Filed Pursuant to Rule 424(b)(3)

Registration No. 333-212639

STRATEGIC STORAGE TRUST IV, INC.

SUPPLEMENT NO. 8 DATED FEBRUARY 23, 2018

TO THE PROSPECTUS DATED MARCH 17, 2017

This document supplements, and should be read in conjunction with, the prospectus of Strategic Storage Trust IV, Inc. dated March 17, 2017. This document amends and supersedes all prior supplements to the prospectus. Unless otherwise defined in this supplement, capitalized terms used in this supplement shall have the same meanings as set forth in the prospectus.

The purpose of this supplement is to disclose:

| | • | | an update on the status of our public offering; |

| | • | | our ability to sell to investors in the State of Washington after meeting the $10 million minimum; |

| | • | | our ability to sell to investors in the Commonwealth of Pennsylvania after meeting the $50 million minimum; |

| | • | | updates to our risk factors; |

| | • | | an update regarding the resignation of one of our independent directors and the appointment of Alexander S. Vellandi as an independent director to our board of directors; |

| | • | | a change in title regarding one of our executive officers; |

| | • | | information regarding our share redemption program; |

| | • | | information regarding related party fees and expenses; |

| | • | | the addition of the “Our Self Storage Properties” section of the prospectus which includes, but is not limited to, disclosures regarding two properties we acquired in Texas and Florida and the potential acquisition of four other self storage properties; |

| | • | | an update to our sponsor’s investment allocation policy; |

| | • | | an update regarding our property management; |

| | • | | an update regarding the use of the “SmartStop® Self Storage” brand; |

| | • | | disclosure regarding the purchase of key-person life insurance; |

| | • | | an update to the “Prior Performance Summary” section of our prospectus; |

| | • | | an update regarding the stockholder servicing fee to be paid with respect to our Class T common stock; |

| | • | | an update to the “Plan of Distribution” section of our prospectus; |

| | • | | revised disclosure regarding Class T Shares and Class W Shares under the “Questions and Answers about this Offering” section of our prospectus; |

| | • | | disclosure of our first quarter 2018 distribution declaration; |

| | • | | disclosure of our fourth quarter 2017 distribution declaration; |

1

| | • | | our distribution declaration history; |

| | • | | selected financial data; |

| | • | | removal of the “Plan of Operation” section of our prospectus and inclusion of Management’s Discussion and Analysis of Financial Condition and Results of Operations to include information for the three and nine months ended September 30, 2017; |

| | • | | our unaudited consolidated financial statements as of and for the three and nine months ended September 30, 2017; |

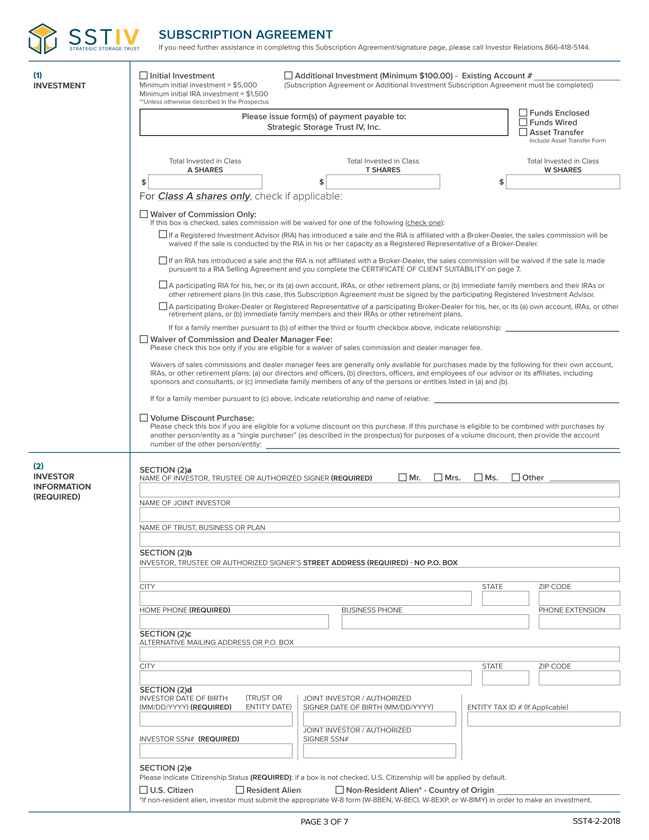

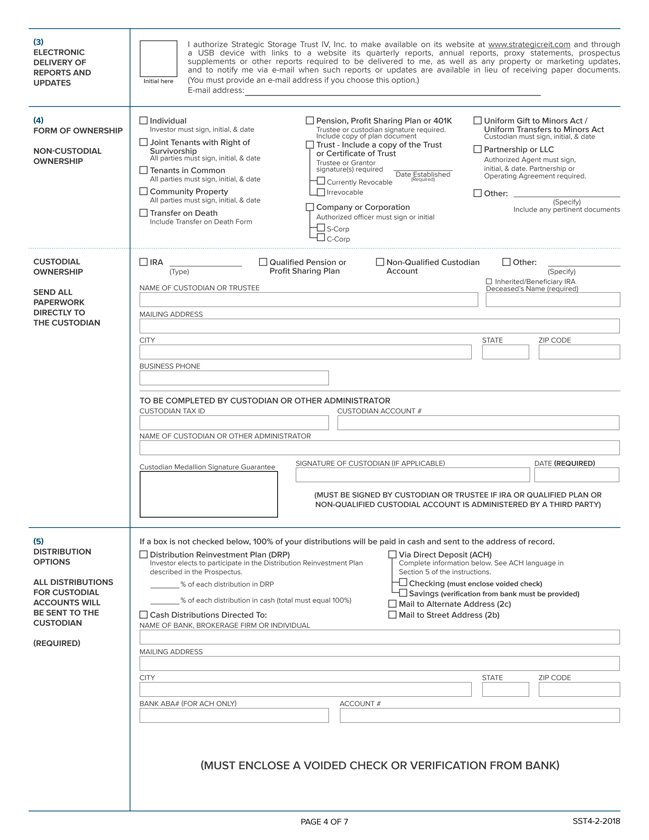

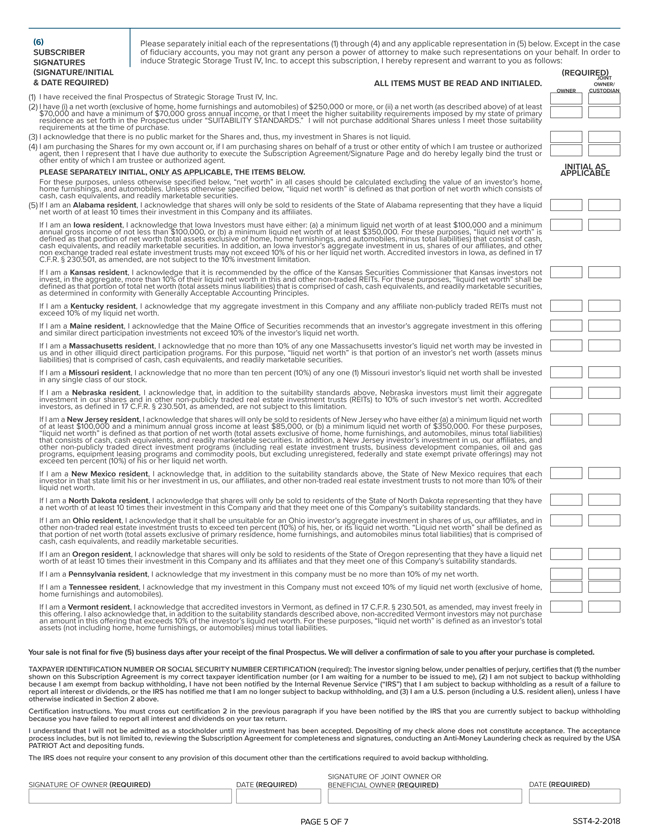

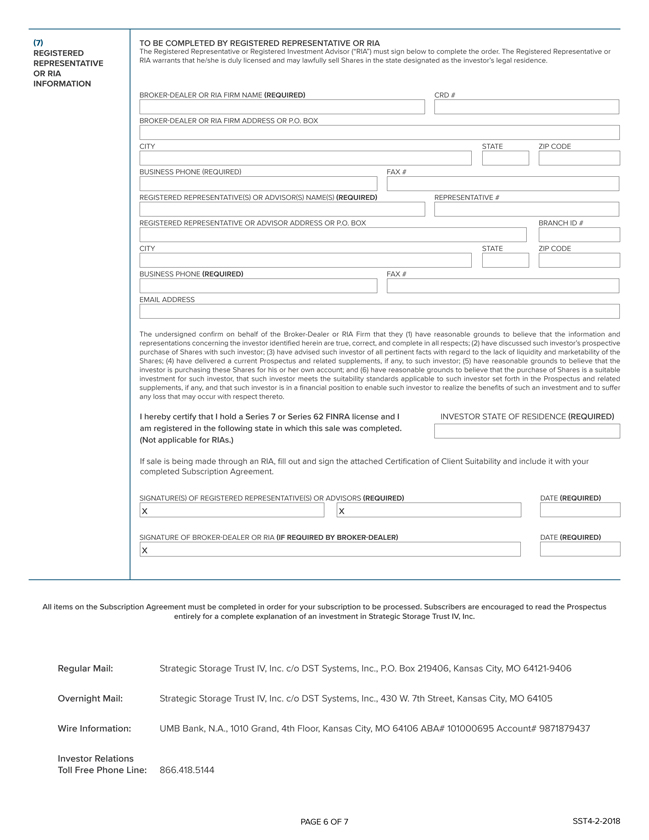

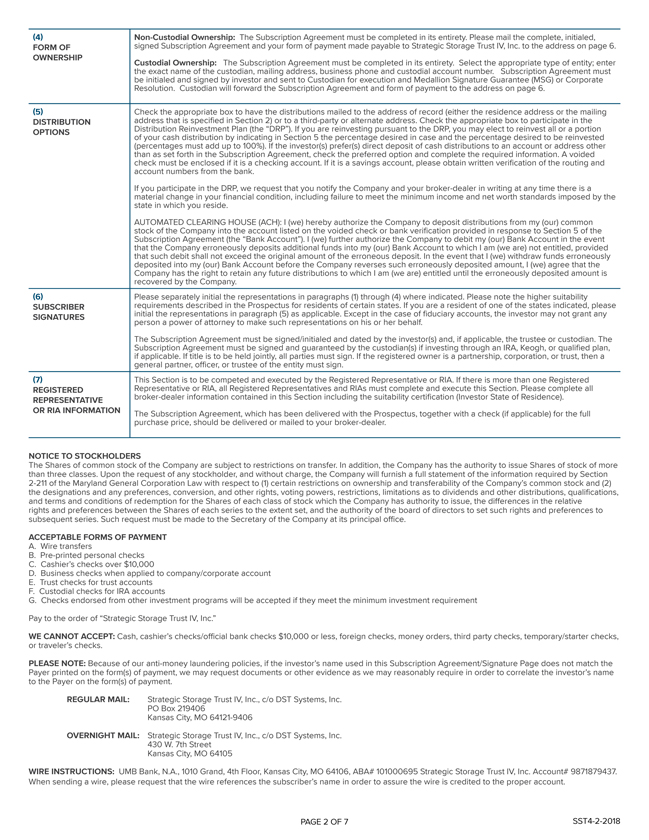

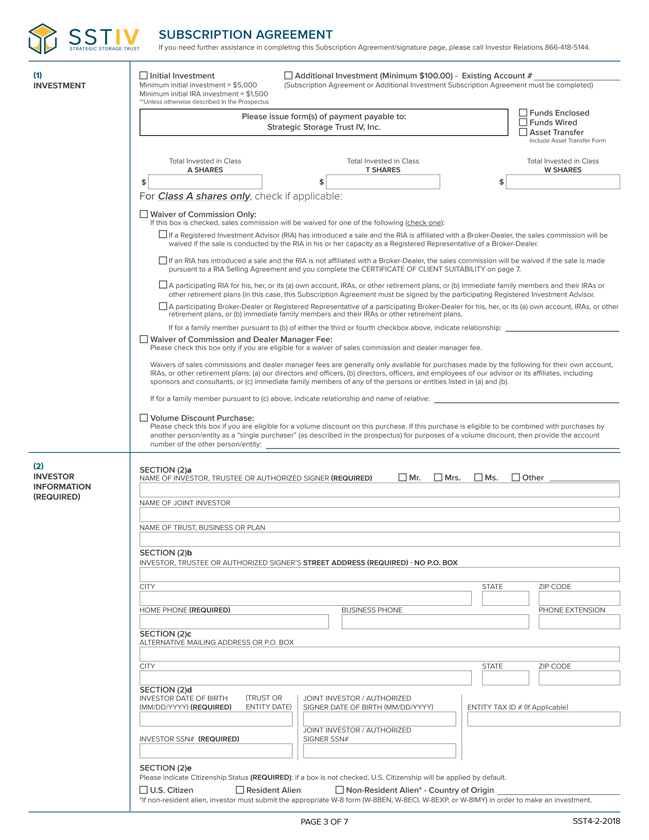

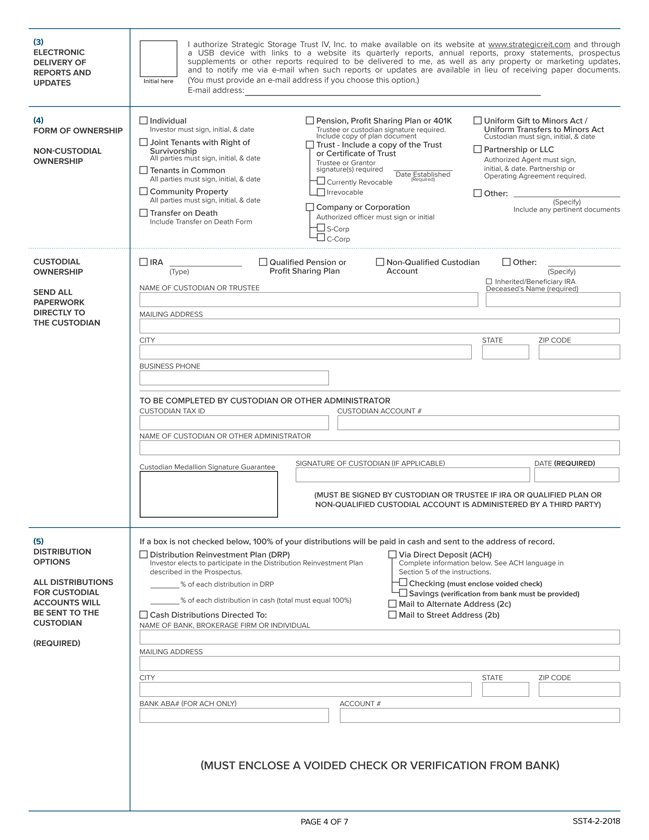

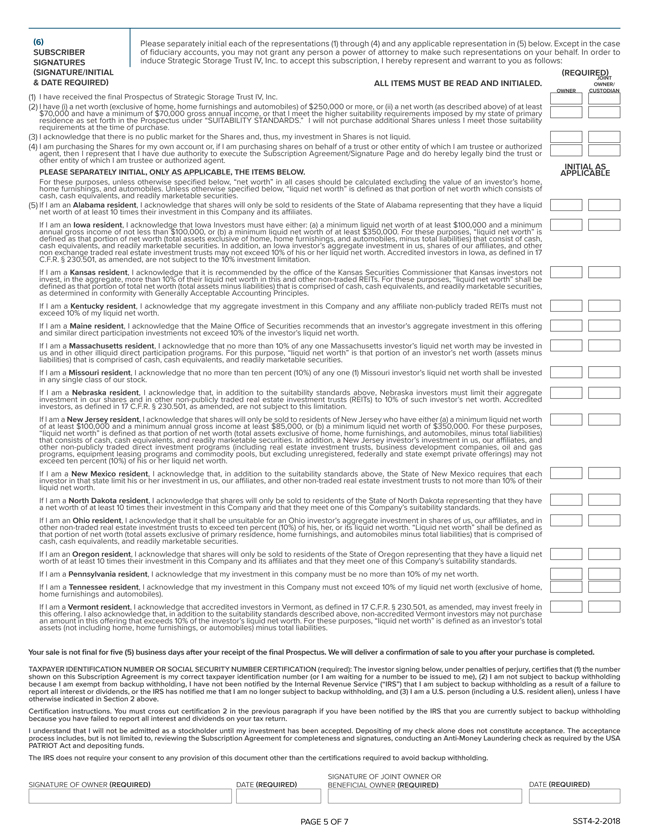

| | • | | a revised subscription agreement; and |

| | • | | updated Prior Performance Tables. |

Status of Our Offering

On January 25, 2017, we sold $7.5 million in Class A shares, or approximately 360,577 Class A shares, to an institutional account investor pursuant to a private offering transaction. On March 17, 2017, our public offering was declared effective. As of February 16, 2018, in connection with our public offering, we have received gross offering proceeds of approximately $45.5 million, consisting of approximately $28.9 million from the sale of approximately 1.2 million Class A shares, approximately $13.5 million from the sale of approximately 556,000 Class T shares, and approximately $3.1 million from the sale of approximately 138,000 Class W shares. As of February 16, 2018, approximately $1.0 billion in shares remained available for sale in our public offering, including shares available pursuant to our distribution reinvestment plan.

Special Notice to Washington Investors

The State of Washington established a minimum offering amount of $10 million for investors residing in its jurisdiction to participate in our public offering. As of June 30, 2017, we had raised more than $10 million in offering proceeds and as a result, we can now sell to investors who reside in the State of Washington. Accordingly, the “Special Notice to Washington Investors” sub-section under the “Subscription Procedures” sub-section of the “Plan of Distribution” section of the prospectus is hereby deleted.

Special Notice to Pennsylvania Investors

The Commonwealth of Pennsylvania established a minimum offering amount of $50 million for investors residing in its jurisdiction to participate in our public offering. As of February 5, 2018, we had raised more than $50 million in offering proceeds and, as a result, we can now sell to investors who reside in Pennsylvania. Accordingly, the “Special Notice to Pennsylvania Investors” sub-section under the “Subscription Procedures” sub-section of the “Plan of Distribution” section of the prospectus is hereby deleted.

Updates to our Risk Factors

The second risk factor on the cover page of our prospectus is hereby replaced with the following:

| | • | | We have paid distributions from sources other than our cash flows from operations, including from the net proceeds of our offering and the private offering transaction. We are not prohibited from undertaking such activities by our charter, bylaws or investment policies, and we may use an unlimited amount from any source to pay our distributions. From commencement of paying cash distributions in February 2017, the payment of distributions has been funded from the private offering transaction and our offering. Until we generate cash flows sufficient to pay distributions to you, we may pay distributions from the net proceeds of this offering or from borrowings in anticipation of future cash flows. |

2

The fourth risk factor under the “Summary Risk Factors” sub-section under the “Prospectus Summary” section of our prospectus is hereby replaced with the following:

| | • | | We have paid, and may continue to pay, distributions from sources other than cash flow from operations; therefore, we will have fewer funds available for the acquisition of properties, and our stockholders’ overall return may be reduced. From commencement of paying cash distributions in February 2017, the payment of distributions has been funded from the private offering transaction and our offering. |

The following should be added as a new risk factor under “Risks Related to this Offering and an Investment in Strategic Storage Trust IV, Inc.”

We have incurred a net loss to date, have an accumulated deficit and our operations may not be profitable in 2017.

We incurred a net loss attributable to stockholders of approximately $660,000 for the nine months ended September 30, 2017. Our accumulated deficit was approximately $660,000 as of September 30, 2017. Given that we are still early in our fundraising and acquisition stage, our operations may not be profitable in 2017.

The risk factor under “Risks Related to this Offering and an Investment in Strategic Storage Trust IV, Inc.” titled, “We may pay distributions from sources other than cash flow from operations, which may include borrowings or the net proceeds of this offering (which may constitute a return of capital); therefore, we will have fewer funds available for the acquisition of properties, and our stockholders’ overall return may be reduced” is hereby deleted and replaced with the following:

We have paid, and may continue to pay, distributions from sources other than cash flow from operations which may include borrowings or the net proceeds of our offering (which may constitute a return of capital); therefore, we will have fewer funds available for the acquisition of properties, and our stockholders’ overall return may be reduced.

In the event we do not have enough cash from operations to fund our distributions, we may borrow, issue additional securities, or sell assets in order to fund the distributions or make the distributions out of net proceeds from our offering (which may constitute a return of capital). It is likely that we will be required to use return of capital to fund distributions in at least the first few years of operation. We are not prohibited from undertaking such activities by our charter, bylaws or investment policies, and we may use an unlimited amount from any source to pay our distributions. From commencement of paying cash distributions in February 2017, the payment of cash distributions has been paid from proceeds from the private offering transaction and our offering. If we continue to pay distributions from sources other than cash flow from operations, we will have fewer funds available for acquiring properties, which may reduce our stockholders’ overall returns. Additionally, to the extent distributions exceed cash flow from operations, a stockholder’s basis in our stock may be reduced and, to the extent distributions exceed a stockholder’s basis, the stockholder may recognize a capital gain.

3

The risk factor under “Risks Related to the Self Storage Industry” titled, “We will depend on on-site personnel to maximize customer satisfaction at each of our facilities, and any difficulties our property manager or sub-property manager encounters in hiring, training, and retaining skilled field personnel may adversely affect our rental revenues.” is hereby deleted and replaced with the following:

We depend on the on-site personnel to maximize customer satisfaction at each of our facilities and any difficulties our Property Manager encounters in hiring, training and retaining skilled field personnel may adversely affect our rental revenues.

The customer service, marketing skills, knowledge of local market demand and competitive dynamics of our facility managers will be contributing factors to our ability to maximize our rental income and to achieve the highest sustainable rent levels at each of our facilities. If our Property Manager is unable to successfully recruit, train and retain qualified field personnel, our rental revenues may be adversely affected, which could impair our ability to make distributions to our stockholders.

Update to Our Independent Directors

On June 26, 2017, Stephen G. Muzzy, an independent director, member and chairman of our audit committee and member of our nominating and corporate governance committee of our board of directors, resigned from such positions. Mr. Muzzy’s decision to resign from our board of directors did not involve any disagreement with us, our management or the board of directors. Mr. Muzzy remains an independent director of Strategic Storage Growth Trust, Inc.

On June 26, 2017, in accordance with our bylaws and charter, the remaining independent director of our board of directors appointed Alexander S. Vellandi as an independent director to fill the vacancy created by Mr. Muzzy’s resignation, to serve in accordance with our bylaws for the remainder of the full term of the directorship and until his successor is duly elected and qualified. On June 26, 2017, Mr. Vellandi was also appointed to serve as a member and chairman of our audit committee and as a member of our nominating and corporate governance committee.

As a result, in all places where Mr. Muzzy is named in our prospectus, his name is hereby replaced with the name of Mr. Vellandi. In addition, Mr. Muzzy’s biographical information contained under the “Executive Officers and Directors” sub-section under the “Management” section of our prospectus is hereby deleted and the following biographical information for Mr. Vellandi is hereby added:

Alexander S. Vellandi. Mr. Vellandi is one of our independent directors and is the chairman of our audit committee and a member of our nominating and corporate governance committee of our board of directors. He has over 18 years of experience in commercial real estate and finance. Mr. Vellandi is currently General Counsel of Money360, Inc., a commercial real estate marketplace lender, responsible for all legal aspects of its corporate and business operations, a position he has held since March 2016. Since 2002, he has also owned a residential real estate brokerage firm, Orange County Property Company. Prior to Money360, Inc., Mr. Vellandi was in-house legal counsel to Sabal Financial Group, LP from November 2011 through March 2016. Mr. Vellandi was a sole practitioner from 2004 to 2011 and was Associate General Counsel of Triple Net Properties, LLC from 2003 to 2004. He has also served as an attorney with two law firms in California, Allen, Matkins, Leck, Gamble & Mallory LLP from 2000 to 2002, which is a California-based law firm specializing in real estate, litigation, labor, tax and business law, and Sheppard, Mullin, Richter & Hampton LLP from 1998 to 2000, which is a global 100 firm handling corporate and technology matters, litigation and financial transactions. In private practice, he has represented large corporations, developers, landlords, tenants, real property purchasers, borrowers and secured lenders on a wide range of real estate related transactions in various states. Mr. Vellandi graduated with his Bachelor of Arts from the University of California at Irvine and his Juris Doctorate from UCLA School of Law. Prior to entering law school, he served as an appointee of former California Governor Pete Wilson from 1995 through 1996. He is a member of the State Bar of California, is a licensed real estate broker and serves in a leadership capacity for various charities and professional organizations.

We believe that Mr. Vellandi’s extensive business background in commercial real estate and banking supports his appointment to our board of directors.

4

Change in Title Regarding One of Our Executive Officers

On December 19, 2017, our board of directors appointed Ken Morrison to serve as our Chief Operations Officer. Mr. Morrison was also appointed the Chief Operations Officer of two additional entities affiliated with our sponsor, Strategic Storage Trust II, Inc. (“SST II”) and Strategic Storage Growth Trust, Inc. (“SSGT”), both public non-traded REITs. Mr. Morrison served as our Senior Vice President – Property Management from June 2016 until December 2017.

Share Redemption Program Information

For the nine months ended September 30, 2017, we did not receive any requests for redemptions.

Related Party Fees and Expenses

The following table summarizes related party costs incurred and paid by us for the nine months ended September 30, 2017, as well as any related amounts payable as of September 30, 2017. There were no related party costs incurred or paid by us for the period from June 1, 2016 (date of inception) through December 31, 2016:

| | | | | | | | | | | | |

| | | Nine Months Ended September 30, 2017 | |

| | | Incurred | | | Paid | | | Payable | |

Expensed | | | | | | | | | | | | |

Operating expenses (including organizational costs) | | $ | 182,502 | | | $ | 153,340 | | | $ | 29,162 | |

Asset management fees | | | 23,394 | | | | 19,250 | | | | 4,144 | |

Property management fees(1) | | | 17,385 | | | | 16,120 | | | | 1,265 | |

Acquisition expenses | | | 94,378 | | | | 74,353 | | | | 20,025 | |

Additional Paid-in Capital | | | | | | | | | | | | |

Selling commissions | | | 1,271,629 | | | | 1,271,629 | | | | — | |

Dealer Manager fees | | | 465,255 | | | | 442,562 | | | | 22,693 | |

Stockholder Servicing Fees and Dealer Manager Servicing Fees(2) | | | 240,240 | | | | 2,547 | | | | 237,693 | |

Offering costs | | | 1,386,947 | | | | 1,358,100 | | | | 28,847 | |

| | | | | | | | | | | | |

Total | | $ | 3,681,730 | | | $ | 3,337,901 | | | $ | 343,829 | |

| | | | | | | | | | | | |

| (1) | During the nine months ended September 30, 2017, property management fees included approximately $16,000 of fees paid to the sub-property manager of our Jensen Beach Property. |

| (2) | We pay our Dealer Manager an ongoing stockholder servicing fee that is payable monthly and accrues daily in an amount equal to 1/365th of 1% of the purchase price per share of the Class T Shares and an ongoing dealer manager servicing fee that is payable monthly and accrues daily in an amount equal to 1/365th of 0.5% of the purchase price per share of the Class W Shares sold in our primary offering. |

5

Addition of the “Our Self Storage Properties” Section of the Prospectus

Immediately after the “Estimated Use of Proceeds” section on pages 57–59 of our prospectus, a new section titled “Our Self Storage Properties” is hereby added as follows:

OUR SELF STORAGE PROPERTIES

Our Properties

As of December 31, 2017, we owned the following two self storage facilities:

| | | | | | | | | | | | | | | | | | |

Property | | Address | | Purchase Price | | | Year

Built | | | Approx.

Sq. Ft. (net) | | | Approx.

Units | |

Texas City – TX | | 3730 Emmett F Lowry Expressway | | $ | 7,960,000 | | | | 2010 | | | | 67,000 | | | | 480 | |

Jensen Beach – FL | | 1105 Northeast Industrial Blvd. | | $ | 4,950,000 | | | | 1979 | | | | 60,000 | | | | 600 | |

| | | | | | | | | | | | | | | | | | |

TOTAL | | | | $ | 12,910,000 | | | | | | | | 127,000 | | | | 1,080 | |

| | | | | | | | | | | | | | | | | | |

We acquired the Texas City, Texas property (the “Texas City Property”) from an unaffiliated third party for a purchase price of approximately $8 million, plus closing and acquisition costs. We funded the acquisition of the Texas City Property by utilizing net proceeds from our public offering.

We acquired the Jensen Beach, Florida property (the “Jensen Beach Property”) from an unaffiliated third party for a purchase price of approximately $4.95 million, plus closing and acquisition costs. We funded the acquisition of the Jensen Beach Property by utilizing the proceeds from the private offering transaction.

The weighted average capitalization rate for the two operating self storage facilities we owned as of December 31, 2017 was approximately 5.6%. The weighted average capitalization rate is calculated as the estimated first year annual net operating income at the respective property divided by the property purchase price, exclusive of offering costs, closing costs and fees paid to our advisor. Estimated first year net operating income on our real estate investments is total estimated revenues generally derived from the terms of in-place leases, less property operating expenses generally based on the operating history of the property. In instances where management determines that historical amounts will not be representative of first year revenues or property operating expenses, management uses its best faith estimate of such amounts based on anticipated property operations. Estimated first year net operating income excludes interest expense, asset management fees, depreciation and amortization and our company-level general and administrative expenses. Historical operating income for these properties is not necessarily indicative of future operating results.

Potential Acquisitions

Throughout the term of this offering, we may enter into purchase agreements for the purchase of various properties. Pursuant to the various purchase agreements, we would likely be obligated to purchase such properties only after satisfactory completion of agreed upon closing conditions. We will decide whether to acquire properties generally based upon:

| | • | | our ability to raise sufficient net proceeds from our public offering and/or obtain debt financing; |

| | • | | satisfactory completion of due diligence on the properties and the sellers of the properties; |

| | • | | if applicable, the completion of construction of the self storage facility and the issuance of a certificate of occupancy for such property; |

| | • | | approval by our board of directors to purchase the properties; |

| | • | | satisfaction of the conditions to the acquisitions in accordance with the various purchase agreements; |

| | • | | if applicable, satisfaction of requirements relating to assumption of any loans; and |

| | • | | no material adverse changes relating to the properties, the sellers of the properties or certain economic conditions. |

There can be no assurance that we will complete the acquisition of any additional properties. In some circumstances, if we fail to complete a potential acquisition, we may forfeit our earnest money on such property. Due to the considerable conditions to the consummation of the acquisition of properties, we cannot make any assurances that the closing of any properties is probable.

6

Potential Acquisition of Property in Las Vegas, Nevada

On February 1, 2018, one of our subsidiaries entered into a purchase and sale agreement with an unaffiliated third party (the “Las Vegas Agreement”) for the acquisition of a self storage facility located in Las Vegas, Nevada (the “Las Vegas Property”).

The Las Vegas Property is a self storage facility that contains approximately 56,130 net rentable square feet of storage space, approximately 640 rental units, and one RV/boat space. The purchase price for the Las Vegas Property is approximately $9.15 million, plus closing and acquisition costs. We expect the acquisition of the Las Vegas Property to close in the second quarter of 2018. We expect to fund such acquisition with a combination of net proceeds from our public offering and a credit facility or other debt financing.

Pursuant to the Las Vegas Purchase Agreement, we will be obligated to purchase the Las Vegas Property only after satisfactory completion of agreed upon closing conditions.

There can be no assurance that we will complete the acquisition of the Las Vegas Property. In some circumstances, if we fail to complete the acquisition, we may forfeit up to approximately $175,000 in earnest money on the Las Vegas Property.

Other properties may be identified in the future that we may acquire prior to or instead of the Las Vegas Property. Due to the considerable conditions to the consummation of the acquisition of the Las Vegas Property, we cannot make any assurances that the closing of the Las Vegas Property is probable.

Potential Acquisition of Property in Surprise, Arizona

As previously disclosed, on November 7, 2017, one of our subsidiaries executed a purchase and sale agreement with an unaffiliated third party (the “Surprise Purchase Agreement”) for the acquisition of a self storage facility located in Surprise, Arizona (the “Surprise Property”).

The Surprise Property will be a newly constructed self storage facility that is expected to contain approximately 630 units and 72,000 net rentable square feet. The purchase price for the Surprise Property is approximately $7.5 million, plus closing and acquisition costs. The acquisition of the Surprise Property will occur once a certificate of occupancy is issued which we expect to occur in the fourth quarter of 2018. We expect to fund such acquisition with a combination of net proceeds from our public offering, and a credit facility or other debt financing.

Pursuant to the Surprise Purchase Agreement, we will be obligated to purchase the Surprise Property only after satisfactory completion of agreed upon closing conditions.

There can be no assurance that we will complete the acquisition of the Surprise Property. In some circumstances, if we fail to complete the acquisition, we may forfeit up to approximately $300,000 in earnest money on the Surprise Property.

Other properties may be identified in the future that we may acquire prior to or instead of the Surprise Property. Due to the considerable conditions to the consummation of the acquisition of the Surprise Property, we cannot make any assurances that the closing of the Surprise Property is probable.

Potential Acquisition of Property in Riverside, California

On January 30, 2018, one of our subsidiaries entered into a purchase and sale agreement with an unaffiliated third party (the “Riverside Purchase Agreement”) for the acquisition of a self storage facility located in Riverside, California (the “Riverside Property”).

7

The Riverside Property is a self storage facility that contains approximately 57,600 net rentable square feet of storage space, approximately 460 rental units, and 10 RV/boat spaces. The purchase price for the Riverside Property is approximately $6.85 million, plus closing and acquisition costs. We expect the acquisition of the Riverside Property to close in the second quarter of 2018. We expect to fund such acquisition with a combination of net proceeds from our public offering and a credit facility or other debt financing.

Pursuant to the Riverside Purchase Agreement, we will be obligated to purchase the Riverside Property only after satisfactory completion of agreed upon closing conditions.

There can be no assurance that we will complete the acquisition of the Riverside Property. In some circumstances, if we fail to complete the acquisition, we may forfeit up to approximately $200,000 in earnest money on the Riverside Property.

Other properties may be identified in the future that we may acquire prior to or instead of the Riverside Property. Due to the considerable conditions to the consummation of the acquisition of the Riverside Property, we cannot make any assurances that the closing of the Riverside Property is probable.

Potential Acquisition of Property in San Gabriel, California

On January 4, 2018, one of our subsidiaries entered into a purchase and sale agreement with an unaffiliated third party (the “San Gabriel Purchase Agreement”) for the acquisition of a self storage facility to be located in San Gabriel, California (the “San Gabriel Property”).

The San Gabriel Property will be a newly constructed self storage facility that is expected to contain approximately 68,250 net rentable square feet of storage space and approximately 708 rental units. The purchase price for the San Gabriel Property is approximately $13.5 million, plus closing and acquisition costs. We expect the acquisition of the San Gabriel Property to close in the third quarter of 2019 after construction is complete on the self storage facility and at or about the time a certificate of occupancy has been issued for the San Gabriel Property. We expect to fund such acquisition with a combination of net proceeds from our public offering and a credit facility or other debt financing.

Pursuant to the San Gabriel Purchase Agreement, we will be obligated to purchase the San Gabriel Property only after satisfactory completion of agreed upon closing conditions.

There can be no assurance that we will complete the acquisition of the San Gabriel Property. In some circumstances, if we fail to complete the acquisition, we may forfeit up to approximately $400,000 in earnest money on the San Gabriel Property.

Other properties may be identified in the future that we may acquire prior to or instead of the San Gabriel Property. Due to the considerable conditions to the consummation of the acquisition of the San Gabriel Property, we cannot make any assurances that the closing of the San Gabriel Property is probable.

8

Terminated Purchase and Sale Agreement

As previously disclosed, on August 18, 2017, one of our subsidiaries executed a purchase and sale agreement with an unaffiliated third party (the “Palm Beach Gardens Purchase Agreement”) for the acquisition of a self storage facility located in Palm Beach Gardens, Florida (the “Palm Beach Gardens Property”).

Under the original terms of the Palm Beach Gardens Purchase Agreement, the Approval Period (as defined therein) would have expired on October 30, 2017, and unless our subsidiary provided the seller of the Palm Beach Gardens Property with a notice to consummate the transaction prior to the expiration of the Approval Period, the Palm Beach Gardens Purchase Agreement would have automatically terminated at such time.

On October 27, 2017, the parties to the Palm Beach Gardens Purchase Agreement entered into a First Amendment to the Palm Beach Gardens Purchase Agreement that extended the Approval Period to December 14, 2017; and on November 30, 2017, the parties to the Palm Beach Gardens Purchase Agreement entered into a Second Amendment to the Palm Beach Gardens Purchase Agreement that extended the Approval Period to January 31, 2018. The parties did not agree to any further extension of the Approval Period. Accordingly, on January 31, 2018, the Palm Beach Gardens Purchase Agreement terminated according to its terms and our initial deposit was returned in full.

9

An Update to Our Sponsor’s Investment Allocation Policy

The fourth and fifth bullet points in the “Certain Conflict Resolution Procedures” sub-section in the “Conflicts of Interest” section of the prospectus are hereby deleted and replaced with the following:

| | • | | In the event that an investment opportunity becomes available, our sponsor will allocate such investment opportunity to us, SST II and SSGT, based on the following factors: |

| | • | | the investment objectives of each program; |

| | • | | the amount of funds available to each program; |

| | • | | the financial and investment characteristics of each program, including investment size, potential leverage, transaction structure and anticipated cash flows; |

| | • | | the strategic location of the investment in relationship to existing properties owned by each program; |

| | • | | the effect of the investment on the diversification of each program’s investments; and |

| | • | | the impact of the financial metrics of the investment, such as revenue per square foot, on each program. |

| | • | | If, after consideration and analysis of these factors, the investment opportunity is suitable for us, SST II and SSGT, then: |

| | • | | SST II will have priority for larger portfolios of stabilized properties with an aggregate purchase price in excess of $150 million; |

| | • | | SSGT will have priority for growth properties until SSGT has aggregate assets (based on contract purchase price) of $250 million or more; |

| | • | | we will have priority for all stabilized properties and portfolios with aggregate purchase prices less than $150 million and growth properties once SSGT has aggregate assets (based on contract purchase price) of $250 million. |

In the event all acquisition allocation factors have been exhausted and an investment opportunity remains suitable for two or more of us, SST II and SSGT, then our sponsor will offer the investment opportunity to the program that has had the longest period of time elapse since it was offered an investment opportunity. It will be the duty of our board of directors, including the independent directors, to ensure that this method is applied fairly to us.

An Updated Regarding Our Property Management

Our property manager terminated the sub-property management agreement with Extra Space Storage, Inc. (“Extra Space”) for the management of our Jensen Beach, Florida property effective as of October 1, 2017. As of October 1, 2017, our property manager now manages our property directly. Our property-owning subsidiary and our property manager entered into an amendment to our existing property management agreement in connection therewith. The amendment to the property management agreement provides that our property manager will receive a monthly fee for its services in connection with managing our property, generally equal to the greater of $3,000 or 6% of the gross revenues from the property plus reimbursement of the property manager’s costs of managing the property. Reimbursable costs and expenses include wages and salaries and other expenses of employees engaged in operating, managing and maintaining our property. In the event that our property manager assists with the development or redevelopment of our property, we pay a separate market-based fee for such services. In addition, our property manager is entitled to a construction management fee equal to 5% of the cost of construction or capital improvement work in excess of $10,000. We anticipate entering into a similar property management agreement for each of the properties we acquire in the future.

10

“SmartStop® Self Storage” Brand

On August 18, 2017, our sponsor entered into an agreement with a subsidiary of Extra Space to acquire the “SmartStop® Self Storage” brand. The “SmartStop® Self Storage” brand had been purchased by the subsidiary of Extra Space in connection with the merger of SmartStop Self Storage, Inc. (“SmartStop Self Storage”), an affiliate of our sponsor, with Extra Space on October 1, 2015. Prior to the merger, all self storage properties owned by SmartStop Self Storage, Strategic Storage Trust II, Inc. and Strategic Storage Growth Trust, Inc. utilized the “SmartStop® Self Storage” brand. We began using the “SmartStop® Self Storage” brand at our property effective October 1, 2017. We anticipate using the “SmartStop® Self Storage” brand at future properties we acquire.

Purchase of Key-Person Life Insurance

On April 4, 2017, we entered into a corporate-owned life insurance policy for H. Michael Schwartz, our Chairman of the board of directors and Chief Executive Officer and the chief executive officer of our sponsor (the “Key-Person Life Insurance Policy”). Owing to Mr. Schwartz’s various leadership positions, the death of Mr. Schwartz could cause a disruption and loss of confidence among our investors and broker-dealers, which could negatively impact our fundraising and could lead to loss of our value, potential legal actions, potential lender concerns, and replacement costs to find a qualified replacement. The Key-Person Life Insurance Policy will provide a $10 million death benefit to us in the event of Mr. Schwartz’s death, subject to the terms and conditions contained in the policy forms for the Key-Person Life Insurance Policy. The Key-Person Life Insurance Policy is with a highly rated life insurance carrier, John Hancock, and requires annual premiums of approximately $570,000 over seven years, at which time the premiums will be fully paid. We will earn interest on the Key-Person Life Insurance Policy premiums and in the event we elect to surrender the Key-Person Life Insurance Policy, we will receive a return of the premiums plus interest.

Updated Prior Performance Summary

The information contained in the “Prior Performance Summary” section of our prospectus is hereby deleted and replaced with the following:

PRIOR PERFORMANCE SUMMARY

The information presented in this section represents the historical experience of certain real estate programs sponsored or co-sponsored by affiliates of SmartStop Asset Management. You should not assume that you will experience returns, if any, comparable to those experienced by investors in the prior real estate programs described herein.

The information in this section and in the Prior Performance Tables included in this supplement as Appendix C show relevant summary information regarding certain programs sponsored or co-sponsored by affiliates of SmartStop Asset Management. As described below, affiliates of SmartStop Asset Management have sponsored or co-sponsored public non-traded REIT offerings and private offerings of real estate programs that in some cases have investment objectives, including particular investment types, that are considerably similar to ours. In addition to sponsoring our public offering, SmartStop Asset Management is currently sponsoring SST II (focused on stabilized properties) and SSGT (focused on growth properties), which are public non-traded REITs that have closed their primary offerings to new investors; however, they expect to continue selling shares of common stock pursuant to their distribution reinvestment plans. Some programs remaining in operation may acquire additional properties in the future. Our sponsor in the future may sponsor other private and public offerings of real estate programs. To the extent that such future offerings or programs remaining in operation and share the same or similar investment objectives or acquire properties in the same or nearby markets, such programs may be in competition with the investments made by us. See the “Conflicts of Interest” section of our prospectus for additional information. Programs that list substantially the same investment objectives as we do in their prospectus or private offering memorandum are considered to have investment objectives similar to ours, regardless of the particular emphasis that a program places on each objective.

11

The information in this summary represents the historical experience of certain programs sponsored or co-sponsored by affiliates of SmartStop Asset Management. Unless otherwise noted, the information presented herein is as of December 31, 2016.

The Prior Performance Tables set forth information as of the dates indicated regarding the prior programs described therein that invested in self storage properties, which we deem to have similar investment objectives to us, as to: (1) experience in raising and investing funds (Table I); (2) compensation to sponsor (Table II); (3) annual operating results of prior real estate programs (Table III); (4) results of completed programs (Table IV); and (5) sale or disposals of properties by prior real estate programs (Table V). The purpose of this prior performance information is to enable you to evaluate accurately the experience of our sponsor and its affiliates with like programs.

The following discussion is intended to summarize briefly the objectives and performance of the prior real estate programs and to disclose any material adverse business developments sustained by them.

Public Programs

Strategic Capital Holdings, LLC, or SCH, sponsored one prior public program, SmartStop Self Storage, Inc., or SmartStop Self Storage, formerly known as Strategic Storage Trust, Inc., or SSTI, a public, non-traded REIT focused on investments in self storage properties. SmartStop Self Storage raised approximately $541 million of gross offering proceeds from approximately 16,200 investors as of the close of its follow-on public offering. We believe this program had investment objectives similar to this offering.

SmartStop Asset Management is the sponsor of SST II and SSGT, public non-traded REITs focused on investments in self storage properties. We believe these programs have investment objectives that are similar to this offering. See Tables I and II of the Prior Performance Tables for more detailed information about offerings sponsored by SmartStop Asset Management and its affiliates which have closed during the previous three years ended January 31, 2017.

SmartStop Self Storage

On March 17, 2008, SmartStop Self Storage began its initial public offering of common stock (“Initial Offering”). On May 22, 2008, SmartStop Self Storage satisfied the minimum offering requirements of the Initial Offering and commenced formal operations. On September 16, 2011, the Initial Offering was terminated, having raised gross proceeds of approximately $289 million. On September 22, 2011, SmartStop Self Storage commenced its follow-on public offering of stock (“Follow-on Offering”). On April 2, 2012, SmartStop Self Storage announced that its board had approved an estimated value per share of SmartStop Self Storage’s common stock of $10.79 based on the estimated value of SmartStop Self Storage’s assets less the estimated value of SmartStop Self Storage’s liabilities, or net asset value, divided by the number of shares outstanding on an adjusted fully diluted basis, calculated as of December 31, 2011. Effective June 1, 2012, SmartStop Self Storage raised its offering price for shares sold in the Follow-on Offering from $10.00 per share to $10.79 per share. On September 22, 2013, the Follow-on Offering was terminated, having raised gross proceeds of approximately $251 million. On September 5, 2014, SmartStop Self Storage announced that its board of directors had approved an estimated value per share of SmartStop Self Storage’s common stock of $10.81 based on the estimated value of SmartStop Self Storage’s assets less the estimated value of SmartStop Self Storage’s liabilities, or net asset value, divided by the number of shares outstanding on an adjusted fully diluted basis, calculated as of June 30, 2014. In addition to the Initial Offering and the Follow-on Offering, in September 2009, SmartStop Self Storage also issued approximately 6.2 million shares in connection with the mergers of Self Storage REIT, Inc. and Self Storage REIT II, Inc. described below (the “Mergers”).

12

Through September 30, 2015, with a combination of debt and offering proceeds from the Initial Offering and Follow-on Offering, SmartStop Self Storage invested approximately $614 million in 111 properties in 17 states and Canada consisting of approximately 68,900 units and 8.8 million rentable square feet. Based on the amount invested in these properties, approximately 97% was spent on used (existing) self storage properties and 3% was spent on construction or redevelopment of self storage properties. As a percentage of the aggregate purchase price, the allocation of financing proceeds for these 111 properties was 58% debt proceeds and 42% equity. In addition, SmartStop Self Storage acquired 11 properties in connection with the Mergers. Those properties consist of approximately 8,500 units and 1.4 million rentable square feet and are more specifically described below under “Private Programs”. On October 1, 2015, SmartStop Self Storage and Extra Space closed on a merger transaction in which SmartStop Self Storage was acquired by Extra Space for $13.75 per share in cash, representing an enterprise value of approximately $1.4 billion.

Below is a summary of relevant information of the properties purchased with proceeds from SmartStop Self Storage’s Initial Offering and Follow-on Offering:

| | | | | | | | | | | | | | | | | | | | |

State | | No. of

Properties | | | Units | | | Sq. Ft.

(net)(1) | | | % of Total

Rentable

Sq. Ft. | | | % of

Aggregate

Purchase Price | |

Alabama(2) | | | 2 | | | | 1,135 | | | | 161,900 | | | | 1.8 | % | | | 2.0 | % |

Arizona | | | 4 | | | | 1,975 | | | | 243,900 | | | | 2.8 | % | | | 1.5 | % |

California(2) | | | 7 | | | | 5,140 | | | | 581,900 | | | | 6.6 | % | | | 11.5 | % |

Florida | | | 9 | | | | 6,170 | | | | 668,500 | | | | 7.6 | % | | | 9.0 | % |

Georgia | | | 22 | | | | 12,990 | | | | 1,708,900 | | | | 19.4 | % | | | 17.7 | % |

Illinois(3) | | | 4 | | | | 2,455 | | | | 394,000 | | | | 4.5 | % | | | 2.2 | % |

Kentucky | | | 5 | | | | 2,870 | | | | 415,700 | | | | 4.7 | % | | | 3.2 | % |

Mississippi | | | 3 | | | | 1,495 | | | | 224,300 | | | | 2.6 | % | | | 2.2 | % |

Nevada | | | 6 | | | | 4,015 | | | | 551,100 | | | | 6.3 | % | | | 5.0 | % |

New Jersey | | | 6 | | | | 4,660 | | | | 445,400 | | | | 5.1 | % | | | 8.7 | % |

New York | | | 1 | | | | 700 | | | | 82,800 | | | | 0.9 | % | | | 0.8 | % |

North Carolina | | | 3 | | | | 1,560 | | | | 207,600 | | | | 2.4 | % | | | 1.5 | % |

Ontario, Canada(4) | | | 4 | | | | 3,695 | | | | 411,600 | | | | 4.7 | % | | | 4.9 | % |

Pennsylvania | | | 4 | | | | 2,210 | | | | 285,700 | | | | 3.2 | % | | | 1.8 | % |

South Carolina | | | 12 | | | | 6,765 | | | | 931,800 | | | | 10.6 | % | | | 10.3 | % |

Tennessee | | | 3 | | | | 1,840 | | | | 254,600 | | | | 2.9 | % | | | 4.5 | % |

Texas | | | 11 | | | | 5,960 | | | | 875,100 | | | | 10.0 | % | | | 8.6 | % |

Virginia | | | 5 | | | | 3,280 | | | | 343,900 | | | | 3.9 | % | | | 4.6 | % |

| | | | | | | | | | | | | | | | | | | | |

Total | | | 111 | (5) | | | 68,915 | | | | 8,788,700 | | | | 100 | % | | | 100 | % |

| | | | | | | | | | | | | | | | | | | | |

| (1) | Includes all rentable square feet consisting of storage spaces, parking and commercial office units. |

| (2) | Does not include properties in which SmartStop Self Storage owned a minority interest, including the interests owned in the San Francisco Self Storage DST property, Montgomery County Self Storage, DST properties and the Hawthorne property. |

| (3) | Includes approximately 85,000 rentable square feet of industrial warehouse/office space at the Chicago – Ogden Ave. property. |

| (4) | All of these Canadian properties are located within the greater Toronto metropolitan area. |

| (5) | Excludes the 11 properties acquired in connection with the Mergers consisting of approximately 8,500 units and 1.4 million rentable square feet and properties acquired during 2014 with proceeds from sources other than the Initial Offering and Follow-on Offering. |

See Table III of the Prior Performance Tables for more detailed information as to the operating results of SmartStop Self Storage. See also Table IV of the Prior Performance Tables for more detailed information on the completed program results for SmartStop Self Storage.

The percentage of this public program with investment objectives similar to ours is 100.0%. These properties had an aggregate of approximately 8.8 million square feet of rentable space.

13

Strategic Storage Trust II

In addition to sponsoring our public offering, SmartStop Asset Management is currently sponsoring SST II, another non-traded REIT that was registered to sell up to $1.095 billion of its shares in a public offering. On January 10, 2014, SST II’s public offering was declared effective. On May 23, 2014, SST II reached its minimum offering amount of $1.5 million in sales of shares and SST II commenced operations. On January 9, 2017, SST II closed its primary offering to new investors. SST II sold approximately $493 million in Class A shares and approximately $73 million in Class T shares pursuant to its public offering.

As of March 31, 2017, SST II owned the following self storage facilities:

| | | | | | | | | | | | | | | | |

Property | | Units | | | Sq. Ft.

(net) | | | % of Total

Rentable

Sq. Ft. | | | Physical

Occupancy

%(1) | |

Morrisville – NC | | | 320 | | | | 36,900 | | | | 0.6 | % | | | 88.6 | % |

Cary – NC | | | 310 | | | | 62,100 | | | | 1.0 | % | | | 84.3 | % |

Raleigh – NC | | | 440 | | | | 60,600 | | | | 1.0 | % | | | 93.9 | % |

Myrtle Beach I – SC | | | 760 | | | | 100,100 | | | | 1.7 | % | | | 92.2 | % |

Myrtle Beach II – SC | | | 660 | | | | 94,500 | | | | 1.6 | % | | | 94.1 | % |

La Verne – CA | | | 520 | | | | 49,800 | | | | 0.8 | % | | | 94.0 | % |

Chico – CA | | | 360 | | | | 38,800 | | | | 0.6 | % | | | 95.7 | % |

Riverside – CA | | | 570 | | | | 61,000 | | | | 1.0 | % | | | 95.6 | % |

Fairfield – CA | | | 440 | | | | 41,000 | | | | 0.7 | % | | | 94.4 | % |

Littleton – CO | | | 400 | | | | 45,800 | | | | 0.8 | % | | | 88.0 | % |

Crestwood – IL | | | 460 | | | | 49,300 | | | | 0.8 | % | | | 92.1 | % |

Forestville – MD | | | 530 | | | | 55,200 | | | | 0.9 | % | | | 93.3 | % |

Upland – CA | | | 610 | | | | 56,500 | | | | 0.9 | % | | | 97.8 | % |

Lancaster – CA | | | 700 | | | | 64,700 | | | | 1.1 | % | | | 96.4 | % |

Santa Rosa – CA | | | 1,150 | | | | 116,400 | | | | 1.9 | % | | | 91.9 | % |

Vallejo – CA | | | 510 | | | | 54,400 | | | | 0.9 | % | | | 89.5 | % |

Federal Heights – CO | | | 450 | | | | 40,600 | | | | 0.7 | % | | | 88.8 | % |

Santa Ana – CA | | | 840 | | | | 84,500 | | | | 1.4 | % | | | 93.5 | % |

La Habra – CA | | | 420 | | | | 51,400 | | | | 0.9 | % | | | 93.5 | % |

Monterey Park – CA | | | 390 | | | | 31,200 | | | | 0.5 | % | | | 95.4 | % |

Huntington Beach – CA | | | 610 | | | | 61,000 | | | | 1.0 | % | | | 95.4 | % |

Lompoc – CA | | | 430 | | | | 46,500 | | | | 0.8 | % | | | 92.9 | % |

Aurora – CO | | | 890 | | | | 87,400 | | | | 1.4 | % | | | 79.2 | % |

Everett – WA | | | 490 | | | | 48,100 | | | | 0.8 | % | | | 95.6 | % |

Whittier – CA | | | 510 | | | | 58,600 | | | | 1.0 | % | | | 95.9 | % |

Bloomingdale – IL | | | 570 | | | | 58,200 | | | | 1.0 | % | | | 94.2 | % |

Warren I – MI | | | 500 | | | | 63,100 | | | | 1.0 | % | | | 95.5 | % |

Warren II – MI | | | 490 | | | | 52,100 | | | | 0.9 | % | | | 92.1 | % |

Troy – MI | | | 730 | | | | 82,200 | | | | 1.4 | % | | | 96.5 | % |

Sterling Heights – MI | | | 460 | | | | 63,600 | | | | 1.1 | % | | | 95.1 | % |

Beverly – NJ | | | 460 | | | | 51,000 | | | | 0.8 | % | | | 93.5 | % |

Foley – AL | | | 1,080 | | | | 159,000 | | | | 2.6 | % | | | 92.6 | % |

Tampa – FL | | | 510 | | | | 50,100 | | | | 0.8 | % | | | 91.6 | % |

Boynton Beach – FL | | | 940 | | | | 74,800 | | | | 1.2 | % | | | 89.2 | % |

Lancaster II – CA | | | 600 | | | | 86,200 | | | | 1.4 | % | | | 97.8 | % |

Burlington – Ontario – CAN | | | 900 | | | | 79,700 | | | | 1.3 | % | | | 90.2 | % |

Milton – Ontario – CAN | | | 850 | | | | 70,100 | | | | 1.2 | % | | | 87.7 | % |

Oakville I – Ontario – CAN | | | 820 | | | | 82,400 | | | | 1.4 | % | | | 58.0 | %(2) |

Oakville II – Ontario – CAN | | | 820 | | | | 92,700 | | | | 1.5 | % | | | 88.8 | % |

Burlington II – Ontario – CAN | | | 460 | | | | 54,800 | | | | 0.9 | % | | | 92.2 | % |

Xenia – OH | | | 470 | | | | 57,800 | | | | 1.0 | % | | | 88.6 | % |

14

| | | | | | | | | | | | | | | | |

Property | | Units | | | Sq. Ft.

(net) | | | % of Total

Rentable

Sq. Ft. | | | Physical

Occupancy

%(1) | |

Sidney – OH | | | 410 | | | | 54,400 | | | | 0.9 | % | | | 94.0 | % |

Troy – OH | | | 490 | | | | 59,200 | | | | 1.0 | % | | | 92.2 | % |

Greenville – OH | | | 390 | | | | 46,700 | | | | 0.8 | % | | | 90.9 | % |

Washington Court House – OH | | | 450 | | | | 54,200 | | | | 0.9 | % | | | 98.5 | % |

Richmond – IN | | | 640 | | | | 64,700 | | | | 1.1 | % | | | 96.2 | % |

Connersville – IN | | | 360 | | | | 47,400 | | | | 0.8 | % | | | 97.5 | % |

Port St. Lucie – FL | | | 530 | | | | 59,000 | | | | 1.0 | % | | | 92.8 | % |

Sacramento – CA | | | 530 | | | | 62,200 | | | | 1.0 | % | | | 94.5 | % |

Concord – CA | | | 1,340 | | | | 157,400 | | | | 2.6 | % | | | 95.1 | % |

Oakland – CA | | | 600 | | | | 67,200 | | | | 1.1 | % | | | 92.0 | % |

Pompano Beach – FL | | | 870 | | | | 115,600 | | | | 1.9 | % | | | 92.9 | % |

Lake Worth – FL | | | 830 | | | | 126,800 | | | | 2.1 | % | | | 92.9 | % |

Jupiter – FL | | | 820 | | | | 93,600 | | | | 1.6 | % | | | 94.7 | % |

Royal Palm Beach – FL | | | 850 | | | | 111,000 | | | | 1.8 | % | | | 94.1 | % |

Port St. Lucie II – FL | | | 720 | | | | 108,000 | | | | 1.8 | % | | | 93.8 | % |

Wellington – FL | | | 730 | | | | 86,700 | | | | 1.4 | % | | | 96.7 | % |

Doral – FL | | | 1,030 | | | | 106,000 | | | | 1.8 | % | | | 92.6 | % |

Plantation – FL | | | 910 | | | | 89,800 | | | | 1.5 | % | | | 94.4 | % |

Naples – FL | | | 800 | | | | 80,800 | | | | 1.3 | % | | | 95.6 | % |

Delray Beach – FL | | | 900 | | | | 135,700 | | | | 2.3 | % | | | 93.9 | % |

Baltimore – MD | | | 1,080 | | | | 117,700 | | | | 2.0 | % | | | 89.0 | % |

Sonoma – CA | | | 340 | | | | 44,600 | | | | 0.8 | % | | | 92.5 | % |

Las Vegas I – NV | | | 770 | | | | 106,800 | | | | 1.8 | % | | | 92.9 | % |

Las Vegas II – NV | | | 810 | | | | 101,400 | | | | 1.7 | % | | | 93.5 | % |

Las Vegas III – NV | | | 640 | | | | 82,200 | | | | 1.4 | % | | | 94.0 | % |

Asheville I – NC | | | 590 | | | | 95,600 | | | | 1.6 | % | | | 92.1 | % |

Asheville II – NC | | | 330 | | | | 43,400 | | | | 0.7 | % | | | 96.6 | % |

Hendersonville I – NC | | | 350 | | | | 39,400 | | | | 0.7 | % | | | 97.5 | % |

Asheville III – NC | | | 420 | | | | 55,400 | | | | 0.9 | % | | | 94.2 | % |

Arden – NC | | | 570 | | | | 75,100 | | | | 1.2 | % | | | 94.0 | % |

Asheville IV – NC | | | 480 | | | | 58,300 | | | | 1.0 | % | | | 89.9 | % |

Asheville V – NC | | | 450 | | | | 98,100 | | | | 1.6 | % | | | 95.6 | % |

Asheville VI – NC | | | 380 | | | | 45,500 | | | | 0.8 | % | | | 95.0 | % |

Asheville VII – NC | | | 210 | | | | 26,700 | | | | 0.4 | % | | | 86.5 | % |

Asheville VIII – NC | | | 380 | | | | 54,000 | | | | 0.9 | % | | | 96.1 | % |

Hendersonville II – NC | | | 490 | | | | 71,000 | | | | 1.2 | % | | | 89.8 | % |

Aurora II – CO | | | 400 | | | | 53,400 | | | | 0.9 | % | | | 96.1 | % |

Dufferin – Toronto – CAN | | | 1,070 | | | | 122,700 | | | | 2.0 | % | | | 92.0 | % |

Mavis – Toronto – CAN | | | 800 | | | | 99,900 | | | | 1.7 | % | | | 90.2 | % |

Brewster – Toronto – CAN | | | 770 | | | | 90,600 | | | | 1.5 | % | | | 91.1 | % |

Granite – Toronto – CAN | | | 760 | | | | 80,700 | | | | 1.3 | % | | | 70.0 | % |

Centennial – Toronto – CAN | | | 610 | | | | 66,500 | | | | 1.1 | % | | | 19.7 | %(3) |

| | | | | | | | | | | | | | | | |

Totals | | | 51,330 | | | | 6,029,600 | | | | 100 | % | | | 91.4 | % |

| | | | | | | | | | | | | | | | |

| (1) | Represents the occupied square feet divided by total rentable square feet as of March 31, 2017. |

| (2) | The Oakville I property opened in March 2016 with occupancy at 0%. The Oakville I property’s occupancy has increased to approximately 58% as of March 31, 2017. |

| (3) | The Centennial property was acquired on February 1, 2017 with occupancy at 11%. The Centennial property’s occupancy has increased to approximately 20% as of March 31, 2017. |

See Table III of the Prior Performance Tables for more detailed information as to the operating results of SST II.

15

Strategic Storage Growth Trust

In addition to sponsoring our public offering, SmartStop Asset Management is currently sponsoring SSGT, another non-traded REIT that was registered to sell up to $1.095 billion of its shares in a public offering. On June 17, 2013, SSGT commenced a private offering of up to $109.5 million in shares of SSGT’s common stock to accredited investors only pursuant to a confidential private placement memorandum. On May 23, 2014, SSGT reached the minimum offering amount of $1.0 million in sales of Class A shares in its private offering and SSGT commenced operations. On January 16, 2015, SSGT terminated the private offering of which SSGT raised a total of $7.8 million. On January 20, 2015, SSGT’s public offering was declared effective. On March 31, 2017, SSGT closed its primary offering to new investors. Investors who submitted subscriptions in accordance with SSGT’s close down procedures and were accepted by SSGT were admitted as stockholders effective as of March 31, 2017. SSGT sold approximately $193 million in Class A shares and approximately $79 million in Class T shares pursuant to its public offering.

As of March 31, 2017, SSGT owned the following self storage facilities:

| | | | | | | | | | | | | | | | |

Property | | Units | | | Sq. Ft. (net) | | | % of Total

Rentable Sq.

Ft. | | | Physical

Occupancy %(1) | |

Ft. Pierce – FL | | | 770 | | | | 88,400 | | | | 7.1 | % | | | 96.0 | % |

Las Vegas I – NV | | | 1,210 | | | | 171,100 | | | | 13.7 | % | | | 92.1 | % |

Las Vegas II – NV | | | 1,040 | | | | 89,000 | | | | 7.1 | % | | | 93.7 | % |

Colorado Springs – CO | | | 680 | | | | 61,800 | | | | 4.9 | % | | | 81.6 | % |

Riverside – CA | | | 610 | | | | 60,100 | | | | 4.8 | % | | | 97.4 | % |

Stockton – CA | | | 560 | | | | 49,100 | | | | 3.9 | % | | | 98.0 | % |

Azusa – CA | | | 660 | | | | 64,400 | | | | 5.1 | % | | | 95.3 | % |

Romeoville – IL | | | 680 | | | | 66,700 | | | | 5.3 | % | | | 87.3 | % |

Elgin – IL | | | 410 | | | | 49,600 | | | | 4.0 | % | | | 93.0 | % |

San Antonio I – TX | | | 490 | | | | 76,700 | | | | 6.1 | % | | | 93.8 | % |

Kingwood – TX | | | 470 | | | | 60,100 | | | | 4.8 | % | | | 91.7 | % |

Aurora – CO | | | 440 | | | | 59,500 | | | | 4.8 | % | | | 84.3 | % |

San Antonio II – TX | | | 440 | | | | 83,400 | (2) | | | 6.7 | % | | | 88.0 | % |

Baseline – AZ | | | 840 | | | | 94,000 | | | | 7.5 | % | | | N/A | (2) |

Stoney Creek – TOR – CAN(3) | | | 780 | | | | 81,600 | | | | N/A | (3) | | | N/A | (3) |

Torbarrie – TOR – CAN | | | 900 | | | | 85,000 | | | | N/A | (3) | | | N/A | (3) |

Asheville – NC | | | 650 | | | | 72,000 | | | | N/A | (3) | | | N/A | (3) |

Elk Grove Village – IL | | | 800 | | | | 82,000 | | | | 6.6 | % | | | N/A | (2) |

Garden Grove – CA | | | 960 | | | | 95,000 | | | | 7.6 | % | | | N/A | (2) |

| | | | | | | | | | | | | | | | |

Totals | | | 13,390 | | | | 1,489,500 | | | | 100 | % | | | 91.8 | % |

| | | | | | | | | | | | | | | | |

| (1) | Represents the occupied square feet divided by total rentable square feet as of March 31, 2017. |

| (2) | The Baseline property was acquired on May 26, 2016 with occupancy at 0%. The Baseline property’s occupancy has increased to approximately 68% as of March 31, 2017. The Elk Grove Village property was acquired on January 13, 2017 with occupancy at approximately 32%. The Elk Grove Village property’s occupancy has increased to approximately 41% as of March 31, 2017. The Garden Grove property was acquired on March 16, 2017 with occupancy at approximately 9%. The Garden Grove property’s occupancy has increased to 14% as of March 31, 2017. The Baseline property, Elk Grove property and Garden Grove property were excluded from the physical occupancy statistics above. |

| (3) | The Stoney Creek property, Torbarrie property and Asheville property are self storage properties that are under construction and the numbers are approximate. |

See Table III of the Prior Performance Tables for more detailed information as to the operating results of SSGT.

16

In certain instances, affiliates of SmartStop Asset Management have agreed to make certain accommodations that benefit the owners of these public programs, such as the deferral of payment or waiver of both asset and property management fees and related reimbursable expenses otherwise payable to affiliates of SmartStop Asset Management. Although certain prior programs sponsored by affiliates of SmartStop Asset Management have been adversely affected by the cyclical nature of the real estate market and general risks associated with investments in real estate, at this time, we are not aware of any adverse business developments relative to this program that would be material to investors.

No assurance can be made that our program or other programs sponsored by affiliates of our advisor will ultimately be successful in meeting their investment objectives.

Private Programs

The prior privately-offered programs (the “Private Programs”) sponsored or co-sponsored by affiliates of SmartStop Asset Management include 11 single-asset real estate TIC offerings, two privately-offered REITs, four multi-asset Delaware Statutory Trust (“DST”) offerings, one single-asset DST offering and one single asset real estate limited liability company. Limited partnership units were privately offered in conjunction with four of the aforementioned TIC offerings and limited liability company units were privately offered in conjunction with five of the aforementioned TIC offerings. The entities in which these investors acquired units acquired an undivided TIC interest in the property that was the subject of such offering and in which other investors acquired direct TIC interests. Investors in these 19 Private Programs raised approximately $321 million of gross offering proceeds from approximately 1,730 investors.

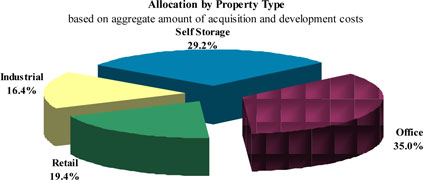

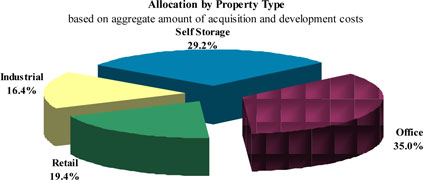

With a combination of debt and offering proceeds, these Private Programs invested approximately $764 million (including acquisition and development costs) in 43 properties located in 14 states. Based on the aggregate amount of acquisition and development costs, approximately 96% was spent on existing or used properties and approximately 4% was spent on construction or redevelopment properties. Over the course of these Private Programs, 39 properties have been sold, which includes 29 properties that were sold or merged into SmartStop. Based on the aggregate amount of acquisition and development costs, the assets in these programs can be categorized as indicated in the chart below:

The following table shows a breakdown by percentage of the aggregate amount of the acquisition and development costs of the properties purchased by the Private Programs:

| | | | | | | | | | | | |

Type of Property | | New | | | Used | | | Construction | |

Office | | | — | | | | 100.0 | % | | | — | |

Self Storage | | | — | | | | 100.0 | % | | | — | |

Industrial | | | — | | | | 73.5 | % | | | 26.5 | % |

Retail | | | — | | | | 100.0 | % | | | — | |

17

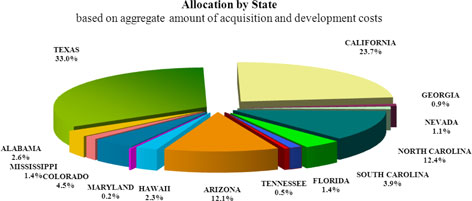

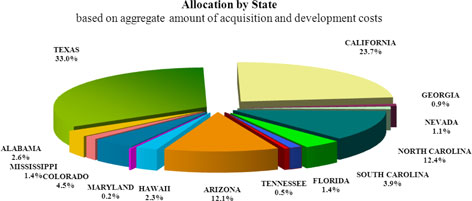

As a percentage of the aggregate amount of acquisition and development costs, the diversification of these 43 properties by geographic area is as follows:

As a percentage of the aggregate amount of acquisition and development costs, the allocation of financing proceeds for these 43 properties is 36% equity and 64% debt proceeds.

See Tables IV and V of the Prior Performance Tables for detailed results of the sale or disposal of properties by the self storage Private Programs with similar investment objectives within the most recent three years.

In total, the properties within all Private Programs had an aggregate of approximately 5.6 million square feet of gross leasable space. Of this, the percentage of all self storage properties with investment objectives similar to ours is approximately 54.5%. There have been no acquisitions of properties by such Private Programs during the previous three years.

The investments of the above mentioned Private Programs include the experience of the sponsor and its affiliates during the previous 10 years.

The investments of the above mentioned Private Programs have all occurred during the previous 10 years. There were no other investments made by these programs prior to this 10 year period and affiliates of SmartStop Asset Management did not sponsor or co-sponsor any programs prior to this 10 year period.

Certain properties have experienced, and may in the future experience, decreases in net income when economic conditions decline. CB Richard Ellis Investors/U.S. Advisor, LLC, along with SCH, co-sponsored the offering of USA 615 North 48th ST, LLC, which together with other TIC interest holders, acquired an approximately 574,000 square foot single-tenant industrial property. The program experienced an involuntary bankruptcy of its single tenant, Le*Nature’s, Inc., as a result of financial fraud by its senior executives perpetrated on financial institutions and auditors, which in turn resulted in the lender commencing foreclosure proceedings and ultimately prison terms for many of the key company executives. The bankruptcy trustee approved the petition of Le*Nature’s to terminate the lease with the TIC owners, resulting in a default on the first lien loan on the property and a receiver for the property was appointed in April 2007. Distributions to the investors were suspended indefinitely as of November 2006. The lien holder of the machinery within the facility was required to make the property lease payments, if the tenant was unable to do so, as long as the equipment remained in the facility. The owner of the equipment committed to making the lease payments through October 2007.

18

In December 2006, the co-sponsors began to market the property for lease. Through that process, the investors were presented with a 16-year lease opportunity. As a result of the TIC structure, unanimous approval by all investors was required in order to proceed to lease execution. All but three of the TIC investors approved the terms of the lease thus preventing a lease execution. In June 2008, an affiliate of CB Richard Ellis Investors (CBREI) purchased the investors’ interest in this property at 60% of their original investment plus the right to receive a share in any future proceeds generated from a subsequent sale of the property to a third party over and above the CBREI affiliate’s original cost of purchase, holding costs and selling expenses. The CBREI affiliate also assumed the senior secured loan and entered into a forbearance agreement with the lender that terminated the foreclosure proceedings.

Subsequent to the sale, the CBREI affiliate immediately re-engaged the original proposed tenant in lease negotiations and ultimately secured a lease in January 2009.

CB Richard Ellis Investors/U.S. Advisor, LLC, along with SCH, co-sponsored the offering of USA Sunset Media, LLC, which together with other TIC interest holders, acquired an approximately 320,905 square foot multi-tenant Class A office and retail building located in Hollywood, California (the “Sunset Media Tower”). At the expiration of its lease in April 2009, HOB Entertainment, Inc., the owner and operator of House of Blues clubs and a 17.03% tenant of the building, decided not to renew its lease. The TIC investors (the “Sunset Media Plaintiffs”) in the Sunset Media Tower filed a lawsuit in the Northern District of California against various entities and individuals including, among others, SCH, CBREI, H. Michael Schwartz, Paula Mathews and an individual associated with CBREI (the “Sunset Media Defendants”). The Sunset Media Defendants denied all claims made against them. SCH had no involvement in the management or operations of this property since the end of 2008 when CBREI assumed full responsibility for the management of the property. In April 2012, the litigation was settled and the lawsuit was dismissed.

In February 2006, SCH sponsored the offering by USA Hawaii Self Storage, LLC of TIC interests in a 931-unit self storage facility located in Honolulu, Hawaii (the “Hawaii Property”). At the time of the acquisition, SCH believed the market for self storage facilities in Honolulu to be well under-supplied. In 2007 and 2008, however, there was a surge in development of self storage properties in this market, which added another 1.7 million square feet of self storage space, before the City of Honolulu placed a moratorium on any further development of self storage facilities. The combination of this surge in supply and the global economic crisis resulted in higher vacancy rates and increased tenant receivables for properties in this market, which, in turn, created the need for facility owners to increase concessions for customers. The net result was decreased revenues for many self storage facilities in the market, including the Hawaii Property.

The TIC owners leased the Hawaii Property, pursuant to a master lease, to an affiliate of SCH. Due to the negative developments discussed above, SCH contributed approximately $600,000 to the master tenant affiliate for operating expense shortfalls and the property managers deferred an additional $550,000 in payroll and management fees over the last six years. Stated rent payments (i.e., distributions to investors) under the master lease were suspended indefinitely as of March 2009. Investors were asked to fund capital calls and chose not to do so. The mortgage loan on the property went into default and a receiver was appointed to manage the property in May 2012. The property was eventually sold pursuant to foreclosure proceedings in August 2014.

In January 2012, certain of the TIC owners filed a demand for arbitration in Chicago, Illinois and a lawsuit in Honolulu, Hawaii against SCH, U.S. Advisor, LLC, U.S. Select Securities, LLC, Mr. Schwartz, Watson & Taylor Management (the initial property manager) and certain other defendants. The TIC owners alleged various causes of action, including breach of contract, negligence and intentional misrepresentations. After conducting non-binding mediations during 2013 and 2014, the parties settled the action in March 2014. Under the terms of the settlement, the plaintiffs dismissed the action and released the respondents from all claims in exchange for a settlement payment funded by SCH’s insurer within the insurance policy limits.

In November 2007, SCH sponsored the offering by Fontaine Business Park, LLC of TIC interests in a multi-tenant office park located in Columbia, South Carolina. In July 2011, the lender substantially increased the required monthly reserve payments to levels SCH believed were unreasonable. While a portion of the increased reserves were paid to the lender, SCH did not apply operating revenue from the property to fund the balance of the increases because it contends that the reserves then held by the lender were more than adequate. The lender,

19

however, declared the loan in default for failure to pay the full amount of the increased reserves and instituted foreclosure proceedings against the TIC investors in November 2012. SCH, on behalf of one TIC owner that is an affiliate of SCH, and the other TIC investors have filed an answer denying that an event of default has occurred and alleging counter-claims against the lender for breach of contract and breach of fiduciary duties. On June 3, 2013, the court ordered the appointment of a receiver to operate the property during the pendency of the litigation. In the same order, the court also acknowledged that the foreclosure action will not proceed until the TIC investors’ claims of lender misconduct are finally adjudicated. The court ruled against the TIC investors’ demand for a jury trial and this decision was affirmed on appeal. The lender and the TIC owners agreed to terminate the litigation with mutual releases of all claims and the lender foreclosed on the property on December 5, 2016.

In July 2006, SCH sponsored the offering by USA 5500 S. Quebec St, LLC of TIC interests in CoBank Center, an office building located in Greenwood Village, Colorado, a suburb of Denver. The mortgage loan was not repaid on its maturity in November 2013. CoBank, the single largest tenant in the building, has indicated that it will not renew its lease in 2016 and, as a result, the property could not be refinanced prior to the maturity of the loan. The lender has instituted foreclosure proceedings and the foreclosure sale was originally scheduled for early May 2014. In April 2014, the TIC owners entered into an agreement to sell the property to a third party, and the lender delayed the foreclosure to permit the sale to take place. The proposed buyer, however, decided not to proceed with the sale and the property was sold pursuant to the foreclosure in August 2014.

In August 2006, SCH sponsored the offering by USA Medical Towers, LP of TIC interests in a ground leasehold interest in Medical Towers, an office and retail building in Houston, Texas. Approximately 82% of the building was leased to one tenant that vacated the premises in August 2013 when its lease expired. As a result, the property was unable to service the mortgage loan and it went into default. In December 2014, a third party developer purchased the mortgage note. Certain of the TIC investors sold their TIC interests while the remaining TIC investors contributed their TIC interests to the developer in exchange for equity interests in the developer’s affiliated entities that will redevelop the property as a hotel. The transaction was structured primarily to defer the taxes that would have been payable by the TIC investors had the property been sold in foreclosure. In October 2015, several of the TIC investors filed a lawsuit in the Orange County California Superior Court against SCH and two entities affiliated with SCH alleging several causes of action related to the offering of the TIC interests. The defendants filed a demurrer to the complaint. The parties were unable to reach a settlement after conducting non-binding mediation. The trial was held on April 3, 2017 and on April 5, 2017, the judge determined that the private placement memorandum provided full disclosure to the plaintiffs and rendered his verdict in favor of the defendants. The plaintiffs have filed an appeal of the judge’s decision.

As a result of the limited ability to raise new capital from these investors and the then current economic crisis, distributions have been either reduced or temporarily ceased on several of these Private Programs as a precautionary measure to preserve cash. Since 11 of SCH’s programs are TIC offerings made primarily to investors exchanging properties in a tax-deferred manner pursuant to Section 1031 of the Code, it is impractical for these investors to make additional capital contributions to fund tenant improvements or other required capital expenditures. In addition, restrictions imposed on DST offerings pursuant to IRS Revenue Ruling 2004-86 prohibit additional capital contributions from the investors in those programs.

In certain instances, the sponsor of these programs, and its affiliates, have agreed to make certain accommodations to benefit the owners of these properties, such as the deferral of asset management fees otherwise payable to the sponsor or its affiliates. See Prior Performance Table III (Annual Operating Results of Prior Real Estate Programs) in Appendix C for further information regarding certain of these Private Programs with similar investment objectives. Our business may be affected by similar conditions. Although certain Private Programs sponsored or co-sponsored by SCH have been adversely affected by the cyclical nature of the real estate market and general risks associated with investments in real estate, at this time, we are not aware of any other adverse business developments other than those described above relative to the prior programs that would be material to investors.

20

No assurance can be made that our program or other programs sponsored by affiliates of our advisor will ultimately be successful in meeting their investment objectives. Below is a summary of the six Private Programs previously sponsored by SCH that we believe are most similar to this offering (i.e. self storage programs consisting of two or more assets). As of January 31, 2017, all of such programs have completed operations with the exception of Montgomery County Self Storage, DST.

Any potential investor may obtain, without charge, the most recent annual report on Form 10-K filed with the SEC by SmartStop Self Storage, Inc., Strategic Storage Trust II, Inc. and Strategic Storage Growth Trust, Inc. within the last 24 months at eitherwww.strategicreit.com orwww.sec.gov. For a reasonable fee, we will provide copies of any exhibits to such Form 10-K.

Self Storage REIT, Inc.

Self Storage REIT, Inc. (now known as Self Storage REIT, LLC) (REIT I) was a privately-offered REIT organized to invest primarily in self storage properties. REIT I completed its offering in March 2007 and raised approximately $29.8 million of gross offering proceeds. With a combination of approximately 57% debt and 43% offering proceeds, REIT I invested approximately $57 million (including acquisition and development costs) in nine properties and a single-asset Delaware Statutory Trust as of December 31, 2008. SmartStop Self Storage acquired REIT I on September 24, 2009 in exchange for 1.05 shares of SmartStop Self Storage common stock for each 1.0 share of REIT I common stock (equivalent to $10.50 per share of REIT I common stock). REIT I owned six self storage properties located in four states (Florida, South Carolina, Tennessee and Texas), consisting of an aggregate of approximately 5,355 units and 869,900 rentable square feet, as well as an ownership interest in an industrial property in Hawthorne, California leased to a single tenant, an approximately 10% ownership interest in USA SF Self Storage, DST, a Delaware Statutory Trust owning a self storage property located in San Francisco, California with 1,123 units and 76,200 rentable square feet, and ownership interests in two additional self storage facilities located in California and Maryland, consisting of an aggregate of approximately 1,800 units and 338,600 rentable square feet. Pursuant to the merger of SmartStop Self Storage with Extra Space on October 1, 2015, the REIT I properties are now owned by Extra Space.

Self Storage REIT II, Inc.

Self Storage REIT II, Inc. (now known as Self Storage REIT II, LLC) (REIT II) was a privately-offered real estate investment trust organized to invest primarily in self storage properties. REIT II completed its offering in December 2008 and raised approximately $26.2 million of gross offering proceeds. With a combination of approximately 61% debt and 39% offering proceeds, REIT II invested approximately $45 million (including acquisition and development costs) in five properties and an interest in three multi-property Delaware Statutory Trusts as of December 31, 2008. SmartStop Self Storage acquired REIT II on September 24, 2009 in exchange for 1.0 shares of SmartStop Self Storage common stock for each 1.0 share of REIT II common stock (equivalent to $10.00 per share of REIT II common stock). REIT II owned four self storage properties located in three states (Alabama, Nevada and Texas), consisting of an aggregate of approximately 1,845 units and 228,800 rentable square feet, as well as: an ownership interest in an additional self storage property located in California, consisting of approximately 1,300 units and 267,700 square feet; a beneficial interest in Self Storage I DST, a Delaware Statutory Trust owning 10 self storage properties in three states, as described in more detail below; a beneficial interest in Southwest Colonial, DST, a Delaware Statutory Trust owning five self storage properties in Texas, as described in more detail below; and a beneficial interest in Montgomery County Self Storage, DST, a Delaware Statutory Trust owning two self storage properties in Alabama with 1,542 units and 155,713 rentable square feet as described in more detail below. Pursuant to the merger of SmartStop Self Storage with Extra Space on October 1, 2015, the REIT II properties are now owned by Extra Space.

21

Self Storage I, DST