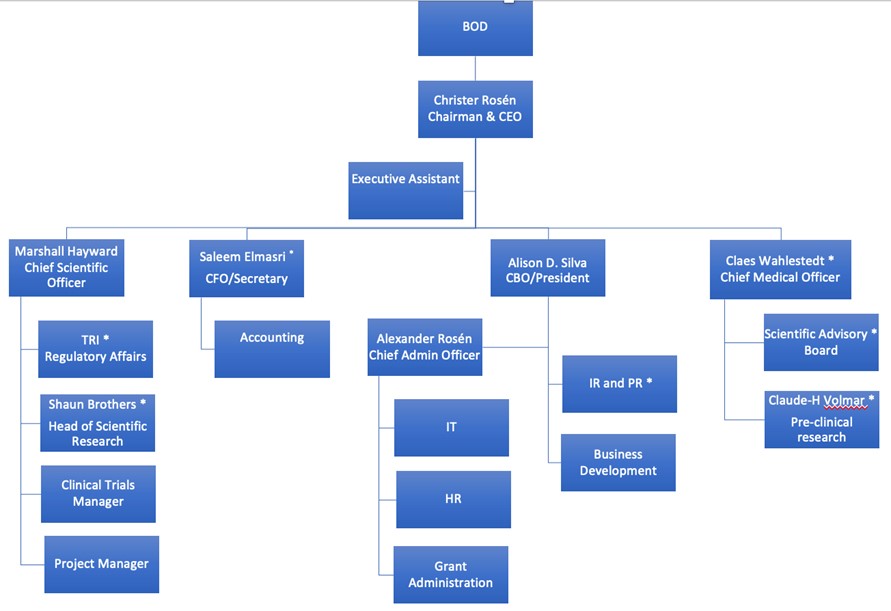

Since inception, we have operated with limited human capital, utilizing agreements with academia to get pre-clinical work executed at no cost, negotiating favorable deals for data already produced for resveratrol (e.g. toxicity studies and Phase II clinical study data), obtaining a full grant from the NIA for our first clinical trial and building a management and scientific consulting team (consisting of the Scientific Advisory Board and business advisors) as well as negotiating service agreements with companies to handle CMC, Regulatory work and Clinical trials in South-East Asia primarily compensated with equity securities of the company. We believe that this compensation method aligns the management, Scientific Advisory Board members and business advisors’ interests with the shareholders. We believe that our structure with a core management team that has experience in the utilization of outside resources makes it possible for us to efficiently execute several programs simultaneously in a cost-effective way.

For the fiscal years ended December 31, 2023 and 2022, we generated no revenues from product sales and reported net losses of $4,783,689 and $4,957,580 respectively, and negative cash flow from operating activities of $480,953 and $1,248,504, respectively. For the six months ended June 30, 2024 and 2023, we generated no revenues from product sales and reported net losses of $320,977 and $2,579,855, respectively, and negative cash flow from operating activities of $172,627 and $156,640, respectively. As noted in our financial statements, as of June 30, 2024, we had an accumulated deficit of $23,903,481. There is substantial doubt regarding our ability to continue as a going concern as a result of our historical recurring losses and negative cash flows from operations as well as our dependence on private equity and financings. See “Risk Factors—We have a history of operating losses, our management has concluded that factors raise substantial doubt about our ability to continue as a going concern and our auditor has included an explanatory paragraph relating to our ability to continue as a going concern in its audit report for the fiscal years ended December 31, 2023 and 2022.

Resveratrol

Resveratrol has been studied for over 50 years by academic institutions as well as by small and large pharmaceutical companies. The multi-functional mechanisms of resveratrol are well documented in over 9,000 scientific publications. Several of these publications, including a summary paper by AY Berman.et al, published in Precision Oncology 2017, point to the issue of the poor bioavailability that has stopped medical utilization of regular resveratrol and never received regulatory approval for any indication. We believe that the Phase I study we have conducted indicates that we have resolved the poor bioavailability issue with JOTROL™. Resveratrol (3,4′,5- trihydroxystilbene) is a nutraceutical that has recently attracted a lot of research attention due to its pharmacological potential. It is a phytoalexin found in many plants including grapes, peanuts, and berries. Resveratrol was first isolated in Veratrum grandiflorum, or white hellebore plant, in the 1940’s. Stilbene compounds are known for their ability to provide plants with resistance to microbial and fungal infection. Early research showed that resveratrol was present in large quantities in injured, infected, and ultraviolet-treated leaves. Processed plant products also contain a significant amount of resveratrol.

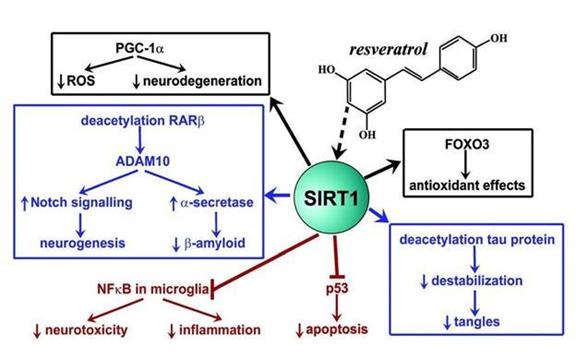

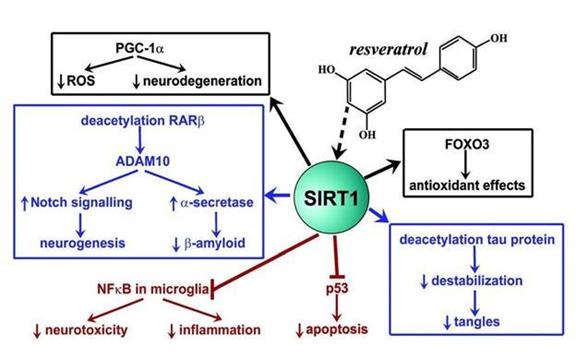

Based upon available scientific literature, it appears that resveratrol is an activator of SIRT1, one of the mammalian forms of the sirtuin family of proteins. SIRT1 deacetylates histones and nonhistone proteins including transcription factors. The SIRT1-regulated pathway affects metabolism, stress resistance, cell survival, cellular senescence, inflammation/immune function, endothelial functions, and circadian rhythms. Resveratrol has been documented in scientific literature to activate SIRT1, NrF2, NLR3P inflammasomes and have an epigenetic mechanism and therefore is predicted to benefit diseases affected by abnormal metabolic control, inflammation, and cell cycle defects. Nonetheless, resveratrol application is a major challenge for the pharmaceutical industry, due to its poor solubility and bioavailability, as well as adverse effects, such as severe gastro-intestinal side effects when taken at effective dose levels (over 2,000 mg daily). In this context, studies have proposed that structural changes in the resveratrol molecule, including glycosylation, alkylation, halogenation, hydroxylation, methylation, and prenylation could lead to the development of derivatives with enhanced bioavailability and pharmacological activity. Resveratrol has never been developed with all the necessary steps to achieve an approval as a pharmaceutical product since the existing natural supplements cannot provide high enough levels of resveratrol in blood plasma to be able to provide a therapeutically effective dose without generating severe gastro-intestinal side effects. This means that we need to take JOTROL™ through the full regulatory NDA (New Drug Application) requirement to obtain a prescription marketing approval in USA.

Resveratrol holds a significant place in Traditional Chinese Medicine (TCM) due to its potent antioxidant and anti-inflammatory properties. In TCM, resveratrol-rich plants, such as the root of Polygonum cuspidatum (commonly known as Hu Zhang), have been used for centuries to treat a variety of ailments. The compound is prized for its ability to combat oxidative stress and inflammation, which are underlying factors in many chronic diseases. This aligns with the TCM principle of restoring balance and harmony within the body to maintain health and prevent disease. Resveratrol’s role in TCM extends to supporting cardiovascular health, boosting immune function, and even exhibiting anti-aging properties, making it a versatile and valuable component of the medicinal repertoire.

The growing body of scientific research on resveratrol has further cemented its importance in TCM by providing a modern understanding of its mechanisms and potential therapeutic benefits. Studies have shown that resveratrol can modulate various molecular pathways, including those involved in cell survival, apoptosis, and inflammation, which are crucial in the management of conditions such as cardiovascular diseases, neurodegenerative disorders, and cancers. This scientific validation supports TCM practitioners in integrating resveratrol into their treatment protocols, enhancing the credibility and acceptance of traditional remedies. Additionally, the compound’s ability to improve metabolic health and its neuroprotective effects are particularly relevant in addressing the rising prevalence of metabolic syndrome and cognitive decline in aging populations. As research continues to unveil the full spectrum of resveratrol’s benefits, its integration into TCM practices is likely to increase, further bridging the gap between ancient wisdom and contemporary medicine.

The Traditional Chinese Medicine (TCM) market is experiencing several technological trends that are transforming how traditional remedies are developed, delivered, and integrated with modern healthcare practices. These advancements are helping to increase the efficacy, accessibility, and acceptance of TCM. Below are some of the key technological trends in the TCM market:

| a. | Digital platforms and telemedicine services allow patients to consult with TCM practitioners remotely, expanding access to TCM treatments. |

| b. | Apps are being developed to help users track their health metrics, manage their treatment plans, and access personalized TCM advice. |

| c. | Using advanced extraction techniques to concentrate active ingredients from traditional herbs, resulting in more potent and consistent products. |

| d. | Development of new delivery methods such as transdermal patches, sustained-release capsules, and nanoparticles to enhance the bioavailability and efficacy of TCM products. |

(source Emergn Research, Global TCM Market, Forecast to 2033).

JOTROL

JOTROL was developed together with our technology partner Aquanova AG, Darmstadt, Germany. JOTROL is formulated with a unique patented micellar technology that is projected to increase the bioavailability profile of resveratrol. Manufacturing technology transfers were completed in 2017 and manufacturing procedures and clinical trial supply manufacturing has been completed at Catalent Pharmaceutical Services, Inc., St Petersburg, Florida.

JOTROL is a micellar non-aqueous solution of resveratrol delivered in a softgel capsule. Each capsule includes 100mg of resveratrol. Pre-clinical trials in mice and rats were conducted comparing JOTROL™ to micronized resveratrol, labeled to have the highest bioavailability in the nutritional market, to demonstrate that we could achieve a significantly higher bioavailability. Summary details of these studies are included in the section “Description of Business”. A Phase I dose finding pharmacokinetic (“PK”) study in healthy volunteers was completed during the first half of 2021. The study results met our targeted goals. The results from this study will be used as a cross-reference for all indications where JOTROL will be used in Phase II and Phase III clinical trials. The Phase I results and the FDA guidance of cross-referencing is further described in the section “Description of Business”. The Company has not discussed the use of cross-referencing in this manner with the FDA or other comparable regulatory authorities.

JOTROL Intellectual Property

We have a worldwide license, from Aquanova AG, the patent holder of micellar technologies, to develop, manufacture, distribute and sell JOTROL.

| | ● | Our CSO, Marshall Hayward and the lead scientist at Aquanova AG, Darius Benham, are the inventors of JOTROL. The patent is owned jointly by Aquanova AG and the Company. The application was assigned to Aquanova AG per an executed agreement between Aquanova AG and the Company. See additional information in the section titled “Description of Business”. |

| | ● | Aquanova AG, a German company, filed an international patent application in Germany on January 29, 2017 entitled “Resveratrol solubilization product for pharmaceutical purposes” (PCT/EP2017/O51659). |

| | ● | The priority date is June 16, 2016 with expiration in 2036 which expiration applies to all territories where that patent is approved. |

This patent has been granted in the USA, specific European countries namely: France, United Kingdom, Switzerland, Italy, Belgium, Netherlands, Ireland, Spain, Sweden, Turkey, Poland, Denmark, Greece, Hungary and Germany, Japan, Hong Kong and China.

For further details, including patented claims and payment terms, see the section “Description of Business”.

Material Agreements

The Company has entered into several material agreements, including the exclusive, worldwide license, from Aquanova AG to develop, manufacture, distribute and sell JOTROL for the company’s presently only product. Other material agreements have been executed with other entities such as Murdoch Children’s Research Institute, Melbourne Australia and with the National Institute on Aging. We have recently agreed to service agreements for development of our product in the South-East Asian territory. The agreements are with 3 contracted companies that will handle CMC (Chemistry, Manufacturing, and Controls), regulatory affairs and clinical trial management. These agreements, which are similar to what we do in the USA, are further described in the section “Other Material Agreements”. In addition, we are in active negotiations with Dominant Treasure Health (“DTH”), a BVI company. DTH has demonstrated to us, through several company introductions, that they have business relationships, either directly or through affiliates, with many South-East Asian pharmaceutical companies as well as companies involved in distribution and sales of TCM, Traditional Chinese Medicine. We are therefore planning to engage DTH in active business development in China, Malaysia and Singapore as soon as we have financing in place for their engagement. DTH has already introduced us to 3 Chinese companies, Beimei Pharma, http://en.beimeiyaoye.com, that specializes in pediatric medications, Sichuan Kelun Pharmaceutical Co., ltd, a publicly traded company that is part of the Kelun Industrial Group, https://www.kelun.com/, and Tianjin Pharmaceuticals, https://en.pharm.com.cn/, that advocates the corporate core values of “Love, Integrity and Power”. TCM products are run in a separate division within Tianjin. Discussions with all three companies are ongoing. We believe that with DTH’s assistance we can co-ordinate and oversee the work of our Service providers in the territory and more expediently negotiate and finalize an out-license agreement with one or more pharmaceutical companies in South-East Asia. The Asian market is very large and hard to penetrate for a small company and we believe that our strategy with these agreements is very cost effective and have the possibility to accelerate an out-licensing deal in the South-East Asian territories. However, there are no assurances that this approach will be successful.

Product Development

Our management, Scientific Board of Advisors and business advisors have extensive experience in regulatory affairs and clinical development of product candidates for the treatment of rare diseases and Alzheimer’s disease. The overall regulatory approval process for product candidates for the treatment of rare diseases are generally conducted with a smaller number of patients in clinical trials and over a shorter amount of time than more prevalent diseases. There is a documented pathway to get accelerated FDA approval for a rare disease indication if there is no existing treatment for the indication, if a product shows efficacy and has a good safety profile. There is also a possibility of receiving a Priority Review Voucher (PRV) from the FDA upon an approval in pediatric population in a rare disease. One or more of our programs, such as MPS-I, will be targeting pediatric patients. The voucher entitles the bearer to regulatory review in about six months rather than the standard ten months. The Food and Drug Administration (FDA) awards a voucher following approval of a treatment for a neglected disease, rare pediatric disease, or medical countermeasure. Two drugs can receive priority review for each voucher: the drug winning a voucher for a neglected or rare pediatric disease, and the drug using a voucher for another indication. The voucher may be sold. For example, a small company might win a voucher for developing a drug for a neglected disease and sell the voucher to a large company for use on a commercial disease.

The Company also plans to investigate the possibility the use of one or more of the following pathways for the indications that it is targeting: (1) Priority Review (2) Fast Track (3) Accelerated Approval Pathway and (4) Breakthrough therapy. For detailed descriptions of the foregoing pathways please see the discussion under “Product Development” in the section titled “Description of Business”. There is however no guarantee that an accelerated pathway will lead to an accelerated FDA review and that a pediatric approval leads to a PRV. Additionally, there can be no guarantee that the Company can be successful in its plans under any FDA pathway.

We have received quotes from clinical research organizations (“CROs”) for Phase II trials in MPS I and Friedreich’s ataxia ranging from $2 million to $5 million per study. Alzheimer’s disease trials are larger and more complex with higher associated costs, we have received quotes ranging between approximately $12 million to $20 million for a Phase II study but we have not received any quotes for a small and shorter-term Proof-Of-Concept (“POC”) study in MCI/early-AD patients. We have not received any quotes for a short POC study in Parkinson’s disease either, but we have initiated discussions with the Michael J. Fox Foundation for possible partial funding of the study. There is no assurance that such funding will be obtained. We believe that with positive Phase II results, in any of the indications, we may be able to garner strategic partnering interest for financing of larger Phase III trials. We also intend to seek collaborations with future licensees and marketing partners, especially in markets outside the United States.

Product Pipeline

The product pipeline represented above assume drawing upon previous preclinical and clinical data conducted by third parties. This data is available either via public domain or under agreements with our key partner which are further described in the section titled “Description of Business”. However, we have not discussed with the FDA the ability to rely on and reference the data from previous third-party trials, such as the Phase II trial in MCI/Early Alzheimer’s disease conducted by Georgetown University.

The table below provides a historical development timeline:

Product Development and Commercialization Timelines

| Milestone | | Target Start Date | | Target Completion Date |

| Identified key issue with resveratrol, poor bioavailability, and investigated possible solutions. | | Q3 2015 | | Completed |

| Worldwide exclusive agreement with Aquanova AG, Germany, for patented micellar technology. | | Q3 2016 | | Completed |

| Patent applications submitted in 2016 and patents have subsequently been issued in USA, in certain European countries, Japan, China and Hong Kong. | | Q2 2016 | | Completed |

| Pre-clinical studies comparing JOTROL with conventional resveratrol, see section “Description of Business”. | | Q1 2017 | | Completed |

| Technology and data transfer agreement with Murdoch Children’s Research Institute, Melbourne, Australia regarding research results and information related to Friedreich’s Ataxia | | Q3 2015 | | Completed |

| Technology transfer from Aquanova, CMC documentation, and clinical trial supplies manufactured (Catalent) | | Q1 2017 | | Completed |

| Orphan Drug Designations (“ODD”) submitted to FDA and ODD received for Friedreich’s ataxia | | Q3 2016 | | Completed |

| Resveratrol toxicity study received from major pharmaceutical company | | Q3 2017 | | Completed |

| Human bioavailability POC study with JOTROL | | Q3 2017 | | Completed |

| NIA grant application for Phase I study submitted and scientific review triggered full financing, $1.76 million. | | Q3 2019 | | Completed |

| Phase I study in healthy volunteers initiated in December 2020 and in-man phase concluded in March 2021 | | Q3 2020 | | Completed |

| Pre-clinical mice trial in Parkinson’s Disease. | | Q1 2021 | | Completed |

| Re-submission of NIA grant application for MCI | | Q4 2023 | | Completed |

For further information on our business and product detail, see “Description of Business” section.

Recent Developments

For a detailed description of recent developments of the Company, see “Description of Business—Recent Developments” on page 113 of this prospectus.

Risks Related to Our Business

Our ability to execute on our business strategy is subject to a number of risks, which are discussed more fully in the section titled “Risk Factors” beginning on page 15. You should carefully consider these risks before making an investment in our common stock. These risks include, among others, the following:

| | ● | We are early in our development efforts, with a limited operating history, and have no products approved for commercial sale. |

| | | |

| | ● | We have not generated any revenue from product sales to date, have incurred significant net losses since our inception, and expect to continue to incur significant net losses for the foreseeable future. |

| | | |

| | ● | Our ability to generate revenue and achieve profitability depends significantly on our ability to achieve several objectives relating to the discovery, development and commercialization of our product candidate. |

| | | |

| | ● | Even if our initial public offering is successful, we will require substantial additional capital to finance our operations. |

| | | |

| | ● | Our substantial amount of indebtedness may adversely affect our cash flow and our ability to operate our business, remain in compliance with debt covenants and make payments on our indebtedness. |

| | | |

| | ● | Our outstanding Secured Note provides our Secured Lender with liens on substantially all of our assets, including our intellectual property, and contains financial covenants and other restrictions on our actions, which may cause significant risks to our stockholders and may impact our ability to pursue certain transactions and operate our business |

| | | |

| | ● | We are substantially dependent on the success of our product candidate, JOTROL. If we are unable to complete development of, obtain approval for and commercialize JOTROL for one or more indications in a timely manner, our business will be harmed. |

| | ● | Our prospects depend upon developing product candidate JOTROL for particular indications and possibly discovering, developing other product candidates in future programs. |

| | ● | Clinical drug development involves a lengthy and expensive process with an uncertain outcome. The clinical trials of our product candidate JOTROL may not demonstrate safety and efficacy to the satisfaction of the U.S. Food and Drug Administration (FDA), European Medicines Agency (EMA) or other comparable foreign regulatory authorities or otherwise produce positive results and the results of preclinical studies and early clinical trials may not be predictive of future results. |

| | ● | We have limited resources and are currently focusing the majority of our efforts on developing JOTROL for particular indications. As a result, we may fail to capitalize on other indications or product candidates that may ultimately have proven to be more profitable. |

| | | |

| | ● | We are planning on entering into a Service Agreement with DOMINANT TREASURE HEALTH COMPANY LIMITED with respect to strategic services in Asia immediately following the completion of the public offering, the fees payable by the Company pursuant to which, are non-refundable and not tied to any milestones or performance, and the foregoing nature of such fees, could have a material negative impact on our business, financial condition and operating results. |

| | ● | We face significant competition, and if our competitors develop and market technologies or products more rapidly than we do or that are more effective, safer or less expensive than the product candidates we develop, our commercial opportunities will be negatively impacted. In particular, we face competition for patients with MPS-I, Friedreich’s ataxia, MELAS, Parkinson’s Disease, Mild Cognitive Impairment, and early Alzheimer’s disease from companies that produce drugs to treat such diseases. For more information regarding competition we face, see the section titled “Business — Competition. |

| | ● | We rely on third parties to conduct our preclinical studies, clinical trials, and manufacturing and these third parties may not perform satisfactorily. |

| | ● | If we engage in future acquisitions or strategic partnerships, this may increase our capital requirements, dilute our stockholders, cause us to incur debt or assume contingent liabilities, and subject us to other risks. |

| | ● | We rely on our management team and other key employees, and the loss of one or more key employees could harm our business. |

| | ● | The failure to attract and retain additional qualified personnel could prevent us from executing our business strategy. |

| | ● | Once our common stock is listed on Nasdaq Capital Market, there can be no assurance that we will be able to comply with Nasdaq Capital Market’s continued listing standards. |

| | | |

| | ● | The price of our common stock could be subject to rapid and substantial volatility. As a relatively small-capitalization company with relatively small public float, we may experience greater stock price volatility, extreme price run-ups, lower trading volume and less liquidity than large-capitalization companies. Such volatility, including any stock-run up, may be unrelated to our actual or expected operating performance and financial condition or prospects, making it difficult for prospective investors to assess the rapidly changing value of our common stock. In addition, if the trading volumes of our common stock are low, persons buying or selling in relatively small quantities may easily influence prices of our common stock. This low volume of trades could also cause the price of our common stock to fluctuate greatly, with large percentage changes in price occurring in any trading day session. Holders of our common stock may also not be able to readily liquidate their investment or may be forced to sell at depressed prices due to low volume trading. |

| | | |

| | ● | As a result of the resale of shares of common stock by Selling Stockholders being a large volume of shares and potentially at different pricing after the initial fixed price, there is a potential for price volatility or depreciation for investors in our initial public offering |

Our management has concluded that our historical recurring losses from operations and negative cash flows from operations as well as our dependence on securing private equity and other financings raise substantial doubt about our ability to continue as a going concern and our auditor has included an explanatory paragraph relating to our ability to continue as a going concern in its audit reports for the fiscal years ended December 31, 2023 and 2022.

Implications of Being an Emerging Growth Company

As a company with less than $1.235 billion in revenues during our last fiscal year, we qualify as an emerging growth company as defined in the Jumpstart Our Business Startups Act, or the JOBS Act, enacted in 2012. As an emerging growth company, we expect to take advantage of reduced reporting requirements that are otherwise applicable to public companies. These provisions include, but are not limited to:

| | ● | being permitted to present only two years of audited financial statements, in addition to any required unaudited interim financial statements, with correspondingly reduced “Management’s Discussion and Analysis of Financial Condition and Results of Operations” disclosure in this prospectus; |

| | ● | not being required to comply with the auditor attestation requirements of Section 404 of the Sarbanes-Oxley Act of 2002, as amended; |

| | ● | reduced disclosure obligations regarding executive compensation in our periodic reports, proxy statements and registration statements; and |

| | ● | exemptions from the requirements of holding a nonbinding advisory vote on executive compensation and shareholder approval of any golden parachute payments not previously approved. |

We may use these provisions until the last day of our fiscal year following the fifth anniversary of the completion of our initial public offering. However, if certain events occur prior to the end of such five-year period, including if we become a “large accelerated filer,” our annual gross revenues exceed $1.235 billion or we issue more than $1.00 billion of non-convertible debt in any three-year period, we will cease to be an emerging growth company prior to the end of such five-year period.

As an emerging growth company, we intend to take advantage of an extended transition period for complying with new or revised accounting standards as permitted by The JOBS Act.

To the extent that we continue to qualify as a “smaller reporting company,” as such term is defined in Rule 12b-2 under the Securities Exchange Act of 1934, as amended, after we cease to qualify as an emerging growth company, certain of the exemptions available to us as an emerging growth company may continue to be available to us as a smaller reporting company, including: (i) not being required to comply with the auditor attestation requirements of Section 404(b) of the Sarbanes Oxley Act; (ii) scaled executive compensation disclosures; and (iii) the requirement to provide only two years of audited financial statements, instead of three years.

Corporate Information

We are currently incorporated and in good standing in the State of Delaware. Our principal executive offices are located at 1001 North US Hwy 1, Suite 504, Jupiter, Florida 33477, and our telephone number is (561) 406-6154. Our website address is www.jupiterneurosciences.com. The information contained on our website is not incorporated by reference into this prospectus, and you should not consider any information contained on, or that can be accessed through, our website as part of this prospectus or in deciding whether to purchase our common stock.

Stock Splits

On January 25, 2022, our board of directors and shareholders holding a majority of the voting power of our issued and outstanding voting capital stock approved the reverse stock split in a ratio of 1-for-2. On January 25, 2022, we filed a certificate of amendment to our Certificate of Incorporation, as amended (the “Certificate of Incorporation”), implementing the reverse stock split in a ratio of 1-for-2, effective January 25, 2022.

On June 13, 2024, our board of directors and shareholders holding a majority of the voting power of our issued and outstanding voting capital stock approved the forward stock split in a ratio of 15-for-4. On June 14, 2024, we filed a certificate of amendment to our Certificate of Incorporation, as amended (the “Certificate of Incorporation”), implementing the stock split in a ratio of 15-for-4, effective June 14, 2024.

Except as otherwise indicated, all references to our common stock, share data, per share data and related information has been adjusted for the reverse stock split ratio of 1-for-2 (“Reverse Stock Split”) and the subsequent stock split ratio of 15-for-4 (the “2024 Forward Stock Split”) as if they had occurred at the beginning of the earliest period presented. The Reverse Stock Split and the 2024 Forward Stock Split, combined each two shares of our outstanding common stock into one share of common stock and then subsequently split each four shares of our outstanding common stock into fifteen shares of common stock, each without any change in the par value per share, and the Reverse Stock Split and the 2024 Forward Stock Split correspondingly adjusted, among other things, the exercise rate of our warrants into our common stock. No fractional shares were issued in connection with the Reverse Stock Split or the 2024 Forward Stock Split, and any fractional shares resulting from the Reverse Stock Split, or the 2024 Forward Stock Split were rounded up to the nearest whole share.

THE OFFERING

| Common stock offered by the Selling Stockholders: | | This prospectus relates to 3,600,000 shares of common stock that may be sold from time to time by the selling stockholders named in this prospectus |

| | | |

| Common stock outstanding at commencement of the offering(1): | | 32,876,413 shares of common stock based on our initial public offering price of $4.00 per share. |

| | | |

| Use of proceeds: | | We will not receive any proceeds from the sales of outstanding shares of common stock by the selling stockholders. |

| | | |

| Risk Factors: | | Investing in our common stock involves a high degree of risk. See “Risk Factors” beginning on page 15 of this prospectus for a discussion of some of the factors you should carefully consider before deciding to invest in our common stock. |

| | | |

| Trading market and symbol: | | Our common stock has been approved for listing on Nasdaq Capital Market (“Nasdaq Capital Market”) under the symbol “JUNS”. This resale offering will not proceed unless our initial public offering is closed. |

(1) The number of shares of common stock outstanding at the commencement of the offering assumes the issuance by us of common stock pursuant to our initial public offering prospectus filed contemporaneously with this prospectus, is based on 32,876,413 shares of common stock outstanding as of the date of this prospectus or that may be outstanding before the commencement of our initial public offering, and excludes:

| | ● | 10,633,988 shares of our common stock issuable upon exercise of outstanding options at a weighted average exercise price of $1.02 per share as of September 13, 2024; |

| | | |

| | ● | 1,359,375 shares of our common stock issuable upon exercise of outstanding warrants at a weighted average exercise price of $0.80 per share as of September 13, 2024; and |

| | | |

| | ● | approximately 222,756 shares of our common stock issuable upon the conversion of our issued and outstanding convertible notes at an average conversion price of $2.80 (70% of the initial public offering price of $4.00). |

SELECTED HISTORICAL FINANCIAL DATA

The following table presents our selected historical financial data for the periods indicated. The selected historical financial data for the years ended December 31, 2023 and 2022 and the balance sheet data as of December 31, 2023 and 2022 are derived from the audited financial statements. The summary historical financial data for the six months ended June 30, 2024 and 2023 and the balance sheet data as of June 30, 2024 and June 30, 2023 are derived from our unaudited financial statements.

Historical results are included for illustrative and informational purposes only and are not necessarily indicative of results we expect in future periods, and results of interim periods are not necessarily indicative of results for the entire year. The data presented below should be read in conjunction with, and are qualified in their entirety by reference to, “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and our financial statements and the notes thereto included elsewhere in this prospectus.

| | | Year Ended | | | Six Months Ended | |

| | | December 31,

2023 | | | December 31,

2022 | | | June 30,

2024 | | | June 30,

2023 | |

| | | | | | | | | (unaudited) | |

| Statement of Operations Data | | | | | | | | | | | | |

| Grant and other revenue | | $ | - | | | $ | 233,281 | | | $ | - | | | $ | - | |

| Operating expenses | | | | | | | | | | | | | | | | |

| Research and development | | | 954,793 | | | | 942,806 | | | | 199,744 | | | | 470,605 | |

| General and administrative | | | 2,915,978 | | | | 2,722,922 | | | | 939,635 | | | | 1,422,397 | |

| Total operating expenses | | | 3,870,771 | | | | 3,665,728 | | | | 1,139,379 | | | | 1,893,002 | |

| Loss from operations | | | (3,870,771 | ) | | | (3,432,447 | ) | | | (1,139,379 | ) | | | (1,893,002 | ) |

| Total other income (expense) | | | (912,918 | ) | | | (1,525,133 | ) | | | 818,402 | | | | (686,853 | ) |

| Income (loss) before provision for taxes | | | (4,783,689 | ) | | | (4,957,580 | ) | | | (320,977 | ) | | | (2,579,855 | ) |

| Income tax provisions | | | - | | | | - | | | | - | | | | - | |

| Net income (loss) | | $ | (4,783,689 | ) | | $ | (4,957,580 | ) | | $ | (320,977 | ) | | $ | (2,579,855 | ) |

| Basic and diluted net loss per share | | $ | (0.18 | ) | | $ | (0.20 | ) | | $ | (0.01 | ) | | $ | (0.10 | ) |

| | | | | | | | | | | | | | | | | |

| Balance Sheet Data (at period end) | | | | | | | | | | | | | | | | |

| Cash | | $ | 28,478 | | | $ | 64,431 | | | $ | 14,851 | | | | 27,791 | |

| Working capital (deficit) (1) | | | (5,743,166 | ) | | | (7,190,821 | ) | | | (5,288,337 | ) | | | (8,887,226 | ) |

| Total assets | | | 148,592 | | | | 235,944 | | | | 136,751 | | | | 172,618 | |

| Total liabilities | | | 5,949,946 | | | | 7,380,028 | | | | 5,491,782 | | | | 9,109,193 | |

| Stockholders’ equity (deficit) | | | (5,801,354 | ) | | | (7,144,084 | ) | | | (5,355,031 | ) | | | (8,936,575 | ) |

| (1) | Working capital represents total current assets less total current liabilities. |

RISK FACTORS

An investment in our securities carries a significant degree of risk. You should carefully consider the following risks, as well as the other information contained in this prospectus, including our historical financial statements and related notes included elsewhere in this prospectus, before you decide to purchase our securities. Any one of these risks and uncertainties has the potential to cause material adverse effects on our business, prospects, financial condition and operating results which could cause actual results to differ materially from any forward-looking statements expressed by us and a significant decrease in the value of our common stock. Refer to “Cautionary Statement Regarding Forward-Looking Statements.”

We may not be successful in preventing the material adverse effects that any of the following risks and uncertainties may cause. These potential risks and uncertainties may not be a complete list of the risks and uncertainties facing us. There may be additional risks and uncertainties that we are presently unaware of, or presently consider immaterial, that may become material in the future and have a material adverse effect on us. You could lose all or a significant portion of your investment due to any of these risks and uncertainties.

Below is a summary of material risks, uncertainties and other factors that could have a material effect on the Company and its operations:

| | ● | We are early in our development efforts, with a limited operating history, and have no products approved for commercial sale. |

| | ● | We have not generated any revenue from product sales to date, have incurred significant net losses since our inception, and expect to continue to incur significant net losses for the foreseeable future. |

| | ● | Our ability to generate revenue and achieve profitability depends significantly on our ability to achieve several objectives relating to the discovery, development and commercialization of our product candidate. |

| | | |

| | ● | Even if our initial public offering is successful, we will require substantial additional capital to finance our operations. |

| | ● | Our substantial amount of indebtedness may adversely affect our cash flow and our ability to operate our business, remain in compliance with debt covenants and make payments on our indebtedness. |

| | | |

| | ● | Our outstanding Secured Note provides our Secured Lender with liens on substantially all of our assets, including our intellectual property, and contains financial covenants and other restrictions on our actions, which may cause significant risks to our stockholders and may impact our ability to pursue certain transactions and operate our business. |

| | | |

| | ● | We are substantially dependent on the success of our product candidate, JOTROL. If we are unable to complete development of, obtain approval for and commercialize JOTROL for one or more indications in a timely manner, our business will be harmed. |

| | ● | Our prospects depend upon developing product candidate JOTROL for particular indications and possibly discovering, developing other product candidates in future programs. |

| | ● | Clinical drug development involves a lengthy and expensive process with an uncertain outcome. The clinical trials of our product candidate JOTROL may not demonstrate safety and efficacy to the satisfaction of the U.S. Food and Drug Administration (FDA), European Medicines Agency (EMA) or other comparable foreign regulatory authorities or otherwise produce positive results and the results of preclinical studies and early clinical trials may not be predictive of future results. |

| | ● | We have limited resources and are currently focusing the majority of our efforts on developing JOTROL for particular indications. As a result, we may fail to capitalize on other indications or product candidates that may ultimately have proven to be more profitable. |

| | ● | We face significant competition, and if our competitors develop and market technologies or products more rapidly than we do or that are more effective, safer or less expensive than the product candidates we develop, our commercial opportunities will be negatively impacted. In particular, we face competition for patients with MPS-I, Friedreich’s ataxia, MELAS, Parkinson’s Disease, Mild Cognitive Impairment, and early Alzheimer’s disease from companies that produce drugs to treat such diseases. For more information regarding competition we face, see the section titled “Business — Competition. |

| | ● | We rely on third parties to conduct our preclinical studies, clinical trials, and manufacturing and these third parties may not perform satisfactorily. |

| | ● | If we engage in future acquisitions or strategic partnerships, this may increase our capital requirements, dilute our stockholders, cause us to incur debt or assume contingent liabilities, and subject us to other risks. |

| | ● | We rely on our management team and other key employees, and the loss of one or more key employees could harm our business. |

| | ● | The failure to attract and retain additional qualified personnel could prevent us from executing our business strategy. |

| | ● | Once our common stock is listed on Nasdaq Capital Market, there can be no assurance that we will be able to comply with Nasdaq Capital Market’s continued listing standards. |

| | | |

| | ● | The price of our common stock could be subject to rapid and substantial volatility. As a relatively small-capitalization company with relatively small public float, we may experience greater stock price volatility, extreme price run-ups, lower trading volume and less liquidity than large-capitalization companies. Such volatility, including any stock-run up, may be unrelated to our actual or expected operating performance and financial condition or prospects, making it difficult for prospective investors to assess the rapidly changing value of our common stock. In addition, if the trading volumes of our common stock are low, persons buying or selling in relatively small quantities may easily influence prices of our common stock. This low volume of trades could also cause the price of our common stock to fluctuate greatly, with large percentage changes in price occurring in any trading day session. Holders of our common stock may also not be able to readily liquidate their investment or may be forced to sell at depressed prices due to low volume trading. |

| | | |

| | ● | As a result of the resale of shares of common stock by Selling Stockholders being a large volume of shares and potentially at different pricing after the initial fixed price, there is a potential for price volatility or depreciation for investors in our initial public offering |

Risks Related to Our Financial Position, Need for Additional Capital and Limited Operating History

We are early in our development efforts, with a limited operating history, and we have no products approved for commercial sale, which may make it difficult for you to evaluate our current business and likelihood of success and future viability.

We are an early clinical stage pharmaceutical company with a limited operating history upon which you can evaluate our business and prospects. We are developing one medication to treat rare diseases (MPS I, Friedreich’s ataxia, and MELAS) as well as larger indications, Parkinson’s Disease and Mild Cognitive Impairment / early Alzheimer’s disease, which is an unproven and highly uncertain undertaking and involves a substantial degree of risk. We commenced operations in January 2016, have no products approved for commercial sale and have not generated any revenue. We initiated and completed our Phase I clinical trial for our sole product candidate, JOTROL, in March 2021. Since our inception in 2016, we have devoted substantially all of our focus and financial resources to discovering, identifying and developing our product candidate, JOTROL, including advancing our development program, conducting a preclinical study of our product candidate and initiating a clinical trial, organizing and staffing our company, business planning, raising capital and securing related intellectual property rights.

We have not yet demonstrated our ability to successfully complete efficacy clinical trials that can lead to a New Drug Application (“NDA”) submission, obtain marketing approvals, manufacture a commercial-scale product, or obtain a proposal for any out-licensing or distribution agreements. As a result, it may be more difficult for investors to accurately predict our likelihood of success and viability than it could be if we had a longer operating history.

In addition, we may encounter unforeseen expenses, difficulties, complications, delays and other known and unknown factors and risks frequently experienced by clinical-stage biopharmaceutical companies in rapidly evolving fields. We also may need to transition from a company with a research and development focus to a company capable of supporting commercial activities. We have not yet demonstrated an ability to successfully overcome such risks and difficulties, or to make such a transition. If we do not adequately address these risks and difficulties or successfully make such a transition, our business will suffer.

We have not generated any revenue from product sales to date, have incurred significant net losses since our inception, and expect to continue to incur significant net losses for the foreseeable future.

We do not have any products approved for sale, and consequently we have not generated any revenue. We have incurred significant net losses since our inception and have financed our operations principally through private placements of our common stock. To date, we have not been profitable and have incurred significant losses and cash flow deficits.

For the fiscal years ended December 31, 2023 and 2022, we generated no revenues from product sales and reported net losses of $4,783,689 and $4,957,580 respectively, and negative cash flow from operating activities of $480,953 and $1,248,504, respectively. For the six months ended June 30, 2024 and 2023, we generated no revenues from product sales and reported net losses of $320,977 and $2,579,855, respectively, and negative cash flow from operating activities of $172,627 and $156,640, respectively. As noted in our financial statements, as of June 30, 2024, we had an accumulated deficit of $23,903,481.

Our sole product candidate, JOTROL, recently completed Phase I clinical trial that commenced in December 2020. As a result, we expect that it will be several years, if ever, before we receive approval to commercialize our product and generate revenue from product sales. Even if we succeed in receiving marketing approval for and commercializing of our approved product candidate, we expect that we will continue to incur substantial research and development and other expenses in order to discover, develop and market additional potential products.

We expect to continue to incur significant expenses and increasing operating losses for the foreseeable future. The net losses we incur may fluctuate significantly from quarter to quarter such that a period-to-period comparison of our results of operations may not be a good indication of our future performance, particularly since we expect our expenses to increase if and when our product candidate progresses through clinical development as a product candidate in later stages of clinical development generally have higher development costs than those in earlier stages, primarily due to the increased size and duration of later-stage clinical trials. The size of our future net losses will depend, in part, on the rate of future growth of our expenses and our ability to have our product candidates approved for marketing and to generate revenue. Our prior losses and expected future losses have had and will continue to have an adverse effect on our working capital, our ability to fund the development of our product candidate and our ability to achieve and maintain profitability and the performance of our stock.

Our management has concluded that factors raise substantial doubt about our ability to continue as a going concern and our auditor has included an explanatory paragraph relating to our ability to continue as a going concern in its audit report for the fiscal years ended December 31, 2023 and 2022.

Our management has concluded that our historical recurring losses from operations and negative cash flows from operations as well as our dependence on private equity and other financings raise substantial doubt about our ability to continue as a going concern and our auditor has included an explanatory paragraph relating to our ability to continue as a going concern in its audit report for the fiscal year ended December 31, 2023 and 2022.

Our financial statements do not include any adjustments that might result from the outcome of this uncertainty. These adjustments would likely include substantial impairment of the carrying amount of our assets and potential contingent liabilities that may arise if we are unable to fulfill various operational commitments. In addition, the value of our securities, including common stock issued in our initial public offering, would be greatly impaired. Our ability to continue as a going concern is dependent upon generating sufficient cash flow from operations and obtaining additional capital and financing, including funds raised in our initial public offering. If our ability to generate cash flow from operations is delayed or reduced and we are unable to raise additional funding from other sources, we may be unable to continue in business even if our initial public offering is successful. For further discussion about our ability to continue as a going concern and our plan for future liquidity, see “Management’s Discussion and Analysis of Financial Condition and Results of Operations—Ability to Continue as a Going Concern.”

Our ability to generate revenue and achieve profitability depends significantly on our ability to achieve several objectives relating to the discovery, development and commercialization of our product candidates, if approved.