1 DIGITALBRIDGE CORPORATE OVERVIEW N o v e m b e r 2 0 2 1

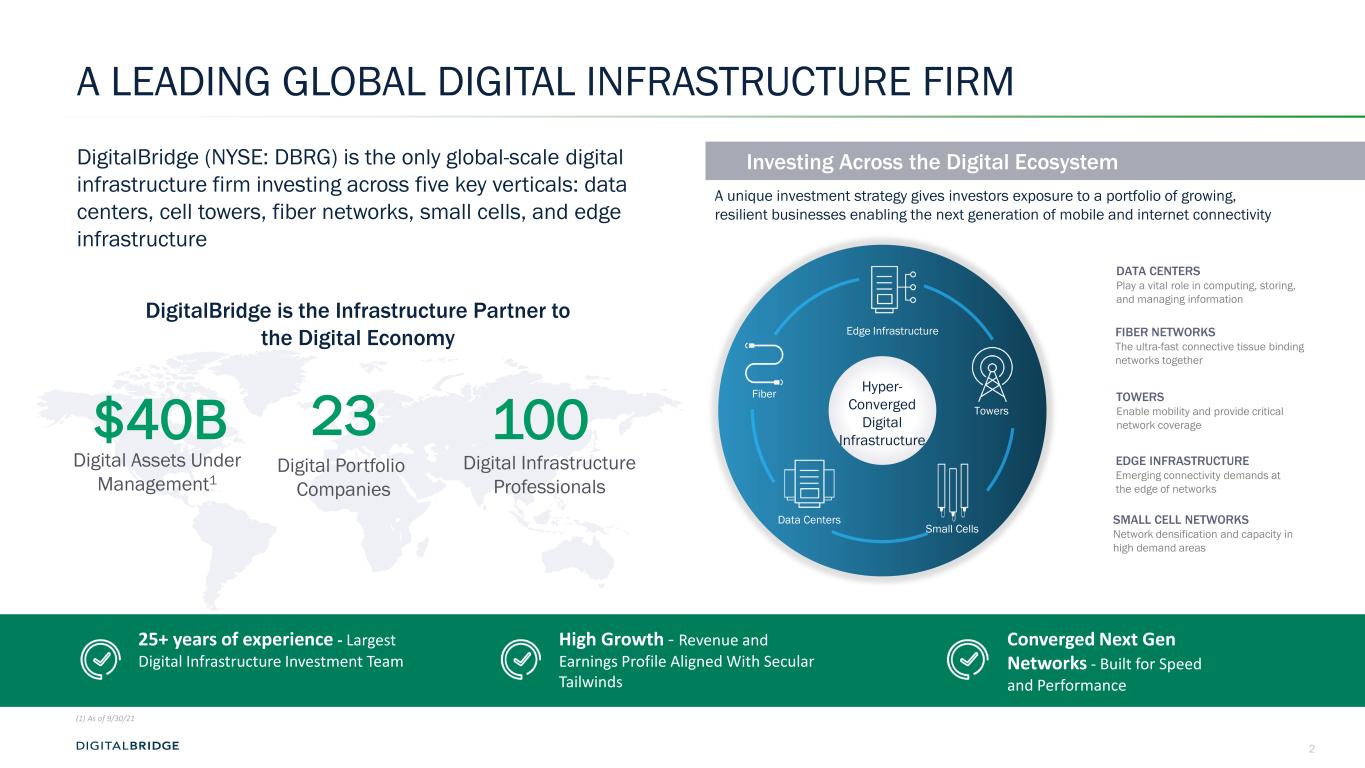

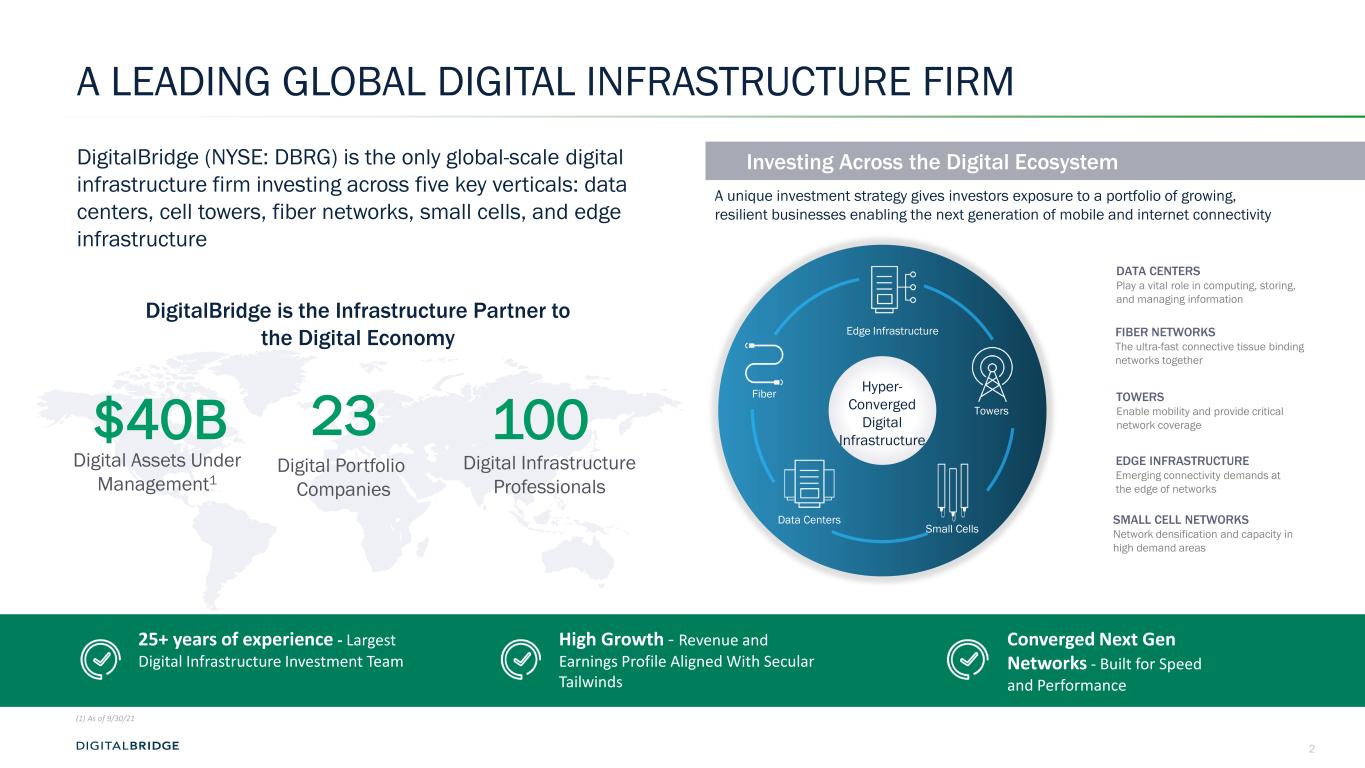

2 DigitalBridge (NYSE: DBRG) is the only global-scale digital infrastructure firm investing across five key verticals: data centers, cell towers, fiber networks, small cells, and edge infrastructure A LEADING GLOBAL DIGITAL INFRASTRUCTURE FIRM 25+ years of experience - Largest Digital Infrastructure Investment Team Converged Next Gen Networks - Built for Speed and Performance High Growth - Revenue and Earnings Profile Aligned With Secular Tailwinds (1) As of 9/30/21 Towers Small Cells Fiber Data Centers Edge Infrastructure Hyper- Converged Digital Infrastructure Investing Across the Digital Ecosystem 100 Digital Assets Under Management1 23 Digital Portfolio Companies $40B Digital Infrastructure Professionals A unique investment strategy gives investors exposure to a portfolio of growing, resilient businesses enabling the next generation of mobile and internet connectivity DATA CENTERS Play a vital role in computing, storing, and managing information FIBER NETWORKS The ultra-fast connective tissue binding networks together TOWERS Enable mobility and provide critical network coverage EDGE INFRASTRUCTURE Emerging connectivity demands at the edge of networks SMALL CELL NETWORKS Network densification and capacity in high demand areas DigitalBridge is the Infrastructure Partner to the Digital Economy

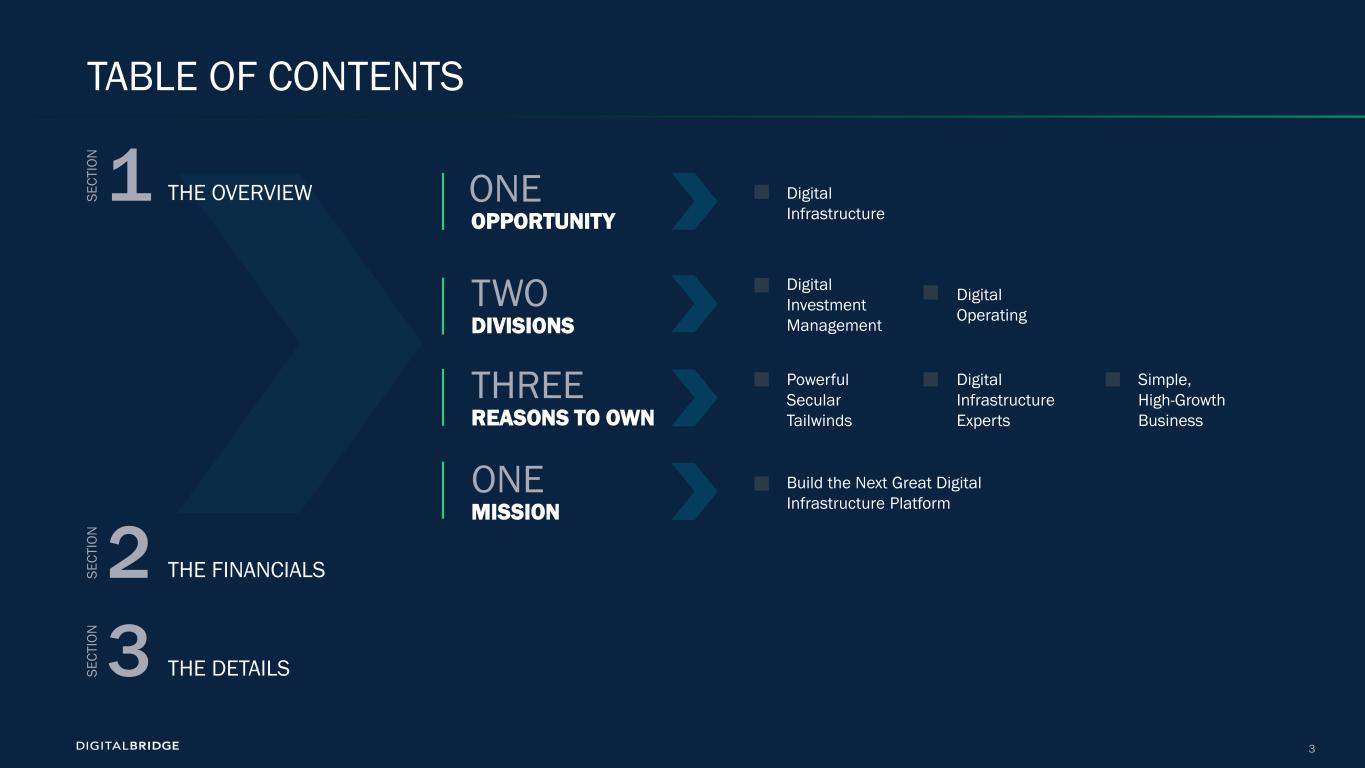

3 TABLE OF CONTENTS Build the Next Great Digital Infrastructure Platform ONE OPPORTUNITY ONE MISSION Digital Infrastructure THE OVERVIEWSE CT IO N 1 THE FINANCIALSSE CT IO N 2 THE DETAILSSE CT IO N 3 Digital Investment Management Digital Operating TWO DIVISIONS Simple, High-Growth Business Digital Infrastructure Experts Powerful Secular Tailwinds THREE REASONS TO OWN

4 ONE OPPORTUNITY Digital Infrastructure

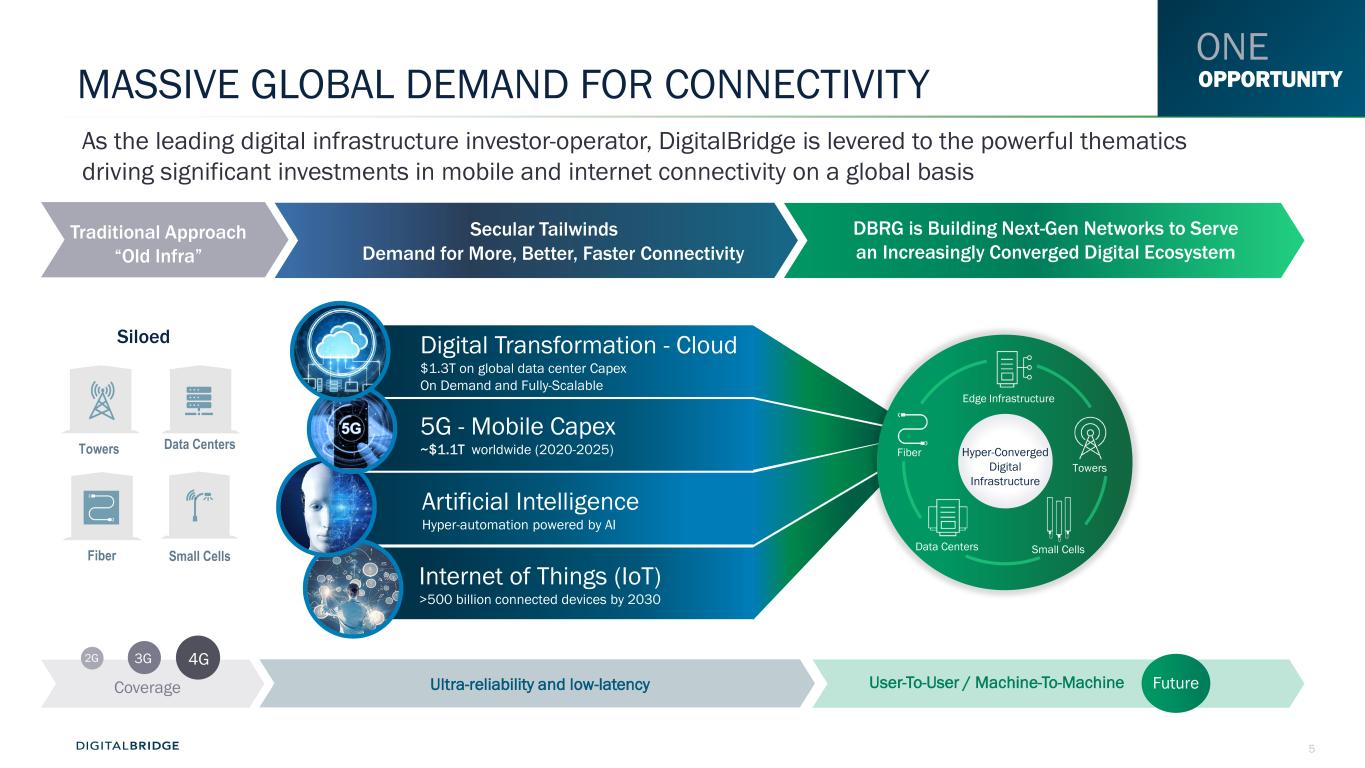

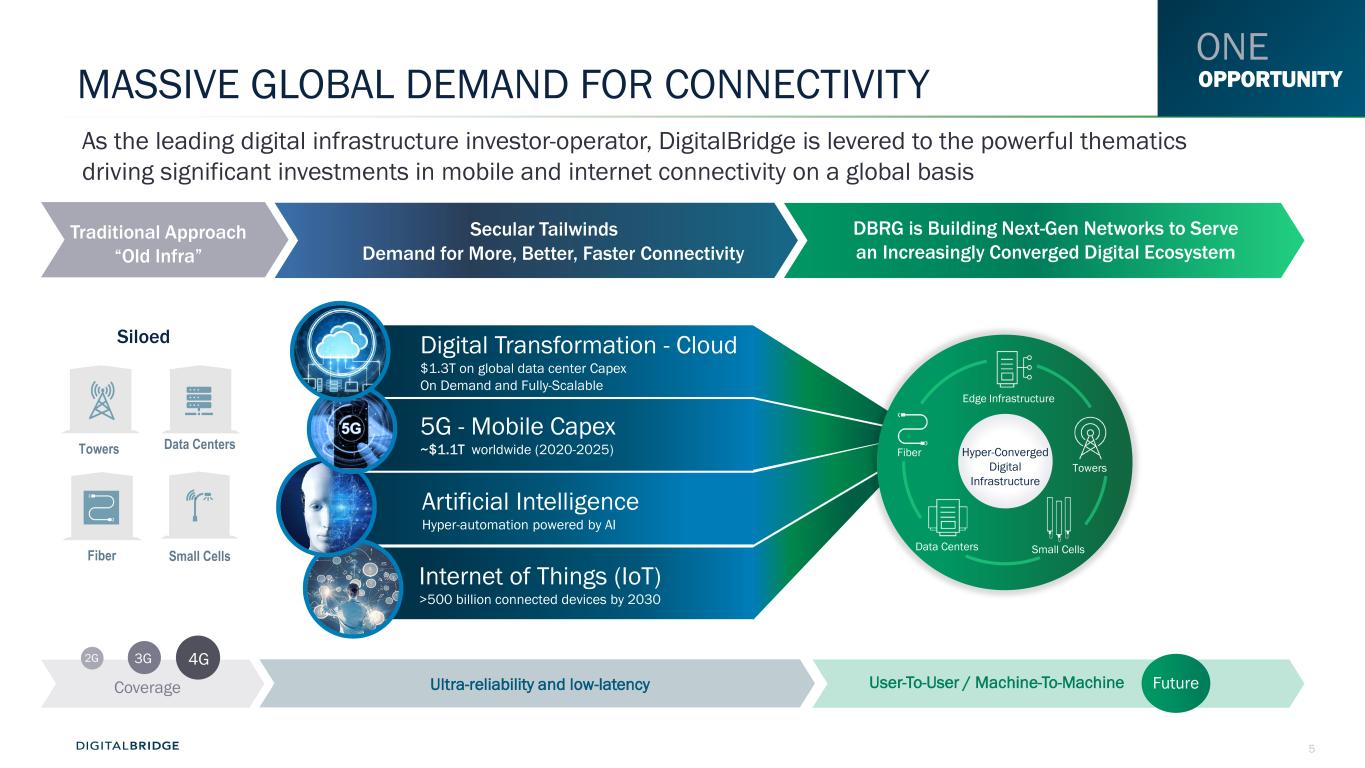

5 Coverage Ultra-reliability and low-latency User-To-User / Machine-To-Machine 2G 3G 4G Future Siloed Towers Data Centers Small CellsFiber Secular Tailwinds Traditional Approach “Old Infra” DBRG is Building Next-Gen Networks to Serve an Increasingly Converged Digital Ecosystem As the leading digital infrastructure investor-operator, DigitalBridge is levered to the powerful thematics driving significant investments in mobile and internet connectivity on a global basis Internet of Things (IoT) >500 billion connected devices by 2030 Artificial Intelligence Hyper-automation powered by AI Towers Small Cells Fiber Data Centers Edge Infrastructure Hyper-Converged Digital Infrastructure 5G - Mobile Capex ~$1.1T worldwide (2020-2025) Digital Transformation - Cloud $1.3T on global data center Capex On Demand and Fully-Scalable Demand for More, Better, Faster Connectivity ONE OPPORTUNITYMASSIVE GLOBAL DEMAND FOR CONNECTIVITY

6 TWO DIVISIONS Digital Investment Management Digital Operating

7 DIGITALBRIDGE BUSINESS PROFILE Operating Earnings from Balance Sheet Investments Investment Management Fees and Profits Participation Digital Investment Management Digital Operating Two business lines that both generate growing, predictable earnings backed by investment grade clients Bu si ne ss M od el Po rt fo lio Pr of ile Leading global digital infrastructure investment platform managing over $17B on behalf of institutional investors Bu si ne ss Pr of ile Direct ownership and control of REIT-qualified digital infrastructure businesses serving leading global technology and telecom companies TWO DIVISIONS

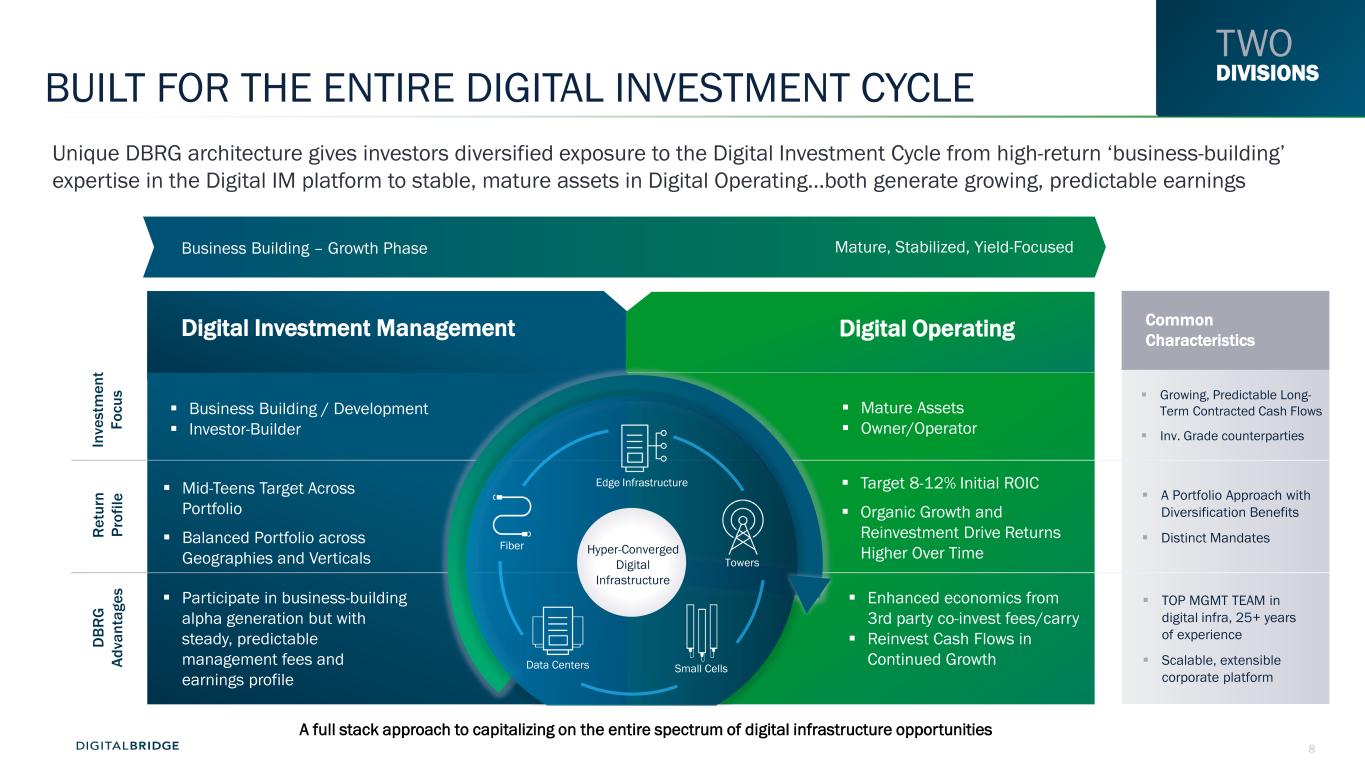

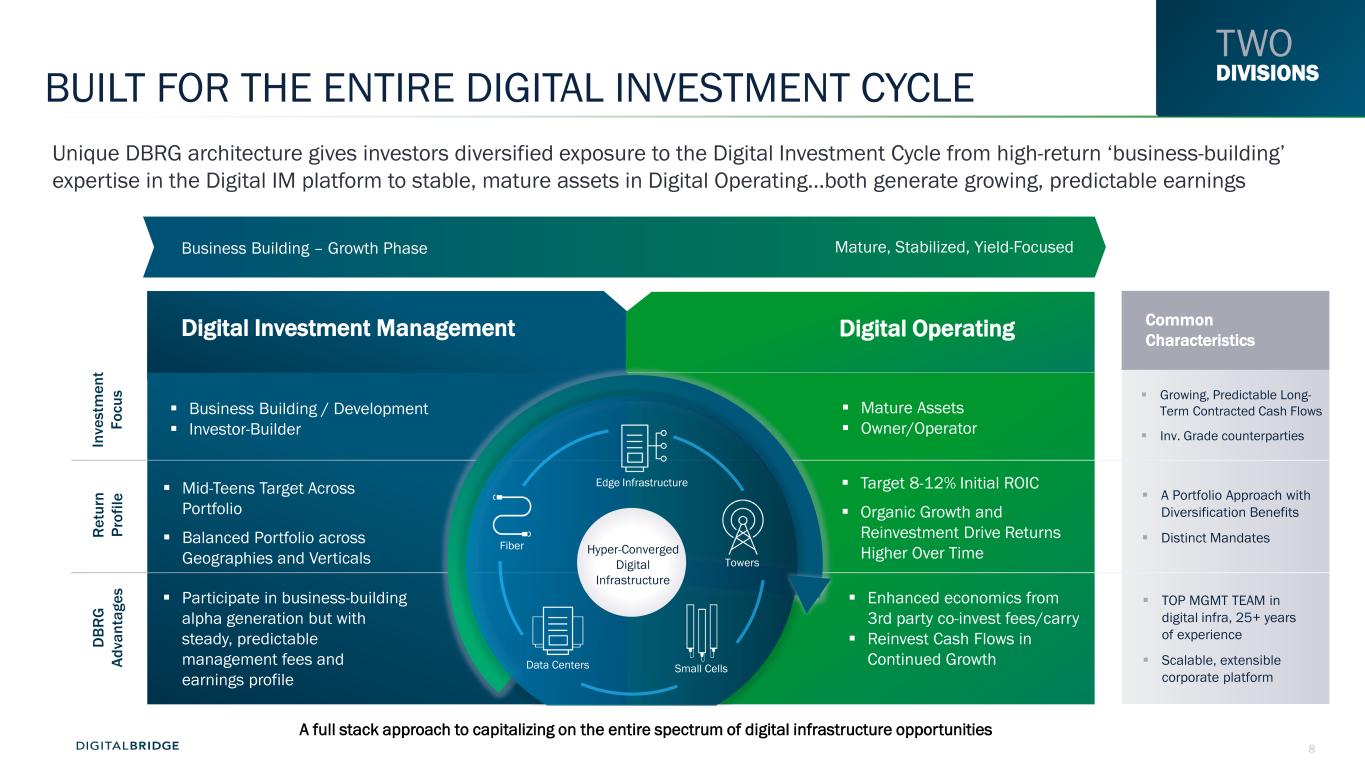

8 BUILT FOR THE ENTIRE DIGITAL INVESTMENT CYCLE Unique DBRG architecture gives investors diversified exposure to the Digital Investment Cycle from high-return ‘business-building’ expertise in the Digital IM platform to stable, mature assets in Digital Operating…both generate growing, predictable earnings Business Building / Development Investor-Builder Mature Assets Owner/Operator Participate in business-building alpha generation but with steady, predictable management fees and earnings profile Mid-Teens Target Across Portfolio Balanced Portfolio across Geographies and Verticals Target 8-12% Initial ROIC Organic Growth and Reinvestment Drive Returns Higher Over Time Enhanced economics from 3rd party co-invest fees/carry Reinvest Cash Flows in Continued Growth TOP MGMT TEAM in digital infra, 25+ years of experience Scalable, extensible corporate platform Growing, Predictable Long- Term Contracted Cash Flows Inv. Grade counterparties A Portfolio Approach with Diversification Benefits Distinct Mandates Digital Investment Management Digital Operating Towers Small Cells Fiber Data Centers Edge Infrastructure Hyper-Converged Digital Infrastructure A full stack approach to capitalizing on the entire spectrum of digital infrastructure opportunities In ve st m en t Fo cu s R et ur n Pr of ile D BR G Ad va nt ag es Common Characteristics Business Building – Growth Phase Mature, Stabilized, Yield-Focused TWO DIVISIONSTWO DIVISIONS

9 THREE REASONS TO OWN

10 THE DBRG INVESTMENT CASE The Demand- Global demand for More, Better, Faster connectivity is driving digital infrastructure investment and DBRG is well positioned for key emerging digital thematics: edge, convergence The Supply– DBRG’s investment management platform is the Partner of Choice as the world’s leading institutional investors increasingly allocate capital to this growing, resilient asset class Investor-Operator - The premier business-builder in digital infrastructure; over 25 years investing and operating digital assets; 100s of years of cumulative experience managing investor capital and operating active infrastructure. Investing Across A Converging Digital Ecosystem - Only global REIT to own, manage, and operate across the entire digital ecosystem with a flexible investment framework built to capitalize on evolving networks. Deep relationship networks drive proprietary sourcing Entering ‘Phase II: The Acceleration’ – DBRG mgmt. completed the 'diversified to digital' transition ahead of schedule and has significant capital to deploy into an earnings-driven framework High-Growth Secular Winner – Two high-growth business lines poised to continue strong momentum, with a clear roadmap to DBRG’s converged vision At the Intersection of Supply & Demand Powerful Secular Tailwinds Executing a Unique Converged Strategy Digital Infrastructure Experts Entering the Next Phase of Growth Simple, High Growth Model THREE REASONS TO OWN

11 THREE REASONS TO OWN 1 2 3 Powerful Secular Tailwinds Digital Infrastructure Experts Simple, High-Growth Business

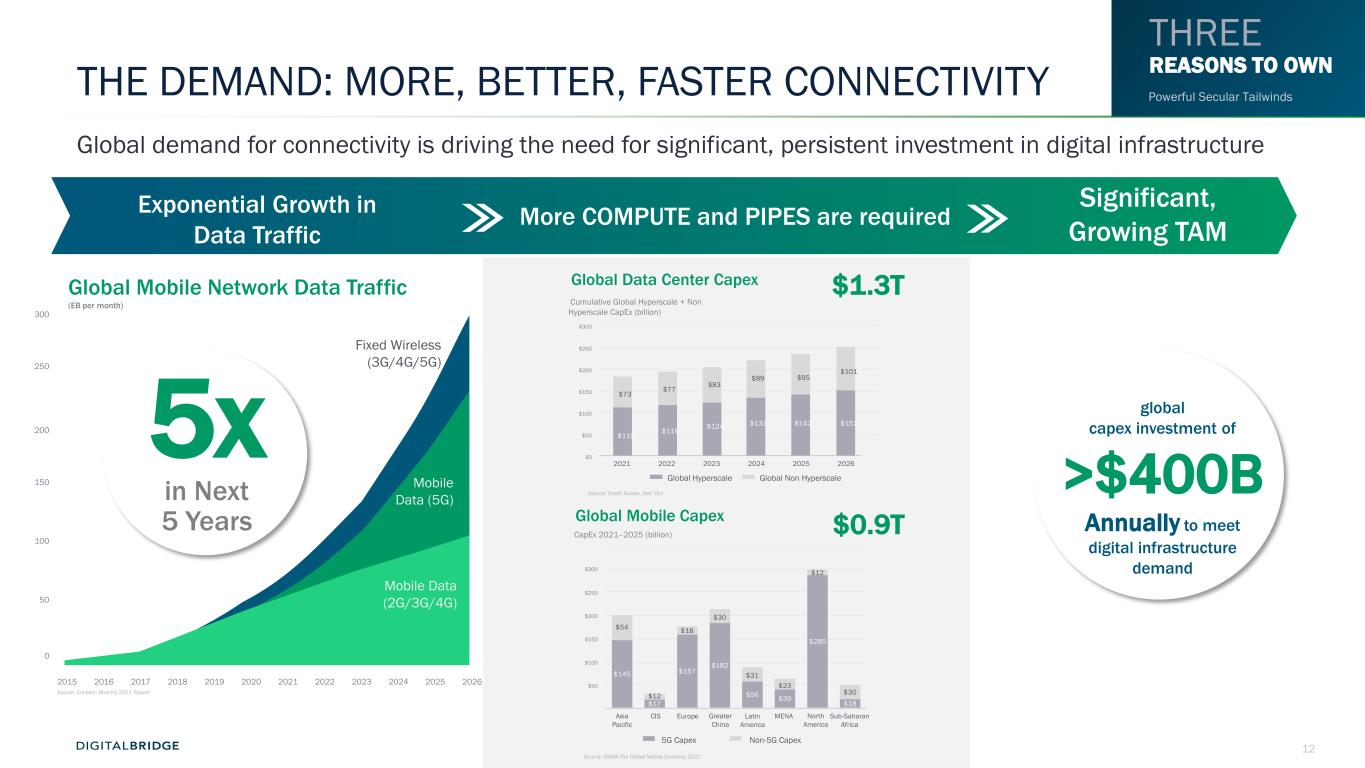

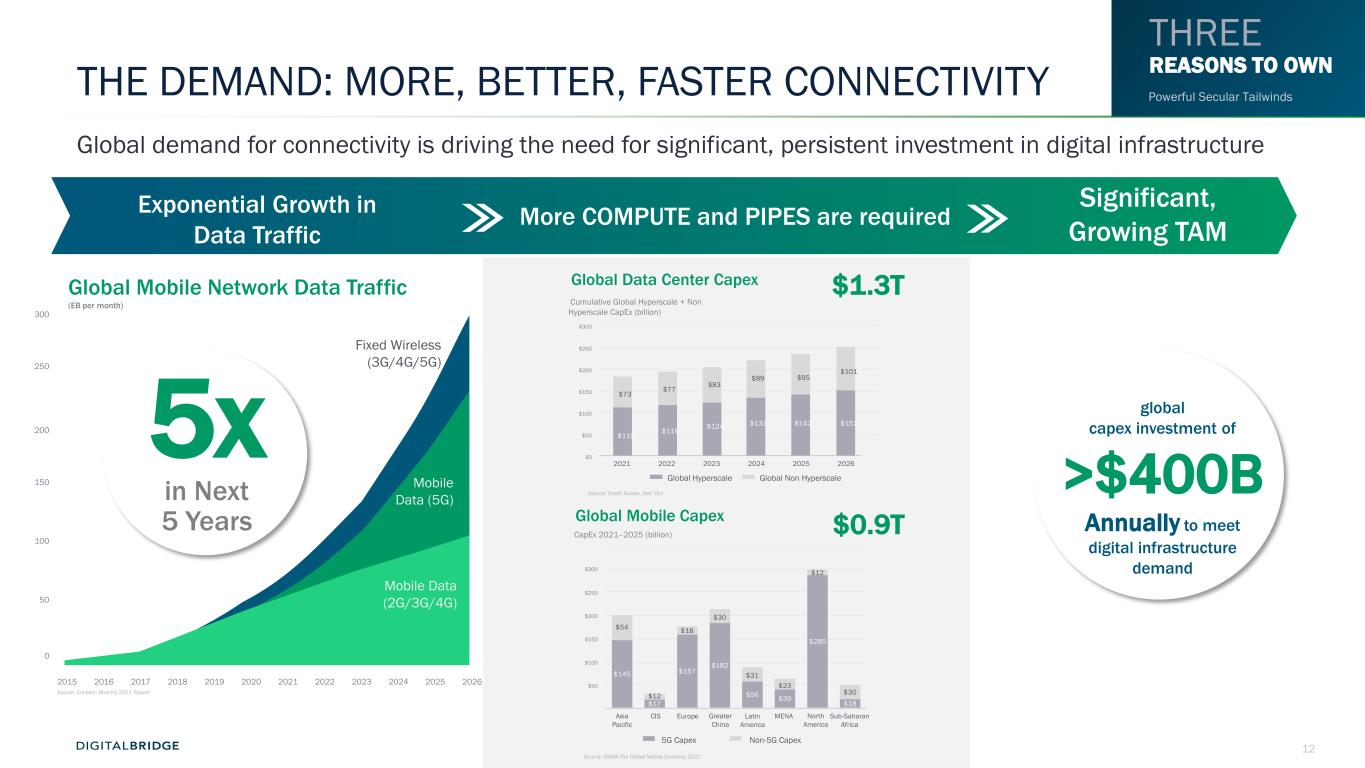

12 THE DEMAND: MORE, BETTER, FASTER CONNECTIVITY Global demand for connectivity is driving the need for significant, persistent investment in digital infrastructure Exponential Growth in Data Traffic global capex investment of >$400B Annually to meet digital infrastructure demand $300 $250 $200 $150 $100 $50 $0 2021 2022 2023 2024 2025 2026 Global Data Center Capex Cumulative Global Hyperscale + Non Hyperscale CapEx (billion) $101 $152 $95 $142 $89 $133$124 $83 $116 $77 $110 $73 Global Hyperscale Global Non Hyperscale Source: Credit Suisse, Dell´Oro $0.9T $1.3T $145 $17 $157 $182 $56 $39 $285 $18 $54 $12 $18 $30 $31 $23 $12 $30 Source: GSMA The Global Mobile Economy 2021 North America Greater China EuropeAsia Pacific Latin America MENA Sub-Saharan Africa CIS 5G Capex Non-5G Capex Global Mobile Capex CapEx 2021–2025 (billion) $300 $250 $200 $150 $100 $50 Significant, Growing TAM Source: Ericsson Mobility 2021 Report Global Mobile Network Data Traffic (EB per month) 2015 2016 2017 2018 2019 2020 2021 2022 2023 2024 2025 2026 0 50 100 150 200 250 300 Fixed Wireless (3G/4G/5G) Mobile Data (5G) Mobile Data (2G/3G/4G) 5x in Next 5 Years More COMPUTE and PIPES are required THREE REASONS TO OWN Powerful Secular Tailwinds

13 THE SUPPLY: DIGITALBRIDGE IS THE PARTNER OF CHOICE DBRG’s investment management platform is the partner of choice as the world’s leading institutional investors increasingly allocate capital to this growing, resilient asset class DIGITAL FEEUMALTERNATIVES AUM Source: Preqin Note: DigitalBridge’s definition of FEEUM is different from Preqin’s definition of AUM, and therefore the two may not be directly comparable. CAGR 10% CAGR +65% $4.06T $11.8T 20212010 $6.8B $17B 20212019 “Paradigm shift”: institutional investors raise allocations to alternatives 1. Moody's Seasoned Aaa Corporate Bond Yield 9% 8% 7% 6% 5% 4% 3% 2% 1% State Pension Plan Return Targets Median Assumed Rate of Return Aaa Corporate Bond Yield1 Alternatives Are Already Exhibiting Steady Growth… We Are Growing Faster Than The Industry Return Needs Not Met Through Traditional Assets Wallet Share 0.14% THREE REASONS TO OWN Powerful Secular Tailwinds

14 THREE REASONS TO OWN 1 2 3 Powerful Secular Tailwinds Digital Infrastructure Experts Simple, High-Growth Business

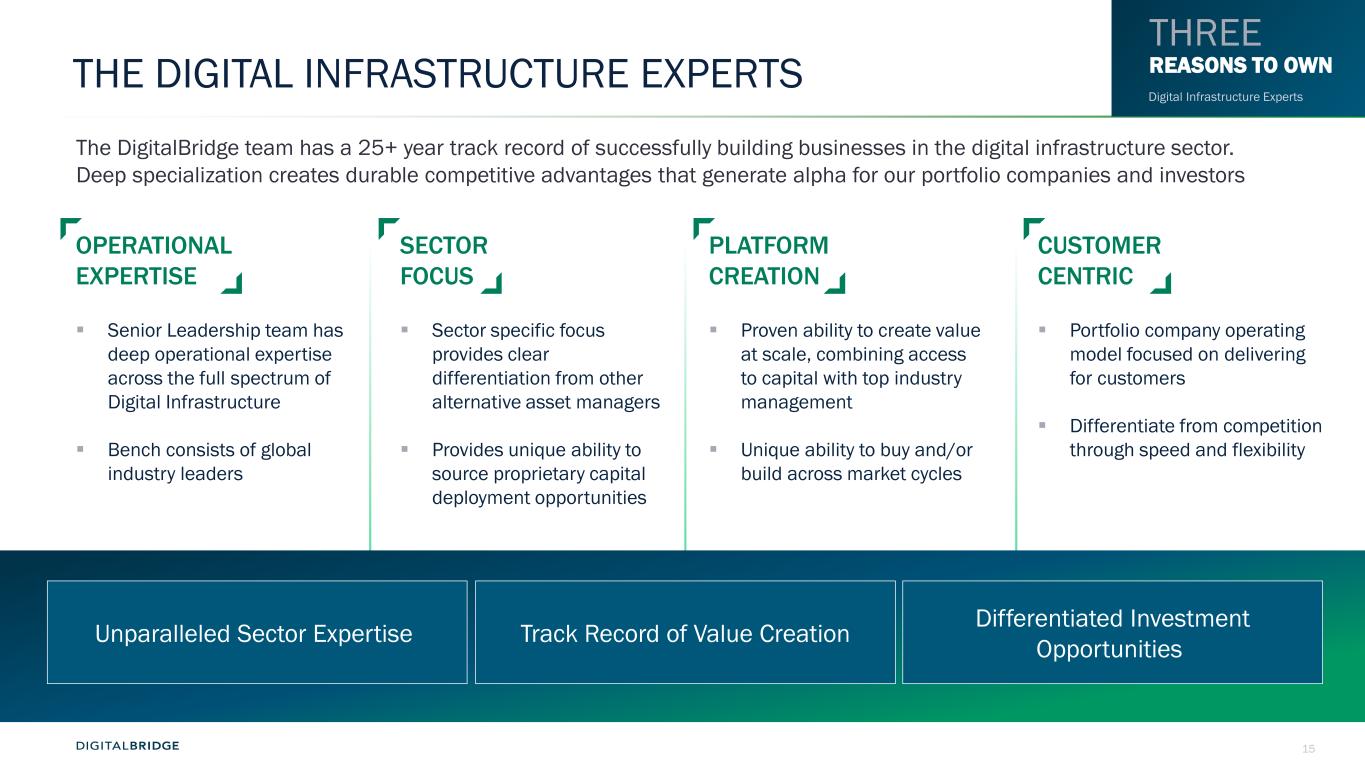

15 THE DIGITAL INFRASTRUCTURE EXPERTS THREE REASONS TO OWN Digital Infrastructure Experts The DigitalBridge team has a 25+ year track record of successfully building businesses in the digital infrastructure sector. Deep specialization creates durable competitive advantages that generate alpha for our portfolio companies and investors OPERATIONAL EXPERTISE SECTOR FOCUS PLATFORM CREATION CUSTOMER CENTRIC Senior Leadership team has deep operational expertise across the full spectrum of Digital Infrastructure Bench consists of global industry leaders Sector specific focus provides clear differentiation from other alternative asset managers Provides unique ability to source proprietary capital deployment opportunities Proven ability to create value at scale, combining access to capital with top industry management Unique ability to buy and/or build across market cycles Portfolio company operating model focused on delivering for customers Differentiate from competition through speed and flexibility Unparalleled Sector Expertise Track Record of Value Creation Differentiated Investment Opportunities

16 EXPERIENCED TEAM DEDICATED TO DIGITAL INFRA EXECUTIVE LEADERSHIP Marc Ganzi President and Chief Executive Officer Jacky Wu Chief Financial Officer Ben Jenkins CIO, Digital Investment Management DIGITAL INVESTMENT & ASSET MANAGEMENT TEAM Leslie Golden Managing Director Jeff Ginsberg Managing Director & CAO Steven Sonnenstein Senior Managing Director TOWER LEAD Jon Mauck Senior Managing Director DATA CENTER LEAD Warren Roll Managing Director FIBER & SMALL CELL LEAD BOCA RATON Kevin Smithen Chief Commercial & Strategy Officer Tom Yanagi Managing Director Peter Hopper Managing Director Dean Criares Managing Director Digital Credit Geoff Goldschein Managing Director, General Counsel Sadiq Malik Managing Director Scott McBride Principal Hayden Boucher Principal LONDON Manjari Govada Principal James Burke Principal Matt Evans Managing Director, Head of Europe Justin Chang Managing Director Head of Asia Wilson Chung Principal Geneviève Maltais-Boisvert Principal DATA CENTER TEAM OPERATIONS, IT, FINANCE & COMPLIANCE GLOBAL INDUSTRY LEADERS & LOCAL EXPERTS Raul Martynek Senior Advisor CEO of DataBank Sureel Choksi Senior Advisor Board Member of Zayo & Scala; President and CEO of Vantage Brokaw Price Operating Partner NORTH AMERICA Michael Foust Senior Advisor Chairman of Databank & Vantage Marcos Peigo Senior Advisor CEO of Scala Data Centers SOUTH AMERICA GLOBAL Josh Joshi Operating Partner Chairman of AtlasEdge EUROPE Giles Proctor Senior Advisor President of Vantage APAC ASIA Giuliano Di Vitantonio Operating Partner CEO of AtlasEdge TOWER TEAM Alex Gellman Senior Advisor Board Member of Highline and FreshWave; CEO of Vertical Bridge Jose Sola Senior Advisor CEO of Mexico Tower Partners Daniel Seiner Senior Advisor CEO of Andean Telecom Partners Fernando Viotti Senior Advisor CEO of Highline NORTH AMERICA SOUTH AMERICA EUROPE Michael Bucey Operating Partner Steve Smith Senior Advisor CEO of Zayo Group Michael Finley Operating Partner CEO of Boingo Murray Case Operating Partner Chairman of Scala Data Centers Dan Armstrong Senior Advisor CEO and Board Member of Beanfield Technologies NORTH AMERICA SOUTH AMERICA Richard Coyle Operating Partner Interim CEO of ExteNet Systems David Pistacchio Operating Partner Chairman of Beanfield; Board Member of Aptum and Zayo FIBER & SMALL CELLS TEAM NEW YORK SINGAPORE Graham Payne Senior Advisor Executive Chairman of Freshwave Liam Stewart Managing Director & Chief Operating Officer Mark Serwinowski Managing Director, Chief Information Officer Matty Yohannan Chief of Staff Kristen Whealon Chief Compliance Officer Severin White Head of Public Investor Relations Kay Papantoniou Managing Director, Global Head of HR Ron Sanders Chief Legal Officer & Secretary Donna L. Hansen Chief Admin Officer & Global Head of Tax Sonia Kim Chief Accounting Officer Leon Schwartzman Managing Director, Chief Risk and Compliance Officer THREE REASONS TO OWN Digital Infrastructure ExpertsACTIVE INFRASTRUCTURE SPECIALISTS

17 WHY DOES A CONVERGED STRATEGY MATTER? DigitalBridge forges deeper relationships with customers through a structural ‘at-bats’ advantage that leads to proprietary deals and the ability to offer ‘converged solutions’ vs. components FLEXIBILITY Relative contribution and relevance of verticals shifts as use cases change 2G/3G/4G Today Tomorrow AI 5G/IOT Towers Data Centers Small Cells Fiber Edge Connectivity Spectrum: Demand Grows and Use Case Complexity Increases Built for change: DBRG flexible capital allocation evolves alongside the digital infra ecosystem DEEPER RELATIONSHIPS Customer Siloed approach digital peers CUSTOMER Touchpoints = Deeper Relationships compared to siloed-approach peers Towers Data Centers Silo Fiber Small Cells Edge 1 Touchpoint VS THREE REASONS TO OWN Digital Infrastructure Experts DigitalBridge’s flexible capital allocation strategy is built to ‘follow the logos’ as networks evolve, aligning investor exposures with the best opportunities over time MICRO MACRO

18 THREE REASONS TO OWN 1 2 3 Powerful Secular Tailwinds Digital Infrastructure Experts Simple, High-Growth Business

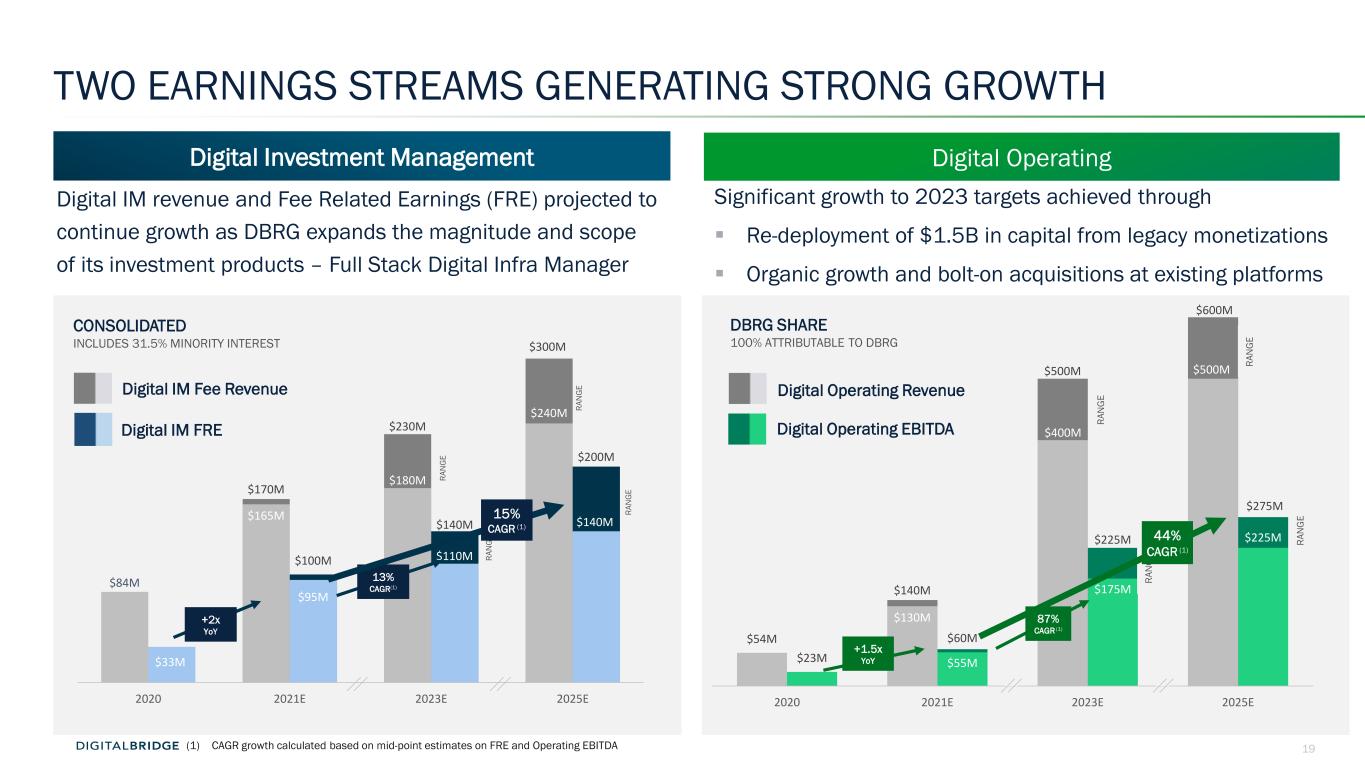

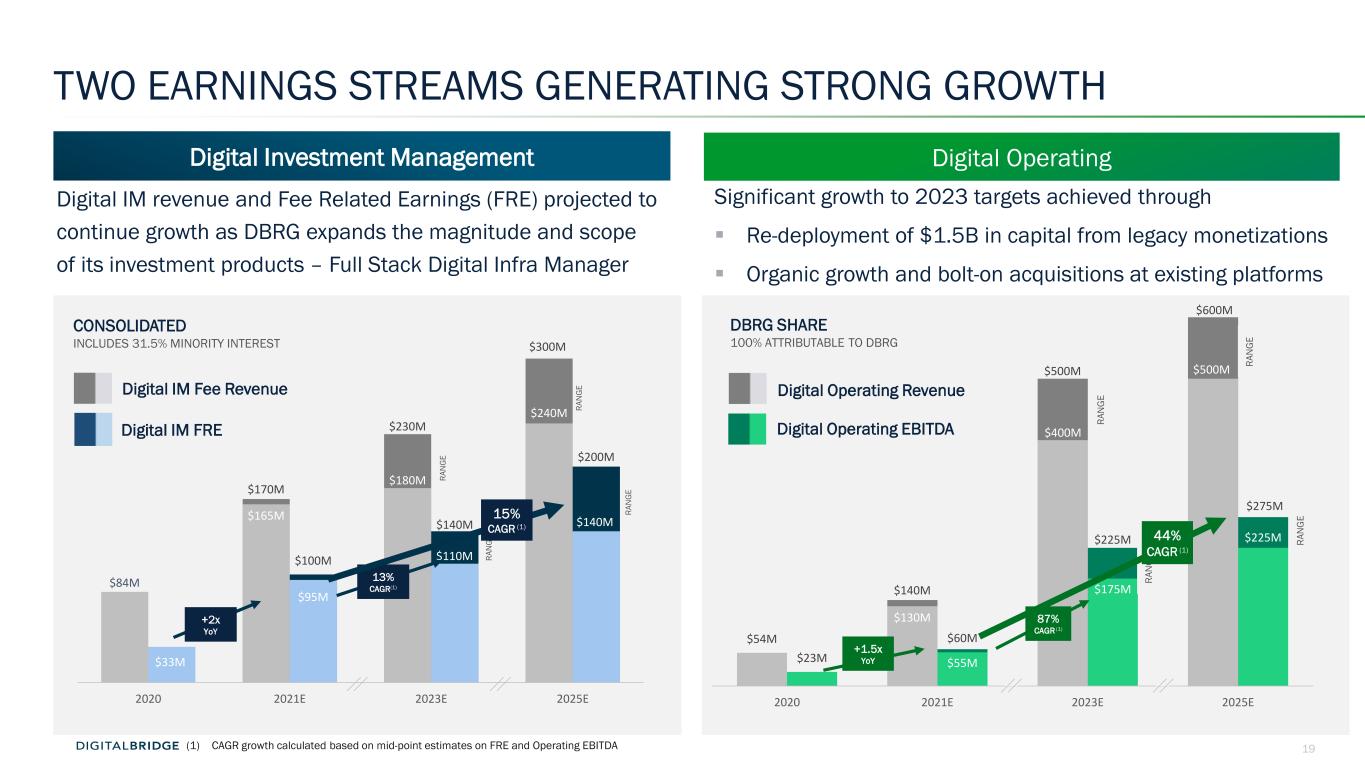

19 $170M $230M $300M $100M $140M $200M $84M $165M $180M $240M $33M $95M $110M $140M 2020 2021E 2023E 2025E $140M $500M $600M $60M $225M $275M $54M $130M $400M $500M $23M $55M $175M $225M 2020 2021E 2023E 2025E Digital IM revenue and Fee Related Earnings (FRE) projected to continue growth as DBRG expands the magnitude and scope of its investment products – Full Stack Digital Infra Manager Significant growth to 2023 targets achieved through Re-deployment of $1.5B in capital from legacy monetizations Organic growth and bolt-on acquisitions at existing platforms Digital Operating Revenue (1) CAGR growth calculated based on mid-point estimates on FRE and Operating EBITDA Digital IM Fee Revenue Digital IM FRE Digital Operating EBITDA TWO EARNINGS STREAMS GENERATING STRONG GROWTH Digital Investment Management Digital Operating RA N G E RA N G E RA N GE RA N GE RA N GE RA N GE RA N G E RA N G E 13% CAGR(1) +2x YoY 15% CAGR (1) +1.5x YoY 87% CAGR (1) 44% CAGR (1) CONSOLIDATED INCLUDES 31.5% MINORITY INTEREST DBRG SHARE 100% ATTRIBUTABLE TO DBRG

20Strictly Private and Confidential ONE MISSION Build the Next Great Digital Infrastructure Platform

21 DBRG STRATEGIC ROADMAP…NOW ENTERING STAGE II Stage I The Transition (2019-2021) Stage II The Acceleration (2021-2023) Identify new platform opportunities that benefit from DBRG platform Invest in existing portfolio to build value In ve st m en t M an ag em en t D ig ita l O pe ra tin g $2B Capital D i g i t a l F i r e p o w e r PROMISES MADE – PROMISES KEPT 2021 Adjusted EBITDA $55-60M Capital Deployment Into Stable Mature Yield-focused Assets 1. Support existing Data Center platforms Vantage SDC/DataBank 2. Developed Market Cell Tower Assets 3. Develop Market Wholesale/Dark Fiber Assets Broader/Deeper Offerings Flagship With the transition complete, DBRG is set to ‘play offense’, focused on driving continued growth in Digital IM platform through new offerings and The Acceleration of Digital Operating earnings from balance sheet redeployment into digital Deploy Balance Sheet Capital 2023 Adjusted EBITDA $175-225M 2021 FRE $95-100M 2023 FRE $110-140M Grow FEEUM via new offerings Healthcare Real Estate Industrial Real Estate Hospitality Real Estate BrightSpire Management Other Equity and Debt Legacy Invest. Management (1) Other Equity and Debt & Healthcare segments are currently under contract and expected to close 4Q21 and 1Q22, respectively

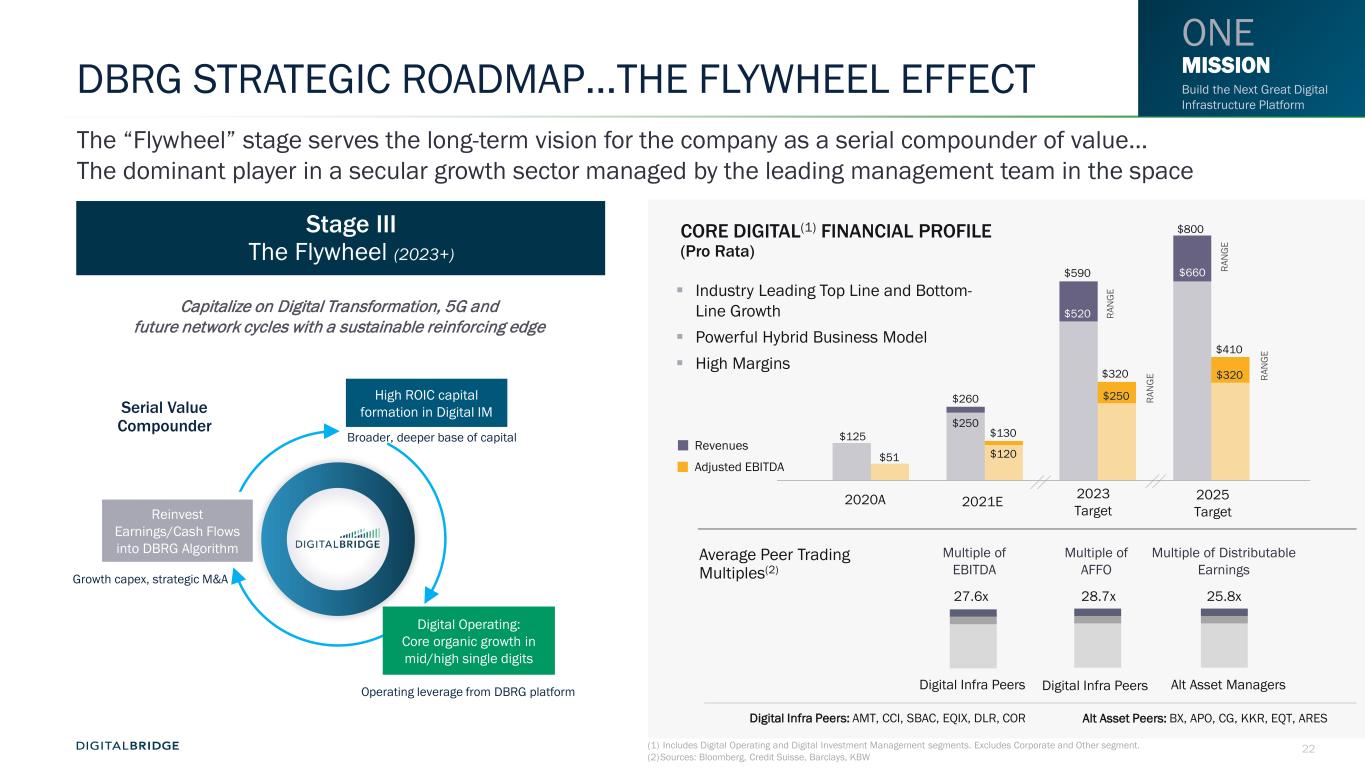

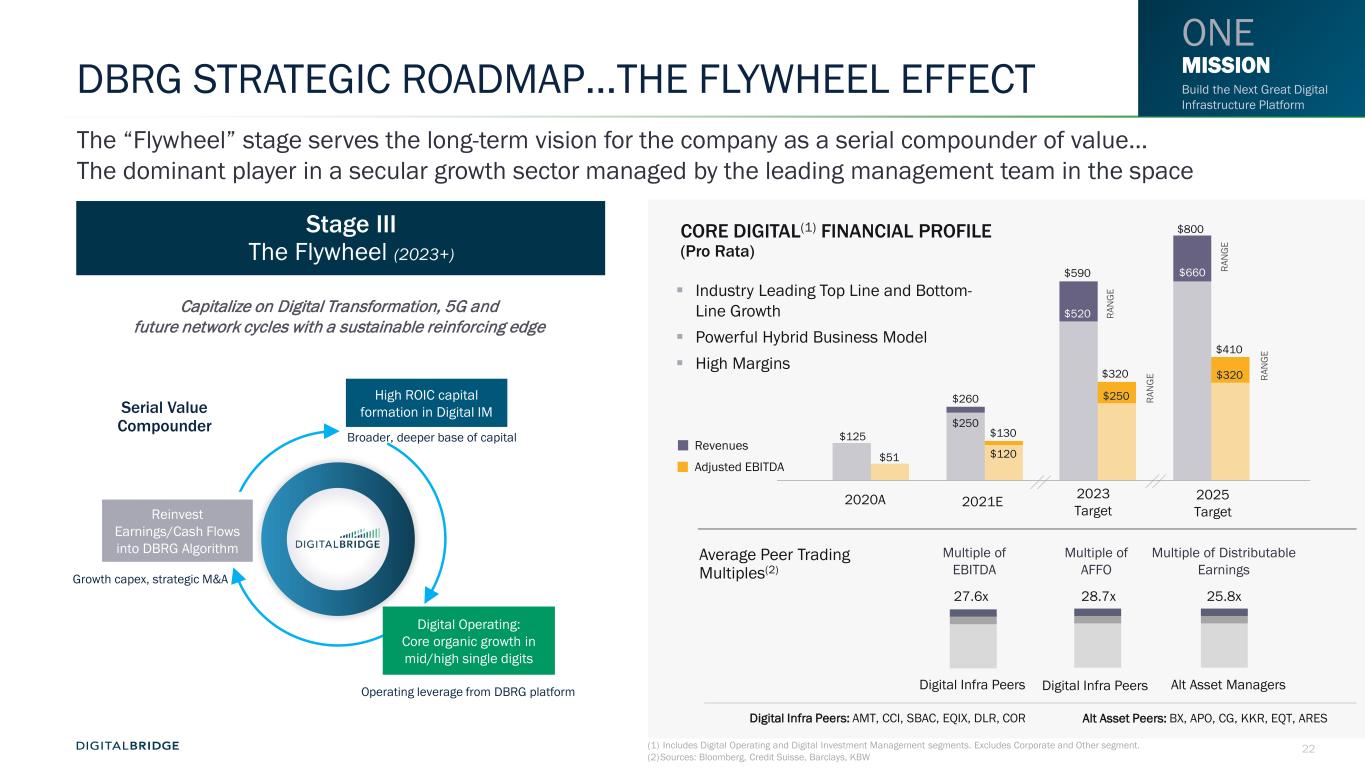

22 DBRG STRATEGIC ROADMAP…THE FLYWHEEL EFFECT The “Flywheel” stage serves the long-term vision for the company as a serial compounder of value… The dominant player in a secular growth sector managed by the leading management team in the space Stage III The Flywheel (2023+) Capitalize on Digital Transformation, 5G and future network cycles with a sustainable reinforcing edge Serial Value Compounder High ROIC capital formation in Digital IM Digital Operating: Core organic growth in mid/high single digits Operating leverage from DBRG platform Reinvest Earnings/Cash Flows into DBRG Algorithm Growth capex, strategic M&A Broader, deeper base of capital ONE MISSION Build the Next Great Digital Infrastructure Platform 2020A 2021E 2023 Target 2025 Target $125 $51 $260 $250 $130 $120 $520 $590 $320 $250 $660 $800 $320 $410 Industry Leading Top Line and Bottom- Line Growth Powerful Hybrid Business Model High Margins Alt Asset Managers Multiple of Distributable Earnings Multiple of AFFO Multiple of EBITDA Digital Infra Peers Digital Infra Peers Average Peer Trading Multiples(2) CORE DIGITAL(1) FINANCIAL PROFILE (Pro Rata) RA N G E RA N G E RA N G E Digital Infra Peers: AMT, CCI, SBAC, EQIX, DLR, COR Alt Asset Peers: BX, APO, CG, KKR, EQT, ARES 25.8x28.7x27.6x RA N G E Revenues Adjusted EBITDA (1) Includes Digital Operating and Digital Investment Management segments. Excludes Corporate and Other segment. (2)Sources: Bloomberg, Credit Suisse, Barclays, KBW

23 2 THE FINANCIALS

24 SUMMARY FINANCIAL OVERVIEW NOTE: All $ in millions except per share & AUM DigitalBridge revenue and earnings growth in core digital segments has been rapid over the past two years driven by: • Strong capital formation momentum in Digital IM • Growth in Digital Operating driven by new acquisitions and organic growth Beginning in 3Q21, DBRG is introducing AFFO as a key measure: • During 3Q21, AFFO was $0.7M net of maintenance capital expenditures of $1.3M, which was above our anticipated normalized spend expected to average less than 3% of Monthly Recurring Revenue (“MRR”) TOTAL COMPANY 3Q20 2Q21 3Q21 Y/Y% Consolidated Revenues $123.0 $237.2 $252.2 +105% DBRG OP Share of Revenues $33.6 $66.7 $73.6 +119% Adjusted EBITDA (DBRG OP Share) $(5.5) $15.4 $17.6 N/M CFFO ($30.7) ($4.8) $2.0 N/M Per Share ($0.06) ($0.01) $0.00 N/M Net Income (DBRG Shareholder) ($205.8) ($141.3) $41.0 N/M Per Share ($0.44) ($0.29) $0.08 N/M Digital AUM ($B) $23.3 $34.9 $37.8 +63% Consolidated Revenues $20.4 $46.9 $53.8 +164% DBRG OP Share of Revenues $14.1 $33.4 $37.0 +163% DBRG OP Share of FRE $6.3 $17.4 $20.7 +229% Consolidated Revenues $98.5 $189.1 $195.0 +98% DBRG OP Share of Revenues $15.6 $32.6 $33.8 +116% DBRG OP Share of Adjusted EBITDA $6.9 $13.8 $13.6 +97% DIGITAL OPERATING DIGITAL INVESTMENT MANAGEMENT (IM)

25 $76M $79M $85M $100M $124M $137M $155M $40M $38M $40M $41M $62M $70M $79M 1Q20 2Q20 3Q20 4Q20 1Q21 2Q21 3Q21 Annualized Revenue Annualized FRE $36M $34M $62M $84M $131M $131M $138M $13M $13M $28M $39M $56M $55M $56M 1Q20 2Q20 3Q20 4Q20 1Q21 2Q21 3Q21 Annualized Revenue Annualized EBITDA STABILIZED GROWTH Digital IM and Digital Operating divisions have continued to grow consistently with ‘lower left to upper right trajectory’ Driven primarily by strong fundraising in the DCP and Co-Investment vehicles, annualized revenue in the IM segment has grown consistently since 1Q20 Continued strong bookings and low churn offset by unfavorable power margin due to unusual short term weather conditions. CONSOLIDATED INCLUDES 31.5% MINORITY INTEREST EXCLUDES 1X ITEMS DBRG Pro-Rata 100% ATTRIBUTABLE TO DBRG Investment Management Digital Operating 1 (1) 3Q21 Digital Operating results includes annualized impact of CA22 acquisition, completed in September 2021

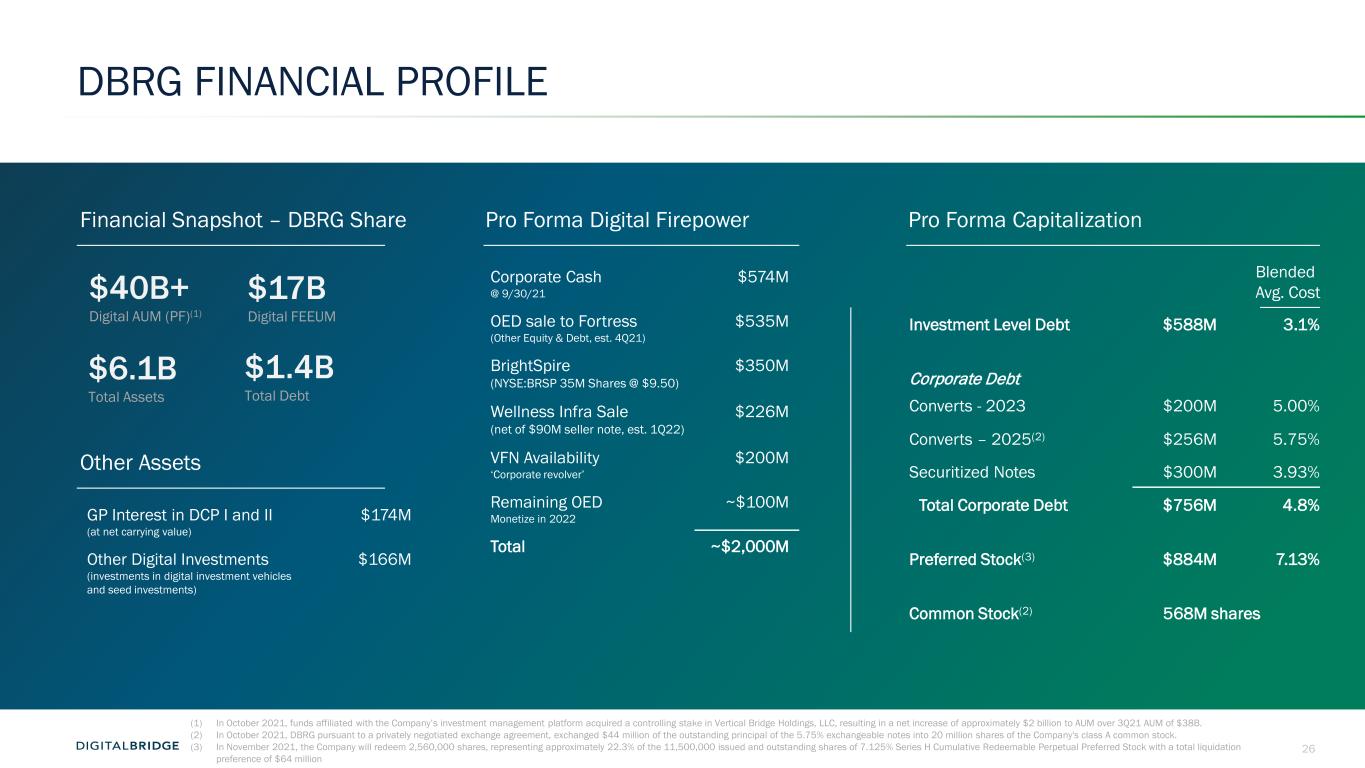

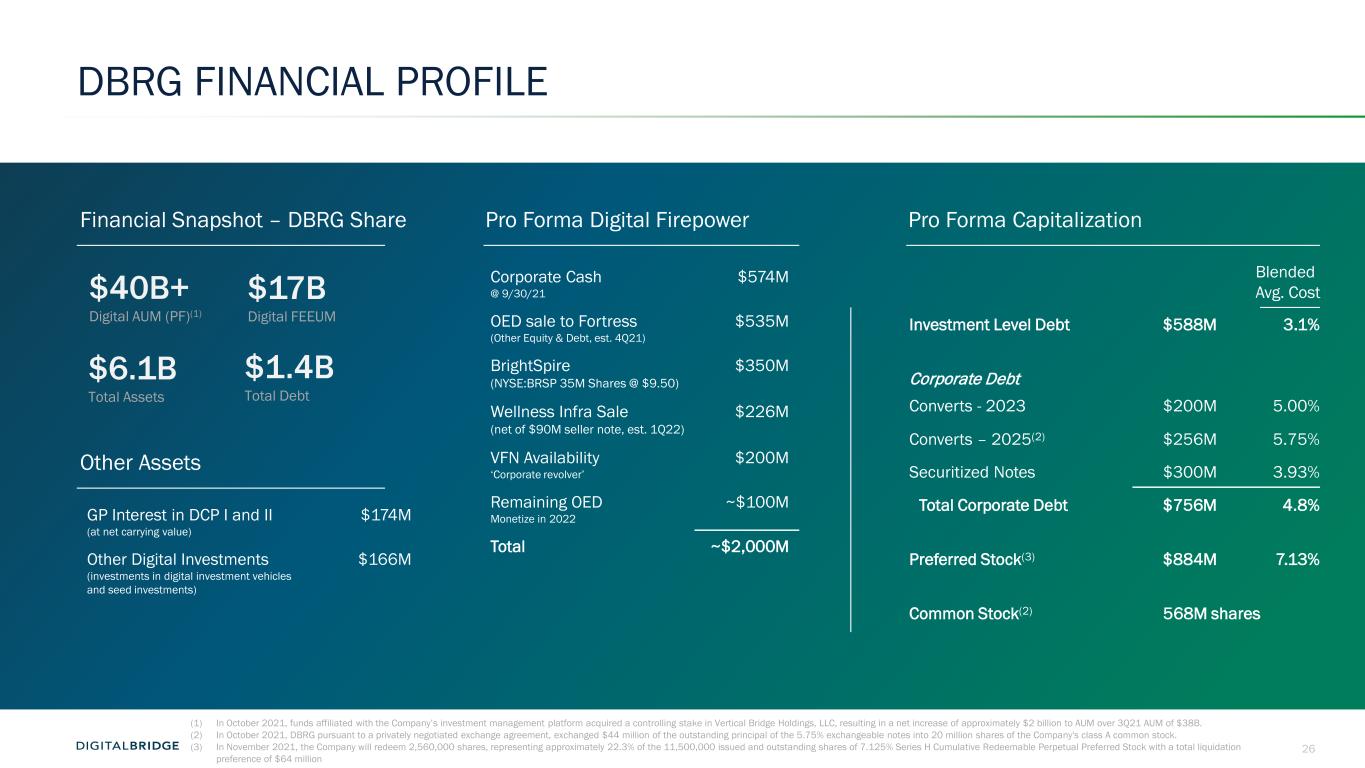

26 DBRG FINANCIAL PROFILE Financial Snapshot – DBRG Share $40B+ Digital AUM (PF)(1) $6.1B Total Assets $1.4B Total Debt Corporate Cash @ 9/30/21 $574M OED sale to Fortress (Other Equity & Debt, est. 4Q21) $535M BrightSpire (NYSE:BRSP 35M Shares @ $9.50) $350M Wellness Infra Sale (net of $90M seller note, est. 1Q22) $226M VFN Availability ‘Corporate revolver’ $200M Remaining OED Monetize in 2022 ~$100M Total ~$2,000M Pro Forma Capitalization Investment Level Debt $588M 3.1% Corporate Debt Converts - 2023 $200M 5.00% Converts – 2025(2) $256M 5.75% Securitized Notes $300M 3.93% Total Corporate Debt $756M 4.8% Preferred Stock(3) $884M 7.13% Common Stock(2) 568M shares Blended Avg. Cost Pro Forma Digital Firepower $17B Digital FEEUM Other Assets GP Interest in DCP I and II (at net carrying value) $174M Other Digital Investments (investments in digital investment vehicles and seed investments) $166M (1) In October 2021, funds affiliated with the Company’s investment management platform acquired a controlling stake in Vertical Bridge Holdings, LLC, resulting in a net increase of approximately $2 billion to AUM over 3Q21 AUM of $38B. (2) In October 2021, DBRG pursuant to a privately negotiated exchange agreement, exchanged $44 million of the outstanding principal of the 5.75% exchangeable notes into 20 million shares of the Company's class A common stock. (3) In November 2021, the Company will redeem 2,560,000 shares, representing approximately 22.3% of the 11,500,000 issued and outstanding shares of 7.125% Series H Cumulative Redeemable Perpetual Preferred Stock with a total liquidation preference of $64 million

27 $100M $140M $33M $95M $110M $0M $50M $100M $150M $200M $250M 2020 2021E 2023T2020 2021E 2023T SPV Coinvest DCPI DCPII Future DIGITAL INVESTMENT MANAGEMENT ALGORITHM AVG. FEEUM (avg. of beginning and ending #s) REVENUE FRE/Adjusted EBITDA Figures do not include Performance Fees RevenueFEEUM Average Investment Management Fee of 90-100bps Fee-Related Earnings / EBITDA 55-60%+ marginRevenue Revenue algorithm FRE/EBITDA algorithm Margin 55% to 60%+ bps 90-100$15B $9B TBD RAN GE $170M $230M $84M $165M $180M $0M $50M $100M $150M $200M $250M 2020 2021E 2023T

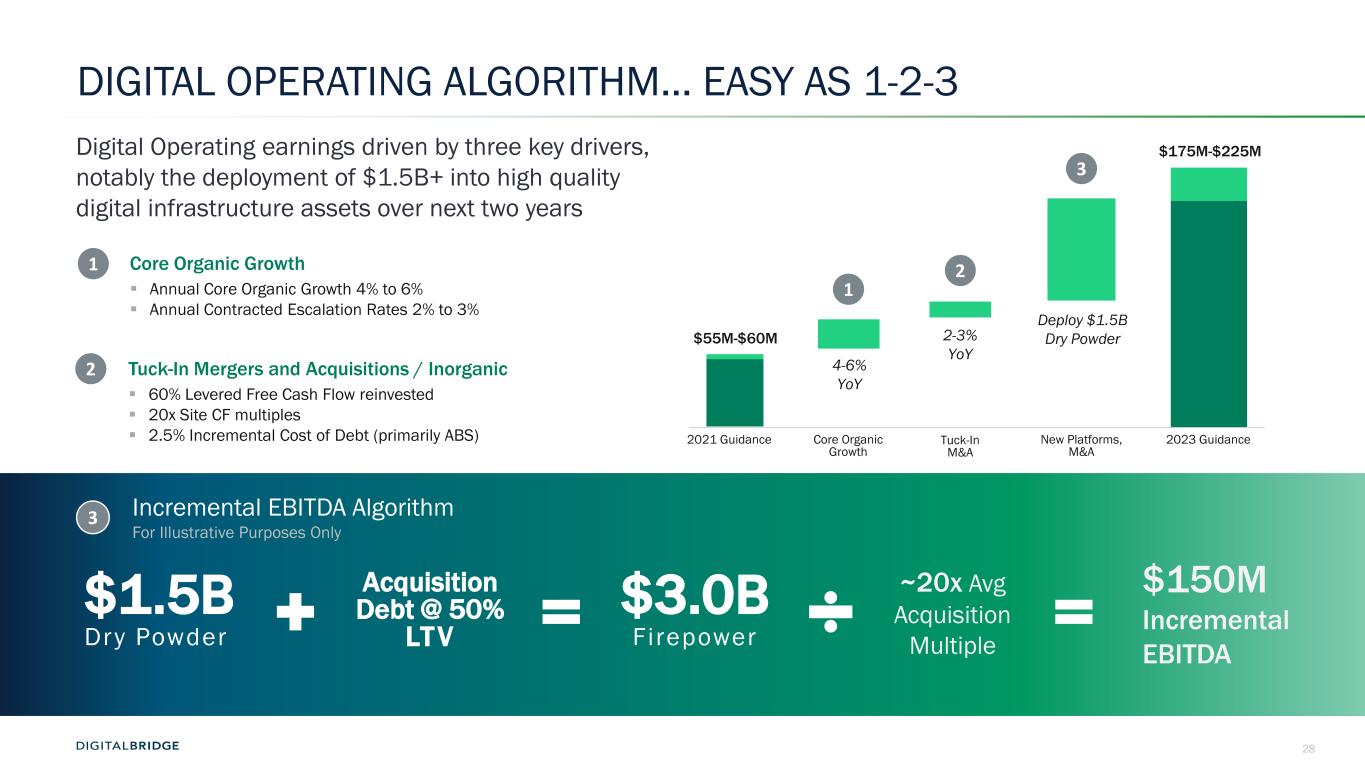

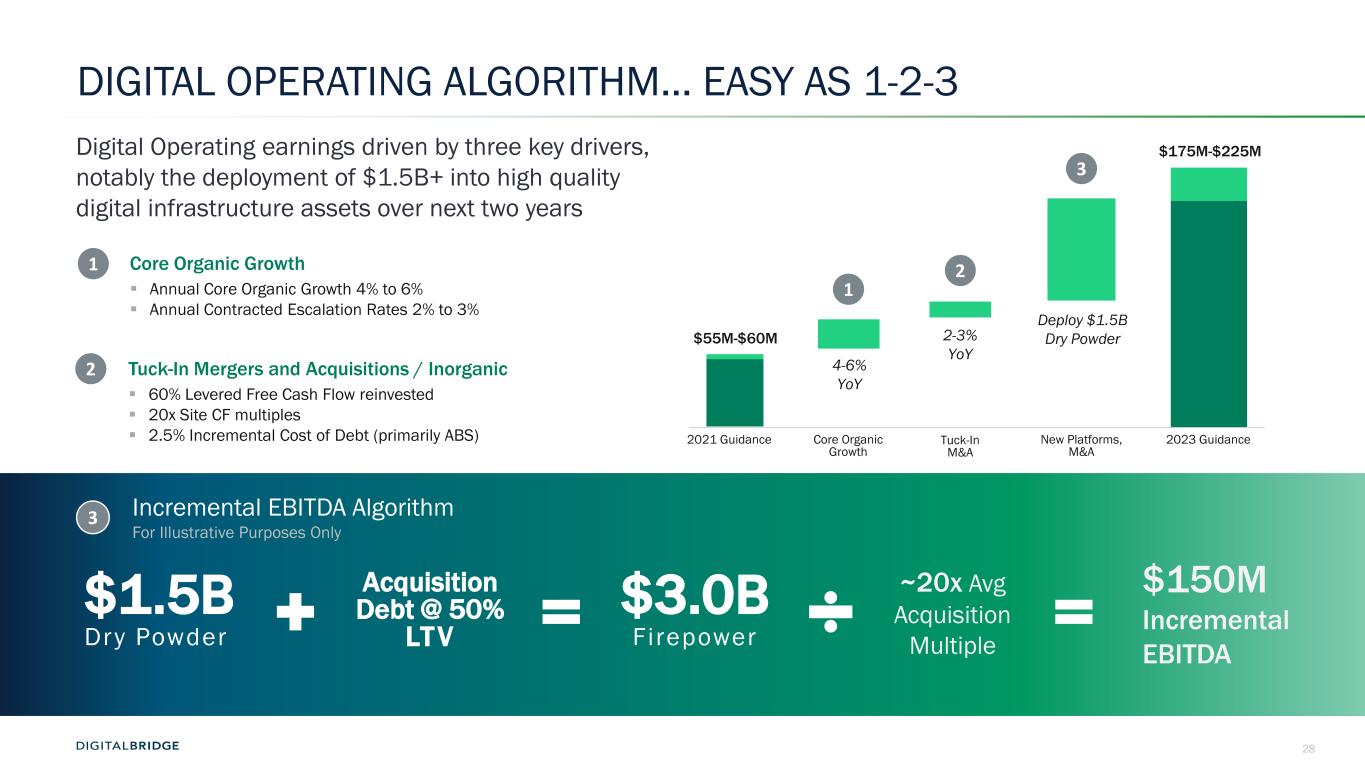

28 DIGITAL OPERATING ALGORITHM… EASY AS 1-2-3 $55M-$60M 2021 Guidance Core Organic Growth Tuck-In M&A New Platforms, M&A 2023 Guidance 4-6% YoY 2-3% YoY $175M-$225M Deploy $1.5B Dry Powder 3 1 2 3 Incremental EBITDA Algorithm For Illustrative Purposes Only Core Organic Growth Annual Core Organic Growth 4% to 6% Annual Contracted Escalation Rates 2% to 3% Tuck-In Mergers and Acquisitions / Inorganic 60% Levered Free Cash Flow reinvested 20x Site CF multiples 2.5% Incremental Cost of Debt (primarily ABS) $1.5B Dry Powder $150M Incremental EBITDA 1 2 ~20x Avg Acquisition Multiple $3.0B Firepower Acquisition Debt @ 50% LTV Digital Operating earnings driven by three key drivers, notably the deployment of $1.5B+ into high quality digital infrastructure assets over next two years

29 3 THE DETAILS

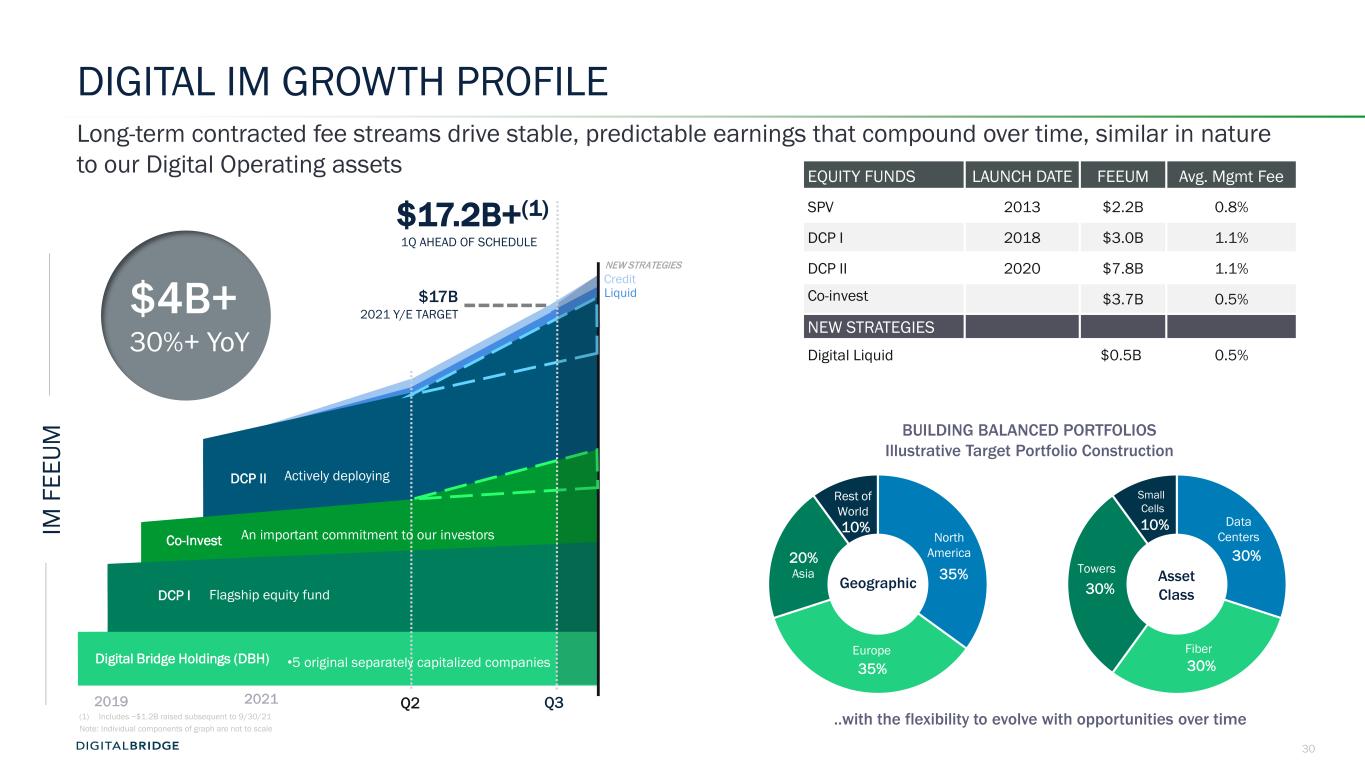

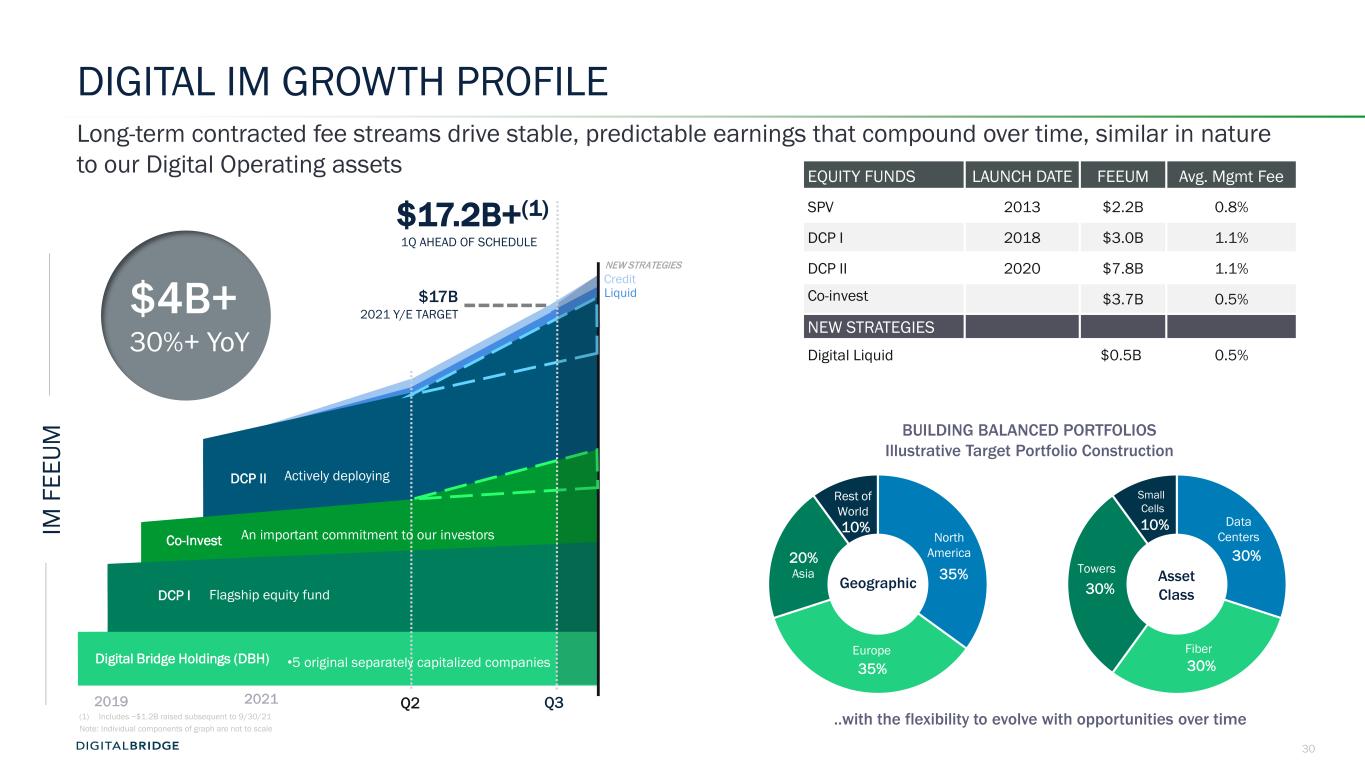

30 35% 35% 20% 10% DIGITAL IM GROWTH PROFILE Long-term contracted fee streams drive stable, predictable earnings that compound over time, similar in nature to our Digital Operating assets EQUITY FUNDS LAUNCH DATE FEEUM Avg. Mgmt Fee SPV 2013 $2.2B 0.8% DCP I 2018 $3.0B 1.1% DCP II 2020 $7.8B 1.1% Co-invest $3.7B 0.5% NEW STRATEGIES Digital Liquid $0.5B 0.5% BUILDING BALANCED PORTFOLIOS Illustrative Target Portfolio Construction Asia 30% 30% 30% 10% Geographic North America Europe Rest of World Asset Class Towers Fiber Data Centers Small Cells ..with the flexibility to evolve with opportunities over time Note: Individual components of graph are not to scale (1) Includes ~$1.2B raised subsequent to 9/30/21 •Former the original base for growth $8.1B passed ($6B) 2019 2021 Digital Bridge Holdings (DBH) DCP II Q2 Co-Invest Q3 DCP I 1Q AHEAD OF SCHEDULE $17B 2021 Y/E TARGET Credit Liquid NEW STRATEGIES IM F EE UM $4B+ 30%+ YoY •5 original separately capitalized companies Actively deploying An important commitment to our investors Flagship equity fund $17.2B+(1)

31 Digital Operating segment comprised of stakes in two data center businesses: DataBank and Vantage SDC Segment focused on growing exposure to mature, yield-focused digital infrastructure assets with stable growth profile and positive cash flows DBRG maintains management control as investment sponsor, consolidates financials DBRG balance sheet capital invested alongside 3rd party co-invest capital generating fees and carry, amplifying core investment returns. DIGITAL OPERATING PROFILE Overview North American portfolio of stabilized hyperscale data centers Portfolio 13 data centers / 4 hyperscale markets Profile Yield-focused, stabilized (90% + utilization) data centers with long-term contracts and investment-grade hyperscale customers DBRG Growth Strategy M&A of Stabilized Assets - Support continued growth primarily through acquisition and integration of stabilized hyperscale data centers Initial Acquisition Value ~$3.7B Initial Acquisition Value Investment $200 million balance sheet investment, Jul/Oct 2020 Ownership ‘Minority Control’ structure; 13% interest Overview Premier edge/colocation data center platform with nationwide US footprint Portfolio 64 data centers / 29 edge markets served Profile Nationwide footprint with continued growth driven by enterprise customer demand as data gravitates to the Edge DBRG Growth Strategy New Build + M&A - support ‘new build’ strategy driven by customer demand and strategic M&A to build out ‘edge’ opportunity Initial Acquisition Value ~$3.0B Initial Acquisition Value Investment $334 million balance sheet investment, Dec 2019/Dec 2020 Ownership 'Minority Control' structure; 20% interest

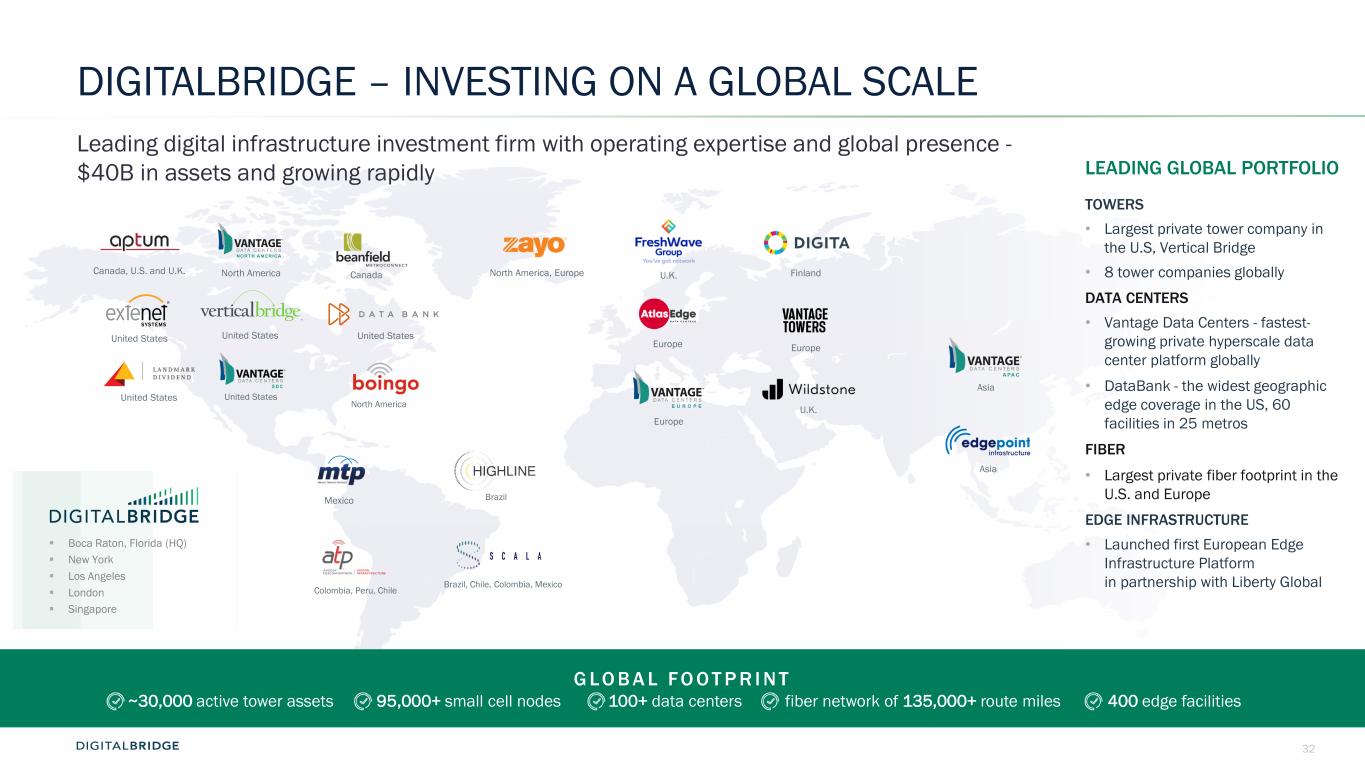

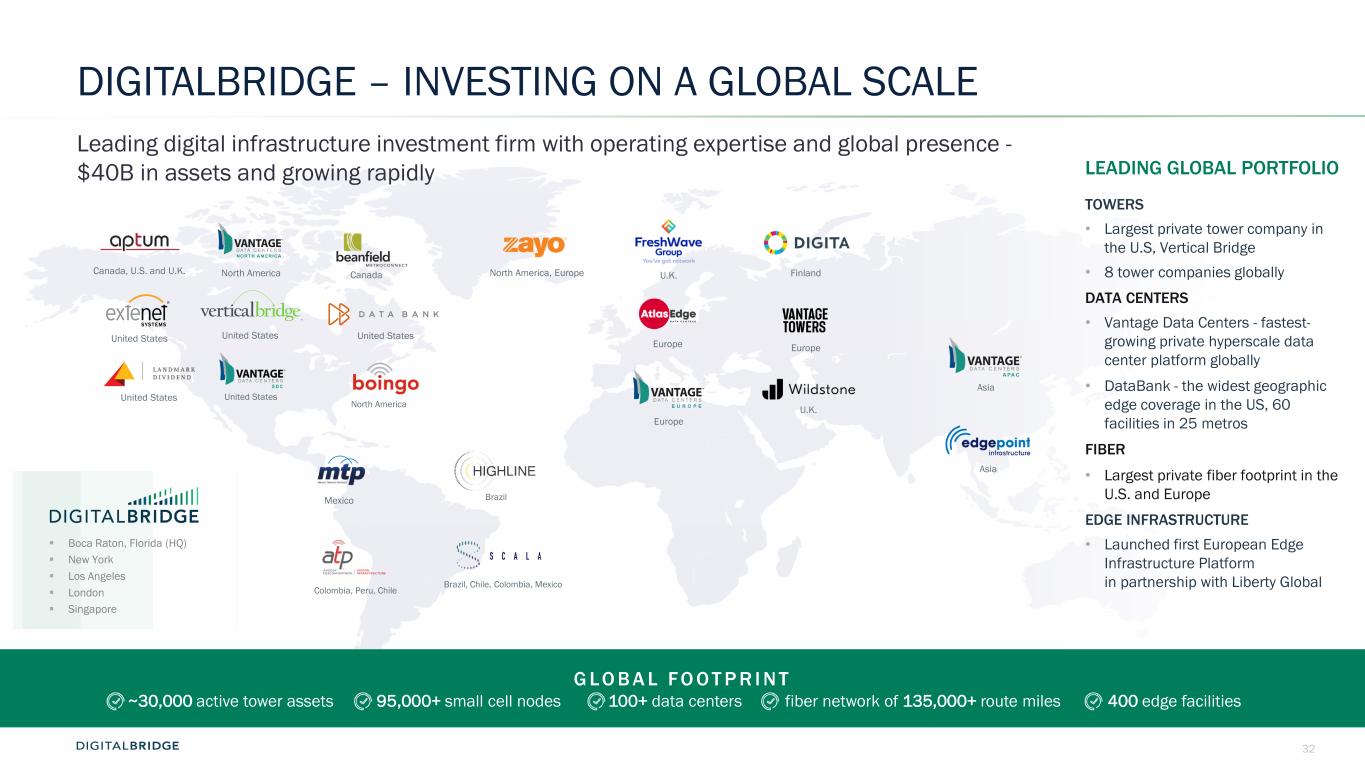

32 DIGITALBRIDGE – INVESTING ON A GLOBAL SCALE Leading digital infrastructure investment firm with operating expertise and global presence - $40B in assets and growing rapidly Colombia, Peru, Chile Canada, U.S. and U.K. U.K. United StatesUnited States United States Brazil Brazil, Chile, Colombia, Mexico U.K. Asia Europe North America Europe United States 3 Mexico North America Europe Canada FinlandNorth America, Europe Asia G LO B A L FO O T P R I N T ~30,000 active tower assets 95,000+ small cell nodes 100+ data centers fiber network of 135,000+ route miles 400 edge facilities Boca Raton, Florida (HQ) New York Los Angeles London Singapore United States LEADING GLOBAL PORTFOLIO TOWERS • Largest private tower company in the U.S, Vertical Bridge • 8 tower companies globally DATA CENTERS • Vantage Data Centers - fastest- growing private hyperscale data center platform globally • DataBank - the widest geographic edge coverage in the US, 60 facilities in 25 metros FIBER • Largest private fiber footprint in the U.S. and Europe EDGE INFRASTRUCTURE • Launched first European Edge Infrastructure Platform in partnership with Liberty Global

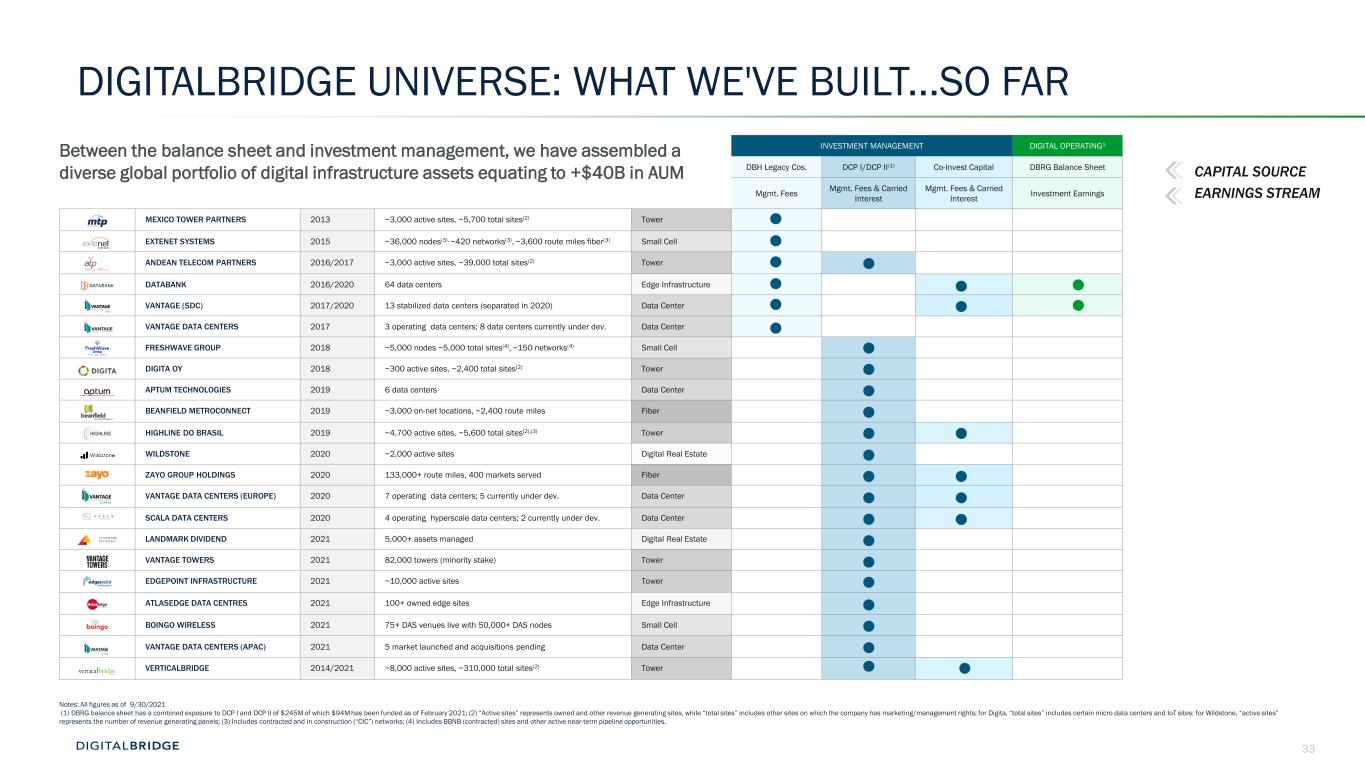

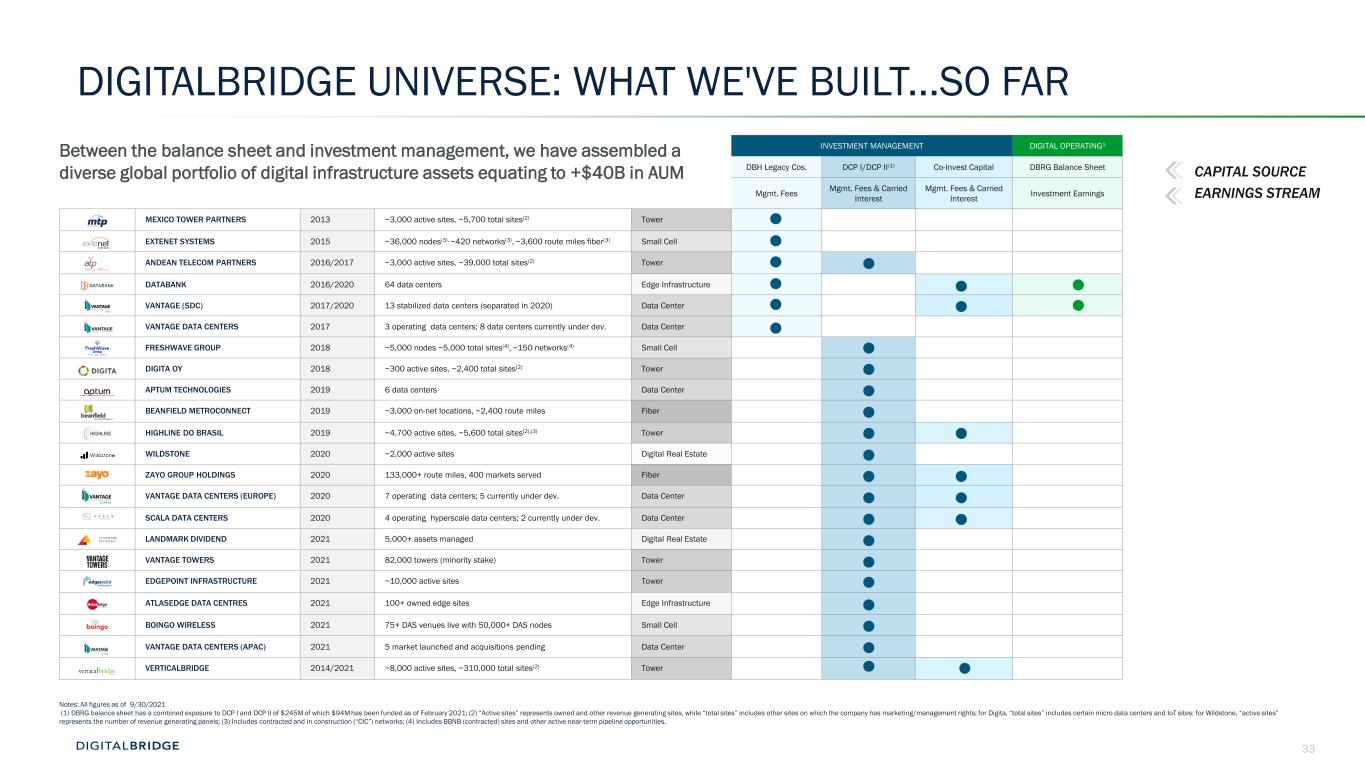

33 DIGITALBRIDGE UNIVERSE: WHAT WE'VE BUILT...SO FAR INVESTMENT MANAGEMENT DIGITAL OPERATING1 DBH Legacy Cos. DCP I/DCP II(1) Co-Invest Capital DBRG Balance Sheet Mgmt. Fees Mgmt. Fees & Carried Interest Mgmt. Fees & Carried Interest Investment Earnings MEXICO TOWER PARTNERS 2013 ~3,000 active sites, ~5,700 total sites(2) Tower EXTENET SYSTEMS 2015 ~36,000 nodes(3), ~420 networks(3), ~3,600 route miles fiber(3) Small Cell ANDEAN TELECOM PARTNERS 2016/2017 ~3,000 active sites, ~39,000 total sites(2) Tower DATABANK 2016/2020 64 data centers Edge Infrastructure VANTAGE (SDC) 2017/2020 13 stabilized data centers (separated in 2020) Data Center VANTAGE DATA CENTERS 2017 3 operating data centers; 8 data centers currently under dev. Data Center FRESHWAVE GROUP 2018 ~5,000 nodes ~5,000 total sites(4), ~150 networks(4) Small Cell DIGITA OY 2018 ~300 active sites, ~2,400 total sites(2) Tower APTUM TECHNOLOGIES 2019 6 data centers Data Center BEANFIELD METROCONNECT 2019 ~3,000 on-net locations, ~2,400 route miles Fiber HIGHLINE DO BRASIL 2019 ~4,700 active sites, ~5,600 total sites(2),(3) Tower WILDSTONE 2020 ~2,000 active sites Digital Real Estate ZAYO GROUP HOLDINGS 2020 133,000+ route miles, 400 markets served Fiber VANTAGE DATA CENTERS (EUROPE) 2020 7 operating data centers; 5 currently under dev. Data Center SCALA DATA CENTERS 2020 4 operating hyperscale data centers; 2 currently under dev. Data Center LANDMARK DIVIDEND 2021 5,000+ assets managed Digital Real Estate VANTAGE TOWERS 2021 82,000 towers (minority stake) Tower EDGEPOINT INFRASTRUCTURE 2021 ~10,000 active sites Tower ATLASEDGE DATA CENTRES 2021 100+ owned edge sites Edge Infrastructure BOINGO WIRELESS 2021 75+ DAS venues live with 50,000+ DAS nodes Small Cell VANTAGE DATA CENTERS (APAC) 2021 5 market launched and acquisitions pending Data Center VERTICALBRIDGE 2014/2021 ~8,000 active sites, ~310,000 total sites(2) Tower Notes: All figures as of 9/30/2021 (1) DBRG balance sheet has a combined exposure to DCP I and DCP II of $245M of which $94M has been funded as of February 2021; (2) “Active sites” represents owned and other revenue generating sites, while “total sites” includes other sites on which the company has marketing/management rights; for Digita, “total sites” includes certain micro data centers and IoT sites; for Wildstone, “active sites” represents the number of revenue generating panels; (3) Includes contracted and in construction (“CIC”) networks; (4) Includes BBNB (contracted) sites and other active near-term pipeline opportunities. Between the balance sheet and investment management, we have assembled a diverse global portfolio of digital infrastructure assets equating to +$40B in AUM EARNINGS STREAM CAPITAL SOURCE

34 WE ARE ACTIVELY BUILDING WORLDWIDE EUROPE ASIA NORTH AMERICA LATAM

35 Towers Small Cells Fiber Data Centers Edge Infrastructure Hyper-Converged Digital Infrastructure DigitalBridge (NYSE: DBRG) is the leading global digital infrastructure investor, managing and operating assets across five key verticals: data centers, cell towers, fiber networks, small cells, and edge infrastructure DigitalBridge is the infrastructure partner to the Digital Economy

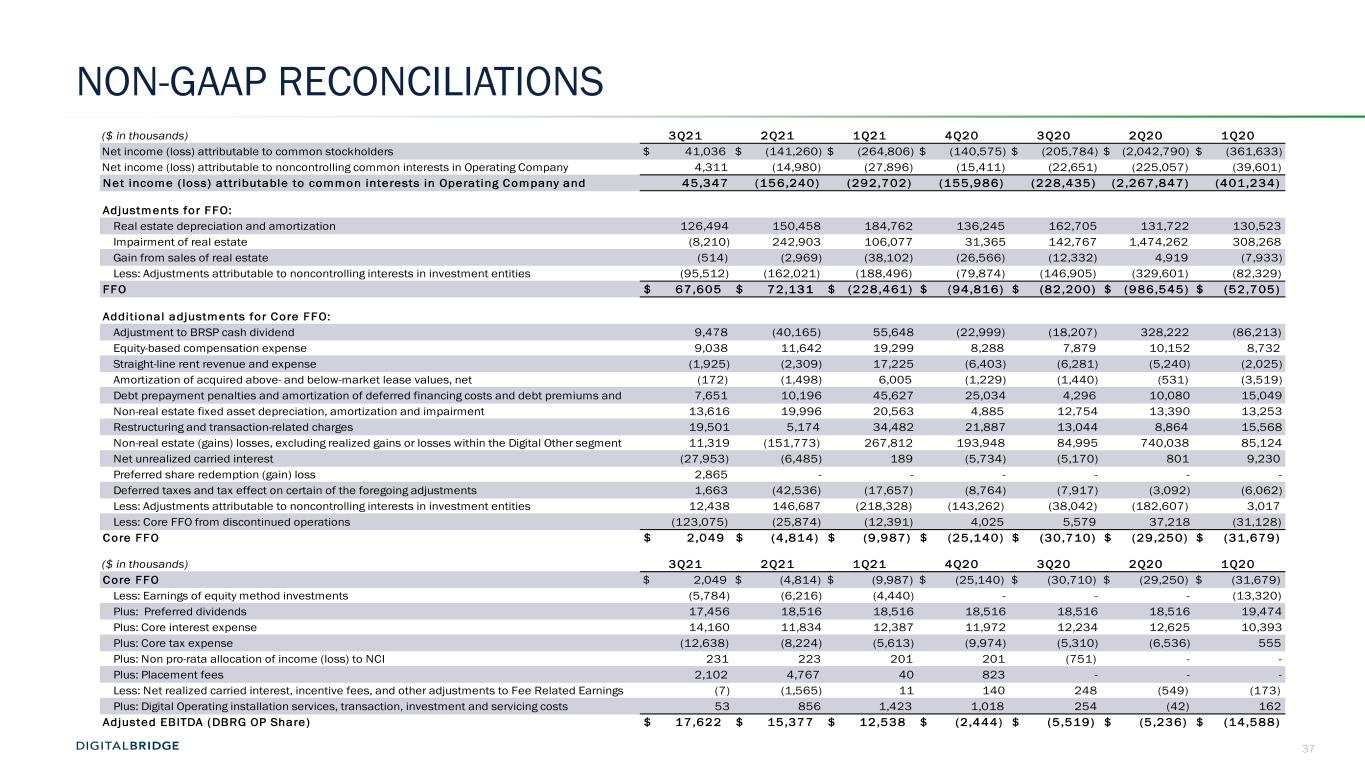

36 NON-GAAP RECONCILIATIONS ($ in thousands) 3Q21 2Q21 1Q21 4Q20 3Q20 2Q20 1Q20 Digi tal IM net income ( loss ) $ 39,272 $ 15,786 $ 7,663 $ 2,702 $ 3,539 $ 2,424 $ 2,529 Adjustments: Interest income 2,250 - (1) (1) (2) - (30) Investment and servicing expense - - 32 204 - - - Depreciation and amortization 8,242 6,298 8,912 6,421 10,259 6,605 6,603 Compensation expense—equity-based 4,673 1,837 1,533 655 189 682 589 Compensation expense—carried interest and incentive 31,736 8,266 (33) 994 912 - Administrative expenses—straight-line rent 74 50 (2) (1) 14 16 16 Administrative expenses—placement agent fee 3,069 6,959 59 1,202 - - - Incentive/performance fee income (1,313) (4,489) - - - - - Equity method (earnings) losses (59,196) (11,203) 195 (6,744) (6,134) (277) (3) Other (gain) loss, net (461) (119) (165) (102) (32) 8 (47) Income tax (benefit) expense 3,089 2,236 7 (757) 144 (151) 393 Digi tal IM FRE / Adjus ted EBITDA $ 31,435 $ 25,621 $ 18,200 $ 4,573 $ 8,889 $ 9,307 $ 10,050 DBRG OP share of Digi tal IM FRE / Adjus ted EBITDA $ 20,736 $ 17,449 $ 11,645 $ 2,051 $ 6,306 $ 9,307 $ 10,050 3Q21 2Q21 1Q21 4Q20 3Q20 2Q20 1Q20 Digi tal Operat ing n et income ( loss ) f rom con t inu ing operat ions (71,822) (10,850) (64,260) (53,591) (38,795) (21,262) (18,415) Adjustments: Interest expense 29,839 29,272 31,133 41,815 18,589 8,170 9,402 Income tax (benefit) expense 1,922 (66,788) (12,268) (6,967) (6,091) (2,673) (5,730) Depreciation and amortization 120,458 126,227 122,220 78,554 73,032 28,571 30,031 EBITDAre: $ 80,397 $ 77,861 $ 76,825 $ 59,811 $ 46,735 $ 12,806 $ 15,288 Straight-line rent expenses and amortization of above- and below-market lease intangibles 482 (98) (399) (2,607) (2,106) 1,837 (338) Compensation expense—equity-based 308 308 308 728 148 296 - Installation services (4,058) 576 880 429 (65) 493 289 Transaction, restructuring & integration costs 4,042 2,999 4,670 1,155 420 1,021 748 Other gain/loss, net (285) 349 - 200 46 - - D igi tal Operat ing Adjus ted EBITDA $ 80,886 $ 81,995 $ 82,284 $ 59,716 $ 45,178 $ 16,453 $ 15,987 DBRG OP share of Digi tal Operat ing Adjus ted EBITDA $ 13,637 $ 13,776 $ 13,948 $ 9,620 $ 6,914 $ 3,294 $ 3,200

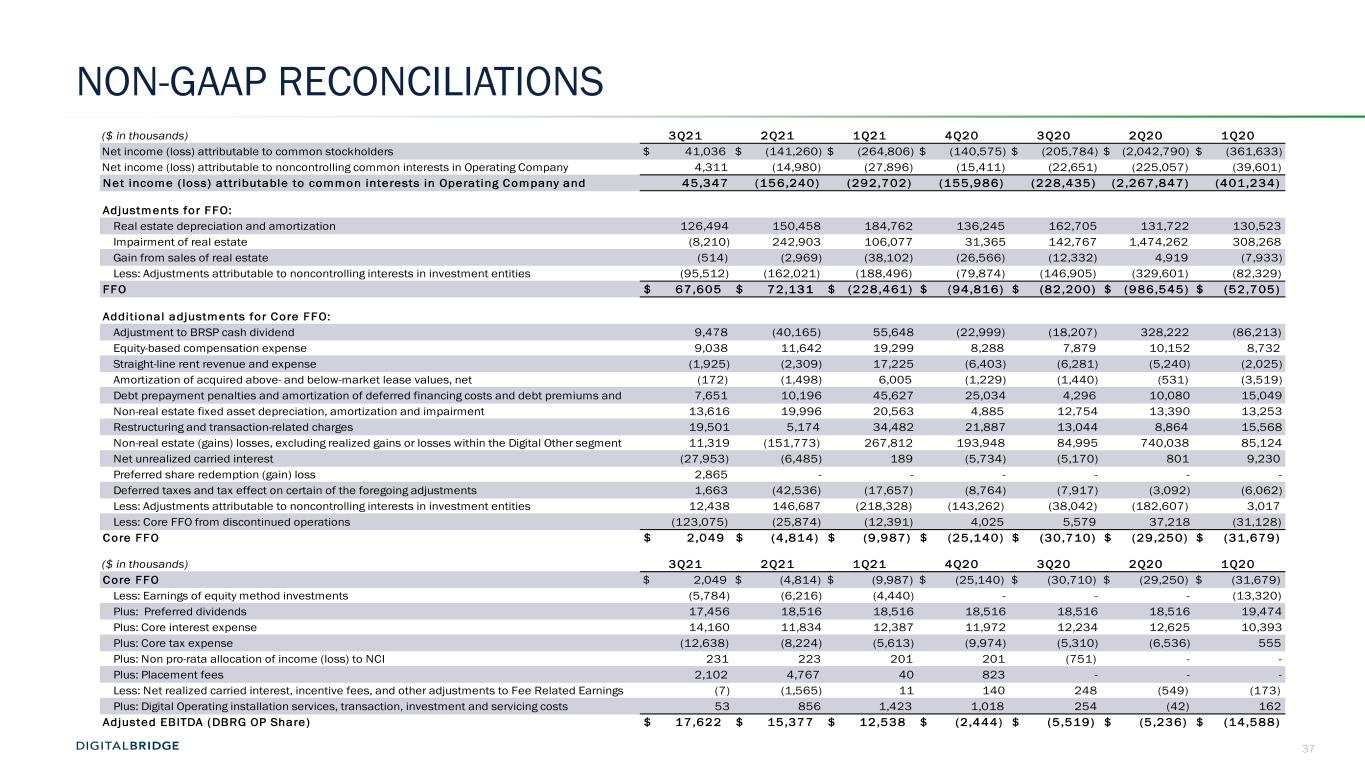

37 NON-GAAP RECONCILIATIONS ($ in thousands) 3Q21 2Q21 1Q21 4Q20 3Q20 2Q20 1Q20 Net income (loss) attributable to common stockholders $ 41,036 $ (141,260) $ (264,806) $ (140,575) $ (205,784) $ (2,042,790) $ (361,633) Net income (loss) attributable to noncontrolling common interests in Operating Company 4,311 (14,980) (27,896) (15,411) (22,651) (225,057) (39,601) Net income ( loss) attributable to common interests in Operating Company and 45,347 (156,240) (292,702) (155,986) (228,435) (2 ,267,847) (401,234) Adjustments for FFO: Real estate depreciation and amortization 126,494 150,458 184,762 136,245 162,705 131,722 130,523 Impairment of real estate (8,210) 242,903 106,077 31,365 142,767 1,474,262 308,268 Gain from sales of real estate (514) (2,969) (38,102) (26,566) (12,332) 4,919 (7,933) Less: Adjustments attributable to noncontrolling interests in investment entities (95,512) (162,021) (188,496) (79,874) (146,905) (329,601) (82,329) FFO $ 67,605 $ 72,131 $ (228,461) $ (94,816) $ (82,200) $ (986,545) $ (52,705) Additional adjustments for Core FFO: Adjustment to BRSP cash dividend 9,478 (40,165) 55,648 (22,999) (18,207) 328,222 (86,213) Equity-based compensation expense 9,038 11,642 19,299 8,288 7,879 10,152 8,732 Straight-line rent revenue and expense (1,925) (2,309) 17,225 (6,403) (6,281) (5,240) (2,025) Amortization of acquired above- and below-market lease values, net (172) (1,498) 6,005 (1,229) (1,440) (531) (3,519) Debt prepayment penalties and amortization of deferred financing costs and debt premiums and 7,651 10,196 45,627 25,034 4,296 10,080 15,049 Non-real estate fixed asset depreciation, amortization and impairment 13,616 19,996 20,563 4,885 12,754 13,390 13,253 Restructuring and transaction-related charges 19,501 5,174 34,482 21,887 13,044 8,864 15,568 Non-real estate (gains) losses, excluding realized gains or losses within the Digital Other segment 11,319 (151,773) 267,812 193,948 84,995 740,038 85,124 Net unrealized carried interest (27,953) (6,485) 189 (5,734) (5,170) 801 9,230 Preferred share redemption (gain) loss 2,865 - - - - - - Deferred taxes and tax effect on certain of the foregoing adjustments 1,663 (42,536) (17,657) (8,764) (7,917) (3,092) (6,062) Less: Adjustments attributable to noncontrolling interests in investment entities 12,438 146,687 (218,328) (143,262) (38,042) (182,607) 3,017 Less: Core FFO from discontinued operations (123,075) (25,874) (12,391) 4,025 5,579 37,218 (31,128) Core FFO $ 2 ,049 $ (4 ,814) $ (9 ,987) $ (25,140) $ (30,710) $ (29,250) $ (31,679) ($ in thousands) 3Q21 2Q21 1Q21 4Q20 3Q20 2Q20 1Q20 Core FFO $ 2,049 $ (4,814) $ (9,987) $ (25,140) $ (30,710) $ (29,250) $ (31,679) Less: Earnings of equity method investments (5,784) (6,216) (4,440) - - - (13,320) Plus: Preferred dividends 17,456 18,516 18,516 18,516 18,516 18,516 19,474 Plus: Core interest expense 14,160 11,834 12,387 11,972 12,234 12,625 10,393 Plus: Core tax expense (12,638) (8,224) (5,613) (9,974) (5,310) (6,536) 555 Plus: Non pro-rata allocation of income (loss) to NCI 231 223 201 201 (751) - - Plus: Placement fees 2,102 4,767 40 823 - - - Less: Net realized carried interest, incentive fees, and other adjustments to Fee Related Earnings (7) (1,565) 11 140 248 (549) (173) Plus: Digital Operating installation services, transaction, investment and servicing costs 53 856 1,423 1,018 254 (42) 162 Adjusted EBITDA (DBRG OP Share) $ 17,622 $ 15,377 $ 12,538 $ (2 ,444) $ (5 ,519) $ (5 ,236) $ (14,588)

38 DISCLAIMER This presentation may contain forward-looking statements within the meaning of the federal securities laws, including statements related to our digital transformation. Forward-looking statements relate to expectations, beliefs, projections, future plans and strategies, anticipated events or trends and similar expressions concerning matters that are not historical facts. In some cases, you can identify forward-looking statements by the use of forward-looking terminology such as “may,” “will,” “should,” “expects,” “intends,” “plans,” “anticipates,” “believes,” “estimates,” “predicts,” or “potential” or the negative of these words and phrases or similar words or phrases which are predictions of or indicate future events or trends and which do not relate solely to historical matters. You can also identify forward-looking statements by discussions of strategy, plans or intentions. Forward-looking statements involve known and unknown risks, uncertainties, assumptions and contingencies, many of which are beyond the Company’s control, and may cause the Company’s actual results to differ significantly from those expressed in any forward-looking statement. Factors that might cause such a difference include, without limitation, the duration and severity of the current novel coronavirus (COVID-19) pandemic, and its impact on the global market, economic and environmental conditions generally and in the digital and communications technology, wellness infrastructure and hospitality real estate, other commercial real estate equity and debt, and investment management sectors; the effect of COVID-19 on the Company's operating cash flows, debt service obligations and covenants, liquidity position and valuations of its real estate investments; whether we will successfully execute our strategic transformation to become a digital infrastructure and real estate focused company within the timeframe contemplated or at all, and the impact of such transformation on the Company's legacy portfolios and assets, including whether such transformation will be consistent with the Company’s REIT status; our ability to obtain and maintain financing arrangements, including securitizations, on favorable or comparable terms or at all; the Company's ability to complete anticipated monetizations of non-core assets within the timeframe and on the terms contemplated, if at all; the impact of the completion of the sale of the Company's hospitality portfolios and whether we will realize the anticipated benefits of our exit from our hospitality business; the impact of completed or anticipated initiatives related to our digital transformation, including the strategic investment by Wafra and the formation of certain other investment management platforms, on our company's growth and earnings profile; whether we will realize any of the anticipated benefits of our strategic partnership with Wafra, including whether Wafra will make additional investments in our Digital Other and Digital Operating segments; our ability to integrate and maintain consistent standards and controls, including our ability to manage our acquisitions in the digital industry effectively; the ability to realize anticipated strategic and financial benefits from terminating the management agreement with Brightspire Capital, Inc. (NYSE:BRSP; formerly, Colony Credit Real Estate, Inc. or CLNC); the impact to our business operations and financial condition of realized or anticipated compensation and administrative savings through cost reduction programs; our ability to redeploy any proceeds received from the sale of our non-digital or other legacy assets within the timeframe and manner contemplated or at all; our business and investment strategy, including the ability of the businesses in which we have a significant investment (such as BRSP) to execute their business strategies; BRSP's trading price and its impact on the carrying value of the Company's investment in BRSP; performance of our investments relative to our expectations and the impact on our actual return on invested equity; our ability to grow our business by raising capital for the companies that we manage; our ability to deploy capital into new investments consistent with our digital business strategies, including the earnings profile of such new investments; the impact of adverse conditions affecting a specific asset class in which we have investments; the availability of, and competition for, attractive investment opportunities; our ability to achieve any of the anticipated benefits of certain joint ventures, including any ability for such ventures to create and/or distribute new investment products; our ability to satisfy and manage our capital requirements; our expected hold period for our assets and the impact of any changes in our expectations on the carrying value of such assets; the general volatility of the securities markets in which we participate; stability of the capital structure of our wellness infrastructure portfolio and remaining hospitality portfolio; changes in interest rates and the market value of our assets; interest rate mismatches between our assets and any borrowings used to fund such assets; effects of hedging instruments on our assets; the impact of economic conditions on third parties on which we rely; any litigation and contractual claims against us and our affiliates, including potential settlement and litigation of such claims; our levels of leverage; adverse domestic or international economic conditions, including those resulting from the COVID-19 pandemic, and the impact on the commercial real estate or real-estate related sectors; the impact of legislative, regulatory and competitive changes; actions, initiatives and policies of the U.S. and non-U.S. governments and changes to U.S. or non-U.S. government policies and the execution and impact of these actions, initiatives and policies; whether we will maintain our qualification as a real estate investment trust for U.S. federal income tax purposes and our ability to do so; our ability to maintain our exemption from registration as an investment company under the Investment Company Act of 1940, as amended; changes in our board of directors or management team, and availability of qualified personnel; our ability to make or maintain distributions to our stockholders; our understanding of our competition, and other risks and uncertainties, including those detailed in the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2020 and Quarterly Report on Form 10-Q for the quarter ended June 30, 2021, each under the heading “Risk Factors,” as such factors may be updated from time to time in the Company’s subsequent periodic filings with the U.S. Securities and Exchange Commission (“SEC”). All forward-looking statements reflect the Company’s good faith beliefs, assumptions and expectations, but they are not guarantees of future performance. Additional information about these and other factors can be found in the Company’s reports filed from time to time with the SEC. The Company cautions investors not to unduly rely on any forward-looking statements. The forward-looking statements speak only as of the date of this press release. The Company is under no duty to update any of these forward-looking statements after the date of this press release, nor to conform prior statements to actual results or revised expectations, and the Company does not intend to do so. This presentation may contain statistics and other data that has been obtained or compiled from information made available by third-party service providers. The Company has not independently verified such statistics or data. This presentation is for informational purposes only and does not constitute an offer to sell or a solicitation of an offer to buy any securities of the Company. This information is not intended to be indicative of future results. Actual performance of the Company may vary materially.

39 IMPORTANT NOTE REGARDING NON-GAAP FINANCIAL MEASURES This presentation includes certain “non-GAAP” supplemental measures that are not defined by generally accepted accounting principles, or GAAP, including the financial metrics defined below, of which the calculations may from methodologies utilized by other REITs for similar performance measurements, and accordingly, may not be comparable to those of other REITs. FFO: The Company calculates funds from operations (FFO) in accordance with standards established by the Board of Governors of the National Association of Real Estate Investment Trusts, which defines FFO as net income or loss calculated in accordance with GAAP, excluding (i) extraordinary items, as defined by GAAP; (ii) gains and losses from sales of depreciable real estate; (iii) impairment write-downs associated with depreciable real estate; (iv) gains and losses from a change in control in connection with interests in depreciable real estate or in-substance real estate, plus (v) real estate-related depreciation and amortization; and (vi) including similar adjustments for equity method investments. Included in FFO are gains and losses from sales of assets which are not depreciable real estate such as loans receivable, equity method investments, as well as equity and debt securities, as applicable. Core FFO: The Company computes core funds from operations (Core FFO) by adjusting FFO for the following items, including the Company’s share of these items recognized by its unconsolidated partnerships and joint ventures: (i) equity-based compensation expense; (ii) effects of straight-line rent revenue and expense; (iii) amortization of acquired above- and below-market lease values; (iv) debt prepayment penalties and amortization of deferred financing costs and debt premiums and discounts; (v) non-real estate depreciation, amortization and impairment; (vi) restructuring and transaction-related charges; (vii) non-real estate loss (gain), fair value loss (gain) on interest rate and foreign currency hedges, and foreign currency remeasurements except realized gain and loss from the Digital Other segment; (viii) net unrealized carried interest; and (ix) the tax effect on certain of the foregoing adjustments. The Company’s Core FFO from its interest in BrightSpire Capital, Inc. (NYSE: BRSP) represented the cash dividends declared in the reported period. The Company excluded results from discontinued operations in its calculation of Core FFO and applied this exclusion to prior periods. Beginning with the first quarter 2021, the Company revised the computation of Core FFO and applied this revised computation methodology to prior periods presented. FFO and Core FFO should not be considered alternatives to GAAP net income as indications of operating performance, or to cash flows from operating activities as measures of liquidity, nor as indications of the availability of funds for our cash needs, including funds available to make distributions. FFO and Core FFO should not be used as supplements to or substitutes for cash flow from operating activities computed in accordance with GAAP. The Company uses FFO and Core FFO as supplemental performance measures because, in excluding real estate depreciation and amortization and gains and losses, it provides a performance measure that captures trends in occupancy rates, rental rates, and operating costs, and such a measure is useful to investors as it excludes periodic gains and losses from sales of investments that are not representative of its ongoing operations. The Company also believes that, as widely recognized measures of the performance of REITs, FFO and Core FFO will be used by investors as a basis to compare its operating performance with that of other REITs. However, because FFO and Core FFO exclude depreciation and amortization and capture neither the changes in the value of the Company’s properties that resulted from use or market conditions nor the level of capital expenditures and leasing commissions necessary to maintain the operating performance of its properties, all of which have real economic effect and could materially impact the Company’s results from operations, the utility of FFO and Core FFO as measures of the Company’s performance is limited. FFO and Core FFO should be considered only as supplements to GAAP net income as a measure of the Company’s performance. Additionally, Core FFO excludes the impact of certain fair value fluctuations, which, if they were to be realized, could have a material impact on the Company’s operating performance DigitalBridge Operating Company, LLC (DBRG OP): DBRG OP is the operating partnership through which the Company conducts all of its activities and holds substantially all of its assets and liabilities. The Company is the sole managing member of, and directly owns approximately 90% of the common units in, DBRG OP. The remaining common units in DBRG OP are held primarily by current and former employees of the Company. Each common unit is redeemable at the election of the holder for cash equal to the then fair value of one share of the Company’s Class A common stock or, at the Company’s option, one share of the Company’s Class A common stock. DBRG OP share excludes noncontrolling interests in investment entities. Throughout this presentation, consolidated figures represent the interest of both the Company (and its subsidiary, the “DBRG OP”) and noncontrolling interests. Figures labeled as DBRG OP share represent the Company’s pro-rata share. Adjusted Earnings before Interest, Taxes, Depreciation and Amortization (Adjusted EBITDA): The Company calculates Adjusted EBITDA by adjusting Core FFO to exclude cash interest expense, preferred dividends, tax expense or benefit, earnings from equity method investments, placement fees, realized carried interest and incentive fees and revenues and corresponding costs related to installation services. The Company uses Adjusted EBITDA as a supplemental measure of our performance because they eliminate depreciation, amortization, and the impact of the capital structure from its operating results. However, because Adjusted EBITDA is calculated before recurring cash charges including interest expense and taxes and are not adjusted for capital expenditures or other recurring cash requirements, their utilization as a cash flow measurement is limited. Digital Operating Earnings before Interest, Taxes, Depreciation and Amortization for Real Estate (EBITDAre) and Adjusted EBITDA: The Company calculates EBITDAre in accordance with the standards established by the National Association of Real Estate Investment Trusts, which defines EBITDAre as net income or loss calculated in accordance with GAAP, excluding interest, taxes, depreciation and amortization, gains or losses from the sale of depreciated property, and impairment of depreciated property. The Company calculates Adjusted EBITDA by adjusting EBITDAre for the effects of straight-line rental income/expense adjustments and amortization of acquired above- and below-market lease adjustments to rental income, revenues and corresponding costs related to the delivery of installation services, equity-based compensation expense, restructuring and transaction related costs, the impact of other impairment charges, gains or losses from sales of undepreciated land, gains or losses from foreign currency remeasurements, and gains or losses on early extinguishment of debt and hedging instruments. The Company uses EBITDAre and Adjusted EBITDA as supplemental measures of our performance because they eliminate depreciation, amortization, and the impact of the capital structure from its operating results. EBITDAre represents a widely known supplemental measure of performance, EBITDA, but for real estate entities, which we believe is particularly helpful for generalist investors in REITs. EBITDAre depicts the operating performance of a real estate business independent of its capital structure, leverage and noncash items, which allows for comparability across real estate entities with different capital structure, tax rates and depreciation or amortization policies. Additionally, exclusion of gains on disposition and impairment of depreciated real estate, similar to FFO, also provides a reflection of ongoing operating performance and allows for period-over-period comparability. However, because EBITDAre and Adjusted EBITDA are calculated before recurring cash charges including interest expense and taxes and are not adjusted for capital expenditures or other recurring cash requirements, their utilization as a cash flow measurement is limited. Digital Investment Management Fee Related Earnings (“FRE”) / Adjusted EBITDA: The Company calculates FRE / Adjusted EBITDA for its investment management business within the digital segment as base management fees, other service fee income, and other income inclusive of cost reimbursements, less compensation expense (excluding equity-based compensation), administrative expenses (excluding fund raising placement agent fee expenses), and other operating expenses related to the investment management business. The Company uses FRE as a supplemental performance measure as it may provide additional insight into the profitability of the overall digital investment management business. FRE / Adjusted FRE is presented prior to the deduction for Wafra's 31.5% interest. Assets Under Management (AUM): Assets owned by the Company’s balance sheet and assets for which the Company and its affiliates provide investment management services, including assets for which the Company may or may not charge management fees and/or performance allocations. Balance sheet AUM is based on the undepreciated carrying value of digital investments and the impaired carrying value of non digital investments as of the reporting date. Investment management AUM is based on the cost basis of managed investments as reported by each underlying vehicle as of the reporting date. AUM further includes uncalled capital commitments, but excludes DBRG OP’s share of non wholly-owned real estate investment management platform’s AUM. The Company's calculations of AUM may differ from the calculations of other asset managers, and as a result, this measure may not be comparable to similar measures presented by other asset managers. Fee-Earning Equity Under Management (FEEUM): Equity for which the Company provides investment management services and derives management fees and/or performance allocations. FEEUM generally represents the basis used to derive fees, which may be based on invested equity, stockholders’ equity, or fair value pursuant to the terms of each underlying investment management agreement. The Company's calculations of FEEUM may differ materially from the calculations of other asset managers, and as a result, this measure may not be comparable to similar measures presented by other asset managers. Monthly Recurring Revenue (“MRR”): The Company defines MRR as revenue from ongoing services that is generally fixed in price and contracted for longer than 30 days. This presentation includes forward-looking guidance for certain non-GAAP financial measures, of guidance for Adjusted EBITDA or FRE to the most directly comparable GAAP measure because the Company is not able to predict with reasonable certainty the amount or nature of all items that including Adjusted EBITDA and FRE. These measures will differ from net income, determined in accordance with GAAP, in ways similar to those described in the reconciliations at the end of this presentation. We do not provide guidance for net income, determined in accordance with GAAP, or a reconciliation will be included in net income.

40