Second Quarter Update Strategic Storage Trust IV, Inc. This property is not owned by Strategic Storage Trust IV, Inc. This property is owned by our sponsor. H. Michael Schwartz – Founder & Chairman This is neither an offer to sell nor a solicitation of an offer to buy the securities described herein. Only the prospectus makes such an offer. The literature must be read in conjunction with the prospectus in order to fully understand all of the implications and risk of the offering of securities to which it relates. Please read the prospectus in its entirety before investing for complete information and to learn more about the risks associated with this offering. Shares Offered through Select Capital Corporation ( Member of FINRA and SIPC ) Exhibit 99.1

Risk Factors & Other Information This investor presentation may contain certain forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. Such forward-looking statements can generally be identified by our use of forward-looking terminology such as “may,” “will,” “expect,” “intend,” “anticipate,” “estimate,” “believe,” “continue,” or other similar words. Because such statements include risks, uncertainties and contingencies, actual results may differ materially from the expectations, intentions, beliefs, plans or predictions of the future expressed or implied by such forward-looking statements. These risks, uncertainties and contingencies include, but are not limited to: uncertainties relating to changes in general economic and real estate conditions; uncertainties relating to the implementation of our real estate investment strategy; uncertainties relating to financing availability and capital proceeds; uncertainties relating to the closing of property acquisitions; uncertainties related to the timing and availability of distributions; and other risk factors as outlined in the Company’s public filings with the Securities and Exchange Commission. This is neither an offer nor a solicitation to purchase securities. As of June 30, 2019, our accumulated deficit was approximately $11.1 million, and we anticipate that our operations will not be profitable in 2019. We have paid distributions from sources other than our cash flows from operations, including from the net proceeds of this offering and the private offering transaction. We are not prohibited from undertaking such activities by our charter, bylaws or investment policies, and we may use an unlimited amount from any source to pay our distributions. From commencement of paying cash distributions in February 2017, the payment of distributions has been funded from the private offering transaction and this offering. Until we generate cash flows sufficient to pay distributions to you, we may pay distributions from the net proceeds of this offering or from borrowings in anticipation of future cash flows. Until we generate operating cash flows sufficient to pay distributions to you, we may pay distributions from financing activities, which may include borrowings in anticipation of future cash flows or the net proceeds of this offering (which may constitute a return of capital). It is likely that we will be required to use return of capital to fund distributions (if any) in at least the first few years of operation. We are not prohibited from undertaking such activities by our charter, bylaws or investment policies, and we may use an unlimited amount from any source to pay our distributions, and it is likely that we will use offering proceeds to fund a majority of our initial distributions. No public market currently exists for shares of our common stock and we may not list our shares on a national securities exchange before three to five years after completion of this offering, if at all; therefore, it may be difficult to sell your shares. If you sell your shares, it will likely be at a substantial discount. Our charter does not require us to pursue a liquidity transaction at any time. This is an initial public offering; we have limited operating history, and the prior performance of real estate programs sponsored by affiliates of our sponsor may not be indicative of our future results. This is a “best efforts” offering. If we are unable to raise substantial funds in this offering, we may not be able to invest in a diverse portfolio of real estate and real estate-related investments, and the value of your investment may fluctuate more widely with the performance of specific investments. We are a “blind pool.” As a result, you will not be able to evaluate the economic merits of our future investments prior to their purchase. We may be unable to invest the net proceeds from this offering on acceptable terms to investors, or at all. Investors in this offering will experience immediate dilution in their investment primarily because (i) we pay upfront fees in connection with the sale of our shares that reduce the proceeds to us, (ii) on January 25, 2017 we sold approximately 360,577 shares of our Class A common stock at a purchase price of approximately $20.80 per share in a private offering transaction as described above, and (iii) we paid offering expenses in connection with our private offering transaction. There are substantial conflicts of interest among us and our sponsor, advisor, property manager, transfer agent and dealer manager. Our advisor will face conflicts of interest relating to the purchase of properties, including conflicts with SmartStop Self Storage REIT, Inc. and other private programs sponsored by our sponsor, and such conflicts may not be resolved in our favor, which could adversely affect our investment opportunities. We have no employees and must depend on our advisor to select investments and conduct our operations, and there is no guarantee that our advisor will devote adequate time or resources to us. We will pay substantial fees and expenses to our advisor, its affiliates and participating broker-dealers, which will reduce cash available for investment and distribution. We may incur substantial debt, which could hinder our ability to pay distributions to our stockholders or could decrease the value of your investment. We may fail to qualify as a REIT, which could adversely affect our operations and our ability to make distributions. Our board of directors may change any of our investment objectives without your consent.

SmartStop Asset Management, LLC

SmartStop Asset Management, LLC SmartStop Asset Management, LLC (“SAM”) and its affiliates* have a managed real estate portfolio of approximately $1.9 billion. An affiliate* of SAM sponsors, advises and manages one public, non-traded REIT and one private REIT focusing on self storage properties Growing self storage portfolio of properties in the greater Toronto area, comprising over 1 million net rentable square feet Company and affiliates have acquired over $6 billion in real estate assets over the past 15 years National sponsor of 1031 DST programs Current managed portfolio comprises approx. 11.6 million rentable square feet across 21 states & Toronto, Canada SAM and its affiliates have an aggregate of over 370 employees, including 32 self storage employees in Toronto, Canada Experienced developer of self storage and mixed-use properties in the U.S. and Toronto, including ground up & redevelopment projects Sponsor of public, non-traded REIT investing in student & senior housing *Self Storage REITs are sponsored by SmartStop REIT Advisors, LLC., an affiliate of SAM

Strategic Storage Trust IV, Inc. Executive Team H. Michael Schwartz Chairman of the Board & Chief Executive Officer Wayne Johnson Chief Investment Officer Michael McClure President Matt Lopez Chief Financial Officer & Treasurer Nicholas Look Secretary

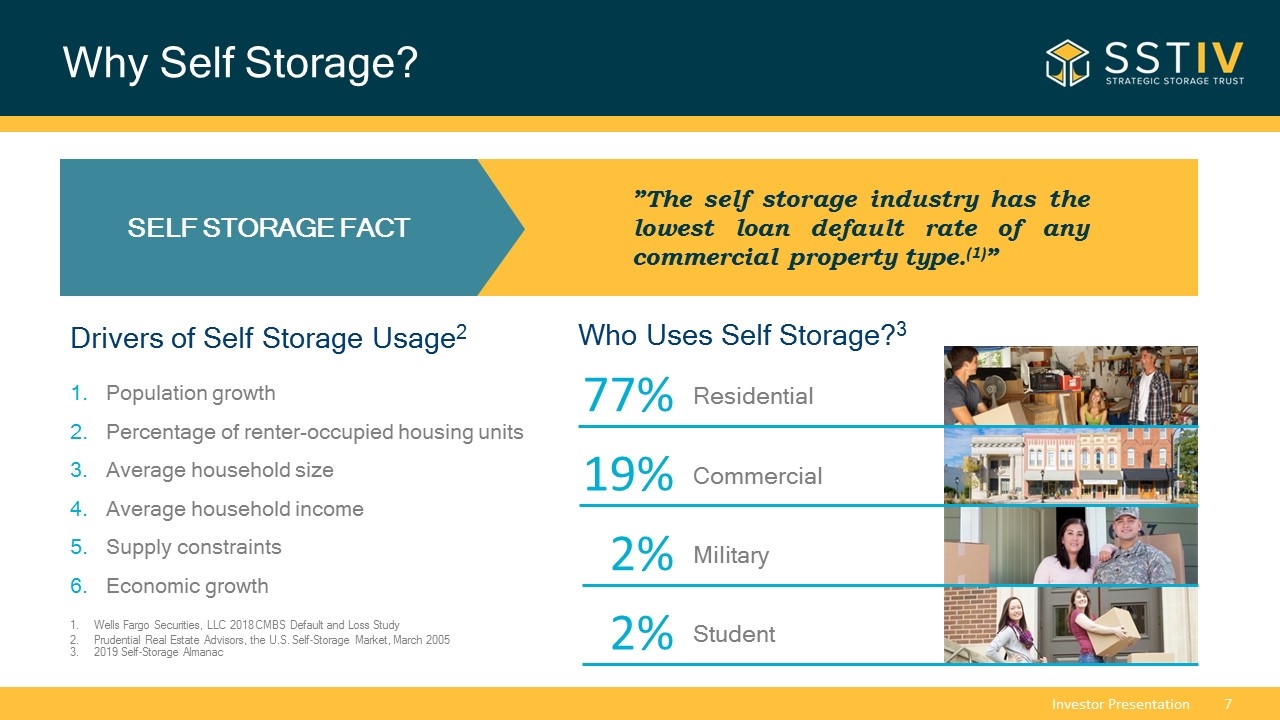

Why Self Storage?

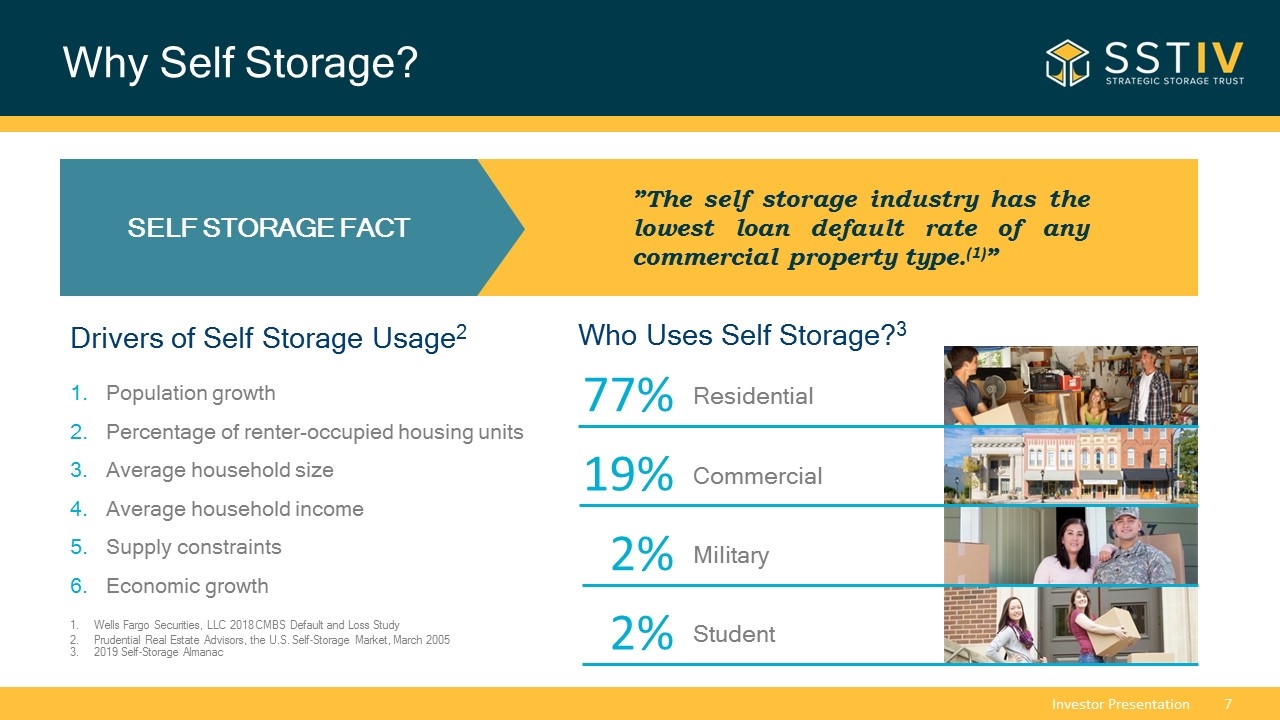

Why Self Storage? SELF STORAGE FACT ”The self storage industry has the lowest loan default rate of any commercial property type.(1)” Drivers of Self Storage Usage2 Population growth Percentage of renter-occupied housing units Average household size Average household income Supply constraints Economic growth Who Uses Self Storage?3 77% 19% 2% 2% Residential Commercial Military Student Wells Fargo Securities, LLC 2018 CMBS Default and Loss Study Prudential Real Estate Advisors, the U.S. Self-Storage Market, March 2005 2019 Self-Storage Almanac

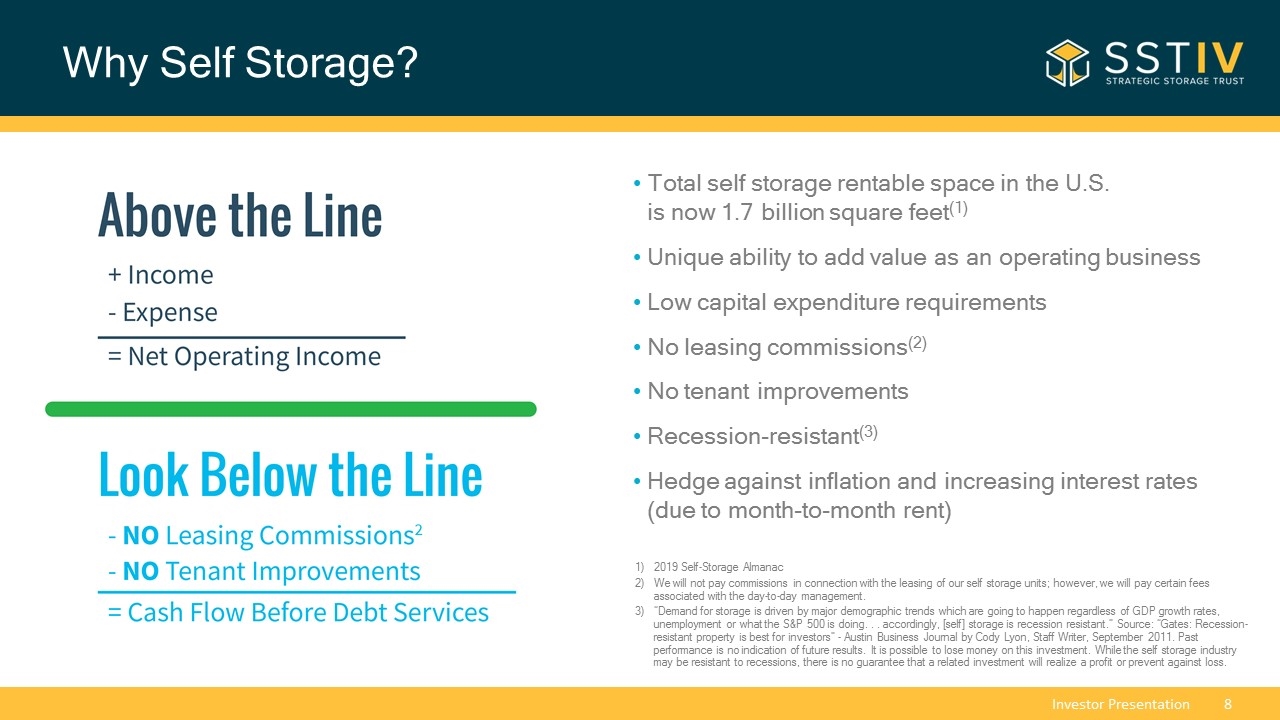

Why Self Storage? Total self storage rentable space in the U.S. is now 1.7 billion square feet(1) Unique ability to add value as an operating business Low capital expenditure requirements No leasing commissions(2) No tenant improvements Recession-resistant(3) Hedge against inflation and increasing interest rates (due to month-to-month rent) 2019 Self-Storage Almanac We will not pay commissions in connection with the leasing of our self storage units; however, we will pay certain fees associated with the day-to-day management. “Demand for storage is driven by major demographic trends which are going to happen regardless of GDP growth rates, unemployment or what the S&P 500 is doing. . . accordingly, [self] storage is recession resistant.” Source: “Gates: Recession-resistant property is best for investors” - Austin Business Journal by Cody Lyon, Staff Writer, September 2011. Past performance is no indication of future results. It is possible to lose money on this investment. While the self storage industry may be resistant to recessions, there is no guarantee that a related investment will realize a profit or prevent against loss.

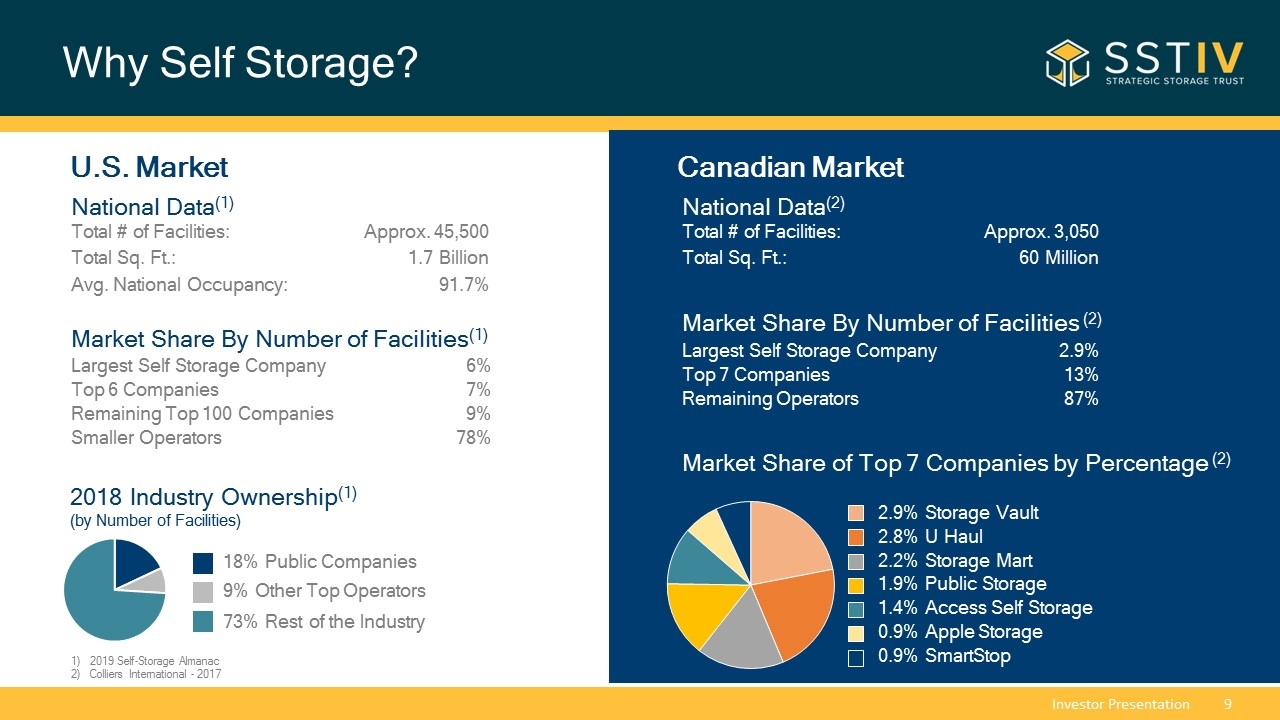

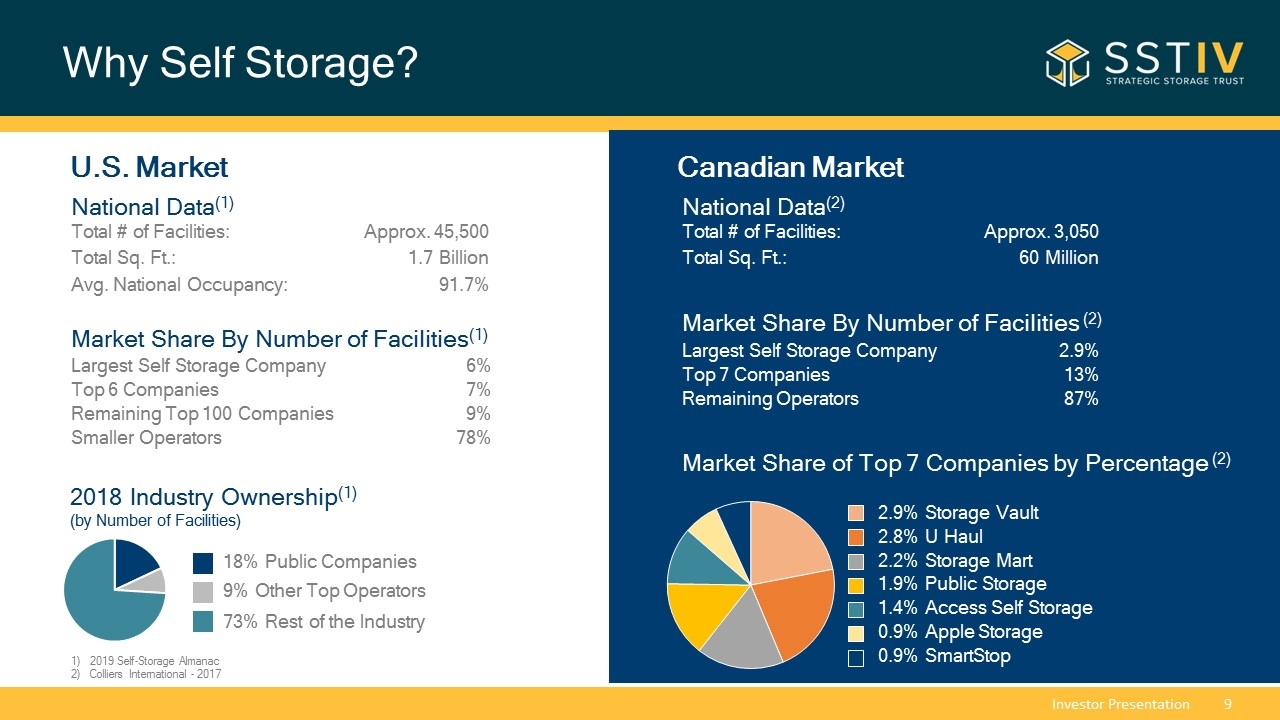

Why Self Storage? Canadian Market National Data(2) Total # of Facilities: Approx. 3,050 Total Sq. Ft.: 60 Million Market Share By Number of Facilities (2) Largest Self Storage Company 2.9% Top 7 Companies 13% Remaining Operators 87% 2.9% Storage Vault 2.8% U Haul 2.2% Storage Mart 1.9% Public Storage 1.4% Access Self Storage 0.9% Apple Storage 0.9% SmartStop Market Share of Top 7 Companies by Percentage (2) National Data(1) Total # of Facilities: Approx. 45,500 Total Sq. Ft.: 1.7 Billion Avg. National Occupancy: 91.7% Market Share By Number of Facilities(1) Largest Self Storage Company 6% Top 6 Companies 7% Remaining Top 100 Companies 9% Smaller Operators 78% 2019 Self-Storage Almanac Colliers International - 2017 2018 Industry Ownership(1) (by Number of Facilities) 9% Other Top Operators 18% Public Companies 73% Rest of the Industry U.S. Market

Strategic Storage Trust IV, Inc.

Strategic Storage Trust IV, Inc. Stabilized + Growth Self Storage Properties NO Acquisition Fees* NO Financing Fees* NO Disposition Fees* *Although there are no acquisition fees, disposition fees or financing fees, there are significant fees including, but not limited to, asset management fees, property management fees, construction fees and related expenses. These fees could be greater overall than another REIT’s total fees, regardless of the types of fees charged.

Income & Growth Property Focus Targeting Facilities With Strong Physical Occupancy Potentially Under Occupied Economically, Increasing Future Cash Flows Revenue-Optimizing Algorithms Utilized To Increase Rent Per Square Foot (RPSF) And Reduce Discounts Approximately 75% Income Allocation Certificate of Occupancy / Lease Up / Development / Redevelopment / Expansion Has Not Yet Reached Stabilization Existing Management Unable to Boost Occupancy Institutional Management and Marketing Make a Difference! Approximately 25% Growth Allocation

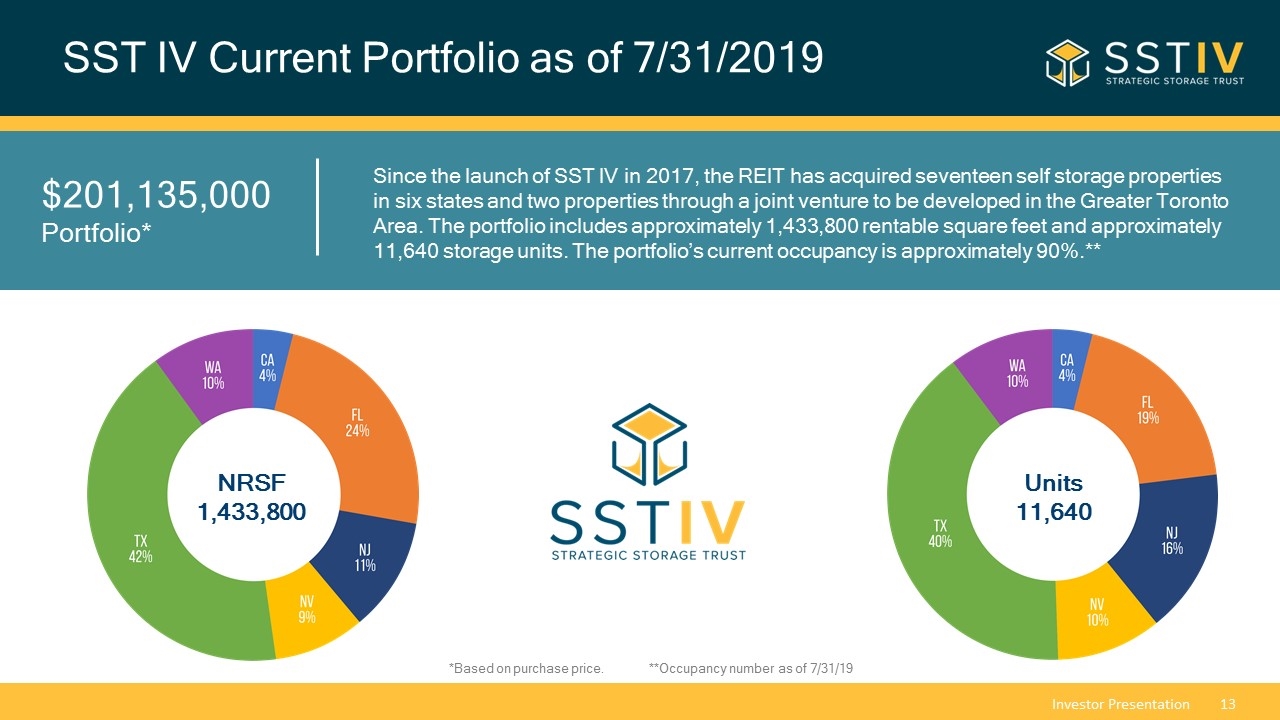

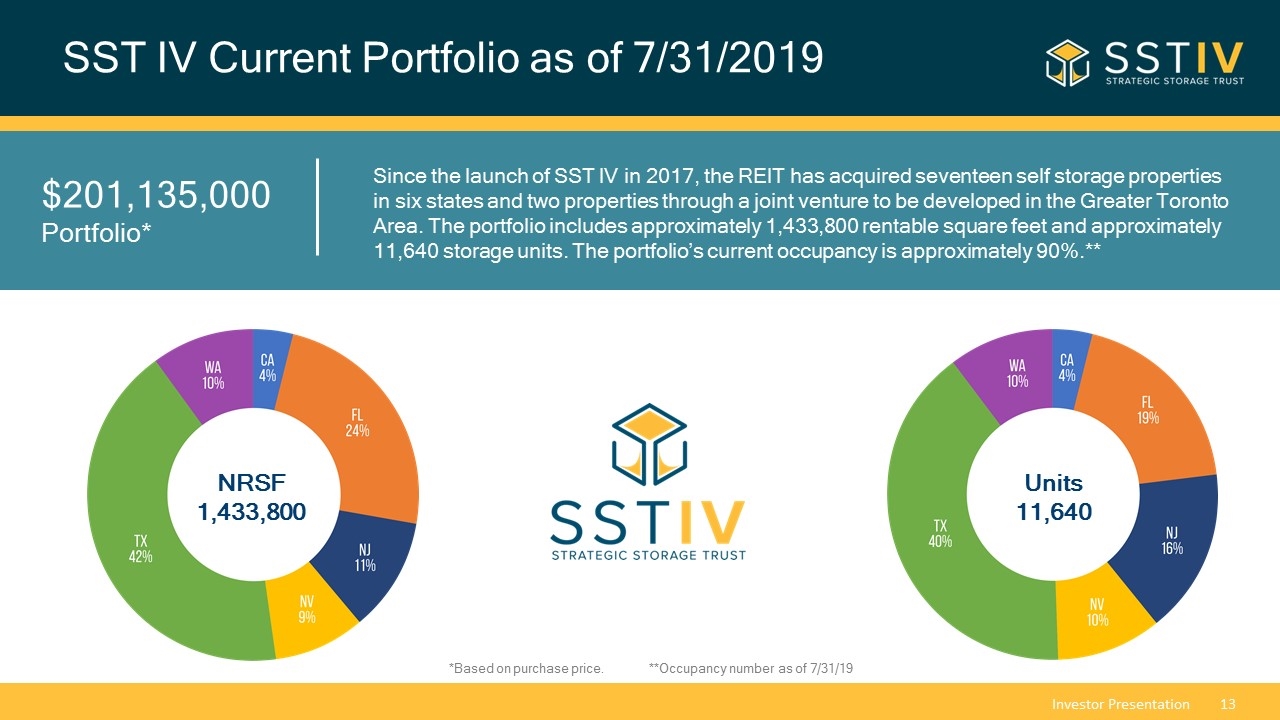

SST IV Current Portfolio as of 7/31/2019 $201,135,000 Portfolio* Since the launch of SST IV in 2017, the REIT has acquired seventeen self storage properties in six states and two properties through a joint venture to be developed in the Greater Toronto Area. The portfolio includes approximately 1,433,800 rentable square feet and approximately 11,640 storage units. The portfolio’s current occupancy is approximately 90%.** NRSF 1,433,800 Units 11,640 **Occupancy number as of 7/31/19 *Based on purchase price.

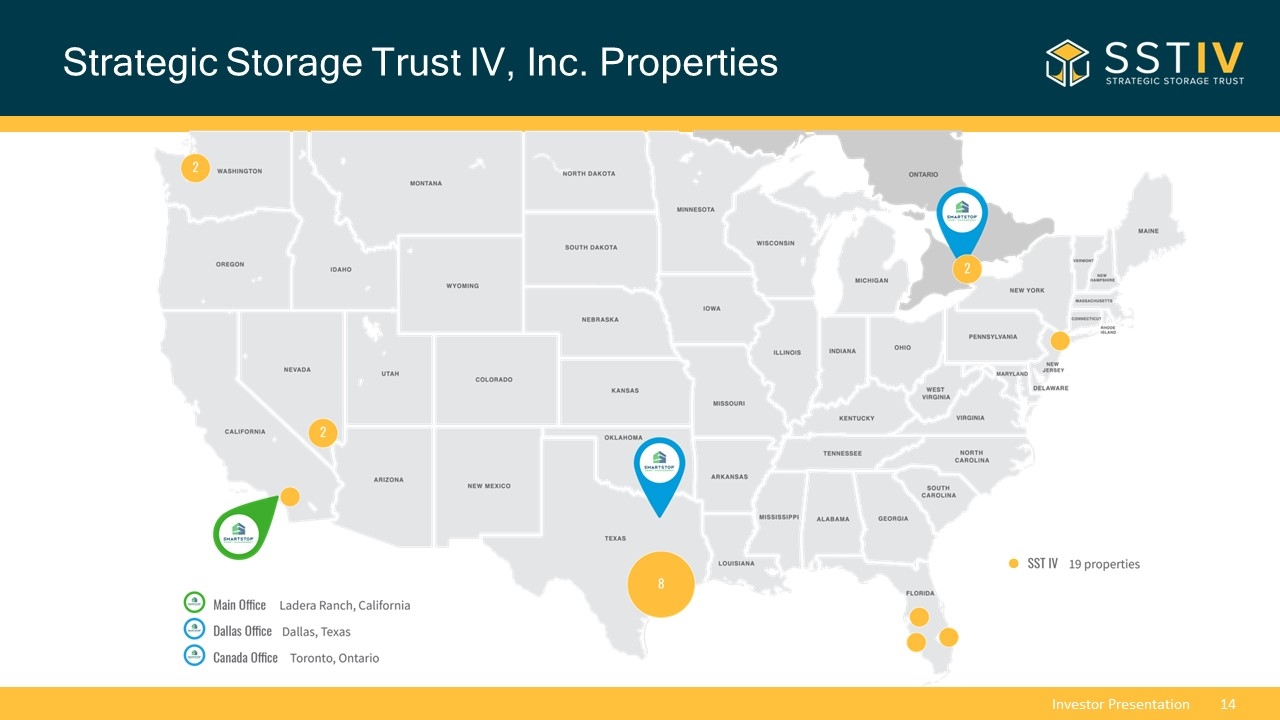

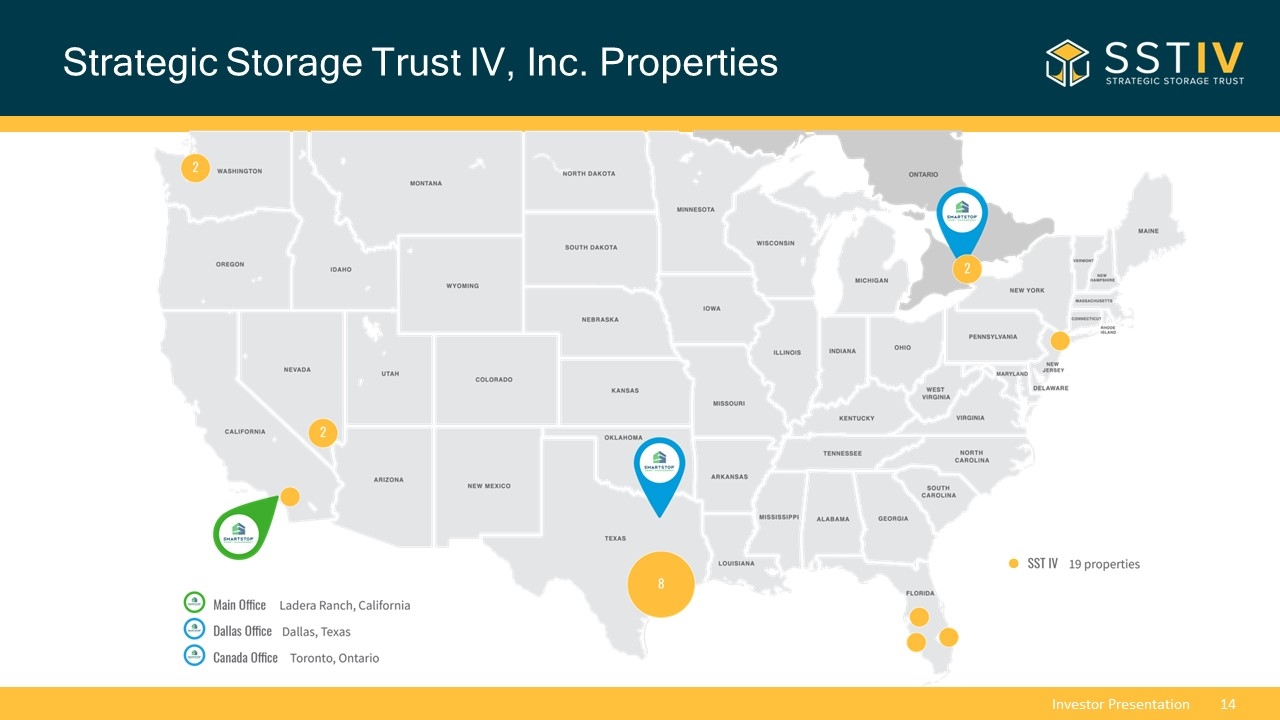

Strategic Storage Trust IV, Inc. Properties

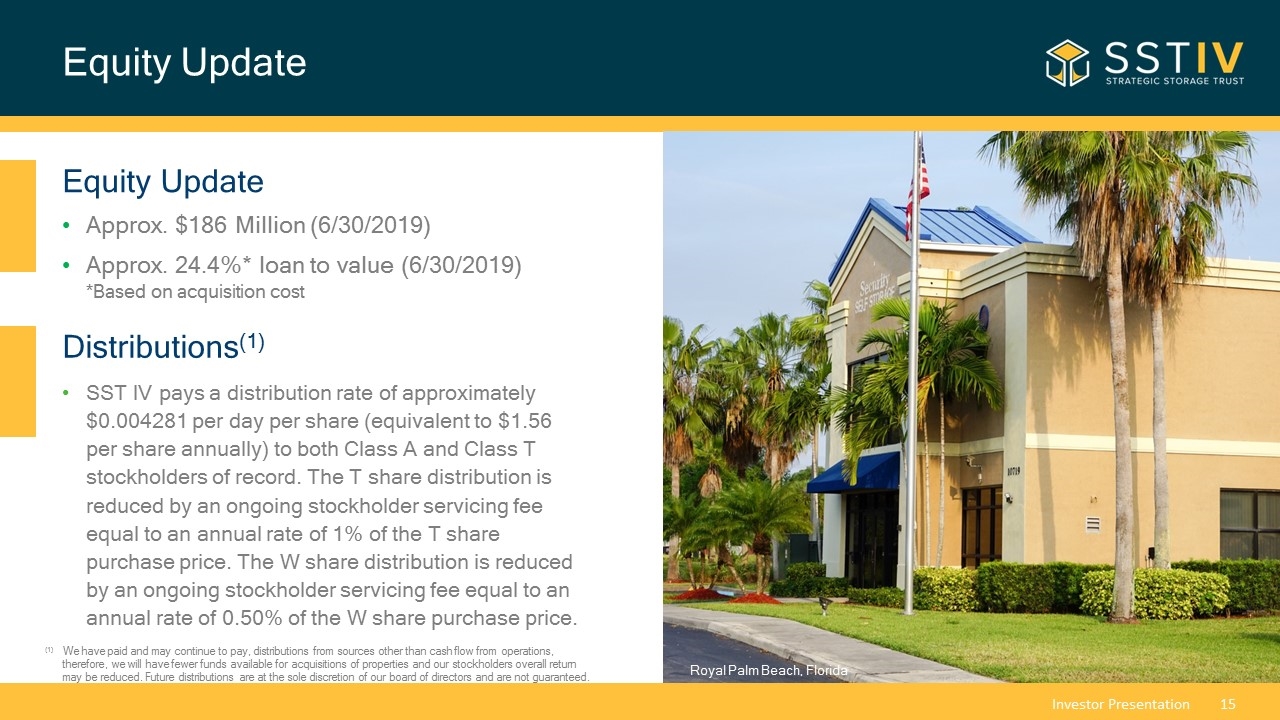

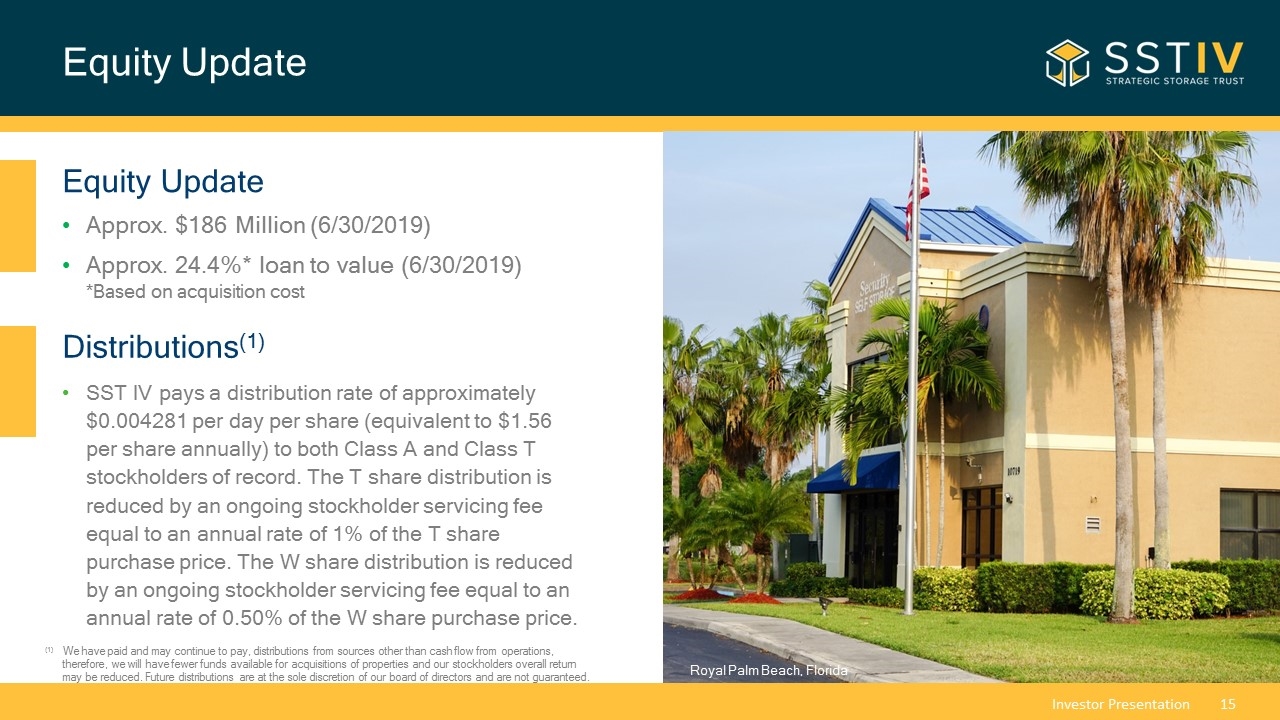

Equity Update Royal Palm Beach, Florida Equity Update Approx. $186 Million (6/30/2019) Approx. 24.4%* loan to value (6/30/2019) *Based on acquisition cost Distributions(1) SST IV pays a distribution rate of approximately $0.004281 per day per share (equivalent to $1.56 per share annually) to both Class A and Class T stockholders of record. The T share distribution is reduced by an ongoing stockholder servicing fee equal to an annual rate of 1% of the T share purchase price. The W share distribution is reduced by an ongoing stockholder servicing fee equal to an annual rate of 0.50% of the W share purchase price. (1) We have paid and may continue to pay, distributions from sources other than cash flow from operations, therefore, we will have fewer funds available for acquisitions of properties and our stockholders overall return may be reduced. Future distributions are at the sole discretion of our board of directors and are not guaranteed.

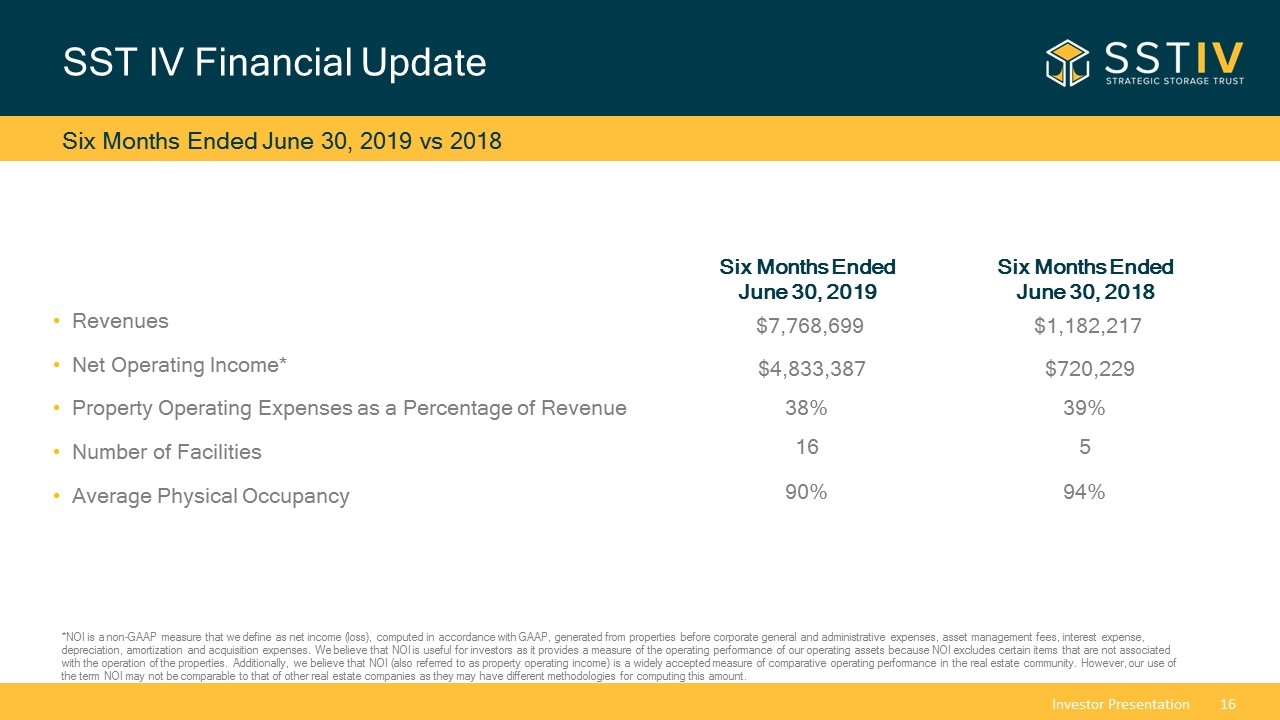

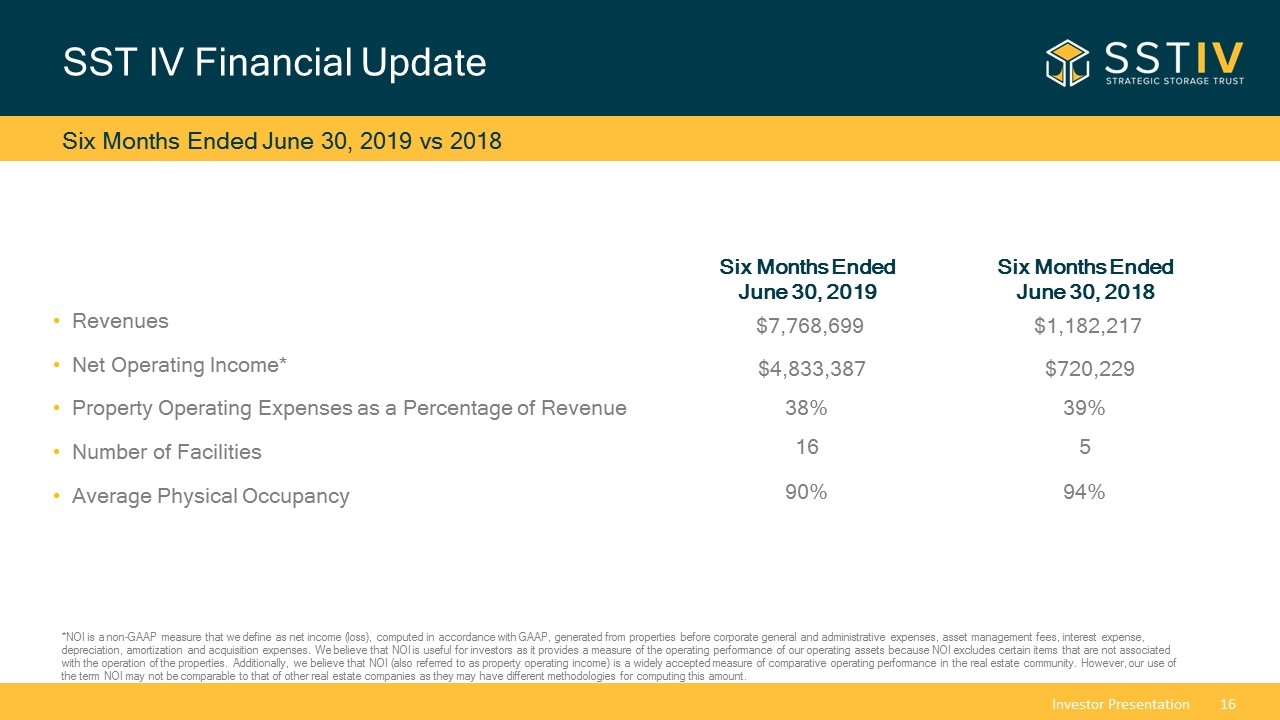

SST IV Financial Update Six Months Ended June 30, 2019 vs 2018 Modified FFO Revenues Net Operating Income* Property Operating Expenses as a Percentage of Revenue Number of Facilities Average Physical Occupancy Six Months Ended June 30, 2019 $7,768,699 $4,833,387 38% 16 90% Six Months Ended June 30, 2018 $1,182,217 $720,229 39% 5 94% *NOI is a non-GAAP measure that we define as net income (loss), computed in accordance with GAAP, generated from properties before corporate general and administrative expenses, asset management fees, interest expense, depreciation, amortization and acquisition expenses. We believe that NOI is useful for investors as it provides a measure of the operating performance of our operating assets because NOI excludes certain items that are not associated with the operation of the properties. Additionally, we believe that NOI (also referred to as property operating income) is a widely accepted measure of comparative operating performance in the real estate community. However, our use of the term NOI may not be comparable to that of other real estate companies as they may have different methodologies for computing this amount.

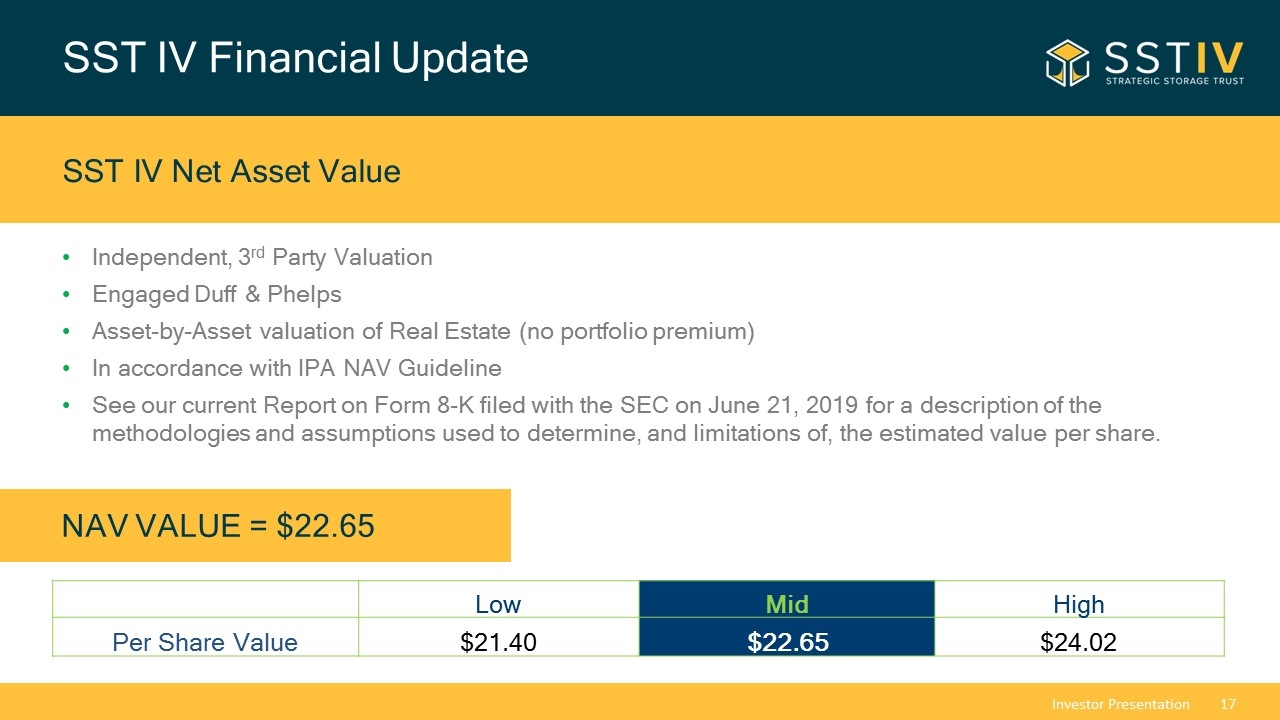

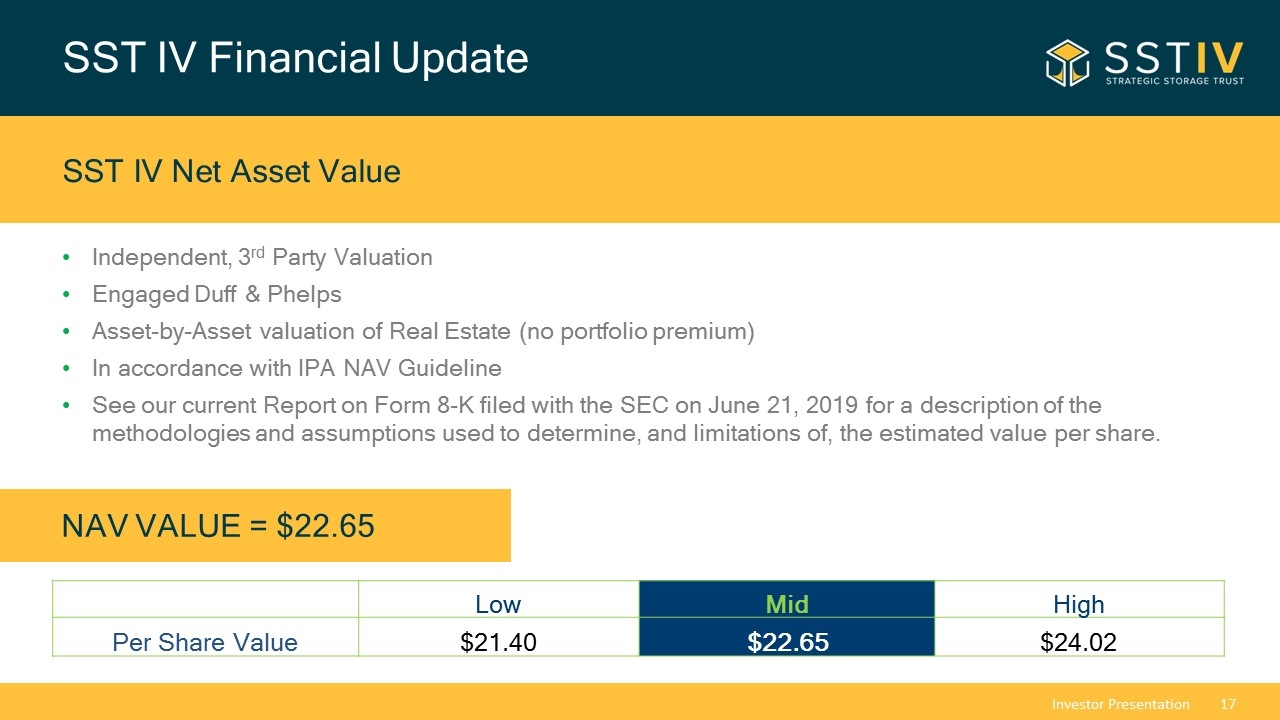

SST IV Financial Update SST IV Net Asset Value Independent, 3rd Party Valuation Engaged Duff & Phelps Asset-by-Asset valuation of Real Estate (no portfolio premium) In accordance with IPA NAV Guideline See our current Report on Form 8-K filed with the SEC on June 21, 2019 for a description of the methodologies and assumptions used to determine, and limitations of, the estimated value per share. NAV VALUE = $22.65 Low Mid High Per Share Value $21.40 $22.65 $24.02

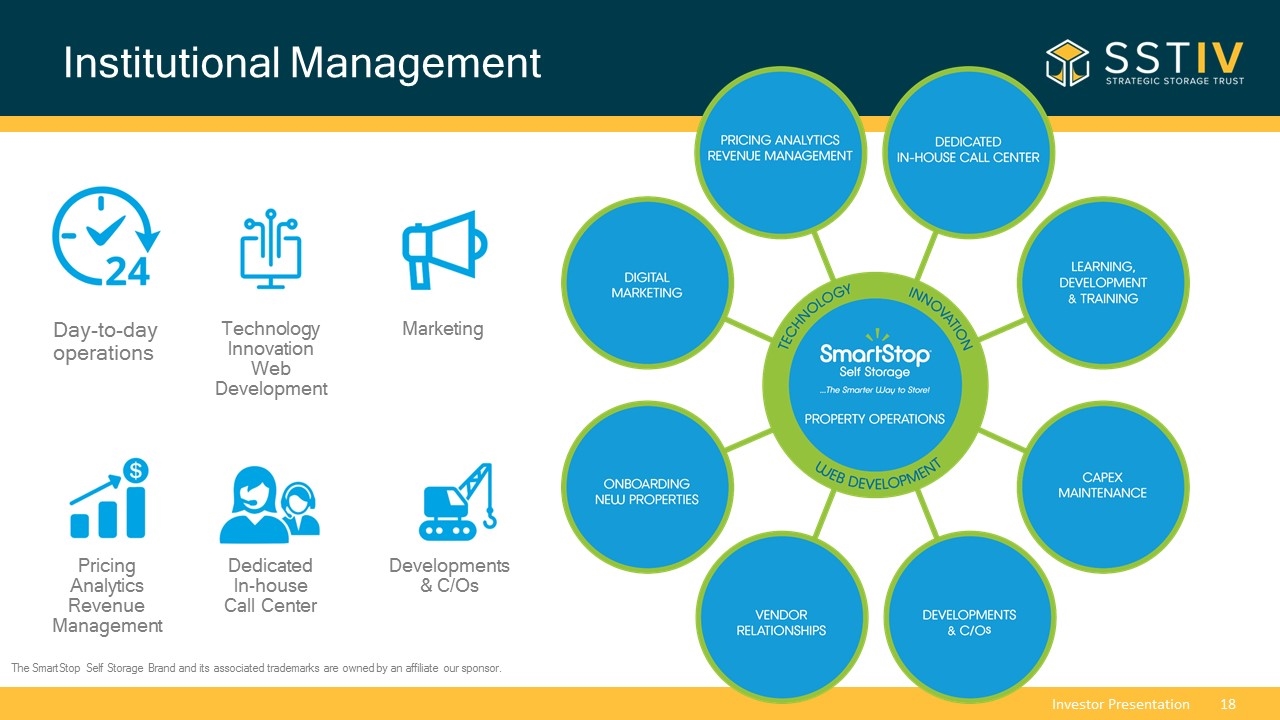

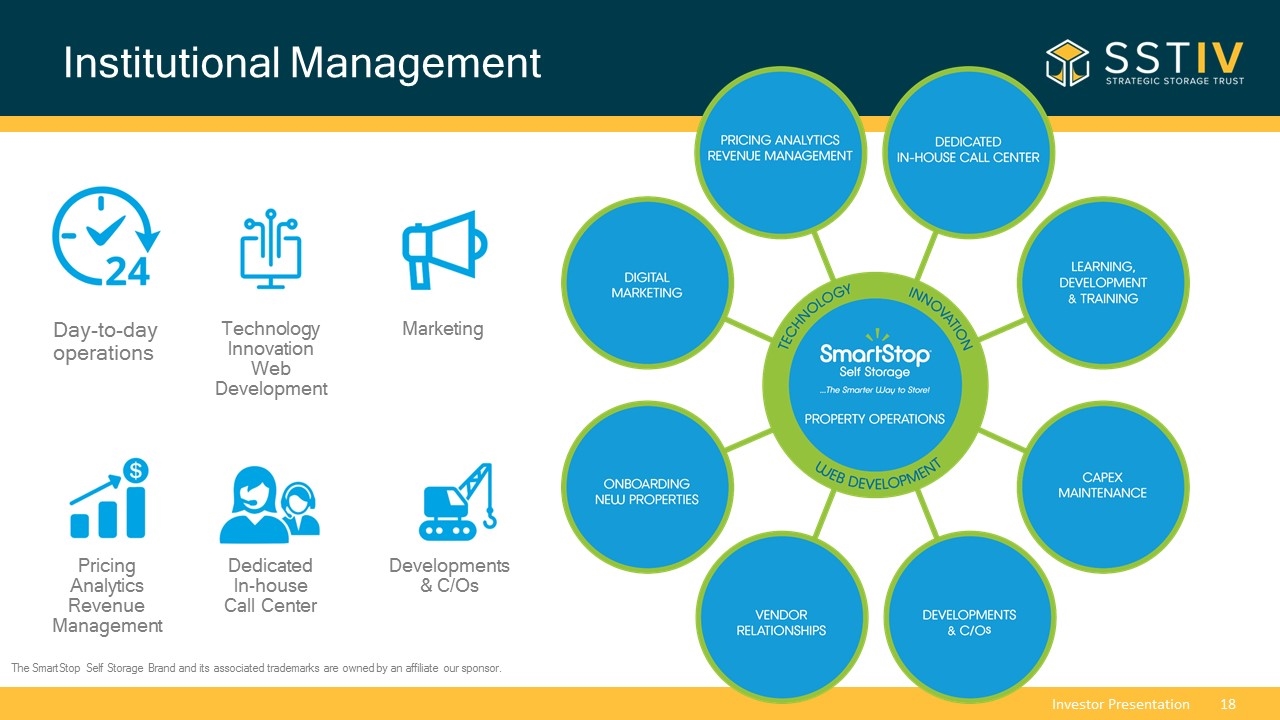

Institutional Management Day-to-day operations Technology Innovation Web Development Marketing Pricing Analytics Revenue Management Dedicated In-house Call Center Developments & C/Os The SmartStop Self Storage Brand and its associated trademarks are owned by an affiliate our sponsor.

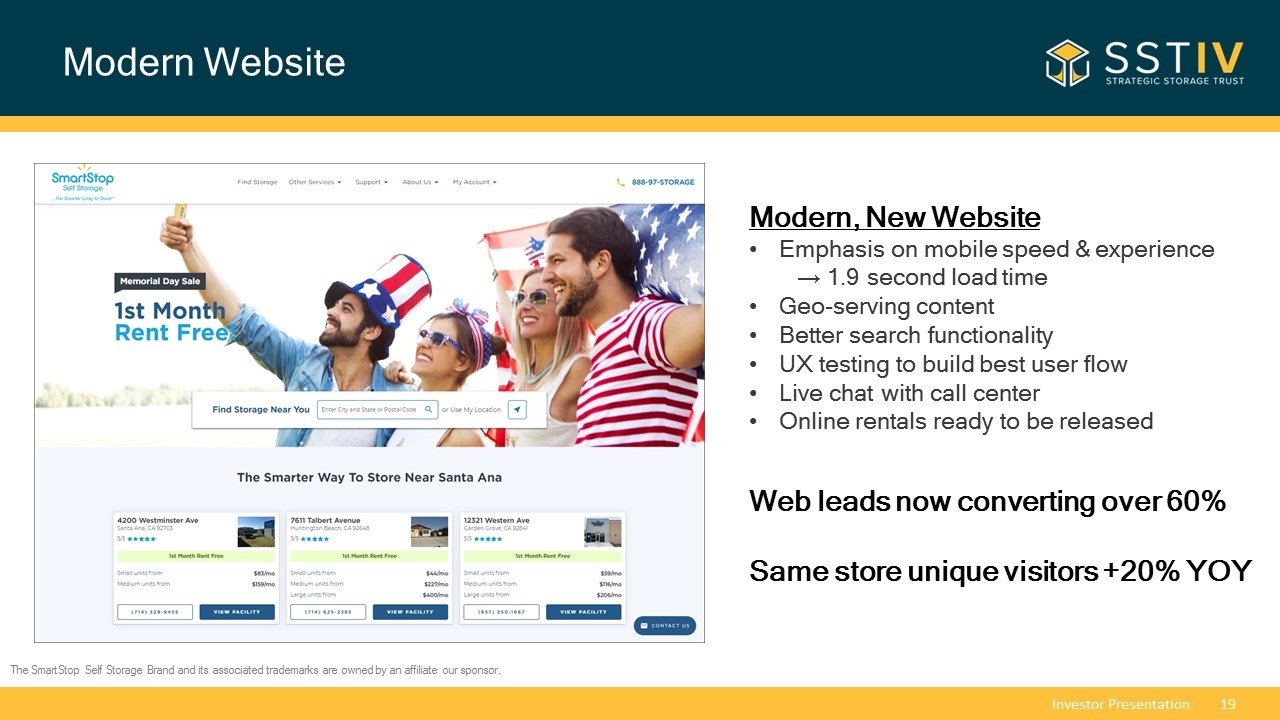

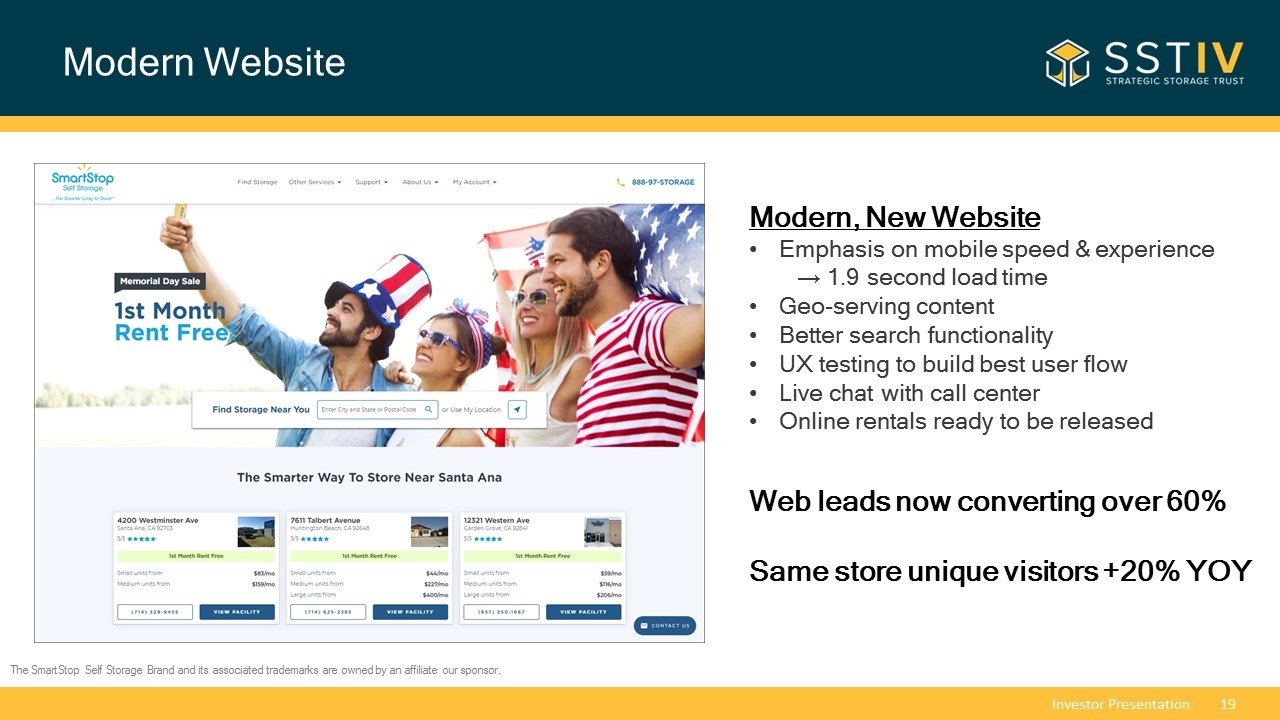

Modern Website Modern, New Website Emphasis on mobile speed & experience → 1.9 second load time Geo-serving content Better search functionality UX testing to build best user flow Live chat with call center Online rentals ready to be released Web leads now converting over 60% Same store unique visitors +20% YOY The SmartStop Self Storage Brand and its associated trademarks are owned by our sponsor. The SmartStop Self Storage Brand and its associated trademarks are owned by an affiliate our sponsor.

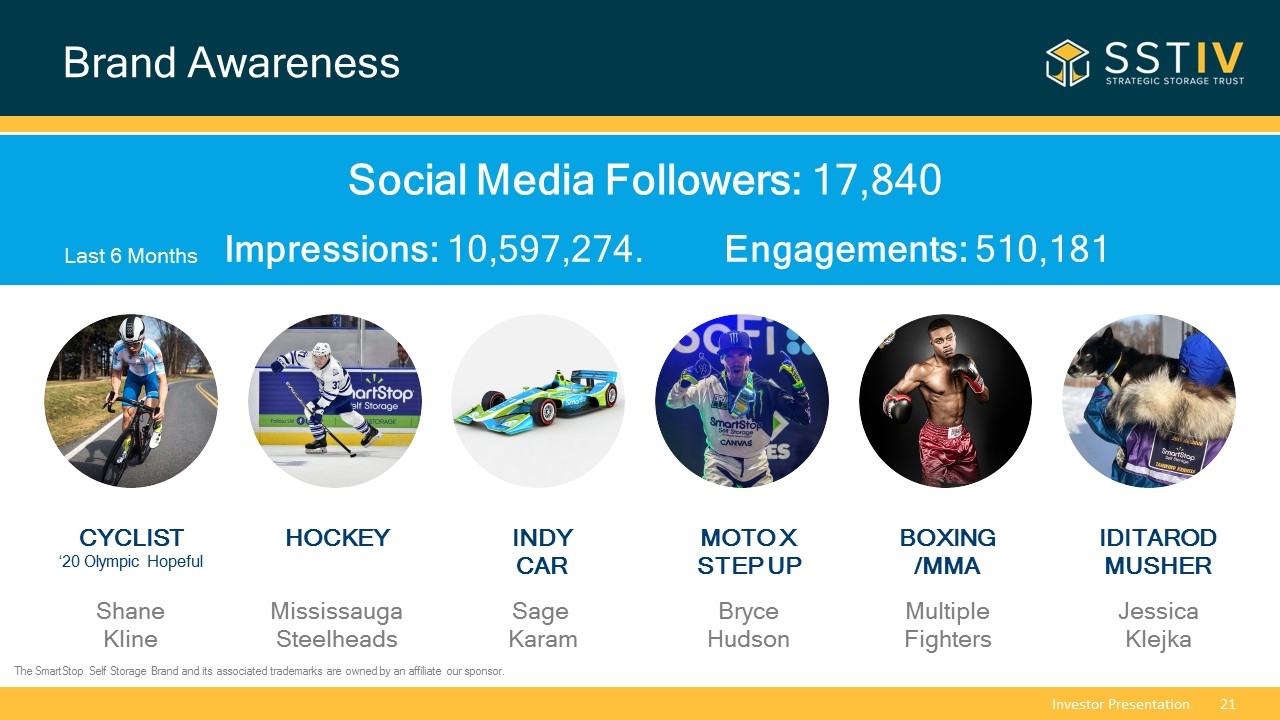

SmartStop Self Storage – Branding Brand Awareness Strong, well-known brand name Brand protection Registered trademarks in U.S./Canada 250 U.S./Canadian domain names Processes in place to act upon potential brand infringement Store Branding Locations feature SmartStop signage and colors The SmartStop brand appears on: Moving supplies SmartStop website Advertising and marketing efforts Special events/team sponsorships Employee uniforms, name tags, etc. Flags, banners and printed materials The SmartStop Self Storage Brand and its associated trademarks are owned by our sponsor. The SmartStop Self Storage Brand and its associated trademarks are owned by an affiliate our sponsor.

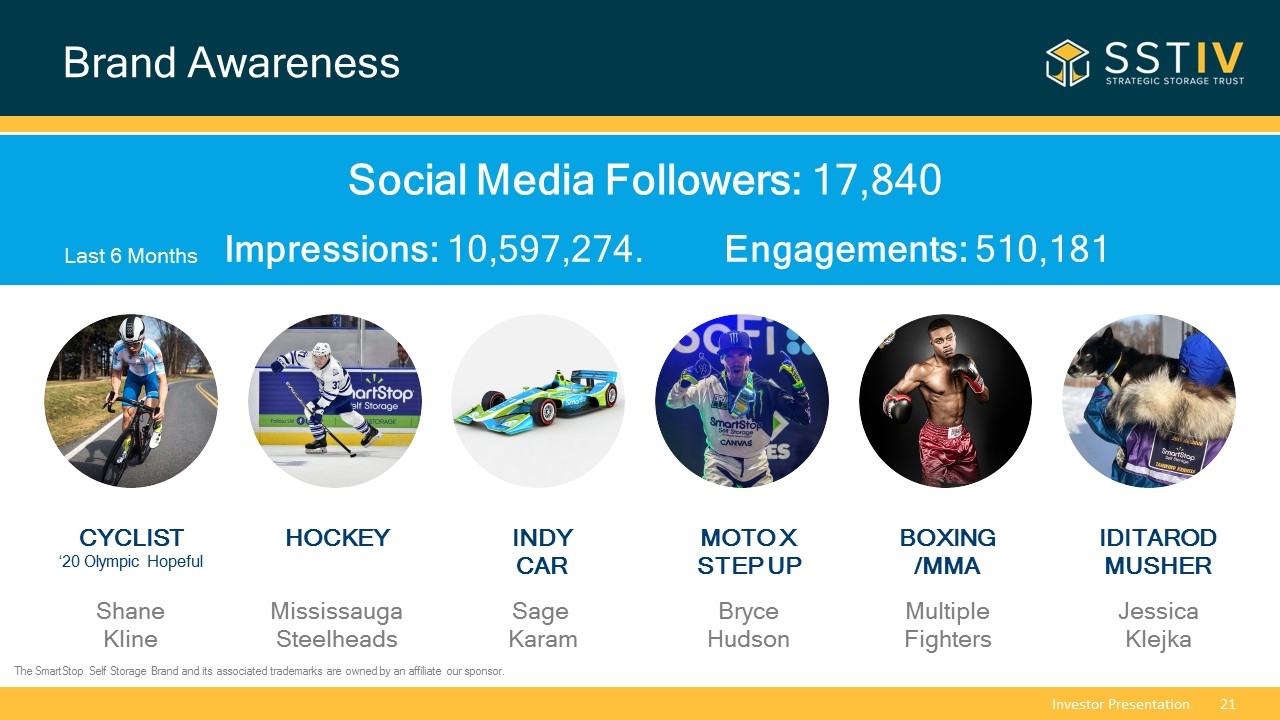

Brand Awareness Shane Kline Mississauga Steelheads Jessica Klejka Multiple Fighters CYCLIST ‘20 Olympic Hopeful HOCKEY IDITAROD MUSHER BOXING /MMA Social Media Followers: 17,840 Impressions: 10,597,274. Engagements: 510,181 Last 6 Months INDY CAR Sage Karam Bryce Hudson MOTO X STEP UP The SmartStop Self Storage Brand and its associated trademarks are owned by our sponsor. The SmartStop Self Storage Brand and its associated trademarks are owned by an affiliate our sponsor.

Recent Acquisitions 1401 N Meridian Puyallup, Washington 830 Units 98,000 NRSF Approx. 92% Occupancy* Purchase Price: $13,600,000 *Occupancy number as of 7/31/2019 2555 W Centennial Pkwy. North Las Vegas, Nevada *Occupancy number as of 7/31/2019 640 Units 76,500 NRSF Approx. 94% Occupancy* Purchase Price: $12,800,000

Recent Acquisition 275 Goodlette-Frank Rd. N. Naples, Florida 700 Units 77,900 NRSF Approx. 90% Occupancy* Purchase Price: $27,250,000 *Occupancy number as of 7/31/2019 1610 Jim Johnson Rd. Plant City, Florida *Occupancy number as of 7/31/2019 820 Units 110,000 NRSF Approx. 84% Occupancy* Purchase Price: $14,500,000

Recent Acquisition Metro Mini Portfolio 7 Properties 4,130 Units 545,900 NRSF Approx. 90% Occupancy* Purchase Price: $58.5M *Occupancy number as of 7/31/2019

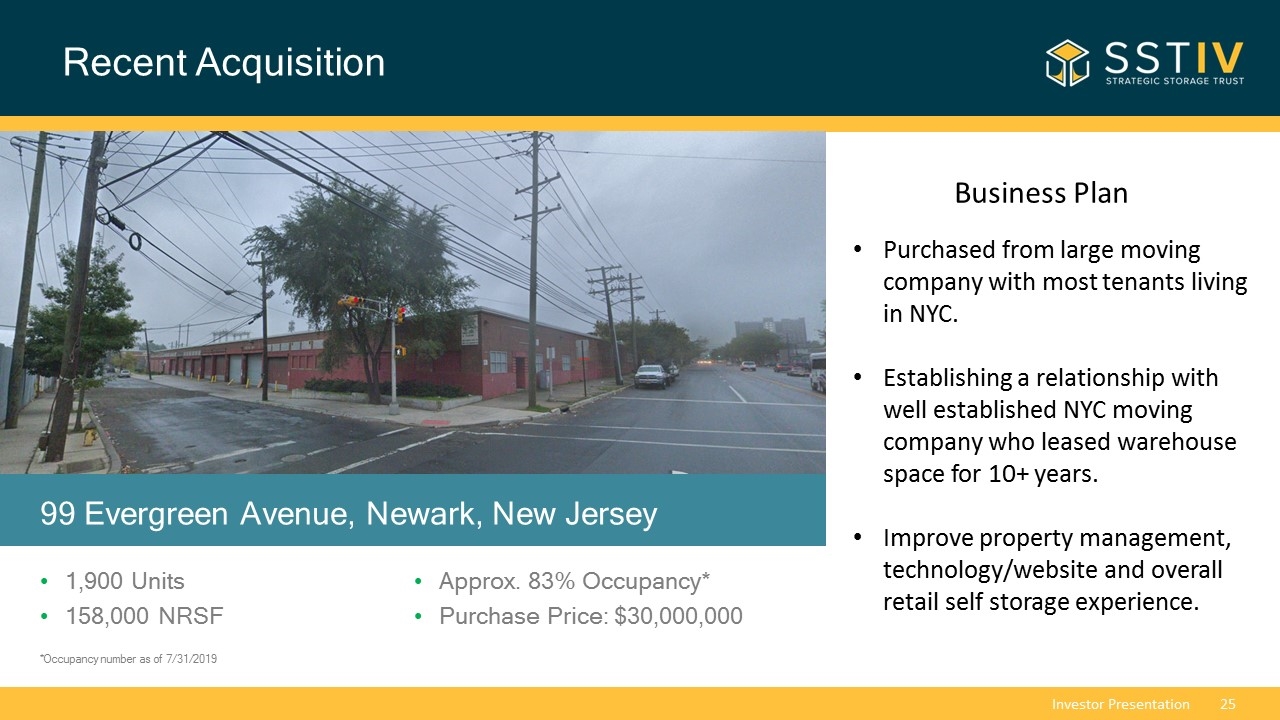

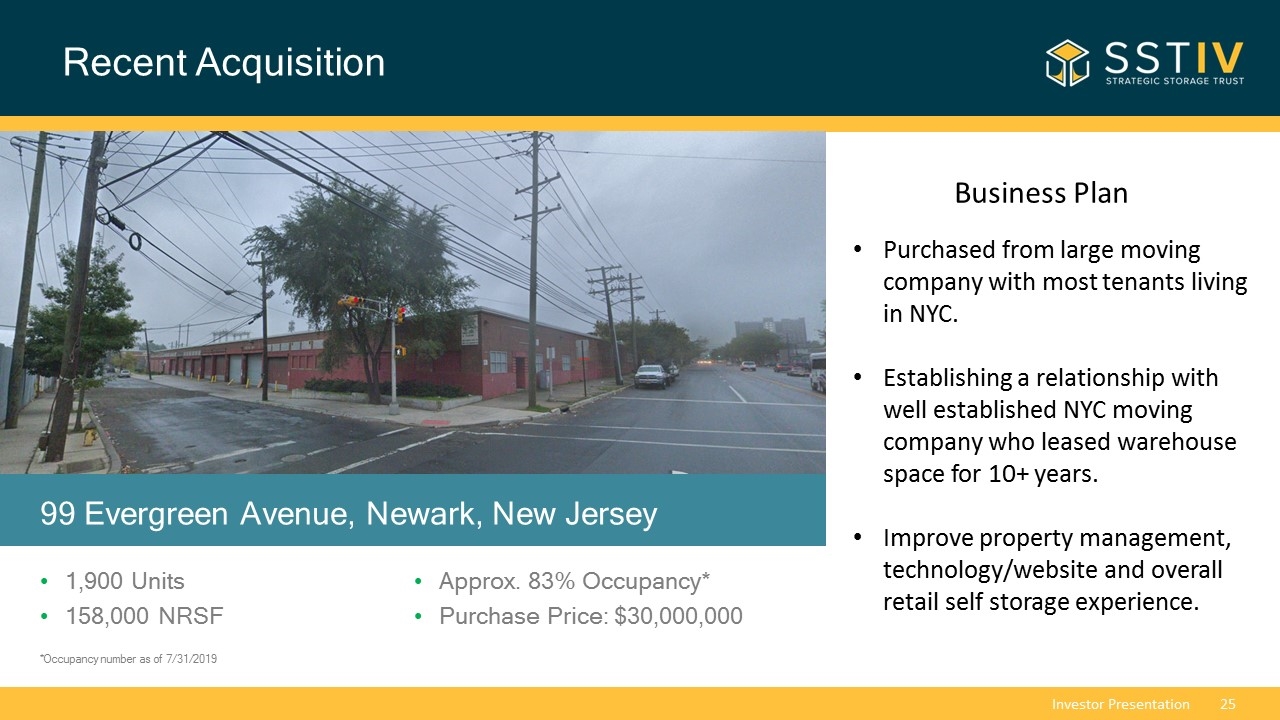

Recent Acquisition 99 Evergreen Avenue, Newark, New Jersey 1,900 Units 158,000 NRSF Approx. 83% Occupancy* Purchase Price: $30,000,000 *Occupancy number as of 7/31/2019 Business Plan Purchased from large moving company with most tenants living in NYC. Establishing a relationship with well established NYC moving company who leased warehouse space for 10+ years. Improve property management, technology/website and overall retail self storage experience.

Recent Acquisition 23316 Redmond-Fall City Rd NE Redmond, Washington 350 Units 48,000 NRSF Approx. 91% Occupancy* Purchase Price: $11,500,000 *Occupancy number as of 7/31/2019

Strategic Storage Trust IV, Inc. Goals Monthly Distributions(1) Capital Appreciation Recession Resistant(2) Hedge Against Inflation & Increasing Interest Rates (Due to month to month rents) No Tenant Improvements / Leasing Commissions(3) Goal of Meeting Current & Future Income Needs 3-5 Year Anticipated Hold After Completion of Offerings(4) (1)We have paid distributions from sources other than our cash flows from operations, including from the net proceeds of this offering and the private offering transaction. We are not prohibited from undertaking such activities by our charter, bylaws or investment policies, and we may use an unlimited amount from any source to pay our distributions. From commencement of paying cash distributions in February 2017, the payment of distributions has been funded from the private offering transaction and this offering. Until we generate cash flows sufficient to pay distributions to you, we may pay distributions from the net proceeds of this offering or from borrowings in anticipation of future cash flows. Demand for storage is driven by major demographic trends which are going to happen regardless of GDP growth rates, unemployment or what the S&P 500 is doing accordingly, [self] storage is recession resistant.” Source: “Gates: Recession-resistant property is best for investors” - Austin Business Journal by Cody Lyon, Staff Writer, September 2011. Past performance is no indication of future results. It is possible to lose money on this investment. While the self storage industry may be resistant to recessions, there is no guarantee that a related investment will realize a profit or prevent against loss. We will not pay commissions in connection with the leasing of our self storage units; however, we will pay certain fees associated with the day – to day management and operations of our self storage facilities. The timing of our exit strategy is subject to market conditions and the discretion of our Board of Directors. There is no assurance that we will achieve one or more of the liquidity events we intend to seek within this time frame or at all. Our offering may last up to 3 years and our Board of Directors may determine that it is in the best interest of our stockholders to conduct a follow-on offering, in which case offerings of our common stock could be conducted for 6 years or more.

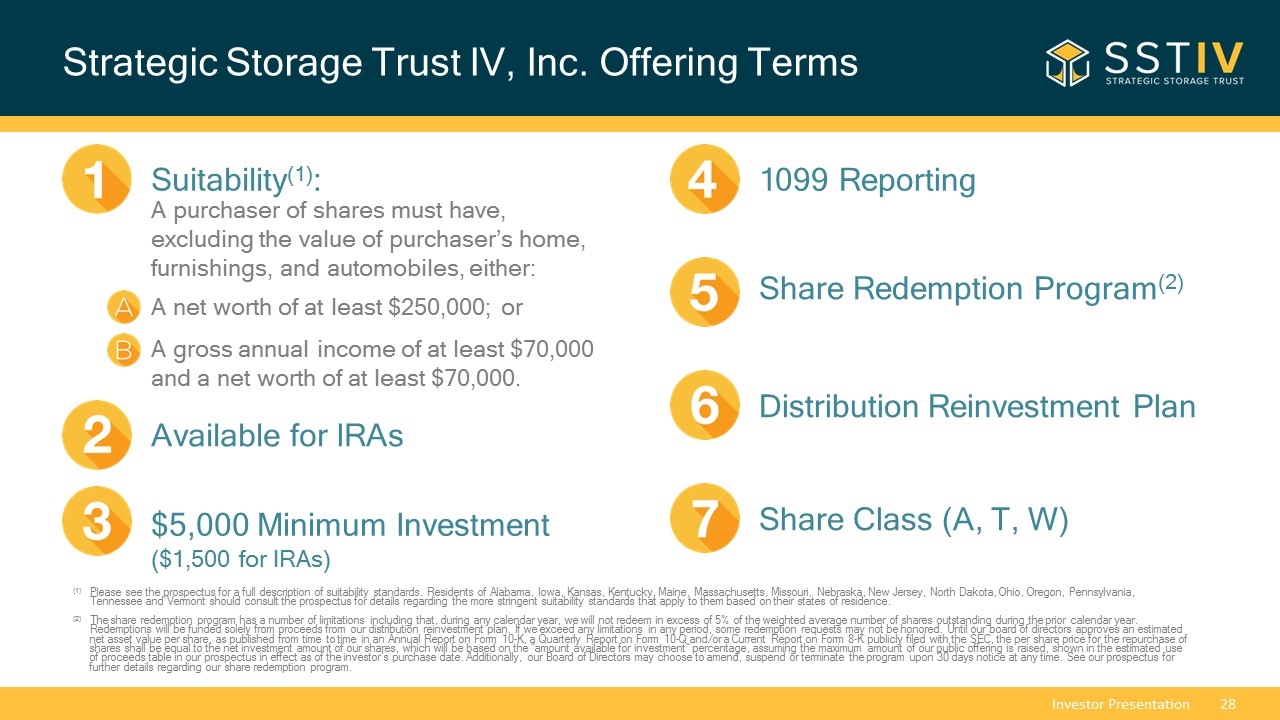

Strategic Storage Trust IV, Inc. Offering Terms Suitability(1): (1) Please see the prospectus for a full description of suitability standards. Residents of Alabama, Iowa, Kansas, Kentucky, Maine, Massachusetts, Missouri, Nebraska, New Jersey, North Dakota, Ohio, Oregon, Pennsylvania, Tennessee and Vermont should consult the prospectus for details regarding the more stringent suitability standards that apply to them based on their states of residence. (2) The share redemption program has a number of limitations including that, during any calendar year, we will not redeem in excess of 5% of the weighted average number of shares outstanding during the prior calendar year. Redemptions will be funded solely from proceeds from our distribution reinvestment plan. If we exceed any limitations in any period, some redemption requests may not be honored. Until our board of directors approves an estimated net asset value per share, as published from time to time in an Annual Report on Form 10-K, a Quarterly Report on Form 10-Q and/or a Current Report on Form 8-K publicly filed with the SEC, the per share price for the repurchase of shares shall be equal to the net investment amount of our shares, which will be based on the “amount available for investment” percentage, assuming the maximum amount of our public offering is raised, shown in the estimated use of proceeds table in our prospectus in effect as of the investor’s purchase date. Additionally, our Board of Directors may choose to amend, suspend or terminate the program upon 30 days notice at any time. See our prospectus for further details regarding our share redemption program. A net worth of at least $250,000; or A gross annual income of at least $70,000 and a net worth of at least $70,000. Available for IRAs $5,000 Minimum Investment ($1,500 for IRAs) A purchaser of shares must have, excluding the value of purchaser’s home, furnishings, and automobiles, either: 1099 Reporting Share Redemption Program(2) Distribution Reinvestment Plan Share Class (A, T, W)

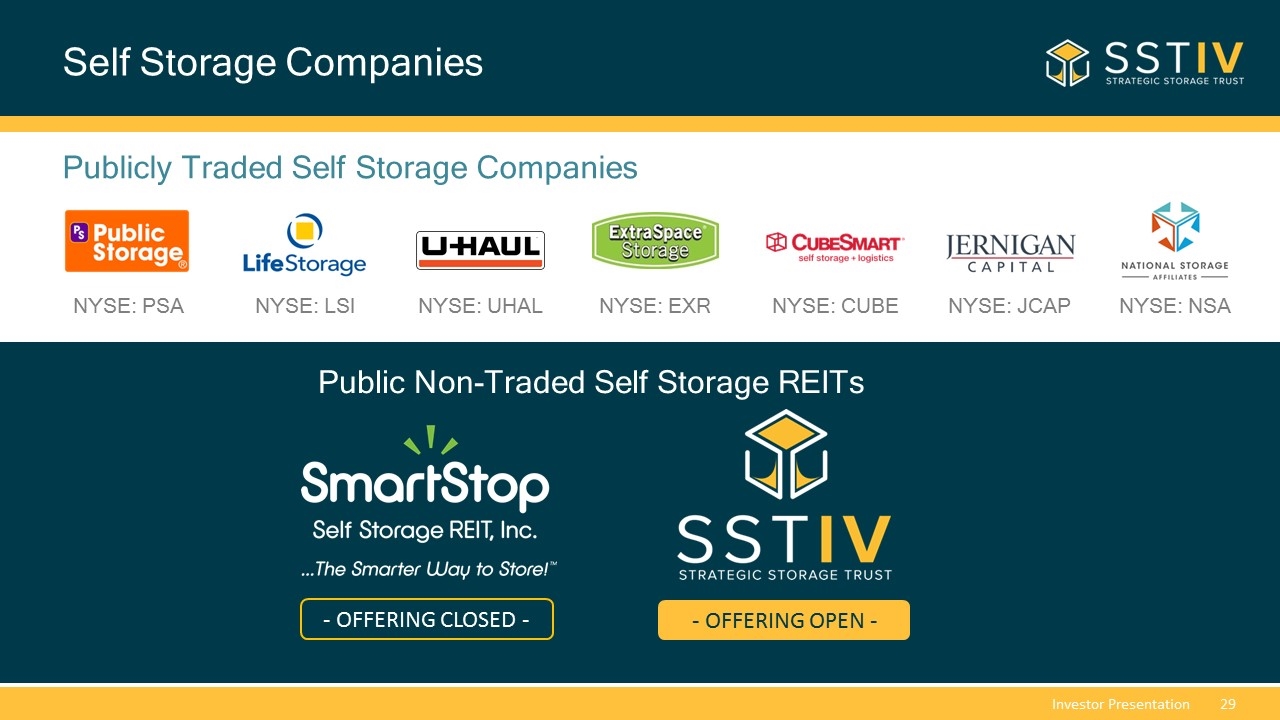

Self Storage Companies Publicly Traded Self Storage Companies NYSE: EXR NYSE: PSA NYSE: CUBE NYSE: LSI NYSE: UHAL NYSE: JCAP NYSE: NSA Public Non-Traded Self Storage REITs - OFFERING CLOSED - - OFFERING OPEN -

Next Steps Main Office 10 Terrace Road Ladera Ranch, CA 92694 Sales Desk 877.32.REIT5 (877.327.3485) info@strategicREIT.com Company Info: StrategicREIT.com Storage Rentals: SmartStopSelfStorage.com Investor Services 866.418.5144 Shares Offered Through Select Capital Corporation, Dealer Manager for Strategic Storage Trust IV, Inc. Member FINRA | SIPC 866.699.5338

Questions?