Exhibit 6.2

Reserve Evaluation Report

Ross et al Leasehold

Center Township

Gibson County, Indiana

November 20, 2013

Prepared for:

K & M Oil, Inc.

9 Crystal Lake Road, Suite 250

Lake in the Hill, IL 60156

Prepared by:

Adena Resources LLC

Cincinnati, Ohio

|

ADENA RESOURCES LLC |

| | 7253 Jethve Lane, Cincinnati OH 45243 Phone: 513.253.8459 |

|

Adena Resources, LLC |

November 20, 2013

K&M Oil, Inc.

9 Crystal Lake Road, Suite 250

Lake in the Hill, IL 60156

| Attn: | Mr. Brian Knight |

| Phone: | 847-791-9753 |

| Re: | Reserve Evaluation Report |

| | Ross et al Lease |

| | Center Township, Gibson County, Indiana |

Dear Mr. Knight:

Enclosed is the Reserve Report for the Ross et al leasehold located in Center Township, Gibson County, Ohio. This report was prepared in accordance with the“Canadian Oil and Gas Evaluation Handbook, Second Edition, dated September 1, 2007”.

Adena Resources, LLC accepts no responsibility or liability to any person or organization for any claim, for loss or damage caused, or believed to be caused, directly or indirectly by reliance on information in this report. No warranties, express or implied, are intended or made.

If you have comments or questions, please call (513) 253-8459.

Sincerely,

Adena Resources, LLC

Randy Bishop, PG

Principal Geologist

Enclosure

Reserve Evaluation Report |  |

Adena Resources, LLC |

Ross Leasehold Center Township, Gibson County, Indiana

Center Township, Gibson County, Indiana

November 20, 2013

TABLE OF CONTENTS

| 1.0 | EXECUTIVE SUMMARY | 1 |

| 2.0 | SUPPORTING INFORMATION FOR MAJOR PROPERTY | 8 |

| | 2.1 | Leasehold Information | 8 |

| | 2.2 | Geological Information | 8 |

| | 2.3 | Decline Curve Analysis | 8 |

Reserve Evaluation Report |  |

Adena Resources, LLC |

Ross Leasehold Center Township, Gibson County, Indiana

Center Township, Gibson County, Indiana

November 20, 2013

| List of Tables | Page |

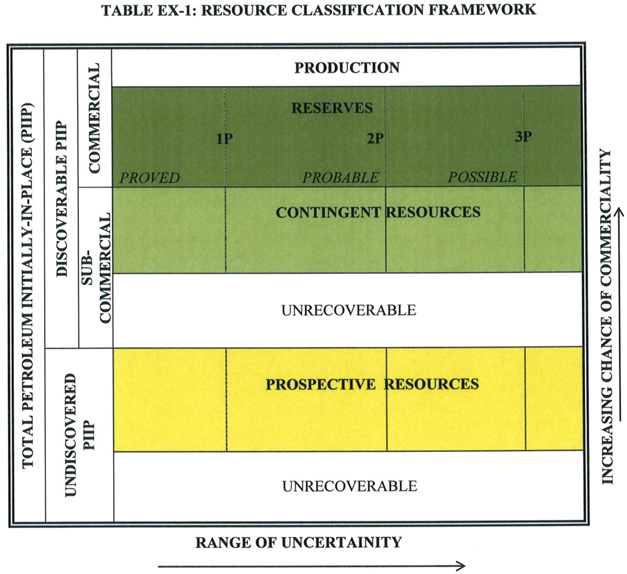

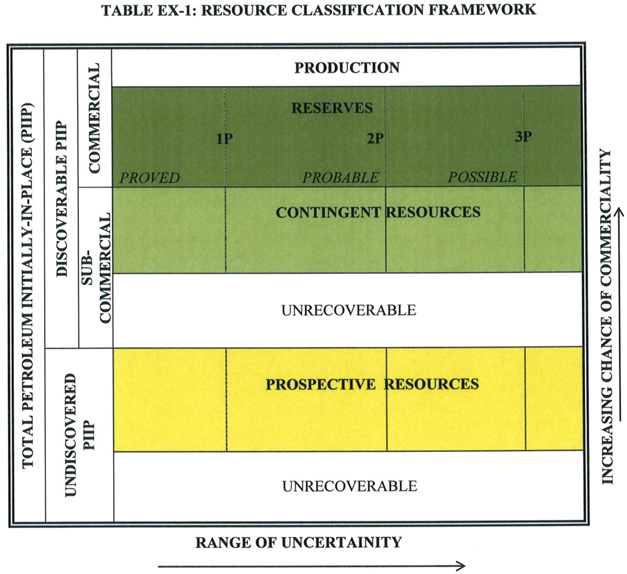

| Table EX-1: Resource Classification Framework | 3 |

| Table EX-2: Reserve Summary For Ross Et Al Leasehold, Gibson County, IN | 4 |

| Table EX-3: Summary of the Evaluation of the Petroleum Reserves | |

| As of November 2013 of the Ross Leasehold, Indiana | 7 |

| | |

| List of Figures | |

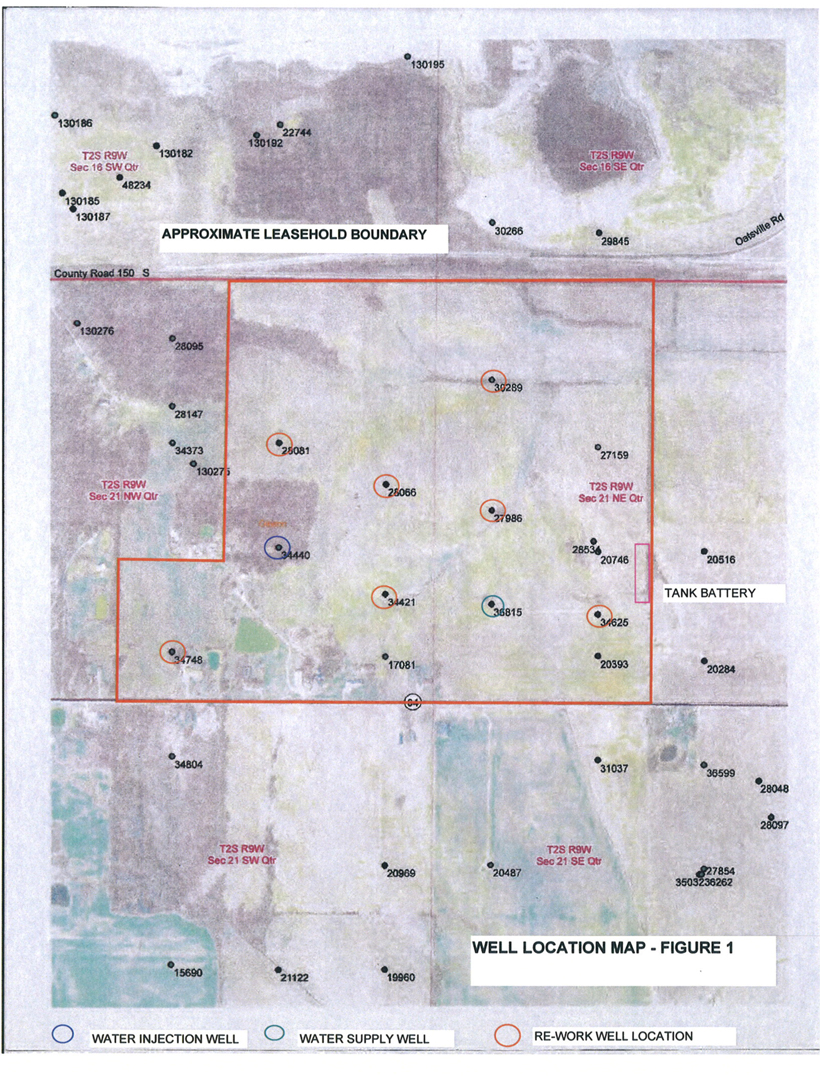

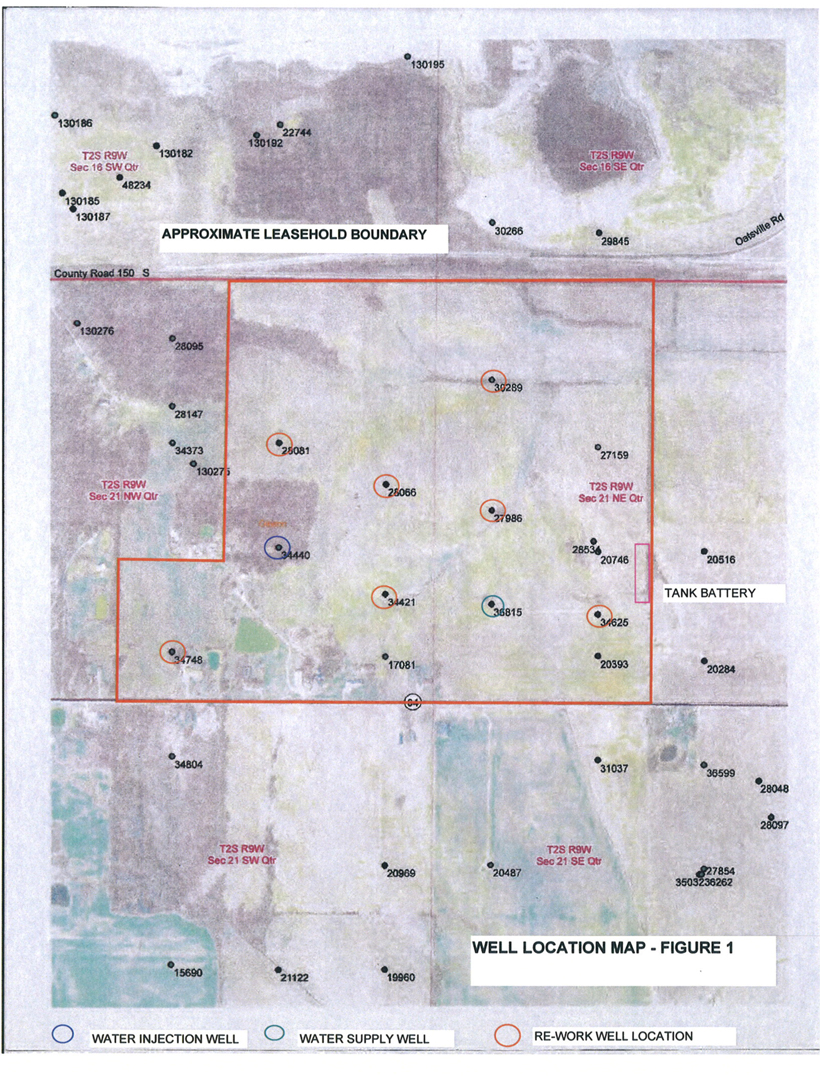

| Figure 1: Well Location Map | 6 |

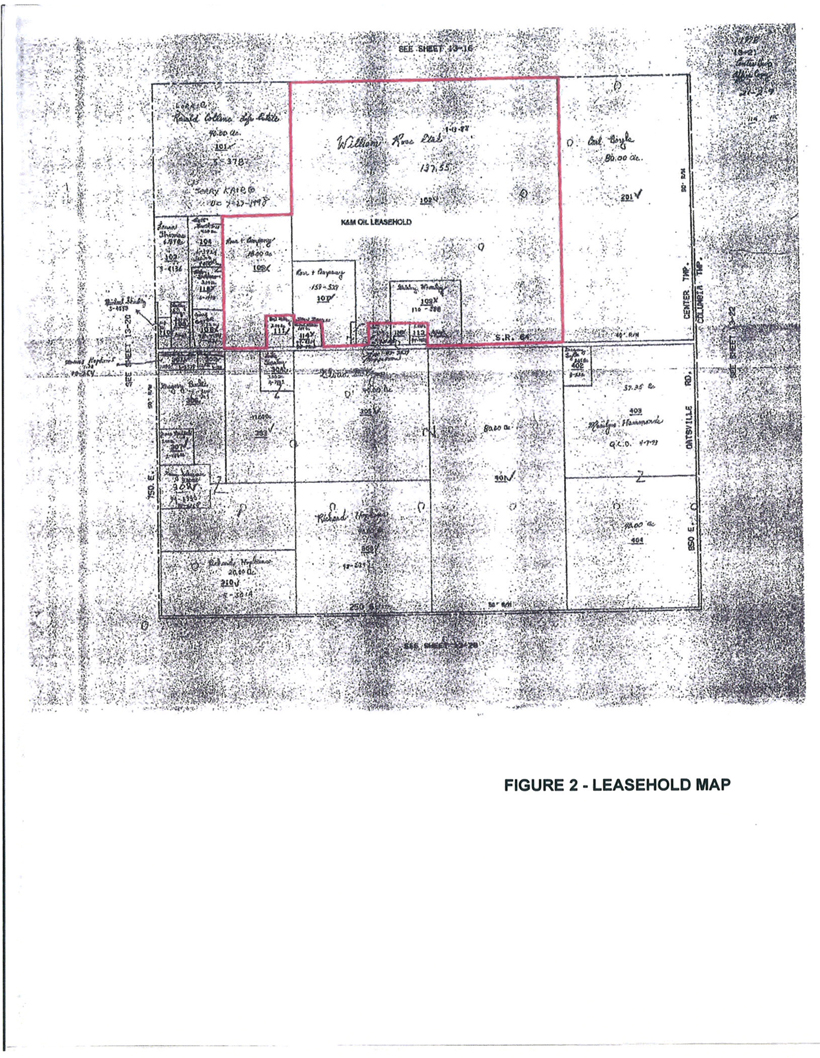

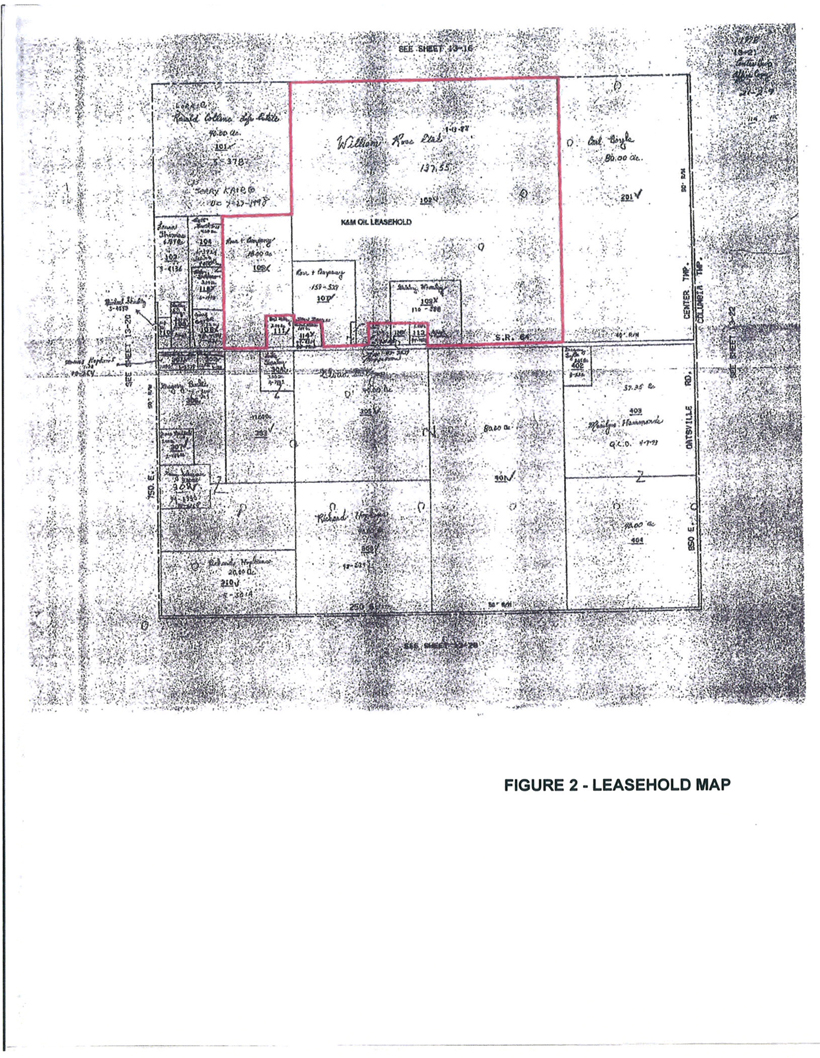

| Figure 2: Leasehold Map | 9 |

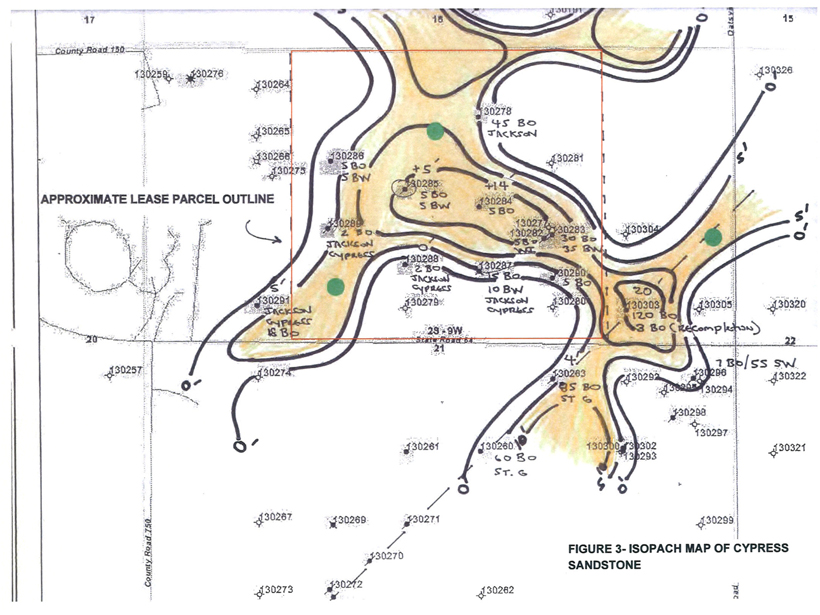

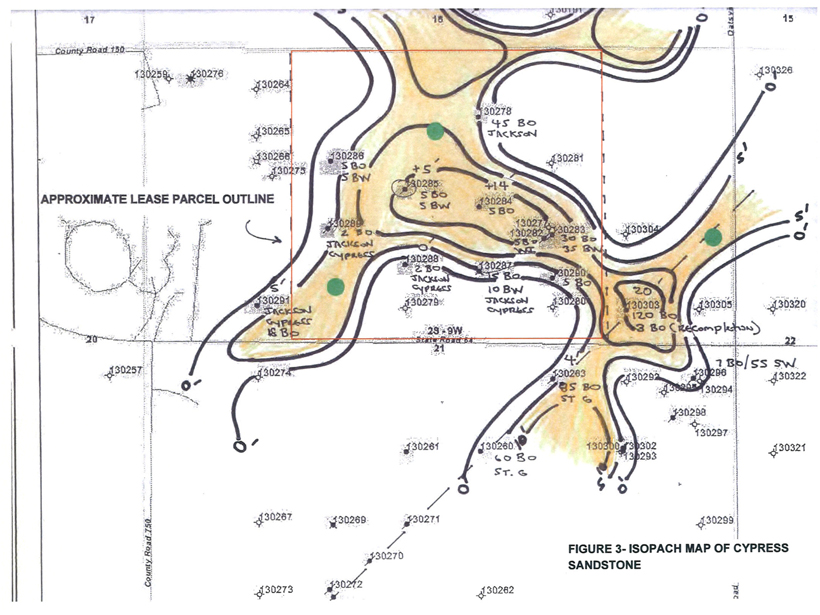

| Figure 3: Cypress Isopach Map | 10 |

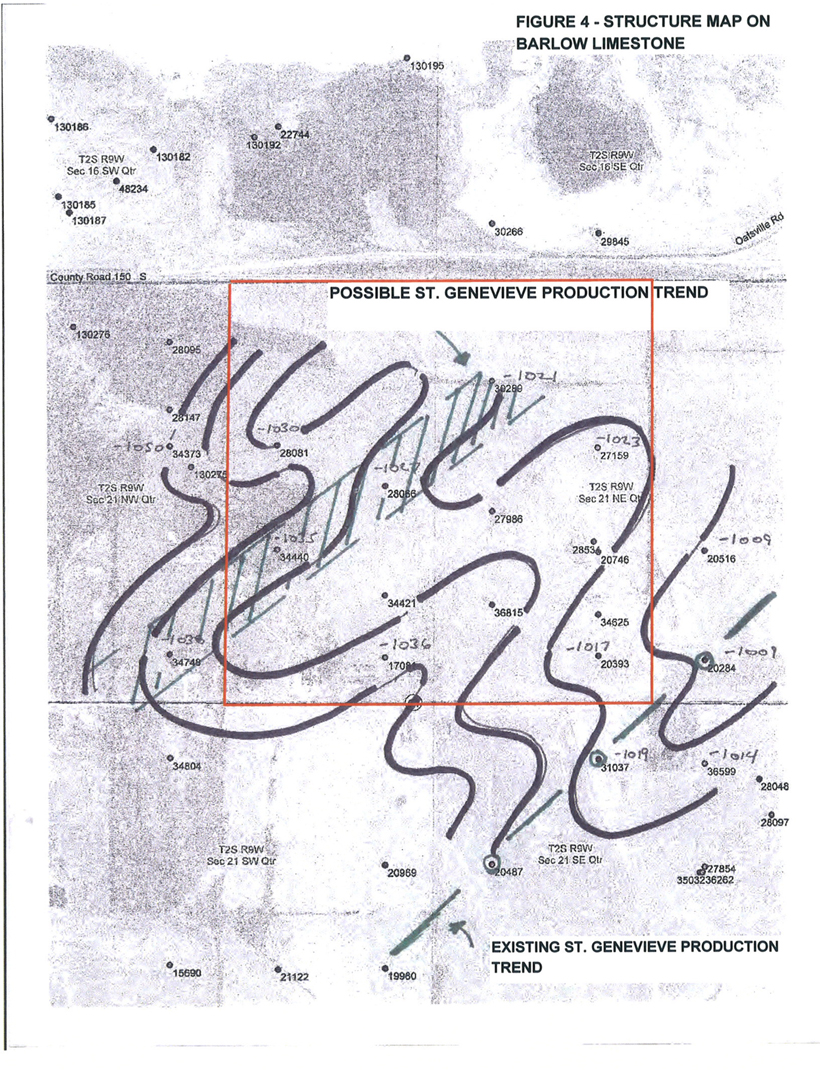

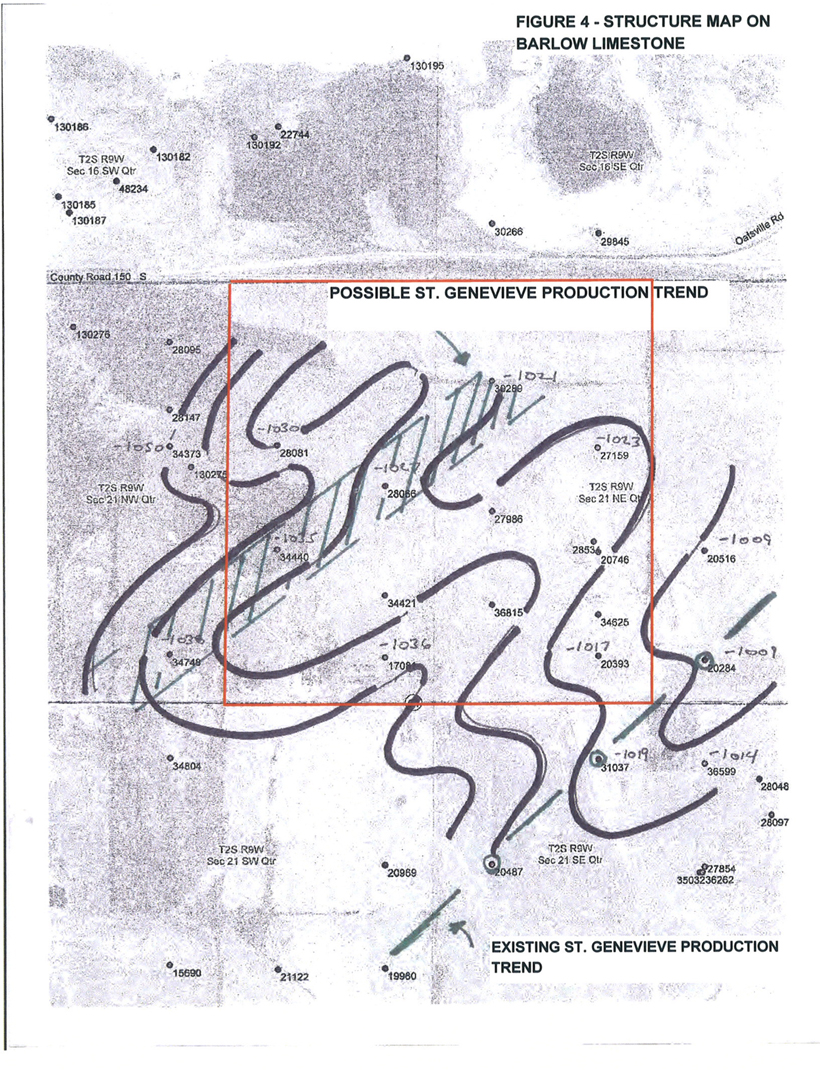

| Figure 4: Structure Map on Barlow Limestone | 11 |

| List of Appendices | |

| A: Qualifications of the Reserve Evaluator | |

| B: Engagement Letter | |

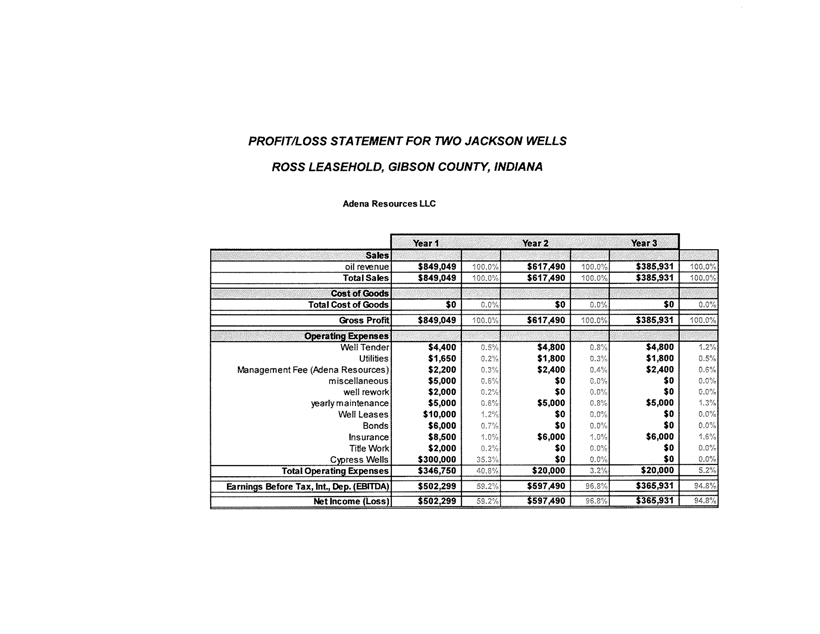

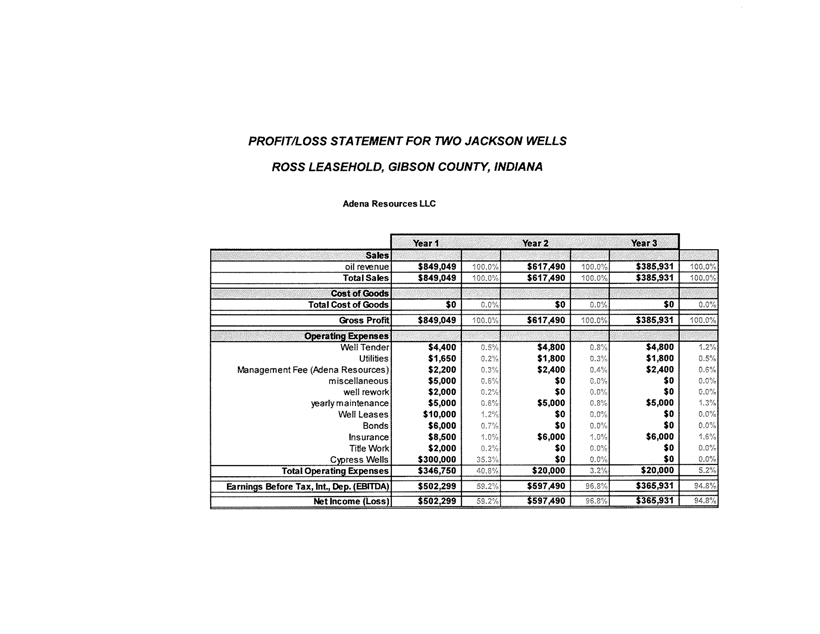

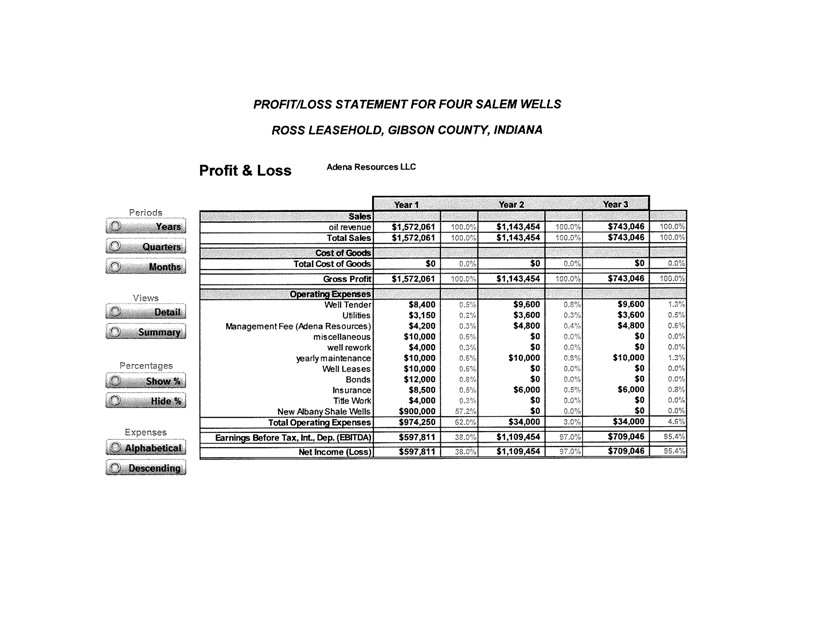

| C: Jackson Wells Profit and Loss Statement | |

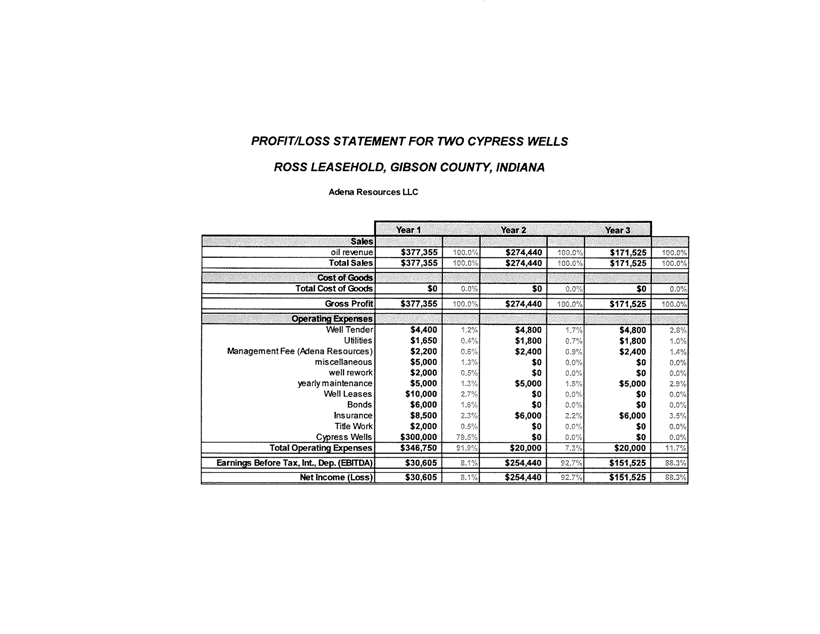

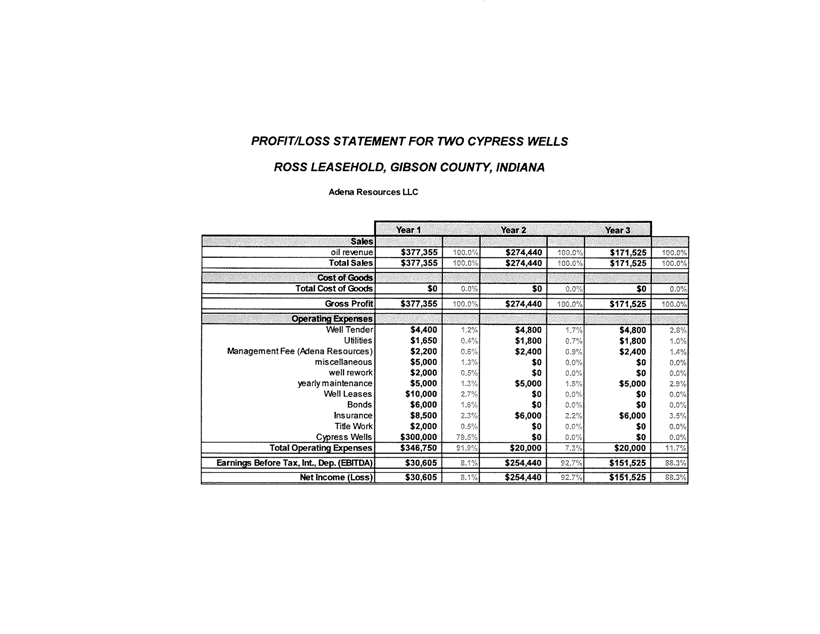

| D: Cypress Wells Profit and Loss Statement | |

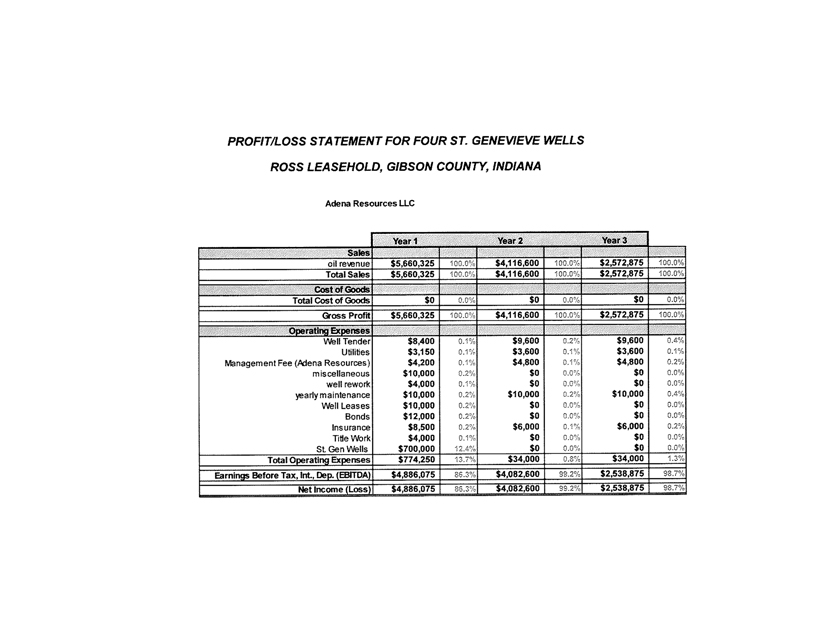

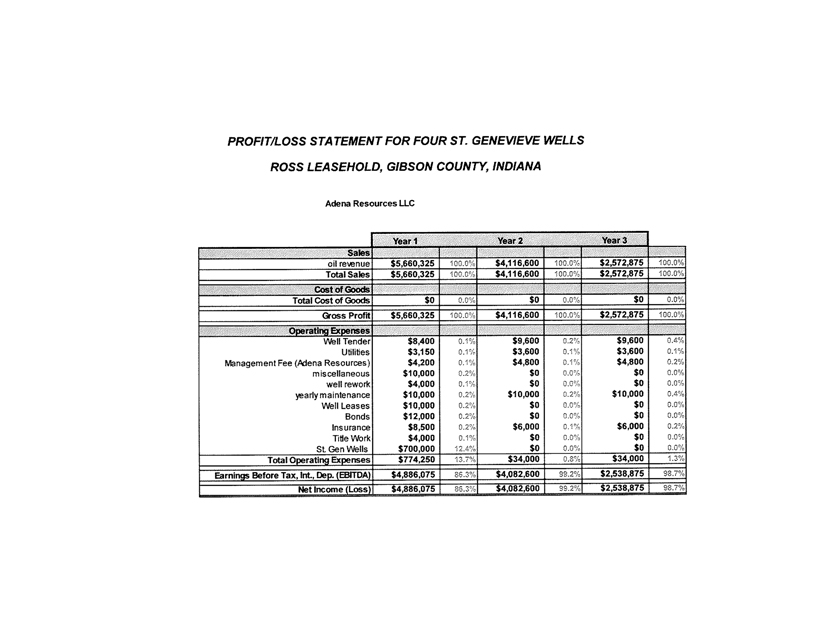

| E: St. Genevieve Wells Profit and Loss Statement | |

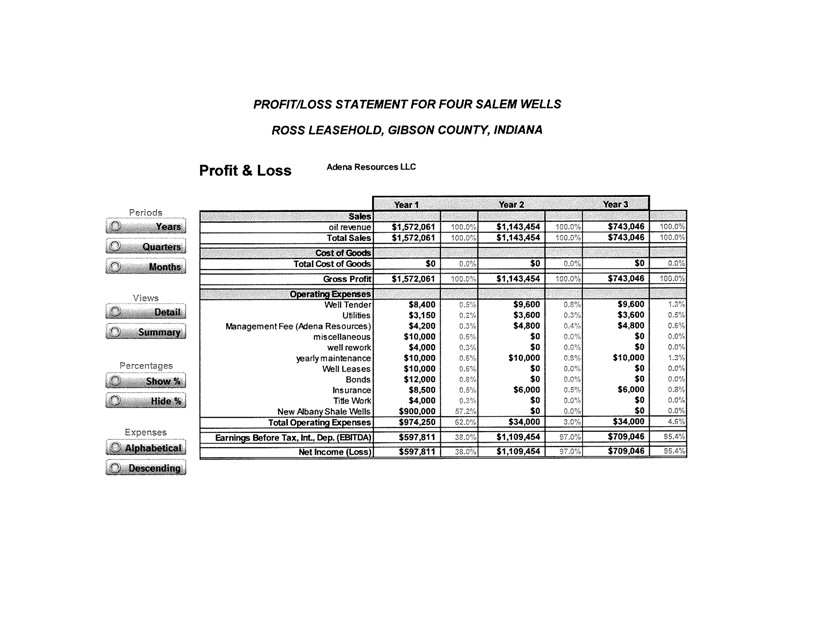

| F: Salem Wells Profit and Loss Statement | |

| G: Legal Description of Leasehold | |

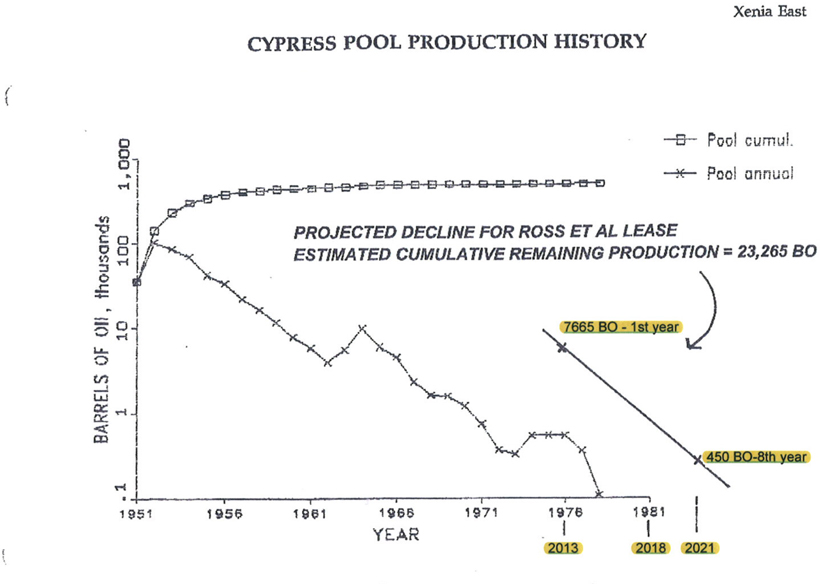

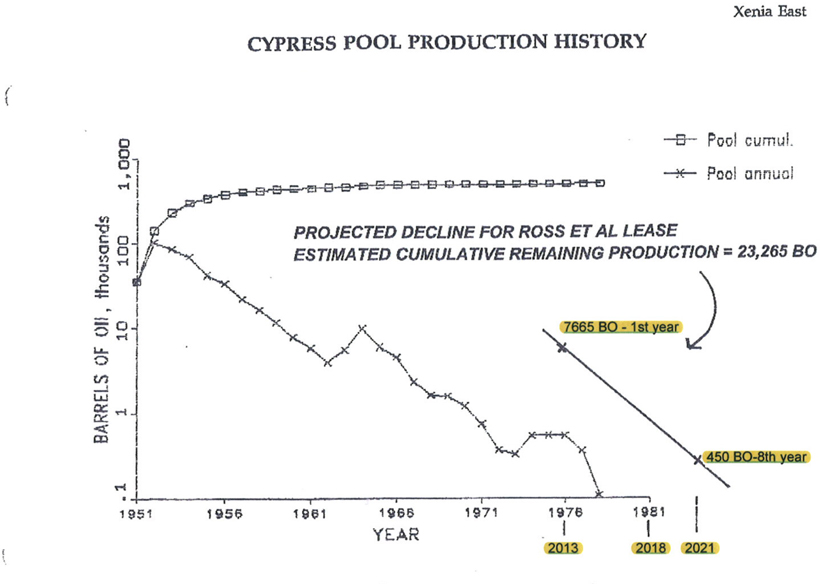

| H: Cypress Decline Curve | |

The purpose of this Reserve Report is to determine, using sound geological and engineering practices, obtainable oil reserves for the Ross et al Leasehold located in Center Township, Gibson County, Indiana. This report has been prepared by Adena Resources, LLC following general guidelines established in the“Canadian Oil and Gas Evaluation Handbook, Second Edition, dated September 1,2007”. Qualifications of the reserve evaluator are provided as Appendix A. Mr. Randy Bishop (reserve evaluator) has over 30 years of geological experience and is a member of the American Association of Petroleum Geologists (AAPG). Mr. Bishop was engaged by K&M Oil, Inc. (client) for this evaluation. A copy of the engagement letter is provided as Appendix B.

Definitions referred to or utilized in this report (taken from the above-referenced guideline) are as follows:

Total Petroleum Initially-In-Place (PIIP)is that quantity of petroleum that is estimated to exist originally in naturally occurring accumulations. It includes that quantity of petroleum that is estimated, as of a given date,to be contained in known accumulations, prior to production, plus those estimated quantities in accumulations yet to be discovered (equivalent to “total resources”).

Discovered Petroleum Initially-In-Place (equivalent to discovered resources)is that quantity of petroleum that is estimated, as of a given date, to be contained in known accumulations prior to production. The recoverable portion of discovered petroleum initially in place includes production, reserves, and contingent resources; the remainder is unrecoverable.

Reservesare estimated remaining quantities of oil and natural gas and related substances anticipated to be recoverable from known accumulations, as of a given date, based on the analysis of drilling, geological, geophysical, and engineering data; the use of established technology; and specified economic conditions, which are generally accepted as being reasonable. Reserves are further classified according to the level of certainty associated with the estimates and may be subclassified based on development and production status. To be classified as reserves, estimated recoverable quantities must be associated with a project(s) that has demonstrated commercial viability. Under the fiscal conditions applied in the estimation of reserves, the chance of commerciality is effectively 100 percent.

Proved reservesare those reserves that can be estimated with a high degree of certainty to be recoverable. It is likely that the actual remaining quantities recovered will exceed the estimated proved reserves.

Probable reservesare those additional reserves that are less certain to be recovered than proved reserves. It is equally likely that the actual remaining quantities recovered will be greater or less than the sum of the estimated proved +probable reserves. This definition shows the 2P estimate to be a “best estimate”of the remaining recoverable quantities. The 2P reserves estimate is the quantity that best represents the expected outcome with no optimism or conservatism, and as such is of key importance in reserves evaluation and reporting.

Possible reservesare those additional reserves that are less certain to be recovered than probable reserves. It is unlikely that the actual remaining quantities recovered will exceed the sum of the estimated proved +probable + possible reserves. This definition shows 3P reserves to be a relatively optimistic estimate of the remaining recoverable quantities.

Contingent Resourcesare those quantities of petroleum estimated, as of a given date, to be potentially recoverable from known accumulations using established technology or technology under development, but which are not currently considered to be commercially recoverable due to one or more contingencies. Contingencies may include factors such as economic, legal, environmental, political, and regulatory matters, or a lack of markets. It is also appropriate to classify as contingent resources the estimated discovered recoverable quantities associated with a project in the early evaluation stage. Not all technically feasible development plans will be commercial. The commercial viability of a development project is dependent on the forecast of fiscal conditions over the life of the project. For contingent resources the risk component relating to the likelihood that an accumulation will be commercially developed is referred to as the “chance of development.” For contingent resources the chance of commerciality is equal to the chance of development.

Prospective Resourcesare those quantities of petroleum estimated, as of a given date, to be potentially recoverable from undiscovered accumulations by application of future development projects. Prospective resources have both an associated chance of discovery and a chance of development. Prospective Resources are further subdivided in accordance with the level of certainty associated with recoverable estimates assuming their discovery and development and may be sub classified based on project maturity. Not all exploration projects will result in discoveries. The chance that an exploration project will result in the discovery of petroleum is referred to as the “chance of discovery.” Thus, for an undiscovered accumulation the chance of commerciality is the product of two risk components: the chance of discovery and the chance of development.

Table EX-1 (below) illustrates the various definitions described above. Reserves for the Ross Leasehold are classified as “probable reserves” (2P) and “possible reserves” (3P) categories and further described in Table EX-2.

Table EX-2 illustrates the reserve summary for the Ross et al leasehold currently controlled by K&M Oil, Inc. 2P expected value is $1,094,606 (see definitions above). 3P expected value is $6,433,057, taking into account site appropriate risk factors. Guidelines indicate various levels of uncertainty (i.e., low [10], best [50], and high [90]). Adena has used deterministic methods of probability (based on review of available literature and field information) to arrive at an 80% (P80) probability for 2P reserves and a probability of P10 to P30 to P60 for 3P (Probable reserves). Adena believes this correlates to a P50 definition guideline.

TABLE EX-2

RESERVE SUMMARY FOR ROSS ETAL LEASEHOLD, GIBSON COUNTY, INDIANA

Producing

Formation | | Developed

Producing

Reserves

(1P) | | Developed

Non-

Producing

Probable

Reserves

(2P) | | Capital

Costs | | Value | | 2P

Confidence

Level

(Probability

of

Occurrence) | | 2P

Expected

Reserves | | 2P

Expected

Capital

Costs | | 2P

Expected

Value | | Non-Developed

Possible Reserves (3P) | | Capital Costs

(3YR) | | Value

(3YR)7 | | 3P Confidence

Level

(Probability of

Occurrence) | | 3P Expected

Reserves

(3YR) | | 3P Expected

Capital Costs

(3YR) | | 3P Expected

Value

(3YR)7 | |

| Jackson (Big Clifty) | | | 0 | | | 23,265 BO | | $ | 200,000 | | $ | 1,347,257 | | | 80 | % | | 18,612 | | $ | 160,000 | | $ | 1,077,801 | | 24,000 BO (two wells)2 | | $ | 386,750 | | $ | 823,343 | | | 60 | % | 7,200 BO | | $ | 232,050 | | $ | 494,006 | |

| Cypress | | | 0 | | | | | | | | | | | | | | | | | | | | | | | 54,000 BO (two wells)3 | | $ | 386,750 | | $ | 1,852,523 | | | 60 | % | 16,200 BO | | $ | 232,050 | | $ | 1,111,514 | |

| St. Genevieve* | | | 0 | | | 0 | | | - | | | - | | | - | | | - | | | - | | | - | | 360,000 BO (four wells)4 | | $ | 842,250 | | $ | 12,350,151 | | | 30 | % | 54,000 BO | | $ | 252,675 | | $ | 3,705,045 | |

| Salem | | | 0 | | | 0 | | | - | | | - | | | - | | | - | | | - | | | - | | 100,000 BO (four wells)5 | | $ | 942,250 | | $ | 3,430,598 | | | 15 | % | 7,500 BO | | $ | 141,338 | | $ | 514,590 | |

| New Albany | | | 0 | | | 0 | | | - | | | - | | | - | | | - | | | - | | | - | | 177,200 BOE (four wells)6 | | $ | 1,042,250 | | $ | 6,079,019 | | | 10 | % | 8,860 BO | | $ | 104,225 | | $ | 607,902 | |

| TOTAL | | | | | | 23,265 BO | | $ | 200,000 | | $ | 1,347,257 | | | | | | 18,612 | 1 | $ | 160,000 | 1 | $ | 1,077,801 | 1 | 715,200 BO | | $ | 3,600,250 | | $ | 24,535,634 | | | | | 93,760 BO1 | | $ | 962,338 | 1 | $ | 6,433,057 | 1 |

*Includes the Paoli and St. Louis Limestone

1 – Adjusted by taking into account the confidence (risk) factor

2 – Analogous production from the West Fork Consolidated Pool in Gibson County, IN using a 50% reservoir depletion factor

3 – Analogous production from the Coe South Field in Pike County, IN using a reservoir depletion factor of 50%

4 – Analogous production from the Spencer Consolidated Field in Posey County, IN.

5 – Analogous production from the Plummer Field, luka Field, and the Keenville Field (Illinois)

6 – Analogous production from the Marcellus Shale Formation in Ohio, based on professional judgment

7 – Assumes 50% of the production occurs within the first three years

|

Adena Resources, LLC |

As illustrated on Table EX-2, current oil production is obtained from the Jackson (Big Clifty) and Cypress formations on the property. Figure 1 illustrates the well locations and re-work possibilities for the leasehold. Capital costs for re-work of the existing well network (i.e., 2P costs) are estimated at $160,000 ($20,000/well plus $20K pipeline/ancillary costs). This is based on estimated per well cost to date from similar workover operations.

Reserves and costs Non-Developed Possible Reserves (3P) are based on the following:

| • | Two new producing oil wells in the Jackson (Big Cliffy) formation |

| • | Two new producing oil wells in the Cypress formation |

| • | Four new producing oil wells in the St. Genevieve formation |

| • | Four new producing oil wells in the Salem Formation |

| • | Four new producing (oil equivalent) wells in the New Albany Formation |

Appendices C through G denote the Profit and Loss Statements for each formation.

Table EX-3 is a summary of the Petroleum Reserves for the Ross Leasehold, taking the data from Table EX-2. A net present value (NPR) was calculated for 0%, 5%, 10%, 15%, and 20%. Please note that the estimated net present values reported might not necessarily be the fair market value of the reserves. The estimated NPR was calculated using the calculator from the following website:http://ncalculators.com/investment/npv-net-present-value-calculator.htm.

‘Gross” and ‘Net” reserves were calculated using the confidence level factor identified from Table EX-2. The effects of income tax were not calculated in this evaluation. An 83.5 Net Revenue Interest (NRI) was factored into the table, based on communication with K&M Oil, Inc. personnel. $93/barrel of oil (BO) was used; this was based on the recent approximate average per barrel oil price from 11/18-11/22 as reported fromhttp://www.eia.gov/dnav/. This price was held constant of the evaluation. Based on communication with local oil purchasers, a charge of $10/B0 was utilized as the transportation charge. A three year “flush” production was used for the reserve calculations, based on the estimate that 50% of the production will, in the majority of cases, occur within the first three years.

Site visits were periodically conducted during the months of August through September 2013. This was in response to repair work being conducted on the tank battery.

Table EX-3 Summary of the Evaluation of the Petroleum Reserves As of

November 2013 of the Ross Leasehold, Gibson County, IN

| Product Classification | | Ultimate Reserves (BO) | | | Remaining Reserves (BO) | | | Net Present Values ($) | |

| | | | | | Company | | | Before Income Taxes | | | After Income Taxes | |

| | | | | | Gross | | | Net | | | 0% | | | 5% | | | 10% | | | 15% | | | 20% | | | 0% | | | 5% | | | 10% | | | 15% | | | 20% | |

Light, Medium Oil (Mbbl)

Proved Developed Producing

Proved Developed Non-Producing

Proved Undeveloped

Total Proved | | | UNK. | | | | 0

23,265

39,000

62,265 | **

** | | | 0

18,612

23,400

42,012 | **

** | | | 1,077,801

1,605,520

2.683.321 | | | | 1,002,188

1,360,429

2.362.617 | | | | 888.857

1,216,802

2.105.659 | | | | 794.344

1,096,337

1,890,681 | | | | 714.739

994,329

1,709,068 | | | | | | | | | | | | | | | | | | | | | |

Probable (St. Gen)

Probable (Satem)

Probable (New Albany)

Total Proved + Probable | | | | | | | 180,000

50,000

88,600

380,865 | **

**

**

**

| | | 54,000

7,500

8,600

112,112 | **

**

**

** | | | 3,705,045

514,590

607,902

7,510,758 | | | | 3,225,677

446,235

531,541

6,566,070 | | | | 2,853,731

398,761

472,533 5,830,684 | | | | 2,542,277

58,978

423,118

5,215,054 | | | | 2,279,094 325,318 381,349

4,694.829 | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Heavy Oil (Mbbl)

Proved Developed Producing

Proved Developed Non-Producing

Proved Undeveloped Total Proved Probable

Total Proved + Probable | | | NA | | | | NA | | | | NA | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Non-Associated and Associated Gas (MMcf)

Proved Developed Producing

Proved Developed Non-Producing

Proved Undeveloped Total Proved Probable

Total Proved + Probable | | | NA | | | | NA | | | | NA | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

*5-year calculated NPV

83.5 NRI

$93/BO (WTI as of 5/29/2012)

$10/BO (Transportation)

1% severance tax

** 3yr calculation (50% of production occurs within this period)

2.0 SUPPORTING INFORMATION FOR MAJOR PROPERTY

2.1 Leasehold Information

The leasehold is located in Center and Columbia Townships, Gibson County, IN; T2S, R 9 W; Sections 14,15, 21, 22, and 29. A leasehold map is provided as Figure 2; a legal description of the leasehold is provided as Appendix G. The leasehold comprises approximately 166 acres.

2.2 Geological Information

The Cypress Sandstone was deposited in a delta-distributary channel, primarily in a southwest-northeast direction. Oil is stratigraphically trapped where the sandstone crosses positive structural features, or where the sand pinches out. Similar to the Big Clifty, deposition and oil production from the Cypress is affected by deep-seated basement faulting, which trends northeast-southwest. The attached Figure 3 illustrates Cypress Sandstone thickness over the leasehold. A type log (Highland Oil - Winget No.1), located immediately within the prospective leasehold, had initial production of 120 BO/day from the Cypress.

The St. Genevieve Limestone is one of the most important petroleum-producing formations in the Illinois Basin. Oil reservoirs are associated with lenses of oolitic grainstone (i.e., McClosky sands) encased in limestone. The Illinois Basin during St. Genevieve time was a broad, shallow ramp, dipping gently to the south. Tidal flow on and off the ramp kept the ooids in motion in shallow water and was probably responsible for the north-south orientation (along with basement faulting). Oil fields within the St. Genevieve are sometimes expressed by a pronounced structural nose. Information regarding the Stringtown Field, a St. Genevieve Limestone Pool which is believed to be similar to what is expected on the prospective leasehold, is provided. Structural mapping on top of the Renault Limestone (stratigraphically above the St. Genevieve) in the prospective area illustrates a pronounced structural nosing, similar to the Stringtown Field (see Figure 4). Twelve producing wells within the St. Genevieve can be identified along this trend.

2.3 Decline Curve Analysis

Due to lack of field production information, decline curve analysis for the Cypress formation was completed using historic data taken from the Xenia East Field, from Indiana Department of Natural Resource (IDNR) records. The decline curve is provided as Appendix H. Production analysis from the other formations evaluated (e.g., Jackson, St, Genevieve, etc.) were also taken from analogous field production, reported by IDNR and the state of Illinois.

Appendix A

Reserve Estimator Qualifications |

| Randy Bishop, P.G. |  | |

| Managing Partner, Principal Geologist | adena

RESOURCES LLC |

| | 7809 Laurel Avenue Suite 8 |

| | Cincinnati, Ohio 45243 513.253.8459

888.248.1733 |

Adena Resources LLC is an independent consulting firm specializing in the exploration, development, and production of domestic oil and gas reserves. The personnel at Adena have a combined 60+ years of experience in the oil and gas industry which includes extensive geological, drilling, and production experience in the Gulf Coast, Appalachian Basin and Illinois Basin (i.e., Kentucky, Pennsylvania, West Virginia, Ohio, Indiana, and Illinois).

Registration

| • | Registered Geologist: State of Kentucky, License No. 223 |

| • | Notary Public, State of Ohio; commission expires May 19,2013 |

Fields of Competence

| • | Oil and gas prospect development and drilling experience in the Gulf Coast, Appalachian and Illinois Basins. |

| • | Drilling oversight; geophysical well log evaluation and interpretation. |

| • | Re-conditioning existing oil and gas wells to optimize production. |

| • | Seismic program development and interpretation. |

| • | Consultation on oil and gas property evaluation / appraisals. |

| • | Aeromagnetic evaluation and data interpretation. |

| • | Remote sensing (i.e., Landsat, SLAR, etc.). |

Credentials

| • | B.S., Geology, cum laude, Marshall University, 1981. Minors in mathematics and chemistry. |

Key Projects

Exploration Manager for a +$15M drilling program in Ohio. Over 200 wells were drilled and completed in a two-year period with a 90% success rate. The average depth of these wells ranged from 4,000 to 6.0 feet. Approximately 20 BCF of gas reserves were discovered and produced.

Part of a regional geological pathfinding team for a major oil company developing and evaluating major oil and gas plays within North America. Play development involved utilizing regional seismic, remote sensing techniques and available well log information.

Exploration Manager for a startup oil and gas company in Ohio. Developed a regional exploratory play within the Cambrian-age Knox formation. Oversaw the development and interpretation of reflective seismic and gravity/magnetic studies to prove up prospect development. Conducted oil and gas leasing within key hot spot prospects. Approximately 3 initial wells were drilled with discovered reserves estimated at 1.0 BCF and 100,000 BO.

Oil and gas appraisal for select properties in West Virginia. Evaluated 5,000+ acres within the Upper Devonian sands and Middle Devonian Oriskany Play within central Pennsylvania for oil and gas potential. Based upon detailed reserve analysis, negotiated lease with major oil company on behalf of landowner.

APRIL 2009

Appendix B Engagement Letter |

Contract for Services Rendered

This is a contract entered into byADENA RESOURCES, LLL(hereinafter referred to as “the Provider”) andSTRATEGIC LENDING SOLUTIONS, LLC(hereinafter referred to as “the Client”) on this date, March 4, 2013

The Provider’s place of business is7809 Laurel Avenue, Suite 8, Cincinnati, OH 45243andthe Client’s place of business is9 Crystal Lake Road, Ste. 250, Lake In TheHills, IL60156.

The Client hereby engages the Provider to provide services described herein under “Scope and Manner of Services.” The Provider hereby agrees to provide the Client with such services in exchange for consideration described herein under “Payment for Services Rendered”.

Scope and Manner of Services

Services To Be Rendered By Provider: enumerate here each particular task to be performed and its acceptable result, i. e.,

| 1. | Perform Geological services in anticipation of meeting the requirements of National Instrument 51-101, |

| 2. | Complete National instrument 51-101, and |

| 3. | Assist when needed with the process Involved in listing the asset on theTSXVExchange. |

Payment for Services Rendered

The Client shall pay the Provider for services rendered according to the attached Payment Schedule.

Applicable Law

This contract shall be governed by the laws of the County of Cook in the State of Illinois and any applicable Federal law.

| |

| Initials | |

Signatures

In witness of their agreement to the terms above, the parties or their authorized agents hereby affix their signatures:

| /s/ Brian Knight | 3/4/13 | | /s/Randy Bishop | 3/4/13 |

| Brian Knight, Strategic Lending Solutions, LLC | | Randy Bishop, Adena Resources, LLC |

| BRIAN KNIGHT | | RANDY BISHOP |

| (Signature of Client or agent) / (Date) | | (Signature of Provider or agent) / (Date) |

| |

| Initials | |

PAYMENT SCHEDULE

Payment for services rendered will be submitted in accordance with the following:

| 1. | Four Thousand Dollars and no/100 ($4,500,00) will be rendered to Provider upfront, |

| 2. | An additional Two Thousand Dollars and no/100 ($1,500.00) will be rendered to Provider upon completion of the services described above in Section“Scope and Manner of Services” |

| 3. | Costs Incurred by Provider such as materials will be reimbursed by Client. |

| 4. | Shares will be granted to Provider based on 3% of the overall stock and a 1% overriding royalty should the asset be purchased by a publicly traded company. |

| 5. | Additionally Provider will be entitled to a stock options incentive program to be outlined at the onset of the purchase of the asset by CapGain or a CPC from K&M Oil/Strategic Lending Solutions. |

| |

| Initials | |

APPENDIX C

Jackson Wells PNL |

APPENDIX D

Cypress Wells PNL |

APPENDIX E St. Genevieve Wells PNL |

APPENDIX F Salem Wells PNL |

APPENDIX G Legal Description of Leasehold |

LEGAL DESCRIPTION - OIL AND GAS LEASES

Tract 1: A part of the East Half of the Northwest Quarter of Section 21; Township 2 South, Range 9 West in Gibson County, Indiana and more particularly described as follows: Beginning at the Northwest corner of the said half quarter section; thence South 89 degrees 51 minutes 57 seconds East along the North line of Section 21 a distance of 984.06 feet; thence South 00 degrees 02 minutes 39 seconds East a distance of 1987.14 feet; thence South 89 degrees 59 minutes 43 seconds West a distance of 30.73 feet; thence South 00 degrees 02 minutes 39 seconds East a distance of 418.00 feet; thence South 89 degrees 59 minutes 43 seconds West a distance of 225.60 feet; thence South 00 degrees 02 minutes 39 seconds East a distance of 242 feet to the South line of the said half quarter section; thence South 89 degrees 59 minutes 43 seconds West along the said South line a distance of 111.56 feet; thence North 00 degrees 00 minutes 47 seconds West a distance of 878.17 feet; thence South 89 degrees 53 minutes 46 seconds West a distance of 618.00 feet to the West line of the said half quarter section; thence North 00 degrees 00 minutes 00 seconds East along the said West line a distance of 1772.43 feet to the point of beginning and containing 45.72 acres, more or less.

Tract 2:Part of the Southeast Quarter of the Northwest Quarter of Section 21, Township 2 South, Range 9 West in Gibson County, Indiana more particularly described as follows: The place of beginning may be found at an iron at the Southwest corner of said quarter quarter, said iron is located 1.3 feet north of the center line of Highway #64 and at station 473 + 96.1, and run thence North and along the West line of said quarter quarter 877.10 feet to an iron; thence East 618 feet to an iron; thence South and parallel to the West line thereof 623 feet to an iron; thence West and parallel to the South line thereof 50 feet; thence South and parallel to the West line thereof 255.17 feet to the South line of said quarter quarter, said point being 0.75 feet north of the center line of said highway; thence west and along the South line of said quarter quarter 568.20 feet to the place of beginning and containing 12.1605 acres,

Excepting therefrom a part of the Southeast Quarter of the Northwest Quarter of Section 21, Township 2 South, Range 9 West in Gibson County, Indiana more particularly described as follows: Begin at an iron found being the southwest corner of the Southeast Quarter of the Northwest Quarter of said Section 21, thence measure North 0 degrees 00 minutes East along the West line of said quarter quarter, a distance of 269.40 feet to a 5/8 inch iron set; thence measure South 88 degrees 21 minutes East, a distance of 268.00 feet to a 5/8 inch iron set; thence measure South 3 degrees 44 minutes East, to the South line of said quarter quarter, a distance of 262.28 feet to a point; thence measure South 90 degrees 00 minutes West, a distance of 286.89 feet to the point of beginning and containing 1.69 acres in said exception.

Tract 2A:a part of the Southeast Quarter of the Northwest Quarter of Section 21, Township 2 South, Range 9 West in Gibson County, Indiana more particularly described as follows; Begin at an iron found being the southwest corner of the Southeast Quarter of the Northwest Quarter of said Section 21, thence measure North 0 degrees 00 minutes East along the West line of said quarter quarter, a distance of 269.40 feet to a 5/8 inch iron set; thence measure South 88 degrees 21 minutes East, a distance of 268.00 feet to a 5/8 inch iron set; thence measure South 3 degrees 44 minutes East, to the South line of said quarter quarter, a distance of 262.28 feet to a point; thence measure South 90 degrees 00 minutes West, a distance of 286.89 feet to the point of beginning and containing 1.69 acres in said exception.

Tract 3: Part of the Southeast Quarter of the Northwest Quarter of Section 21, Township 2 South, Range 9 West in Gibson County, Indiana, and more particularly described as follows: Beginning at a point in the south line thereof 568.20 feet east of the southwest corner thereof; thence north and parallel to the west line thereof 255,37 feet; thence east and parallel to the south line thereof 50.00 feet; thence south and parallel to the west line thereof 255.17 feet to the south line; thence west along said south line 50.00 feet to the place of beginning and containing ..2929 acres.

Tract 4: A part of the East half of the Northwest Quarter and part of the West half of the Northeast Quarter all in section 21, Township 2 South, Range 9 West in Gibson County, Indiana and more particularly described as follows: Commencing at the Northwest comer of the East half of the Northwest Quarter of said Section 21; thence South 89 degrees 51 minutes 57 Seconds East along the North line of Section 21 a distance of 984.06 feet to the point of the beginning; thence South 89 degrees 51 minutes 57 seconds East along the North line of Section 21 a distance of 601.68 feet; thence South 00 degrees 12 minutes 19 seconds East a distance of 620.14 feet; thence South 89 degrees 50 minutes 5 seconds East a distance of 397.38 feet; thence South 00 degrees 12 minutes 19 seconds Fast a distance of 2024.37 feet to the South line of the West half of the Northeast Quarter of Section 21; thence South 89 degrees 59 minutes 43 seconds West along the said South line a distance of 377.22 feet; thence North 00 degrees 02 minutes 39 seconds West a distance of 660,00 feet; thence South 89 degrees 59 minutes 43 seconds West a distance of 629.27 feet; thence North 00 degrees 02 minutes 39 seconds West a distance of 1987.14 feet to the point of the beginning and containing 45.72 acres, more or less.

Tract 5: A part of the Southeast Quarter of the Northwest Quarter and a part of the Southwest Quarter of the Northeast Quarter of Section 21, Township 2 South, Range 9 West, Gibson County, Indiana and more particularly described as follows: Beginning at a 2 inch pipe at the southwest corner of the Southwest Quarter of the Northeast Quarter of said Section; run thence East 276.00 feet to a nail with a battle cap; thence North 660.00 feet to a point 3.9 feet south of an iron; thence West 660.00 feet, thence South 660.00 feet to a nail with a bottle cap in Hwy 64; thence East 384.00 feet to the place of beginning, containing 10 acres,

EXCEPTING THEREFROM, A part of the Southeast Quarter of the Southeast Quarter of the Northwest Quarter of Section 21, Township 2 South, Range 9 West, Gibson County, Indiana described as follows: beginning at a 2 inch pipe marking the southeast comer of the Southeast Quarter of the Northwest Quarter of Section 21, said pipe being slightly south of the centerline of State Road #64; thence bear West along the south line of said Quarter Quarter Section, a distance of 180.00 feet to a point, thence bear north 242,00 feet to a 5/8 inch iron; thence bear east a distance of 180.00 feet to a 5/8 inch iron set in the east line of said Quarter Quarter section; thence bear South 242.00 feet to the place of beginning, containing 1 acre in said exception.

AND ALSO EXCEPTING THEREFROM, A part of the Southeast Quarter of the Southeast Quarter of the Northwest Quarter of Section 21, Township 2 South, Range 9 West, Gibson County, Indiana described as follows: beginning at a 2 inch pipe marking the southeast corner of the Southeast Quarter of the Northwest Quarter of Section 21, said pipe being slightly south of the centerline of State Road #64; thence bear West along the south line of said Quarter Quarter Section, a distance of 180.00 feet to a point, thence bear north 242.00 feet to a 5/8 inch iron; thence bear east a distance of 180.00 feet to a 5/8 inch iron set in the east line of said Quarter Q

Tract 5A: A part of the Southeast Quarter of the Southeast Quarter of the Northwest Quarter of Section 21, Township 2 South, Range 9 West, Gibson County, Indiana described as follows: beginning at a 2 inch pipe marking the southeast corner of the Southeast Quarter of the Northwest Quarter of Section 21, said pipe being slightly south of the centerline of State Road #64; thence bear West along the south line of said Quarter Quarter Section, a distance of 180.00 feet to a point, thence bear north 242.00 feet to a 5/8 inch iron; thence bear east a distance of 180.00 feet to a 5/8 inch iron set in the east line of said Quarter Quarter section; thence bear South 242.00 feet to the place of beginning, containing 1 acre in said exception.

Tract 5B: A part of the Southeast Quarter of the Northwest Quarter of Section 21, Township 2 South, Range 9 West in Gibson County, Indiana, and more particularly described as follows: The place of beginning may be found by measuring West along the South line of said Quarter Quarter Section, 180.00 feet from a 2 inch iron at the Southeast comer thereof, and from said place of beginning, run thence west along the South line of said Quarter Quarter Section, 204.00 feet to the Southwest corner of a 9-acre parcel owned by Shirley Joan Woolsey; thencc North and along the West fine of the Wooisey property 242.00 feet; thence East and parallel to the South line thereof 204.00 feet to a 5/8 inch iron; thence South along the Woolsey -Russell Beasley one-acre parcel, 242.0 feet to the place of beginning, containing 1.13 acres in said exception.

Tract 6: A part of the West half of the Northeast quarter of Section 21, Township 2 South, Range 9 West in Gibson County, Indiana, and more particularly described as follows: Beginning at the Northeast corner of the West half of the Northeast Quarter of Section 21; thence South 00 degrees 12 minutes 19 seconds East along the East line of said half quarter section a distance of 2643.13 feet to the Southeast corner of the said half quarter section; thence South 89 degrees 59 minutes 43 seconds West along the quarter section line a distance of 660.00 feet; thence North 00 degrees 12 minutes 19 seconds West a distance of 2024.37 feet; thence North 89 degrees 50 minutes 05 seconds West a distance of 397.38 feet; thence North 00 degrees 12 minutes 19 seconds West a distance of 620.14 feet to the North line of Section 21; thence South 89 degrees 51 minutes 57 seconds East along the Section line a distance of 1074.94 feet to the point of the beginning and containing 45.71 acres, more or less.

APPENDIX H Cypress Decline Curve |

The production graph clearly illustrates that Xenia East was initially produced at a high rate. More than half of the total oil produced was extracted within three years of discovery.

Center Township, Gibson County, Indiana

Center Township, Gibson County, Indiana