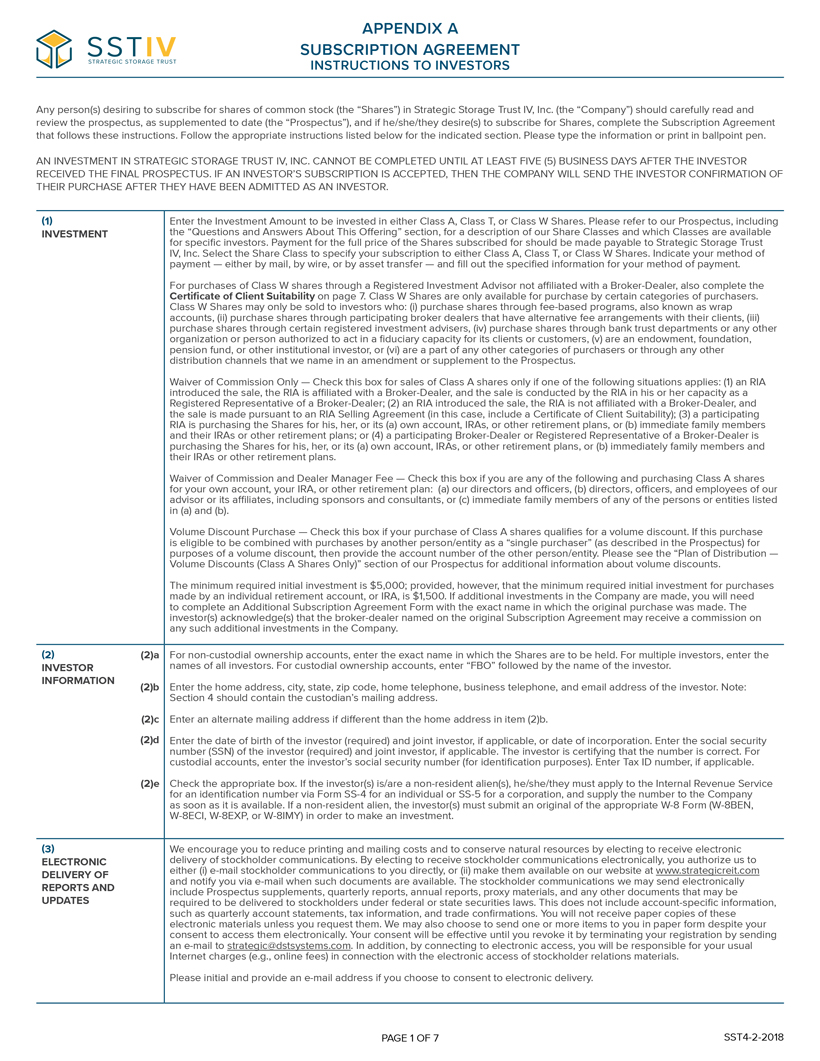

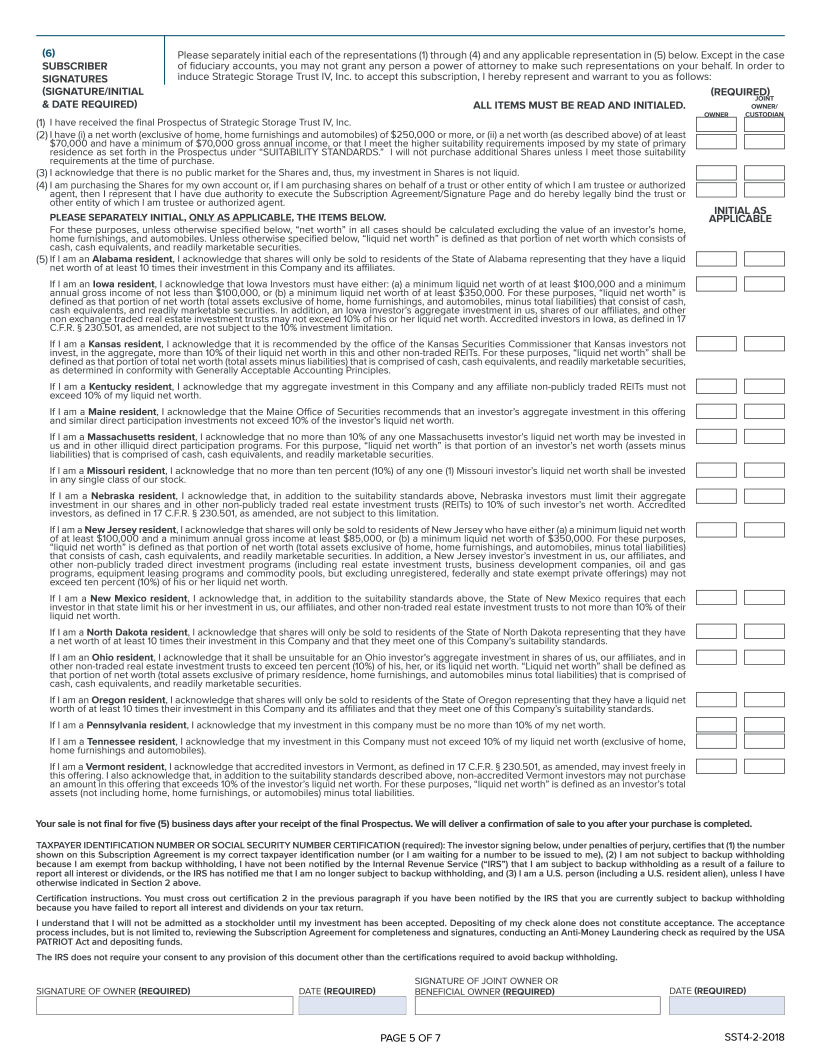

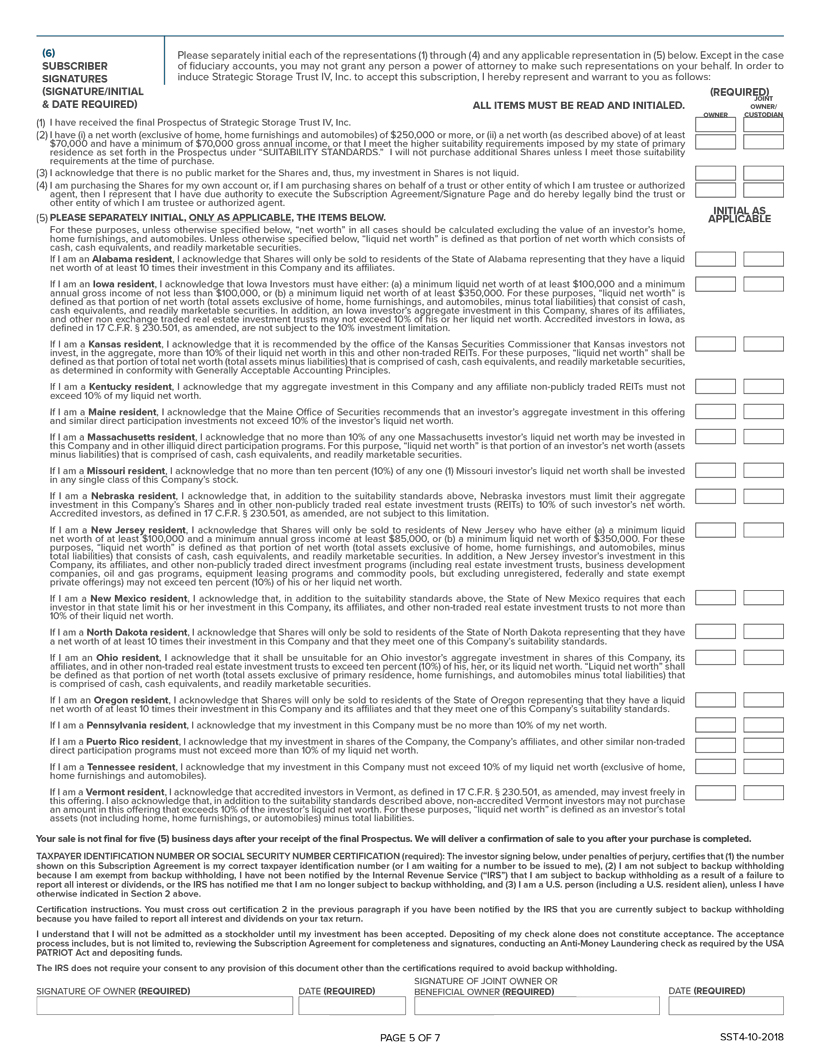

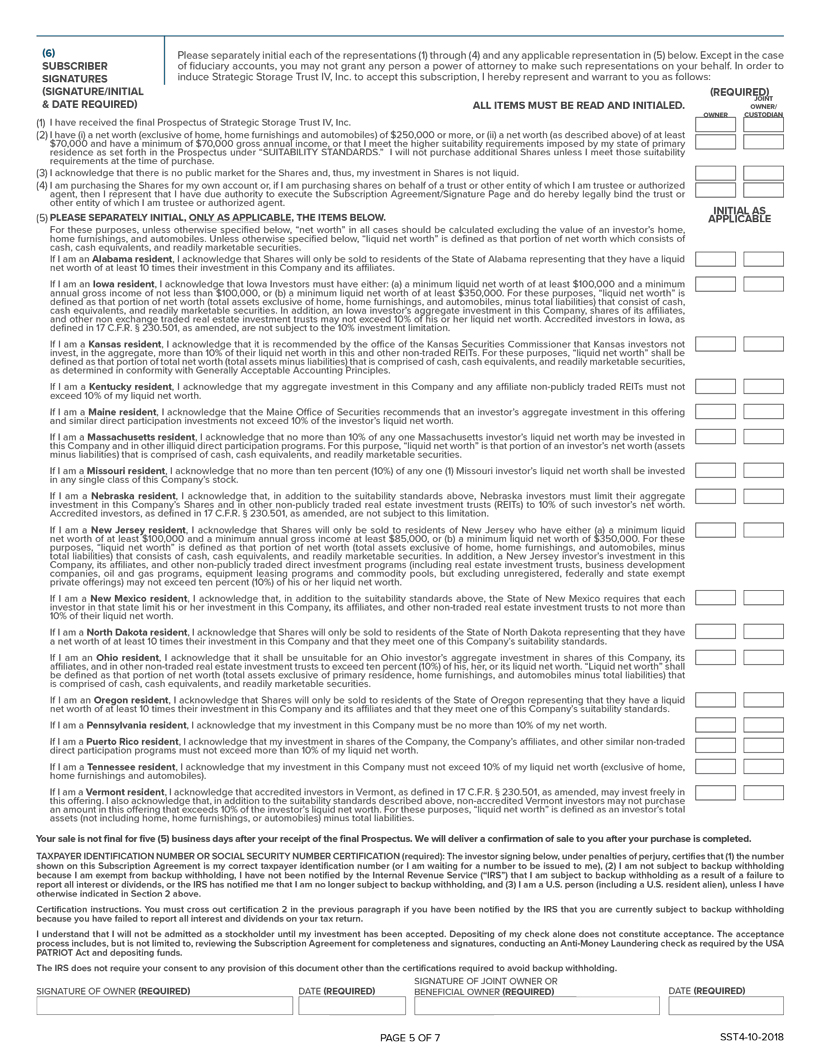

(6) Please separately initial each of the representations (1) through (4) and any applicable representation in (5) below. Except in the case SUBSCRIBER of fiduciary accounts, you may not grant any person a power of attorney to make such representations on your behalf. In order to SIGNATURES induce Strategic Storage Trust IV, Inc. to accept this subscription, I hereby represent and warrant to you as follows: (SIGNATURE/INITIAL (REQUIRED) & DATE REQUIRED) JOINT ALL ITEMS MUST BE READ AND INITIALED. OWNER/ OWNER CUSTODIAN (1) I have received the final Prospectus of Strategic Storage Trust IV, Inc. (2) I have (i) a net worth (exclusive of home, home furnishings and automobiles) of $250,000 or more, or (ii) a net worth (as described above) of at least $70,000 and have a minimum of $70,000 gross annual income, or that I meet the higher suitability requirements imposed by my state of primary residence as set forth in the Prospectus under “SUITABILITY STANDARDS.” I will not purchase additional Shares unless I meet those suitability requirements at the time of purchase. (3) I acknowledge that there is no public market for the Shares and, thus, my investment in Shares is not liquid. (4) I am purchasing the Shares for my own account or, if I am purchasing shares on behalf of a trust or other entity of which I am trustee or authorized agent, then I represent that I have due authority to execute the Subscription Agreement/Signature Page and do hereby legally bind the trust or other entity of which I am trustee or authorized agent. INITIAL AS (5) PLEASE SEPARATELY INITIAL, ONLY AS APPLICABLE, THE ITEMS BELOW. APPLICABLE For these purposes, unless otherwise specified below, “net worth” in all cases should be calculated excluding the value of an investor’s home, home furnishings, and automobiles. Unless otherwise specified below, “liquid net worth” is defined as that portion of net worth which consists of cash, cash equivalents, and readily marketable securities. If I am an Alabama resident, I acknowledge that Shares will only be sold to residents of the State of Alabama representing that they have a liquid net worth of at least 10 times their investment in this Company and its affiliates. If I am an Iowa resident, I acknowledge that Iowa Investors must have either: (a) a minimum liquid net worth of at least $100,000 and a minimum annual gross income of not less than $100,000, or (b) a minimum liquid net worth of at least $350,000. For these purposes, “liquid net worth” is defined as that portion of net worth (total assets exclusive of home, home furnishings, and automobiles, minus total liabilities) that consist of cash, cash equivalents, and readily marketable securities. In addition, an Iowa investor’s aggregate investment in this Company, shares of its affiliates, and other non exchange traded real estate investment trusts may not exceed 10% of his or her liquid net worth. Accredited investors in Iowa, as defined in 17 C.F.R. § 230.501, as amended, are not subject to the 10% investment limitation. If I am a Kansas resident, I acknowledge that it is recommended by the office of the Kansas Securities Commissioner that Kansas investors not invest, in the aggregate, more than 10% of their liquid net worth in this and othernon-traded REITs. For these purposes, “liquid net worth” shall be defined as that portion of total net worth (total assets minus liabilities) that is comprised of cash, cash equivalents, and readily marketable securities, as determined in conformity with Generally Acceptable Accounting Principles. If I am a Kentucky resident, I acknowledge that my aggregate investment in this Company and any affiliatenon-publicly traded REITs must not exceed 10% of my liquid net worth. If I am a Maine resident, I acknowledge that the Maine Office of Securities recommends that an investor’s aggregate investment in this offering and similar direct participation investments not exceed 10% of the investor’s liquid net worth. If I am a Massachusetts resident, I acknowledge that no more than 10% of any one Massachusetts investor’s liquid net worth may be invested in this Company and in other illiquid direct participation programs. For this purpose, “liquid net worth” is that portion of an investor’s net worth (assets minus liabilities) that is comprised of cash, cash equivalents, and readily marketable securities. If I am a Missouri resident, I acknowledge that no more than ten percent (10%) of any one (1) Missouri investor’s liquid net worth shall be invested in any single class of this Company’s stock. If I am a Nebraska resident, I acknowledge that, in addition to the suitability standards above, Nebraska investors must limit their aggregate investment in this Company’s Shares and in othernon-publicly traded real estate investment trusts (REITs) to 10% of such investor’s net worth. Accredited investors, as defined in 17 C.F.R. § 230.501, as amended, are not subject to this limitation. If I am a New Jersey resident, I acknowledge that Shares will only be sold to residents of New Jersey who have either (a) a minimum liquid net worth of at least $100,000 and a minimum annual gross income at least $85,000, or (b) a minimum liquid net worth of $350,000. For these purposes, “liquid net worth” is defined as that portion of net worth (total assets exclusive of home, home furnishings, and automobiles, minus total liabilities) that consists of cash, cash equivalents, and readily marketable securities. In addition, a New Jersey investor’s investment in this Company, its affiliates, and othernon-publicly traded direct investment programs (including real estate investment trusts, business development companies, oil and gas programs, equipment leasing programs and commodity pools, but excluding unregistered, federally and state exempt private offerings) may not exceed ten percent (10%) of his or her liquid net worth. If I am a New Mexico resident, I acknowledge that, in addition to the suitability standards above, the State of New Mexico requires that each investor in that state limit his or her investment in this Company, its affiliates, and othernon-traded real estate investment trusts to not more than 10% of their liquid net worth. If I am a North Dakota resident, I acknowledge that Shares will only be sold to residents of the State of North Dakota representing that they have a net worth of at least 10 times their investment in this Company and that they meet one of this Company’s suitability standards. If I am an Ohio resident, I acknowledge that it shall be unsuitable for an Ohio investor’s aggregate investment in shares of this Company, its affiliates, and in othernon-traded real estate investment trusts to exceed ten percent (10%) of his, her, or its liquid net worth. “Liquid net worth” shall be defined as that portion of net worth (total assets exclusive of primary residence, home furnishings, and automobiles minus total liabilities) that is comprised of cash, cash equivalents, and readily marketable securities. If I am an Oregon resident, I acknowledge that Shares will only be sold to residents of the State of Oregon representing that they have a liquid net worth of at least 10 times their investment in this Company and its affiliates and that they meet one of this Company’s suitability standards. If I am a Pennsylvania resident, I acknowledge that my investment in this Company must be no more than 10% of my net worth. If I am a Puerto Rico resident, I acknowledge that my investment in shares of the Company, the Company’s affiliates, and other similarnon-traded direct participation programs must not exceed more than 10% of my liquid net worth. If I am a Tennessee resident, I acknowledge that my investment in this Company must not exceed 10% of my liquid net worth (exclusive of home, home furnishings and automobiles). If I am a Vermont resident, I acknowledge that accredited investors in Vermont, as defined in 17 C.F.R. § 230.501, as amended, may invest freely in this offering. I also acknowledge that, in addition to the suitability standards described above,non-accredited Vermont investors may not purchase an amount in this offering that exceeds 10% of the investor’s liquid net worth. For these purposes, “liquid net worth” is defined as an investor’s total assets (not including home, home furnishings, or automobiles) minus total liabilities. Your sale is not final for five (5) business days after your receipt of the final Prospectus. We will deliver a confirmation of sale to you after your purchase is completed. TAXPAYER IDENTIFICATION NUMBER OR SOCIAL SECURITY NUMBER CERTIFICATION (required): The investor signing below, under penalties of perjury, certifies that (1) the number shown on this Subscription Agreement is my correct taxpayer identification number (or I am waiting for a number to be issued to me), (2) I am not subject to backup withholding because I am exempt from backup withholding, I have not been notified by the Internal Revenue Service (“IRS”) that I am subject to backup withholding as a result of a failure to report all interest or dividends, or the IRS has notified me that I am no longer subject to backup withholding, and (3) I am a U.S. person (including a U.S. resident alien), unless I have otherwise indicated in Section 2 above. Certification instructions. You must cross out certification 2 in the previous paragraph if you have been notified by the IRS that you are currently subject to backup withholding because you have failed to report all interest and dividends on your tax return. I understand that I will not be admitted as a stockholder until my investment has been accepted. Depositing of my check alone does not constitute acceptance. The acceptance process includes, but is not limited to, reviewing the Subscription Agreement for completeness and signatures, conducting an Anti-Money Laundering check as required by the USA PATRIOT Act and depositing funds. The IRS does not require your consent to any provision of this document other than the certifications required to avoid backup withholding. SIGNATURE OF OWNER (REQUIRED) DATE (REQUIRED) SIGNATURE BENEFICIAL OF OWNER JOINT (REQUIRED) OWNER OR DATE (REQUIRED) PAGE 5 OF 7SST4-10-2018