|

|

| Cautionary Statement Regarding Forward-Looking Statements |

| |

This presentation may contain forward-looking statements within the meaning of the federal securities laws. Forward-looking statements relate to expectations, beliefs, projections, future plans and strategies, anticipated events or trends and similar expressions concerning matters that are not historical facts. In some cases, you can identify forward-looking statements by the use of forward-looking terminology such as “may,” “will,” “should,” “expects,” “intends,” “plans,” “anticipates,” “believes,” “estimates,” “predicts,” or “potential” or the negative of these words and phrases or similar words or phrases which are predictions of or indicate future events or trends and which do not relate solely to historical matters. You can also identify forward-looking statements by discussions of strategy, plans or intentions.

Forward-looking statements involve known and unknown risks, uncertainties, assumptions and contingencies, many of which are beyond the Company’s control, and may cause the Company’s actual results to differ significantly from those expressed in any forward-looking statement. Factors that might cause such a difference include, without limitation, the Company’s ability to build the leading digital real estate provider and funding source for the occupancy, infrastructure, equity and credit needs of the world’s mobile communications and data-driven companies, including whether the Company will be the only global REIT that owns, manages and operates assets across all major components of digital ecosystem including data centers, cell towers, fiber networks and small cells, whether our public shareholders and private limited partners will benefit from the Company’s investment management business and direct investment interests on the balance sheet, whether digital investment management will be a dominant driver of growth for the Company or at all, the ability to monetize non-strategic Other Equity and Debt assets within the time and manner the Company’s expect or at all, the availability of significant global opportunities in the digital ecosystem, whether the Company will complete a disposition of its management agreement with Colony Credit Real Estate, Inc. (CLNC) on the terms and timeframe anticipated or at all, whether the Company’s operations of its non-digital business units will result in maximizing cash flows and value over time, including whether cash flows will be improved for the healthcare and hospitality units, the impact of impairments, the impact of changes to the Company’s management or board of directors, employee and organizational structure, including the implementation and timing of CEO succession plans, Digital Colony’s ability to complete the pending acquisition of Zayo Group Holdings, Inc. on the terms contemplated or at all, Colony Capital’s financial flexibility and liquidity, including borrowing capacity under its revolving credit facility, the use of sales proceeds and available liquidity, the performance of the Company’s investment in CLNC, including the CLNC share price as compared to book value and how the Company evaluates the Company’s investment in CLNC, whether the Company’s exploration of potential opportunities to maximize value of the credit and opportunity fund investment management business will result in a definitive transaction in the form of a joint venture, sale or realignment of operational management or at all, the Company’s ability to minimize balance sheet commitments to its managed investment vehicles, the performance of the Company’s investment in DataBank and whether the Company will continue to invest in edge/colocation data center sector and support future growth opportunities through potential add-on acquisitions and greenfield edge data center developments, and whether if consummated such additional investments and growth opportunities result in any of the benefits we anticipate or at all, whether the Company will realize any anticipated benefits from the Alpine Energy joint venture, the Company's portfolio composition, the Company's expected taxable income and net cash flows, excluding the contribution of gains, whether the Company will maintain or produce higher Core FFO per share (including or excluding gains and losses from sales of certain investments) in the coming quarters, or ever, the Company’s ability to maintain or grow the dividend at all in the future, including the Company’s expectation to maintain its common stock dividend at $0.44 per share for the full year 2020, the impact of any changes to the Company’s management agreements with NorthStar Healthcare Income, Inc. and CLNC and other managed investment vehicles, whether Colony Capital will be able to maintain its qualification as a REIT for U.S. federal income tax purposes, the timing of and ability to deploy available capital, including whether any redeployment of capital will generate higher total returns, the timing of and ability to complete repurchases of Colony Capital’s stock, Colony Capital’s ability to maintain inclusion and relative performance on the RMZ, Colony Capital’s leverage, including the Company’s ability to reduce debt and the timing and amount of borrowings under its credit facility, increased interest rates and operating costs, adverse economic or real estate developments in Colony Capital’s markets, Colony Capital’s failure to successfully operate or lease acquired properties, decreased rental rates, increased vacancy rates or failure to renew or replace expiring leases, increased costs of capital expenditures, defaults on or non-renewal of leases by tenants, the impact of economic conditions on the borrowers of Colony Capital’s commercial real estate debt investments and the commercial mortgage loans underlying its commercial mortgage backed securities, adverse general and local economic conditions, an unfavorable capital market environment, decreased leasing activity or lease renewals, and other risks and uncertainties, including those detailed in the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2018 and our Quarterly Report on Form 10-Q for the quarter ended June 30, 2019, under the heading “Risk Factors,” as such factors may be updated from time to time in our subsequent periodic filings with the U.S. Securities and Exchange Commission (“SEC”).

All forward-looking statements reflect Colony Capital’s good faith beliefs, assumptions and expectations, but they are not guarantees of future performance. Additional information about these and other factors can be found in Colony Capital’s reports filed from time to time with the SEC. Colony Capital cautions investors not to unduly rely on any forward-looking statements. The forward-looking statements speak only as of the date of this presentation. Colony Capital is under no duty to update any of these forward-looking statements after the date of this presentation, nor to conform prior statements to actual results or revised expectations, and Colony Capital does not intend to do so.

This presentation may contain statistics and other data that has been obtained or compiled from information made available by third-party service providers. Colony Capital has not independently verified such statistics or data.

This presentation is for informational purposes only and does not constitute an offer to sell or a solicitation of an offer to buy any securities of Colony Capital. This information is not intended to be indicative of future results. Actual performance of Colony Capital may vary materially.

The appendices herein contain important information that is material to an understanding of this presentation and you should read this presentation only with and in context of the appendices.

|

| | |

Colony Capital | Supplemental Financial Report | | |

|

|

| Important Note Regarding Non-GAAP Financial Measures |

| |

This supplemental package includes certain “non-GAAP” supplemental measures that are not defined by generally accepted accounting principles, or GAAP, including; funds from operations, or FFO; core funds from operations, or Core FFO; net operating income (“NOI”); and pro rata financial information.

FFO: The Company calculates funds from operations (“FFO”) in accordance with standards established by the Board of Governors of the National Association of Real Estate Investment Trusts, which defines FFO as net income or loss calculated in accordance with GAAP, excluding (i) extraordinary items, as defined by GAAP; (ii) gains and losses from sales of depreciable real estate; (iii) impairment write-downs associated with depreciable real estate; (iv) gains and losses from a change in control in connection with interests in depreciable real estate or in-substance real estate, plus (v) real estate-related depreciation and amortization; and (vi) including similar adjustments for equity method investments. Included in FFO are gains and losses from sales of assets which are not depreciable real estate such as loans receivable, equity method investments, as well as equity and debt securities, as applicable.

Core FFO: The Company computes core funds from operations (“Core FFO”) by adjusting FFO for the following items, including the Company’s share of these items recognized by its unconsolidated partnerships and joint ventures: (i) gains and losses from sales of depreciable real estate within the Other Equity and Debt segment, net of depreciation, amortization and impairment previously adjusted for FFO; (ii) gains and losses from sales of businesses within the Investment Management segment and impairment write-downs associated with the Investment Management segment; (iii) equity-based compensation expense; (iv) effects of straight-line rent revenue and expense; (v) amortization of acquired above- and below-market lease values; (vi) amortization of deferred financing costs and debt premiums and discounts; (vii) unrealized fair value gains or losses on interest rate and foreign currency hedges, and foreign currency remeasurements and realized gains and losses on interest rate hedging instruments existing at the time of the January 2017 merger with remaining terms greater than one year that served as economic hedges for any financing or refinancing of the Company's real estate verticals; (viii) acquisition and merger related transaction costs; (ix) restructuring and merger integration costs; (x) amortization and impairment of finite-lived intangibles related to investment management contracts and customer relationships; (xi) gain on remeasurement of consolidated investment entities and the effect of amortization thereof; (xii) non-real estate depreciation and amortization; (xiii) change in fair value of contingent consideration; and (xiv) tax effect on certain of the foregoing adjustments. Beginning with the first quarter of 2018, the Company’s Core FFO from its interest in Colony Credit Real Estate (NYSE: CLNC) and NorthStar Realty Europe (NYSE: NRE) represented its percentage interest multiplied by CLNC’s Core Earnings and NRE’s Cash Available for Distribution (“CAD”), respectively. Refer to CLNC’s and NRE's respective filings with the SEC for the definition and calculation of Core Earnings and CAD.

FFO and Core FFO should not be considered alternatives to GAAP net income as indications of operating performance, or to cash flows from operating activities as measures of liquidity, nor as indications of the availability of funds for our cash needs, including funds available to make distributions. FFO and Core FFO should not be used as supplements to or substitutes for cash flow from operating activities computed in accordance with GAAP. The Company’s calculations of FFO and Core FFO may differ from methodologies utilized by other REITs for similar performance measurements, and, accordingly, may not be comparable to those of other REITs.

The Company uses FFO and Core FFO as supplemental performance measures because, in excluding real estate depreciation and amortization and gains and losses from property dispositions, it provides a performance measure that captures trends in occupancy rates, rental rates, and operating costs. The Company also believes that, as widely recognized measures of the performance of REITs, FFO and Core FFO will be used by investors as a basis to compare its operating performance with that of other REITs. However, because FFO and Core FFO exclude depreciation and amortization and capture neither the changes in the value of the Company’s properties that resulted from use or market conditions nor the level of capital expenditures and leasing commissions necessary to maintain the operating performance of its properties, all of which have real economic effect and could materially impact the Company’s results from operations, the utility of FFO and Core FFO as measures of the Company’s performance is limited. FFO and Core FFO should be considered only as supplements to GAAP net income as a measure of the Company’s performance. Additionally, Core FFO excludes the impact of certain fair value fluctuations, which, if they were to be realized, could have a material impact on the Company’s operating performance. The Company also presents Core FFO excluding gains and losses from sales of certain investments as well as its share of similar adjustments for CLNC. The Company believes that such a measure is useful to investors as it excludes periodic gains and losses from sales of investments that are not representative of its ongoing operations.

|

| | |

Colony Capital | Supplemental Financial Report | | |

|

|

| Important Note Regarding Non-GAAP Financial Measures |

| |

NOI: NOI for our real estate segments represents total property and related income less property operating expenses, adjusted for the effects of (i) straight-line rental income adjustments; (ii) amortization of acquired above- and below-market lease adjustments to rental income; and (iii) other items such as adjustments for the Company’s share of NOI of unconsolidated ventures.

The Company believes that NOI is a useful measure of operating performance of its respective real estate portfolios as it is more closely linked to the direct results of operations at the property level. NOI also reflects actual rents received during the period after adjusting for the effects of straight-line rents and amortization of above- and below- market leases; therefore, a comparison of NOI across periods better reflects the trend in occupancy rates and rental rates of the Company’s properties.

NOI excludes historical cost depreciation and amortization, which are based on different useful life estimates depending on the age of the properties, as well as adjust for the effects of real estate impairment and gains or losses on sales of depreciated properties, which eliminate differences arising from investment and disposition decisions. This allows for comparability of operating performance of the Company’s properties period over period and also against the results of other equity REITs in the same sectors. Additionally, by excluding corporate level expenses or benefits such as interest expense, any gain or loss on early extinguishment of debt and income taxes, which are incurred by the parent entity and are not directly linked to the operating performance of the Company’s properties, NOI provides a measure of operating performance independent of the Company’s capital structure and indebtedness. However, the exclusion of these items as well as others, such as capital expenditures and leasing costs, which are necessary to maintain the operating performance of the Company’s properties, and transaction costs and administrative costs, may limit the usefulness of NOI. NOI may fail to capture significant trends in these components of U.S. GAAP net income (loss) which further limits its usefulness.

NOI should not be considered as an alternative to net income (loss), determined in accordance with U.S. GAAP, as an indicator of operating performance. In addition, the Company’s methodology for calculating NOI involves subjective judgment and discretion and may differ from the methodologies used by other comparable companies, including other REITs, when calculating the same or similar supplemental financial measures and may not be comparable with other companies.

NOI before Reserve for Furniture, Fixtures and Equipment Expenditures (“NOI before FF&E Reserve”): For our hospitality real estate segment, NOI before FF&E Reserve represents NOI before the deduction of reserve contributions for the repair, replacement and refurbishment of furniture, fixtures, and equipment ("FF&E"), which are typically 4% to 5% of revenues, and required under certain debt agreements and/or franchise and brand-managed hotel agreements.

Pro-rata: The Company presents pro-rata financial information, which is not, and is not intended to be, a presentation in accordance with GAAP. The Company computes pro-rata financial information by applying its economic interest to each financial statement line item on an investment-by-investment basis. Similarly, noncontrolling interests’ share of assets, liabilities, profits and losses was computed by applying noncontrolling interests’ economic interest to each financial statement line item. The Company provides pro-rata financial information because it may assist investors and analysts in estimating the Company’s economic interest in its investments. However, pro-rata financial information as an analytical tool has limitations. Other equity REITs may not calculate their pro-rata information in the same methodology, and accordingly, the Company’s pro-rata information may not be comparable to such other REITs' pro-rata information. As such, the pro-rata financial information should not be considered in isolation or as a substitute for our financial statements as reported under GAAP, but may be used as a supplement to financial information as reported under GAAP.

Tenant/operator provided information: The information related to the Company’s tenants/operators that is provided in this presentation has been provided by, or derived from information provided by, such tenants/operators. The Company has not independently verified this information and has no reason to believe that such information is inaccurate in any material respect. The Company is providing this data for informational purposes only.

|

| | |

Colony Capital | Supplemental Financial Report | | |

|

|

Note Regarding CLNY Reportable Segments / Consolidated and OP Share of Consolidated Amounts

|

| |

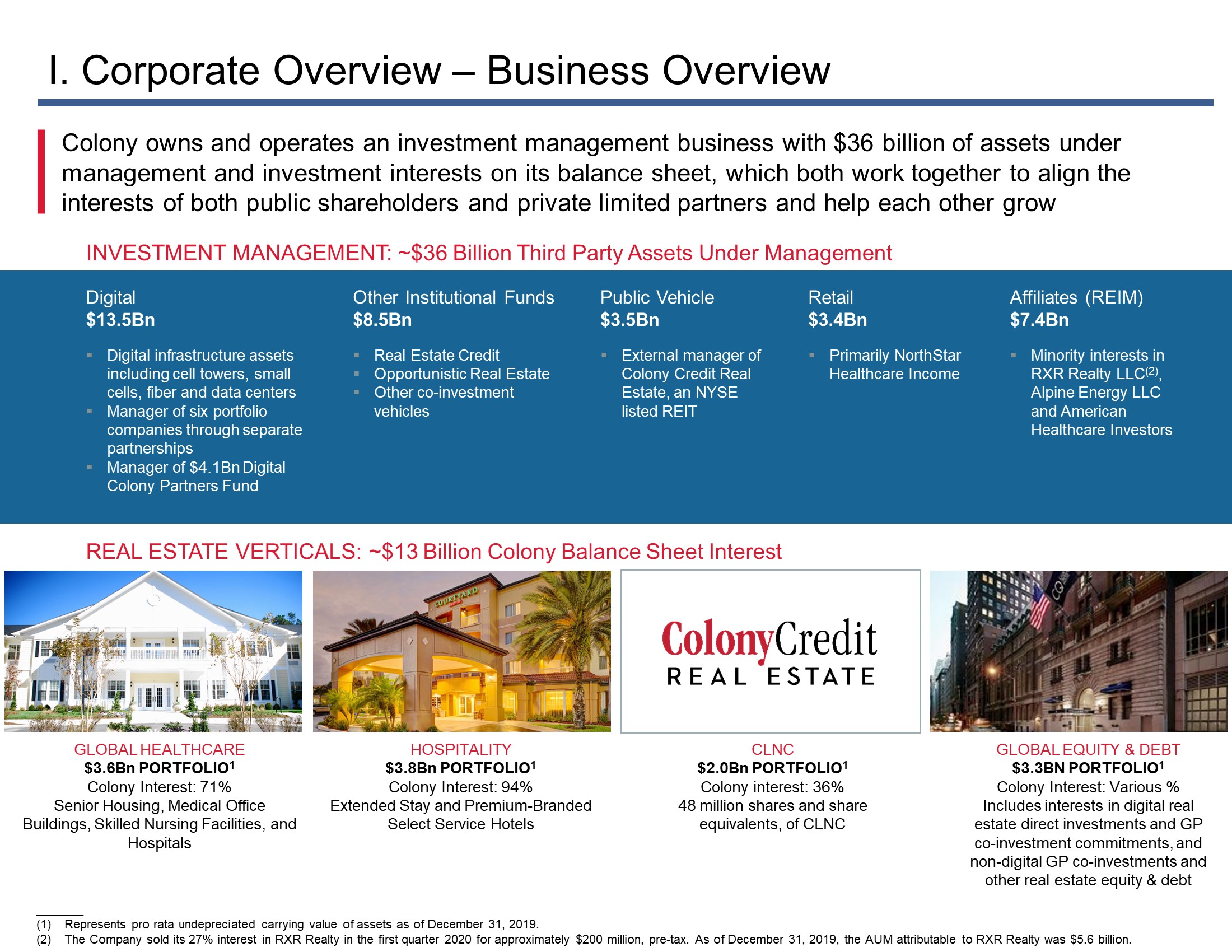

This presentation includes supplemental financial information for the following segments: Investment Management; Healthcare Real Estate; Industrial Real Estate; Hospitality Real Estate; CLNC; and Other Equity and Debt.

Investment Management

The Company’s Investment Management segment includes the management of digital real estate and infrastructure assets through Digital Colony and traditional commercial real estate investments through private real estate credit funds and related co-investment vehicles, CLNC, a public non-traded healthcare REIT and interests in other investment management platforms, among other smaller investment vehicles. This segment included the industrial investment management business, which was sold with the light industrial portfolio in December 2019, and is presented as discontinued operations on the consolidated statements of operations.

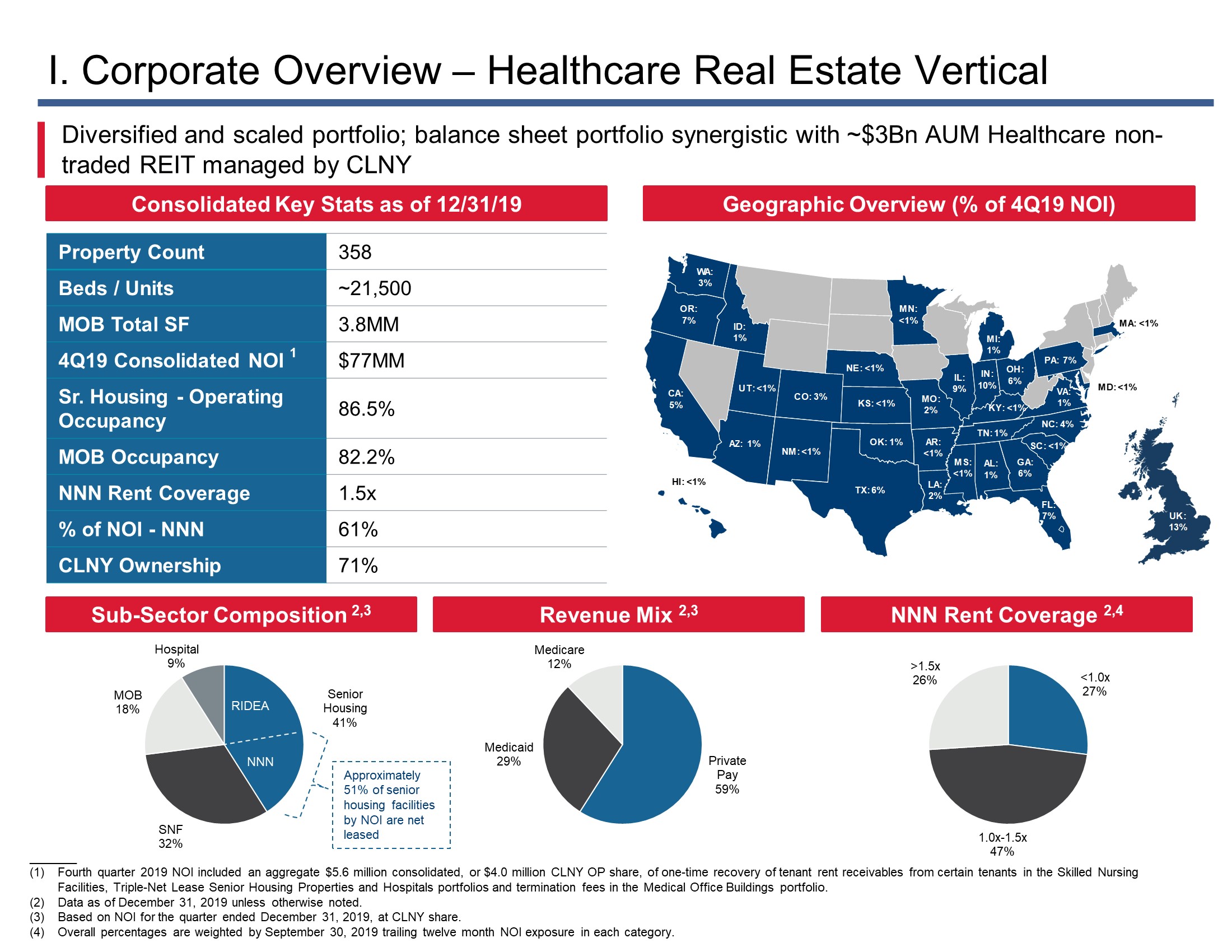

Healthcare Real Estate

As of December 31, 2019, the consolidated healthcare portfolio consisted of 358 properties: 154 senior housing properties, 106 medical office properties, 89 skilled nursing facilities and 9 hospitals. The Company’s equity interest in the consolidated Healthcare Real Estate segment was approximately 71% as of December 31, 2019. The healthcare portfolio earns rental income from our senior housing, skilled nursing facilities and hospital assets that are under net leases to single tenants/operators and from medical office buildings which are both single tenant and multi-tenant. In addition, we also earn resident fee income from senior housing properties that are managed by operators under a REIT Investment Diversification and Empowerment Act of 2007 (“RIDEA”) structure.

Industrial Real Estate

In December 2019, the Company completed the sale of its light industrial portfolio and related operating platform for an aggregate $5.7 billion, which resulted in a net cash gain and incentive fees of approximately $475 million and net cash proceeds of approximately $1.25 billion for the Company’s share. Accordingly, this segment will no longer be a reportable segment in the future and for all current and prior periods presented, the related operating results are presented as income from discontinued operations on the consolidated statement of operations. The Company continues to own the remaining bulk industrial assets, which are still held for sale with operating results presented as income from discontinued operations on the consolidated statements of operations.

As of December 31, 2019, the consolidated bulk industrial portfolio consisted of six bulk industrial buildings totaling 4.2 million rentable square feet across five major U.S. markets and was 67% leased. The Company's equity interest in the consolidated bulk industrial portfolio was approximately 51%, or $72 million, with the other 49% owned by third-party capital, which is managed by the Company.

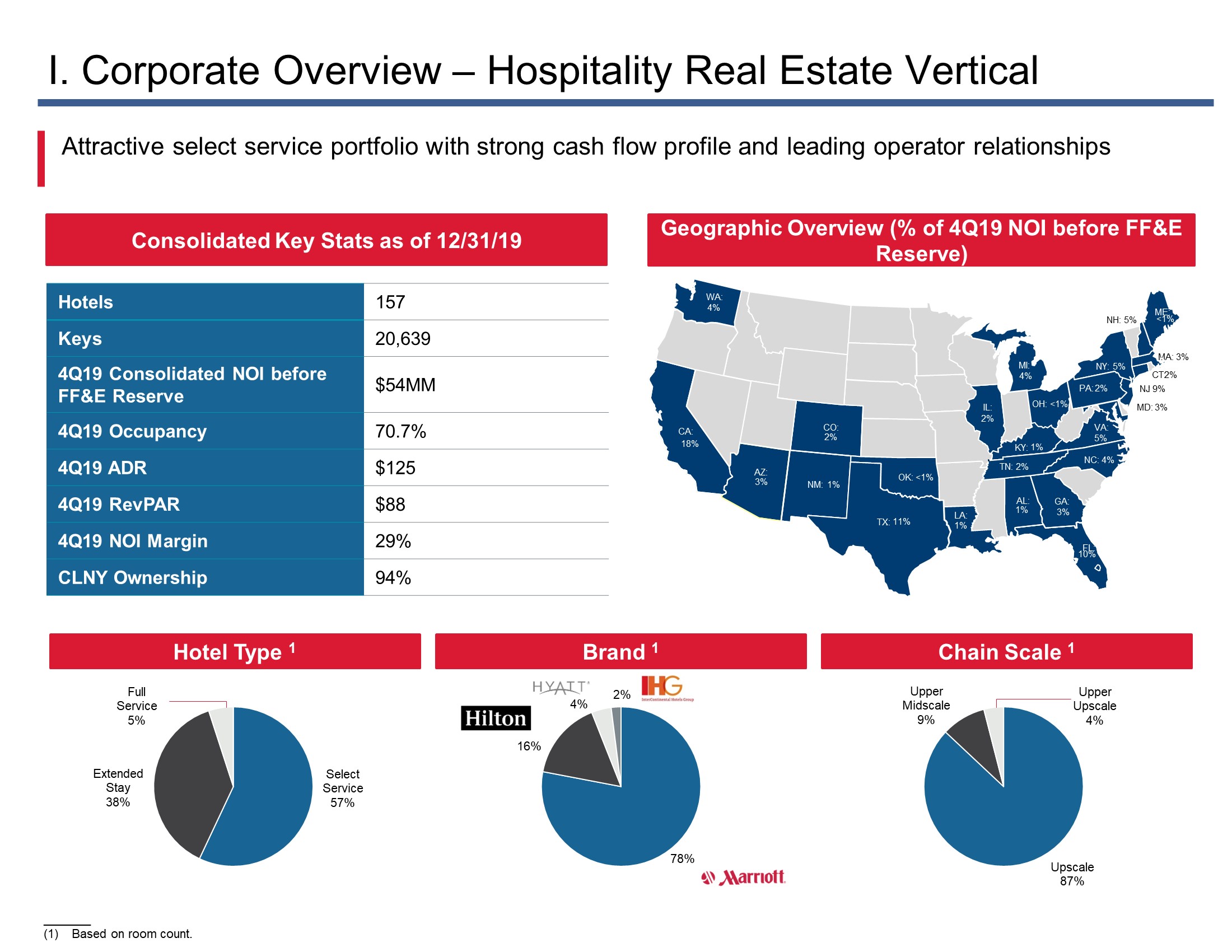

Hospitality Real Estate

As of December 31, 2019, the consolidated hospitality portfolio consisted of 157 properties: 87 select service properties, 66 extended stay properties and four full service properties. The Company’s equity interest in the consolidated Hospitality Real Estate segment was approximately 94% as of December 31, 2019. The hospitality portfolio consists primarily of select service and extended stay hotels located mostly in major metropolitan markets in the U.S., with the majority affiliated with top hotel brands. The select service hospitality portfolio referred to as the THL Hotel Portfolio, which the Company acquired through consensual transfer during the third quarter 2017, is not included in the Hospitality Real Estate segment and is included in the Other Equity and Debt segment.

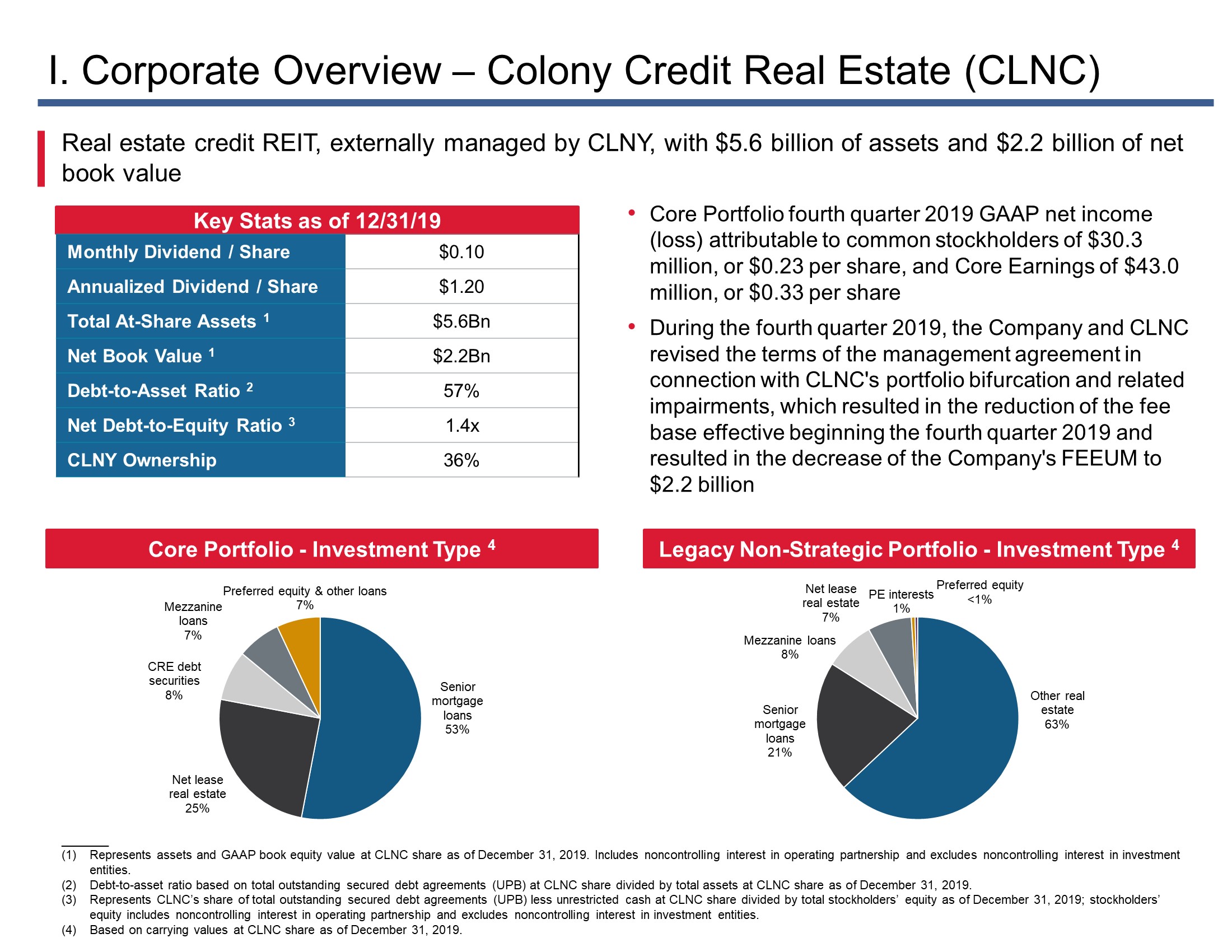

Colony Credit Real Estate, Inc. (“CLNC”)

Colony Credit Real Estate, Inc. is a commercial real estate credit REIT externally managed by the Company with $5.6 billion in assets and $2.2 billion in GAAP book equity value as of December 31, 2019. The Company owns approximately 48.0 million shares and share equivalents, or 36%, of CLNC and earns an annual base management fee of 1.5% on stockholders’ equity (as defined in the CLNC management agreement) and an incentive fee of 20% of CLNC’s Core Earnings over a 7% hurdle rate.

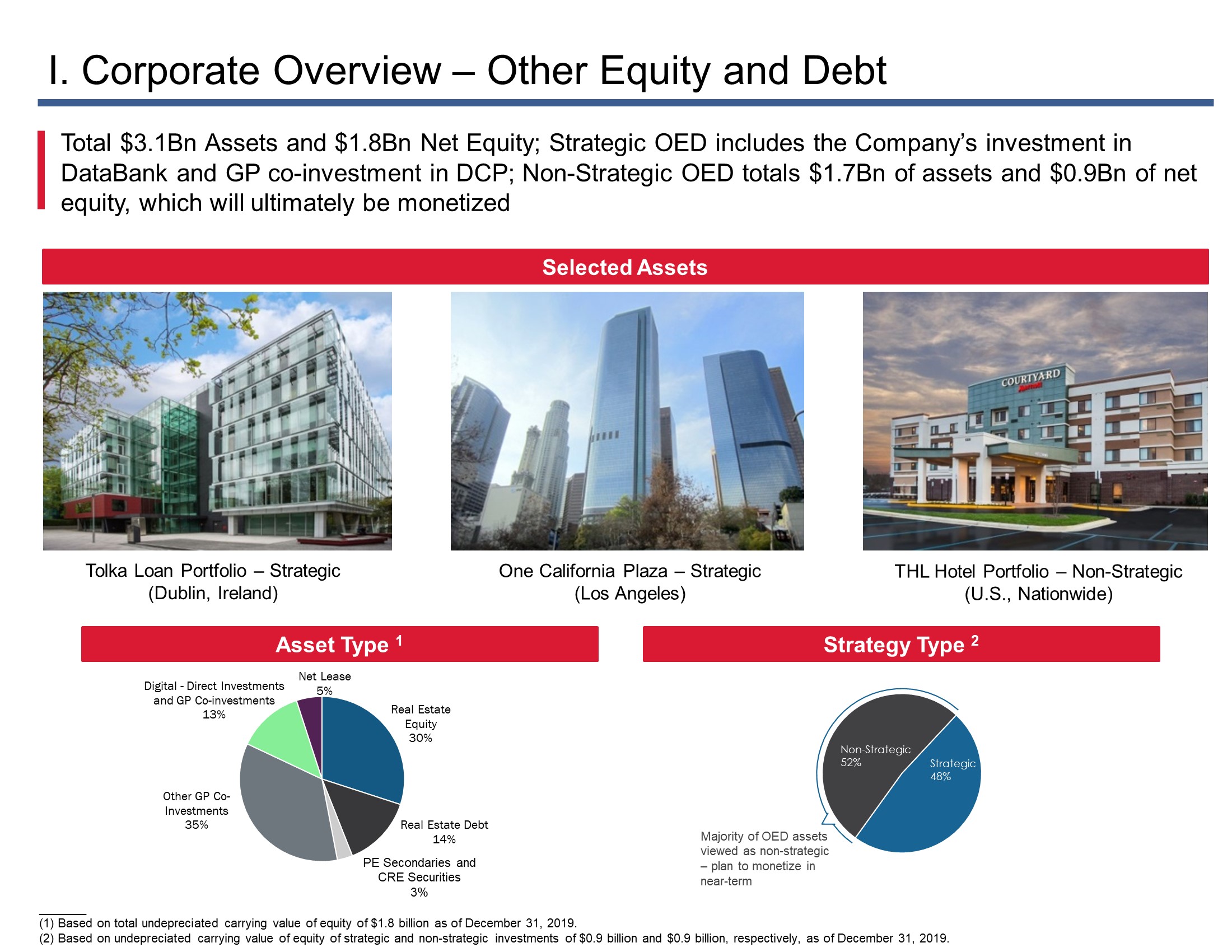

Other Equity and Debt

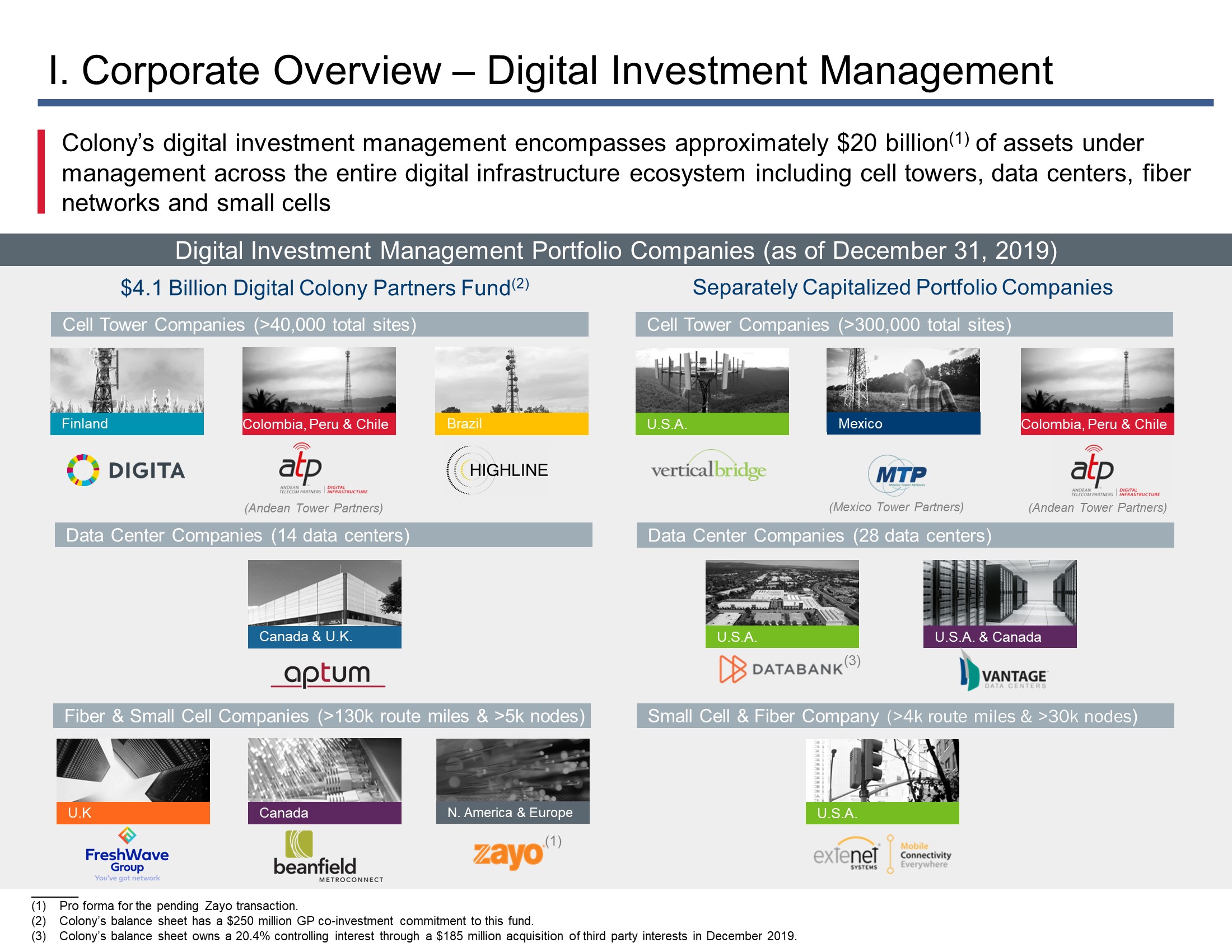

The Company owns a diversified group of strategic and non-strategic real estate and real estate-related debt and equity investments. Strategic investments include the Company’s digital balance sheet interests in digital real estate, including the 20% controlling interest in DataBank and the $250 million GP co-investment commitment to DCP, and non-digital investments for which the Company acts as a general partner and/or manager (“GP Co-Investments”) and receives various forms of investment management economics on the related third-party capital. Non-strategic investments are composed of those investments the Company does not intend to own for the long term including commercial real estate equity and debt investments and other real estate-related securities, among other holdings.

Throughout this presentation, consolidated figures represent the interest of both the Company (and its subsidiary Colony Capital Operating Company or the “CLNY OP”) and noncontrolling interests. Figures labeled as CLNY OP share represent the Company’s pro-rata share.

|

| | |

Colony Capital | Supplemental Financial Report | | |

|

| | | |

| | | | Page |

| I. | | 6-13 |

| | | | |

| II. | Financial Overview | |

| | a. | | 14 |

| | b. | | 15-16 |

| III. | Financial Results | |

| | a. | | 17 |

| | b. | | 18 |

| | c. | | 19 |

| | d. | | 20 |

| | e. | | 21 |

| IV. | Capitalization | |

| | a. | | 22 |

| | b. | | 23 |

| | c. | | 24 |

| | d. | | 25 |

| | e. | | 26 |

| V. | Investment Management | |

| | a. | Summary Metrics | 27-28 |

| | b. | Assets Under Management | 29 |

| VI. | Healthcare Real Estate | |

| | a. | Summary Metrics and Operating Results | 30 |

| | b. | Portfolio Overview | 31-32 |

| | | | |

|

| | | |

| | | | Page |

| VII. | Hospitality Real Estate | |

| | a. | | 33 |

| | b. | | 34 |

| VIII. | CLNC | |

| | a. | | 35 |

| IX. | | 36 |

| | a. | | 37 |

| | b. | | 38 |

| | c. | | 39-41 |

| | d. | | 42 |

| X. | Appendices | |

| | a. | | 44-45 |

| | b. | | 46-47 |

| | c. | Industrial Real Estate - Discontinued Operations | 48 |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

|

| | | |

Colony Capital | Supplemental Financial Report | | 5

| |

|

| | | |

Colony Capital | Supplemental Financial Report | | 6

| |

|

| | | |

Colony Capital | Supplemental Financial Report | | 7

| |

|

| | | |

Colony Capital | Supplemental Financial Report | | 8

| |

|

| | | |

Colony Capital | Supplemental Financial Report | | 9

| |

|

| | | |

Colony Capital | Supplemental Financial Report | | 10

| |

|

| | | |

Colony Capital | Supplemental Financial Report | | 11

| |

|

| | | |

Colony Capital | Supplemental Financial Report | | 12

| |

|

| | | |

Colony Capital | Supplemental Financial Report | | 13

| |

|

|

| IIa. Financial Overview - Summary Metrics |

| |

|

| | | |

| ($ and shares in thousands, except per share data and as noted; as of or for the three months ended December 31, 2019, unless otherwise noted) (Unaudited) |

| Financial Data | |

| Net income (loss) attributable to common stockholders | $ | (26,251 | ) |

| Net income (loss) attributable to common stockholders per basic share | (0.06 | ) |

Core FFO(1) | 47,590 |

|

| Core FFO per basic share | 0.09 |

|

| Q1 2020 dividend per share | 0.11 |

|

| Annualized Q1 2020 dividend per share | 0.44 |

|

| | |

| Balance Sheet, Capitalization and Trading Statistics | |

| Total consolidated assets | $ | 19,832,184 |

|

| CLNY OP share of consolidated assets | 13,678,097 |

|

Total consolidated debt(2) | 9,407,842 |

|

CLNY OP share of consolidated debt(2) | 6,835,312 |

|

| Shares and OP units outstanding as of December 31, 2019 | 541,039 |

|

| Shares and OP units outstanding as of February 25, 2020 | 540,631 |

|

| Share price as of February 25, 2020 | 4.55 |

|

| Market value of common equity & OP units as of February 25, 2020 | 2,459,871 |

|

| Liquidation preference of perpetual preferred equity | 1,033,750 |

|

| Insider ownership of shares and OP units as of February 25, 2020 | 9.5 | % |

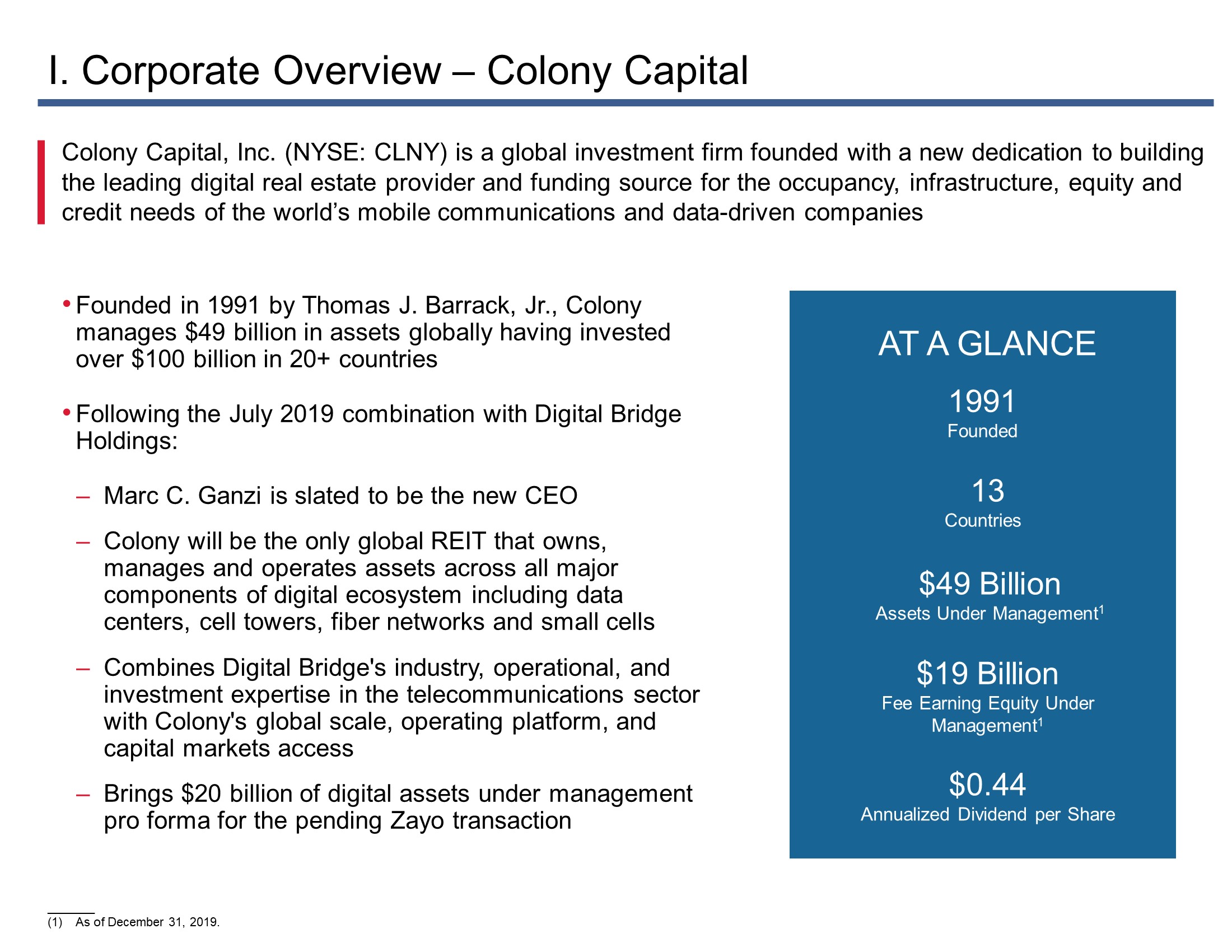

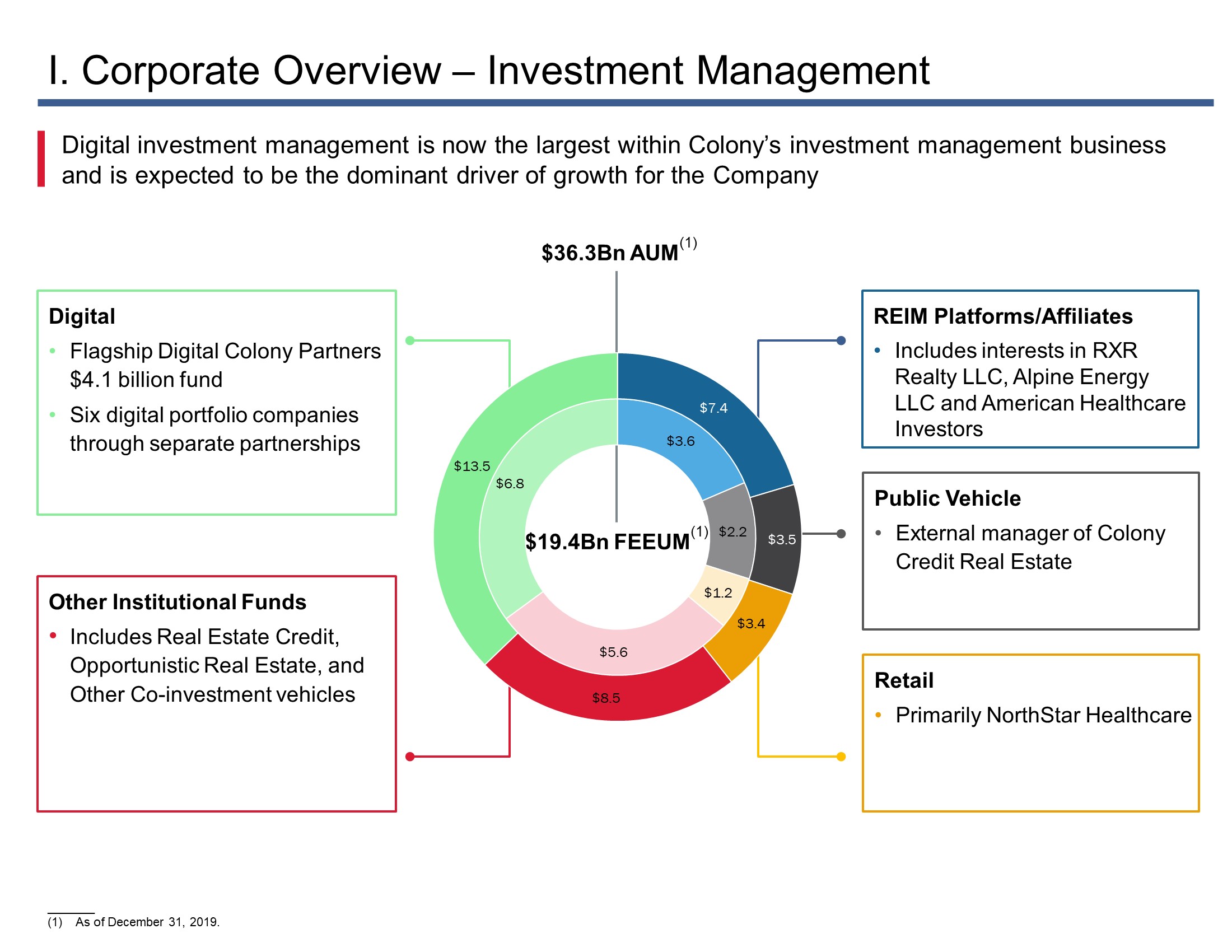

| Total Assets Under Management ("AUM") | $ 49.0 billion |

|

| Fee Earning Equity Under Management ("FEEUM") | $ 19.4 billion |

|

Notes:

In evaluating the information presented throughout this presentation see the appendices to this presentation for definitions and reconciliations of non-GAAP financial measures to GAAP measures.

| |

| (1) | Fourth quarter 2019 Core FFO included net losses of $21.4 million. |

| |

| (2) | Represents principal balance and excludes debt issuance costs, discounts and premiums. |

|

| | | |

Colony Capital | Supplemental Financial Report | | 14

| |

|

|

| IIb. Financial Overview - Summary of Segments |

| |

|

| | | | | | |

| ($ in thousands; as of or for the three months ended December 31, 2019, unless otherwise noted) | Consolidated amount | | CLNY OP share of consolidated amount |

| Investment Management | | | |

| Third-party AUM ($ in millions) | | | $ | 36,286 |

|

FEEUM ($ in millions)(1) | | | 19,440 |

|

| Q4 2019 fee revenue and REIM platform equity method earnings | | | 46,778 |

|

| | | | |

| Healthcare Real Estate | | | |

Q4 2019 net operating income(2)(3) | 76,571 |

| | 54,366 |

|

Annualized net operating income(4) | 283,884 |

| | 201,271 |

|

Investment-level non-recourse financing(5) | 2,953,706 |

| | 2,104,721 |

|

| | | | |

| Hospitality Real Estate | | | |

Q4 2019 NOI before FF&E Reserve(3) | 54,129 |

| | 50,827 |

|

TTM NOI before FF&E Reserve(6) | 274,793 |

| | 258,604 |

|

Investment-level non-recourse financing(5) | 2,667,347 |

| | 2,495,952 |

|

Notes:

| |

| (1) | Subsequent to the fourth quarter 2019, the Company completed the sale of its 27.2% ownership interest in RXR Realty, which represents $1.9 billion of FEEUM. |

| |

| (2) | NOI includes $0.9 million consolidated or $0.7 million CLNY OP share of interest earned related to $43 million consolidated or $30 million CLNY OP share carrying value of healthcare real estate development loans. This interest income is in the Interest Income line item on the Company’s Statement of Operations for the three months ended December 31, 2019. |

| |

| (3) | For a reconciliation of net income/(loss) attributable to common stockholders to NOI, please refer to the appendix to this presentation. |

| |

| (4) | Annualized NOI excludes an aggregate $5.6 million consolidated, or $4.0 million CLNY OP share, of fourth quarter 2019 one-time items from the recovery of tenant rent receivables from certain tenants in the Skilled Nursing Facilities, Triple-Net Lease Senior Housing Properties and Hospitals portfolios and termination fees in the Medical Office Buildings portfolio. |

| |

| (5) | Represents unpaid principal balance. |

| |

| (6) | TTM = trailing twelve month. |

|

| | | |

Colony Capital | Supplemental Financial Report | | 15

| |

|

|

| IIb. Financial Overview - Summary of Segments (cont’d) |

| |

|

| | | | | | | | |

| ($ in thousands except as noted; as of or for the three months ended December 31, 2019, unless otherwise noted) | Consolidated amount | | CLNY OP share of consolidated amount | |

| CLNC | | | | |

| Net carrying value of 36% interest | $ | 725,443 |

| | $ | 725,443 |

| |

Other Equity and Debt (1) | | | | |

| 1) Strategic Investments | | | | |

| a) Digital - direct investments and Digital Colony Partners GP co-investments - net carrying value | 954,754 |

| | 232,891 |

| |

| b) GP Co-investments in CDCF IV and CDCF V investments - net carrying value | 1,617,815 |

| | 280,848 |

| |

| c) Other GP co-investments - net carrying value | 365,664 |

| | 356,029 |

| |

| 2) Net lease real estate equity | | | | |

| a) Q4 2019 net operating income | 771 |

| | 770 |

| |

b) Investment-level non-recourse financing(2) | 104,061 |

| | 103,441 |

| |

| 3) Other real estate equity | | | | |

a) Undepreciated carrying value of real estate assets(3) | 1,864,369 |

| | 927,905 |

| |

b) Investment-level non-recourse financing(2) | 1,237,397 |

| | 614,299 |

| |

| c) Carrying value - equity method investments (including Albertsons) | 317,010 |

| | 237,410 |

| |

| 4) Real estate debt | | | | |

| a) Carrying value - consolidated | 300,825 |

| | 214,573 |

| |

b) Investment-level non-recourse financing(2) | — |

| | — |

| |

| c) Carrying value - equity method investments | 11,160 |

| | 6,089 |

| |

d) Carrying value - real estate assets (REO within debt portfolio) and other(3) | 45,030 |

| | 25,841 |

| |

| 5) CRE securities and real estate PE fund investments | | | | |

| a) Carrying value | | | 60,251 |

| |

| Net Assets | | | | |

Cash and cash equivalents, restricted cash and other assets(4) | 2,116,008 |

| | 1,782,074 |

| |

Accrued and other liabilities and dividends payable(5) | 1,410,867 |

| | 1,118,468 |

| |

| Net assets | $ | 705,141 |

| | $ | 663,606 |

| |

Notes:

| |

| (1) | Includes assets classified as held for sale on the Company’s financial statements. |

| |

| (2) | Represents unpaid principal balance. |

| |

| (3) | Includes all components related to real estate assets, including tangible real estate and lease-related intangibles, and excludes accumulated depreciation. |

| |

| (4) | Other assets excludes $3 million consolidated and CLNY OP share of deferred financing costs and $24 million consolidated or $13 million CLNY OP share of restricted cash which is included in the undepreciated carrying value of the hotel portfolio in Other Real Estate Equity shown on page 38. |

| |

| (5) | Accrued and other liabilities exclude $8 million consolidated and CLNY OP share of deferred tax liabilities and other liabilities which are not due in cash and $117 million of derivative liability which is included in the debt of Other GP Co-investments shown on page 37. |

|

| | | |

Colony Capital | Supplemental Financial Report | | 16

| |

|

|

| IIIa. Financial Results - Consolidated Balance Sheet |

| |

|

| | | | |

| ($ in thousands, except per share data) | | As of December 31, 2019 |

| Assets | | |

| Cash and cash equivalents | | $ | 1,205,190 |

|

| Restricted cash | | 203,923 |

|

| Real estate, net | | 10,860,518 |

|

| Loans receivable, net | | 1,552,824 |

|

| Equity and debt investments | | 2,313,805 |

|

| Goodwill | | 1,452,891 |

|

| Deferred leasing costs and intangible assets, net | | 638,853 |

|

| Assets held for sale | | 870,052 |

|

| Other assets | | 682,648 |

|

| Due from affiliates | | 51,480 |

|

| Total assets | | $ | 19,832,184 |

|

| Liabilities | | |

| Debt, net | | $ | 8,983,908 |

|

| Accrued and other liabilities | | 1,015,898 |

|

| Intangible liabilities, net | | 111,484 |

|

| Liabilities related to assets held for sale | | 268,152 |

|

| Due to affiliates | | 34,064 |

|

| Dividends and distributions payable | | 83,301 |

|

| Preferred stock redemptions payable | | 402,855 |

|

| Total liabilities | | 10,899,662 |

|

| Commitments and contingencies | | |

| Redeemable noncontrolling interests | | 6,107 |

|

| Equity | | |

| Stockholders’ equity: | | |

| Preferred stock, $0.01 par value per share; $1,033,750 liquidation preference; 250,000 shares authorized; 41,350 shares issued and outstanding | | 999,490 |

|

| Common stock, $0.01 par value per share | | |

| Class A, 949,000 shares authorized; 487,044 shares issued and outstanding | | 4,871 |

|

| Class B, 1,000 shares authorized; 734 shares issued and outstanding | | 7 |

|

| Additional paid-in capital | | 7,553,599 |

|

| Accumulated deficit | | (3,389,592 | ) |

| Accumulated other comprehensive income | | 47,668 |

|

| Total stockholders’ equity | | 5,216,043 |

|

| Noncontrolling interests in investment entities | | 3,254,188 |

|

| Noncontrolling interests in Operating Company | | 456,184 |

|

| Total equity | | 8,926,415 |

|

| Total liabilities, redeemable noncontrolling interests and equity | | $ | 19,832,184 |

|

|

| | | |

Colony Capital | Supplemental Financial Report | | 17

| |

|

|

| IIIb. Financial Results - Noncontrolling Interests’ Share Balance Sheet |

| |

|

| | | | |

| ($ in thousands, except per share data) (unaudited) | | As of December 31, 2019 |

| Assets | | |

| Cash and cash equivalents | | $ | 114,224 |

|

| Restricted cash | | 35,865 |

|

| Real estate, net | | 3,300,115 |

|

| Loans receivable, net | | 779,143 |

|

| Equity and debt investments | | 650,980 |

|

| Goodwill | | 381,349 |

|

| Deferred leasing costs and intangible assets, net | | 247,446 |

|

| Assets held for sale | | 450,117 |

|

| Other assets | | 194,848 |

|

| Total assets | | $ | 6,154,087 |

|

| Liabilities | | |

| Debt, net | | $ | 2,419,539 |

|

| Accrued and other liabilities | | 292,399 |

|

| Intangible liabilities, net | | 47,004 |

|

| Liabilities related to assets held for sale | | 134,850 |

|

| Total liabilities | | 2,893,792 |

|

| Commitments and contingencies | | |

| Redeemable noncontrolling interests | | 6,107 |

|

| Equity | | |

| Stockholders’ equity: | | |

| Preferred stock, $0.01 par value per share; $1,033,750 liquidation preference; 250,000 shares authorized; 41,350 shares issued and outstanding | | — |

|

| Common stock, $0.01 par value per share | | |

| Class A, 949,000 shares authorized; 487,044 shares issued and outstanding | | — |

|

| Class B, 1,000 shares authorized; 734 shares issued and outstanding | | — |

|

| Additional paid-in capital | | — |

|

| Accumulated deficit | | — |

|

| Accumulated other comprehensive income | | — |

|

| Total stockholders’ equity | | — |

|

| Noncontrolling interests in investment entities | | 3,254,188 |

|

| Noncontrolling interests in Operating Company | | — |

|

| Total equity | | 3,254,188 |

|

| Total liabilities, redeemable noncontrolling interests and equity | | $ | 6,154,087 |

|

|

| | | |

Colony Capital | Supplemental Financial Report | | 18

| |

|

|

| IIIc. Financial Results - Consolidated Segment Operating Results |

| |

|

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Three Months Ended December 31, 2019 |

| ($ in thousands) (Unaudited) | | Investment Management | | Healthcare | | Industrial | | Hospitality | | CLNC | | Other Equity and Debt | | Amounts not allocated to segments | | Total |

| Revenues | | | | | | | | | | | | | | | | |

| Property operating income | | $ | — |

| | $ | 153,099 |

| | $ | — |

| | $ | 186,423 |

| | $ | — |

| | $ | 107,046 |

| | $ | — |

| | $ | 446,568 |

|

| Interest income | | 75 |

| | 932 |

| | — |

| | — |

| | — |

| | 43,324 |

| | 1,078 |

| | 45,409 |

|

| Fee income | | 45,600 |

| | — |

| | — |

| | — |

| | — |

| | — |

| | — |

| | 45,600 |

|

| Other income | | 7,182 |

| | 347 |

| | — |

| | 27 |

| | — |

| | 4,329 |

| | 2,899 |

| | 14,784 |

|

| Total revenues | | 52,857 |

| | 154,378 |

| | — |

| | 186,450 |

| | — |

| | 154,699 |

| | 3,977 |

| | 552,361 |

|

| Expenses | | | | | | | | | | | | | | | | |

| Property operating expense | | — |

| | 66,106 |

| | — |

| | 132,710 |

| | — |

| | 67,760 |

| | — |

| | 266,576 |

|

| Interest expense | | 1,645 |

| | 41,930 |

| | — |

| | 45,484 |

| | — |

| | 26,537 |

| | 13,281 |

| | 128,877 |

|

| Investment and servicing expense | | 81 |

| | 3,137 |

| | — |

| | 1,787 |

| | — |

| | 19,967 |

| | 1,724 |

| | 26,696 |

|

| Transaction costs | | 319 |

| | — |

| | — |

| | — |

| | — |

| | 366 |

| | — |

| | 685 |

|

| Placement fees | | 1,429 |

| | — |

| | — |

| | — |

| | — |

| | — |

| | — |

| | 1,429 |

|

| Depreciation and amortization | | 8,697 |

| | 41,208 |

| | — |

| | 36,035 |

| | — |

| | 22,612 |

| | 1,501 |

| | 110,053 |

|

| Provision for loan loss | | — |

| | — |

| | — |

| | — |

| | — |

| | 33 |

| | — |

| | 33 |

|

| Impairment loss | | 410,954 |

| | 43,132 |

| | — |

| | 14,649 |

| | — |

| | 2,492 |

| | — |

| | 471,227 |

|

| Compensation expense | | | | | | | | | | | | | | | | |

| Cash and equity-based compensation | | 20,382 |

| | 1,597 |

| | — |

| | 1,615 |

| | — |

| | 4,652 |

| | 25,590 |

| | 53,836 |

|

| Carried interest and incentive compensation | | 3,300 |

| | — |

| | — |

| | — |

| | — |

| | — |

| | — |

| | 3,300 |

|

| Administrative expenses | | 4,765 |

| | 885 |

| | — |

| | 481 |

| | — |

| | 7,135 |

| | 12,546 |

| | 25,812 |

|

| Total expenses | | 451,572 |

| | 197,995 |

| | — |

| | 232,761 |

| | — |

| | 151,554 |

| | 54,642 |

| | 1,088,524 |

|

| Other income (loss) | | | | | | | | | | | | | | | | |

| Gain on sale of real estate assets | | — |

| | 551 |

| | — |

| | — |

| | — |

| | 18,611 |

| | — |

| | 19,162 |

|

| Other gain (loss), net | | 738 |

| | 5,690 |

| | — |

| | 1,492 |

| | — |

| | (16,489 | ) | | (1,596 | ) | | (10,165 | ) |

| Equity method earnings (loss) | | (613 | ) | | — |

| | — |

| | — |

| | 13,064 |

| | 25,613 |

| | — |

| | 38,064 |

|

| Equity method earnings—carried interest | | 5,424 |

| | — |

| | — |

| | — |

| | — |

| | — |

| | — |

| | 5,424 |

|

| Income (loss) before income taxes | | (393,166 | ) | | (37,376 | ) | | — |

| | (44,819 | ) | | 13,064 |

| | 30,880 |

| | (52,261 | ) | | (483,678 | ) |

| Income tax benefit (expense) | | 3,241 |

| | (1,232 | ) | | — |

| | 1,700 |

| | — |

| | (3,695 | ) | | (266 | ) | | (252 | ) |

| Income (loss) from continuing operations | | (389,925 | ) | | (38,608 | ) | | — |

| | (43,119 | ) | | 13,064 |

| | 27,185 |

| | (52,527 | ) | | (483,930 | ) |

| Income (loss) from discontinued operations | | (10,561 | ) | | — |

| | 1,426,219 |

| | — |

| | — |

| | — |

| | — |

| | 1,415,658 |

|

| Net income (loss) | | (400,486 | ) | | (38,608 | ) | | 1,426,219 |

| | (43,119 | ) | | 13,064 |

| | 27,185 |

| | (52,527 | ) | | 931,728 |

|

| Net income (loss) attributable to noncontrolling interests: | | | | | | | | | | | | | | | | |

| Redeemable noncontrolling interests | | — |

| | — |

| | — |

| | — |

| | — |

| | 242 |

| | — |

| | 242 |

|

| Investment entities | | (28,531 | ) | | (4,107 | ) | | 943,647 |

| | (3,816 | ) | | — |

| | 31,423 |

| | — |

| | 938,616 |

|

| Operating Company | | (36,305 | ) | | (3,366 | ) | | 47,078 |

| | (3,834 | ) | | 1,275 |

| | (438 | ) | | (7,277 | ) | | (2,867 | ) |

| Net income (loss) attributable to Colony Capital, Inc. | | (335,650 | ) | | (31,135 | ) | | 435,494 |

| | (35,469 | ) | | 11,789 |

| | (4,042 | ) | | (45,250 | ) | | (4,263 | ) |

| Preferred stock redemption | | — |

| | — |

| | — |

| | — |

| | — |

| | — |

| | (5,150 | ) | | (5,150 | ) |

| Preferred stock dividends | | — |

| | — |

| | — |

| | — |

| | — |

| | — |

| | 27,138 |

| | 27,138 |

|

| Net income (loss) attributable to common stockholders | | $ | (335,650 | ) | | $ | (31,135 | ) | | $ | 435,494 |

| | $ | (35,469 | ) | | $ | 11,789 |

| | $ | (4,042 | ) | | $ | (67,238 | ) | | $ | (26,251 | ) |

|

| | | |

Colony Capital | Supplemental Financial Report | | 19

| |

|

|

IIId. Financial Results - Noncontrolling Interests’ Share Segment Operating Results

|

| |

|

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Three Months Ended December 31, 2019 |

| ($ in thousands) (unaudited) | | Investment

Management | | Healthcare | | Industrial | | Hospitality | | CLNC | | Other Equity and Debt | | Amounts not allocated to segments | | Total |

| Revenues | | | | | | | — |

| | | | | | | | | |

| Property operating income | | $ | — |

| | $ | 43,486 |

| | $ | — |

| | $ | 11,673 |

| | $ | — |

| | $ | 56,532 |

| | $ | — |

| | $ | 111,691 |

|

| Interest income | | — |

| | 279 |

| | — |

| | — |

| | — |

| | 24,167 |

| | — |

| | 24,446 |

|

| Fee income | | — |

| | — |

| | — |

| | — |

| | — |

| | — |

| | — |

| | — |

|

| Other income | | — |

| | 71 |

| | — |

| | 4 |

| | — |

| | 1,699 |

| | — |

| | 1,774 |

|

| Total revenues | | — |

| | 43,836 |

| | — |

| | 11,677 |

| | — |

| | 82,398 |

| | — |

| | 137,911 |

|

| Expenses | | | | | | | | | | | | | | | | |

| Property operating expense | | — |

| | 18,237 |

| | — |

| | 8,558 |

| | — |

| | 33,610 |

| | — |

| | 60,405 |

|

| Interest expense | | — |

| | 11,966 |

| | — |

| | 3,167 |

| | — |

| | 12,489 |

| | — |

| | 27,622 |

|

| Investment and servicing expense | | — |

| | 854 |

| | — |

| | 137 |

| | — |

| | 9,824 |

| | — |

| | 10,815 |

|

| Transaction costs | | — |

| | — |

| | — |

| | — |

| | — |

| | — |

| | — |

| | — |

|

| Placement fees | | — |

| | — |

| | — |

| | — |

| | — |

| | — |

| | — |

| | — |

|

| Depreciation and amortization | | — |

| | 11,877 |

| | — |

| | 2,342 |

| | — |

| | 13,319 |

| | — |

| | 27,538 |

|

| Provision for loan loss | | — |

| | — |

| | — |

| | — |

| | — |

| | 27 |

| | — |

| | 27 |

|

| Impairment loss | | — |

| | 9,857 |

| | — |

| | 1,254 |

| | — |

| | 3,582 |

| | — |

| | 14,693 |

|

| Compensation expense | | | | | | | | | | | | | | | |

|

|

| Cash and equity-based compensation | | — |

| | — |

| | — |

| | — |

| | — |

| | 2,581 |

| | — |

| | 2,581 |

|

| Carried interest and incentive compensation | | — |

| | — |

| | — |

| | — |

| | — |

| | — |

| | — |

| | — |

|

| Administrative expenses | | — |

| | 246 |

| | — |

| | 21 |

| | — |

| | 4,141 |

| | — |

| | 4,408 |

|

| Total expenses | | — |

| | 53,037 |

| | — |

| | 15,479 |

| | — |

| | 79,573 |

| | — |

| | 148,089 |

|

| Other income (loss) | | | | | | | | | | | | | | | | |

| Gain on sale of real estate assets | | — |

| | 103 |

| | — |

| | — |

| | — |

| | 14,295 |

| | — |

| | 14,398 |

|

| Other gain (loss), net | | — |

| | 1,727 |

| | — |

| | (14 | ) | | — |

| | (3,175 | ) | | — |

| | (1,462 | ) |

| Equity method earnings (losses) | | 145 |

| | — |

| | — |

| | — |

| | — |

| | 19,845 |

| | — |

| | 19,990 |

|

| Equity method earnings—carried interest | | (596 | ) | | — |

| | — |

| | — |

| | — |

| | — |

| | — |

| | (596 | ) |

| Income (loss) before income taxes | | (451 | ) | | (7,371 | ) | | — |

| | (3,816 | ) | | — |

| | 33,790 |

| | — |

| | 22,152 |

|

| Income tax benefit (expense) | | — |

| | (439 | ) | | — |

| | — |

| | — |

| | (2,125 | ) | | — |

| | (2,564 | ) |

| Net income (loss) | | (451 | ) | | (7,810 | ) | | — |

| | (3,816 | ) | | — |

| | 31,665 |

| | — |

| | 19,588 |

|

| Income (loss) from discontinued operations | | — |

| | — |

| | 943,647 |

| | — |

| | — |

| | — |

| | — |

| | 943,647 |

|

| Non-pro rata allocation of income (loss) to NCI | | (28,080 | ) | | 3,703 |

| | — |

| | — |

| | — |

| | — |

| | — |

| | (24,377 | ) |

| Net income (loss) attributable to noncontrolling interests | | $ | (28,531 | ) | | $ | (4,107 | ) | | $ | 943,647 |

| | $ | (3,816 | ) | | $ | — |

| | $ | 31,665 |

| | $ | — |

| | $ | 938,858 |

|

|

| | | |

Colony Capital | Supplemental Financial Report | | 20

| |

|

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Three Months Ended December 31, 2019 |

| | | OP pro rata share by segment | | Amounts attributable to noncontrolling interests | | CLNY consolidated as reported |

| ($ in thousands) (Unaudited) | | Investment Management | | Healthcare | | Industrial | | Hospitality | | CLNC | | Other Equity and Debt | | Amounts not allocated to segments | | Total OP pro rata share | | |

| Net income (loss) attributable to common stockholders | | $ | (335,650 | ) | | $ | (31,135 | ) | | $ | 435,494 |

| | $ | (35,469 | ) | | $ | 11,789 |

| | $ | (4,042 | ) | | $ | (67,238 | ) | | $ | (26,251 | ) | | $ | — |

| | $ | (26,251 | ) |

| Net income (loss) attributable to noncontrolling common interests in Operating Company | | (36,305 | ) | | (3,366 | ) | | 47,078 |

| | (3,834 | ) | | 1,275 |

| | (438 | ) | | (7,277 | ) | | (2,867 | ) | | — |

| | (2,867 | ) |

| Net income (loss) attributable to common interests in Operating Company and common stockholders | | (371,955 | ) | | (34,501 | ) | | 482,572 |

| | (39,303 | ) | | 13,064 |

| | (4,480 | ) | | (74,515 | ) | | (29,118 | ) | | — |

| | (29,118 | ) |

| Adjustments for FFO: | | | | | | | | | | | | | | | | | | | | |

| Real estate depreciation and amortization | | 1,729 |

| | 30,807 |

| | 3,205 |

| | 33,693 |

| | 7,397 |

| | 9,471 |

| | — |

| | 86,302 |

| | 31,951 |

| | 118,253 |

|

| Impairment of real estate | | — |

| | 33,275 |

| | — |

| | 13,395 |

| | — |

| | (1,090 | ) | | — |

| | 45,580 |

| | 14,693 |

| | 60,273 |

|

| Gain from sales of real estate | | — |

| | (448 | ) | | (486,874 | ) | | — |

| | — |

| | (4,372 | ) | | — |

| | (491,694 | ) | | (957,346 | ) | | (1,449,040 | ) |

| Less: Adjustments attributable to noncontrolling interests in investment entities | | — |

| | — |

| | — |

| | — |

| | — |

| | — |

| | — |

| | — |

| | 910,702 |

| | 910,702 |

|

| FFO | | $ | (370,226 | ) | | $ | 29,133 |

| | $ | (1,097 | ) | | $ | 7,785 |

| | $ | 20,461 |

| | $ | (471 | ) | | $ | (74,515 | ) | | $ | (388,930 | ) | | $ | — |

| | $ | (388,930 | ) |

| Additional adjustments for Core FFO: | | | | | | | | | | | | | | | | | | | | |

Gains and losses from sales of depreciable real estate within the Other Equity and Debt segment, net of depreciation, amortization and impairment previously adjusted for FFO(1) | | — |

| | — |

| | — |

| | — |

| | — |

| | (5,264 | ) | | — |

| | (5,264 | ) | | 5,901 |

| | 637 |

|

| Gains and losses from sales of businesses within the Investment Management segment and impairment write-downs associated with the Investment Management segment | | 409,426 |

| | — |

| | (9,427 | ) | | — |

| | — |

| | — |

| | — |

| | 399,999 |

| | — |

| | 399,999 |

|

CLNC Core Earnings adjustments(2) | | — |

| | — |

| | — |

| | — |

| | (5,401 | ) | | — |

| | — |

| | (5,401 | ) | | — |

| | (5,401 | ) |

| Equity-based compensation expense | | 2,666 |

| | 539 |

| | 6,035 |

| | 545 |

| | 1,218 |

| | 421 |

| | 8,730 |

| | 20,154 |

| | — |

| | 20,154 |

|

| Straight-line rent revenue and expense | | 255 |

| | (1,586 | ) | | (906 | ) | | 280 |

| | — |

| | (669 | ) | | (526 | ) | | (3,152 | ) | | (2,583 | ) | | (5,735 | ) |

| Amortization of acquired above- and below-market lease values, net | | — |

| | (6,303 | ) | | (268 | ) | | — |

| | (144 | ) | | (29 | ) | | — |

| | (6,744 | ) | | (3,247 | ) | | (9,991 | ) |

| Amortization of deferred financing costs and debt premiums and discounts | | 102 |

| | 1,915 |

| | 9,275 |

| | 10,424 |

| | (2 | ) | | 2,487 |

| | 1,734 |

| | 25,935 |

| | 23,318 |

| | 49,253 |

|

| Unrealized fair value losses on interest rate and foreign currency hedges, and foreign currency remeasurements and realized gains and losses on interest rate hedging instruments existing at the time of the January 2017 merger with remaining terms greater than one year that served as economic hedges for any financing or refinancing of the Company's real estate verticals | | (15 | ) | | (4,113 | ) | | — |

| | — |

| | (716 | ) | | 1,072 |

| | 1,745 |

| | (2,027 | ) | | 1,138 |

| | (889 | ) |

| Acquisition and merger-related transaction costs | | 319 |

| | — |

| | — |

| | (1,629 | ) | | — |

| | 366 |

| | — |

| | (944 | ) | | — |

| | (944 | ) |

Restructuring and merger integration costs(3) | | 1,070 |

| | — |

| | 11,559 |

| | — |

| | — |

| | — |

| | 4,055 |

| | 16,684 |

| | — |

| | 16,684 |

|

| Amortization and impairment of investment management intangibles | | 8,640 |

| | — |

| | — |

| | — |

| | — |

| | — |

| | — |

| | 8,640 |

| | — |

| | 8,640 |

|

| Non-real estate depreciation and amortization | | 36 |

| | — |

| | 30 |

| | — |

| | — |

| | 85 |

| | 1,500 |

| | 1,651 |

| | 271 |

| | 1,922 |

|

| Amortization of gain on remeasurement of consolidated investment entities | | — |

| | — |

| | — |

| | — |

| | — |

| | 3 |

| | — |

| | 3 |

| | 3 |

| | 6 |

|

| Tax effect of Core FFO adjustments, net | | (3,333 | ) | | — |

| | (3,575 | ) | | — |

| | — |

| | — |

| | (956 | ) | | (7,864 | ) | | — |

| | (7,864 | ) |

| Preferred share redemption gain | | — |

| | — |

| | — |

| | — |

| | — |

| | — |

| | (5,150 | ) | | (5,150 | ) | | — |

| | (5,150 | ) |

| Less: Adjustments attributable to noncontrolling interests in investment entities | | — |

| | — |

| | — |

| | — |

| | — |

| | — |

| | — |

| | — |

| | (24,801 | ) | | (24,801 | ) |

| Core FFO | | $ | 48,940 |

| | $ | 19,585 |

| | $ | 11,626 |

| | $ | 17,405 |

| | $ | 15,416 |

| | $ | (1,999 | ) | | $ | (63,383 | ) | | $ | 47,590 |

| | $ | — |

| | $ | 47,590 |

|

Notes:

| |

| (1) | Net of $18.0 million consolidated or $9.6 million CLNY OP share of depreciation, amortization and impairment charges previously adjusted to calculate FFO. |

| |

| (2) | Represents adjustments to align the Company’s Core FFO with CLNC’s definition of Core Earnings to reflect the Company’s percentage interest in CLNC's earnings. |

| |

| (3) | Restructuring and merger integration costs primarily represent costs and charges incurred as a result of the corporate restructuring and reorganization plan announced in November 2018 and the implementation of the digital evolution, including the completed sale of the Industrial business, NorthStar Realty Europe and future sales and disposition of non-digital businesses, platforms and investments. These costs and charges include severance, retention, relocation, transition and other related restructuring costs, which are not reflective of the Company’s core operating performance and the Company does not expect to incur these costs subsequent to the completion of the corporate restructuring and reorganization plan and the digital evolution. |

|

| | | |

Colony Capital | Supplemental Financial Report | | 21

| |

|

|

| IVa. Capitalization - Overview |

| |

|

| | | | | | | | | | | |

| ($ in thousands; except per share data; as of December 31, 2019, unless otherwise noted) | | | Consolidated amount | | CLNY OP share of consolidated amount |

| | | | | | |

| Debt (UPB) | | | | | |

| $750,000 Revolving credit facility | | | $ | — |

| | $ | — |

|

| Convertible/exchangeable senior notes | | | 616,105 |

| | 616,105 |

|

| Corporate aircraft promissory note | | | 35,072 |

| | 35,072 |

|

| Trust Preferred Securities ("TruPS") | | | 280,117 |

| | 280,117 |

|

| Investment-level debt: | | | | | |

| Healthcare | | | 2,953,706 |

| | 2,104,721 |

|

| Industrial | | | 235,000 |

| | 119,850 |

|

| Hospitality | | | 2,667,347 |

| | 2,495,952 |

|

Other Equity and Debt(1) | | | 2,620,495 |

| | 1,183,495 |

|

| Total investment-level debt | | | 8,476,548 |

| | 5,904,018 |

|

| Total debt | | | $ | 9,407,842 |

| | $ | 6,835,312 |

|

| | | | | | |

| Perpetual preferred equity, redemption value | | | | | |

Total perpetual preferred equity(2) | | | | | $ | 1,033,750 |

|

| | | | | | |

| Common equity as of February 25, 2020 | Price per share | | Shares / Units | | |

| Class A and B common stock | $ | 4.55 |

| | 487,370 |

| | $ | 2,217,534 |

|

| OP units | 4.55 |

| | 53,261 |

| | 242,338 |

|

| Total market value of common equity | | | | | $ | 2,459,872 |

|

| | | | | | |

| Total market capitalization | | | | | $ | 10,328,934 |

|

Notes:

| |

| (1) | In December 2019, the Company made its inaugural direct balance sheet investment in digital real estate by acquiring a 20.4% interest in DataBank. Debt related to Databank of $539 million consolidated or $110 million CLNY OP share is included in Other Equity and Debt. |

| |

| (2) | On January 10, 2020, the Company redeemed all of its outstanding 8.25% Series B and 8.75% Series E cumulative redeemable perpetual preferred stock for $408 million, including accrued interest of $5 million, eliminating $34 million of annualized preferred dividends. |

|

| | | |

Colony Capital | Supplemental Financial Report | | 22

| |

|

|

| IVb. Capitalization - Investment-Level Debt Overview |

| |

|

| | | | | | | | | | | | | | | | |

| ($ in thousands; as of or for the three months ended December 31, 2019, unless otherwise noted) |

| Non-recourse investment-level debt overview |

| | | | | Consolidated | | CLNY OP share of consolidated amount |

| | | Fixed / Floating | | Unpaid principal balance | | Unpaid principal balance | | Wtd. avg. years remaining to maturity | | Wtd. avg. interest rate(1) |

| Healthcare | | Fixed | | $ | 405,980 |

| | $ | 285,039 |

| | 5.1 |

| | 4.5 | % |

| Healthcare | | Floating | | 2,547,726 |

| | 1,819,682 |

| | 4.3 |

| | 5.2 | % |

| Bulk Industrial | | Floating | | 235,000 |

| | 119,850 |

| | 4.2 |

| | 3.8 | % |

| Hospitality | | Fixed | | 13,494 |

| | 13,156 |

| | 1.6 |

| | 12.7 | % |

| Hospitality | | Floating | | 2,653,853 |

| | 2,482,796 |

| | 4.6 |

| | 4.8 | % |

| Other Equity and Debt | | | | | | | | | | |

| Net lease real estate equity | | Fixed | | 104,061 |

| | 103,441 |

| | 3.4 |

| | 5.0 | % |

| Other real estate equity | | Fixed | | 45,979 |

| | 13,221 |

| | 3.2 |

| | 2.8 | % |

| Other real estate equity | | Floating | | 1,191,418 |

| | 601,078 |

| | 2.8 |

| | 4.6 | % |

GP Co-investments(2) | | Floating | | 1,277,300 |

| | 465,409 |

| | 2.8 |

| | 4.5 | % |

| GP Co-investments | | Fixed | | 1,737 |

| | 346 |

| | 3.6 |

| | 2.4 | % |

| Total investment-level debt | | | | $ | 8,476,548 |

| | $ | 5,904,018 |

| | 4.2 |

| | 4.9 | % |

| | | | | | | | | | | |

| Fixed / Floating Summary |

| Fixed | | | | $ | 571,251 |

| | $ | 415,203 |

| | | | |

| Floating | | | | 7,905,297 |

| | 5,488,815 |

| | | | |

| Total investment-level debt | | | | $ | 8,476,548 |

| | $ | 5,904,018 |

| | | | |

Notes:

| |

| (1) | Based on 1-month LIBOR of 1.76% and 3-month LIBOR of 1.91% for floating rate debt. |

| |

| (2) | In December 2019, the Company made its inaugural direct balance sheet investment in digital real estate by acquiring a 20.4% interest in DataBank. Debt related to Databank of $539 million consolidated or $110 million CLNY OP share is included in Other Equity and Debt. |

|

| | | |

Colony Capital | Supplemental Financial Report | | 23

| |

|

|

| IVc. Capitalization - Revolving Credit Facility Overview |

| |

|

| | | | |

| ($ in thousands, except as noted; as of December 31, 2019) | | |

| Revolving credit facility | | |

| Maximum principal amount | | $ | 750,000 |

|

| Amount outstanding | | — |

|

| Initial maturity | | January 11, 2021 |

|

| Fully-extended maturity | | January 10, 2022 |

|

| Interest rate | | LIBOR + 2.25% |

|

| | | |

| Financial covenants as defined in the Credit Agreement: | | Covenant level |

| Consolidated Tangible Net Worth | | Minimum $4,550 million |

Consolidated Fixed Charge Coverage Ratio(1) | | Minimum 1.30 to 1.00 |

Interest Coverage Ratio(2) | | Minimum 3.00 to 1.00 |

| Consolidated Leverage Ratio | | Maximum 0.65 to 1.00 |

| | | |

| Company status: As of December 31, 2019, CLNY is meeting all required covenant threshold levels |

Notes:

| |

| (1) | In the event the Fixed Charge Coverage Ratio is between 1.50 and 1.30 to 1.00, the borrowing base formula will be discounted by 10%. |

| |

| (2) | Interest Coverage Ratio represents the ratio of the sum of (1) earnings from borrowing base assets and (2) certain investment management earnings divided by the greater of (a) actual interest expense on the revolving credit facility and (b) the average balance of the facility multiplied by 7.0% for the applicable quarter. |

|

| | | |

Colony Capital | Supplemental Financial Report | | 24

| |

|

|

| IVd. Capitalization - Corporate Securities Overview |

| |

|

| | | | | | | | | | | | | | | | | | |

| ($ in thousands; except per share data; as of December 31, 2019, unless otherwise noted) |

| Convertible/exchangeable debt | | | | | | | | | | | | |

| Description | | Outstanding principal | | Final due date(1) | | Interest rate | | Conversion price (per share of common stock) | | Conversion ratio | | Conversion shares |

| 5.0% Convertible senior notes | | $ | 200,000 |

| | April 15, 2023 | | 5.00% fixed | | $ | 15.76 |

| | 63.4700 |

| | 12,694 |

|

| 3.875% Convertible senior notes | | 402,500 |

| | January 15, 2021 | | 3.875% fixed | | 16.57 |

| | 60.3431 |

| | 24,288 |

|

| 5.375% Exchangeable senior notes | | 13,605 |

| | June 15, 2033 | | 5.375% fixed | | 12.04 |

| | 83.0837 |

| | 1,130 |

|

| Total convertible debt | | $ | 616,105 |

| | | | | | | | | | |

|

| | | | | | | | |

| TruPS | | | | | | |

| Description | | Outstanding principal | | Final due date | | Interest rate |

| Trust I | | $ | 41,240 |

| | March 30, 2035 | | 3M L + 3.25% |

| Trust II | | 25,780 |

| | June 30, 2035 | | 3M L + 3.25% |

| Trust III | | 41,238 |

| | January 30, 2036 | | 3M L + 2.83% |

| Trust IV | | 50,100 |

| | June 30, 2036 | | 3M L + 2.80% |

| Trust V | | 30,100 |

| | September 30, 2036 | | 3M L + 2.70% |

| Trust VI | | 25,100 |

| | December 30, 2036 | | 3M L + 2.90% |

| Trust VII | | 31,459 |

| | April 30, 2037 | | 3M L + 2.50% |

| Trust VIII | | 35,100 |

| | July 30, 2037 | | 3M L + 2.70% |

| Total TruPS | | $ | 280,117 |

| | | | |

|

| | | | | | | | | |

| Perpetual preferred stock | | | | | | |

| Description | | Liquidation preference | | Shares outstanding (In thousands) | | Callable period |

| Series G 7.5% cumulative redeemable perpetual preferred stock | | 86,250 |

| | 3,450 |

| | Callable |

| Series H 7.125% cumulative redeemable perpetual preferred stock | | 287,500 |

| | 11,500 |

| | On or after April 13, 2020 |

| Series I 7.15% cumulative redeemable perpetual preferred stock | | 345,000 |

| | 13,800 |

| | On or after June 5, 2022 |

| Series J 7.125% cumulative redeemable perpetual preferred stock | | 315,000 |

| | 12,600 |

| | On or after September 22, 2022 |

| Total preferred stock | | $ | 1,033,750 |

| | 41,350 |

| | |

Notes:

| |

| (1) | Callable at principal amount only if CLNY common stock has traded at least 130% of the conversion price for 20 of 30 consecutive trading days: on or after April 22, 2020, for the 5.0% convertible senior notes; on or after January 22, 2019, for the 3.875% convertible senior notes; and on or after on or after June 15, 2020, for the 5.375% exchangeable senior notes. |

|

| | | |

Colony Capital | Supplemental Financial Report | | 25

| |

|

|

| IVe. Capitalization - Debt Maturity and Amortization Schedules |

| |

|

| | | | | | | | | | | | | | | | | | | | | | | | |

| ($ in thousands; as of December 31, 2019) | | Payments due by period(1) |

| Consolidated debt | Fixed / Floating | 2020 | | 2021 | | 2022 | | 2023 | | 2024 and after | | Total |

| $750,000 Revolving credit facility | Floating | $ | — |

| | $ | — |

| | $ | — |

| | $ | — |

| | $ | — |

| | $ | — |

|

| Convertible/exchangeable senior notes | Fixed | — |

| | 402,500 |

| | — |

| | 200,000 |

| | 13,605 |

| | 616,105 |

|

| Corporate aircraft promissory note | Fixed | 2,243 |

| | 2,359 |

| | 2,480 |

| | 2,608 |

| | 25,382 |

| | 35,072 |

|

| TruPS | Floating | — |

| | — |

| | — |

| | — |

| | 280,117 |

| | 280,117 |

|

| Investment-level debt: | | | | | | | | | | | | |

| Healthcare | Fixed | 6,809 |

| | 8,083 |

| | 9,068 |

| | 9,510 |

| | 372,510 |

| | 405,980 |

|

| Healthcare | Floating | 53,914 |

| | 284,059 |

| | 7,891 |

| | 8,129 |

| | 2,193,733 |

| | 2,547,726 |

|

| Bulk Industrial | Floating | — |

| | — |

| | — |

| | — |

| | 235,000 |

| | 235,000 |

|

| Hospitality | Fixed | — |

| | 13,494 |

| | — |

| | — |

| | — |

| | 13,494 |

|

| Hospitality | Floating | — |

| | 206,802 |

| | 780,000 |

| | — |

| | 1,667,051 |

| | 2,653,853 |

|

| Other Equity and Debt | Fixed | 13,435 |

| | 35,025 |

| | 19,572 |

| | 80,389 |

| | 3,356 |

| | 151,777 |

|

| Other Equity and Debt | Floating | 316,940 |

| | 199,546 |

| | 992,504 |

| | 33,879 |

| | 925,849 |

| | 2,468,718 |

|

| Total consolidated debt | | $ | 393,341 |

| | $ | 1,151,868 |

| | $ | 1,811,515 |

| | $ | 334,515 |

| | $ | 5,716,603 |

| | $ | 9,407,842 |

|

| |

| Pro rata debt | Fixed / Floating | 2020 | | 2021 | | 2022 | | 2023 | | 2024 and after | | Total |

| $750,000 Revolving credit facility | Floating | $ | — |

| | $ | — |

| | $ | — |

| | $ | — |

| | $ | — |

| | $ | — |

|

| Convertible/exchangeable senior notes | Fixed | — |

| | 402,500 |

| | — |

| | 200,000 |

| | 13,605 |

| | 616,105 |

|

| Corporate aircraft promissory note | Fixed | 2,243 |

| | 2,359 |

| | 2,480 |

| | 2,608 |

| | 25,382 |

| | 35,072 |

|

| TruPS | Floating | — |

| | — |

| | — |

| | — |

| | 280,117 |

| | 280,117 |

|

| Investment-level debt: | | | | | | | | | | | | |

| Healthcare | Fixed | 4,781 |

| | 5,675 |

| | 6,366 |

| | 6,677 |

| | 261,540 |

| | 285,039 |

|

| Healthcare | Floating | 38,264 |

| | 227,548 |

| | 5,601 |

| | 5,774 |

| | 1,542,495 |

| | 1,819,682 |

|

| Bulk Industrial | Floating | — |

| | — |

| | — |

| | — |

| | 119,850 |

| | 119,850 |

|

| Hospitality | Fixed | — |

| | 13,156 |

| | — |

| | — |

| | — |

| | 13,156 |

|

| Hospitality | Floating | — |

| | 201,632 |

| | 702,000 |

| | — |

| | 1,579,164 |

| | 2,482,796 |

|

| Other Equity and Debt | Fixed | 4,892 |

| | 26,438 |

| | 6,739 |

| | 77,820 |

| | 1,119 |

| | 117,008 |

|

| Other Equity and Debt | Floating | 105,067 |

| | 191,303 |

| | 513,720 |

| | 7,148 |

| | 249,249 |

| | 1,066,487 |

|

| Total pro rata debt | | $ | 155,247 |

| | $ | 1,070,611 |

| | $ | 1,236,906 |

| | $ | 300,027 |

| | $ | 4,072,521 |

| | $ | 6,835,312 |

|

Notes:

| |

| (1) | Based on initial maturity dates or extended maturity dates to the extent criteria are met and the extension option is at the borrower’s discretion. |

|

| | | |

Colony Capital | Supplemental Financial Report | | 26

| |

|

|

| Va. Investment Management - Summary Metrics |

| |

|

| | | | |

| ($ in thousands, except as noted; as of December 31, 2019) | | |

| Fee Revenue | | CLNY OP Share |

| Digital Bridge Holdings | | $ | 18,347 |

|

| Institutional funds | | 13,983 |

|

| Colony Credit Real Estate (NYSE:CLNC) | | 8,273 |

|

| Retail companies | | 4,997 |

|

| Non-wholly owned REIM platforms (equity method earnings) | | 1,178 |

|

| Total reported fee revenue and REIM platform equity method earnings | | $ | 46,778 |

|

| Operating Results | | |

| Revenues | | |

| Total fee revenue and REIM earnings of investments in unconsolidated ventures | | $ | 46,778 |

|

| Interest Income and Other Income | | 7,257 |

|

| Expenses | | |

| Interest expense | | 1,645 |

|

| Investment and servicing expense | | 81 |

|

| Transaction costs | | 319 |

|

| Placement fees | | 1,429 |

|

| Depreciation and amortization | | 8,697 |

|

(Recovery of) impairment loss(1) | | 410,954 |

|

| Compensation expense | | |

| Cash and equity-based compensation | | 20,382 |

|

| Carried interest and incentive compensation | | 3,300 |

|

| Administrative expenses | | 4,765 |

|

| Total expenses | | 451,572 |

|

| Other gain (loss), net | | 738 |

|

| Equity method earnings | | (1,936 | ) |

| Equity method earnings—carried interest | | 6,020 |

|

| Income tax benefit (expense) | | 3,241 |

|

Income (loss) from discontinued operations(2)(3) | | (10,561 | ) |

Non-pro rata allocation of income (loss) to NCI(3) | | 28,080 |

|

| Net loss attributable to common interests in OP and common stockholders | | (371,955 | ) |

| Real estate depreciation and amortization | | 1,729 |

|

| (Gains) and losses from sales of businesses and impairment write-downs associated with the Investment Management segment | | 409,426 |

|

| Equity-based compensation expense | | 2,666 |

|

| Straight-line rent revenue and expense | | 255 |

|

| Amortization of deferred financing costs and debt premiums and discounts | | 102 |

|

| Unrealized fair value losses on interest rate and foreign currency hedges, and foreign currency remeasurements | | (15 | ) |

| Acquisition and merger-related transaction costs | | 319 |

|

| Restructuring and merger integration costs | | 1,070 |

|

| Amortization and impairment of investment management intangibles | | 8,640 |

|

| Non-real estate depreciation and amortization | | 36 |

|

| Tax effect of Core FFO adjustments, net | | (3,333 | ) |

| Core FFO | | $ | 48,940 |

|

|

| | | |

Colony Capital | Supplemental Financial Report | | 27

| |

|

|

| Va. Investment Management - Summary Metrics |

| |

Notes:

| |

| (1) | Represents a $401 million write-down of goodwill resulting from a reduction in value of the non-digital investment management business and a $10 million write-down of contract intangibles. Reduction of goodwill and contract intangibles are added back to the Company's net loss to calculate Core FFO. |

| |

| (2) | In December 2019, the Company completed the sale of its light industrial portfolio and related operating platform. Accordingly, for all current and prior periods presented, the related operating results are presented as income from discontinued operations on the consolidated statement of operations. |

| |

| (3) | Net loss and Core FFO included $17 million of realized incentive fees, which is net of related compensation expenses, from the sale of the light industrial portfolio and related operating platform. |

|

| | | |

Colony Capital | Supplemental Financial Report | | 28

| |

|

|

| Vb. Investment Management – Assets Under Management |

| |

|

| | | | | | | | | | | | | | | |

| ($ in millions, except as noted; as of December 31, 2019, unless otherwise noted) | | | | |

| Segment | | Products (FEEUM) | | Description | | AUM CLNY OP Share | | FEEUM CLNY OP Share | | Fee Rate |

| | | | | | | | | | | |

| Digital | | • Digital ($6.8 billion) | | • Leading global investment manager of digital infrastructure assets including cell towers, small cells, fiber and data centers • Manager of six portfolio companies through separate partnerships • Manager of Digital Colony Partners Fund | | $ | 13,502 |

| | $ | 6,788 |

| | 1.0 | % |

| Other Institutional Funds | | • Credit ($2.5 billion) • Opportunistic ($0.5 billion) • Other co-investment vehicles ($2.7 billion) | | • 27 years of institutional investment management experience • Sponsorship of private equity funds and vehicles earning asset management fees and performance fees • More than 300 investor relationships | | 8,500 |

| | 5,654 |

| | .8 | % |

| Public Company | | • Colony Credit Real Estate, Inc. ($2.2 billion) | | • NYSE-listed credit focused REIT • Contract with base management fees with potential for incentive fees | | 3,523 |

| | 2,181 |

| | 1.5 | % |

| Retail Companies | | • NorthStar Healthcare ($1.2 billion)(1) • CC Real Estate Income Funds(2)(3) | | • Manage public non-traded vehicles earning asset management and performance fees | | 3,432 |

| | 1,211 |

| (1) | 1.5 | % |