| Name of Partner | Category of Partner | Capital Contributions (RMB 10,000 Yuan) | Capital Proportion (%) |

| Shanghai Shangguo Investment Asset Management Co., Ltd. | Limited Partner | 1,400 | 60.26 |

| Shanghai Jiushen Equity Investment Fund Partnership Enterprise (L.P.) | Limited Partner | 800 | 34.43 |

| FAN LIU | Limited Partner | 100 | 4.30 |

| Shanghai Jiuyou Chuangu Investment Management Co., Ltd. | General Partner | 23.23 | 1.00 |

| Total | | 2,323.23 | 100.00 |

(3) Basic Information of the General Partner

| Name | Shanghai Jiuyou Chuangu Investment Management Co., Ltd. |

| Domicile | Room 08, 5/F, No.2 Office Building, Lane 180, Zhangheng Road, China (Shanghai) Pilot Free Trade Zone |

Date of Establishment | January 16, 2013 |

Uniform Social Credit Code | 91310115060900342P |

Legal Representative | XIAOLONG LIU |

| Registered Capital | RMB 5 million Yuan |

| Business Scope | Industrial investment; investment management; investment consultancy; business consultancy, enterprise management consultancy (brokerage services are not included in the above consultancy services); asset management (For projects subject to any approval in accordance with laws, business activities may be carried out only after such approval of relevant authorities has been obtained) |

12. Runguang Investment

(1) Basic Information

| Name | Hefei Runguang Equity Investment Partnership (L.P.) |

| Domicile | Room 560, Fund Tower, Building E1, Innovation Industrial Park Phase II, No.2800 Innovation Avenue, High-tech Zone, Hefei City |

Uniform Social Credit Code | 91340100MA2TER55XC |

| Executive Partner | Huaxin Yuanchuang (Qingdao) Capital Management Co., Ltd. |

| Registered Capital | RMB 100 million Yuan |

| Type of Enterprise | Limited Partnership |

| Business Scope | Using self-owned funds to make equity investment; enterprise management consultancy services. (being prohibited from engaging in financial businesses such as deposit taking, financing guarantee, financial management for clients without the approval of financial regulators) (For projects subject to any approval in accordance with laws, business activities may be carried out only after such approval of relevant authorities has been obtained) |

| Business Term | From January 23, 2019 to January 22, 2026 |

(2) As of the signing date of the [***], the shareholding structure of Runguang Investment is as follows:

| Name of Partner | Category of Partner | Capital Contributions (RMB 10,000 Yuan) | Contribution Proportion (%) |

| Shenzhen Xiaoyezitan Investment Partnership (L.P.) | Limited Partner | 5,772 | 59.94 |

| Hefei Huadeng Integrated Circuit Industry Investment Fund Co., Ltd. | Limited Partner | 3,848 | 39.96 |

| Huaxin Yuanchuang (Qingdao) Capital Management Co., Ltd. | General Partner | 9.53 | 0.10 |

| Total | | 10,000 | 100.00 |

(3) Basic Information of the General Partner

| Name | Huaxin Yuanchuang (Qingdao) Capital Management Co., Ltd. |

| Domicile | Room 2004, No.658, Jinggangshan Road, Huangdao District, Qingdao City, Shandong Province |

Date of Establishment | September 20, 2016 |

Uniform Social Credit Code | 91370211MA3CH4UD45 |

Legal Representative | Hing Wong |

| Registered Capital | RMB 100 million Yuan |

| Business Scope | Entrusted to manage the investment business of investment enterprises; providing investment consultancy and investment management consultancy services; enterprise management consultancy. (The above services do not involve fund business; being prohibited from engaging in financial services such as deposit taking, financing guarantee, financial management for clients without the approval of financial regulators) (The above business scope does not include any project restricted, prohibited and ousted by state laws and regulations, and projects subject to approval according to law shall be approved by the relevant departments before carrying out business activities) (Projects subject to approval according to law shall be approved by the relevant departments before carrying out business activities) |

13. ZJTVC

(1) Basic Information

| Name | Shanghai Zhangjiang Science and Technology Venture Capital Co., Ltd. |

| Domicile | Room 209, Building 1 Complex, No.3000 Longdong Avenue, China (Shanghai) Pilot Free Trade Zone |

Uniform Social Credit Code | 913100007679066259 |

| Legal Representative | HONGLIANG YU |

| Registered Capital | RMB 1billion Yuan |

| Type of Enterprise | Limited Company |

| Business Scope | Venture capital investment; providing agency services for other venture capital investment enterprises and other institutions or individuals as to their venture capital investment, venture capital investment consultancy |

| | businesses; providing venture capital management service business for venture capital enterprises; participating in the set up of venture capital investment enterprises and venture capital management consultancy institutions. (For projects subject to any approval in accordance with laws, business activities may be carried out only after such approval of relevant authorities has been obtained) |

| Business Term | From October 9, 2004 to October 8, 2054 |

(2) As of the signing date of the [***], the shareholding structure of ZJTVC is as follows:

| Name of Shareholder | Capital Contributions (RMB 10,000 Yuan) | Percentage of Shareholding (%) |

| Zhangjiang Group | 100,000 | 100 |

| Total | 100,000 | 100 |

14. SYEM

(1) Basic Information

| Name | Shanghai Shanyi Enterprise Management Center (L.P.) |

| Domicile | Room 601-31, No.198 Wudong Road, Yangpu District, Shanghai |

Uniform Social Credit Code | 91310110MA1G92DE5Y |

| Executive Partner | SULAN LV |

Capital Contributions | RMB 15.17 million Yuan |

| Type of Enterprise | Limited Partnership |

| Business Scope | Enterprise management and consultancy; commercial information |

| | consultancy; financial consultancy. (For projects subject to any approval in accordance with laws, business activities may be carried out only after such approval of relevant authorities has been obtained) |

| Business Term | From September 19, 2019 to September 18, 2029 |

(2) As of the signing date of the [***], the shareholding structure of SYEM is as follows:

| Name of Partner | Category of Partner | Capital Contributions (RMB 10,000 Yuan) | Contribution Proportion (%) |

| SULAN LV | General Partner | 1,316.756 | 86.80 |

| JUN JIANG | Limited Partner | 100.122 | 6.60 |

| XU LU | Limited Partner | 100.122 | 6.60 |

| Total | - | 1,517.000 | 100.00 |

15. SRJY

(1) Basic Information

| Name | Shanghai Shangrong JuYuan Equity Investment Center (L.P.) |

| Domicile | Room 1206, 12/F, No.407-1 Yishan Road, Xuhui District, Shanghai |

Uniform Social Credit Code | 91310000MA1FL3X64K |

| Executive Partner | Beijing Shang Finance Corporation |

Capital Contributions | RMB 460 million Yuan |

| Type of Enterprise | Limited Partnership |

| Business Scope | Equity investment; industrial investment; investment management; asset management. (For projects subject to any approval in accordance with laws, business activities may be carried out only after such approval of relevant authorities has been obtained) |

| Business Term | From May 8, 2017 to May 7, 2027 |

(2) As of the signing date of the [***], the shareholding structure of SRJY is as follows:

| Name of Partner | Category of Partner | Capital Contributions (RMB 10,000 Yuan) | Contribution Proportion (%) |

| Gongqingcheng Shangrong Investment Management Partnership (L.P.) | Limited Partner | 45,100 | 98.04 |

| Beijing Shang Finance Corporation | General Partner | 450 | 0.98 |

| Ningbo Ronghui Investment Center (L.P.) | Limited Partner | 450 | 0.98 |

| Total | | 46,000 | 100.00 |

(3) Basic Information of the General Partner

Shangrong Innovation and SRJY share the same general partner, i.e. Beijing Shang Finance Corporation.

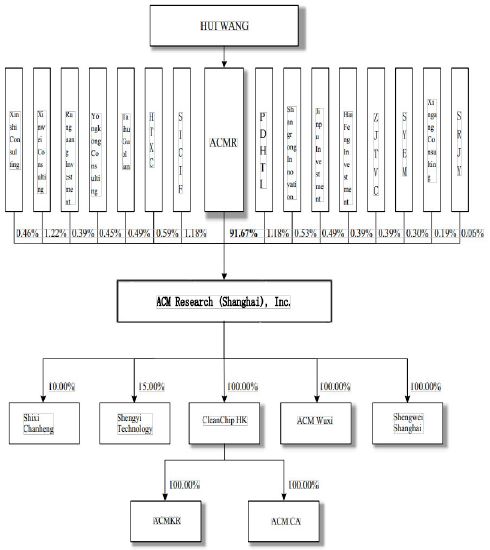

(VI) The Relationship between the Associated Shareholders and their Respective Shareholding Proportions before the Offering

Before the Offering, the association relationships between the shareholders are as follows:

| 1. | Xinshi Consulting and Xingang Consulting |

The managing partner of Xinshi Consulting and Xingang Consulting is Xindai Management Consulting (Shanghai) Co., Ltd. Xinshi Consulting and Xingang Consulting hold 0.46% and 0.19% of the Company’s shares respectively.

PDHTI holds 7.02% of SICIF’s shares. SICIF and PDHTI hold 1.18% of the Company’s shares respectively.

| | 3. | Shangrong Innovation and SRJY |

The managing partner of Shangrong Innovation and SRJY is Beijing Shang Finance Corporation. Shangrong Innovation and SRJY holds 0.53% and 0.06% of the Company’s shares respectively.

(VII) The Influence of Public Offering of Shares by the Shareholders of the Issuer on the Control, Governance Structure and Production and Operation of the Issuer

The Offering does not involve any public offering of shares by any shareholder of the Issuer.

VII. Brief Information of Directors, Supervisors, Senior Managers and Core Technicians

| (I) | Members of the Board of Directors |

The Company’s board of directors is composed of nine directors, including three independent directors. The details are as follows:

| No. | Name | Position | Nominator | Term of Office |

| 1 | HUI WANG | Chairman | ACMR | Nov.14,2019 -Nov.13,2022 |

| 2 | HAIPING DUN | Director | ACMR | Nov.14,2019 -Nov.13,2022 |

| 3 | STEPHEN SUN-HAI CHIAO | Director | ACMR | Nov.14,2019 -Nov.13,2022 |

| 4 | Charles Law | Director | ACMR | Nov.14,2019 -Nov.13,2022 |

| 5 | JIANG LI | Director | SICIF | Mar 30, 2020 -Nov.13,2020 |

| 6 | CHEN HUANG | Director | PDHTI | Mar 30, 2020 -Nov.13,2020 |

| 7 | DI ZHANG | Independent Director | Board of Directors | Nov.14,2019 -Nov.13,2022 |

| 8 | MINGXIU PENG | Independent Director | Board of Directors | Nov.14,2019 -Nov.13,2022 |

| 9 | ZHANBING REN | Independent Director | Board of Directors | Nov.14,2019 -Nov.13,2022 |

The resumes of the board members are as follows:

HUI WANG, male, born in November, 1961, an American citizen with the permanent residency in China, PH.D. of Precision Engineering, winner of Shanghai Pujiang Talent Plan. From February, 1994 to November, 1997, Mr. WANG served as the research and development manager of Quester Technology Inc. in the USA. From May, 1998 to now, Mr. WANG has served as the chairman and CEO of ACMR and the chairman of ACMSH.

HAIPING DUN, male, born in December, 1949, a Chinese Taiwan citizen with the permanent residency in USA, Ph.D. in material science and engineering. From 1983 to 2004, Mr. DUN served as a senior director in Intel Corporation. From 2008 to 2018, Mr. DUN served as the president and executive director of Champion Microelectronic Corporation. From 2003 to now, Mr. DUN has served as a director of ACMR. From May, 2005 to now, Mr. DUN has served as a director of ACMSH.

STEPHEN SUN-HAI CHIAO, male, born in April, 1948, an American citizen without the permanent residency in other countries, Ph.D. in material science and engineering. From January, 1977 to July, 1980, Stephen served as a senior scientist of Varian Medical Systems. From July, 1980 to September, 1983, Stephen served as a project manager of Hewlett Packard Enterprise Development LP. From September, 1983 to September, 1986, Stephen served as the manager of R&D Department of U.S. AMIS Company. From September, 1986 to June, 2015, Stephen served as a professor of San Jose State University. From September, 1989 to September, 2003, Stephen served as the vice president of the global enterprise development department of Mosel Vitelic Inc. From September, 1999 to now, Stephen has served as a manage director of Sycamore Management Corporation. From May, 2005 to now, Stephen has served as a director of ACMSH.

Charles Law, male, born in December, 1959, a Chinese Taiwan citizen without the permanent residency in other countries, with Master of Laws degree. From November, 1992 to January, 2001, Charles served as a managing partner of U.S. Zhongzhi Law Firm. From January, 2001 to July, 2017, Charles served as a partner of King and Wood Mallesons. From July, 2017 to now, Charles has served as a partner of U.S. Sycamore

Venture. From February, 2018 to now, Charles has served as the managing partner of Law & Law. From November, 2019 to now, Charles has served as a director of ACMSH.

JIANG LI, male, born in March, 1980, a Chinese citizen without permanent residency in a foreign country, master of management science and engineering. From September 2003 to August 2005, Mr. LI served as the sales manager of the foreign trade department of Shanghai Light Industrial International Development Corp., Ltd. From September 2005 to October 2010, Mr. LI served as the manager of the investment and development department of Shanghai Zhangjiang Medicine Public Service Platform Co., Ltd. From October 2010 to December 2016, Mr. LI served as the senior investment manager of the project investment department of Shanghai STVC (Group) Co., Ltd. From January 2017 till now, he has served as the investment director of Shanghai Integrated Circuit Industry Investment Fund Co., Ltd. From March, 2020 to now, Mr. LI has served as a director of ACMSH.

CHEN HUANG, male, born in January, 1991, a Chinese citizen without permanent residency in a foreign country, master of East Asian Development Studies, master of Business Administration, senior economist. From August 2014 to August 2015, Mr. HUANG served as the assistant of the strategic department of Shanghai Pudong Financing Guarantee Co., Ltd. From September, 2015 to October, 2016, Mr. HUANG served as the risk control manager of Shanghai Pudong Financing Guarantee Co., Ltd. From October, 2016 to January, 2020, Mr. HUANG served successively as the manager of the strategic planning and information department, the investment manager of the second investment department, and the assistant to the general manager of the second investment department of SPINNOTEC Group Co., Ltd. From February 2020 to now, Mr. HUANG has served as the assistant to the general manager of the first investment department of SPINNOTEC Group Co., Ltd. From March 2020 till now, Mr. HUANG has served as a director of ACMSH.

DI ZANG, male, born in March, 1957, a Chinese citizen without permanent residency in a foreign country, Ph.D. in material science, winner of the National Natural Science Award (Second Class Prize), and winner of “May 1 Labor Metal” in Shanghai. From 1988 to now, Mr. ZHANG has served as a teacher in Shanghai Jiaotong University. In December, 1993, Mr. ZHANG served as a professor in Shanghai Jiaotong University. Currently he serves as a chair professor in Shanghai Jiaotong University, the director of the State Key Laboratory of Metal Matrix Composites and a distinguished professor of “Cheungkong Scholars” of the Ministry of Education. From June, 2019 to now, Mr. ZHANG has served as a director of ACMSH.

MINGXIU PENG, female, born in February, 1962, a Chinese Taiwan citizen, without the permanent residency in other countries, Master of Business Administration and EMBA. From January 1999 to July 2019, she served successively as the chief financial officer, deputy general manager, chairman, CEO of Champion Microelectronic Corporation. Currently she serves as the chairman of Haiye Investment Co., Ltd. From November, 2019 to now, she has served as a director of ACMSH.

ZHANBING REN, male, born in May, 1959, a Swiss citizen with the permanent residency in China, Doctor of Engineering, an academician of Swiss Academy of Engineering Sciences. From September, 1994 to September, 1996, Mr. REN served as a production engineer in Swiss Bobst. From October, 1996 to August, 2011, Mr. REN successively held the posts of the production manager (Shanghai), general manager (Shanghai), president (Greater China) and top management member, regional operations manager (Asia), and president (Great China and Southeast Asia) in Bobst Group. From September, 2011 to December, 2013, Mr. REN served as the president (Asia Pacific) in GF Piping Systems. From January, 2014 to now, Mr. REN has served as the managing director at Shanghai SinoSwiss International Trading Co., Ltd. From July, 2015 to October, 2017, Mr. REN served as the general manager of China Banknote SICPA Security Ink Co., Ltd. From January, 2018 to now, Mr. REN has served as the managing director of Shanghai Mengtebao International Trade Co., Ltd. From November, 2019 to now, Mr. REN has served as a director of ACMSH.

(II) Members of the Supervisory Board

The Supervisory Board of the Company consists of three supervisors, among

which, one supervisor is an employee representative supervisor, specifically:

| No. | Name | Position | Nominator | Term of Office |

| 1 | TRACY DONG LIU | Supervisor | ACMR | Nov.14,2019 -Nov.13,2022 |

| 2 | QIAN DONG | Supervisor | ACMR | Mar 30, 2020 -Nov.13,2020 |

| 3 | QIAN LI | Employee Representative Supervisor | General Meeting of Employee Representative | Nov.14,2019 -Nov.13,2022 |

The resumes of the supervisory board members are as follows:

TRACY DONG LIU, female, born in November 1964, an American citizen without permanent residence of other countries. She has obtained an accounting master degree and registered as U.S. certified public accountant. She served as a Financial Controller of the San Jose Radisson Hotel in the U.S. from January 1994 to June 1995, as an Accounting Manager of KPMG from January 1996 to April 2000, as a Senior Accounting Manager of Deloitte from May 2000 to May 2005, and she has served as a Founder and Managing Partner of H&M Int’l CPAs, LLP from June 2005 to date, as a director of ACMR from September 2016 to date, and as a supervisor and president of the supervisory board of ACMSH from November 2019 to date.

QIAN DONG, female, born in March 1955, a Chinese citizen without permanent residency in a foreign country. She is a bachelor majoring in Chinese. She served as a worker of Shanghai Fengshou Tractor Factory from November 1972 to February 1979, as deputy secretary of Youth League Committee, HR head of Shanghai Light Industry School from March 1979 to March 1989, as general manager’s assistant and office director of Shanghai Dongfang Storage Tank Ltd. from April 1989 to January 1997, as secretary of board of directors and office director of Shanghai Belling Co., Ltd. from February 1997 to October 2001, as deputy general manager of business development of Premier Devices Inc. from October 2001 to February 2004, as deputy general manager and office director of Spreadtrum Communications, Inc. from March 2004 to November 2014, and she has held the post of consultant of Ruizhang Technology Co., Ltd. from November 2014 to date, and of general manager of Yunnan Energy Investment Ruizhang Internet of Things Technology Ltd. from April 2019 to date. She has served as a supervisor of ACMSH from March 2020 to date.

QIAN LI, female, born in January 1995, a Chinese citizen without permanent residency in a foreign country. She is a bachelor majoring in management. She has served as an assistant of the chairman’s office of ACMSH from July 2017 to date. She has served as a supervisor of ACMSH from November 2019 to date.

(III) Senior Managers

The Company has 5 senior managers in total, including general manager, deputy general manager, person in charge of financial matters and secretary of board of directors, etc., specifically:

| No. | Name | Position |

| 1 | JIAN WANG | General Manager |

| 2 | FUPING CHEN | Deputy General Manager |

| 3 | SOTHEARA CHEAV | Deputy General Manager |

| 4 | LISA YI LU FENG | Person in Charge of Financial Matters |

| 5 | MINGZHU LUO | Secretary of Board of Directors |

The resume of each senior manager of the Company is as follows:

JIAN WANG, male, born in February 1965, a Chinese citizen without permanent residency in a foreign country. He is a master majoring in mechanics and computer

science. He served as a technician of Hangzhou Xihu Television Factory from July 1986 to April 1987, as a technician of Japan Fuji Fine Printing Corporation from April 1996 to December 1999, as a process engineer and deputy general manager of ACMSH from December 2001 to April 2019 and as General Manager of ACMSH from May 2019 to date, and he has successfully researched and developed stress-free copper polishing and electrochemical copper plating technology, participated in and applied for more than 100 patents, and been responsible for various significant scientific research projects.

FUPING CHEN, male, born in August 1981, a Chinese citizen without permanent residency in a foreign country. He is a master majoring in materials science. He successively served as an engineer and deputy manager of SK Hynix semiconductor (China) Co., Ltd. from April 2006 to January 2010, and as a project manager, technical manager, technical director and senior director of ACMSH from January 2010 to December 2017. He has served as Deputy General Manager of ACMSH from January 2018 to date, who has participated in and successfully researched and developed advanced packaging wet processing equipment, SAPS uniwafer cleaning equipment, TEBO uniwafer cleaning equipment, Tahoe uniwafer tank combined cleaning equipment and full automatic tank cleaning equipment, he has published 5 academic papers and participated in and applied for more than one hundred patents.

SOTHEARA CHEAV, male, born in March 1952, an American citizen without permanent residency of other countries. He is a bachelor majoring in technology of electronics. He successively served as a manager of manufacturing department, director of manufacturing department from March 2007 to December 2014. He has served as deputy general manager of ACMSH from January 2015 to date.

LISA YI LU FENG, female, born in April 1958, an American citizen without permanent residency of other countries. She has obtained an accounting mater degree. She served as a regional financial director of Lumenis Inc. from January 2004 to August 2008, as financial director of Amlogic (CA) Co., Inc. from August 2008 to September 2017, as financial director of ACMR from September 2017 to November 2019, and has served as a person in charge of financial matters of ACMSH from May 2019 to date.

MINGZHU LUO, female, born in August 1983, a Chinese citizen without permanent residency in a foreign country. She is a bachelor majoring in veterinary medicine. She has successively served as assistant of president, manager of president office and director of president office of ACMSH from December 2006 to October 2019. She has served as secretary of board of directors of ACMSH from November 2019 to date.

(IV) Key Technician

The Company determines key technicians based on the following standards: (1) responsible persons or core members of the Company and departments in connection with research and development; (2) relevant persons responsible for the direction of research and development and processing improvements which are significant to the business development and future development strategy of the Company; (3) relevant persons who have contributed to intellectual property rights and core technologies of the Company. The Company has 6 key technicians in total, specifically:

| No. | Name | Position |

| 1 | HUI WANG | Chairman |

| 2 | JIAN WANG | General Manager |

| 3 | FUPING CHEN | Deputy General Manager |

| 4 | SOTHEARA CHEAV | Deputy General Manager |

| 5 | JUN WANG | Vice President of Electrical Engineering |

| 6 | XUEJUN LI | Vice President of After-sale Services |

The resume of each key technician of the Company is as follows:

HUI WANG, please refer to “VII (I) Members of Board of Directors” in this Section for his resume.

JIAN WANG, please refer to “VII (III) Senior Managers” in this Section for his resume.

SOTHEARA CHEAV, please refer to “VII (III) Senior Managers” in this Section for his resume.

FUPING CHEN, please refer to “VII (III) Senior Managers” in this Section for his resume.

JUN WANG, male, born in March 1984, a Chinese citizen without permanent residency in a foreign country. He is a master majoring in electronics and communication engineering. He successively served as an electrical engineering manager, senior manager and director of electrical engineering of ACMSH from May 2007 to April 2020, and has served as vice president of electrical engineering of ACMSH from May 2020 to date, being responsible for the design of all equipment and electrical control system and team building. He has participated in relevant patent applications of TEBO uniwafer cleaning equipment and Tahoe uniwafer tank combined cleaning equipment and been responsible for Chinese 02 Technology Significant Special Research and Development Projects-“Research and Development of 65-45nm Copper Interconnection Stress-free Polishing Equipment” and “Reseach, Development and Application of 20-14nm Copper Interconnection Copper Plating Equipment”, and the development of electronical control system of the project of “Research, Development and Industrialization of Uniwafer Tank Combined Cleaning Equipment” which is a Significant Project of Shanghai Strategic Emerging Industry.

XUEJUN LI, male, born in May 1970, being a Chinese citizen without permanent residency in a foreign country. He is a bachelor majoring in electric automatization. He successively served as a manager of after-sale services, senior manager, director of after-sale services from May 2009 to April 2020. He has served as vice president of after-sale services of ACMSH from May 2020 to date, being responsible for the provision of technical services to clients and the construction of after-sale service team. He has participated in the research and development and patent applications of technologies in connection with semiconductor cleaning equipment, provided product technical supports and solutions to main clients of the Company, and focused on the improvement of production efficiency and product yield of clients.

(V) Information on Positions in other Companies held by Directors, Supervisors, Senior Managers and Key technicians of the Company

As of the date of signing the [***], positions in other companies held by the directors, supervisors, senior managers and key technicians of the Company are as follows:

| Name | Position in the Company | Name of Employer | Position | Relationship with the Issuer |

HUI WANG | Chairman | ACMR | Chairman, CEO | Controlling Shareholder |

| ACM Research(Cayman) | Director | Related party |

| NINEBELL | Director | Related party |

| HAIPING DUN | Director | ACMR | Director | Controlling Shareholder |

| STEPHEN SUN-HAI CHIAO | Director | Sycamore Management Corporation | Managing Partner | Related party |

| Silicon Technology Investment (Cayman) Corp. | Director | Related party |

| Charles Law | Director | Law and Law | Managing Partner | Related party |

|

| Sycamore Management Corporation | Partner | Related party |

| Nanjing Shuige Investment and Management Consultancy Co., Ltd. | Supervisor | None |

| CHEN HUANG | Director | Shanghai Pudong Technology Innovation Group Co., Ltd. | Investment I Department Assistant General Manager | None |

| ASR Microelectronics (Shanghai) Co., Ltd. | Director | Related party |

| Ideal Energy (Shanghai) Sunflower Thin Film Equipment Ltd. | Director | Related party |

| JIANG LI | Director | Shanghai Integrated Circuit Industry Investment Fund Management Co., Ltd. | Investment Director | None |

| SMIC Southern Integrated Circuit Manufacturing Co., Ltd. | Supervisor | None |

| Shanghai Jita Semiconductor Co, Ltd. | Director | Related party |

| EverDisplay Optronics (Shanghai) Limited | Director | Related party |

| Shanghai Qiyuji Sports Technology Development Co., Ltd. | Supervisor | None |

| DI ZHANG | Independent Director | School of Materials Science and Engineering, Shanghai Jiao Tong University | Professor | None |

| MINGXIU PENG | Independent Director | Haihua Investment Co., Ltd. | Chairman | None |

| Avision Inc. | Independent Director | None |

| Qifa Electronics Co., Ltd. | Director | None |

| Longcai Technology Co., Ltd. | Director | None |

| Mars Semiconductor Corp. | Independent Director | None |

| ZHANBING REN | Independent Director | Shanghai Mengtebao International Trading Co., Ltd. | Executive Director | None |

| Shanghai Ruizhong International Trading Co., Ltd. | Executive Director | None |

| Black Peony (Group) Co., Ltd. | Independent Director | None |

| TRACY DONG LIU | Supervisor | ACMR | Director | Controlling Shareholder |

| H&M Int’l CPAs, LLP | Managing Partner | Related party |

| QIAN DONG | Supervisor | Yunnan Energy Investment Ruizhang Internet of Things Technology Ltd. | Director and General Manager | Related party |

| | | Shanghai Viewnoon Information

Technology Co., Ltd. | Director | Related party |

| | | Shanghai Zhaonengkun Information | Director | Related party |

|

| Technology Co., Ltd. |

|

|

| Shanghai Zhimeng Internet of Things Technology Co., Ltd. | Executive Director and General Manager | Related party |

| JIAN WANG | General Manager | ShengYuan Management Consulting (Shanghai) Co., Ltd. | Executive Director | Related party |

| FUPING CHEN | Deputy General Manager | Wuxi Hengchuang Micro-Technology Ltd. | Supervisor | None |

| MINGZHU LUO | Secretary of Board of Directors | ShengYuan Management Consulting (Shanghai) Co., Ltd. | Supervisor | Related party |

| Shengyi Technology | Director | Shareholding Subsidiary |

(VI) Family Relation among Directors, Supervisors, Senior Managers and Key technicians of the Company

As of the date of signing the [***], except for the brotherhood relation between the Chairman, HUI WANG, and the General Manager, JIAN WANG, there is no family relation among directors, supervisors, senior managers and key technicians of the Company.

VIII. Agreements between the Company and any of Directors, Supervisors, Senior Managers and Key technicians and their Performance

As of the date of signing the [***], the Company has entered into the Labor Contract, the Non-competition Agreement and the Confidentiality and Intellectual Property Protection Agreement regarding horizontal competition and confidentiality matters with each director, supervisor, senior manager and key technician who works in and receives remuneration from the Company, and the Company and directors, supervisors, senior managers and key technicians are protected and bound by provisions of relevant labor contracts.

The first Extraordinary General Meeting of the Company in 2019 resolved to pass the Proposal on 2019 Stock Option Incentive Plan (Draft) of the Company on November 29, 2019, pursuant to which, the Company entered into the Stock Option Grant Agreement with its directors, senior managers, key technicians, key employees, etc.

Except for the above, none of director, supervisor, senior manager and key technician of the Company enters into any other contract or agreement with the Company. As of the date of signing the [***], the above contracts or agreements are performed normally without any default.

IX. Changes in Directors, Supervisors, Senior Managers and Key technicians of the Company within the Last Two Years

(I) Changes in Directors of the Company

The board of directors of ACMSH consisted of HUI WANG, HAIPING DUN, STEPHEN SUN-HAI CHIAO early 2018.

The board of directors of ACMSH resolved that Charles Law and DI ZHANG

were elected as additional members of the board of directors of the Company on June 26, 2019.

The establishment meeting and the first general meeting of shareholders of the Company elected HUI WANG, HAIPING DUN, STEPHEN SUN-HAI CHIAO, Charles Law, DI ZHANG, MINGXIU PENG and ZHANBING REN as members of the first-session board of directors of the Company on November 14, 2019.

The first Extraordinary General Meeting of the Company in 2020 elected CHEN HUANG, JIANG LI as members of the first-session board of directors of the Company on March 30, 2020.

In the last two years, the reasons for changes in directors of the Company are the nomination of newly elected directors after changes in shareholders of the Company and the establishment of independent director system after the Company is changed into a joint stock company in its entirety.

(II) Changes in Supervisors of the Company

The supervisor of ACMSH was TRACY DONG LIU early 2018.

The establishment meeting and the first general meeting of shareholders of the Company elected TRACY DONG LIU and SHOULEI JIANG as members of the supervisory board of the Company, and the first-session supervisory board of the Company comprised the above two supervisors and QIAN LI, the employee representative supervisor elected by the general meeting of employees of the Company, on November 14, 2019.

SHOULEI JIANG, a supervisor of the Company, resigned as supervisor for personal reasons and the first extraordinary general meeting of shareholders of the Company in 2020 elected QIAN DONG as a member of the first-session supervisory board.

In the last two years, the main reasons for changes in supervisors of the Company are the nomination of newly elected supervisors after changes in shareholders of the Company and further perfection of the governance structure of the Company and election of employee supervisor after the Company became a joint stock company.

(III) Changes in Senior Managers

The senior managers of the Company comprised HUI WANG. The board of directors of ACMSH resolved to pass the appointment of JIAN WANG as the general manager of the Company and LISA YI LU FENG as the person in charge of financial matters in May 2019.

In November 2019, the first meeting of the first-session board of directors of ACMSH resolved to approve the appointment of JIAN WANG as the general manager of the Company, FUPING CHEN and SOTHEARA CHEAV as deputy general managers, LISA YI LU FENG as the person in charge of financial matters and MINGZHU LUO as the secretary of board of directors.

In the last two years, HUI WANG, a senior manger of the Company, no longer held his position for personal reasons, and other senior managers were engaged by the board of directors after the Company was changed into a joint stock company in its entirety. All of the above persons hold positions in the Company during the Reporting Period, and there is no material change in senior managers of the Company.

(IV) Changes in Key Technicians

In the last two years, there is no change in key technicians of the Company.

X. External Investments Made by Directors, Supervisors, Senior Managers and Key Technicians of the Company

As of the date of signing the [***], external investments made by directors, supervisors, senior managers and key technicians of the Company are as follows:

| Name | Position in the Company | Name of Investee | Shareholding Percentage | Relationship with the Issuer |

| STEPHEN SUN-HAI CHIAO | Director | Green Expedition LLC | 100% | Related party |

| ZHANBING REN | Independent Director | Shanghai Mengtebao International Trading Co., Ltd. | 50% | Related party |

| Shanghai Ruizhong International Trading Co., Ltd. | 30% | Related party |

| QIAN DONG | Supervisor | Shanghai Zhimeng Internet of Things Technology Co., Ltd. | 60% | None |

| Shanghai Lianwan Investment Management Center (Limited Partnership) | 50% | Related party |

| Shanghai Zhaonengkun Information Technology Co., Ltd. | 12.14% | None |

| Xinwei Consulting | 3.23% | Shareholder |

| JIAN WANG | General Manager | ShengYuan Management Consulting (Shanghai) Co., Ltd. | 100% | Related party |

| FUPING CHEN | Deputy General Manager | Shengxin Shanghai | 2.94% | Related party |

| MINGZHU | Secretary of Board of

| 1.55% | |

XI. Shares Held by Directors, Supervisors, Senior Managers and Key technicians of the Company and their Immediate Relatives

As of the date of signing the [***], none of director, supervisor, senior manager and key technician of the Company and their immediate relatives directly hold any share of the Company, information on shares of the Company indirectly held by the above persons is as follows:

Company holding the shares of the Company | Relationship with the Issuer | Name | Position/Family Relation | Information on Shareholding |

| ACMR | Holding 91.67% of shares in the Company | HUI WANG | Chairman | Holding 168,006 Class A shares and 1,146,934 Class B shares of ACMR, indirectly holding 206,667 Class A shares and 60,000 Class A shares of ACMR through David Hui Wang & Jing Chen Family Living Trust and David Hui Wang & Jing Chen Irrevocable Trust respectively, and indirectly holding 7,334 Class B shares of ACMR through David Hui Wang & Jing Chen Irrevocable Trust |

| JING CHEN | Spouse of HUI

| Holding 33,334 Class B shares of ACMR, indirectly holding 206,667

|

| | | | WANG | Class A shares and 60,000 Class A shares of ACMR through David Hui Wang & Jing Chen Family Living Trust and David Hui Wang & Jing Chen Irrevocable Trust respectively, and indirectly holding 7,334 Class B shares of ACMR through David Hui Wang & Jing Chen Irrevocable Trust |

| | | BRIAN WANG | Son of HUI WANG | Holding 117,334 Class B shares of ACMR |

| | | SOPHIA WANG | Daughter of HUI WANG | Holding 15,279 Class A shares and 117,334 Class B shares of ACMR |

| | | HAIPING DUN | Director | Hoding 285,030 Class A shares and 100,000 Class B shares of ACMR |

| | | STEPHEN SUN-HAI CHIAO | Director | Holding 69,815 Class B shares of ACMR, indirectly holding 55,000 Class A shares of ACMR through Green Expedition LLC, and indirectly holding 30,000 Class B shares of ACMR through Stephen Sun-Hai And Mary Wu-Chun Chiao Revocable Trust |

| | | Charles Law | Director | Holding 30,112 Class A shares of ACMR |

| | | ZHANBING REN | Independent Director | Holding 3,334 Class B shares of ACMR |

| | | TRACY DONG LIU | Supervisor | Holding 16,924 Class A shares of ACMR |

| | | JIAN WANG | Deputy General Manager | Holding 84,386 Class A shares and 50,001 Class B shares of ACMR |

| | | SOTHEARA CHEAV | Deputy General Manager | Holding 43,334 Class A shares of ACMR |

| | | LISA YI LU FENG | Person in Charge of Financial Matters | Holding 6,943 Class A shares of ACMR |

| | | XUEJUN LI | Key Technician | Holding 800 Class A shares of ACMR |

| Xinwei Consulting | Holding 1.22% of shares in the Company | QIAN DONG | Supervisor | Holding 3.23% of shares in Xinwei Consulting |

| Xinshi Consulting | Holding 0.46% of shares in the Company | JUN WANG | Key Technician | Holding 5.40% of shares in Xinshi Consulting |

| XUEJUN LI | Key Technician | Holding 5.40% of shares in Xinshi Consulting |

Note: The data on the percentage of shares held by the above persons in ACMR is as of December 31, 2019.

XII. Information on Remuneration of Directors, Supervisors, Senior Managers and Key Technicians of the Company

(I) Composition, Basis of Determination, Procedures Performed of Remuneration and its Percentage

The remuneration of directors, supervisors, senior managers and key technicians who hold positions responsible for specific business in the Company consists of basic salary, year-end bonus, etc. Based on the needs of each position, duties and working performance, the Company will pay equitable and reasonable salary in accordance with remuneration regulations and ensure that all of remuneration and benefits of employees are competitive in the same industry and market. The Compensation and Appraisal Committee of the Company formulates remuneration policies and plans of directors and senior managers, conducts appraisals on performance of duties of directors and senior managers and submits the results to the board of directors or the general meeting of shareholders for review and deliberation; independent directors of the Company receive fixed allowances.

During the Reporting Period, the total remuneration for directors, supervisors, senior managers and key technicians of the Company are RMB 3,178,800 Yuan, RMB 4,467,700 Yuan and RMB 5,780,600 Yuan respectively, accounting for 23.83%, 4.34% and 3.76% of total profit of the Company for each period.

(II) Remuneration Received by Directors, Supervisors, Senior Managers and Key technicians from the Issuer in the Latest Year

Information on remuneration received by directors, supervisors, senior managers and key technicians from the Company in 2019 is as follows:

Unit: RMB 10,000 Yuan

| No. | Name | Position | Remuneration in 2019 |

| 1 | HUI WANG | Chairman | 61.87 |

| 2 | HAIPING DUN | Director | - |

| 3 | STEPHEN SUN-HAI CHIAO | Director | - |

| 4 | Charles Law | Director | - |

| 5 | CHEN HUANG | Director | - |

| 6 | JIANG LI | Director | - |

| 7 | DI ZHANG | Independent Director | 5.14 |

| 8 | MINGXIU PENG | Independent Director | 1.30 |

| 9 | ZHANBING REN | Independent Director | 1.30 |

| 10 | TRACY DONG LIU | Supervisor | 0.78 |

| 11 | QIAN DONG | Supervisor | - |

| 12 | QIAN LI | Employee Representative Supervisor | 9.18 |

| 13 | JIAN WANG | General Manager | 65.81 |

| 14 | FUPING CHEN | Deputy General Manager | 74.74 |

| 15 | SOTHEARA CHEAV | Deputy General Manager | 76.58 |

| 16 | LISA YI LU FENG | Person in Charge of Financial Matters | 98.81 |

| 17 | MINGZHU LUO | Secretary of Board of Directors | 41.56 |

| 18 | JUN WANG | Key Technician | 74.83 |

| 19 | XUEJUN LI | Key Technician | 65.38 |

Note: 1. Certain directors of the Company do not receive any remuneration from the Company; 2. The allowance of each independent director of the Company is RMB 100,000 Yuan/year; 3. QIAN DONG served as supervisor in March 2020, and did not receive any remuneration in 2019.

(III) Other Treatments and Pension Plans for the Above Persons of the Company

As of the date of signing the [***], the Company has not formulated any other treatments, pension plans, etc.for its directors, supervisors, senior managers and key technicians.

XIII. Equity Incentives and Relevant Arrangements of the Issuer prior to this Offering

(I) Employee Shareholding Platform

As of the date of signing the [***], the Issuer has established two employee shareholding platforms prior to the submission and application of this Offering: Xinshi Consulting and Xingang Consulting, each of which holds 0.46% and 0.19% of shares of the Company respectively.

| | 1. | Basic Information on Employee Shareholding Platforms |

(1) For basic information on Xinshi Consulting, please refer to “(5) Xinshi Consulting” of “VI(V) New Shareholders of the Issuer in the Latest Year” of this Section.

(2) For basic information on Xingang Consulting, please refer to “(7) Xingang Consulting” of “VI(V) New Shareholders of the Issuer in the Latest Year” of this Section.

| | 2. | Employee Shareholding Platforms’ Confirmation of Share-based Payment |

The above employee shareholding platforms become shareholders of the Company by the means of increase in capital, the price at which the capital is increased is lower than the price in the same comparable transaction, and the Company has confirmed costs of share-based payment. For specific information on the increase in capital, please refer to “(4) the Fourth Increase in Capital of ACMSH in May 2019” of “II (III) Information on the Changes of Shareholders of the Issuer”.

| | 3. | Operation of Employee Shareholding Platforms Not Subject to the “Closed Loop Principle” |

Pursuant to the partnership agreement of employee shareholding platforms, all or part of property shares in a partnership may be transferred among limited partners, and also may be transferred to a person other than partners. Therefore, such transfer has not been limited to internal transfer among specific employees only by shareholding platforms, operation of which does not conform to the “closed loop principle”.

| | 4. | Employee Shareholding Platforms Not Being Private Investment Funds |

The above employee shareholding platforms have never raised funds from investors and formed in a non-public manner, and thus are not private investment funds under the Interim Measures on the Supervision and Administration of Private Investment Funds, there is no need to go through private investment fund filings in accordance with the Measures on the Registration of Private Investment Fund Managers and Filing of Funds (Trial) or other provisions.

| | 5. | Share Lock-up Commitments of Employee Shareholding Platforms |

Each of the above employee shareholding platforms undertakes that:

(1) During 12 months as of the date on which stocks of the Issuer are listed, it will not transfer shares which are held by this enterprise and have been issued by the Issuer prior to this Offering and listing (hereinafter referred to as the “Pre-initial Offering Shares”), entrust others to manage such shares, or propose to repurchase such part of shares by the Issuer.

(2) If this enterprise decreases the Pre-initial Offering Shares held by it after the lock-up period expires, it will strictly comply with laws, administrative regulations, departmental rules, normative documents and relevant provisions of the Shanghai Stock Exchange and perform corresponding obligations of information disclosure.

(3) If this enterprise decreases its shares of the Issuer in violation of the above commitments, then actual proceeds (if any) received from the sale of such part of shares of the Issuer shall belong to the Issuer, and all losses and legal consequences resulting therefrom shall be borne by this enterprise.

(II) Option Incentive Plan Made by the Issuer for Employees

The Issuer has an option incentive plan which is formulated prior to the application of initial public offering and will be implemented after it is listed (hereinafter referred to as the “Incentive Plan”), the specific information of the plan is as follows:

| | 1. | Procedures of Formulating the Incentive Plan |

On November 14, 2019, the Company held the first session meeting of the first board of directors and resolved to pass the Proposal on the Stock Option Incentive Plan of the Company in 2019 (Draft), the Proposal on Measures on Implementing Appraisal and Administration of the Stock Option Incentive Plan of the Company in 2019, the Proposal on the Submission and Application to the General Meeting of Shareholders for Authorizing the Board of Directors to Deal With Matters in connection with 2019 Stock Option Incentive and other proposals. Independent directors issued their independent opinions consenting to the above proposals.

On November 14, 2019, the Company held the first session meeting of the first supervisory board and resolved to pass the Proposal on the Stock Option Incentive Plan of the Company in 2019 (Draft), the Proposal on Measures on Implementing Appraisal and Administration of the Stock Option Incentive Plan of the Company in 2019 and other proposals.

On November 15, 2019, the Issuer published name and position of each incentive

object in the Company internally through on-site posting in the Company and other means, the period of publicity shall not less than 10 days.

On November 25, 2019, the Company held the second session meeting of the first supervisory board and resolved to pass the Proposal on the Supervisory Board’s Explanation on Reviewing Opinions and Publicity of the List of Stock Option Incentive Objects.

On November 29, 2019, the Company held the first-session extraordinary meeting of shareholders in 2019 and resolved to pass the Proposal on the Stock Option Incentive Plan of the Company in 2019 (Draft), the Proposal on Measures on Implementing Appraisal and Administration of the Stock Option Incentive Plan of the Company in 2019, the Proposal on the Authorization to the Board of Directors to Deal With Matters in connection with 2019 Stock Option Incentive and other proposals

The Compensation and Appraisal Committee of the board of directors of the Company held the first-session extraordinary meeting in 2019 and resolved to pass the Proposal on the Adjustment of Incentive Objects and Granting Amounts of Stock Option Incentive Plan, the Proposal on Granting Stock Options to Incentive Objects and other documents, and submitted to the board of directors of the Company for review and deliberation on December 20, 2019.

On December 31, 2019, the Company held the second session meeting of the first board of directors and the third session meeting of the first supervisory board respectively, and resolved to pass the Proposal on the Adjustment of Incentive Objects and Granting Amounts of Stock Option Incentive Plan, the Proposal on Granting Stock Options to Incentive Objects and other proposals. Independent directors issued their independent opinions consenting to the above proposals.

In conclusion, the formulation of this incentive plan by the Issuer has performed necessary procedures.

| | 2. | Basic Content of the Incentive Plan |

The basic content of this incentive plan is as follows:

(1) Incentive Objects

The number of incentive objects involved in this incentive plan is 88 in total, including directors, senior managers of the Company and middle-level management personnel and core business employees of the Company and its controlled subsidiaries. The above incentive objects shall not include any independent directors or supervisors of the Company. The directors and senior managers of the Company must be elected by the general meeting of shareholders of the Company or engaged by the board of directors of the Company. Each incentive object must enter into a labor contract or engagement contract with the Company or any of controlled subsidiaries of the Company within the appraisal period of this incentive plan.

Accordingly, incentive objects under the incentive plan do not exist any circumstance as described in paragraph 2 of Article 8 of the Measures on the Administration of Equity Incentives of Listed Companies, and comply with provisions of Article 10.4 of the Rules Governing the Listing of Stocks on the STAR Market of Shanghai Stock Exchange.

(2) Relevant Clauses of the Incentive Plan

Article 1 of Chapter III of the Incentive Plan provides that “This Plan adopts stock options as tools of equity incentive. The source of stocks under this Plan shall be stocks issued by the Company specifically to incentive objects. Subject to conditions as provided for under this Plan, each stock option granted to an incentive object shall have the right to purchase one ordinary share from ACMSH at the exercise price within the exercisable period. None of stock options granted to incentive objects may be transferred or used for creating any security or repaying any debt.”

Chapter IV of the Incentive Plan provides for effective period, date of grant, waiting period and exercise arrangement of stock options, among which, Article 4 of Chapter IV provides that “The stock options will be exercised in two installments upon the expiration of 36 months after such options are granted, the exercisable options in each instalment shall account for 1/2 and 1/2 of the total amount of granted stock options respectively. Within exercisable days, subject to the fulfillment of conditions of exercise as stipulated under this Plan, each inventive object may exercise his/her stock options which have been granted to him/her in two installments in accordance with arrangements as stipulated in the table below. The period of exercise for exercisable options shall be 12 months, the beginning date of the next period of exercise shall not be earlier than the expiration date of the last period of exercise, and relevant interests shall not be deferred to the next period when conditions of exercise for stock options in each installment fail to be fulfilled.”

Chapter IX of the Incentive Plan provides for how to deal with special circumstances of the incentive plan and specifies circumstances under which the Company repurchases options or incentive objects terminate their exercise of options.

Chapter XII of the Incentive Plan provides for the formulation of this incentive plan, granting and exercising of options and other aspects.

In conclusion, the definitions of incentive tools, restrictions of rights, exercise arrangements, repurchasing or terminating exercise of options, procedures of implementation and other content involved in the incentive plan are formulated by reference to relevant provisions of the Measures on the Administration of Equity Incentives of Listed Companies.

(3) Exercise Price

The exercise price of this incentive plan is determined on the basis of the transaction price in the most recent increase in capital of ACMSH by investors, and thus the exercise price shall be RMB 13 Yuan per share.

The price per share shall be RMB 0.66 Yuan on the basis of the audited net assets of ACMSH in the most recent one year, and the price per share shall be RMB 3.52 Yuan on the basis of the value as estimated in the most recent period. Accordingly, this

incentive plan is not less than the audited net assets or estimated value in the most recent year.

(4) Total Amount of Granted Stock Options

The first Extraordinary General Meeting of the Issuer in 2019 reviewed and passed the 2019 Option Incentive Plan and the 2019 Appraisal Administration Measures and agreed to grant 5,677,500 stock options, representing 1.46% of the total amount of capital shares of the Company as of such grant, to 88 qualified incentive objects after adjustment. The effective period shall not exceed 72 months from the date on which stock options are granted to the date on which all stock options granted to incentive objects are exercised or cancelled.

Accordingly, the percentage of shares in connection with all of the Issuer’s option incentive plans which are within effective period to the total amount of capital shares of the Company immediately prior to the listing of the Company does not exceed 15%, and none of reserved interests is created.

(5) Waiting Period

The waiting period shall be 36 months as of the date on which stock options are granted. Within the waiting period, none of incentive objects shall exercise any of options which are granted in accordance with this plan.

(6) No Change in de facto controller will be Caused

According to the total amount of stock options granted under this incentive plan, the de facto controller of the Company will not be changed resulting from any exercise of options of the Issuer after the listing.

(7) Lock-up Commitments

According to Article 4 of Chapter IV of the Incentive Plan, if the time point of exercising stock options under this incentive plan is after the listing of the Company, then: (i) none of incentive objects shall decrease his/her stocks acquired resulting from his/her exercise of options after the Company is listed within 3 years; (ii) upon the expiration of the above lock-up period, each incentive object shall decrease his/her stocks by reference to relevant provisions of decreasing stocks by directors, supervisors and senior managers of the Company, and comply with then relevant laws, regulations, normative documents and rules of the stock exchange where the Company is listed.

| | 3. | Effects of the Equity Incentives on the Company |

Through the formulation of this incentive plan, the Company is intended to motivate working enthusiasm of managers, key technicians, key employees of the Company, realize the unification of objectives of shareholders, the Company and employees and promote the operating efficiency of the Company.

After any grant is made under this incentive plan, the costs of share-based payment confirmed due to amortization of cost incurred by stock options will be increased, which will cause certain effect on the operational performance of the Company in the future.

Under the equity incentive plan of the Company, each incentive object who has received equity options will hold no more than 1% of stocks in the Company after his/her exercise, which will not cause any significant effect on the shareholding structure of the Company, and the equity incentives will not affect the controlling power over the Company.

| | 4. | Accounting Treatments of Equity Incentives |

According to relevant provisions on the determination of fair value in the Accounting Standards for Business Enterprises No.11-Share-based Payment and the Accounting Standards for Business Enterprises No.22-Determination and Measurement of Financial Tools issued by the Ministry of Finance, it is necessary to select an appropriate valuation model to calculate the fair value of stock options. The cost of stock options granted under this incentive plan is estimated based on the Black-Scholes model.

The cost of stock options granted under this incentive plan shall be amortized before each instalment of options becomes exercisable, and the actual accounting cost shall be revalued based on such parameters as actual stock prices and volatility on the date of grant as determined by the board of directors. Therefore, the amortization of the cost of stock options will cause certain effect on the operational performance of the Company.

During the Reporting Period, the Company does not involve any share-based payment resulting from this incentive plan which will cause effect on the operational performance of the Company.

| | 5. | Verification Opinions of Intermediary Agencies |

Upon verification, the Sponsor and the Reporting Accountant consider that:

(1) The formulation and implementation of the above option incentive plan have performed necessary decision-making procedures, and incentive objects comply with provisions of Article 10.4 of the Rules Governing the Listing of Stocks on the STAR Market of Shanghai Stock Exchange;

(2) The Issuer has fully disclosed relevant information of the option incentive plan in the [***];

(3) The measurement methods and results of fair value with respect to equity instruments in connection with share-based payment of the Issuer is reasonable;

(4) Relevant accounting treatments with respect to share-based payment of the Issuer comply with relevant provisions of the Accounting Standards for Business Enterprises.

(III) Stock Options Acquired by Employees of the Issuer in the Controlling Shareholder of the Issuer

Since the establishment of ACMR, the controlling shareholder of the Company, has granted stock options of ACMR to certain employees in order to establish and perfect long-acting incentive mechanism, maintain stability of core team and fully motivate enthusiasm of core and key employees of the Company. As of December 31, 2019, HUI WANG, the de facto controller of the Company, held 1,053,335 stock options of ACMR, and other employees of the Company held 1,702,513 stock options of ACMR in total.

During the Reporting Period, the Company has confirmed costs of share-based payment for stock options of ACMR acquired by the above persons, the amount of which is RMB 1.7247 million Yuan, RMB 3.9978 million Yuan and RMB 7.3990 million Yuan respectively.

XIV. Employees of the Issuer and their Social Securities

(I) Employees

As at the end of each Reporting Period, the number of employees of the Company is 187, 270 and 358 respectively. As of December 31, 2019, the professional structure, educational level and age distribution of employees of the Company are as follows:

| Professional Structure of Employees | | Percentage of Total Number of Employees |

| Management Personnel | 29 | 8.10% |

| Marketing Sales Personnel | 10 | 2.79% |

| After-sales Service Personnel | 76 | 21.23% |

| Production Personnel | 84 | 23.46% |

| Finance Personnel | 9 | 2.51% |

| Technology Research and Development Personnel | 150 | 41.90% |

| Total | 358 | 100.00% |

| Educational Level of Employees | Headcount | Percentage of Total Number of Employees |

| Master degree and above | 72 | 20.11% |

| Bachelor degree | 140 | 39.11% |

| College degree and below | 146 | 40.78% |

| Total | 358 | 100.00% |

| Age Distribution of Employees | Headcount | Percentage of Total Number of Employees |

| 50 and above | 13 | 3.63% |

| 40-49 | 28 | 7.82% |

| 30-39 | 162 | 45.25% |

| 30 and below | 155 | 43.30% |

| Total | 358 | 100.00% |

(II) Implementation of Social Security System by the Issuer

The Company and its domestic subsidiaries implement the system of labor contract, they enter into a labor contract with each employee in accordance with the Labor Law. The Company and its domestic subsidiaries have bought social insurances, such as pension insurance, medical insurance, unemployment insurance, employment injury insurance and maternity insurance, and contributed housing provident funds for their employees in accordance with national and local laws and regulations in connection with social security.

Each foreign subsidiary of the Company has entered into a labor contract with each foreign employee and implemented the system of social security in accordance with laws and regulations of the place where the subsidiary is located.

During the Reporting Period, there is no dispute or litigation of the Issuer and its subsidiaries arising out of the issue of payment of social insurance, nor is there any administrative punishment arising out of the issue of payment of social insurance premiums. As of the execution date of this [***], all of the number of employees, base number, percentage, etc. of social insurance premiums paid by the Issuer for employees comply with provisions of laws, regulations and normative documents. The Issuer has contributed housing provident funds for Chinese employees of the Company in accordance with provisions of national and local governmental authorities.

According to the reply letter issued by Huangpu Sub-center of Shanghai Social Security Business Administration Center on May 20, 2020, ACMSH has no overdue premium of social securities during the period from January 1, 2017 to December 31, 2019.

According to the certificate issed by Xinwu District Human Resources and Social Security Bureau of Wuxi on April 24, 2020, it is not found that ACM Wuxi has any violation of laws, regulations or rules in connection with labor security or any adverse record that ACM Wuxi is subject to any administrative penalty or administrative process imposed by labor administration departments due to its violation of laws during the period from January 1, 2017 to April 13, 2020.

According to the certificate issued by Shanghai Housing Provident Fund Administration Center on March 10, 2020, ACMSH has established a housing provident fund account, and the housing provident fund account is in the status of normal contribution without any administrative punishment record imposed by the Housing Provident Fund Administration Center.

According to the certificate issued by Wuxi Housing Provident Fund Administration Center on April 13, 2020, during the period commencing from January 1, 2017 to the date of issuance of the certificate, ACM Wuxi has never been subject to any recovery for its failure of contribution, fine or any other form of administrative punishment imposed by Wuxi Housing Provident Fund Administration Center arising out of any of its violation of housing provident fund regulations.

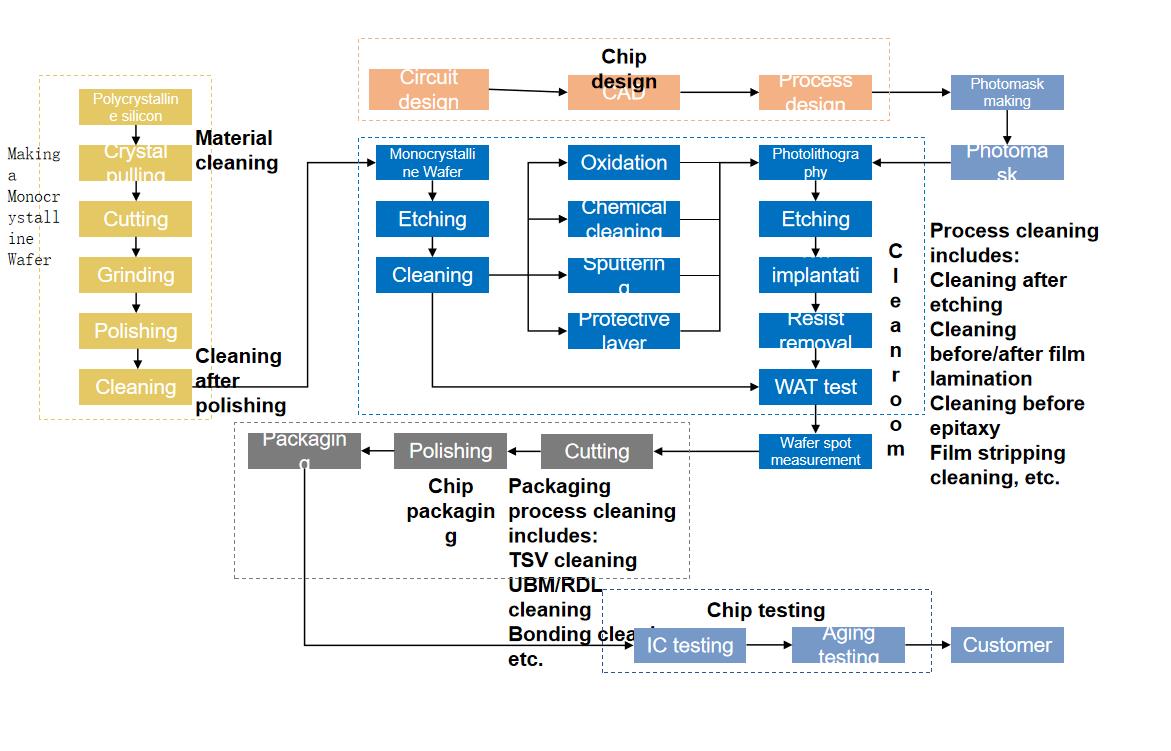

Section VI Business and Technology

Ⅰ. Main Business and Main Products of the Issuer

(Ⅰ) Main business, main products and income component

| | 1. | Basic situation of main business |

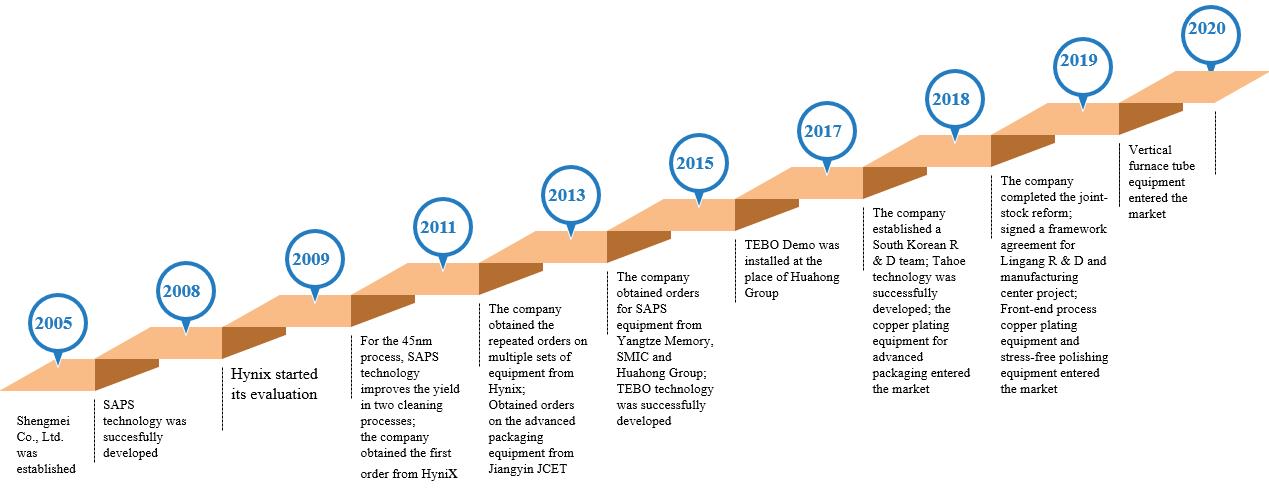

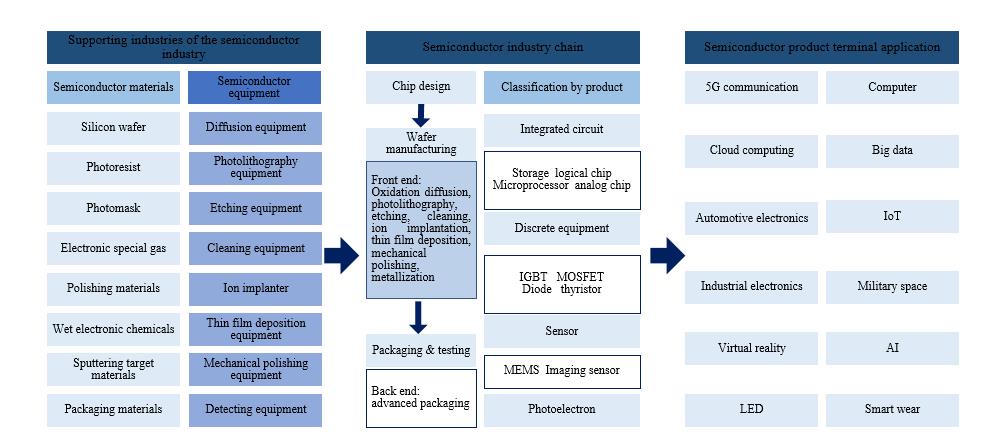

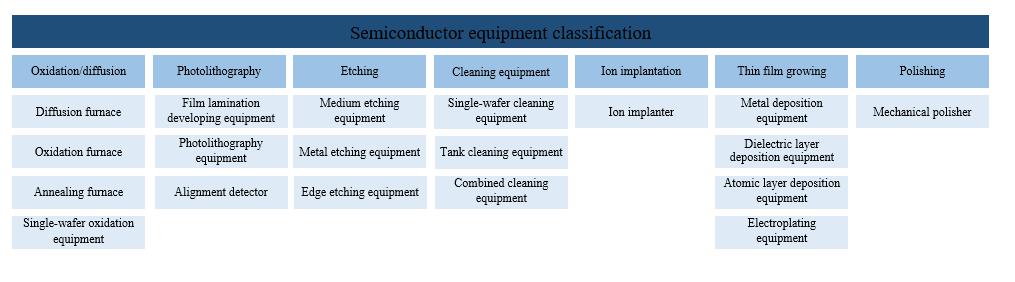

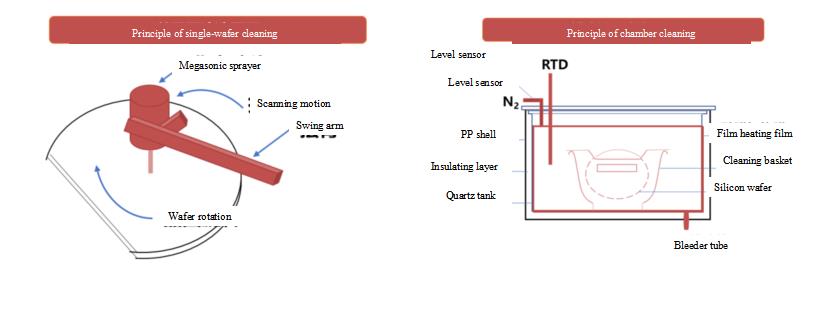

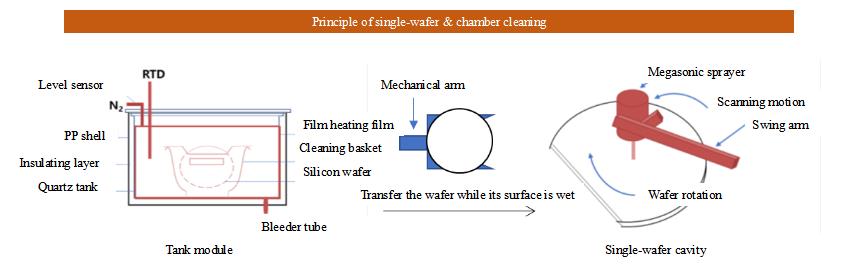

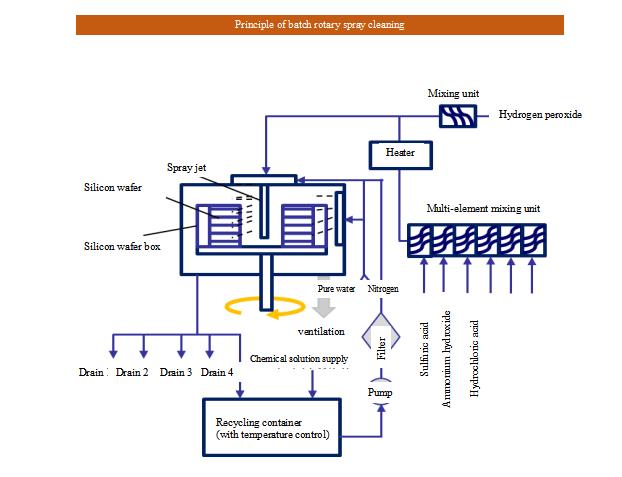

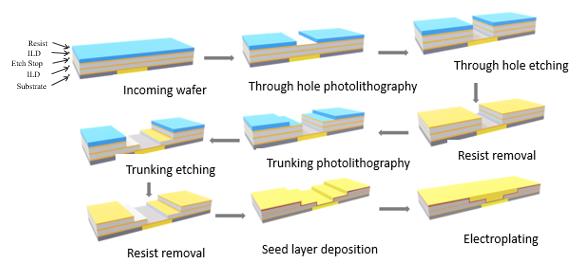

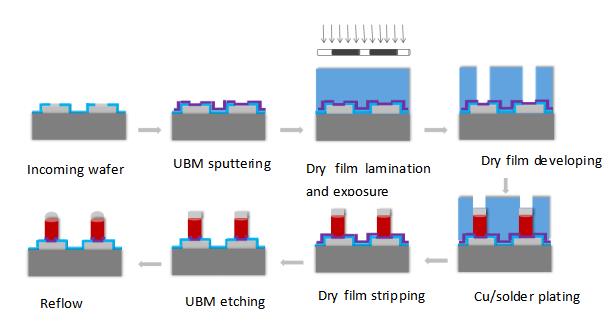

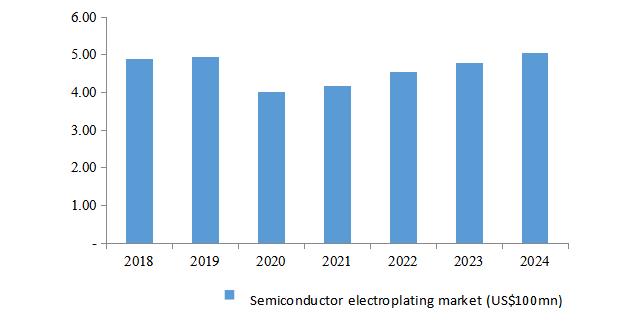

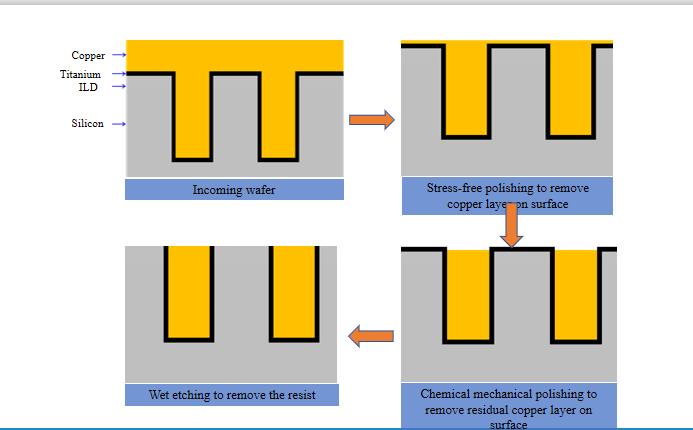

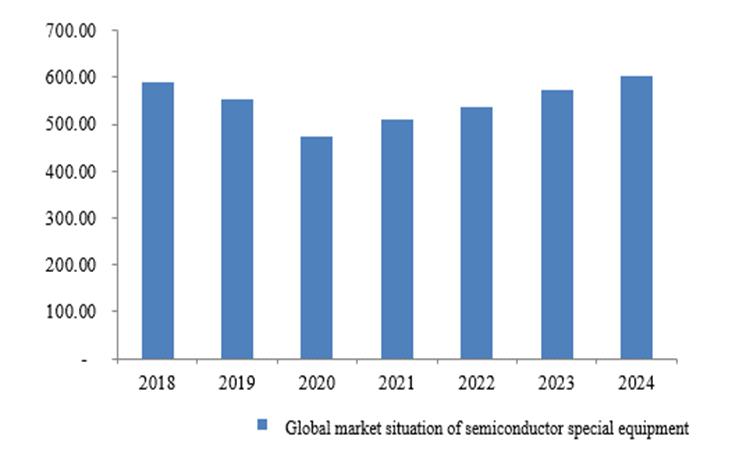

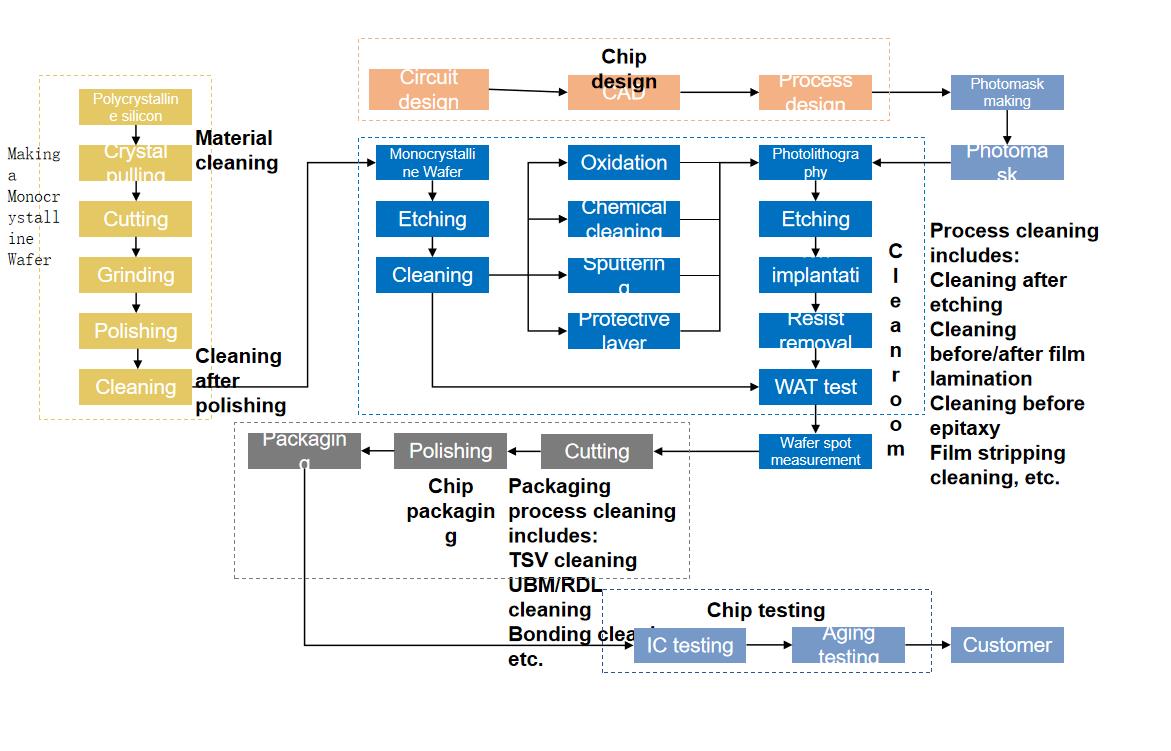

The company is mainly occupied in the research, development, production and sales of semiconductor special equipment. Its main products include semiconductor cleaning equipment, semiconductor electroplating equipment and advanced packaging wet equipment. The company persists in the development strategy of differentiated competition and innovation. Through self-developed single-chip megasonic cleaning technology, single-chip slot-type combined cleaning technology, electroplating technology, stress-free polishing technology and vertical furnace tube technology, the company provides customized equipment and process solutions to global wafer manufacturing, advanced packaging and other customers, effectively improving the customer’s production efficiency, product yield and reduce production costs.

Based on independent innovation, the company has successfully developed the world’s first SAPS and TEBO megasonic cleaning technology and Tahoe single-chip slot-type combined cleaning technology through years of technological research and process accumulation. These technologies can be applied in the wafer cleaning field of 45nm and below technology nodes, which can effectively solve the cleaning problem of organic contamination and particle after etching, and significantly reduce the use of concentrated sulfuric acid and other chemical reagents. It helps customers reduce production costs while meeting the energy saving and emission reduction requirements.

With advanced technology and rich product lines, the company has developed into one of the few semiconductor special equipment providers with certain international competitiveness in Chinese Mainland. The company’s products have been recognized by many mainstream semiconductor manufacturers at home and abroad, and have obtained good market reputation. The main customers of the company are as follows:

| Number | Field of Customer | Name of Customer |

| 1 | Wafer manufacturing | Hynix, Huahong Group, Yangtze Memory, SMIC, Hefei Changxin |

| 2 | Advanced Packaging | JCET, TFME, SJsemi, Nepes |

| 3 | Manufacturing and recycling of semiconductor silicon wafer | ZING SEMI, Wafer Works, Wafer Works, PSI |

| 4 | Research institutes | Institute of Microelectronics of Chinese Academy of Sciences, Shanghai Integrated Circuit, NCAP |

The company’s technical level for the megasonic single-chip cleaning equipment, single-chip slot-type combined cleaning equipment and electroplating process equipment of copper interconnection, has reached international leading or international advanced level. As of December 31, 2019, the company and its holding subsidiaries has 232 main licensed patents, including 108 domestic patents and 124 overseas patents. Among them, there are 227 invention patents. The company also won the title of “Shanghai Key Laboratory of Advanced Wet Process Equipment for Integrated Circuits”. It is the main subject unit of major scientific research projects in China such as “Research and development and application for 20-14nm copper plating equipment of copper interconnection” and “Research and development for 65-45nm stress-free polishing equipment of copper interconnection”, and other (“02 Special Project”) major scientific projects in China.

After years of continuous research and development investment and technology accumulation, the company has developed cleaning equipment for single-chip cleaning,

slot-type cleaning, and single-chip slot-type combined cleaning and others, copper interconnection electroplating equipment for the front end of chip manufacturing, advanced packaging electroplating equipment for the back end, as well as the wet etching equipment, gumming equipment, developing equipment, degumming equipment, stress-free polishing equipment, vertical furnace tube serial equipment and other equipment for advanced packaging. At present, the company’s products are mostly used in the integrated circuit industry. The company’s main products are as follows:

| Main products | Technical characteristics | Application field |

| Semiconductor cleaning equipment |

Single-chip cleaning equipment | The equipment can simultaneously clean the front and back of the wafer. Each equipment can be equipped with a variety of chemical liquids, which can be applied to single-chip wet cleaning and single-chip wet etching technology. | The equipment can be used for front and back cleaning of film deposition in chip manufacturing, cleaning after dry etching, cleaning after ion implantation ashing, cleaning after chemical mechanical grinding, cleaning after polishing and epitaxy, cleaning for chemical wet etching and other process. |

SAPS single-chip cleaning equipment | On the basis of the traditional single-chip cleaning equipment configuration, the equipment is equipped with the megasonic cleaning technology (SAPS) independently developed by the company. The equipment is mainly aimed at the cleaning process of flat

| The equipment can be used for front and back cleaning of film deposition in chip manufacturing, cleaning after dry etching, cleaning after ion implantation ashing, cleaning after

|

| | wafer surfaces and deep holes, focusing on the removal of small particles. In the process below 45nm, it effectively solves the cleaning problem of organic contamination and particles after etching, which greatly improves the cleaning efficiency. | chemical mechanical grinding, cleaning after polishing and epitaxy process and other process. |

TEBO single-chip cleaning equipment | On the basis of the configuration of the traditional single-chip cleaning equipment, the equipment is equipped with the megasonic cleaning technology of Timely Energized Bubble Oscillation (TEBO), which is independently developed by the company, to provide efficient cleaning of 3D structure wafers. In the case where the high aspect ratio of 3D chip is gradually improved, TEBO technology can stabilize the bubble’s oscillation to achieve low damage or even zero damage. | The equipment can be used for front cleaning of film deposition in chip manufacturing, cleaning after dry etching, cleaning after ion implantation ashing and other process. |

Single-chip slot-type combined cleaning equipment | Its integrated single-cavity cleaning module and slot-type cleaning module integrate the slot-type degumming process with the single-chip cleaning process. Compared with the traditional single-chip cleaning equipment, it can greatly save the amount of sulfuric acid, and the cleaning ability is comparable to

| The equipment can be used in photoresist stripping and cleaning of chip manufacturing, cleaning after dry etching, cleaning after ion implantation, cleaning after chemical mechanical grinding, metal

|

| | the single-chip cleaning equipment. | film removal and other process. |

Single-chip back cleaning equipment | The equipment uses non-contact clamping method of Bernoulli suspension, which can effectively protect the surface of wafer device and perform the cleaning or wet etching for the spray chemical liquid on the back of the wafer. It can be used for ultra-thin wafers with large warping degree or bonded wafers with carriers. | It can be used for the cleaning and wet etching process of the wafer backside in chip manufacturing. |

Scrubbing equipment for front end | The equipment adapts a single-chip cavity to clean the front and back of the wafer according to the working procedure. It can perform cleaning process including wafer backside scrubbing, wafer edge scrubbing, front and back cleaning for two-phase fluid, etc .; the equipment occupies a small area with high productivity and strong stability. There are various cleaning methods to be flexibly selected. | It can be used in the scrubbing process from the front end to the last end in chip manufacturing. |

Slot-type cleaning equipment | The equipment uses pure water, alkaline and acidic liquids as cleaning agents, and is combined with cleaning methods such as spray, hot dip, overflow and bubbling, and is equipped with advanced IPA drying method to clean the wafers in batches. | It can be used for cleaning, wet etching, film stripping, photoresist removal and other processes in the field of chip manufacturing. |

| Semiconductor electroplating equipment |

Copper interconnection electroplating equipment for the front end | Aiming at Ultra ECP map of the copper interconnection electroplating technology for the front end, which is the 55nn, 40nm, 28nm and below 20-14 nm technology nodes, the equipment mainly acts on the wafer to deposit a layer of dense and uniformly distributed copper without holes, gaps and other defects. | It can be used in the dual damascene electro-coppering process in logical circuits and memory circuits. |

Advanced packaging electroplating equipment for the back end | The equipment is developed in a differentiated manner to meet the needs of advanced packaging electroplating and can be used for high-current and high-speed electroplating applications. It adopts a modular design, which is convenient for maintenance and control, can shorten the maintenance time of equipment and improve the utilization rate of equipment. | It can be used in the advanced packaging Pillar Bump, RDL, HD Fan-out and TSV, and the electroplating processes, such as copper, nickel, tin, silver, gold, etc. |

| Advanced packaging wet equipment |

| The equipment uses a single-chip cavity to perform wet etching on the wafer surface. It integrates all the chemical liquid, pure water and gas lines for drying in a complete process into a

| It can be used for wet silicon etching of 12-inch and 8-inch wafers and UBM metal wet etching processes in advanced packaging, such

|

| Advanced packaging wet equipment | cavity. The equipment occupies a small area, consumes less chemicals and pure water with high flexibility in process adjustment. | as copper, titanium, nickel, tin, gold, etc. |

Gumming equipment | The equipment uses a single-chip cavity to perform the photoresist spin coating on the surface of the wafer, and completes the subsequent roasting and cooling working procedure in the hot and the cold plate. The equipment pioneers the self-cleaning function of the cavity, which replaces the traditional manual disassembly of the cavity for cleaning, avoiding the damage to the machine caused by frequent manual disassembly of the precision gumming machine. At the same time, the cleaning efficiency is greatly improved, the maintenance cost of the machine is reduced, and the service life of the machine is increased. | It can be used for the coating process of positive and negative glue and thin and thick glue for 12-inch and 8-inch wafers in advanced packaging. |

Developing equipment | The equipment uses a single-chip cavity to spray the developing solution on the surface of the wafer, and cleans and dries the wafer after spraying the developing solution. The equipment combines the developing technology of Spray and puddle. | It can be used for the developing process of 12-inch and 8-inch wafers in advanced packaging. |

Degumming machine | The equipment integrates slot-type degumming with single-chip degumming, completes the soaking process in the slot, softens and removes most of the thick glue. The single-chip degumming can complete the subsequent removal of residual glue, contaminants and particles and make up for the shortcomings of insufficient capacity of single-chip equipment. | It can be used for the degumming process of 12-inch and 8-inch wafers in advanced packaging. |

Advanced packaging scrubbing equipment | The equipment uses a single-chip cavity to spray chemical liquid or deionized water on the front and back of the wafer to achieve the cleaning, and use the physical brush to clean the wafer. | It can be used for the scrubbing and cleaning process of 12-inch and 8-inch wafers in advanced packaging. |

Stress-free polishing equipment | Stress-free polishing machine (Ultra SFP) is based on the principle of electro-chemistry and integrates stress-free polishing, chemical mechanical polishing, and wet etching processes. In advanced packaging applications, it can greatly reduce the consumption of polishing solution and reduce chemical emissions. | It can be used for 3D TSV, 2.5D silicon interposer, RDL, HD Fan-out, and others in advanced packaging. |

| Other equipment |

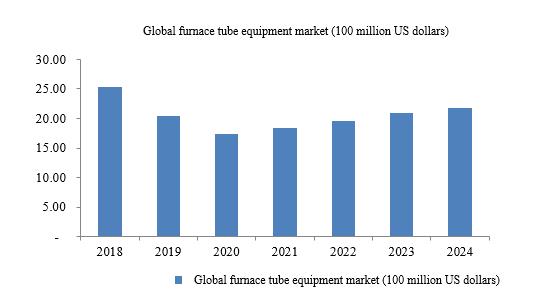

Vertical furnace tube equipment | The equipment can handle wafers process in batches to complete the deposition process of different types of non-metal thin films on the surface of wafers. It is mainly used for polycrystalline silicon, silicon nitride, silicon oxide and other thin films. | It can be used for the film deposition of polycrystalline silicon, silicon nitride, and silicon oxide in front end process of logical circuits and memory circuits. |

| | 3. | Composition of main business income |

During the reporting period, the company’s main business income according to product composition is as follows:

Unit: RMB 10,000 Yuan

| Project | 2019 | 2018 | 2017 |

| Amount | Proportion | Amount | Proportion | Amount | Proportion |

Semiconductor cleaning equipment | 62,522.30 | 84.10% | 50,135.96 | 92.91% | 21,492.48 | 86.27% |

Among them: single-chip cleaning equipment | 55,099.52 | 74.12% | 50,135.96 | 92.91% | 21,492.48 | 86.27% |

Slot-type cleaning equipment | 4,801.36 | 6.46% | - | - | - | - |

Single-chip slot-type combined cleaning equipment | 2,621.43 | 3.53% | - | - | - | - |

Semiconductor

| 7,857.39 | 10.57% | 1,191.13 | 2.21% | - | - |

| electroplating equipment | | | | | | |

Advanced packaging wet equipment | 3,961.12 | 5.33% | 2,634.07 | 4.88% | 3,421.33 | 13.73% |

Total | 74,340.81 | 100.00% | 53,961.17 | 100.00% | 24,913.81 | 100.00% |

During the reporting period, the income from the single-chip cleaning equipment has accounted for a relatively high proportion and grew rapidly. This is the company’s main source of income. Besides, the company has successfully developed the first scrubbing equipment for front end, the first stress-free polishing equipment, and the first vertical furnace tube equipment, and they have entered the customer verification; during the reporting period, there is no sales revenue.

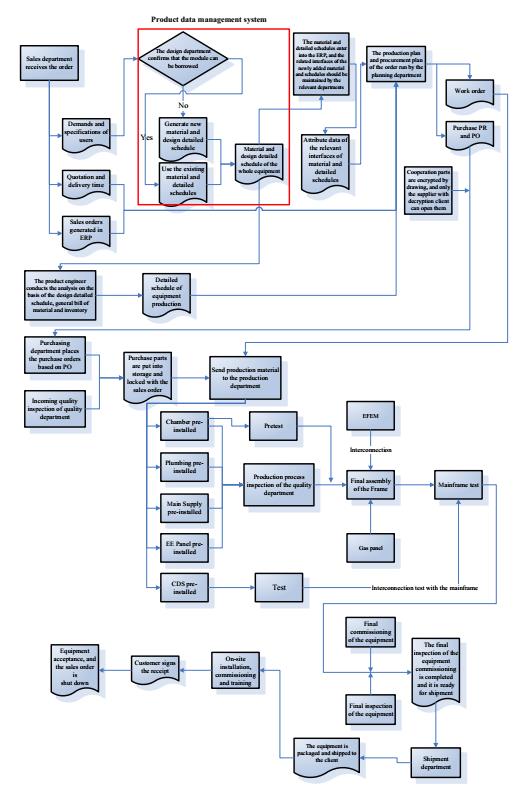

(Ⅱ) Main operation model