2 CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING STATEMENTS This presentation may contain forward-looking statements within the meaning of the federal securities laws, including statements relating to (i) our strategy, outlook and growth prospects and, (ii) our operational and financial targets. Forward-looking statements relate to expectations, beliefs, projections, future plans and strategies, anticipated events or trends and similar expressions concerning matters that are not historical facts. In some cases, you can identify forward-looking statements by the use of forward-looking terminology such as “may,” “will,” “should,” “expects,” “intends,” “plans,” “anticipates,” “believes,” “estimates,” “predicts,” or “potential” or the negative of these words and phrases or similar words or phrases which are predictions of or indicate future events or trends and which do not relate solely to historical matters. You can also identify forward-looking statements by discussions of strategy, plans or intentions. Forward-looking statements involve known and unknown risks, uncertainties, assumptions and contingencies, many of which are beyond the Company’s control, and may cause the Company’s actual results to differ significantly from those expressed in any forward-looking statement. Factors that might cause such a difference include, without limitation, whether the Company’s transactions with AMP Capital and Wafra described herein will be completed within the time frame and on the terms anticipated or at all, whether the Company will realize any of the anticipated benefits from the transactions with AMP Capital and Wafra, whether the Digital IM business will continue to grow at the rate anticipated, whether the Company will be able to utilize certain tax attributes to offset future income and gains as contemplated, the duration and severity of the current novel coronavirus (COVID-19) pandemic, the impact of the COVID-19 pandemic on the global market, economic and environmental conditions generally and in the digital and communications technology and investment management sectors; the effect of COVID-19 on the Company's operating cash flows, debt service obligations and covenants, liquidity position and valuations of its real estate investments, as well as the increased risk of claims, litigation and regulatory proceedings and uncertainty that may adversely affect the Company; our status as an owner, operator and investment manager of digital infrastructure and real estate and our ability to manage any related conflicts of interest; our ability to obtain and maintain financing arrangements, including securitizations, on favorable or comparable terms or at all; the impact of initiatives related to our digital transformation, including formation of certain investment management platforms, on our growth and earnings profile; whether we will realize any of the anticipated benefits of our strategic partnership with Wafra, including whether Wafra will make additional investments in our Digital IM and Digital Operating segments; our ability to integrate and maintain consistent standards and controls, including our ability to manage our acquisitions in the digital industry effectively; whether we will be able to effectively deploy the capital we have committed to capital expenditures and greenfield investments; the impact to our business operations and financial condition of realized or anticipated compensation and administrative savings through cost reduction programs; our ability to redeploy the proceeds received from the sale of our non-digital legacy assets within the timeframe and manner contemplated or at all; our business and investment strategy, including the ability of the businesses in which we have a significant investment (such as Brightspire Capital, Inc. (NYSE:BRSP)) to execute their business strategies; the trading price of BRSP shares and its impact on the carrying value of the Company's investment in BRSP, including whether the Company will recognize further other-than-temporary impairment on its investment in BRSP; performance of our investments relative to our expectations and the impact on our actual return on invested equity, as well as the cash provided by these investments and available for distribution; our ability to grow our business by raising capital for the companies that we manage; our ability to deploy capital into new investments consistent with our digital business strategies, including the earnings profile of such new investments; the availability of, and competition for, attractive investment opportunities; our ability to achieve any of the anticipated benefits of certain joint ventures, including any ability for such ventures to create and/or distribute new investment products; our ability to satisfy and manage our capital requirements; our expected hold period for our assets and the impact of any changes in our expectations on the carrying value of such assets; the general volatility of the securities markets in which we participate; changes in interest rates and the market value of our assets; interest rate mismatches between our assets and any borrowings used to fund such assets; effects of hedging instruments on our assets; the impact of economic conditions on third parties on which we rely; any litigation and contractual claims against us and our affiliates, including potential settlement and litigation of such claims; our levels of leverage; adverse domestic or international economic conditions, including those resulting from the impact of legislative, regulatory and competitive changes; our ability to maintain our exemption from registration as an investment company under the Investment Company Act of 1940, as amended; changes in our board of directors or management team, and availability of qualified personnel; our ability to make or maintain distributions to our stockholders; our understanding of our competition; and other risks and uncertainties, including those detailed in the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2021 under the heading “Risk Factors,” as such factors may be updated from time to time in the Company’s subsequent periodic filings with the U.S. Securities and Exchange Commission (“SEC”). All forward-looking statements reflect the Company’s good faith beliefs, assumptions and expectations, but they are not guarantees of future performance. Additional information about these and other factors can be found in the Company’s reports filed from time to time with the SEC. The Company cautions investors not to unduly rely on any forward-looking statements. The forward-looking statements speak only as of the date of this press release. The Company is under no duty to update any of these forward-looking statements after the date of this presentation, nor to conform prior statements to actual results or revised expectations, and the Company does not intend to do so. The transaction with AMP Capital described herein is anticipated to close in 2022 and is subject to regulatory clearance and customary closing conditions. We can provide no assurance that it will close on the timing anticipated or at all. This presentation is for informational purposes only and does not constitute an offer to sell or a solicitation of an offer to buy any securities of the Company. This information is not intended to be indicative of future results. Actual performance of the Company may vary materially. The appendix hereto contains important information relating to non-GAAP financial measures that is material to an understanding of this presentation, and you should read this presentation only with and in context of the appendix.

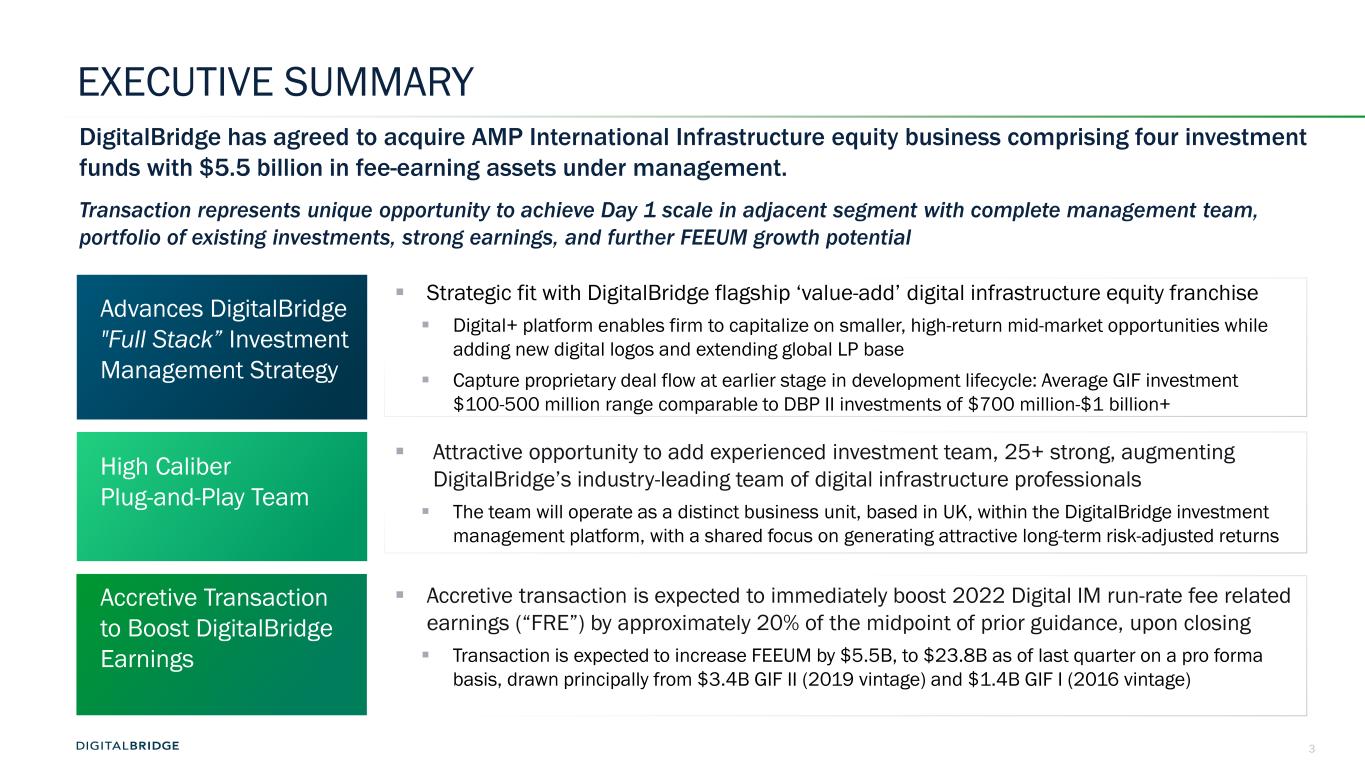

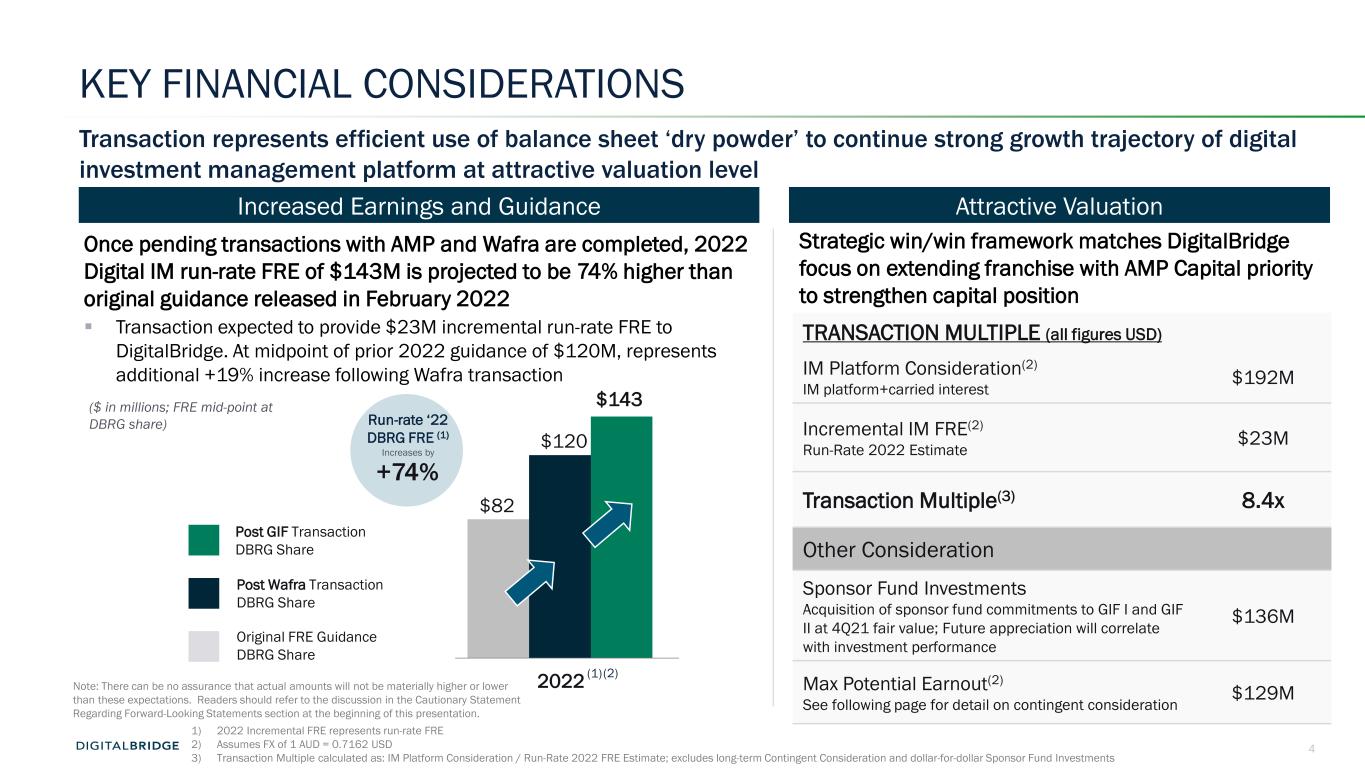

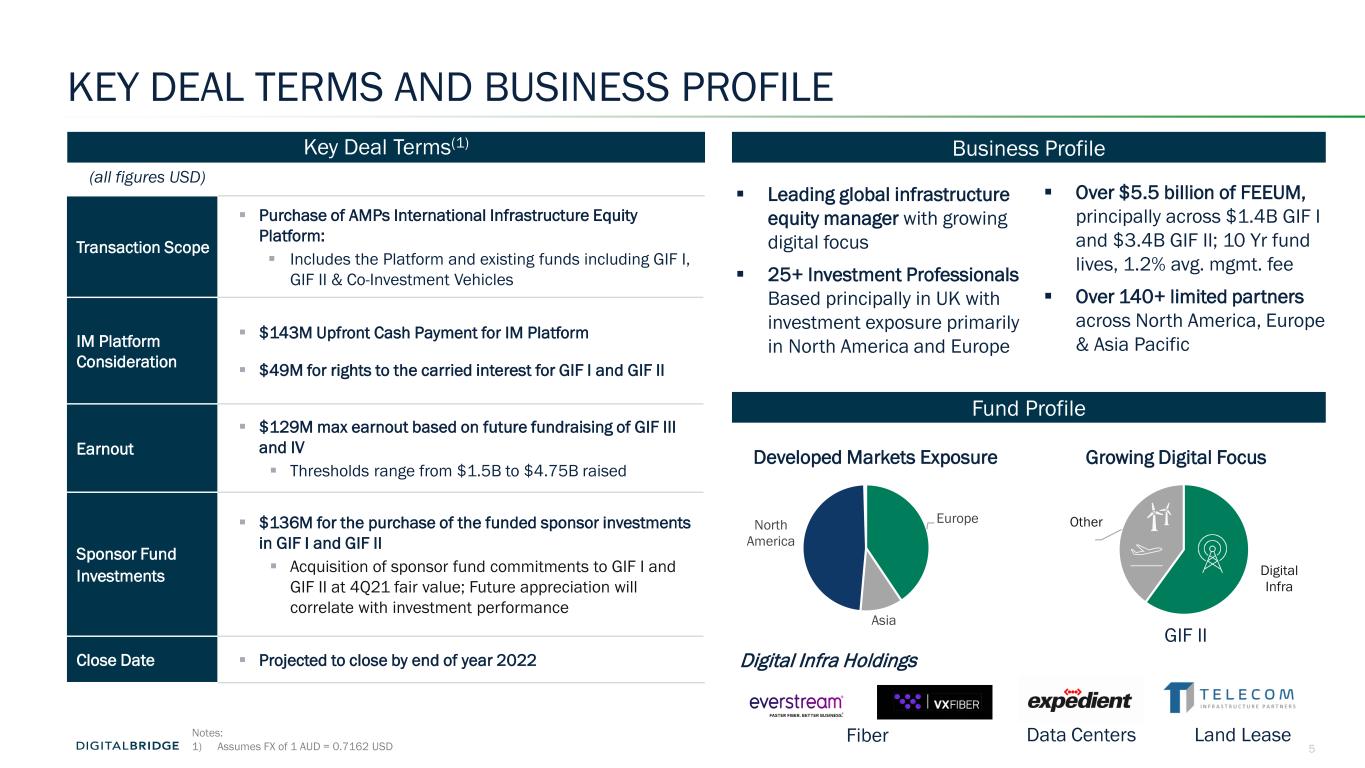

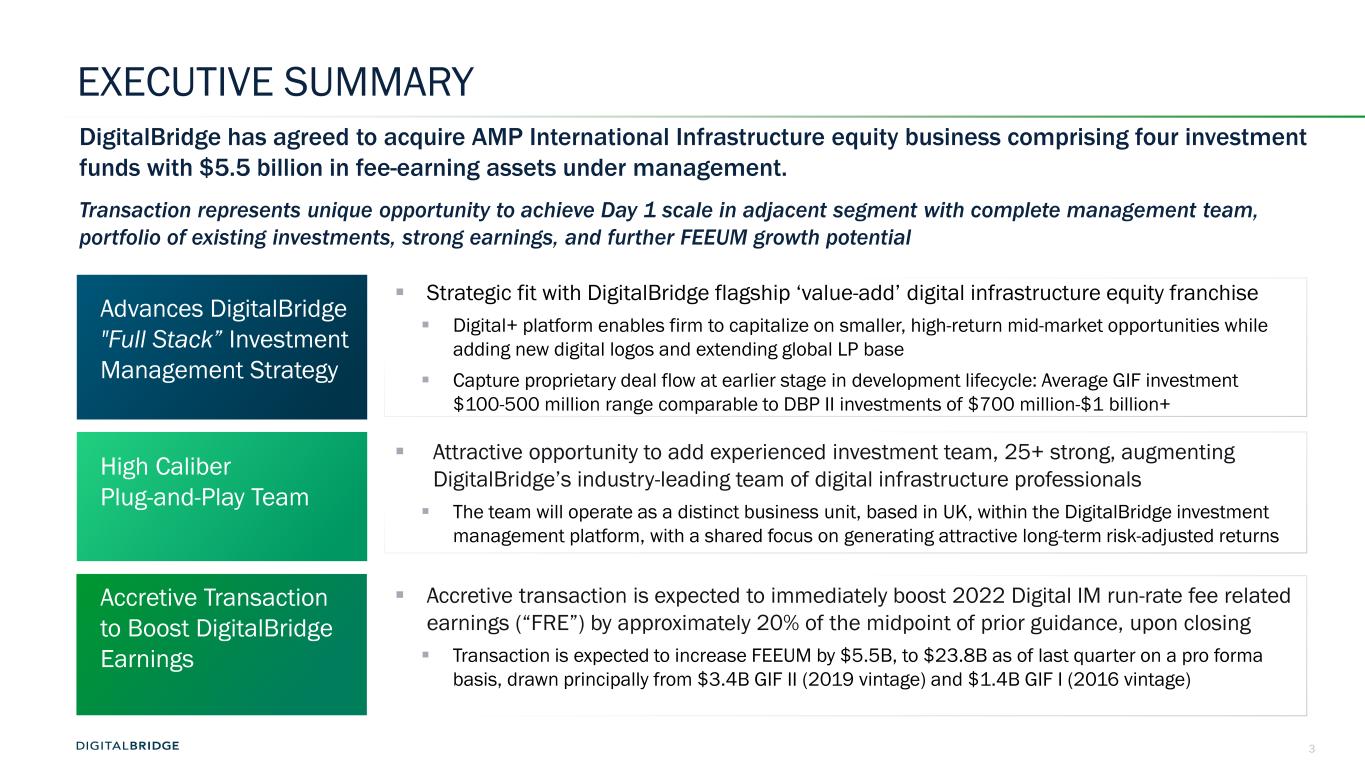

3 EXECUTIVE SUMMARY Strategic fit with DigitalBridge flagship ‘value-add’ digital infrastructure equity franchise Digital+ platform enables firm to capitalize on smaller, high-return mid-market opportunities while adding new digital logos and extending global LP base Capture proprietary deal flow at earlier stage in development lifecycle: Average GIF investment $100-500 million range comparable to DBP II investments of $700 million-$1 billion+ Advances DigitalBridge "Full Stack” Investment Management Strategy Accretive Transaction to Boost DigitalBridge Earnings High Caliber Plug-and-Play Team Accretive transaction is expected to immediately boost 2022 Digital IM run-rate fee related earnings (“FRE”) by approximately 20% of the midpoint of prior guidance, upon closing Transaction is expected to increase FEEUM by $5.5B, to $23.8B as of last quarter on a pro forma basis, drawn principally from $3.4B GIF II (2019 vintage) and $1.4B GIF I (2016 vintage) Attractive opportunity to add experienced investment team, 25+ strong, augmenting DigitalBridge’s industry-leading team of digital infrastructure professionals The team will operate as a distinct business unit, based in UK, within the DigitalBridge investment management platform, with a shared focus on generating attractive long-term risk-adjusted returns DigitalBridge has agreed to acquire AMP International Infrastructure equity business comprising four investment funds with $5.5 billion in fee-earning assets under management. Transaction represents unique opportunity to achieve Day 1 scale in adjacent segment with complete management team, portfolio of existing investments, strong earnings, and further FEEUM growth potential

6 IMPORTANT NOTE REGARDING NON-GAAP FINANCIAL MEASURES This presentation includes certain “non-GAAP” supplemental measures that are not defined by generally accepted accounting principles, or GAAP, including the financial metrics defined below, of which the calculations may differ from methodologies utilized by other companies for similar performance measurements, and accordingly, may not be comparable to those of other companies. Digital Investment Management Fee Related Earnings (FRE): The Company calculates FRE for its investment management business within the digital segment as base management fees, other service fee income, and other income inclusive of cost reimbursements, less compensation expense excluding equity-based compensation, carried interest and incentive compensation, administrative expenses (excluding fund raising placement agent fee expenses), and other operating expenses related to the investment management business. The Company uses FRE as a supplemental performance measure as it may provide additional insight into the profitability of the overall digital investment management business. This presentation includes forward-looking guidance for certain non-GAAP financial measures, including FRE. These measures will differ from net income, determined in accordance with GAAP, in ways similar to those described in reconciliations of historical FRE to net income previously reported by the Company. We do not provide guidance for net income, determined in accordance with GAAP, or a reconciliation of guidance for FRE to the most directly comparable GAAP measure because the Company is not able to predict with reasonable certainty the amount or nature of all items that will be included in net income.